31 July 2023 Afternoon Session Analysis

The EUR strengthened after France and Spain boosted their economies.

The EUR strengthened against the dollar index last Friday after the French and Spanish second displayed unexpected resilience in the second quarter but the German economy remains weak in the eurozone. French’s GDP recorded a 0.5% upbeat estimation of 0.1% while the Spanish GDP grew by 0.4% in line with market expectations. Data from France and Spanish, the bloc’s second and fourth larger economies, grew at a sustained pace in the second quarter and was driven by stronger exports and tourism led the growth. However, German GDP stagnated in the second quarter as the reading recorded -0.2% for two consecutive quarters and lower than expected 0.1%. Due to manufacturing and service slowing down, the German economy pointed to a weakness in the second quarter. Consumers tightened their purses as high inflation caused weak purchasing power. Therefore, the industrial order book was slowing after a soft purchasing power in German. Other economic data released on the same data showed that Spanish and German price pressure remains elevated as the yearly CPI remains at a higher pace. The Spanish July CPI in yearly reading grew to 2.3% from 1.9%m higher than 1.5%, and Germany slightly decreased to 6.2% from 6.4%. Both countries’ CPI is still far from the European Central Bank’s (ECB) 2% to 3% long-term target. It also increases the pressure on ECB to choose whether to further tighten or pause its tightening moves. As of writing the EURUSD traded lower by -0.01% to 1.1014.

In the commodities market, the crude oil price slipped by -0.41% to 80.25 as weak China PMI weighed on crude oil prices. On the other hand, the gold prices dipped by -0.20% to 1955.30 after the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Jul) | 5.5% | 5.3% | – |

