30 November 2022 Afternoon Session Analysis

Dollar standstill ahead of Fed Powell speech.

The dollar index, which gauges its value against a basket of six major currencies, teetering near the brink while market participants are waiting for the long-awaited speech from the Federal Reserve Chairman Jerome Powell. Recently, the St. Louis Fed President James Bullard commented that the official cash rate needed to increase further and hold for an extended period of time throughout the year of 2024 in order to effectively cool down the sky-high inflation. Importantly, James Bullard also warned that the market is now underpricing the risk FOMC may be more aggressive. Hence, it urged the market participants to eye on the speech from the Fed Chairman, in order to identify if there is any deviation on their standpoint regarding the rate hike plan. Moreover, the US GDP data which scheduled to release tonight, is expected to provide a crucial view on the economic current health situation to the investors. As of writing, the dollar index dropped -0.14% to 106.65.

In the commodities market, the crude oil price edged down by -0.03% to $79.40 per barrel as China Covid-19 cases remain high, whereby it deteriorated the outlook of the oil market. Besides, the gold prices edged up 0.22% to $1753.00 per troy ounce amid the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Nov) | 8K | 13K | – |

| 18:00 | EUR – CPI (YoY) (Nov) | 10.6% | 10.4% | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Nov) | 239K | 200K | – |

| 21:30 | USD – GDP (QoQ) (Q3) | 2.6% | 2.7% | – |

| 23:00 | USD – JOLTs Job Openings (Oct) | 10.717M | 10.300M | – |

| 23:00 | USD – Pending Home Sales (MoM) (Oct) | -10.2% | -5.0% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -3.691M | -2.758M | – |

