230623 Morning Session Analysis

23 June 2023 Morning Session Analysis

Dollar jumped amid persistent hawkish statement from Powell.

The dollar index, which was traded against a basket of six major currencies, bounced off after hitting the lowest level in 6 weeks as Federal Reserve Chairman Jerome Powell backed further U.S. interest rate hikes, albeit at a “cautious” pace, and a succession of central bank rate hikes raised concerns about the outlook for global growth. During the second day of testimony, Jerome Powell, expressed that the central bank would proceed with adjusting interest rates cautiously and gradually. When questioned about the possibility of rate cuts, Powell stated that they were not expected to occur in the near future. He emphasized that any rate cuts would require a period of confidence in seeing inflation decrease to the Federal Reserve’s target of 2%. On Thursday, recent U.S. data revealed that the number of individuals filing for state unemployment benefits for the first time remained at a 20-month high. This level has persisted for three consecutive weeks, indicating a potential early sign of a labor market that is experiencing a softening trend. According to the Census Bureau, the US Initial Jobless Claims came in at 264K, in line with the previous reading while slight higher than the consensus forecast at 260K. Despite, the downbeat data failed to drag the dollar market. As of writing, the dollar index rose 0.33% to 102.40.

In the commodities market, crude oil prices was down by -0.03% to $69.40 per barrel as a slew of rate hikes From Bank Of England (BoE) and Swiss National Bank (SNB) darken the prospect of this black commodity. Besides, the gold prices edged down by -0.02% to $1913.75 per troy ounce as the aggressive rate hike comment from Jerome Powell lifted the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Jun) | 43.2 | 43.5 | – |

