29 November 2021 Morning Session Analysis

Dollar slumped amid dovish market repricing.

The Dollar Index which traded against a basket of six major currency pairs slumped significantly amid dovish repricing from the market. Despite Fed’s contractionary monetary policy expectation had been being brought forward amid strong US data, high inflation and hawkish talk by Fed members, the strike of new Covid-19 variant known as Omicron leaves the US dollar more vulnerable to a dovish repricing in Fed policy expectations. The discovery of Omicron by the World Health Organization has caused worries around the world as it could resist vaccinations and is potentially more contagious than previous variants of the disease. Likewise, risks of the new variant of Covid-19 are hampering expectations for rate hike next year from the world’s major central banks, hence resulting in a potential setback for the US dollar. According to Reuters, market has no longer fully price a 25-basis-point interest rate rise by the Federal Reserve by June 2022 amid the fear of coronavirus. As of writing, the Dollar Index depreciated by 0.81% to 96.05.

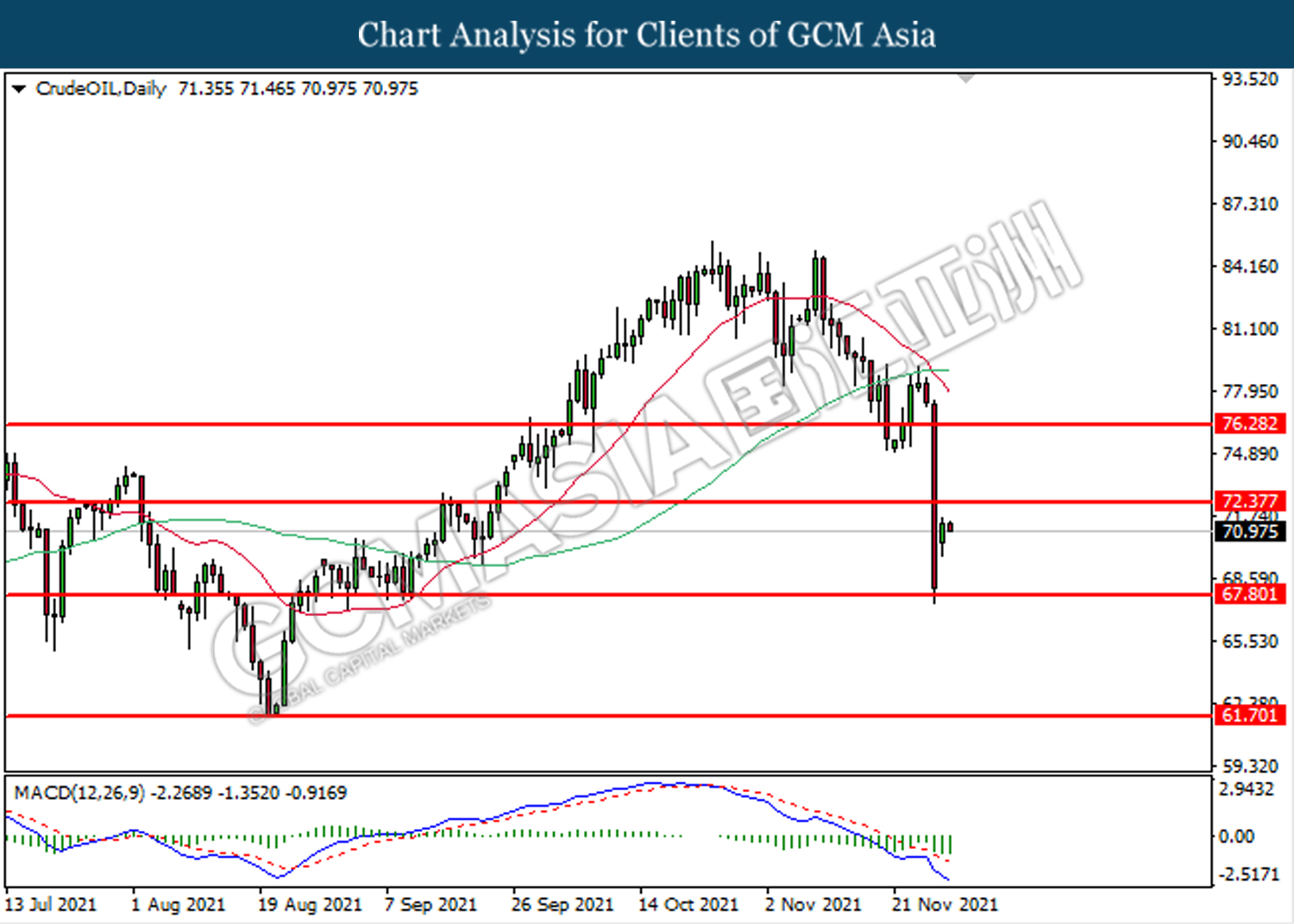

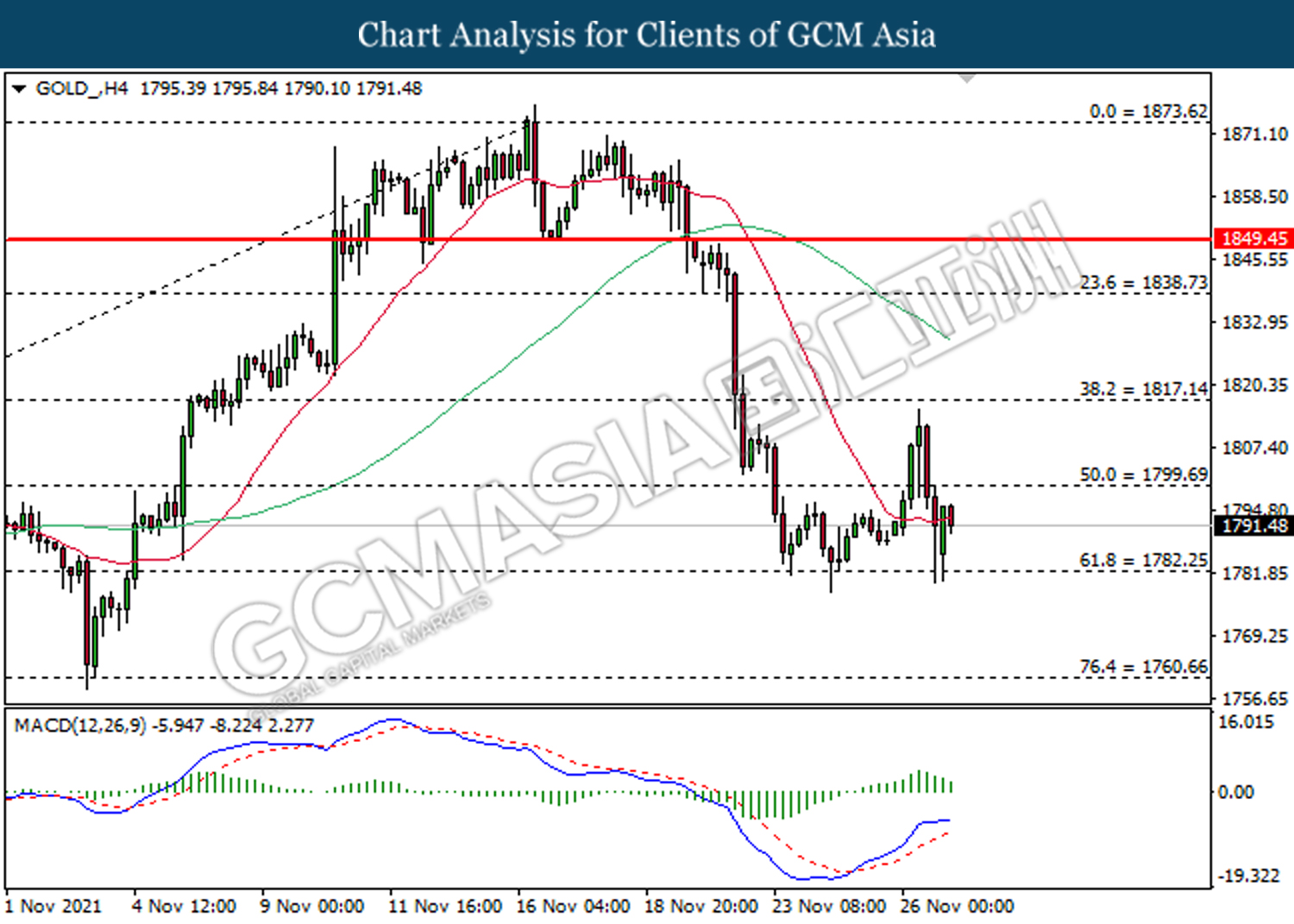

In the commodities market, the crude oil price slumped 0.34% to $70.80 as of writing amid bearish oil demand outlook. According to Reuters, the large oil importer countries such as UK, India and EU have imposed travel ban on Southern Africa in order to stem the spread of coronavirus. On the other hand, the