31 May 2023 Morning Session Analysis

Dollar retreated following Japan emergency meeting.

The dollar index, which was traded against a basket of six major currencies, failed to extend its gains after hitting the 10 week high following the emergency meeting yesterday. In the meeting, the country top currency diplomat revealed that Japan will closely monitor the currency market movement and they would respond “appropriately” as needed. The statement came out after the financial authorities including Ministry of Finance (MOF), Bank of Japan (BoJ) and regulator met in response to a weakening in the yen to its softest in six months versus the dollar. With that, the Japanese Yen surged against the US dollar as it signaled a potential market intervention such as huge buy back of the currency in order to tame the sharp depreciation of Yen. However, the drop in dollar value was limited as the optimism over the debt ceiling issue still supporting the dollar index. Now, investors are eyeing on the key vote of passing the debt limit proposal in Congress, as an unexpected result would disrupt the entire financial market. As of writing, the dollar index edged down -0.14% to 104.05.

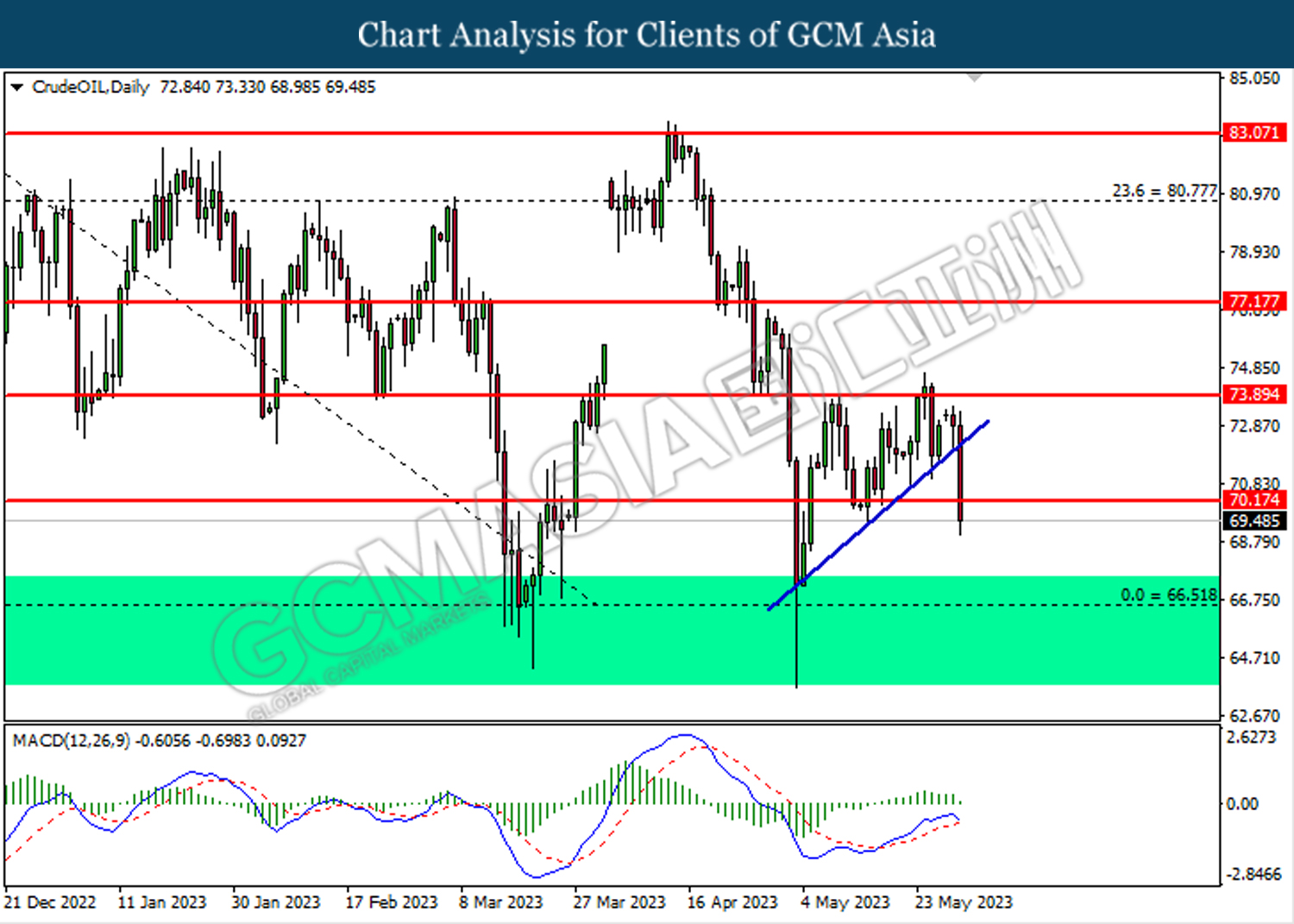

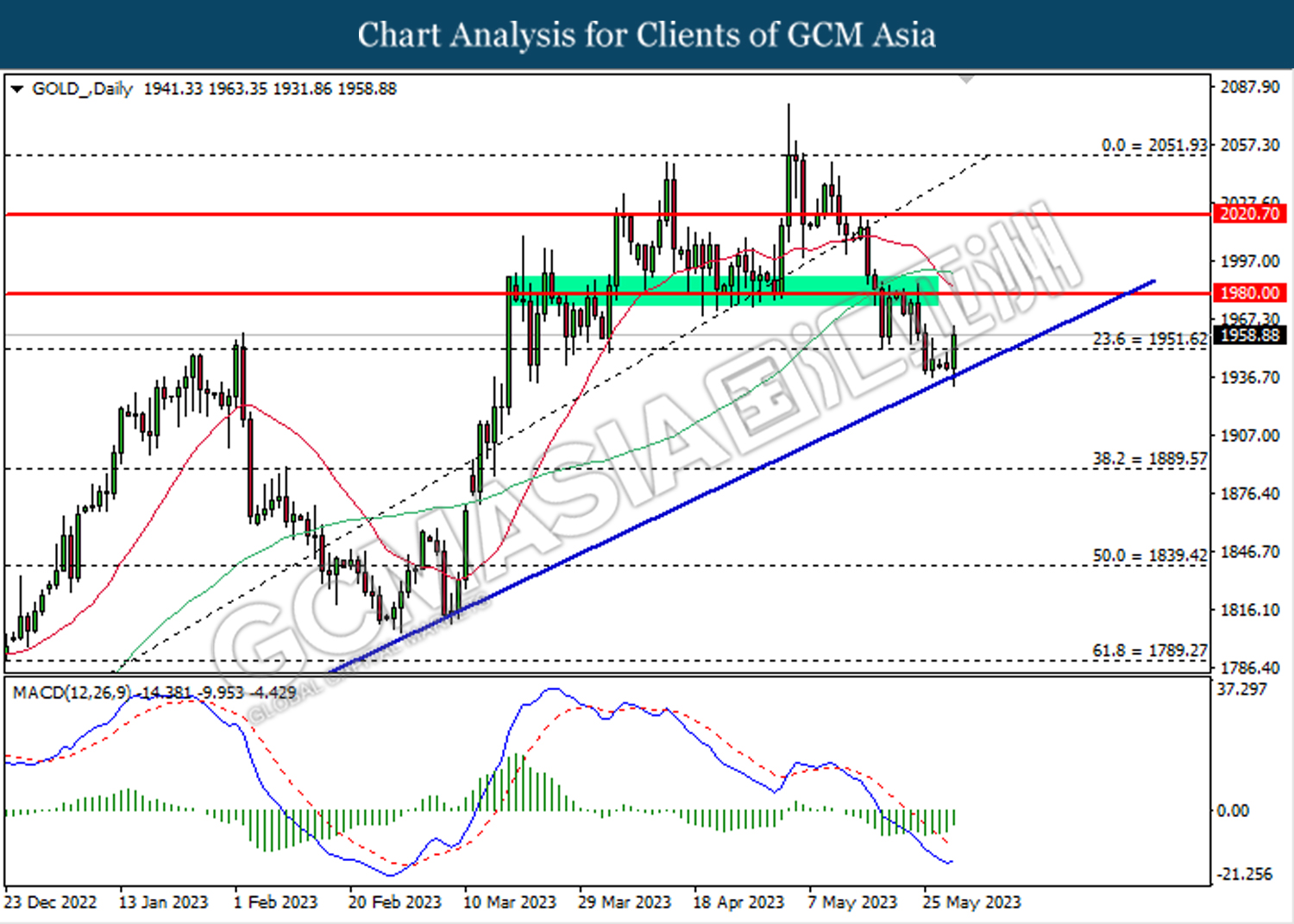

In the commodities market, crude oil prices plunged by -3.79% to $70.15 per barrel as the market concerned about the progress of passing the debt ceiling deal. Besides, gold prices were up by 0.03% to $1958.65 per troy ounce following the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (May) | 24K | – | – |

