29 November 2021 Afternoon Session Analysis

Pound sterling fell following news of Omicron virus in U.K.

The pound sterling which traded against the dollar and other currency pairs remain pressured and fell amid the spread of newfound virus Omicron in the U.K. According to the U.K Health Security Agency, a third case of Omicron coronavirus variant has been detected in the U.K. After the Omicron incident, British Prime Minister Boris Johnson announcing the mandatory use of masks in public places to curb its spread. Scientists said that the spread of the new coronavirus is 5 times that of the Delta virus and it can also avoid the immune system. Investors are worried that the variant of Omicron will be widely spread in the UK and prompted the British central government to implement a comprehensive movement control order, thus potentially affect economic recovery and causing economic recession in the future. As of writing, GBP/USD fell 0.03% to 1.3336.

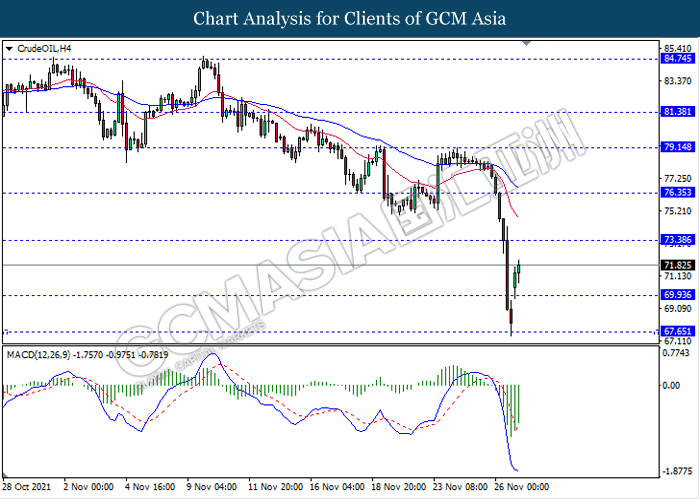

In the commodities market, crude oil price rebound 5.15% to $72.39 barrel at the time of writing following technical correction. However, overall sentiment remains weak as the spread of the new highly mutated Omicron may jeopardize the global economy and also crude oil demand. On the other hand, gold price rose 0.44% to $1795.93 a troy ounce as of writing amid rising demand for safe-haven due to Omicron virus.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – Pending Home Sales (MoM) (Oct) | -2.30% | 1.00% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar was traded higher following prior rebound from the support level 96.05. MACD which illustrate diminishing bearish momentum signal suggest the dollar to extend its rebound toward the resistance level 96.80.

Resistance level: 96.80, 97.55

Support level: 96.05, 95.50

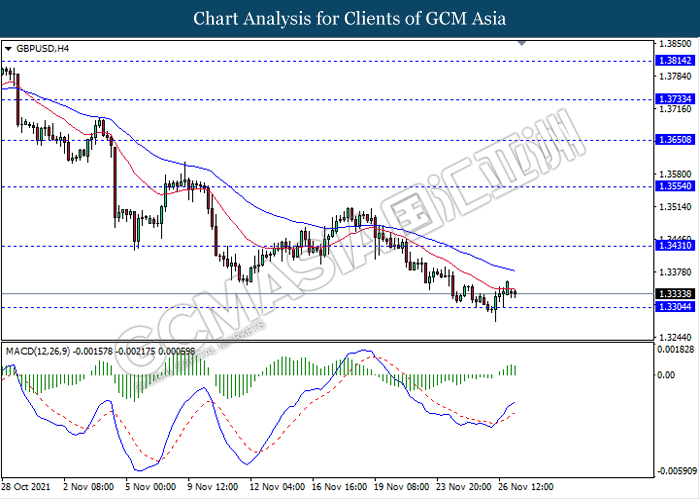

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level 1.3305. MACD which illustrate bullish momentum signal suggest the pair to extend its rebound towards the resistance level 1.3430.

