30 January 2023 Afternoon Session Analysis

Euro strengthened amid ECB hawkish statement.

The Euro, which traded as a major currency, was strengthened by the hawkish statement from Christine Lagarde, the President of the Europe Central Bank (ECB). In the statement, the president of the ECB mentioned the need of hiking the interest rate significantly in order to reach the 2% inflation target and stay at a higher level for as long as necessary. According to a Bloomberg report, the first ECB policy meeting of 2023 is almost certainly delivering a half-point hike. However, the euro uptrend was offset by the optimistic US economic data. The positive data for the last few days such as 2.9% GDP and 185k initial jobless claims were well above market expectations. Those data dialed up the market optimism toward economic progression in the US. These economic data indicated that the US economy is back on track and strengthened the appeal of the US dollar. Therefore, the dollar index was positively boosted by the economic data and brought the euro currency to slip from a higher level. Apart from this, Germany will release Gross Domestic Product (GDP) with an estimation of 0.0%, with a possibility that the data might post a lower reading compared to the prior month. As of writing, EURUSD was depreciated -0.03% to $1.0864.

In the commodity market, the crude oil price depreciated by -0.58% to $79.22 per barrel as of writing following a news source report that Russia increased the oil loadings at Baltic ports by 50% this month. On the other hand, the gold price appreciated by 0.92% to $1947.10 per troy ounce as of writing amid the expectations of a smaller rate hike of 25 basis points only.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German GDP (QoQ) (Q4) | 0.40% | 0.00% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior breakout above the previous resistance level at 101.70. MACD which illustrated bullish momentum suggests the index extends its gains toward the resistance level at 103.00.

