30 September 2022 Afternoon Session Analysis

Greenback plunged amid mixed market sentiment.

The dollar index, which was traded against a basket of six major currencies, extended its losses for the second consecutive days after a series of economic data disrupted the market sentiment of the dollar index. According to the Bureau of Economic Analysis, the US GDP data for quarter from April through June came in at -0.6%, in line with the market economist’s expectation, mirroring the on-track recovery was undergoing in the post-pandemic US amid massive fiscal stimulus. Besides, the US Initial Jobless Claims also posted a lower-than-expected reading over the past one week. According to the Department of Labor, the US Initial Jobless Claims came in at 193K, lower than the economist forecast at 215K, showing that the US labor market remains resilience. Despite that, the bull in the dollar market failed to turn its head up amid the appealing of other currencies such as the Pound. As of writing, the dollar index dropped -0.24% to 112.00.

In the commodities market, the crude oil price dropped -0.63% to $81.05 per barrel following the slight rebound of the Greenback value, which diminishing the demand of oil by the non-US buyers. Besides, the gold prices depreciated by -0.05% to $1659.85 per troy ounce as the dollar strengthen.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) | -0.1% | – | – |

| 15:55 | EUR – German Unemployment Change (Sep) | 28K | 20K | – |

| 17:00 | EUR – CPI (YoY) (Sep) | 9.1% | 9.6% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Aug) | 0.1% | 0.4% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Sep) | 59.5 | 59.5 | – |

Technical Analysis

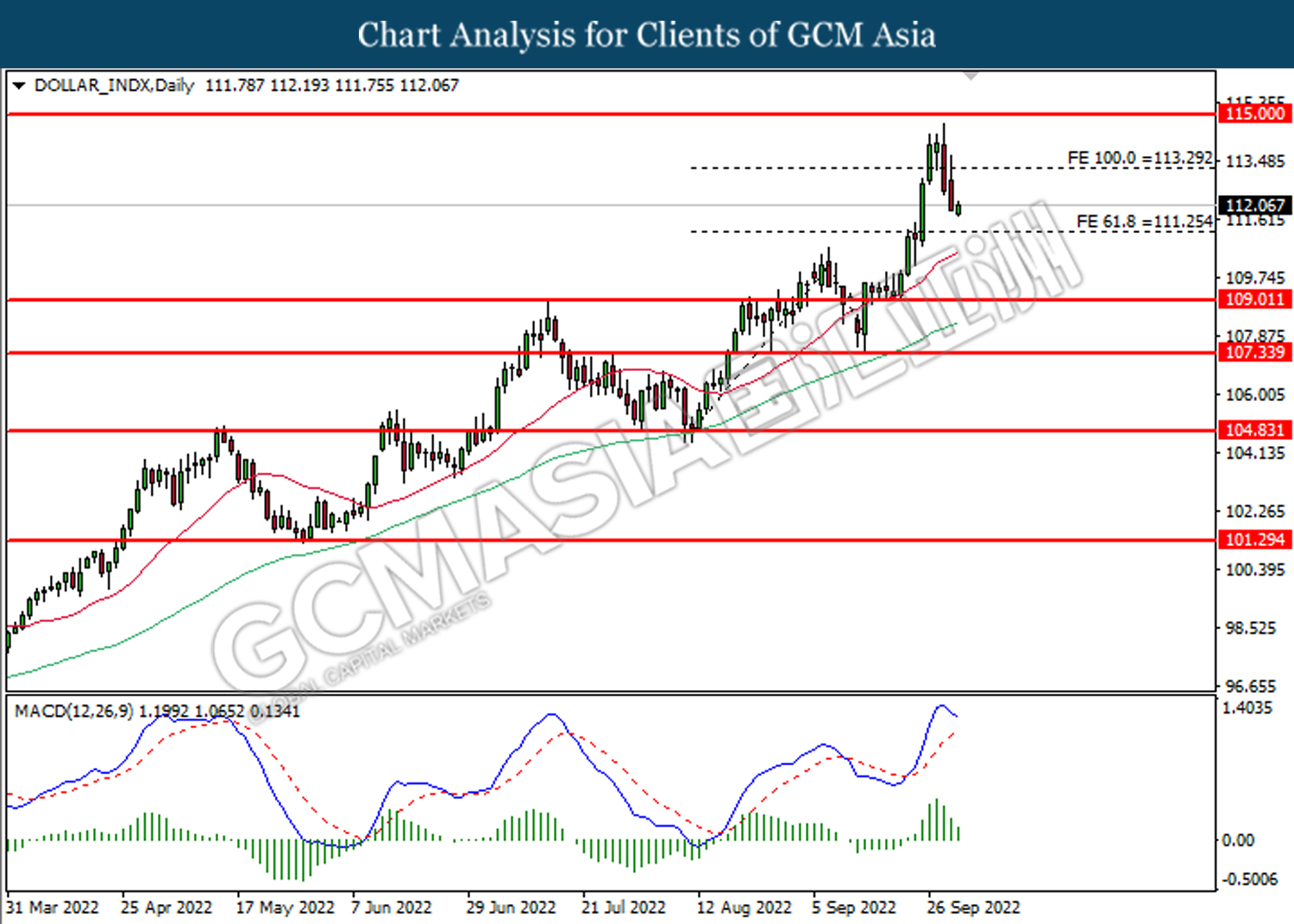

DOLLAR_INDX, Daily: Dollar index was traded lower following a breakout below the previous support level at 113.30. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 111.25.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

