100223 Morning Session Analysis

10 February 2023 Morning Session Analysis

US Dollar plunged following labor market weakened.

The Dollar Index which traded against a basket of six major currencies recorded some losses on yesterday following the downbeat economic data has been released. According to the US Department of Labor, the US Initial Jobless Claims notched up from the previous reading of 183K to 196K, exceeding the consensus forecast of 190K. With the rising of data figures, it mean the current labor market in the US was turning fragile, as well as bringing negative prospects toward economic progression in the US. On the other hand, the value of US Dollar was hit by the speech of Fed’s member upon a slowing economy in the US. Richmond Fed President Thomas Barkin claimed on Thursday that the contractionary monetary which implemented by Fed was curbing the US economy, whereas allowing Fed to reexamine the rate hike moves in the future path. Nonetheless, the losses of Dollar Index was limited following the expectation of sharp fall in UK inflation from Bank of England Governor Andrew Bailey. As of writing, the Dollar Index dropped by 0.17% to 103.09.

In the commodity market, the crude oil price edged up by 0.01% to $77.67 per barrel as of writing following the market optimism against China reopening keep hovering in the market. In addition, the gold price rose by 0.01% to $1862.32 per troy ounce as of writing over the weakening of US Dollar during Asia morning trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (QoQ) (Q4) | 1.9% | 0.4% | – |

