040723 Afternoon Session Analysis

04 Jul 2023 Afternoon Session Analysis

Euro flat as increasing gloomy economic outlook.

The Euro which traded against the dollar index flatted as euro area manufacturing data slipped, reflecting a tightening monetary policy from European Central Bank (ECB) weighs on the manufacturing market. Markit Economics published a survey on Monday that showed all four of the euro zone’s biggest economies in contraction condition. As Spanish and French manufacturing PMI released a higher-than-expected PMI reading which stood at 48.0 and 46.0 respectively, higher than the economist forecast of 47.7 and 45.5. While the Italian and German manufacturing PMI slipped to 43.8 and 40.6, lower than market expectations of 45.3 and 41.0. Therefore, the euro manufacturing PMI slipped to 43.4 from 44.8 in June. Although some countries manufacturing PMI is higher than market expectation, the reading below the 50 thresholds indicates a contraction condition. German manufacturing firms reported deeper production cuts in response to the weakening of demand. A firm in Spain also commented that the weakness in the manufacturing sector is likely to continue for a few more months. As of writing, the EURUSD ticked down by -0.05% to 1.0906.

In the commodities market, crude oil prices edged up by 0.64%% to $70.24 per barrel as market weigh on supply cuts and manufacturing slump. Elsewhere, the gold price steadily by adding 0.08% to 1923.10 ahead of crucial economic data release.

Today’s Holiday Market Close

Time Market Event

All Day USD Independence Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

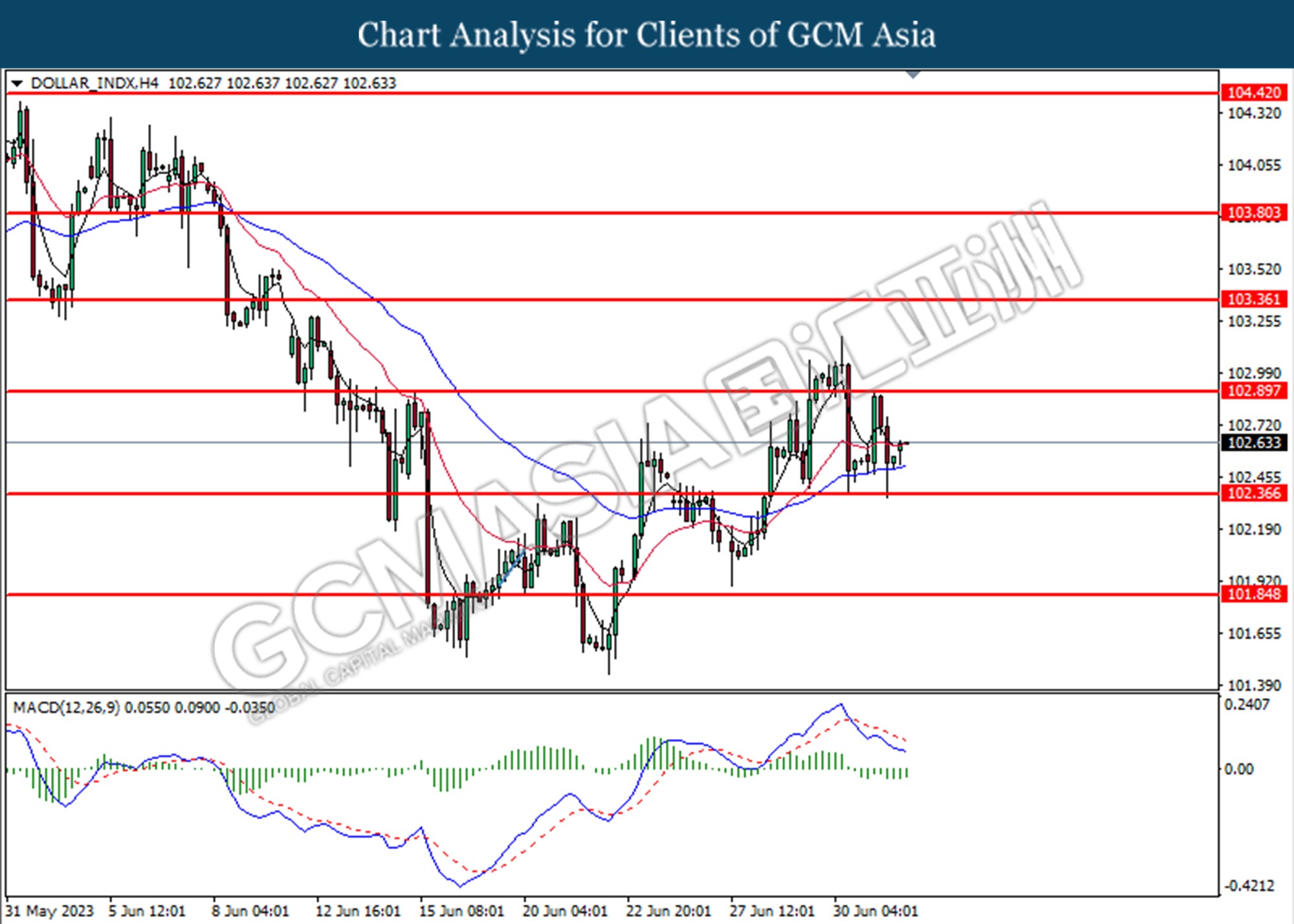

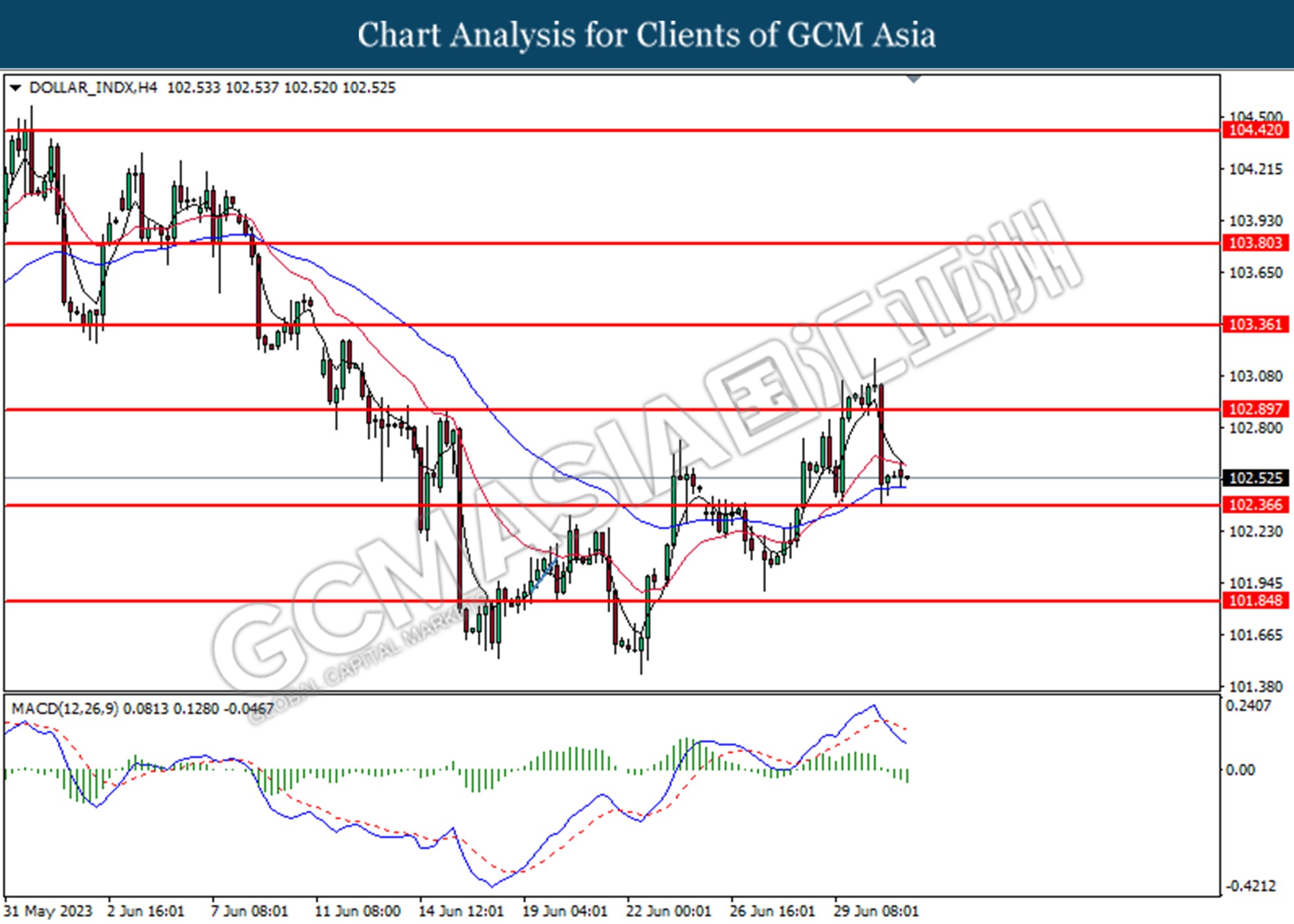

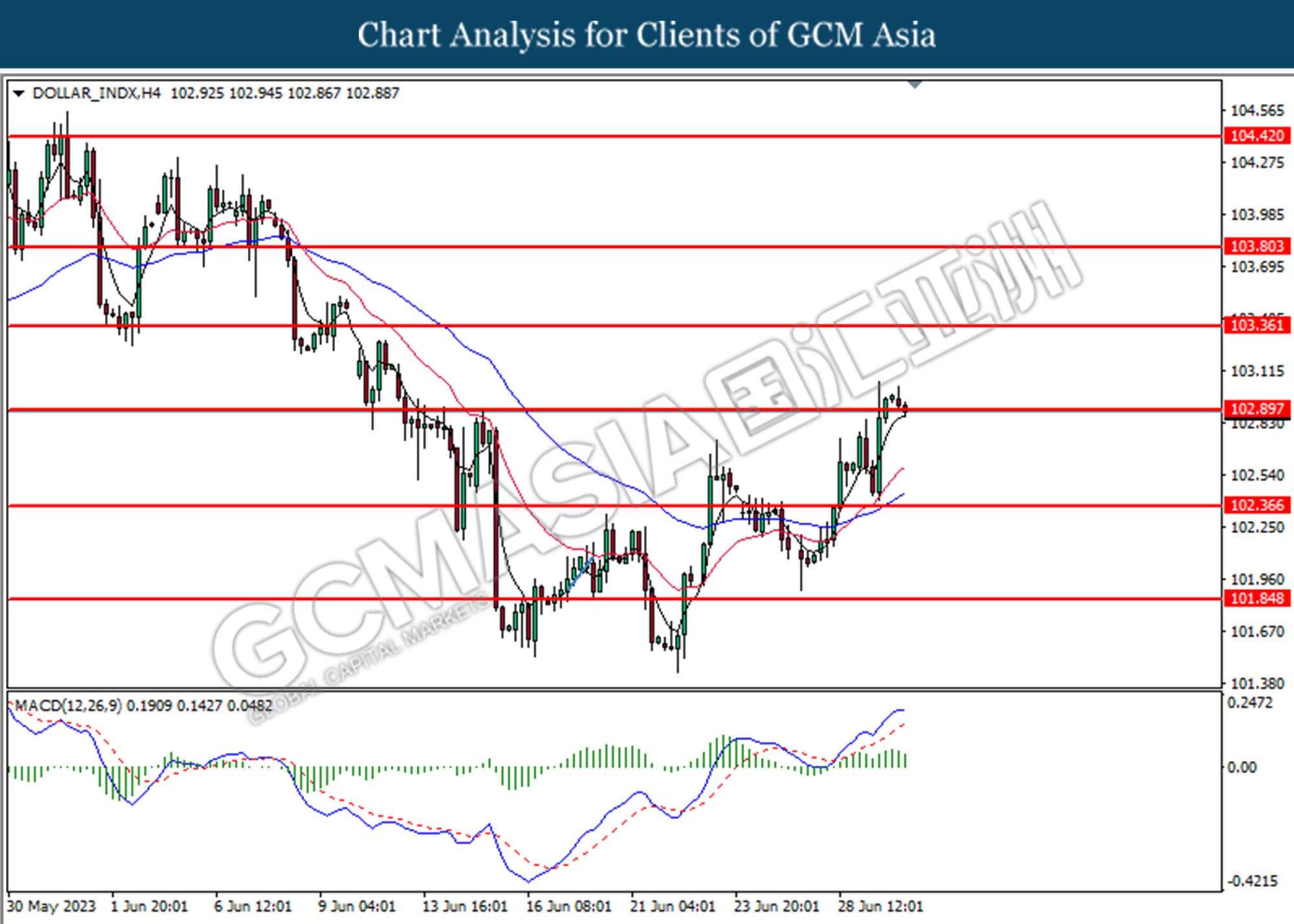

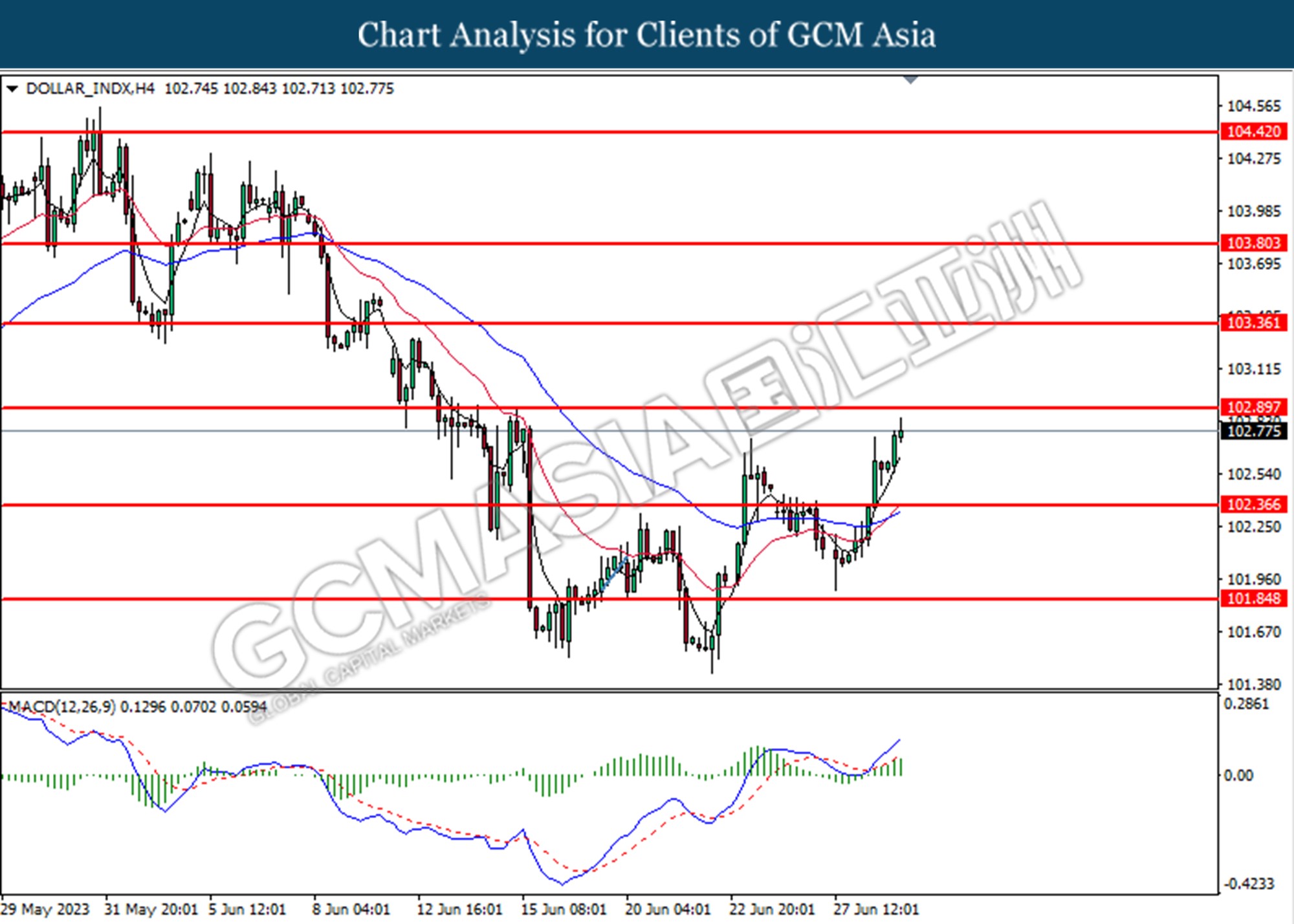

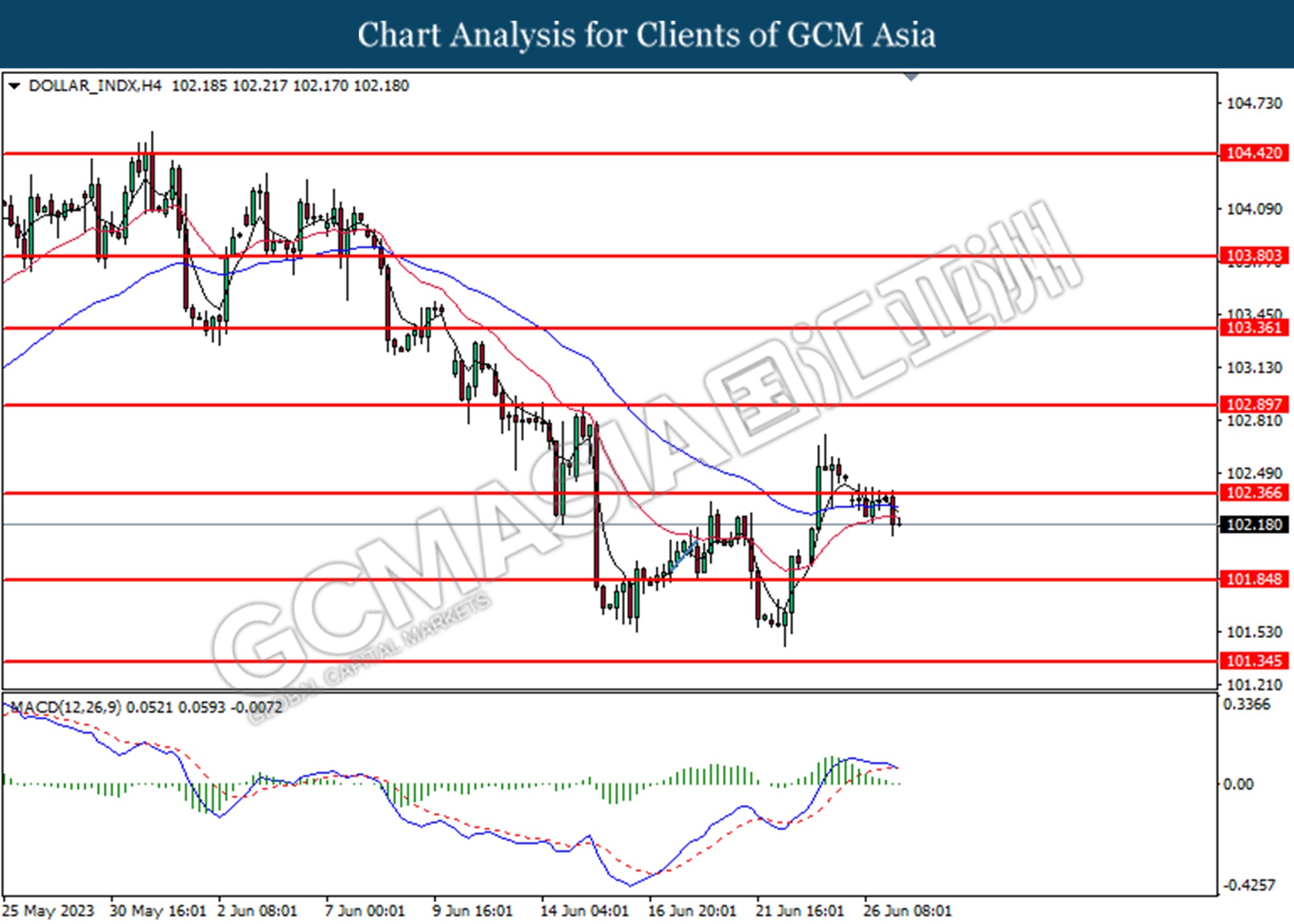

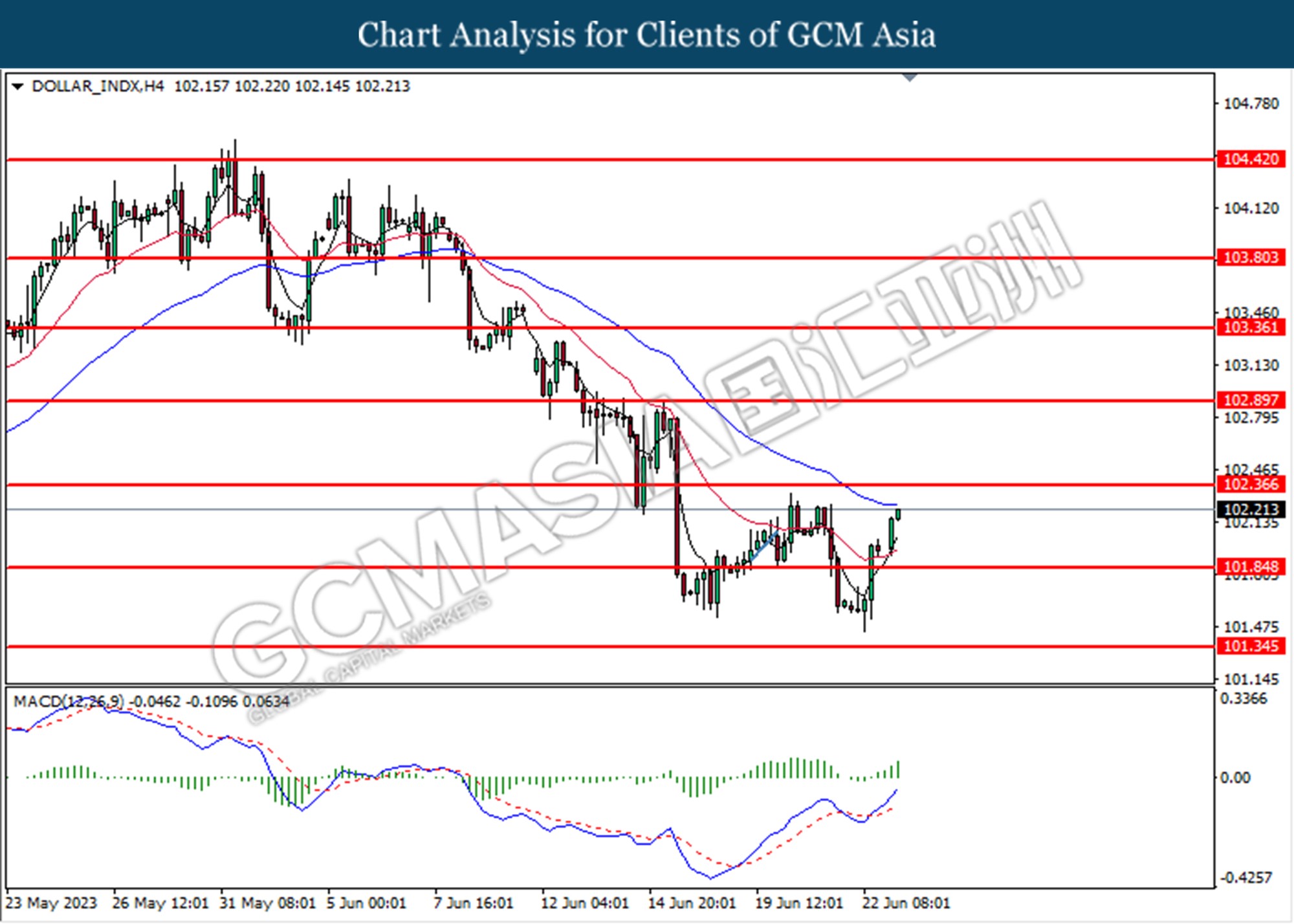

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the support level at 102.35. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 102.90.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

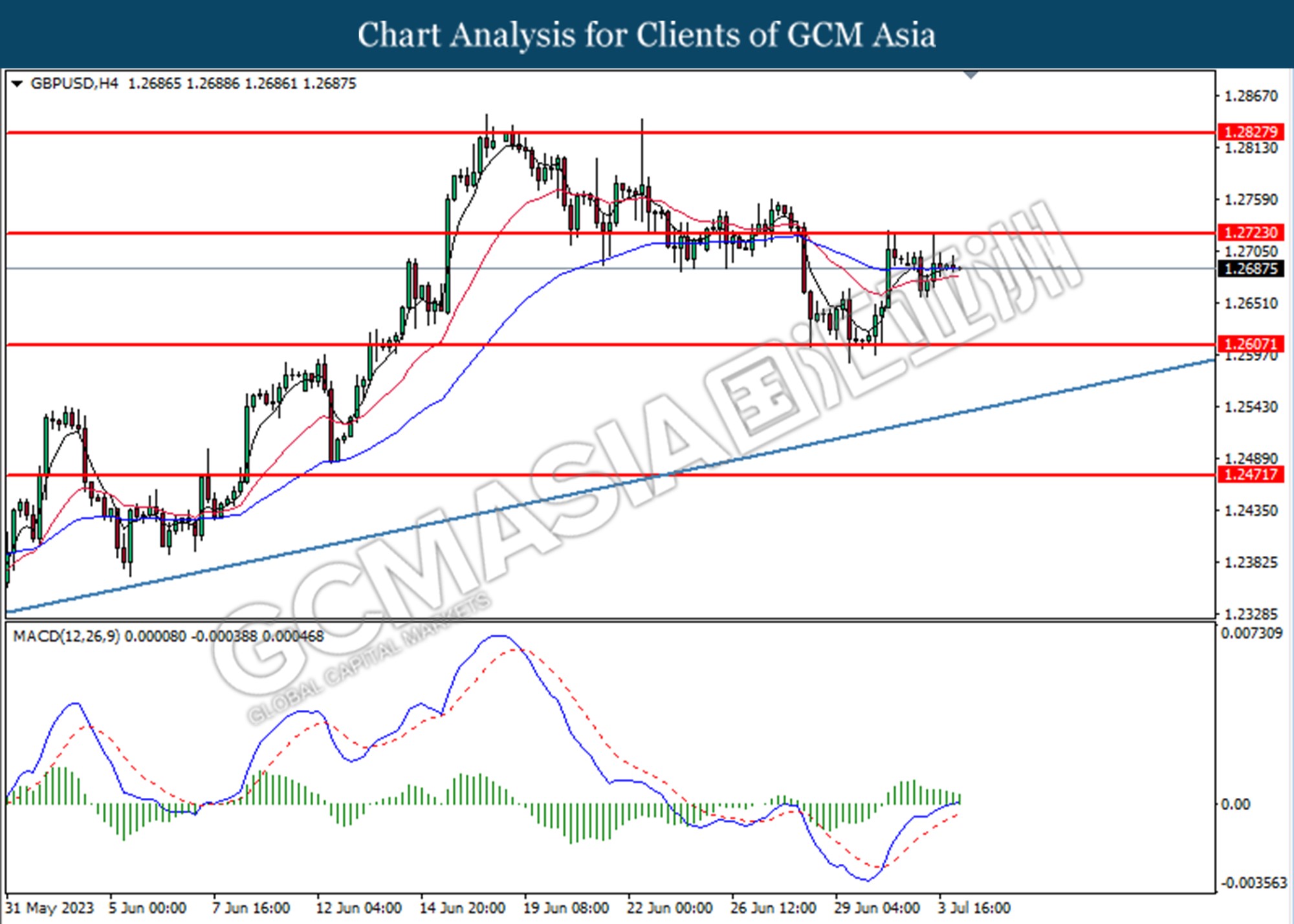

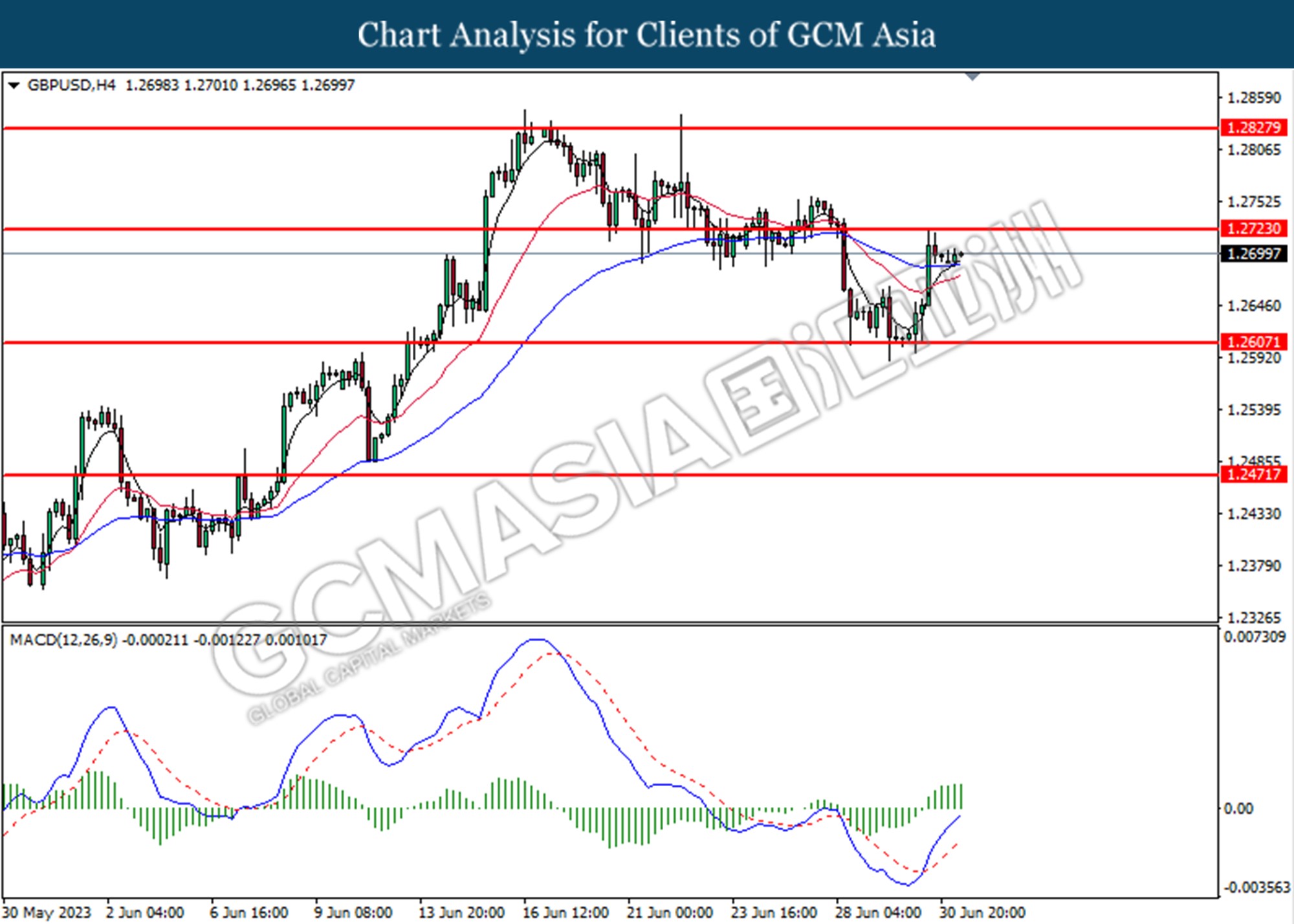

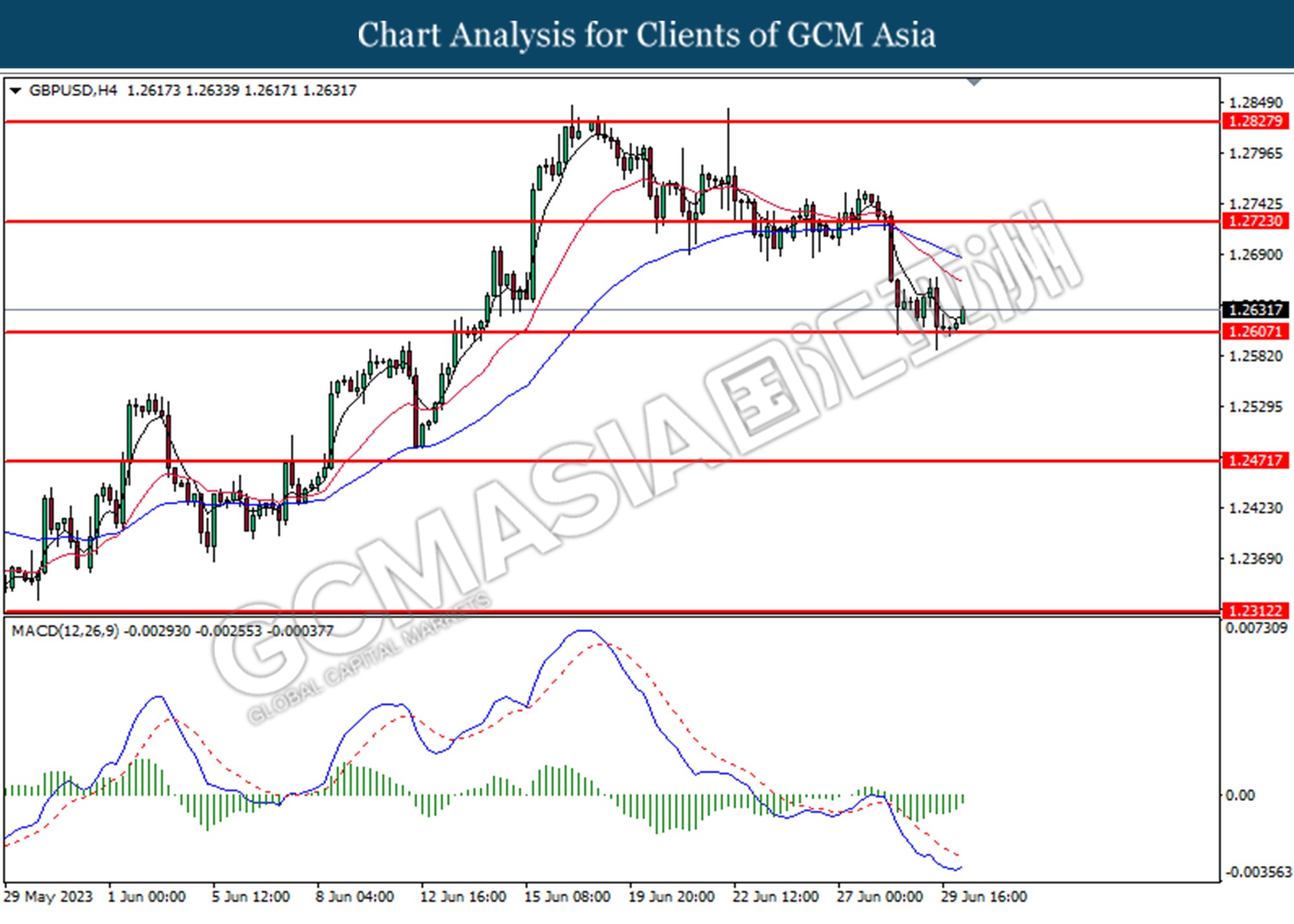

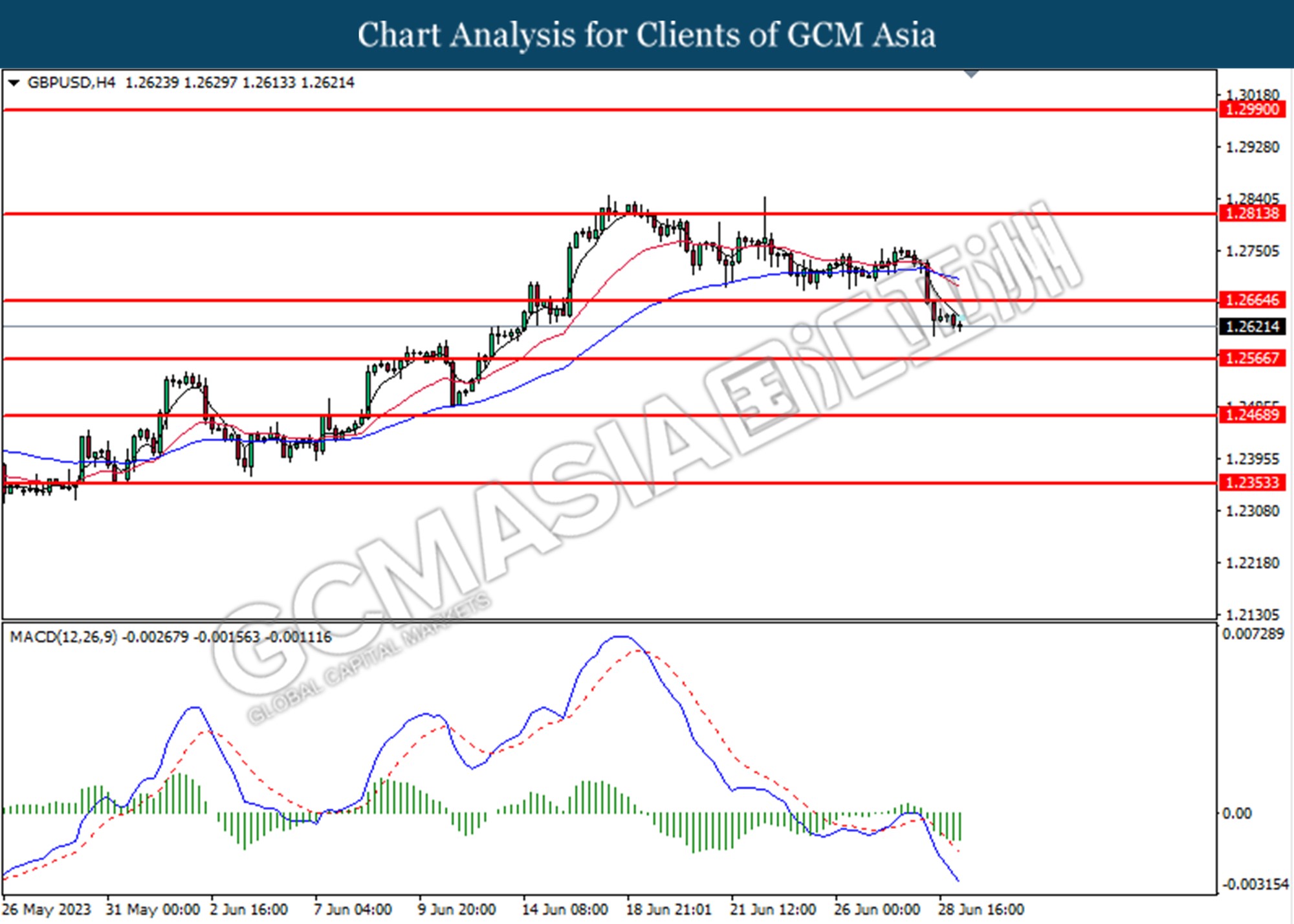

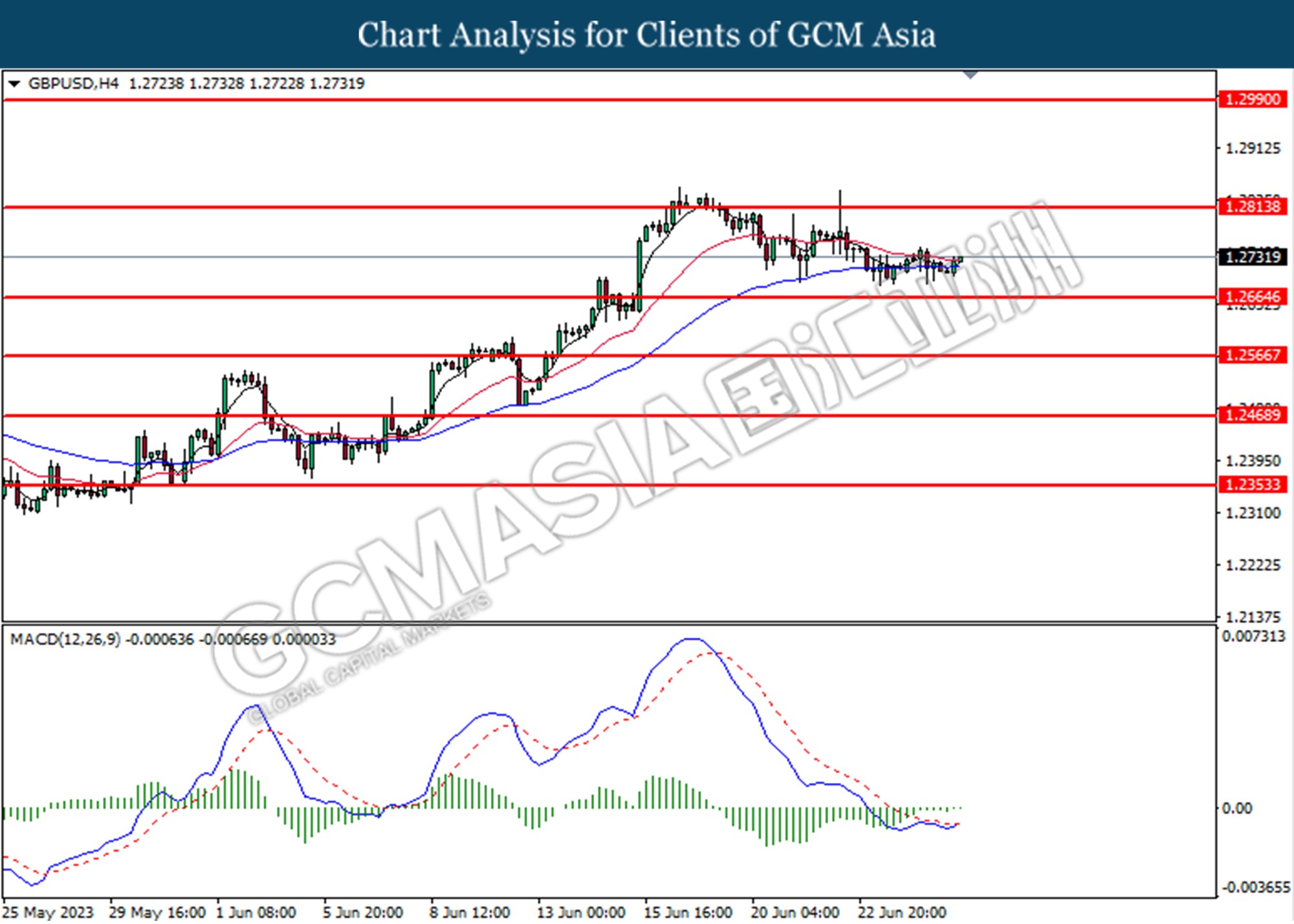

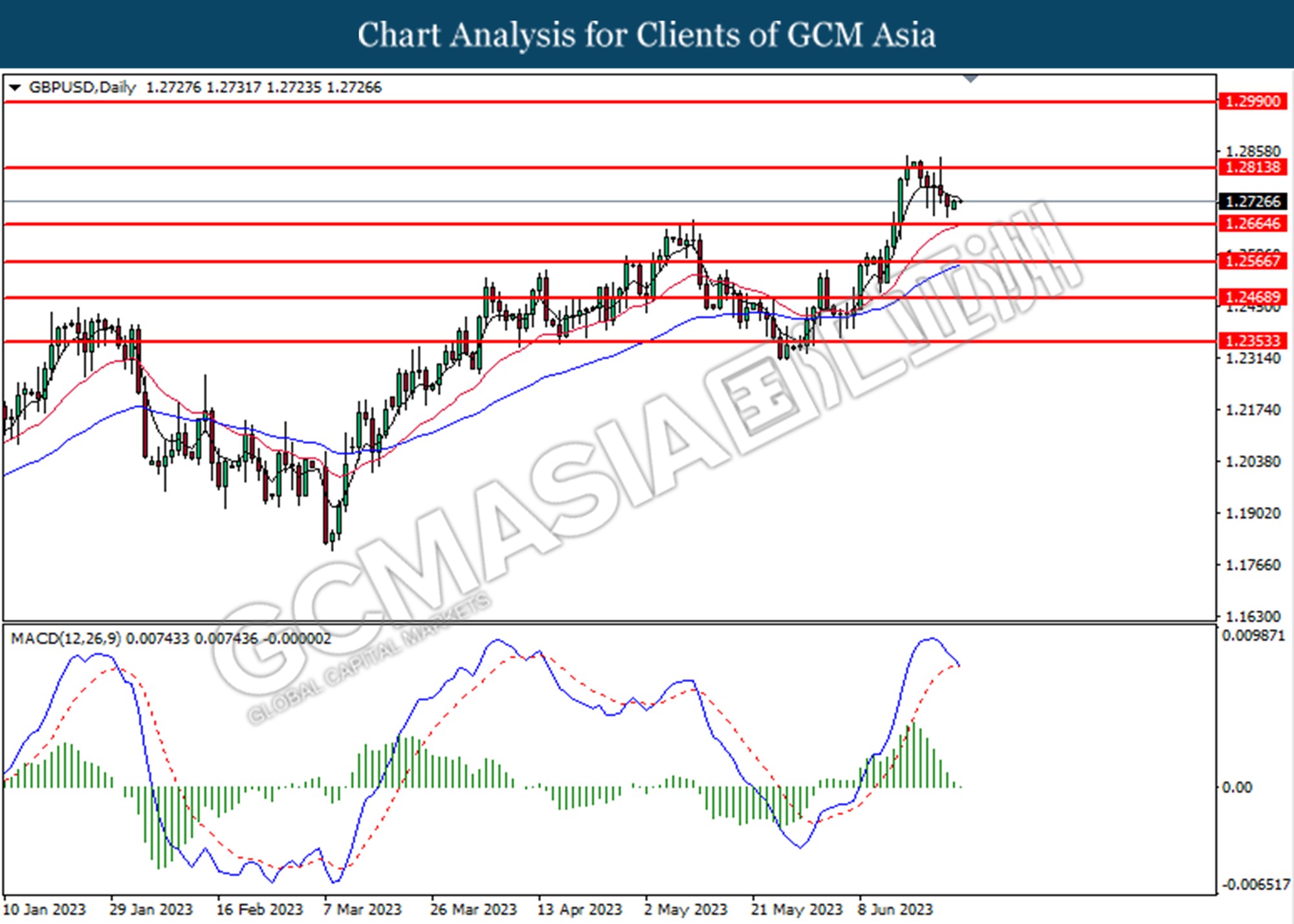

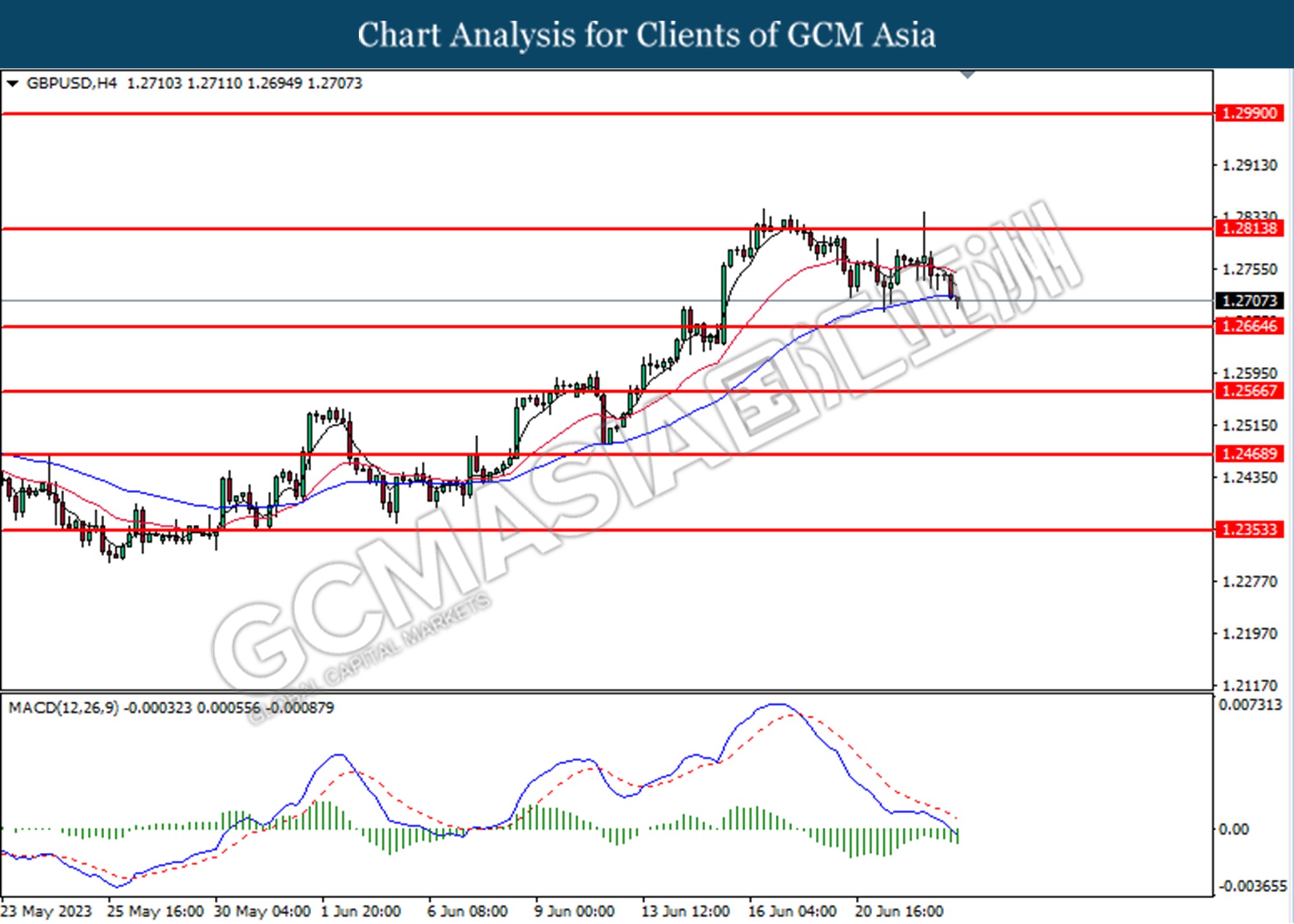

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2725. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2725, 1.2830

