29 July 2020 Afternoon Session Analysis

Aussie rose following upbeat CPI data.

The Aussie dollar which traded against the greenback and other currency pairs have regain some support and appreciated after the positive release of CPI. According to the Australian Bureau of Statistics, the consumer price index based on quarterly basis have improved to -1.9%, slightly better than market expectation with the reading of -2%. Meanwhile, the annualized figure also came it at -0.3% which is also beating market expectation of -0.4%. At the same time, the momentum was also supported by the weakness in greenback as US dollar fails to regain buyer’s confidence. As of now, trader continue to doubt the U.S policymakers will be able to sign the phase 4 coronavirus stimulus package. The scepticism was confirmed further by U.S House Speaker Nancy Pelosi which she stated that both Republicans and opposition Democrats are still far apart in reaching any deal. At the time of writing, AUD/USD rose 0.15% to 0.7168 while dollar index slips 0.03% to 93.58.

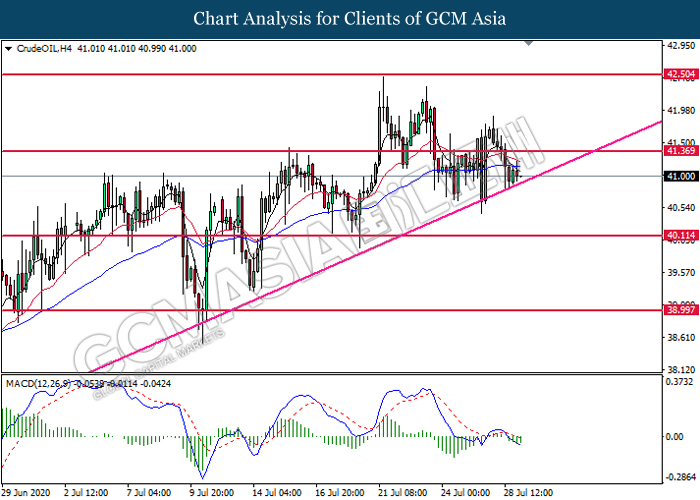

In the commodities market, crude oil price fell 0.04$ to $40.98 per barrel as of writing amid demand concerns continue to weigh. Earlier on, positive inventory data from the API have help the commodity to regain some support. However, the momentum was short-lived as market remains concerned over demand outlook due to raging COVID-19 pandemic, thus limiting the upside of the commodity. On the other hand, gold price jumps 0.11% to $1953.35 a troy ounce at the time of writing following ongoing weakness in the greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Pending Home Sales (MoM) (Jun) | 44.3% | 15.3% | – |

| 22:30 | CrudeOIL – EIA Crude Oil Inventories | 4.892M | -2.088M | – |

| 02:00

(30th) |

USD – Fed Interest Rate Decision | 0.25% | 0.25% |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 93.35. MACD which illustrate bearish bias momentum signal suggest the dollar to extend its losses after it successfully breakout below the support level.

Resistance level: 94.40, 95.00

Support level: 93.35, 92.30

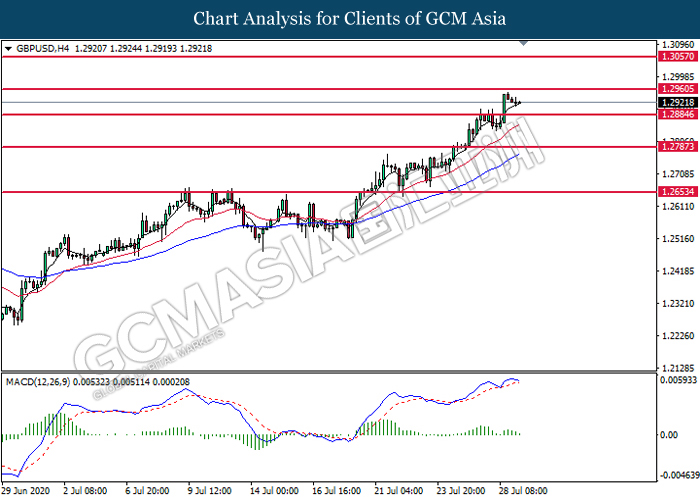

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2960. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 1.2885.