| 15:00 | GBP – Manufacturing Production (MoM) | -0.5% | -0.2% | – |

| 21:30 | CAD – Employment Change (Jan) | 104.0K | 17.3K | – |

| 23:00 | USD – Michigan Consumer Sentiment (Feb) | 64.9 | 64.9 | – |

Technical Analysis

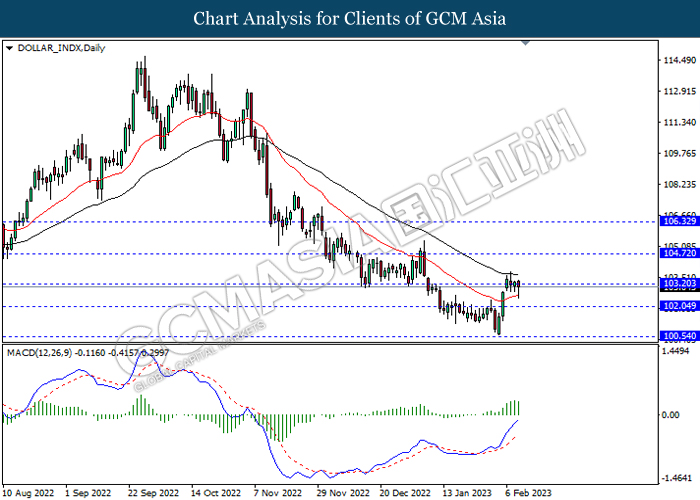

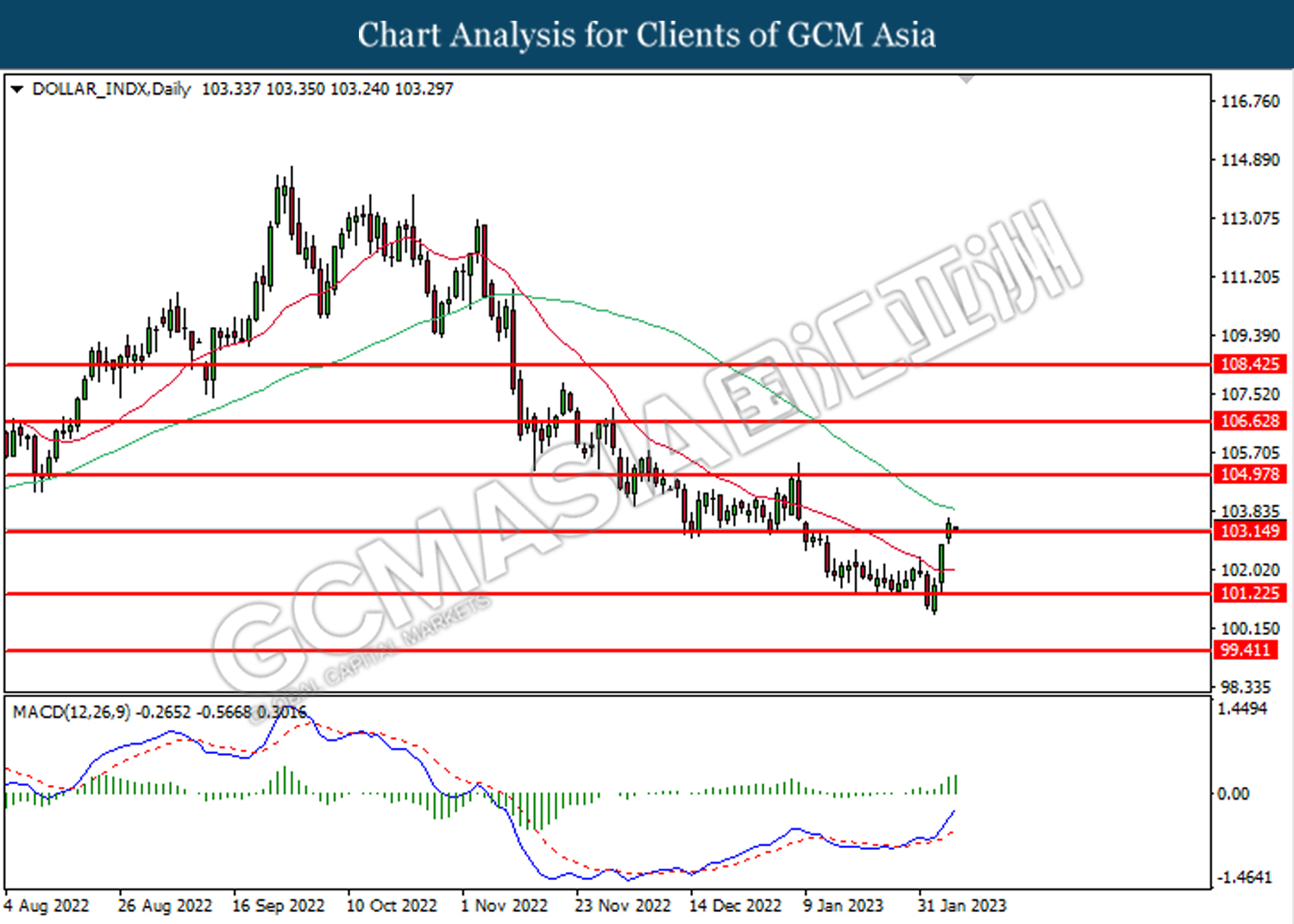

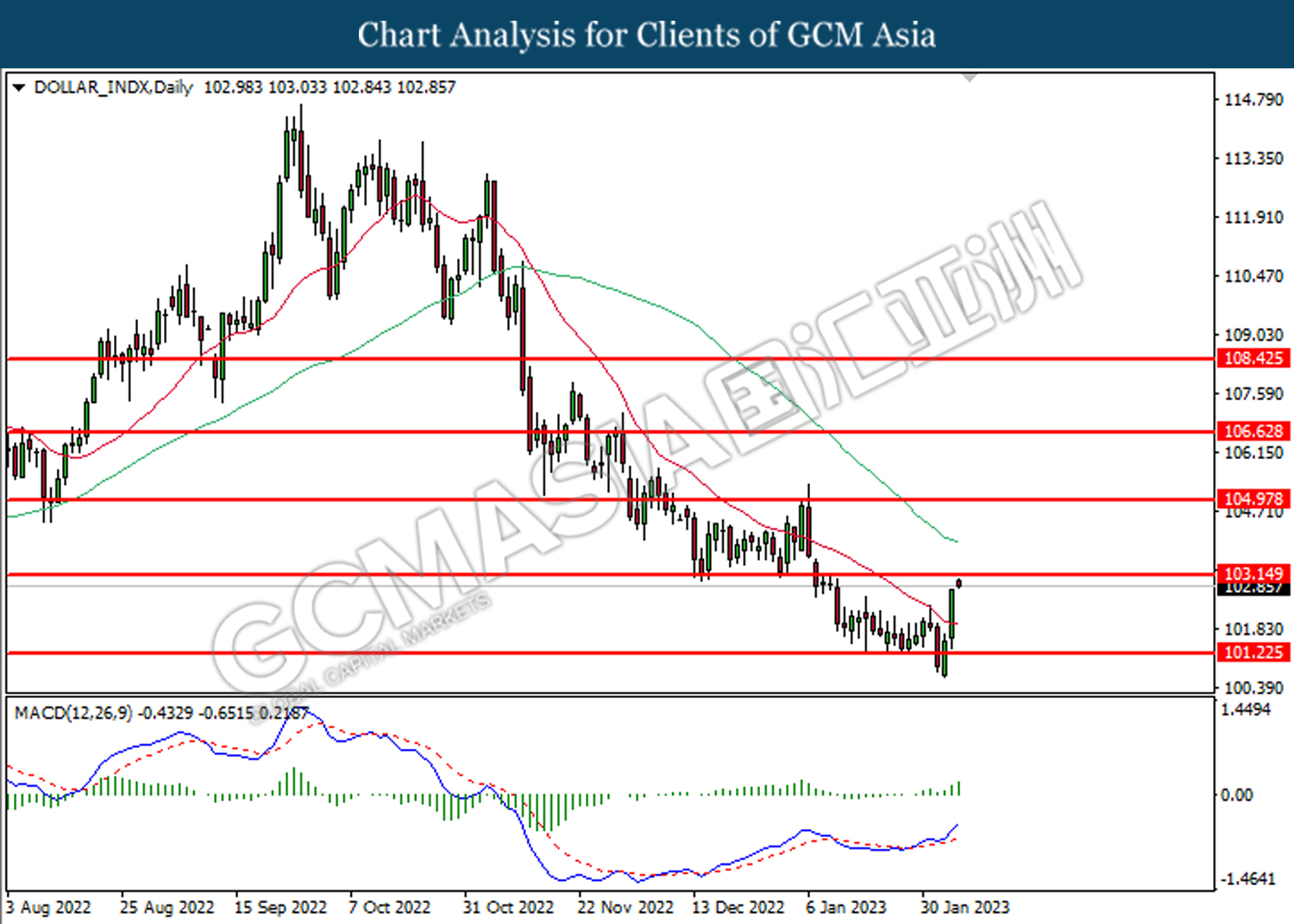

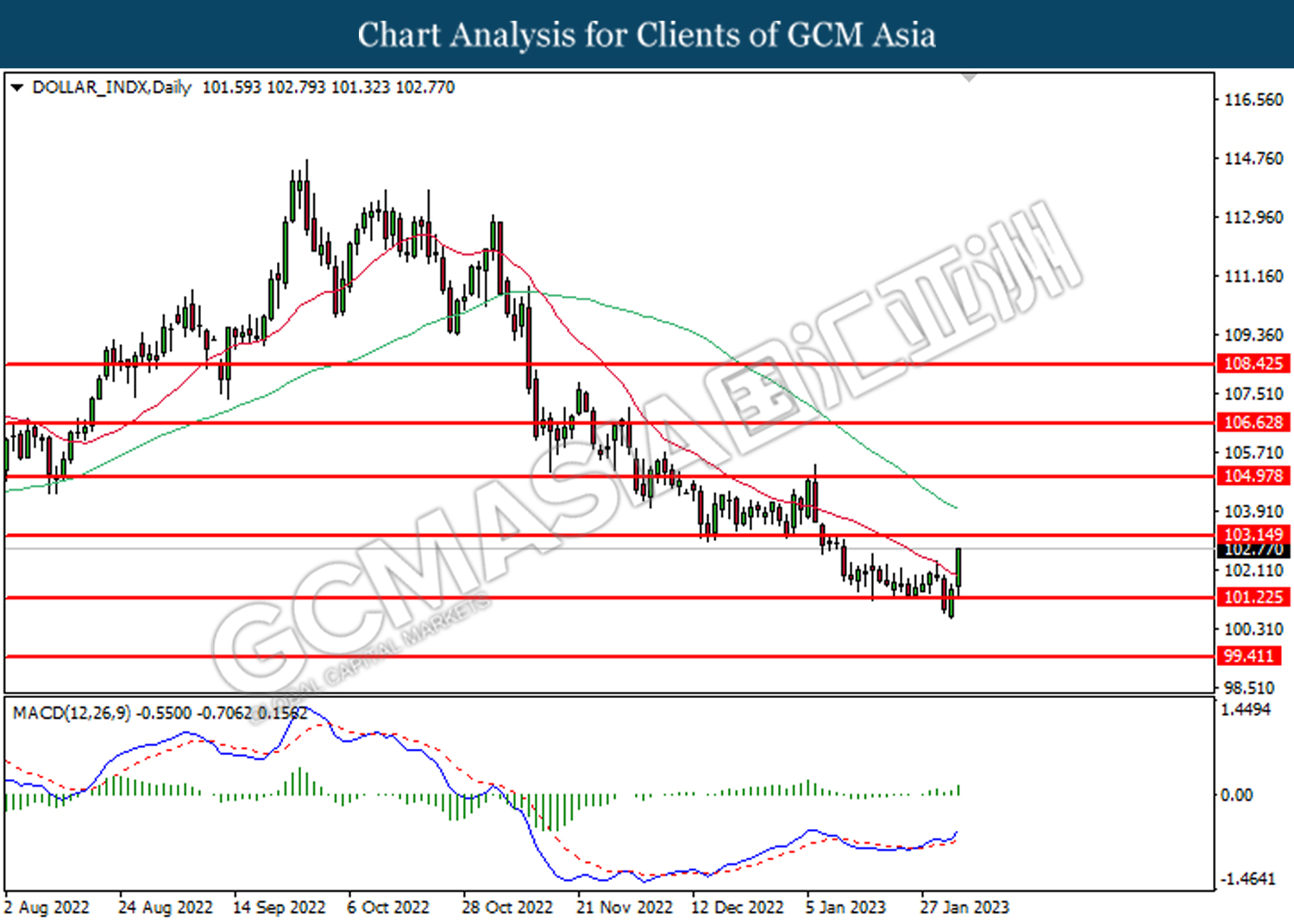

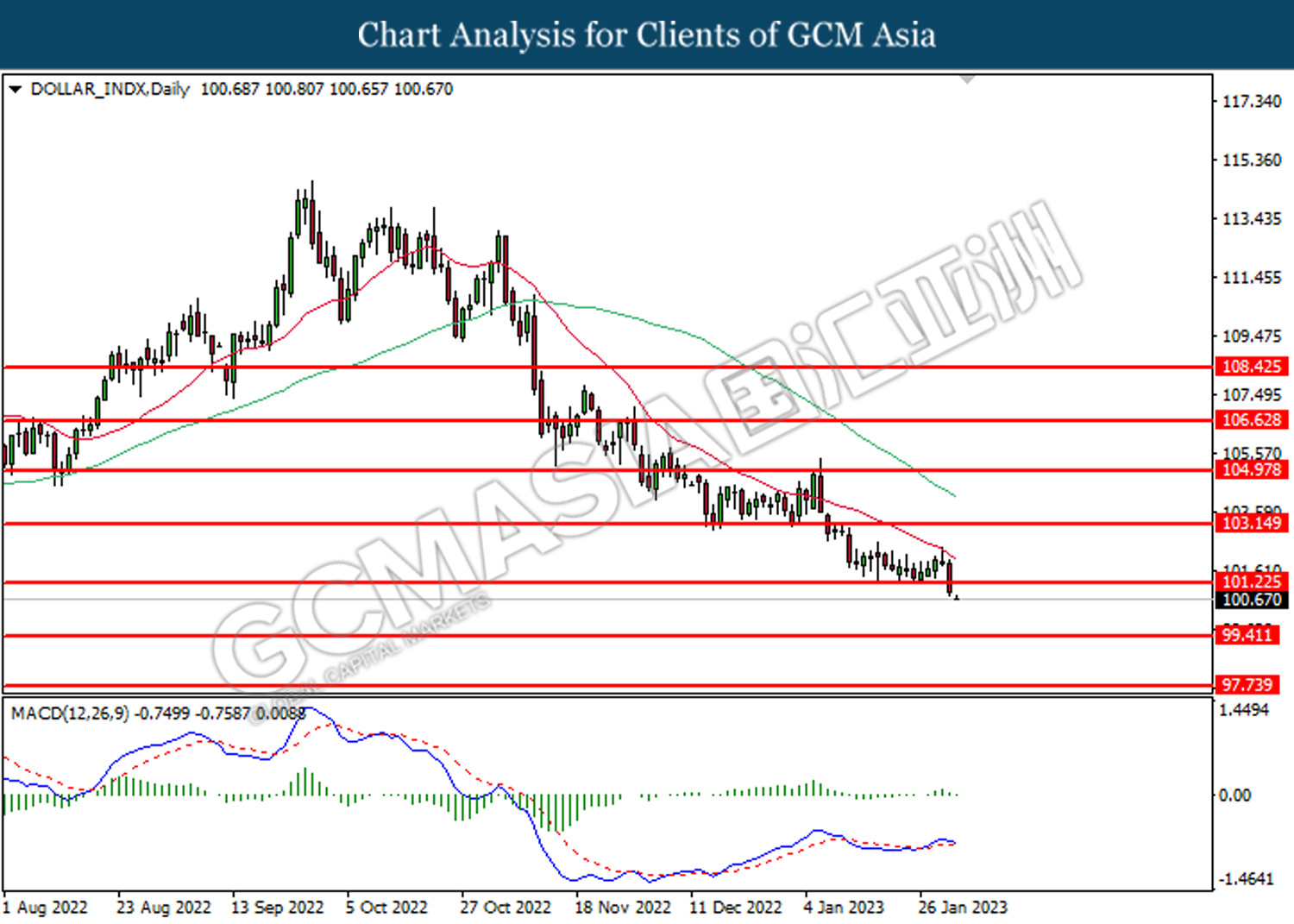

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.55

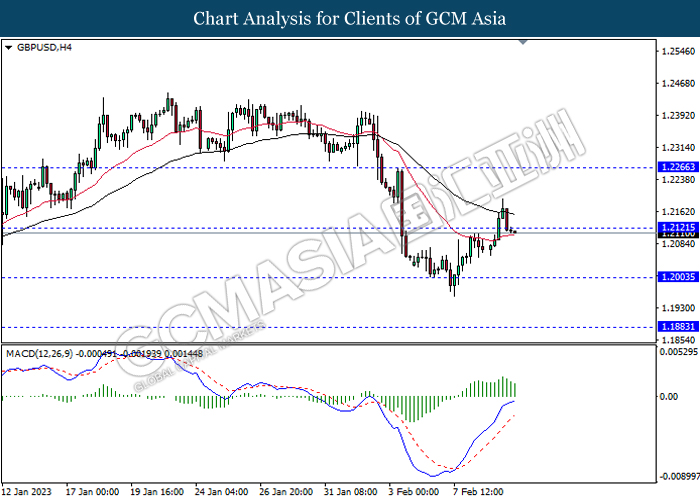

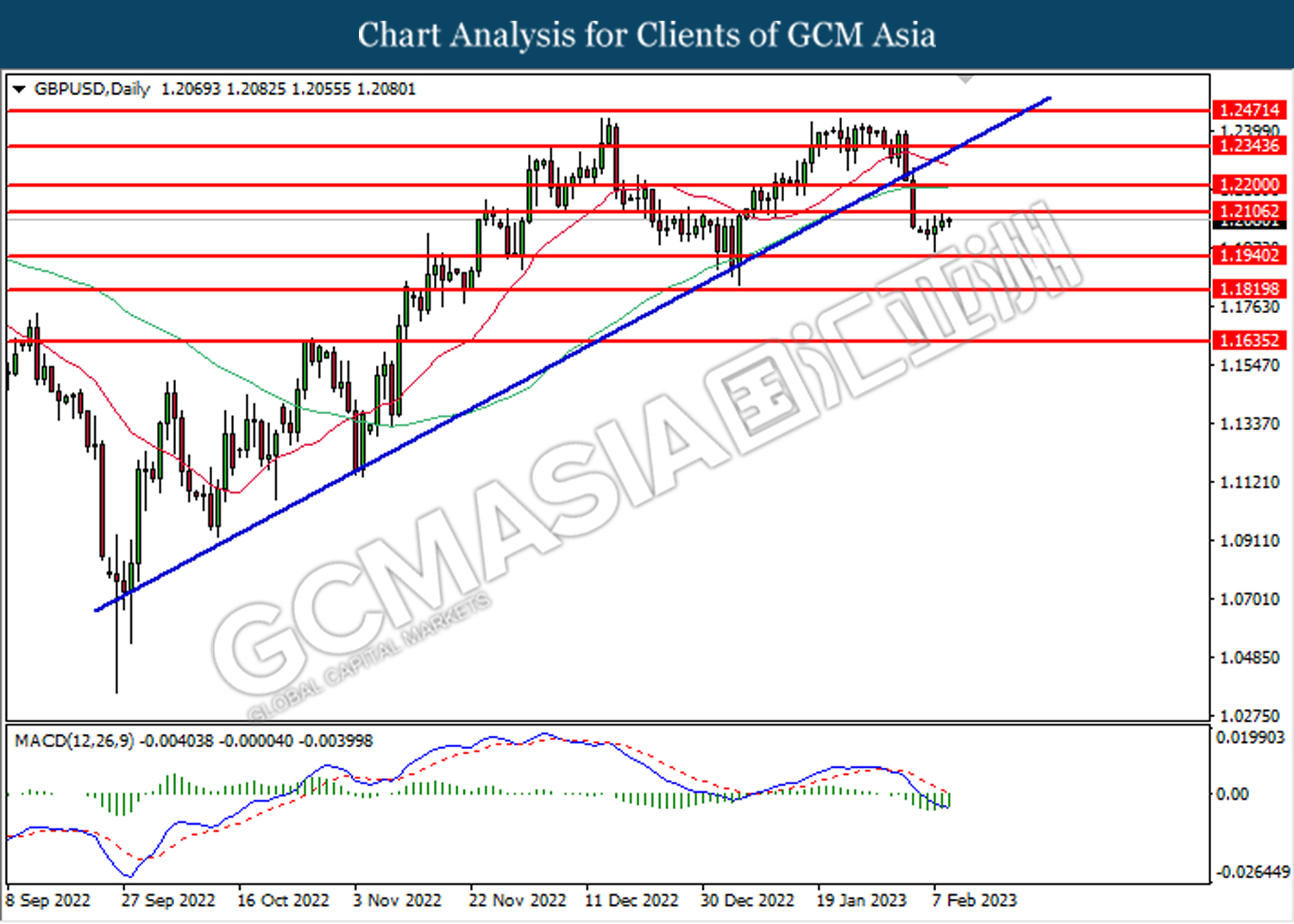

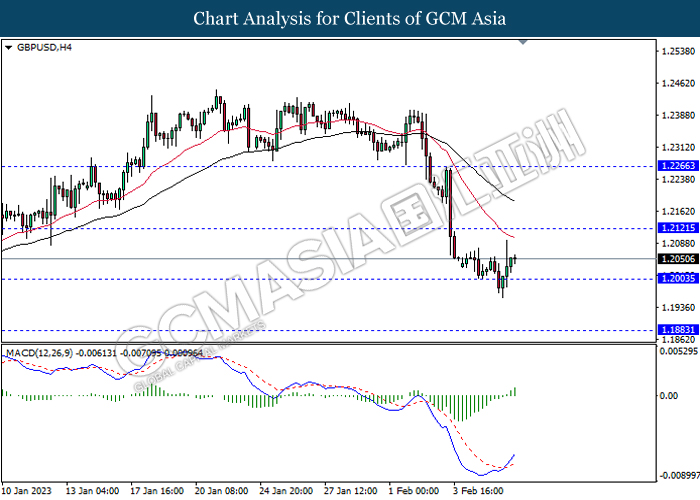

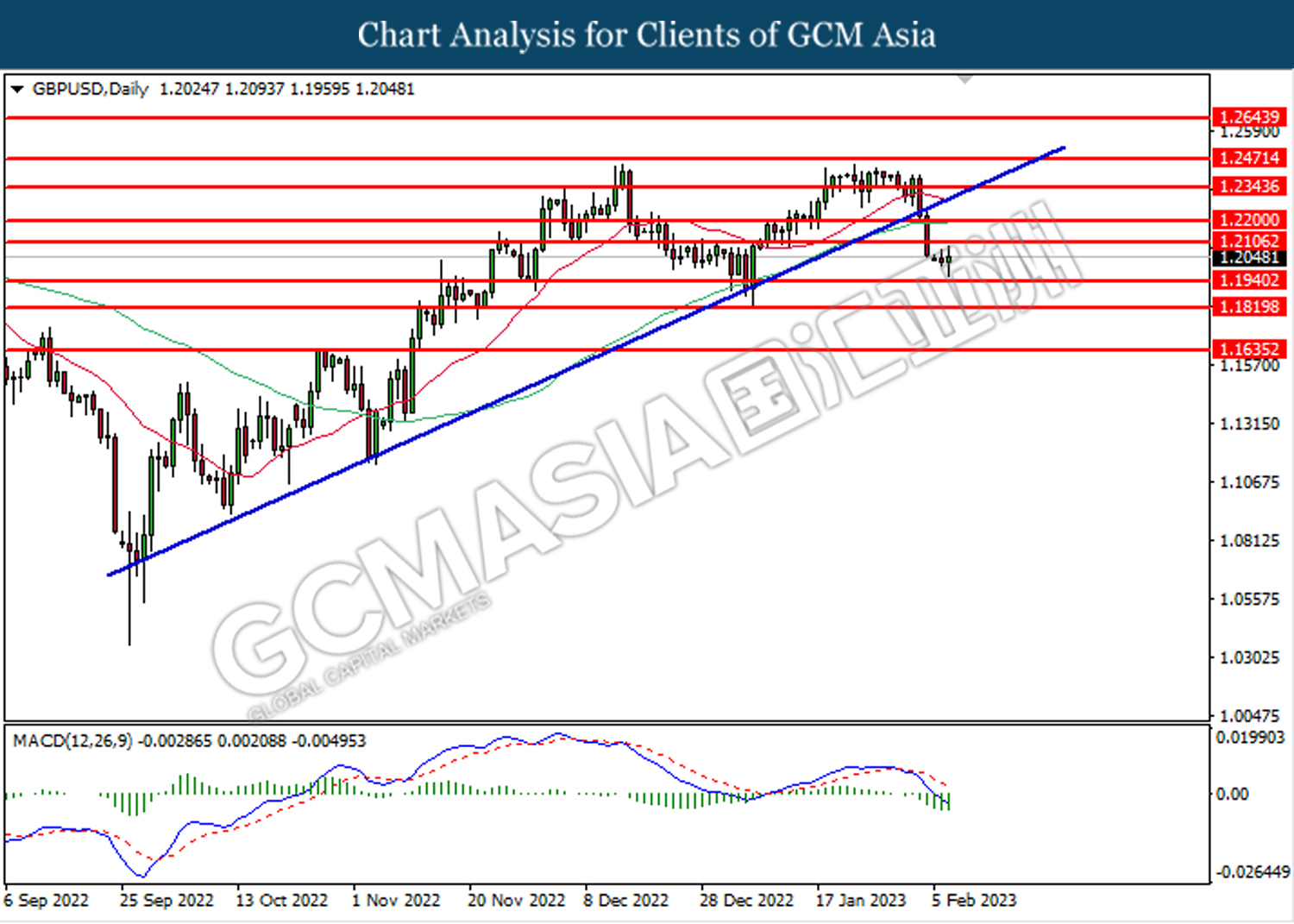

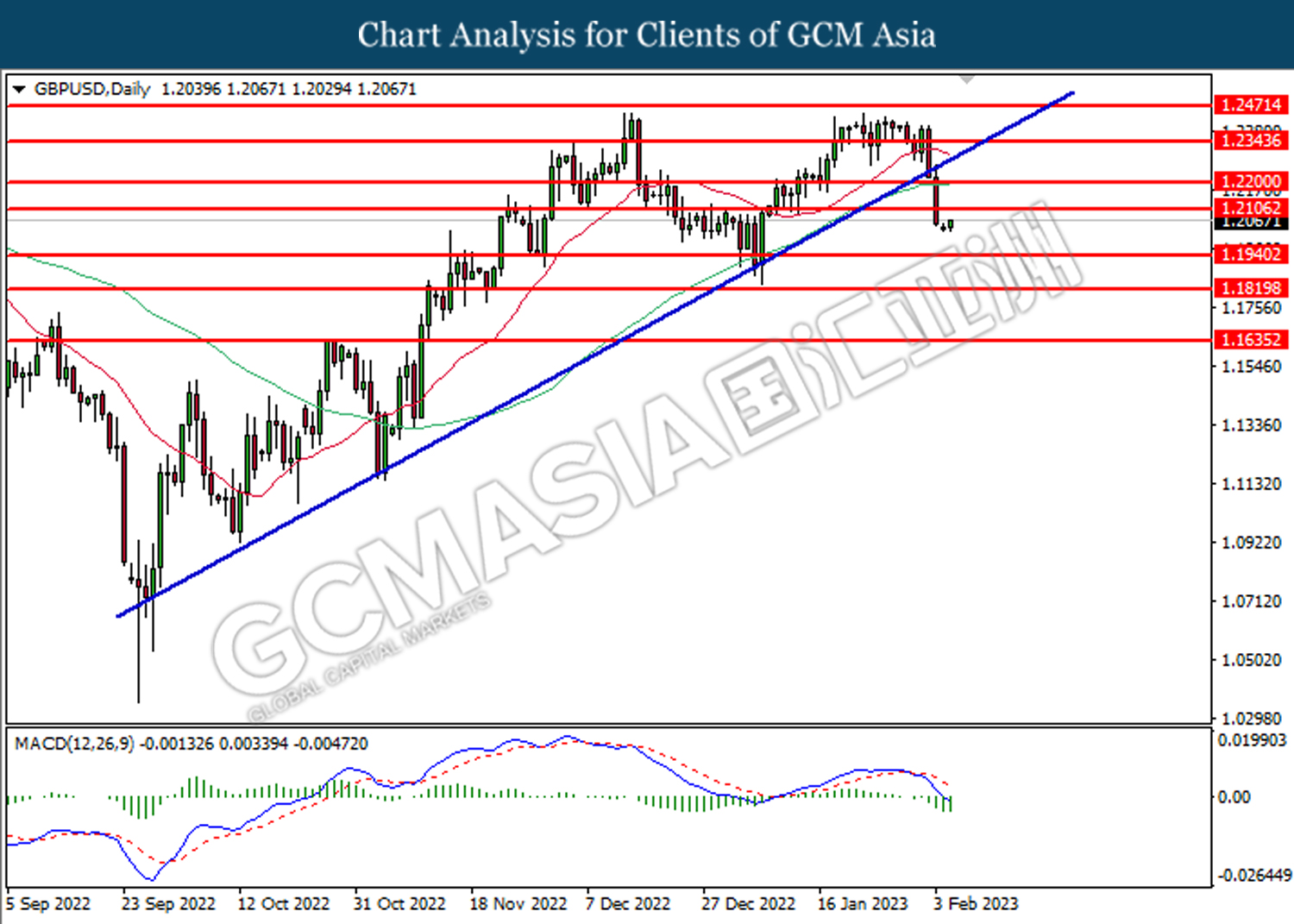

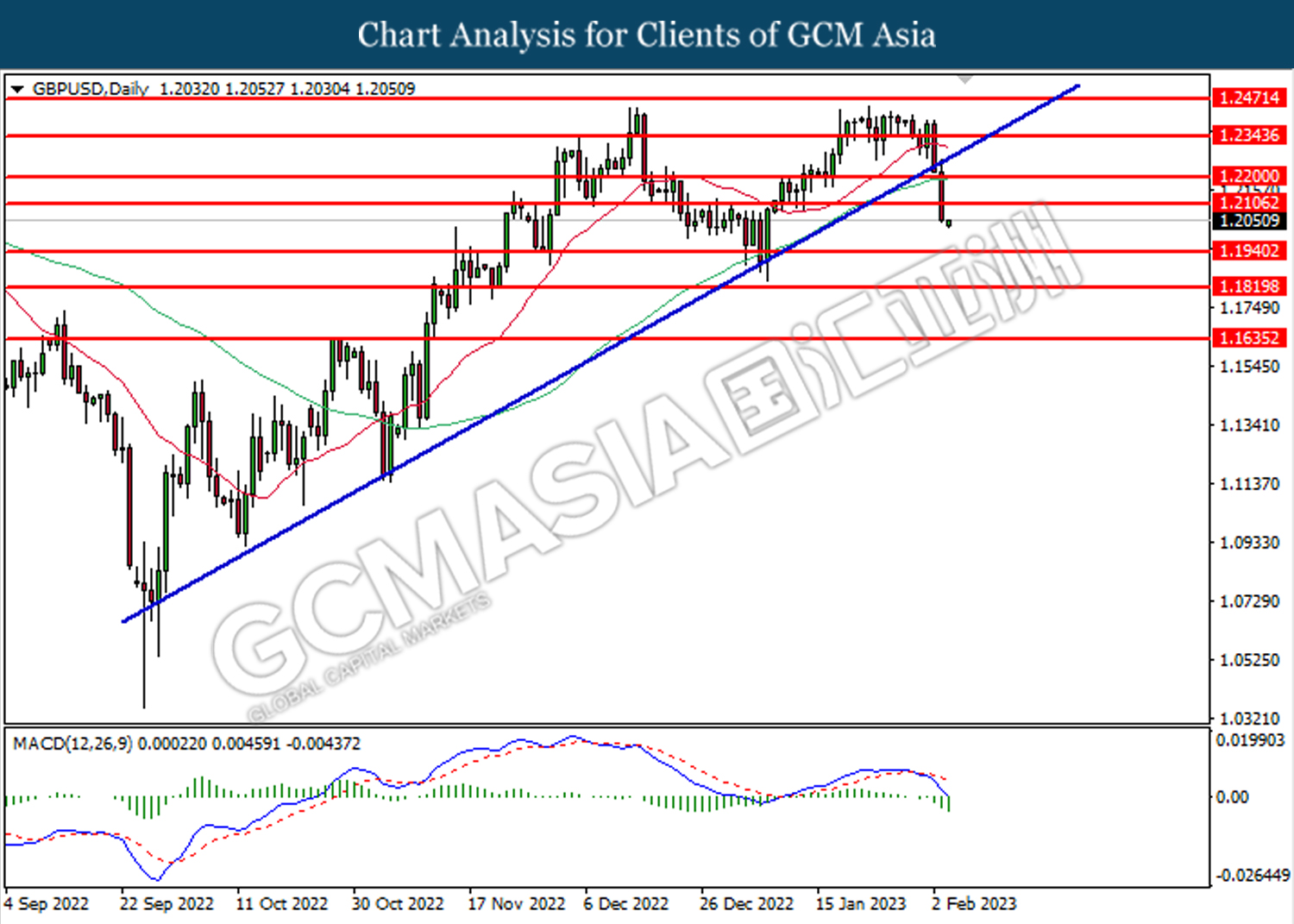

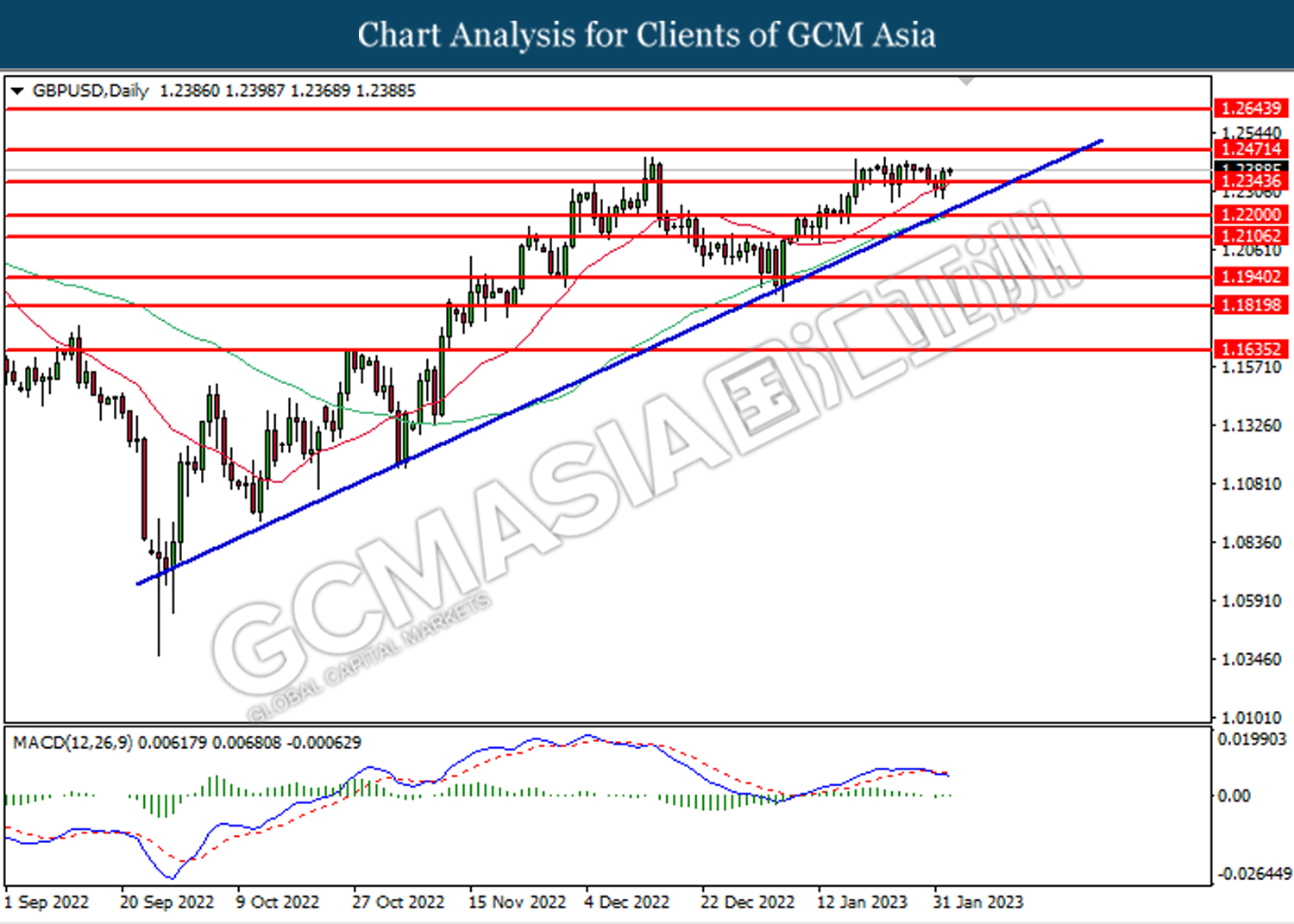

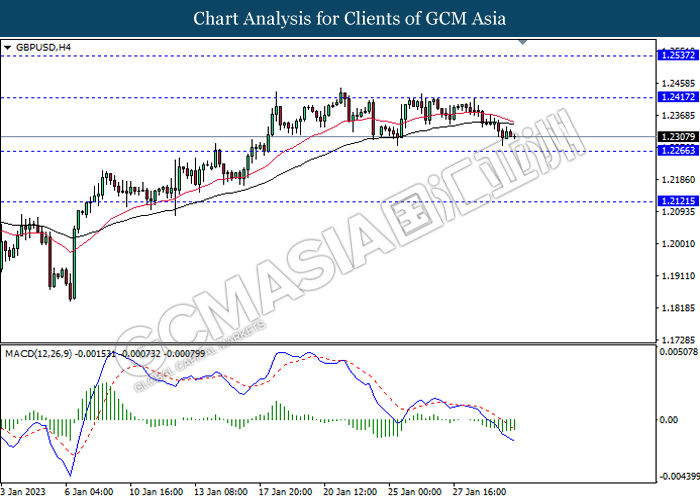