Resistance level: 103.00, 104.55

Support level: 101.70, 100.35

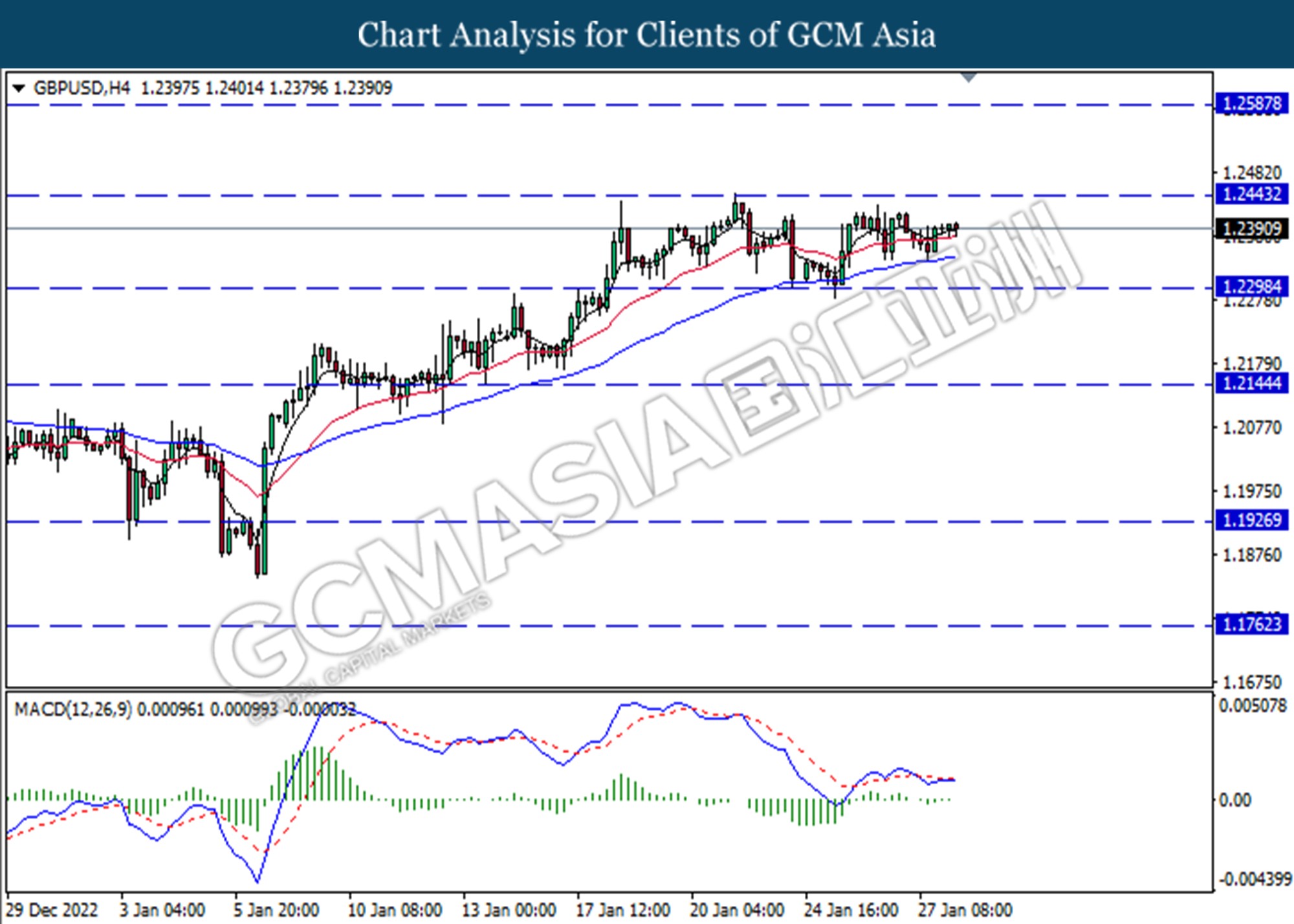

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 1.2440.

