29 May 2023 Morning Session Analysis

US dollar jumped after a tentative debt ceiling deal was achieved.

The dollar index, which was traded against a basket of six major currencies, extended its rally in the morning trading session as the achievement of a tentative deal in raising the debt ceiling wiped off the market worries over the risk of default. Yesterday, US President Joe Biden and House speaker Kevin McCarthy agreed in principle to a tentative deal that would increase the debt limit while the temporary cap on some federal spending at current levels. In detail, the deal would suspend the debt ceiling through January 2025. Although the deal will avert a catastrophically destabilizing default, there is still a difficult path whereby it has to pass through Congress before the US runs out of money to pay back its debt before the 5th of June. The House and Senate are expected to return Wednesday after Memorial Day. McCarthy said the House would vote Wednesday and then send the bill to the Senate. The bill will be passed to Joe Biden right after the approval has been granted by the majority of the Senator. If all goes well, the US will be able to avoid the potential default by June 5. As of writing, the dollar index rose 0.05% to 104.25.

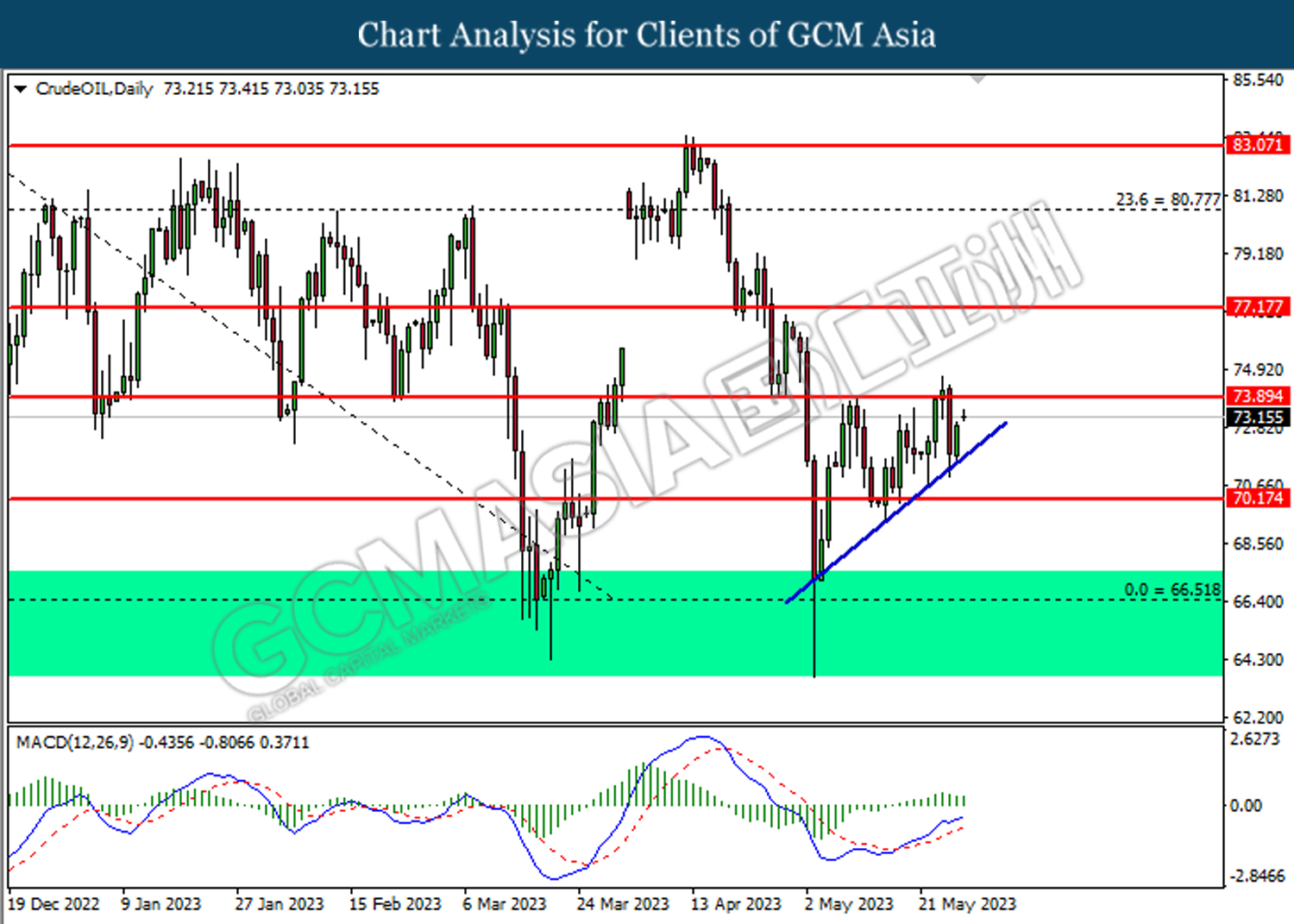

In the commodities market, crude oil prices edged up by 0.43% to $73.25 per barrel as the tentative deal of raising the debt limit has cleared up the cloudy prospect of this black commodity. Besides, gold prices dropped by -0.03% to $1945.20 per troy ounce as the risk of default fell significantly right after a deal had been achieved between Joe Biden and McCarthy.