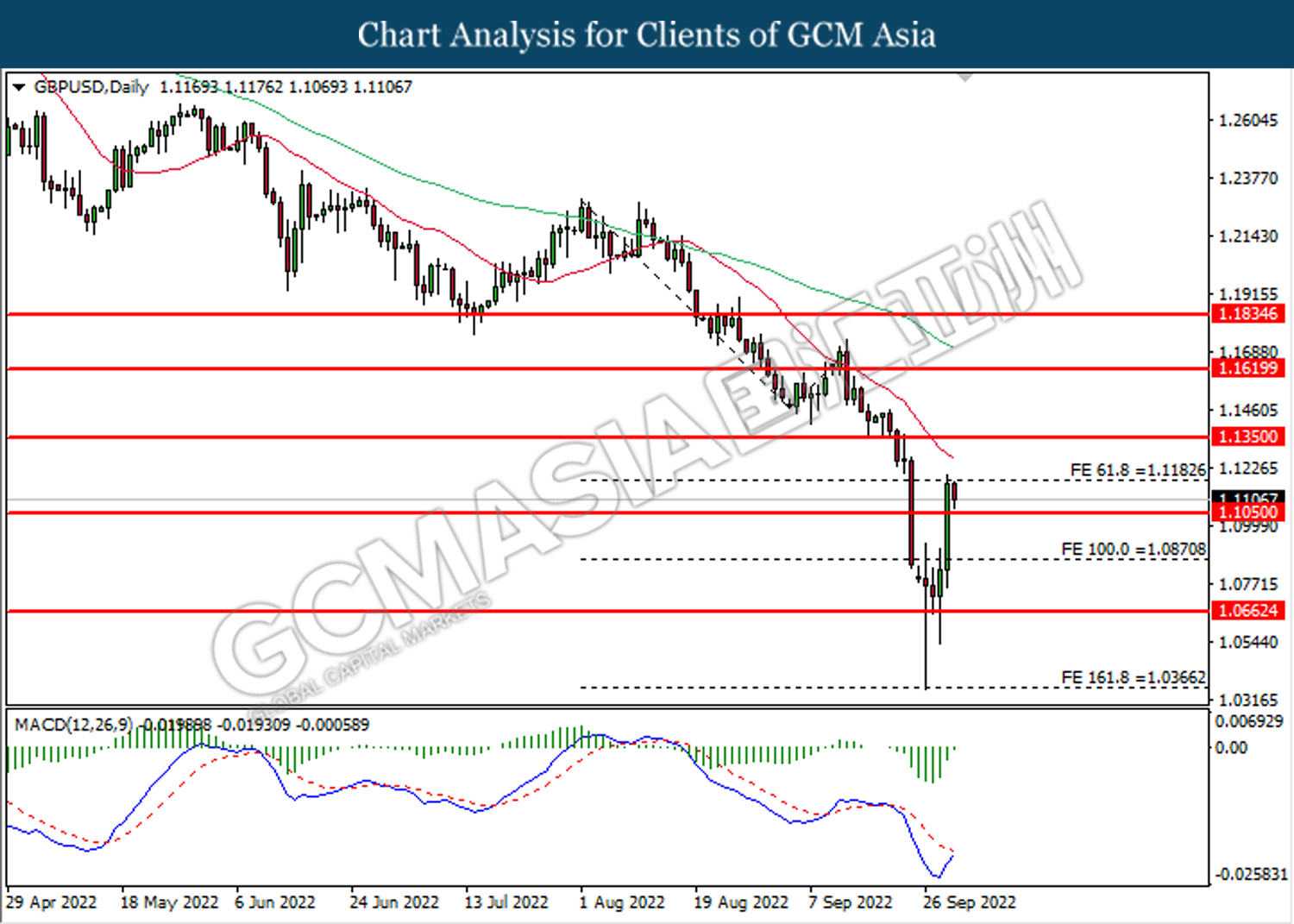

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1185. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1185, 1.1350

