31 March 2017 Daily Analysis

Dollar-bull retaliates with firm consumer spending.

US dollar advance further up during Asian trading hours, poised for a weekly gain as solid US economic data buoyed higher expectation for more frequent interest rate hike this year. The dollar index was up 0.13% and last seen at 100.35. Overnight’s revised US gross domestic production reading showed that US fourth quarter growth subside less than expected, underpinned by higher consumer spending that was partially offset by large gain in imports. In other region, euro nursed some losses and was up 0.06% to $1.0683 against the greenback although remained under pressure due to softer inflation data. Both German and Spanish consumer price index showed that inflation wind down more sharply than expected due to slumping oil price, offering some respite to the European Central Bank as it faces further pressure to taper down its monetary stimulus.

Otherwise, crude oil price rose to a three-weeks high of $50.47 after Kuwait backed an extension of OPEC production cut, further catalyzing positivism for an extension during second half of the year. Otherwise, gold price was down 0.31% to $1,241.19 as the greenback remains resilient due to positive US economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Event

Time Market Event

N/A

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:00 | CNY – Manufacturing PMI (Mar) | 51.6 | 51.6 | 51.8 |

| 16:00 | EUR – German Unemployment Change (Mar) | -14K | -10K | – |

| 16:30 | GBP – GDP (QoQ) (Q4) | 0.7% | 0.7% | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 2.0% | 1.8% | – |

| 20:30 | USD – Personal Spending (MoM) (Feb) | 0.2% | 0.2% | – |

| 20:30 | CAD – GDP (MoM) (Jan) | 0.3% | 0.3% | – |

| 21:45 | USD – Chicago PMI (Mar) | 57.4 | 56.9 | – |

| 22:00 | USD – Michigan Consumer Sentiment (Mar) | 97.6 | 97.6 | – |

| 02:00 | Crude Oil – US Baker Hughes Oil Rig Count | 652 | – | – |

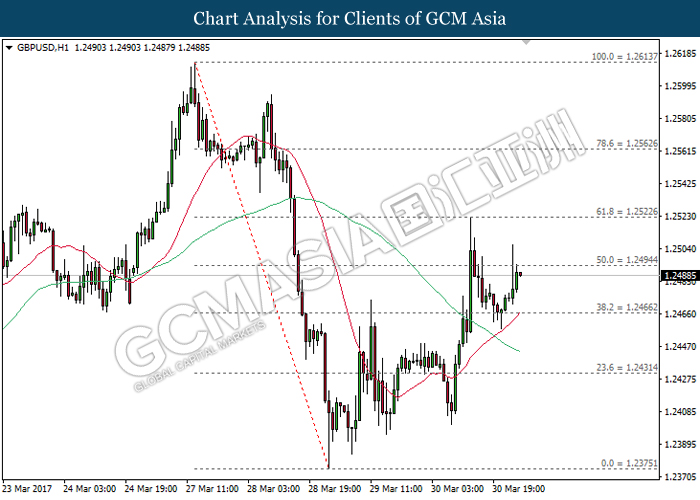

GBPUSD

GBPUSD. H1: GBPUSD was traded higher following a rebound from the support level of 1.2465, concurrent with the formation of golden cross by both moving average line. As both MA line continues to expand upwards, a successful closure above the resistance level of 1.2495 would suggest GBPUSD to extend its upward momentum.

Resistance level: 1.2495, 1.2525

Support level: 1.2465, 1.2430

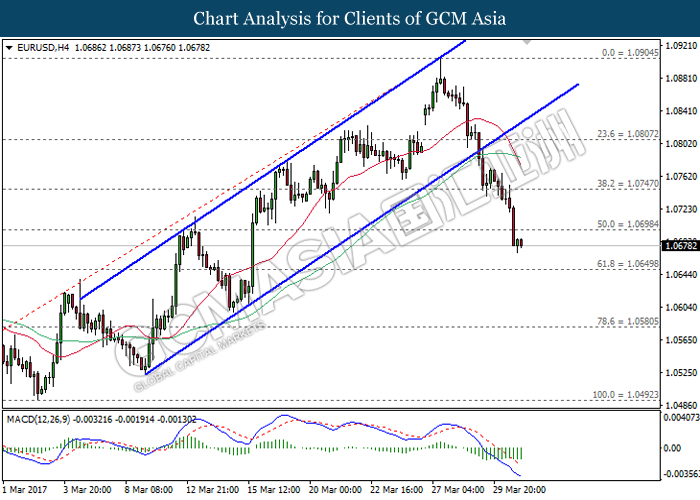

EURUSD

EURUSD, H4: EURUSD extended its losses following prior breakout from the lower level of upward channel while recently closed below the strong support level of 1.0700. As the downward signal line from MACD histogram continues to expand downwards, EURUSD is expected to advance towards the target of support level at 1.0650.

