29 November 2022 Morning Session Analysis

Dollar surged following a hawkish rate-hike stance from Fed member.

The dollar index, which gauges its value against a basket of six major currencies, managed to regain its luster yesterday after muting for two trading sessions amid the Thanksgiving holiday. In the last trading session, the St. Louis Fed President James Bullard revealed that the official cash rate needed to increase further and hold for an extended period of time throughout the year of 2024 in order to effectively cool down the sky-high inflation. Besides, he also reiterated that the interest rate should be risen to the range between 5.00% to 5.25%, while their long-term inflation objective is still 2.0%. Importantly, James Bullard also warned that the market is now underpricing the risk FOMC may be more aggressive. With that, it reversed the earlier losses of the dollar index while urging investors to shift their capital into the appealing currency market. At this juncture, the economic data, such as GDP and NonFarm Payroll, are still being highly focused on by the market participant. As of writing, the dollar index rose by 0.65% to 106.65.

In the commodities market, the crude oil price declined by -0.14% to $77.05 per barrel after the China Covid-19 cases hit a new high record, which extinguished the market hopes of recovery in the world’s second-largest economy. Besides, the gold prices edged down -0.74% to $1741.60 per troy ounce amid a hawkish comment from the Fed’s Bullard.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:00 | EUR – German CPI (YoY) (Nov) | 10.4% | 10.4% | – |

