29 July 2020 Morning Session Analysis

US Dollar fall over the U.S. economic worries.

The dollar index which gauge its value against a basket of six major currencies slumped over the backdrop of negative economic data from the United States on yesterday. According to Conference Board, the U.S. CB Consumer Confidence notched down significantly from the preliminary reading of 98.3 to 92.6, missing the market forecast at 94.5, which dialling down the market optimisms toward the economic progression from the Untied States. Besides, the US Dollar extend its losses following the US coronavirus cases have passed 4.3 million, with nearly 150,000 people killed in the country by the virus. The spiked of the coronavirus infections from the United States had prompted some U.S. states to roll back reopening measures, which causing tens of millions of people out of work. Nonetheless, investors would scrutinize the latest updates with regards of the latest monetary and fiscal stimulus from the Federal Reserve in order to receive further trading signals. Against the backdrop of the rising coronavirus cases that threaten the economic outlook, investors expected the Federal Reserve could opt for a more dovish tone during the FOMC meeting. As of writing, the Dollar index appreciated by 0.06% to 93.65.

In the commodities market, the crude oil price appreciated by 0.24% to $41.07 per barrel as of writing following the positive oil inventory data was released. According to American Petroleum Institute (API), the U.S. API Weekly Crude Oil Stock had declined significantly from the previous reading of 7.544M to -6.829M, lower than the market forecast at -1.200M while spurring positive prospect for the future demand of this black-commodity. On the other hand, the gold price appreciated by 0.11% to $1956.40 per troy ouns as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Pending Home Sales (MoM) (Jun) | 44.3% | 15.3% | – |

| 22:30 | CrudeOIL – EIA Crude Oil Inventories | 4.892M | -2.088M | – |

| 02:00

(30hb) |

USD – Fed Interest Rate Decision | 0.25% | 0.25% |

Technical Analysis

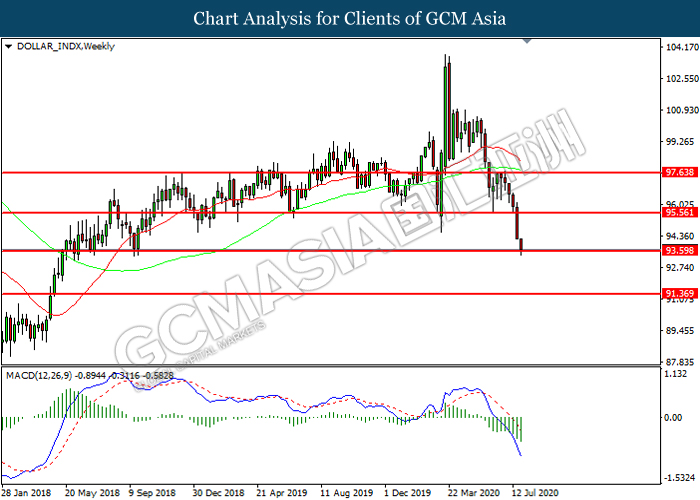

DOLLAR_INDX, Weekly: Dollar index was traded lower while currently testing the support level at 93.60. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 95.55, 97.65

Support level: 93.60, 91.35

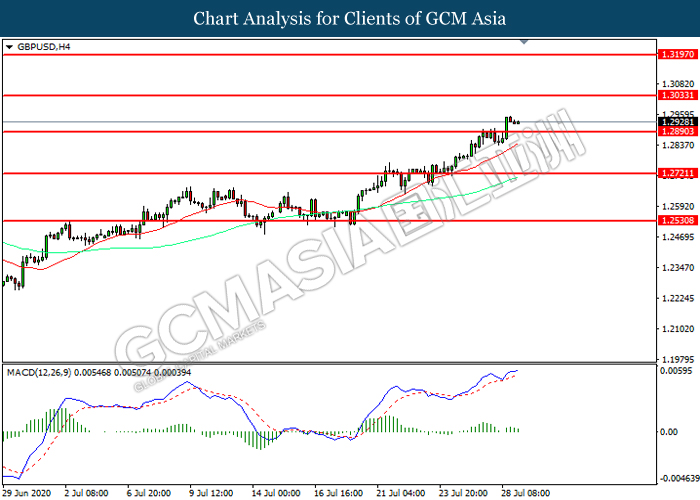

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2890. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3035, 1.3195

Support level: 1.2890, 1.2720

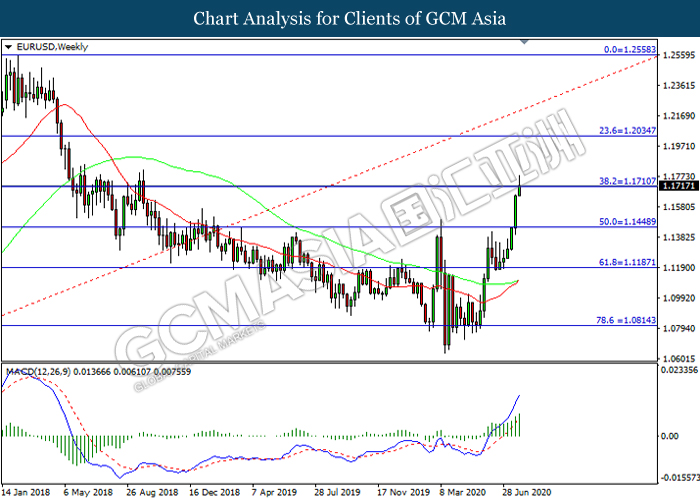

EURUSD, Weekly: EURUSD was traded higher while currently testing the resistance level at 1.1710. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.1710.