Support level: 1.1050, 1.0870

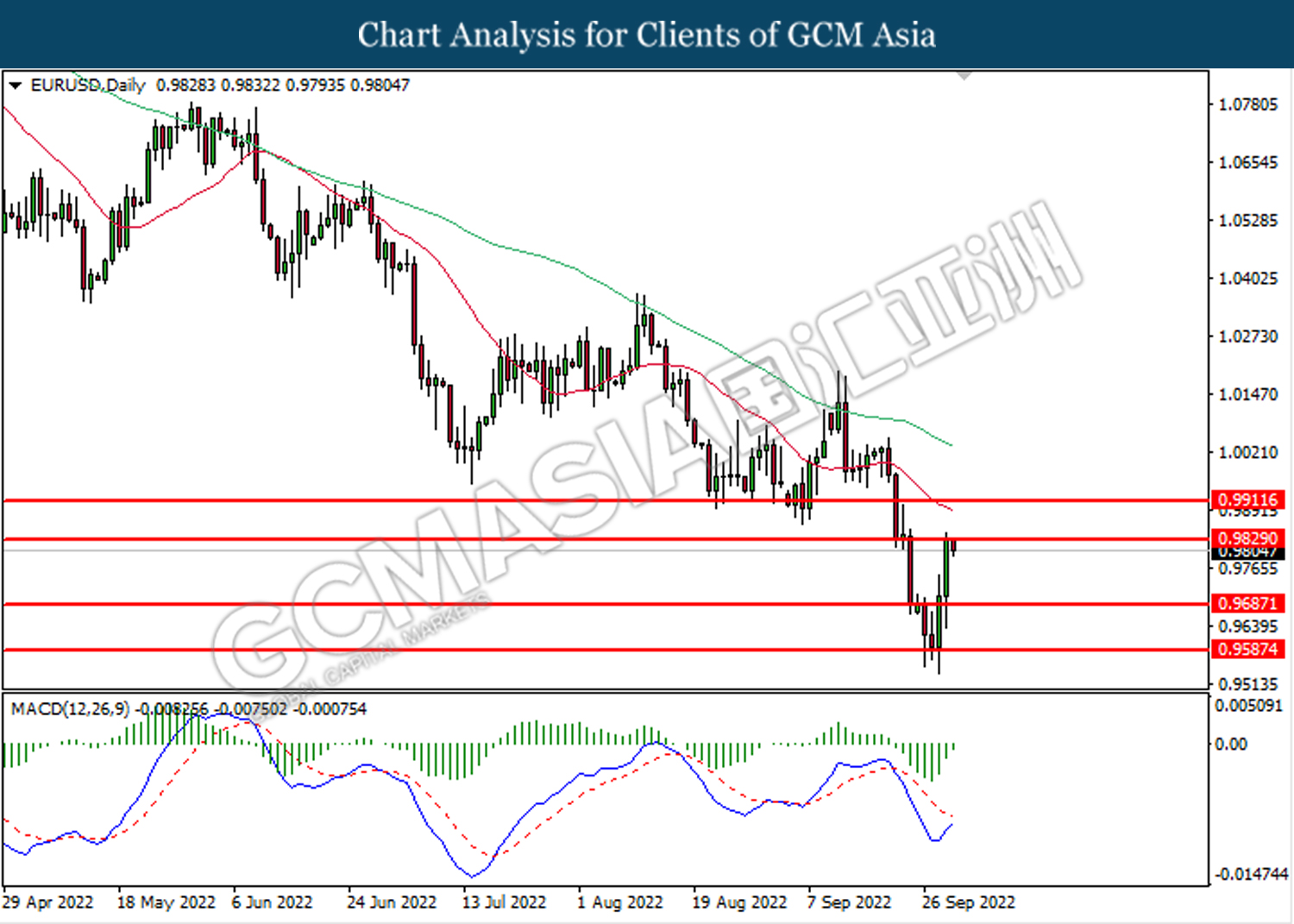

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 0.9830. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