| 21:30 | CAD – GDP (MoM) (Sep) | 0.1% | 0.1% | – |

| 23:00 | USD – CB Consumer Confidence (Nov) | 102.5 | 100.0 | – |

Technical Analysis

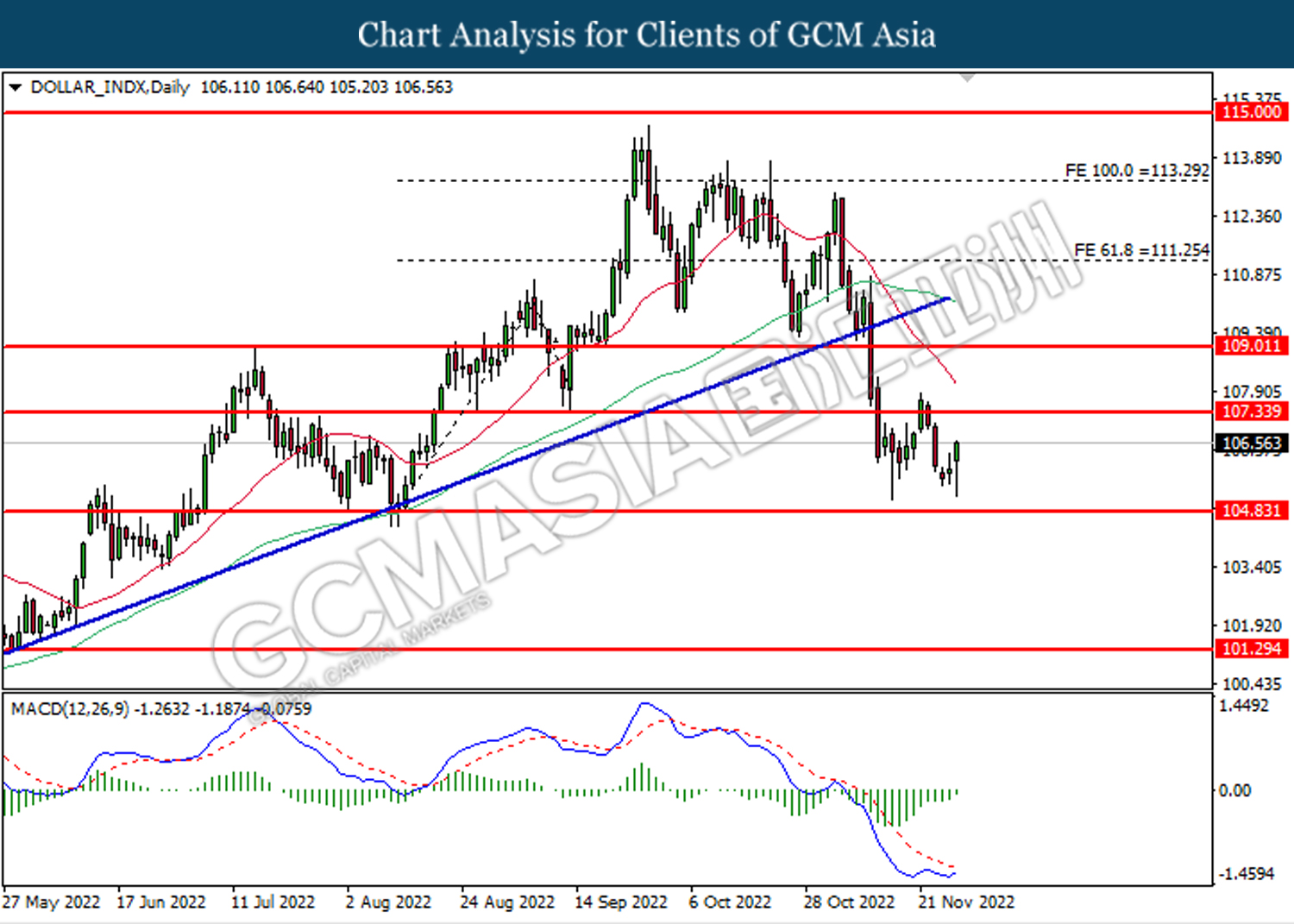

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.35.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

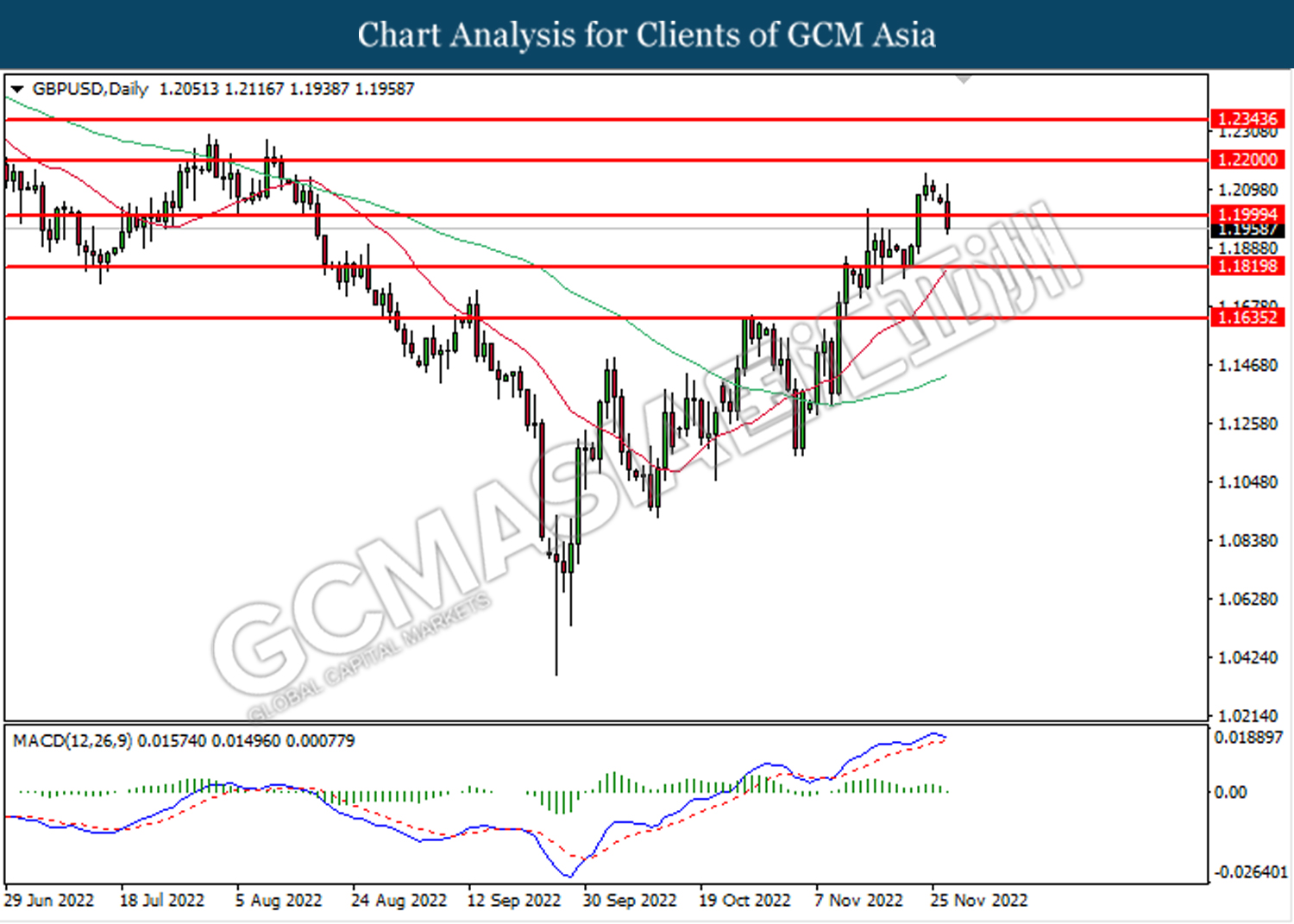

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2000. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

