240622 Morning Session Analysis

24 June 2022 Morning Session Analysis

US Dollar depreciated after Fed Chairman speech.

The Dollar Index which traded against a basket of six major currencies eased on Thursday after the US Fed Chair Powell Testifies. According to Reuters, Federal Reserve Chairman Jerome Powell reiterated his comments on yesterday, which claimed that the Fed is “unconditional” to stabilize the soaring inflation risk, even though the rate hike would likely to push up unemployment rate. He also mentioned that the Fed have to implement aggressive tightening monetary policy in order to have a sustained period of maximum employment where the benefits are spread very widely. Despite the implementation of rate hike would likely to combat inflation risk, it would also increase the borrowing cost while diminishing the consumer and corporation spending in short-time period. It led investors to shift their capitals out of US market temporarily and look for other currencies. Besides, the Dollar Index extend its losses over the downbeat economic data. According to US Department of Labor, the US Initial Jobless Claims came in at the reading of 229K, which exceeding the market forecast of 227K. The higher-than-expected reading indicated that the current US labor market remained fragile, which brought negative prospects toward economic progression in US. As of writing, the Dollar Index edged up by 0.17% to 104.16.

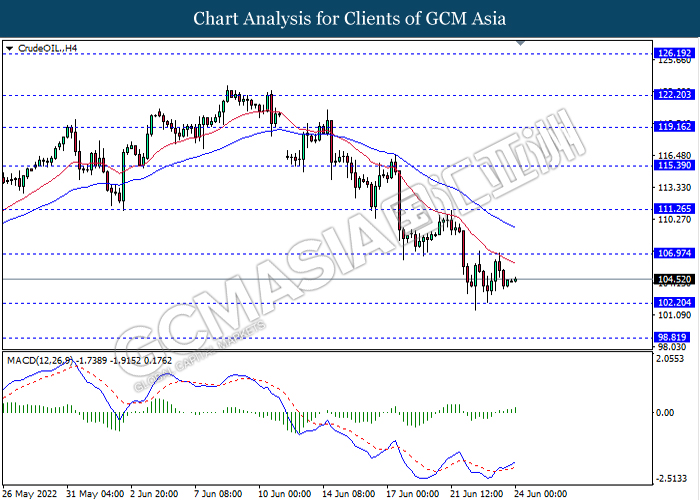

In the commodities market, crude oil price appreciated by 0.20% to $104.50 per barrel as of writing. Nonetheless, the overall trend of oil price remained bearish following the fears of rate hikes might slow economic growth. On the other hands, gold price depreciated by 0.24% to $1825.40 per troy ounce as of writing amid the Fed Chairman was fully committed to bring prices down.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (May) | 1.4% | -0.9% | – |

