31 May 2021 Afternoon Session Analysis

Aussie rose on mixed China PMI data.

The Australian dollar which traded against the dollar and other currency pairs have rose following the release of China’s official activity numbers. According to China Federation of Logistics and Purchasing (CFLP), China’s Non-Manufacturing PMI for May have improved to 55.2, higher than market expectation of 52.7. Meanwhile, NBS Manufacturing PMI have eased to 51.1, slightly weaker than 51.1. Overall, risk appetite in the market continue to support the pair. US President Joe Biden’s multi-billion-dollar worth of budget and spending plans join receding covid infections in Victoria to keep the buyers hopeful. At the time of writing, AUD/rose 0.16% to 0.7726.

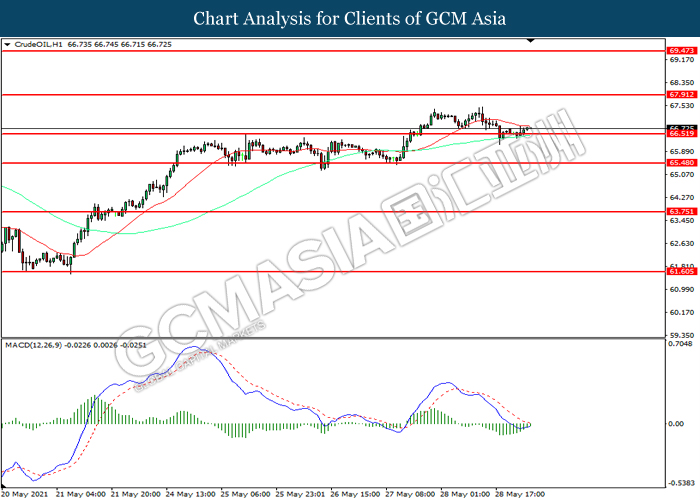

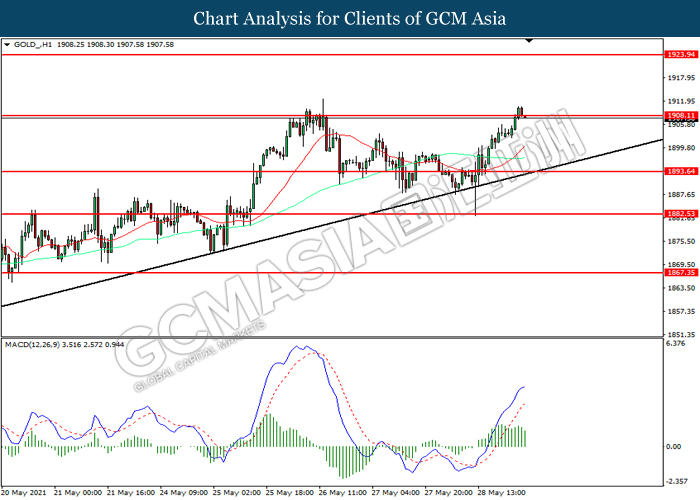

In the commodities market, crude oil price stays firm and rose 0.17% to $66.75 per barrel at the time of writing following bright outlook for fuel demand growth. According to reports, analysts expect that oil demand growth to outstrip supply despite the possible return of Iranian crude and condensate exports. Focus are now turned to OPEC as it is expected to stick with a decision to boost output in July when the group gathers on Tuesday. On the other hand, gold price rose 0.11% to $1909.10 a troy ounce at the time of writing following weaker dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

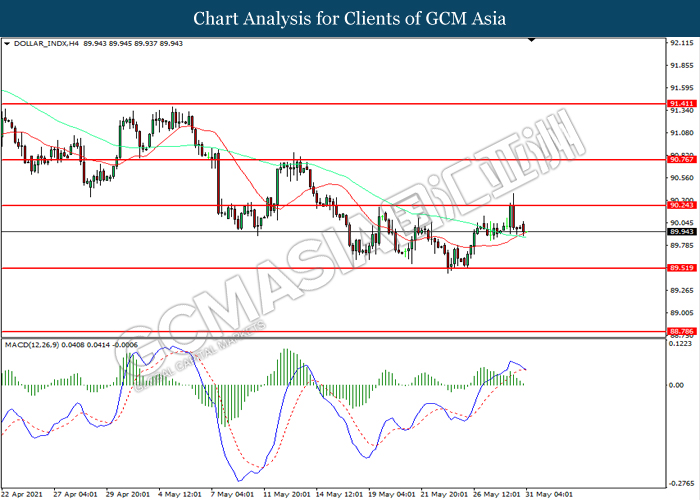

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 90.25. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward support level at 89.50.

