29 October 2020 Morning Session Analysis

New lock-down measures, Euro dipped into 1-week low.

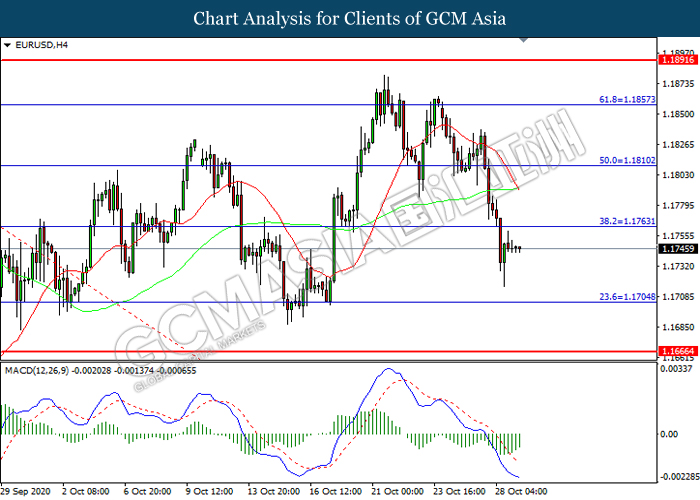

The pair of EUR/USD slumped significantly to one-week lows amid news of lockdowns in Germany and France in order to curb a sharp rise in Covid-19 infections, which dialled down the market optimism toward the economic progression from the European region while spurring bearish momentum on the currency. According to Reuters, Germany had decided to shut bars and restaurants for a month and France prepared to tighten controls on movement. Under the new French measures which come into force on Friday, people will be required to stay in their homes except to buy essential goods, seek medical attention or exercise for up to an hour a day. Besides, France’s employee will be permitted to go to work if their employers deem it impossible for them to do the job from home while the school will stay open. A series of new measures to fight the pandemic from the European region had prompted the world risky assets dive in to dip amid market participants expected that such measures would drive the global economy this year into its deepest recession in generations. As of writing, EUR/USD depreciated by 0.02% to 1.1745.

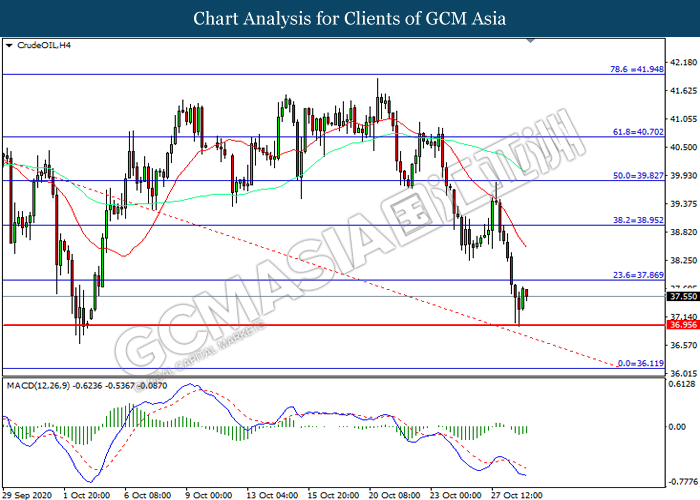

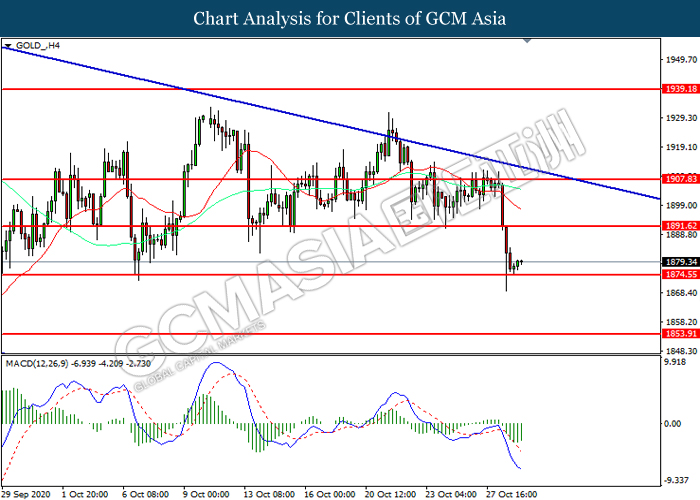

In the commodities market, the crude oil price depreciated by 0.10% to $37.60 per barrel as of writing. The oil market dipped significantly on yesterday amid the worried over the latest lockdown and spiking numbers of the coronavirus from the world had spurred negative prospect for the oil demand in future. On the other hand, the gold market slumped 0.05% to $1878.70 per troy ounces as of writing as investors started to selloff the gold commodity while changing it into cash in order to prevent margin call from bank following the global equity market crash on yesterday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative JPY BoJ Monetary Policy Statement