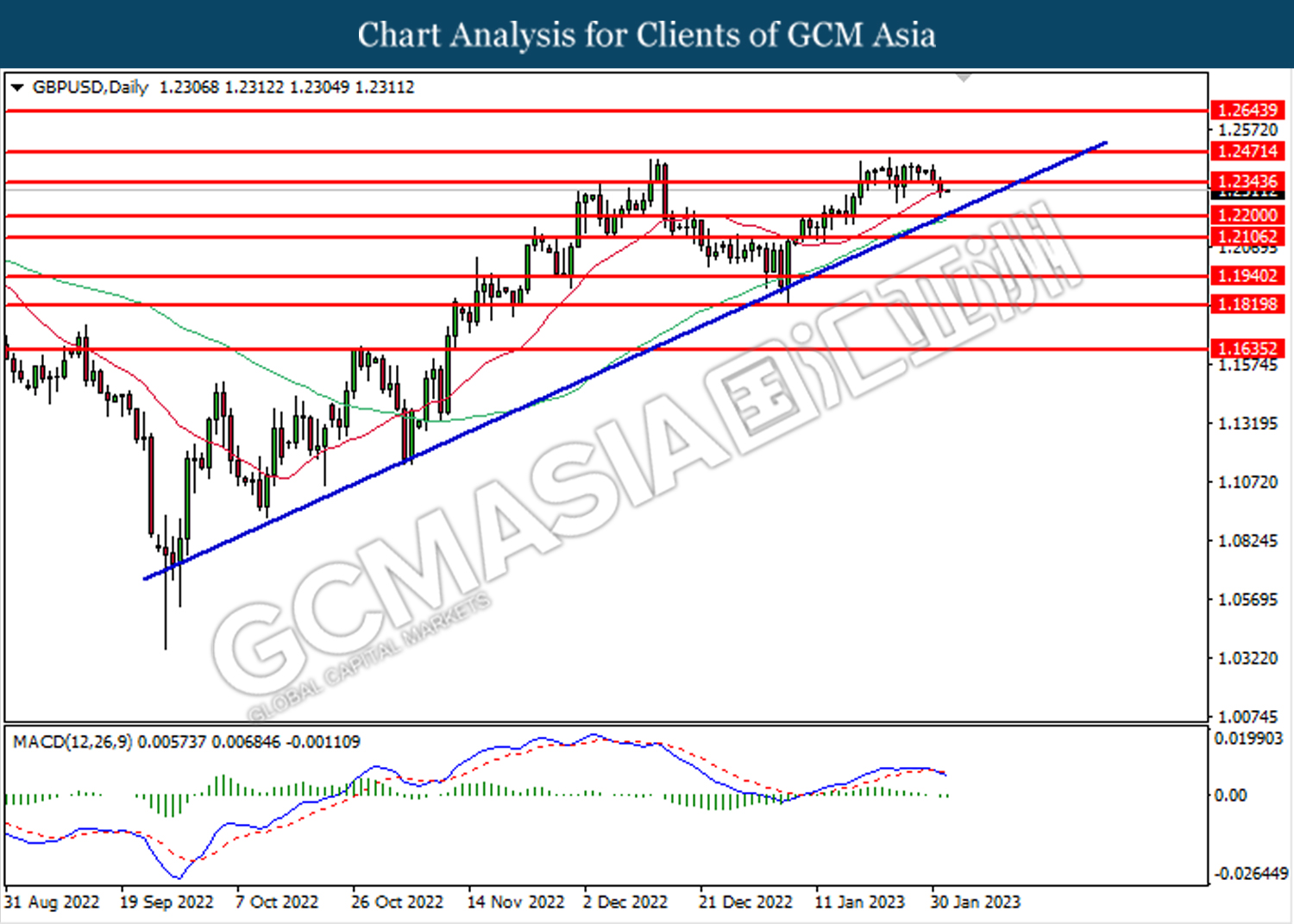

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

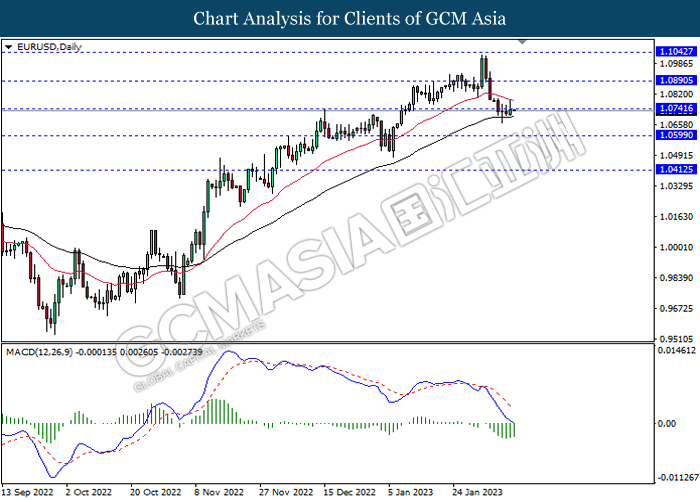

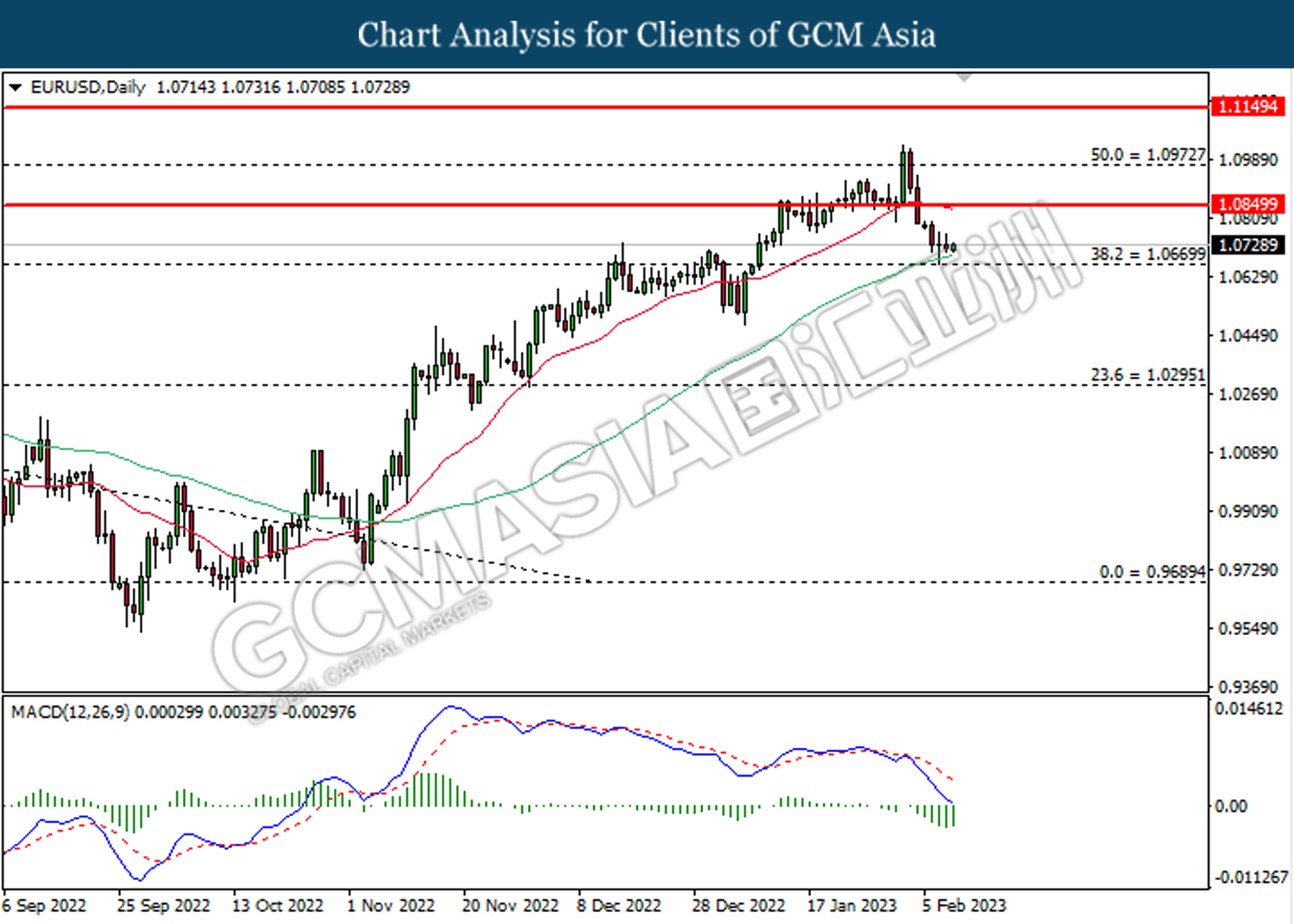

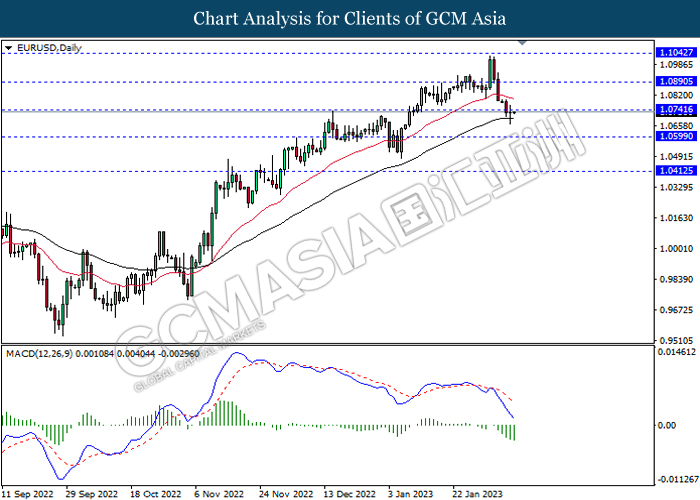

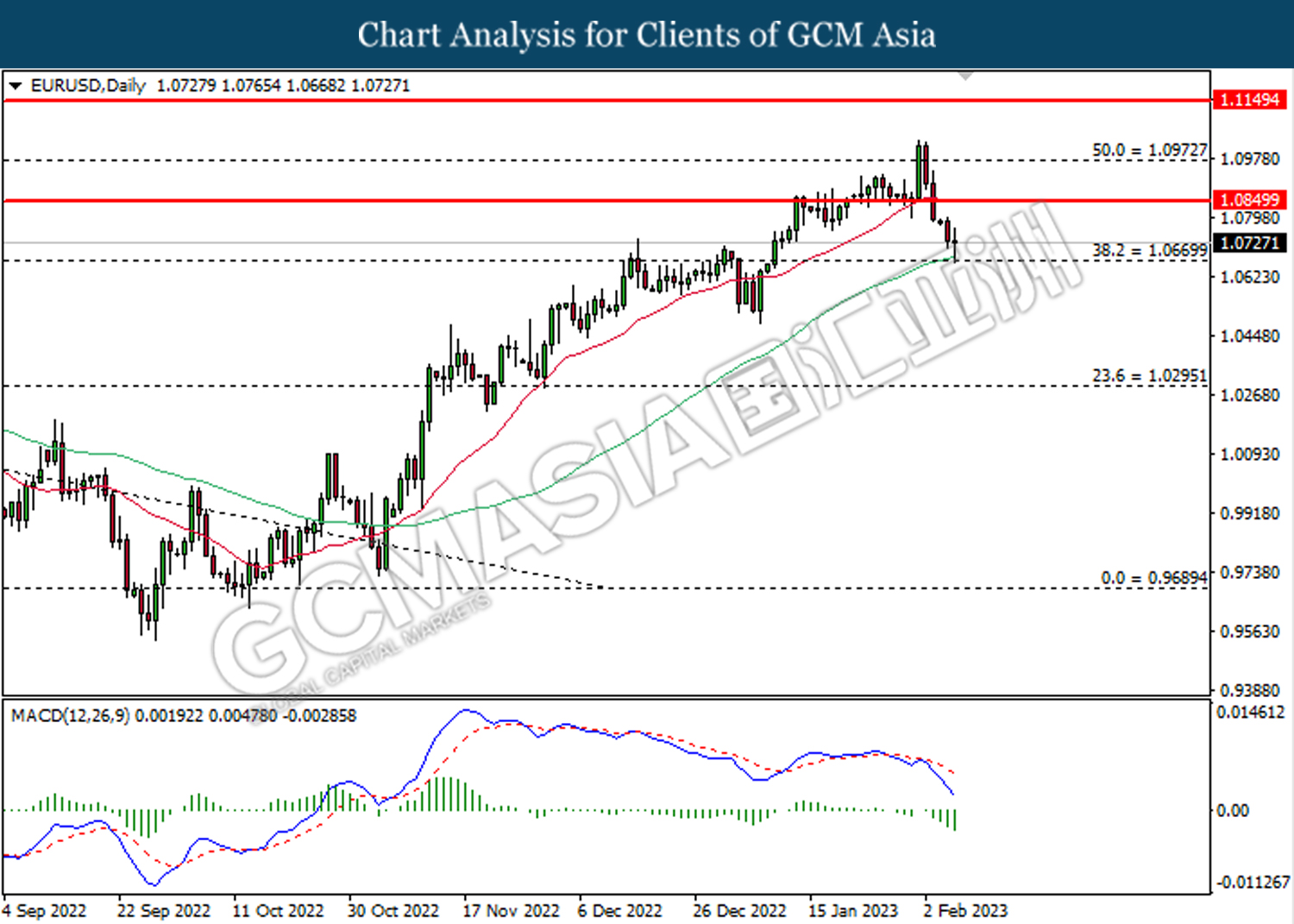

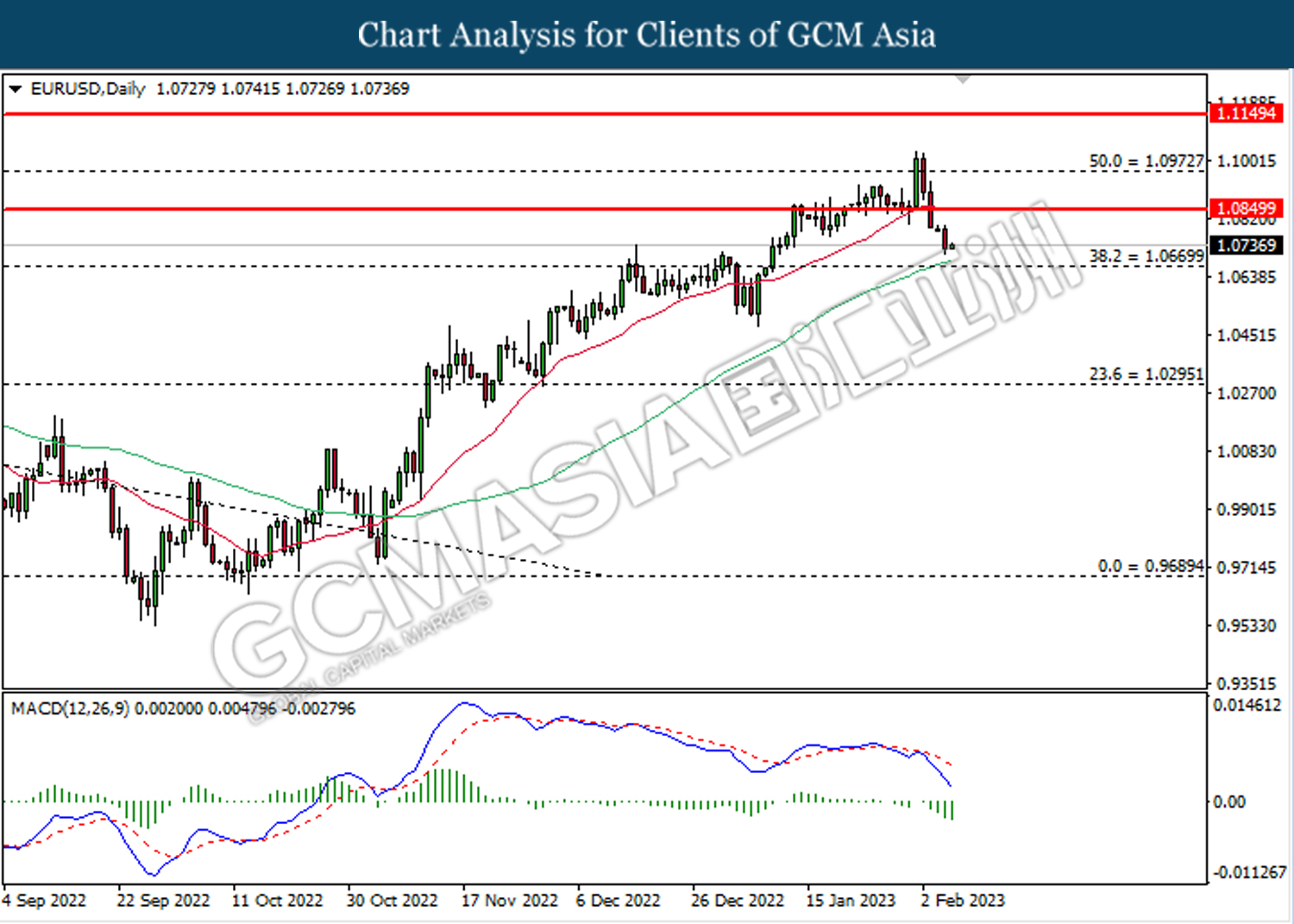

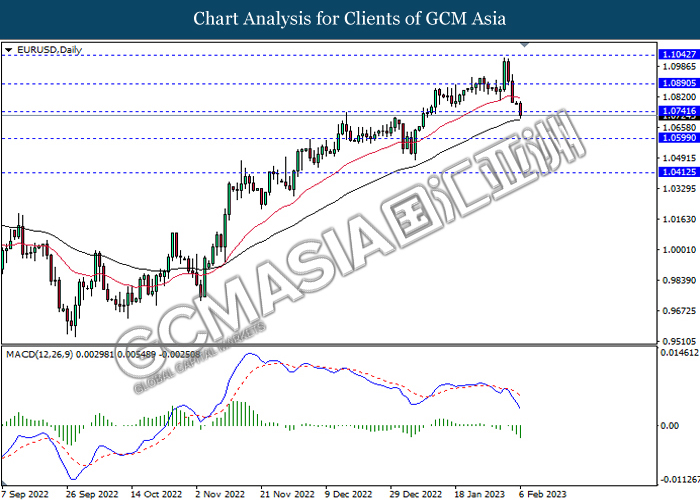

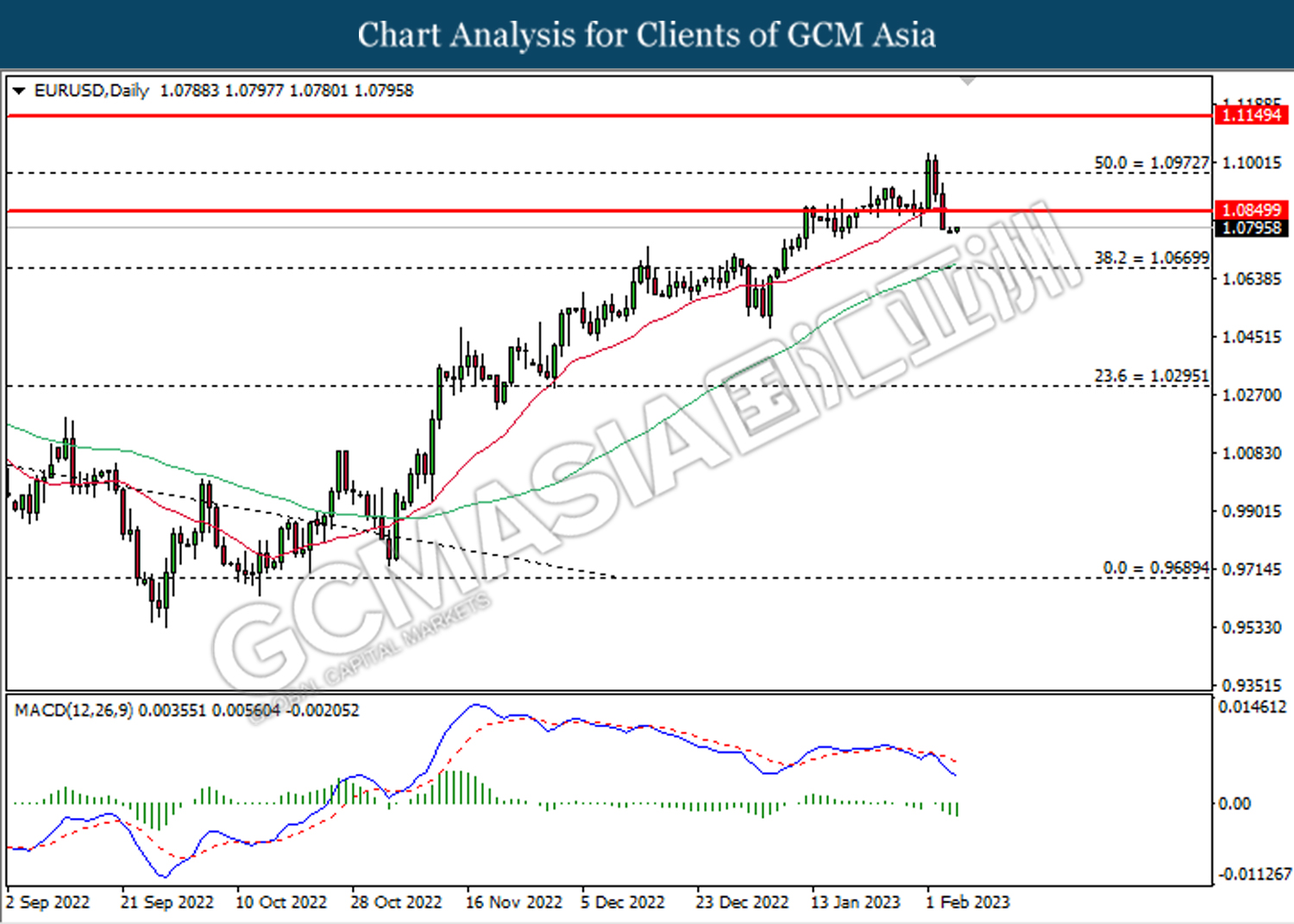

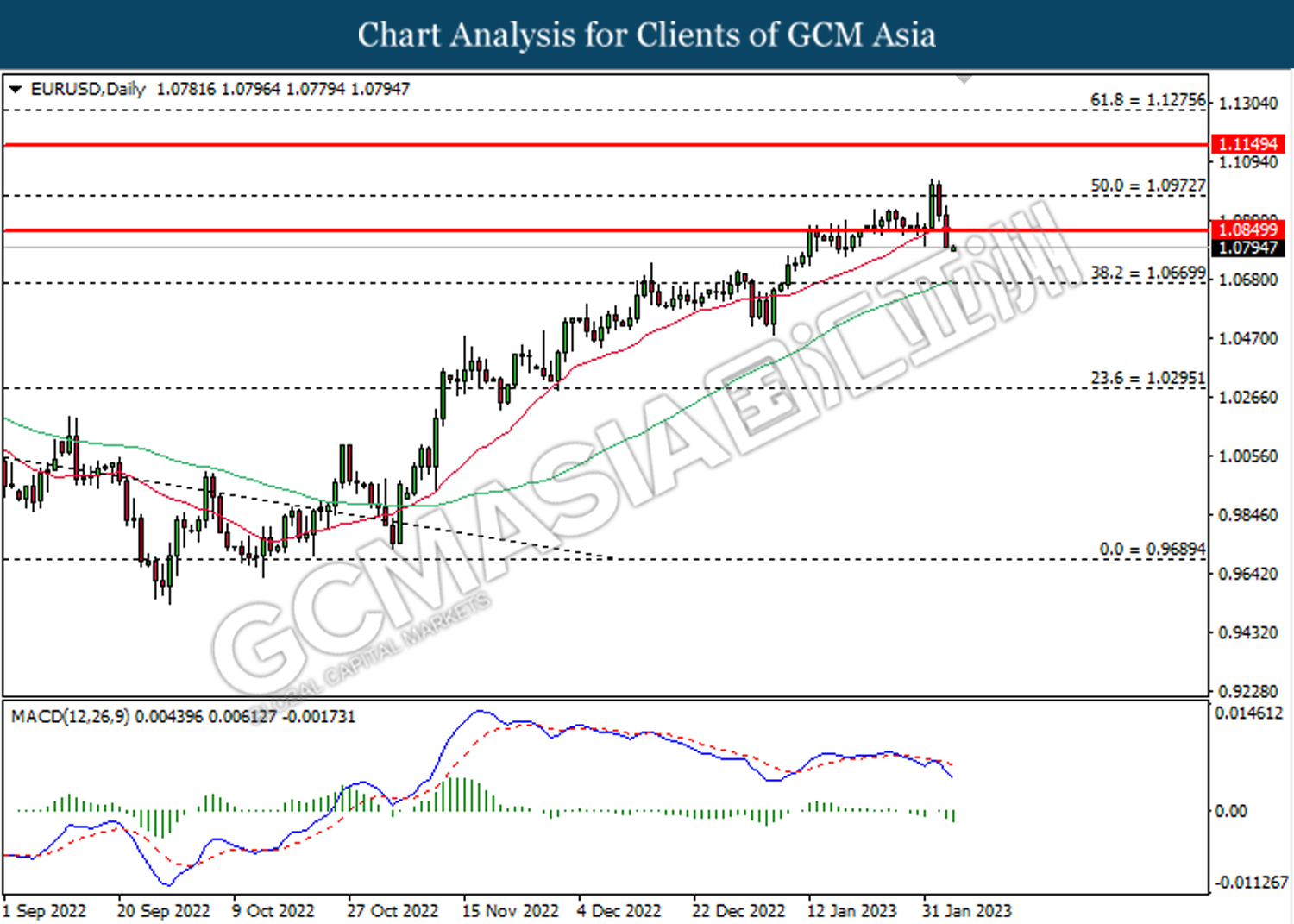

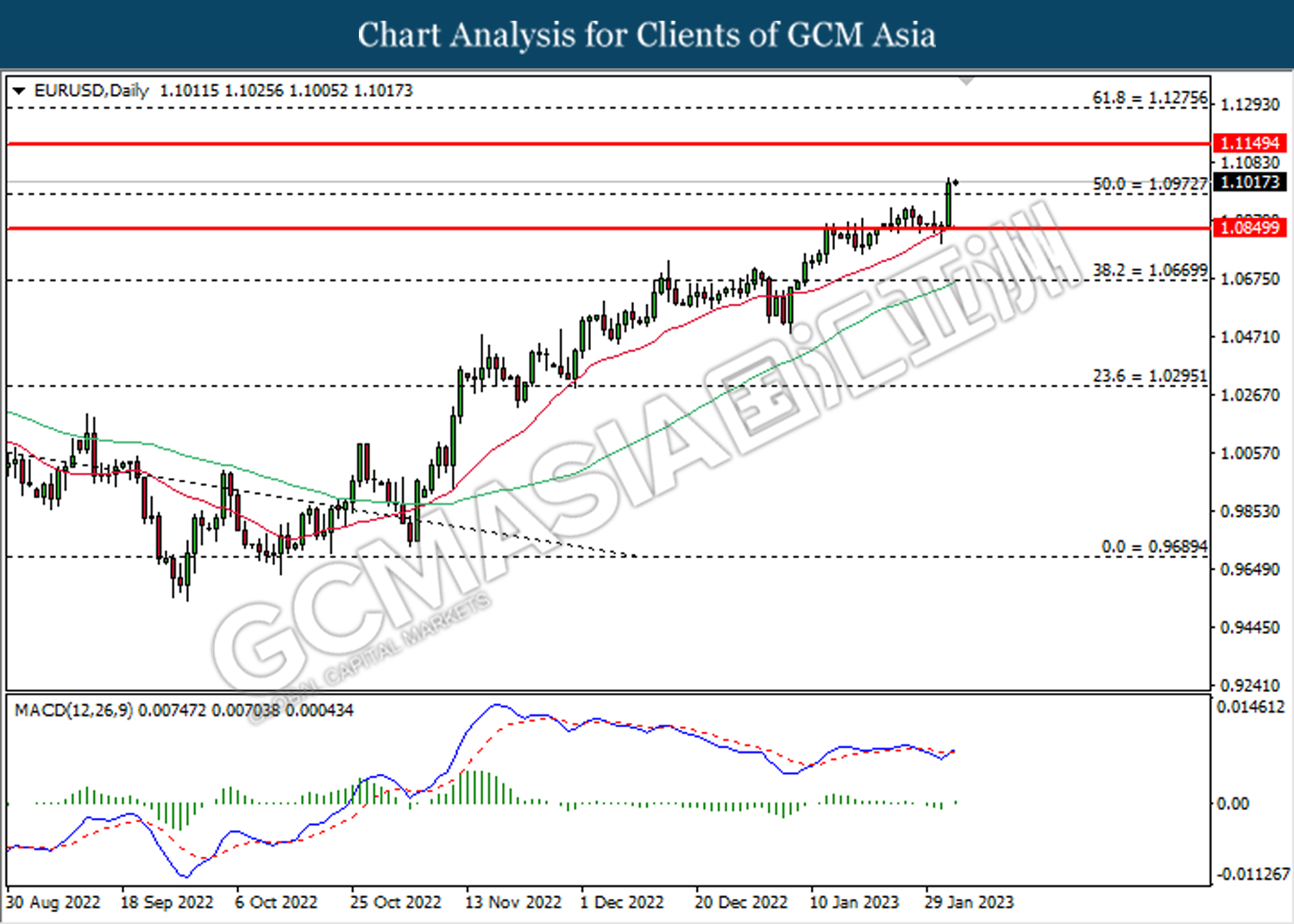

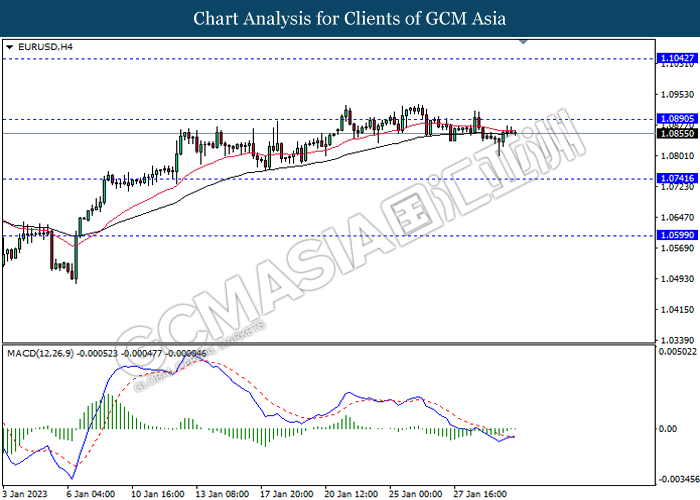

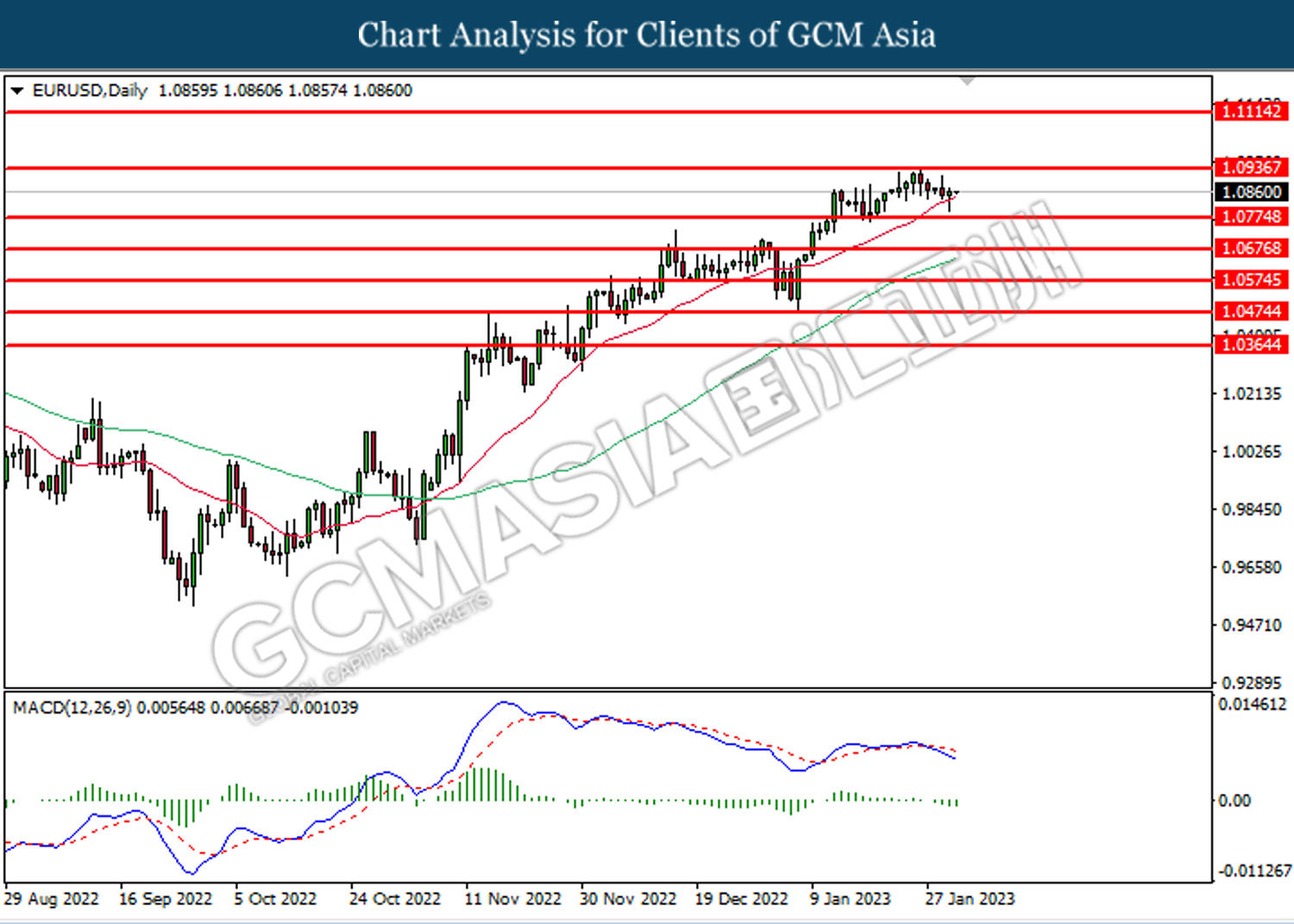

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

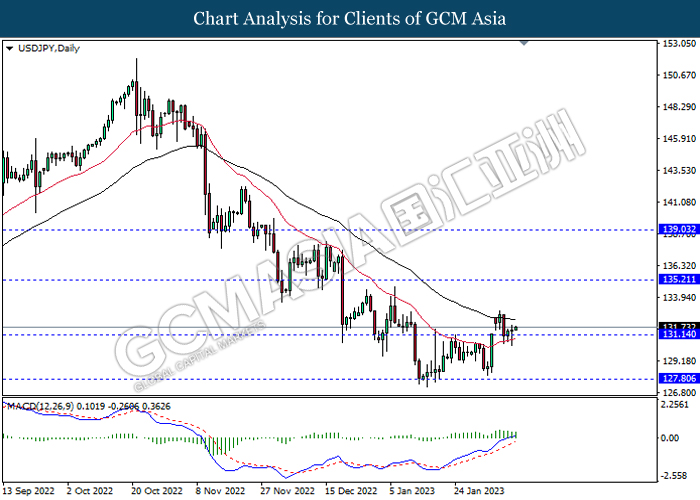

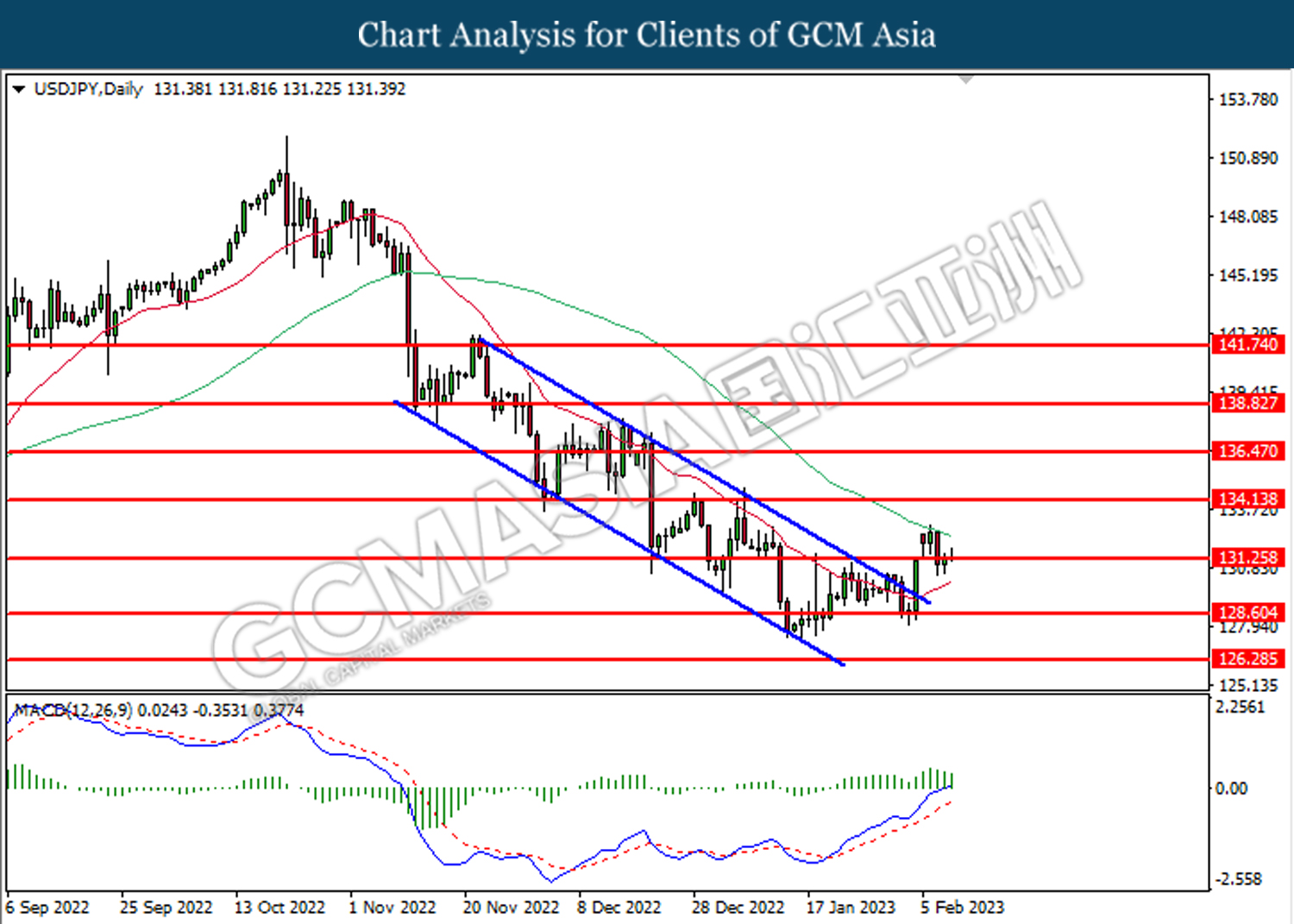

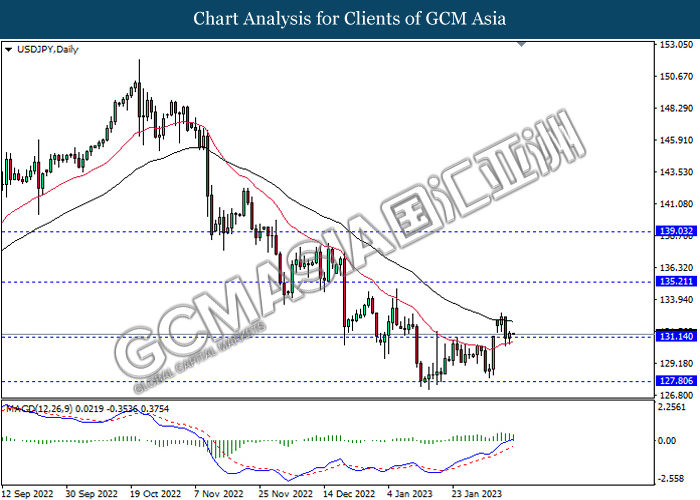

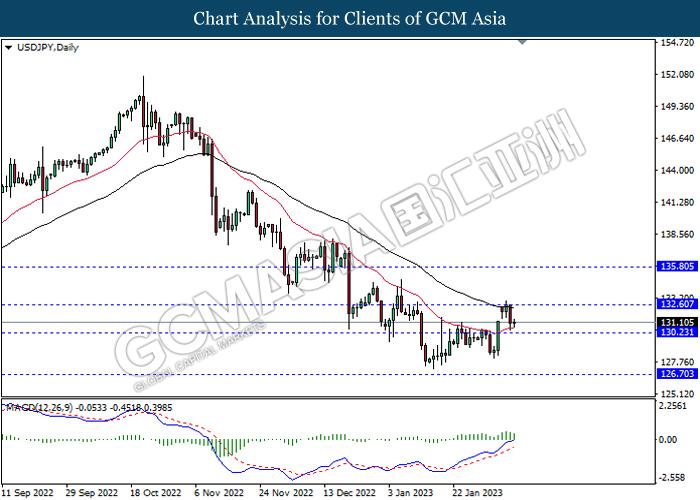

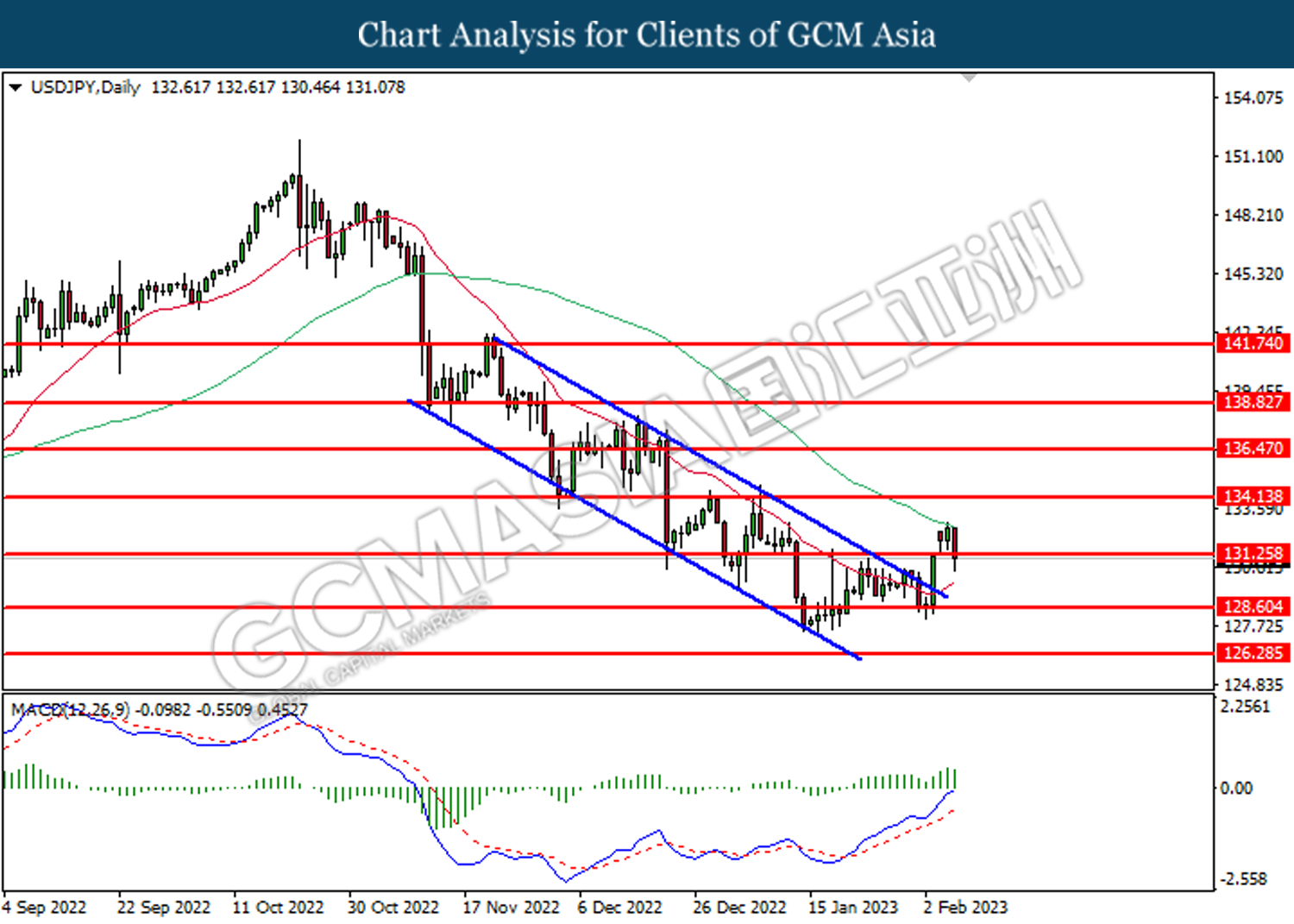