Technical Analysis

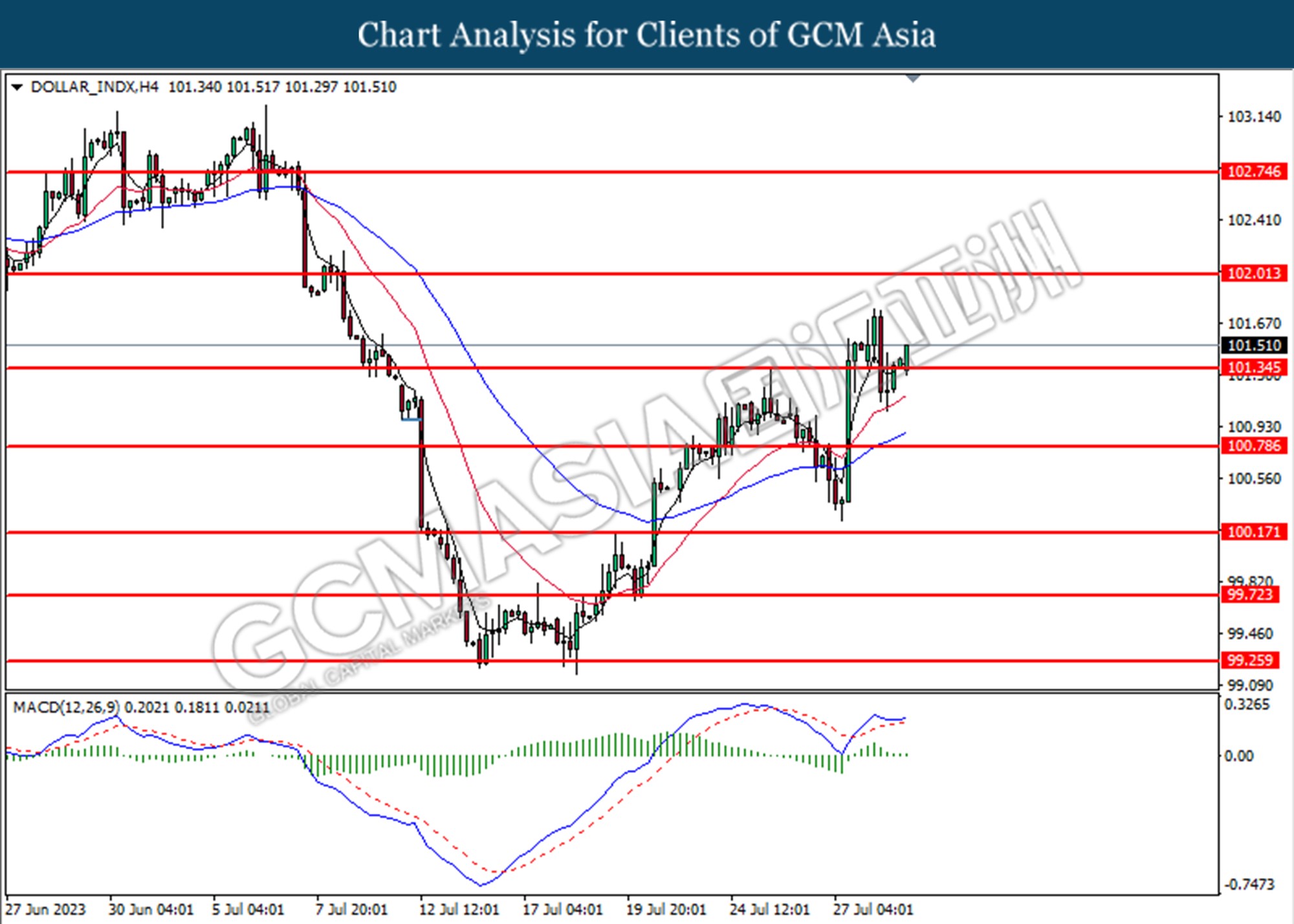

DOLLAR_INDX, H4: Dollar index was traded higher following the prior breaks above from the previous resistance level at 101.35. However, MACD which illustrated diminishing bullish momentum suggests the index undergoes a technical correction in the short term.

