30 May 2023 Morning Session Analysis

US dollar muted amid Memorial Day.

The dollar index, which was traded against a basket of six major currencies, lingered near the highest level in 10 weeks amid subdued trading activities on Memorial Day holiday in the US. Prior to that, the appeal of the US dollar was boosted by the optimism over the debt ceiling deal, where a deal was sealed between US President Joe Biden and the House’s Speaker McCarthy. However, the deal must still be needed to go through a legal process before enforcement, which means it is still subject to the approval of Congress. The voting on the bill is set to start after Memorial Day in the House and the Senate. On the other hand, the high possibility of a further rise in the US cash rates continued to support the value of the dollar index, prompted by the upbeat economic data last week. According to the CME FedWatch Tools, the chances of taking a step further in the rate hike path rose from the prior week’s reading of 25.7% to 61.9% this week, while the likelihood of leaving the rate at the current level is at 38.1%. In the second half of the week, market participants will keep a close eye on the ISM manufacturing PMI, the ADP employment change, and the Bureau of Labor Statistics May employment report. As of writing, the dollar index rose 0.04% to 104.25.

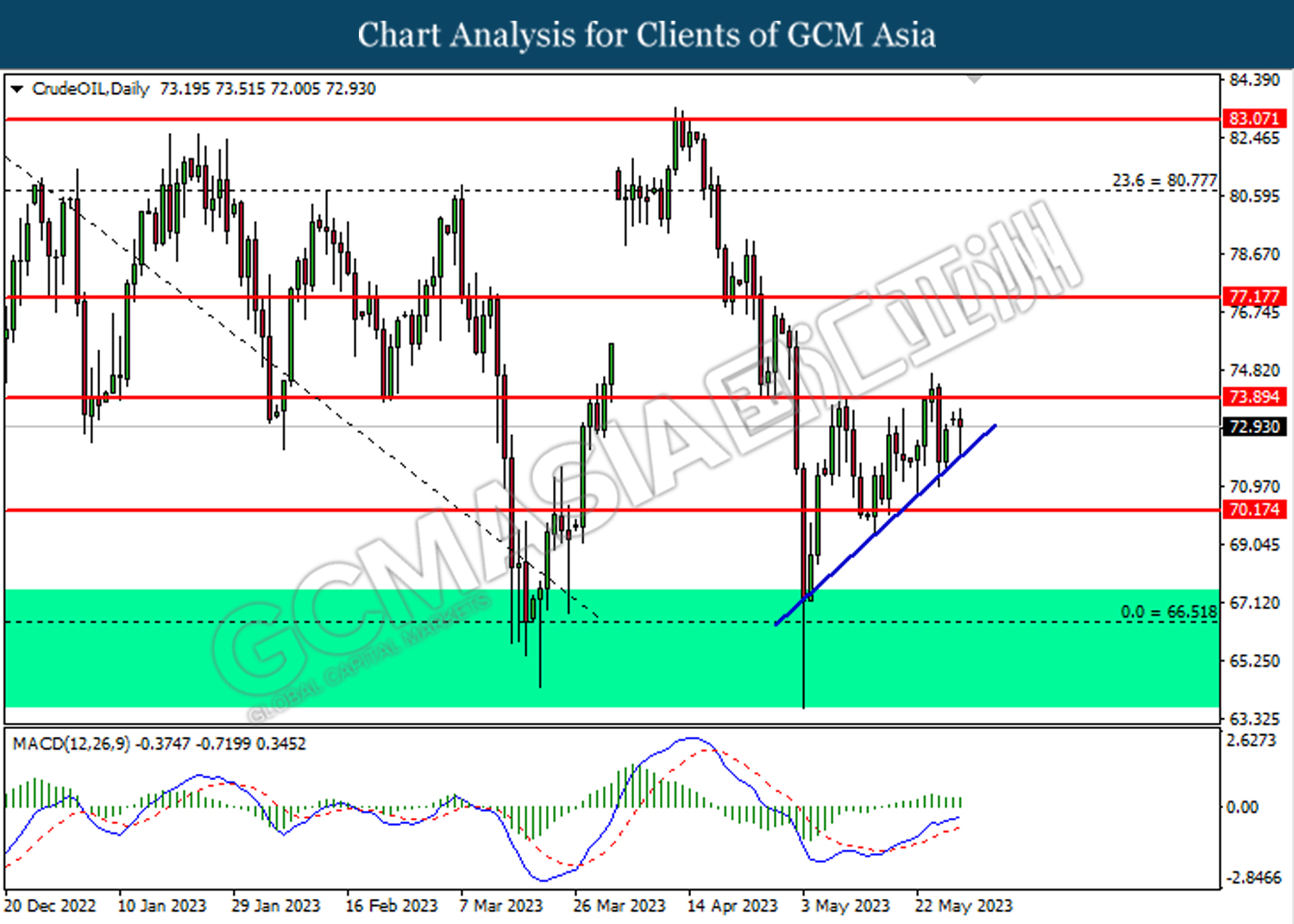

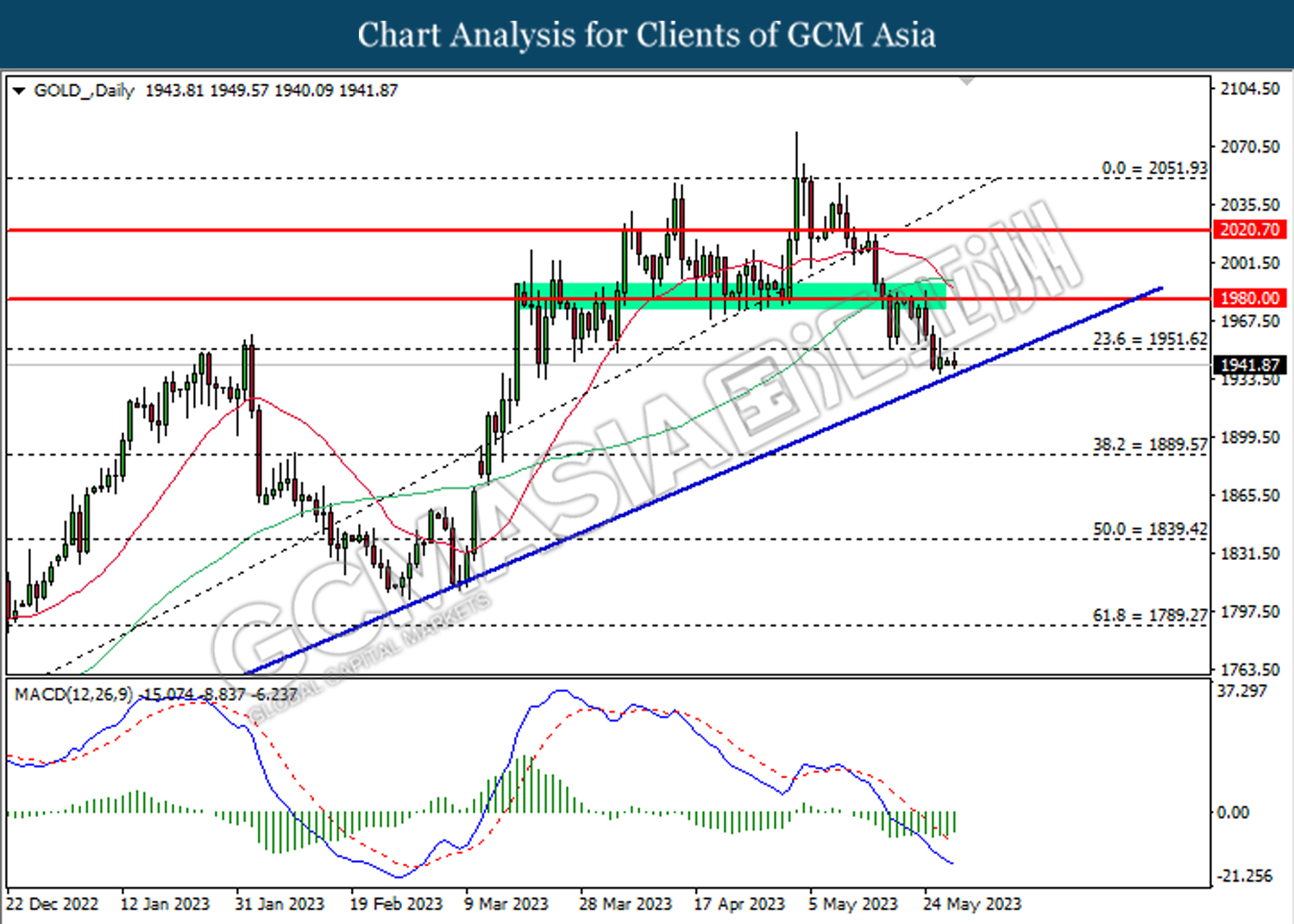

In the commodities market, crude oil prices edged down by -0.53% to $72.55 per barrel as the market concerns about further rate rise outweigh the temporary debt ceiling deal struck in the US. Besides, gold prices dropped by -0.14% to $1943.05 per troy ounce as the default risk eased.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (May) | 101.3 | 99.0 | – |

