31 July 2023 Morning Session Analysis

The US dollar dipped amid further signs that inflation is easing.

The dollar index, which was traded against a basket of six major currencies, failed to extend its prior rallies as the latest US inflation data showed a further sign of easing. In June, the annual U.S. inflation saw its smallest increase in over two years, with underlying price pressures showing moderation. If this trend continues, it might bring the Federal Reserve closer to ending its aggressive interest rate hike cycle. The positive outlook on inflation was reinforced by additional data on Friday, indicating that labor costs experienced their smallest rise in two years during the second quarter, with wage growth cooling down. This aligns with previous reports this month, highlighting the economy’s shift towards disinflation, with consumer prices moderating notably in June and producer inflation remaining subdued. Excluding volatile food and energy components, the PCE price index saw a 0.2% increase after rising 0.3% in the previous month. This led to a year-on-year rise of 4.1% in the core PCE price index, marking the smallest increase since September 2021. In May, the annual core PCE price index had climbed by 4.6%. The decelerating trends in inflation, wages, and expected slowdown in spending all support the belief that the recent rate hike is likely the last one for now. As of writing, the dollar index dropped -0.07% to 101.70.

In the commodities market, crude oil prices were up by 1.08% to $80.70 per barrel as the US dollar eased further following the announcement of inflation data, which prompted the investors to rush into the oil market. Besides, gold prices surged by 0.05% to $1960.05 per troy ounce amid positive outlook on easing of inflation.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Jul) | 5.5% | 5.3% | – |

Technical Analysis

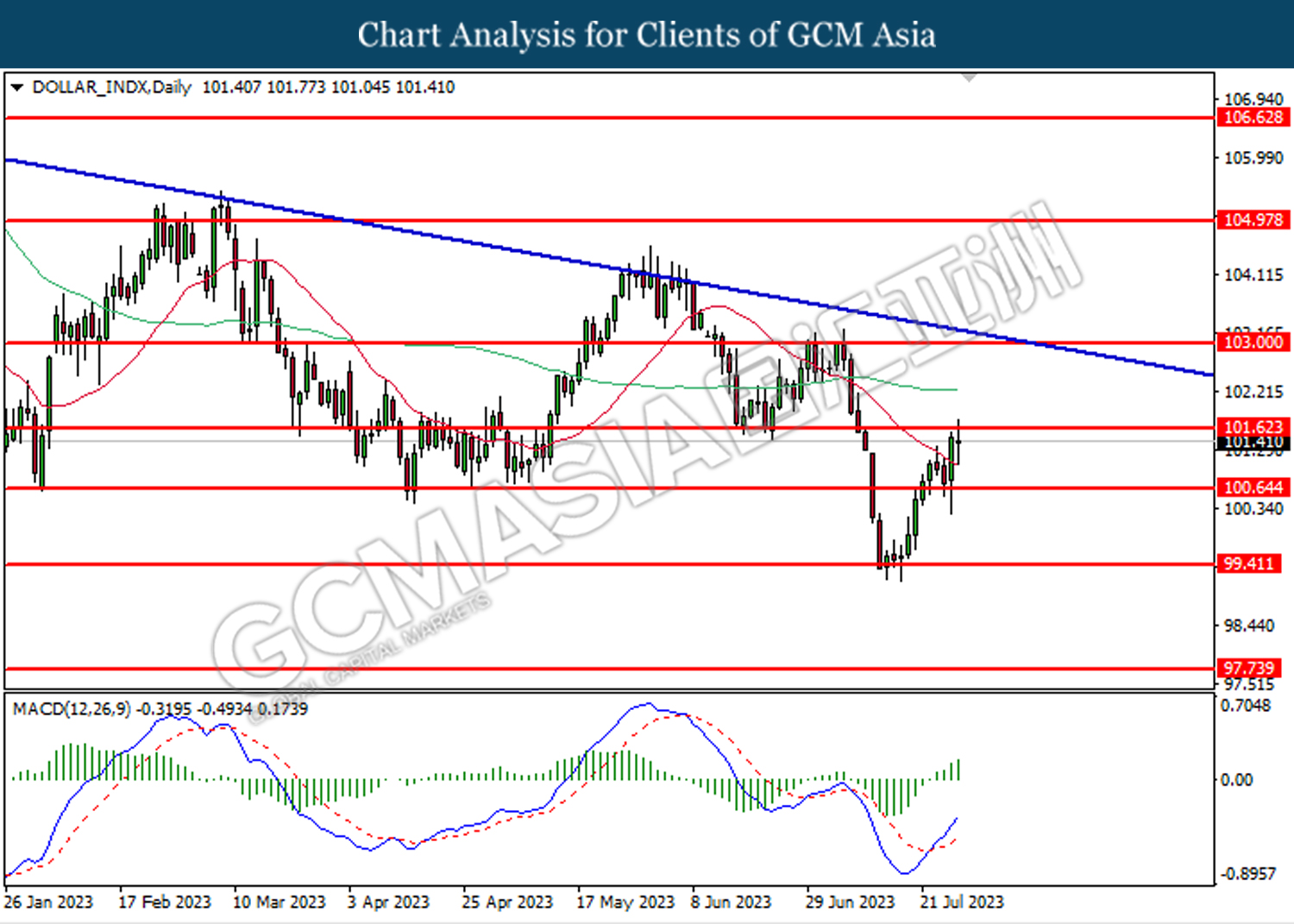

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 101.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.60, 103.00