Today’s Holiday Market Close

Time Market Event

All Day USD Memorial Day

All Day GBP Bank Holiday

All Day CHF Pentecost

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

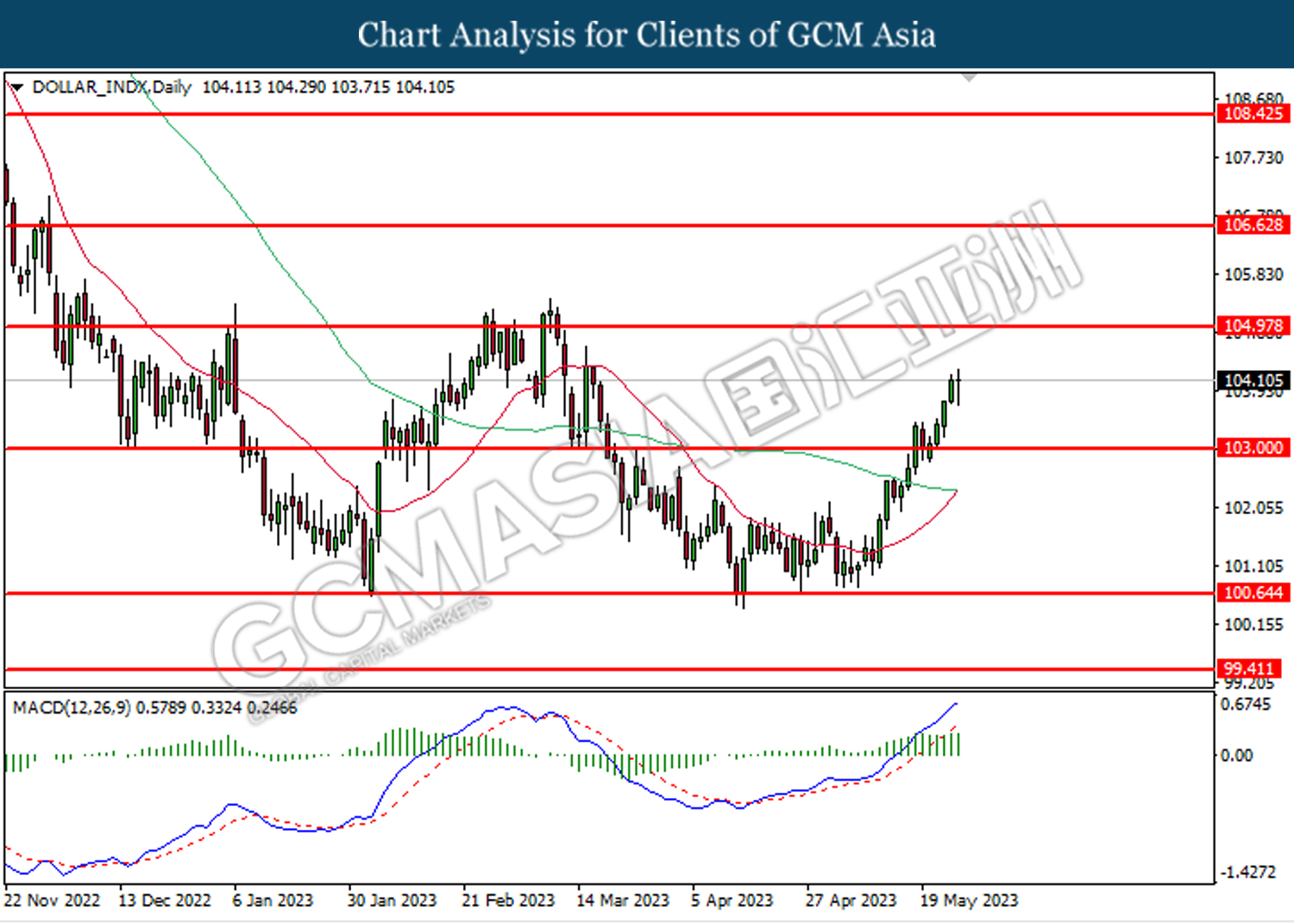

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 103.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