Technical Analysis

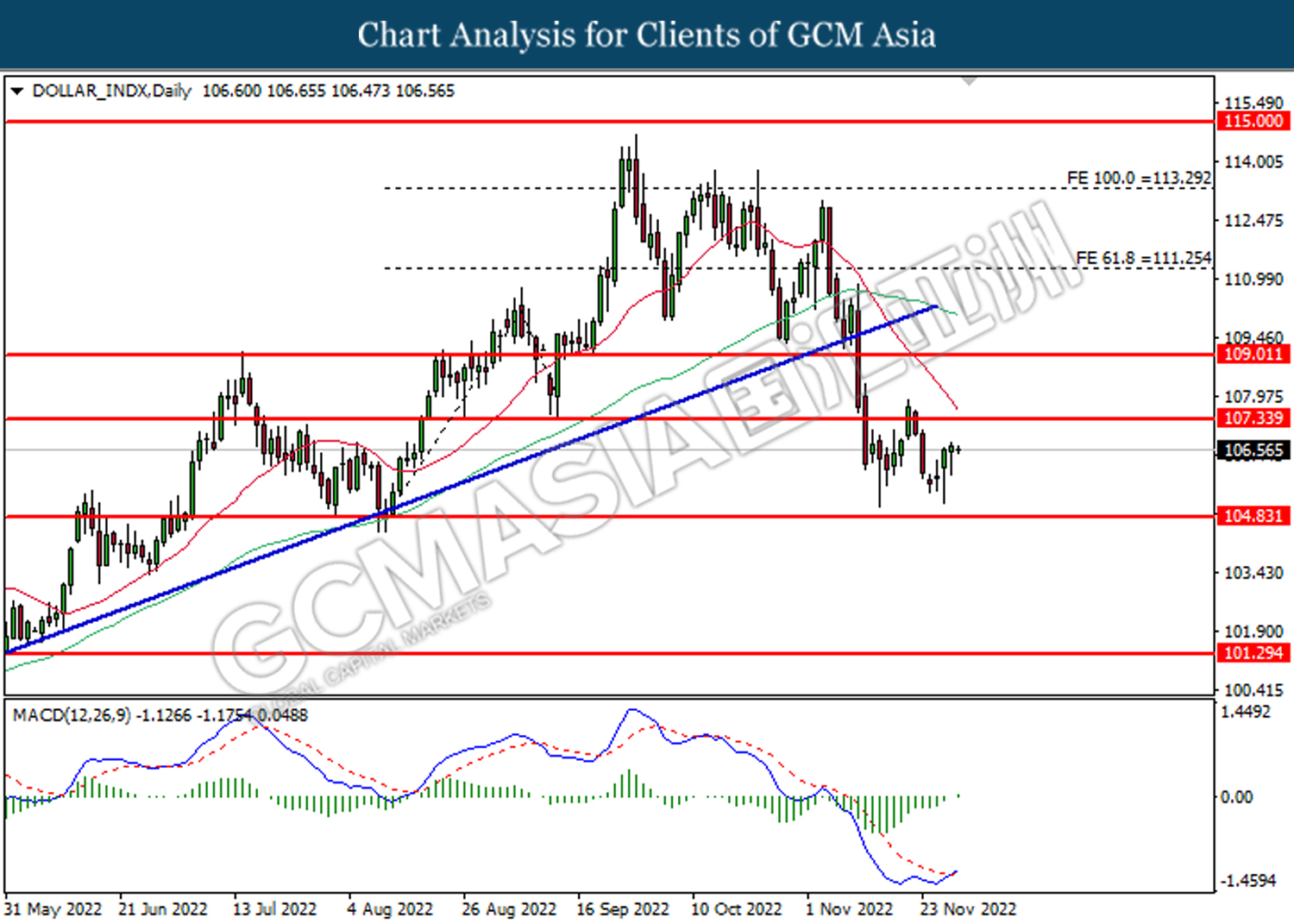

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.35.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

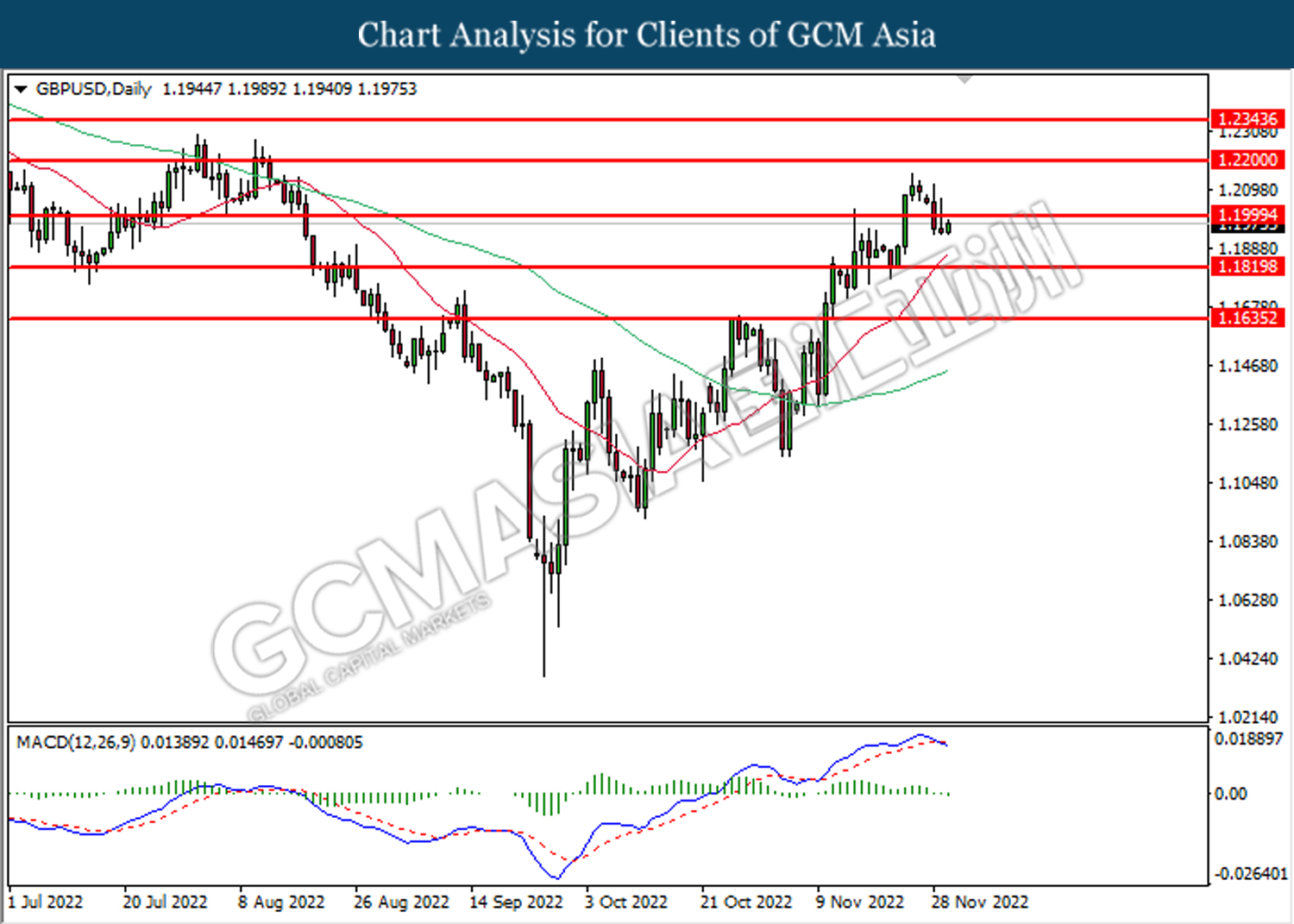

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1820.