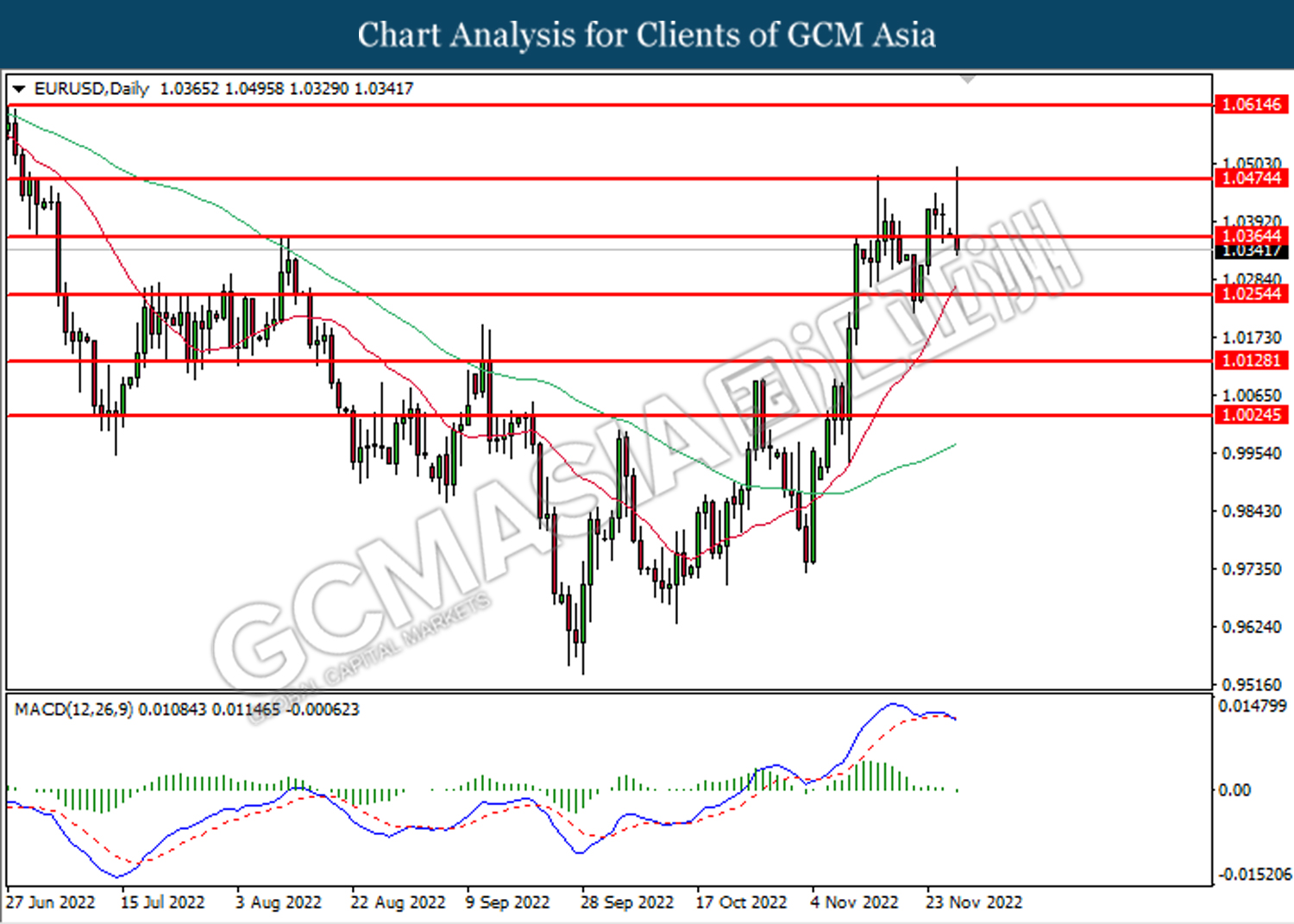

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0365. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0475, 1.0615

