31 March 2023 Morning Session Analysis

US Dollar retreated as economy outlook weakened.

The Dollar Index which traded against a basket of six major currencies received significant bearish momentum on Thursday following the downbeat economic data had beaten down the value of US Dollar. According to Bureau of Economic Analysis, the US Gross Domestic Product (GDP) in the forth quarter has notched down from the previous reading of 3.2% to 2.6%, missing the market forecast of 2.7%. Besides, the Initial Jobless Claims report had shown that the labor market in the US turned fragile, whereby the citizen who looking for the unemployment insurance increased last week. With such background, it cut the space for Fed officials to implement further rate hike in the future in order to restore economy stability. On the other hand, several Fed members offered their views on inflation and interest rates on yesterday. Though, the Dollar Index keep ranging at the recent low level, due to their different thoughts. One of the member claimed on yesterday that the inflation was still high in the US, which signaling Fed to increase its rate, while another member was concerned about the side effects of high interest rate. Thus, the Core PCE data that will be released today would be the key to gauge the next move of Fed. As of writing, the Dollar Index depreciated by 0.43% to 101.85.

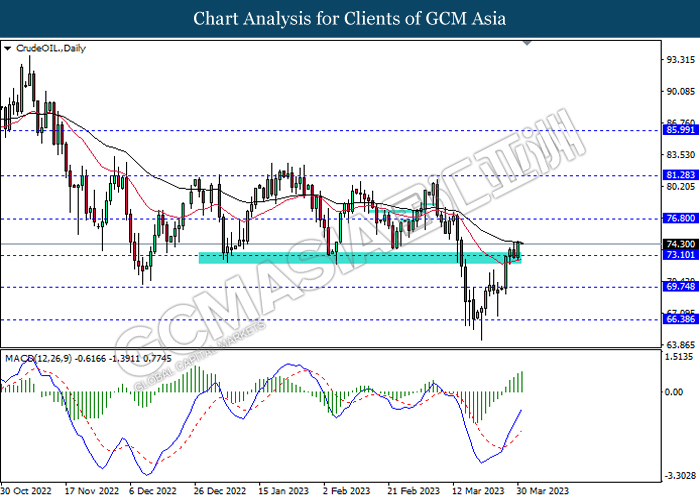

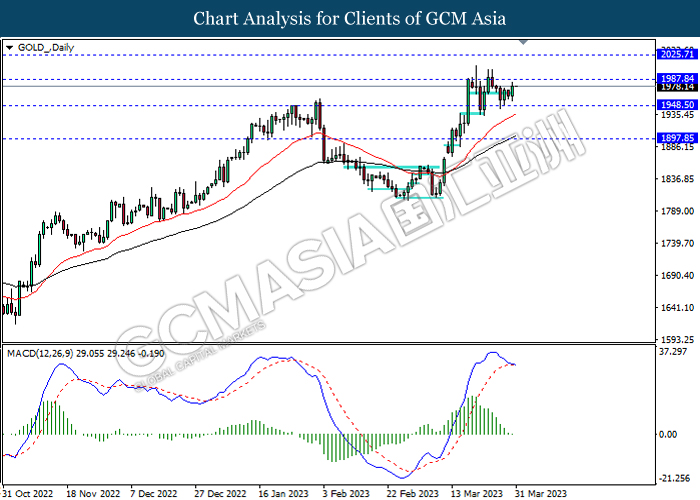

In the commodity market, the crude oil price edged up by 0.01% to $74.38 per barrel as of writing following the halt to exports from Iraq’s Kurdistan region. In addition, the gold price depreciated by 0.04% to $1978.84 per troy ounce as of writing amid the strengthening of US Dollar at the moment.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) (Q4) | 0.20% | 0.40% | – |

| 14:00 | GBP – GDP (QoQ) (Q4) | -0.20% | -0.20% | – |

| 15:55 | EUR – German Unemployment Change (Mar) | 2K | 3K | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 8.50% | 7.20% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Feb) | 0.60% | 0.40% | – |