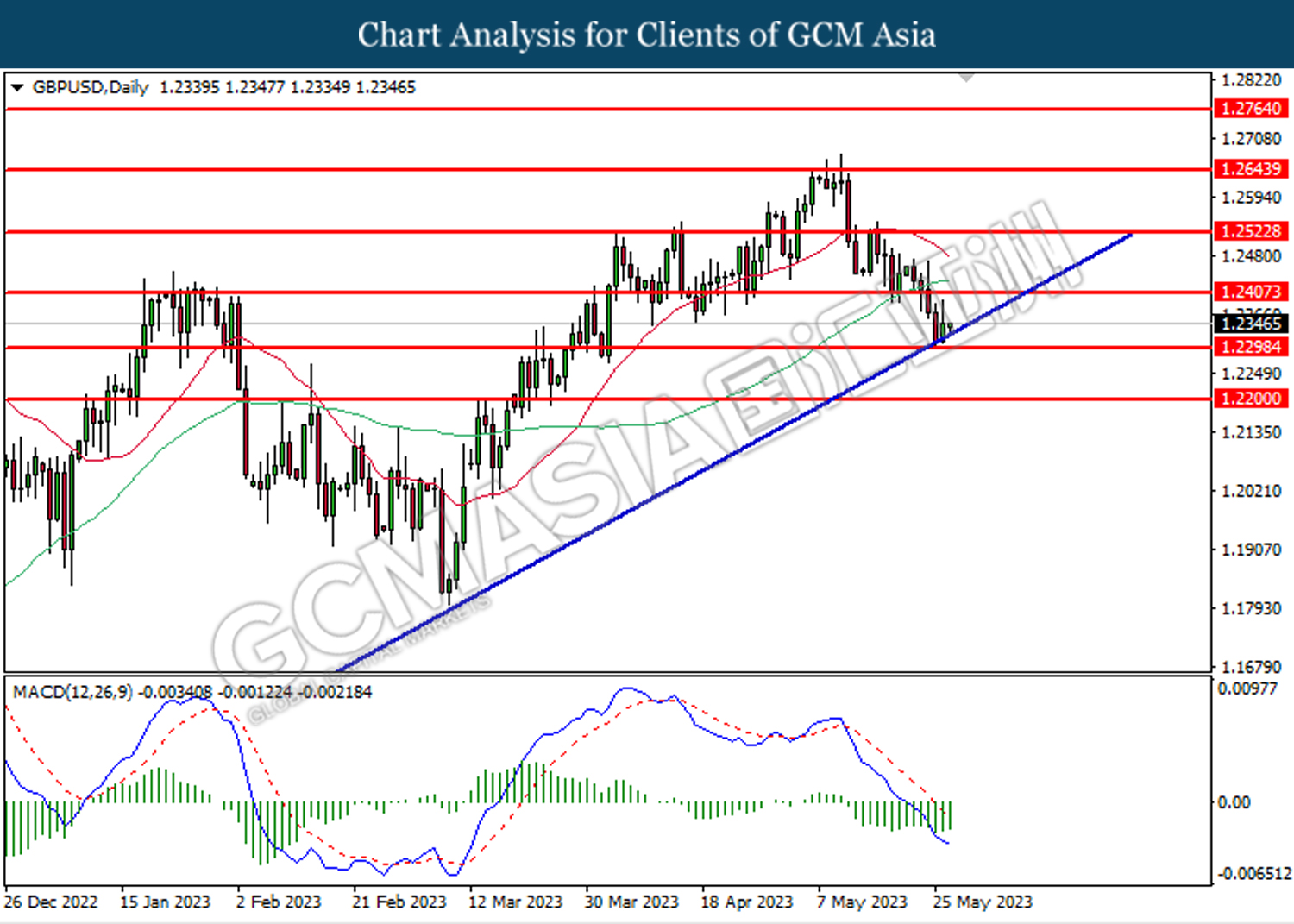

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2300. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2405, 1.2525

Support level: 1.2300, 1.2200

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0770. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0665.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

