080822 Morning Session Analysis

8 August 2022 Morning Session Analysis

US Dollar surged over the bullish employment data.

The Dollar Index which traded against a basket of six major currencies rose significantly after the upbeat employment data have been released. According to Bureau of Labor Statistics, the US Nonfarm Payrolls for the month of July notched up from the previous reading of 398K to 528K, exceeding the consensus forecast of 250K. Besides, the US Unemployment Rate for July had posted at the reading of 3.5%, which lower than the 3.6% as widely expected. The optimistic reading of these two crucial employment data hinted that the current US labor market remained forceful, which led investors to turn their eyes on economic progression in the US. In addition, the Dollar Index extended its gains following the hawkish statement from Fed member. According to CNBC, Federal Reserve Governor Michelle Bowman claimed that she supports the big rate hikes which recently implemented by the central bank as well as the path of rate hikes would likely to continue until inflation is subdued. As of writing, the Dollar Index appreciated by 0.04% to 106.53.

In the commodities market, the crude oil price dropped by 1.17% to $87.97 per barrel as of writing as the global economy outlook remained clouded. On the other hand, the gold price depreciated by 0.04% to $1774.18 per troy ounce as of writing amid the value of US Dollar heightened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

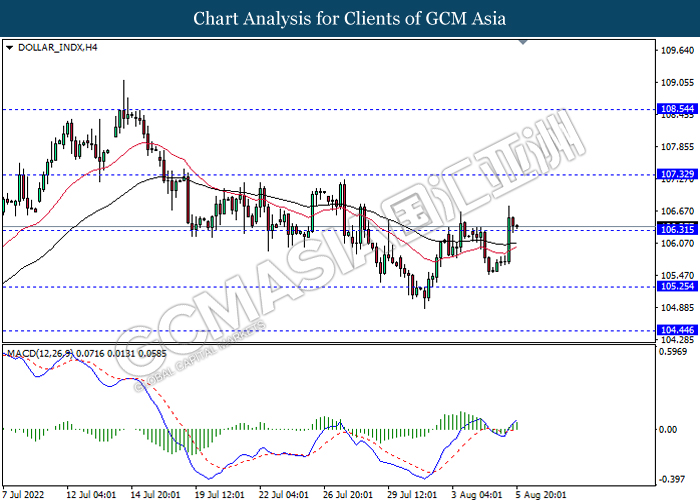

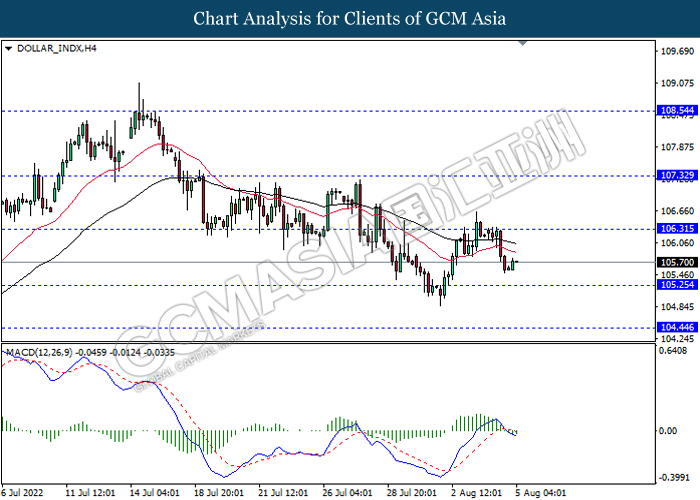

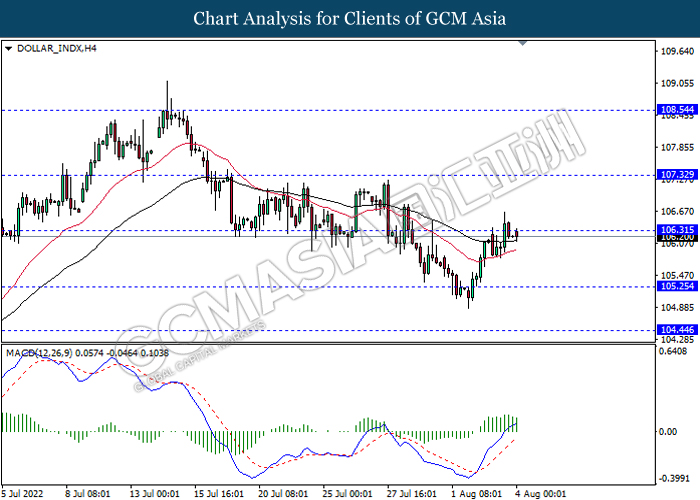

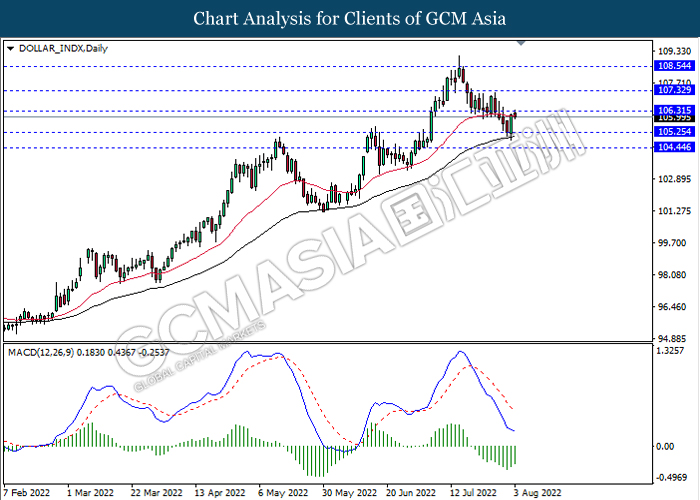

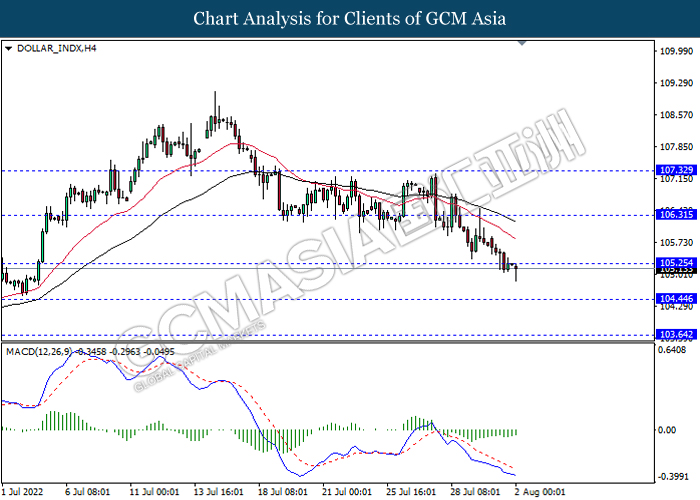

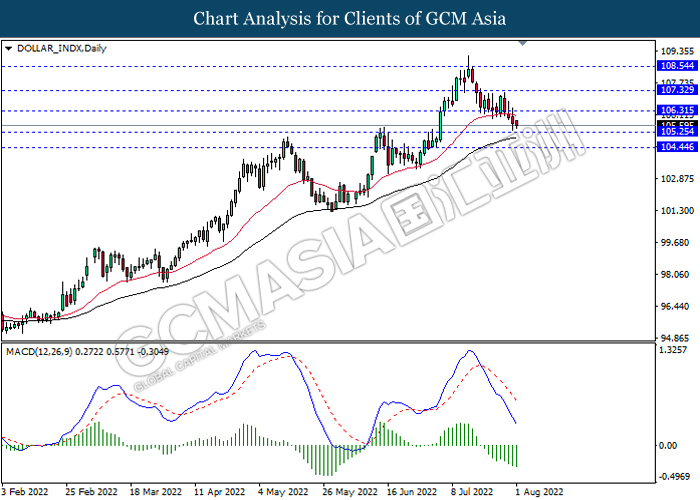

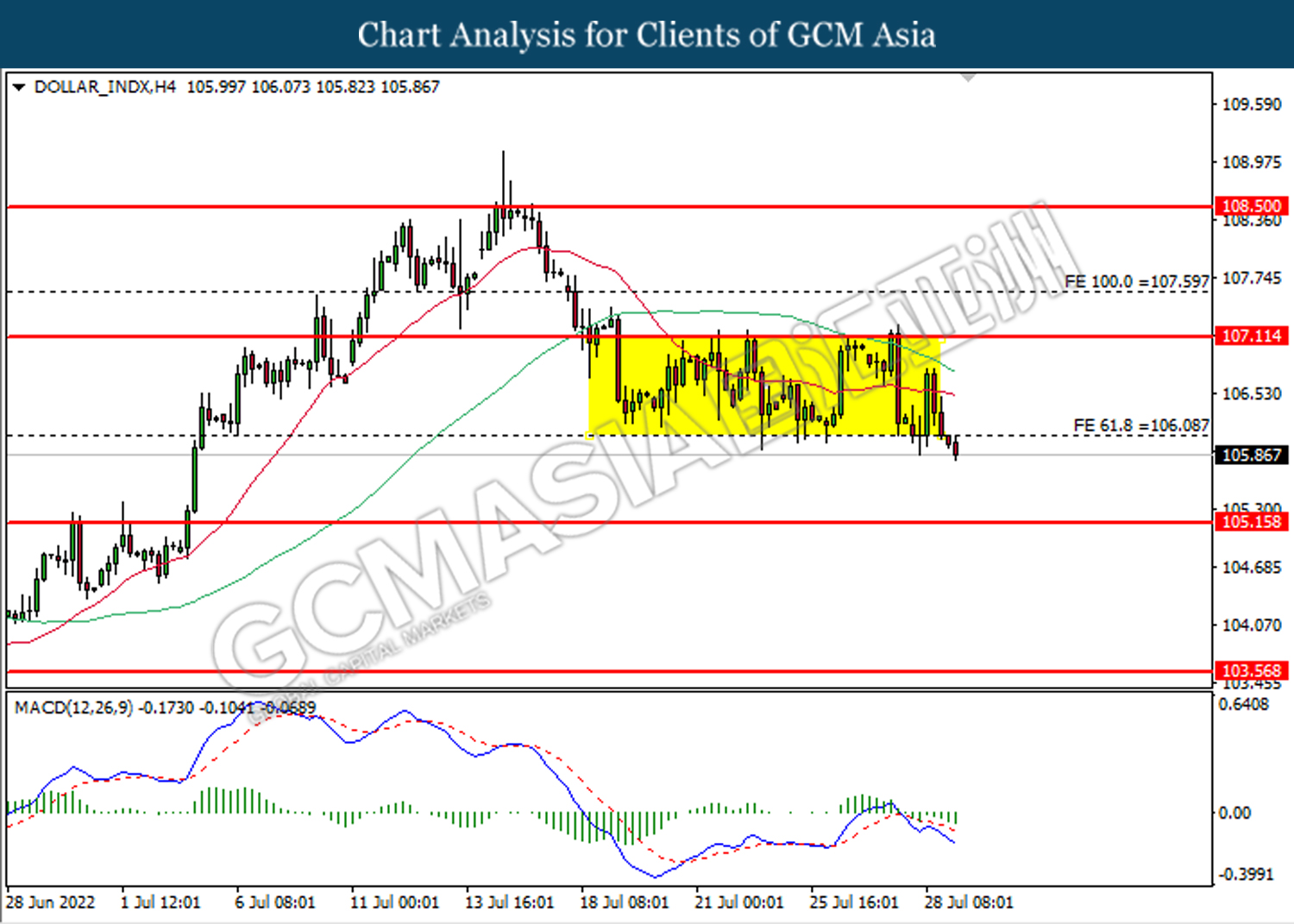

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 107.30, 108.55

Support level: 106.30, 105.25

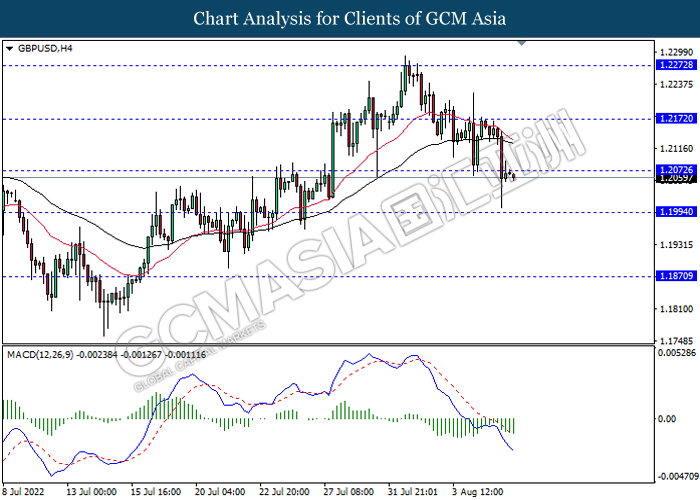

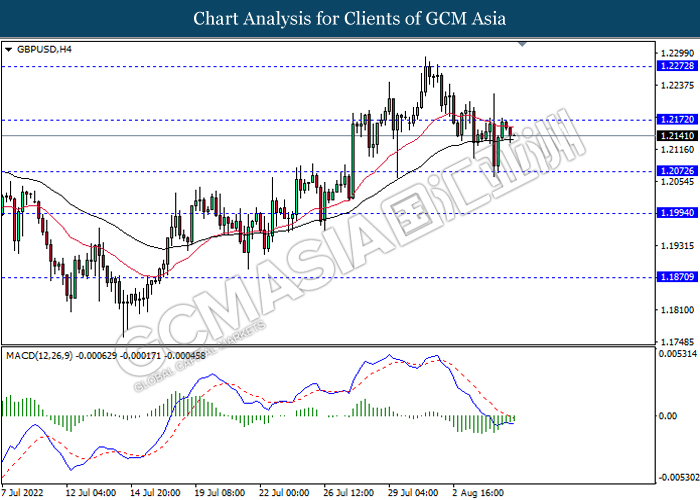

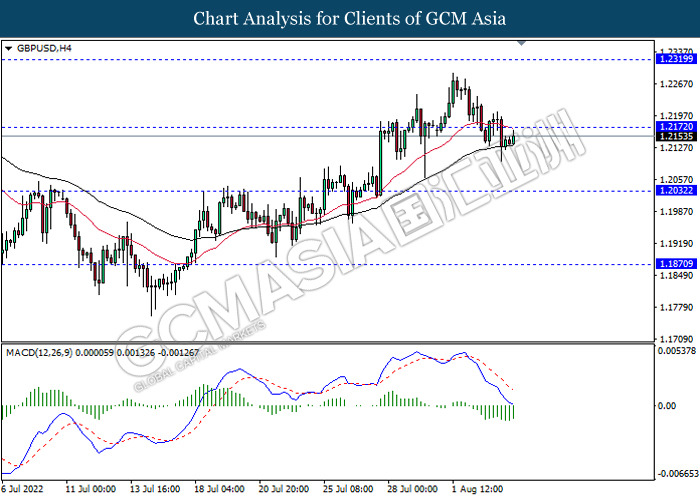

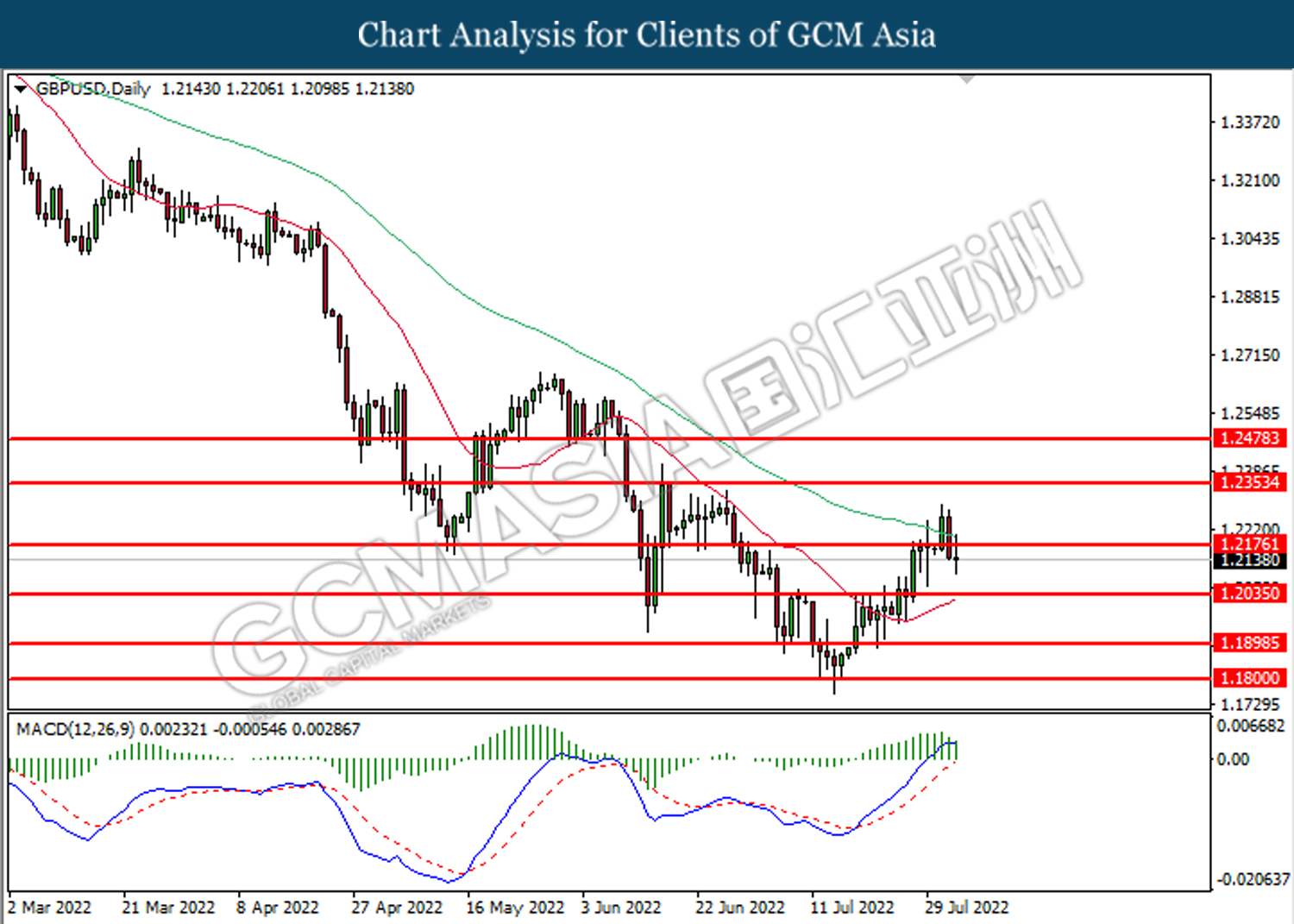

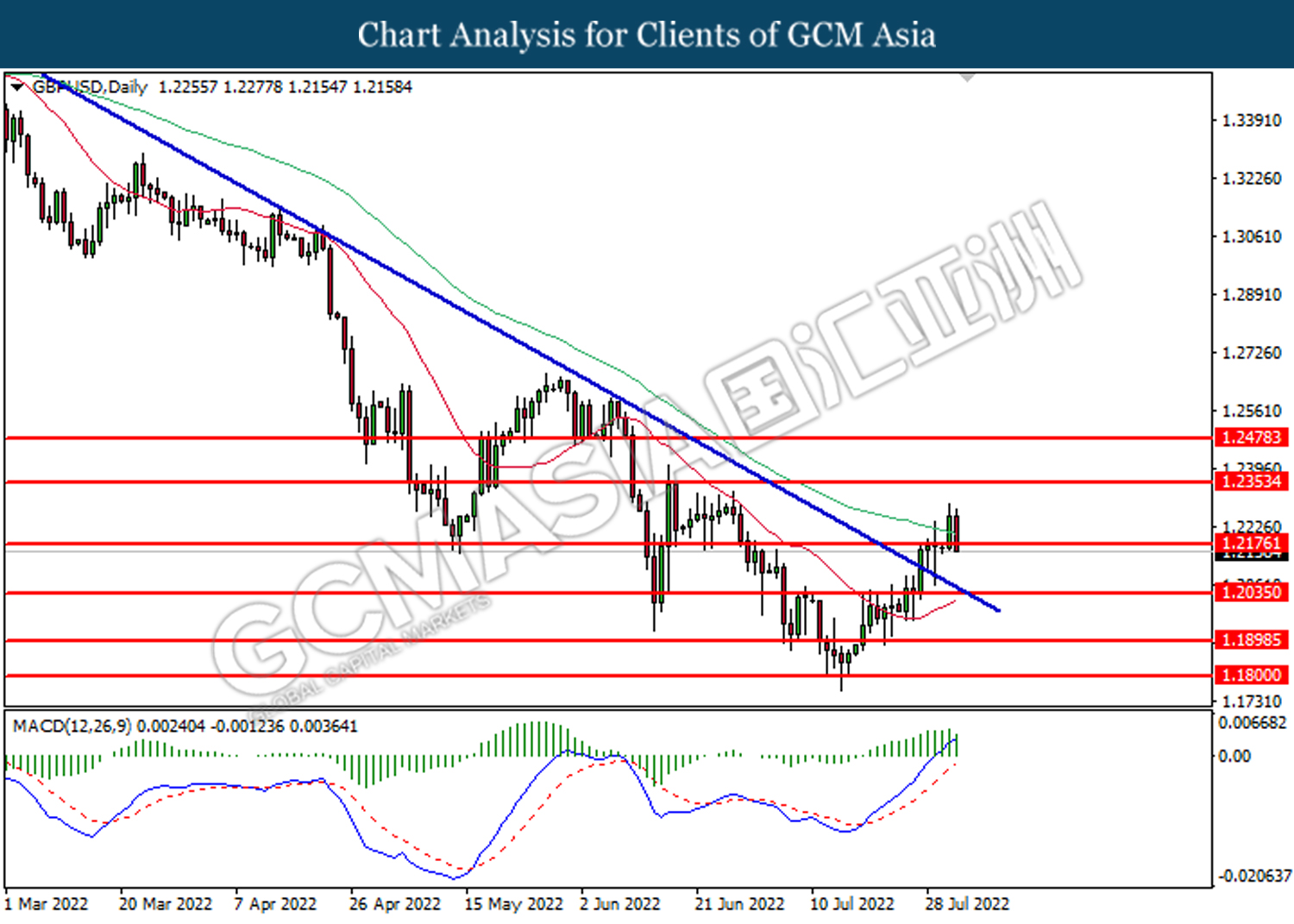

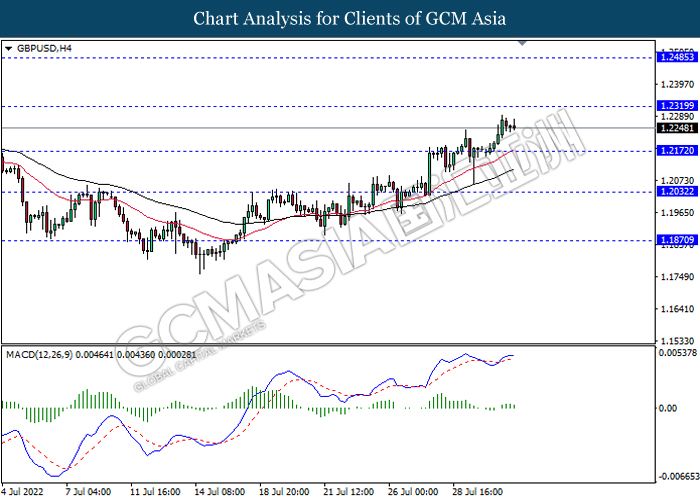

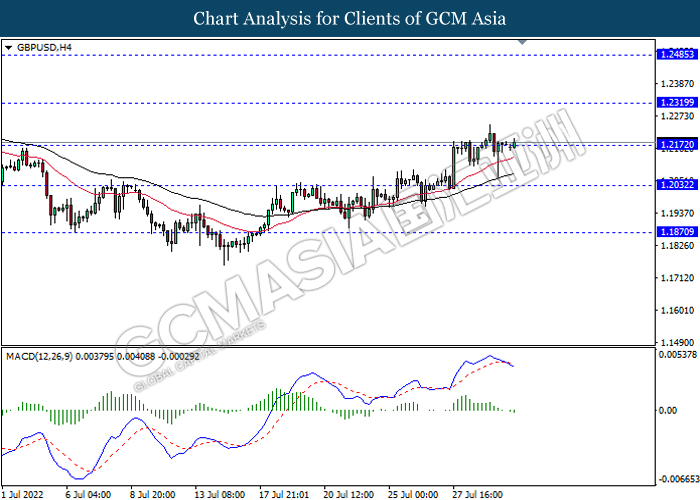

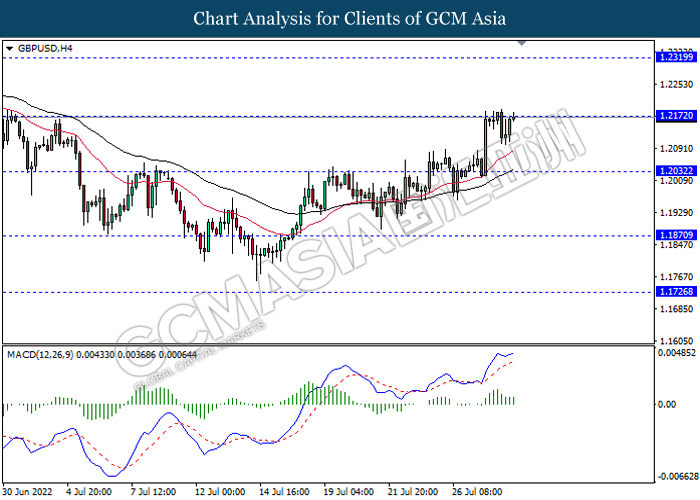

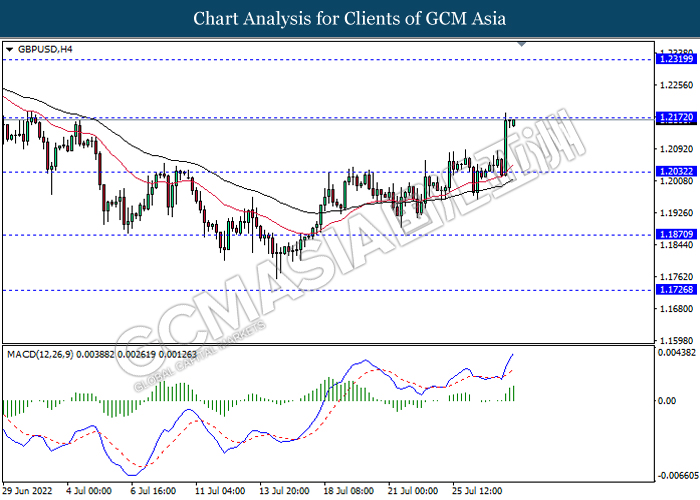

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2070, 1.2170

Support level: 1.1995, 1.1870

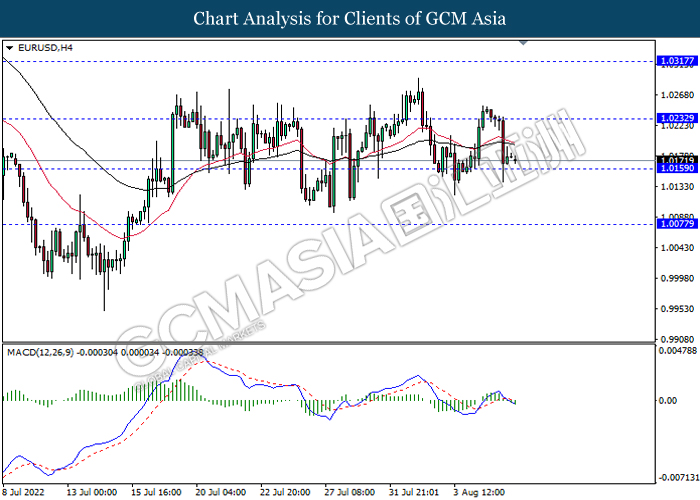

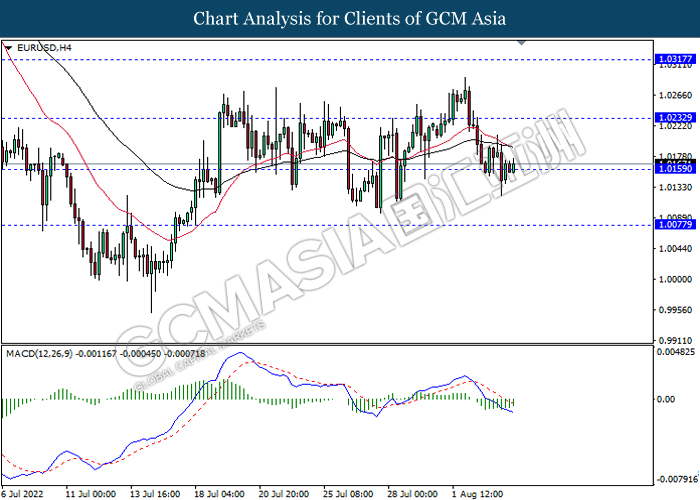

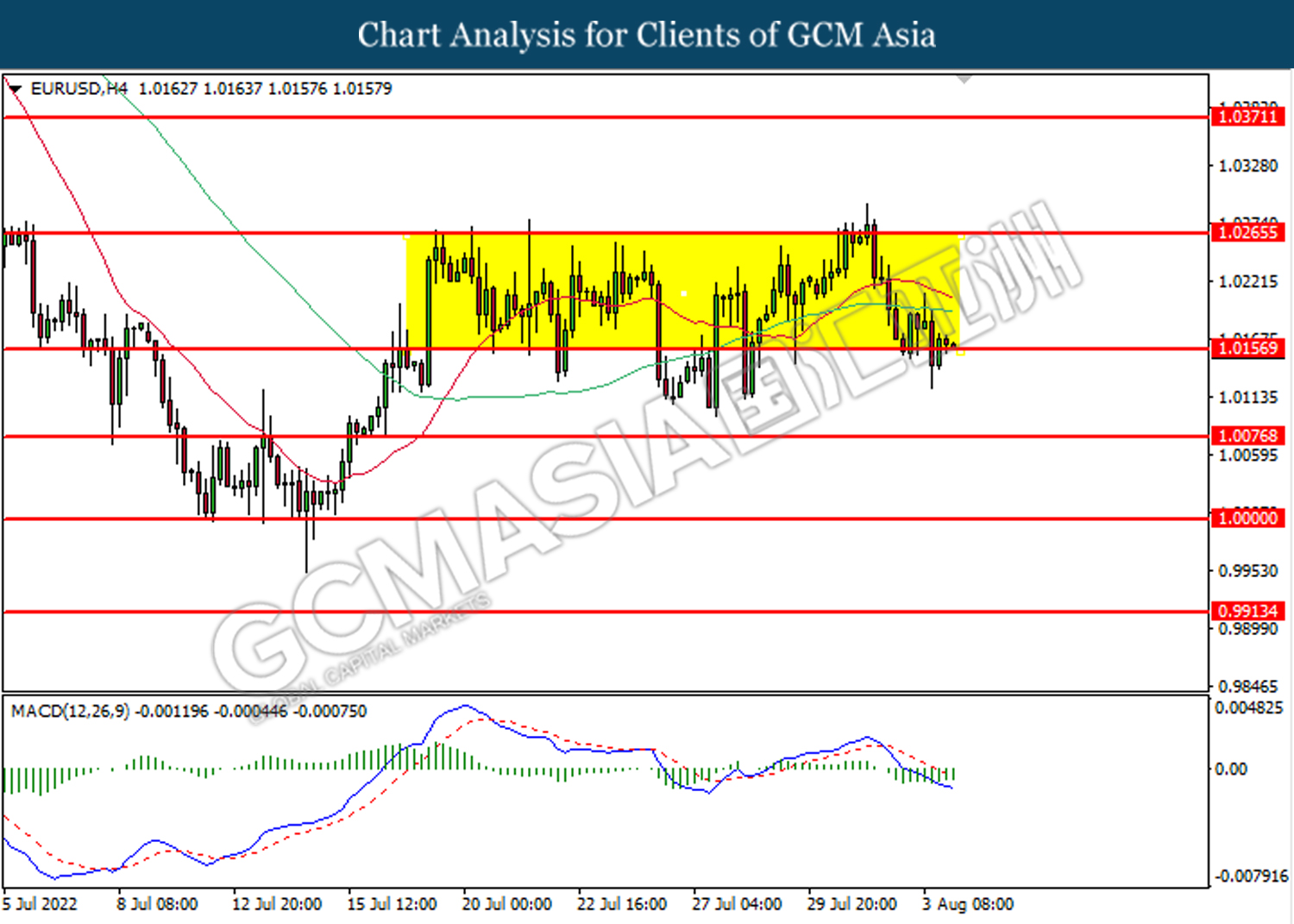

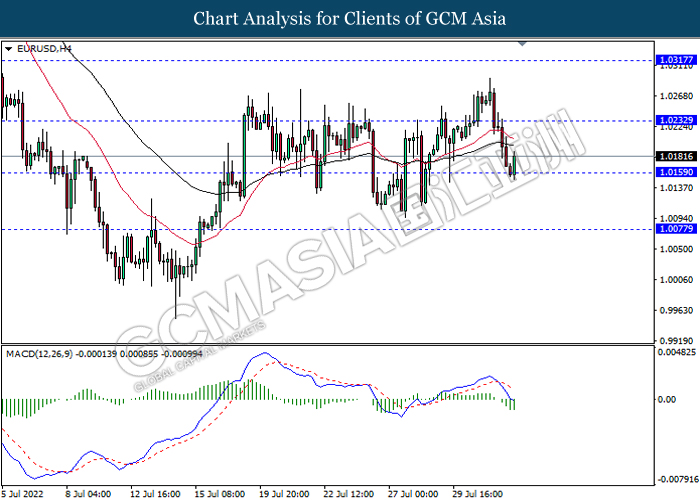

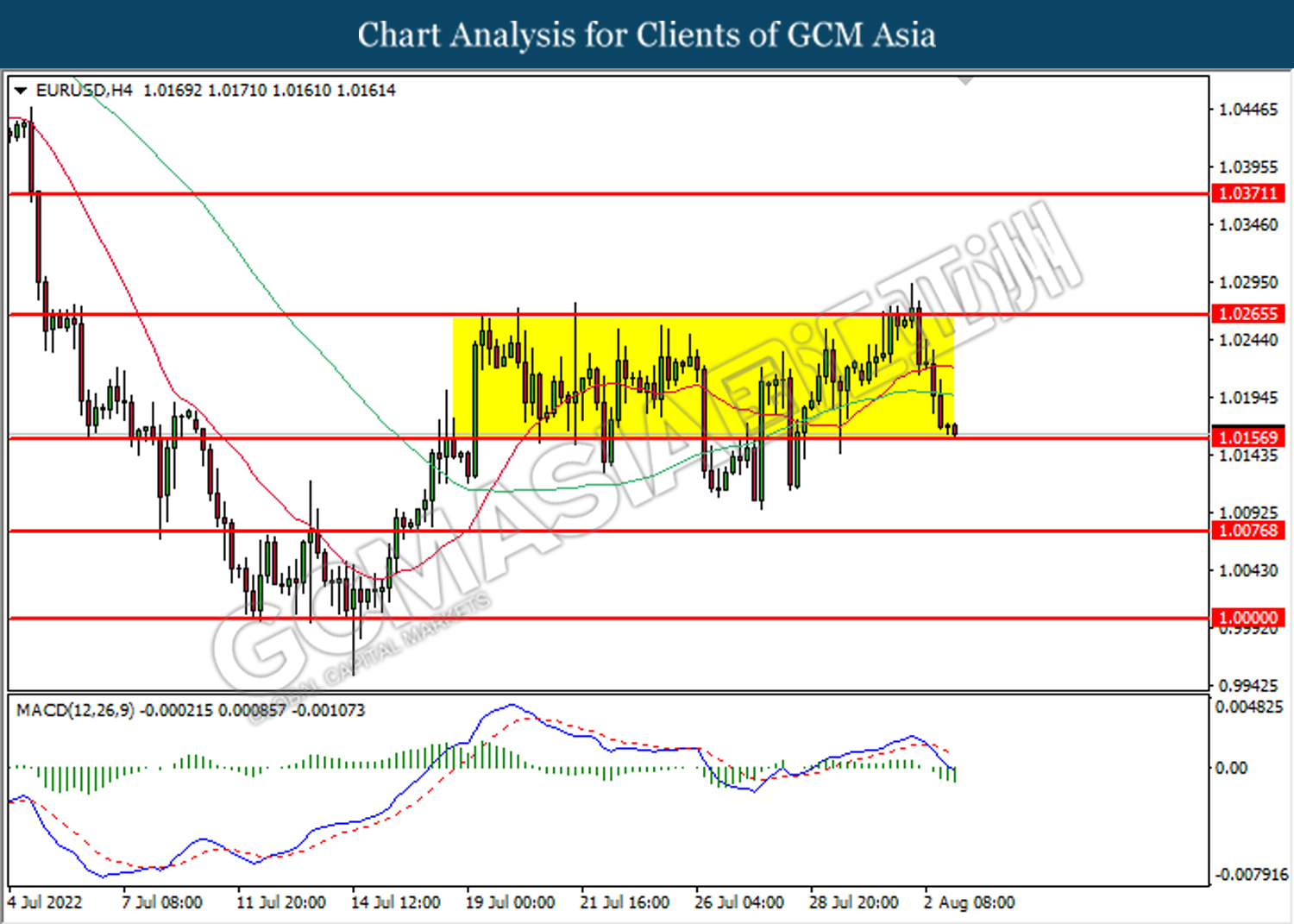

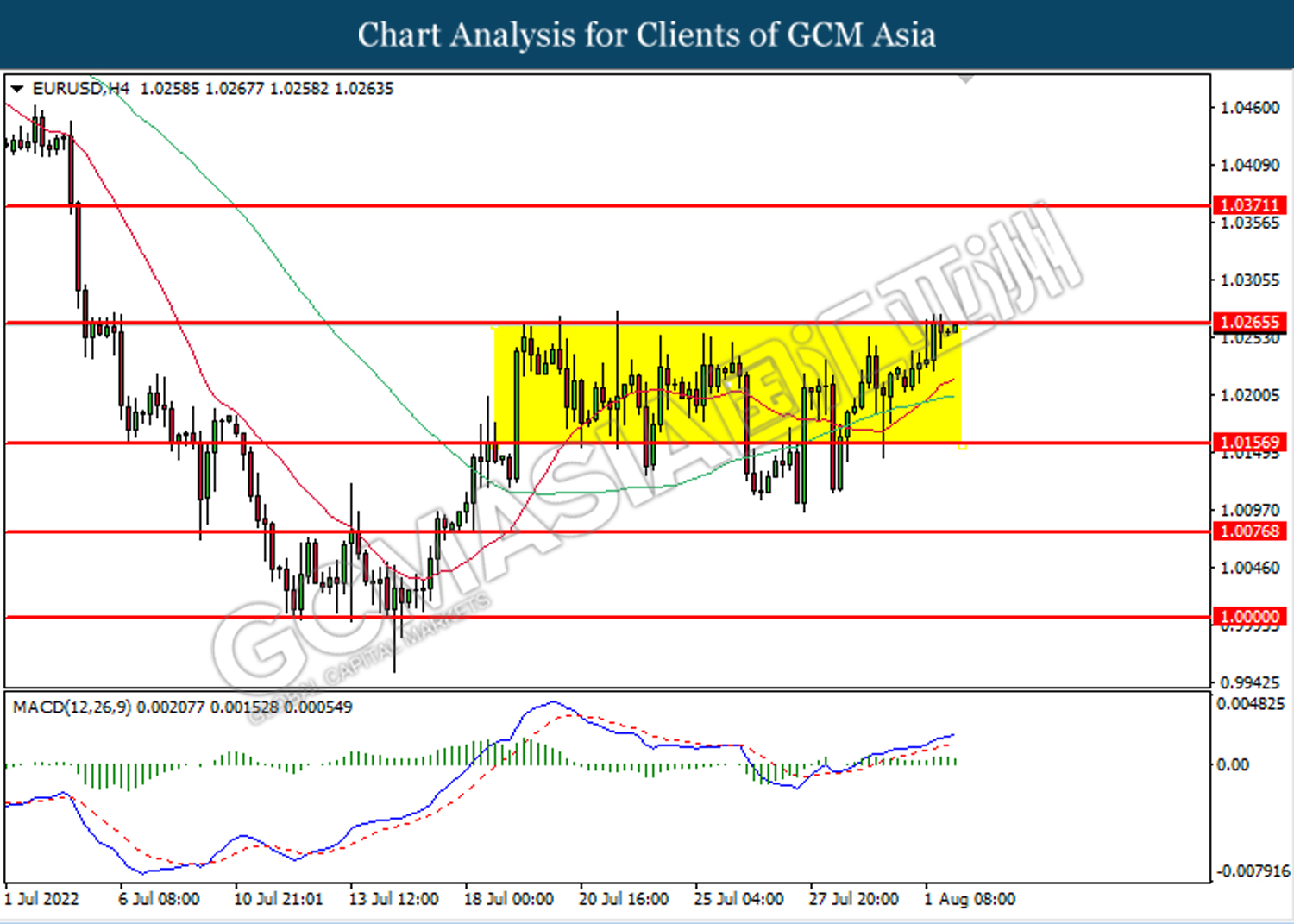

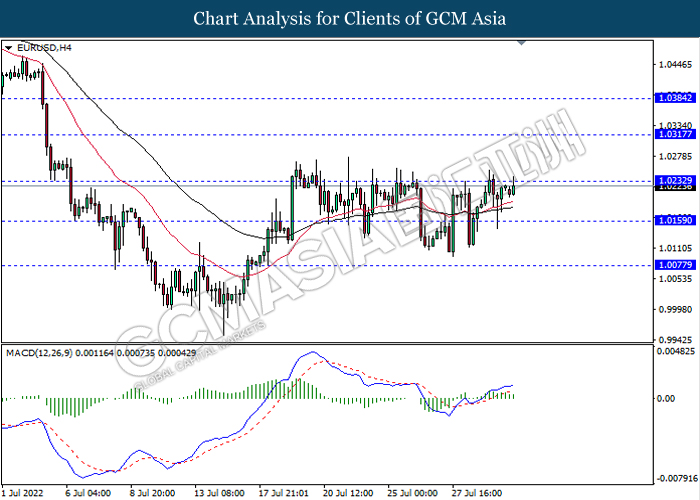

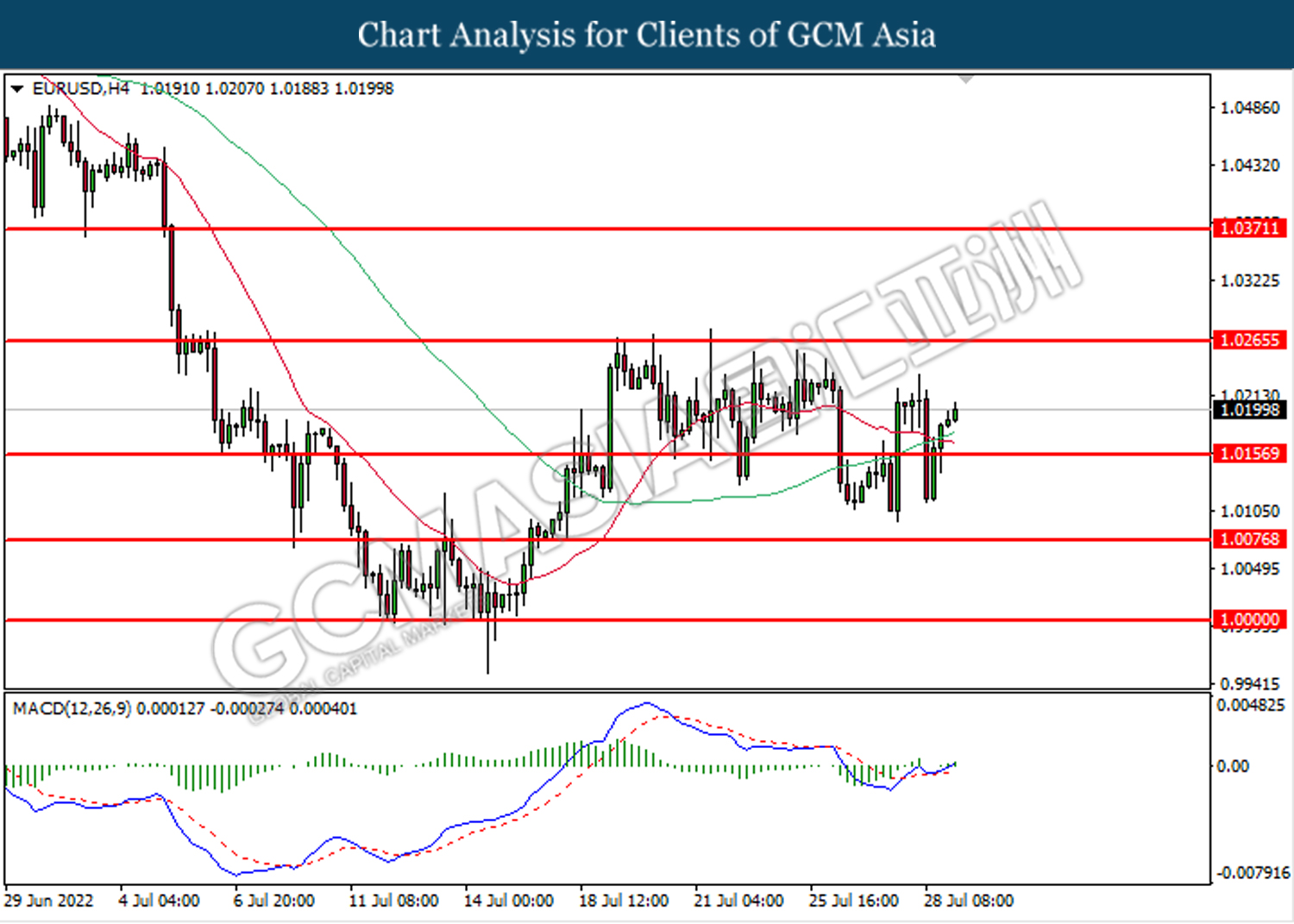

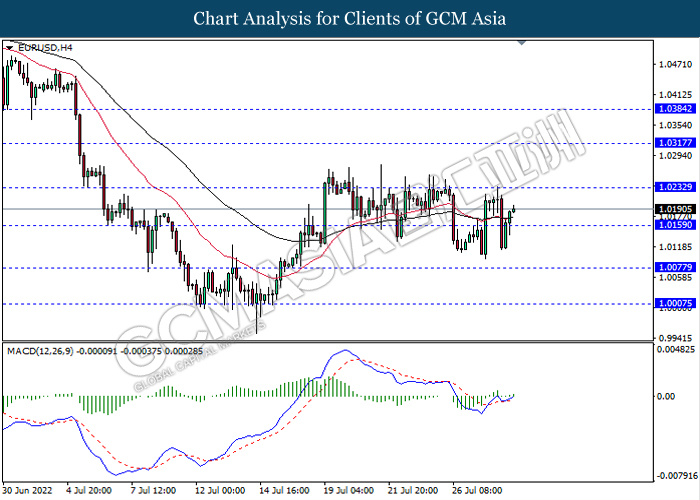

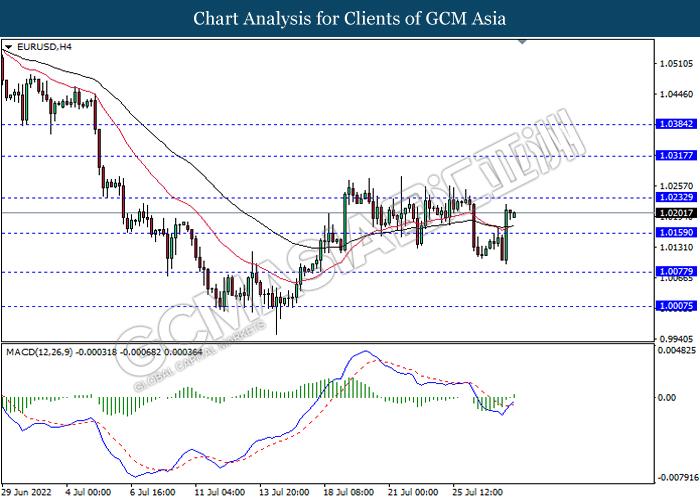

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

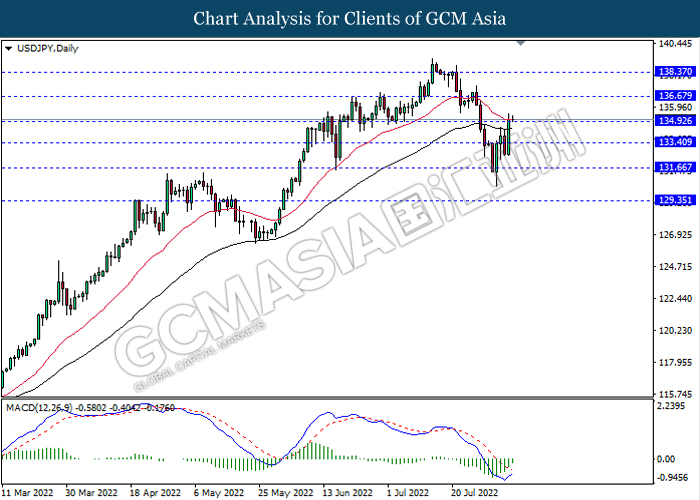

