31 March 2023 Afternoon Session Analysis

The Aussie rose after the strong Chinese PMI was released.

The Aussie dollar climbed higher after strong Chinese PMI data was released, as China is one of the major trading partners in Australia. The China Composite PMI readings rose to 57.0, from the previous reading of 56.4, while the manufacturing PMI at 51.9 and non-manufacturing PMI at 58.2, both figures were above the consensus. The stronger-than-expected result suggests China’s economy is recovering from a contraction after the easing of covid epidemic prevention measures. The recovery in China’s business activity will likely give a boost to Australia’s economy going forward. Besides, the Australian prime minister recommended minimum wages increase that matches the inflation in Australia. According to Reuters, the Australian Council of Trade Unions is demanding a 7% increase in the wage rate. However, Prime Minister said the government’s submission to the Fair Work Commission (FWC) did not contain a specific figure for the minimum wage increase, and he welcomed any figure that matched the increase in inflation. The increase in the minimum wage can relieve the pressure on households against inflation and improve consumption power, thus promoting the Australian economy and strengthening the currency. As of writing, the AUD/USD appreciated by 0.18% to 0.6719.

In the commodity market, the crude oil prices were traded up by 0.01% to $74.38 per barrel as of writing as the expansion of China’s manufacturing activity lifted the crude oil demands. In addition, the gold price edged up by 0.06% to $1998.80 per troy ounce as of writing due to the weakening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (Mar) | 2K | 3K | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 8.50% | 7.20% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Feb) | 0.60% | 0.40% | – |

| 20:30 | CAD – GDP (MoM) (Jan) | -0.10% | 0.40% | – |

Technical Analysis

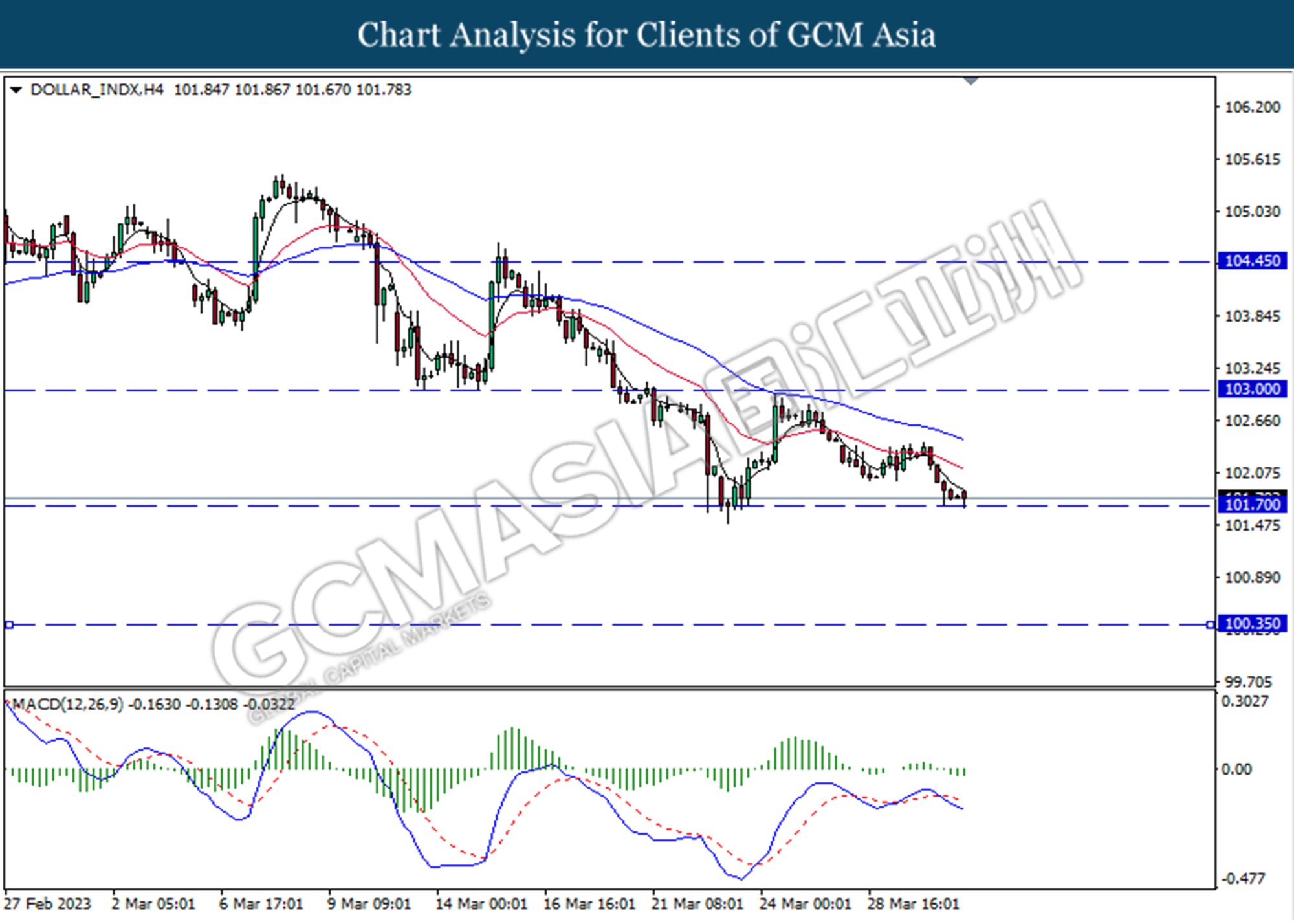

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing for a support level at 101.70. MACD which illustrated increasing bearish momentum suggests the index extended its losses if it successfully breaks below the support level.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

