31 May 2023 Afternoon Session Analysis

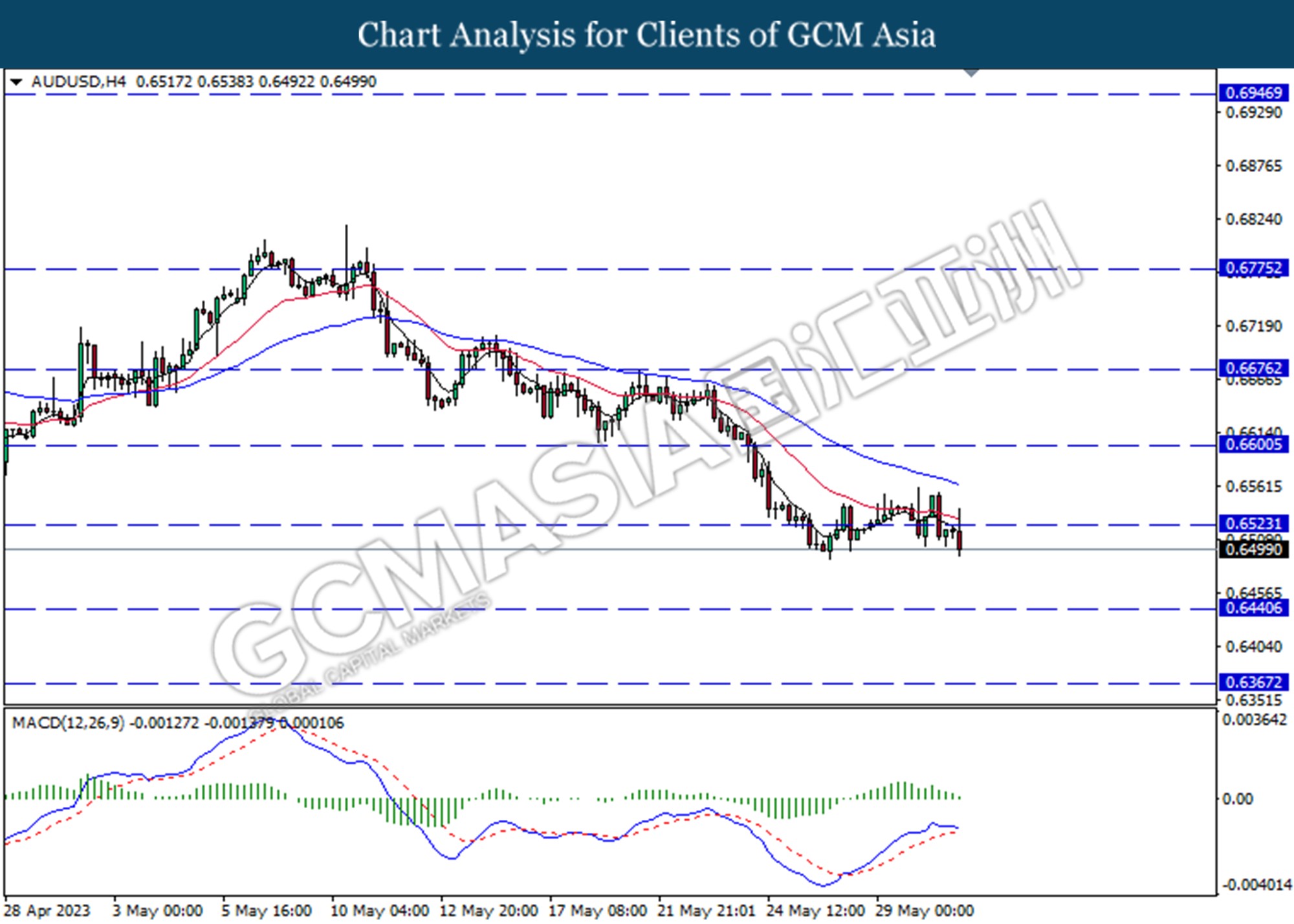

The Aussie dipped after the crucial economic data release.

The pair of AUS/USD, which is commonly knowns as the Aussie, failed to extend its gains after a series of crucial economic data releases. A stronger-than-expected consumer price index (CPI) and private sector spending in April pushed the Aussie higher but revised its trend to decline after weaker Chinese manufacturing data. The CPI rose to 6.8% in April from a year earlier, Australian Statistician data showed on Wednesday, compared with 7.0% in the previous reading and market expectations of 6.4%. While the private sector credit marked at 0.6% on a monthly basis, higher than the previous figure of 0.2% and market expectations of 0.3%. Both economic data reflect that Australian consumer spending power remains resilient despite the Reserve Bank of Australia rose the interest rate by 375 basis points since May last year to 11 years higher 3.85%. Consumer prices rose more than expected in April, with strong consumer spending suggesting sticky inflation could weigh on the central bank. Nonetheless, the Aussie changed its moves from gains to losses after China manufacturing showed a contraction in business activity in May. Manufacturing PMI in May recorded 48.8 in May, lower than 49.2 in April, China Logistics Information central data showed, as economists expect the figures to rise back to 51.4. China’s manufacturing sector has contracted for two consecutive months, which will lead to a decline in Australian export transactions. As a result, demand for the Australian dollar falls. As of writing, the AUD/USD dipped by -0.37% to 0.6494.