Resistance level: 102.00, 102.75

Support level: 101.35, 100.80

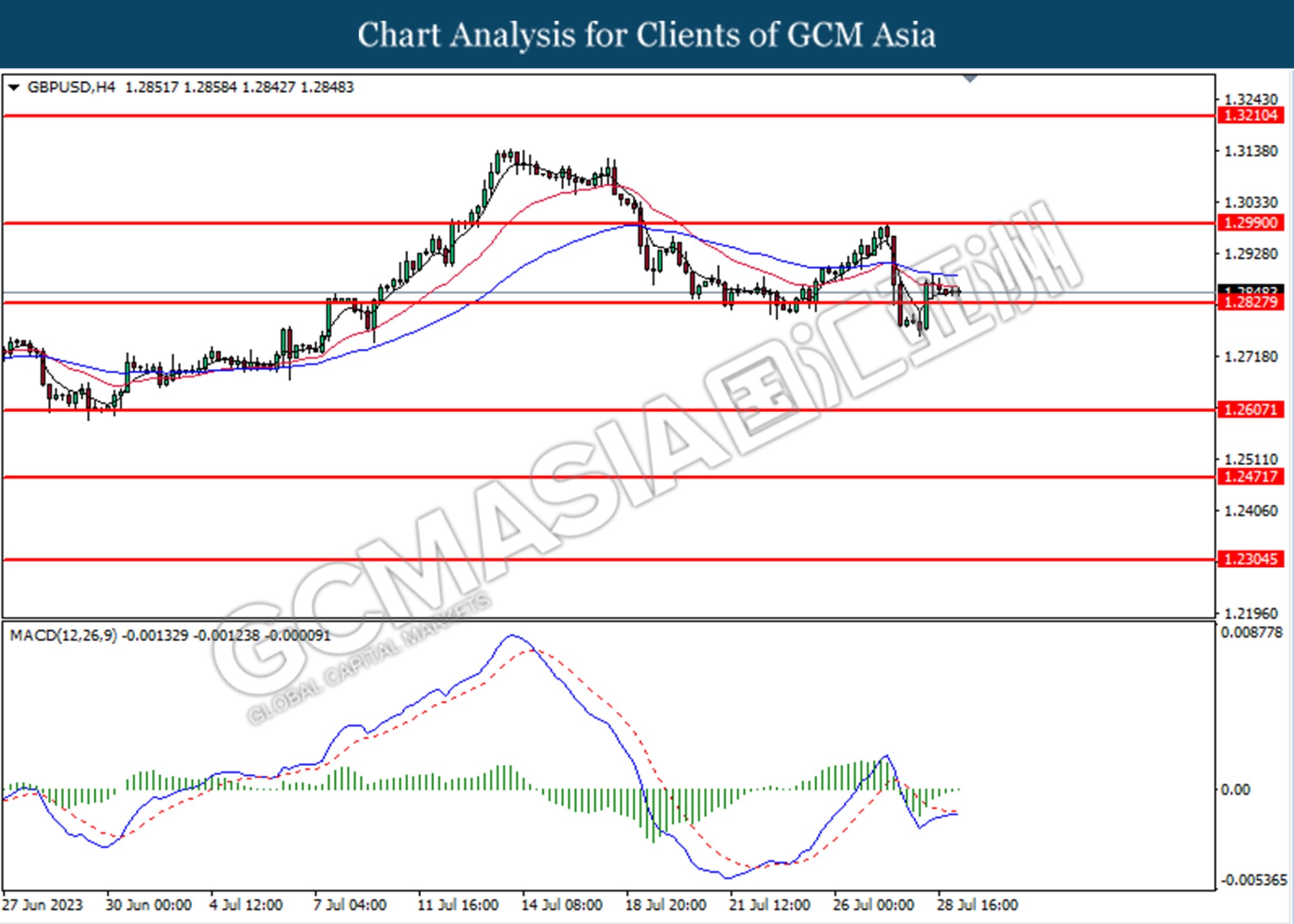

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.2990, 1.3210

Support level: 1.2830, 1.2610

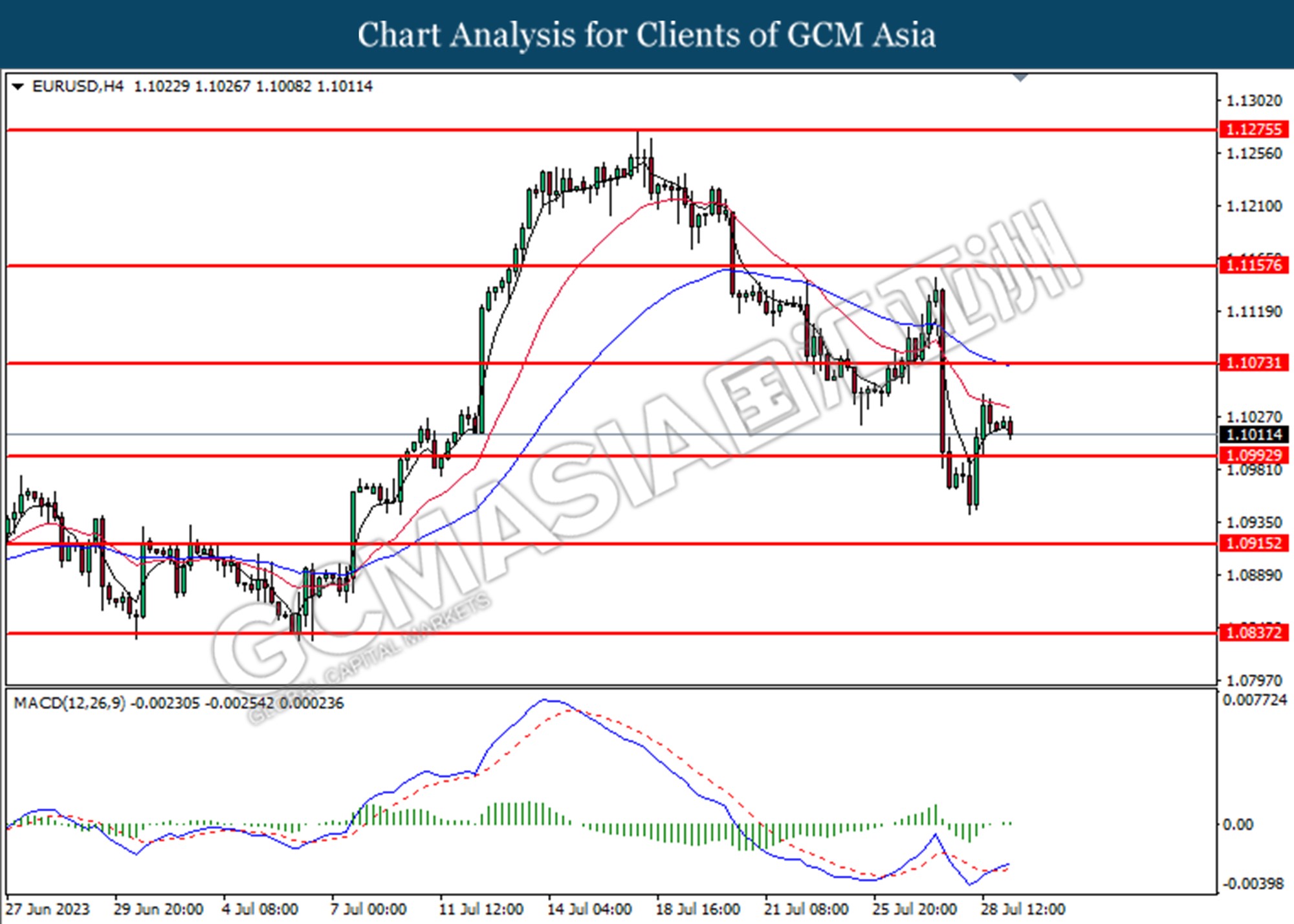

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.1075, 1.1160

Support level: 1.0990, 1.0915

USDJPY, H4: USDJPY was traded higher following the prior breaks above the previous resistance level at 141.40. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards the next resistance level at 142.70