Resistance level: 1.2440, 1.2590

Support level: 1.2300, 1.2145

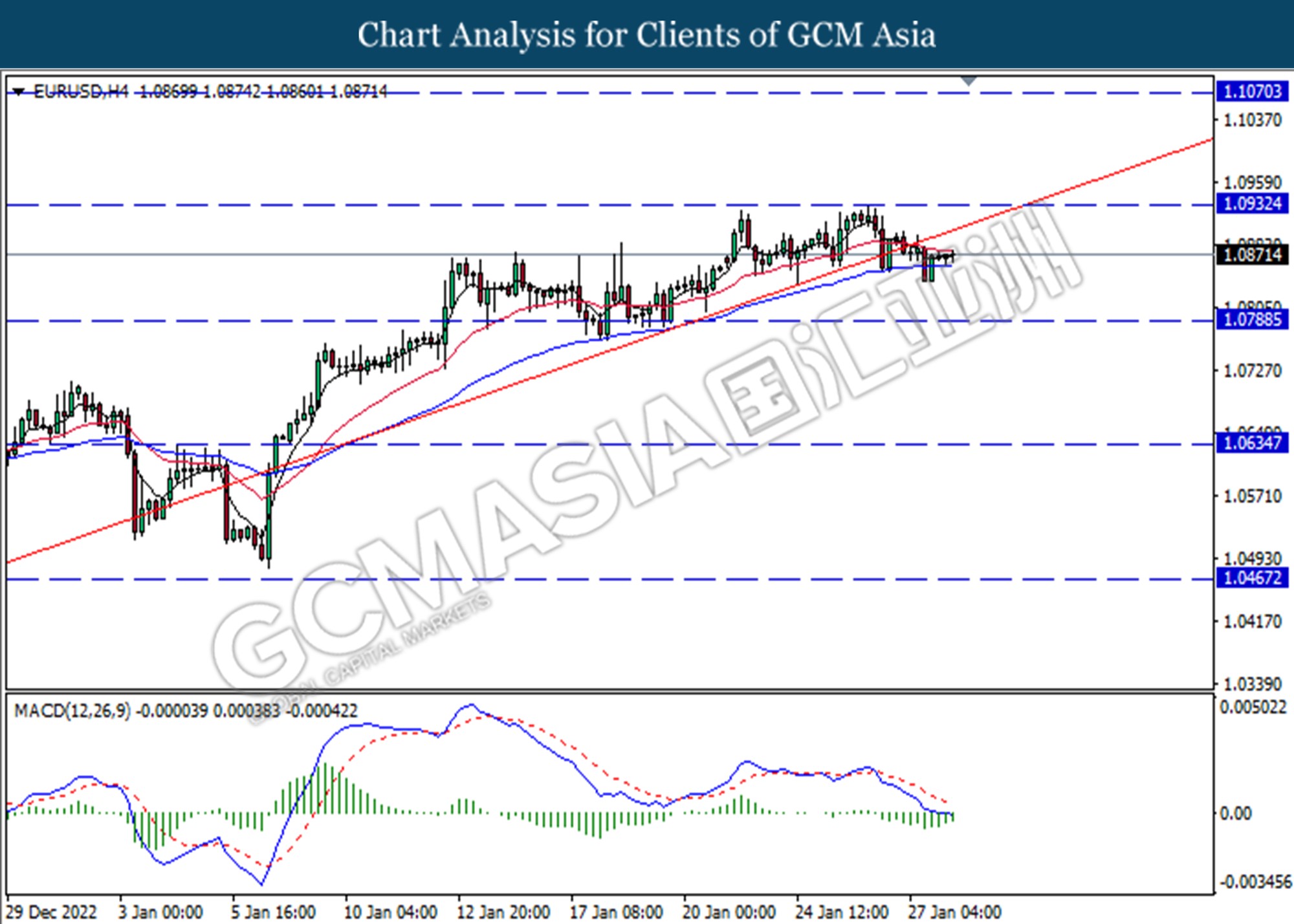

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the higher level.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