Support level: 1.2610, 1.2470

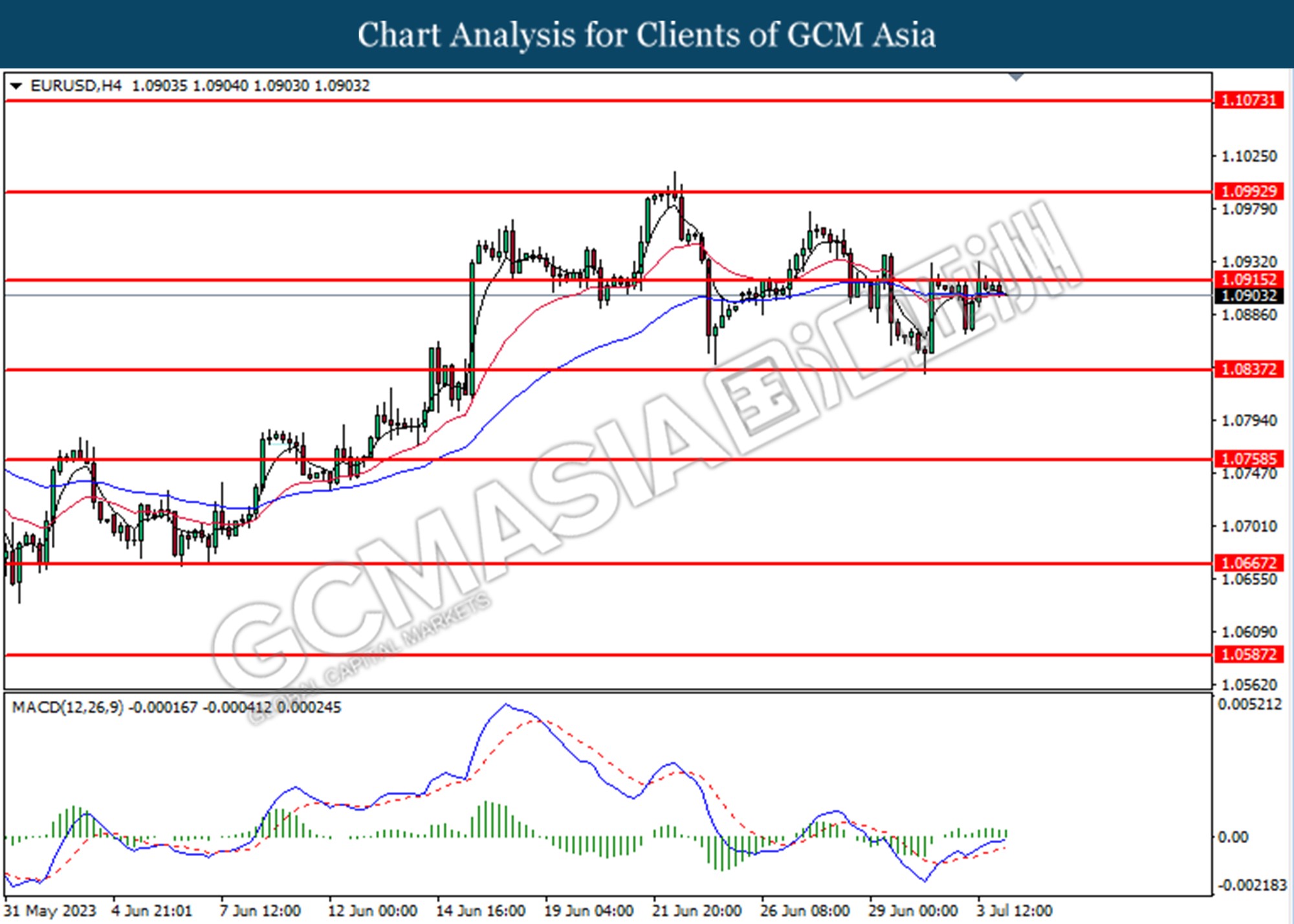

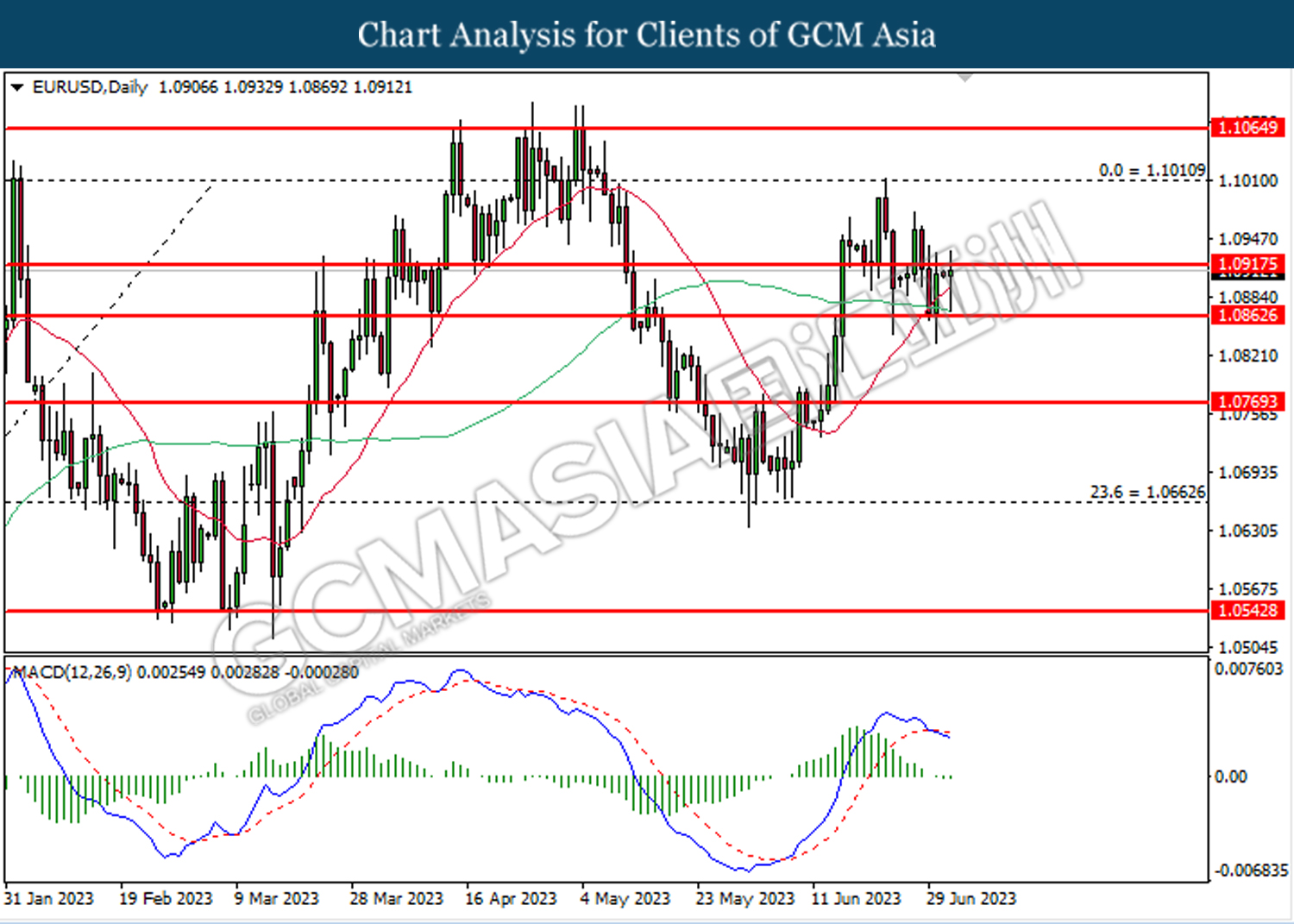

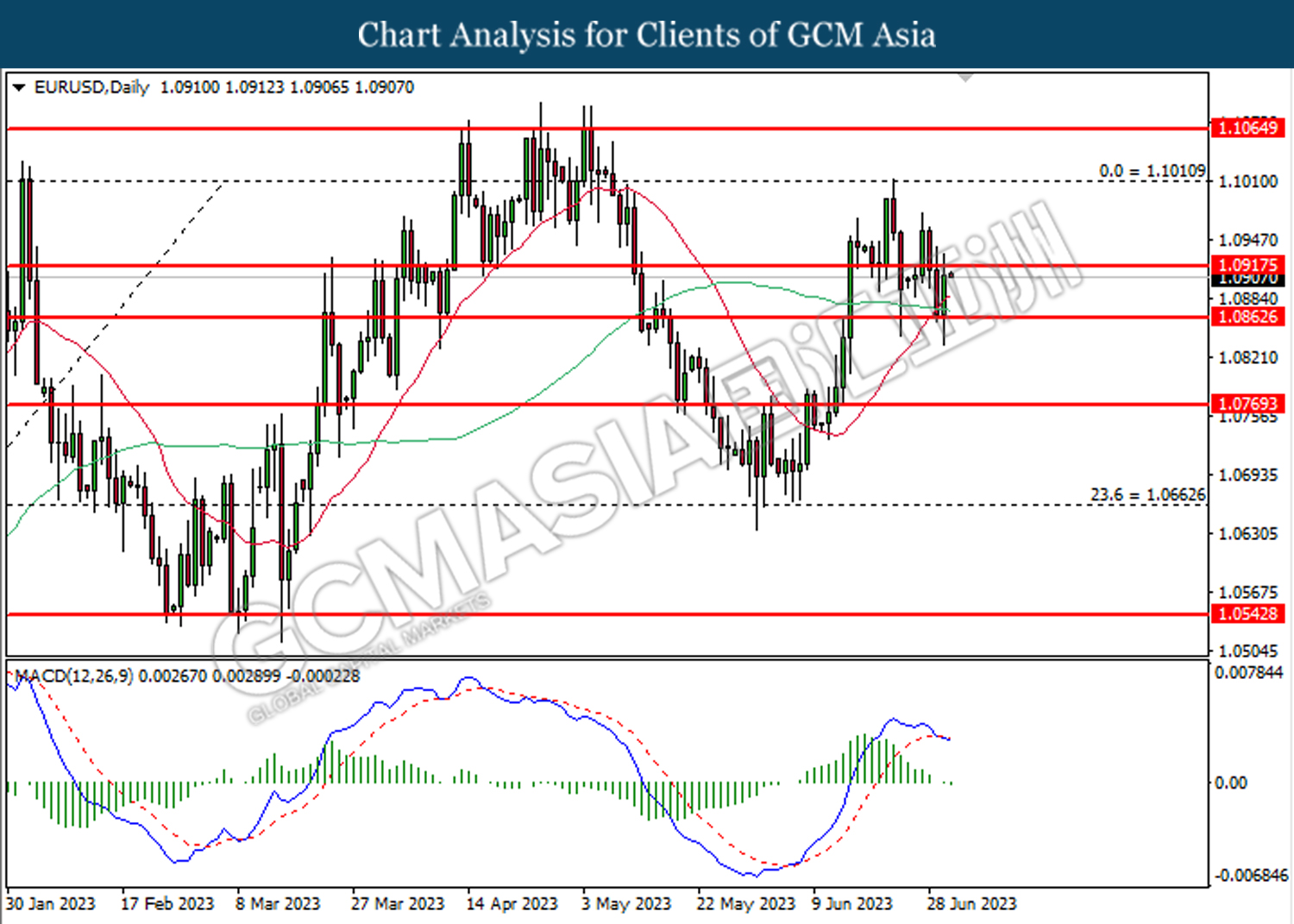

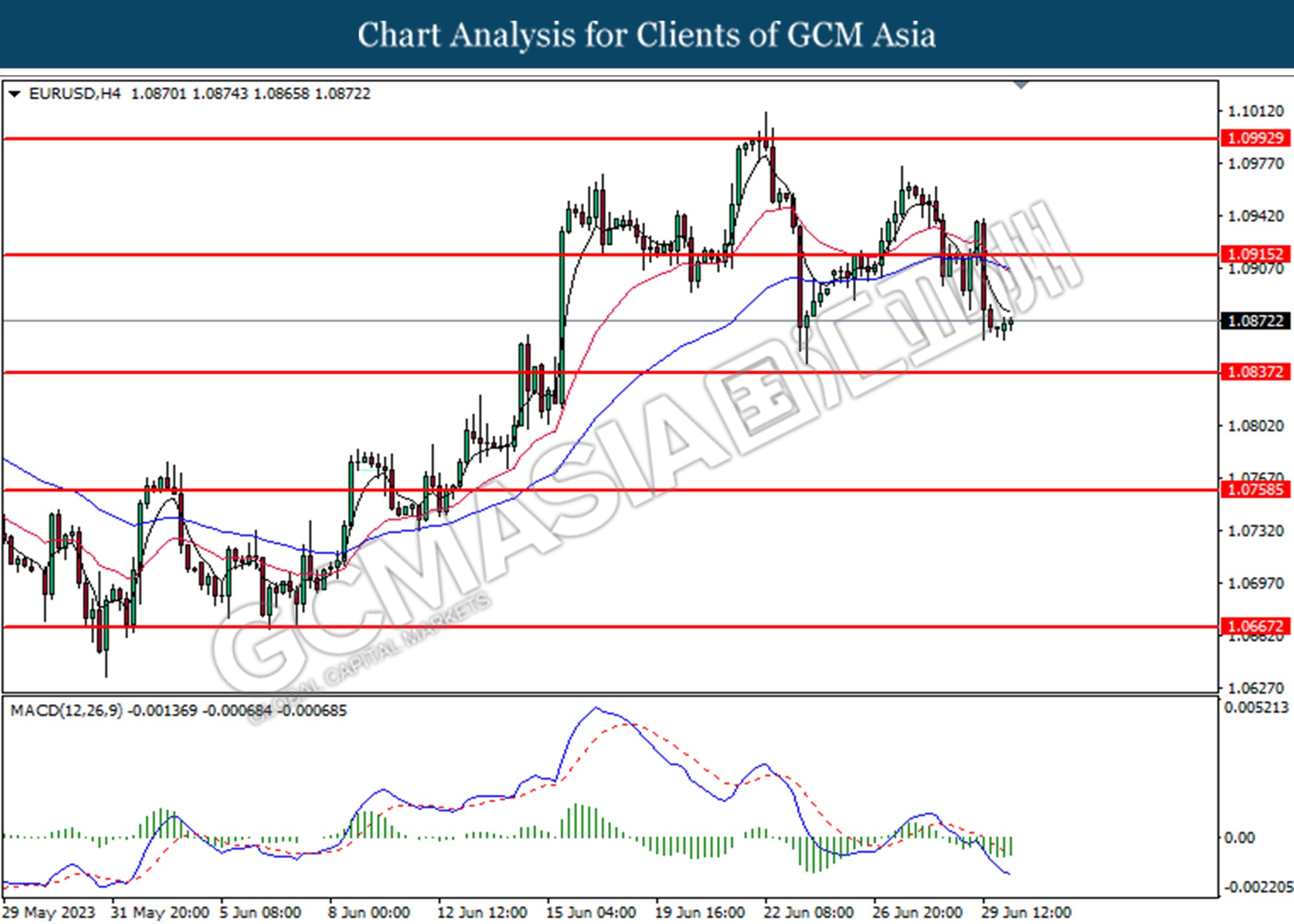

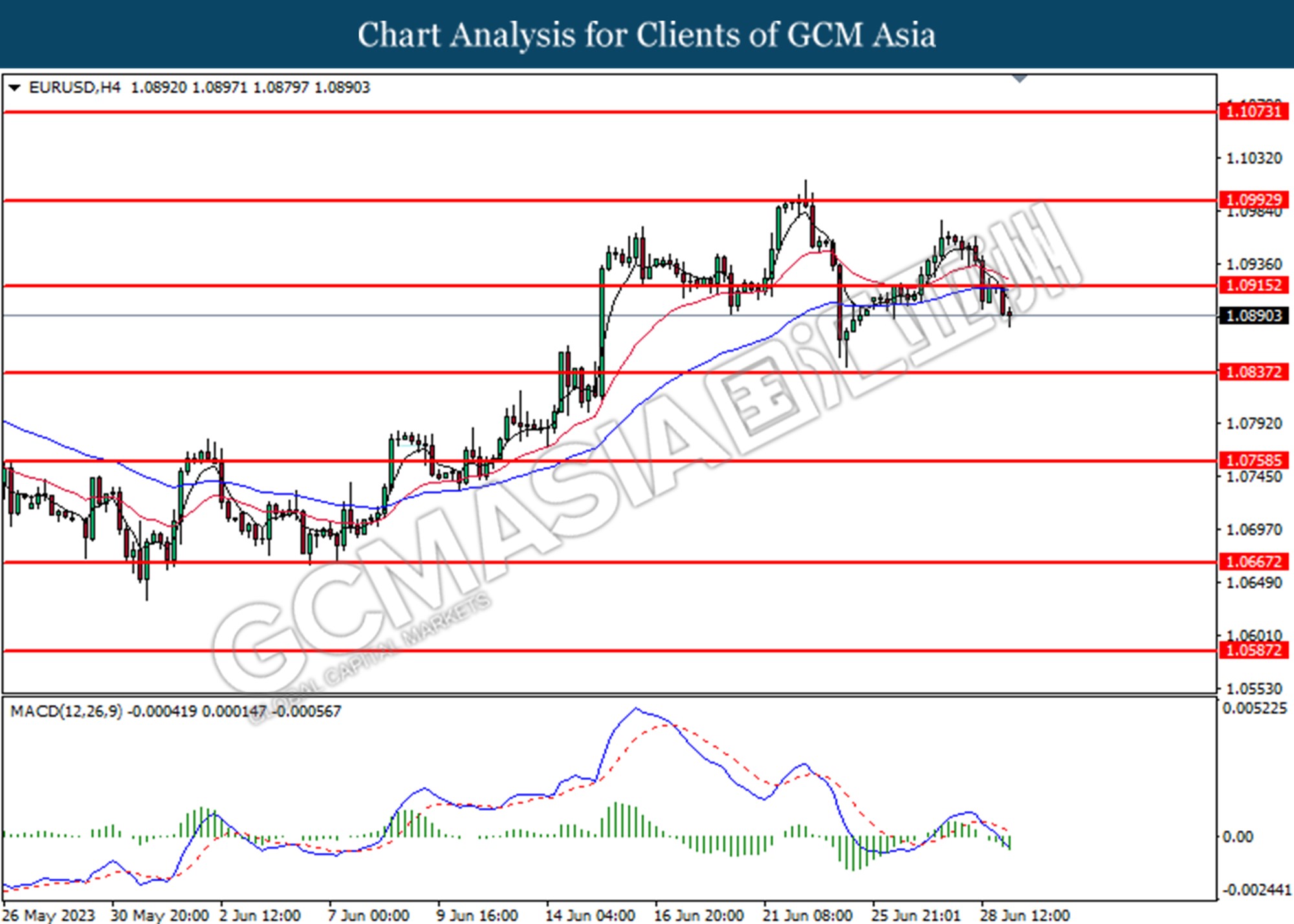

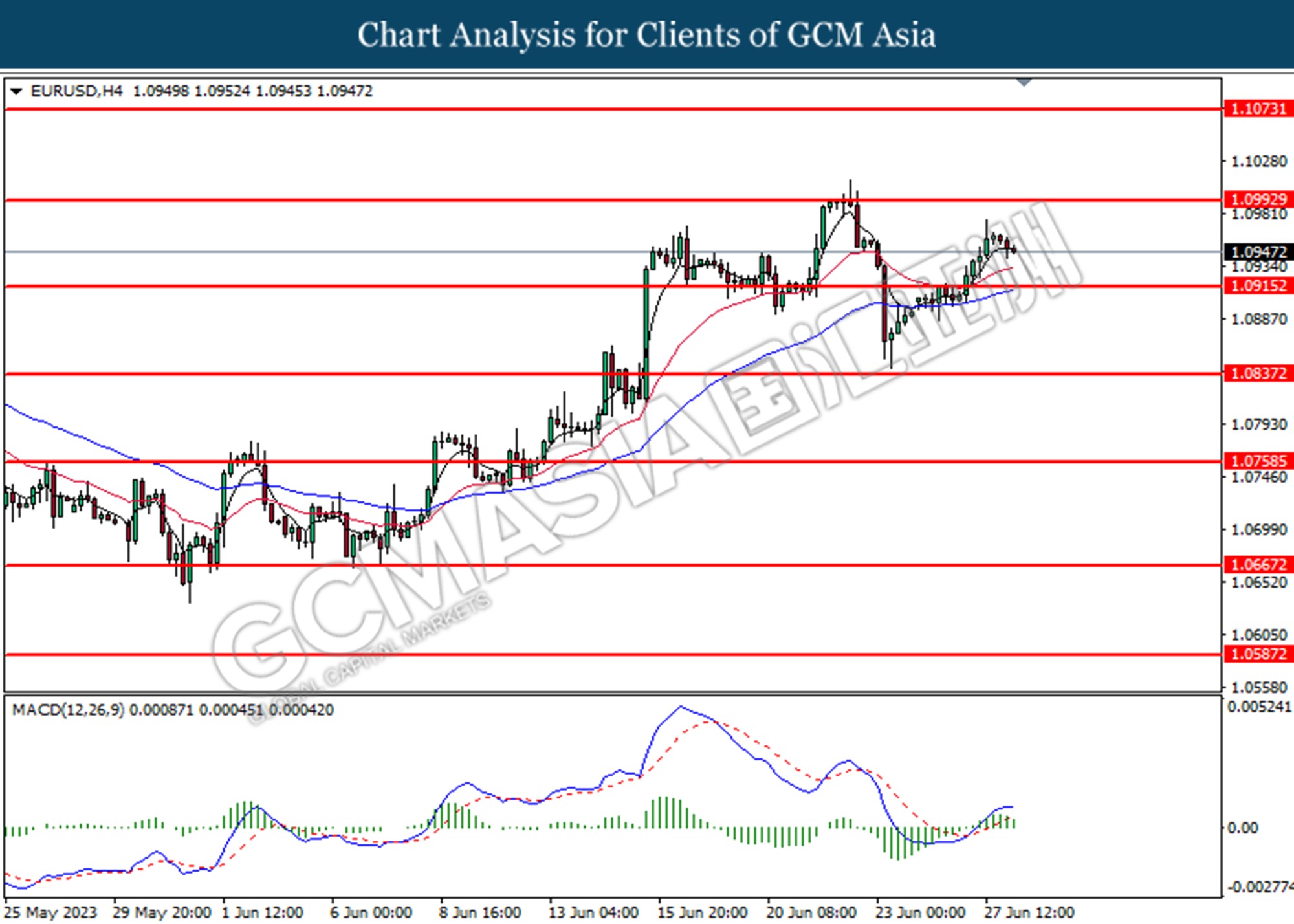

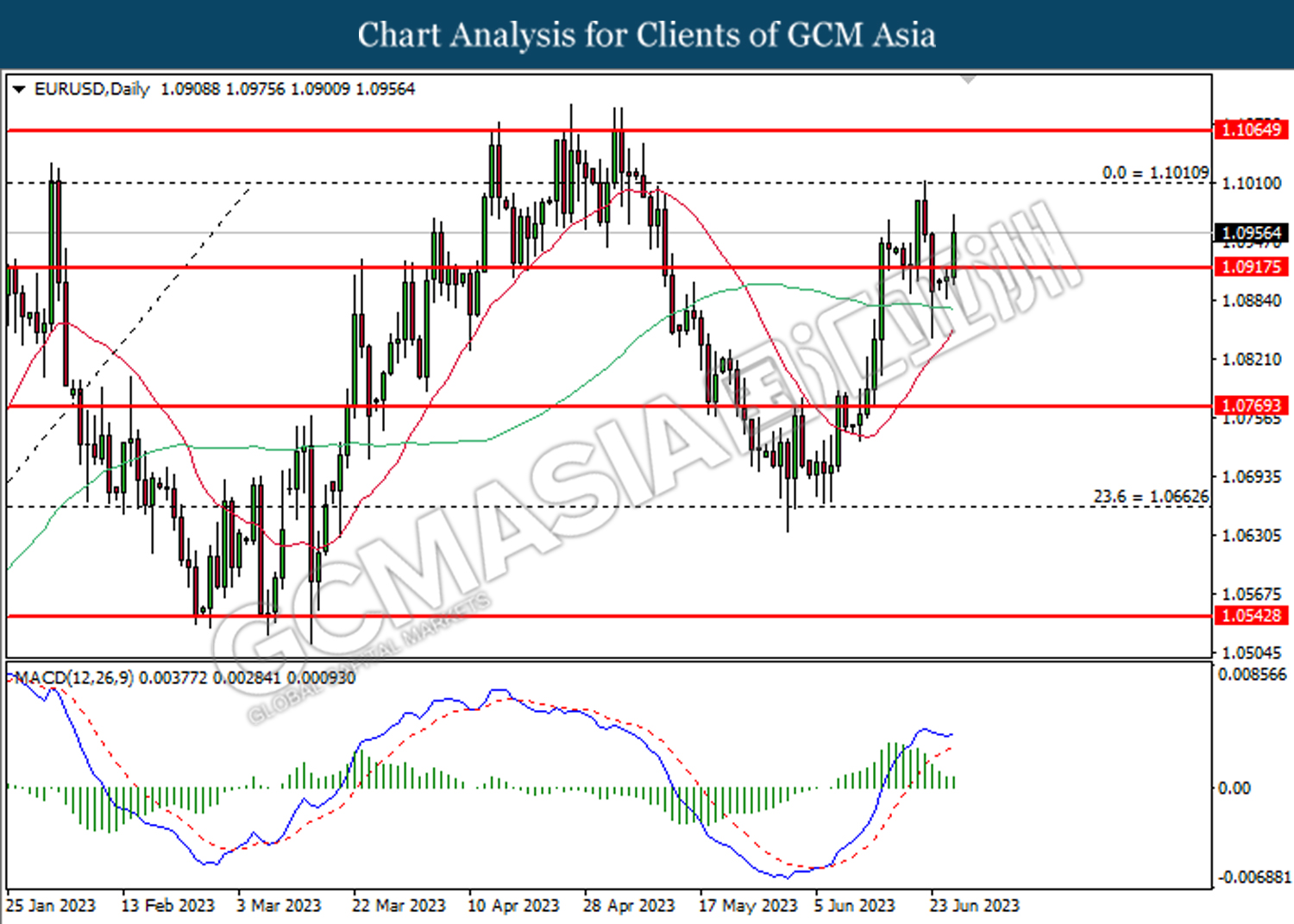

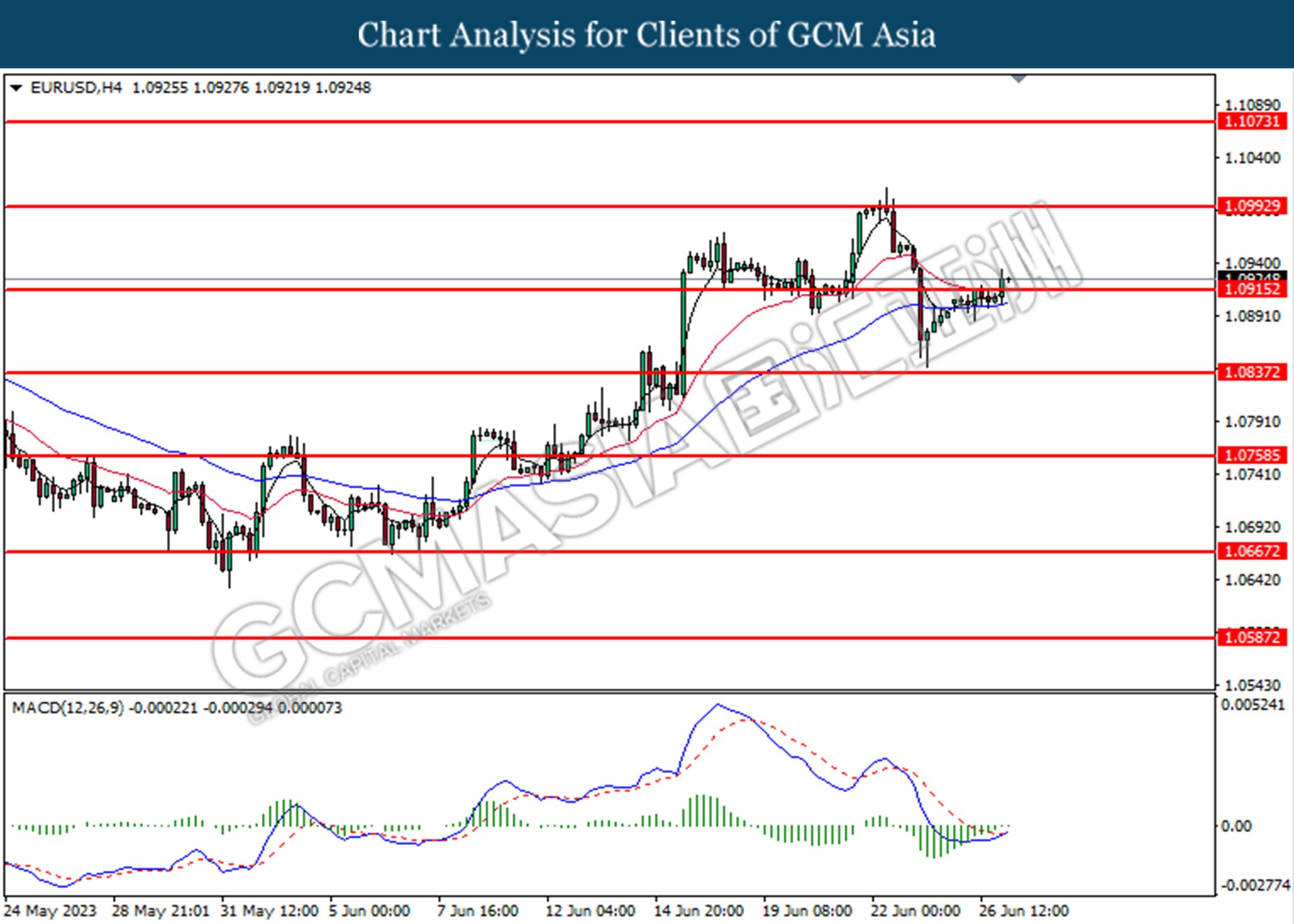

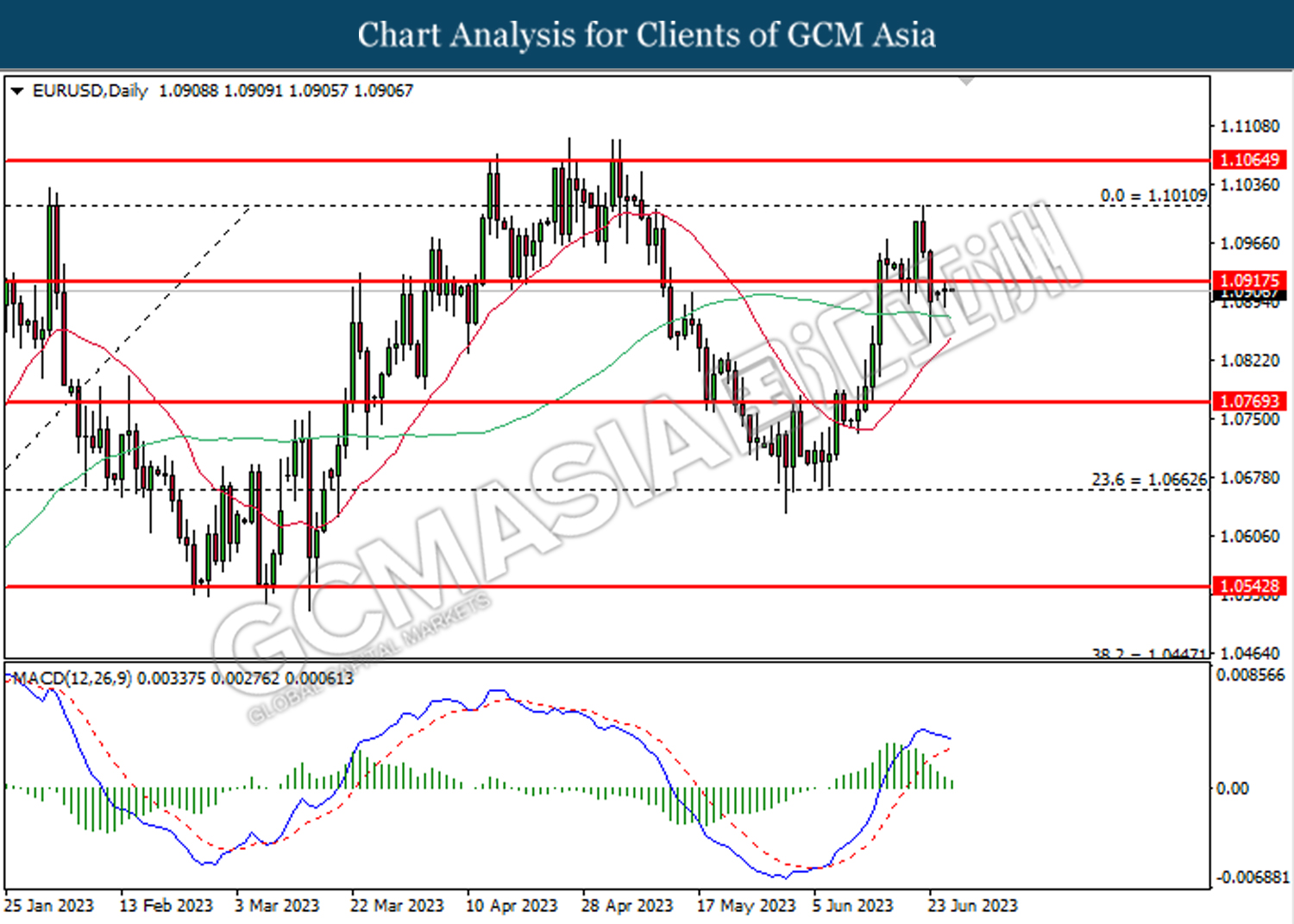

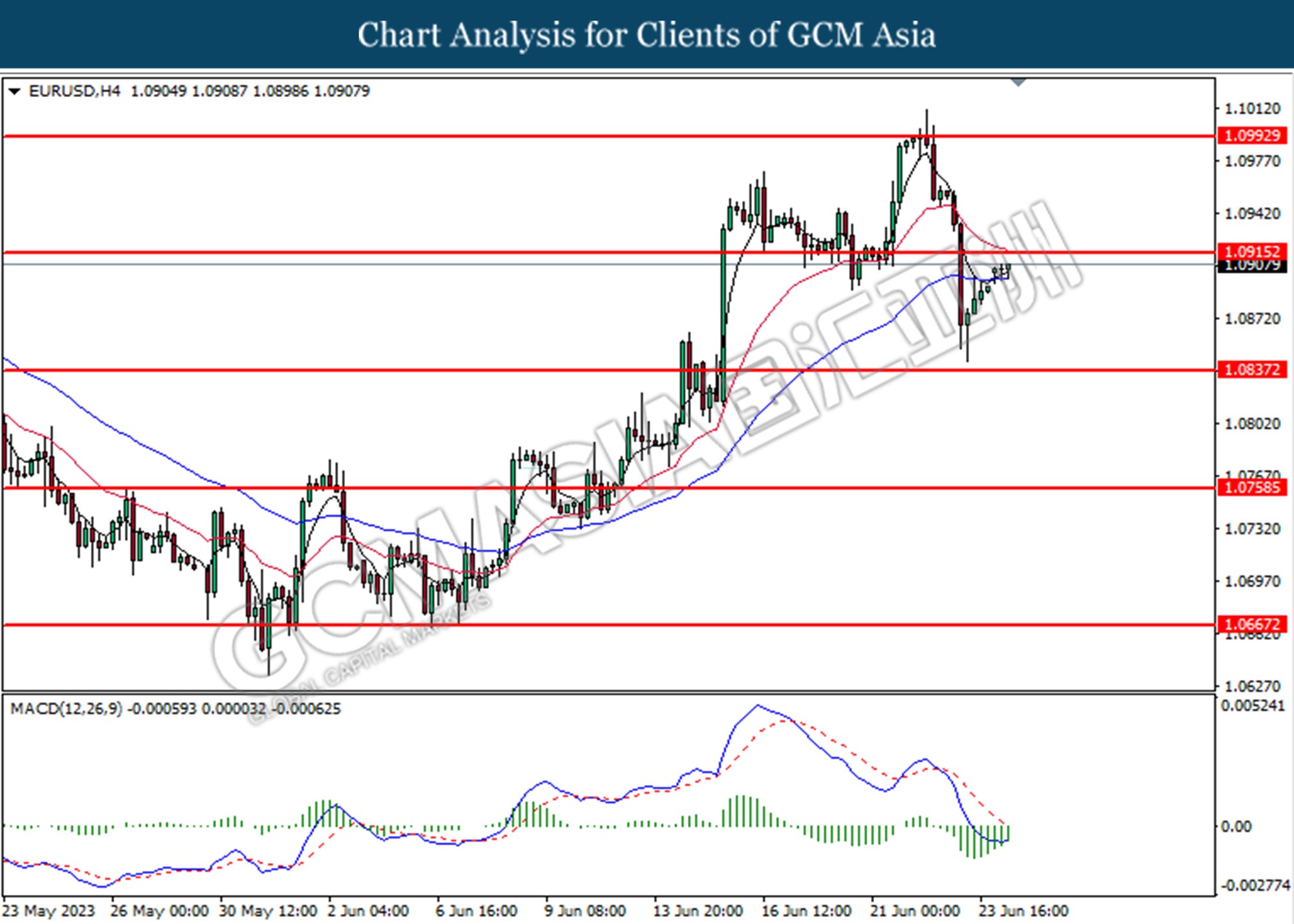

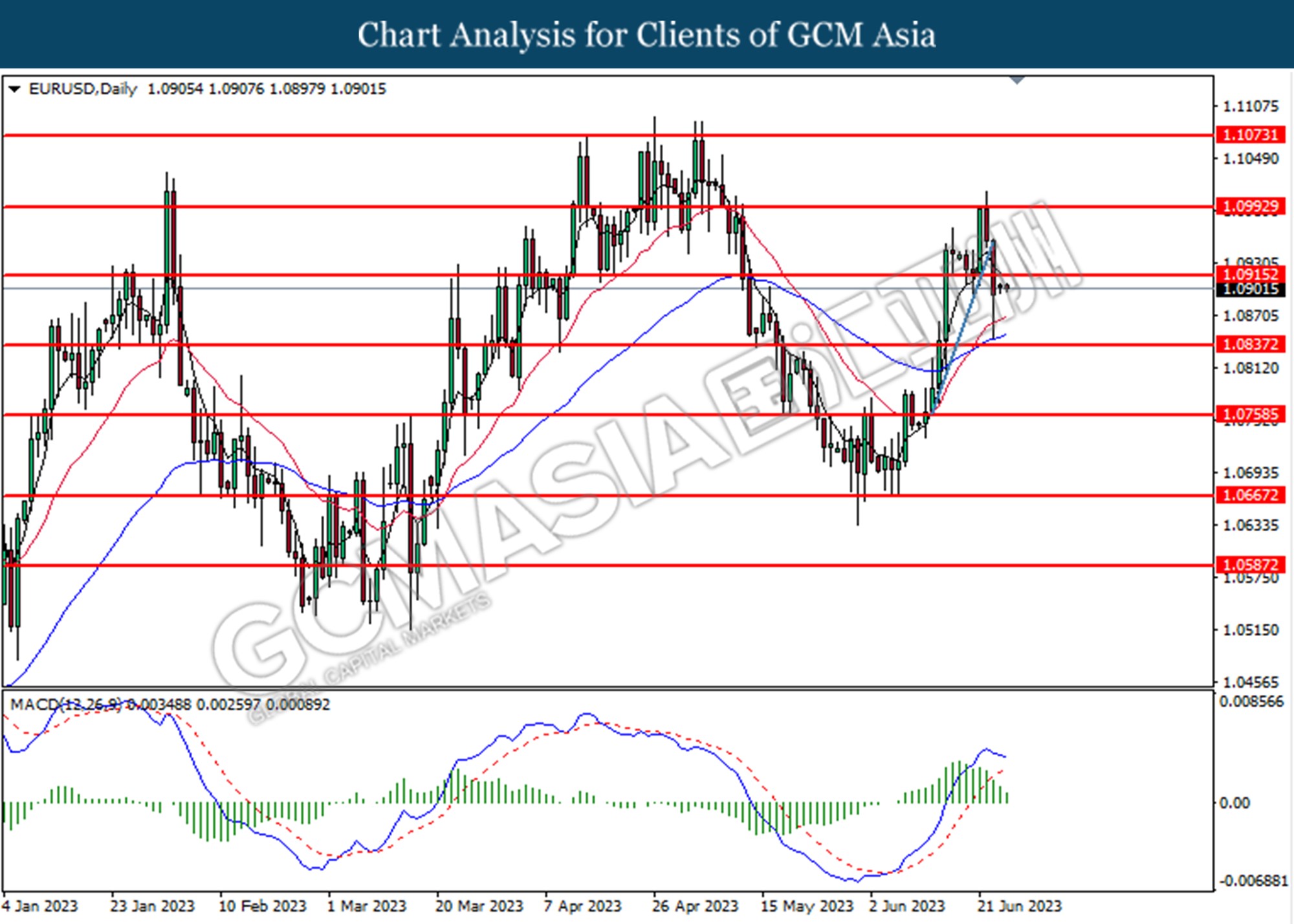

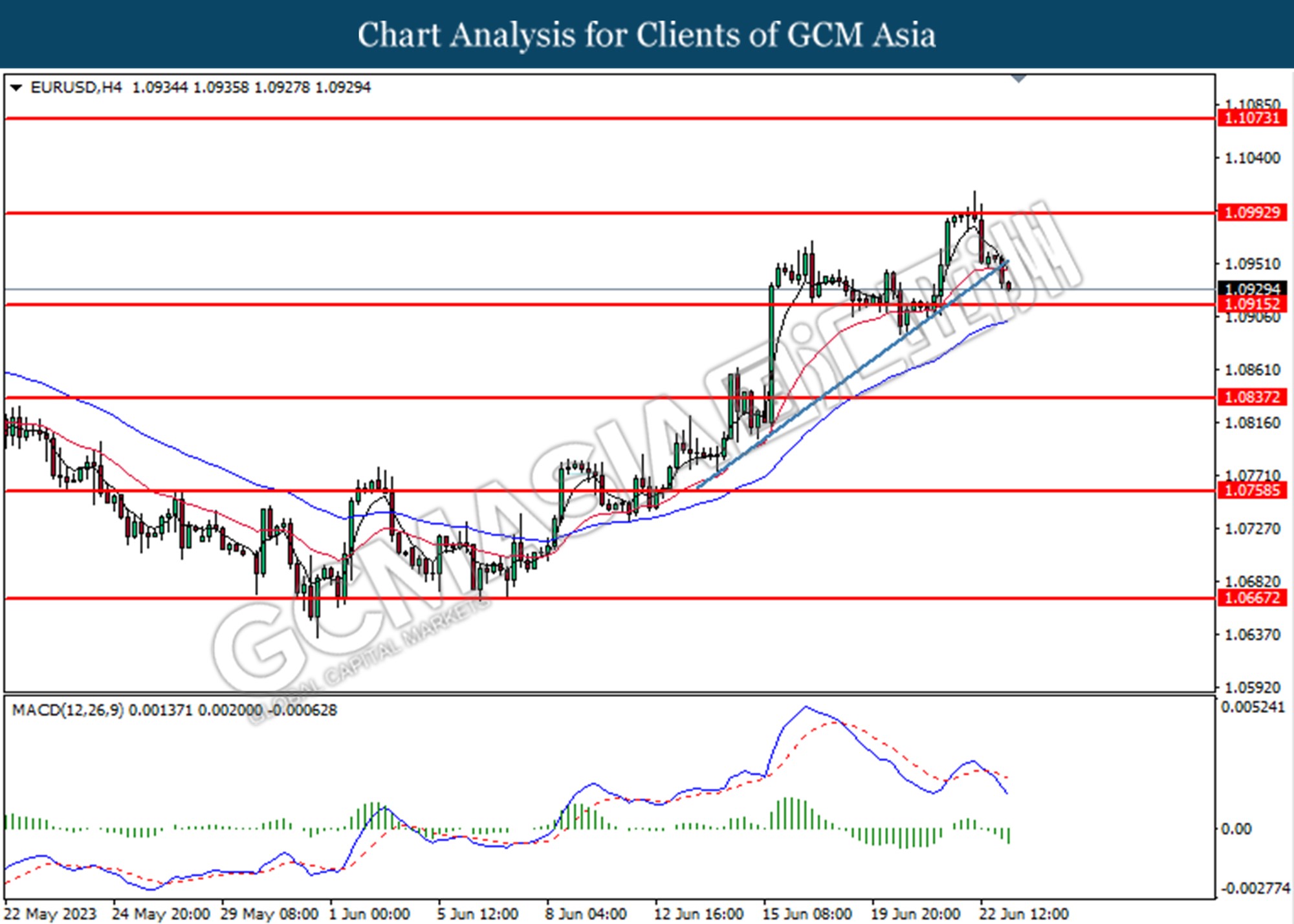

EURUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level at 1.0915. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