Support level: 100.65, 99.40

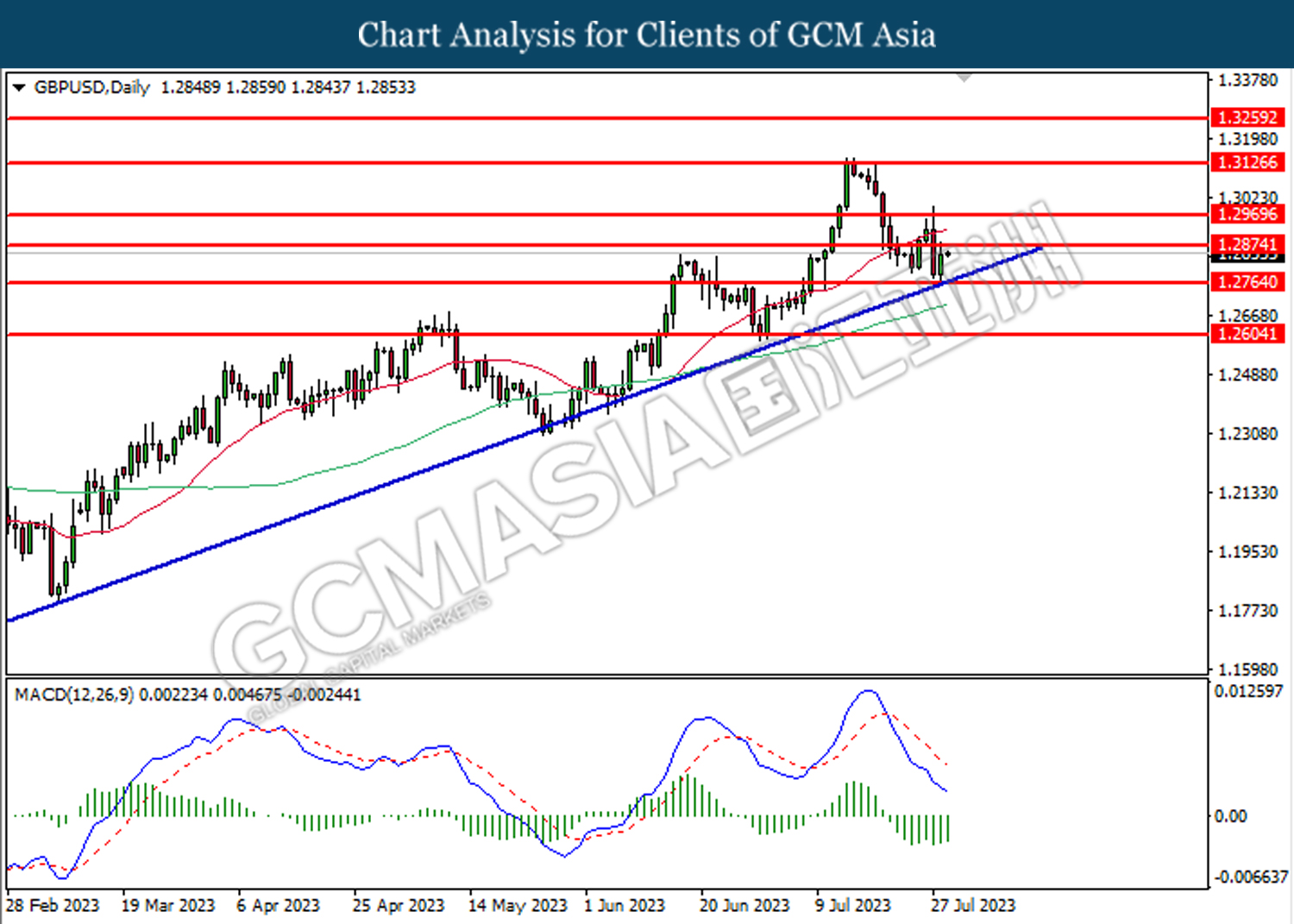

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2875. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