Support level: 1.0365, 1.0255

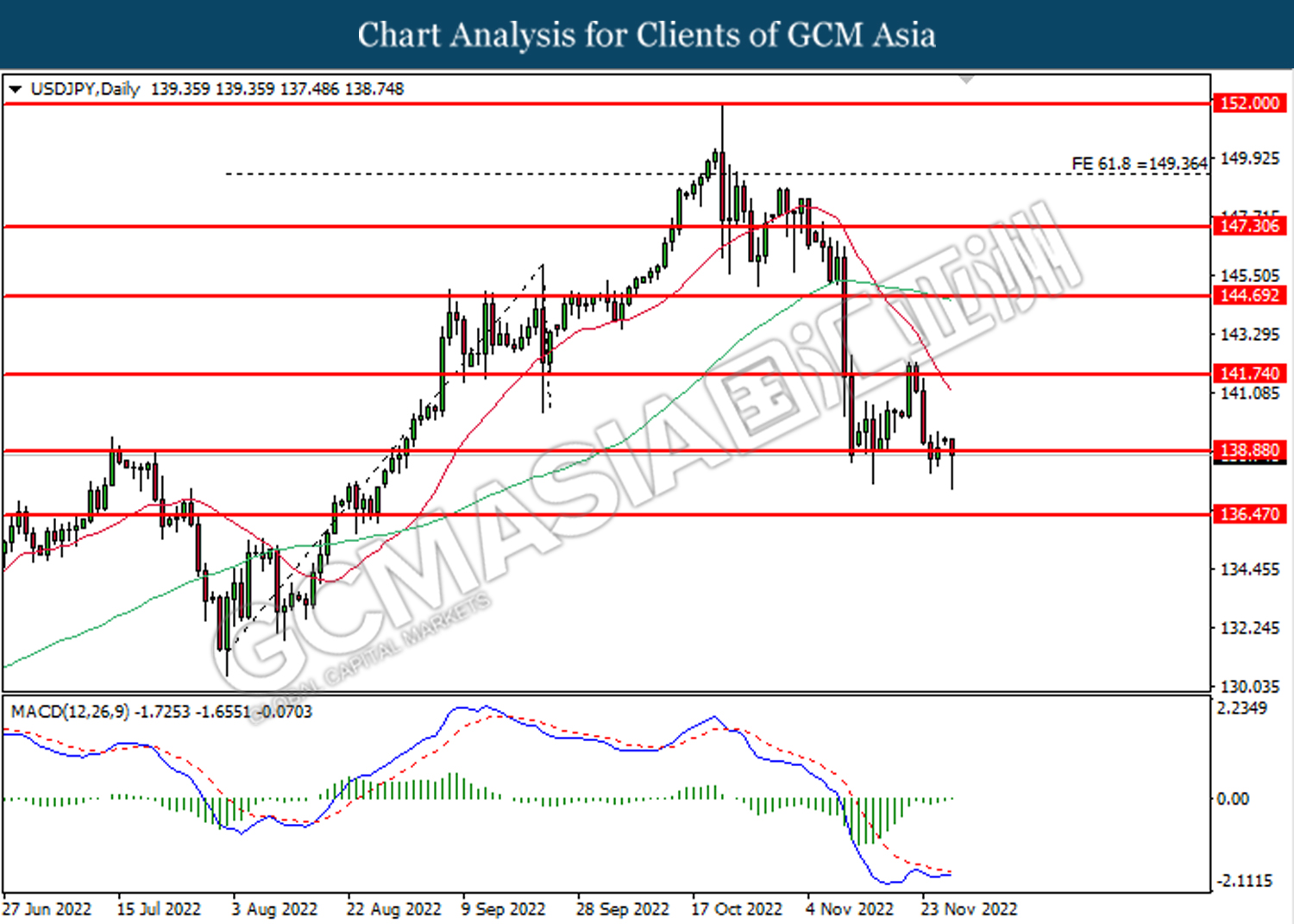

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.90. MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

