30 December 2020 Afternoon Session Analysis

Aussie rose on risk-on mood.

During late Asian session, the Australian dollar which traded against the dollar and other currency pairs taking huge bid and rose following risk on mood causes by US policymakers jostle with the coronavirus (COVID-19) aid package while the virus recently troubled the US, Japan and Australia. Following US Senate Republican Majority Leader Mitch McConnell obstructed the $2,000 pay check, Congress members are trying to delay the voting over the much-awaited stimulus unless they win a runoff in Georgia, as per the latest chatters. However, US Treasury Secretary Steve Mnuchin’s statement suggesting $600 relief will be out tonight have favoured the risks. At the same time, adding further to the positivity was reports of China shows readiness to return two Hong Kong activists, out of 12 who detained over illegal border crossing. At the time of writing, AUD/USD rose 0.59% to 0.7650.

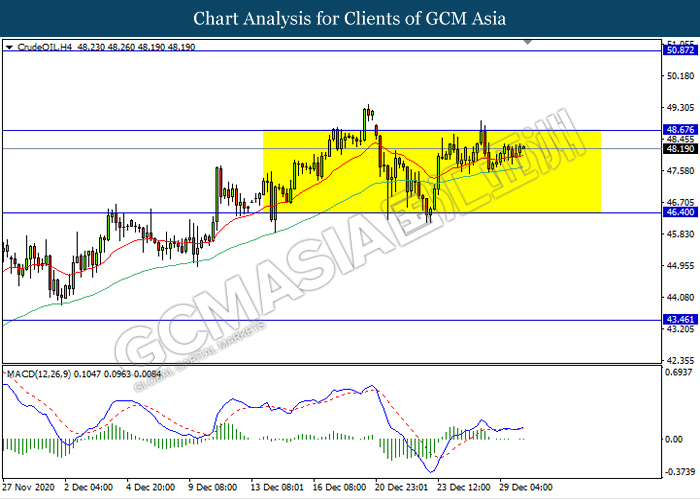

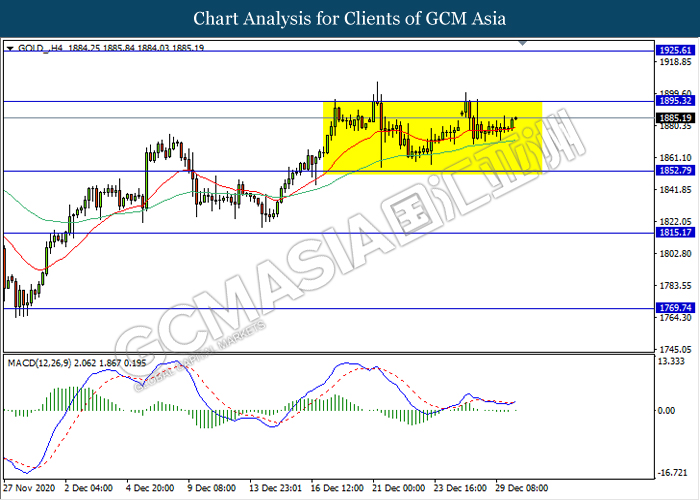

In the commodities market, crude oil price remains stable and edge higher 0.40% to $48.21 per barrel at the time of writing as the commodity continue to find support from hopes of recovery in demand. Following vaccination programmes around the world begin next year, countries is expected to eased restrictions on movement and business activity which in turn could boost demand for oil and fuel. On the other hand, gold price also rose 0.38% to 1885.23 a troy ounce as of writing following weakening greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – Pending Home Sales (MoM) (Nov) | -1.1% | 0.2% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -0.562M | -2.583M | – |

Technical Analysis

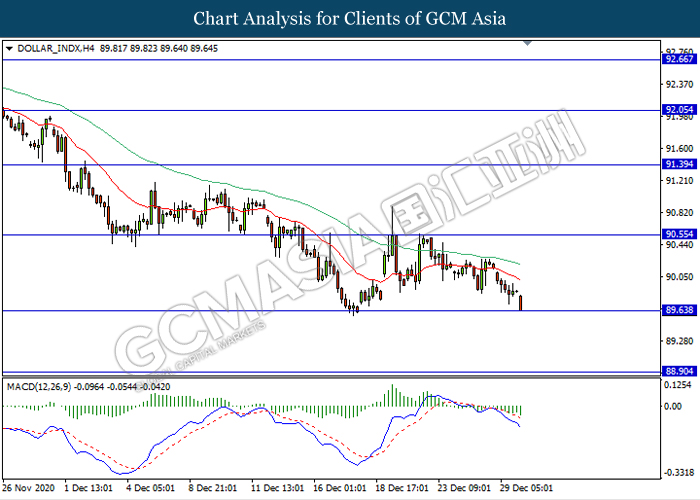

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level 89.65. MACD which illustrate bearish bias signal suggest the dollar to extend its losses after it breaks below the support level.