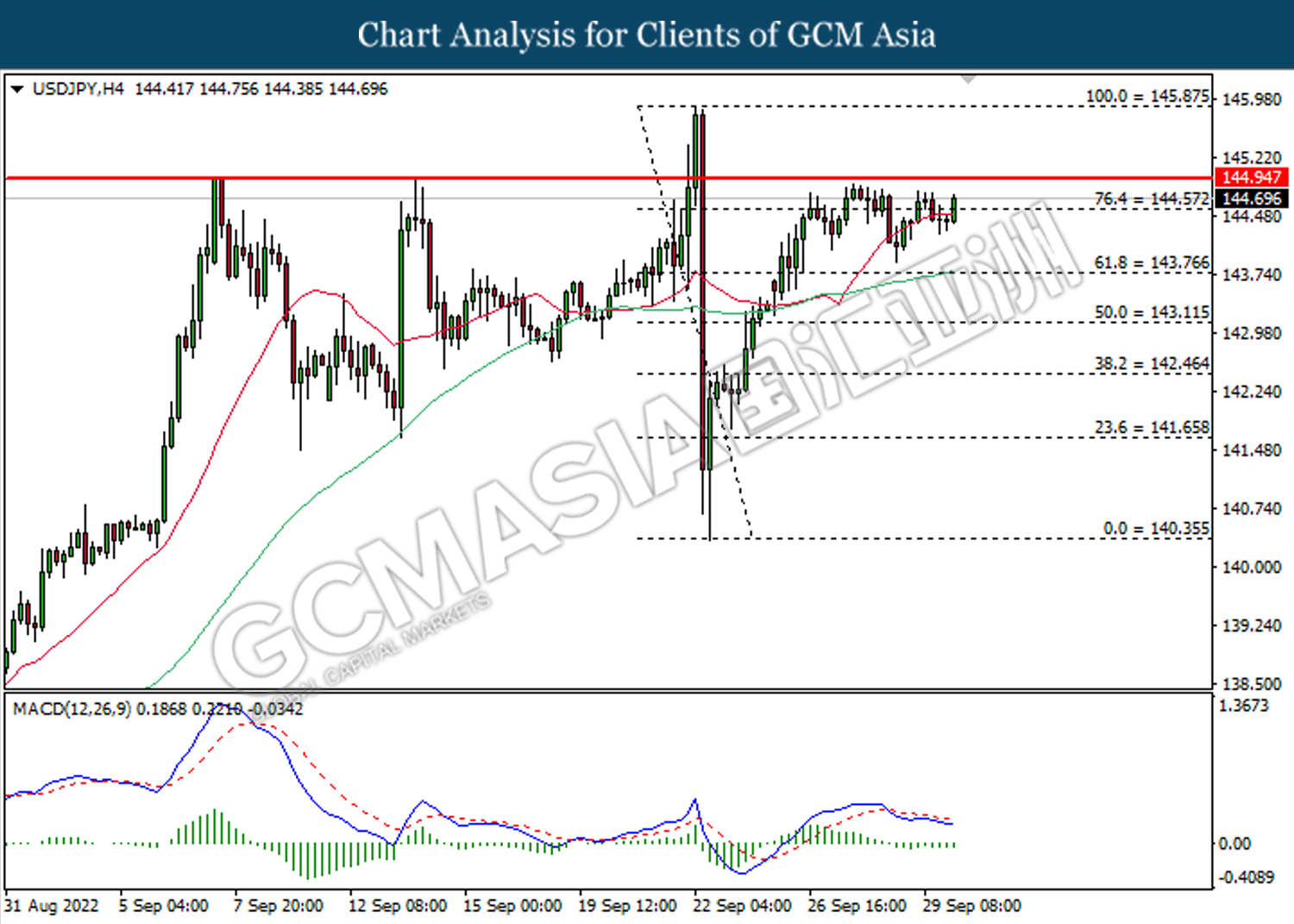

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 144.55. MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 144.55, 144.95

Support level: 143.75, 143.10

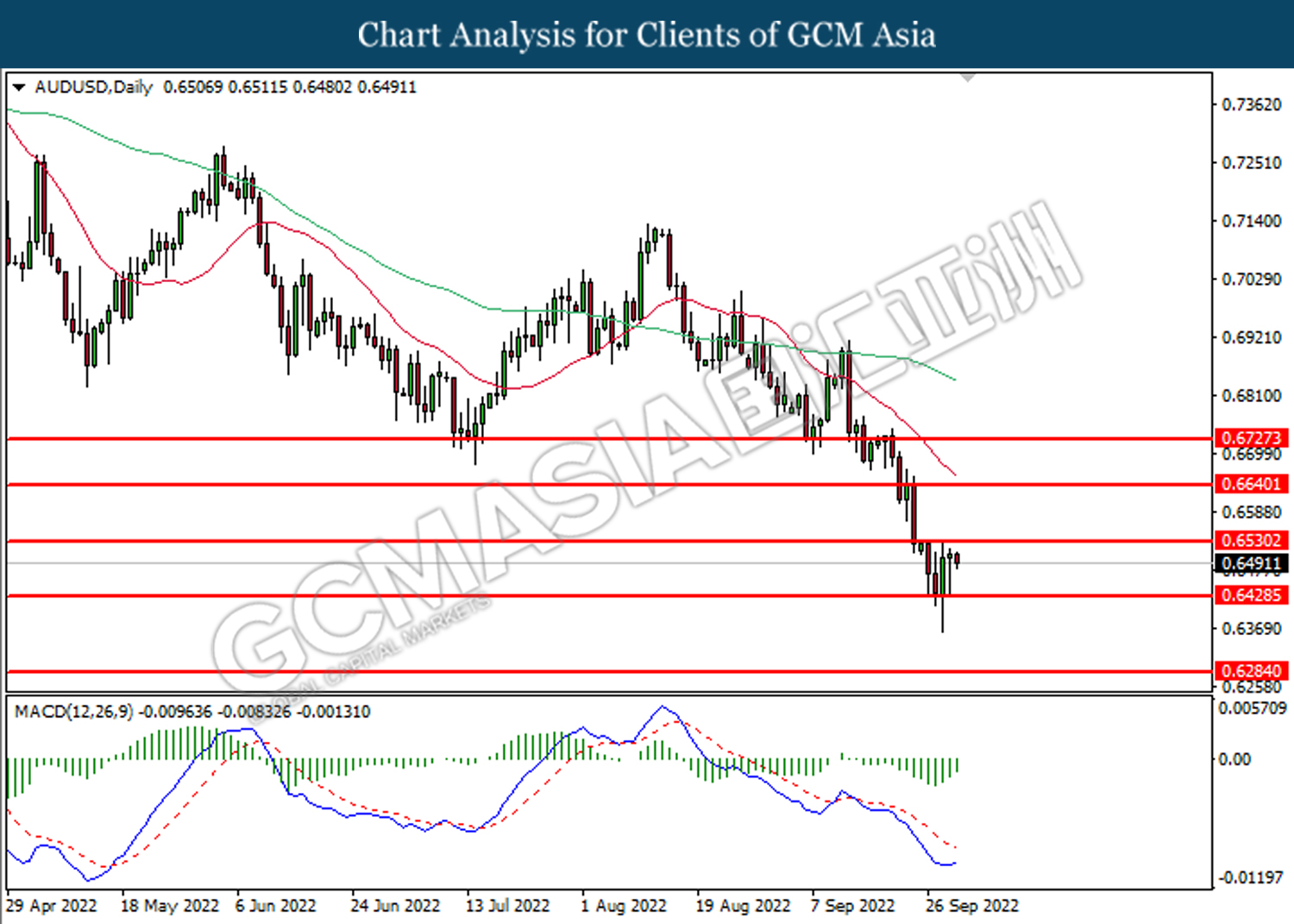

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6530. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6530, 0.6640