| 20:00 | EUR – German CPI (MoM) (May) | 0.4% | 0.6% | – |

| 20:30 | CAD – GDP (MoM) (Mar) | 0.1% | 0.2% | – |

| 22:00 | USD – JOLTs Job Openings (Apr) | 9.590M | 9.775M | – |

Technical Analysis

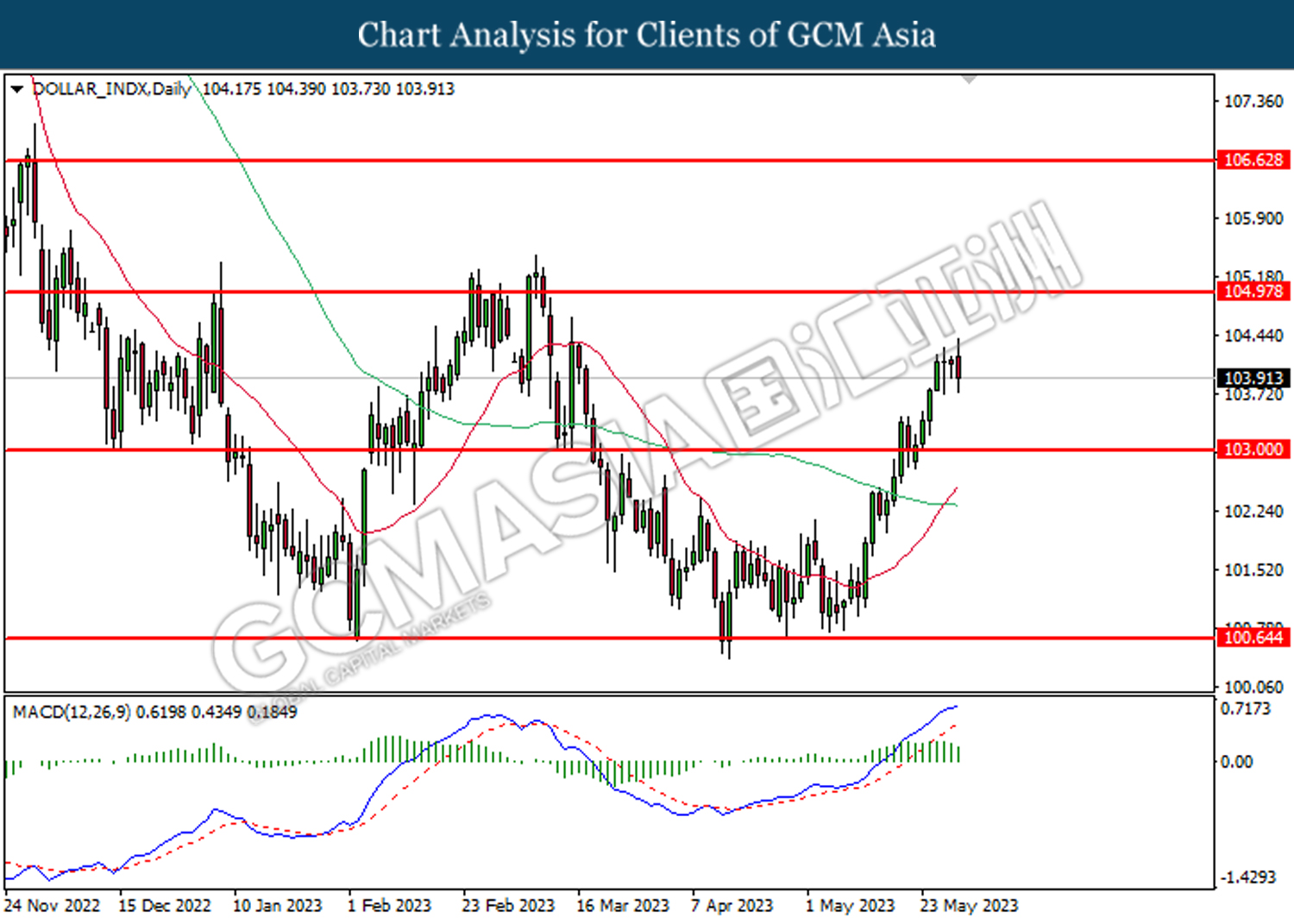

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 103.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

