29 June 2020 Morning Session Analysis

Pound slumped amid risk-off sentiment.

Pound Sterling slumped on last Friday, reaching its lowest level in almost month amid Brexit uncertainty had weighed on the demand of the currency. Besides, the unstoppable accelerating of the coronavirus infections had also stoked a shift in sentiment toward the safe-haven asset such as US Dollar, spurring further selloff for the riskier currency such as Pound Sterling. According to Reuters, the European Union negotiator Michel Barnier claimed that the UK and EU have not yet achieved any consensus with regards of the post-Brexit deal, which dimming the outlook for the trade relationship between both countries. Moreover, the fear of the second wave of the coronavirus infections remained amid the death toll from COVID-19 reached half a million people on Sunday. As for now, the coronavirus had killed more than 500,000 fatalities while more than 10 million people had been infected by the coronavirus. Meanwhile, more than 4,700 people are dying every 24 hours due to coronavirus infections, according to Reuters calculation based on an average from 1st to 27th June. Nonetheless, investors at this time will continue to remain focus on the development with regards of the coronavirus and Brexit issues in order to gauge the likelihood movement for the currency. As of writing, the GBP/USD depreciated by 0.09% to 1.2341.

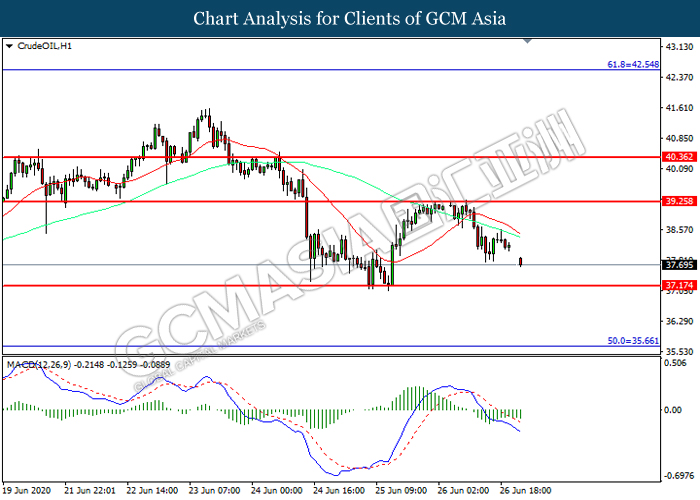

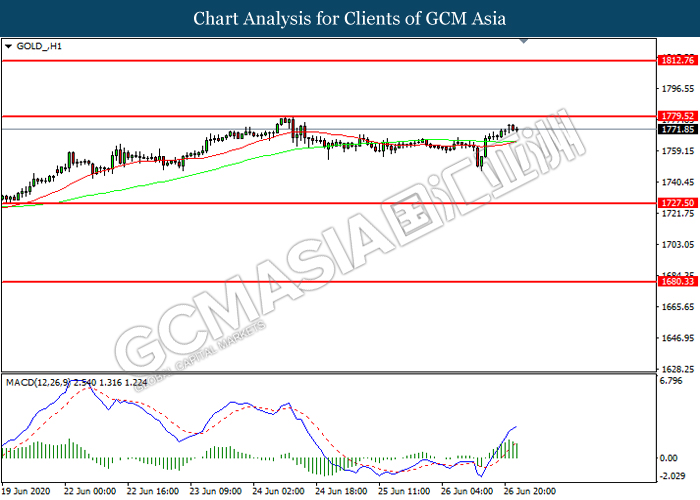

In the commodities market, the crude oil price slumped 0.25% to $37.72 per barrels as of writing. The oil market edged lower as investors remained cautious over the second wave of the coronavirus. On the other hand, the gold market appreciated by 0.09% to $1772.88 per troy ounces as of writing amid diminishing risk appetite in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Pending Home Sales MoM | -21.8% | 19.7% | – |

Technical Analysis

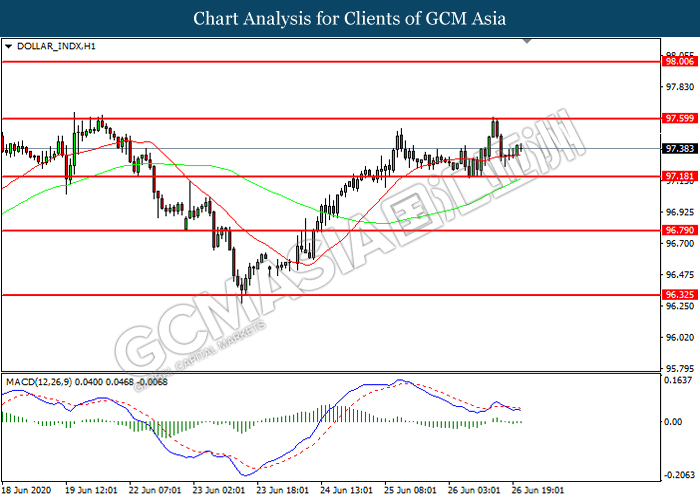

DOLLAR_INDX, H1: Dollar index was traded lower following prior retracement from the resistance level at 97.60. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 97.60, 98.00