Technical Analysis

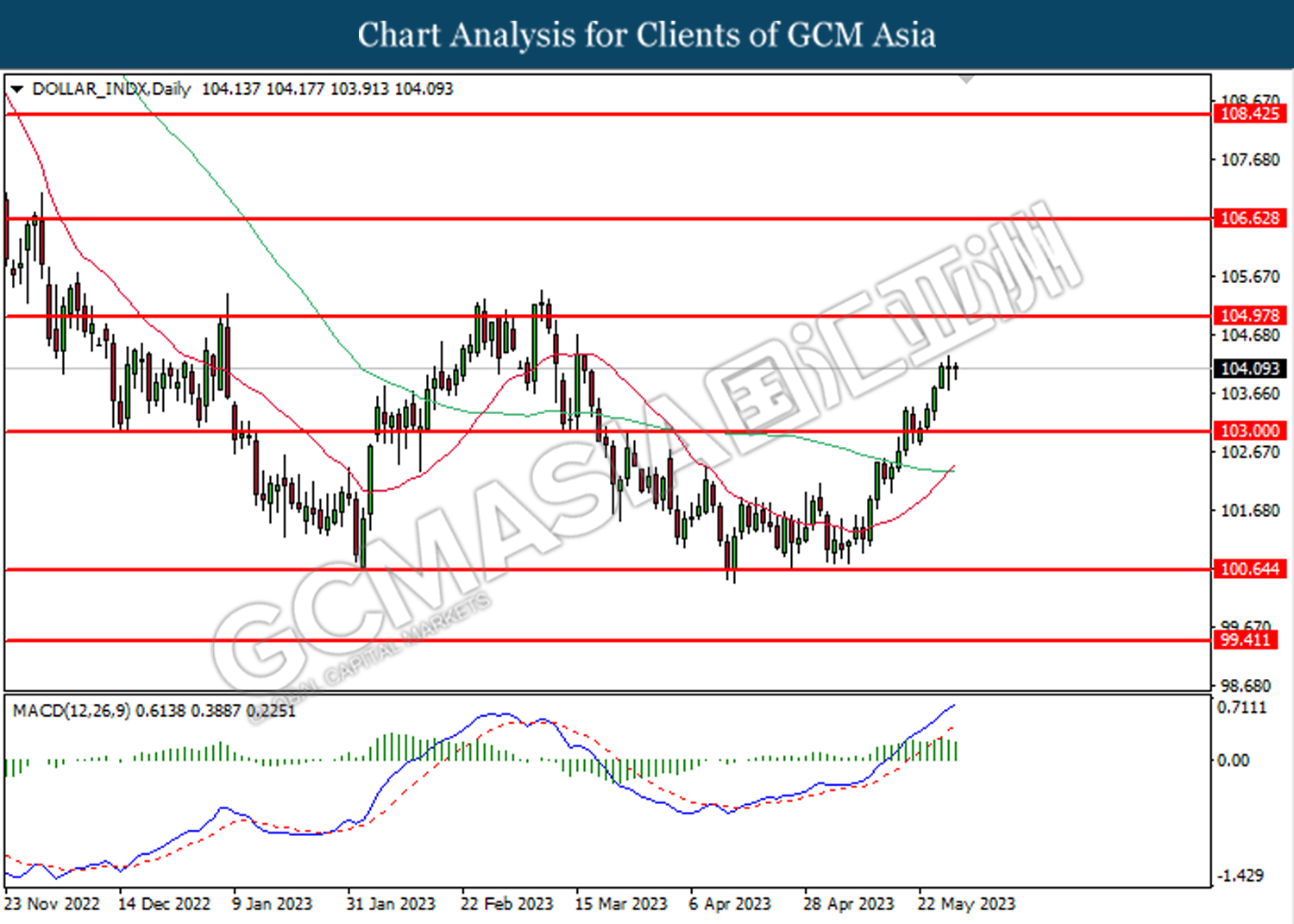

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 103.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