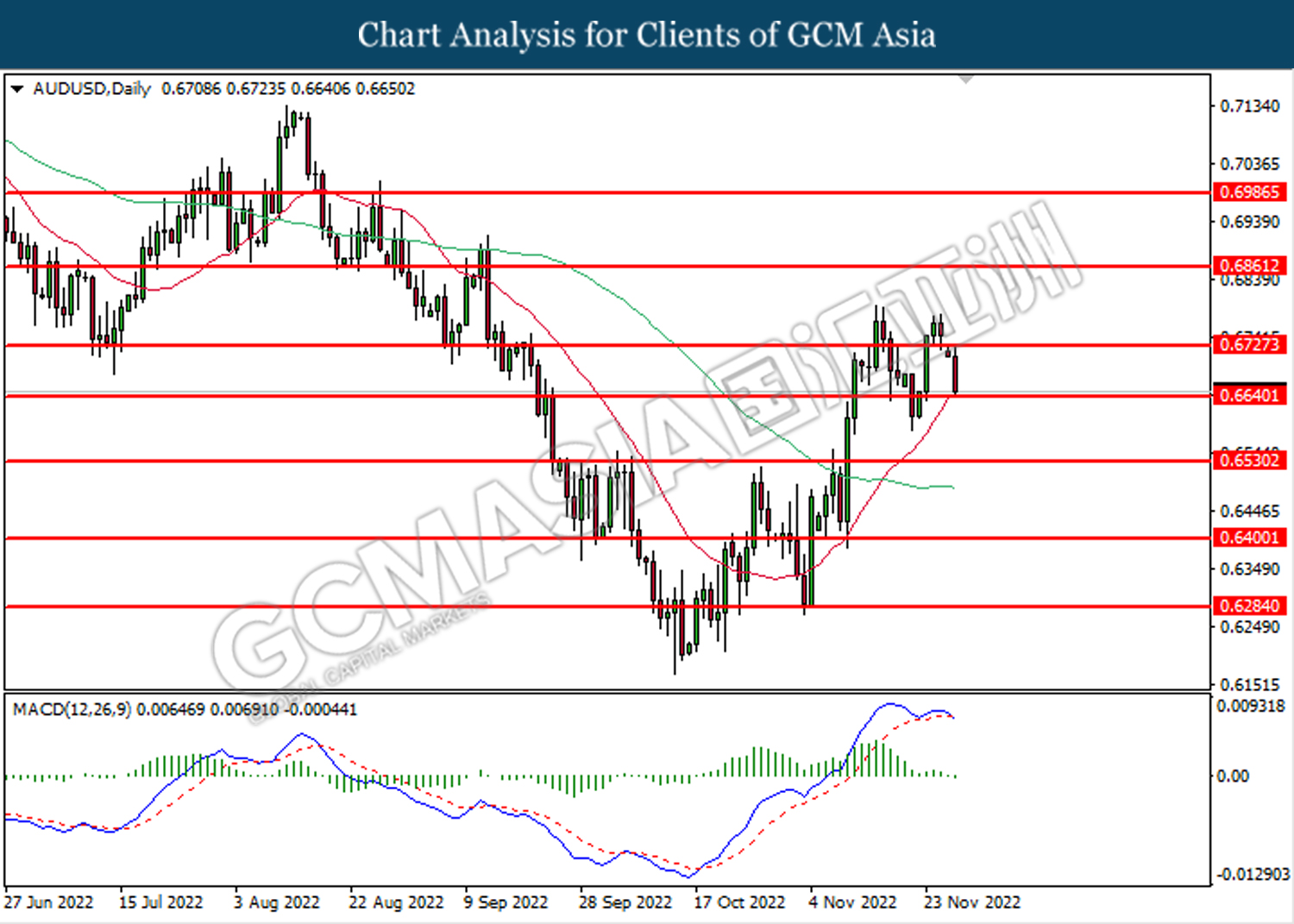

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6640. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