| 16:00 | EUR – German Ifo Business Climate Index (Jun) | 93.0 | 92.9 | – |

| 22:00 | USD – New Home Sales (May) | 591K | 585K | – |

Technical Analysis

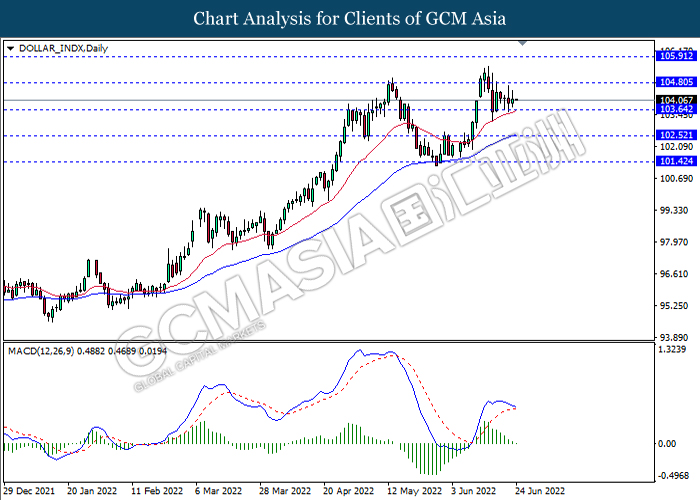

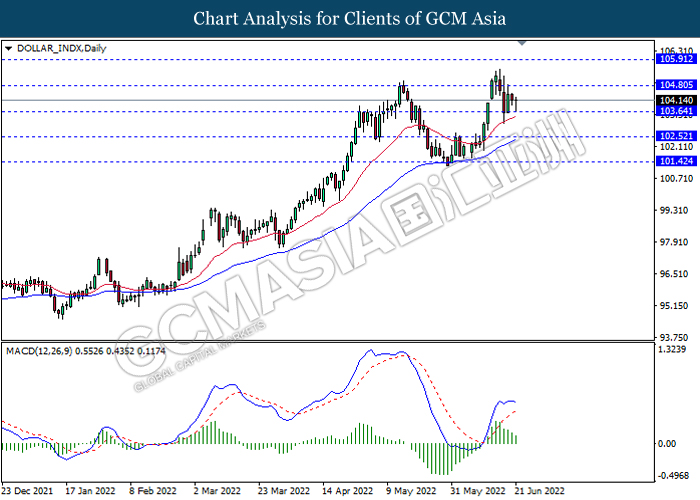

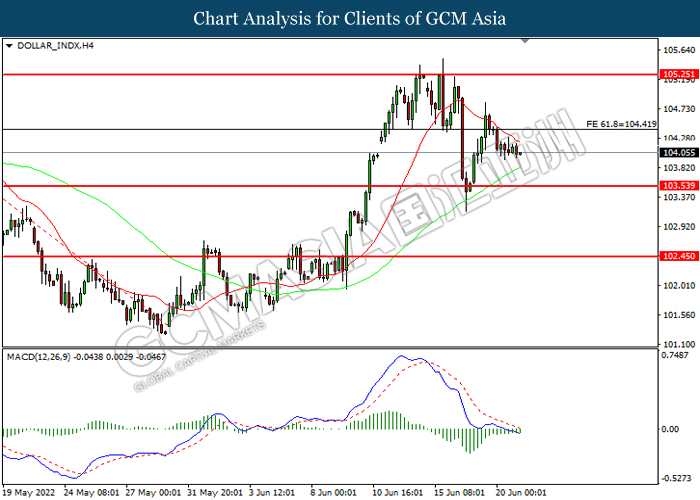

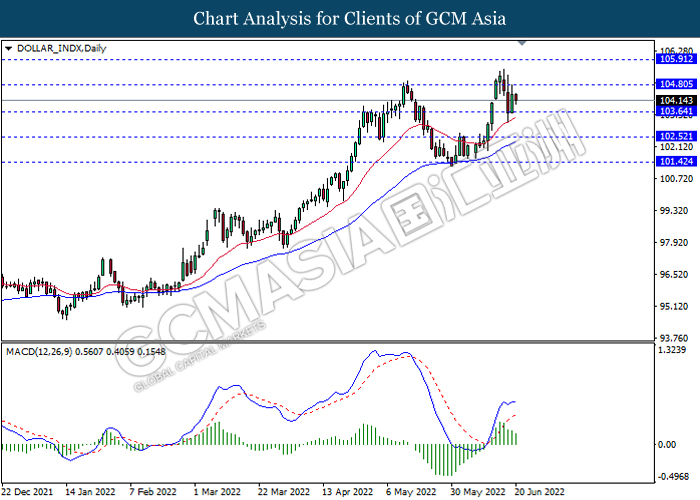

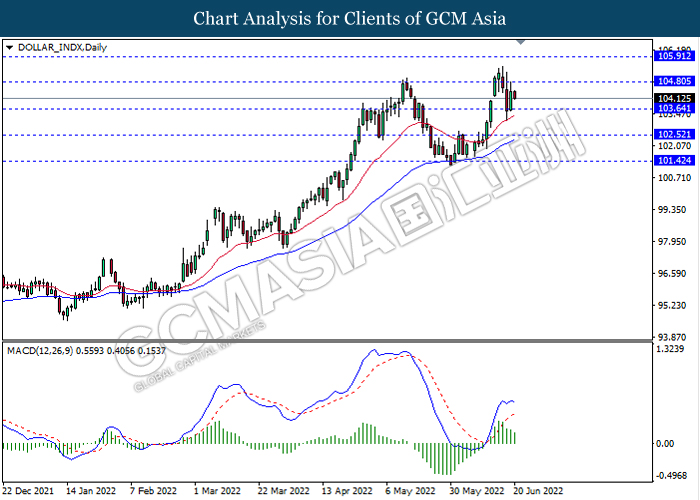

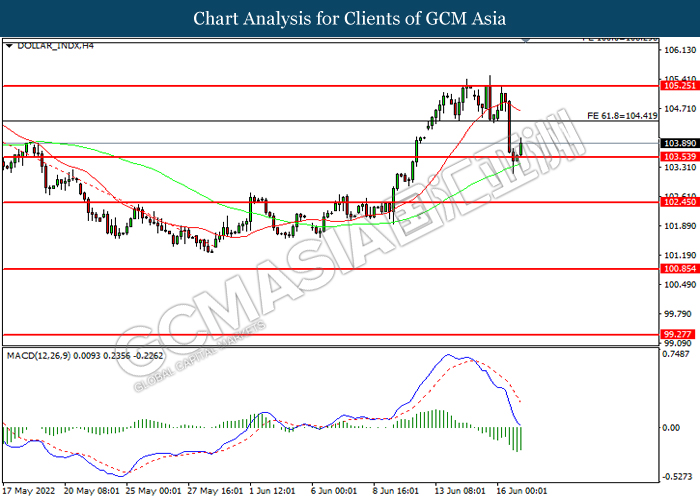

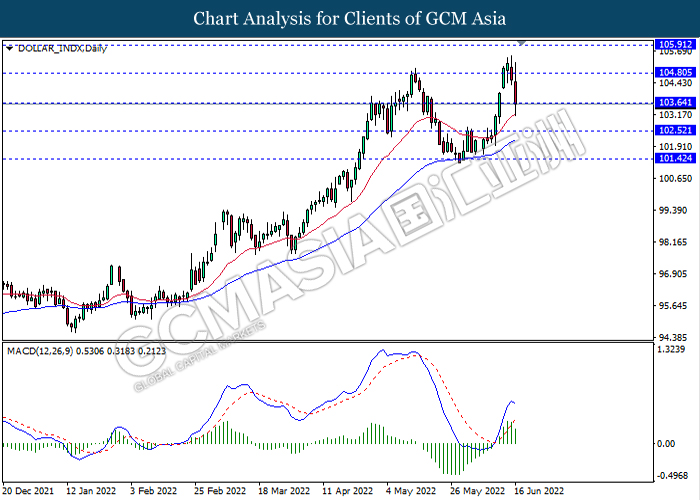

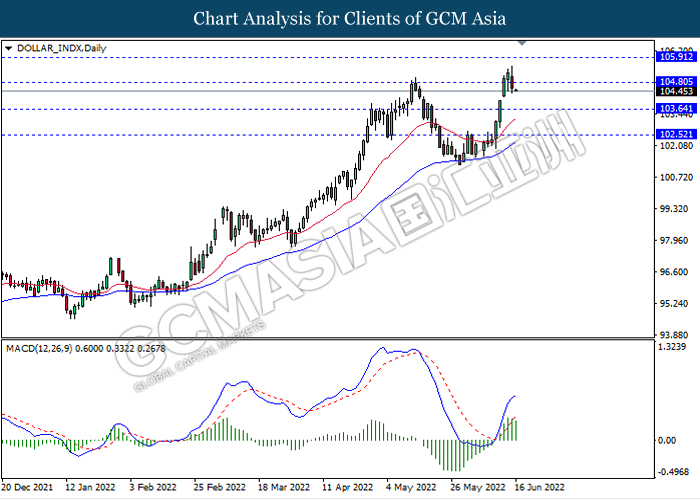

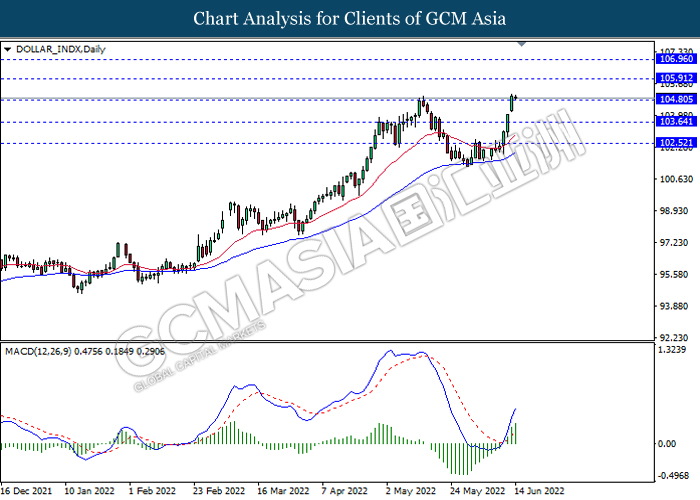

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

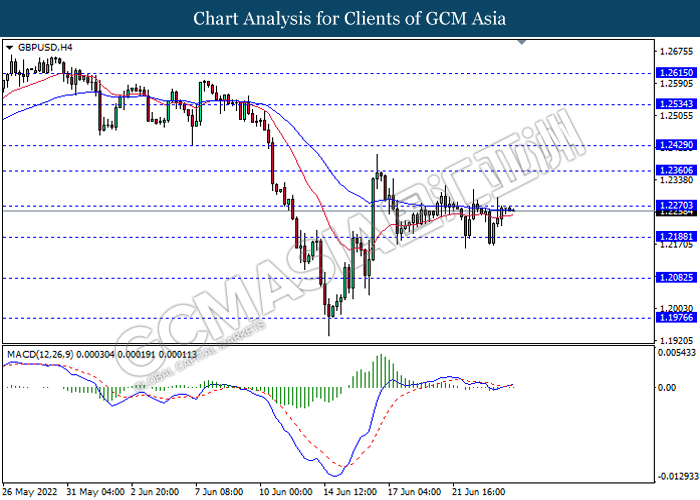

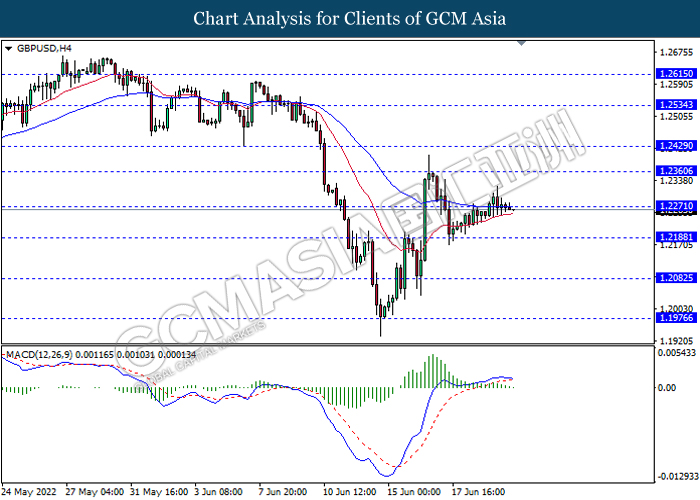

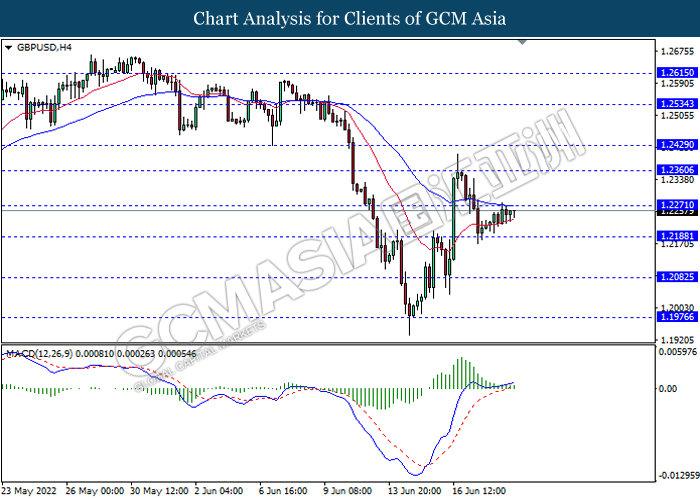

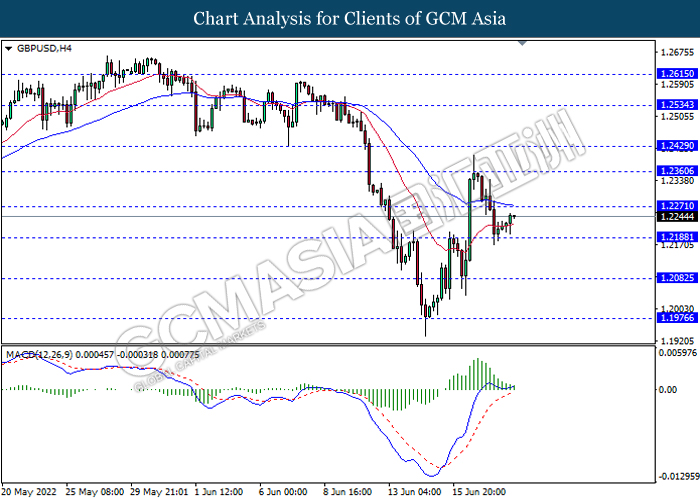

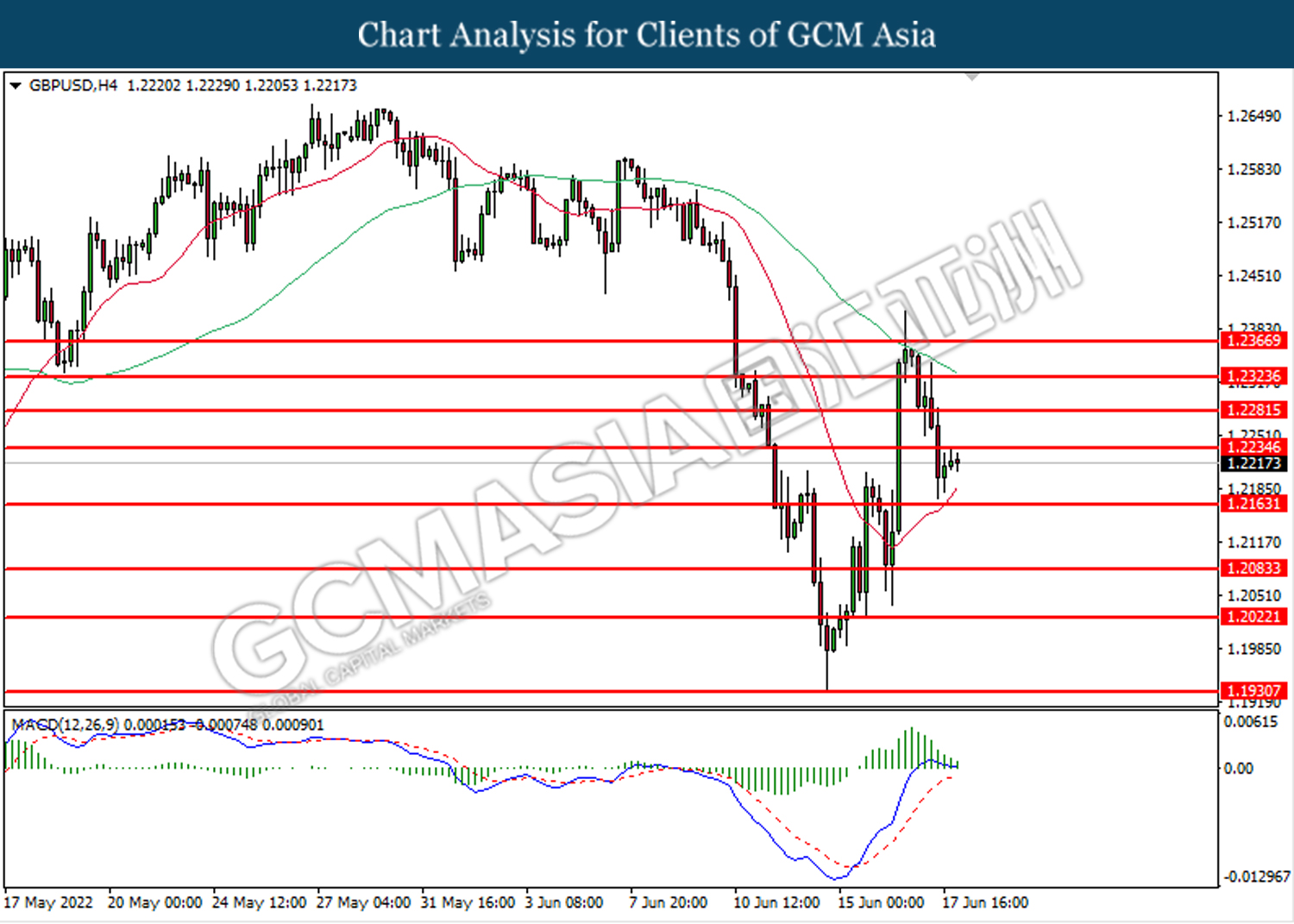

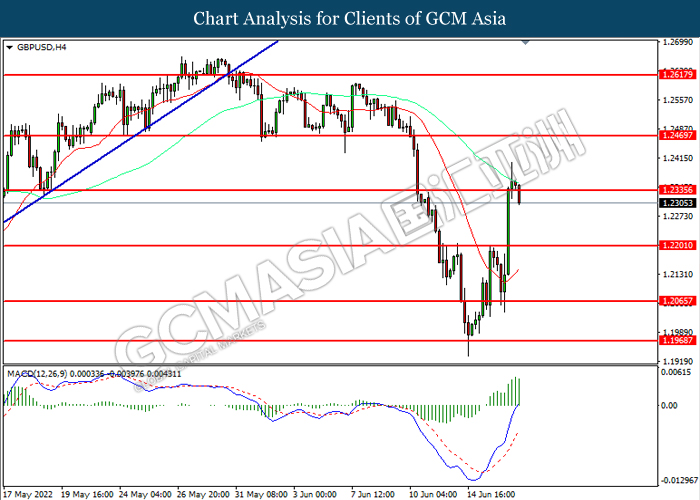

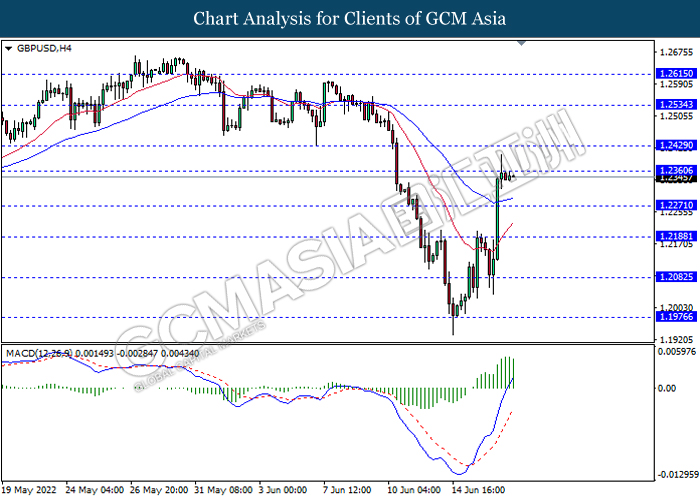

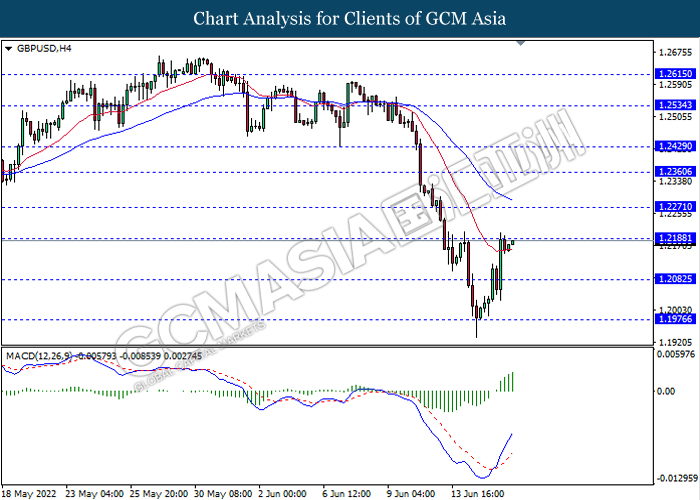

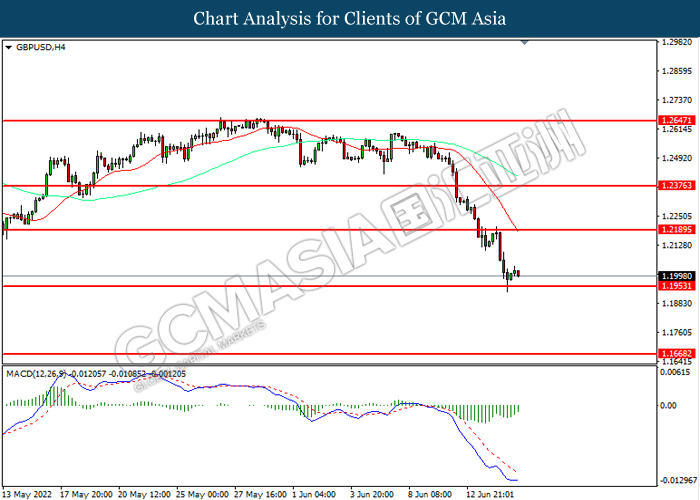

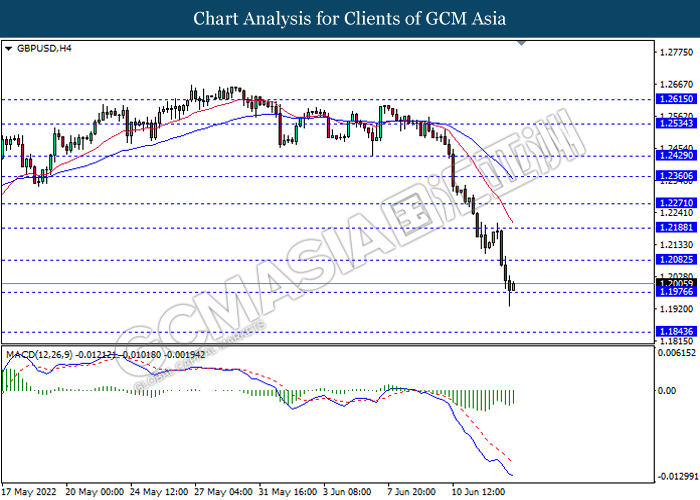

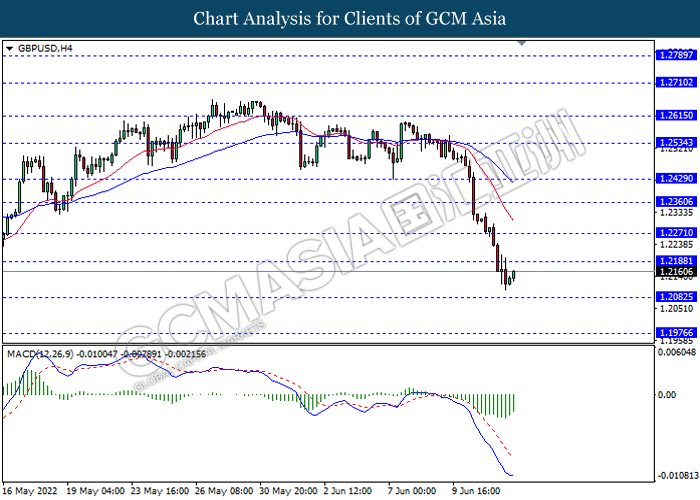

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2270, 1.2360

Support level: 1.2190, 1.2080

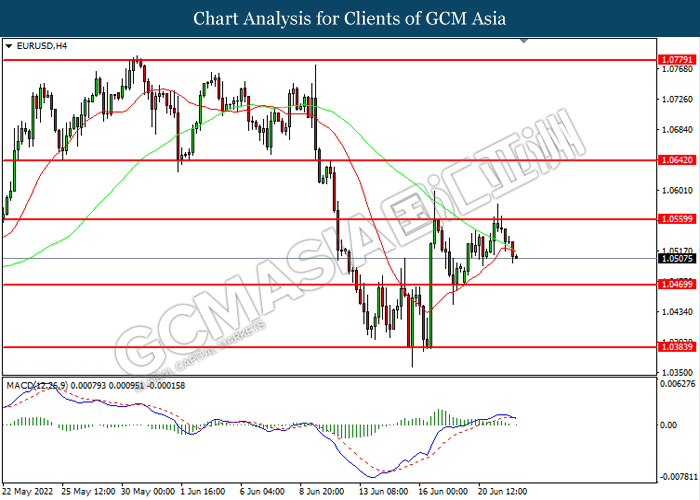

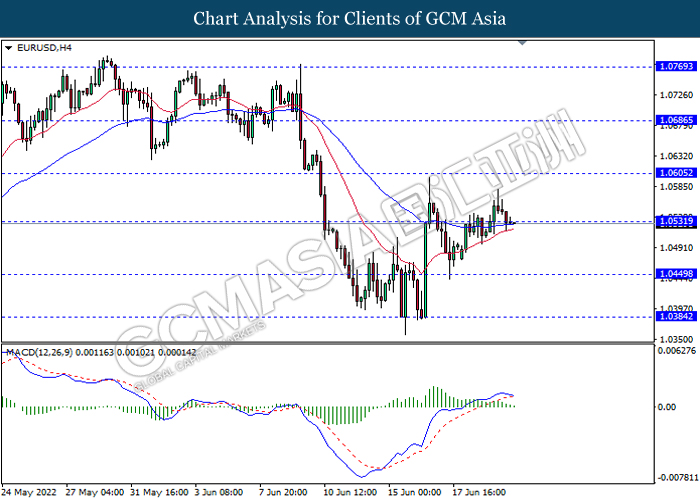

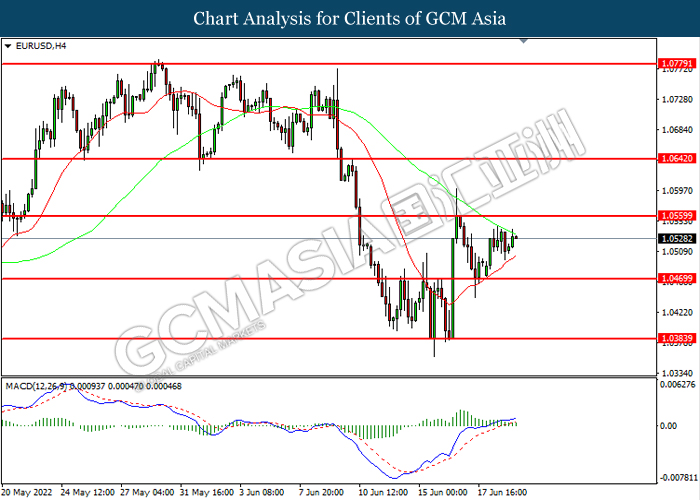

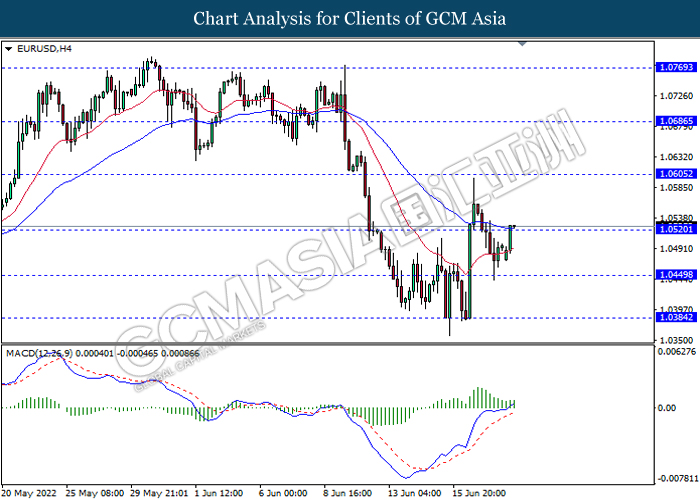

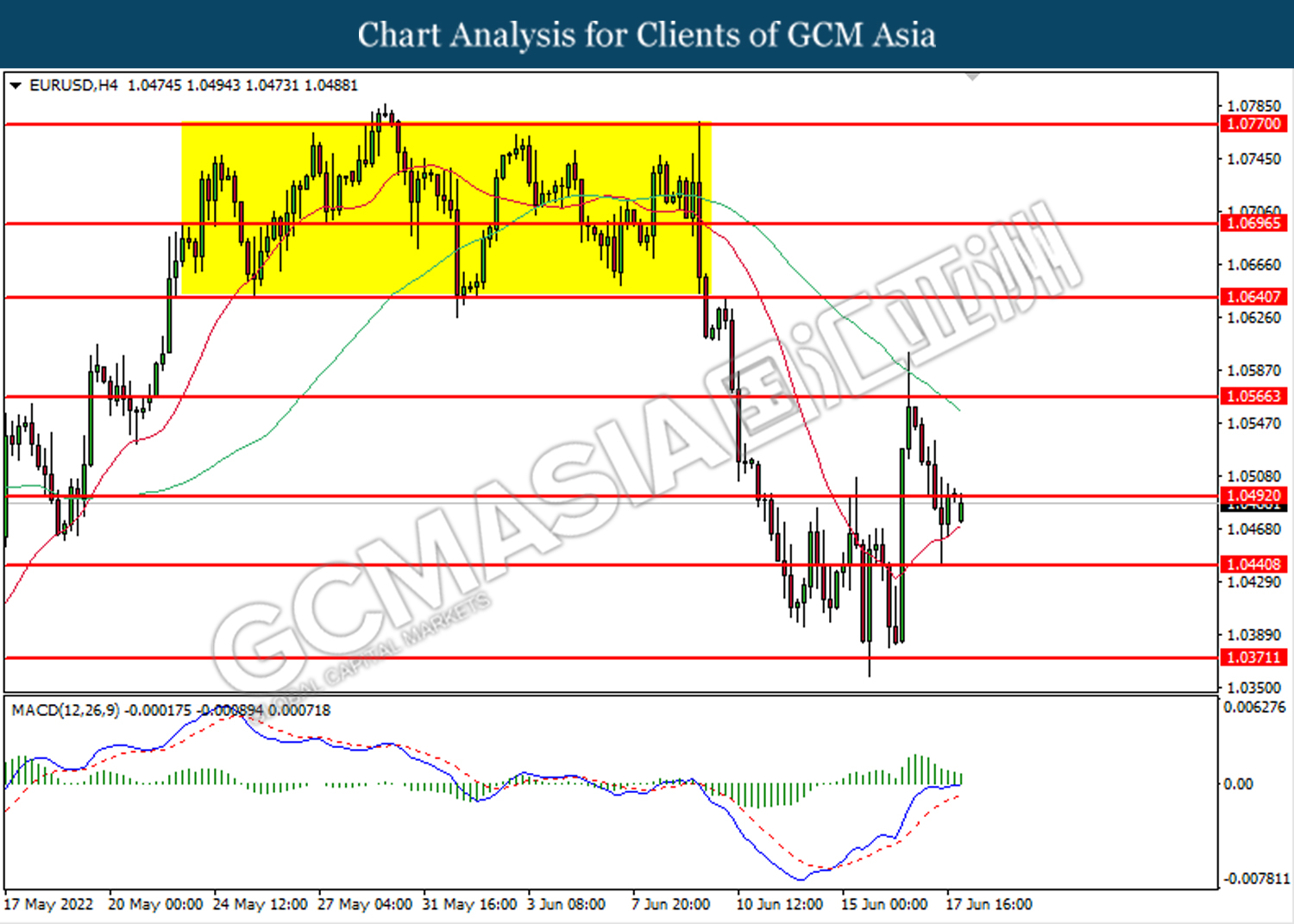

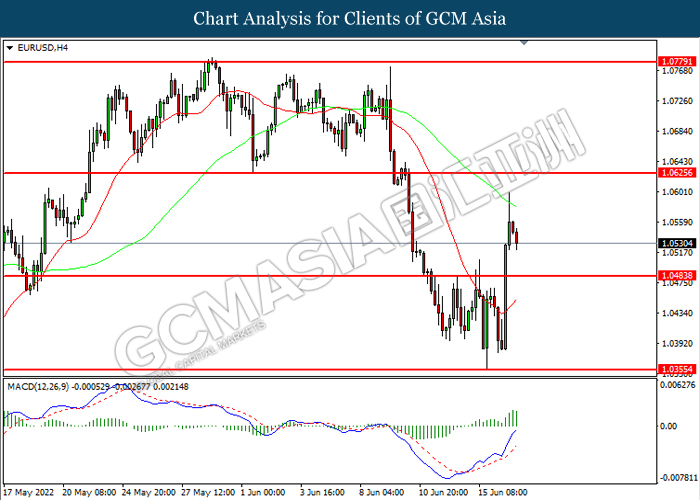

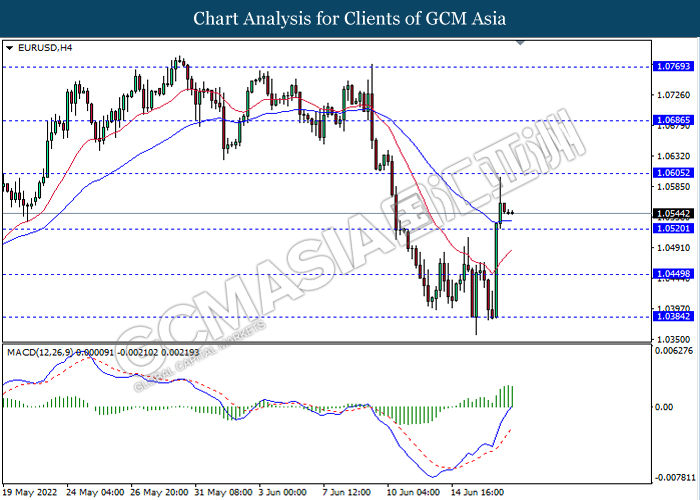

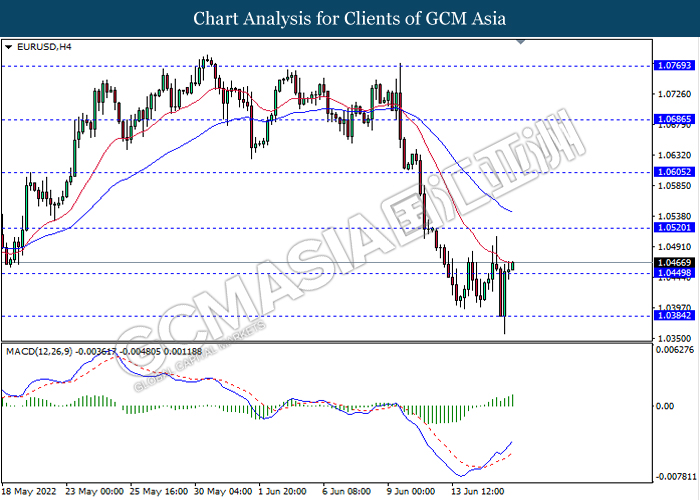

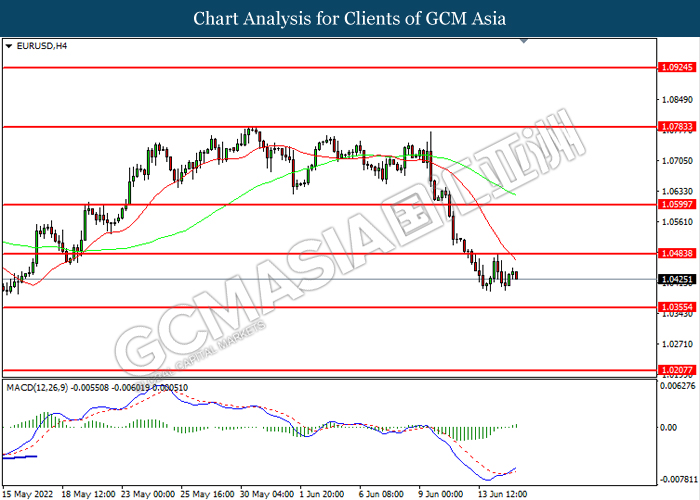

