300922 Afternoon Session Analysis

30 September 2022 Afternoon Session Analysis

Greenback plunged amid mixed market sentiment.

The dollar index, which was traded against a basket of six major currencies, extended its losses for the second consecutive days after a series of economic data disrupted the market sentiment of the dollar index. According to the Bureau of Economic Analysis, the US GDP data for quarter from April through June came in at -0.6%, in line with the market economist’s expectation, mirroring the on-track recovery was undergoing in the post-pandemic US amid massive fiscal stimulus. Besides, the US Initial Jobless Claims also posted a lower-than-expected reading over the past one week. According to the Department of Labor, the US Initial Jobless Claims came in at 193K, lower than the economist forecast at 215K, showing that the US labor market remains resilience. Despite that, the bull in the dollar market failed to turn its head up amid the appealing of other currencies such as the Pound. As of writing, the dollar index dropped -0.24% to 112.00.

In the commodities market, the crude oil price dropped -0.63% to $81.05 per barrel following the slight rebound of the Greenback value, which diminishing the demand of oil by the non-US buyers. Besides, the gold prices depreciated by -0.05% to $1659.85 per troy ounce as the dollar strengthen.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) | -0.1% | – | – |

| 15:55 | EUR – German Unemployment Change (Sep) | 28K | 20K | – |

| 17:00 | EUR – CPI (YoY) (Sep) | 9.1% | 9.6% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Aug) | 0.1% | 0.4% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Sep) | 59.5 | 59.5 | – |

Technical Analysis

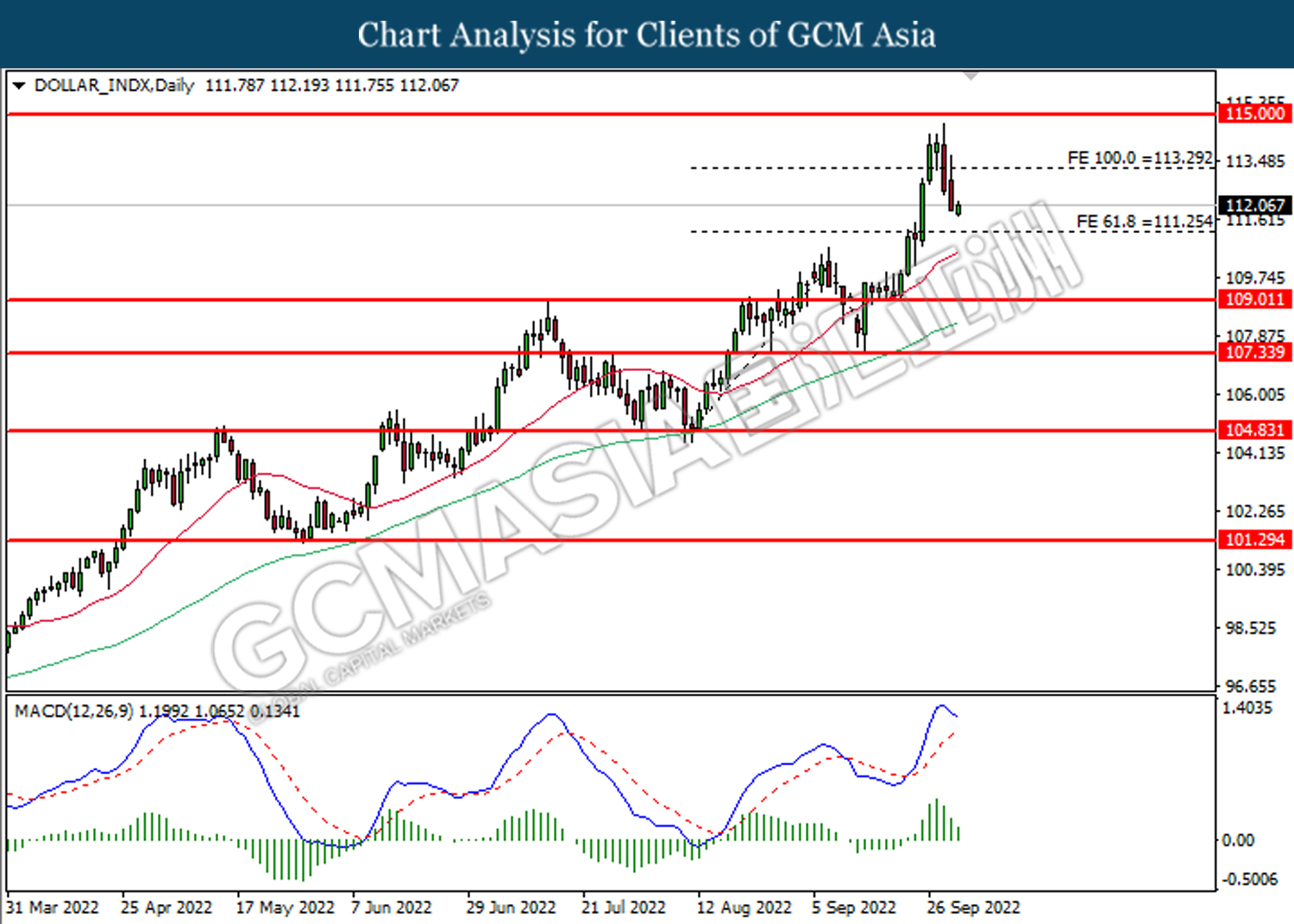

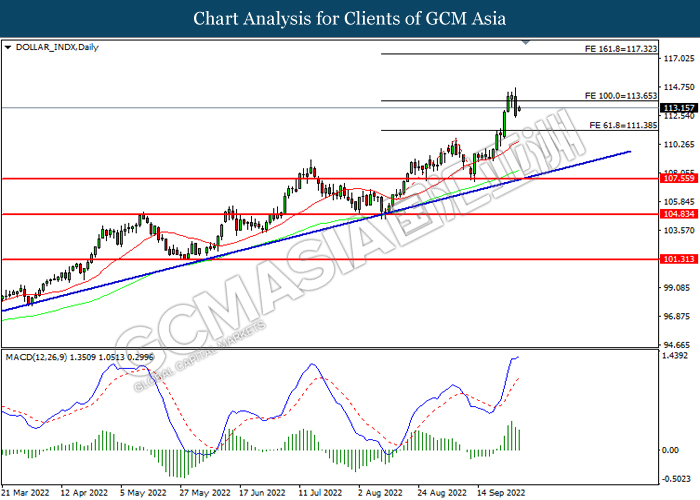

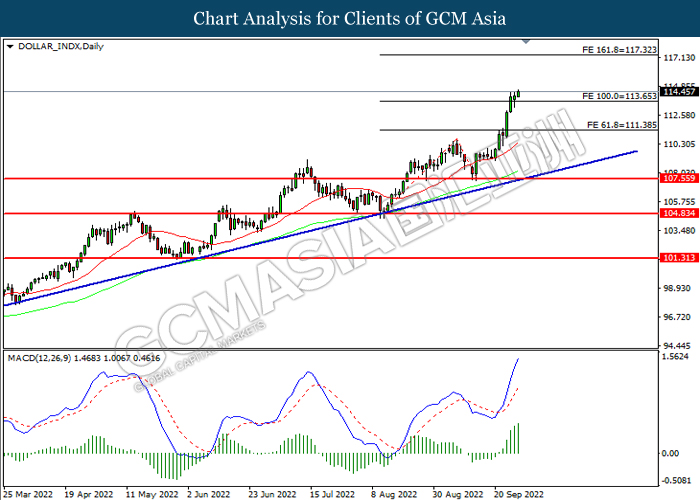

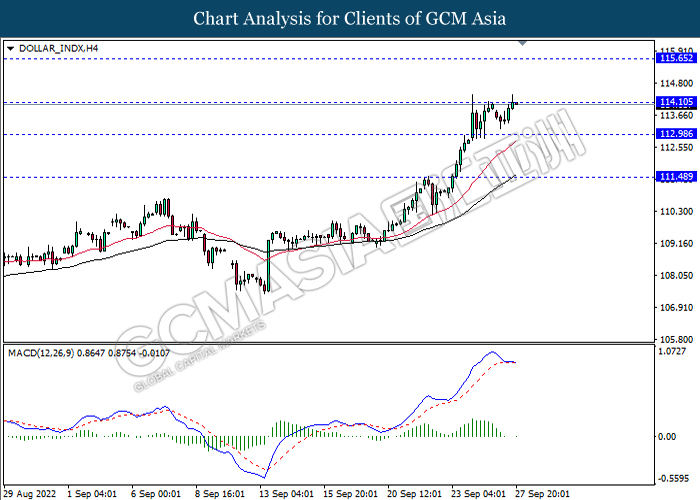

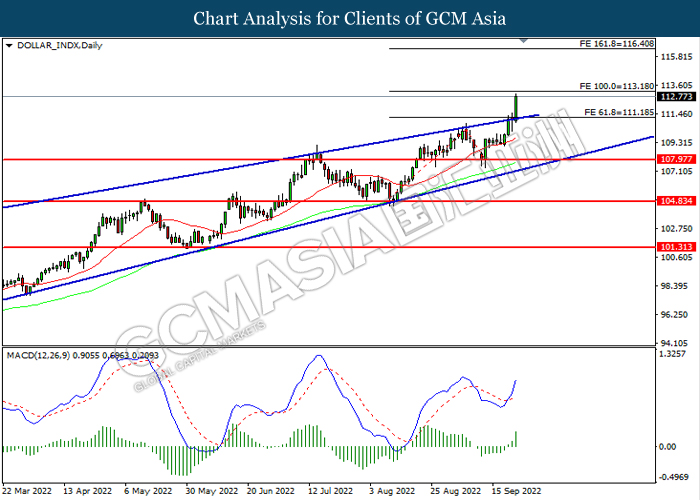

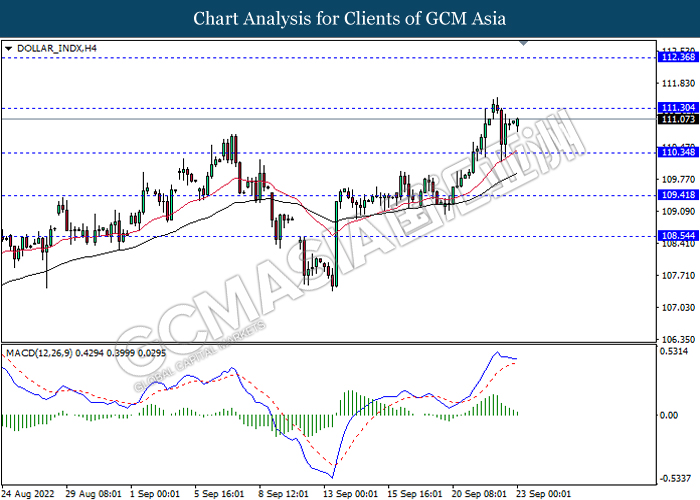

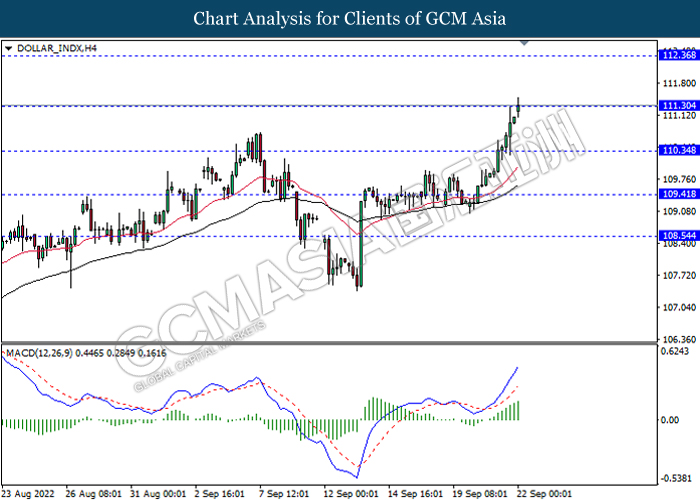

DOLLAR_INDX, Daily: Dollar index was traded lower following a breakout below the previous support level at 113.30. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 111.25.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

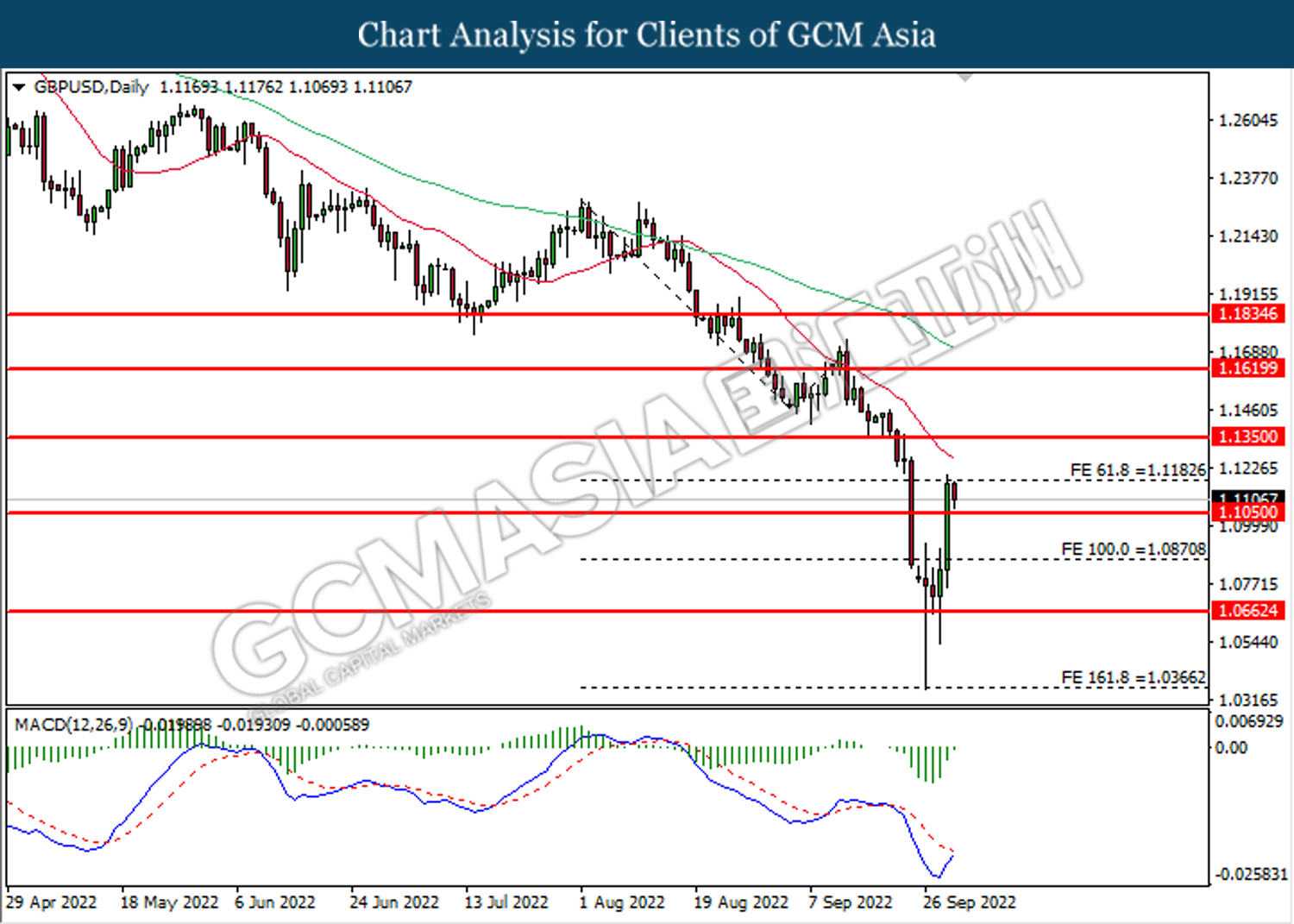

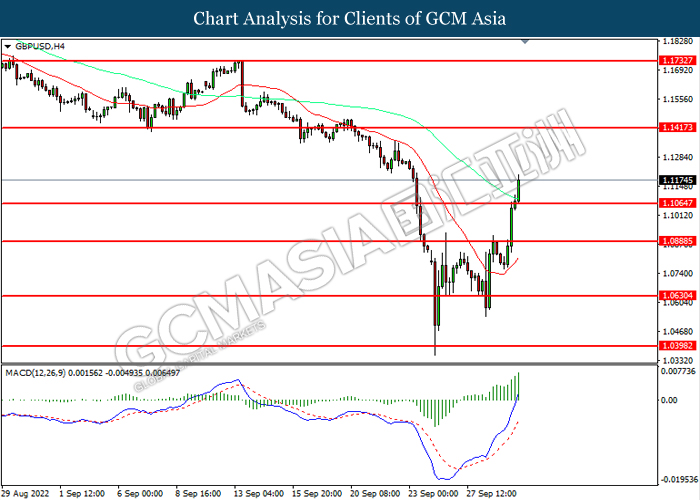

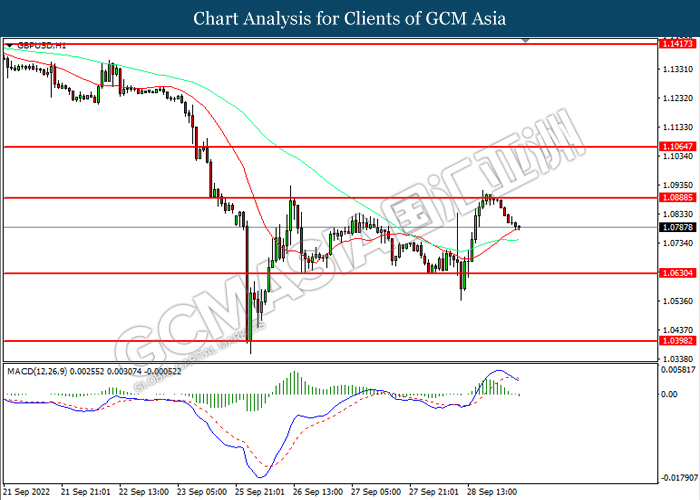

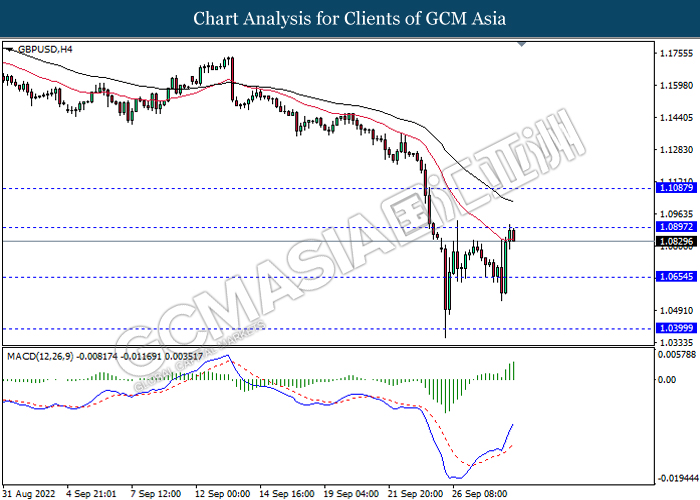

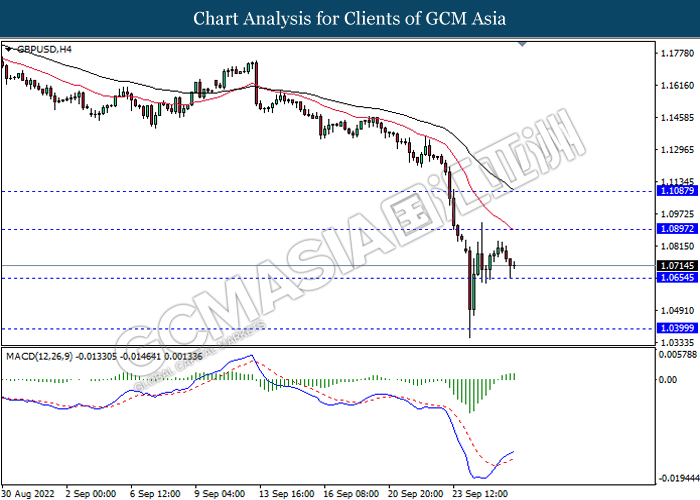

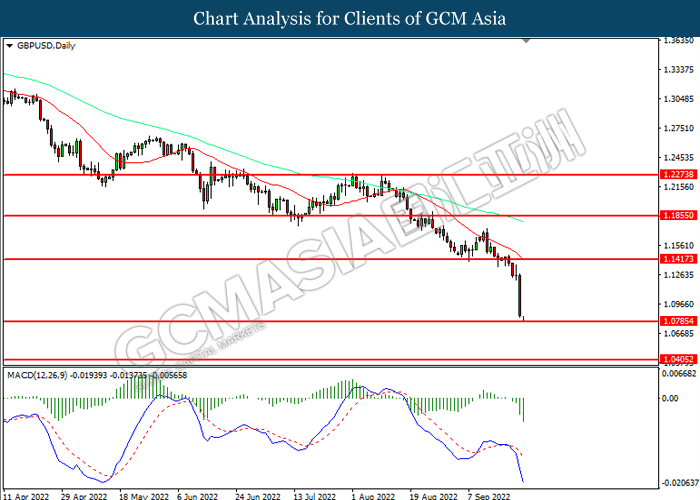

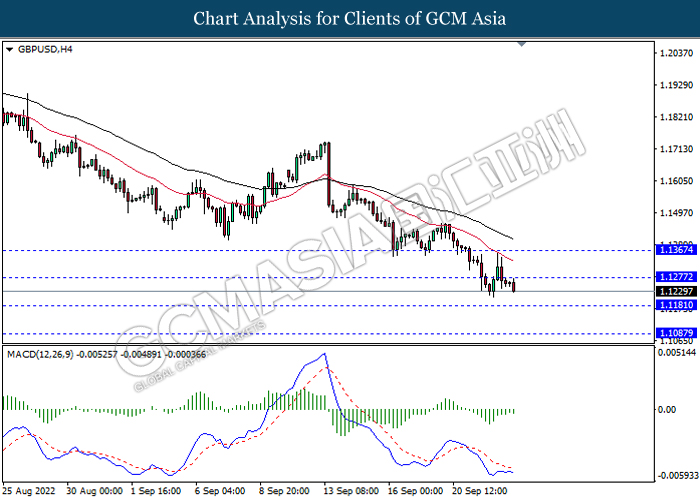

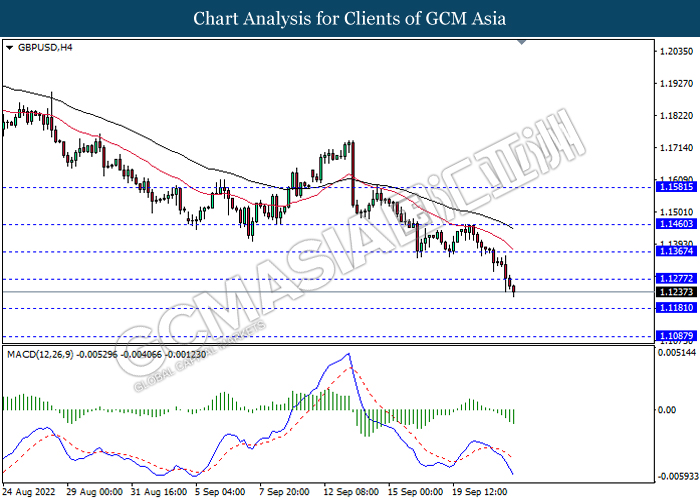

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1185. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1185, 1.1350