Resistance level: 1.2000, 1.2200

Support level: 1.1820, 1.1635

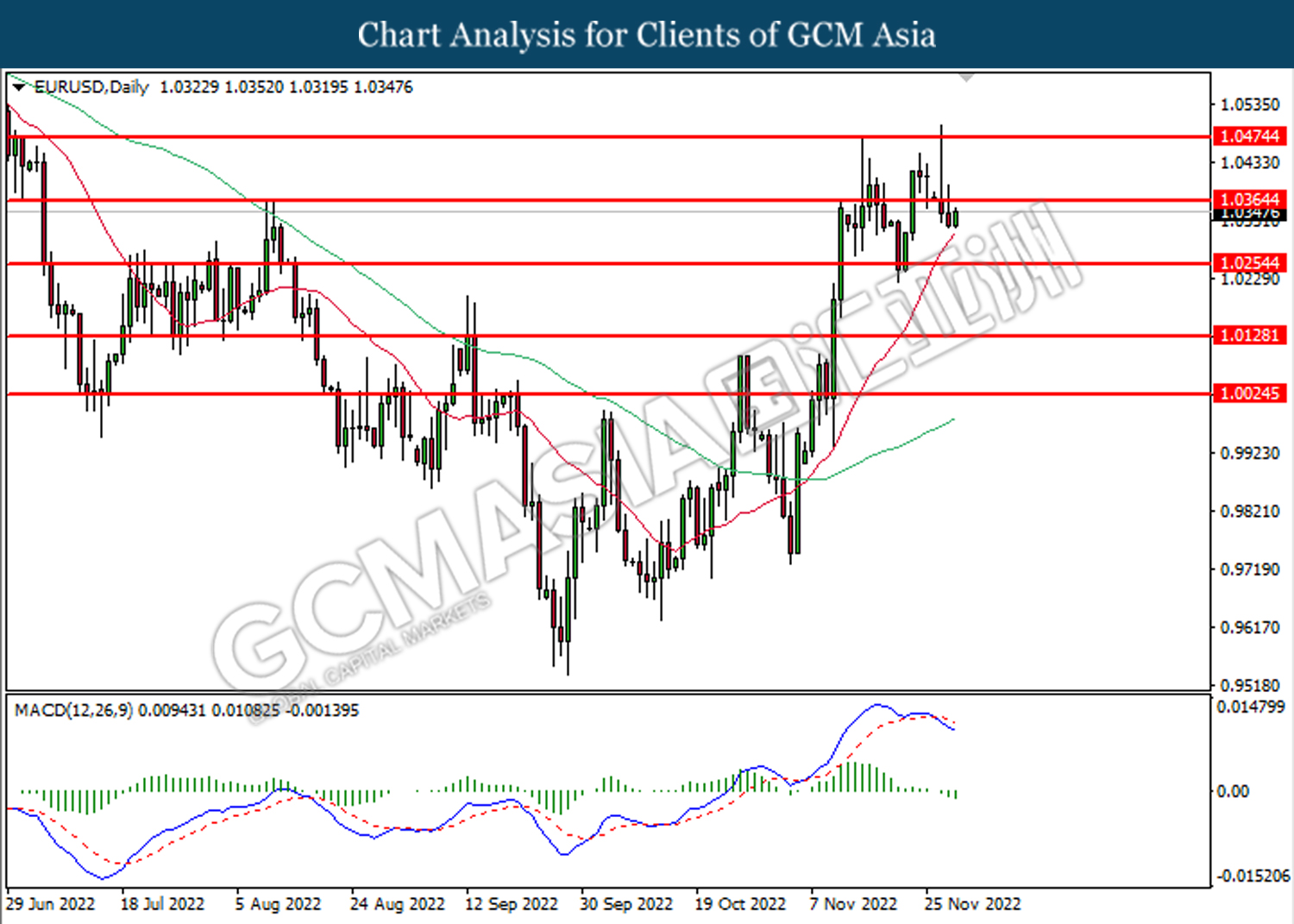

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0365. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0255.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

