31 January 2023 Morning Session Analysis

US Dollar buoyed ahead of blockbuster week.

The dollar index, which traded against a basket of six major currencies, managed to find its foot and regained its luster following the significant rise in the US Treasury yields. At this juncture, the central bank policy announcement is highly focused by the market participants as it may shed light on the progress that has been made in cooling down the inflation. According to the CME FedWatch Tool, the probability that the Federal Reserve (Fed) would implement a 25-basis point of rate hike is close to 97.6%, whereas the likelihood of a 50-basis point of rate hike is 2.4%. Prior to that, the dollar index has been experiencing tremendous sell-off pressures since the inflation figure started to fall as the aggressiveness of tightening monetary stance diminished alongside. On top of that, the dollar index was further supported following the release of downbeat data in Europe. According to the Statistisches Bundesamt Deutschland, the German GDP for the fourth quarter dropped -0.2%, missing the consensus forecast at 0.0%, surprising the market participants with a sign of recession in Germany. As of writing, the dollar index rose 0.29% to 102.22.

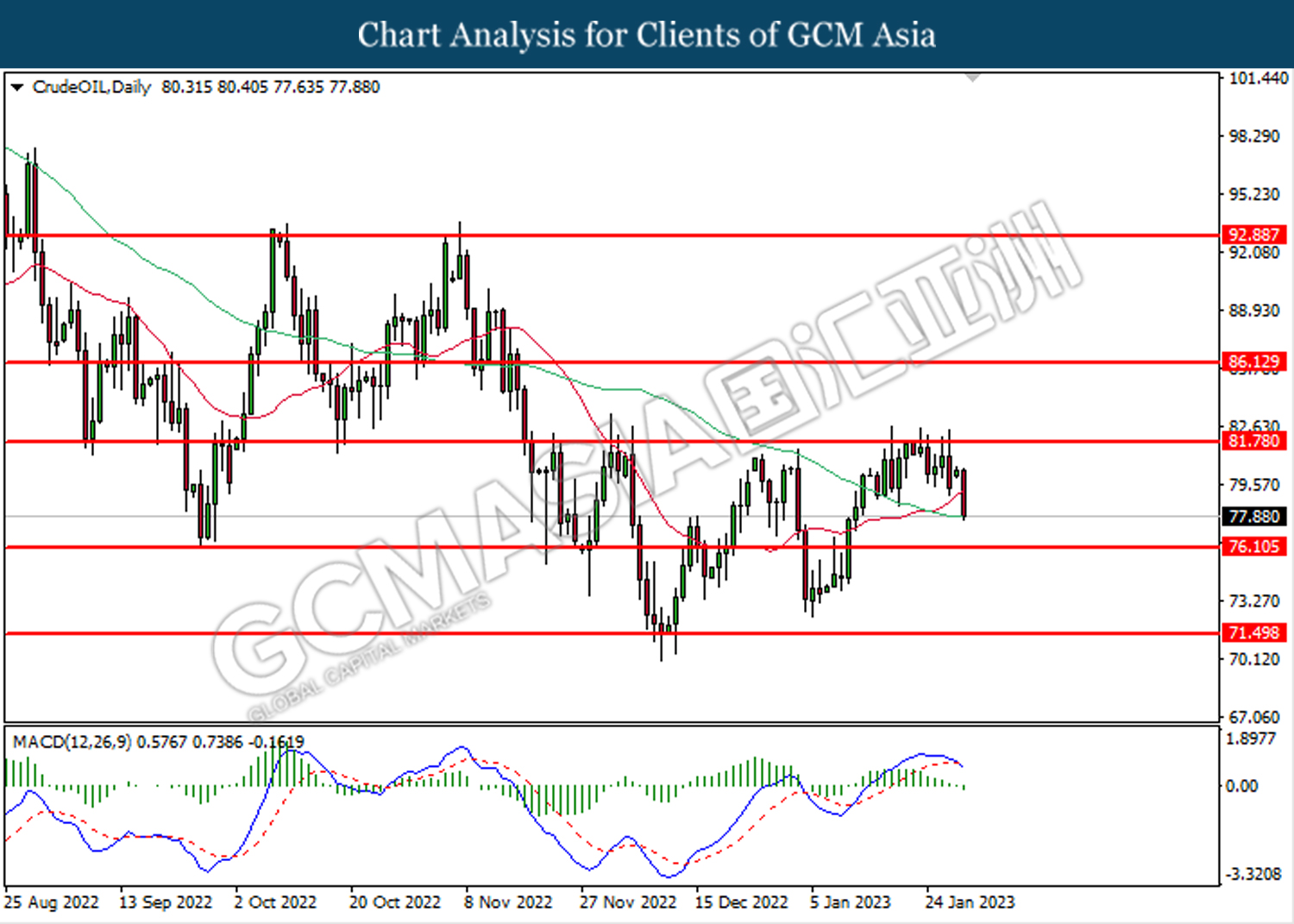

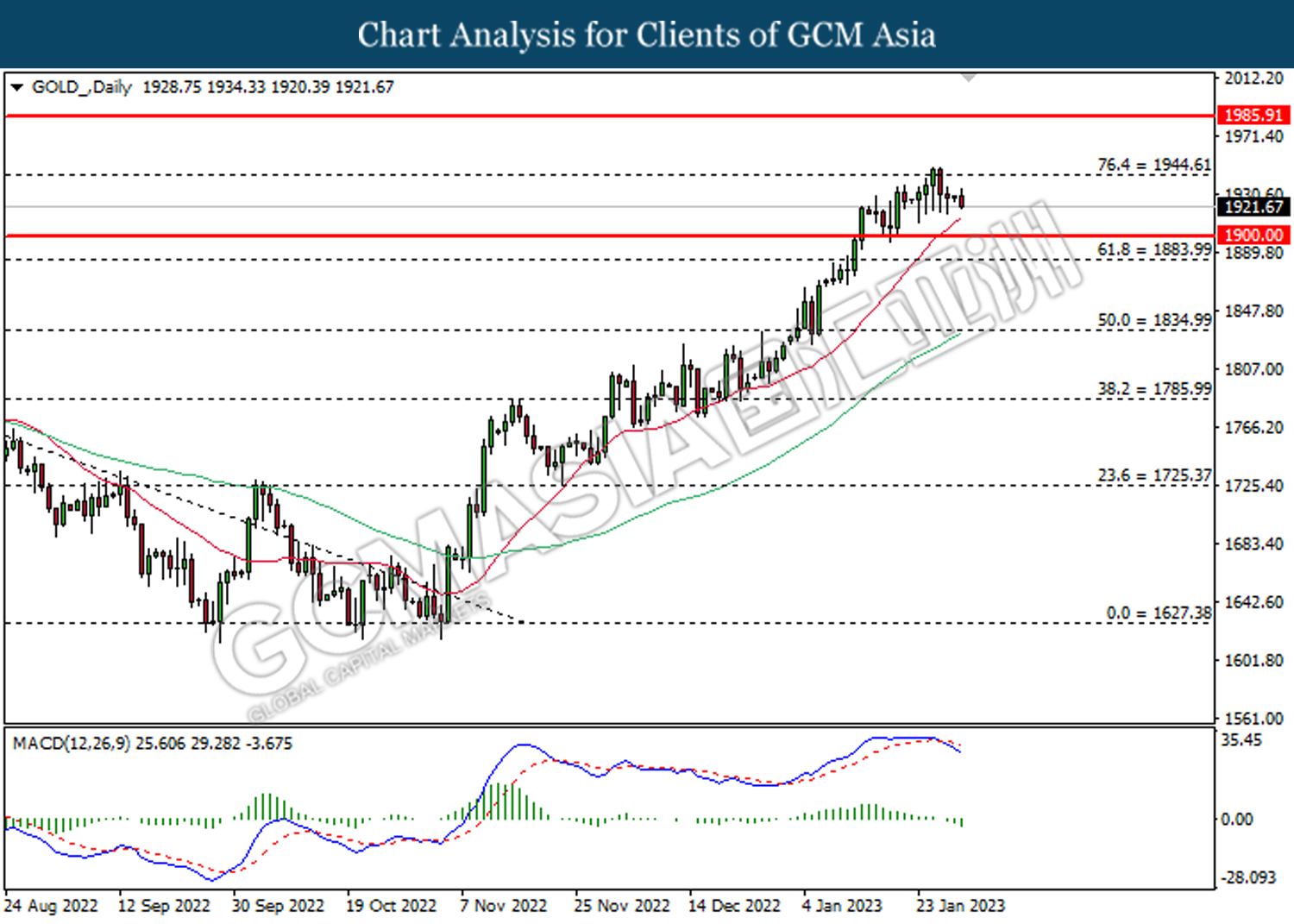

In the commodities market, crude oil prices edged up by 0.21% to $77.90 per barrel after slumping significantly yesterday amid Russia oil flows remains strong. Besides, gold prices depreciated by -0.03% to $1922.65 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Jan) | -13K | 5K | – |

| 21:00 | EUR – German CPI (YoY) (Jan) | 8.60% | 9.20% | – |

| 21:30 | CAD – GDP (MoM) (Nov) | 0.10% | 0.10% | – |

| 23:00 | USD – CB Consumer Confidence (Jan) | 108.3 | 109 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 101.25. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

