30 May 2023 Afternoon Session Analysis

The Japanese Yen climbed after unemployment data was reduced.

The Japanese Yen, which was traded against the greenback, climbed after the unemployment data was reduced. Japan’s unemployment slips 0.2% more than market expectations of 2.7% from 2.8% to 2.6%, government data showed Tuesday. The number of full-time workers rose to 36.34 million, the highest since 2013. Companies are paying higher wages to lure workers amid chronic labour shortages, with Japanese top companies, in particular, agreeing to the biggest pay increase in decades as inflation surges. Besides the active job openings-to-applicants ratio in April was in line with market expectations and marked at 1.32. Construction and manufacturing are laying off workers as higher raw material prices and higher commodity prices worsen the order environment. However, the gains of the Japanese yen were limited by BoJ’s Governor Ueda’s speech. Governor Kazuo Ueda said the inflation rate is not sustained by 2% and predicted the inflation would begin to fall sharply in the middle of the year. Hence, BoJ might extend its ultra-loosen monetary policy to keep inflation sustainable at 2%. As of writing, the JPY/USD slipped to -0.26% to $140.22.

In the commodities market, crude oil prices ticked down by -0.39% to $ 72.40 per barrel as the market’s concerns over the rate hike possibility. Besides, gold prices teeter down by -0.22% to $1941.49 per troy ounce as the investor risk appetite increased.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (May) | 101.3 | 99.0 | – |