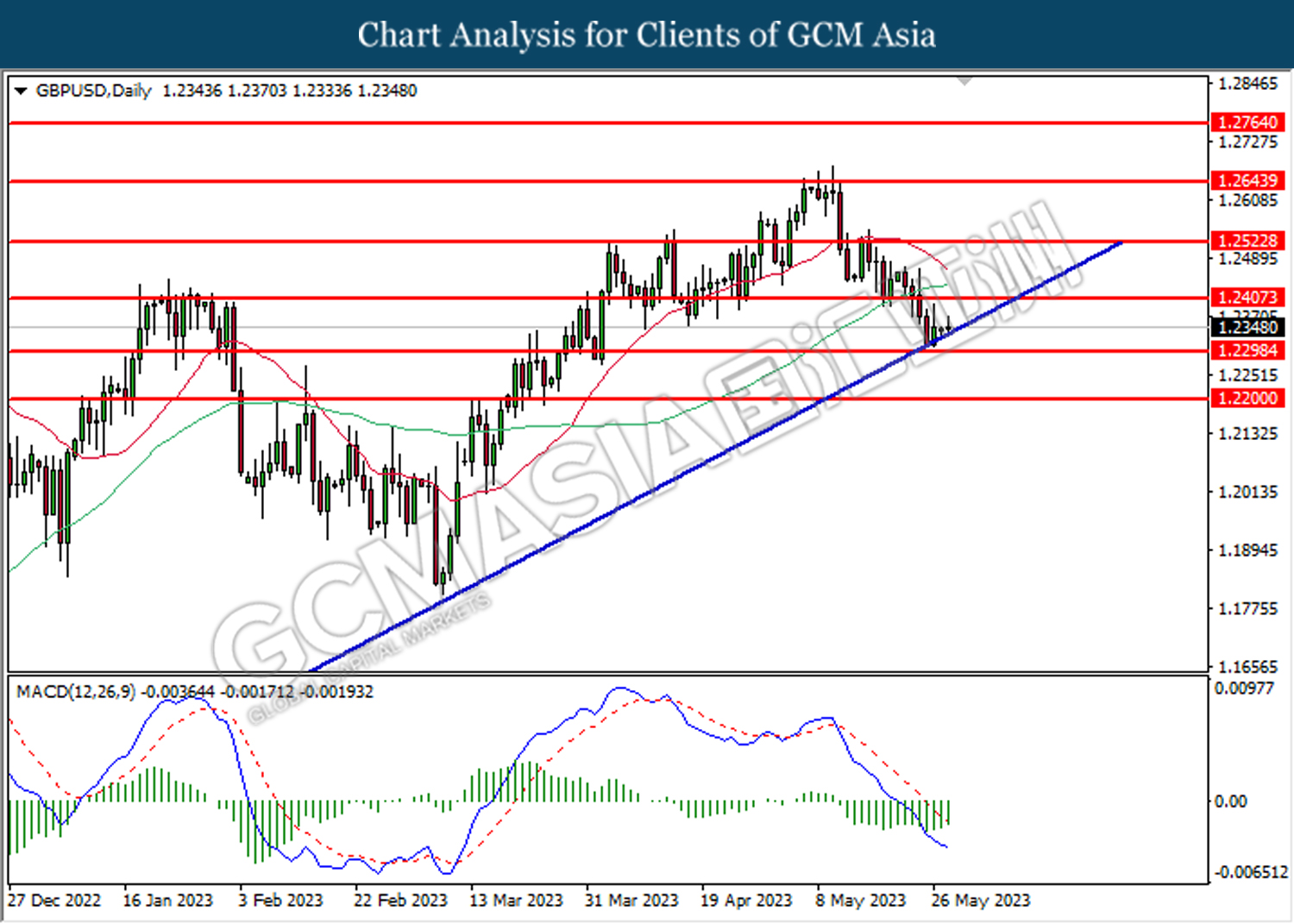

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2300. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2405, 1.2525

Support level: 1.2300, 1.2200

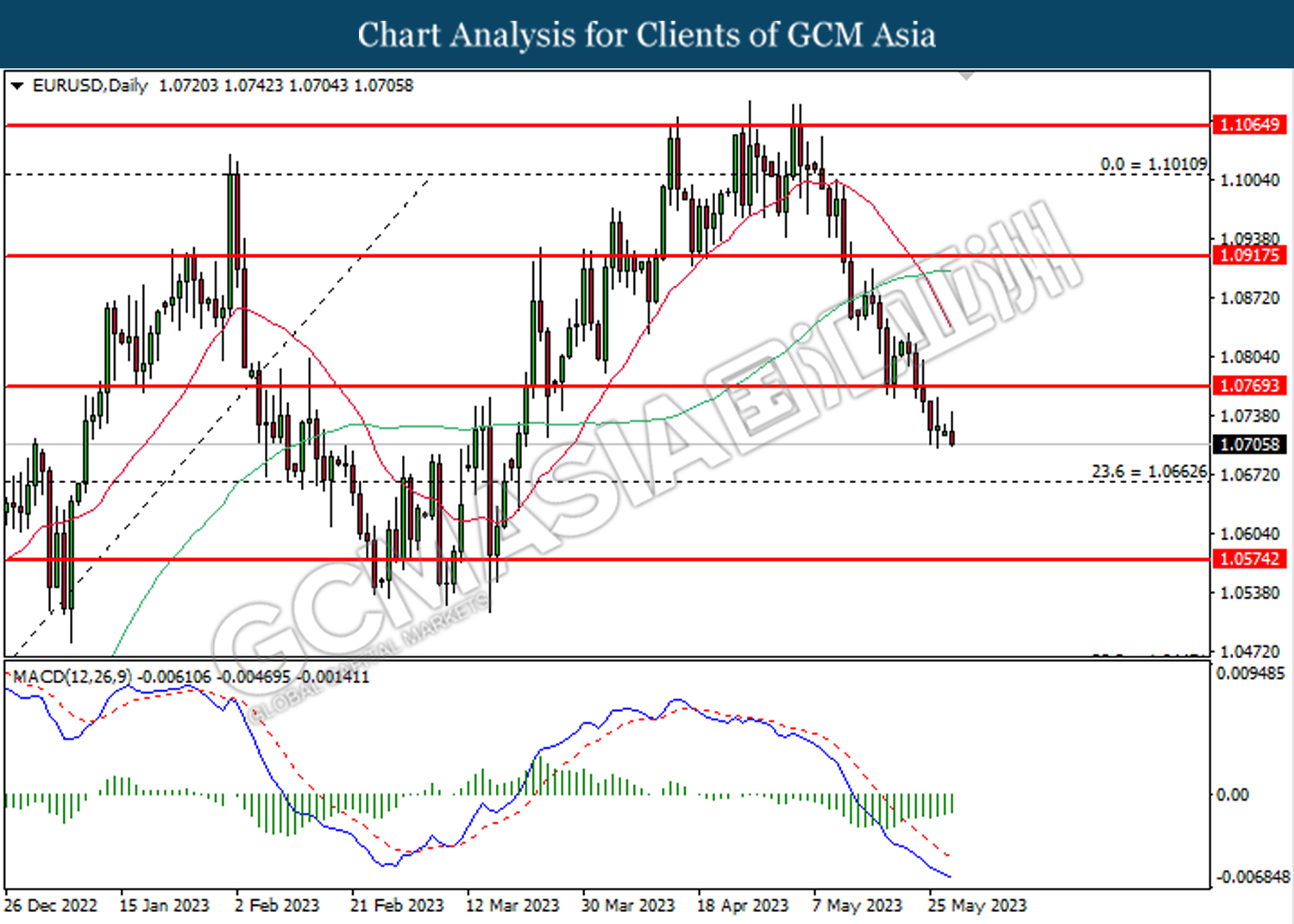

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0770. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0665.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