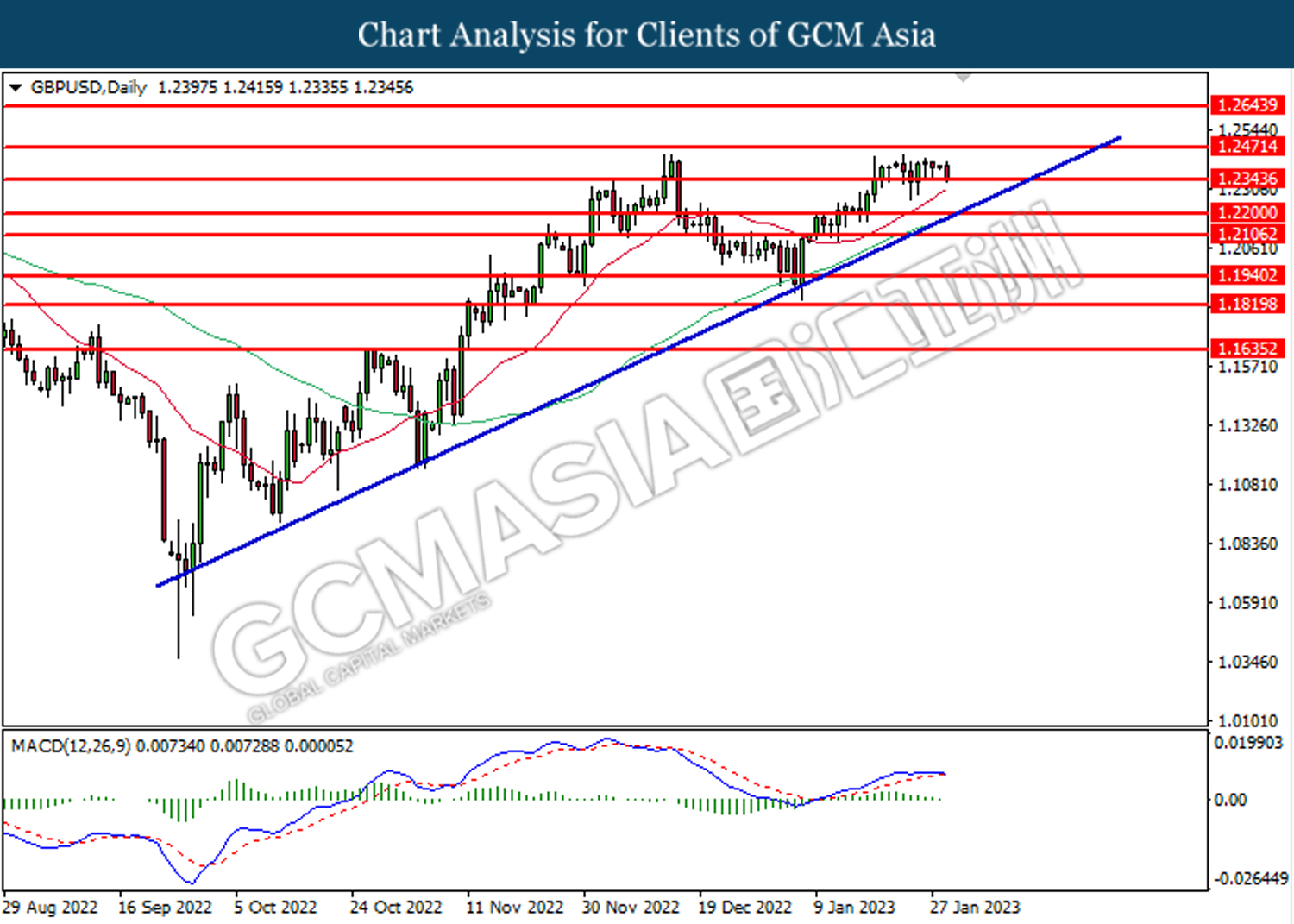

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2345. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2470, 1.2645

Support level: 1.2345, 1.2200