Technical Analysis

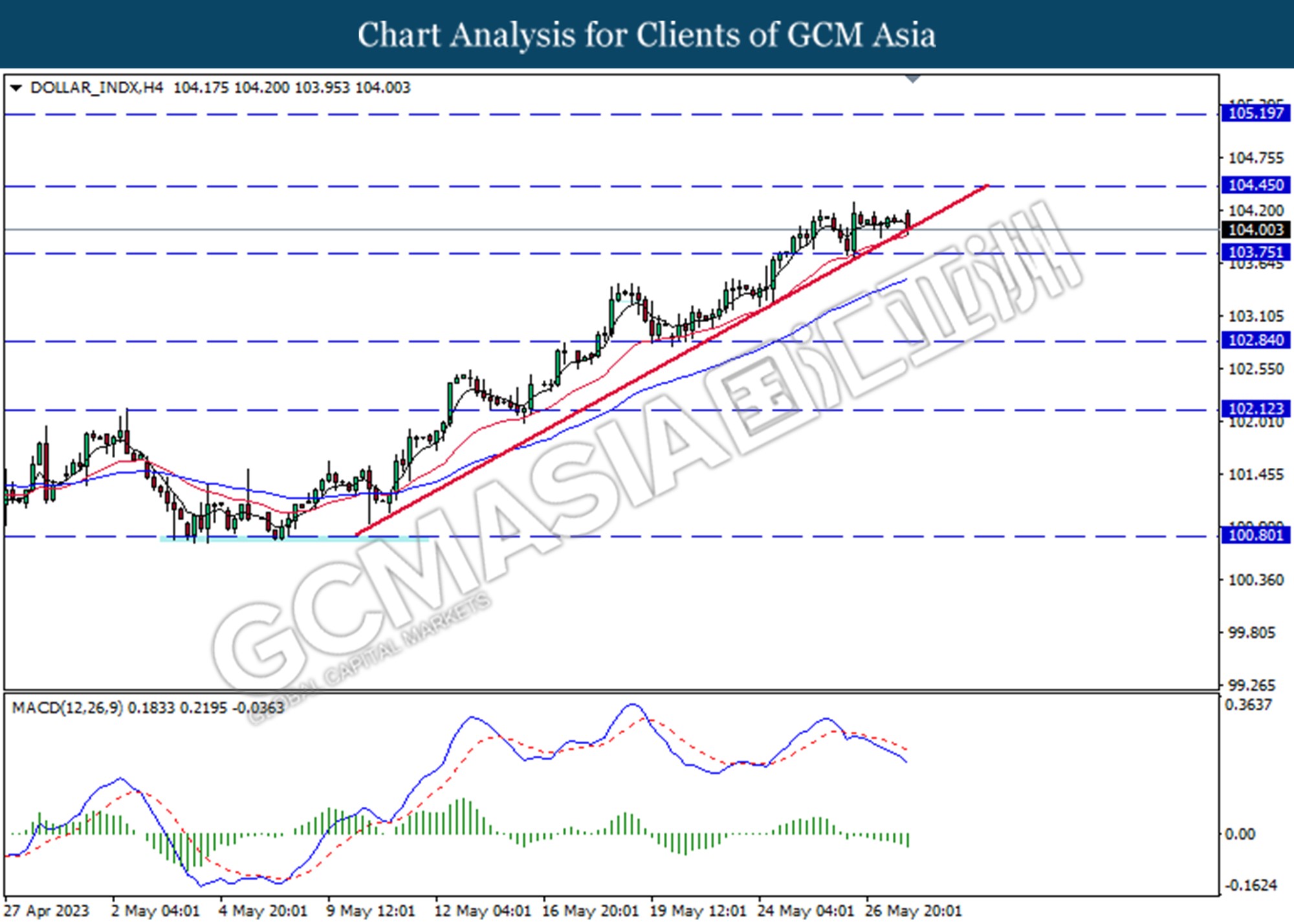

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing to the upward trend line. MACD which illustrated increasing bearish momentum suggests the index extended its losses after it successfully break below the upward trend line.

Resistance level: 104.45, 105.20

Support level: 103.75, 102.85

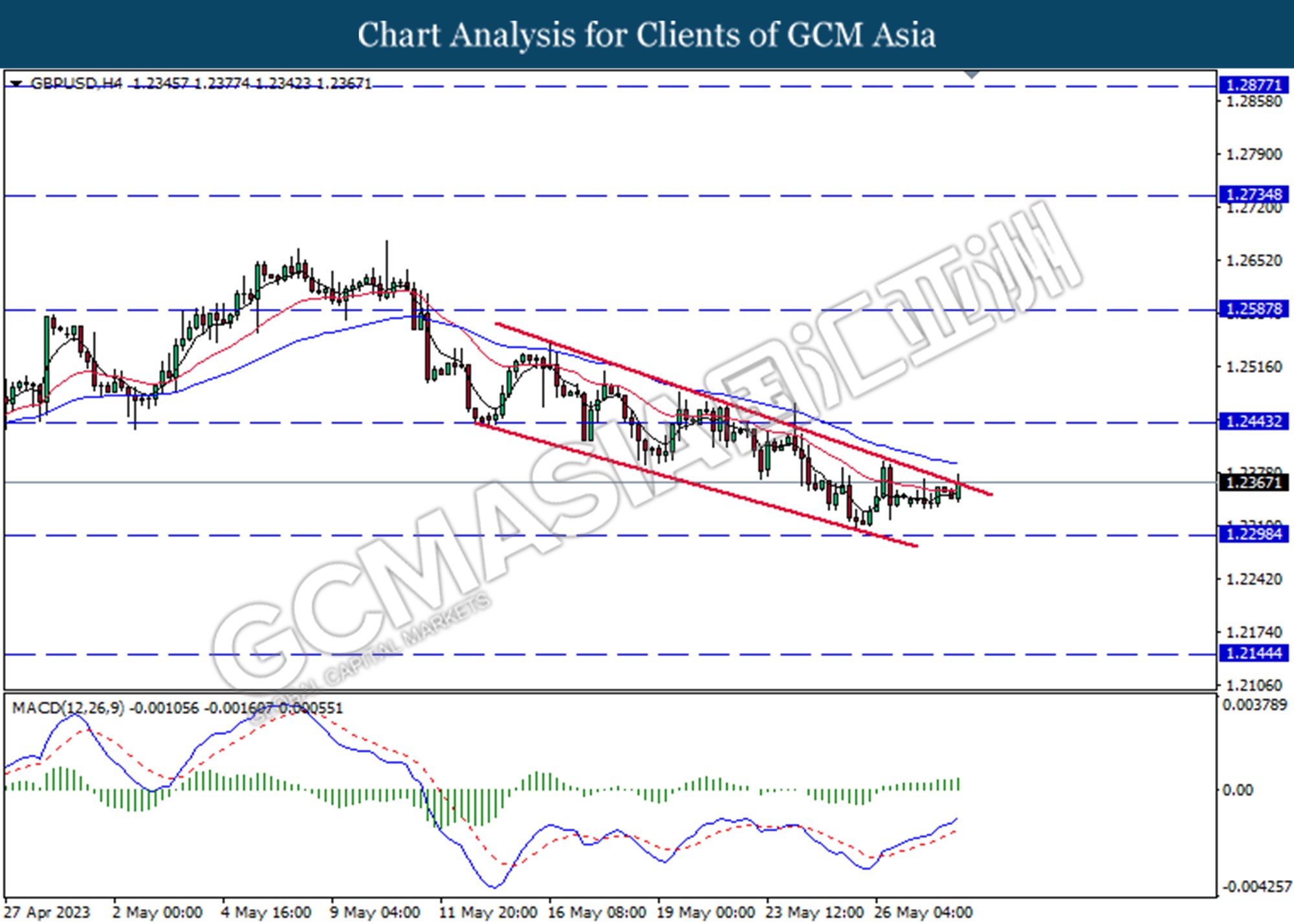

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2445, 12590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded higher while currently testing for the downward trend line. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully breaks above the downward trend line.

