29 June 2022 Morning Session Analysis

US Dollar surged amid hawkish expectation from Fed.

The Dollar Index which traded against a basket of six major currencies rebounded significantly yesterday over the backdrop of risk-off sentiment amid the global recession risk as well as hawkish sentiment from Federal Reserve continue to linger in the global financial market. Yesterday, Federal Reserve policymakers vowed for further rapid rate hike in July meeting in order to bring down the spiking inflation risk, triggering tensions over the economic growth as higher borrowing costs would trigger a steep downturn. Earlier, the Federal Reserve implemented the biggest rate hike since 1998 to a range of 1.5% – 1.75% to combat the 40-year high inflation. Meanwhile, they also reiterated that another 75 basis-point rate hike during the next month will be warranted. Meanwhile, New York Federal Reserve Bank President John Williams also claimed that he sees the need to act appropriately to stabilize the inflation rate. On the economic data front, US CB Consumer Confidence notched down significantly from the previous reading of 103.2 to 98.7, missing the market forecast at 100.4. As of writing, the Dollar Index appreciated by 0.535 to 104.50.

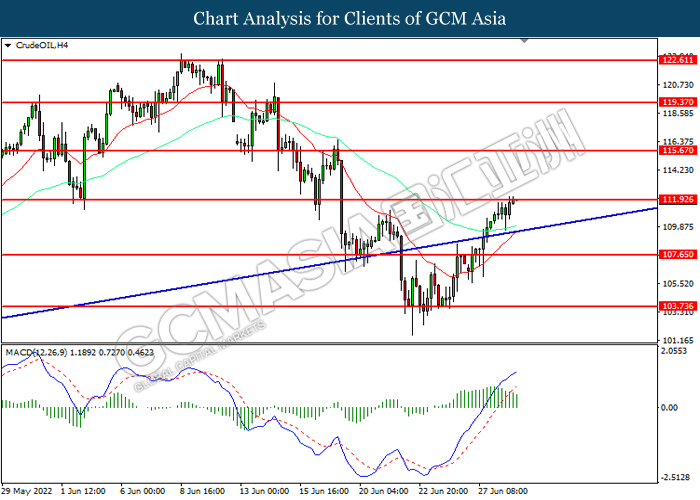

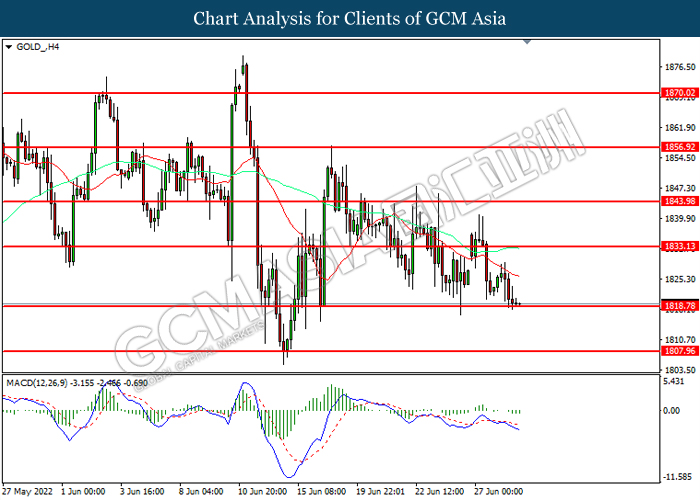

In the commodities market, the crude oil price surged 0.03% to $111.95 per barrel as of writing. The crude oil price extends its gains over the backdrop of positive inventory data. According to American Petroleum Institute (API), US API Weekly Crude Oil Stock came in at -3.799M, lower than the market forecast -0.110M. On the other hand, the gold price slumped 0.03% to $1818.80 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 USD Fed Chair Powell Speaks

21:00 EUR ECB President Lagarde Speaks

21:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | -1.5% | -1.5% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.956M | – | – |

