140723 Morning Session Analysis

14 July 2023 Morning Session Analysis

The dollar fell as PPI showed further signs of slowing inflation.

The dollar index, which was traded against a basket of six major currencies, continued to weaken as the US inflationary pressures showed further sign of easing. In June, U.S. producer prices index saw minimal growth, indicating a further decline in inflationary pressures and providing additional evidence of the economy’s transition into a disinflation phase. According to the Labor Department’s report on Thursday, the producer price index for final demand increased by a mere 0.1% during the previous month. Over the 12 months leading up to June, the PPI experienced a meager 0.1% gain. This marks the smallest year-on-year increase since August 2020 and follows a 0.9% rise in May. These findings align with recent data from Wednesday, which revealed a slight increase in consumer prices for June. The overall trend suggests that inflation is subsiding as supply chain bottlenecks gradually dissipate and demand for goods slows down in response to higher interest rates. However, the losses of the dollar index were limited by the upbeat initial jobless claims. According to the Department of Labor, the number of American who filed for unemployment claims only rose by 237K, lower than the market expectation at 250K, showing that the US labor market remained tight. As of writing, the dollar index dropped -0.76% to 99.75.

In the commodities market, crude oil prices edged up by 1.73% to $77.15 per barrel, buoyed by a significant decline in the value of the U.S. dollar against major currencies. Besides, gold prices ticked up 0.03% to $1960.00 per troy ounce as the US PPI data showed further signs of easing.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Michigan Consumer Sentiment (Jul) | 65.5 | 64.4 | – |