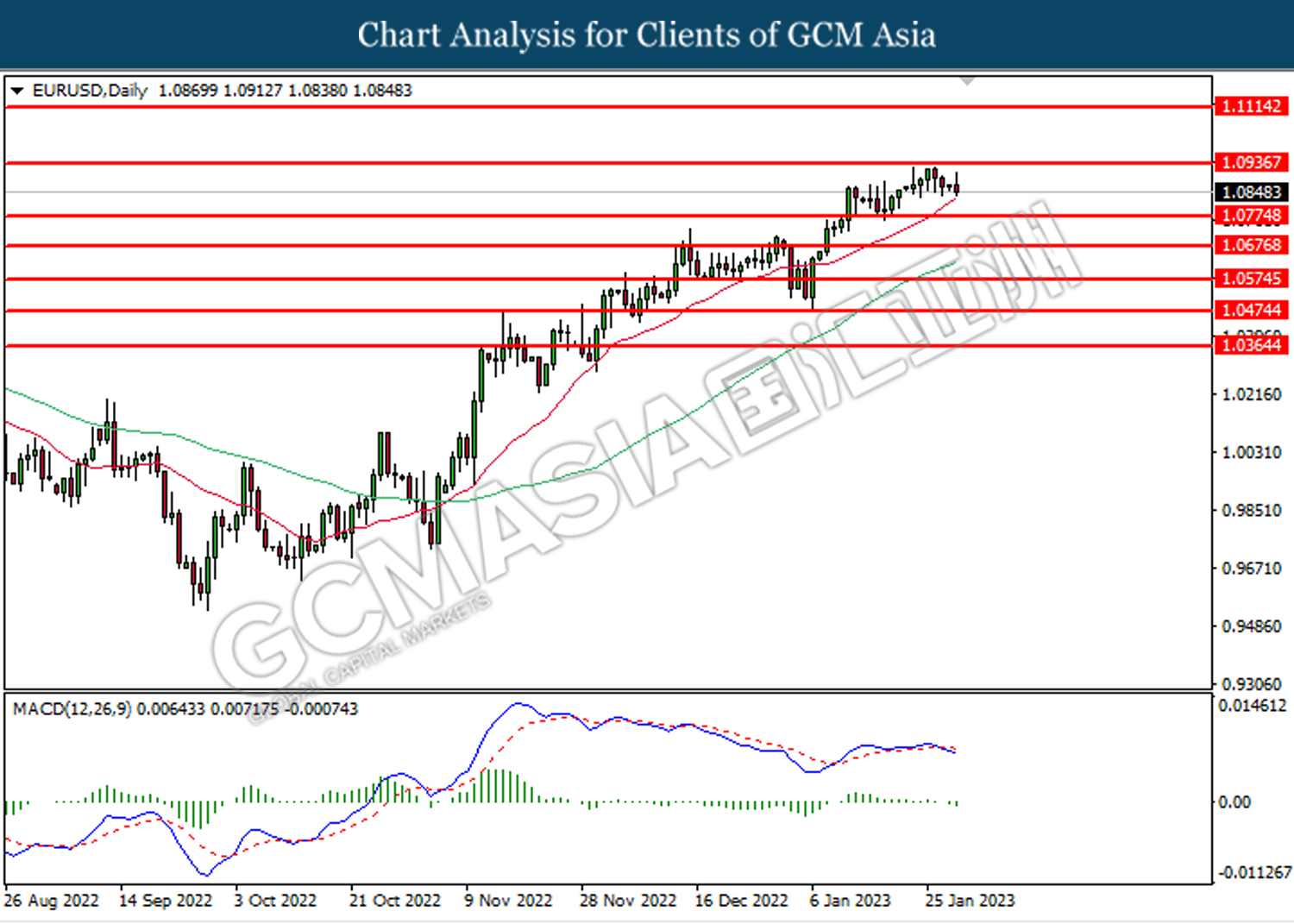

EURUSD, Daily: EURUSD was traded lower following prior retracement from the resistance level at 1.0935. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0775.