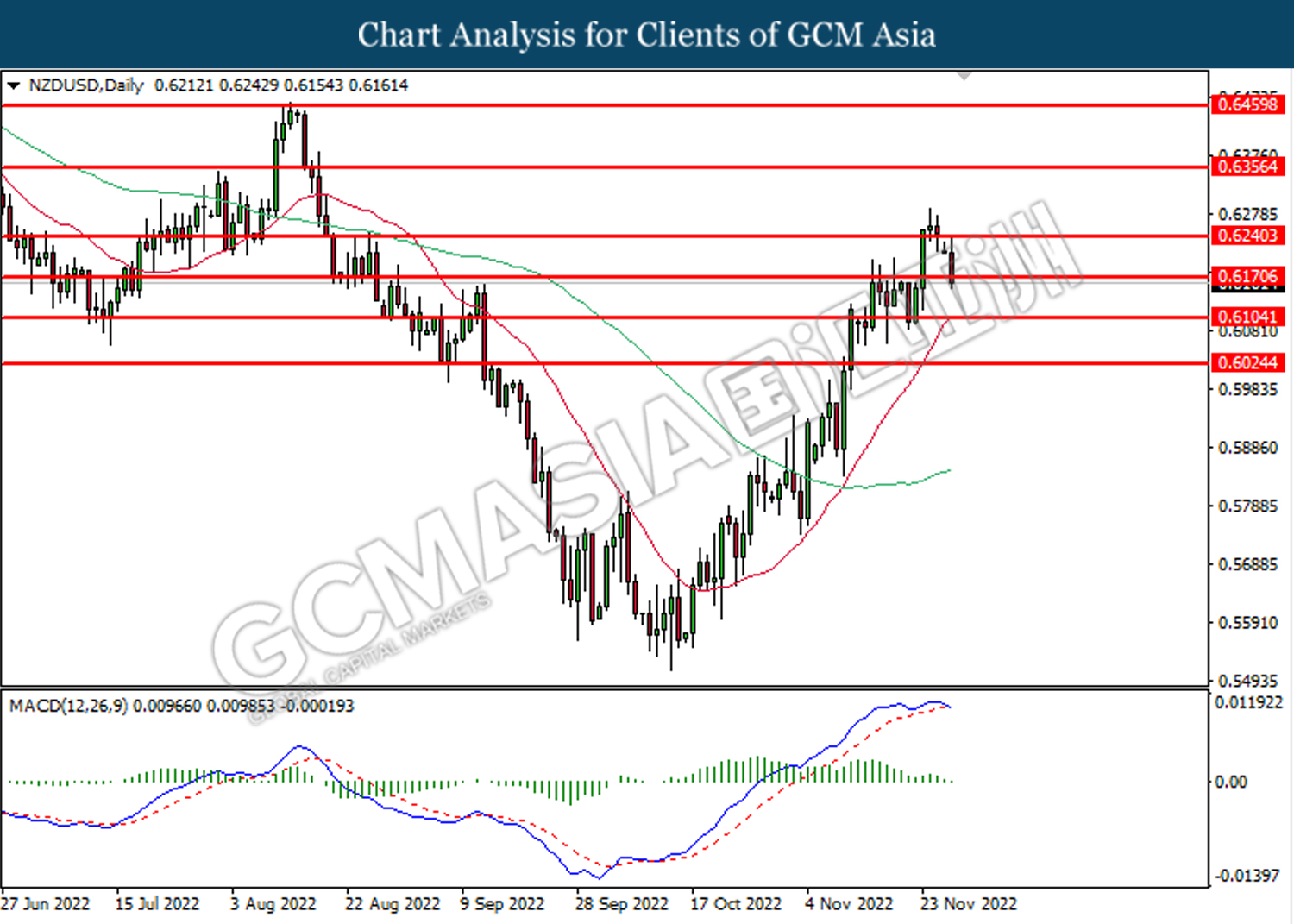

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6170. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6240, 0.6355