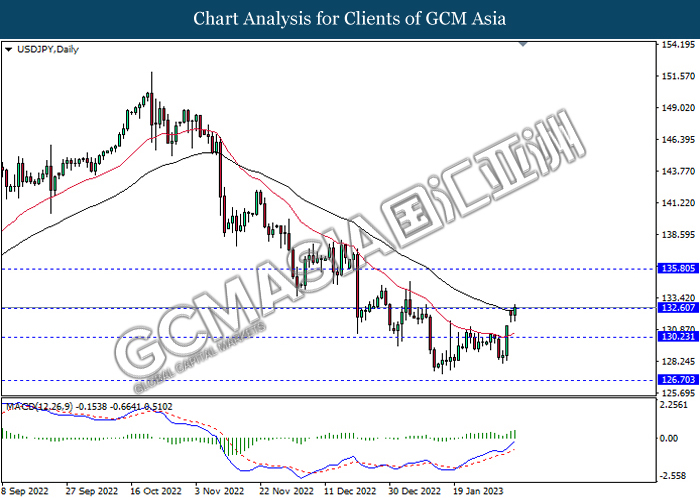

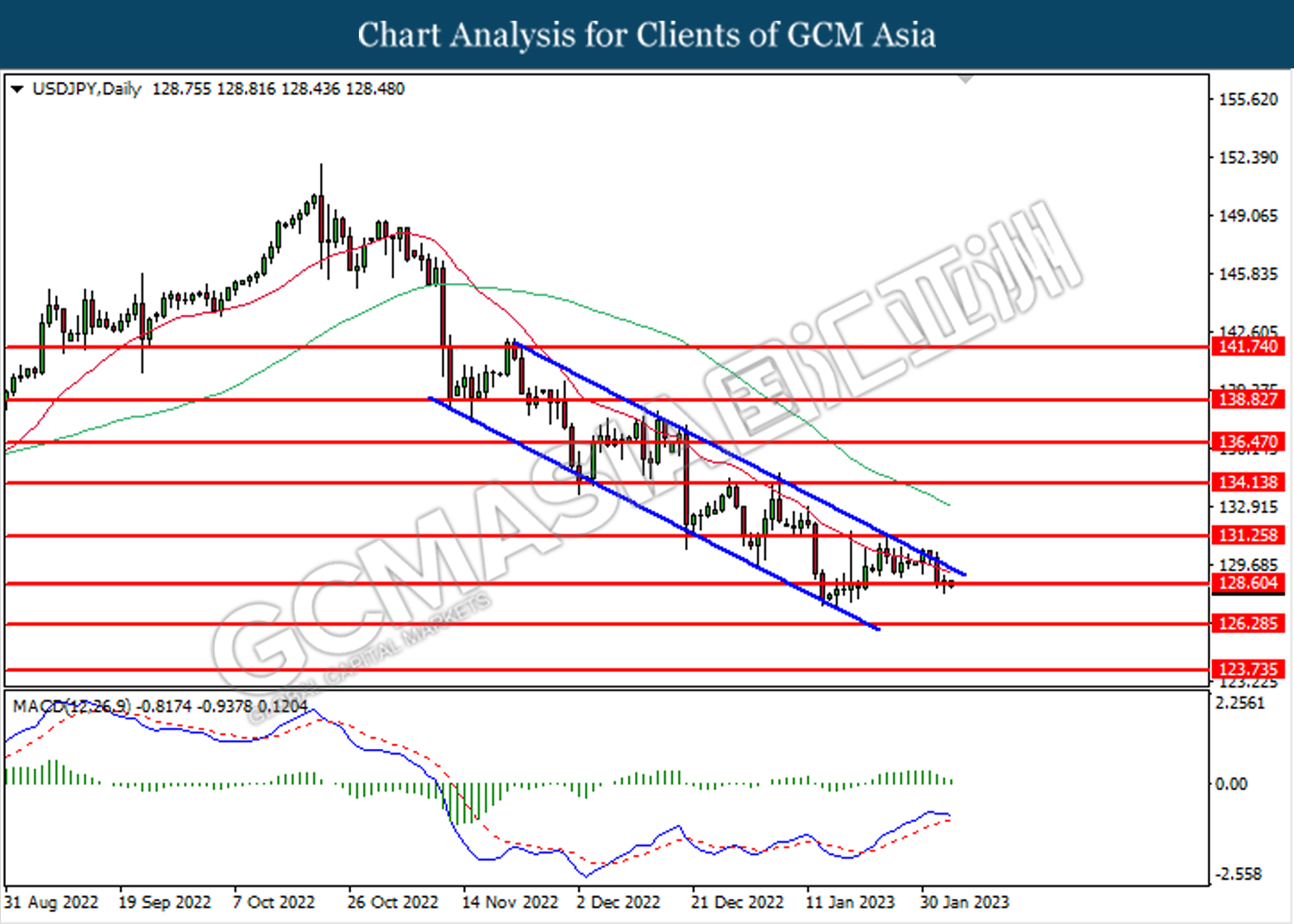

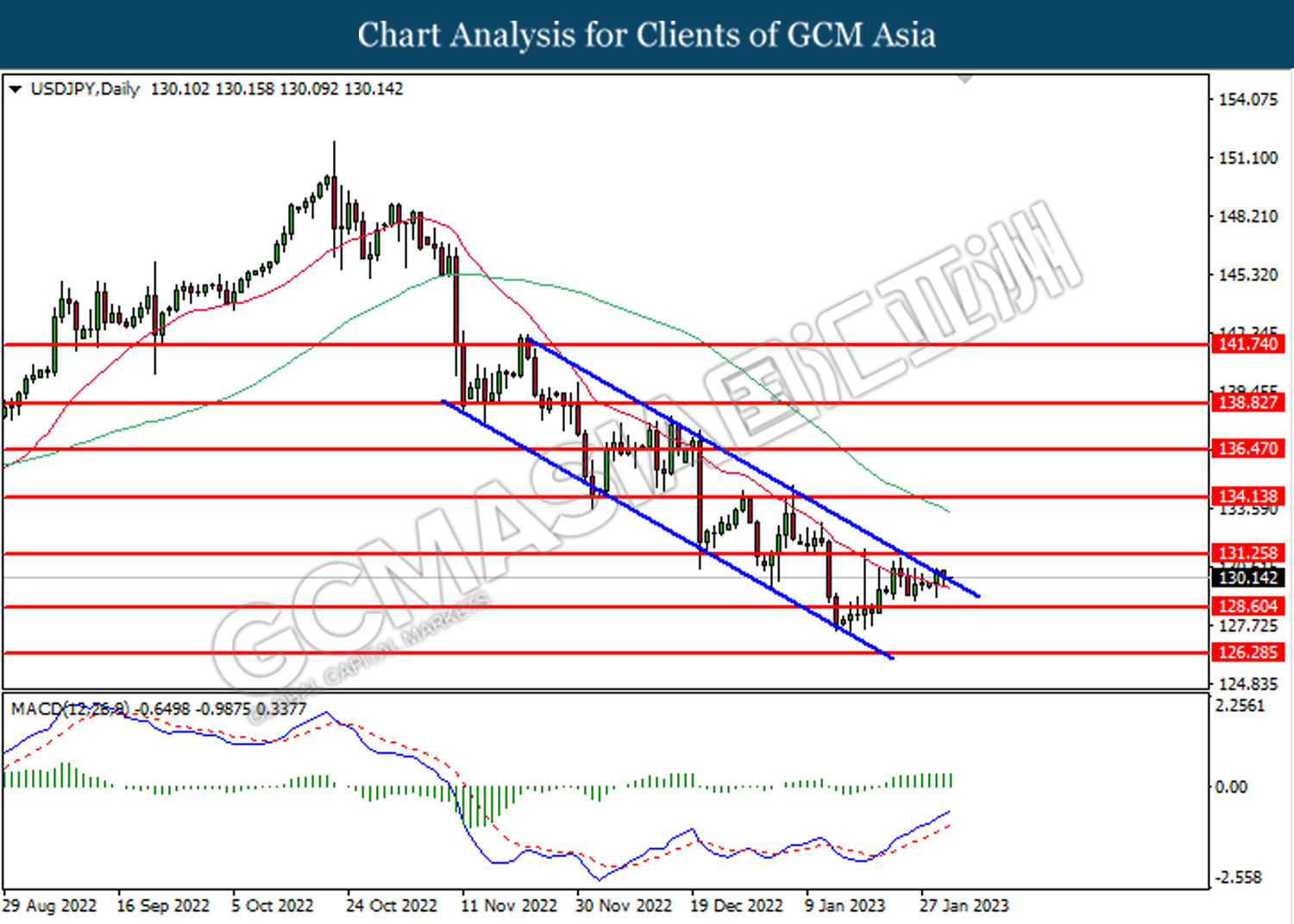

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

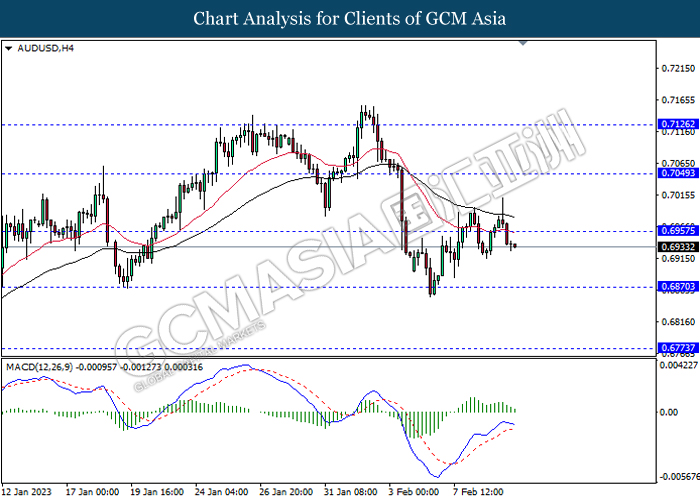

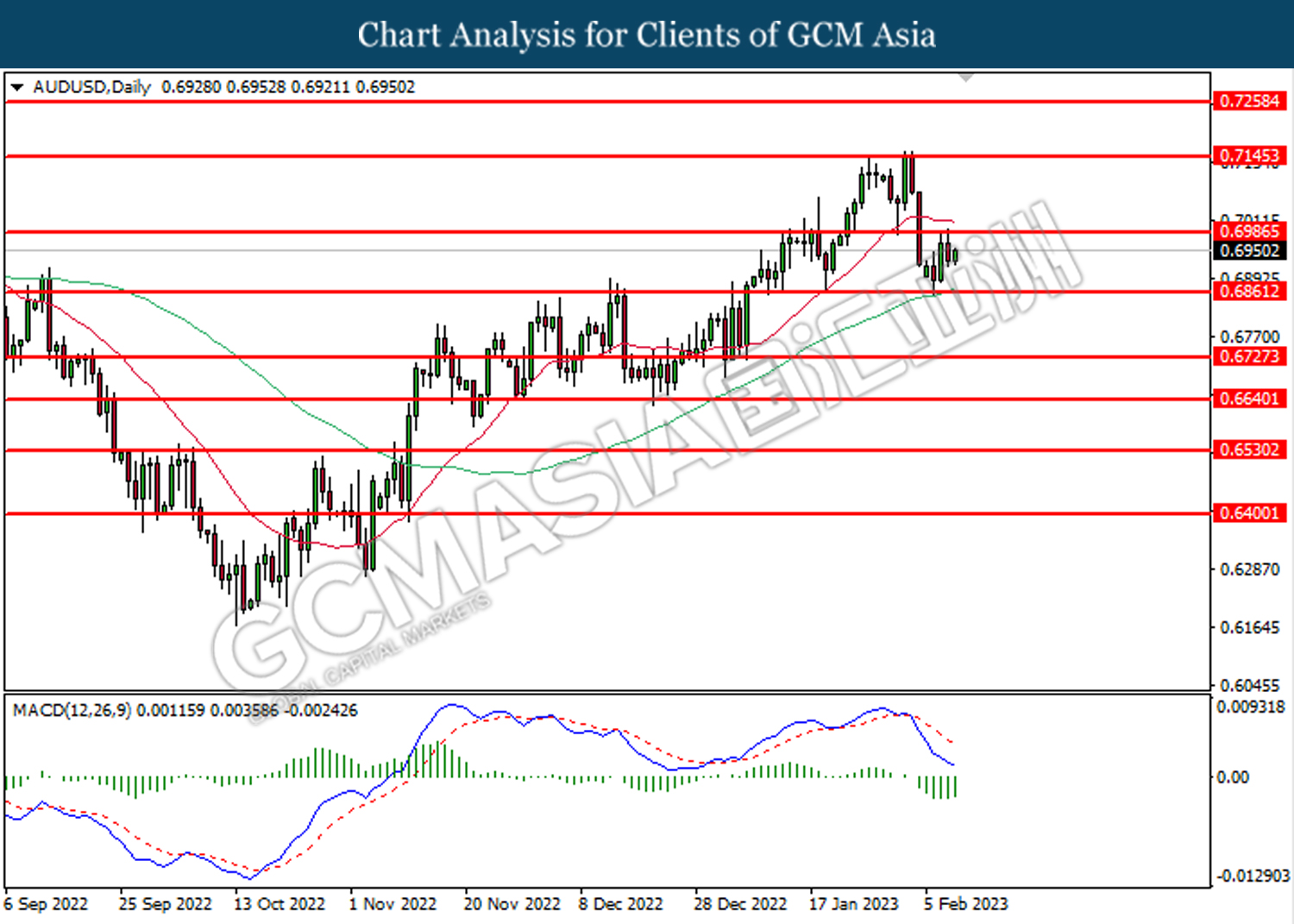

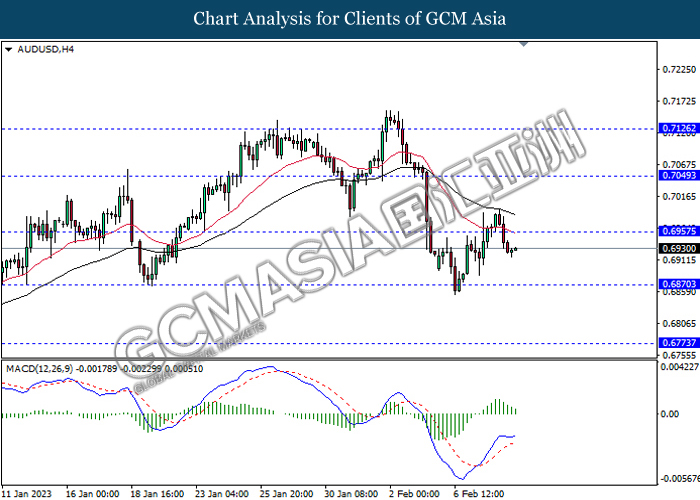

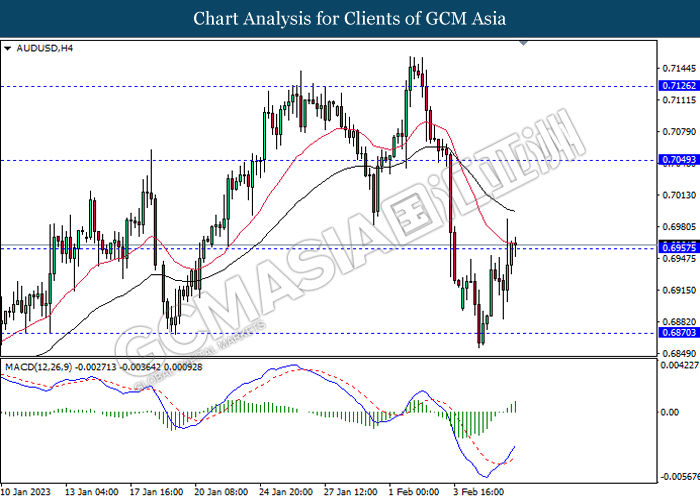

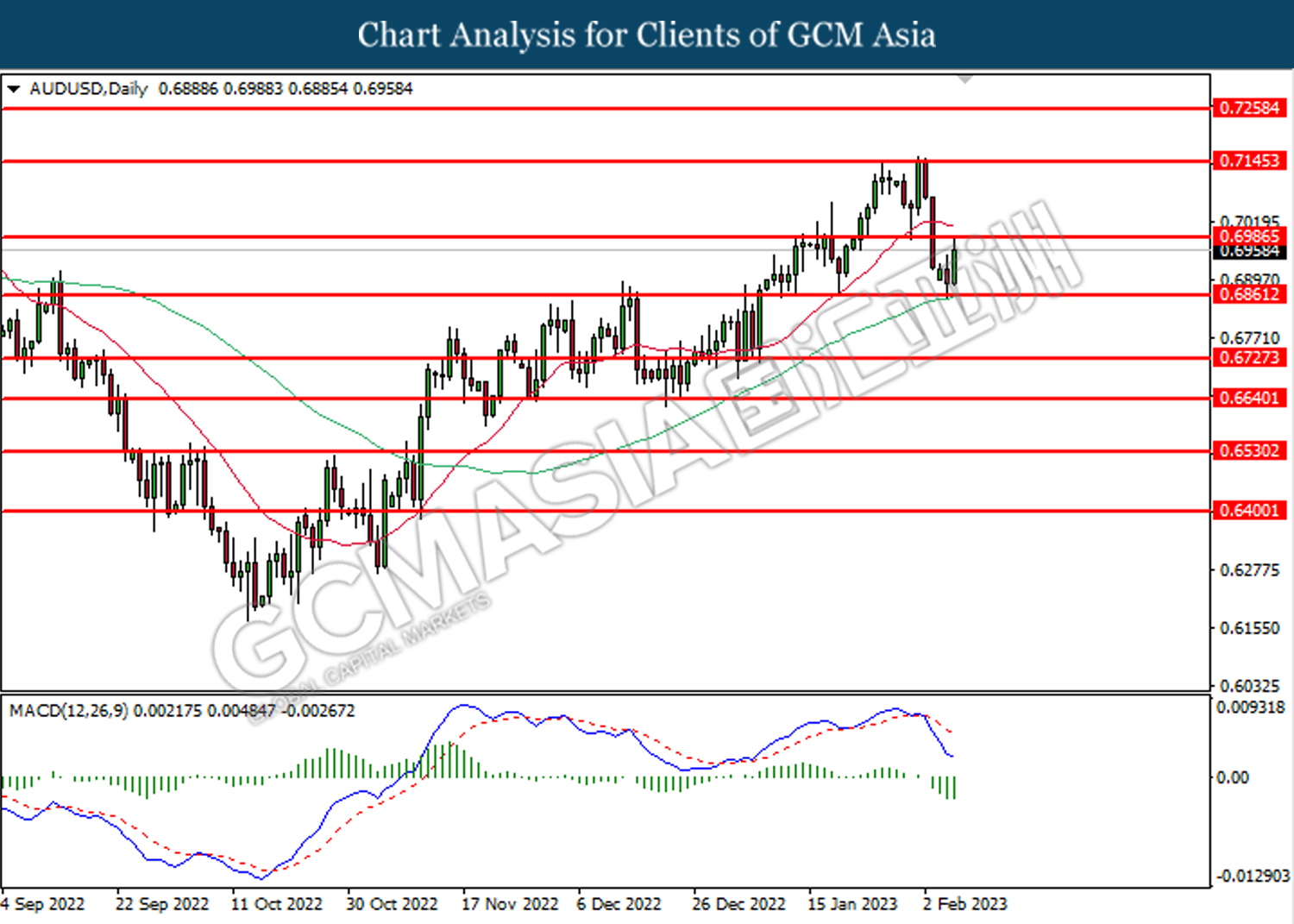

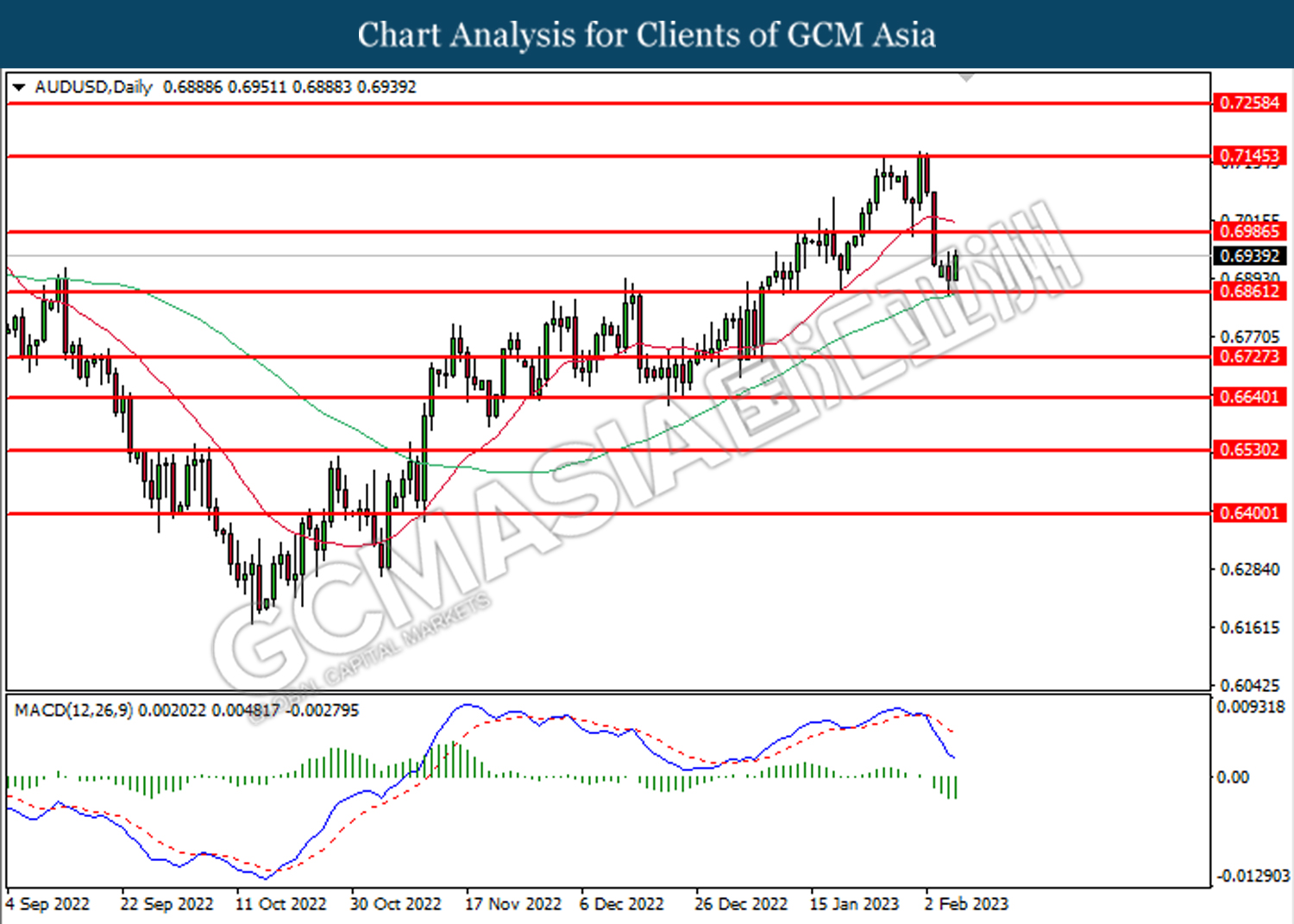

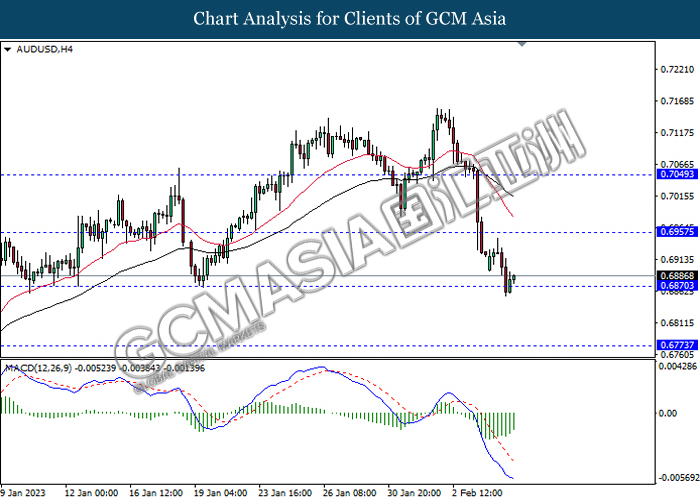

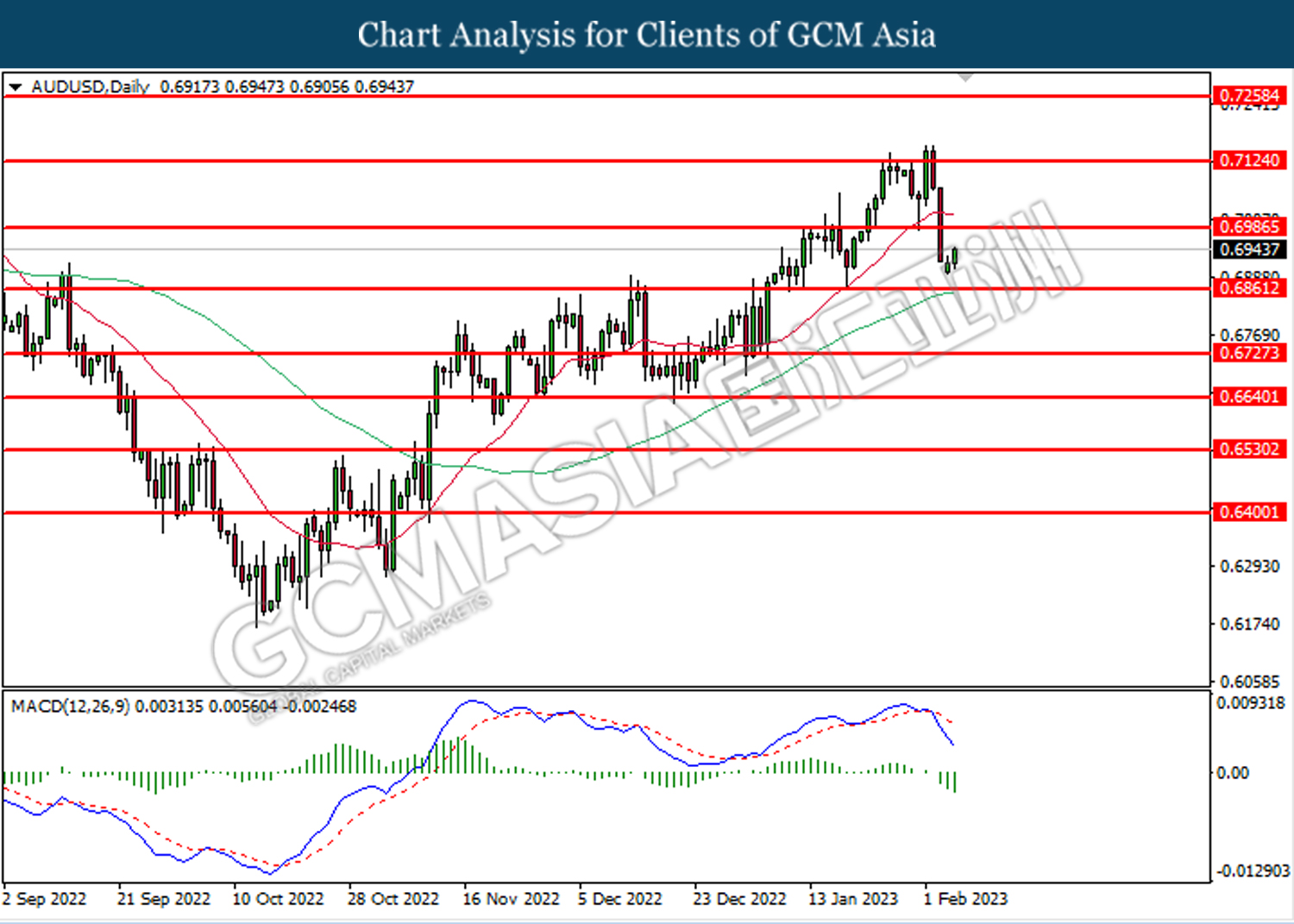

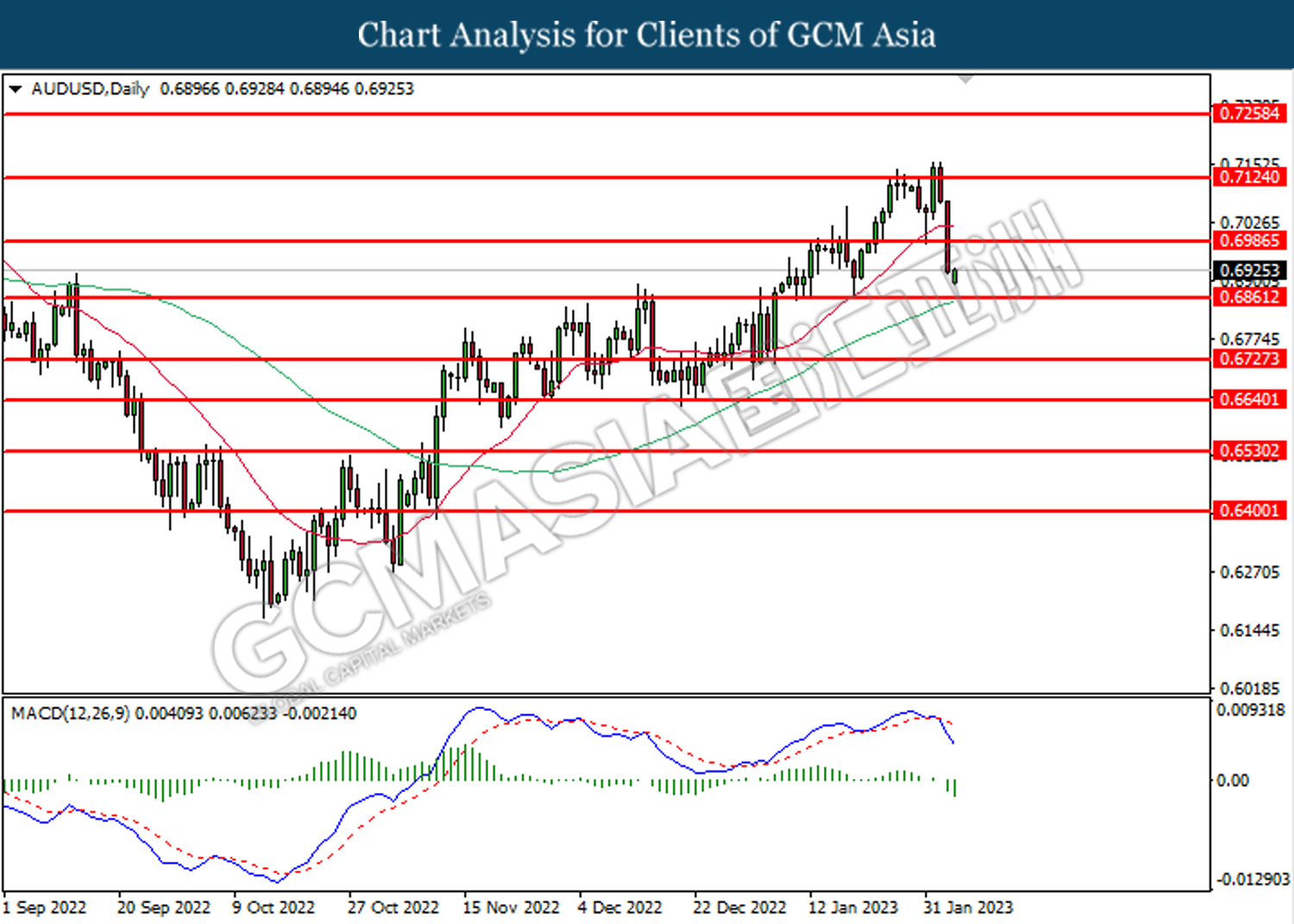

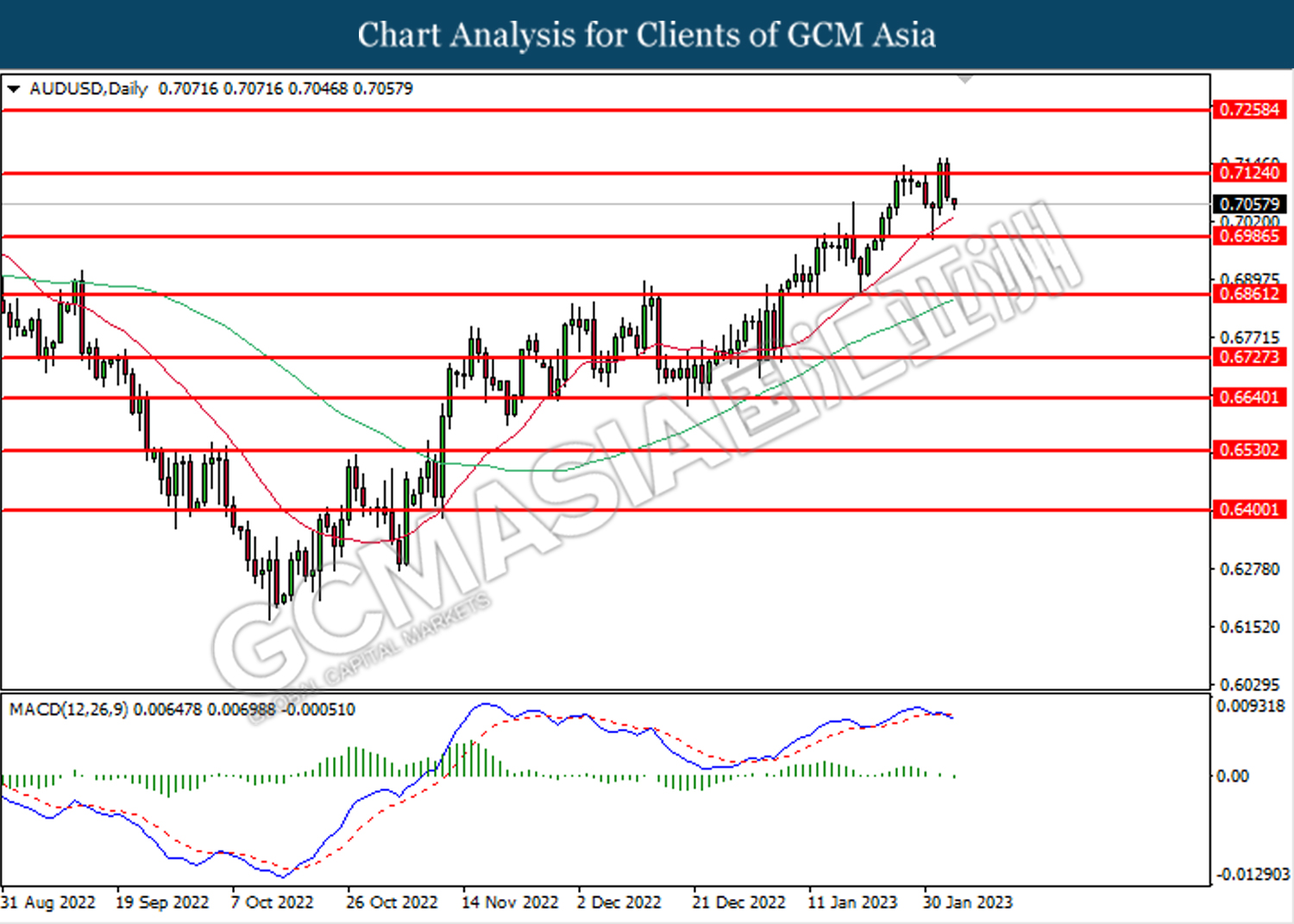

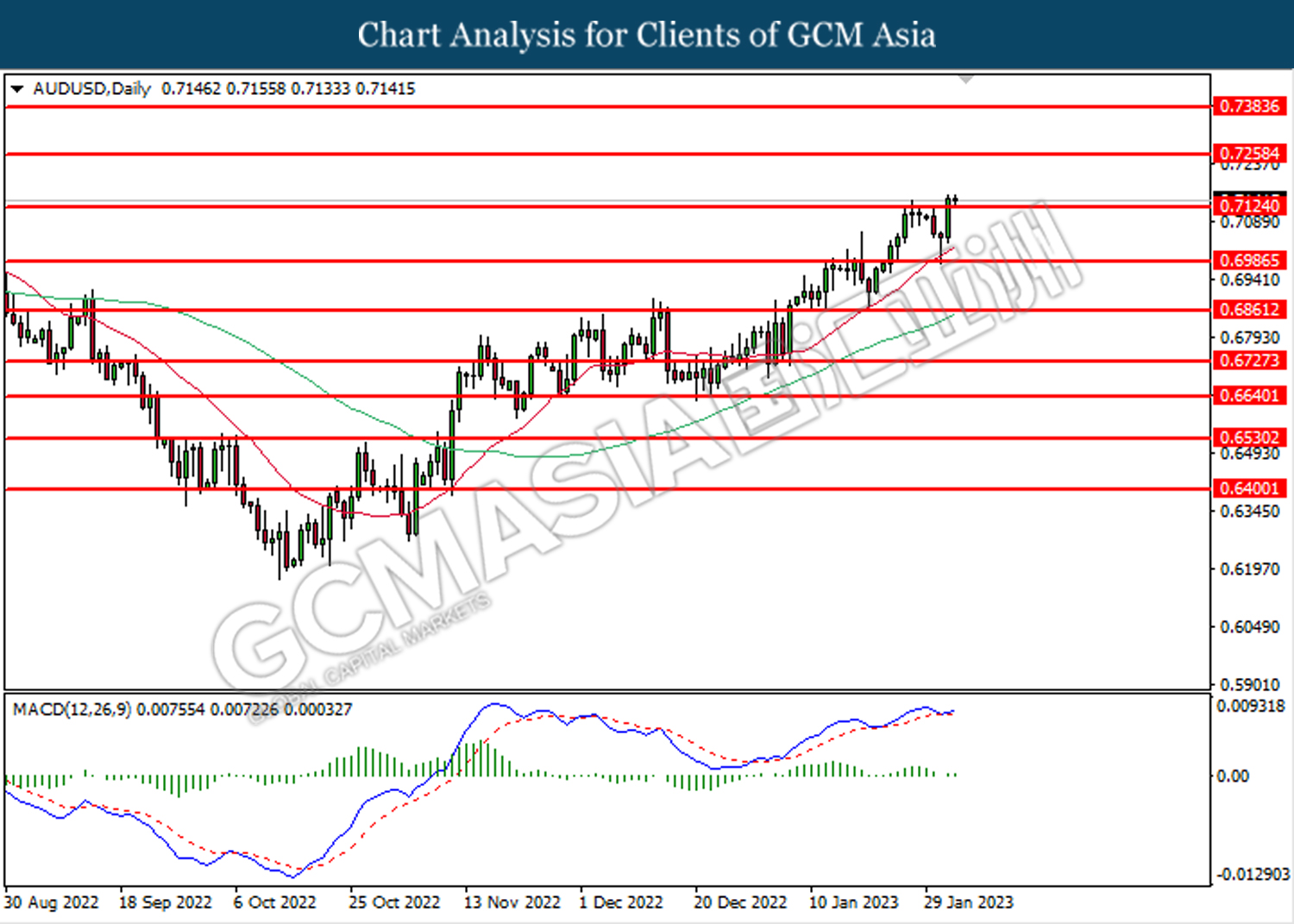

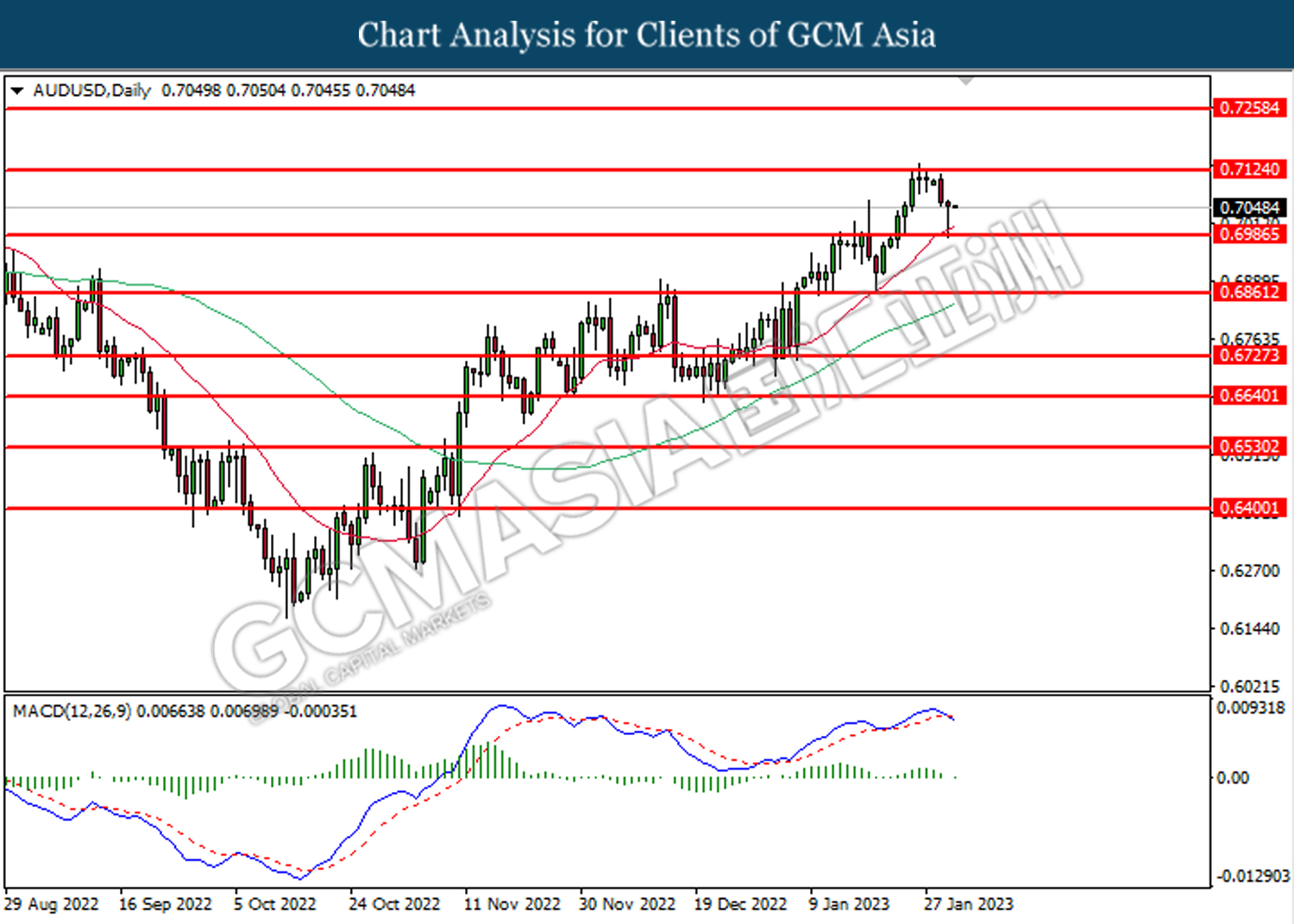

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6955, 0.7050

Support level: 0.6870, 0.6775

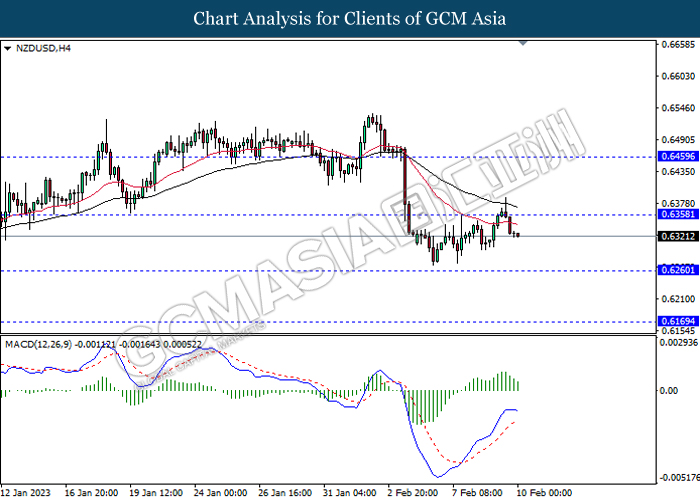