Resistance level: 1.1710, 1.2035

Support level: 1.1450, 1.1185

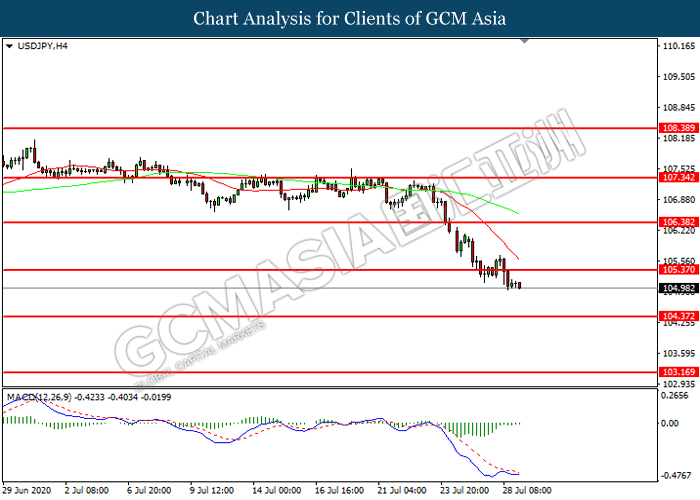

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 105.35. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 105.35, 106.40

Support level: 104.35, 103.15

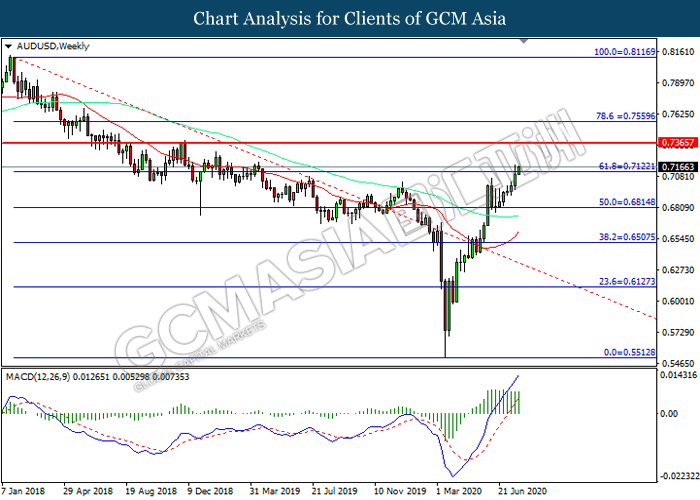

AUDUSD, Weekly: AUDUSD was traded higher while currently testing the resistance level 0.7120. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7120, 0.7365

Support level: 0.6815, 0.6505

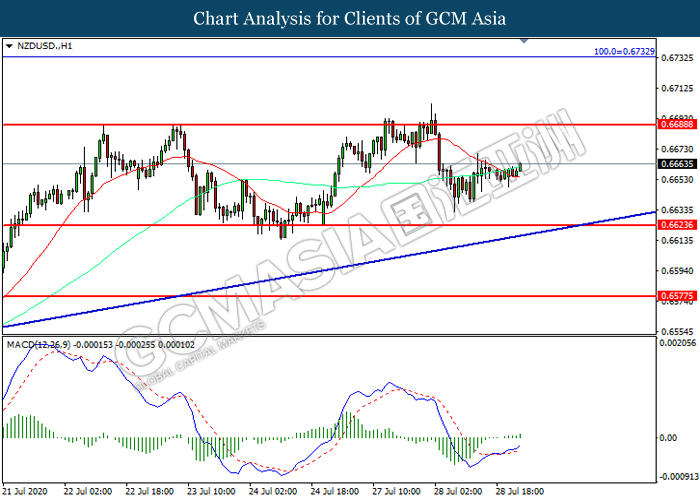

NZDUSD, H1: NZDUSD was traded higher following prior rebound from the support level at 0.6625. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6690.