| 20:30 | CAD – GDP (MoM) (Jan) | -0.10% | 0.40% | – |

Technical Analysis

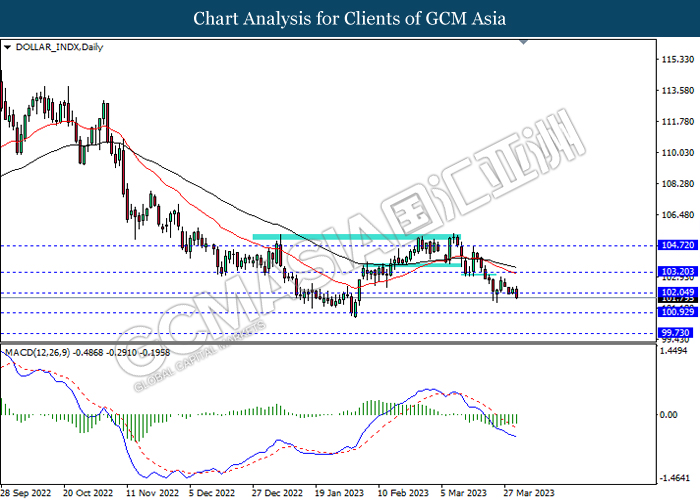

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

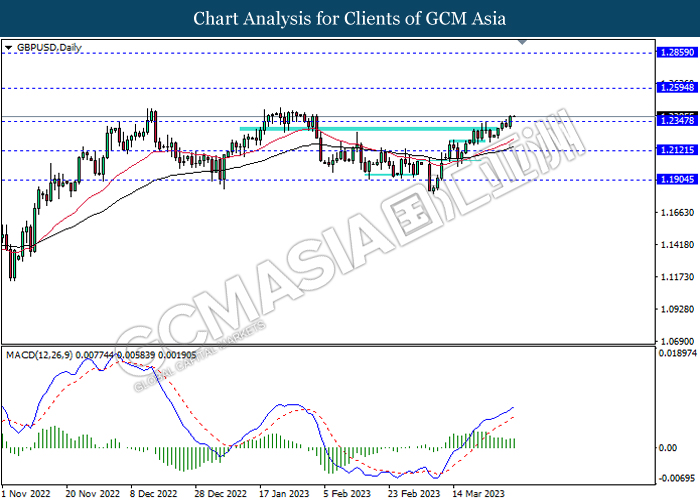

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

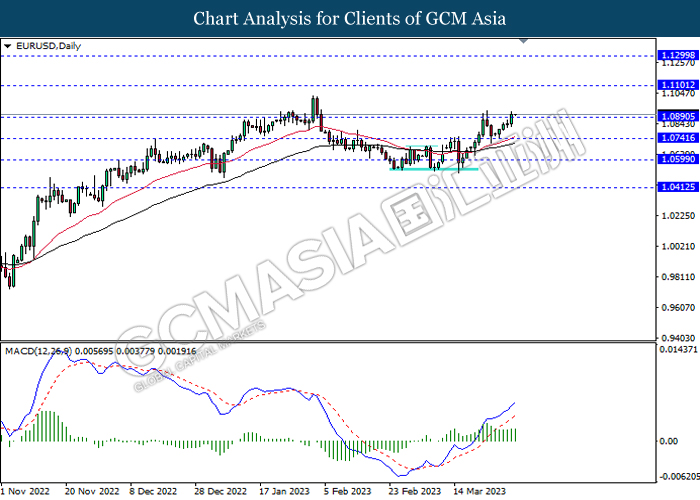

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

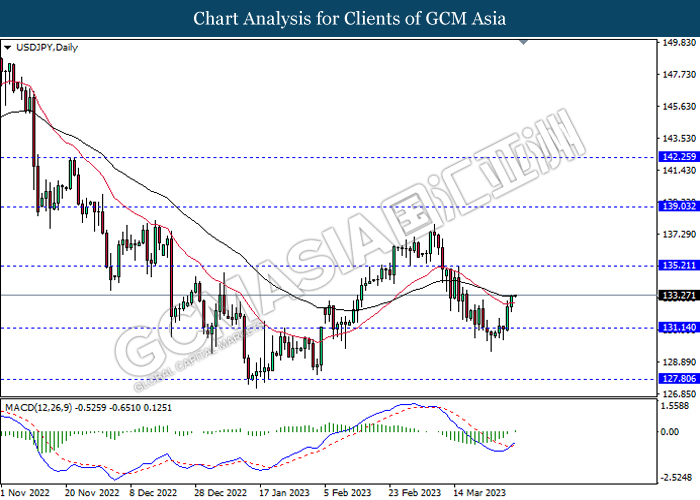

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

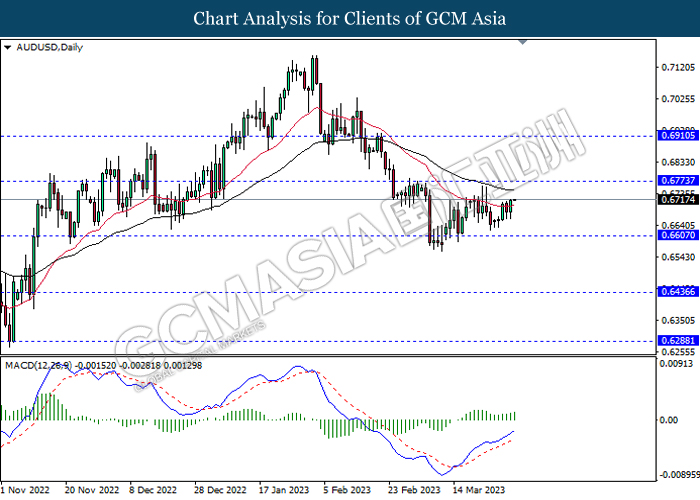

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