In the commodities market, crude oil prices shrank by –0.29% to $59.26 per barrel after China’s manufacturing sector showed a contraction condition. Besides, gold prices were traded down by -0.07% to $1958.03 per troy ounce following the dollar strengthening

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (May) | 24K | – | – |

| 20:00 | EUR – German CPI (MoM) (May) | 0.4% | 0.6% | – |

| 20:30 | CAD – GDP (MoM) (Mar) | 0.1% | 0.2% | – |

| 22:00 | USD – JOLTs Job Openings (Apr) | 9.590M | 9.775M | – |

Technical Analysis

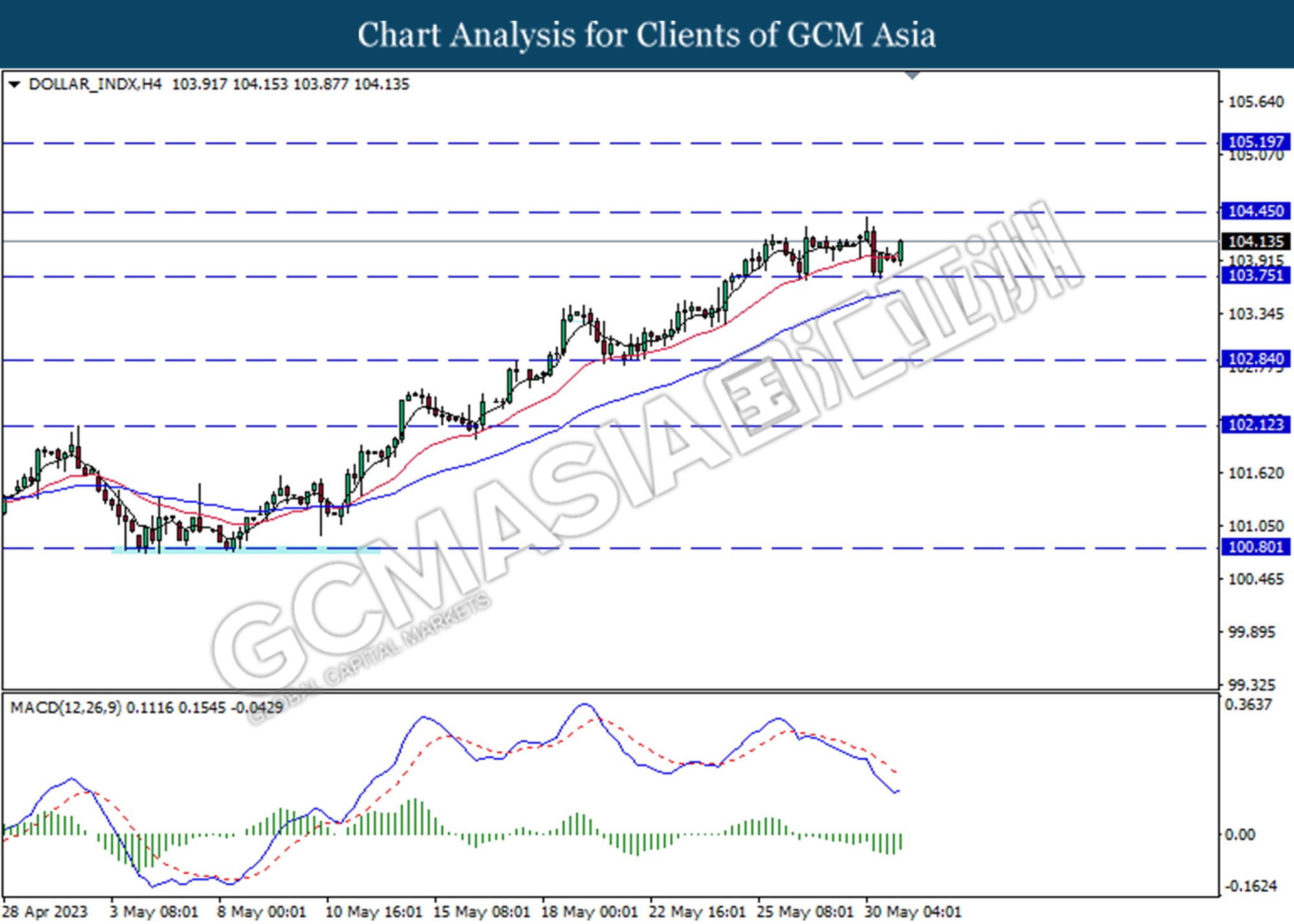

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 104.45.

