30 November 2021 Afternoon Session Analysis

Euro flatten amid upbeat economic data.

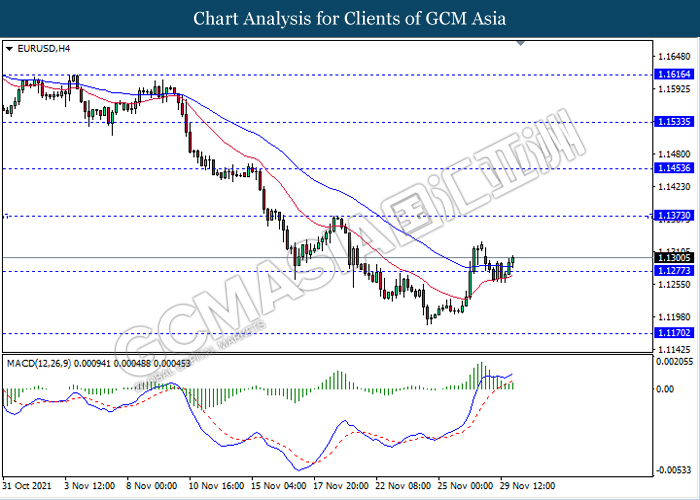

The Euro was traded flat amid upbeat economic data. According to the Federal Statistical Office Germany, Germany Consumer Price Index (CPI) in November edged higher from the previous reading of 4.5% to 5.2%, exceeding the market forecast at 5.0%. The data suggested that the soaring inflation pressure was driven by higher demand after the easing of coronavirus-led restrictions which eventually pushed up energy prices and led to shortages of key materials and labor around the world. Chief of Bundesbank Jens Weidmann has warned that the price hikes could last longer than expected. Likewise, the Euro extended its losses amid risk off sentiment. The widespread of Omicron virus in the Europe region could lead to sell-off of the currency in financial market while reiterated the appeal of US dollar as safe haven. As of writing, the pair of EUR/USD flattened around 1.1295.

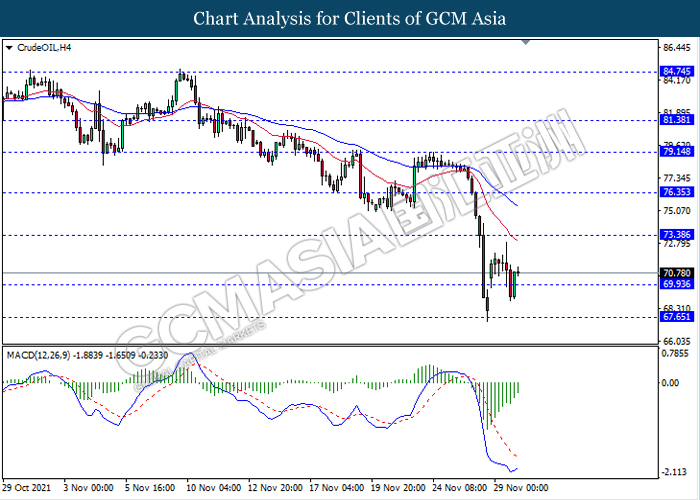

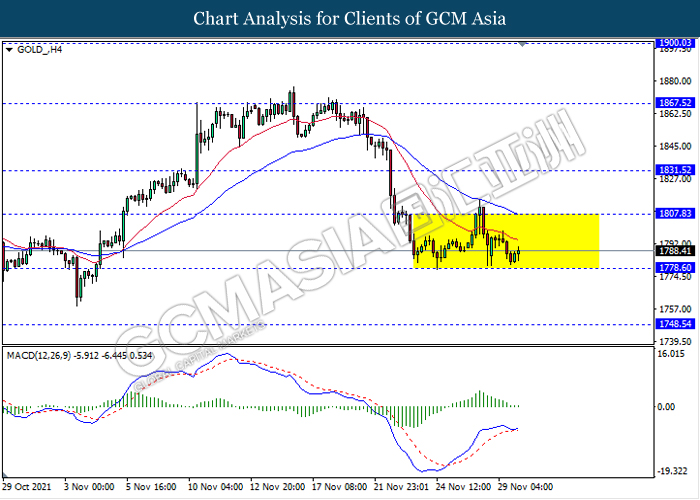

In the commodities market, the crude oil price slumped 0.35% to $70.60 per barrel as of writing amid fear of oversupplying. According to report, Iran is determined to return to its pre-sanction oil production level of 5 million barrels per day despite there is lack of progress on nuclear talk. On the other hand, the gold price was up 0.21% to $1787.20 per troy ounces amid risk off sentiment.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Nov) | -39K | -25K | – |