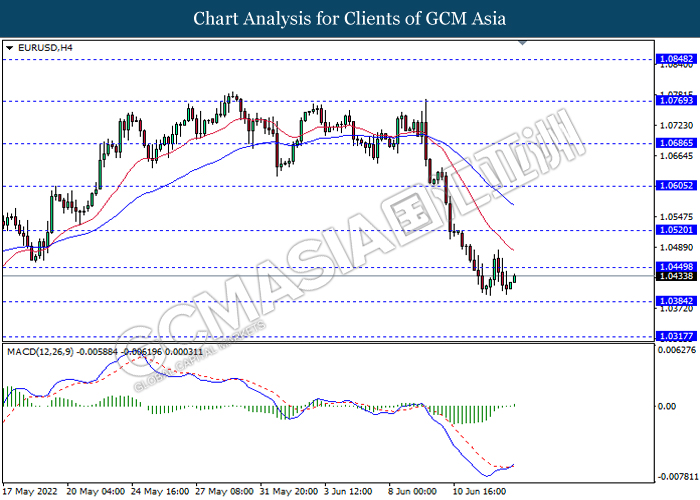

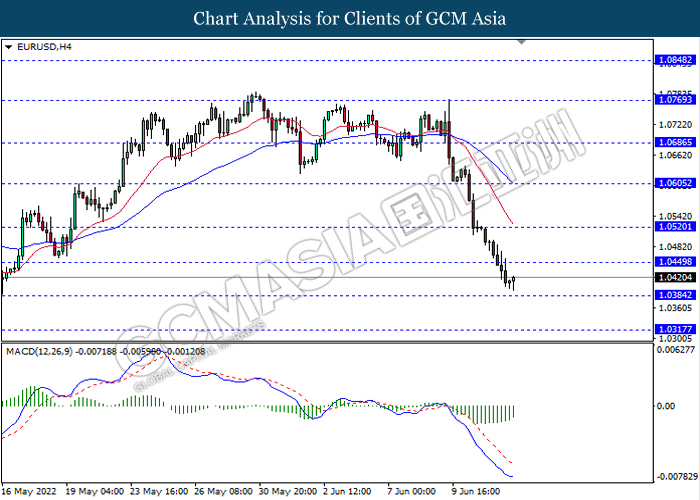

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0530, 1.0605

Support level: 1.0450, 1.0385

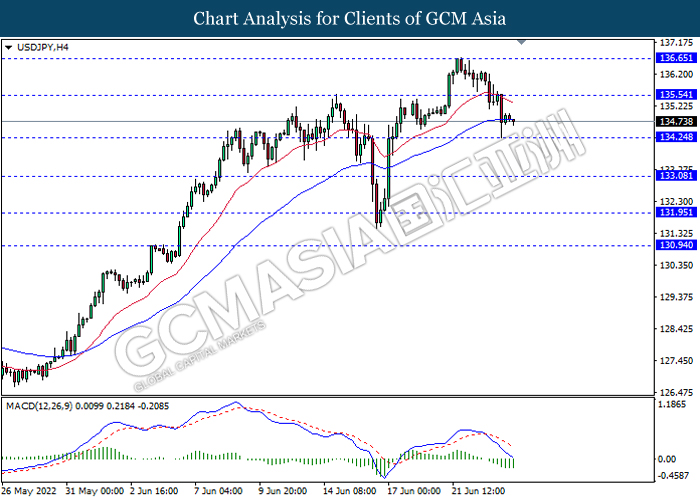

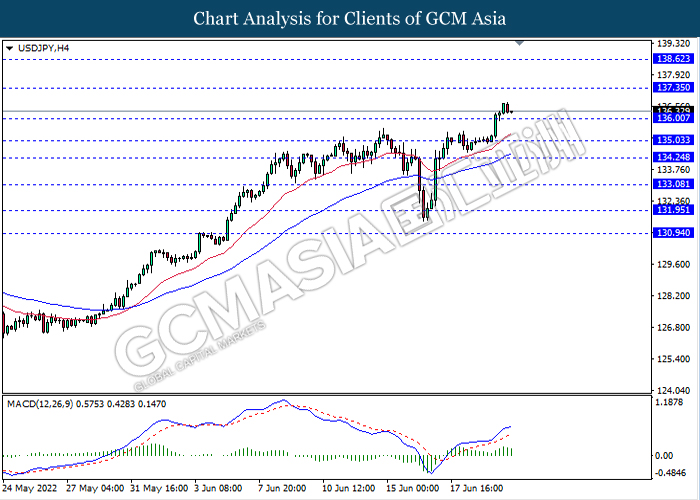

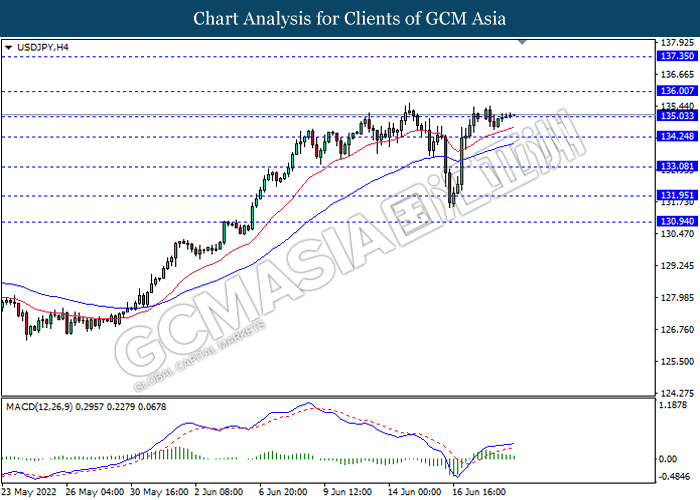

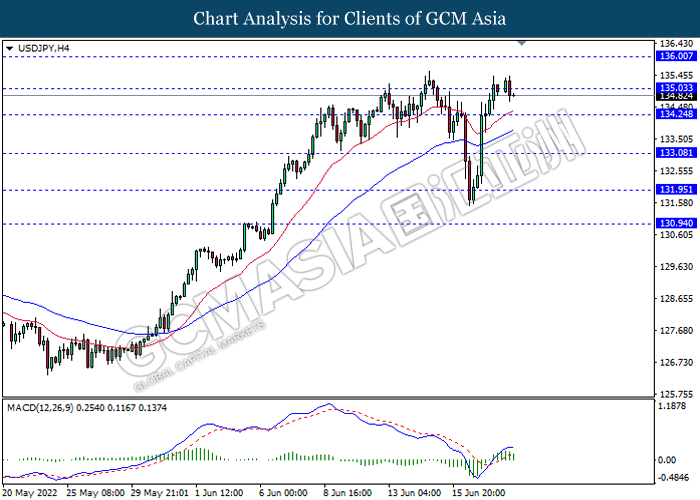

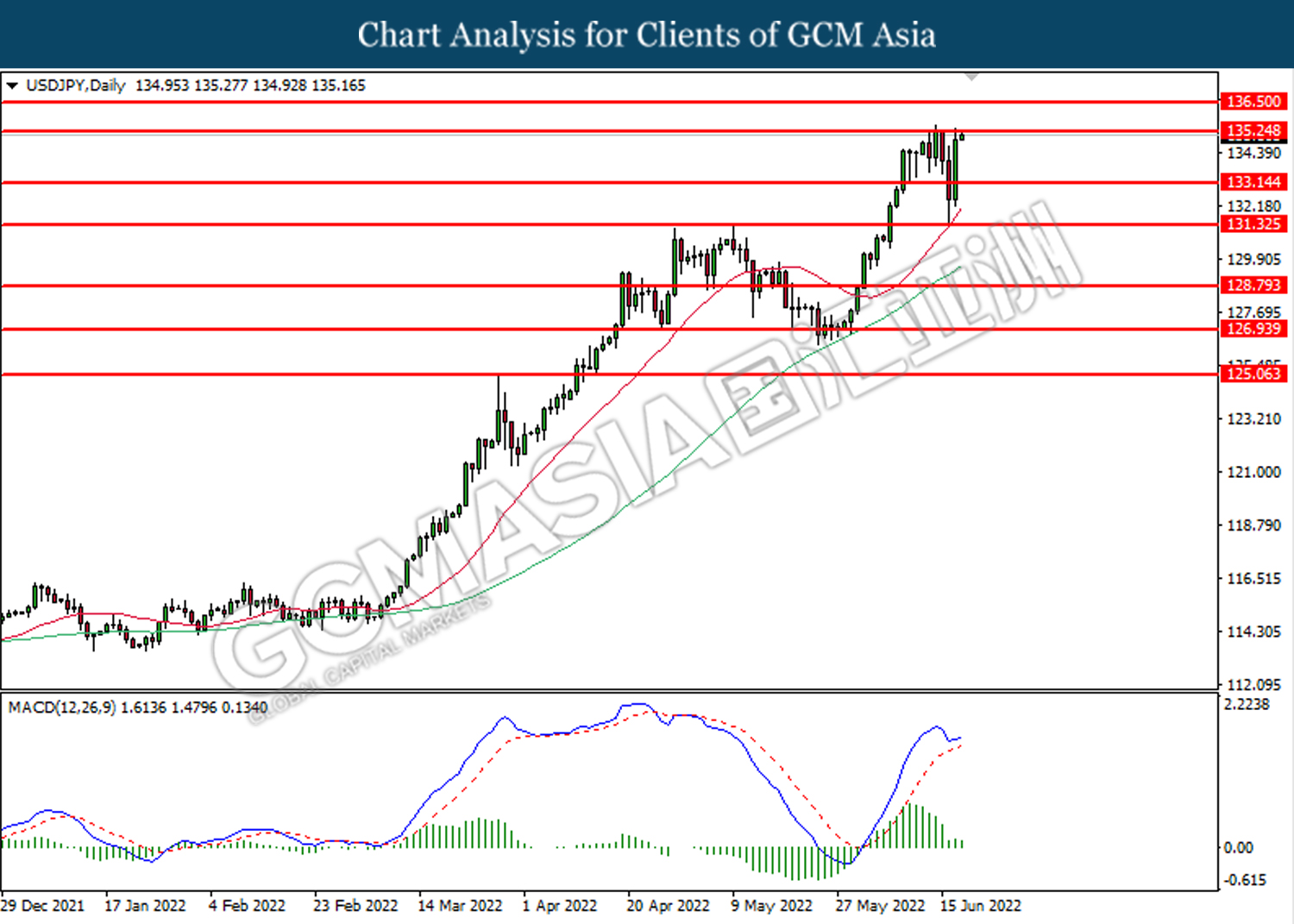

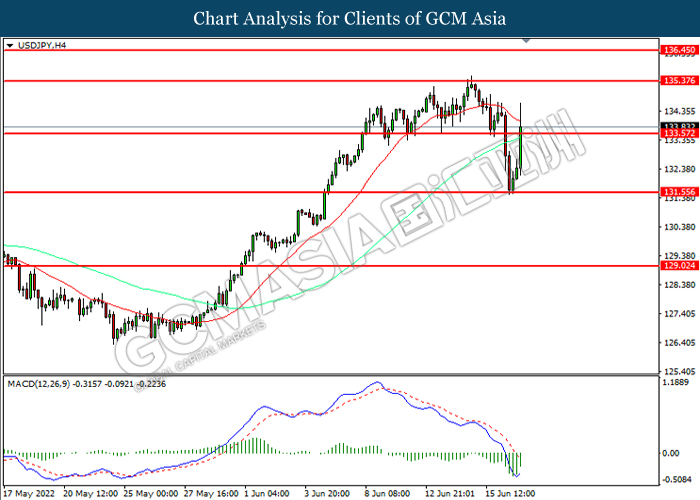

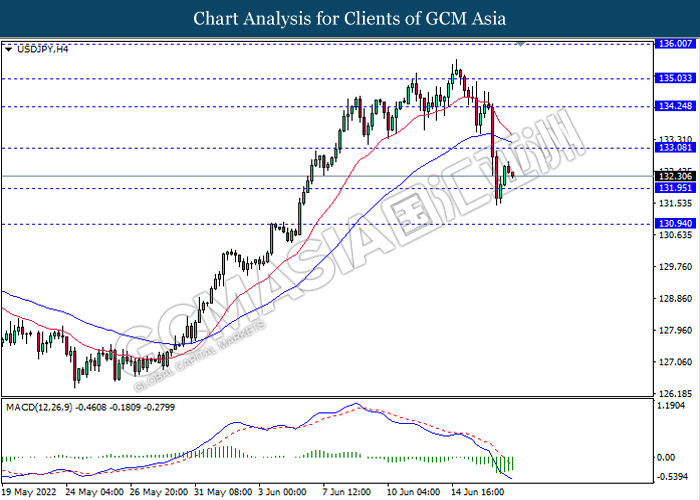

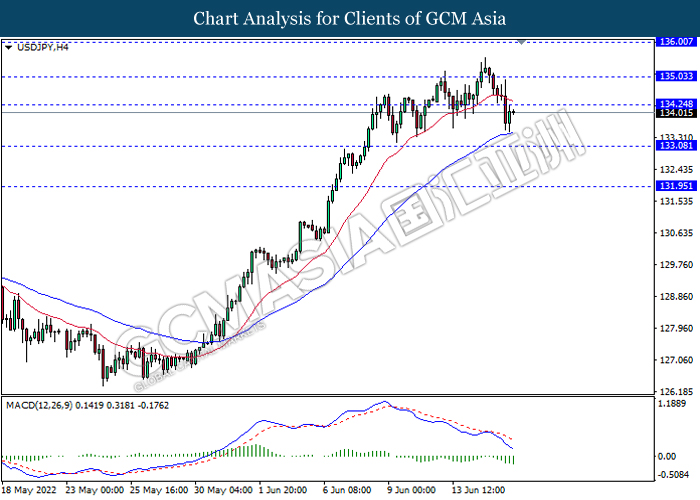

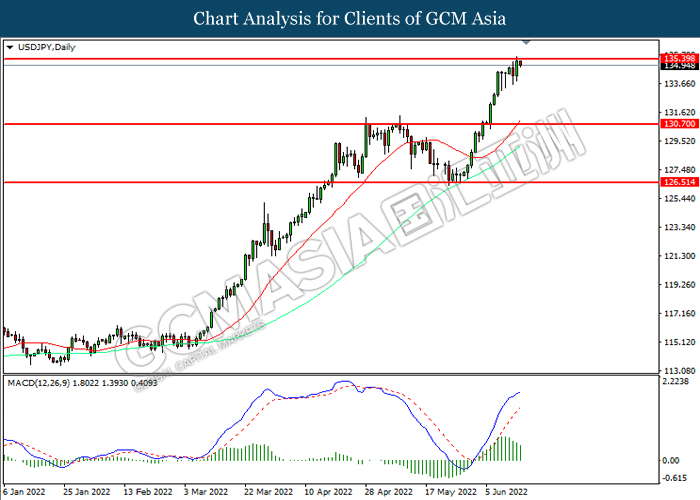

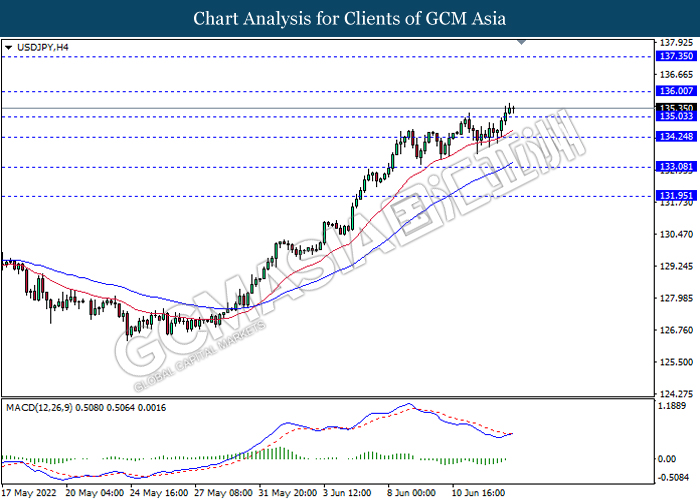

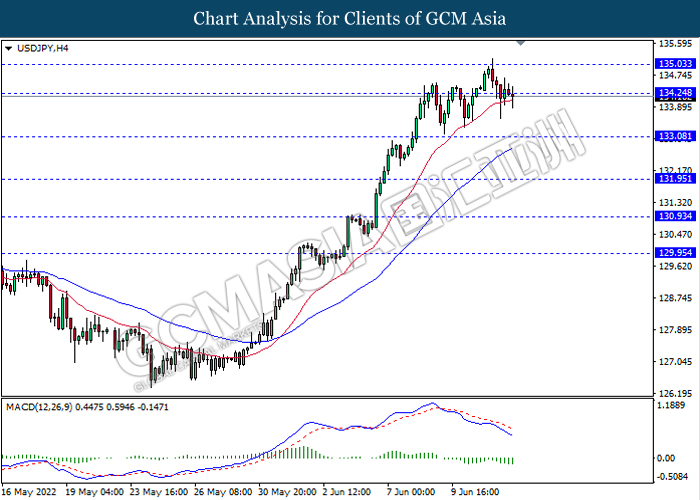

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 135.55, 136.65

Support level: 134.25, 133.10

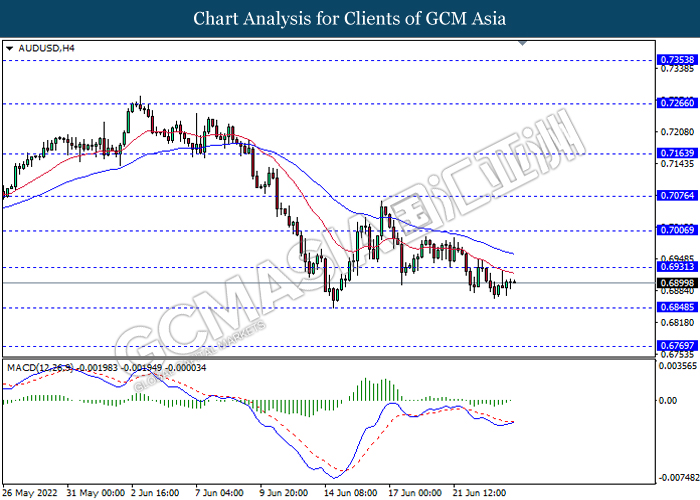

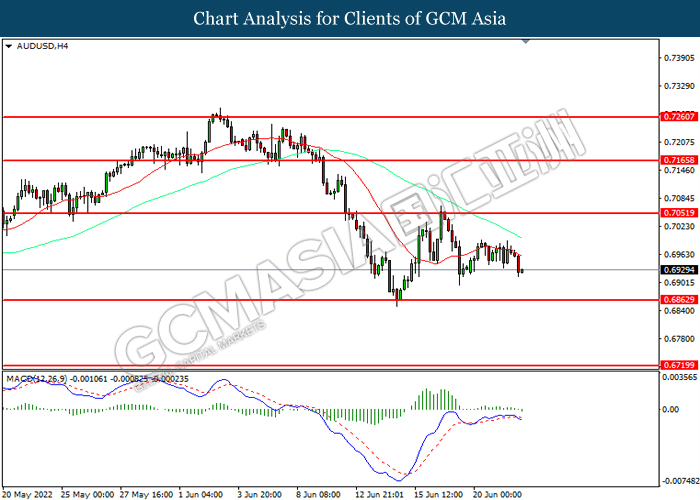

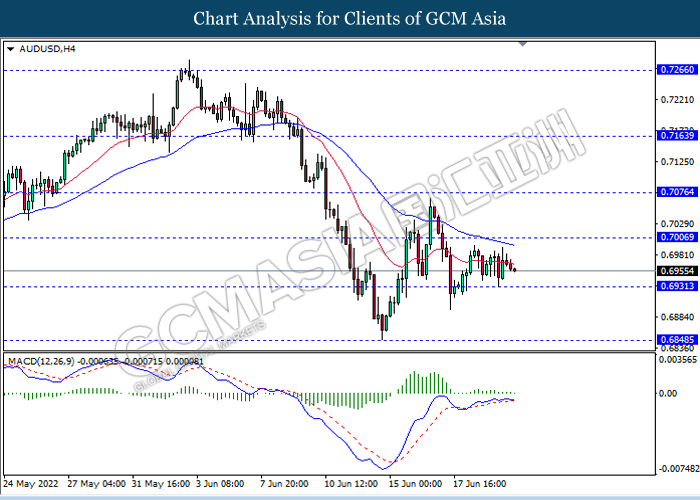

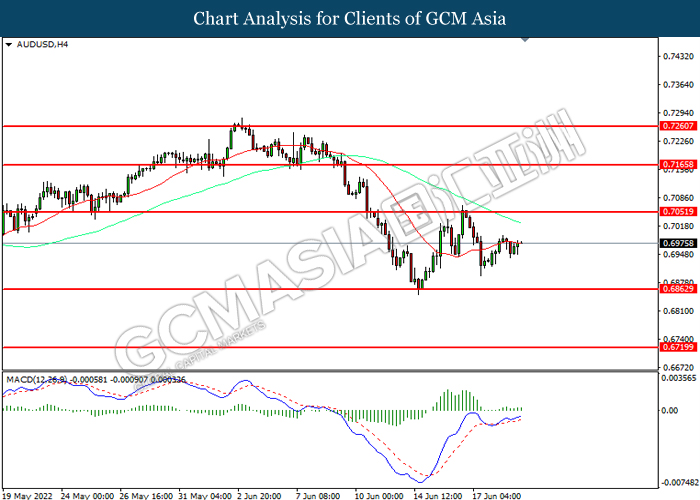

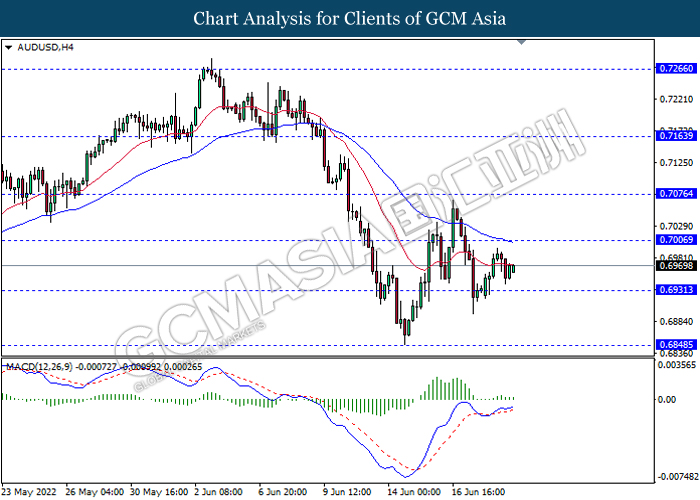

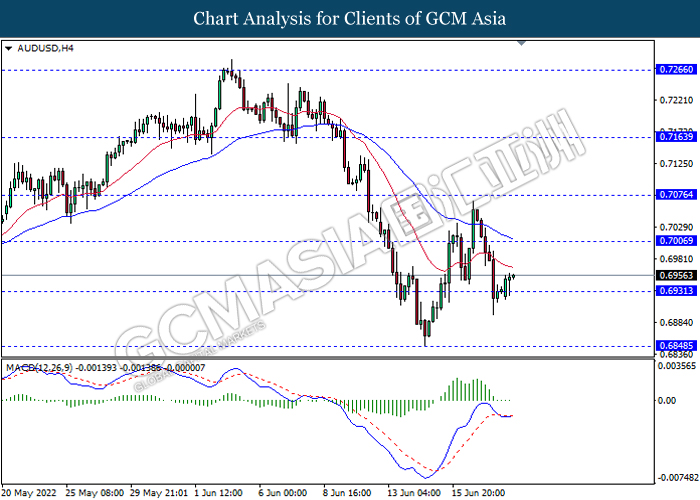

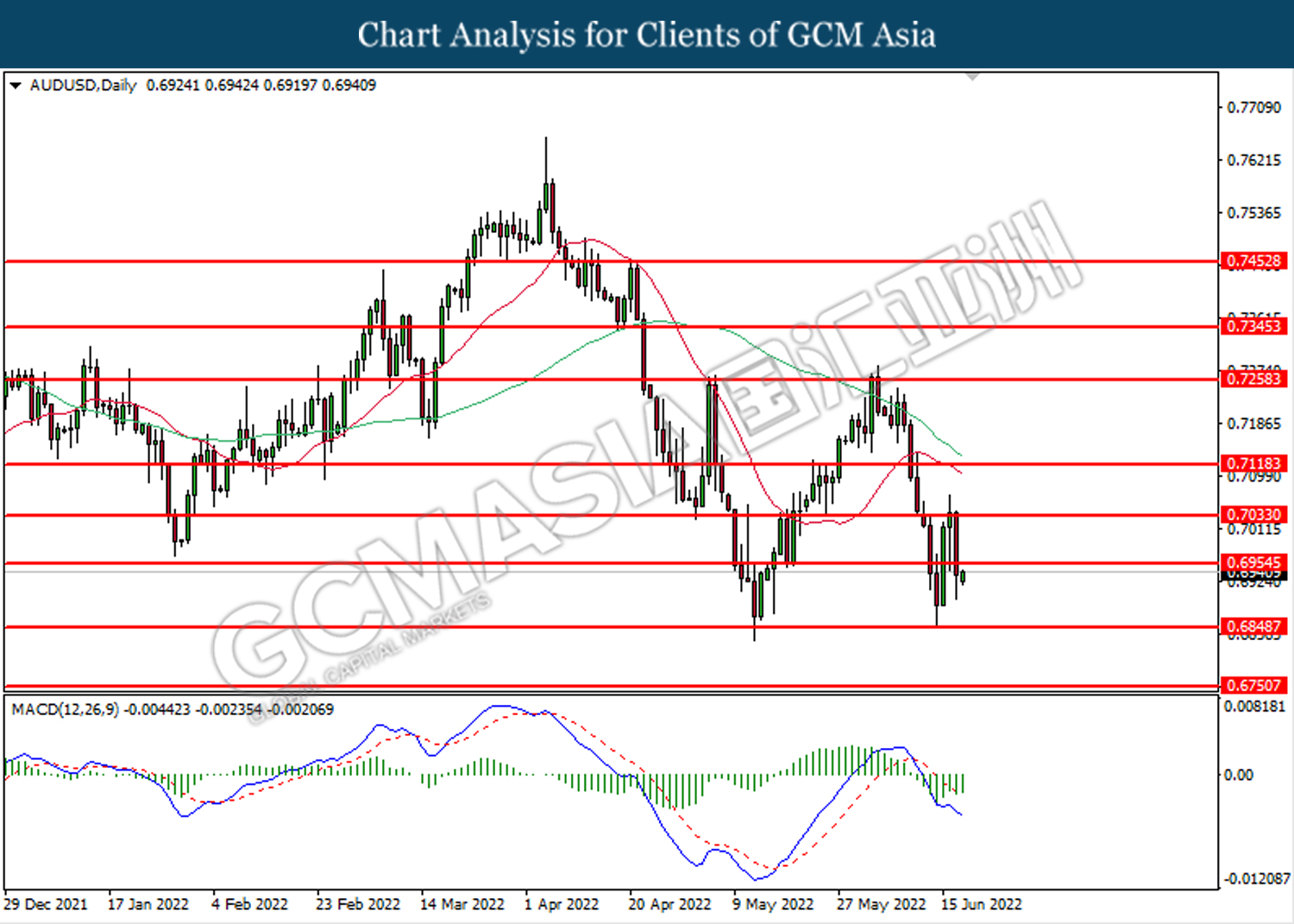

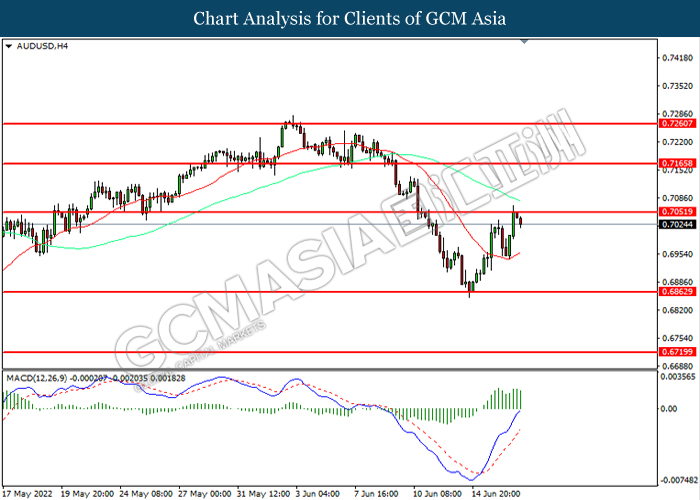

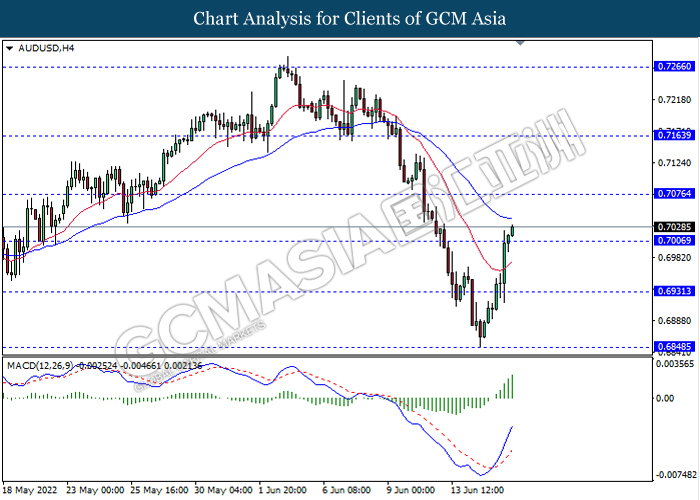

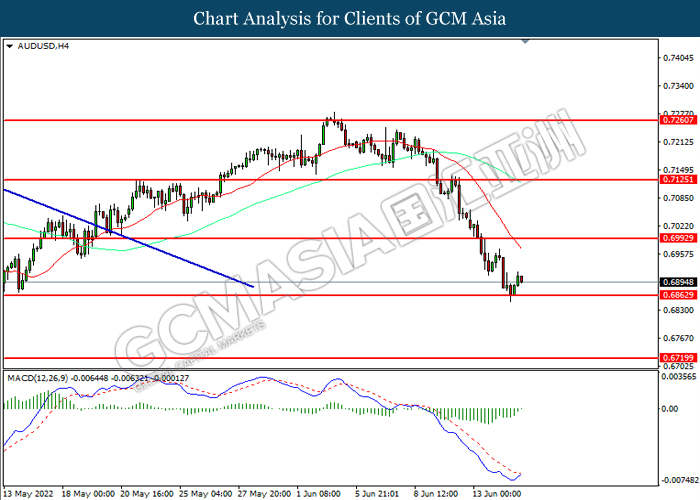

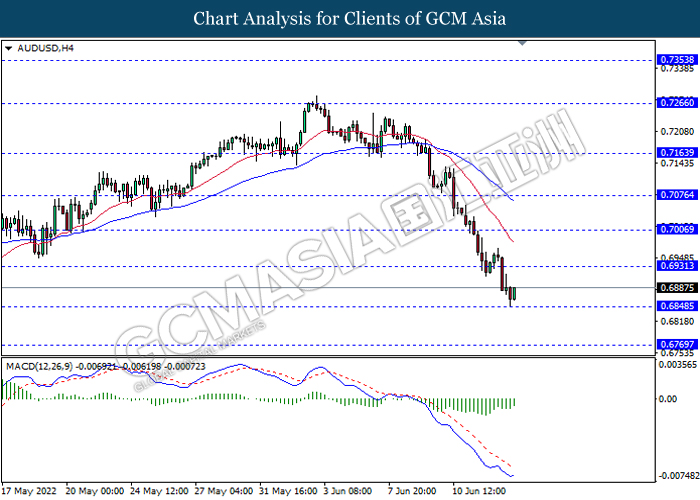

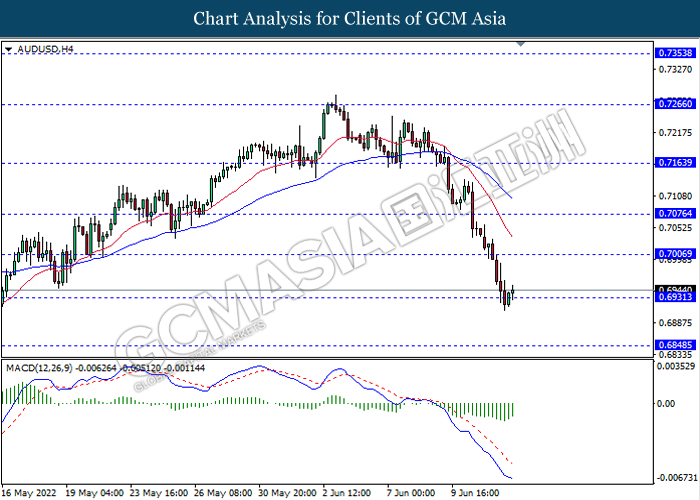

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

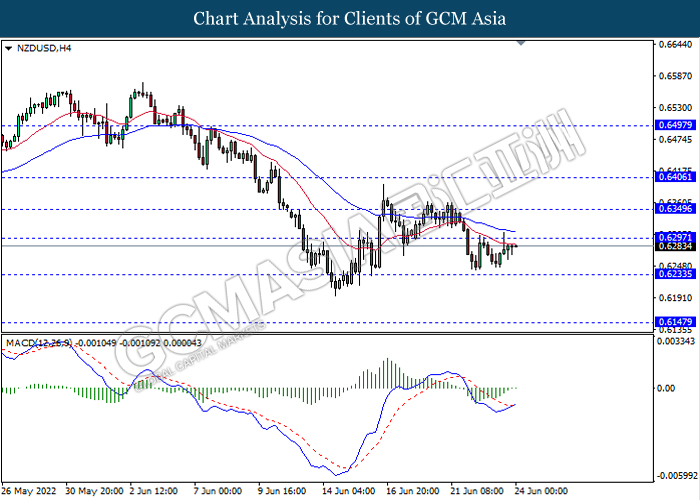

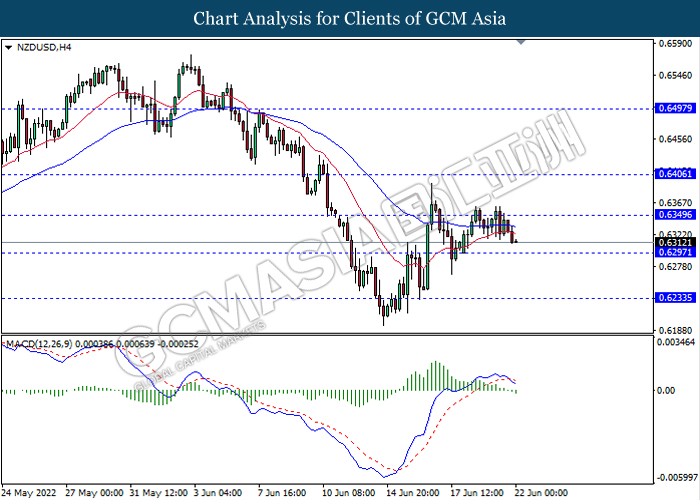

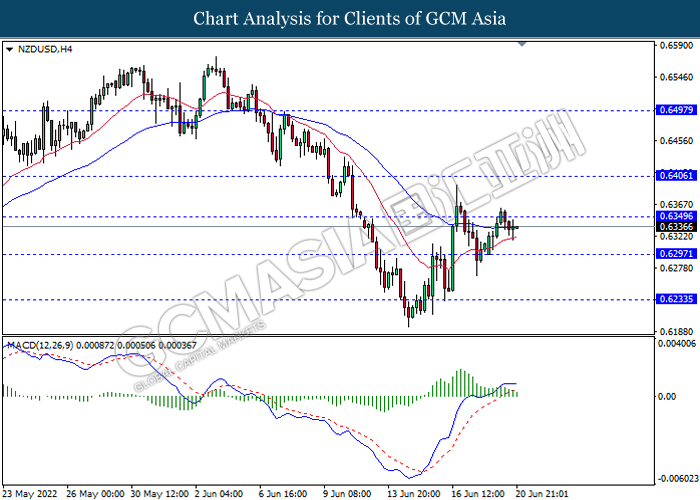

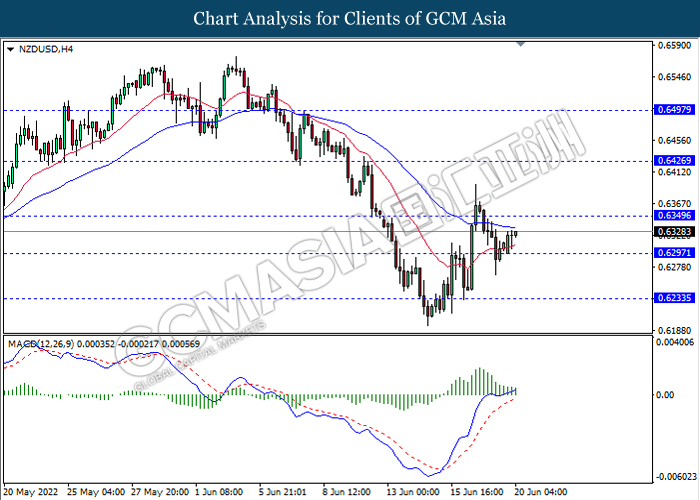

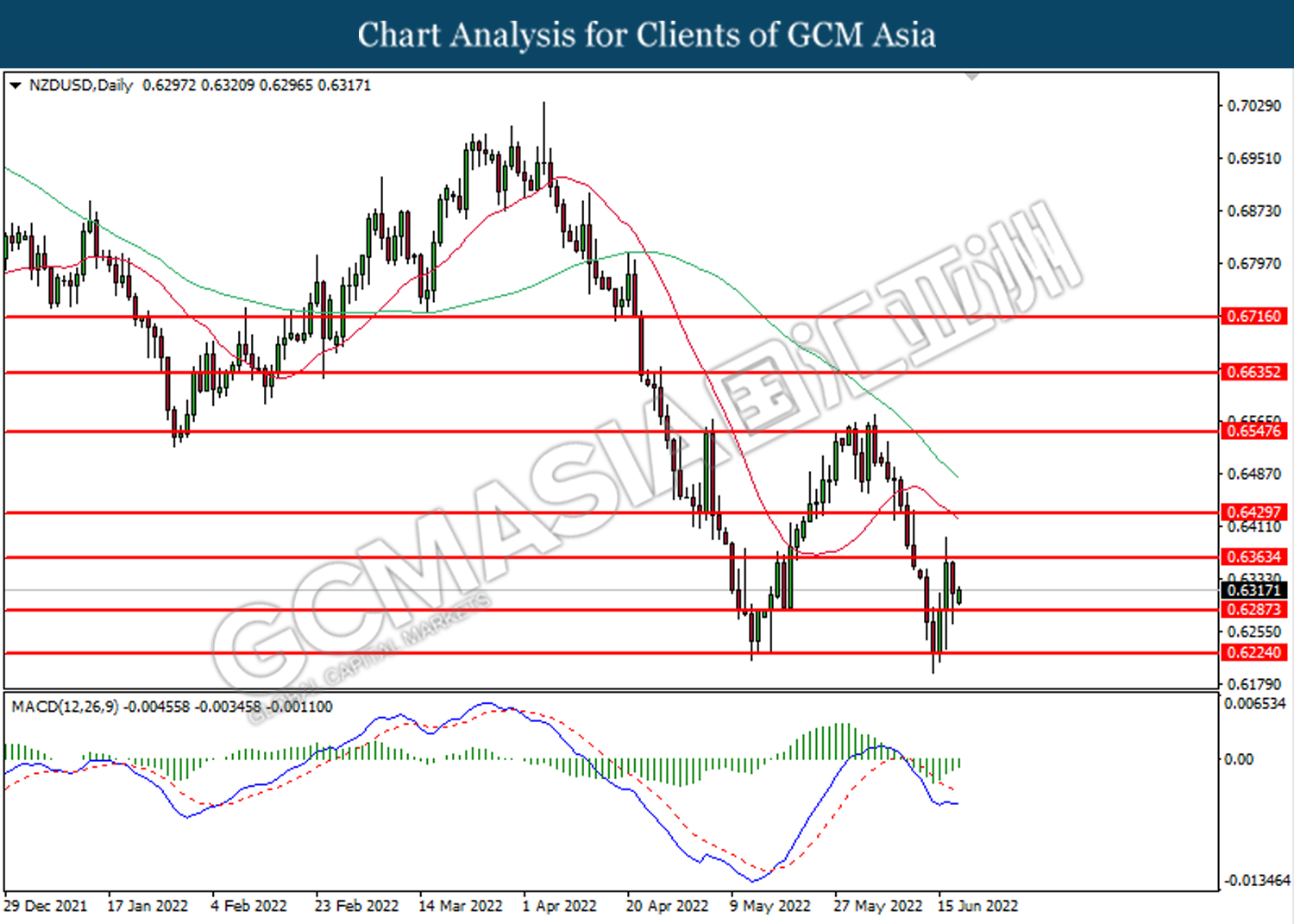