Support level: 1.1050, 1.0870

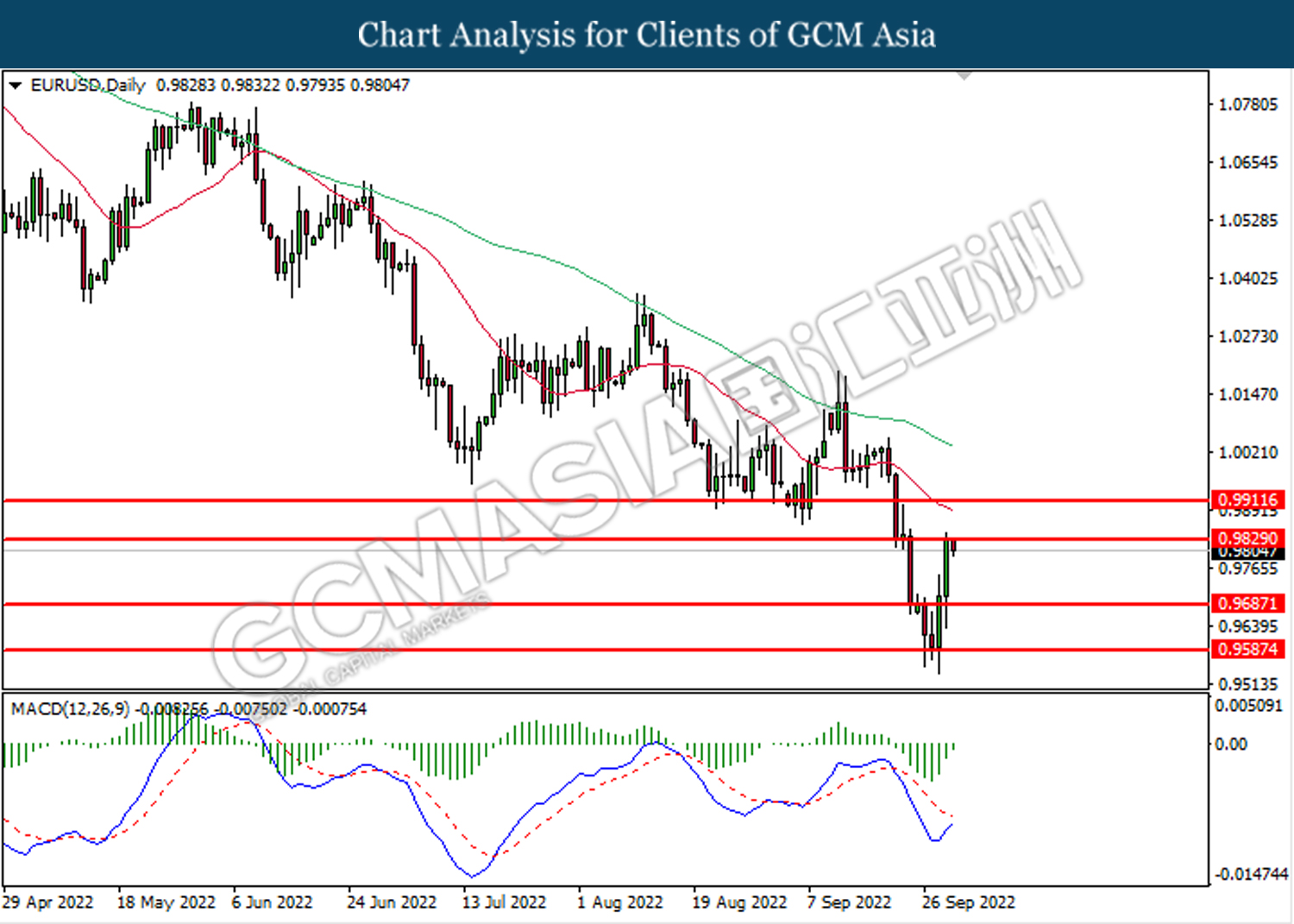

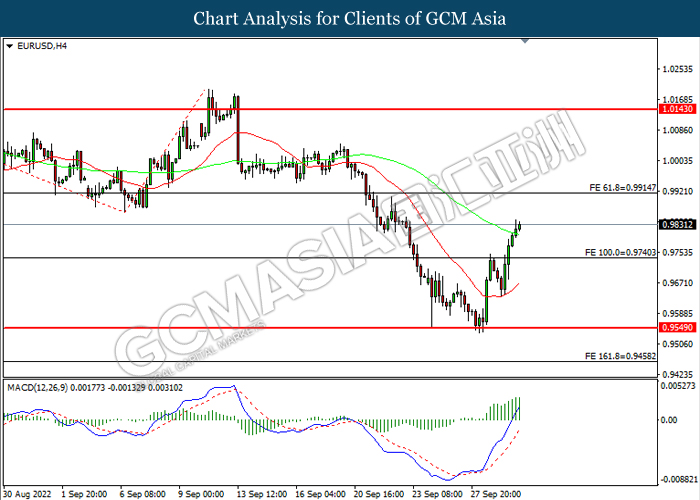

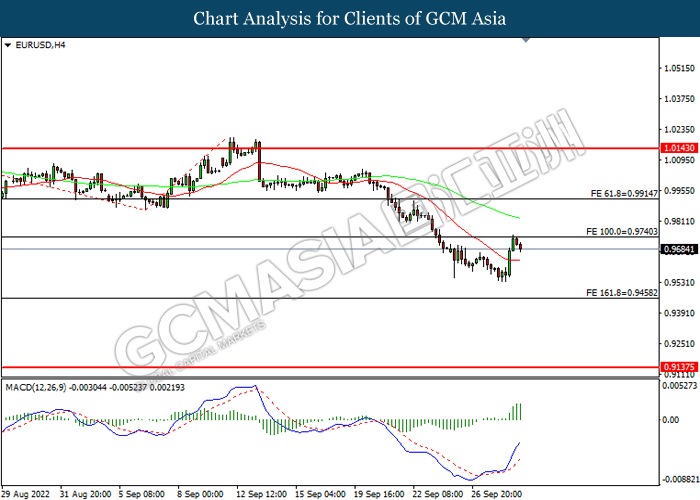

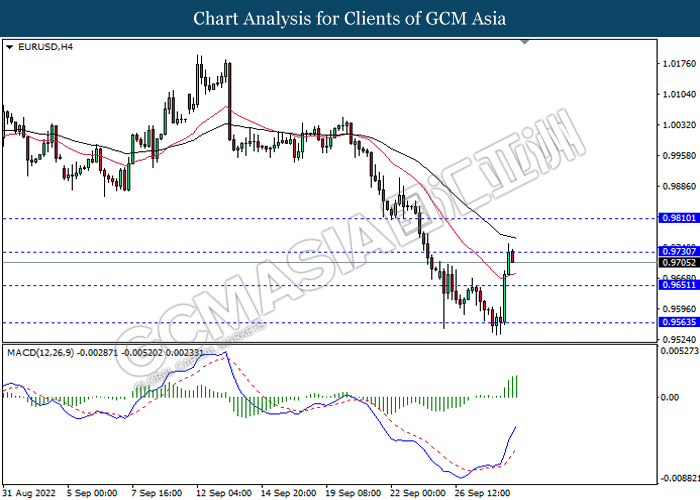

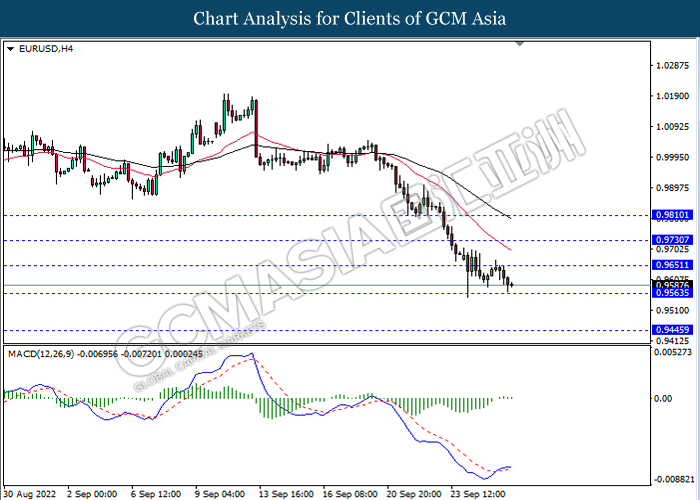

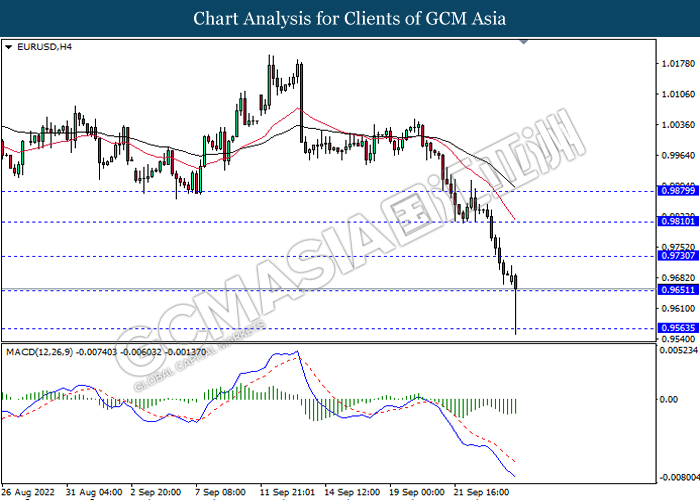

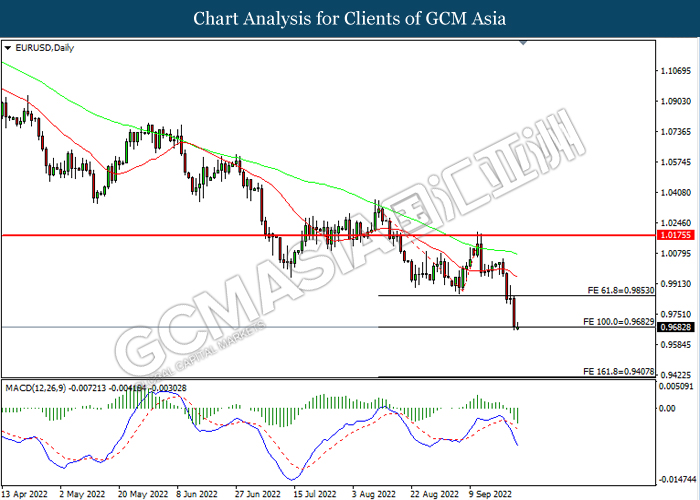

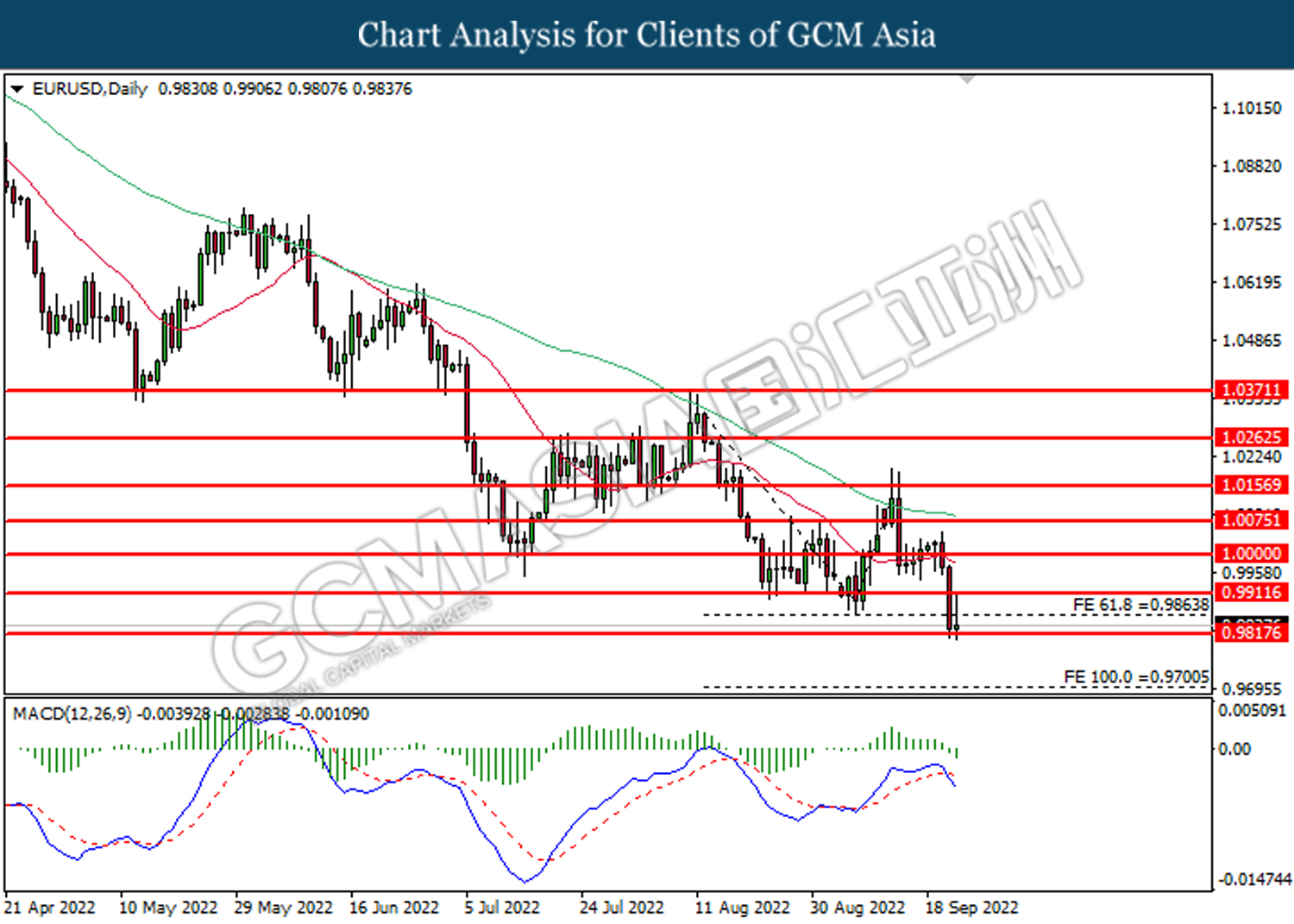

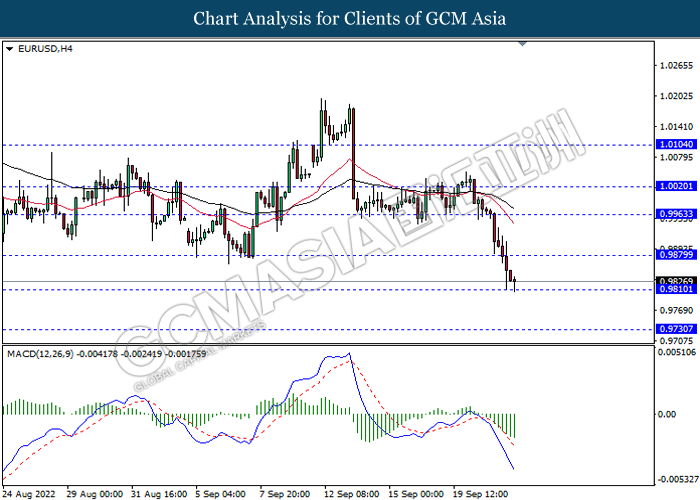

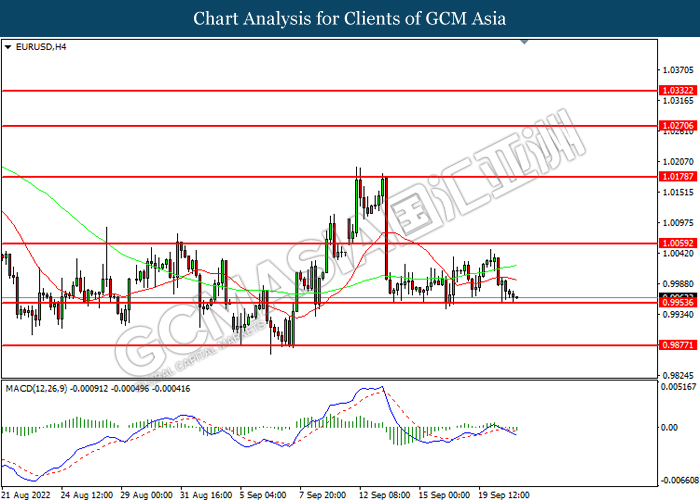

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 0.9830. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

