29 November 2019 Morning Session Analysis

Greenback hovered amid Thanksgiving holiday.

Dollar index which gauge its value against a basket of six major currencies was traded flat around two weeks high level at 98.25 amid US market closed. In Thanksgiving holidays, all the market in US is expected to have minimal volatility and thin liquidity as not much of important economic data will be released within these two days. However, escalation in trade war due to US President Donald Trump recent sign off on backing Hong Kong bill lit up the market fears over achievability of phase 1 trade deal. Yesterday, China vowed that they will take retaliatory measures against US as Hong Kong extradition affair are China internal affairs that not allow for any other countries interference. Nonetheless, no further details on retaliatory action been announced from China administration yet, thus market participants are still keeping their eye on more development in trade war between this two parties. Moreover, the pair of EUR/USD rose despite disappointed German CPI been announced on last night. German CPI which acted as advanced inflation gauging data fail to excite the euro market sentiment as the data came in at -0.8, weaker than economist forecast at -0.6%. As of writing, dollar index down 0.04% to 98.25 while EUR/USD quoted up 0.05% to 1.1010.

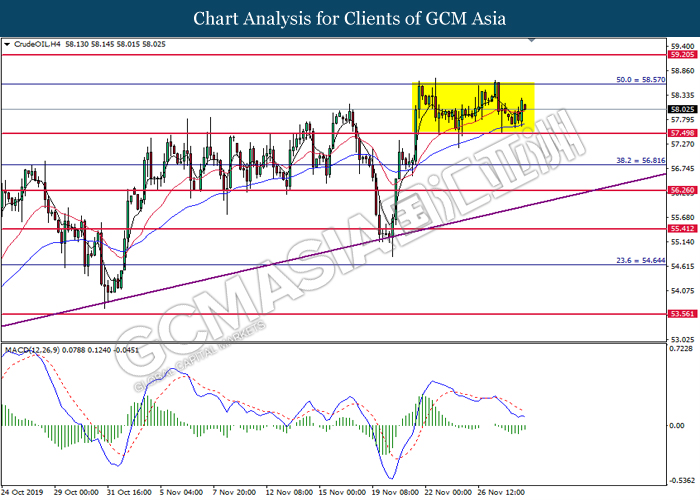

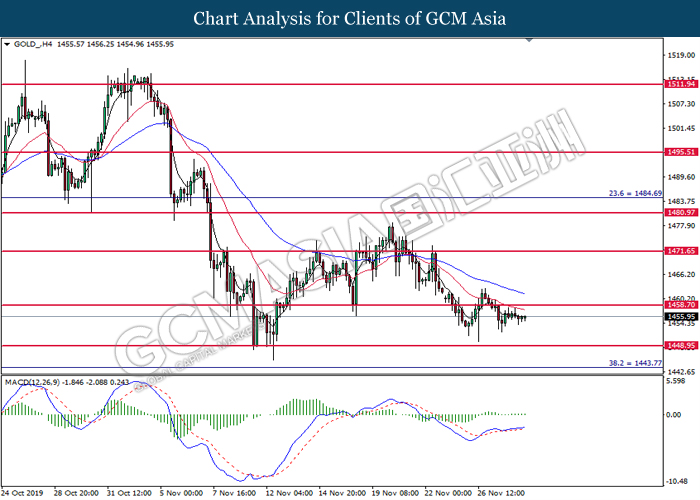

In the commodities market, crude oil price inched down 0.33% to $58.00 per barrel amid recent crude oil inventories build and Trump’s backing on Hong Kong bills tampered the future outlook of crude oil market. On the other hand, gold price dipped by 0.13% to $1456.00 a troy ounce due to the lack of risk factors in the market.

Today’s Holiday Market Close

Time Market Event

Early close at 2AM USD Thanksgiving Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change | 6K | 5K | – |

| 18:00 | EUR – CPI (YoY) (Nov) | 0.7% | 0.9% | – |

| 21:30 | CAD – GDP (MoM) (Sep) | 0.1% | 0.1% | – |

Technical Analysis

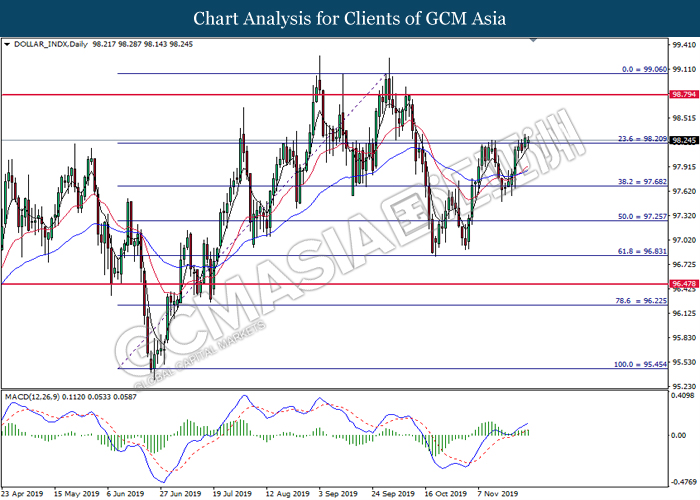

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 98.20. MACD which illustrate bullish bias momentum suggest the pair to extend its gains toward next resistance level at 98.80.