Tentative JPY BoJ Outlook Report

Tentative JPY BoJ Press Conference

21:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Oct) | -8K | -5K | – |

| 20:30 | USD – GDP (QoQ) (Q3) | -31.5% | 31.9% | – |

| 20:30 | USD – Initial Jobless Claims | 787K | 775K | – |

| 20:45 | EUR – ECB Interest Rate Decision | 0.00% | – | – |

| 22:00 | USD – Pending Home Sales (MoM) (Sep) | 8.8% | 4.5% | – |

Technical Analysis

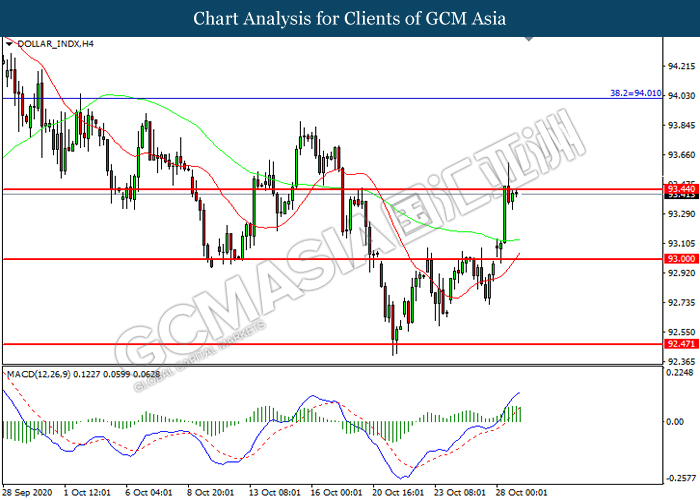

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 93.45. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 93.45, 94.00

Support level: 93.00, 92.45

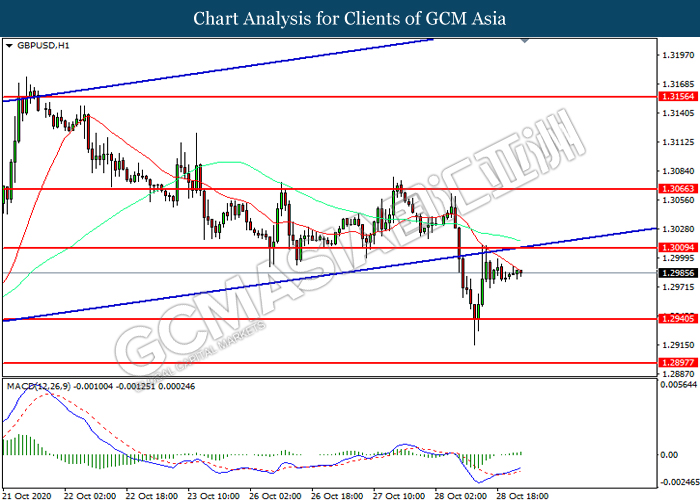

GBPUSD, H1: GBPUSD was traded higher following prior rebound from the support level at 1.2940. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3010.

Resistance level: 1.3010, 1.3065

Support level: 1.2940, 1.2895

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1765. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1765, 1.1810

Support level: 1.1705, 1.1665

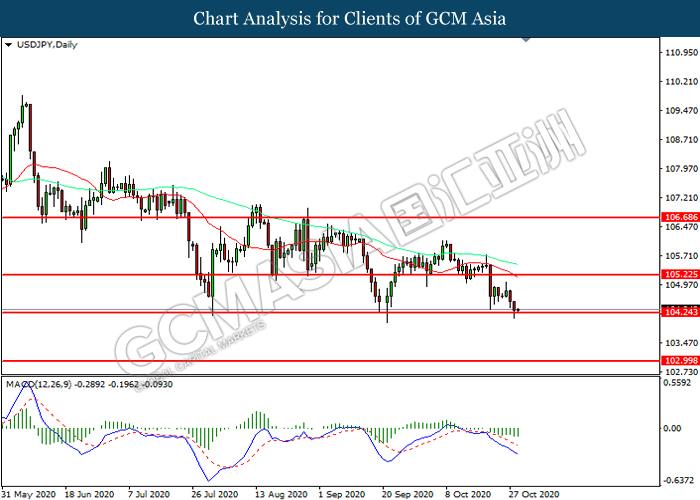

USDJPY, Daily: USDJPY was traded lower while currently testing the support level 104.25. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 105.25, 106.70