Technical Analysis

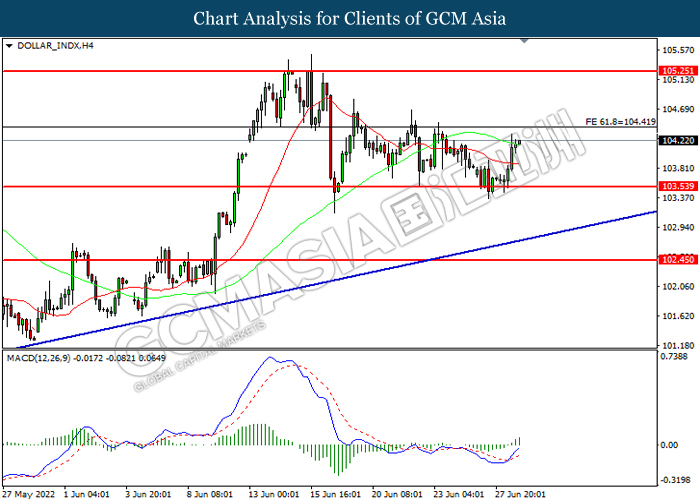

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 104.40, 105.25

Support level: 103.55, 102.45

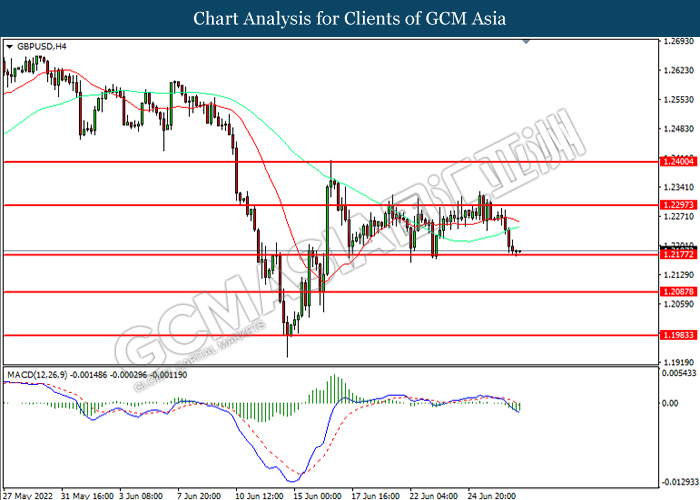

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2295, 1.2400

Support level: 1.2175, 1.2085

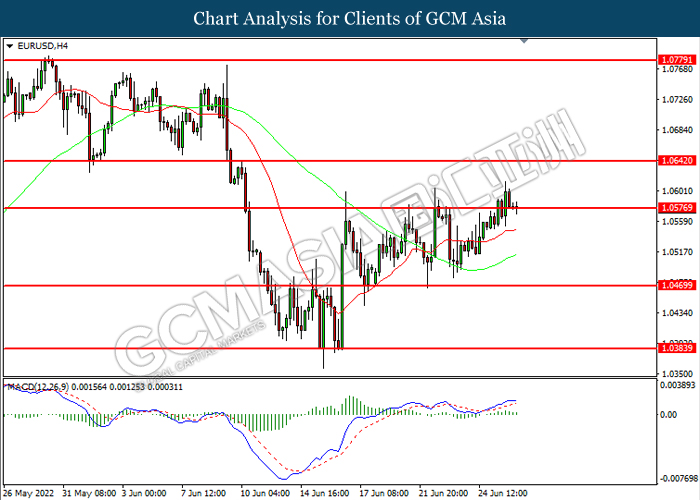

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0575, 1.0640

Support level: 1.0470, 1.0385

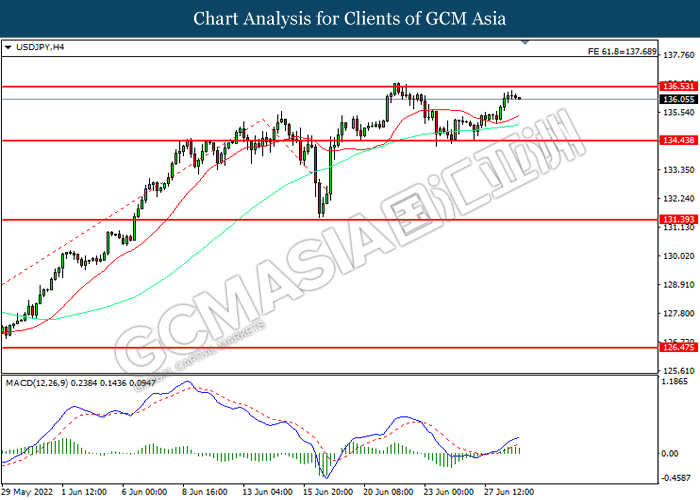

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 136.55, 137.70

Support level: 134.45, 131.40

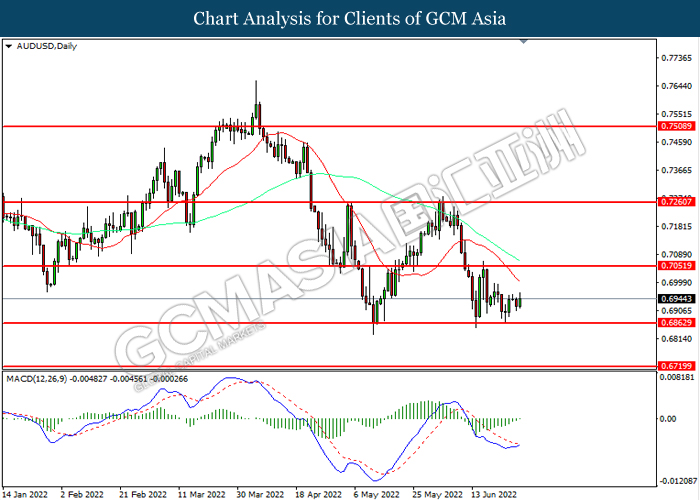