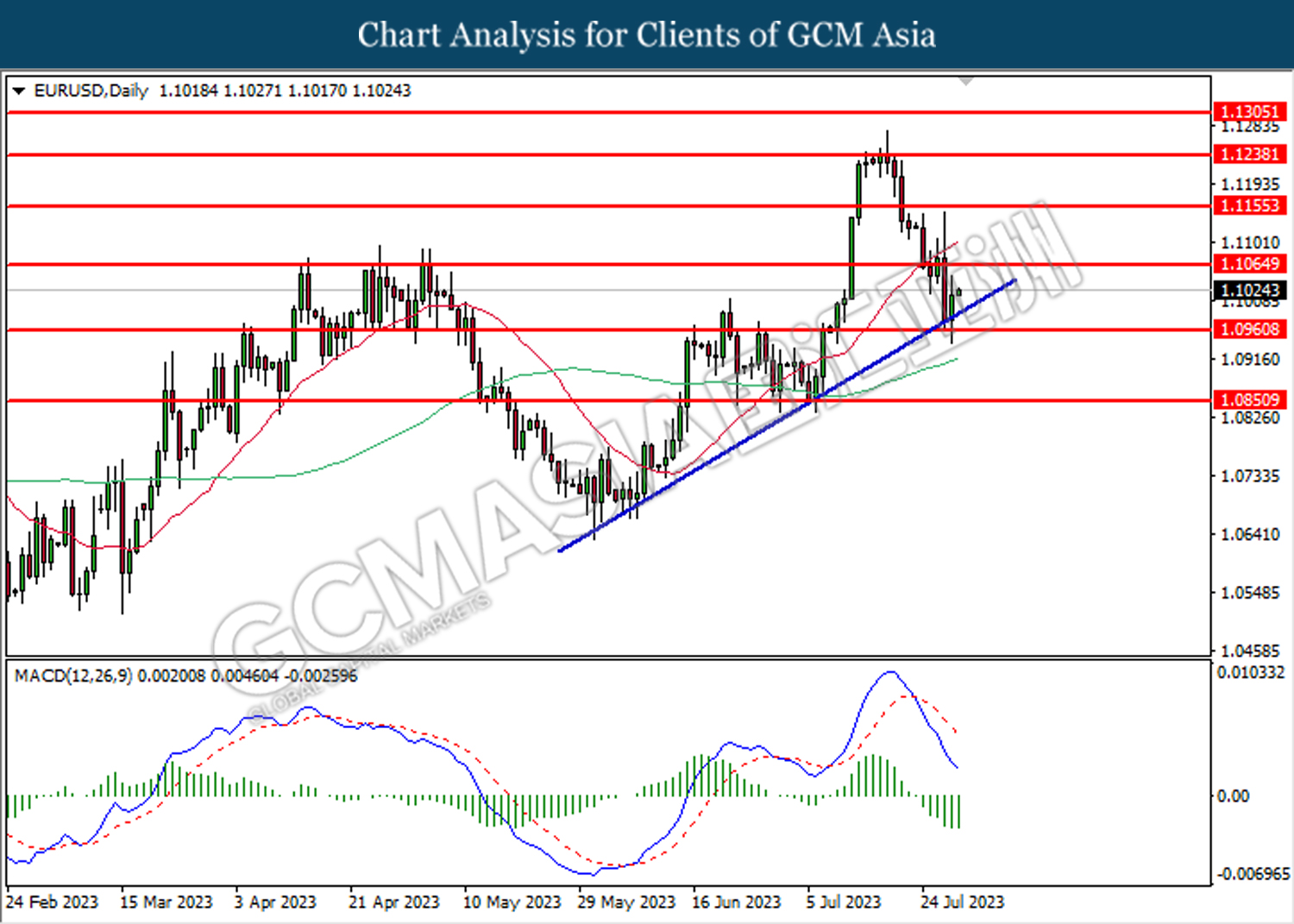

EURUSD, Daily: was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

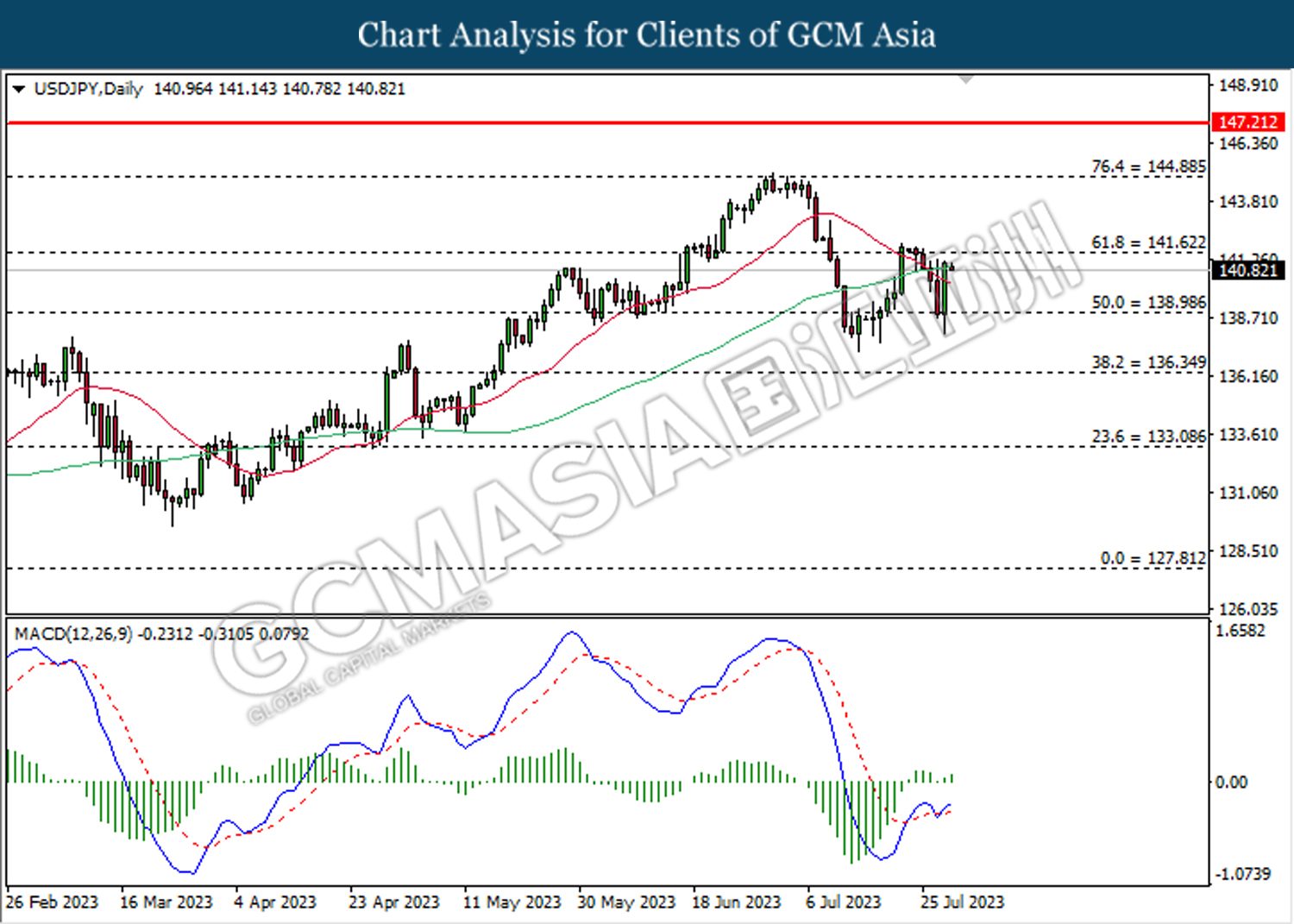

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 139.00. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 141.60.