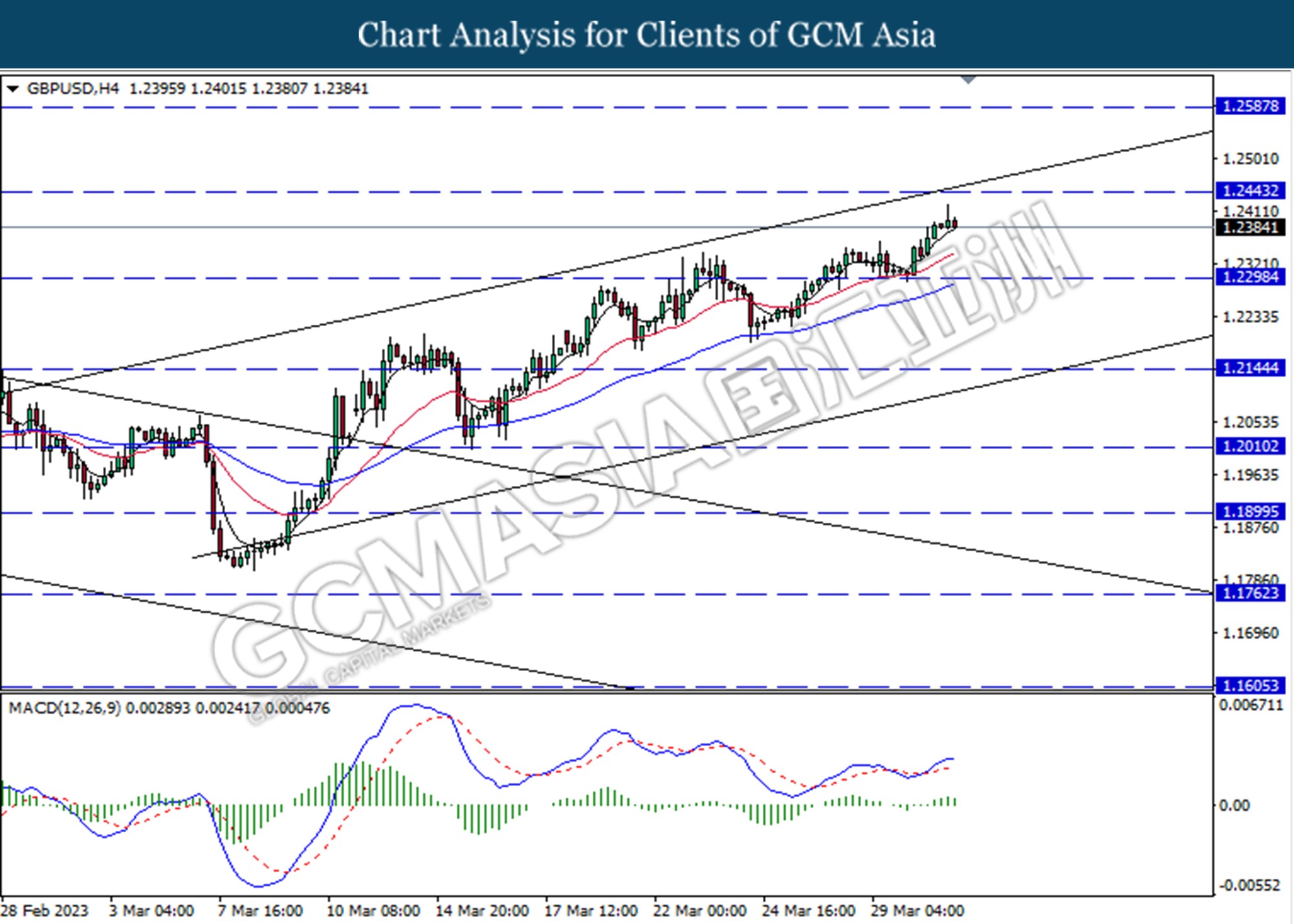

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. However, MACD which illustrated decreasing bullish momentum suggests the pair to traded lower as technical correction.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

