29 December 2020 Morning Session Analysis

Euro surged amid risk-on sentiment.

The Euro surged on yesterday amid the positive development with regards of the Brexit deal as well as the U.S. President Donald Trump’s decision to approve a new fiscal stimulus package had increased the risk appetite the in FX market, which prompting investors to shift their portfolio toward the riskier currencies such as Euro. On the economic stimulus plan, Reuters reported that the Democratic-led U.S. House of Representatives voted 275-134 to support U.S. President Donald Trump’s demand for $2,000 Covid-19 relief checks on Monday. Nonetheless, the bill now heads to the Senate where Republicans have the greater power to vote. Besides, the progress on further Covid-19 vaccines had boosted the market sentiment toward the risky assets. According to CNBC, AstraZeneca’s vaccine is expected to get the regulatory nod from UK health authorities later this week. As for now, investors would continue to scrutinize the latest development with regards of latest economic stimulus from the U.S. government as well as Covid-19 vaccines progress in order to gauge the likelihood movement for the currency. As of writing, EUR/USD appreciated by 0.04% to 1.2220.

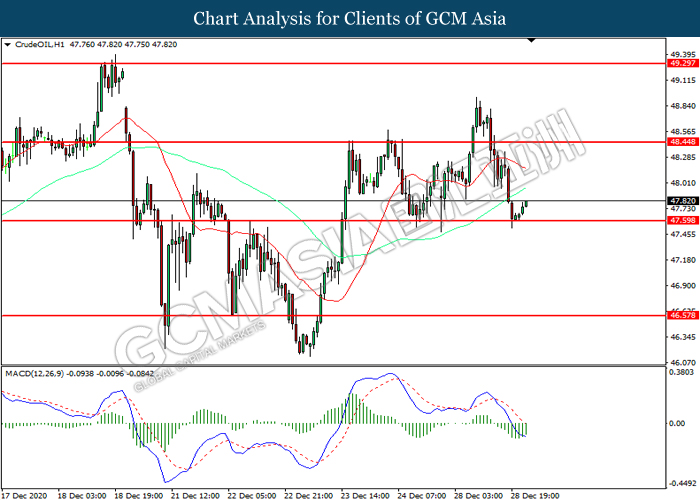

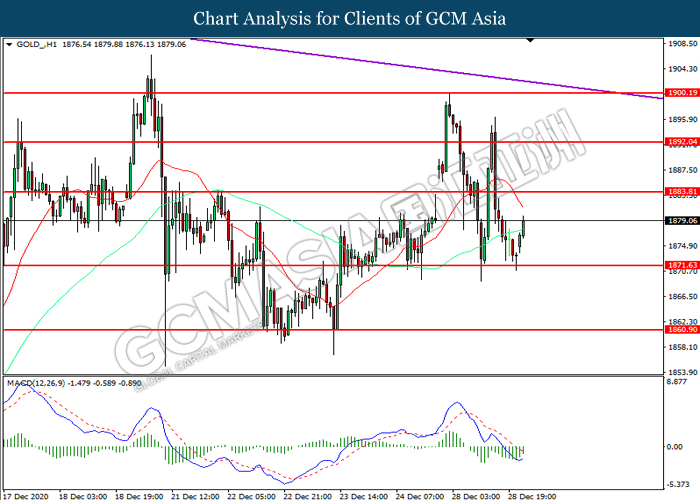

In the commodities market, the crude oil price surged 0.25% to $47.80 per barrel as of writing amid positive development with regards of the Covid-19 vaccines and massive economic stimulus plan from the U.S. region had provided further bullish momentum for this black-commodity. On the other hand, the gold price slumped 0.25% to $1875.55 per troy ounces as of writing amid risk-on sentiment in the FX market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – CB Consumer Confidence (Dec) | 96.1 | 97.0 | – |

Technical Analysis

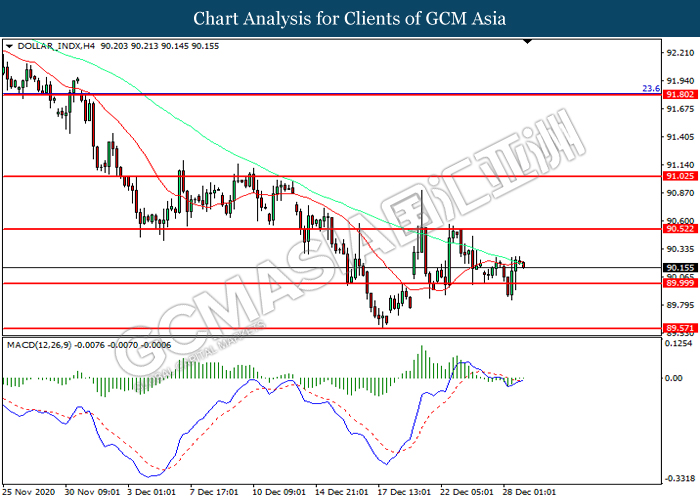

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 90.00. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level at 90.50.