Resistance level: 1.0700, 1.0745

Support level: 1.0650, 1.0580

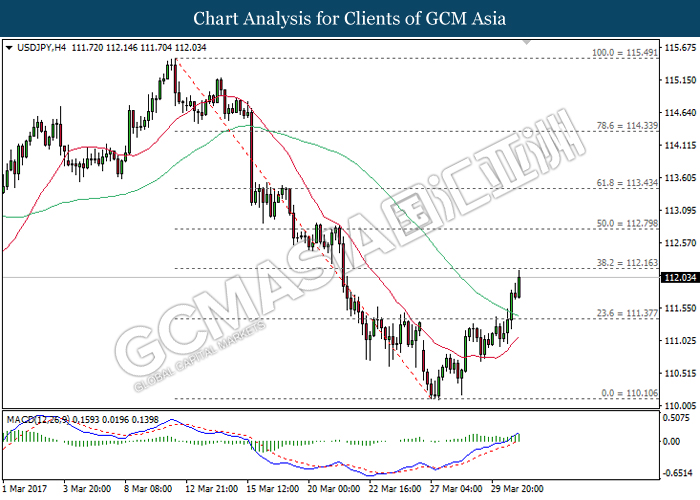

USDJPY

USDJPY, H4: USDJPY was traded higher following prior rebound from the 20-moving average line (red) while closing above the strong resistance level of 111.40. With regards to the MACD histogram which continues to illustrate upward signal and momentum, USDJPY is expected to move further upwards after breaking the resistance level of 112.15.

Resistance level: 112.15, 112.80

Support level: 111.40, 110.10

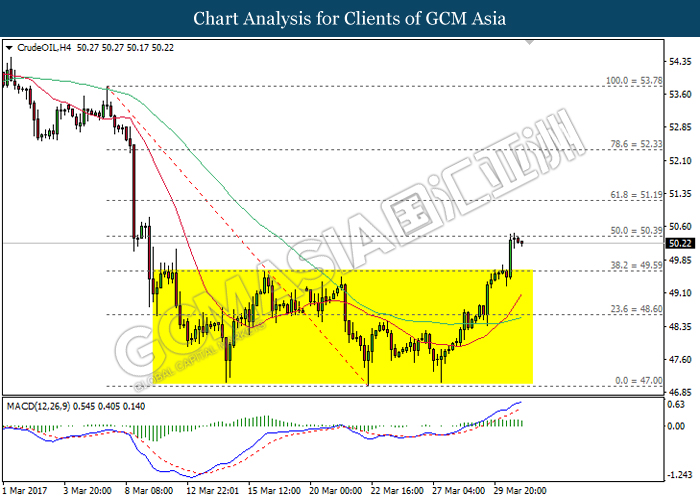

CrudeOIL

CrudeOIL, H4: Crude oil price has recently break out from the top level of sideways channel, signaling a change in trend direction to move further upwards. Referring to the MACD histogram which continues to illustrate upward signal and momentum above the threshold of 0, a closure above the resistance level of 50.40 would suggest crude oil price to move further upwards thereafter.

Resistance level: 50.40, 51.20

Support level: 49.60, 48.60

GOLD

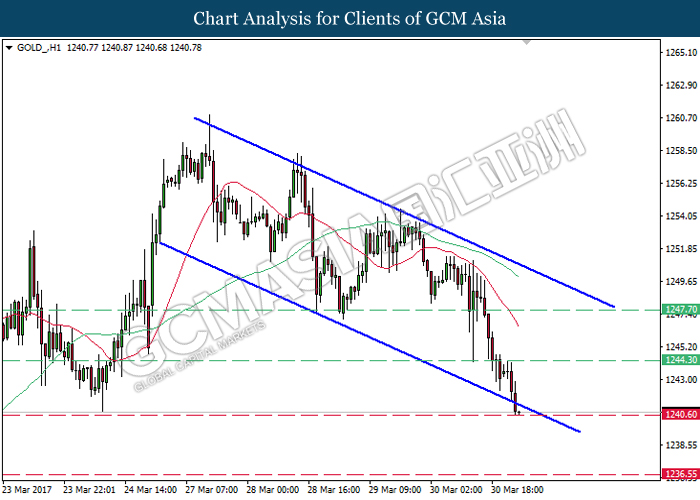

GOLD_, H1: Gold price has recently break out from the bottom level of downward channel, signaling a change in trend direction to move further downwards. It is expected to extend its current losses after successful closing below previous low, near the support level of 1240.60.

Resistance level: 1244.30, 1247.70

Support level: 1240.60, 1236.55