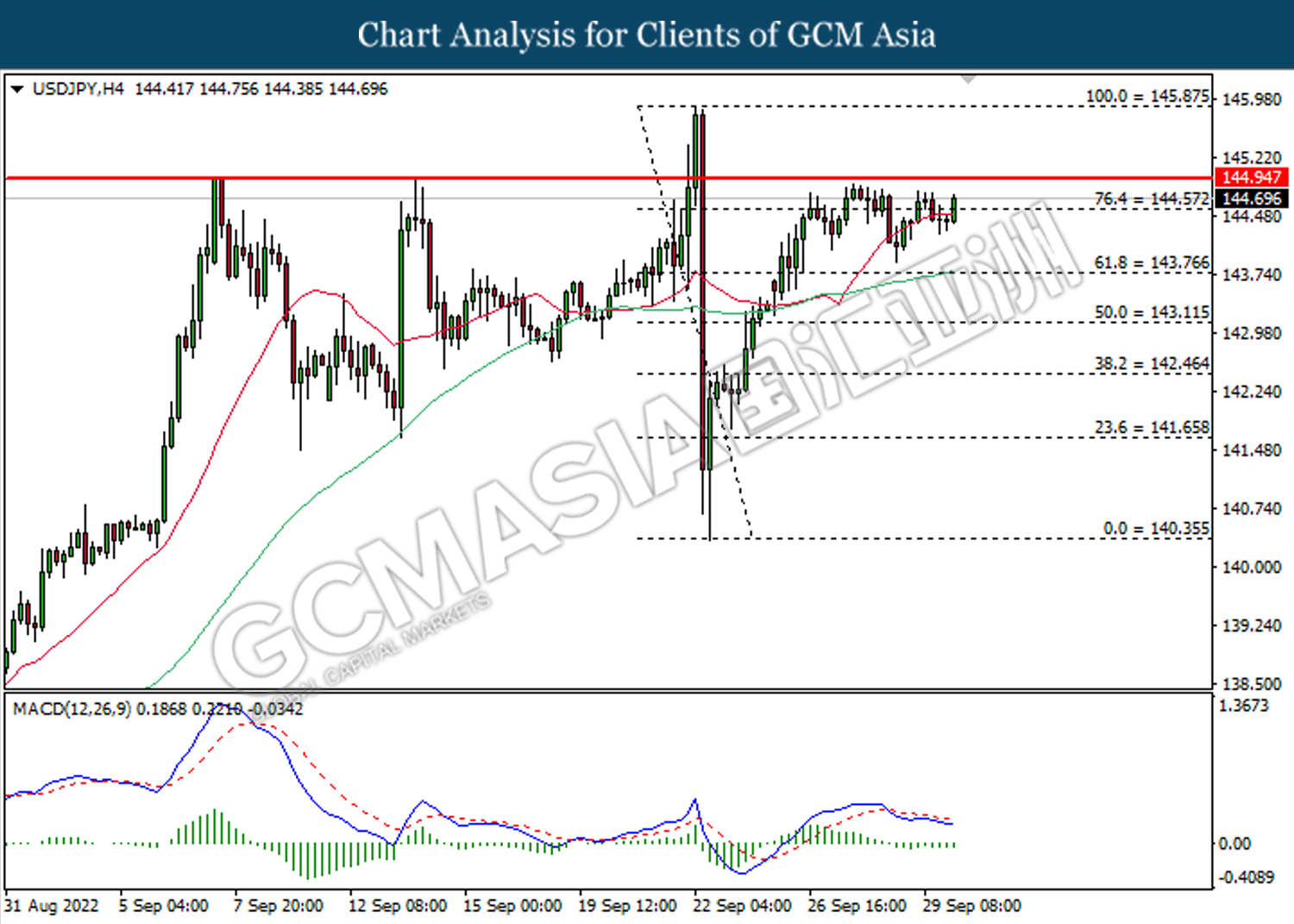

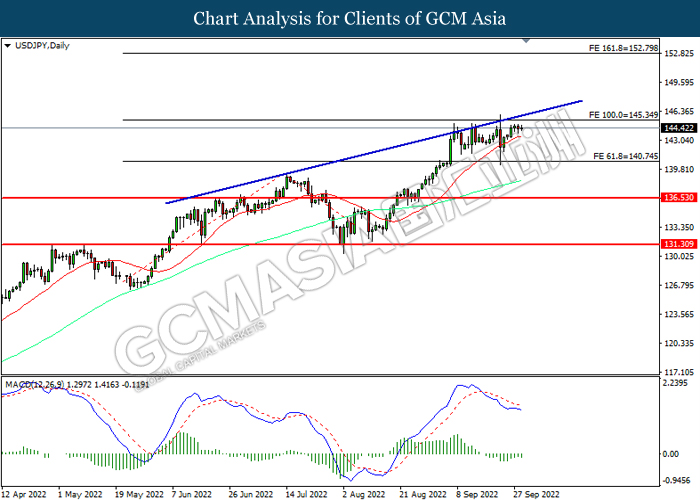

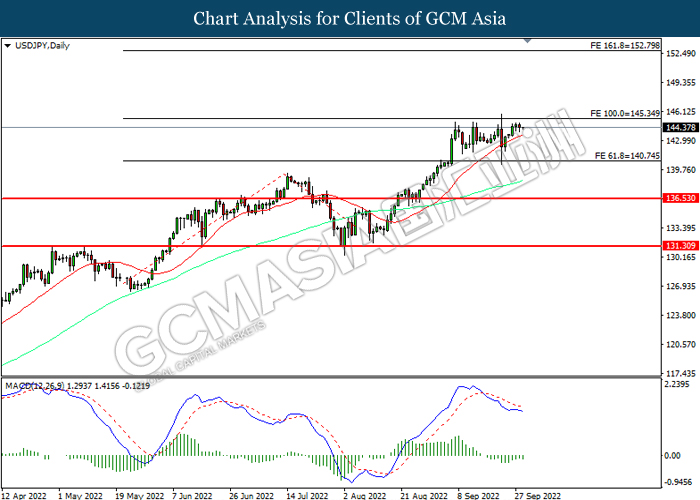

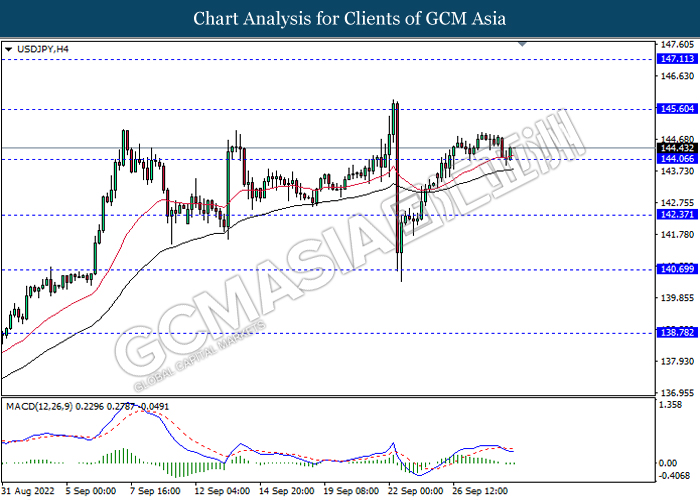

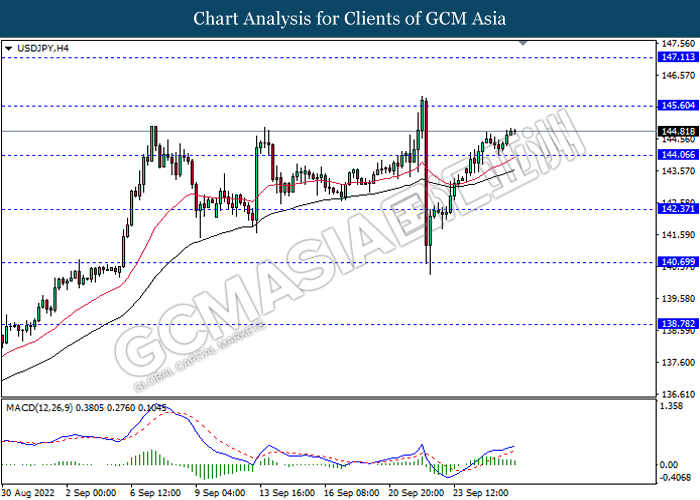

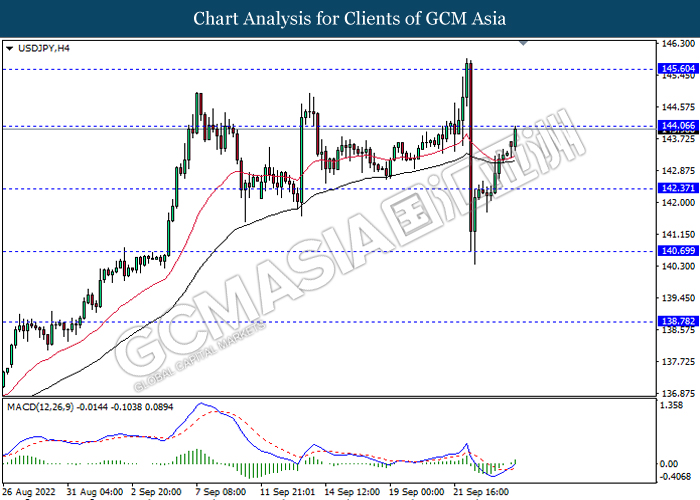

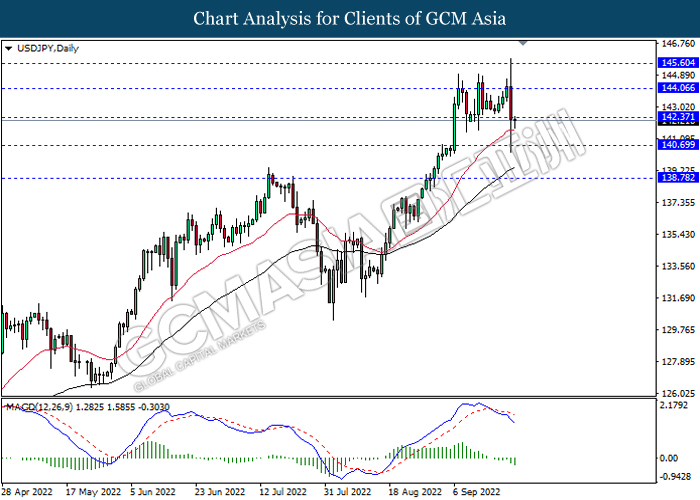

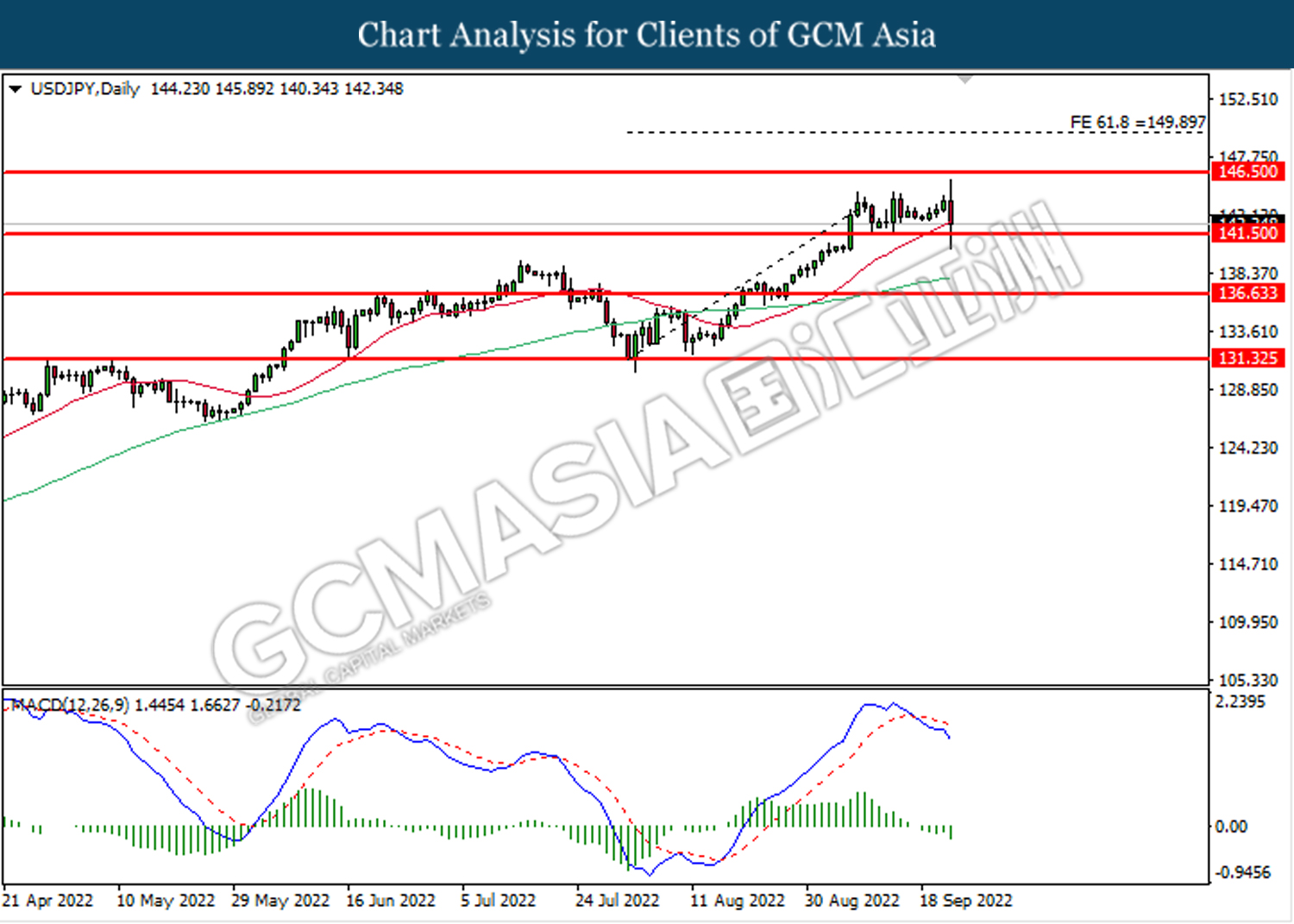

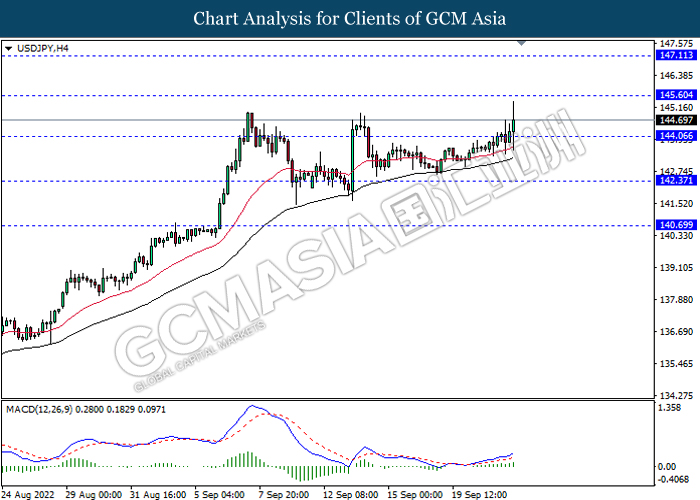

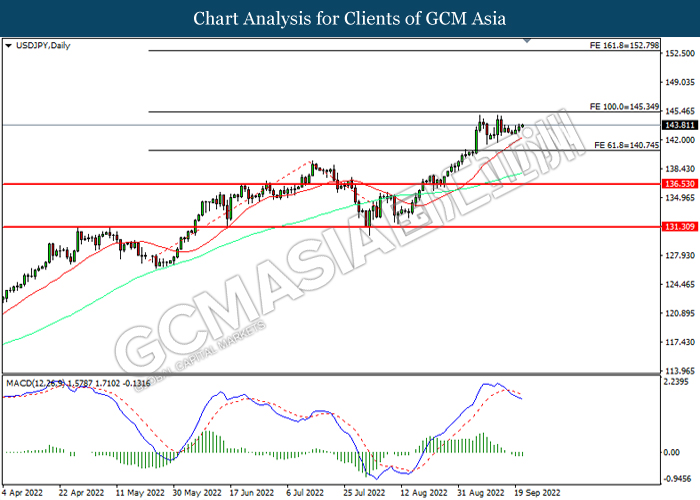

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 144.55. MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 144.55, 144.95

Support level: 143.75, 143.10

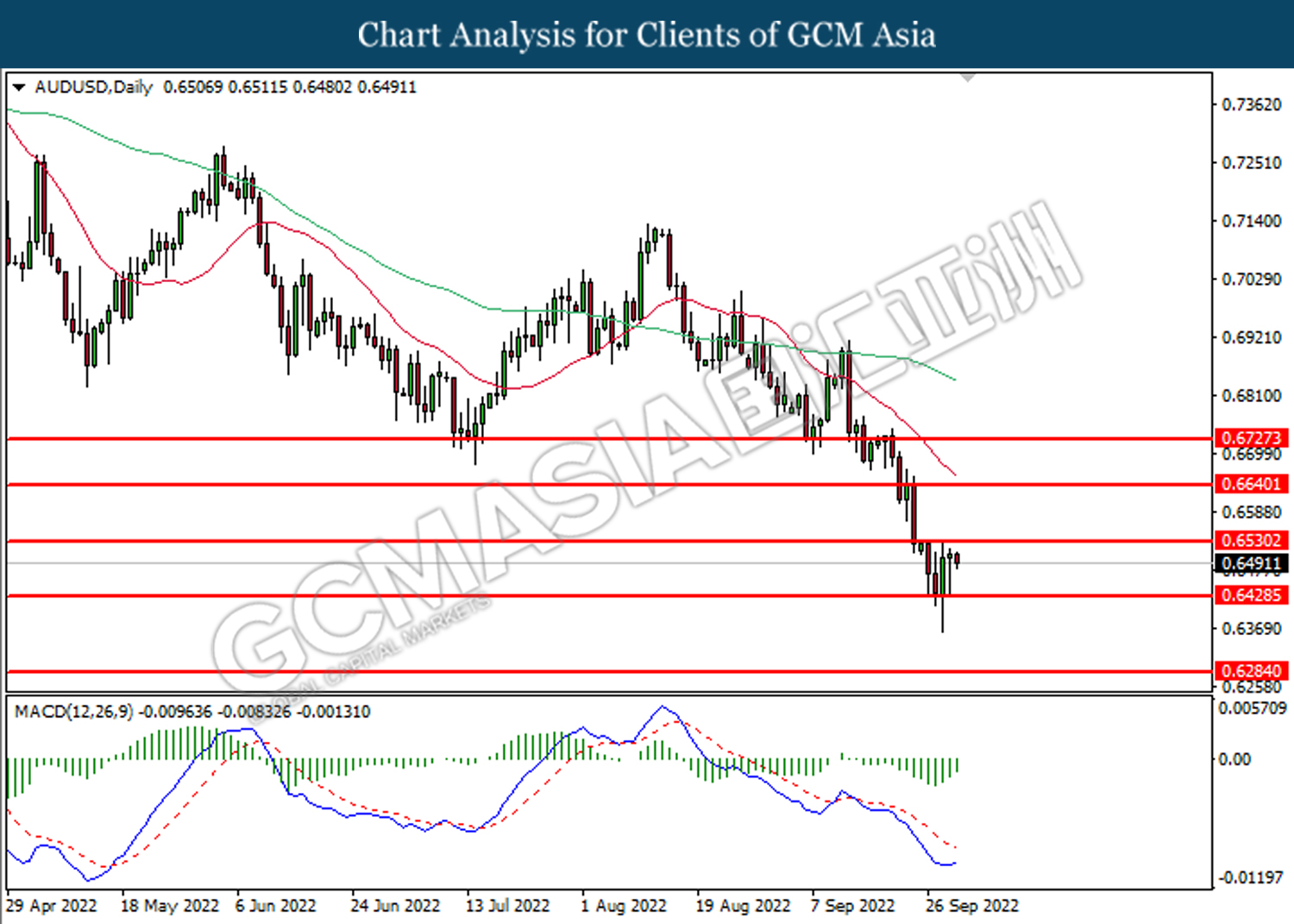

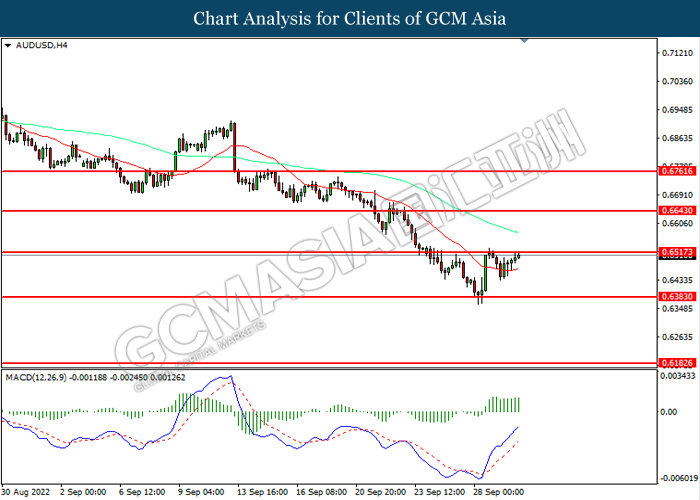

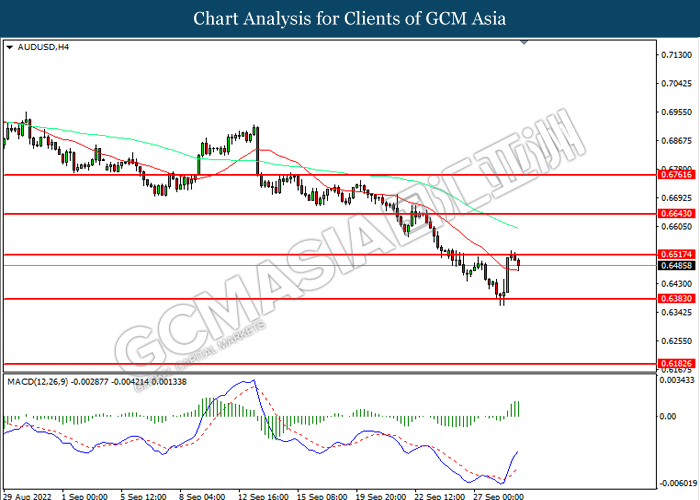

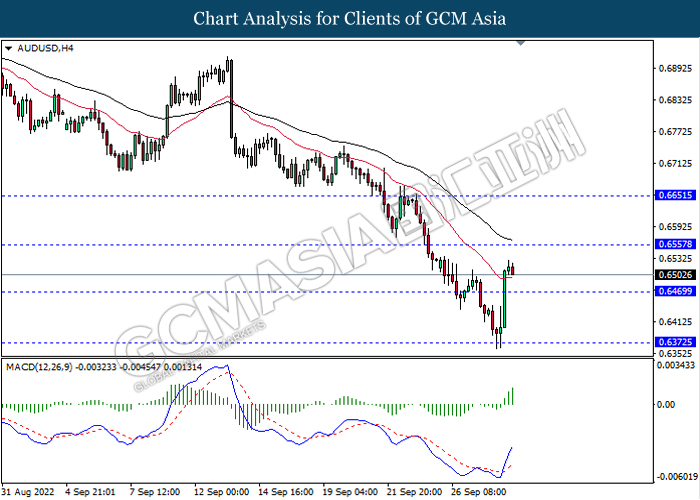

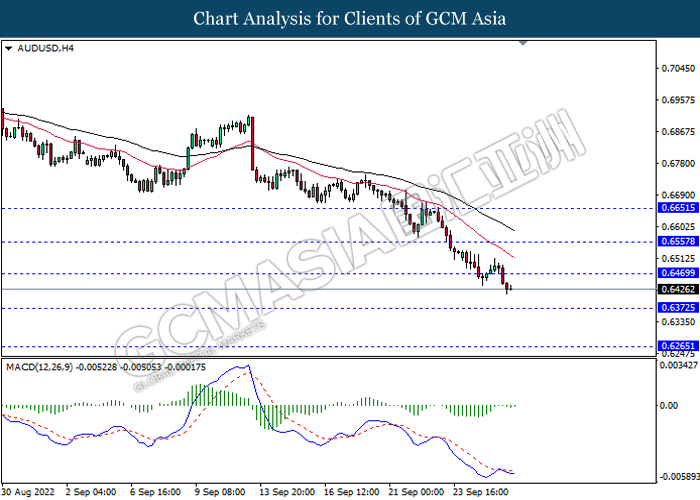

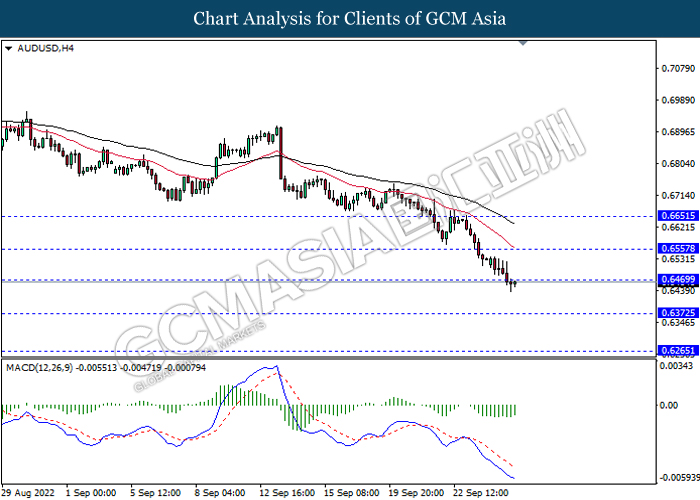

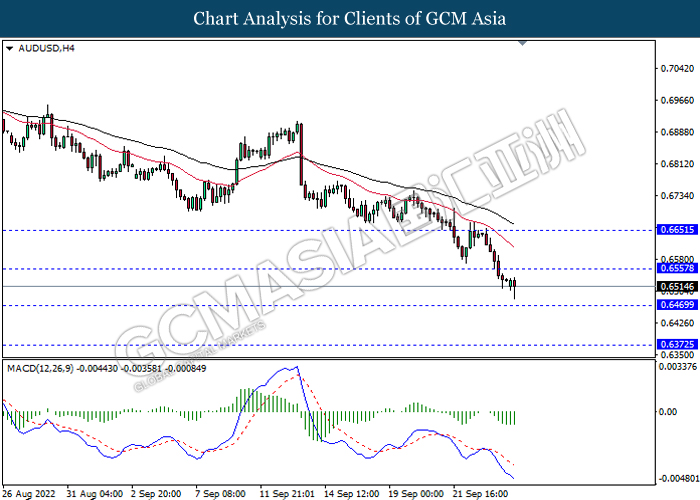

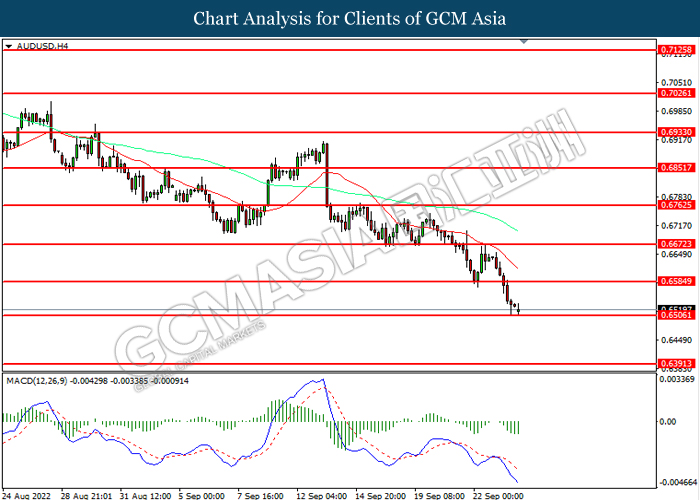

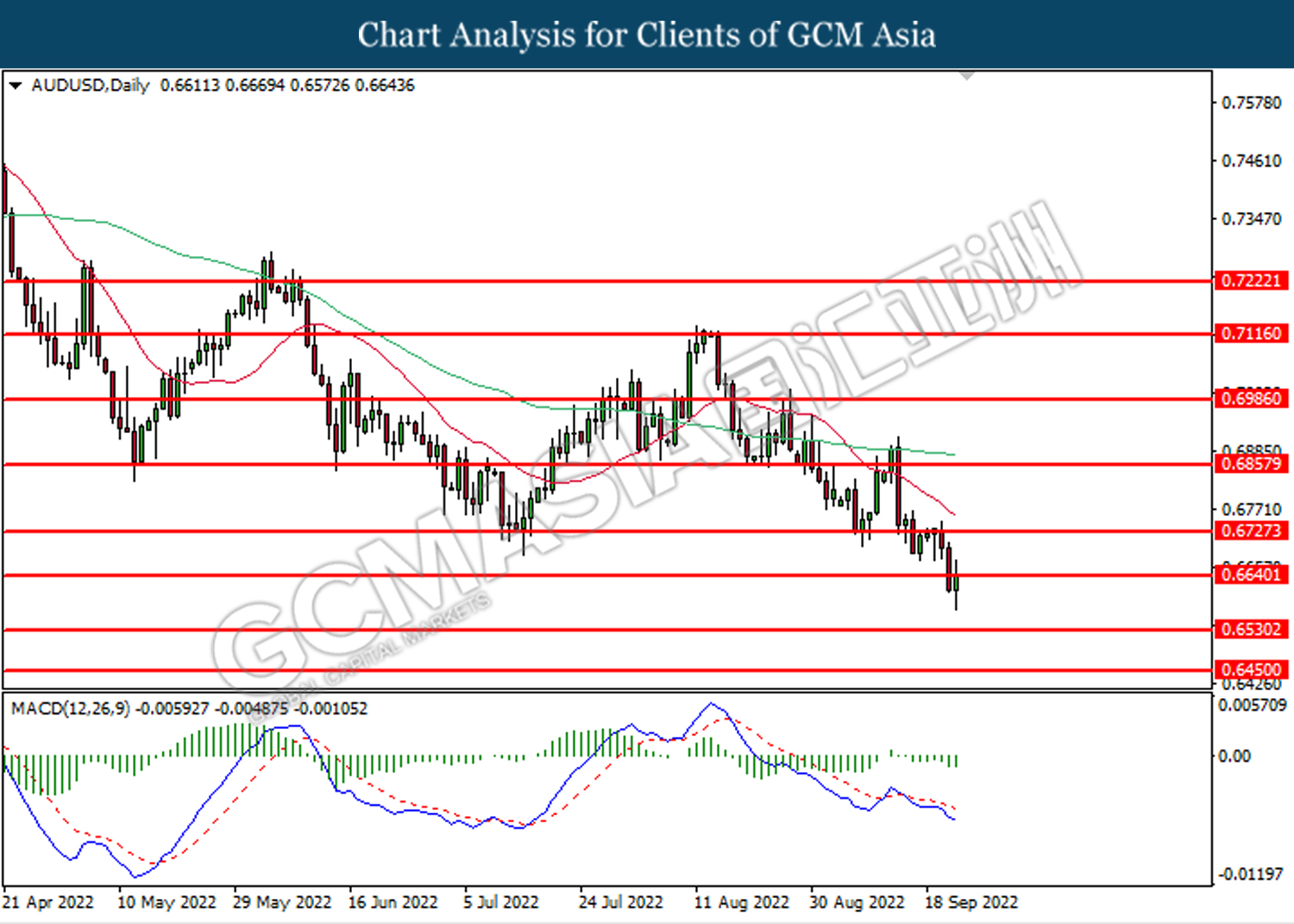

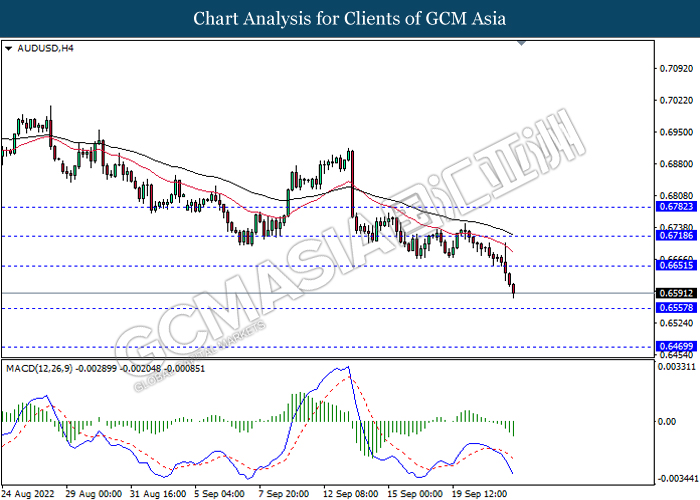

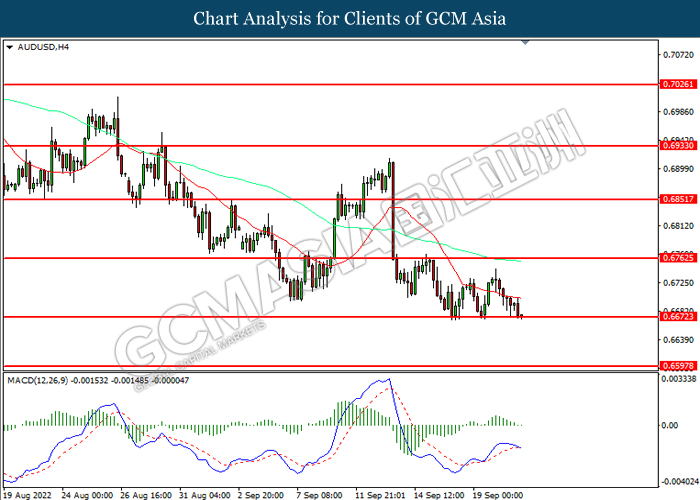

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6530. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6530, 0.6640

