29 June 2022 Afternoon Session Analysis

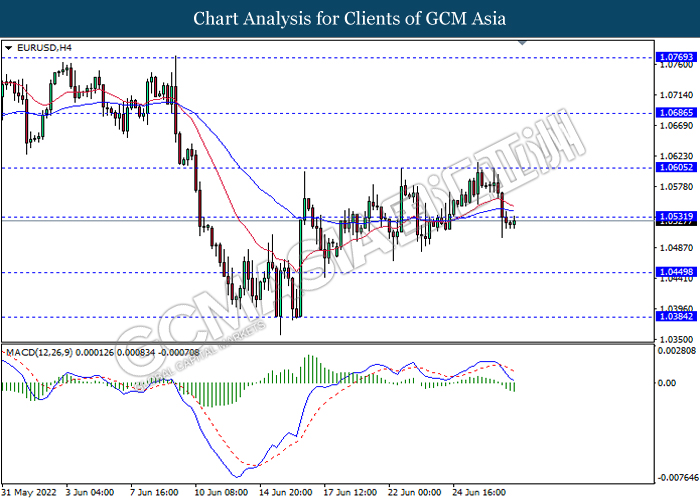

EURUSD slumped after the speech of ECB President.

The EURUSD retreated from its overnight gains after European Central Bank (ECB) President Lagarde release her speech. According to her speech, she emphasized that the rising commodities price such as crude oil was the main factor to cause inflation risk in Euro area. As Europe was large dependent on the commodities, the war-driven inflation had led to the soaring import cost in Europe while it brought negative prospects toward the economic progression in Europe region. Besides, Euro extended it losses following the hawkish tone from New York Federal Reserve President John Williams, which prompting investors to shift their capitals toward US Dollar which having better prospects. At this juncture, investors would continue to focus on the latest updates with regards of ECB President’s speech tonight in order to gauge the likelihood movement of EURUSD. As of writing, EURUSD appreciated by 0.10% to 1.0528.

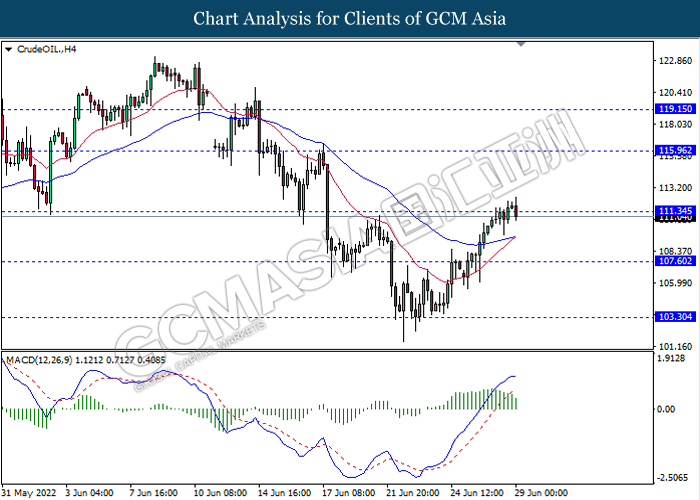

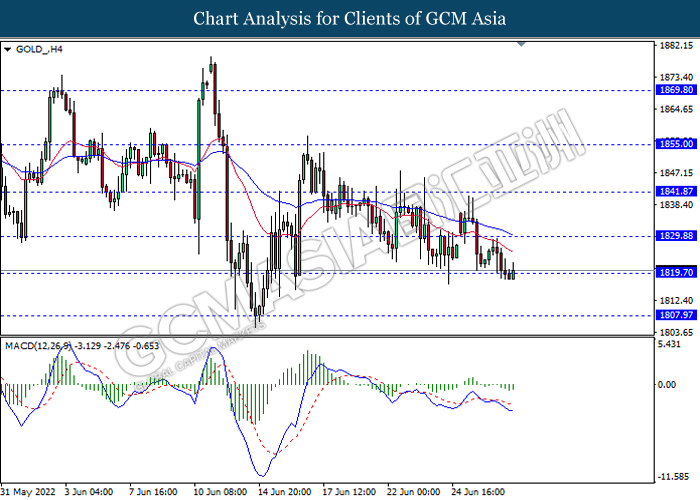

In the commodities market, crude oil price eased by 0.66% to $111.01 per barrel as of writing. Nonetheless, the overall trend of oil price remained bullish over the global supply tightness, where there is limited room for major producers such as Saudi Arabia to boost production. On the other hand, gold price appreciated by 0.02% to $1821.70 per troy ounce as of writing after a sharp decline throughout the overnight session amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 USD Fed Chair Powell Speaks