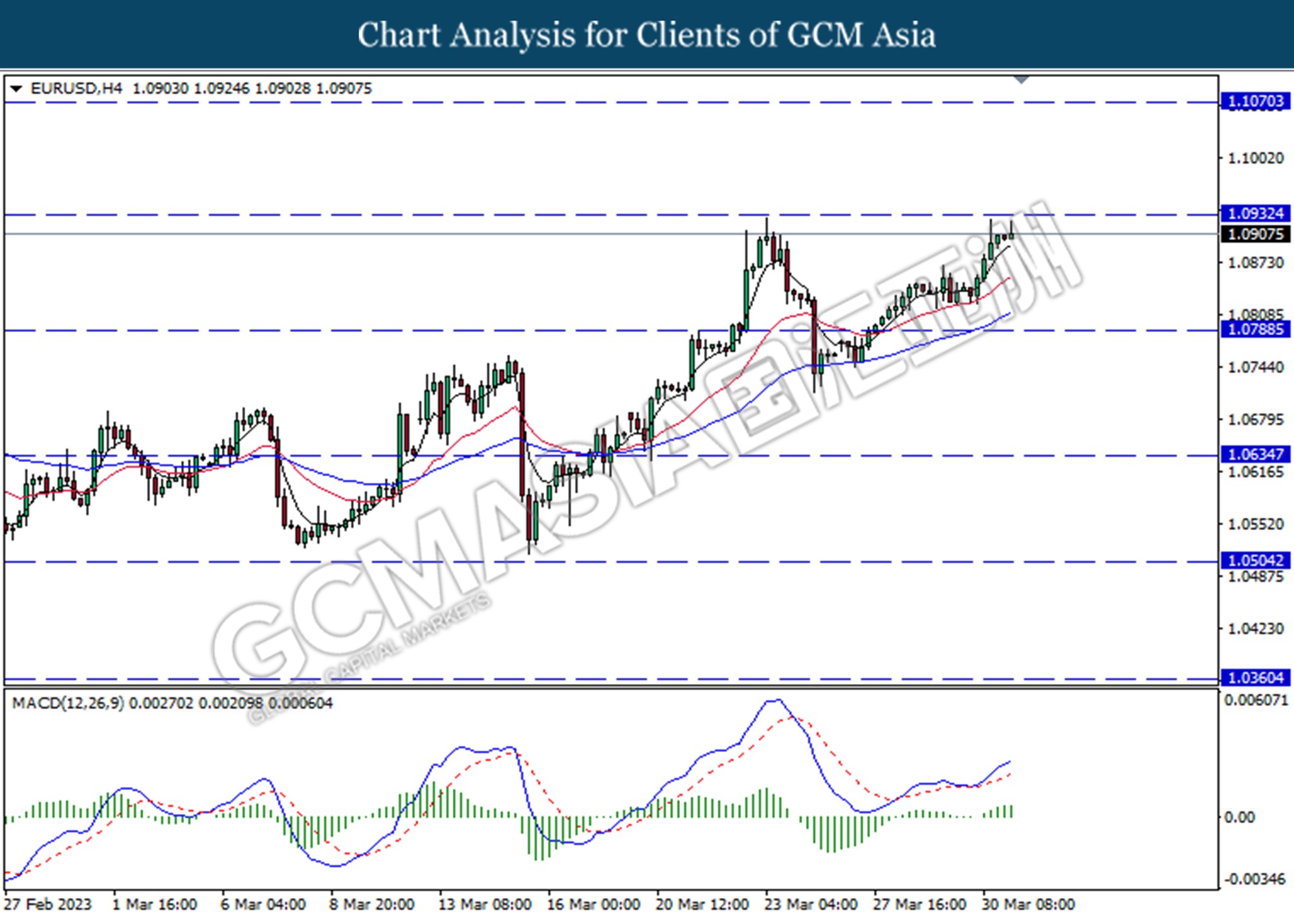

EURUSD, H4: EURUSD was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.0930.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