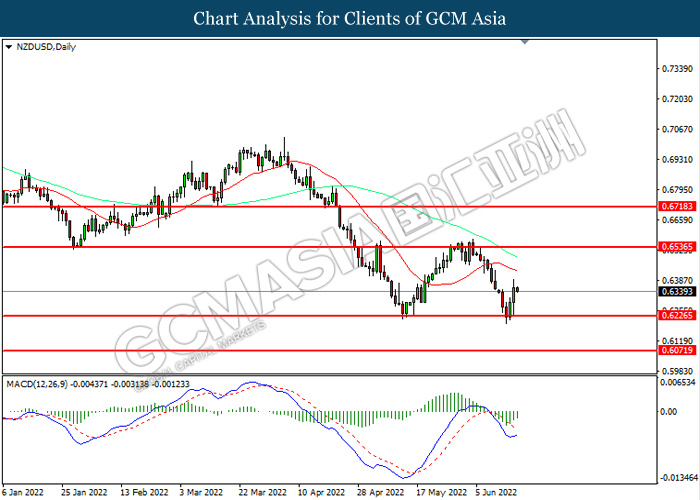

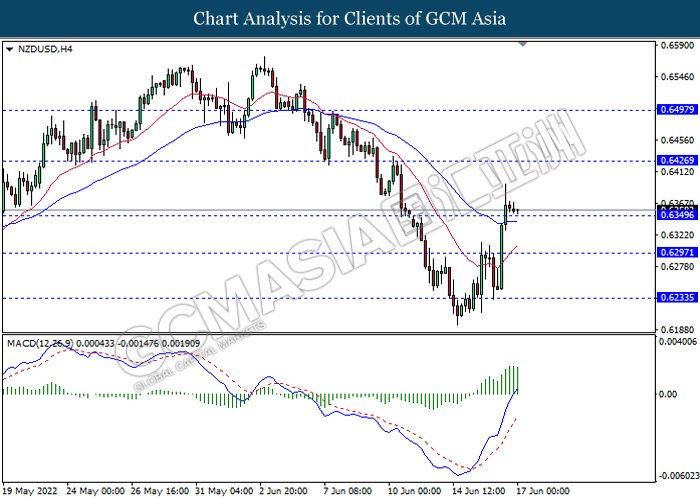

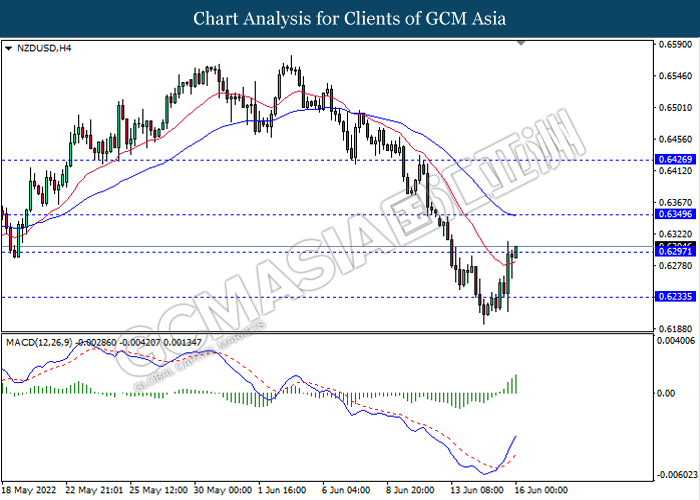

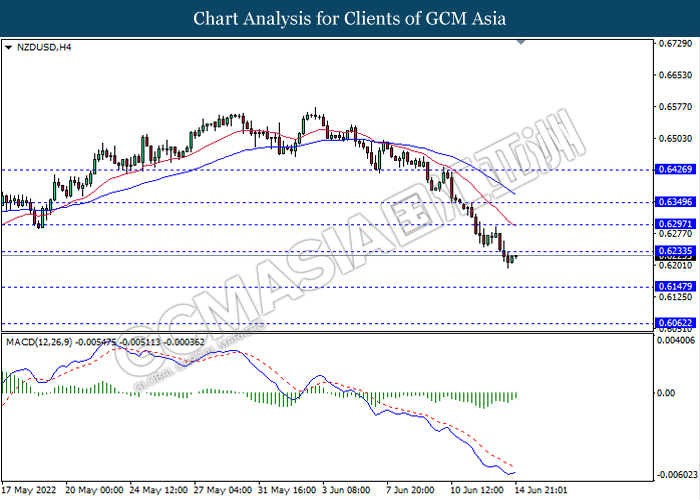

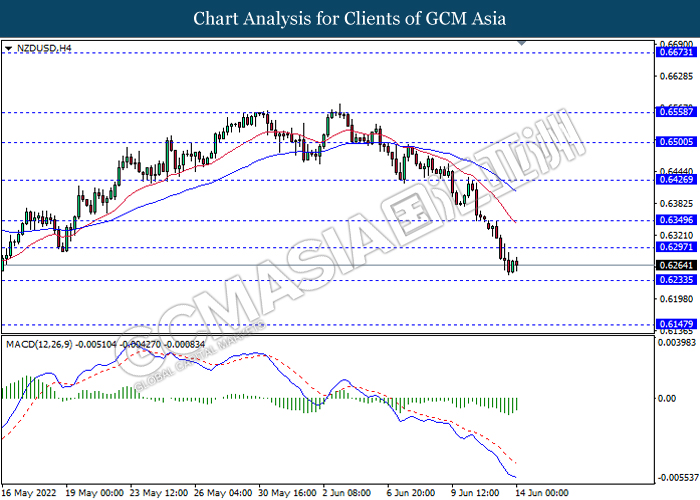

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6145

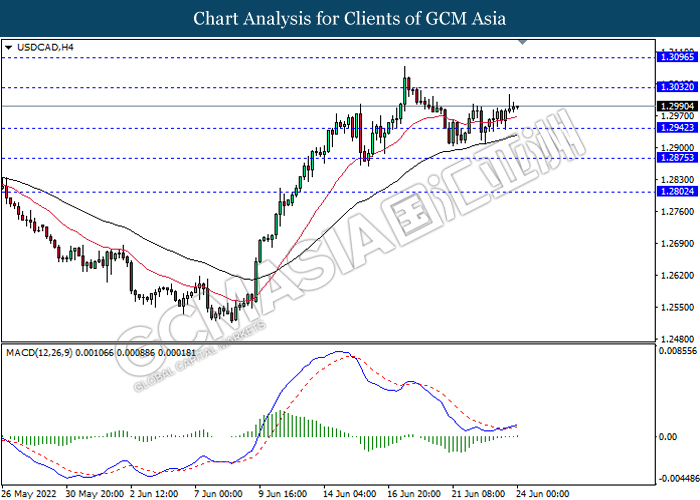

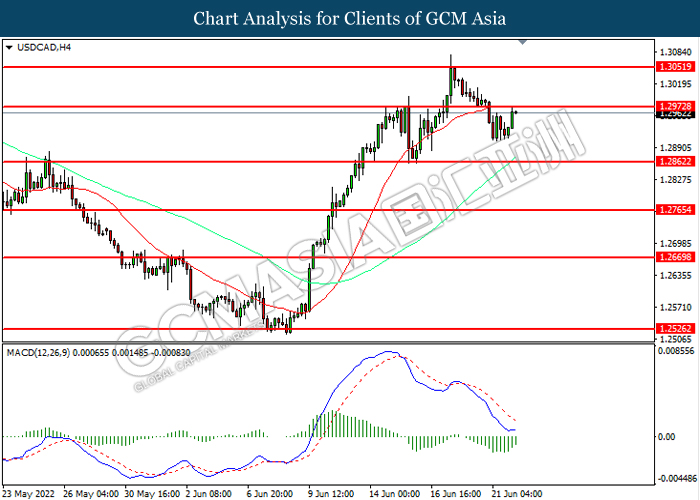

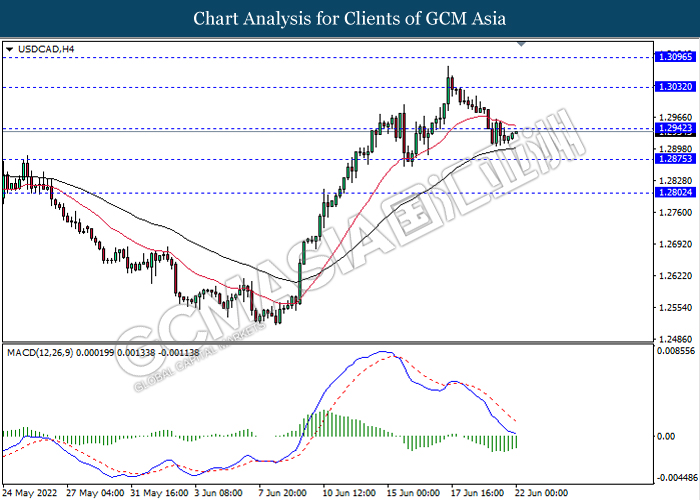

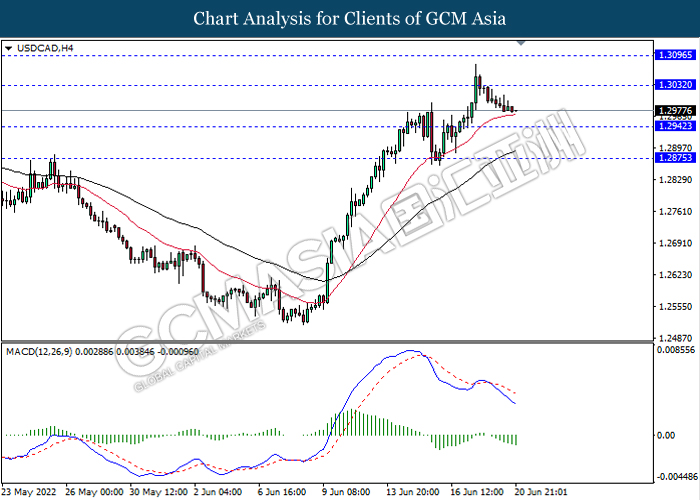

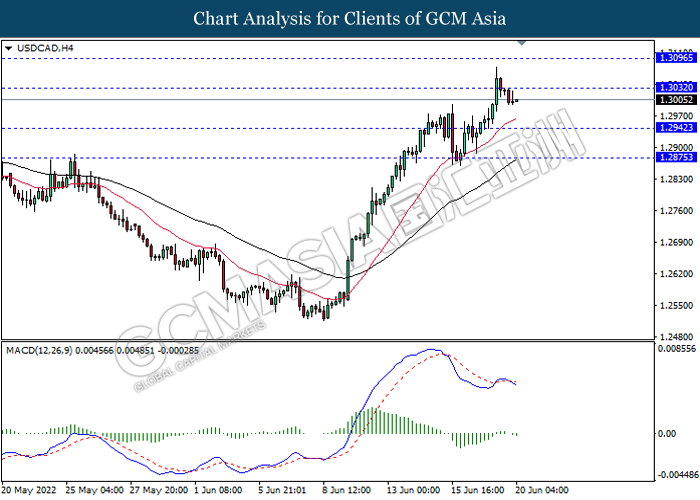

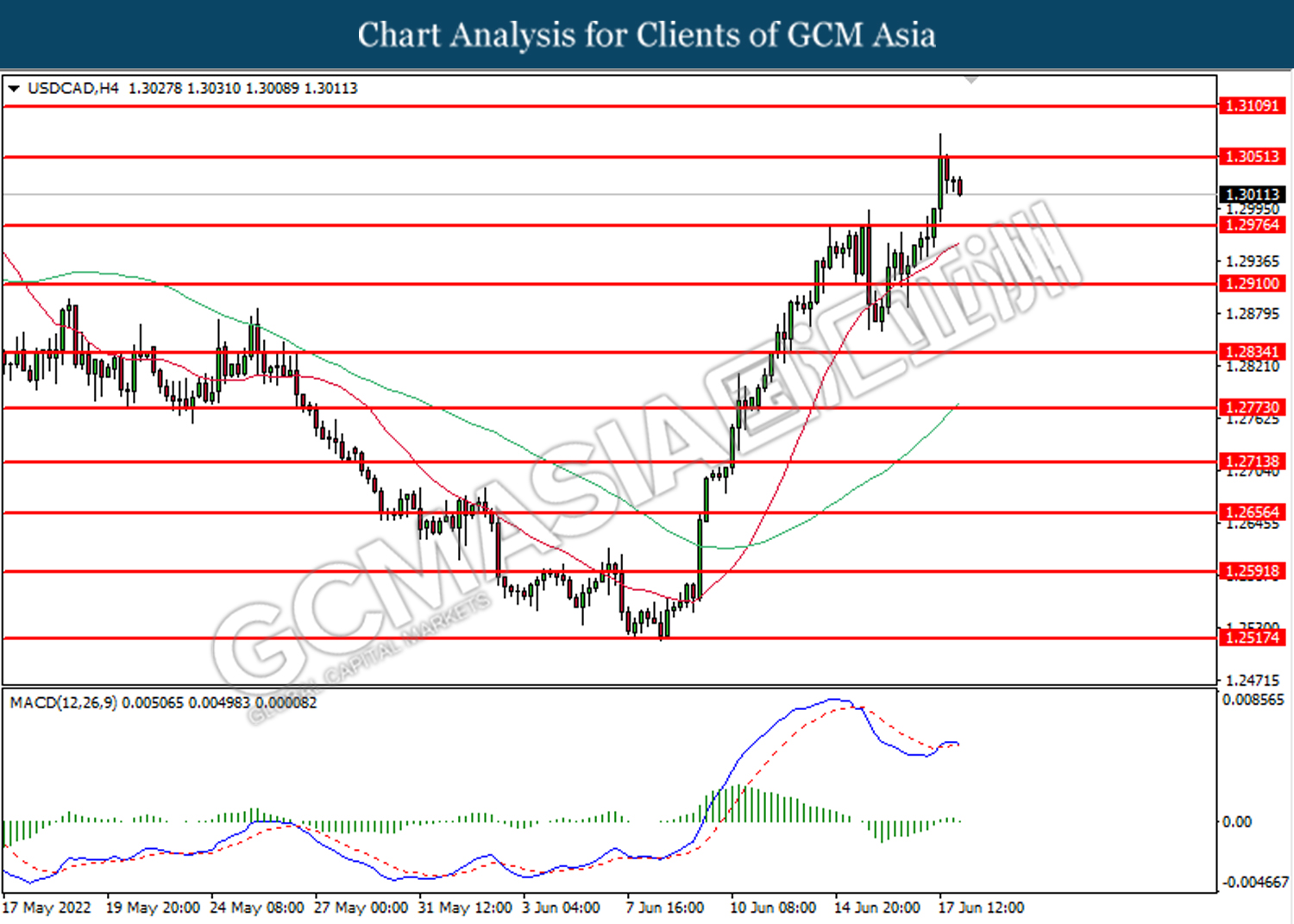

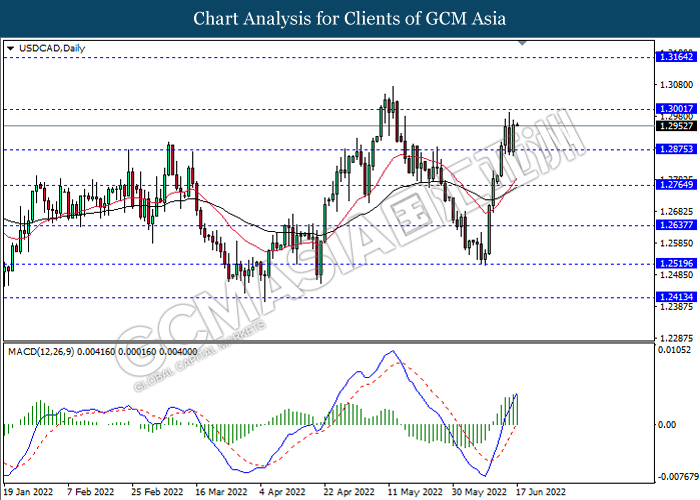

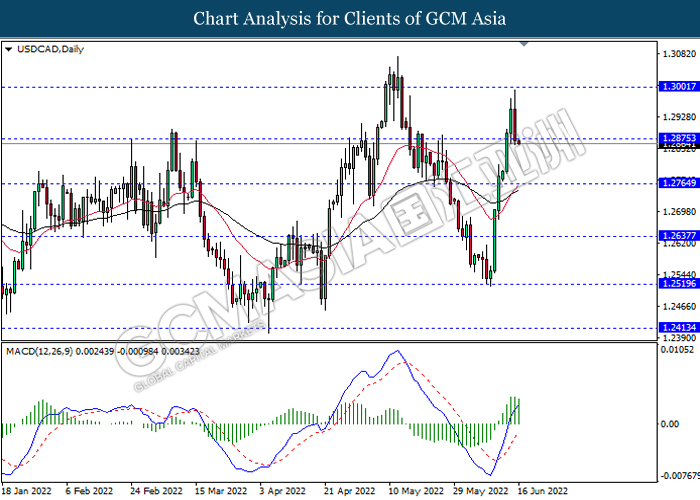

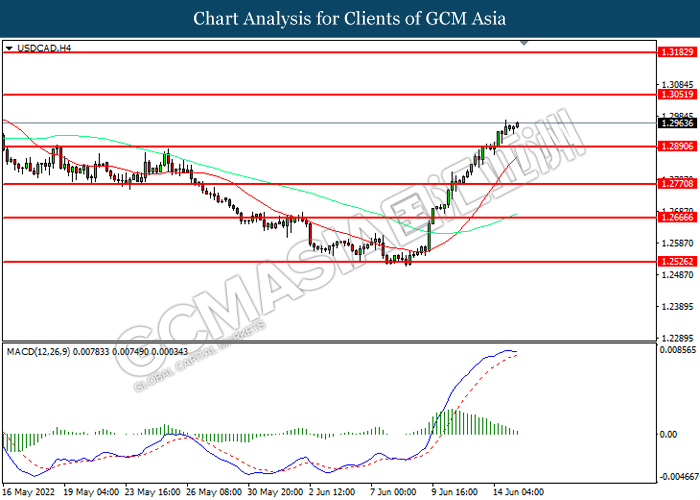

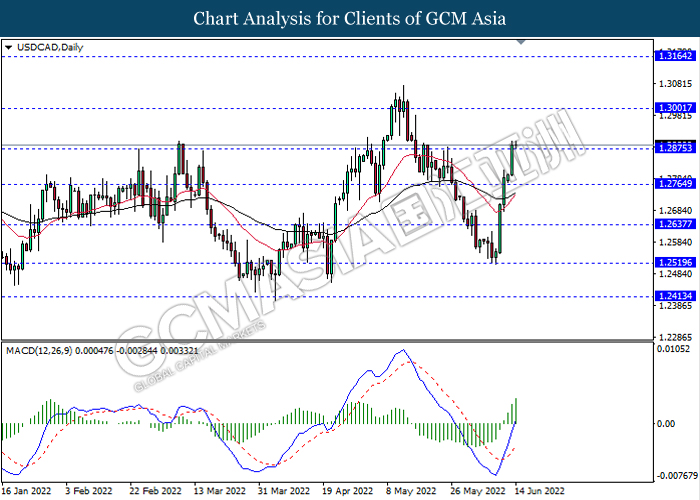

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3030, 1.3095

Support level: 1.2940, 1.2875

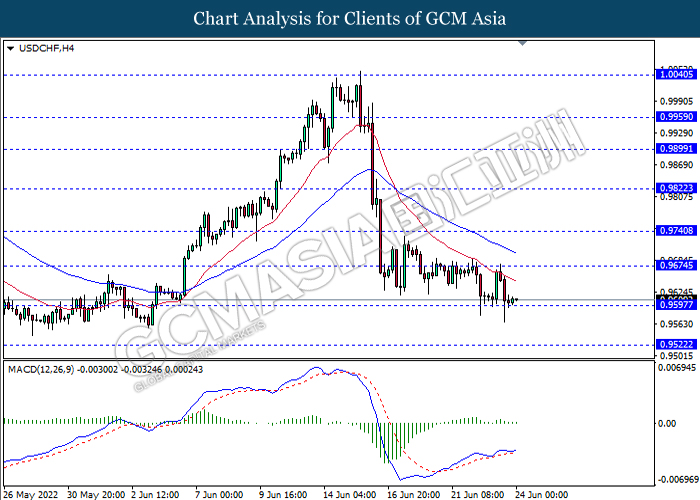

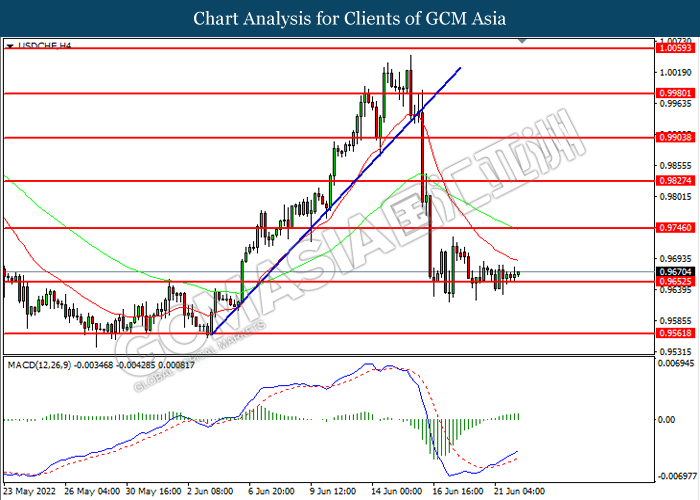

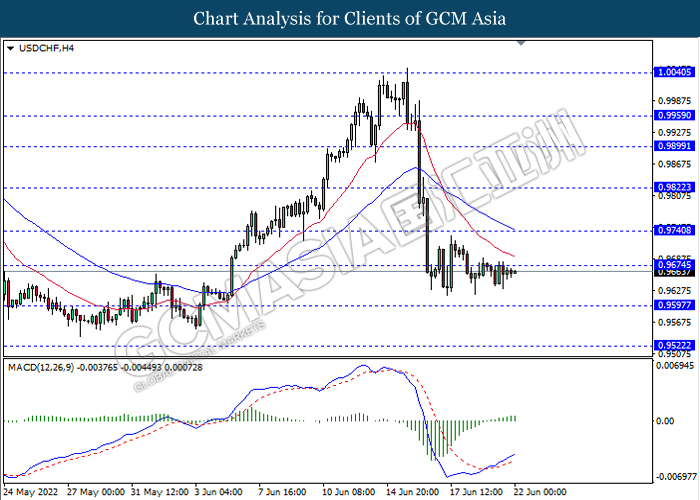

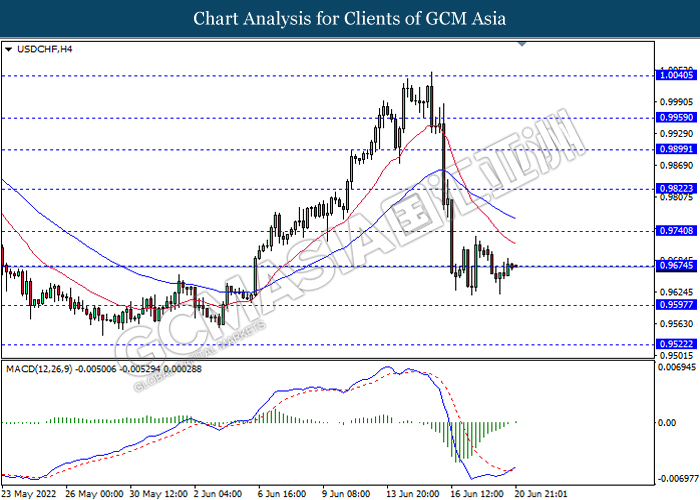

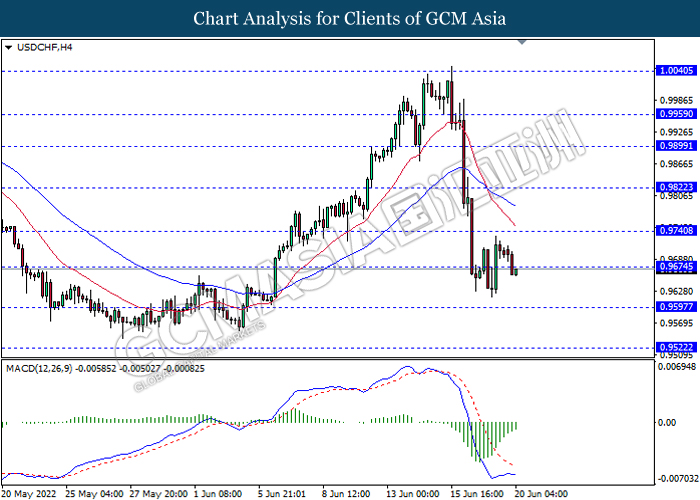

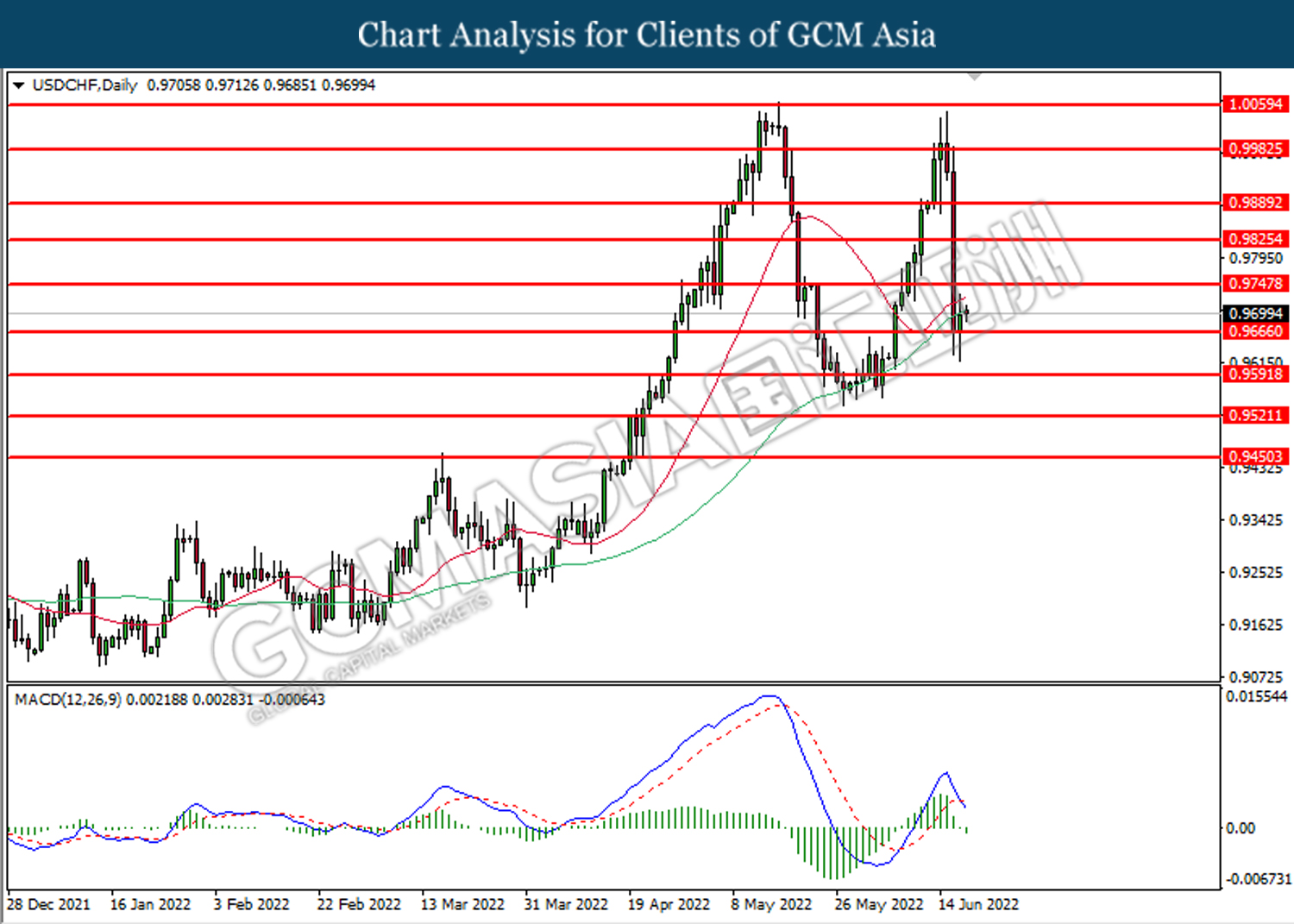

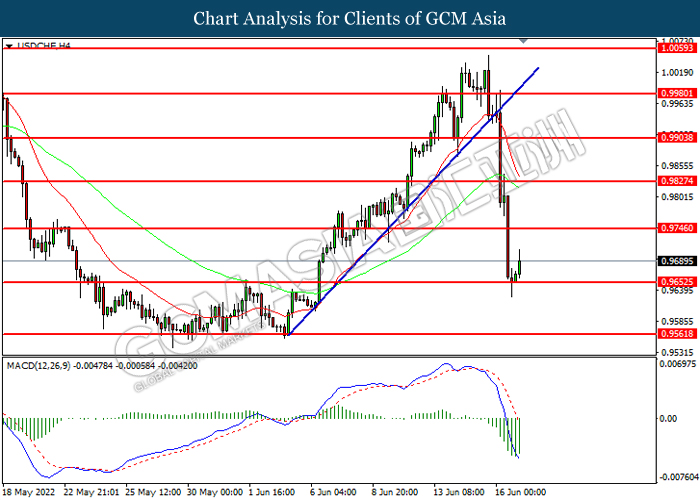

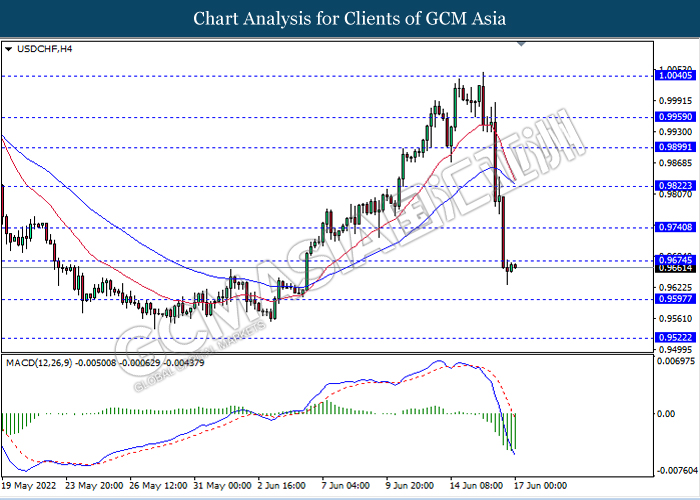

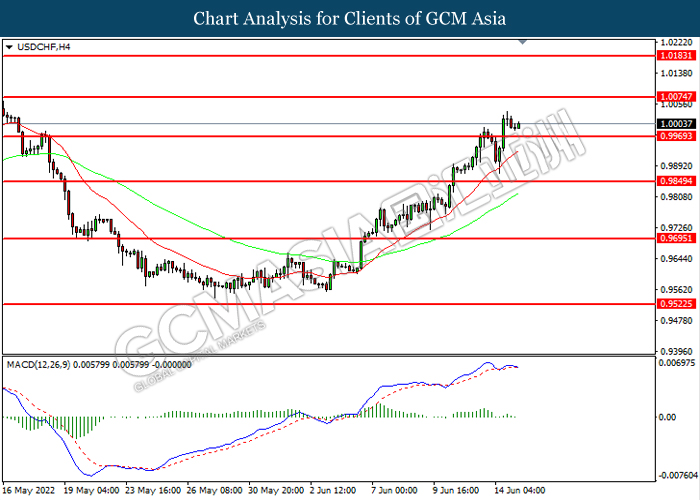

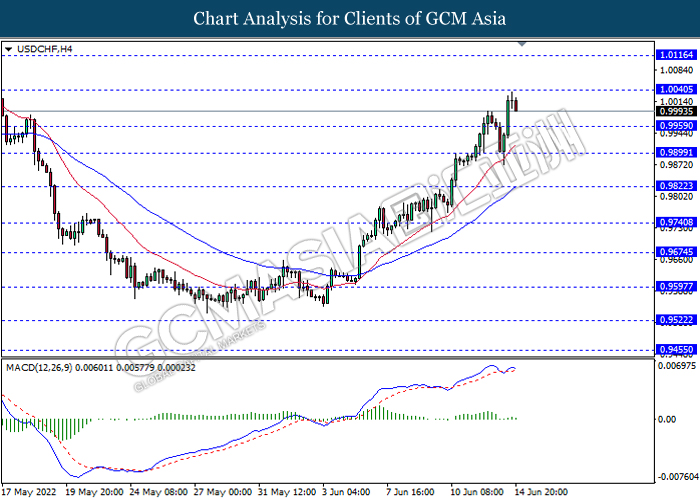

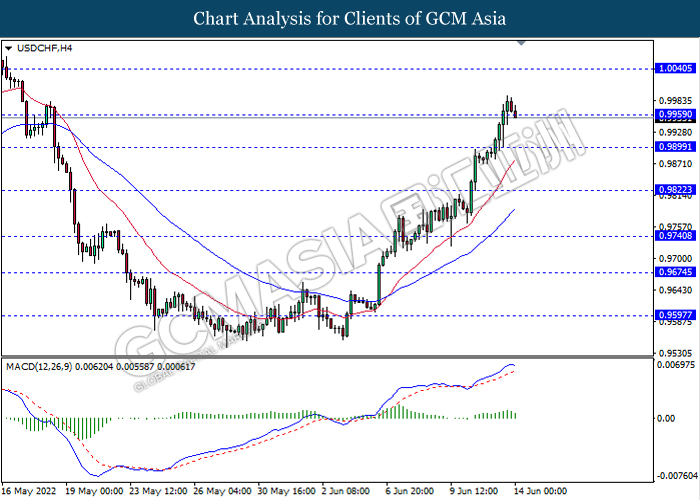

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

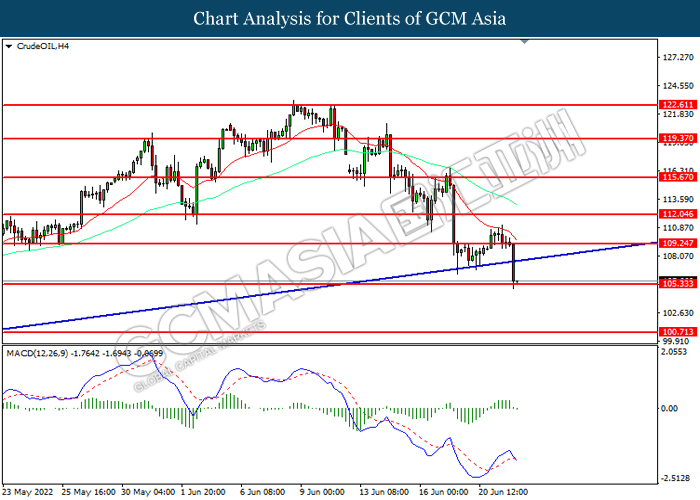

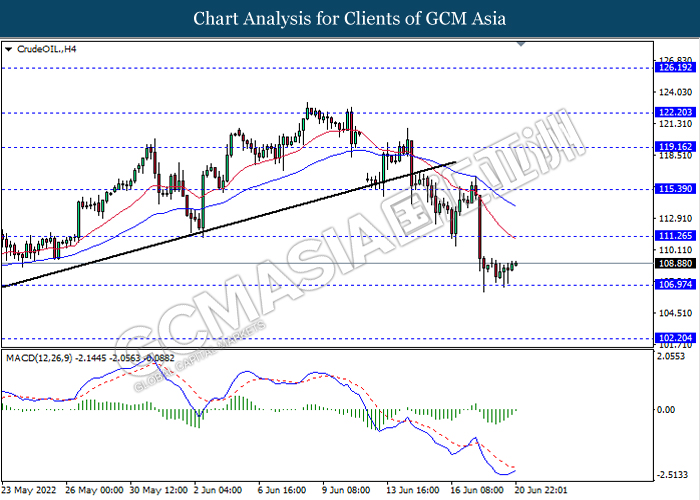

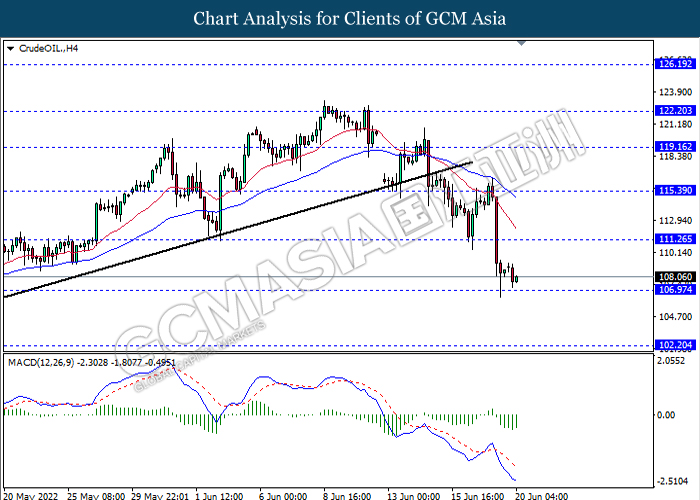

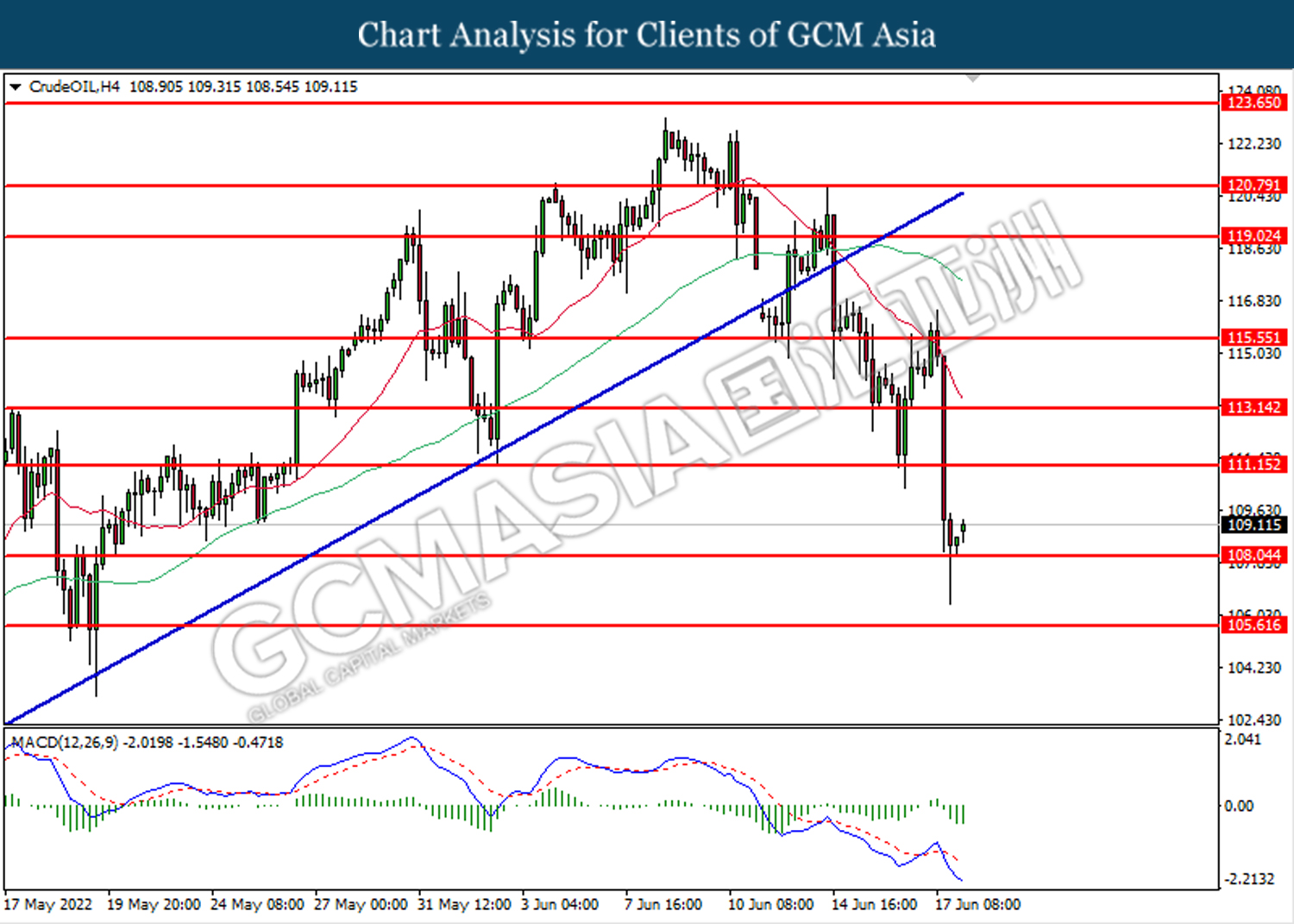

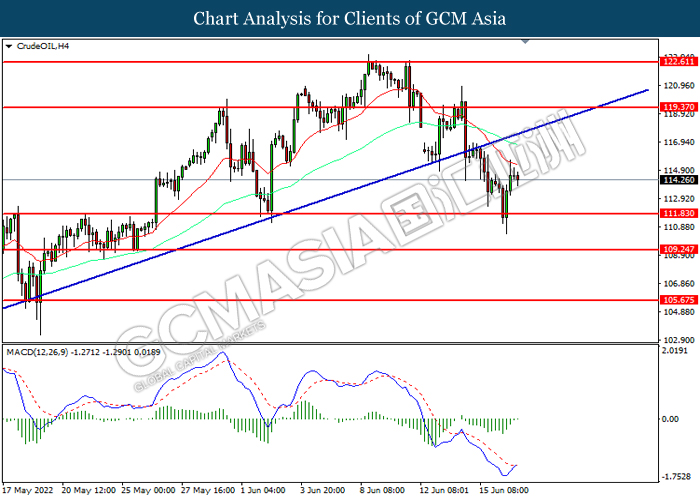