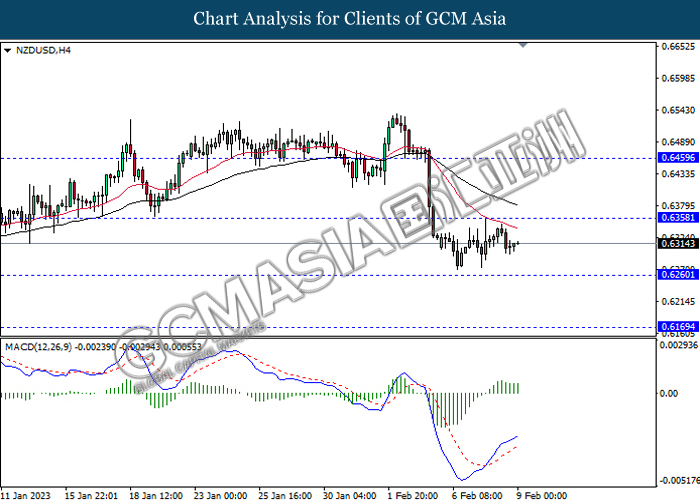

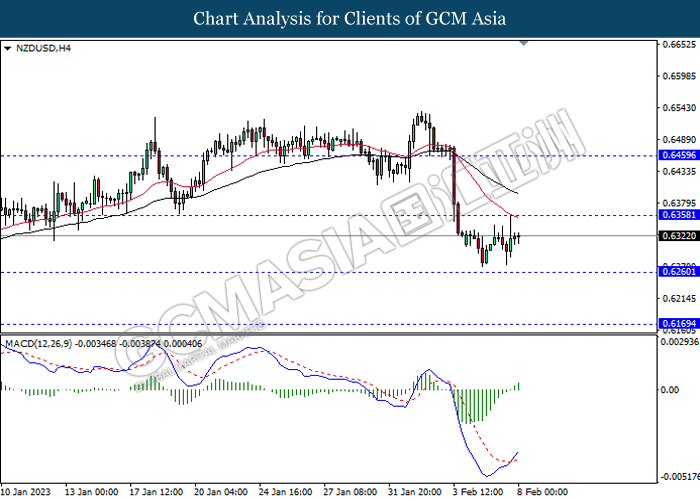

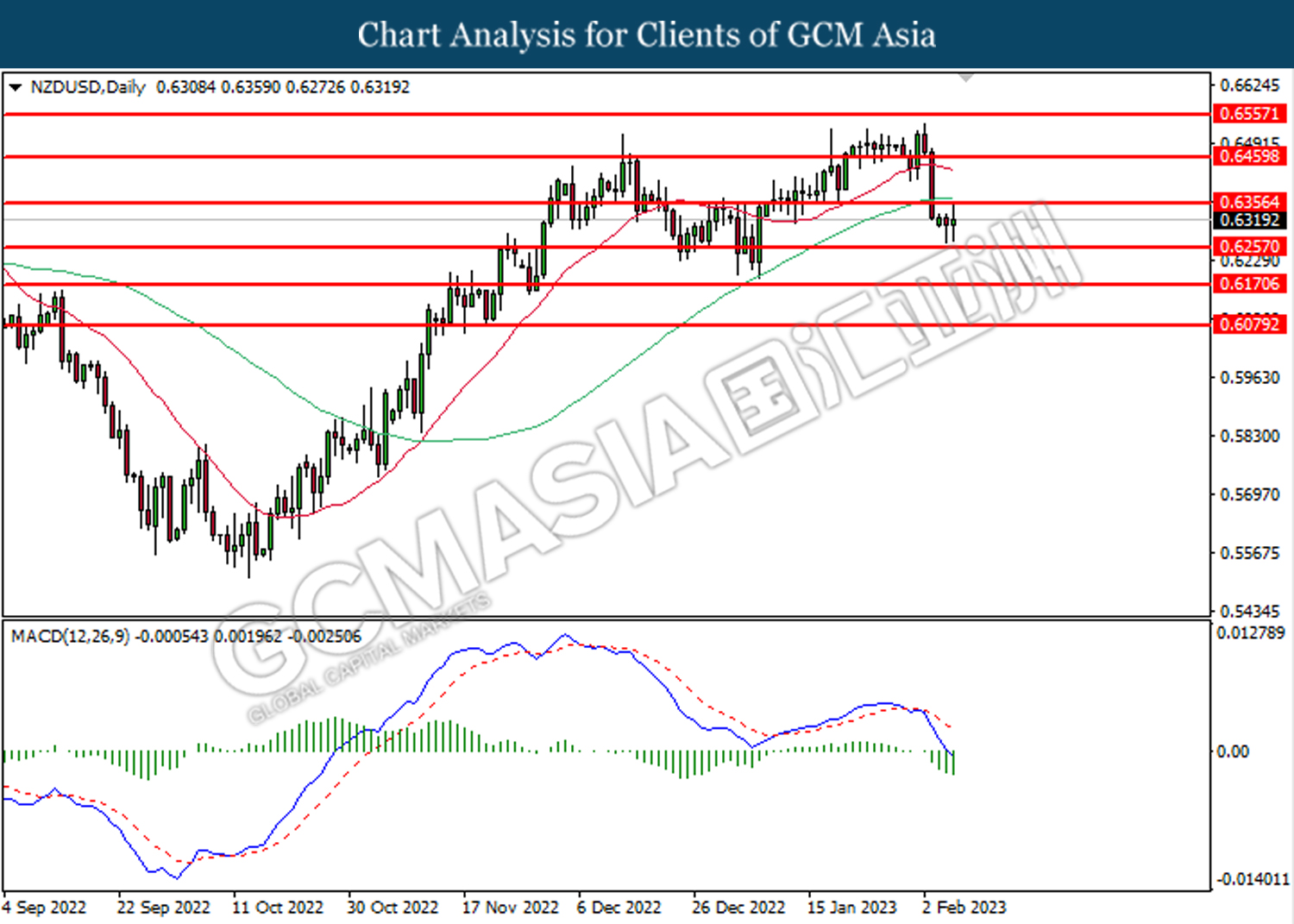

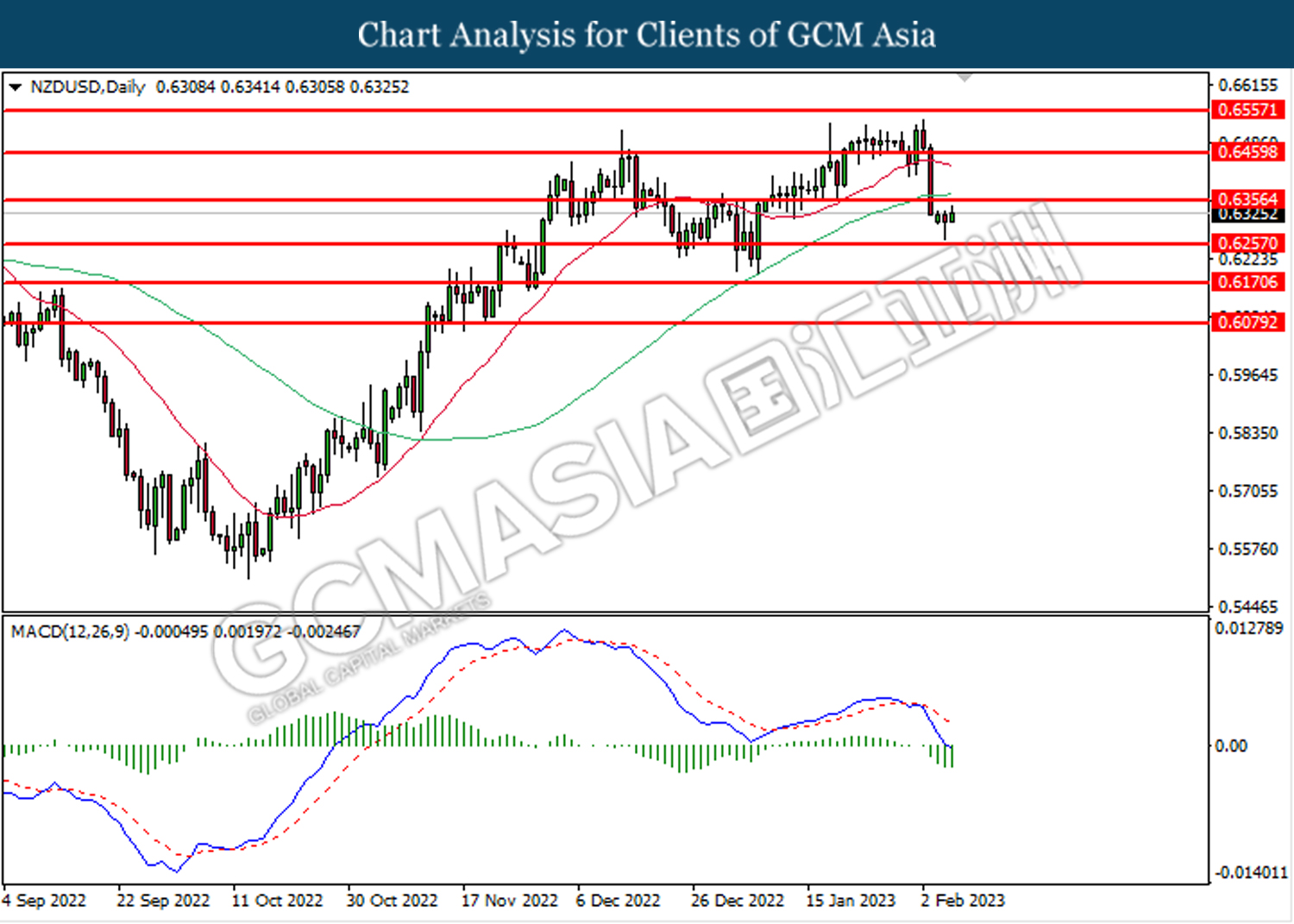

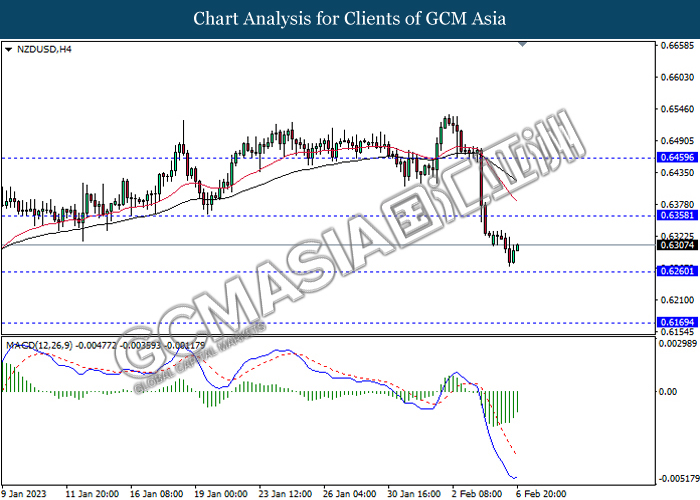

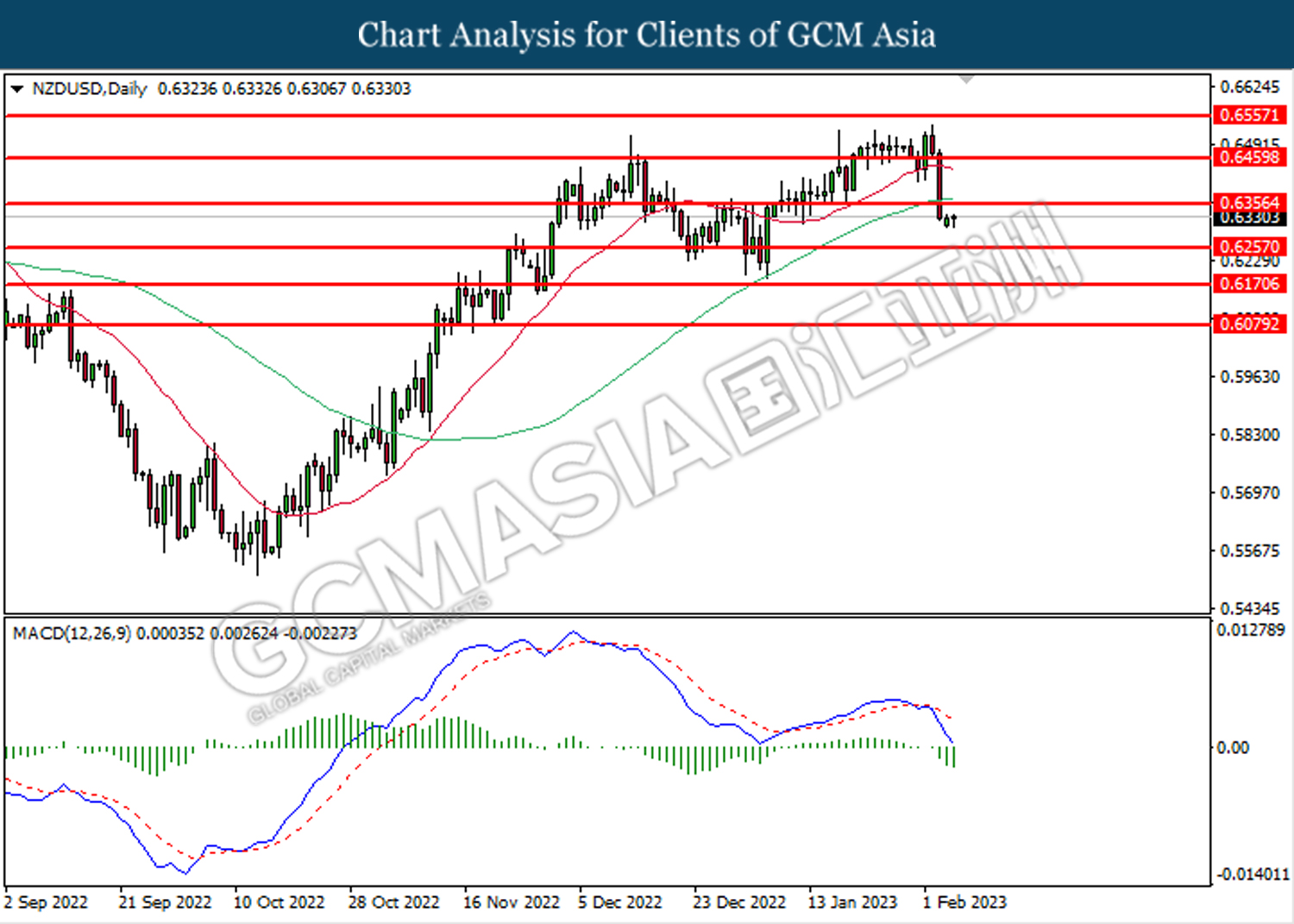

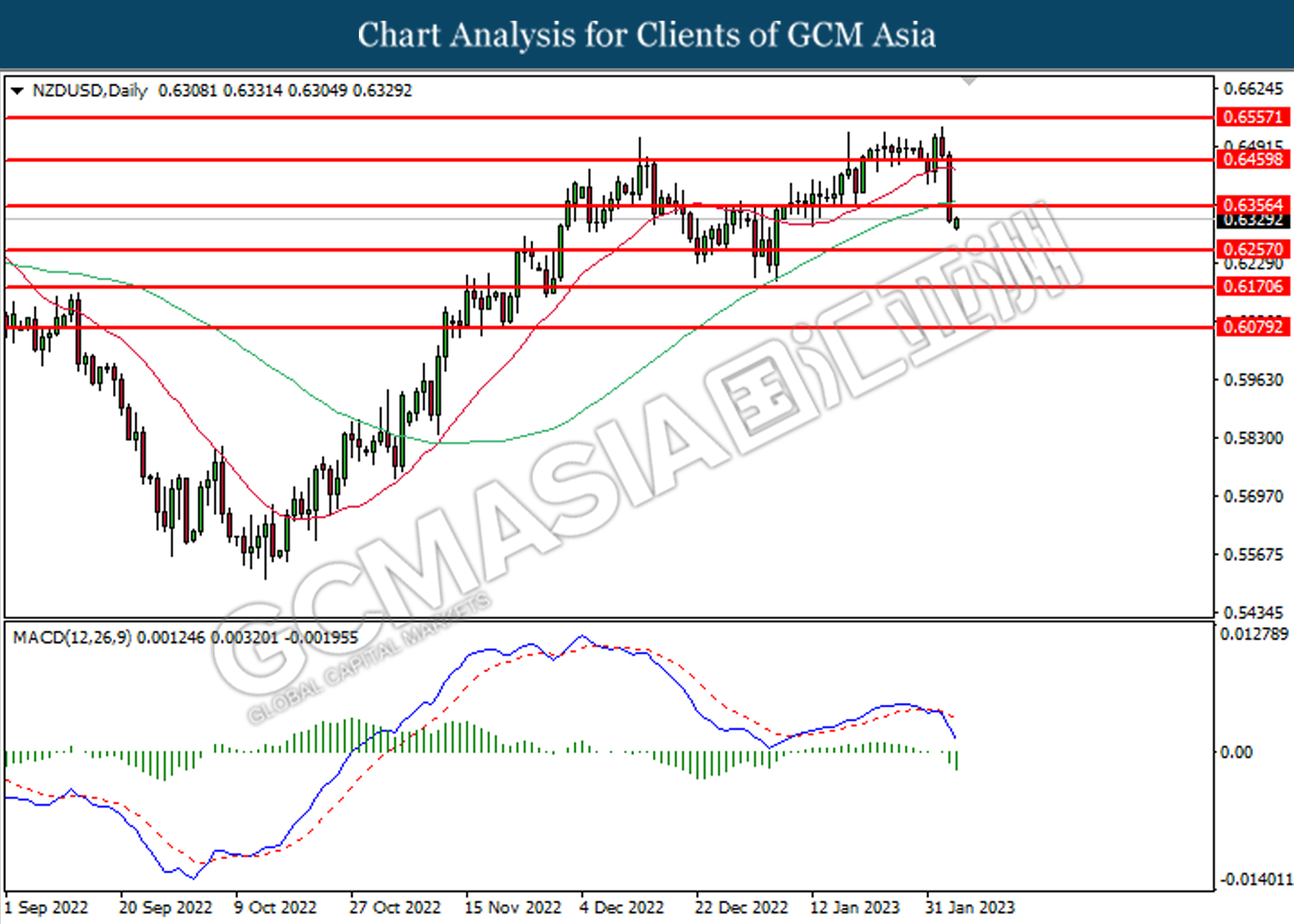

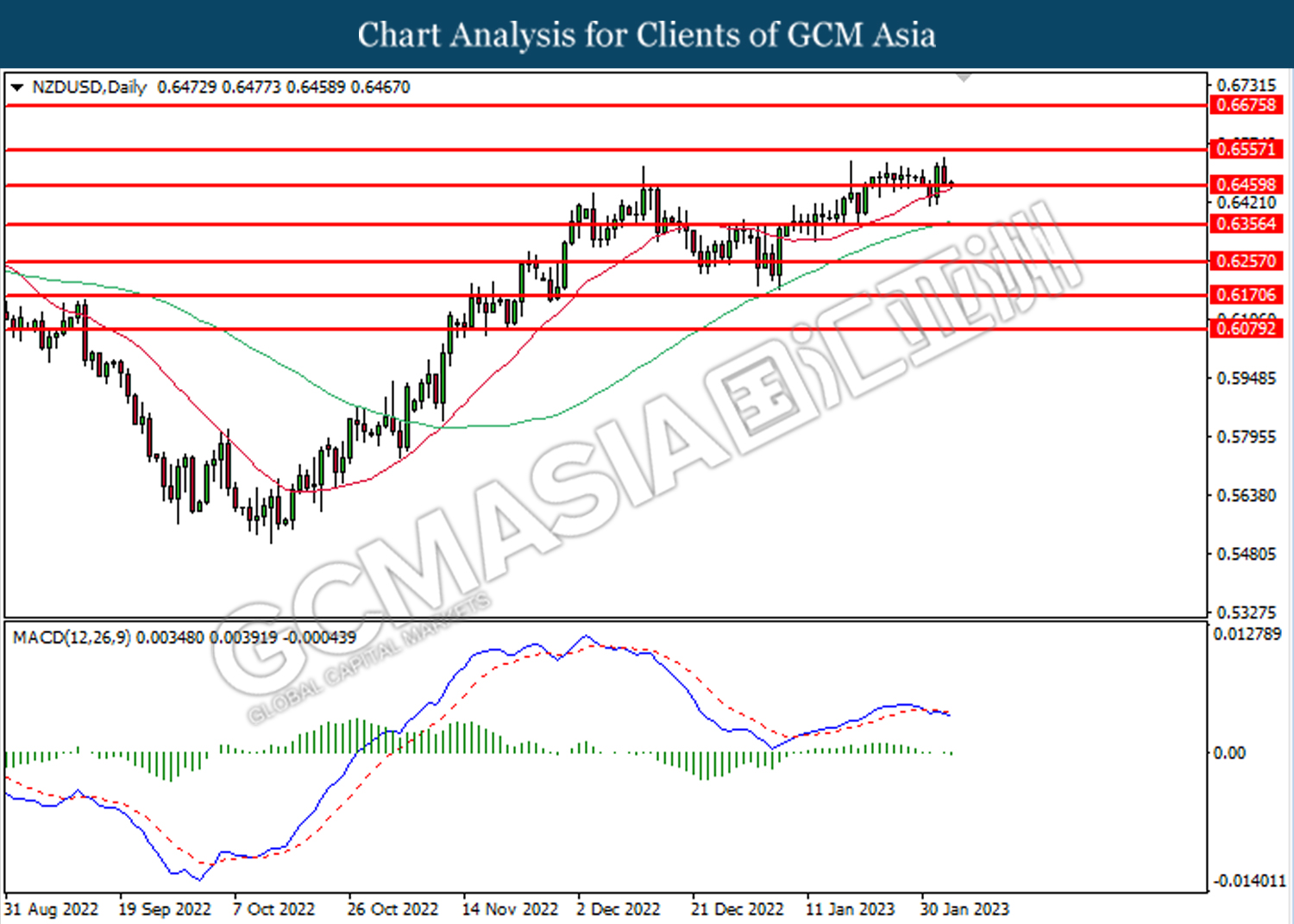

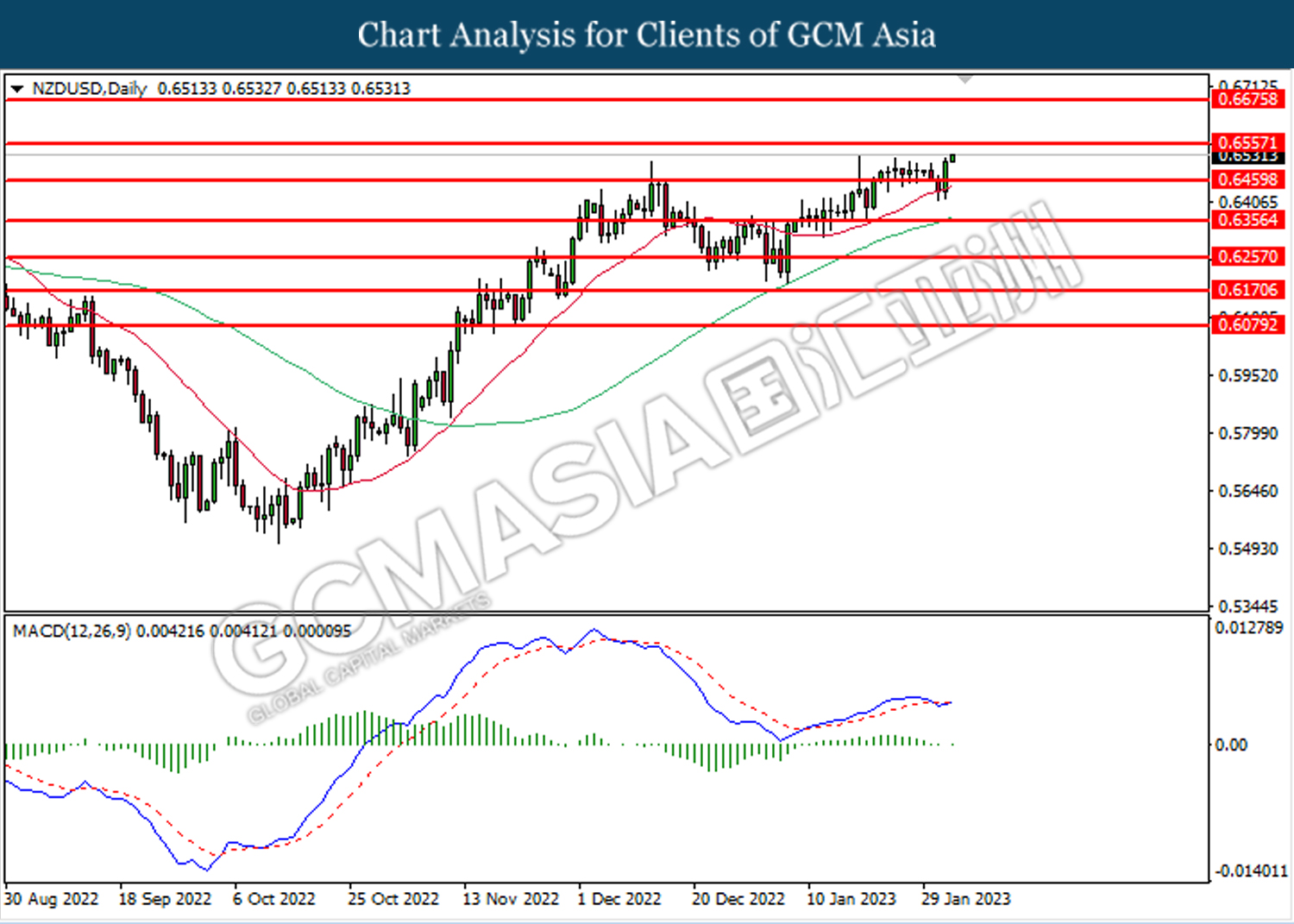

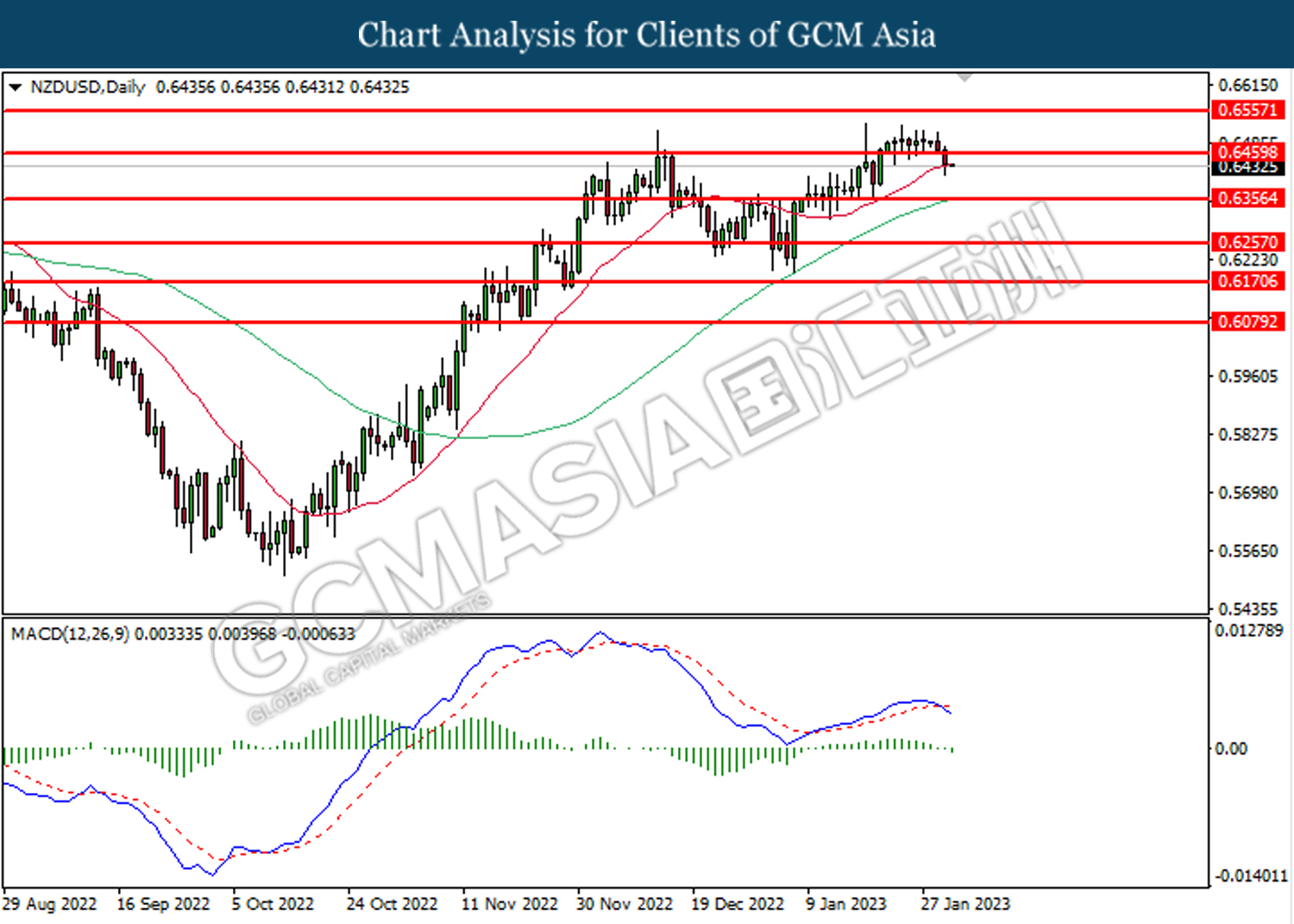

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6170

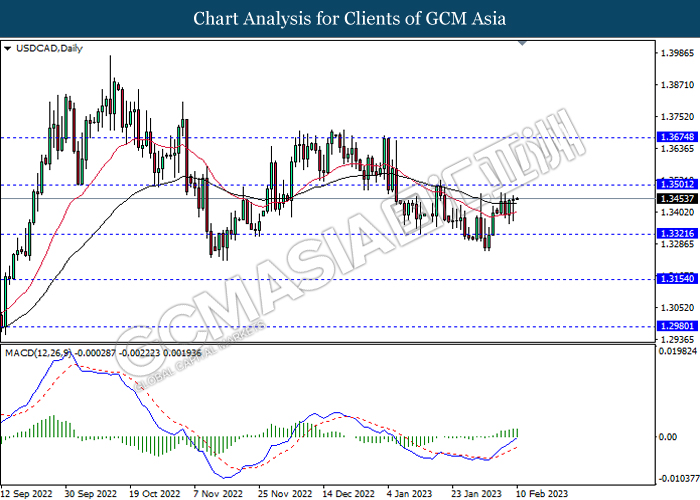

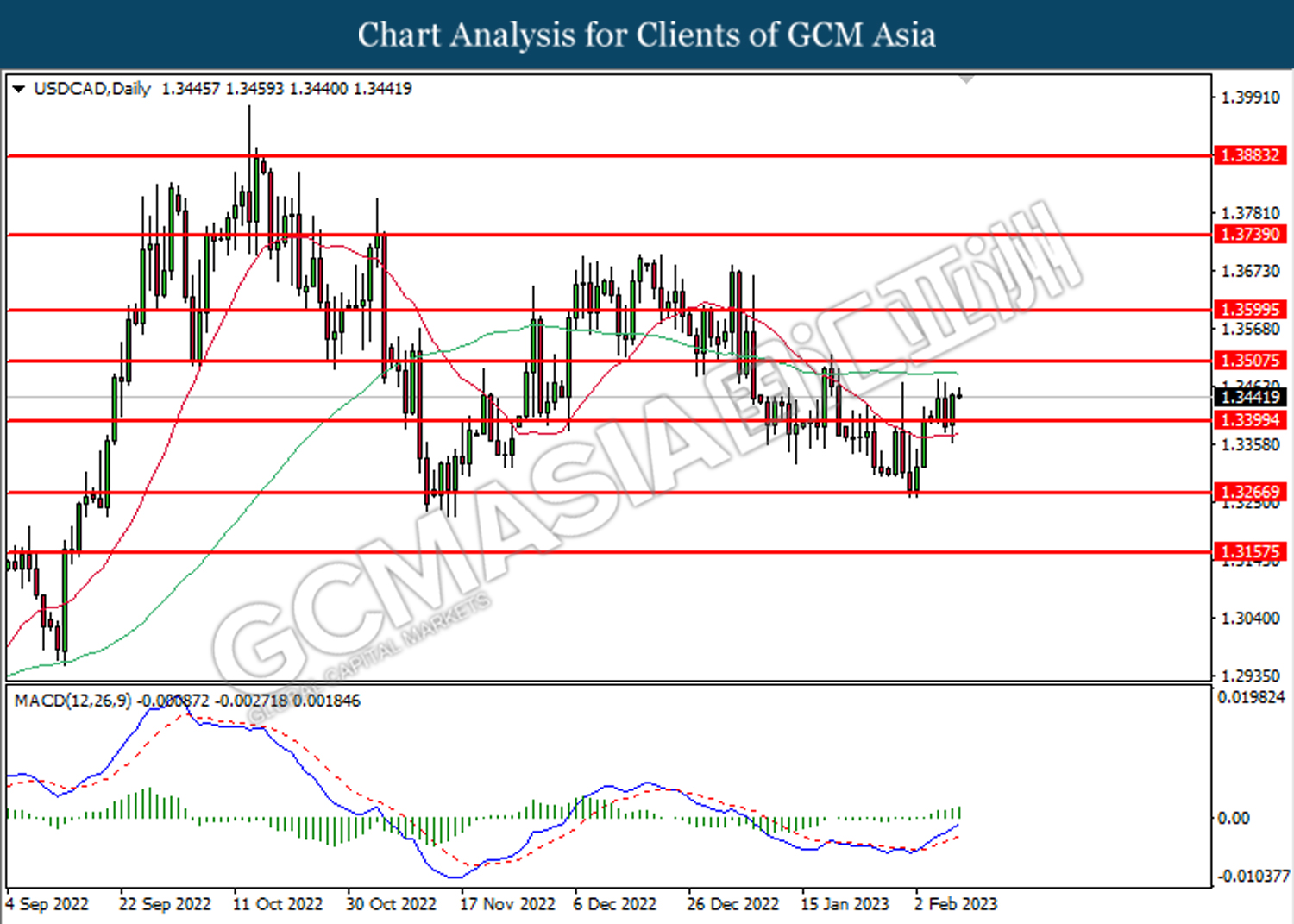

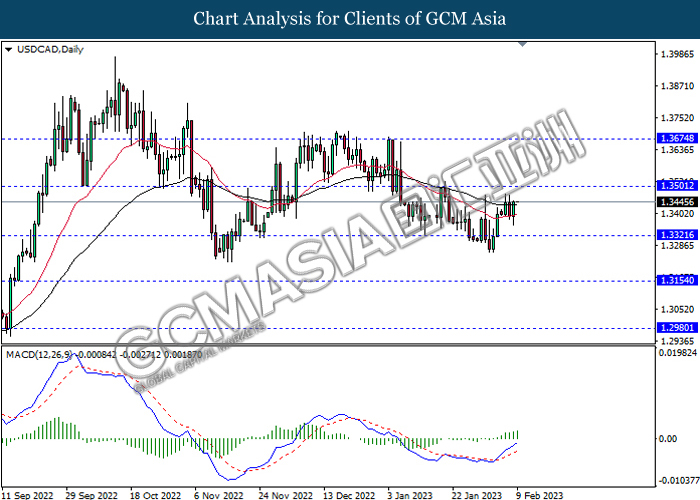

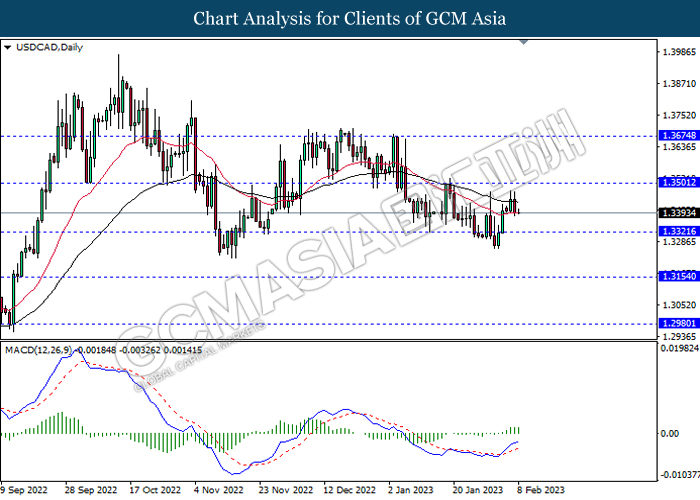

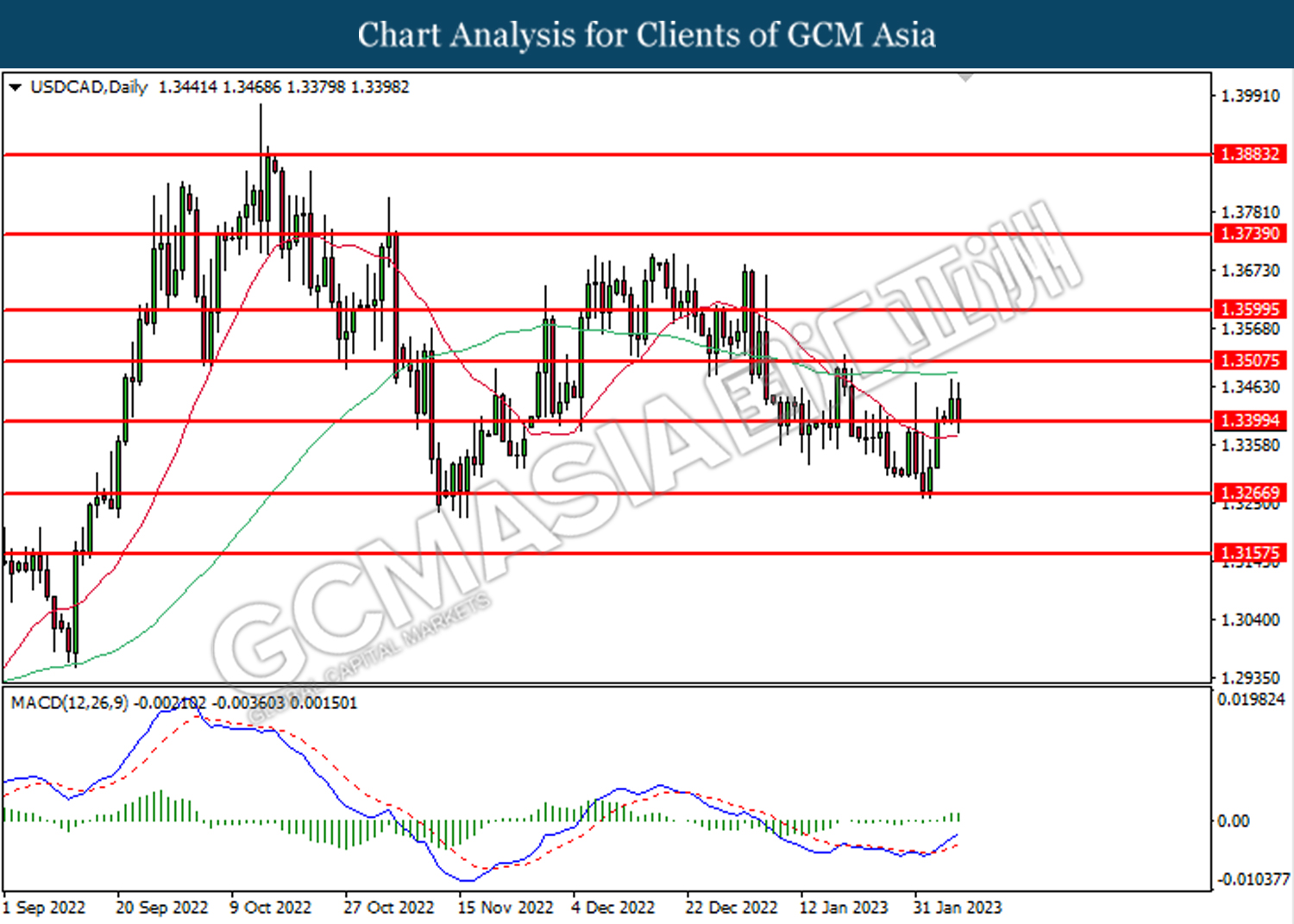

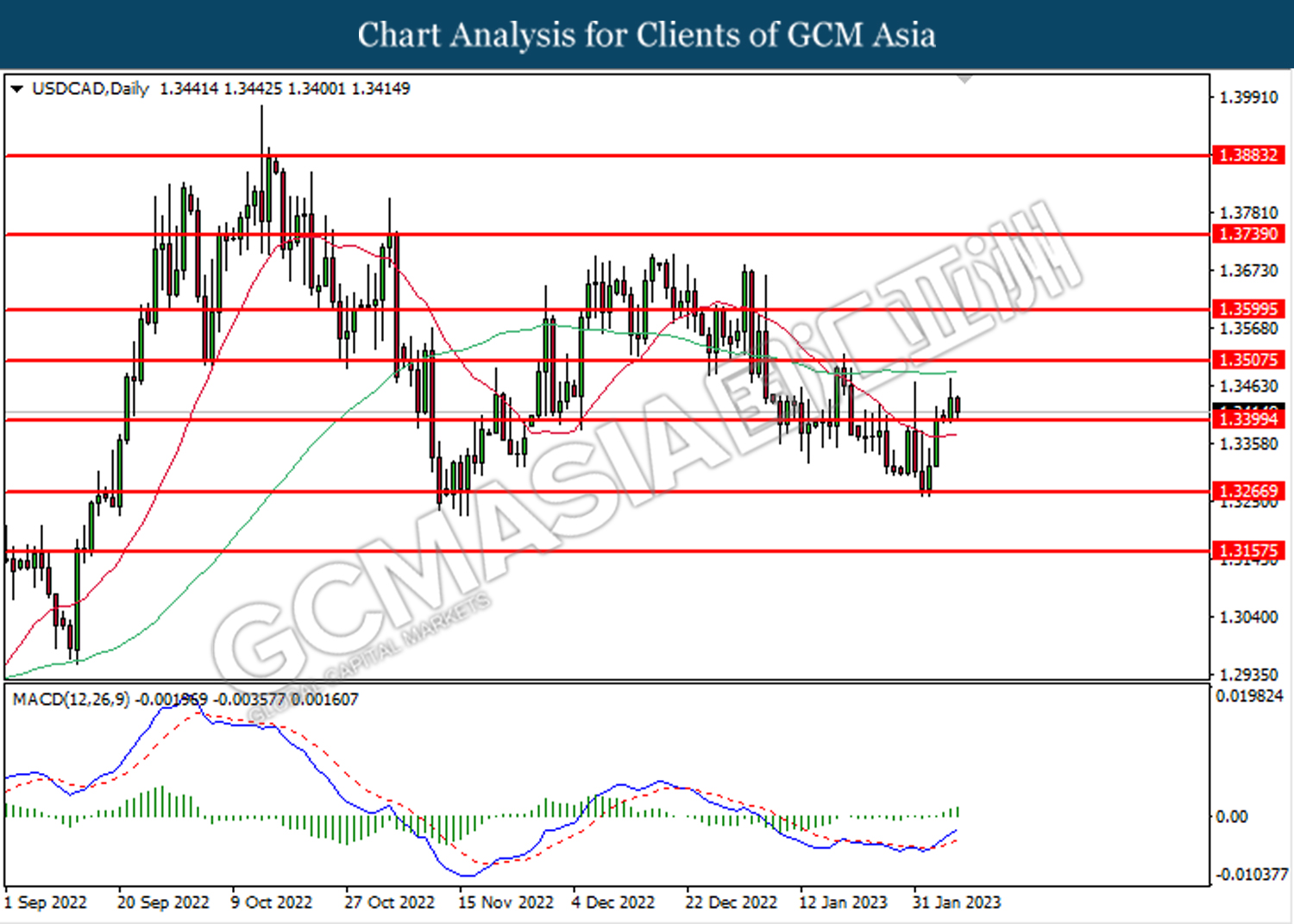

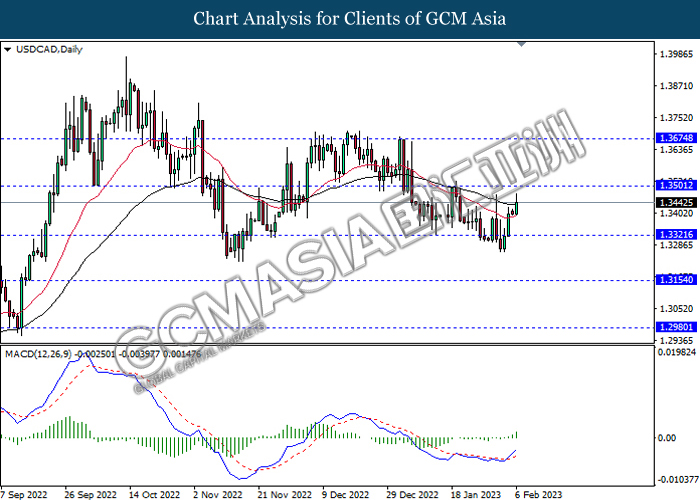

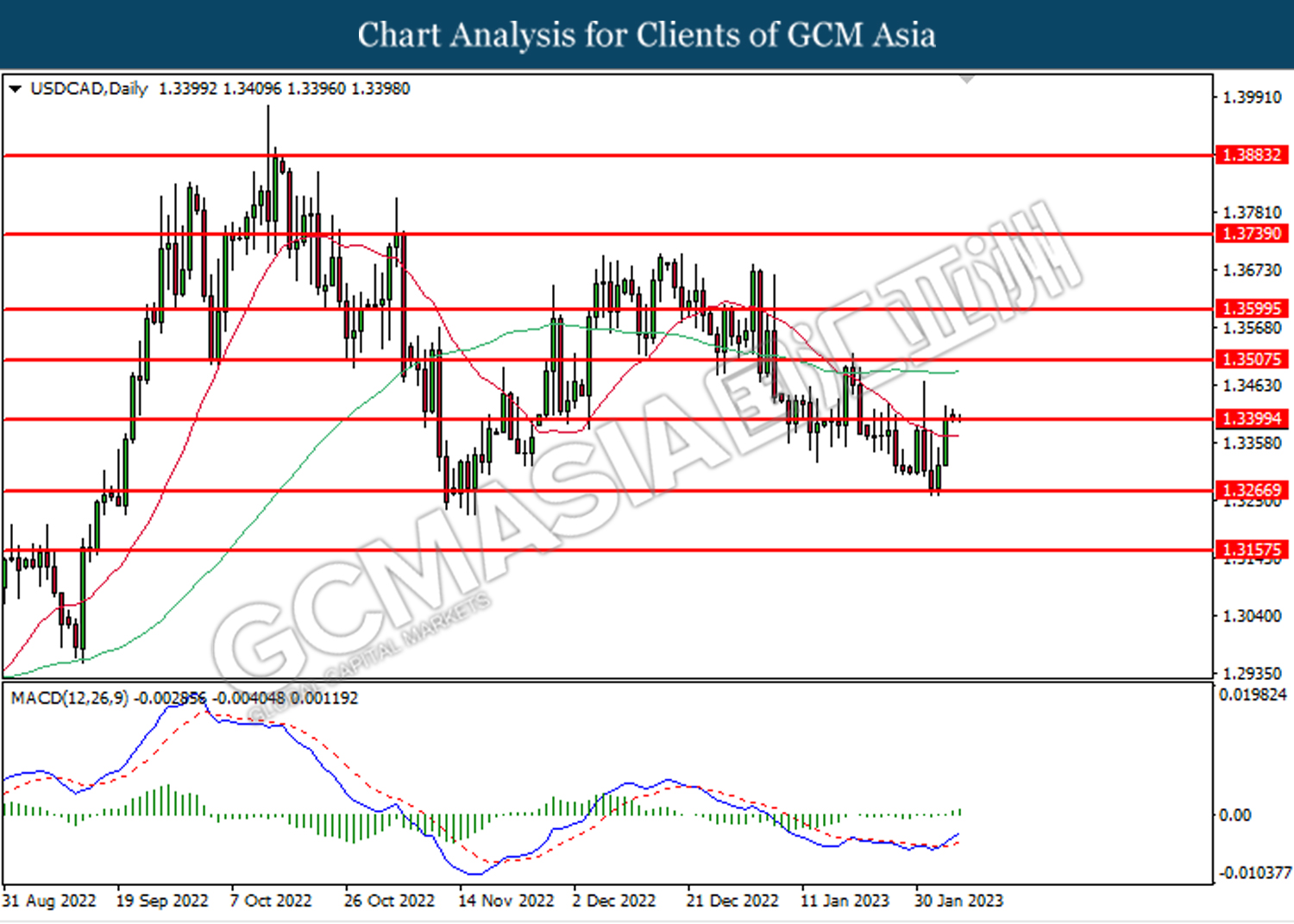

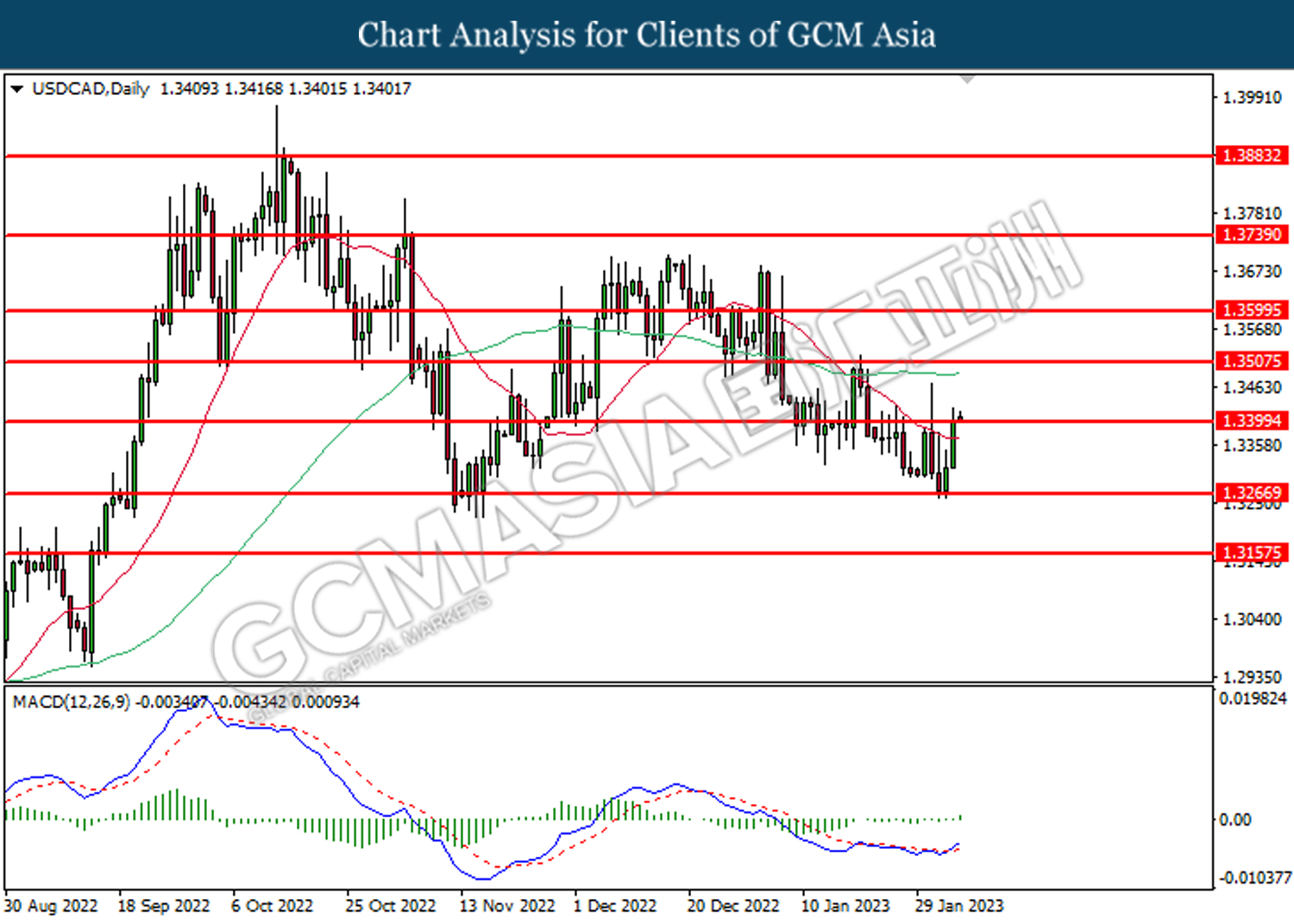