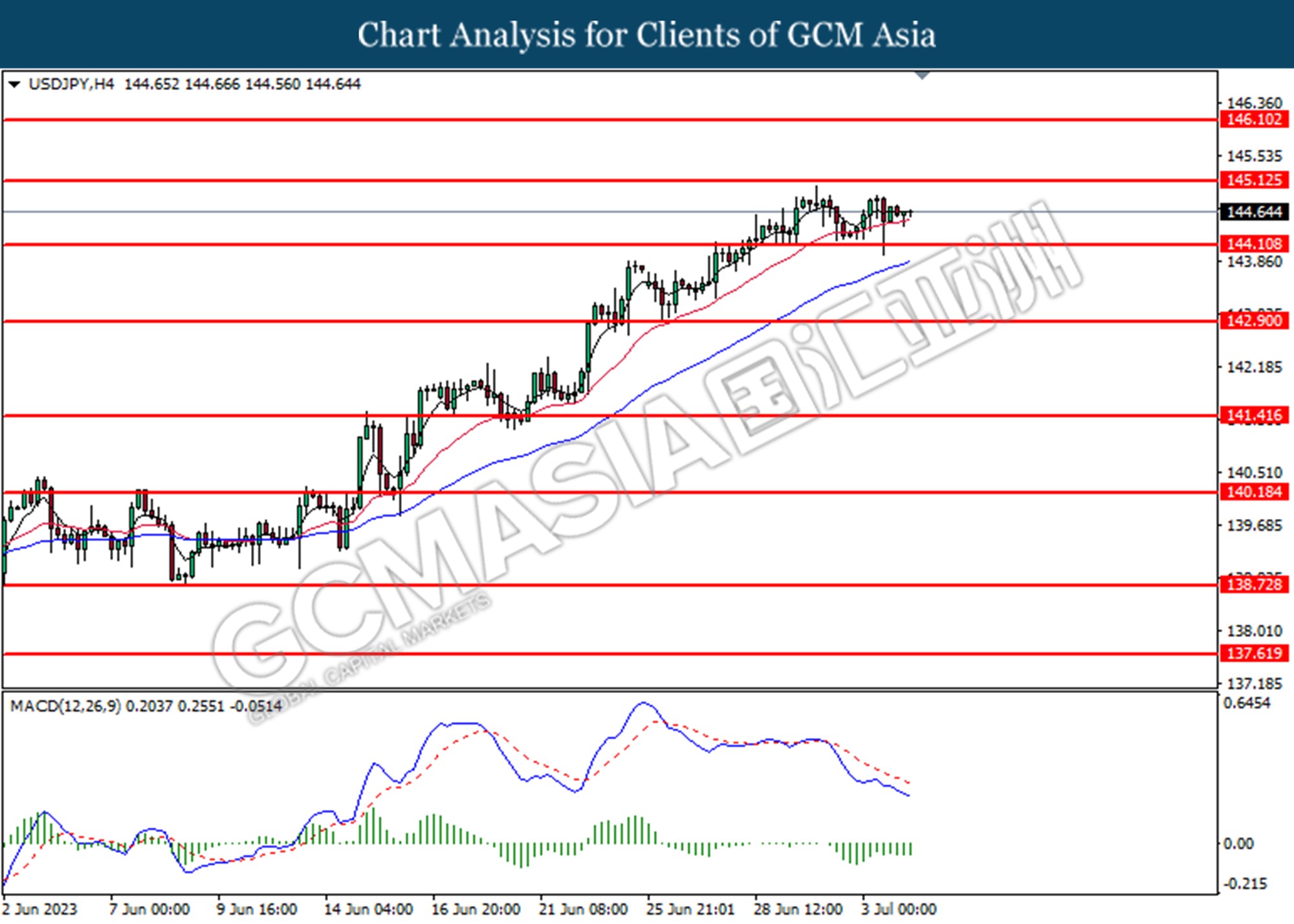

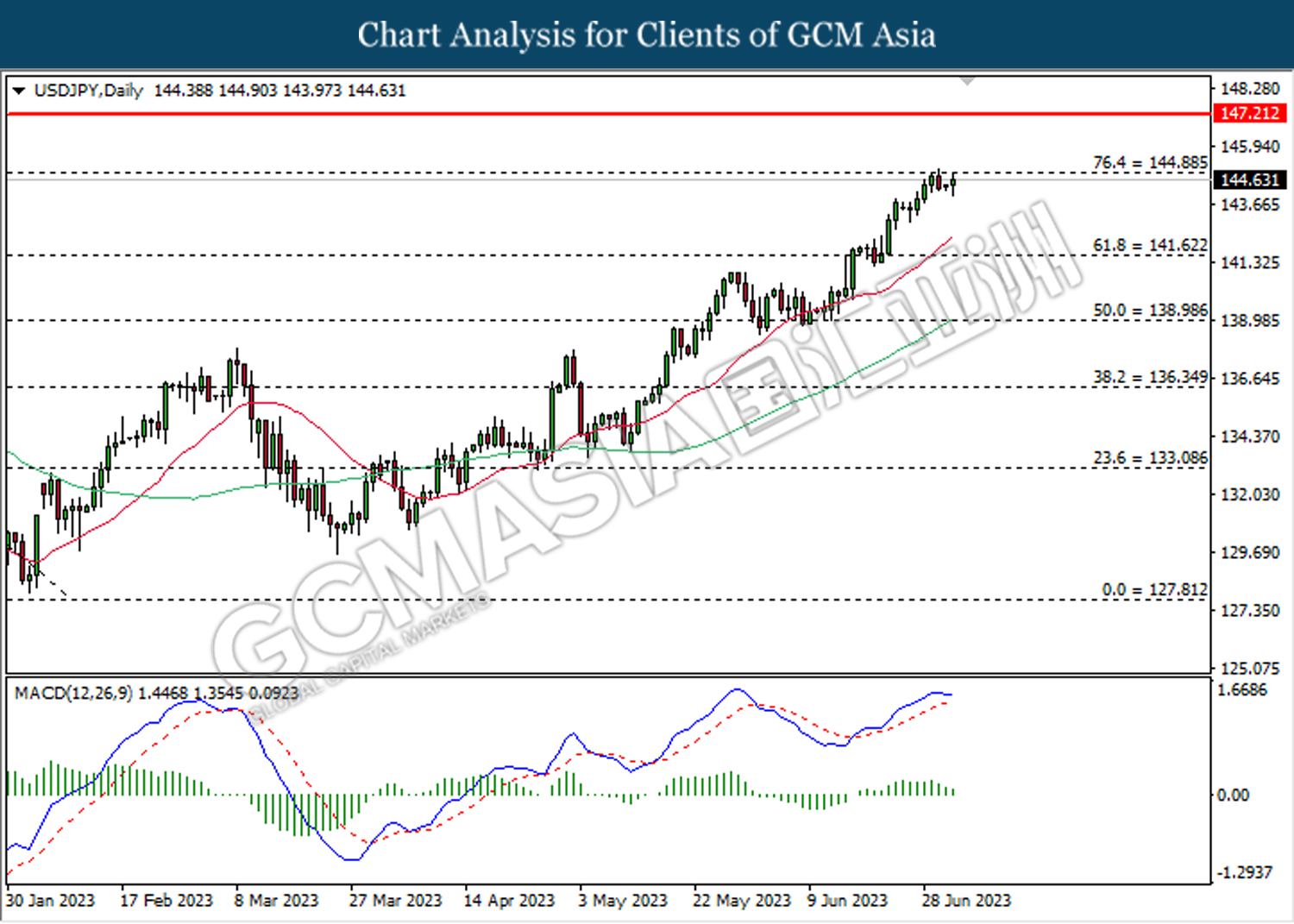

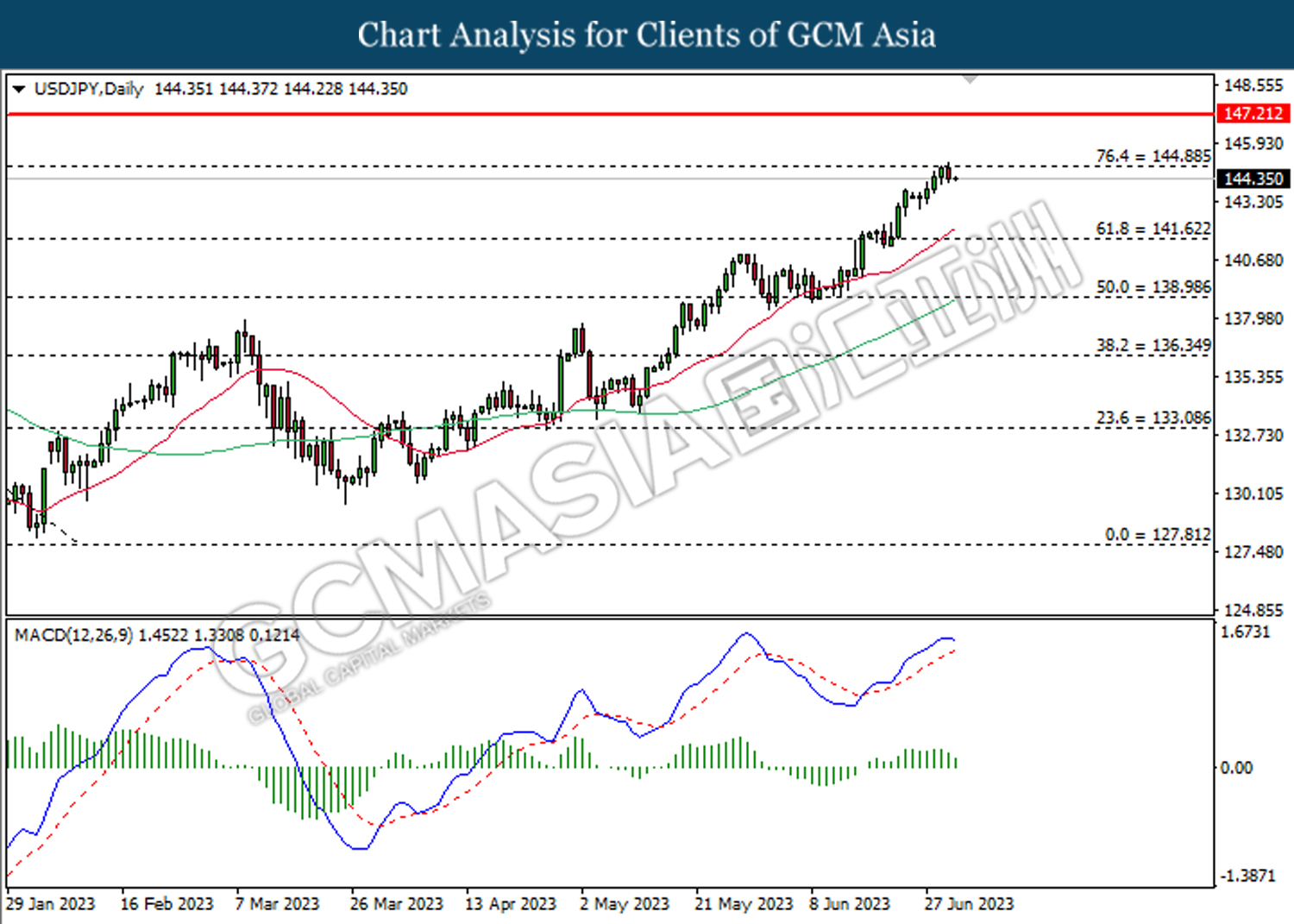

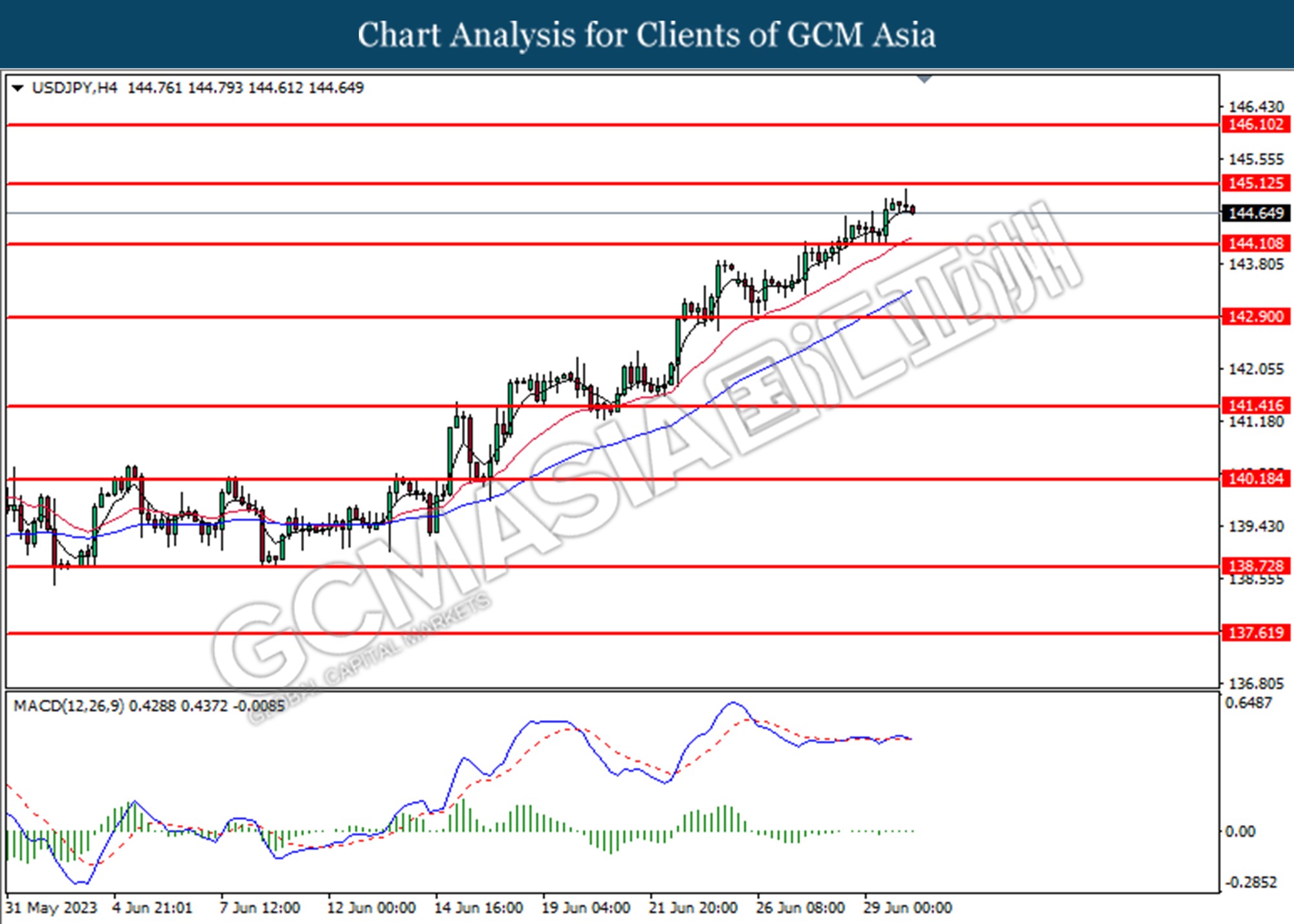

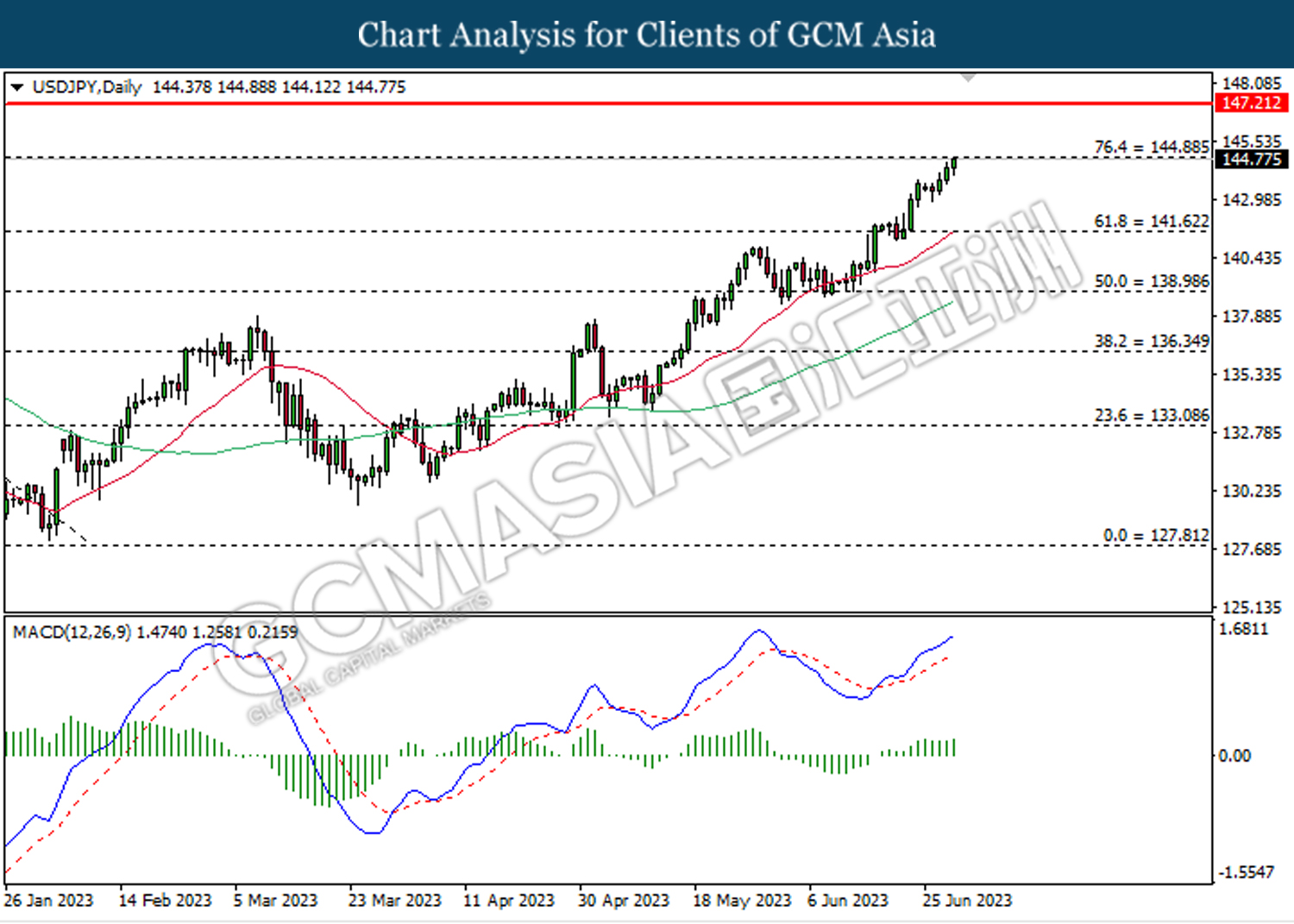

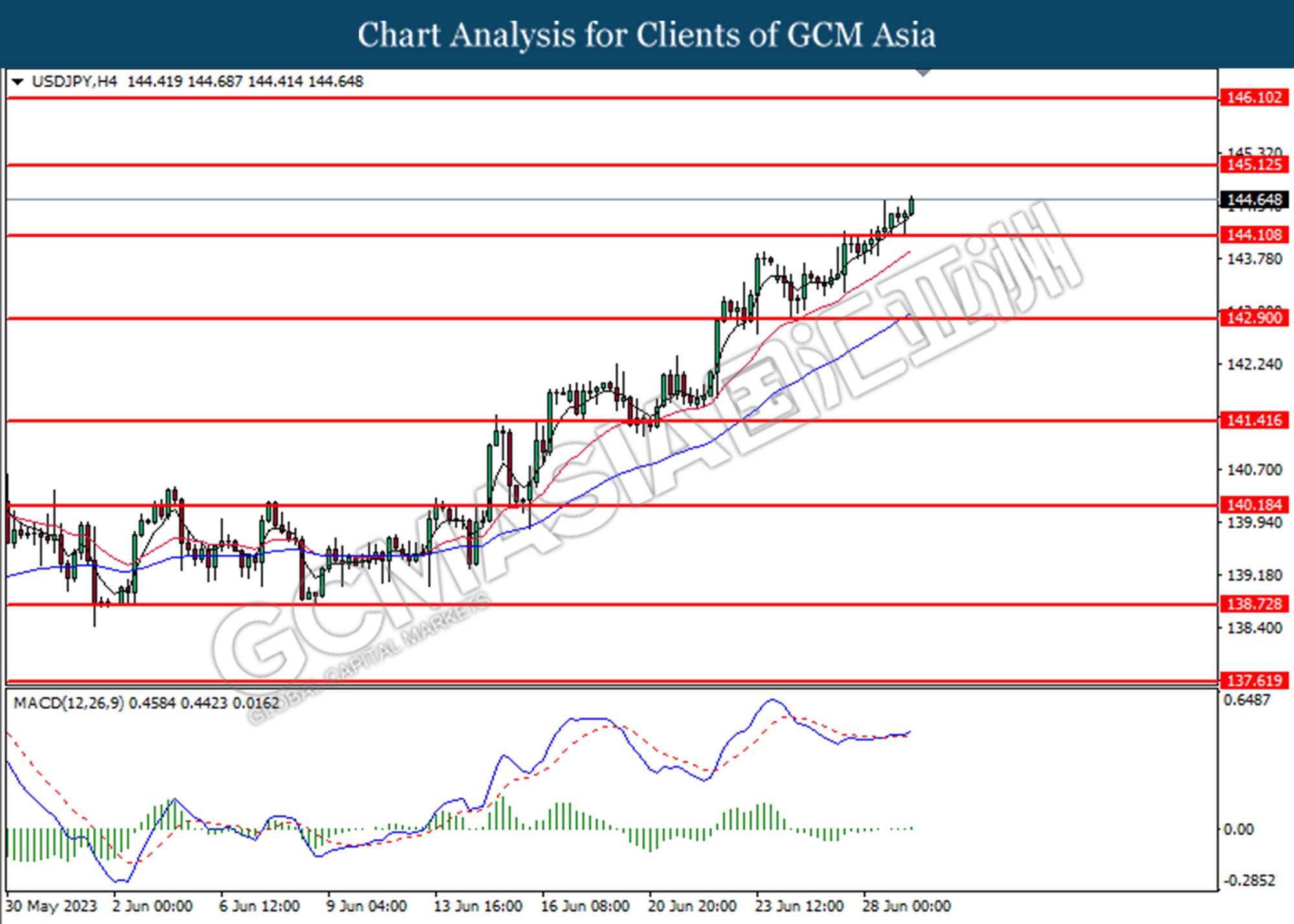

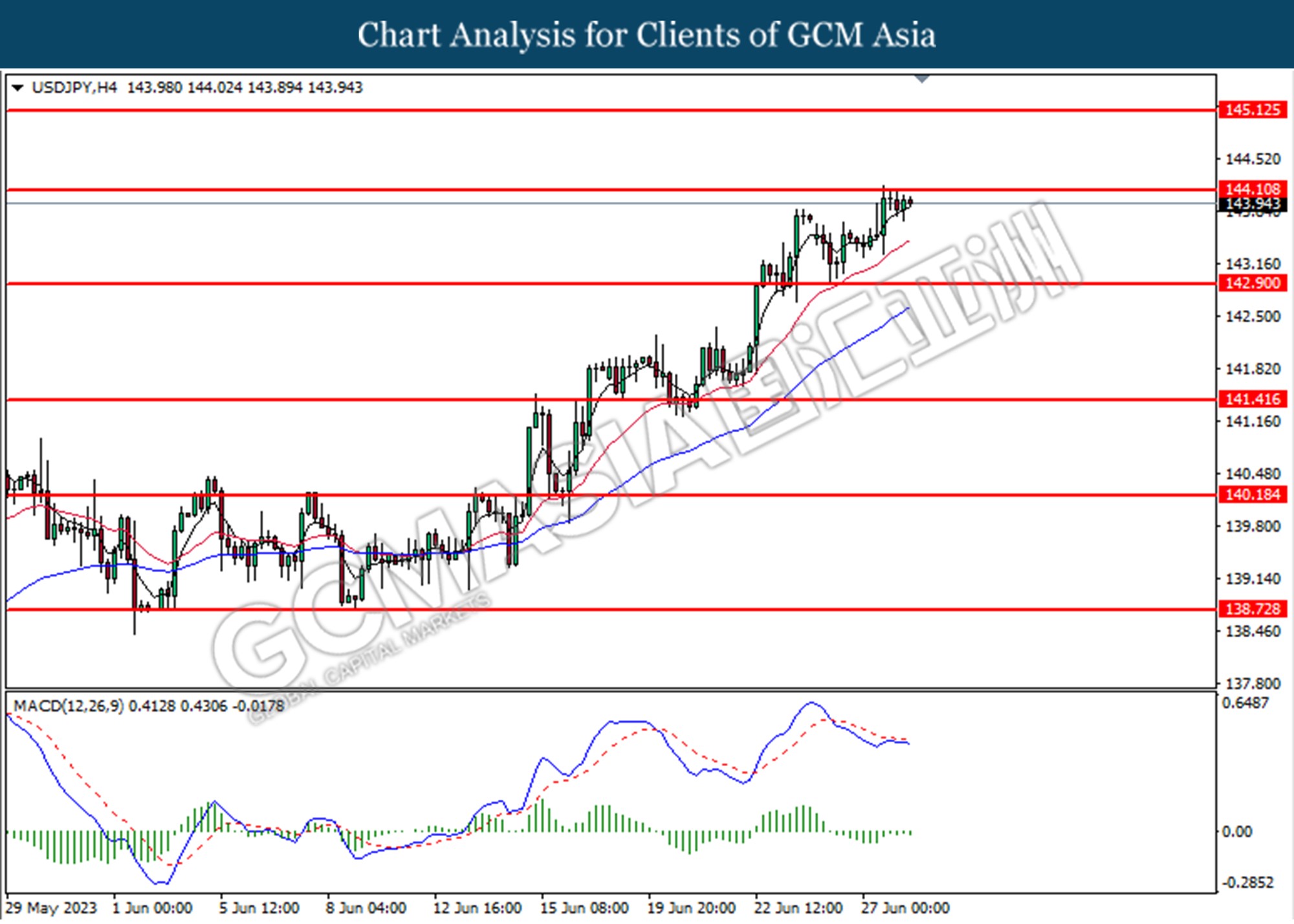

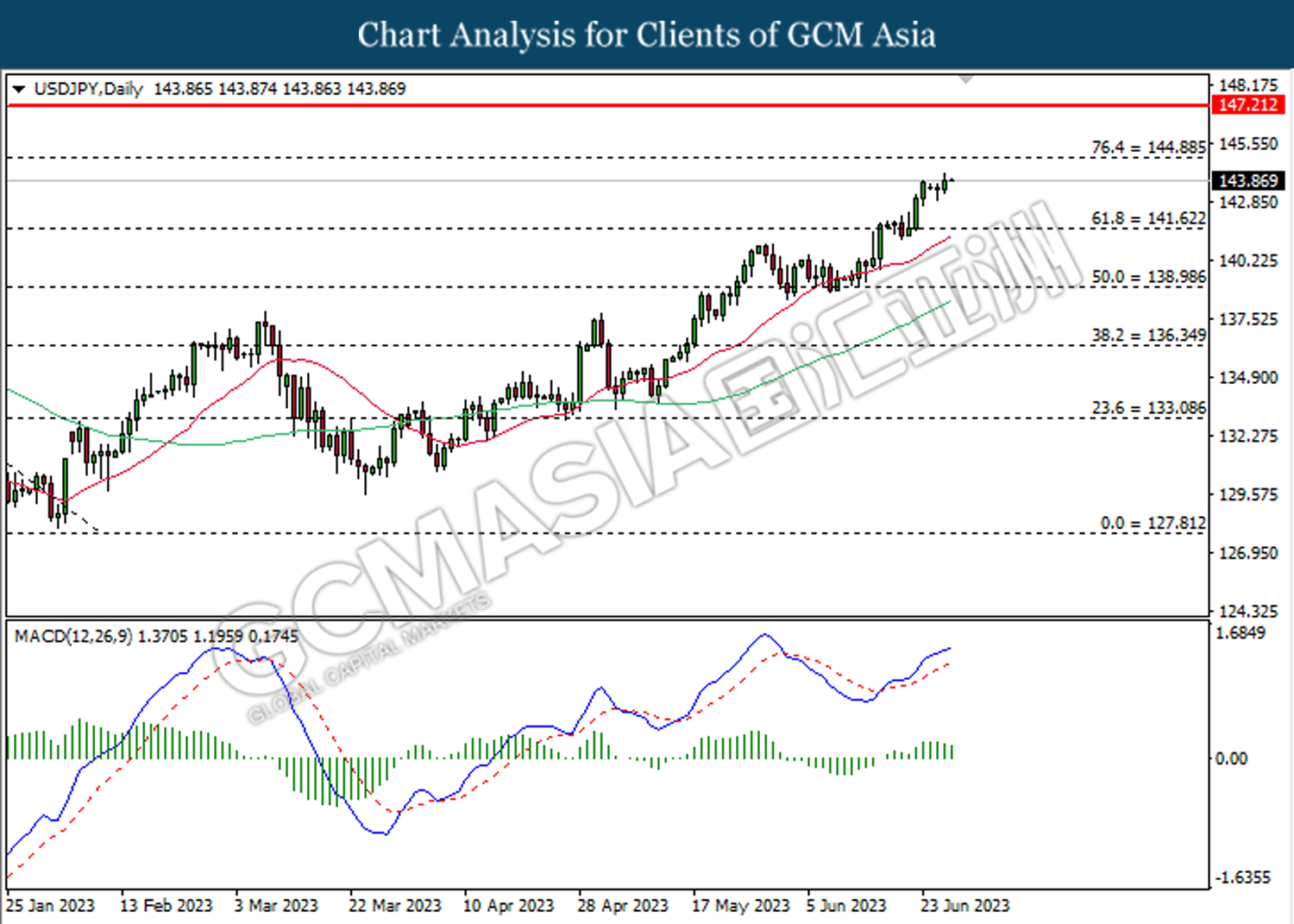

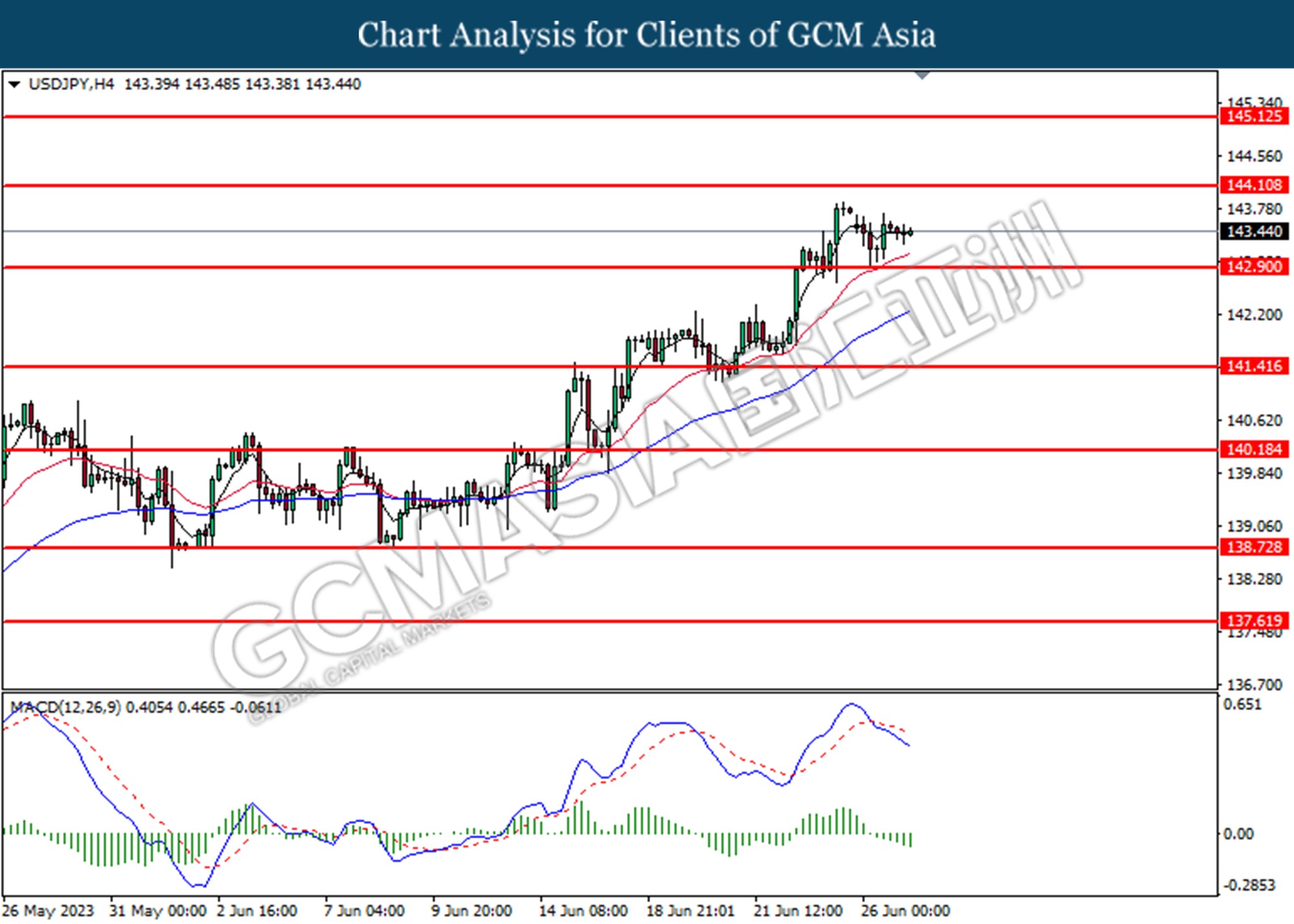

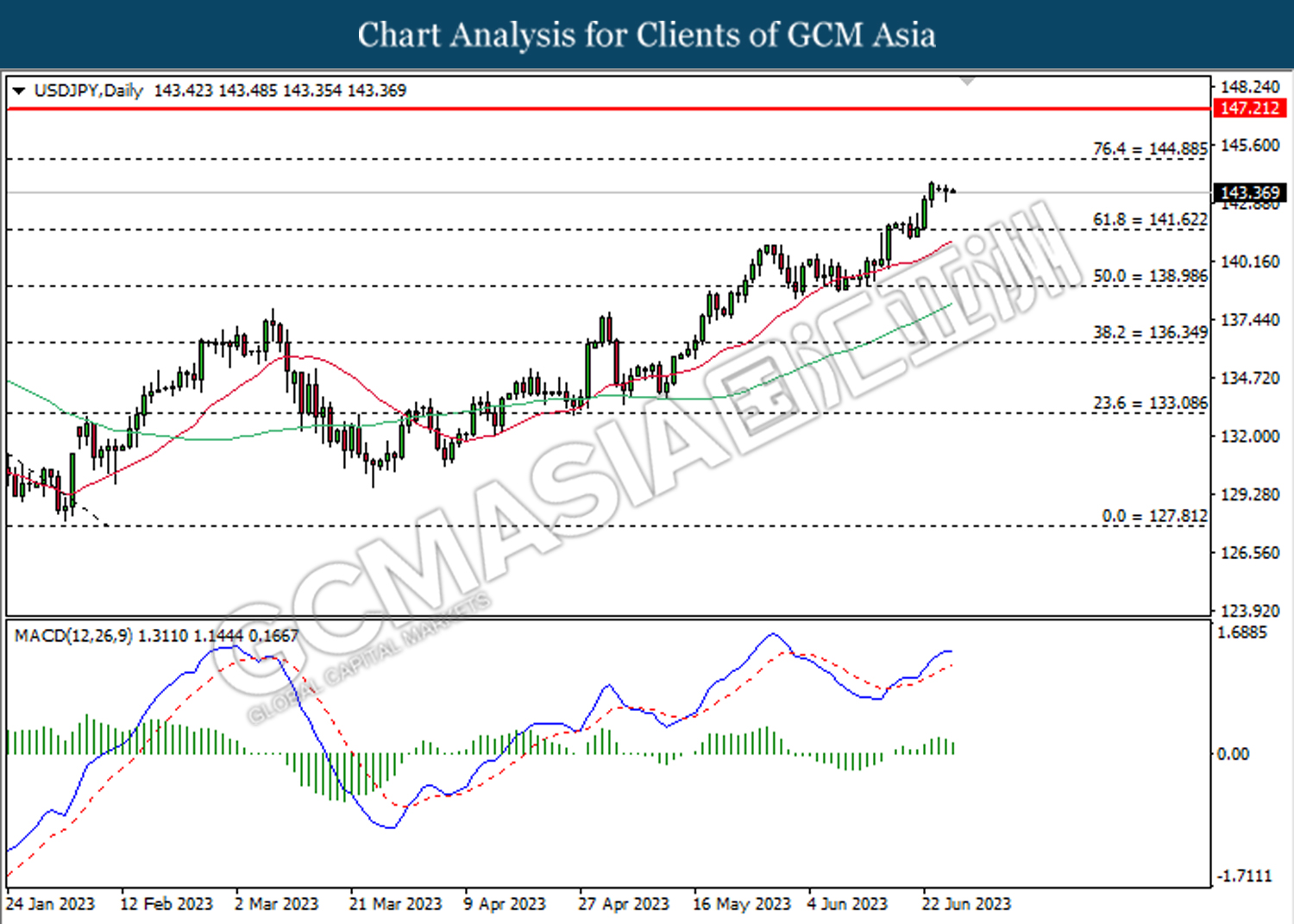

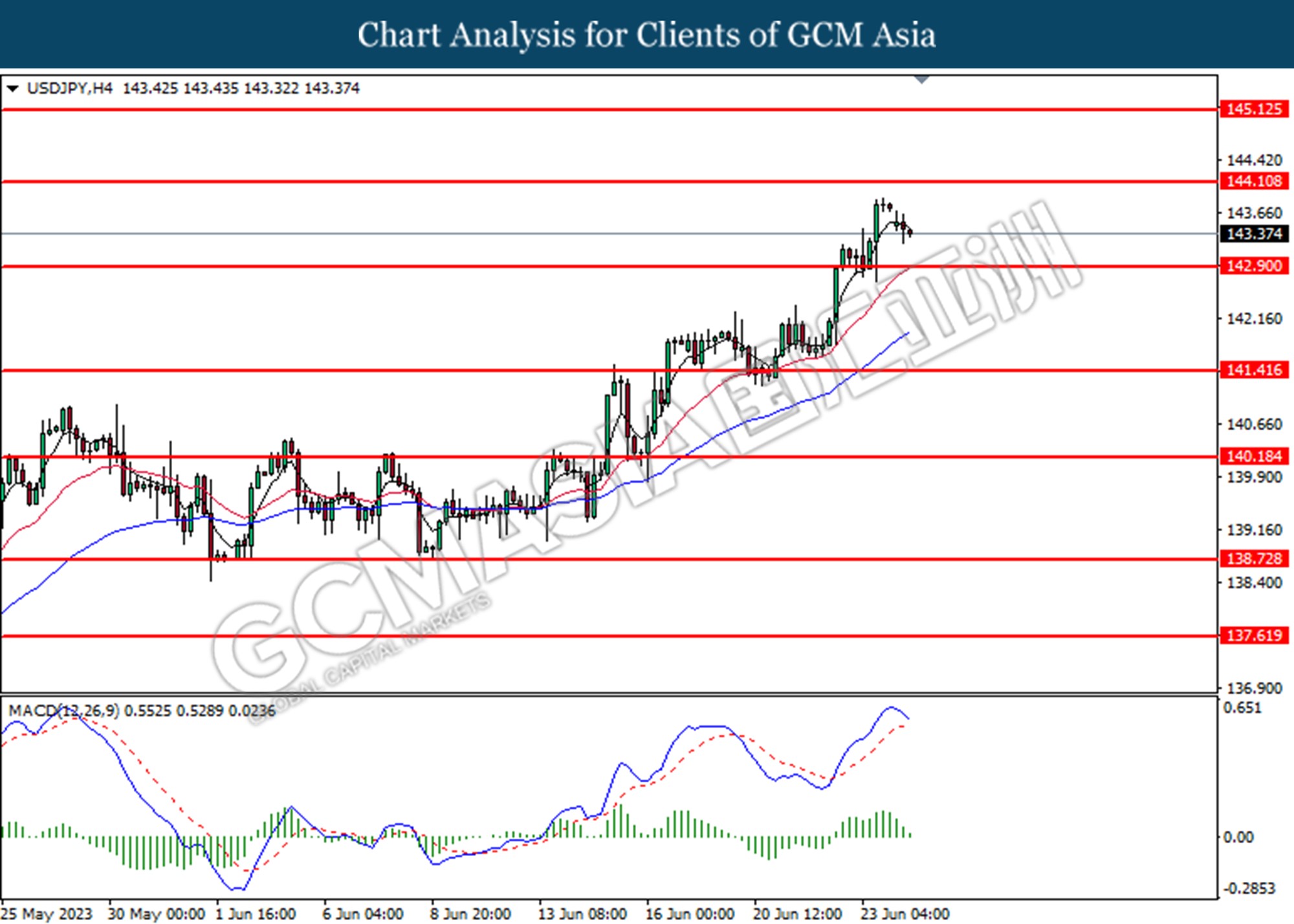

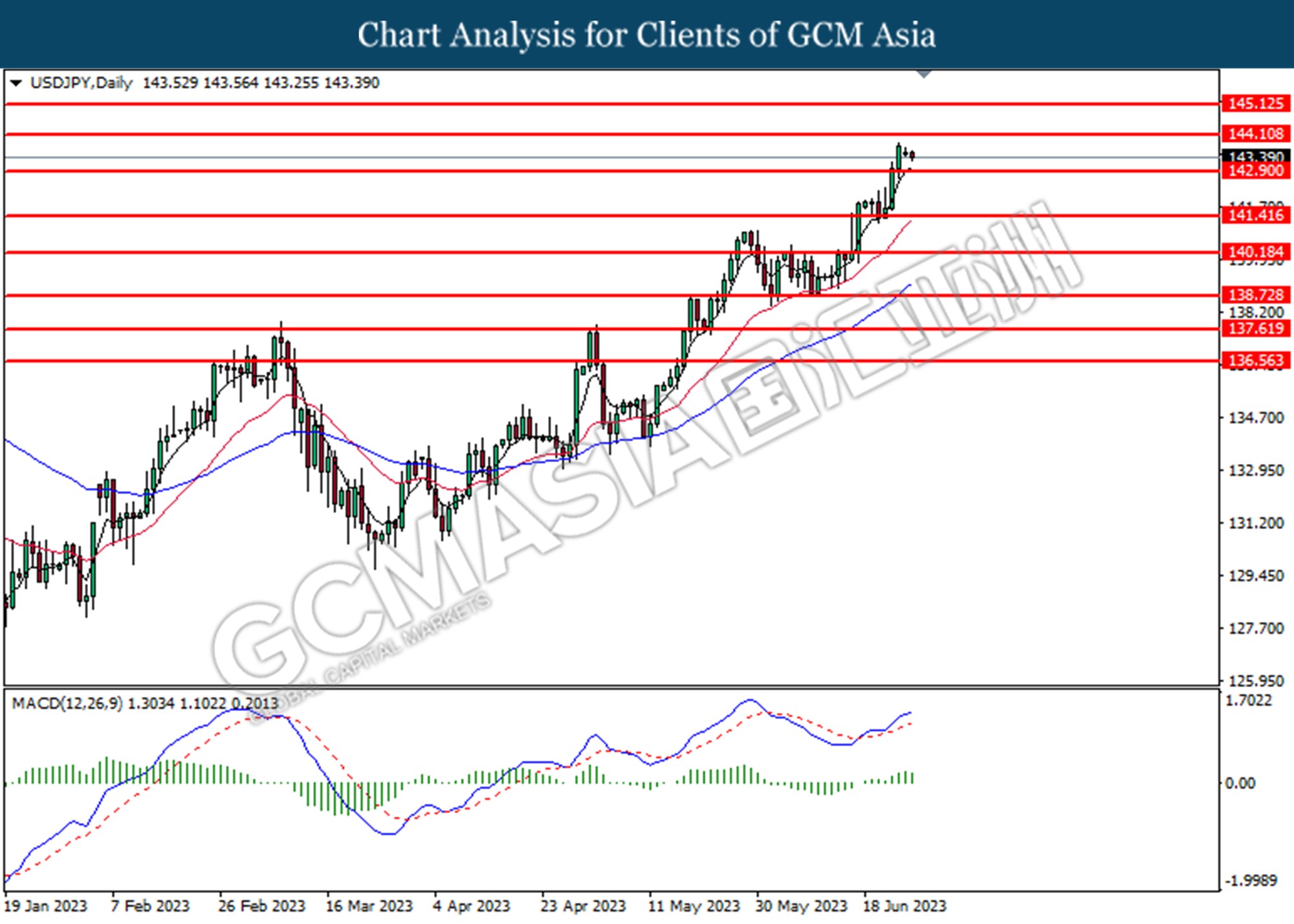

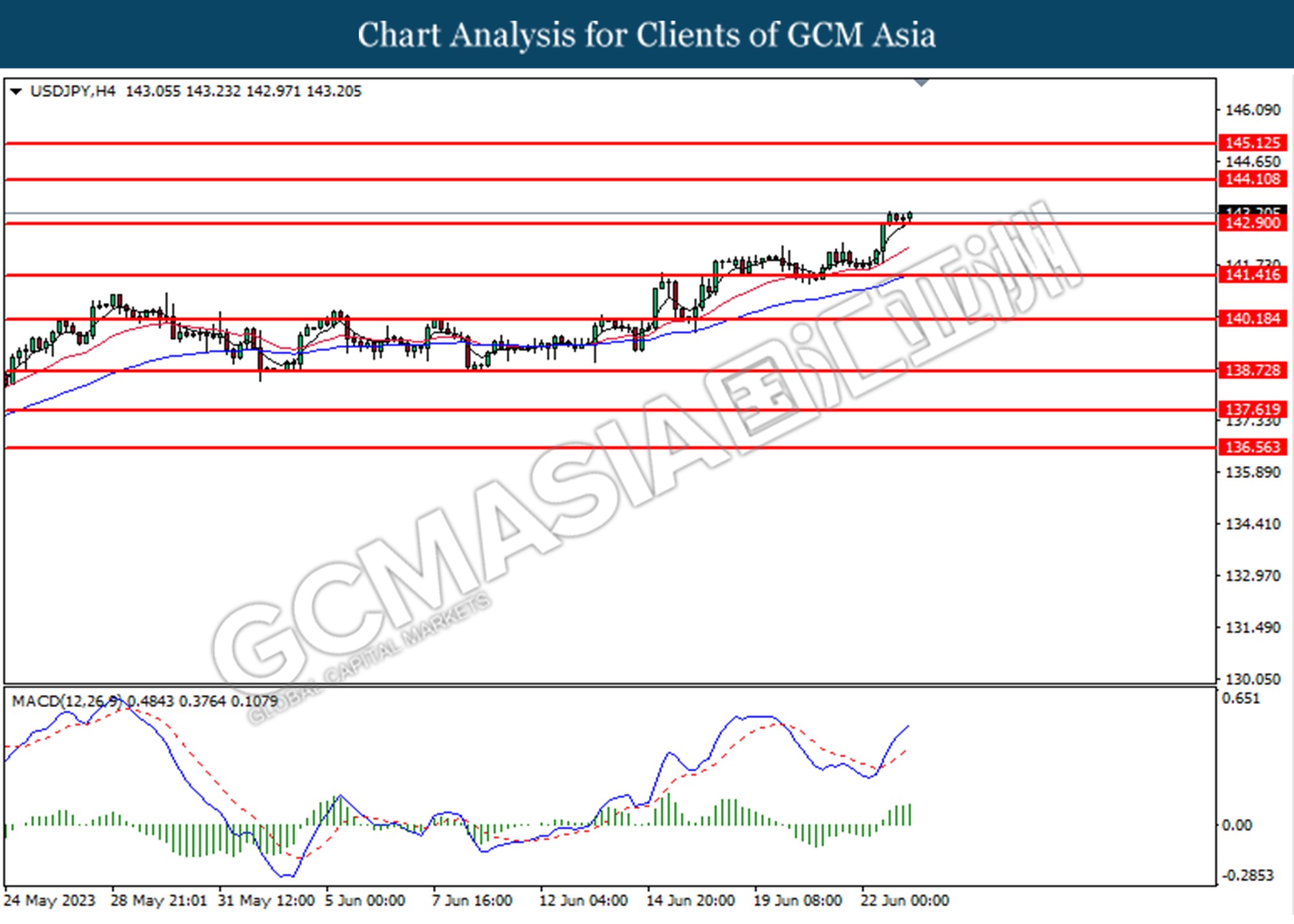

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 145.10, 146.10

Support level: 144.10, 142.90

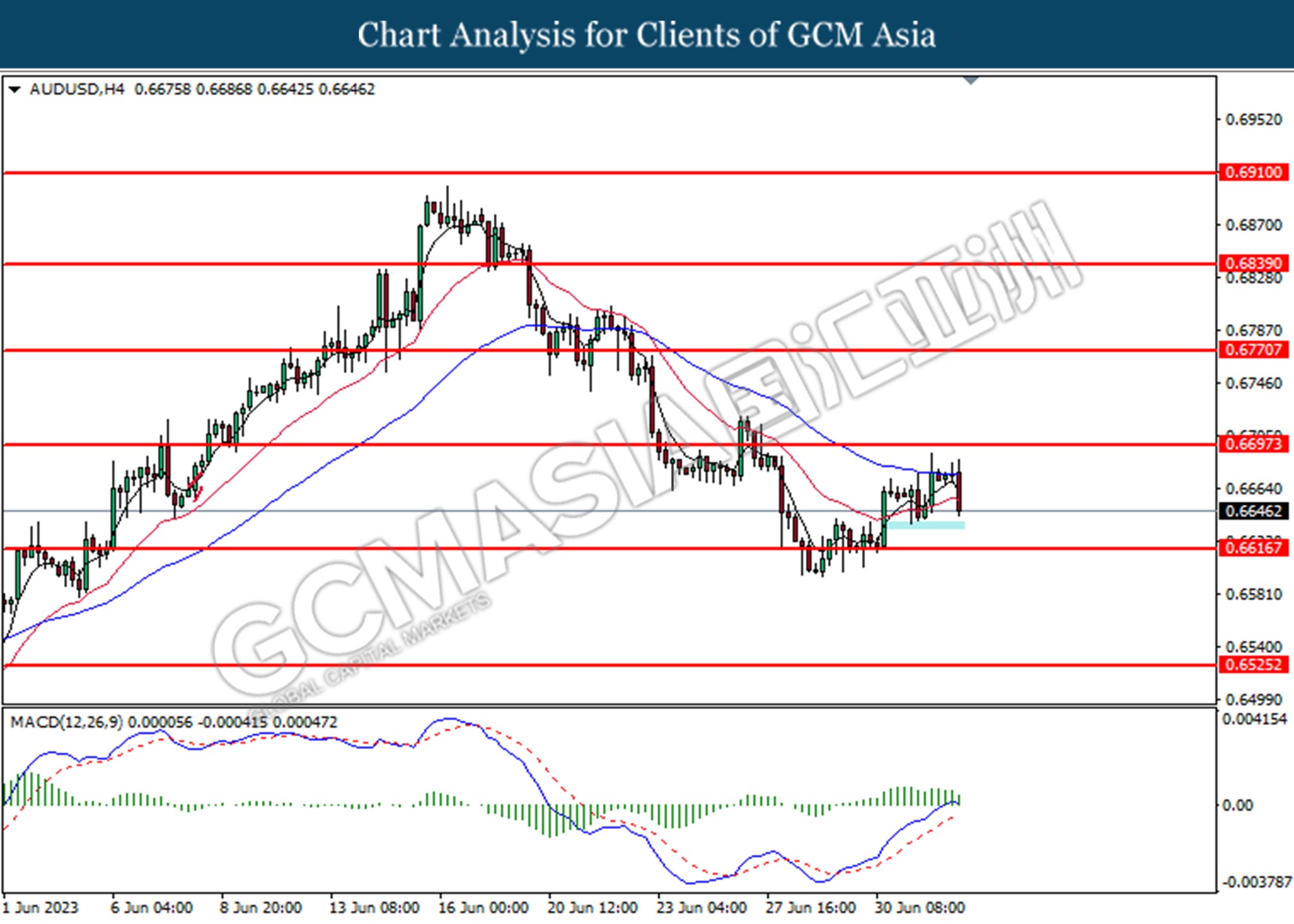

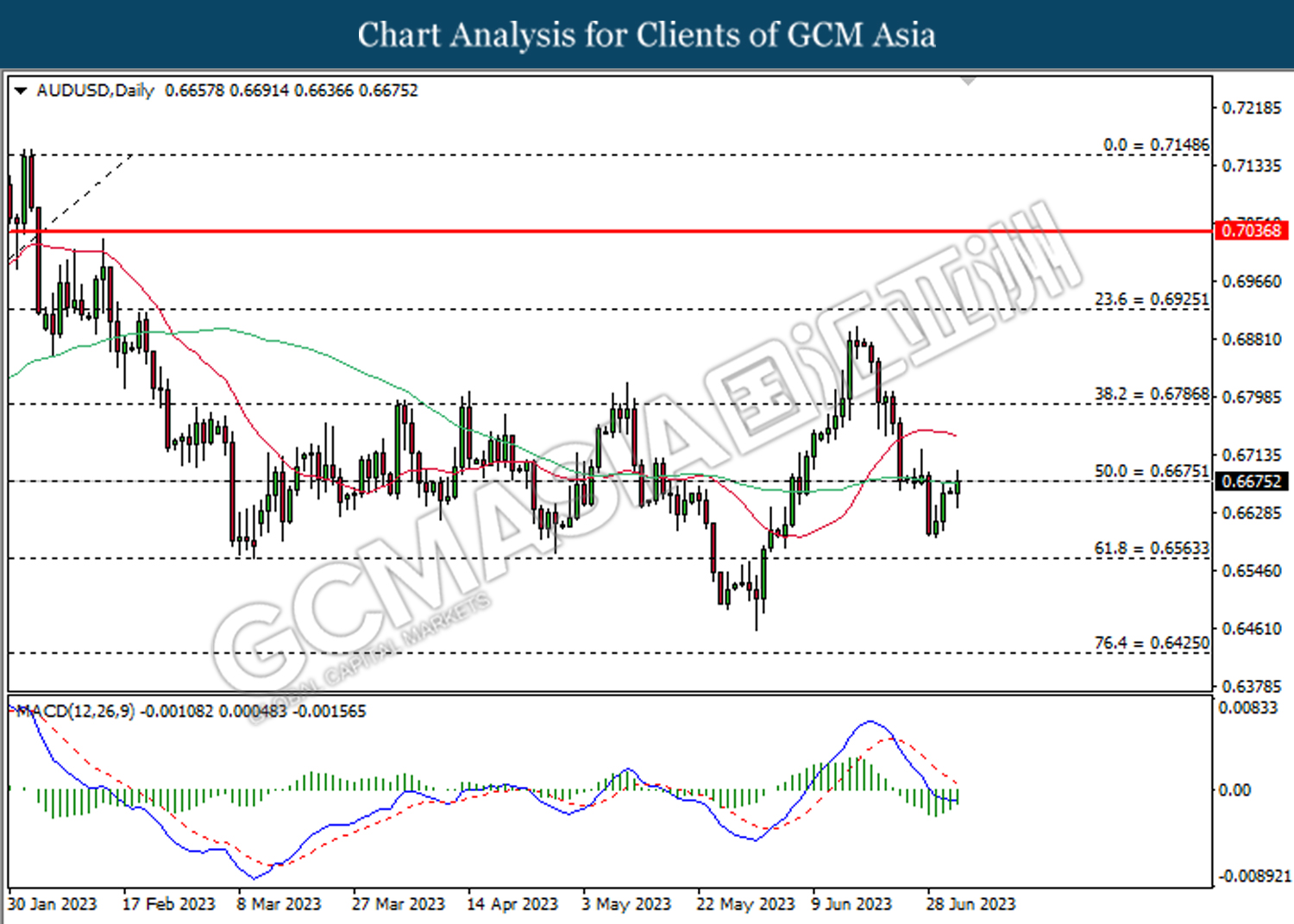

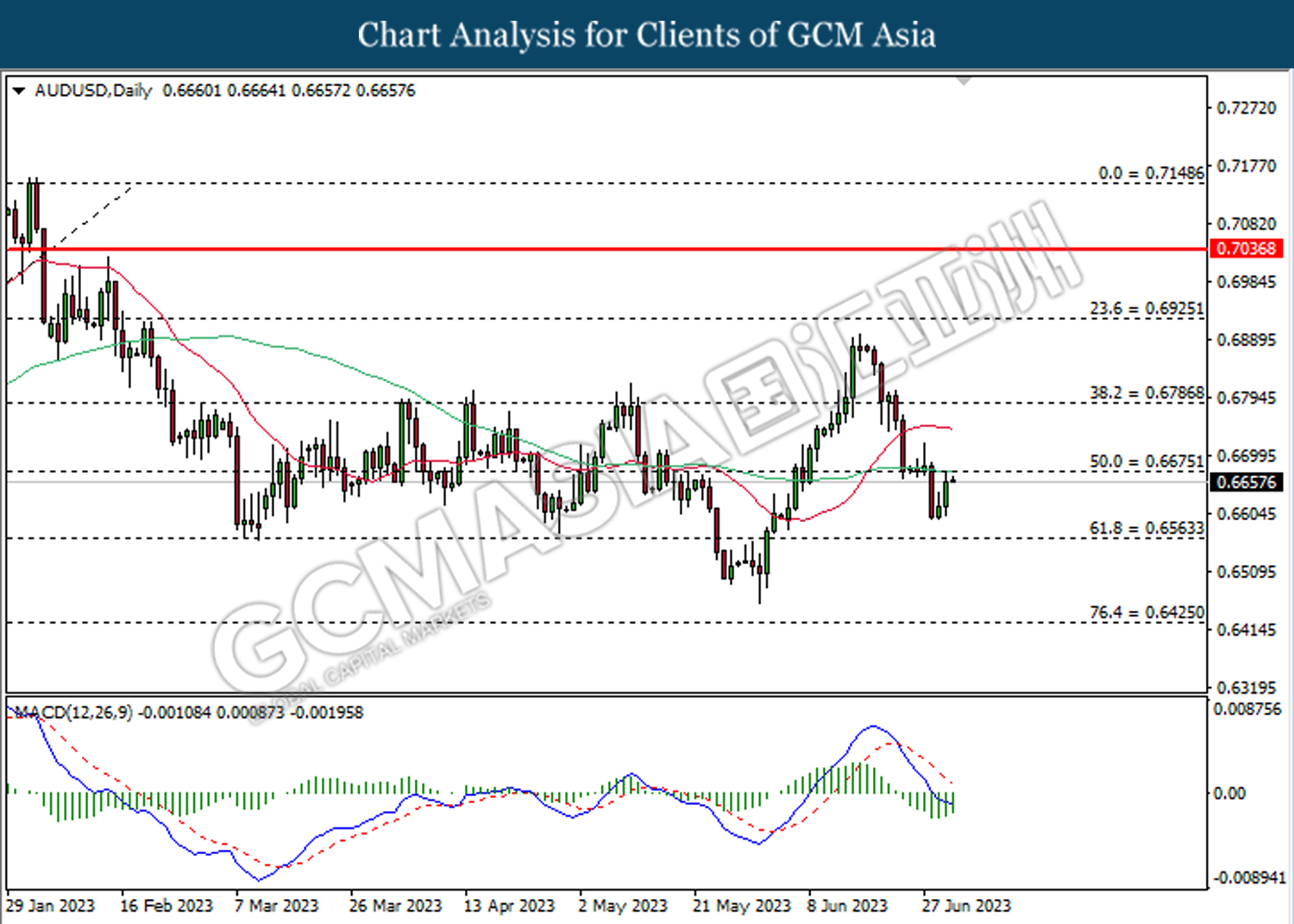

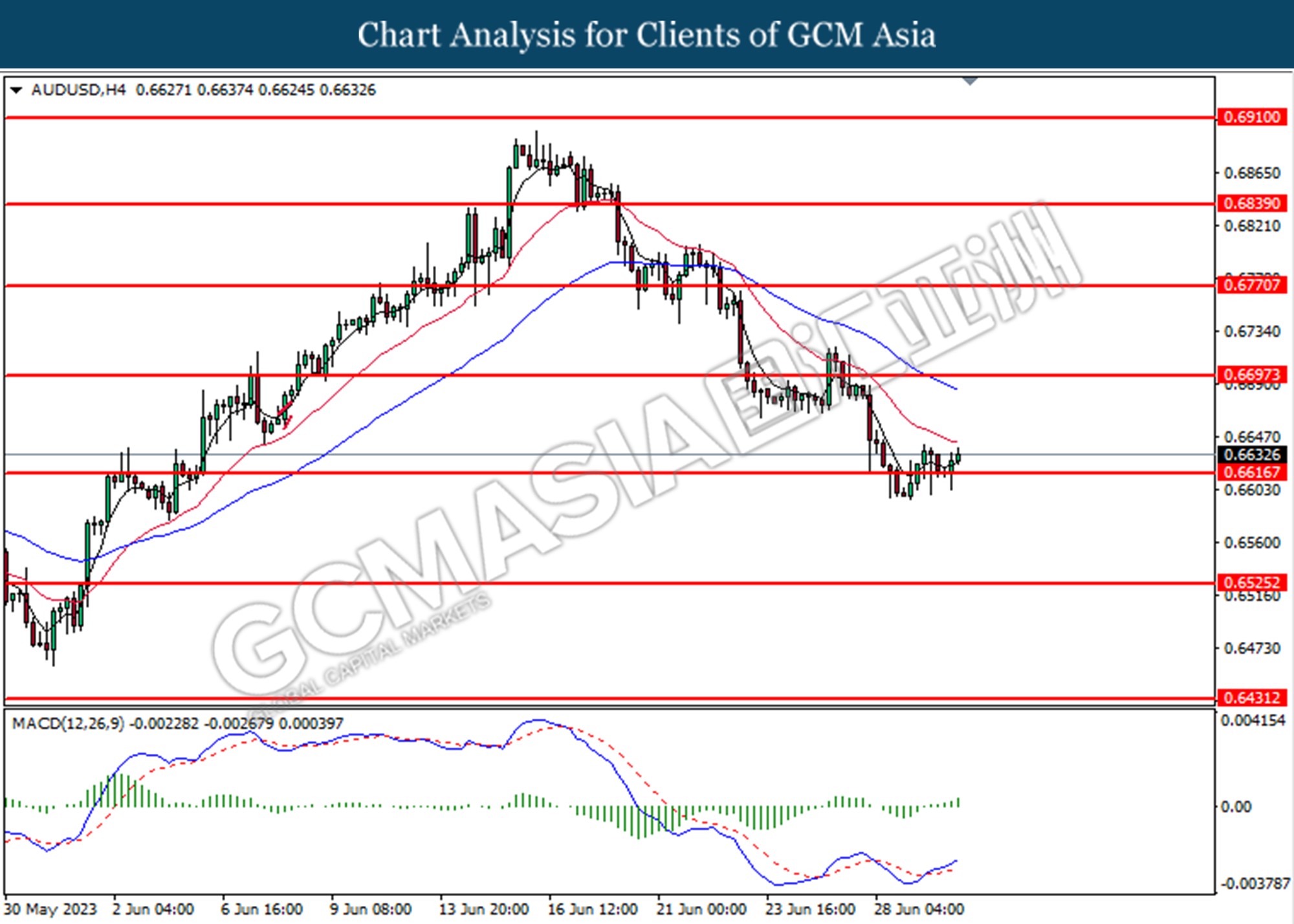

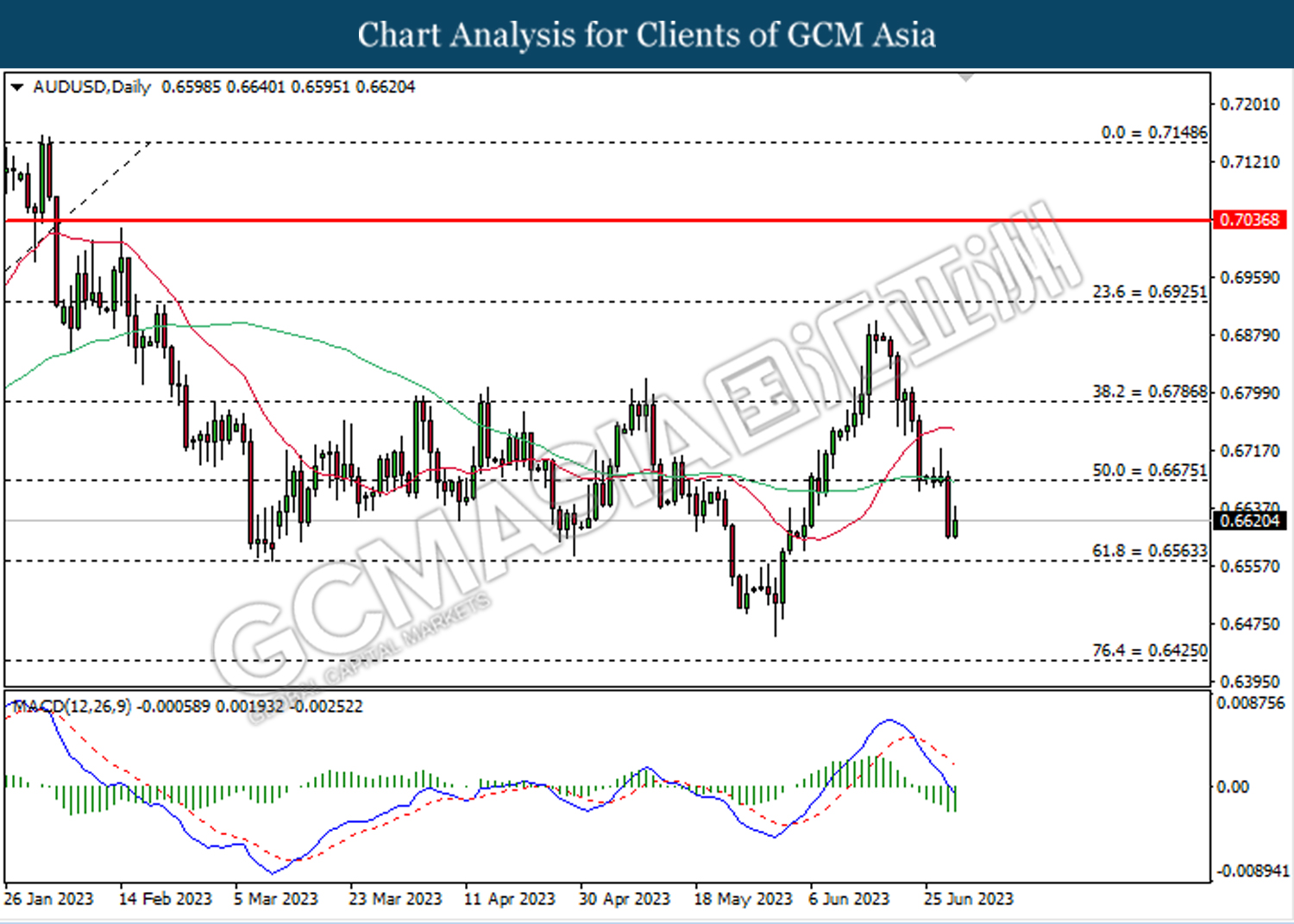

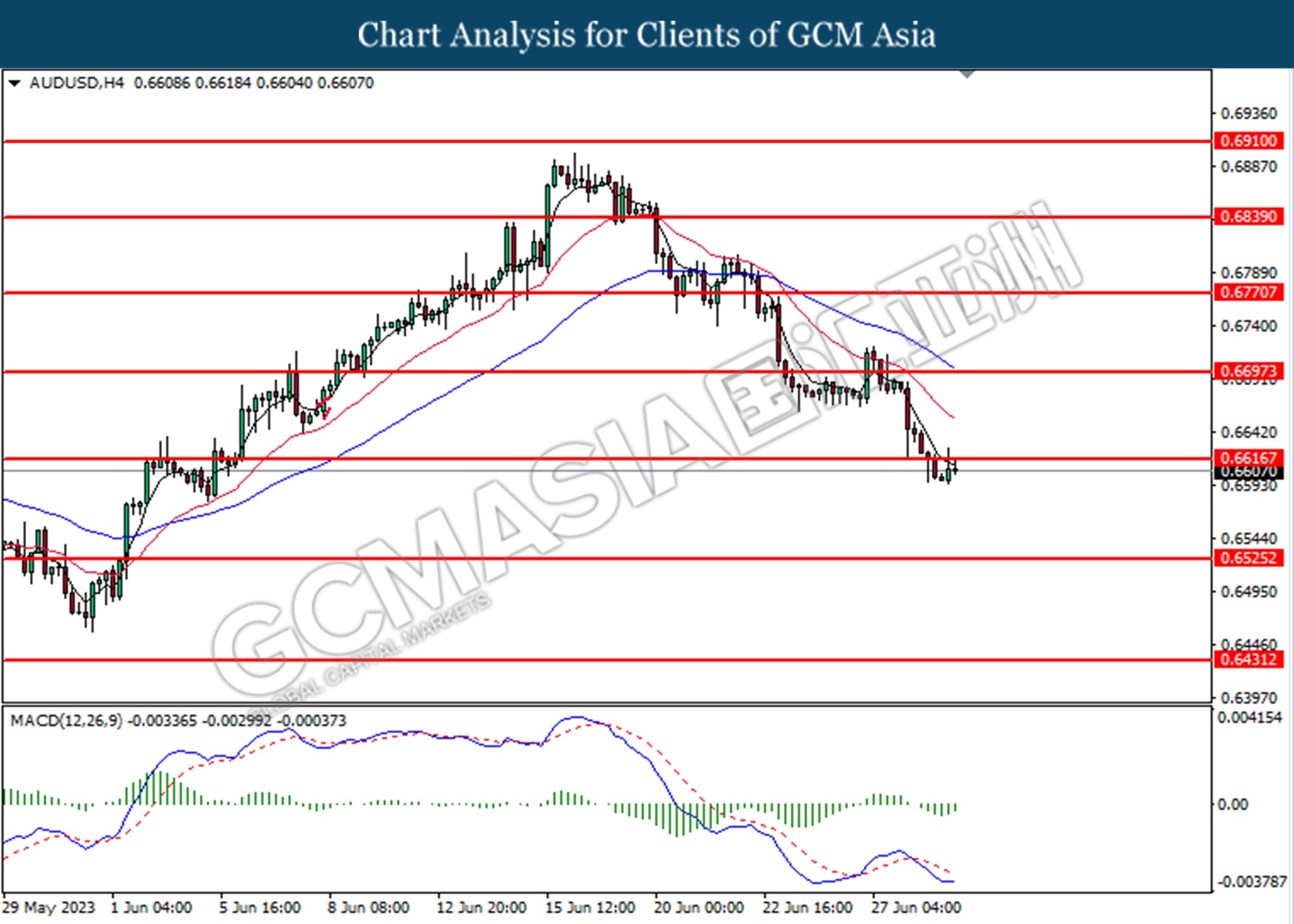

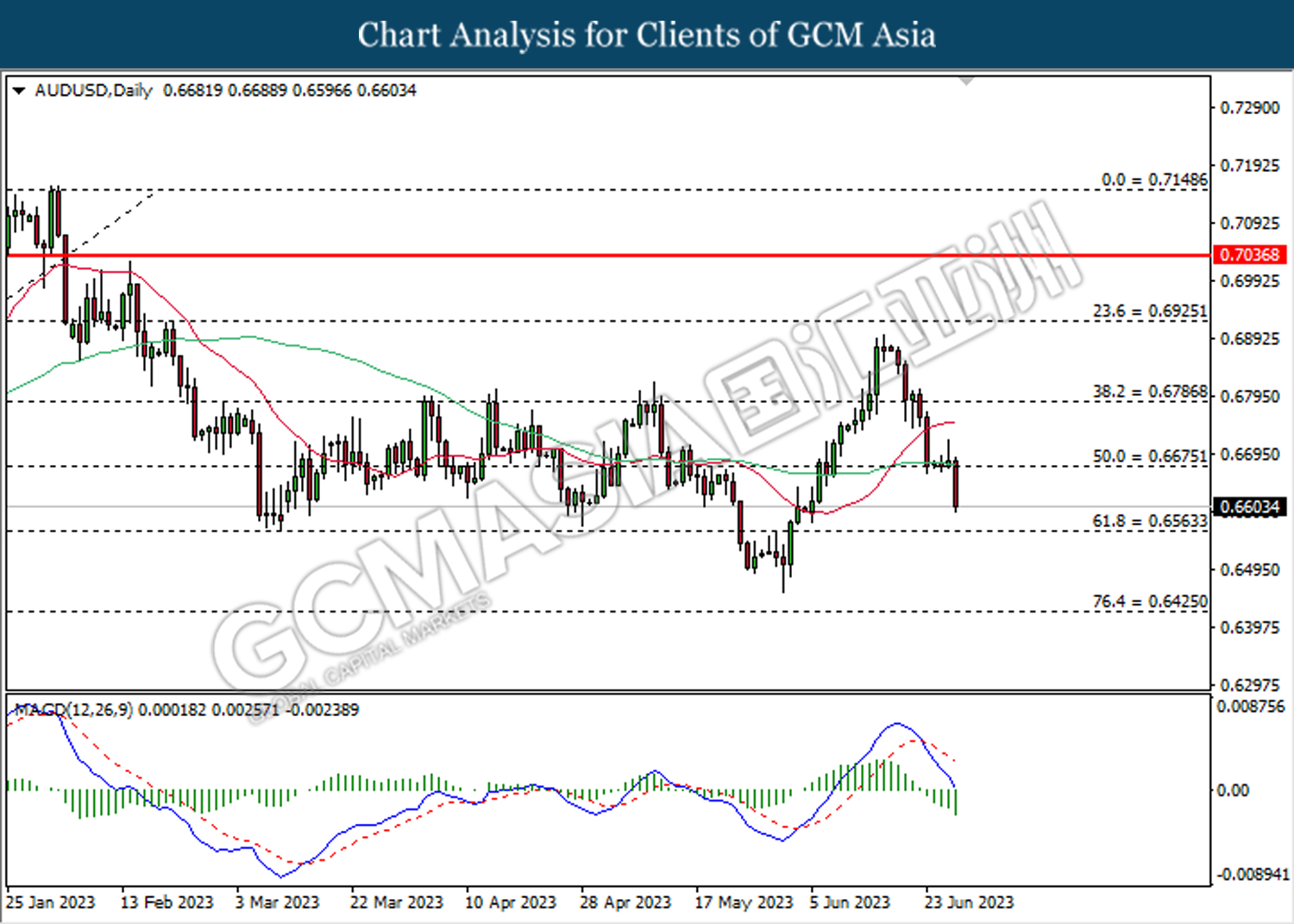

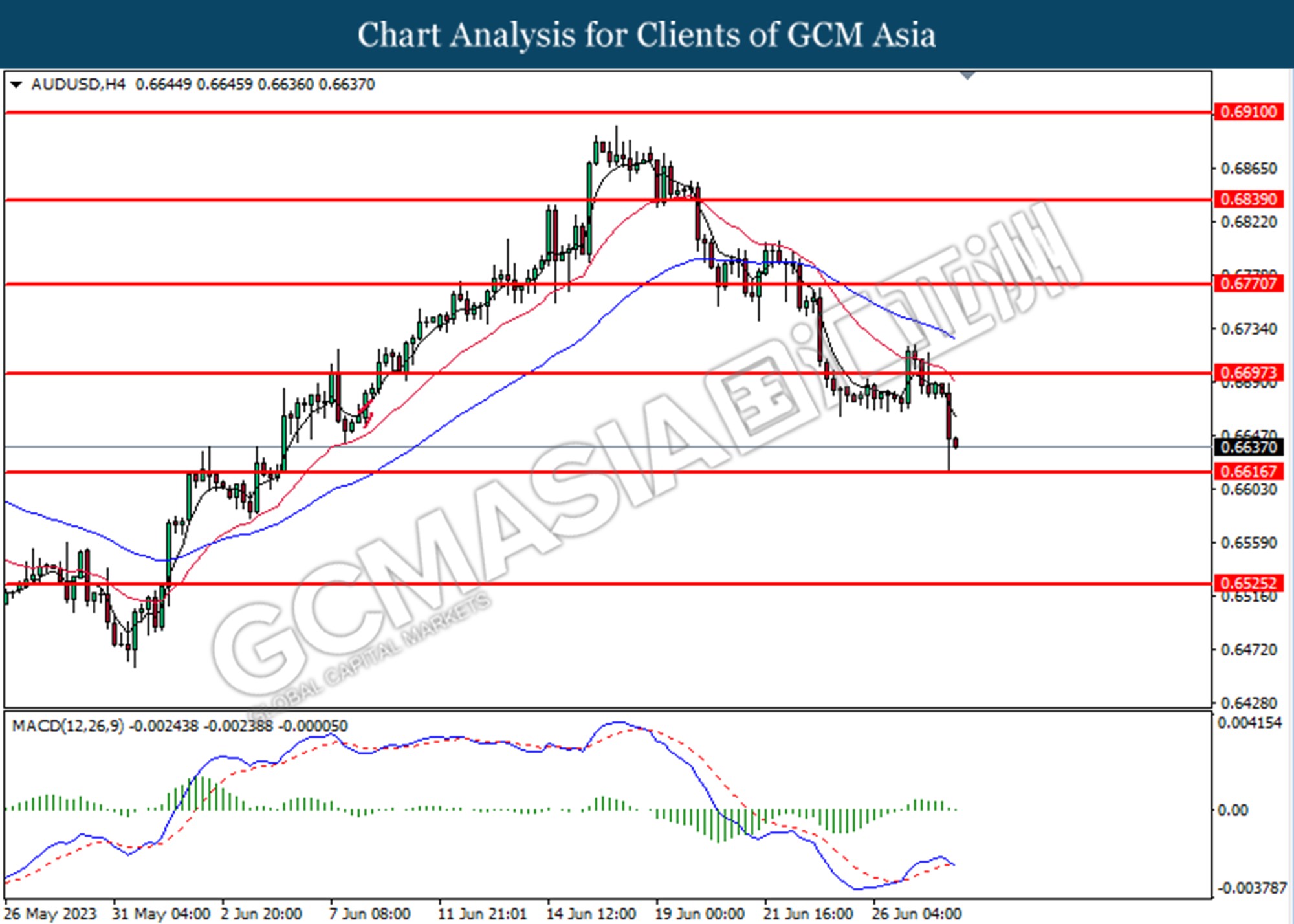

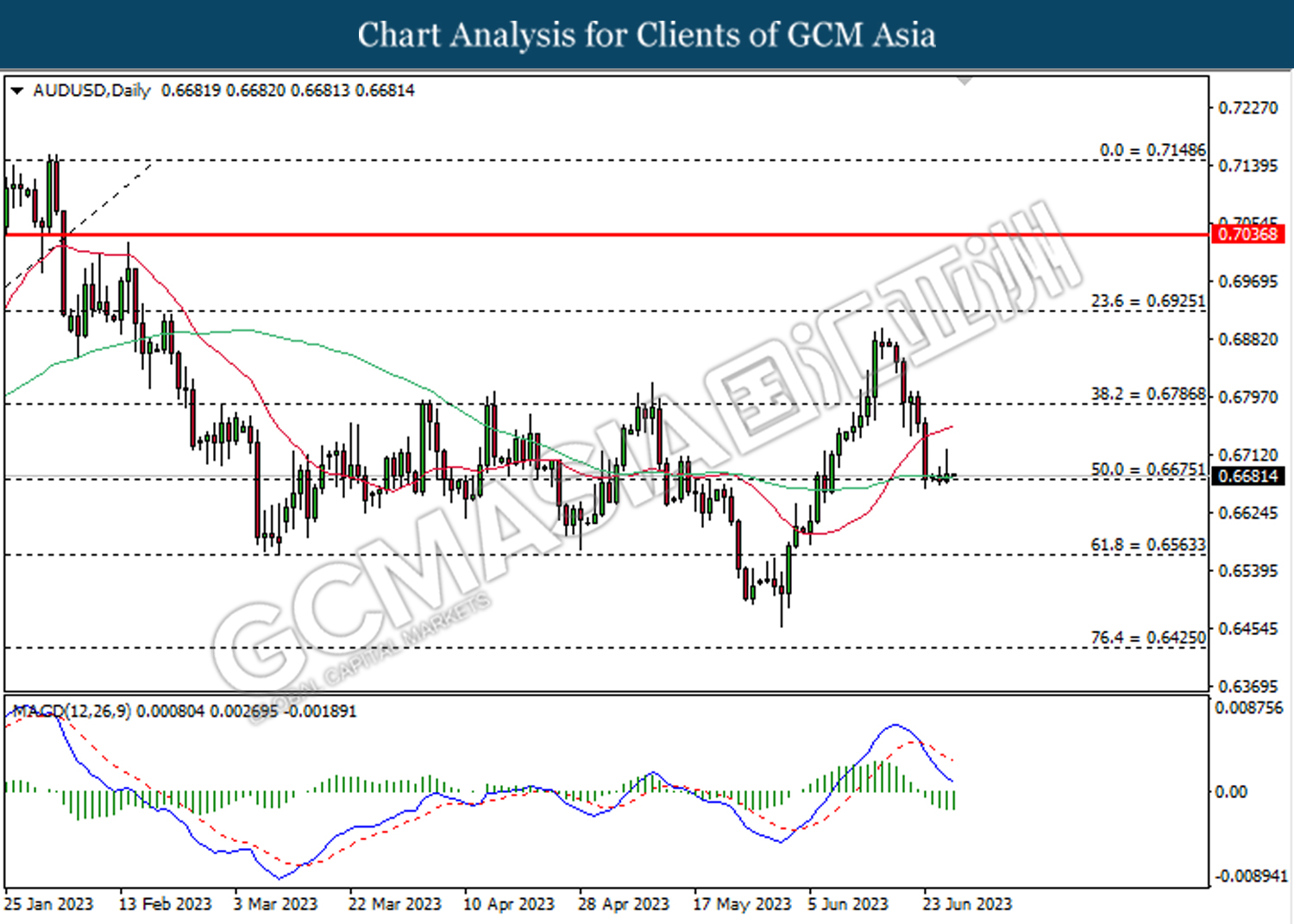

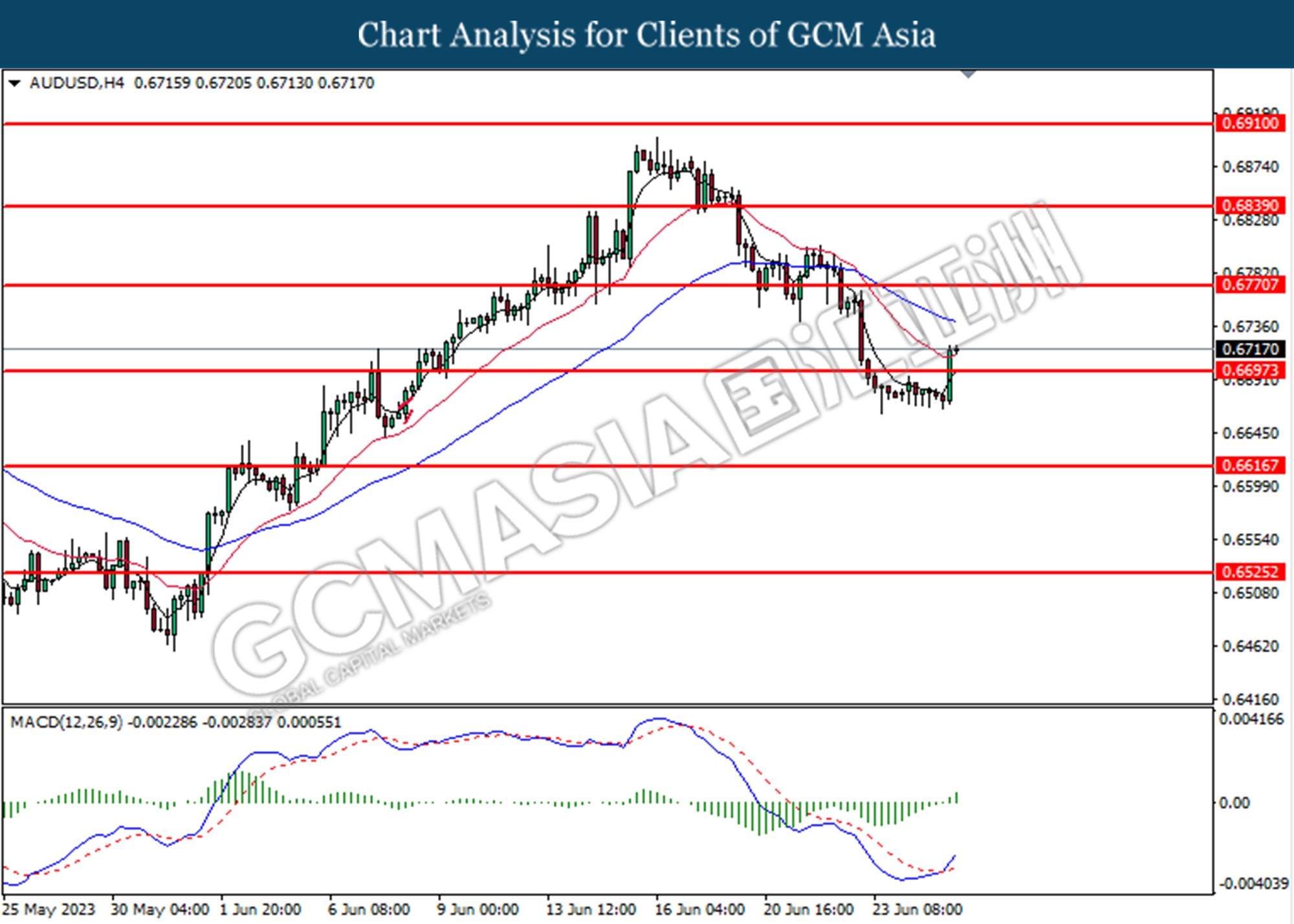

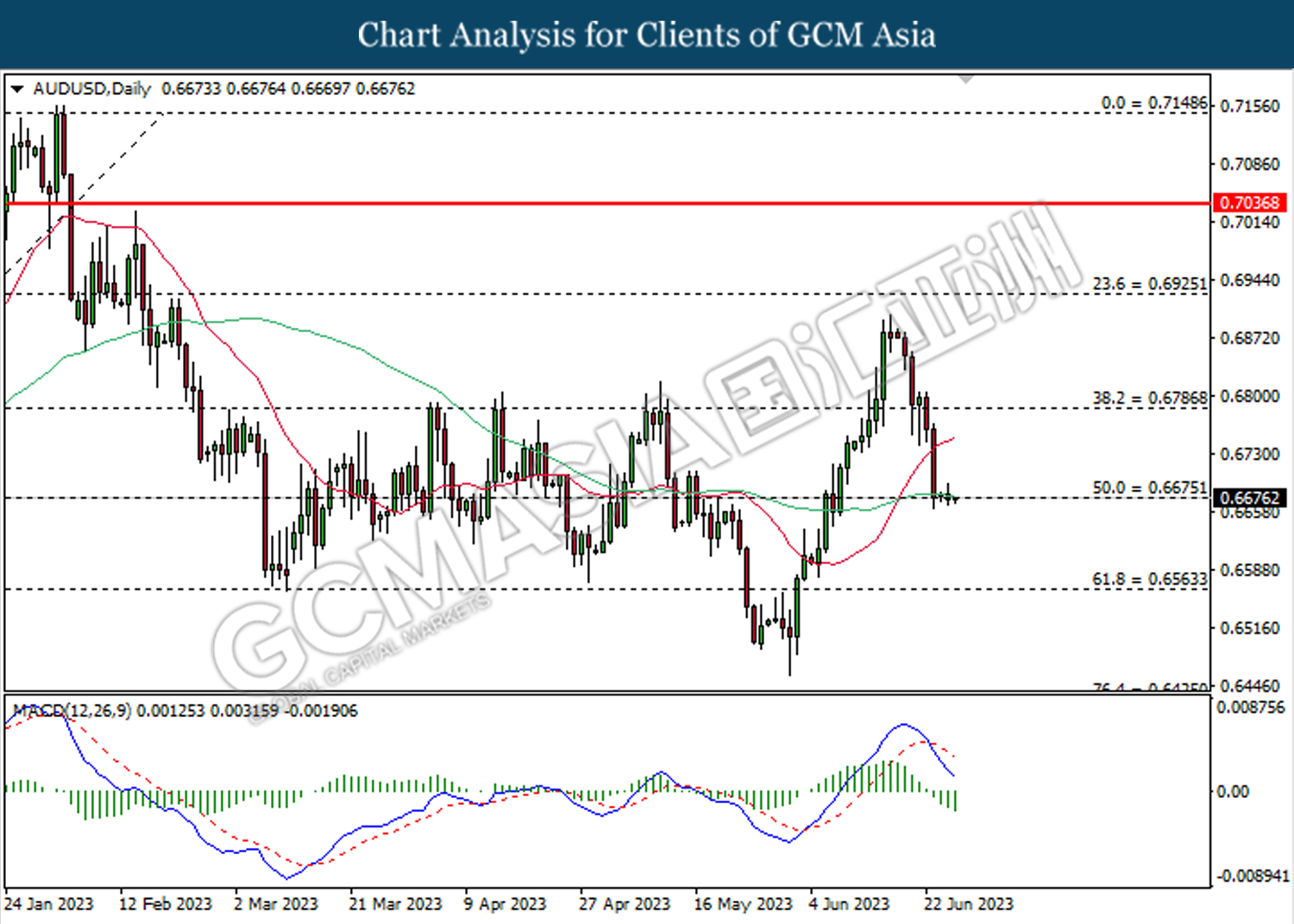

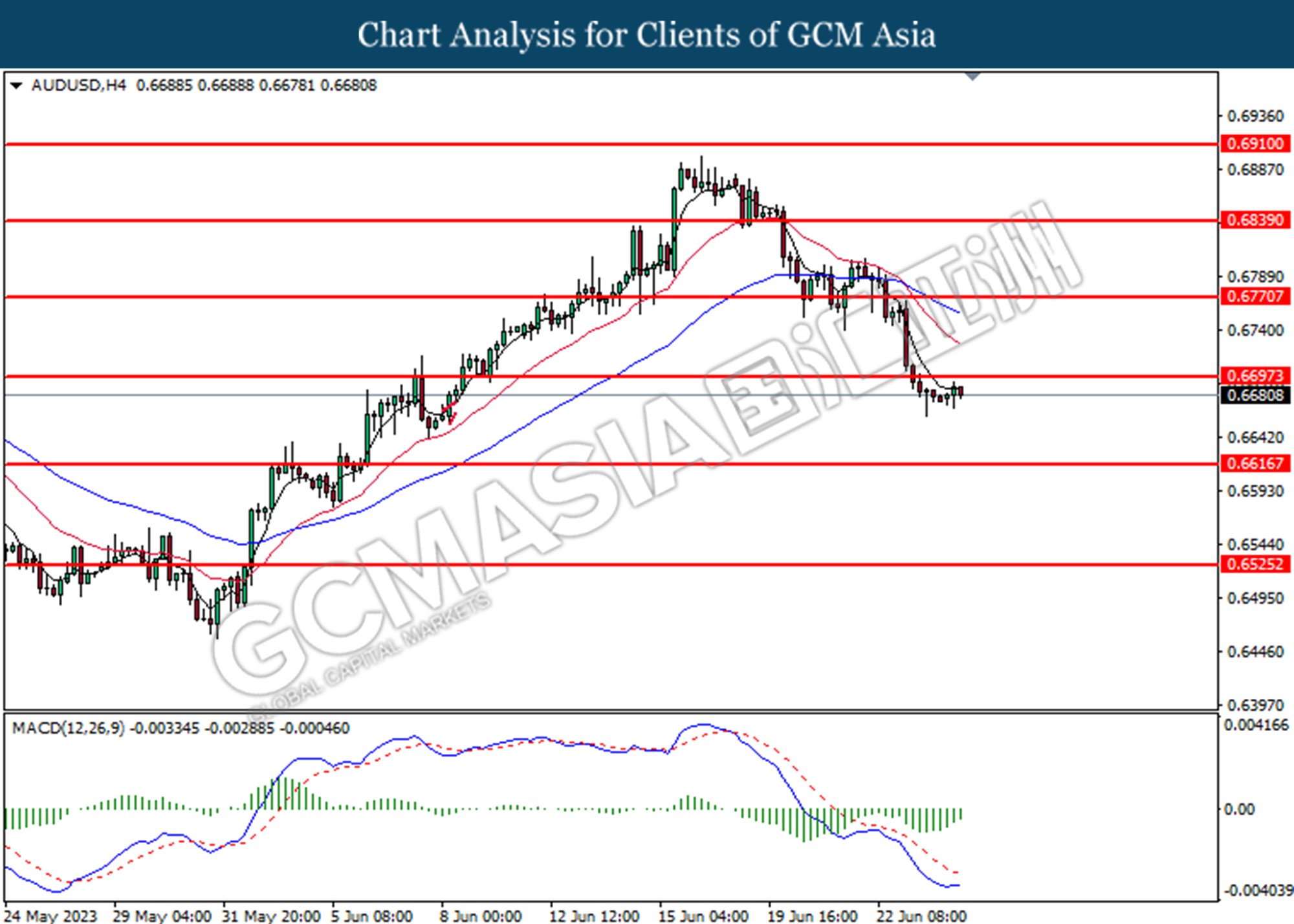

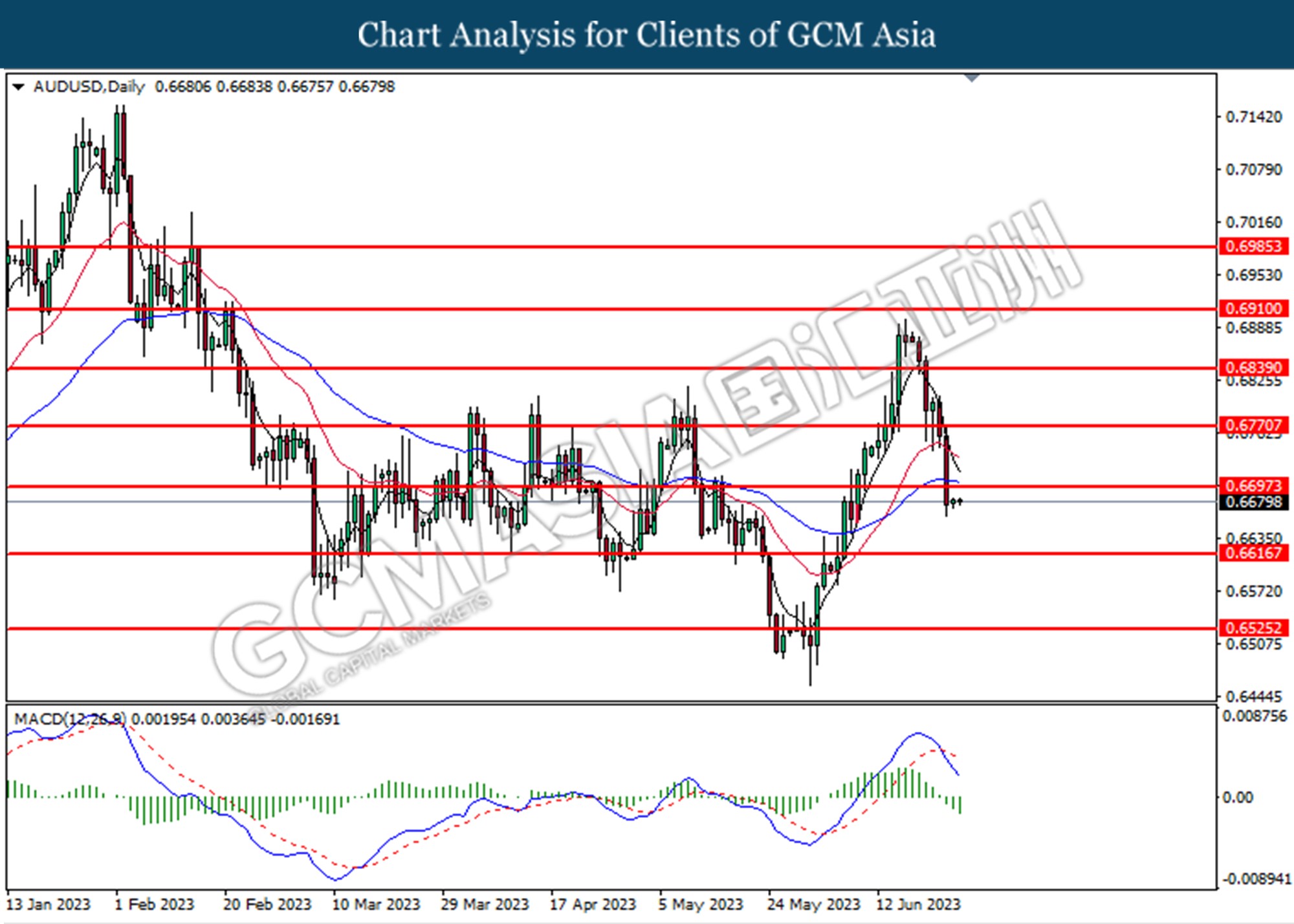

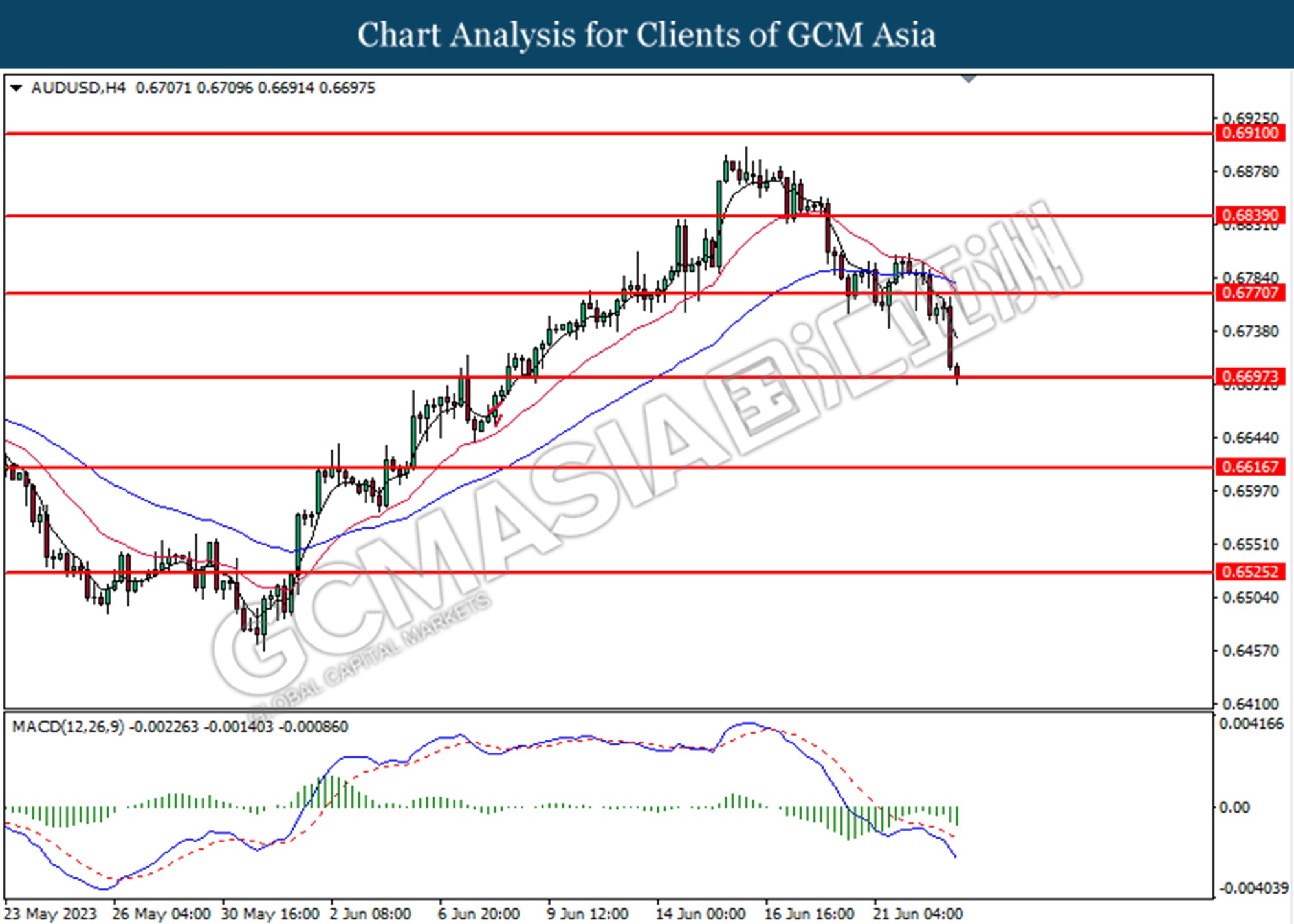

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6615.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