Technical Analysis

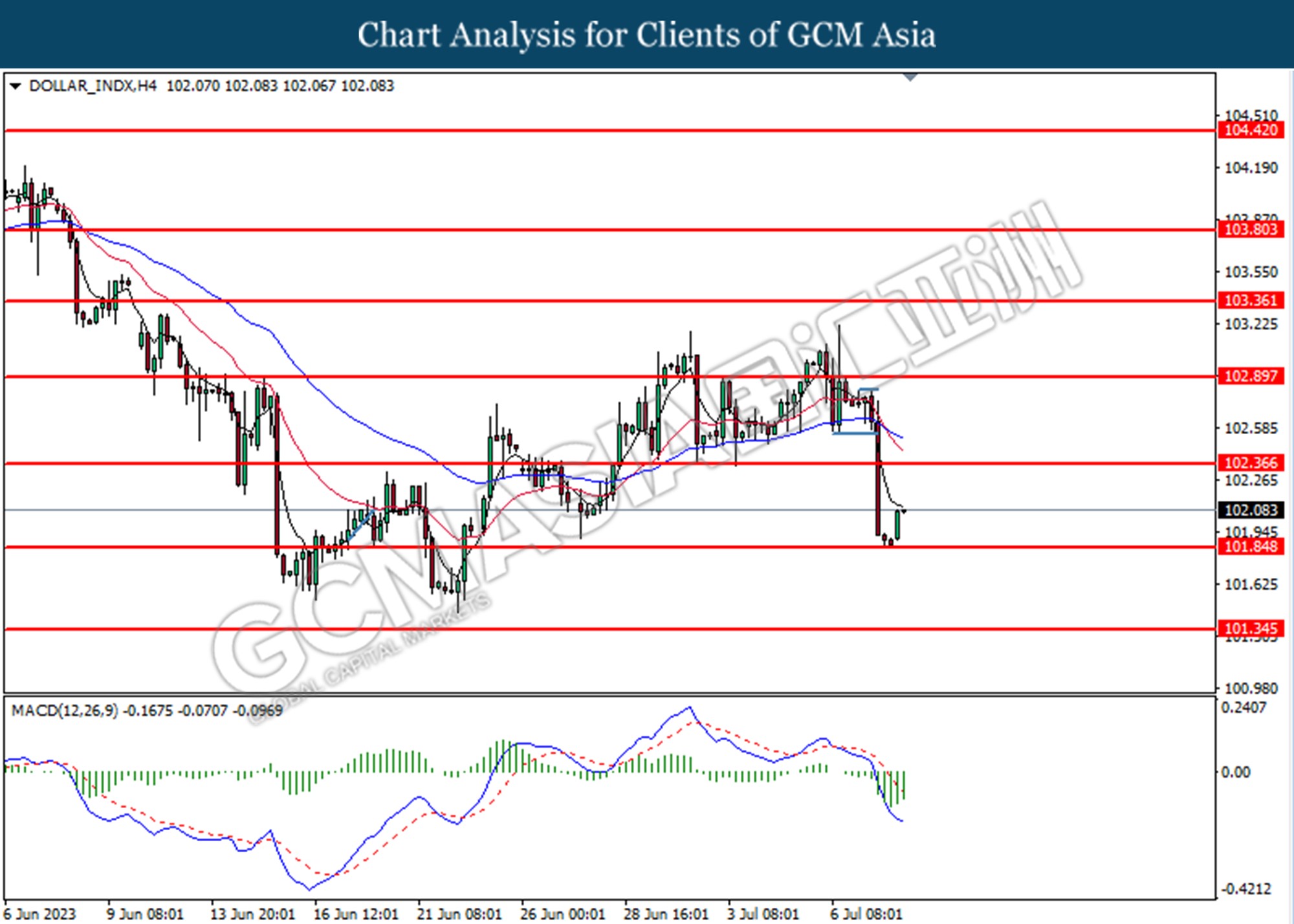

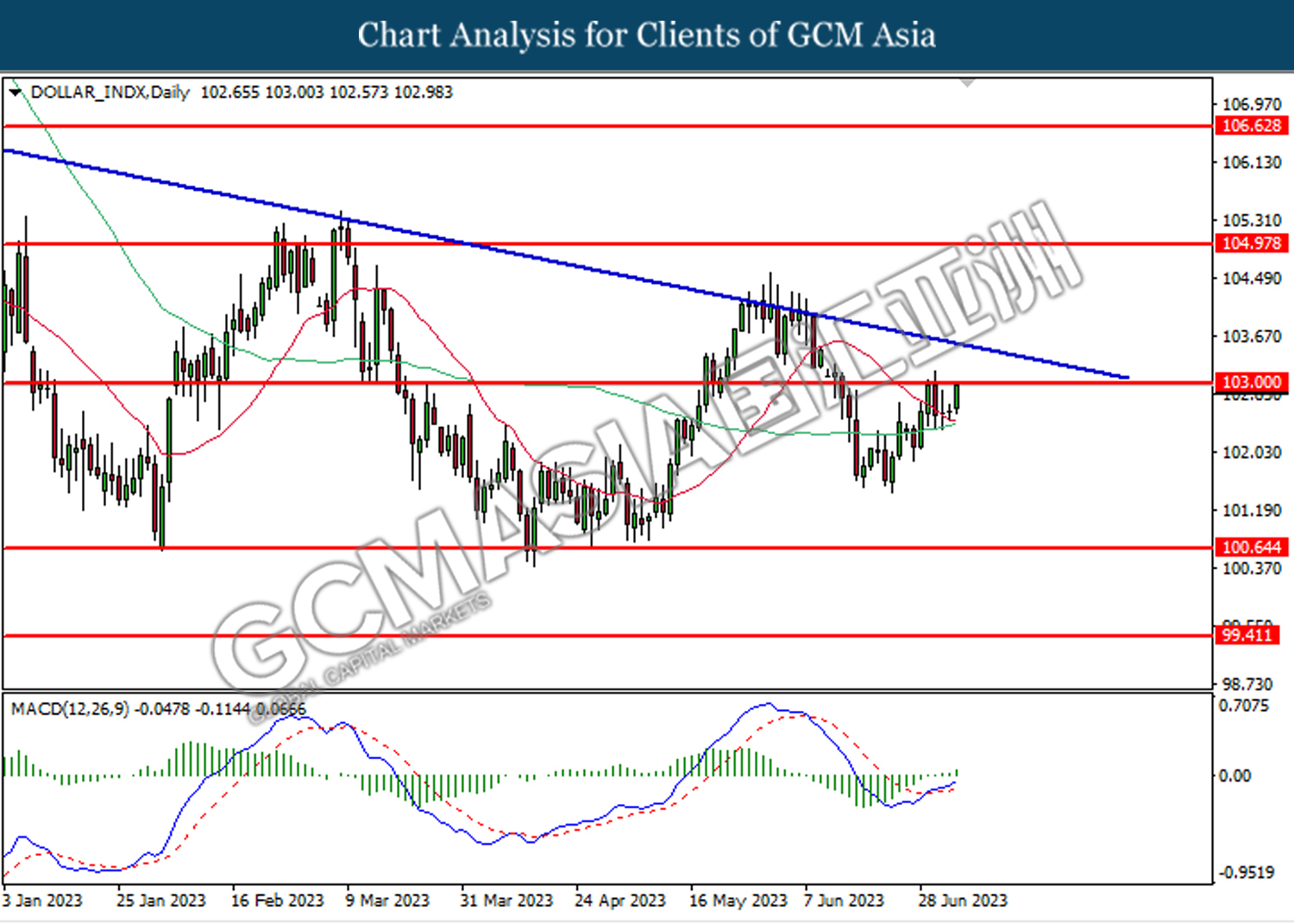

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 99.40. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level at 99.40.