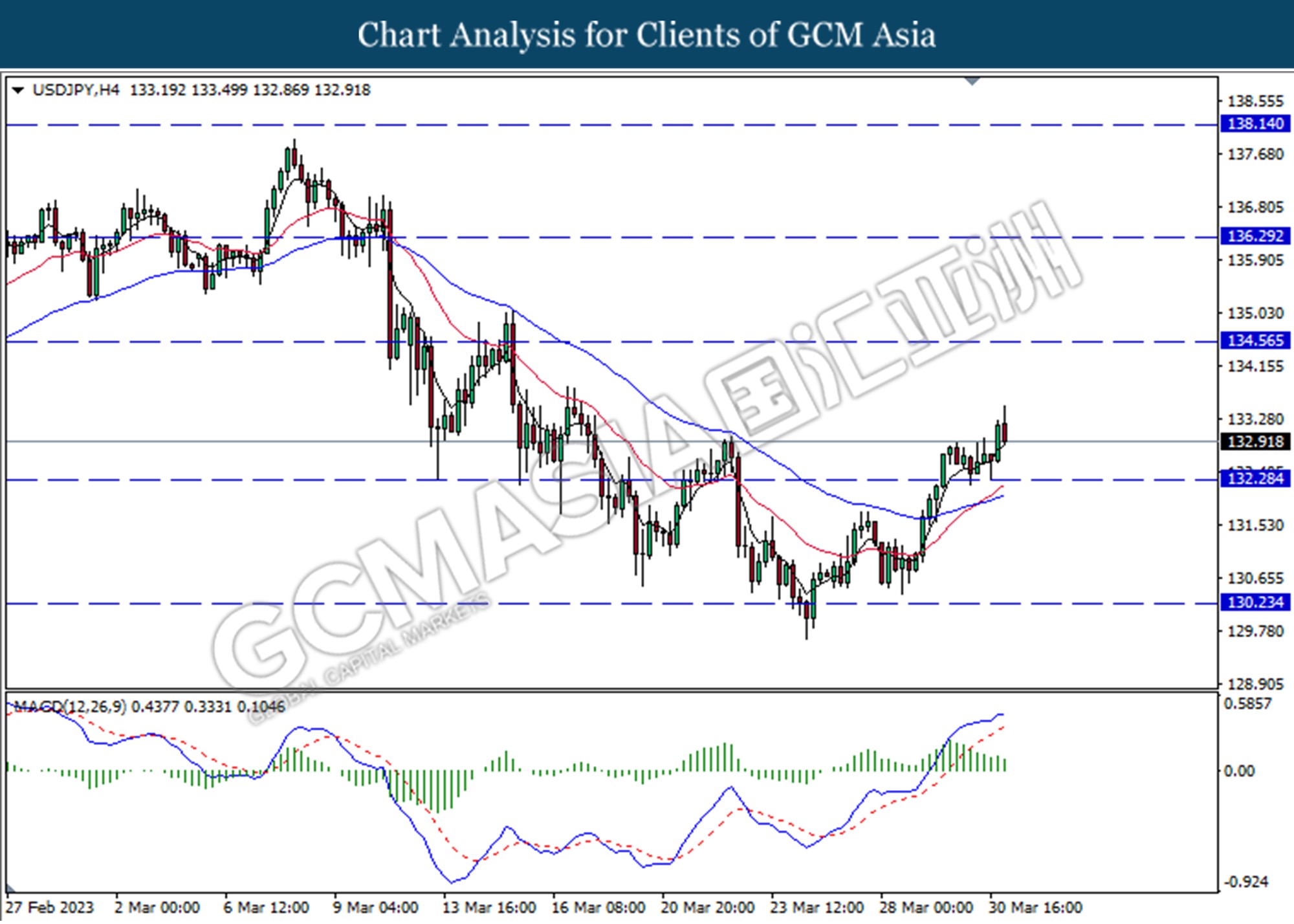

USDJPY, H4: USDJPY was traded lower following a retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 132.30.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

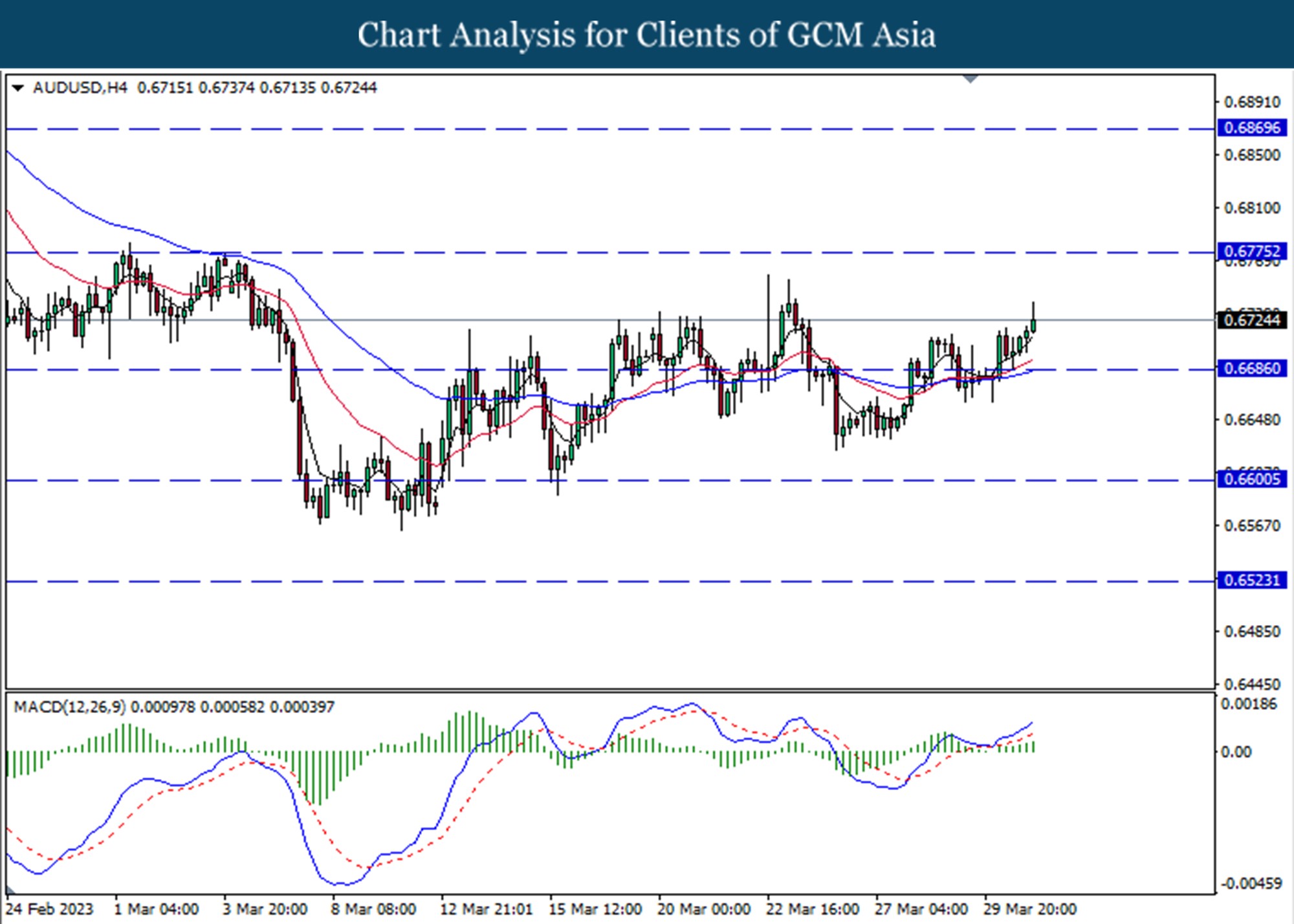

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the support level at 0.6685. MACD which illustrated increasing bullish momentum suggests the pair extended its gains.