Support level: 0.6170, 0.6105

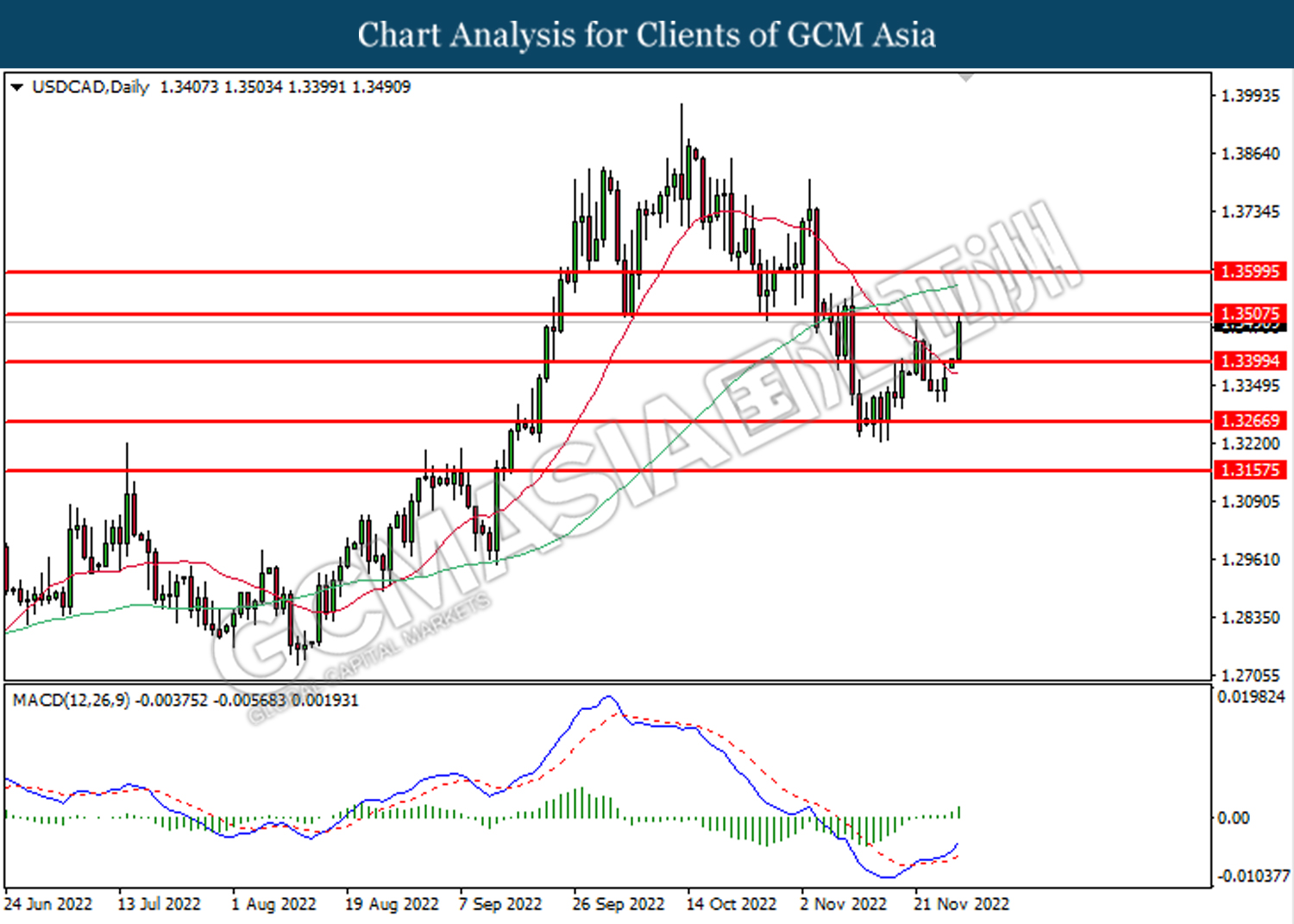

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3505. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