Resistance level: 100.65, 103.00

Support level: 99.40, 97.75

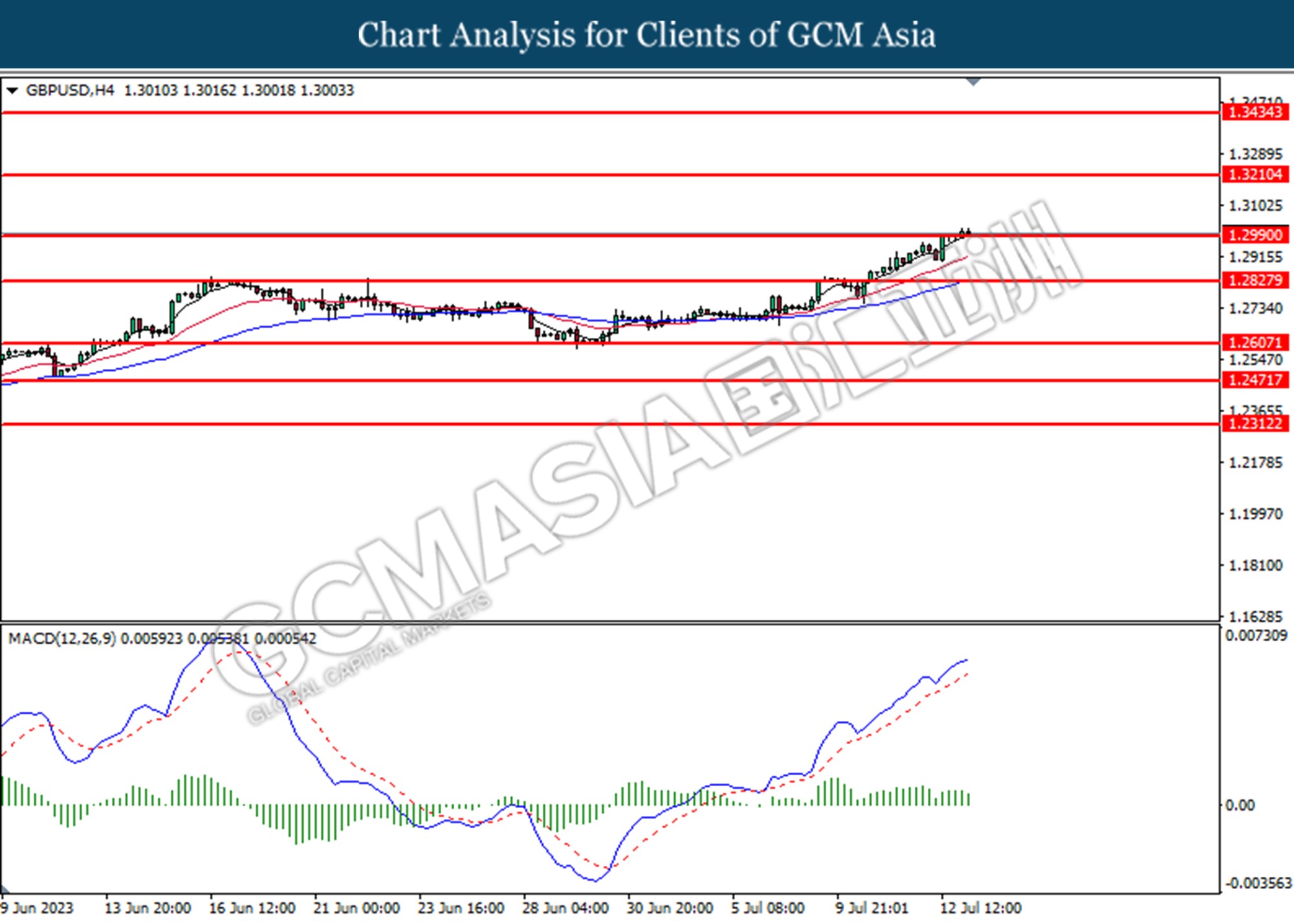

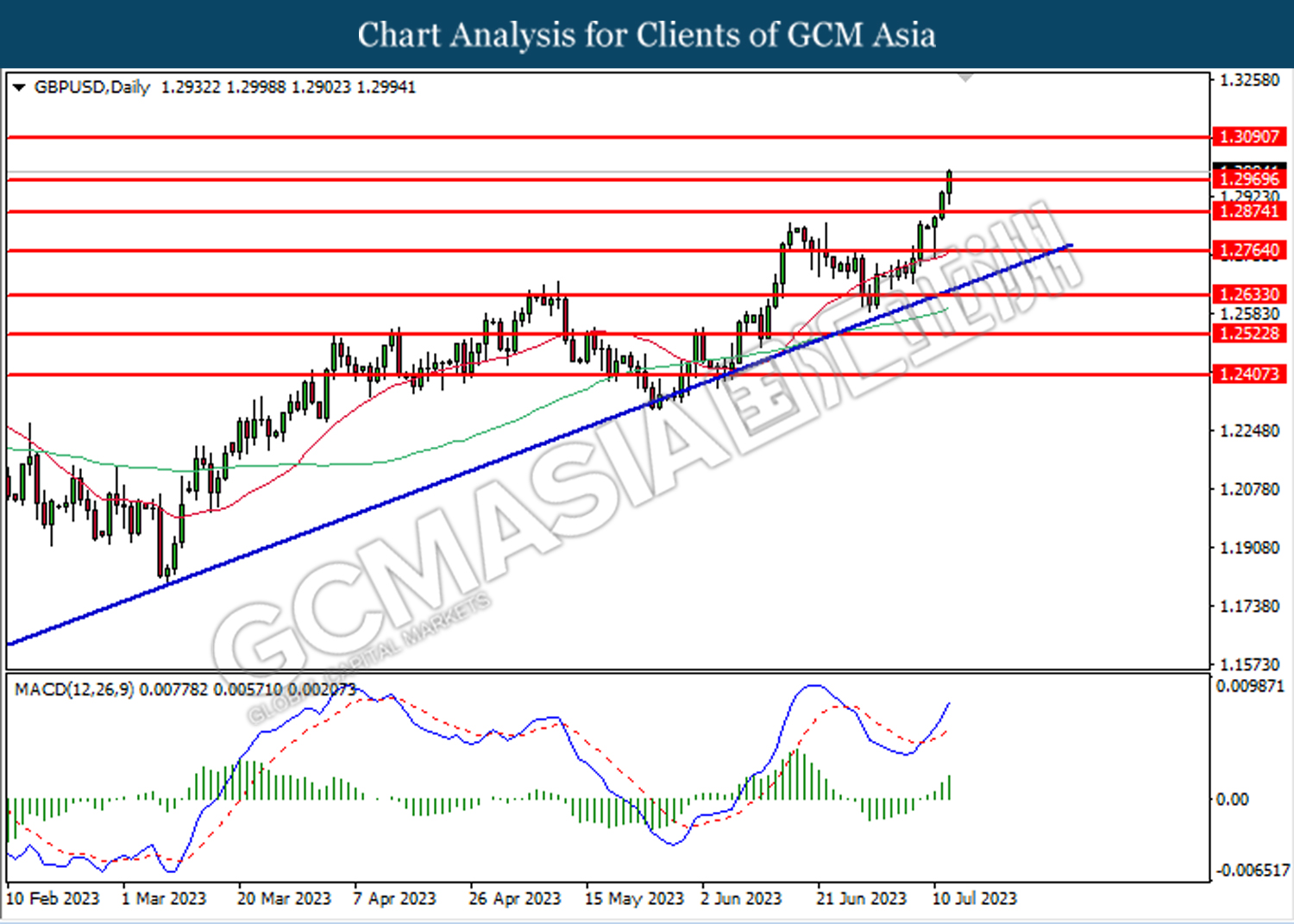