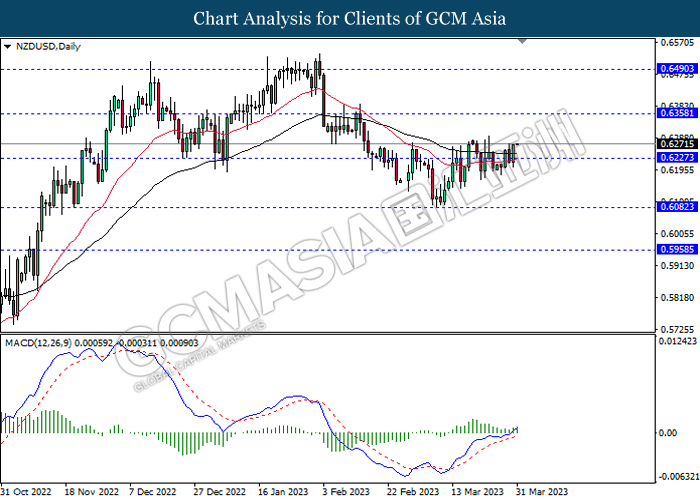

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

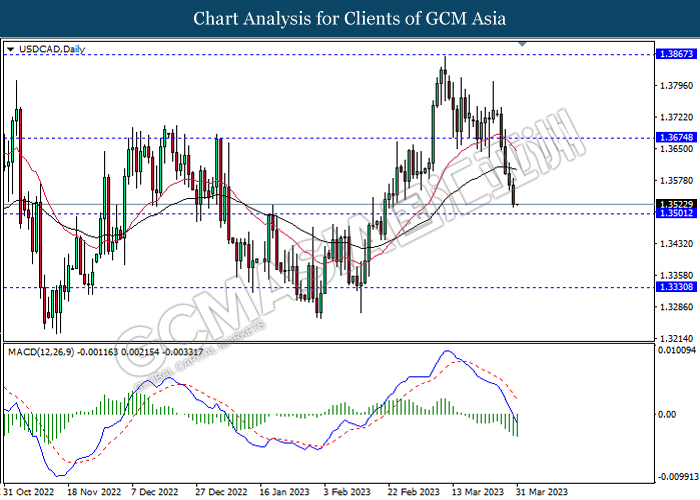

USDCAD, Daily: USDCAD was traded lower following prior breakout below the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3330

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 76.80, 81.30

Support level: 73.10, 69.75

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to b traded lower as technical correction.

Resistance level: 1987.85, 2025.70

Support level: 1948.50, 1897.85