30 November 2022 Morning Session Analysis

US Dollar rallied as interest rate might be increased further.

The Dollar Index which traded against a basket of six major currencies extended its gains on yesterday after the upbeat economic data has been released. According to Conference Board, the US CB Consumer Confidence for November came in at the reading of 100.2, slightly higher than the market forecast of 100.0. The higher-than-expected data figures indicated the higher US consumer optimism toward economic progression in the US, while showing that the US economy was not entering into recession yet. Besides that, the optimistic economic data has increased the odds of aggressive rate hikes by Fed. Earlier of the week, St. Louis Fed President James Bullard reiterated that the Federal Reserve needs to raise interest rates quite a bit further and then hold them there throughout next year and into 2024 to gain control of inflation and bring it back down toward the US central bank’s 2% goal. Thus, the GDP data and Fed Chairman’s speech in the upcoming events would be the key factors to determine the size of rate hike. As of writing, the Dollar Index appreciated by 0.09% to 106.73.

In the commodities market, the crude oil price rose by 0.84% to $78.84 per barrel as of writing following the investors anticipated that China will be pressured by its protesting citizens to reopen its economy from COVID lockdowns. In addition, the gold price dropped by 0.09% to $1746.90 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Nov) | 8K | 13K | – |

| 18:00 | EUR – CPI (YoY) (Nov) | 10.6% | 10.4% | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Nov) | 239K | 200K | – |

| 21:30 | USD – GDP (QoQ) (Q3) | 2.6% | 2.7% | – |

| 23:00 | USD – JOLTs Job Openings (Oct) | 10.717M | 10.300M | – |

| 23:00 | USD – Pending Home Sales (MoM) (Oct) | -10.2% | -5.0% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -3.691M | -2.487M | – |