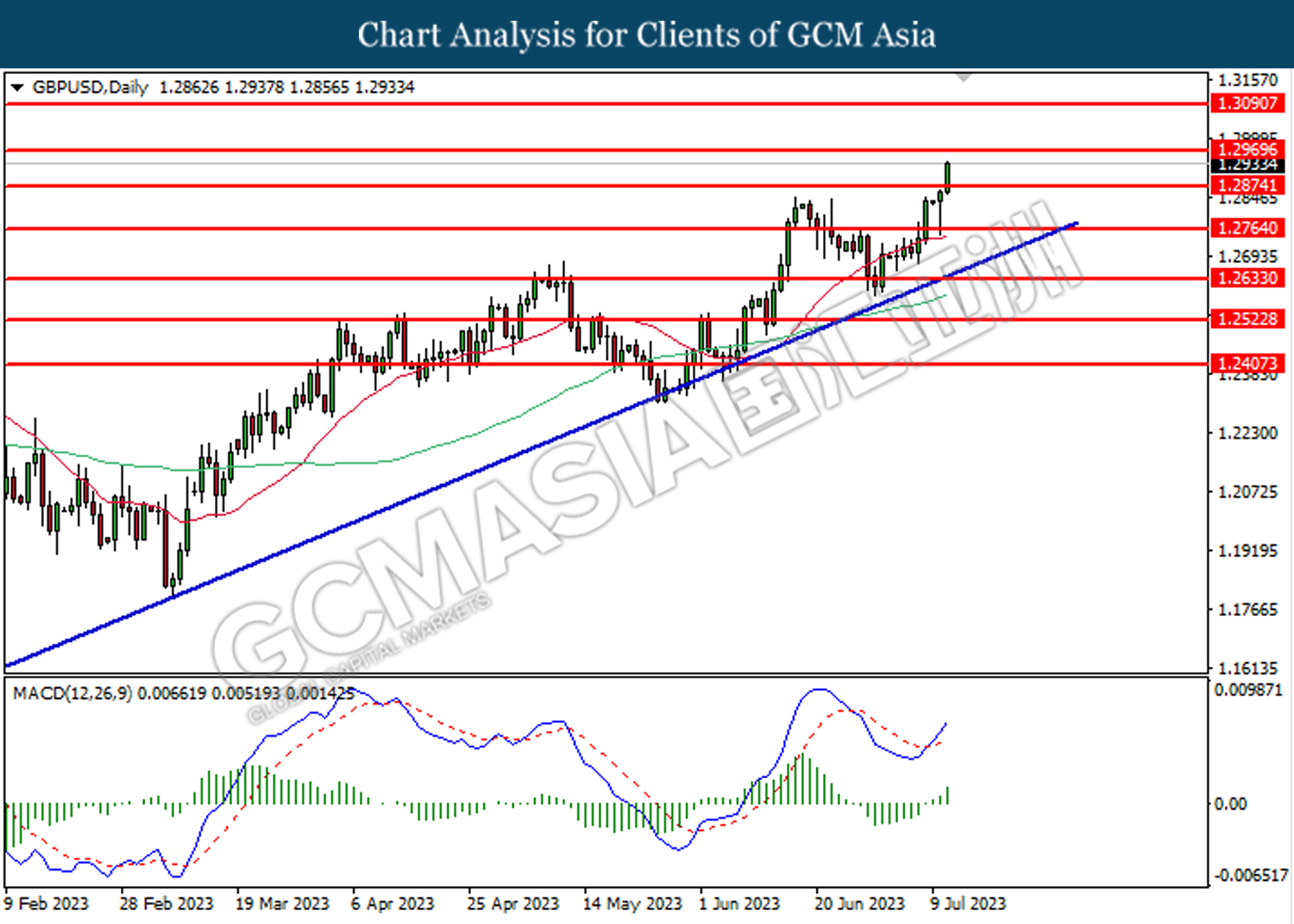

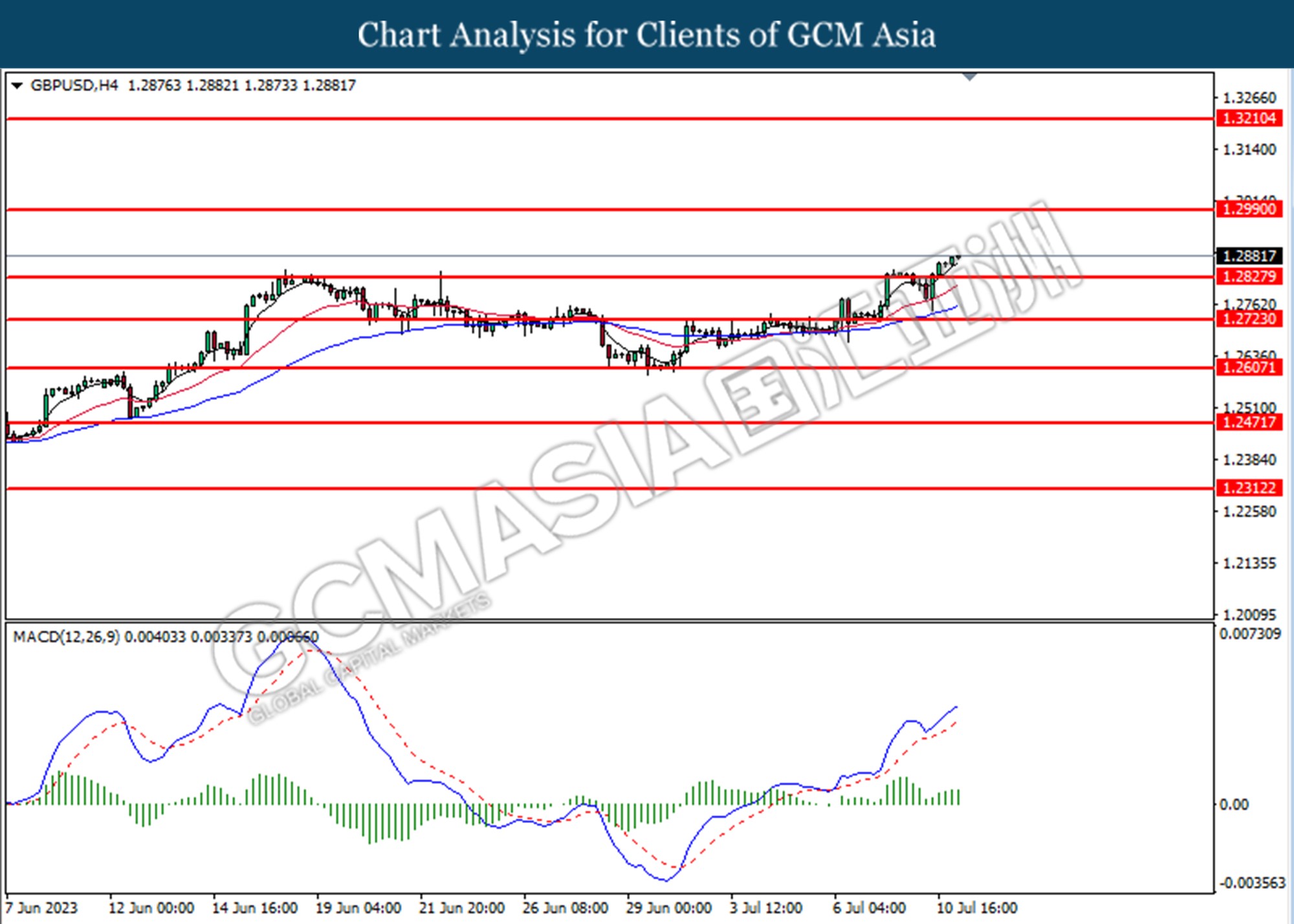

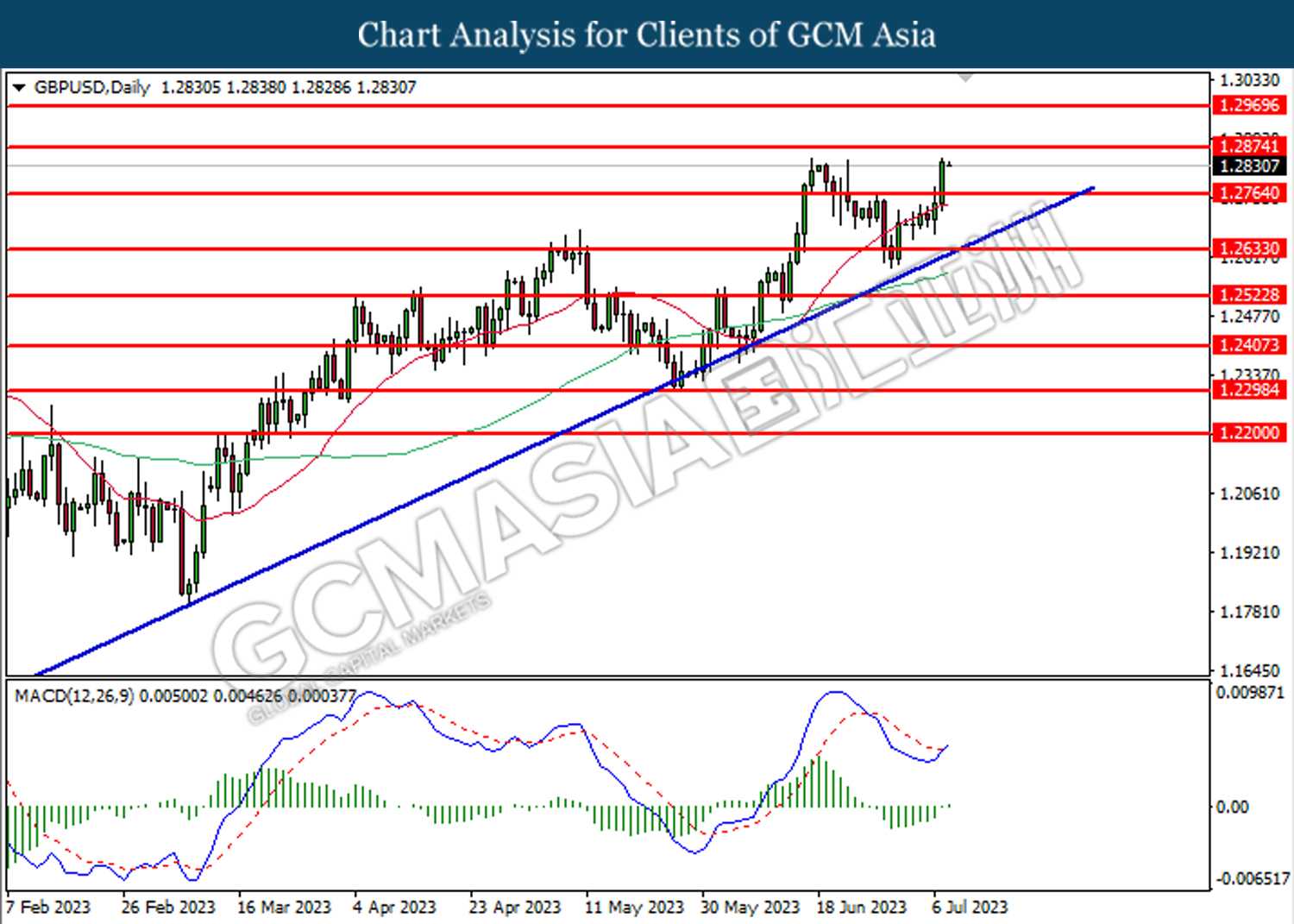