Resistance level: 141.60, 144.90

Support level: 139.00, 136.35

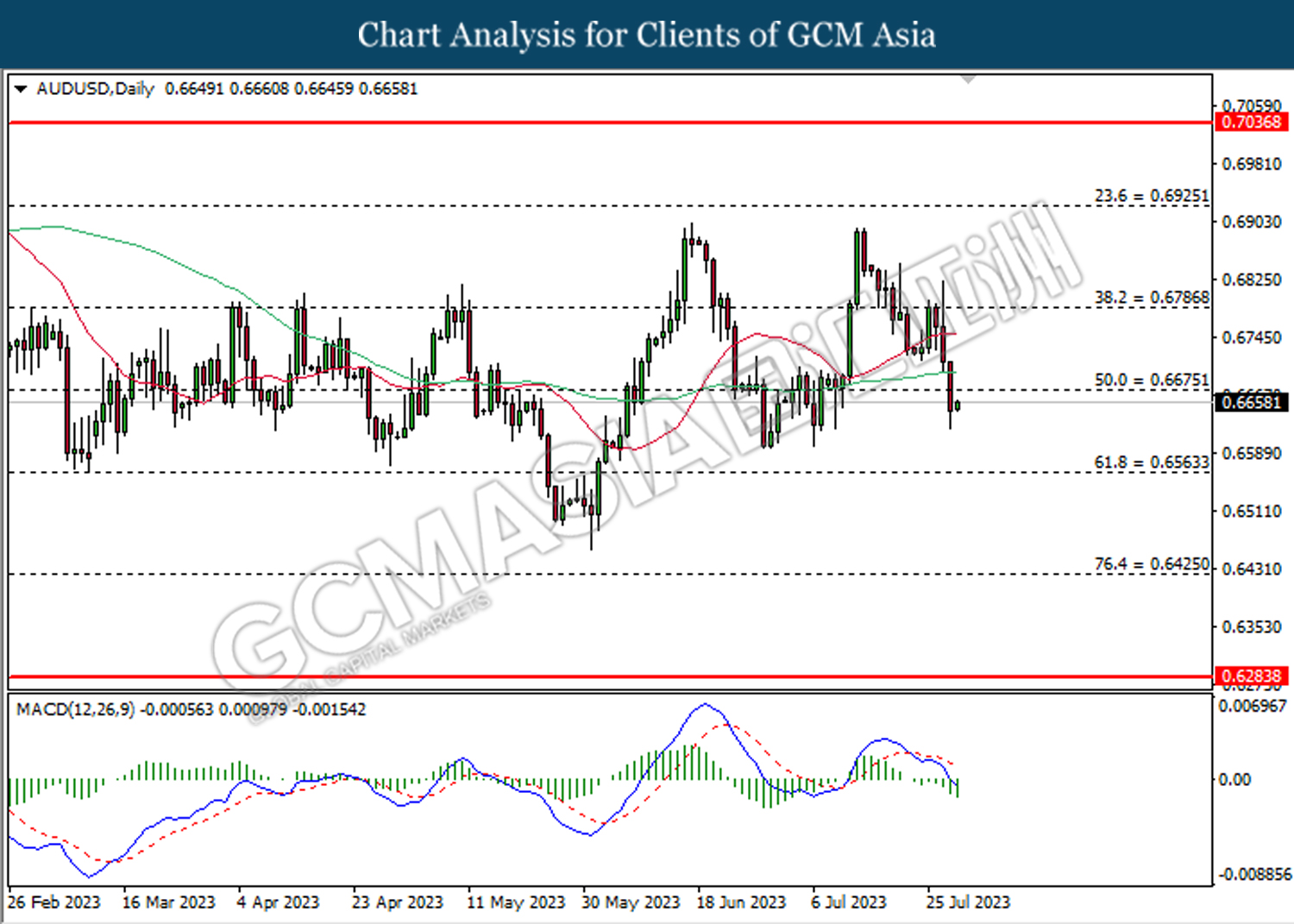

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