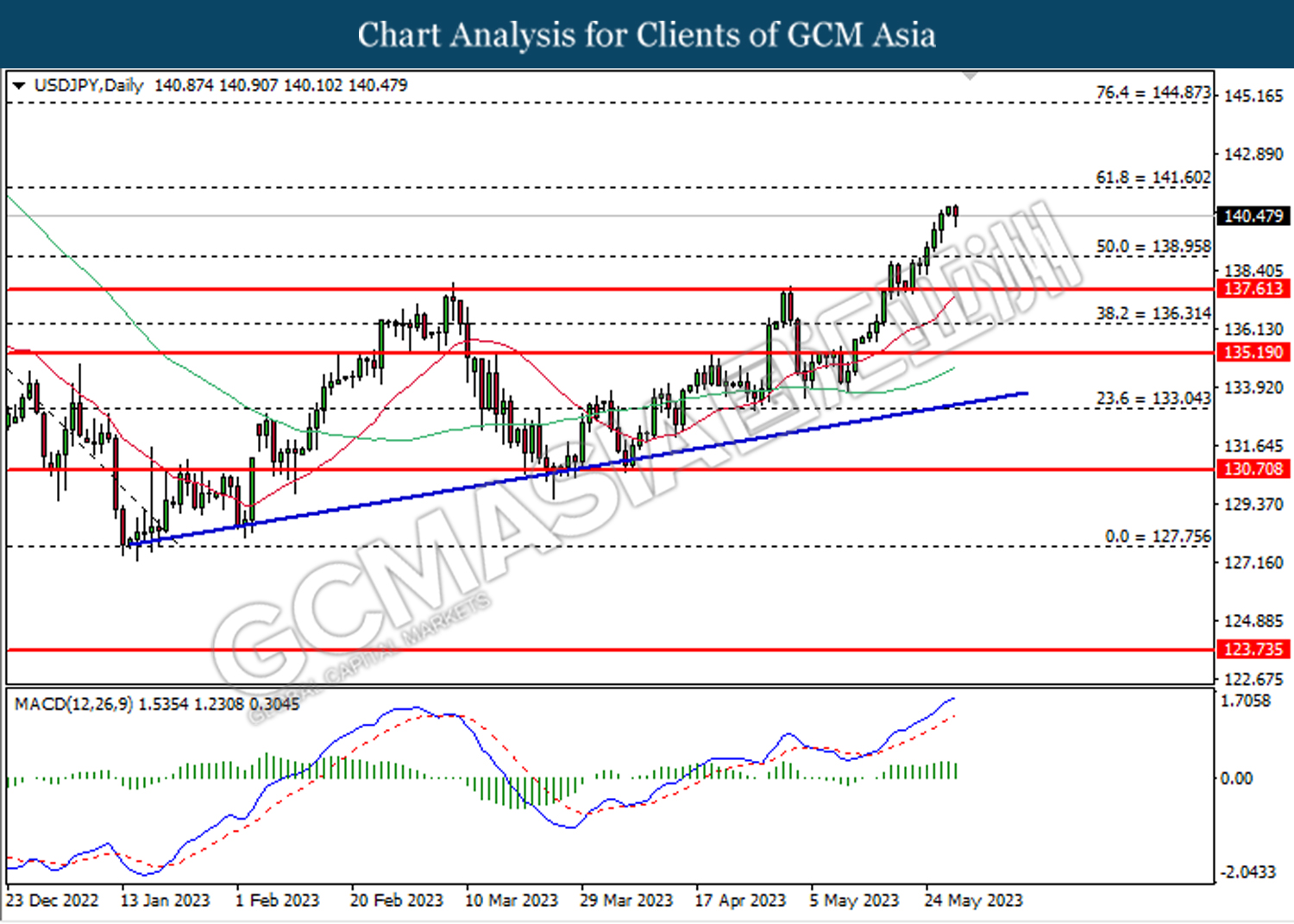

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 138.95. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 141.60.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