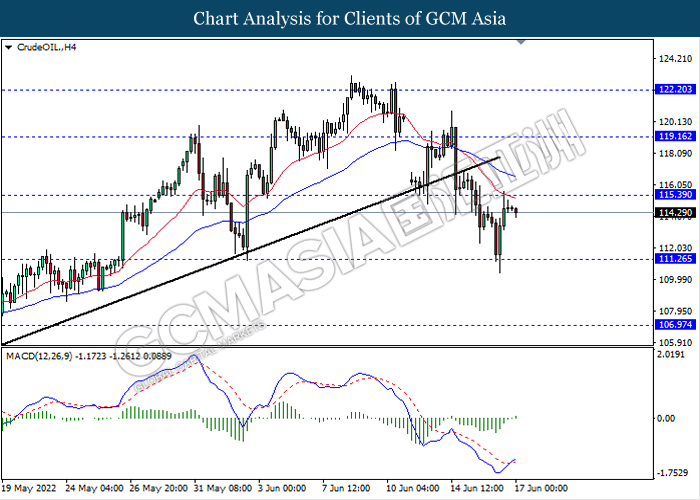

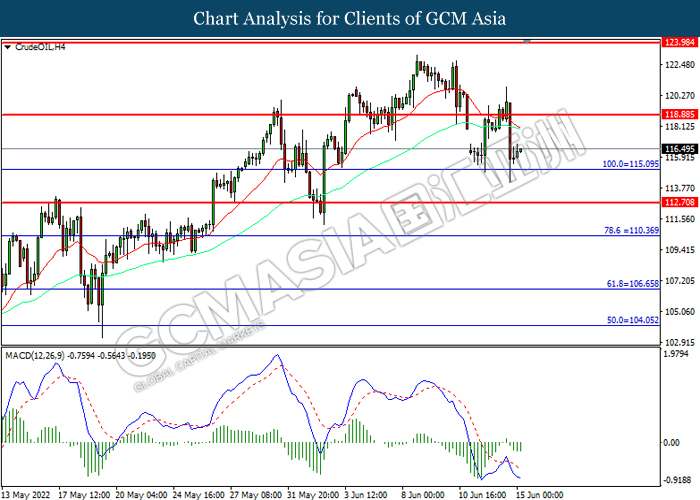

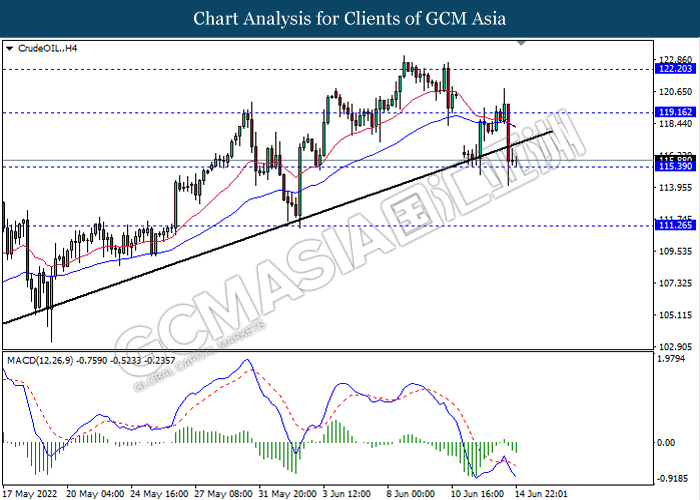

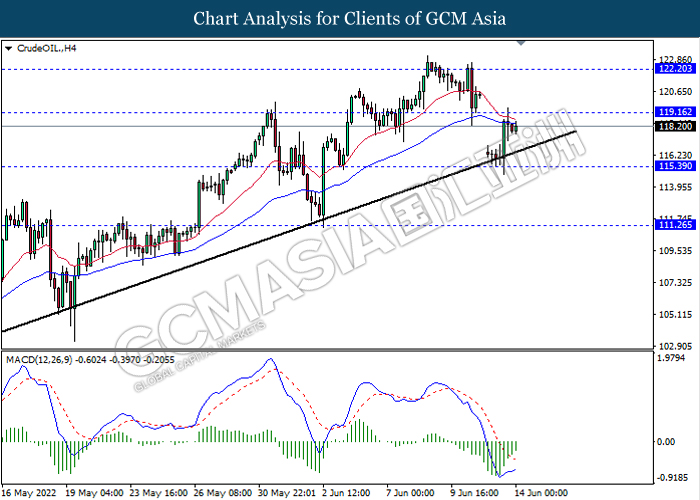

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 106.95, 111.25

Support level: 102.20, 98.80

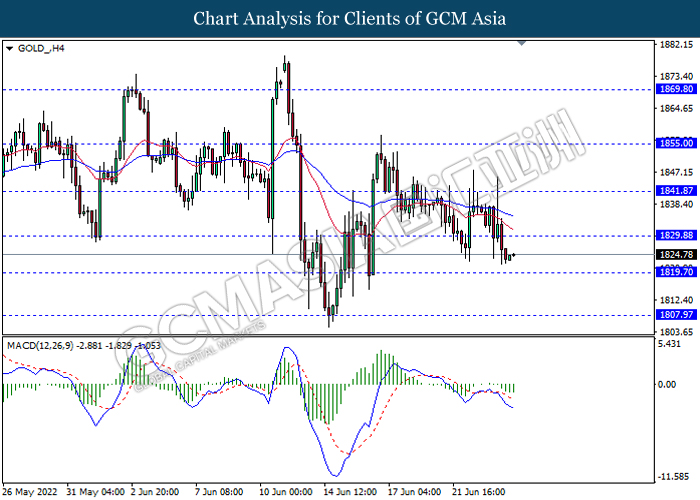

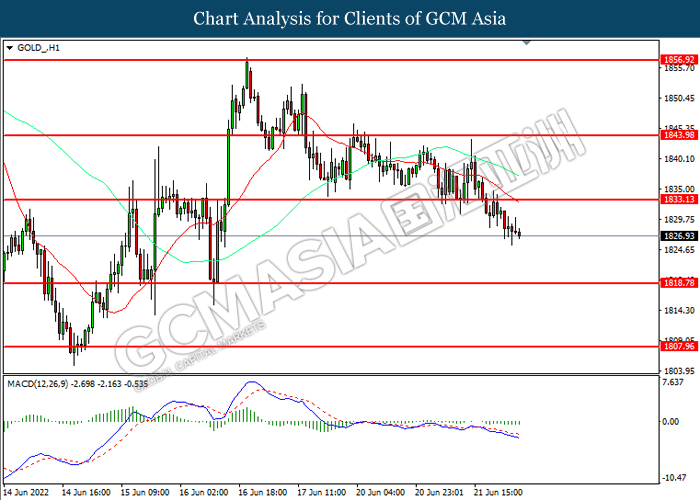

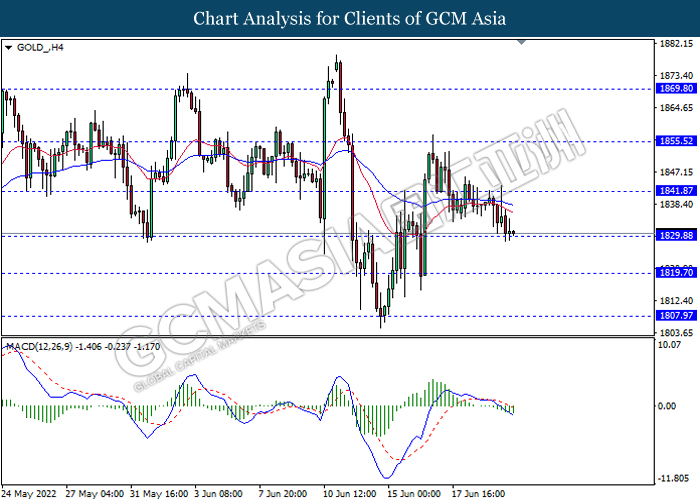

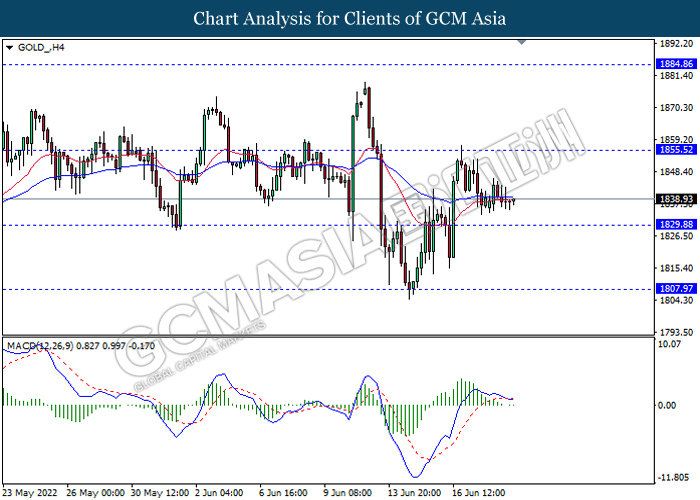

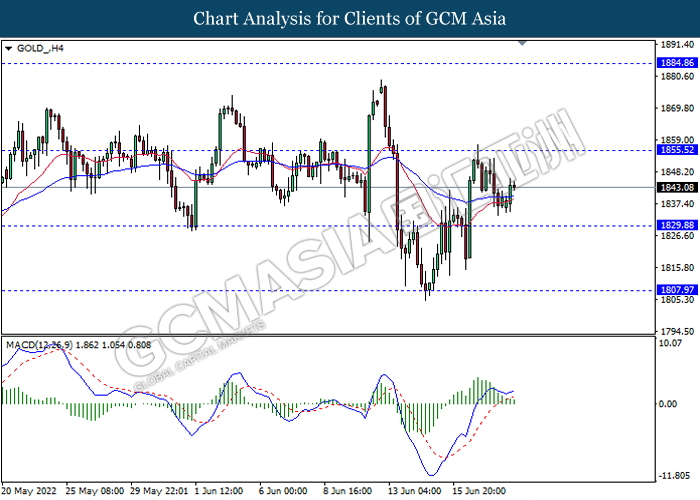

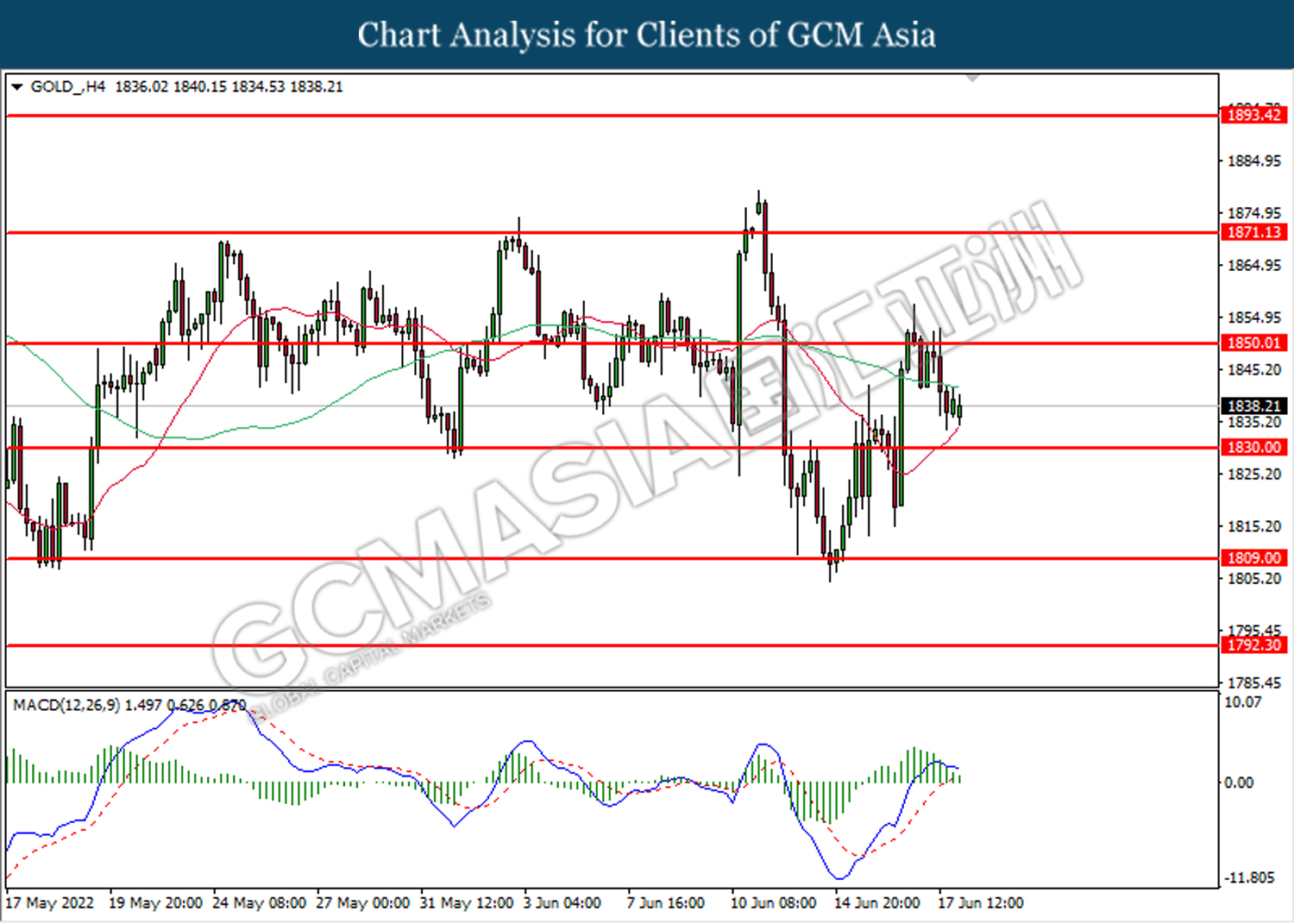

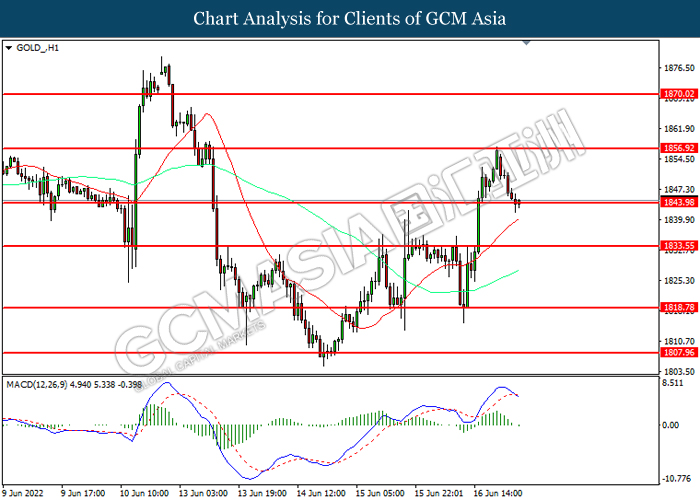

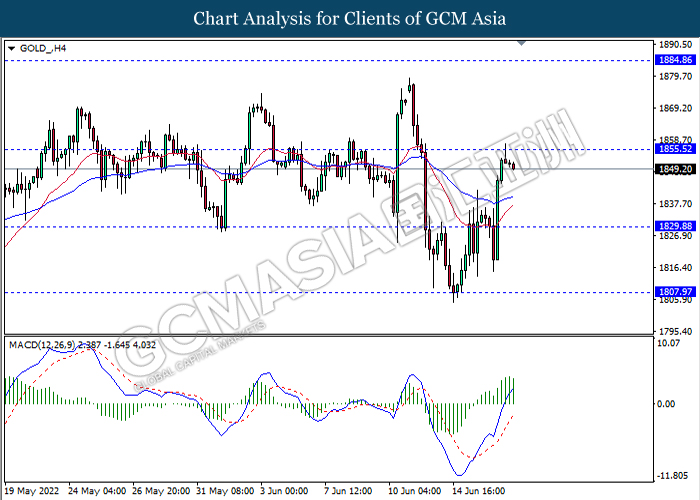

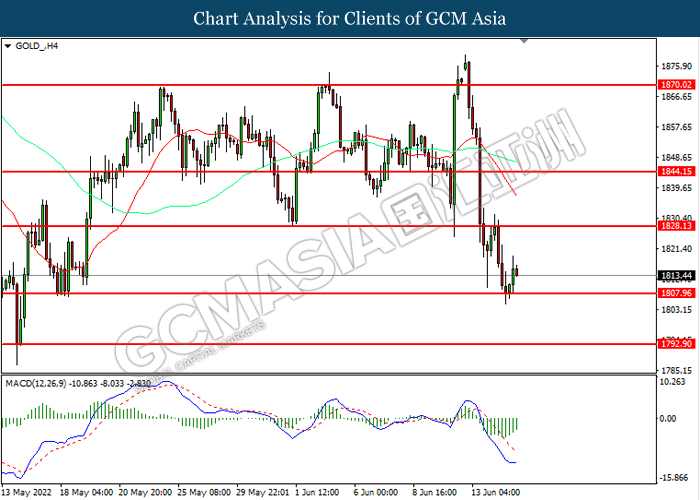

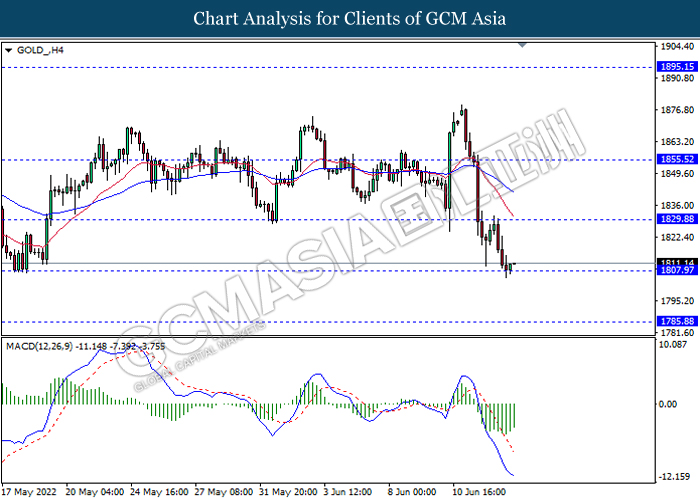

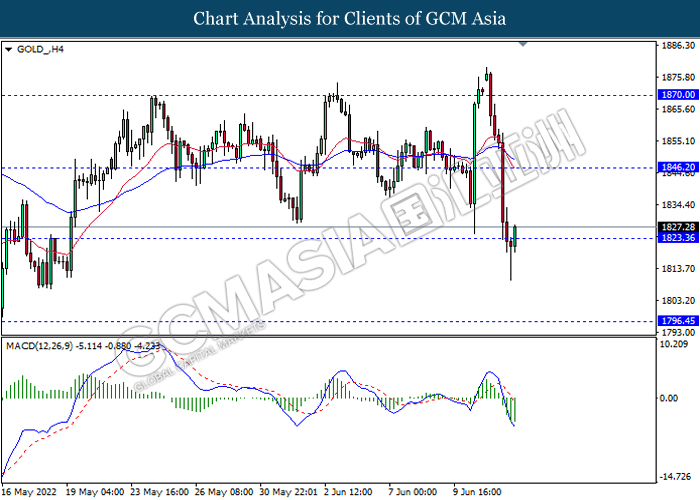

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1829.90, 1841.85

Support level: 1819.70, 1807.95

230622 Afternoon Session Analysis

23 June 2022 Afternoon Session Analysis

Pound Sterling slumped amid stagflation risk continue to linger in market.

The GBP/USD retreated following UK inflation hit new record high in May, spurring further stagflation risk in future while dragging down the appeal for the Pound Sterling. According to Office for National Statistics, UK Consumer Price Index notched up significantly from the previous reading of 9.0% to 9.1%, aligned with market expectations from economists. UK’s Office for National Statistics claimed that they predicted the inflation rate in UK would reach nearly 11% in January. Besides, economists have also flagged signs of