Resistance level: 1.0935, 1.1115

Support level: 1.0775, 1.0675

USDJPY, Daily: USDJPY was traded higher while currently testing the upper level of the downward channel. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the upper level.

Resistance level: 131.25, 134.15

Support level: 128.60, 126.30

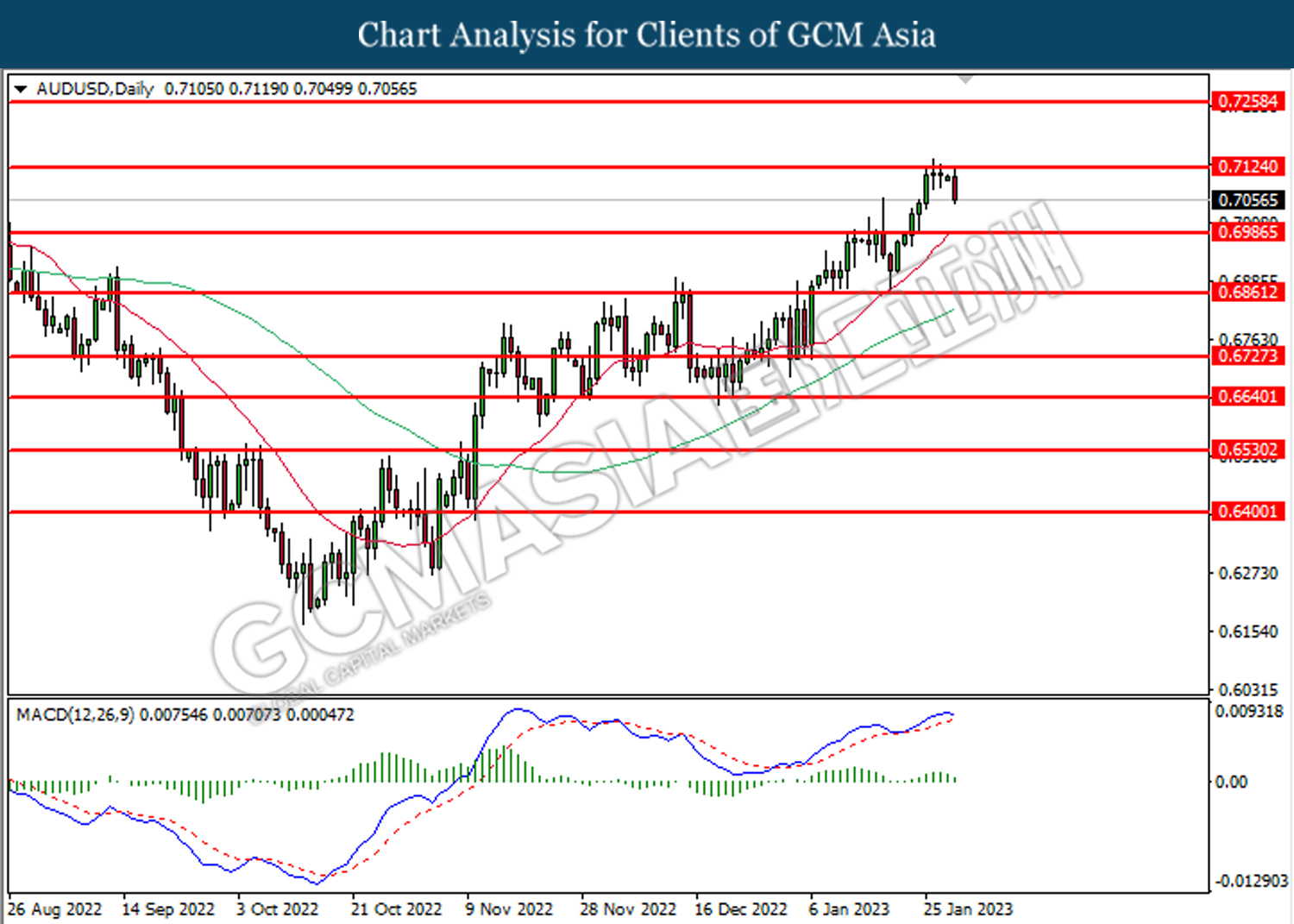

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.7125. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6985.