Resistance level: 90.55, 91.40

Support level: 89.65, 88.90

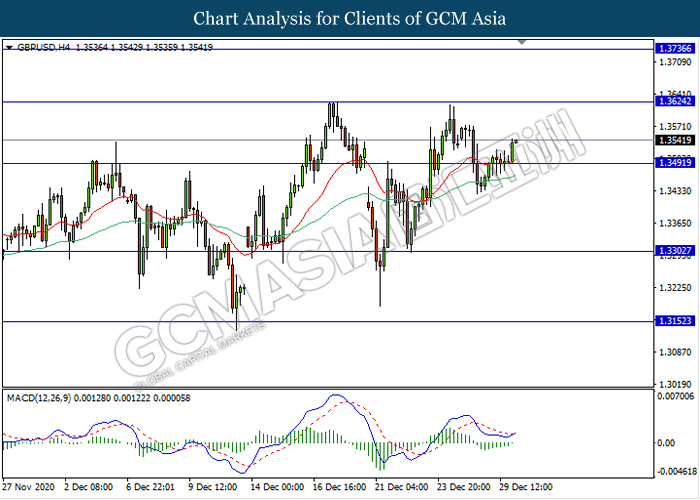

GBPUSD, H4: GBPUSD was traded higher following recent breakout above the previous resistance level 1.3490. MACD which illustrate bullish bias signal with the starting formation of golden cross suggest the pair to extend its gains towards the resistance level 1.3625.

Resistance level: 1.3625, 1.3735

Support level: 1.3490, 1.3300

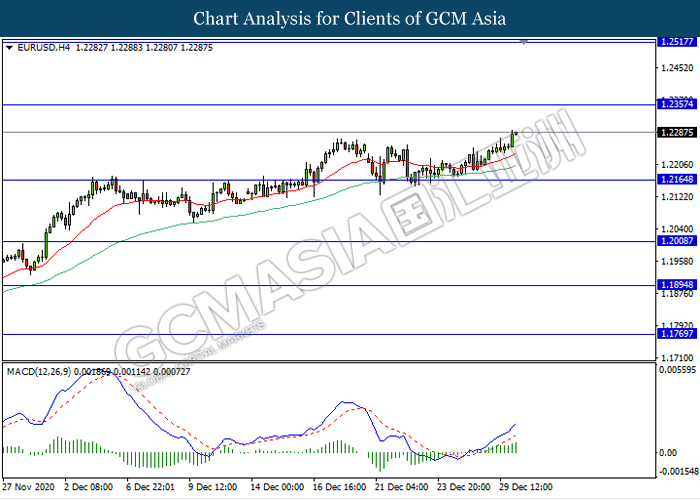

EURUSD, H4: EURUSD was traded higher following recent rebound from the support level 1.2165. MACD which illustrate persistent bullish momentum signal suggest the pair to extend its gains towards the resistance level 1.2355.

Resistance level: 1.2355, 1.2515

Support level: 1.2165, 1.2010

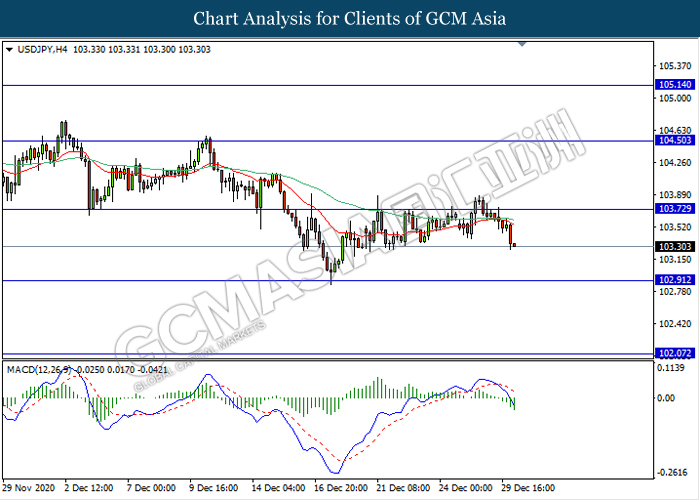

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level 103.70. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its retracement towards the support level 102.90.

Resistance level: 103.70, 104.50

Support level: 102.90, 102.05

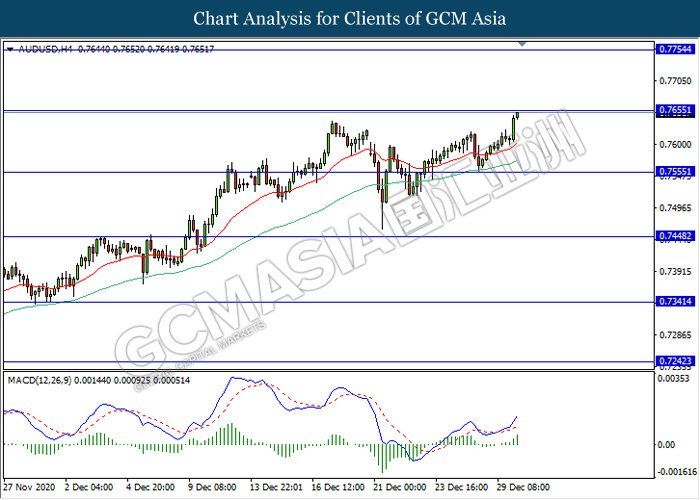

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level 0.7655. MACD which illustrate bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.7655, 0.7755