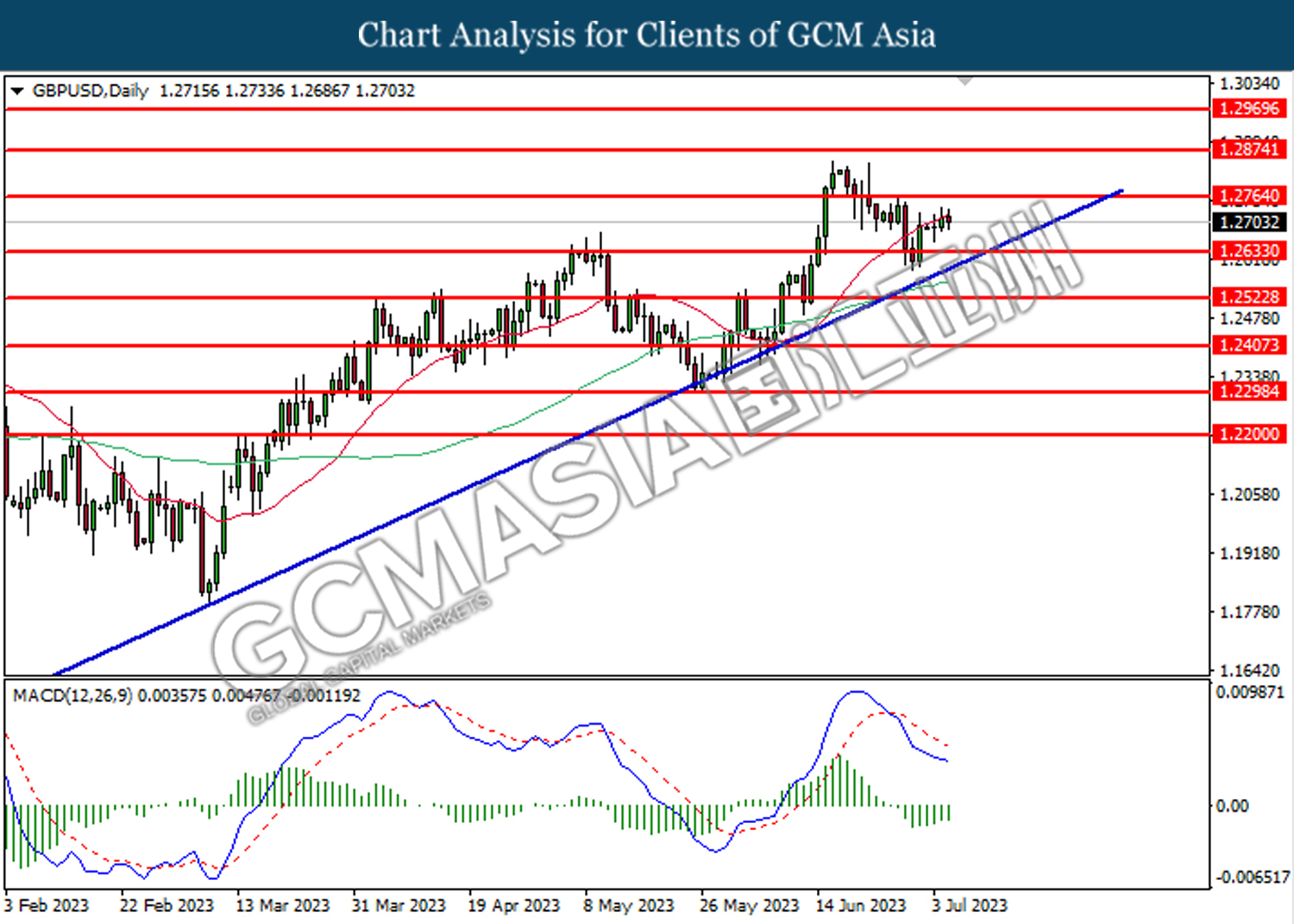

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.3090. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.3090.