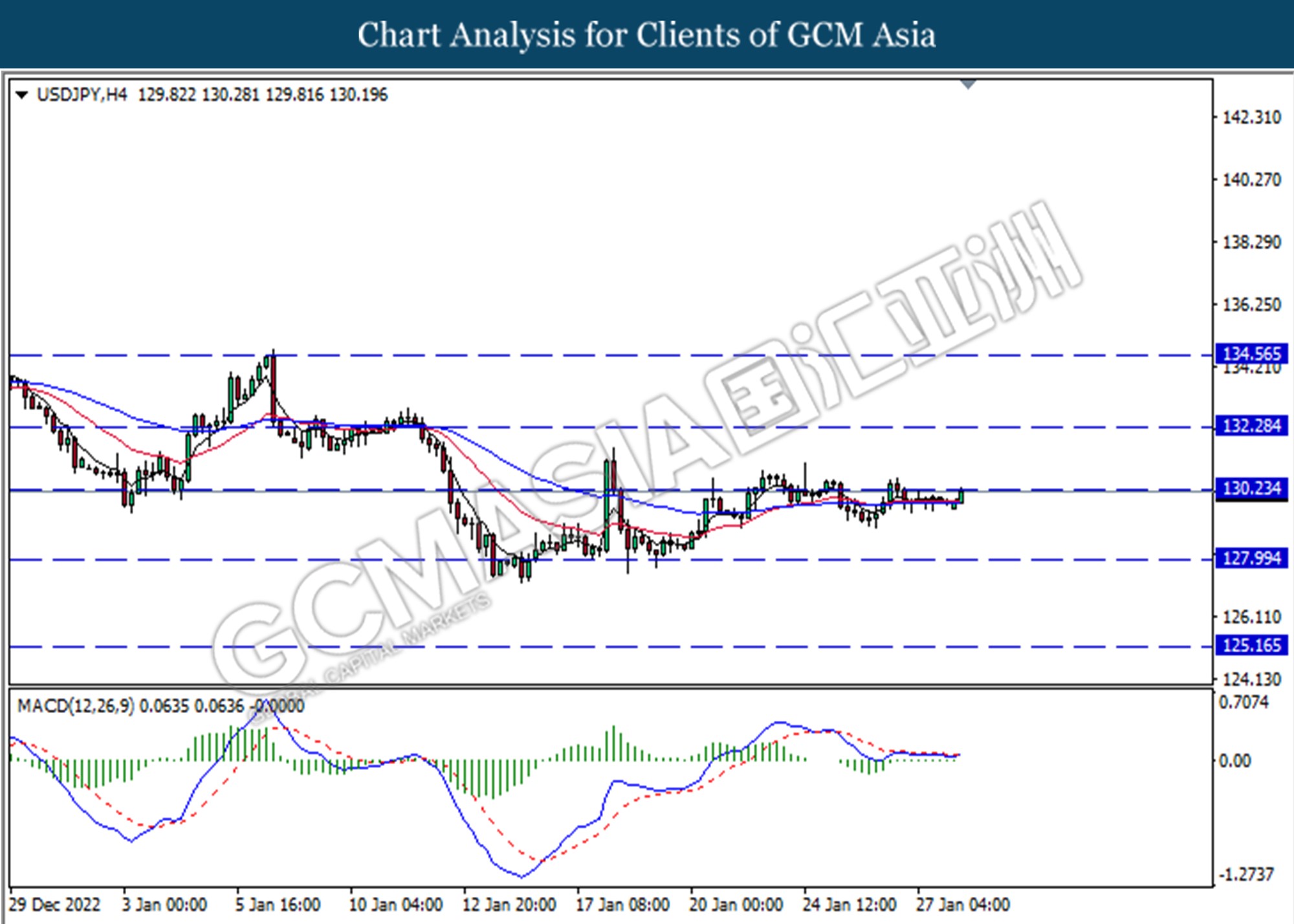

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 130.25. MACD which illustrated bullish momentum suggests the pair to extend its gains if successfully break out the resistance level.

