30 March 2017 Daily Analysis

Brexit: A prodigious test for EU and UK.

Great British Pound oscillates during Asian trading hours after receiving no clear direction and details from Britain’s formal execution of its exit from the European Union. UK Prime Minister Theresa May invoked the official Brexit procedure yesterday, declaring that there will be no turning back while ushering in a tortuous process that will test the bloc’s cohesion and pitch her country into the unknown. “I think it will continue to trade in sideways until we get a clearer picture on the European Union’s negotiating stance with Britain,” said currency strategist Alvin Tan. May’s six-page Brexit letter was delivered to the European Council President Donald Tusk in which outlay a positive tone to approach for talks although admitting that to reach a comprehensive agreement within two years would be a challenge. Pair of GBP/USD was up 0.10% to $1.2449 as of writing. Concurrently, the dollar index was up 0.07% to 99.85, buoyed by better-than-expected US home sales data while the depreciation of euro and sterling further underpinned the upside of the currency.

Otherwise, crude oil price was up 5 cents to $49.57 a barrel following a lower-than-expected reading of US crude stockpiles. Concurrently, gold price was held steady at $1,250.45, supported by the uncertainties of Britain’s departure from the European Union.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – Spanish CPI (YoY) (Mar) | 3.0% | – | – |

| 20:00 | EUR – German CPI (MoM) (Mar) | 0.6% | 0.4% | – |

| 20:30 | USD – GDP (QoQ) (Q4) | 1.9% | 2.0% | – |

| 20:30 | USD – Initial Jobless Claims | 261K | 248K | – |

| 20:30 | CAD – RMPI (MoM) (Feb) | 1.7% | 0.8% | – |

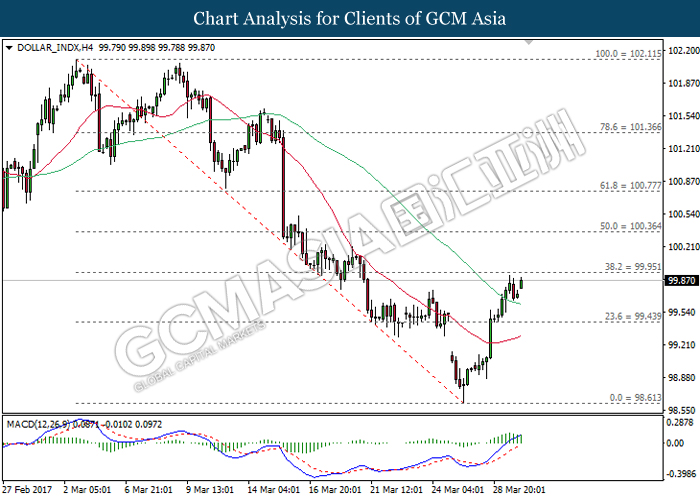

DOLLAR_INDX

DOLLAR_INDX, H4: Dollar index was traded higher following a successful rebound from the 60-moving average line (green) while currently testing near the strong support level of 99.95. Referring to the MACD histogram which continues to illustrate upward signal and momentum, a closure above the level of 99.95 would suggest the dollar index to advance further upwards.

Resistance level: 99.95, 100.35

Support level: 99.45, 98.60

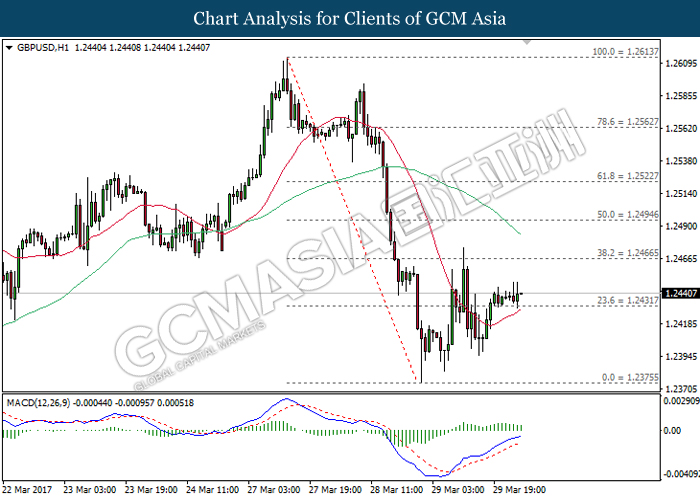

GBPUSD

GBPUSD, H1: GBPUSD was traded higher following prior closure above the 20-moving average line (red) while currently testing near the support level of 1.2430. With regards to the MACD histogram which illustrates upward signal and momentum above the threshold of 0, a rebound form the level of 1.2430 would suggest GBPUSD to advance towards the target of resistance level at 1.2465.

