30 March 2023 Morning Session Analysis

US Dollar firmed as Fed official ensured US banking condition.

The Dollar Index which traded against a basket of six major currencies found its ground on yesterday amid the background of easing fears on bank collapse. As the Silicon Valley Bank (SVB) has been takeover by First Citizen Bank, it diminished the market expectations of a financial crisis. Besides, the speech from Fed official might signaled that the banking system in the US was remaining in a healthy condition. Michael Barr, the Fed’s vice chairman for supervision claimed on Wednesday that the bankruptcy of SVB was led by its own risk management fault, while it would likely to be an isolated case. With that, it could cause investors to shift their views and start thinking the Fed may have more room to keep raising rates. On the economic data front, the upbeat economic data has brought US Dollar higher. According to National Association of Realtors, the US Pending Home Sales MoM in February came in at the reading of 0.8%, which exceeding the market expectation of -2.3%. Though, investors are also awaiting for the announcement of upcoming essential economic data, such as GDP and Core PCE Price Index, in order to gauge the next move of Fed. Thus, the gains of Dollar Index was limited following investors decided to step back from the market. As of writing, the Dollar Index appreciated by 0.19% to 102.30.

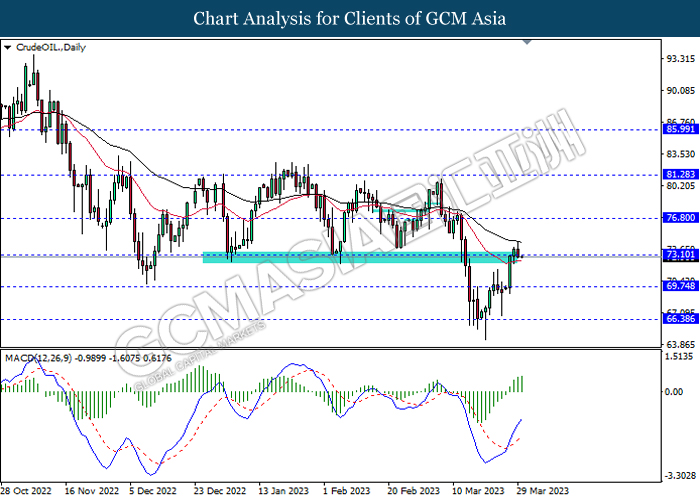

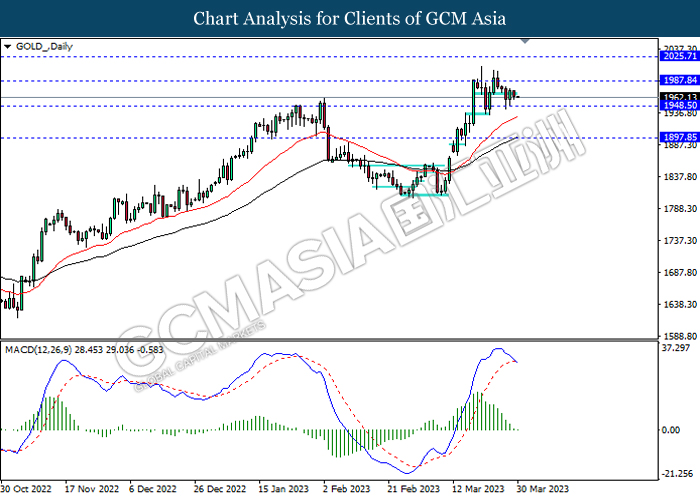

In the commodity market, the crude oil price eased by 0.12% to $72.92 per barrel as of writing following the Russia output cut was lesser than market anticipation. On the other hand, the gold price depreciated by 0.19% to $1962.80 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative GBP BOE Inflation Letter

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | EUR – German CPI (YoY) (Mar) | 8.70% | 7.30% | – |