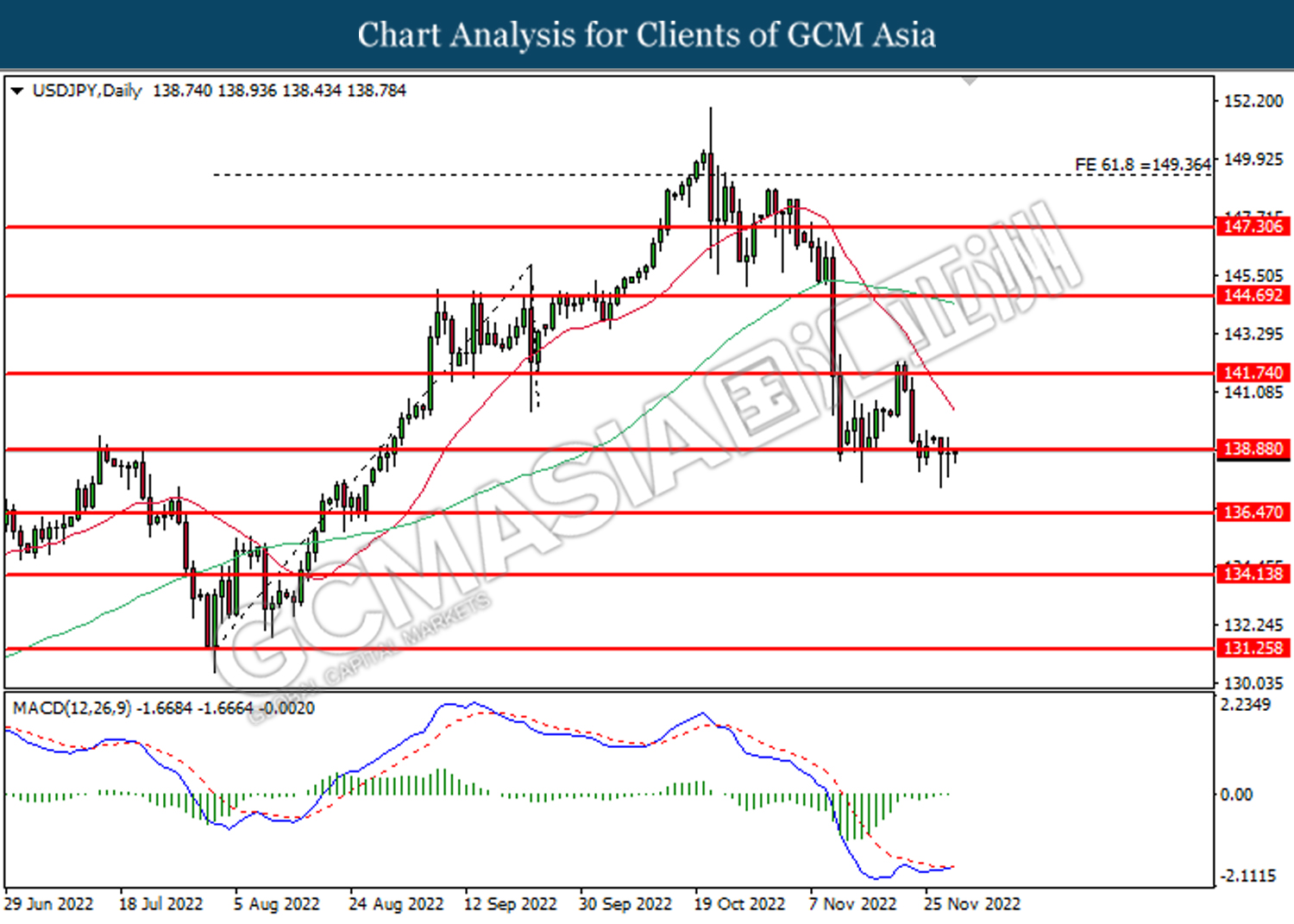

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.90. MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