Resistance level: 142.70, 143.90

Support level: 141.40, 140.20

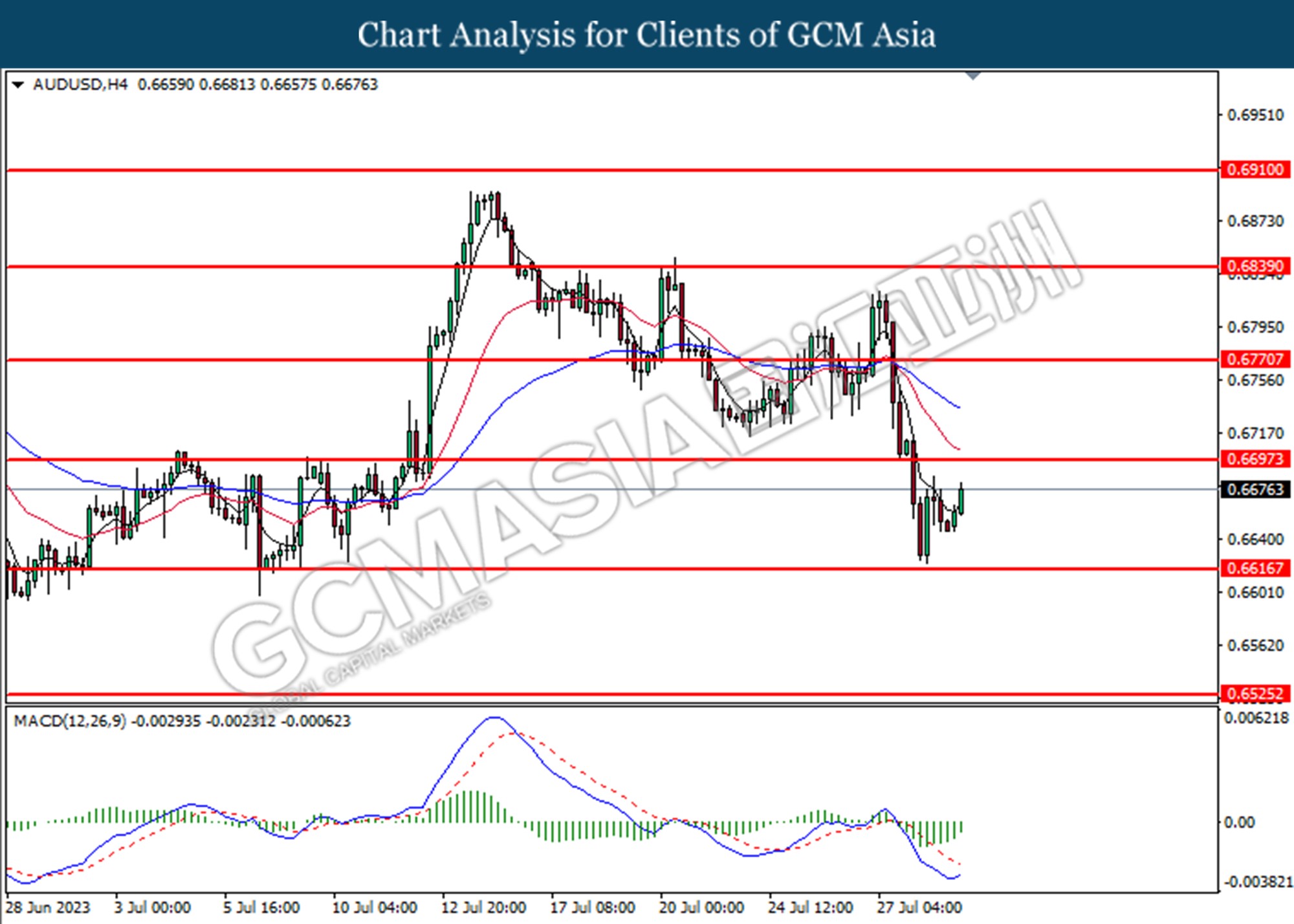

AUDUSD, H4: AUDUSD was traded higher following the prior rebound for the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6700.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