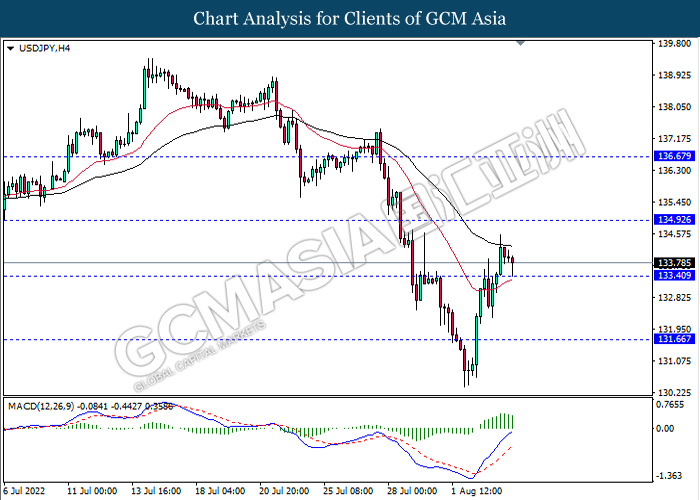

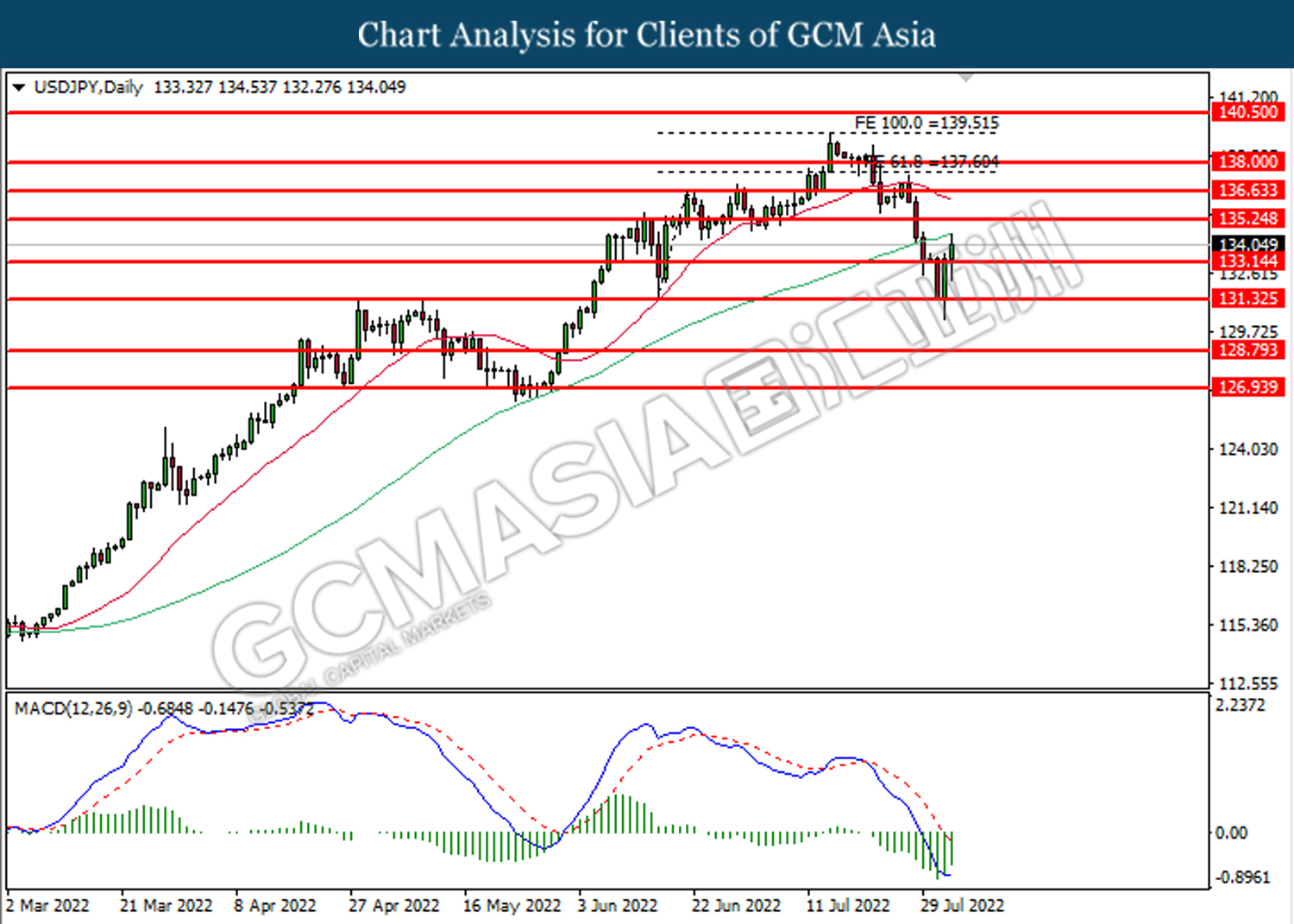

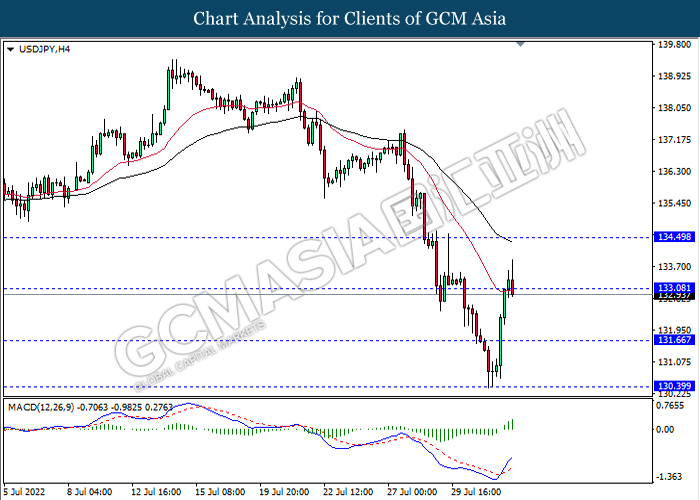

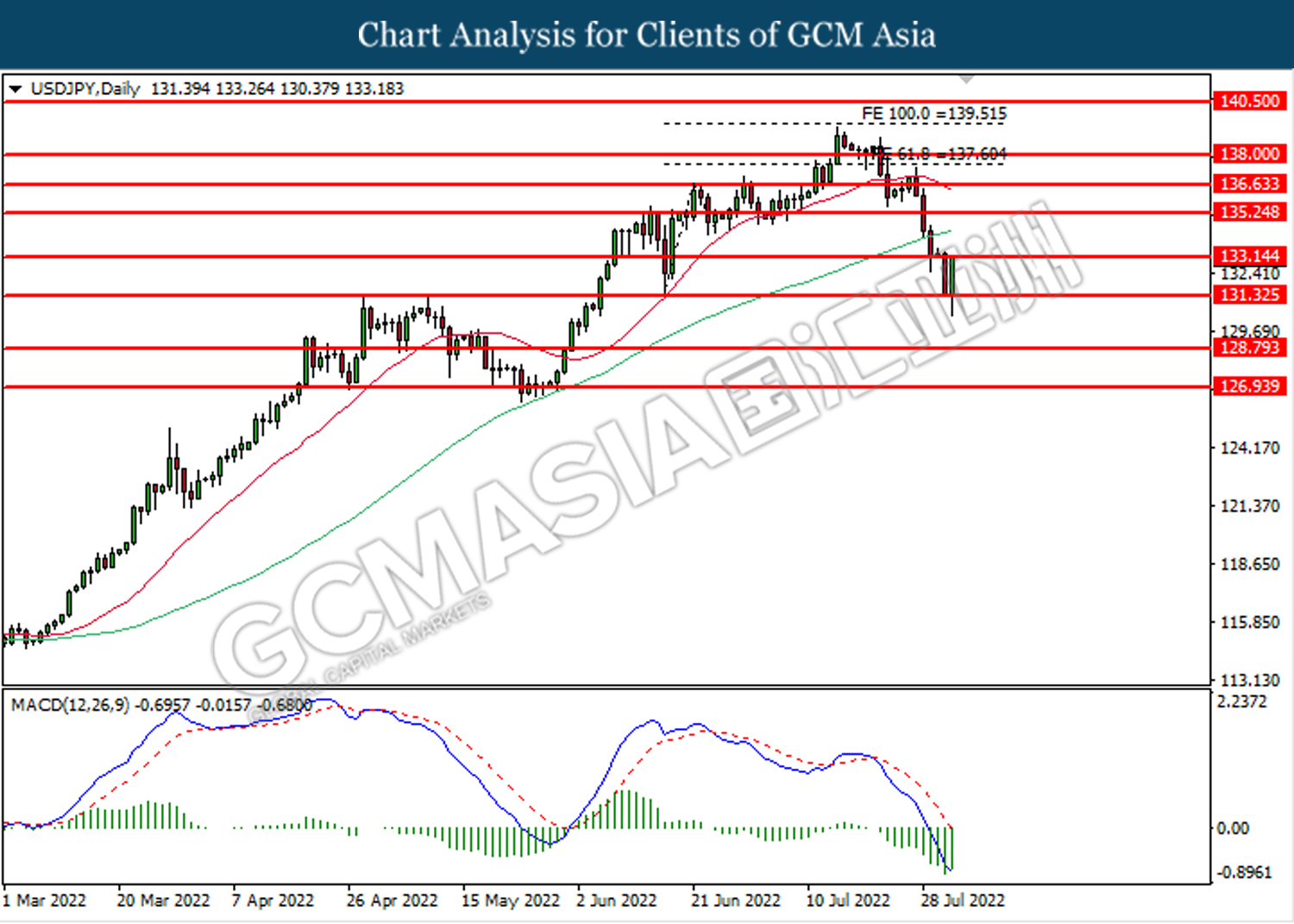

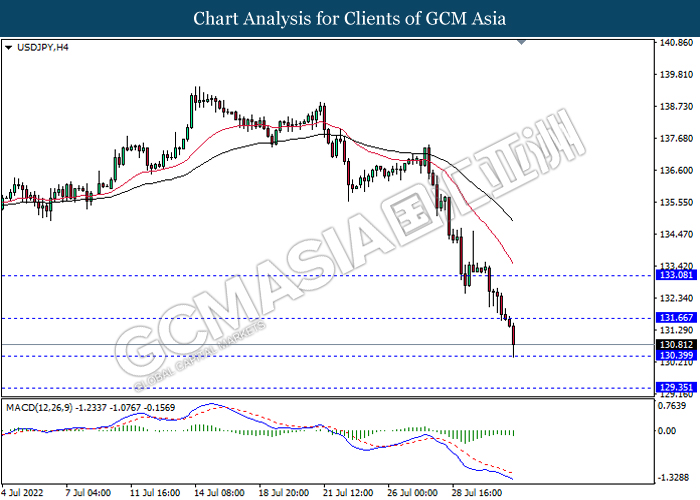

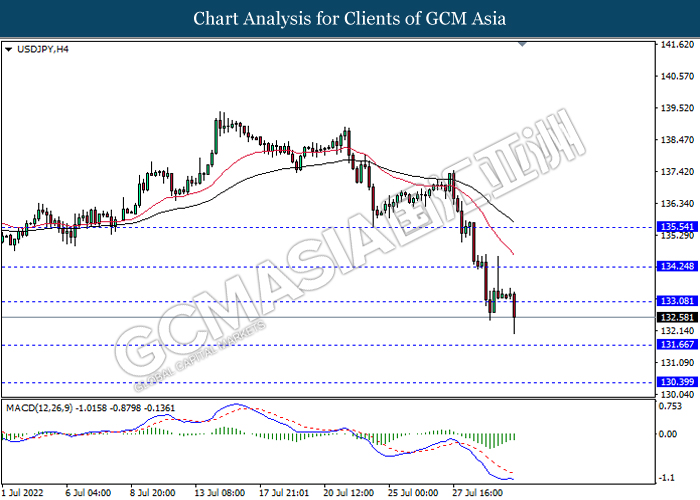

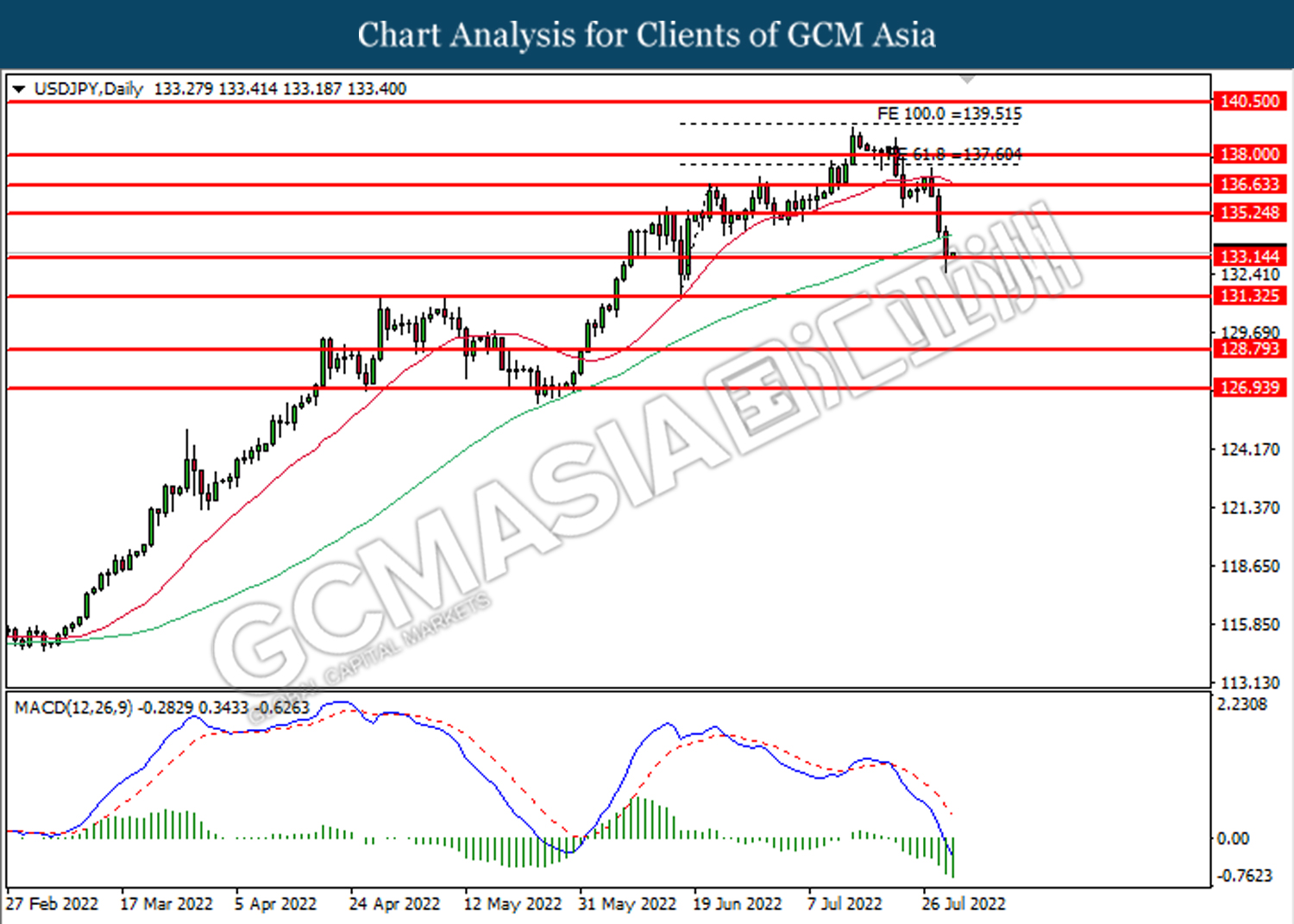

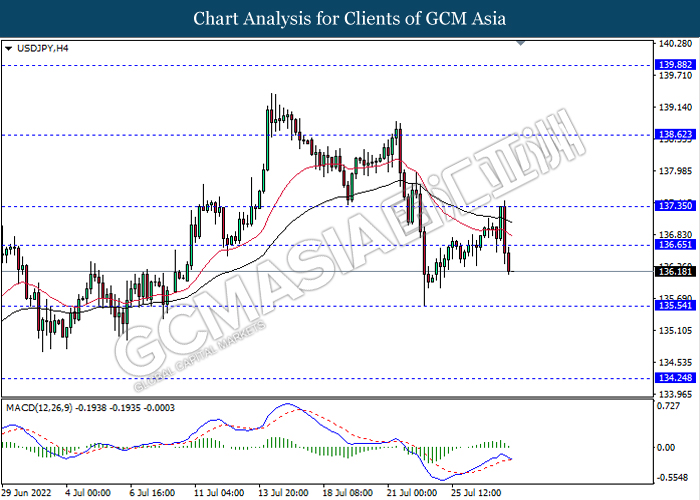

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 136.65, 138.35

Support level: 134.90, 133.40

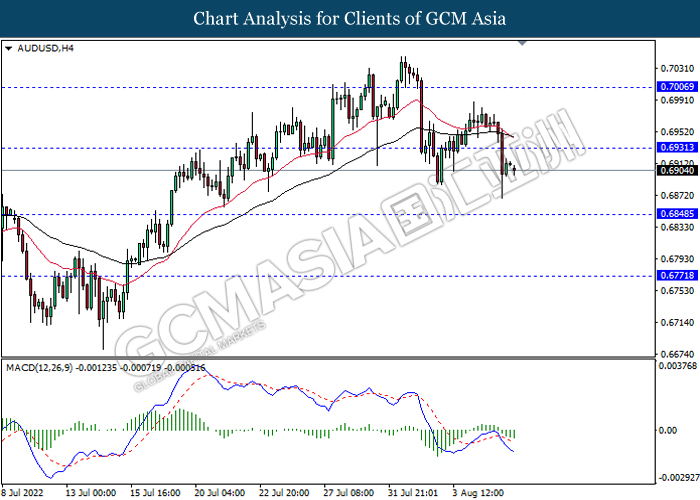

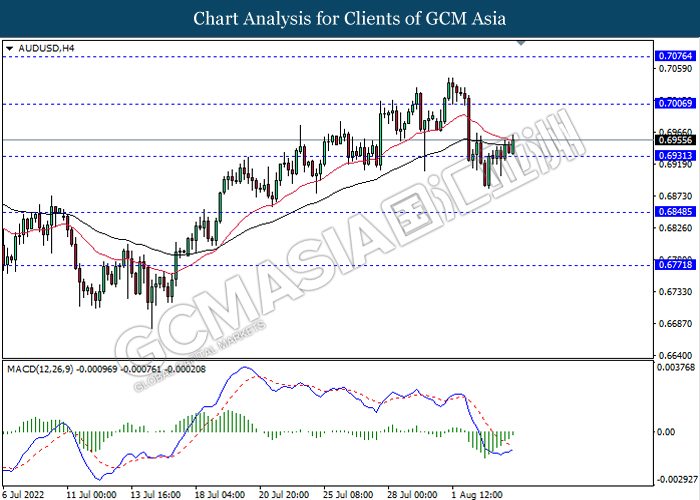

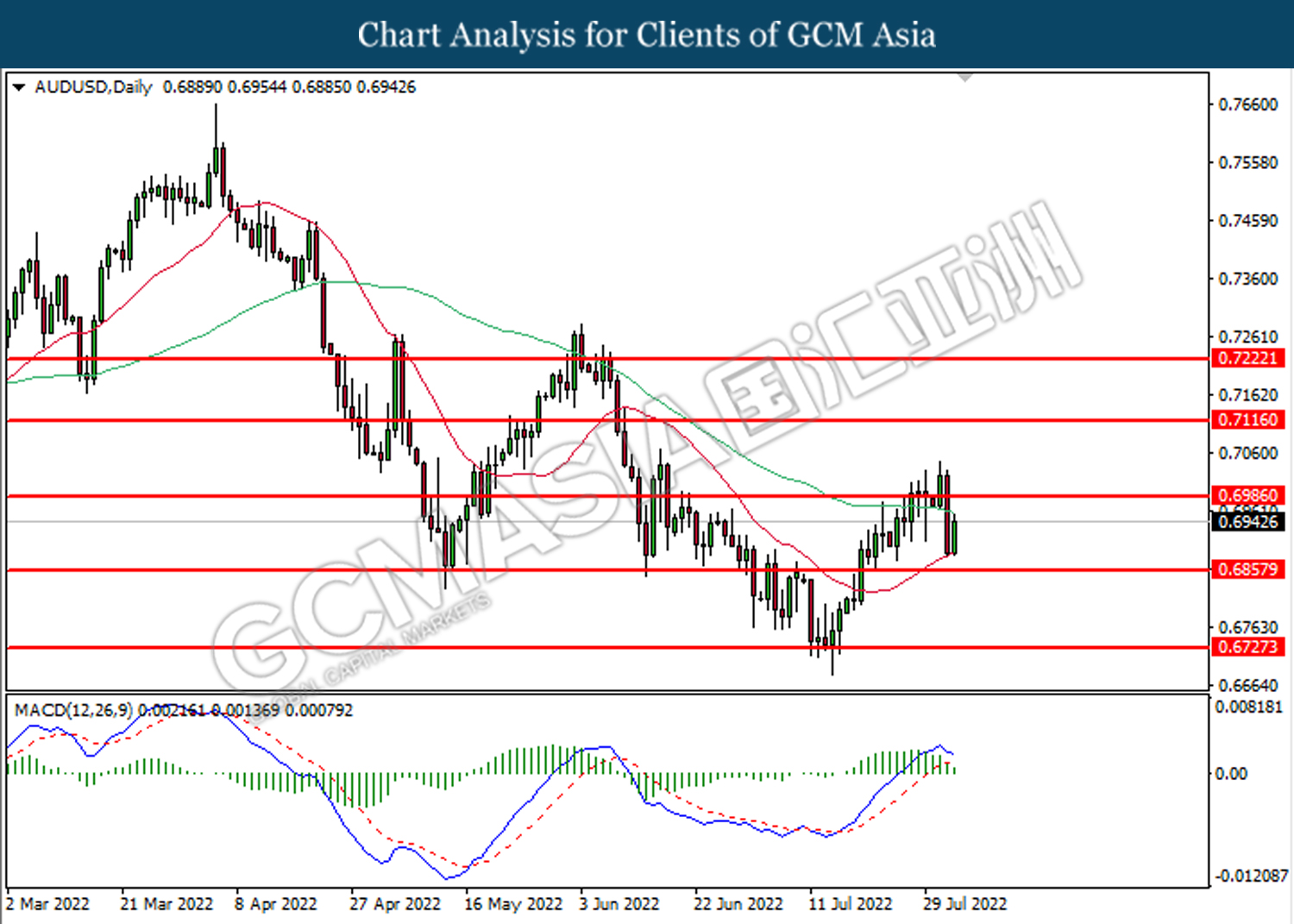

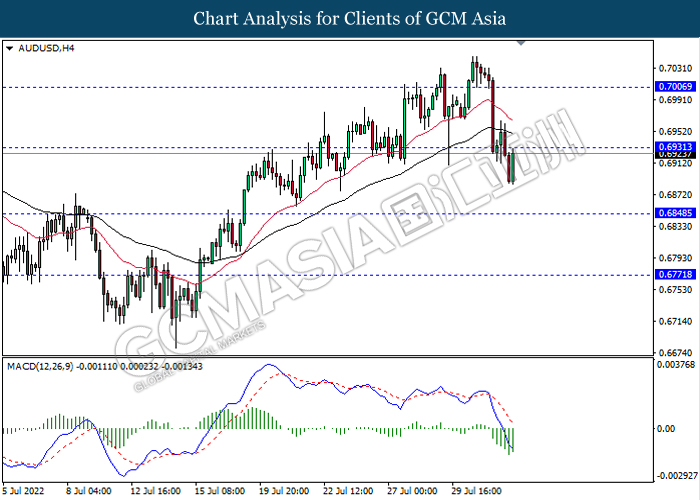

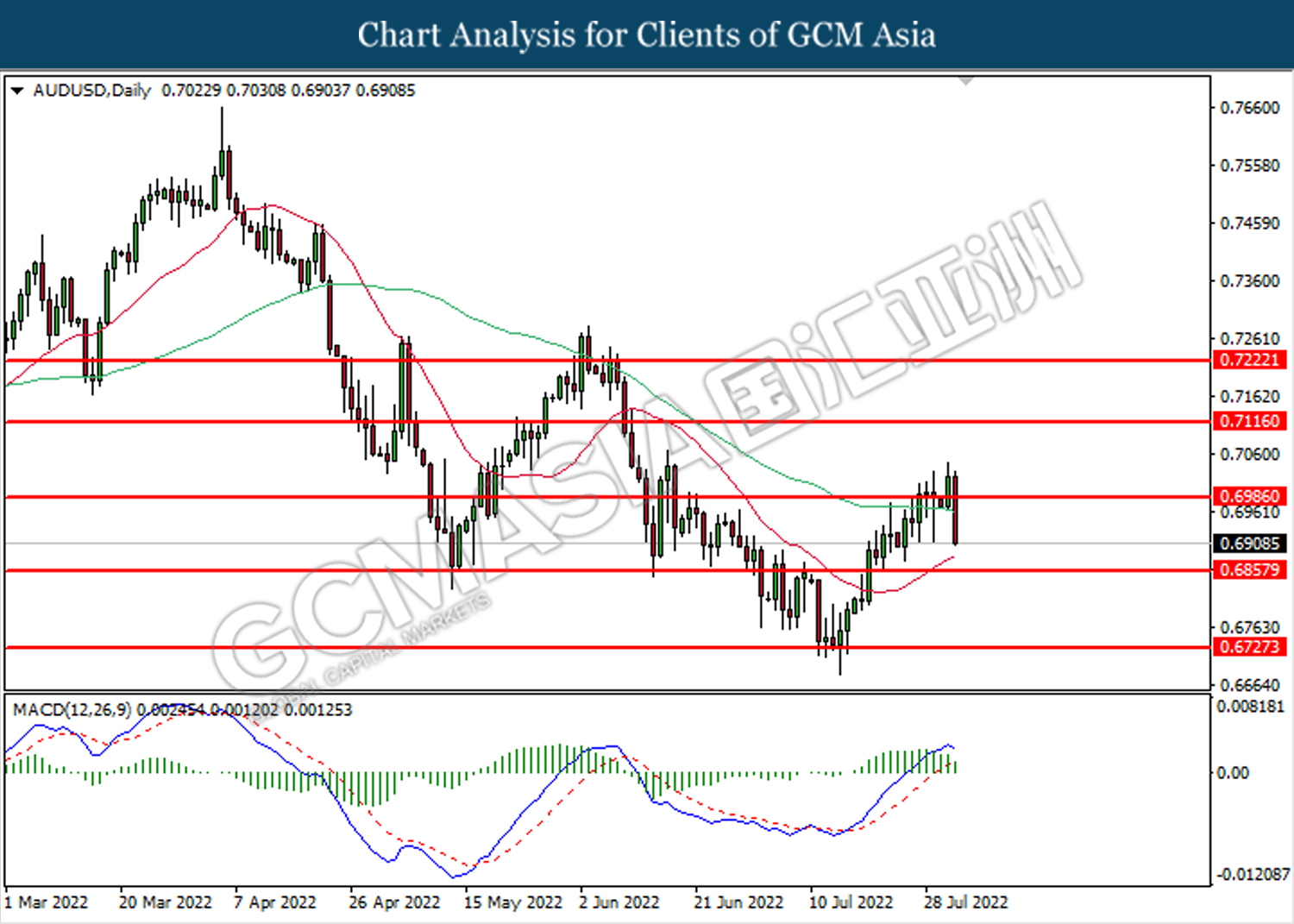

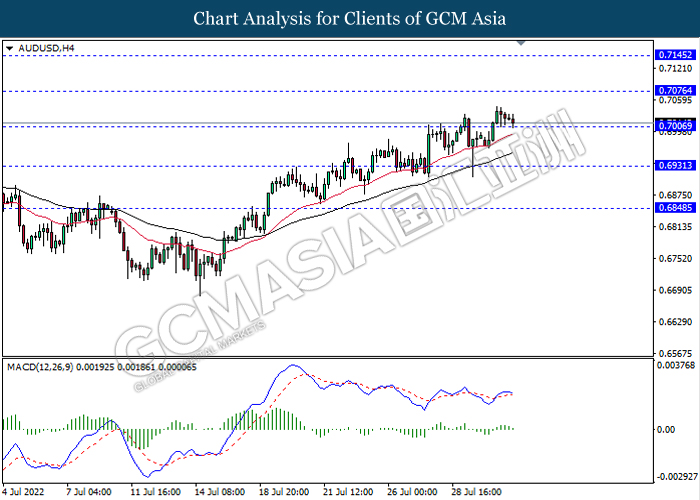

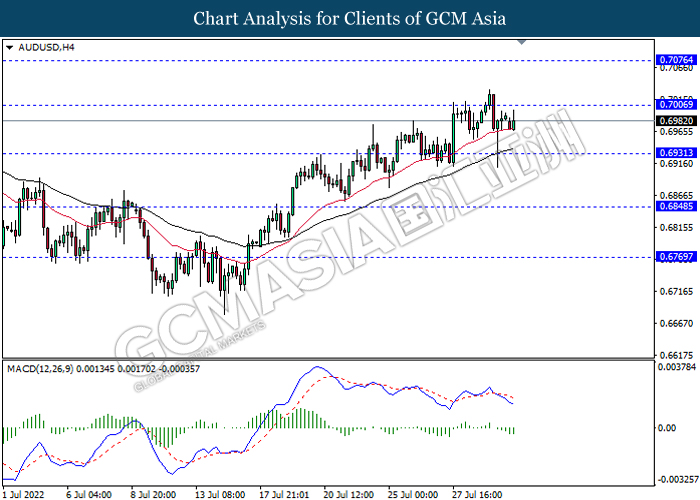

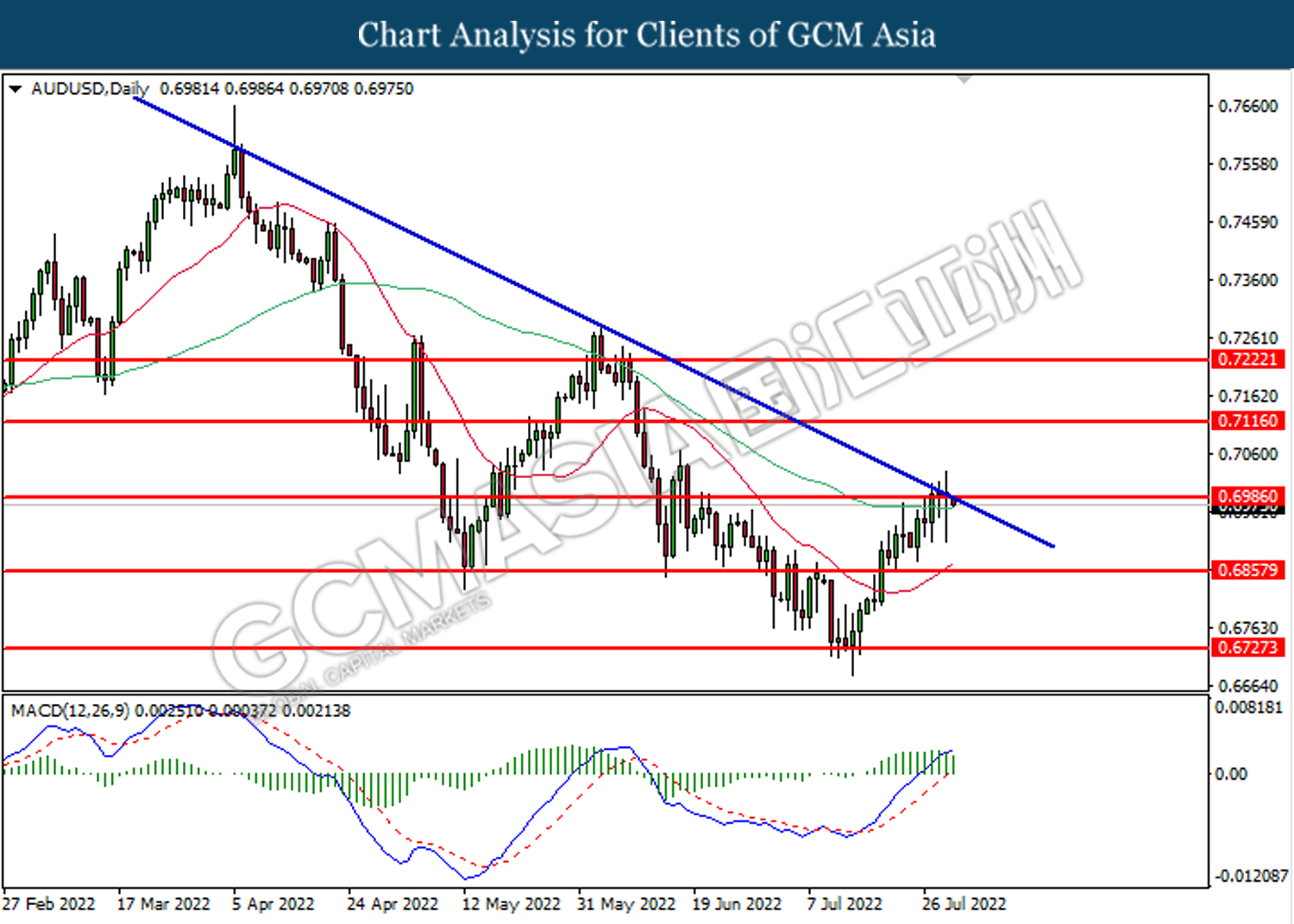

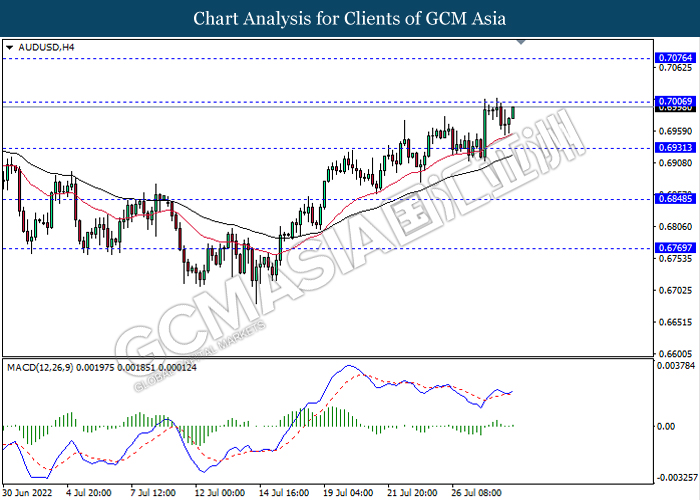

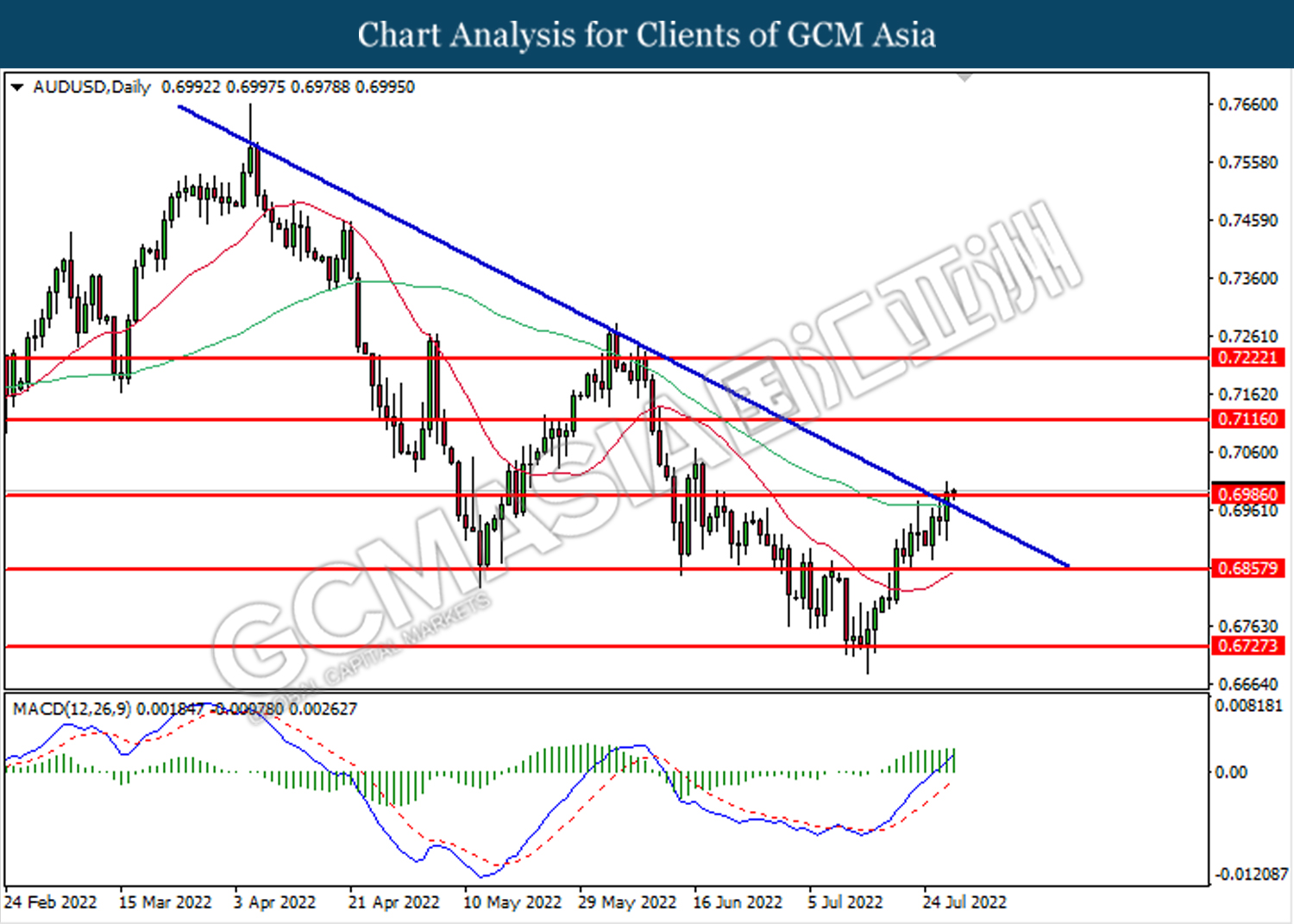

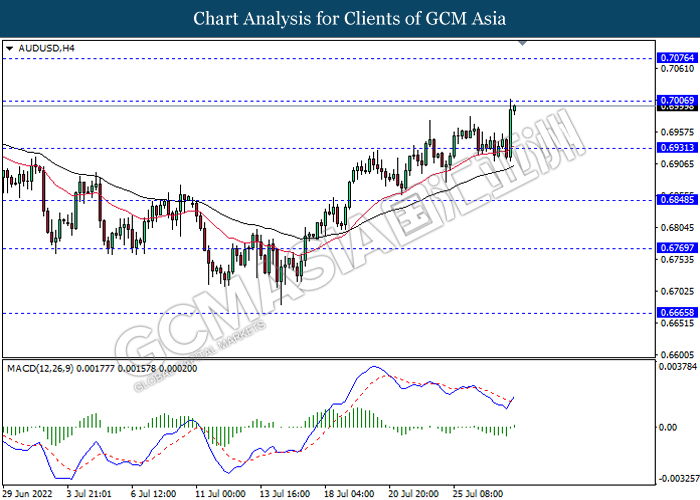

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

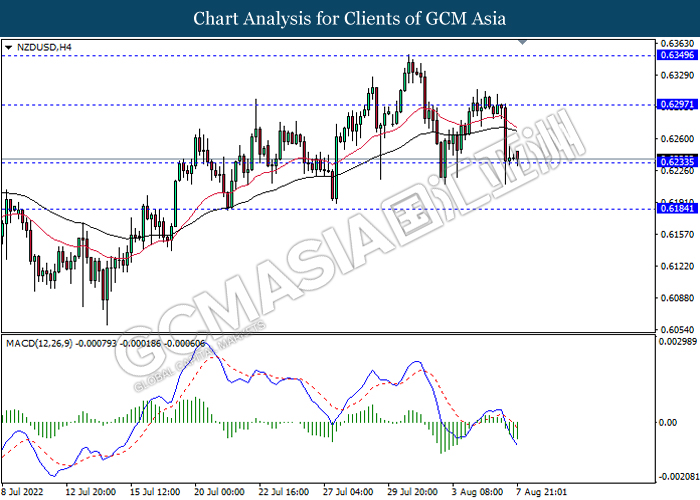

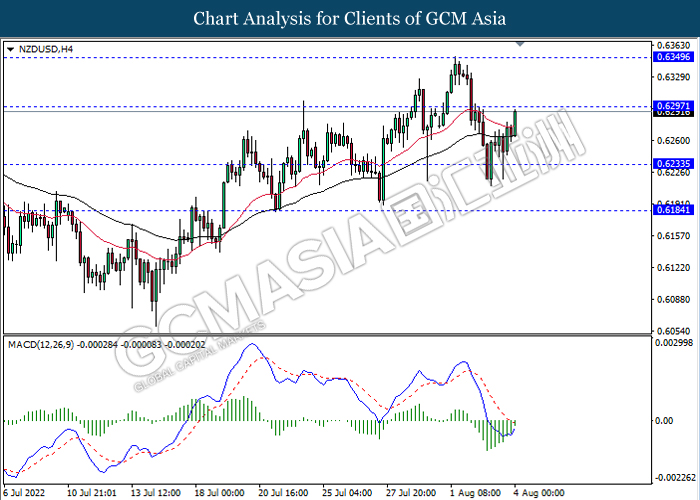

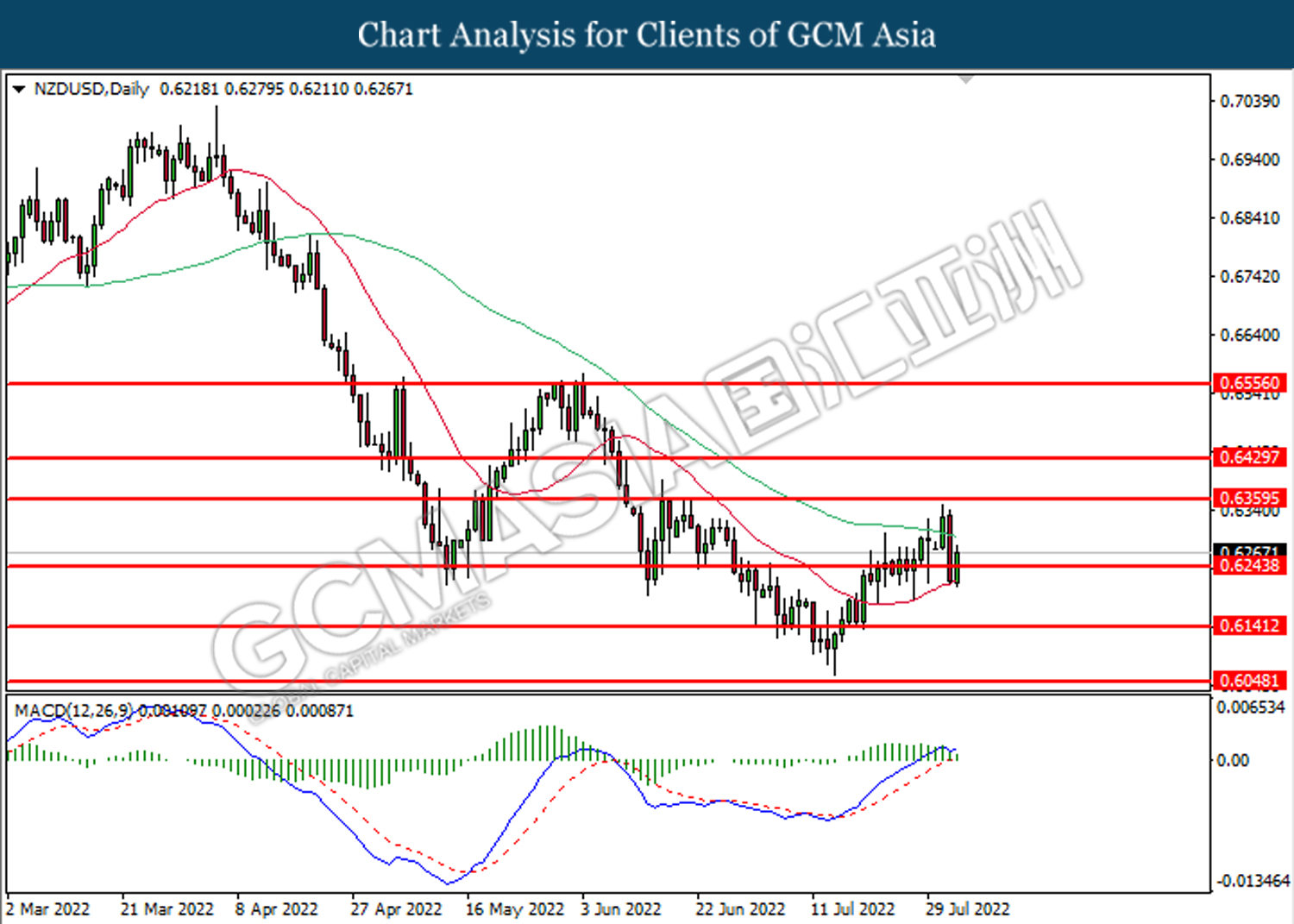

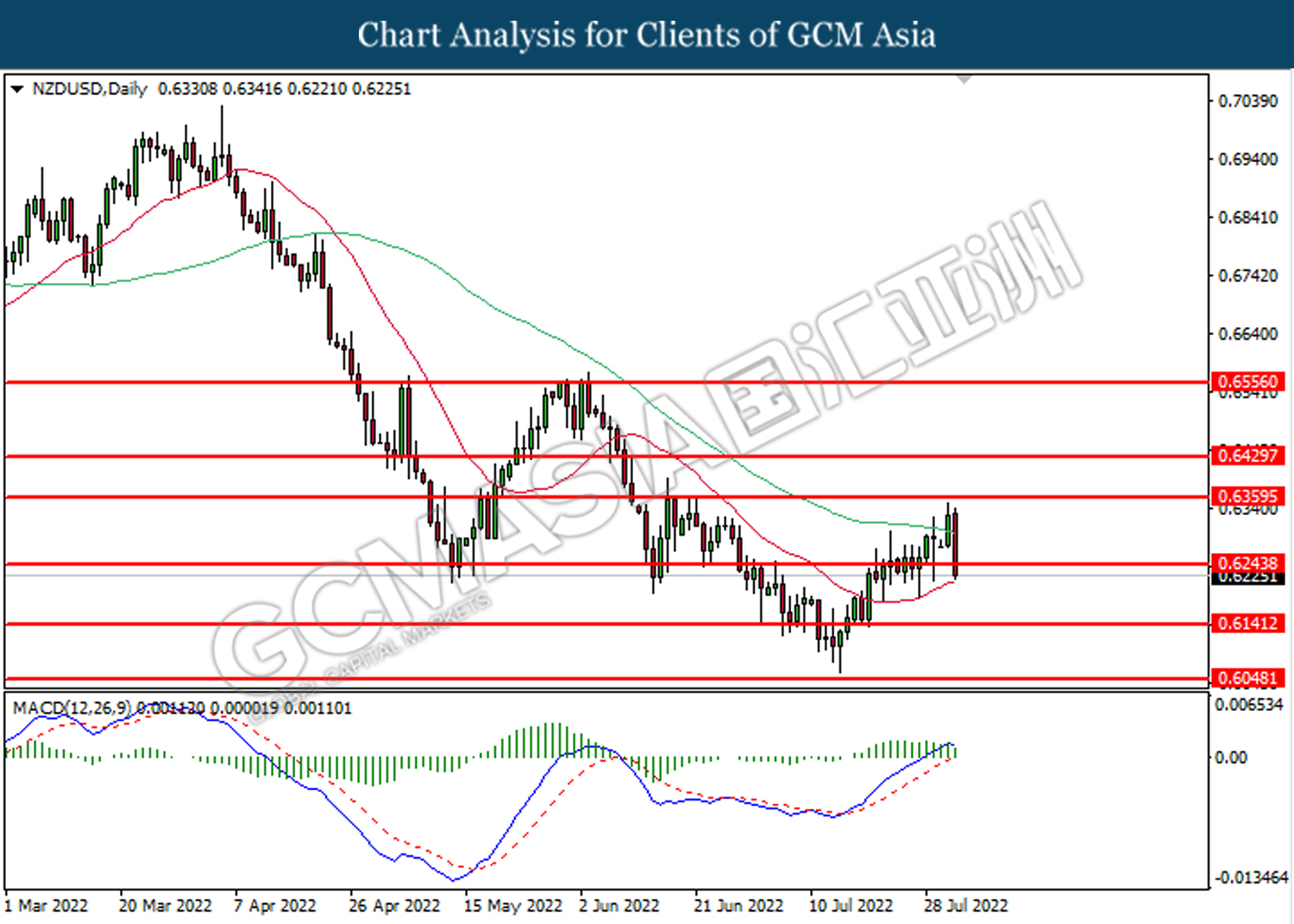

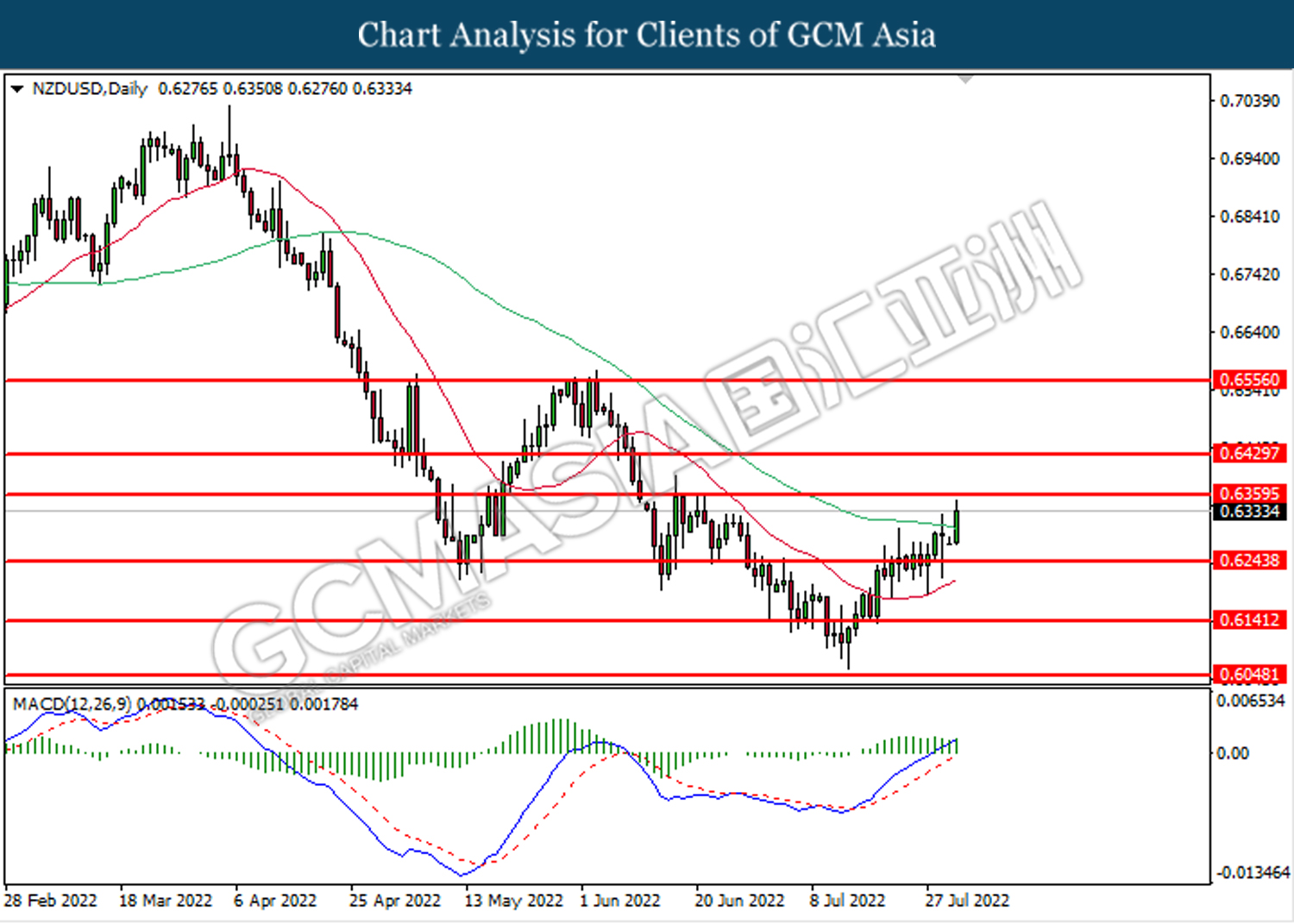

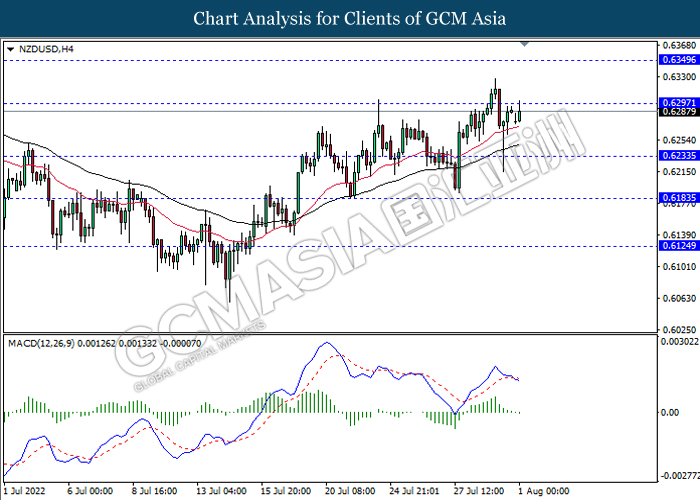

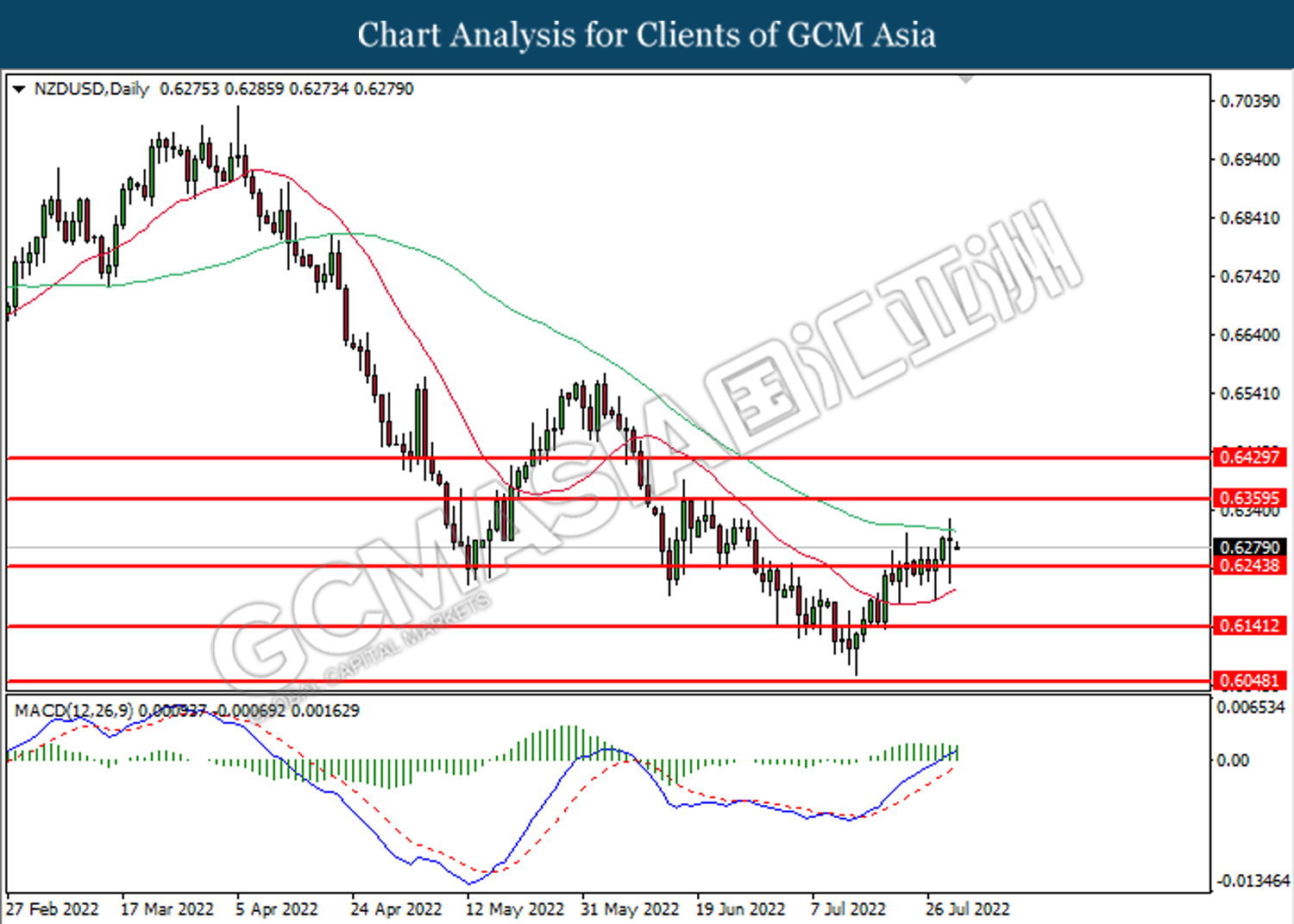

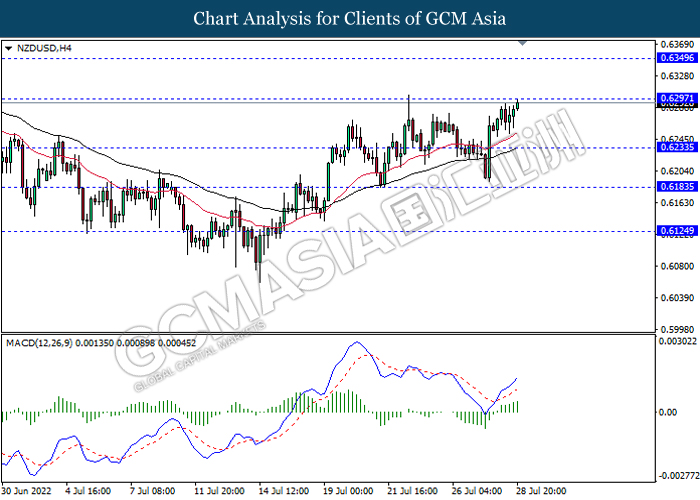

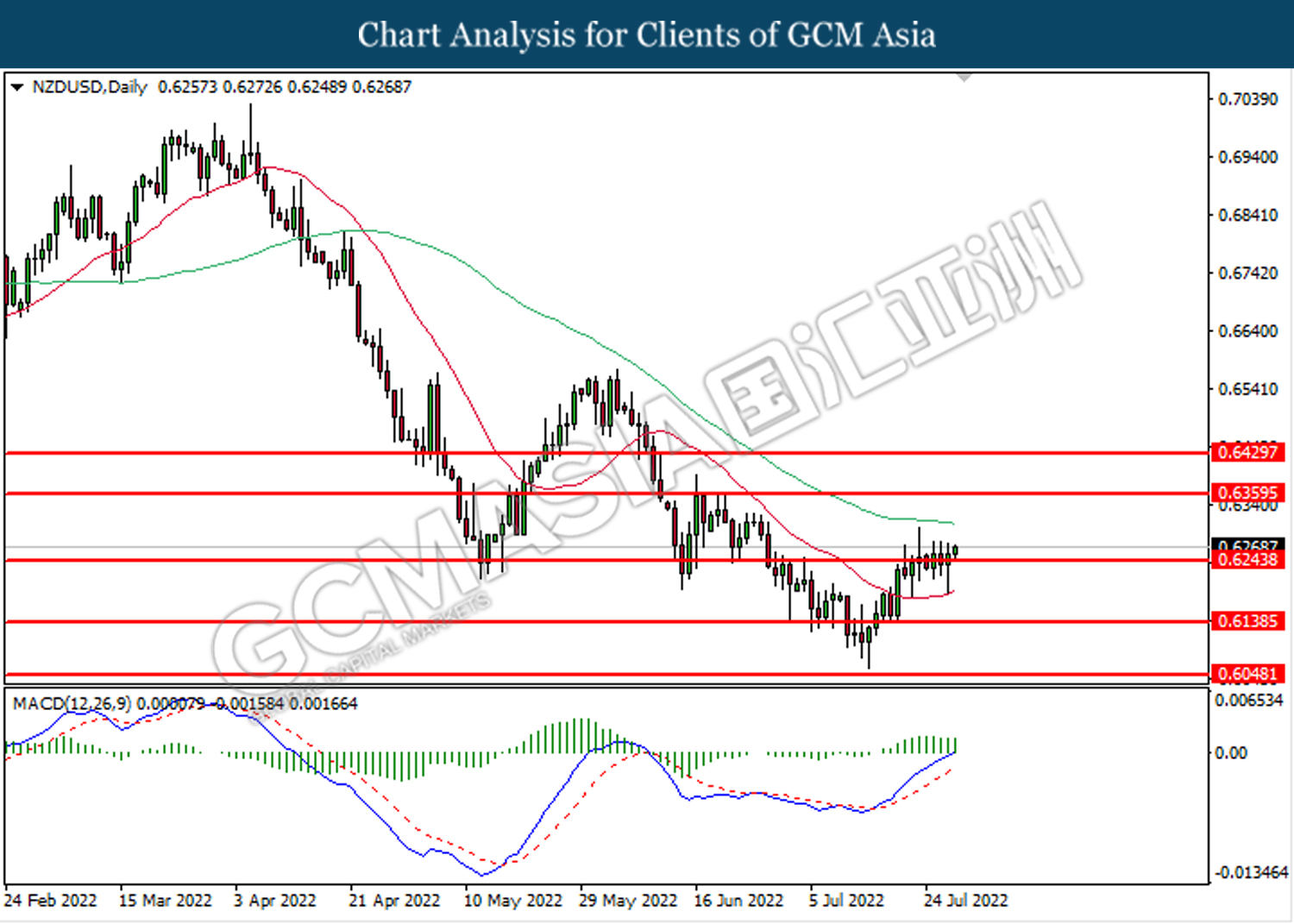

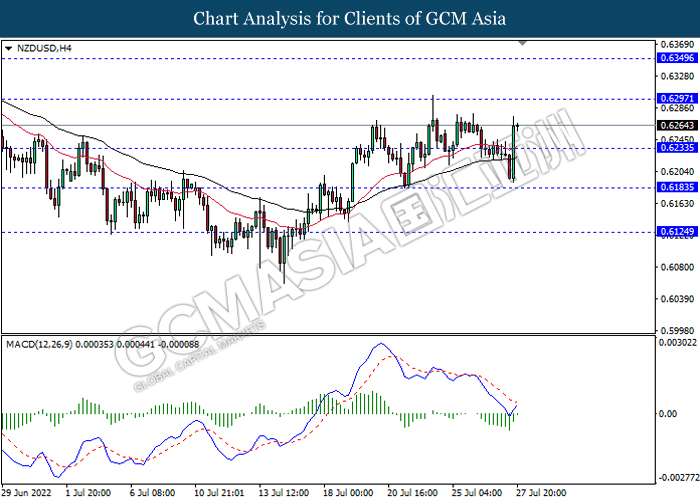

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