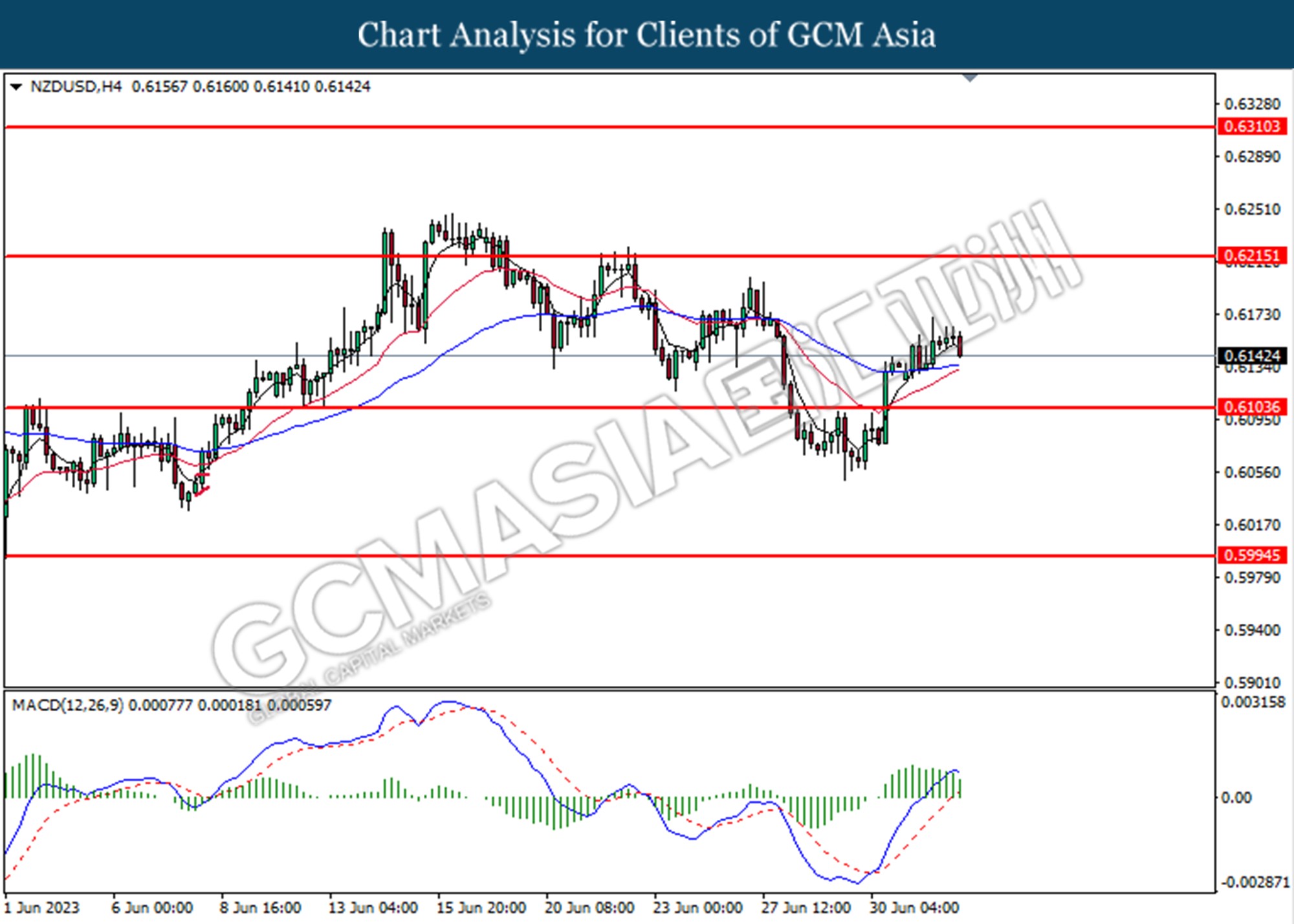

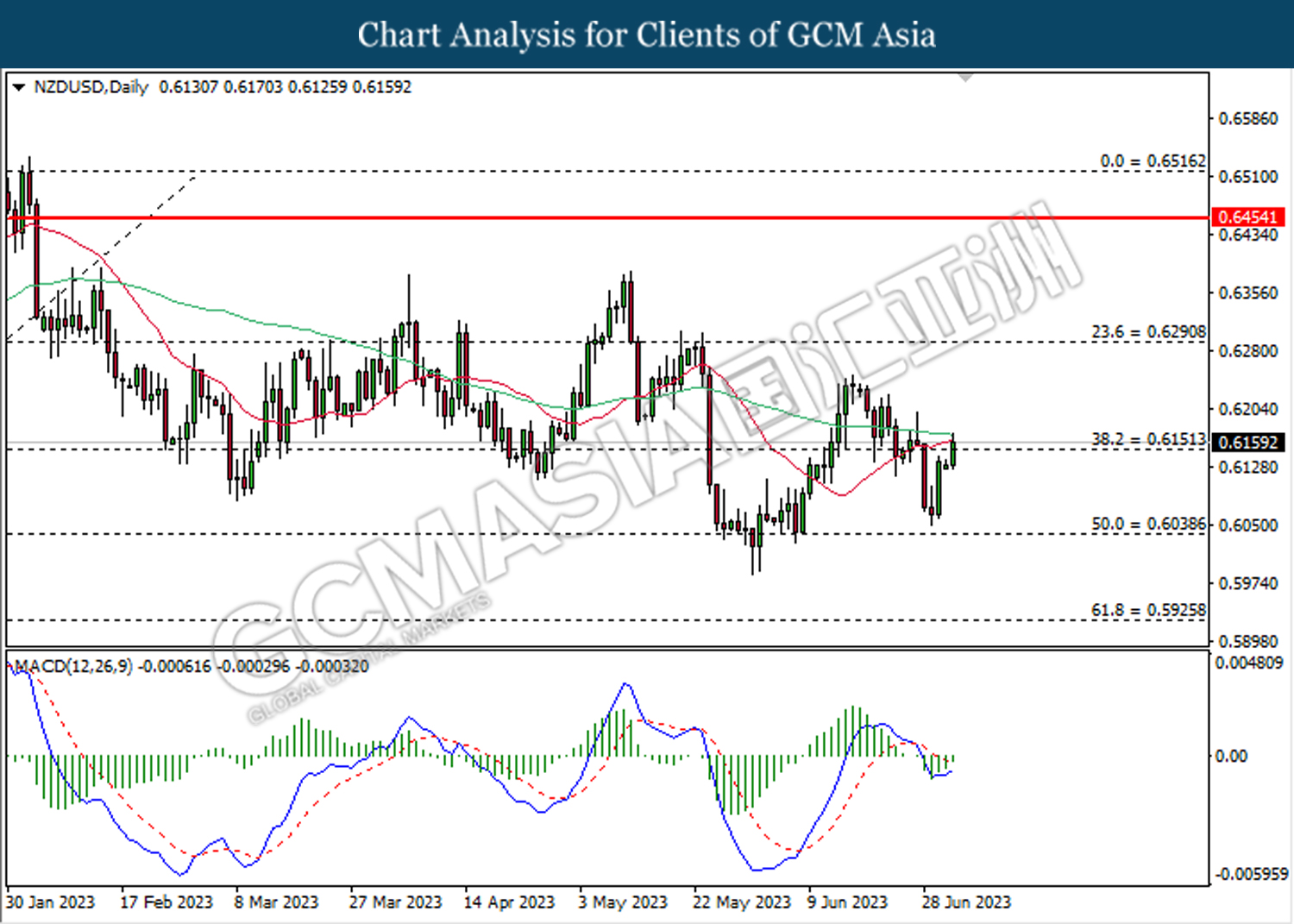

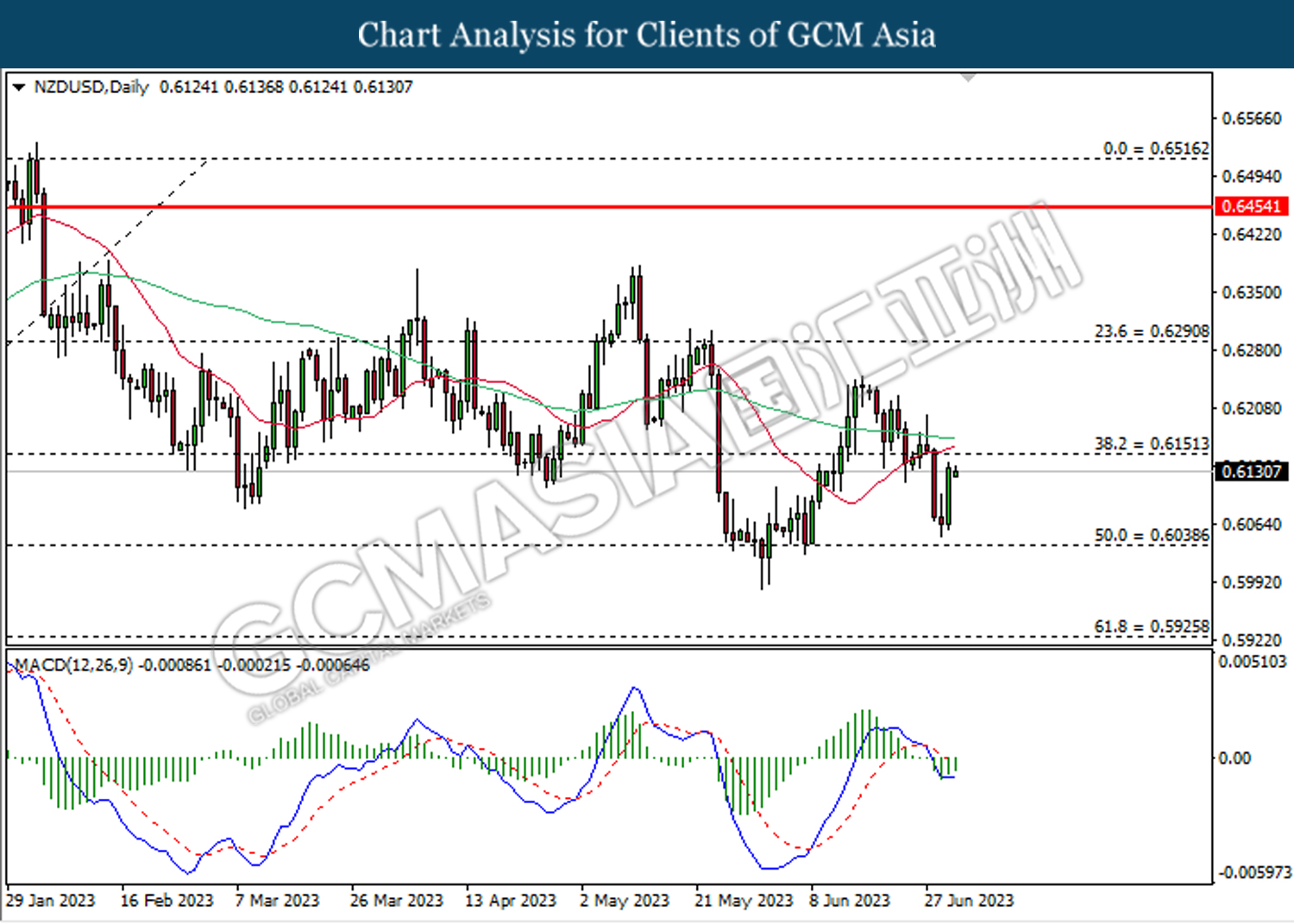

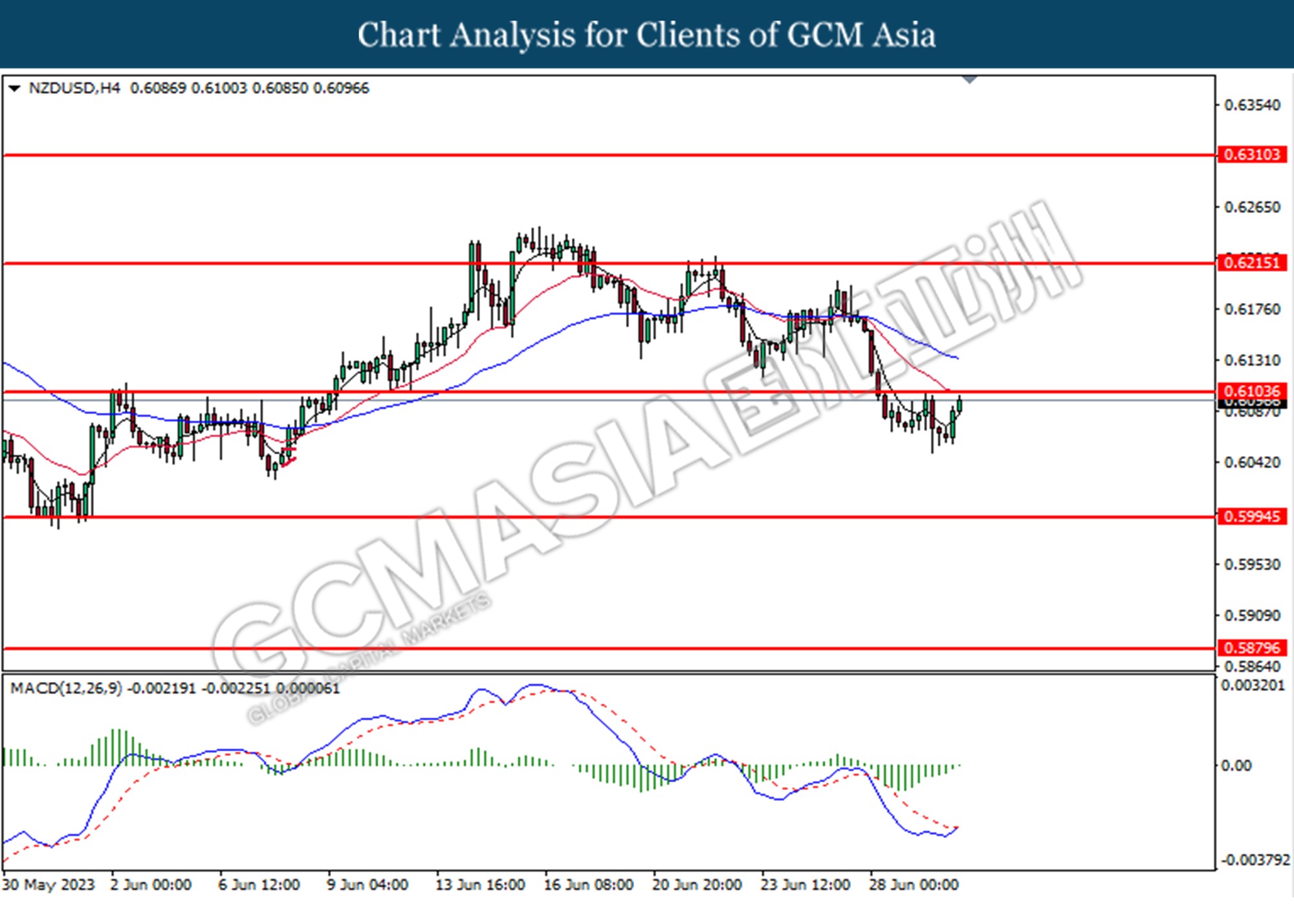

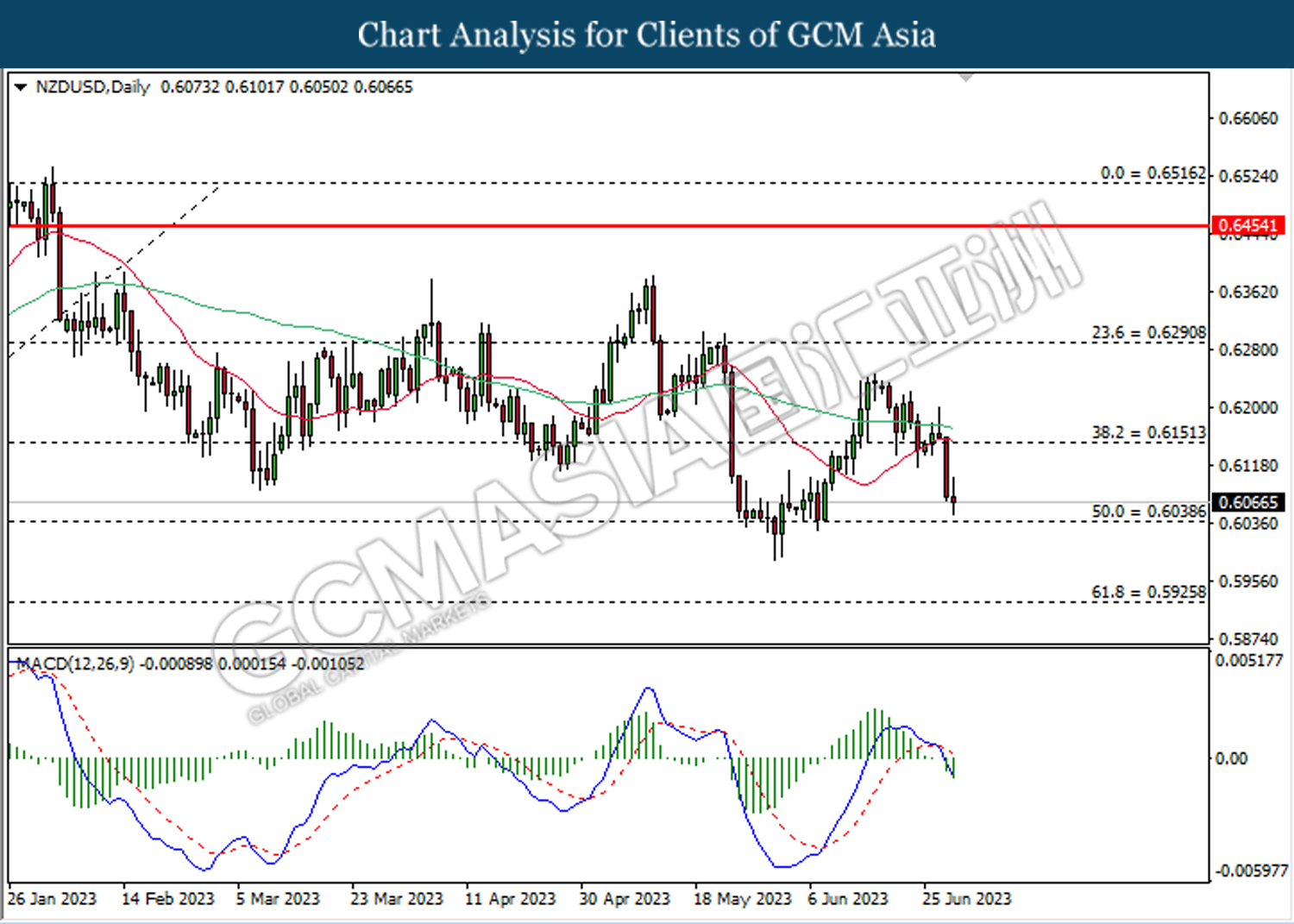

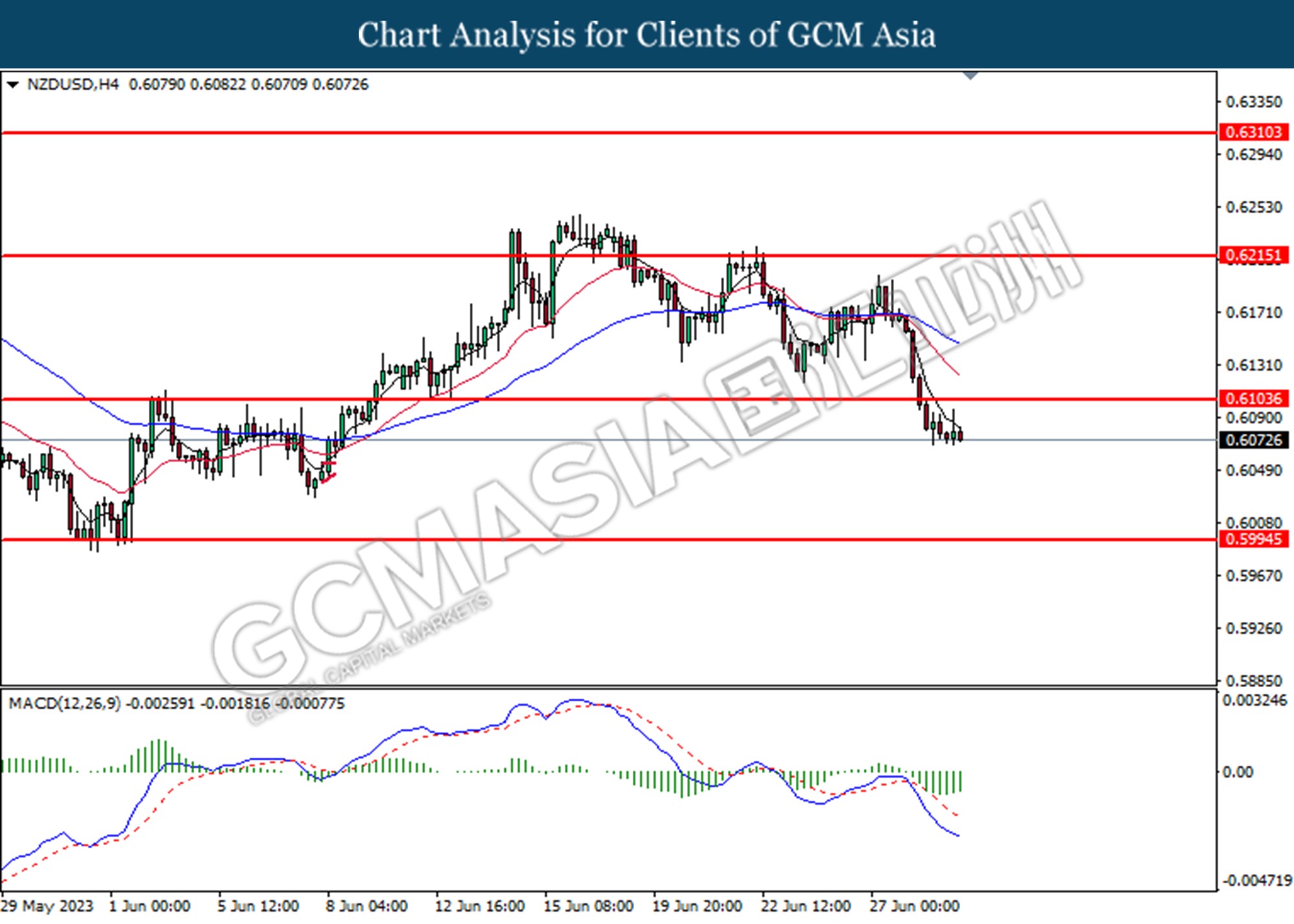

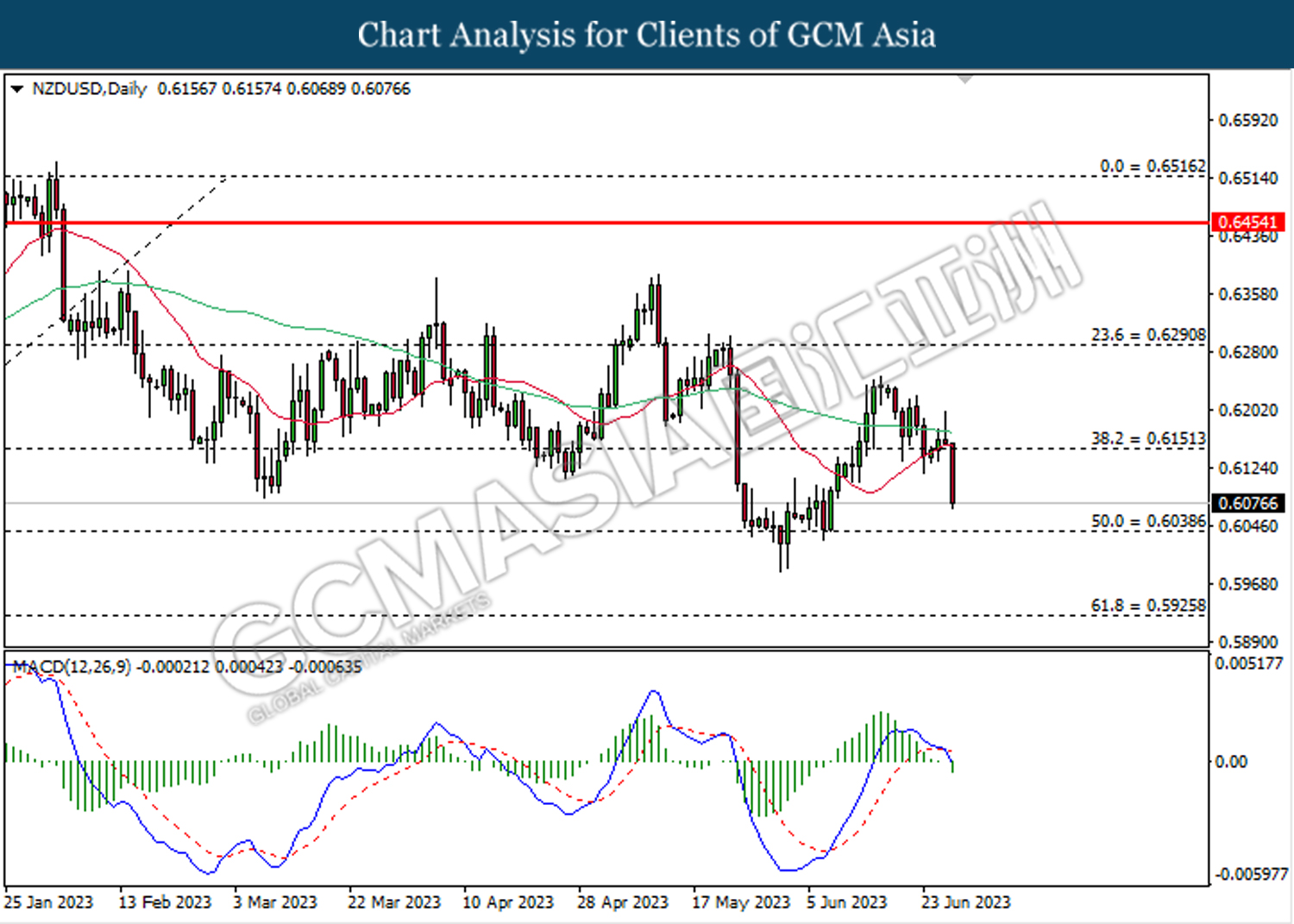

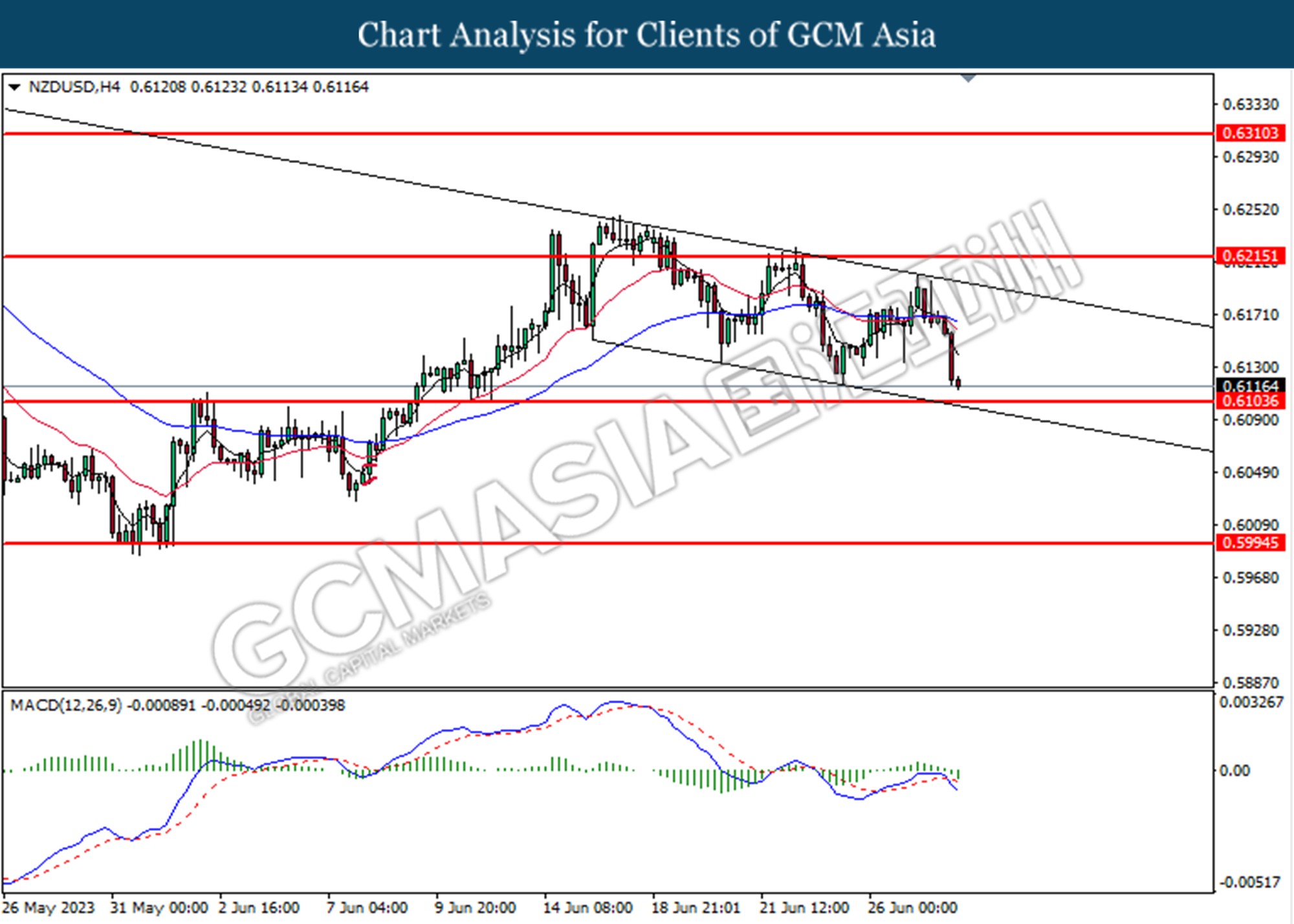

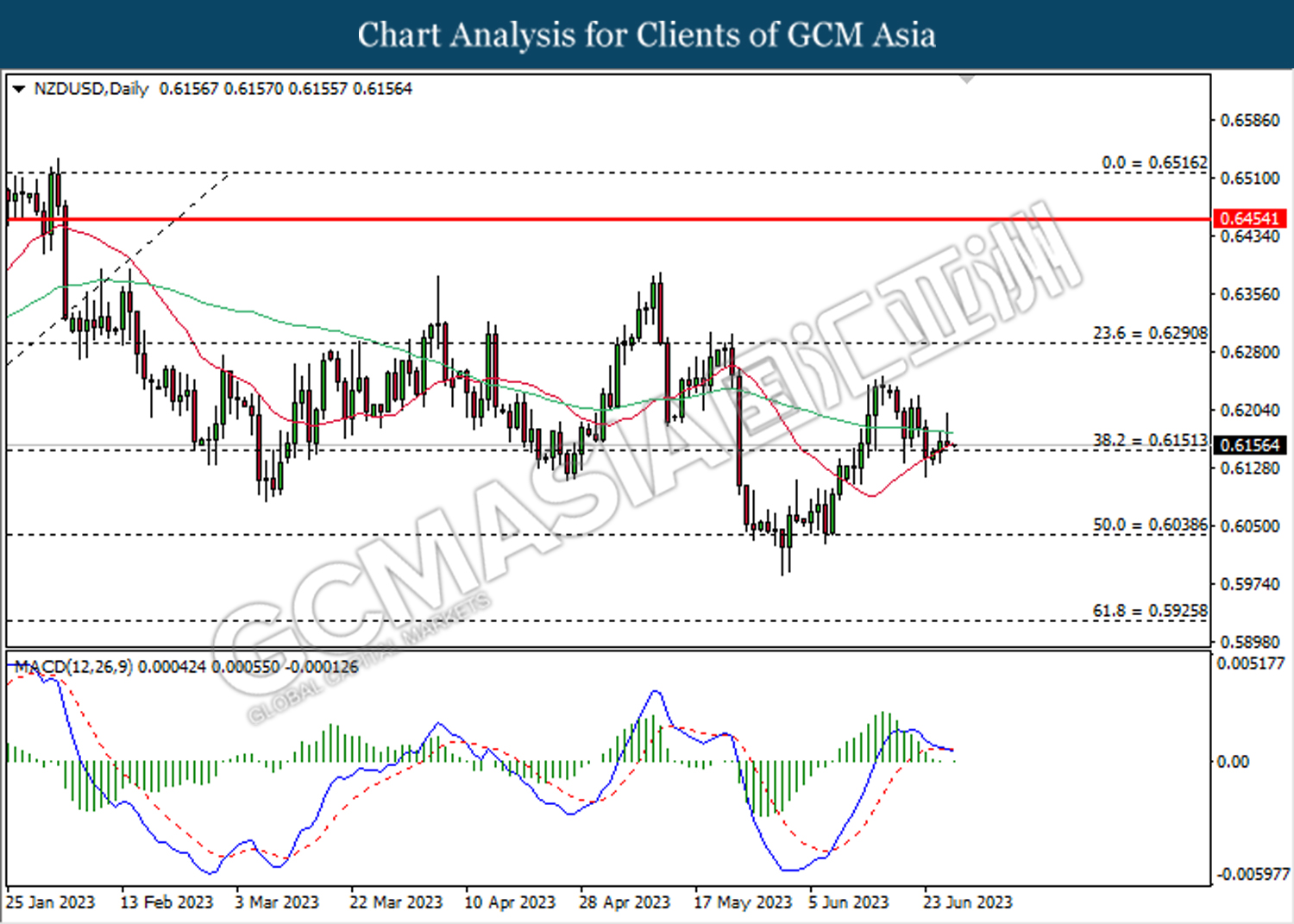

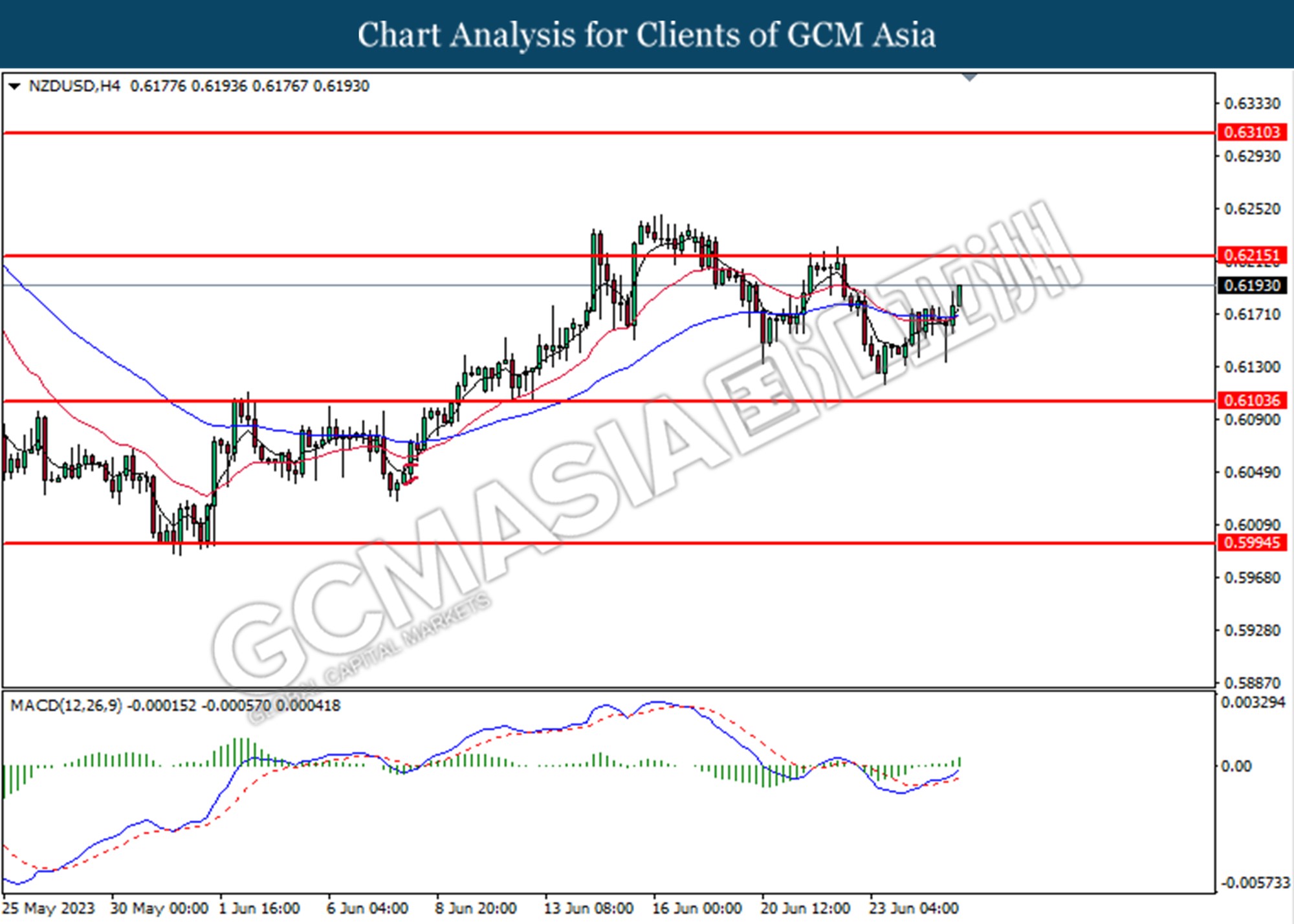

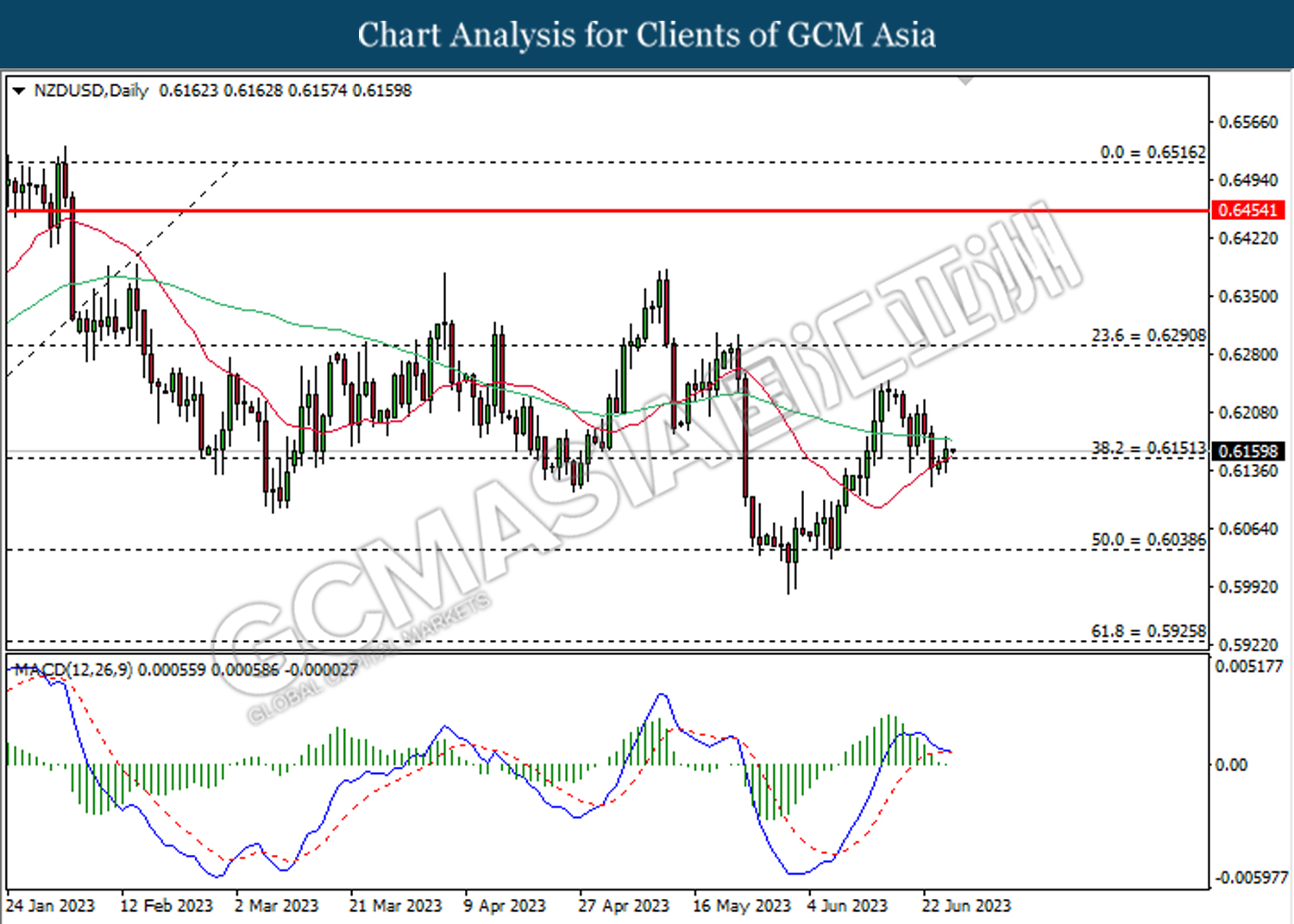

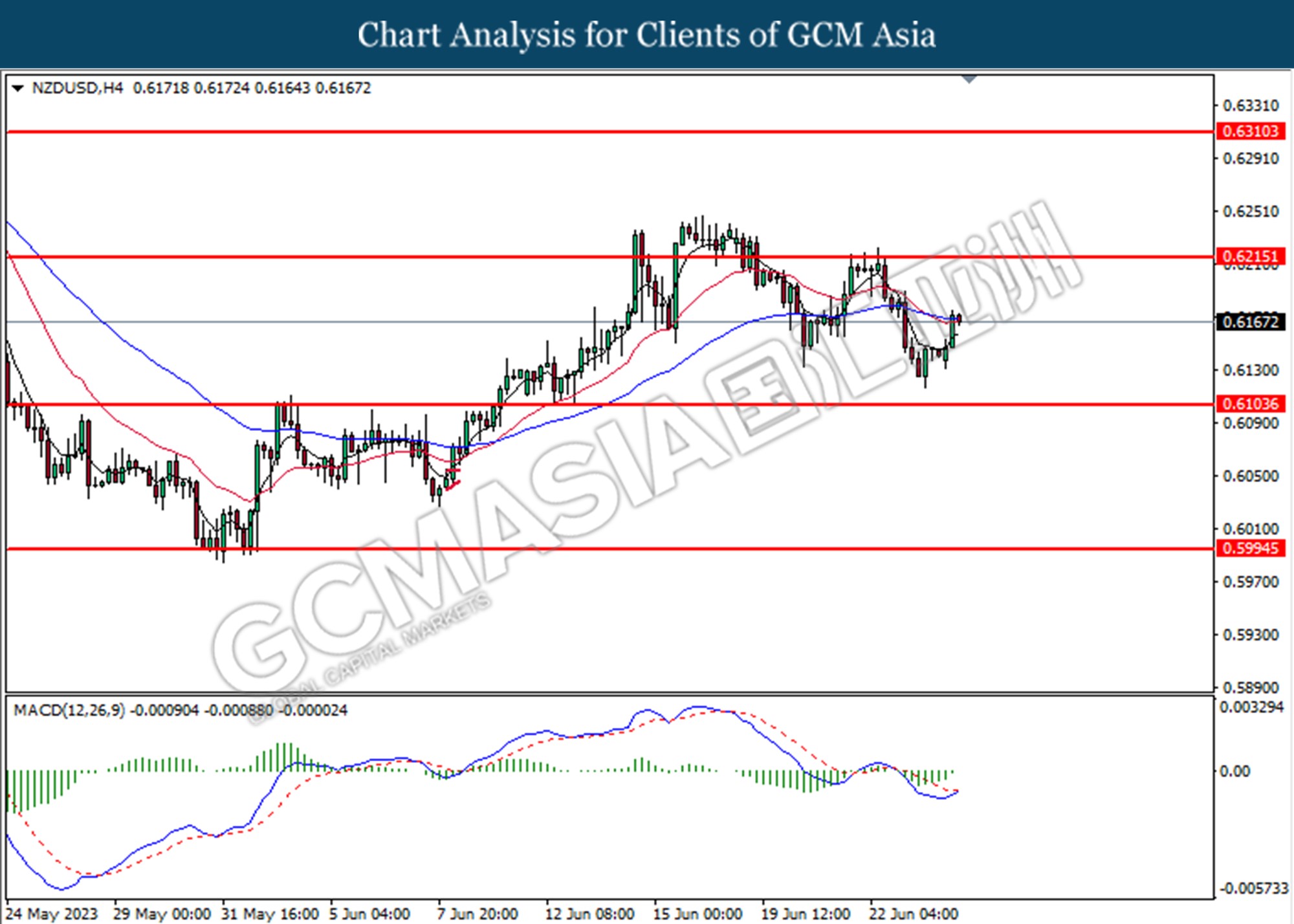

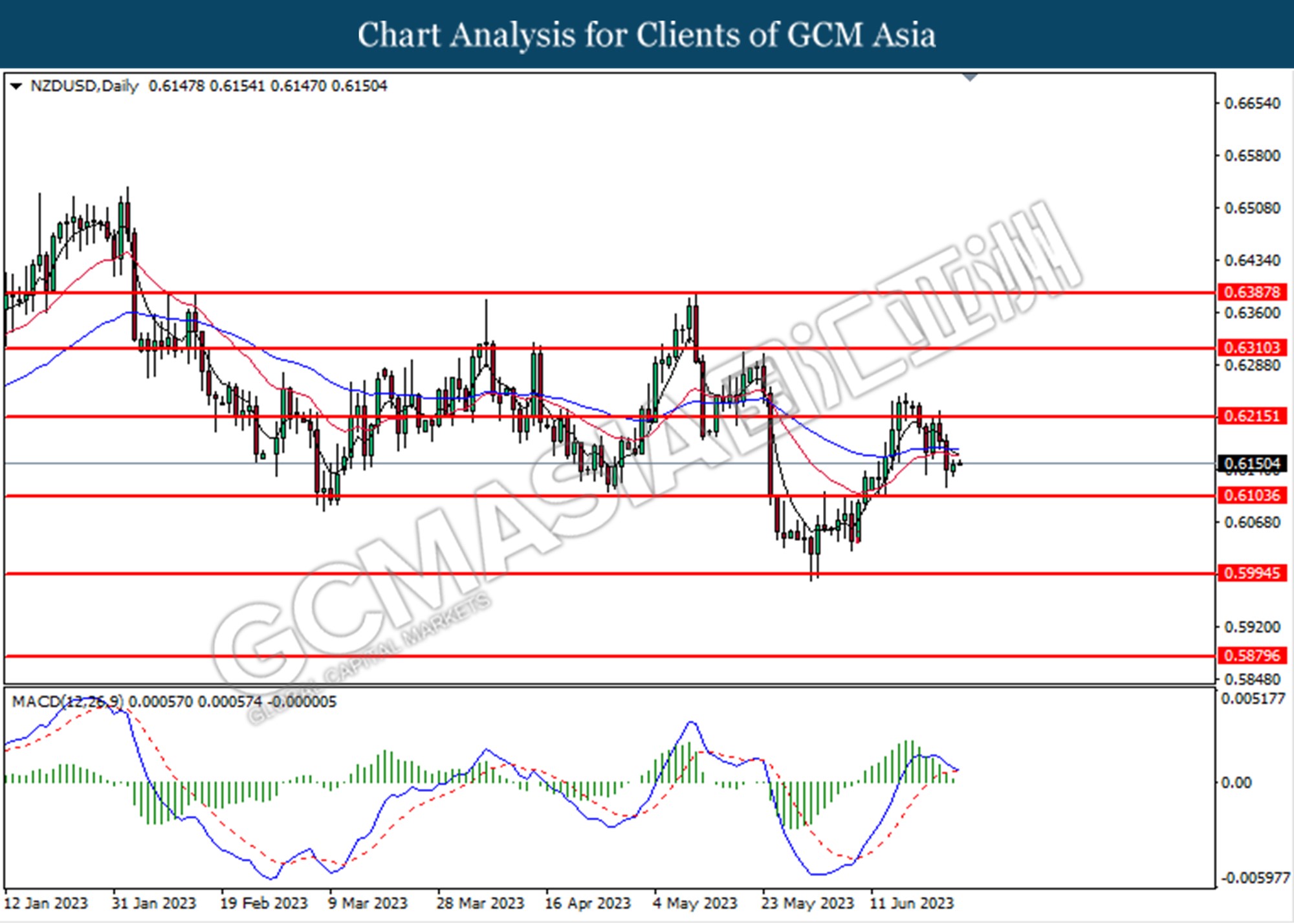

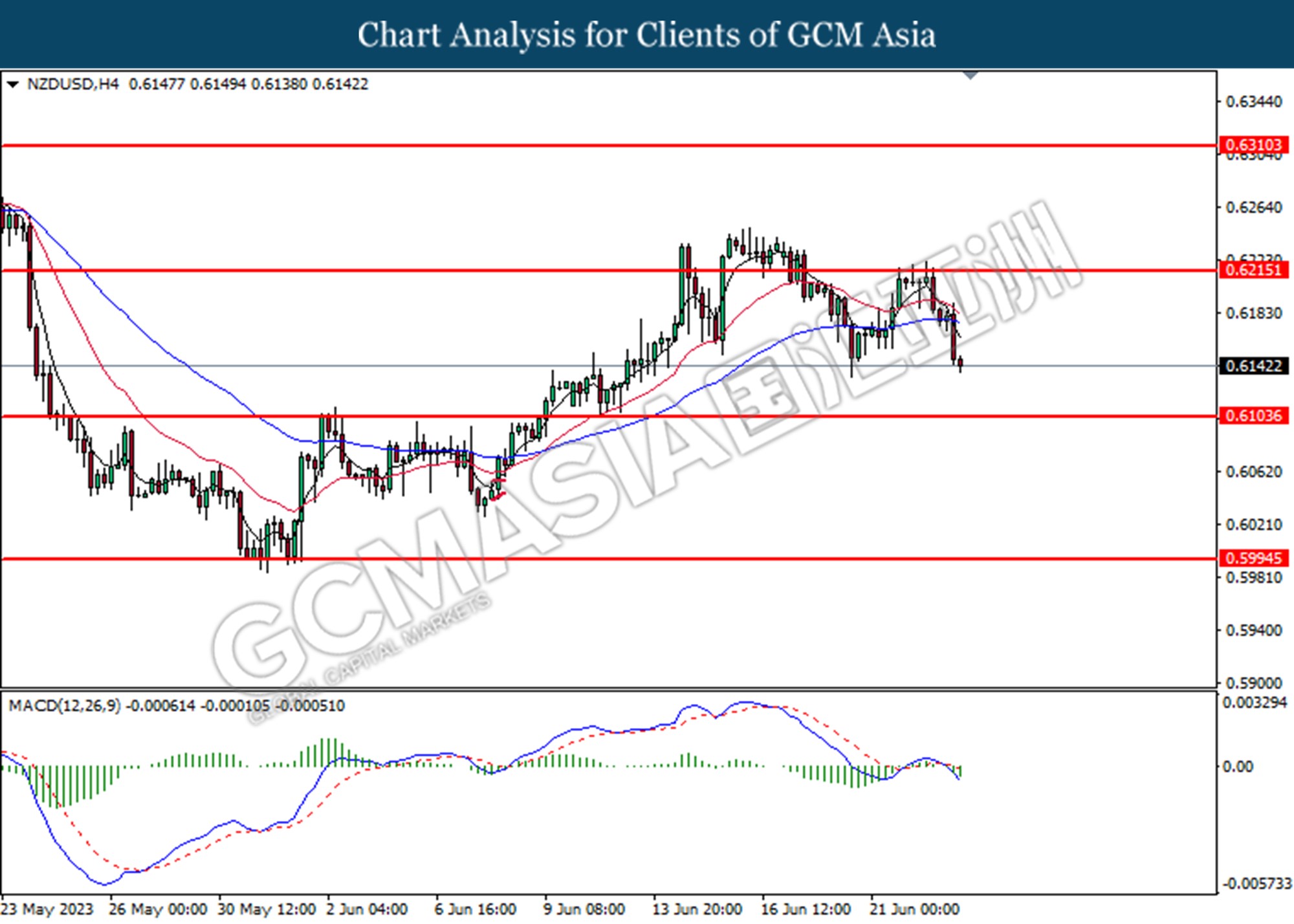

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6105.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

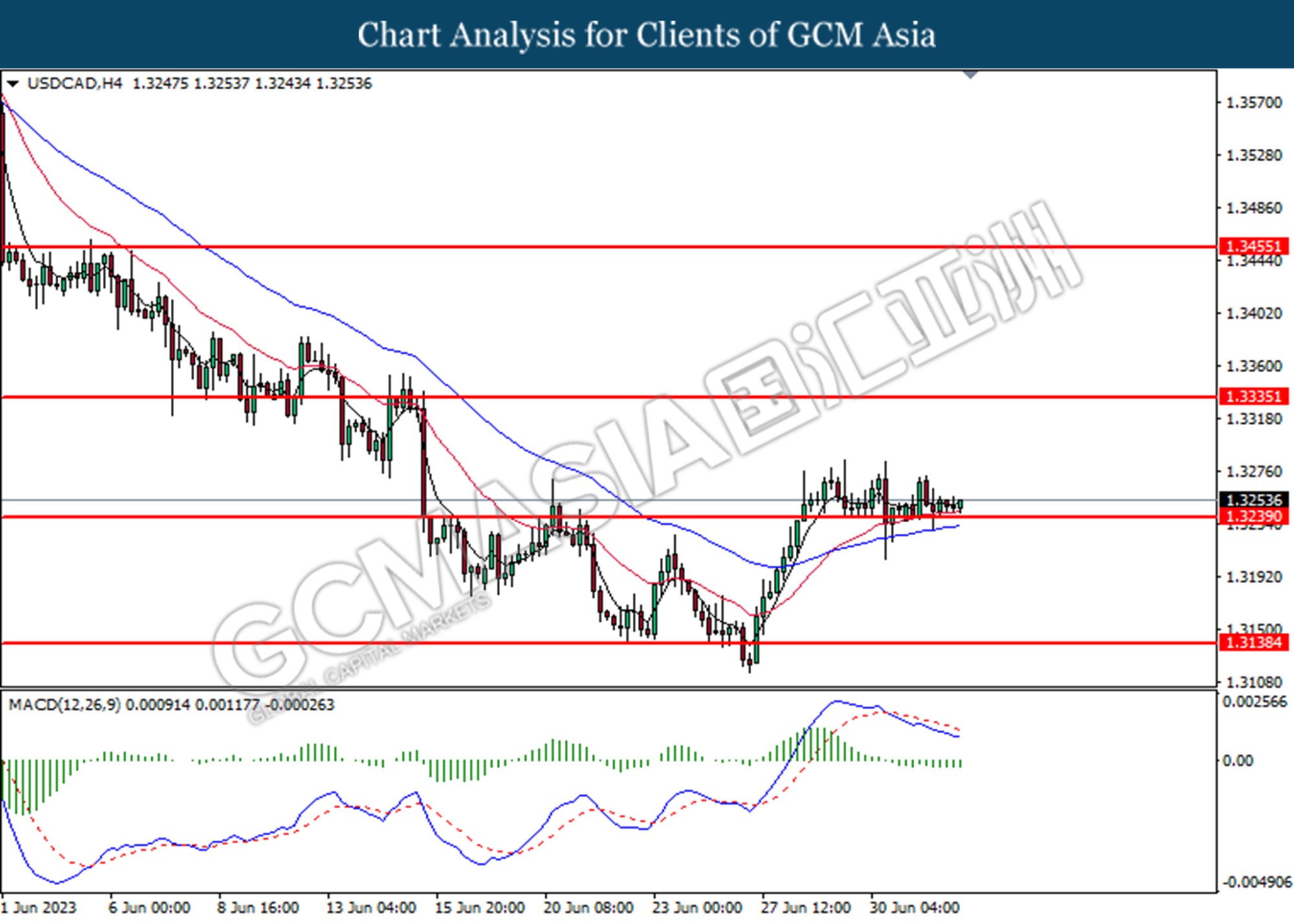