Support level: 0.6430, 0.6285

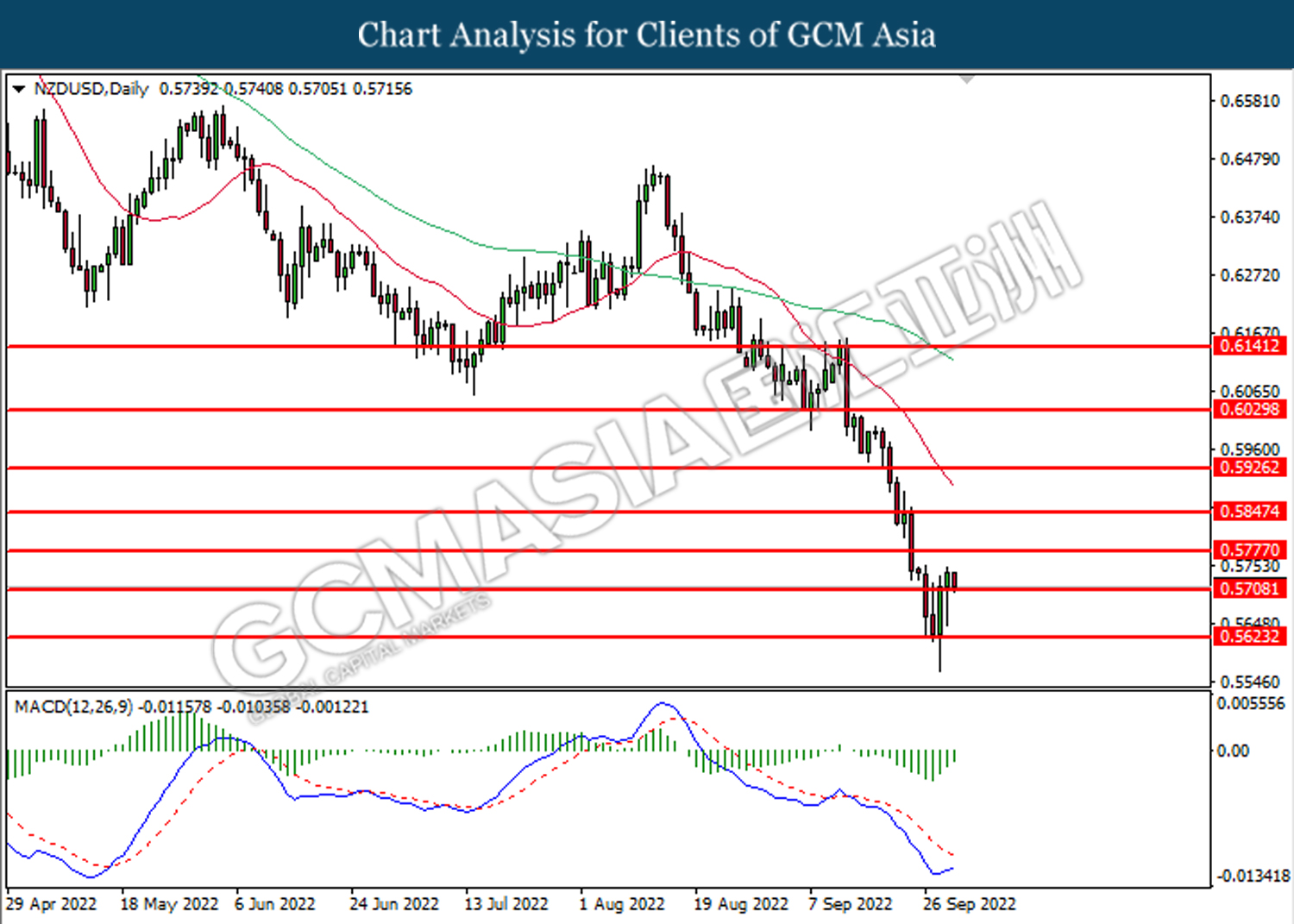

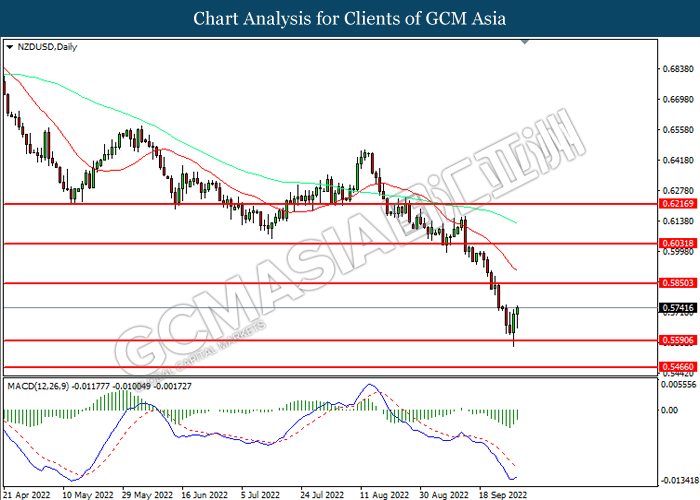

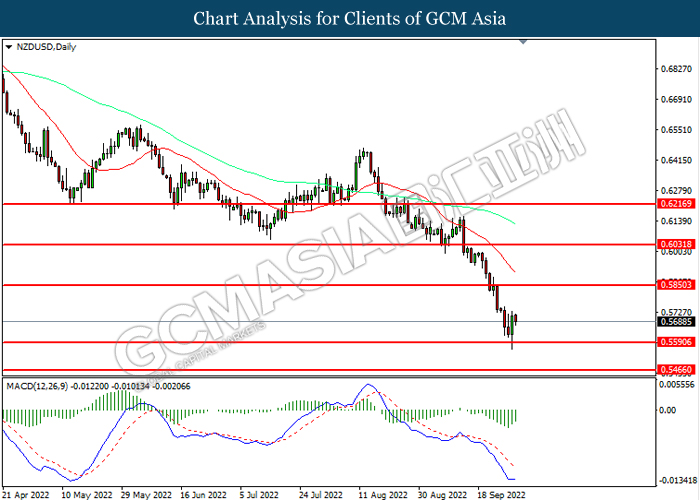

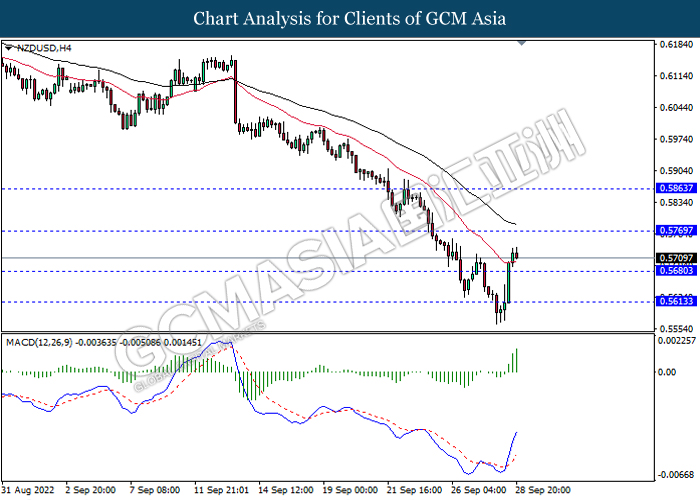

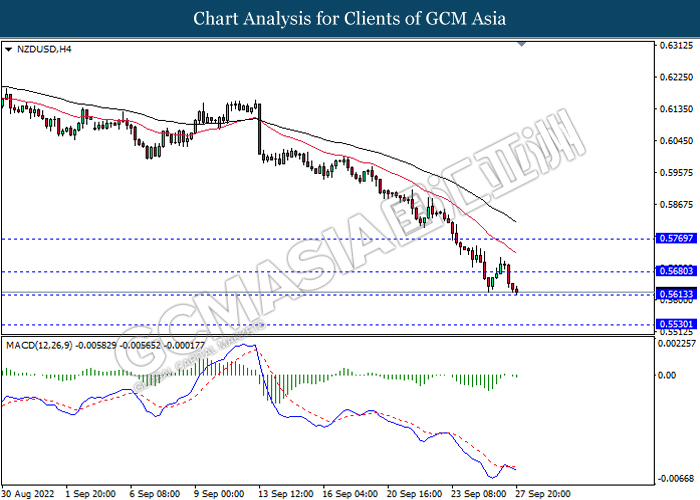

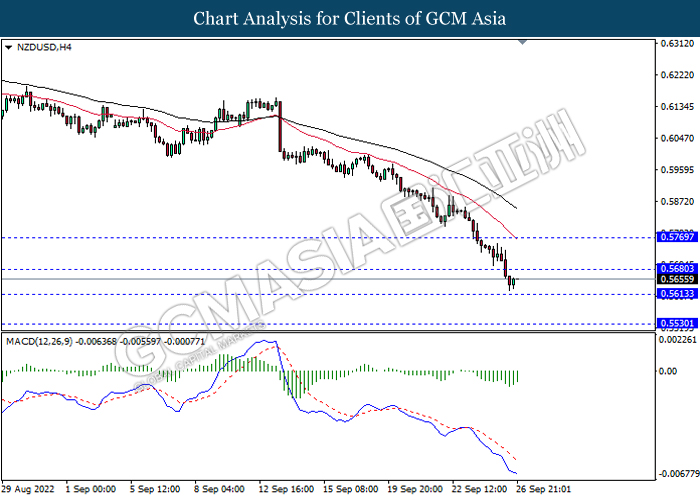

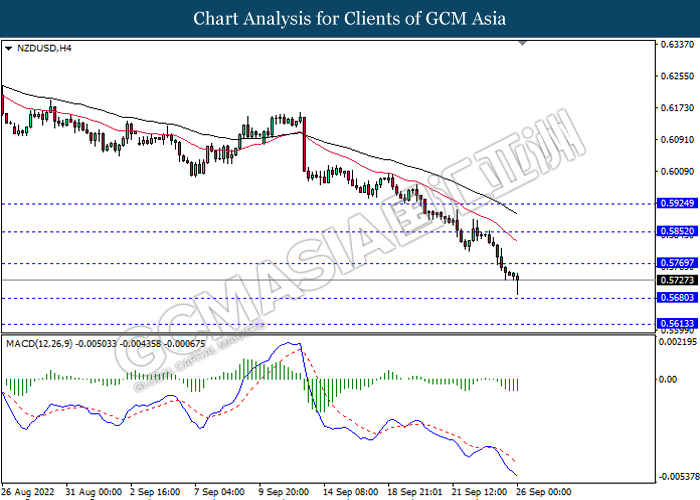

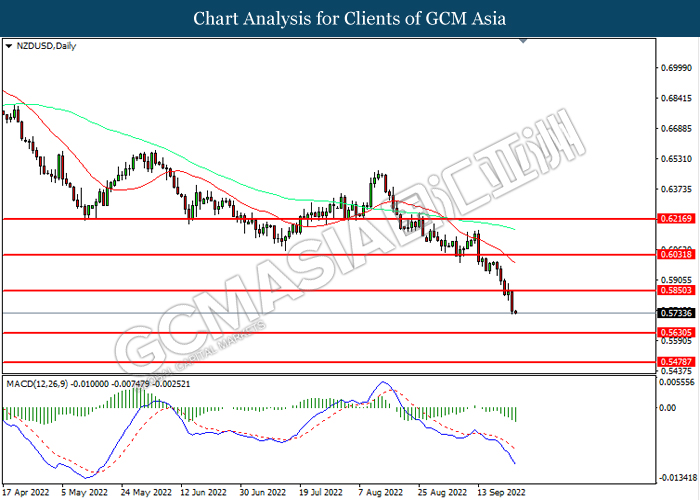

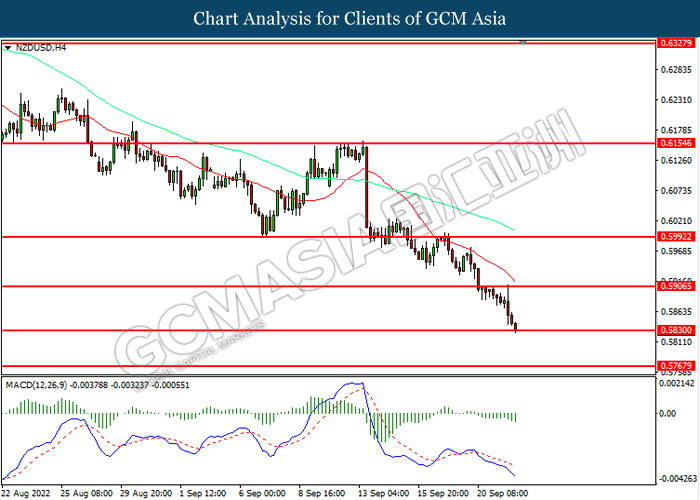

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.5710. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains in short term.

Resistance level: 0.5775, 0.5845

Support level: 0.5710, 0.5625

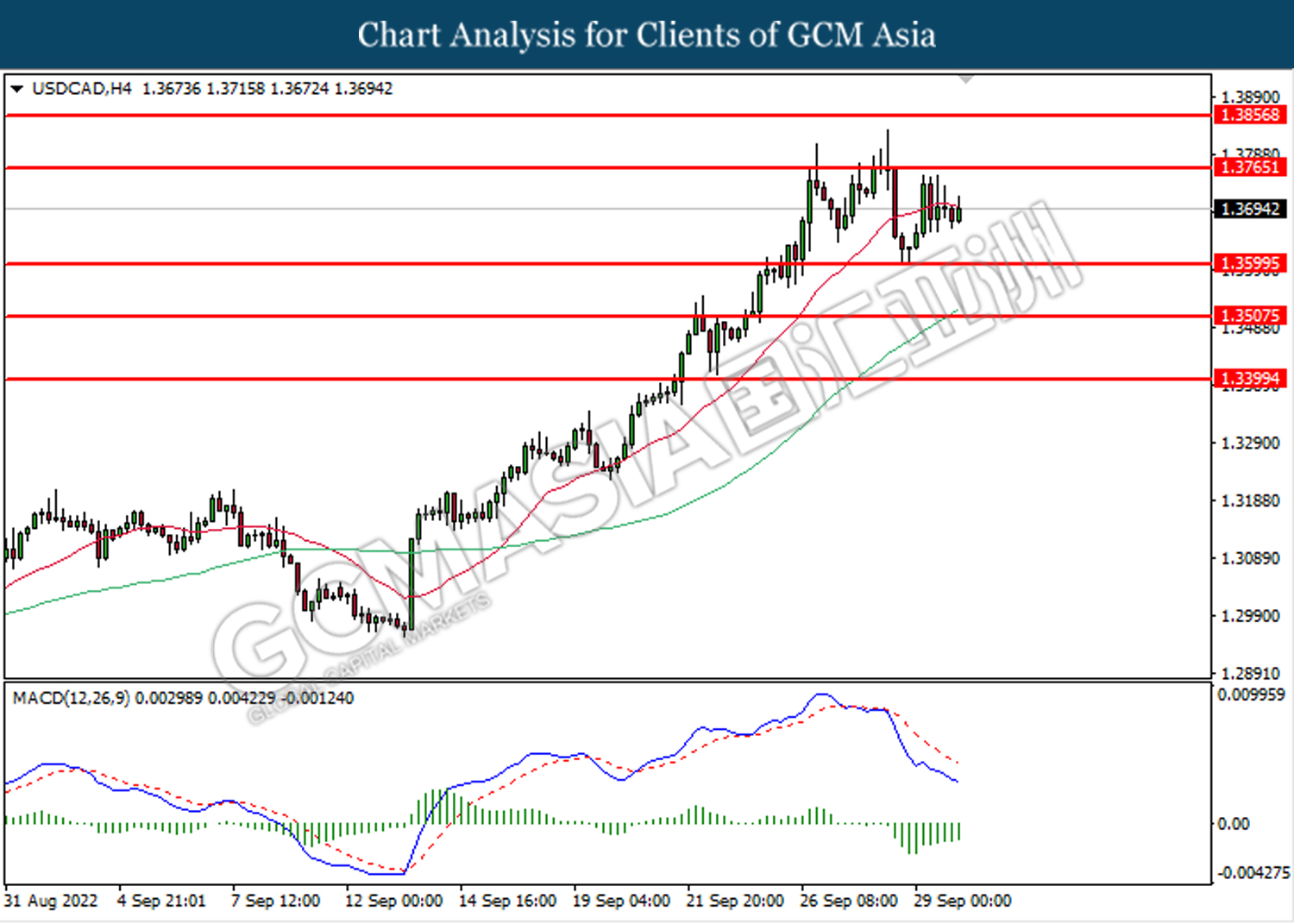

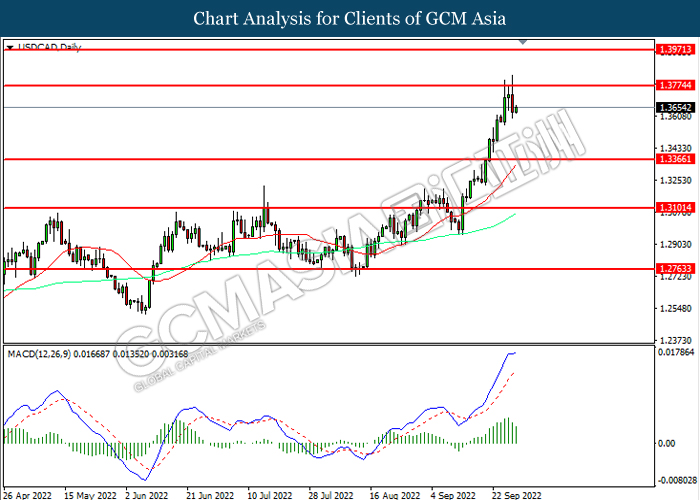

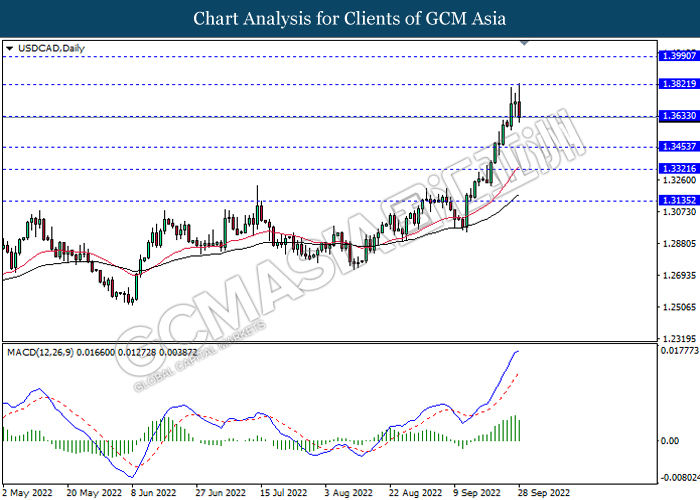

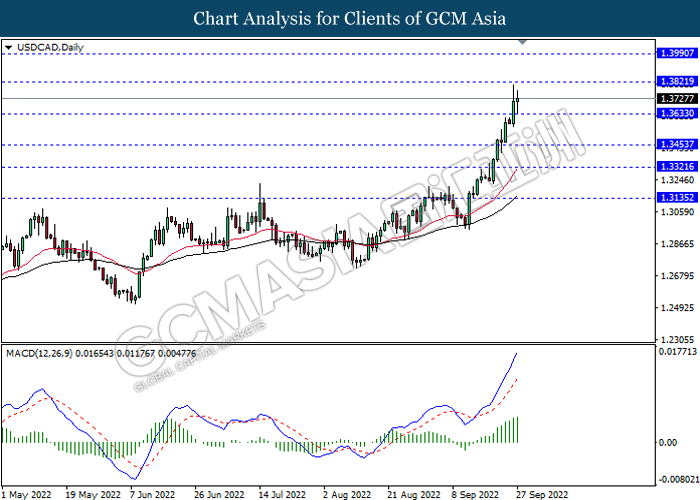

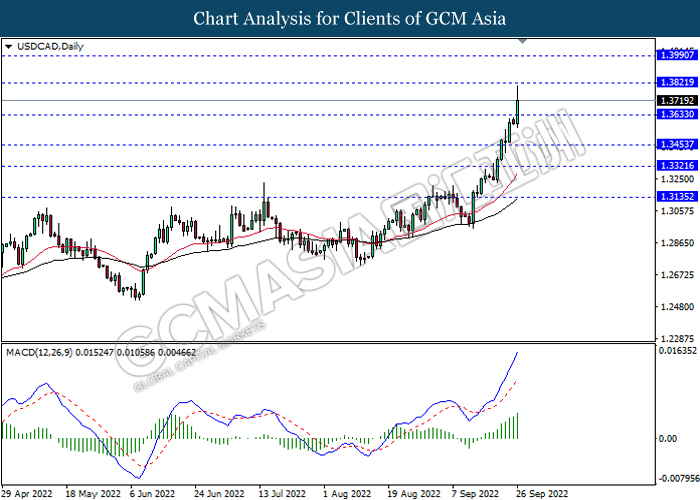

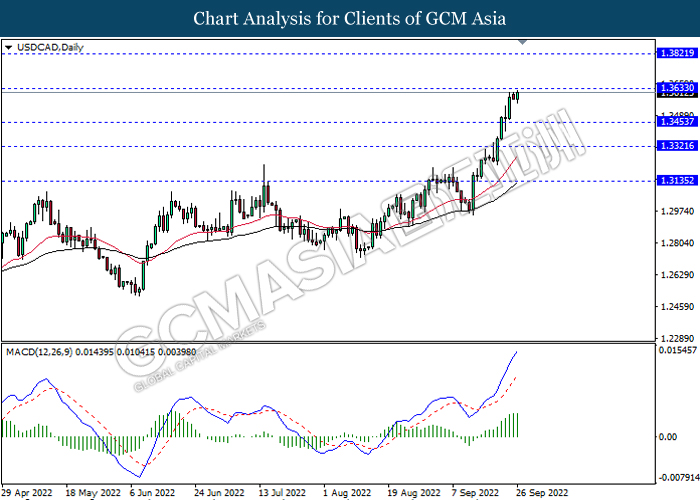

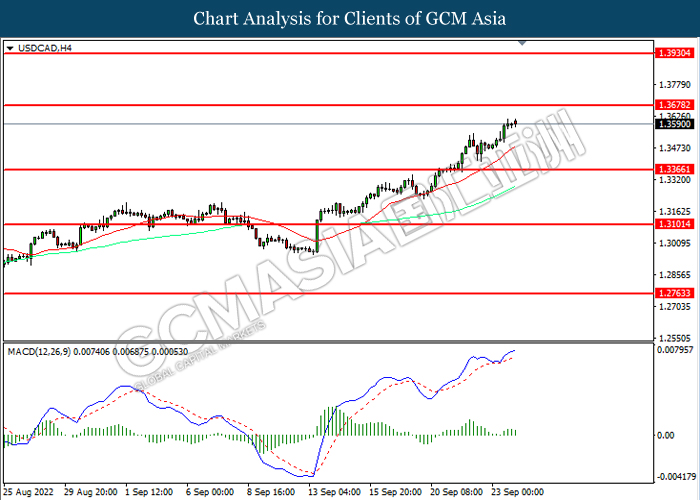

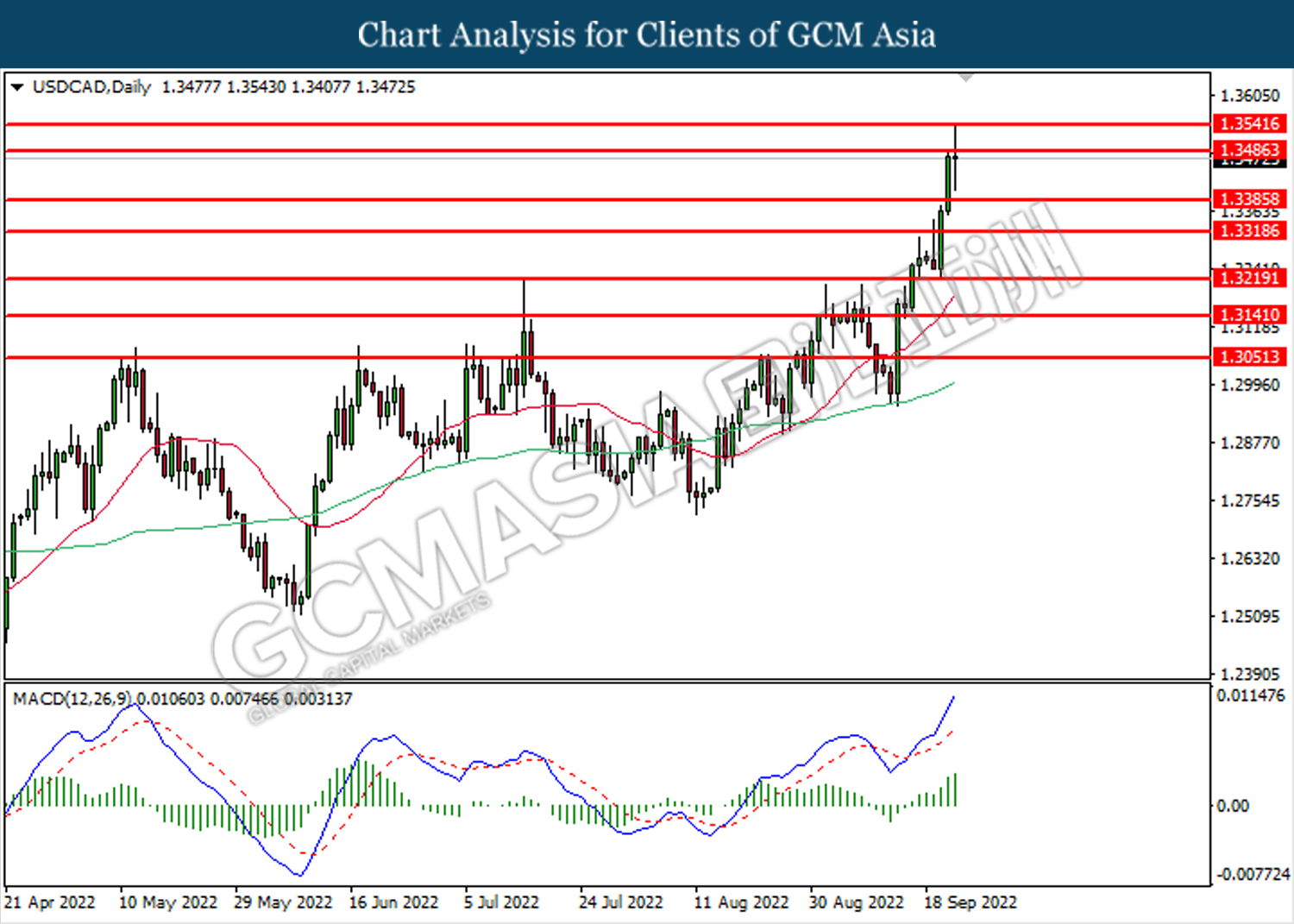

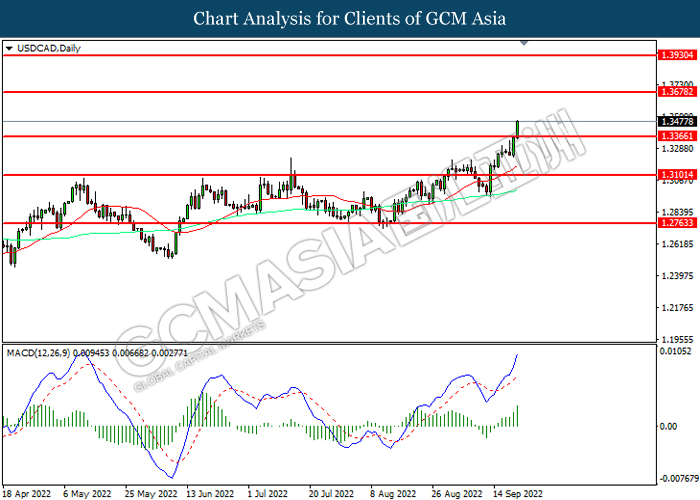

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3600. MACD which illustrated diminishing bearish momentum suggests the pair to extend gains toward the resistance level at 1.3765.