Resistance level: 104.45, 105.20

Support level: 103.75, 102.85

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2445. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

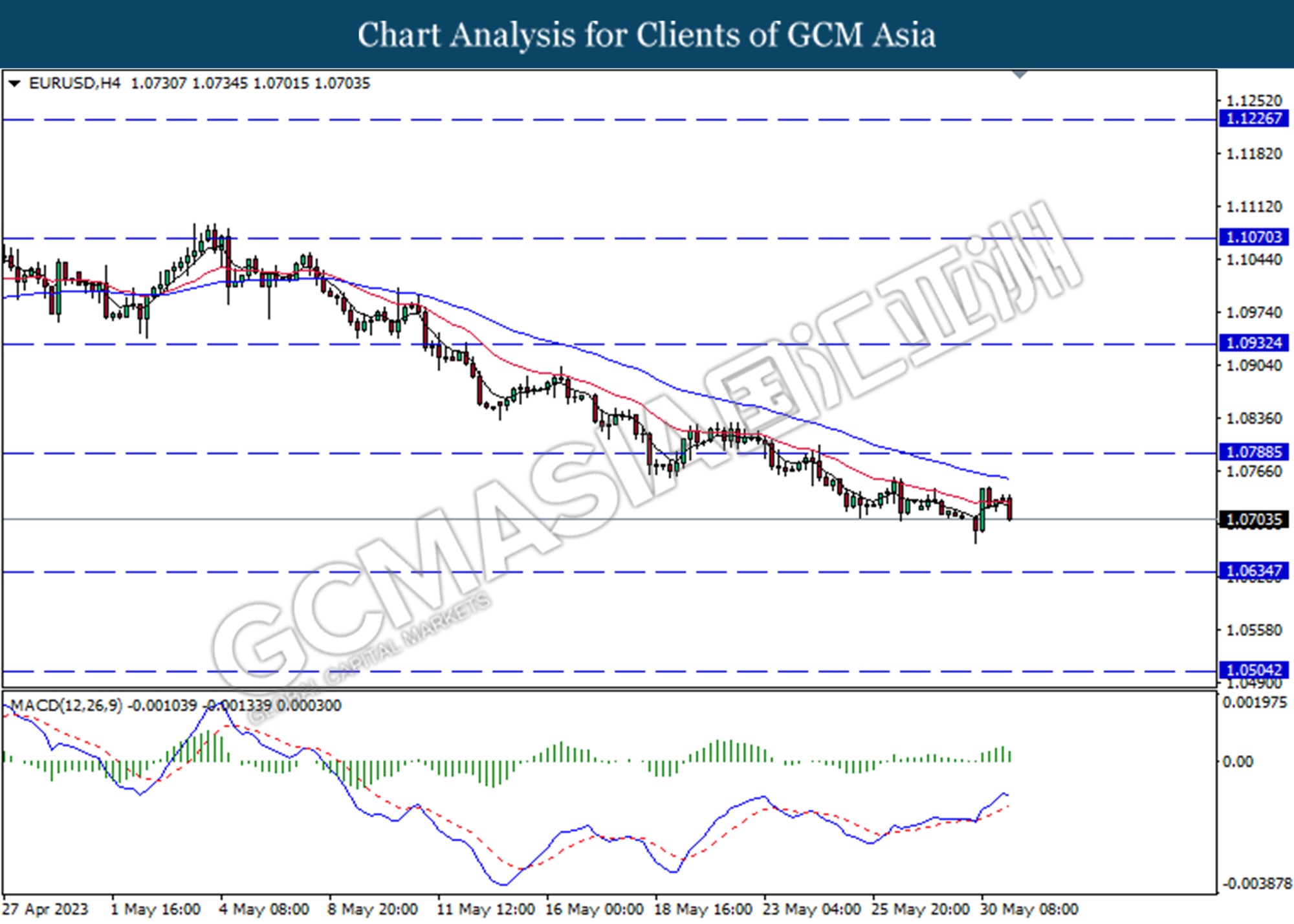

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.0635.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