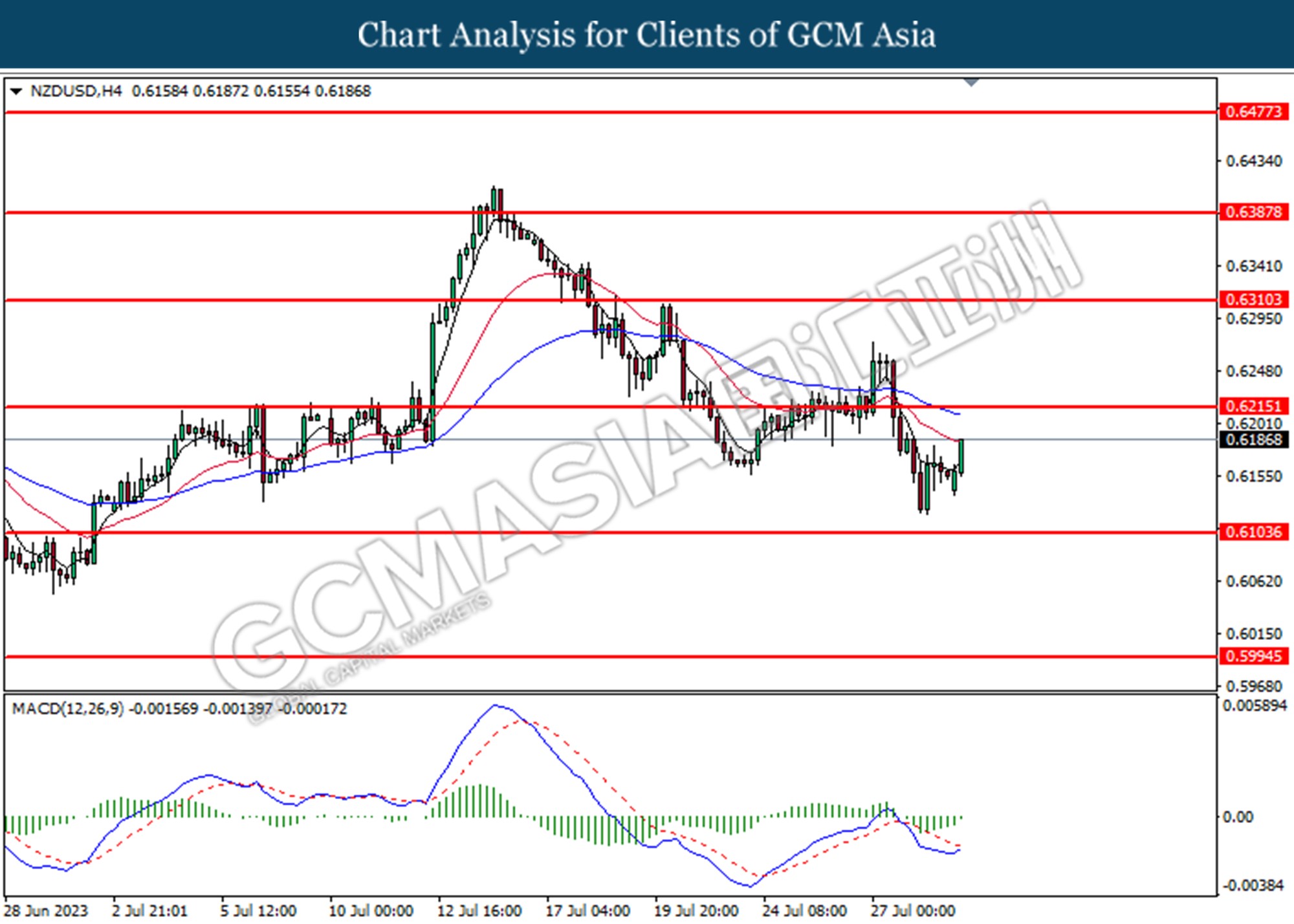

NZDUSD, H4: NZDUSD was traded higher following the rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6215.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