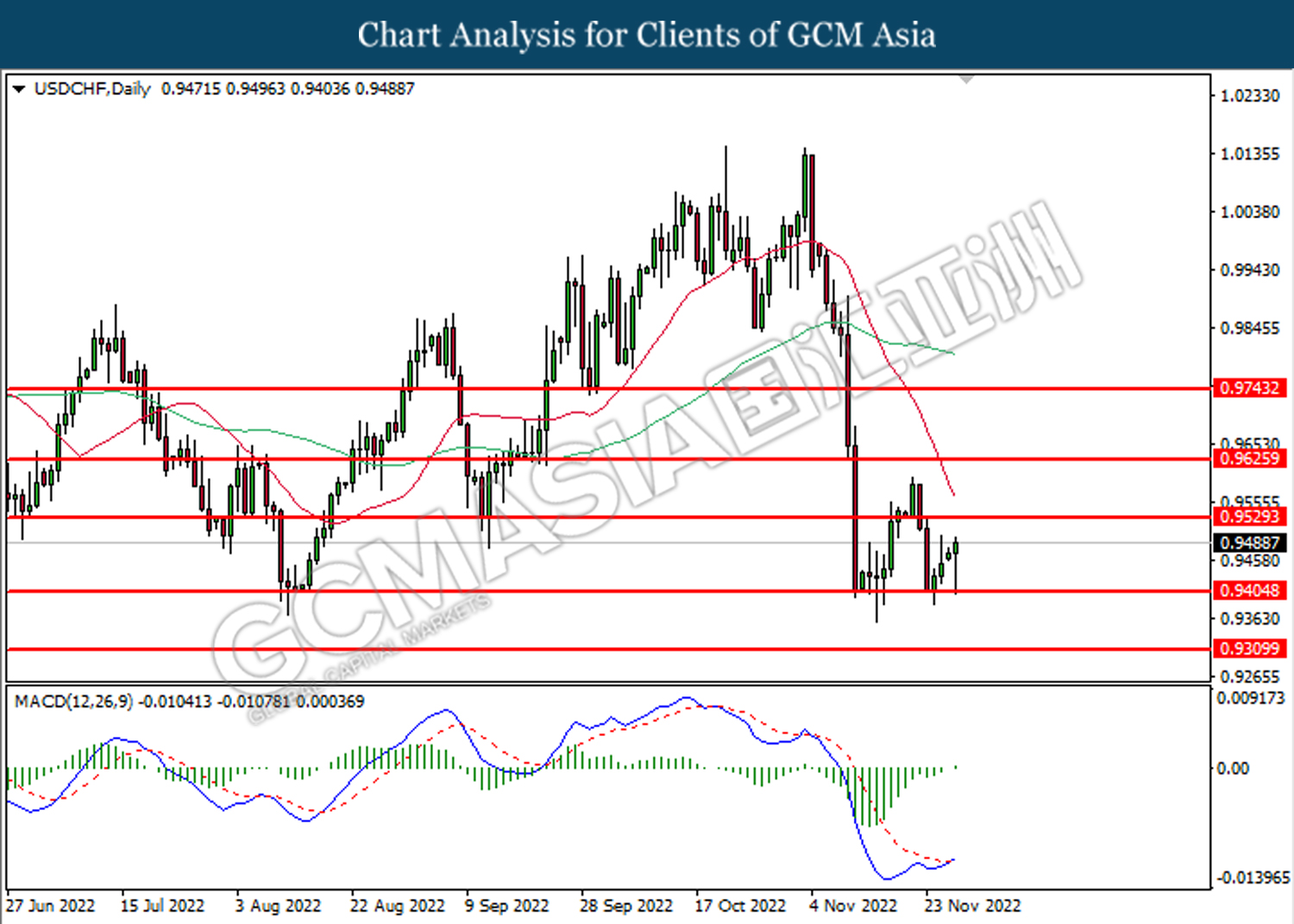

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

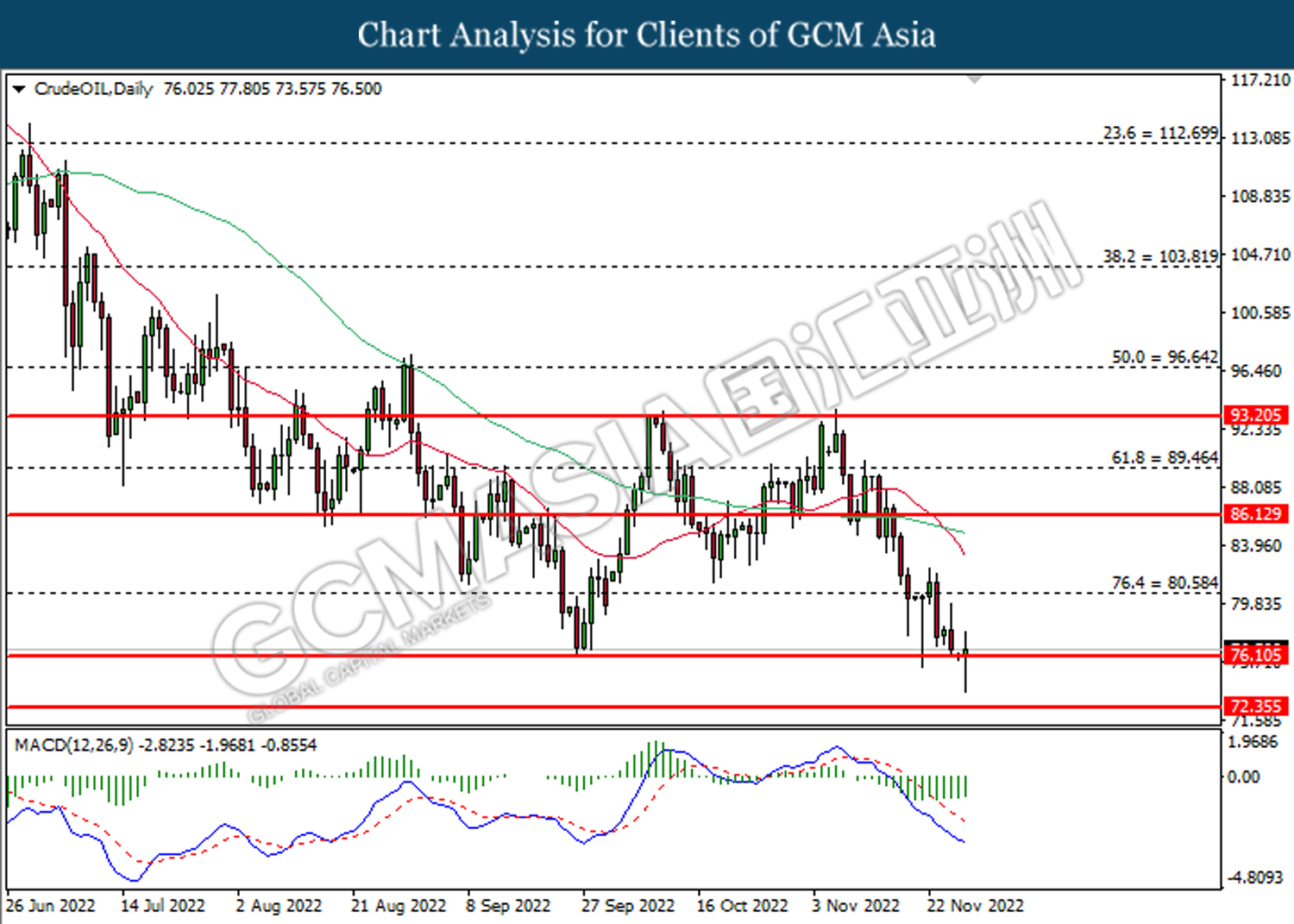

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 80.60, 86.15

Support level: 76.10, 72.35

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1766.50. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1726.15.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35