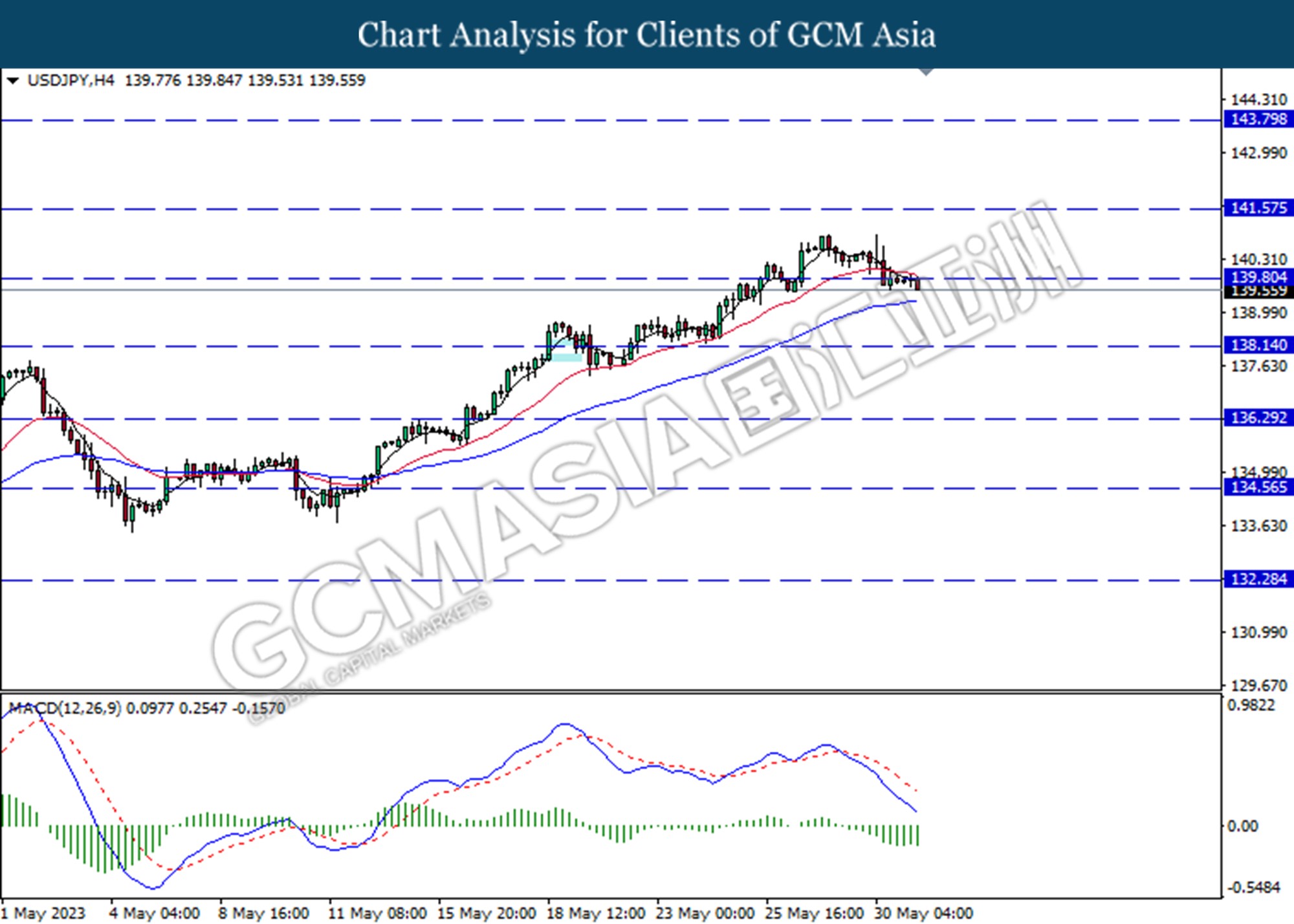

USDJPY, H4: USDJPY was traded lower following the prior breaks below the previous support level at 139.80. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 139.80, 141.60

Support level: 138.15, 136.30

AUDUSD, H4: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6525. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6525, 0.6600