Resistance level: 1.3430, 1.3555

Support level: 1.3305, 1.3195

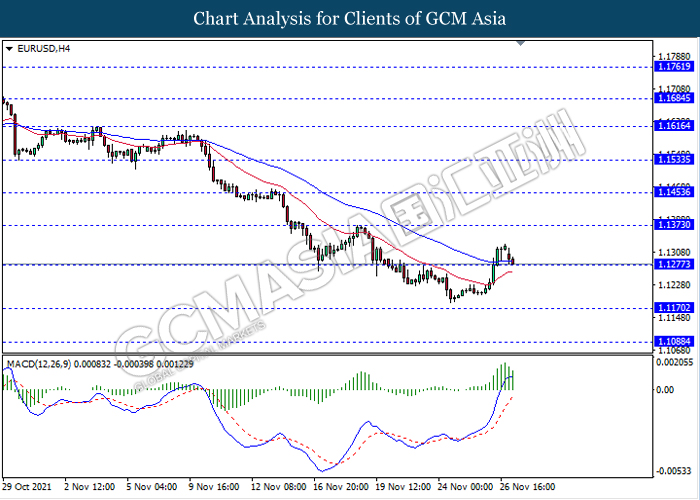

EURUSD, H4: EURUSD was traded lower while currently testing the support level 1.1275. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement after it breaks below the support level.

Resistance level: 1.1375, 1.1455

Support level: 1.1275, 1.1170

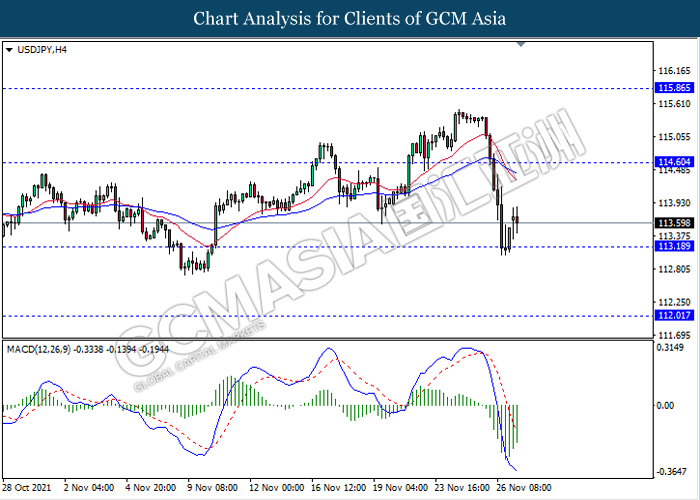

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level 113.20. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 114.60.

Resistance level: 114.60, 115.85

Support level: 113.20, 112.00

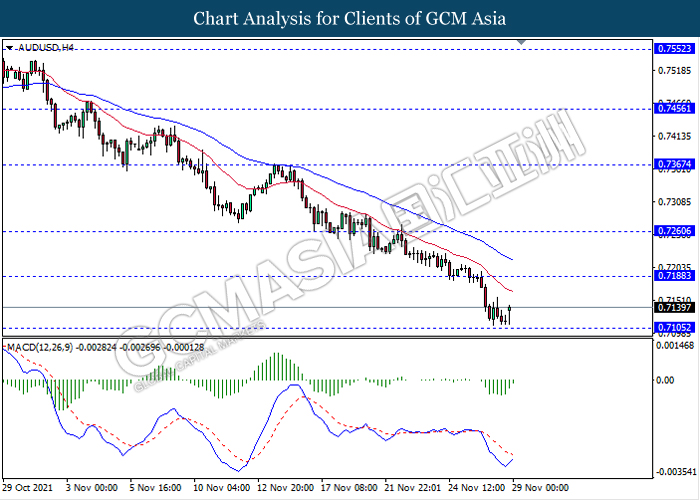

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level 0.7105. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 0.7190.

Resistance level: 0.7190, 0.7260

Support level: 0.7105, 0.7005

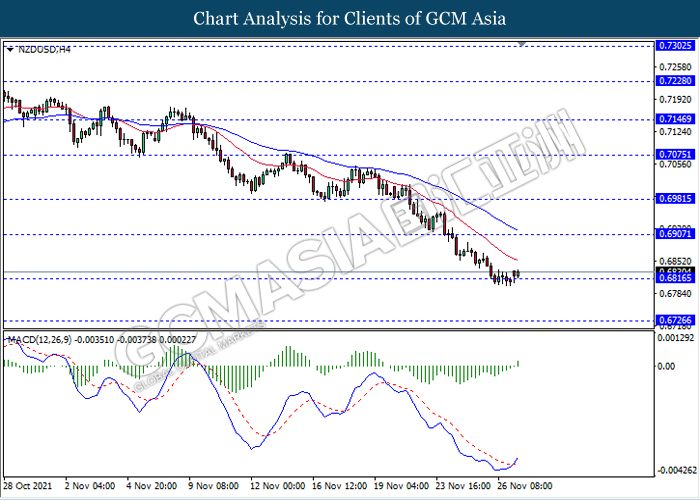

NZDUSD, H4: NZDUSD was traded flat while currently testing the support level 0.6815. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 0.6905.