Resistance level: 90.25, 90.75

Support level: 89.50, 88.80

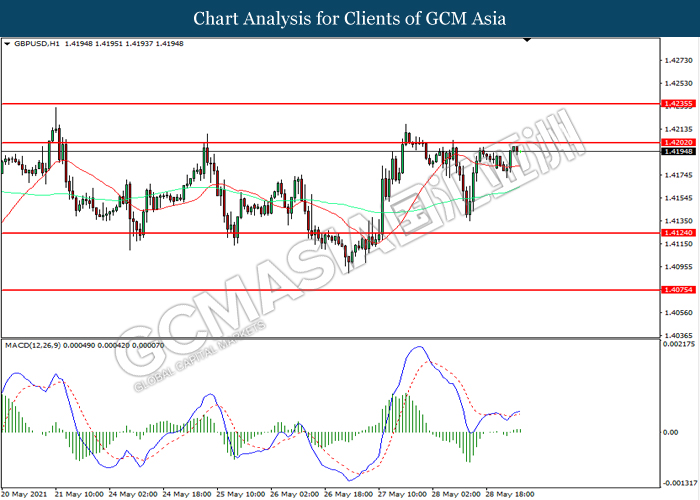

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level at 1.4200. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.4200, 1.4235

Support level: 1.4125, 1.4075

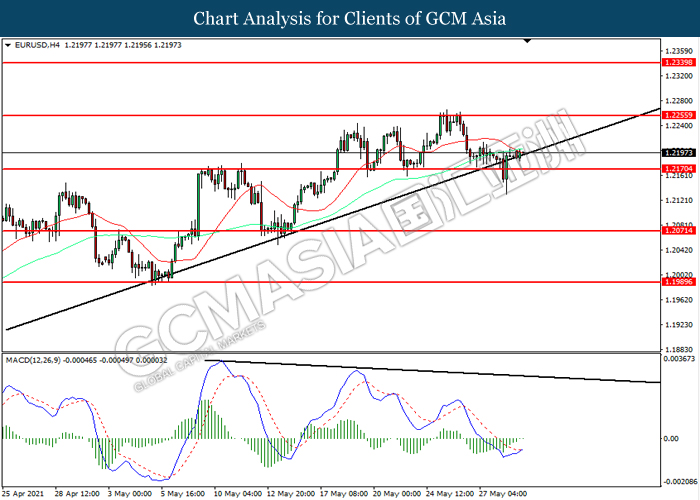

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.2170. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.2255.

Resistance level: 1.2255, 1.2340

Support level: 1.2170, 1.2070

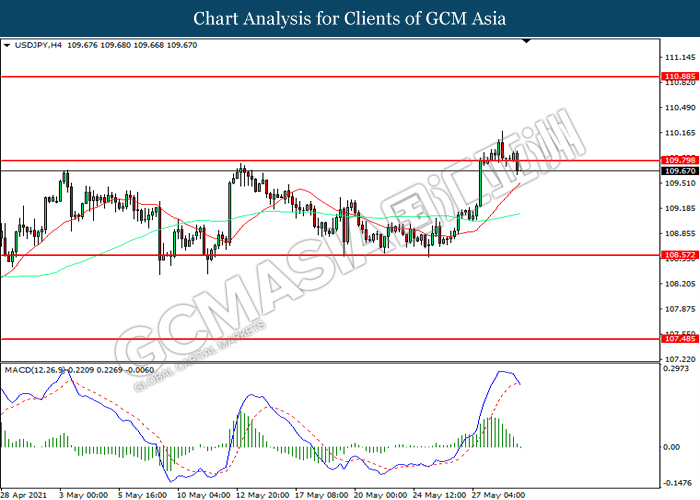

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 109.80. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 109.80, 110.90