Resistance level: 1.3090, 1.3260

Support level: 1.2970, 1.2875

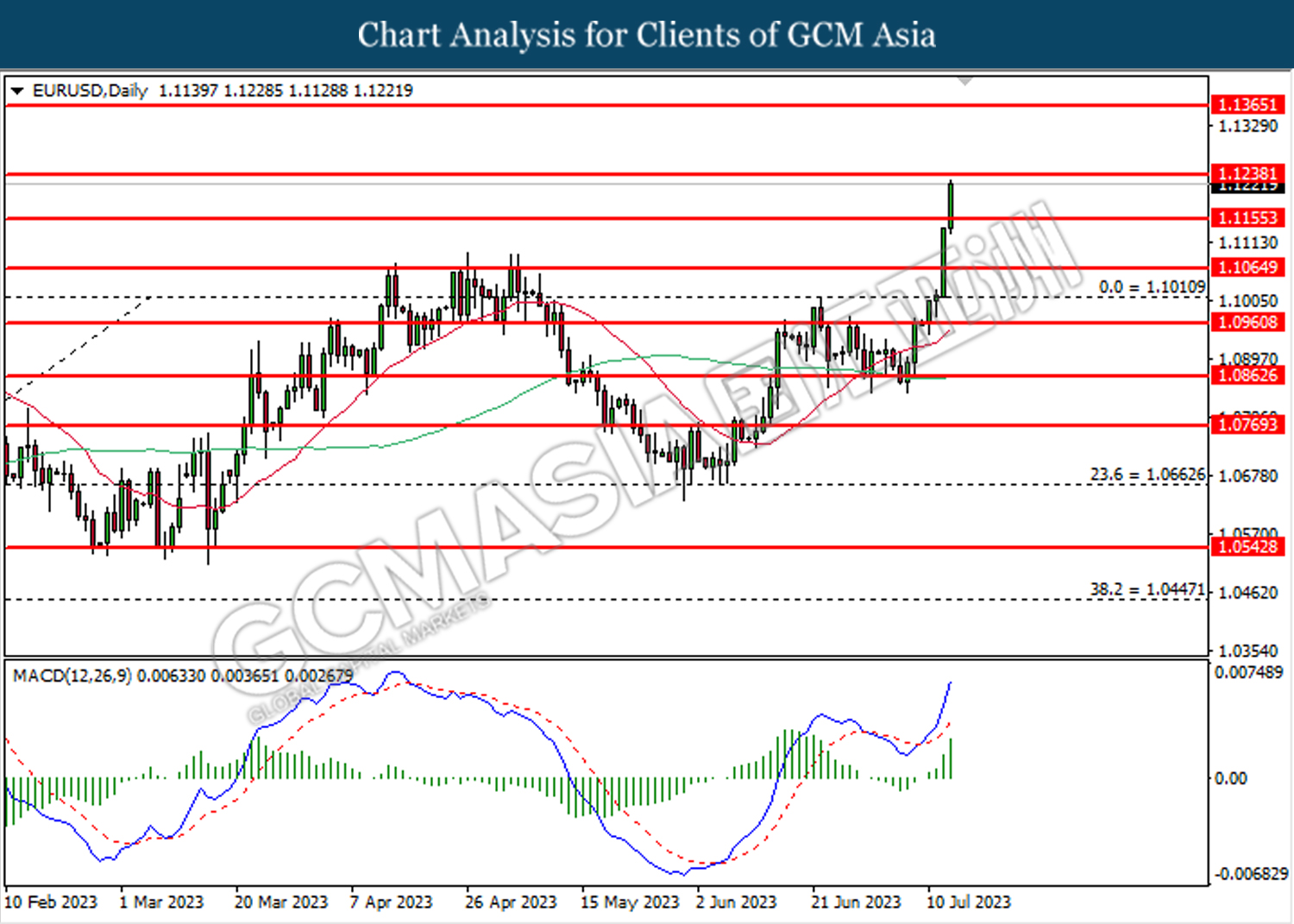