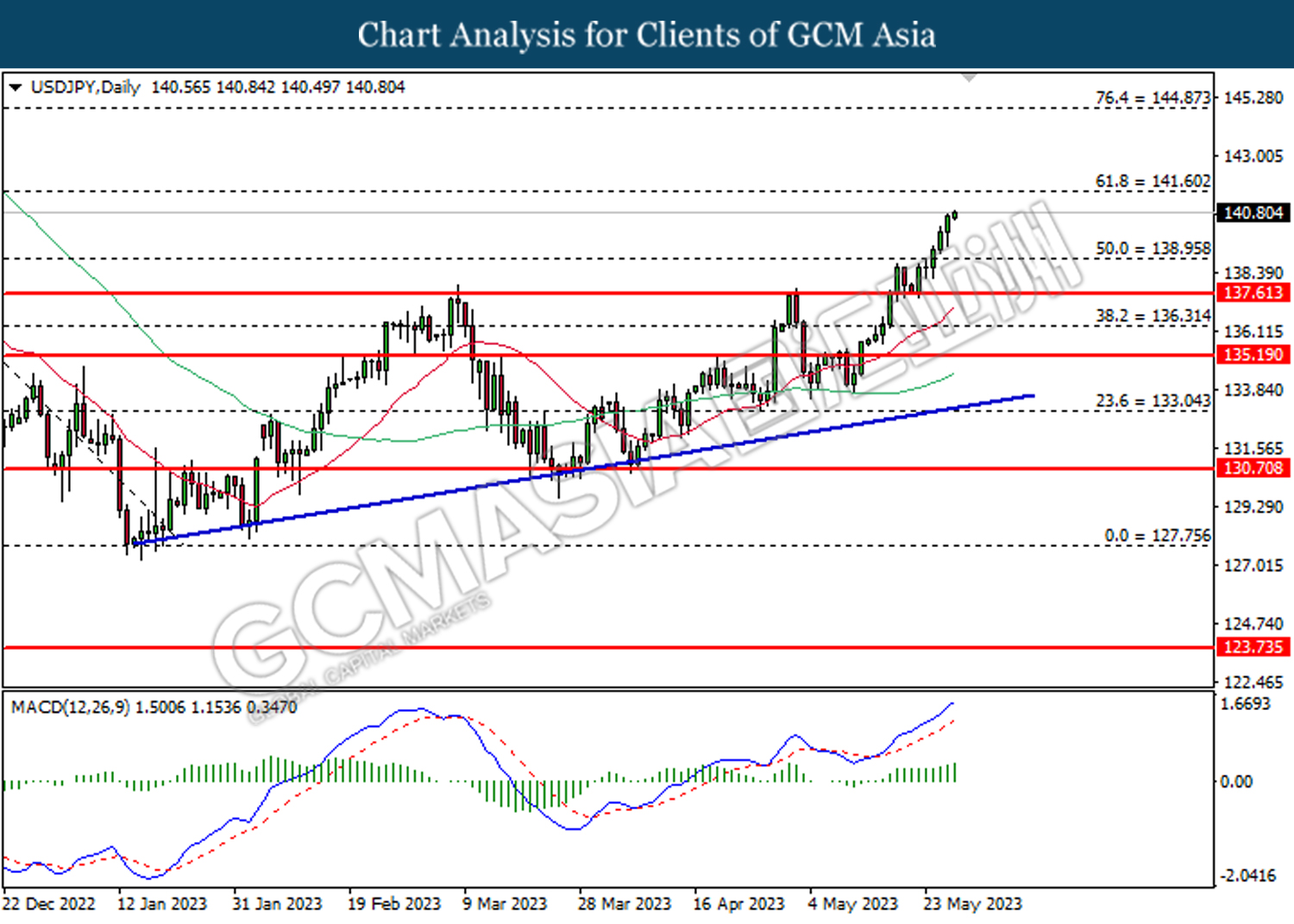

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 138.95. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 141.60.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