Resistance level: 98.80, 99.05

Support level: 98.25, 97.70

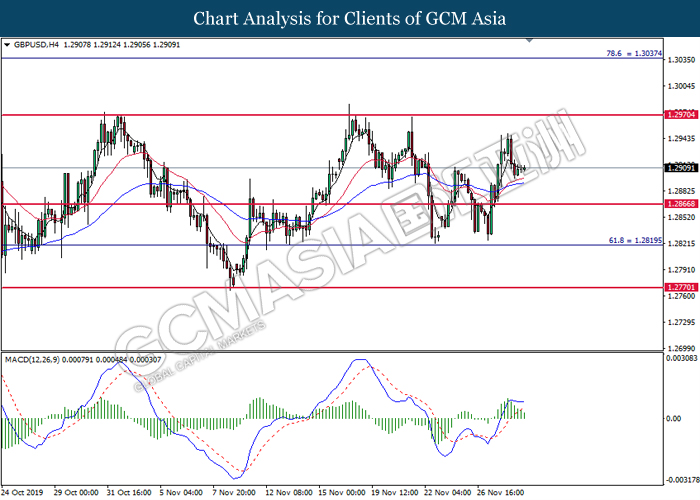

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the higher level. MACD which illustrated bearish signal suggest the pair to be traded lower toward the support level at 1.2865.

Resistance level: 1.2970, 1.3035

Support level: 1.2865, 1.2820

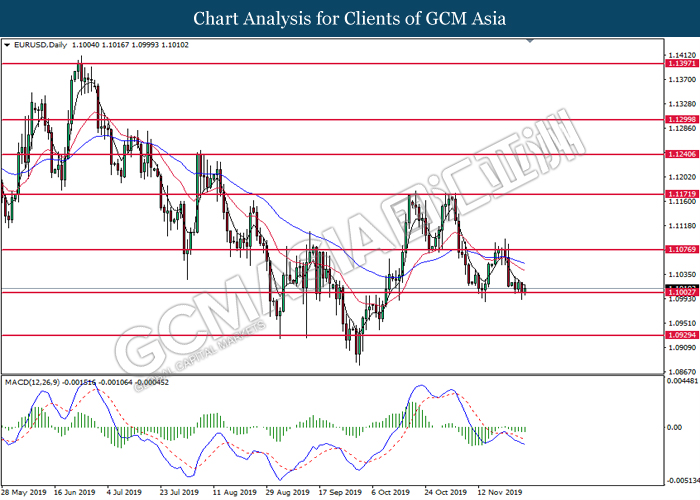

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1075, 1.1170

Support level: 1.1000, 1.0930

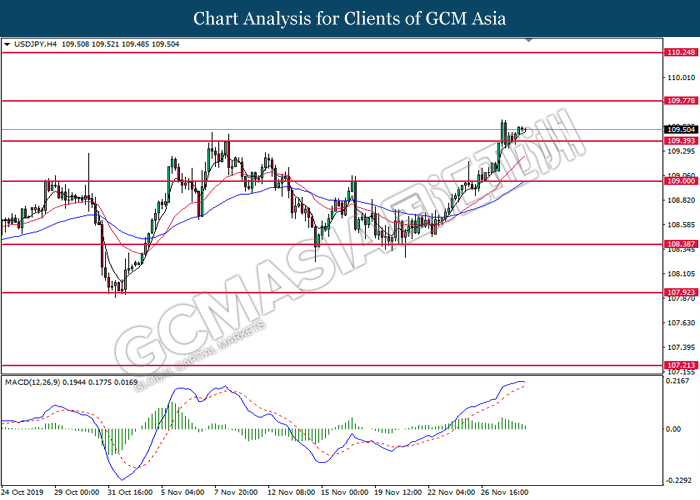

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 109.40. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo short term technical correction toward the support level.

Resistance level: 109.80, 110.25

Support level: 109.40, 109.00

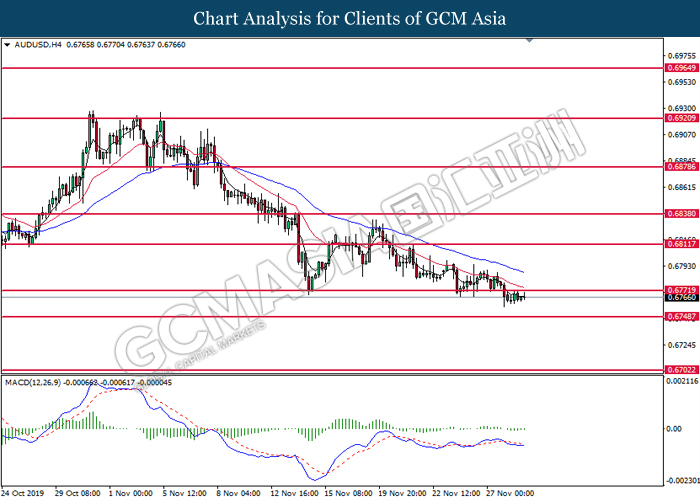

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.6770. MACD which illustrated bearish momentum suggest the pair to extend its losses toward the support level at 0.6750.

