30 June 2023 Morning Session Analysis

US dollar jumped amid stronger-than-expected economic data.

The dollar index, which was traded against a basket of six major currencies, managed to regain its foot back to the highest level in 10 days after the nation posted a few of upbeat economic data yesterday. According to the Bureau of Economic Analysis, the US GDP came in at 2.0% for the first quarter of 2023, stronger than the consensus forecast at 1.4%. The main attributors of the upbeat GDP were the upward revisions of exports and consumer spending. Consumption has boosted the U.S. economy, providing a strong start to 2023, even as banking turmoil and rising interest rates weigh on the outlook. But, the overall economic activity has been slowing as the U.S. central bank rapidly raises its benchmark lending rate to curb stubborn inflation. Besides, the number of American filed for unemployment claims has finally dropped after buoying at a high level for more than 3 weeks. According to the Department of Labor, US Initial Jobless Claims decreased from 265K to 239K this week, significantly lower than the consensus forecast at 266K, mirroring some sign of persistent labor market strength despite hefty rate hikes from the Federal Reserve. As of writing, the dollar index rose 0.43% to 103.35.

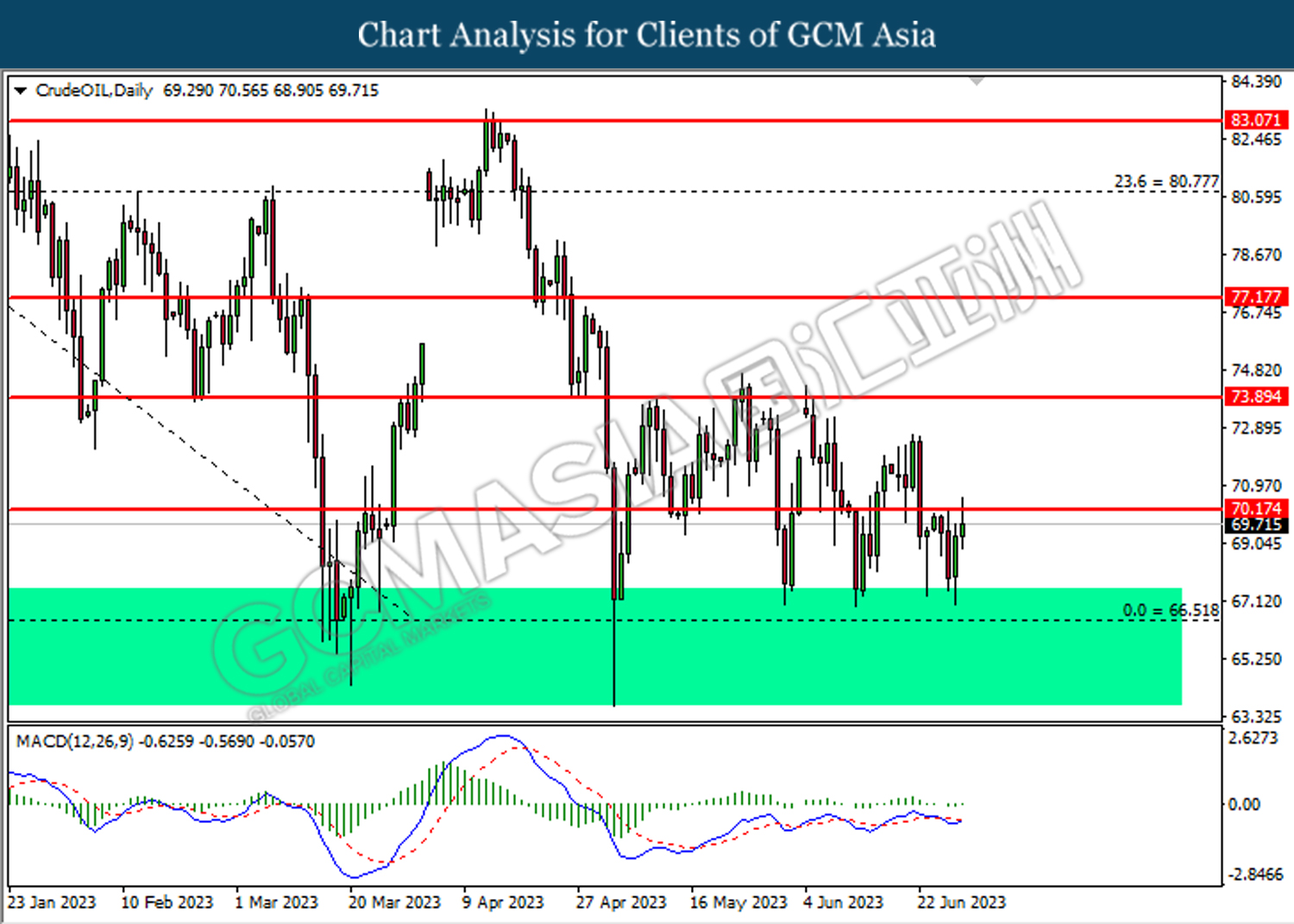

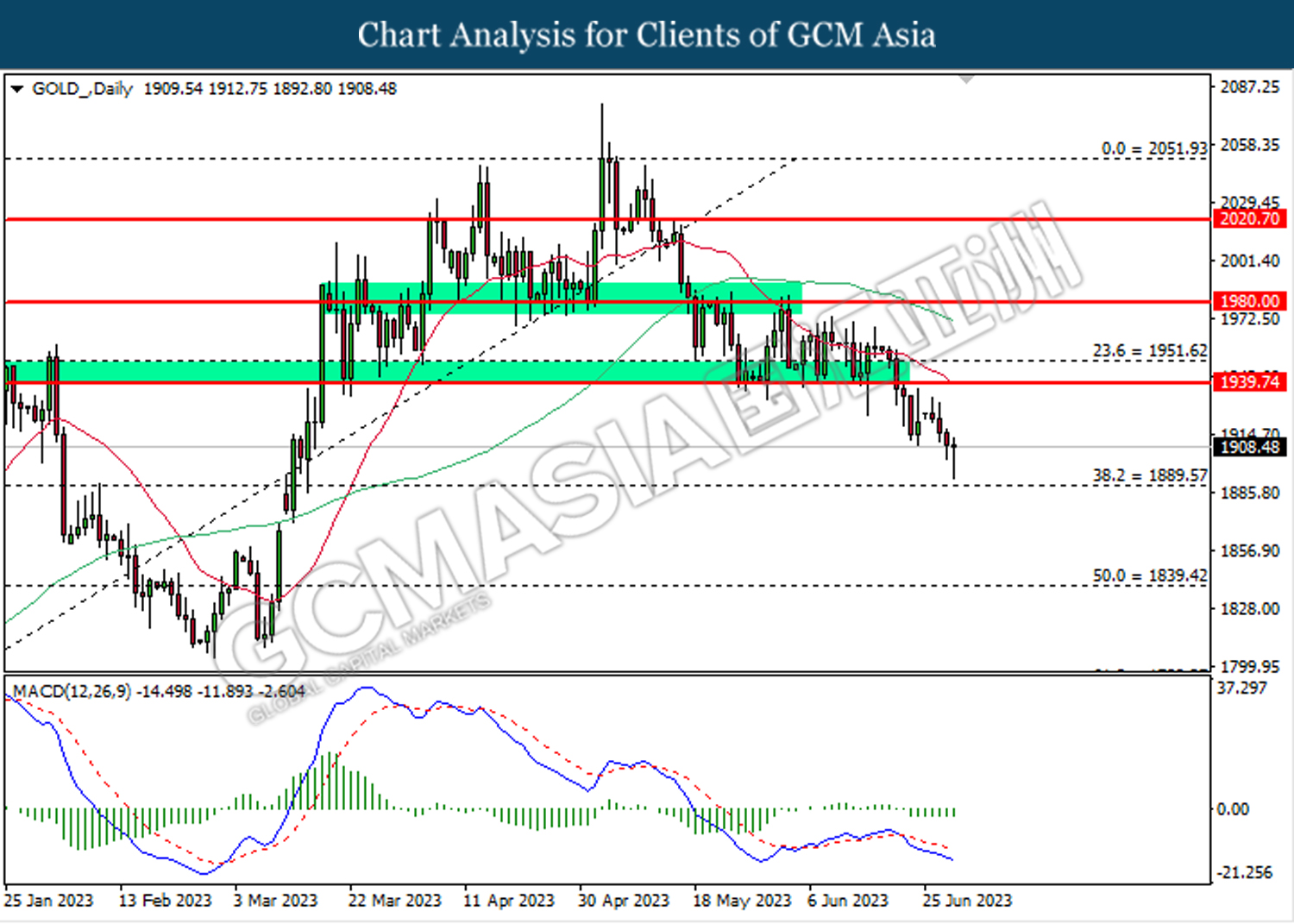

In the commodities market, crude oil prices appreciated by 0.01% to $69.70 per barrel as the huge draw of EIA crude stockpiles continued to outweigh the market concern over the future rate hikes. Besides, the gold prices ticked down by -0.05% to $1907.40 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) (Q1) | 0.2% | 0.6% | – |

| 17:00 | EUR – CPI (YoY) (Jun) | 6.1% | 5.6% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (May) | 0.4% | 0.4% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Jun) | 59.2 | 63.9 | – |

