30 November 2021 Morning Session Analysis

Dollar remained bullish amid risk-off sentiment.

The Dollar Index which traded against a basket of six major currency pairs was traded lower on yesterday amid technical correction, though the overall momentum for the US Dollar was still remained bullish over the backdrop of risk-off sentiment following the market participants anticipated the latest Omicron variant would continue to affect the global economic. The World Health Organization (WHO) designated Omicron as a variant of concern on 26th November due to the number of mutations that can affect how it spreads and its health effects. The possibility of new variant might be prompting the government to re-implement the highly stringent nationwide lockdown in order to combat the spiking numbers of the Covid-19, which diminishing the growth effects on the global economic. Nonetheless, the scientist still required significant data to determine whether Omicron is more transmissible than other variants, including Delta, according to WHO. As of writing, the Dollar Index appreciated by 0.11% to 96.20.

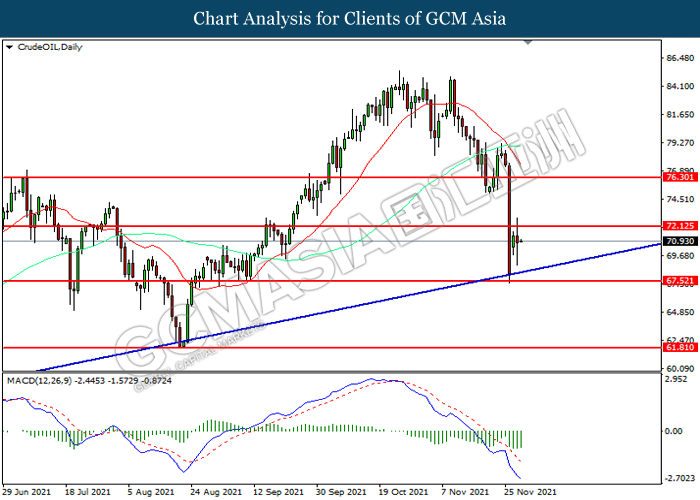

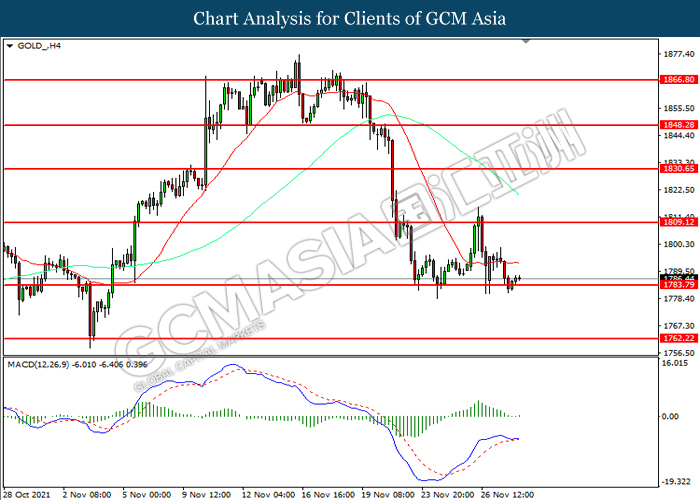

In the commodities market, the crude oil price surge 0.80% to $71.25 per barrel as of writing. Nonetheless, the overall volatility for the crude oil price remained significant high as investors still waited for further data from the latest Omicron variant. On the other hand, the gold price appreciated by 0.20% to $1787.10 per troy ounces as of writing as market participants speculated the global central bank would start to begin to raise the interest rate to stabilize the inflation risk in next year, diminishing the appeal for the safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Nov) | -39K | -25K | – |

| 18:00 | EUR – CPI (YoY) (Nov) | 4.10% | 4.40% | – |

| 21:30 | CAD – GDP (MoM) (Sep) | 0.40% | 0.10% | – |

| 23:00 | USD – CB Consumer Confidence (Nov) | 113.8 | 110.9 | – |

Technical Analysis

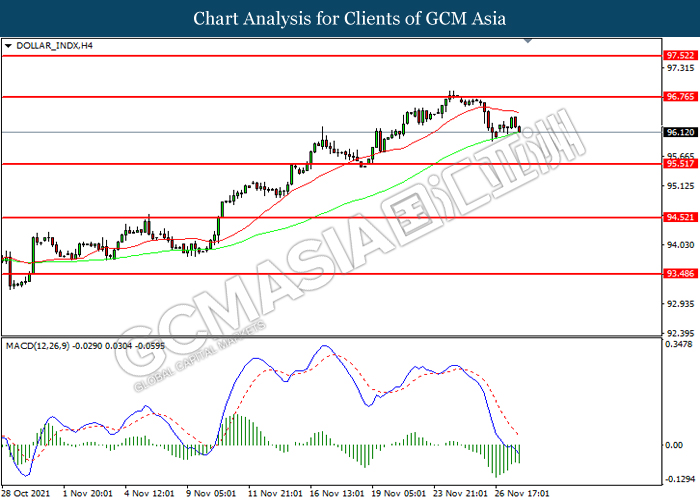

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 96.75. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 95.50.