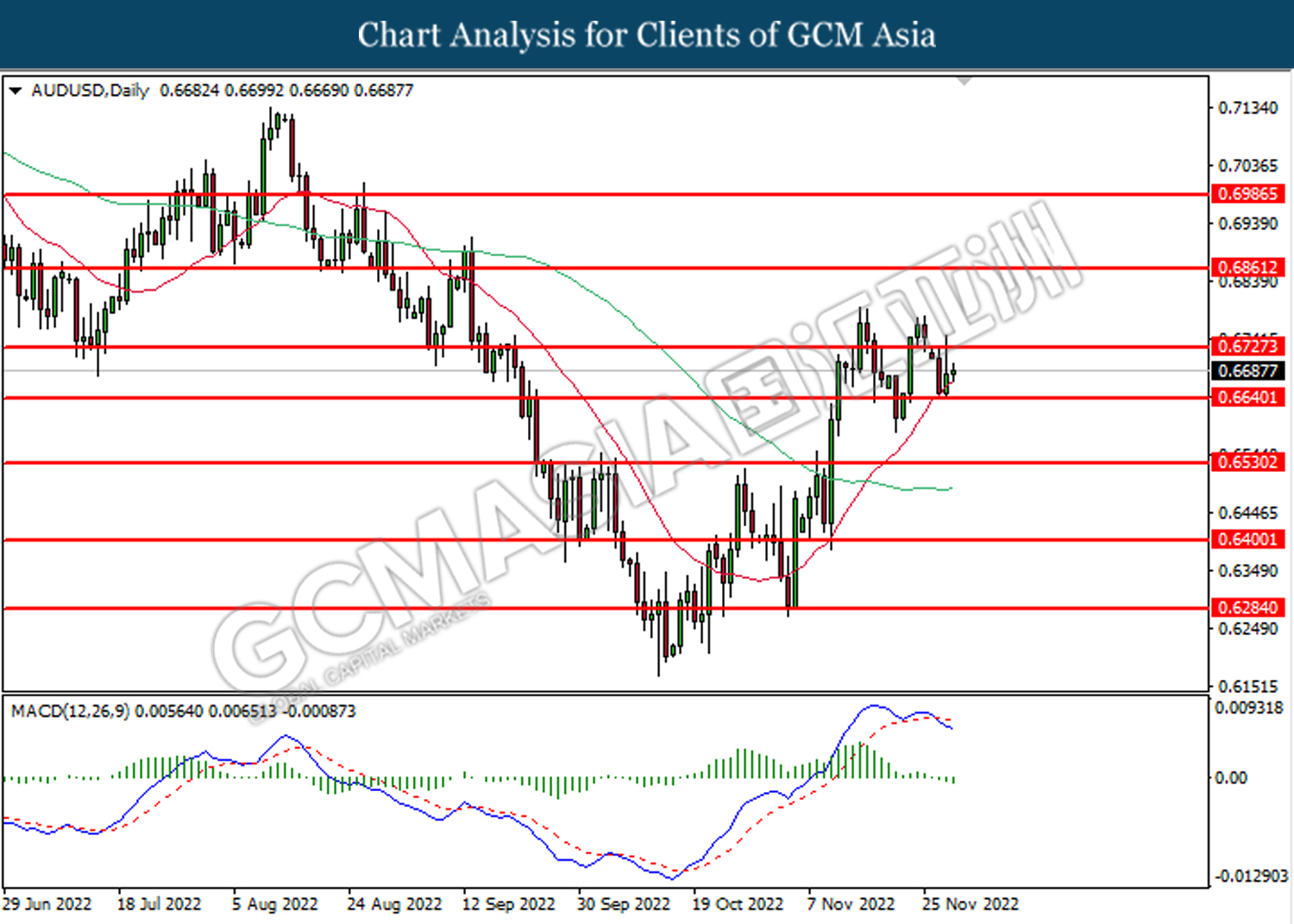

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6640. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