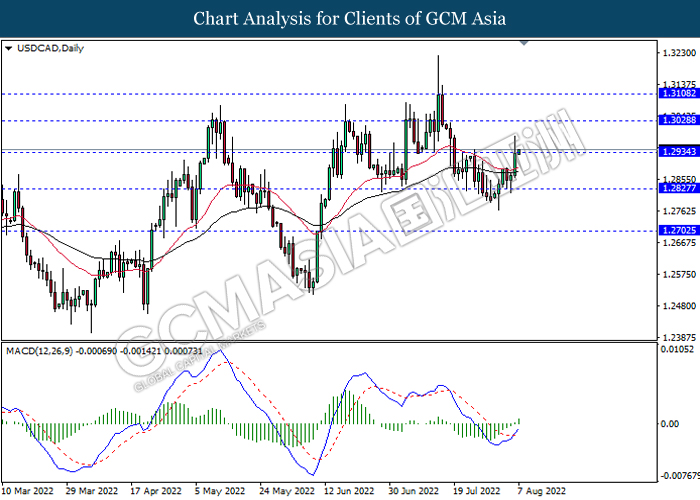

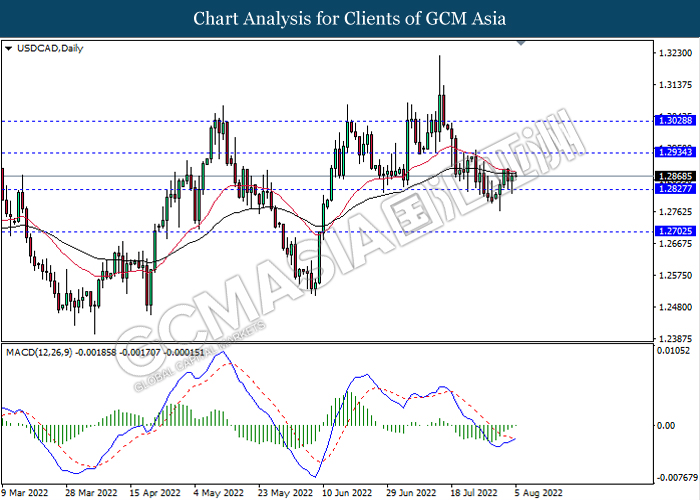

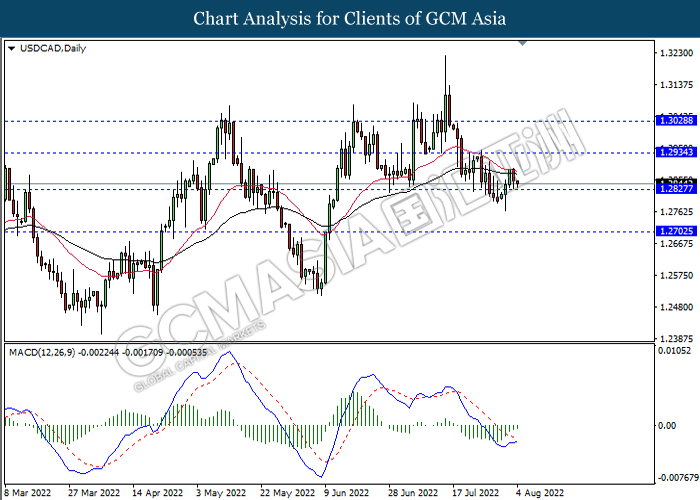

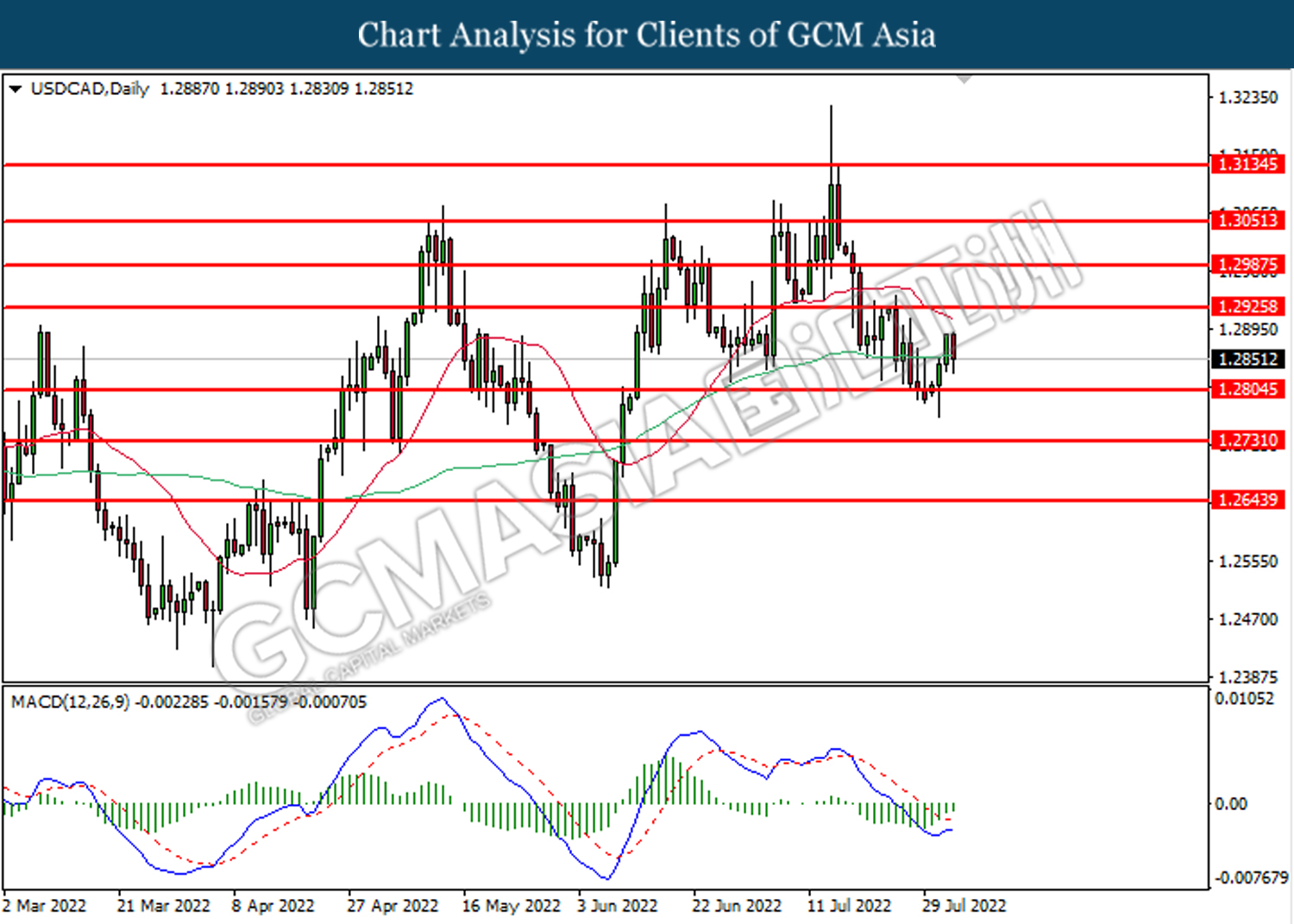

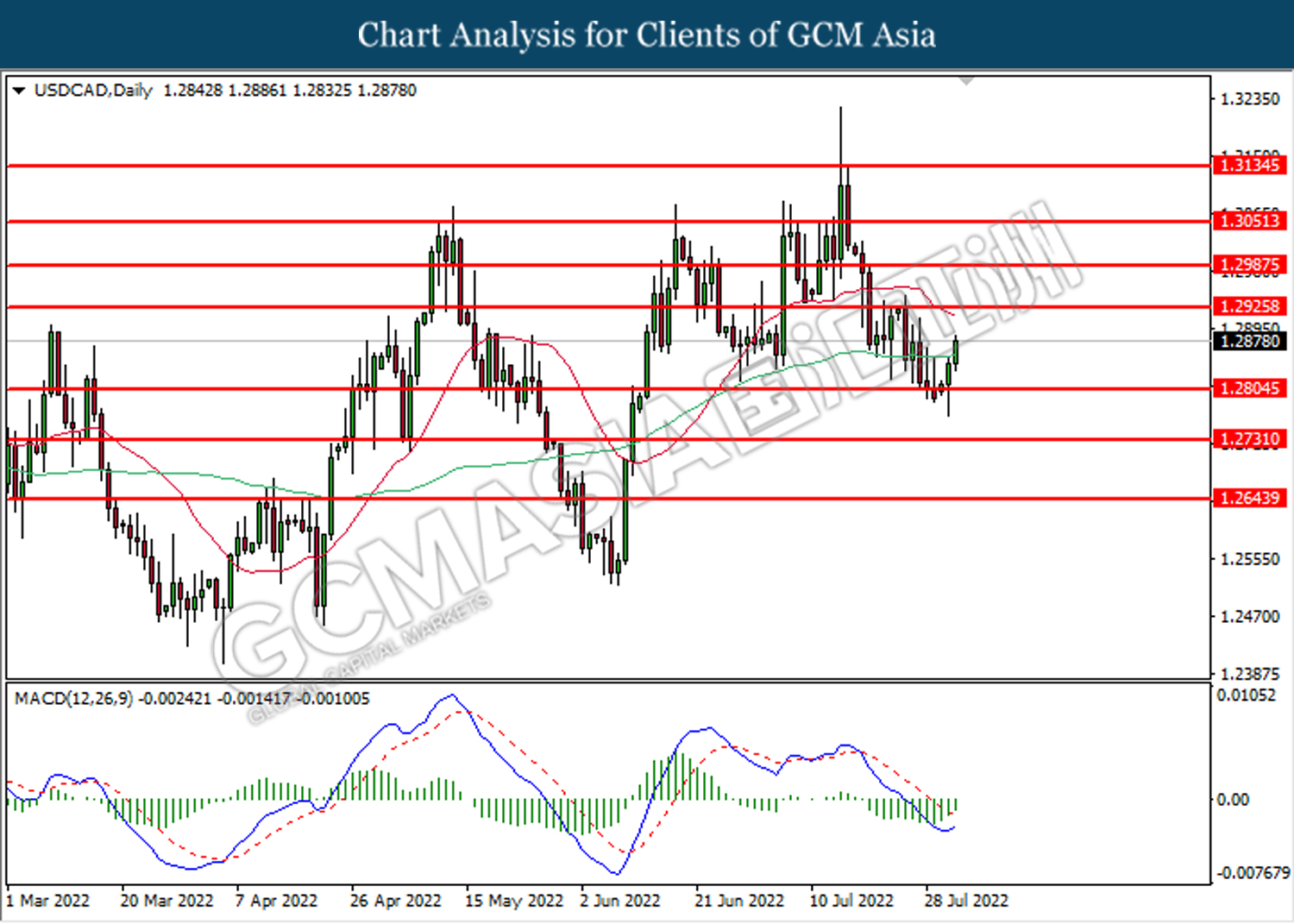

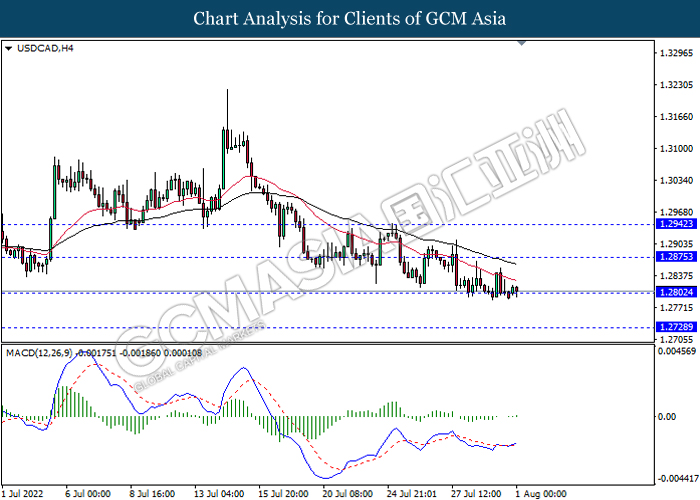

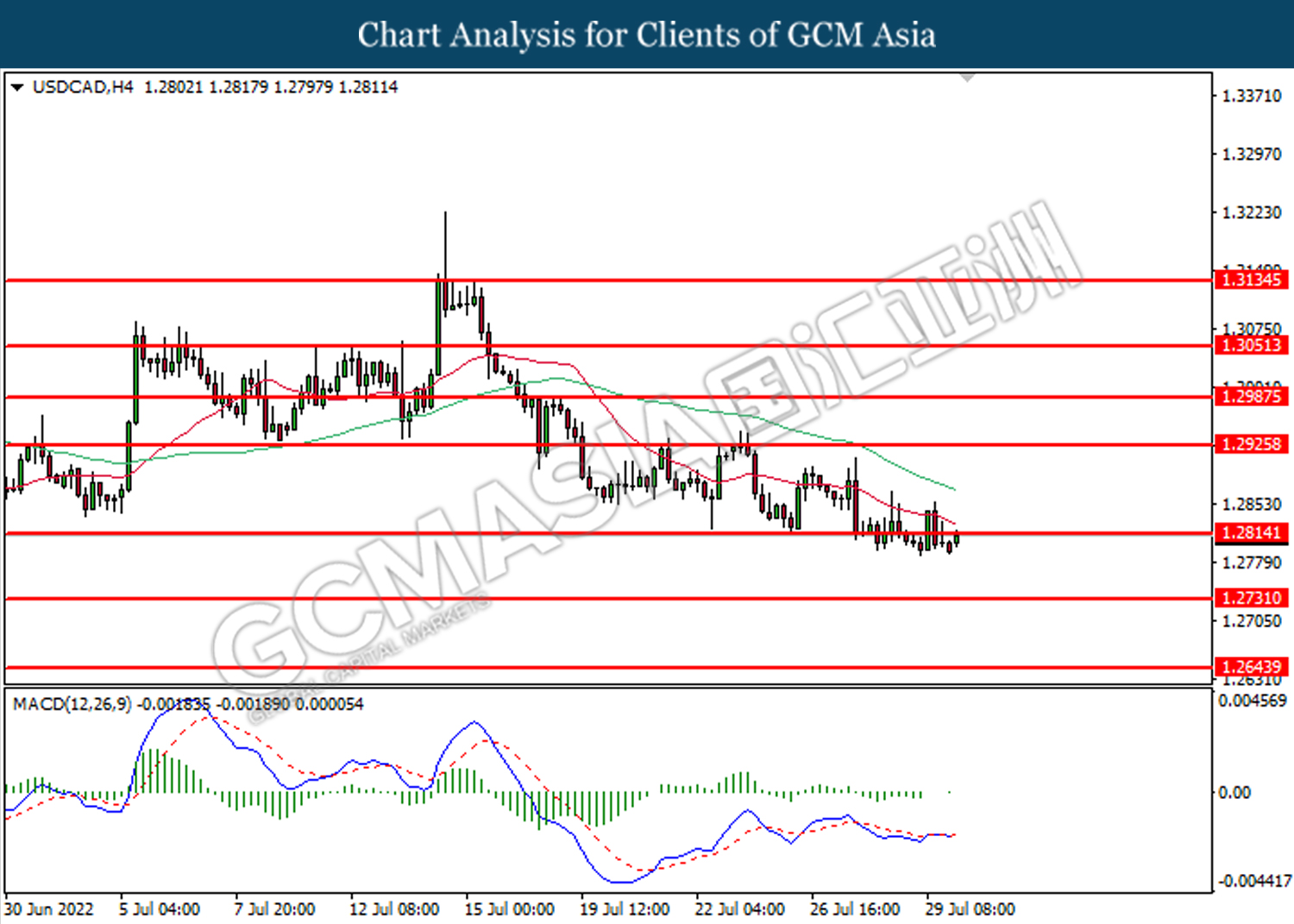

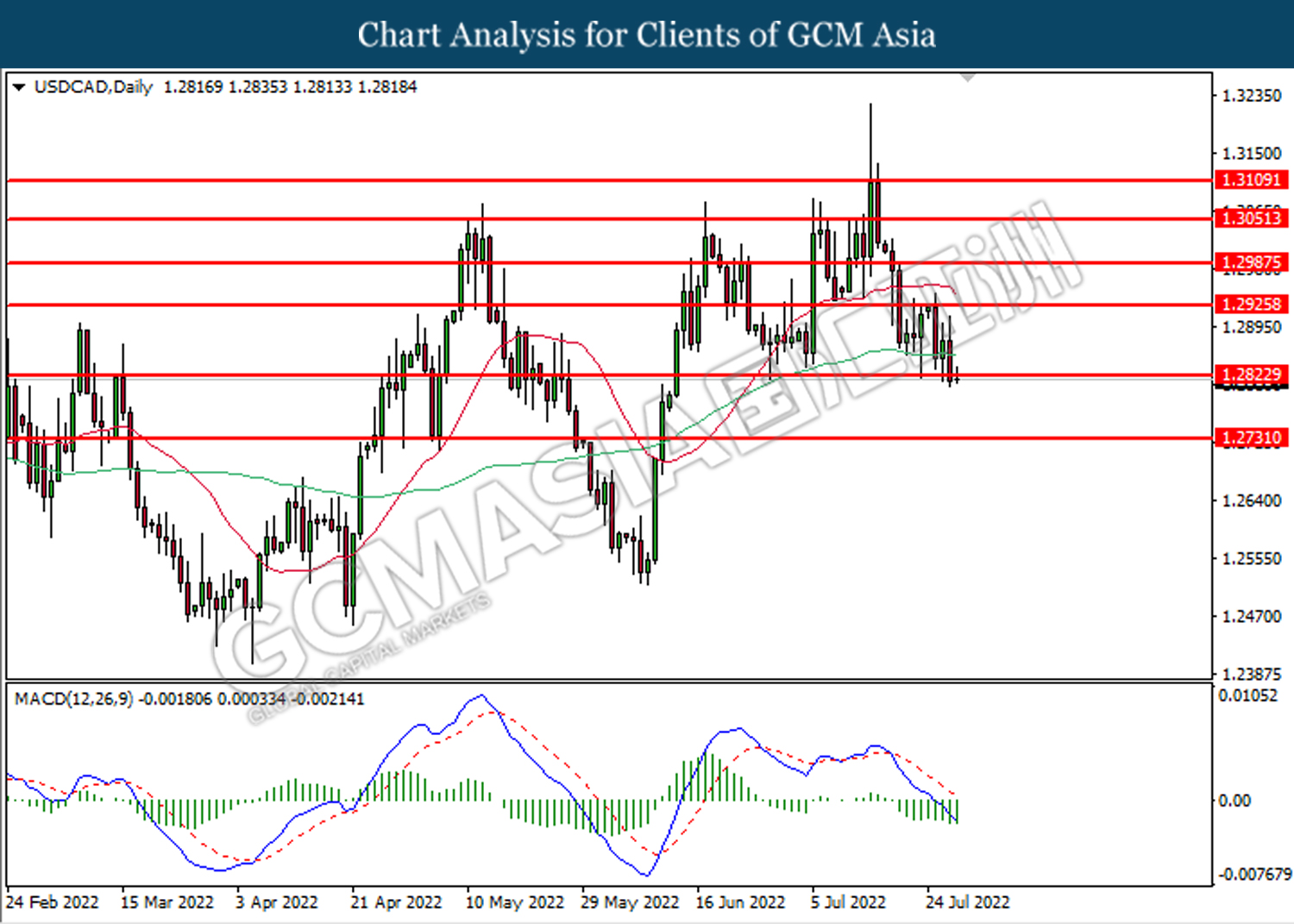

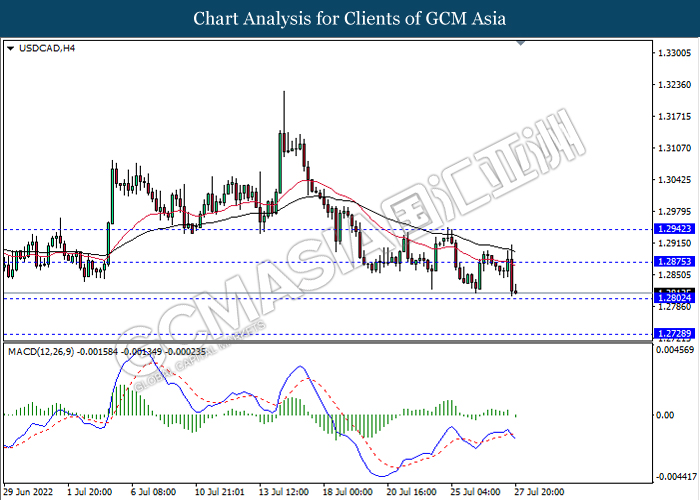

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3030, 1.3110

Support level: 1.2935, 1.2825

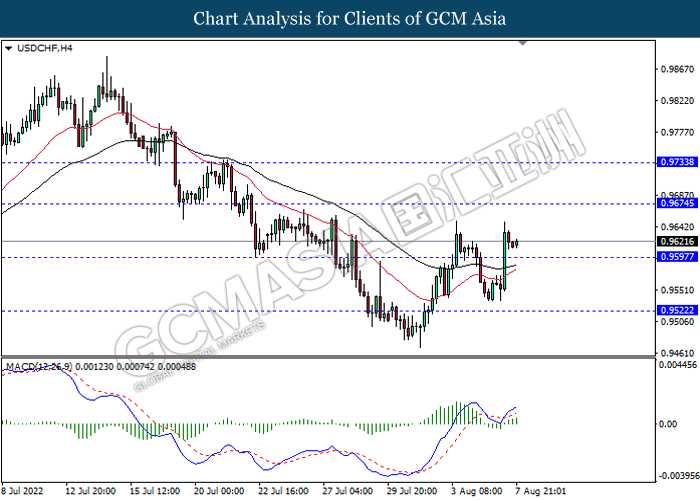

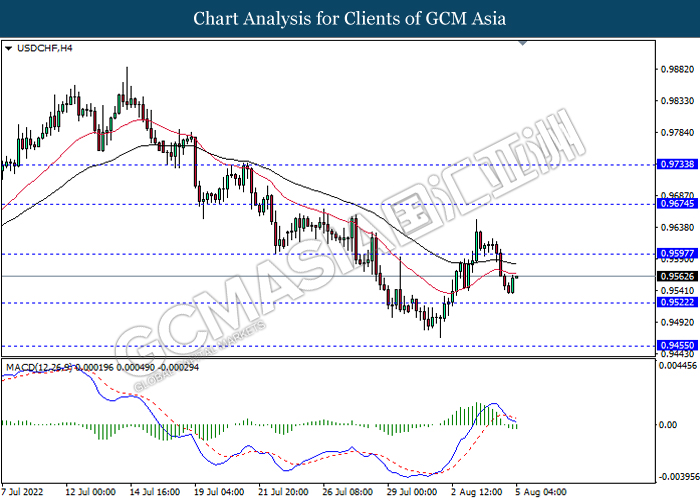

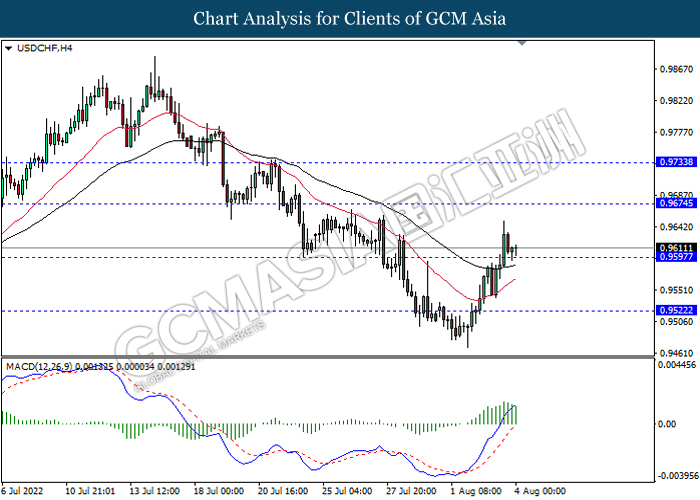

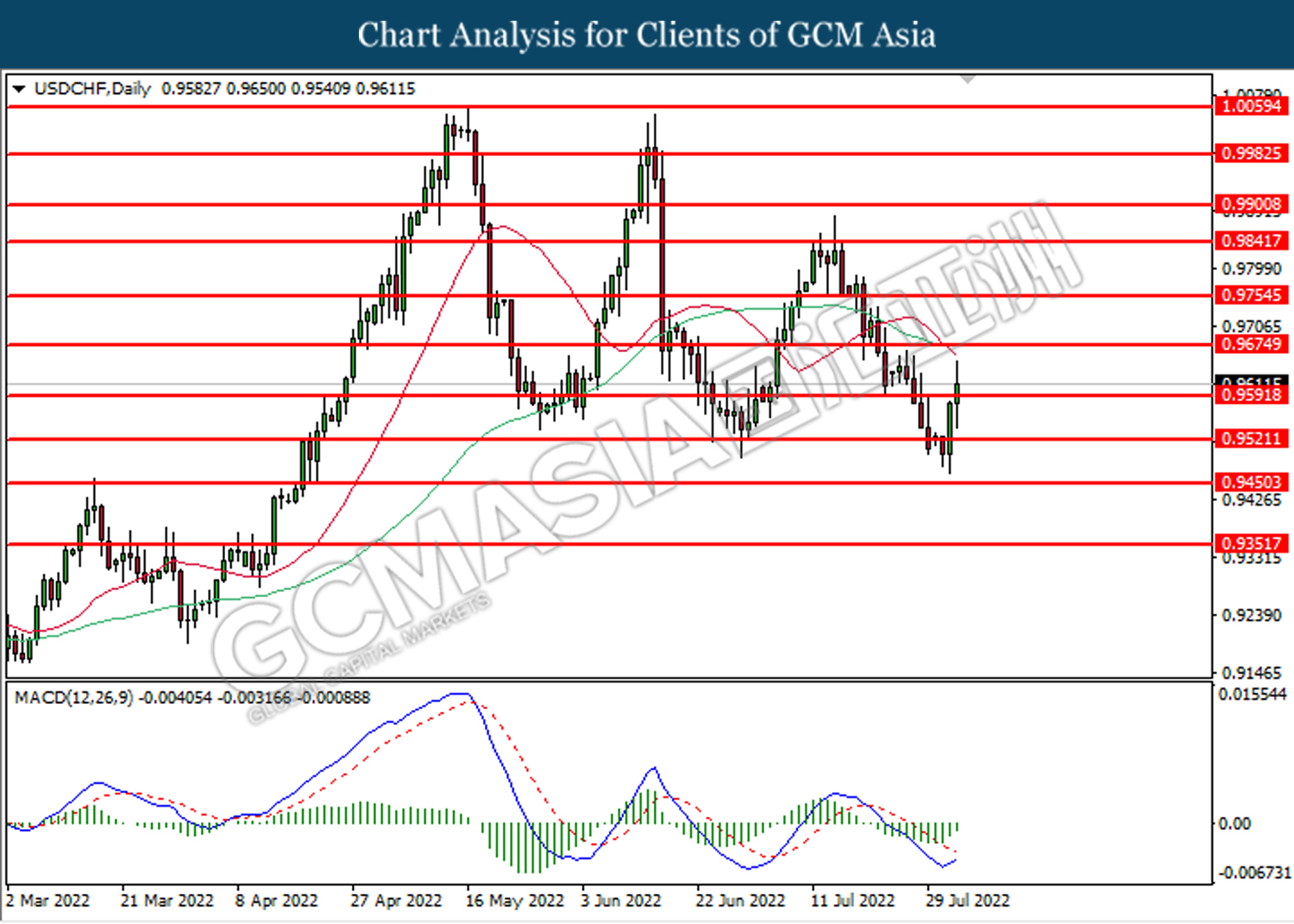

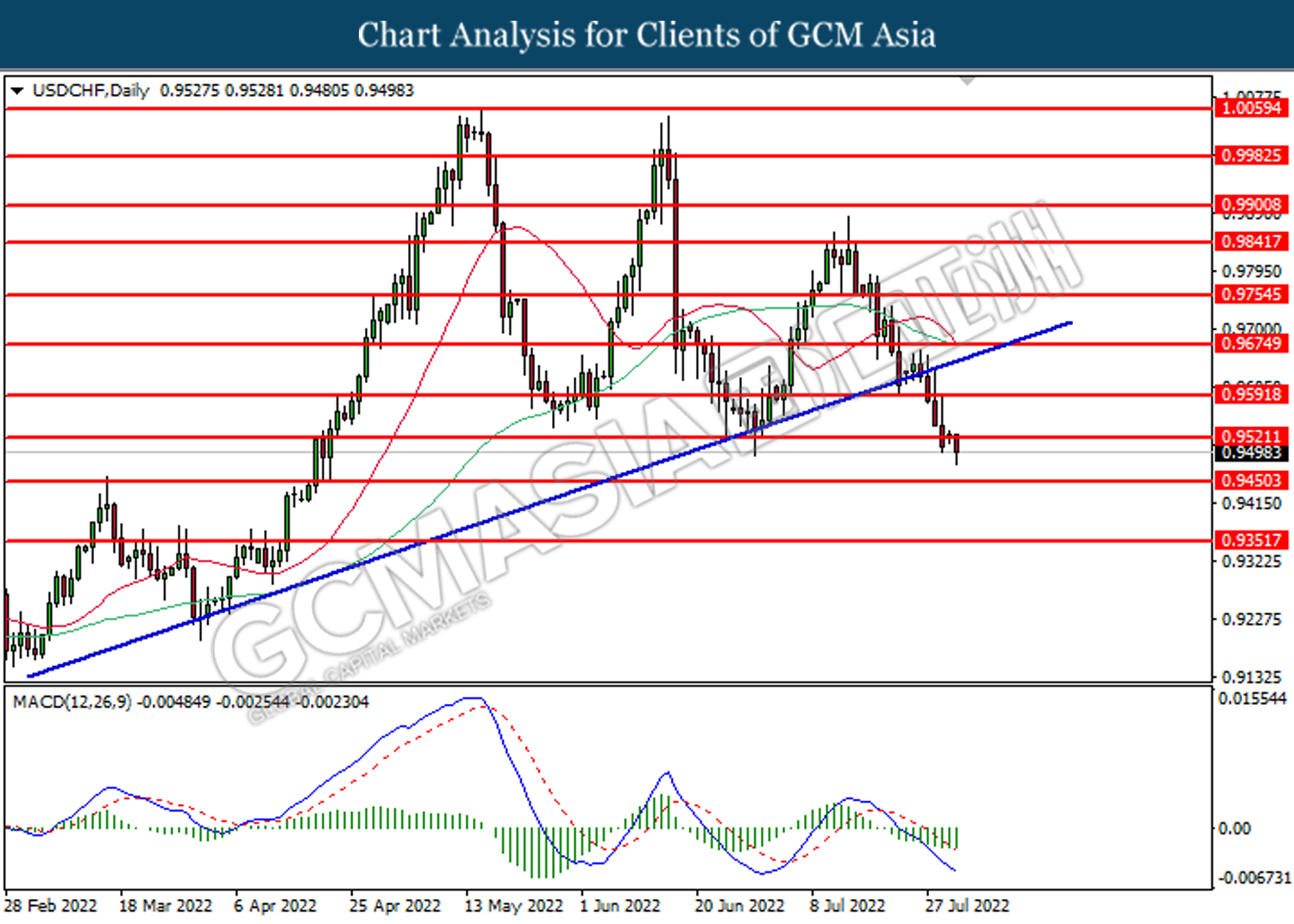

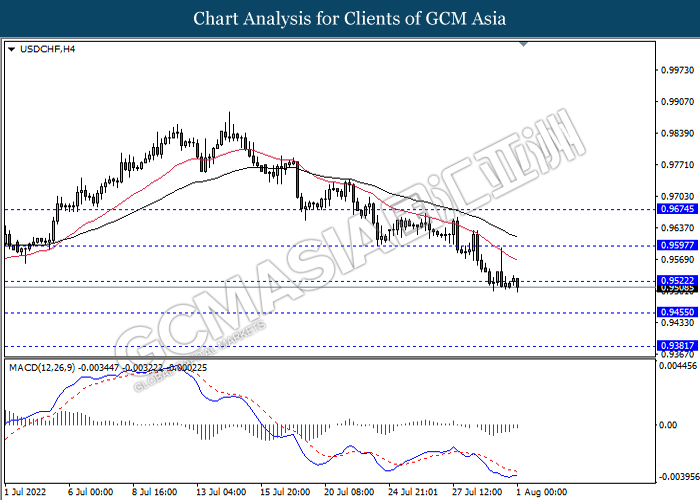

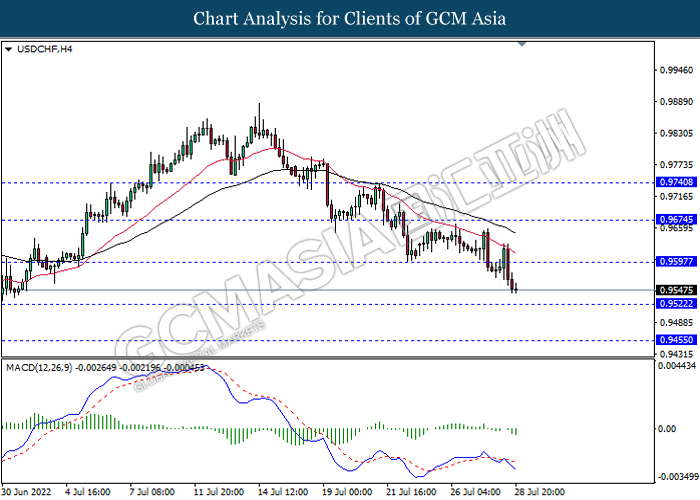

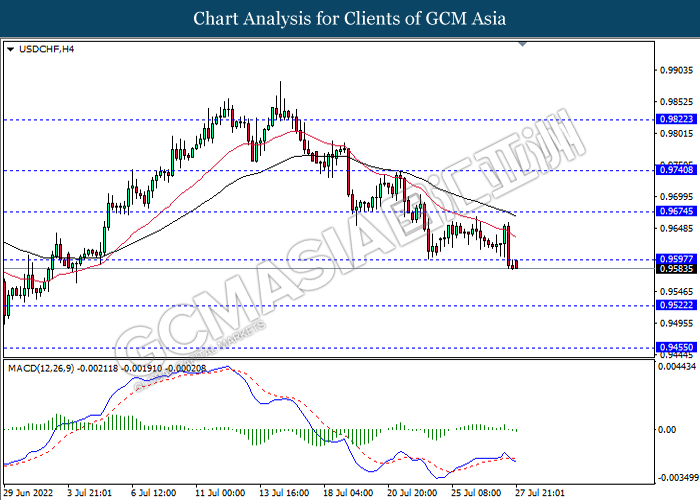

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9675, 0.9735

Support level: 0.9595, 0.9520

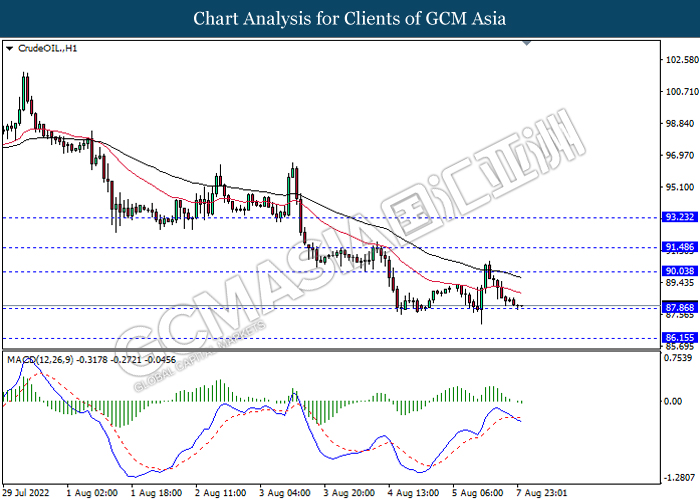

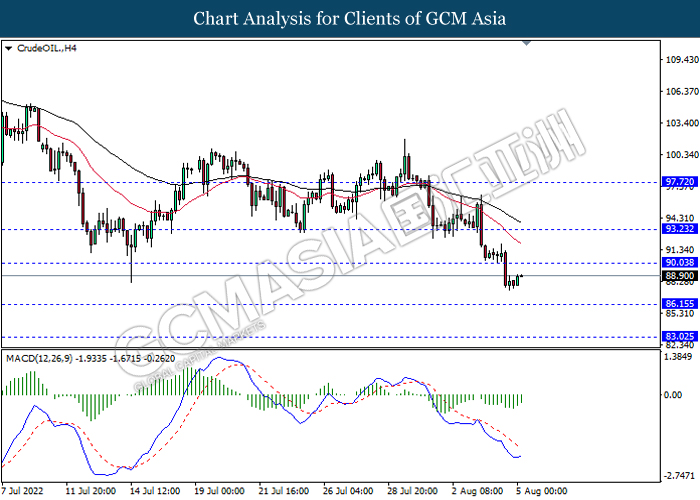

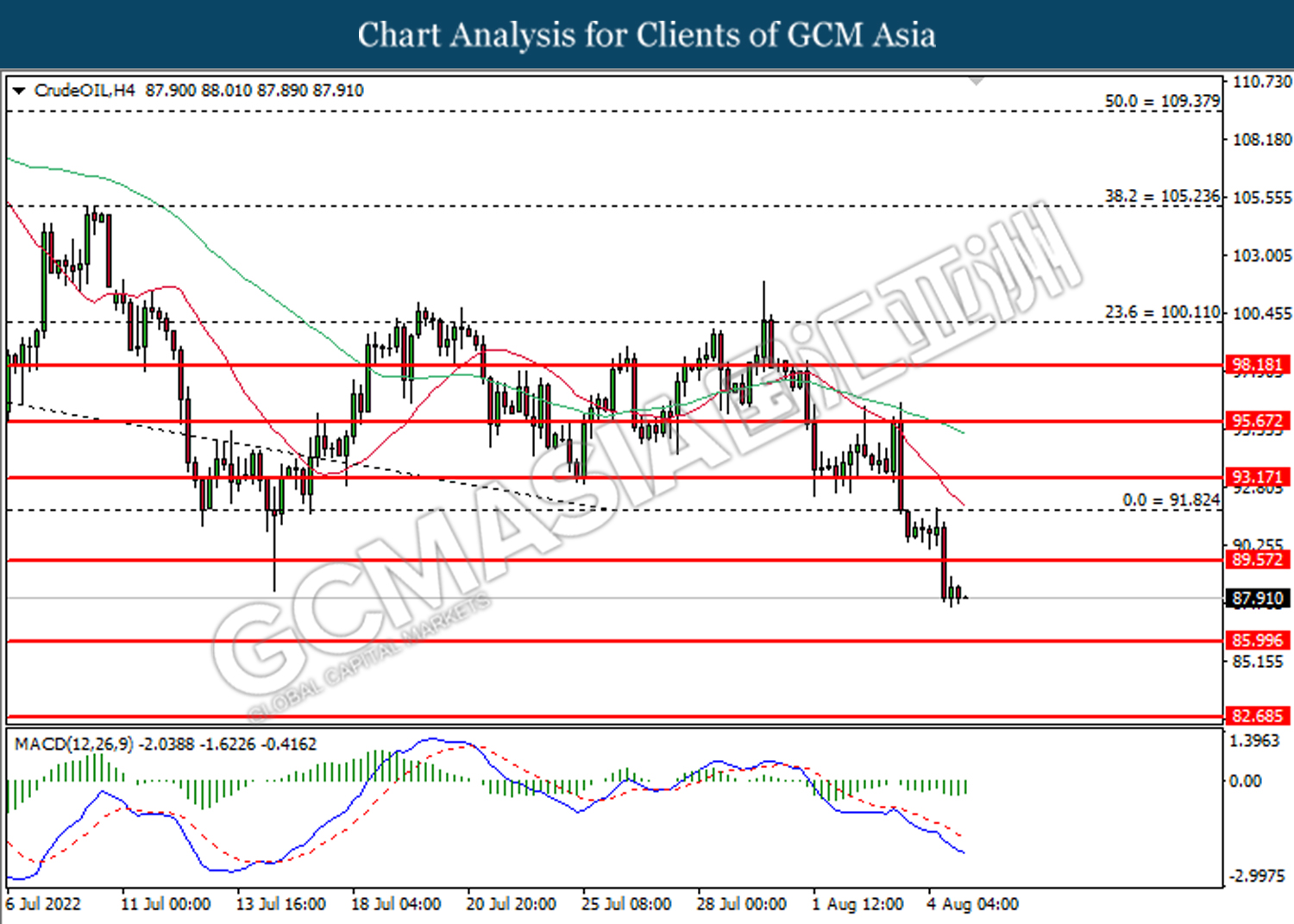

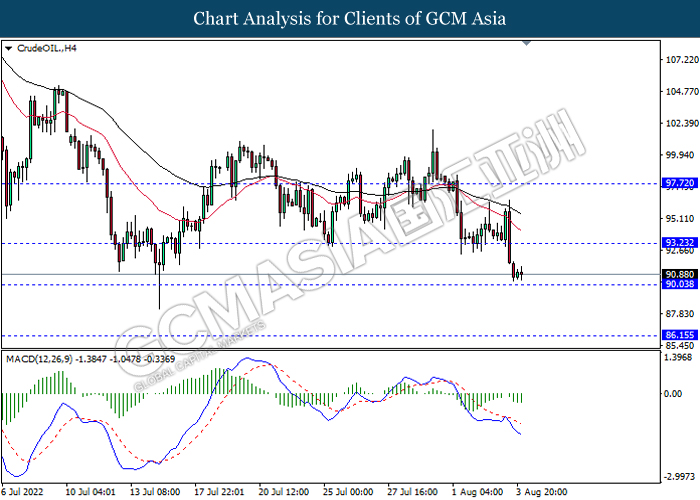

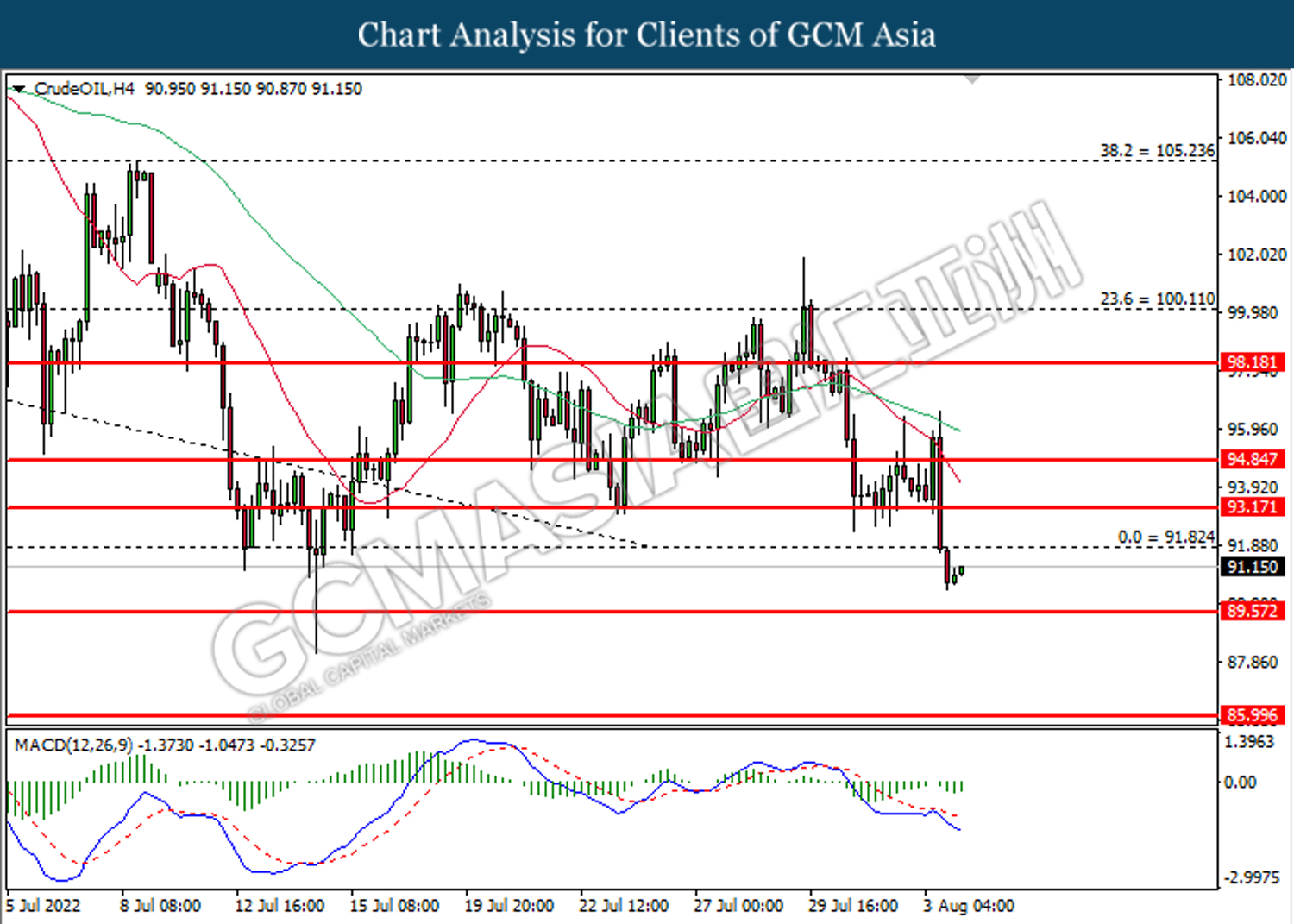

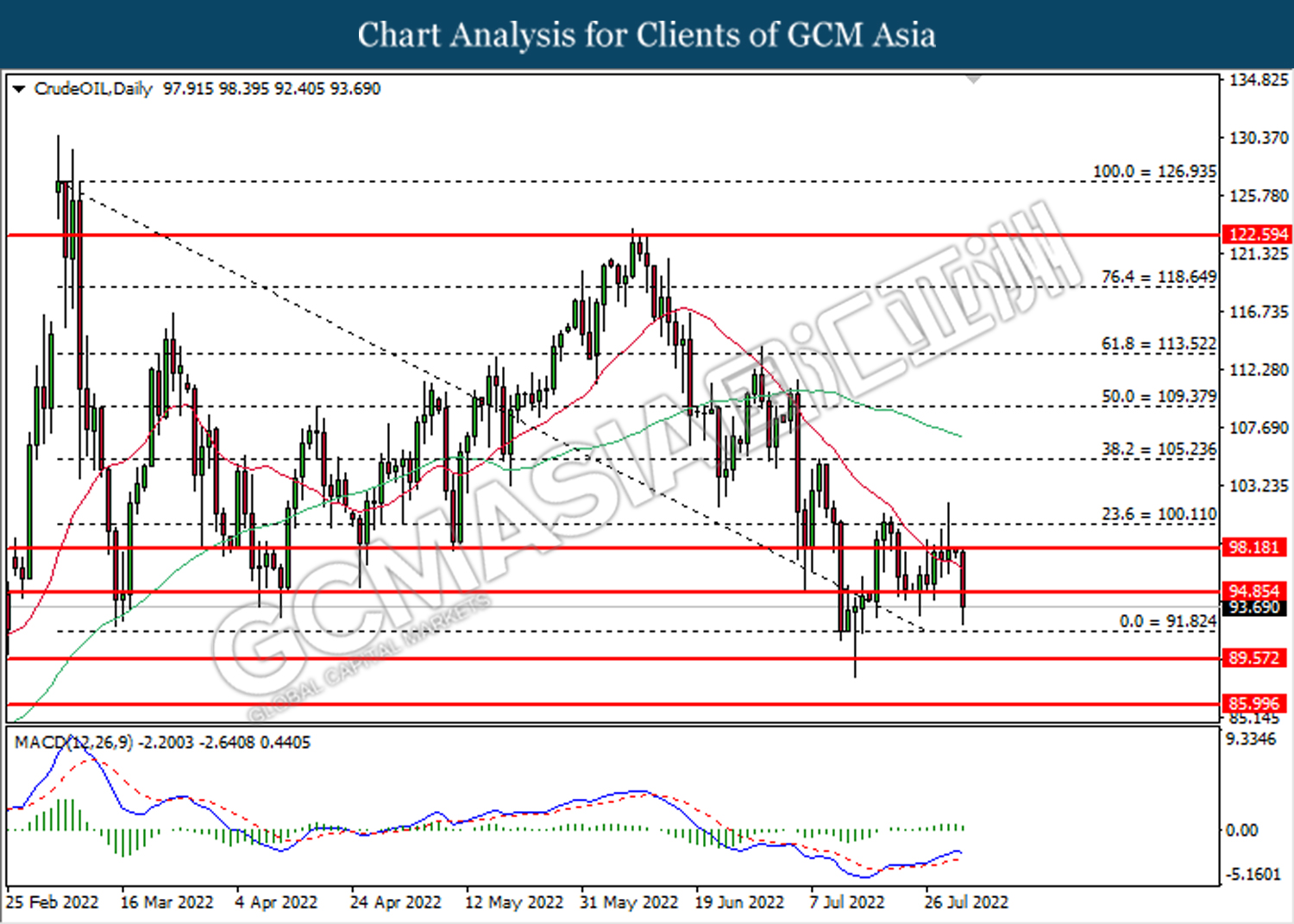

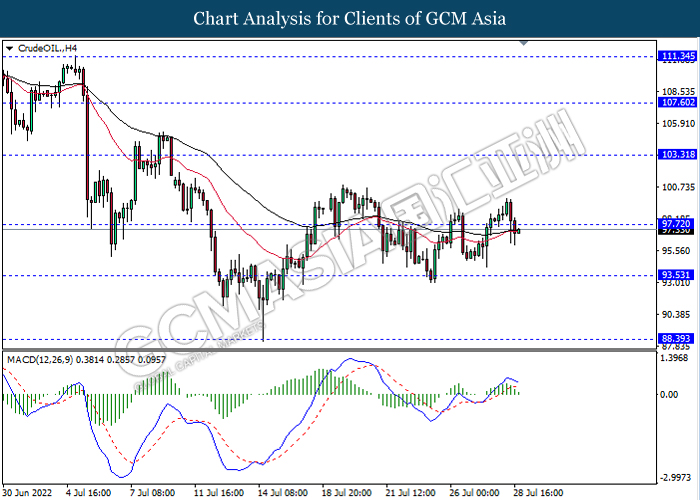

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 90.05, 91.48

Support level: 87.85, 86.15

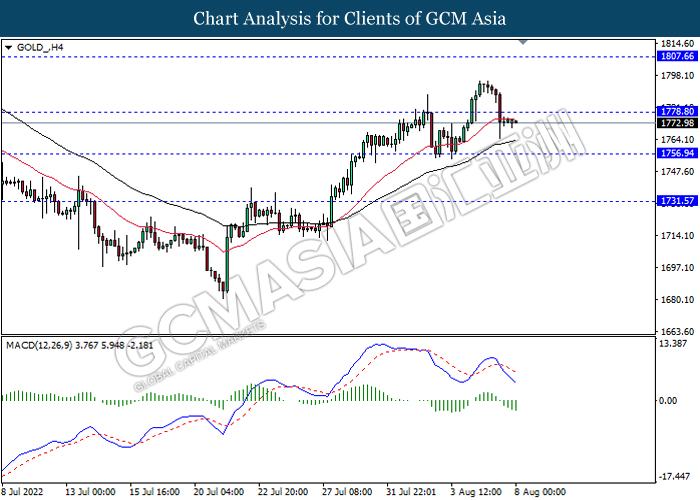

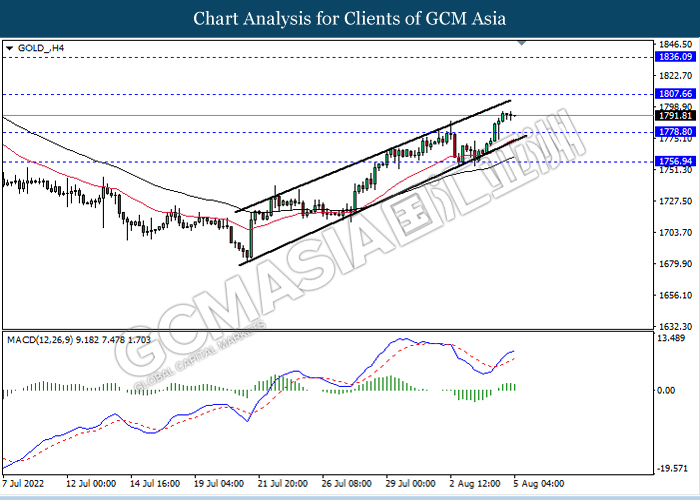

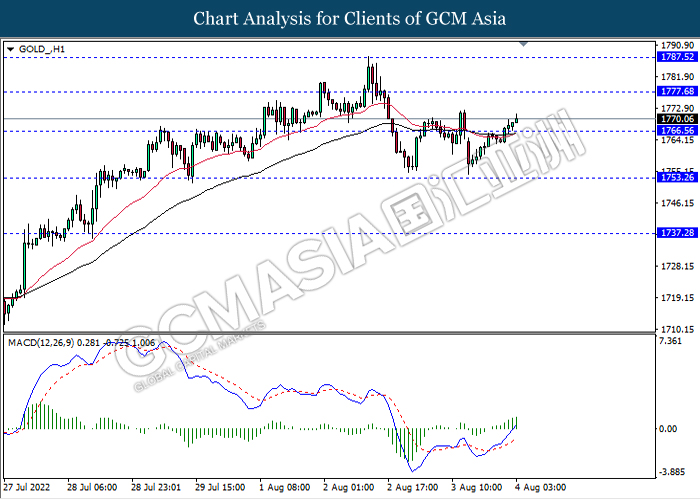