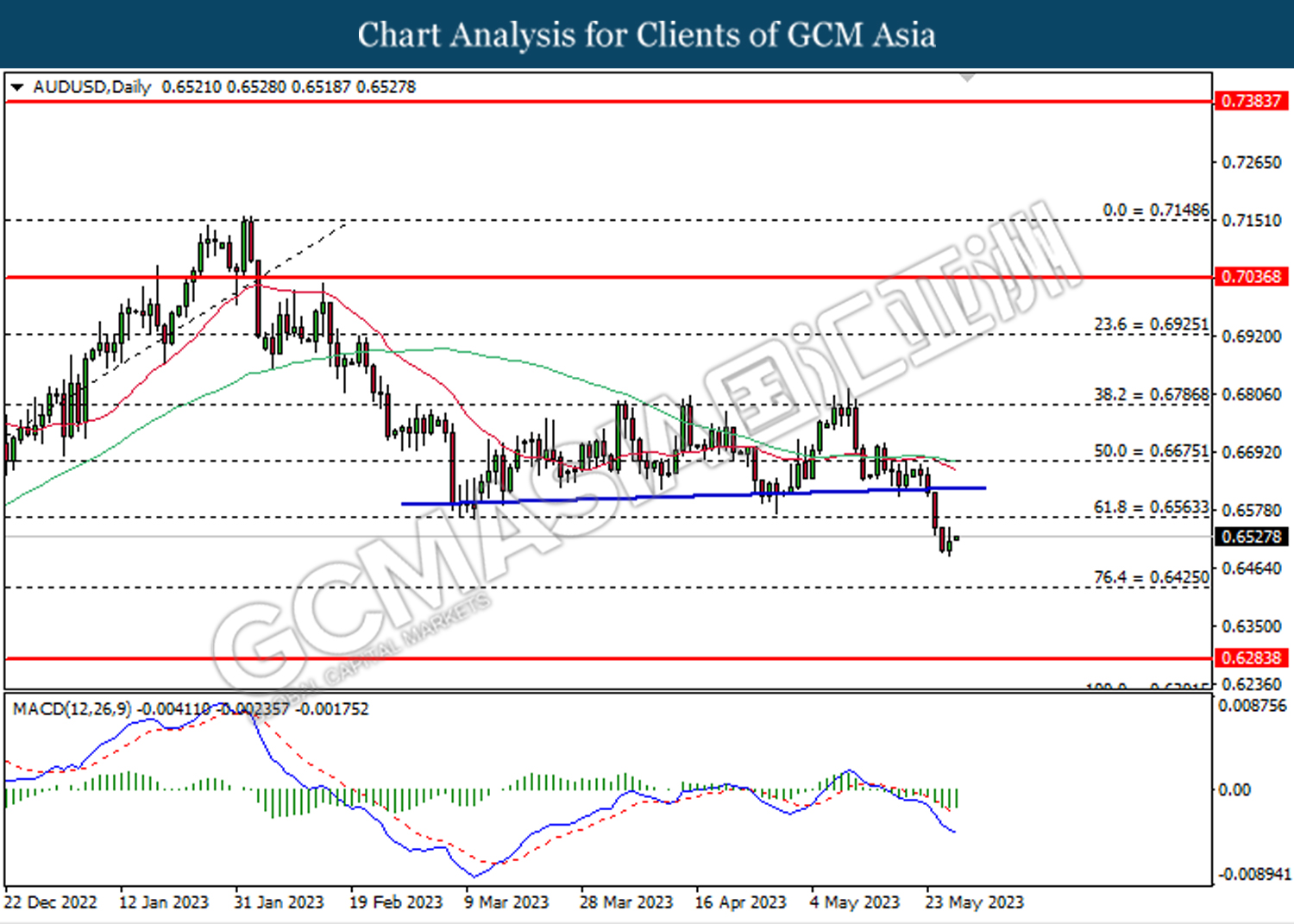

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6425.

