30 July 2020 Morning Session Analysis

US Dollar slumped amid dovish statement from Fed.

The dollar index which gauge its value against a basket of six major currencies slumped over the dovish statement from the Federal Reserve in the early morning. The Federal Reserve maintained its benchmark rate within a 0%-0.25% range while pledged to keep such lower rates until it is confident that the economy has weathered recent events and is on track to achieve maximum employment and price stability goals. Besides that, the spiking number of new coronavirus infections had continued to weigh on the US Dollar. According to The Guardian, Florida had reported another record one-day rise in coronavirus deaths on Tuesday, while the cases in Texas had surpassed the 400,000 mark, spurring the fears that the United States is still not taking control of the coronavirus outbreak and adding doubts against the V-shape economic recovery from the United States. Nonetheless, the losses experienced by the dollar index was limited over the backdrop of the positive economic data which released on yesterday. According to National Association of Realtor, the U.S. Pending Home Sales for last month came in at 16.6%, slightly better than the economist forecast at 15.0%. As of writing, the Dollar Index depreciated by 0.46% to $93.20.

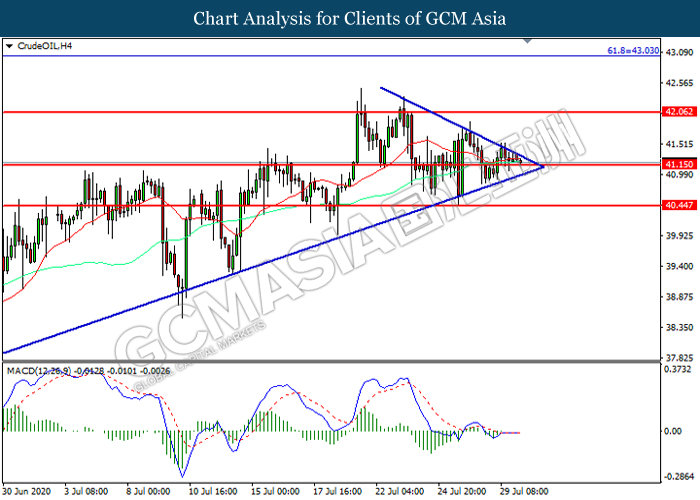

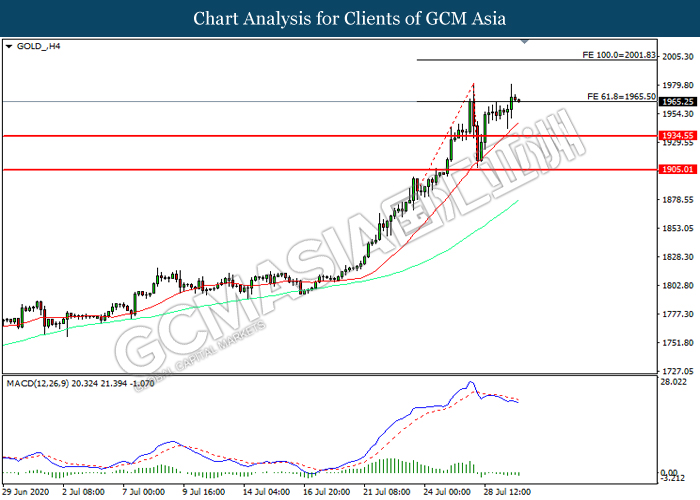

In the commodities market, the crude oil price surged 0.05% to $41.25 per barrel as of writing following data showed a staggering unexpected drawdown in weekly U.S. crude stockpiles on yesterday. According to Energy Information Administration (EIA), the U.S. crude oil inventories had massively declined from the preliminary reading of 4.892M to -10.612M, lower than the market forecast at 0.357M. On the other hand, the gold market appreciated by 0.17% to $1967.50 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (Jul) | 0.25% | 45K | – |

| 16:00 | EUR – German GDP (QoQ) (Q2) | – | -9.0% | – |

| 20:30 | USD – GDP (QoQ) (Q2) | 69K | -34.0% | |

| 20:30 | USD – Initial Jobless Claims | -2.2% | 1,400K |

Technical Analysis

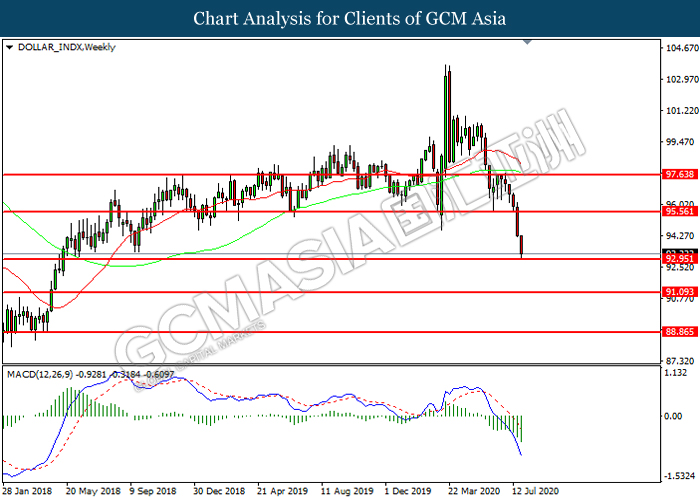

DOLLAR_INDX, Weekly: Dollar index was traded lower while currently testing the support level at 92.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 95.55, 97.65