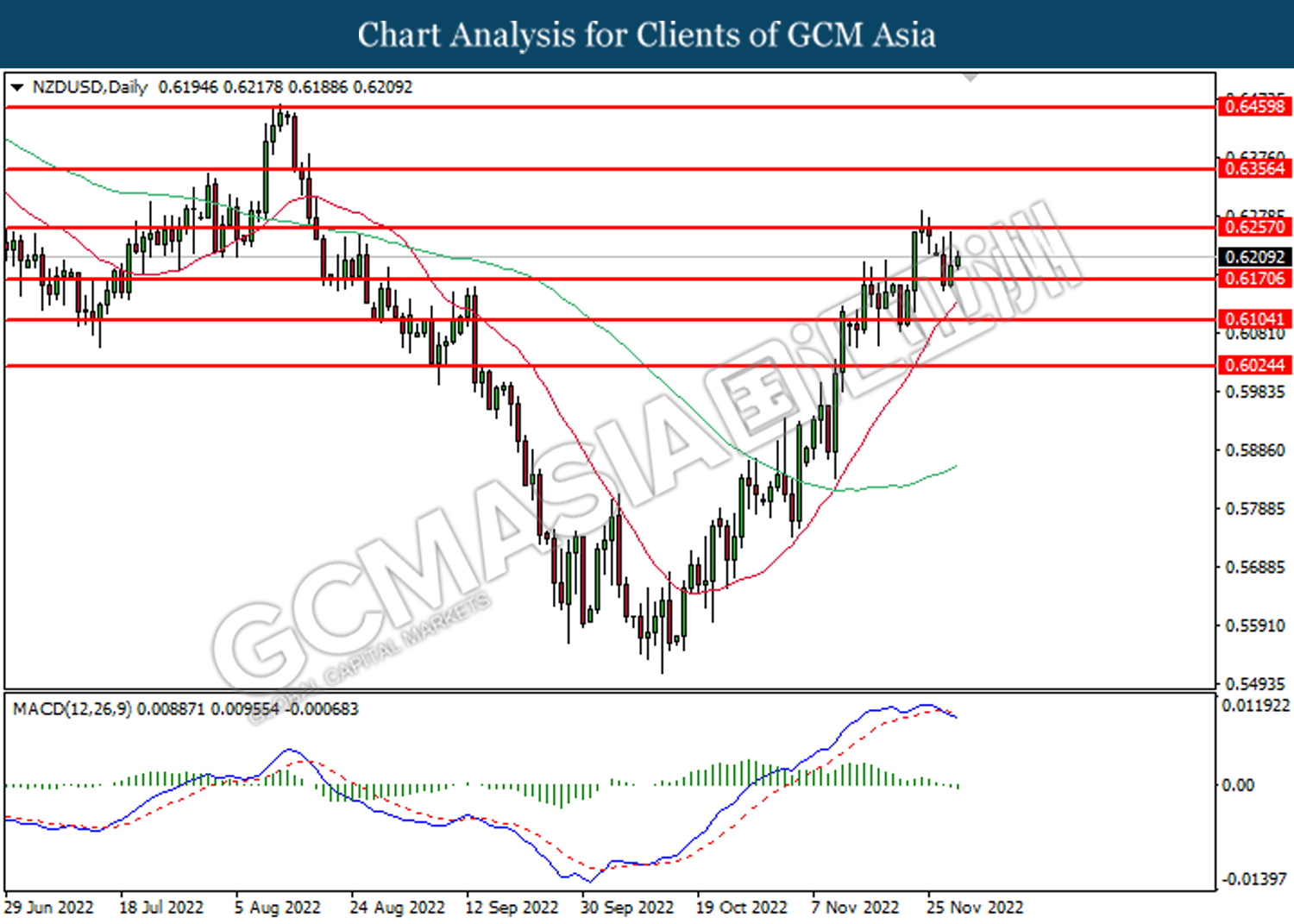

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6170. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6255, 0.6355