Resistance level: 1.0790, 1.0930

Support level: 10635, 1.0505

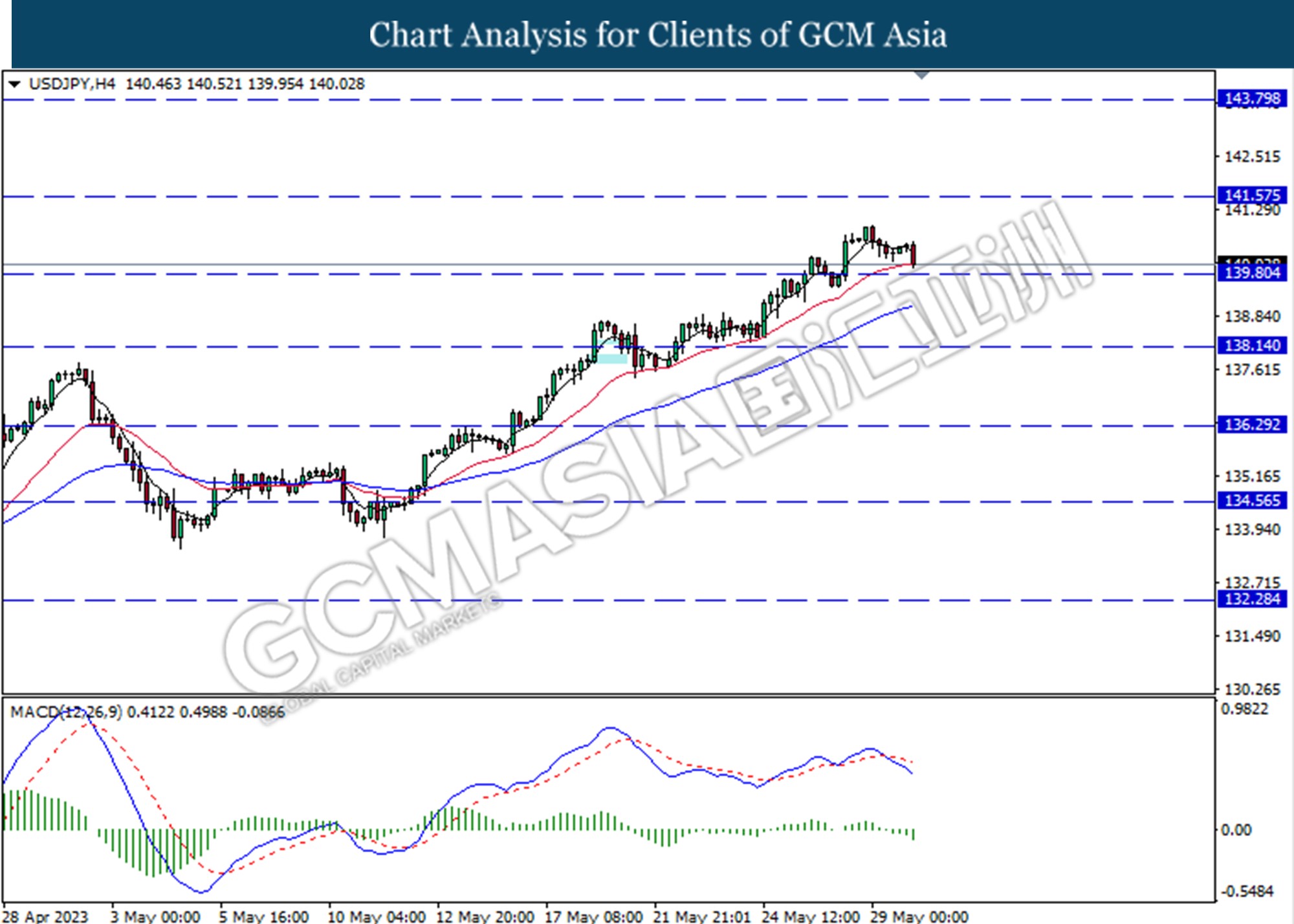

USDJPY, H4: USDJPY was traded lower following the prior breakout retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 139.80.

