29 October 2020 Afternoon Session Analysis

Dollar soars amid U.S election uncertainty, COVID-19

During late Asian session, the U.S dollar which traded against a basket of six major currency pairs have skyrocketed as safe-haven demand boosted by worsening COVID-19 and uncertainty towards upcoming U.S election. As of now, former Vice President, Joe Biden continue to lead in the polls over President Donald Trump which led traders to cautiously bet on his victory and a “blue wave” outcome where Democrats controlled both chambers of Congress. Despite that, Donald Trump is also seen catching up in some part of swing states which could slowly even the playing field and become a close battle. With U.S election just day away, the uncertainty remains in the market until the results is out, thus support the demand for safe-haven. At the same time, worsening COVID-19 conditions also help boosting the demand as massive second wave coronavirus continue to threaten Europe. At the time of writing, dollar index rose 0.03% to 93.38.

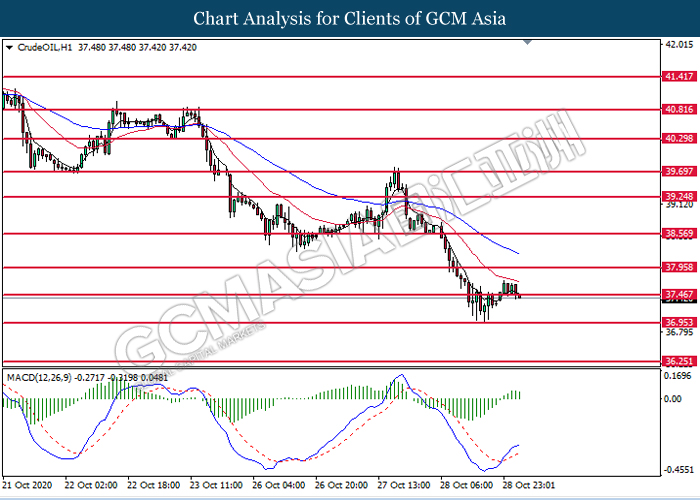

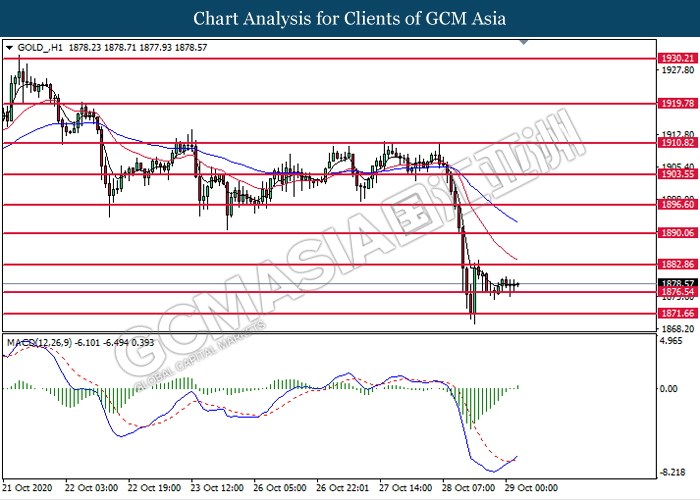

In the commodities market, crude oil price rose extend losses and plunged 0.19% to $37.44 per barrel at the time of writing as rising supply and weak demand overwhelmed market sentiment. On supply front, U.S crude oil stockpiles rose more than expected with the reading of 4.32 million increase compared to the expectation of 1.23 million. At the same time, surging cases in U.S and EU which prompted EU to re-impose lockdowns recently also continue to add into weak demand expectation, which further pressuring the commodity. On the other hand, gold price fell 0.09% to $1877.90 a troy ounce at the time of writing following dollar strength and ongoing liquidation of assets in order to prevent margin call.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Oct) | -8K | -5K | – |

| 20:30 | USD – GDP (QoQ) (Q3) | -31.5% | 31.9% | – |

| 20:30 | USD – Initial Jobless Claims | 787K | 775K | – |

| 20:45 | EUR – ECB Interest Rate Decision | 0.00% | – | – |

| 22:00 | USD – Pending Home Sales (MoM) (Sep) | 8.8% | 4.5% | – |

Technical Analysis

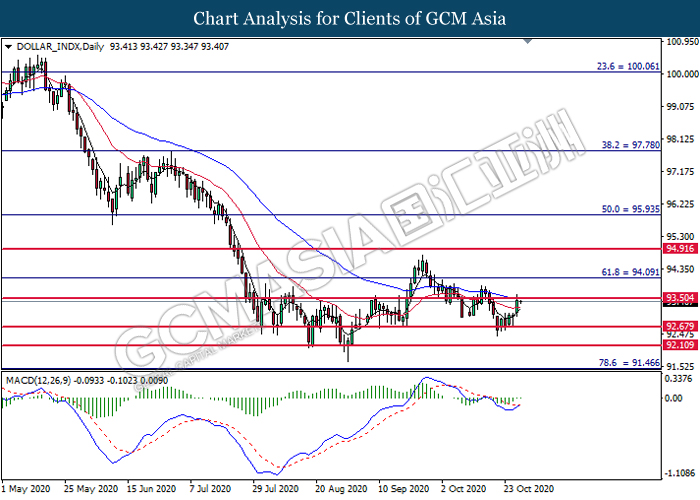

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 92.70. MACD which illustrate diminishing bearish momentum signal suggest the dollar to extend its gains toward the resistance level at 93.50.