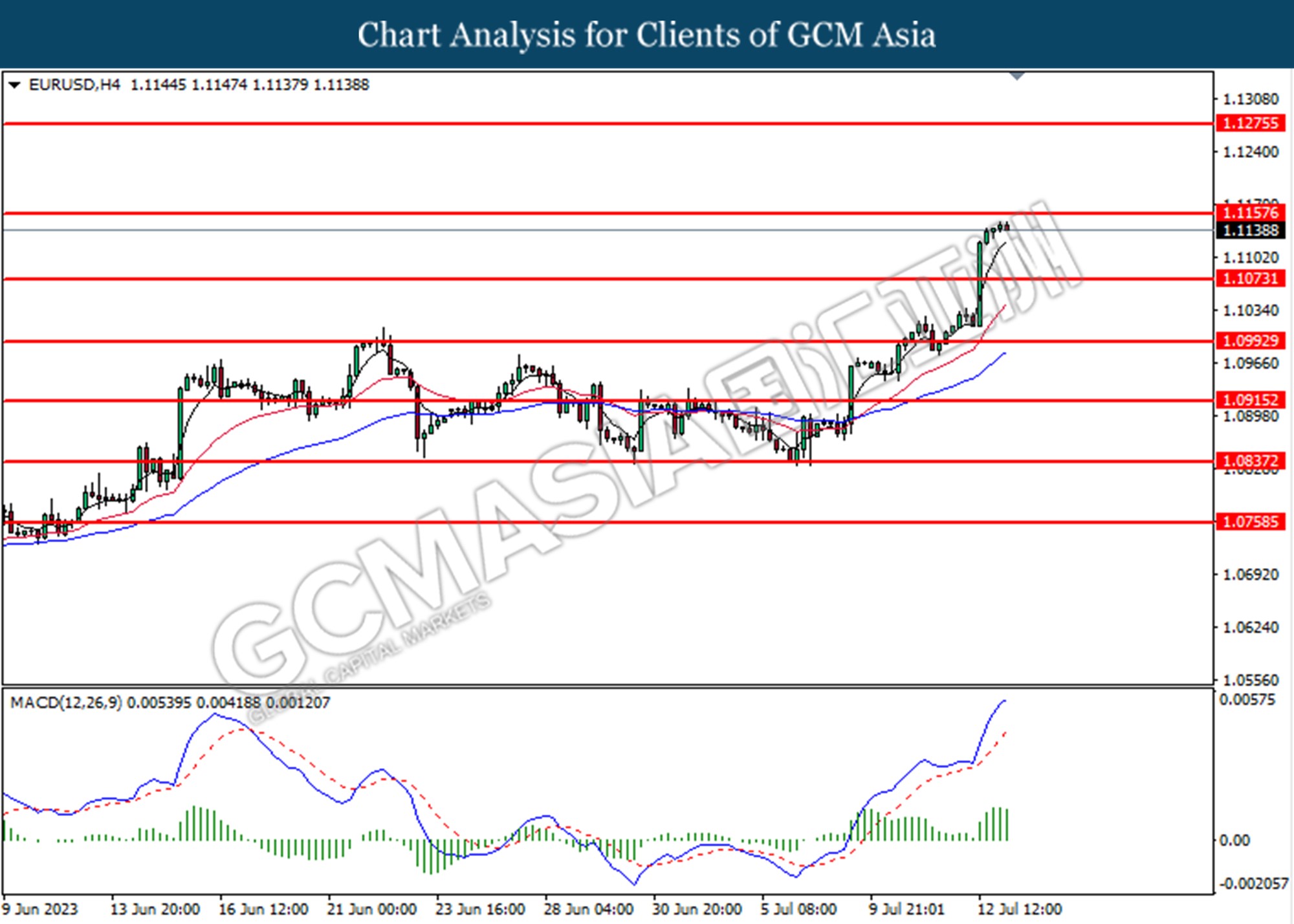

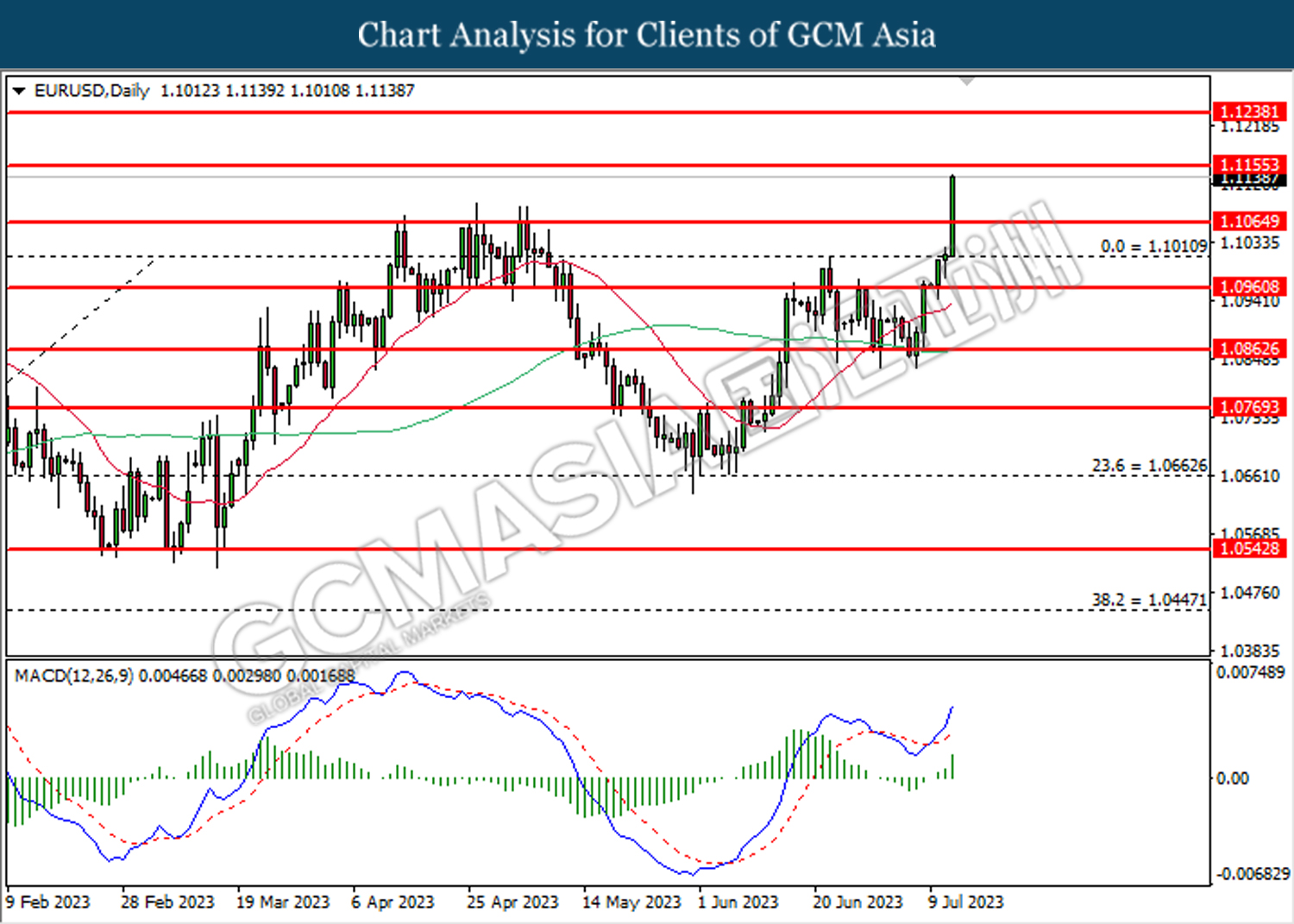

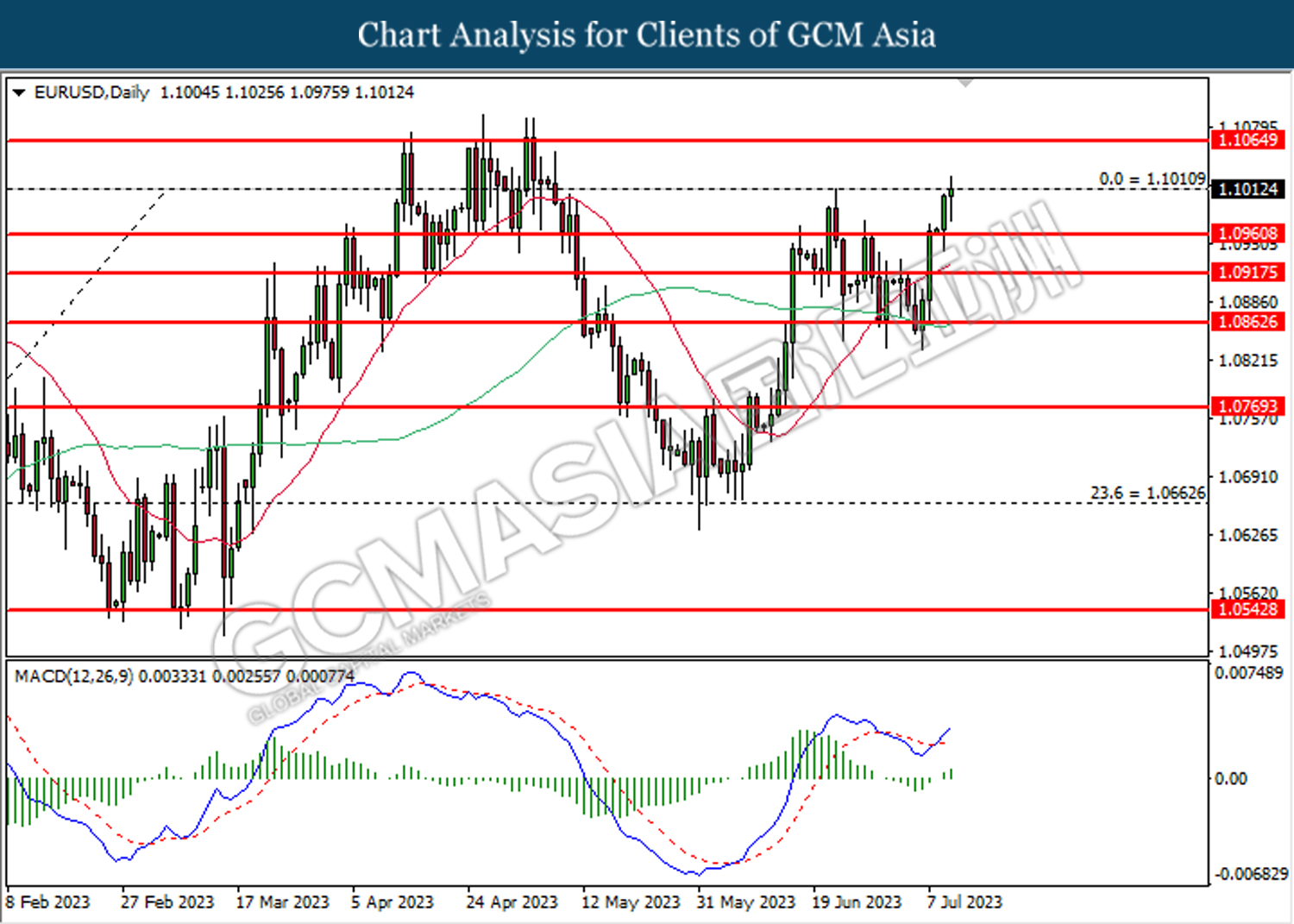