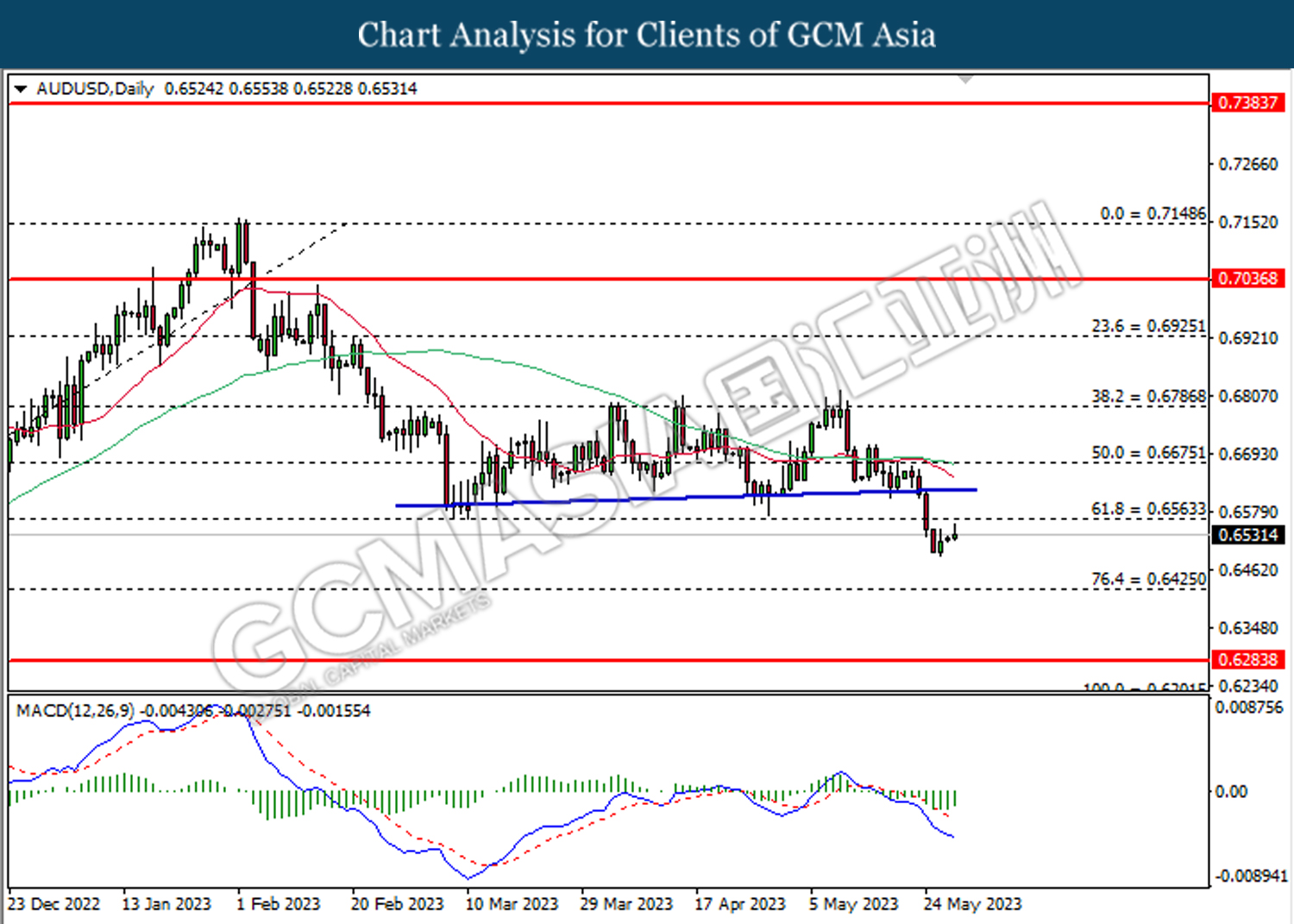

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6425.