gold price was up 0.24% to $1792.35 per troy ounces amid weakening US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – Pending Home Sales (MoM) (Oct) | -2.30% | 1.00% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from higher levels. MACD which illustrate downward momentum suggests the index to be traded lower in short-term.

Resistance level: 96.15, 96.50

Support level: 95.75, 95.35

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished upward momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.3355, 1.3410

Support level: 1.3290, 1.3220

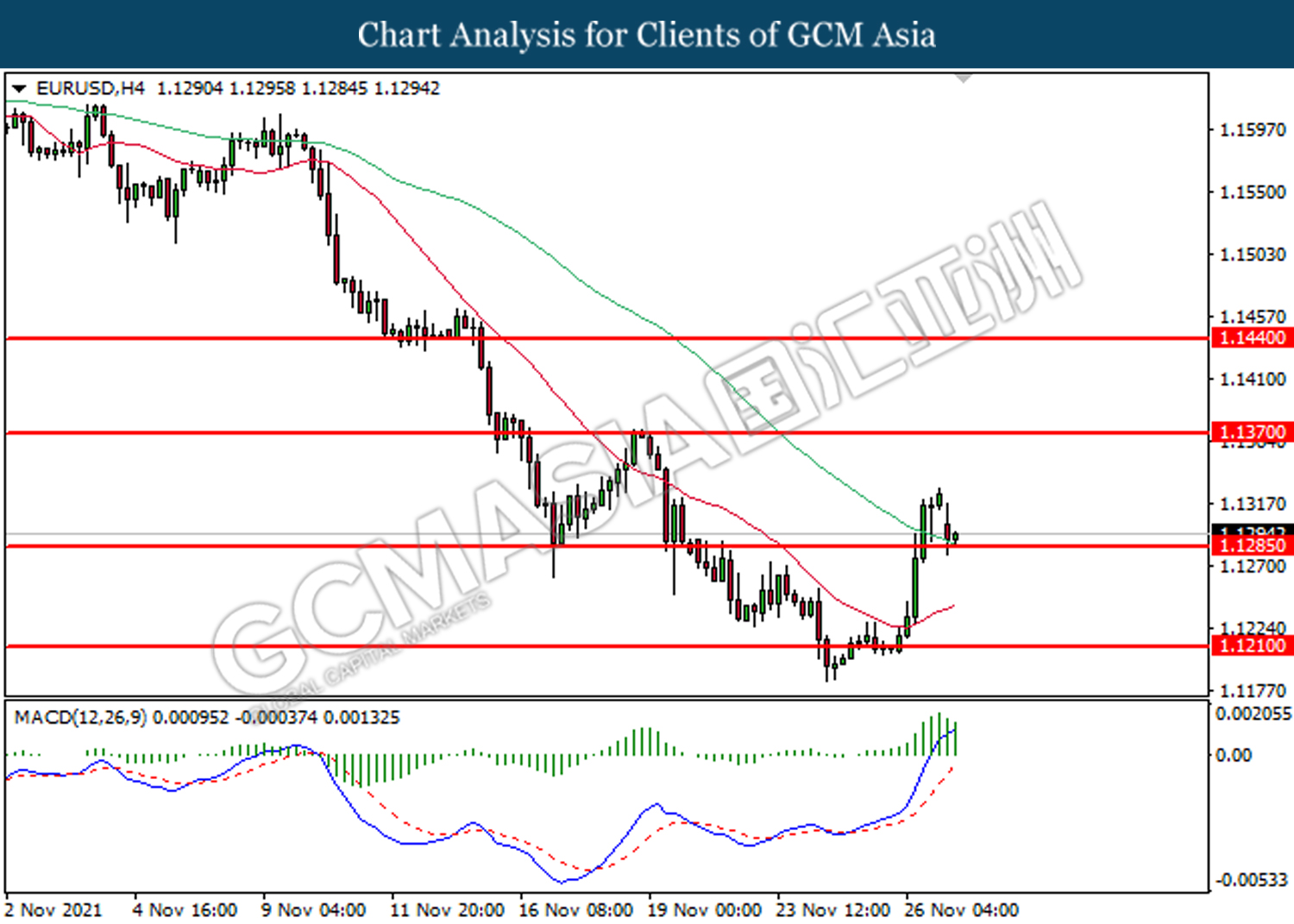

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate diminished upward momentum suggests the pair to be traded lower after closing below 1.1285.