Resistance level: 0.6905, 0.6980

Support level: 0.6815, 0.6725

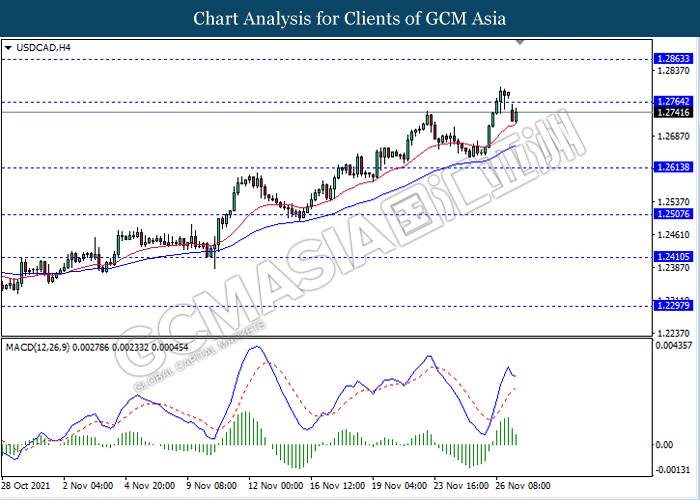

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level 1.2765. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its retracement towards the support level 1.2615.

Resistance level: 1.2765, 1.2865

Support level: 1.2615, 1.2505

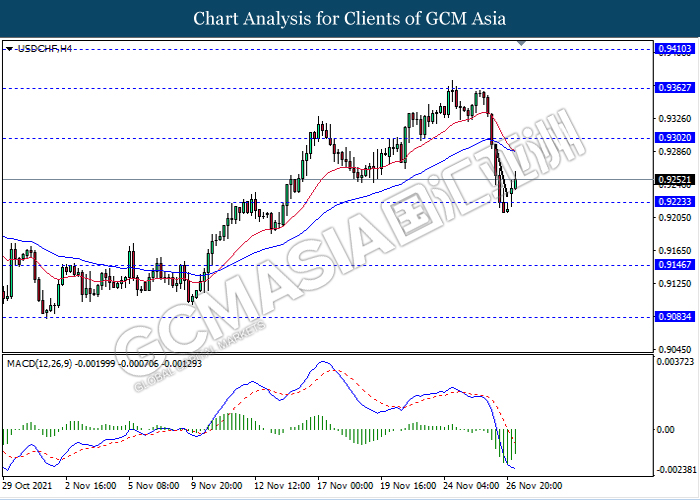

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level 0.9225. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 0.9300.

Resistance level: 0.9300, 0.9360

Support level: 0.9225, 0.9145

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level 69.95. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend rebound towards the resistance level 73.40.

Resistance level: 73.40, 76.35

Support level: 69.95, 67.65

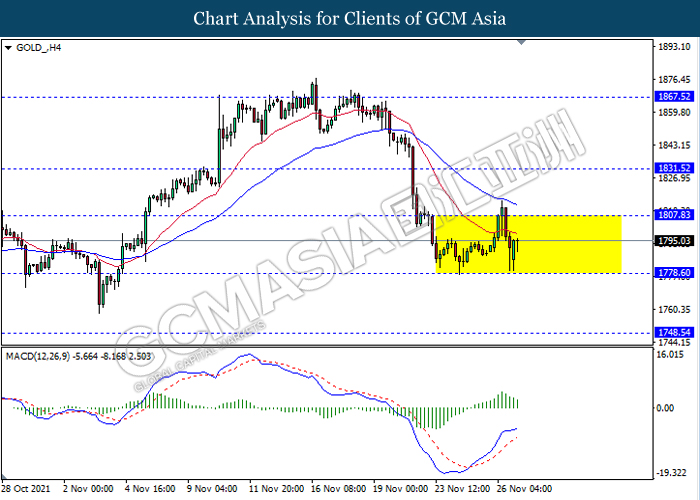

GOLD_, H4: Gold price remain traded in a sideway channel. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses towards the support level 1778.60.

Resistance level: 1807.85, 1831.50

Support level: 1778.60, 1748.55