Support level: 92.95, 91.10

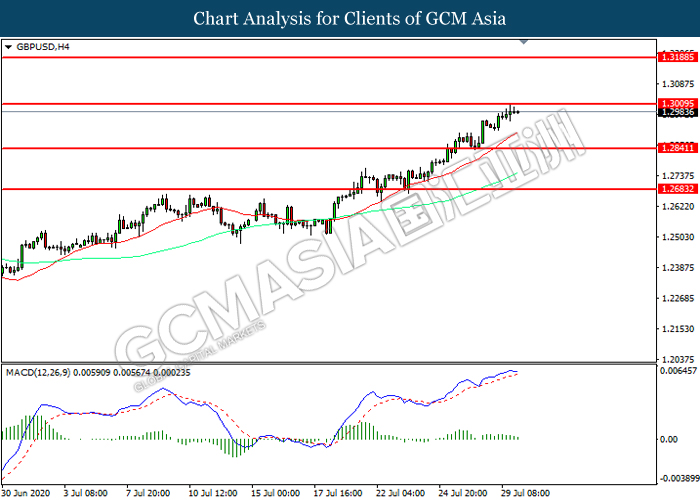

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3010. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3010, 1.3190

Support level: 1.2840, 1.2685

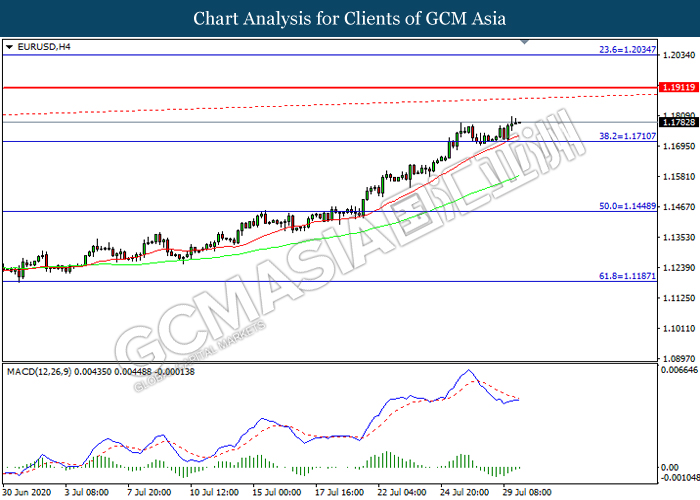

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1710. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.1910.

Resistance level: 1.1910, 1.2035

Support level: 1.1710, 1.1450

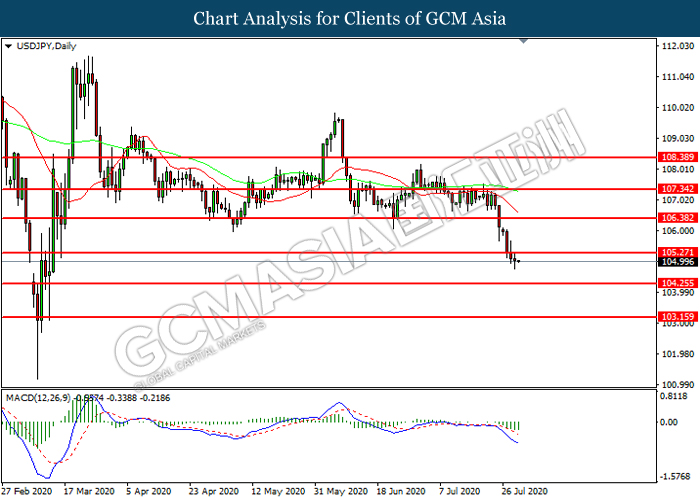

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 105.25. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 104.25.