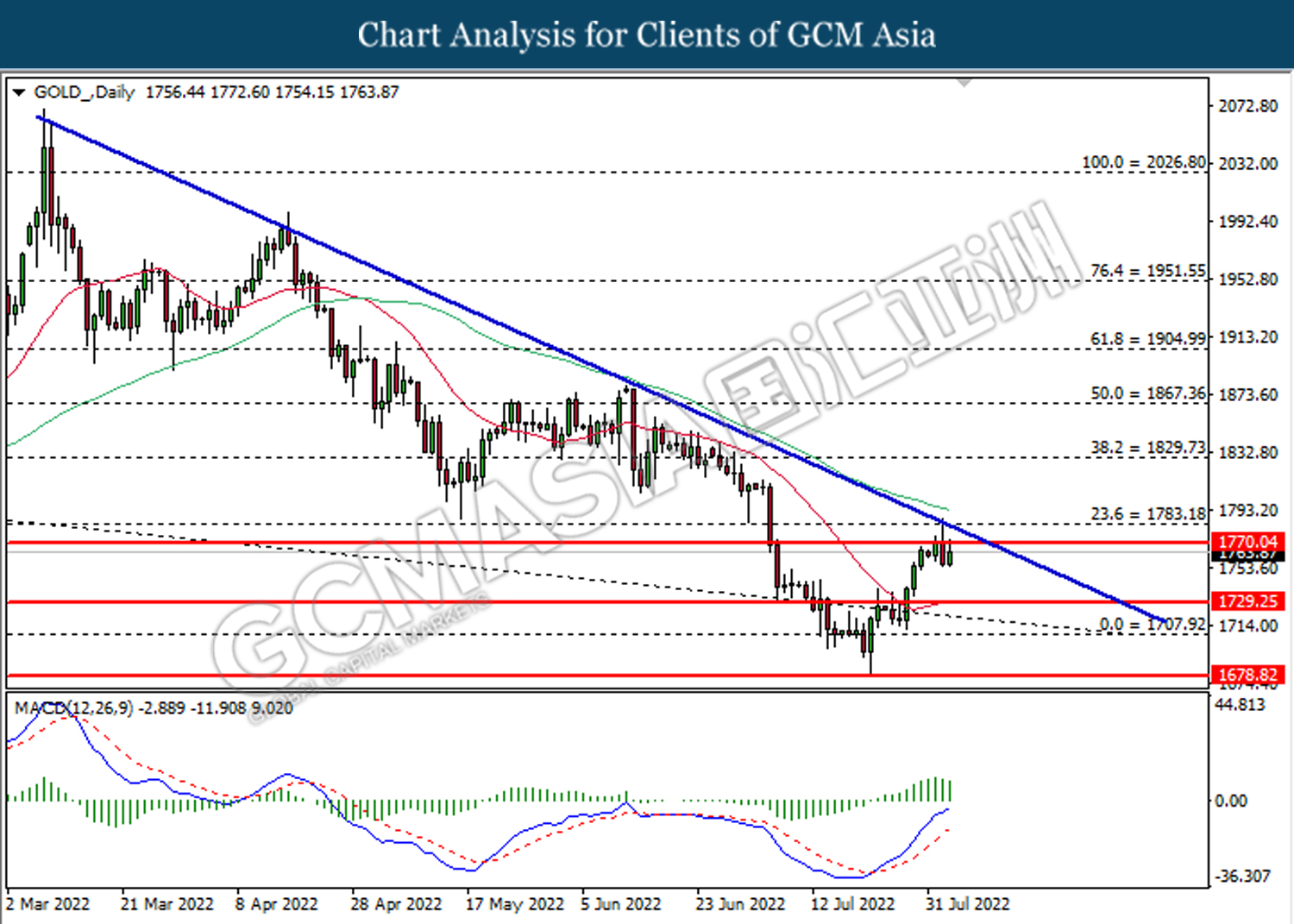

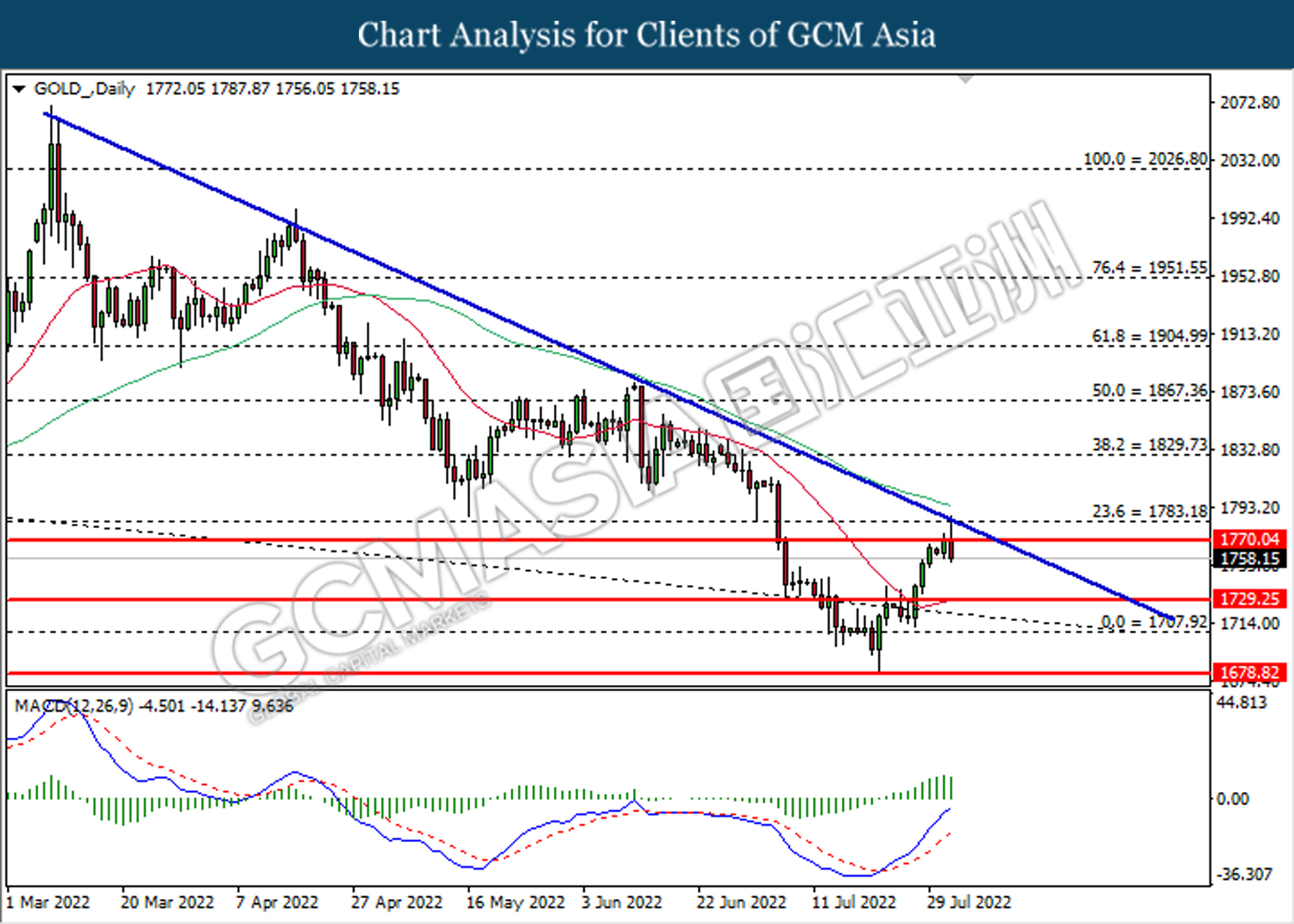

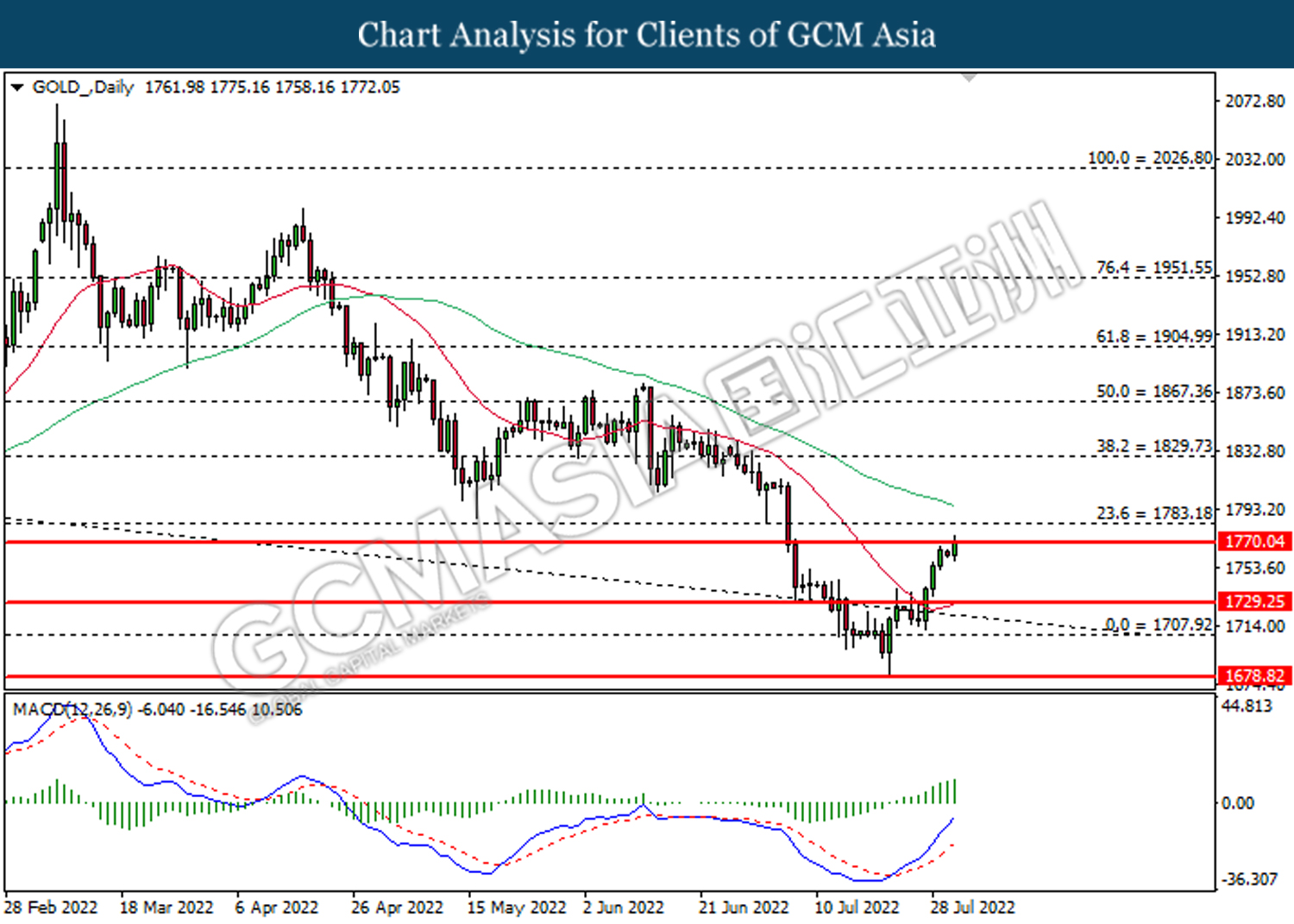

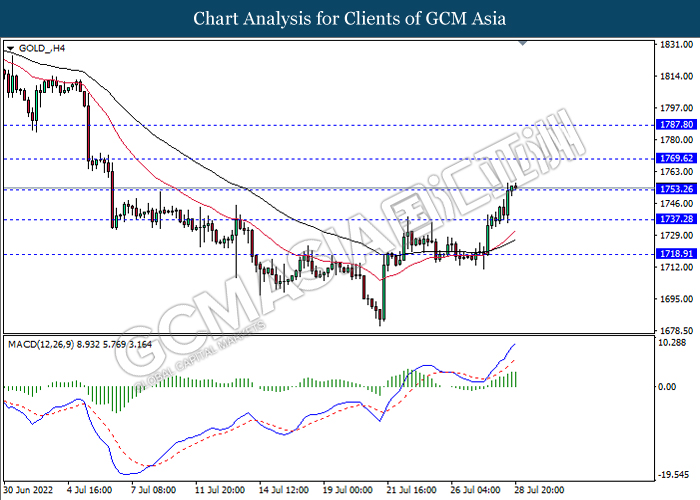

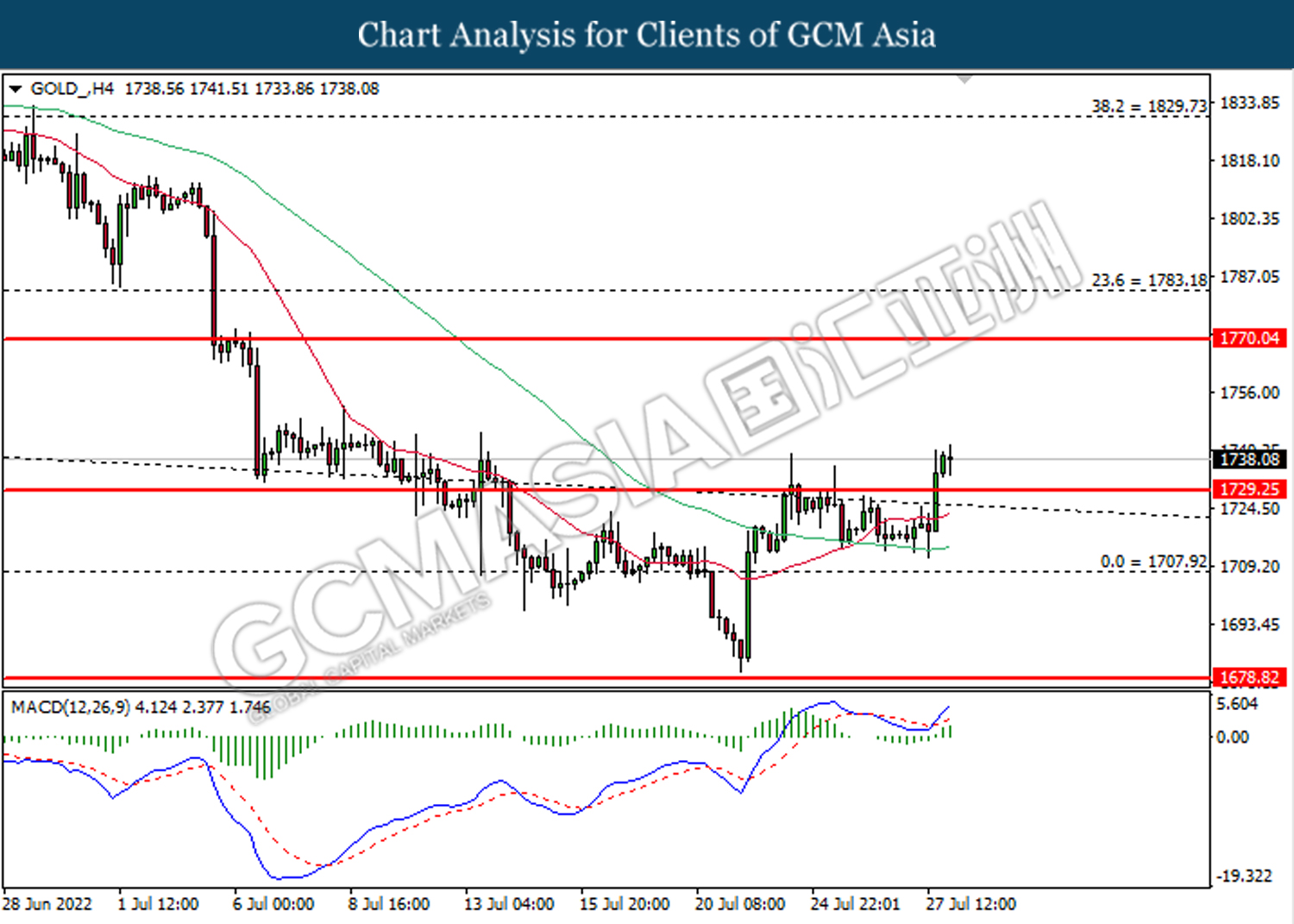

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1778.80, 1807.65

Support level: 1756.95, 1731.55

050822 Afternoon Session Analysis

5 August 2022 Afternoon Session Analysis

US Dollar under pressure over the bearish employment data.

The Dollar Index which traded against a basket of six major currencies dropped significantly after the downbeat economic data has been unleashed. According to the US Department of Labor, the US Initial Jobless Claims notched up from the previous reading of 254K to 260K, exceeding the consensus forecast of 259K. The rising of jobless claims data indicated the softening in the labor market, which brought negative prospects for economic progression in the US. Though, the losses experienced by Dollar Index was limited following the hawkish statement from the Fed member. Cleveland Fed President Loretta Mester claimed on Thursday that the central bank should raise its interest rate to above 4% to tackle inflation, and the policy aimed to keep tightening through the first half of next year. As of now, investors would highly focus on the Nonfarm Payrolls and Unemployment Rate from the US to receive further trading signals. As of writing, the Dollar Index appreciated by 0.19% to 105.77.