Resistance level: 0.7125, 0.7260

Support level: 0.6985, 0.6725

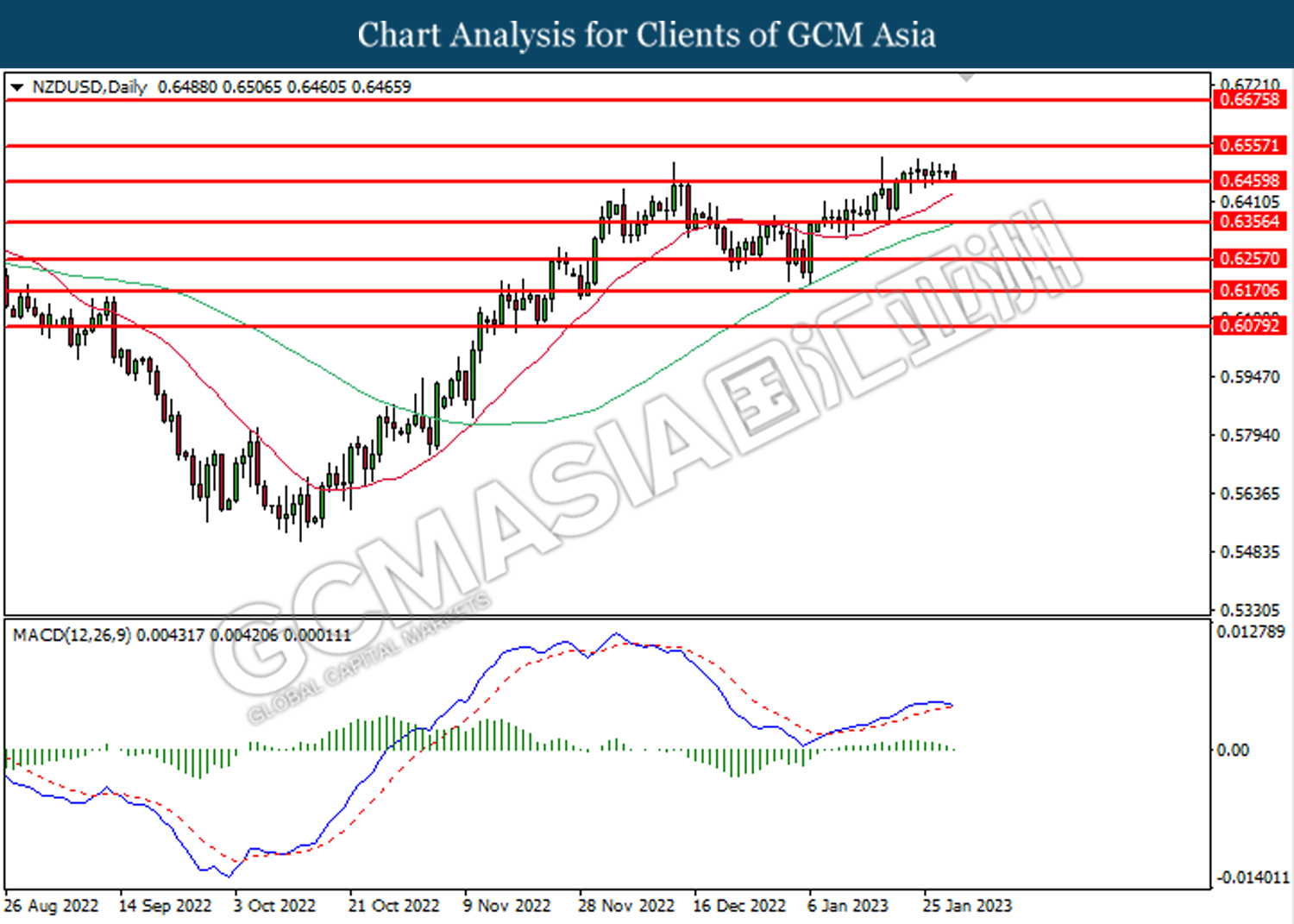

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6460. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6555, 0.6675