Resistance level: 0.6775, 0.6910

Support level: 0.6600, 0.6525

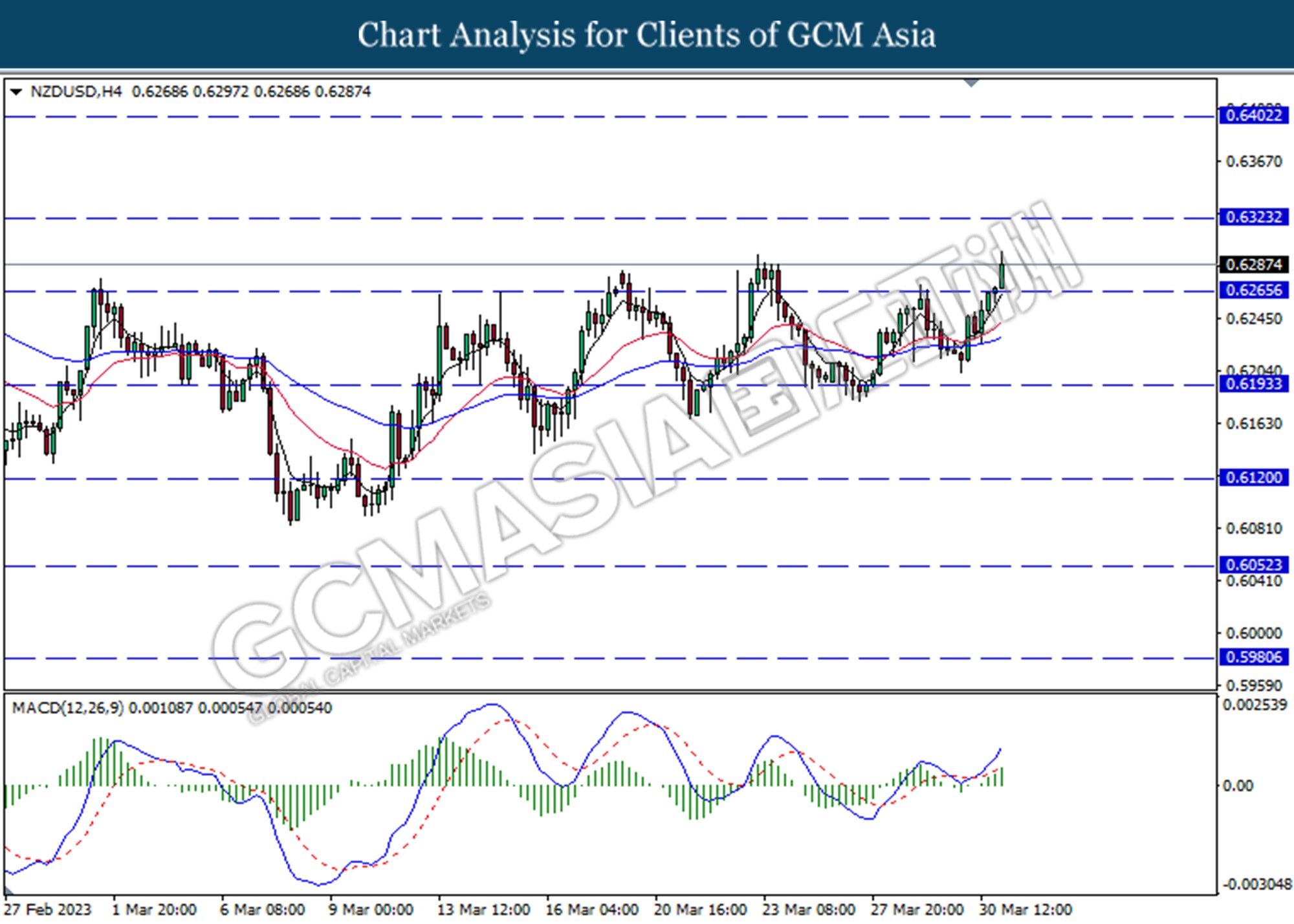

NZDUSD, H4: NZDUSD was traded higher following a prior breakout above the previous resistance level at 0.6265. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6320.