Support level: 0.6170, 0.6105

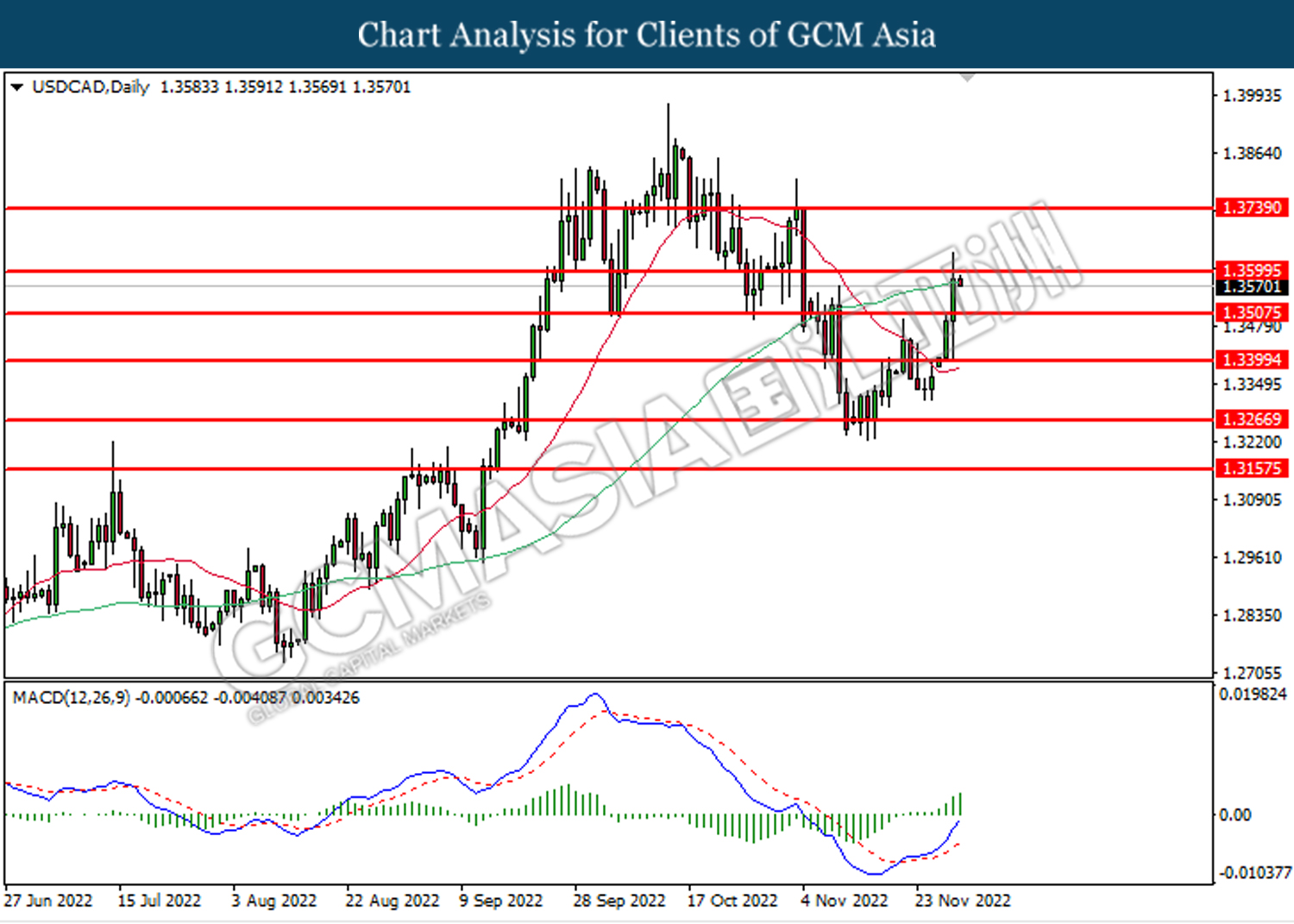

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

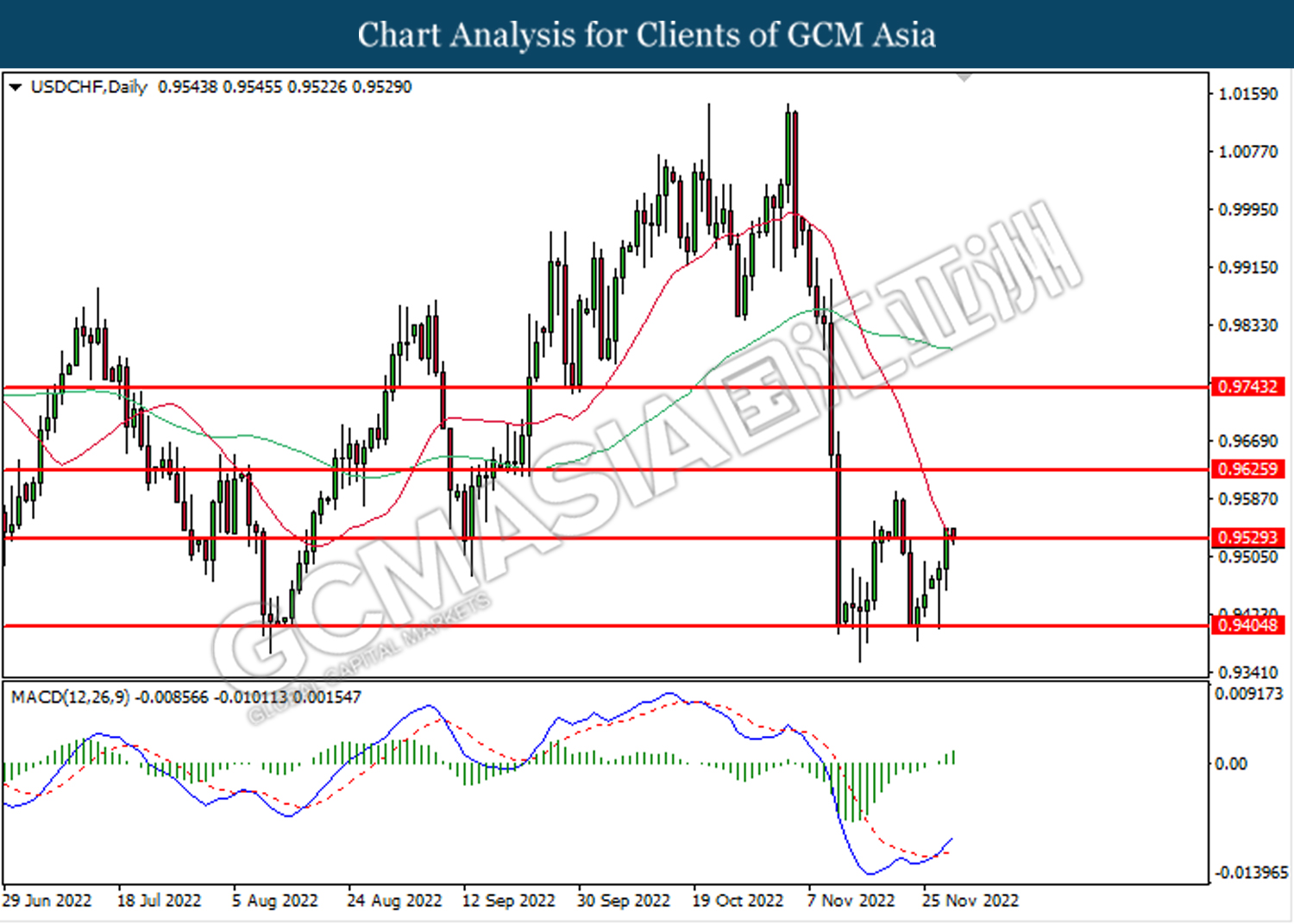

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9530. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9625.