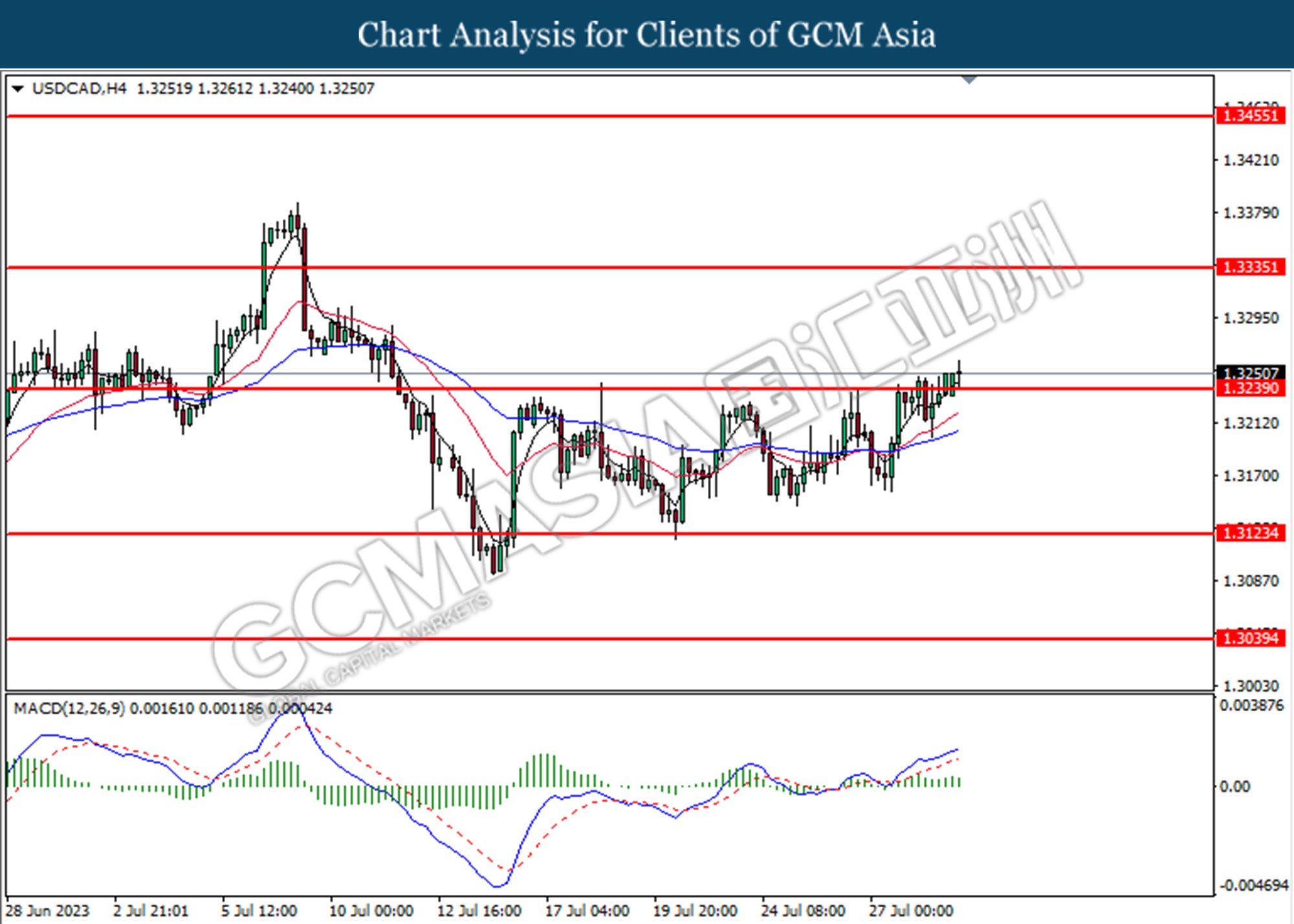

USDCAD, H4: USDCAD was traded higher following the prior breaks above the previous resistance level at 1.3240. MACD illustrated bullish momentum suggests the pair extended its gains toward the next resistance level at 1.3335.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3125