Resistance level: 1.2465, 1.2495

Support level: 1.2430, 1.2375

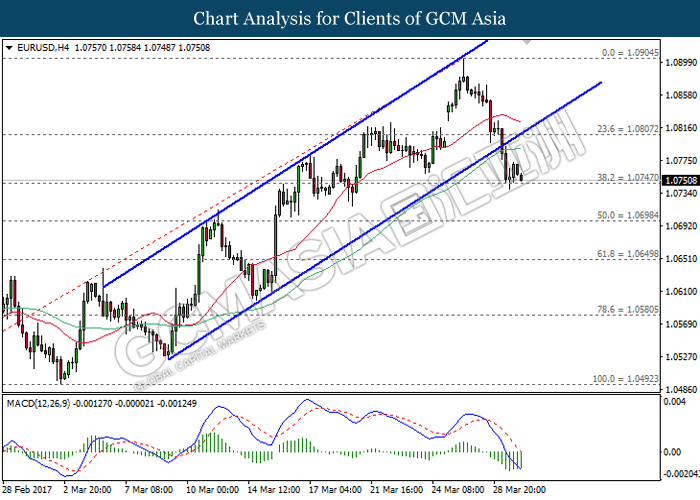

EURUSD

EURUSD, H4: EURUSD has recently broke out from the bottom level of upward channel, signalling a change in trend direction to move further downwards. As the downward signal from MACD histogram continues to expand downwards, EURUSD is expected to extend its losses after breaking the support level of 1.0745.

Resistance level: 1.0805, 1.0905

Support level: 1.0745, 1.0700

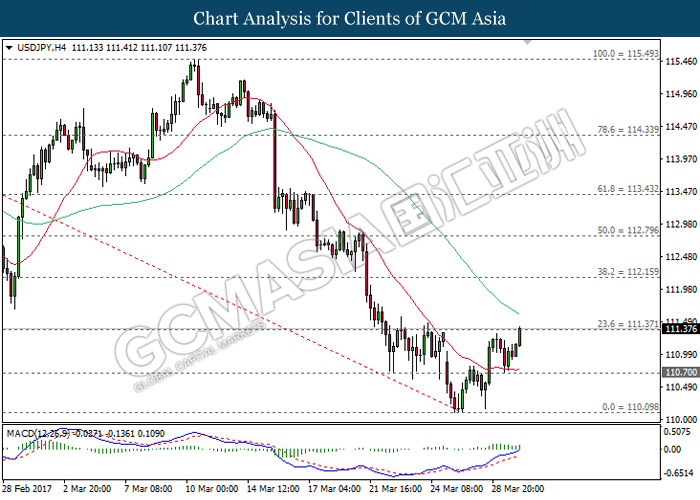

USDJPY

USDJPY, H4: USDJPY was traded higher following prior rebound near the support level of 110.70 while currently testing at the strong resistance level of 111.40. As the MACD histogram continues to illustrate and upward signal and momentum, a closure above the level of 111.40 would suggest USDJPY to extend its upward momentum.

Resistance level: 111.40, 112.15

Support level: 110.70, 110.10

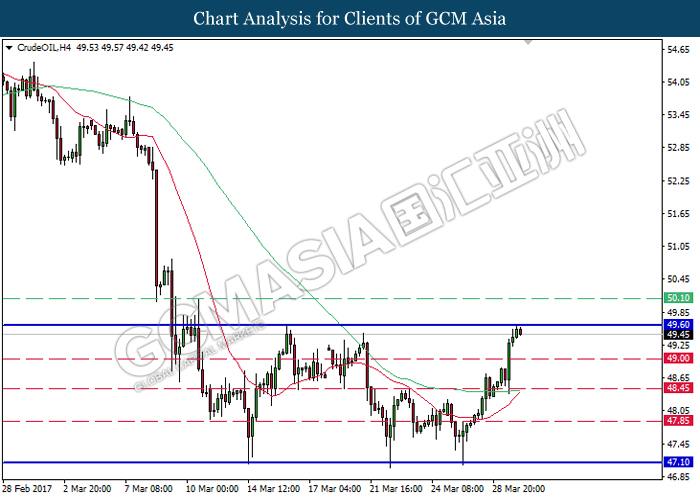

CrudeOIL

CrudeOIL, H4: Crude oil price remains traded within the sideways channel while currently testing at the top level of the channel. A breakout from this level would signal a change in trend direction for crude oil price to move further upwards. Otherwise, a retrace from this level may suggest crude oil price to be traded lower within the sideways channel in short-term thereafter.

Resistance level: 49.60, 50.10

Support level: 49.00, 48.45, 47.85, 47.10

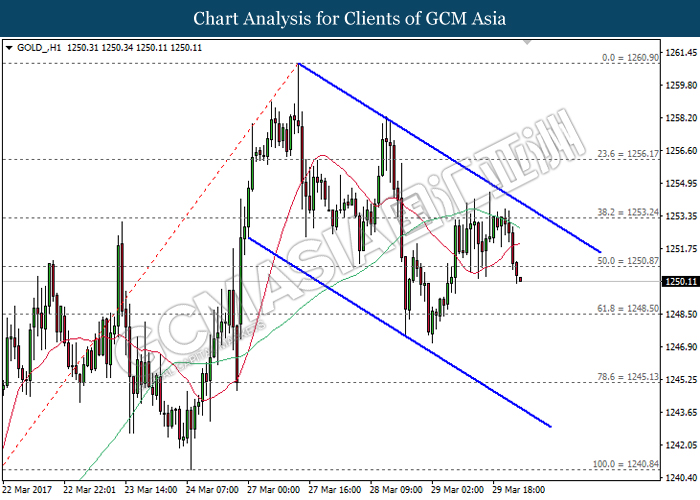

GOLD

GOLD_, H1: Gold price continued to be traded within a downward channel following prior retracement from the resistance level of 1253.25. Recent closure below the strong support level of 1250.90 suggests gold price to advance further down, towards the support level of 1248.50.

Resistance level: 1250.90, 1253.25

Support level: 1248.50, 1245.15