In the commodities market, the crude oil price rose by 0.42% to $88.91 per barrel as of writing after a sharp decline throughout the overnight session following the worries about global economy slowdown keep hovering in the market. Besides that, the gold price edged down by 0.01% to $1789.91 per troy ounce as of writing. However, the gold price surged on yesterday amid the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Jul) | 372K | 250K | – |

| 20:30 | USD – Unemployment Rate (Jul) | 3.6% | 3.6% | – |

| 20:30 | CAD – Employment Change (Jul) | -43.2K | 20.0K | – |

| 22:00 | CAD – Ivey PMI (Jul) | 62.2 | 60.0 | – |

Technical Analysis

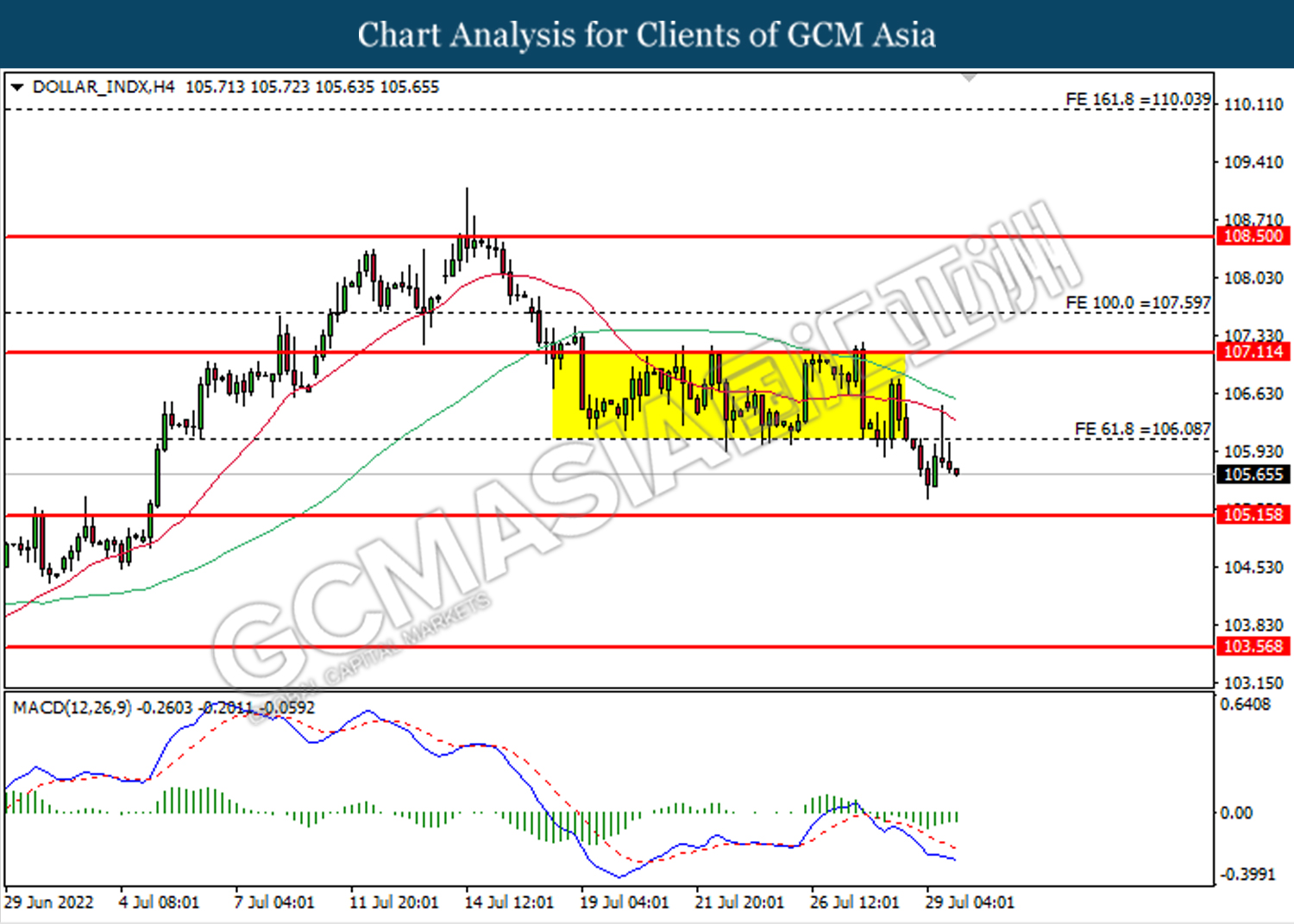

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its gains.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2170, 1.2270

Support level: 1.2070, 1.1995

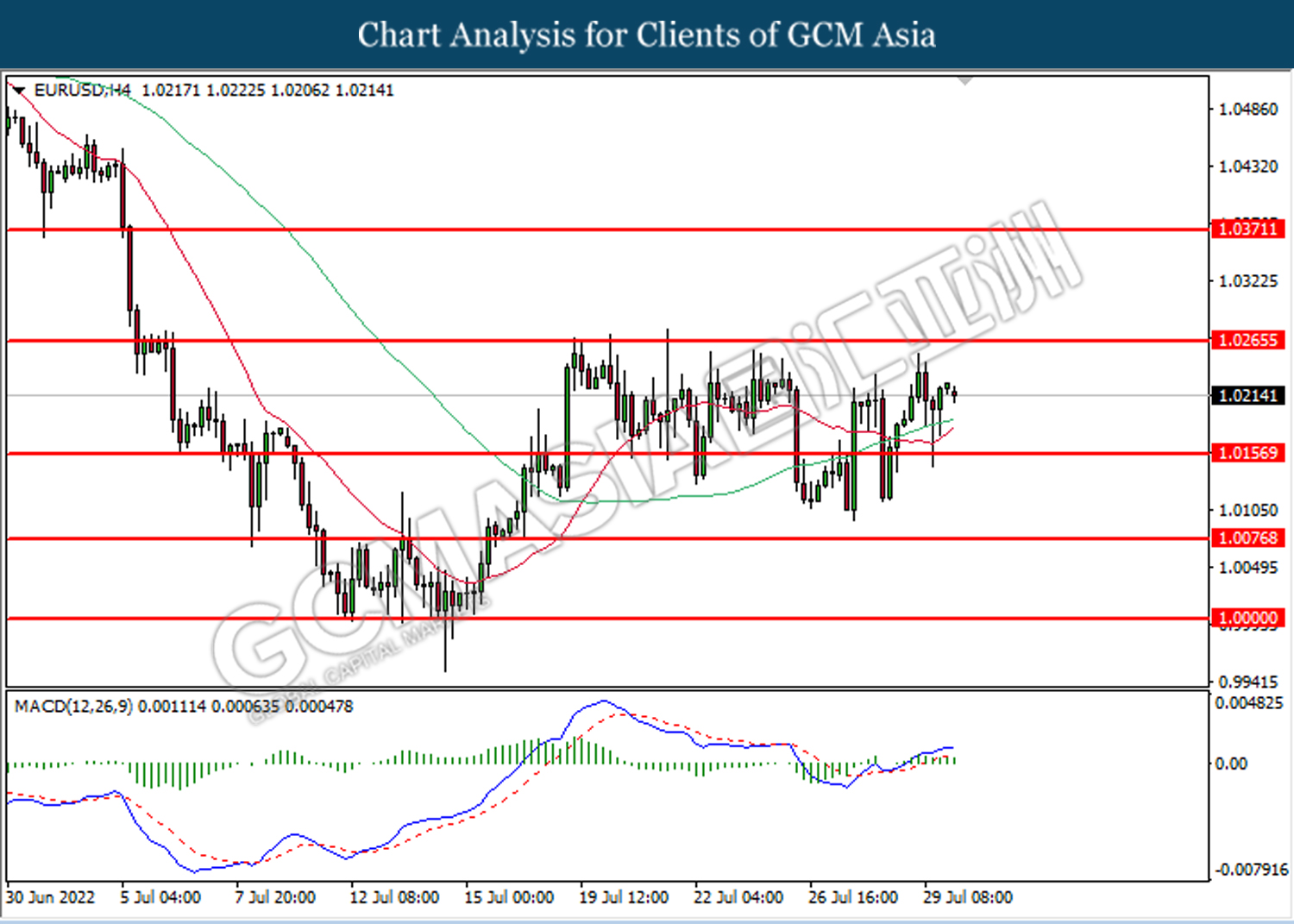

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0315, 1.0385

Support level: 1.0230, 1.0160

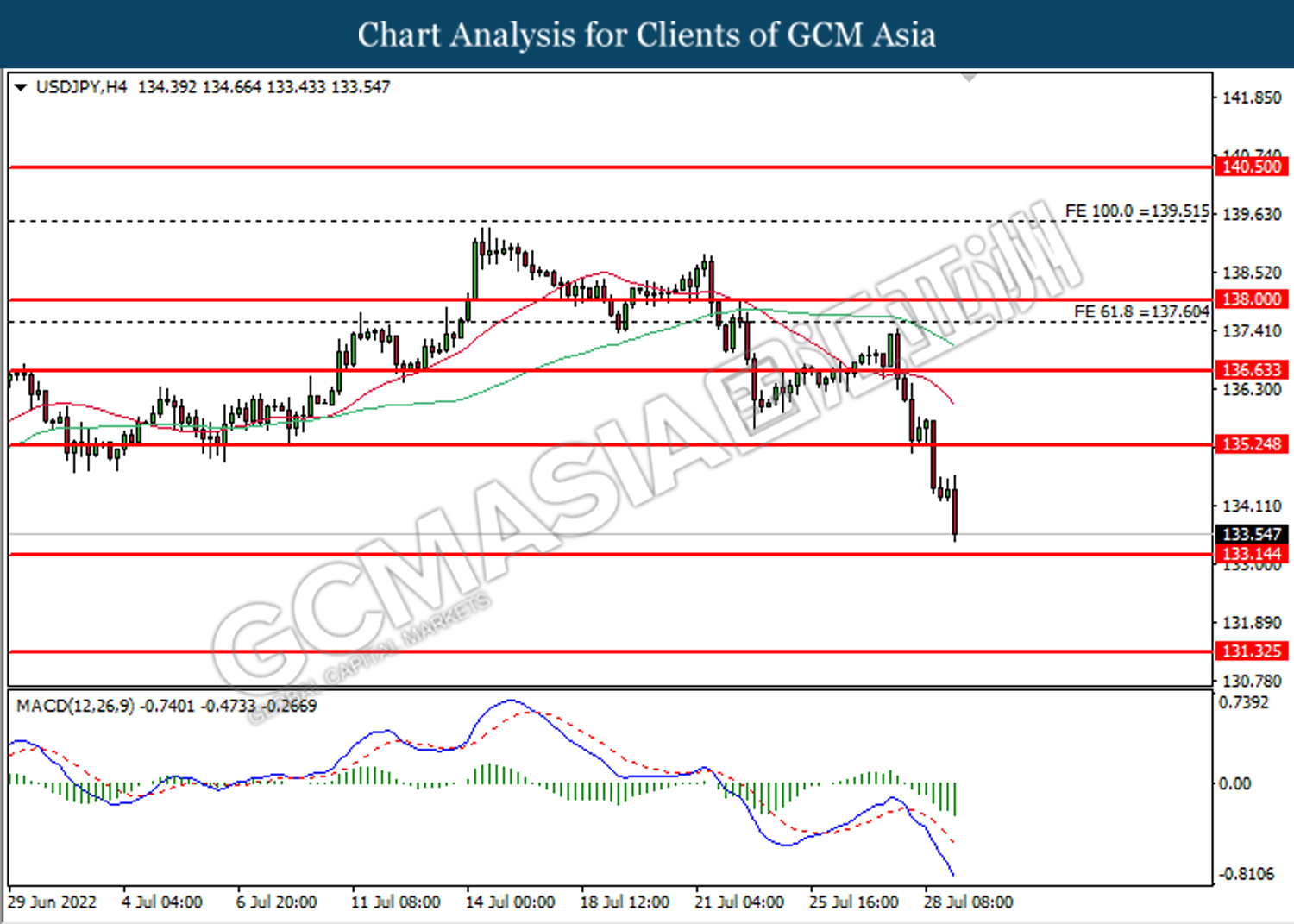

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 133.40, 134.90

Support level: 131.65, 129.35

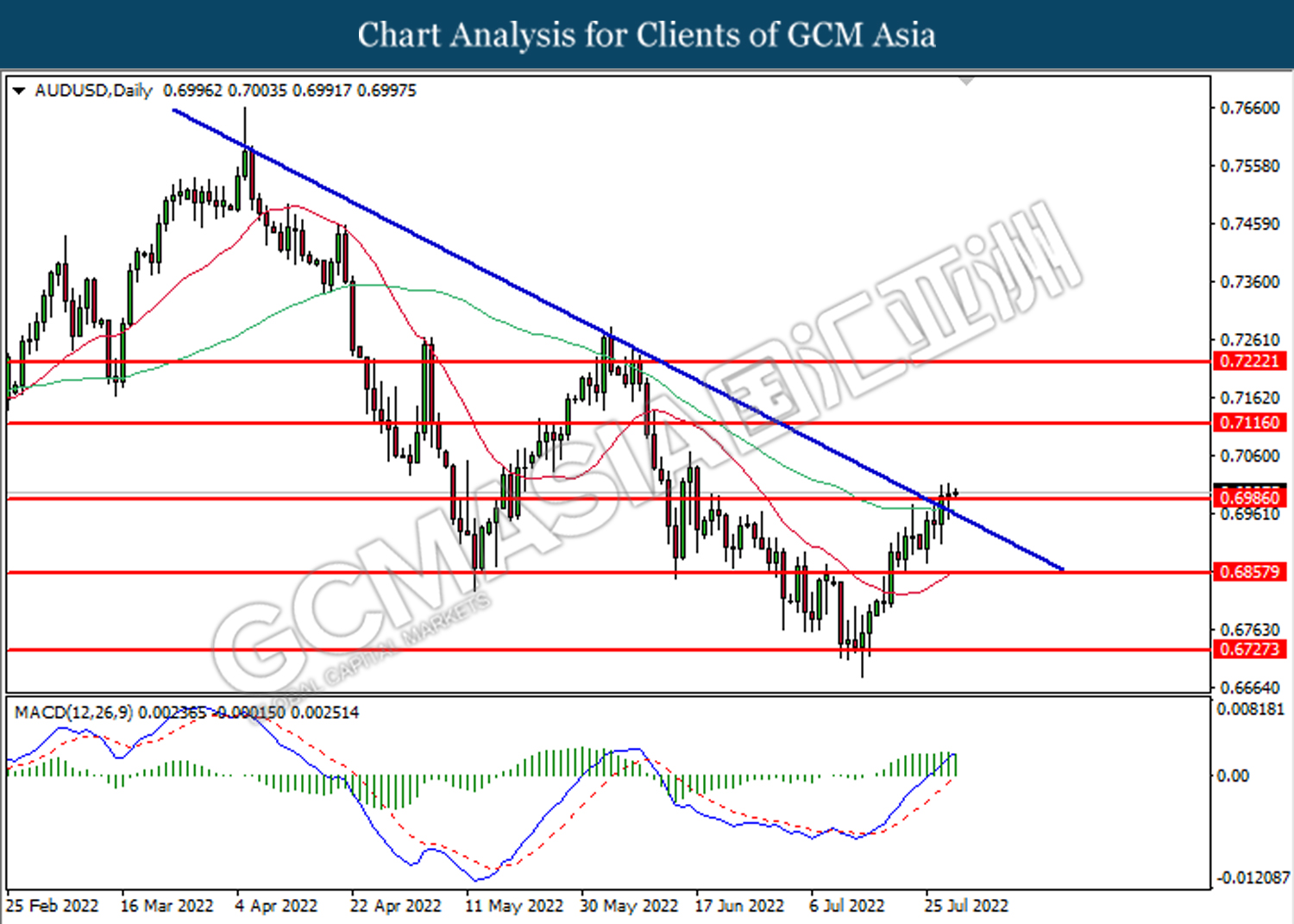

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

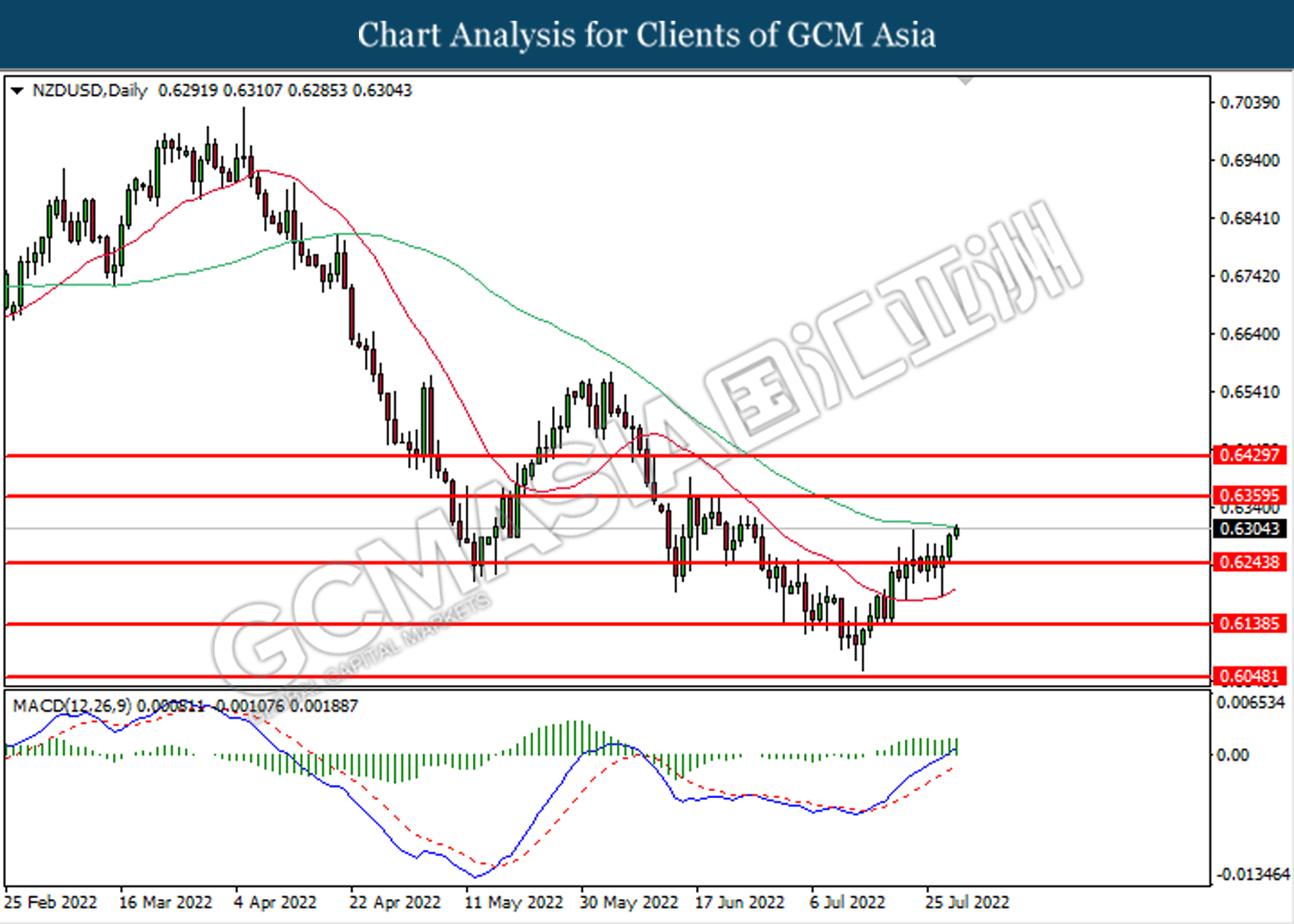

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2935, 1.3030

Support level: 1.2825, 1.2700

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

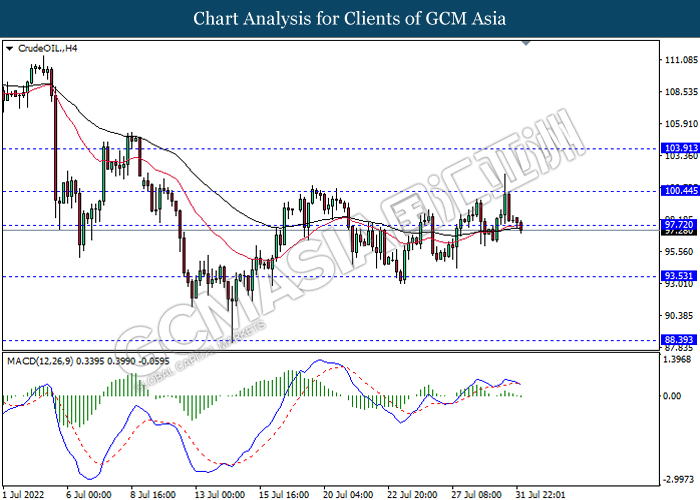

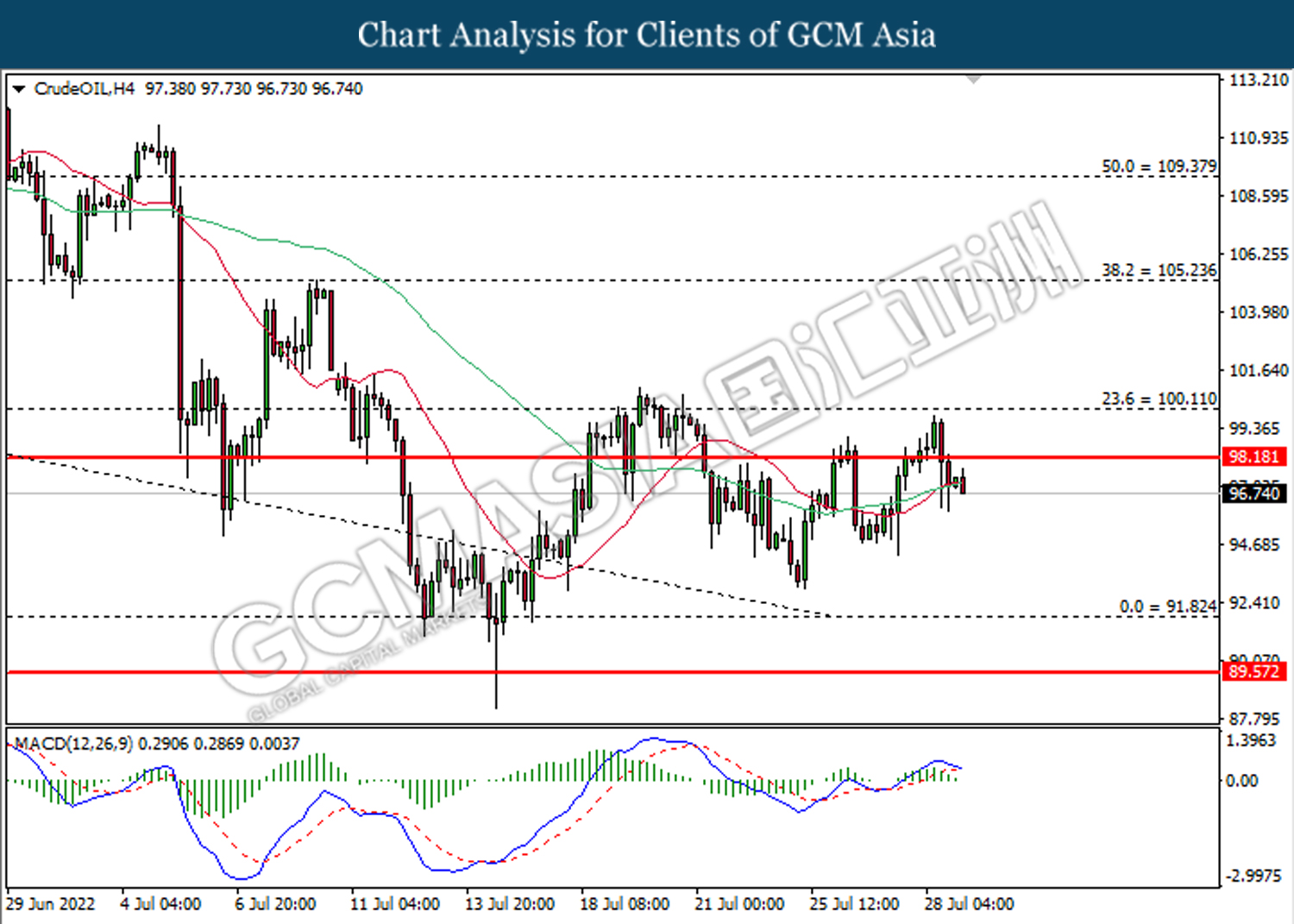

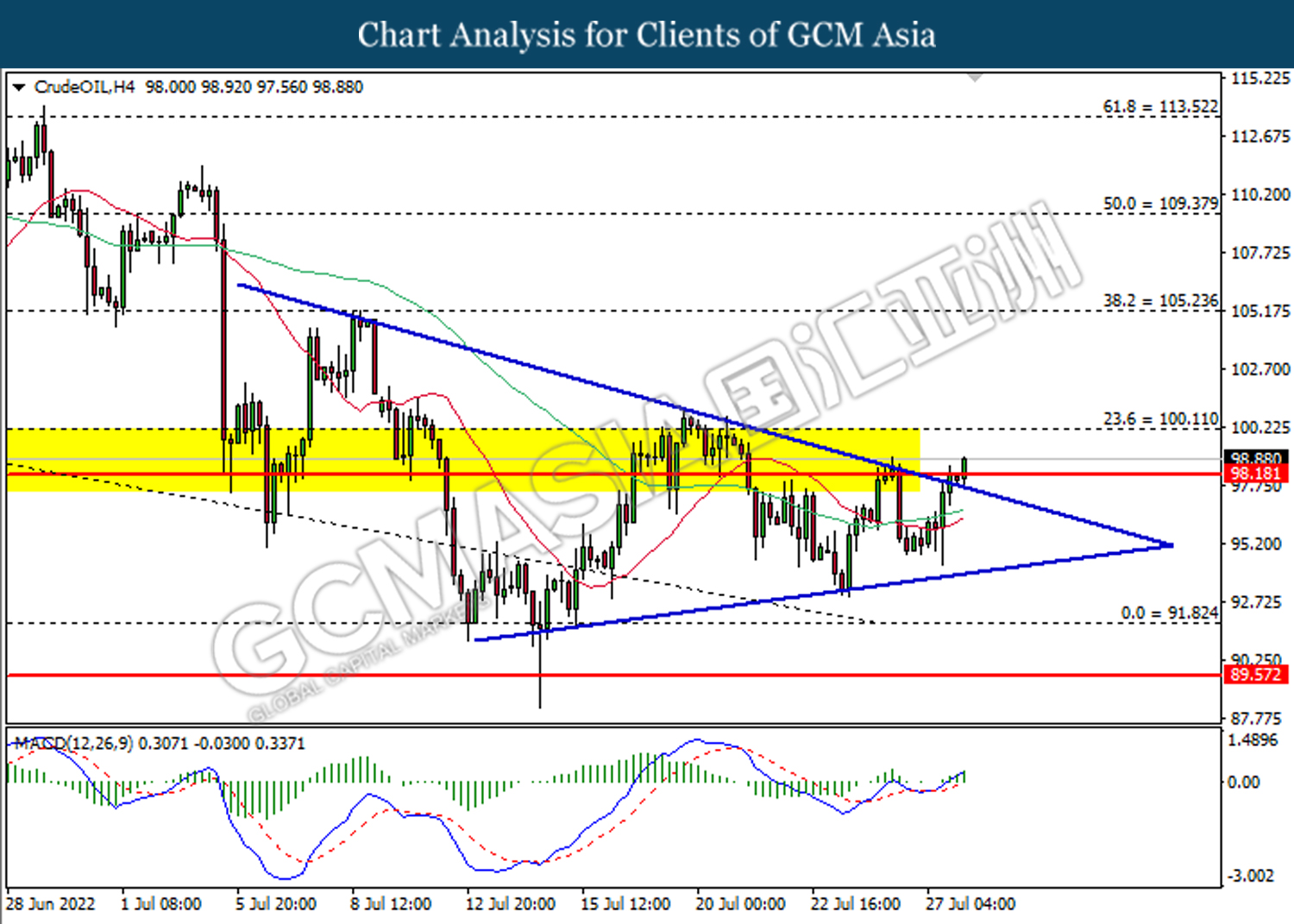

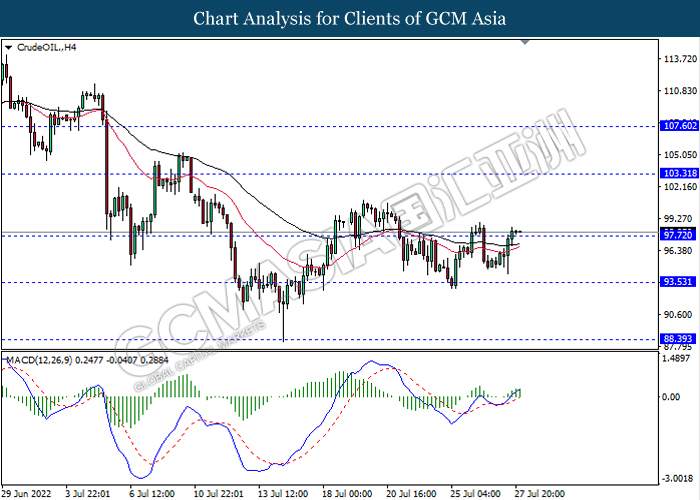

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 90.05, 93.25

Support level: 86.15, 83.00

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1807.65, 1836.10

Support level: 1778.80, 1756.95

050822 Morning Session Analysis

5 August 2022 Morning Session Analysis

Pound plummeted following the BoE Interest Rate Decision.

The Pound Sterling, which is widely traded by the investors in globe, plunged significantly after the Bank of England (BoE) interest rate decision has been released. During the BoE meeting, the policymakers have decided to raise the interest rates by 50 basis points from 1.25% to1.75%, the biggest rate hike since 1995. The Monetary Policy Committee revealed that the big rate hike was aimed to tackle the extraordinarily high inflationary pressures in the UK. However, the sell-off pressures were quite heavy last night as a pessimistic statement has been given by the members of BoE. The MPC projects UK to enter into a recession in the 4th quarter of 2022, while expecting it will last for 5 quarters, the longest recession since the global financial crisis. Besides, the BoE also emphasized that the latest surge in gas prices will also further exacerbate the dire outlook for activity in the UK. With the outlook for the UK economic growth remain clouded, the investors flee away from the Pound market and shift their capital to other market. As of writing, the pair of GBP/USD rose 0.01% to 1.2160.

In the commodities market, the crude oil price up 0.20% to $88.00 a barrel after plunging more than 1.3% yesterday as the recession fears continues to grow and investors fear a demand drop for the commodity. Besides, the gold prices rose 0.02% to $1790.40 per troy ounce amid the heightening of geopolitical tensions between the US and China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Jul) | 372K | 250K | – |

| 20:30 | USD – Unemployment Rate (Jul) | 3.6% | 3.6% | – |

| 20:30 | CAD – Employment Change (Jul) | -43.2K | 20.0K | – |

| 22:00 | CAD – Ivey PMI (Jul) | 62.2 | 60.0 | – |

Technical Analysis

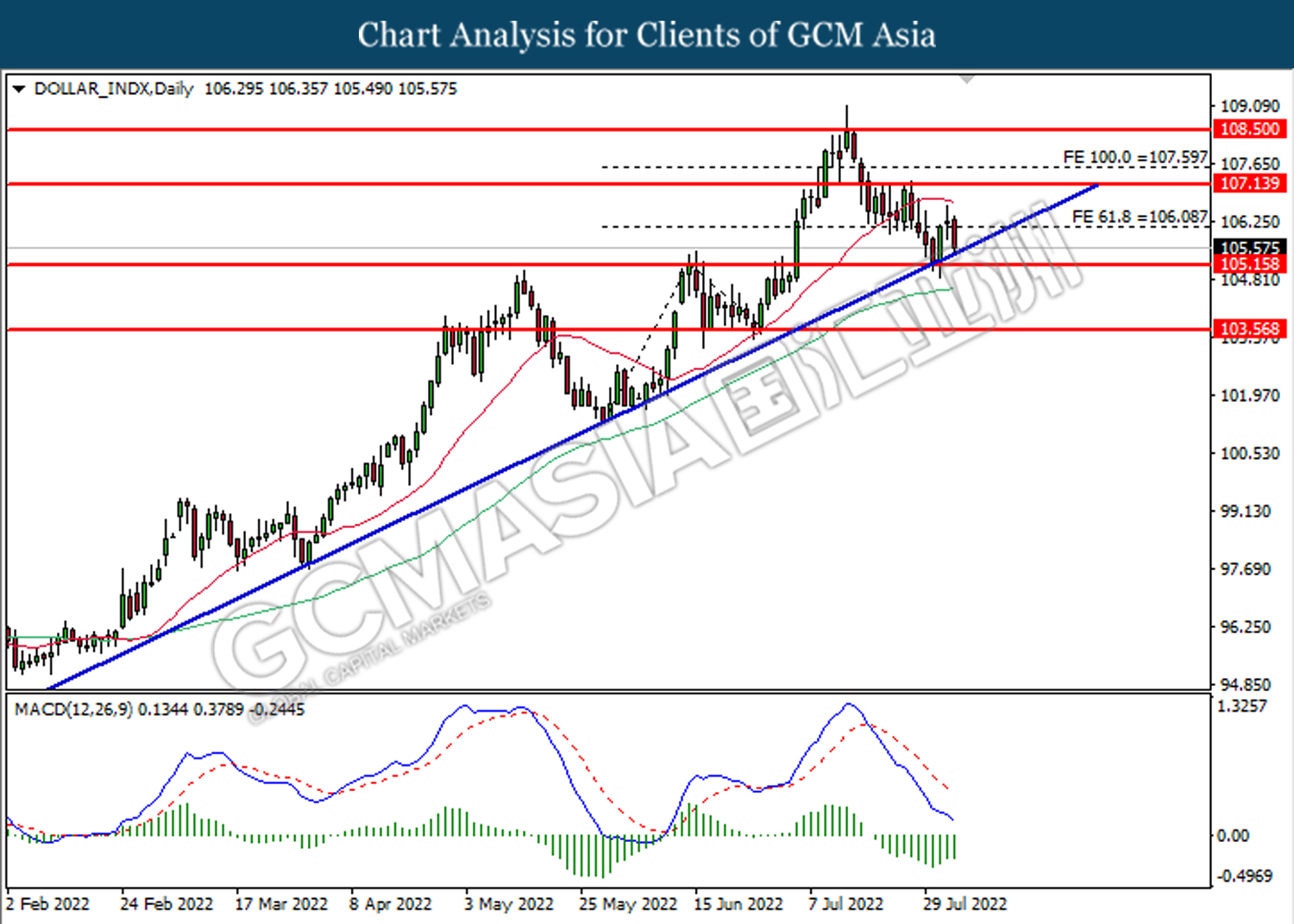

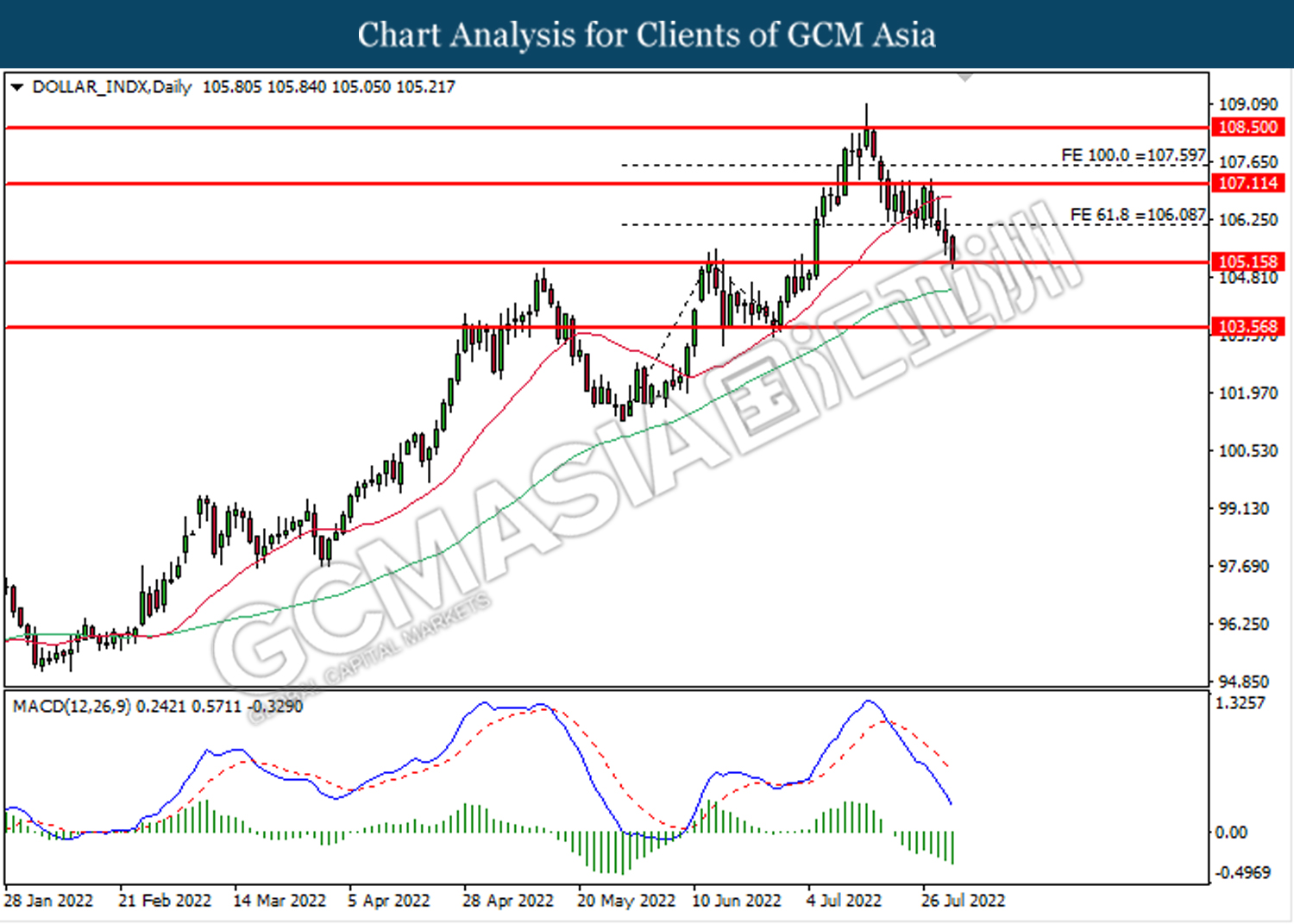

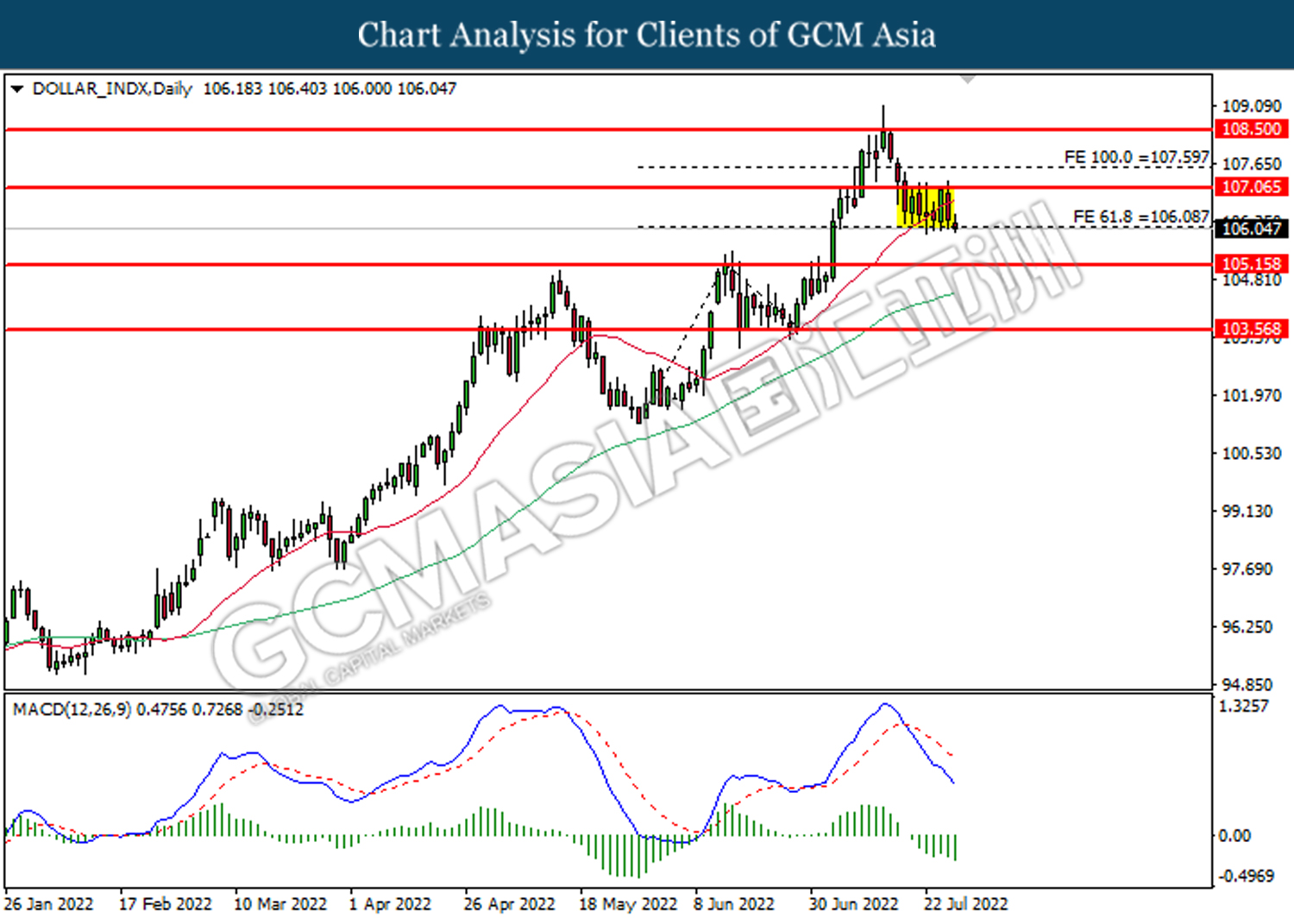

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the upward trendline. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo short-term correction.