Technical Analysis

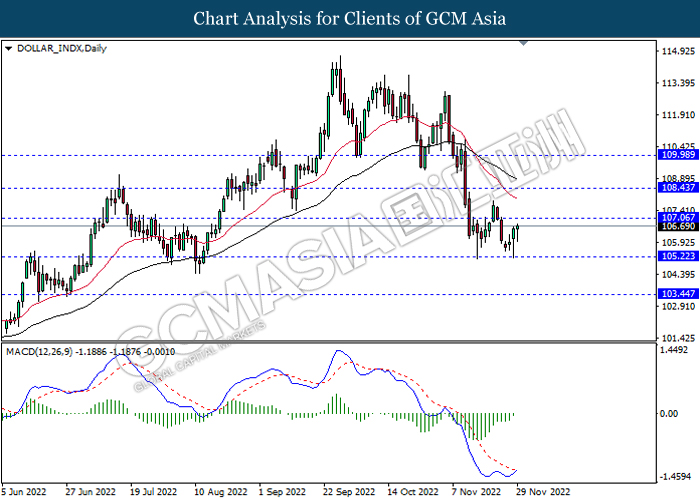

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

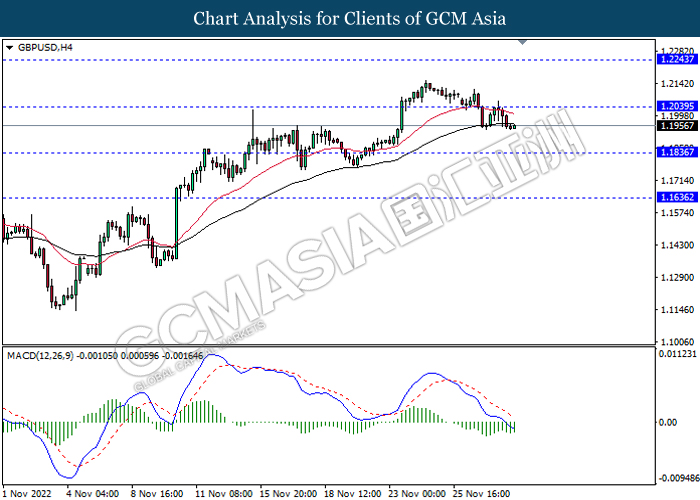

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2040, 1.2245

Support level: 1.1835, 1.1635

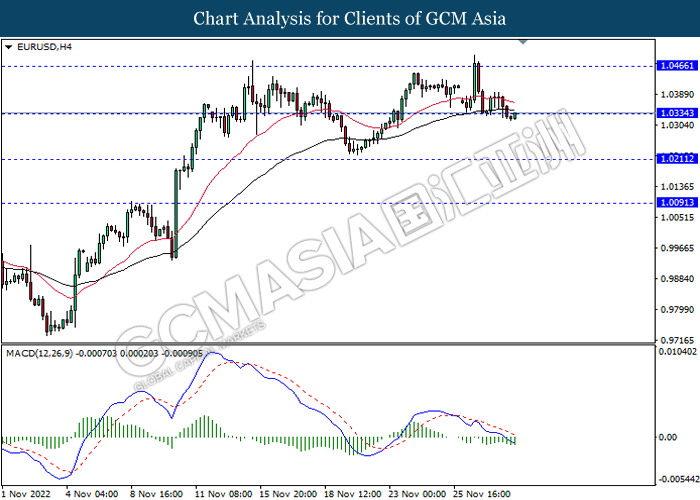

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0335, 1.0465

Support level: 1.0210, 1.0090

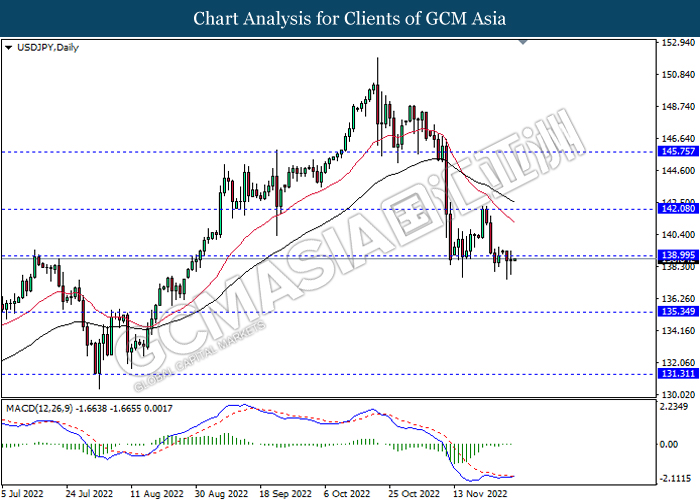

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

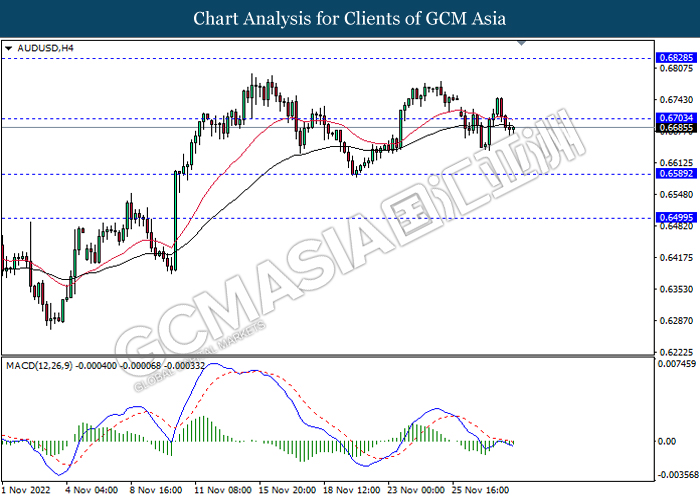

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

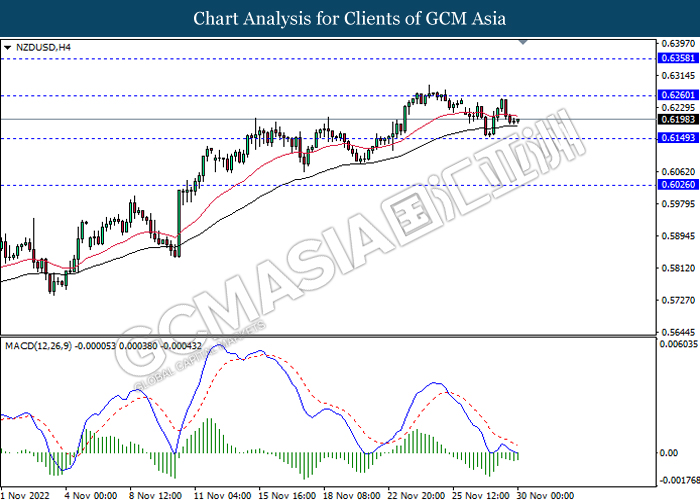