Technical Analysis

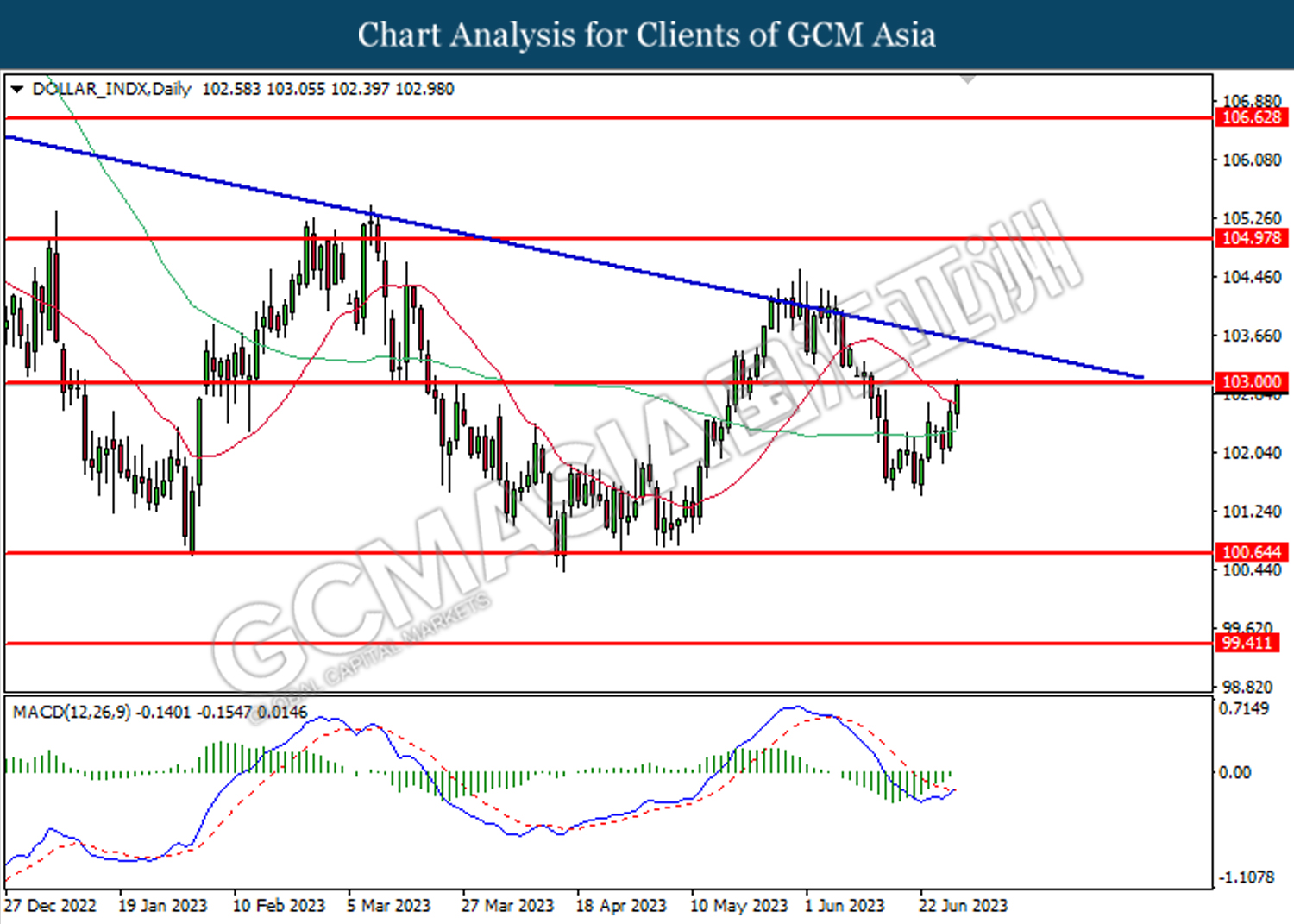

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 103.00. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