| 18:00 | EUR – CPI (YoY)(Nov) | 4.10% | 4.50% | – |

| 21:30 | CAD – GDP (MoM)(Sep) | 0.40% | 0.10% | – |

| 23:00 | USD – CB Consumer Confidence (Nov) | 113.8 | 110.9 | – |

Technical Analysis

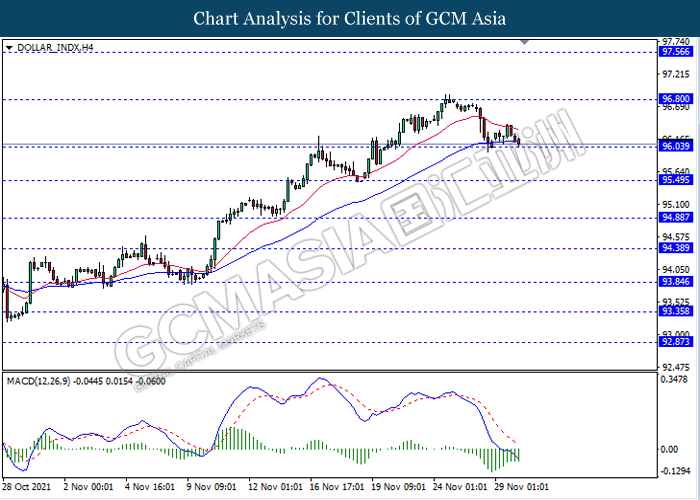

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level 96.05. MACD which illustrate ongoing bearish momentum signal suggest the dollar to extend its losses after it breaks below the support level.

Resistance level: 96.80, 97.55

Support level: 96.05, 95.50

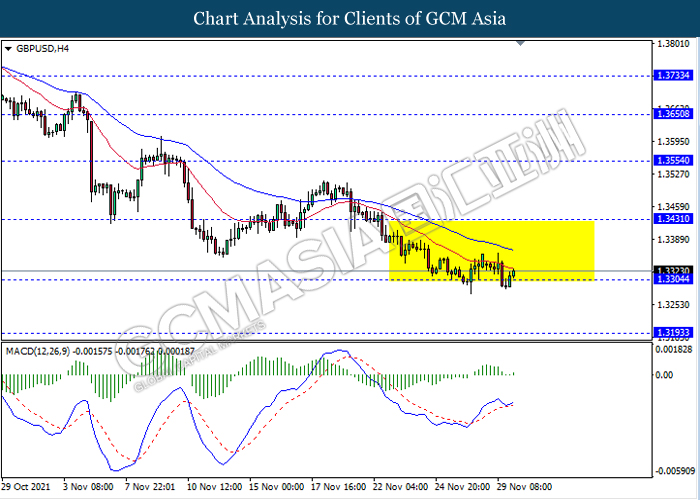

GBPUSD, H4: GBPUSD remain traded in a sideway channel following prior rebound the support level 1.3305. However, MACD which illustrate bullish momentum signal suggest the pair to extend its rebound in short term towards the resistance level 1.3430.

Resistance level: 1.3430, 1.3555

Support level: 1.3305, 1.3195

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level 1.1275. MACD which illustrate bullish bias signal suggest the pair to extend its gains towards the resistance level 1.1375.

Resistance level: 1.1375, 1.1455

Support level: 1.1275, 1.1170

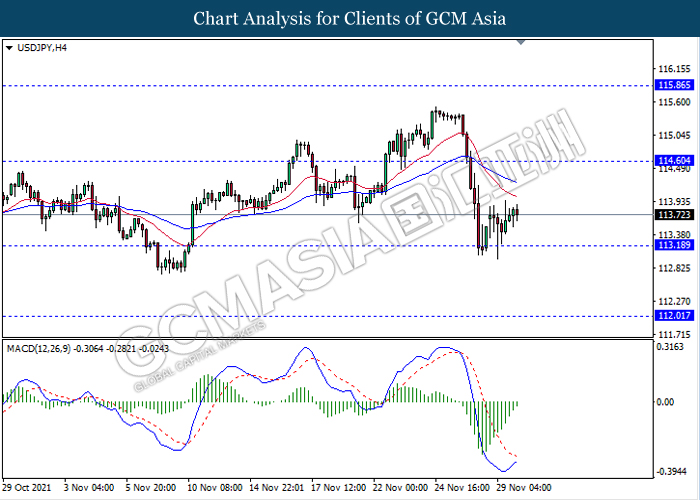

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level 113.20. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 114.60.

Resistance level: 114.60, 115.85

Support level: 113.20, 112.00

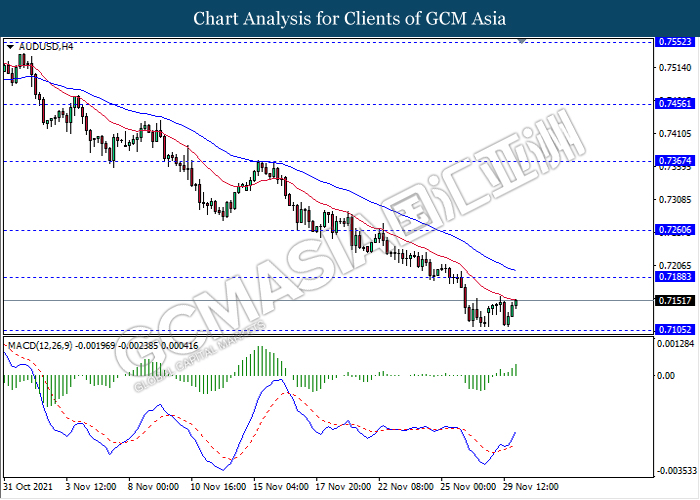

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level 0.7105. MACD which illustrate bullish momentum signal suggest the pair to extend its rebound towards the resistance level 0.7190.