Resistance level: 0.6690, 0.6735

Support level: 0.6625, 0.6575

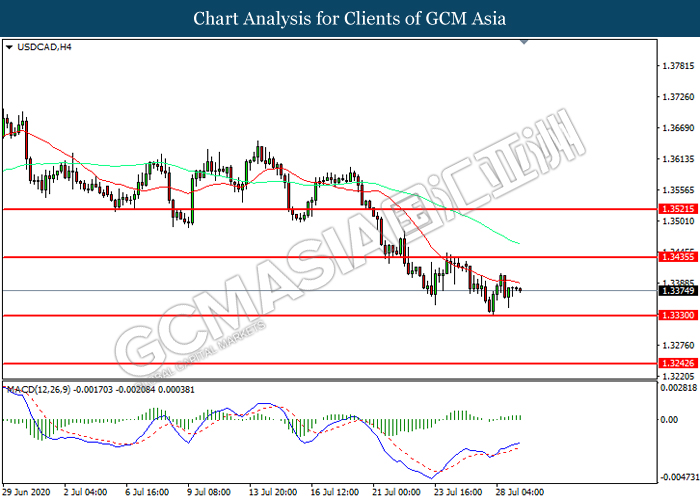

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3330. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3435.

Resistance level: 1.3435, 1.3520

Support level: 1.3330, 1.3245

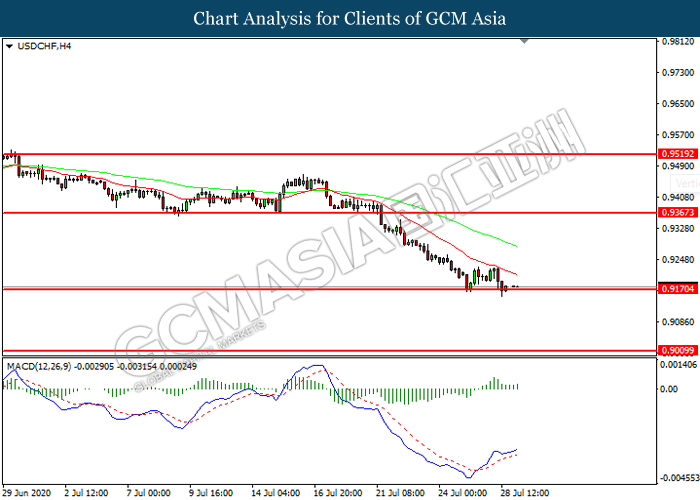

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9170. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9365, 0.9520

Support level: 0.9175, 0.9010

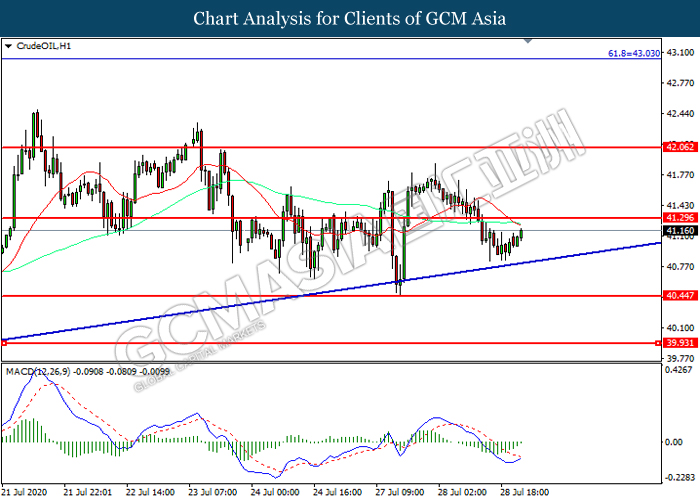

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the upward trend line. MACD which illustrated increasing diminishing bearish momentum suggest the commodity to be traded higher toward resistance level at 41.30.

Resistance level: 41.30, 42.05

Support level: 40.45, 39.95

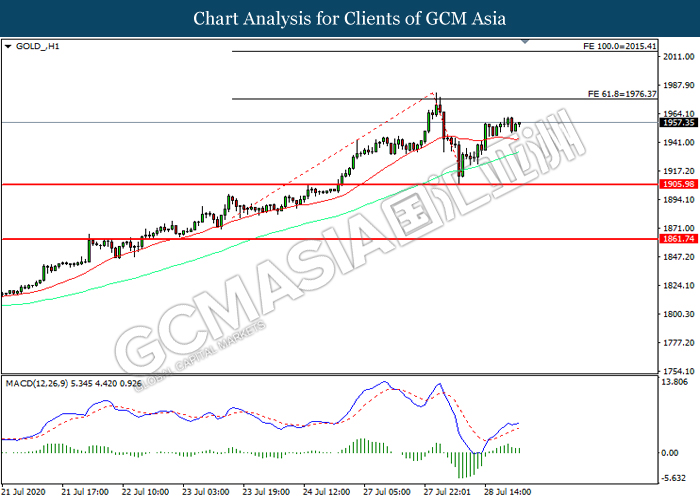

GOLD_, H1: Gold price was traded higher following prior rebound from the support level at 1906.00. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1976.35, 2015.40

Support level: 1906.00, 1861.75