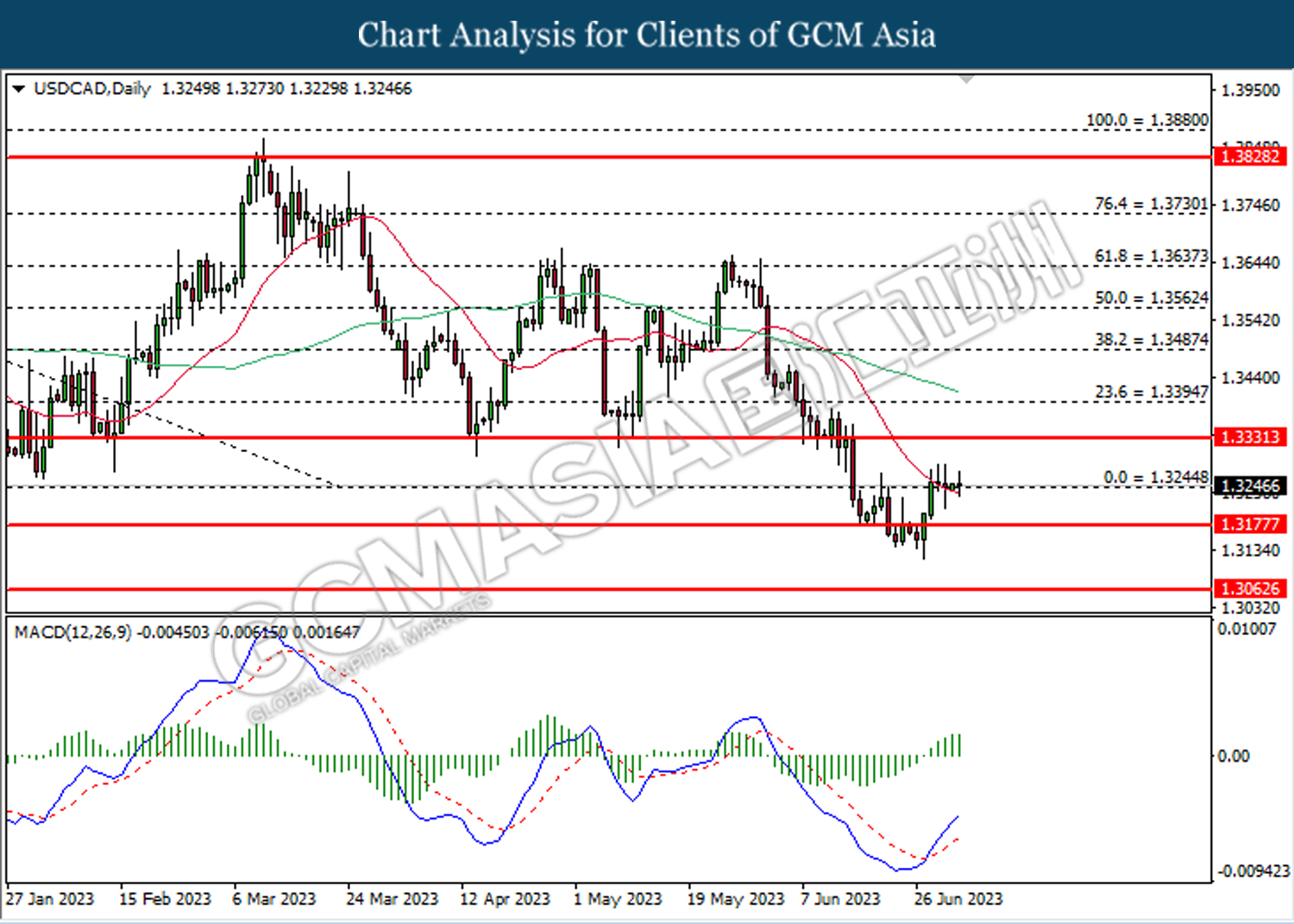

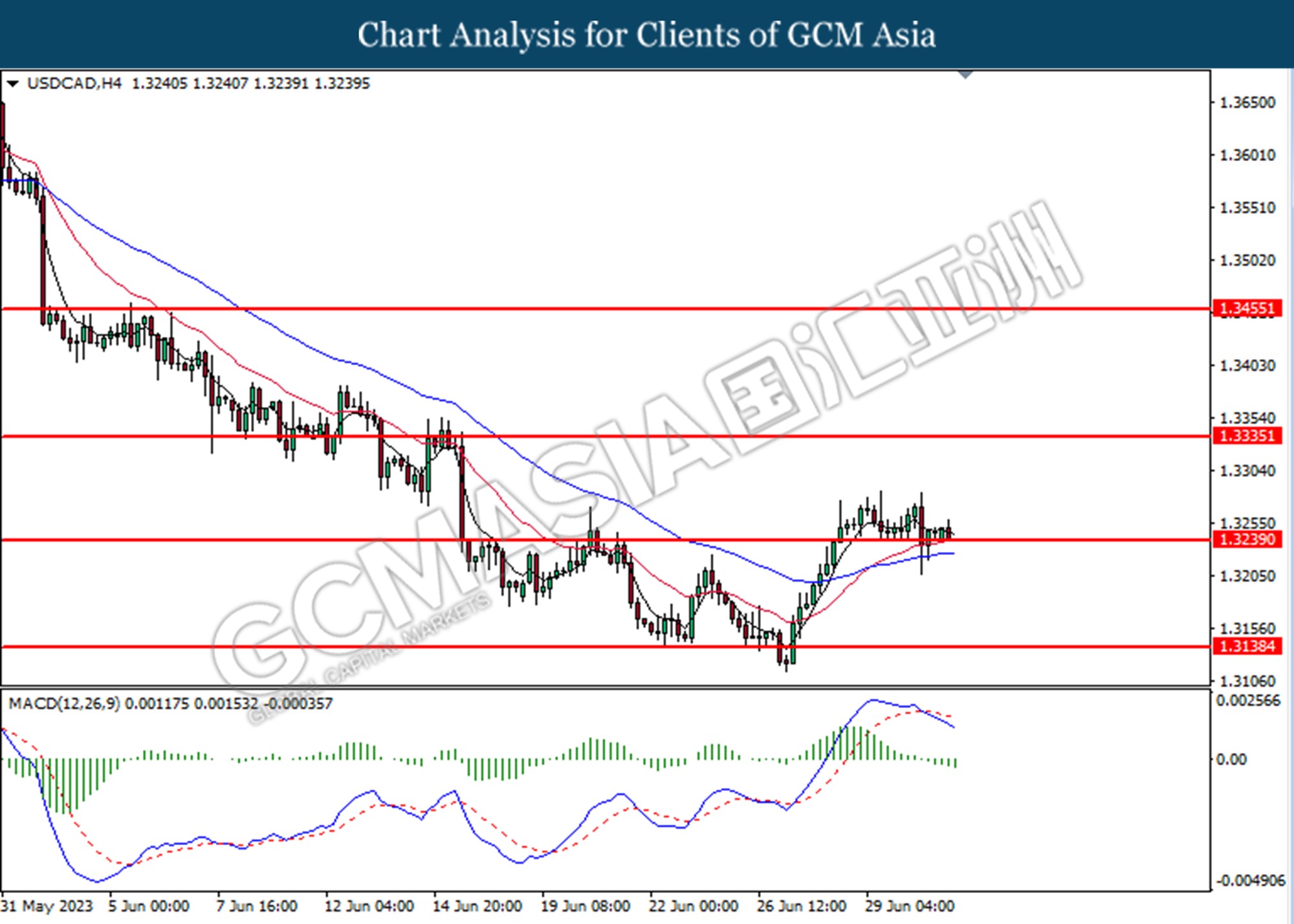

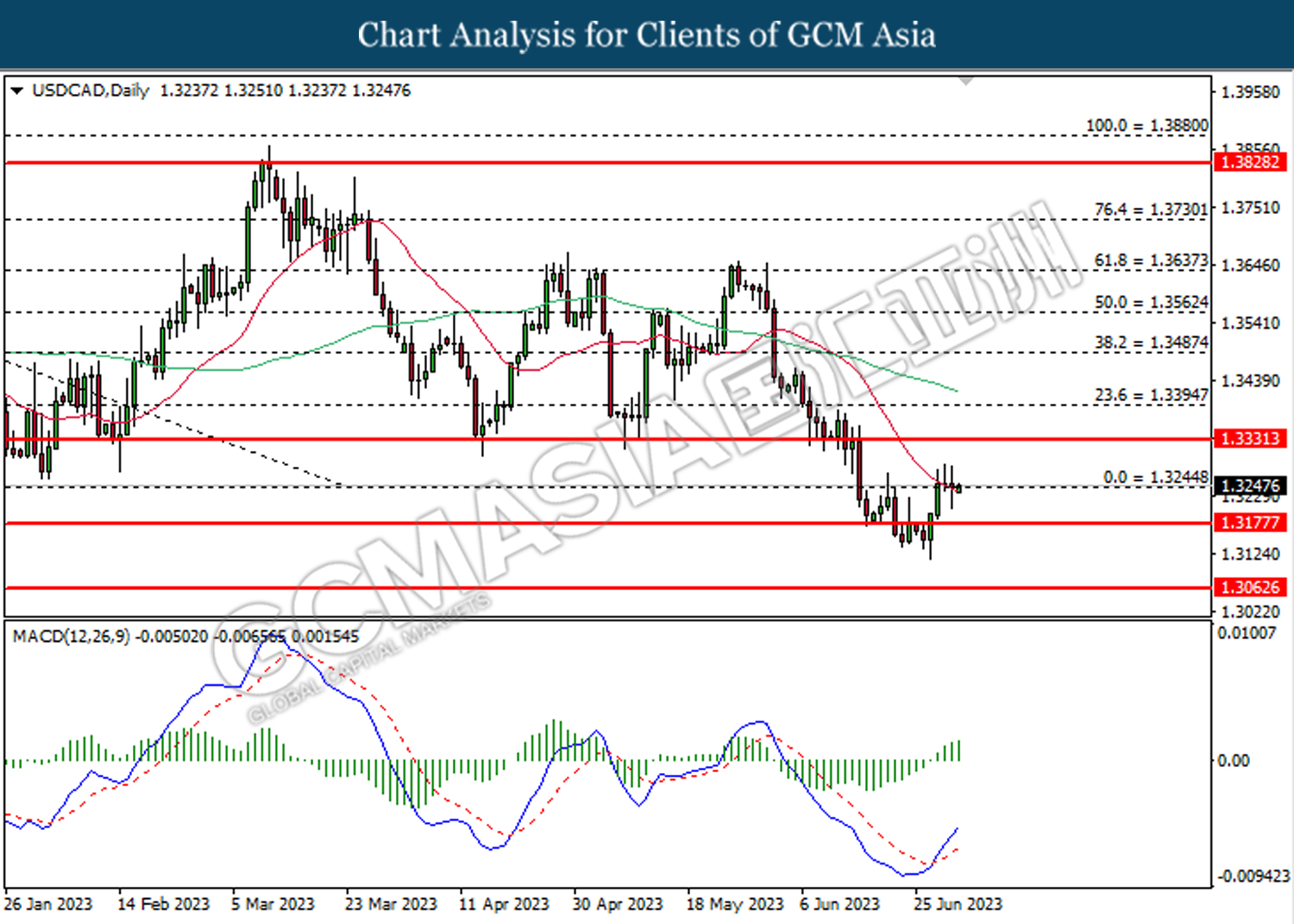

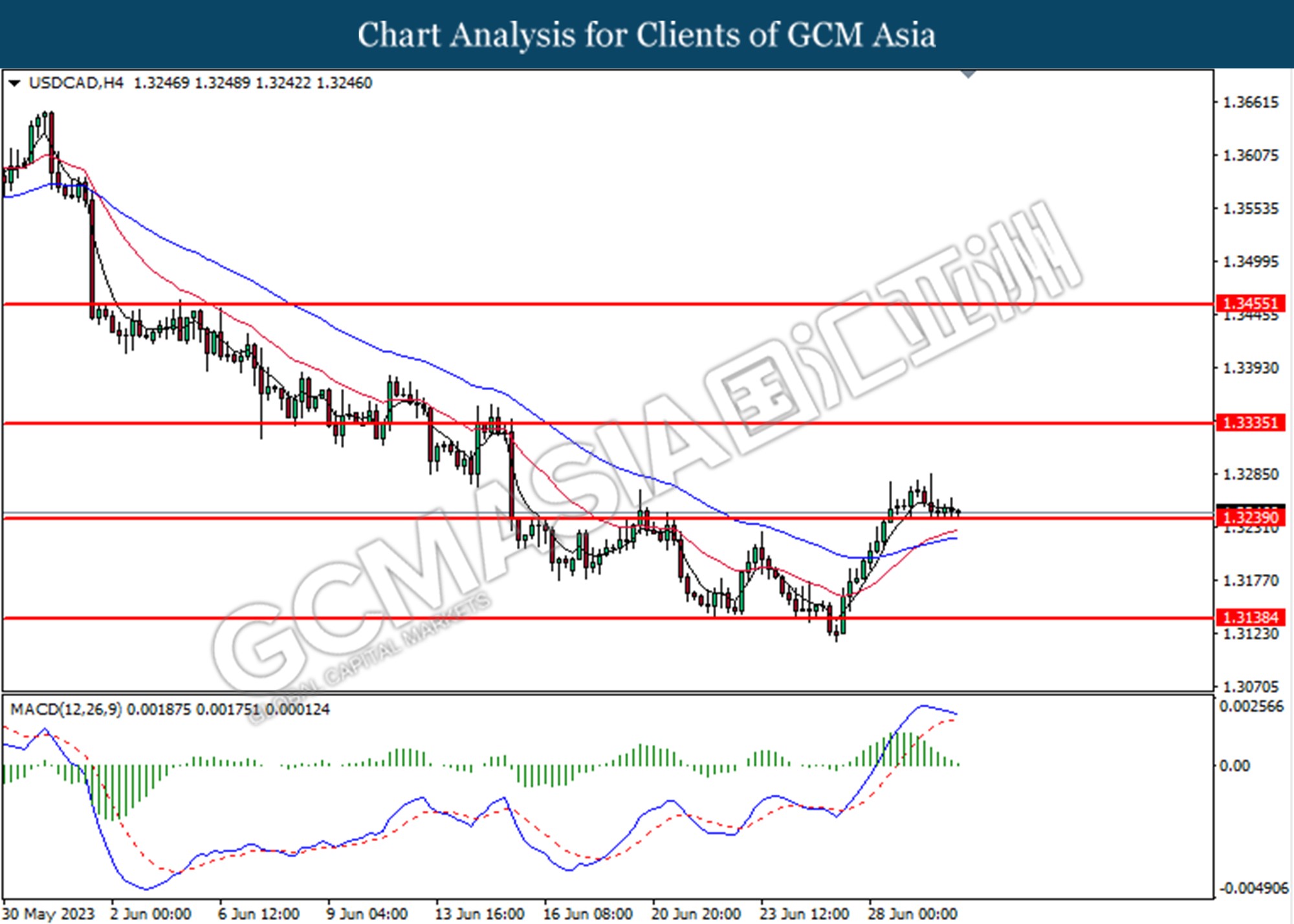

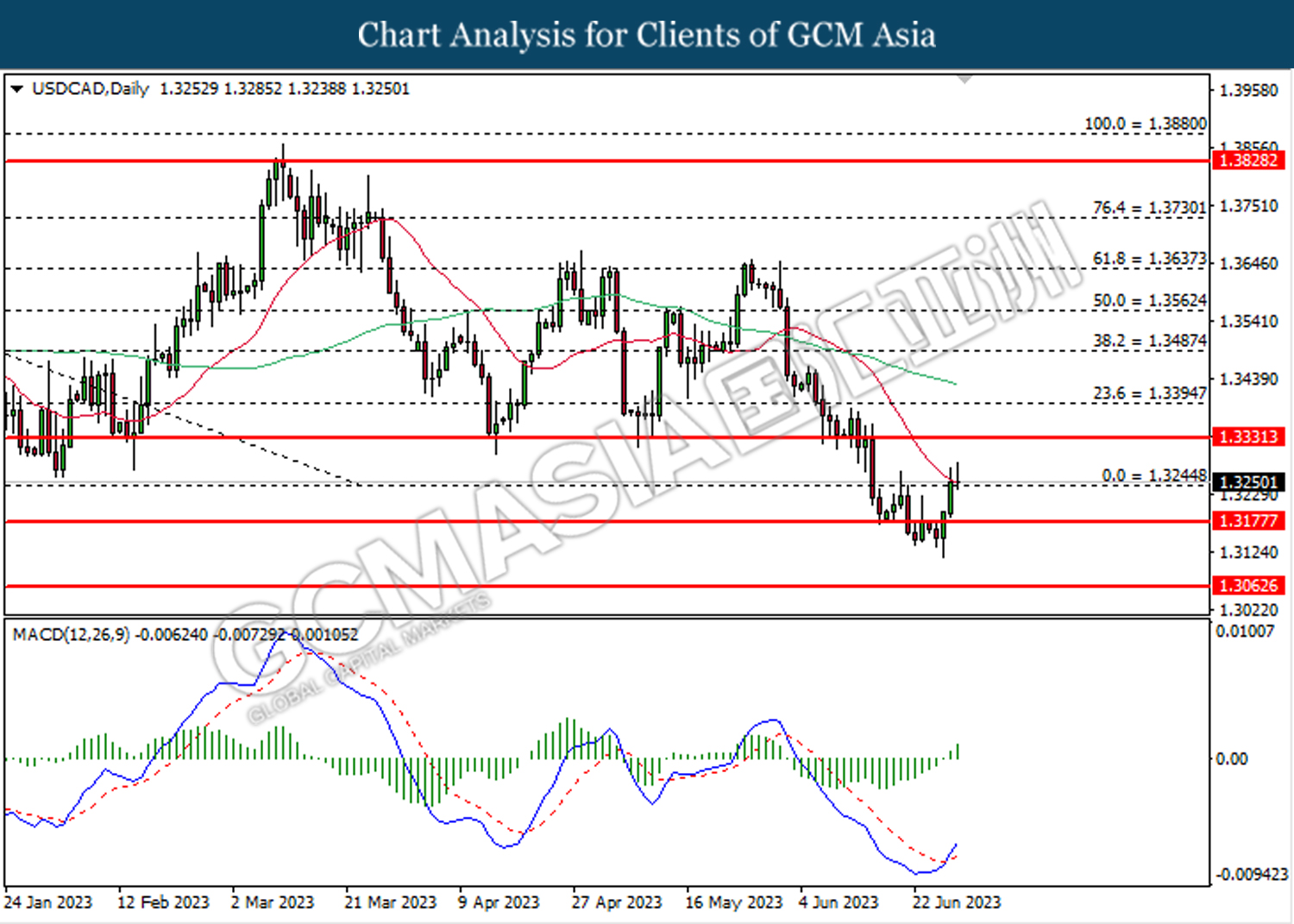

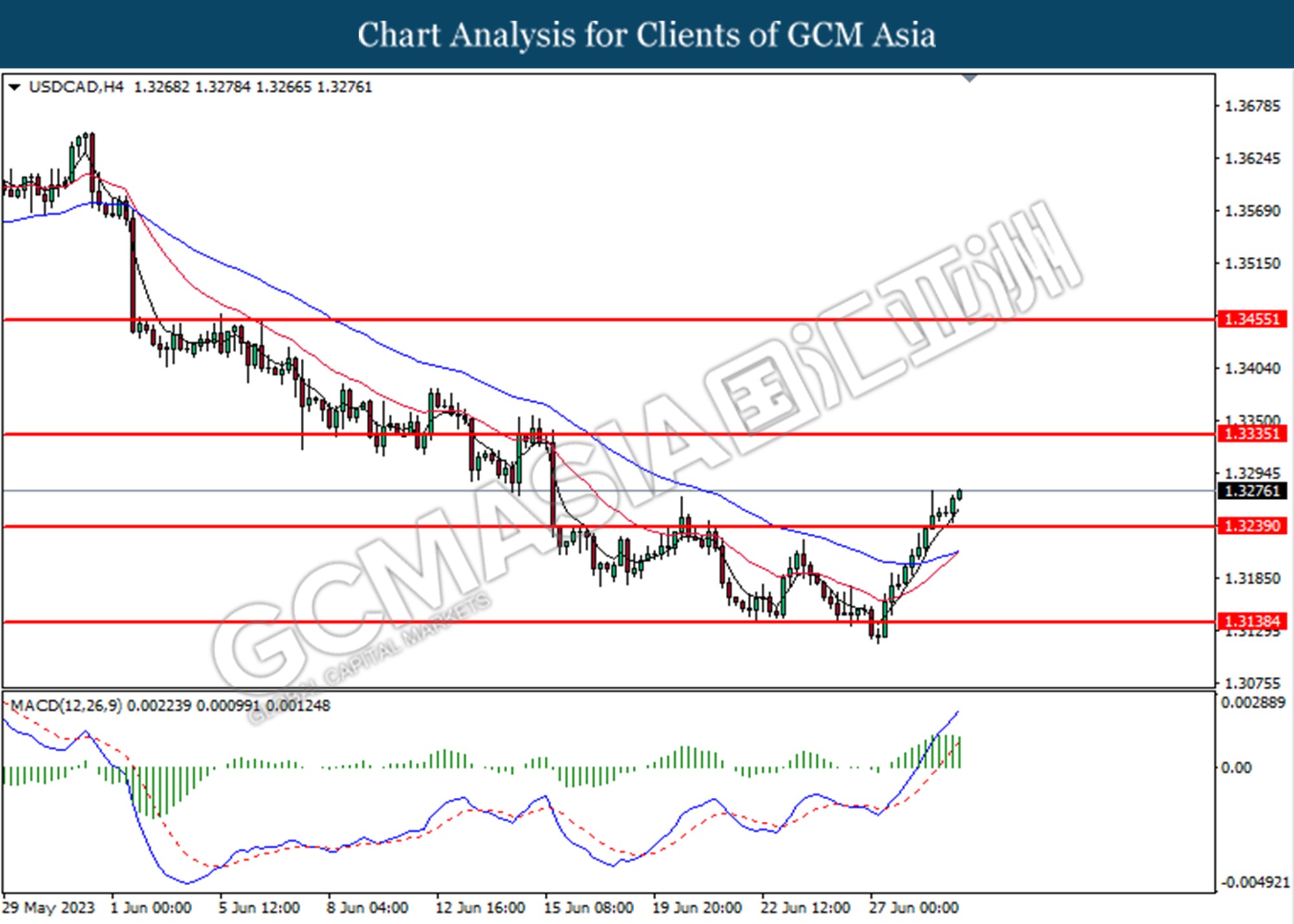

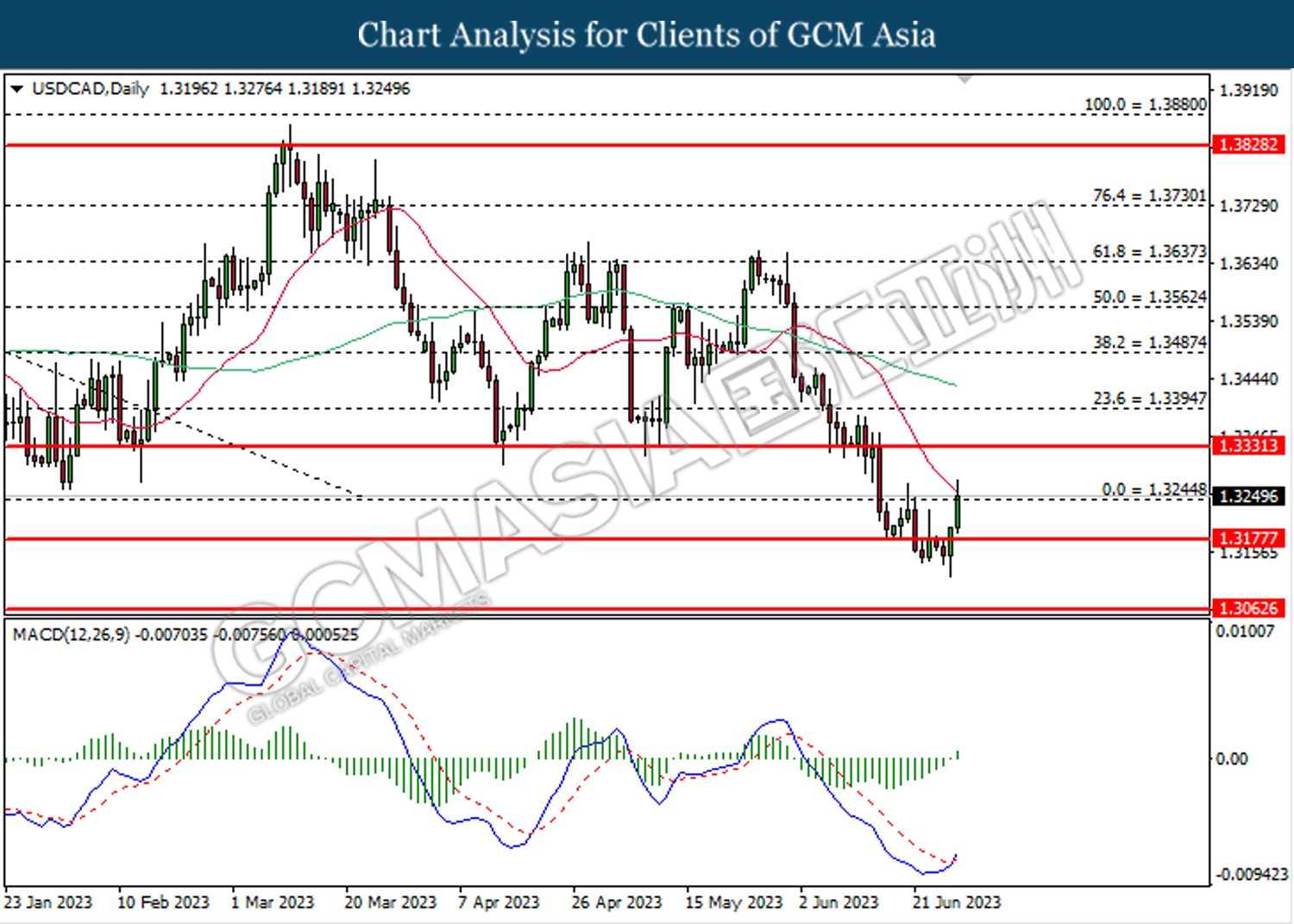

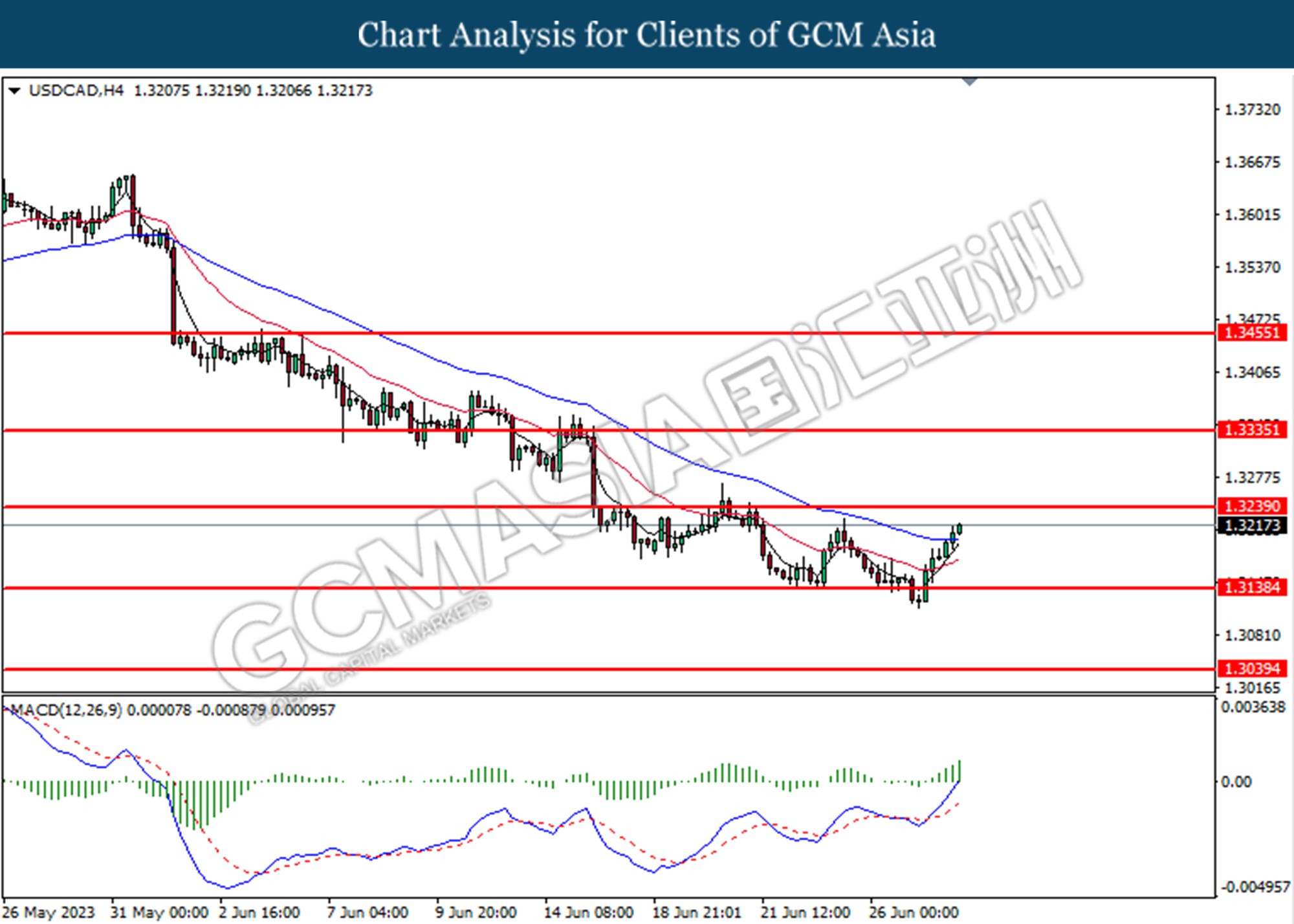

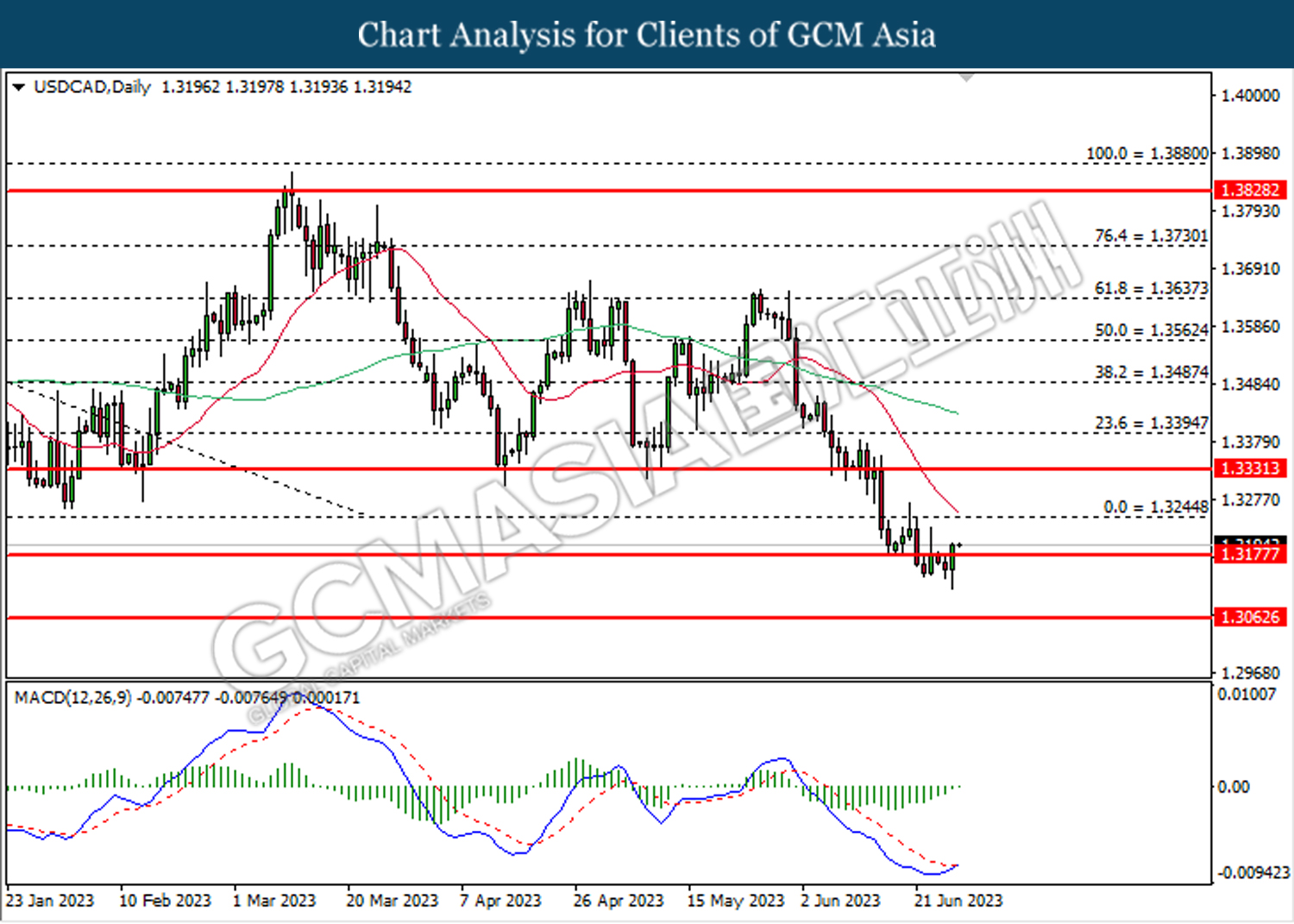

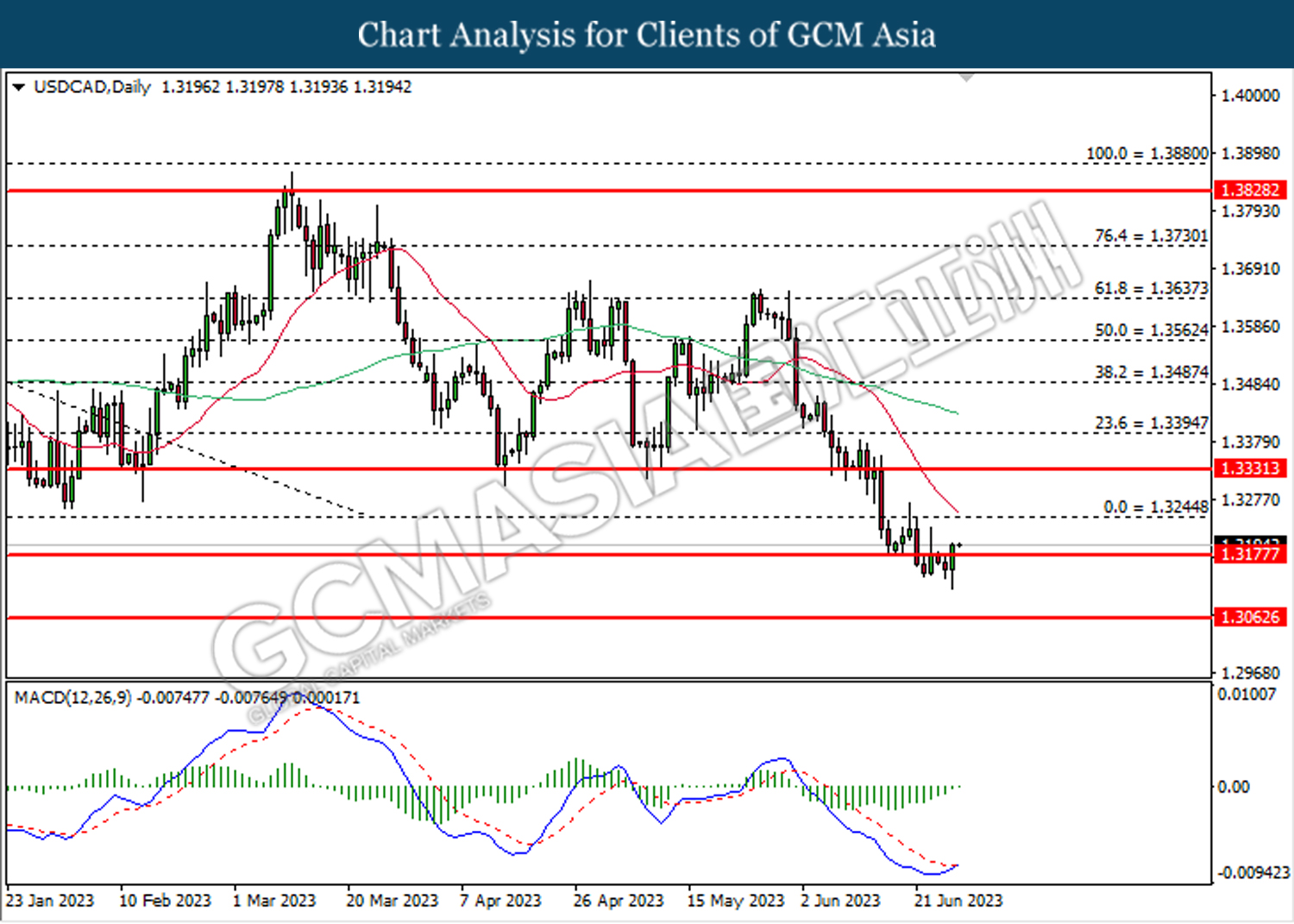

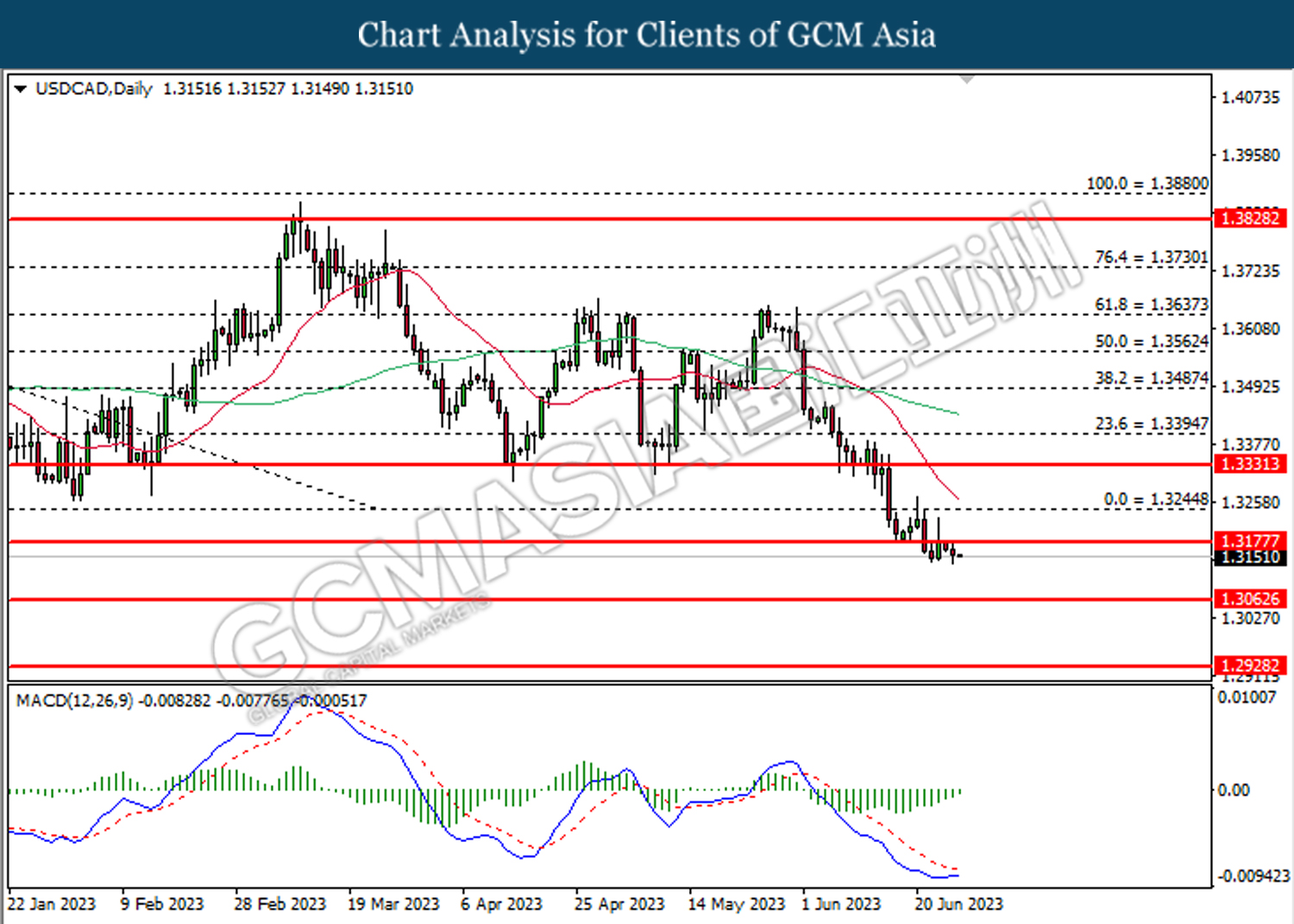

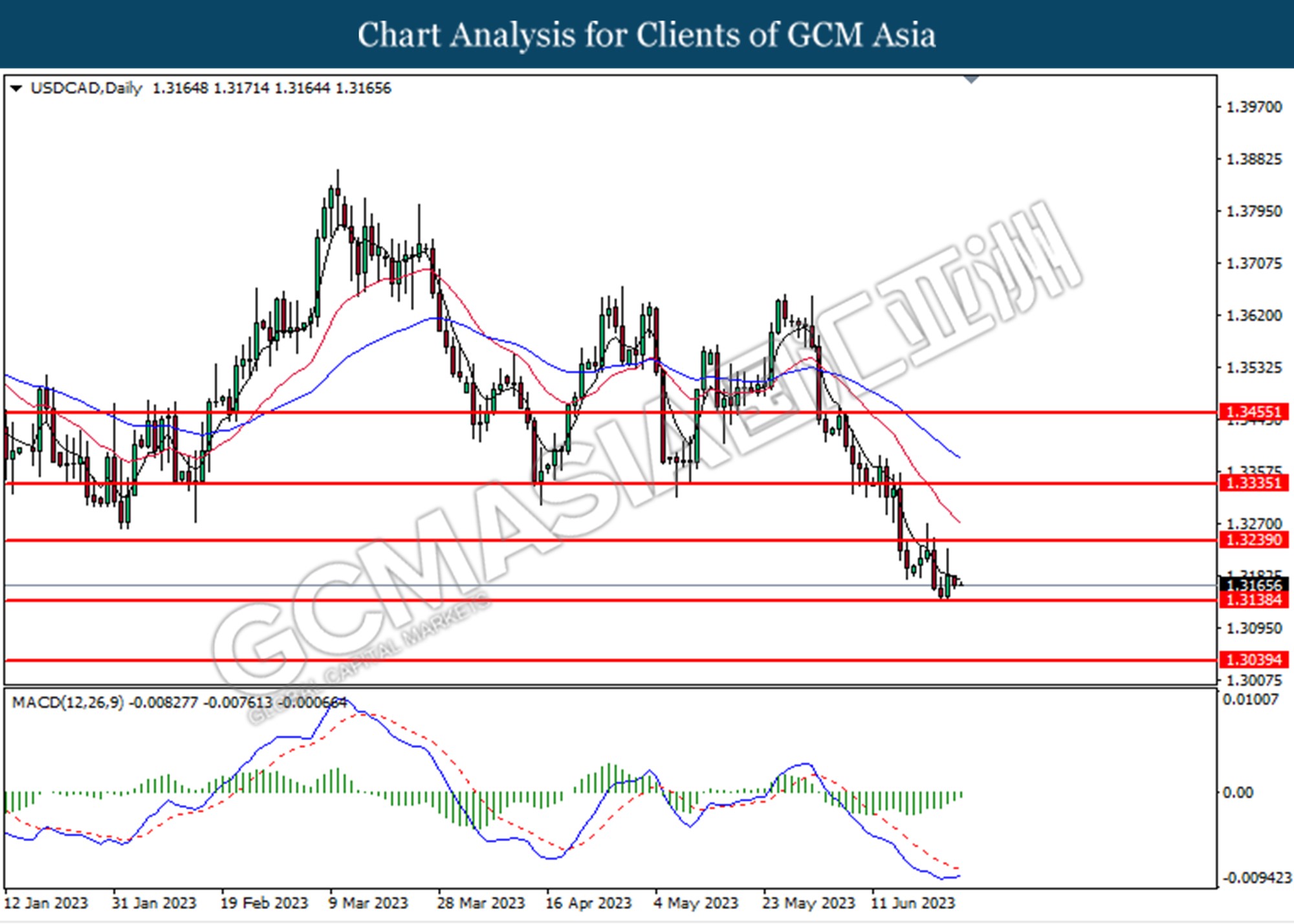

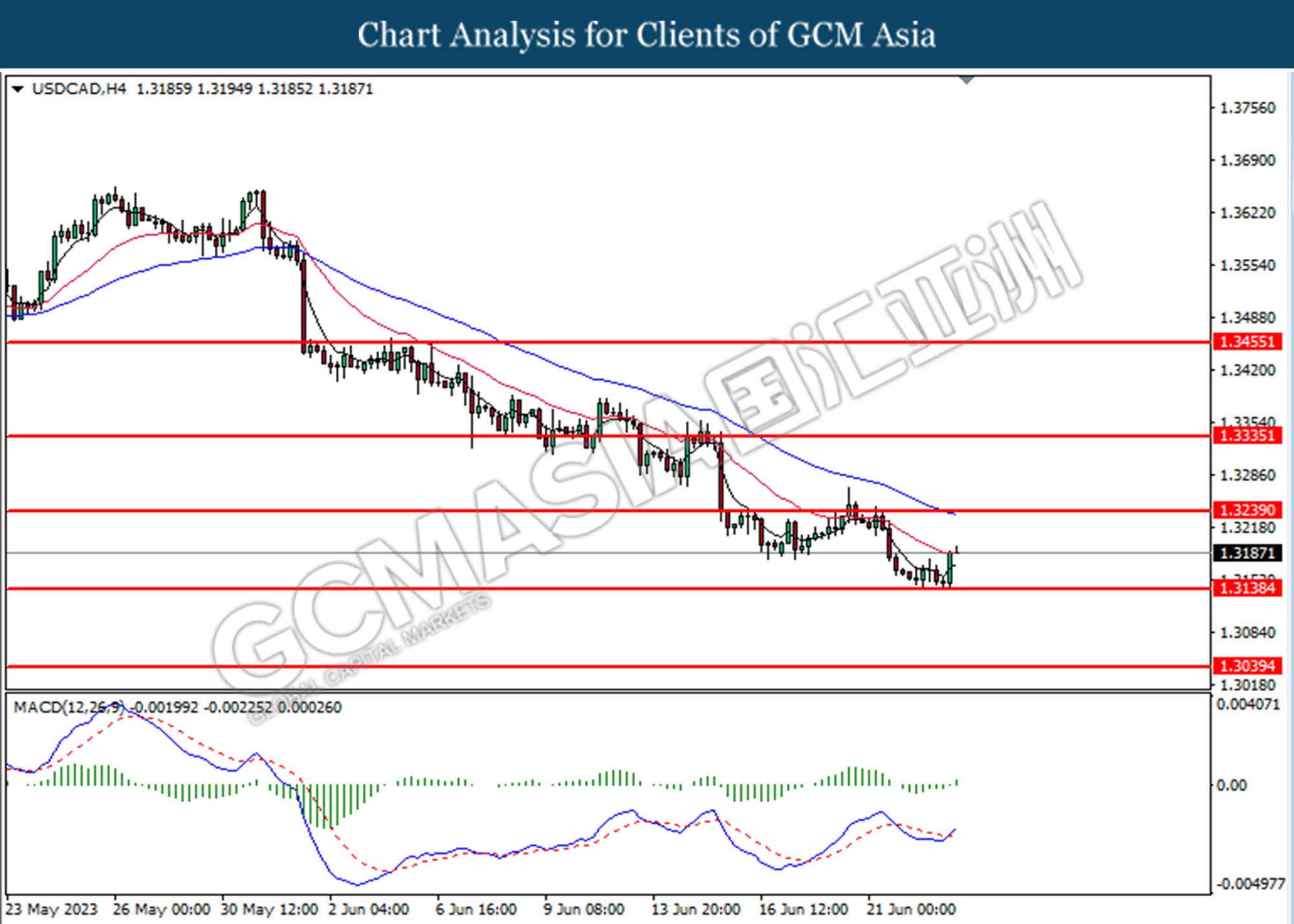

USDCAD, H4: USDCAD was traded higher following the prior rebound from the support level at 1.3240. However, MACD which illustrated bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