Resistance level: 93.50, 94.10

Support level: 92.70, 92.10

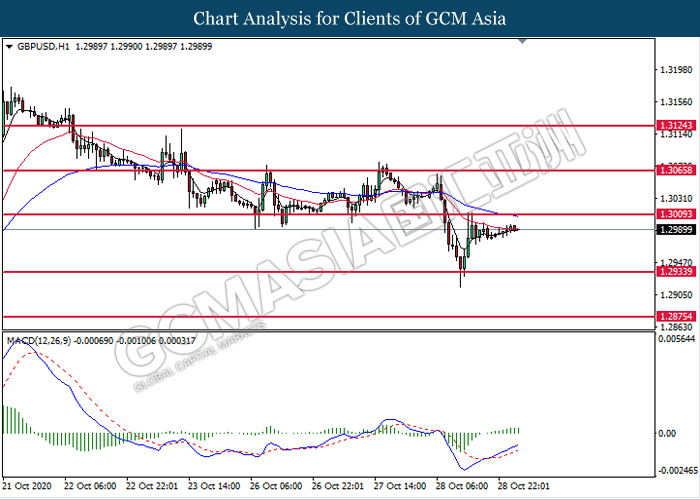

GBPUSD, H1: GBPUSD was traded higher following prior rebound from the support level at 1.2935. MACD which illustrates bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.3010.

Resistance level: 1.3010, 1.3065

Support level: 1.2935, 1.2875

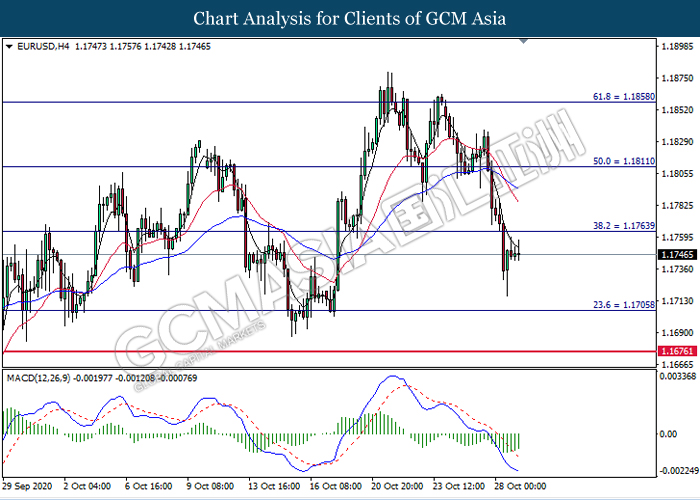

EURUSD, H4: EURUSD was traded higher following prior rebound from the lower level. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 1.1765.

Resistance level: 1.1765, 1.1810

Support level: 1.1705, 1.1675

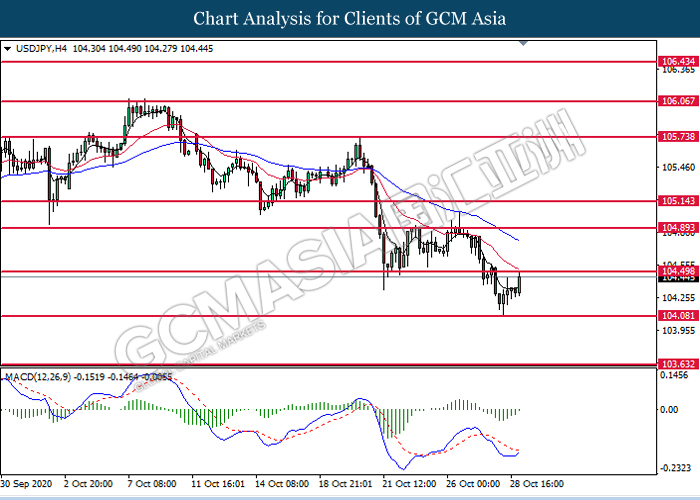

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 104.50. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 104.50.

Resistance level: 104.50, 104.90

Support level: 104.10, 103.65

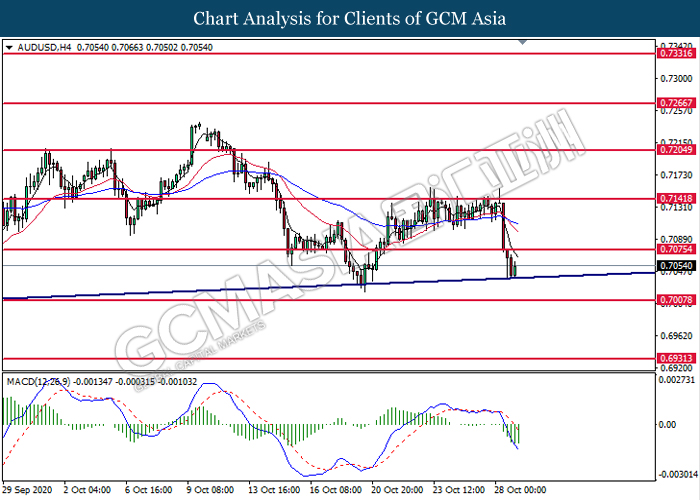

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the upward trend line. MACD which illustrate diminishing bearish momentum suggest the pair to undergo technical rebound toward the resistance level at 0.7075.