Resistance level: 0.6565, 0.6675

Support level: 0.6425, 0.6285

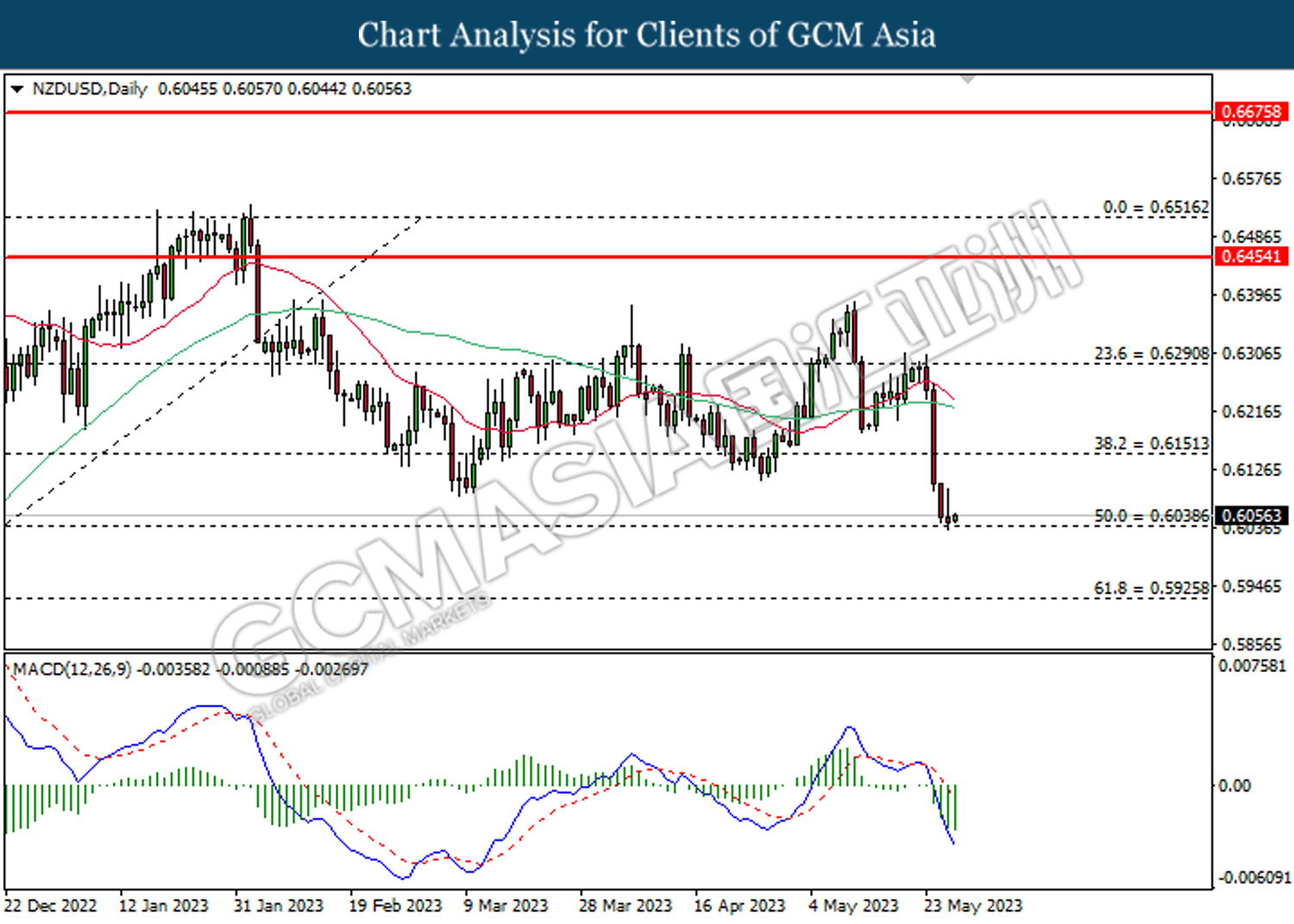

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6040. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