Resistance level: 0.7190, 0.7260

Support level: 0.7105, 0.7005

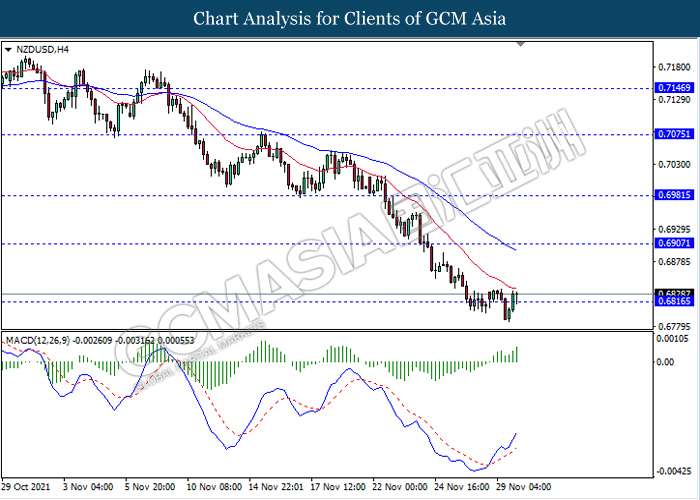

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level 0.6815. MACD which illustrate bullish momentum signal suggest the pair to extend its rebound towards the resistance level 0.6905.

Resistance level: 0.6905, 0.6980

Support level: 0.6815, 0.6725

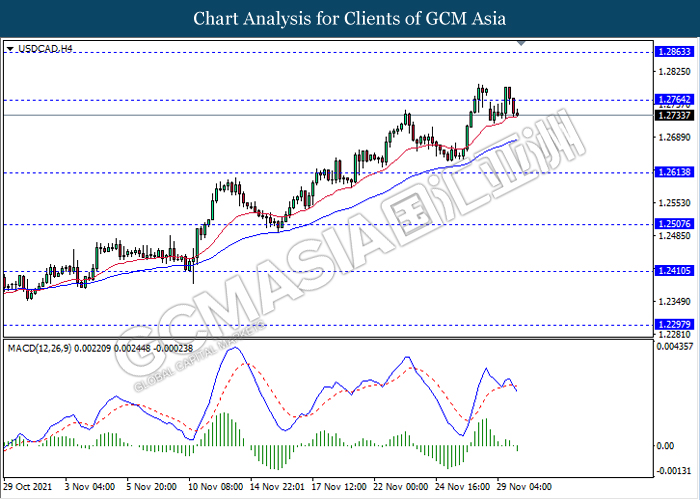

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level 1.2765. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses towards the support level 1.2615.

Resistance level: 1.2765, 1.2865

Support level: 1.2615, 1.2505

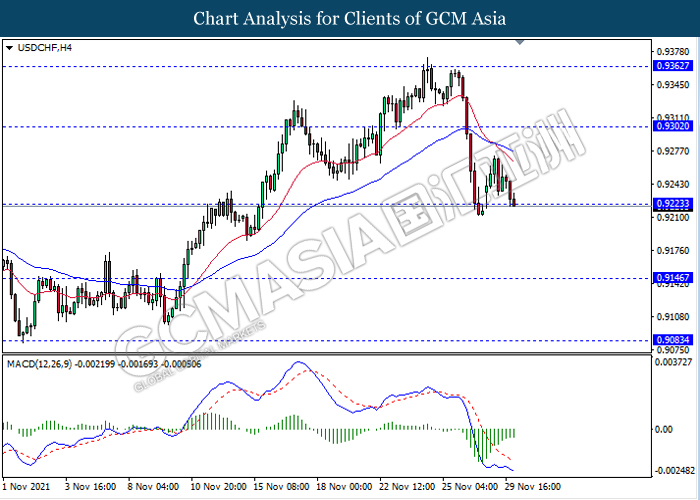

USDCHF, H4: USDCHF was traded lower while currently testing the support level 0.9225. MACD which illustrate ongoing bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.9300, 0.9360

Support level: 0.9225, 0.9145

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level 69.90. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 73.40.

Resistance level: 73.40, 76.35

Support level: 69.95, 67.65

GOLD_, H4: Gold price remain traded in a sideway channel while currently testing the support level 1778.60. However, MACD which illustrate diminishing bullish momentum signal suggest the commodity to be traded lower after it breaks below the support level 1778.60.

Resistance level: 1807.80, 1831.50

Support level: 1778.60, 1748.55