Resistance level: 130.25, 132.30

Support level: 128.00, 126.50

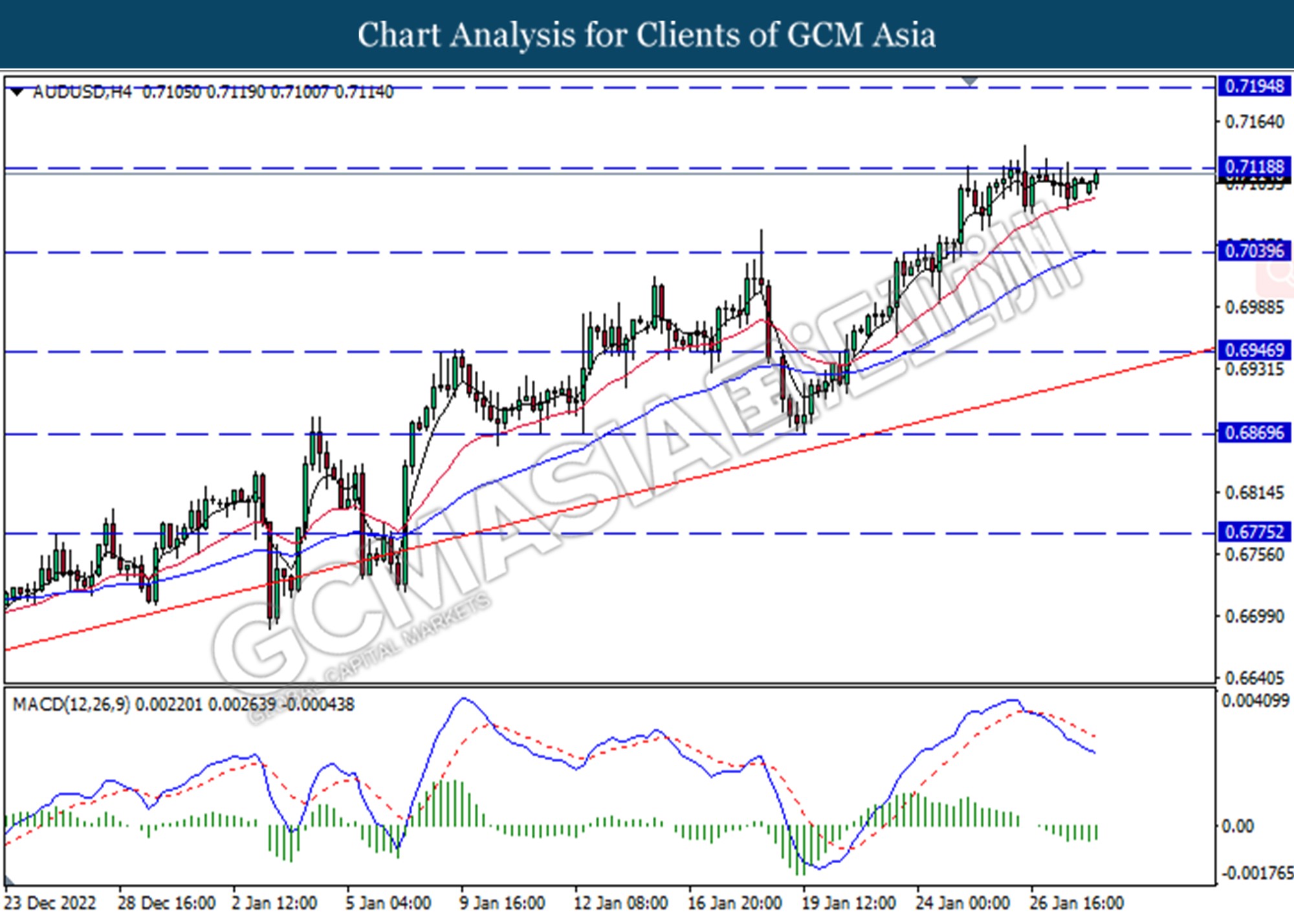

AUDUSD, H4: AUDUSD was traded higher while currently testing for the resistance level at 0.7120. However, MACD which illustrated bearish momentum suggests the pair to be traded higher as a technical correction.

Resistance level: 0.7120, 0.7195

Support level: 0.7040, 0.6950

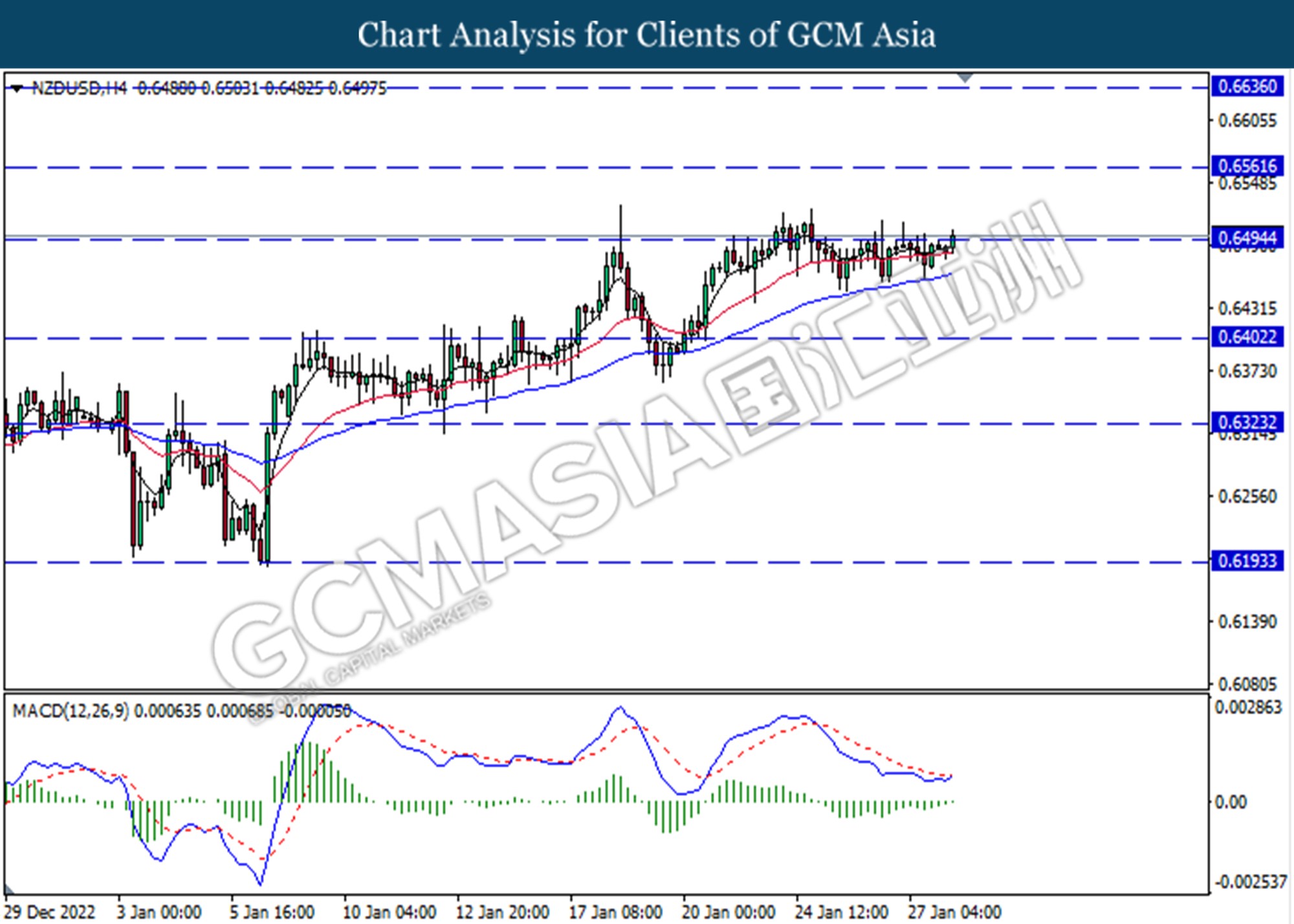

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6495. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6495, 0.6560