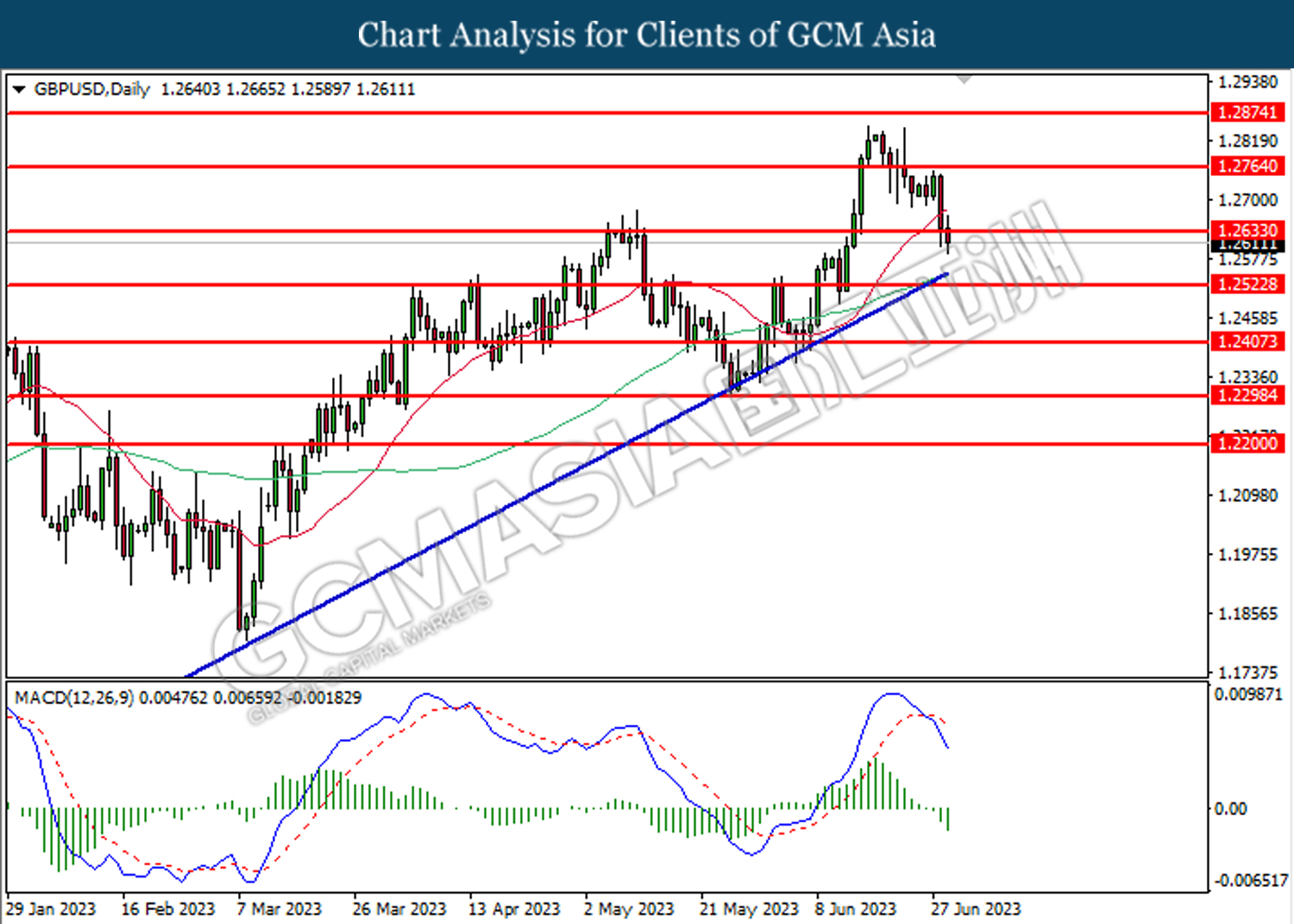

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2635. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