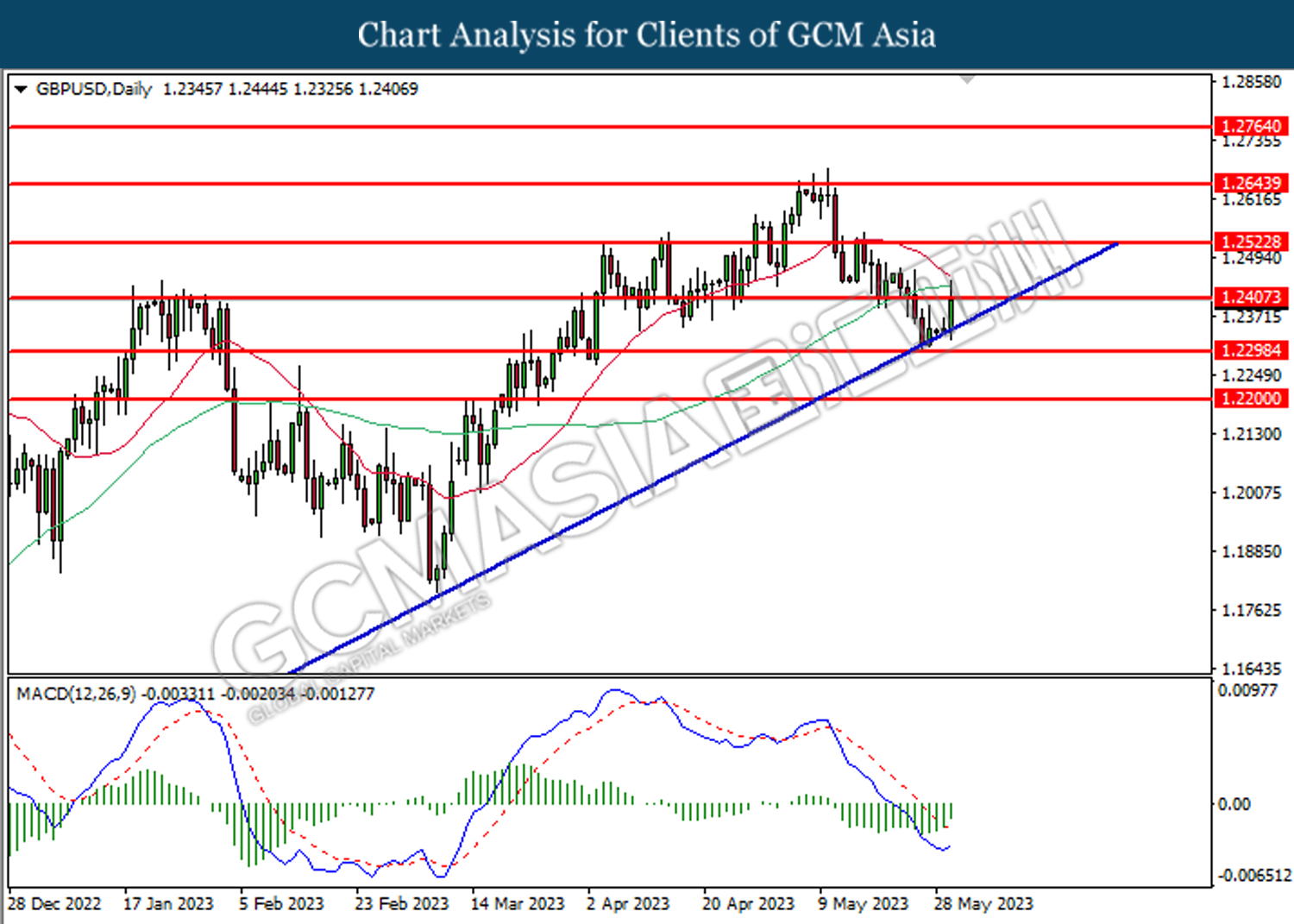

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2405, 1.2525

Support level: 1.2300, 1.2200

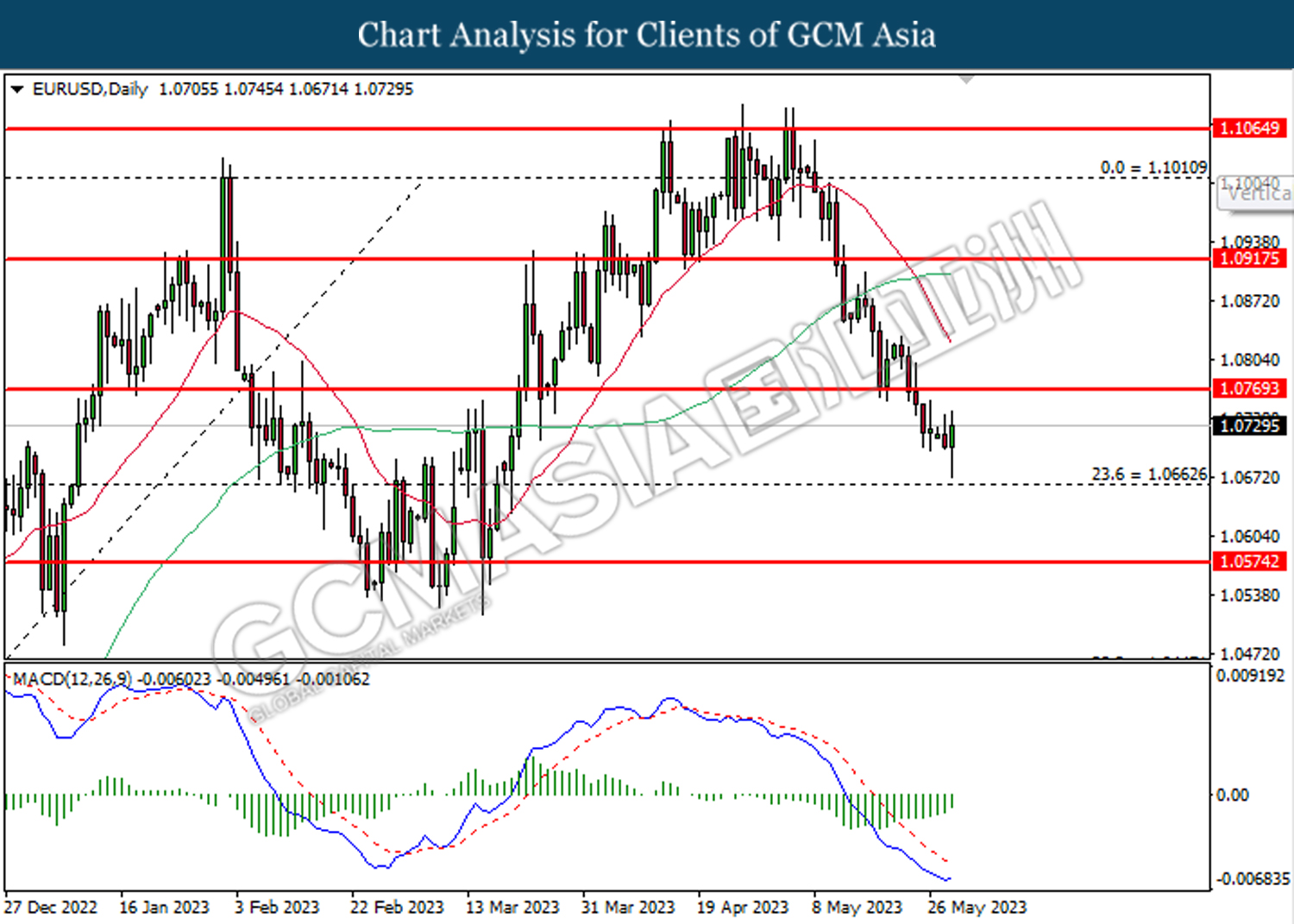

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0665. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