Resistance level: 96.75, 97.50

Support level: 95.50, 94.50

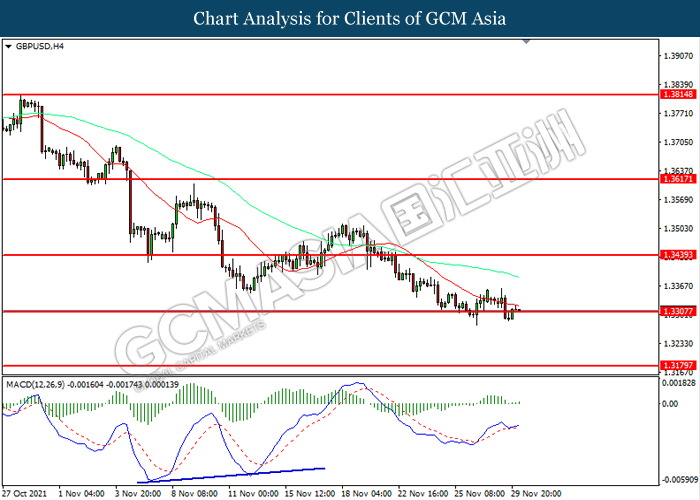

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3305. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3440, 1.3615

Support level: 1.3305, 1.3180

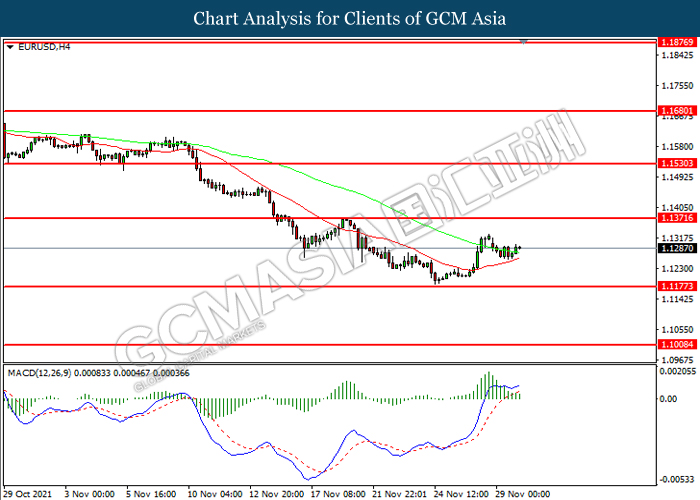

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1175. However, MACD illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1370, 1.1530

Support level: 1.1175, 1.1010

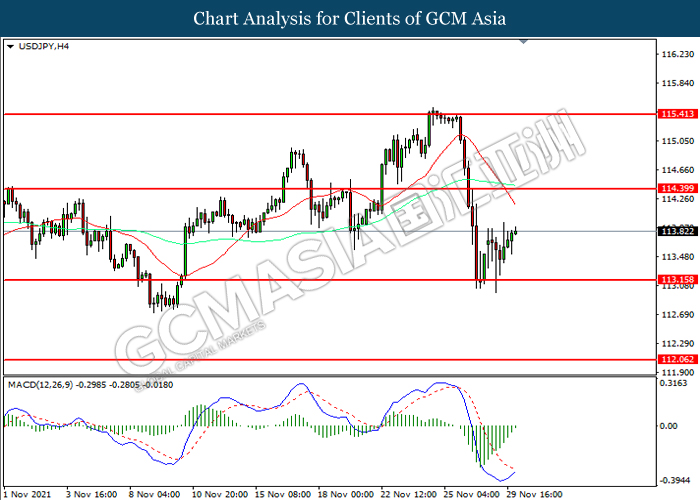

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level at 113.15. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 114.40.