Support level: 0.6430, 0.6285

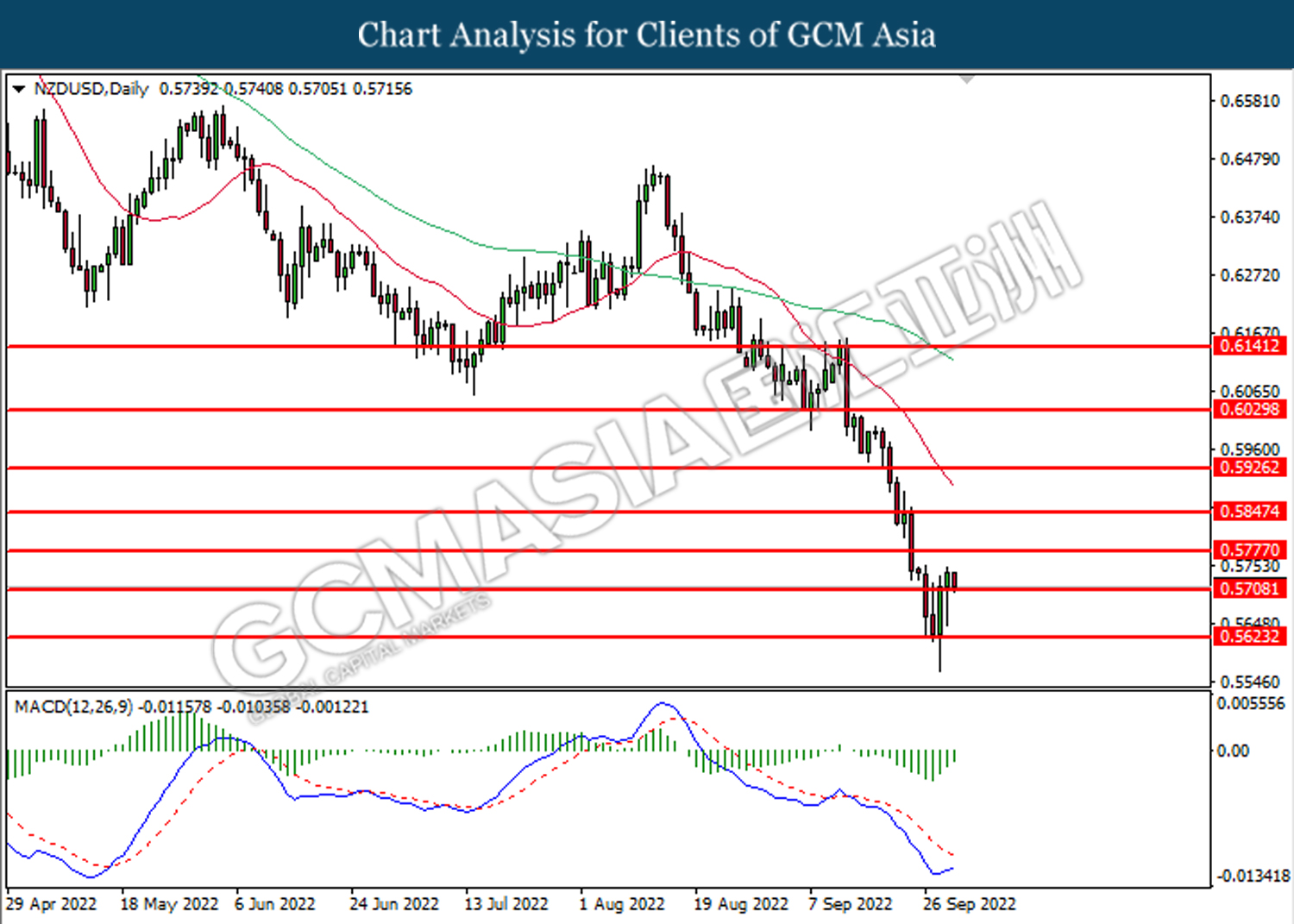

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.5710. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains in short term.