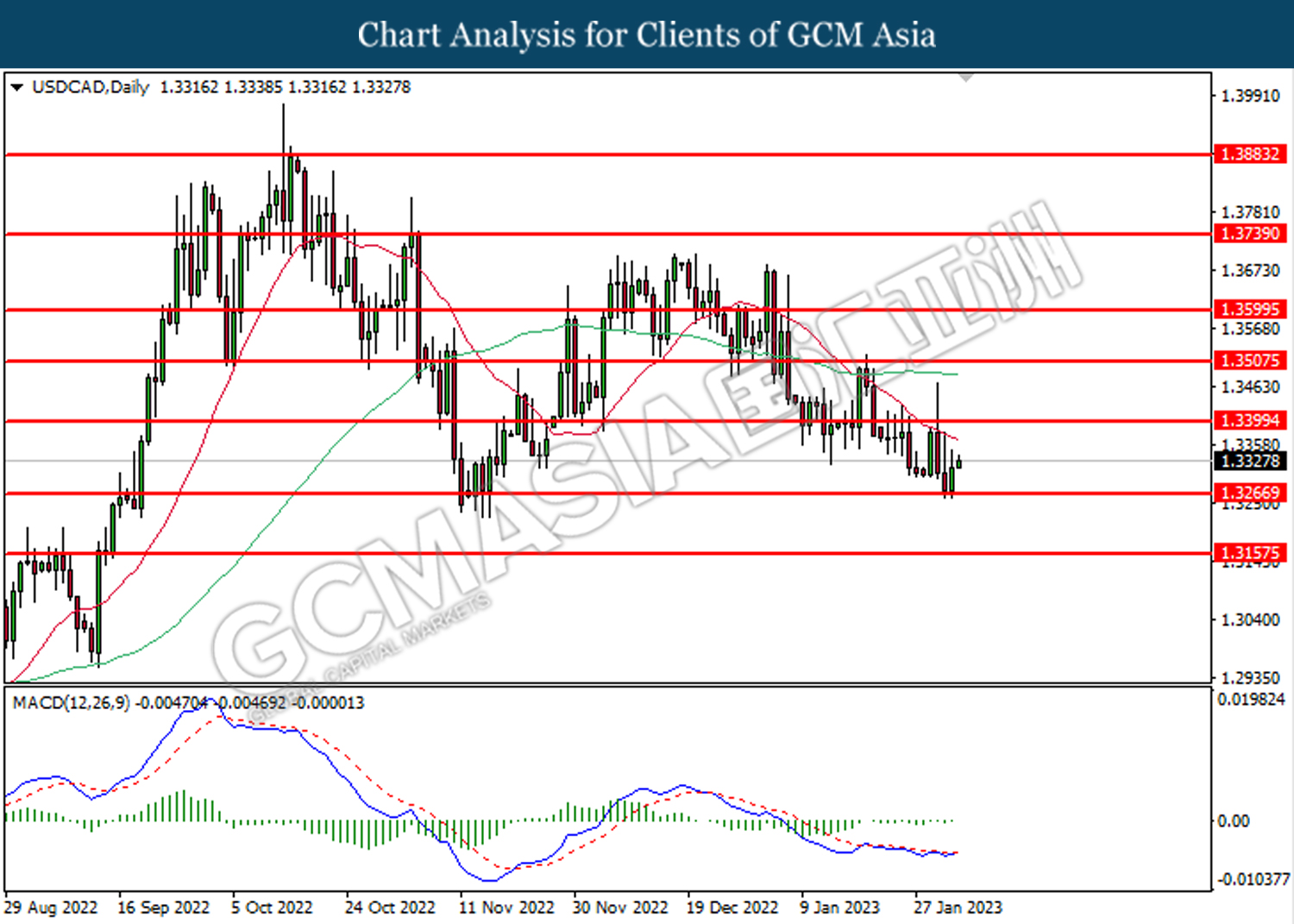

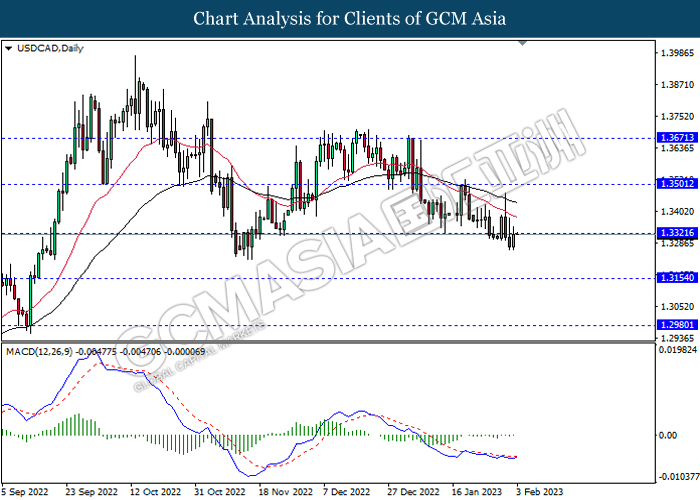

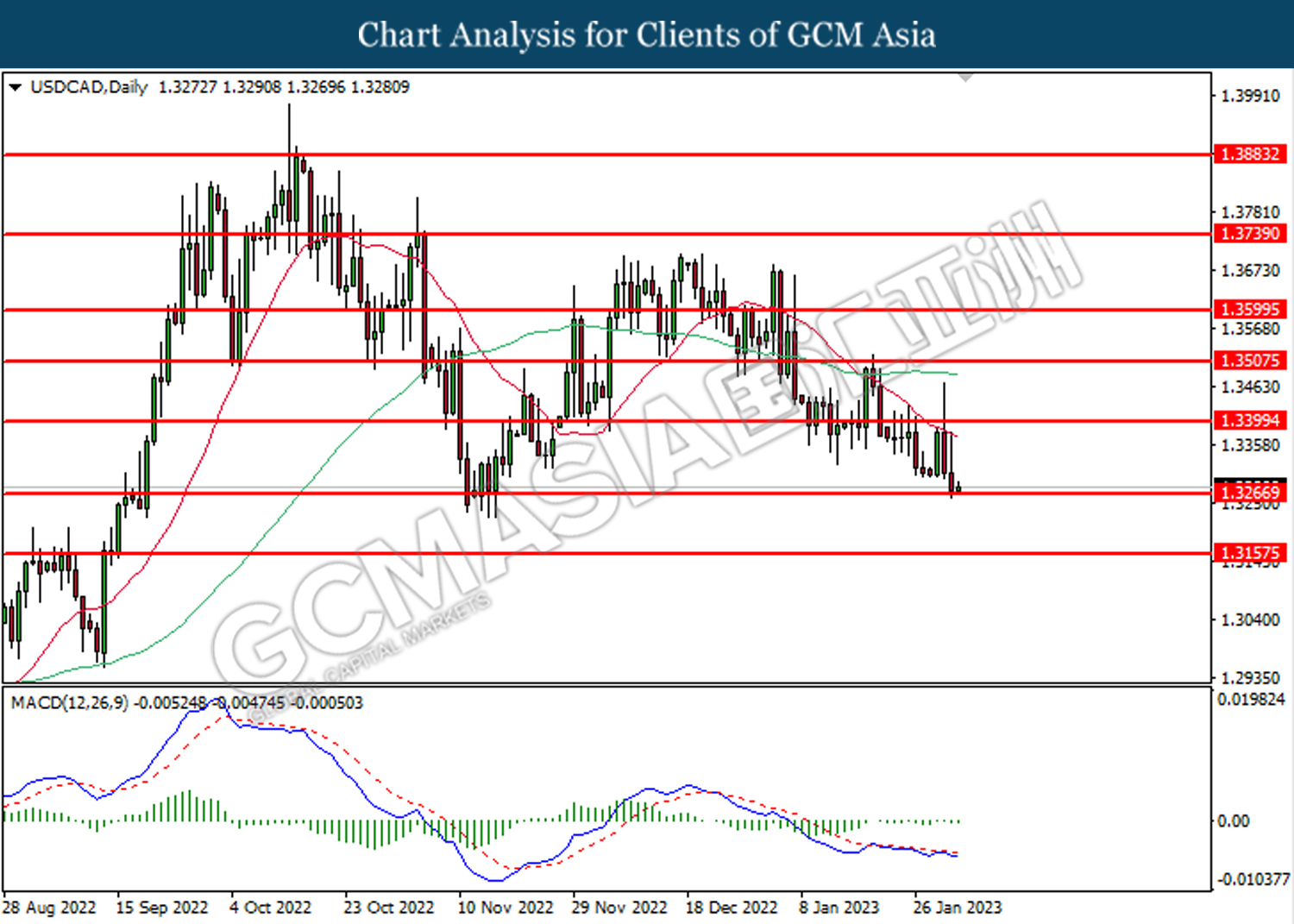

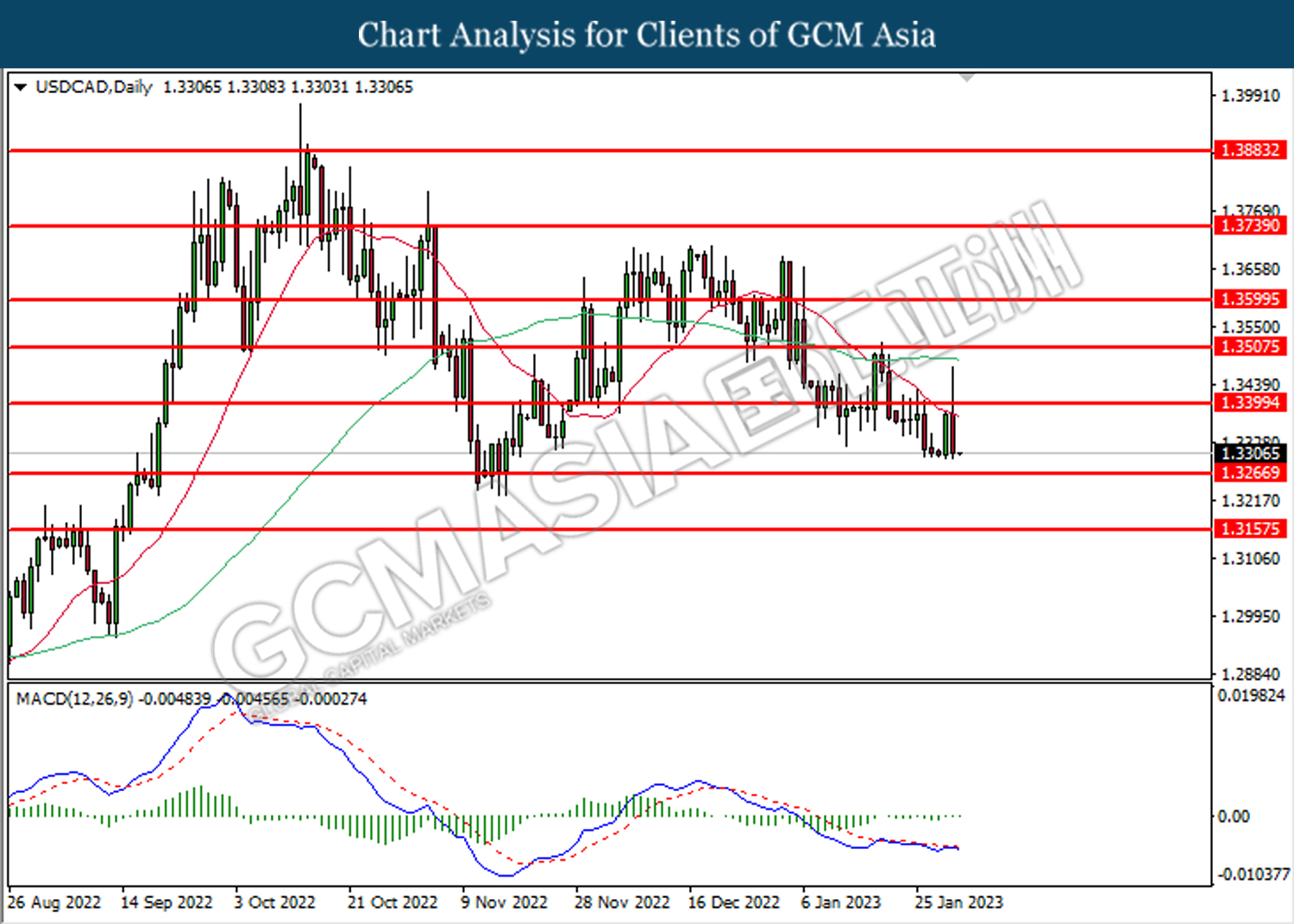

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3320, 1.3155

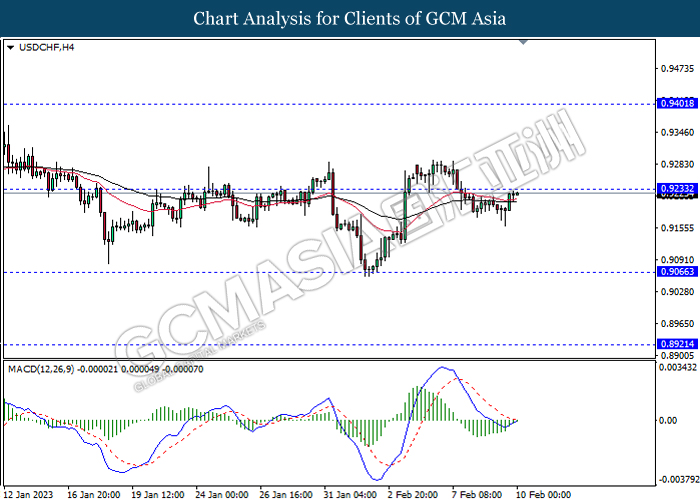

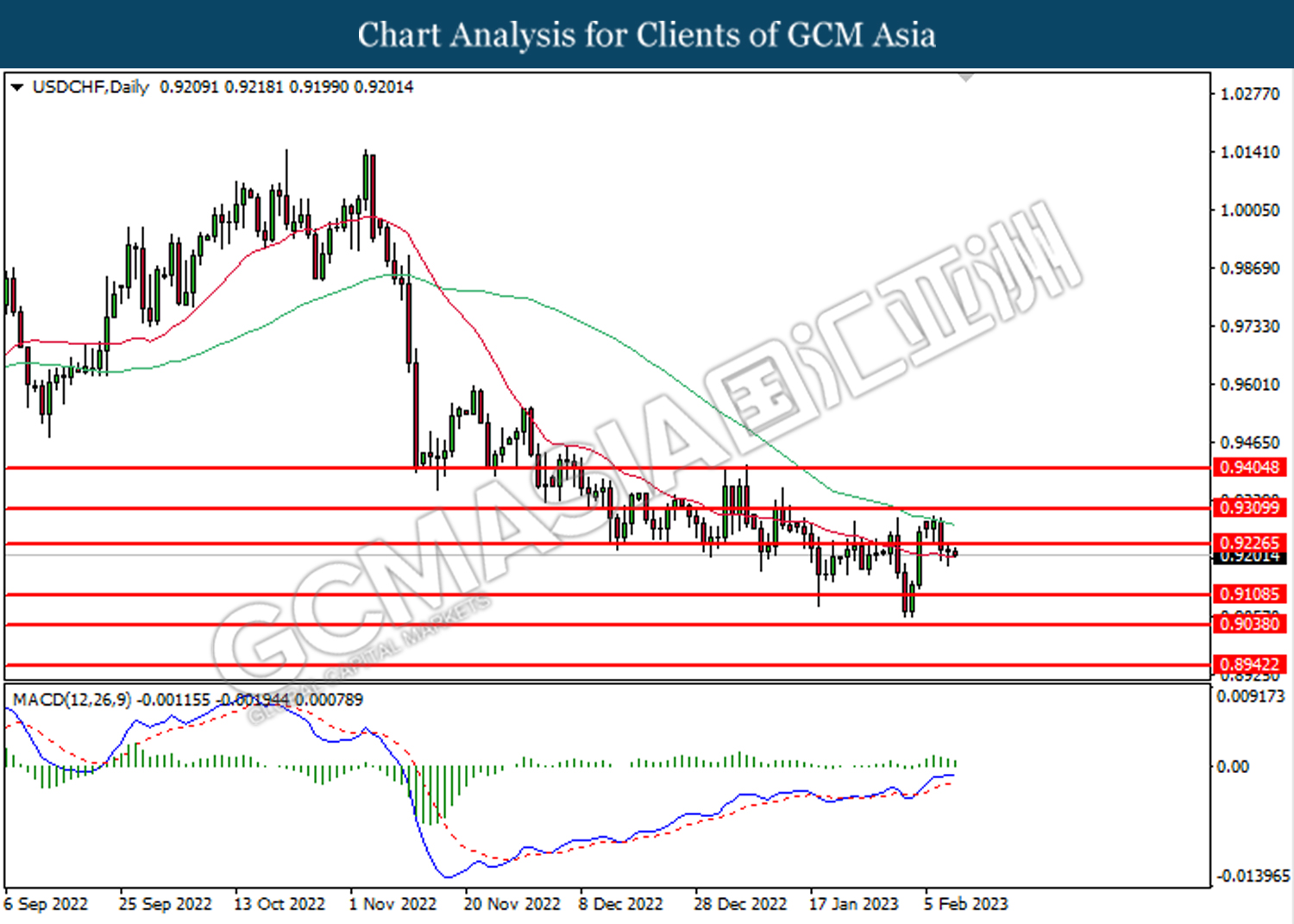

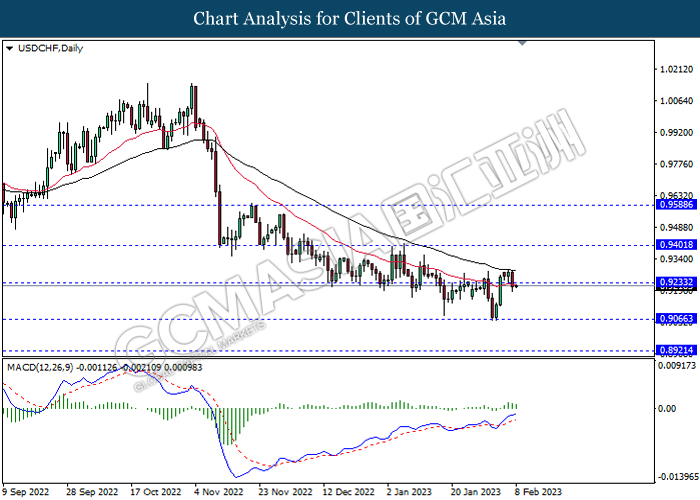

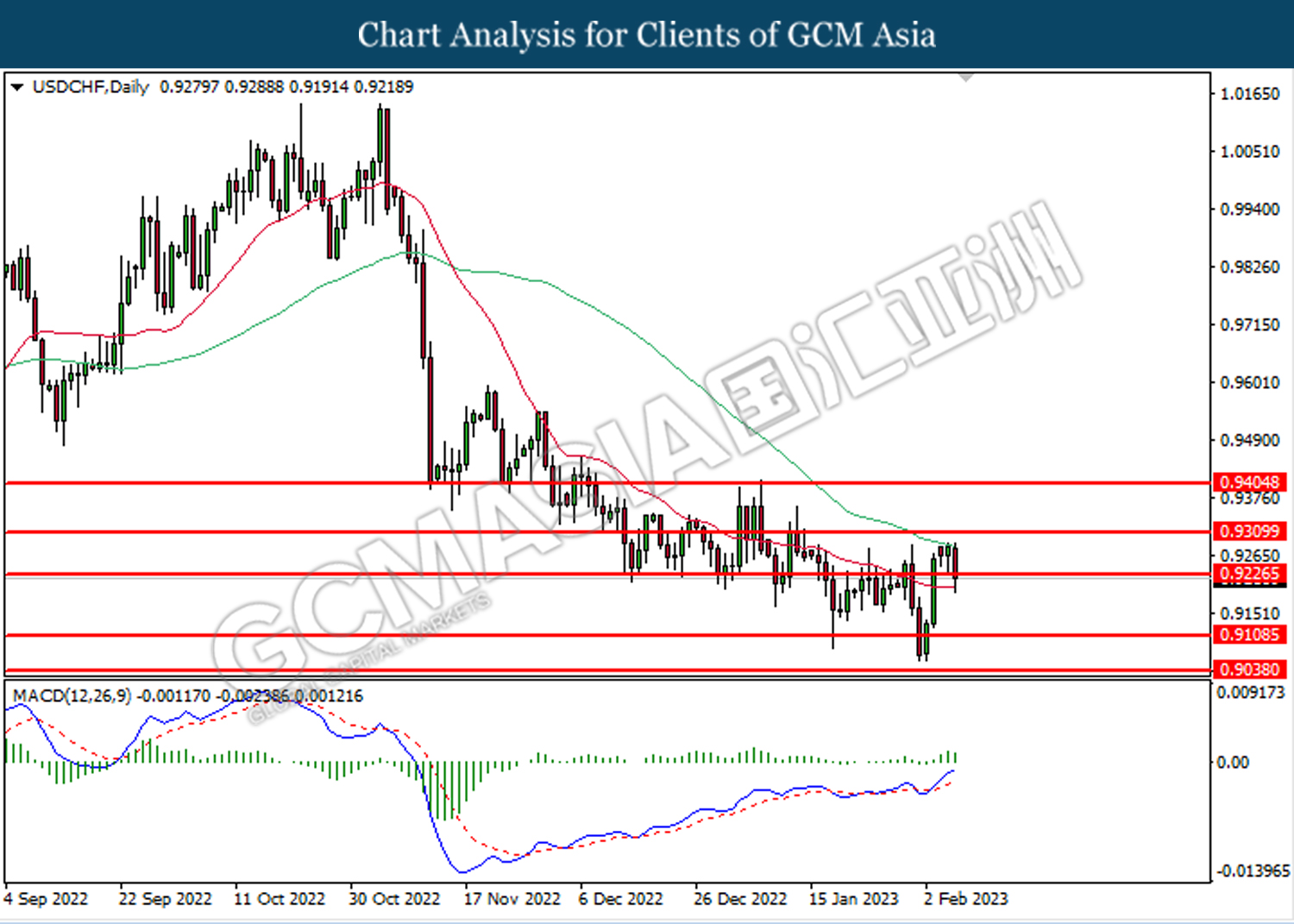

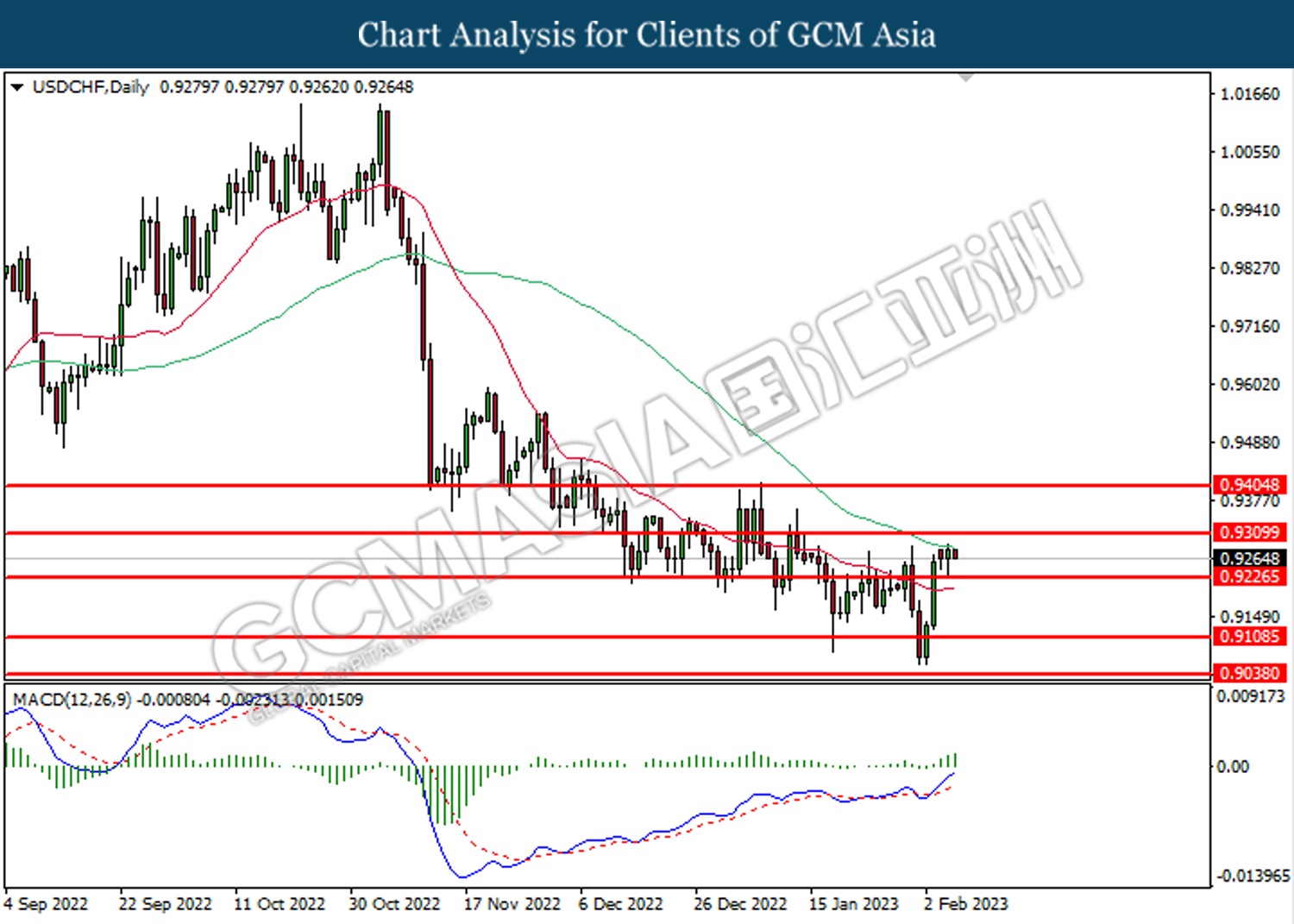

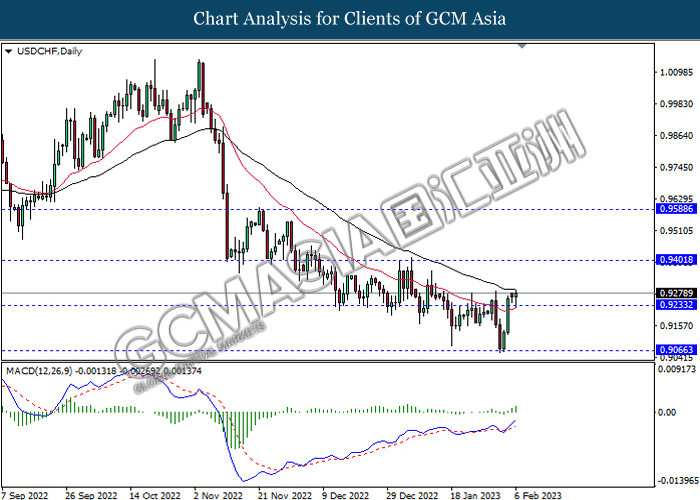

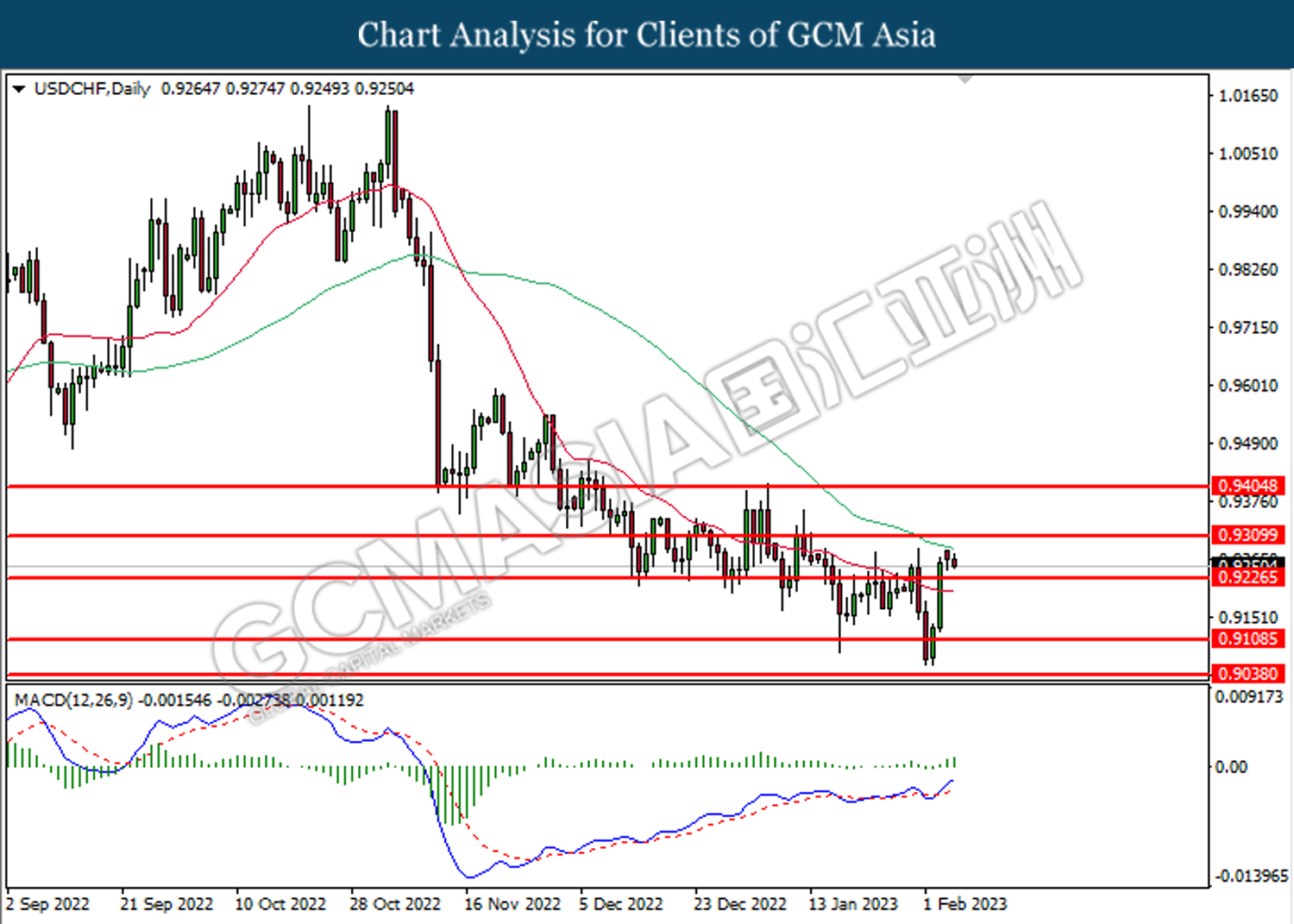

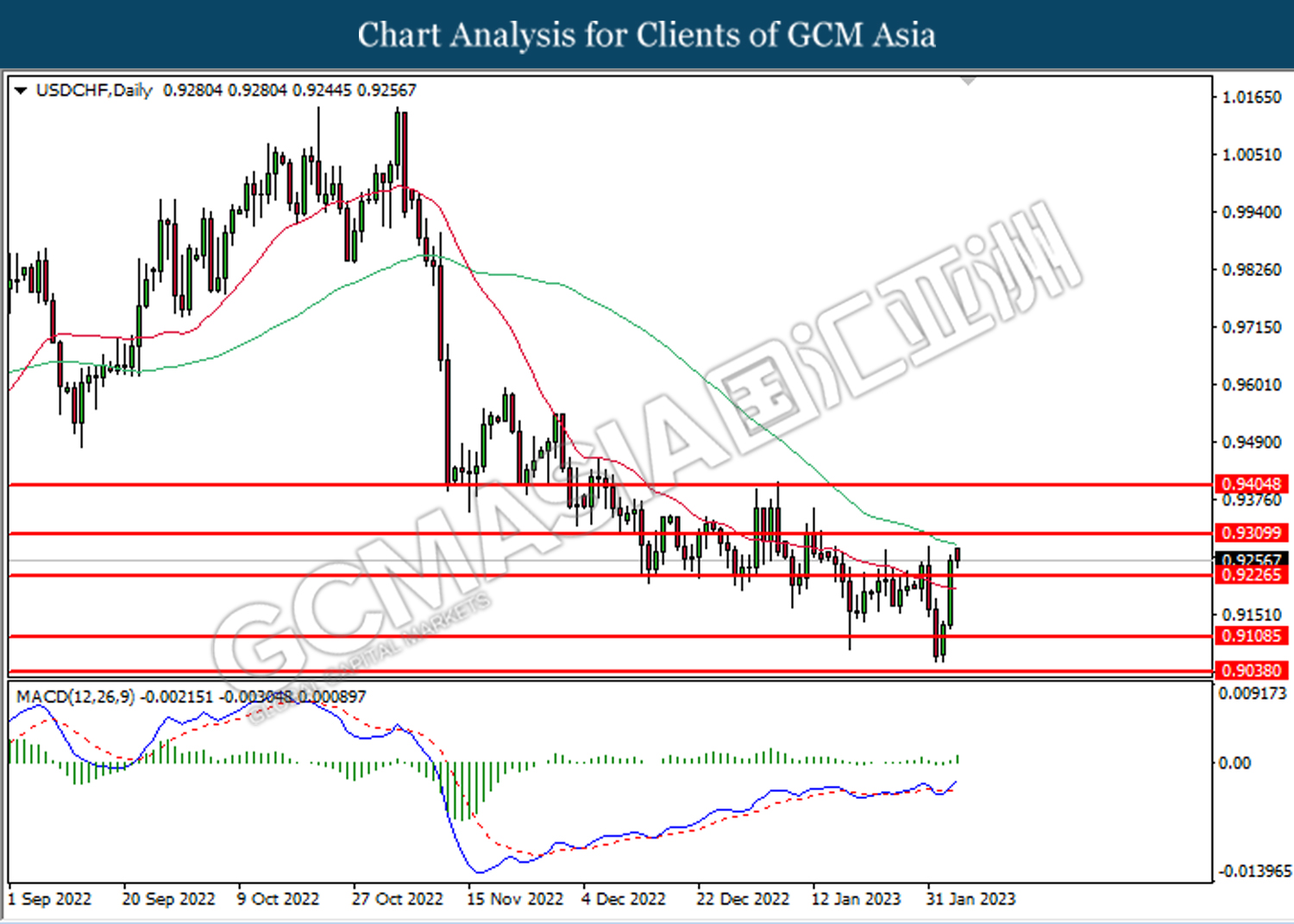

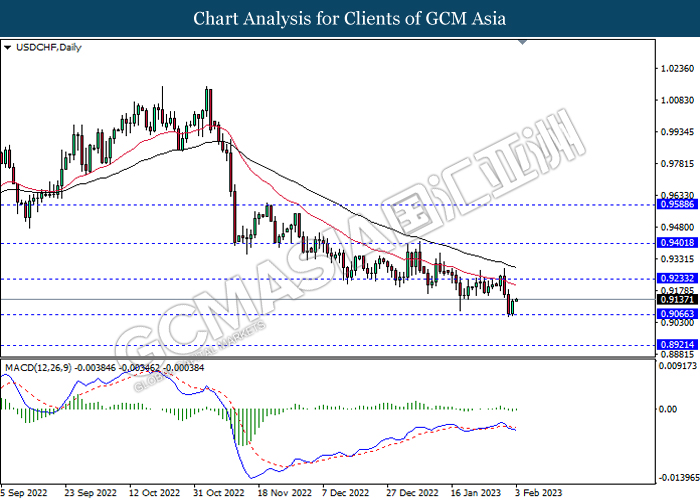

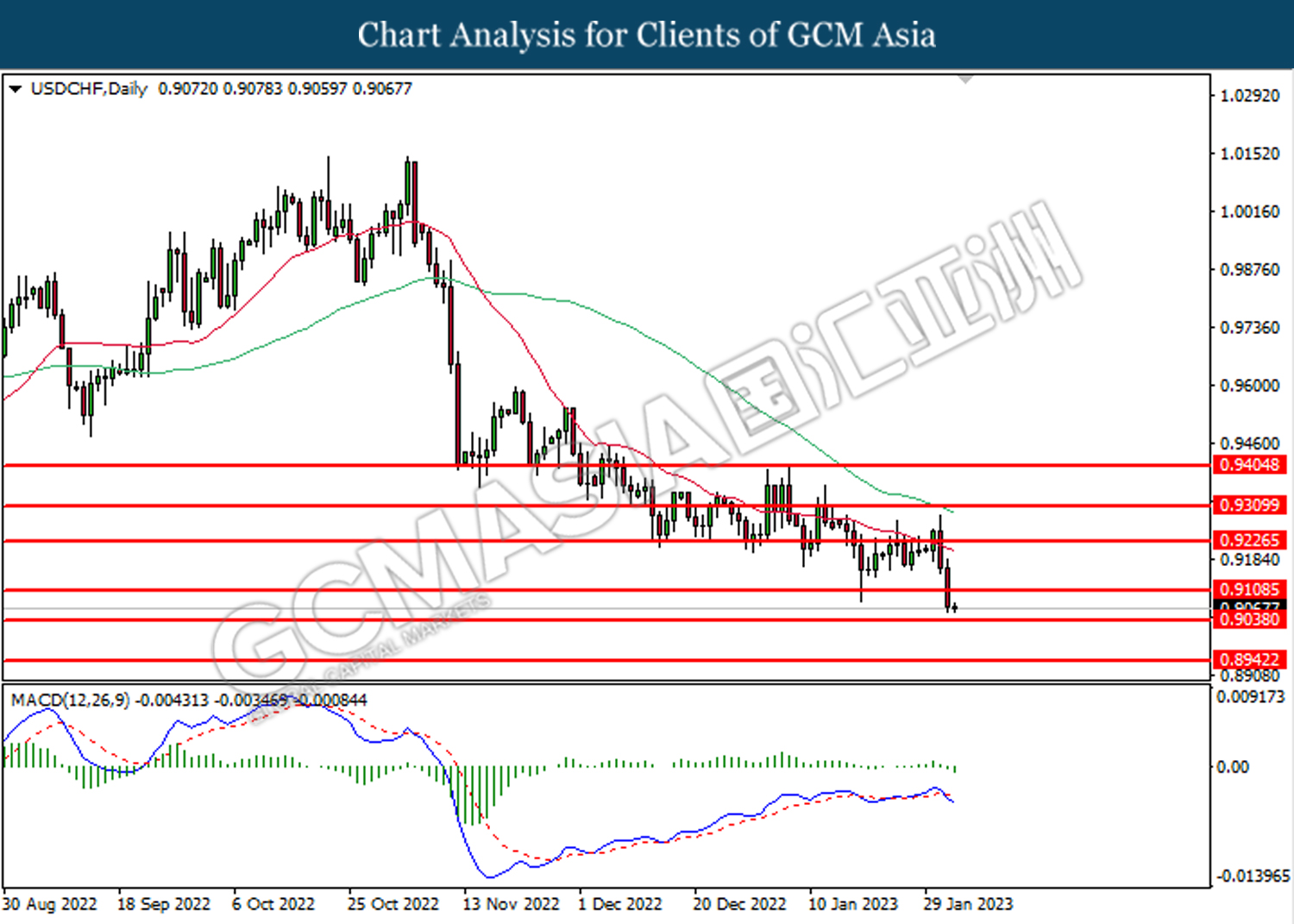

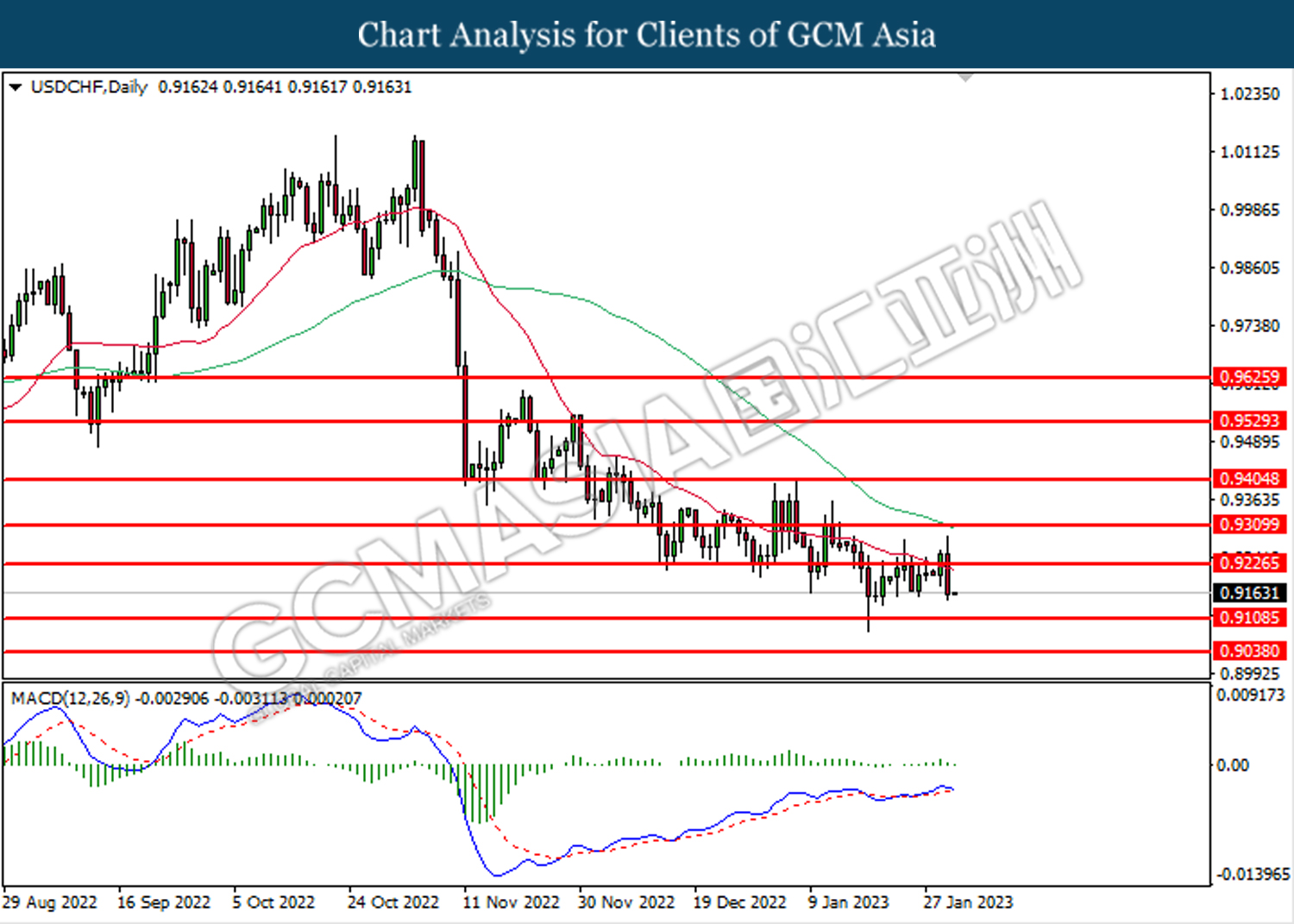

USDCHF, H4: USDCHF was traded higher while currently testing the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