Support level: 97.20, 96.80

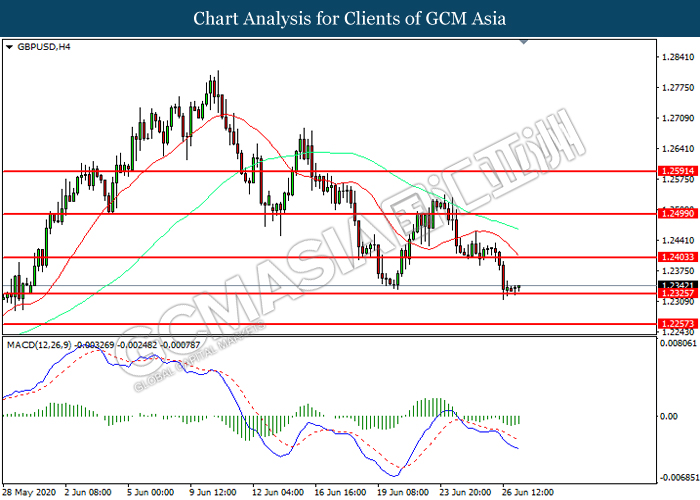

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2325. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2405, 1.2500

Support level: 1.2325, 1.2255

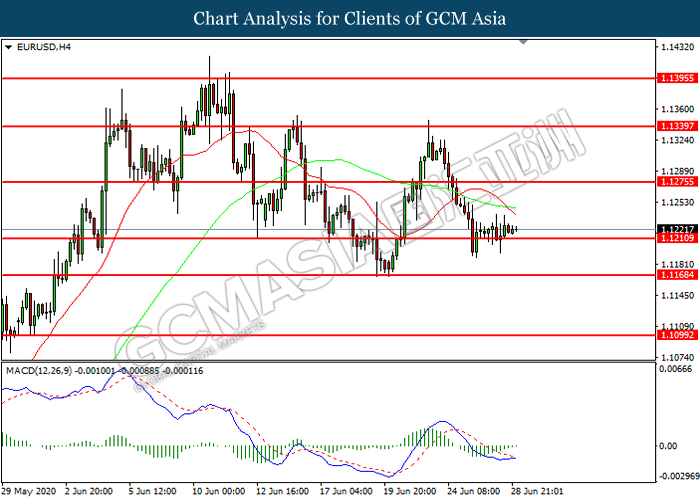

EURUSD, H4: EURUSD was traded within a range while currently testing the support level at 1.1210. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1275, 1.1340

Support level: 1.1210, 1.1170

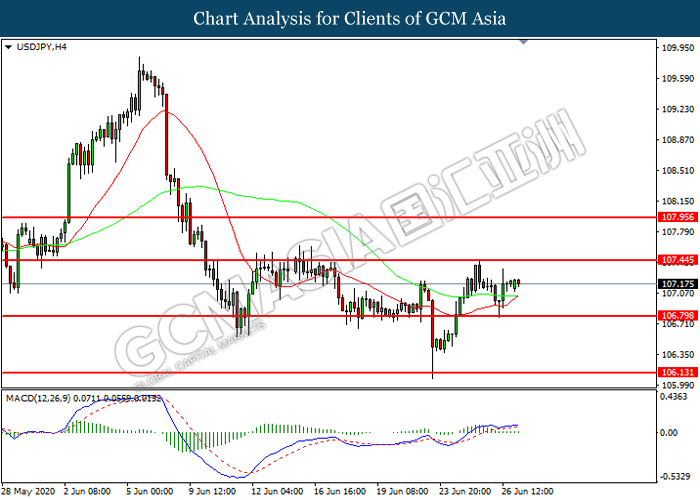

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 106.708. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 107.45, 107.95