Support level: 0.6460, 0.6355

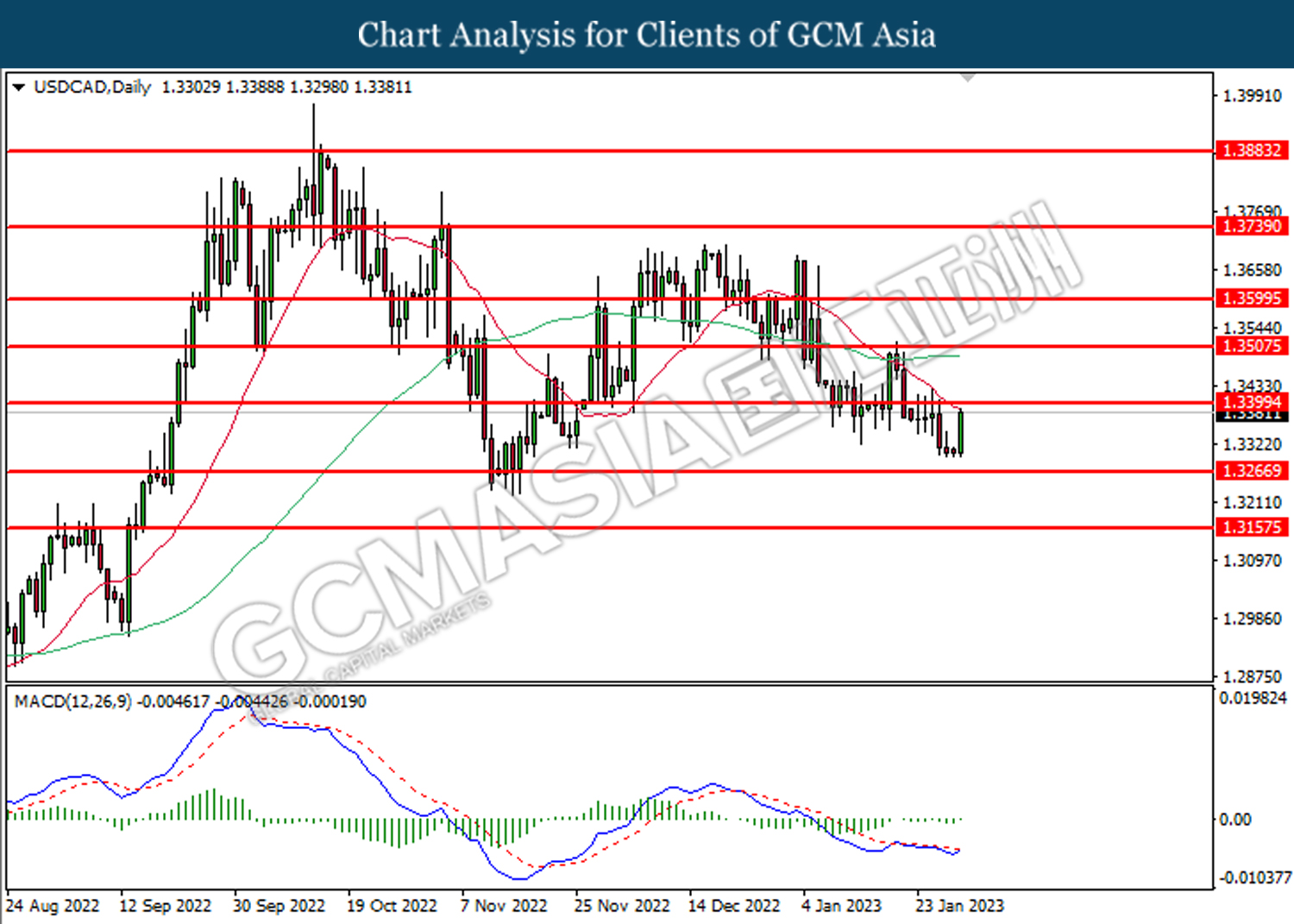

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3400. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