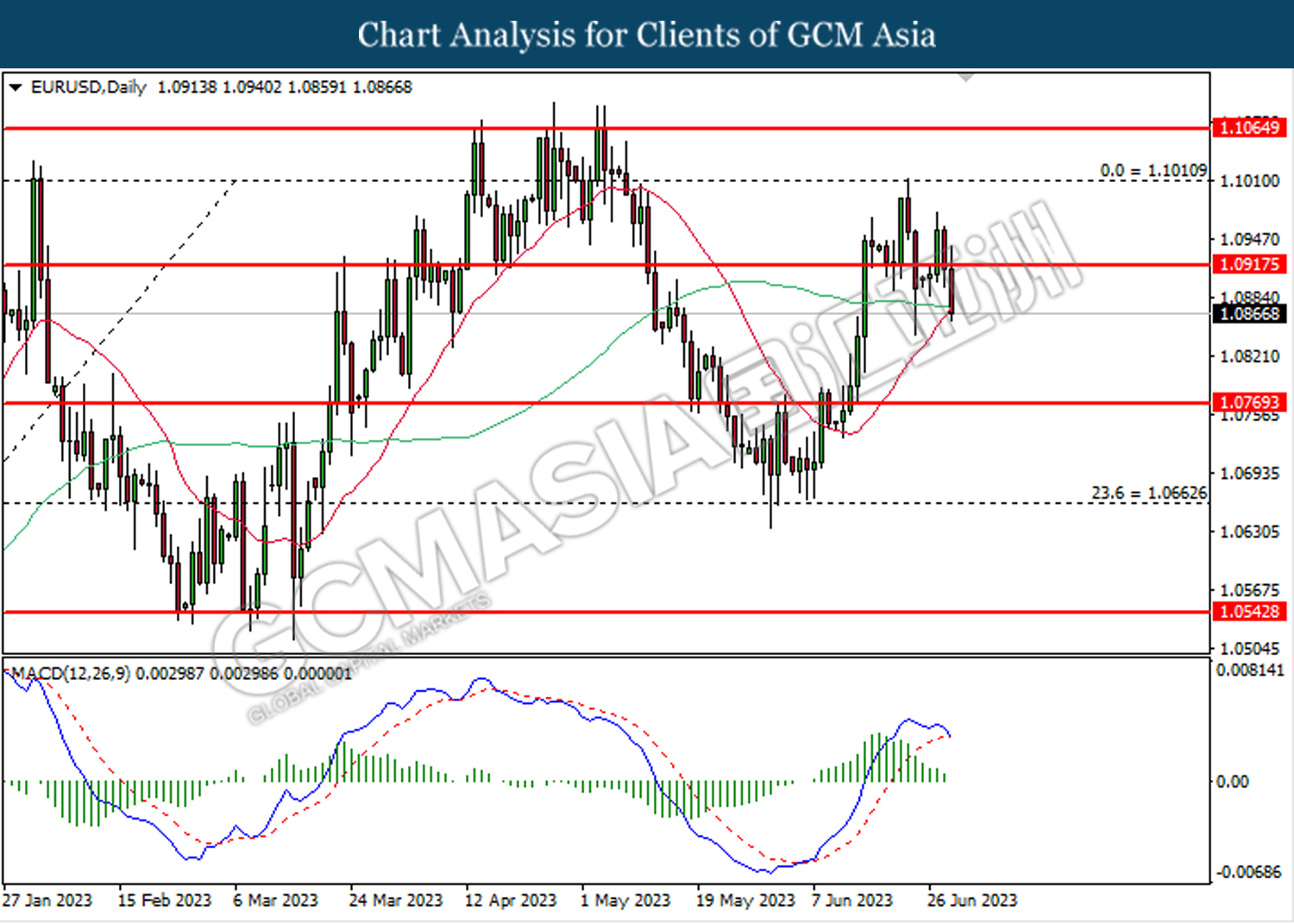

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

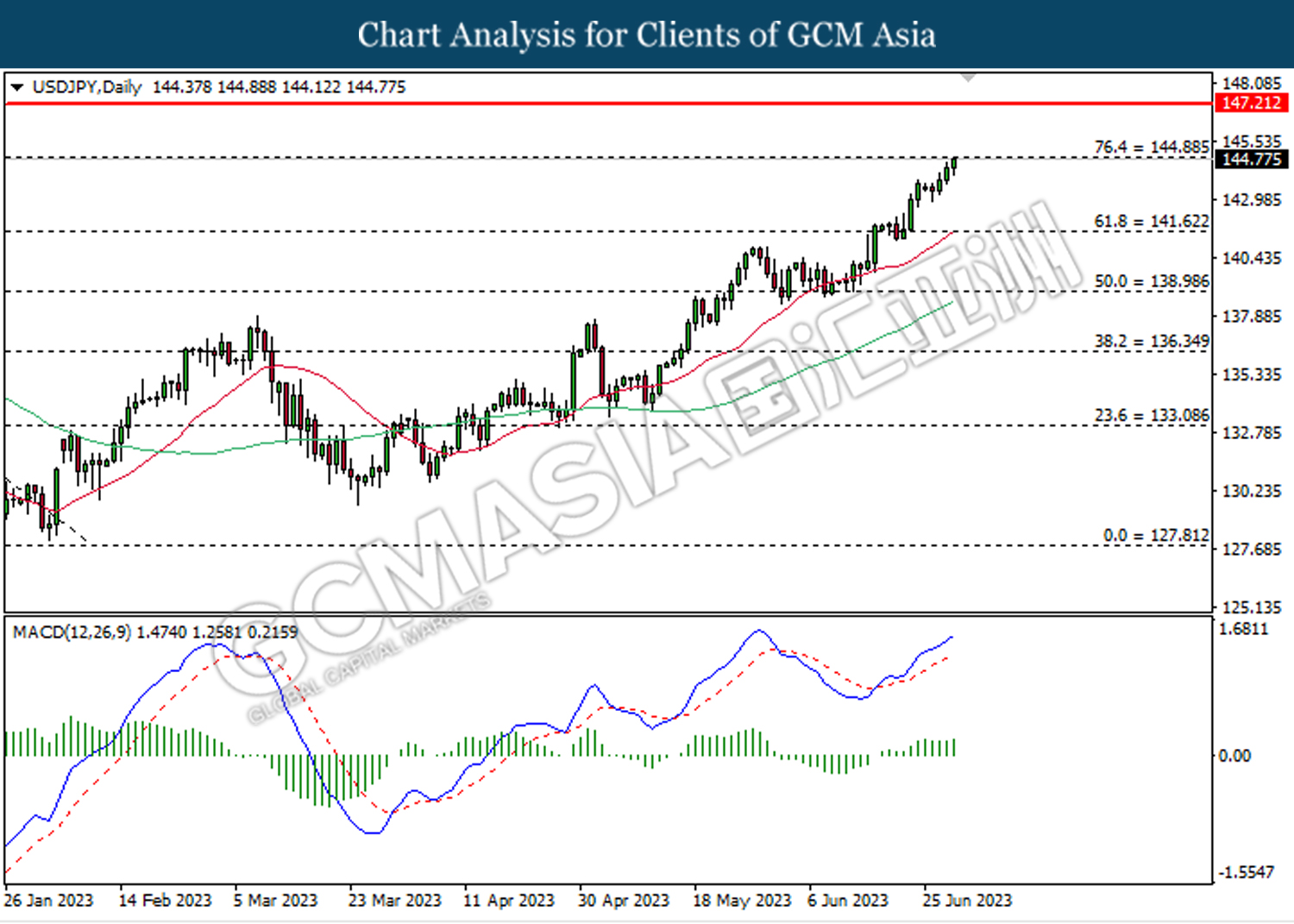

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 144.90. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 144.90.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