Resistance level: 1.3765, 1.3855

Support level: 1.3600, 1.3505

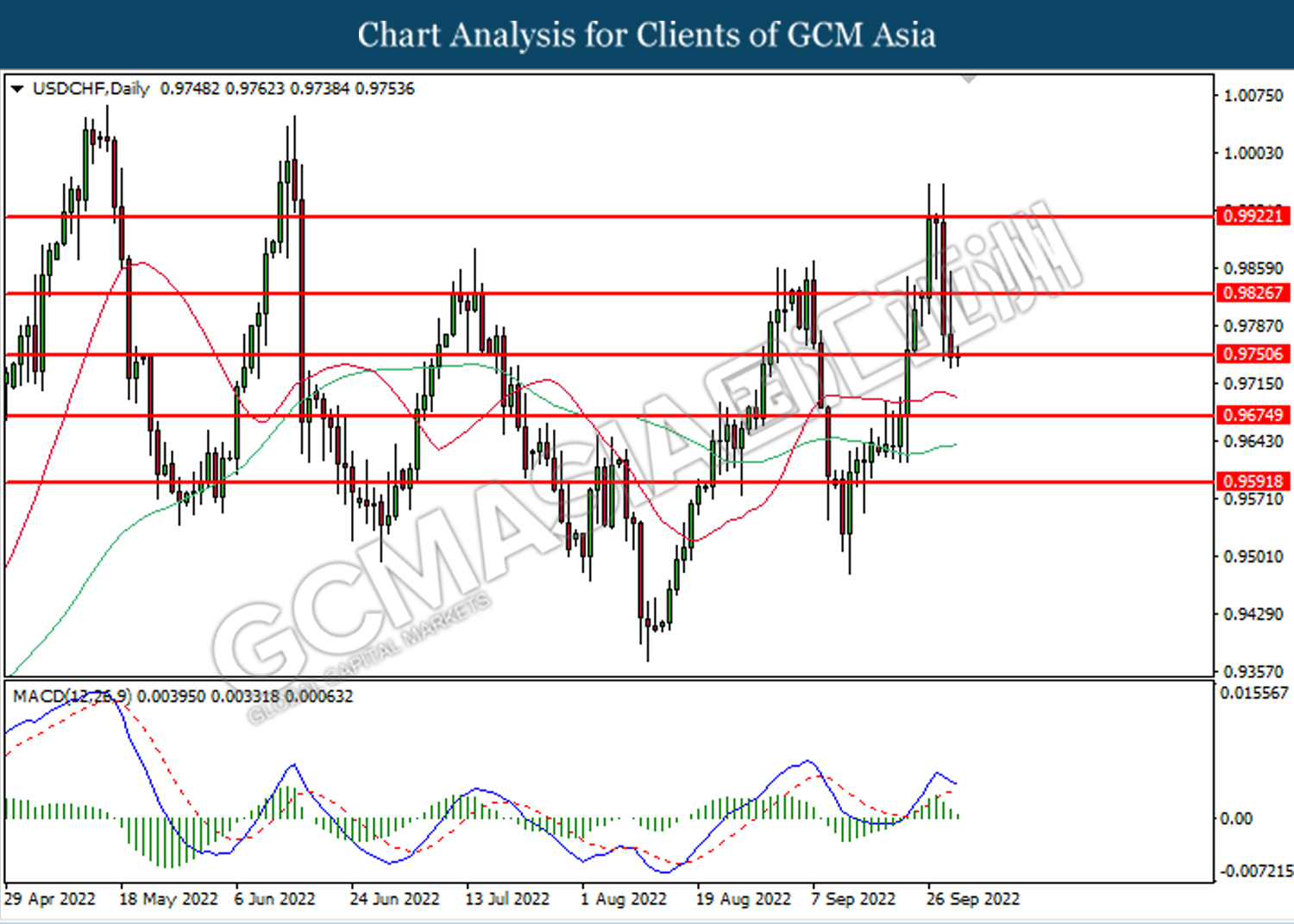

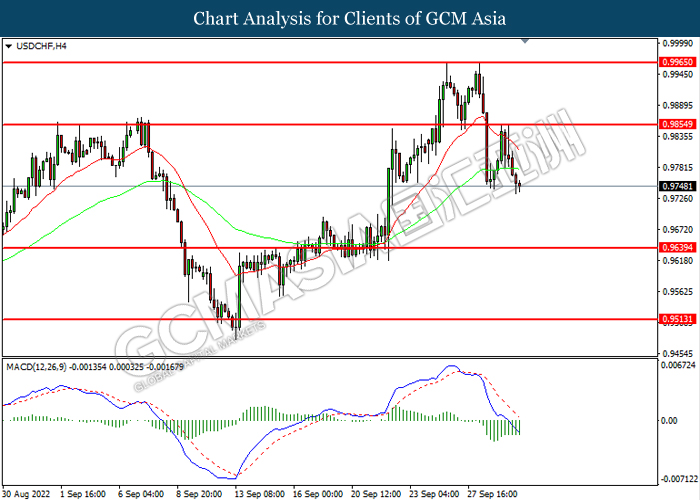

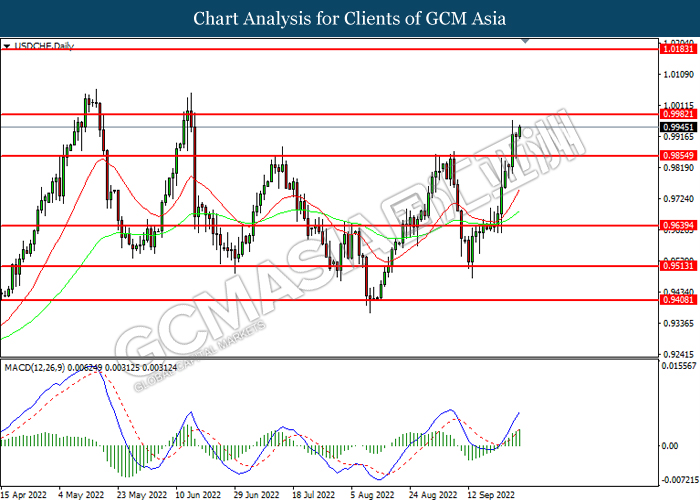

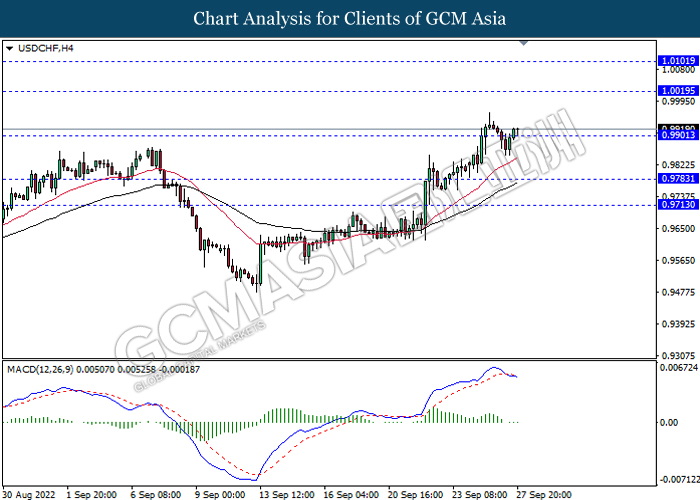

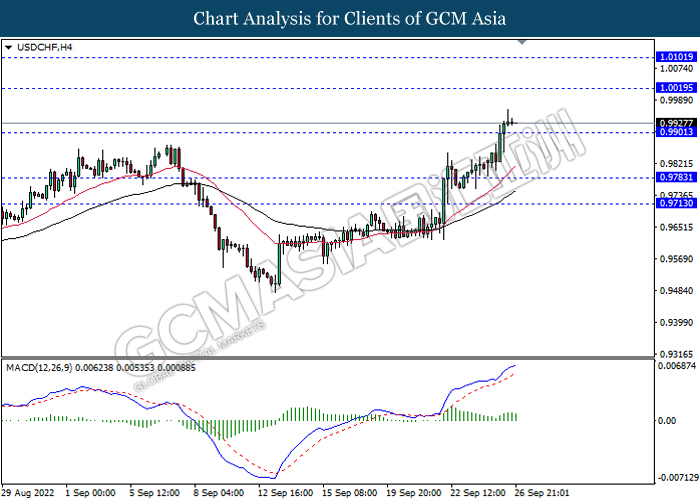

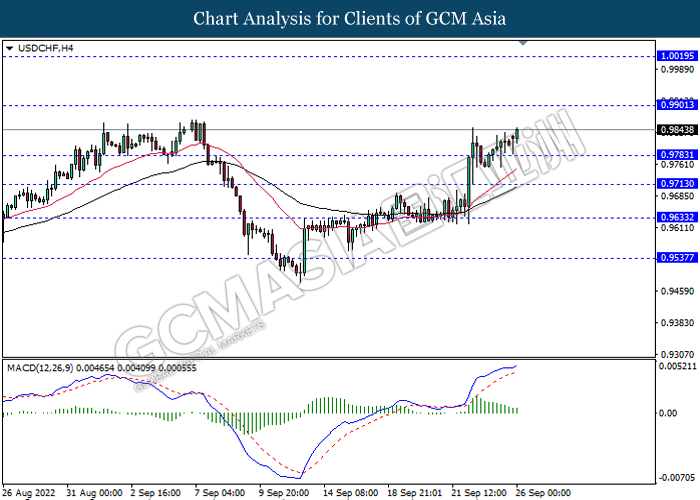

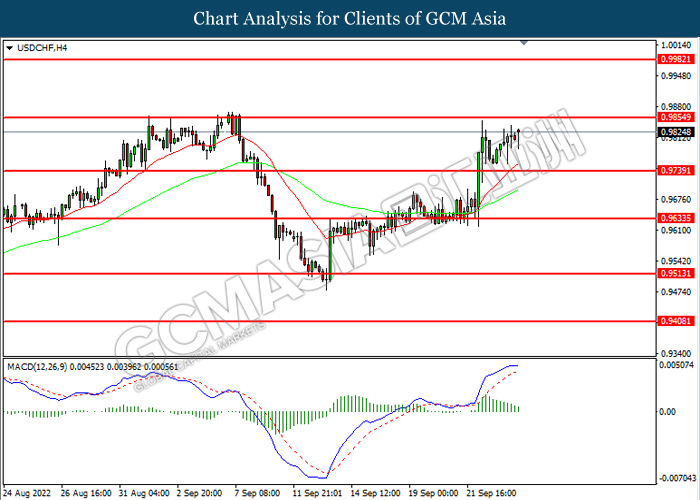

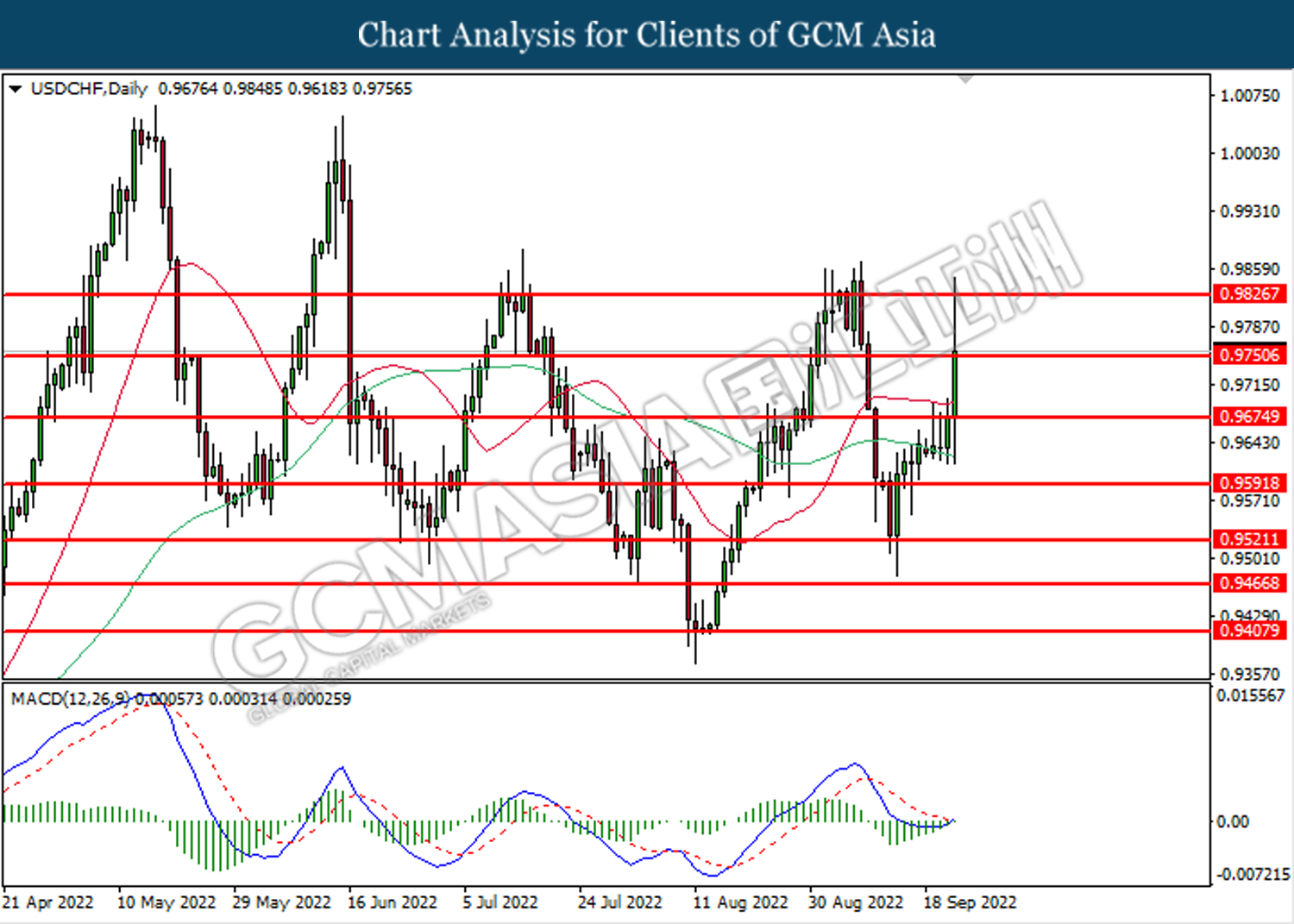

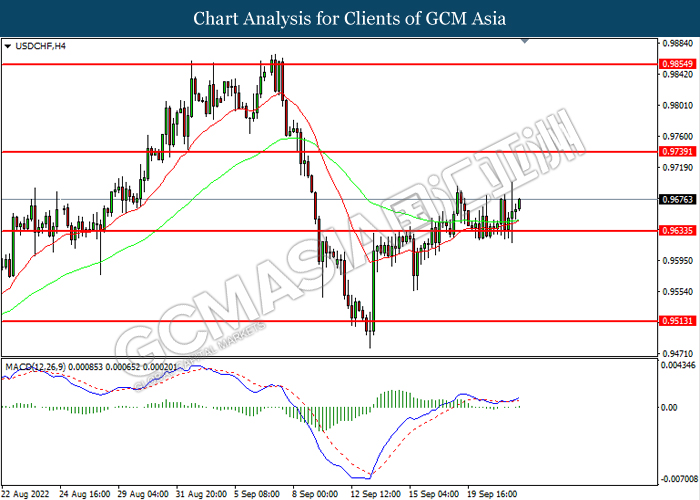

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9750. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9825, 0.9920