Support level: 0.6400, 0.6325

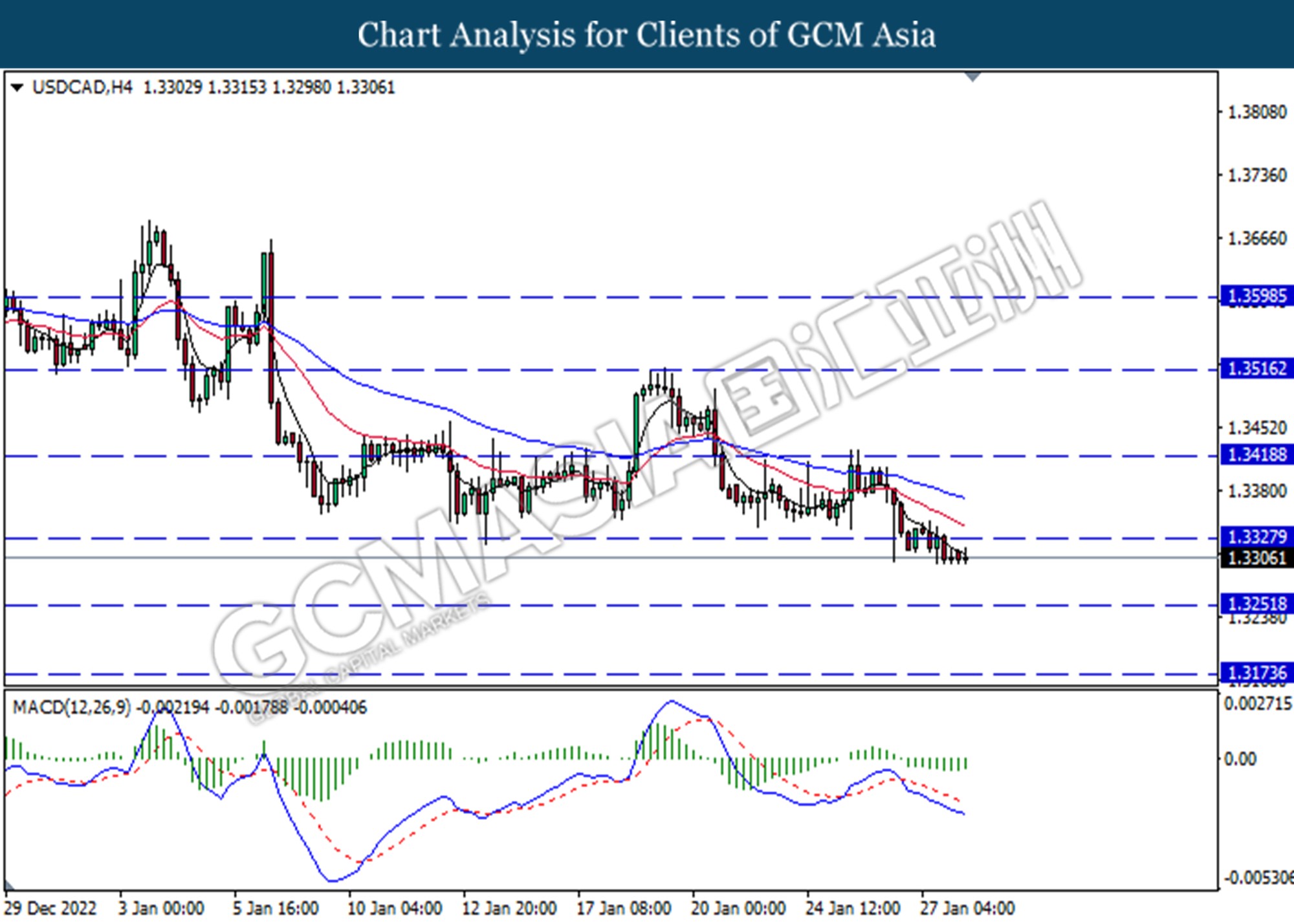

USDCAD, H4: USDCAD was traded lower following a prior breakout below the previous support level at 1.3330. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3250.