| 20:30 | USD – GDP (QoQ) (Q4) | 2.70% | 2.70% | – |

| 20:30 | USD – Initial Jobless Claims | 191K | 196K | – |

Technical Analysis

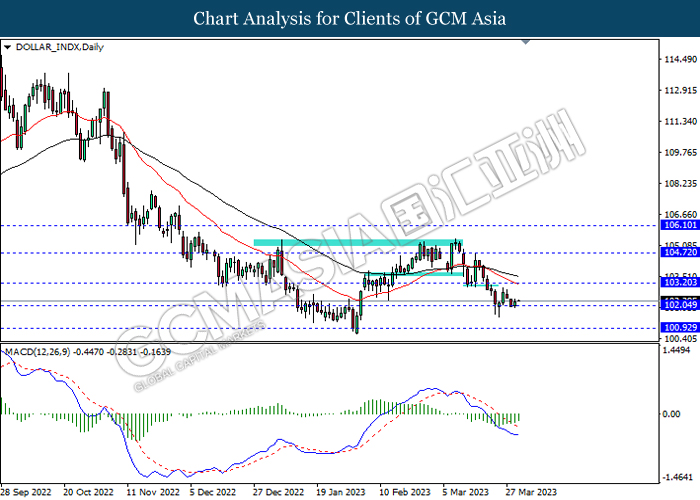

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

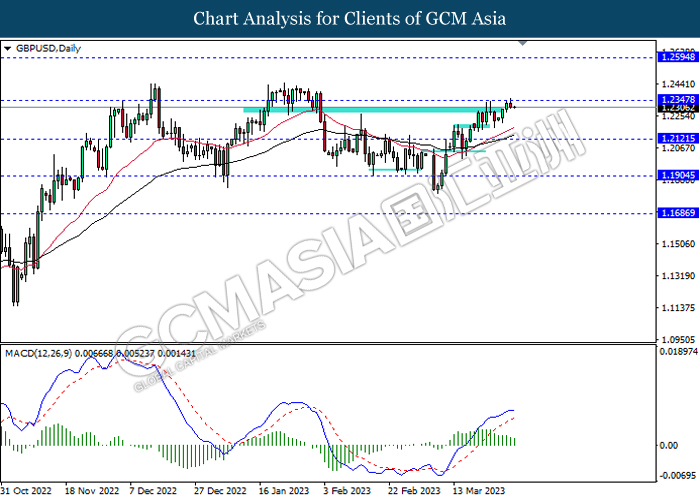

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

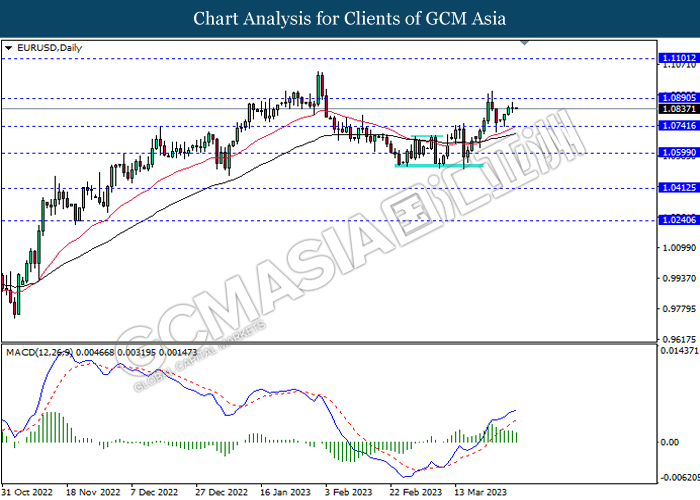

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

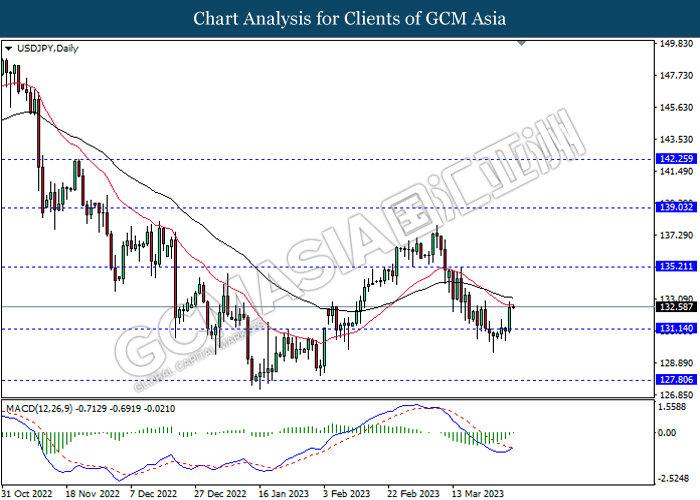

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

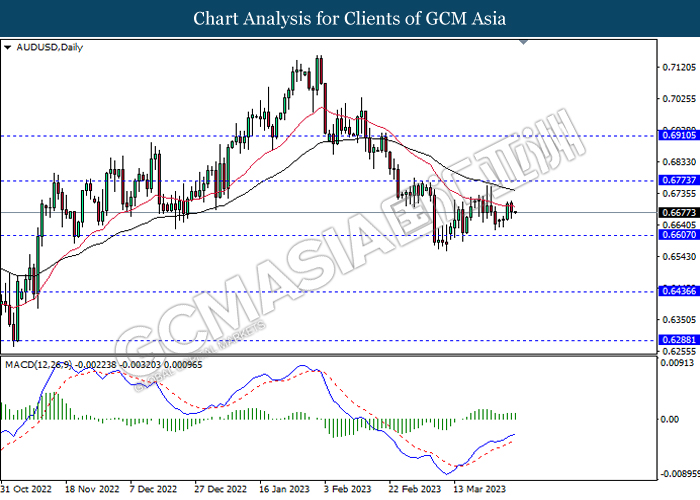