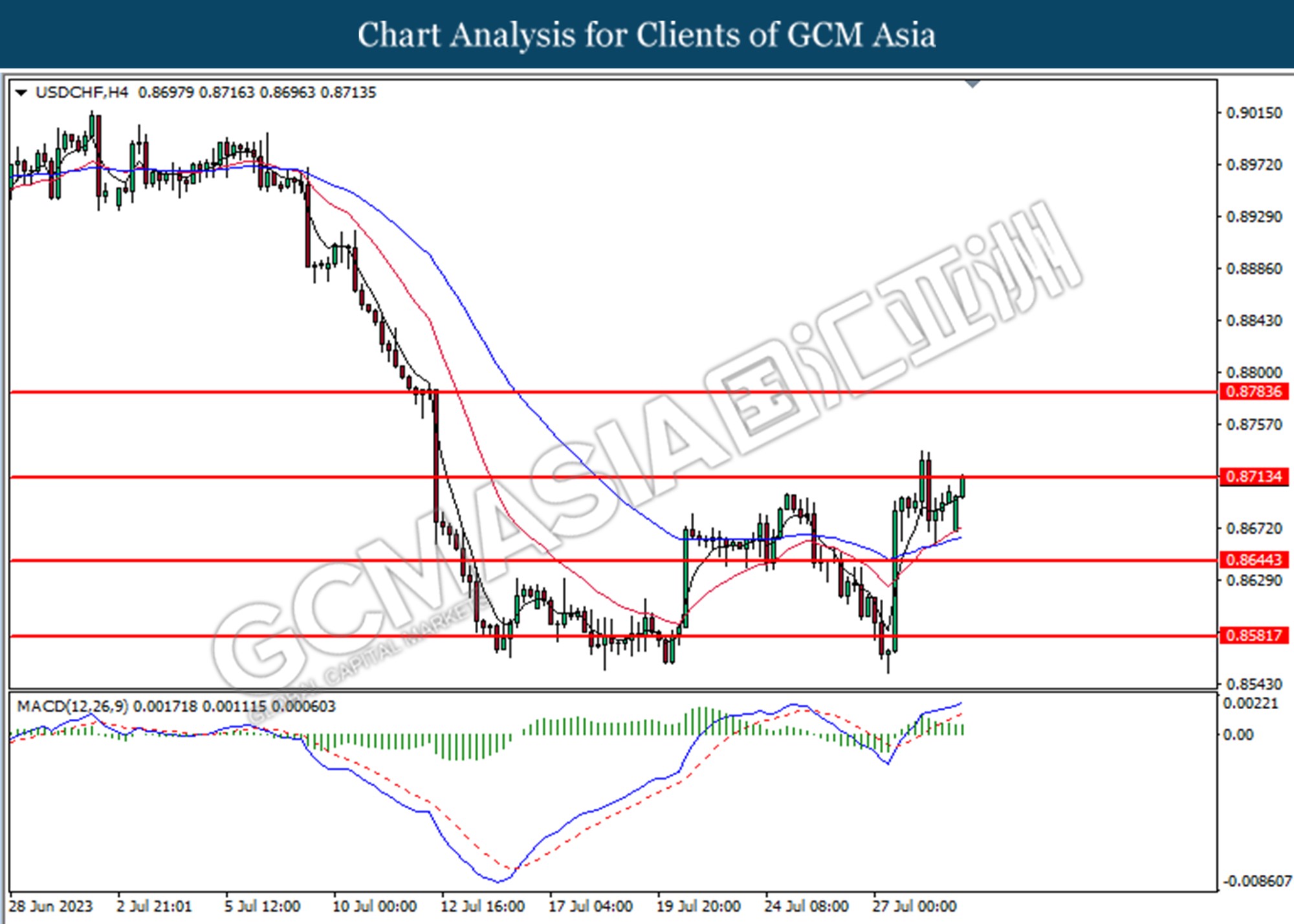

USDCHF, H4: USDCHF was traded higher while currently testing for the resistance level at 0.8715. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.8715, 0.8785