Resistance level: 1.1370, 1.1440

Support level: 1.1285, 1.1210

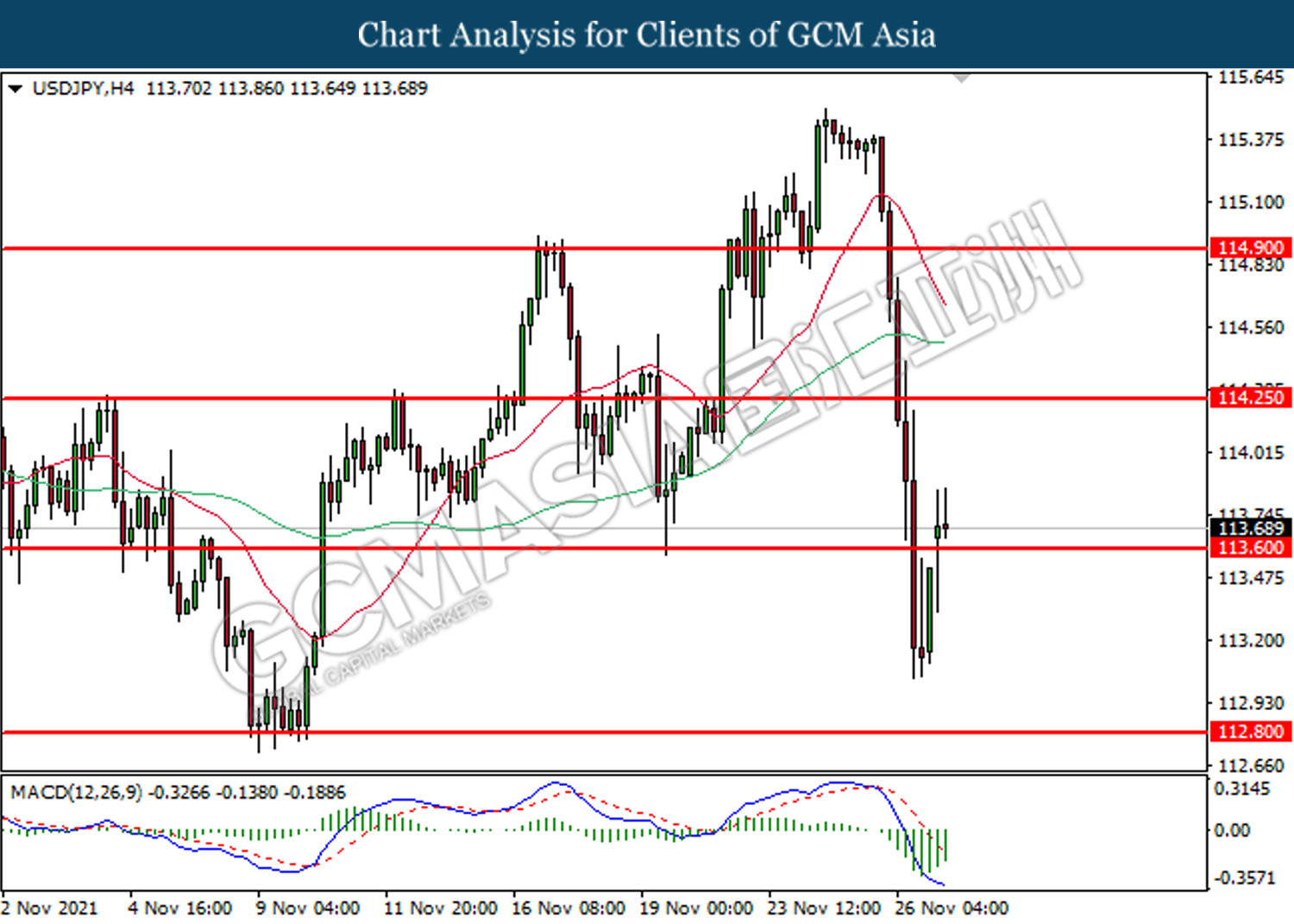

USDJPY, H4: USDJPY was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 114.25, 114.90