Support level: 106.80, 106.15

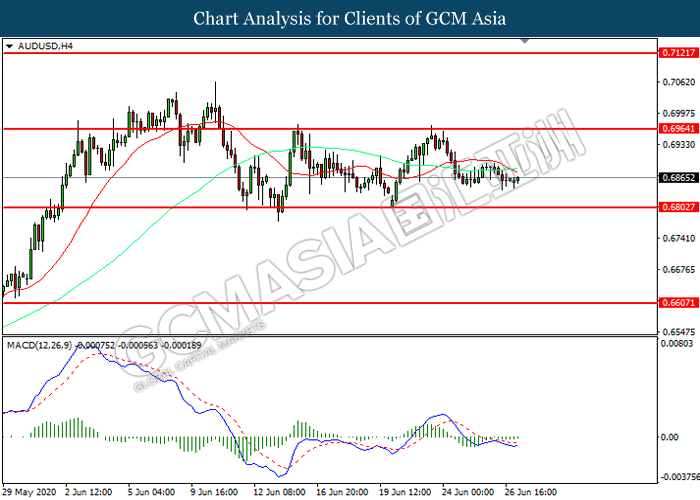

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.6965. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6965, 0.7120

Support level: 0.6805, 0.6605

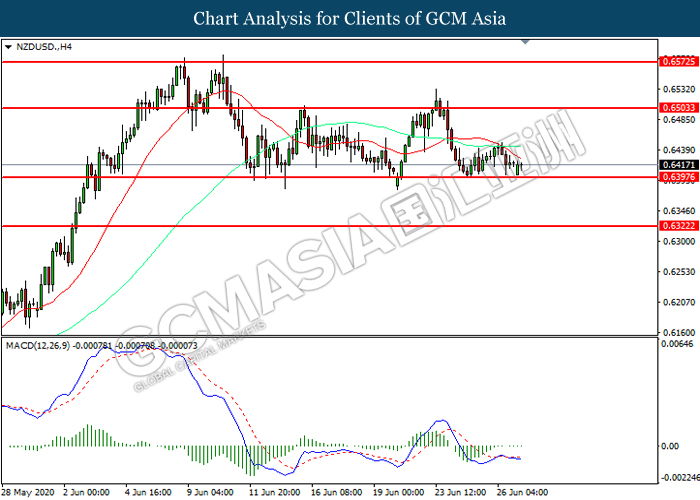

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6395. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6505, 0.6575

Support level: 0.6395, 0.6320

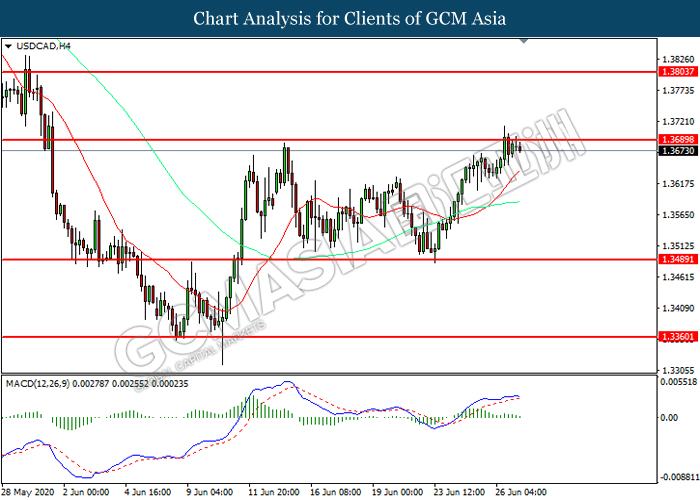

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3690. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3690, 1.3805

Support level: 1.3490, 1.3360

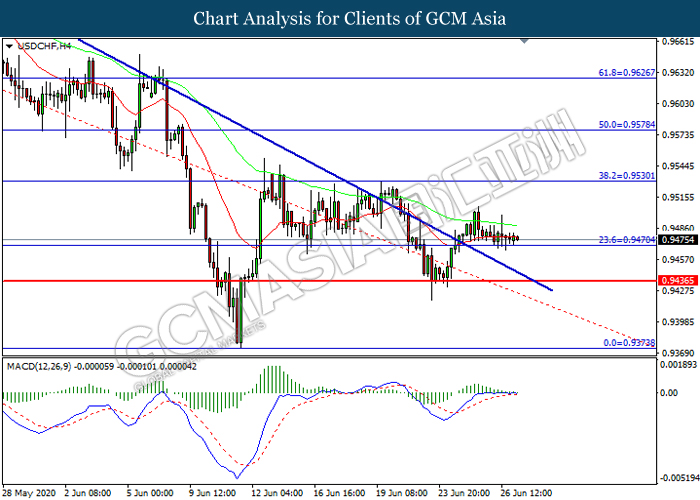

USDCHF, H4: USDCHF was traded within a range while currently testing the support level at 0.9470. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9580

Support level: 0.9470, 0.9435

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 39.25. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 37.15.

Resistance level: 39.25, 40.35

Support level: 37.15, 35.65

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1779.50. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1779.50, 1812.75

Support level: 1727.50, 1680.35