a tightening of labor market conditions and recession risk in the UK region. Nonetheless, investors would continue to scrutinize the latest data from the UK region to receive further trading signal. On the other hand, riskier asset such as the Australia Dollar received bearish momentum yesterday amid the rising worries about the risk of a global recession and expectation upon the aggressive rate hike from the global central bank continue to stoke a shift in sentiment toward safe-haven asset. As of writing, GBP/USD depreciated by 0.07% to 1.2255 while AUD/USD slumped 0.40% to 0.6895.

In the commodities market, the crude oil price slumped 0.80% to $103.55 per barrel as of writing amid the global recession risk continue to weigh down the appeal for this black-commodity. On the other hand, the gold price slumped 0.19% to $1834.20 per troy ounces as of writing amid tightening monetary policy from the global central bank sparked selloff on the gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (Jun) | 54.8 | 54.0 | – |

| 16:30 | GBP – Composite PMI (Jun) | 51.8 | 51.8 | – |

| 16:30 | GBP – Manufacturing PMI (Jun) | 54.6 | 54.6 | – |

| 16:30 | GBP – Services PMI (Jun) | 51.8 | 51.8 | – |

| 20:30 | USD – Initial Jobless Claims | 229K | 225K | – |

Technical Analysis

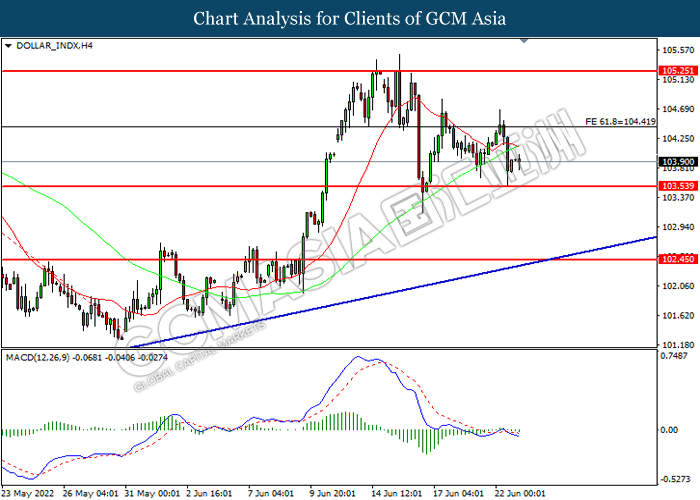

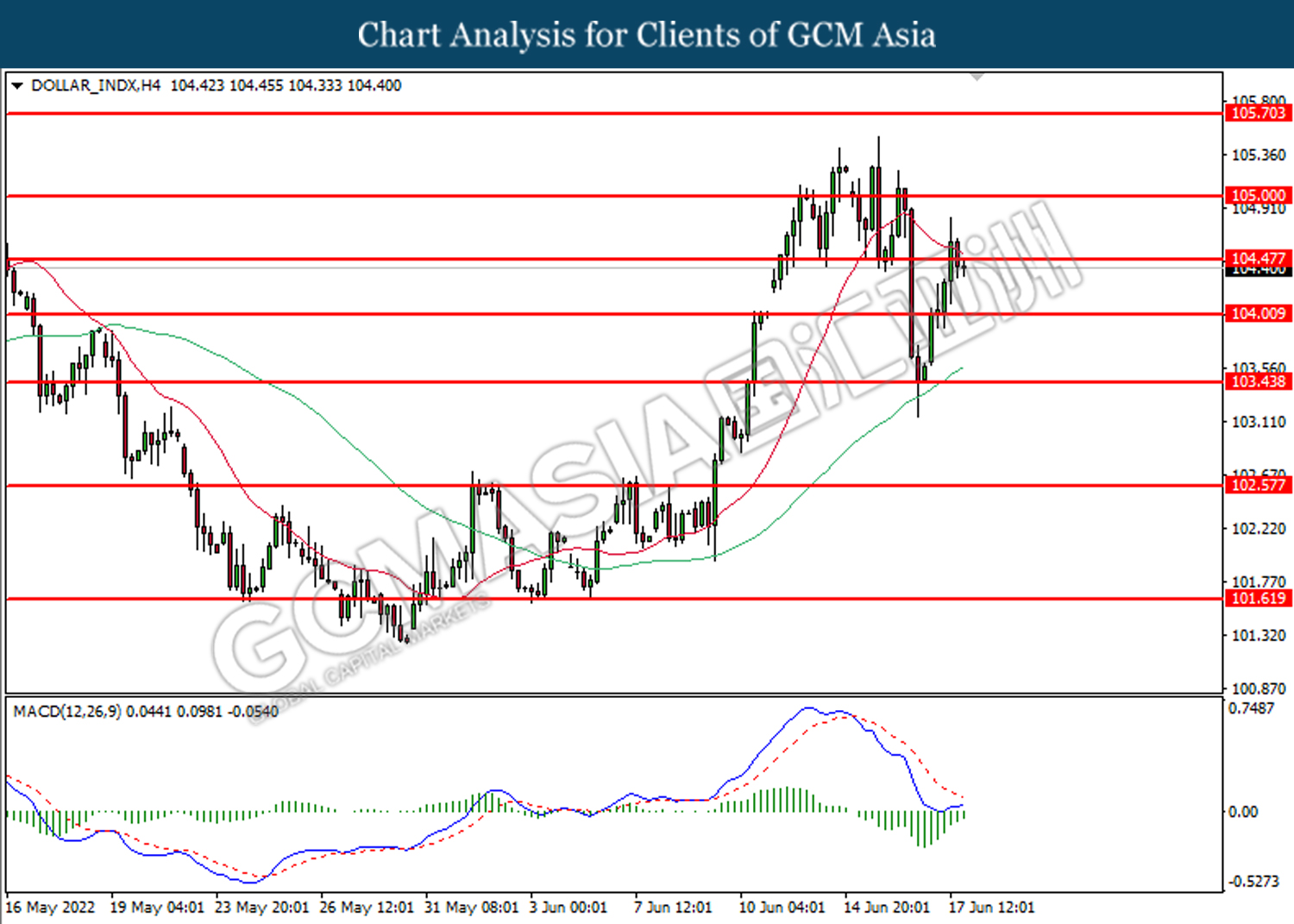

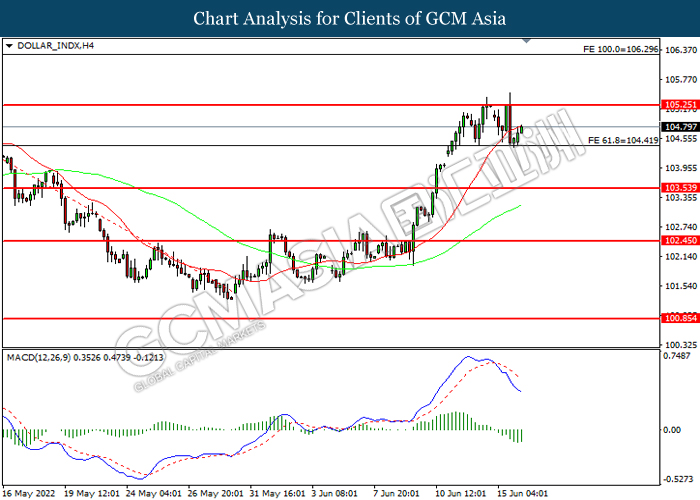

DOLLAR_INDX, H4: Dollar index was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after breakout.