Support level: 0.6440, 0.6365

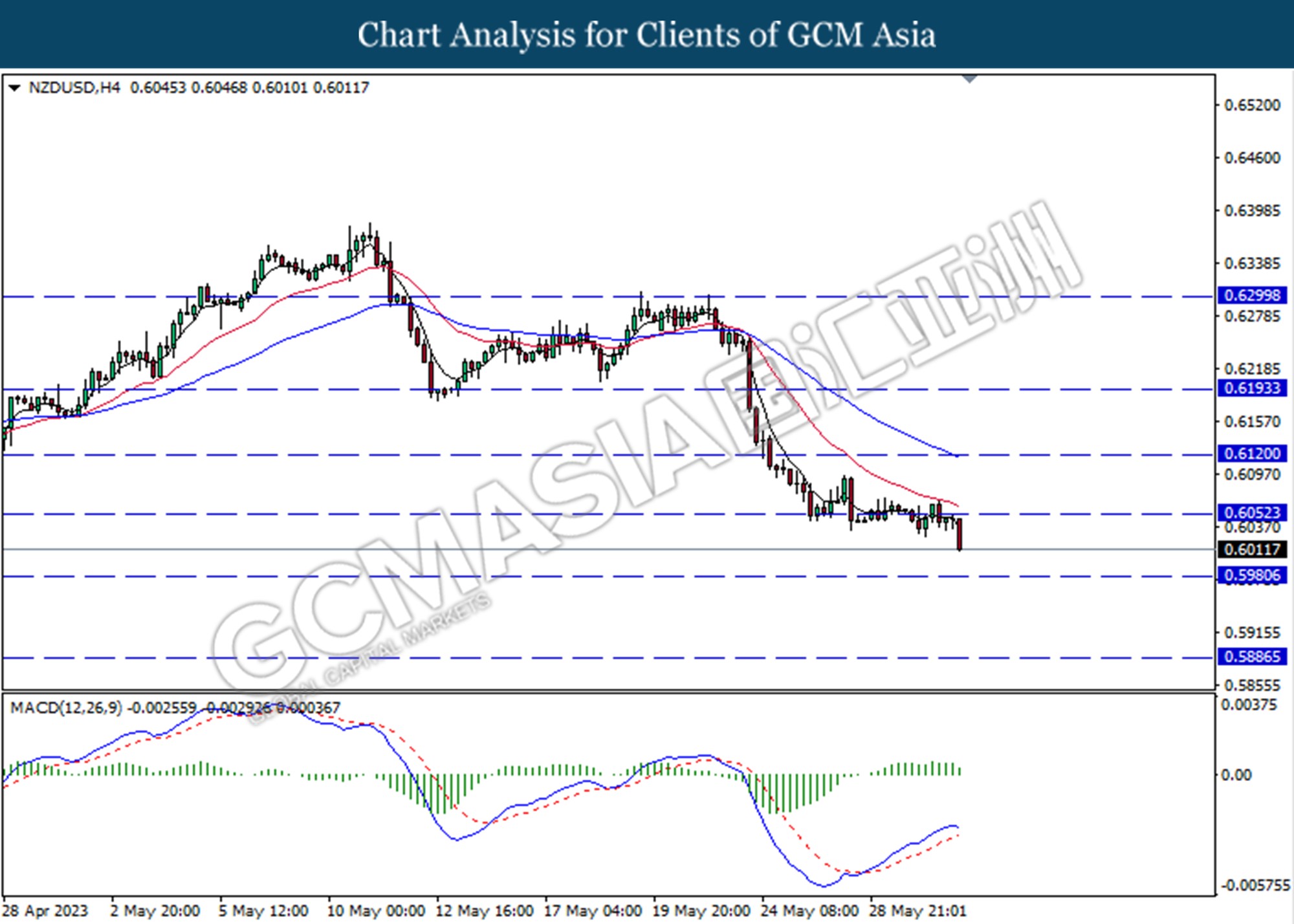

NZDUSD, H4: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6050. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.5980.