| 16:30 | GBP – Composite PMI | 54.0 | 53.7 | – |

| 16:30 | GBP – Manufacturing PMI | 47.1 | 46.8 | – |

| 16:30 | GBP – Services PMI | 55.2 | 54.7 | – |

| 21:45 | USD – Manufacturing PMI (Jun) | 48.4 | 48.3 | – |

| 21:45 | USD – S&P Global Composite PMI (Jun) | 54.3 | – | – |

| 21:45 | USD – Manufacturing PMI (Jun) | 54.9 | 54.0 | – |

Technical Analysis

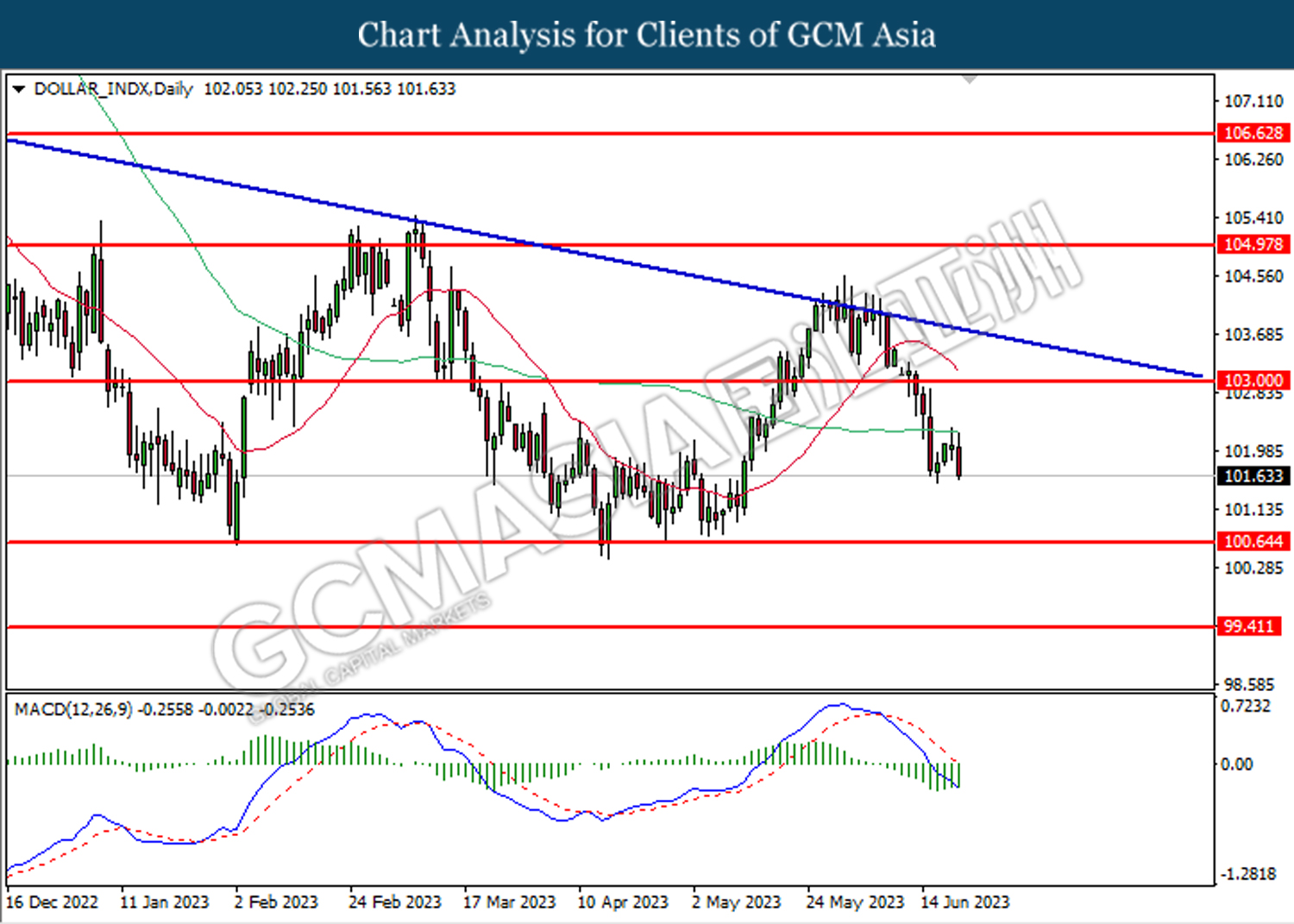

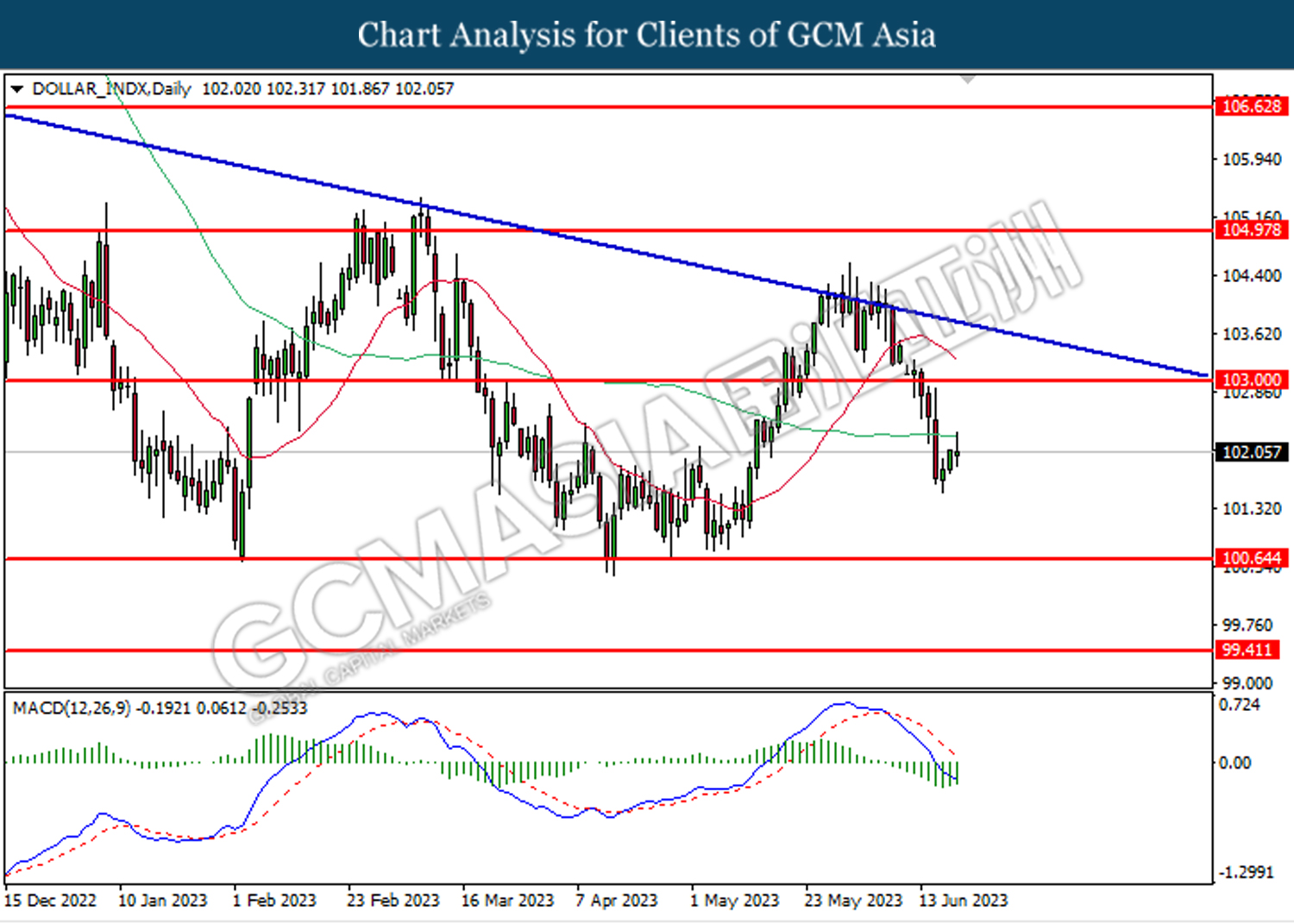

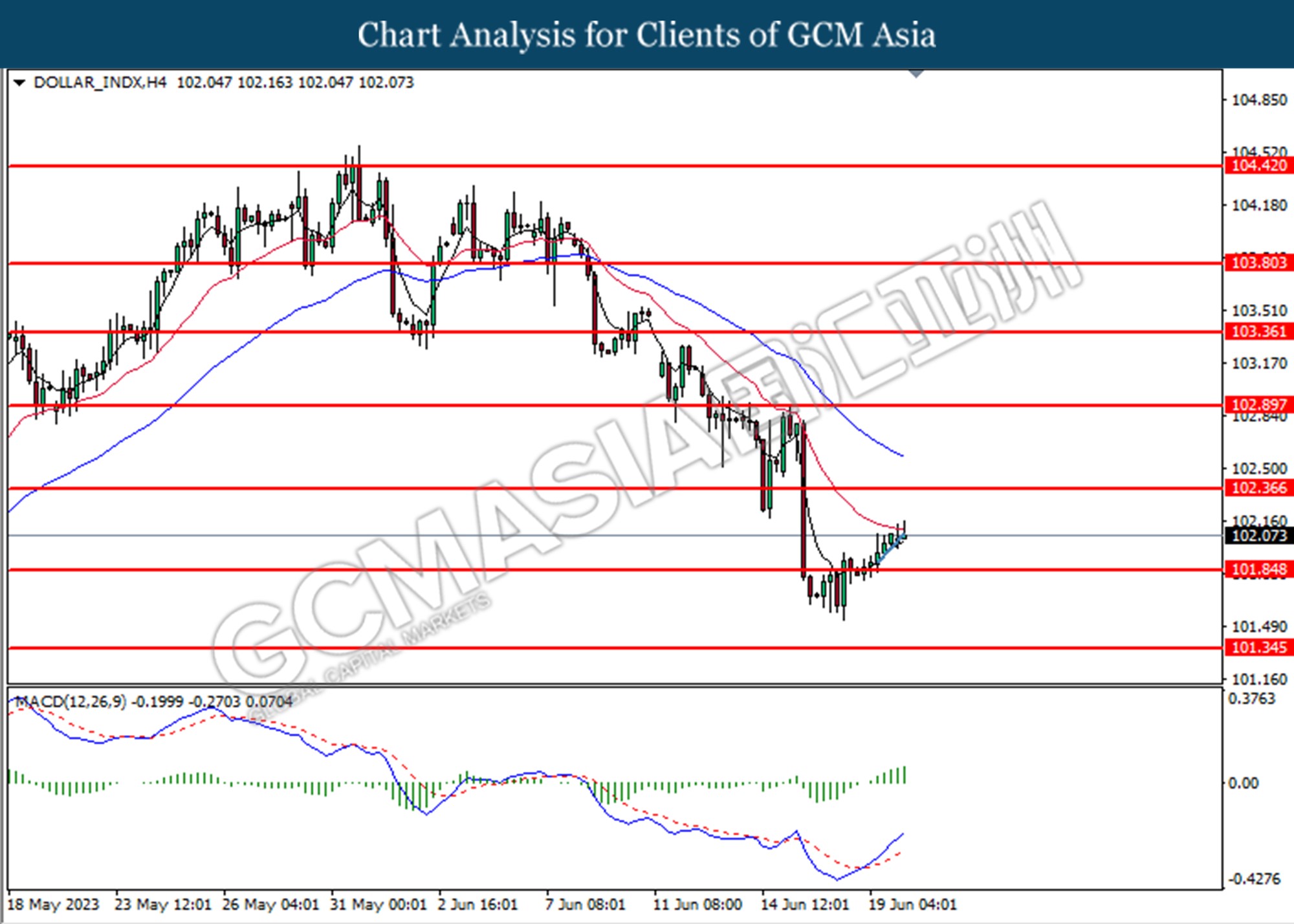

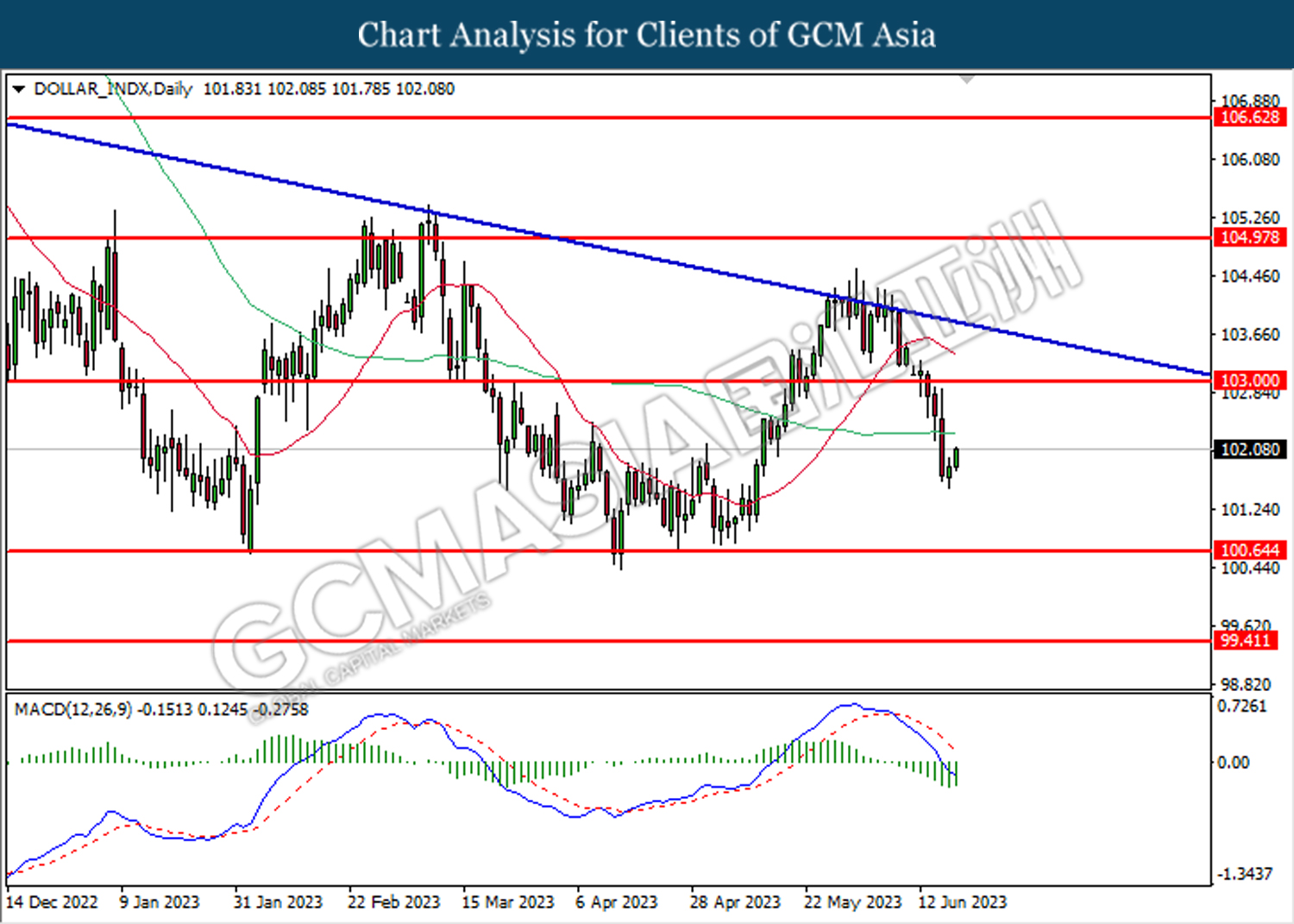

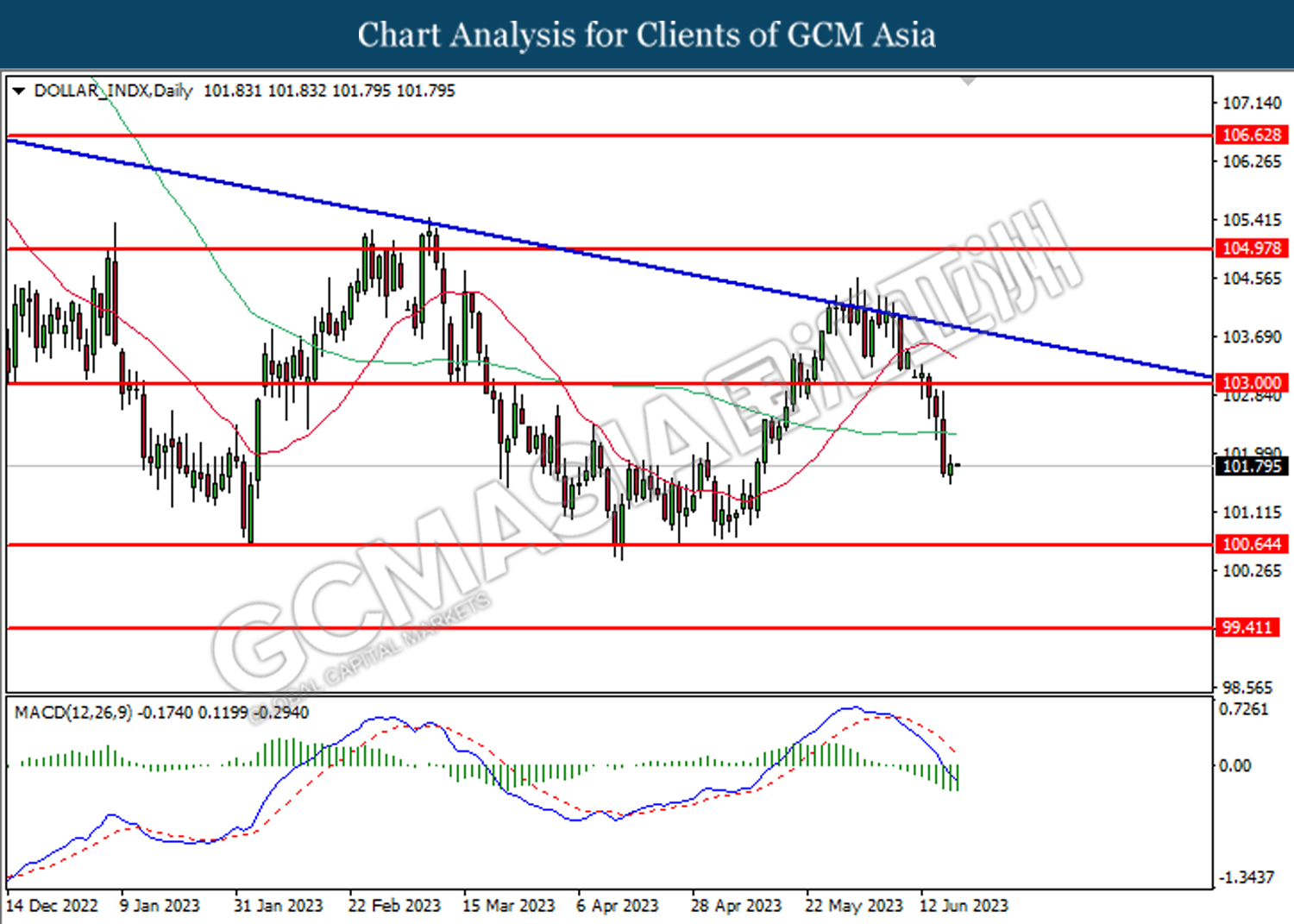

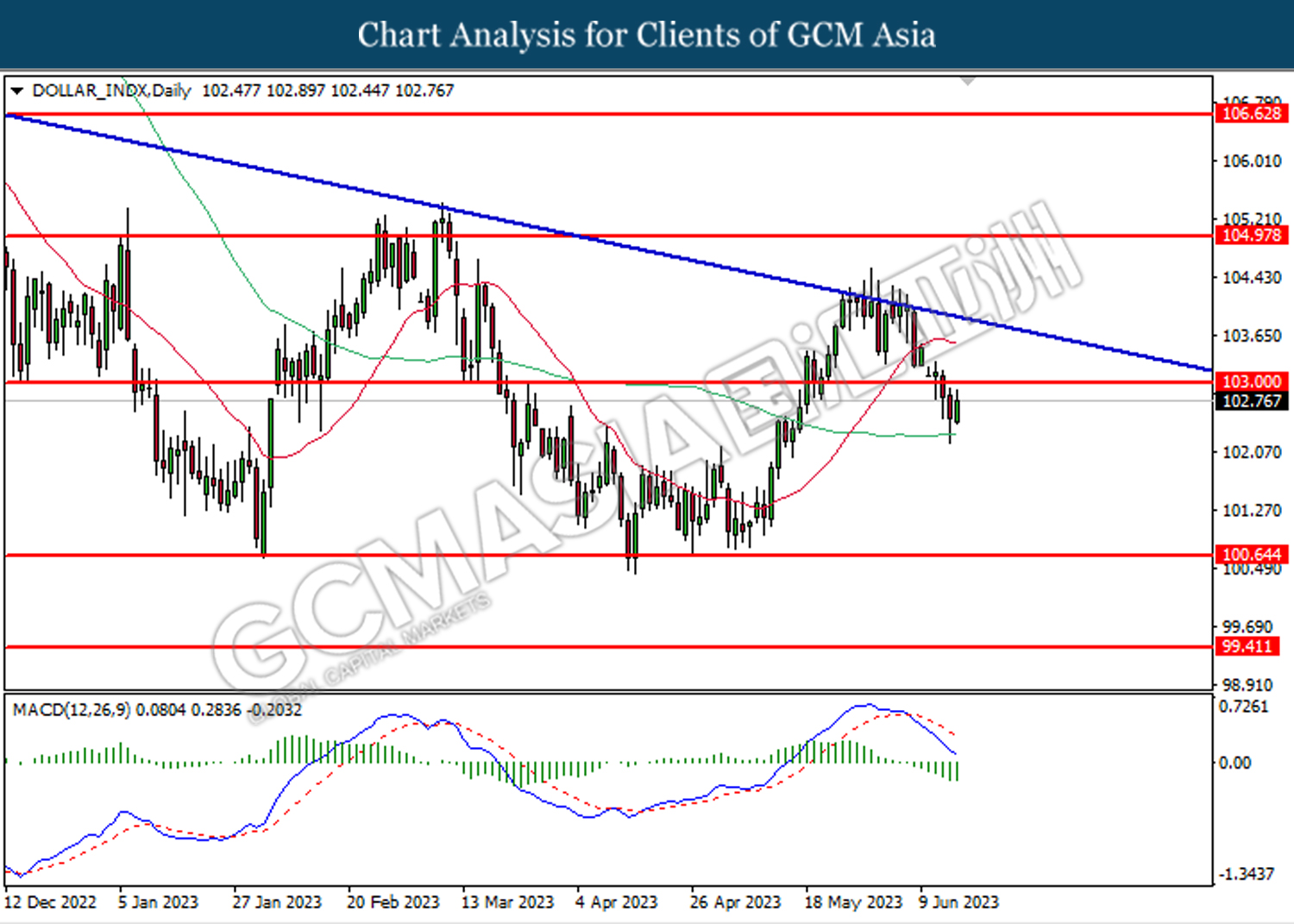

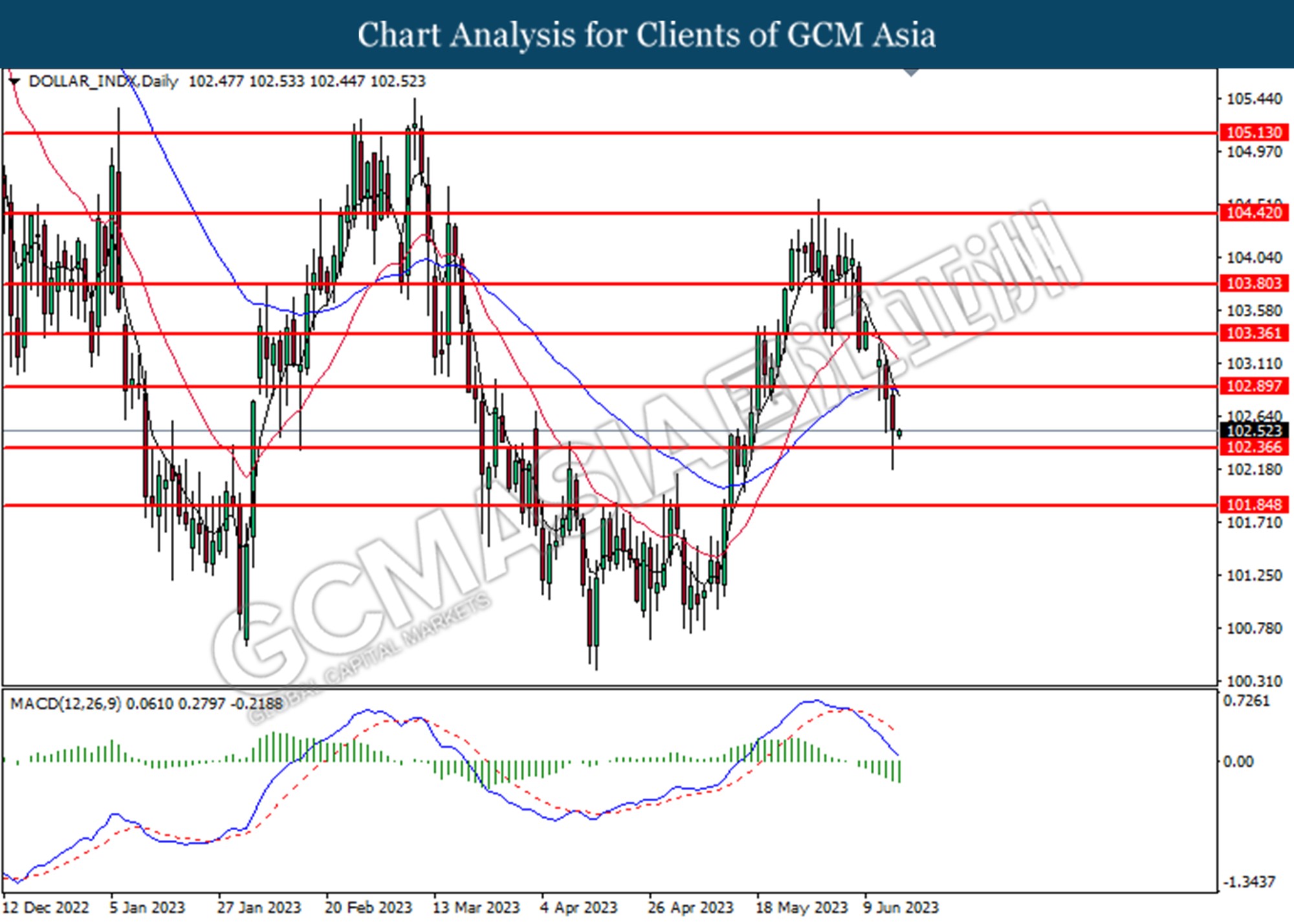

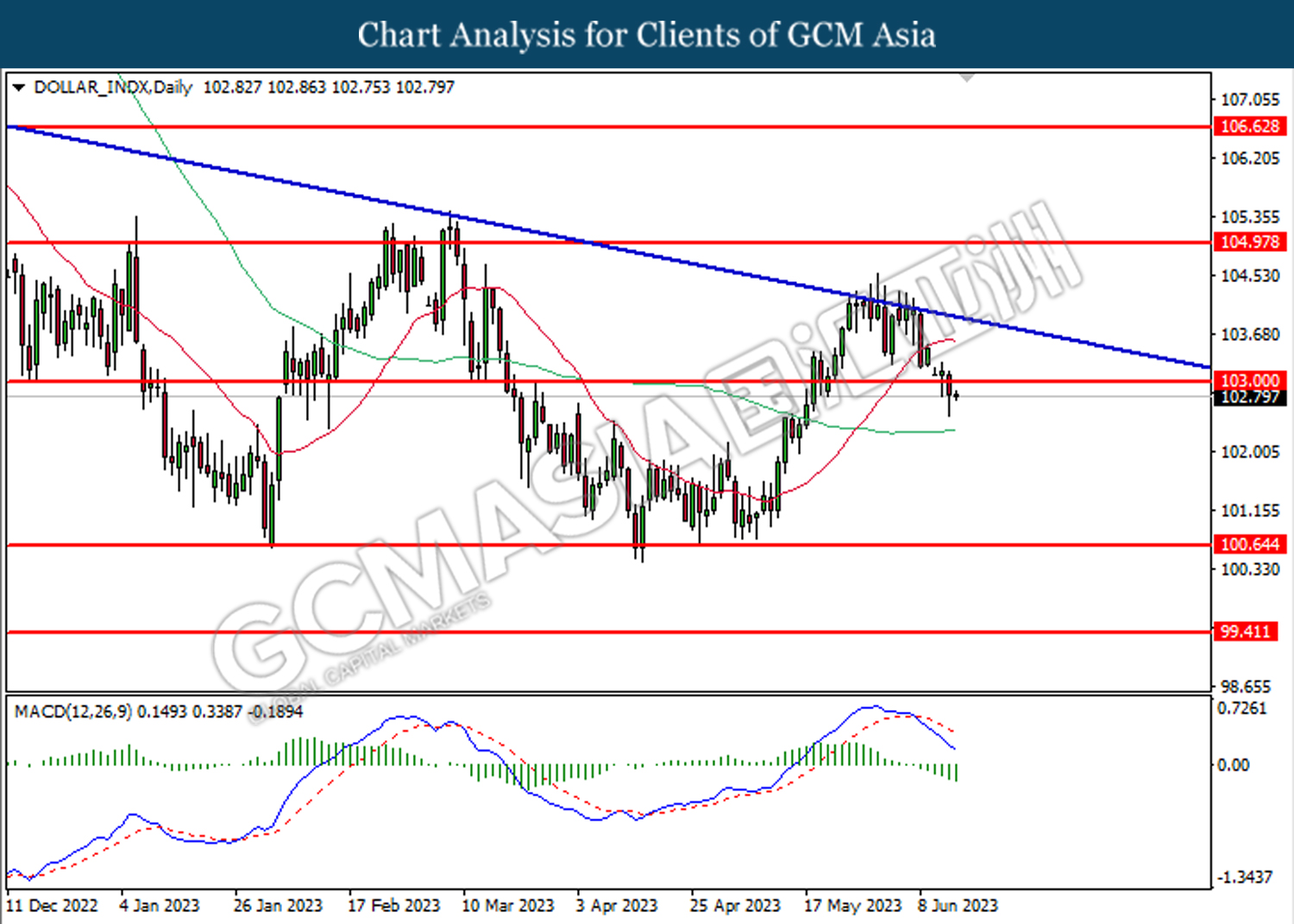

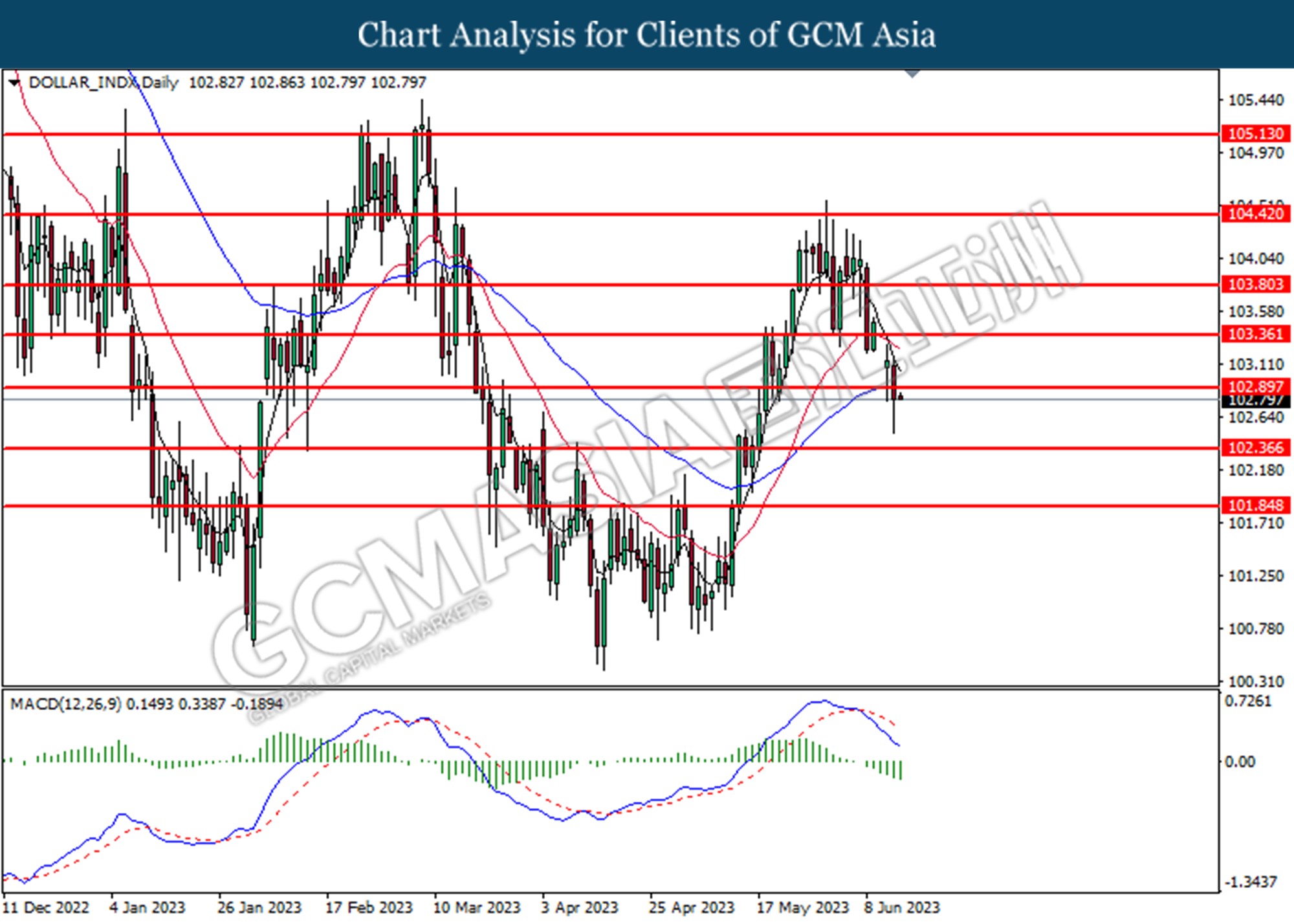

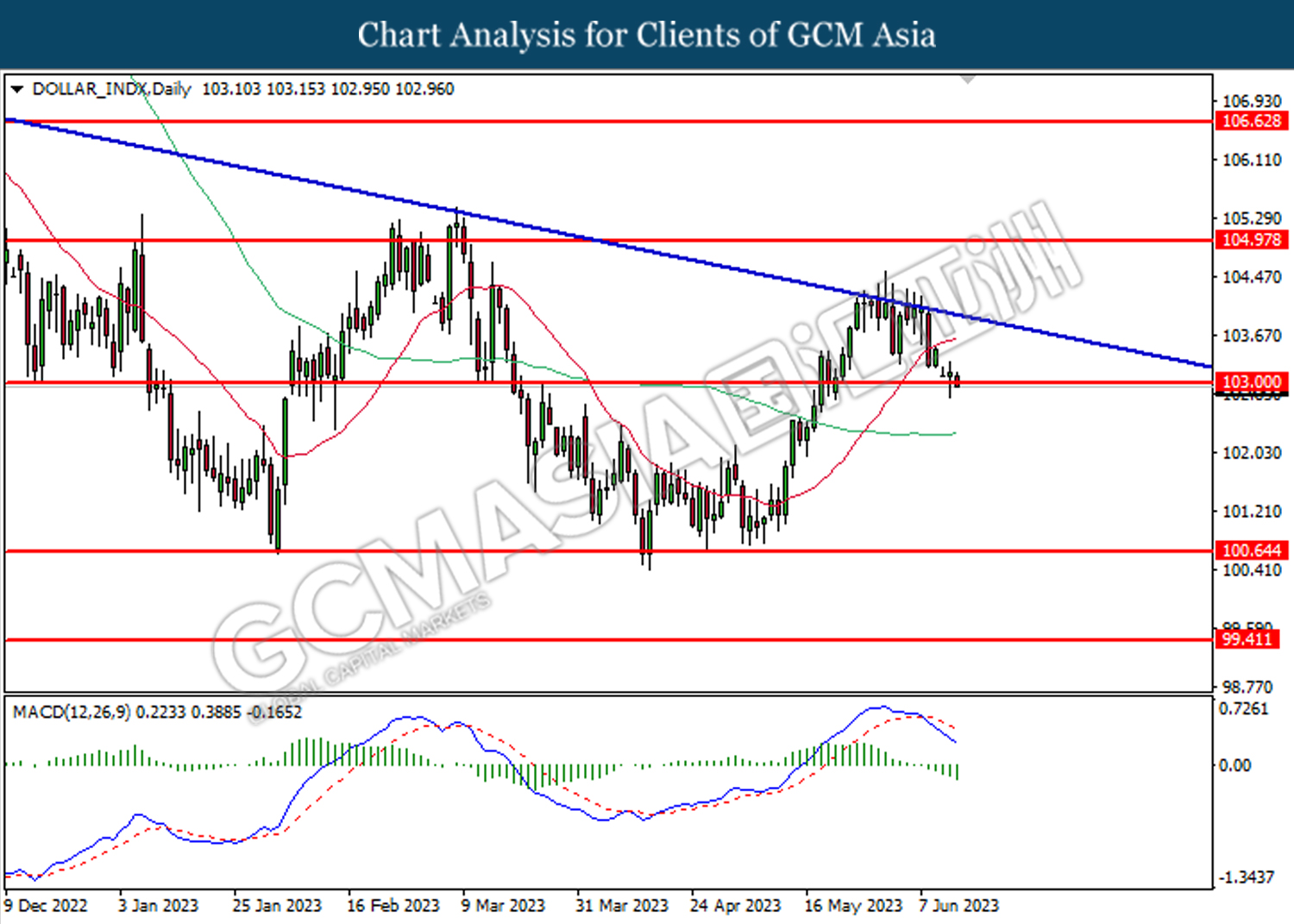

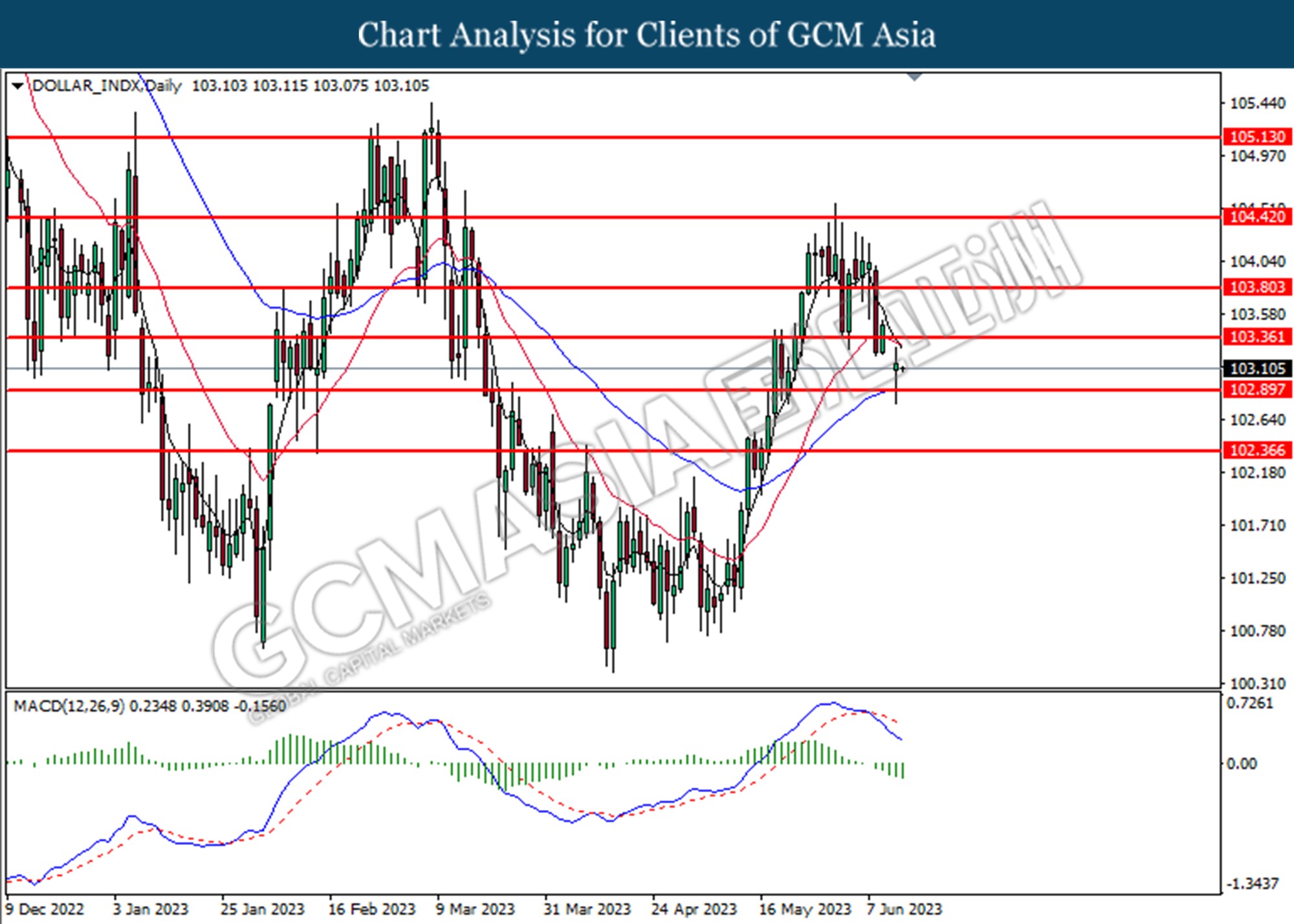

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

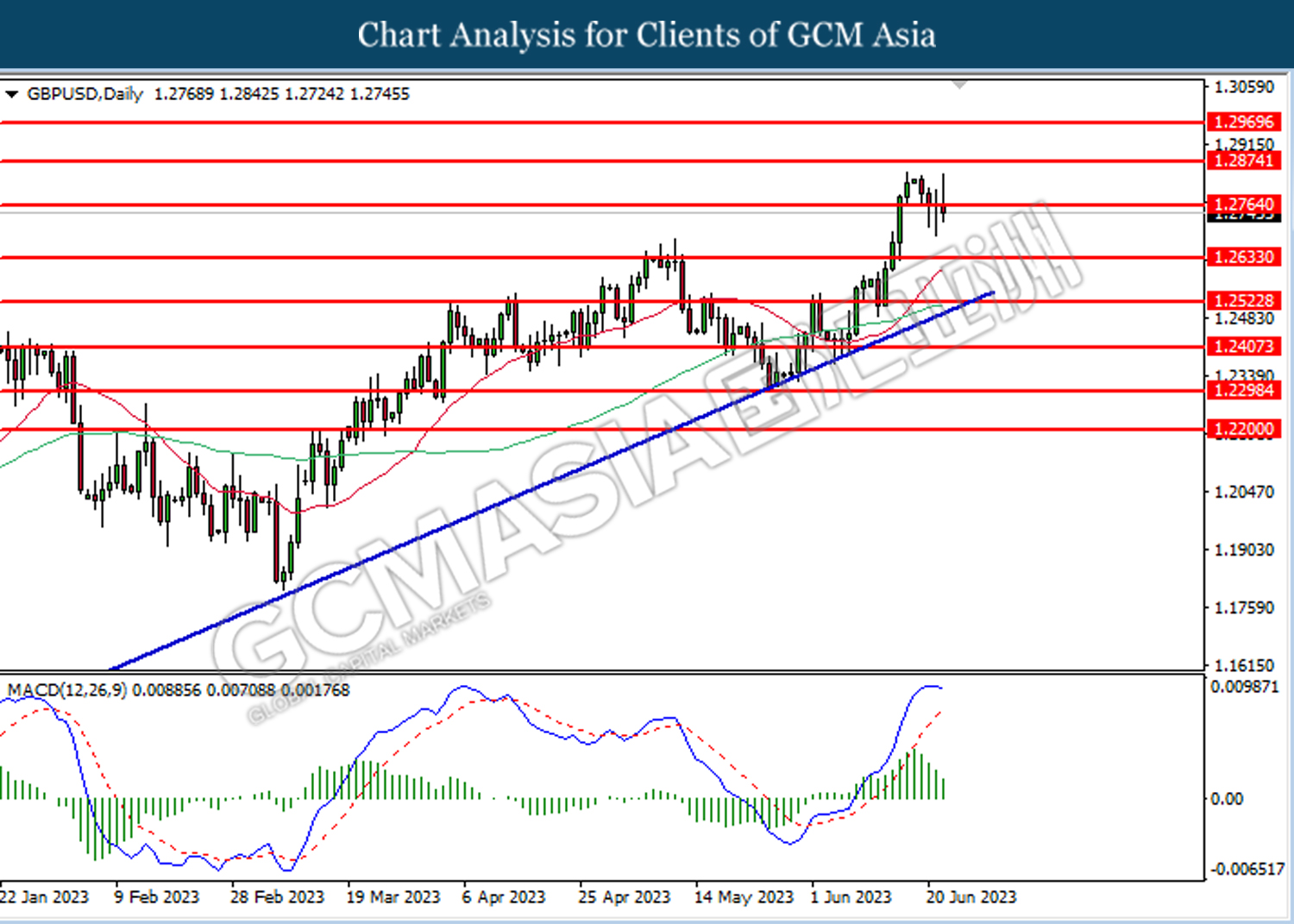

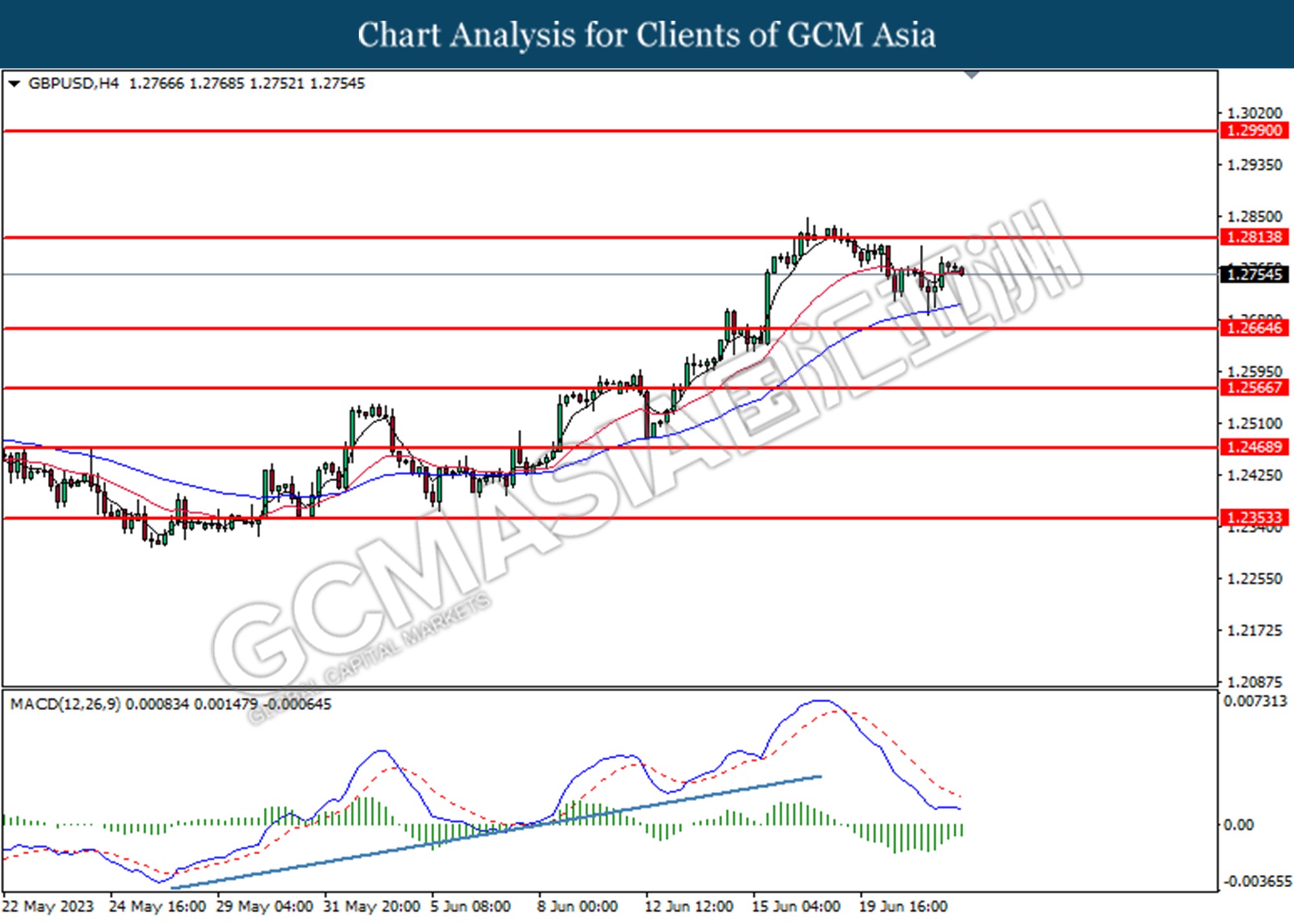

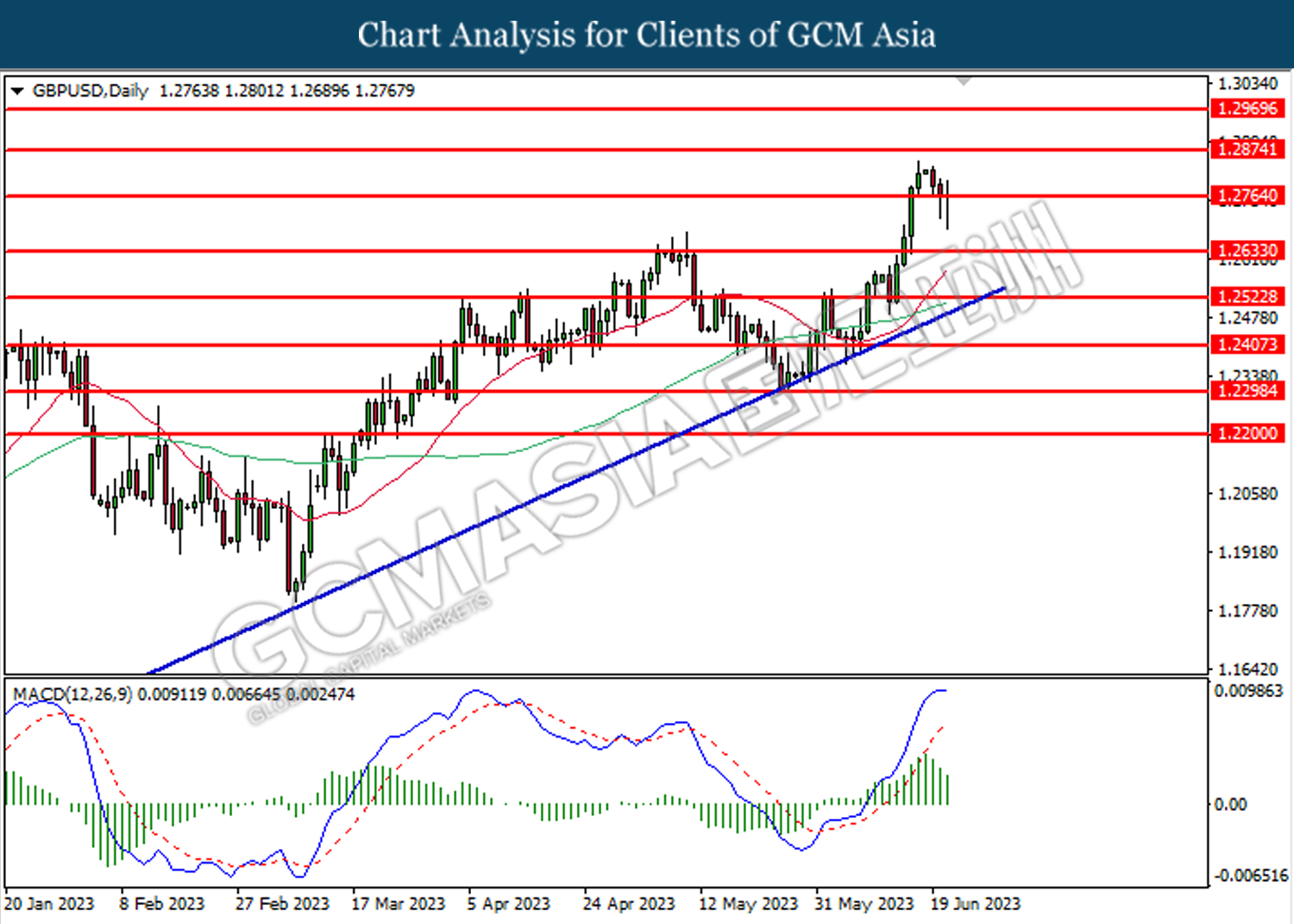

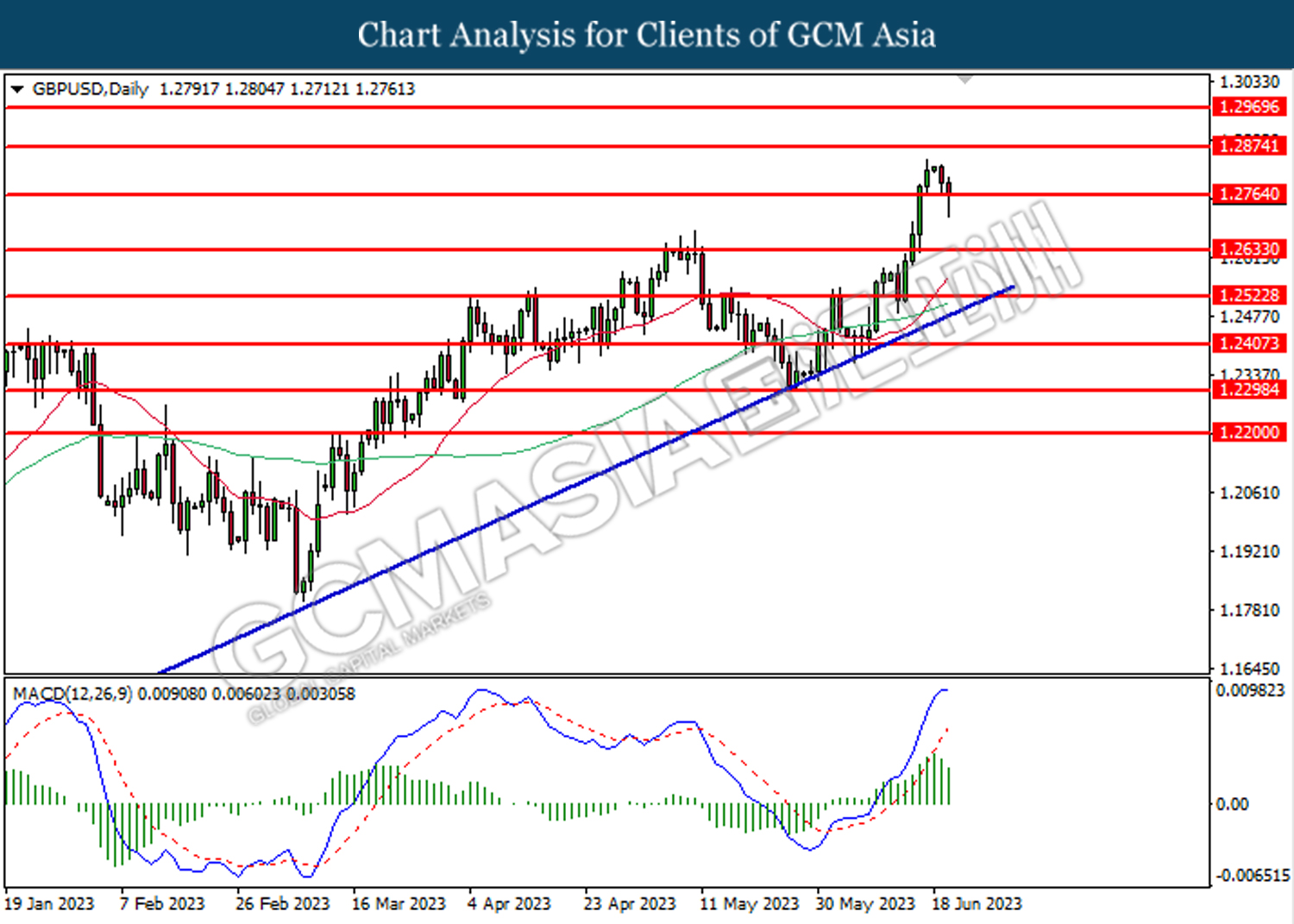