Support level: 113.60, 112.80

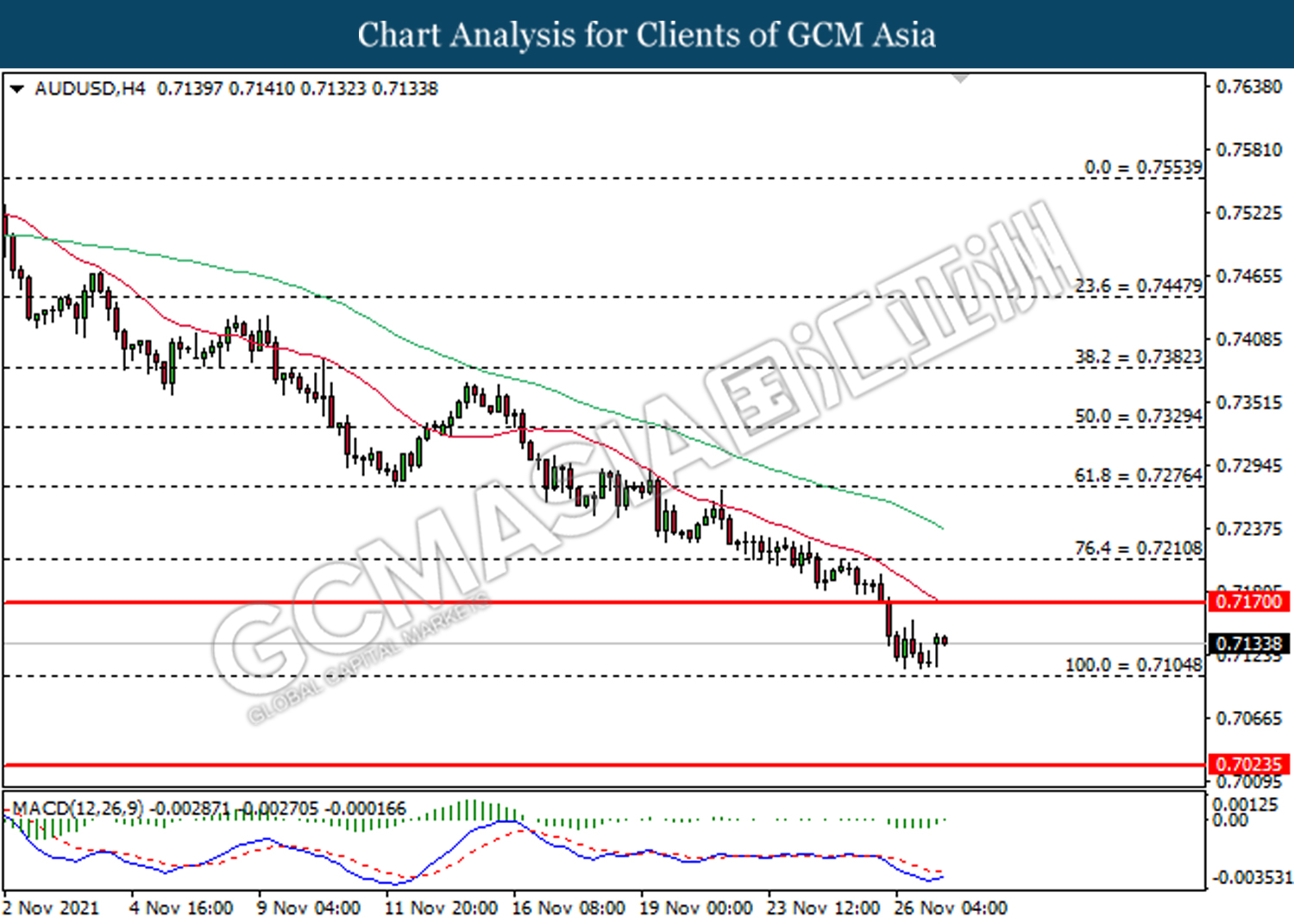

AUDUSD, H4: AUDUSD was traded higher following rebound from lower level. MACD which illustrate diminished bearish momentum suggests the pair to be traded loin short-term as technical correction.