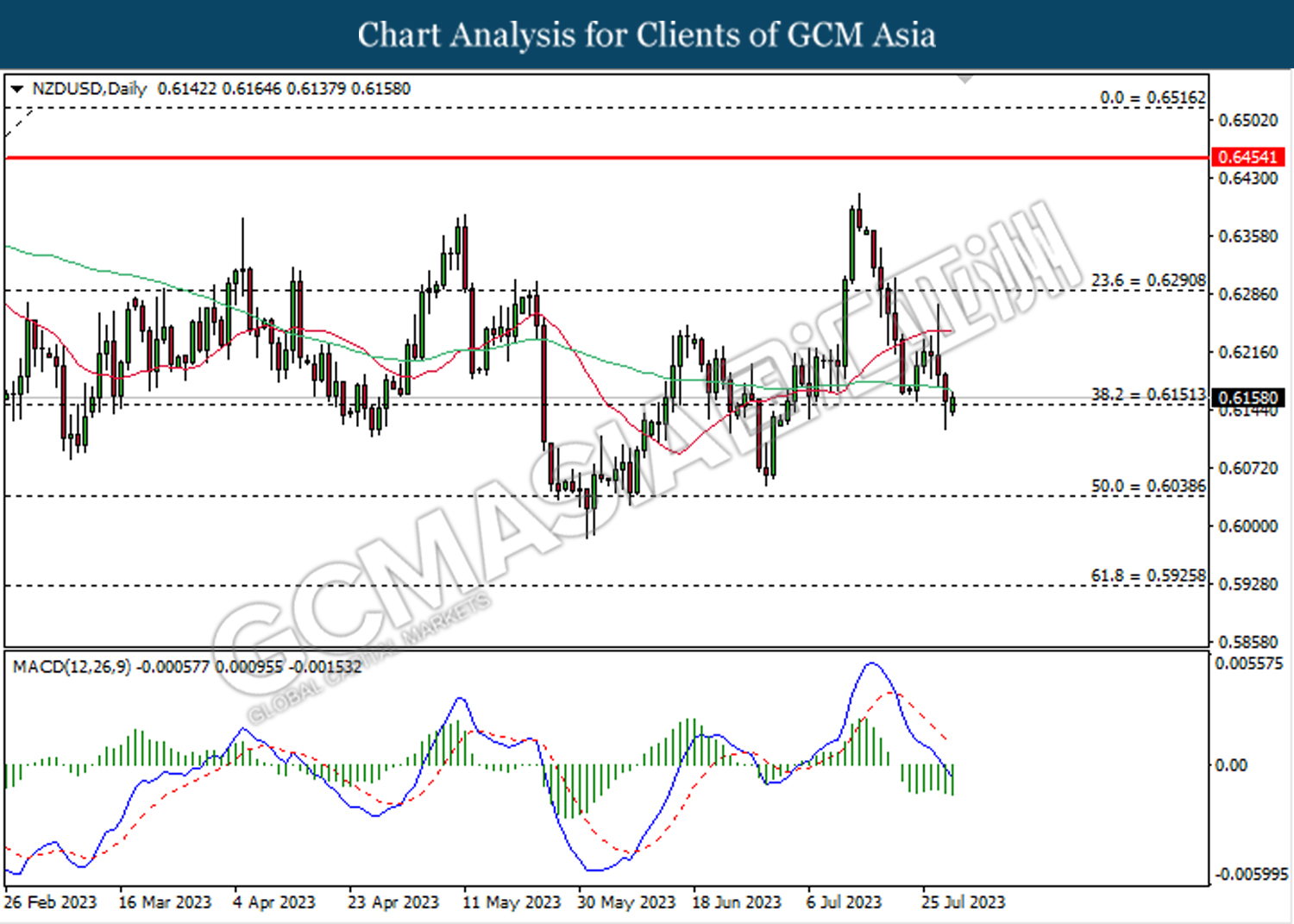

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

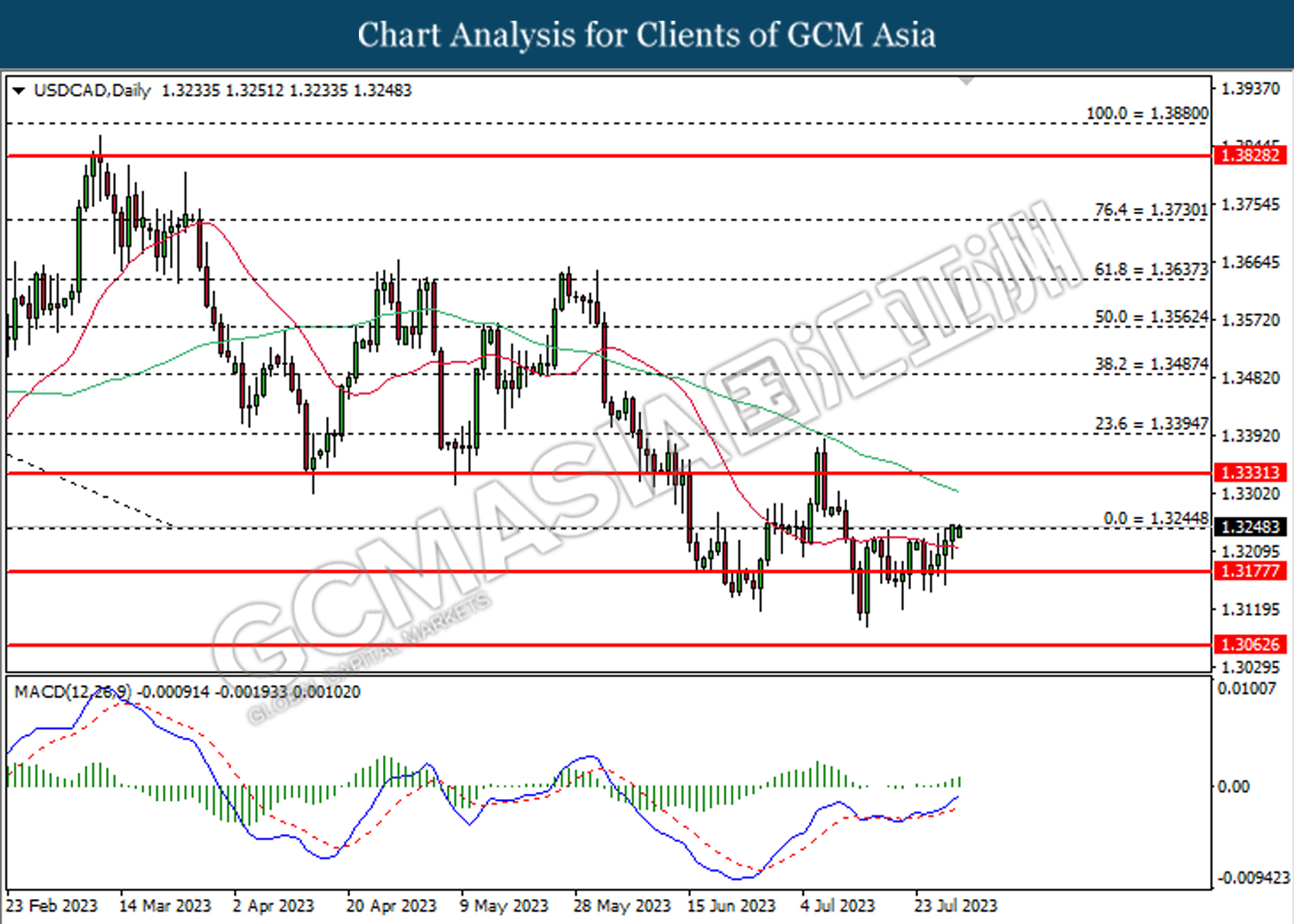

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