Resistance level: 0.6320, 0.6400

Support level: 0.6262, 0.6195

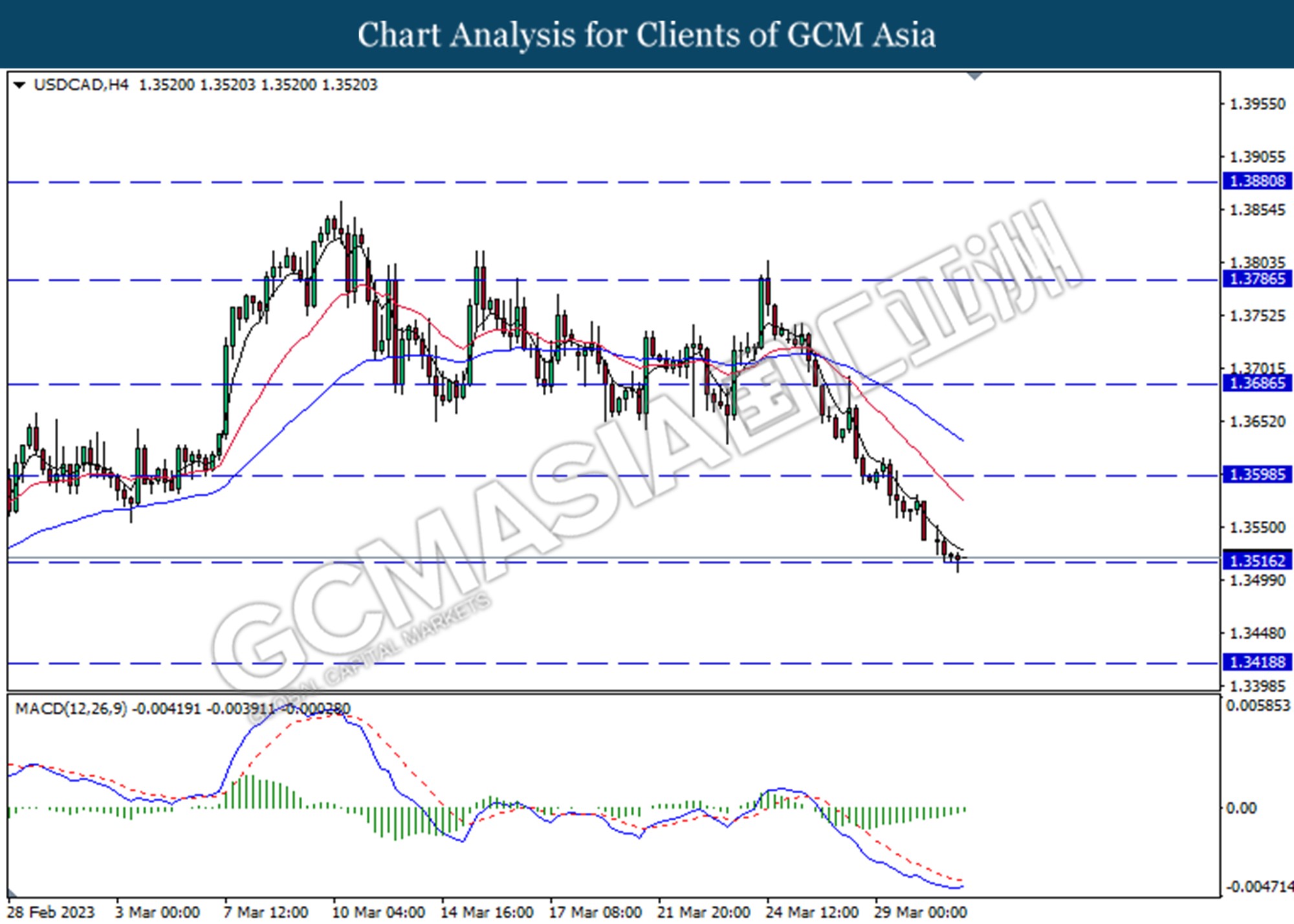

USDCAD, H4: USDCAD was traded lower while currently testing for the support level at 1.3515. However, MACD which illustrated decreasing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