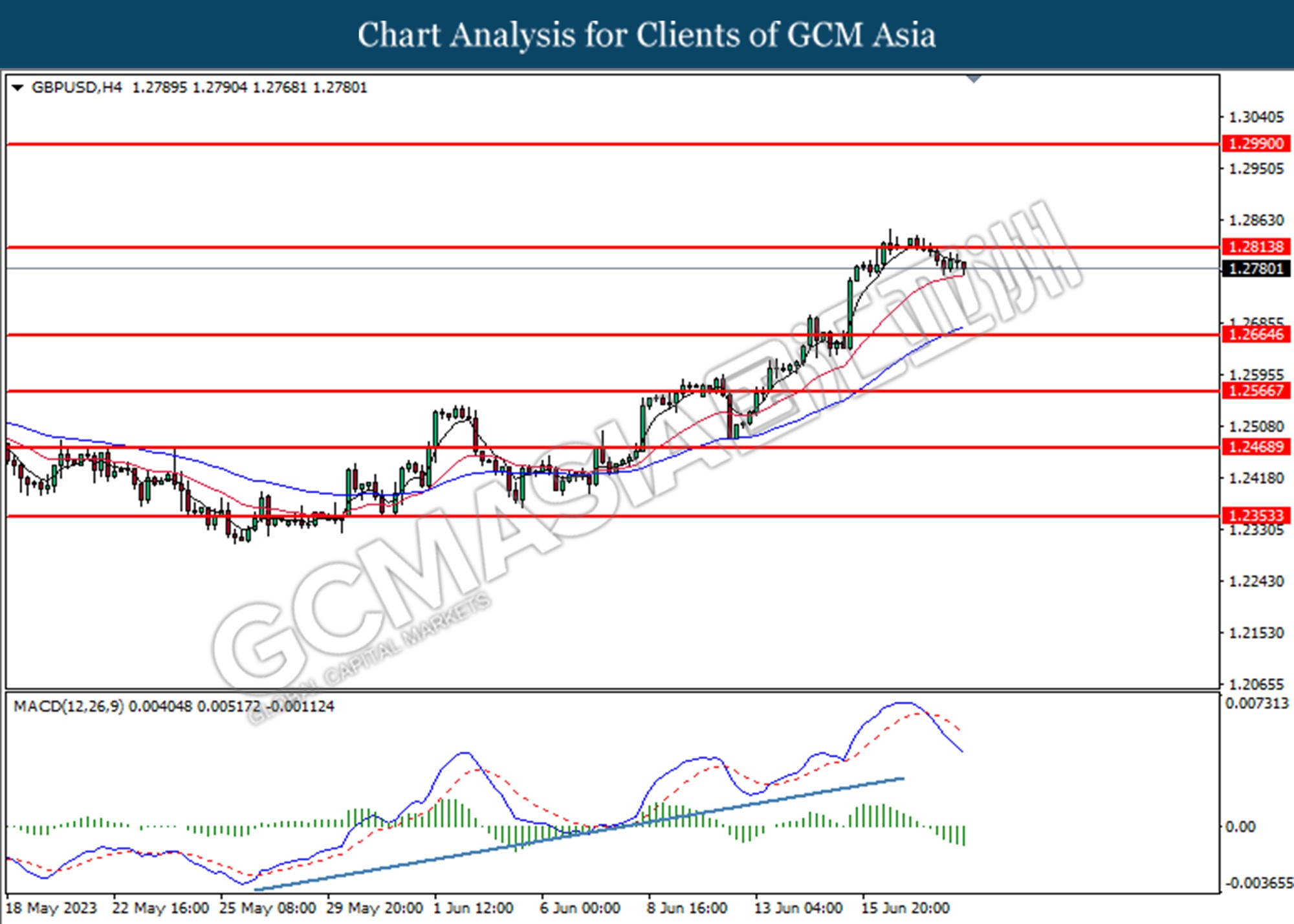

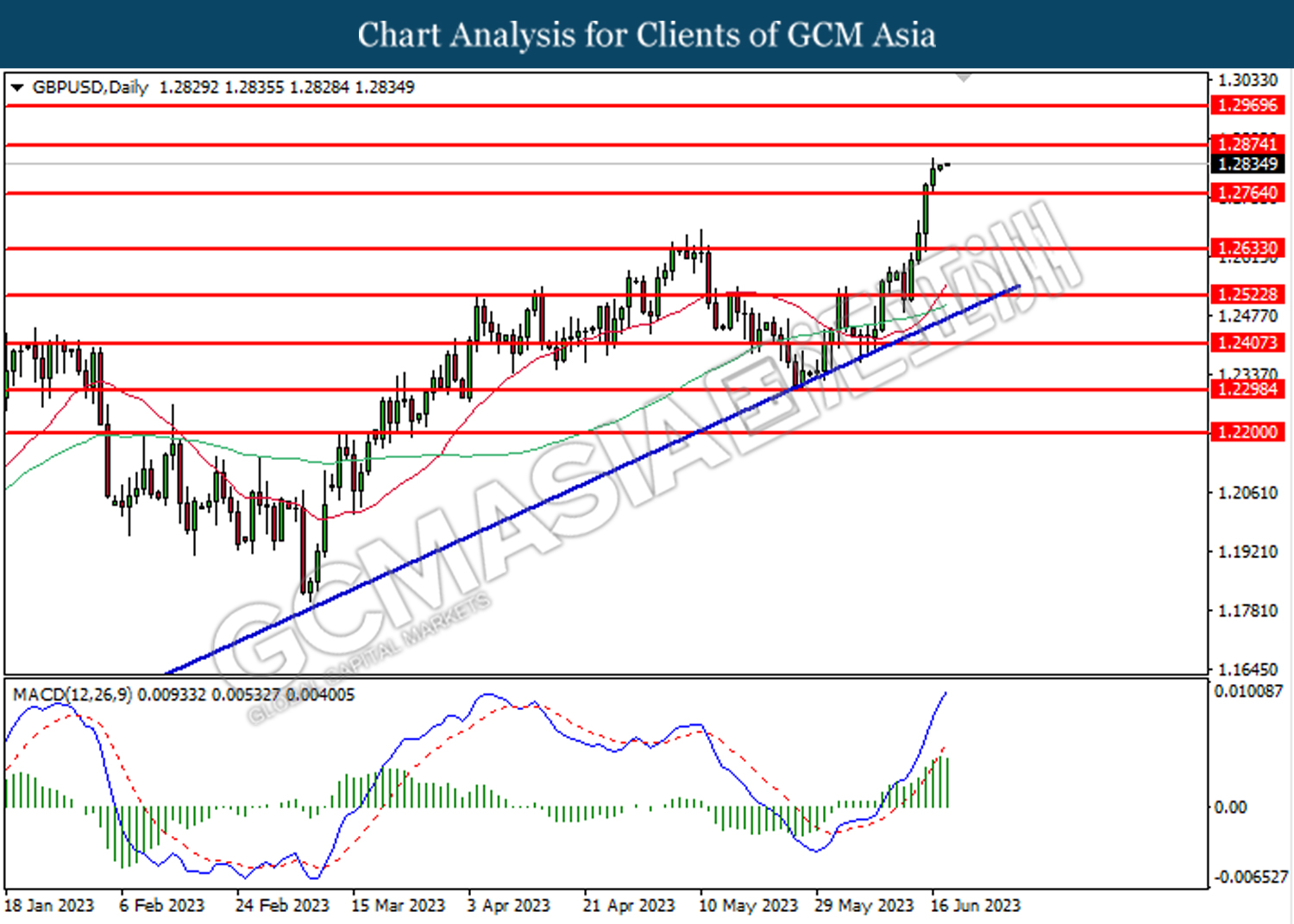

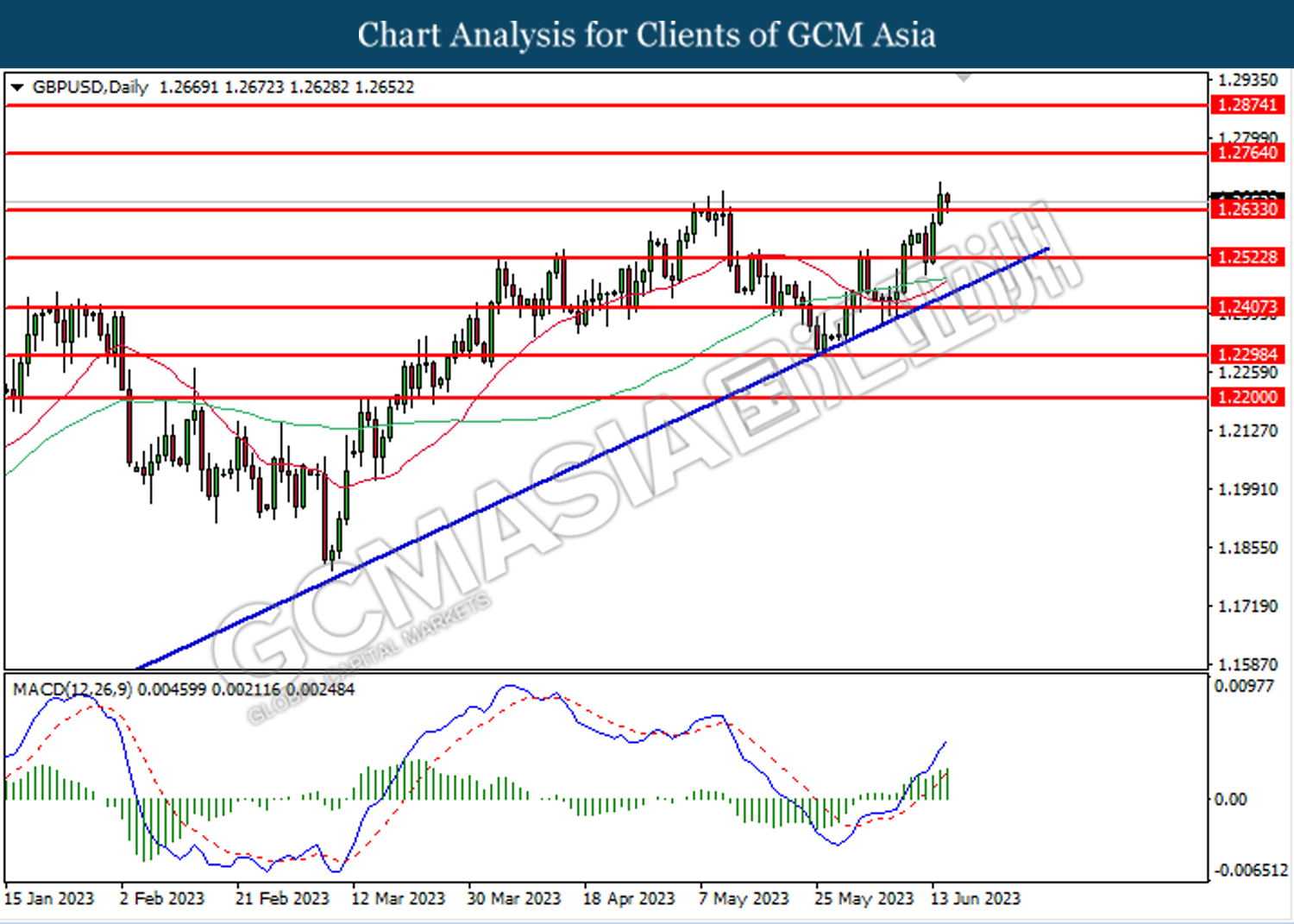

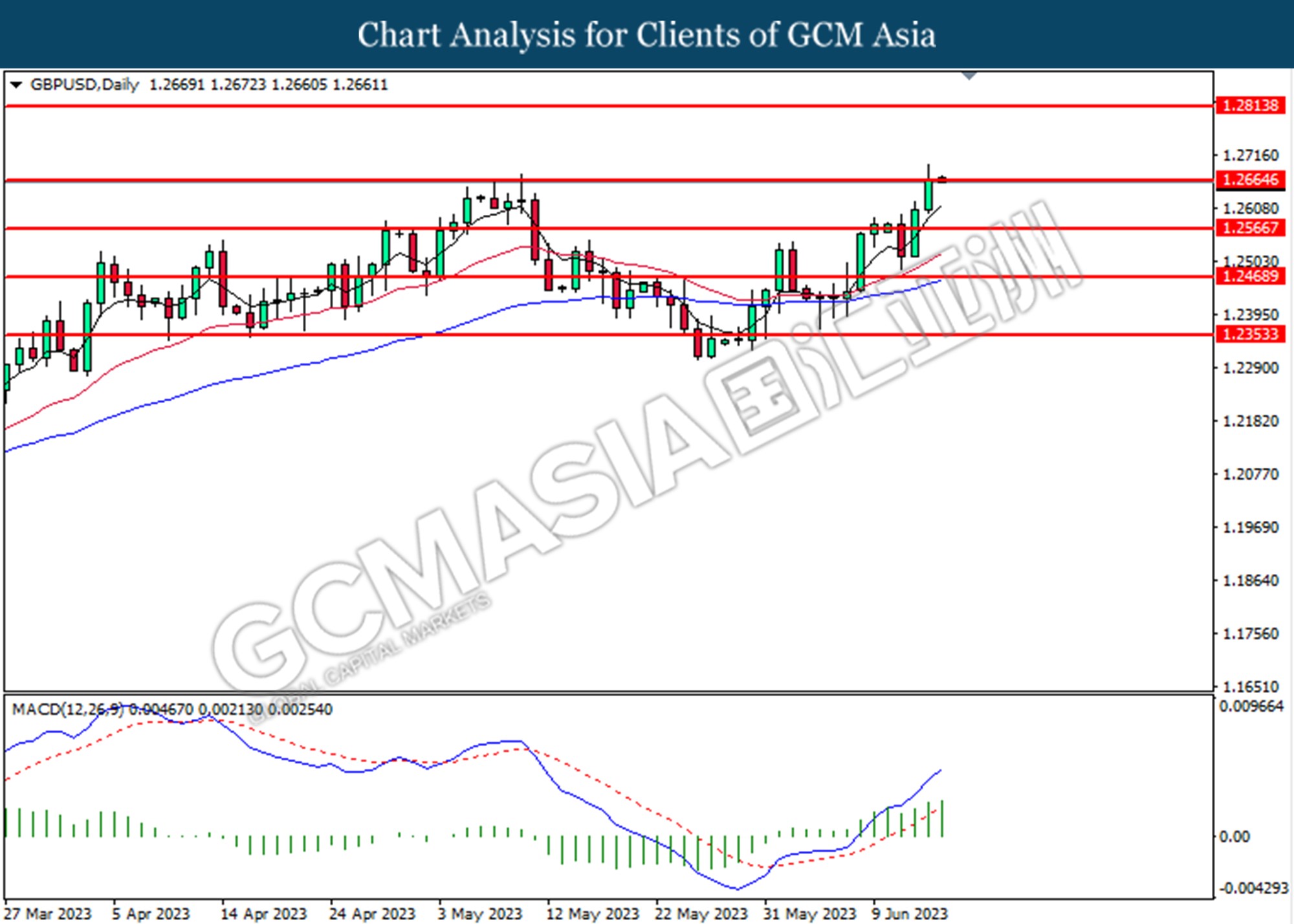

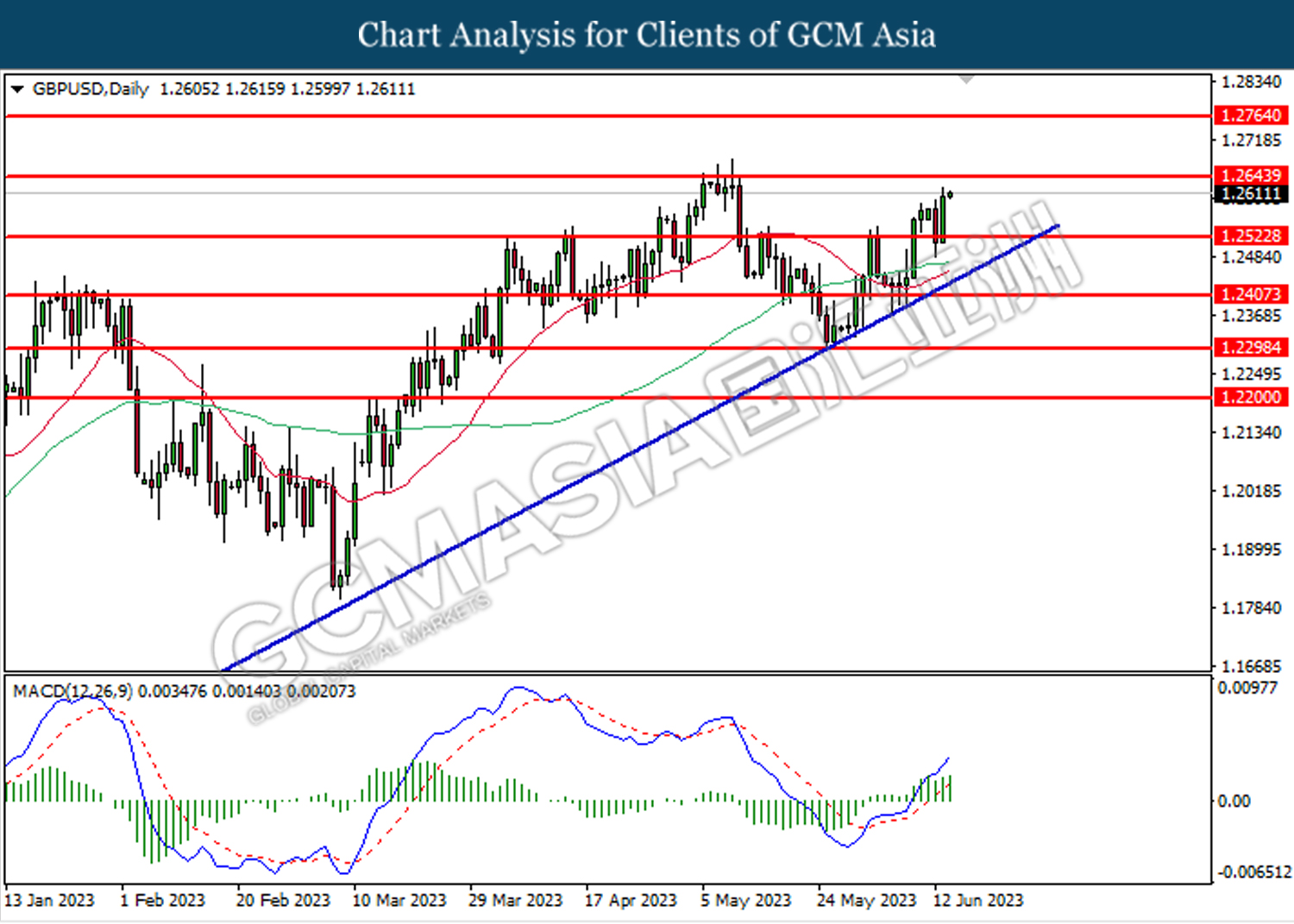

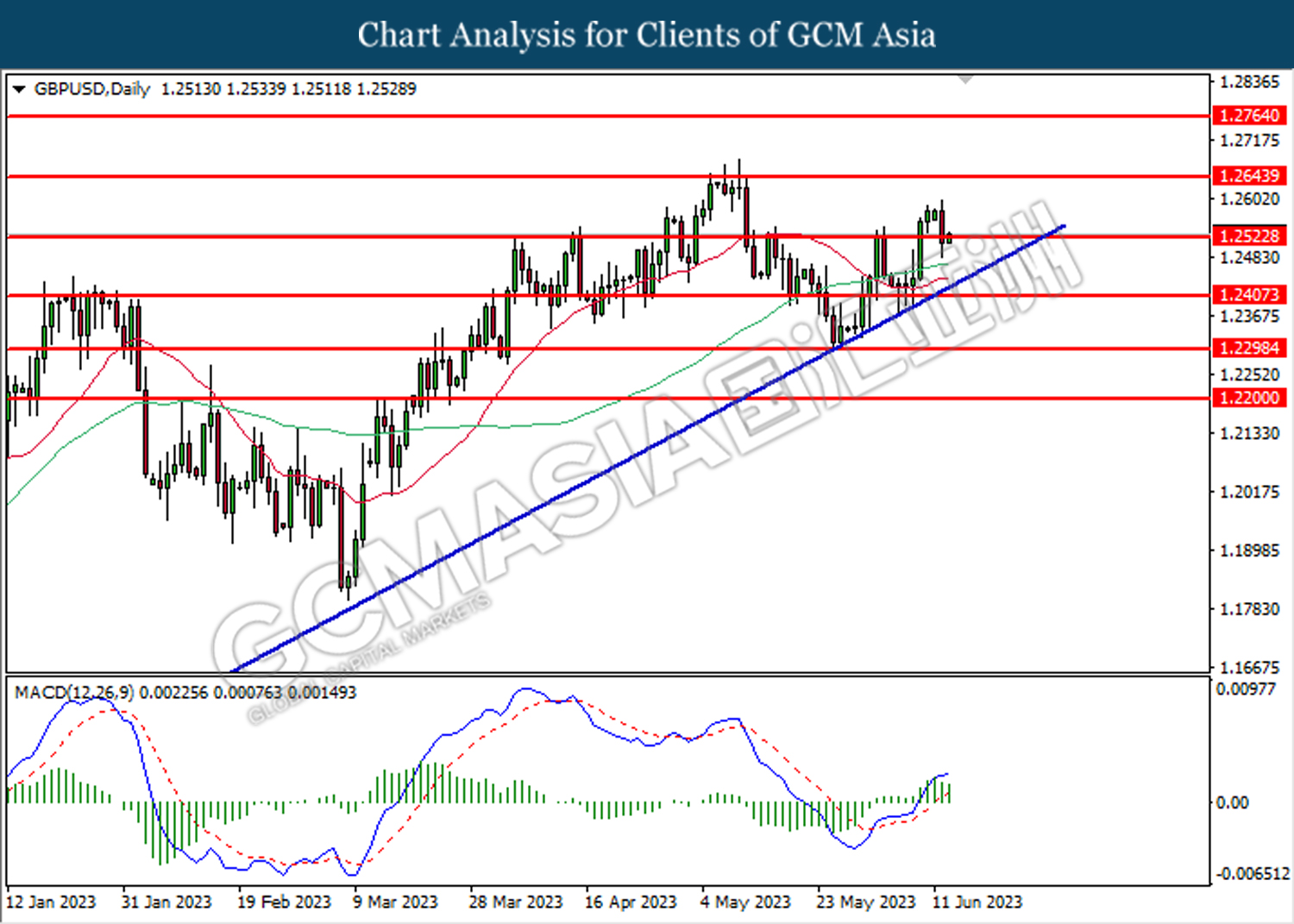

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2765. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2635, 1.2525

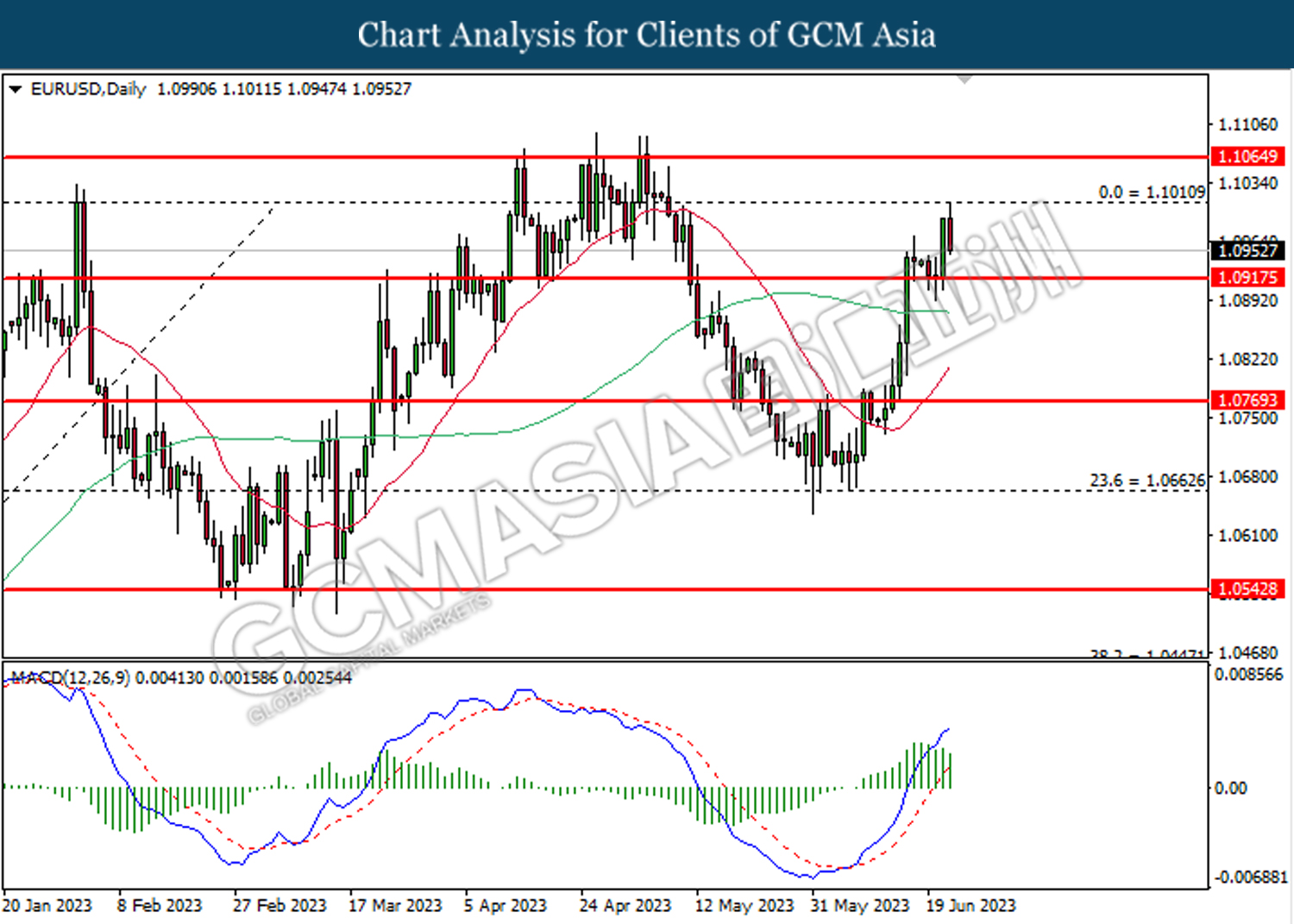

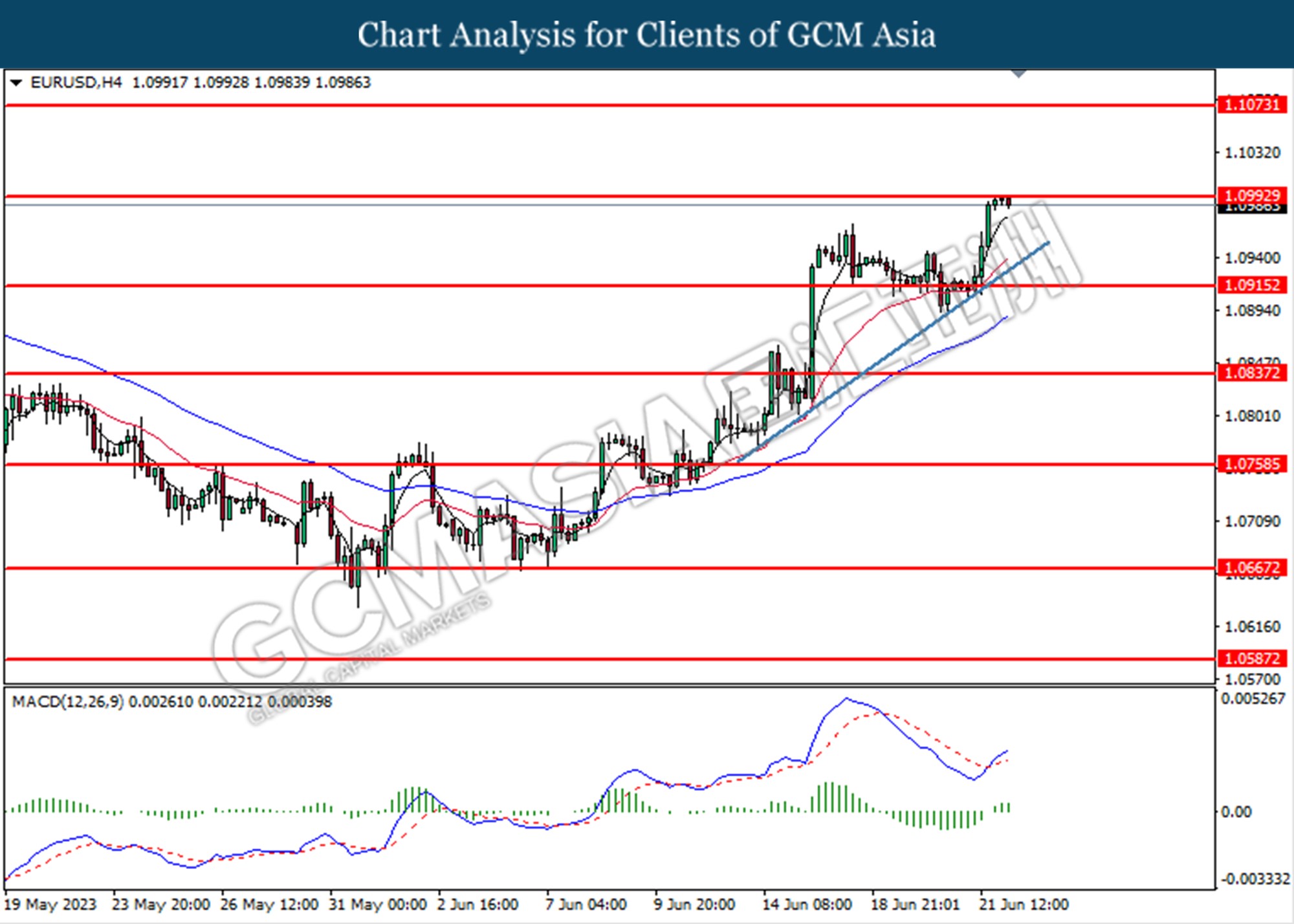

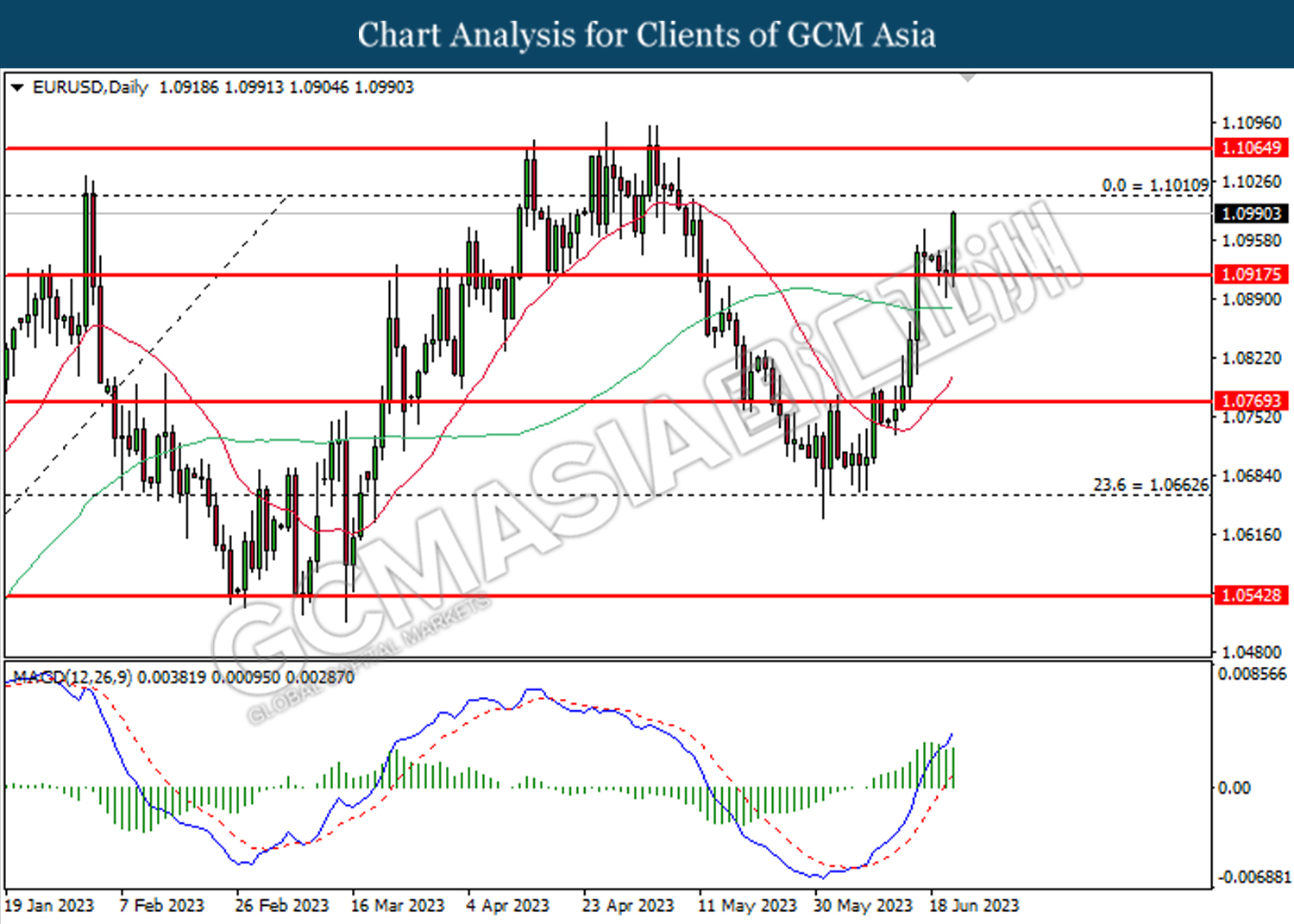

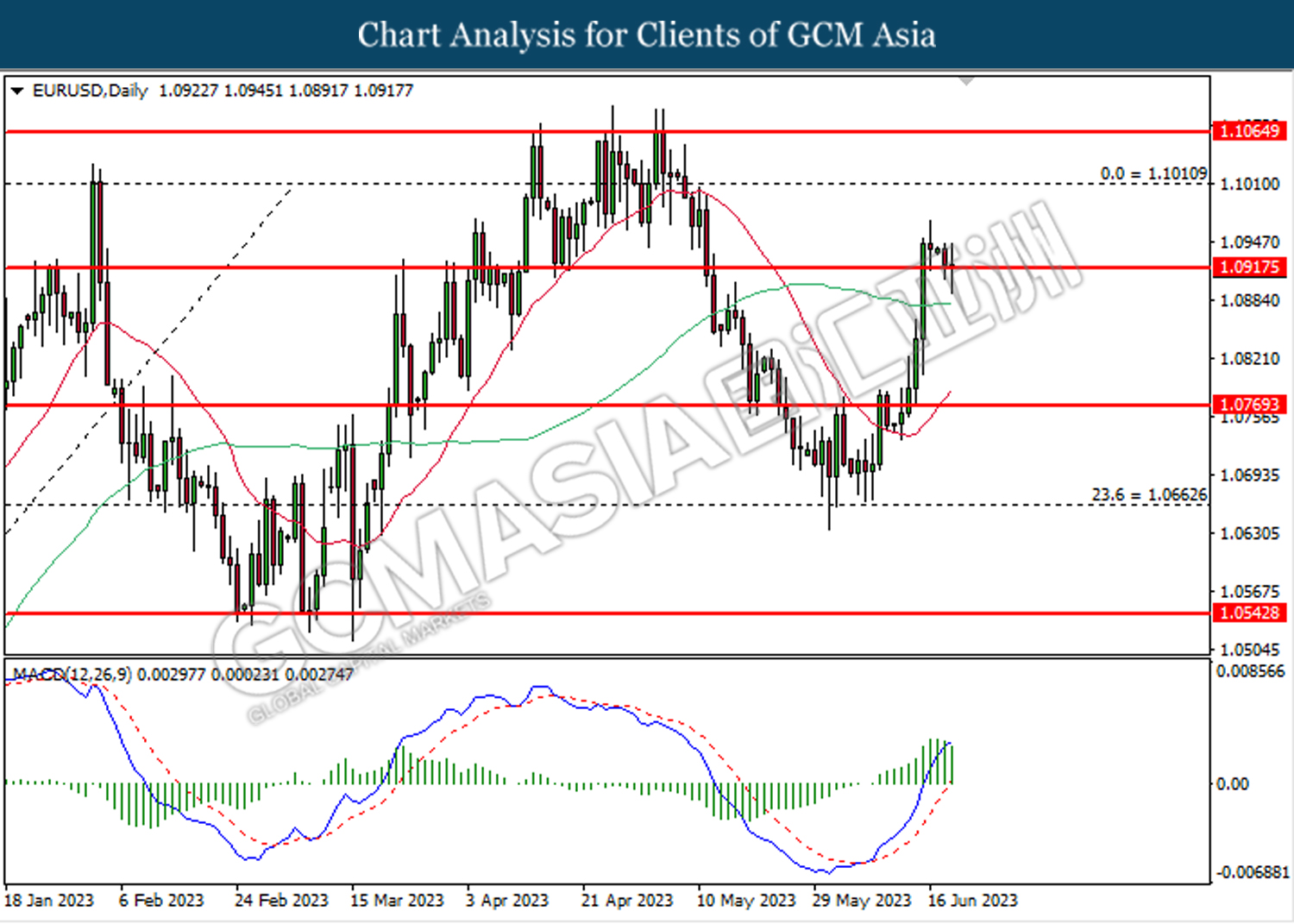

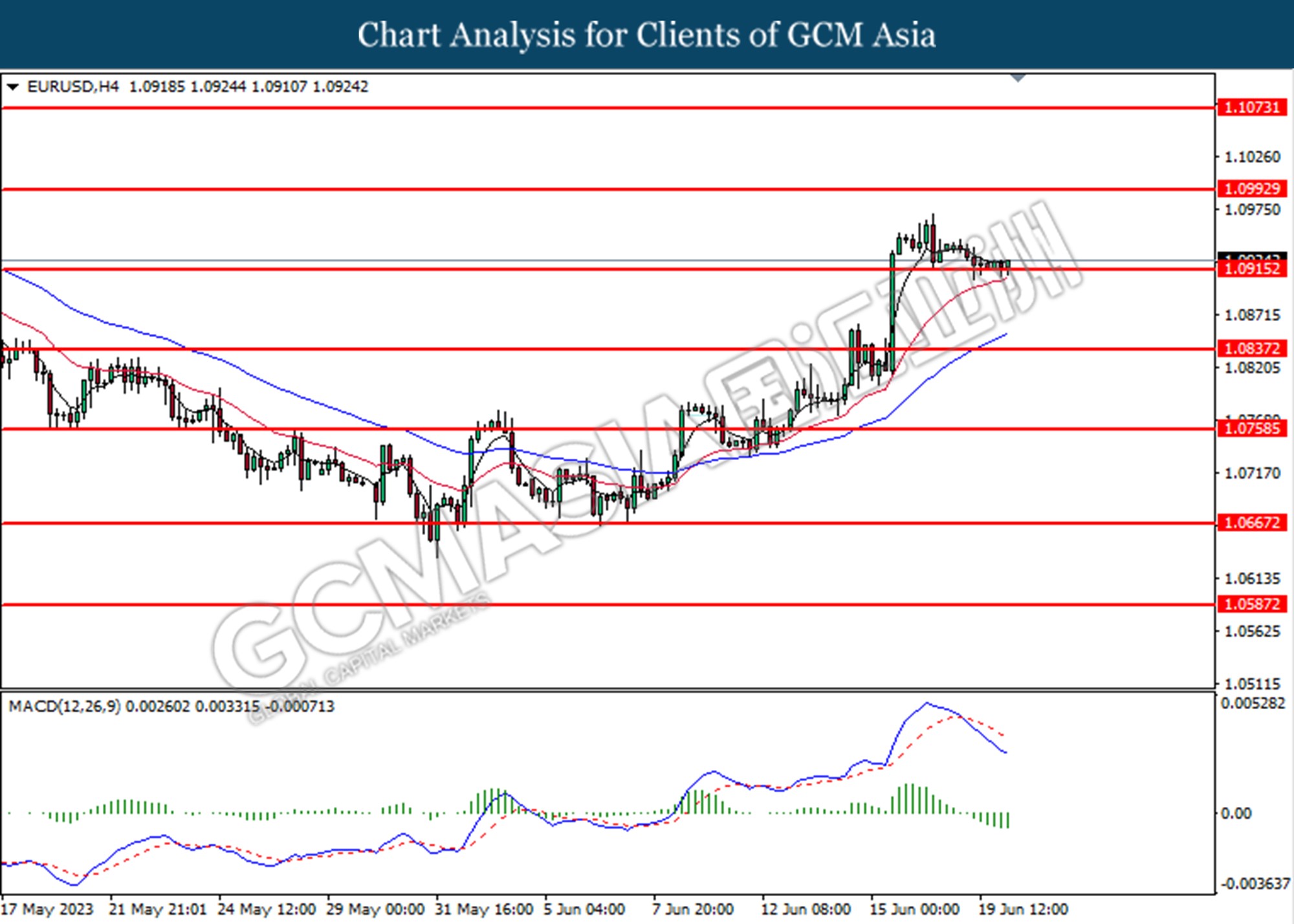

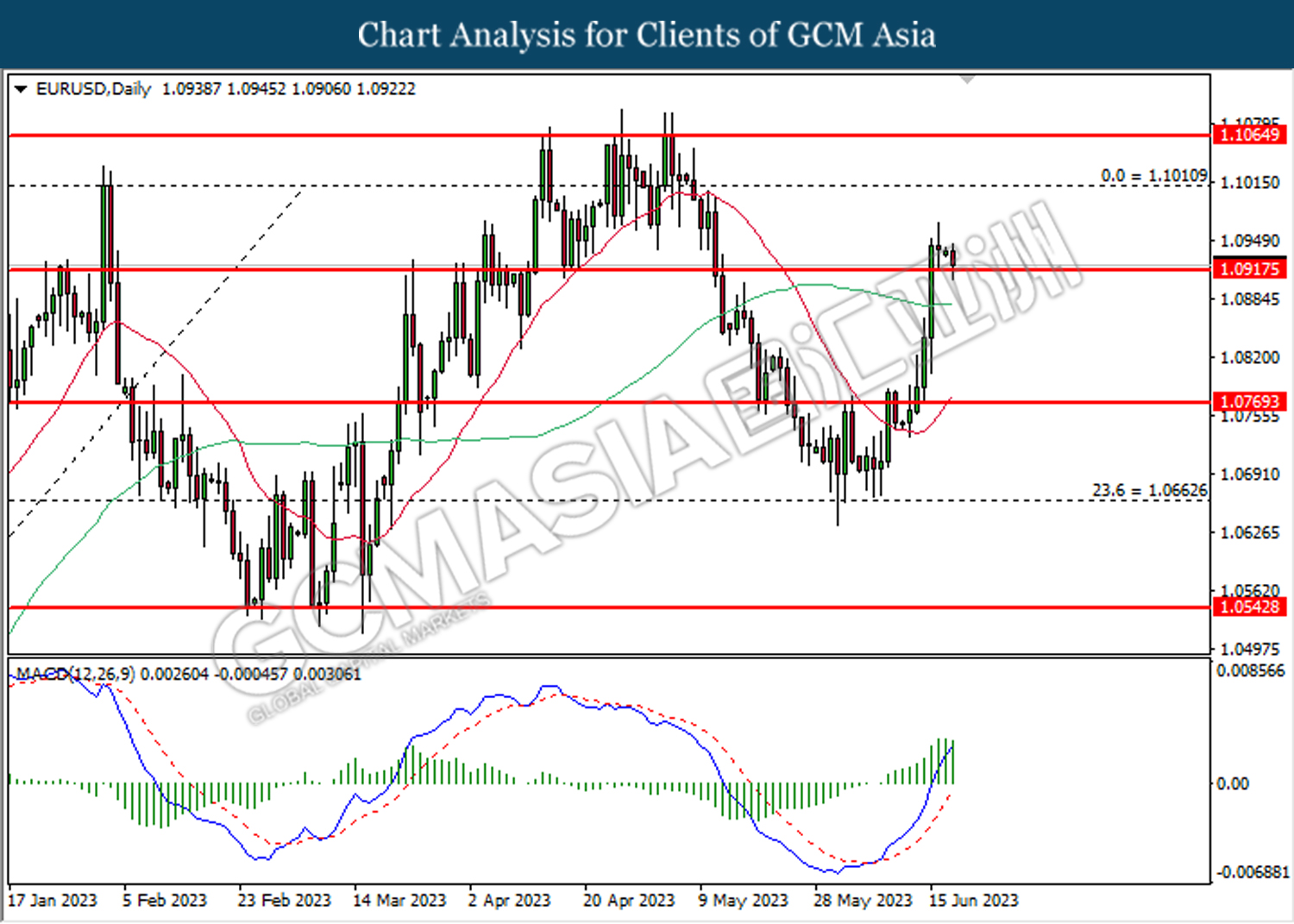

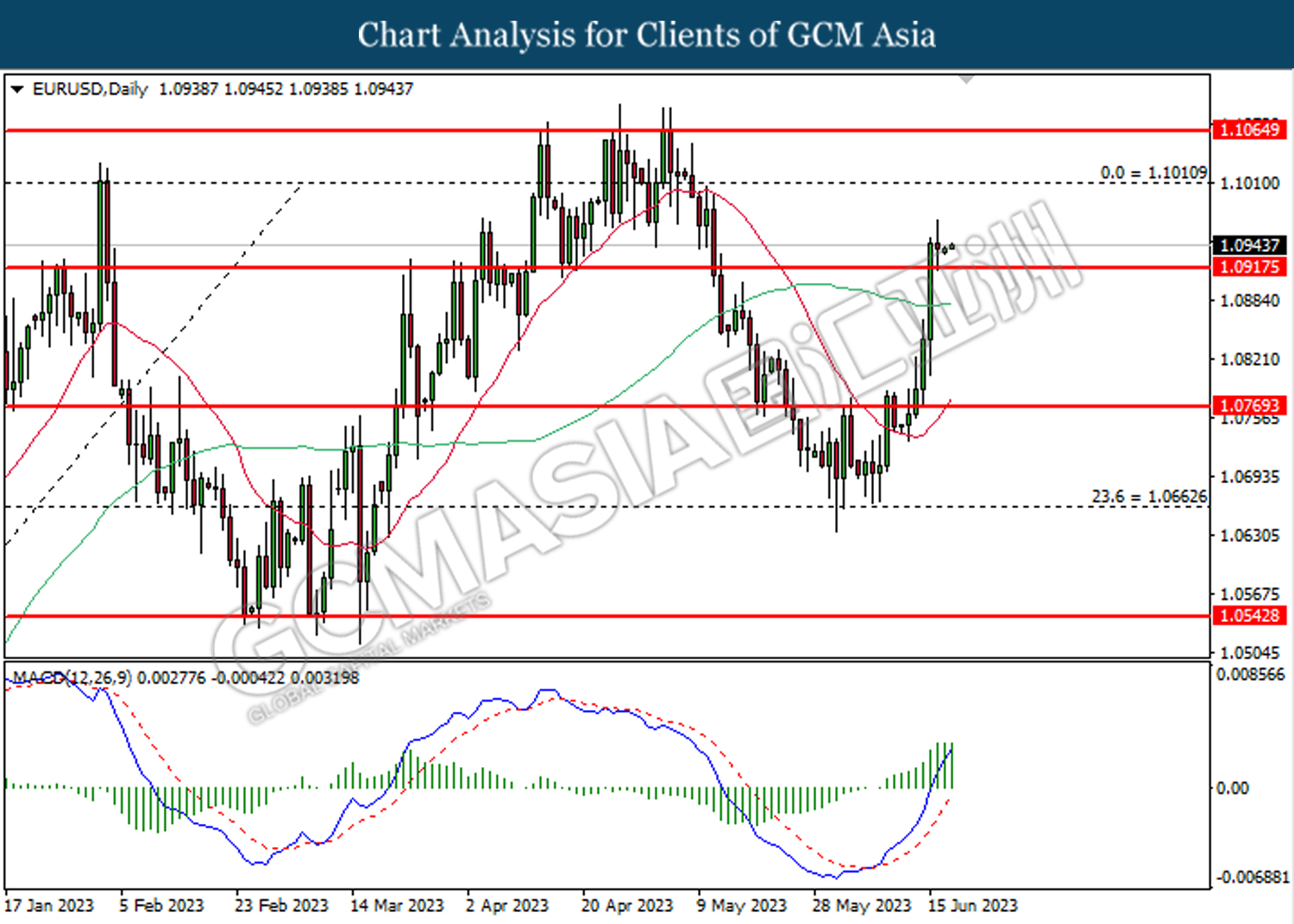

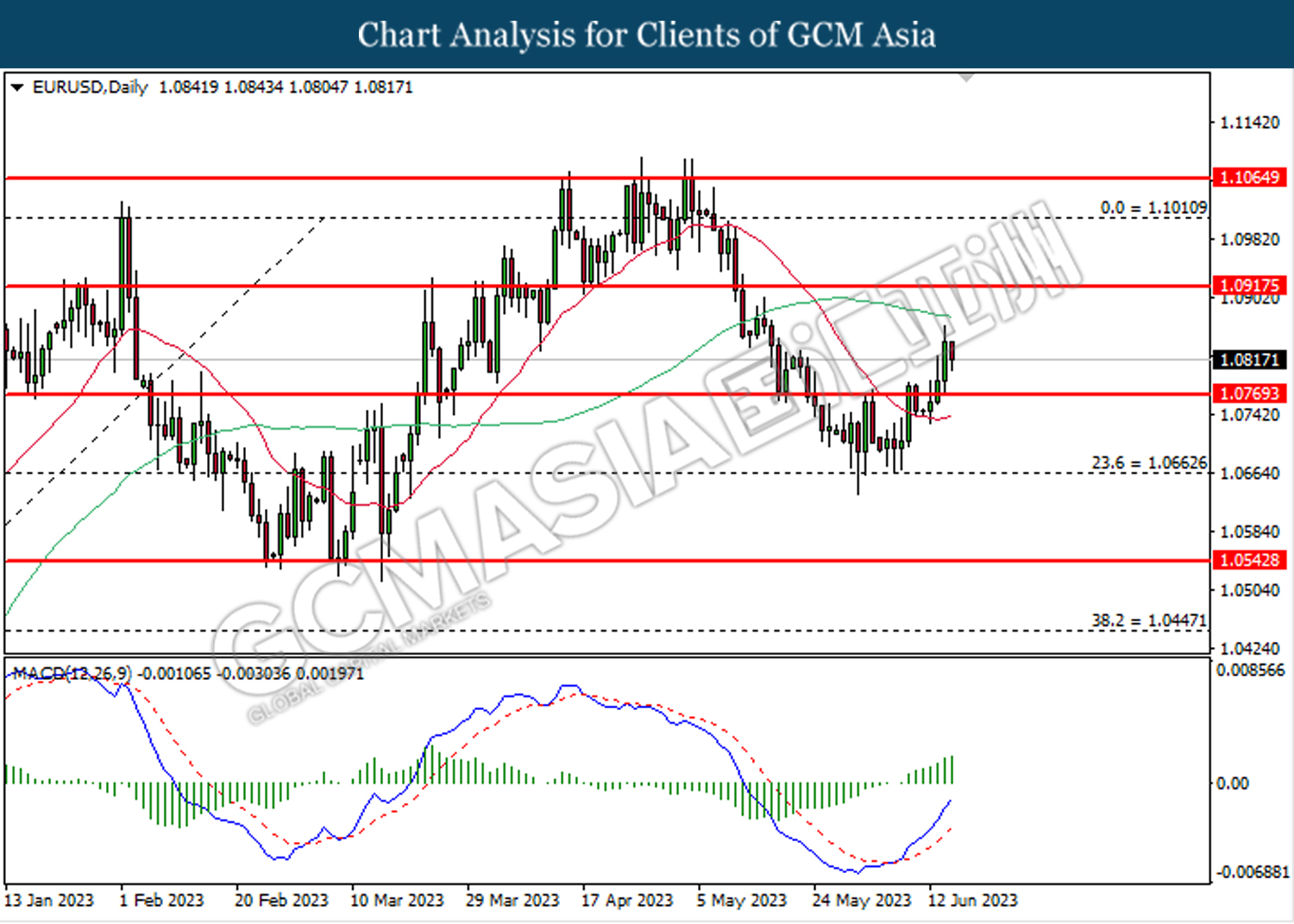

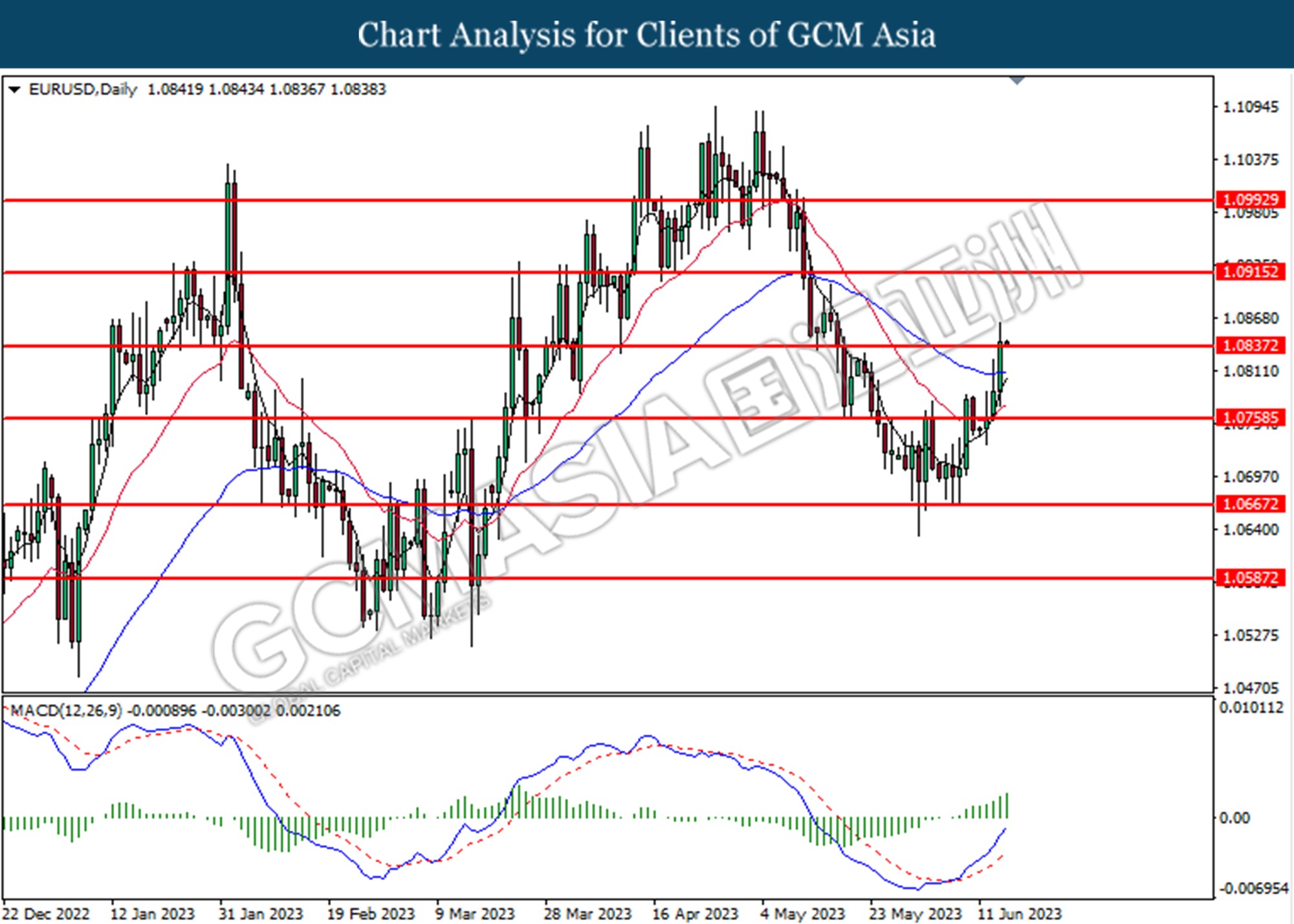

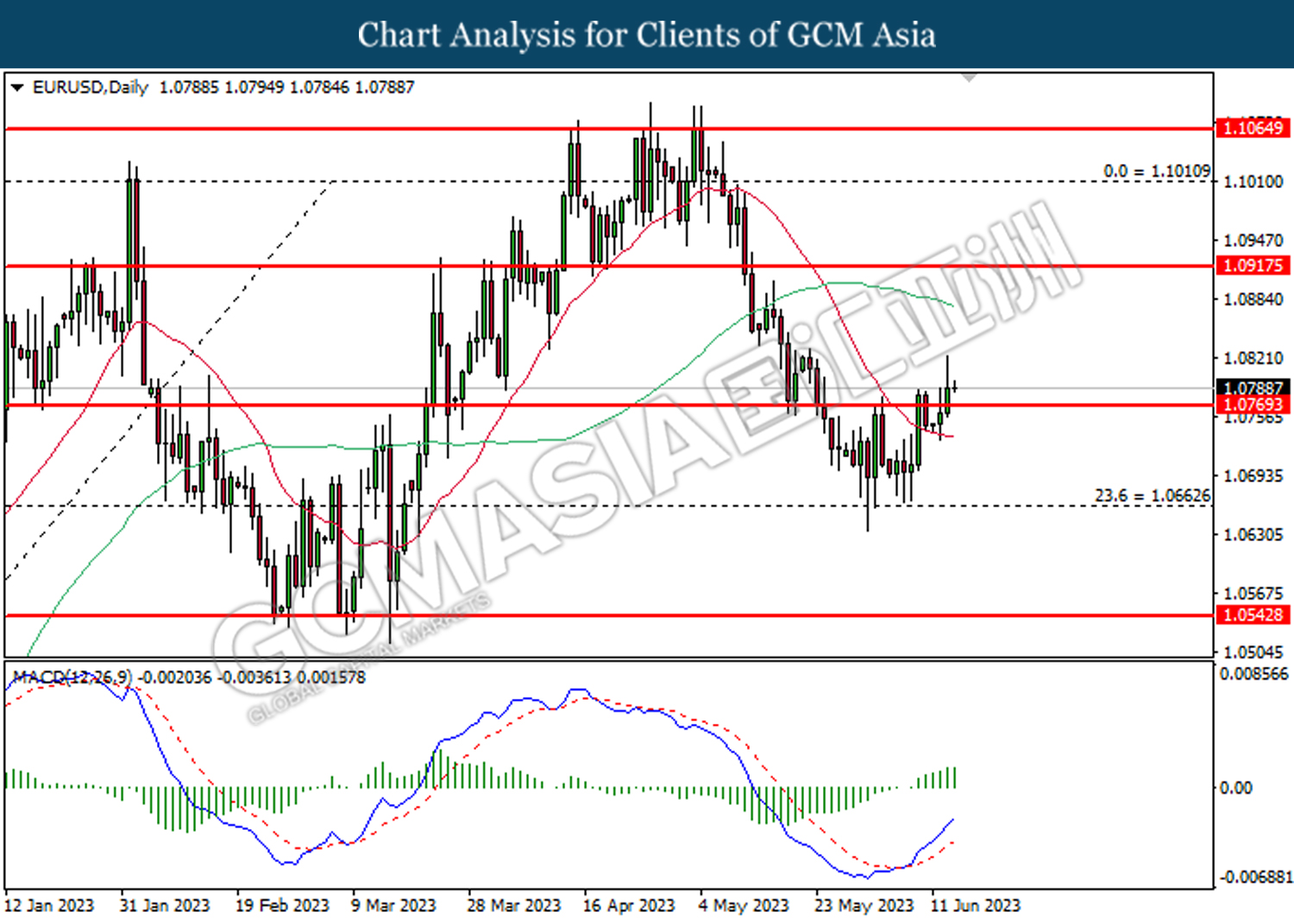

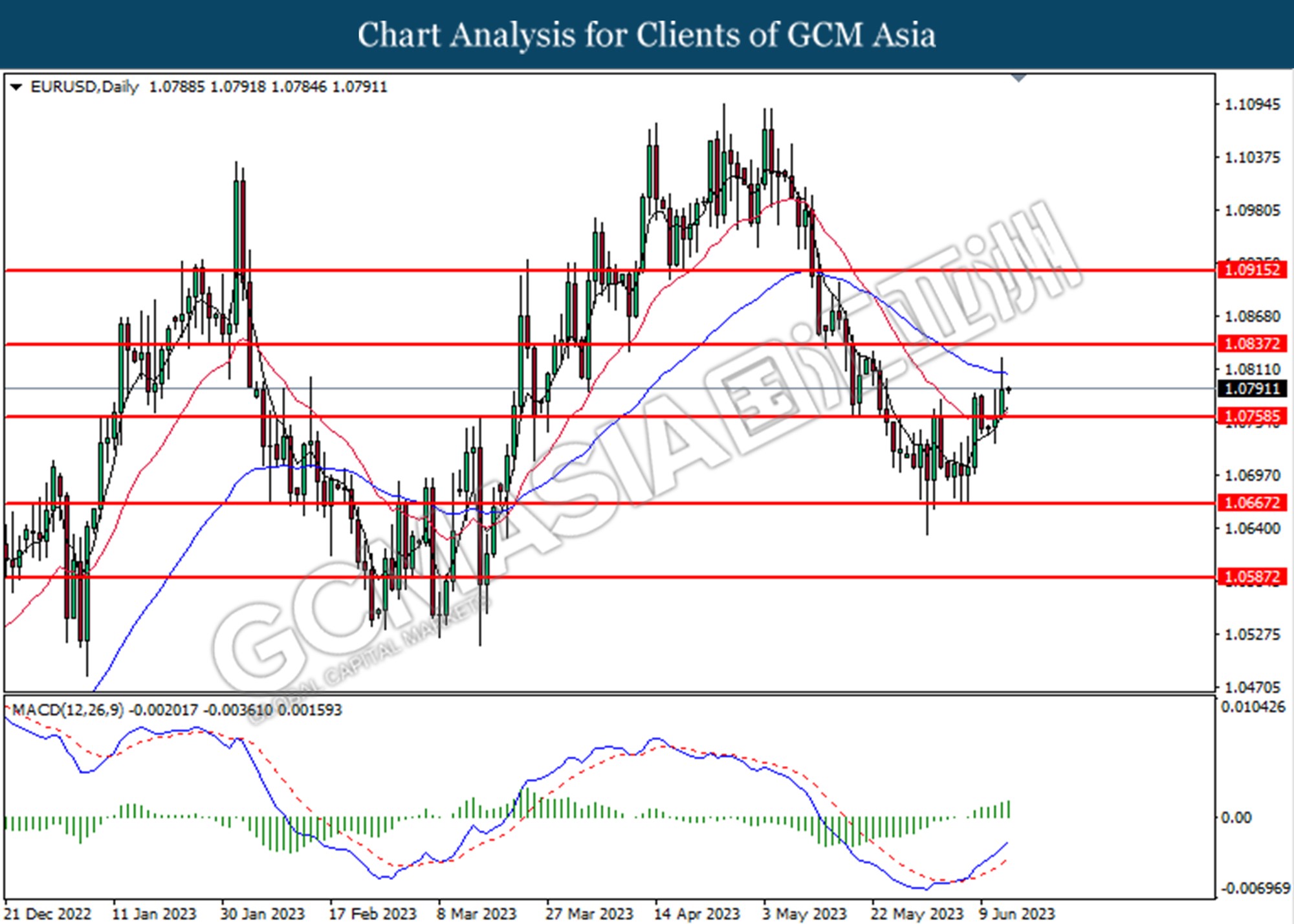

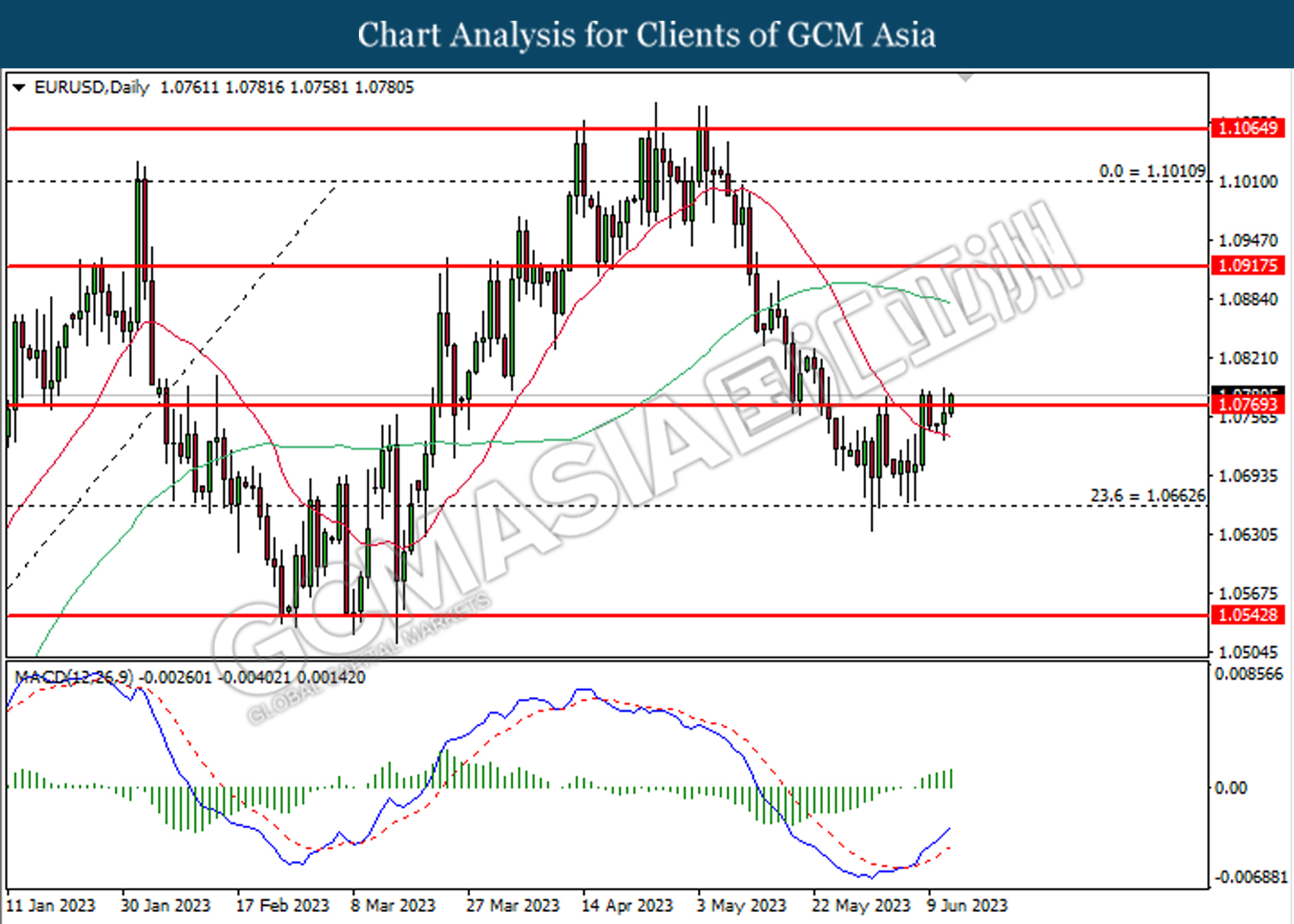

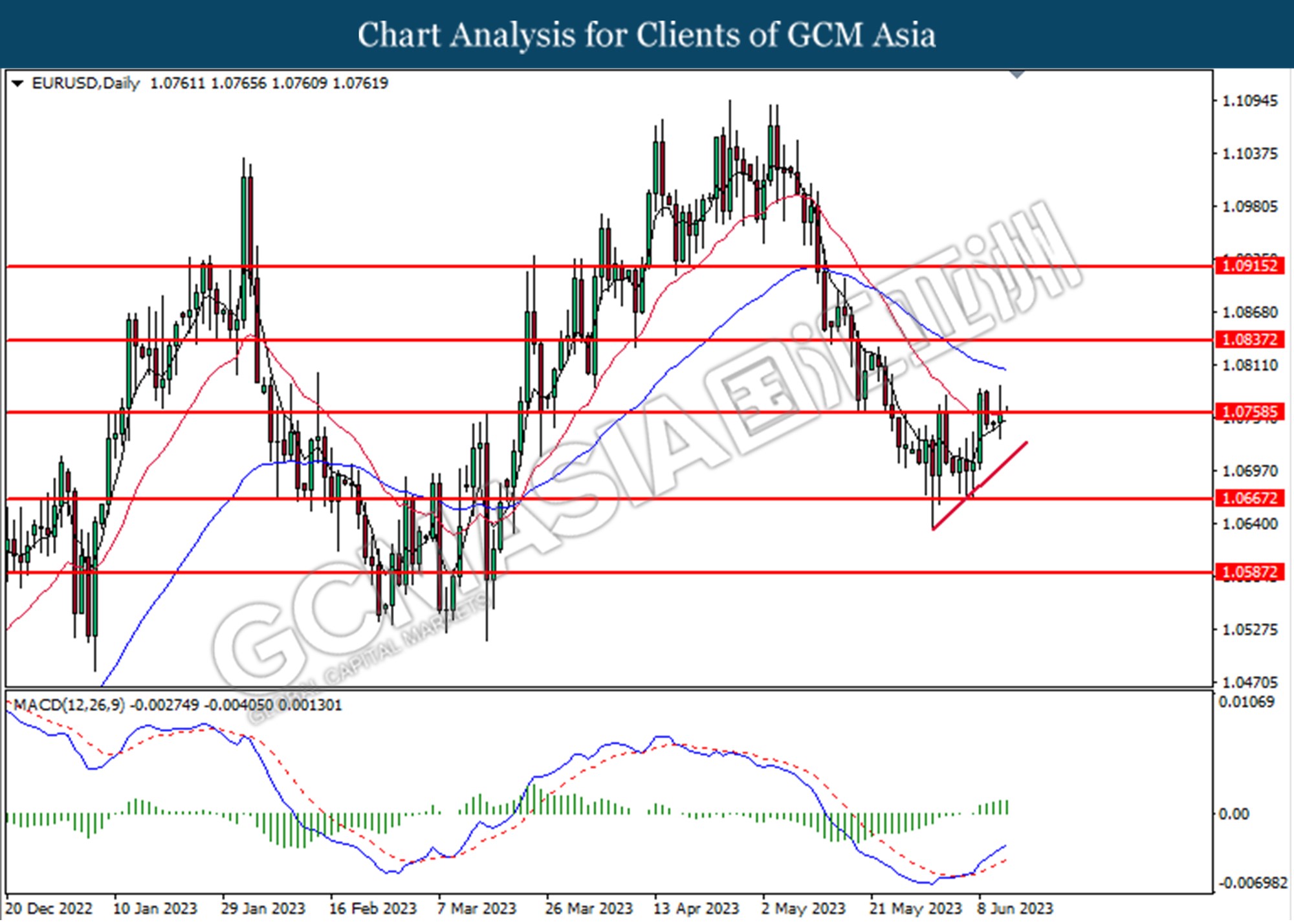

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0915. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