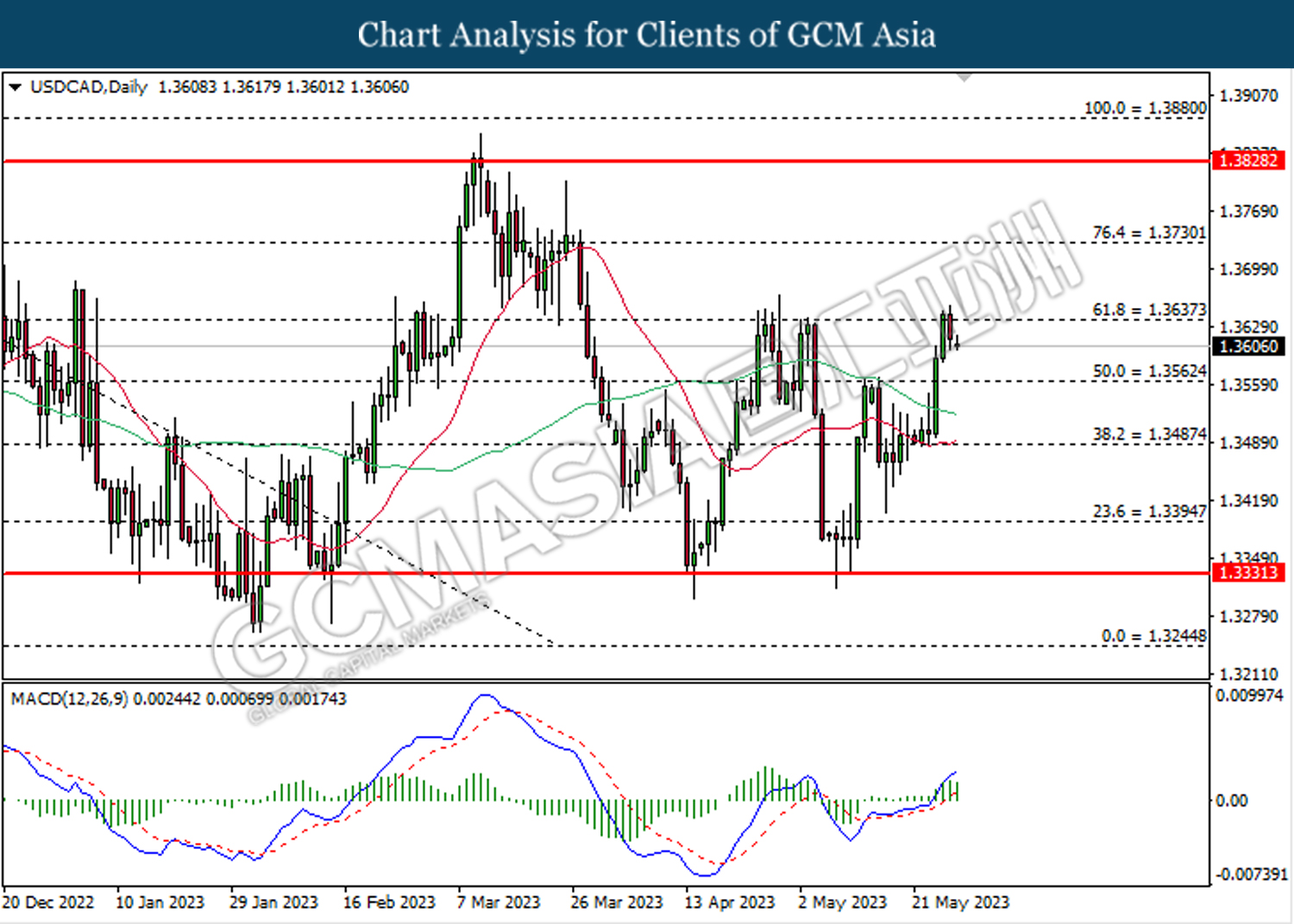

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3635. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

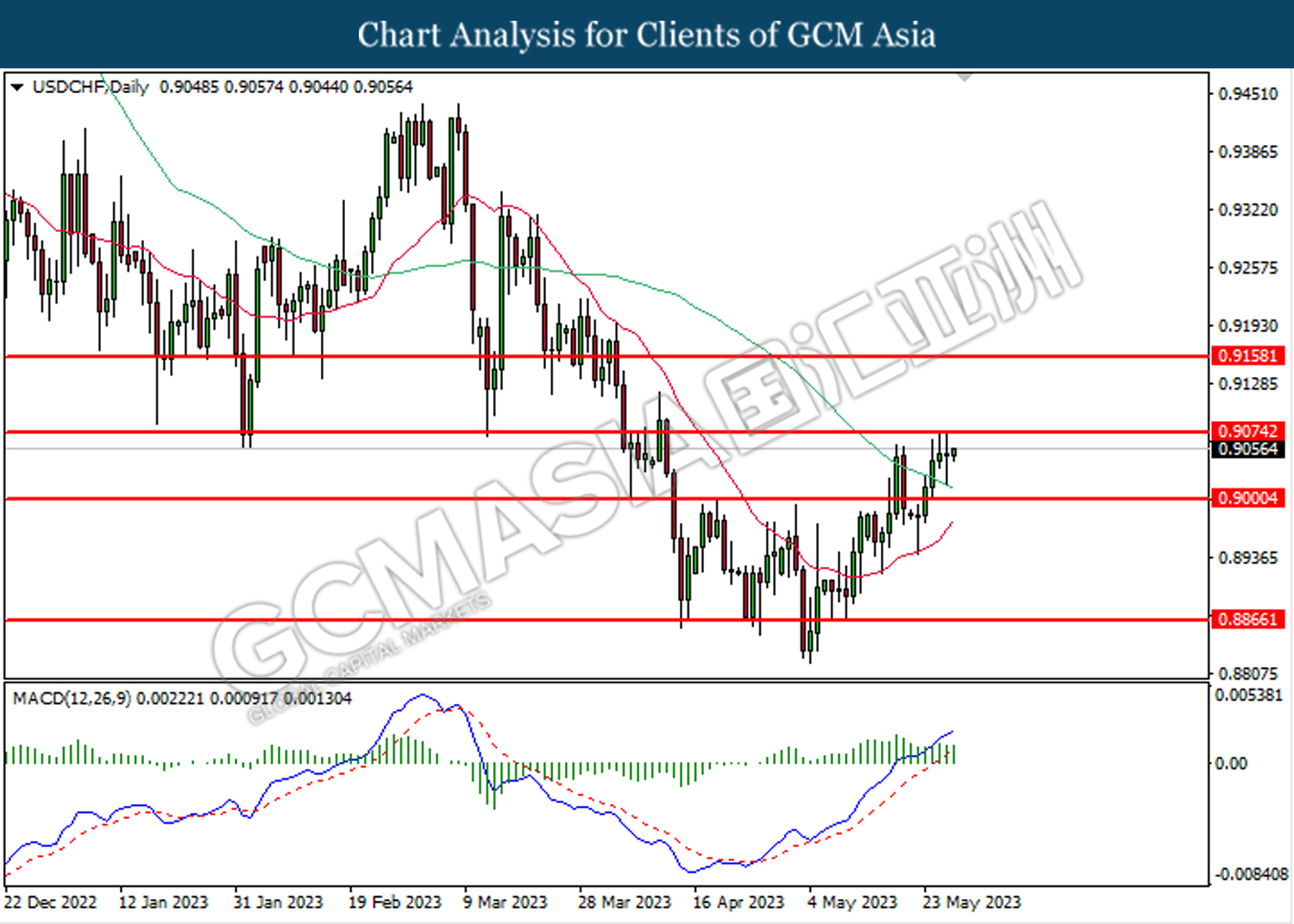

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9075. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the upward trend line. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