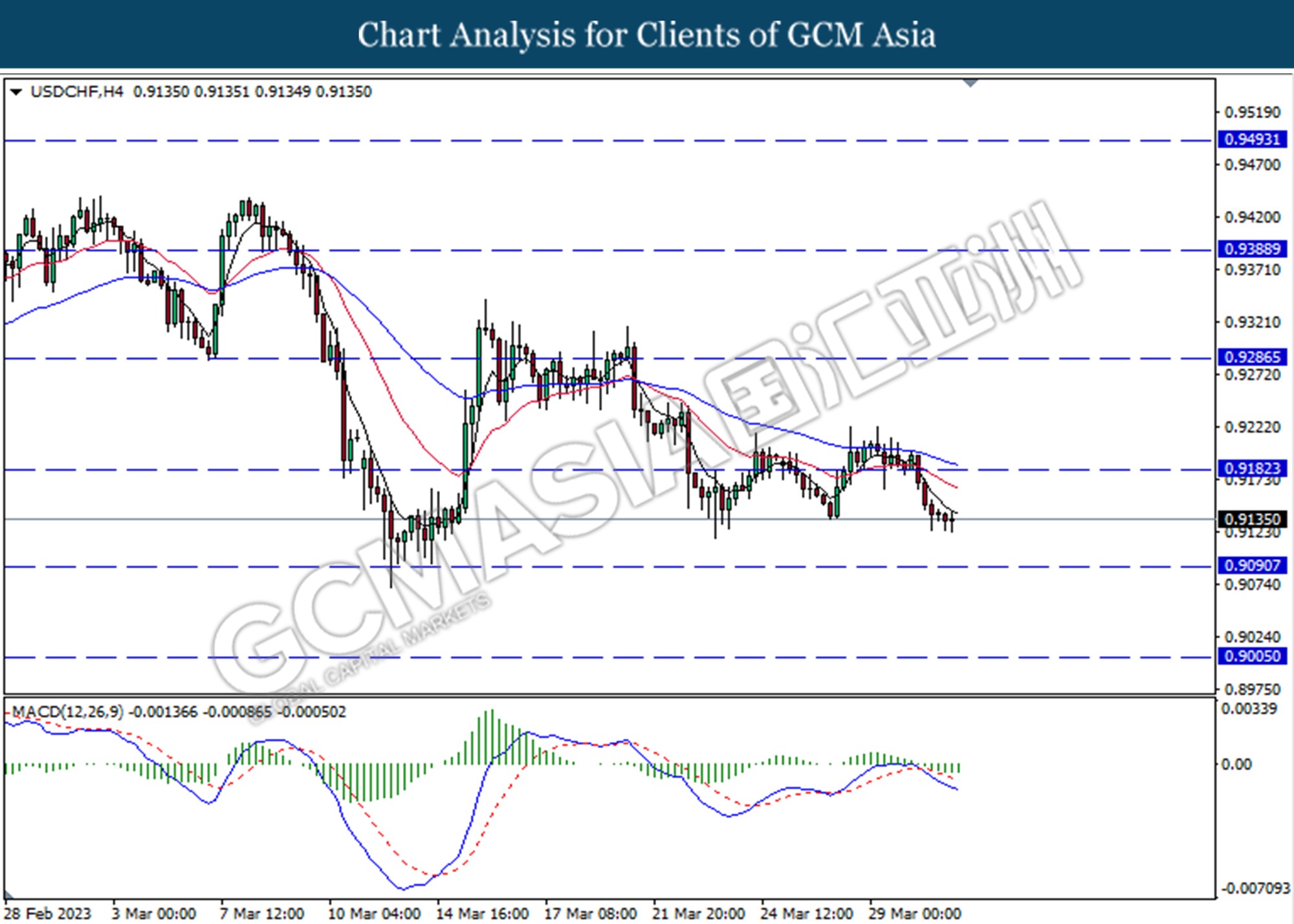

USDCHF, H4: USDCHF was traded lower following a prior breakout below the previous support level at 0.9180. MACD which illustrated bearish momentum suggests the pair extend its losses toward the support level at 0.9090