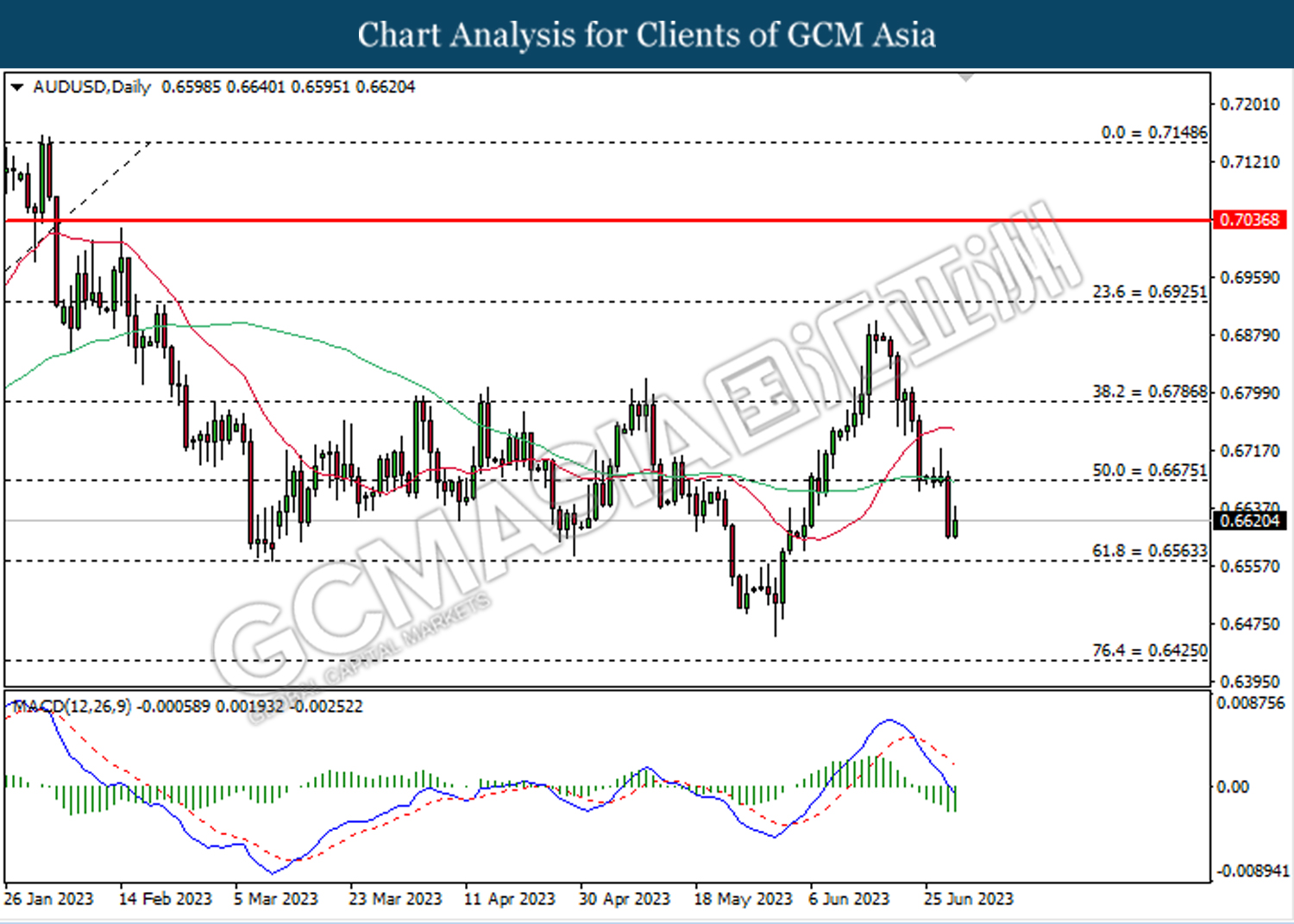

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

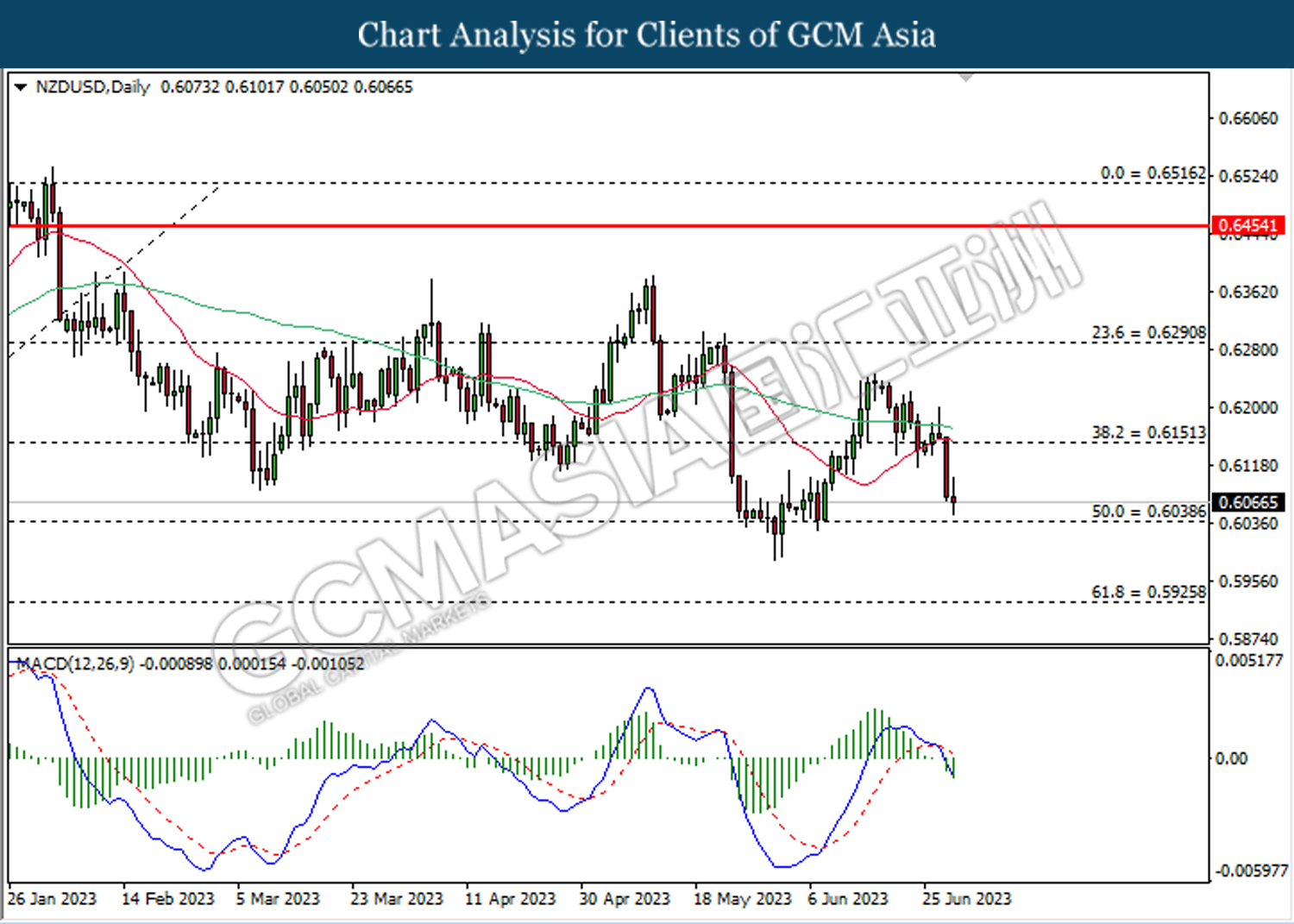

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