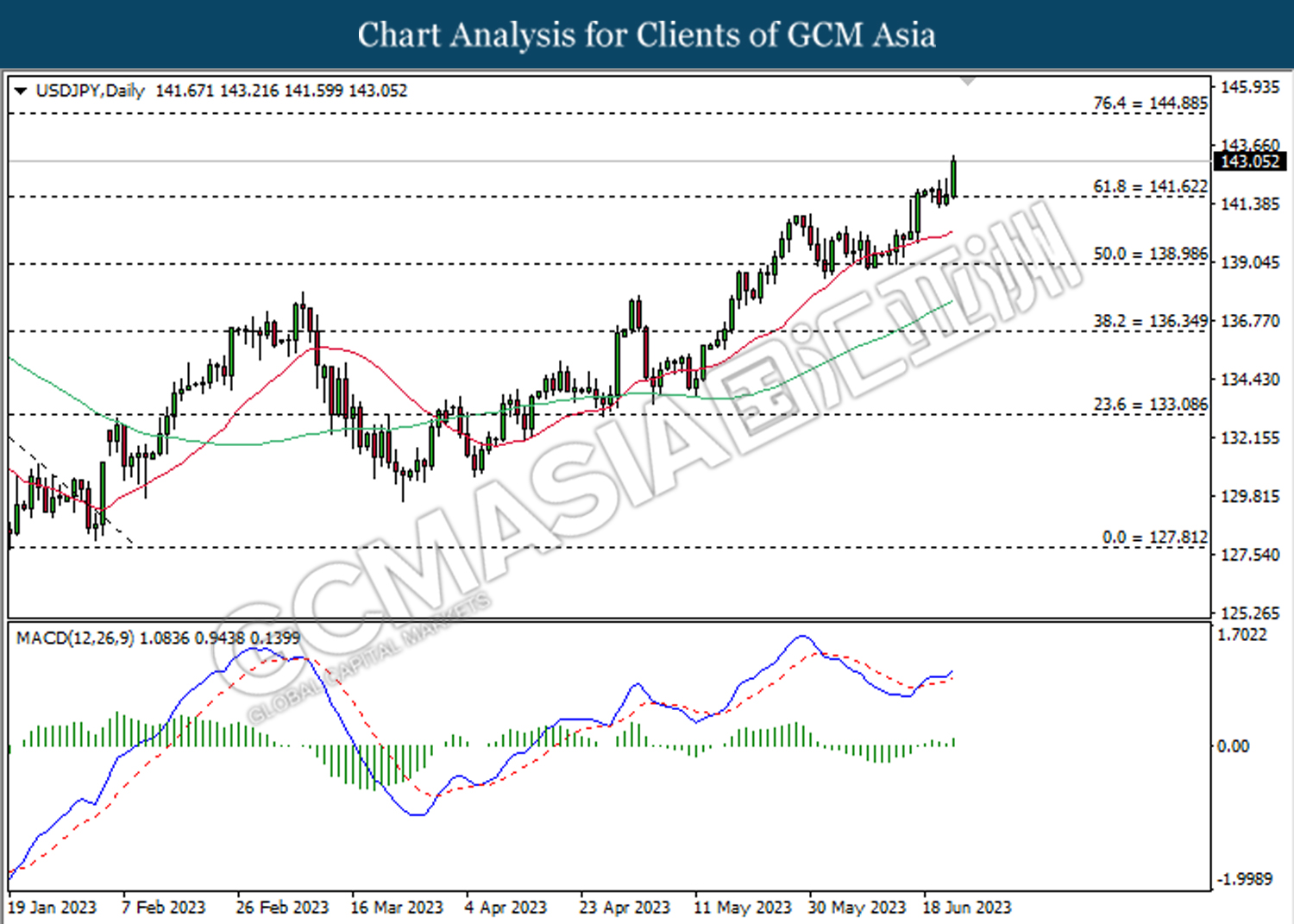

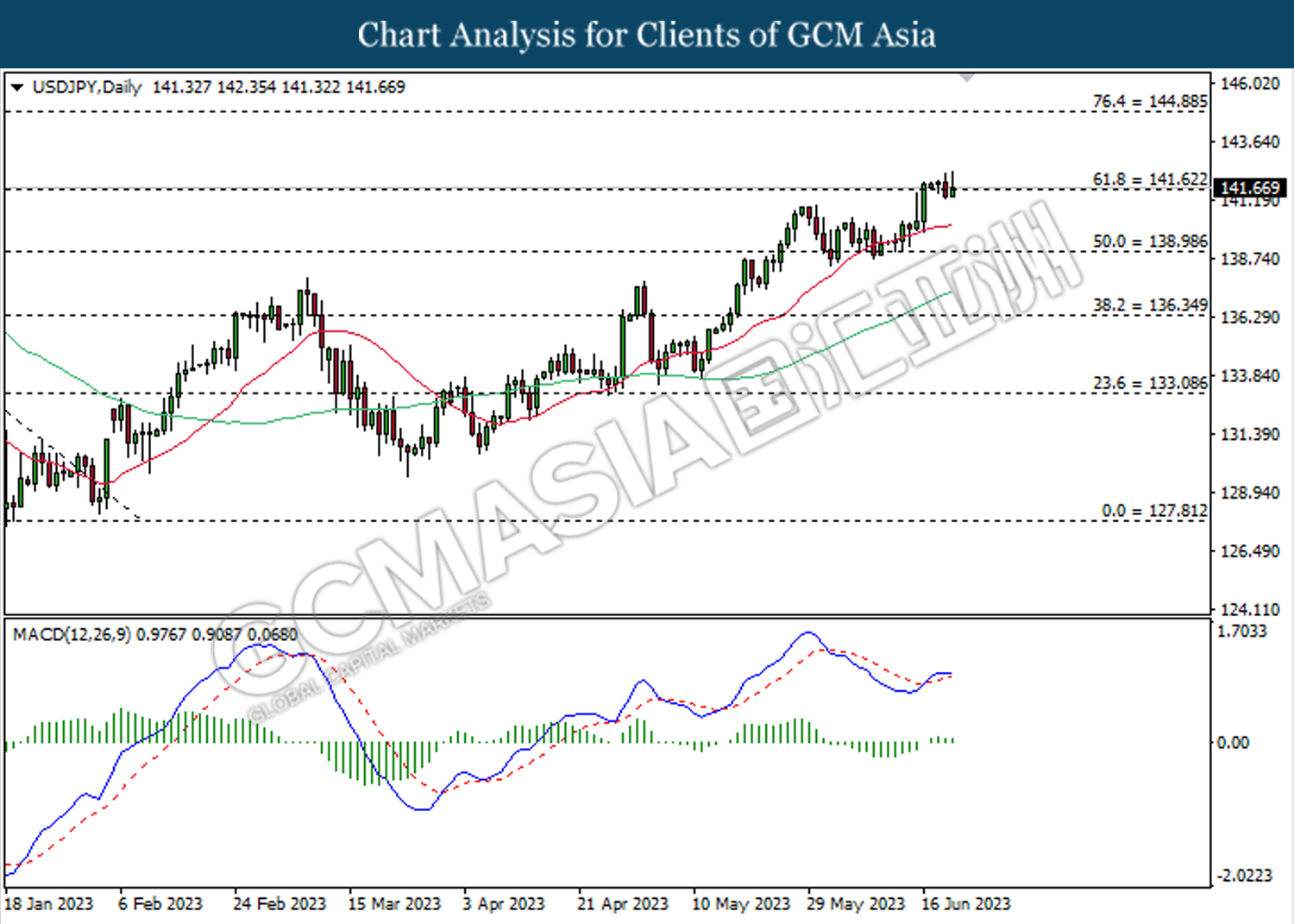

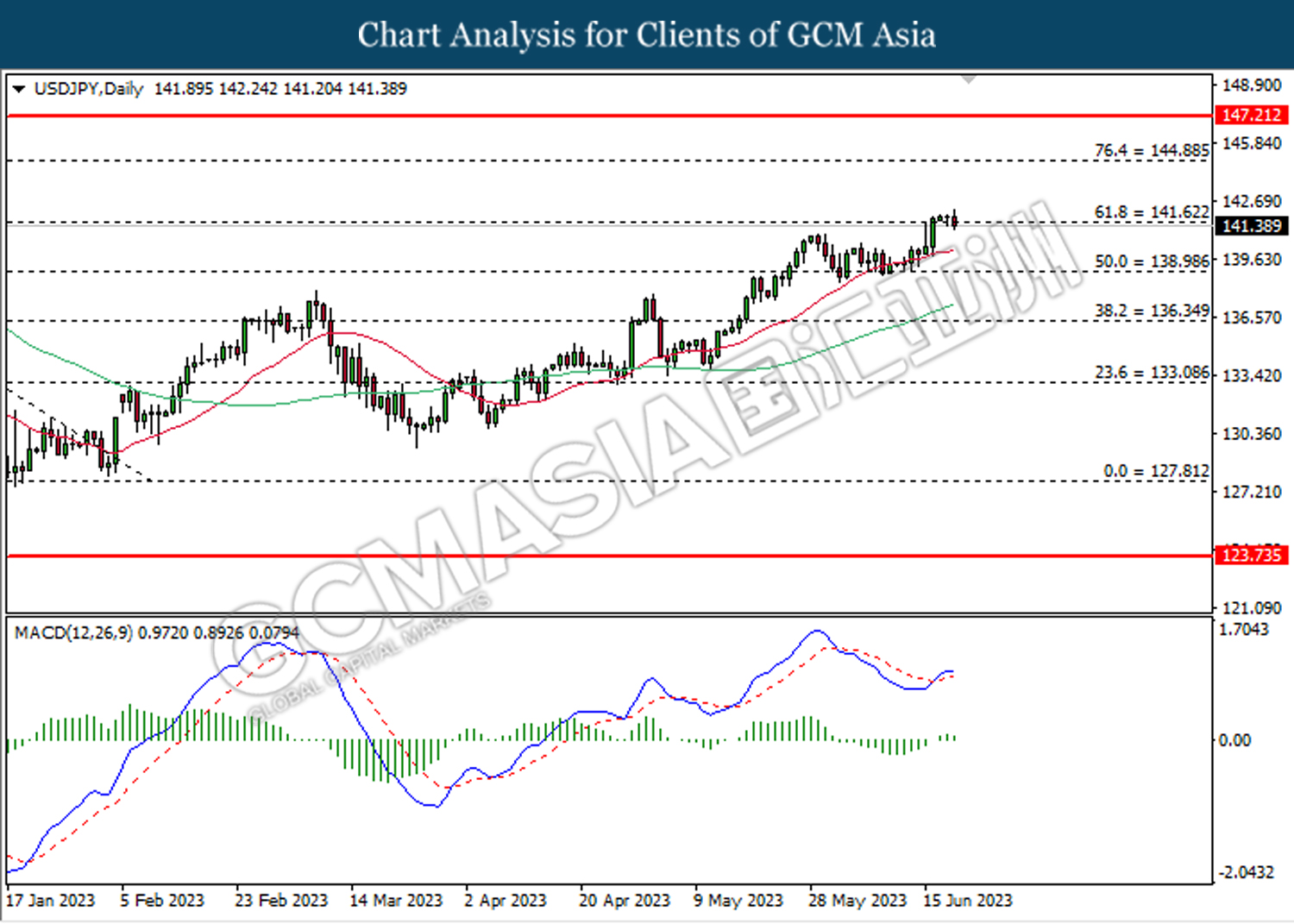

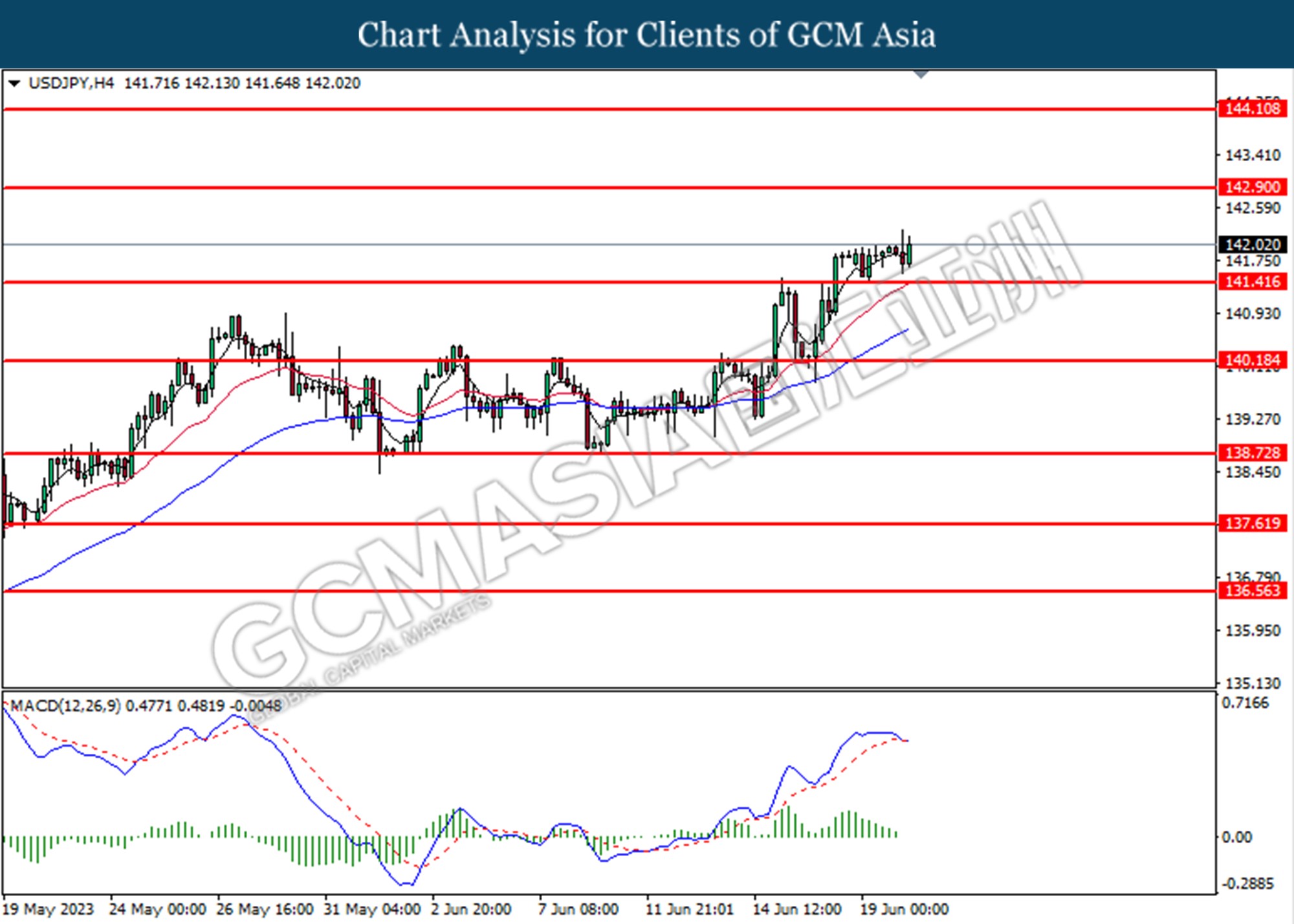

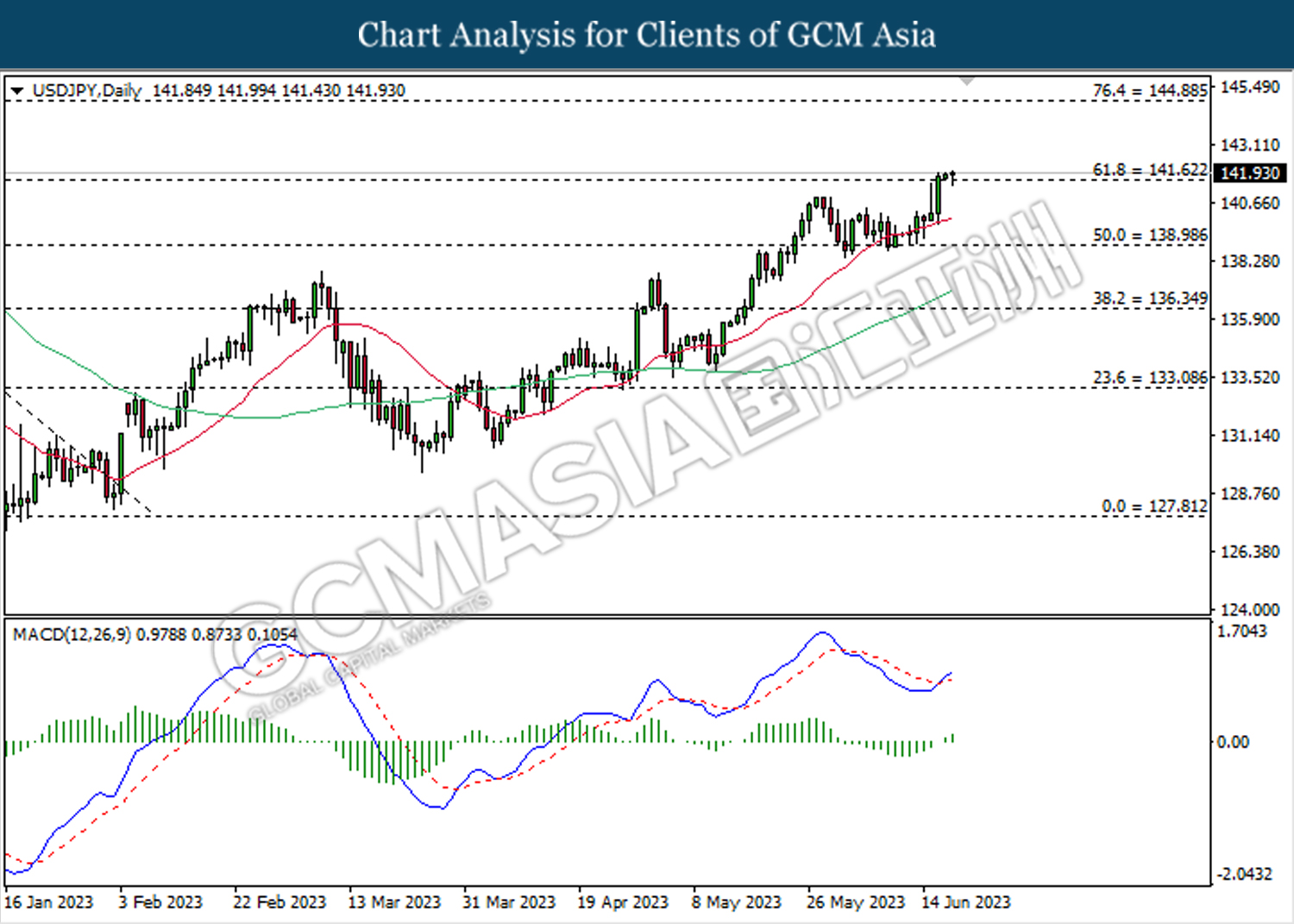

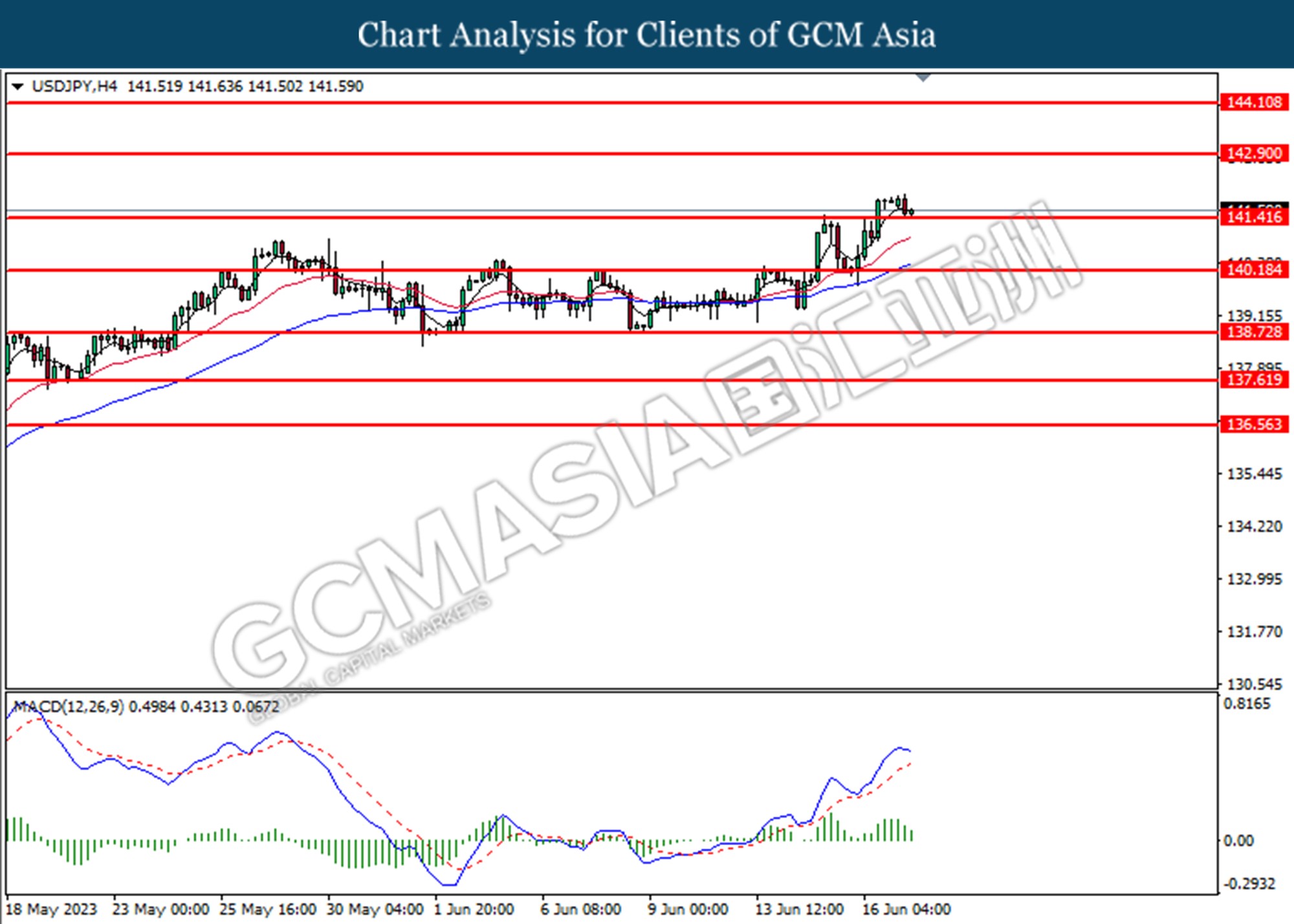

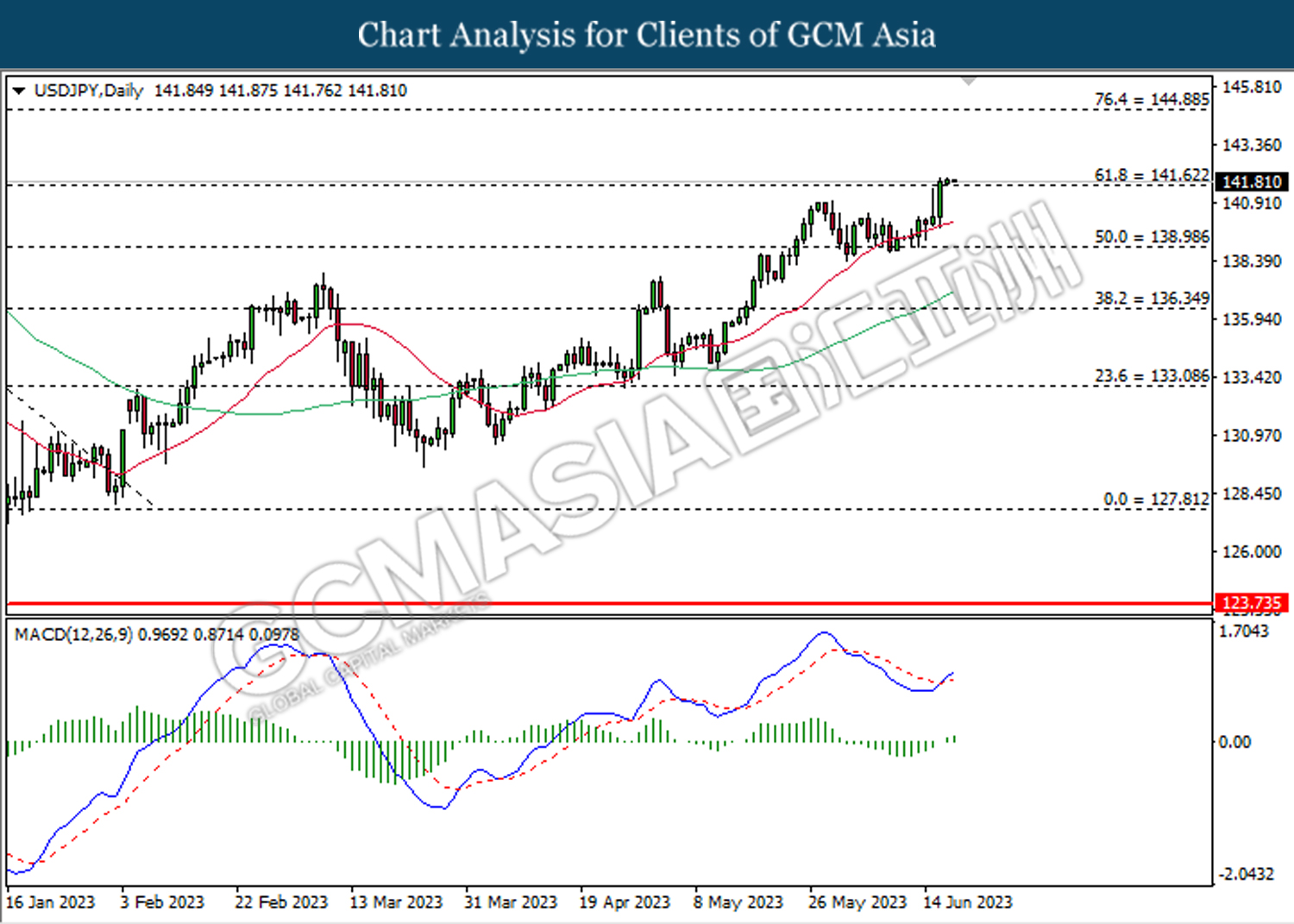

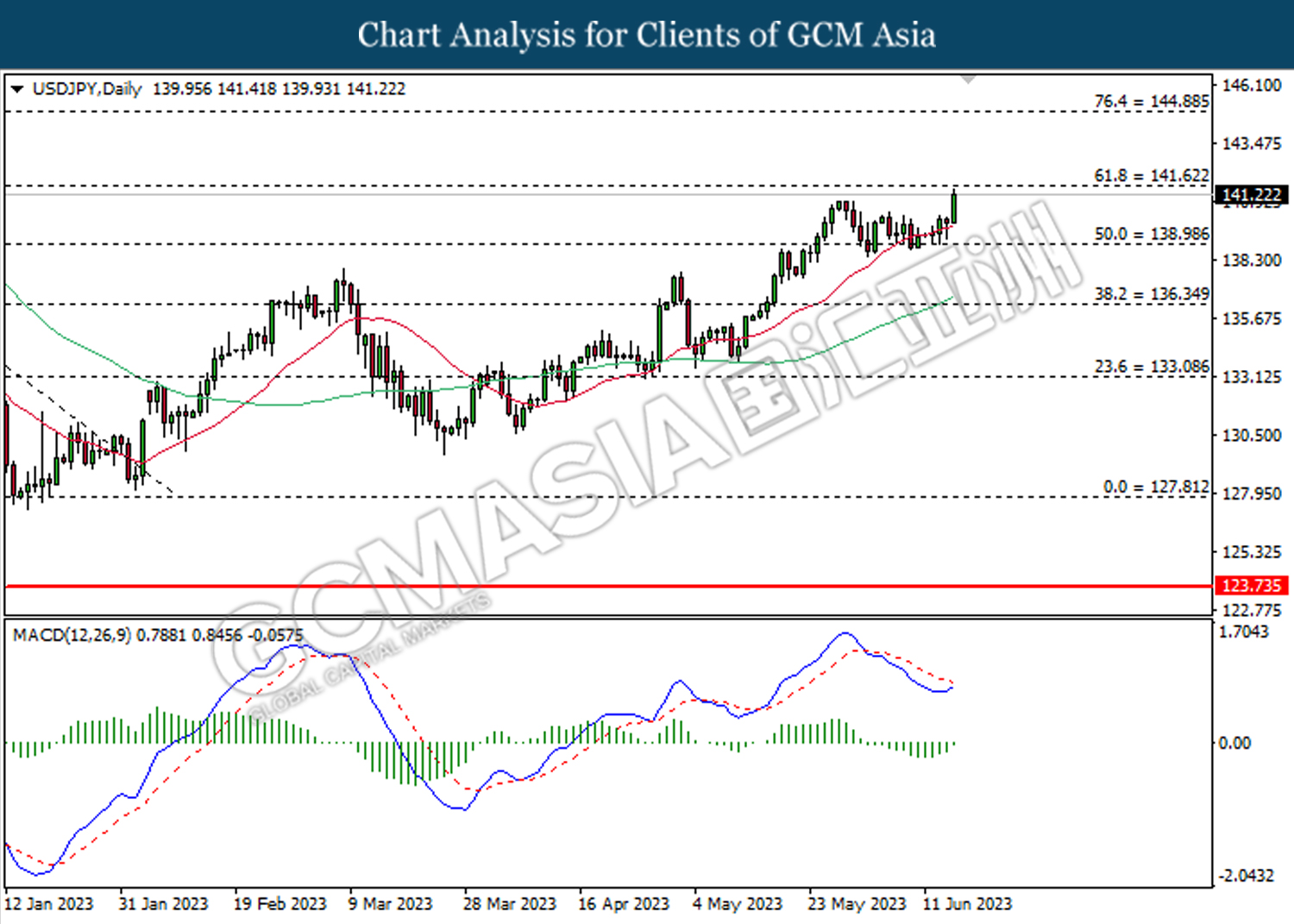

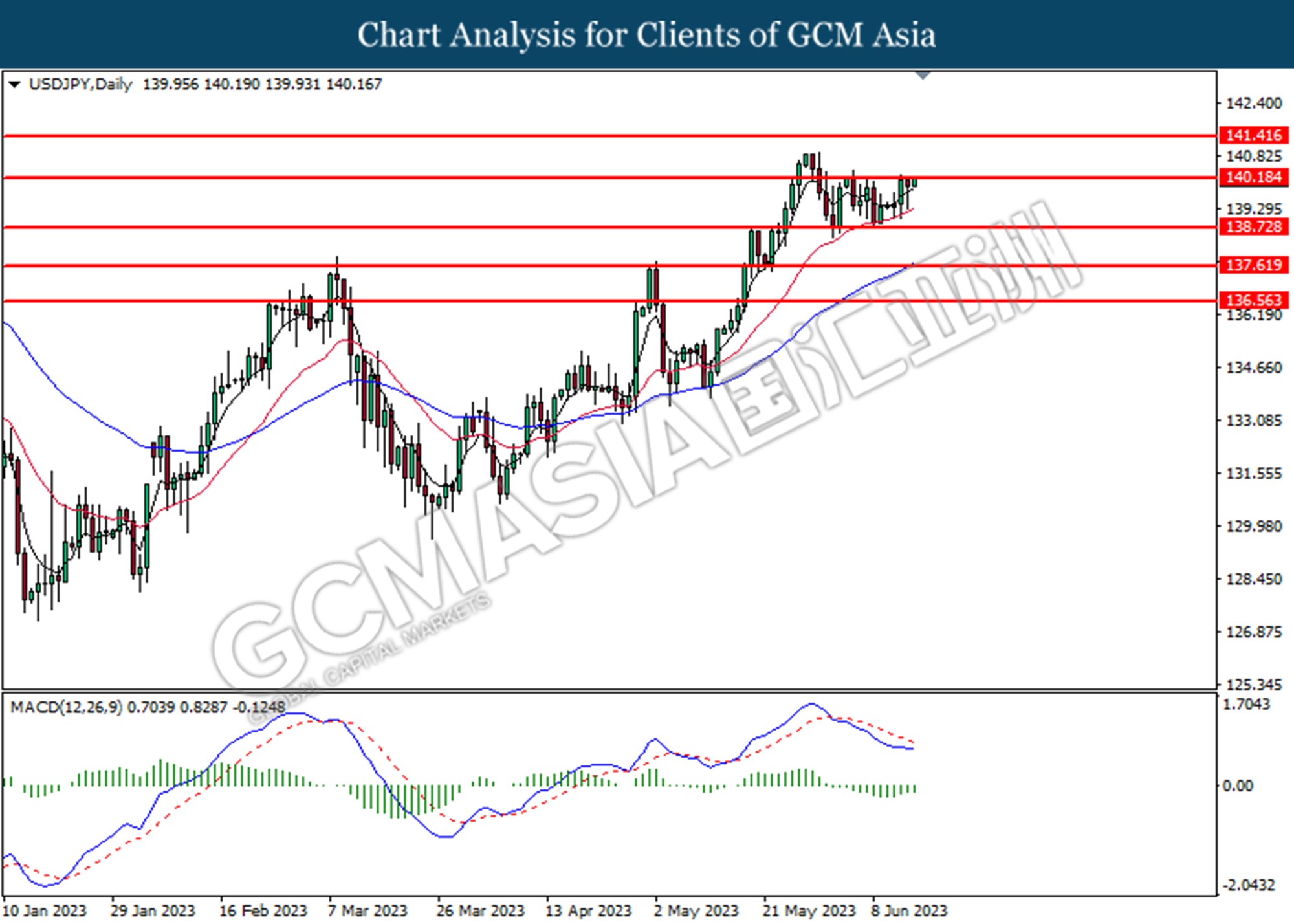

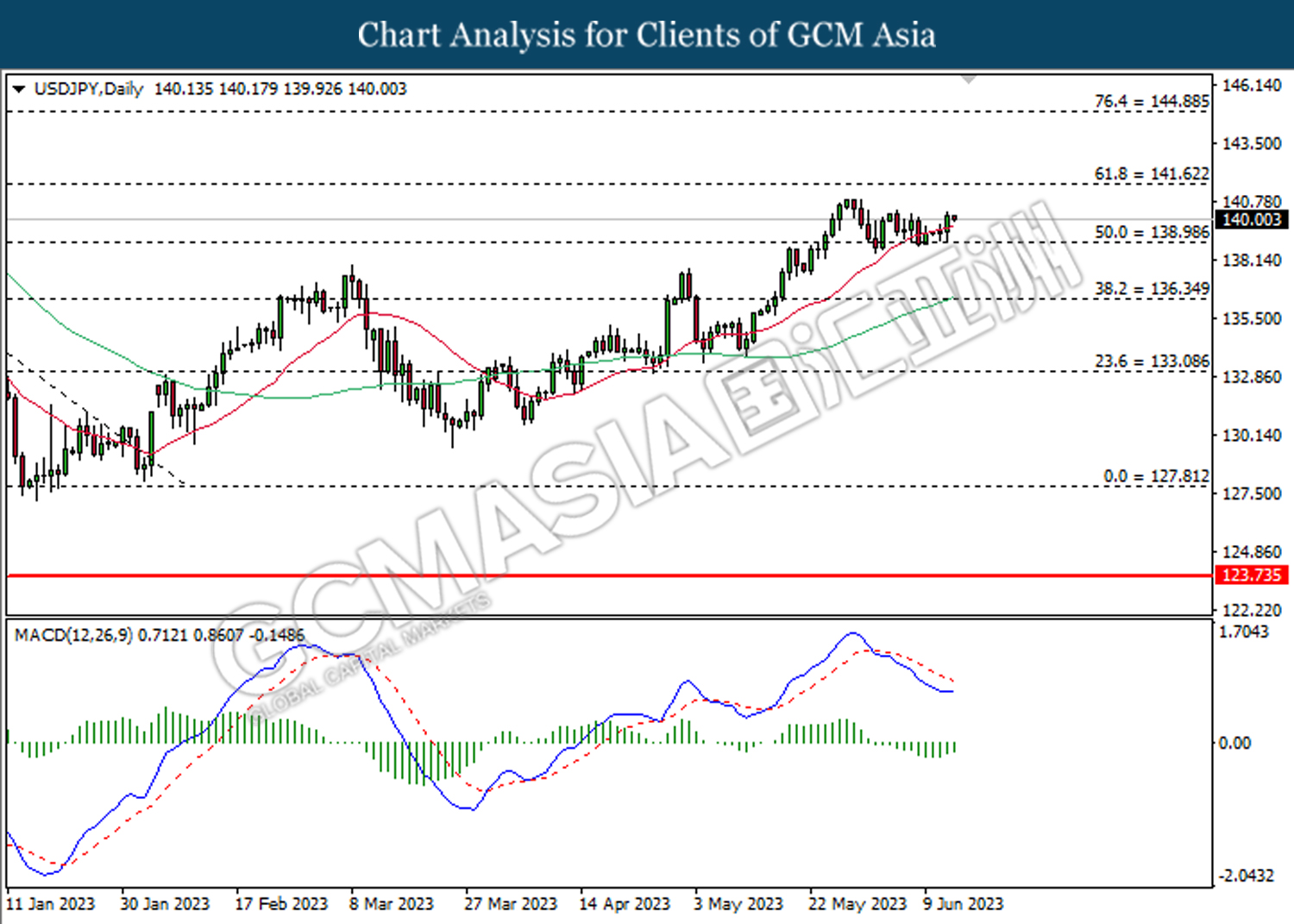

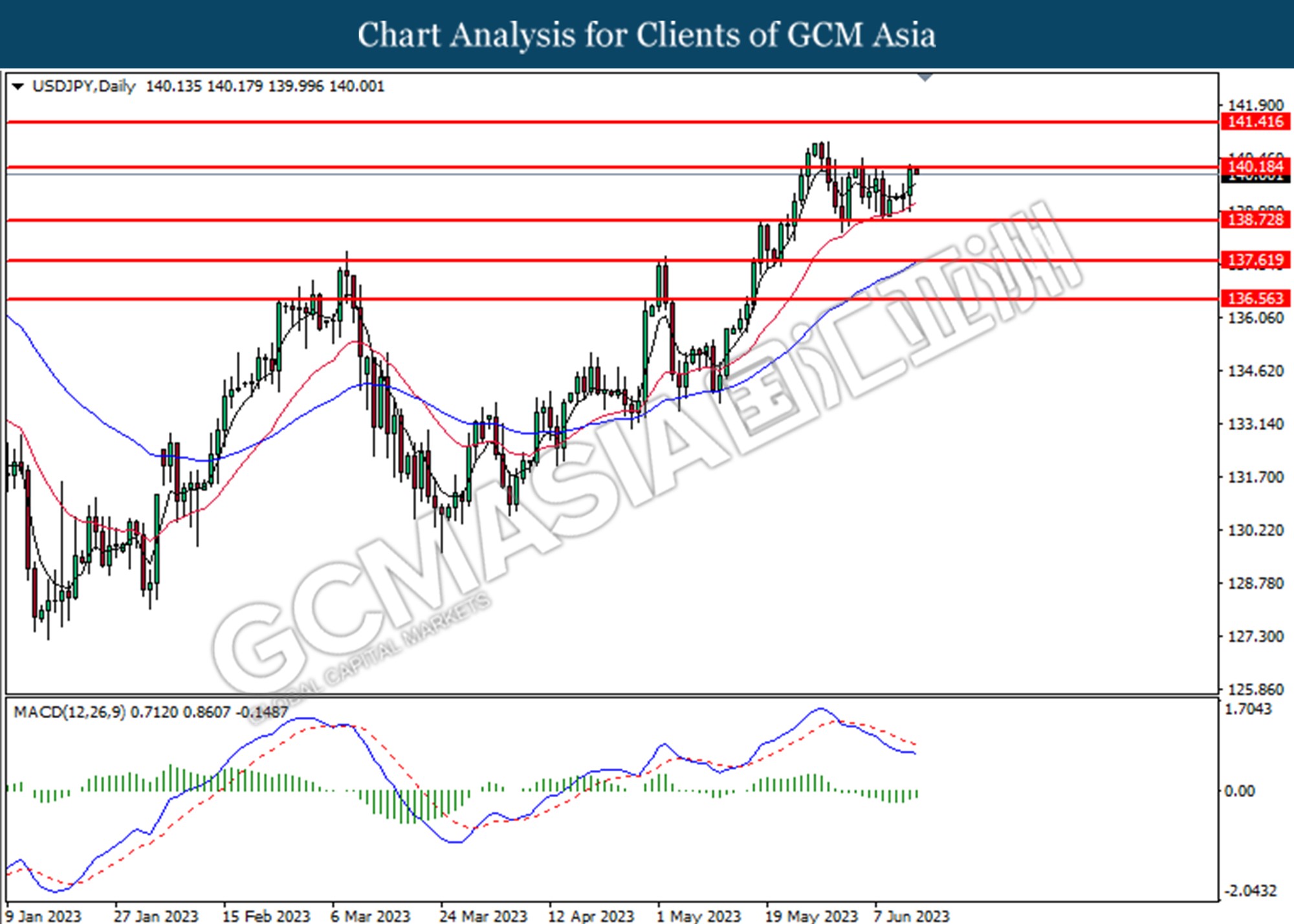

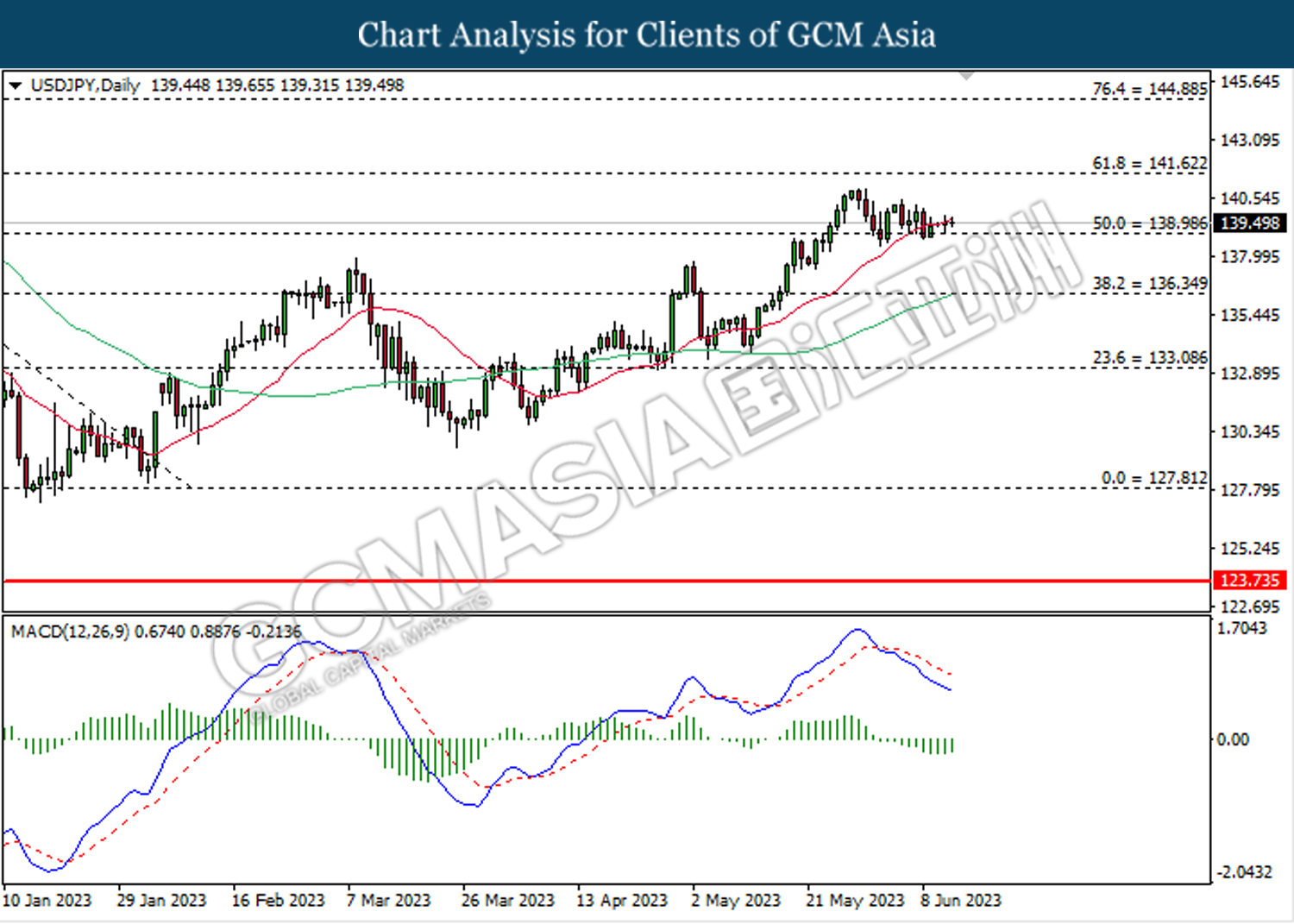

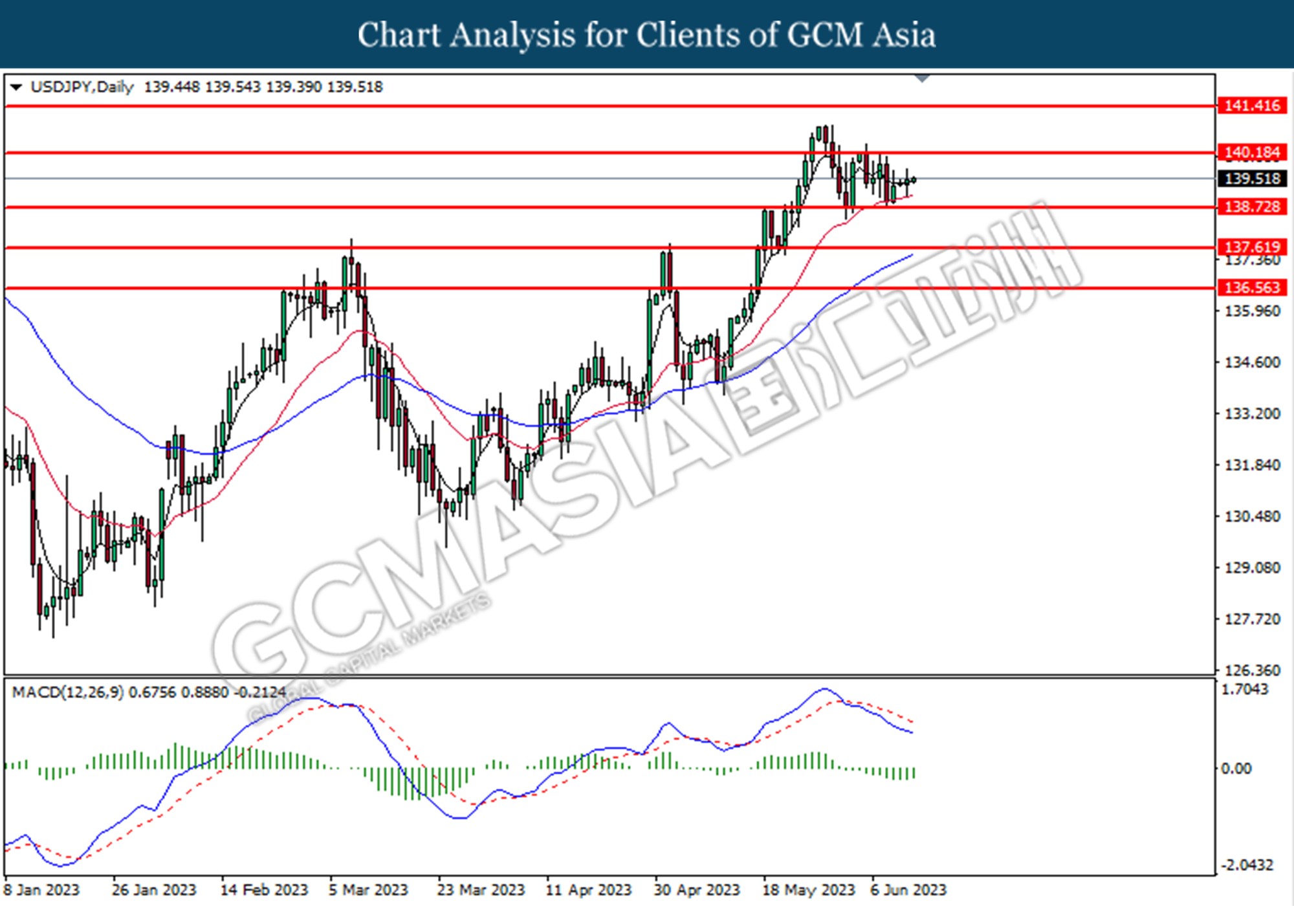

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

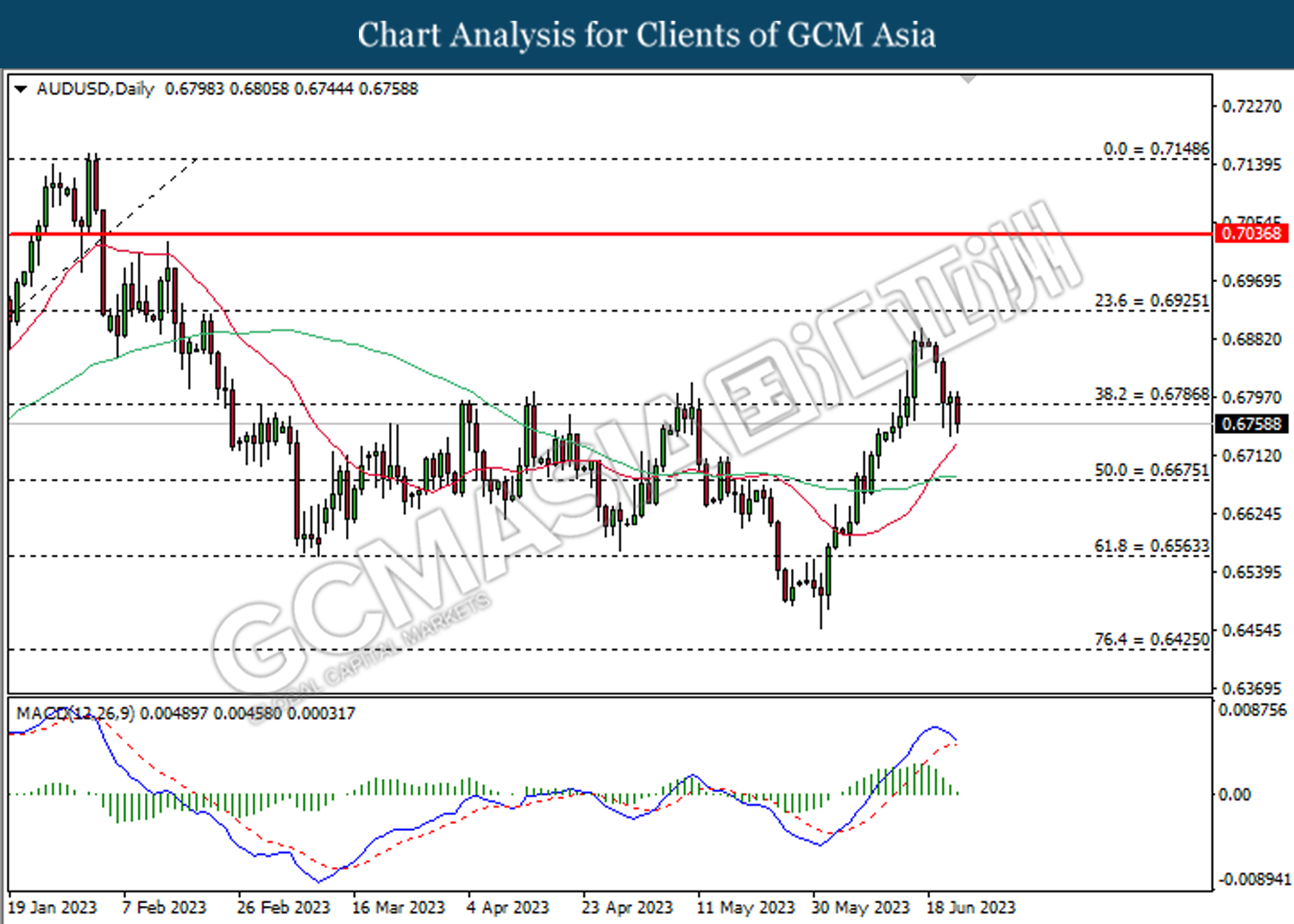

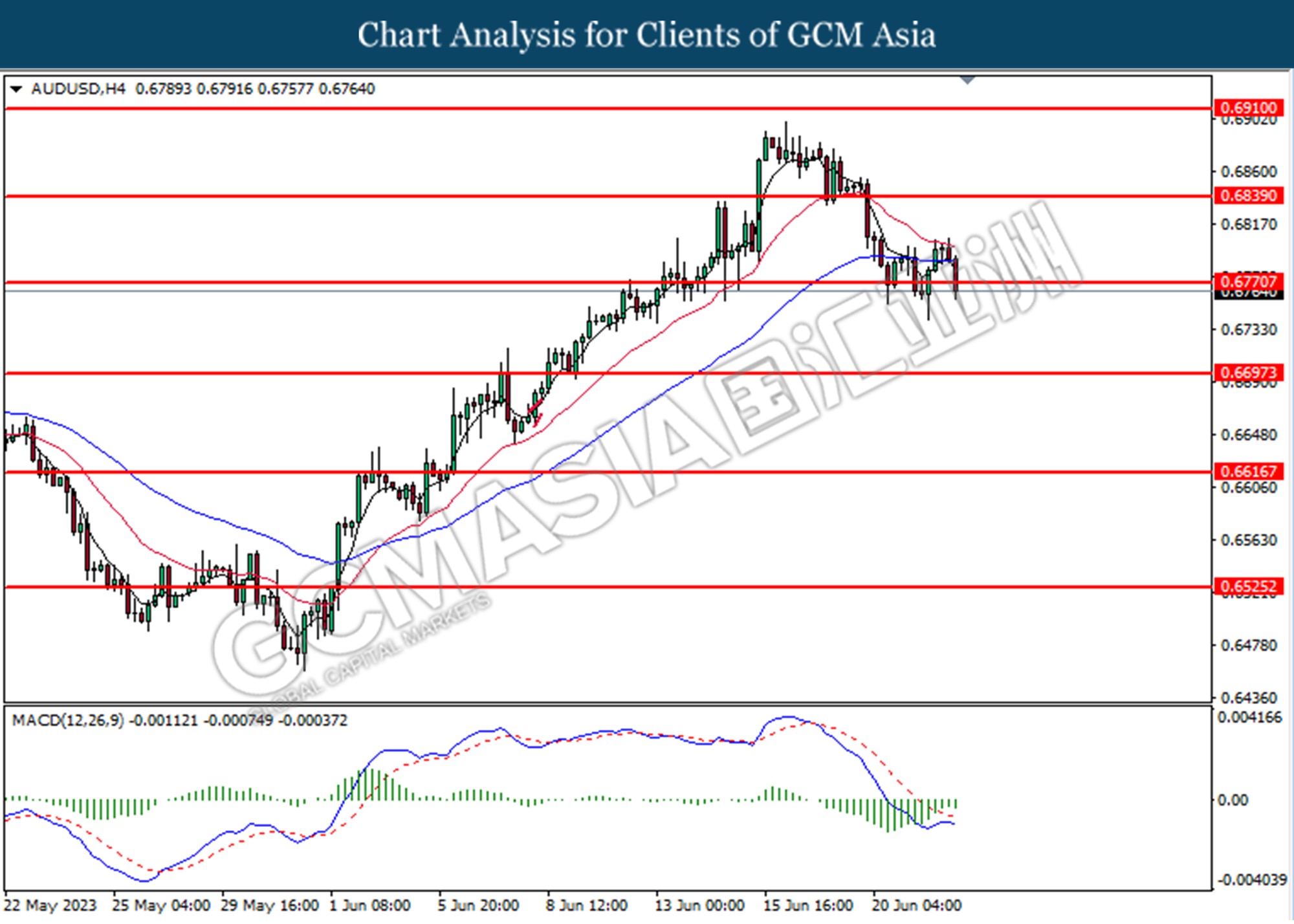

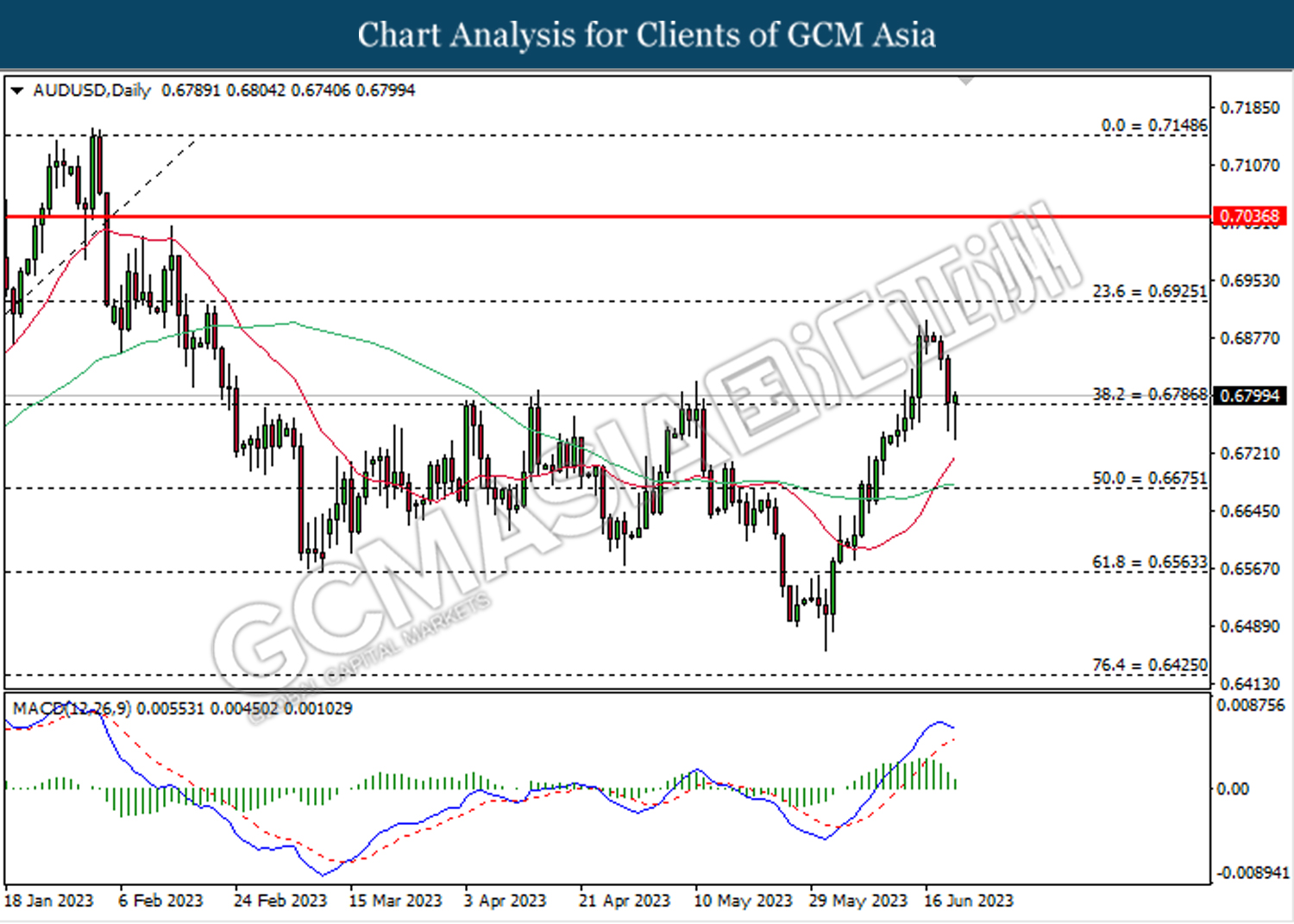

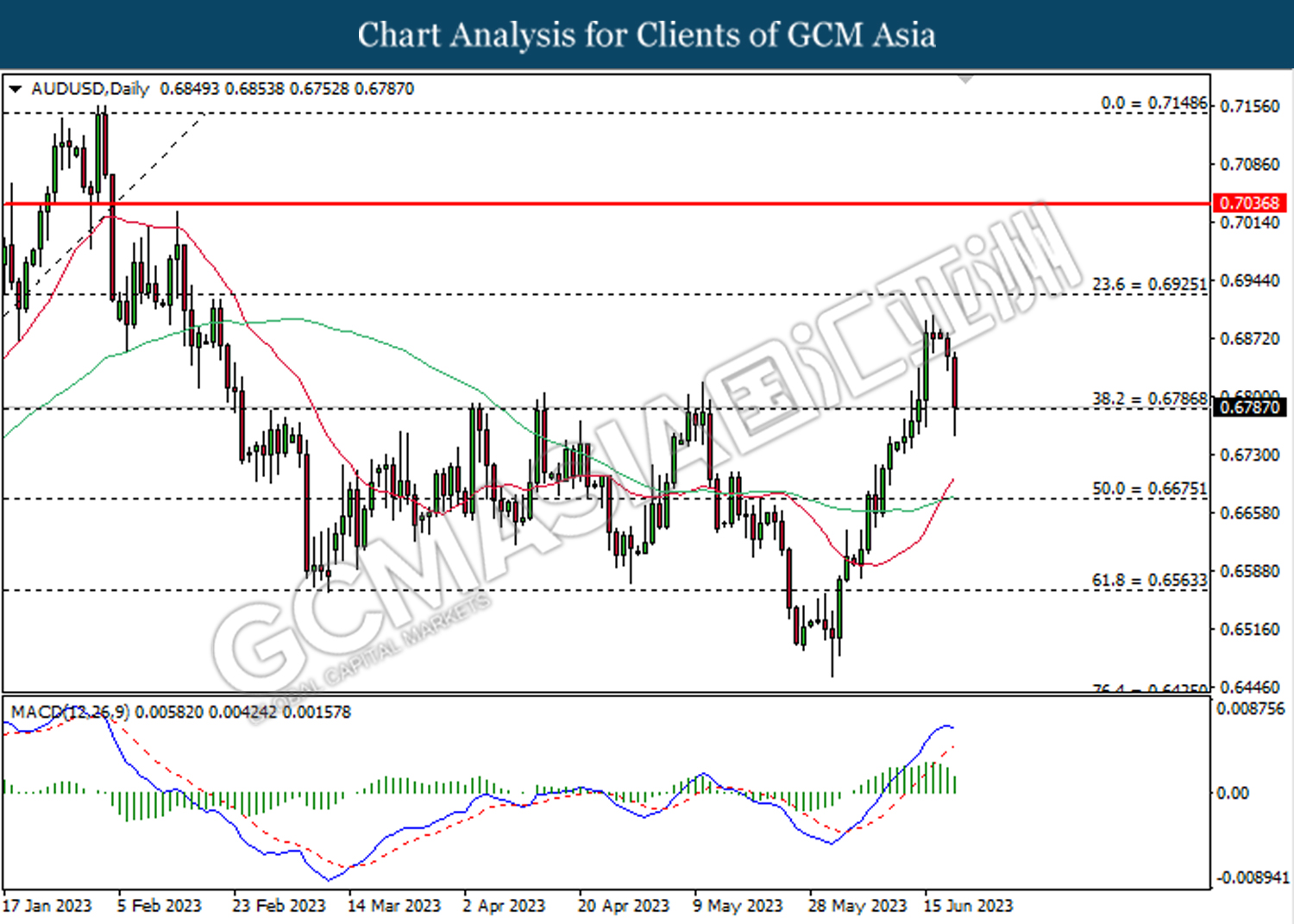

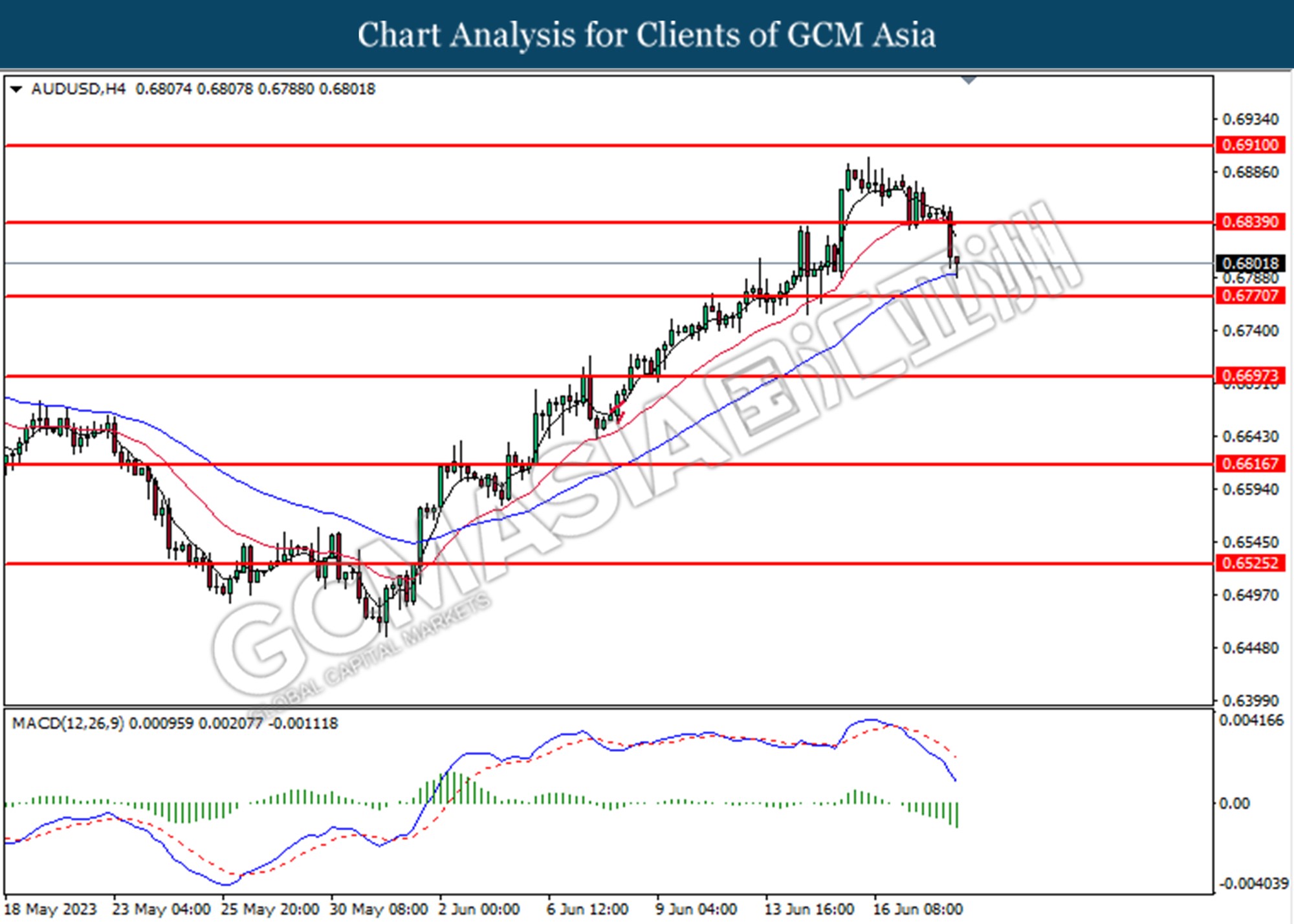

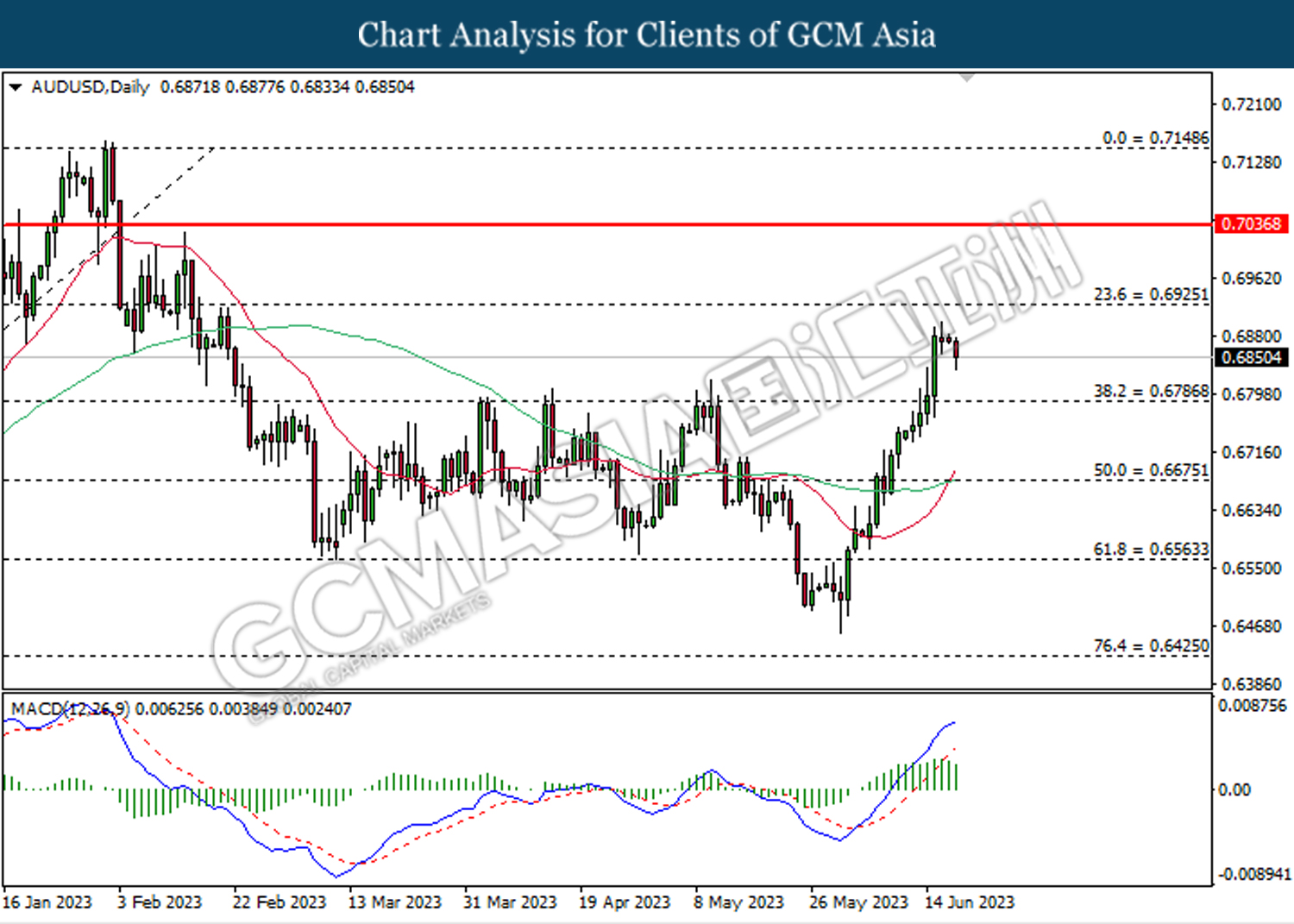

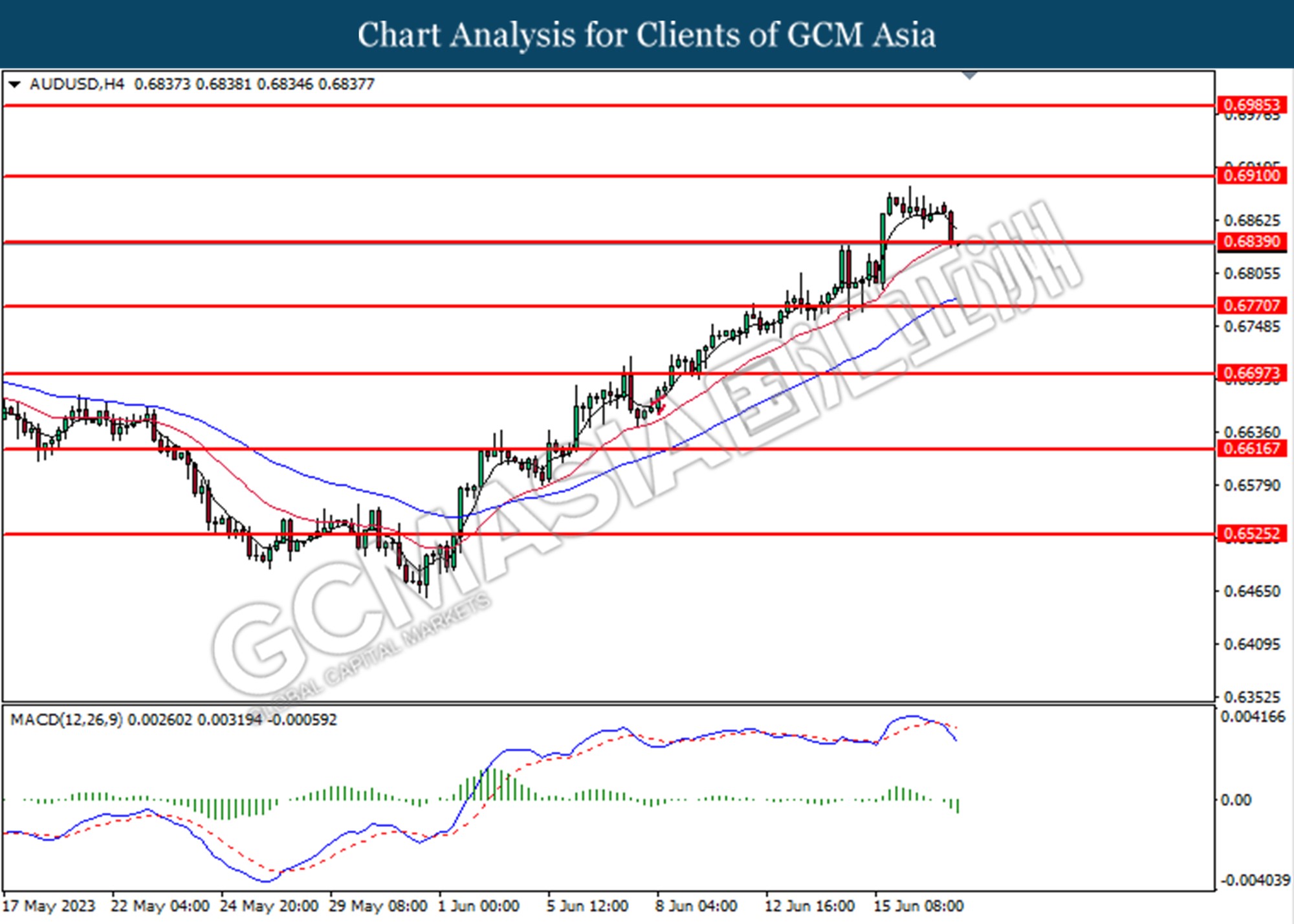

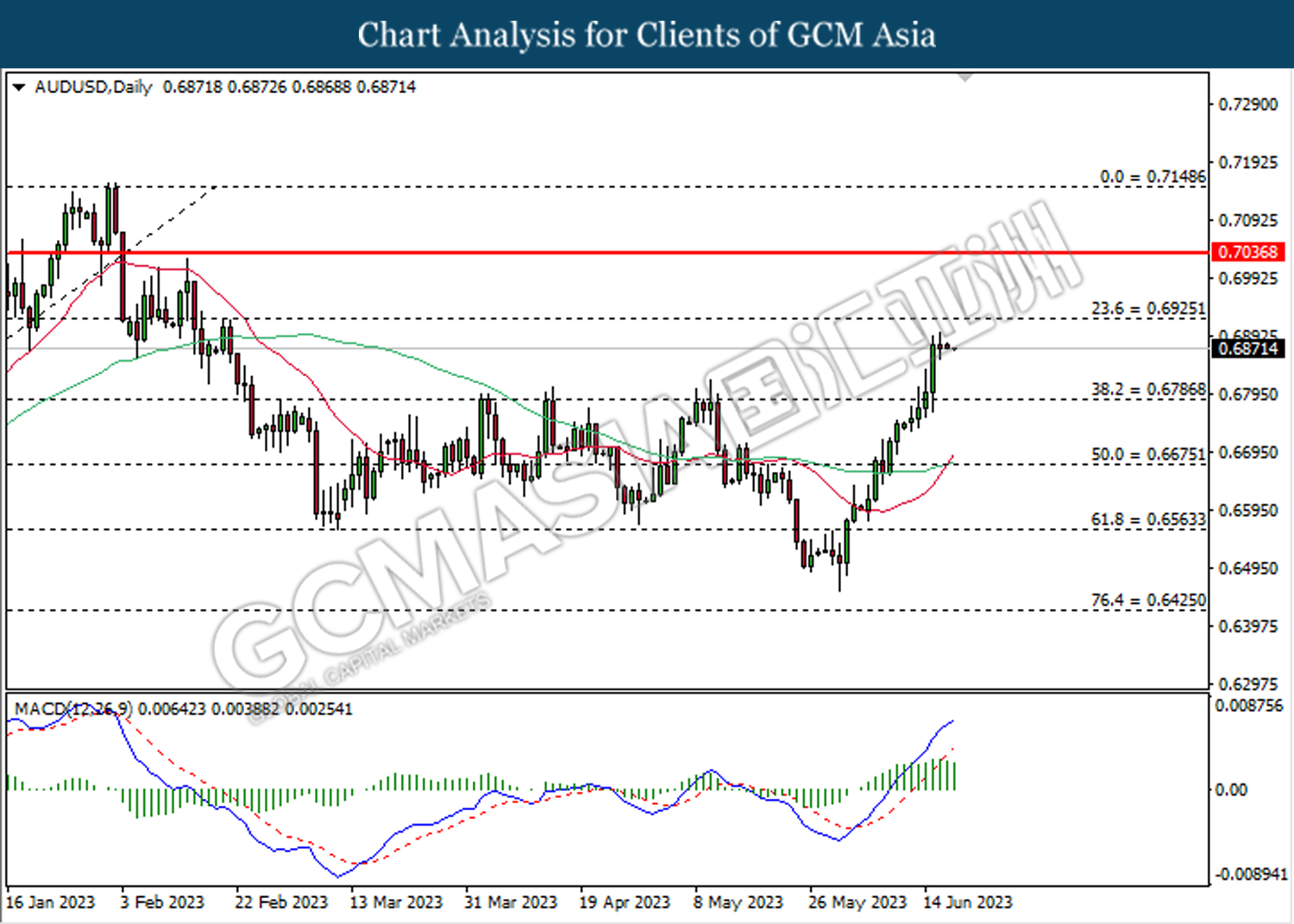

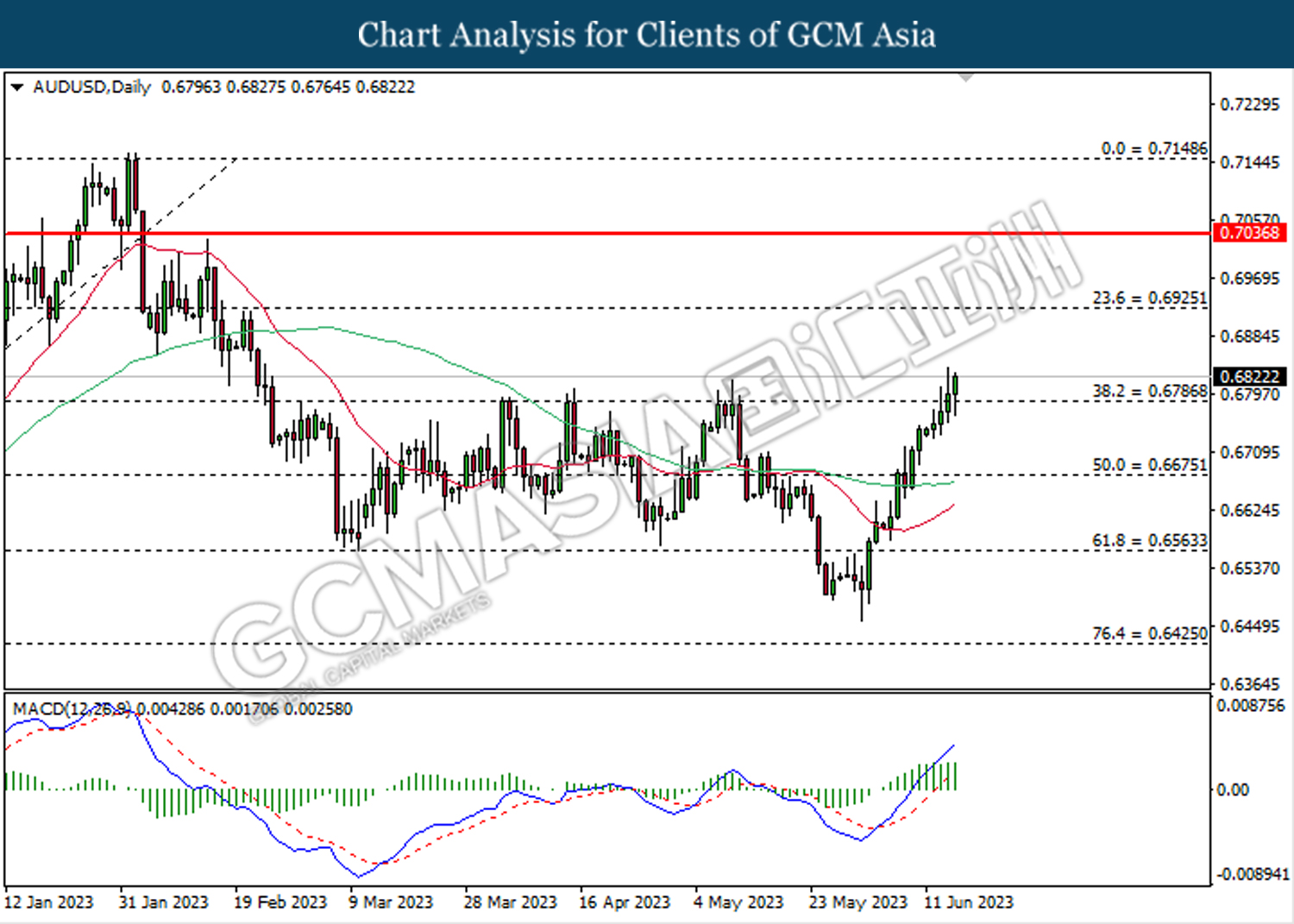

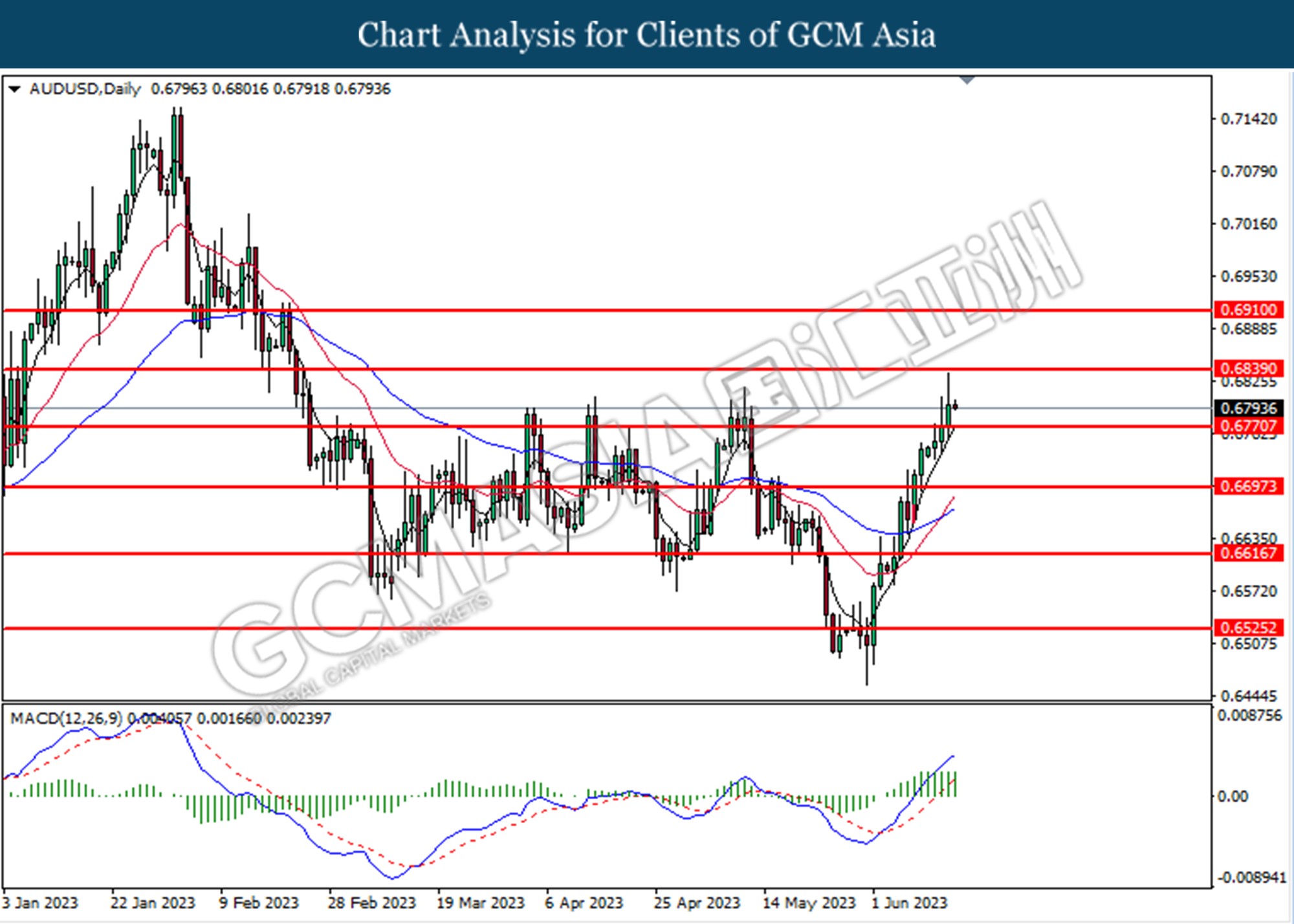

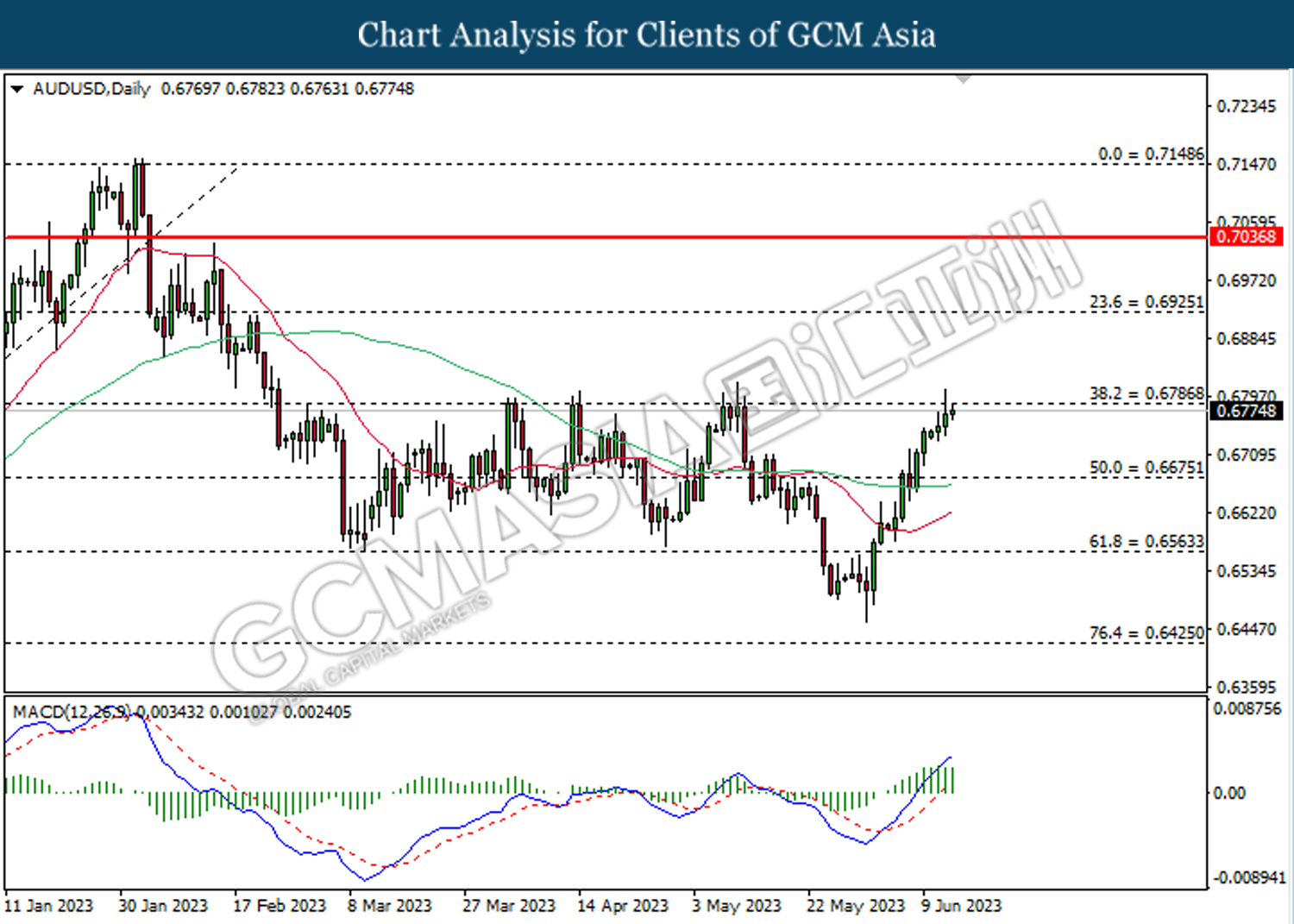

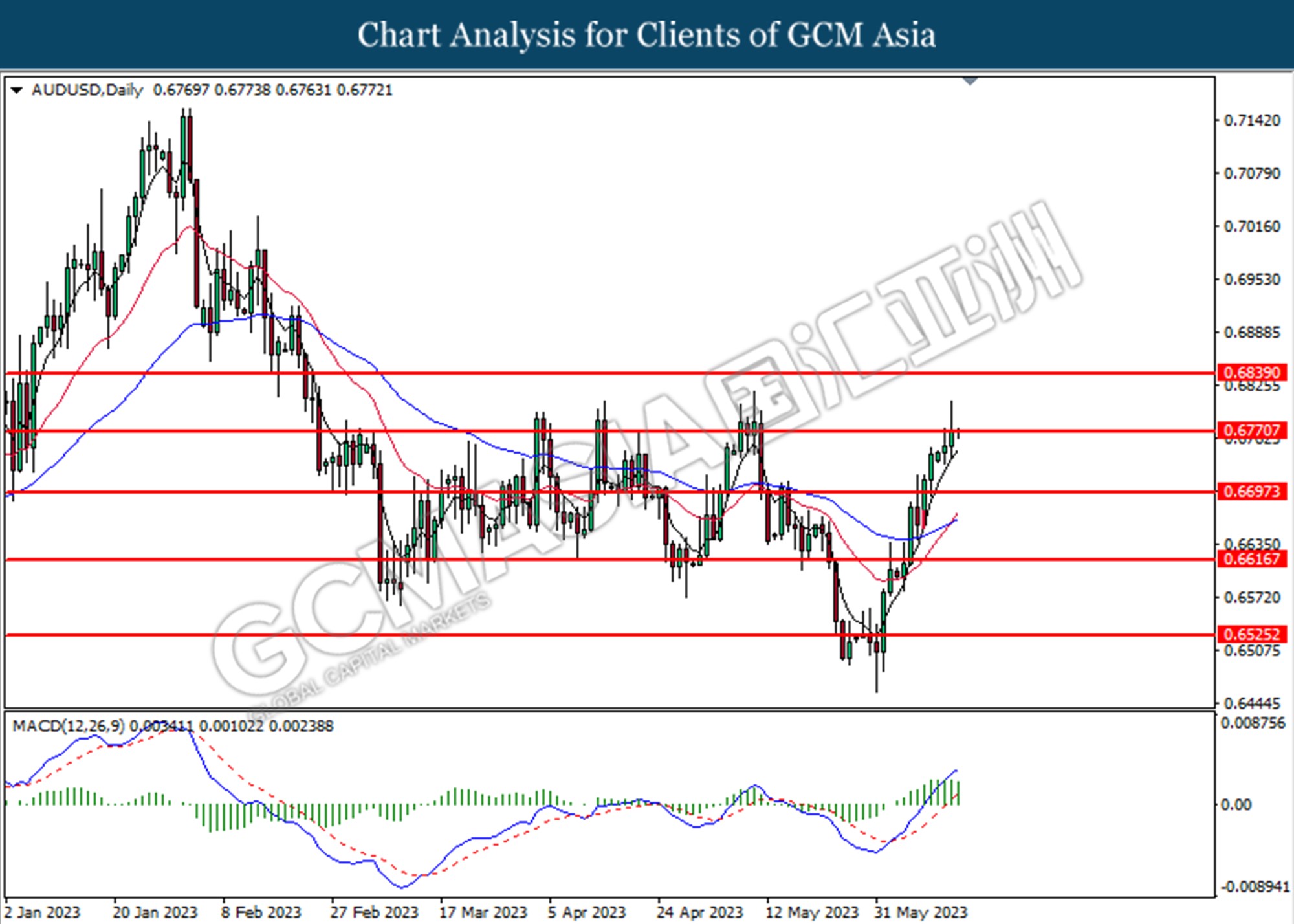

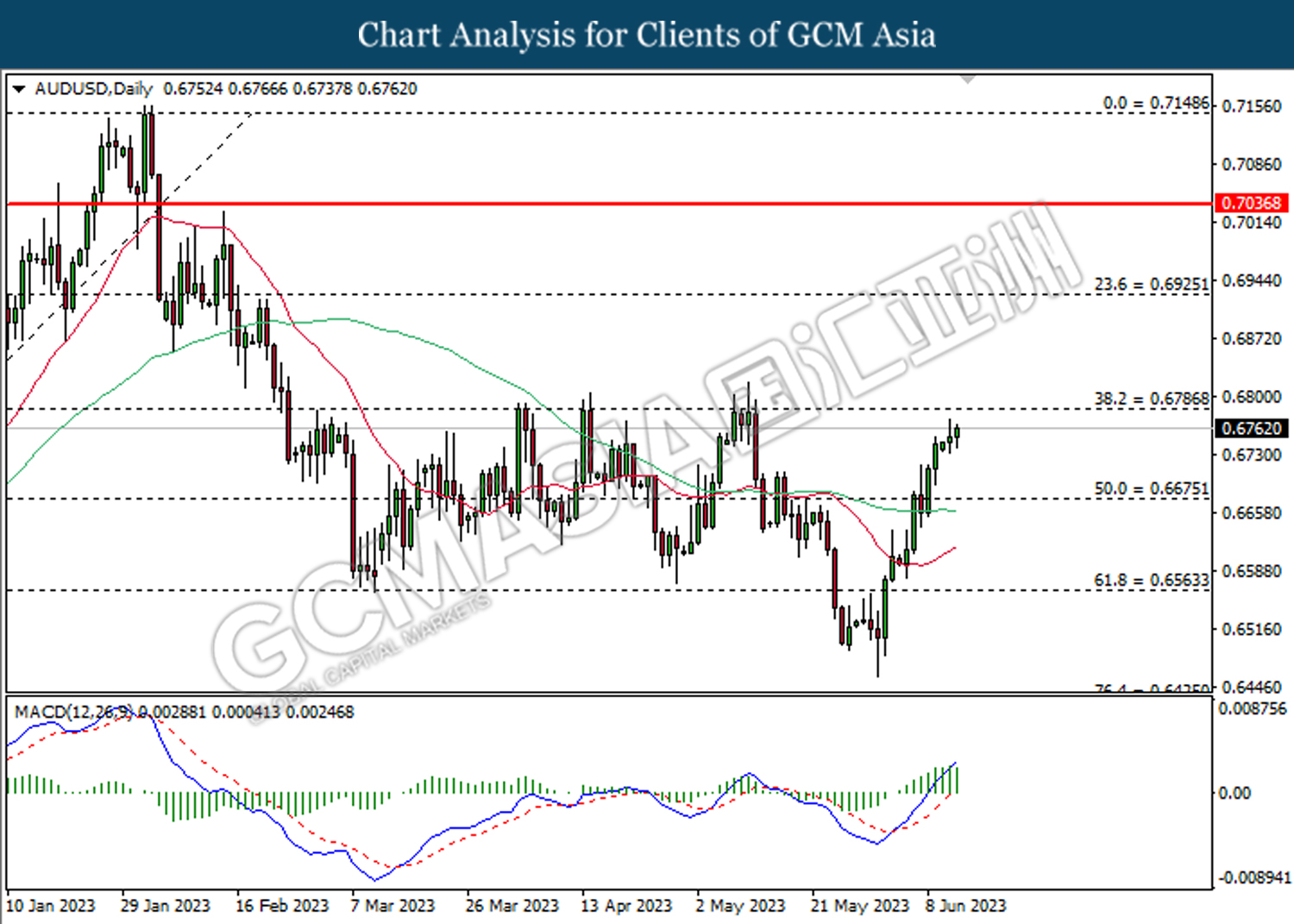

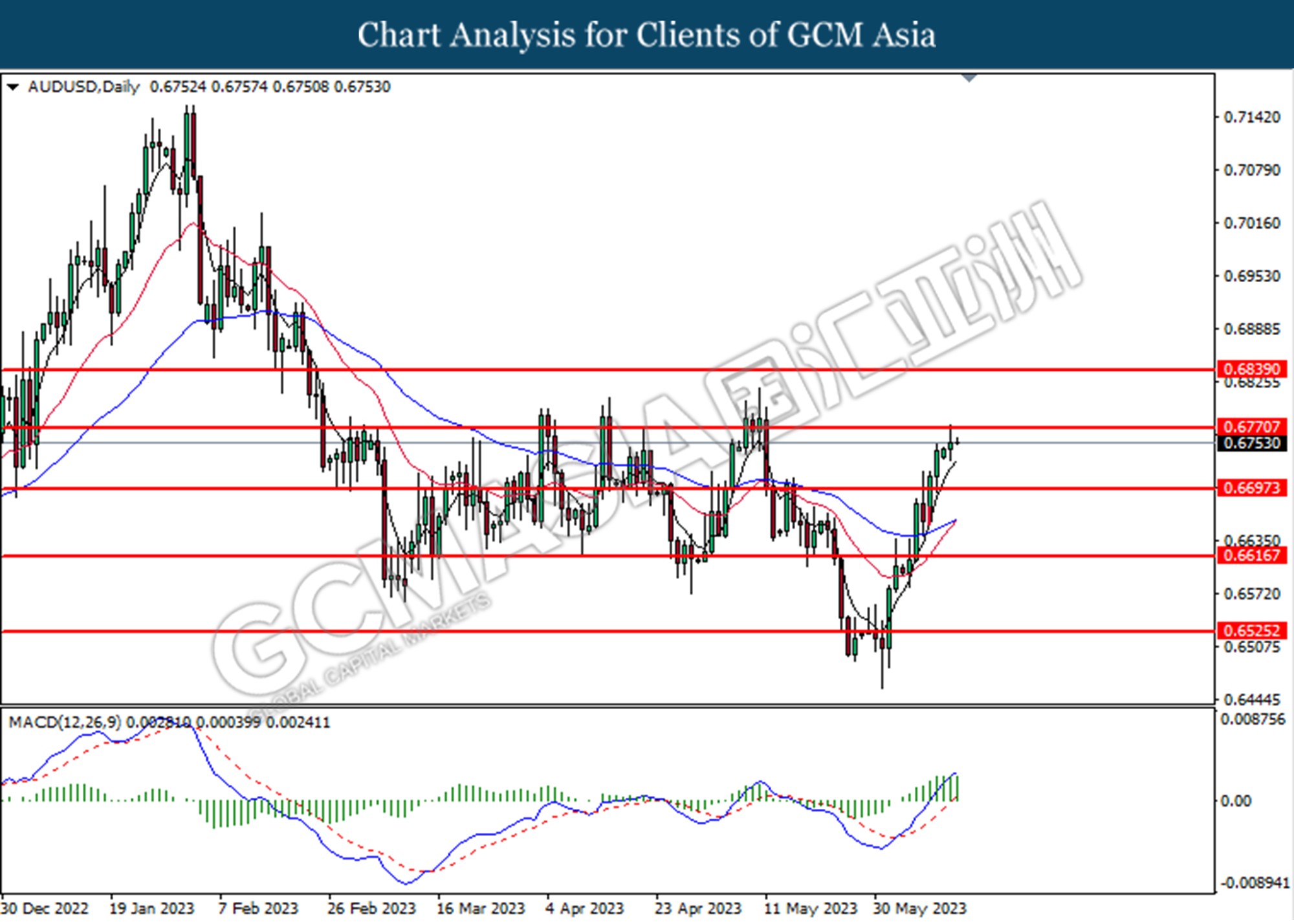

AUDUSD, Daily: AUDUSD was traded lower while currently testing support level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