Resistance level: 1.2960, 1.3055

Support level: 1.2885, 1.2785

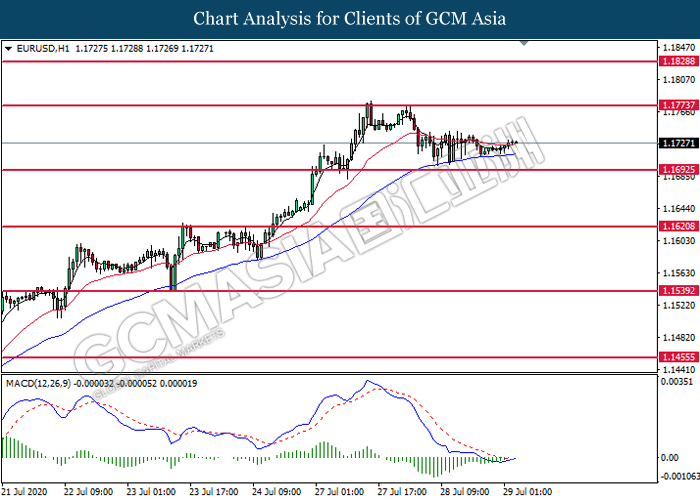

EURUSD, H1: EURUSD was traded higher following prior rebound from the support level at 1.1695. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1775.

Resistance level: 1.1775, 1.1830

Support level: 1.1695, 1.1620

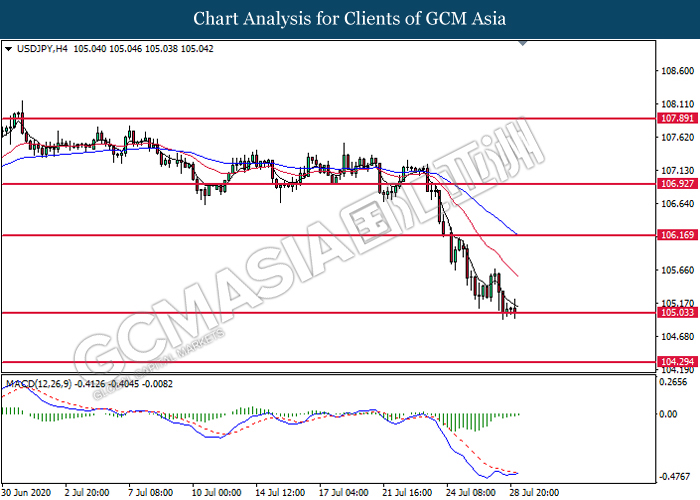

USDJPY, H4: USDJPY was traded lower while currently testing near the support level at 105.05. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to undergo technical correction toward the higher level.

Resistance level: 106.15, 106.95

Support level: 105.05, 104.30

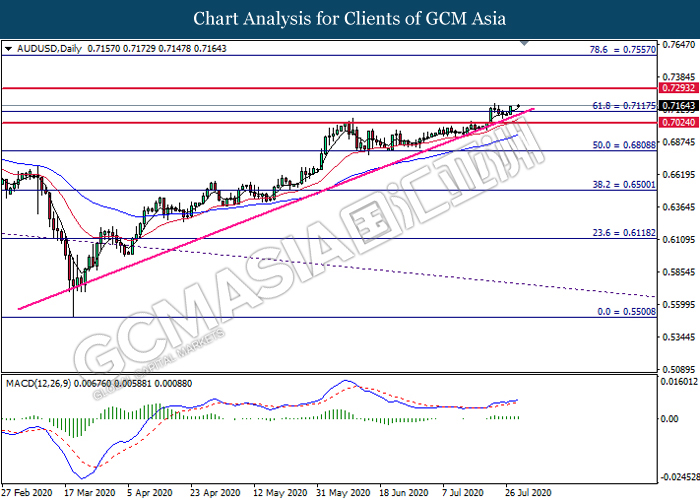

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7115. MACD which illustrate bullish momentum signal suggest the pair to extend its after toward the resistance level at 0.7295.