Resistance level: 0.7170, 0.7210

Support level: 0.7105, 0.7025

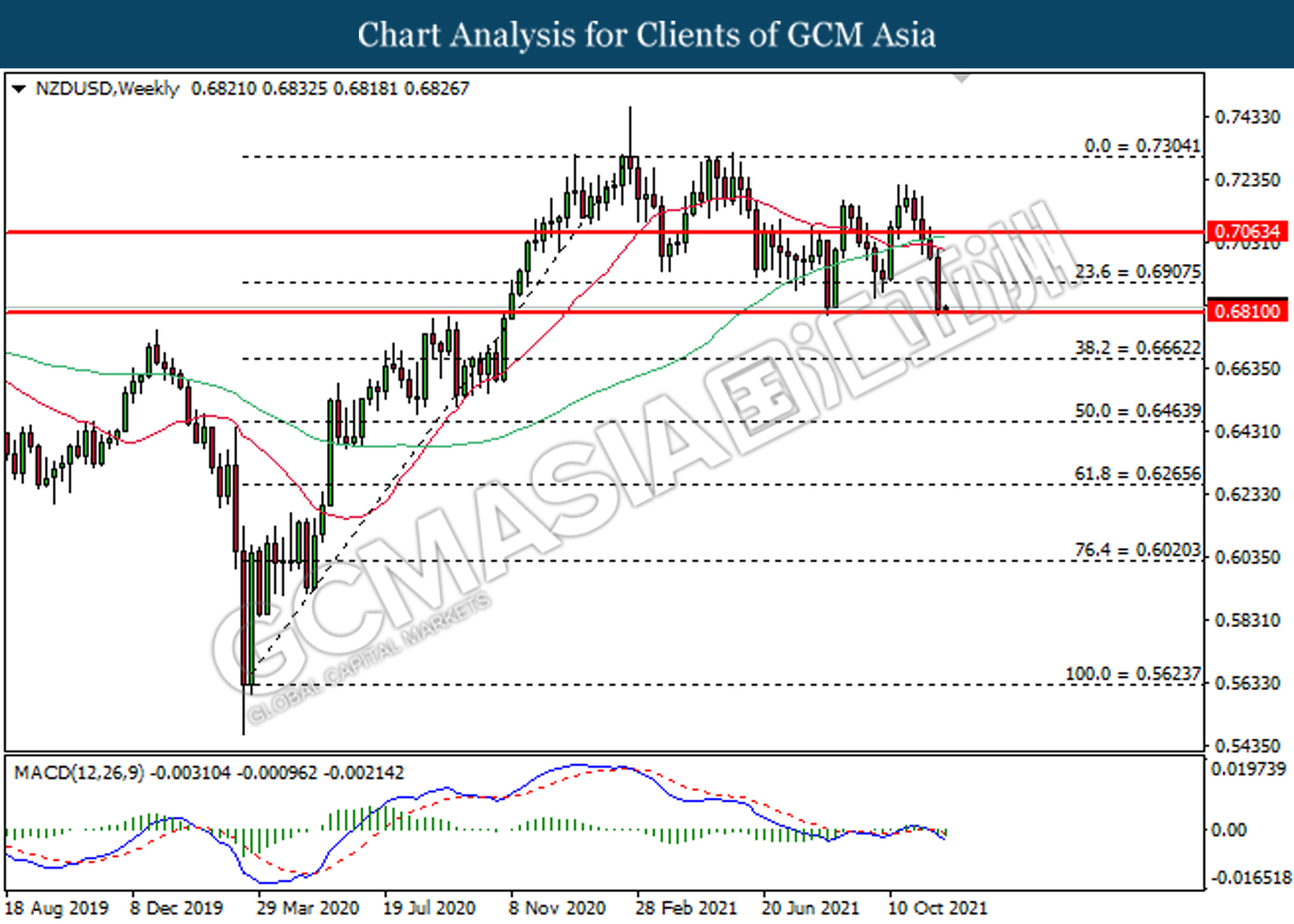

NZDUSD, Weekly: NZDUSD was traded lower following prior closure below 0.6905. MACD which begins to form bearish signal suggests the pair to be traded lower after closing below 0.6810.