Resistance level: 141.60, 143.80

Support level: 139.80, 138.15

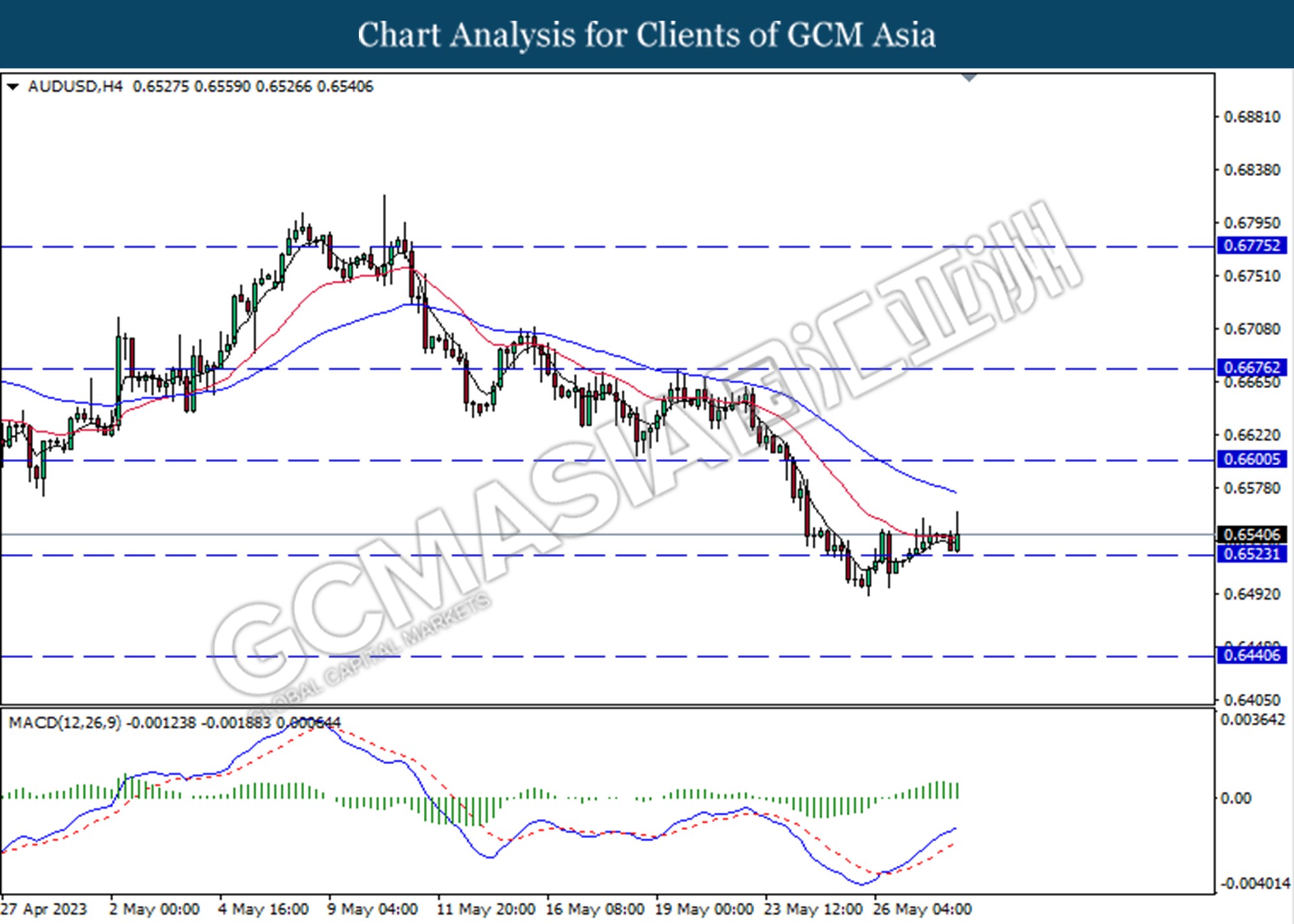

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6525. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6600, 0.6675