Resistance level: 0.6770, 0.6810

Support level: 0.6750, 0.6700

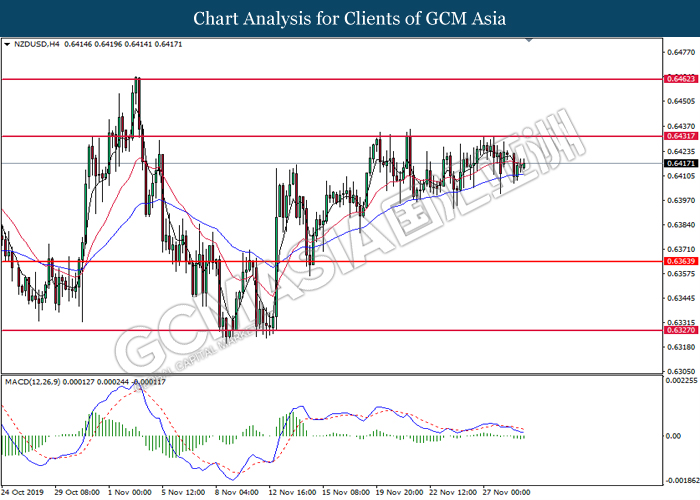

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level at 0.6430. MACD which illustrate bearish signal suggest the pair to extend its losses toward the support level at 0.6365.

Resistance level: 0.6430, 0.6460

Support level: 0.6365, 0.6325

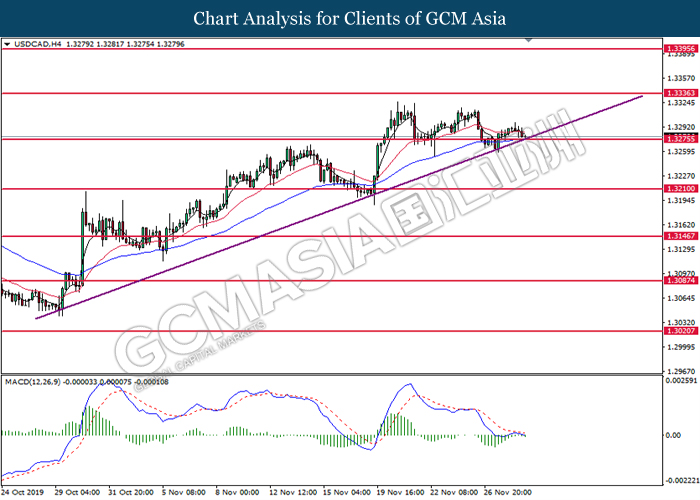

USDCAD, H4: USDCAD was traded lower while currently testing the upward trend line. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the upward trend line.

Resistance level: 1.3335, 1.3395

Support level: 1.3275, 1.3210

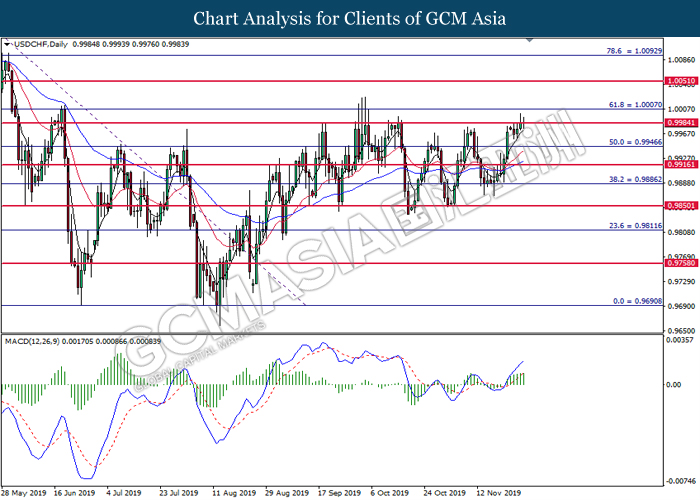

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after successfully breakout above the resistance level at 0.9985.

Resistance level: 0.9985, 1.0005

Support level: 0.9945, 0.9915

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the 50 moving average line (Blue). MACD which illustrated diminishing of bearish momentum suggest the commodity to extend its gains toward the resistance level at 58.55.

Resistance level: 58.55, 59.20

Support level: 57.50, 56.80

GOLD_, H4: Gold price was traded flat below the resistance level at 1458.70. MACD which illustrate bullish signal suggest the commodity to be traded higher in short term.

Resistance level: 1458.70, 1471.65

Support level: 1448.95, 1443.75