Resistance level: 0.5775, 0.5845

Support level: 0.5710, 0.5625

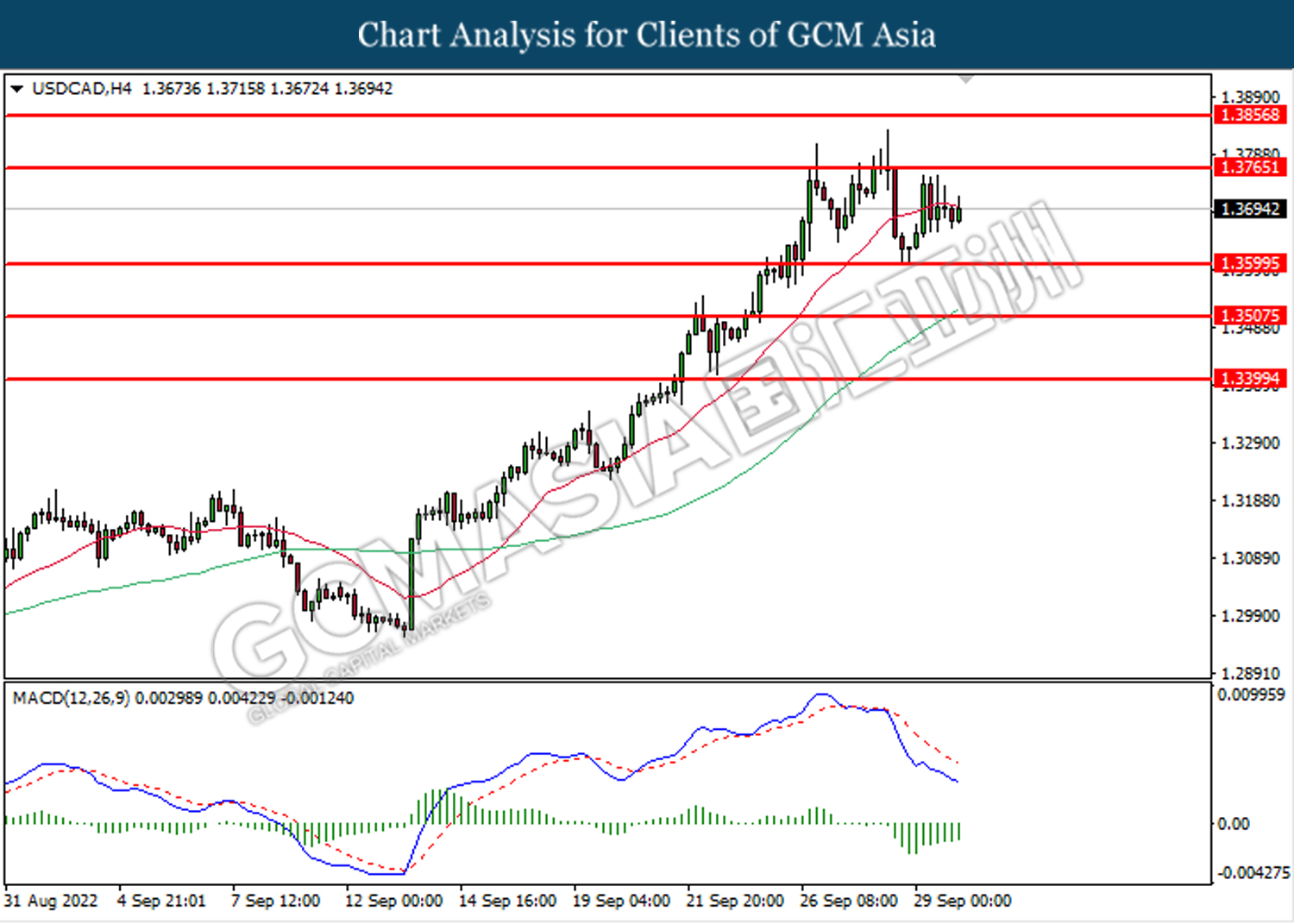

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3600. MACD which illustrated diminishing bearish momentum suggests the pair to extend gains toward the resistance level at 1.3765.