Resistance level: 0.9180, 0.9285

Support level: 0.9090, 0.9005

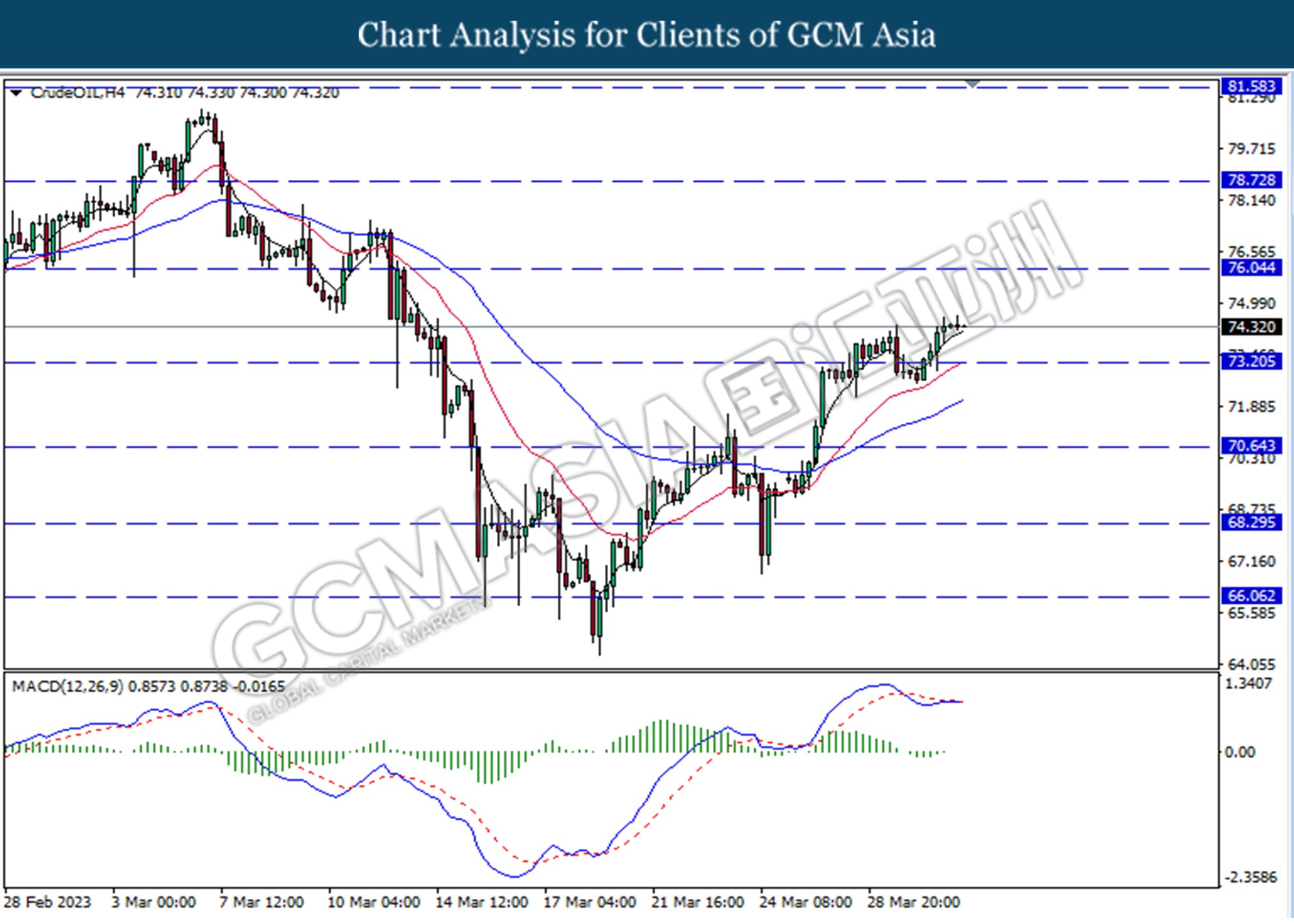

CrudeOIL, H4: Crude oil price was traded higher following a prior breakout above the resistance level at 73.20. MACD which illustrated decreasing bearish momentum suggests the commodity extended its gains toward the resistance level at 76.05

Resistance level: 73.20, 76.05

Support level: 70.65, 68.30

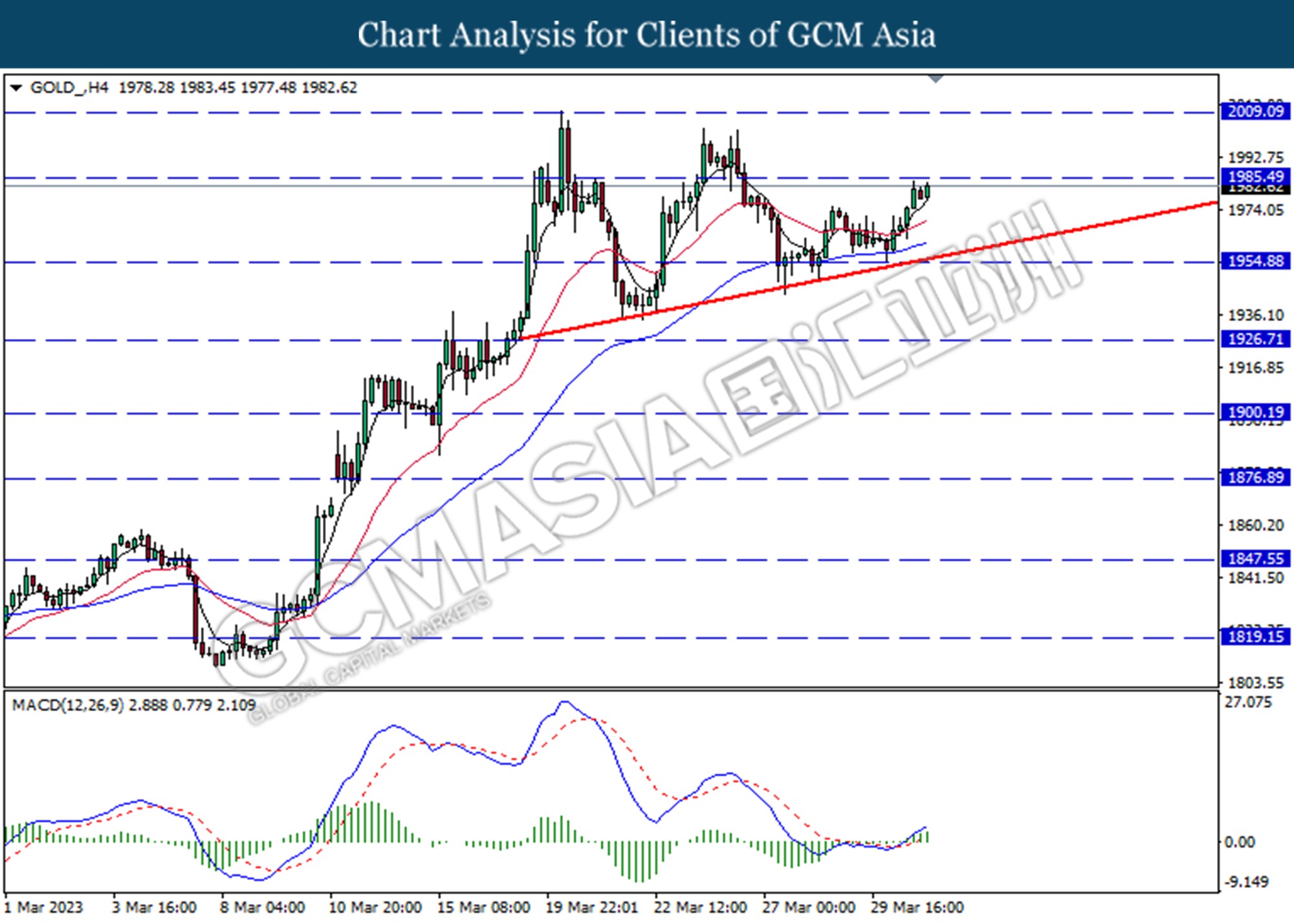

GOLD_, H4: Gold price was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 1985.50

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70