Support level: 0.7555, 0.7450

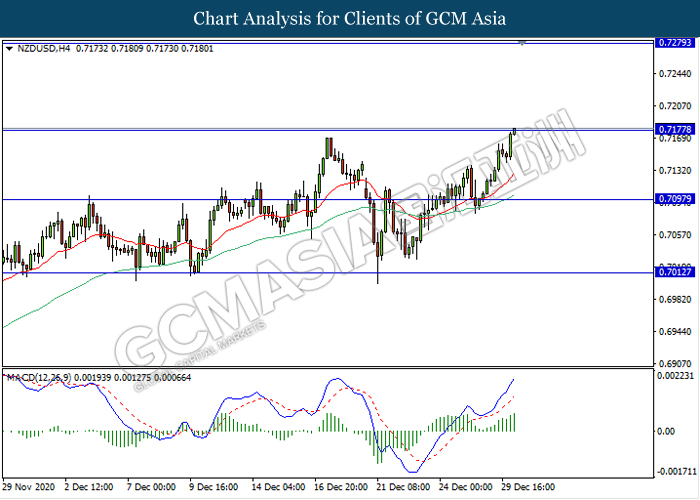

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.7175. MACD which illustrate ongoing bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.7175, 0.7280

Support level: 0.7095, 0.7010

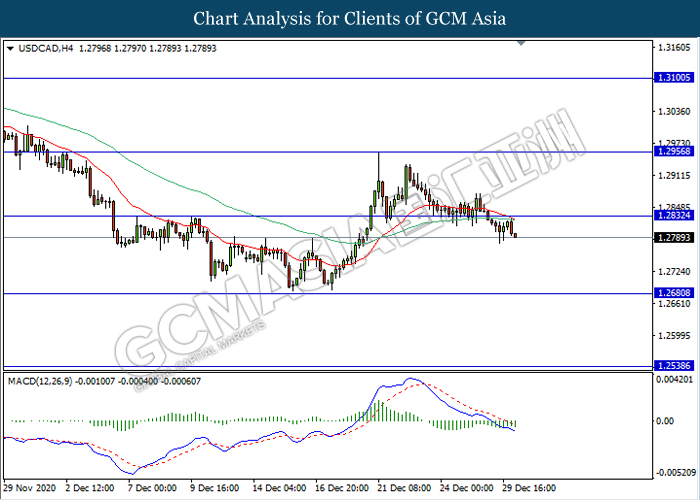

USDCAD, H4: USDCAD was traded lower following recent retracement from the resistance level 1.2830. MACD which illustrate persistent bearish momentum signal suggest the pair to extend its losses towards the support level 0.2680.

Resistance level: 1.2830, 1.2955

Support level: 1.2680, 1.2540

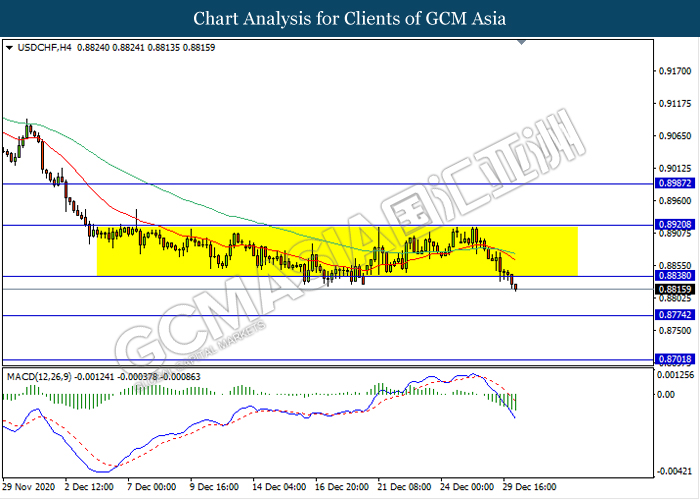

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level 0.8840. MACD which illustrate bearish momentum signal suggest the pair to extend its losses towards the support level 0.8775.

Resistance level: 0.8840, 0.8920

Support level: 0.8775, 0.8700

CrudeOIL, H4: Crude oil price remain traded flat near the resistance level 48.65. Due to lack of momentum and clear direction from MACD, it is suggested to wait until further signal appear before entering the market.

Resistance level: 48.65, 50.85

Support level: 46.40, 43.45

GOLD_, H4: Gold price remain traded flat in a sideway channel. Due to lack of momentum and clear direction from MACD, it is suggested to wait until further signal appear before entering the market.

Resistance level: 1895.30, 1925.60

Support level: 1852.80, 1815.15.