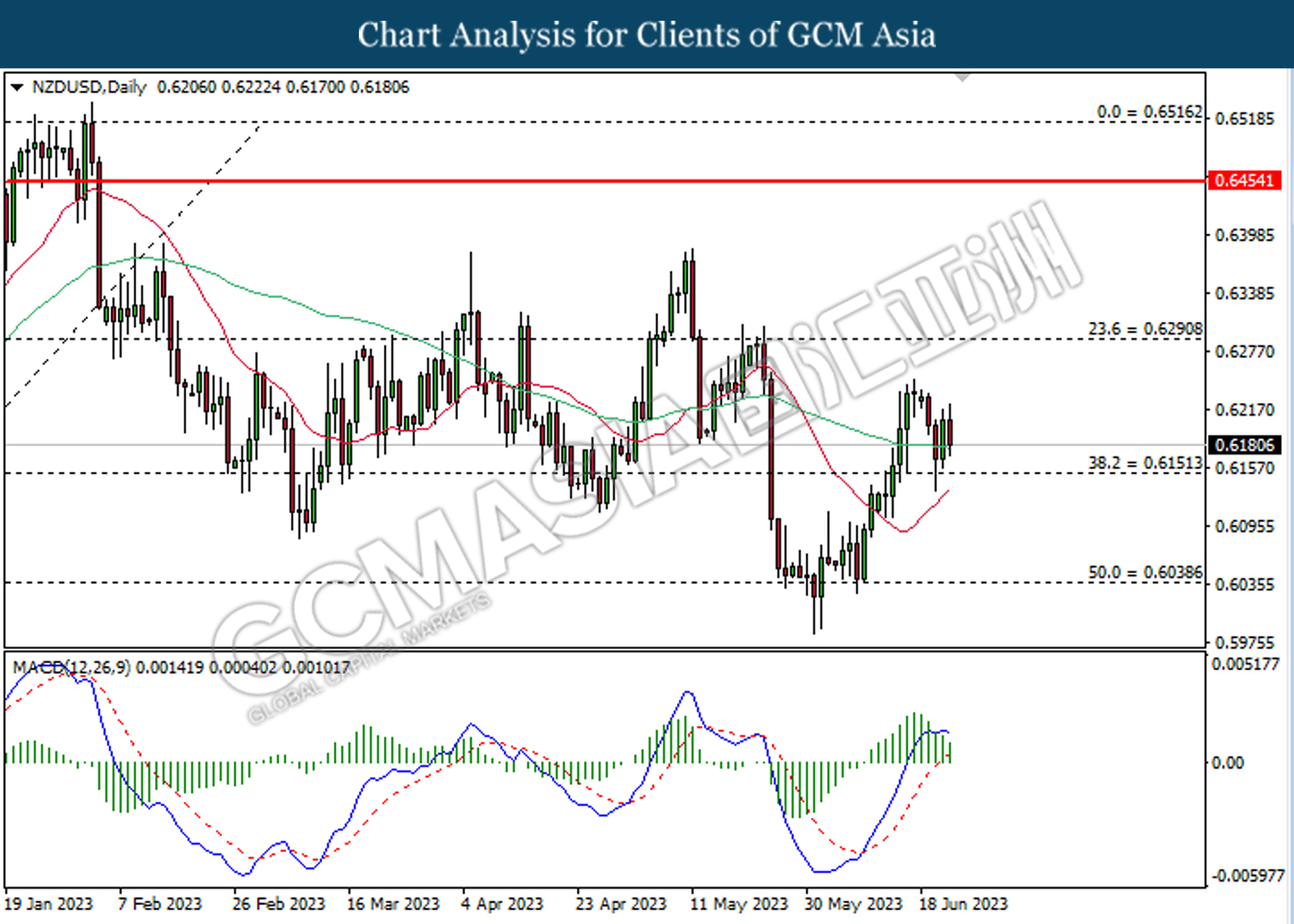

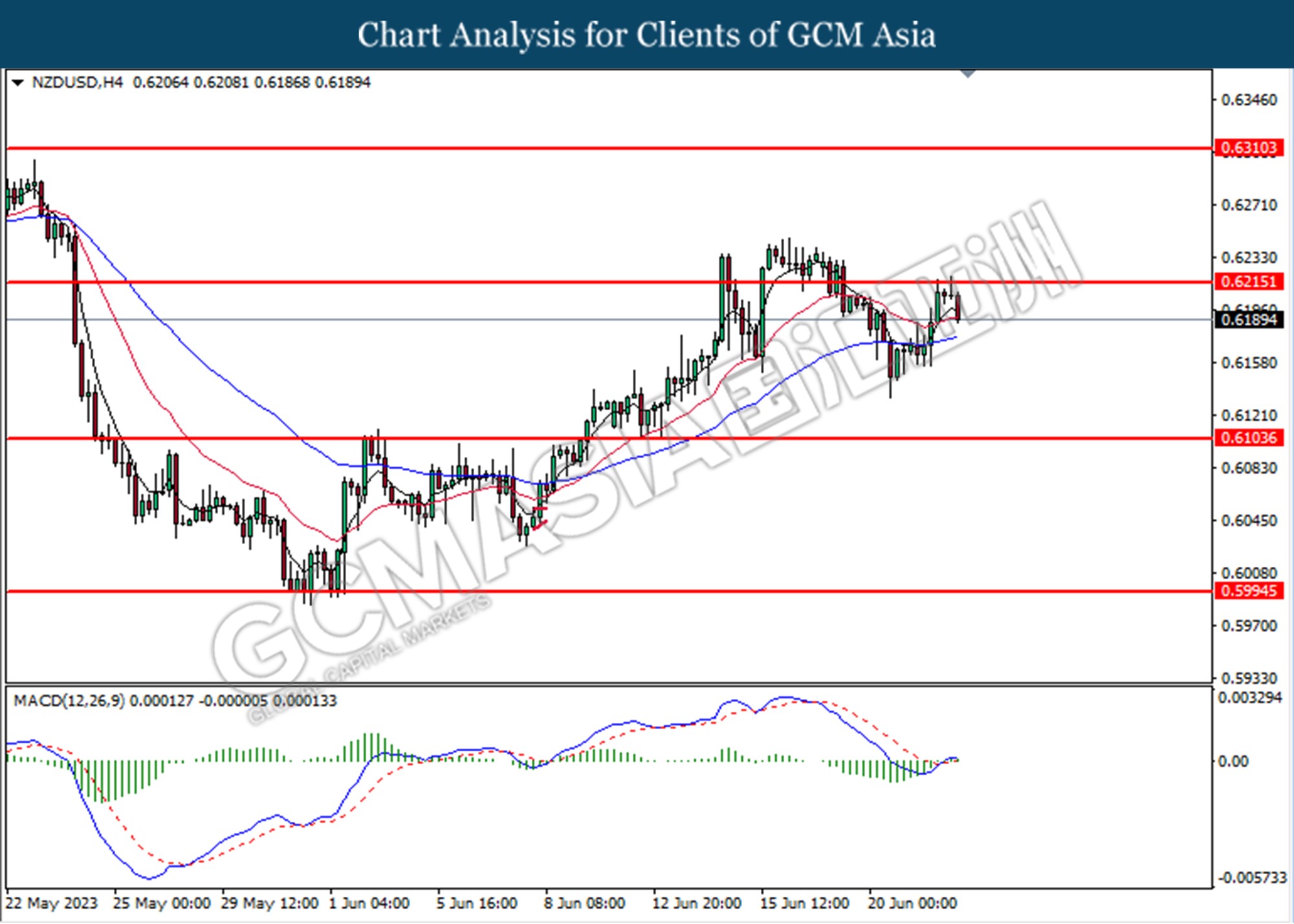

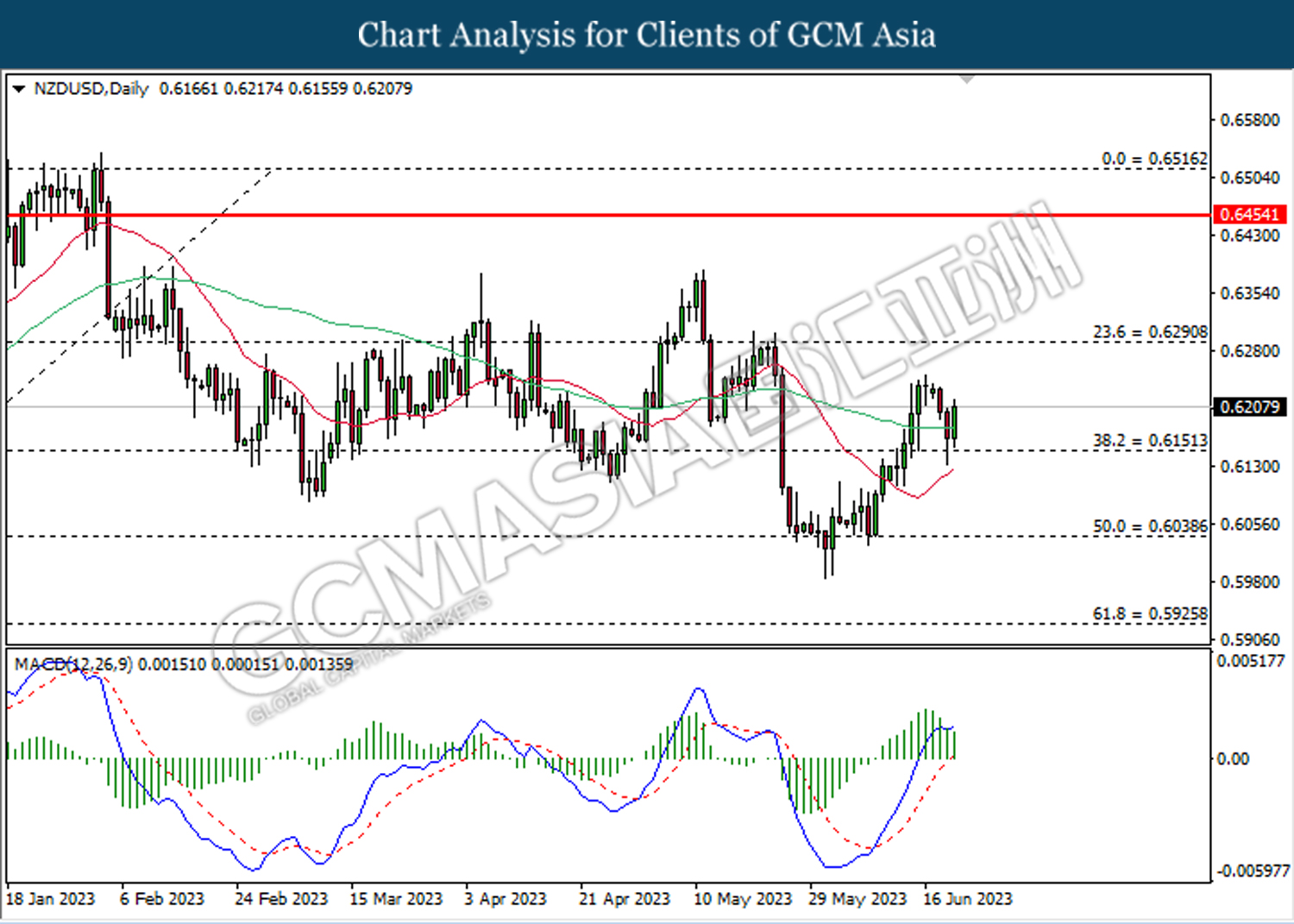

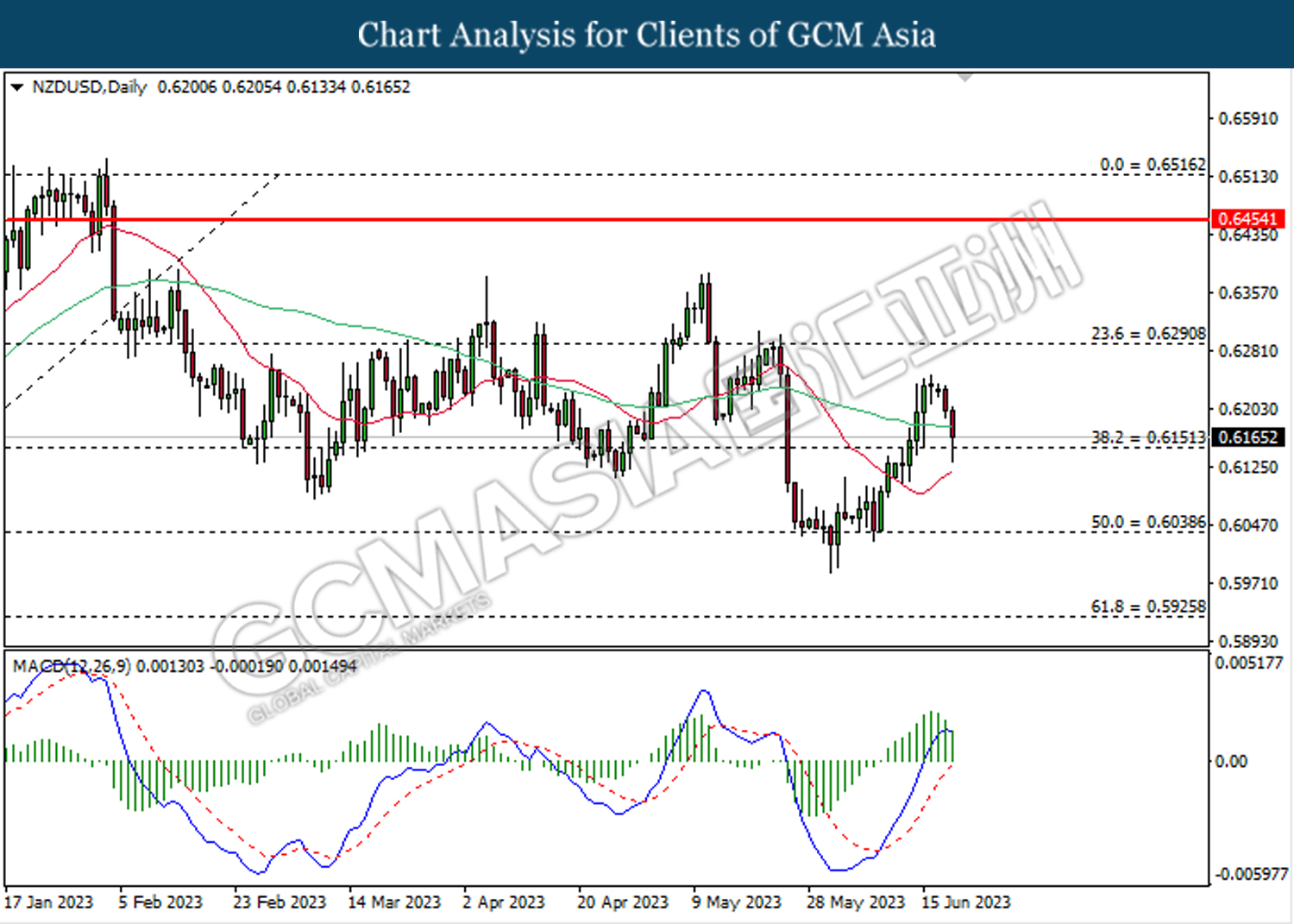

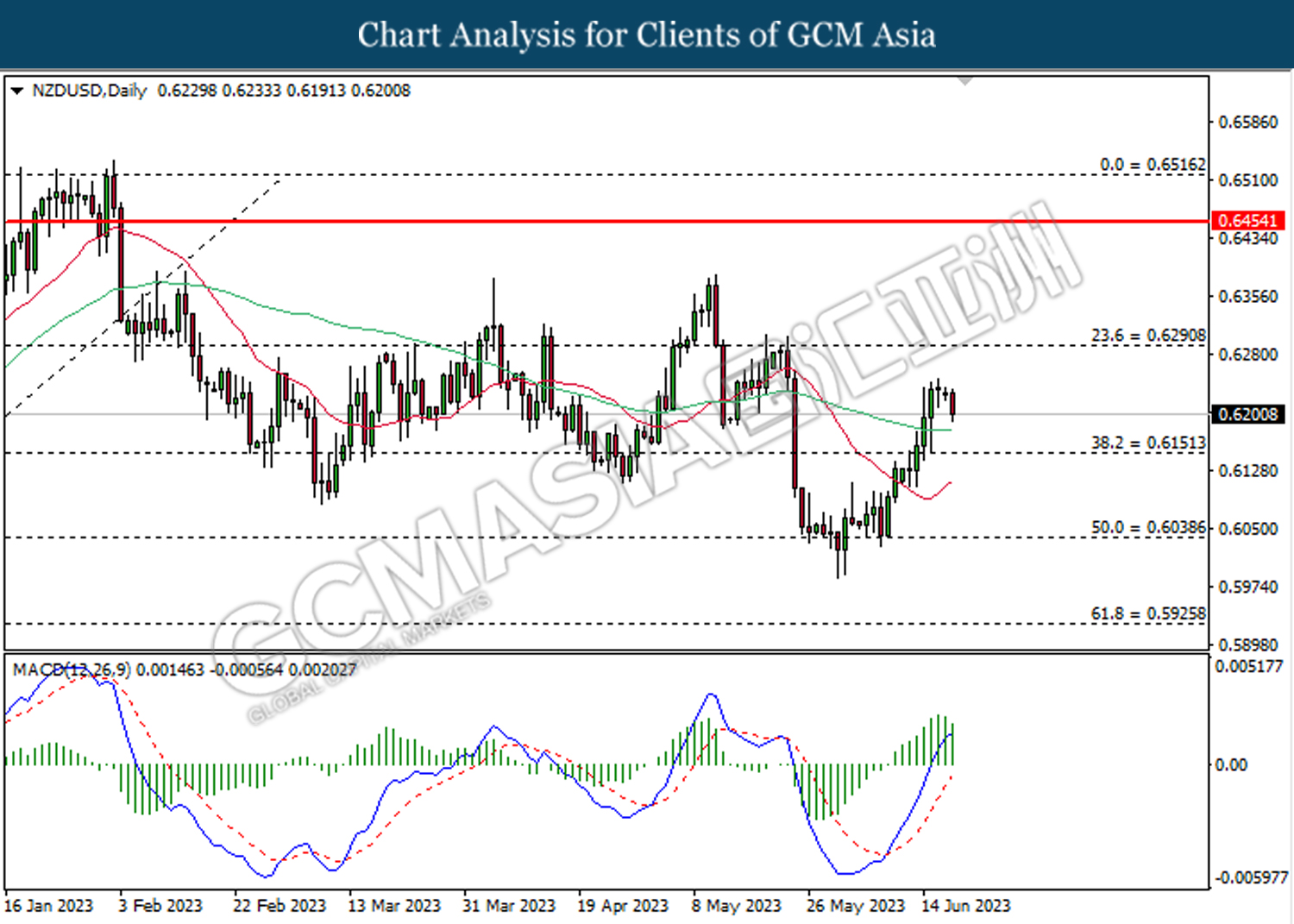

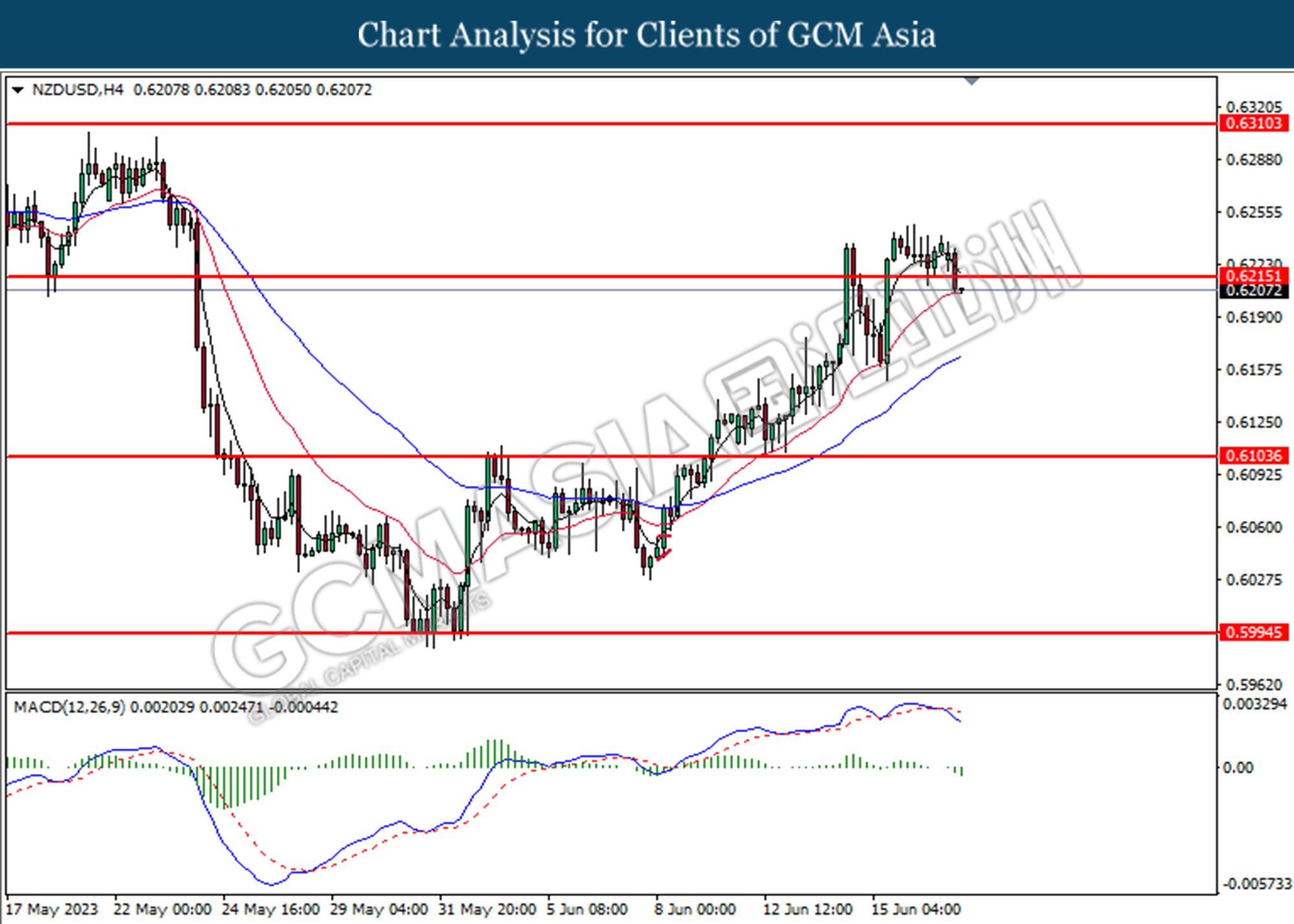

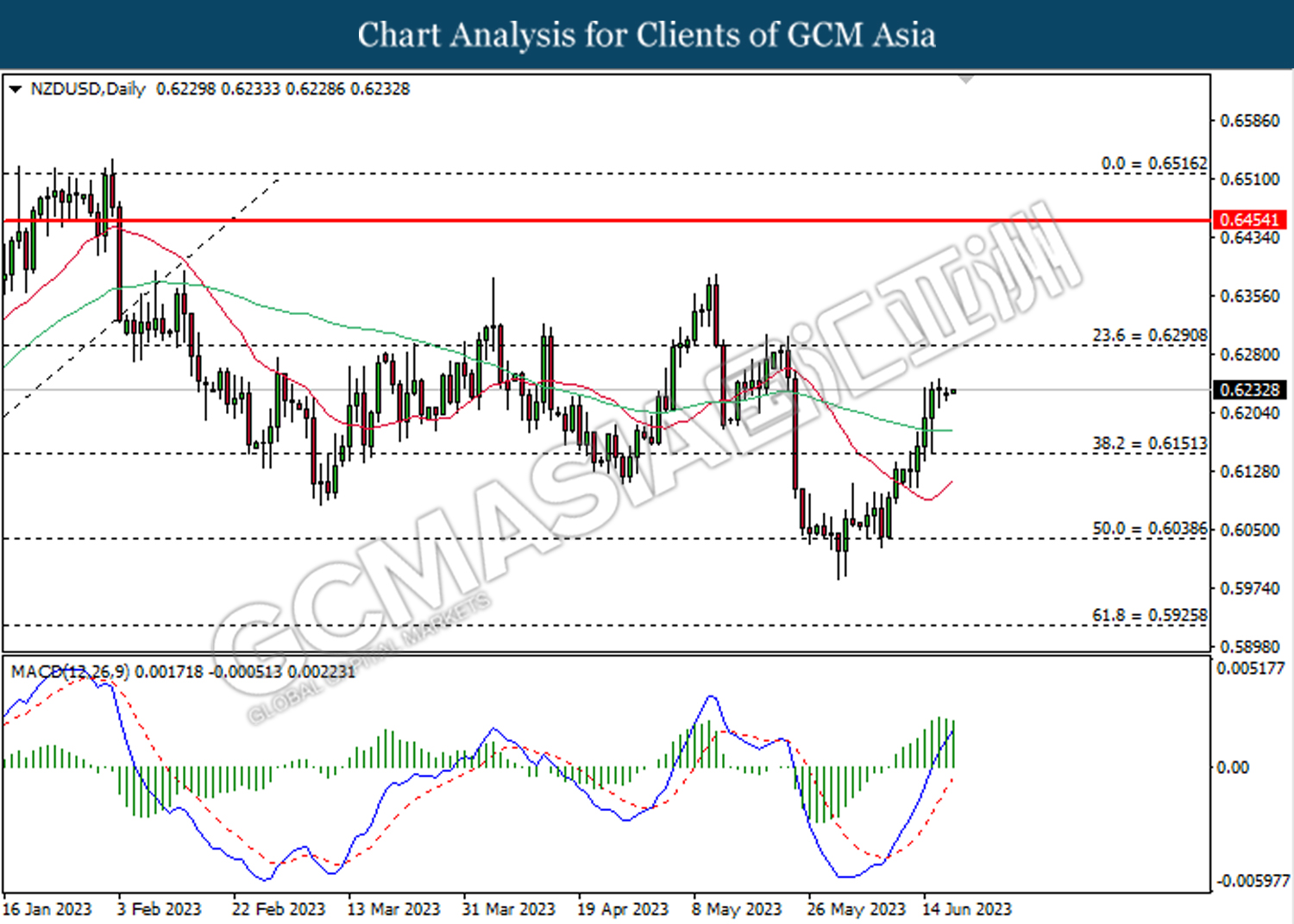

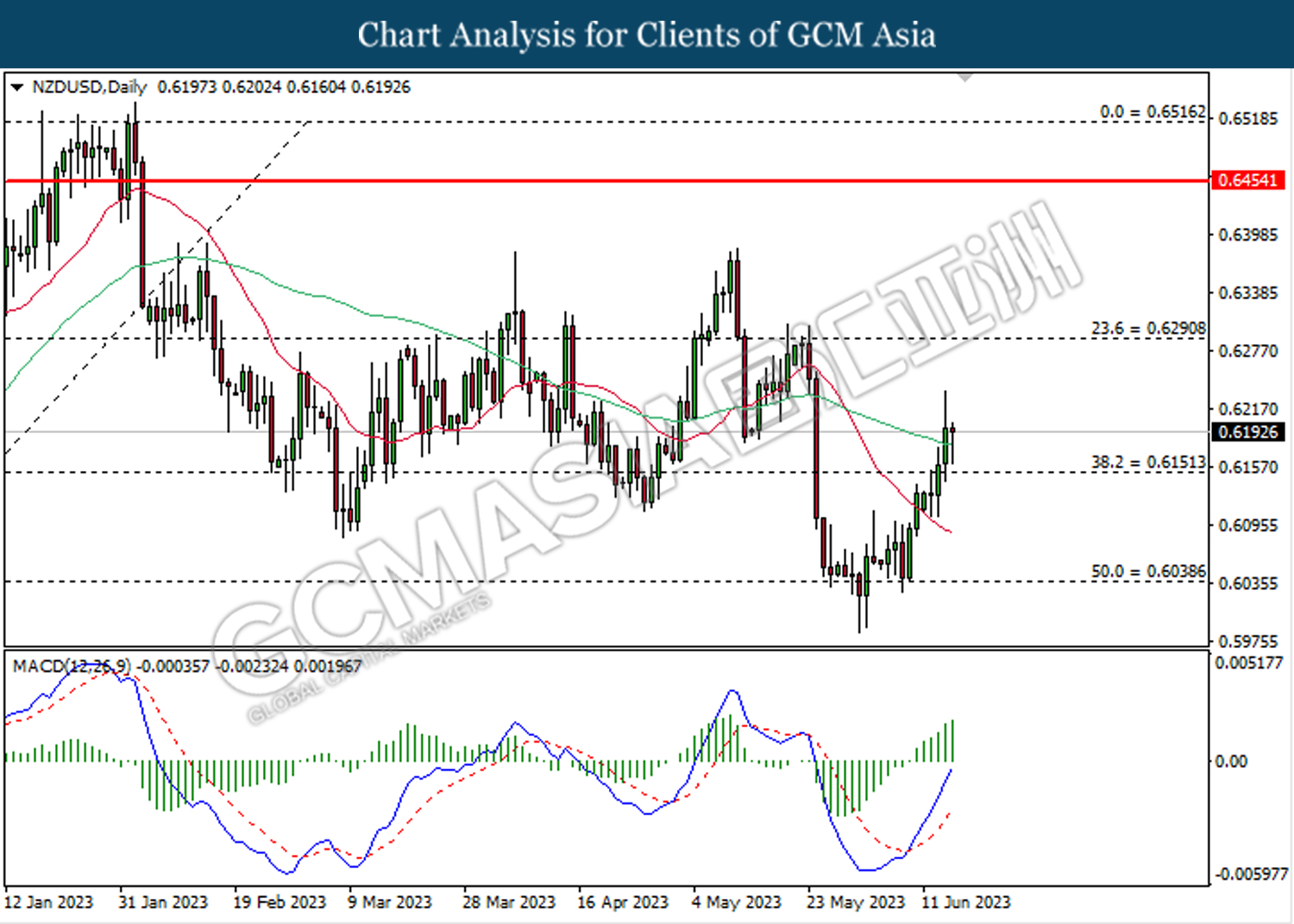

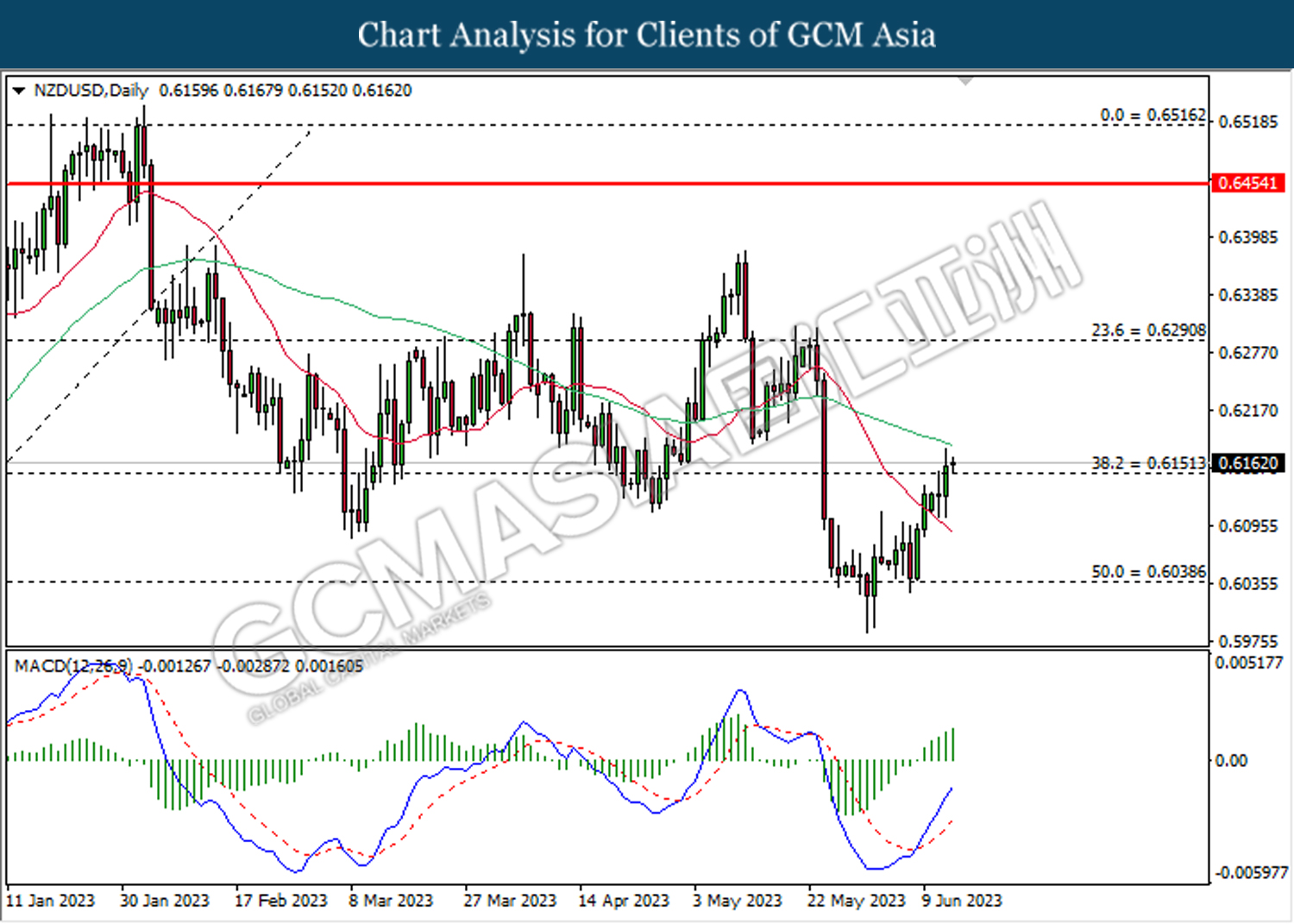

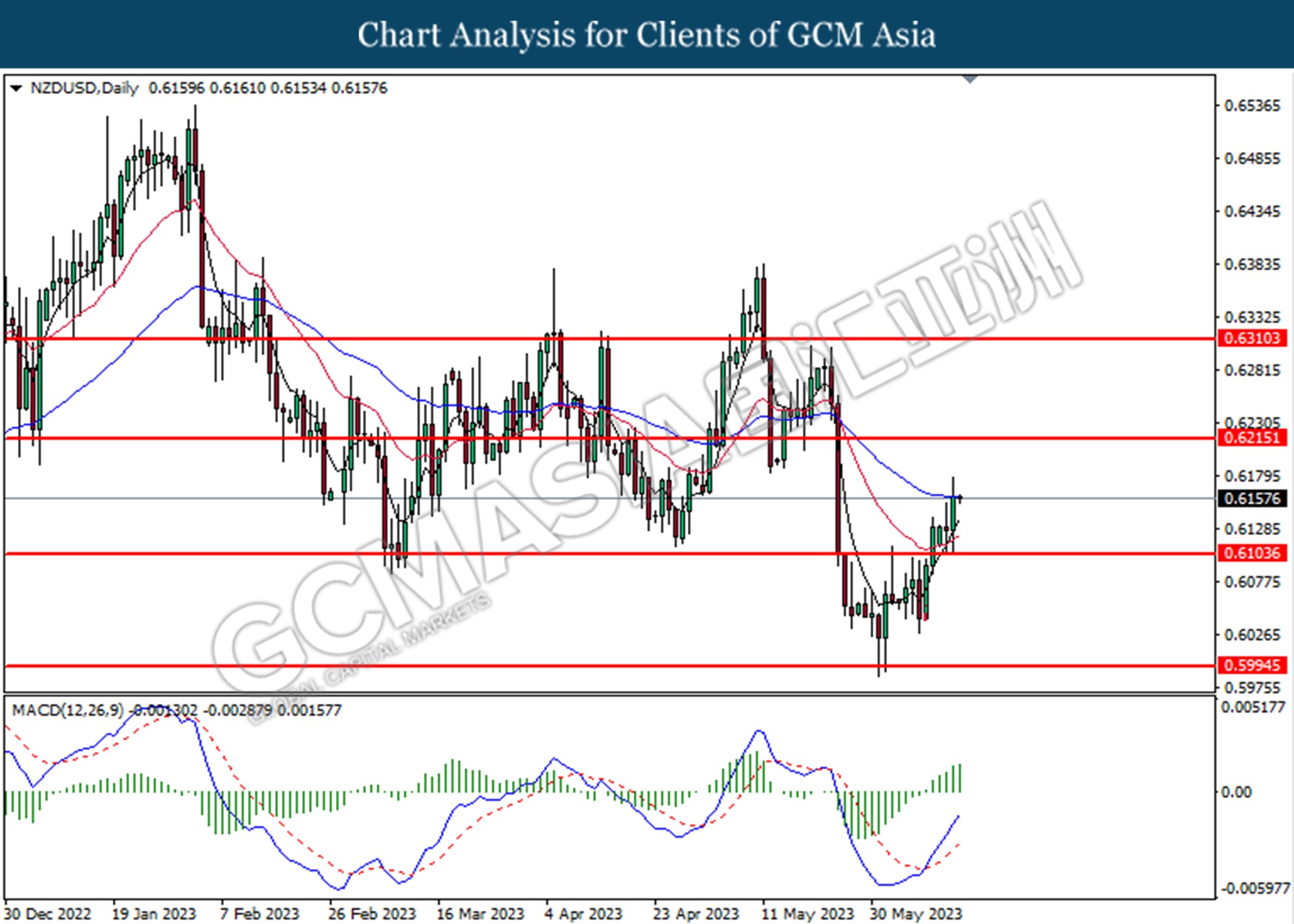

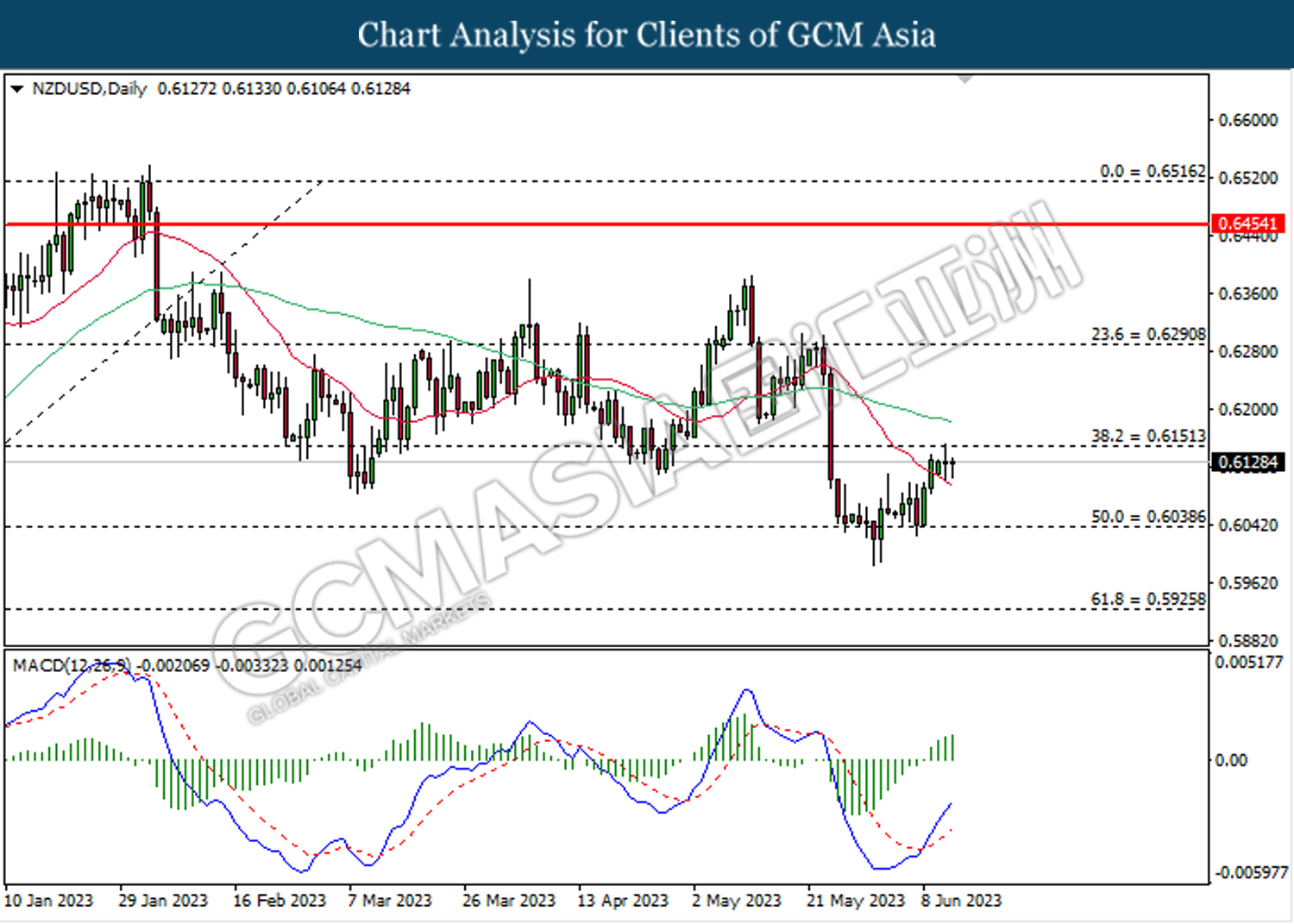

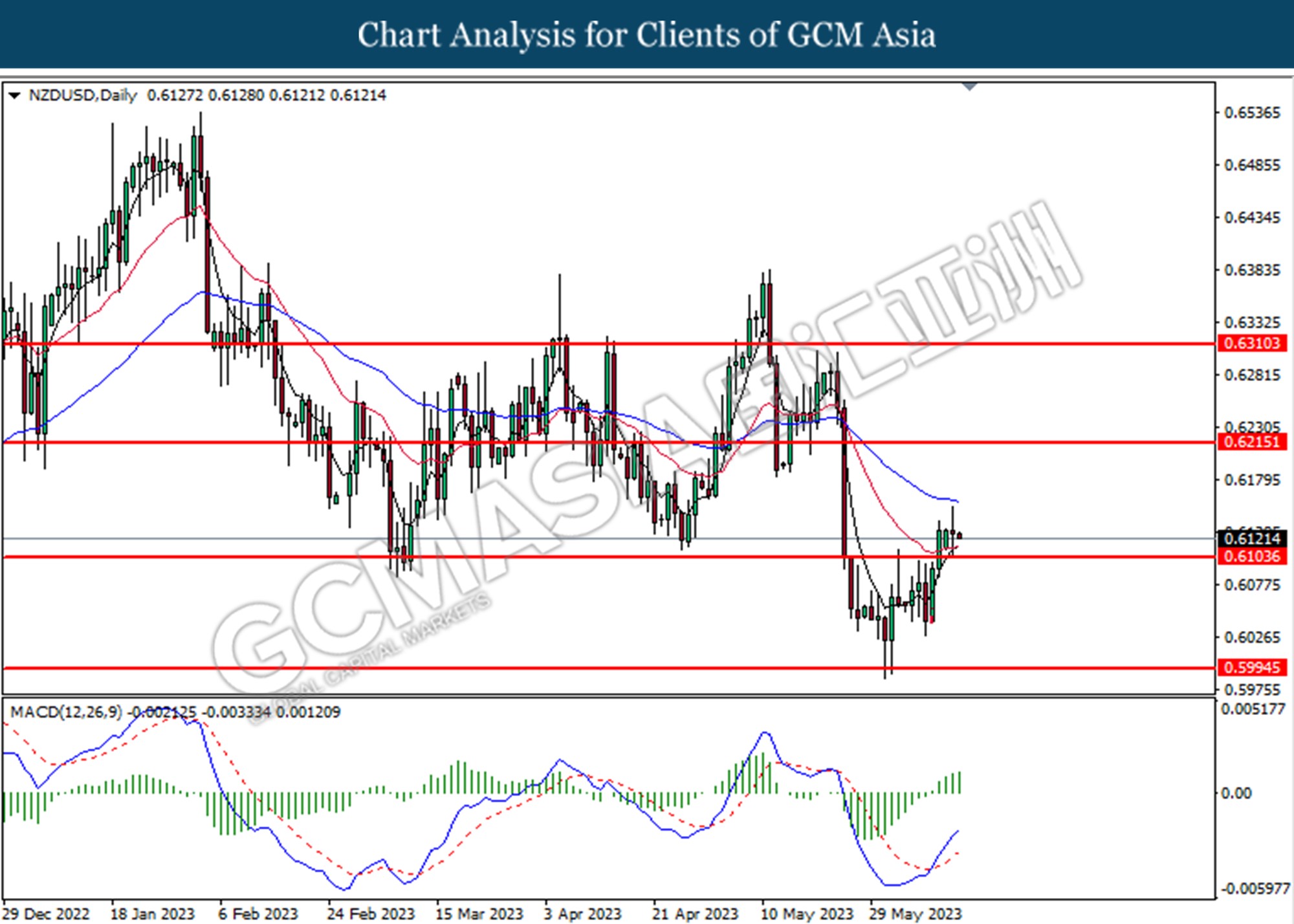

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

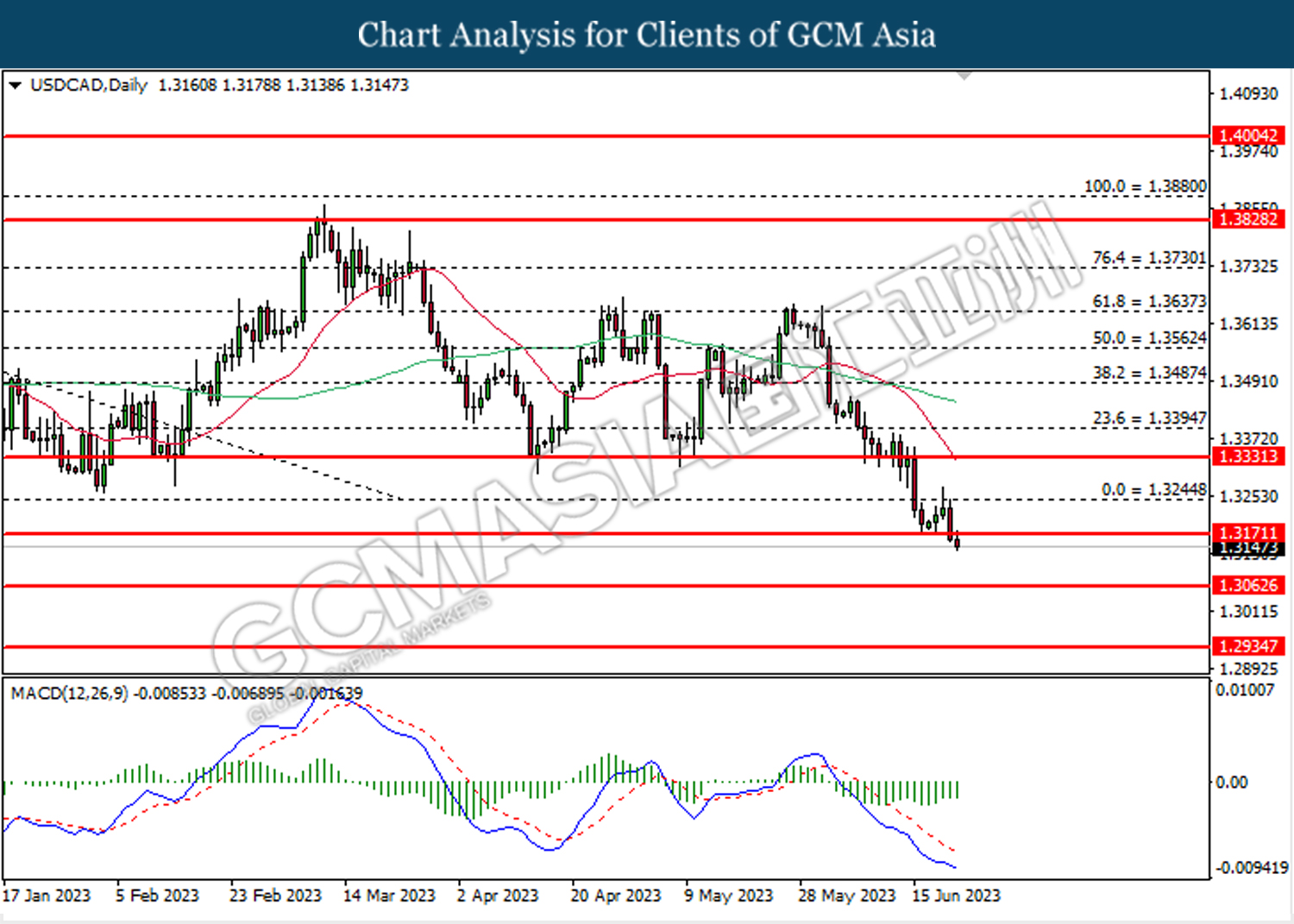

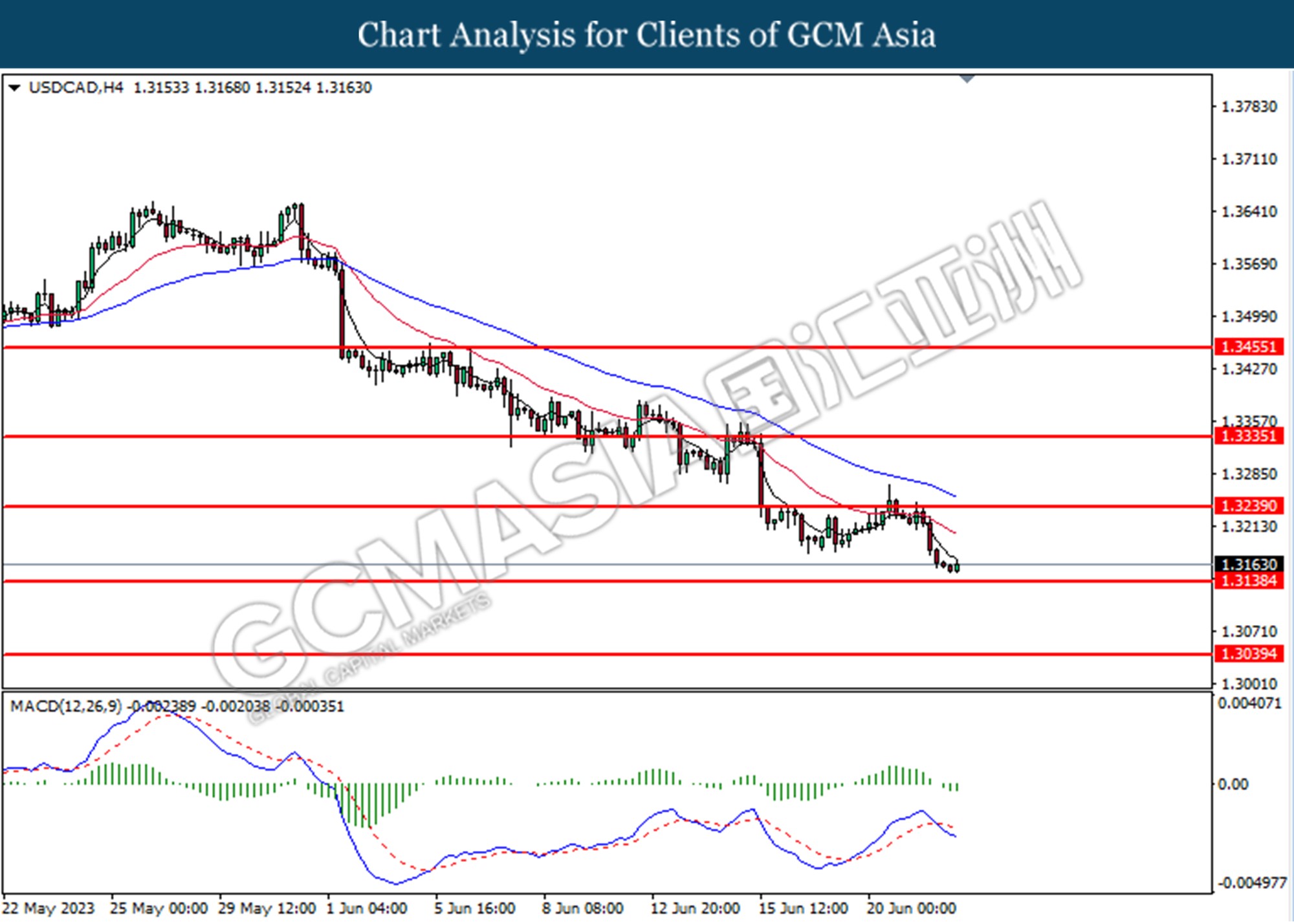

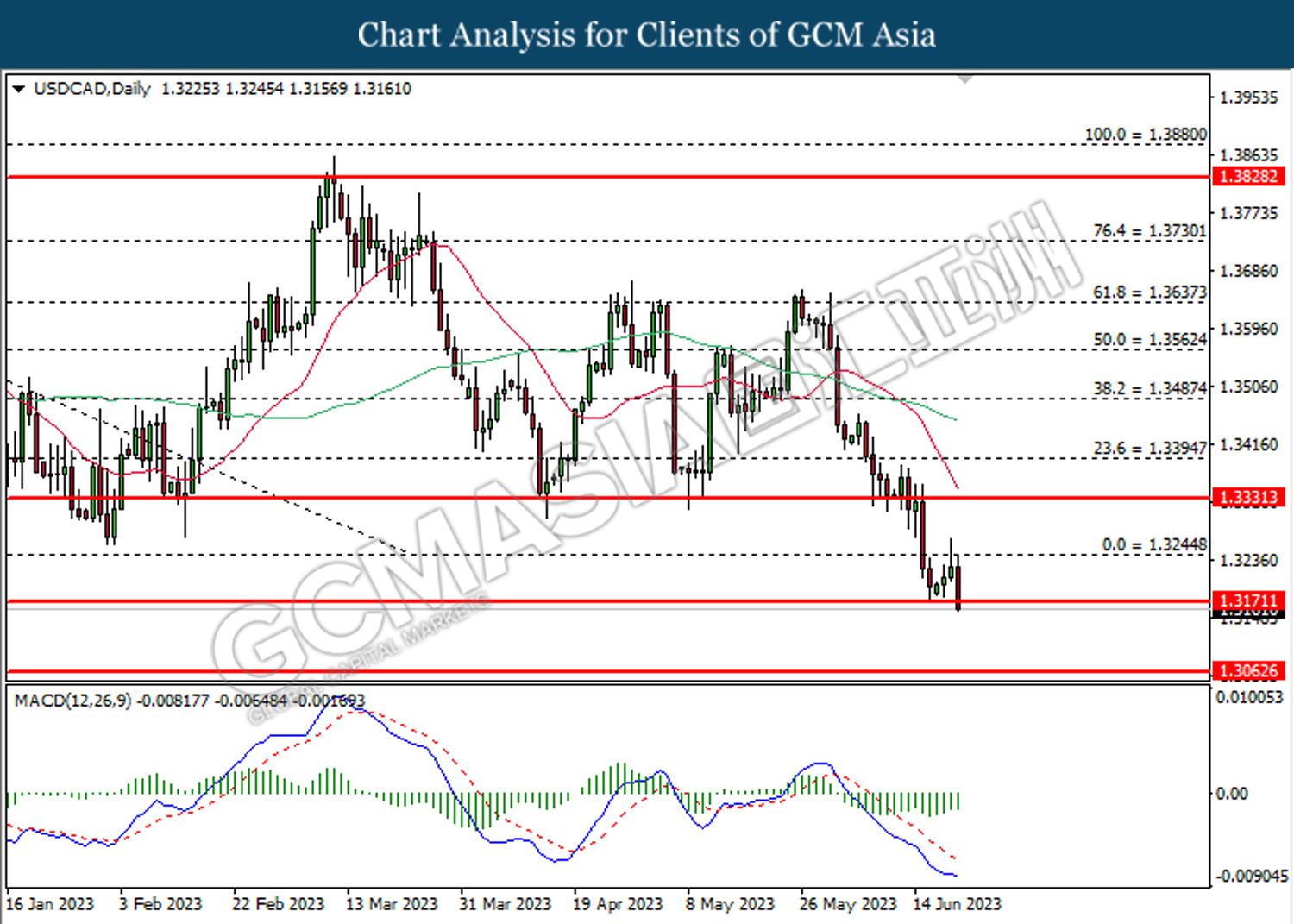

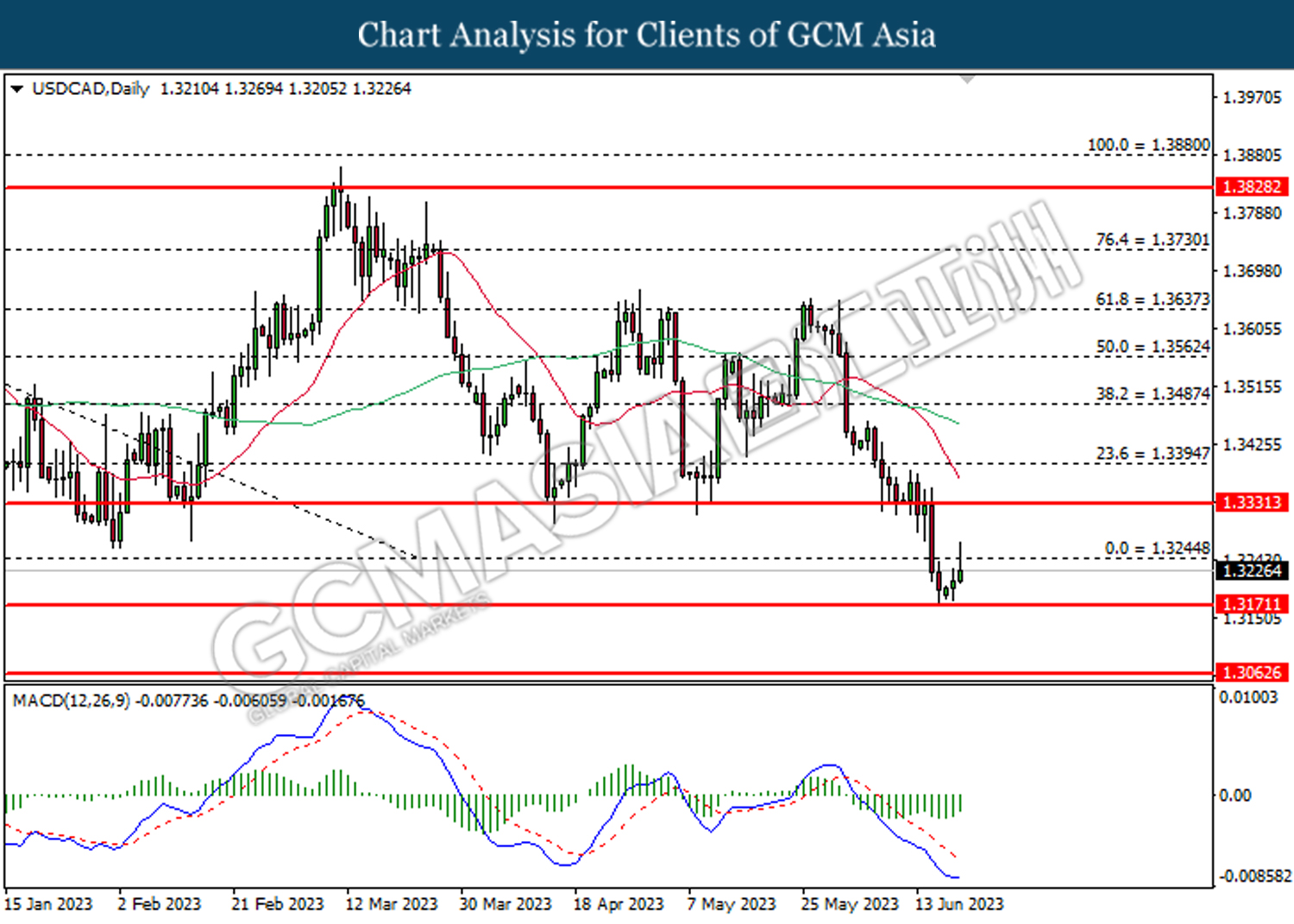

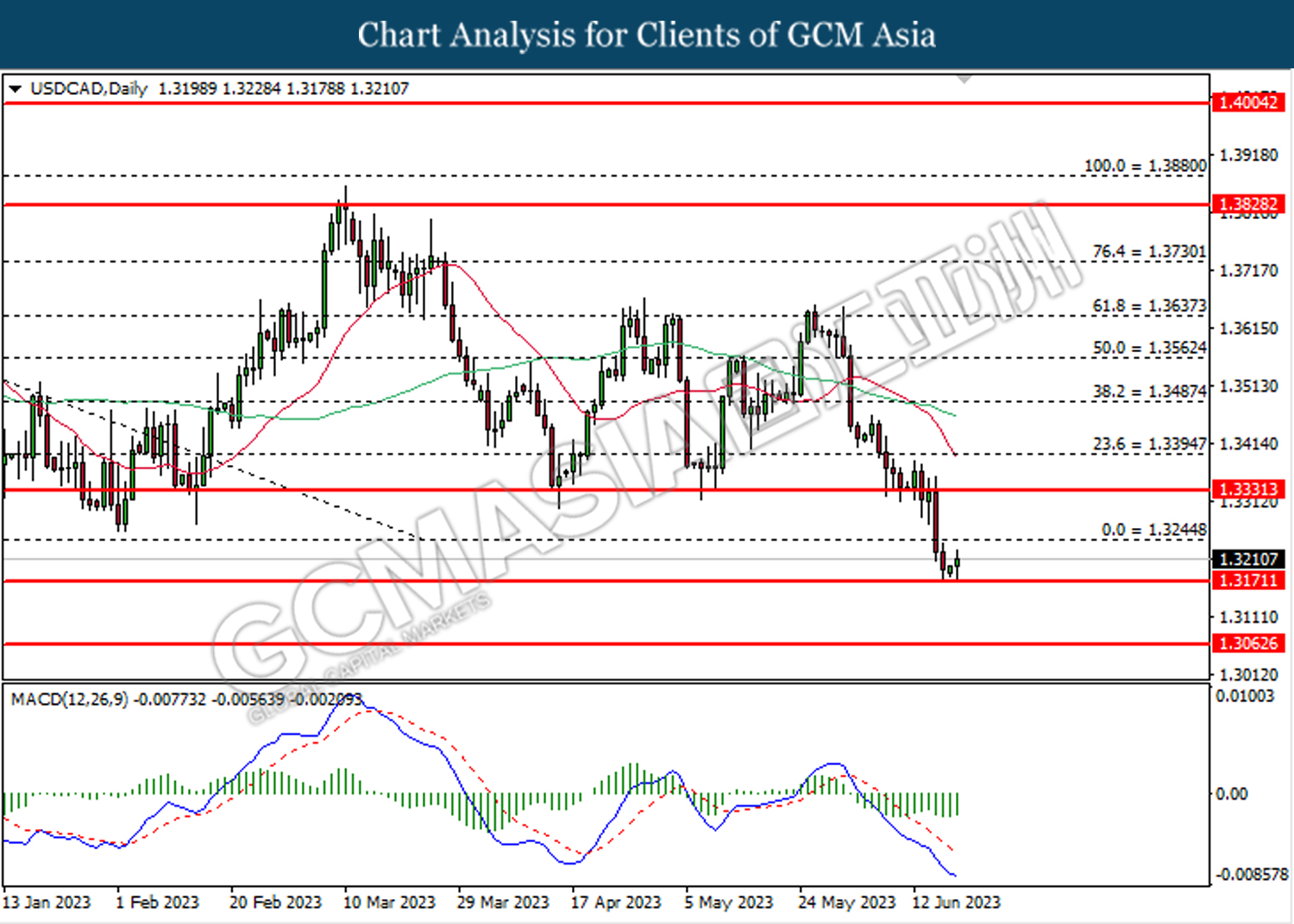

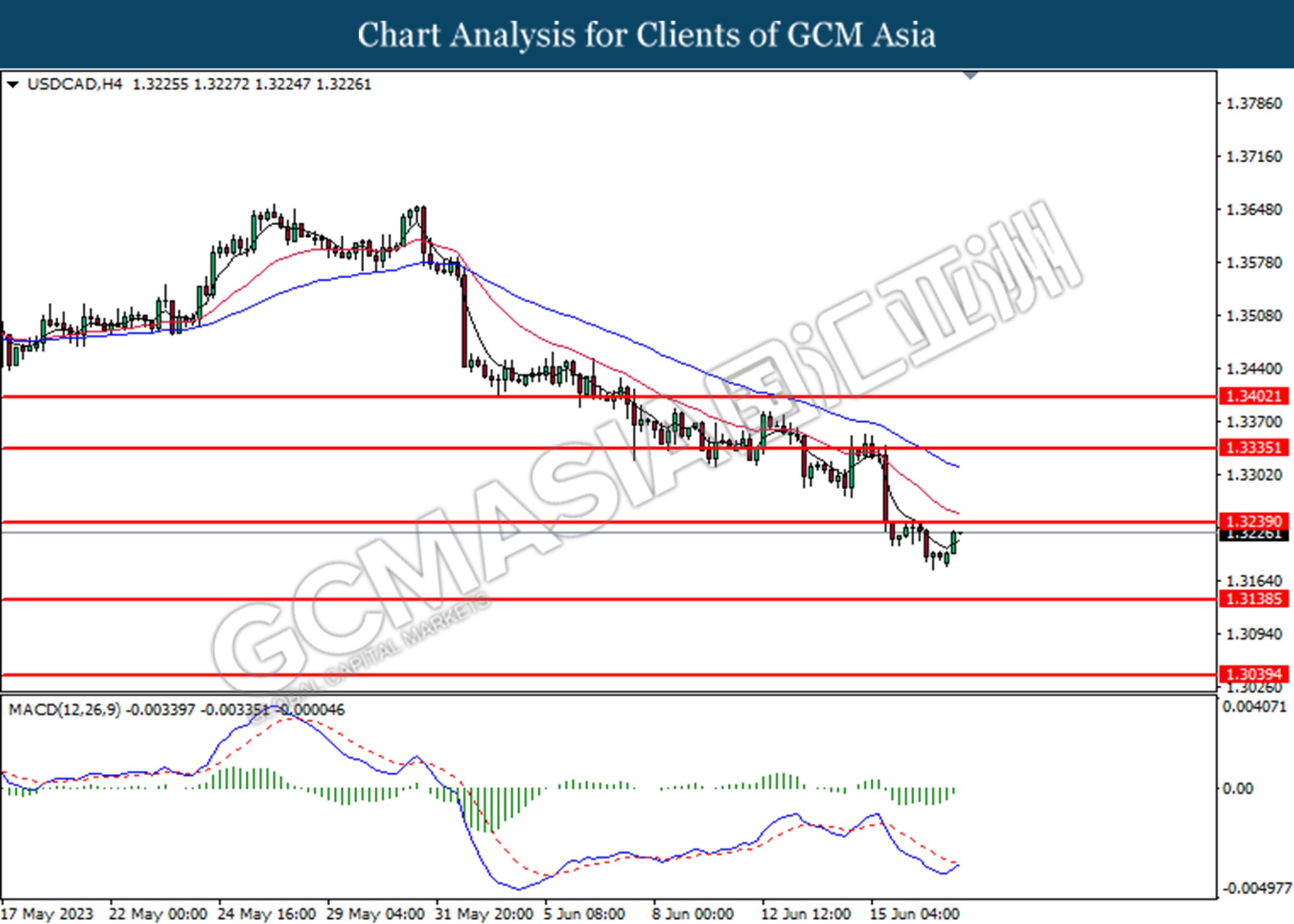

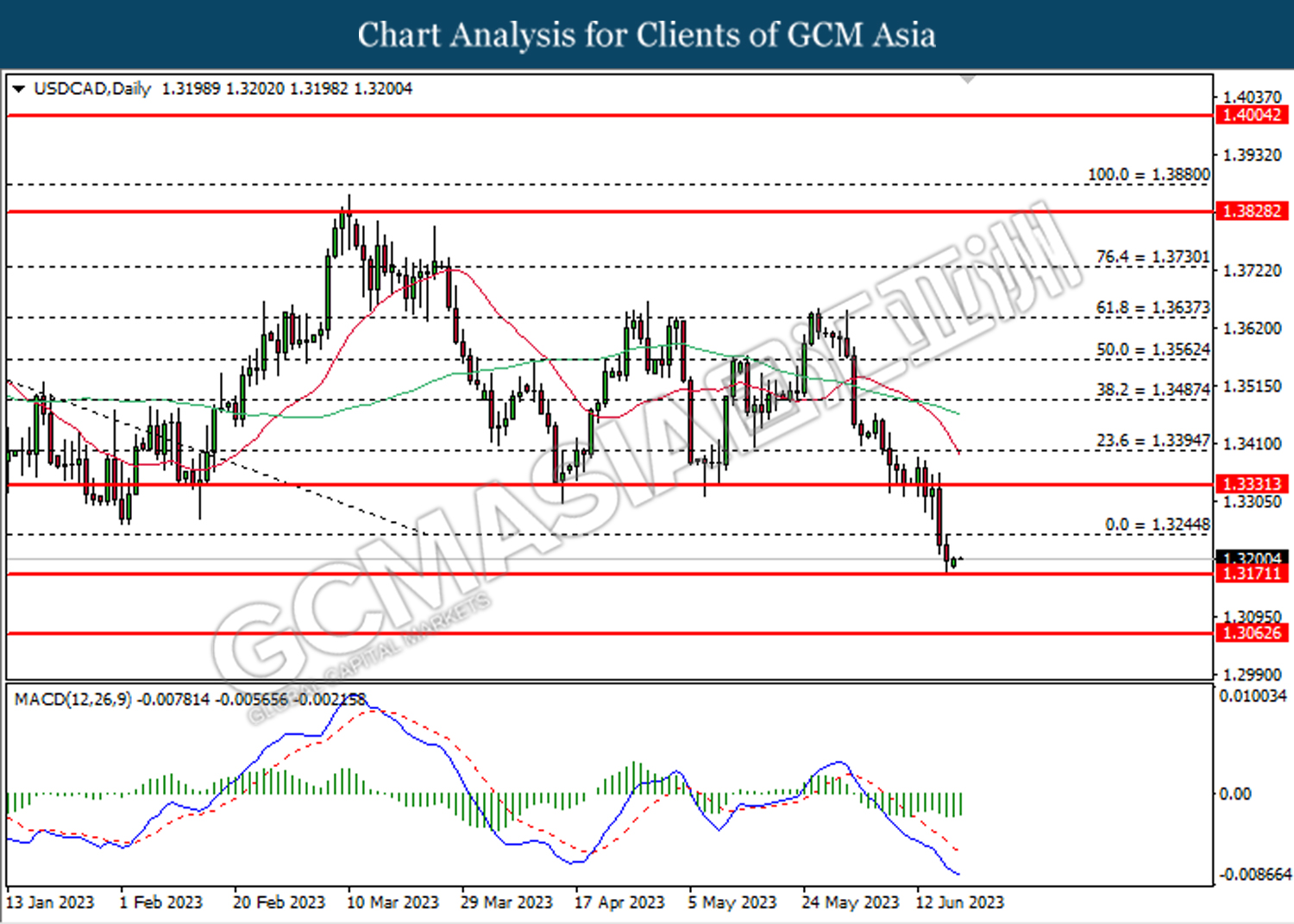

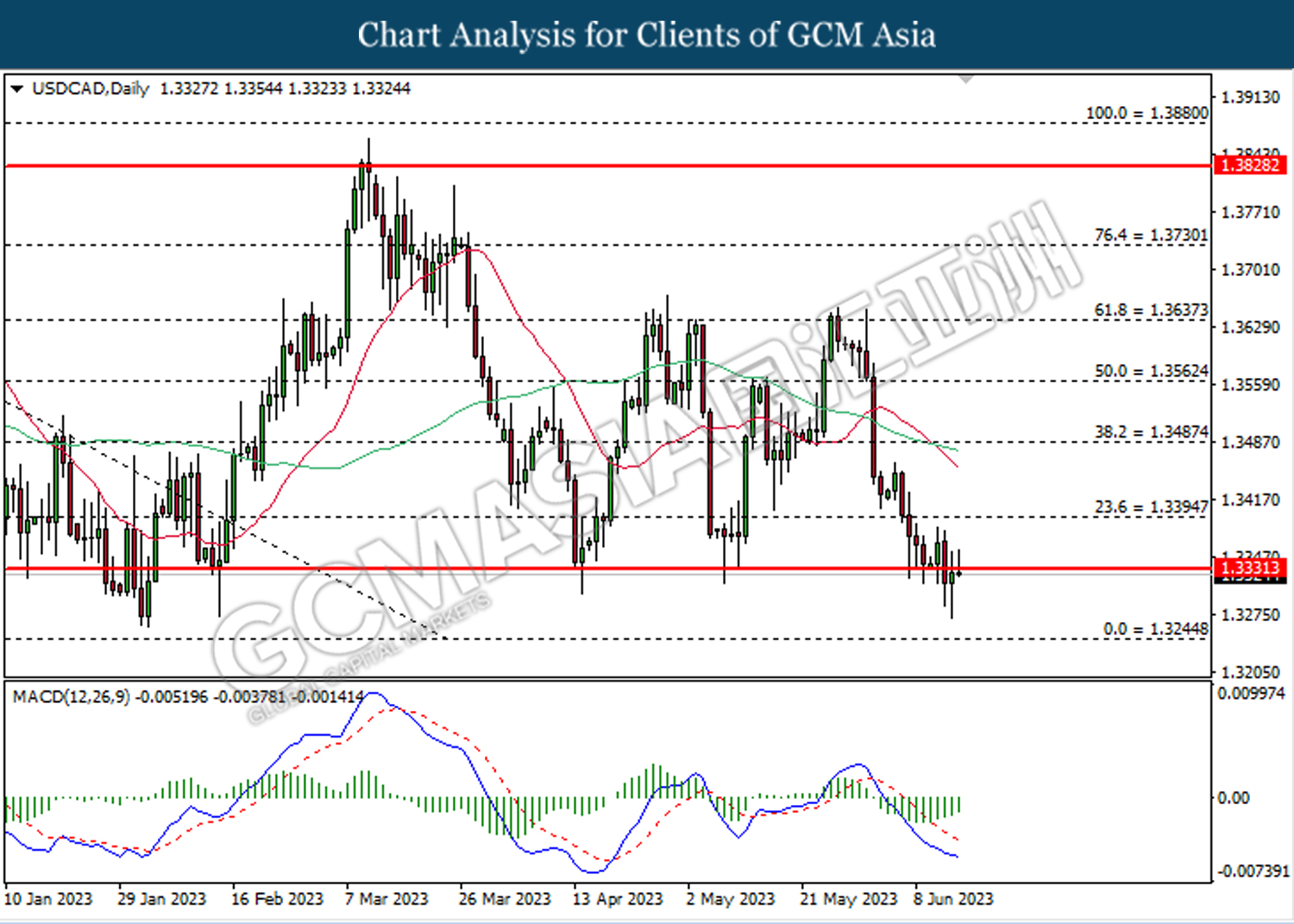

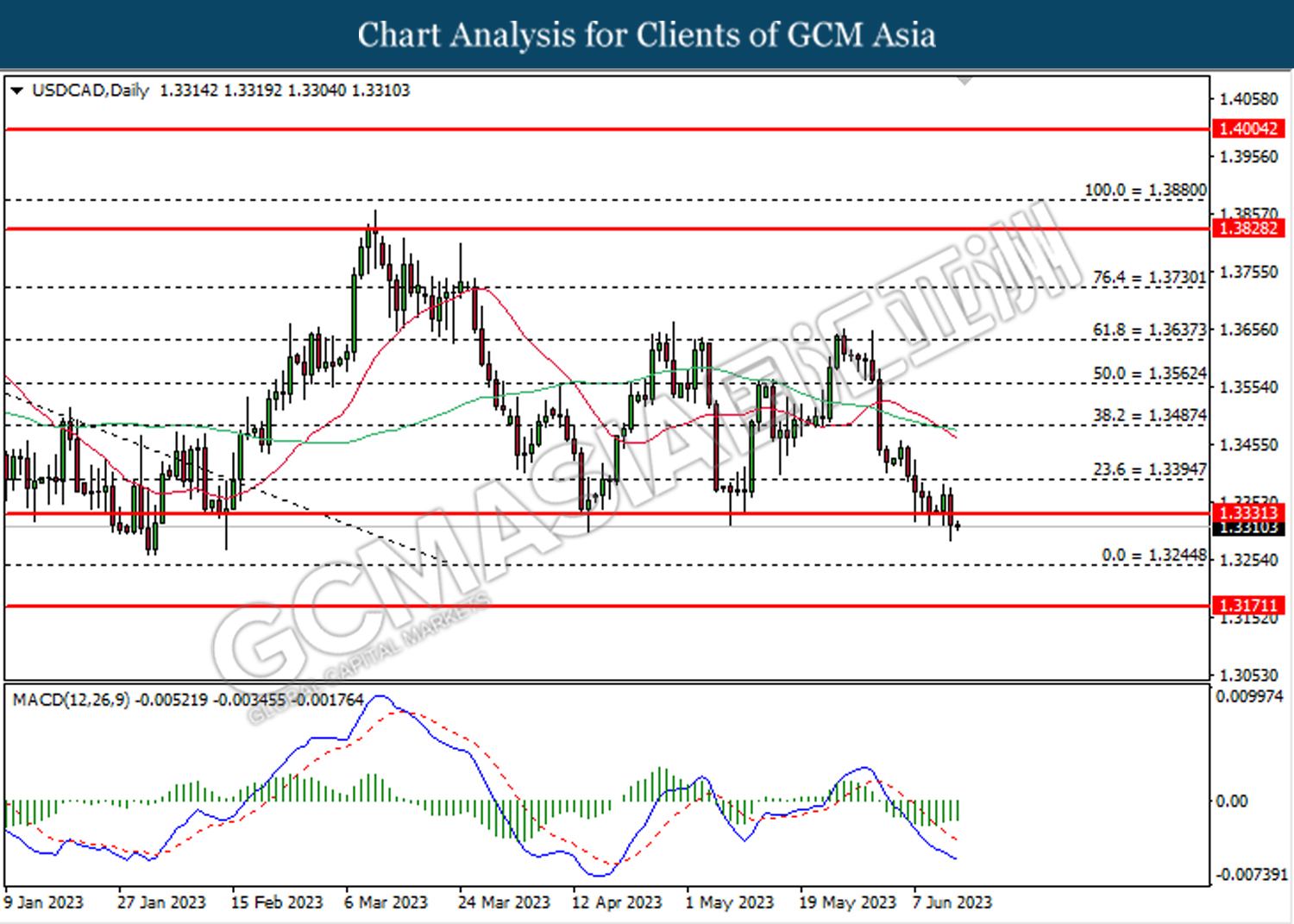

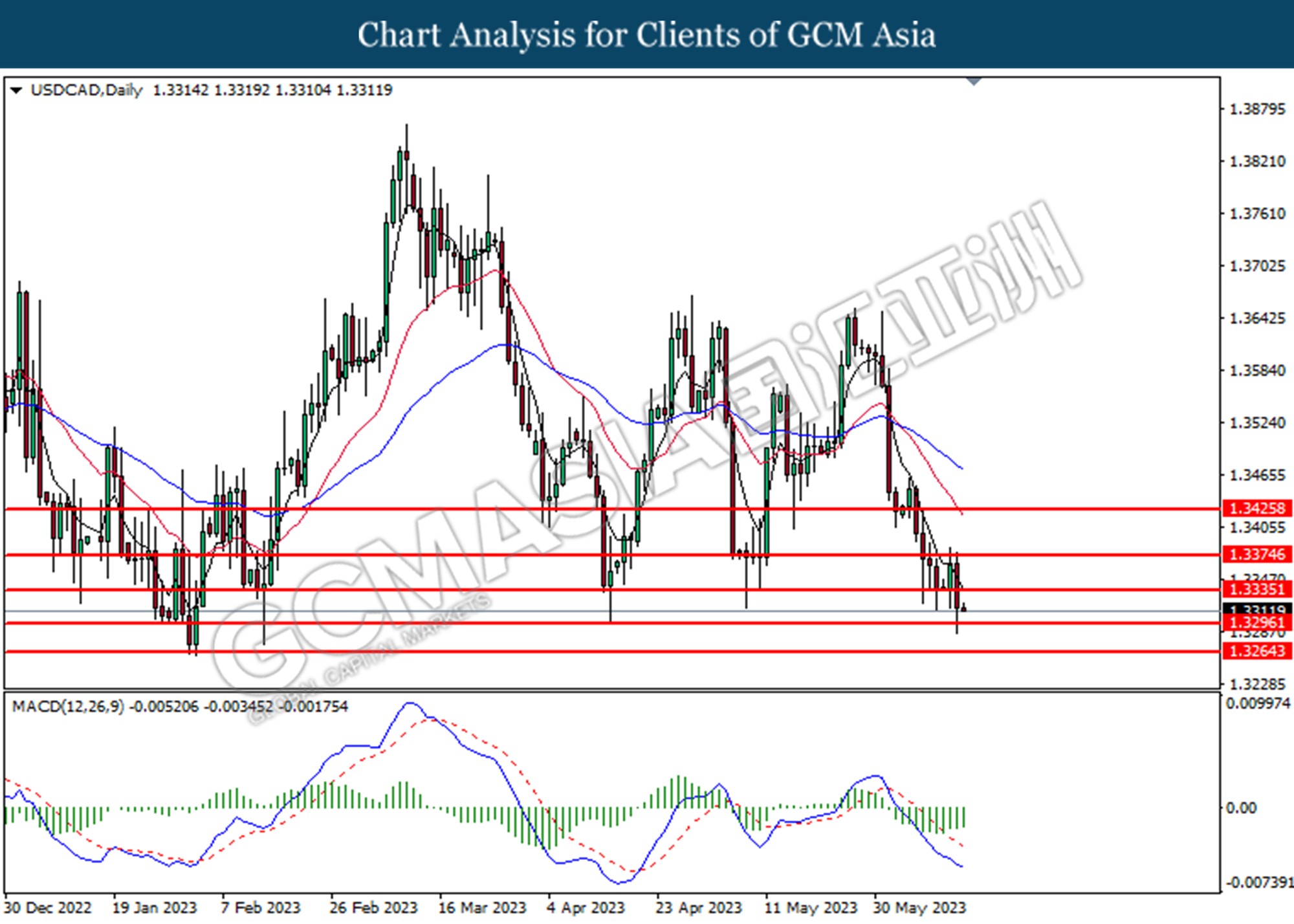

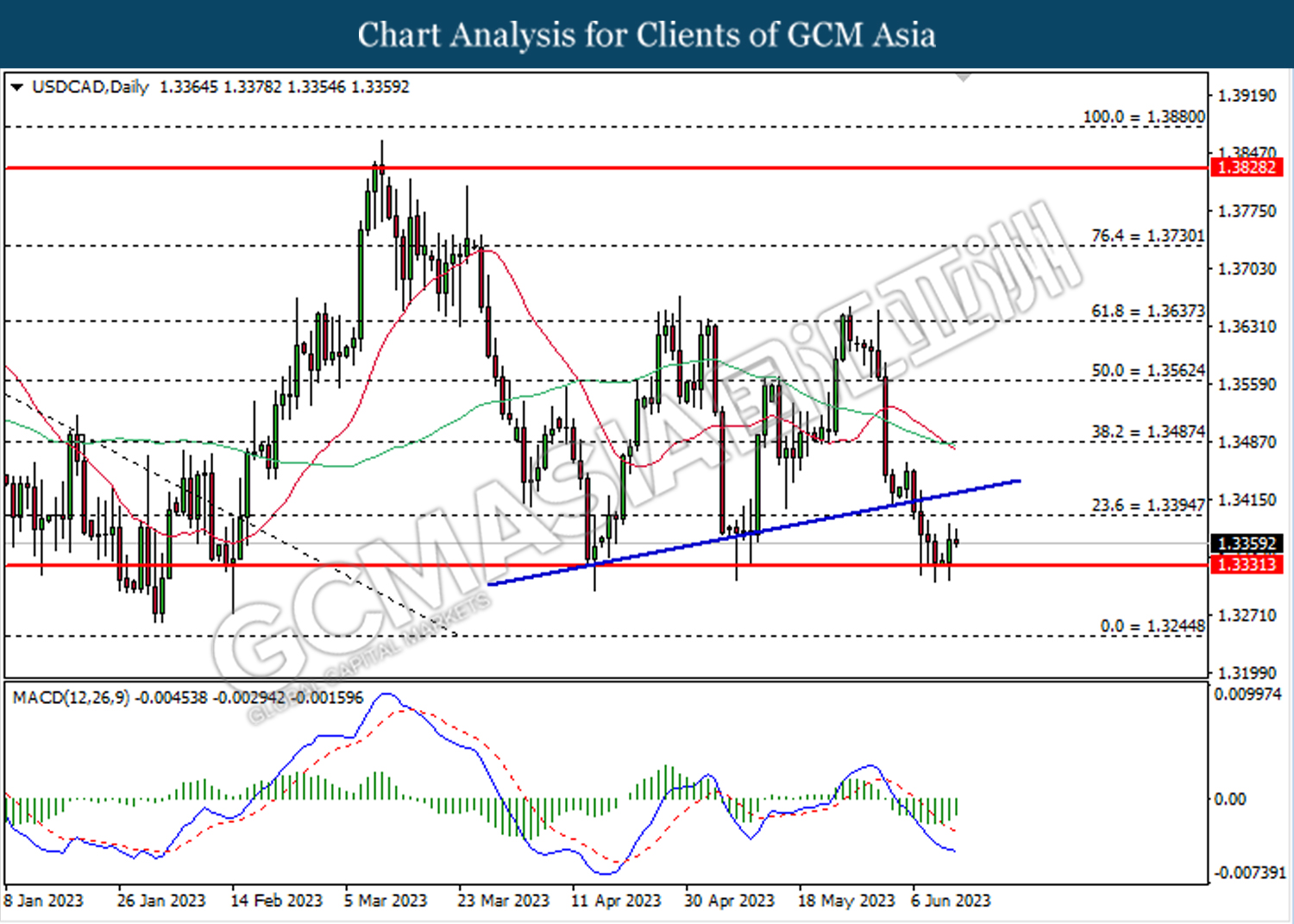

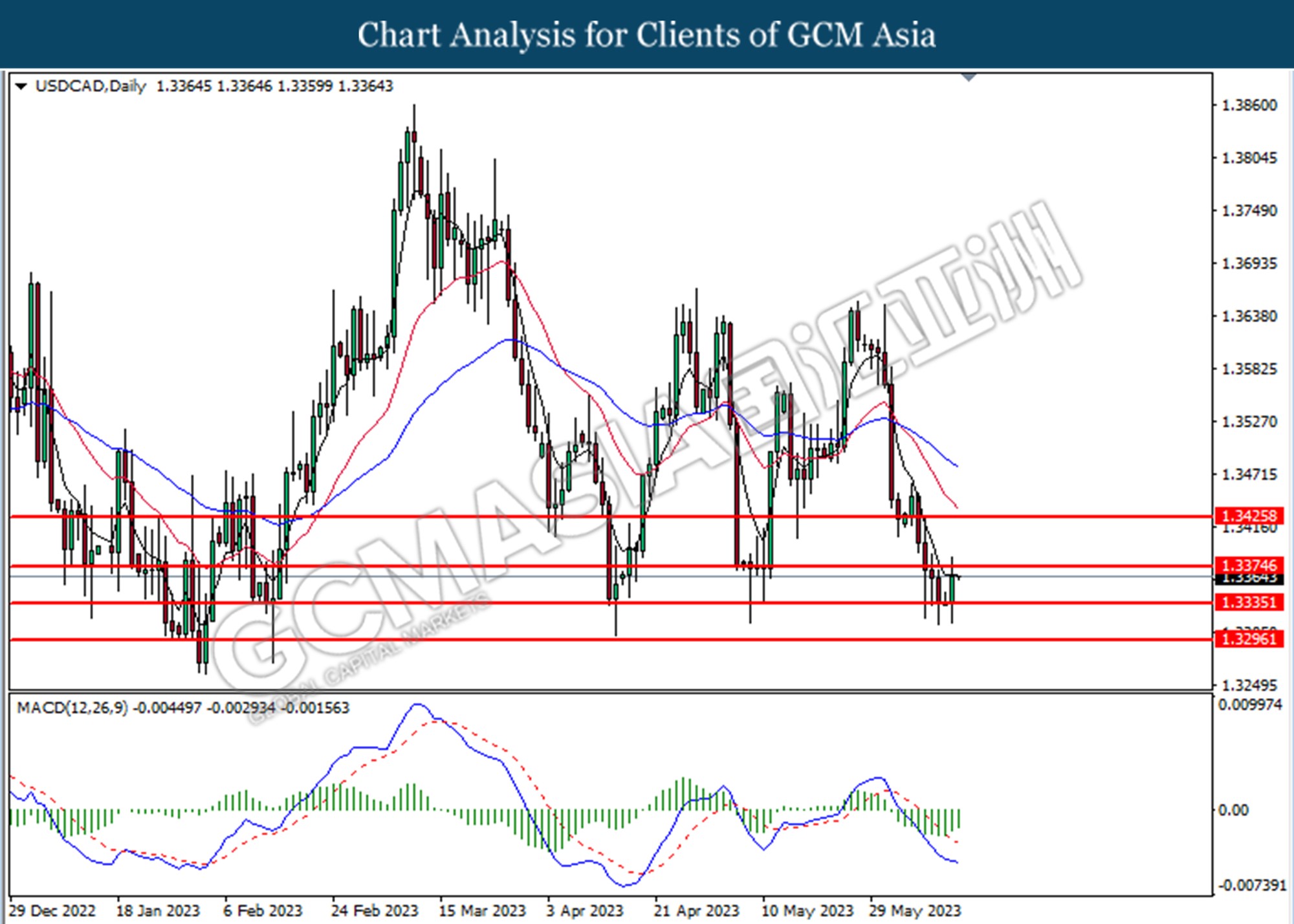

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3170. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3245, 1.3330