Support level: 0.8645, 0.8580

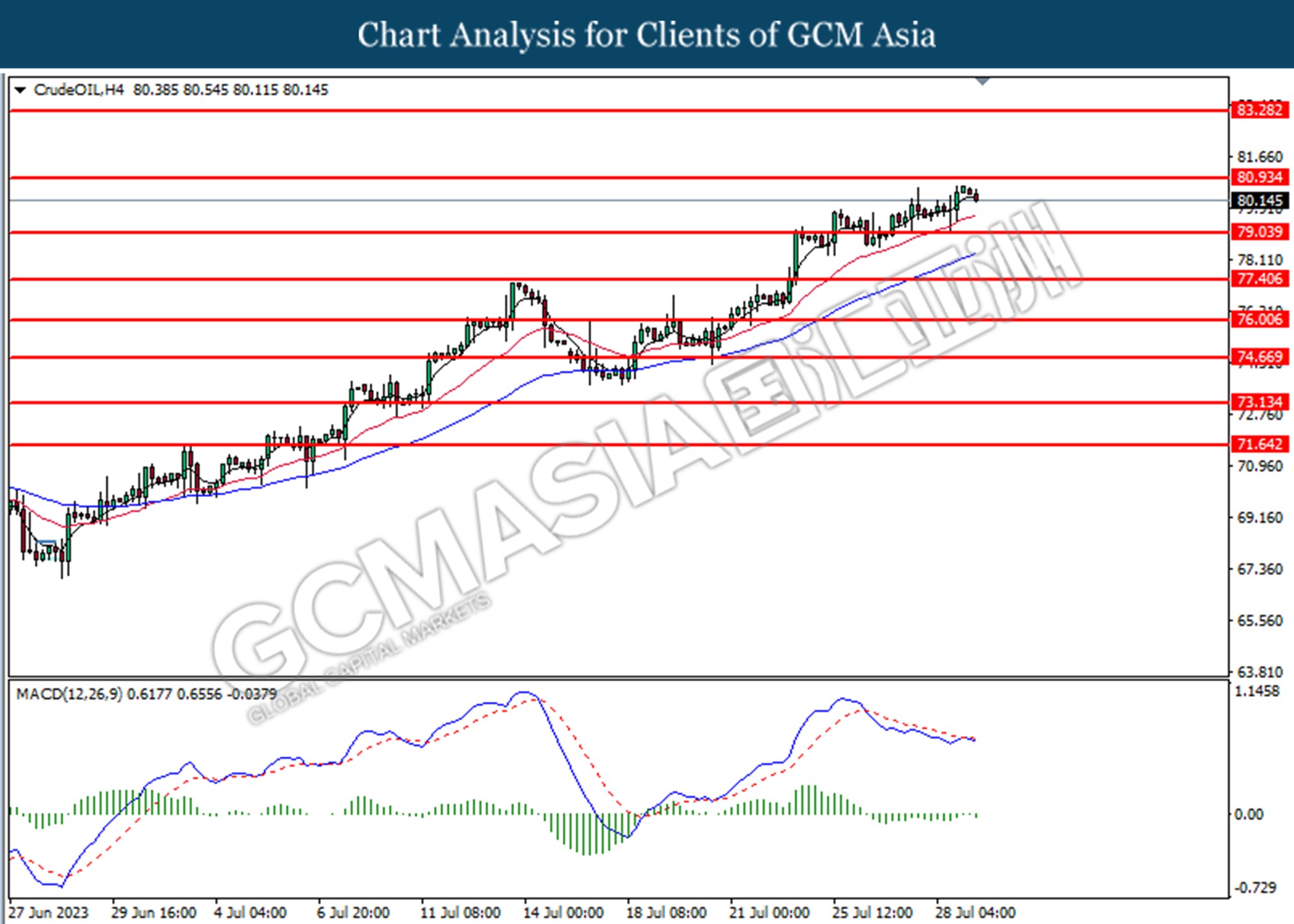

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 80.95, 83.30

Support level: 79.05, 77.40

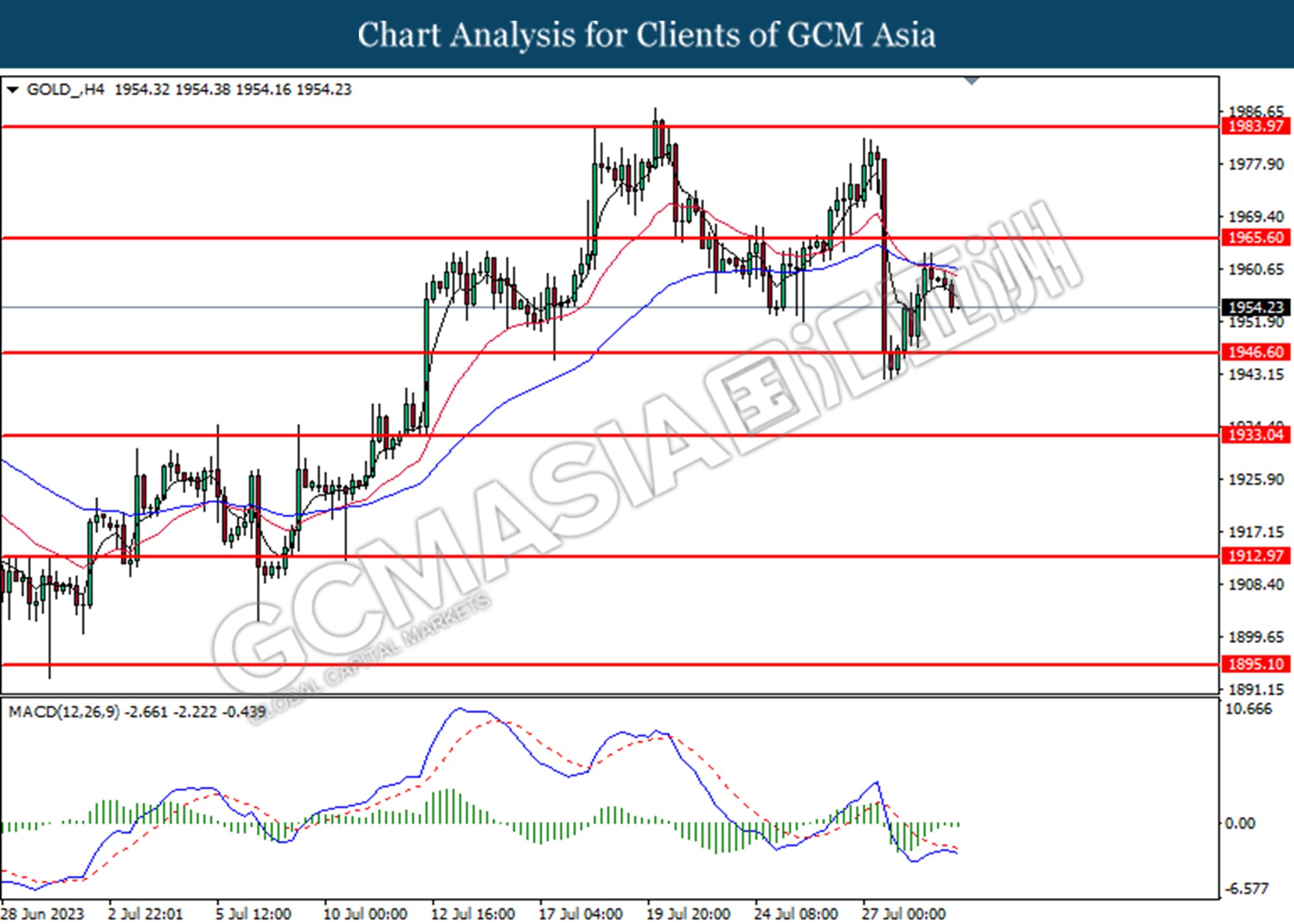

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 1965.60, 1984.00

Support level: 1946.60, 1933.05