Support level: 0.6525, 0.6440

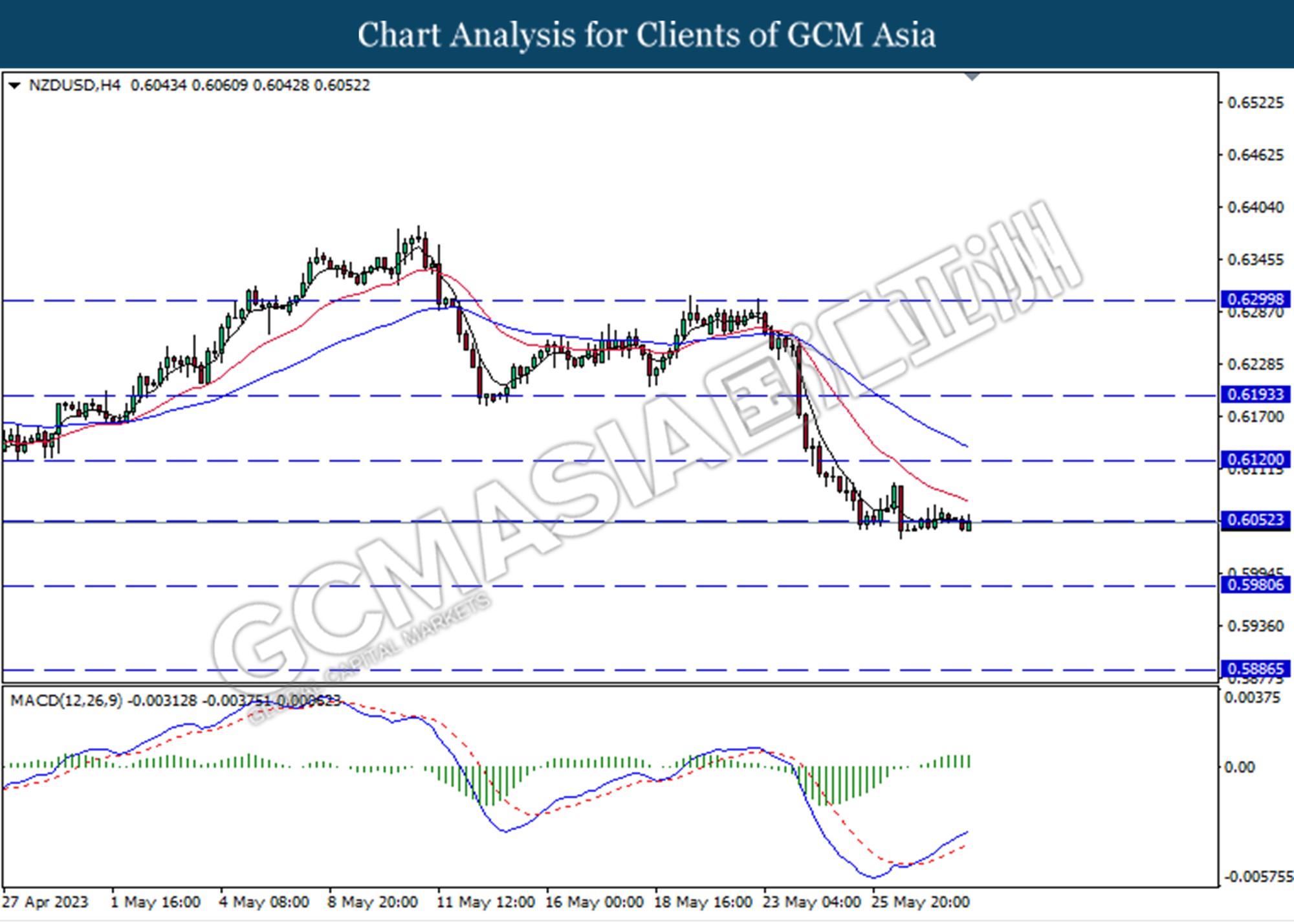

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6050. MACD which illustrated bullish momentum suggests the pair extended its gains after it successfully breakout above the resistance level.