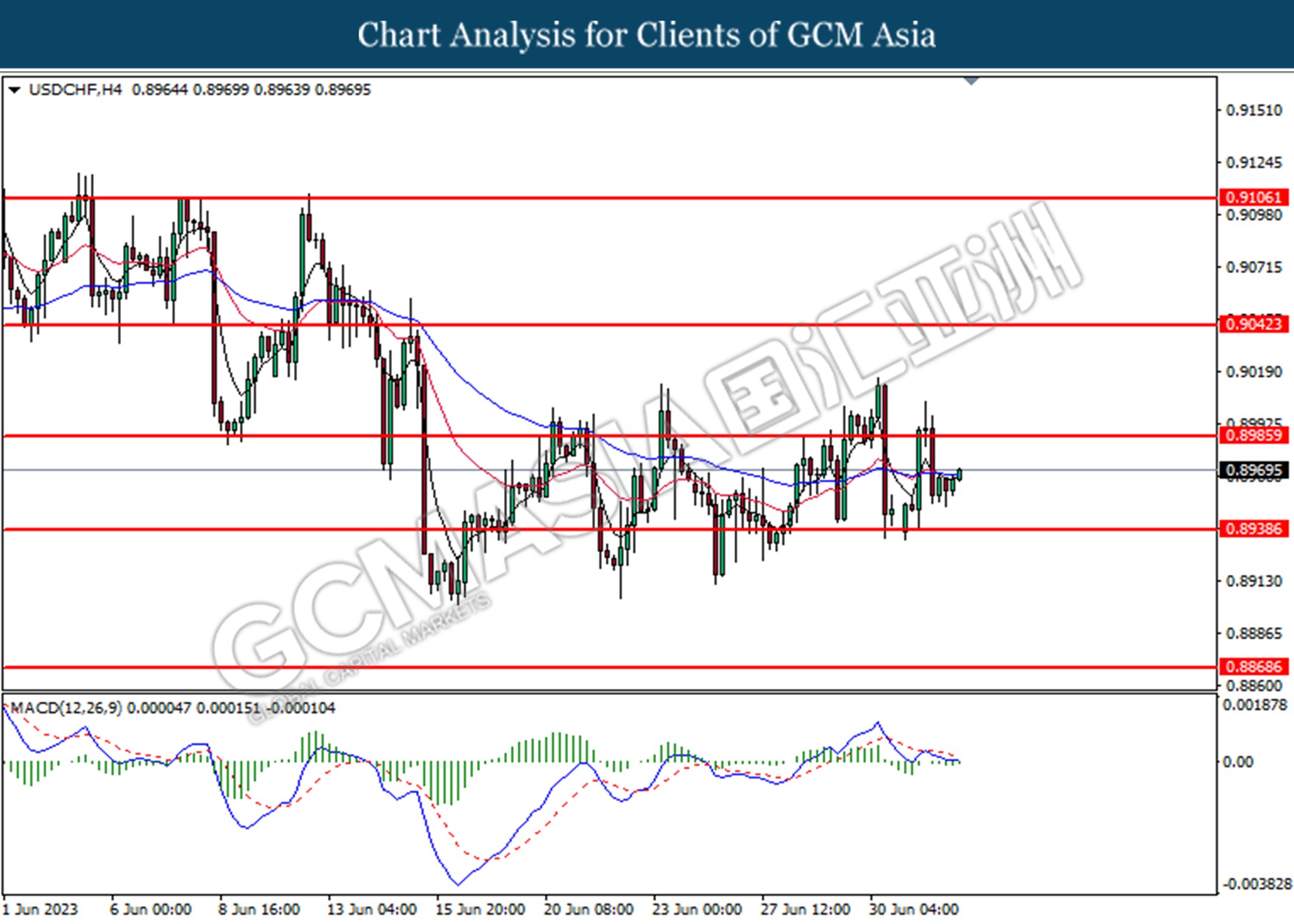

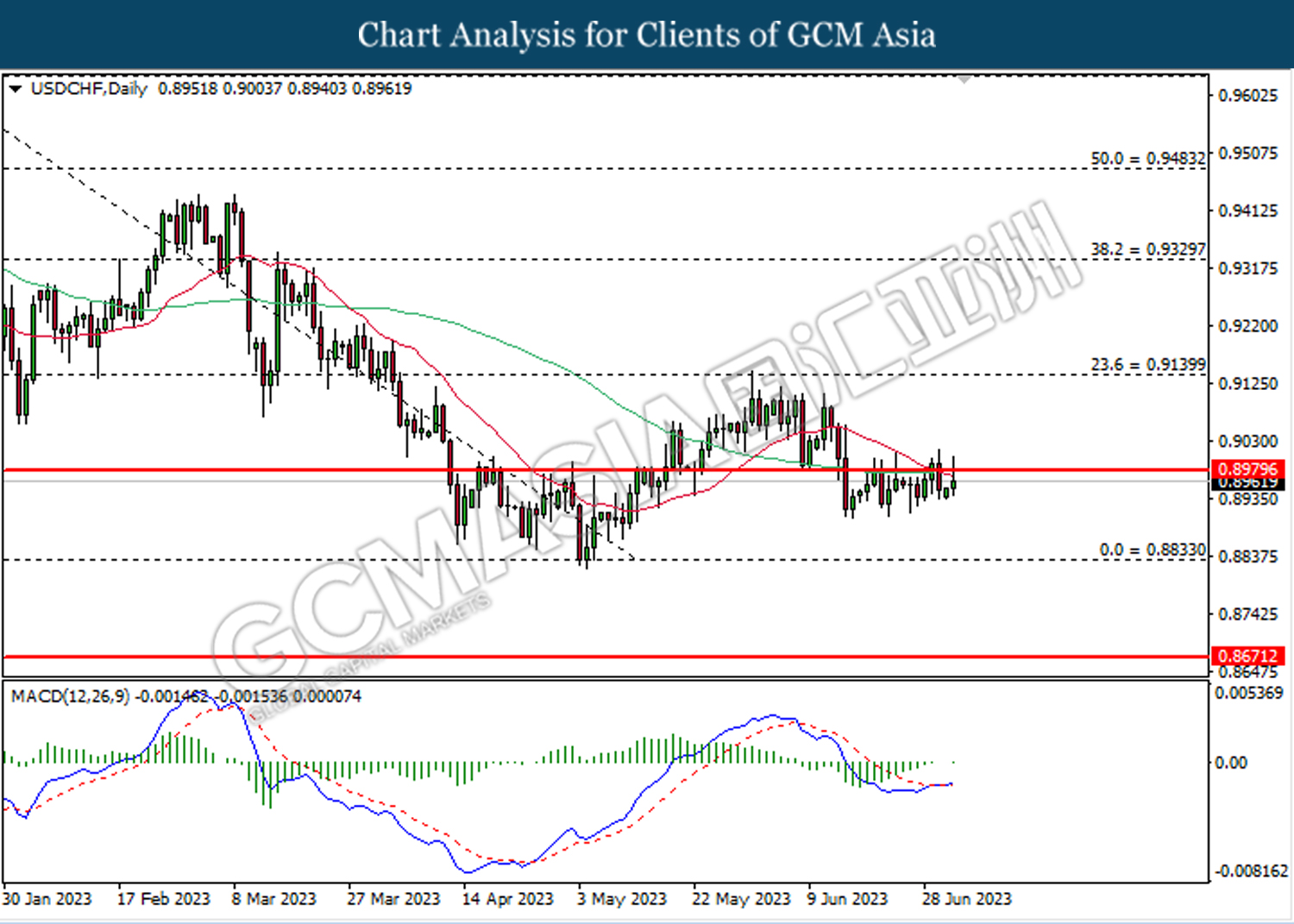

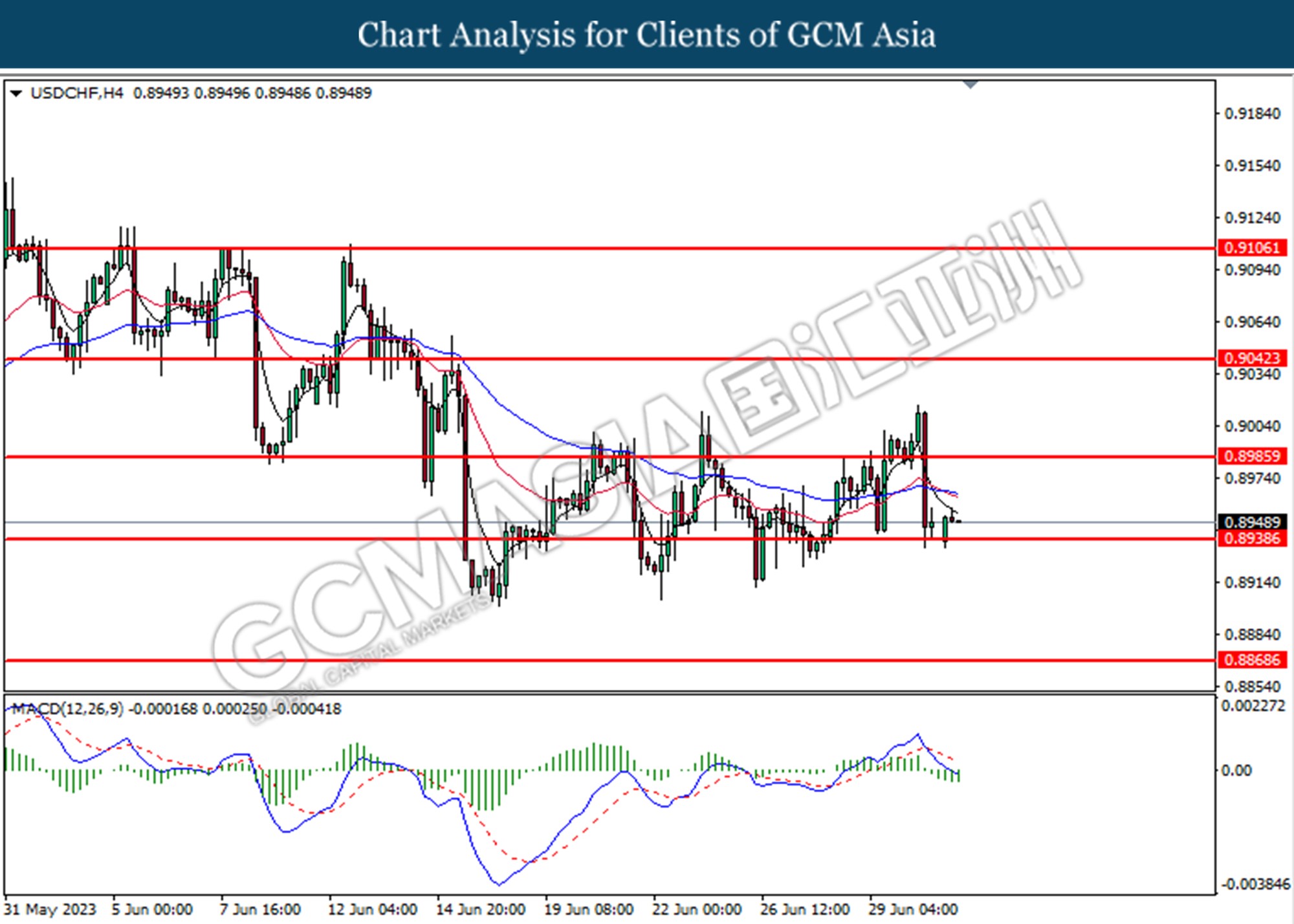

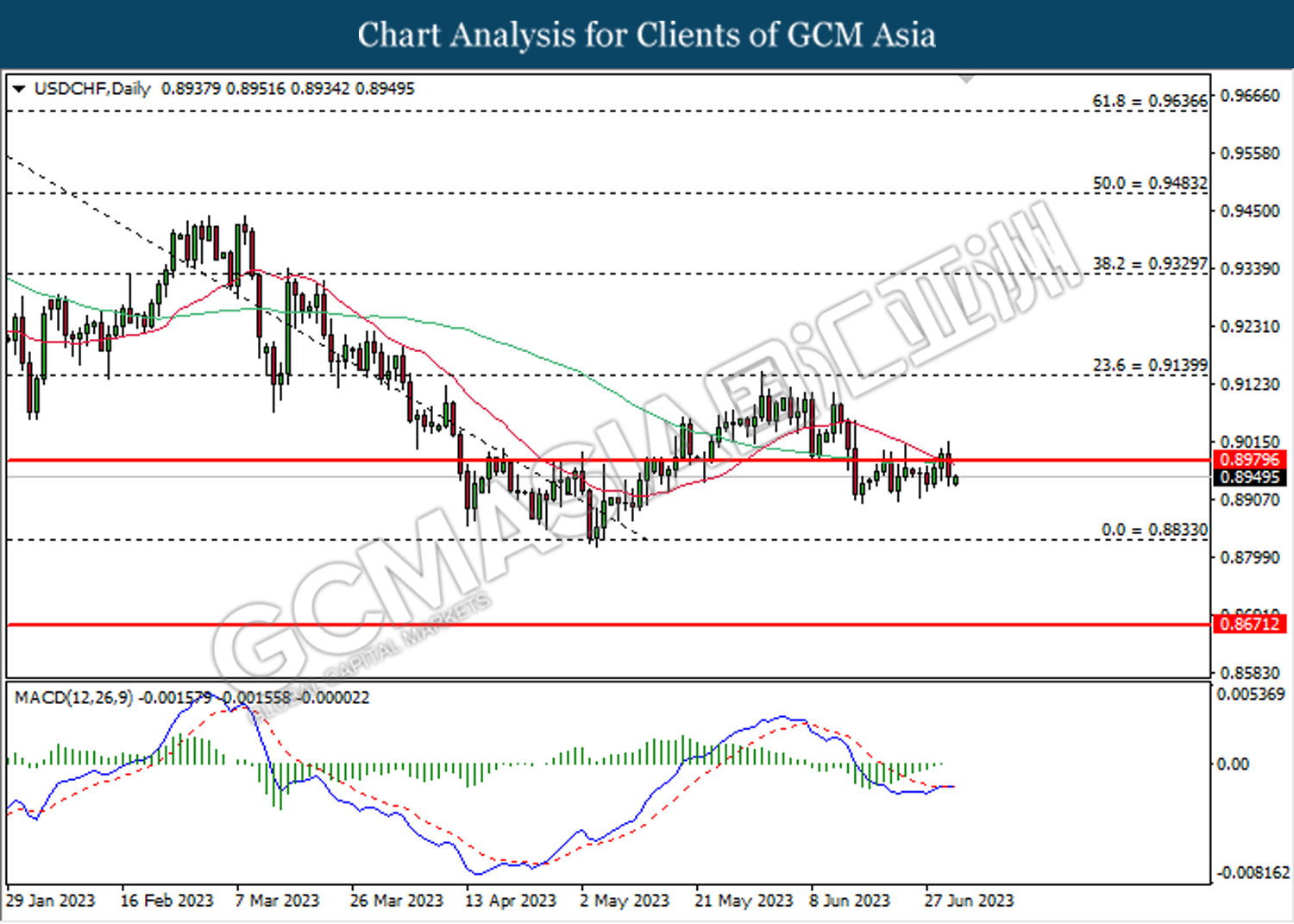

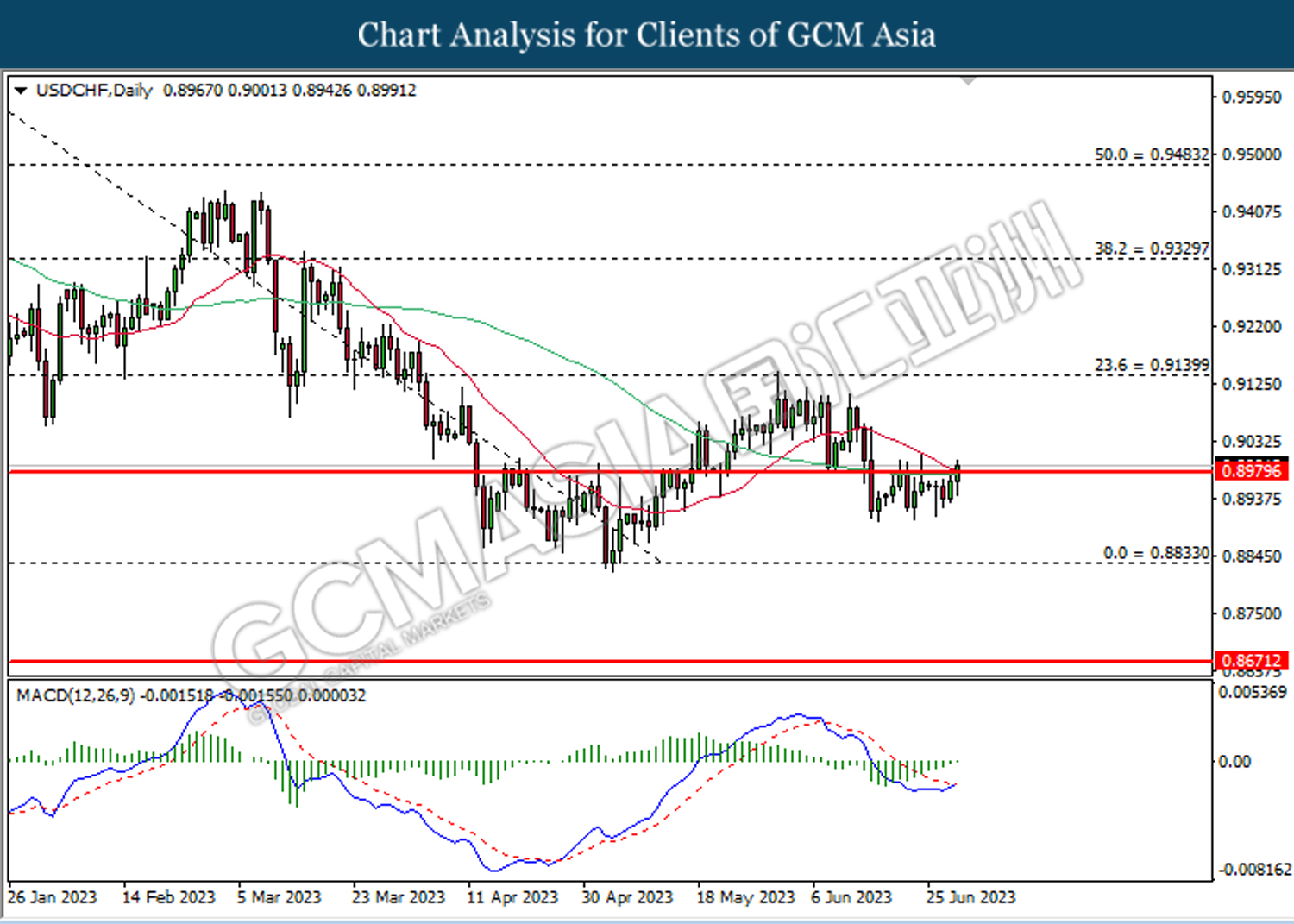

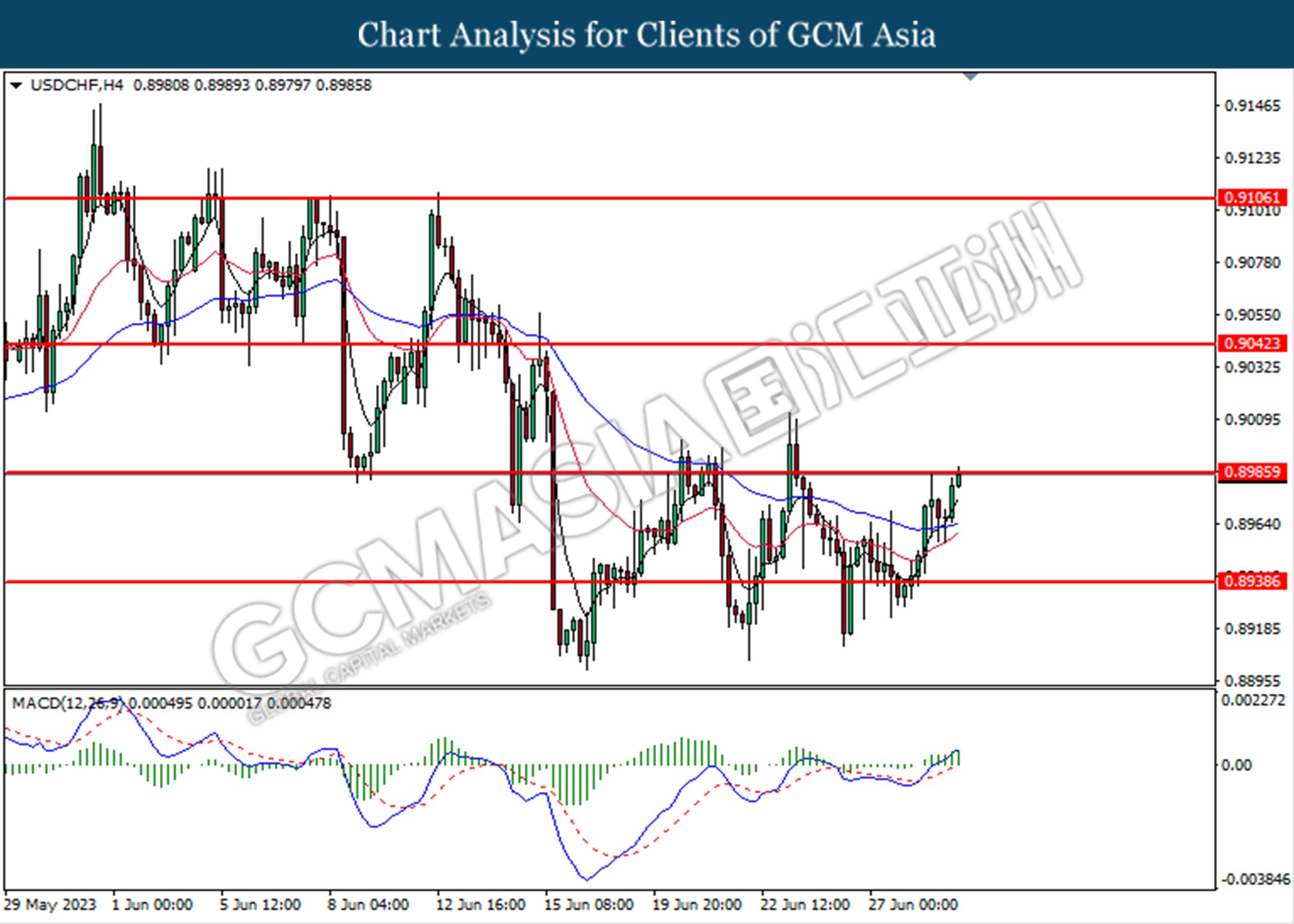

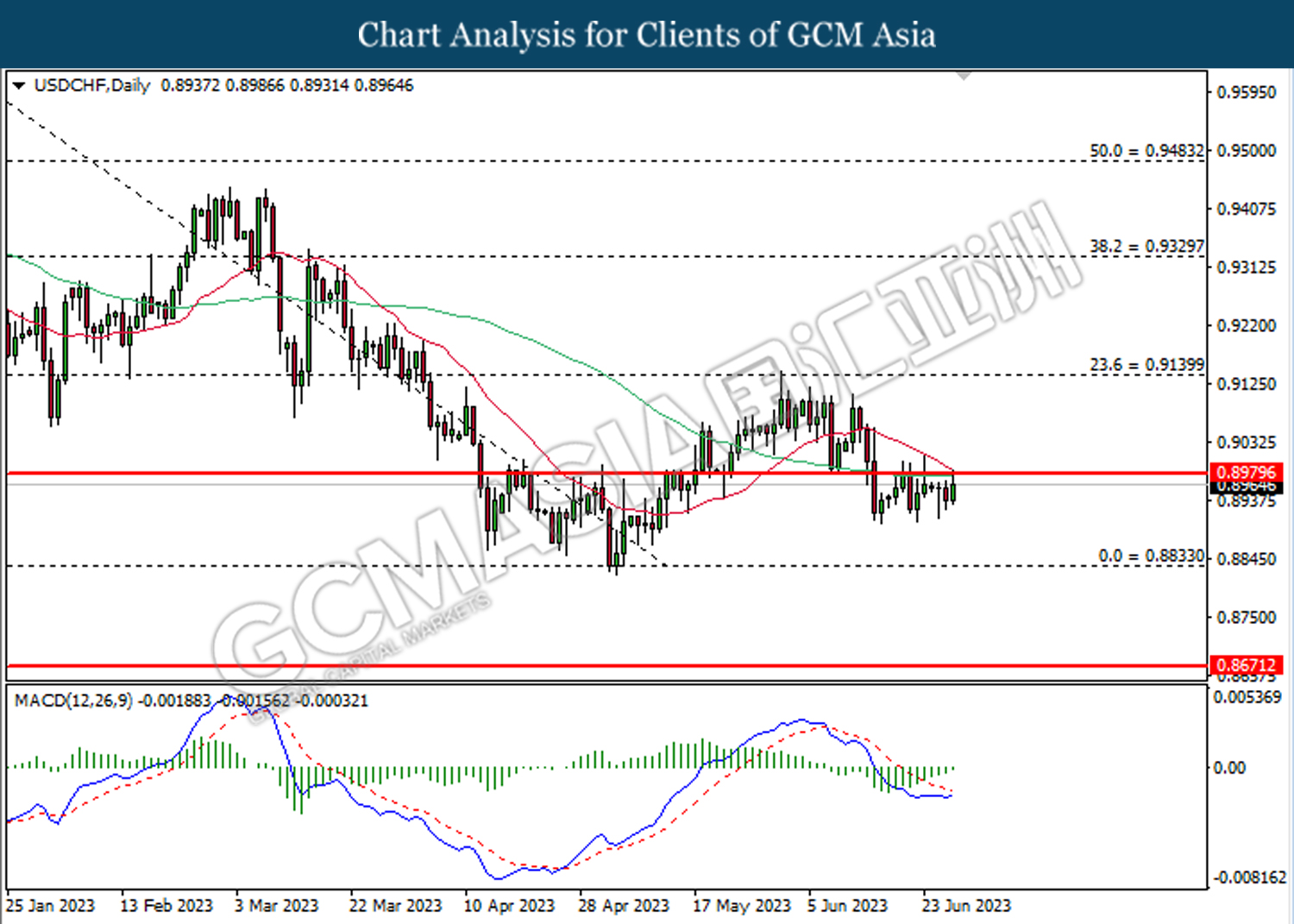

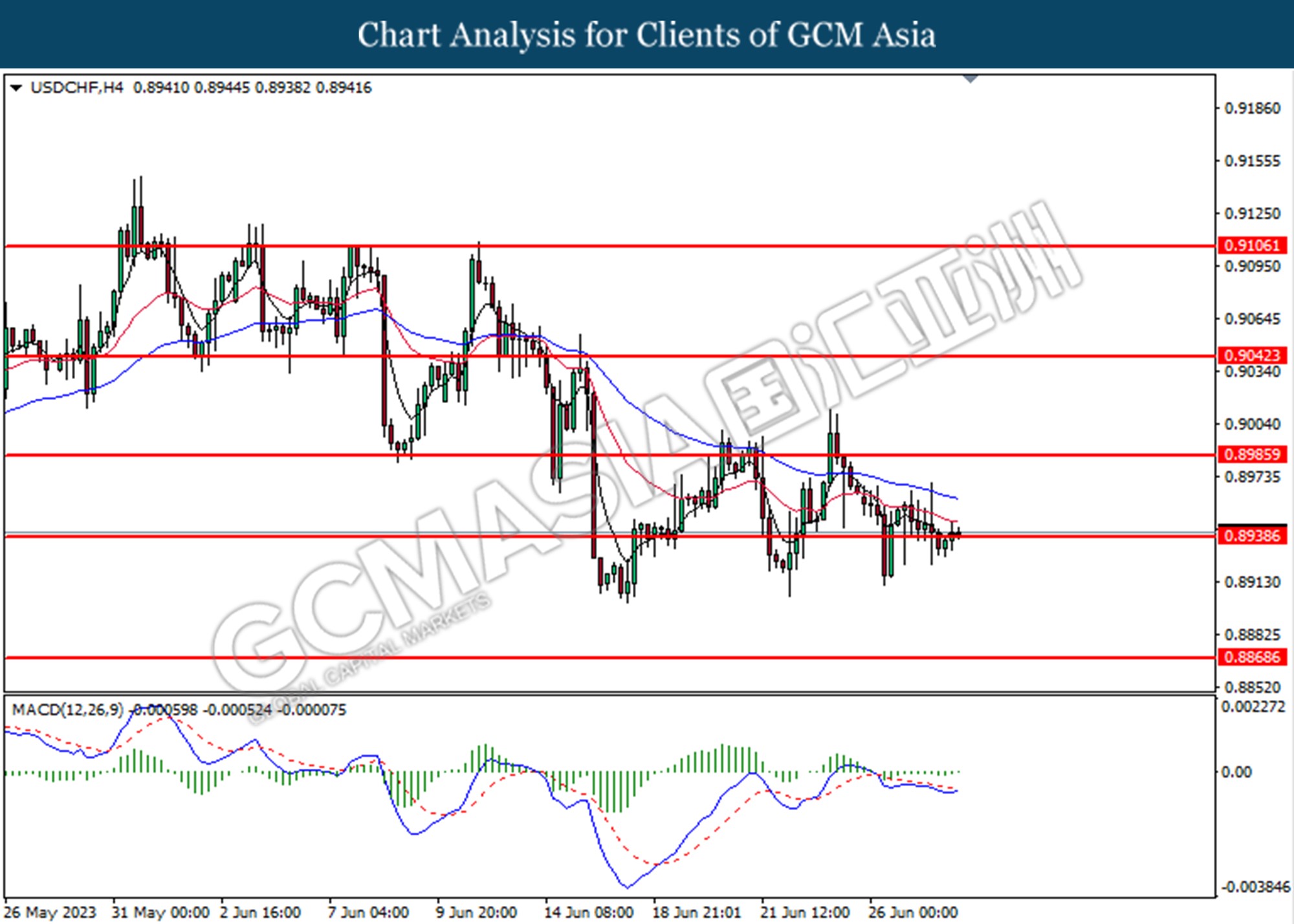

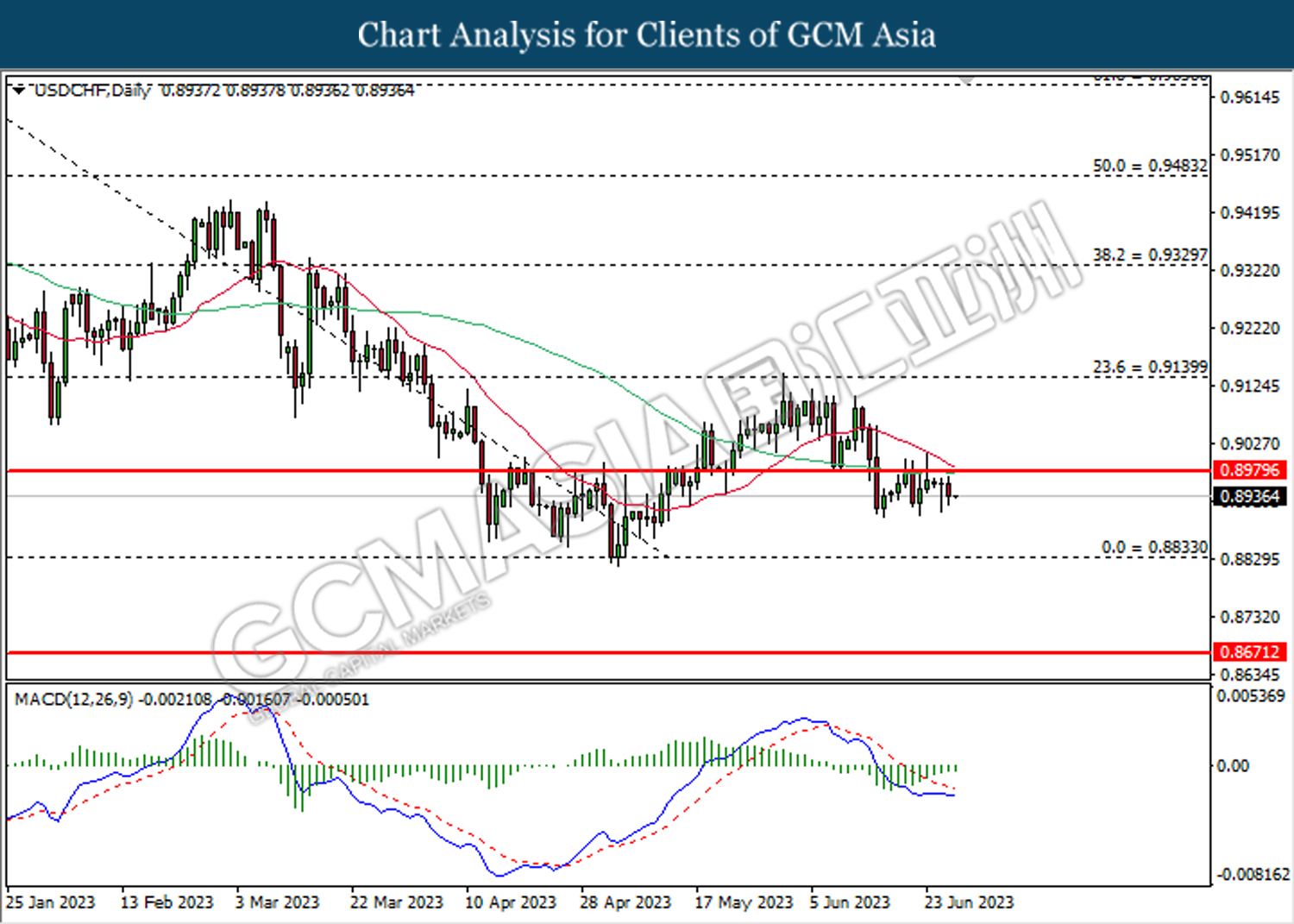

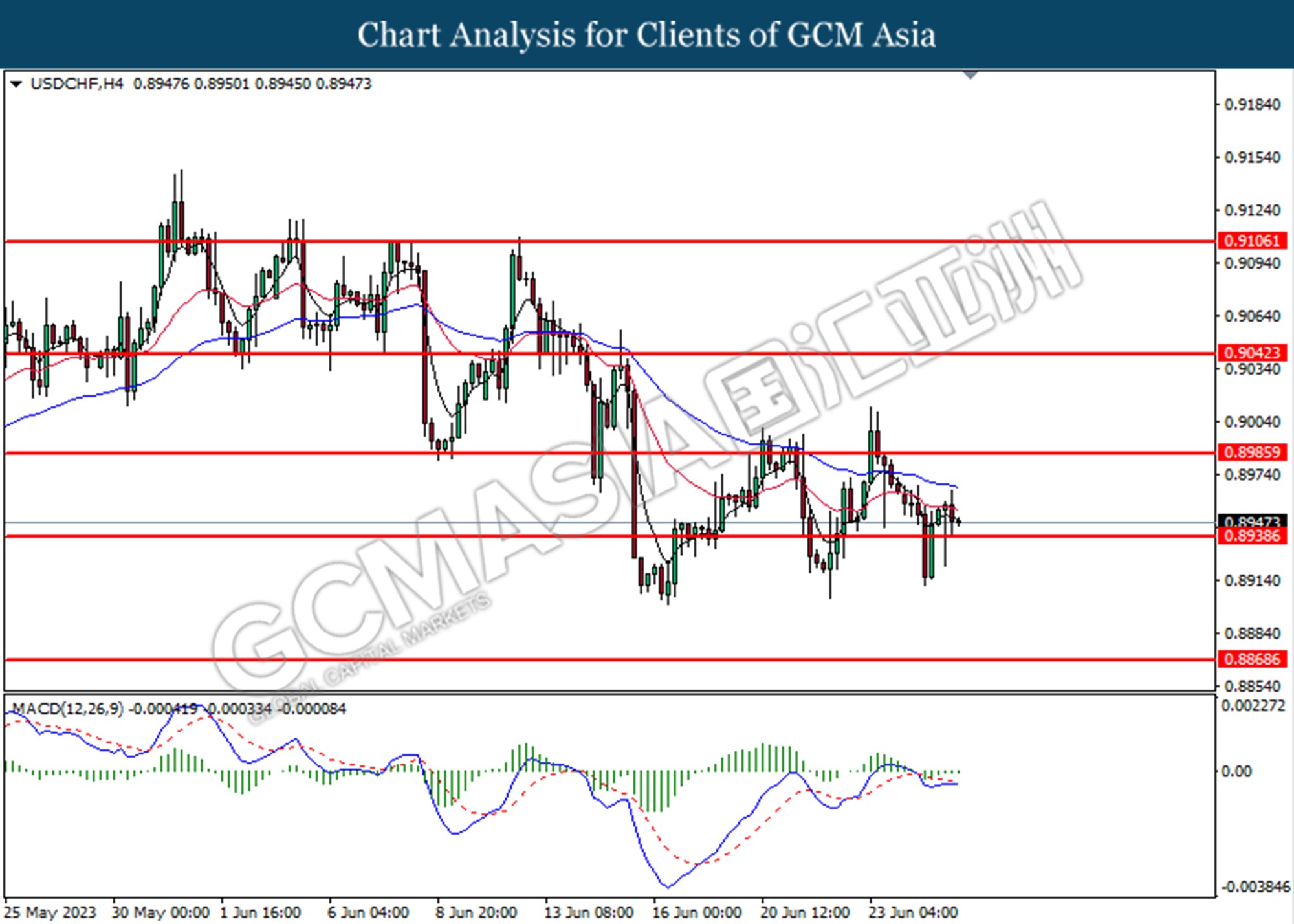

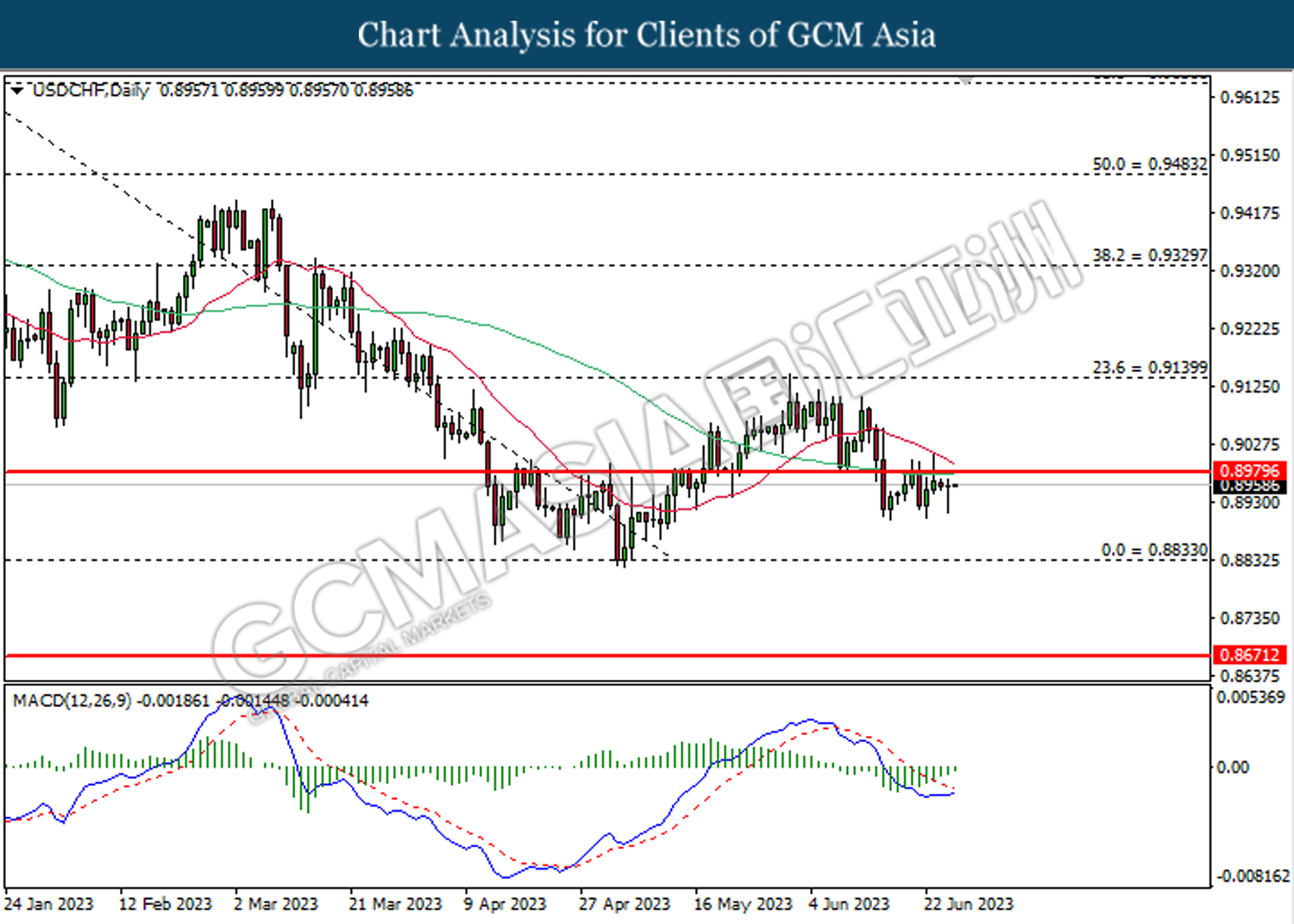

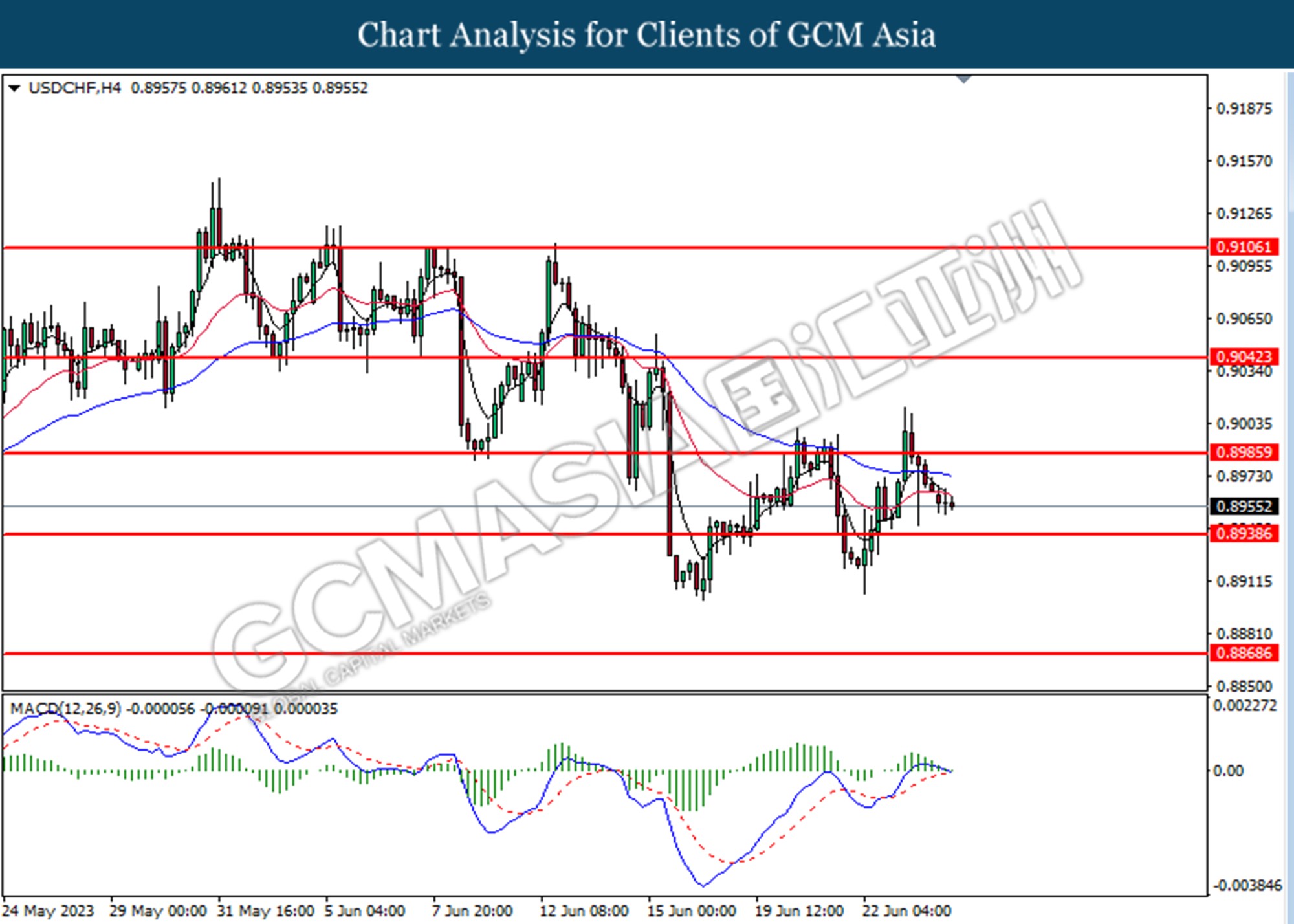

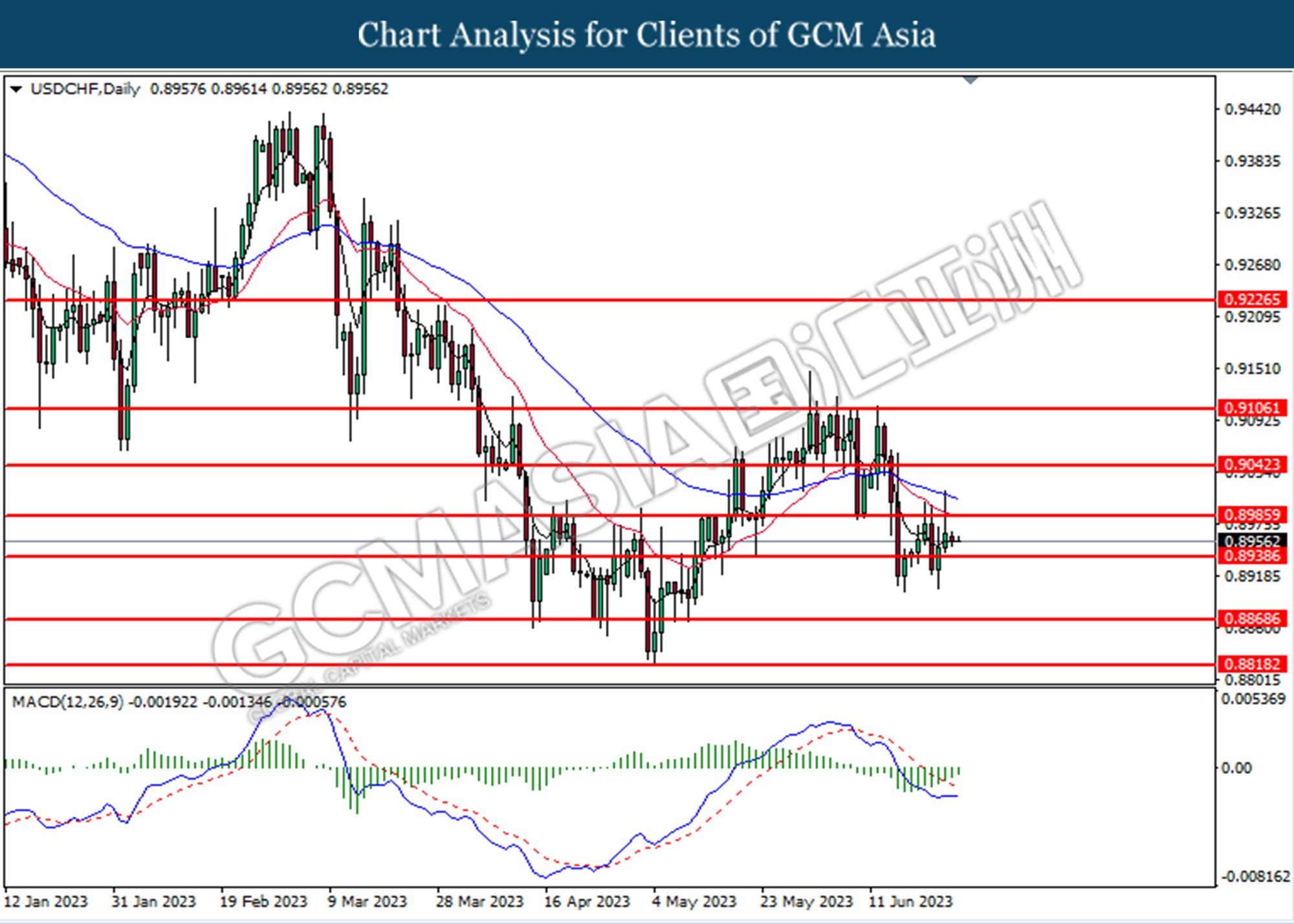

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. However, MACD which illustrated bearish momentum suggests the pair undergoes a technical correction in the short term,