Support level: 0.9750, 0.9675

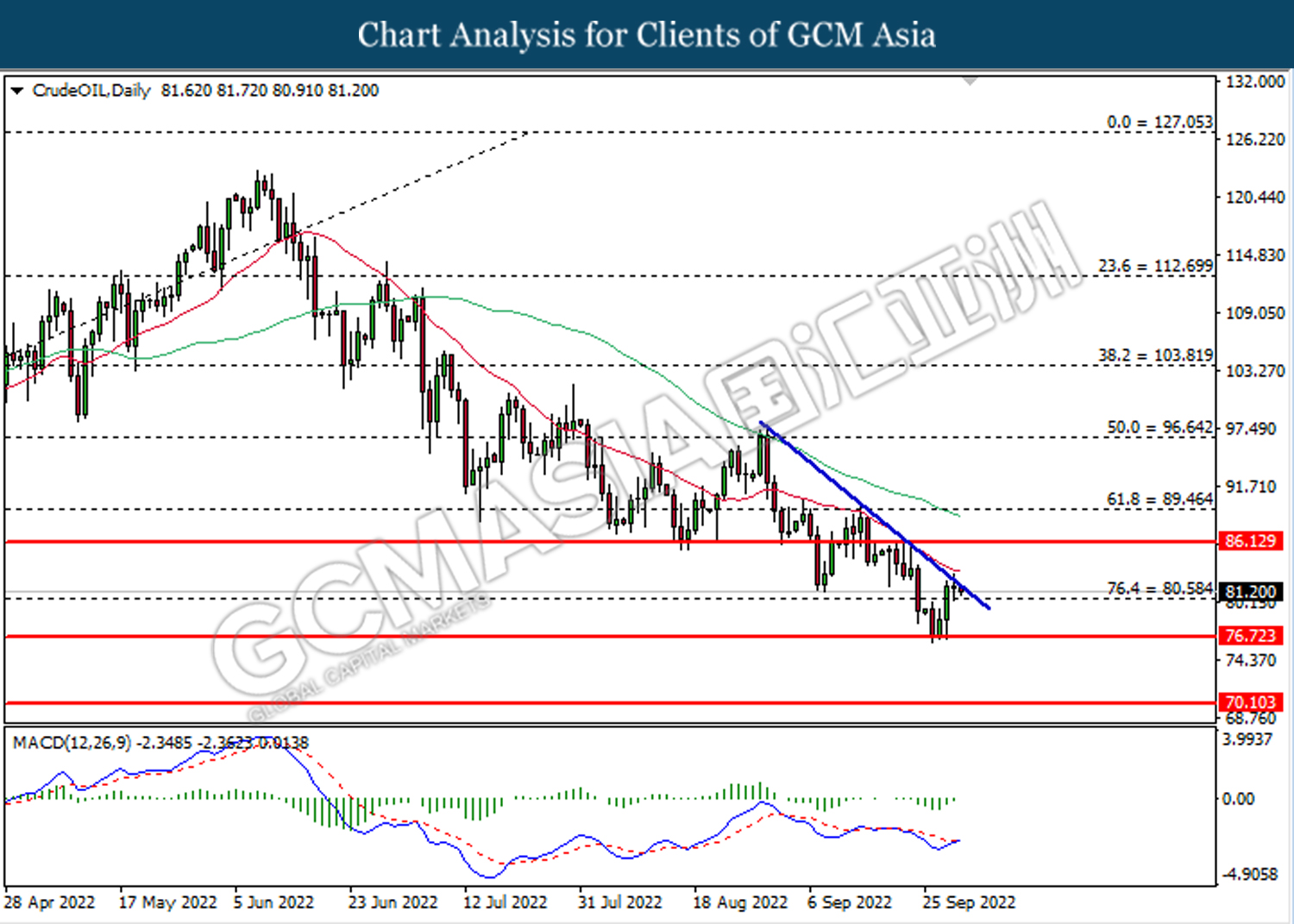

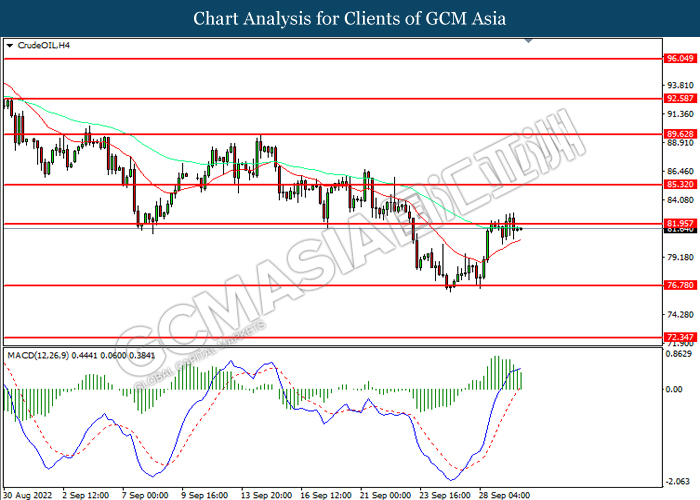

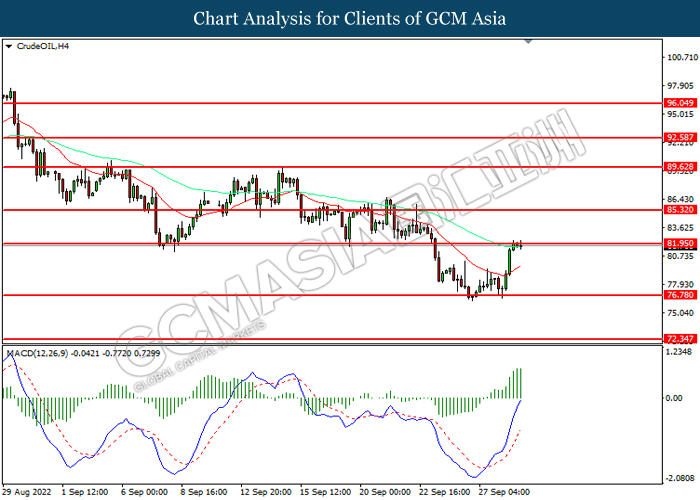

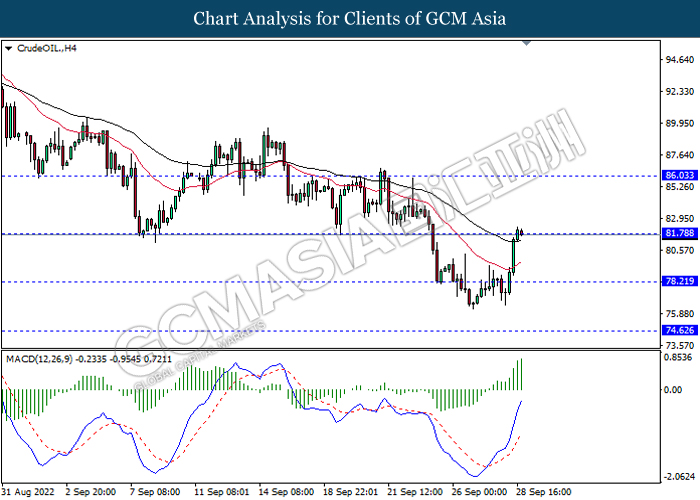

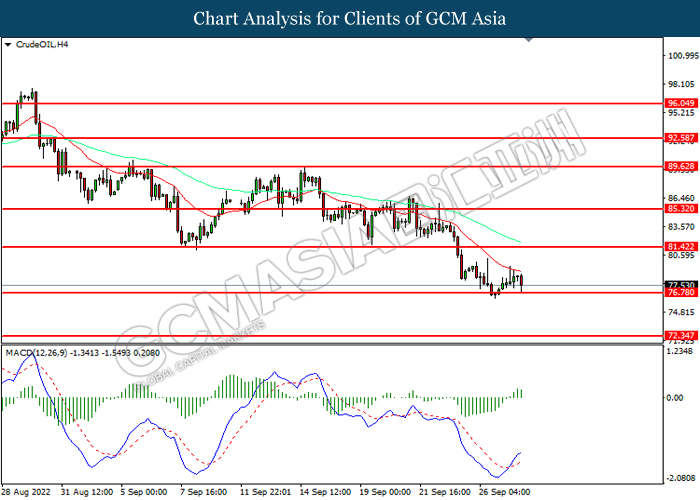

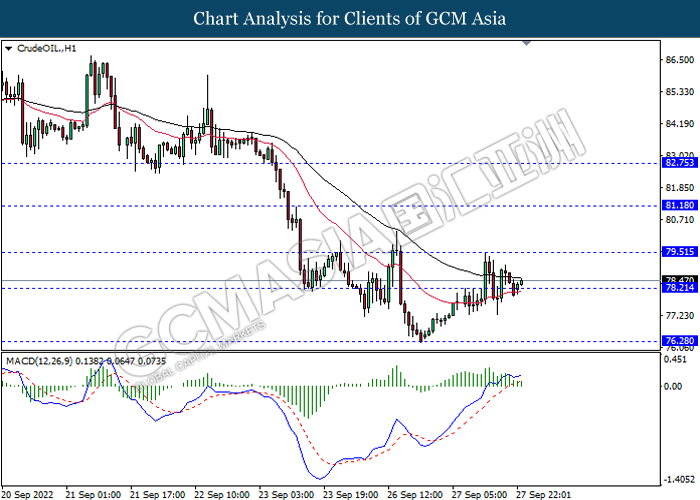

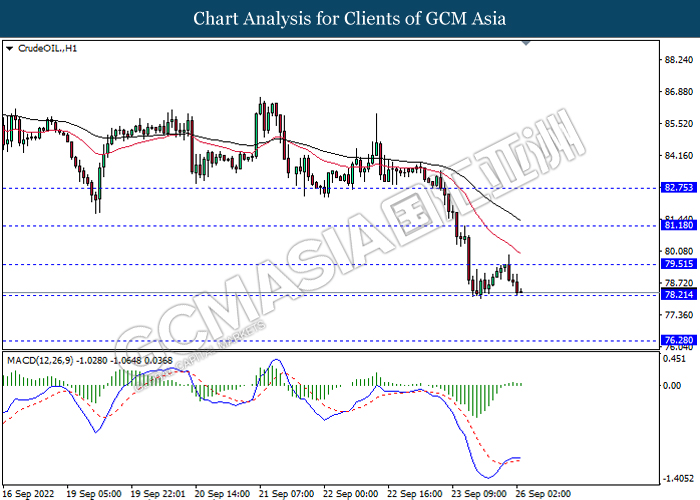

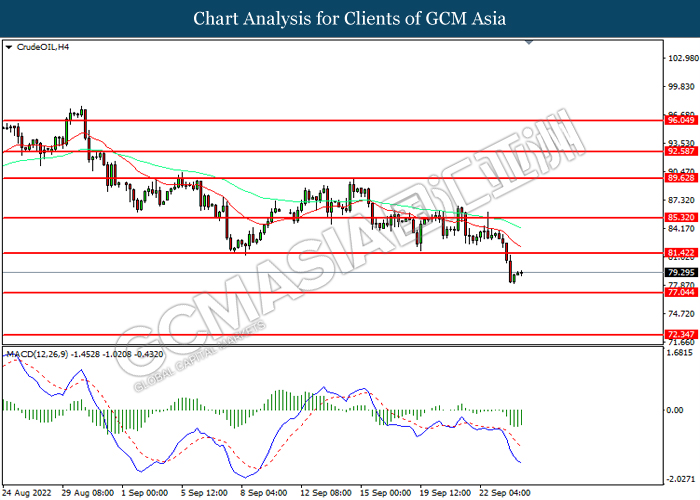

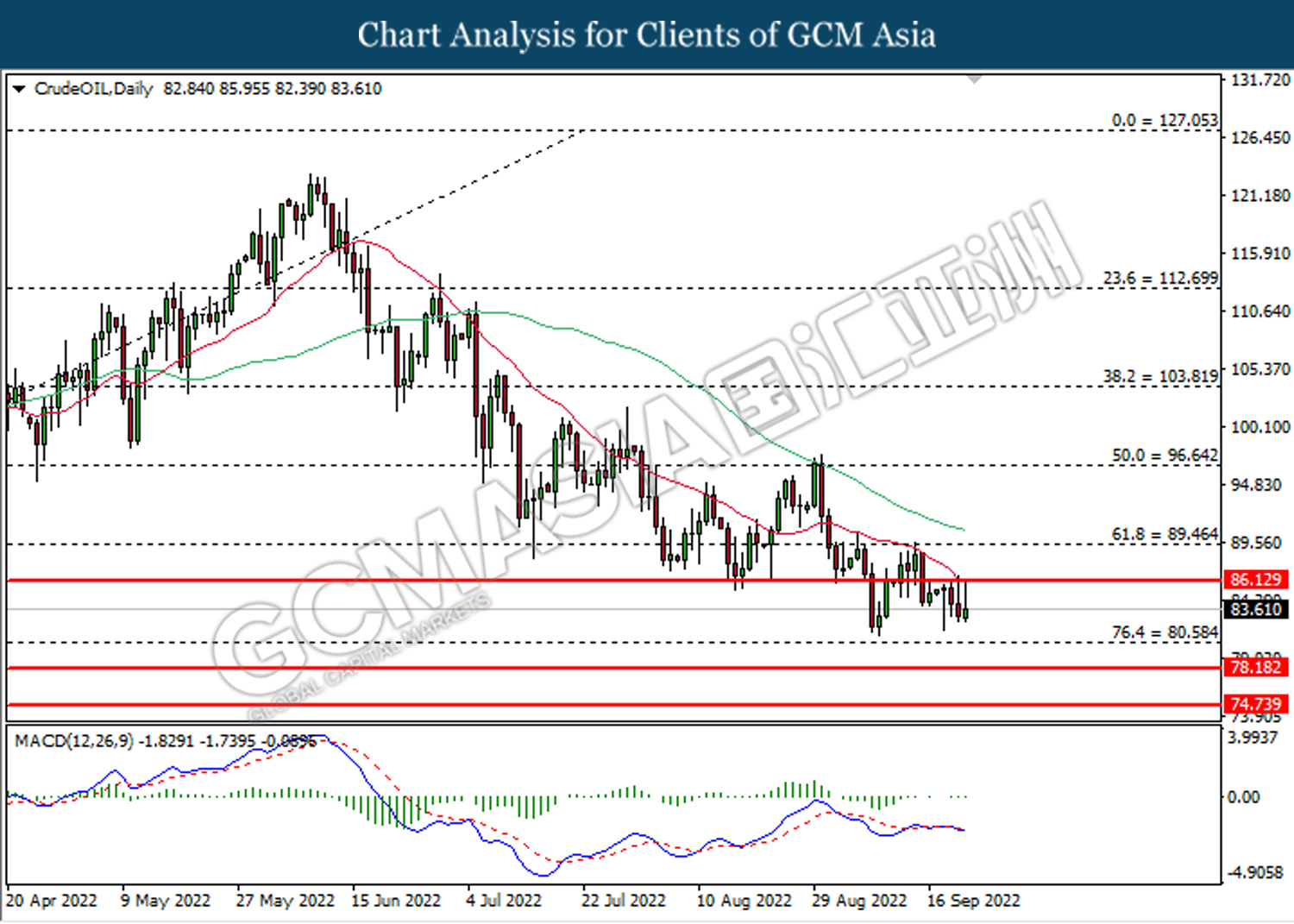

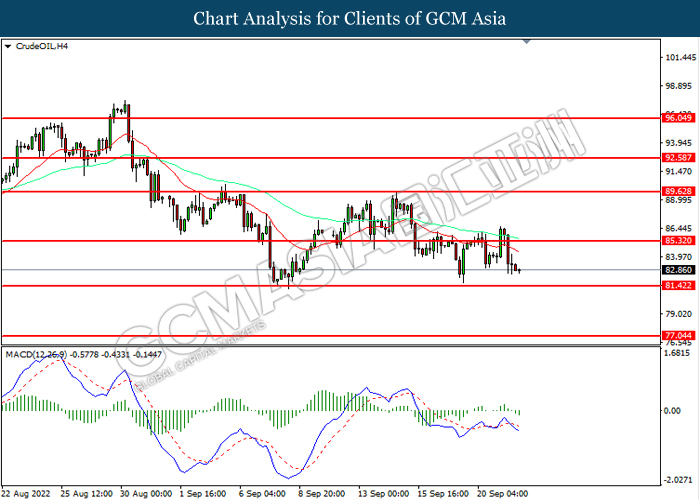

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the downward trendline. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the downward trendline.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.70

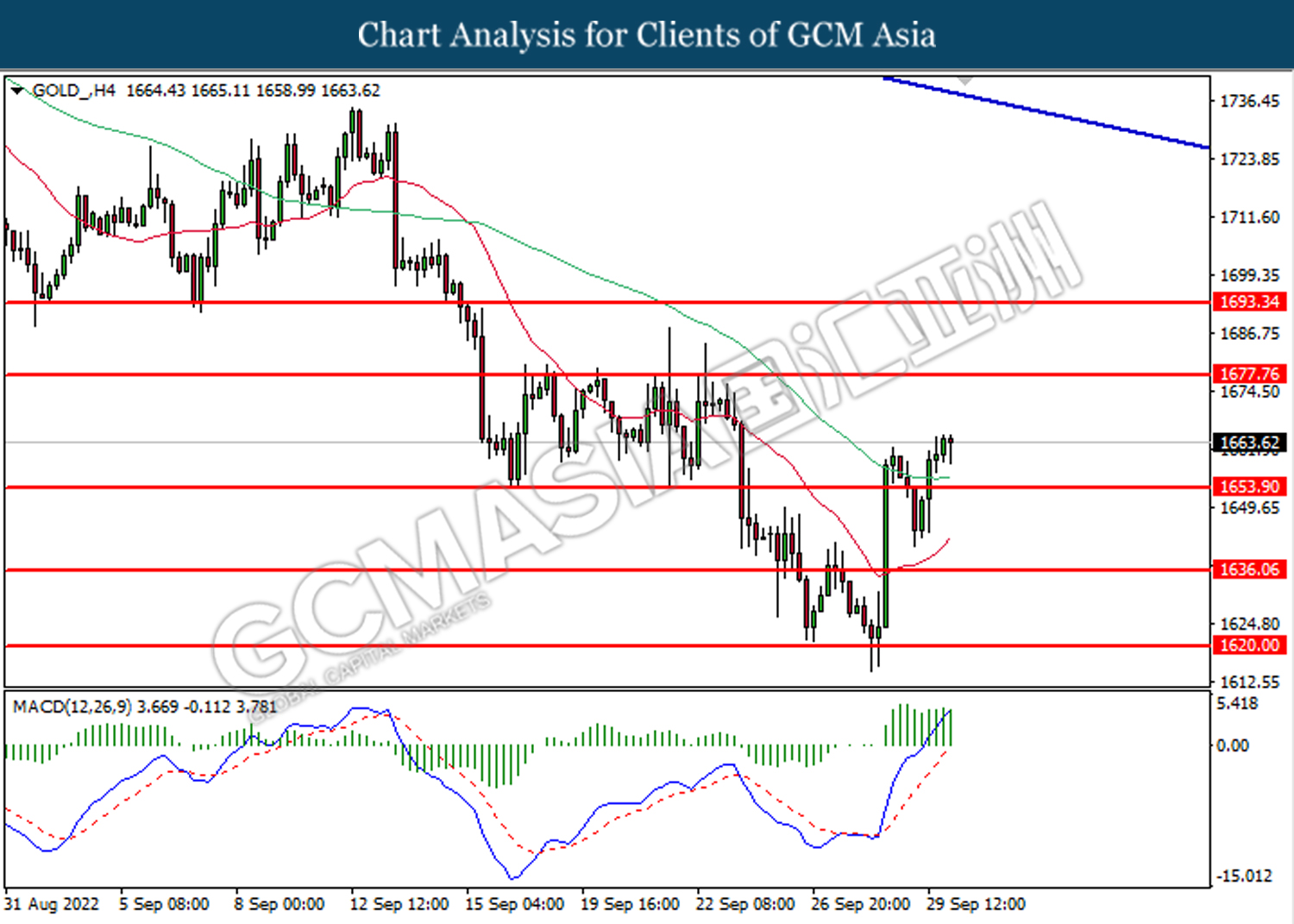

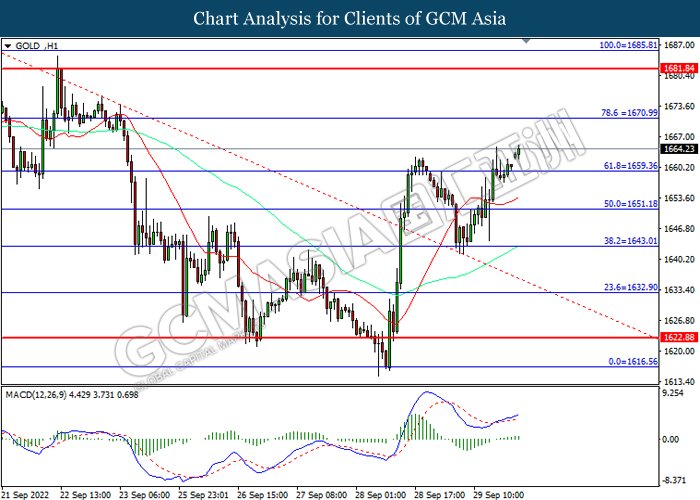

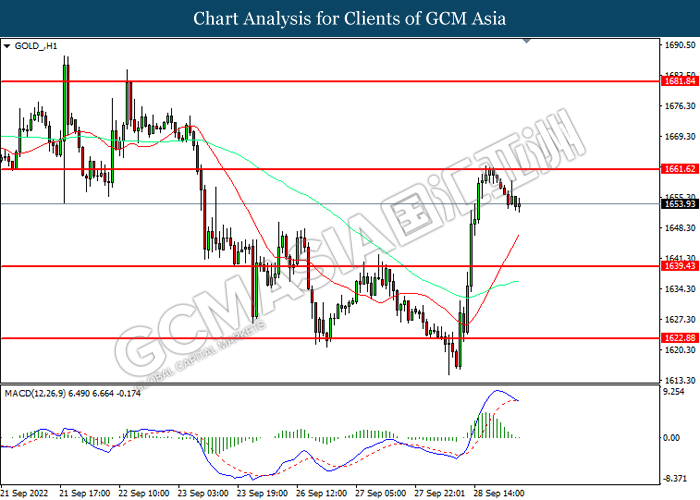

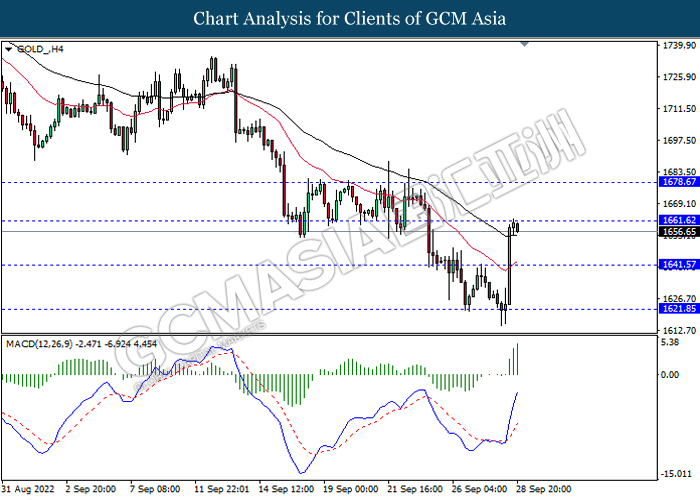

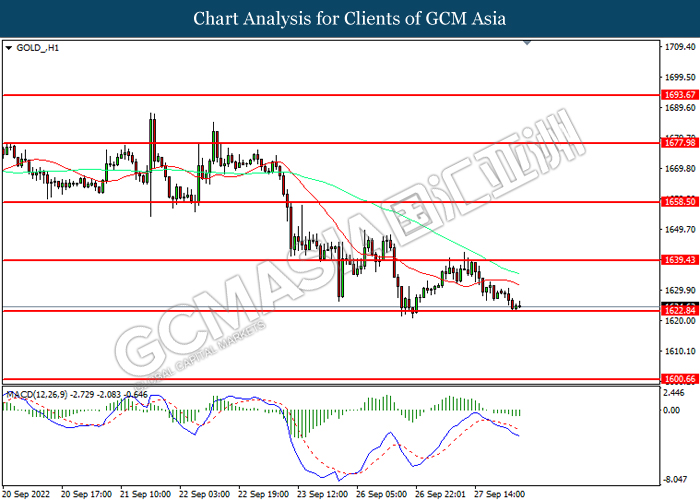

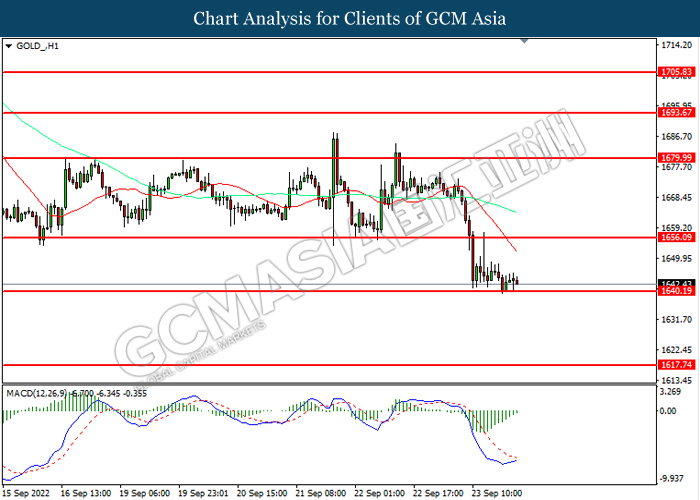

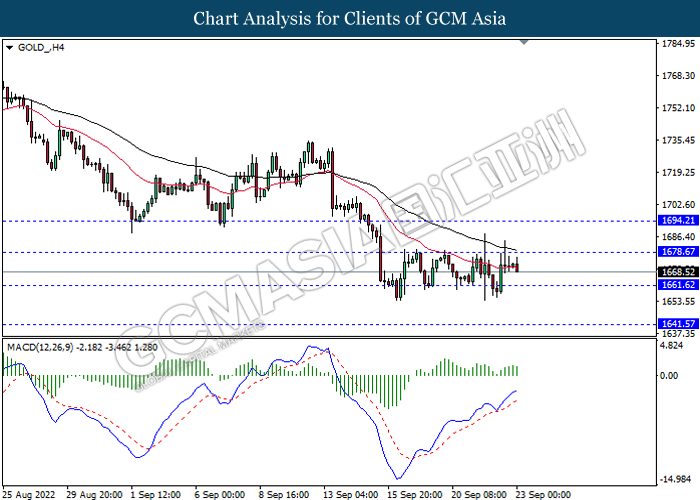

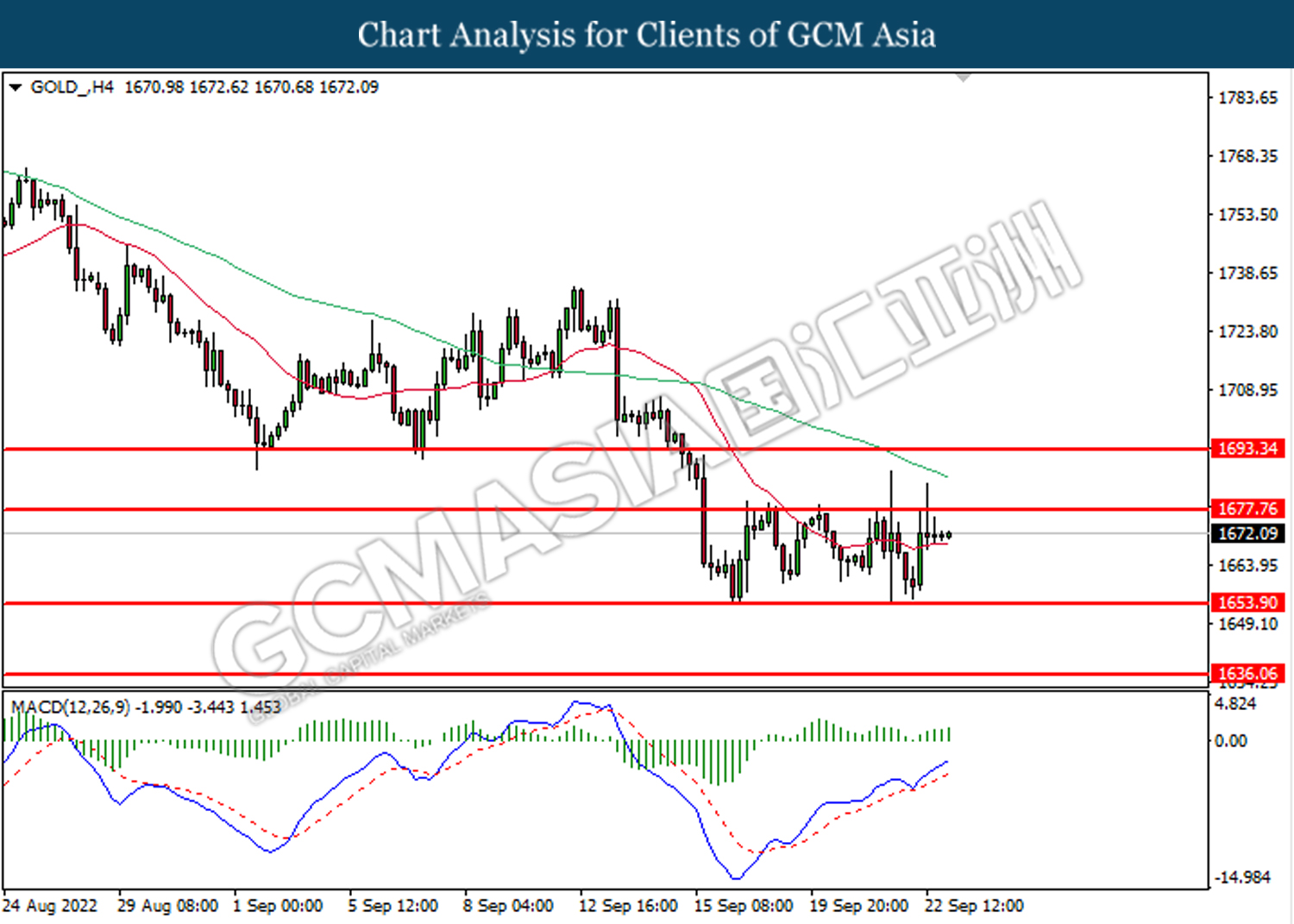

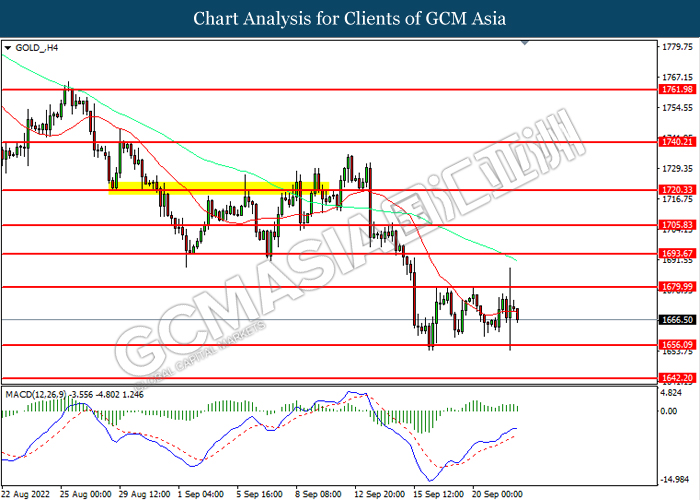

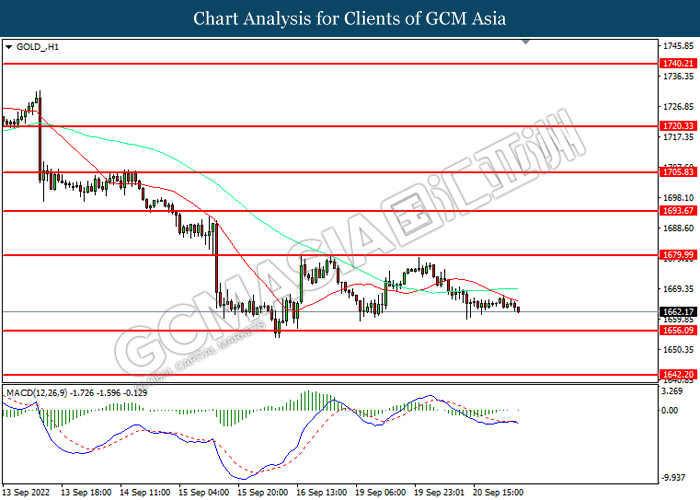

GOLD_, H4: Gold price was traded higher following prior rebound from the lower level. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1677.75.

Resistance level: 1677.75, 1693.35

Support level: 1653.90, 1636.10

300922 Morning Session Analysis

30 September 2022 Morning Session Analysis

Sterling continues its bull’s run following the bond intervention from BoE.

The Pound Sterling extends its gains significantly on Thursday, rebounding from recent lows amid the Bank of England conducted a second day of bond repurchasing program to stabilize the financial markets following the new Prime Minister Liz Truss’ tax-cutting plans triggered financial chaos. According to Reuters, the Bank of England had purchased around 1.415 billion pounds of UK government bonds with maturities of more than 20 years, recouping the losses for the UK government bond. The BoE reiterated that the bond purchases were designed to restore orderly market conditions. On the monetary policy front, the BoE Chief Economist Huw Pill claimed that the Bank of England would also likely to delivery another significant rate hike to prop up the value of the Pound Sterling and limit further inflation pressure. Meanwhile, Governor Andrew Bailey said that the BoE will not hesitate to increase interest rates if needed but added that the Monetary Policy Committee would make a full assessment of the situation at its November meetings. As of writing, GBP/USD appreciated by 0.31% to 1.1150.

In the commodities market, the crude oil price appreciated by 0.01% to $81.60 per barrel as of writing. The oil market was edged higher yesterday amid speculation of a production cut to be announced by OPEC+ next week, adding further concerns about the oil supply disruption in future. On the other hand, the gold price appreciated by 0.19% to $1663.75 per troy ounces as of writing amid weaking US Dollar following investors started to shift their portfolio from US Dollar into other currencies such as Pound Sterling.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) | -0.1% | – | – |

| 15:55 | EUR – German Unemployment Change (Sep) | 28K | 20K | – |

| 17:00 | EUR – CPI (YoY) (Sep) | 9.1% | 9.6% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Aug) | 0.1% | 0.4% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Sep) | 59.5 | 59.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses.