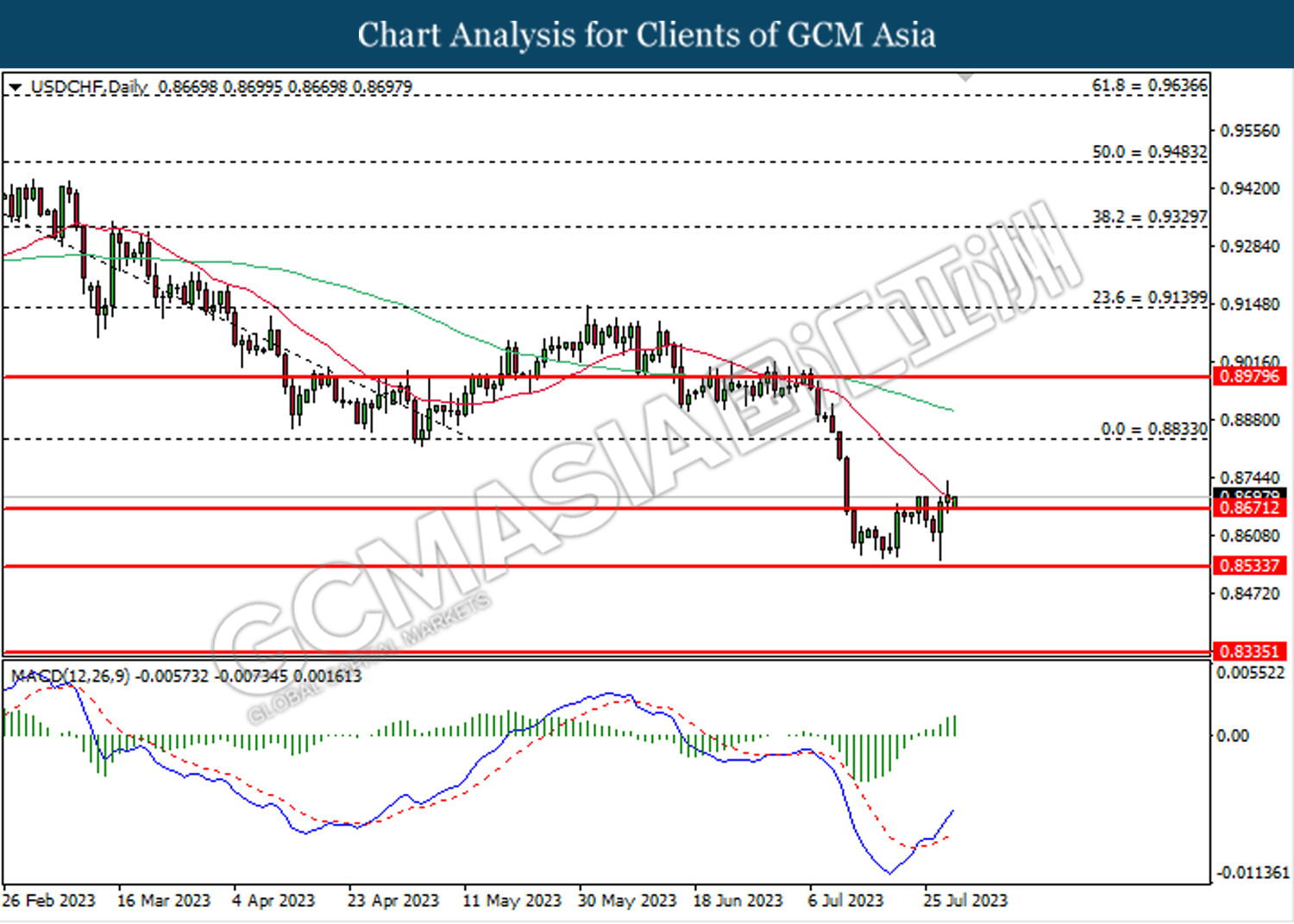

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.8835.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