Resistance level: 106.10, 107.15

Support level: 105.15, 103.55

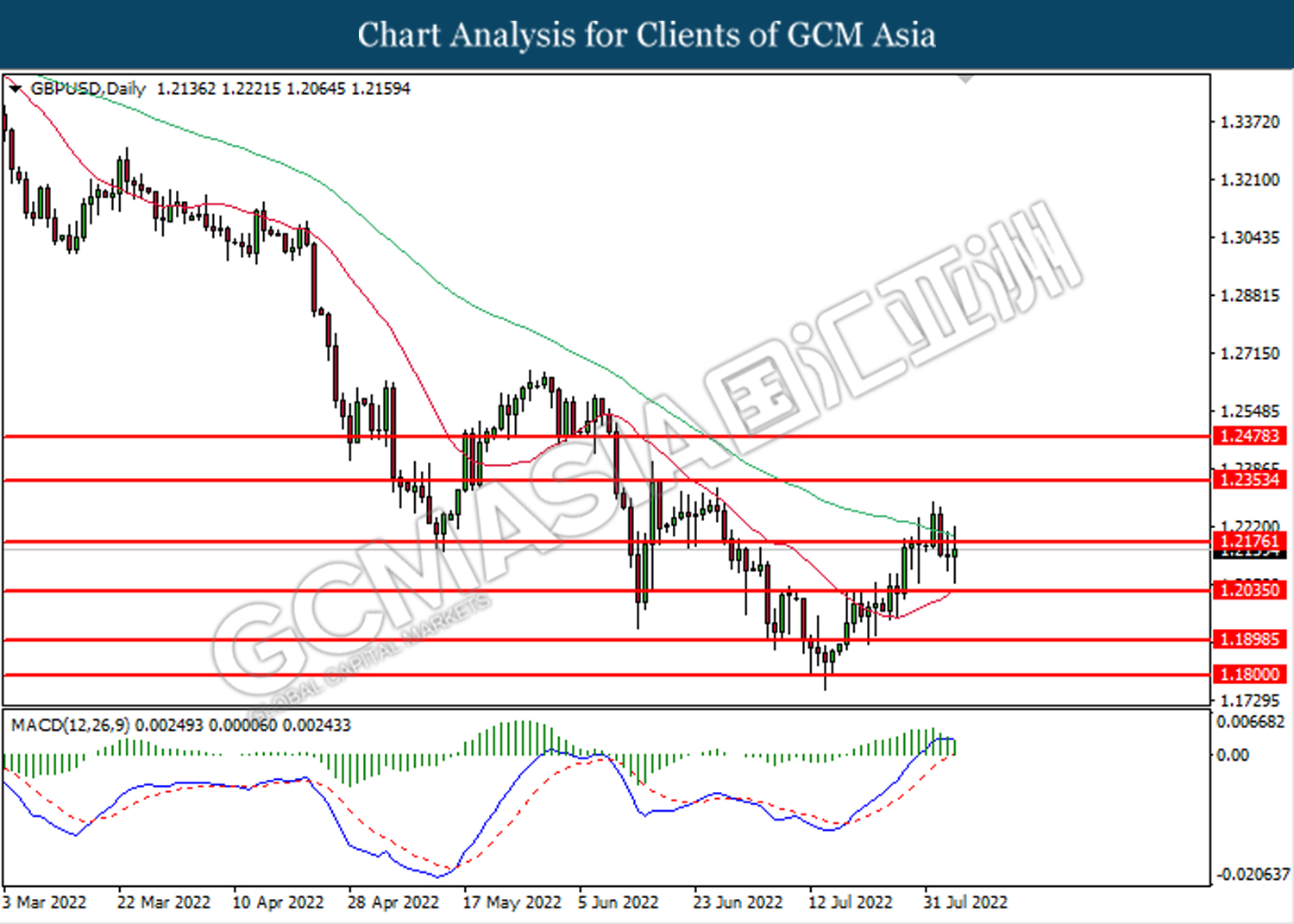

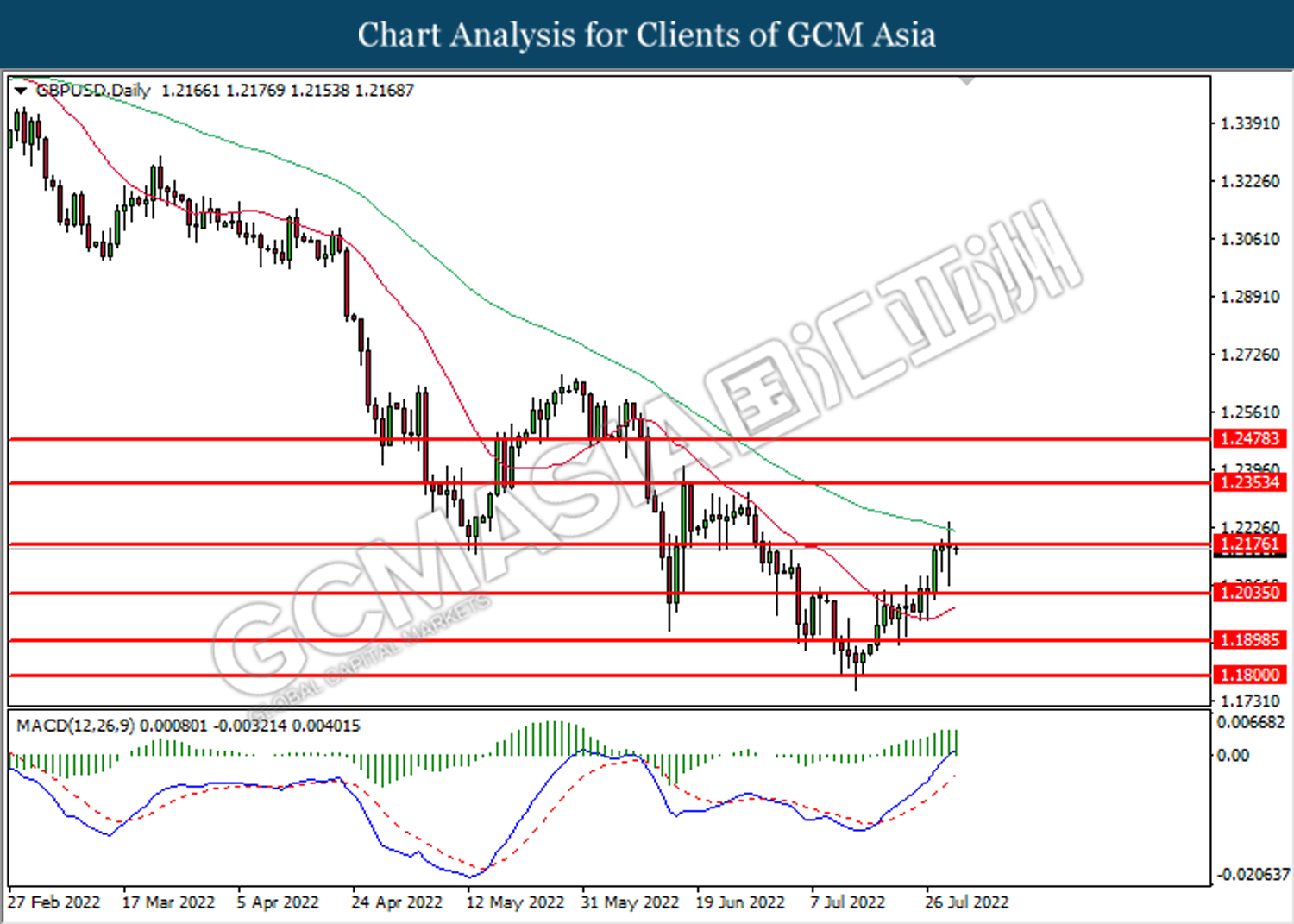

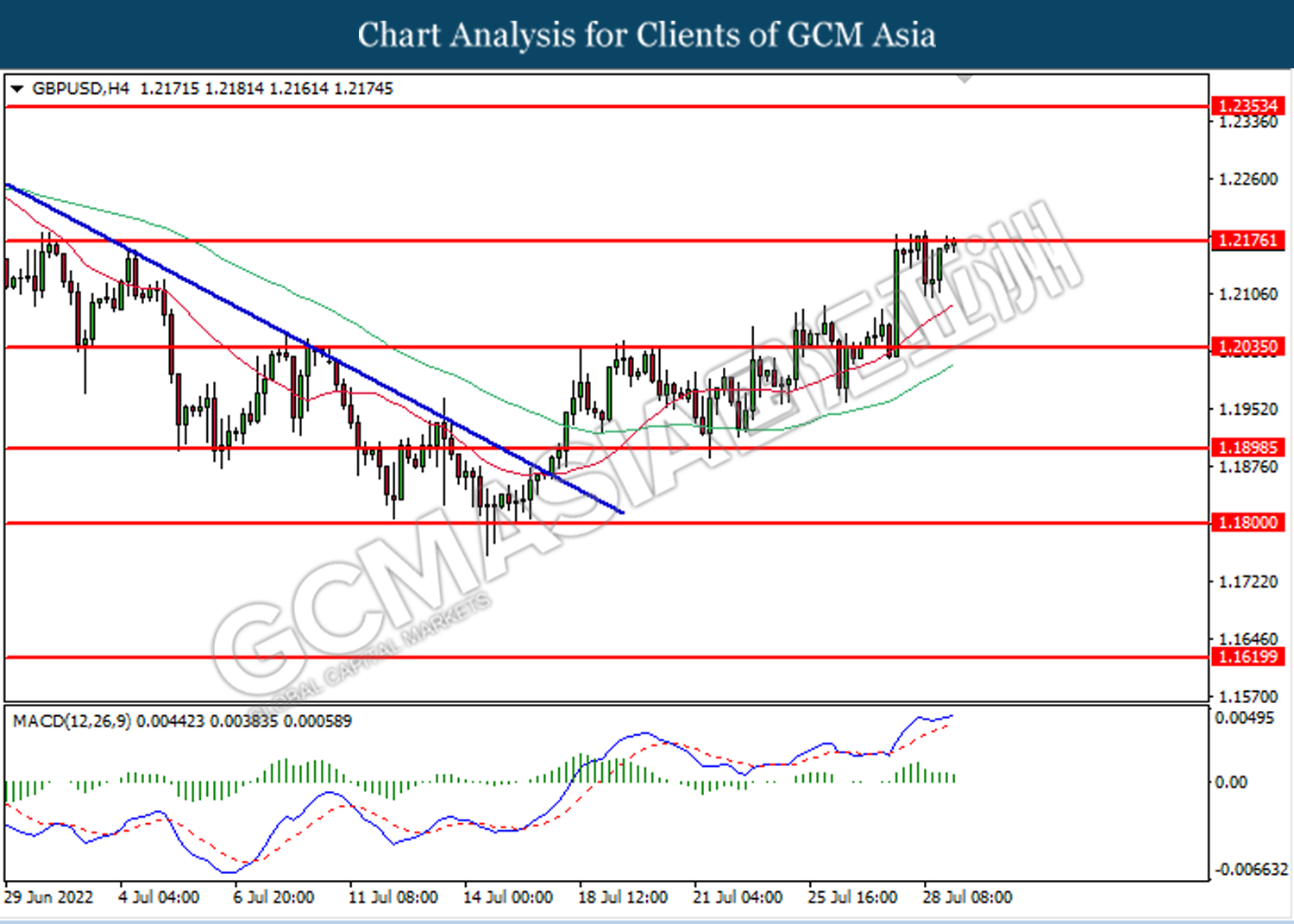

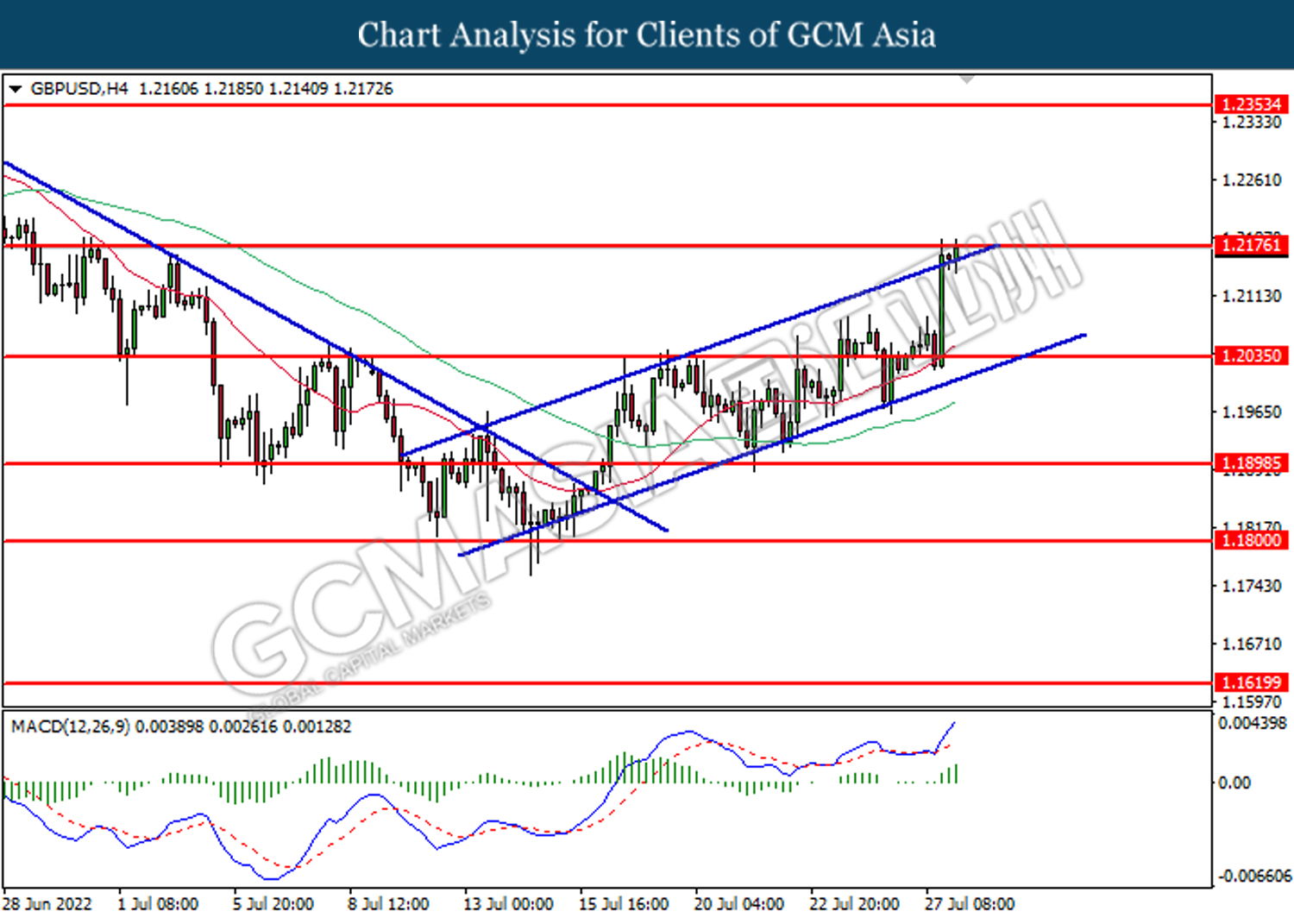

GBPUSD, Daily: GBPUSD was traded higher while currently retesting the resistance level at 1.2175. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction toward the lower level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

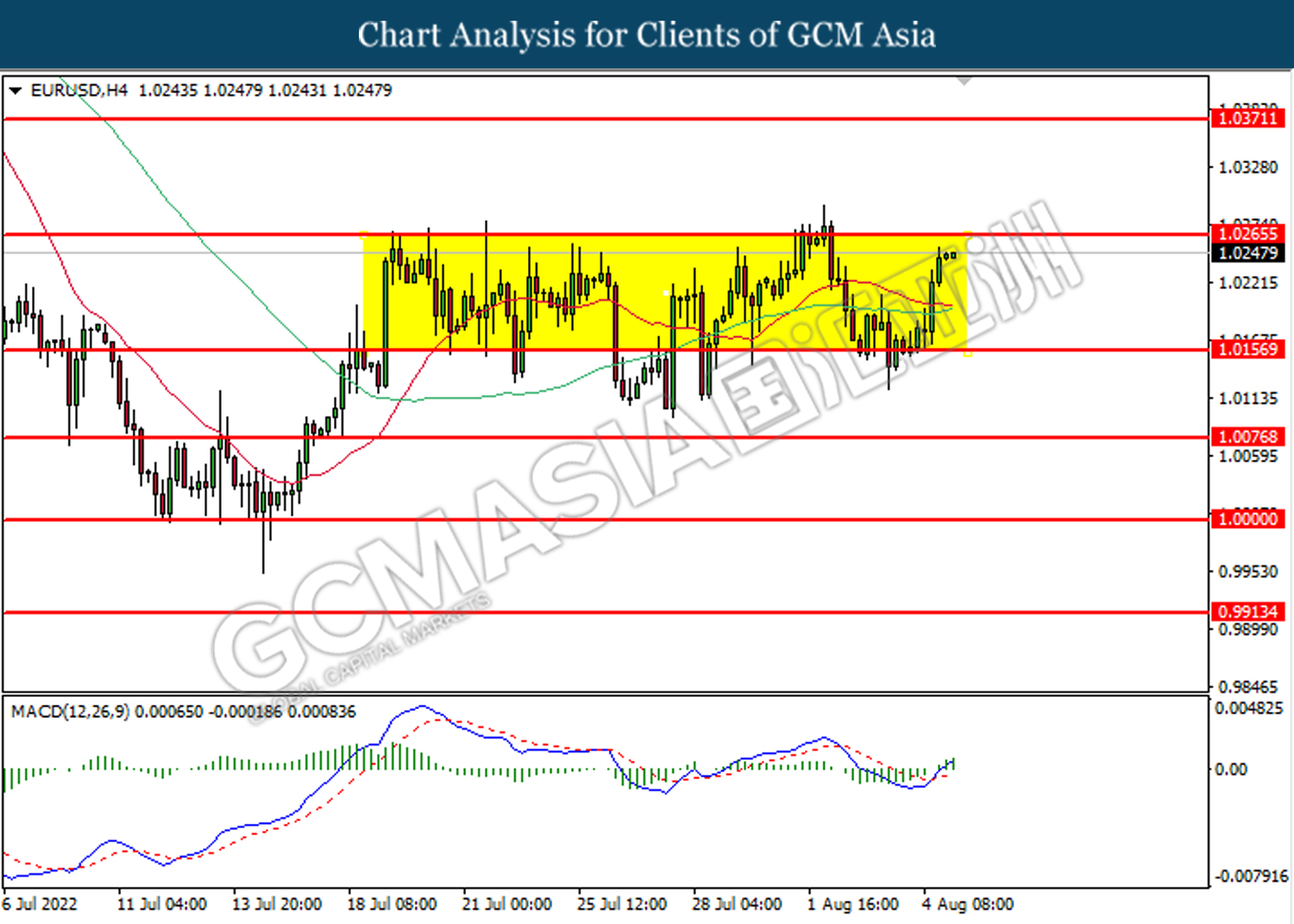

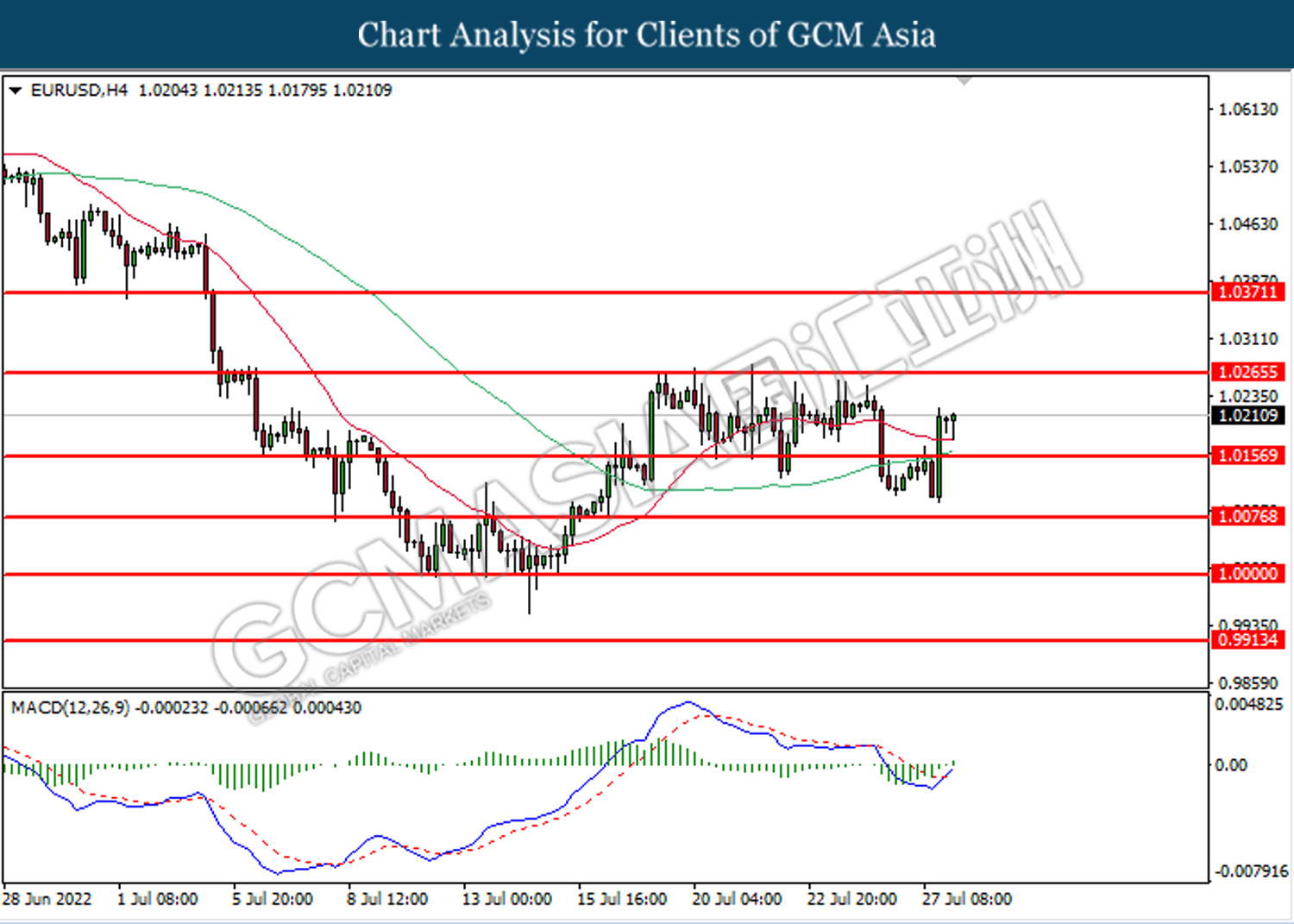

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.0155. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

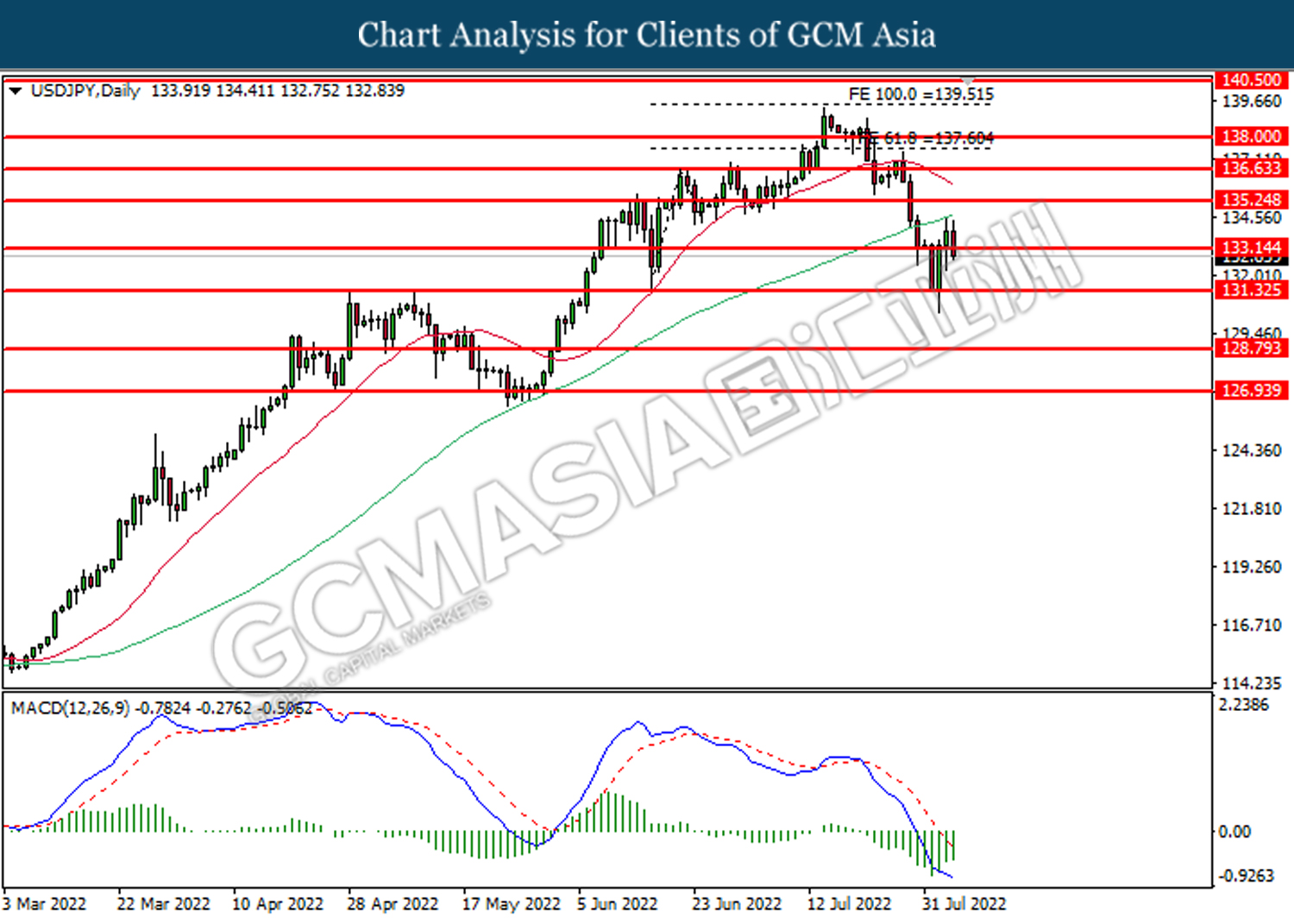

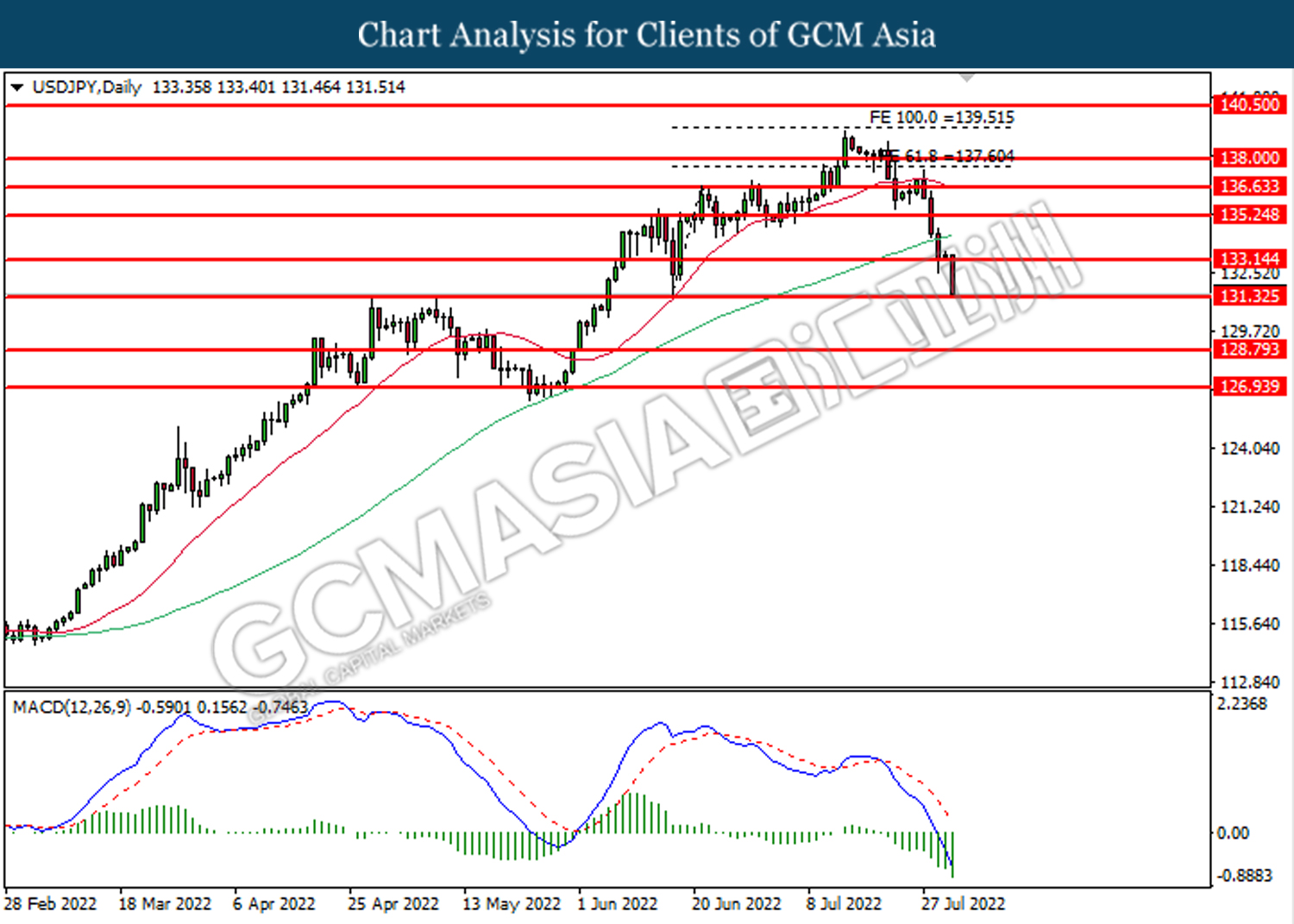

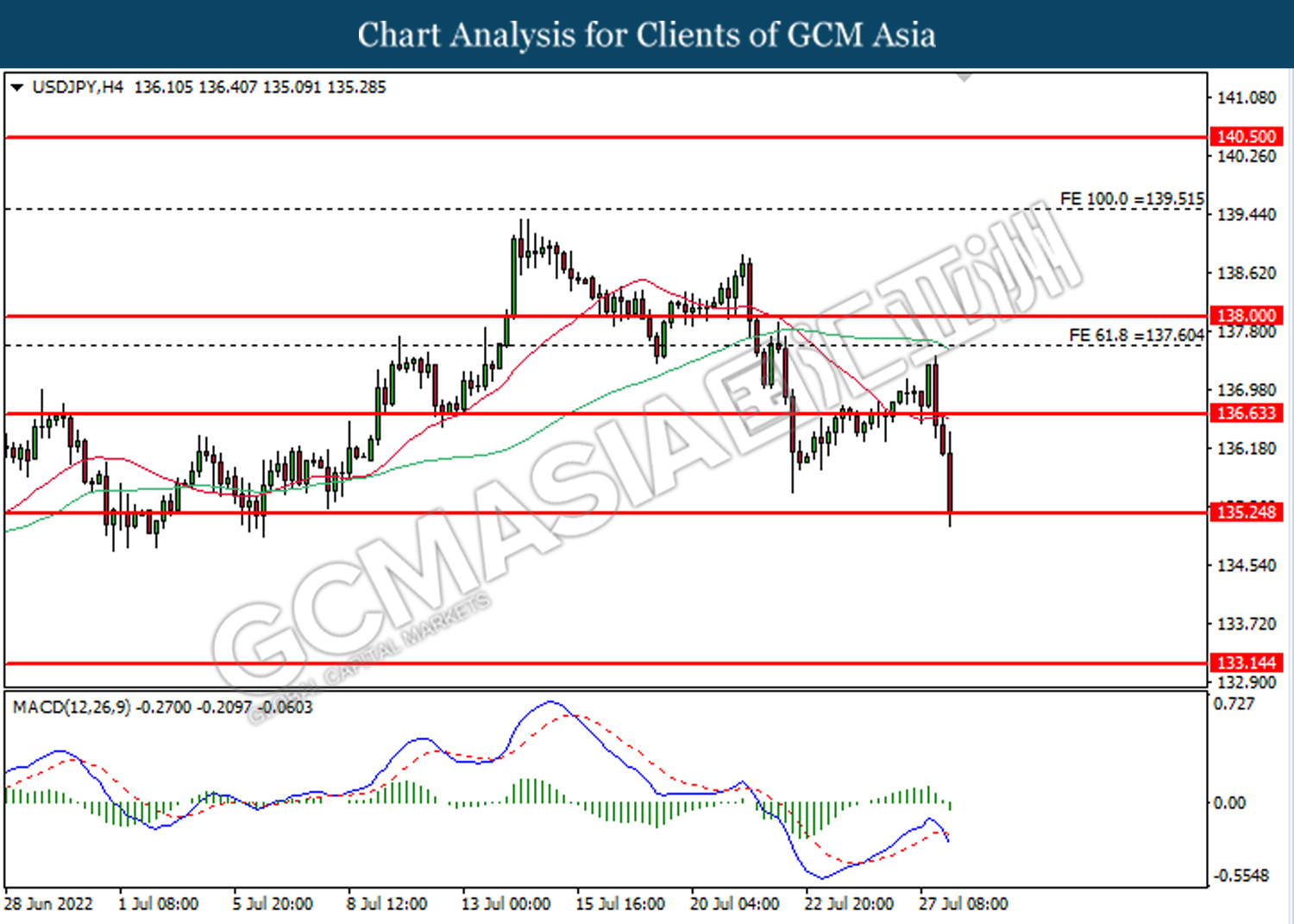

USDJPY, Daily: USDJPY was traded lower while currently retesting the support level at 133.15. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo short-term technical rebound.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.35