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

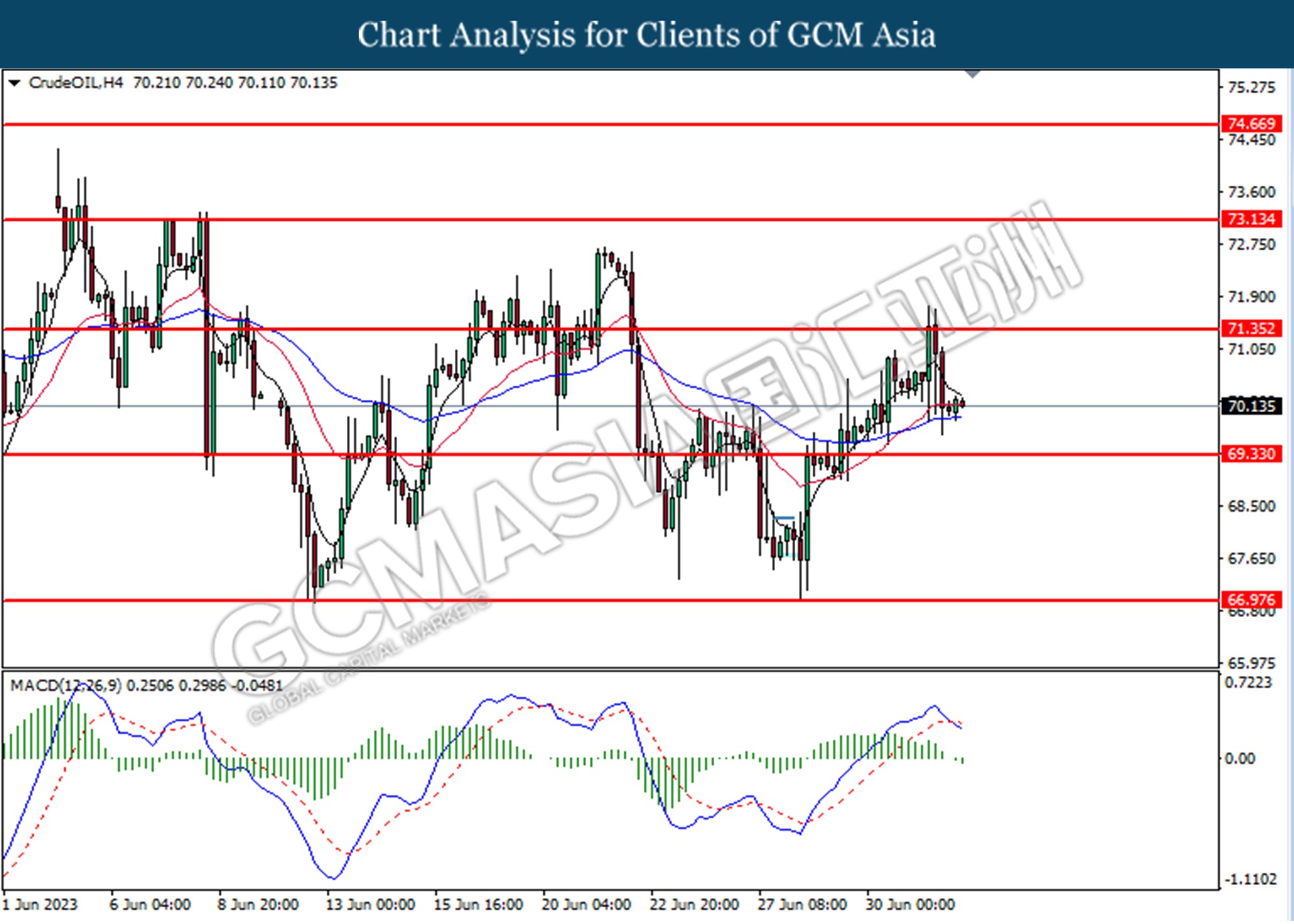

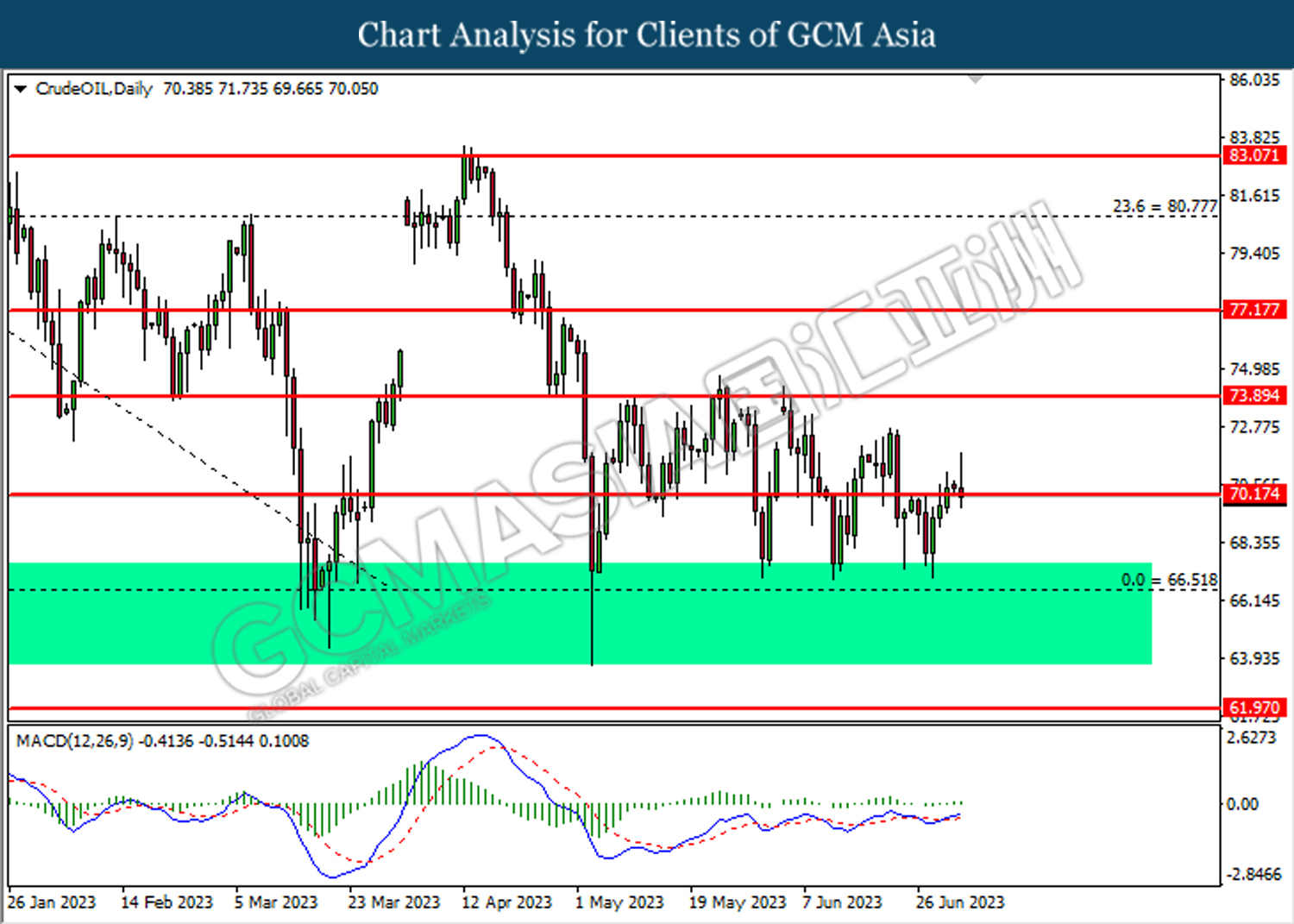

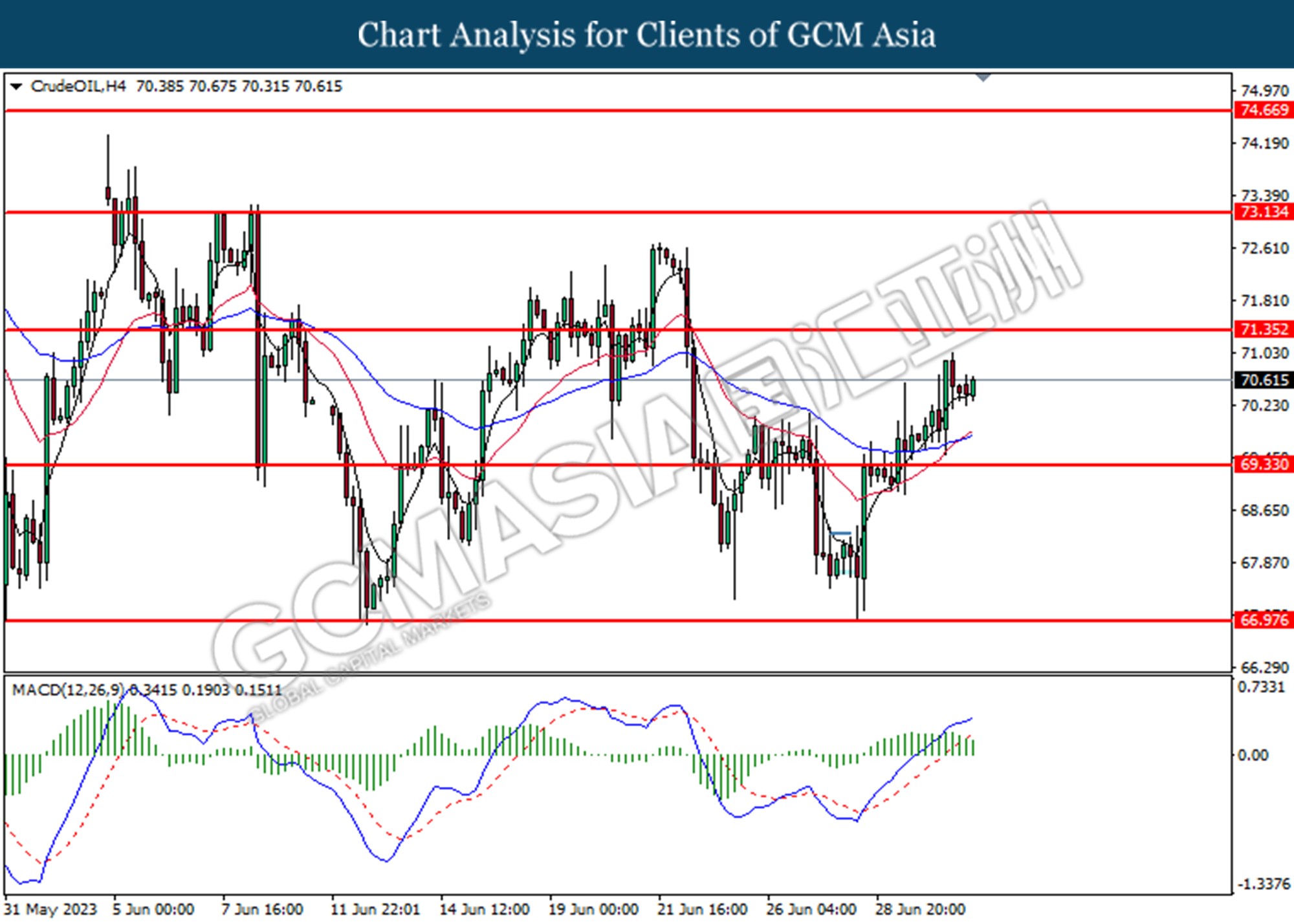

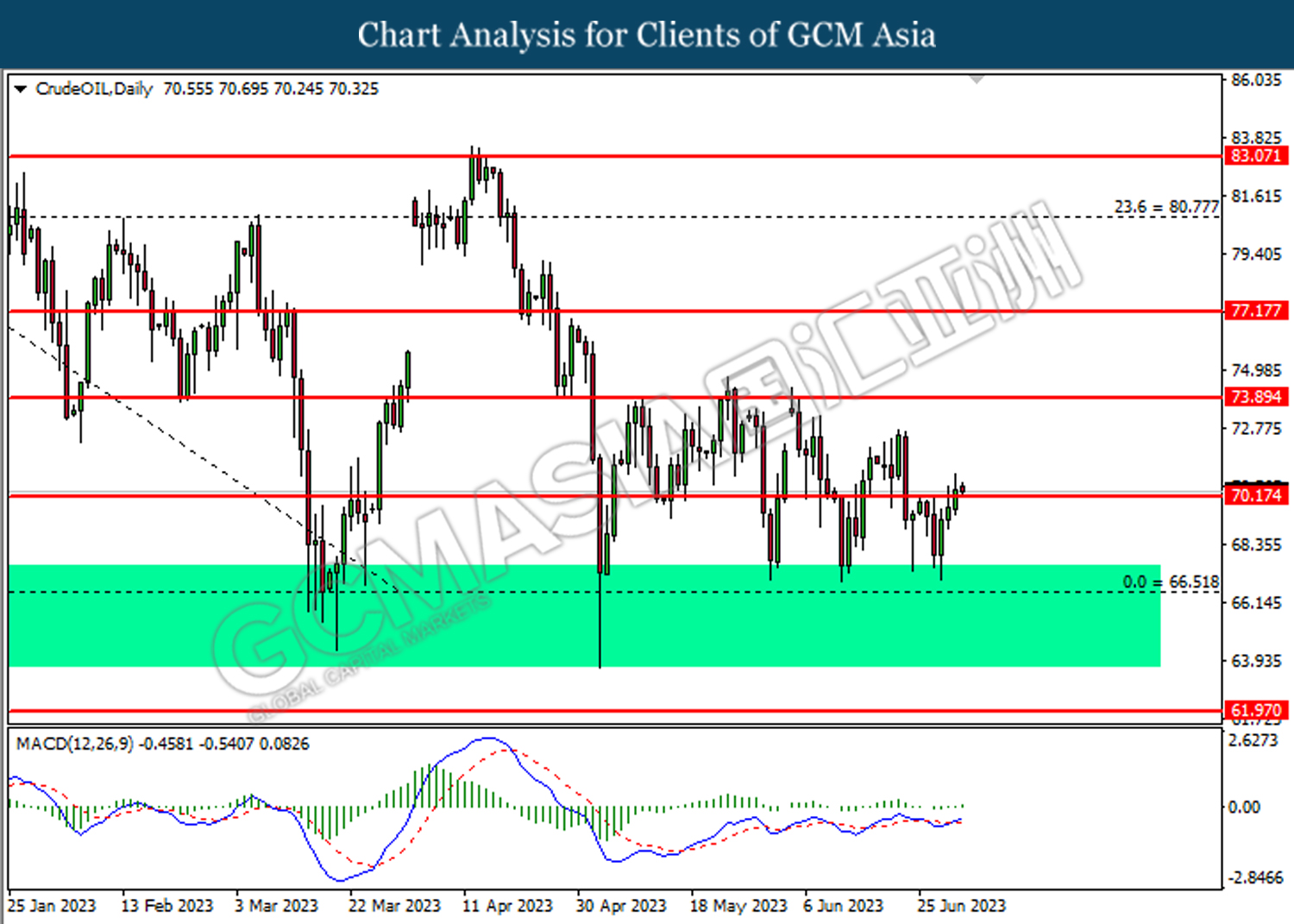

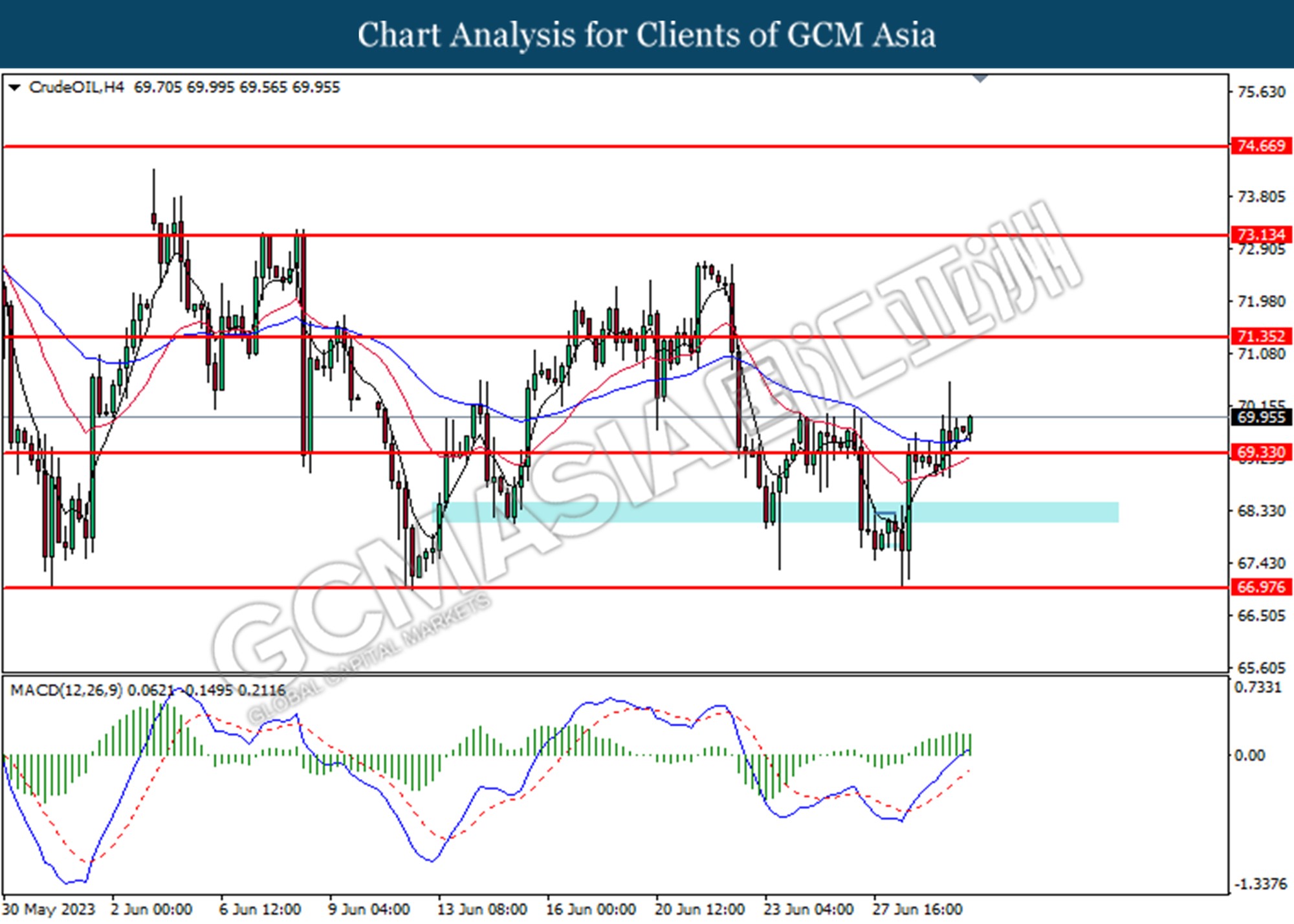

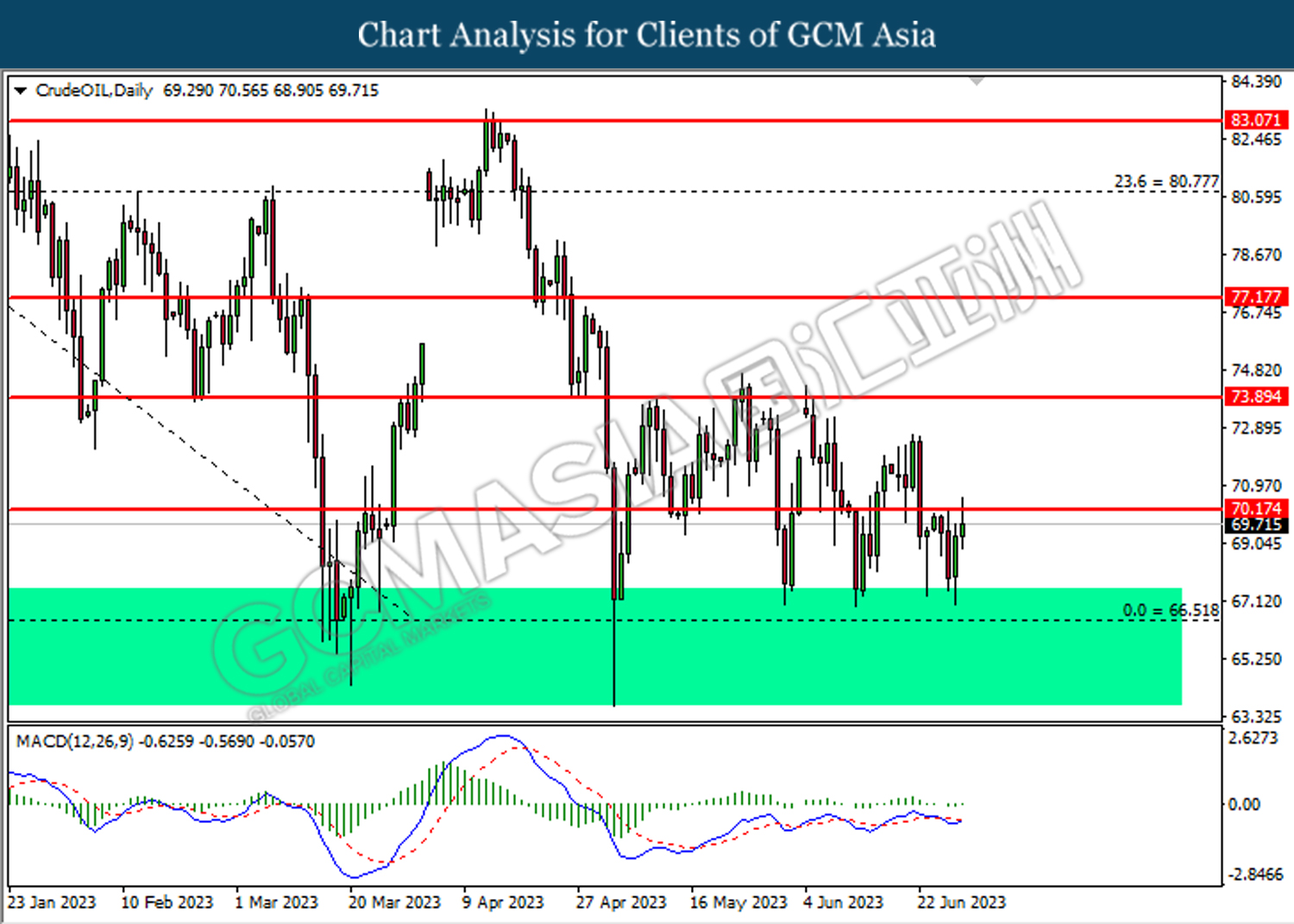

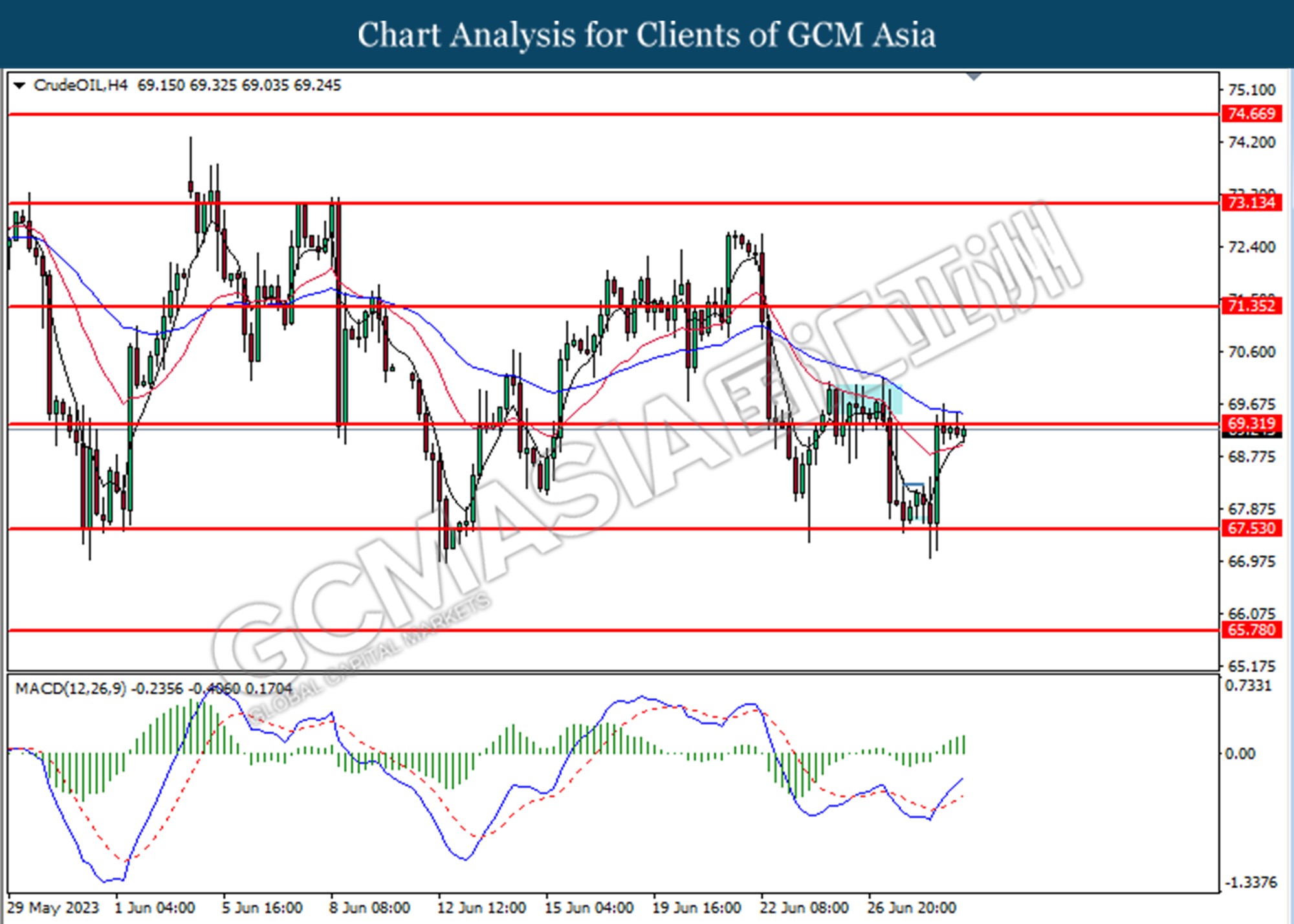

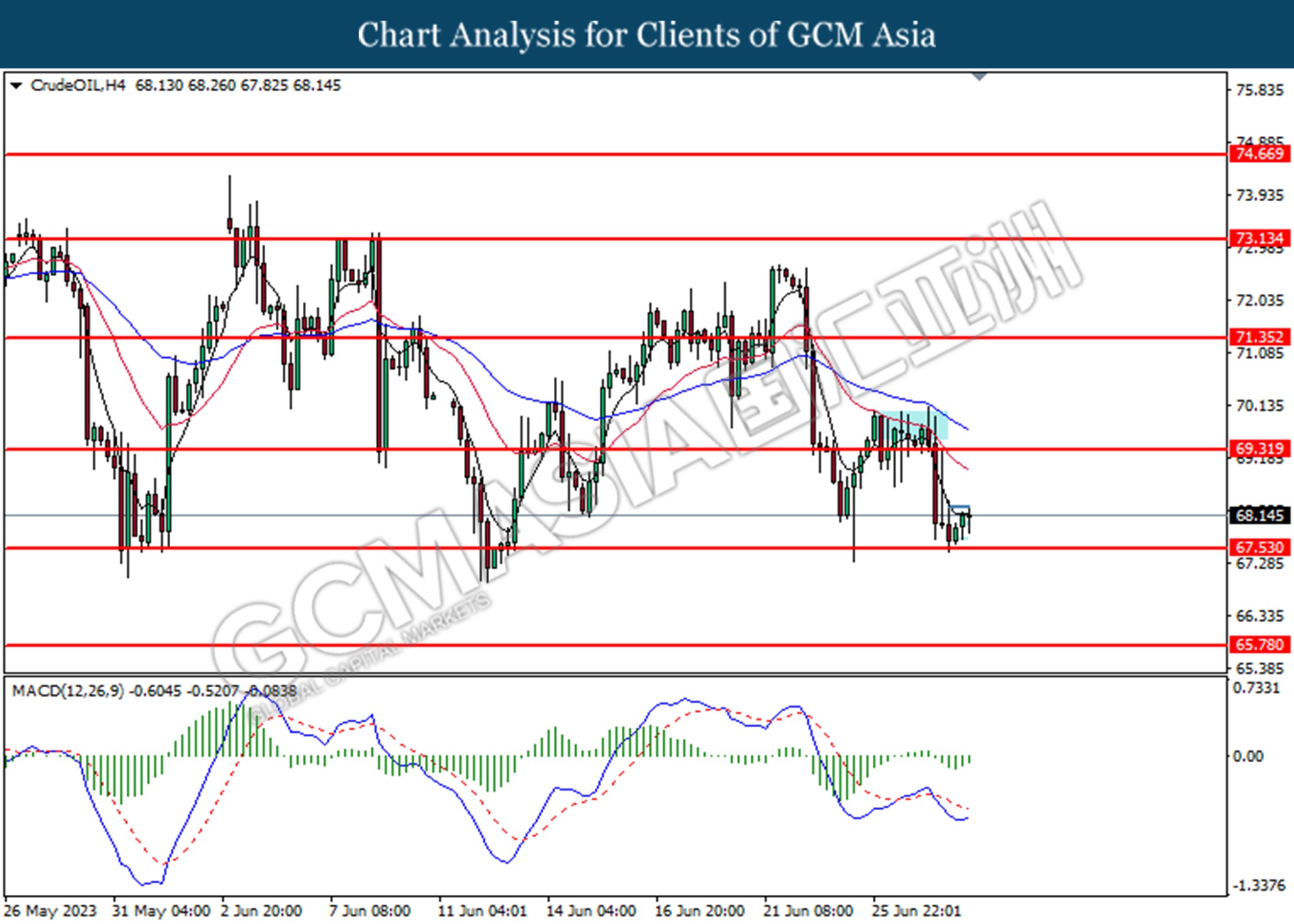

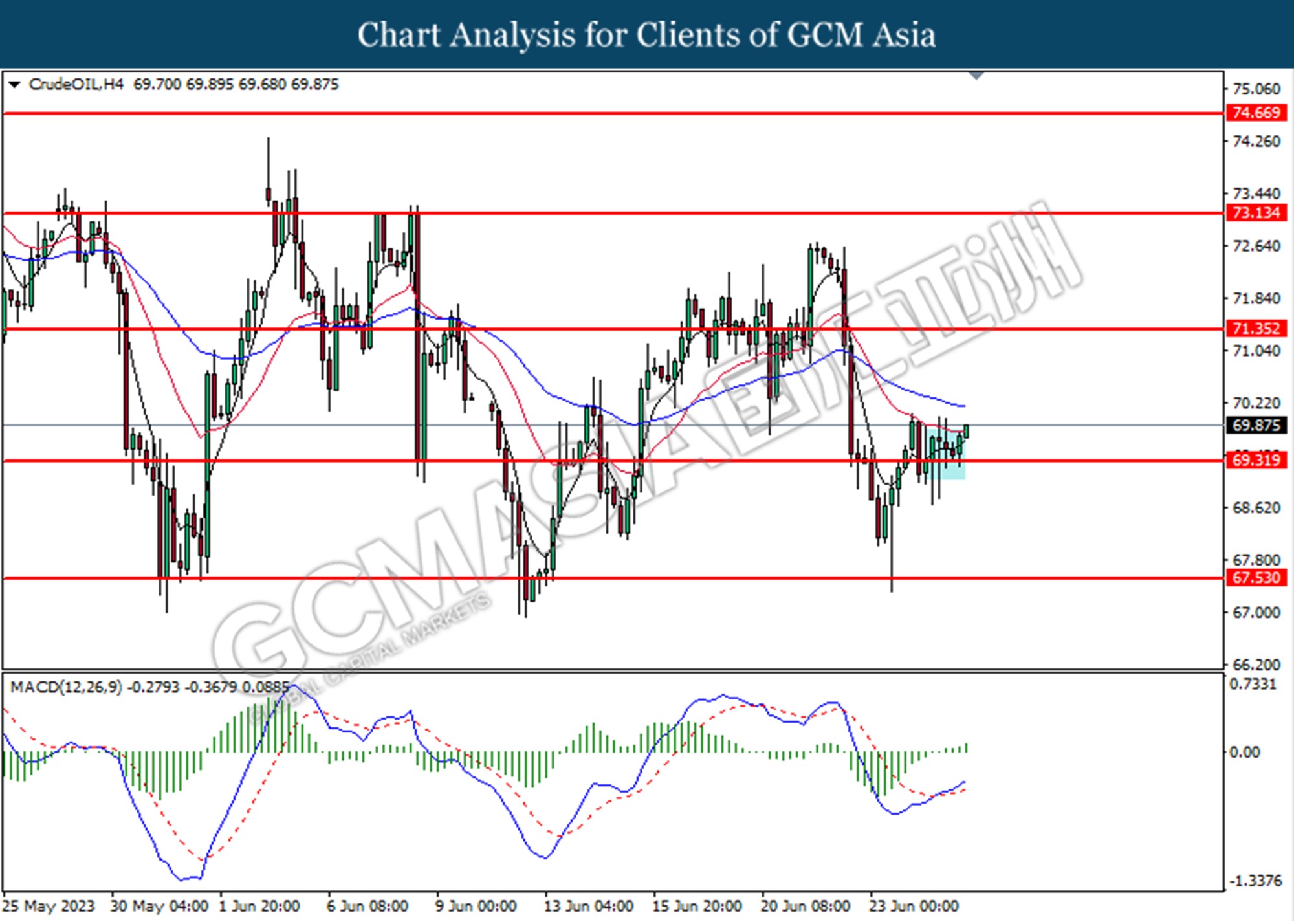

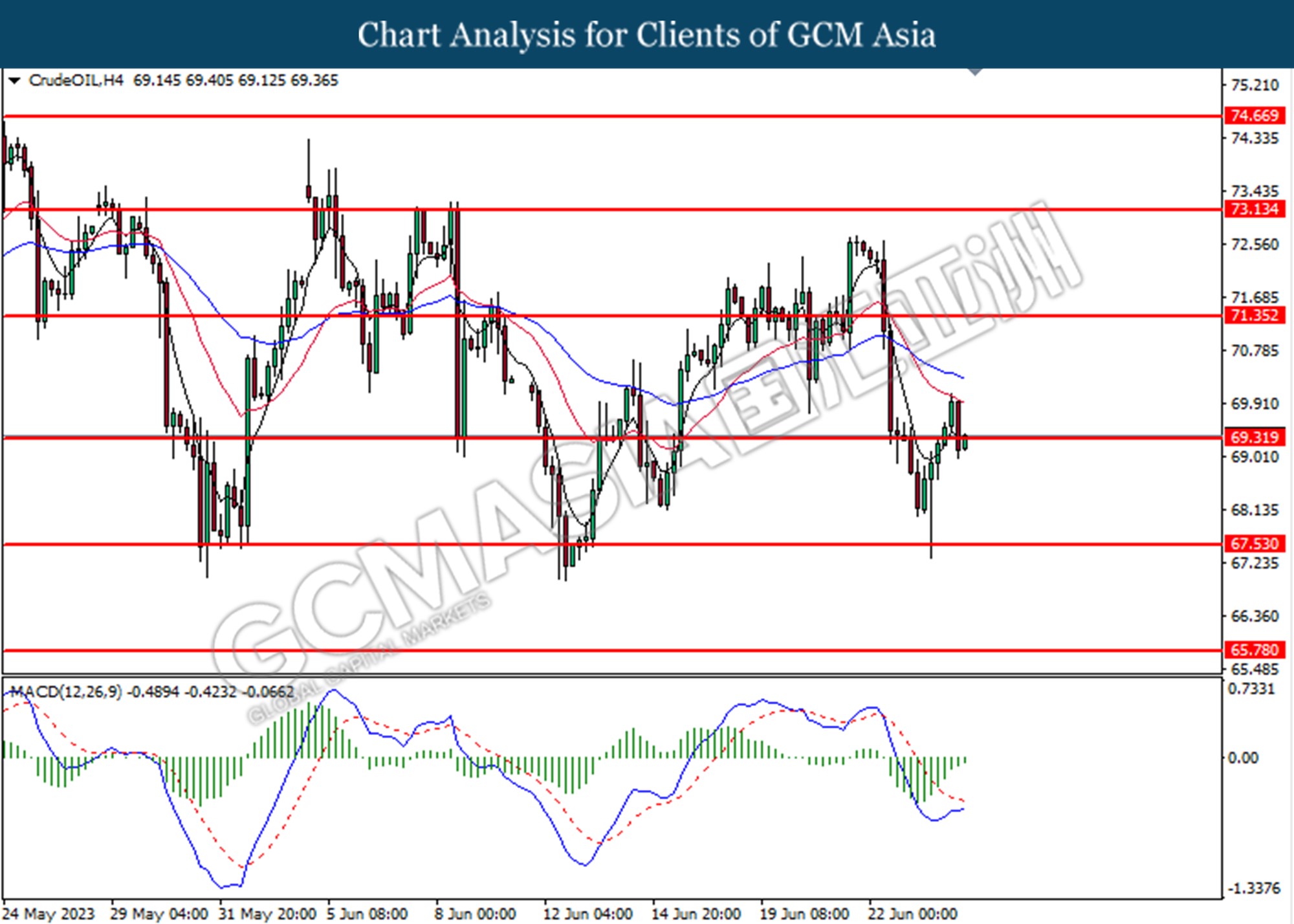

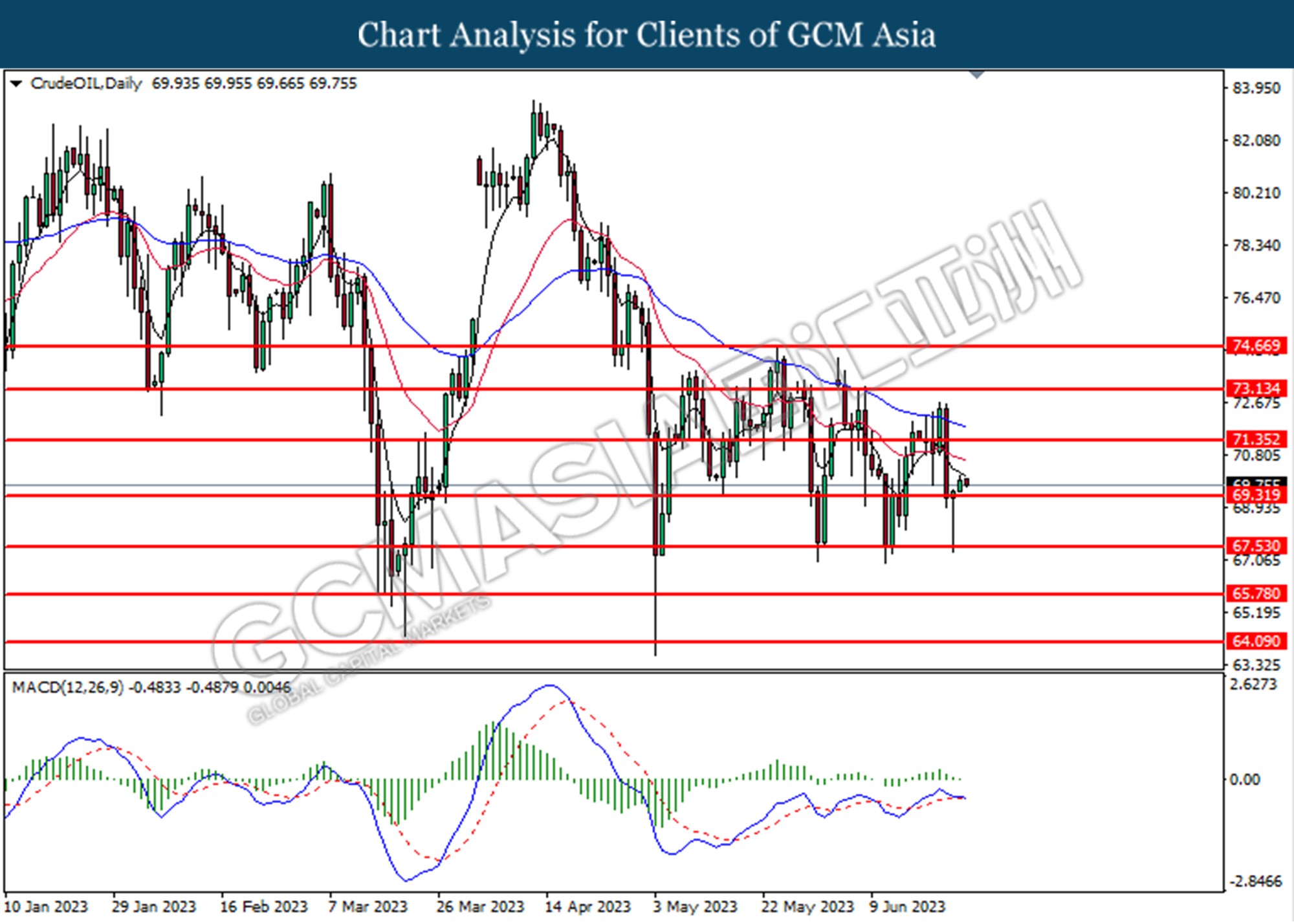

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 71.35,73.15

Support level: 69.30, 67.55

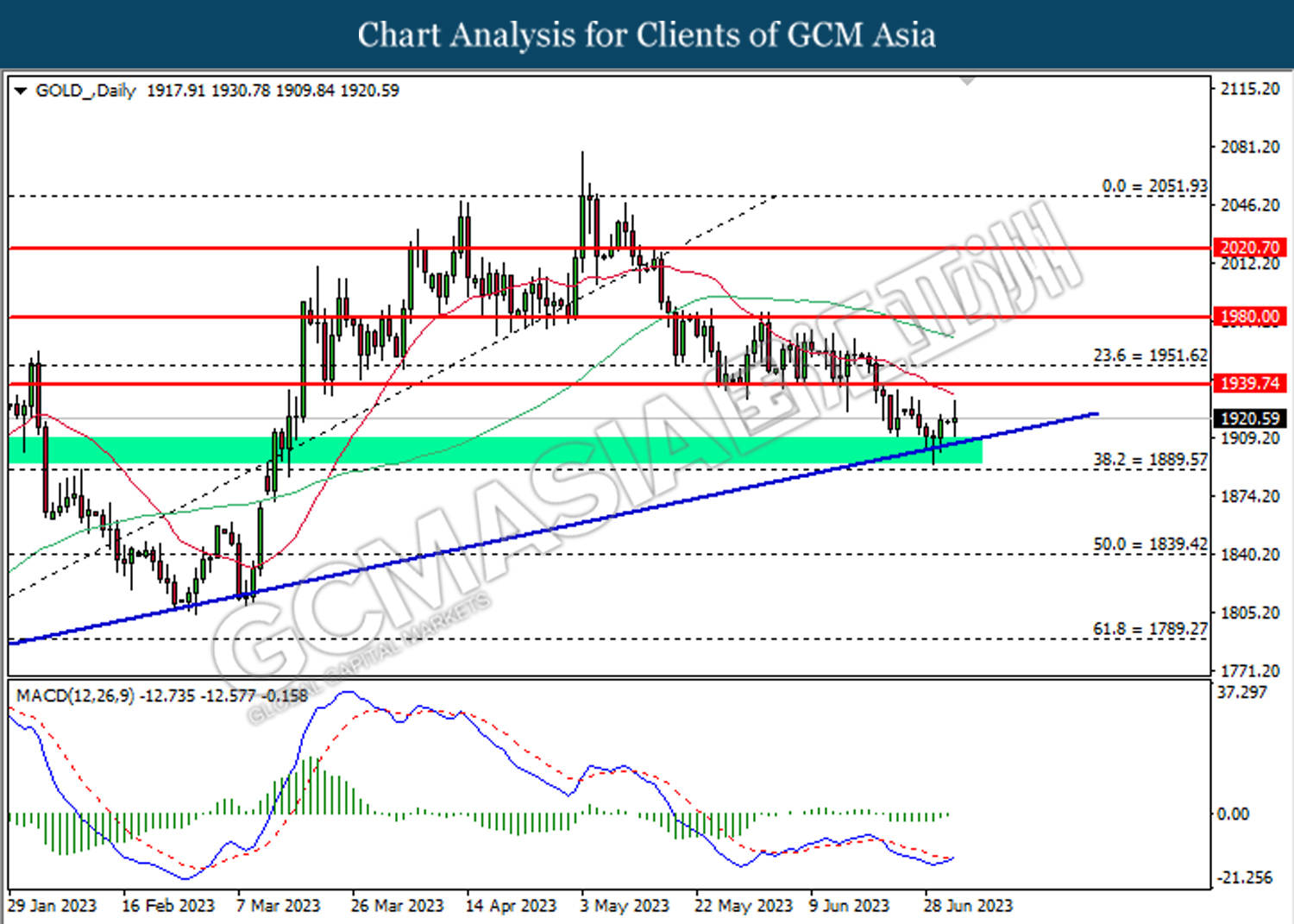

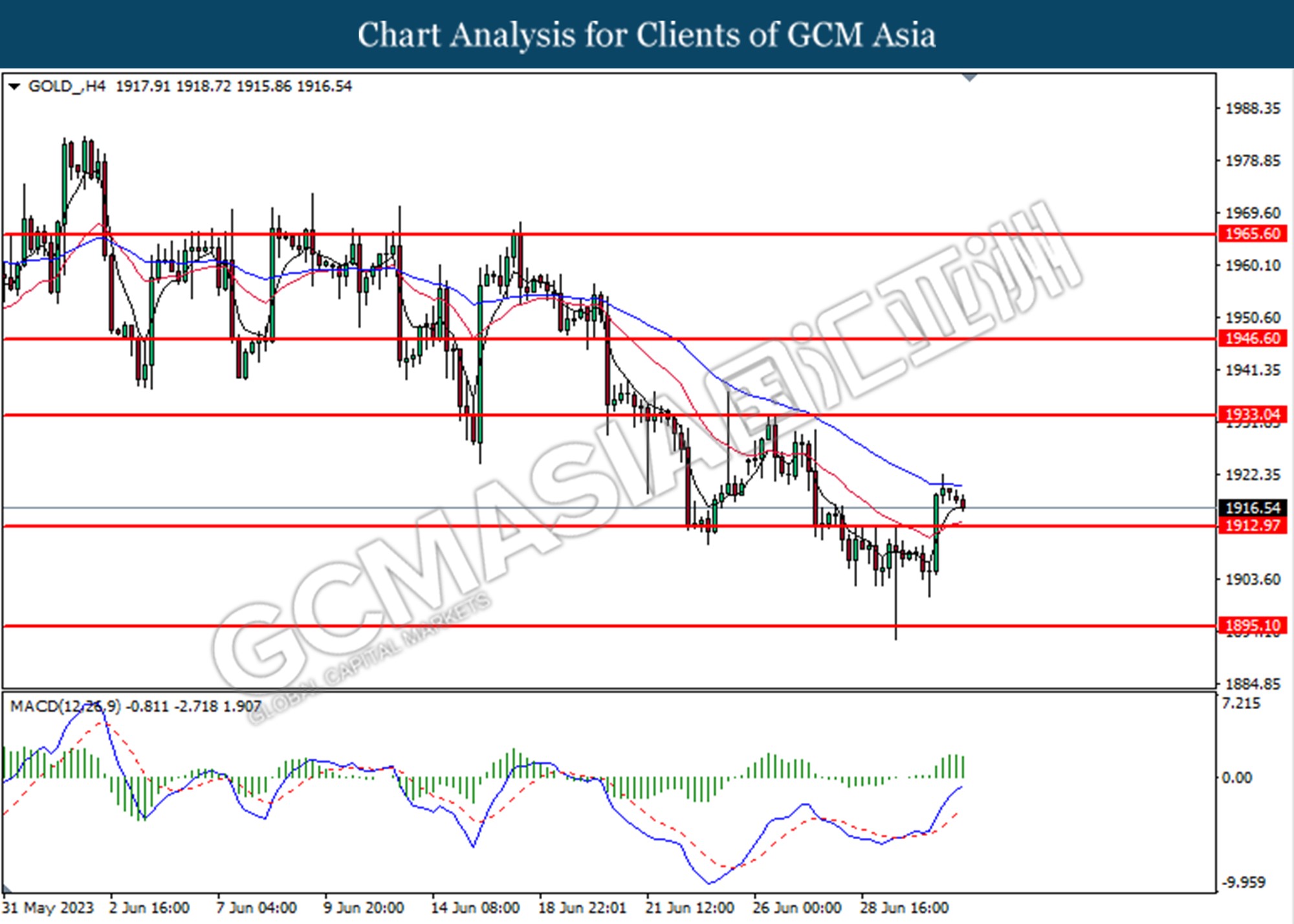

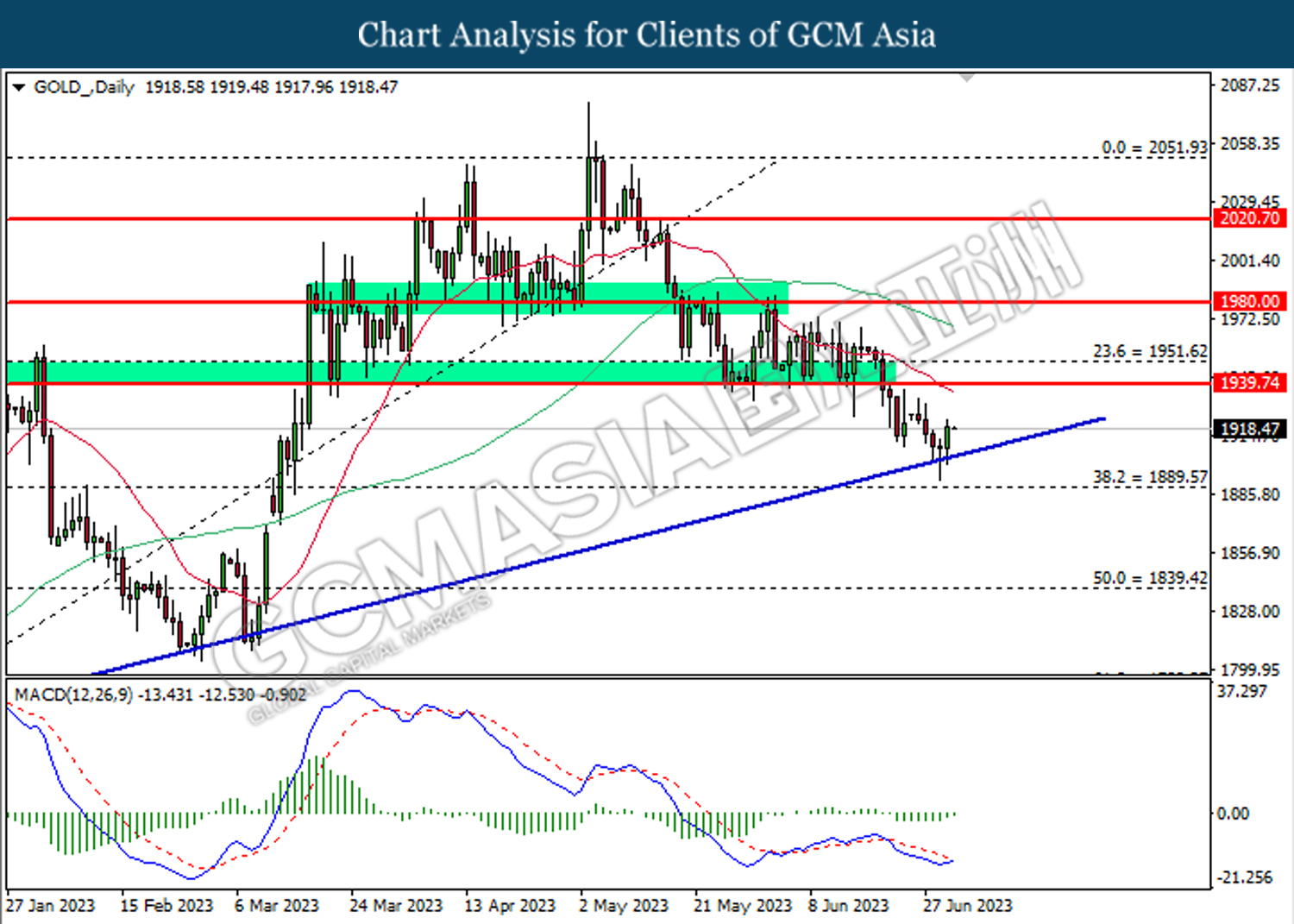

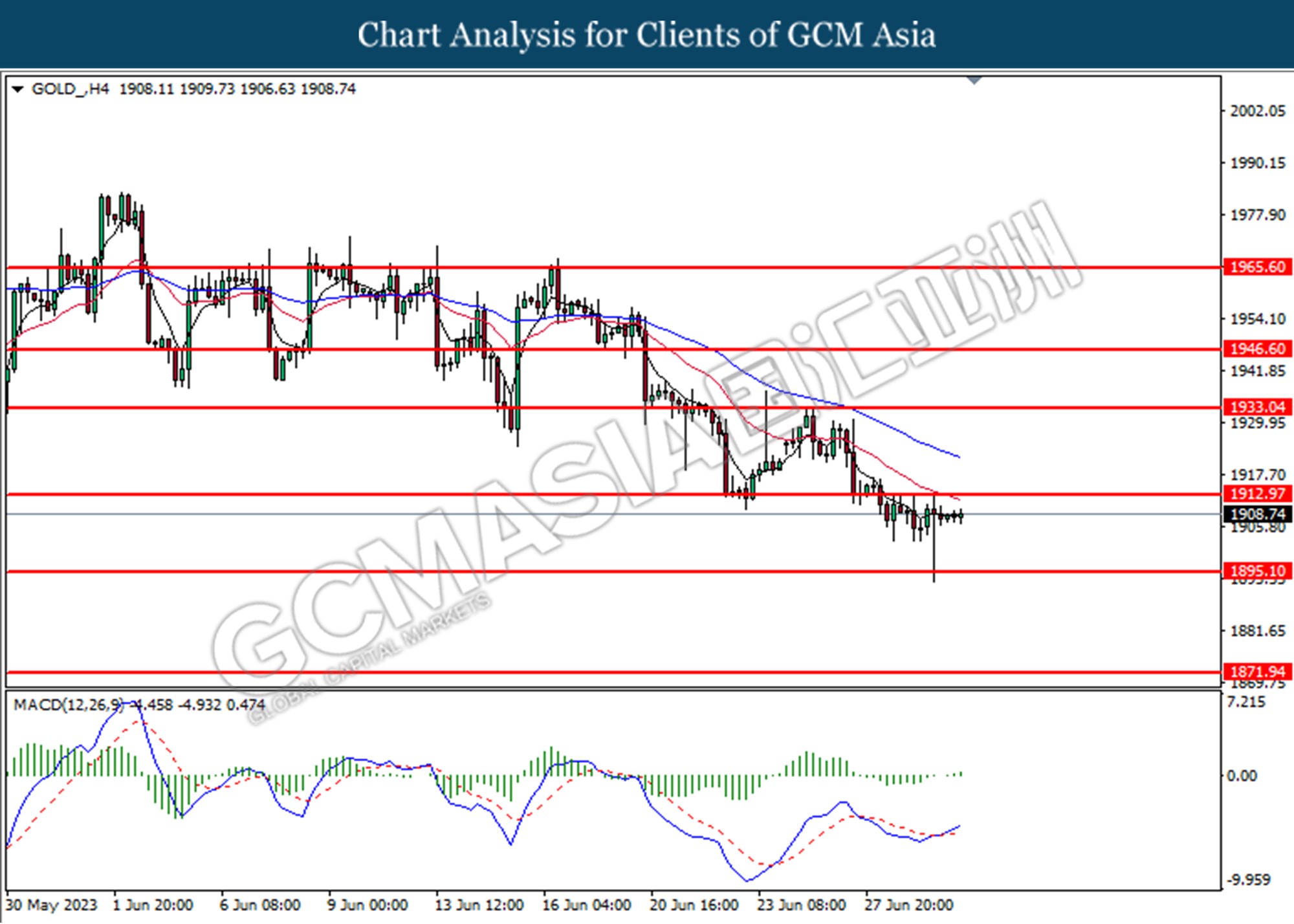

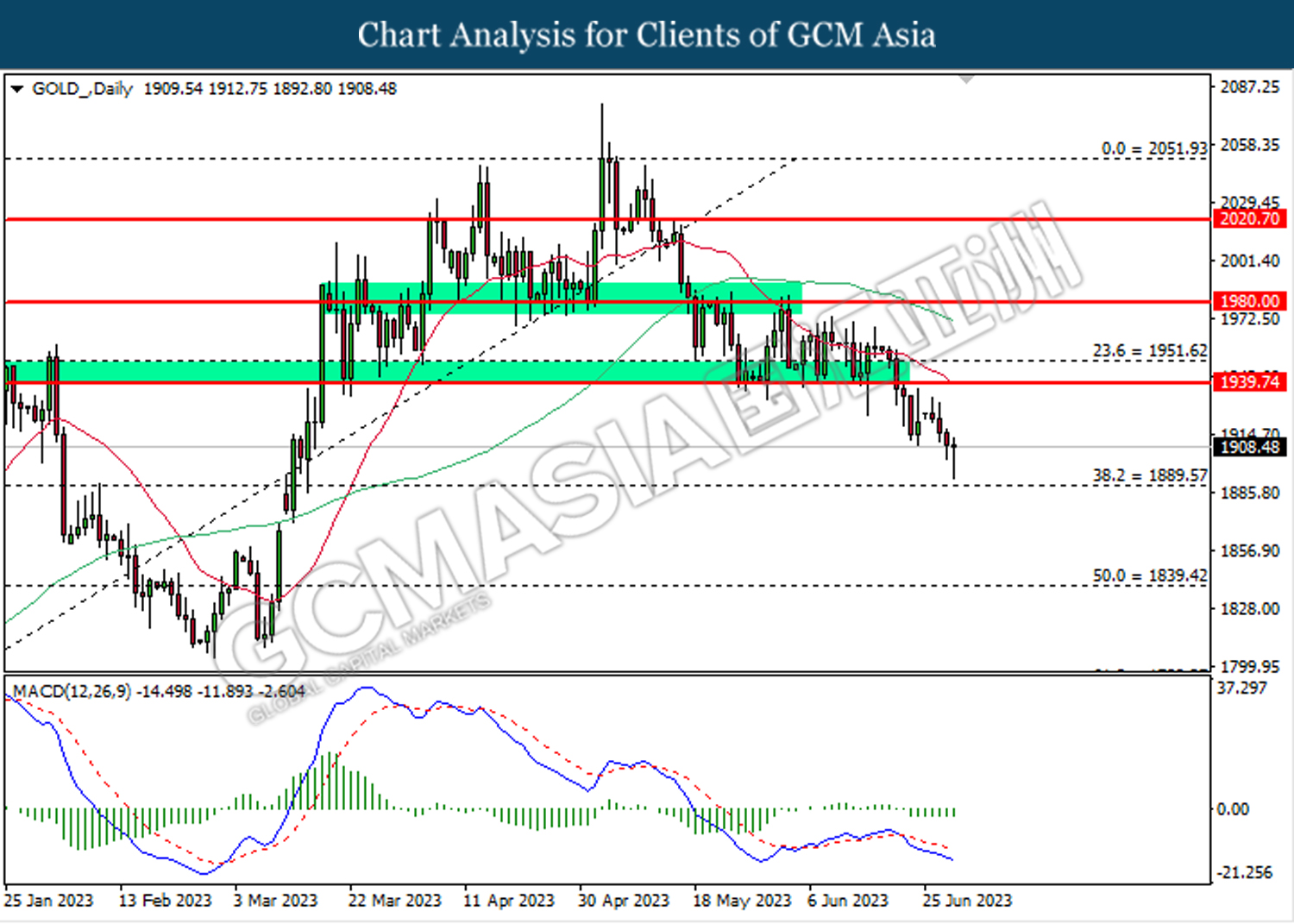

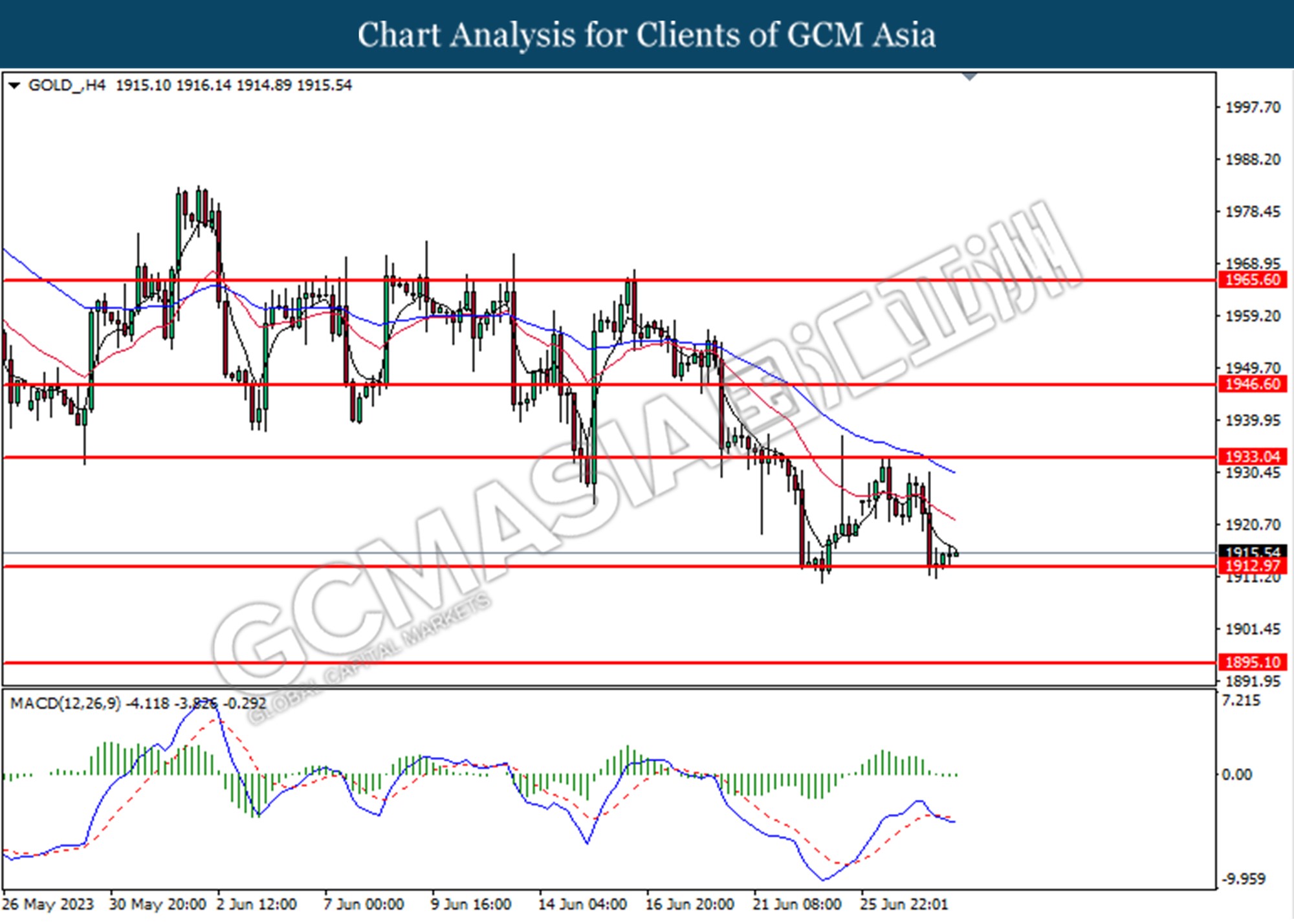

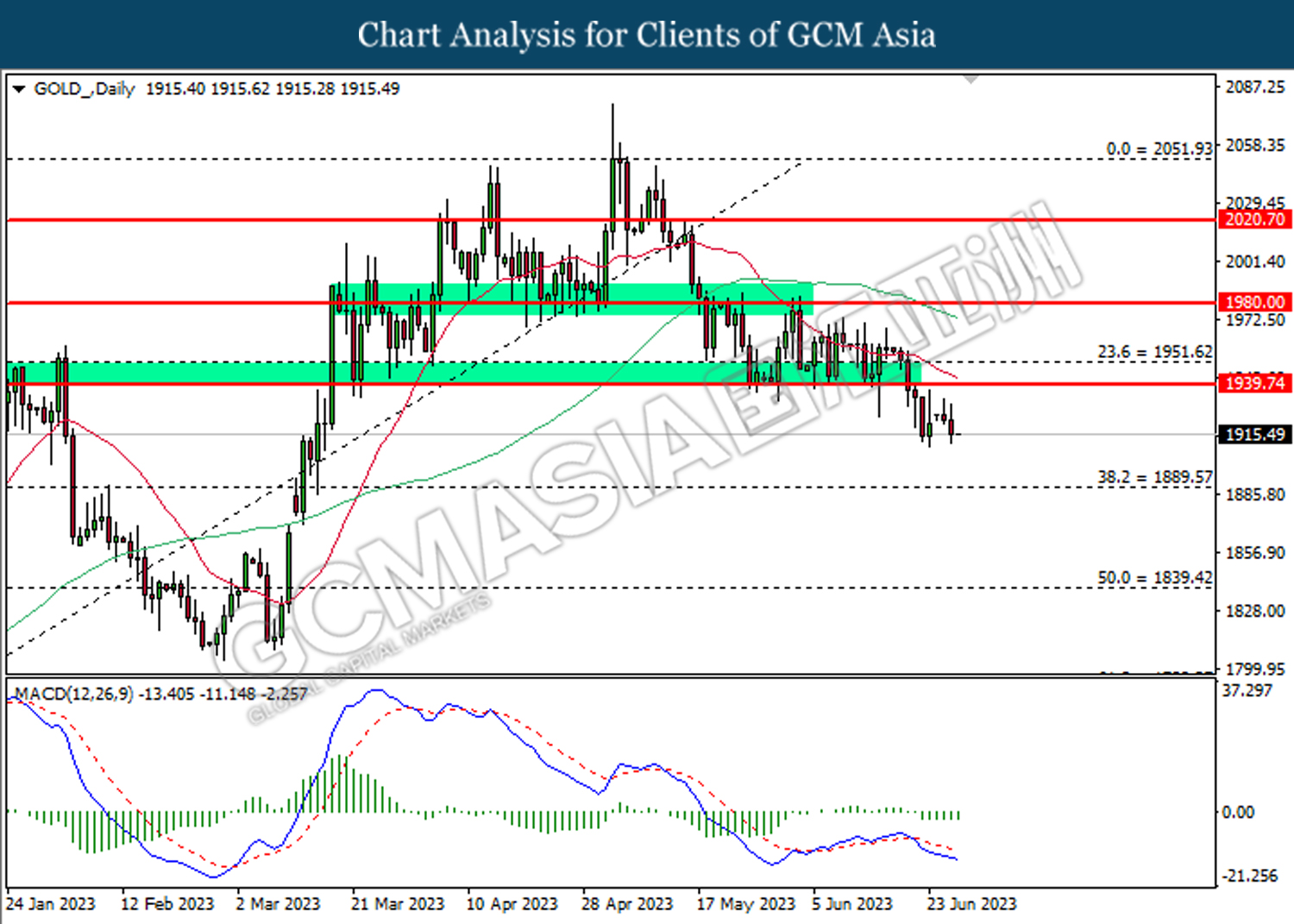

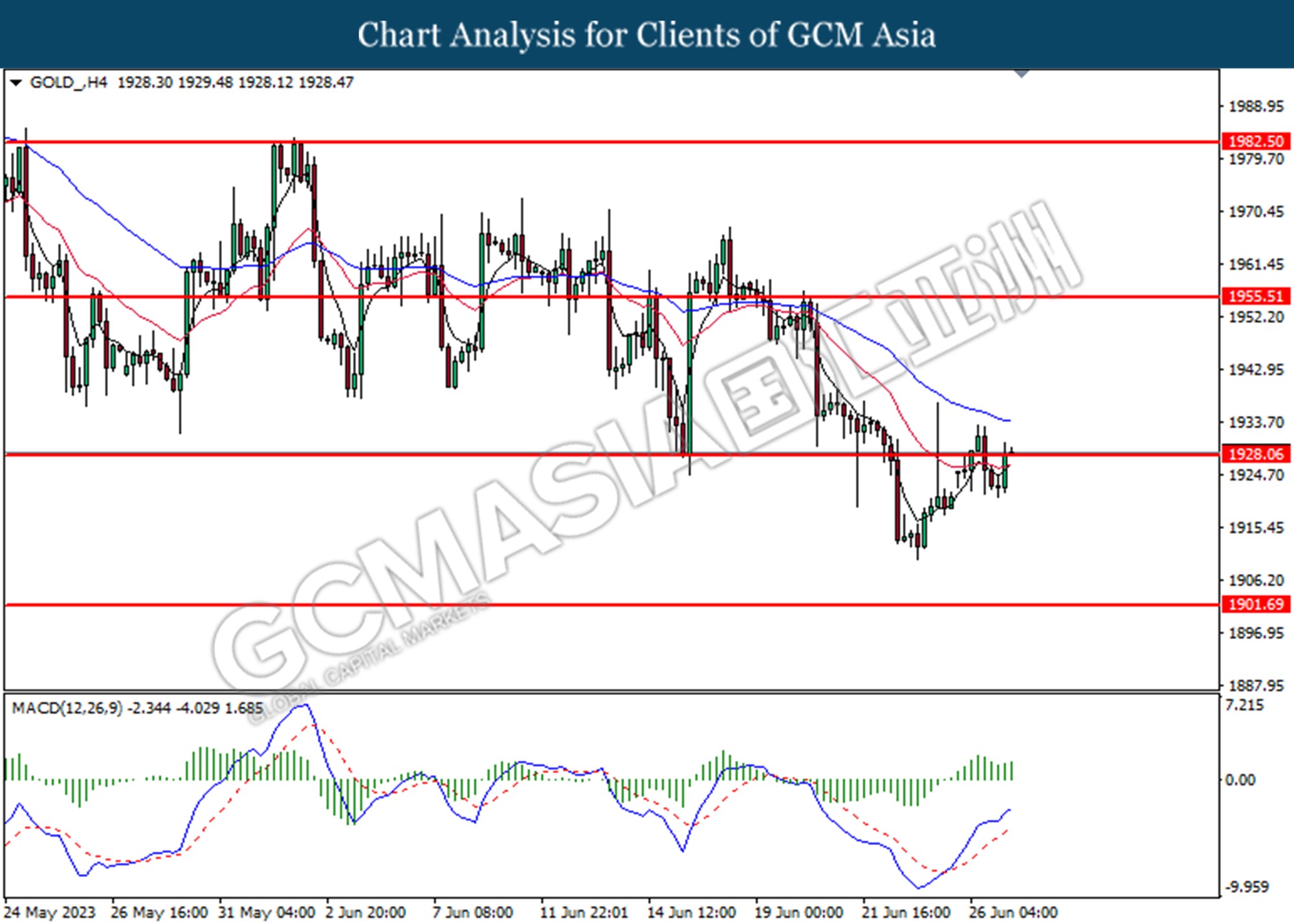

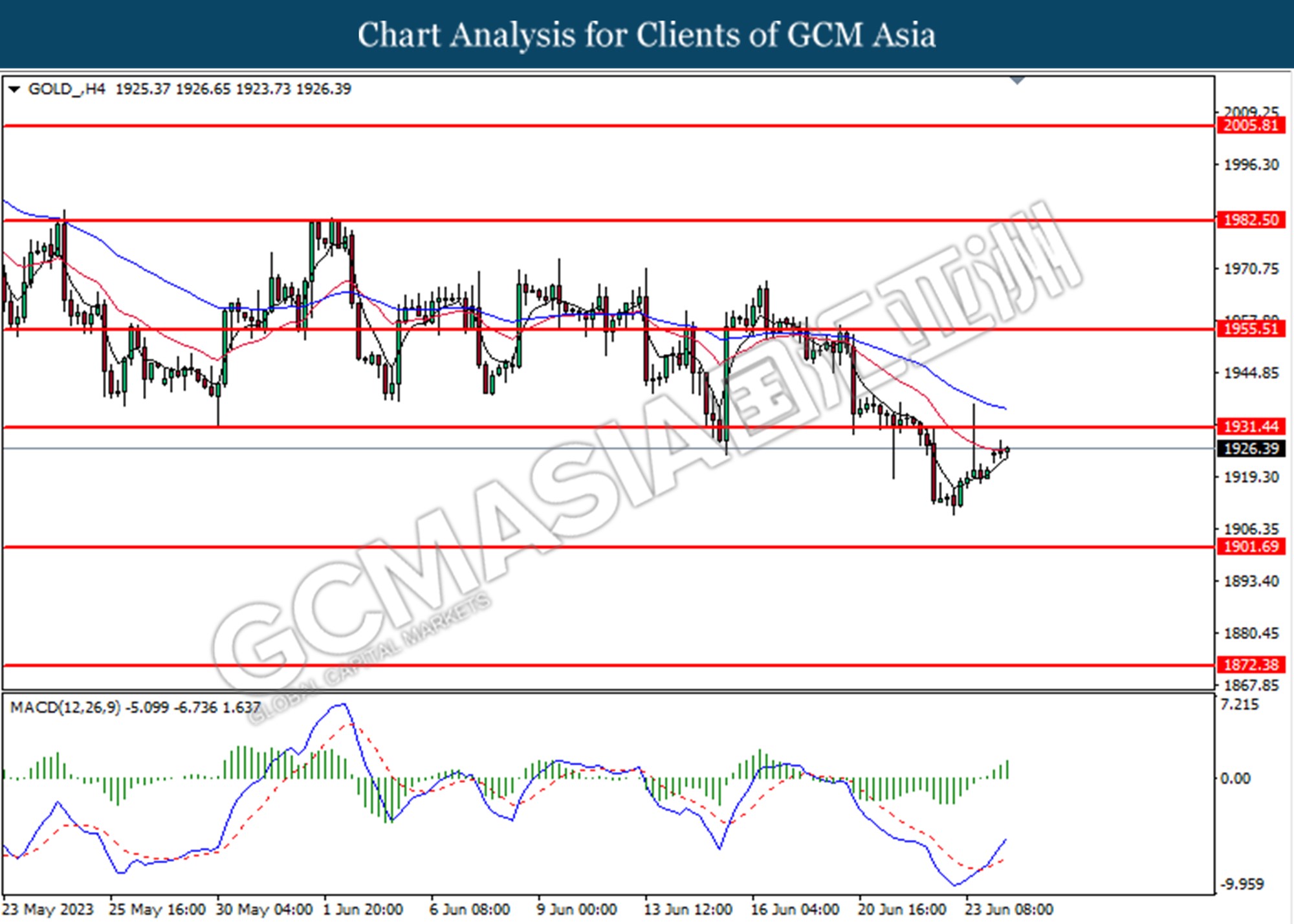

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level at 1933.05.