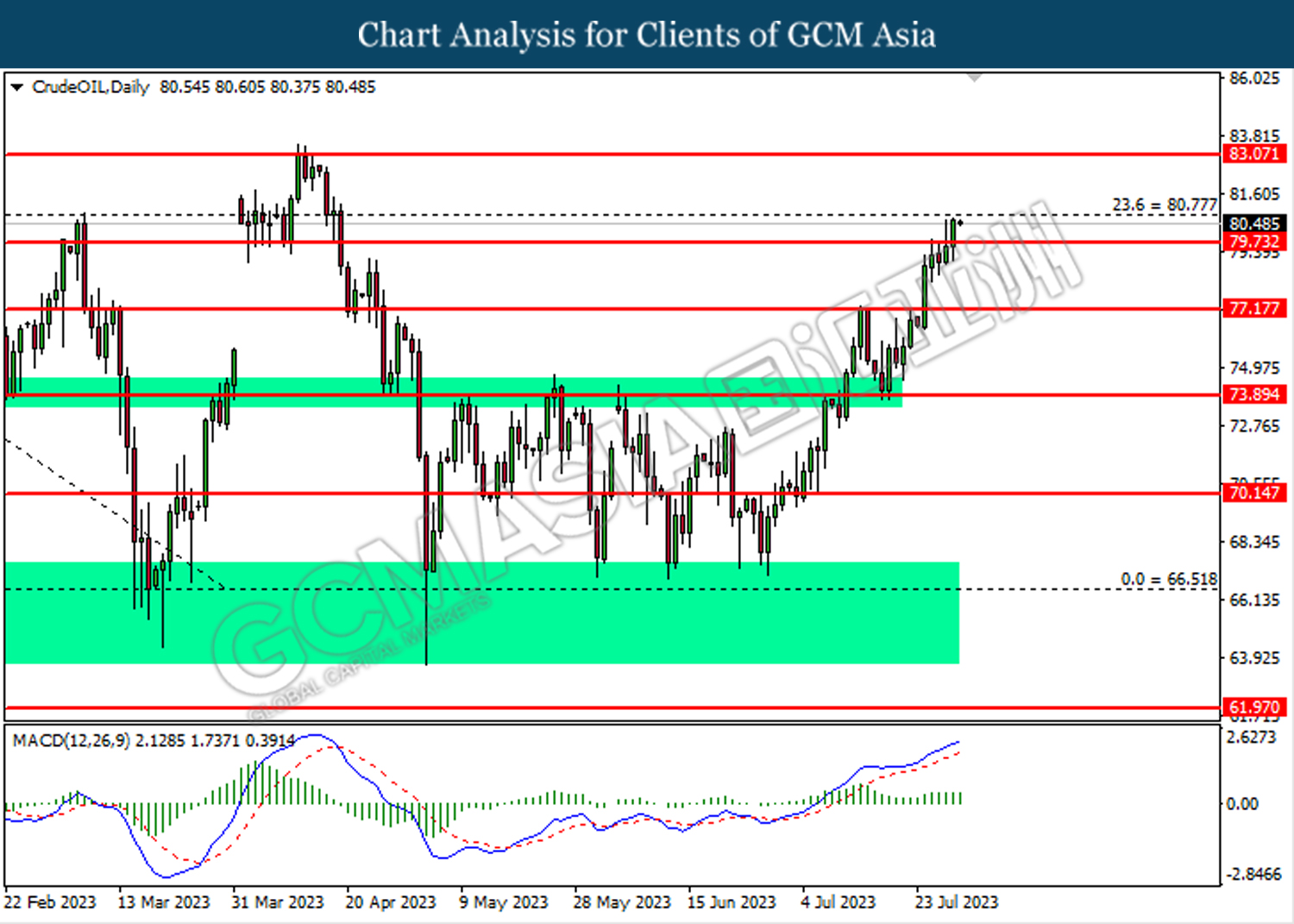

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 80.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 80.75, 83.05