Support level: 1.3170, 1.3065

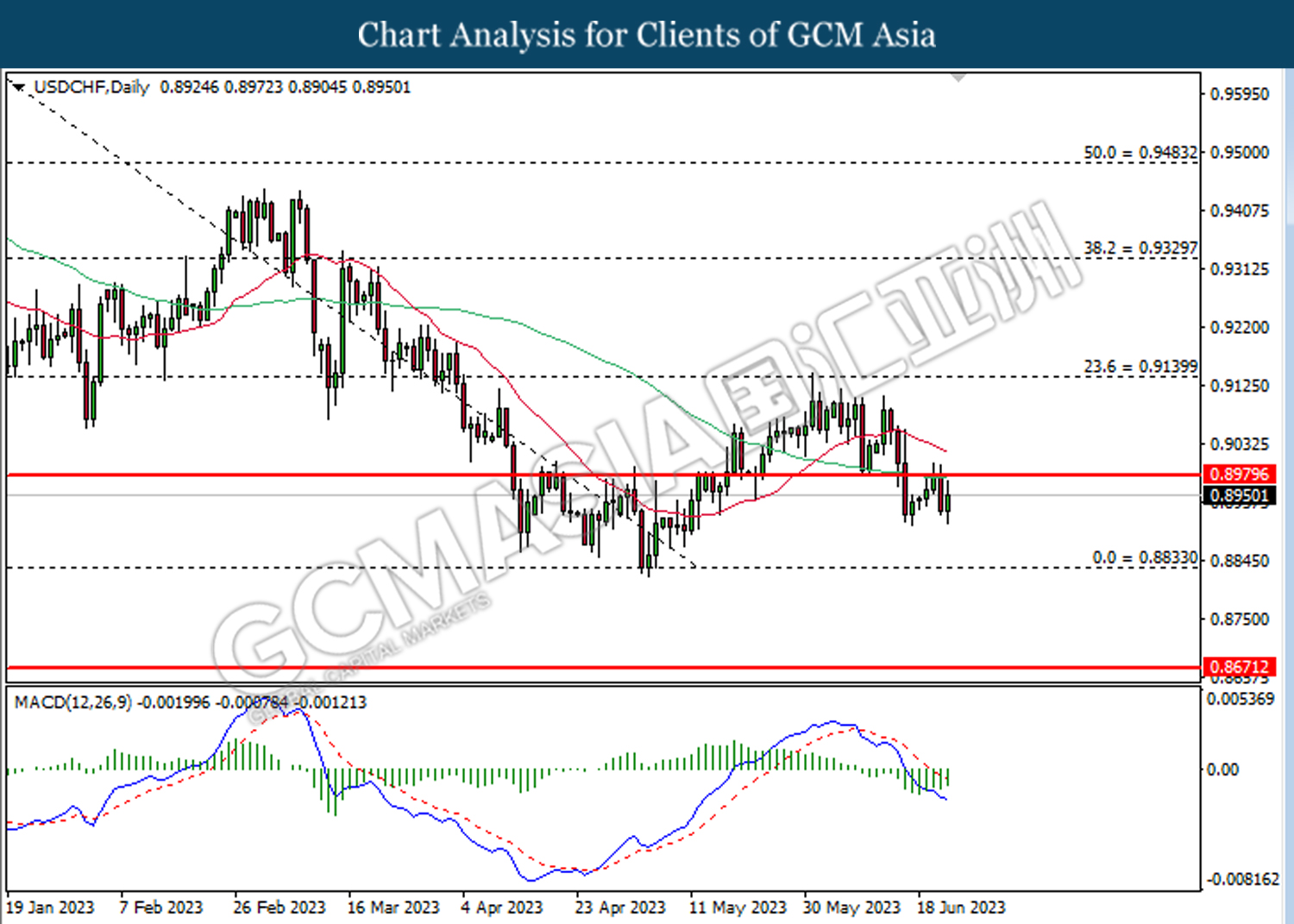

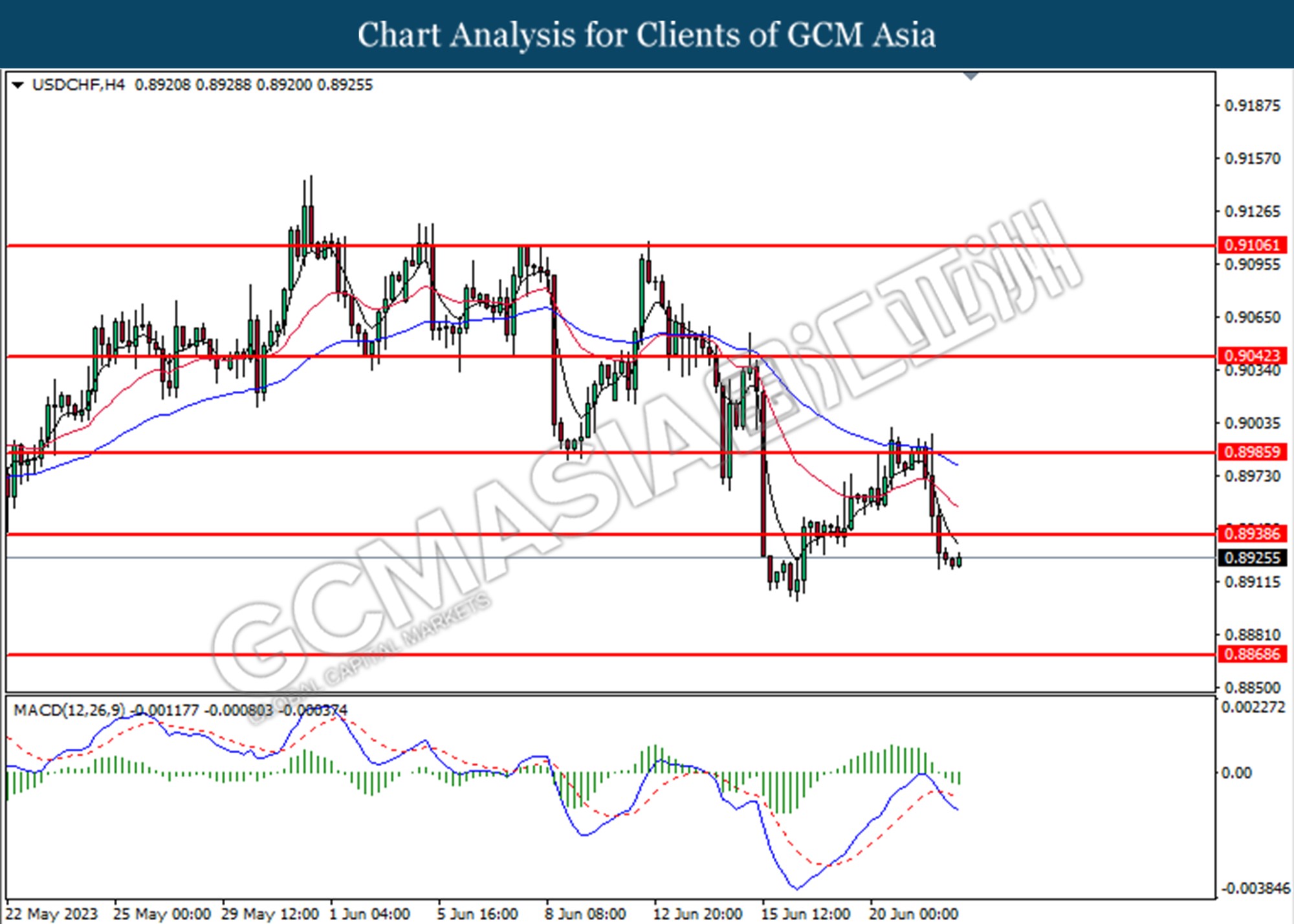

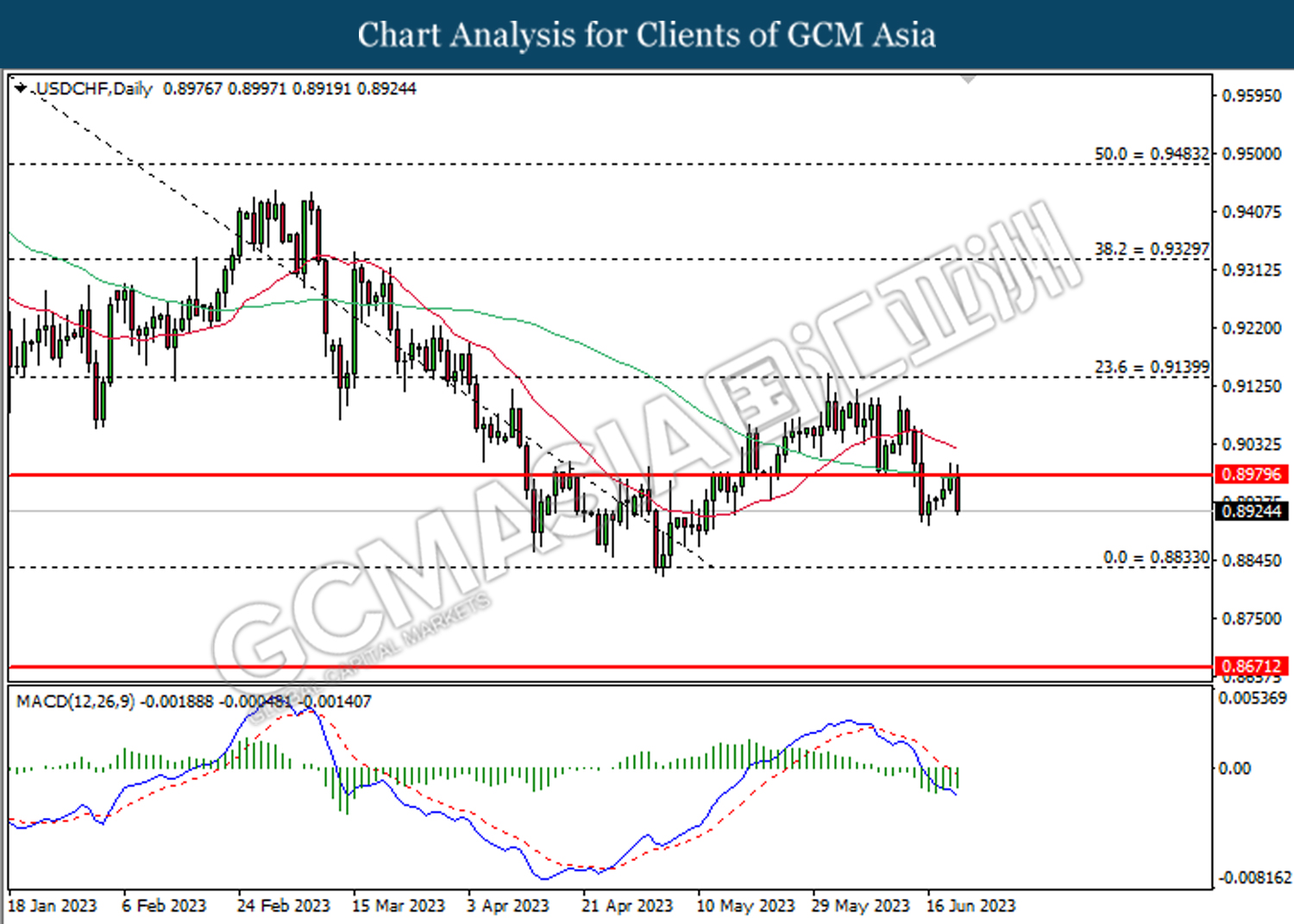

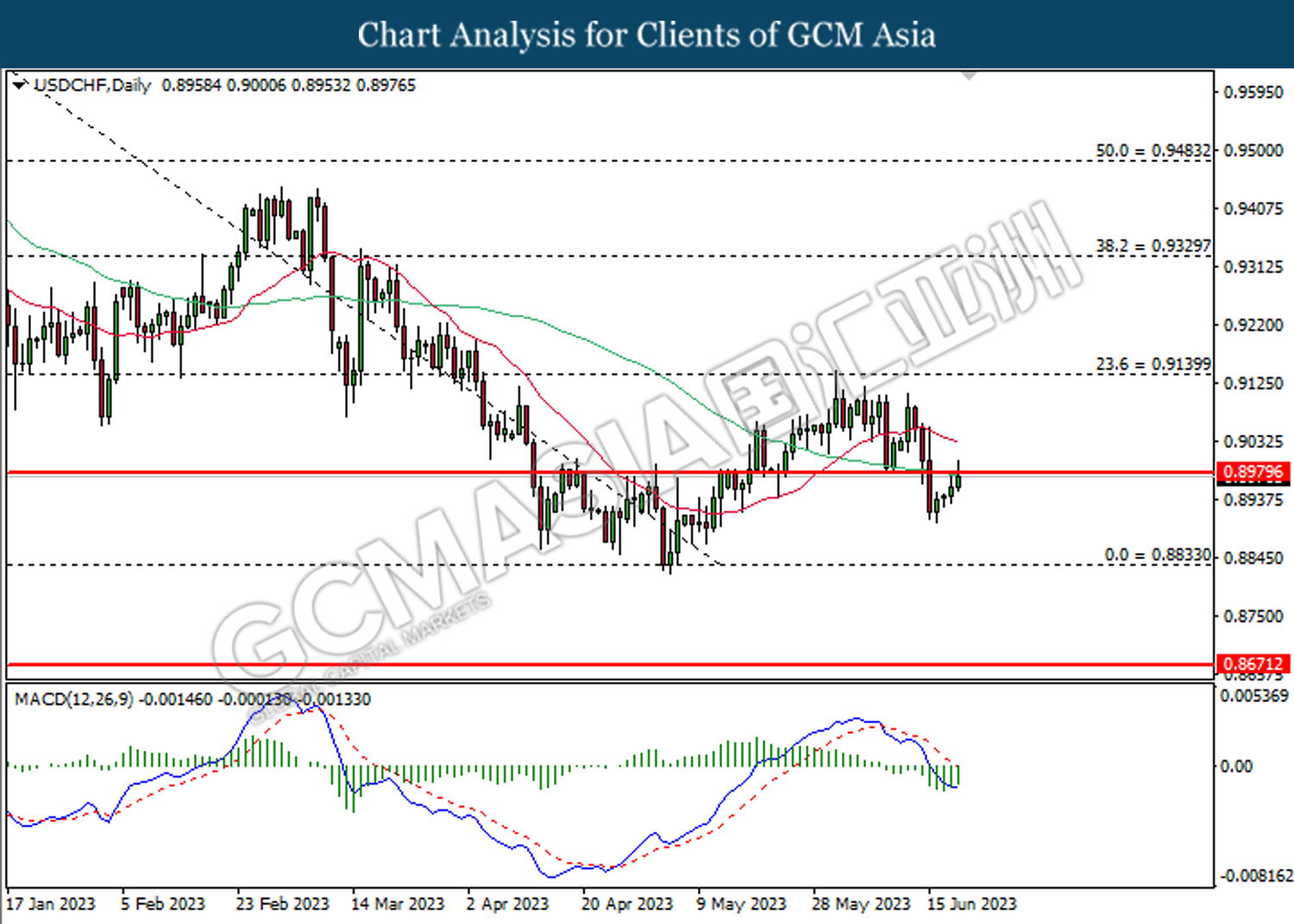

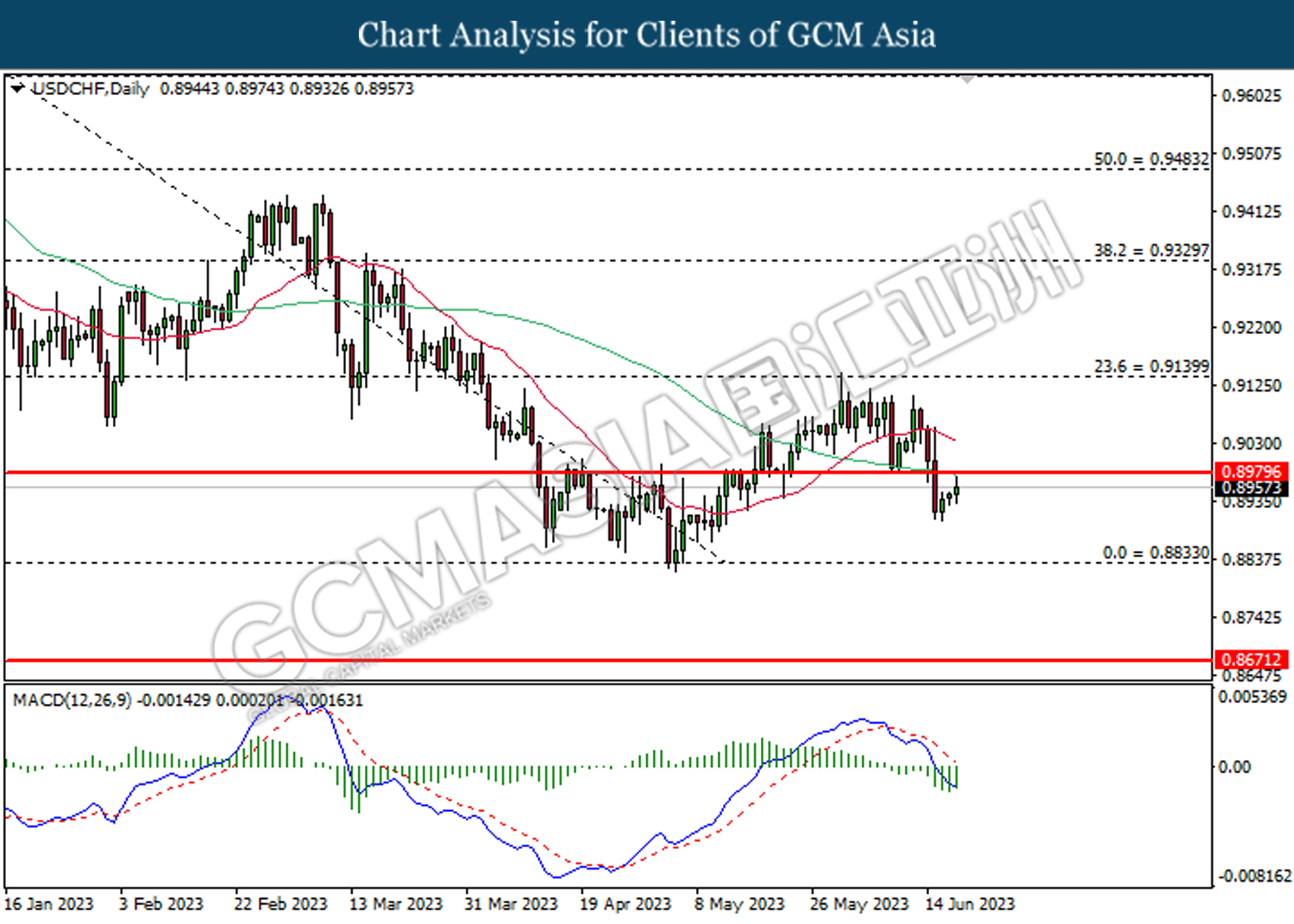

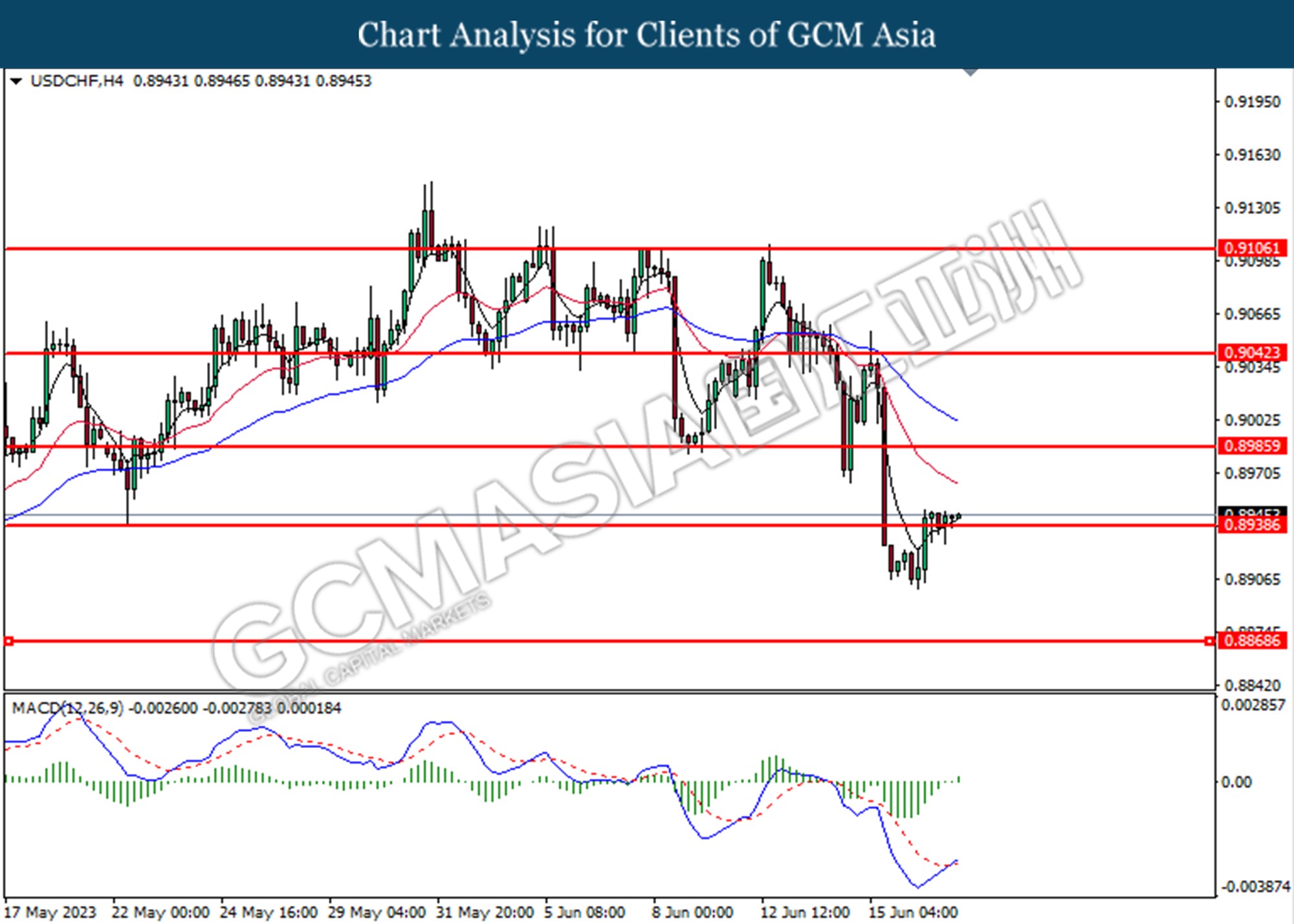

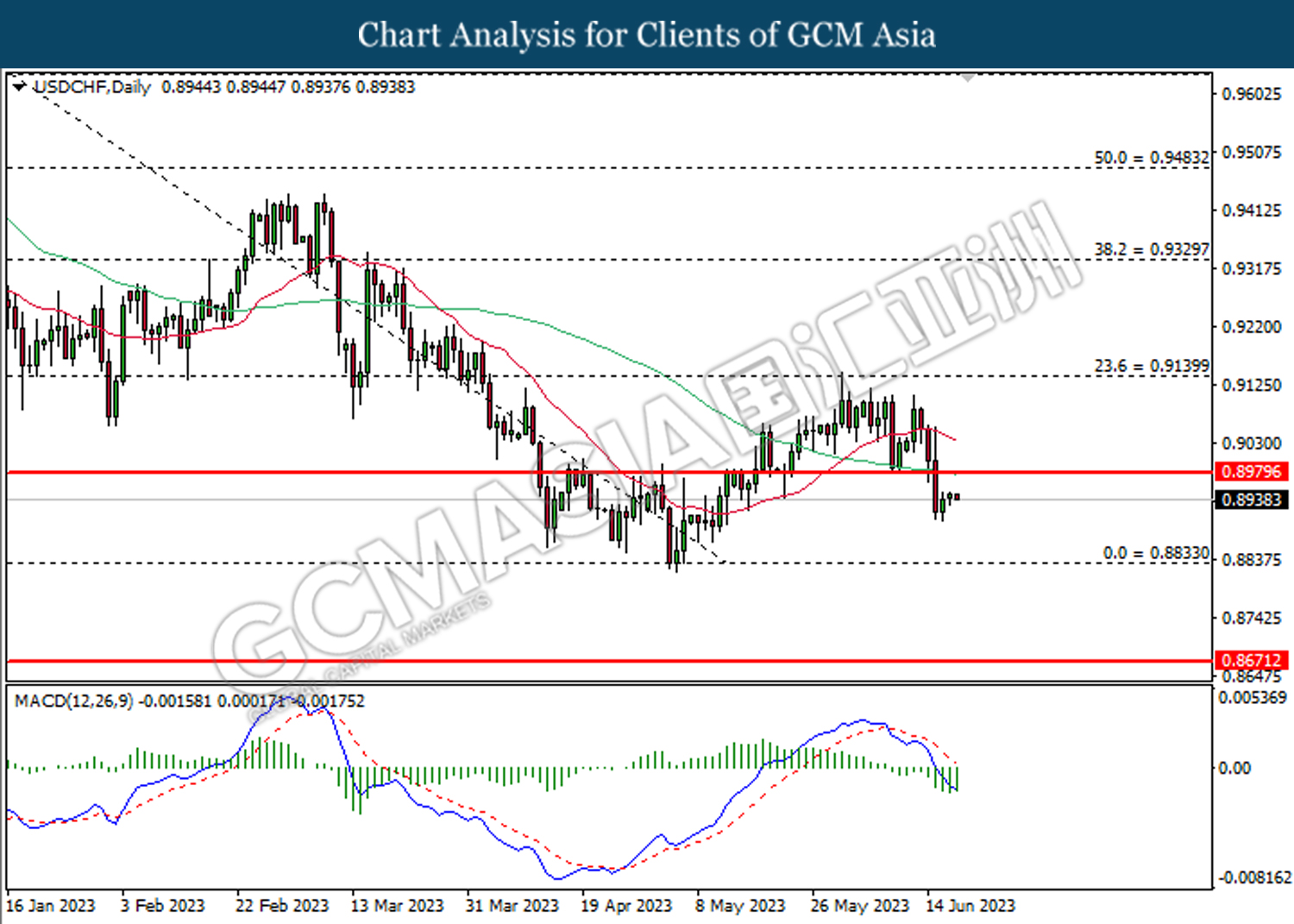

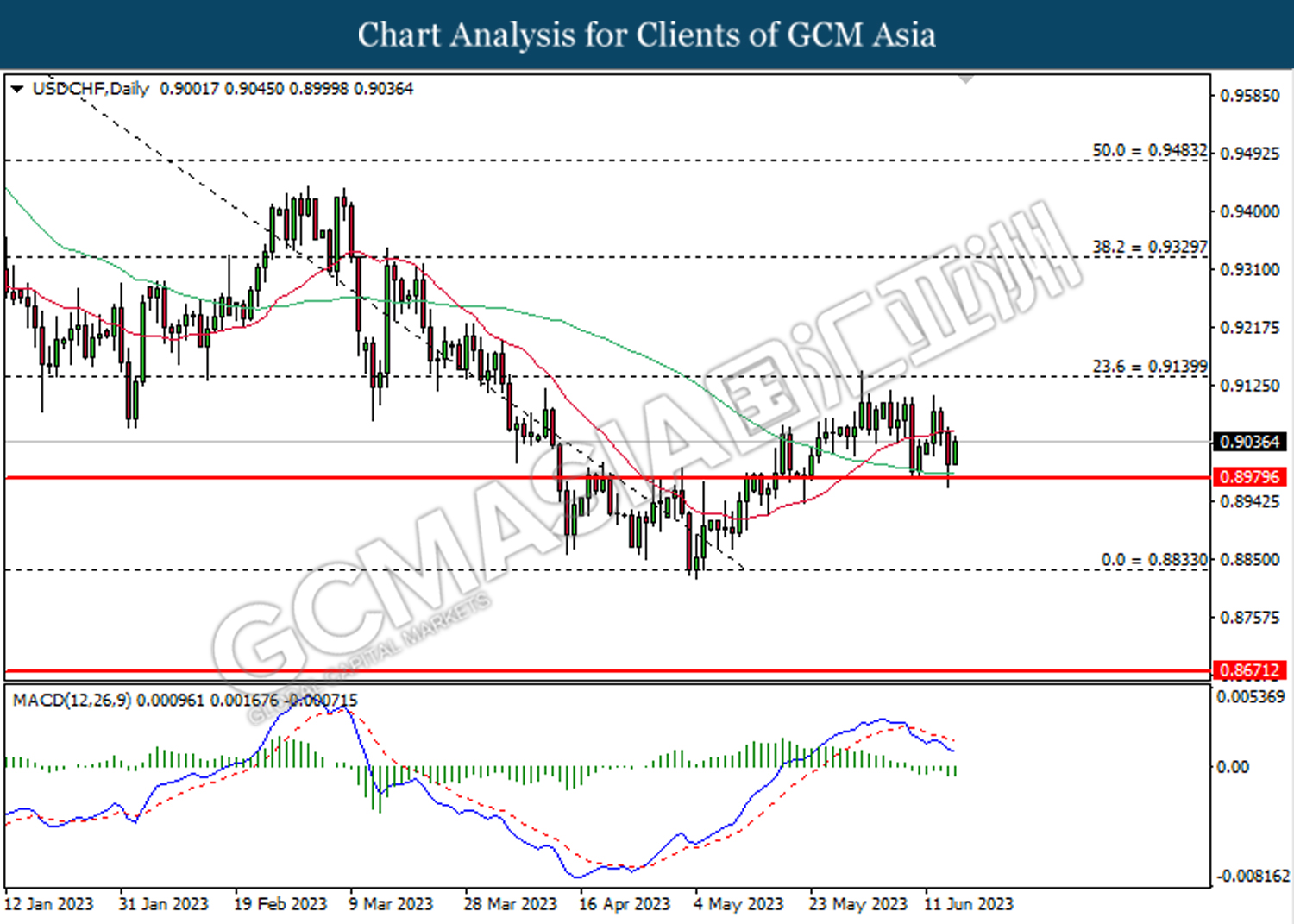

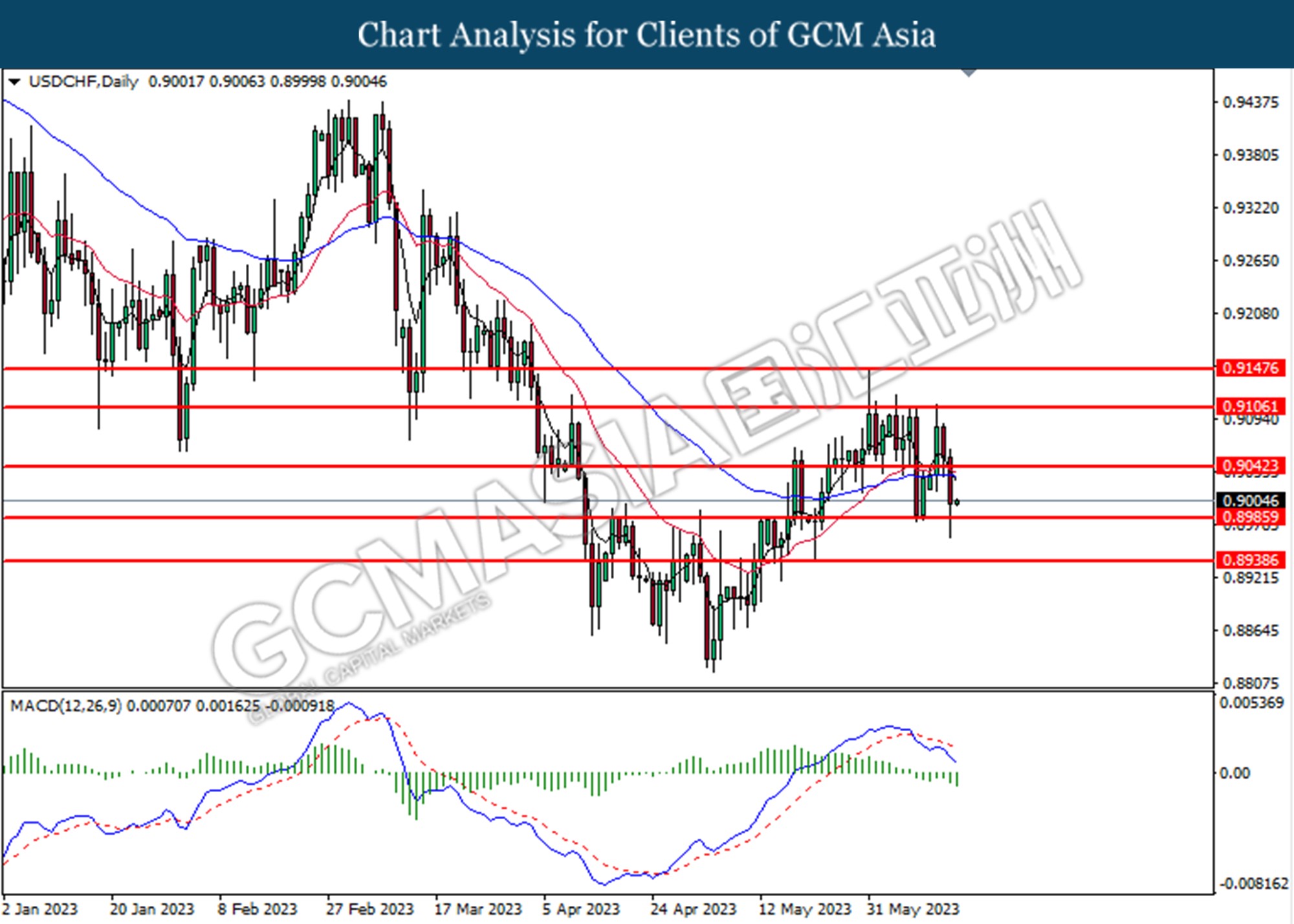

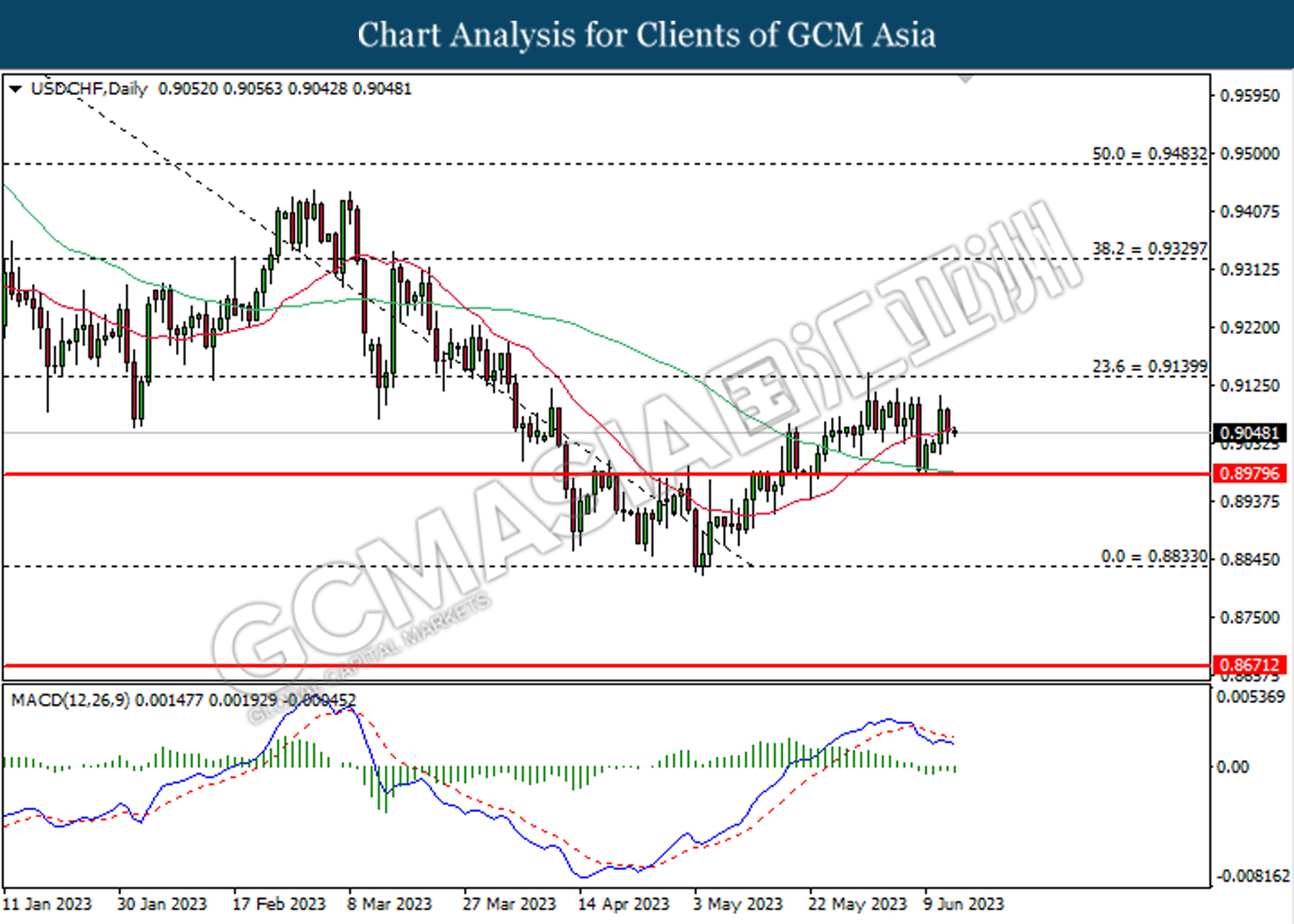

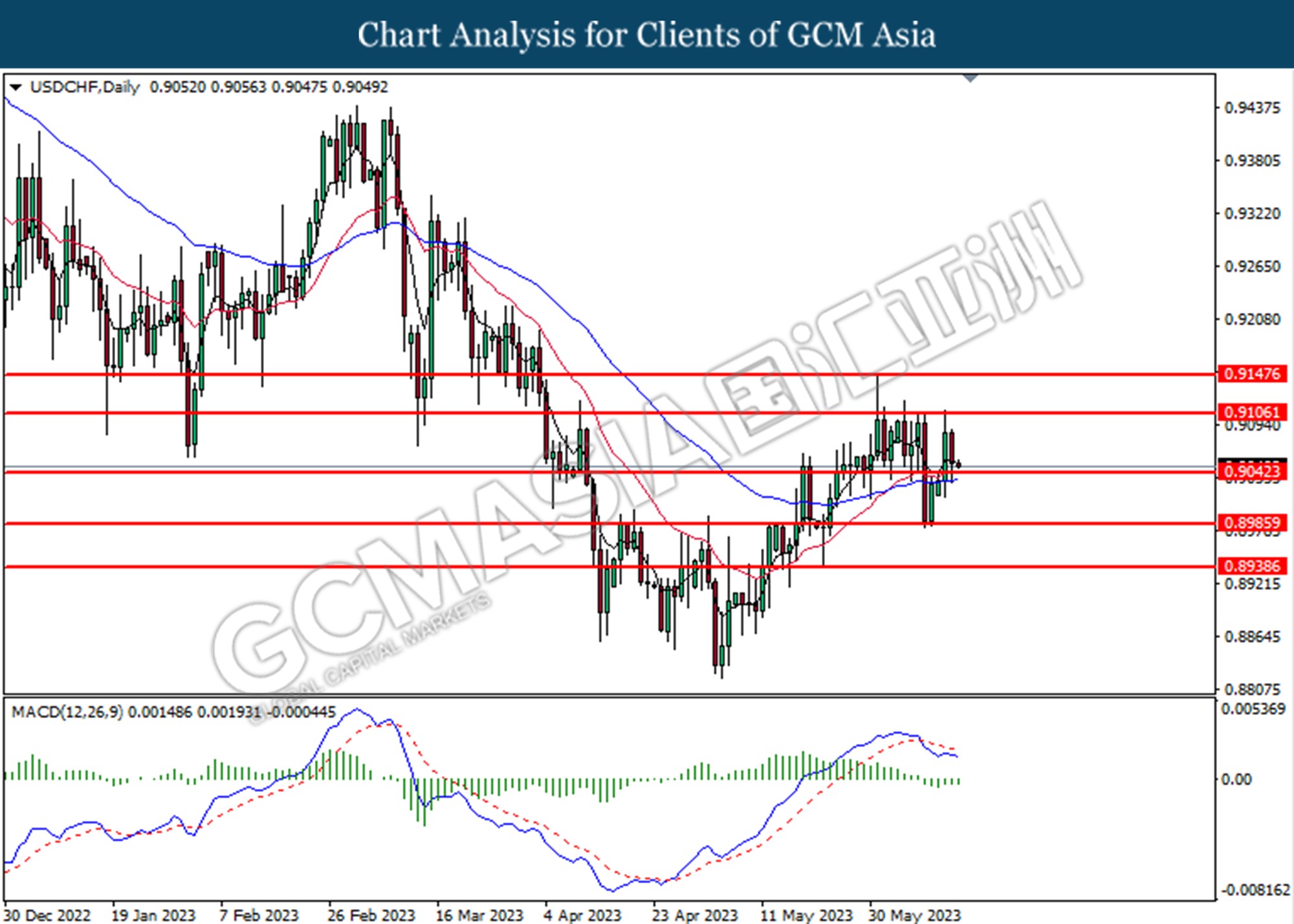

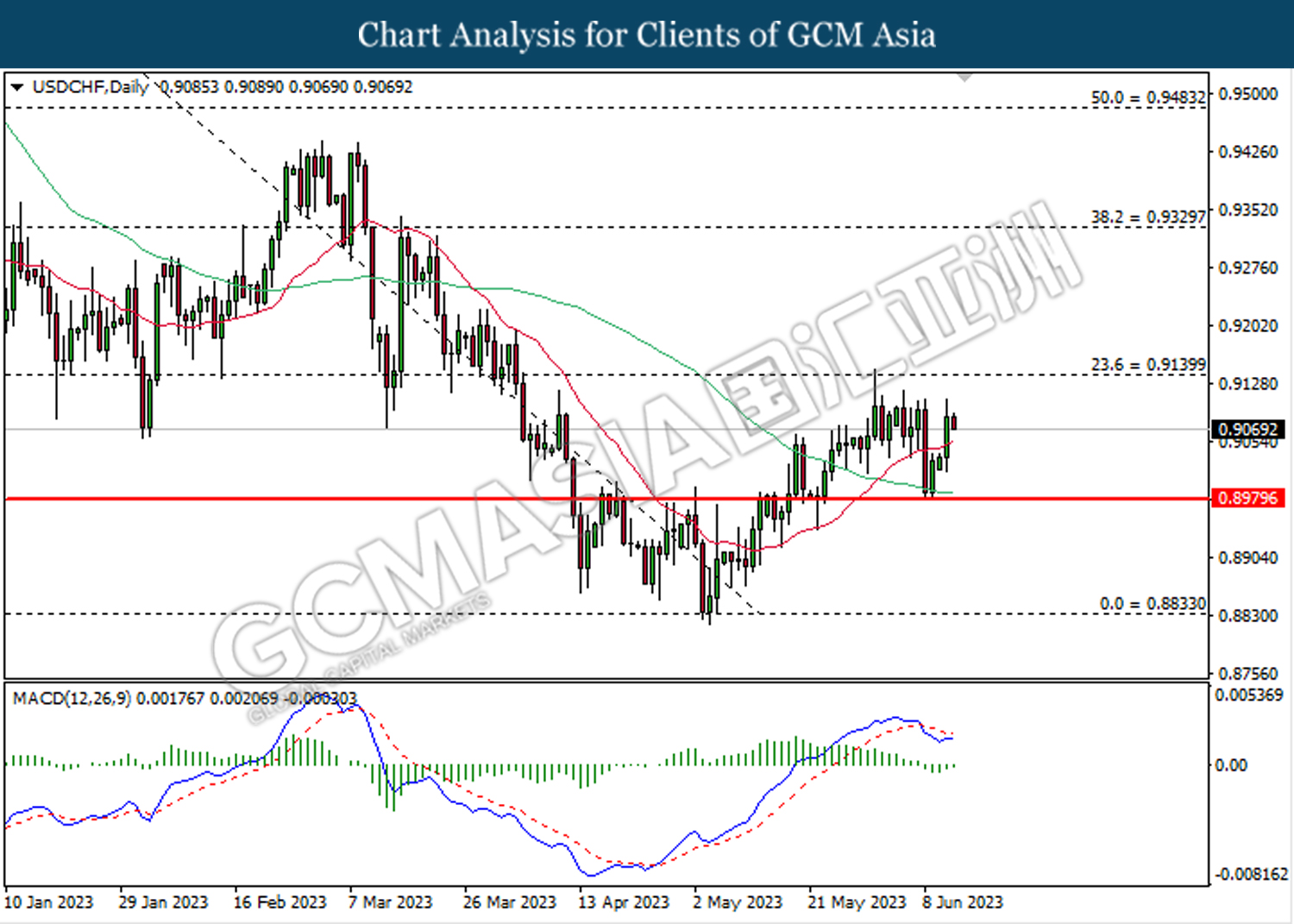

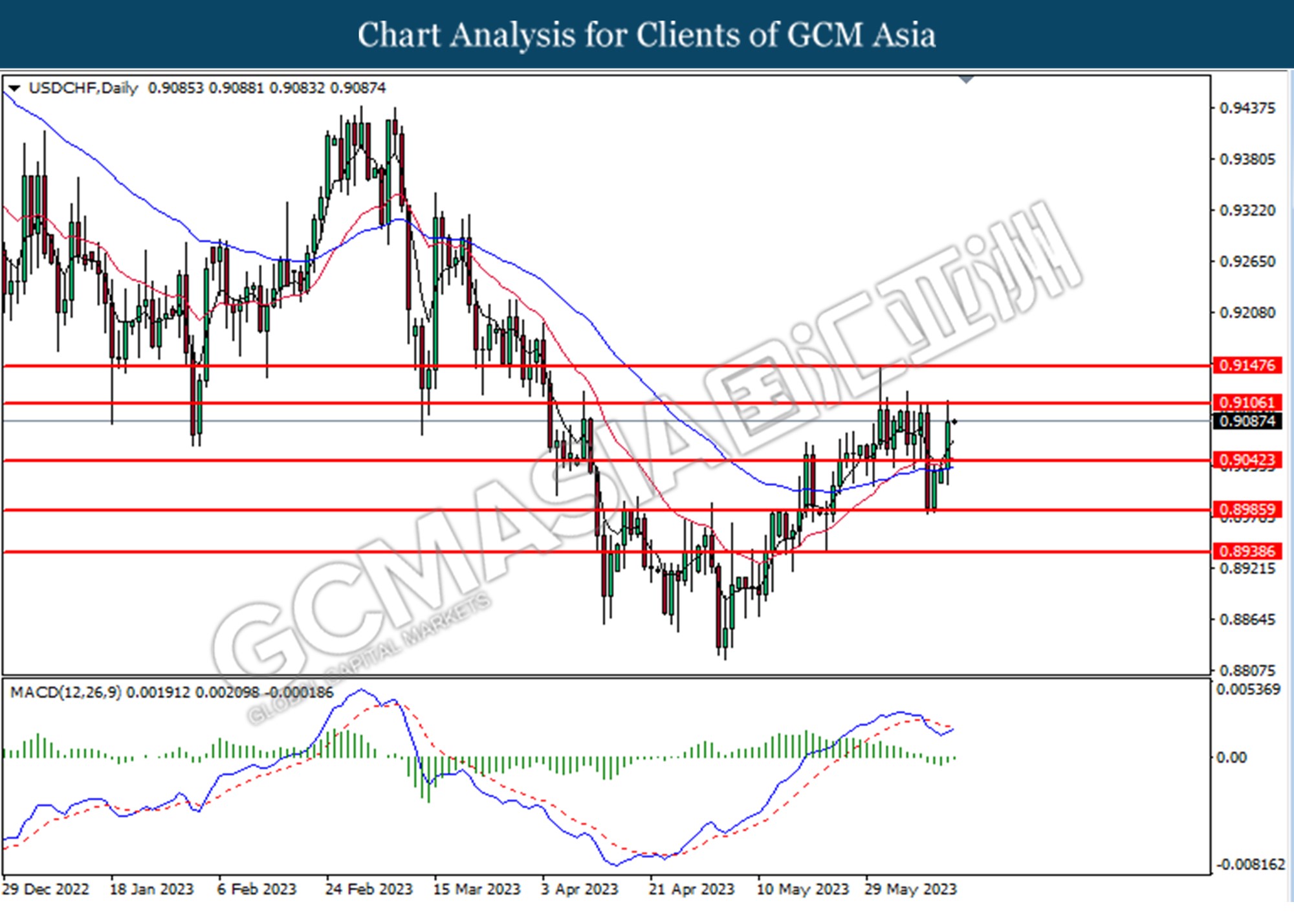

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8980. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8835.