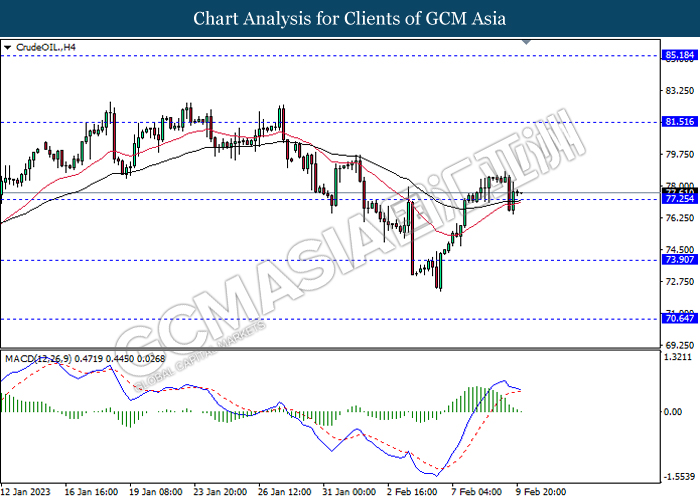

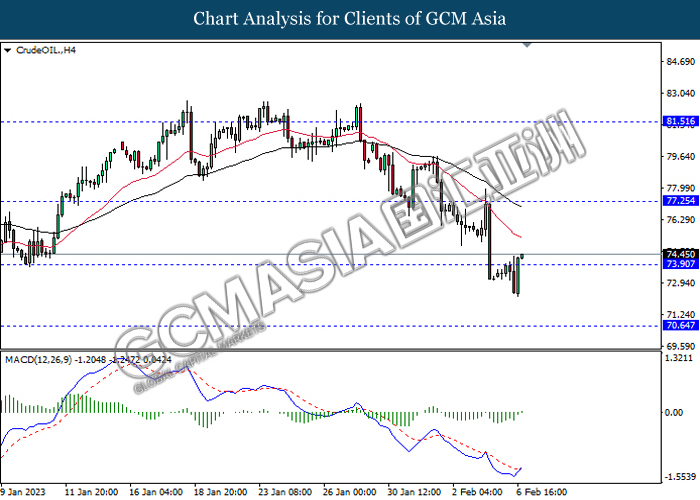

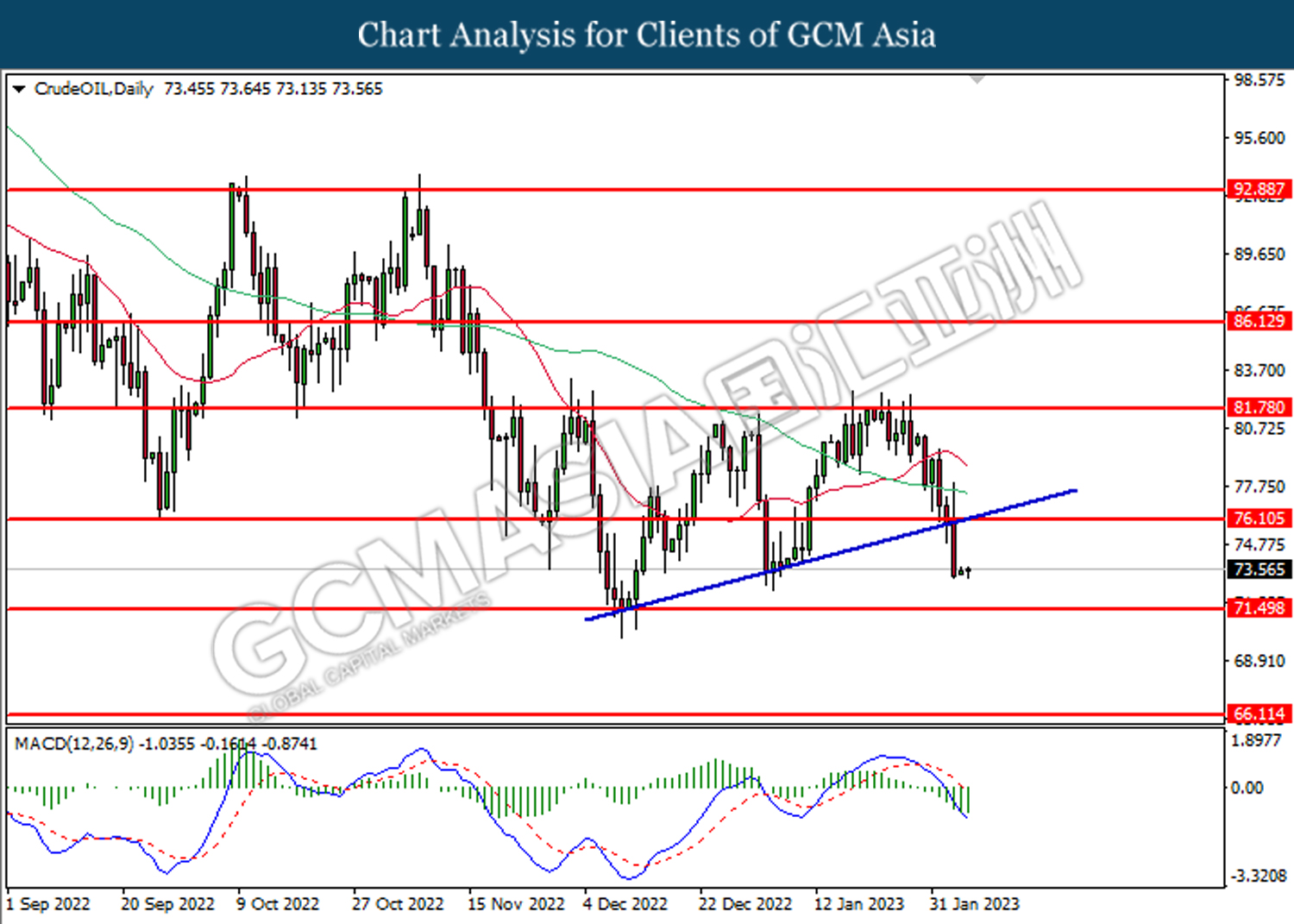

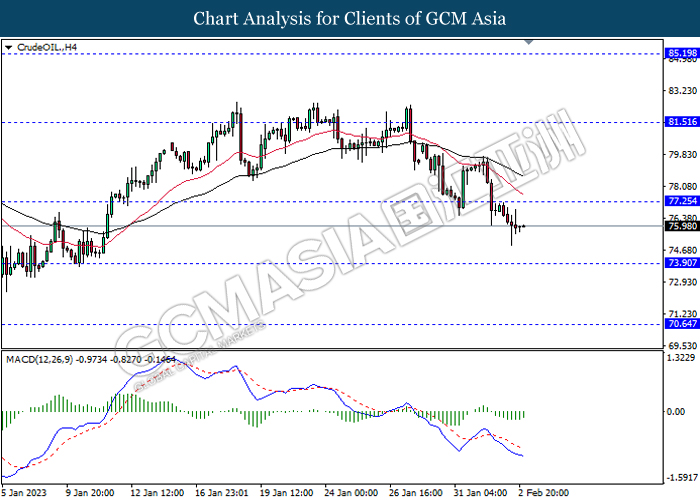

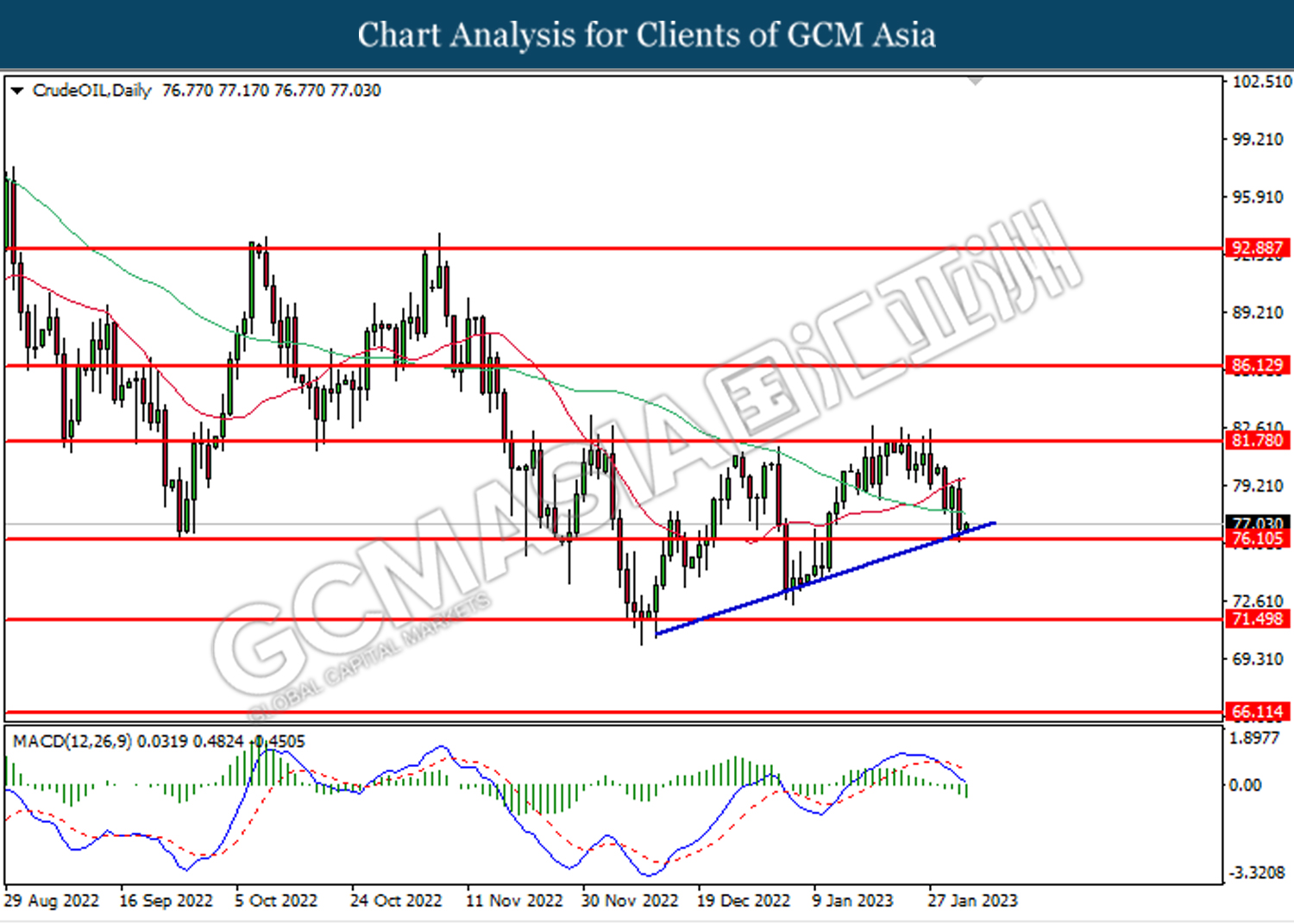

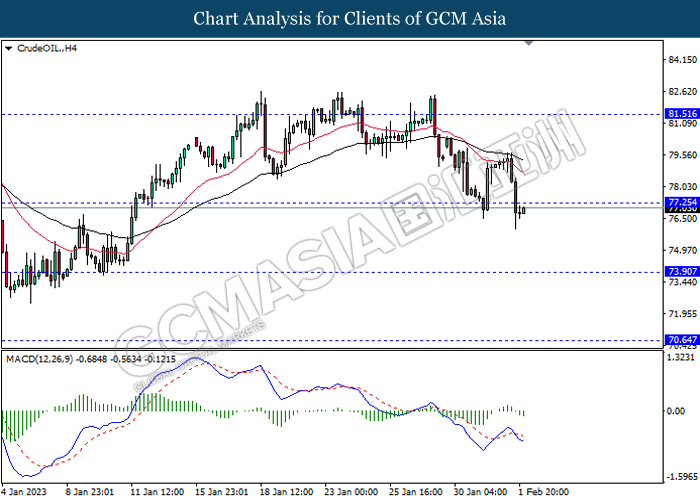

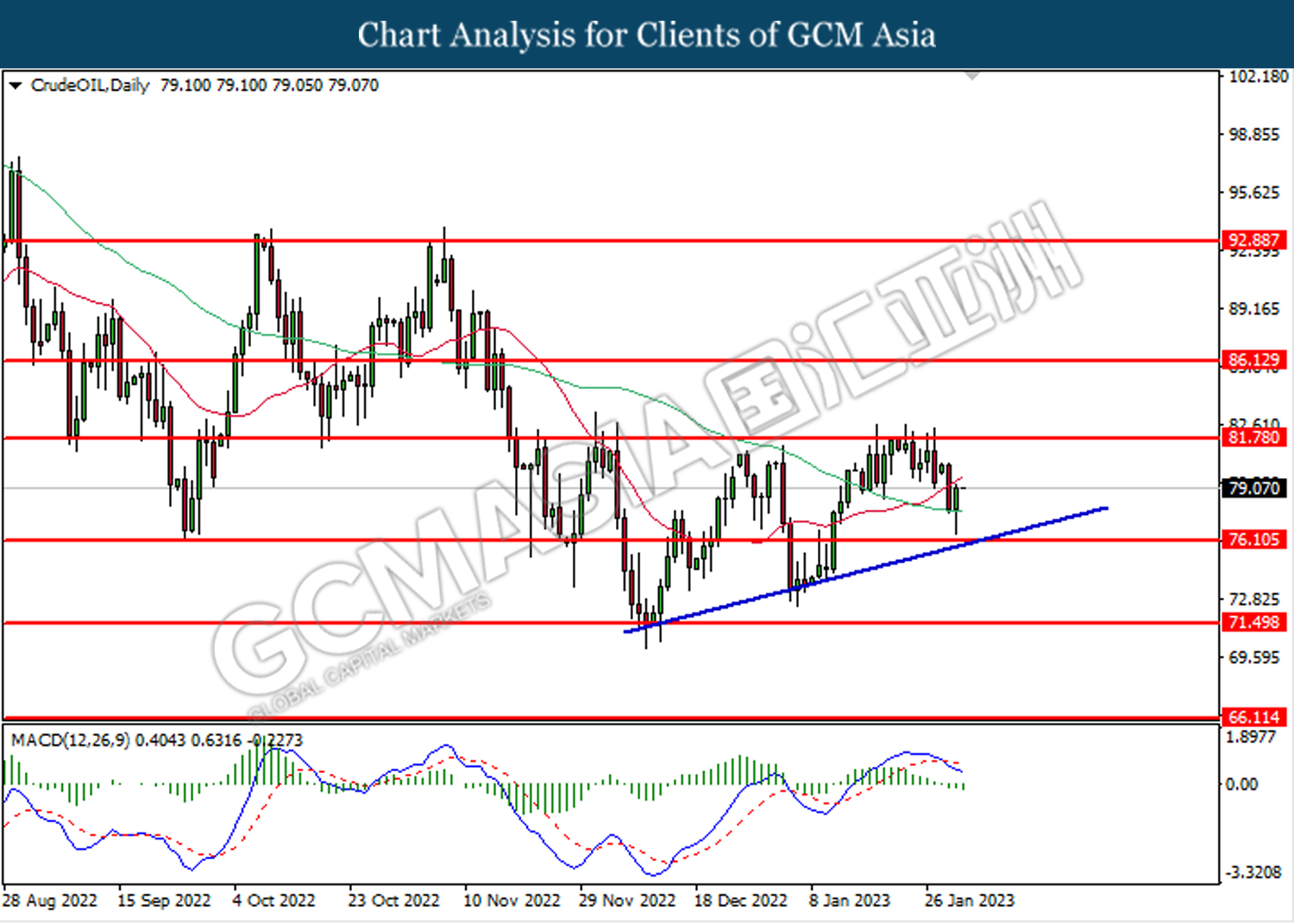

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

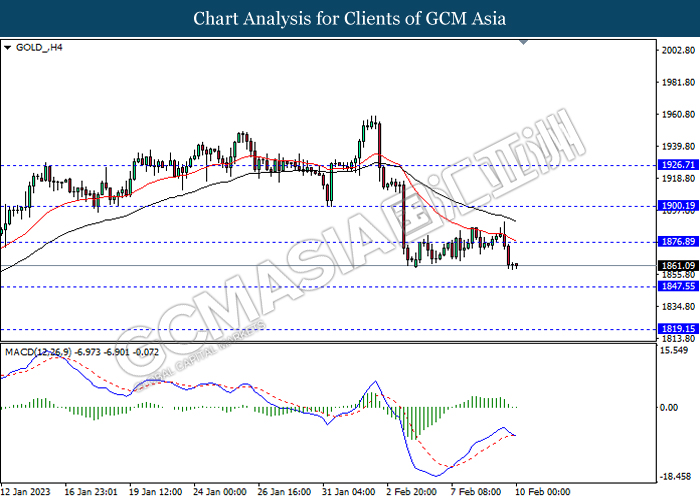

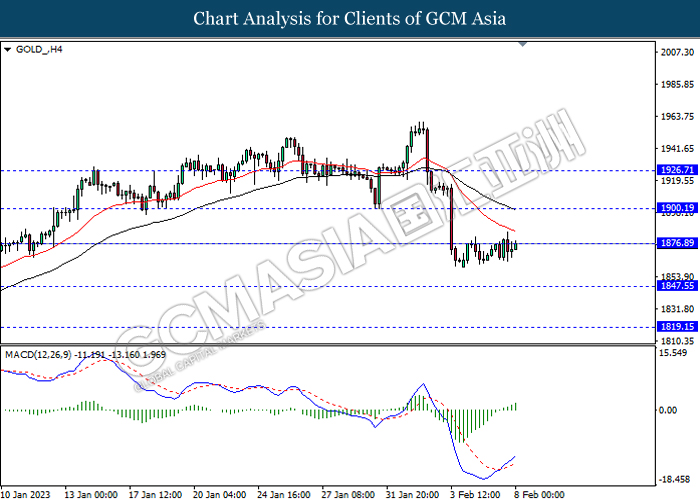

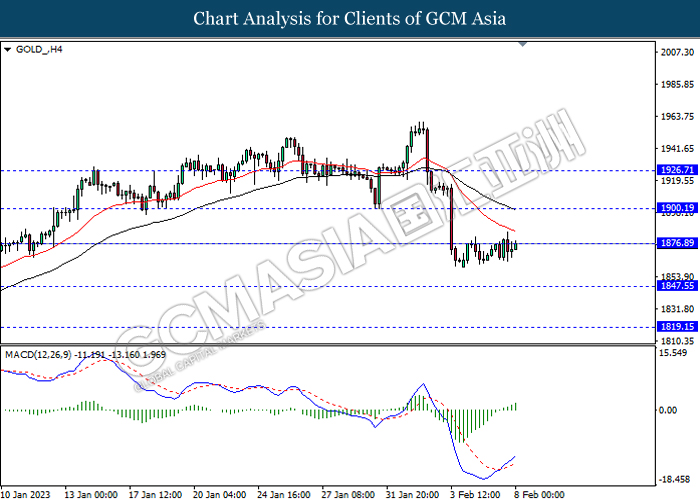

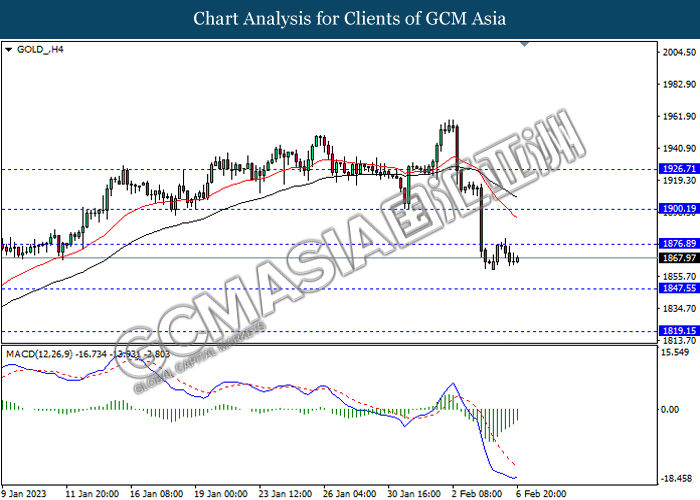

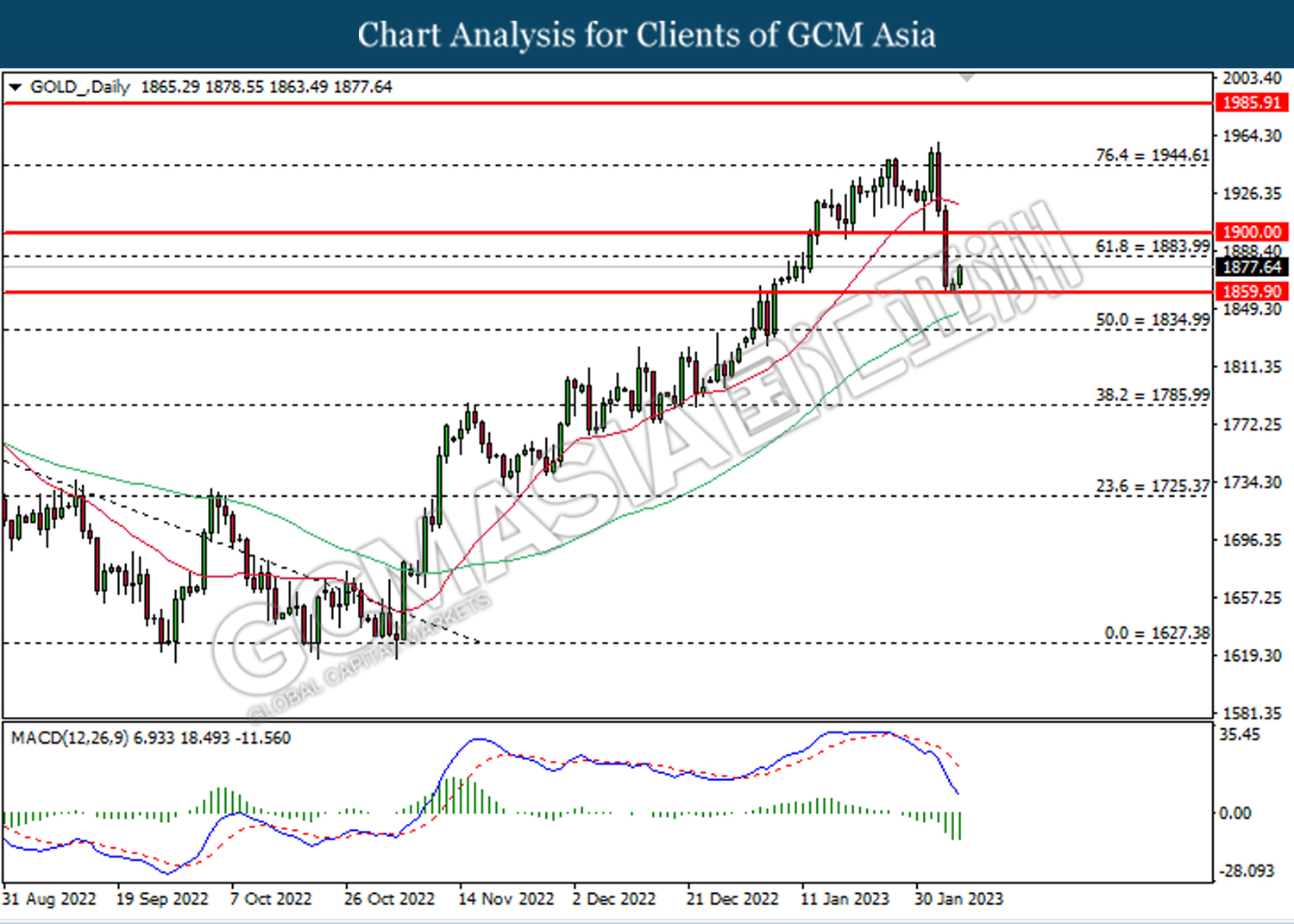

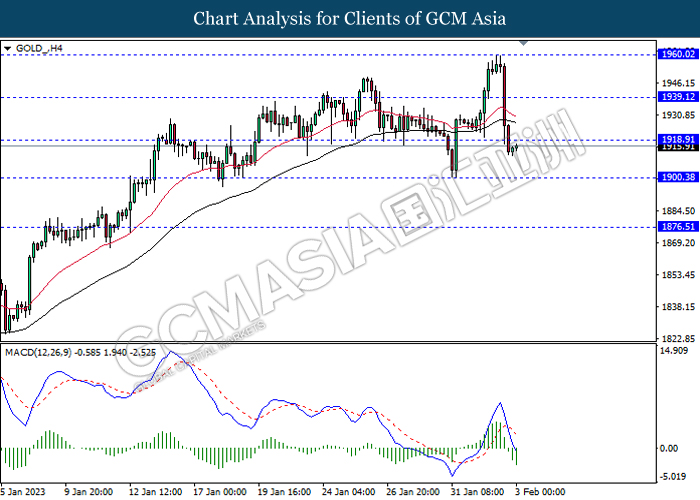

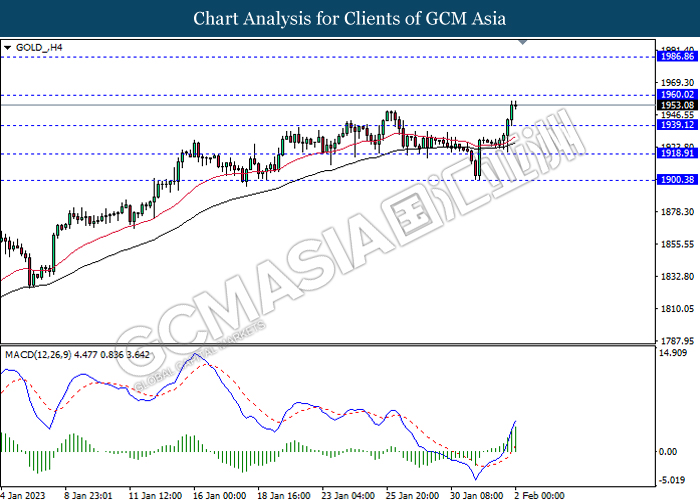

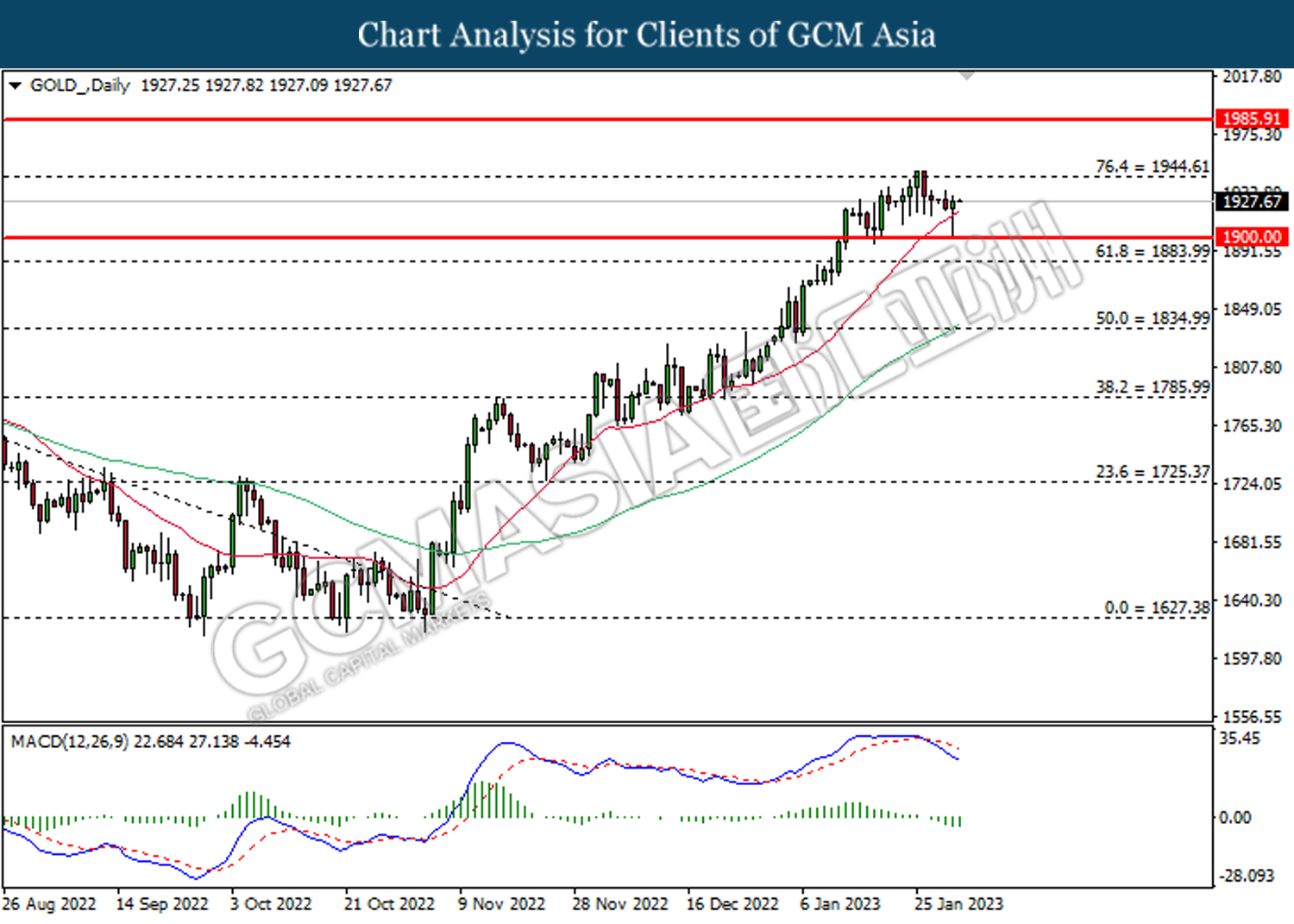

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15

090223 Afternoon Session Analysis

9 February 2023 Afternoon Session Analysis

EUR rebound amid hawkish statement from ECB council members

The euro, one of the most traded currency in the foreign exchange market, rebounded after 3 consecutive days of downward trends. The rebound in the euro market was mainly attributed to the hawkish statement from the Europe Central Bank (ECB) council member Martins Kazaks. Kazaks argued that the euro inflation is still tilted on the upside and should raise the rate significantly to curb the sky-high inflation. Besides, the weakness of dollar market also supported a rebound in the euro market after the Fed chairman Jerome Powell’s less hawkish statement. Powell mentioned that the disinflation situation occurred in the US economy urged the dollar to drop. However, the rebound trends of the EUR were offset by the statement from Knot, the Dutch central bank governor. Knot mentioned that the inflation around the peak and the sharp decrease in energy prices could bring down the inflation faster than projection. This statement led investors to expect slowing in a rate hike for the upcoming ECB monetary policy decisions. Due to market uncertainty, investors are waiting for more cues from the upcoming EU economic forecast. As of writing, the EUR/USD gained 0.20% to $1.0730.