Resistance level: 113.65, 117.30

Support level: 111.40, 107.55

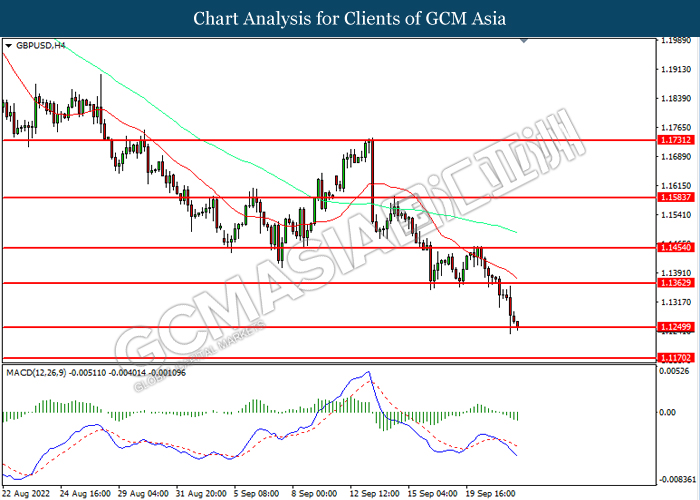

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1415, 1.1730

Support level: 1.1065, 1.0890

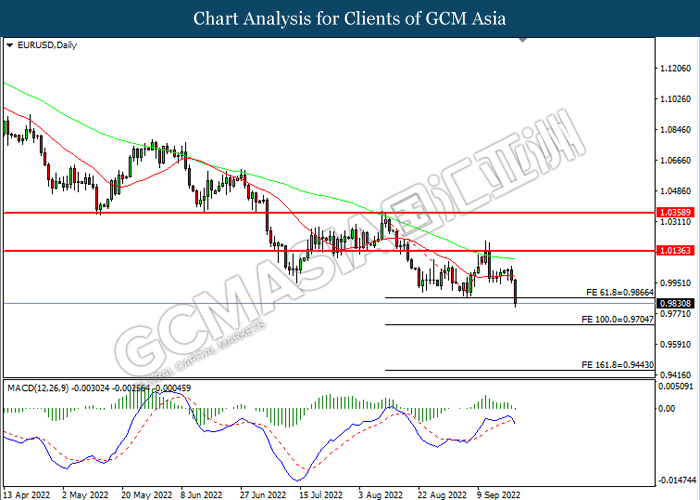

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

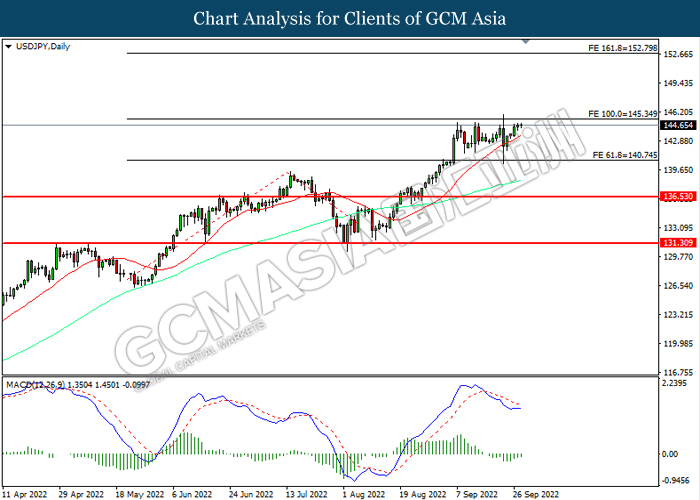

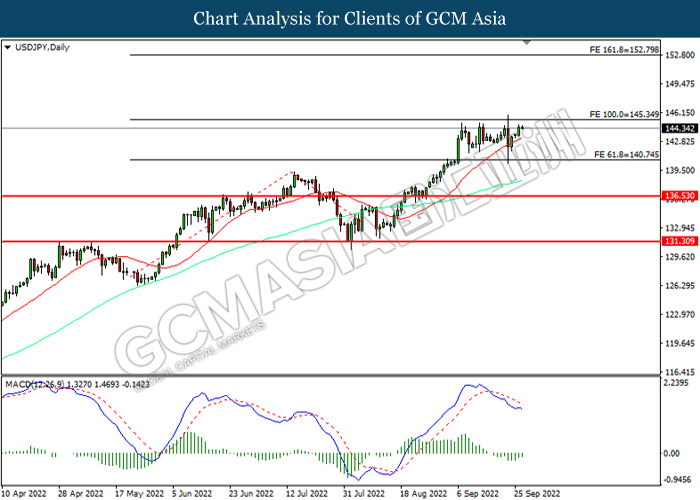

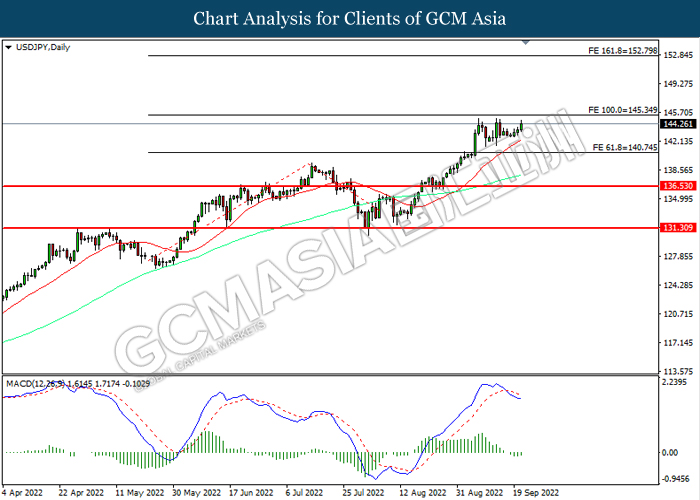

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

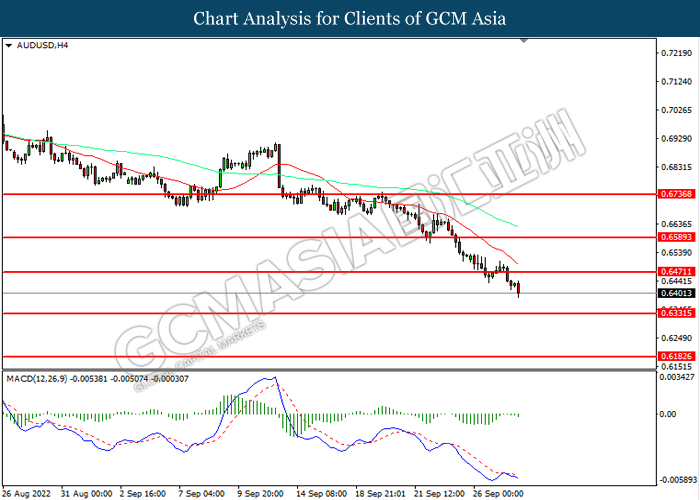

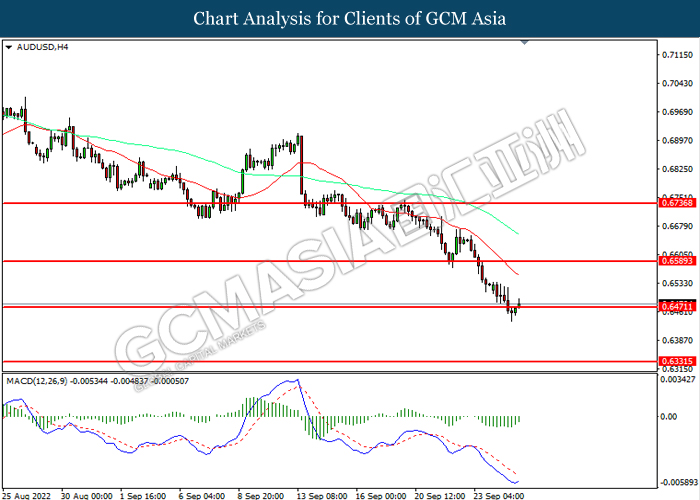

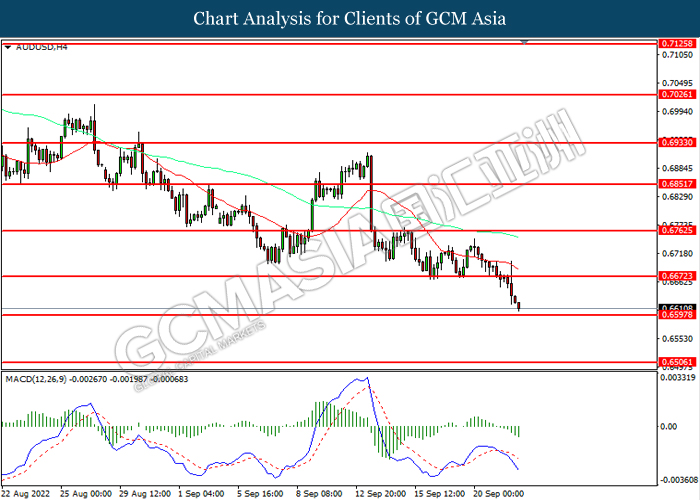

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6515, 0.6645

Support level: 0.6385, 0.6185

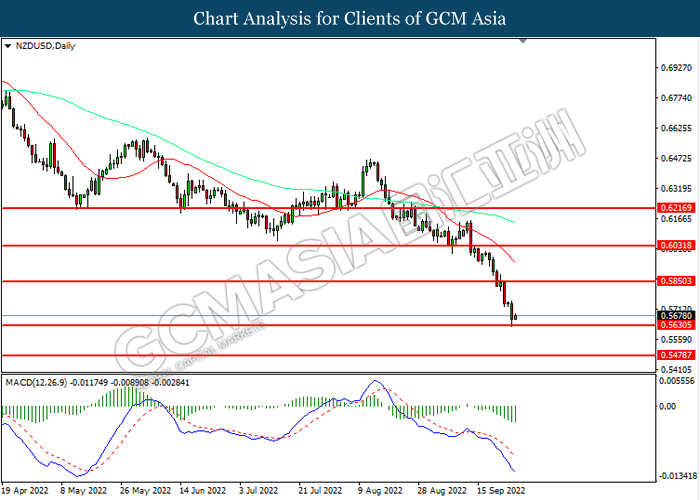

NZDUSD, Daily: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.5850, 0.6030

Support level: 0.5590, 0.5465

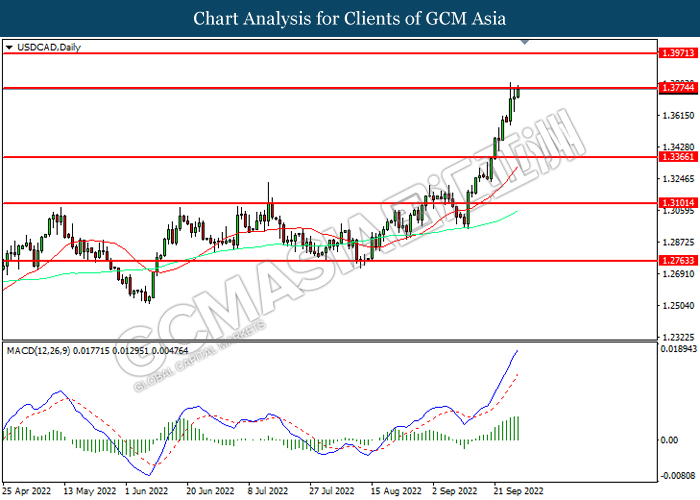

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3775, 1.3970

Support level: 1.3365, 1.3100

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9855, 0.9965

Support level: 0.9640, 0.9515

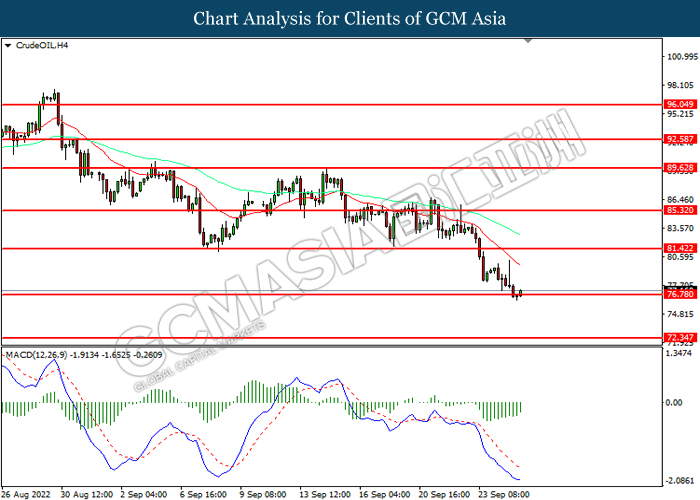

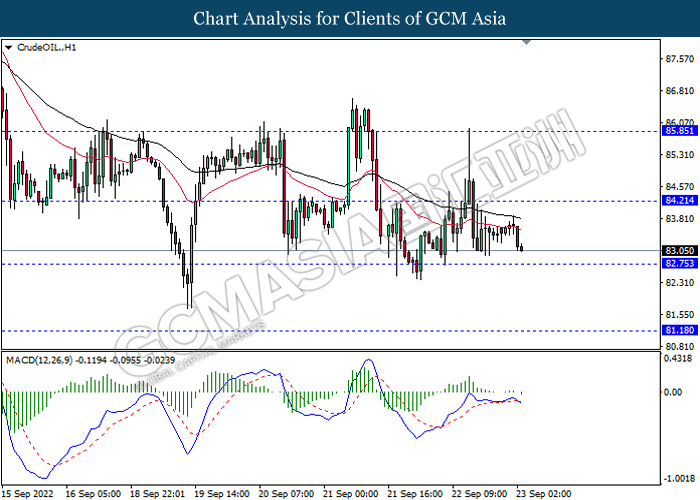

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.95, 85.30

Support level: 76.80, 72.35

GOLD_, H1: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1671.00, 1681.85

Support level: 1659.35, 1651.20

290922 Afternoon Session Analysis

29 September 2022 Afternoon Session Analysis

Dollar’s bull, turn its head down following downbeat data was released.

The Dollar Index which traded against a basket of six major currencies retreated from its highest level over the backdrop of the downbeat economic data. According to National Association of Realtor, US Pending Home Sales for last month notched down significantly from the preliminary reading of -0.6% to -2.0%, missing the market forecast at -1.4%. The contracts to purchase US home fell for a third straight month in August, weighed down by the spiking interest rate and inflation risk, which diminishing the affordability. As for now, investors would continue to scrutinize the crucial economic data from United States region tonight to gauge the likelihood movement for the US Dollar. On the other hand, the US Dollar extend its losses following the Bank of England claimed to purchase long-term bond in order to sustain the economic development, which prompting investors to sell off the US Dollar while shifting into UK market. As of writing, the Dollar Index appreciated by 0.62% to 113.30.

In the commodities market, the crude oil price appreciated by 0.01% to $81.75 per barrel as of writing. The crude oil price rebounded from its lower level as the precautionary shutdowns in production on the Gulf of Mexico by Chevron and BP, which diminishing the oil supply. On the other hand, the gold price surged 0.01% to $1653.50 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 NZD RBNZ Gov Orr Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q2) | 9.0% | 8.9% | – |

| 20:30 | USD – Initial Jobless Claims | 213K | 215K | – |

| 20:30 | CAD – GDP (MoM) (Jul) | 0.1% | -0.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 113.65, 117.30

Support level: 107.55, 107.55

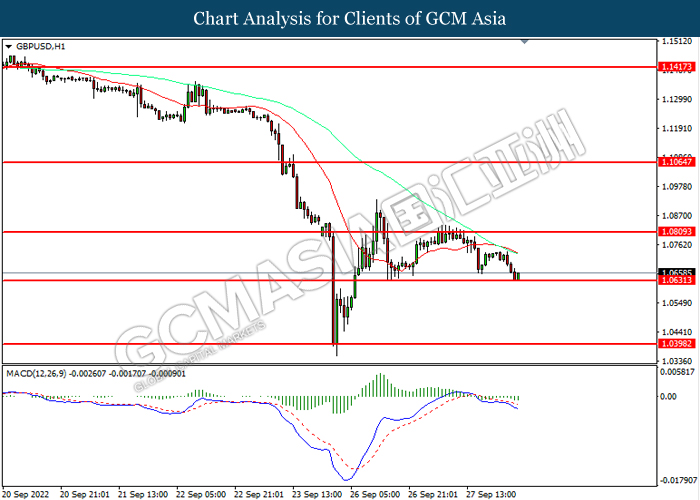

GBPUSD, H1: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.0890, 1.1065

Support level: 1.0630, 1.0400

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout the resistance level.

Resistance level: 0.9740, 0.9915

Support level: 0.9460, 0.9135

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6515, 0.6645

Support level: 0.6385, 0.6185

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5850, 0.6030

Support level: 0.5590, 0.5465

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3775, 1.3970

Support level: 1.3365, 1.3100

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9855, 0.9965

Support level: 0.9640, 0.9515

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 81.95, 85.30

Support level: 76.80, 72.35

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1661.60, 1681.85

Support level: 1639.45, 1622.90

290922 Morning Session Analysis

29 September 2022 Morning Session Analysis

Pound jumped as BoE intervened the gilt market.

The GBP/USD, which traded by majority of investors surged on yesterday amid the intervention of UK central bank. According to CNBC, the Bank of England (BoE) would start buying long-dated bonds in order to restore market functioning and reduce any risks contagion to credit conditions for UK household and businesses. The monthly rise of yields of UK government bonds has spiked to a high level since 1957 as the market participants had flee away from the UK fixed income market, after the fiscal policy has been announced. The bond purchase started from 28 September and the central bank will stop purchasing it on 14 October. Besides, the bank’s Financial Policy Committee had acknowledged that the dysfunction in the gilt market caused a material risk to the country’s financial stability. Thus, they decided to take action immediately. The move from BoE would stimulate the nation spending in short-term period, which brought positive prospects toward economic progression in UK. As of writing, GBP/USD eased by 0.43% to 1.0845.

In the commodities market, the crude oil price dropped by 0.50% to $81.74 per barrel as of writing. However, the oil price rose significantly on yesterday following the crude oil inventories decreased by 0.215M barrel, missing the market expectation of 0.443M increase. In addition, the gold price depreciated by 0.23% to $1657.34 per troy ounce as of writing. Yesterday, the gold price spiked over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 NZD RBNZ Gov Orr Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q2) | 9.0% | 8.9% | – |

| 20:30 | USD – Initial Jobless Claims | 213K | 215K | – |

| 20:30 | CAD – GDP (MoM) (Jul) | 0.1% | -0.1% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 113.00, 114.10

Support level: 111.50, 110.50

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0895, 1.1085

Support level: 1.0655, 1.0400

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9730, 0.9810

Support level: 0.9650, 0.9565

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6555, 0.6650

Support level: 0.6470, 0.6370

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.5770, 0.5865

Support level: 0.5680, 0.5615

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9785, 0.9865

Support level: 0.9715, 0.9635

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 81.80, 86.05

Support level: 78.20, 74.60

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1661.60, 1678.65

Support level: 1641.55, 1621.85

280922 Afternoon Session Analysis

28 September 2022 Afternoon Session Analysis

Pound slumped amid worsening budget deficit.

The Pound Sterling extends its losses following the UK-denominated bond experienced a worst selloff in decades, with UK corporate bonds losing a stunning 27% this year. Earlier, the UK denominated bond slumped following the UK Prime Minister Liz Truss’s new government rolled out policy for large-scale tax cuts in order to boost up the economic momentum. Such policy had spurred further tensions toward the government’s already sizable budget deficit, which further dragging down the appeal for the Pound Sterling. On the other hand, the pair of EUR/USD received significant bearish momentum yesterday as market participants concerned that the shutdown of Nord Stream pipeline would likely to jeopardize the economic development in European region. According to Reuters, European Commission chief Ursula von der Leyen on Tuesday claimed that the leaks of the Nord Stream pipelines were caused by sabotage, deepening uncertainty about European energy security as soaring prices and fears of running short of fuel over the winter. As of writing, GBP/USD depreciated by 0.68% to 1.0655 while EUR/USD slumped 0.30% to 0.9560.

In the commodities market, the crude oil price depreciated by 0.54% to $77.55 per barrel as of writing amid downbeat economic prospect would likely to weigh down the market demand on this black-commodity. On the other hand, the gold price slumped 0.25% to $1624.95 per troy ounces as of writing following the United States released a string of positive economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:15 EUR ECB President Lagarde Speaks

22:15 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Pending Home Sales (MoM) (Aug) | -1.0% | -1.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.142M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 117.30, 120.00

Support level: 113.65, 111.40

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout the support level.

Resistance level: 1.0810, 1.1065

Support level: 1.0630, 1.0400

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9740, 0.9915

Support level: 0.9460, 0.9135

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6470, 0.6590

Support level: 0.6330, 0.6185

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.5850, 0.6030

Support level: 0.5590, 0.5465

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3775, 1.3970

Support level: 1.3365, 1.3100

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9980, 1.0185

Support level: 0.9855, 0.9640

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 81.40, 85.30

Support level: 76.80, 72.35

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1639.45, 1658.50

Support level: 1622.85, 1600.65

280922 Morning Session Analysis

28 September 2022 Morning Session Analysis

Optimistic economic data supported US Dollar to rise.

The Dollar Index which traded against a basket of six major currencies rose significantly amid the background of upbeat economic data. According to Conference Board, the US CB Consumer Confidence in September notched up from the previous reading of 103.6 to 108.0, exceeding the market forecast of 104.5. Besides, the US New Home Sales had also increased from the prior figure of 532K to 685K, far higher that consensus expectation of 500K. A series of bullish data had indicated that the US economy is beginning to show signs of improvement, which dialed up the market optimism toward economy progression in the US. In addition, the US Dollar received further bullish momentum over the hawkish stand of Fed members. Chicago Fed President Charles Evans claimed on Tuesday that the US central bank would need to hike its interest rate to a range between 4.50% and 4.75%. He also reiterated the importance of rate hike path which is continuing, even the rate hike would lead to an economy recession. Such hawkish speech has sparked the appeal of US Dollar. As of writing, the Dollar Index appreciated by 0.07% to 114.10.

In the commodities market, the crude oil price dropped by 0.13% to $78.41 per barrel as of writing. Nonetheless, the oil price surged throughout yesterday trading session over the likelihood of reduced supply from Hurricane Ian. On the other hand, the gold price edged down by 0.02% to $1628.58 per troy ounce as of writing following the strengthened US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:15 EUR ECB President Lagarde Speaks

22:15 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Pending Home Sales (MoM) (Aug) | -1.0% | -1.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.142M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 114.10, 115.65

Support level: 113.00, 111.50

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0895, 1.1085

Support level: 1.0655, 1.0400

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9650, 0.9730

Support level: 0.9565, 0.9445

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6470, 0.6555

Support level: 0.6370, 0.6265

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.5680, 0.5770

Support level: 0.5615, 0.5530

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0020, 1.0100

Support level: 0.9900, 0.9785

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 79.50, 81.20

Support level: 78.20, 76.30

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1641.55, 1661.60

Support level: 1621.85, 1600.30

270922 Afternoon Session Analysis

27 September 2022 Afternoon Session Analysis

Pound rebounded on rate hike expectation from BoE.

The Pound Sterling rebounded from an all-time low against the Greenback on Monday following the Bank of England (BoE) unleashed their hawkish tone to shore up the battered of Pound Sterling. According to CNBC, the BOE governor claimed that the Monetary Policy Committee (MPC) would make a “full assessment” at its next monetary policy meeting in November while reiterating to act accordingly to stabilize the significant depreciation of Pound Sterling as well as the inflation risk. As for now, the money markets priced in more than 200 basis point rate hike from Bank of England (BoE) during the next monetary policy meeting in November, four times higher compare to its last hike. Earlier, the announcement by the Prime Minister Liz Truss’ administration with regards of a significant tax cuts had sent the Pound Sterling to slump significantly, which prompting the Pound Sterling to be weakened by more than 20% against US Dollar this year. As of writing, GBP/USD appreciated by 0.89% to 1.0780.

In the commodities market, the crude oil price appreciated by 1.02% to $77.10 per barrel as of writing amid technical correction following reaching its recent low. Nonetheless, the overall long-term prospect for this black-commodity still remained bearish amid the rate hike decision from the global central bank continue to drag down the appeal for the crude oil. On the other hand, the gold price extend its losses by 0.01% to $1630.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 USD Fed Chair Powell Speaks

19:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Aug) | 0.2% | 0.2% | – |

| 22:00 | USD – CB Consumer Confidence (Sep) | 103.2 | 104.0 | – |

| 22:00 | USD – New Home Sales (Aug) | 511K | 500K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 113.65, 117.30

Support level: 111.40, 107.55

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.0830, 1.1065

Support level: 1.0500, 1.0095

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9740, 0.9915

Support level: 0.9460, 0.9135

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6590, 0.6735

Support level: 0.6470, 0.6330

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.5850, 0.6030

Support level: 0.5630, 0.5480

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3700, 1.3930

Support level: 1.3365, 1.3100

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9980, 1.0185

Support level: 0.9855, 0.9640

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 81.40, 85.30

Support level: 76.80, 72.35

GOLD_, H1: Gold price was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1645.20, 1658.50

Support level: 1622.85, 1594.80

270922 Morning Session Analysis

27 September 2022 Morning Session Analysis

US Dollar jumped as rate hike expectation remain aggressive.

The dollar index which traded against a basket of six major currencies surged on yesterday over the hawkish statement from Fed member. According to Reuters, Cleveland Fed President Loretta Mester claimed on Monday that the central bank should life rates higher and keep the contractionary policy for some time in order to tamp down the “unacceptable high” inflation. She also expressed her thoughts that it can be better policymakers to act more aggressively when there was uncertainty, because the aggressive and pre-emptive action can prevent the worst-case outcomes from actually coming out. Last week, Fed has hiked its interest rate by 75 basis point for the third consecutive time as well as hinting that same size of rate hike might be implemented again in the upcoming meeting. On the other hand, the possibility of 0.75% rate hike has reached 67.5%, according to CME FedWatch Tool. The recent hawkish speech from Fed members had sparked positive prospects of US Dollar, which made the US currency remain optimistic. As of writing, the Dollar Index appreciated by 1.02% to 114.11.

In the commodities market, the crude oil price edged down by 0.01% to $76.70 per barrel as of writing following the global economy recession has weighed down the demand of this black commodity. In addition, the gold price rose by 0.02% to $1633.70 per troy ounce as of writing after a sharp decline throughout the yesterday trading session amid the US Dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 USD Fed Chair Powell Speaks

19:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Aug) | 0.2% | 0.2% | – |

| 22:00 | USD – CB Consumer Confidence (Sep) | 103.2 | 104.0 | – |

| 22:00 | USD – New Home Sales (Aug) | 511K | 500K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 114.10, 115.65

Support level: 112.35, 111.30

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0895, 1.1085

Support level: 1.0655, 1.0400

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9650, 0.9730

Support level: 0.9565, 0.9445

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6470, 0.6555

Support level: 0.6370, 0.6265

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.5680, 0.5770

Support level: 0.5615, 0.5530

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0020, 1.0100

Support level: 0.9900, 0.9785

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 78.20, 79.50

Support level: 76.30, 74.60

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1641.55, 1661.60

Support level: 1621.85, 1600.30

260922 Afternoon Session Analysis

26 September 2022 Afternoon Session Analysis

Pound dived after UK government announced for tax cuts.

The GBP/USD slumped significantly on last Friday trading session after UK government announced to apply tax cut to tackle recession. According to CNBC, the new UK government that leaded by Liz Truss was targeting a medium-term 2.5% trend rate in economic growth, while they believe that high taxes rate would diminish incentives to work as well as disrupt investment and corporate development. Based on the announcement, a reduction in the basic rate of income tax from 20% to 19% has implemented. Also, they have cancelled a planned rise in corporation tax to 25% and keeping it at 19%, the tax paid on incomes over high income groups would take a top rate of 40%. Tax cuts would increase consumer spending in nation. However, in the perspective of investors, the move from the UK government would likely to reduce nation income, which make the economic progression in UK become pessimistic. As of writing, GBP/USD dropped by 2.86% to 1.0546.

In the commodities market, the crude oil price depreciated by 0.37% to $78.44 per barrel as of writing following the market feared that showing global economic activity recession will dent demand for oil. On the other hand, the gold price eased by 0.52% to $1639.85 per troy ounce as of writing following the value of US Dollar heightened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q3) | -0.25% | 0.50% | – |

| 16:00 | EUR – German Ifo Business Climate Index (Sep) | 1.75% | 2.25% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 114.10, 115.65

Support level: 112.35, 111.30

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0655, 1.0895

Support level: 1.0400, 1.0170

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9730, 0.9810

Support level: 0.9650, 0.9565

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 144.05, 145.60

Support level: 142.35, 140.70

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6555, 0.6650

Support level: 0.6470, 0.6370

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.5770, 0.5850

Support level: 0.5680, 0.5615

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfullt breakout the resistance level.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9900, 1.0020

Support level: 0.9785, 0.9715

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 79.50, 81.20

Support level: 78.20, 76.30

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1641.55, 1661.60

Support level: 1621.85, 1600.30

260922 Morning Session Analysis

26 September 2022 Morning Session Analysis

US Dollar continues its bull trend as hawkish expectation from Fed.