Resistance level: 1.3765, 1.3855

Support level: 1.3600, 1.3505

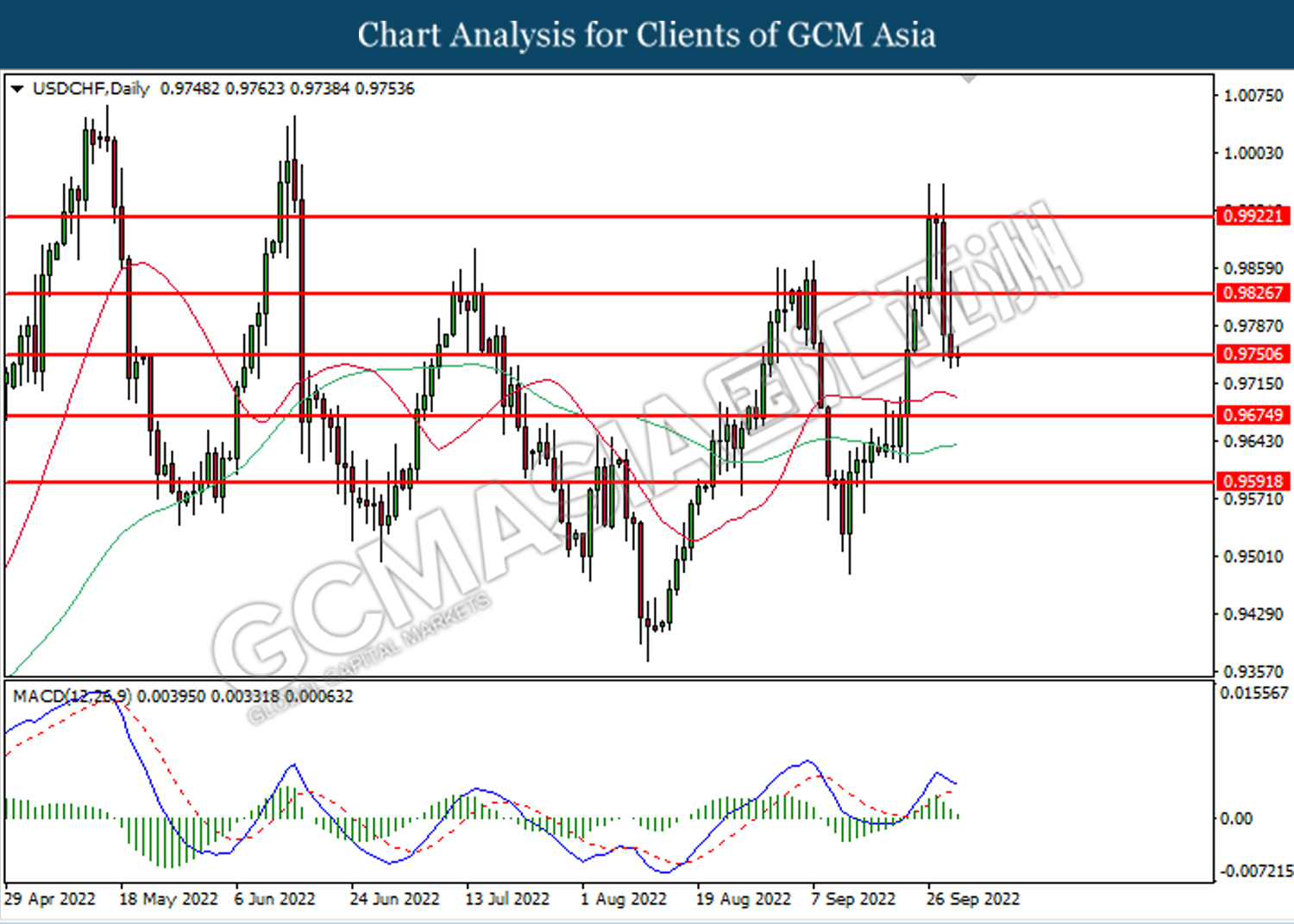

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9750. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9825, 0.9920