Resistance level: 90.50, 91.05

Support level: 90.00, 89.55

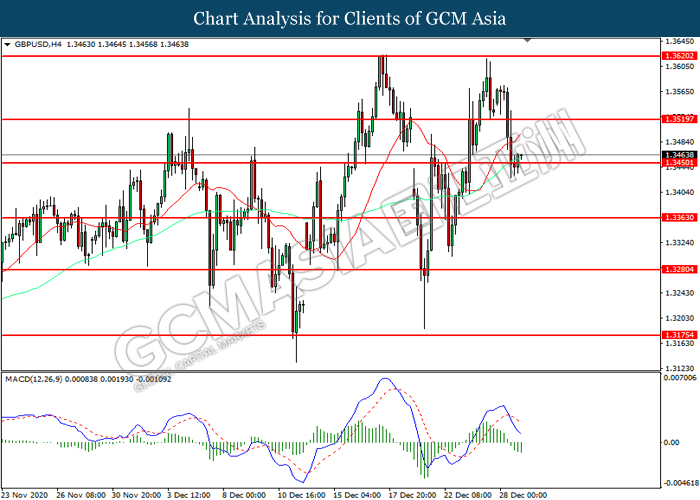

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3450. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3520, 1.3620

Support level: 1.3450, 1.3365

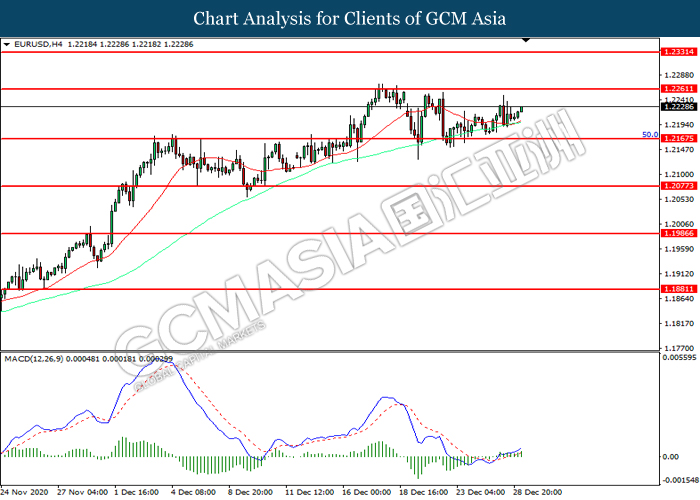

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.2165. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2260.

Resistance level: 1.2260, 1.2330

Support level: 1.2165, 1.2075

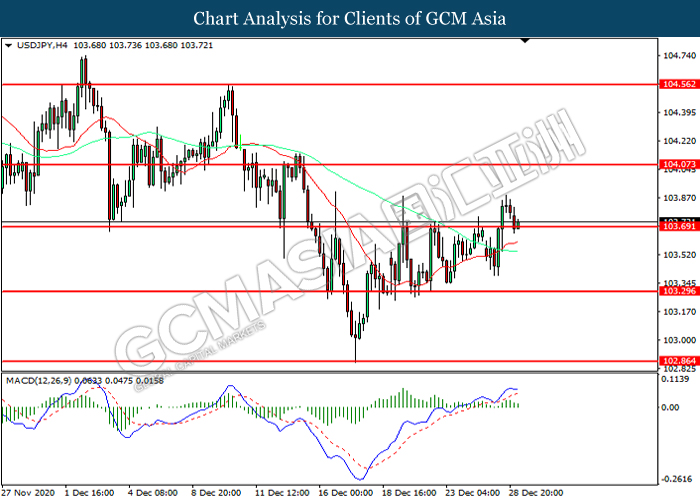

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 103.70. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 104.05, 104.55

Support level: 103.70, 103.30

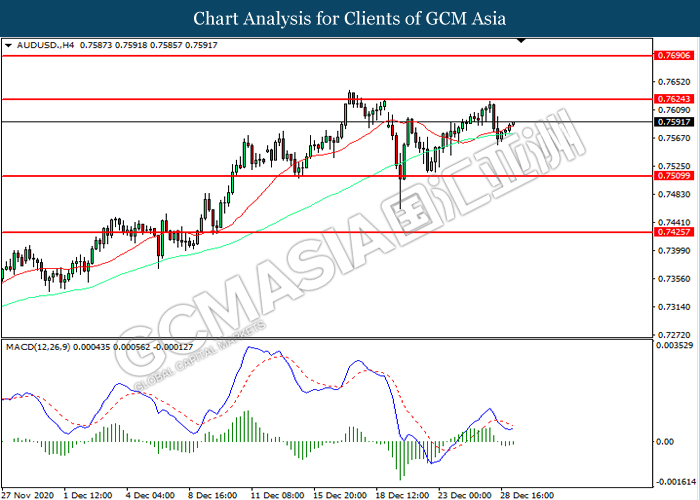

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7625. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7625, 0.7690