Resistance level: 0.6050, 0.6120

Support level: 0.5980, 0.5885

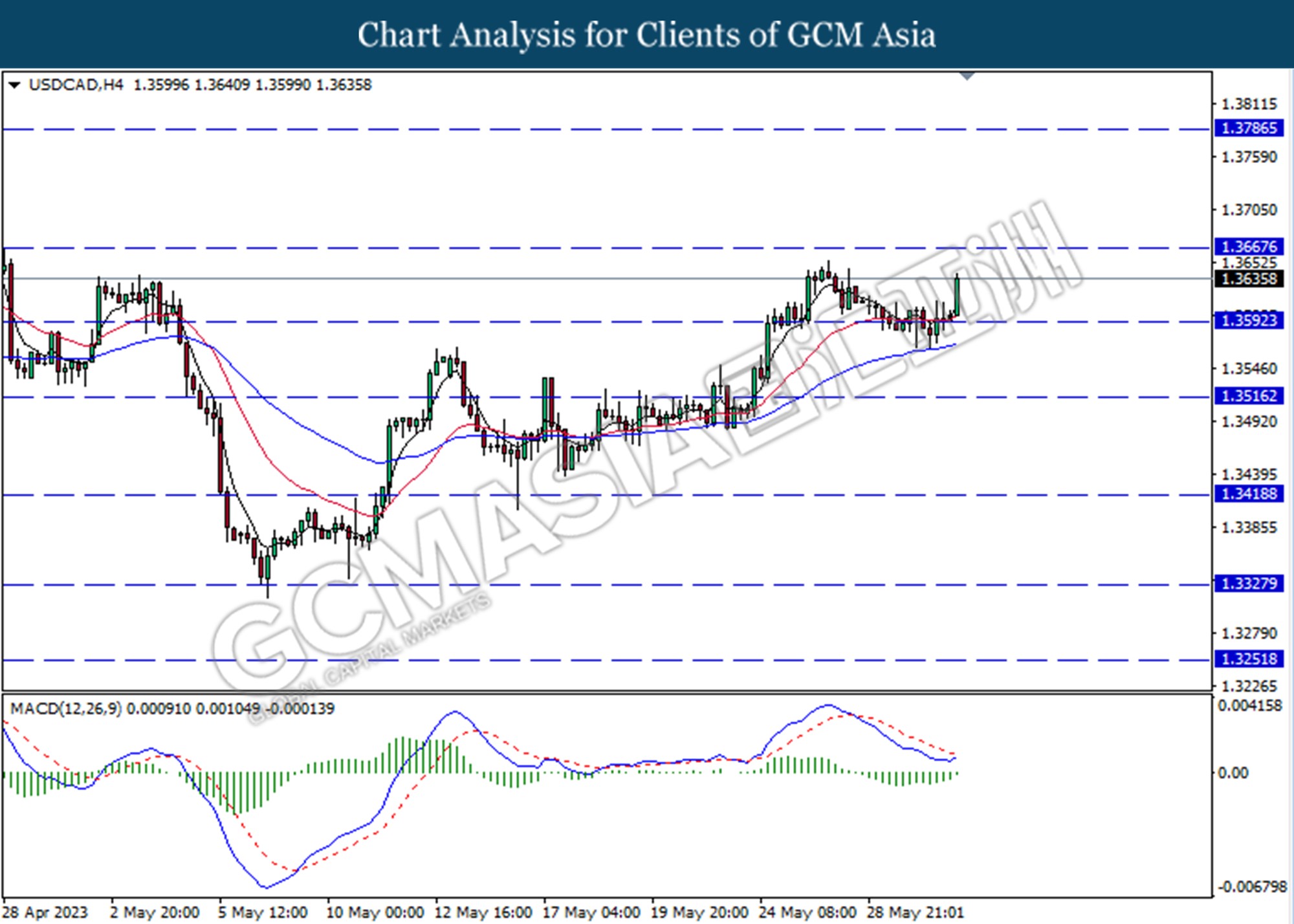

USDCAD, H4: USDCAD was traded higher following the prior rebound from the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3665.