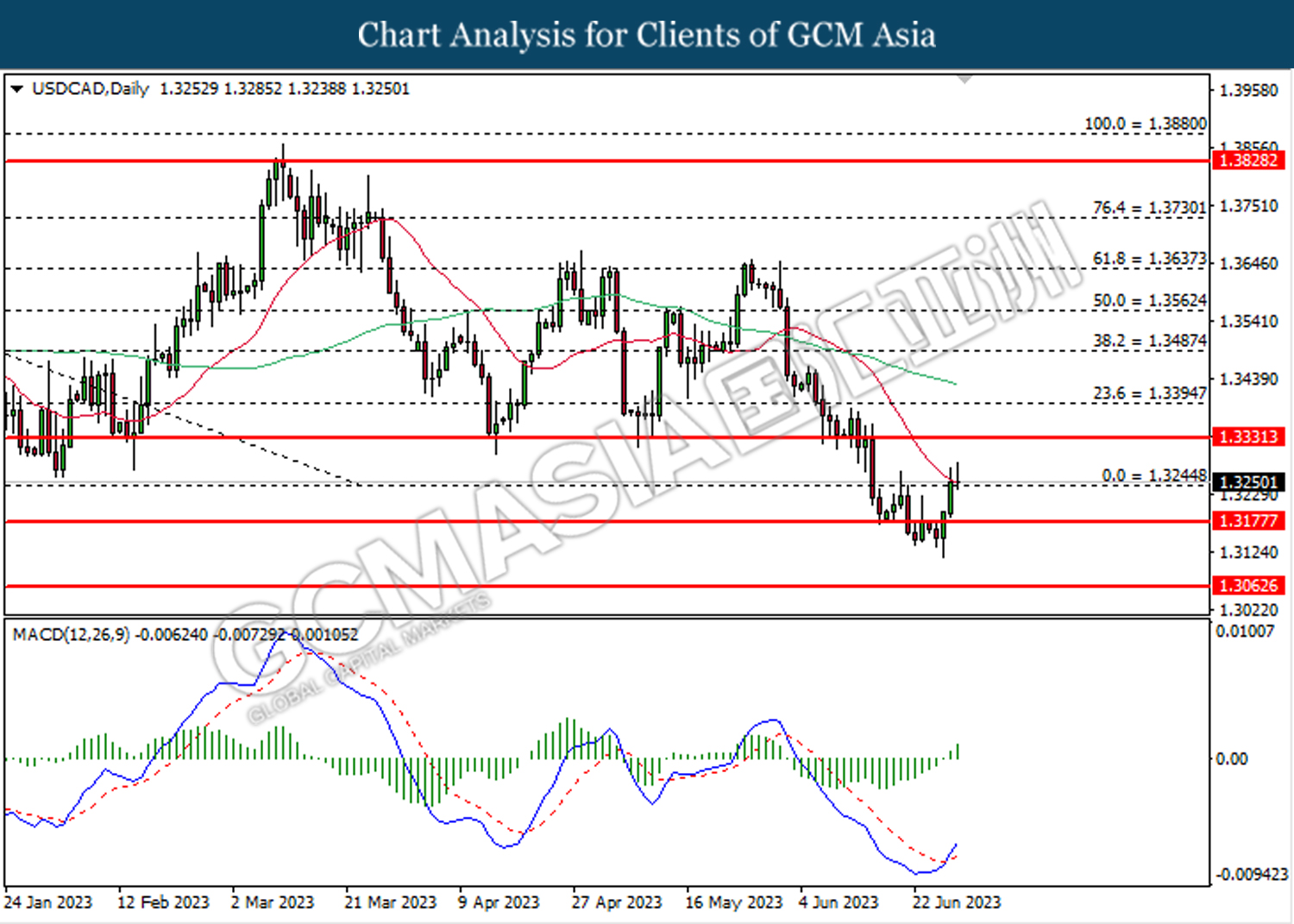

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

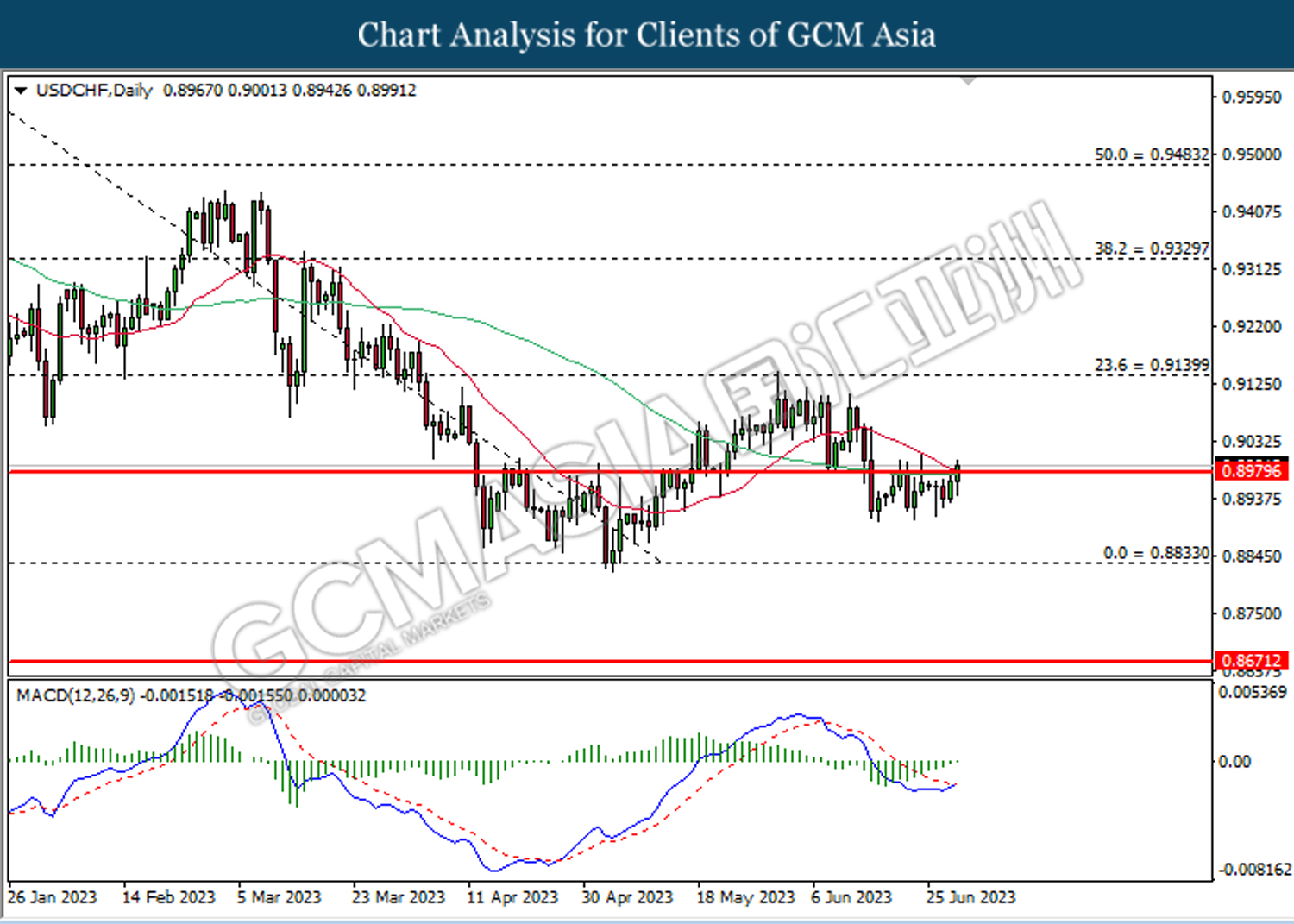

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support zone. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 70.15.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1939.75. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40