Resistance level: 0.6050, 0.6120

Support level: 0.5980, 0.5885

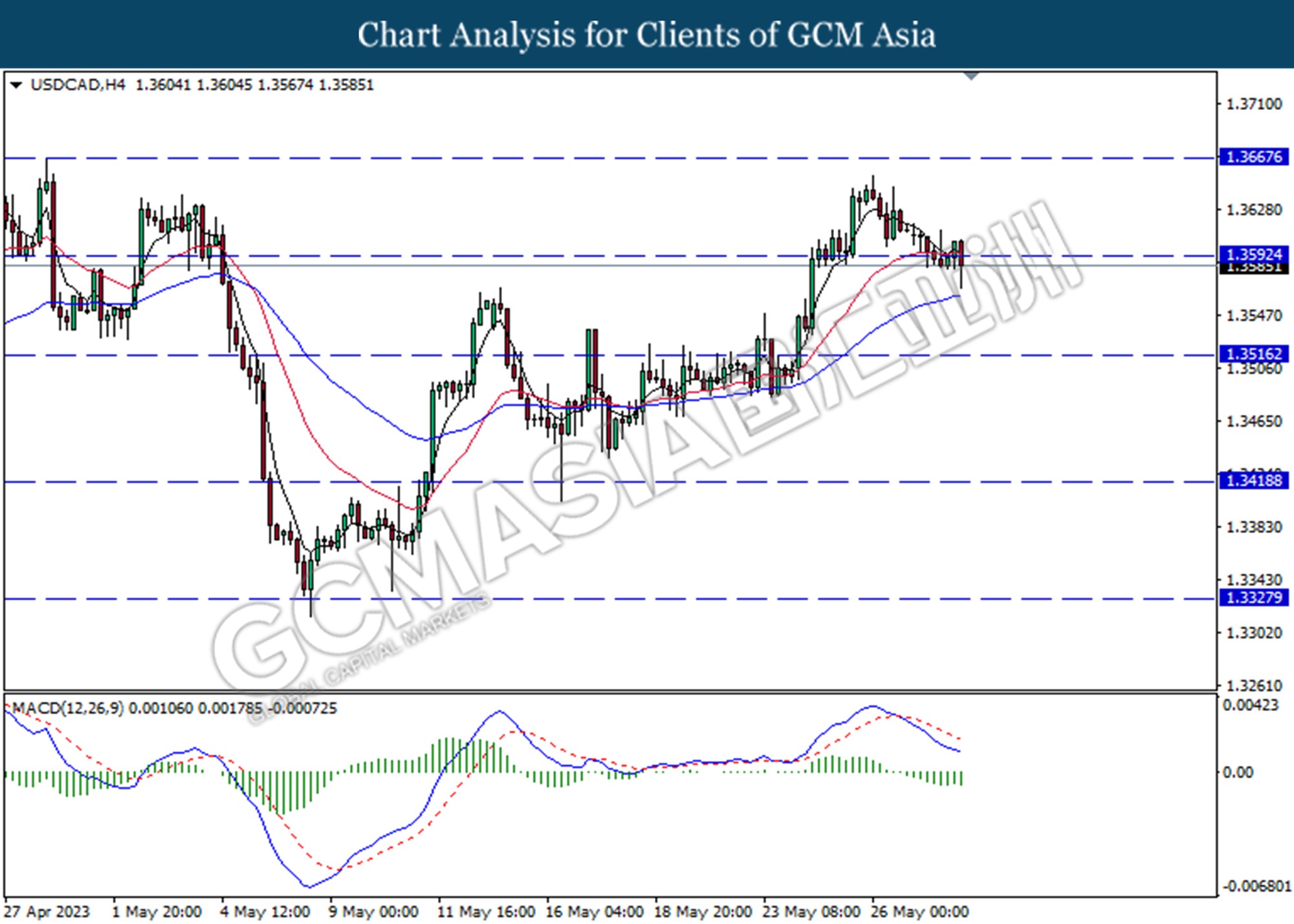

USDCAD, H4: USDCAD was traded lower following the prior breaks below the previous support level at 1.3600. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1,3600, 1.3665