Resistance level: 104.40, 105.25

Support level: 103.55, 102.45

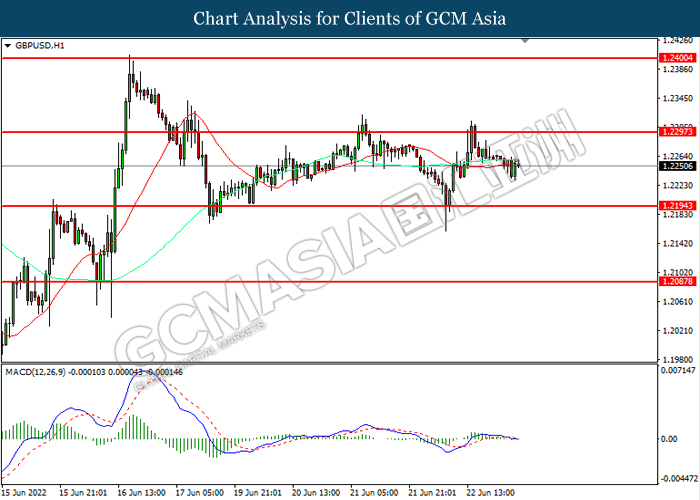

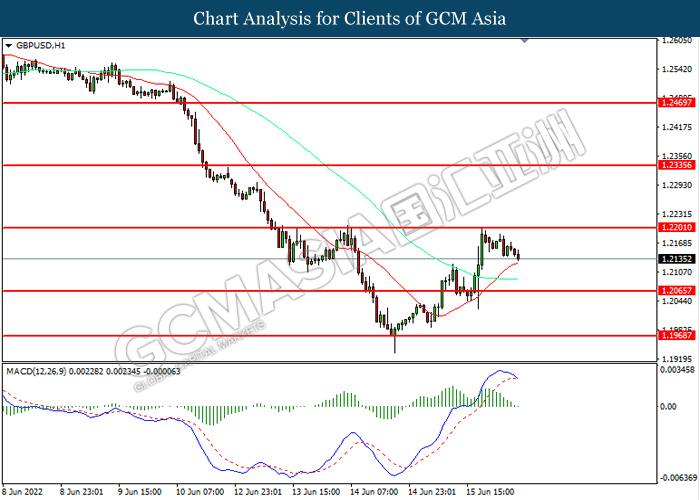

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2295, 1.2400

Support level: 1.2195, 1.2085

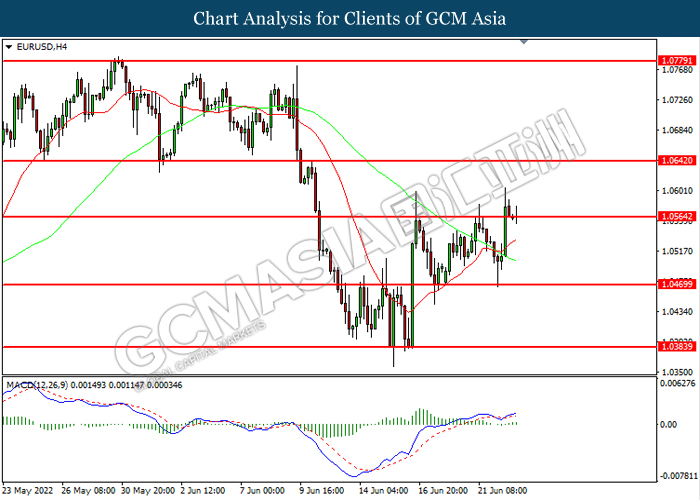

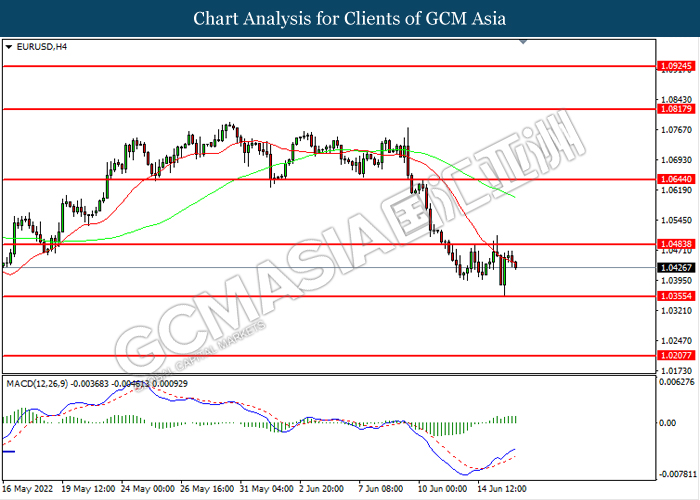

EURUSD, H4: EURUSD was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.0565, 1.0640

Support level: 1.0490, 1.0385

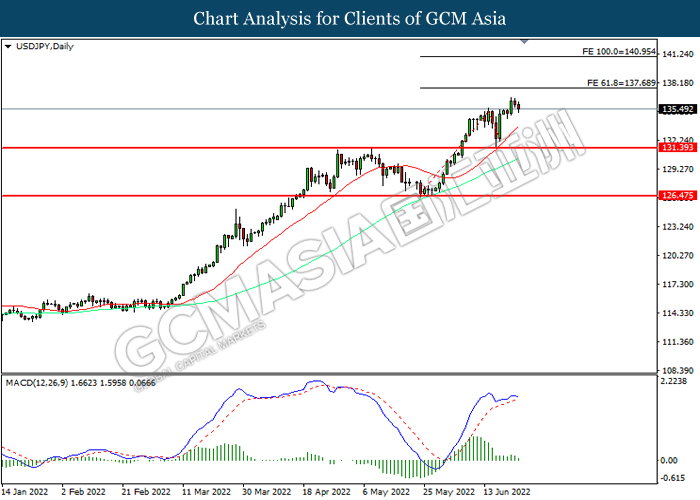

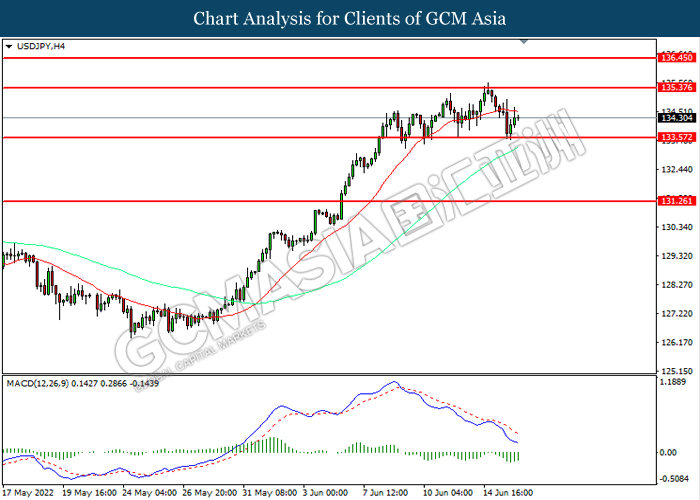

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 137.70, 140.95

Support level: 131.40, 126.45

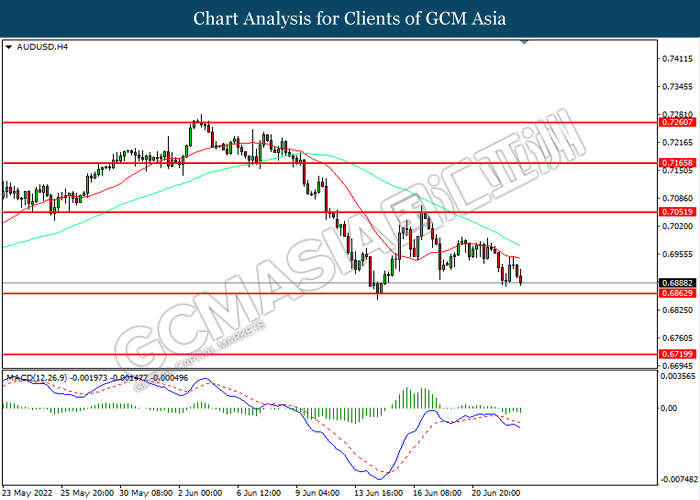

AUDUSD, H4: AUDUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7050, 0.7165

Support level: 0.6865, 0.6720

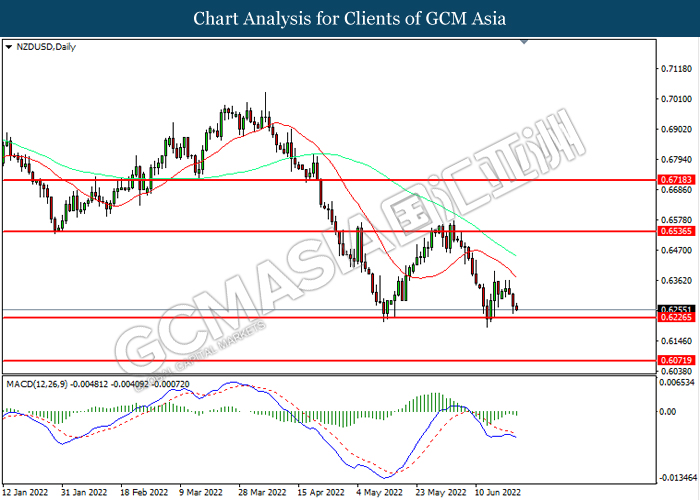

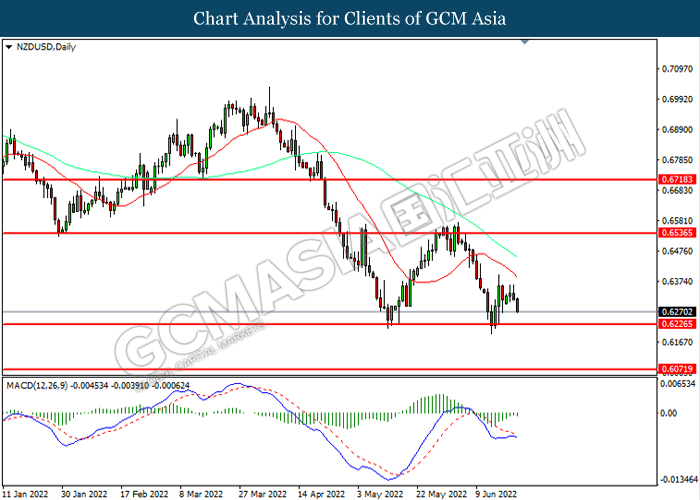

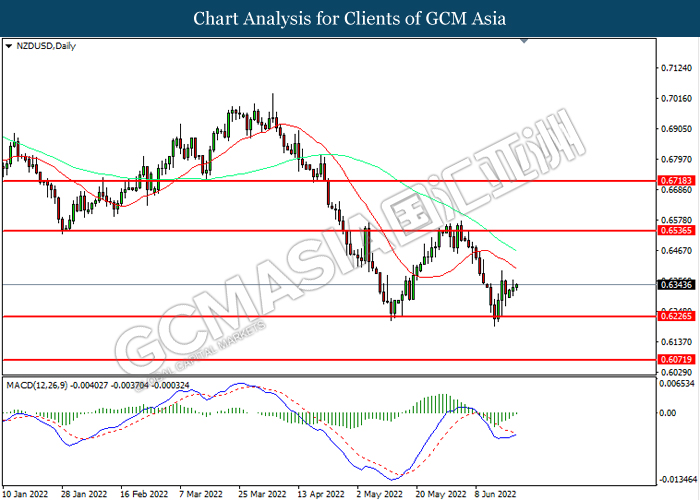

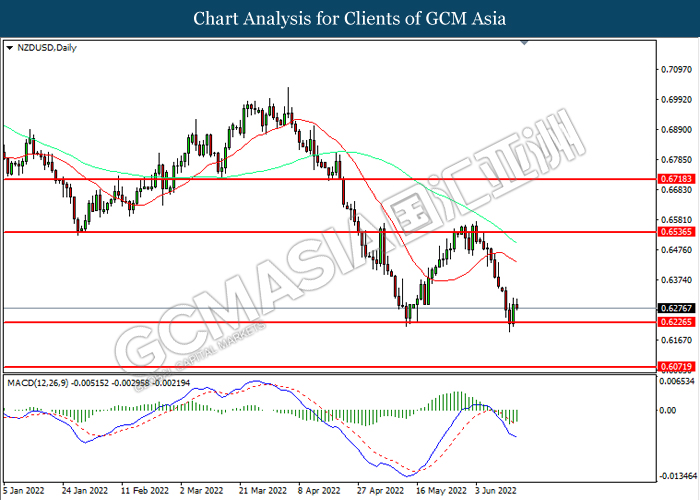

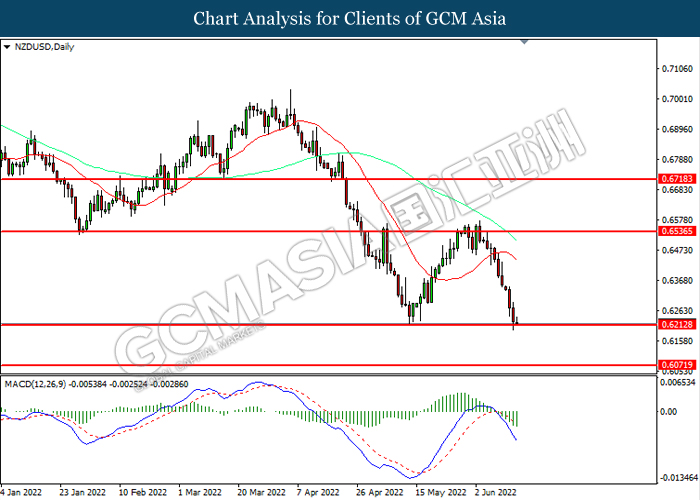

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

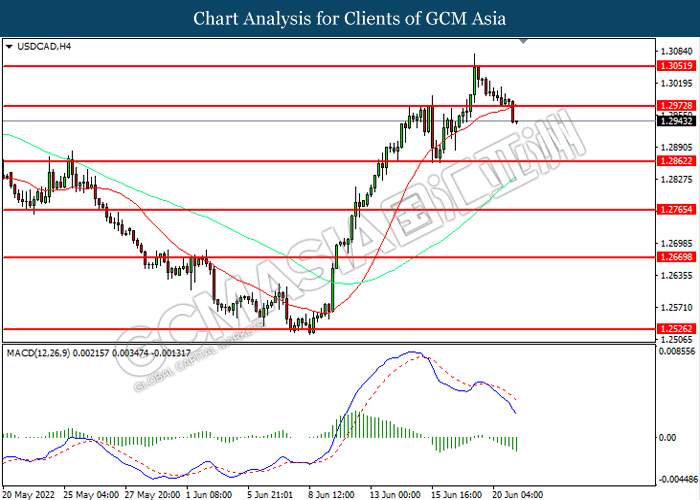

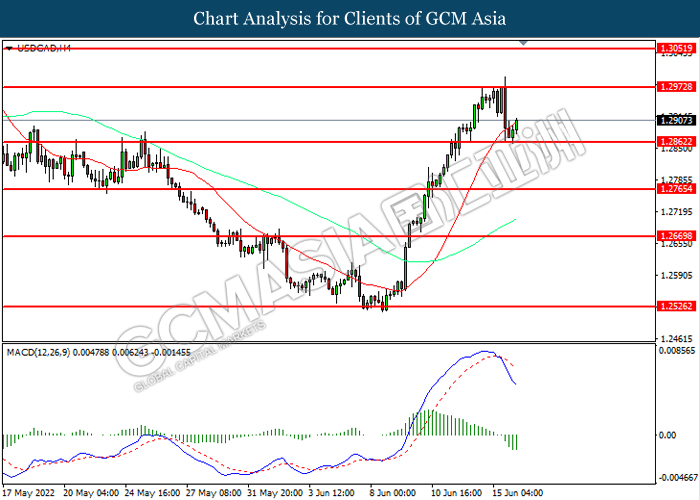

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

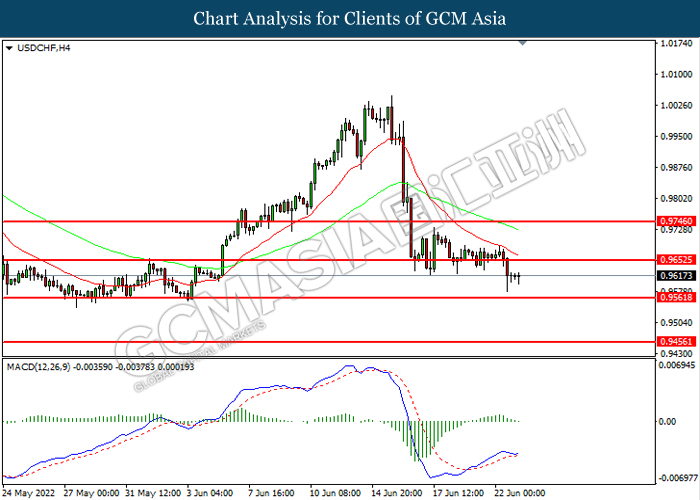

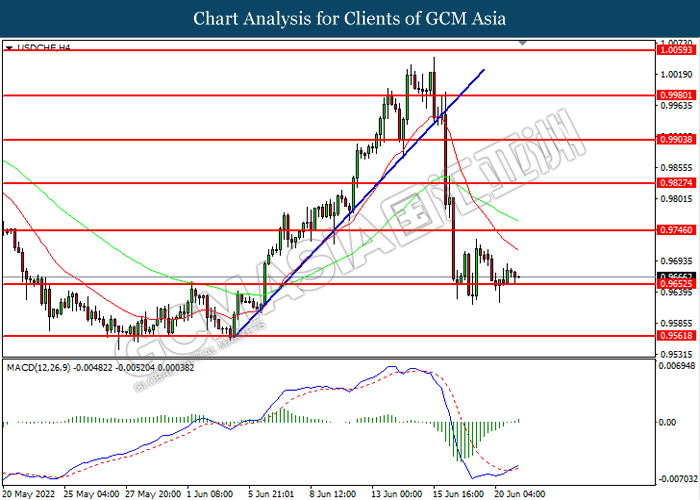

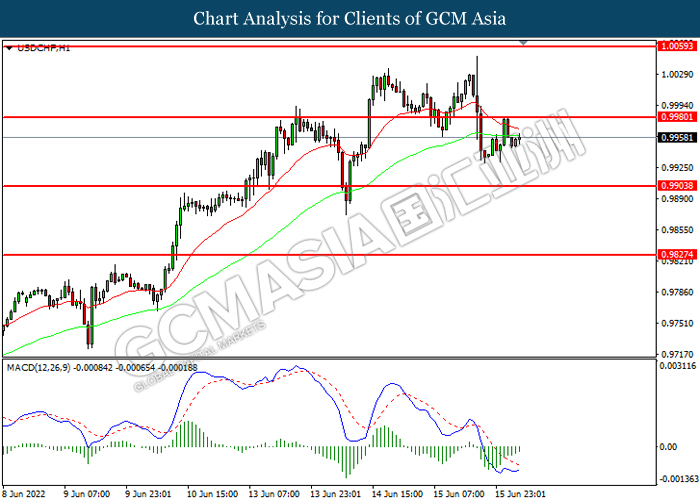

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9655, 0.9745

Support level: 0.9560, 0.9455

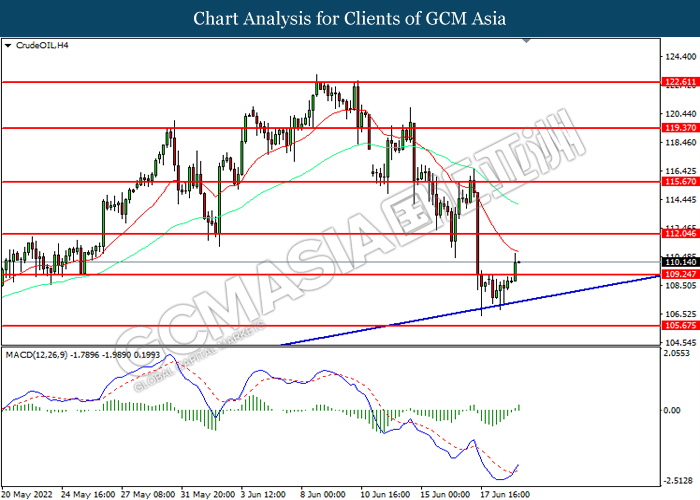

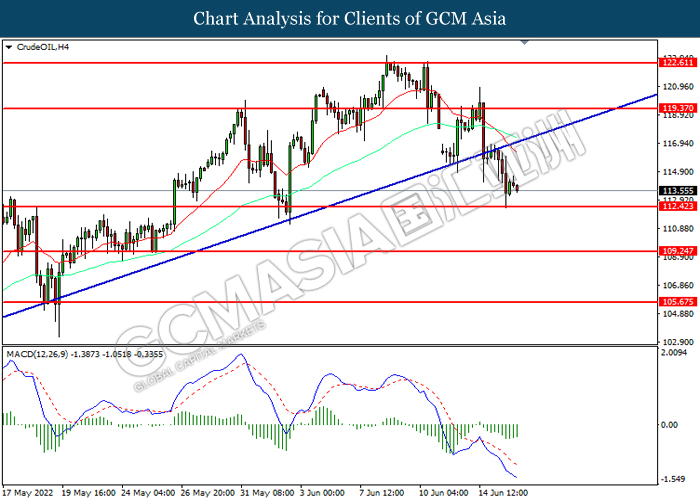

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 105.35, 109.25

Support level: 100.70, 95.90

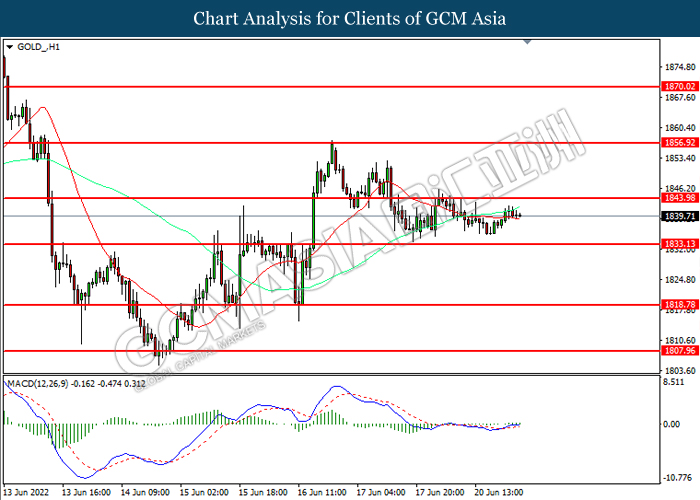

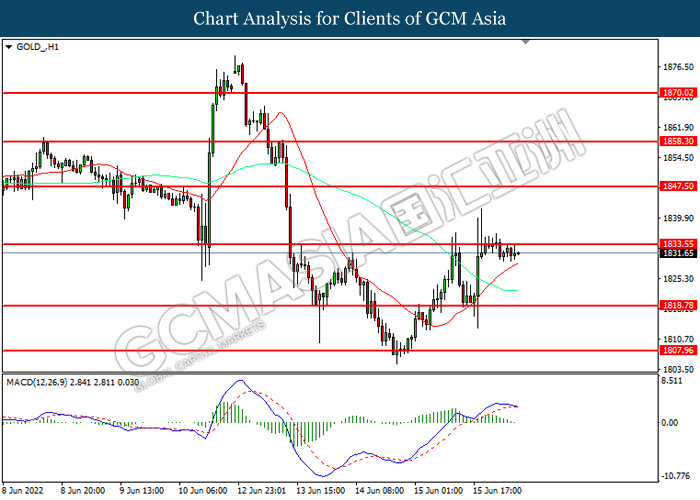

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout the support level.

Resistance level: 1844.00, 1856.90

Support level: 1835.15, 1818.80

220622 Afternoon Session Analysis

22 June 2022 Afternoon Session Analysis

Euro slumped amid recession risk continue linger in financial market.

The Euro retreated from its higher level amid market participants worried that the Germany would likely to faces certain recession risk if Russian gas supplies stop completely. Currently, the EU relied on Russia for as much as 40% while 55% for Germany. Gas prices currently have hit record levels, driving a significant spike in inflation risk and adding further challenges for policymakers trying to haul Europe back from an economic precipice. Despite the Europe is seeking more gas supplies from its own producers from Norway and other states, though most producers are already pushing the limits of output. The supply disruption following the rising tensions between Russia-Ukraine had continued to spark further stagflation risk in future. Germany’s BDI industry association on Tuesday downgraded its economic growth forecast for 2022 to 1.5% from the 3.5% expected before the war began on 24th February. As of writing, EUR/USD depreciated by 0.14% to 1.0510.

In the commodities market, the crude oil price slumped 3.84% to $105.50 per barrel as of writing following US President Joe Biden vowed that he will try to bring down soaring fuel costs, including applying pressure on major US oil firms to help ease the pain from the rising oil price recently. On the other hand, the gold price depreciated by 0.28% to $1828.85 per troy ounces as of writing following the Federal Reserve unleashed their hawkish tone toward the economic progression in the United States.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (May) | 9.0% | 9.1% | – |

| 20:30 | CAD – Core CPI (MoM) (May) | 0.7% | 0.4% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 104.40, 105.25

Support level: 103.55, 102.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2320, 1.2400

Support level: 1.2240, 1.2140

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0560, 1.0640

Support level: 1.0470, 1.0385

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 137.70, 140.95

Support level: 1331.40, 126.45

AUDUSD, H4: AUDUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7050, 0.7165

Support level: 0.6865, 0.6720

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9745, 0.9825

Support level: 0.9655, 0.9560

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 109.25, 112.05

Support level: 105.35, 100.70

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1833.15, 1844.00

Support level: 1818.80, 1807.95

220622 Morning Session Analysis

22 June 2022 Morning Session Analysis

US Dollar rallied after upbeat data was released.