Resistance level: 0.8980, 0.9140

Support level: 0.8835, 0.8670

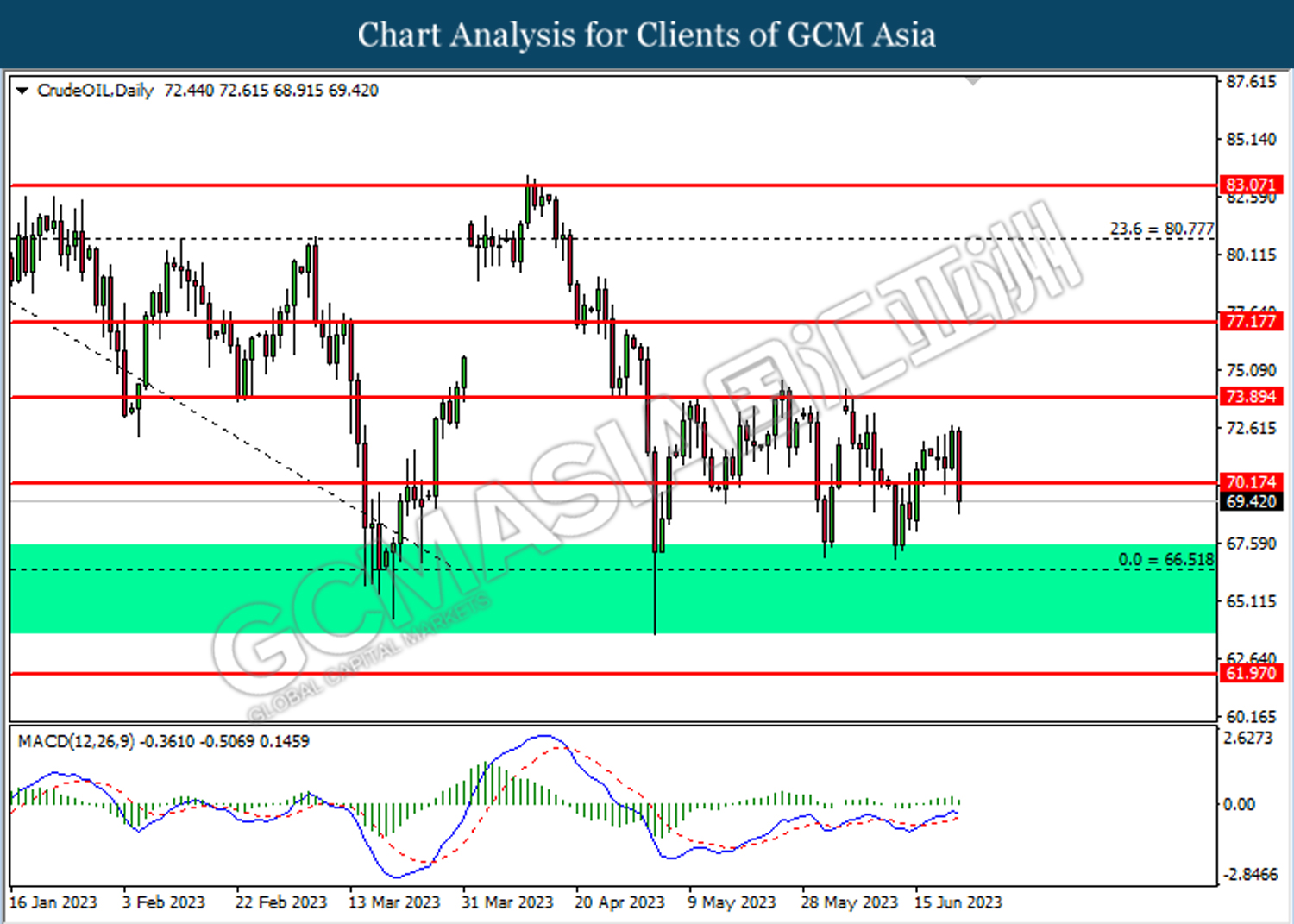

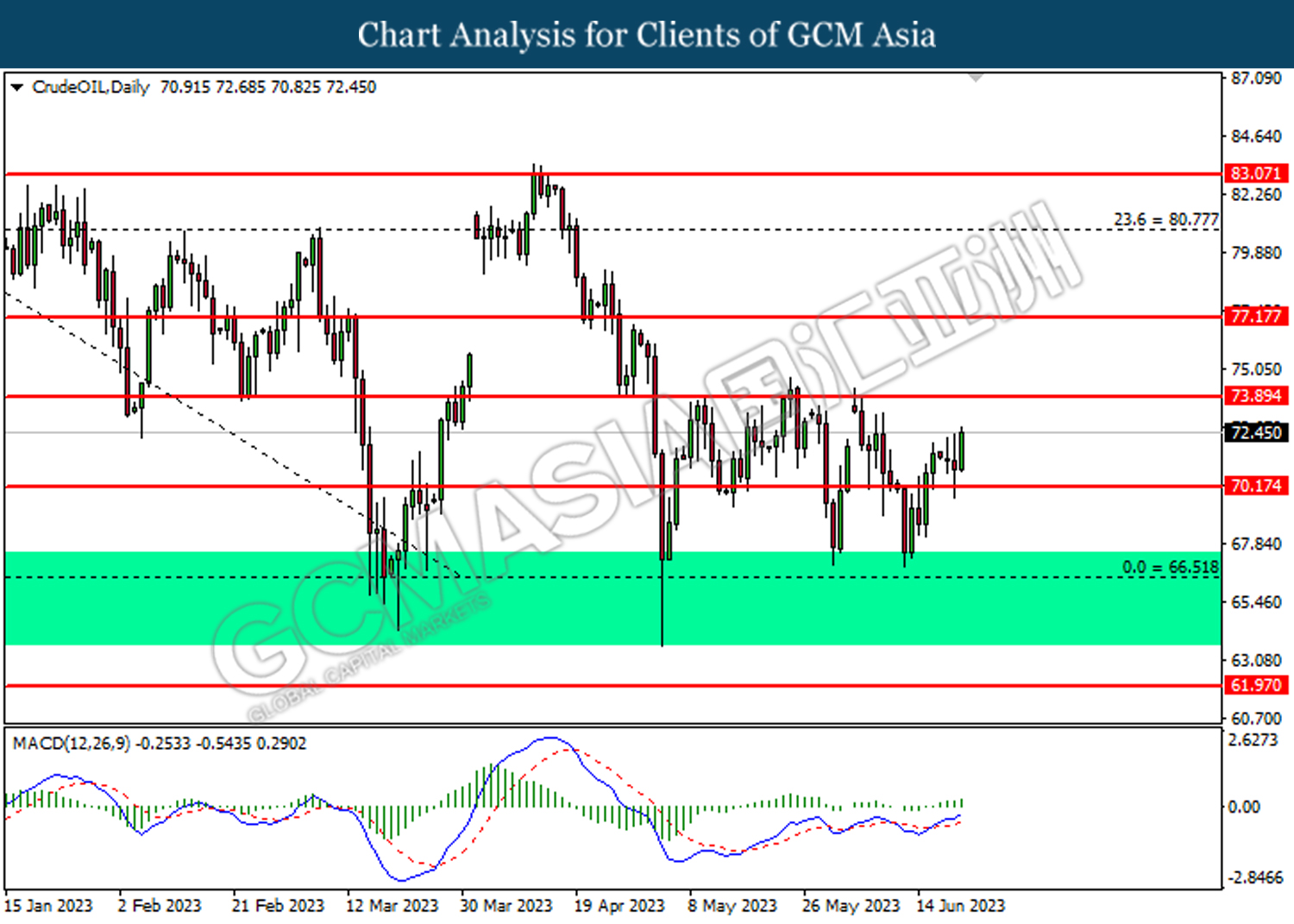

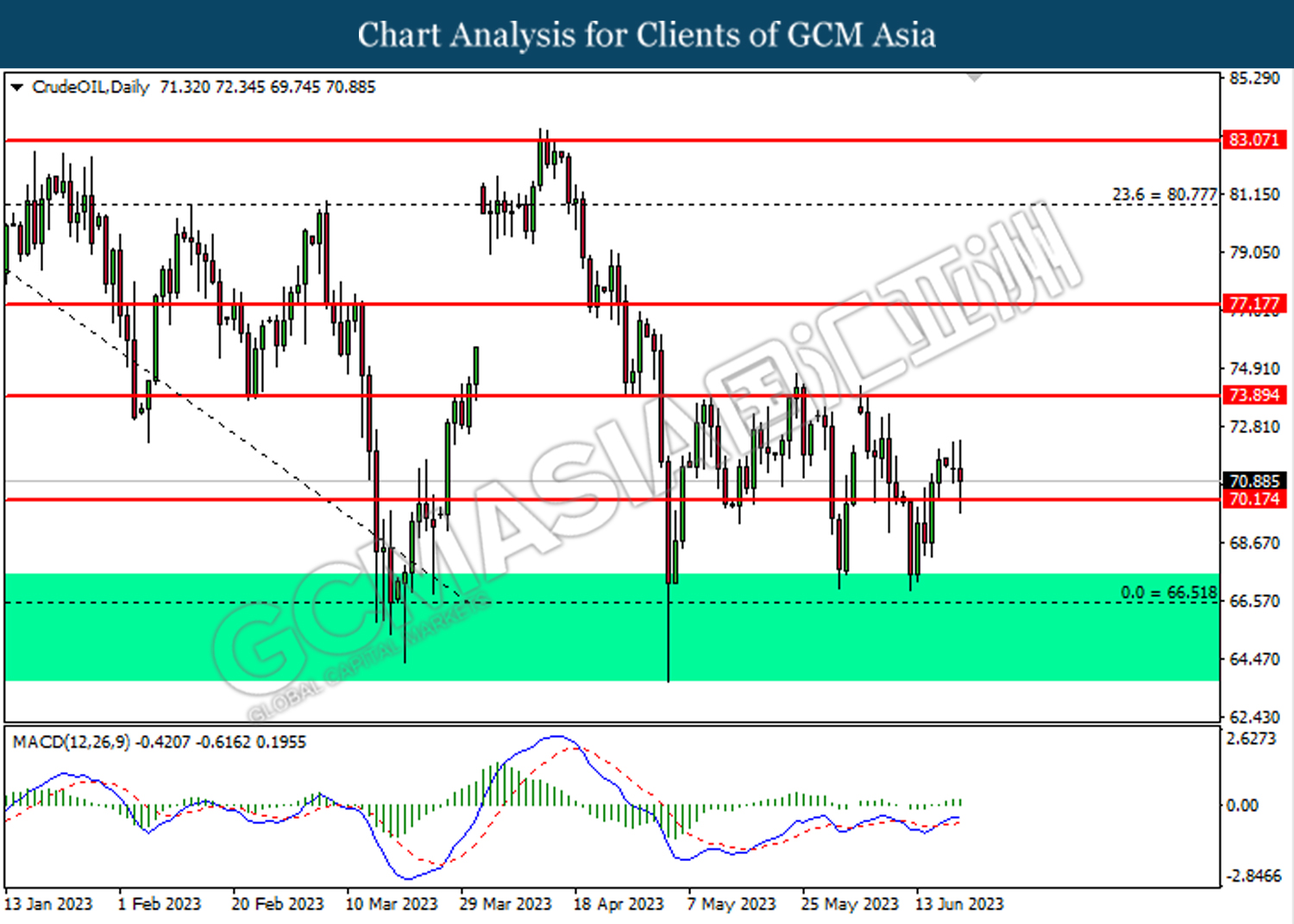

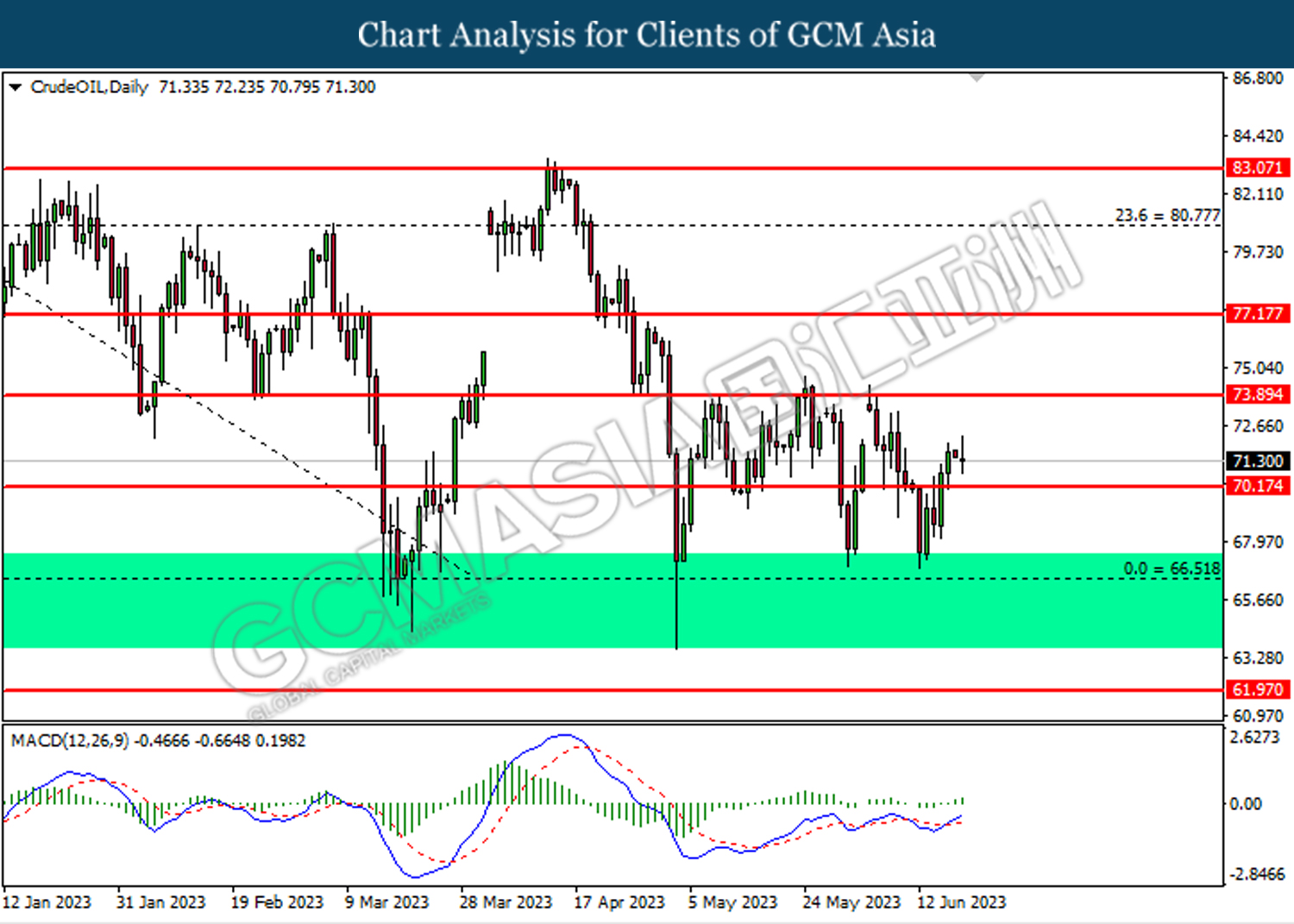

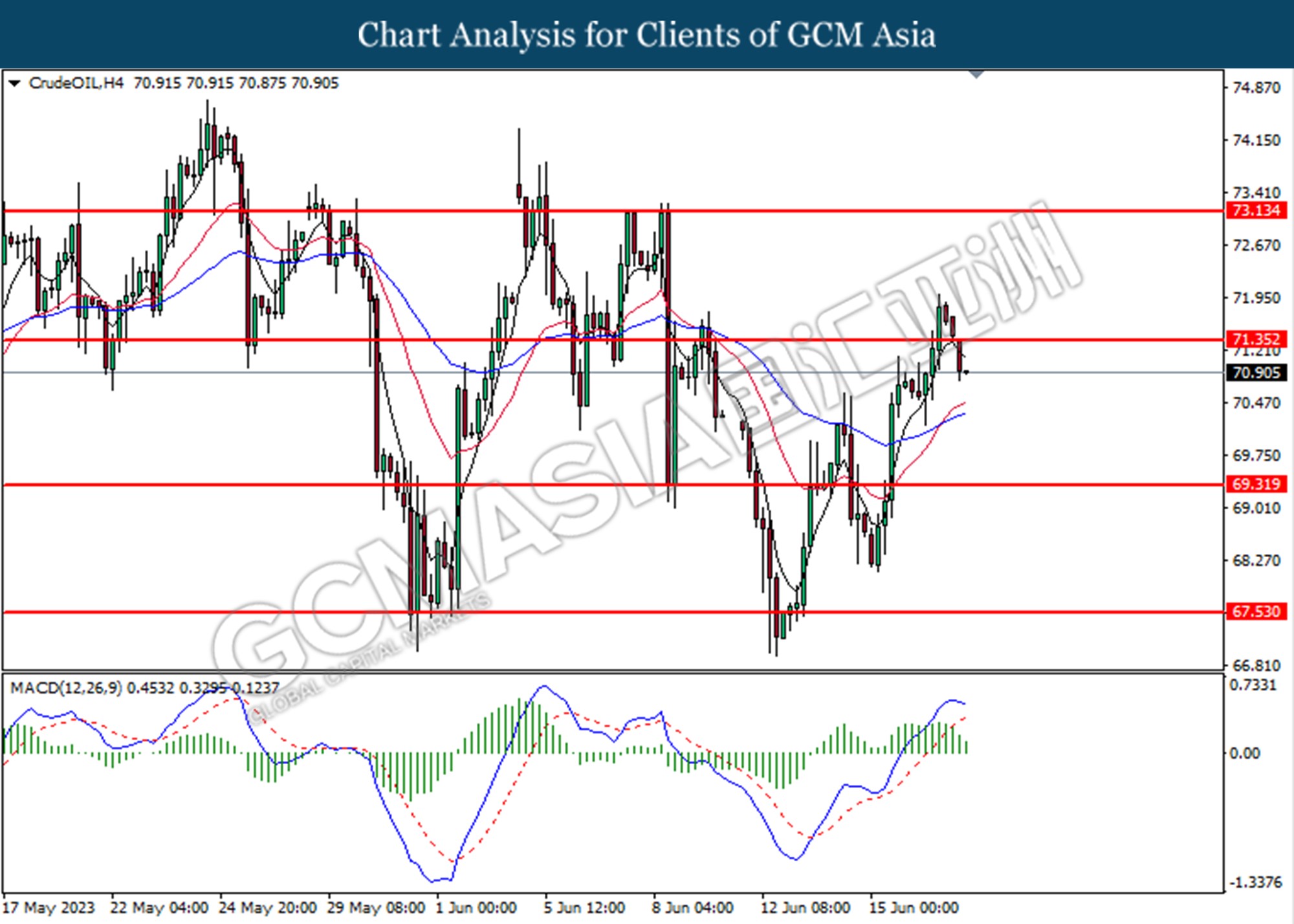

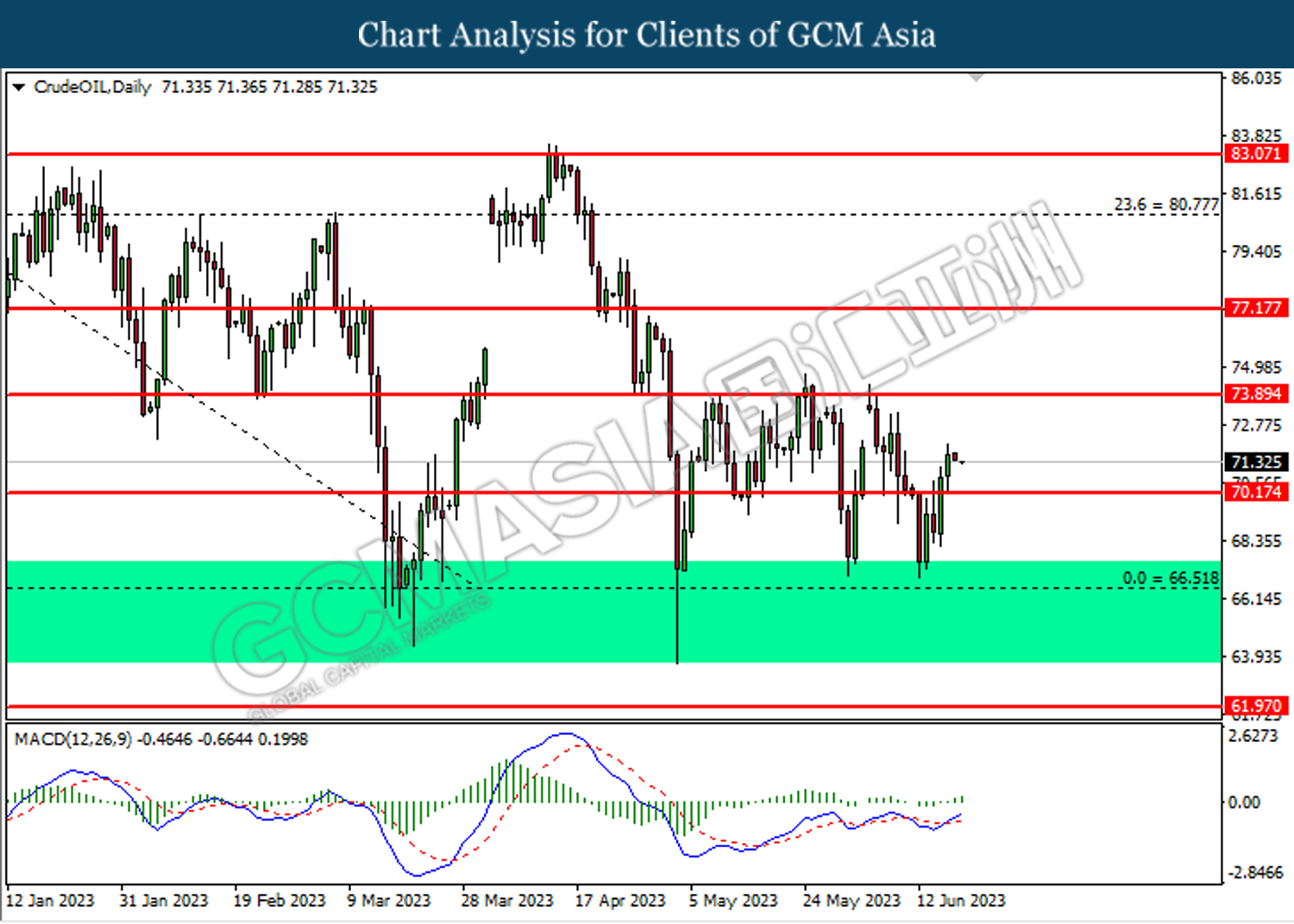

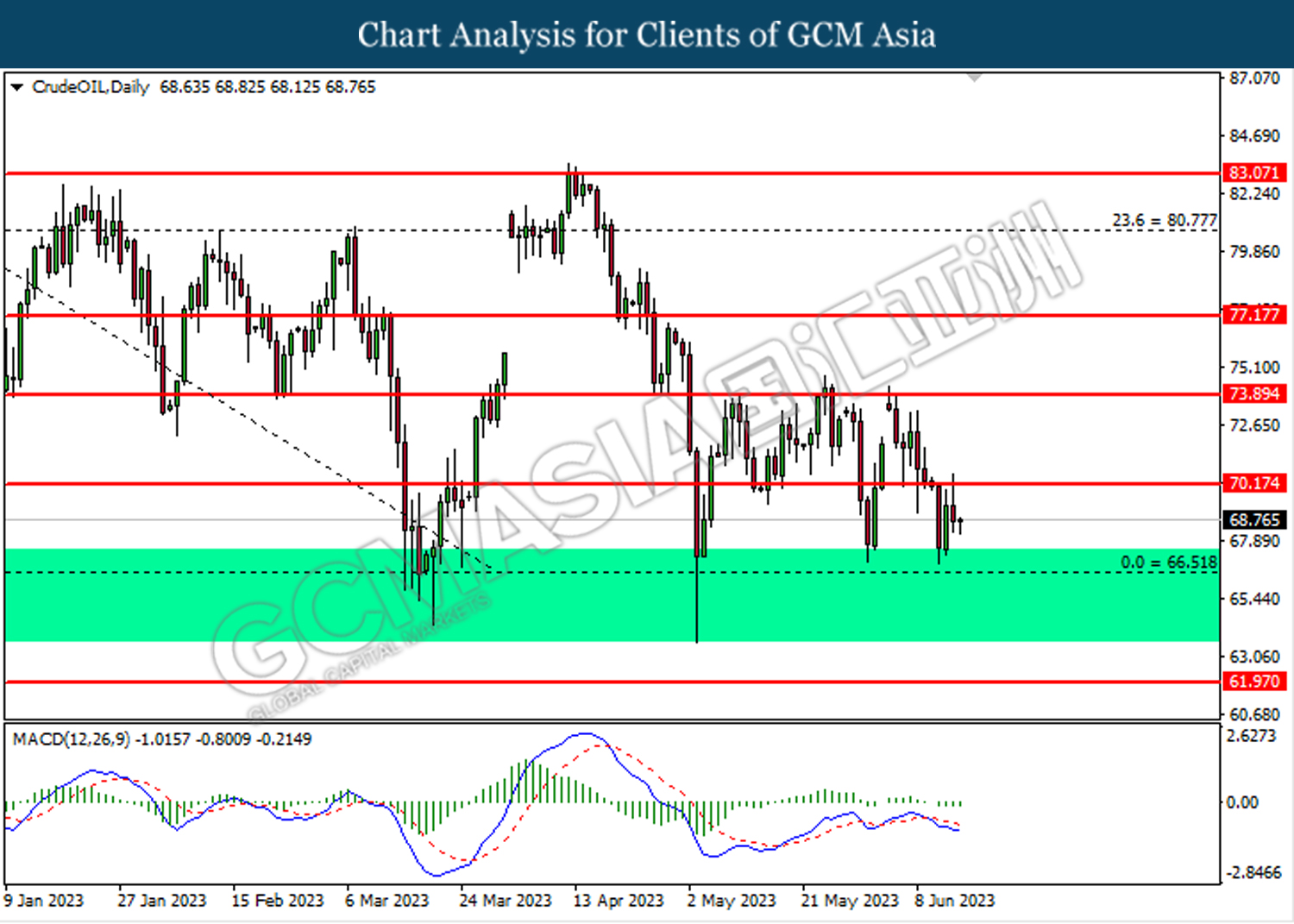

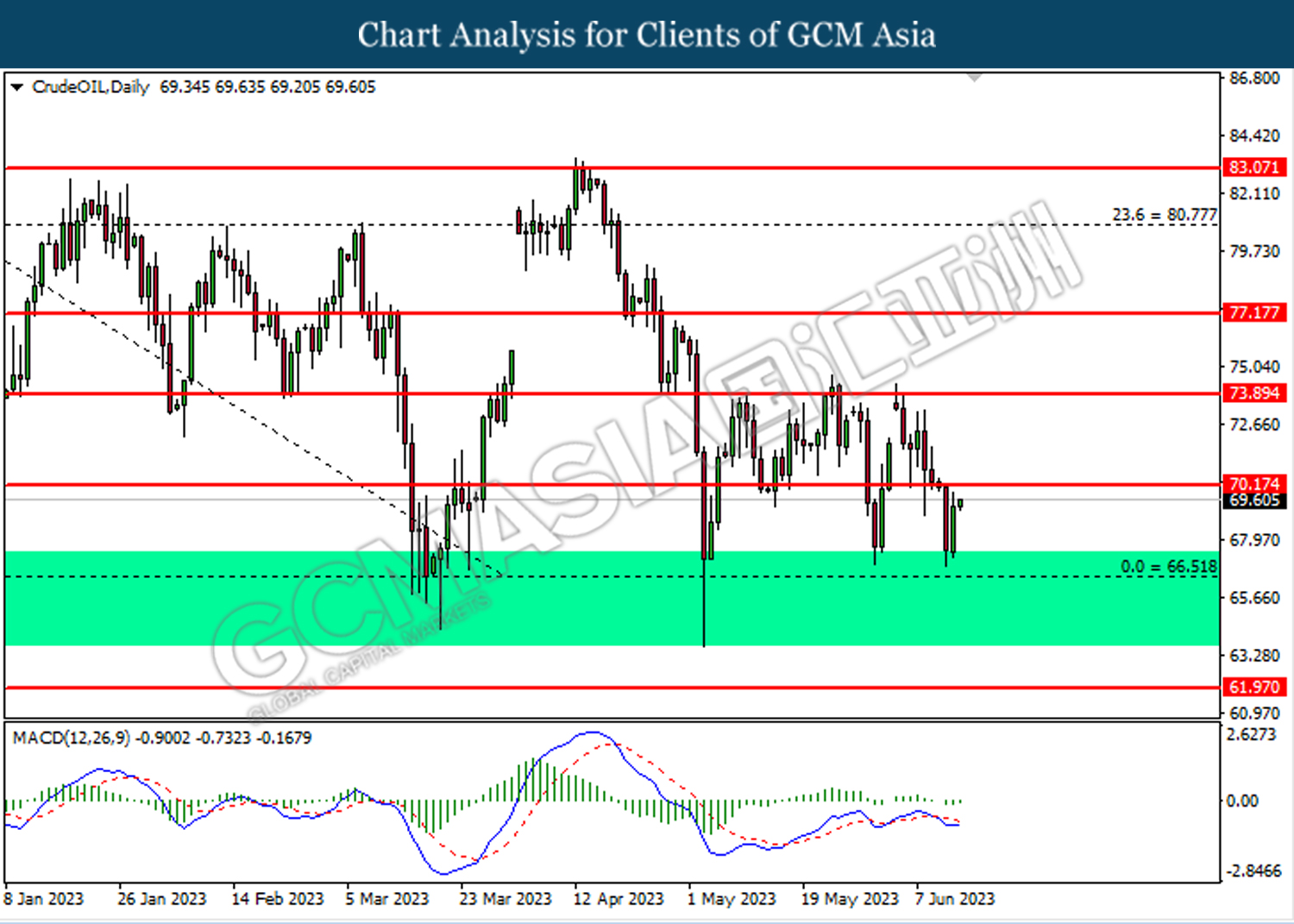

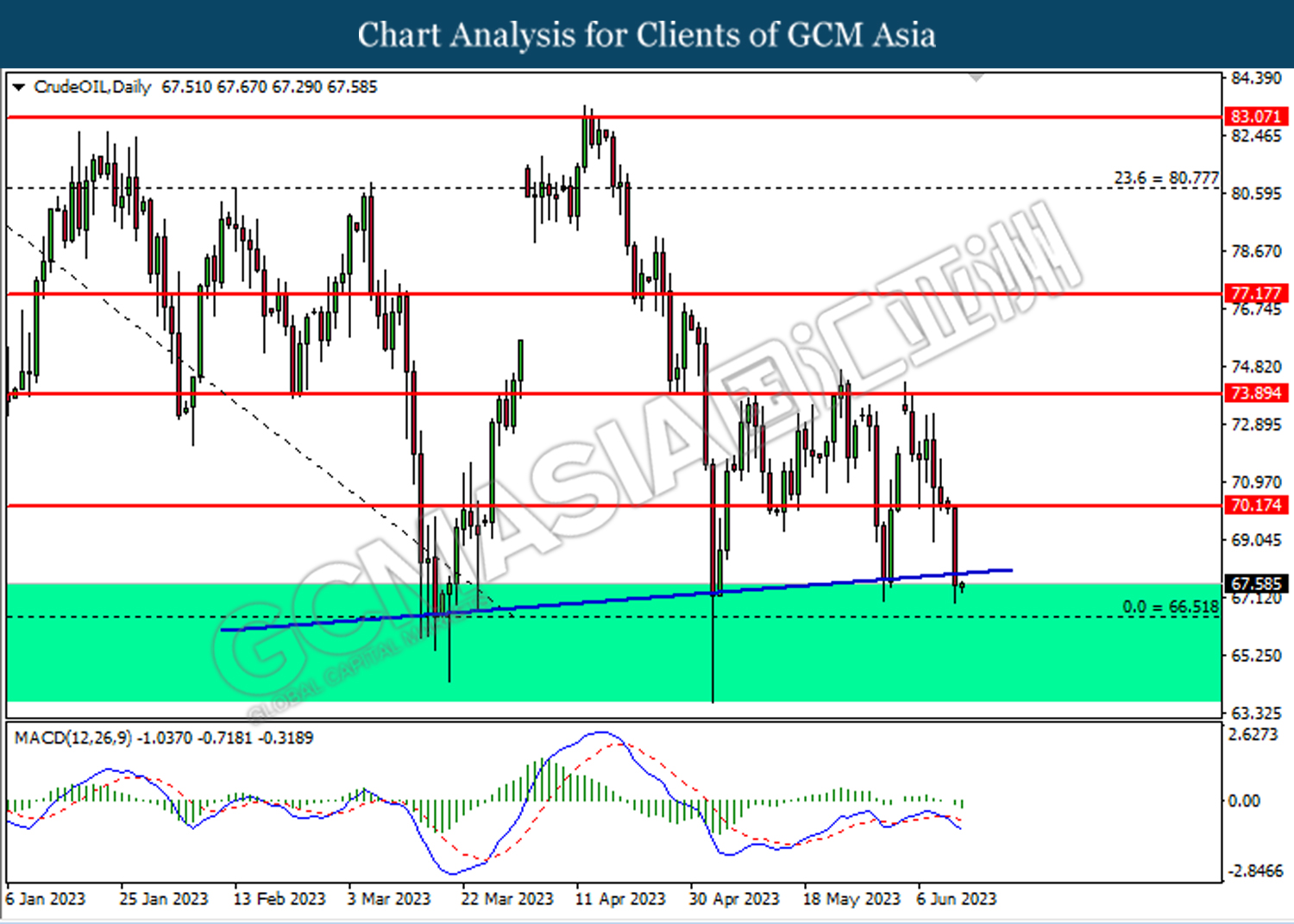

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

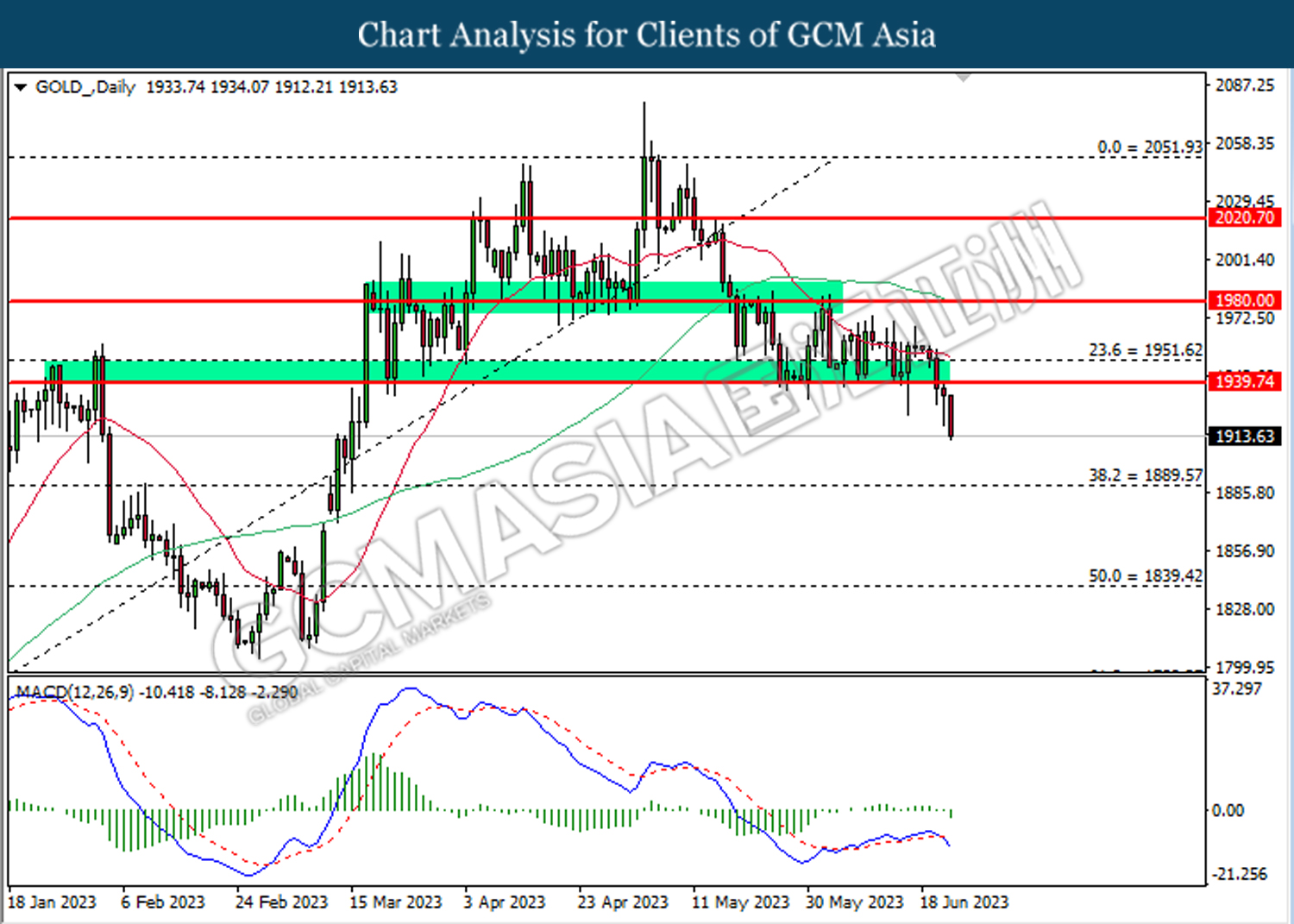

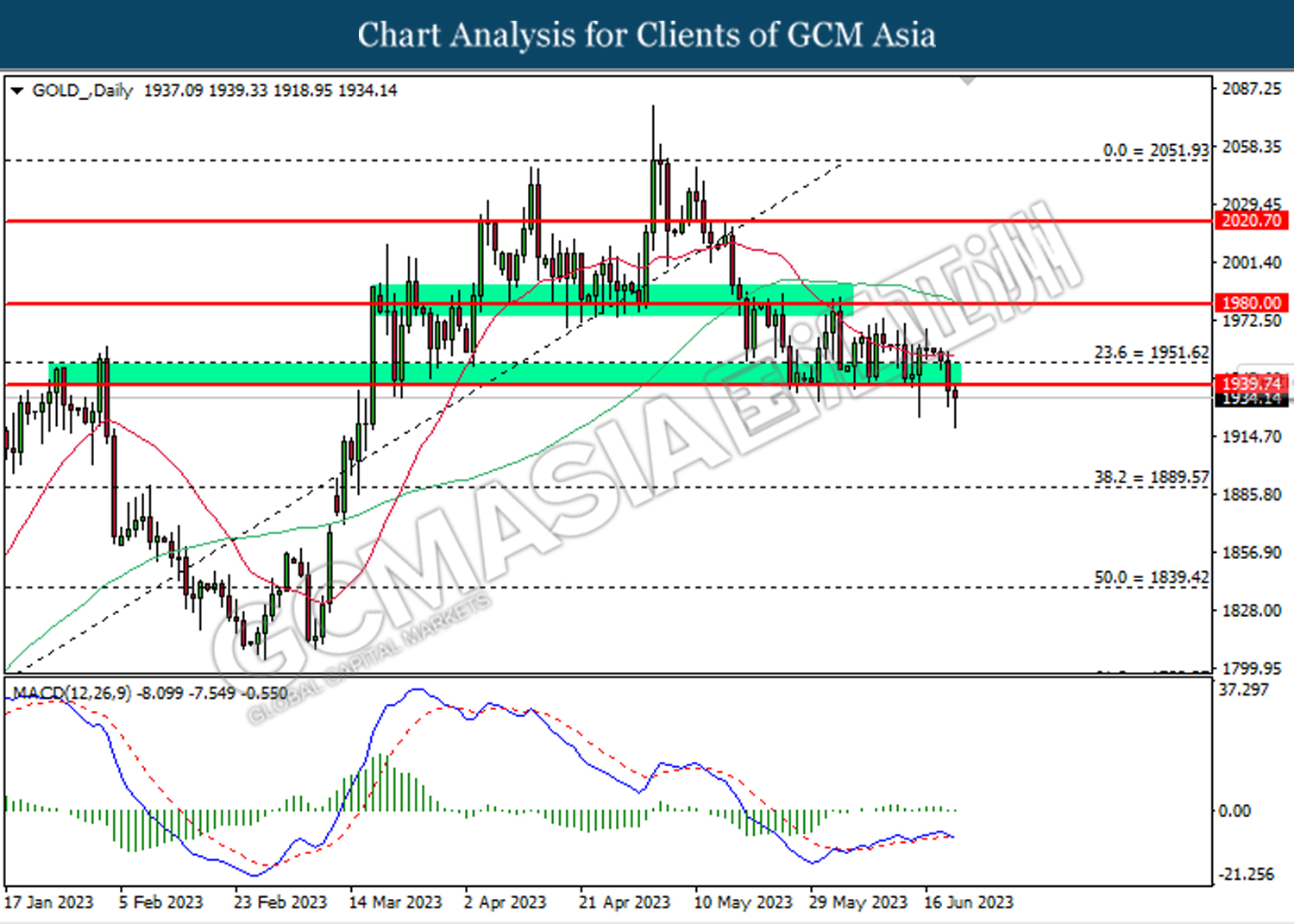

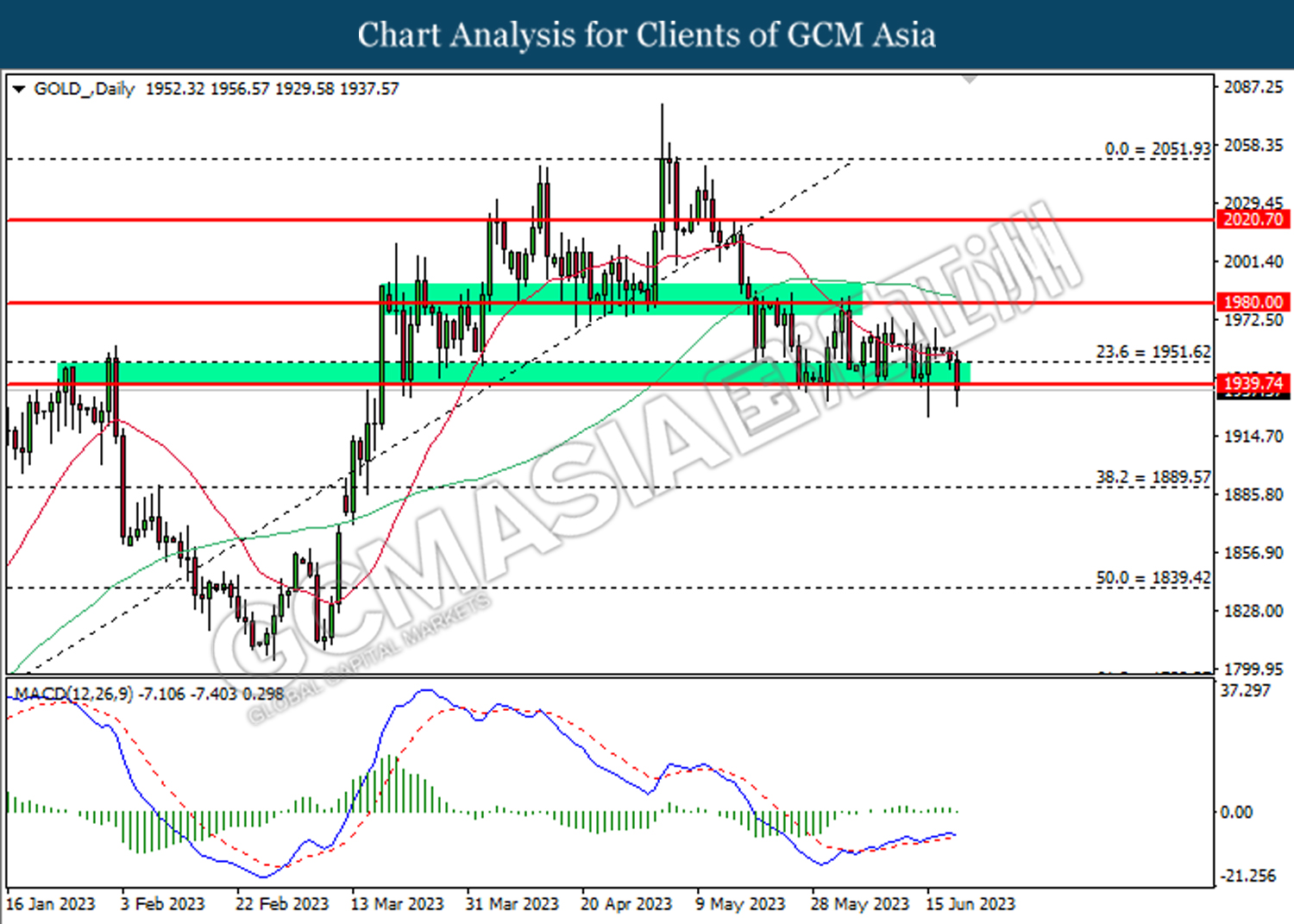

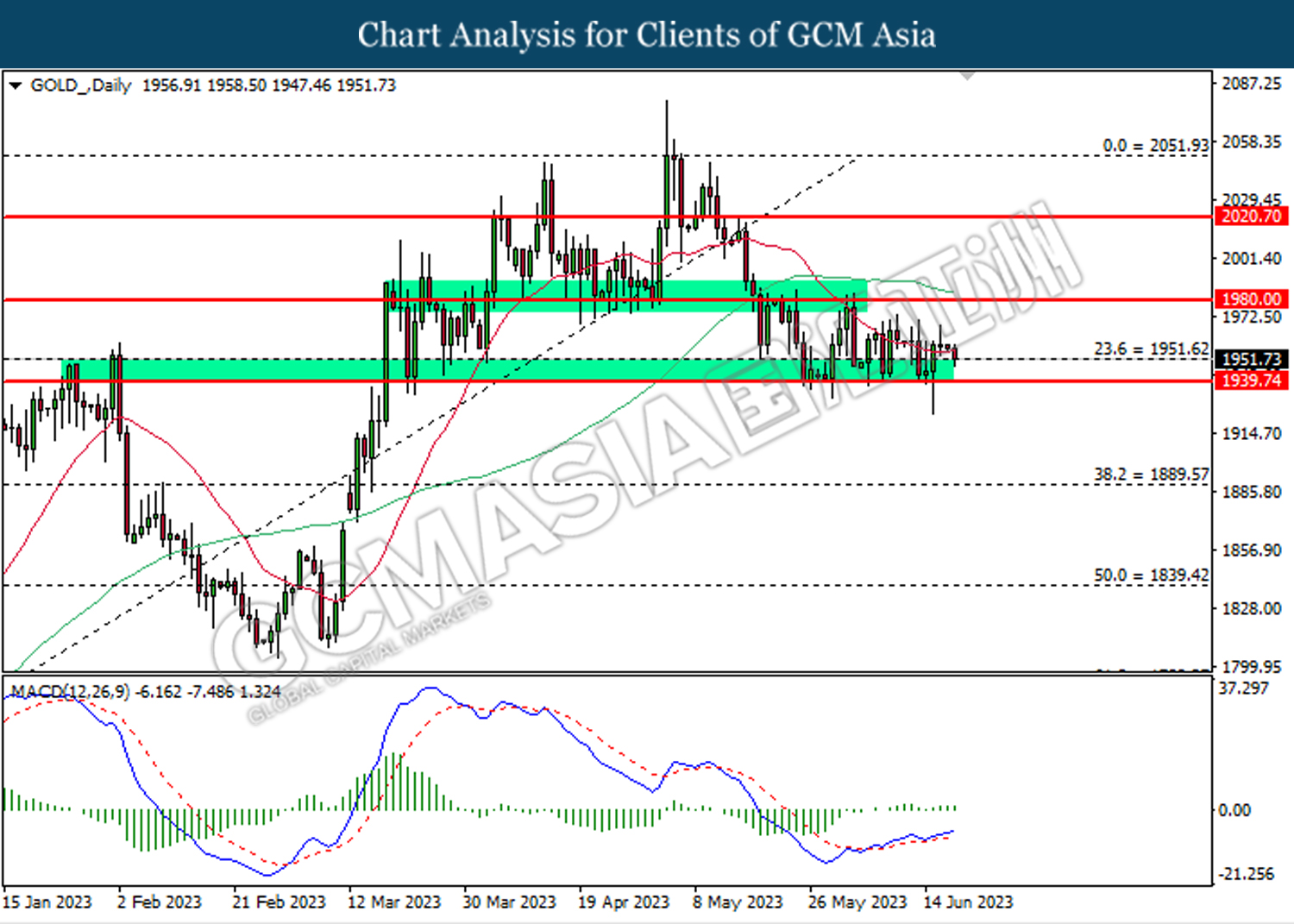

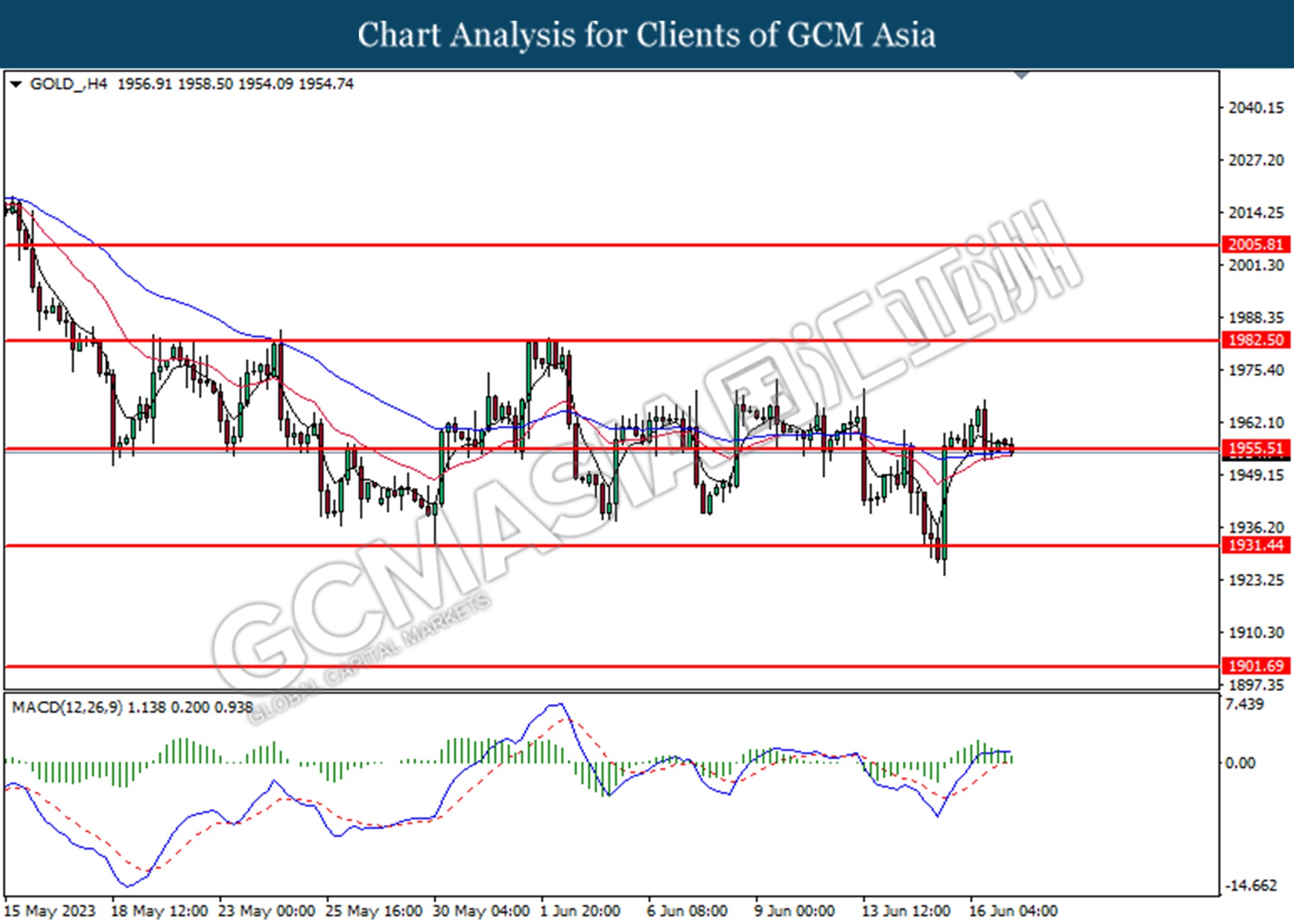

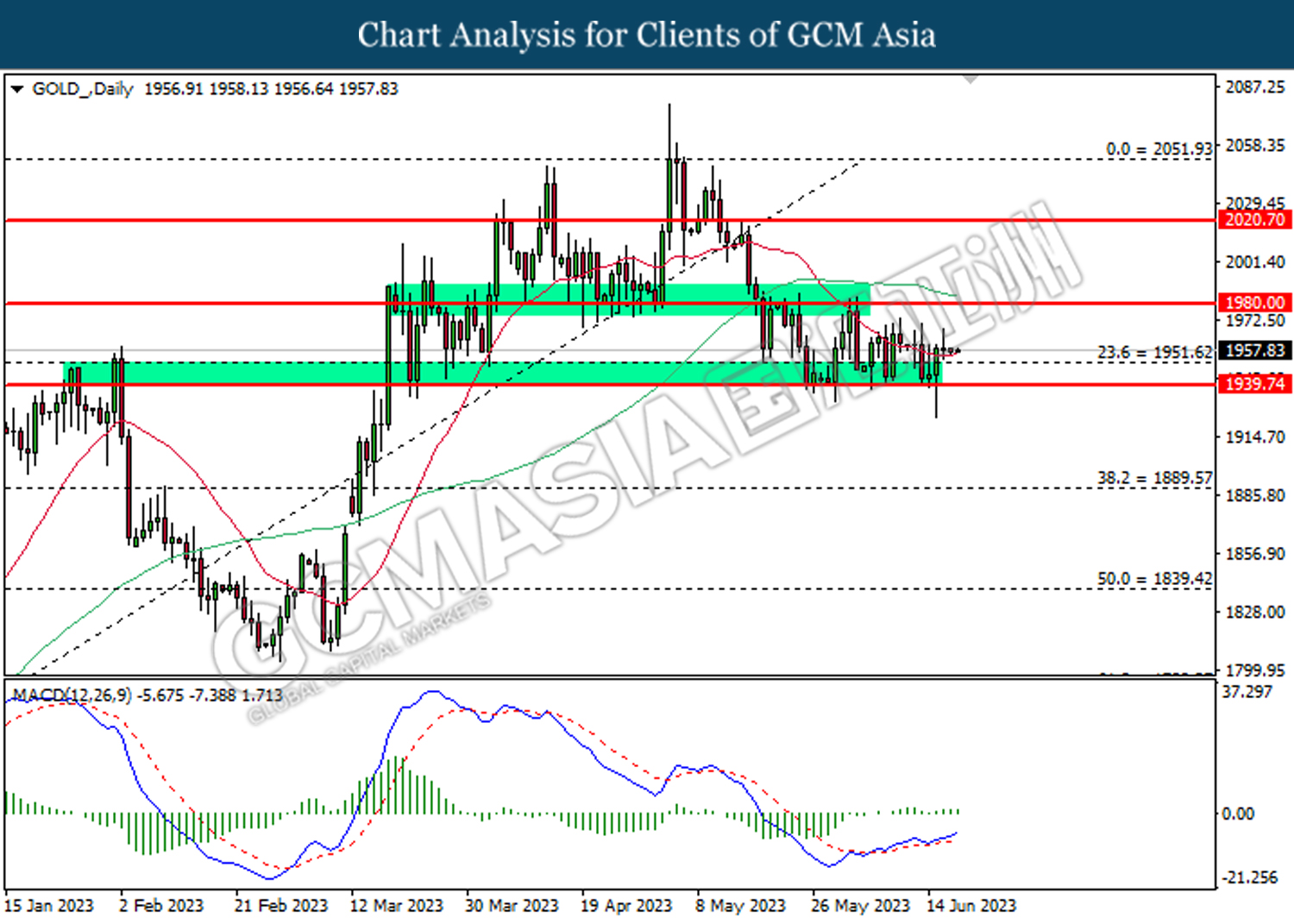

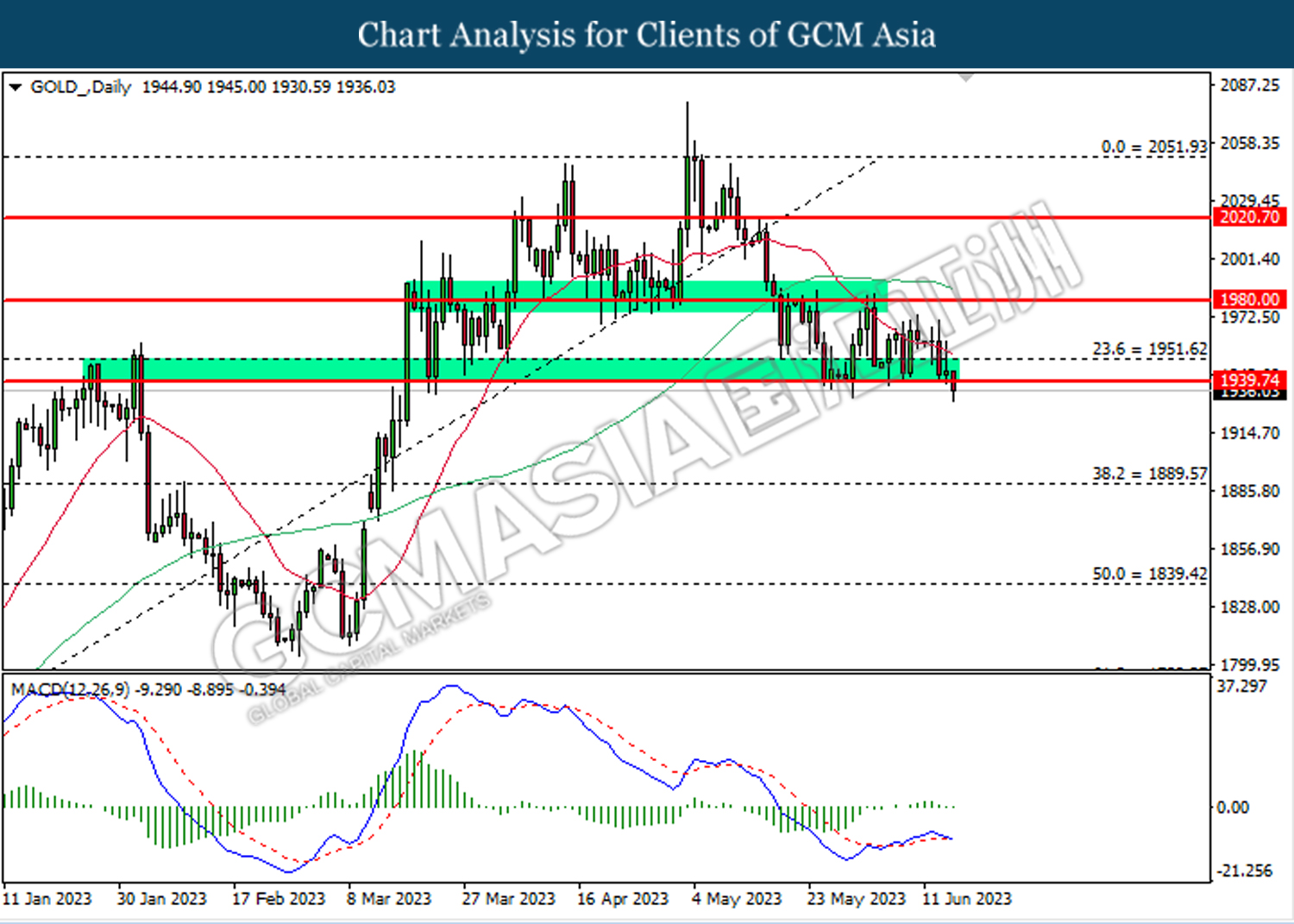

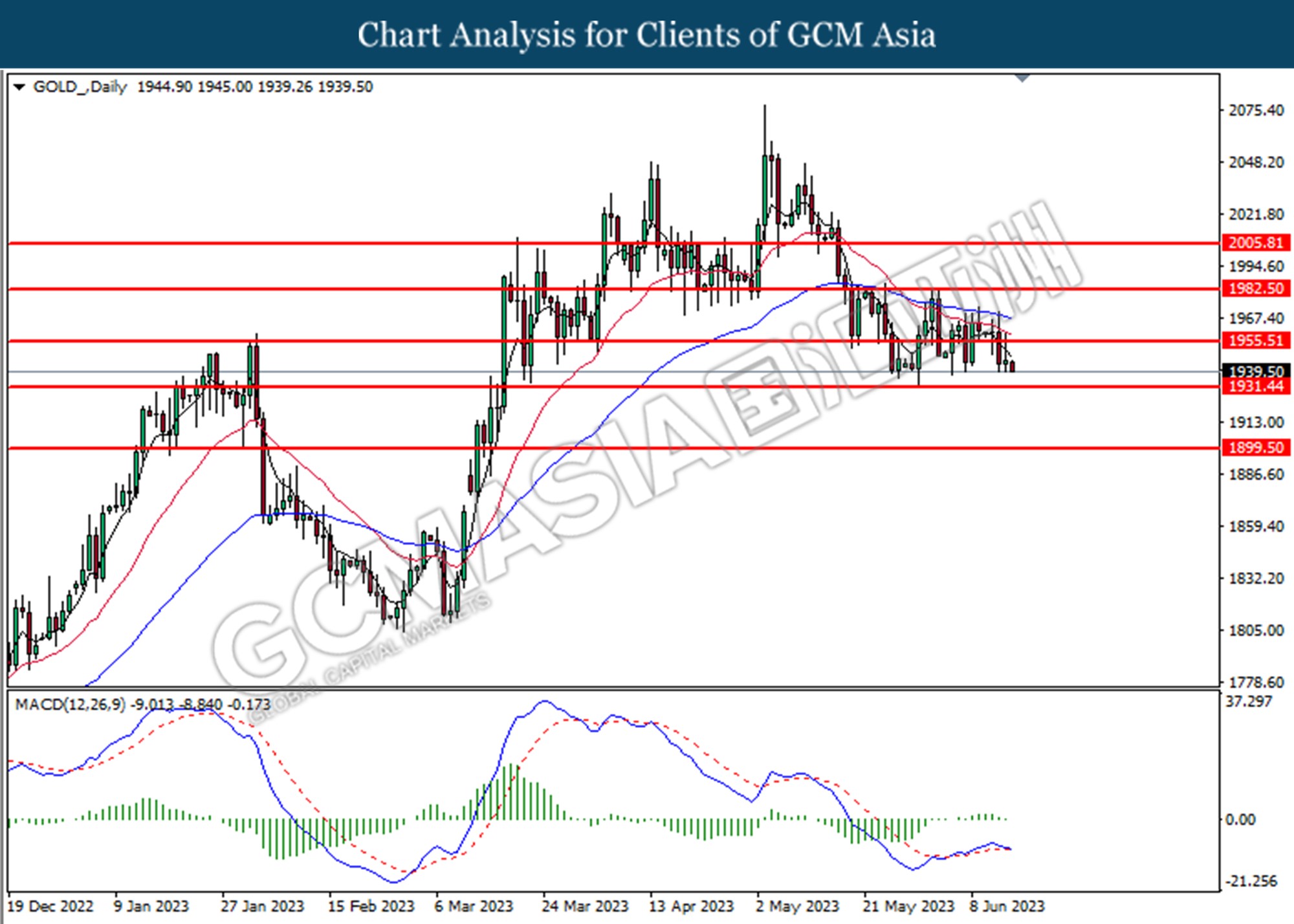

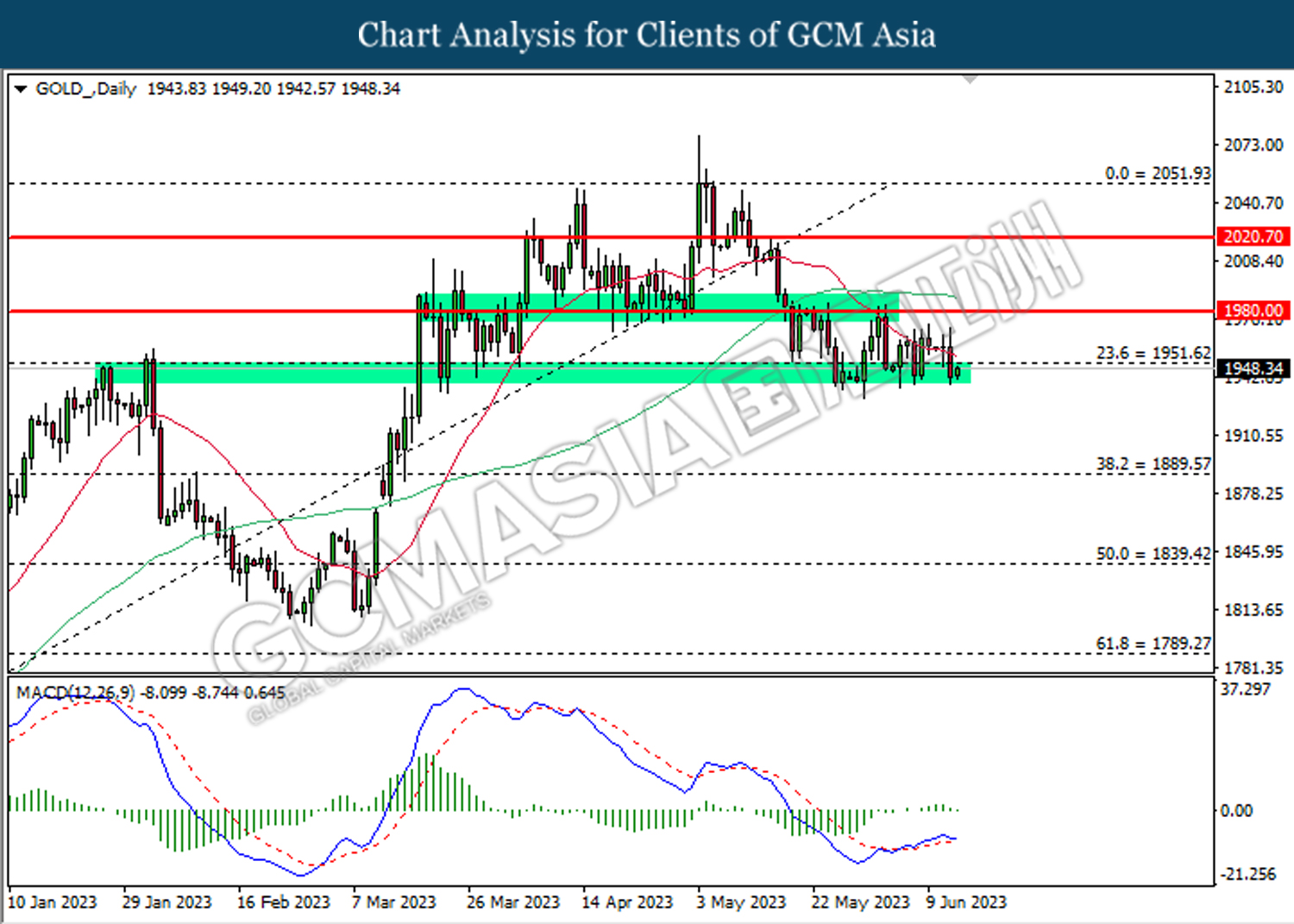

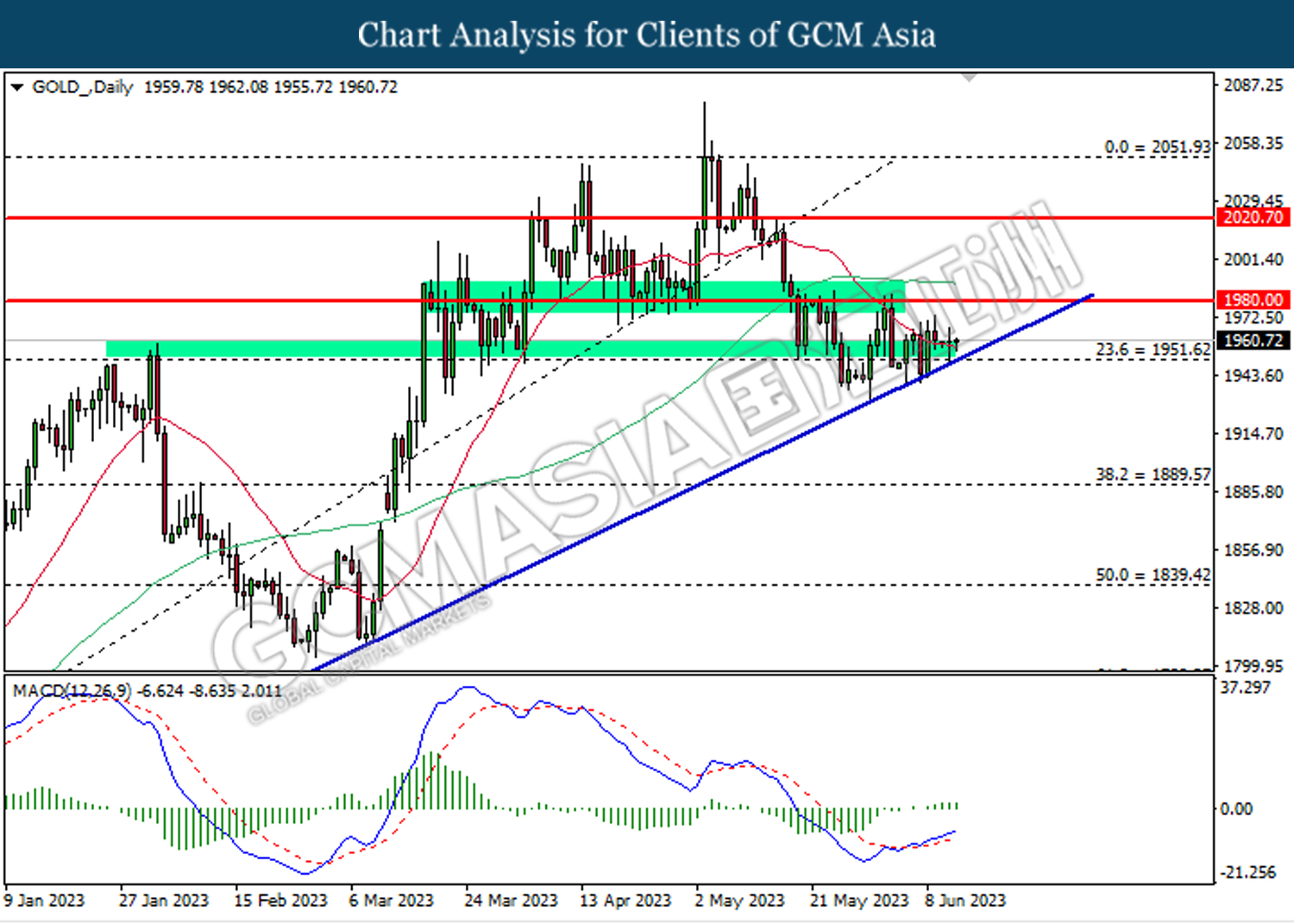

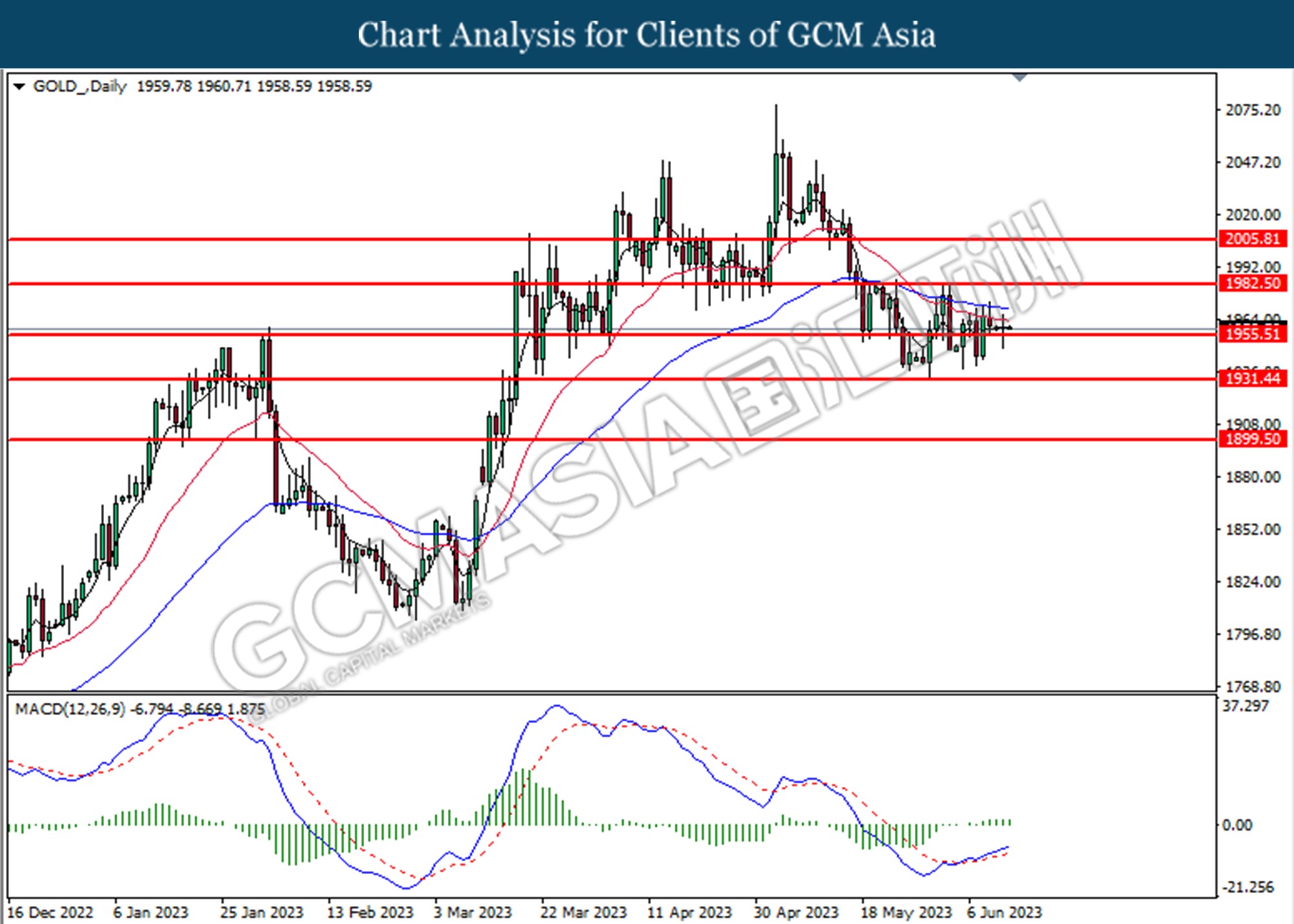

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1939.75. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

220623 Afternoon Session Analysis

22 June 2023 Afternoon Session Analysis

Sterling price jitters as CPI steadily and the economy worsen.

The Pound Sterling, which traded against the dollar index, continued to jitter as the May CPI remained steady as the previous month’s reading, but the economic growth worsened. British headline inflation was unchanged at 8.7% in May compared to April’s data, figures from Office National Statistics showed on Wednesday. Economists polled by Reuters forecast that the annual CPI would drop to 8.4%, but the figures were above economists’ estimation. However, the UK Producer Price Index (PPI) revealed at -1.5% month-on-month in May, slipped more than expected by -0.5%. The ONS said that the fall in input prices was mainly driven by the fall in energy prices. The higher-than-expected CPI prompted investors that the BoE (Bank of England) is under pressure to turn more aggressive. With the CPI remaining steady, the probability of a 5bps hike now stands at 40% from 30%. Nonetheless, the pairs of GBP/USD traded lower following the CPI data revealed. The sterling experience a selloff by global investors after the ONS announced that UK public sector net debt surpassed 100% of gross domestic product (GDP) in May since the year of 1961. Meanwhile, the investors are an eye on BoE monetary policy decisions followed by meeting minutes. As of writing, the GBP/USD ticked down by -0.02% to 1.2769.

In the commodities market, crude oil prices traded lower by -0.30%% to $72.30 per barrel following the prior American Petroleum Institution (API) revealed crude oil inventory surprise dip at -1.246M. Besides, the gold prices appreciated by 0.02% to $1933.11 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day CNY Dragon Boat Festival

Today’s Highlight Events

Time Market Event

16:00 CHF SNB Press Conference

20:00 GBP BOE Inflation Letter

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q2) | 1.50% | 1.75% | – |

| 19:00 | GBP – BoE Interest Rate Decision (Jun) | 4.50% | 4.75% | – |

| 20:30 | USD – Initial Jobless Claims | 262K | 260K | – |

| 22:00 | USD – Existing Home Sales (May) | 4.28M | 4.24M | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | 7.919M | 1.873M | – |

Technical Analysis

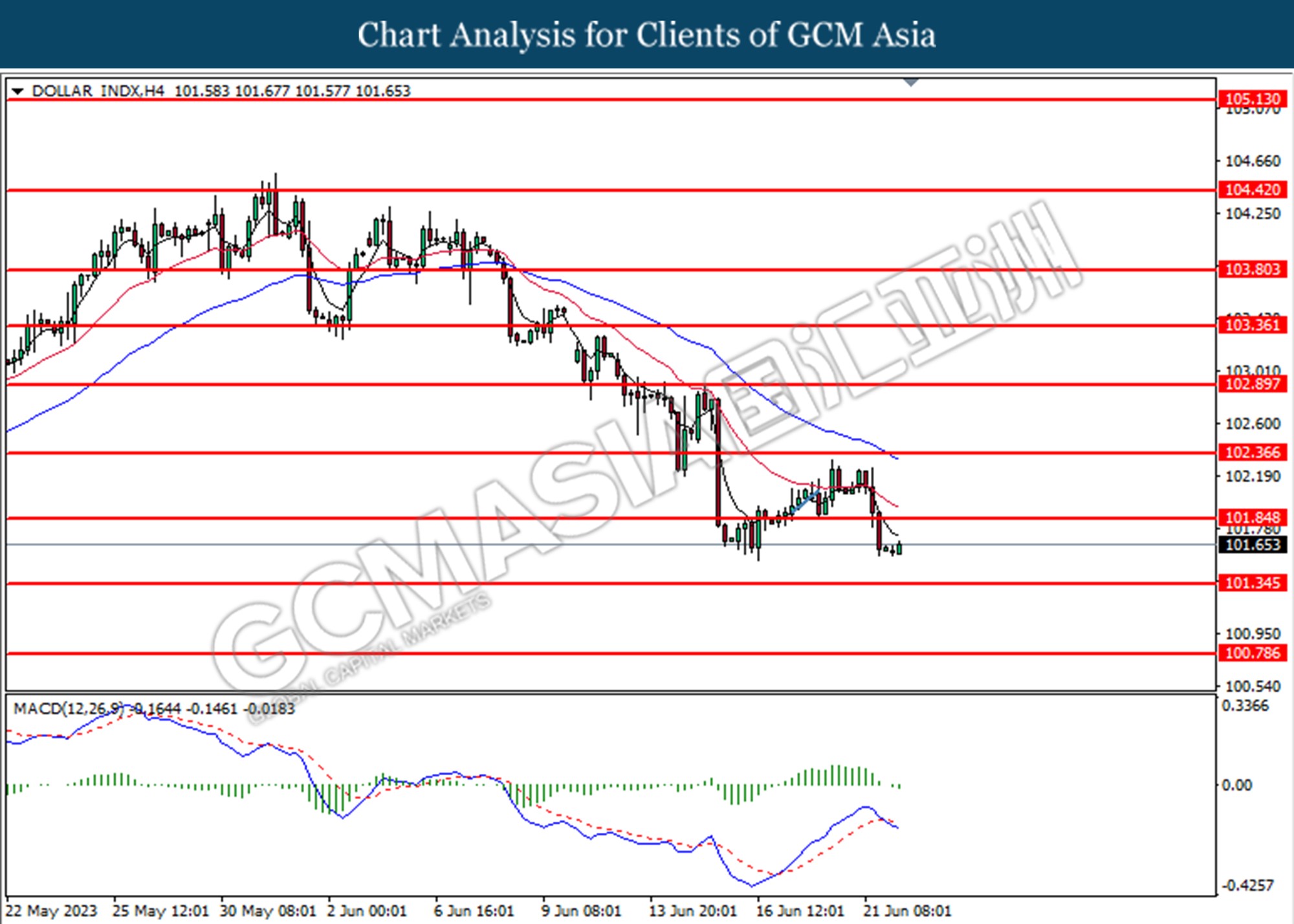

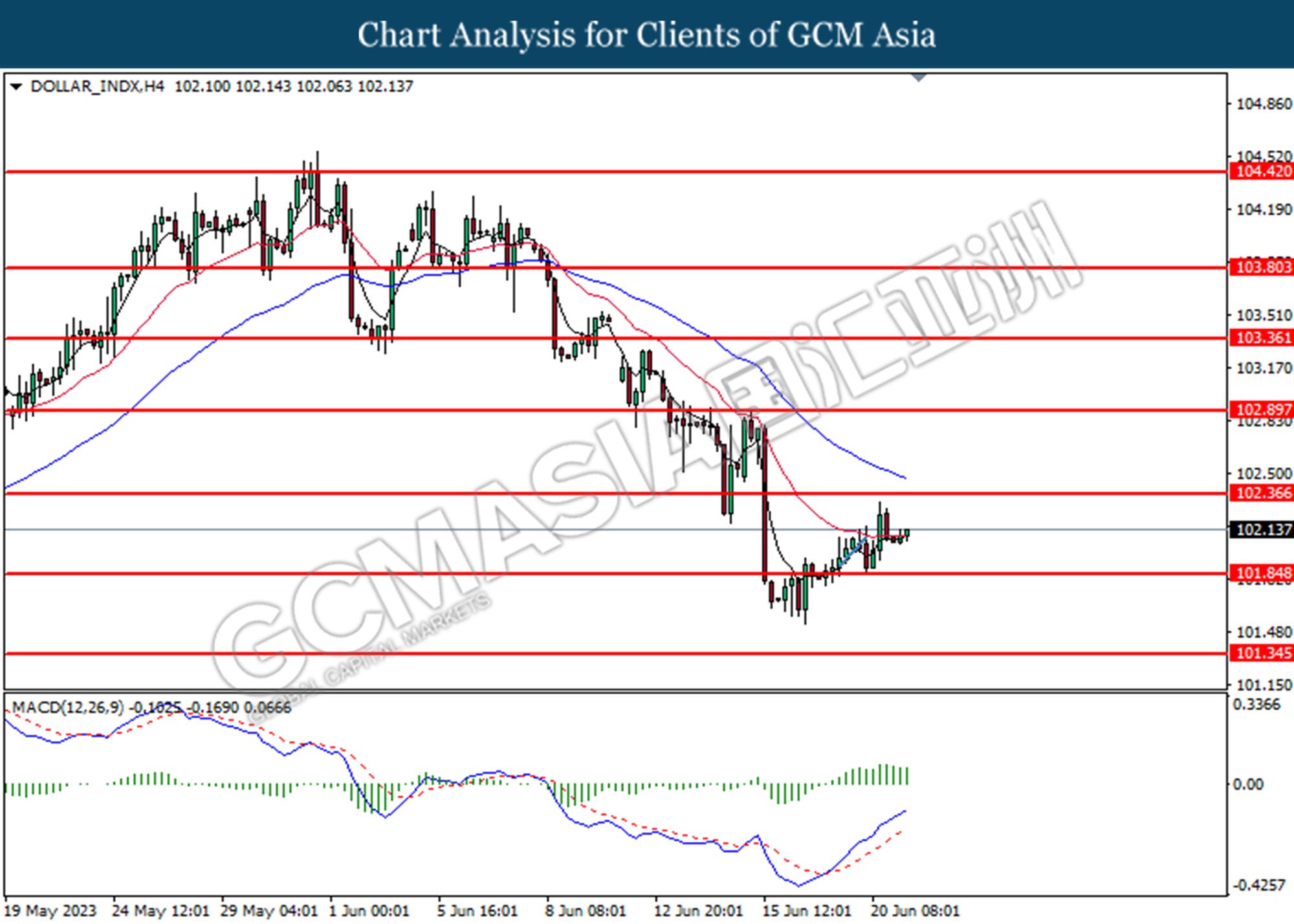

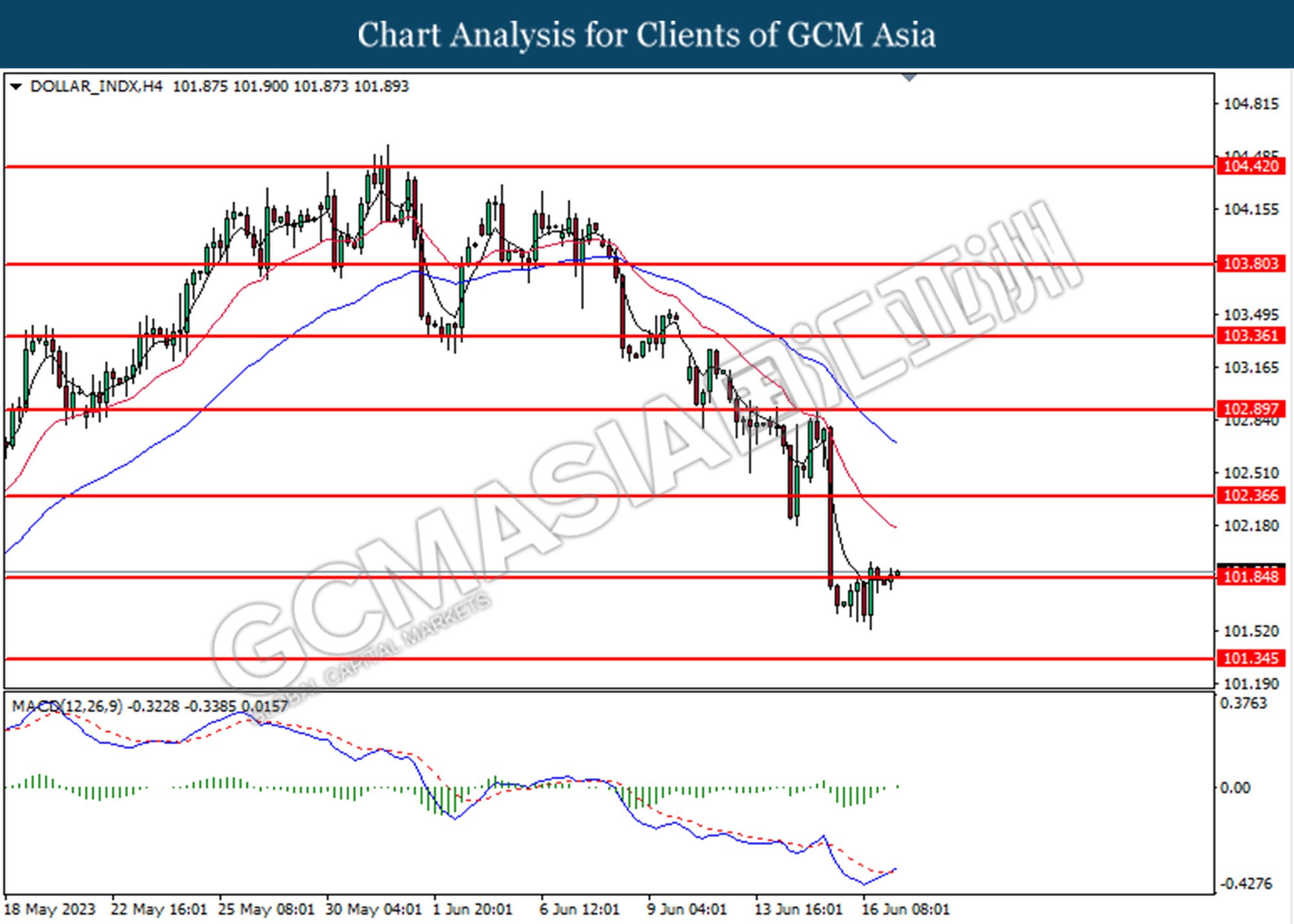

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from lower level. However, MACD which illustrated bearish momentum suggests the index undergoes a technical correction in the short term.

Resistance level: 101.85,102.35

Support level: 101.35, 100.80

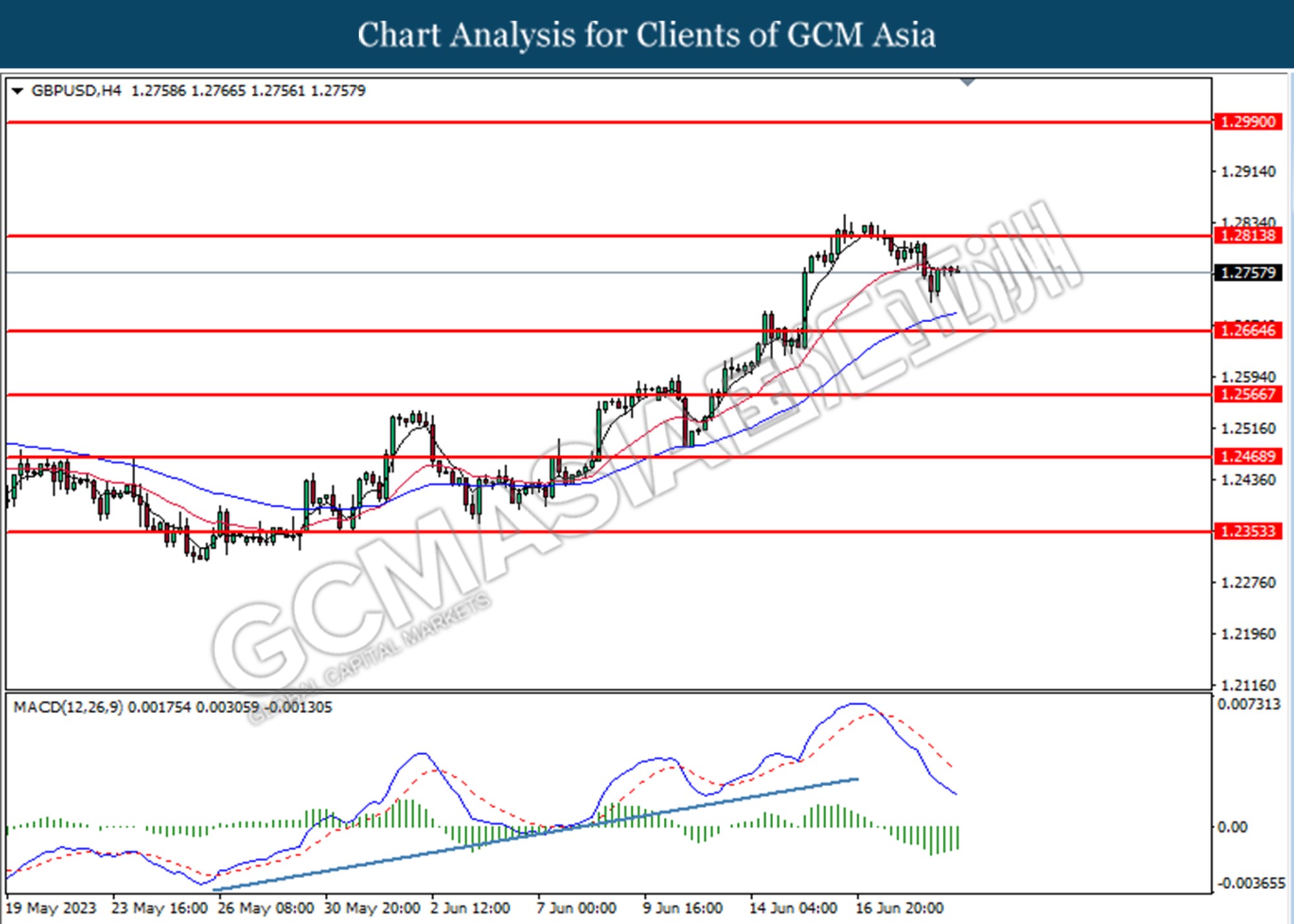

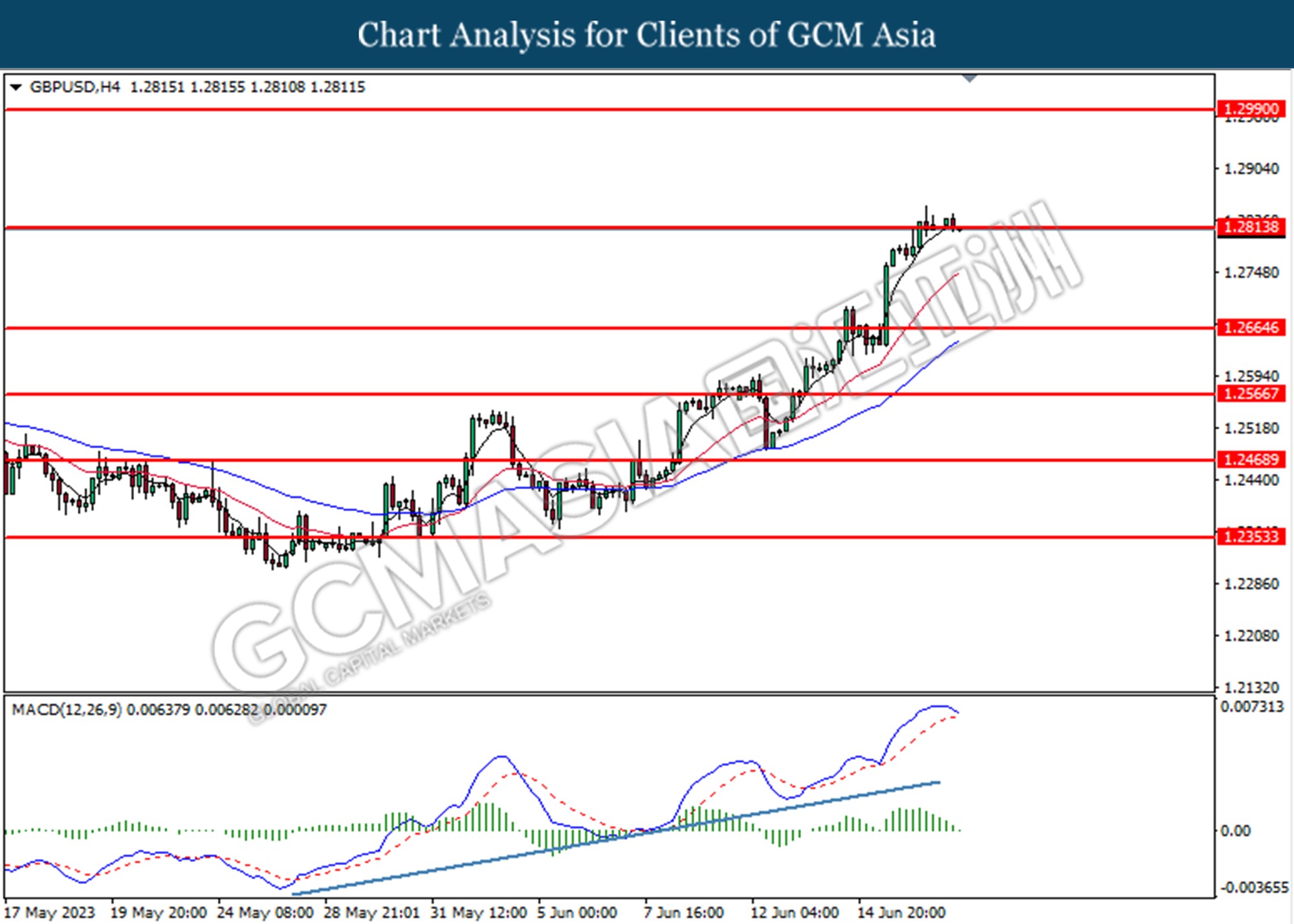

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

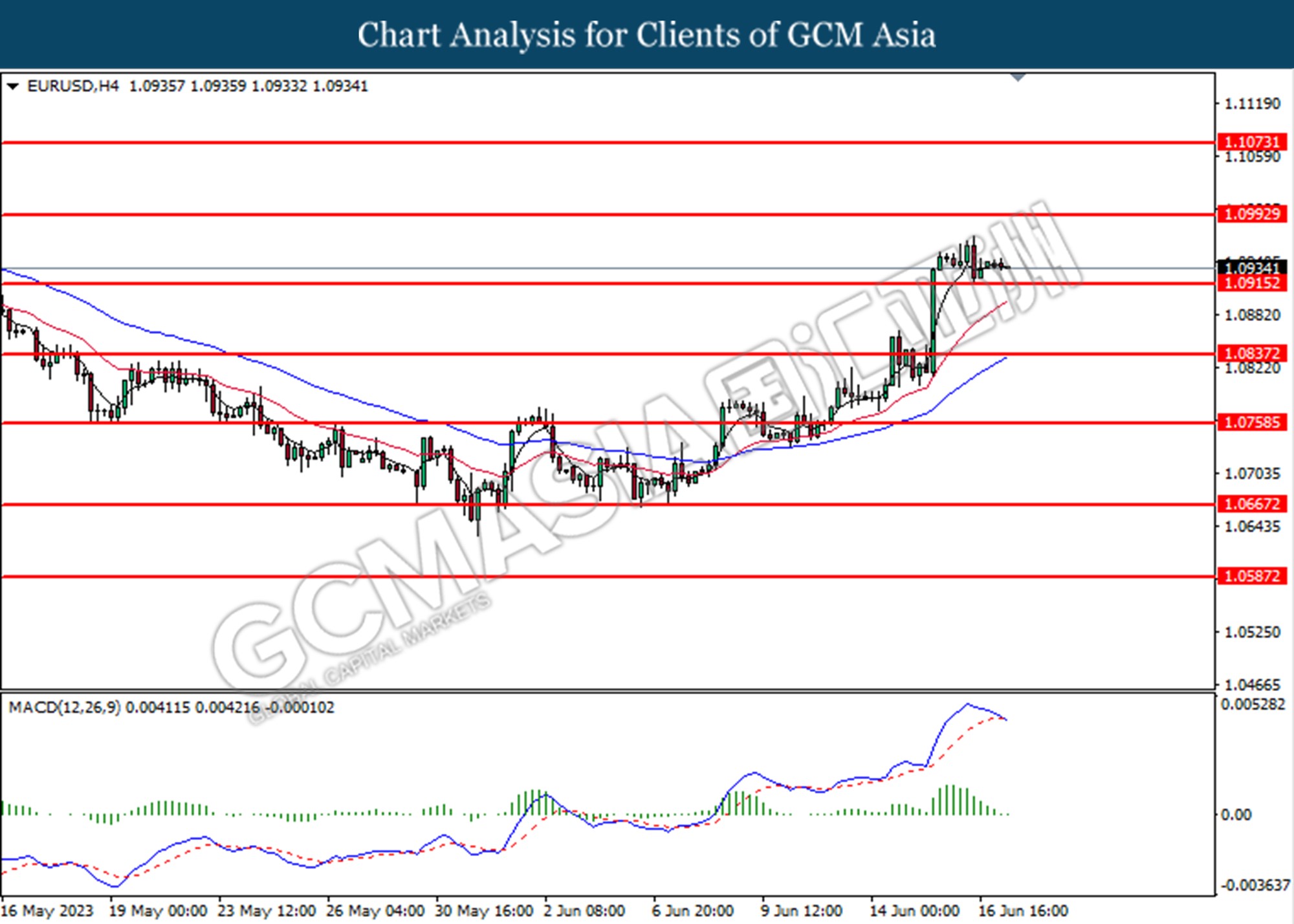

EURUSD, H4: EURUSD was traded lower following the prior retracement from below from the resistance level at 1.0990. However, MACD which illustrated increasing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

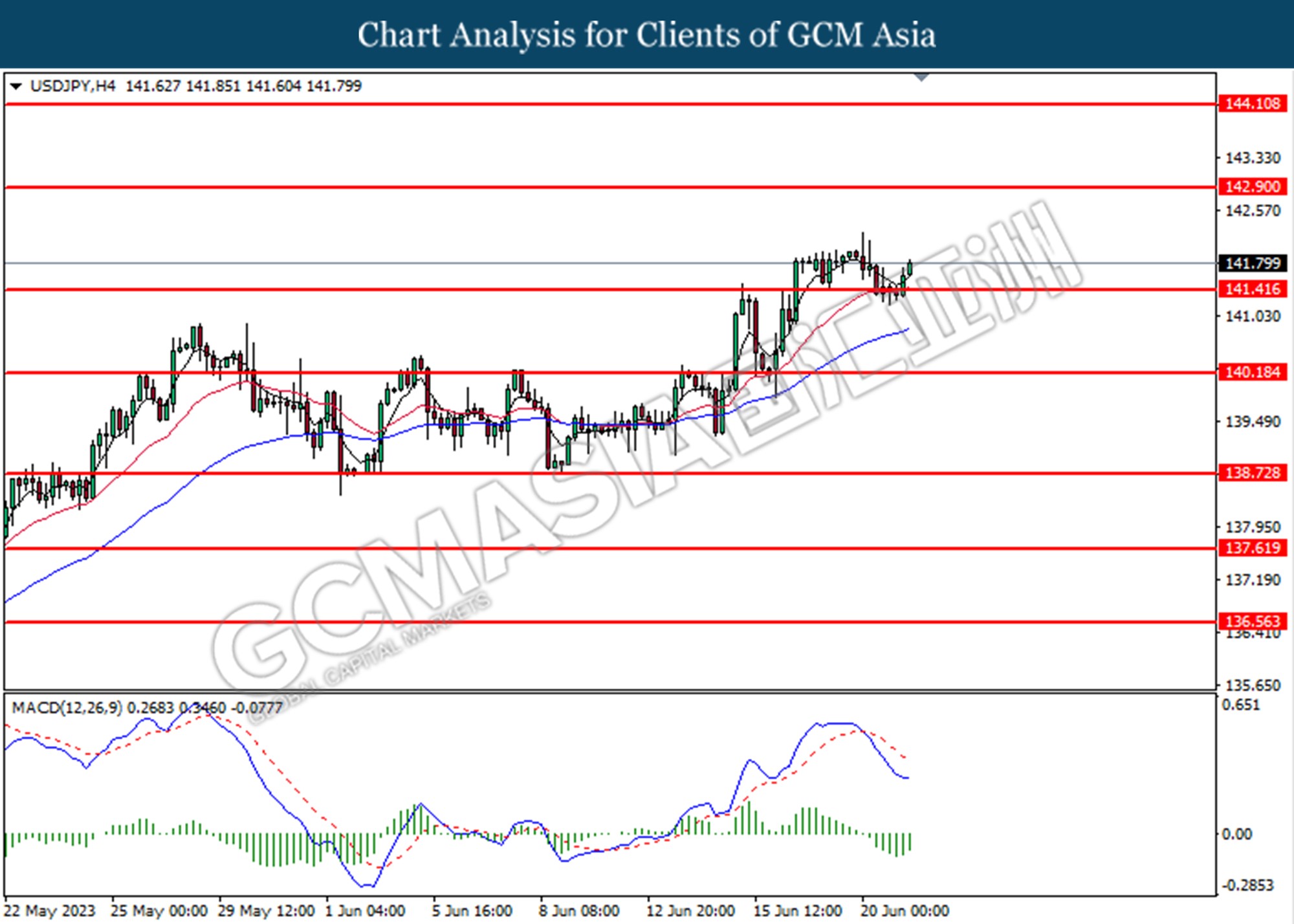

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 142.90, 144.10

Support level: 141.40, 140.20

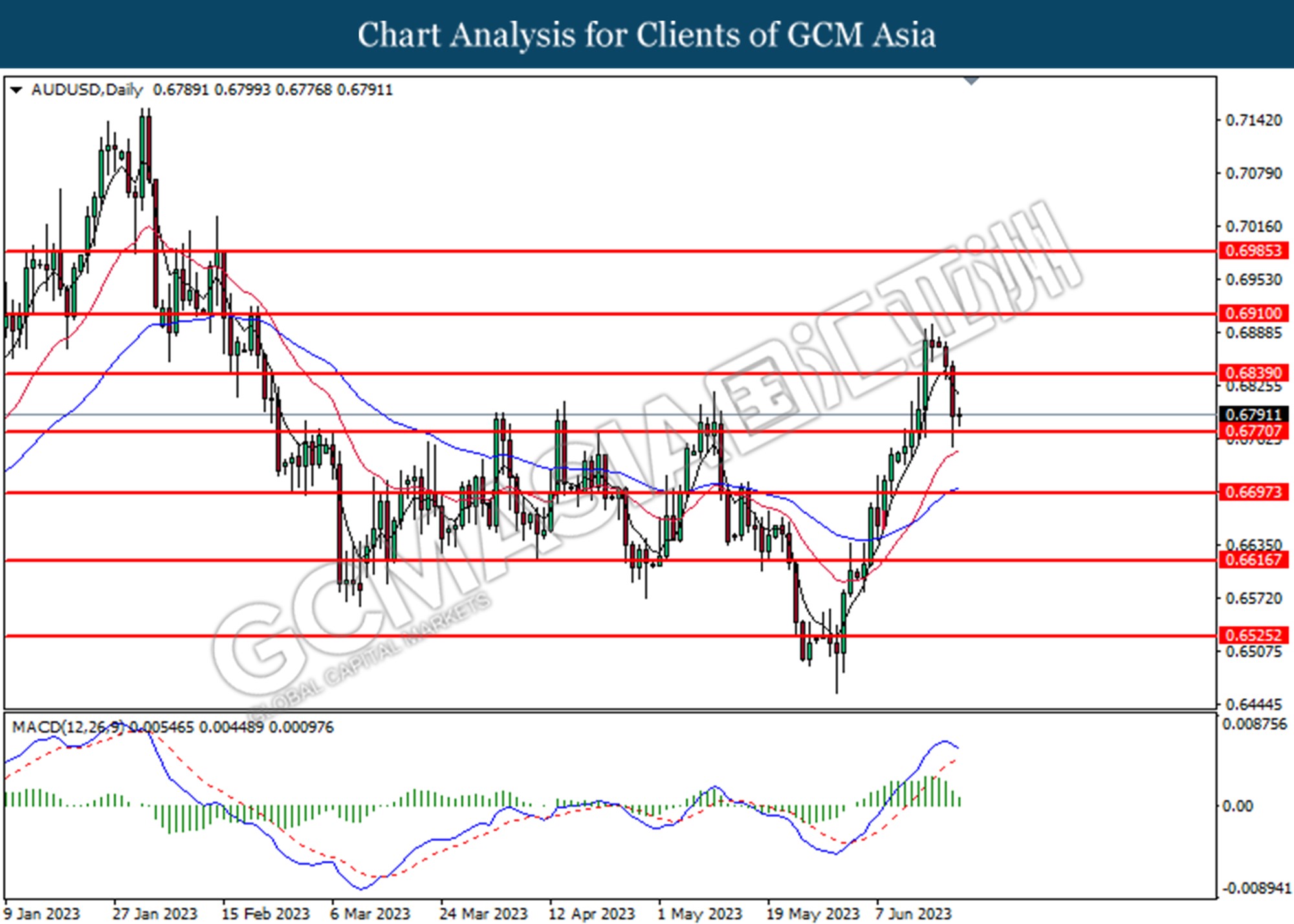

AUDUSD, H4: AUDUSD was traded lower following the prior breaks below from the previous support level at 0.6770. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