Support level: 1.3515, 1.3420

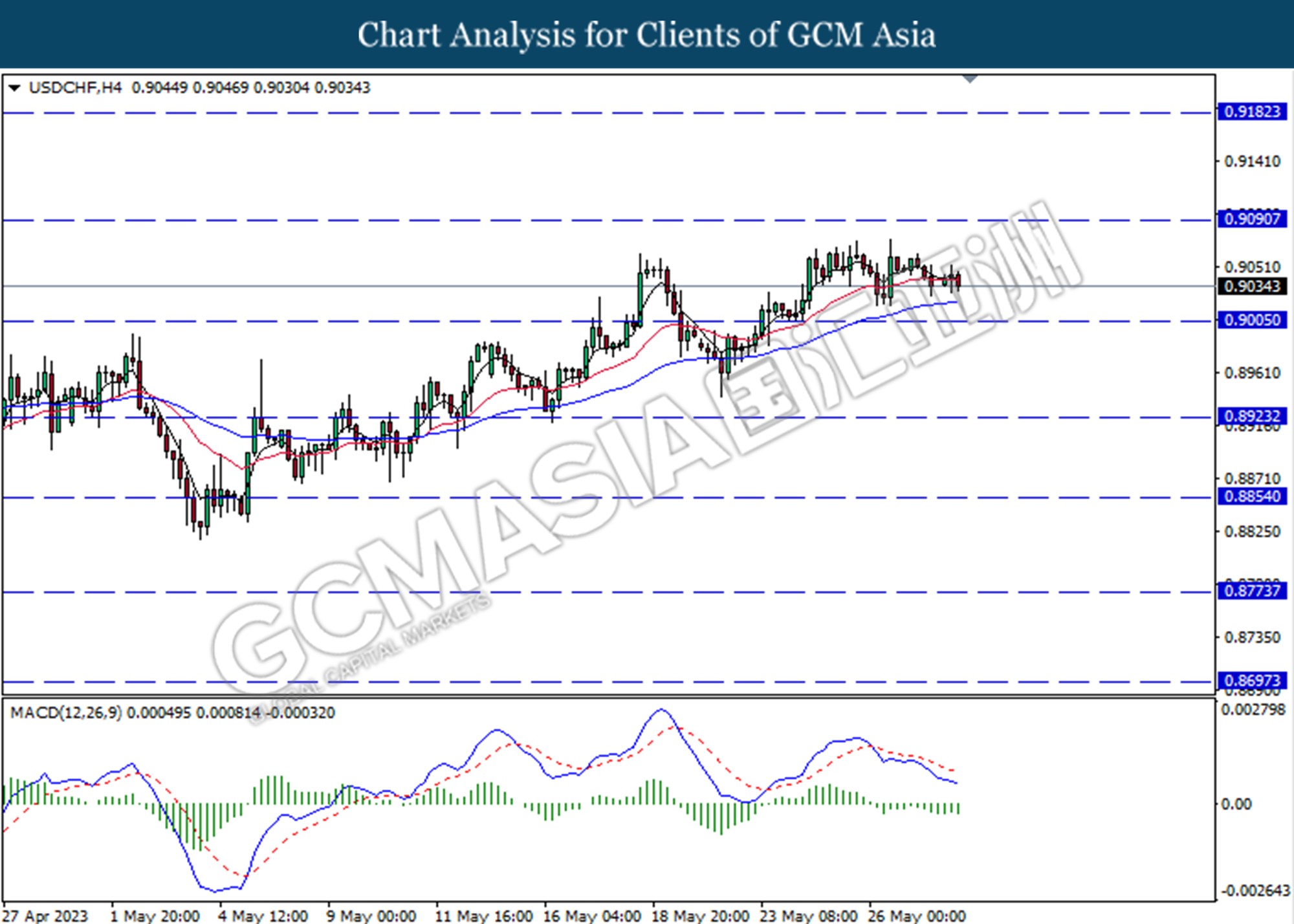

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 0.9005.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