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7050, 0.7165

Support level: 0.6865, 0.6720

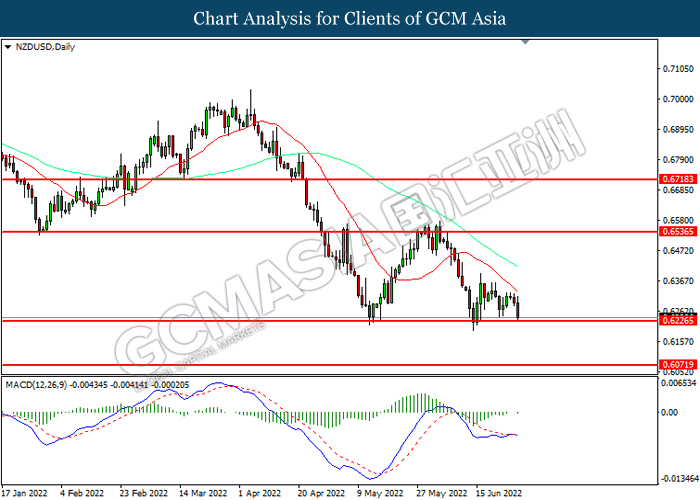

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

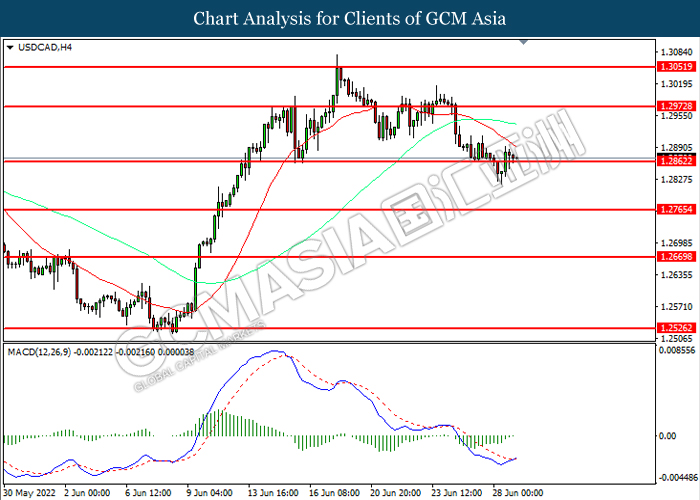

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

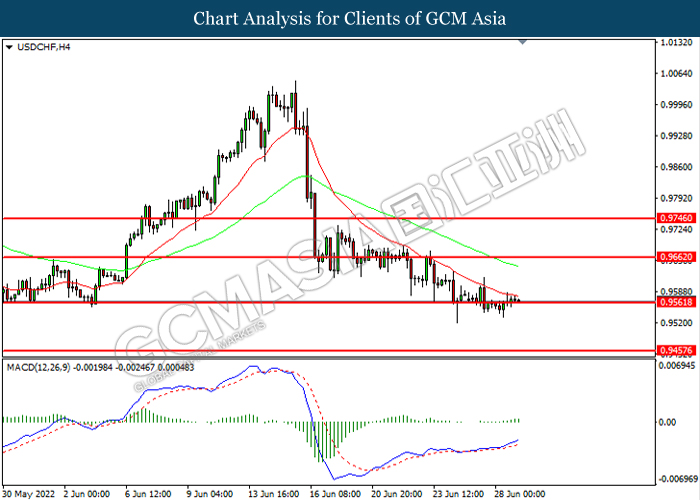

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9660, 0.9745

Support level: 0.9560, 0.9460

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 111.95, 115.65

Support level: 107.65, 103.75

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1833.15, 1844.00

Support level: 1818.80, 1807.9 5