The Dollar Index which traded against a basket of six major currencies edged up on Tuesday after the bullish economic data was unleashed. According to National Association of Realtors, the US Existing Home Sales for May came in at the reading of 5.41M while exceeding the market forecast of 5.39M. The data used to measure the change in the annualized number of existing residential buildings that were sold during the previous month. The higher-than-expected reading indicated that the recovery in US housing market, which brought positive prospects toward the economic progression in US. Besides, the slump of Japanese Yen was had also spurred further bullish momentum on the US Dollar. Bank of Japan keep remaining its ultra-loose monetary policy would likely to diminish the risk-free return of investors in Japan, which prompted the shift their capitals toward other currencies which having better prospects such as US Dollar. As of writing, the Dollar Index depreciated by 0.29% to 104.18.

In the commodities market, crude oil price eased by 0.37% to $109.12 per barrel as of writing. Nonetheless, the overall trend of oil price remained bullish following the high summer fuel demand while supplies remained tight because of sanctions on Russian oil. On the other hand, gold price depreciated by 0.33% to $1832.90 per troy ounce as of writing amid the surging of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (May) | 9.0% | 9.1% | – |

| 20:30 | CAD – Core CPI (MoM) (May) | 0.7% | 0.4% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2270, 1.2360

Support level: 1.2190, 1.2080

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0530, 1.0605

Support level: 1.0450, 1.0385

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 137.35, 138.60

Support level: 136.00, 135.05

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6350, 0.6405

Support level: 0.6295, 0.6235

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2940, 1.3030

Support level: 1.2875, 1.2800

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 111.25, 115.40

Support level: 106.95, 102.20

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1841.85, 1855.50

Support level: 1829.90, 1819.70

210622 Afternoon Session Analysis

21 June 2022 Afternoon Session Analysis

Aussie surged following the governor Philip Lowe warned further rate hike.

The Australia Dollar surged over the backdrop of hawkish tone from the Reserve Bank of Australia. According to the monetary policy statement from Reserve Bank of Australia, the Monetary Policy Committee (MPC) claimed that they are currently committed to implement necessary policy to ensure the inflation rate stabilize to 2-3% and household should prepare for further rate hike. Besides, he also reiterated that the possibility of recession in Australia Dollar remained low, claiming that the fundamentals of the economy in Australia remained strong. Besides, the Reserve Bank of Australia raised their inflation forecast to peak of around 7% in the December quarter, higher than the earlier predicted of 6%. As for now, they will still remain their footsteps of contractionary monetary policy while eyeing on global growth risk, more rate hike can be anticipated if the course of events urged the inflation growth goes against their expectation. As of writing, AUD/USD appreciated by 0.40% to 0.6975.

In the commodities market, the crude oil price surged 0.90% to $110.05 per barrel as of writing. The crude oil price was traded higher amid the rising tensions between US-Iran over the nuclear deal meeting had continued to spark further supply concerns, increasing the appeal for this black-commodity. On the other hand, the gold price appreciated by 0.01% to $1839.85 per troy ounces amid the fears upon the global recession risk had stoked a shift In sentiment toward safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core Retail Sales (MoM) (Apr) | 2.4% | 0.6% | – |

| 22:00 | USD – Existing Home Sales (May) | 5.61M | 5.39M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 104.40, 105.25

Support level: 103.55, 102.45

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2320, 1.2400

Support level: 1.2240, 1.2140

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0560, 1.0640

Support level: 1.0470, 1.0385

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 135.40, 136.45

Support level: 133.55, 131.25

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.7050, 0.7165

Support level: 0.6865, 0.6720

NZDUSD, Daily: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9745, 0.9825

Support level: 0.9655, 0.9560

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 112.05, 115.65

Support level: 109.25, 105.65

GOLD_, H1: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1844.00, 1856.90

Support level: 1833.15, 1818.80

210622 Morning Session Analysis

21 June 2022 Morning Session Analysis

Euro eased after ECB’s member released its speech.

The EURUSD edged down on Monday after one of the European Central Bank (ECB) member appeared a speech. According to Reuters, European Central Bank chief economist Philip Lane had claimed on Monday that the record-high inflation in the euro zone could be fuelling “inflation psychology,” referring to the phenomenon of consumers and businesses adjusting their habits in anticipation of higher prices. He emphasized that once inflation psychology sets in, consumers would likely to bring forward their spending to beat the rise in prices while businesses start lifting their own prices as expecting higher costs, which causing the inflation keep soaring. Despite ECB would likely to implement contractionary monetary policy to lower down inflation risk, another comments of Philip Lane had prompted investors to shift their capitals toward other currencies. He mentioned that the rate hike increment in September still undecided, which dialed down the market optimism toward Euro. As of writing, EURUSD edged up by 0.09% to 1.0518.

In the commodities market, crude oil price appreciated by 0.10% to $108.88 per barrel as of writing amid China’s crude oil imports from Russia soared 55% from a year earlier to a record level in May. On the other hand, gold price depreciated by 0.02% to $1840.30 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core Retail Sales (MoM) (Apr) | 2.4% | 0.6% | – |

| 22:00 | USD – Existing Home Sales (May) | 5.61M | 5.39M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2270, 1.2360

Support level: 1.2190, 1.2080

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0520, 1.0605

Support level: 1.0450, 1.0385

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 136.00, 137.35

Support level: 135.05, 134.25

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6350, 0.6405

Support level: 0.6295, 0.6235

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3030, 1.3095

Support level: 1.2940, 1.2875

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 111.25, 115.40

Support level: 106.95, 102.20

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1855.50, 1884.85

Support level: 1829.90, 1807.95

200622 Afternoon Session Analysis

20 June 2022 Afternoon Session Analysis

Euro surged after CPI data was unleashed.

The EURUSD rebounded from its recent low after the Eurozone CPI data was released. According to Eurostat, the Eurozone Consumer Price Index (CPI) YoY notched up from the previous reading of 7.4% to 8.1% while it meet the market expectation. The CPI data had showed that the price of goods and services in Europe still remained in high level, which increased the odds of Bank of Europe (BoE) to implement tightening monetary policy in order to cool down the soaring price. Nonetheless, the overall trend of Euro remained bearish over the hawkish tone from Federal Reserve. According to Reuters, Fed member Neel Kashkari mentioned that he supported the US central bank’s 75 basic point rate hike last week and could support another similar-sized one in July, but said the Fed should be “cautious” about doing too much or too fast. Another aggressive rate hike is expected in the next FOMC meeting, which sparkling the appeal of US Dollar. As of writing, EURUSD appreciated by 0.27% to 1.0526.

In the commodities market, crude oil price depreciated by 0.15% to $107.83 per barrel as of writing following the US State Department sent letters to Eni and Spain’s Repsol in May authorizing them to resume taking Venezuelan crude oil, which cause the oil supply to increase. Besides, gold price rallied by 0.39% to $1847.85 per troy ounce as of writing. However, the gold price still under pressure amid the hawkish speech from Fed member.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – Juneteenth

Today’s Highlight Events

Time Market Event

21:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2270, 1.2360

Support level: 1.2190, 1.2080

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0605, 1.0685

Support level: 1.0520, 1.0450

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 135.05, 136.00

Support level: 134.25, 133.10

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6350, 0.6425

Support level: 0.6295, 0.6235

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3030, 1.3095

Support level: 1.2940, 1.2875

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 111.25, 115.40

Support level: 106.95, 102.20

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1855.50, 1884.85

Support level: 1829.90, 1807.95

200622 Morning Session Analysis

20 June 2022 Morning Session Analysis

US dollar clawed back amid hawkish tone from Fed member.

The dollar index, which traded against a basket of six major currencies recovered from its prior losses after Federal Reserve (Fed) member gave a hawkish statement regarding to the pace of future rate hike. During an interview with President of the Fed Bank on Minneapolis, Neel Kashkari mentioned that he supported the U.S. central bank’s 0.75 percentage point interest-rate hike last week and could support another similar-sized one in July, but said the Fed should be “cautious” about doing too much or too fast. Such a hawkish titled statement boosted the market sentiment in the dollar market, as an aggressive rate hike is expected to be carried out by the Fed in the upcoming meeting. Besides, the catalyst that urged US dollar ended the Friday trading session with strong gains was after the Bank of Japan maintained its ultra-easy monetary policy in contrast to the aggressive tightening of its peers. With that, investors chose to move their capital away from the Japanese Yen to other market with higher risk-free return such as US dollar. As of writing, the dollar index up 0.02% to 104.75.

In the commodities market, the crude oil price was up by 0.25% to $111.70 after falling tremendously during the Friday late trading session amid the heightening of recession worries. Besides, the gold prices dropped 0.03% to $1838.90 a troy ounce after the US dollar climbed back to its recent high level.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – Juneteenth

Today’s Highlight Events

Time Market Event

21:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level at 104.45. However, MACD which illustrated bullish bias momentum suggest the index to undergo technical correction in short term.

Resistance level: 104.45, 105.00

Support level: 104.00, 103.45

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2235. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2235, 1.2280

Support level: 1.2165, 1.2085

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.0490. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0490, 1.0565

Support level: 1.0440, 1.0370

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.25, 136.50

Support level: 133.15, 131.35

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6955. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6850.

Resistance level: 0.6955, 0.7035

Support level: 0.6850, 0.6750

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6285. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6365.

Resistance level: 0.6365, 0.6430

Support level: 0.6285, 0.6225

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.3050. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2975.

Resistance level: 1.3050, 1.3110

Support level: 1.2975, 1.2910

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9665. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9750, 0.9825

Support level: 0.9665, 0.9590

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 108.00. However, MACD which illustrated bearish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 111.15, 113.15

Support level: 108.00, 105.60

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1850.00. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1830.00.

Resistance level: 1850.00, 1871.15

Support level: 1830.00, 1809.00

170622 Afternoon Session Analysis

17 June 2022 Afternoon Session Analysis

Swiss Franc surged following Switzerland implement first rate hike in 15 years.

The Swiss Franc surged significantly following the Swiss National Bank increased its benchmark interest rate for the first time in 15 years in an unexpected move on Thursday, while reiterating that they will continue to rate hike further, aligning with other central banks in contractionary monetary policy to combat the spiking number of inflation. According to Swiss National Bank, the Switzerland Interest Rate Decision increased from the previous reading of -0.75% to -0.25%, exceeding the market expectation at -0.75%. It was the first-rate hike by the SNB since September 2007. Besides that, the other central banks are also implementing contractionary monetary policy in attempt to cool inflation. Yesterday, the Bank of England also increased the UK interest rate by a quarter point, which also spurring further bullish market demand on the Pound Sterling. Recently, the fresh data has shown that UK inflation soared to 40-yer high of 9% annually in April as rising food and energy prices, and the country faces a major cost of living crisis. As of writing, USD/CHF depreciated by 0.10% to 0.9680 while GBP/USD retreated by 0.34% to 1.2309.

In the commodities, the crude oil price depreciated by 0.38% to $117.00 per barrel as of writing. The oil market retraced from its higher level amid the fears upon the recession risk in future continue to weigh down the appeal for this black-commodity. On the other hand, the gold price slumped 0.69% to $1843.90 per troy ounces amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:45 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (May) | 8.1% | 8.1% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after breakout.

Resistance level: 104.40, 105.25

Support level: 103.55, 102.45

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2335, 1.2470

Support level: 1.2200, 1.2065

EURUSD, H4: EURUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0625, 1.0780

Support level: 1.0485, 1.0355

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.40, 136.45

Support level: 133.55, 131.25

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7050, 0.7165

Support level: 0.6865, 0.6720

NZDUSD, Daily: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9745, 0.9825

Support level: 0.9655, 0.9560

CrudeOIL, H4: Crude oil price was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains.

Resistance level: 119.35, 112.60

Support level: 111.85, 109.25

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1856.90, 1870.00

Support level: 1844.00, 1833.55

170622 Morning Session Analysis

17 June 2022 Morning Session Analysis

US Dollar eased after downbeat economic data was unleashed.

The Dollar Index which traded against a basket of six major currencies slumped on Thursday over the unleash of bearish economic data. According to Census Bureau, the US Building Permits notched down from the previous reading of 1.823M to 1.695M, which lower than the market forecast of 1.785M. In addition to this data, the US Philadelphia Fed Manufacturing Index and US Initial Jobless Claims had also released its downbeat reading, which are -3.3 and 229K, missing the economist expectation of 5.5 and 215K respectively. These bearish economic data were consistent with the projection of Federal Reserve on Thursday, which they mentioned that the economy growth was expected to be lower and unemployment rate would be higher. The growth forecast lowered to 1.7% for 2022 from 2.8%, and the unemployment rate forecast raised to 3.7% for 2022 from 3.5%. As the appeal of US Dollar has been dragged down, investors were prompted to look for other currencies which having better prospects. As of writing, the Dollar Index eased by 1.23% to 103.64.

In the commodities market, crude oil price depreciated by 0.60% to $116.86 per barrel as of writing. Nonetheless, throughout the overnight trading session, oil price rose strongly amid the US announced new sanctions on Iran’s oil. On the other hand, gold price edged up by 0.16% to $1852.85 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

TBC JPY BoJ Press Conference

20:45 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | JPY – BoJ Interest Rate Decision | -0.10% | – | – |

| 17:00 | EUR – CPI (YoY) (May) | 8.1% | 8.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 103.65, 104.80

Support level: 102.50, 101.40

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2360, 1.2430

Support level: 1.2270, 1.2190

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0605, 1.0685

Support level: 1.0520, 1.0450

USDJPY, H4: USDJPY was traded higher following prior breakout above the previousresistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 133.10, 134.25

Support level: 131.95, 130.95

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7075, 0.7165

Support level: 0.7005, 0.6930

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6425, 0.6495

Support level: 0.6350, 0.6295

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3000, 1.3165

Support level: 1.2875, 1.2765

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 115.40, 119.15

Support level: 111.25, 106.95

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1855.50, 1884.85

Support level: 1829.90, 1807.95

160622 Afternoon Session Analysis

16 June 2022 Afternoon Session Analysis

Yen rebounded following BoJ unleashed their concern over sharp drop in Yen.

The Japanese Yen rebounded yesterday following the Japan’s top government claimed that they will “respond appropriately” by manipulating the Yen market if needed, issuing a fresh warning to market. In earlier, the overall trend for the Japanese Yen remained bearish following the Bank of Japan (BOJ) has repeatedly committed to keeping interest rate low, in contrast with other major central banks, which are flagging aggressive interest hikes to tackle inflation. The Central bank chief Haruhiko Kuroda also warned the significant depreciation of Japanese Yen would likely to create further tensions for the economic growth in Japanese. Though, Kuroda repeated his pledged to maintain ultra-loose monetary policy while communicating closely with government. On the other hand, the US Dollar retreated yesterday following the Federal Reserve unleashed their downbeat tone toward the economic prospect in United States despite rate hike decision from Fed. As of writing, USD/JPY depreciated by 0.03% to 134.30.

In the commodities market, the crude oil price depreciated by 0.03% to $113.70 per barrel as of writing over the backdrop of bearish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at 1.956M, exceeding the market forecast at -1.314M. On the other hand, the gold price surged 0.03% to $1831.00 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:30 CHF SNB Monetary Policy Assessment

16:30 CHF SNB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q2) | -0.75% | – | – |

| 19:00 | GBP – BoE Interest Rate Decision (Jun) | 1.00% | 1.25% | – |

| 20:30 | USD – Building Permits (May) | 1.823M | 1.787M | – |

| 20:30 | USD – Initial Jobless Claims | 229K | 215K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jun) | 2.6 | 5.3 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after breakout.

Resistance level: 105.25, 106.20

Support level: 104.40, 103.55

GBPUSD, H1: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2200, 1.2335

Support level: 1.2065, 1.1970

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0485, 1.0600

Support level: 1.0355, 1.0205

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.40, 136.45

Support level: 133.55, 131.25

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.7015, 0.7125

Support level: 0.6865, 0.6720

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

USDCAD, H4: USDCAD was traded higher following prior rebounded from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

USDCHF, H1: USDCHF was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be trade higher as technical correction.

Resistance level: 0.9980, 1.0060

Support level: 0.9905, 0.9825

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 119.35, 112.60

Support level: 112.40, 109.25

GOLD_, H1: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1833.55, 1847.50

Support level: 1818.80, 1807.95

160622 Morning Session Analysis

16 June 2022 Morning Session Analysis

US Dollar eased despite the hawkish move of Fed.

The Dollar Index which traded against a basket of six major currencies slumped after the FOMC meetings. According to Reuters, Federal Reserve had implement a 75 basic point rate hike in the meetings, which exceeding the market forecast of 50 basic point. Nonetheless, the US Dollar retraced from its recent highs amid the economic forecast from Fed. According to its own economic projections, the Fed expects growth to be weaker and the unemployment rate to be higher after the aggressive rate hike. The growth forecast lowered to 1.7% for 2022 from 2.8%, and the unemployment rate forecast raised to 3.7% for 2022 from 3.5%. Despite the rate hike implementation would likely to combat inflation risk, it might also increase the borrowing cost of consumer too. Consequences, it would likely to diminish the consumer spending in US, which brought negative prospects toward economic progression in US region. Besides, the bearish retails sales data spurred further bearish momentum on the Dollar Index. The US Core Retail Sales MoM and US Retail Sales MoM for May had given a downbeat reading, which are 0.5% and -0.3%, lower than the market forecast of 0.8% and 0.2% respectively. It prompted investors to shift their capitals toward other assets which having better prospects. As of writing, the Dollar Index depreciated by 0.69% to 104.61.

In the commodities market, crude oil price appreciated by 0.94% to $116.39 per barrel as of writing. However, the overall trend for oil price remained bearish following the higher-than-expected oil inventories. On the other hand, gold price rallied by 0.84% to $1834.75 per troy ounce as of writing over the economic recession forecast from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:30 CHF SNB Monetary Policy Assessment

16:30 CHF SNB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q2) | -0.75% | – | – |

| 19:00 | GBP – BoE Interest Rate Decision (Jun) | 1.00% | 1.25% | – |

| 20:30 | USD – Building Permits (May) | 1.823M | 1.787M | – |

| 20:30 | USD – Initial Jobless Claims | 229K | 215K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jun) | 2.6 | 5.3 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2190, 1.2270

Support level: 1.2080, 1.1975

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0520, 1.0605

Support level: 1.0450, 1.0385

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 134.25, 135.05

Support level: 133.10, 131.95

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7075, 0.7165

Support level: 0.7005, 0.6915

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6350, 0.6425

Support level: 0.6295, 0.6235

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2875, 1.3000

Support level: 1.2765, 1.2635

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9960, 1.0040

Support level: 0.9900, 0.9820

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 115.40, 119.15

Support level: 111.25, 106.95

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1855.50, 1884.85

Support level: 1829.90, 1807.95

150622 Afternoon Session Analysis

15 June 2022 Afternoon Session Analysis

US Dollar hovered at decade high while investors are eyeing on FOMC meeting.

The Dollar Index which traded against a basket of six major currencies hovered at new decade high as investors continue to eye on an aggressive rate hike from Federal Reserve. Currently the market expected that nearly 90% probability for a 75-basis-point increase in interest rate at the conclusion of two-day meeting on Wednesday, according to FedWatch Tool. With the rising stagflation risk and growth-related concerns continue to jeopardize the global economic, investors started to shift their portfolio toward safe-haven US Dollar. On the economic data front, the Producer Price Index (PPI) rose 0.8% for last month, doubling of the 0.4% reading in April. As for now, investors continue to scrutinize the latest updates with regards of the latest monetary policy decision to receive further trading signal for the US Dollar. As of writing, the Dollar Index appreciated by 0.02% to 105.30.

In the commodities market, the crude oil price depreciated by 0.01% to $116.40 per barrel as of writing. The oil market edged lower as OPEC delegates and industry sources forecasted that the world oil demand growth will slow down in 2023 as surging commodity prices recently continue to drive up the stagflation risk while dragging down the economic momentum in the world. On the other hand, the gold price surged 0.35% to $1814.35 per troy ounces as of writing amid technical correction. Though, the overall trend for the gold still remained bearish amid hopes upon the tightening monetary policy from global central bank.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (May) | 0.6% | 0.8% | – |

| 20:30 | USD – Retail Sales (MoM) (May) | 0.9% | 0.2% | – |

| 22:30 | USD – Crude Oil Inventories | 2.025M | -1.917M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 105.25, 106.20

Support level: 104.30, 103.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2190, 1.2375

Support level: 1.1955, 1.1670

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0485, 1.0600

Support level: 1.0355, 1.0205

USDJPY, Daily: USDJPY was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 135.40, 140.00

Support level: 130.70, 126.50

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6995, 0.7125

Support level: 0.6865, 0.6720

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6535, 0.6720

Support level: 0.6215, 0.6070

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3050, 1.3185

Support level: 1.2890, 1.2770

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0075, 1.0185

Support level: 0.9970, 0.9850

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 118.90, 124.00

Support level: 115.10, 112.70

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1828.15, 1844.15

Support level: 1807.95, 1792.90

150622 Morning Session Analysis

15 June 2022 Morning Session Analysis

GBPUSD beaten down after the bearish economic data released.

The GBPUSD extended its losses on Tuesday amid the negative economic data was unleashed. According to Office for National Statistics, the UK Average Earnings Index +Bonus notched down from the previous reading of 7.0% to 6.8%, missing the market forecast of 7.6%. In addition to the data, the UK Claimant Count Change and UK Unemployment Rate had also given downbeat reading, which were -19.7K and 3.8%, higher than the economist expectation of 49.4K and 3.6% respectively. These downbeat data had showed that the UK labor market remained fragile, which would likely to bring negative prospects toward economic progression in UK. Thus, Bank of England (BoE) would less likely to implement rate hike in the upcoming meeting, which dialed down the market optimism toward Pound Sterling. Nonetheless, investors should continue to scrutinize the latest updates with regards of the interest rate decisions of BoE which will be announced on Thursday in order to gauge the likelihood movement of the pair. As of writing, GBPUSD edged up by 0.08% to 1.2003.

In the commodities market, crude oil price depreciated by 0.50% to $118.33 per barrel as of writing over the fears on US Federal Reserve will surprise markets with a higher-than-expected interest rate hike. On the other hand, gold price eased by 0.25% to $1808.90 per troy ounce as of writing following the rising of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (May) | 0.6% | 0.8% | – |

| 20:30 | USD – Retail Sales (MoM) (May) | 0.9% | 0.2% | – |

| 22:30 | USD – Crude Oil Inventories | 2.025M | -1.917M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 105.90, 106.95

Support level: 104.80, 103.65

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2080, 1.2190

Support level: 1.1975, 1.1845

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0450, 1.0520

Support level: 1.0385, 1.0315

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 136.00, 137.35

Support level: 135.05, 134.25

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3000, 1.3165

Support level: 1.2875, 1.2765

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0040, 1.0115

Support level: 0.9960, 0.9900

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 119.15, 122.20

Support level: 115.40, 111.25

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1829.90, 1855.50

Support level: 1807.95, 1785.90

140622 Afternoon Session Analysis

14 June 2022 Afternoon Session Analysis

US Dollar surged following the hawkish expectation from Fed.

The Dollar Index which traded against a basket of six major currencies spiked since yesterday over the backdrop of hawkish expectation from Fed. According to CNBC, Central bank policymakers are entertaining the idea of a 75 basis point increase to the Fed’s benchmark funds rate that banks charge each other for overnight financing, and the Wall Street firm’s economists now foresee consecutive 75 basis point rate hikes in June and July. The US Core Consumer Price Index (CPI) MoM for May which announced on June 10, has came in at the reading of 0.6% while exceeding the market forecast of 0.5%. Besides, the US CPI YoY had reached its 41-years highs, which is 8.6%. It increased the odds of Federal Reserve to implement aggressive tightening monetary policy in order to cool down the inflation, which sparkling the appeal of the US Dollar. At this juncture, investors would continue to focus on the latest updates with regards of interest rate decisions from Fed which will be announced on upcoming Thursday in order to receive further trading signals. As of writing, the Dollar Index appreciated by 0.11% to 105.08.

In the commodities market, crude oil price edged up by 0.12% to $121.08 per barrel as of writing despite recession fears and potential new COVID-19 curbs in China that could dampen demand as the market remains tightly supplied. Besides, gold price depreciated by 0.27% to $1827.10 per troy ounces as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Apr) | 7.0% | 7.6% | – |

| 14:00 | GBP – Claimant Count Change (May) | -56.9K | -42.5K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Jun) | -34.3 | -27.5 | – |

| 20:30 | USD – PPI (MoM) (May) | 0.5% | 0.8% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 105.90, 106.95

Support level: 104.80, 103.65

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2190, 1.2270

Support level: 1.2080, 1.1975

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0450, 1.0520

Support level: 1.0385, 1.0315

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 134.25, 135.05

Support level: 133.10, 131.95

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6145

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3000, 1.3165

Support level: 1.2875, 1.2765

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9960, 1.0040

Support level: 0.9900, 0.9820

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 119.05, 122.20

Support level: 115.40, 111.25

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1846.20, 1870.00

Support level: 1823.35, 1796.45