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6260, 0.6360

Support level: 0.6150, 0.6025

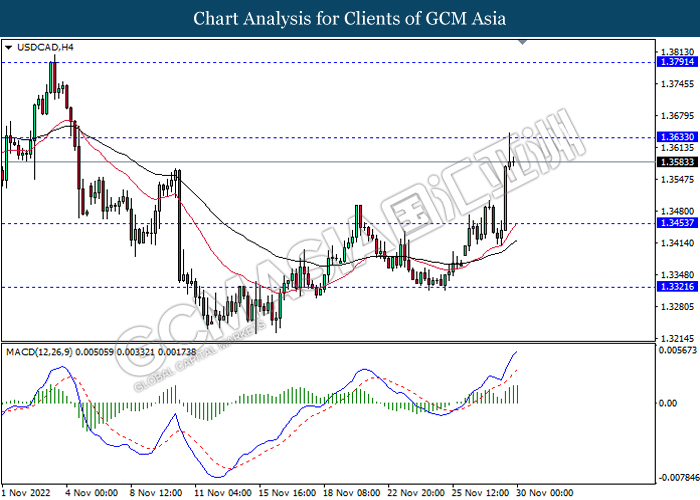

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3635, 1.3790

Support level: 1.3455, 1.3320

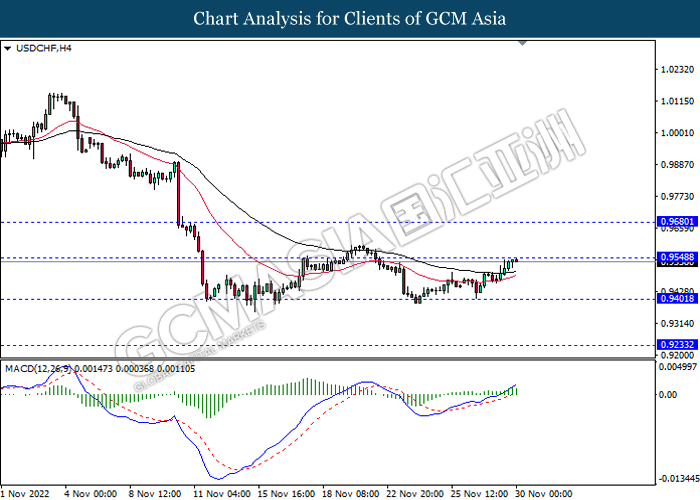

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

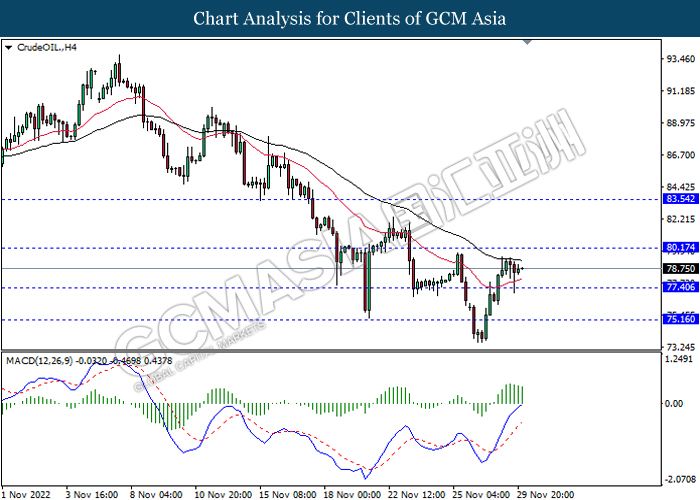

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 80.15, 83.55

Support level: 77.40, 75.15

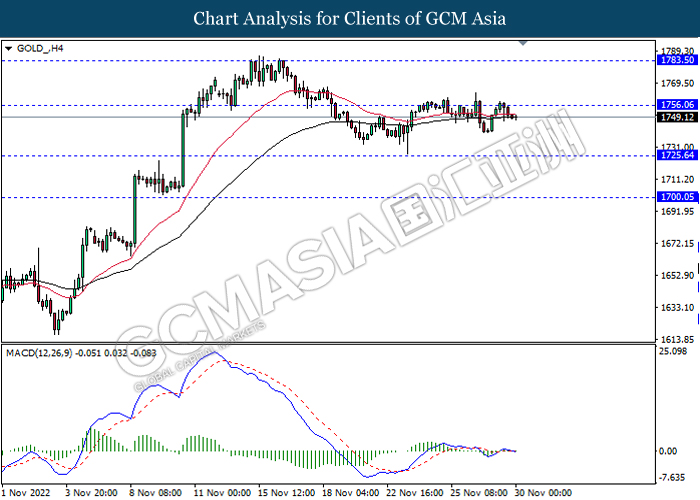

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1756.05, 1783.50

Support level: 1725.65, 1700.05