21:00 EUR ECB President Lagarde Speaks

21:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | -1.5% | -1.5% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.956M | – | – |

Technical Analysis

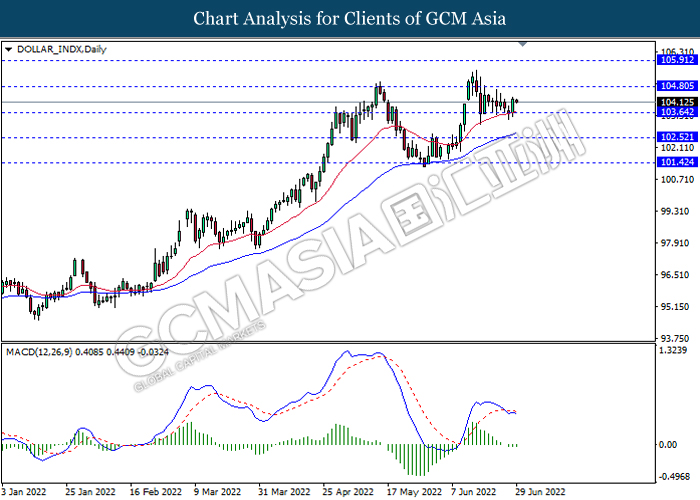

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

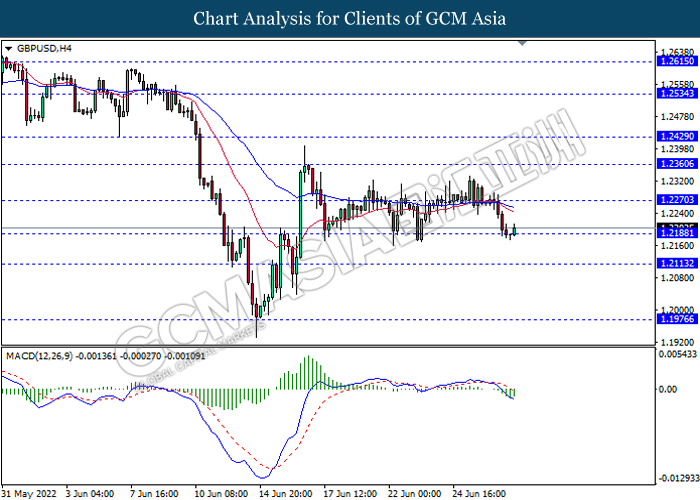

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2270, 1.2360

Support level: 1.2190, 1.2115

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0530, 1.0605

Support level: 1.0450, 1.0385

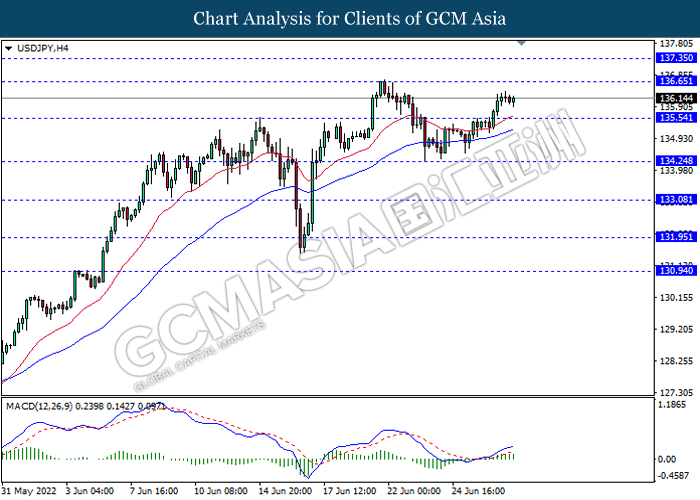

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 136.65, 137.35