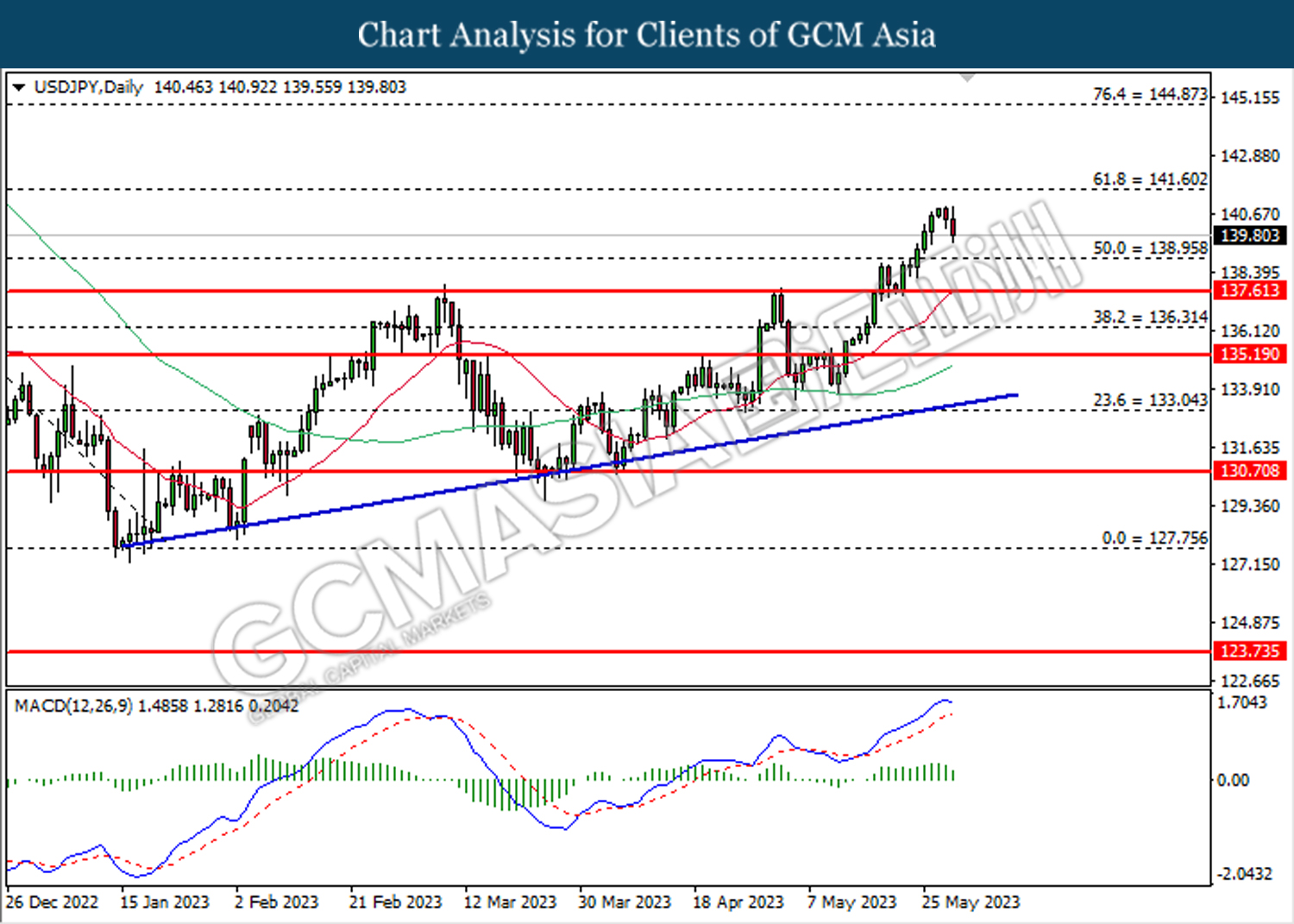

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 141.60. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