In the commodity market, the crude oil price depreciated by -0.10% to $78.40 per barrel as of writing following a 3-day rally amid Fed uncertainty and US inventory build. In addition, the gold price appreciated by 0.04% to $1891.50 per troy ounce as of writing amid the weakening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:45 GBP BoE MPC Treasury Committee Hearings

18:00 EUR EU Economic Forecasts

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German CPI (YoY) (Jan) | 8.6% | 9.2% | – |

| 21:30 | USD – Initial Jobless Claims | 183K | 194K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2105. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level at 1.0850. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0670.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded higher while currently retesting the resistance level at 131.25. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 131.25, 134.15

Support level: 128.60, 126.30

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6860. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3505.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

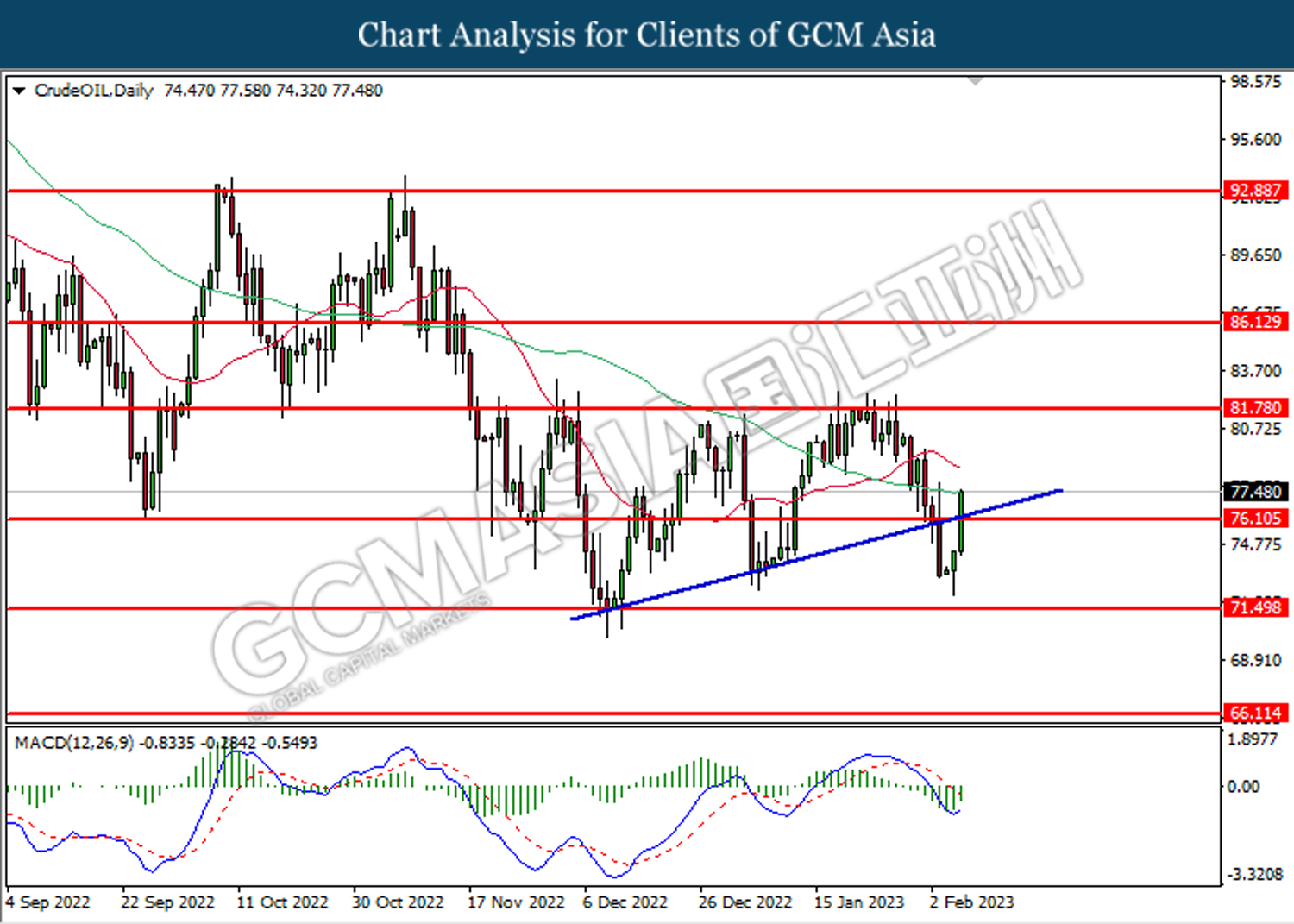

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

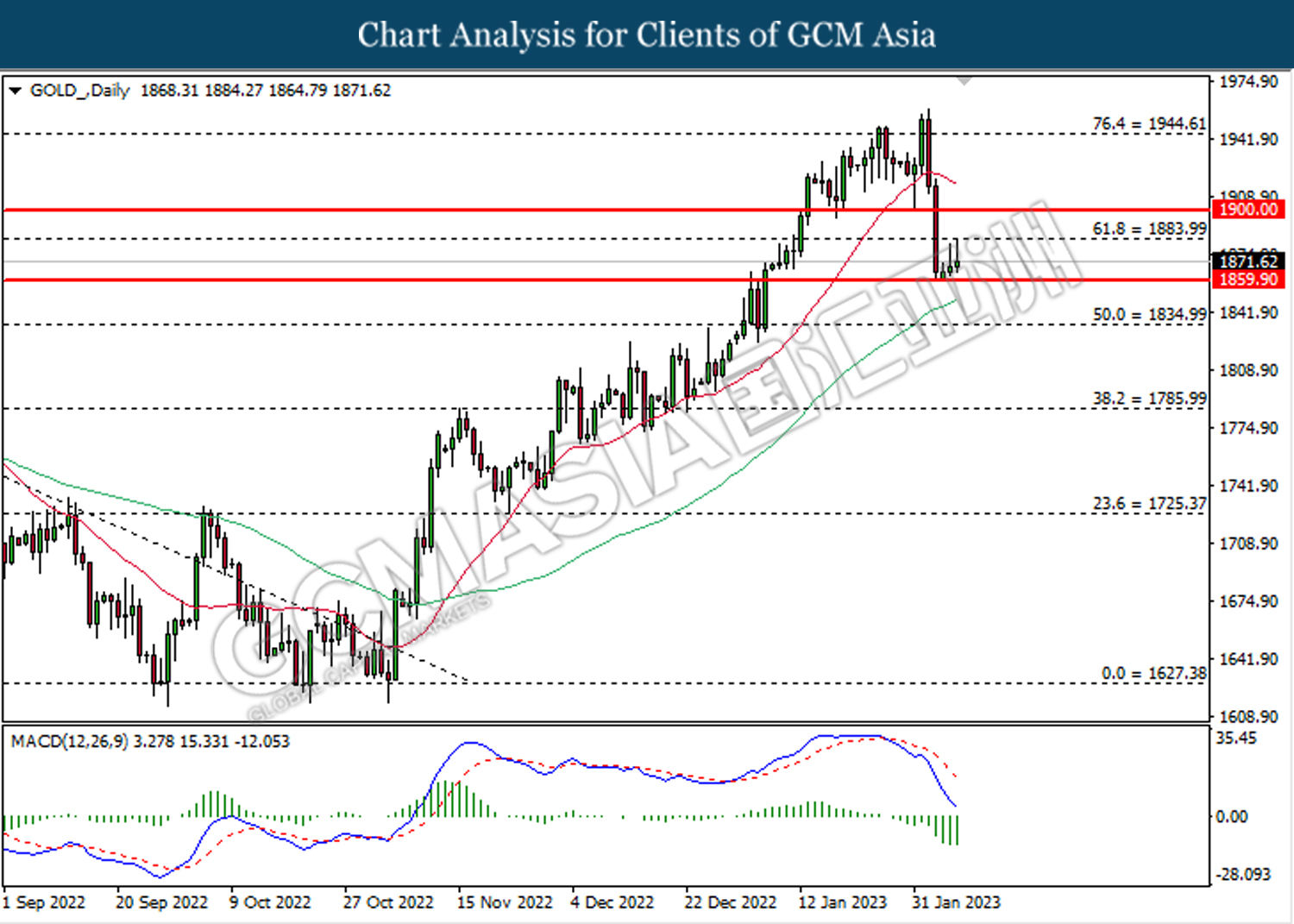

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1884.00. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1884.00.

Resistance level: 1884.00, 1900.00

Support level: 1859.90, 1835.00

090223 Morning Session Analysis

9 February 2023 Morning Session Analysis

US Dollar rose, buoyed by Fed’s hawkish speech.

The Dollar Index which traded against a basket of six major currencies found its ground on yesterday over the Fed member hawkishness. According to Reuters, the Federal Reserve Governor Christopher Waller claimed on Wednesday that the path for bring down the sky-high inflation would be a ‘long journey’, while the interest rate might be stay at high level for longer period. Fresh concerns about inflation had risen following the upbeat employment data, which showing 517,000 job creation in January and a dip in unemployment to 3.4%, a 53-year low. With that, a strong labor market would likely to boost wages rate in the US, whereas it run counter to the purpose of aggressive rate hike plan. Besides that, another Fed member, New York Federal Reserve President John Williams said that Fed would possible to raise its rate to the range of 5% to 5.25%, and it still was an acceptable level. For now, most of investors were anticipating another 25 basis points hike in the next meeting, whereby the likelihood has reached 92.2%, according to the CME FedWatch Tool. As of writing, the Dollar Index appreciated by 0.04% to 103.33

In the commodity market, the crude oil price edged up by 0.01% to $78.48 per barrel as of writing following the increase in crude oil inventories was less than expected. According to EIA, the US Crude Oil Inventories was raised by 2.423M barrels, which is lower than the consensus forecast of 2.457M barrels. In addition, the gold price depreciated by 0.07% to $1874.70 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:45 GBP BoE MPC Treasury Committee Hearings

18:00 EUR EU Economic Forecasts

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German CPI (YoY) (Jan) | 8.6% | 9.2% | – |

| 21:30 | USD – Initial Jobless Claims | 183K | 194K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6955, 0.7050

Support level: 0.6870, 0.6775

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6170

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3320, 1.3155

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15

080223 Afternoon Session Analysis

08 February 2023 Afternoon Session Analysis

Euro rebound ahead of Germany CPI release.

The Euro, which is traded globally as the mainstream of currency, rebounded from the lower level ahead of Germany’s CPI release. The previous month’s German CPI yearly reading stood at 8.6% while the investors predicted the upcoming Jan CPI will grow by 0.3% to 8.9%. A positive reading prediction from the economic data attracted investors’ demand for more Euro as the market increases the expectation for an ECB rate hike. As the ECB target a 2% inflation rate across all Europe countries while Germany is still far away from the target rate, it is likely that the ECB will increase the interest rate aggressively in the upcoming monetary policy decision. Besides, previous services PMI data released by Markit Economics interpreted that the German economy was recovering from the bottom and it increased the space that ECB will continue for a more aggressive rate hike. At the same time, the reversal trend of the Euro is also supported by the weakening of the dollar index aftermath of Jerome Powell’s less-hawkish comment. As of writing, the EUR/USD appreciated 0.08% to $1.0732.

In the commodities market, crude oil price gained 0.21% to $77.31 per barrel as the US API data showed that the US crude oil inventories reduced throughout the week, pushing the oil price to a higher level. Besides, gold prices tipped by 0.23% to $1889.45 per troy ounce after the Fed’s chairman eased the rate hike concerns.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | 4.140M | 2.457M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggests the index to extend its gains if successfully breakout the resistance level.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.55

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the support level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 130.25, 126.70

AUDUSD, H4: AUDUSD was traded higher following the prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains.

Resistance level: 0.7050, 0.7125

Support level: 0.6955, 0.6870

NZDUSD, H4: NZDUSD was traded lower following a prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggests the pair to be traded higher as a technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6170

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggests the pair to be traded lower as technical correction.

Resistance level: 1.3500, 1.3675

Support level: 1.3320, 1.3155

USDCHF, Daily: USDCHF was traded lower following a prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded lower following the prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggests the commodity to extend its losses.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15

080223 Morning Session Analysis

08 February 2023 Morning Session Analysis

US dollar slips amid less-hawkish comment from Powell.

The dollar index, which traded against a basket of mainstream currencies, was teetering on the brink of collapse following the disinflation comment from the Chairman of Federal Reserve, Jerome Powell. Early morning today, Jerome Powell reinstated his disinflation comment, emphasizing that the disinflation has started in the US while expecting the inflation figure to drop further in this year. In the communique, he highlighted the last Friday’s ‘monster’ job report, but not seeing disinflation in services sector. Prior to the speech, majority of the investors were foreseeing the Fed’s chairman would shift his posture to a more aggressive extend following a series of upbeat economic data. Yet, he refused to do so and disappointed the market with a less hawkish statement, urging the dollar index to drop at the end. At this juncture, the investors’ focus point would be gathered on the upcoming inflation figure, which included the CPI and PPI data, to gauge the path of US monetary policy going forward. As of writing, the dollar index edged down -0.26% to 103.35.

In the commodities market, crude oil price surged 1.82% to $75.70 per barrel as the less hawkish statement from Jerome Powell deteriorated the selling pressure in the US dollar, pushing the oil price to a higher level. Besides, gold prices tipped by 0.33% to $1873.80 per troy ounce after the Fed’s chairman eased the rate hike concerns.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | 4.140M | 2.457M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower following a prior breakout below the previous support level at 1.2105. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1940.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level at 1.0850. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0670.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6860. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6255.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3400. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 76.10, 81.80

Support level: 71.50, 66.10

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1859.90. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1884.00, 1900.00

Support level: 1859.90, 1835.00

070223 Afternoon Session Analysis

7 February 2023 Afternoon Session Analysis

Aussie rises after RBA announces rate hike.

The Aussie dollar, which was majorly traded by global investors, appreciated after the interest rate decision made by the Reserve Bank of Australia (RBA). The appreciation came from RBA raising its interest rate from 25 basis point to 3.35%, which is in line with the market expectation. However, the Aussie dollar’s gains were dragged down by the dovish statement from the governor of RBA Philip Lowe. In the communique, RBA expect the inflation to decline 4.75% this year and stand around 3% by mid of 2025, while maintaining the economic growth at a stable pace. This statement increased investors’ expectation that RBA will raise the interest rate more defensively to achieve a soft landing on their economy. At the same time, the uptrend trend of the Aussie dollar was boosted by the softening position of the US dollar this morning. Investors were taking profit after digesting the previous upbeat economic data. As of writing, the AUD/USD gained 0.77% to $0.6934.

In the commodities market, the crude oil price rose by 0.93% to $74.80 per barrel as of writing as markets are optimistic about China’s economic reopening. In addition, the gold price edged up by 0.39% to $1886.85 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

01:00 USD EIA Short-Term Energy Outlook

(8th Feb)

01:40 USD Fed Chair Powell Speaks

(8th Feb)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 05:30

(8th Feb) |

USD – API Weekly Crude Oil Stock | 6.330M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower following a prior breakout below the previous support level at 1.2105. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1940.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level at 1.0850. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0670.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 131.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 134.15.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6860. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6255.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3505.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded higher following a prior breakout above the previous resistance level at 0.9225. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9310.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 73.30. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 76.10.

Resistance level: 76.10, 81.80

Support level: 71.50, 66.10

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1859.90. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1884.00, 1900.00

Support level: 1859.90, 1835.00

070223 Morning Session Analysis

7 February 2023 Morning Session Analysis

US Dollar’s bull extended over the red-hot employment report.

The Dollar Index which traded against a basket of six major currencies extended its upward movement on Monday, which supporting by the robust US employment data. On the last Friday, the Bureau of Labor Statistics has reported a series of upbeat employment data, which surprising the market participants that the labor market in the US was remaining resilience and hot even the prior aggressive rate hike move by Fed. With that, it might stoke a shift of stance from the Fed, whereby the hefty rate hike process would likely to be continued as well as sparked the appeal of US Dollar. On the other hand, the gains experienced by Dollar Index was extended amid the positive speech from the US government. According to Reuters, the US Treasury Secretary Janet Yellen claimed on Monday that the US economy would likely to avoid recession with the strong labor market and the easing inflation risk. As she emphasized about the truth of far-better NFP data and the lowest unemployment rate in 53 years, the market optimism upon US economy prospects has been dialed up. As of writing, the Dollar Index appreciated by 0.72% to 103.49

In the commodity market, the crude oil price dropped by 0.04% to $74.41 per barrel as of writing. Yesterday, the oil price has found its ground over the optimism upon reopening of China. In addition, the gold price edged up by 0.02% to $1867.62 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Feb) | 3.10% | 3.35% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 132.60, 135.80

Support level: 130.25, 126.70

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6955, 0.7050

Support level: 0.6870, 0.6775

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6170

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3320, 1.3155

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15

060223 Afternoon Session Analysis

06 February 2023 Afternoon Session Analysis

Downbeat retail sales weigh on Australian dollar.

The Aussie dollar, which was majorly traded by global investors, slammed following the release of the downbeat retail sales data in the nation. According to the Australian Bureau of Statistics, the Australia Retail Sales (MoM) dropped sharply from the reading at 1.7% to -3.9% in January, in line with the consensus forecast. The plunge in the Australian retail sales volume was mainly attributed to the higher borrowing costs, which trimmed the shopper spending in the end of 2022. Albeit, the tightening path of the Reserve Bank of Australia (RBA) is not expected to stopped at the time being, whereby the central bank will likely to hike rate in the upcoming meeting to further cooldown the inflationary pressure in the economy. Nonetheless, the pairing of AUD/USD was dominated by the ‘monster’ job report last Friday. The larger-than-expected jobs added in the month of January showed that the US labor market remained resilient and tight, leaving ample room for the Federal Reserve (Fed) to increase rate further. As of writing, the AUD/USD rebounded 0.27% to 0.6940.

In the commodities market, the crude oil prices were up by 0.48% to $73.45 per barrel after plummeting more than 6% last Friday amid the upbeat NFP report. Besides, gold prices rose by 0.66% to $1877.20 per troy ounce amid the market correction in the post-NFP trading session.

Today’s Holiday Market Close

Time Market Event

All Day NZD National Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Jan) | 48.8 | 49.6 | – |

| 23:00 | CAD – Ivey PMI (Jan) | 33.4 | 42.3 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 101.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 105.00

Support level: 101.20, 99.40

GBPUSD, Daily: GBPUSD was traded lower following a prior breakout below the previous support level at 1.2105. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1940.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level at 1.0850. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0670.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6985. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6255.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3505.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded higher following a prior breakout above the previous resistance level at 0.9225. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9310.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the trendline. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 71.50.

Resistance level: 76.10, 81.80

Support level: 71.50, 66.10

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1884.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1835.00

Resistance level: 1884.00, 1900.00

Support level: 1835.00, 1786.00

060223 Morning Session Analysis

06 February 2023 Morning Session Analysis

US dollar skyrocketed amid strong labor data.

The dollar index, which traded against a basket of mainstream currencies, revived as the US labor market enjoyed the red-hot January with outstanding jobs added throughout the month. According to the US Bureau of Labor Statistics, US NonFarm Payrolls printed a stronger-than-expected reading at 517K, higher than both the previous and forecast reading at 260K and 185K respectively, while posting the strongest jobs numbers since August 2022. On top of that, the US labor market also experienced a further drop on unemployment rate from the prior month reading’s 3.5% to 3.4% in January. With that, it indicated that the US labor market remained resilience and tight despite the aggressive rate hikes by the Federal Reserve (Fed) over the past few months. Moreover, the shininess of the dollar index turned brighter after the Institute for Supply Management (ISM) reported its Non-Manufacturing PMI data for the month of January. According to the data, the Services PMI jumped from 49.2 to 55.2, beating the consensus forecast at 50.4, mirroring that the sector was generally expanding after slowing down in the last month of 2022. As of writing, the dollar index spiked 1.22% to 103.00.

In the commodities market, crude oil price plunged by -3.61% to $73.15 per barrel as US dollar strengthened following the releases of upbeat economic data. Besides, gold prices edged down by -0.02% to $1864.95 per troy ounce amid magnificent Nonfarm Payrolls and Unemployment Rate data.

Today’s Holiday Market Close

Time Market Event

All Day NZD National Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Jan) | 48.8 | 49.6 | – |

| 23:00 | CAD – Ivey PMI (Jan) | 33.4 | 42.3 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 101.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 105.00

Support level: 101.20, 99.40

GBPUSD, Daily: GBPUSD was traded lower following a prior breakout below the previous support level at 1.2105. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1940.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level at 1.0850. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0670.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6985. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6255.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3505.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded higher following a prior breakout above the previous resistance level at 0.9225. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9310.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the trendline. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 71.50.

Resistance level: 76.10, 81.80

Support level: 71.50, 66.10

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1884.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1835.00

Resistance level: 1884.00, 1900.00

Support level: 1835.00, 1786.00

030223 Afternoon Session Analysis

3 February 2023 Afternoon Session Analysis

BoE hikes rates but sterling slumps.

The pound sterling paired with the dollar fall back toward $1.2200 after the interest rate decision by the Bank of England, the central bank of the UK. The BoE’s rate hike was in line with market expectations, where it raised its interest rate by 50 basis points to 4.00%. However, this rate hike did not let the pound break its highest level since June 2022. In the monetary policy decision communique by BoE, Andrew Bailey – the president of the central bank, commented that inflation has probably peaked. However, as the prices of goods and services in the UK and the global supply chain have started to ease, it increased the market expectation that the BoE might start to slow down its aggressive rate hike plan. Besides, the sharp decline in the pound market was also boosted by the strengthening of the dollar. The dollar regained its luster following the upbeat economic data released by the US Department of Labor. According to the report, the US initial Jobless claims hit 183K, which is lower than the previous reading 186kas well as the consensus expectation of 200k. As of writing, the GBP/USD depreciated -0.12% to $1.2208.

In the commodity market, the crude oil price rebounded by 0.01% to $75.89 per barrel after a sharp decline throughout the overnight trading session as the market concern on rate hike side effects kept hovering in the market. In addition, the gold price dropped by -0.01% to $1930.55 per troy ounce as of writing amid the strengthening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

|

Time |

Nation & Data | Previous | Forecast | Actual |

| 17:30 |

GBP – Composite PMI (Jan) |

47.8 | 47.8 | – |

| 17:30 | GBP – Services PMI (Jan) | 48 | 48 | – |

| 21:30 | USD – Nonfarm Payrolls (Jan) | 223K | 185K | – |

| 21:30 | USD – Unemployment Rate (Jan) | 3.50% | 3.60% | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Jan) | 49.6 | 50.3 |

– |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 101.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 105.00

Support level: 101.20, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2200. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level at 1.0975. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.0850.

Resistance level: 1.0975, 1.1150

Support level: 1.0845, 1.0670

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 128.60. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level at 128.60.

Resistance level: 131.25, 134.15

Support level: 128.60, 126.30

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.7125. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 0.6985.

Resistance level: 0.7125, 0.7260

Support level: 0.6985, 0.6725

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6460. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6555, 0.6675

Support level: 0.6460, 0.6355

USDCAD, Daily: USDCAD was traded higher following a prior rebound from the support level at 1.3265. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3400.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded higher following a prior breakout above the previous resistance level at 0.9110. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.9225.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the upward trendline. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the trendline.

Resistance level: 76.10, 81.80

Support level: 71.50, 66.10

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1944.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1900.00.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00

030223 Morning Session Analysis

3 February 2023 Morning Session Analysis

US Dollar revived as initial jobless claims decreased.

The Dollar Index which traded against a basket of six major currencies regained its luster on yesterday following the upbeat economic data has been unleashed. According to the US Department of Labor, the US Initial Jobless Claims has notched down from the previous reading of 186K to 183K, which is lower than the consensus forecast of 200K. The better-than-expected data has shown that the labor market in the US remained strong, as the number of unemployment was reducing. With that, it brought positive prospects toward economic progression in the US. On the other hand, investors would anticipating a bullish reading of NFP data might be released tonight with the upbeat employment report, which spurring further bullish momentum on the Greenback. In this juncture, market participants would continue to scrutinize the latest update of NFP announcement in order to gauge the likelihood movement of the market. Though, the gains experienced by the US Dollar was limited over the hawkish statement by European Central Bank (ECB). As of writing, the Dollar Index appreciated by 0.54% to 101.57.

In the commodity market, the crude oil price rose by 0.16% to $76.00 per barrel as of writing after a sharp decline throughout overnight trading session following the concern of rate hike side effects keep hovering in the market. In addition, the gold price dropped by 0.03% to $1916.15 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Jan) | 47.8 | 47.8 | – |

| 17:30 | GBP – Services PMI (Jan) | 48 | 48 | – |

| 21:30 | USD – Nonfarm Payrolls (Jan) | 223K | 185K | – |

| 21:30 | USD – Unemployment Rate (Jan) | 3.50% | 3.60% | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Jan) | 49.6 | 50.3 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 102.05, 103.20

Support level: 100.55, 99.10

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2265, 1.2415

Support level: 1.2120, 1.2005

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.1040, 1.1165

Support level: 1.0890, 1.0740

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 130.35, 132.60

Support level: 126.70, 123.65

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.7140, 0.7235

Support level: 0.7050, 0.6955

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6560, 0.6675

Support level: 0.6460, 0.6360

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3320, 1.3500

Support level: 1.3155, 1.2980

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1918.90, 1939.10

Support level: 1900.40, 1876.50

020223 Afternoon Session Analysis

2 February 2023 Afternoon Session Analysis

Pound sterling rose amid US Dollar weakened.

The pound sterling rose to the highest level since June 2022 level as the dollar slumped after the Fed Chairman Jerome Powell’s speech at the FOMC press conference. In the communique, Jerome Powell mentioned that US inflation has cooled, and the market started to expect that future interest rate hike decisions will come in peace or remain unchanged. As a result, the US dollar depreciated and boosted other currencies that pair with USD, such as the pound sterling. Apart from this, the pound sterling uptrend was also boosted by investors’ expectations, whereby the Bank of England (BoE) will likely have a 50-basis point rate hike in the upcoming BoE monetary policy committee meeting. According to the latest inflation data announced by the UK office for national statistics, the country’s inflation rate was at a 10.5% level in December, while the BoE target of a 2% inflation rate. An aggressive rate hike plan could affect the UK economy to enter into a recession that would weigh on the Pound. As of writing, GBP/USD appreciated 0.10% to $1.2388.

In the commodity market, the crude oil price appreciated by 0.71% to $76.95 per barrel as of writing as a weaker Greenback made the US oil price cheaper for other currency holders, and boosted the oil demand. On the other hand, the gold price raised by 1.28% to $1951.04 per troy ounce as of writing over the weakening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE MPC Meeting Minutes

21:15 EUR ECB Monetary Policy Statement

21:45 EUR ECB Press Conference

22:15 GBP BoE Gov Bailey Speaks

23:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | GBP – BoE Interest Rate Decision (Jan) | 3.50% | 4.00% | – |

| 21:15 | EUR – Deposit Facility Rate (Feb) | 2.00% | 2.50% | – |

| 21:15 | EUR – ECB Marginal Lending Facility | 2.75% | – | – |

| 21:15 | EUR – ECB Interest Rate Decision (Feb) | 2.50% | 3.00% | – |

| 21:30 | USD – Initial Jobless Claims | 186K | 200K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar was traded lower following a prior breakout below the previous support level at 101.20. MACD which illustrated diminishing bullish momentum suggested the index to extend its losses toward the support level at 99.40.

Resistance Level: 101.20, 103.15

Support Level : 99.40, 97.75

GBPUSD, Daily: GBPUSD was traded higher following a prior breakout above the previous resistance level at 1.2345. MACD which illustrated bullish bias momentum suggested the pair extend its gains toward the resistance level at 1.2470.

Resistance Level:1.2470, 1.2645

Support Level: 1.2345, 1.2200

EURUSD, Daily: EURUSD was traded higher following a prior breakout above the previous resistance level at 1.0975. MACD which illustrated increasing bullish momentum suggested the pair extend it gains towards the resistance level at 1.1150.

Resistance Level: 1.1150, 1.1275

Support Level : 1.0975, 1.0850

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 128.60. MACD which illustrated diminishing bullish momentum suggested the pair extend its losses after it successfully breakout below the support at 128.60.

Resistance Level: 131.25, 134.15

Support Level : 128.60, 126.30

AUDUSD, Daily: AUDUSD was traded higher following a prior breakout above the previous resistance level at 0.7125. MACD which illustrated increasing bullish momentum suggested the pair extend its gains toward the resistance level at 0.7260.

Resistance Level: 0.7260, 0.7385

Support Level : 0.7125, 0.6985

NZDUSD, Daily: NZDUSD was traded higher following a prior breakout above the previous resistance level at 0.6460. MACD which illustrated bullish bias momentum suggested the pair to extend its gains toward the resistance level at 0.6555.

Resistance Level: 0.6555, 0.6675

Support Level : 0.6460, 0.6355

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3265. MACD which illustrated bearish bias momentum suggested the pair extend its losses after it successfully breakout below the support level.

Resistance Level: 1.3400, 1.3505

Support Level : 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded lower following a prior breakout below the previous support level at 0.9110. MACD which illustrated bearish bias momentum suggested the pair will extend its losses toward the support level at 0.9040.

Resistance Level: 0.9110, 0.9225

Support Level : 0.9040, 0.8940

CrudeOIL, Daily: Crude oil was traded lower while currently testing the upward trendline. MACD which illustrated bearish bias momentum suggested the commodity will extend its losses after it successfully breakout below the trendline.

Resistance Level: 81.80, 86.15

Support Level : 76.10, 71.50

GOLD, Daily: Gold was traded higher following a prior breakout above the previous resistance level at 1944.60. MACD which illustrated diminishing bearish momentum suggested the commodity will extend its gains towards the resistance level at 1985.90.

Resistance Level: 1985.90, 2042.60

Support Level : 1944.60, 1900.00

020223 Morning Session Analysis

2 February 2023 Morning Session Analysis

US Dollar dived following the Fed’s smaller hikes.

The Dollar Index which traded against a basket of six major currencies slumped on Thursday after Fed’s Chairman acknowledged that the inflationary risk was easing. Earlier of the day, the US central bank decided to raise its interest rate by 25 basis point to 4.75%, which was the second consecutive lower rate hike after the four 75 basis point hikes in a row. In the Press Conference, Federal Reserve Chair Jerome Powell claimed that there was a significant effects in bringing down inflation pressure, whereby hinting that Fed would likely to step back from its aggressive contractionary monetary policy in the March meeting. Though, it was noteworthy that the Fed might continue to increase its rates as they were committed to restore price stability, according to the speech of Fed in Press Conference. Thus, the likelihood of another rate hike might not be excluded. On the economic data front, a series of downbeat economic data has spurred further bearish momentum toward US Dollar. The data such as US ADP Nonfarm Employment Change and US ISM Manufacturing Purchasing Managers Index (PMI) has disappointed market participants, which highlighting the side effects that driven by prior aggressive rate hike by Fed. As of writing, the Dollar Index dropped by 0.94% to 100.95.

In the commodity market, the crude oil price appreciated by 0.79% to $77.04 per barrel as of writing following the smaller rate hike by Fed has offset the market concern upon recession. On the other hand, the gold price raised by 1.28% to $1951.04 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE MPC Meeting Minutes

21:15 EUR ECB Monetary Policy Statement

21:45 EUR ECB Press Conference

22:15 GBP BoE Gov Bailey Speaks

23:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | GBP – BoE Interest Rate Decision (Jan) | 3.50% | 4.00% | – |

| 21:15 | EUR – Deposit Facility Rate (Feb) | 2.00% | 2.50% | – |

| 21:15 | EUR – ECB Marginal Lending Facility | 2.75% | – | – |

| 21:15 | EUR – ECB Interest Rate Decision (Feb) | 2.50% | 3.00% | – |

| 21:30 | USD – Initial Jobless Claims | 186K | 200K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its losses.

Resistance level: 102.05, 103.20

Support level: 100.55, 99.10

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2415, 1.2535

Support level: 1.2265, 1.2120

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.1040, 1.1165

Support level: 1.0890, 1.0740

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 130.35, 132.60

Support level: 126.70, 123.65

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7235, 0.7355

Support level: 0.7140, 0.7050

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6560, 0.6675

Support level: 0.6460, 0.6360

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3320, 1.3500

Support level: 1.3155, 1.2980

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1960.00, 1986.85

Support level: 1939.10, 1918.90

010223 Afternoon Session Analysis

1 February 2023 Afternoon Session Analysis

New Zealand unemployment climbs, Kiwi dollar falls afterward.

The Kiwi dollar which is traded as one of the major currencies globally slipped after a downbeat labor market report was released. According to the data from Statistics New Zealand, the unemployment rate climbs to 3.4%, which is well above the market expectations of 3.3%. The Employment Change data posted a reading of 0.2%, weaker than the consensus forecast of 0.3%. Both data showed that the labor market remains tight after the Reserve Bank of New Zealand’s aggressive rate hike. The New Zealand Finance Minister, Grant Roberson, mentioned that the country’s unemployment rate actually still remains low and the number of workers has increased significantly through the work visa and working holiday schemes to fill the local labor market. With that, the market participants would continue to eye on more economic data, in order to scrutinize the future monetary policy of the Reserve Bank of New Zealand (RBNZ). As of writing, NZDUSD depreciated -0.275% to $0.6421.

In the commodities market, the crude oil price appreciated 0.14% to $78.98 per barrel as of writing amid EU country sanctions on Russian oil productions. Besides, the gold price depreciated -0.16% to $1942.05 per troy ounce as investors are waiting for more cues on the monetary policy from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

3:00 USD FOMC Statement

(2nd Feb)

3:00 USD FOMC Press Conference

(2nd Feb)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Jan) | 47.0 | 47.0 | – |

| 17:30 | GBP – Manufacturing PMI (Jan) | 46.7 | 46.7 | – |

| 18:00 | EUR – CPI (YoY) (Jan) | 9.2% | 9.0% | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Jan) | 235k | 178k | – |

| 23:00 | USD – ISM Manufacturing PMI (Jan) | 48.4 | 48.0 | – |

| 23:00 | USD – JOLTs Job Openings (Dec) | 10.458M | 10.250M | – |

| 23:30 | USD – Crude Oil Inventories | 0.533M | 0.376M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggests the index to extend its gains if successfully breakout the resistance level.

Resistance level: 102.05, 103.20

Support level: 100.55, 99.10

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggests the pair be traded higher as a technical correction.

Resistance level: 1.2415, 1.2535

Support level: 1.2265, 1.2120

EURUSD, H4: EURUSD was traded lower following the prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggests the pair be traded higher as a technical correction.

Resistance level: 1.0890, 1.1040

Support level: 1.0740, 1.0600

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggests the pair to be traded lower as technical correction.

Resistance level: 130.25, 132.60

Support level: 126.70, 123.65

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7050, 0.7140

Support level: 0.6955, 0.6870

NZDUSD, H4: NZDUSD was traded lower following a prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

USDCAD, Daily: USDCAD was traded lower following a prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggests the pair to be trade higher as technical correction.

Resistance level: 1.3320, 1.3500

Support level: 1.3155, 1.2980

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the support level. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher following the prior breakout above the resistance level. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains.

Resistance level: 1939.10, 1960.00

Support level: 1918.90, 1900.40

010223 Morning Session Analysis

01 February 2023 Morning Session Analysis

US Dollar tumbled amid lower consumer optimism.

The dollar index, which is traded against a basket of six major currencies, lost its foot and reversed a large part of its gain in the previous trading session as downbeat data wiped the positive sentiment in the dollar market. According to the Conference Board, US CB Consumer Confidence printed a reading at 107.1, missing both the consensus forecast and the prior month’s reading at 109.0, pointing to a deterioration of consumer confidence in the economic activity. In fact, the reduction of consumer confidence was mainly attributed to the aggressive rate hike plan from the Federal Reserve (Fed), whereby it had led to lower wage growth and higher borrowing costs in the US as the objective of the Fed was to achieve a dual mandate which includes price stability and full employment, thus, investors are now eyeing on the Fed pivot to scrutinize the future trend of the markets. Despite the fact that the market has fully priced in a 25-basis point rate hike that would be implemented in the Fed meeting, the still-high inflation in the US likely put the US interest rate at an elevated level for an extended period of time. As of writing, the dollar index dropped -0.18% to 102.10.

In the commodities market, crude oil prices rose by 1.67% to $79.00 per barrel as the oil demand surged with the backdrop of dollar’s weakness. Besides, gold prices appreciated 0.26% to $1928.20 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

3:00 USD FOMC Statement

(2nd Feb)

3:00 USD FOMC Press Conference

(2nd Feb)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Jan) | 47.0 | 47.0 | – |

| 17:30 | GBP – Manufacturing PMI (Jan) | 46.7 | 46.7 | – |

| 18:00 | EUR – CPI (YoY) (Jan) | 9.20% | 9.10% | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Jan) | 235K | 170K | – |

| 23:00 | USD – ISM Manufacturing PMI (Jan) | 48.4 | 48 | – |

| 23:00 | USD – JOLTs Job Openings (Dec) | 10.458M | 10.200M | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 0.533M | 0.376M | – |

| 3:00

(2nd Feb) |

USD – Fed Interest Rate Decision | 4.50% | 4.75% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 101.25. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded lower following a prior breakout below the previous support level at 1.2345. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2200.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

EURUSD, Daily: EURUSD was traded lower following prior retracement from the resistance level at 1.0935. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0775.

Resistance level: 1.0935, 1.1115

Support level: 1.0775, 1.0675

USDJPY, Daily: USDJPY was traded higher while currently testing the upper level of the downward channel. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the upper level.

Resistance level: 131.25, 134.15

Support level: 128.60, 126.30

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.7125. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6985.

Resistance level: 0.7125, 0.7260

Support level: 0.6985, 0.6725

NZDUSD, Daily: NZDUSD was traded lower following a prior breakout below the previous support level at 0.6460. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6355.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3400. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 76.10. However, MACD which illustrated bearish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1900.00. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1944.60.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00