Support level: 135.55, 134.25

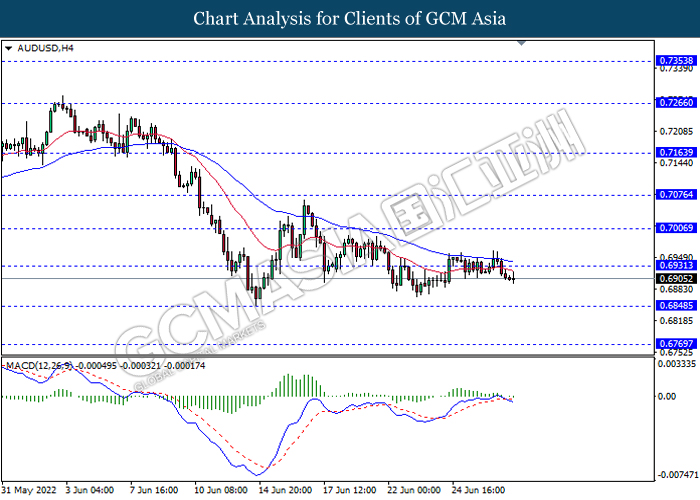

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

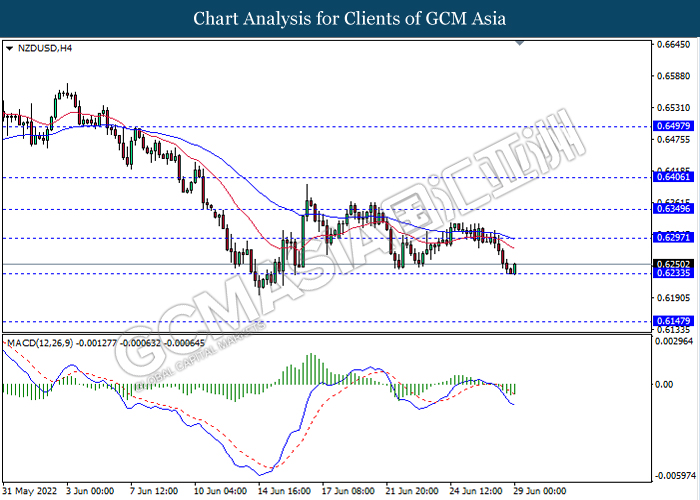

NZDUSD, H4: NZDUSD was traded higher following prior rebound form the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6145

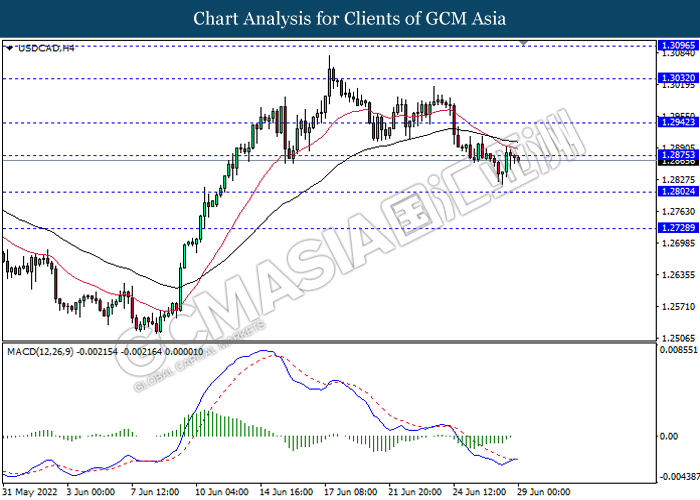

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

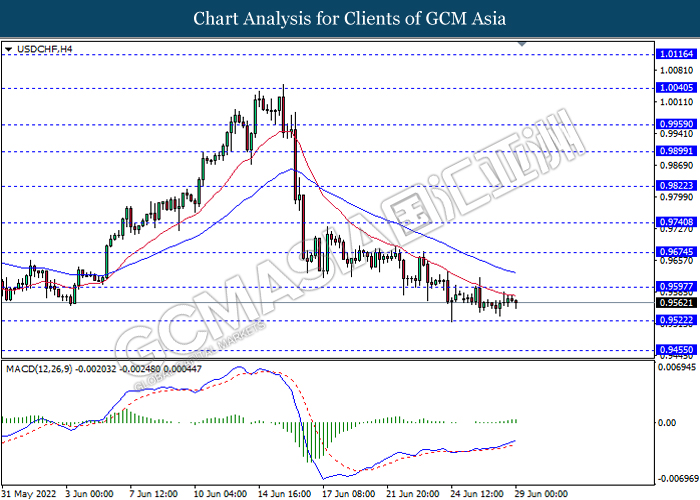

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 111.35, 115.95

Support level: 107.60, 103.30

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1829.90, 1841.85

Support level: 1819.70, 1807.95