Support level: 79.75, 77.15

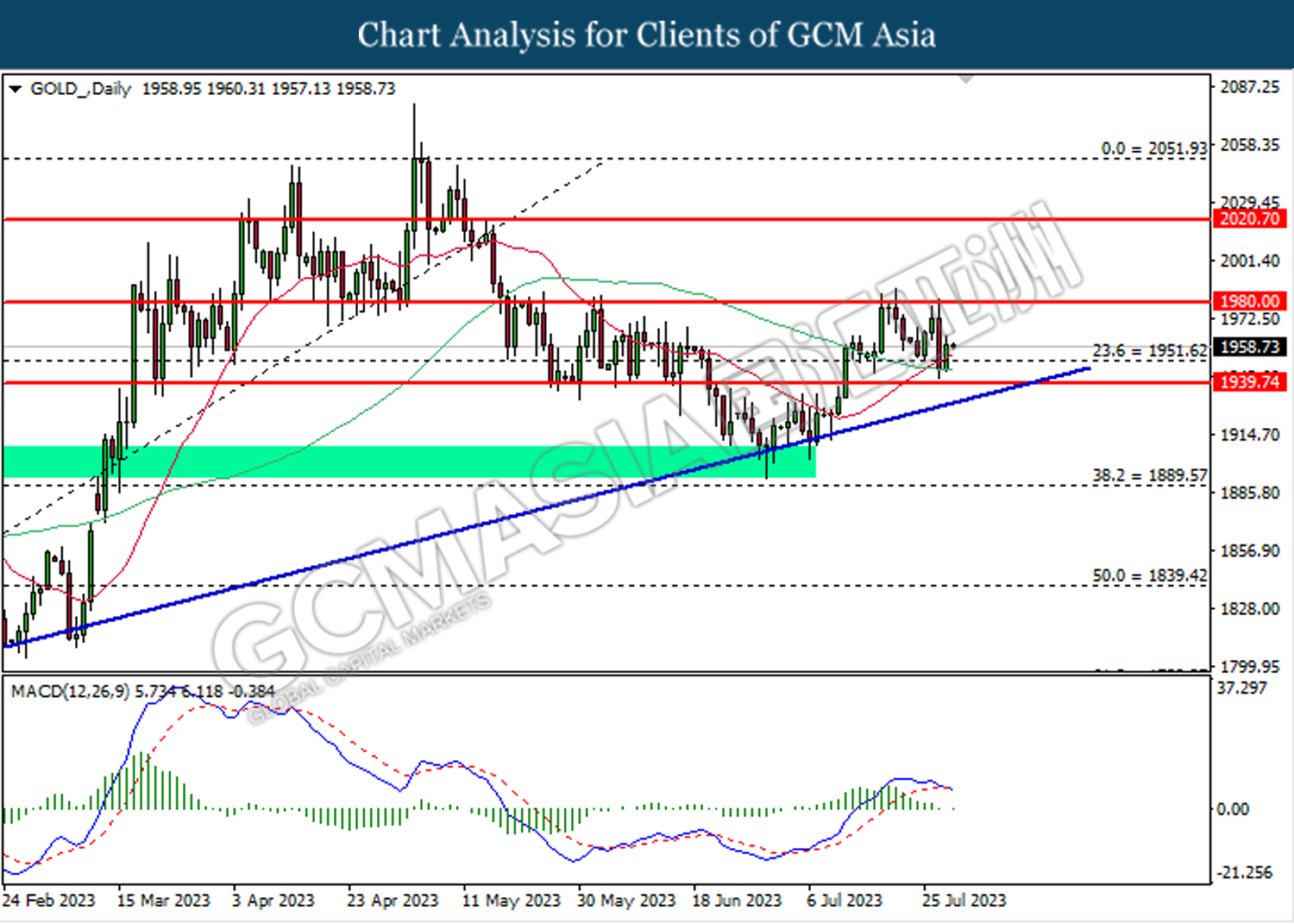

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1951.60. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75