Resistance level: 0.6565, 0.6675

Support level: 0.6425, 0.6285

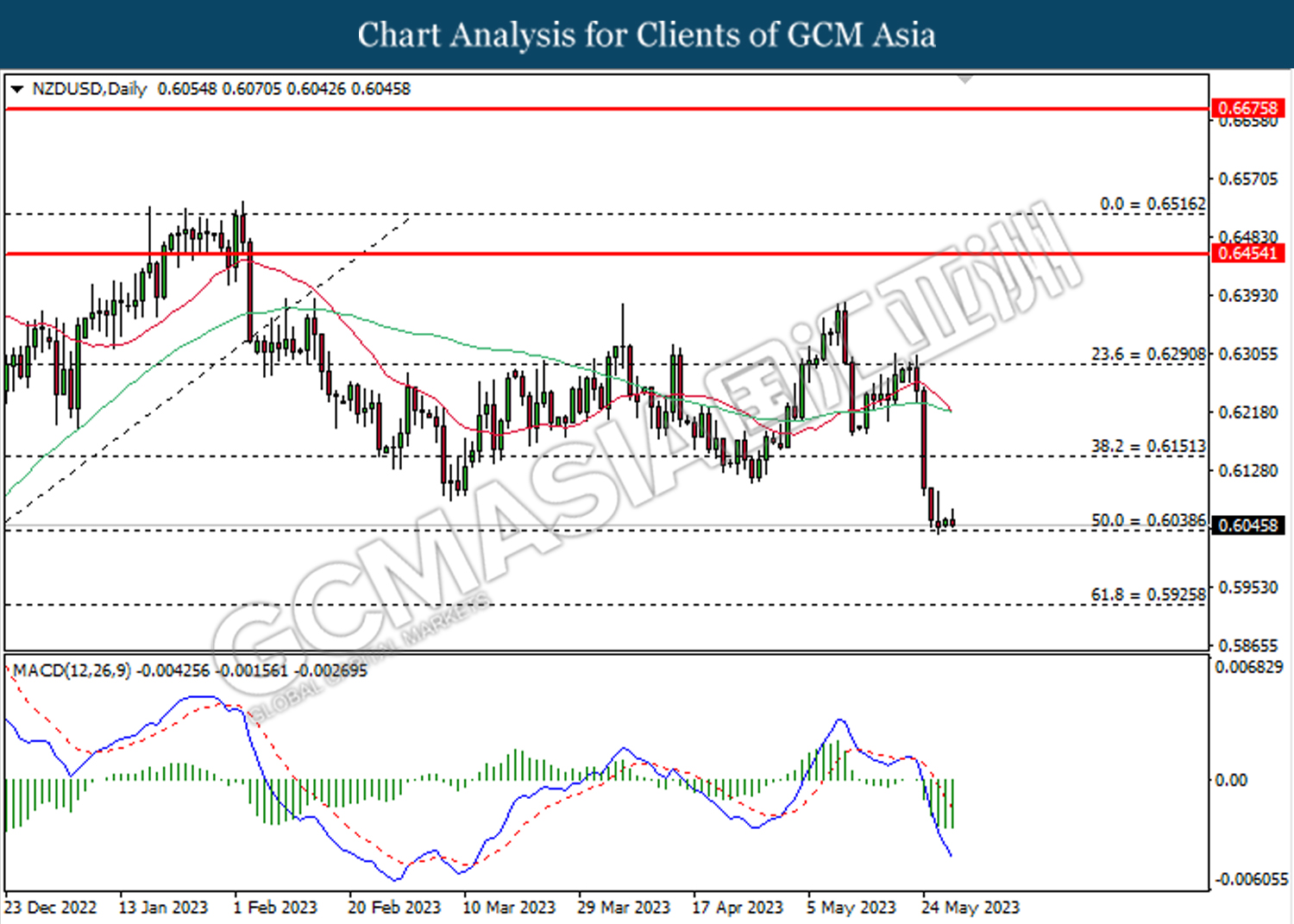

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6040. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