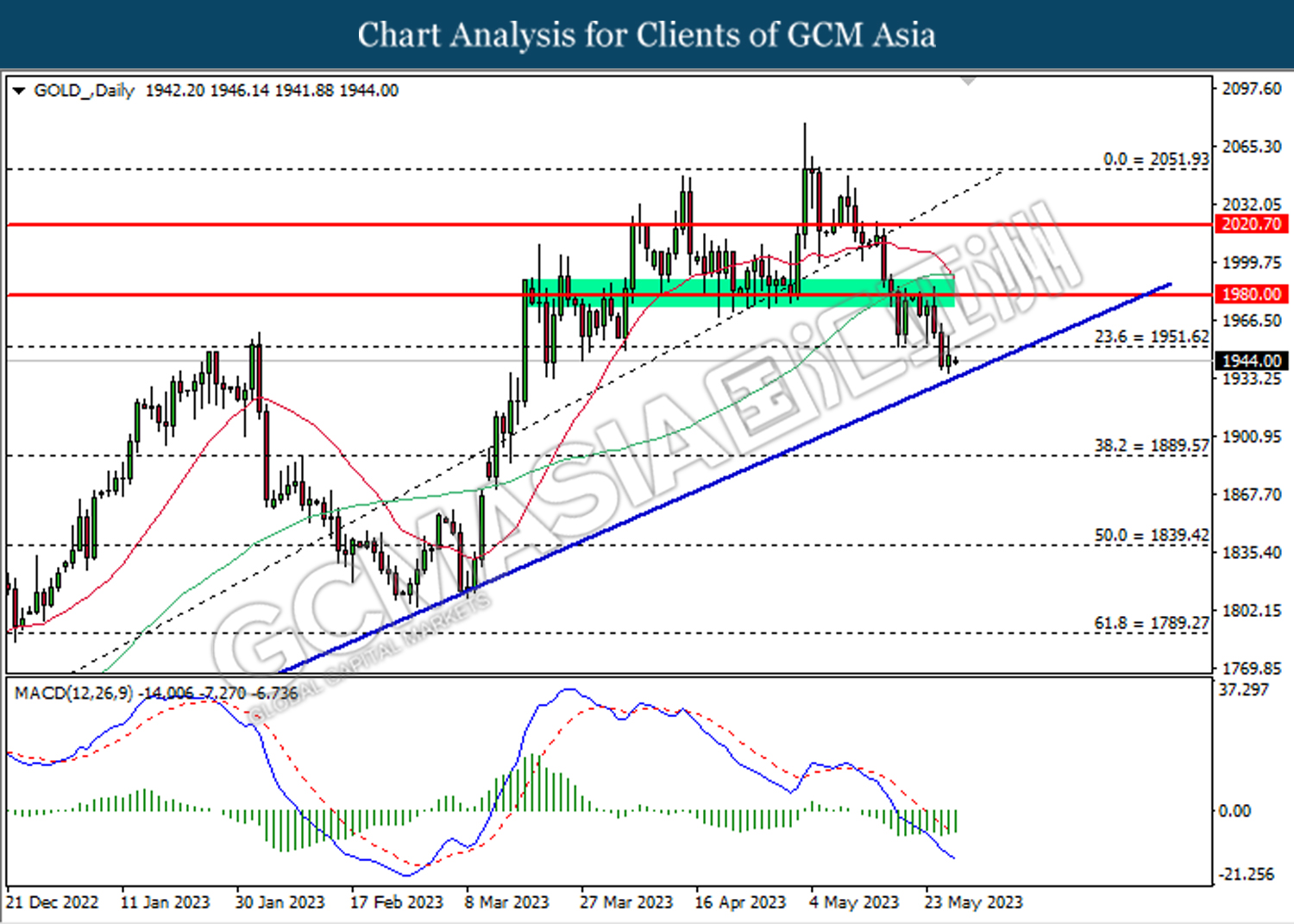

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1951.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the upward trend line.

Resistance level: 1951.60, 1980.00

Support level: 1889.55, 1839.40