The Dollar Index which traded against a basket of six major currencies surged significantly into a fresh two-decade high as market participants continue to digest the rate hike decision from Federal Reserve. Last week, the Federal Reserve increased their interest rates by another 75-basis point while signaling a larger rate hike decision at its upcoming meetings. According to Reuters, the Fed Chair Jerome Powell claimed that the Fed will act aggressively now to stabilize the inflation rate into 2%. Currently, the Fed’s new projections indicated the US policy rate rising to 4.4% by the end of 2022 while rate cuts are not expected until the year of 2024. Following the implementation of the aggressive contractionary monetary policy from the major central bank last week, investors will be bracing themselves for new volatility in the week ahead. Several Federal Reserve members are expected to speak this week, while other crucial economic data from US region would be also the main focus for the global investors to gauge the likelihood movement for the US Dollar. As of writing, the Dollar Index depreciated by 0.16% to 113.00.

In the commodities market, the crude oil price slumped 0.03% to $79.45 per barrel as of writing amid concerns upon the global recession risk continue to weigh down the appeal for this black-commodity. On the other hand, the gold market slumped 0.01% to $1642.15 per troy ounces amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q3) | -0.25% | 0.50% | – |

| 16:00 | EUR – German Ifo Business Climate Index (Sep) | 1.75% | 2.25% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 113.20, 116.40

Support level: 111.20, 107.95

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.1415, 1.1855

Support level: 1.0785, 1.0405

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9855, 1.0175

Support level: 0.9685, 0.9410

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6585, 0.6670

Support level: 0.6505, 0.6390

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.5850, 0.6030

Support level: 0.5630, 0.5480

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3680, 1.3930

Support level: 1.3365, 1.3100

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9855, 0.9980

Support level: 0.9740, 0.9635

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 81.40, 85.30

Support level: 77.05, 72.235

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1656.10, 1680.00

Support level: 1640.20, 1617.75

230922 Afternoon Session Analysis

23 September 2022 Afternoon Session Analysis

Yen spiked following Japan intervened the market.

The USD/JPY, which widely traded by majority of investors dived significantly on yesterday amid the intervention of Japan government and central bank. According to Reuters, the Japan government and central bank intervened forex market by buying its nation currency, Yen, in order to support the weakening nation currency. Bank of Japan (BoJ) remained its loosening monetary policy has pressured the value of Yen against US Dollar, which led Japan to intervene the market. Besides that, Prime Minister of Japan Fumio Kishida claimed on yesterday that the government would highly eye on the exchange rate of its currency and they might implement intervention again if necessary. As Japanese currency supported by its government, it prompted investors to shift their capitals toward Yen. On the other hand, the USD/CHF rose on yesterday after the Swiss National Bank (SNB) released its interest rate decision. The SNB hiked its rates by 75 basis point from -0.25% to 0.50%, which meet with the market expectation. As of writing, USD/JPY eased by 0.23% to 142.02 as well as USD/CHF edged up by 0.16% to 0.9783.

In the commodities market, the crude oil price dropped by 0.37% to $83.18 per barrel as of writing over the backdrop of economic recession which driven by rate hike. In addition, the gold price depreciated by 0.11% to $1671.02 per troy ounce as of writing following the US Dollar strengthened.

Today’s Holiday Market Close

Time Market Event

All Day JPY Public Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Sep) | 49.4 | 48.3 | – |

| 16:30 | GBP – Composite PMI | 49.6 | 49.0 | – |

| 16:30 | GBP – Manufacturing PMI | 47.3 | 47.5 | – |

| 16:30 | GBP – Services PMI | 50.9 | 50.0 | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Jul) | 0.8% | -1.2% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 111.30, 112.35

Support level: 110.35, 109.40

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1275, 1.1365

Support level: 1.1180, 1.1085

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9880, 0.9965

Support level: 0.9810, 0.9730

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 142.35, 144.05

Support level: 140.70, 138.80

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6650, 0.6720

Support level: 0.6555, 0.6470

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.5850, 0.5925

Support level: 0.5770, 0.5680

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9900, 1.0020

Support level: 0.9785, 0.9715

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 84.20, 85.85

Support level: 82.75, 81.20

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1678.65, 1694.20

Support level: 1661.60, 1641.55

230922 Morning Session Analysis

23 September 2022 Morning Session Analysis

Pound Sterling stumbled following BoE interest rate decision.

Pound Sterling, which was widely traded by the global investors, edged down following the expected 0.25% rate hike after the Bank of England (BoE) meeting. As the UK undergoes a vast change of new government, it does not stop the objective of UK central bank with their steady and predictable rate hike, in order to stop the sky-high inflation that continue weighing on the living cost of the British. Yesterday, the BoE take a further tightening step on the interest rate from 1.75% to 2.25%, missing minority of the investors expectation who having the thought of a 0.75% move. The BoE Committee vowed that if the outlook suggests more persistent inflationary pressures, they will react accordingly to cool down the overheating economy, as necessary. Besides, with the elevating of energy bills and rising cost of goods and services, the economy was heading for a second consecutive quarter of falling output, mirroring the UK economy is still struggling in a recession phase. As of writing, the pair of GBP/USD inched down -0.04% to 1.1252.

In the commodities market, the crude oil price dropped -0.06% to $83.40 per barrel as the Greenback value remain elevated, whereby it reduces the willingness of non-US buyer to replenish the oil. Besides, the gold prices depreciated by -0.02% to $1671.40 per troy ounce as the dollar strengthen.

Today’s Holiday Market Close

Time Market Event

All Day JPY Public Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Sep) | 49.4 | 48.3 | – |

| 16:30 | GBP – Composite PMI | 49.6 | 49.0 | – |

| 16:30 | GBP – Manufacturing PMI | 47.3 | 47.5 | – |

| 16:30 | GBP – Services PMI | 50.9 | 50.0 | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Jul) | 0.8% | -1.2% | – |

Technical Analysis

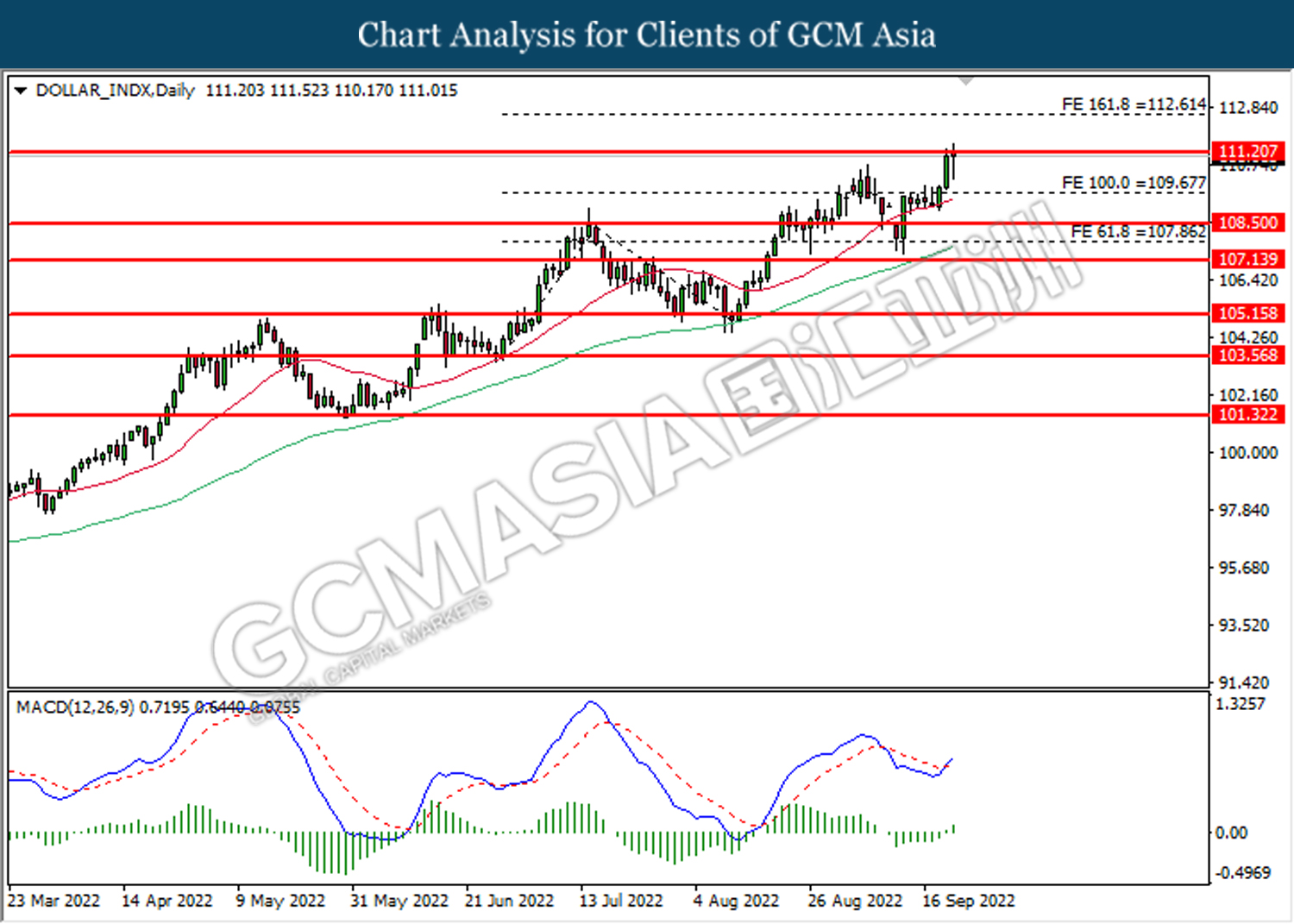

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 111.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 111.20, 112.60

Support level: 109.65, 108.50

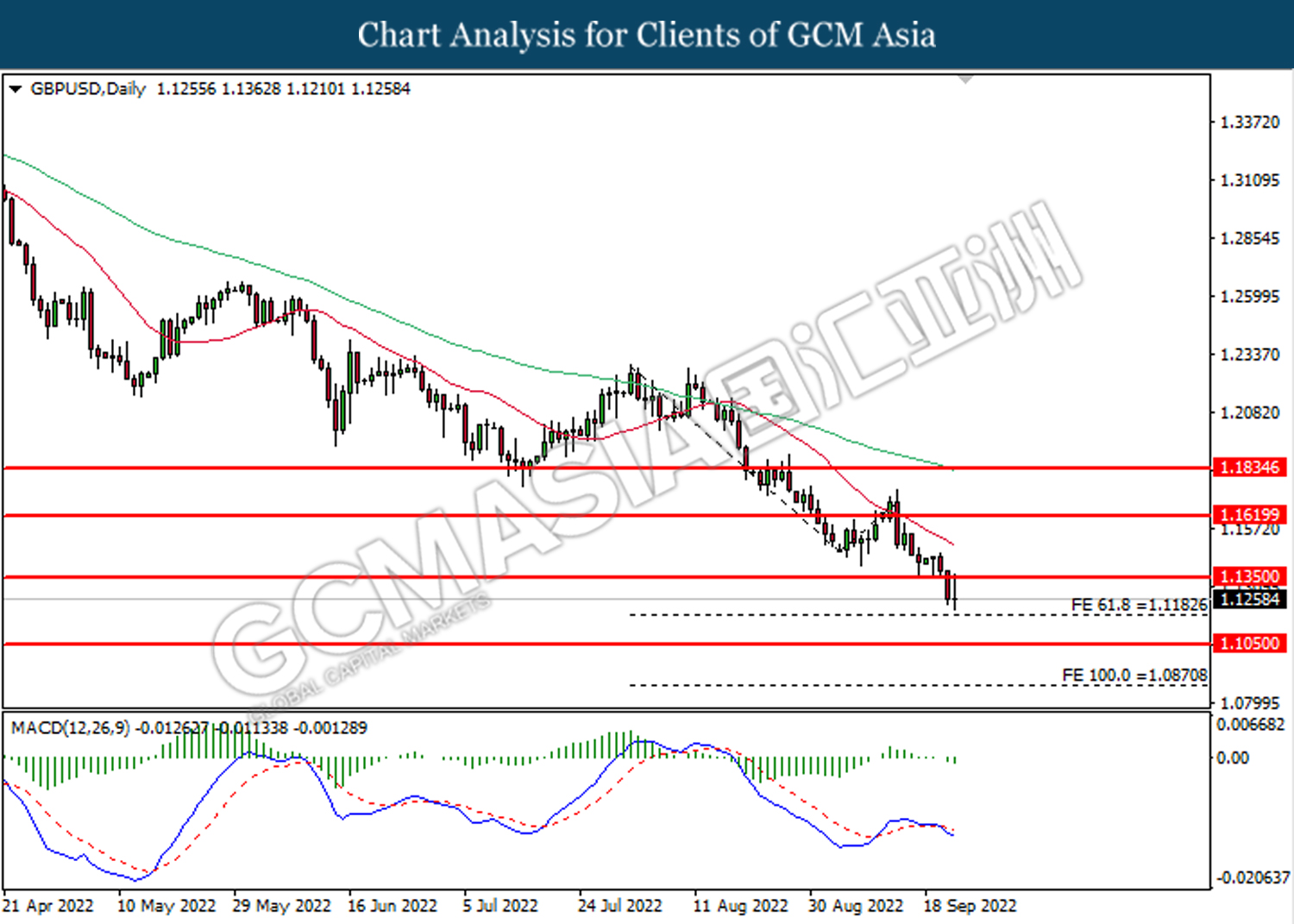

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1350. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1185.

Resistance level: 1.1350, 1.1620

Support level: 1.1185, 1.1050

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9820. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the previous support level at 0.9820.

Resistance level: 0.9865, 0.9910

Support level: 0.9820, 0.9700

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 141.50. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 146.50, 149.90

Support level: 141.50, 136.65

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6640. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6530.

Resistance level: 0.6640, 0.6725

Support level: 0.6530, 0.6450

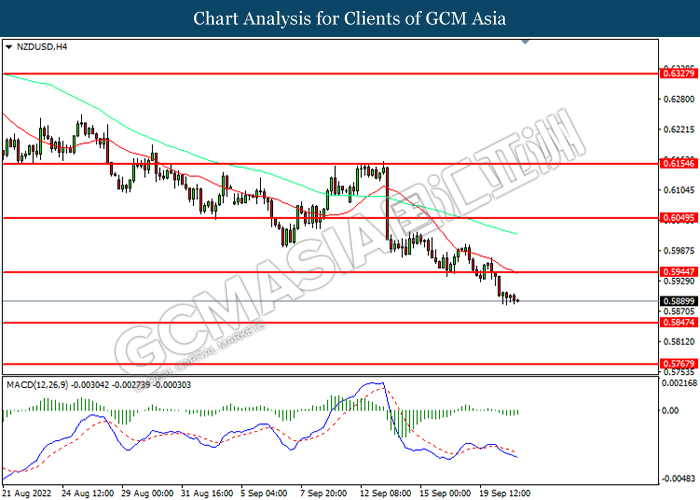

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.5845. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.5775.

Resistance level: 0.5845, 0.5925

Support level: 0.5775, 0.5710

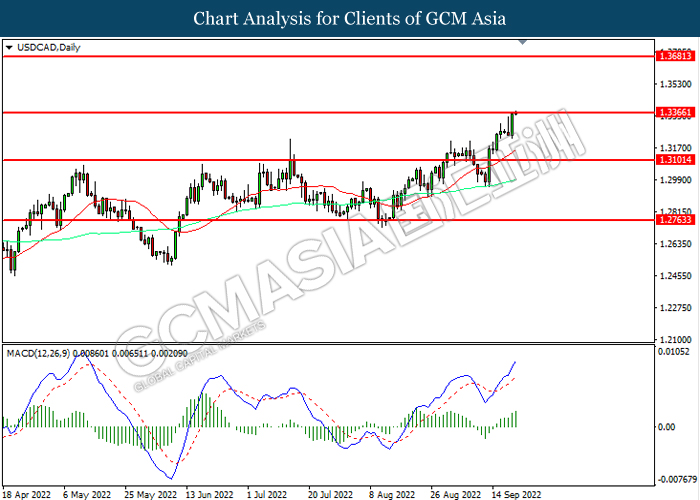

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3485. MACD which illustrated bullish momentum suggests the pair to extend gains after its candle successfully closes above the resistance level at 1.3485.

Resistance level: 1.3485, 1.3510

Support level: 1.3385, 1.3320

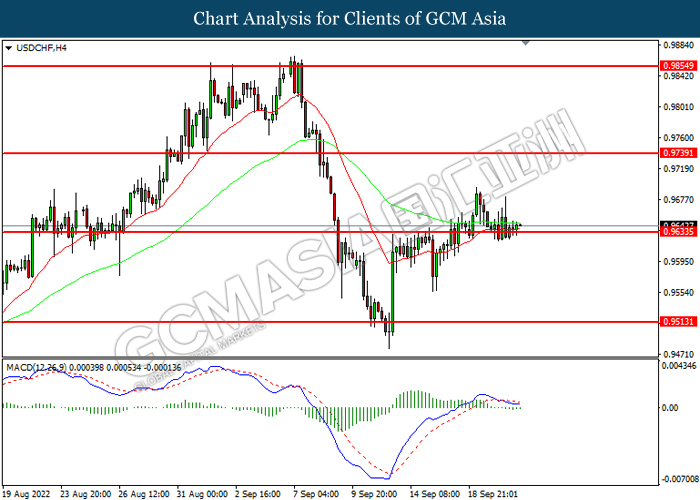

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9750. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.9750.

Resistance level: 0.9750, 0.9825

Support level: 0.9675, 0.9590

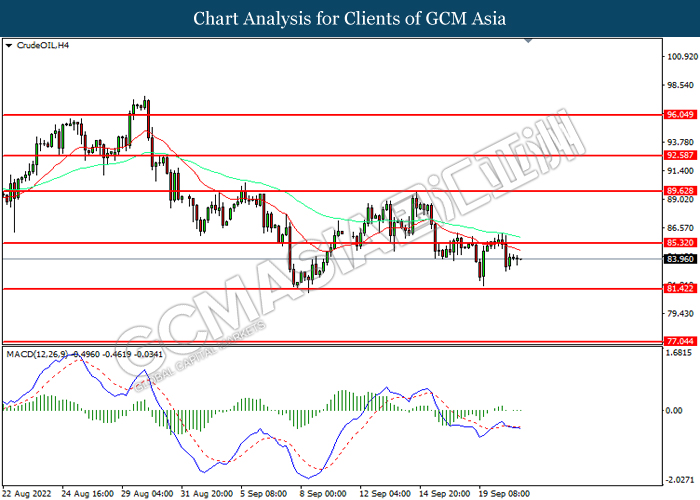

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 86.15. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 86.15, 89.45

Support level: 80.60, 78.20

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1653.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1677.75.

Resistance level: 1677.75, 1693.35

Support level: 1653.90, 1636.10

220922 Afternoon Session Analysis

22 September 2022 Afternoon Session Analysis

Pound Sterling dipped as economic outlook remain clouded.

The GBP/USD, which widely traded by global investors slumped on yesterday amid the pessimistic economic outlook in UK. According to Reuters, Britain’s manufacturers association has diminished the factory output forecast from 1.7% to 0.6%, which driven by soaring energy price and uncertainty of demand. The spiking inflation risk which caused by Russia-Ukraine conflict has threaten the consumer demand and pushed up the operating cost in UK region, which exacerbated the possibility of UK economy entering into recession. Such situation has dragged down the value of Pound Sterling. Besides, that, the GBP/USD has extended its losses after the Fed Chairman Jerome Powell stand with its aggressive rate hike path during early trading session. However, the losses of Pound was limited following the Bank of England (BoE) was expected to hike its rate by 50 basis point in the policy meeting today, while some market participant were anticipating a higher rate hike, says 75 basis point. At this juncture, investors would continue to focus on the interest rate decision from BoE in order to gauge the likelihood movement of Pound. As of writing, GBP/USD depreciated by 0.32% to 1.1229.

In the commodities market, the crude oil price rose by 0.64% to $83.45 per barrel as of writing after a sharp decline on earlier trading session following the hawkish statement from Fed. On the other hand, the gold price eased by 0.41% to $1660.96 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:30 JPY BoJ Press Conference

15:30 CHF SNB Monetary Policy Assessment

15:30 CHF SNB Press Conference

19:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q3) | -0.25% | 0.50% | – |

| 19:00 | GBP – BoE Interest Rate Decision (Sep) | 1.75% | 2.25% | – |

| 20:30 | USD – Initial Jobless Claims | 213K | 218K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 111.30, 112.35

Support level: 110.35, 109.40

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1275, 1.1365

Support level: 1.1180, 1.1085

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9880, 0.9965

Support level: 0.9810, 0.9730

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6650, 0.6720

Support level: 0.6555, 0.6470

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.5850, 0.5925

Support level: 0.5770, 0.5680

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9715, 0.9785

Support level: 0.9635, 0.9535

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 84.20, 85.85

Support level: 82.75, 81.20

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1678.65, 1694.20

Support level: 1661.60, 1641.55

220922 Morning Session Analysis

22 September 2022 Morning Session Analysis

US Dollar soared following rate hike decision from Fed.

The Dollar Index which traded against a basket of six major currencies surged significantly to a fresh two-decade recent high on Wednesday following the Federal Reserve increased their interest rates by three-quarters of a percentage point for the third consecutive time. Meanwhile, the Monetary Policy Committee (MPC) speculated further rate hike decision in future to stabilize the spiking number of inflation rate which stoked by supply constraints caused by the war between Russia and Ukraine and unexpectedly robust demand following the economic recovery. The MPC also claimed that the Fed could lift the rate by at least another 125-basis point by the end of 2022, to a range between 4.25% and 4.5%, according to Fed new projections. On the other hand, the safe-haven US Dollar extend its gains as rising tensions between Russian-Ukraine had sparked further risk-off sentiment in the global financial market. Yesterday, Russia’s President Vladimir Putin claimed that the Russia is willing to use nuclear weapons if Ukraine continues its offensive operations, according to the Guardian. As of writing, the Dollar Index appreciated by 1.00% to 111.05.

In the commodities market, the crude oil price depreciated by 0.25% to $82.75 per barrel as of writing. The oil market was edged lower last week amid the surge in US Dollar urged the non-US oil buyer to temporarily shy away from the black-commodity. The gold price appreciated by 0.27% to $1669.05 per troy ounces as of writing as the rising tensions between Russian-Ukraine, prompting investors to shift their portfolio into safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:30 JPY BoJ Press Conference

15:30 CHF SNB Monetary Policy Assessment

15:30 CHF SNB Press Conference

19:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q3) | -0.25% | 0.50% | – |

| 19:00 | GBP – BoE Interest Rate Decision (Sep) | 1.75% | 2.25% | – |

| 20:30 | USD – Initial Jobless Claims | 213K | 218K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 111.20, 113.20

Support level: 107.95, 104.85

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.1365, 1.1455

Support level: 1.1250, 1.1170

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9865, 1.0135

Support level: 0.9705, 0.9445

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6670, 0.6765

Support level: 0.6595, 0.6505

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.5905, 0.5990

Support level: 0.5830, 0.5765

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.3680, 1.3930

Support level: 1.3365, 1.3100

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9740, 0.9855

Support level: 0.9635, 0.9515

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 85.30, 89.65

Support level: 81.40, 77.05

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1680.00, 1693.65

Support level: 1656.10, 1642.20

210922 Afternoon Session Analysis

21 September 2022 Afternoon Session Analysis

Canada Dollar retreated as easing inflation risk.

The Canada Dollar extends its losses following the released of crucial inflation data, which dialed down the market optimism toward rate hike expectation from Bank of Canada in future. According to Statistics Canada, the annual inflation rate had eased more than expected in August despite the food prices rose at their fastest pace in 41 years. The Canada annual inflation rate came in at 7.0% in August, below the market forecasts at 7.3% and the preliminary reading of 7.6% in July. Currently, the money market speculated on at 50 basis point rate hike to 3.75% at the October rate decision following the data, slightly lower than the previous expectation. Earlier, the Bank of Canada had increased its interest rate by 75 basis point to 3.25% for this month, while claiming that they will still continue to scrutinize the latest updates with regards of latest economic data to determine the monetary policy. As of writing, the pair of USD/CAD appreciated by 0.07% to 1.3370.

In the commodities market, the crude oil price depreciated by 0.25% to $84.00 per barrel as of writing. The oil market edged lower as market participants concerned that the tightening monetary policy from the global central bank would likely to jeopardize the economic momentum, dragging down the appeal for the crude oil demand. On the other hand, the gold price depreciated by 0.08% to $1663.65 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Economic Projections

(22nd Sep)

02:00 USD FOMC Statement

(22nd Sep)

02:00 USD FOMC Press Conference

(22nd Sep)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Existing Home Sales (Aug) | 4.81M | 4.70M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.442M | 2.161M | – |

| 02:00

(22nd Sep) |

USD -Fed Interest Rate Decision | 2.50% | 3.25% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 111.20, 113.20

Support level: 107.95, 104.85

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1455, 1.1585

Support level: 1.1365, 1.1310

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0060, 1.0180

Support level: 0.9955, 0.9875

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6765, 0.6850

Support level: 0.6675, 0.6595

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5945, 0.6050

Support level: 0.5845, 0.5765

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3365, 1.3680

Support level: 1.3100, 1.2765

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9740, 0.9855

Support level: 0.9635, 0.9515

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 85.30, 89.65

Support level: 81.40, 77.05

GOLD_, H1: Gold price was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1680.00, 1693.65

Support level: 1656.10, 1642.20