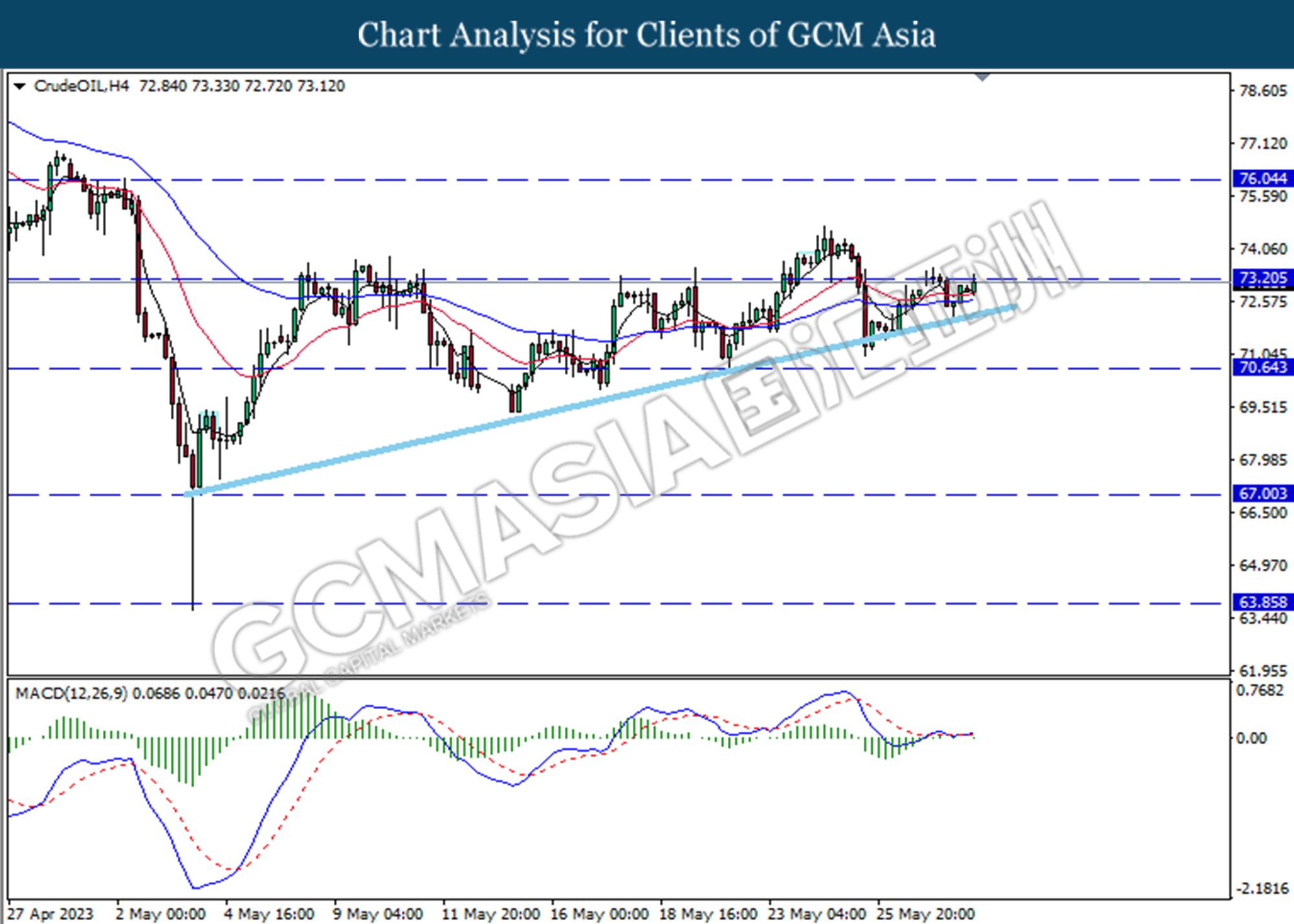

CrudeOIL, H4: Crude oil price was traded higher while currently testing for the resistance level at 73.20. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains after it successfully break above the resistance level.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

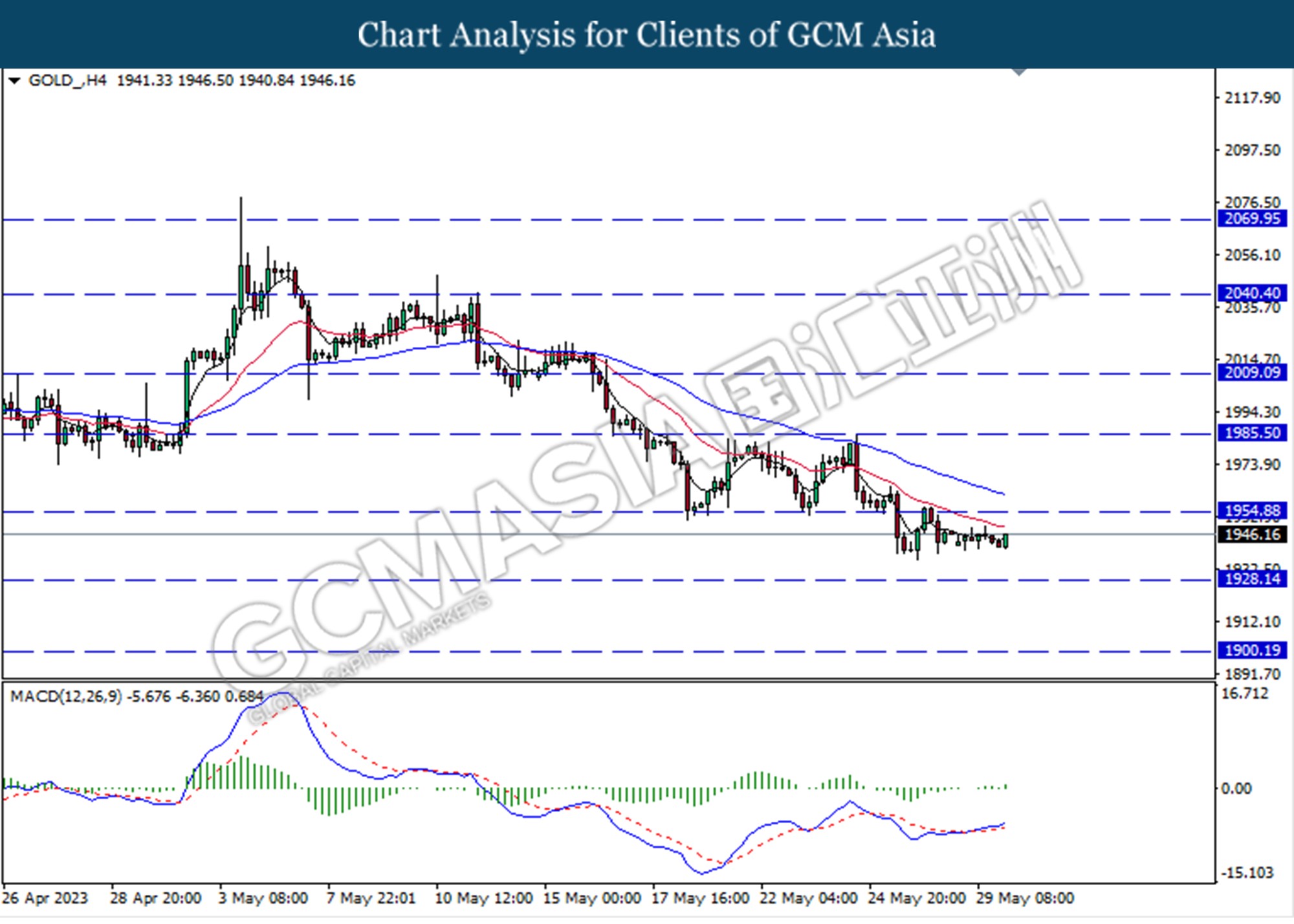

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 1954.90.

Resistance level: 1954.90, 1985.50

Support level: 1928.15, 1900.15