Resistance level: 1933.05, 1946.60

Support level: 1913.00, 1895.10

040723 Morning Session Analysis

04 July 2023 Morning Session Analysis

Greenback plunged as US manufacturing sector contracted.

The dollar index, which was traded against a basket of six major currencies, failed to revive from the losses in previous trading session as the US manufacturing sector showed further sign of contraction in June. According to the Institute for Supply Management (ISM, the US Manufacturing PMI dropped from the prior month reading of 46.9 to 46.0 this month, missing the consensus forecast at 47.2, marking the 8th consecutive month below the benchmark of 50. Besides, it also showed that the economic activity in the US manufacturing sector continued to contract at an accelerating pace, reaching the levels last seen during the initial outbreak of Covid-19. Manufacturing, which accounts for 11.1% of the economy, showed a sign of weakening in the month of June mainly due to weaker demand with the backdrop higher borrowing cost. At this point in time, the market participants are not only waiting for the other major economic data such as Nonfarm Payrolls but also the FOMC meeting minutes in order to scrutinize the further direction of the currency. As of writing, the dollar index edged up by 0.06% to 102.97.

In the commodities market, crude oil prices appreciated by 0.67% to $70.10 per barrel as Saudi Arabia would extend its voluntary oil cut plan that it announced in June through at least August. Besides, the gold prices ticked up by 0.01% to $1921.50 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day USD Independence Day

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Jul) | 4.10% | 4.35% | – |

Technical Analysis

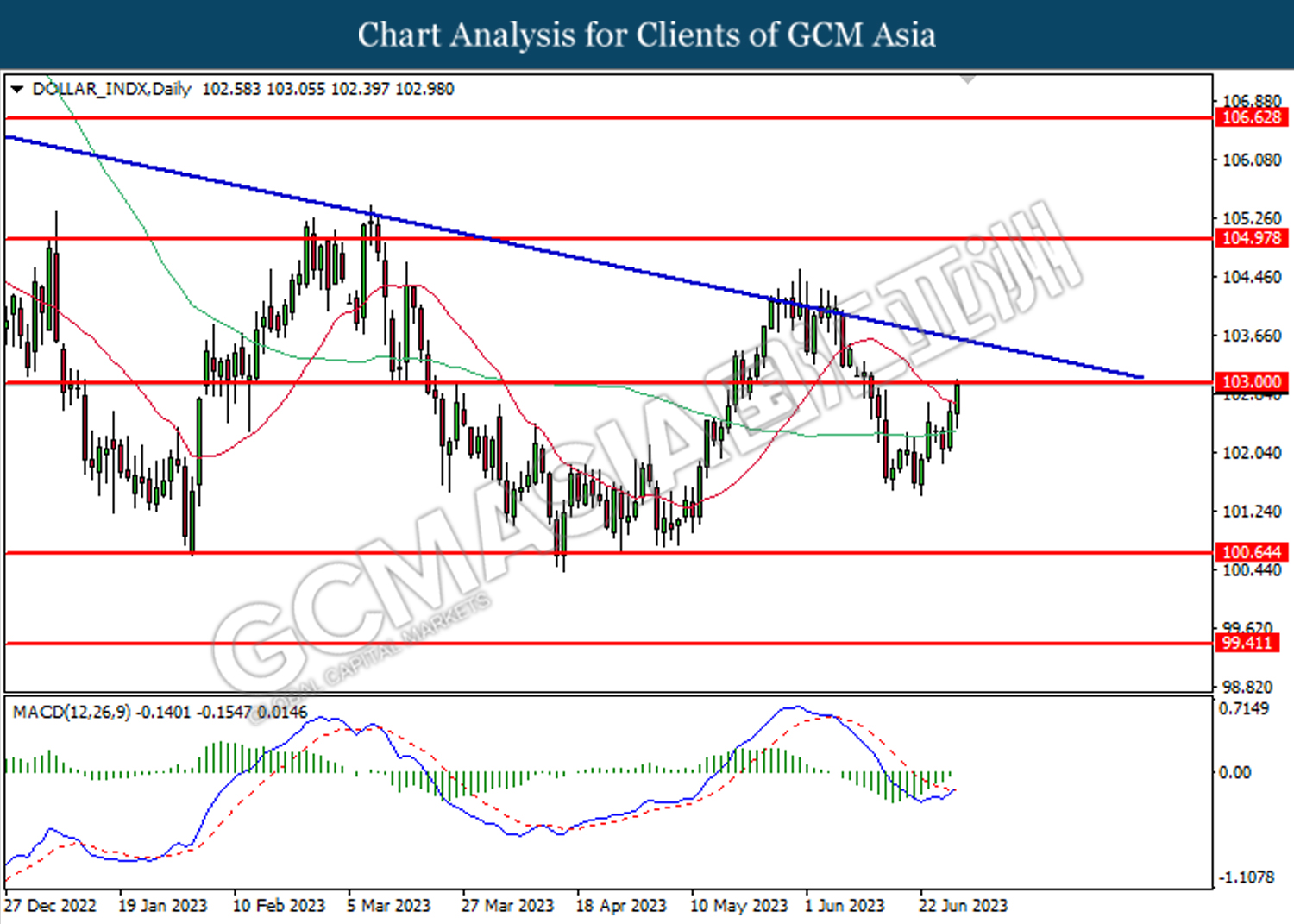

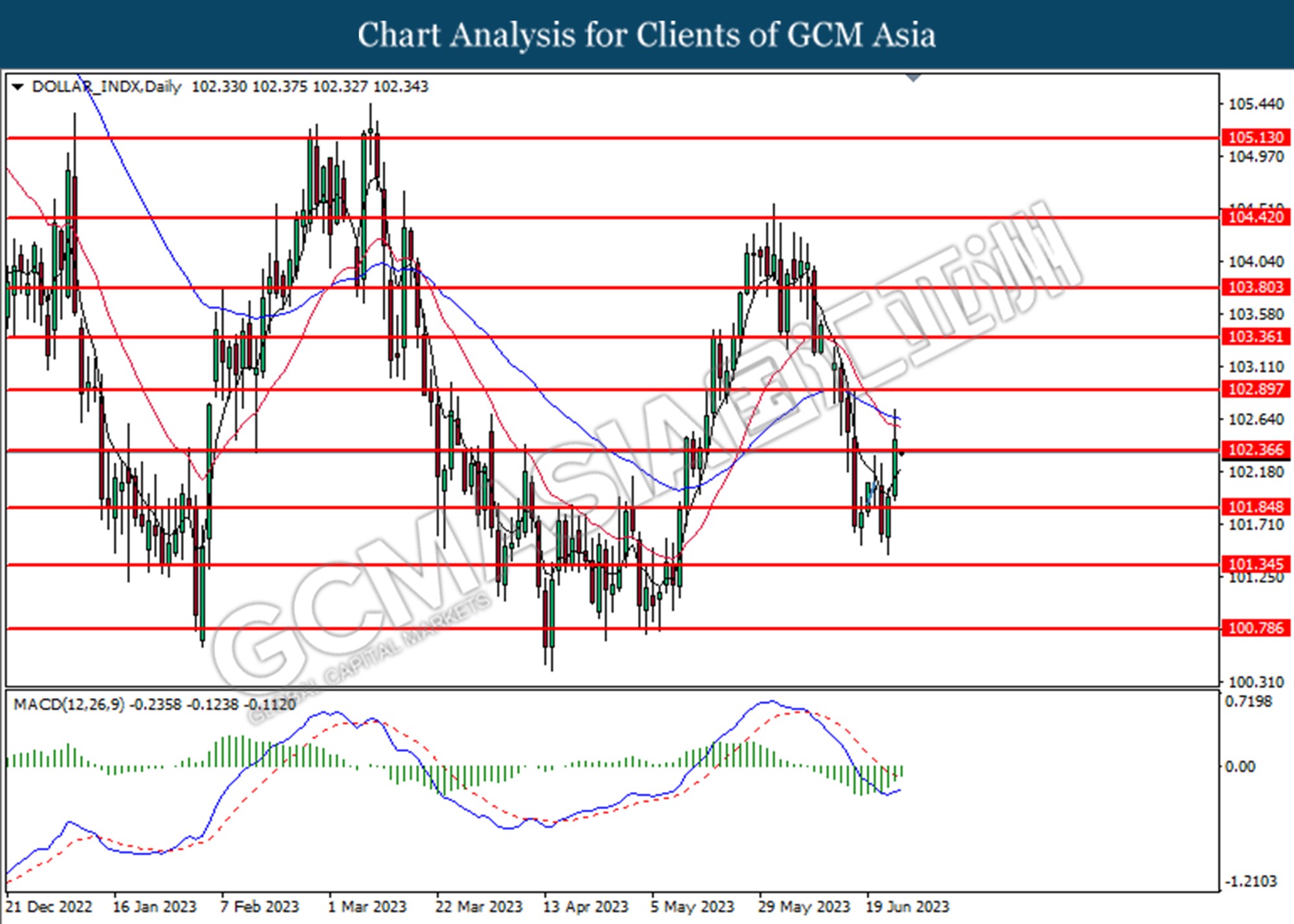

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.00. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in short term.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

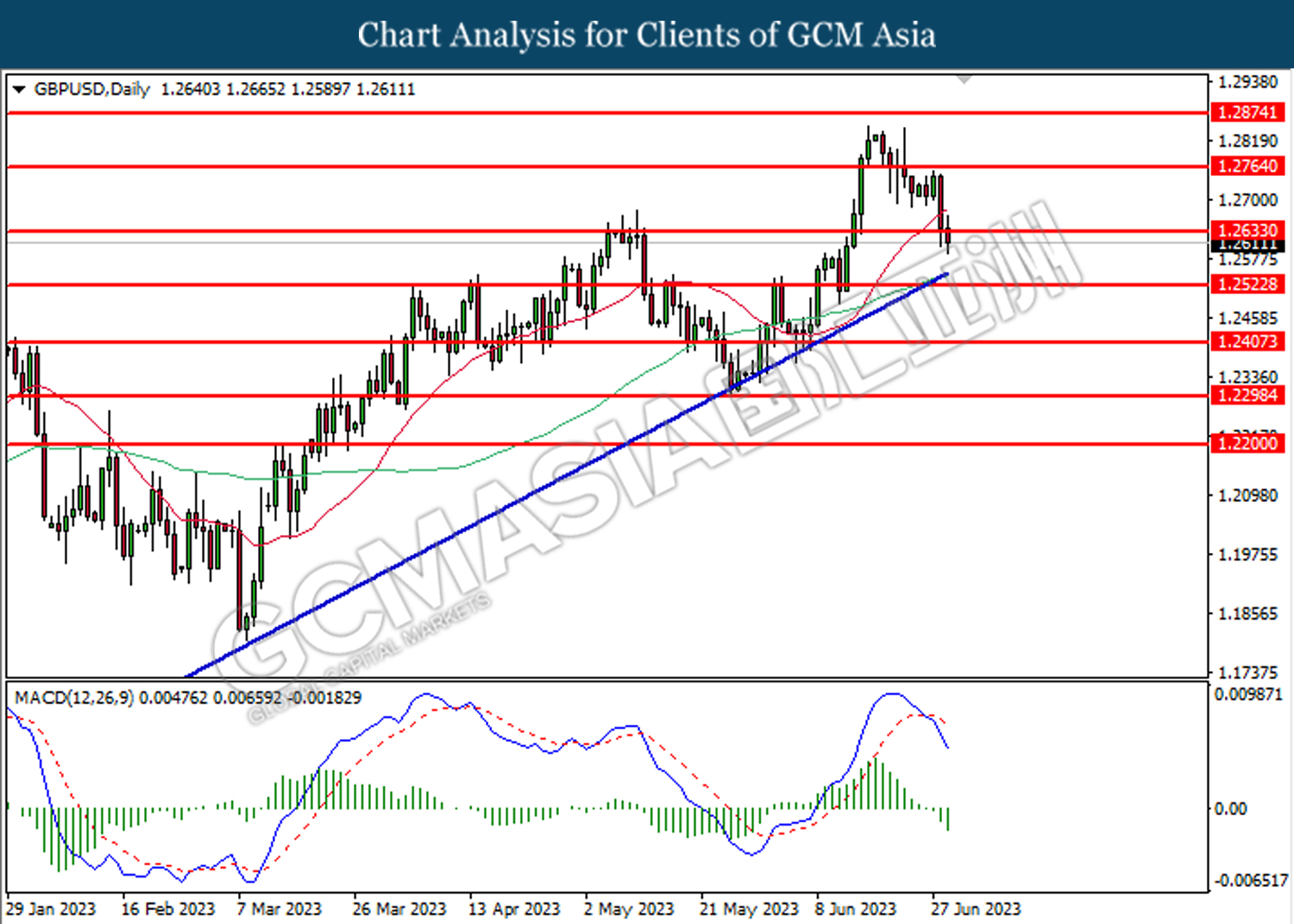

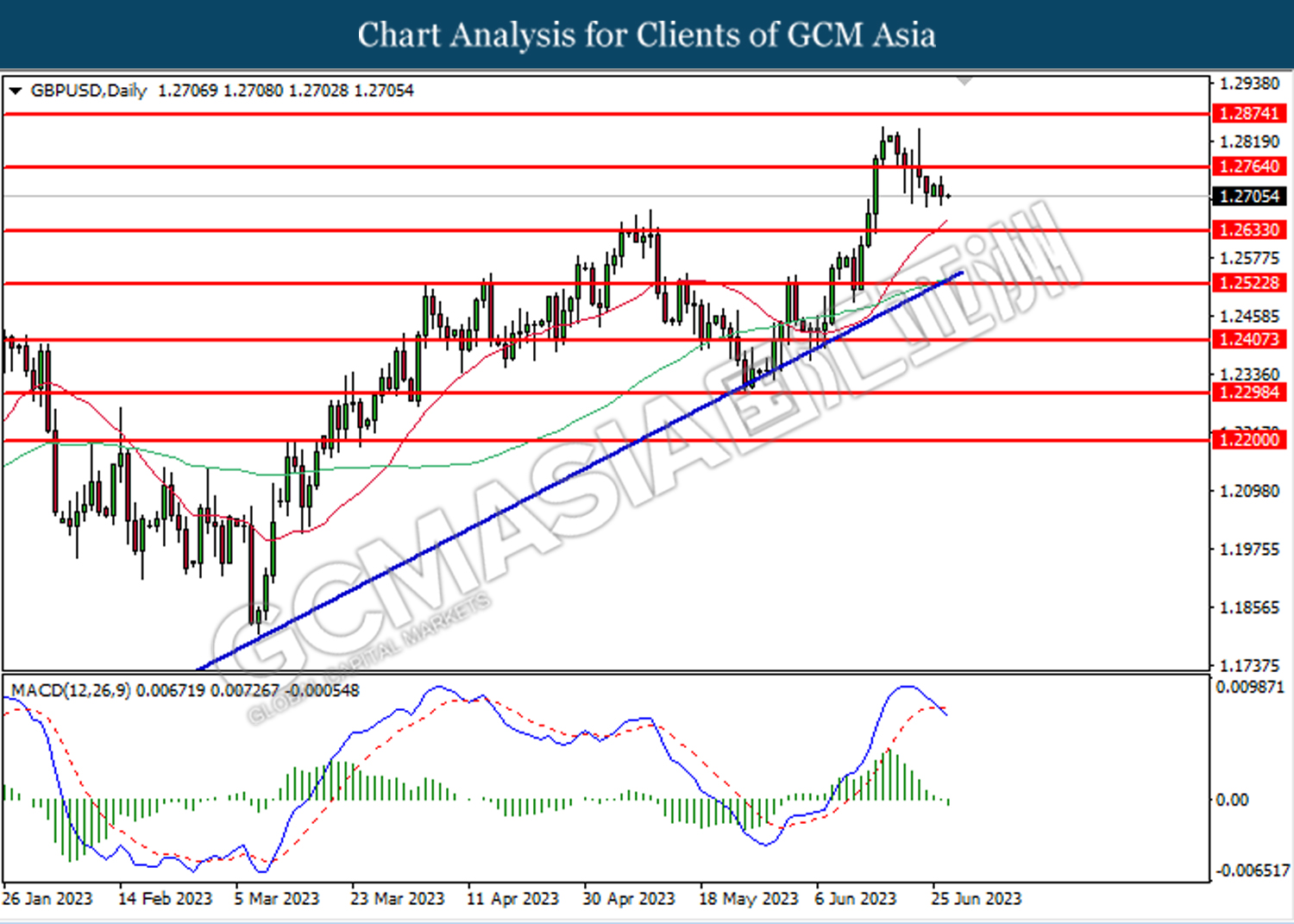

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2635. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2765.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

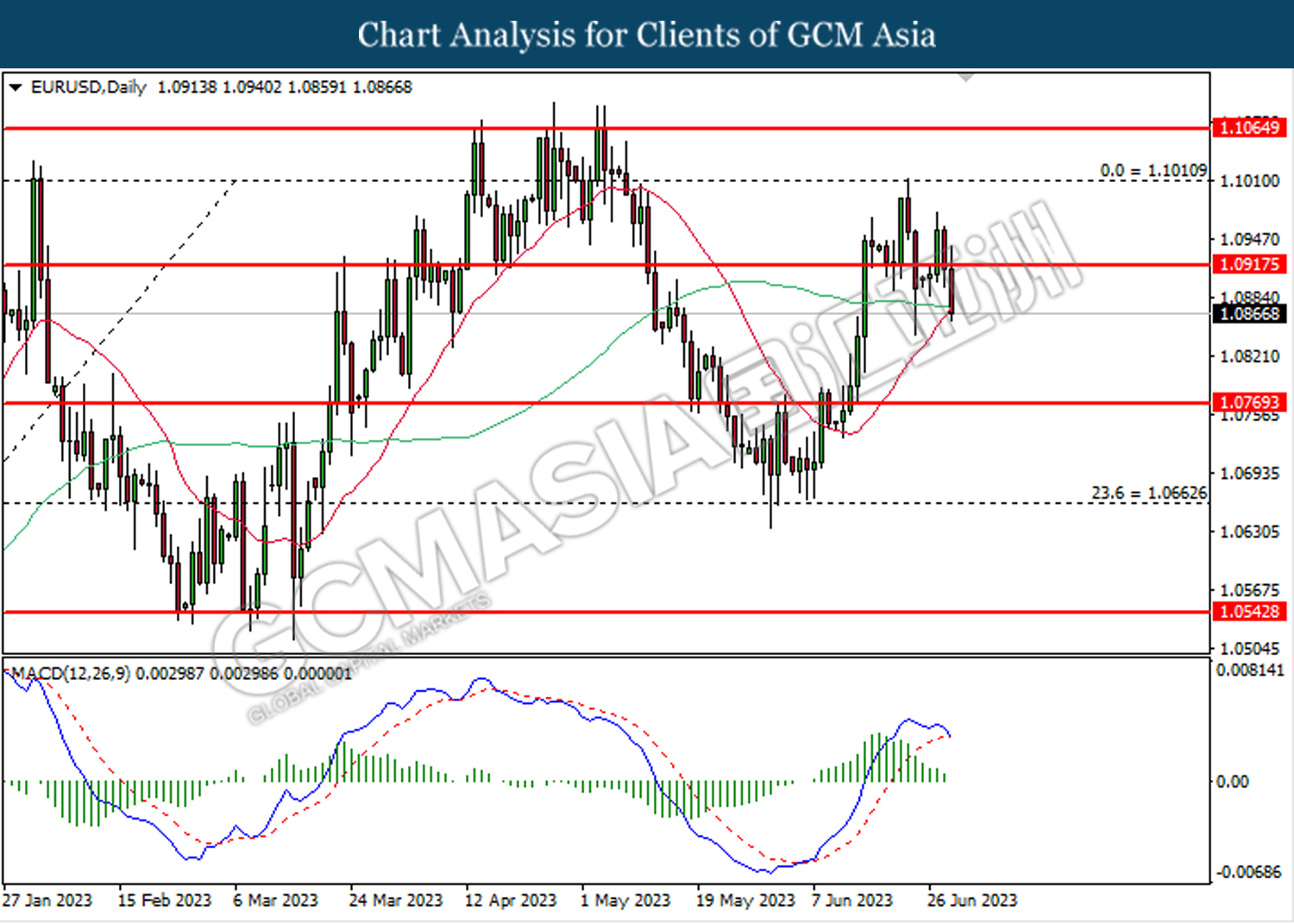

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0915. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0915, 1.1010

Support level: 1.0865, 1.0770

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 144.90. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 70.15. However, MACD which illustrated bullish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

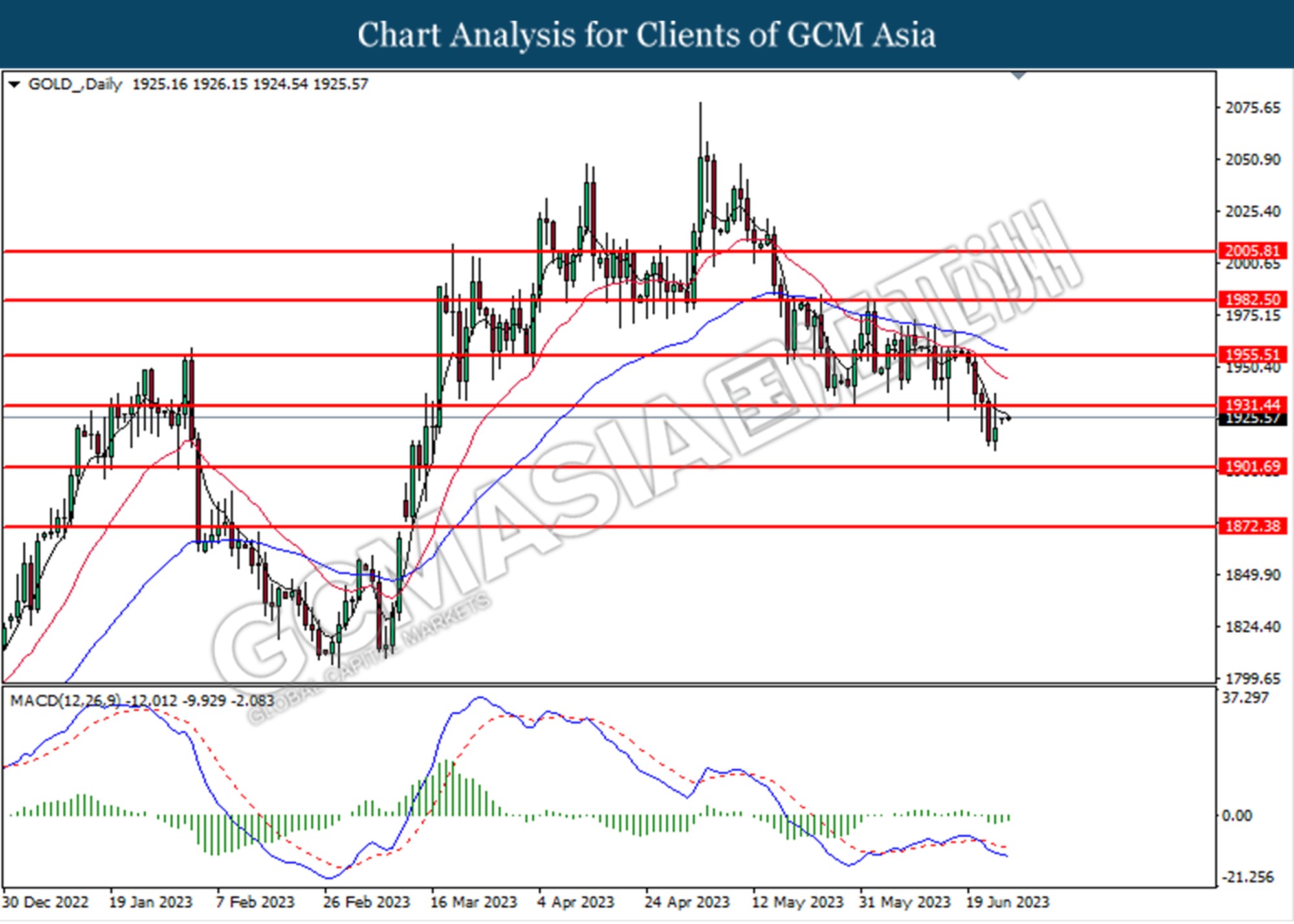

GOLD_, Daily: Gold price was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

030723 Afternoon Session Analysis

03 Jul 2023 Afternoon Session Analysis

Japan’s business sentiment improved but inflation expects to slip.

The Japanese Yen which traded against the dollar index slipped despite the Japanese business sentiment improved in the second quarter. Tankan Manufacturing June sentiment index improved to 5 from 1, upbeat the market expectations of 3. Meanwhile, the Tankan big manufacturing Outlook index improved to 9 from 3, above the economist’s expectation. The survey indicated that manufacturing firms were recovering from the hit from rising raw material prices and supply disruption. While the Tankan larger non-manufacturers index also increases to 23 from 20 in the previous reading, upbeat the economist estimations of 22. The sentiment index for big non-manufacturers increased for the fifth straight quarter and hit the highest since June 2019. In addition, the Tankan All Big industry capital expenditure increased to 13.4% from 3.2%, indicating the firms were expanding their business essentially when compared with the previous quarter. Overall economic indicators deliver a positive result reflecting a sign of steady recovery of the Japanese economy. However, the survey showed companies expect inflation to hit 2.6% a year down from the 2.8% projection made in March. The data prompted the Bank of Japan (BoJ) to keep an ultra-loosen monetary policy to achieve a sustainable 2% target. As of writing, the USDJPY increase 0.18% to 144.57.

In the commodities market, crude oil prices increased by 0.03% to $70.66 per barrel after China Caixin Manufacturing PMI stood at 50.5 upbeat the estimations of 50.2. In addition, U.S. personal consumption expenditures (PCE) showed cooling inflation, allowing investors to take profits after the previous surge in gold prices, with that the gold prices falling -0.04% to 1918.90.

Today’s Holiday Market Close

Time Market Event

All Day CAD Canada Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German Manufacturing PMI (Jun) | 41.0 | 41.0 | – |

| 16:30 | GBP – Manufacturing PMI (Jun) | 46.2 | 46.2 | – |

| 22:00 | USD – ISM Manufacturing PMI (Jun) | 46.9 | 47.2 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level at 102.35.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.2725.

Resistance level: 1.2725, 1.2830

Support level: 1.2610, 1.2470

EURUSD, H4: EURUSD was traded higher while currently testing for the resistance level at 1.0915. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully breaks above the resistance level.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 145.10.

Resistance level: 145.10, 146.10

Support level: 144.10, 142.90

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6700.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded lower while currently testing for the support level at 1.3240. MACD which illustrated increasing bearish momentum suggests the pair extended its losses after if successfully break below the support level.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.8940.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded higher following the prior breaks rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 71.35,73.15

Support level: 69.30, 67.55

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 1913.00.

Resistance level: 1933.00, 1946.60

Support level: 1913.00, 1895.10

030723 Morning Session Analysis

03 July 2023 Morning Session Analysis

Greenback plummeted amid further easing of inflation in US.

The dollar index, which was traded against a basket of six major currencies, lost its foot of gains after hitting the 20-days high as U.S. consumer spending slowed sharply in May. According to the Bureau of Economic Analysis, the US PCE Price Index came in at 3.8%, far lower than the both prior reading and economist forecast at 4.3% and 4.6% respectively. Besides, excluding the volatile food and energy components, the PCE price index was up by 0.3% after rising 0.4% in the prior month. These data pointed to a sign of further easing in the US inflationary pressures, igniting the possibility of smaller or lesser than expected rate hikes in the remaining meeting of this year. Though, at the Fed’s meeting in early June, Fed officials said they expected at least two more quarter-point rate hikes by the end of the year. In addition, during the ECB Economic Forum, the Fed Chairman Jerome Powell mentioned that the level of their long term inflation target is not likely to be reached in several years. Therefore, the investors are now eyeing on more economic data in order to get a clearer clue if hefty rate hikes are still on the table of next Fed’s meeting. As of writing, the dollar index ticked down by -0.01% to 102.90.

In the commodities market, crude oil prices appreciated by 0.95% to $70.30 per barrel as Saudi Arabia’s plan to cut production by 1 million barrels per day has been taken into effect since last weekend. Besides, the gold prices edged up by 0.02% to $1919.45 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day CAD Canada Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German Manufacturing PMI (Jun) | 41.0 | 41.0 | – |

| 16:30 | GBP – Manufacturing PMI (Jun) | 46.2 | 46.2 | – |

| 22:00 | USD – ISM Manufacturing PMI (Jun) | 46.9 | 47.2 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.00. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in short term.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2635. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2765.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0915. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0915, 1.1010

Support level: 1.0865, 1.0770

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 144.90. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6040. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

300623 Afternoon Session Analysis

30 June 2023 Afternoon Session Analysis

Euro slipped despite the German CPI rising.

The euro fell against the dollar despite the German CPI rising. Germany’s annual consumer price index (CPI) rose to 6.4% from 6.1%, beating market expectations of 6.3%, according to the German Federal Statistical Office. According to an official statement, German CPI continues to rise as food price rise above the average rate of 13.7% compared to the same month last year. Due to the Russian-Ukraine war, the energy price has risen, which has led to an increase in food prices compared with the previous year’s reading. Also, measures of the third relief package of the German government, reflected in lower energy prices and caused the food price increase. The EUR/USD index strengthened after German consumer price inflation came in higher than expected. However, a massive downturn revision of the EURUSD after the US announced a series of optimistic economic data. The dollar index lifted after employment jobless claims reduced to 239k versus 266k expectations and upbeat quarter 1 GDP. Meanwhile, investors’ eyes on eurozone CPI to get a clue of market direction. As of writing the EURUSD edged up by 0.08% to 1.0873.

In the commodities market, crude oil prices rose by 0.20% to $70.00 per barrel as Nigeria’s supply concerns lifted the crude prices. Besides, the gold prices were range bound by adding 0.03% to $1908.87 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) (Q1) | 0.2% | 0.6% | – |

| 17:00 | EUR – CPI (YoY) (Jun) | 6.1% | 5.6% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (May) | 0.4% | 0.4% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Jun) | 59.2 | 63.9 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing for the support level at 102.90. MACD which illustrated diminishing bullish momentum suggests the index extended its losses if successfully breaks below the resistance level.

Resistance level: 103.35, 103.80

Support level: 102.90, 102.35

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the support level at 1.2610. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2725, 1.2830

Support level: 1.2610, 1.2470

EURUSD, H4: EURUSD was traded higher following the rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 145.10. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 145.10, 146.10

Support level: 144.10, 142.90

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6615. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6105.

Resistance level: 0.6105, 0.6215

Support level: 0.5995, 0.5880

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.3240.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

USDCHF, H4: USDCHF was traded lower following the prior breaks below the previous support level at 0.8985. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded higher following the prior breaks above the previous resistance level at 69.30. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 71.35,73.15

Support level: 69.30, 67.55

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1895.10. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level at 1913.00

Resistance level: 1913.00, 1933.00

Support level: 1895.10, 1871.95

300623 Morning Session Analysis

30 June 2023 Morning Session Analysis

US dollar jumped amid stronger-than-expected economic data.

The dollar index, which was traded against a basket of six major currencies, managed to regain its foot back to the highest level in 10 days after the nation posted a few of upbeat economic data yesterday. According to the Bureau of Economic Analysis, the US GDP came in at 2.0% for the first quarter of 2023, stronger than the consensus forecast at 1.4%. The main attributors of the upbeat GDP were the upward revisions of exports and consumer spending. Consumption has boosted the U.S. economy, providing a strong start to 2023, even as banking turmoil and rising interest rates weigh on the outlook. But, the overall economic activity has been slowing as the U.S. central bank rapidly raises its benchmark lending rate to curb stubborn inflation. Besides, the number of American filed for unemployment claims has finally dropped after buoying at a high level for more than 3 weeks. According to the Department of Labor, US Initial Jobless Claims decreased from 265K to 239K this week, significantly lower than the consensus forecast at 266K, mirroring some sign of persistent labor market strength despite hefty rate hikes from the Federal Reserve. As of writing, the dollar index rose 0.43% to 103.35.

In the commodities market, crude oil prices appreciated by 0.01% to $69.70 per barrel as the huge draw of EIA crude stockpiles continued to outweigh the market concern over the future rate hikes. Besides, the gold prices ticked down by -0.05% to $1907.40 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) (Q1) | 0.2% | 0.6% | – |

| 17:00 | EUR – CPI (YoY) (Jun) | 6.1% | 5.6% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (May) | 0.4% | 0.4% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Jun) | 59.2 | 63.9 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 103.00. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2635. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 144.90. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 144.90.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support zone. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 70.15.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1939.75. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

290623 Afternoon Session Analysis

29 June 2023 Afternoon Session Analysis

The euro fell despite the European Central Bank’s hawkish stance against inflation.

The euro fell against the dollar against the dollar despite hawkish comments from the European Central Bank (ECB) president. At yesterday’s European Central Bank Forum, the world’s top central bank reiterated that since inflation in significant countries remains high, many countries need to tighten monetary policy further to combat inflation. These include the Federal Reserve, the Bank of England and the European Central Bank. Before that, ECB President Christine Lagarde promised more tightening measures to curb inflation to the 2% target. She said that the euro area will enter a new phase of high inflation, and the second phase of the inflation process is now starting to get stronger. The gap between wages and production has widened as nominal wages have risen, but productivity growth in manufacturing and services has remained weak. Against this background, many companies will face input cost increase pressure. Therefore, further tightening moves are required by the ECB central bank. However, the recent economic data in the eurozone, especially German was entering into a recession phase. The euro was sold by investors as further tightening measures would plunge the eurozone economy into recession. As of writing, the EURUSD slipped by -0.14% to 1.0896.

In the commodities market, crude oil prices traded down by -0.37% to $69.30 per barrel as the previous session crude oil price rose after EIA crude inventory showed in deficit amount. Besides, the gold prices were reduced by -0.16% to $1904.37 per troy ounce as the Fed hints more tightening moves will implement to curb inflation.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:30 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | EUR – German CPI (MoM) (Jun) | -0.1% | 0.2% | – |

| 20:30 | USD – GDP (QoQ) (Q1) | 1.3% | 1.4% | – |

| 20:30 | USD – Initial Jobless Claims | 264k | 266K | – |

| 22:00 | USD – Pending Home Sales (MoM) (May) | 0.0% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the index extended its gains toward the resistance level at 102.90.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

GBPUSD, H4: GBPUSD was traded lower following the prior breaks below the previous support level at 1.2665. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.2565.

Resistance level: 1.2665, 1.2815

Support level: 1.2565, 1.2470

EURUSD, H4: EURUSD was traded lower following the prior breaks below the previous support level at 1.0915. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

USDJPY, H4: USDJPY was traded higher following the prior rebound from the support level at 144.10. MACD which illustrated increasing bullish momentum suggests the pair extended its gain toward the resistance level at 145.10.

Resistance level: 145.10, 146.10

Support level: 144.10, 142.90

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6615. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.6615, 0.6700

Support level: 0.6525, 0.6430

NZDUSD, H4: NZDUSD was traded lower following the prior breaks below from the previous support level at 0.6105. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.6105, 0.6215

Support level: 0.5995, 0.5880

USDCAD, H4: USDCAD was traded higher following the prior breaks above the previous resistance level at 1.3240. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

USDCHF, H4: USDCHF was traded higher while currently testing for the resistance level at 0.8985. MACD which illustrated increasing bullish momentum suggests the pair extended its gains if successfully breaks above the resistance level.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the resistance level at 69.30. However, MACD which illustrated increasing bullish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 69.30, 71.35

Support level: 67.55, 65.80

GOLD_, H4: Gold price was traded lower following the prior retracement from the resistance level at 1913.00. MACD which illustrated bearish momentum suggests the commodity extended its losses toward the support level at 1895.10

Resistance level: 1913.00, 1933.00

Support level: 1895.10, 1871.95

290623 Morning Session Analysis

29 June 2023 Morning Session Analysis

Greenback climbed amid Powell’s hawkish comment.

The dollar index, which was traded against a basket of six major currencies, managed to extend its rally yesterday as his hawkish comment with regards the monetary policy path spurred the sentiment of the dollar index. In the ECB Economic Forum, Federal Reserve Chairman Jerome Powell struck a hawkish tone on inflation, saying that he expects multiple rate hikes in the future, and probably at an aggressive pace. Besides, Jerome Powell also revealed that there were strong majority in Fed committee wanted two or more rate hikes till the end of 2023. The reason behind was that they could not see the inflation coming down to the Fed’s 2% long term target until the year of 2025. Hence, the monetary policy is needed to be restrictive enough and sustained for a sufficiently long time. With the higher likelihood of further rate hikes in the upcoming meeting, the appeal of the dollar index spiked as the outlook of the currency turned brighter. As of writing, the dollar index rose 0.47% to 102.95.

In the commodities market, crude oil prices appreciated by 2.21% to $69.40 per barrel as the EIA reported a huge draw from US crude stockpiles. Besides, the gold prices ticked down by -0.02% to $1909.00 per troy ounce as the dollar strengthened amid Powell’s hawkish speech.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:30 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | EUR – German CPI (MoM) (Jun) | -0.1% | 0.2% | – |

| 20:30 | USD – GDP (QoQ) (Q1) | 1.3% | 1.4% | – |

| 20:30 | USD – Initial Jobless Claims | 264k | 266K | – |

| 22:00 | USD – Pending Home Sales (MoM) (May) | 0.0% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 103.00.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2635. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 141.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 144.90.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support zone. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 70.15.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1939.75. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

280623 Afternoon Session Analysis

28 June 2023 Afternoon Session Analysis

Canada inflation comes at the slowest pace causing CAD slipped

The Canadian dollar which traded against the dollar index slipped after the Canadian inflations in May came in slowest pace after data showed on Tuesday. The country’s annual inflation rate was down to 4.4% from 3.4%, in line with market expectations. While the monthly inflation rate slipped more than expected by recording from 0.7% to 0.4%, while the economist forecasted 0.5%. The annual core Consumer Price Index (CPI) which excludes energy prices and food prices, was reduced from 4.1% to 3.7%. Before that, the central bank hiked its monetary rate to 22 years of 4.75% earlier in June after inflation data unexpectedly ticked up in April. However, the recent inflation reading might suggest the Bank of Canada (BoC) has some reason to skip the rate hike in the upcoming monetary meeting. With a labour market loosening in May an 18.3% drop In gasoline compared with the same month a year earlier, the money market sees a probability of pausing on rate hikes. It’s worth noting that the inflation target remains above the central bank target, and investors see a 100% chance for BoC a quarter-point move. As of writing, the USDCAD edged up by 0.13% to $1.3208.

In the commodities market, crude oil prices traded up by 0.51% to $68.19 per barrel as the previous session dropped over 2% amid concern over major central banks’ interest rate hikes. Besides, the gold prices rebounded by 0.10% to $1915.37 per troy ounce following the prior price dip as the US announced a series of upbeat economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 USD Fed Chair Powell Speaks

21:30 EUR ECB President Lagarde Speaks

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.831M | 1.415M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 102.35.

Resistance level: 102.35,102.90

Support level: 101.85, 101.35

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.2665.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.0915.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 144.10. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 144.10, 145.10

Support level: 142.90, 141.40

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses towards the support level at 0.6615.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6105.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.3140, 1.3240

Support level: 1.3040, 1.2940

USDCHF, H4: USDCHF was traded higher following the prior breaks above the previous resistance level at 0.8940. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction In the short term.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 67.55. MACD which illustrated diminishing bullish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 69.30, 71.35

Support level: 67.55, 65.80

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1913.00. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 1933.00, 1946.60

Support level: 1913.00, 1895.10

280623 Morning Session Analysis

28 June 2023 Morning Session Analysis

US dollar gained on upbeat economic data.

The dollar index, which was traded against a basket of six major currencies, managed to find its ground after a series of economic data in US showed some positive sign of economic development. Last night, the US Census Bureau posted the US Core Durable Goods Orders data at a reading of 0.6% for the month of May, stronger than both the market expectation and previous reading at -0.1% and -0.6% respectively. It showed that the new orders for manufactured durable goods in the US continued to strengthen for the third consecutive month. Besides, the CB Consumer Confidence Index also surged from the prior month reading’s 102.5 to 109.7 this month, exceeding the consensus forecast at 104.0. The report showed that consumers have a brighter outlook for the economic activity in US. Other than that, the US housing data which included Building Permits and New Home Sales also posted a stronger-than-expected results yesterday. With such a backdrop, it wiped off the market worries over the risk of recession as these economic data showed that US economy remains resilient and far from a recession. As of writing, the dollar index dropped -0.10% to 102.50.

In the commodities market, crude oil prices were down by -0.07% to $67.85 per barrel as the continuous rate hikes from the central banks dampened the prospect of this market. Besides, the gold prices edged up by 0.08% to $1915.10 per troy ounce following a slew of upbeat data were released yesterday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 USD Fed Chair Powell Speaks

21:30 EUR ECB President Lagarde Speaks

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.831M | 1.415M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2765. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0915. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 141.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 144.90.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3175. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3245.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8980. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8830.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 70.15. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 66.50.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1939.75. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

270623 Afternoon Session Analysis

27 June 2023 Afternoon Session Analysis

Euro rises despite cloudy outlook over the German economy.

The EUR which traded against the dollar index rise despite the cloudy outlook over the German economy. German business continues to worsen for the second consecutive month as the Business Climate index fall from 91.5 in May to 88.5 in June, while the analysts polled by Reuters estimated a drop to 90.7. Economists were less optimistic about the eurozone as a decline in German Ifo together with the drop in the PMI. The reading suggests that the German economy higher probability of a longer recession. The weaker-than-hoped-for China reopening and ongoing monetary policy tightening seem to be weighing on German business activity, the head of IFO surveys told Reuters in an interview on Monday. The Bundesbank, however, remains optimistic about the German economy’s outlook as private consumption should bottom out due to strong wages rising in the real disposable incomes of private households. The German central bank added that German, the euro zone’s biggest economy ability to cope with continued decline in demand due to lower energy prices, easing supply bottlenecks and full order books would underpin growth in the second quarter GDP. As of writing, the EUR/USD lifted by 0.20% to 1.0926.

In the commodities market, crude oil prices traded up by 0.58% to $69.77 per barrel as Saudi Aramco commented on a good second-half oil outlook on demand from China, and India. Besides, the gold prices rebounded by 0.32% to $1929.38 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | USD – Building Permits | 1.417M | 1.491M | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (May) | -0.2% | -0.2% | – |

| 22:00 | USD – CB Consumer Confidence (Jun) | 102.3 | 103.7 | – |

| 22:00 | USD – New Home Sales (May) | 683K | 670K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement below from the prior support level at 102.35. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level.

Resistance level: 102.35,102.90

Support level: 101.85, 101.35

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.2815.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

EURUSD, H4: EURUSD was traded higher following the prior breaks above the previous resistance level at 1.0915. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.0990.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 142.90.

Resistance level: 144.10, 145.10

Support level: 142.90, 141.40

AUDUSD, H4: AUDUSD was traded higher following the prior breaks above from the previous resistance level at 0.6700. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards the next resistance level at 0.6770.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6215.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded lower following the prior breaks below the previous support level at 1.3140. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.3140, 1.3240

Support level: 1.3040, 1.2940

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 69.30. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the next resistance level.

Resistance level: 71.35, 73.15

Support level: 69.30, 67.55

GOLD_, H4: Gold price was traded lower while currently testing for the support level at 1928.05. However, MACD which illustrated increasing bullish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 1955.50, 1982.50

Support level: 1931.45, 1901.70

270623 Morning Session Analysis

27 June 2023 Morning Session Analysis

US dollar flat ahead of a slew of economic data.

The dollar index, which was traded against a basket of six major currencies, lingered near the similar level throughout the previous trading session amid quiet trading ahead of a series of crucial economic data later today. Yesterday, a comment from the Japan’s top currency diplomat has spurred a relatively large movement in the Japanese Yen market. According to the Japan’s Top FX Diplomat Kanda statement, he mentioned that the Japan government will respond to foreign exchange moves if moves become excessive, while emphasized that the currency should fluctuate steadily based on their fundamentals. With that, it hyped the market expectation that the Japanese government would likely interrupt the exchange rate if the currency value continues to depreciate further. However, it did not resulted any significant movement in the dollar market. At this point in time, the investors are not only eyeing on the economic data later today, also they are focusing on the updates over the weekend munity that appeared to pose a major threat to Russia President Putin. Although the mutiny is over, it derived the stress on Putin’s system of rule and questions swirled about his grip on power. As of writing, the dollar index dropped -0.14% to 102.75.

In the commodities market, crude oil prices were down by -0.12% to $69.30 per barrel after Russian munity was aborted. Besides, the gold prices edged up by 0.02% to $1923.40 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | USD – Building Permits | 1.417M | 1.491M | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (May) | -0.2% | -0.2% | – |

| 22:00 | USD – CB Consumer Confidence (Jun) | 102.3 | 103.7 | – |

| 22:00 | USD – New Home Sales (May) | 683K | 670K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 103.00.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2765. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0915. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0835.

Resistance level: 1.0915, 1.0995

Support level: 1.0770, 1.0665

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 141.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 144.90.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3175. However, MACD which illustrated diminishing bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3175, 1.3245

Support level: 1.3065, 1.2930

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 70.15. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 66.50.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

GOLD_, Daily: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

260623 Afternoon Session Analysis

26 June 2023 Afternoon Session Analysis

Euro zone business stalled EUR slipped.

The EUR which traded against the dollar index slipped after the eurozone business showed stalling conditions in June according to the HCOB flash PMI survey data produced by S&P Global. The Composite PMI index fell from 52.8 to 50.3 in June, lower than the market expectation of 52.5. Although the reading recorded an expansion which stay above the 50-level threshold, the business activity growth drop of 2.5 points was the largest recorded for a year. S&P Global reported that the new order fell for the first time, employment growth slowed, and future output expectations deteriorated. The economic slowdown in the euro has been accompanied by an apparent tightening of monetary policy by the European Central Bank (ECB) to curb high inflation. As inflation was recorded at 6% in May and the labour market is still in resilient conditions, suggesting more price pressure ahead as workers improve their bargaining power. Meanwhile, Germany, the bloc’s biggest economy, outperformed service, and France was a significant drag with a services PMI of 48. Firms surveyed said economic activity was down again, citing inflation and tough financial conditions as reasons for the drop in business activity. As of writing, the EUR/USD edged up by 0.03% to $1.0905.

In the commodities market, crude oil prices slipped by -0.01% to $69.15 per barrel as investors waited for more clarity on news of a mutiny in Russia. Besides, the gold prices rose by 0.19% to $1925.20 per troy ounce as the uncertainty of geopolitical in Russia spurred the gold demand,

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breaks below from the prior support level at 102.35. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level.

Resistance level: 102.35,102.90

Support level: 101.85, 101.35

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.2815.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.0990.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 142.90.

Resistance level: 144.10, 145.10

Support level: 142.90, 141.40

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains towards the resistance level at 0.6700.

Resistance level: 0.6700,0.6770

Support level: 0.6615, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6215.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.3140.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

USDCHF, H4: USDCHF was traded lower following the prior breaks below the previous support level at 0.8985. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.8940.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded higher following the prior breaks above from the prior resistance level at 69.30. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the next resistance level.

Resistance level: 71.35, 73.15

Support level: 69.30, 67.55

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 1931.45.

Resistance level: 1931.45, 1955.50

Support level: 1901.70, 1872.40

260623 Morning Session Analysis

26 June 2023 Morning Session Analysis

US dollar surged as market risk aversion heightened.

The dollar index, which was traded against a basket of six major currencies, managed to extend its gains as the further tightening moves from the central banks soured the risk sentiment in the market. Last week, a number of central banks which including Swiss National Bank (SNB) and Bank of England (BoE) have adjusted their official cash rate upward, whereby BoE even increased their interest rate more than market expectation. Theoretically, a higher interest rates are generally good for currencies, but the risk that higher rates could lead to a recession in the U.K. has hit the pound, prompting some investors to seek safe havens such as the U.S. dollar. Besides, Federal Reserve Chairman Jerome Powell, concluding two days of congressional testimony, reiterated his view that the United States is likely to raise interest rates at least two more times this year to curb high inflation. Also, the dollar index gained further following an upbeat services data was released. According to the Markit, the US Services PMI came in at 54.1, slightly higher than the consensus forecast at 54.0, reflecting the fifth consecutive month of improvement in services sector. As of writing, the dollar index dropped -0.12% to 102.80.

In the commodities market, crude oil prices rebounded by 0.68% to $69.88 per barrel after falling tremendously amid interest rate hikes around the world. Besides, the gold prices edged up by 0.16% to $1924.50 per troy ounce as the Wagner mutiny showed cracks in Putin authority, pointing high uncertainty ahead.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 102.35. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 102.35, 102.90

Support level: 101.85, 101.35

GBPUSD, Daily: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2815. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0835.

Resistance level: 1.0915, 1.0995

Support level: 1.0835, 1.0760

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 142.90. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 144.10.

Resistance level: 144.10, 145.15

Support level: 142.90, 141.40

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6695. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6615.

Resistance level: 0.6695, 0.6770

Support level: 0.6615, 0.6525

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6215. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6105.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3140. However, MACD which illustrated diminishing bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8985. However, MACD which illustrated diminishing bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.8985, 0.9040

Support level: 0.8870, 0.8820

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 69.30. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 71.35, 73.15

Support level: 69.30, 67.55

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1931.45. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1931.45, 1955.50

Support level: 1901.70, 1872.40

230623 Afternoon Session Analysis

23 June 2023 Afternoon Session Analysis

Sterling extended losses despite BoE’s unexpected tightening moves.

The Pound Sterling, which traded against the dollar index, extended its losses despite the Bank of England’s (BoE)’s unexpected tightening of its monetary policy. The Bank of England surprises markets by raising rates by 50 bps to 5.00% from 4.50%, but fails to lift sterling. A drop to 8.5% was forecast due to Wednesday’s inflation data but the actual reading was in line with the previous reading at a high of 8.7%. Following the BoE interest rate decision, the BoE’s Bailey issues a hawkish speech May inflation data leaves the central bank little choice but to hike rates by 50 bps. As a result, the GBP/USD skyrocketed towards its daily high before stabilizing at around 1.2770. However, the BoE’s tightening moves failed to cheer up the sterling as investors’ worries further rates hike will spark UK’s recession concerns. According to Mettis Link News, each percentage point increase in interest rate will increase borrowing costs of total markets adding around 20 billion pounds into the market. Since the UK debt exceeds the GDP of 100%, an additional increase in the interest rate will prompt the UK economy will enter into recession this year. Therefore, the GBPUSD is under selloff pressure by investors as pessimism hangs over the UK economy. As of writing, the GBPUSD edged lower by -0.27% to 1.2714.

In the commodities market, crude oil prices extended losses by -1.05% to $68.78 per barrel as global demand concerns after major central banks lifted their interest rates. Besides, the gold prices dipped by -0.08% to $1912.30 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

All Day CNY Dragon Boat Festival

Today’s Highlight Events

Time Market Event

16:00 CHF SNB Press Conference

20:00 GBP BOE Inflation Letter

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q2) | 1.50% | 1.75% | – |

| 19:00 | GBP – BoE Interest Rate Decision (Jun) | 4.50% | 4.75% | – |

| 20:30 | USD – Initial Jobless Claims | 262K | 260K | – |

| 22:00 | USD – Existing Home Sales (May) | 4.28M | 4.24M | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | 7.919M | 1.873M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from lower level. MACD which illustrated bullish momentum suggests the index extended its gains toward the resistance level at 102.35.

Resistance level: 102.35,102.90

Support level: 101.85, 101.35

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 1.2665.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

EURUSD, H4: EURUSD was traded lower following the prior retracement from below from the higher. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.0915.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

USDJPY, H4: USDJPY was traded higher following the prior rebound from the support level at 142.90. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 144.10, 145.10

Support level: 142.90, 141.40

AUDUSD, H4: AUDUSD was traded lower while currently testing for the support level at 0.6700. MACD which illustrated increasing bearish momentum suggests the pair extended its losses if successfully breaks below the support level.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6105

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded higher following the prior rebound from the support level at 1.3140. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3240.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.8985.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded lower following the prior breaks below from the prior support level at 69.30. MACD which illustrated increasing bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 69.30, 71.35

Support level: 67.55, 65.80

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 1931.45, 1955.50

Support level: 1901.70, 1872.40