Resistance level: 0.6905, 0.7065

Support level: 0.6810, 0.6660

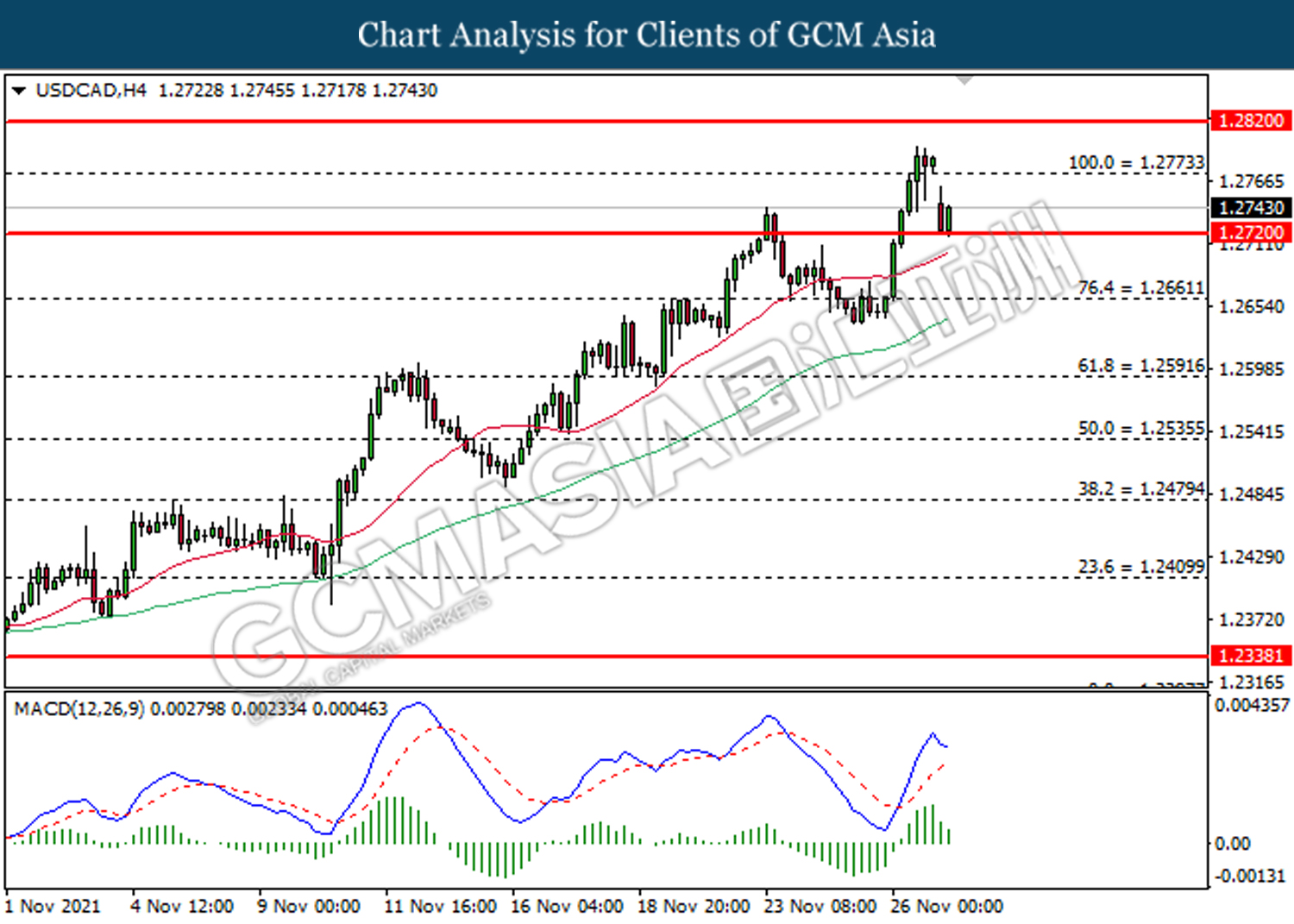

USDCAD, H4: USDCAD was traded lower following prior retrace from higher levels. MACD which illustrate diminished upward momentum suggests the pair to be traded lower after closing below 1.2720.