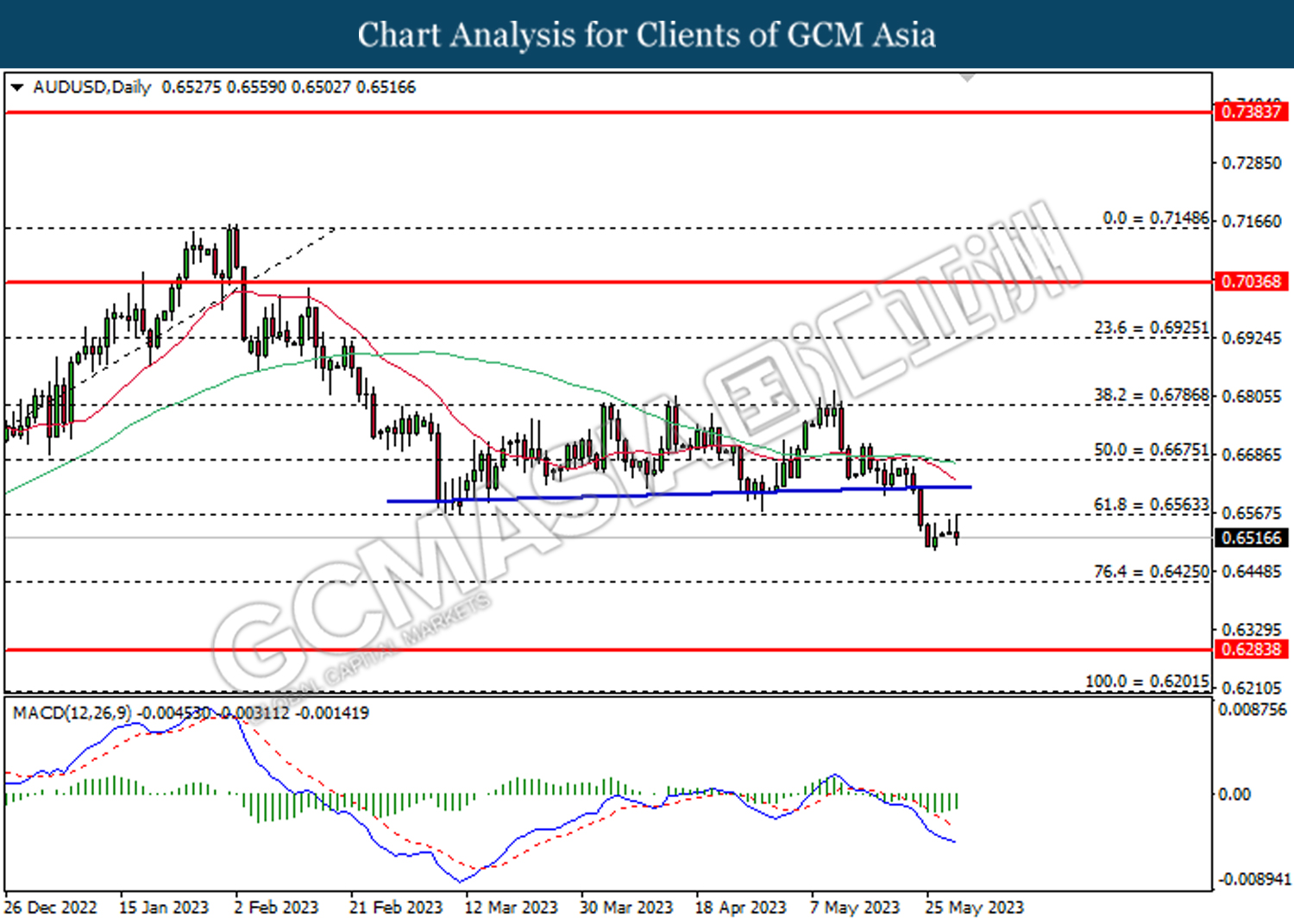

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6425.