Resistance level: 0.7295, 0.7555

Support level: 0.7115, 0.7025

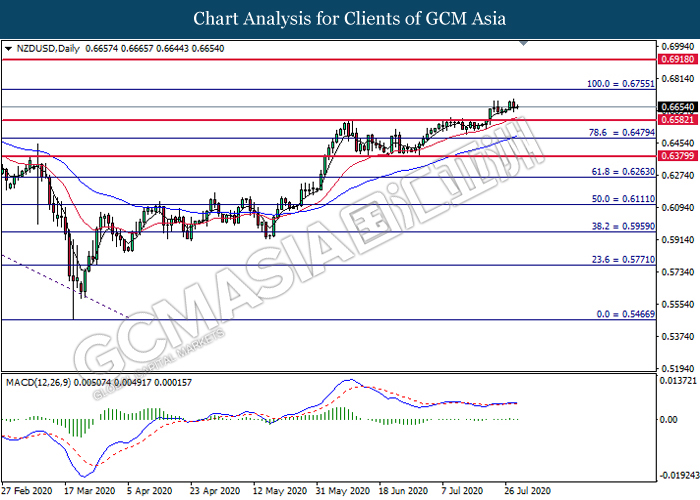

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6580. Due to lack of signal, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 0.6755, 0.6920

Support level: 0.6580, 0.6480

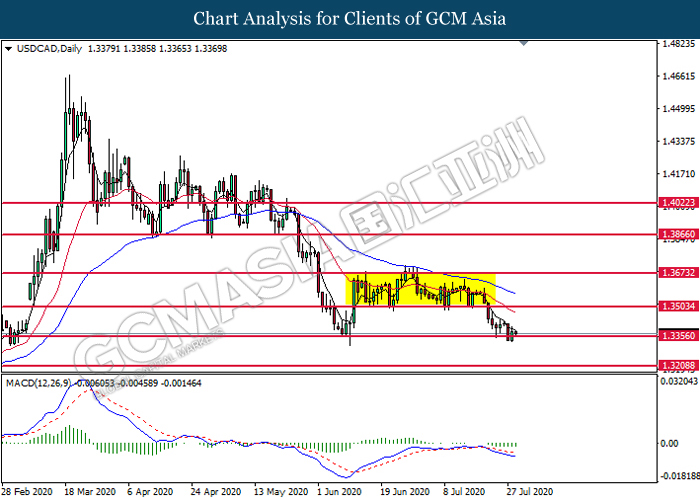

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3355. MACD which illustrate bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.3355.

Resistance level: 1.3505, 1.3675

Support level: 1.3355, 1.3210

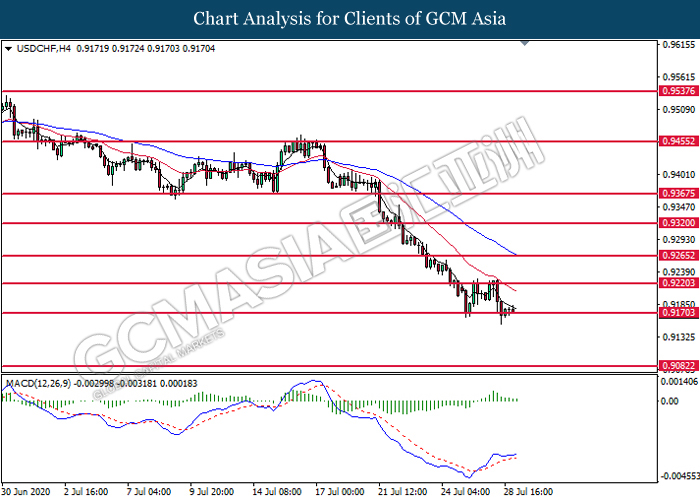

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9170. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses after it successfully breakout below the support level at 0.9170.

Resistance level: 0.9220, 0.9265

Support level: 0.9170, 0.9080

CrudeOIL, H4: Crude oil price was traded lower while currently testing the upward trend line. MACD which illustrate bearish bias momentum signal suggest the commodity to extend its losses after it successfully breakout below the trend line.

Resistance level: 41.35, 42.50

Support level: 40.10, 39.00

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1931.20. However, MACD which illustrate bearish bias momentum signal suggest the commodity to undergo technical correction toward the support level at 1931.20.

Resistance level: 1977.60, 2006.40

Support level: 1931.20, 1900.50