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

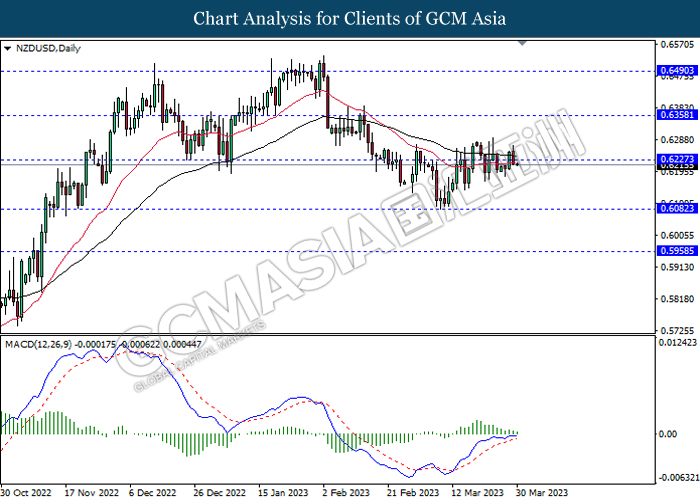

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

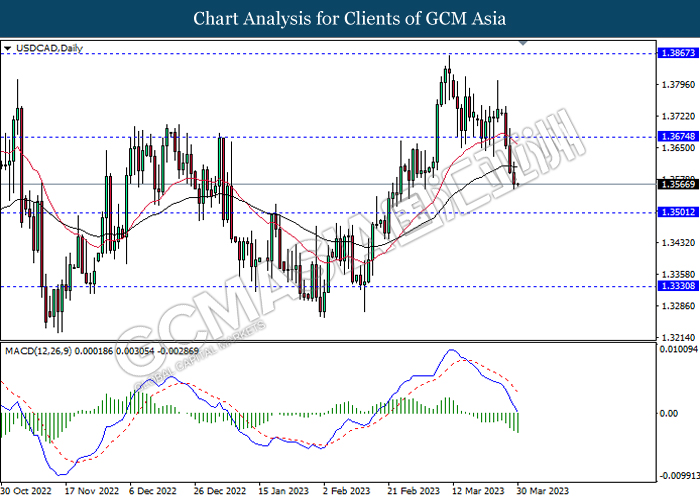

USDCAD, Daily: USDCAD was traded lower following prior breakout below the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3330

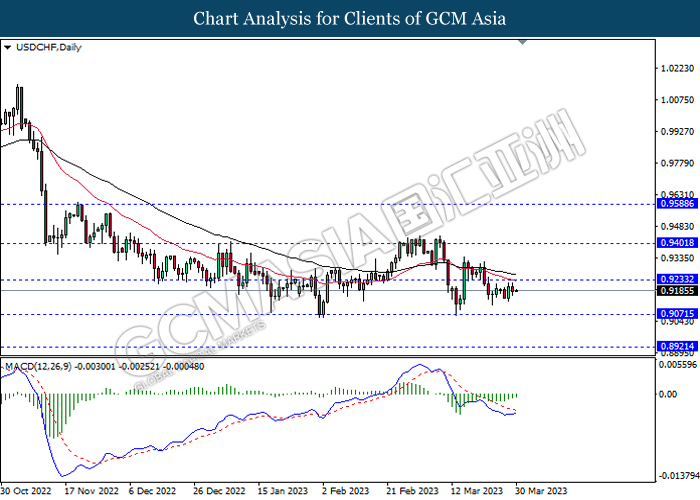

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 73.10, 76.80

Support level: 69.75, 66.40

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1987.85, 2025.70

Support level: 1948.50, 1897.85