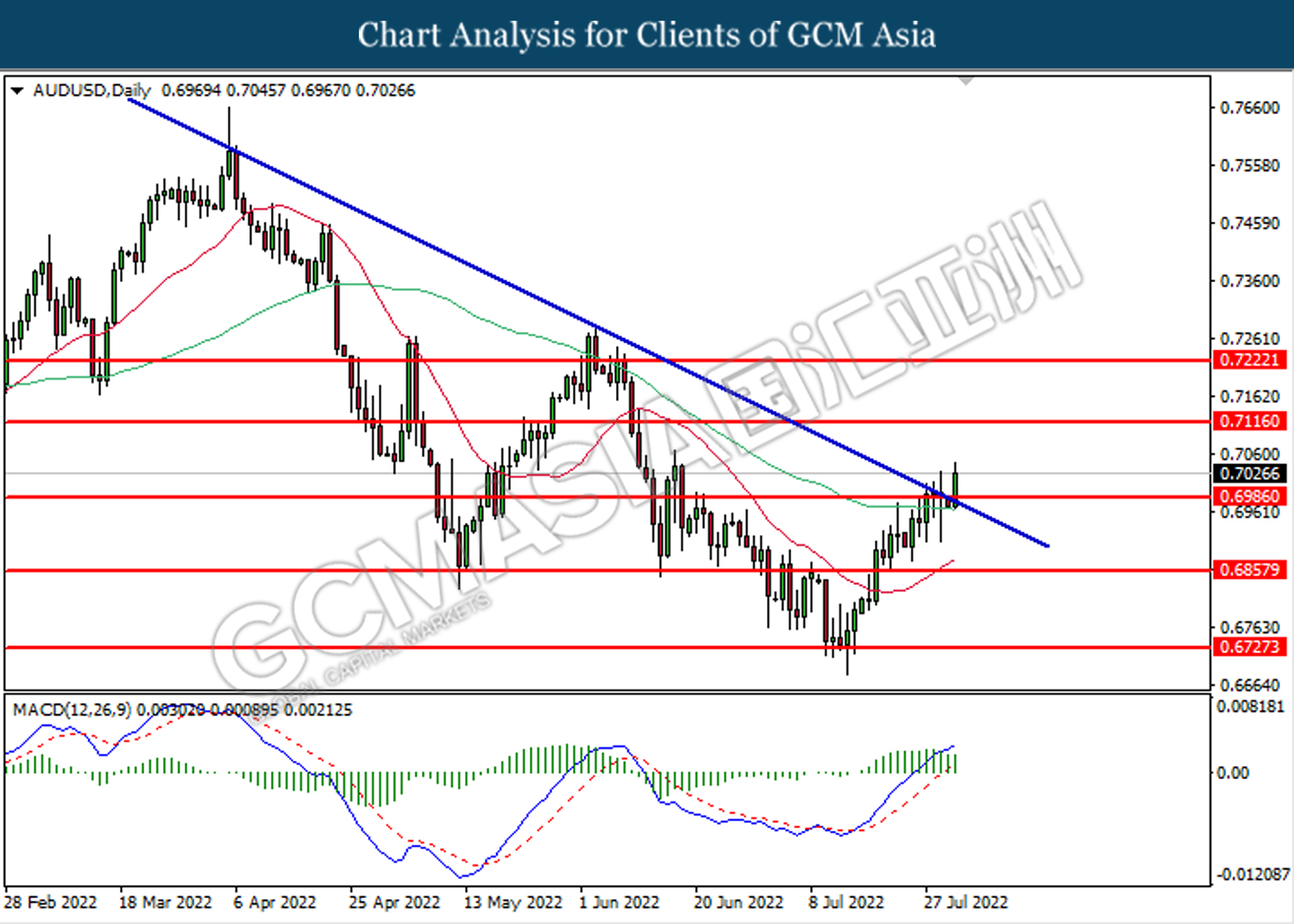

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo short term technical correction.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded higher following prior rebound near the support level at 1.2805. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2925.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9590. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo short-term technical rebound.

Resistance level: 0.9675, 0.9755

Support level: 0.9590, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 89.55. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 86.00.

Resistance level: 89.55, 91.80

Support level: 86.00, 82.70

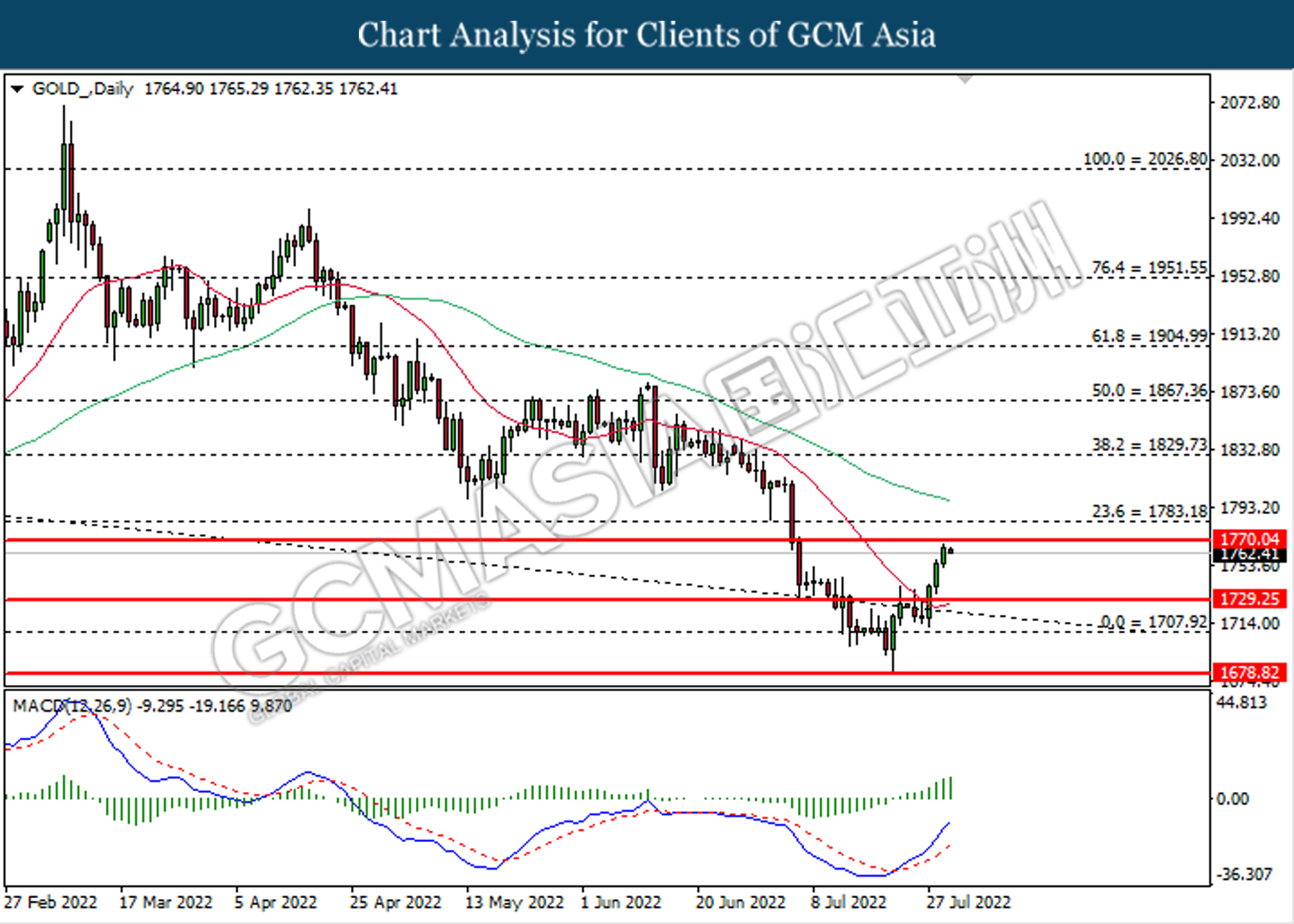

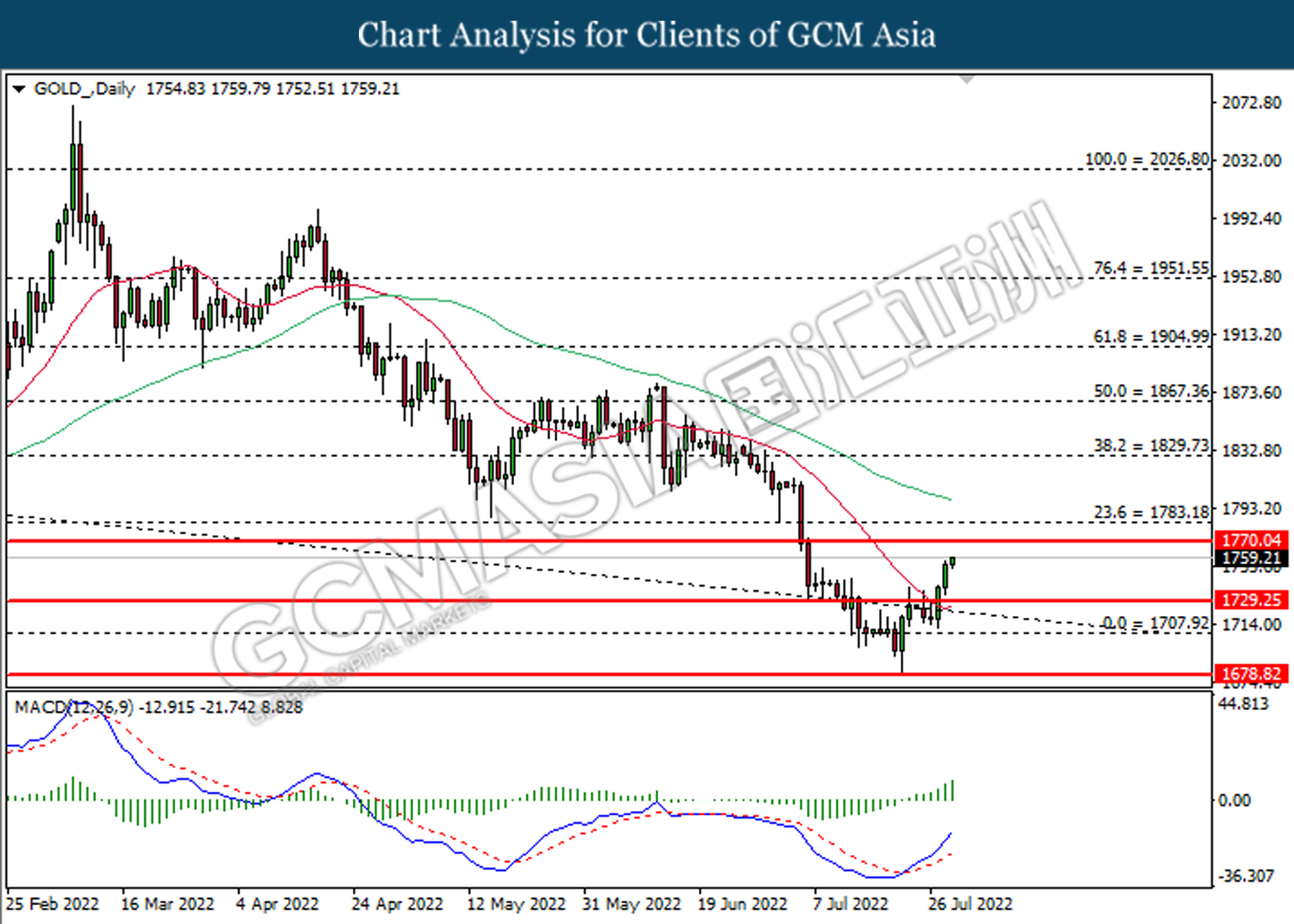

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1783.20. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1783.20, 1829.75

Support level: 1770.05, 1729.25

040822 Afternoon Session Analysis

4 August 2022 Afternoon Session Analysis

Pound on pressure as economic data weakened.

The GBP/USD which well known by majority of investors dropped on yesterday amid the bearish economic data has been unleashed. According to Markit Economics, the UK Composite Purchasing Managers’ Index (PMI) for July notched down from the previous reading of 53.7 to 52.1, missing the market forecast of 52.8. Besides that, the UK Services Purchasing Managers Index (PMI) had also given a pessimistic reading, which came in at the reading of 52.6 while lower than the consensus expectation of 53.3. The lower-than-expected reading indicated that the UK economy is at the risk of recession, which dragged down the appeal of Pound Sterling. At this juncture, investors would continue to scrutinize the interest rate decision from BoE which scheduled at 7pm tonight in order to gauge the likelihood movement of GBP/USD. Market participants are predicting that BoE would likely to implement 50 basis point rate hike, the most since 1995 to suppress the spiking inflation. As of writing, GBP/USD edged up by 0.06% to 1.2152.

In the commodities market, the crude oil price appreciated by 0.47% to $91.15 per barrel as of writing. Nonetheless, the overall trend of oil price remained bearish after OPEC+ claimed that it would increase its oil output. On the other hand, the gold price rallied by 0.45% to $1767.86 per troy ounce as of writing after it slumped throughout the overnight trading session over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Jul) | 52.6 | 52.0 | – |

| 19:00 | GBP – BoE Interest Rate Decision (Aug) | 1.25% | 1.75% | – |

| 20:30 | USD – Initial Jobless Claims | 256K | 259K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2170, 1.2320

Support level: 1.2030, 1.1870

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 134.90, 136.65

Support level: 133.40, 131.65

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2935, 1.3030

Support level: 1.2825, 1.2700

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9675, 0.9735

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 93.25, 97.70

Support level: 90.05, 86.15

GOLD_, H1: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1777.70, 1787.50

Support level: 1766.55, 1753.25

040822 Morning Session Analysis

4 August 2022 Morning Session Analysis

Dollar recovered further on the back of upbeat data.

The dollar index, which traded against a basket of six major currencies, continued to enjoy a revival yesterday as upbeat economic data restrained the index from falling further. According to the Institute for Supply Management (ISM), US ISM Non-Manufacturing PMI rose from the prior month reading of 55.3 to 56.7 in July. To take note, a reading above 50 indicates an expansion in the services sector, while a reading below 50 signals a recession in the particular sector. The increase has put the prior 3 straight monthly declines into an end, while showing that the US services industry picked up amid solid new orders. Undoubtedly, the upbeat services PMI data has also erased the views that US economy is currently in a recession stage. On the other side, the hawkish statement to rein in the high inflation from the Fed officials continue to spur the value of the US dollar. In the statement, the Fed officials signaled that they are committed to cool down the overheating economy, whereby the long-term inflation target will still be around 2%. As of writing, the dollar index rose by 0.13% to 106.40.

In the commodities market, the crude oil price dropped 0.10% to $91.05 a barrel after the US Crude Oil Inventories showed a huge stockpile, dragging the appeal of this black commodity. According to the EIA, the US crude oil inventories level rose by 4.467M, while the consensus forecast was expecting to see a -0.629M of inventories drawdown. Besides, the gold prices rose 0.01% to $1764.25 per troy ounce on the back of US dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Jul) | 52.6 | 52.0 | – |

| 19:00 | GBP – BoE Interest Rate Decision (Aug) | 1.25% | 1.75% | – |

| 20:30 | USD – Initial Jobless Claims | 256K | 259K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 106.10. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the next resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2175. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2035.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.0155. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 133.15. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after its candle successfully close above the resistance level.

Resistance level: 133.15, 135.25

Support level: 131.35, 128.80

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6985. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6855.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

NZDUSD, Daily: NZDUSD was traded higher while retesting the resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after its candle successfully close above the resistance level.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, Daily: USDCAD was traded higher following prior rebound near the support level at 1.2805. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2925.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 91.80. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 89.55.

Resistance level: 91.80, 93.15

Support level: 89.55, 86.00

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1729.25.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

030822 Afternoon Session Analysis

3 August 2022 Afternoon Session Analysis

Aussie beaten down despite the rate hikes from RBA.

The AUD/USD which well known by majority of investors slumped on yesterday after Reserve Bank of Australia (RBA) released its interest rate decision. RBA has raised its interest rate by 50 basis point to 1.85%, which meet the market expectations. As the rate hikes did not surprise market participants and they had already digested the information about rate hikes, investors are turning their eyes to other products with better prospects. Besides, RBA Governor Philip Lowe claimed that the central bank are targeting to tamp down the inflation to the range of 2% – 3%, but the path is “clouded and uncertainty”. He also reiterated that the inflation in Australia would likely to reach its peak at the end of year, and he expected the inflation rate would ease in the coming year. The dovish statement from RBA had reduced the interest of market participants upon Aussie. As of writing, AUD/USD edged up by 0.13% to 0.6928.

In the commodities market, the crude oil price depreciated by 0.25% to $94.17 per barrel as of writing amid the rising concerns on global economy recession. On the other hand, the gold price eased by 0.34% to $1783.70 per troy ounce over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Jul) | 52.8 | 52.8 | – |

| 16:30 | GBP – Services PMI (Jul) | 53.3 | 53.3 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jul) | 55.3 | 53.5 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -4.523M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2170, 1.2320

Support level: 1.2030, 1.1870

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 133.10, 134.50

Support level: 131.65, 130.40

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2935, 1.3030

Support level: 1.2825, 1.2700

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 97.70, 100.45

Support level: 93.30, 90.05

GOLD_, H1: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1777.70, 1787.50

Support level: 1766.55, 1753.25

030822 Morning Session Analysis

3 August 2022 Morning Session Analysis

Dollar revived following hawkish tone from Fed officials.

The dollar index, which traded against a basket of six major currencies, rebounded sharply after falling for 4 consecutive trading days, as Fed officials hinted that more rate hikes could be expected in the near term. According to the statement from San Francisco Fed President Mary Daly, she emphasized that the US central bank still has a long way to cool the overheating economy back to normal, implying higher interest rates in the future. Besides, she also vowed that investors should not interpret the recent big interest rate as an indication of the end of rate hikes, whereby the tightening path will still be continued. On the other side, the Chicago Fed President Charles Evans has also commented that he does not rule out the possibility of raising another half point in September or a more aggressive of 75 basis point hike in the upcoming September meeting. With the hawkish tone from Fed officials, the market participants flee into the US dollar market. However, the gains of the dollar index were limited by the downbeat employment data yesterday. According to the Bureau of Labor Statistics, the US JOLTs Job Openings came in at 10.698M, missing the consensus forecast of 11.000M, providing insight that the US employment market are cooling off.

In the commodities market, the crude oil price was down 0.03% to $93.75 a barrel amid the market concern over the global recession outweigh the supply tight issues, while market participants are waiting for the oil output plan from OPEC+. Besides, the gold prices dropped 0.08% to $1759.50 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Jul) | 52.8 | 52.8 | – |

| 16:30 | GBP – Services PMI (Jul) | 53.3 | 53.3 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jul) | 55.3 | 53.5 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -4.523M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 106.10. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 106.10, 107.10

Support level: 105.15, 103.55

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2175. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2355, 1.2480

Support level: 1.2175, 1.2035

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.0155. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 133.15. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 133.15, 135.25

Support level: 131.35, 128.80

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6985. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6855.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6245. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded higher following prior rebound near the support level at 1.2805. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2925.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

USDCHF, Daily: USDCHF was traded higher following prior rebound near the support level at 0.9520. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9590.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 94.85. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical rebound in short term.

Resistance level: 94.85, 98.20

Support level: 93.15, 91.80

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1729.25.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

020822 Afternoon Session Analysis

2 August 2022 Afternoon Session Analysis

Euro gains limited over the downbeat manufacturing data.

The EUR/USD which traded by majority of investors edged up on yesterday amid the slump of US Dollar. Nonetheless, the gains of Euro was limited after the Eurozone manufacturing data unleashed. According to Markit Economics, the Germany Manufacturing Purchasing Managers Index (PMI) for July came in at the reading of 49.3, higher than the market expectation of 49.2. The reading which lower than 50 indicated that the contraction in Germany manufacturing sector, which spurred bearish momentum on the Euro. Besides that, although GBP/USD rose significantly following the depreciation of US Dollar, the gains experienced by Pound Sterling was limited over the bearish manufacturing data. The UK Manufacturing Purchasing Managers Index (PMI) for July notched down from the previous reading of 52.8 to 52.1, missing the consensus forecast of 52.2. The pessimistic economy outlook in UK had stoked a shift in sentiment toward safe-haven assets such as gold. As of writing, EUR/USD rallied by 0.10% to 1.0272 as well as GBP/USD appreciated by 0.09% to 1.2258.

In the commodities market, the crude oil price depreciated by 0.98% to $92.94 per barrel as of writing following the weakening manufacturing data had raised the market concerns upon global economy slowdown, which suppress the demand of oil. In addition, the gold price appreciated by 0.21% to $1791.50 per troy ounce as of writing over the slip of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – JOLTs Job Openings (Jun) | 11.254M | 11.000M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 105.25, 106.30

Support level: 104.45, 103.65

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2320, 1.2485

Support level: 1.2170, 1.2030

EURUSD, H4: EURUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0315, 1.0385

Support level: 1.0230, 1.0160

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 131.65, 133.10

Support level: 130.40, 129.35

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.7075, 0.7145

Support level: 0.7005, 0.6930

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6350, 0.6405

Support level: 0.6295, 0.6235

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2935, 1.3030

Support level: 1.2825, 1.2700

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9520, 0.9595

Support level: 0.9455, 0.9380

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 93.55, 97.70

Support level: 88.40, 84.25

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1777.70, 1787.50

Support level: 1766.55, 1753.25

020822 Morning Session Analysis

2 August 2022 Morning Session Analysis

Dollar slumped as the tightening path of the Fed rugged.

The dollar index, which traded against a basket of six major currencies, plunged as the global investors reassessed the tightening path of the Fed while expecting the Fed will not increase the interest rate as aggressively as the majority thought. According to the Fed Rate Monitor Tool, the likelihood of a 50-basis point interest rate upward adjustment is roughly about 93%, while the possibility of 75-basis point rate hike is just about 7.0%. With that, it shows that the market participants are expecting a less aggressive rate hike would be carried out by the Federal Reserve in the upcoming meeting, which scheduled on 22 September. On data front, there was a upbeat manufacturing data which released yesterday had limited the losses of the dollar index. According to the ISM, the US ISM Manufacturing PMI came in at 52.8, stronger than the consensus forecast of 52.0. The data showed that the economic activity in the manufacturing sector has achieved a 26th consecutive month of growth since the last contraction in May 2020. Nonetheless, the eyes of the global investors are now on the crucial employment data, including Nonfarm Payroll and Unemployment Rate. As of writing, the dollar index dropped 0.47% to 105.40.

In the commodities market, the crude oil price was down 0.38% to $93.75 a barrel amid surprise contraction in Chinese factory activity, which fueled the market fears over the oil demand outlook. Besides, the gold prices appreciated by 0.04% to $1771.40 per troy ounce as the tensions between US and China heightened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision | 1.35% | 1.85% | – |

| 22:00 | USD – JOLTs Job Openings (Jun) | 11.254M | 11.000M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 105.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 106.10, 107.10

Support level: 105.15, 103.55

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2175. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2355.

Resistance level: 1.2355, 1.2480

Support level: 1.2175, 1.2035

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.0265. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.35. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout the support level.

Resistance level: 133.15, 135.25

Support level: 131.35, 128.80

AUDUSD, Daily: AUDUSD was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the trendline.

Resistance level: 0.6985, 0.7115

Support level: 0.6655, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded higher following prior rebound near the support level at 1.2805. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2925.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9520. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level 94.85. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 98.20, 100.10

Support level: 94.85, 91.80

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1770.05. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

010822 Afternoon Session Analysis

1 August 2022 Afternoon Session Analysis

Eurozone CPI rose higher than expected, Euro heightened.

The EUR/USD which traded by majority of investors rallied on last Friday after the Eurozone CPI data released. According to Eurostat, the Eurozone Consumer Price Index (CPI) YoY posted at the reading of 8.9%, exceeding the market expectation of 8.6%. The higher-than-expected CPI data showed that the soaring inflation risk keep lingering in the European, which increasing the odds of rate hikes from European Central Bank (ECB) in order to tamp down rising prices. Nonetheless, the gains experienced by Euro has been limited over the bearish economic data. The Germany Unemployment Change for July came in at the reading of 48K, which higher than the consensus forecast of 15K. Besides that, the Germany Gross Domestic Product (GDP) QoQ in second quarter notched down from the previous reading of 0.8% to 0.0%, missing the 0.1% as widely expected. The downbeat economic data had raised the market concerns on the economy recession in Eurozone, which spurred bearish momentum on the Euro. As of writing, EUR/USD appreciated by 0.11% to 1.0229.

In the commodities market, the crude oil price depreciated by 1.42% to $97.27 per barrel as of writing after an unexpected drop in Chinese factory activity raised concerns over slowing crude demand in the world’s second largest economy. On the other hand, the gold price edged down by 0.22% to $1778.15 per troy ounce as of writing. However, the overall trend of gold remained bullish amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Jul) | 49.2 | 49.2 | – |

| 16:30 | GBP – Manufacturing PMI (Jul) | 52.2 | 52.2 | – |

| 22:00 | USD – ISM Manufacturing PMI (Jul) | 53.0 | 52.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2320, 1.2485

Support level: 1.2170, 1.2030

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 133.10, 134.25

Support level: 131.65, 130.40

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9520, 0.9595

Support level: 0.9455, 0.9380

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 97.70, 100.45

Support level: 93.55, 88.40

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1769.60, 1787.80

Support level: 1753.25, 1737.30

010822 Morning Session Analysis

1 August 2022 Morning Session Analysis

Dollar seesawed despite an upbeat inflation figure.

The dollar index, which traded against a basket of six major currencies dived after a sudden jump during the late Friday night session amid inflation figure hits the highest level in 40 years. The PCE Price Index, an inflation barometer which the US central bank – Federal Reserve follows closely skyrocketed to its highest level since January 1982 in June. According to the Bureau of Economic Analysis, the US PCE Price Index for the month of June came in at 6.8% as widely expected, while higher than the prior month’s reading of 6.3%. Besides, another inflation gauge which excluding food and energy, the Core PCE data also increased by 0.6%, recording its biggest gain since a year ago. The dollar index initially reacted positively to the positive figure from the inflation data, but loss the footing on gain before the Friday trading session ended. At this juncture, the attention of the market participants would be given to the upcoming crucial employment data, which is the Non-Farm Payrolls and Unemployment rate, in order to scrutinize the further direction of the dollar index. As of writing, the dollar index rose 0.05% to 105.95.

In the commodities market, the crude oil price was down 0.38% to $98.00 a barrel as the market fears over the recession risk outweigh the global supply concern. Besides, the gold prices depreciated by 0.16% to $1763.40 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Jul) | 49.2 | 49.2 | – |

| 16:30 | GBP – Manufacturing PMI (Jul) | 52.2 | 52.2 | – |

| 22:00 | USD – ISM Manufacturing PMI (Jul) | 53.0 | 52.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 106.10. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 105.15.

Resistance level: 106.10, 107.10

Support level: 105.15, 103.55

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2175. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.15. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout the support level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.35

AUDUSD, Daily: AUDUSD was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the trendline.

Resistance level: 0.6985, 0.7115

Support level: 0.6655, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, H4: USDCAD was traded higher while currently retesting the resistance level at 1.2815. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 1.2815, 1.2925

Support level: 1.2730, 1.2645

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9520. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 98.20. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1770.05.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

290722 Afternoon Session Analysis

29 July 2022 Afternoon Session Analysis

Euro surged ahead of the all-eyed CPI data.

The Euro, which is majorly traded by global investors, surged ahead of the release of the inflation data in the Eurozone. Recently, the single currency had been thrown off by the market participants as the tensions between the Eurozone and Russia heightened. The Russian natural gas giant has reduced its gas flow through the Nord Stream 1, where the company claimed that there were some technical issues noticed. The disruption of gas flow has led to the increase of market fears over the recession in the Eurozone. At the same time, the EU has also achieved a consensus to lower its natural gas reliance on Russia by 15% in the next 9 months. Nonetheless, the pair of EUR/USD managed to stay above the level of 1.0100 as the weakening of the dollar index continued to limit the losses of the currency pair. Yesterday, a series of downbeat data, including the US GDP and Initial Jobless Claims, heralded dark clouds for the US economy at this juncture. As of writing, the pair of EUR/USD is up 0.04% to 1.0200.

In the commodities market, the crude oil price was down 0.58% to $96.77 a barrel as the recession risk loomed after a weaker-than-expected GDP was released from the US. Besides, the gold prices appreciated by 0.10% to $1758.10 per troy ounce following the release of the downbeat GDP.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (Jul) | 133K | 15K | – |

| 16:00 | EUR – German GDP (QoQ) (Q2) | 0.20% | 0.10% | – |

| 17:00 | EUR – CPI (YoY) (Jul) | 8.60% | 8.70% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Jun) | 0.30% | 0.50% | – |

| 20:30 | CAD – GDP (MoM) (May) | 0.30% | -0.20% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 106.10. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 105.15.

Resistance level: 106.10, 107.10

Support level: 105.15, 103.55

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2175. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 135.25. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 133.15.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.35

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7115.

Resistance level: 0.7115, 0.7220

Support level: 0.6985, 0.6860

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.2825. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2730.

Resistance level: 1.2825, 1.2925

Support level: 1.2730, 1.2645

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9520. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 98.20. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 91.80.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistnace level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1770.05.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

290722 Morning Session Analysis

29 July 2022 Morning Session Analysis

US Dollar dropped amid weakened economic data.

The Dollar Index which traded against a basket of six major currencies eased since yesterday after the bearish economic data has been released, which dragged down the appeal of US Dollar. According to Bureau of Economic Analysis, the US Gross Domestic Product (GDP) for the second quarter posted at the reading of -0.9%, missing the market forecast of 0.5%. Besides, the US Initial Jobless Claims came in at the reading of 256K, higher than the consensus expectation of 253K. These two economic data had showed that the economy progression in the US was in recession as well as the current US labor market remained fragile, which tamped down investors’ interest to invest in the US currency. In addition, the Dollar Index extended its losses after Apple reported its higher-than-expected fiscal earnings, which prompted investors to turn their attention to risk-appetite market such as US stocks. As of writing, the Dollar Index depreciated by 0.28% to 106.03.

In the commodities market, the crude oil price appreciated by 0.94% to $97.33 per barrel as of writing after a sharp decline throughout the overnight trading session as the global recession fears keep hovering in the market. On the other hand, the gold price appreciated by 0.16% to $1753.05 per troy ounce as of writing over the slip of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (Jul) | 133K | 15K | – |

| 16:00 | EUR – German GDP (QoQ) (Q2) | 0.20% | 0.10% | – |

| 17:00 | EUR – CPI (YoY) (Jul) | 8.60% | 8.70% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Jun) | 0.30% | 0.50% | – |

| 20:30 | CAD – GDP (MoM) (May) | 0.30% | -0.20% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2170, 1.2320

Support level: 1.2030, 1.1870

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

USDJPY, H4: USDJPY was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 135.55, 136.65

Support level: 134.25, 133.10

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 97.70, 103.30

Support level: 93.55, 88.40

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1769.60, 1787.80

Support level: 1753.25, 1737.30

280722 Afternoon Session Analysis

28 July 2022 Afternoon Session Analysis

Aussie seesawed after softer-than-expected retail sales was released.

The Australian dollar, which widely known as Aussie, slipped after Australia posted a downbeat data at home. According to Australian Bureau of Statistic, Australia retail sales data dropped from 0.9% to 0.2%, missing the consensus forecast of 0.5%, citing the heightening risk of economic slowdown in Australia. Despite the downbeat data, the pair of AUD/USD did not experience huge tumble as the dollar index continue to support the upward trend of the currency pair. Early today, the Fed Interest Rate Decision has been unleashed, where the FOMC members adjusted the rate upward from 1.75% to 2.50%, hitting the market analyst expectation. Prior to that, the market participants were in a midst of either a 75-basis point rate hike or a 100-basis point of that. As the rate hike amplitude was not as big as market expects, hence it triggered a huge sell-off pressure in dollar market, while prompting the investors to shift their capital toward other markets such as Pound, Aussie and etc. As of writing, the pair of AUD/USD down 0.11% to 0.6985.

In the commodities market, the crude oil price up 0.46% to $98.70 a barrel as the appreciation of the US dollar caused the cost of oil became slightly cheap for the non-US buyers, while huge crude oil inventories drew further support the black commodity price. Besides, the gold prices jumped 0.06% to $1735.25 per troy ounce following a smaller-than-expected rate hike during the overnight FOMC meeting.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q2) | -1.60% | 0.40% | – |

| 20:30 | USD – Initial Jobless Claims | 251K | 253K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 106.10. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 107.60, 108.50

Support level: 106.10, 105.15

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2175. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 135.25. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 136.65, 138.00

Support level: 135.25, 133.15

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded lower while currently testing near the support level at 1.2825. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2925, 1.2985

Support level: 1.2825, 1.2755

USDCHF, Daily: USDCHF was traded lower following prior breakout below the prior support level at 0.9590. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9520.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 98.20. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after its candle successfully close above the resistance level.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistnace level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1770.05.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90

280722 Morning Session Analysis

28 July 2022 Morning Session Analysis

US Dollar slipped after Fed unleashed its rate hike decision.

The Dollar Index which traded against a basket of six major currencies slumped on Thursday after the Federal Reserve announced its interest rate decision. According to the FOMC meeting in the early day, Fed had raised its interest rate by 75 basis point to 2.50%, which meet the consensus forecast. As the second consecutive 0.75% rate hikes did not surprise the market participants as well as the market had already digested the information about the interest rate increase, it stoked a shift in sentiment toward other assets which having better prospects. Nonetheless, Federal Reserve Chairman Jerome Powell claimed that the central bank would highly focus on the economic data in order to determine future moves at the September meeting. On the economic data front, the Dollar Index extended its losses amid the bearish economic data. According to National Association of Realtors, the US Pending Home Sales MoM for June notched down from the previous reading of 0.4% to -8.6%, missing the market expectation of -1.5%. The downbeat economic data had dialed down the market optimism toward economy progression in the US. As of writing, the Dollar Index eased by 0.66% to 106.34.

In the commodities market, the crude oil price appreciated by 0.90% to $98.15 per barrel as of writing. The US Crude Oil Inventories had decreased by 4.523M, which more than the market forecast of -1.037M. In addition, the gold price surged by 0.98% to $1736.00 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q2) | -1.60% | 0.40% | – |

| 20:30 | USD – Initial Jobless Claims | 251K | 253K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 107.30, 108.55

Support level: 106.30, 105.25

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2170, 1.2320

Support level: 1.2030, 1.1870

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 136.65, 137.35

Support level: 135.55, 134.25

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1753.25, 1766.20

Support level: 1737.30, 1718.90