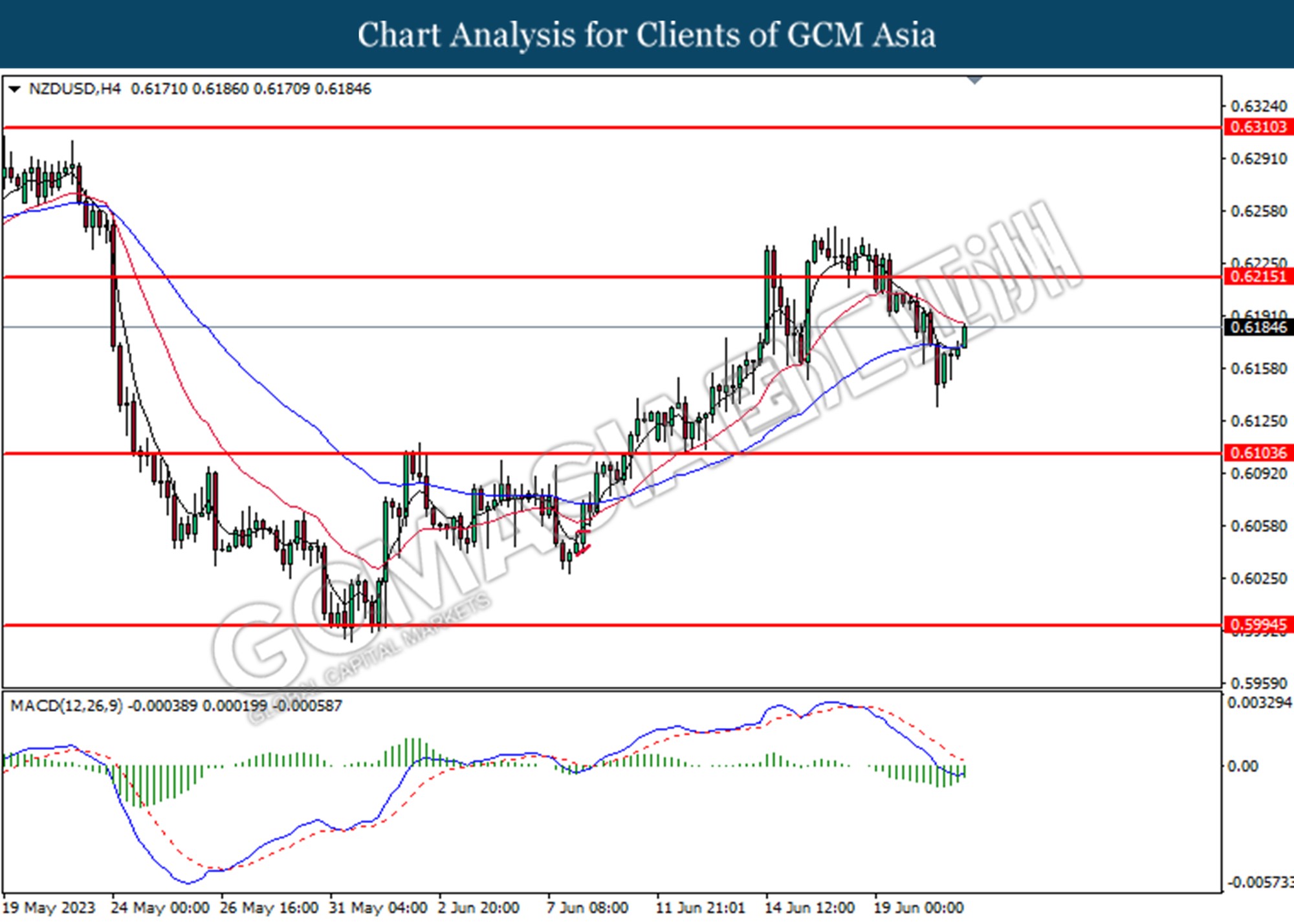

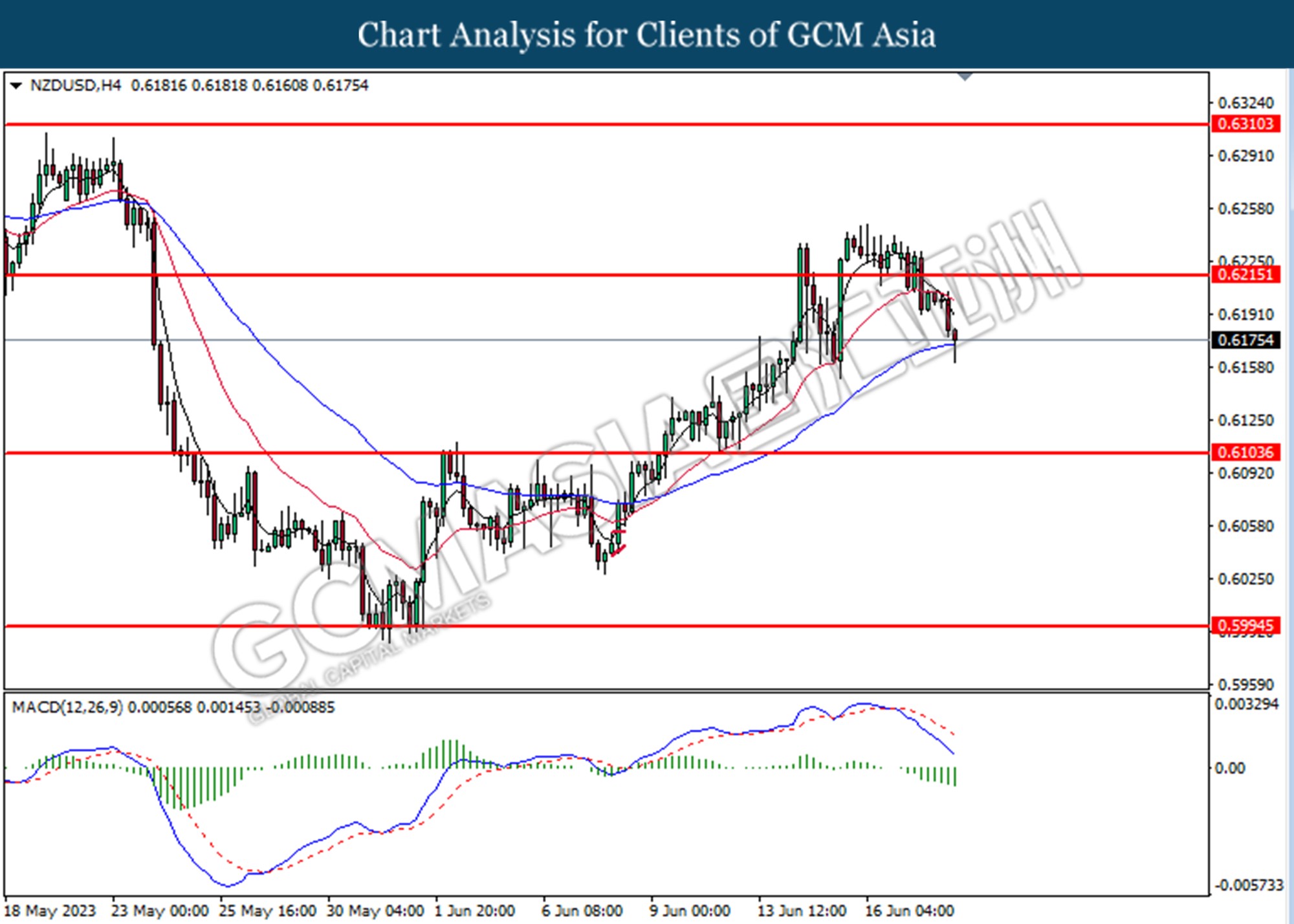

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6215. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

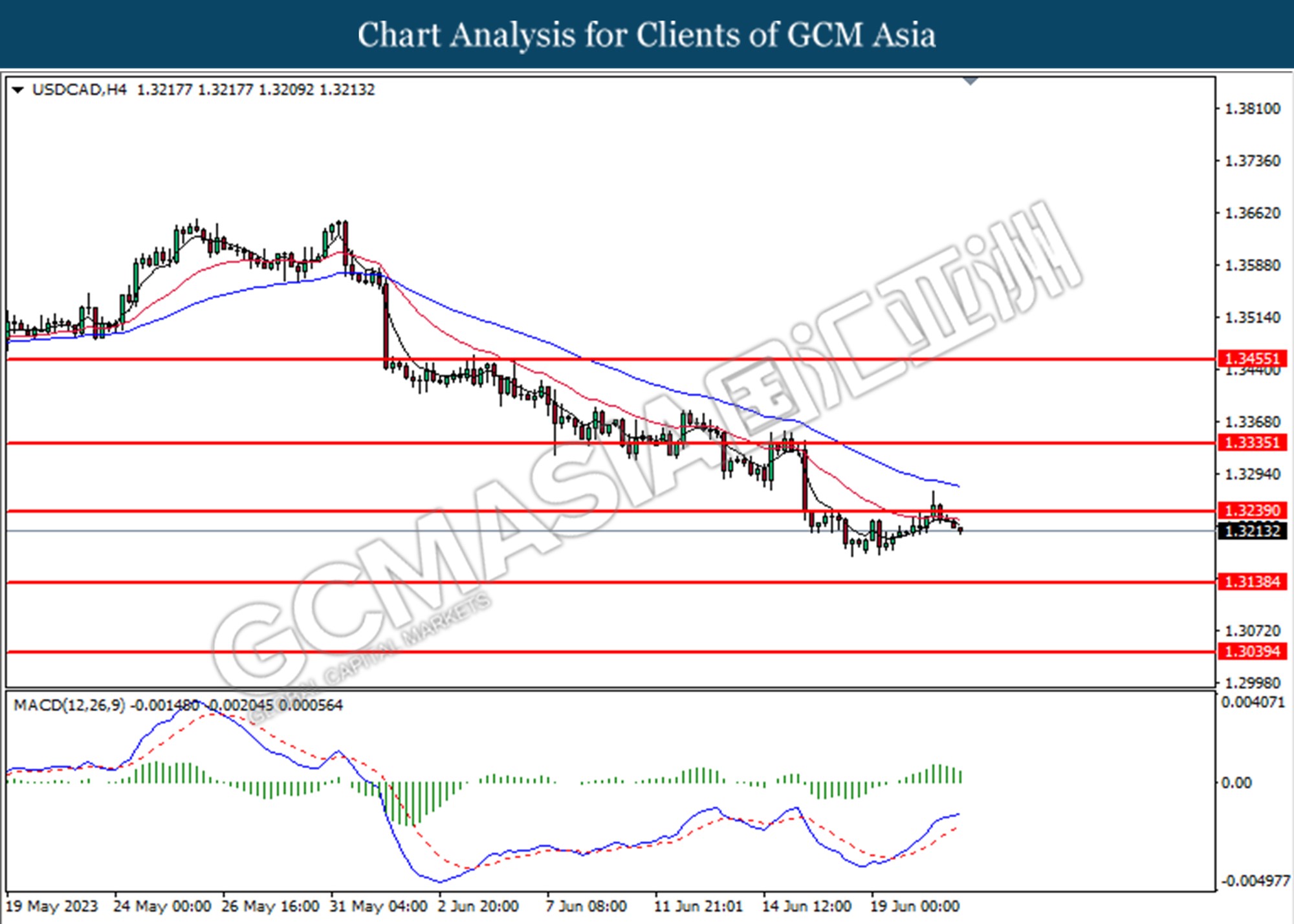

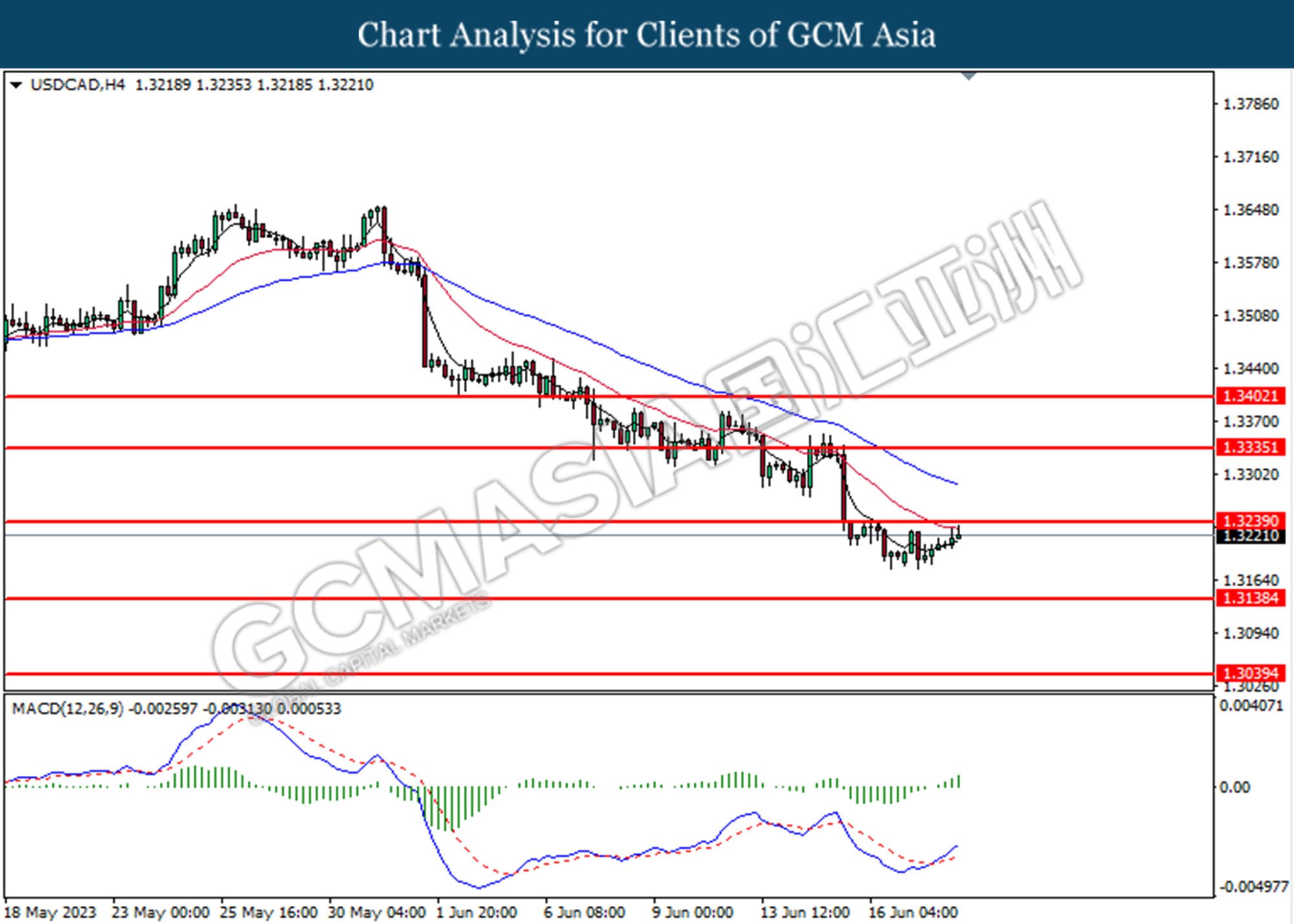

USDCAD, H4: USDCAD was traded lower following the prior retracement from the resistance level at 1.3240. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.3140.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

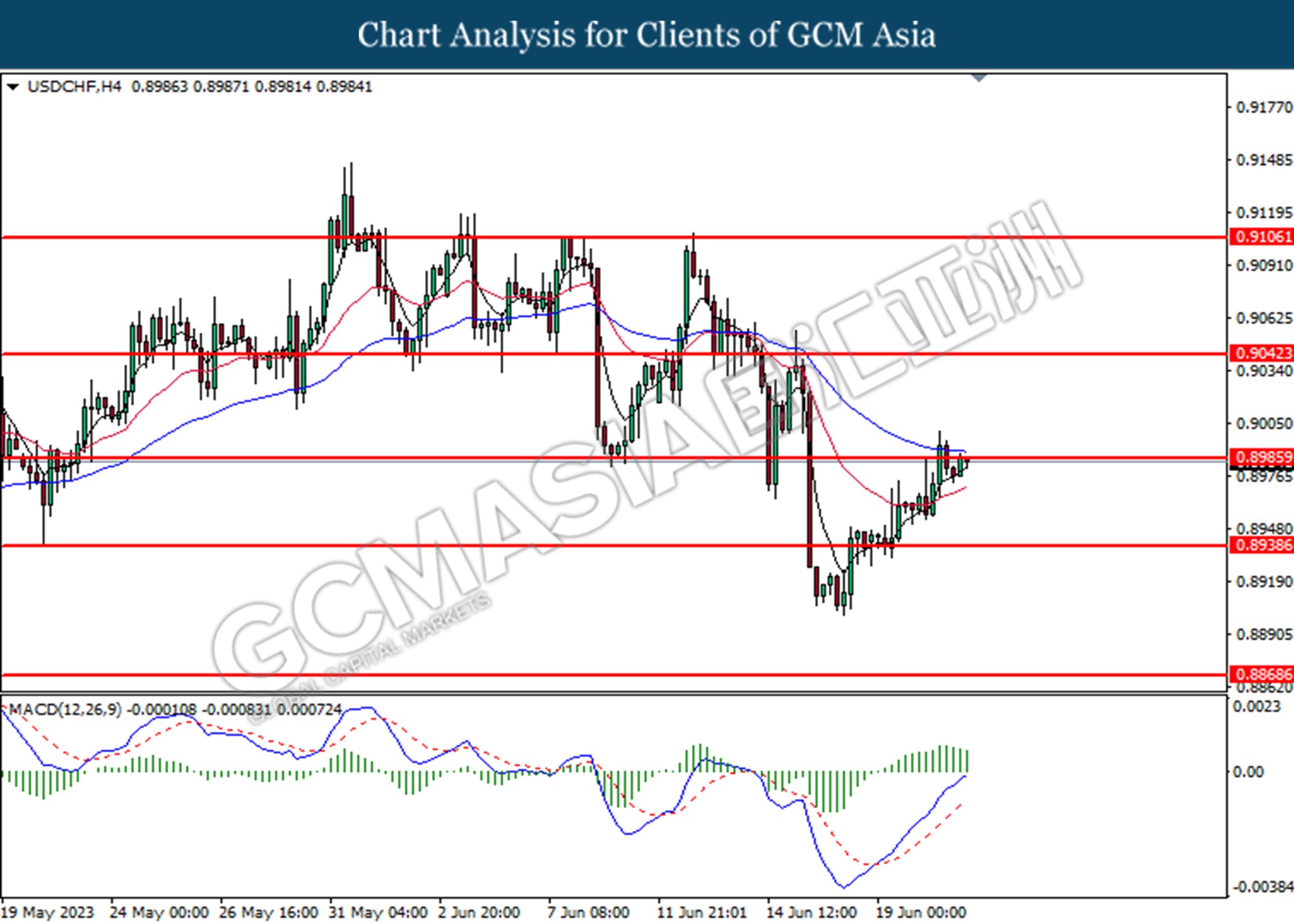

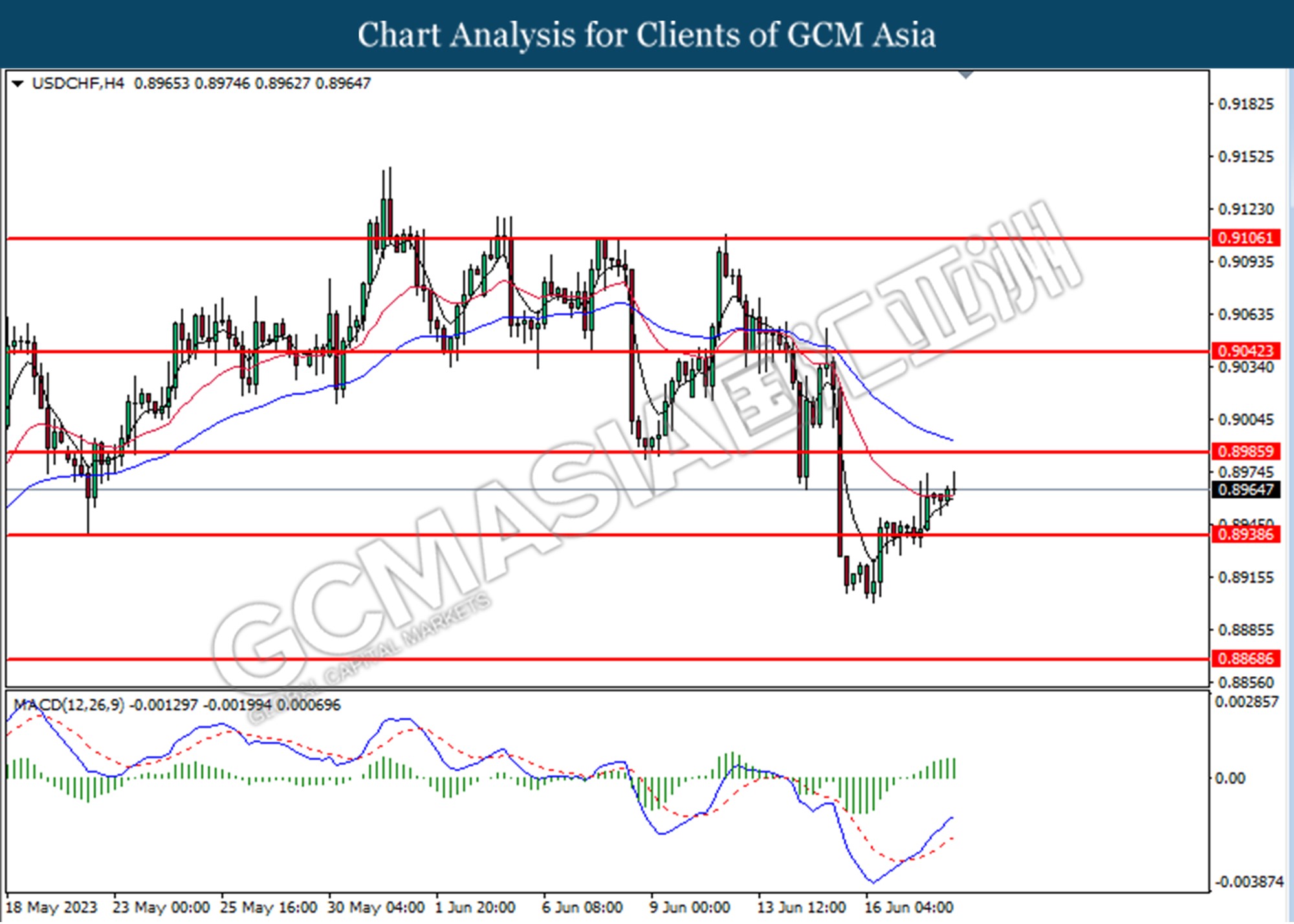

USDCHF, H4: USDCHF was traded lower following the prior breaks below the previous support level at 0.8940. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8940, 0.8985

Support level: 0.8870, 0.8820

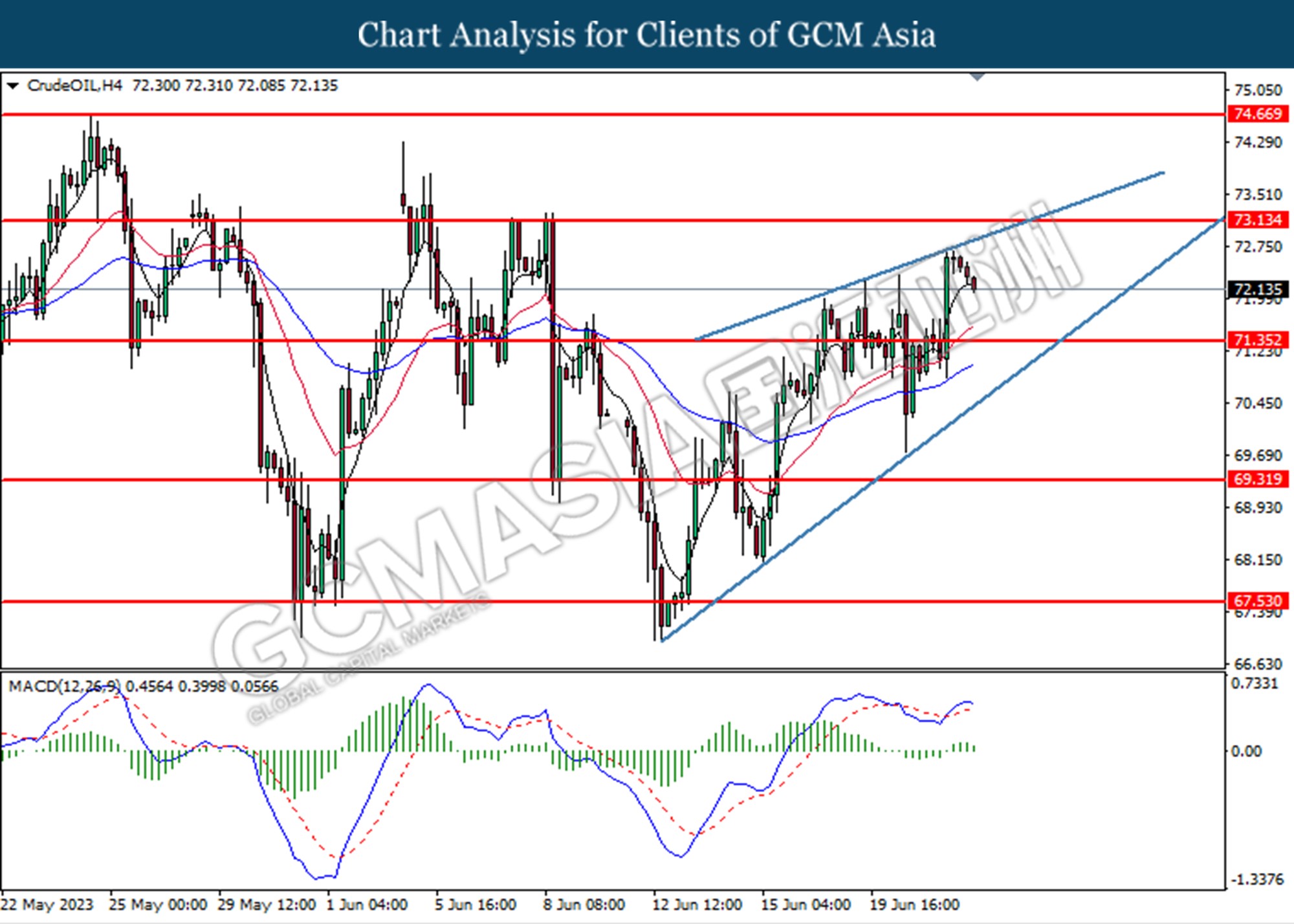

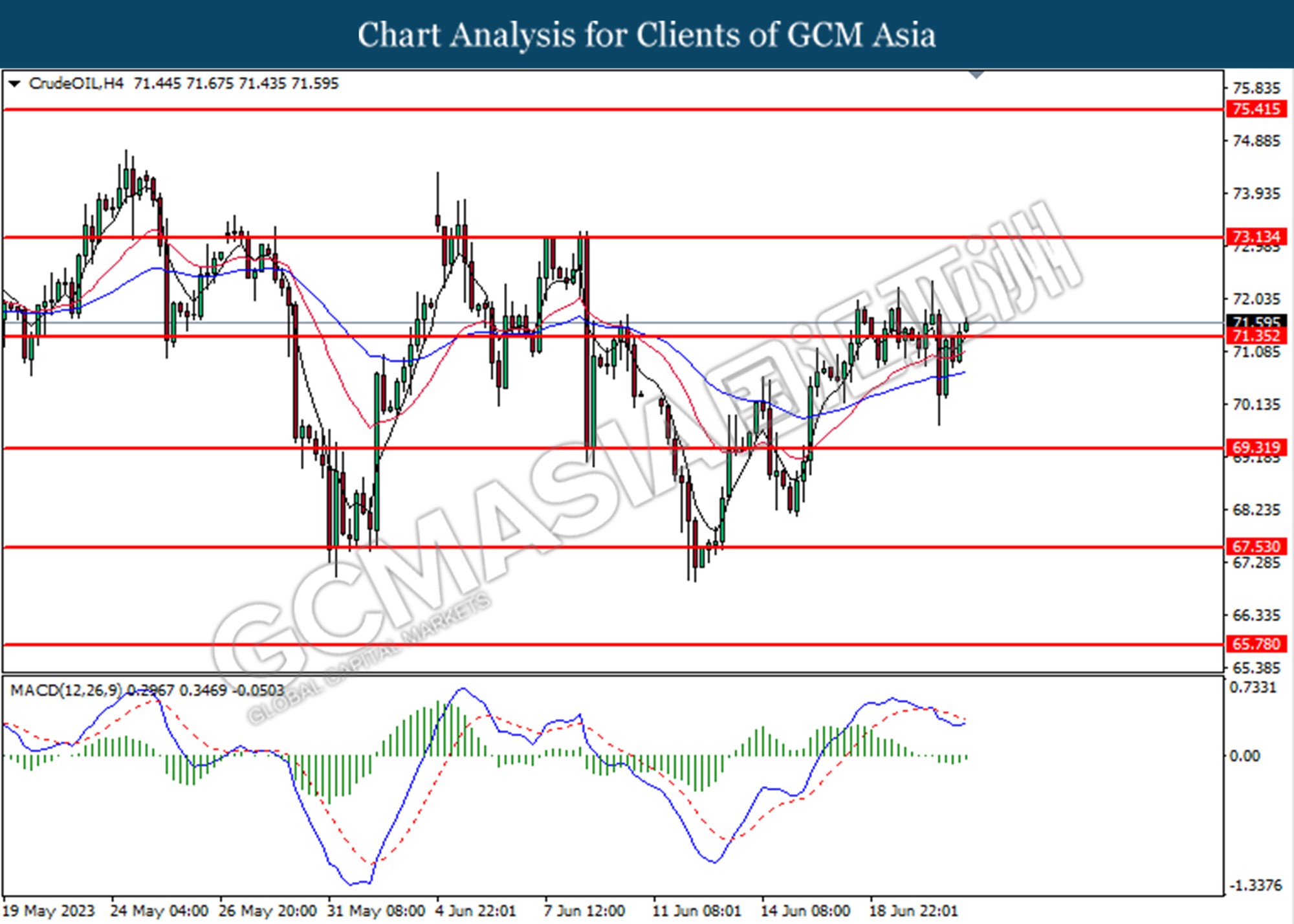

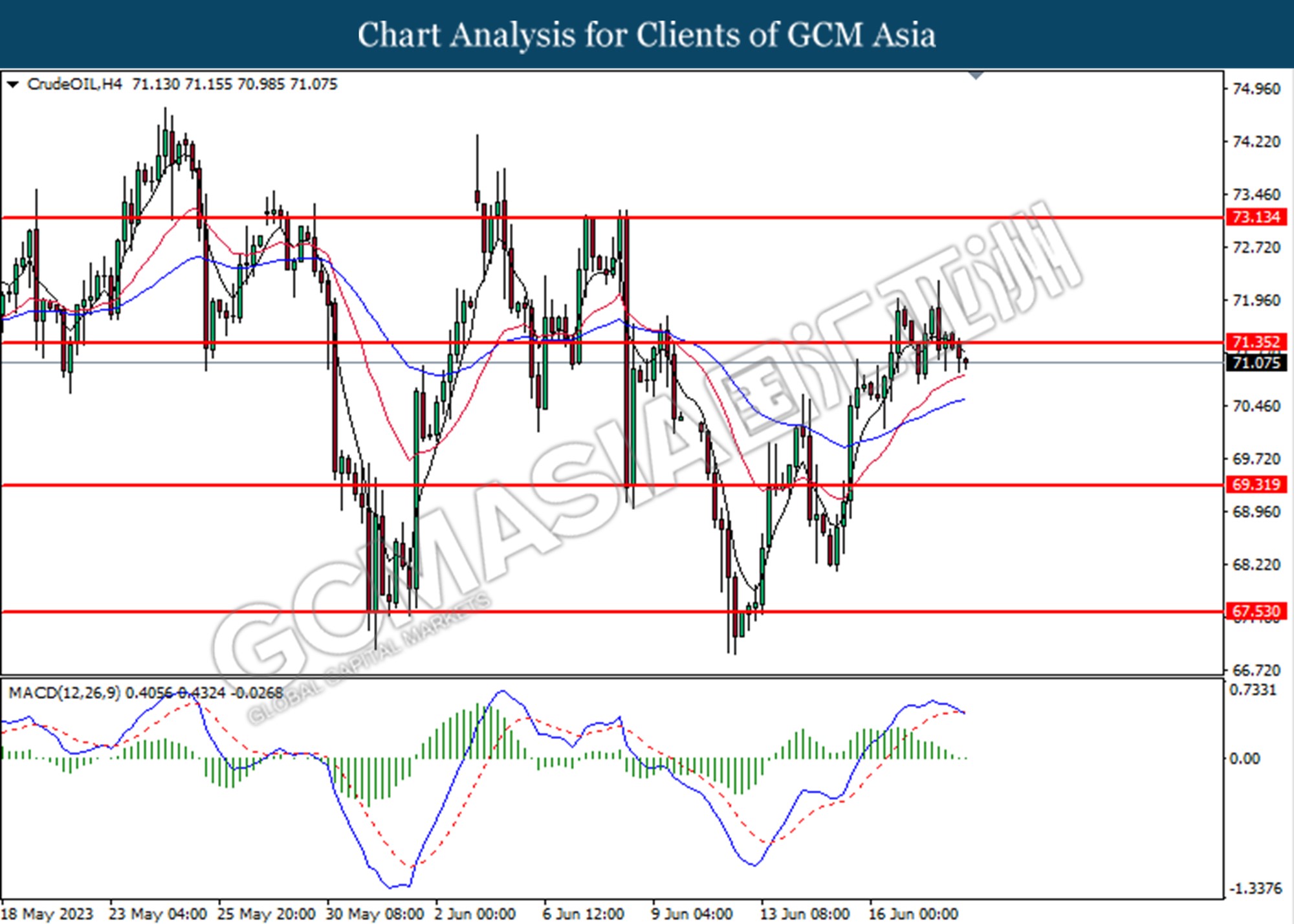

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 71.35.

Resistance level: 73.15, 75.40

Support level: 71.35, 69.30

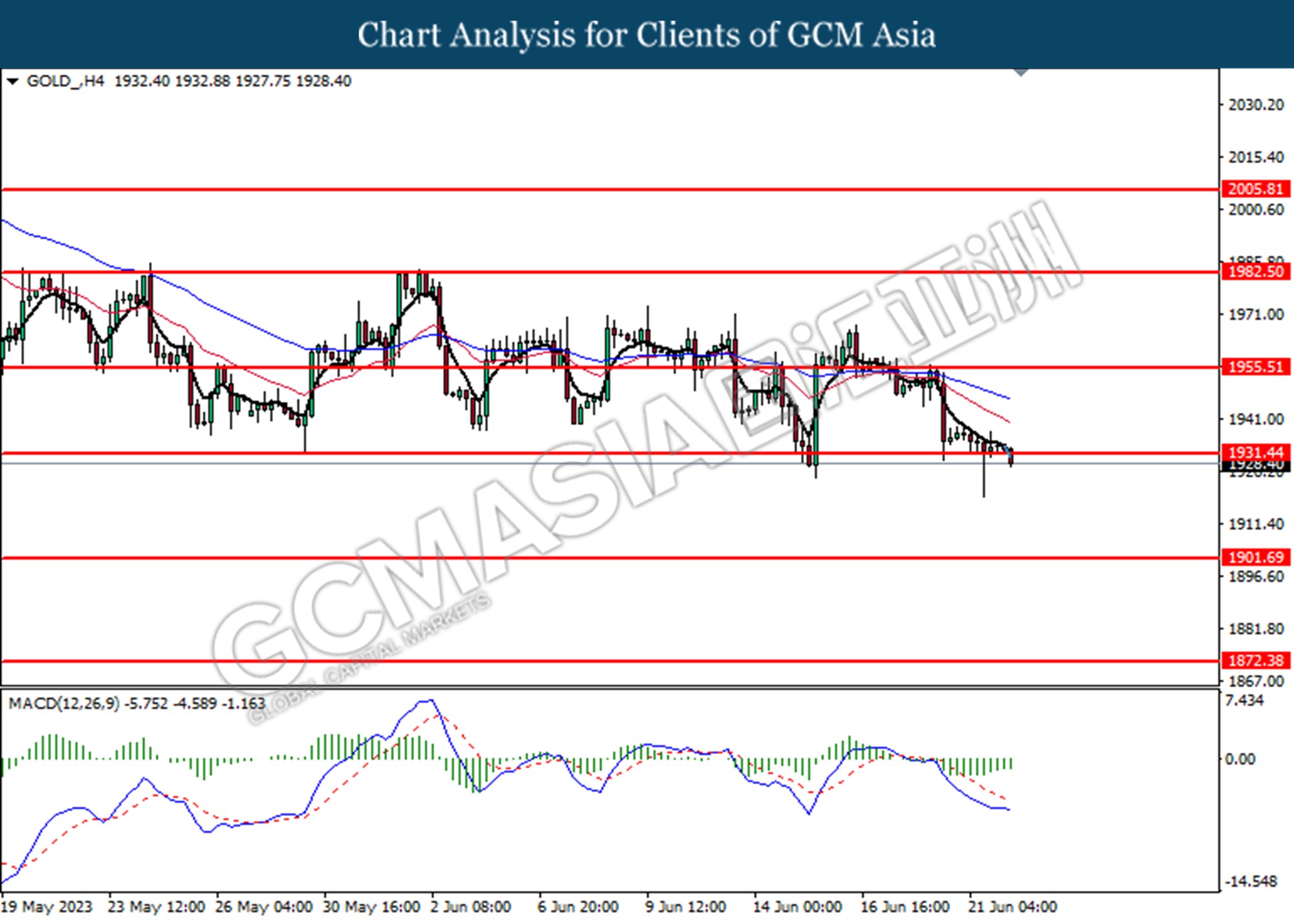

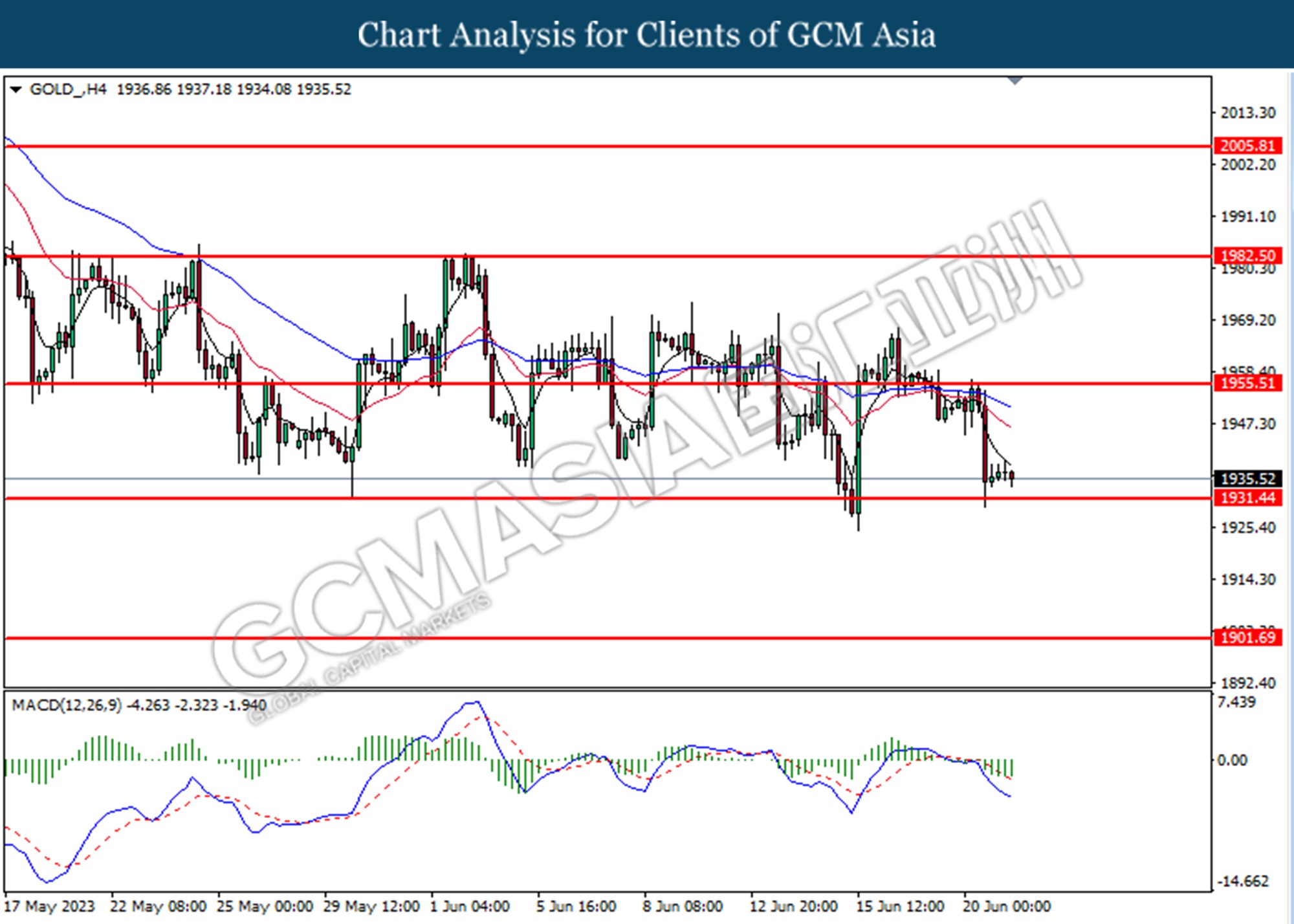

GOLD_, H4: Gold price was traded lower following the prior breaks below from the previous support level at 1931.45. However, MACD which illustrated diminishing bearish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 1931.45, 1955.50

Support level: 1901.70, 1872.40

220623 Morning Session Analysis

22 June 2023 Morning Session Analysis

Greenback slumped despite Powell hawkish statement.

The dollar index, which was traded against a basket of six major currencies, reverted back to its downward trend as Powell testimony failed to satisfy the expectation of hawks. Yesterday, Federal Reserve Chair Jerome Powell testified before the House Financial Services Committee on as part of his semiannual report to both chambers of Congress. In the testimony, Jerome Powell highlighted that the inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go. With that, it signaled that more rate hikes or at least holding the rate at high level will be on the next meeting’s table. However, the hawkish comments from Powell did not hype up the market as the investors have been bracing for a continuous rate hike in the upcoming meeting. Nonetheless, the Fed are still data-dependent where their approaches could be changed if the inflation turns out to be getting closer to their long term target, said by Jerome Powell. Besides, he also reiterated that the household and businesses are also facing the headwinds which created by the stress in the financial sector. As of writing, the dollar index dropped -0.45% to 102.10.

In the commodities market, crude oil prices up by 2.30% to $72.40 per barrel as the weakening of dollar index fueled stronger demand in the oil market. Besides, the gold prices edged up by 0.02% to $1933.10 per troy ounce as the less-hawkish remarks from Jerome Powell disappointed the market participants.

Today’s Holiday Market Close

Time Market Event

All Day CNY Dragon Boat Festival

Today’s Highlight Events

Time Market Event

16:00 CHF SNB Press Conference

20:00 GBP BOE Inflation Letter

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q2) | 1.50% | 1.75% | – |

| 19:00 | GBP – BoE Interest Rate Decision (Jun) | 4.50% | 4.75% | – |

| 20:30 | USD – Initial Jobless Claims | 262K | 260K | – |

| 22:00 | USD – Existing Home Sales (May) | 4.28M | 4.24M | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | 7.919M | 1.873M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2765. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0915. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded lower while currently testing support level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3170. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3245, 1.3330

Support level: 1.3170, 1.3065

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8980. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8835.

Resistance level: 0.8980, 0.9140

Support level: 0.8835, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1939.75. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

210623 Afternoon Session Analysis

21 June 2023 Afternoon Session Analysis

The Yen depreciates following the BoJ minutes release

The Japanese Yen, which was traded against the dollar index, slipped after the Bank of Japan (BoJ) release meeting minutes. Investors’ expectations for BOJ rate hikes drop sharply after meeting minutes. The board member expressed the view that inflation was likely to decline temporarily, overseas economies remain uncertain and it was difficult to assess the sustainability of future wage hikes. Japan won’t be able to maintain 2% inflation target without big wage hikes. Although wages were projected to raise more than expected, the board members voted for the central bank to continue to support momentum for wage hikes by maintaining monetary easing. Furthermore, the BoJ will continue its Yield Curve Control (YCC) to maintain its long-term bond yield at 0% to 1%. By largely purchasing the Japanese Government Bond (JGB), the bond price increase and the bond yield decrease. This allows companies to further stimulate the economy by issuing new bonds at lower rates, using JGB yields as a reference rate. With such a backdrop, the Yen extended its losses against the dollar index. As of writing, the USD/JPY edged up by 0.12% to 141.62.

In the commodities market, crude oil prices shrug by 0.44% to $71.50 per barrel as traders weighed on China rate cuts and Fed Powell’s testimony. Besides, the gold prices traded up by 0.05% to $1937.26 per troy ounce ahead of Powell’s testimony approaches.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 04:30

(22th) |

CrudeOIL – API Weekly Crude Oil Stock | 1.024M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from lower level. MACD which illustrated bullish momentum suggests the index extended its gains toward the resistance level at 102.35.

Resistance level: 102.35, 102.90

Support level: 101.85, 101.35

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

EURUSD, H4: EURUSD was traded lower following the prior breaks below from the previous support level at 1.0915. MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

USDJPY, H4: USDJPY was traded higher following the prior rebound from the support level at 141.40. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 142.90, 144.10

Support level: 141.40, 140.20

AUDUSD, Daily: AUDUSD was traded lower following the prior breaks below from the previous support level at 0.6840. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6770.

Resistance level: 0.6840, 0.6910

Support level: 0.6770, 0.6700

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6215.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded lower following the prior retracement from the resistance level at 1.3240. MACD which illustrated diminishing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.8985. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes technical correction in a short term.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded higher following the prior breakout above the previous resistance level at 71.35. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 73.15, 75.40

Support level: 71.35, 69.30

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 1955.50, 1982.50

Support level: 1931.45, 1901.70

210623 Morning Session Analysis

21 June 2023 Morning Session Analysis

US Dollar surged ahead of Jerome Powell’s testimony.

The dollar index, which was traded against a basket of six major currencies, bounced off from the 6-week lows as investors are awaiting Federal Reserve Chairman Jerome Powell’s testimony before Congress later this week for clues on the outlook for monetary policy. Back at the Fed’s Press Conference last week, the Chairman of Fed Jerome Powell reiterated its hawkish stance regarding the monetary policy outlook, where he signalled more rate hikes may be coming later this year. Although Jerome Powell expressed optimism about the fight against inflation, he ruled out the possibility of cutting interest rates in a couple of years until inflation comes down significantly. With that, investors are eyeing the upcoming Jerome Powell’s speech if he will still maintain his view that the central bank is not done raising interest rates to keep inflation in check. On top of that, US Census Bureau posted stronger-than-expected housing data yesterday, triggering some buying momentum in the dollar market. According to the data, the US Building Permit was up from 1.147M to 1.491M, slightly higher than the consensus forecast at 1.425 M. As of writing, the dollar index ticked down -0.01% to 102.50.

In the commodities market, crude oil prices dropped by -0.02% to $70.75 per barrel as the strengthening of the US dollar weighed on the black commodity. Besides, the gold prices edged up by 0.12% to $1938.60 per troy ounce following the slight retracement of the US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (May) | 8.7% | 8.5% | – |

| 04:30

(22th) |

CrudeOIL – API Weekly Crude Oil Stock | 1.024M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2765. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded lower while currently testing support level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3170. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3170, 1.3065

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8835, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1939.75. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1951.60, 1980.00

Support level: 1939.75, 1889.55

200623 Afternoon Session Analysis

20 June 2023 Afternoon Session Analysis

Aussie moves lower following RBA minutes.

The Aussie, which was traded against the dollar index, slipped following the Reserve Bank of Australia (RBA) released the meeting minutes. Investors choose to take profits as RBA gives simulated ambiguous monetary policy direction. The minutes from the reserve bank’s last meeting resulted in 25 basis points increase to 4.1% to tame high inflation in Australia. The inflation rate had continued to decline as energy prices fall and food price inflation eased, the headline inflation is well above the central bank target. However, growth in economic activity in Australia has been dampened by lower consumer spending and a sharp tightening of monetary policy, dividing RBA members over a rate hike. The board members discussed the imbalance of household spending, noting that some households have tapped into large amounts of extra savings accumulated during the pandemic, while others have faced considerable budget constraints. Nonetheless, the rebounding of housing markets and stronger-than-expected workforce has prompted expectations of further rate hikes. As of writing, the AUD/USD traded down by -0.70% to 0.6800.

In the commodities market, crude oil prices dropped by -0.20% to $71.20 per barrel as investors weighed on oil to China’s economic concerns. Besides, the gold prices edged down by -0.06% to $1948.99 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (May) | 1.417M | 1.435M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the index extended its gains toward the resistance level.

Resistance level: 102.40, 102.90

Support level: 101.85, 101.35

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

EURUSD, H4: EURUSD was traded higher following the prior rebound from the support level at 1.0915. However, MACD which illustrated increasing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0640

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggest the pair undergoes a technical correction in a short term.

Resistance level: 142.90, 144.10

Support level: 141.40, 140.20

AUDUSD, H4: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6840. MACD which illustrated increasing bearish momentum suggest the pair extended its losses toward the support level at 0.6770.

Resistance level: 0.6840, 0.6910

Support level: 0.6770, 0.6700

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bullish momentum suggest the pair extended its losses toward the support level.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3240.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggest the pair extended its gains toward the resistance level at 0.8985.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded lower following the prior breakout below the previous support level at 71.35. MACD which illustrated diminishing bullish momentum suggest the commodity extended its losses toward the support level.

Resistance level: 71.35, 73.15

Support level: 69.30, 67.55

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 1955.50, 1982.50

Support level: 1931.45, 1901.70

200623 Morning Session Analysis

20 June 2023 Morning Session Analysis

US dollar remained silent amid Juneteenth holiday.

The dollar index, which was traded against a basket of six major currencies, lingered near the 6-week low as the Americans are enjoying the Juneteenth holiday, which resulted into lower volumes and less big movement in the forex trading. Also, with the Juneteenth holiday, the stock market in the US remained closed. Hence, the investors are basically awaiting for the upcoming crucial event of this week, such as several speeches from the Fed officials, including the chairman of Fed Jerome Powell. A clearer picture could be provided to the investors regarding how the member’s view the current economic situation and also their outlook on the interest rate path. On top of that, the investor were also eyeing on the meeting between U.S. Secretary of State Antony Blinken and Chinese President Xi Jinping. During the meeting, the Chinese President said that the world needed a “generally stable” China-U.S. relationship, especially after a period of simmering tensions. Besides, US also agreed on the need for the U.S. and China to stabilize bilateral ties. As a result, the first U.S. Secretary of State visit after five years to China could have paved the way for a November meeting between Biden and Xi, orientating to reduce the geopolitical tensions and consolidate bilateral relations. As of writing, the dollar index rose by 0.23% to 102.48.

In the commodities market, crude oil prices dropped by -0.20% to $71.20 per barrel as the strengthening of US dollar sparked bearish pressures on the black commodity. Besides, the gold prices edged down by -0.05% to $1951.65 per troy ounce amid the optimism of Blinken’s trip to China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (May) | 1.417M | 1.435M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2765. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 0.6925.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated bullish bias momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3170. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3170, 1.3065

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8835, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1951.60. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75

190623 Afternoon Session Analysis

19 June 2023 Afternoon Session Analysis

Japanese Yen slipped as BoJ’s move was widely expected.

The Japanese Yen against the US dollar slipped after the Bank of Japan (BoJ) maintained its policy rate at -0.1%, especially intervention in Yield Curve Control (YCC) to support economic growth and achieve a long-term 2% inflation target. Investors widely expected the BOJ’s ultra-loose rate decision as Governor Kazuo Ueda said last month that the central bank is “patiently” maintaining its current policy. As stubbornly low inflation in Japan forced the BoJ to hold YCC longer than expected and ultra loosen monetary policy to achieve a sustainable inflation rate of 2%. However, core inflation was recorded at 3.4% in April, well above the central bank’s 2% target, suggesting that the BOJ will adjust to the YCC sooner or later. In addition, the BoJ Governor also mentioned that inflation is expected to slow below the 2% target in the middle of the current fiscal year and rebound afterwards. As of writing, the pair of USD/JPY traded down by -0.03% to 142.70.

In the commodity market, the crude oil price depreciated by -1.40% as the market was waiting for more rate cuts on China loans. Besides, the gold price slipped by -0.21% to 1954.12 as investors awaited more cues from Fed monetary policy testimonial.

Today’s Holiday Market Close

Time Market Event

All Day USD Juneteenth

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior breakout above the previous resistance level at 101.85. MACD which illustrated increasing bullish momentum suggests the index to extend its gains toward the resistance level.

Resistance level: 102.35, 102.90

Support level: 101.85, 101.35

GBPUSD, H4: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2815. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.0915.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

USDJPY, H4: USDJPY was traded higher following the prior rebound from the support level at 141.40. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 142.90, 144.10

Support level: 141.40, 140.20

AUDUSD, H4: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6840. MACD which illustrated increasing bullish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.6840, 0.6910

Support level: 0.6770, 0.6700

NZDUSD, H4: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6215. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3240.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded lower following the prior breakout below from the previous support level at 71.35. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 71.35, 73.15

Support level: 69.30, 67.55

GOLD_, H4: Gold price was traded lower following the prior breakout below the previous support level at 1955.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 1955.50, 1982.50

Support level: 1931.45, 1901.70

190623 Morning Session Analysis

19 June 2023 Morning Session Analysis

Greenback wobbled amid mixed economic data.

The dollar index, which was traded against a basket of six major currencies, lingered near the 6 week low during later last week as a series of economic data showed unclear signal in the market. Last Thursday, the US reported that the number of American who filed for unemployment claims remained at 262K, far above the market expectations of 249K, showing the labor market in the US remained fragile. Besides, the Philadelphia Fed Manufacturing Index for the month of June came in at -13.7, slightly below the market forecast at -13.5. It was the 10th consecutive negative reading, where the current activity and new orders remained negative. However, the dollar market sentiment was lifted by the upbeat consumer sentiment data from the Michigan University. According to the Friday’s data, the June preliminary report for the Michigan Consumer Sentiment Index came in at 63.9, above the market expectation at 60.0. With that, it reflected that the American were having greater optimism as inflation eased and policymakers resolved the debt ceiling crisis. As of writing, the dollar index rose 0.06% to 102.30.

In the commodities market, crude oil prices dropped by -0.03% to $71.45 per barrel as Chinese higher demand and OPEC cut outbalanced the supply concern. Besides, gold prices edged down by -0.01% to $1957.85 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

All Day USD Juneteenth

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2765. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2875.

Resistance level: 1.2875, 1.2970

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0915. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 0.6925.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3245. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3170.

Resistance level: 1.3245, 1.3330

Support level: 1.3170, 1.3065

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.8980. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8835.

Resistance level: 0.8980, 0.9140

Support level: 0.8835, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1951.60. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75

150623 Afternoon Session Analysis

15 June 2023 Afternoon Session Analysis

Greenback jumped amid Fed’s hawkish comment.

The dollar index, which was traded against a basket of six major currencies, extended its gains during the Asian trading session as the Fed’s hawkish comment continued to spur the sentiment in the dollar market. Prior to the Asian trading hour, the Fed unanimously decided to hold its interest rate at 5.25% as there were some progress in curbing the inflation. In the FOMC Press Conference, the Fed’s chairman Jerome Powell expressed optimism over their effort on cooling down the inflation, where he pointed that the inflationary pressure in the US is meaningfully below trend. However, the Fed predicted that they will still increase the interest rate by twice where the terminal rate would eventually reach 5.6% before 2024. Also, Jerome Powell also said that he does not see a rate cut until inflation comes down meaningfully and significantly. He highlighted that none of the member was considering a rate cut by this year. After all, the investors are now anticipating a 61.5% chance of the Fed hiking rate by a quarter point in the next meeting, according to the CME FedWatch Tool. As of writing, the dollar index rose 0.38% to 103.35.

In the commodities market, crude oil prices edged down -0.01% to $68.70 per barrel as the EIA reported some stockpiles in the inventory level. Besides, gold prices were down by -0.30% to $1936.05 per troy ounce as the dollar strengthened following the hawkish statement from Jerome Powell.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:45 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Jun) | 3.25% | 3.50% | – |

| 20:15 | EUR – ECB Interest Rate Decision (Jun) | 3.75% | 4.00% | – |

| 20:30 | USD – Core Retail Sales (MoM) (May) | 0.4% | 0.1% | – |

| 20:30 | USD – Initial Jobless Claims | 261K | 250K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jun) | -10.4 | -13.5 | – |

| 20:30 | USD – Retail Sales (MoM) (May) | 0.4% | -0.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2635. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2765.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0915.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 139.00. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 141.60.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 0.6925.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3330. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3245.

Resistance level: 1.3330, 1.3395

Support level: 1.3245, 1.3170

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9140.

Resistance level: 0.9140, 0.9330

Support level: 0.8980, 0.8835

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support zone. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 70.15.

Resistance level: 70.15, 74.00

Support level: 66.50, 62.00

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1939.75. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1951.60, 1980.00

Support level: 1939.75, 1889.55

150623 Morning Session Analysis

15 June 2023 Morning Session Analysis

The dollar index slipped as the Fed pause rate as expected.

The dollar index, which was traded against a basket of six major currencies, slipped as the Fed pause rate as expected. Before that, the greenback was trading under heavy selling pressure from global investors after the producer price index (PPI) fell more than expected last month. PPI fell to -0.3% in May from 0.2% in April, while the core PPI was in line with consensus expectations for an unchanged 0.2% month-on-month. The readings were driven by a decline in energy and food prices and decelerated for 11 consecutive months since December 2020. As a result, it cemented that the Fed will have a pause on its interest rate decision announced late in the day. The dollar index extended its losses after the Fed passed the interest rate as widely expected. However, the losses of the greenback were limited by a hawkish speech from Fed President Jerome Powell. The central issued a new projection that suggested interest rates were likely to rise by another half of a percentage due slowing decline in inflation. The core Personal Consumption Expenditures (PCE) index, the Fed’s preferred measure of inflation has held steady for the past six months. Since the labor market remains in strength, inflation is expected to continue. As of writing, the dollar index slipped to 103.00.

In the commodities market, crude oil inched up 0.41% to $68.53 a barrel after falling in the previous session. Crude prices declined after a hawkish statement from Fed. Besides, gold prices traded up by 0.13% to $1944.40 per troy ounce as of writing, as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:45 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 10:00 | CNY – Industrial Production (YoY) (May) | 5.6% | 3.8% | – |

| 10:00 | CNY – Chinese Unemployment Rate (May) | 5.2% | 5.2% | – |

| 20:15 | EUR – Deposit Facility Rate (Jun) | 3.25% | 3.50% | – |

| 20:15 | EUR – ECB Interest Rate Decision (Jun) | 3.75% | 4.00% | – |

| 20:30 | USD – Core Retail Sales (MoM) (May) | 0.4% | 0.1% | – |

| 20:30 | USD – Initial Jobless Claims | 261K | 250K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jun) | -10.4 | -13.5 | – |

| 20:30 | USD – Retail Sales (MoM) (May) | 0.4% | -0.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 102.35. However, MACD which illustrated increasing bearish momentum suggests the index undergoes a technical correction in the short term.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

GBPUSD, Daily: GBPUSD was traded lower following the prior breaks below the previous support level at 1.2665. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.2665, 1.2815

Support level: 1.2565, 1.2470

EURUSD, Daily: EURUSD was traded lower while currently testing for the support level at 1.0840. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.0915 1.0990

Support level: 1.0840, 1.0760

USDJPY, Daily: USDJPY was traded higher while currently testing from the resistance level at 140.20. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains if successfully break above the resistance level.

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6840. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0,6840, 0.6910

Support level: 0.6770, 0.6700

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to traded higher as technical correction.

Resistance level: 0.6215, 0.6310

Support level: 0.6100, 0.5995

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3300. MACD which illustrated diminishing bearish momentum suggests the pair extend its gains toward the resistance level at 1.3335

Resistance level: 1.3335, 1.3375

Support level: 1.3300, 1.3265

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.9040. However, MACD which illustrated increasing bearish momentum suggests the pair traded lower as technical correction.

Resistance level: 0.9040, 0.9105

Support level: 0.8985, 0.8940

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 69.30. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 69.30, 71.35

Support level: 67.55, 65.80

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1955.50. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 1955.50, 1982.50

Support level: 1930.45, 1899.50

140623 Afternoon Session Analysis

14 June 2023 Afternoon Session Analysis

US dollar slid ahead of Fed’s interest rate decision.

The dollar index, which was traded against a basket of six major currencies, lost it ground while extending its downside during the Asian trading session amid the weaker-than-expected inflation figure. Yesterday, the dollar index was being sell-off tremendously by investors as the US inflation rate dropped from 4.9% to 4.0% in May, lower than the market consensus at 4.1%. As a result, the market participants are expecting the Fed to leave the interest rate at the current level, with no any changes in tomorrow’s meeting. According to the CME FedWatch Tool, the probability of maintaining the interest rate is at 96.5% now, whereas the likelihood of another 25 basis points a rate hike is at 3.5% only. With the decent drop in the inflation data, it might cause the Fed’s members to be tilted dovish. Nonetheless, the FOMC Press Conference would be the main focus of the market participants as the Fed will revealed their view regarding the economic outlook and monetary policy path. As of writing, the dollar index ticked down -0.07% to 103.25.

In the commodities market, crude oil prices edged up 0.22% to $69.45 per barrel as OPEC monthly report showed a consistent forecast as last month, signaling their optimistic view over the prospect of this black commodity. Besides, gold prices were up by 0.24% to $1948.15 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 CrudeOIL IEA Monthly Report

02:00 USD FOMC Economic Projections

(15th)

02:00 USD FOMC Statement

(15th)

02:30 USD FOMC Press Conference

(15th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – PPI (MoM) (May) | 0.2% | -0.1% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.451M | 1.482M | – |

| 02:00

(15th) |

USD – Fed Interest Rate Decision | 5.25% | 5.25% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2525. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2645.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0915.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 139.00. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 141.60.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3330. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3245.

Resistance level: 1.3330, 1.3395

Support level: 1.3245, 1.3170

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9140.

Resistance level: 0.9140, 0.9330

Support level: 0.8980, 0.8835

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support zone. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 70.15.

Resistance level: 70.15, 74.00

Support level: 66.50, 62.00

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1951.60. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1951.60, 1980.00

Support level: 1889.55, 1839.40

140623 Morning Session Analysis

14 June 2023 Morning Session Analysis

The dollar index slipped after CPI but rebounded during US session.

The dollar index, which was traded against a basket of six major currencies, slipped after the May consumer price index release but rebounded during the US session. The annual Consumer Price Index (CPI) in the US dropped to 4% in May from 4.9% in the previous, lower than expected 4.1%. As a result, the annual CPI reached its lowest level since March 2021. While the core CPI which excluded large amounts of volatility items in line with market expectations of 5.3%, slightly reduced from the previous reading of 5.5%. The index for shelter was the largest contributor to the index increase, followed by the index for used cars and trucks, but the overall increase was offset by energy prices falling, the US Bureau of Labor Statistics reported. The figures bolster expectations for the Fed to maintain current rates and the dollar index falling after CPI was released. However, the dollar index rebounded during the US session as major banks expect the Fed rates to keep steady in June to a range of 5.25%, but accompanied by communications that lean hawkish. Meanwhile, investors are eyeing on Producer Price Index (PPI) and FOMC meetings to get more cues about the money market’s directions. As of writing, the dollar index traded down by -0.33% to 102.89.

In the commodities market, crude oil prices ticked down by -0.33% to $69.20 per barrel following the API weekly cured oil inventory record a 1.024M barrel excess. Besides, gold prices traded down by -0.03% to $1942.97 per troy ounce following the upbeat US Treasury yields and equities.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) (Apr) | -0.3% | 0.2% | – |

| 20:30 | USD – PPI (MoM) (May) | 0.2% | -0.1% | – |

| 20:30 | CrudeOIL – Crude Oil Inventories | -0.451M | 1.482M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breaks below from the previous support level at 102.90. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

GBPUSD, Daily: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2565. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.2615.

Resistance level: 1.2615, 1.2665

Support level: 1.1.2565, 1.2520

EURUSD, Daily: EURUSD was traded higher following the prior breaks above the previous resistance level at 1.0760. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.0760, 1.0835

Support level: 1.0670, 1.0590

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the higher level at 140.20. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes technical correction in the short term.

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

AUDUSD, Daily: AUDUSD was traded higher while currently testing for the resistance level at 0.6770. MACD which illustrated increasing bullish momentum suggests the pair to extend after its successfully break above the resistance level.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6105. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6215, 0.6310

Support level: 0.6100, 0.5995

USDCAD, Daily: USDCAD was traded lower following the prior breaks below from the previous support level at 1.3335. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.3335, 1.3375

Support level: 1.3300, 1.3265

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extend its losses toward the support level at 0.9040.

Resistance level: 0.9105, 0.9150

Support level: 0.9040, 0.8985

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 69.30. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 69.30, 71.35

Support level: 67.55, 65.80

GOLD_, Daily: Gold price was traded lower following the prior breaks below from the previous support level at 1955.50. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 1982.50, 2005.80

Support level: 1955.50, 1930.45

130623 Afternoon Session Analysis

13 June 2023 Afternoon Session Analysis

Greenback dipped as CPI data looms.

The dollar index, which was traded against a basket of six major currencies, teetered near the brink of collapse ahead of the long-awaited Consumer Price Index (CPI) data. According to the Investing.com, the economists are expecting the inflation rate to come in at 4.1%, far below the market consensus forecast at 4.9%, mirroring that they are optimistic over the effectiveness of the prior rate hikes on cooling down the inflation rate. With that, the financial market is expected to experience huge volatility today due to the announcement of the CPI data. Besides, it is noteworthy to highlight that the inflation reading will also be take into consideration of the Fed’s decision on interest rates following the two-day meeting on Thursday. Based on the CME FedWatch Tool, the probability of making no changes on the US interest rate surged from 70.1% to 81.5% today, whereas the likelihood of a 25 basis point of rate hike is at 18.5% as of writing. However, the losses of the dollar index was limited by the rate cut by the PBOC. The PBOC cut its seven-day reverse repo rate by 10 basis point from 2.0% to 1.9%. As of writing, the dollar index edged down by -0.17% to 103.45.

In the commodities market, crude oil prices edged up 0.22% to $67.45 per barrel ahead of the US CPI data, where the data would provide further confirmation if Fed to hike its rate on Thursday. Besides, gold prices were up by 0.19% to $1961.25 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German CPI (MoM) (May) | 0.4% | 0.1% | – |

| 20:30 | USD – Core CPI (MoM) (May) | 0.4% | 0.4% | – |

| 20:30 | USD – CPI (MoM) (May) | 0.4% | 0.2% | – |

| 20:30 | USD – CPI (YoY) (May) | 4.9% | 4.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2525. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.95. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6040. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3330. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3395.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9140.

Resistance level: 0.9140, 0.9330

Support level: 0.8980, 0.8835

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous upward trend line. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 66.50.

Resistance level: 70.15, 74.00

Support level: 66.50, 62.00

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1951.60. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55

130623 Morning Session Analysis

13 June 2023 Morning Session Analysis

The dollar index range is bound ahead of the May consumer price index (CPI).

The dollar index, which was traded against a basket of six major currencies, range bound in the previous session ahead of the May consumer price index. The US Bureau of Labor Statistics is scheduled to release the May CPI on Tuesday and economists expect the readings will be down to 4.1% from the previous 4.9% on an annual basis. However, the greenback was largely unchanged in the previous session, as traders seemed reluctant to push the greenback weaker ahead of CPI if the price pressure continues to elevate. According to Refinitiv’s FedWatch, money markets are leaning toward a pause in the Fed’s rate hikes, but most expect a hike at its July meeting. If inflation is higher than consensus estimates, that could increase the chances of a rate hike at the July meeting and could change the dollar’s weak trajectory. Nonetheless, U.S. jobless claims surged to their highest level in 1-1/2 years last week, adding to pressure on the Federal Reserve to raise interest rates further. If labor market conditions continue to soften, the Fed may consider pausing rate hikes. As of writing, the dollar index edged up by 0.065 to 103.21.

In the commodities market, crude oil prices ticked up by 0.27% to $67.39 per barrel following the prior crude oil price plummet as Goldman Sachs cut the price forecasts to $81 per barrel from an earlier projection of $89. Besides, gold prices traded up by 0.15 % to $1960.42 per troy ounce ahead of the US May CPI data announcement.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German CPI (MoM) (May) | 0.4% | 0.1% | – |

| 20:30 | USD – Core CPI (MoM) (May) | 0.4% | 0.4% | – |

| 20:30 | USD – CPI (MoM) (May) | 0.4% | 0.2% | – |

| 20:30 | USD – CPI (YoY) (May) | 4.9% | 4.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the index to undergo a technical correction in the short term.

Resistance level: 103.35, 103.80

Support level: 102.90, 102.35

GBPUSD, Daily: GBPUSD was traded lower following the prior breaks below the previous support level at 1.2520. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2520, 1.2565

Support level: 1.2470, 1.2410

EURUSD, Daily: EURUSD was traded higher following the prior breaks above the previous resistance level at 1.0760. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.0760, 1.0835

Support level: 1.0670, 1.0590

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 140.20

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6770.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6105. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6215, 0.6310

Support level: 0.6100, 0.5995

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3335. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 1.3375, 1.3425

Support level: 1.3335, 1.3300

USDCHF, Daily: USDCHF was traded higher following the prior breaks above the previous resistance level at 0.9040. MACD which illustrated diminishing bearish momentum suggests the pair extend its gains toward the resistance level at 0.9105

Resistance level: 0.9105, 0.9150

Support level: 0.9040, 0.8985

CrudeOIL, Daily: Crude oil price was traded lower following the prior breaks below from the previous support level at 67.55. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 67.55, 69.30

Support level: 65.80, 64.10

GOLD_, Daily: Gold price was traded lower following the prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the commodity to undergo a technical correction in the short term.

Resistance level: 1982.50, 2005.80

Support level: 1955.50, 1930.45