Support level: 0.9750, 0.9675

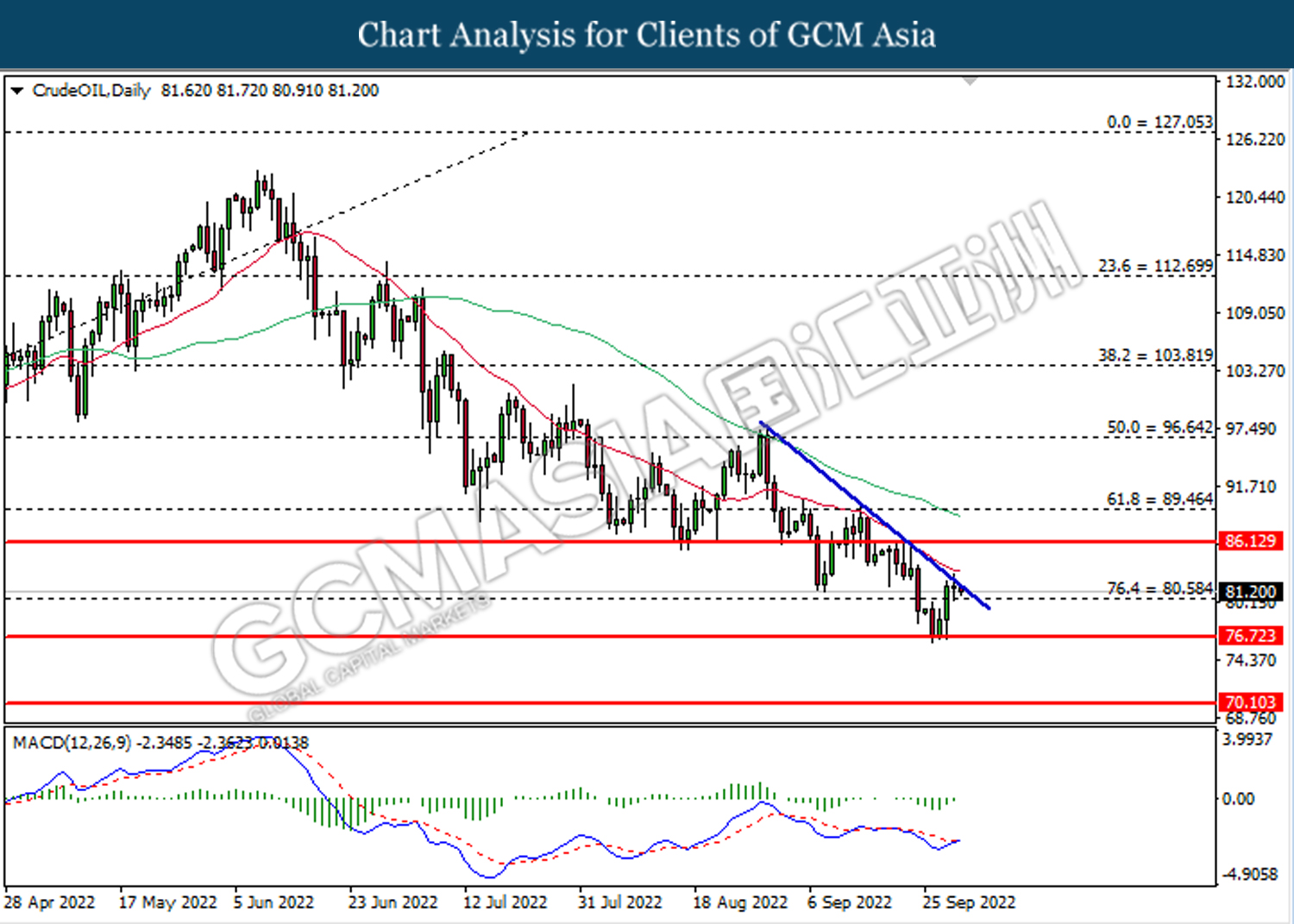

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the downward trendline. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the downward trendline.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.70

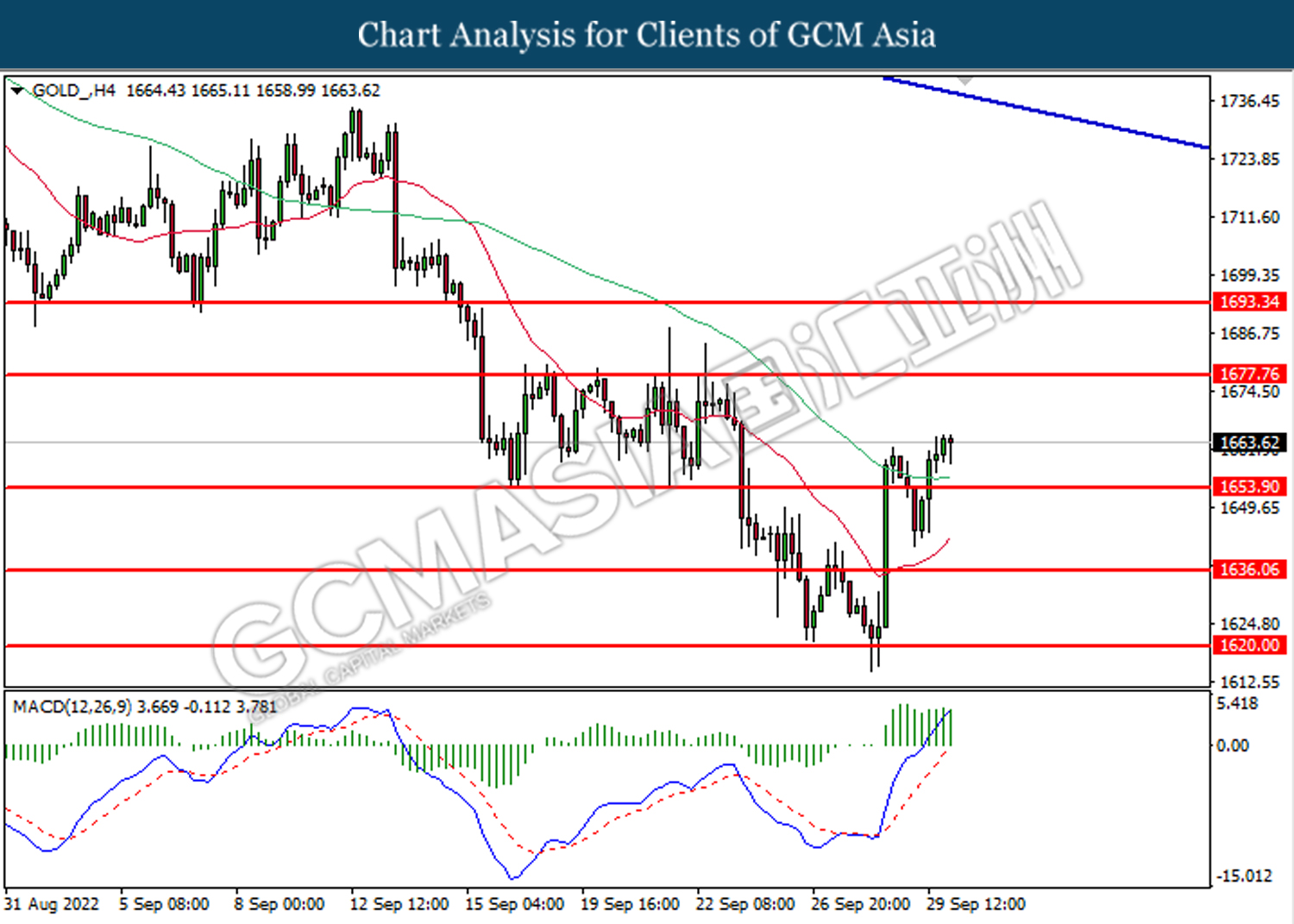

GOLD_, H4: Gold price was traded higher following prior rebound from the lower level. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1677.75.

Resistance level: 1677.75, 1693.35

Support level: 1653.90, 1636.10