Support level: 108.55, 107.50

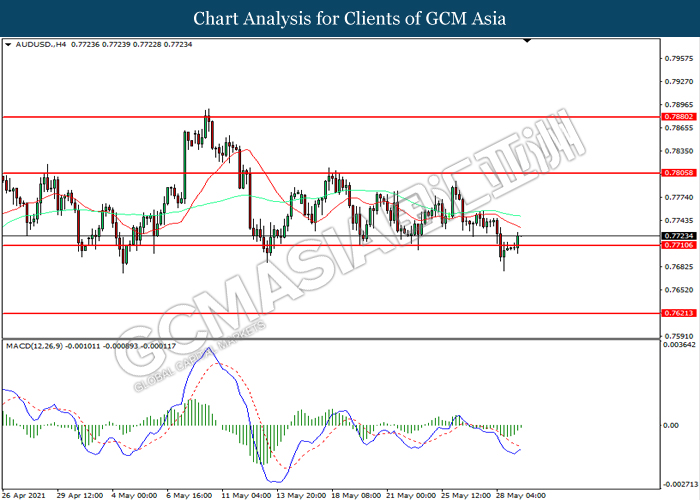

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7710. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7805, 0.7880

Support level: 0.7710, 0.7620

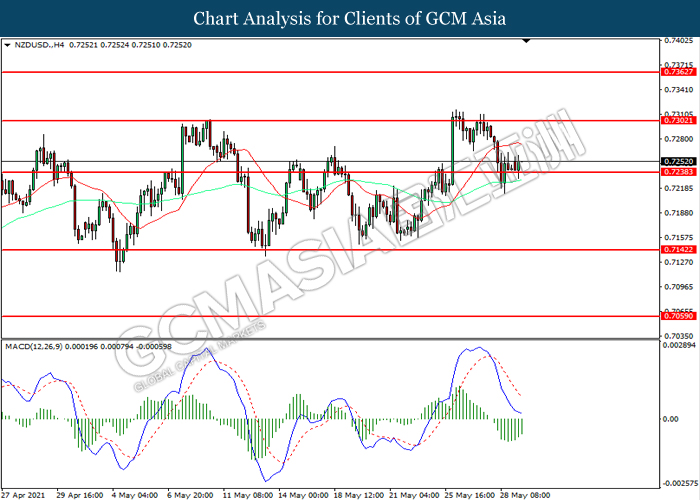

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.7240. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7300, 0.7360

Support level: 0.7240, 0.7140

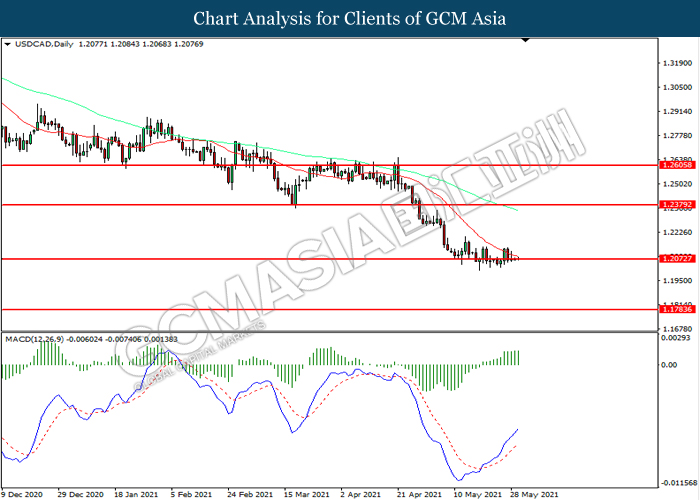

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2075. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2380, 1.2605

Support level: 1.2075, 1.1785

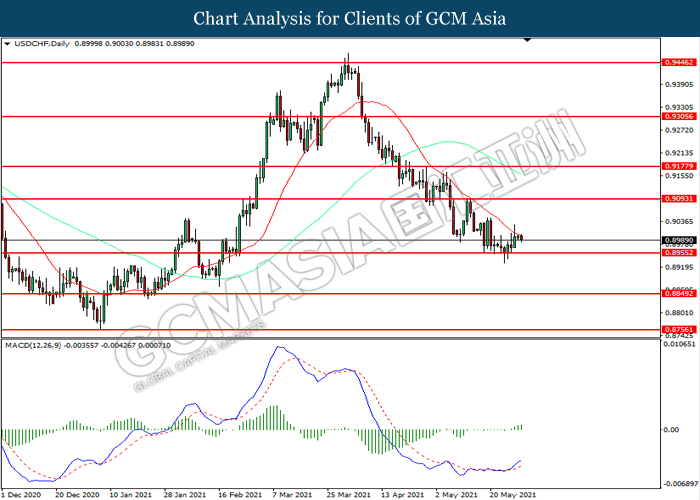

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.8955. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9095, 0.9175

Support level: 0.8955, 0.8850

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level at 66.50. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 67.90, 69.45

Support level: 66.50, 65.50

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1908.10. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1908.10, 1923.95

Support level: 1893.65, 1882.55