Resistance level: 0.6565, 0.6675

Support level: 0.6425, 0.6285

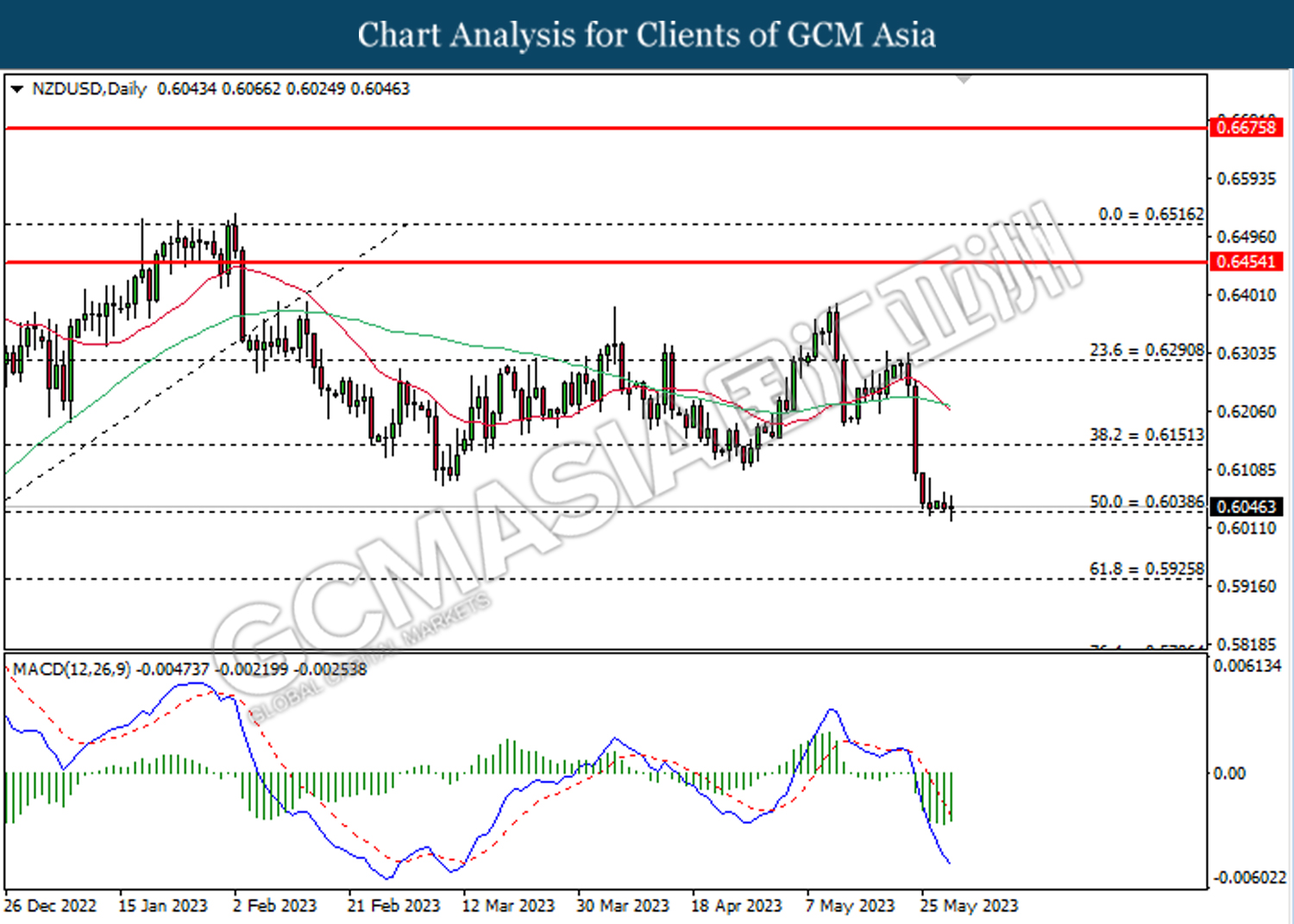

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6040. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