Resistance level: 1.3330,1.3420

Support level: 1.3250, 1.3175

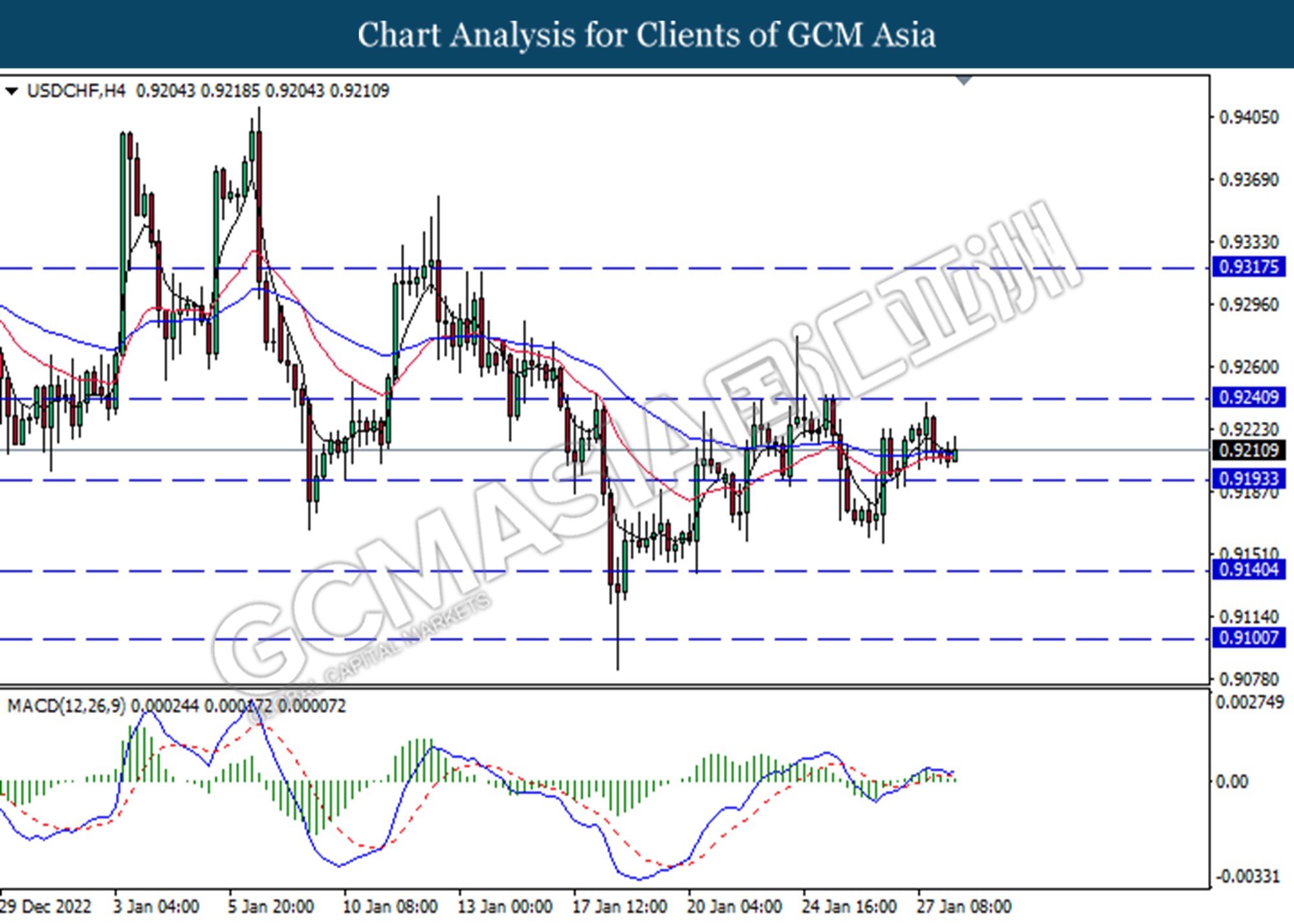

USDCHF, H4: USDCHF was traded lower following a prior retracement from a higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.9195.