Resistance level: 1.3665, 1.3785

Support level: 1.3590, 1.3515

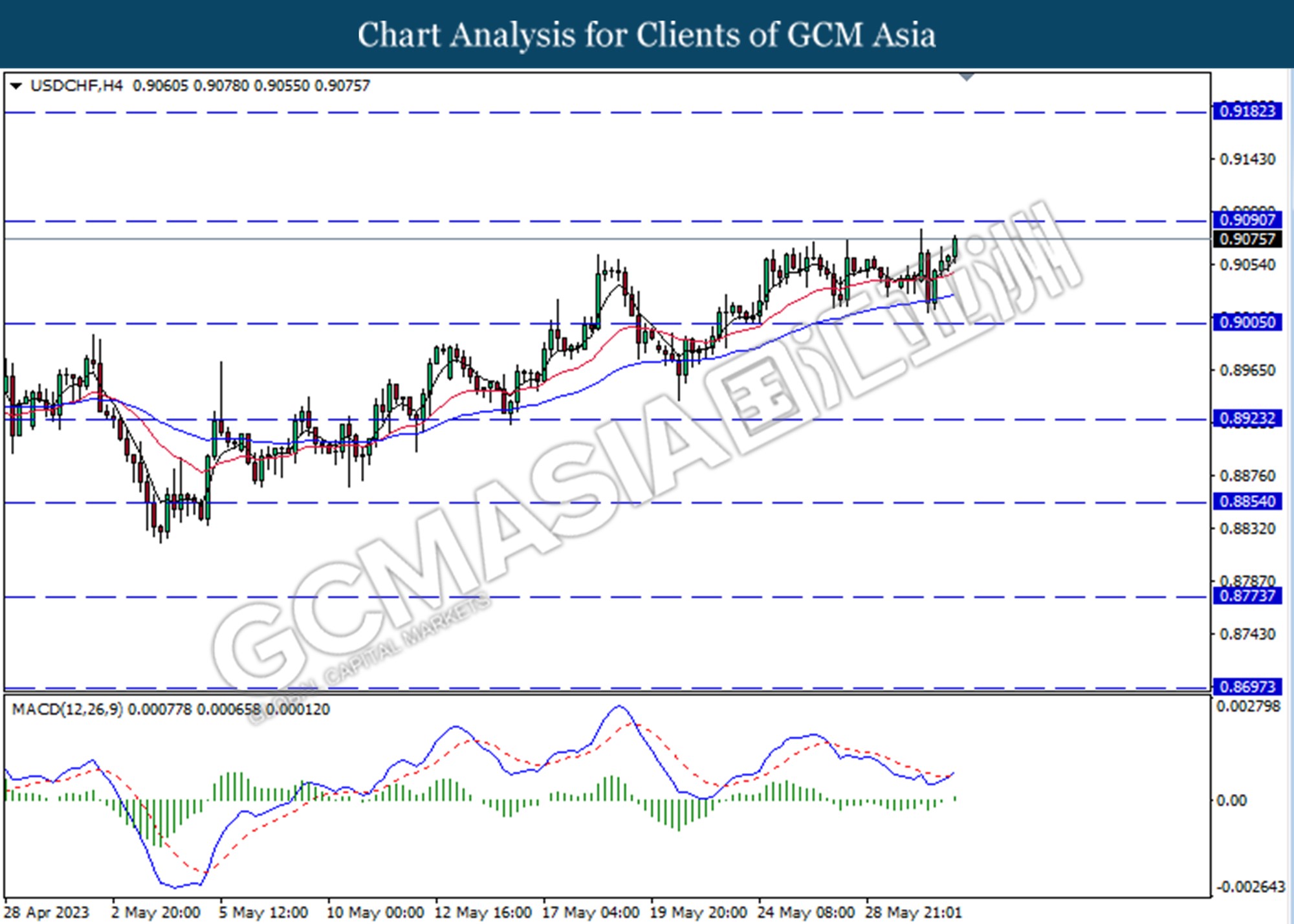

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.9090.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