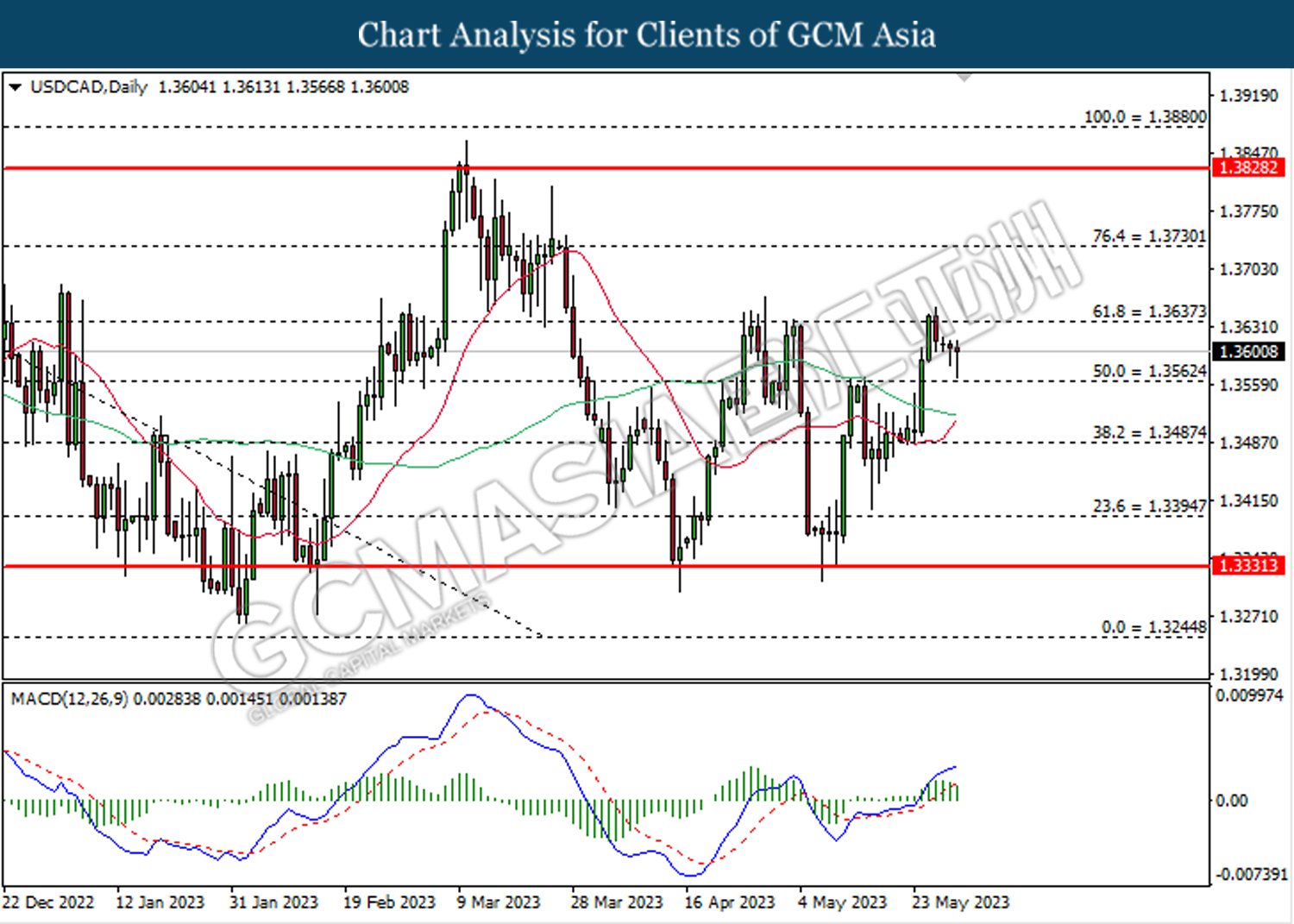

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3635. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3565.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

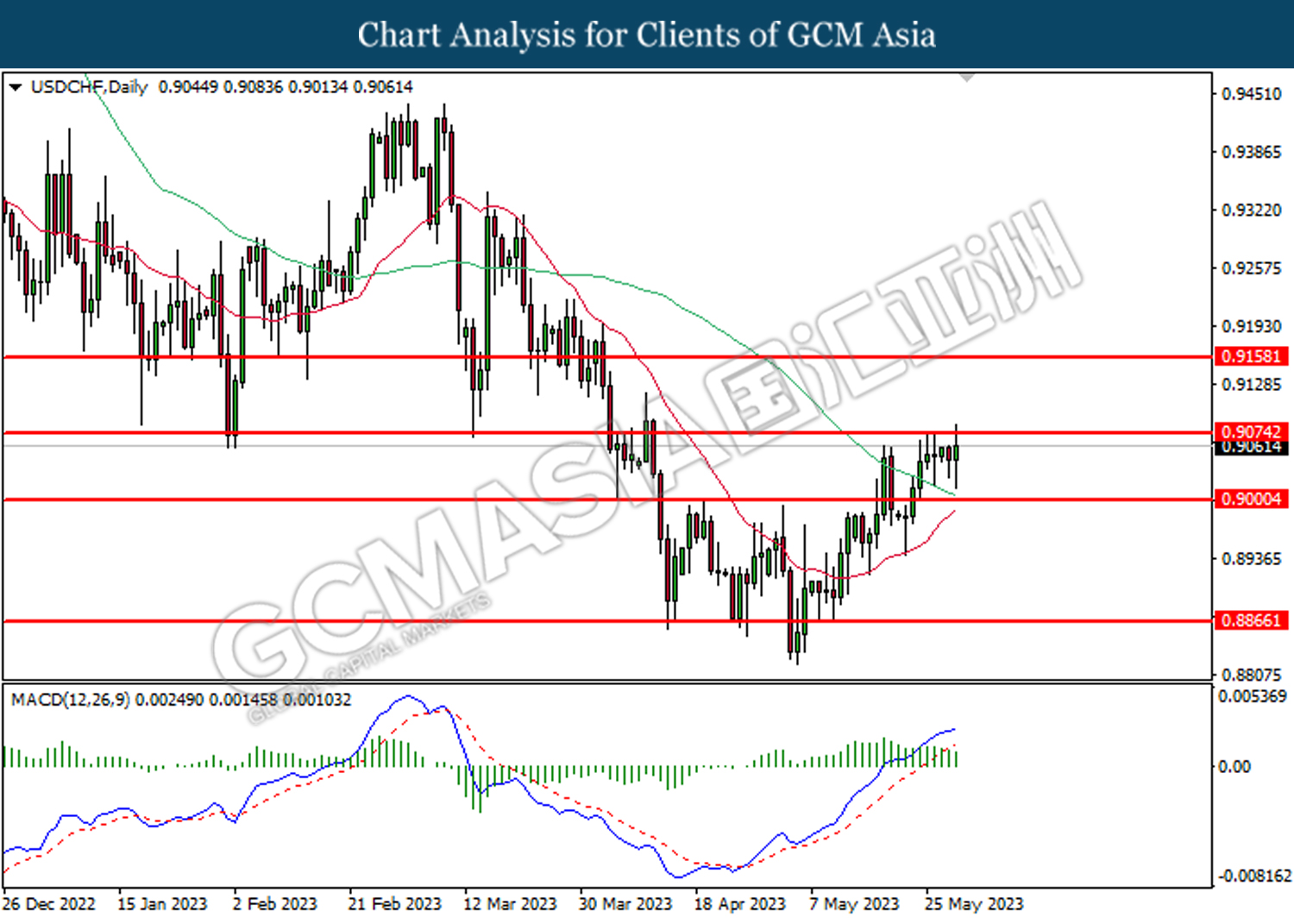

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9075. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 70.15. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1951.60. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1951.60, 1980.00

Support level: 1889.55, 1839.40