Resistance level: 0.7075, 0.7140

Support level: 0.7010, 0.6930

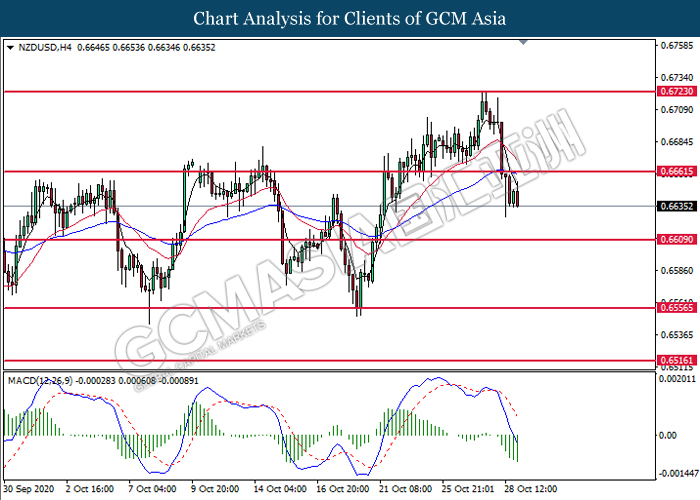

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level at 0.6660. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses toward the support level at 0.6610.

Resistance level: 0.6660, 0.6725

Support level: 0.6610, 0.6555

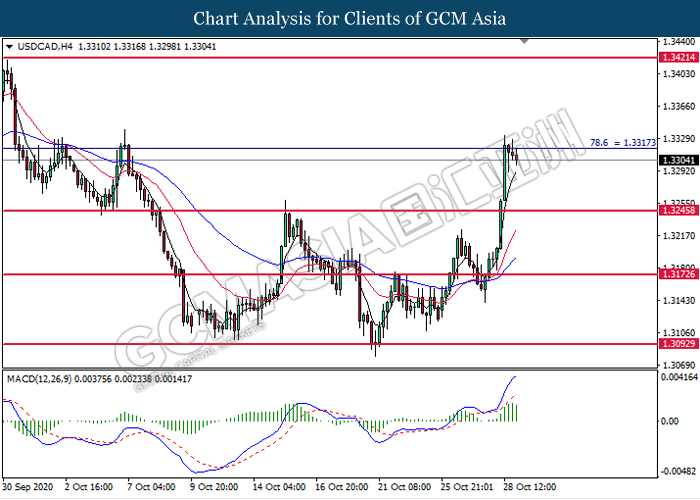

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.3315. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 1.3245.

Resistance level: 1.3315, 1.3420

Support level: 1.3245, 1.3175

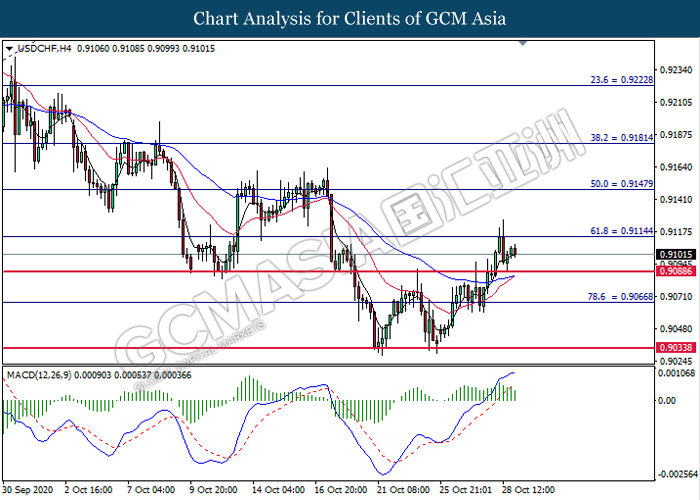

USDCHF, H4: USDCHF was traded lower following prior retracement from the higher level. MACD which display diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9090.

Resistance level: 0.9115, 0.9150

Support level: 0.9090, 0.9065

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level at 37.45. MACD which illustrate diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level at 37.45.

Resistance level: 37.95, 38.55

Support level: 37.45, 36.95

GOLD_, H1: Gold price was traded higher following prior rebound from the support level at 1876.55. MACD which illustrate bullish momentum suggest the commodity to extend its gains toward the resistance level at 1882.85.

Resistance level: 1882.85, 1890.05

Support level: 1876.55, 1871.65