Resistance level: 114.40, 115.40

Support level: 113.15, 112.05

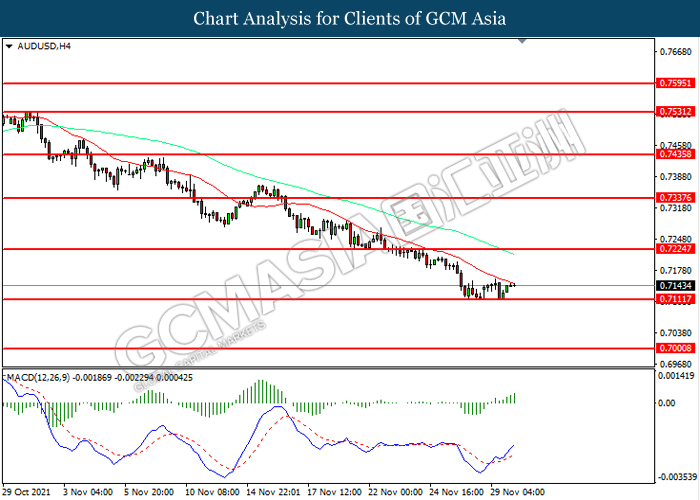

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7110. However. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7225, 0.7335

Support level: 0.7110, 0.7000

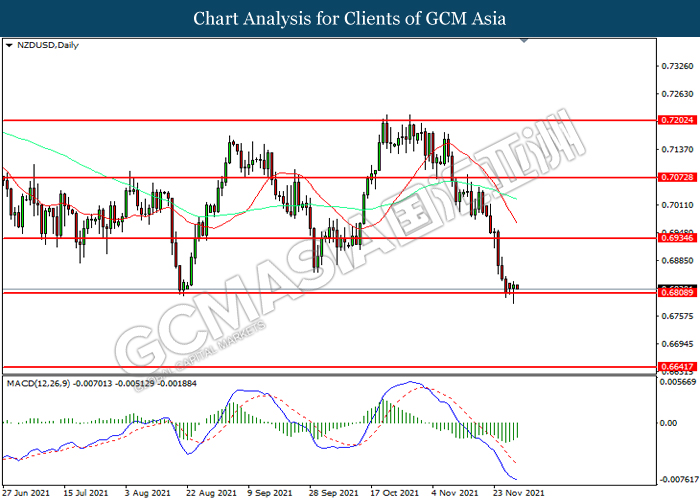

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6810. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6935, 0.7075

Support level: 0.6810, 0.6640

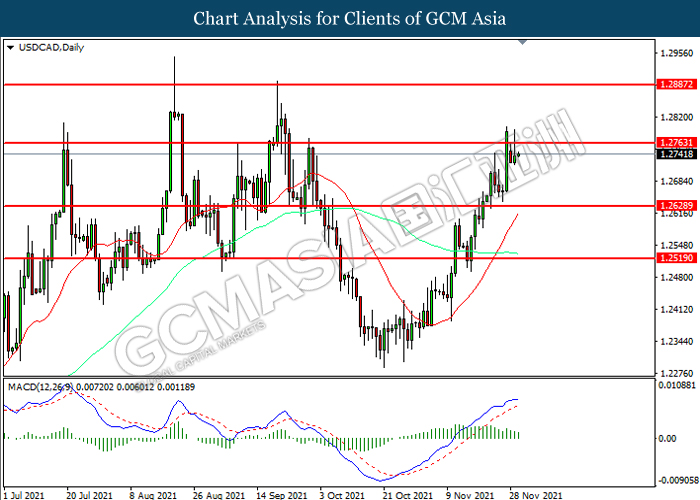

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2765. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2765, 1.2885

Support level: 1.2630, 1.2520

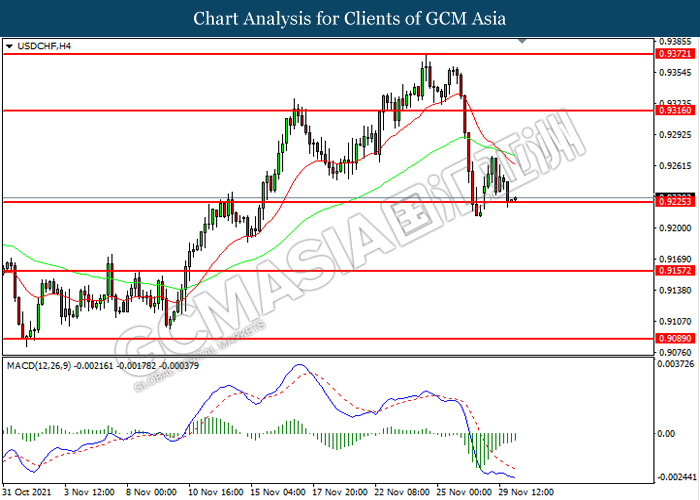

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9225. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9315, 0.9370

Support level: 0.9225, 0.9155

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 72.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 72.15, 76.30

Support level: 67.50, 61.80

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1783.80. However, MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1809.10, 1830.65

Support level: 1783.80, 1762.20

Risk Statement:

Forex, Gold, Crude Oil, Commodities, CFD and all other margin trading investment products involve high level of risk and may not be suitable for all investors. Your previous investment success in stock, futures or any other investment achieved does not mean that all your future investment will obtain the same results. You should carefully consider your investment objectives; risk associated and seek professional advice before deciding to trade or if you have any doubts.