Resistance level: 1.2775, 1.2820

Support level: 1.2720, 1.2660

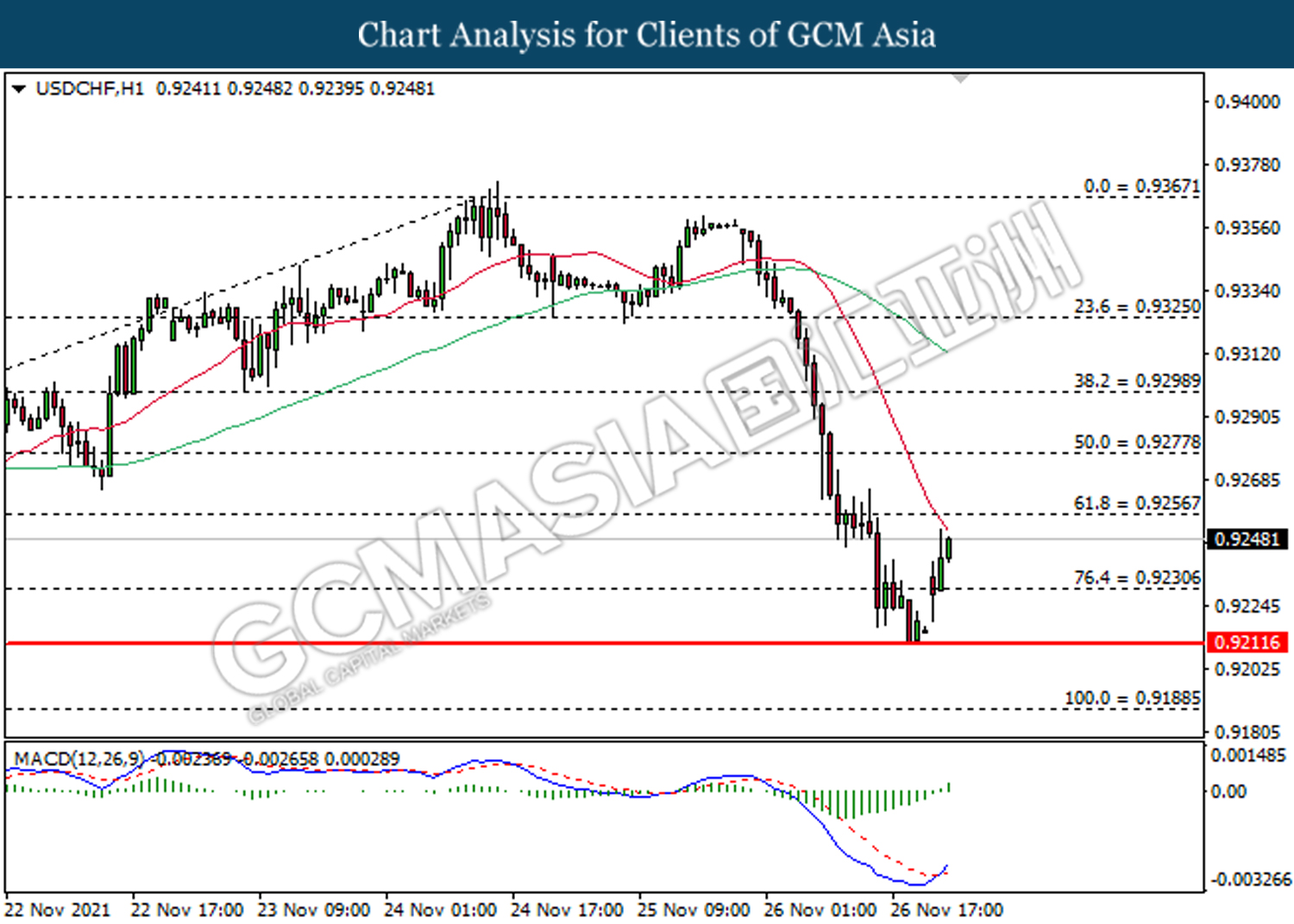

USDCHF, H1: USDCHF was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, Daily: Crude oil price was traded lower following prior closure below 72.40. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 72.80, 76.30

Support level: 67.80, 61.70

GOLD_, H4: Gold price was traded lower following prior retrace from higher level. MACD which illustrate diminished upward momentum suggests the pair to be traded lower in short-term.

Resistance level: 1799.70, 1817.15

Support level: 1782.25, 1760.65