Support level: 104.25, 103.00

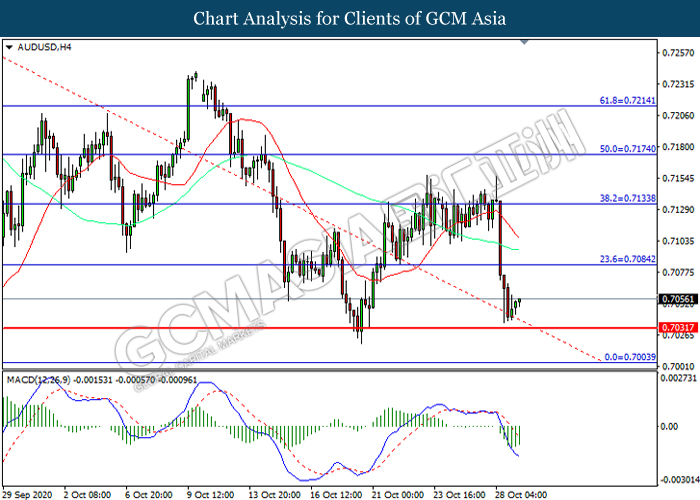

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7030. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.7085.

Resistance level: 0.7085, 0.7135

Support level: 0.7030, 0.7005

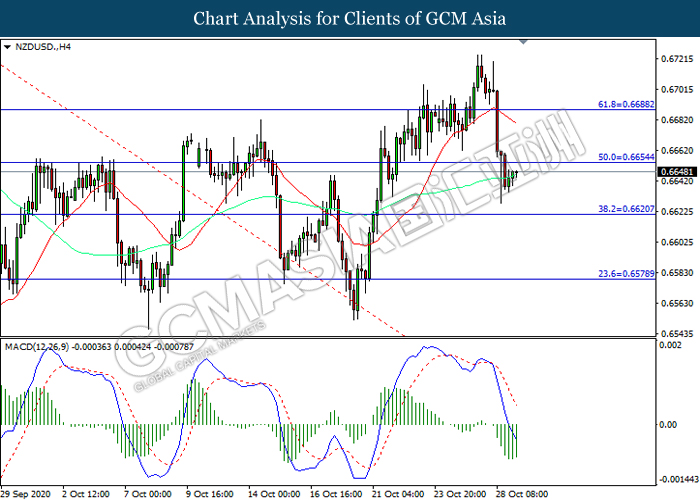

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level at 0.6655. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6655, 0.6690

Support level: 0.6620, 0.6580

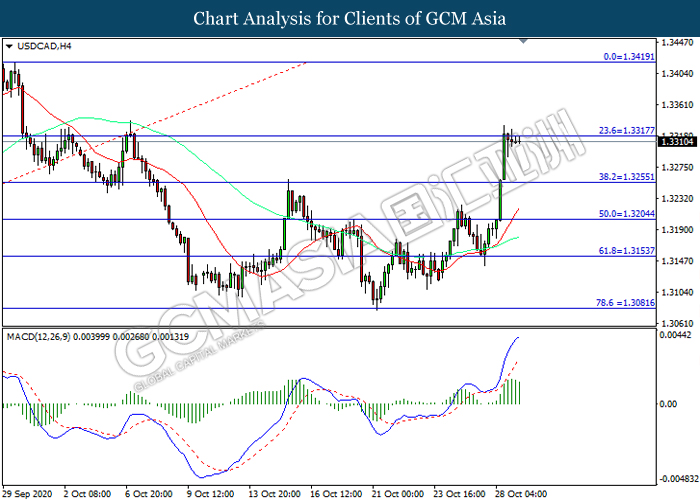

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3315. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3315, 1.3420

Support level: 1.3255, 1.3205

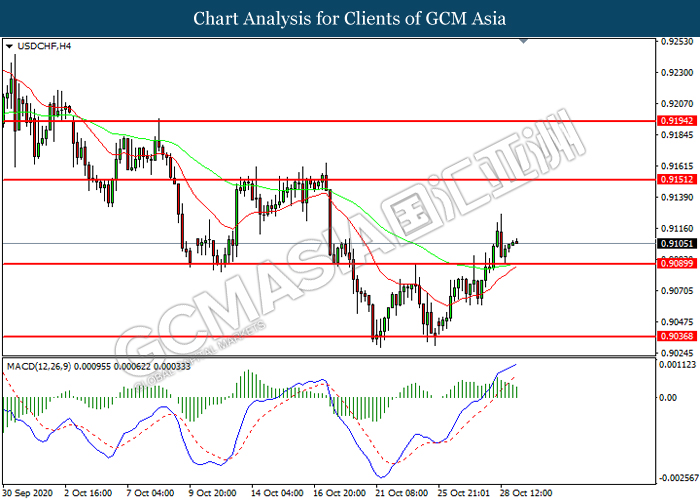

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9090. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9150, 0.9195

Support level: 0.9090, 0.9035

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 36.95. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 37.85.

Resistance level: 37.85, 38.95

Support level: 36.95, 36.10

GOLD_, H4: Gold price was traded lower while currently testing the support level a 1874.55. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 1891.60, 1907.85

Support level: 1874.55, 1853.90