Resistance level: 0.9625, 0.9745

Support level: 0.9530, 0.9405

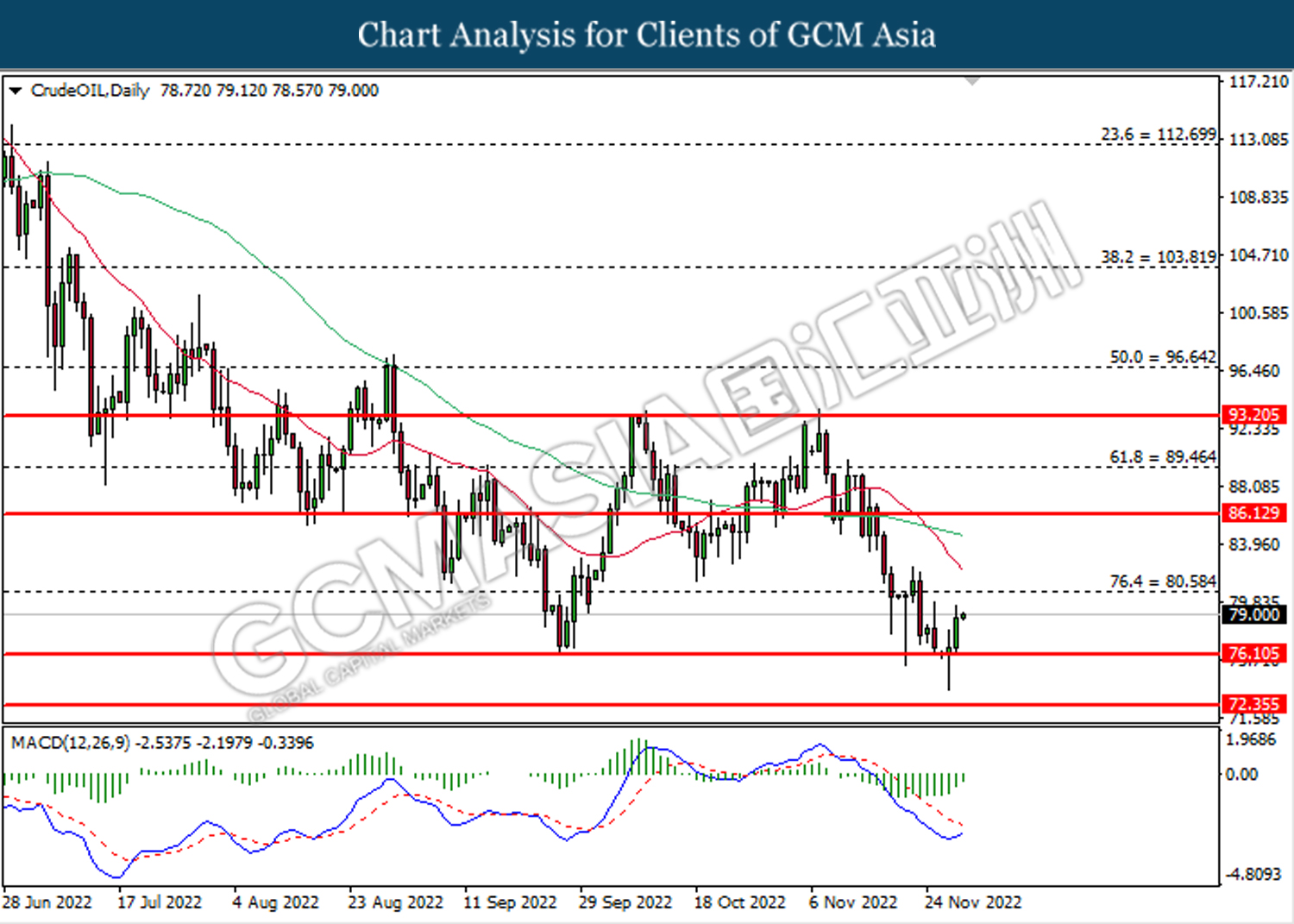

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 80.60.

Resistance level: 80.60, 86.15

Support level: 76.10, 72.35

GOLD_, Daily: Gold price was traded higher following prior rebound from the lower level. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35