Resistance level: 0.9240, 0.9315

Support level: 0.9195, 0.9140

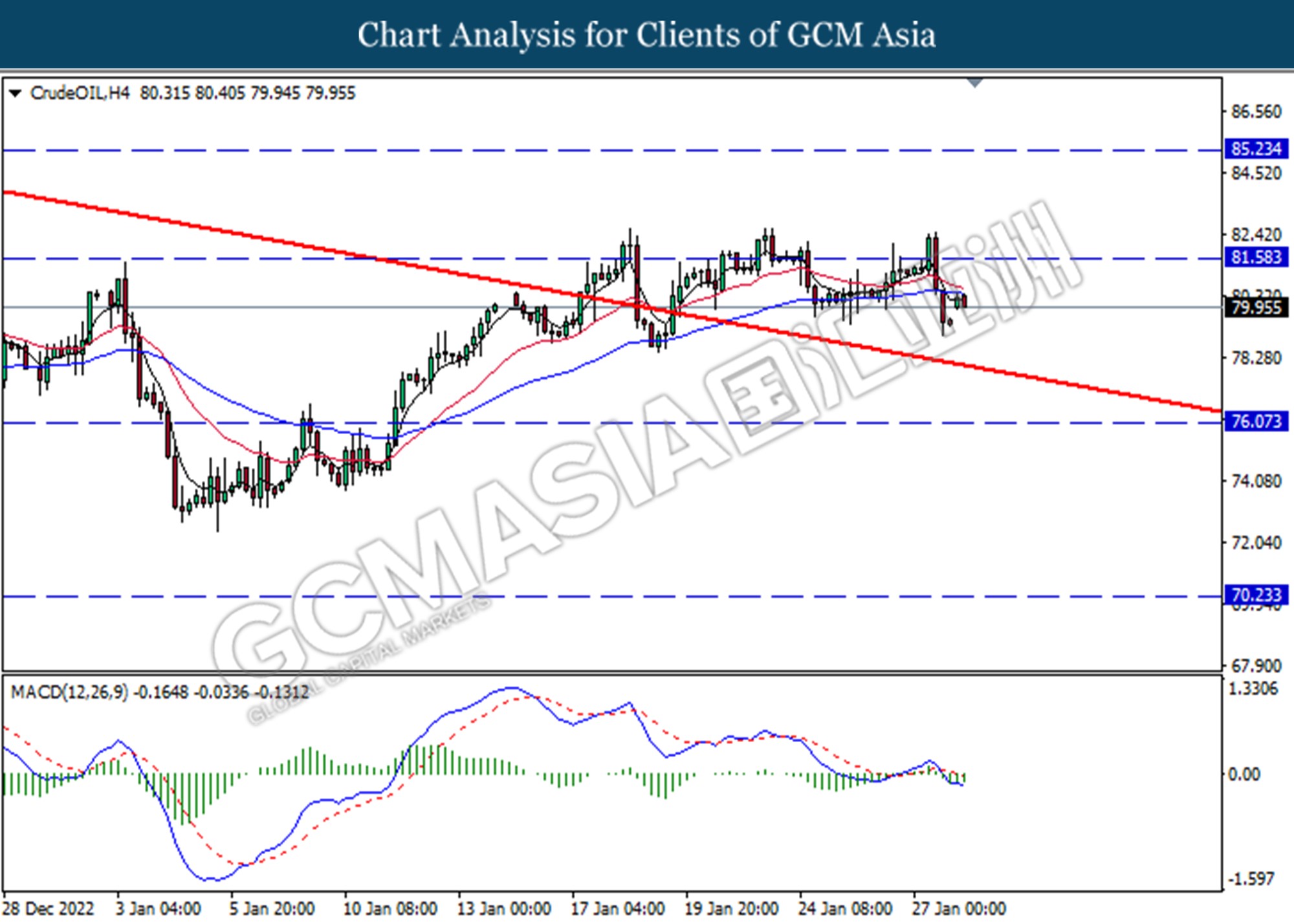

CrudeOIL, H4: Crude oil price was traded lower following a prior breakout below the previous support level at 81.60. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 76.05.

Resistance level: 81.60, 85.25

Support level: 76.05, 70.25

GOLD_, Daily: Gold price was traded lower following prior retracement from the higher level. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level at 1898.65.

Resistance level: 1953.40, 1996.80

Support level: 1898.65, 1845.80