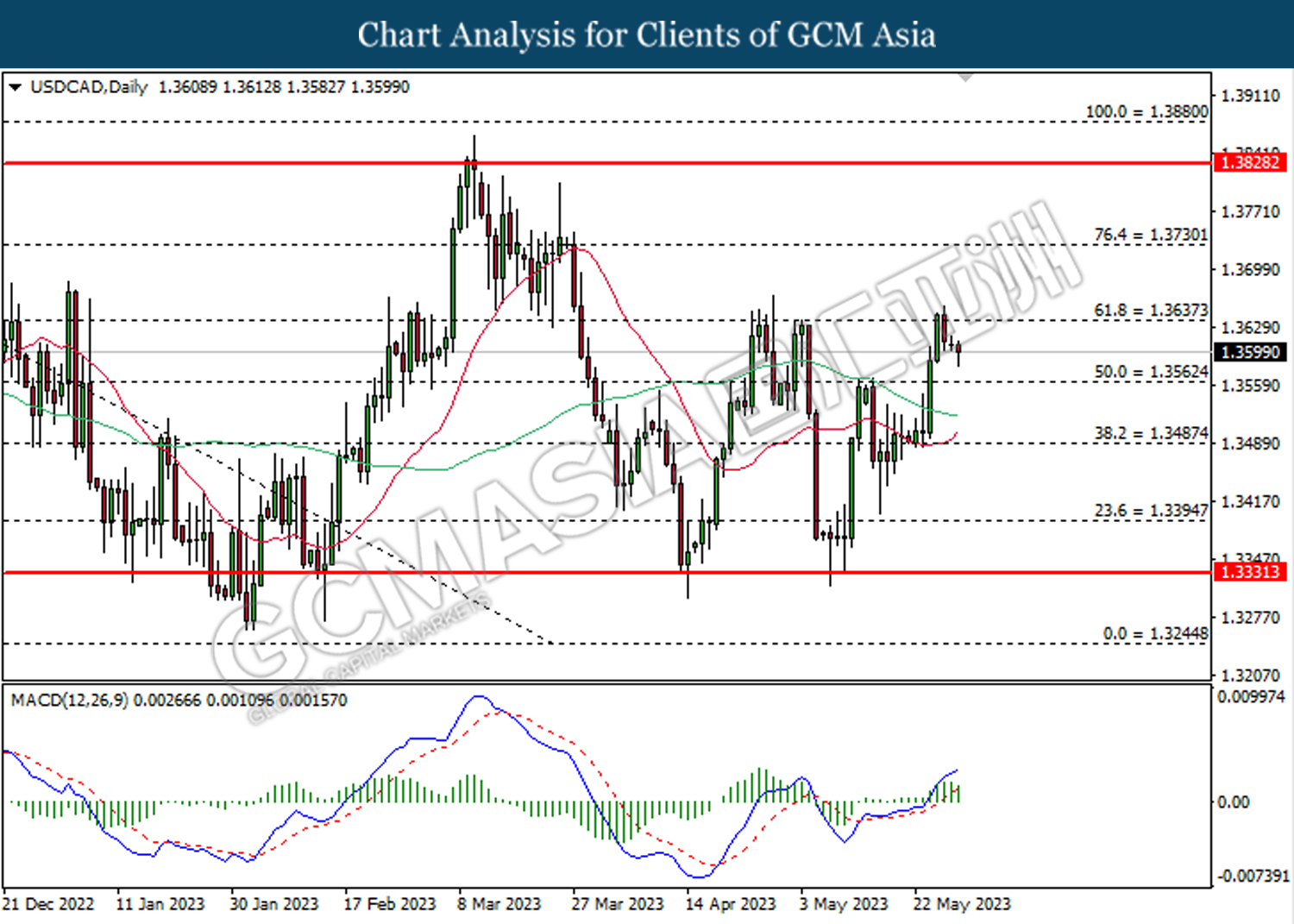

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3635. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3565.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

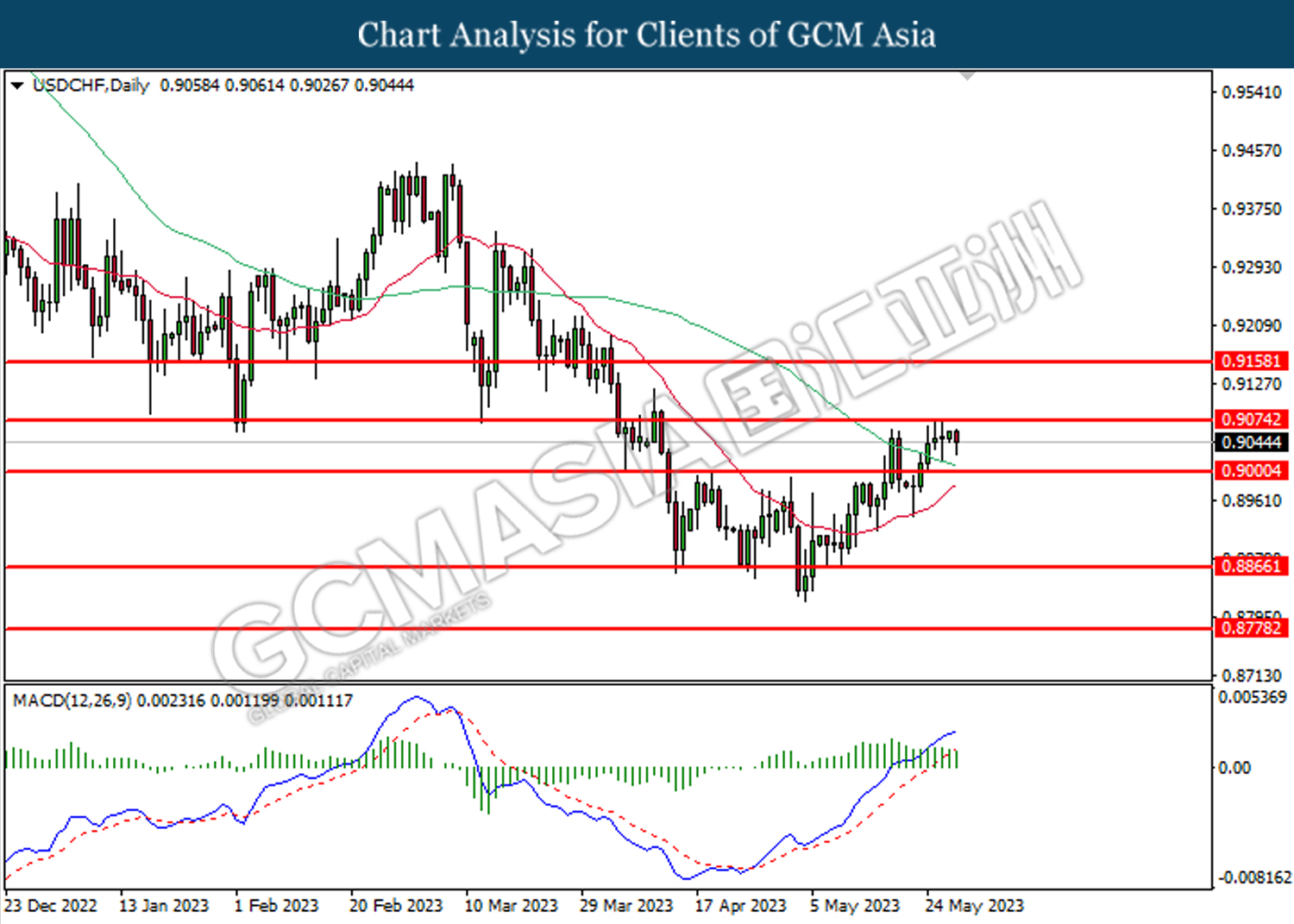

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9075. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the upward trend line. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1951.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the upward trend line.

Resistance level: 1951.60, 1980.00

Support level: 1889.55, 1839.40