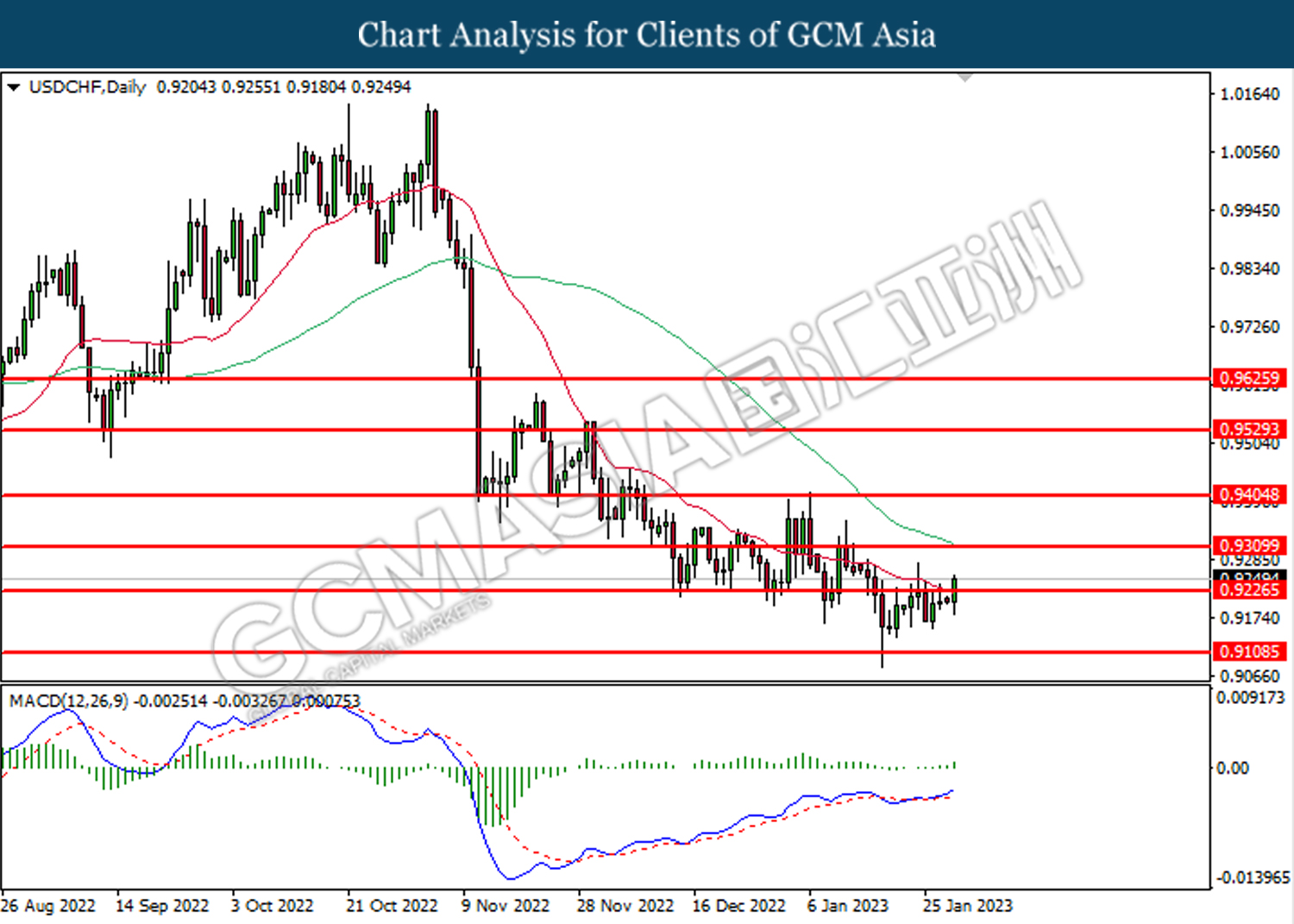

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9225. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 81.80. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 81.35, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1944.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1900.00.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00