Support level: 0.7510, 0.7425

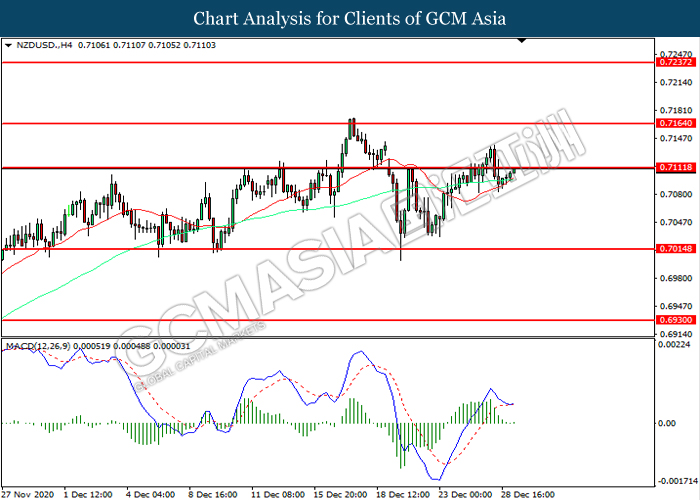

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.7110. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7110, 0.7165

Support level: 0.7015, 0.6930

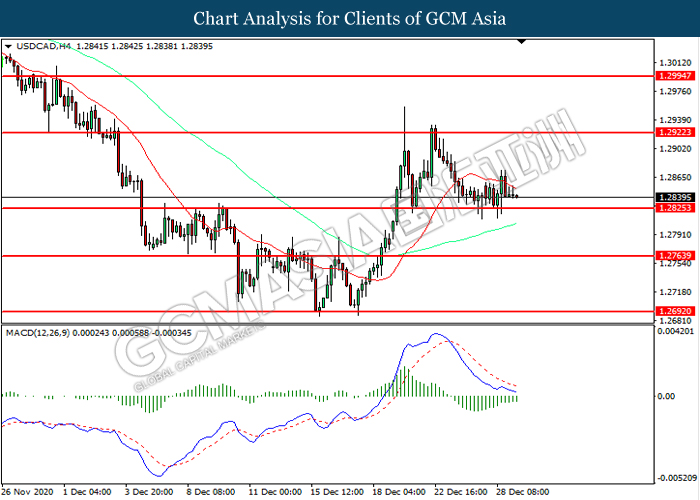

USDCAD, H4: USDCAD was traded within a range while currently testing the support level at 1.2825. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2920, 1.2995

Support level: 1.2825, 1.2765

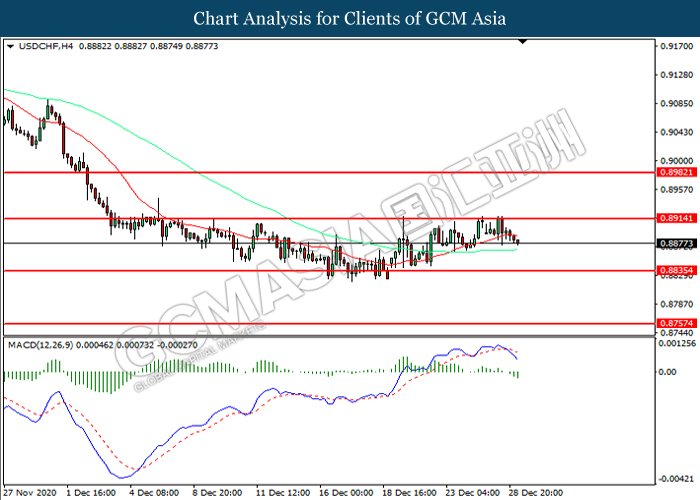

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.8915. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.8835.

Resistance level: 0.8915, 0.8980

Support level: 0.8835, 0.8755

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level at 47.60. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 48.45.

Resistance level: 48.45, 49.30

Support level: 47.60, 46.55

GOLD_, H1: Gold price was traded higher following prior rebound from the support level at 1871.65. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 1883.80.

Resistance level: 1883.80, 1892.05

Support level: 1871.65, 1860.90