Resistance level: 105.25, 106.40

Support level: 104.25, 103.15

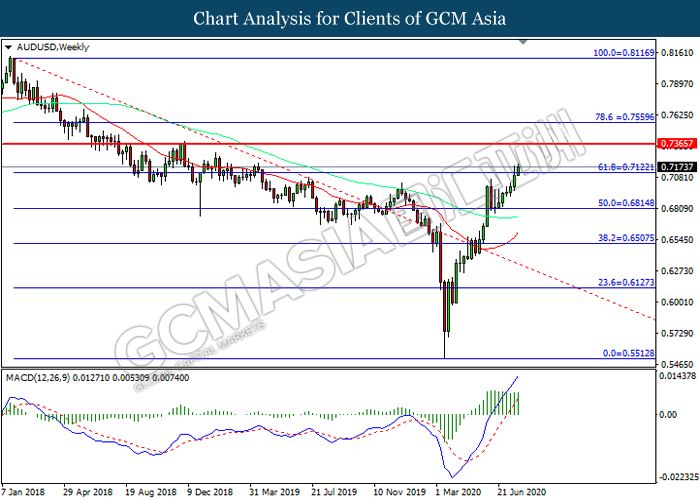

AUDUSD, Weekly: AUDUSD was higher following prior breakout above the previous resistance level at 0.7120. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7365.

Resistance level: 0.7365, 0.7560

Support level: 0.7120, 0.6815

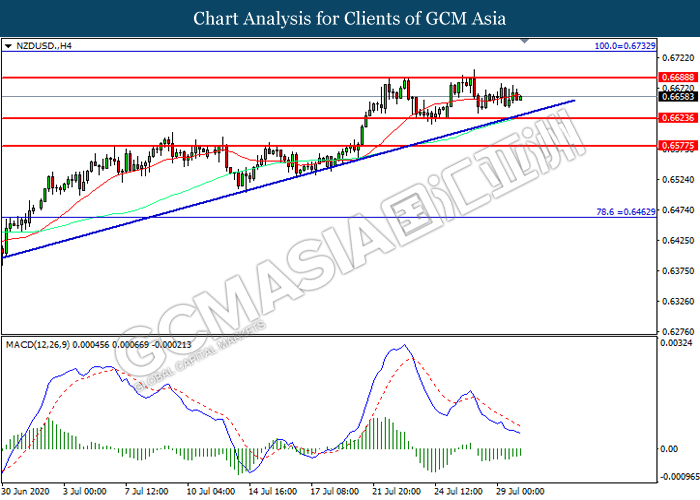

NZDUSD, H4: NZDUSD was traded within a range while currently near the resistance level at 0.6690. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6690, 0.6735

Support level: 0.6625, 0.6575

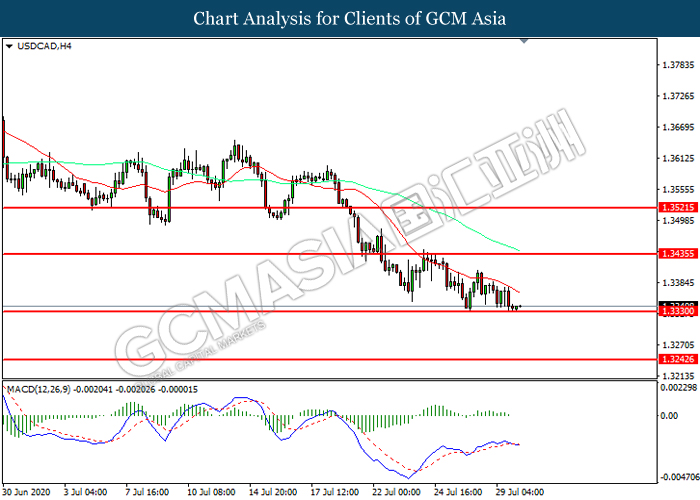

USDCAD, H4: USDCAD was traded lower while currently testing the support level ta 1.3330. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3435, 1.3520

Support level: 1.3330, 1.3245

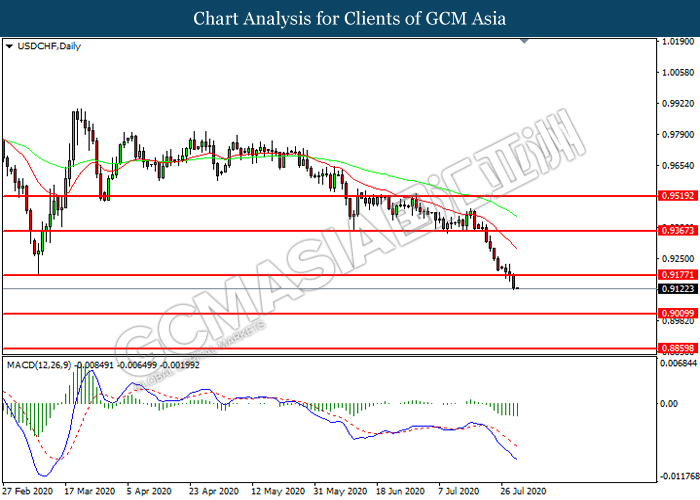

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9175. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9010.

Resistance level: 0.9175, 0.9365

Support level: 0.9010, 0.8860

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 41.15. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 42.05, 43.05

Support level: 41.15, 40.45

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1965.50. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1965.50, 2001.85

Support level: 1934.55, 1905.00