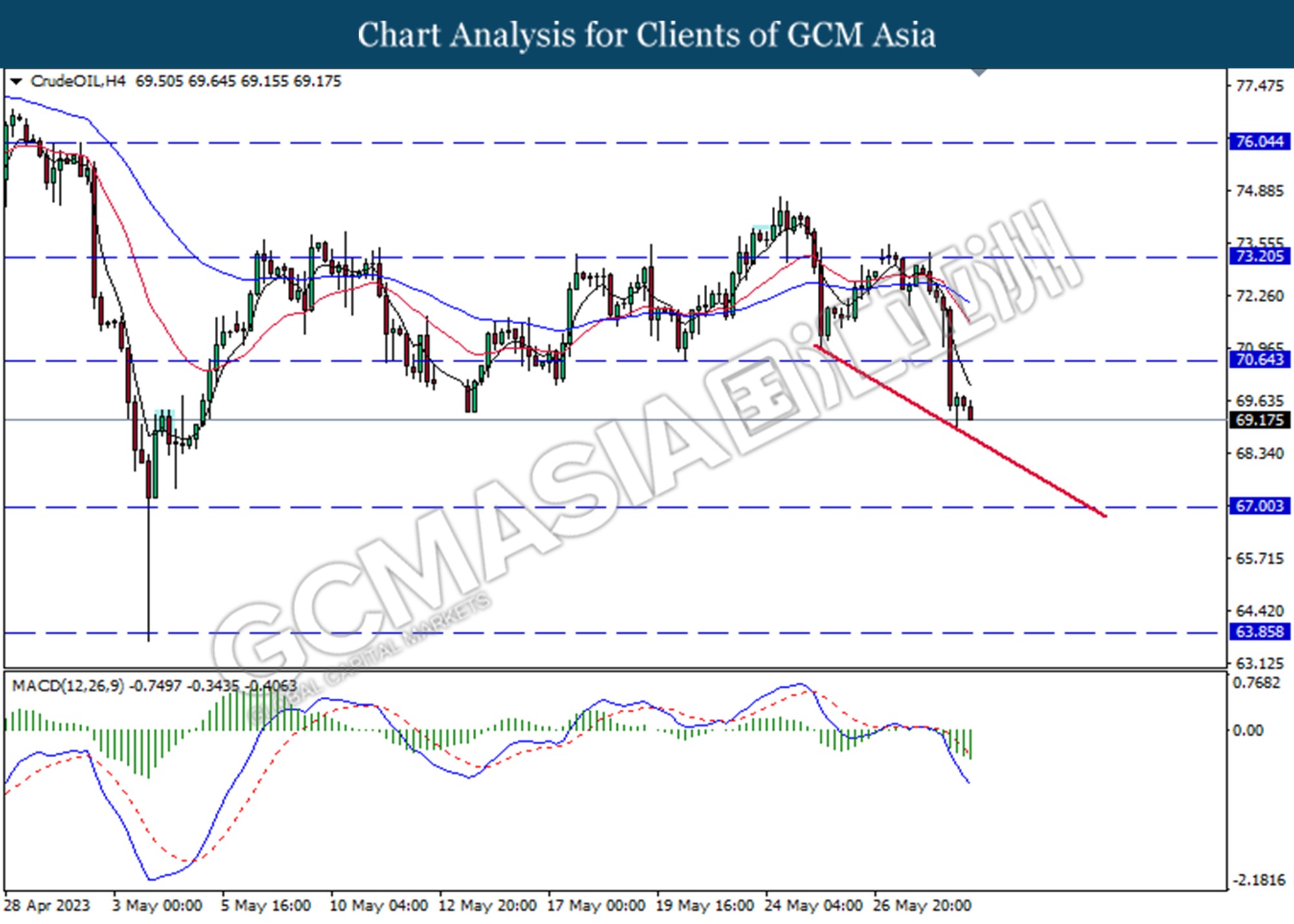

CrudeOIL, H4: Crude oil price was traded lower following the prior breaks below the previous support level at 70.65. MACD which illustrated increasing bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 70.65, 73.20

Support level: 67.00, 63.85

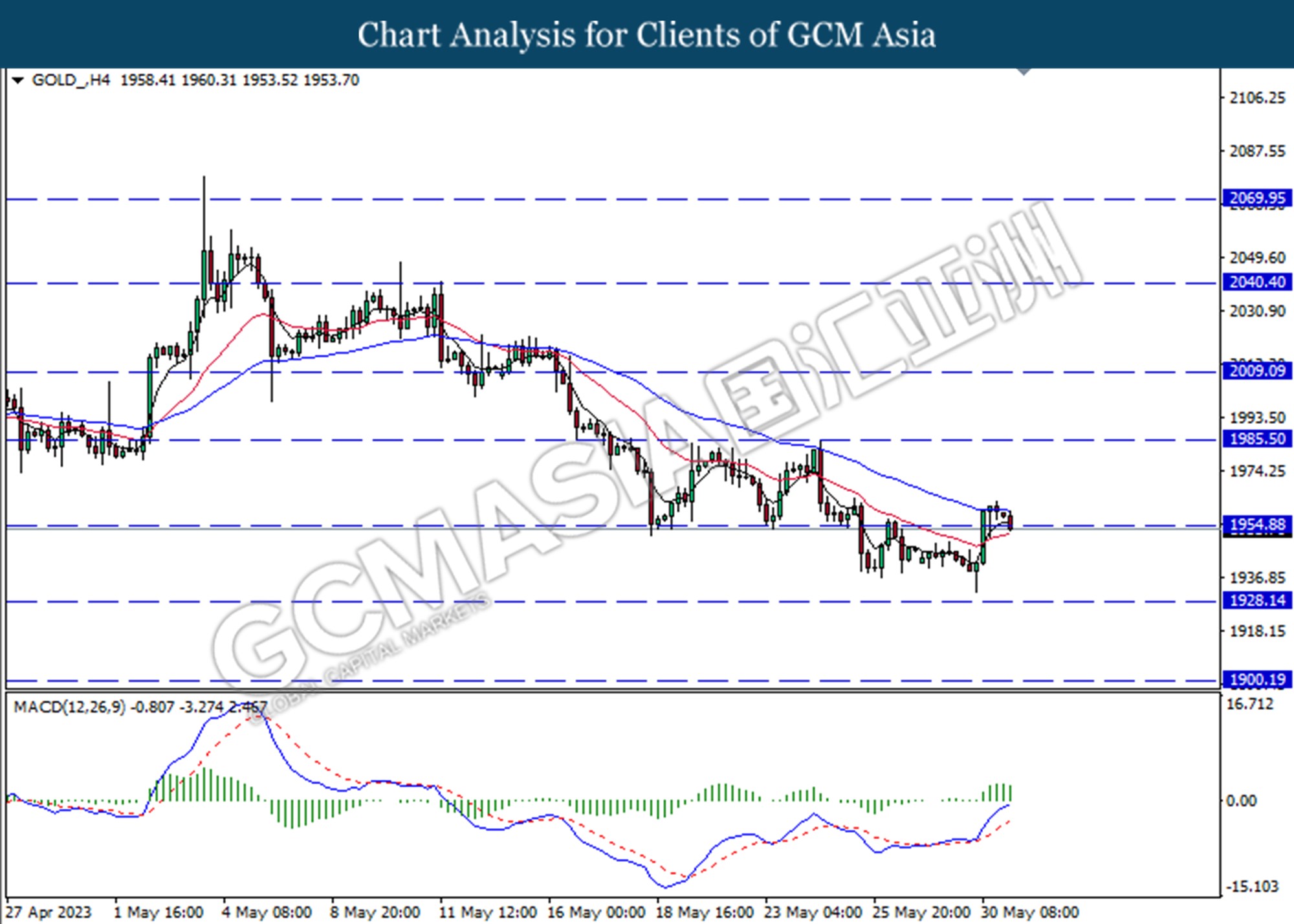

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1954.90. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses after it successfully breakout below the support level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15