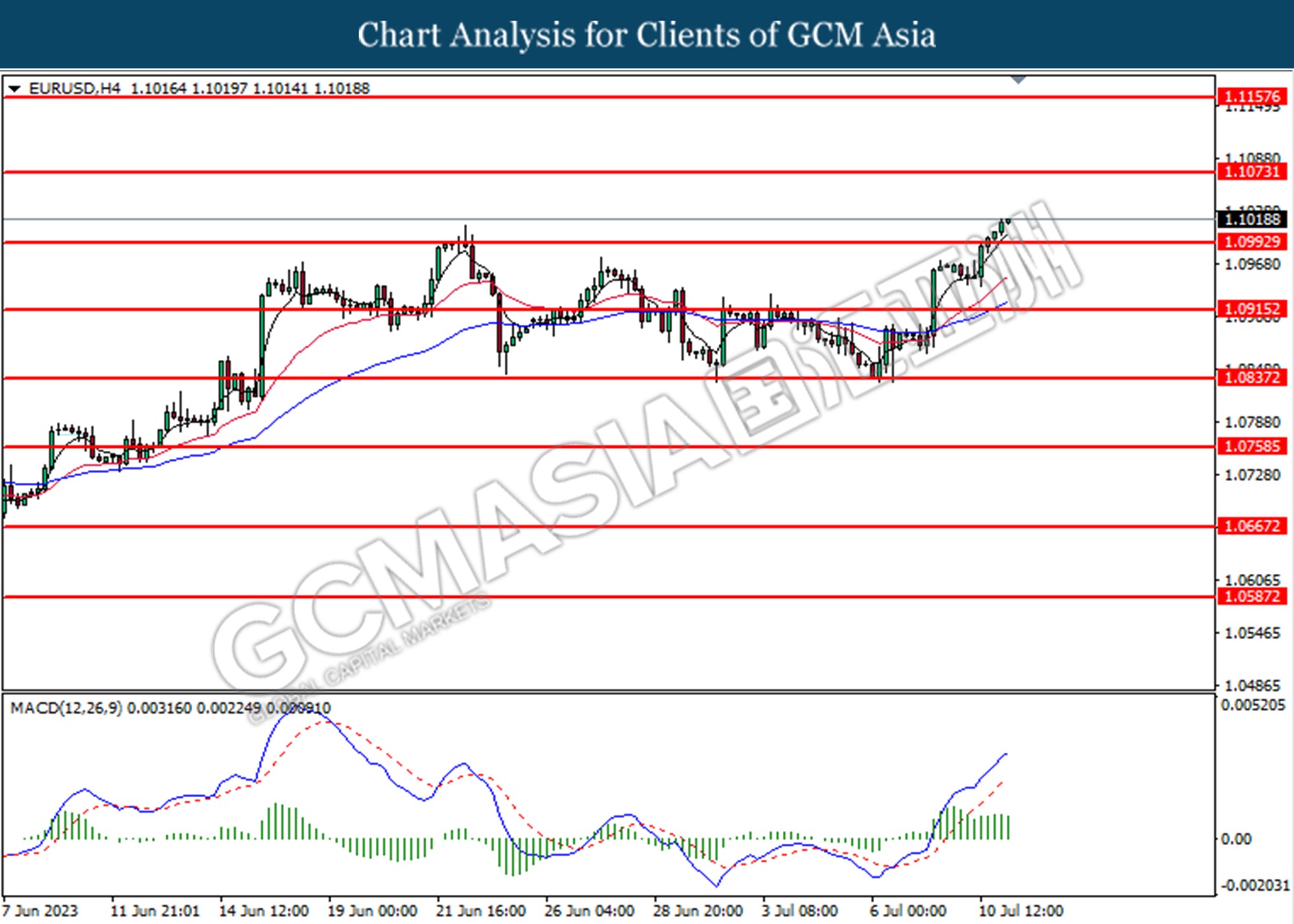

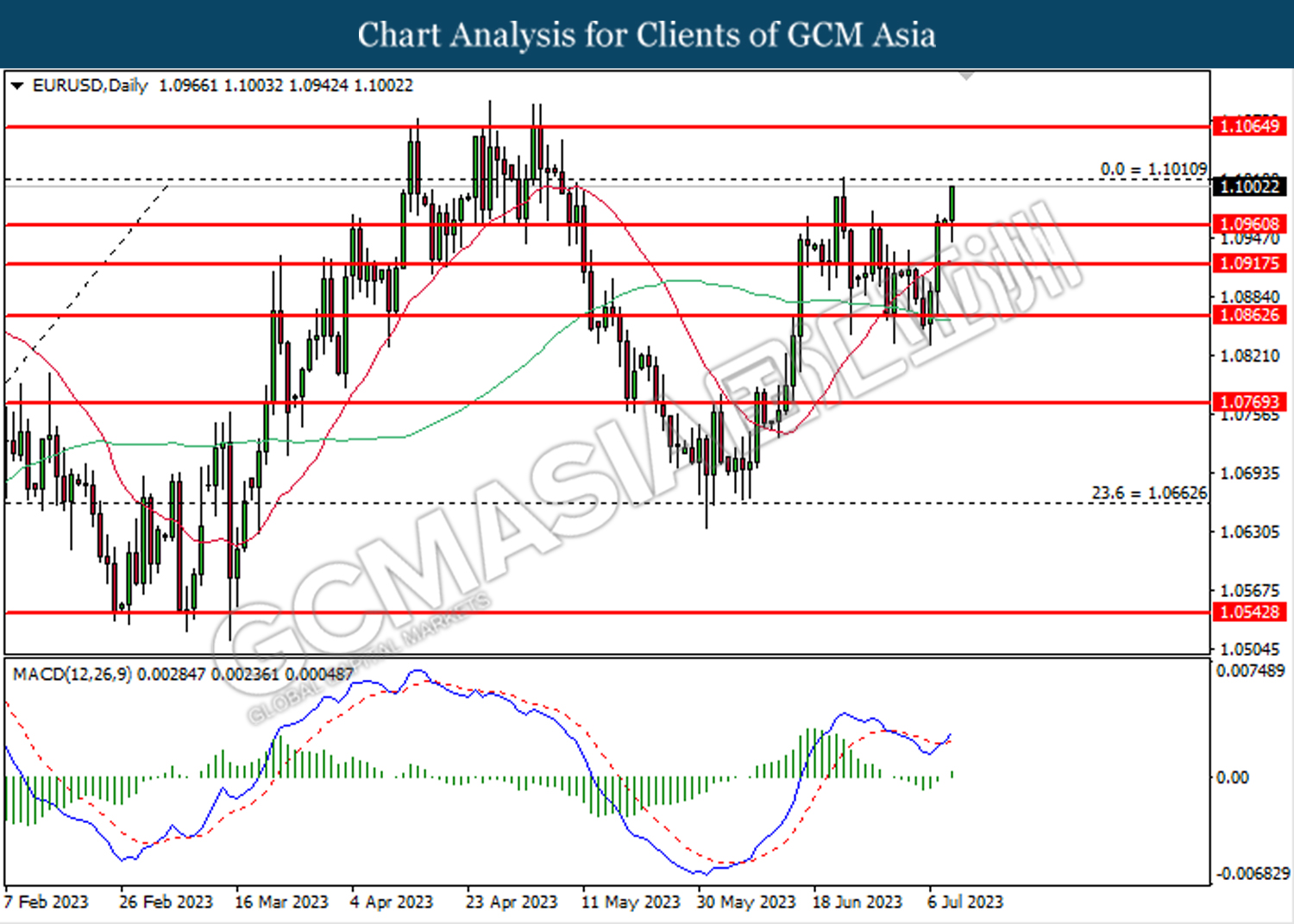

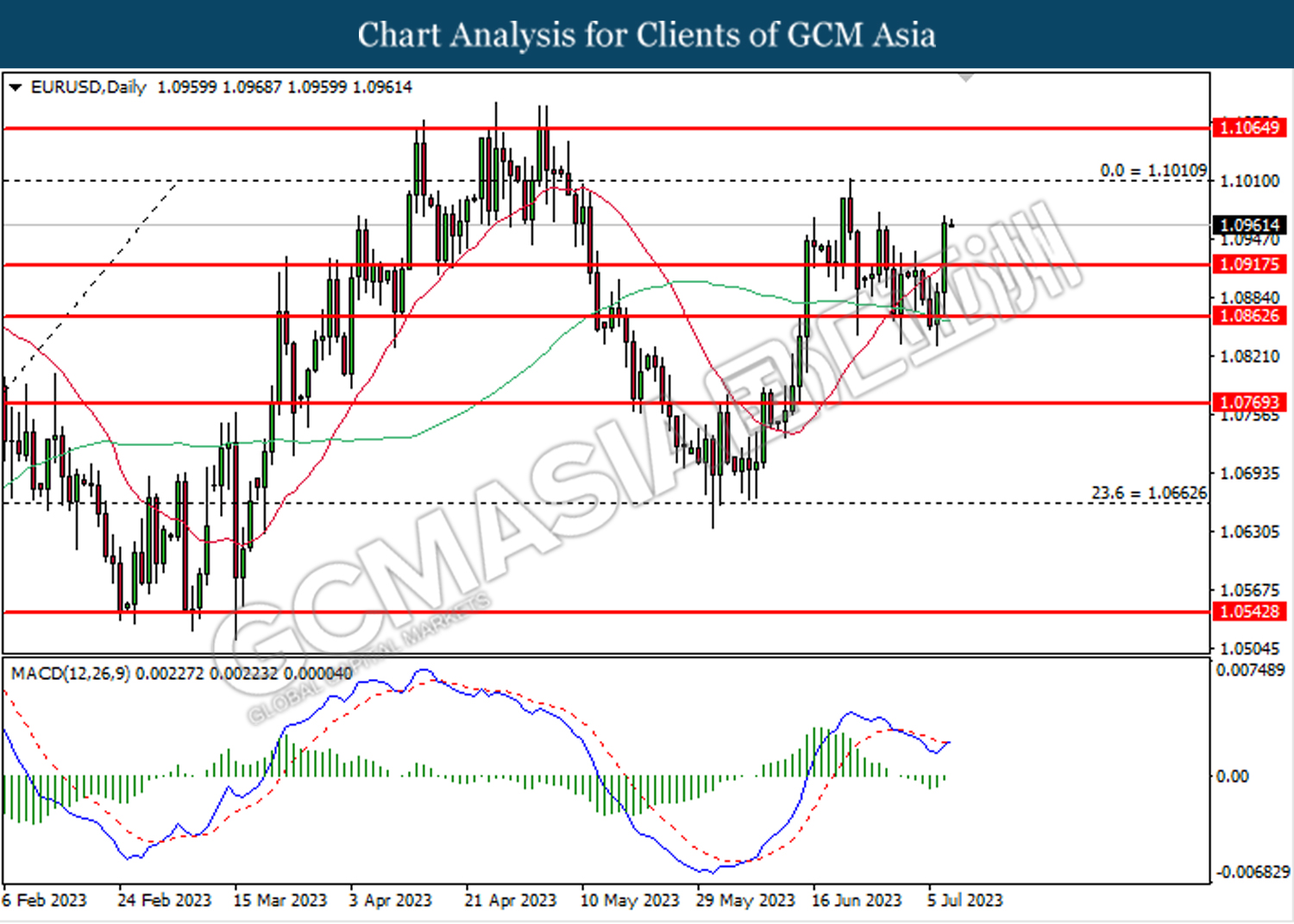

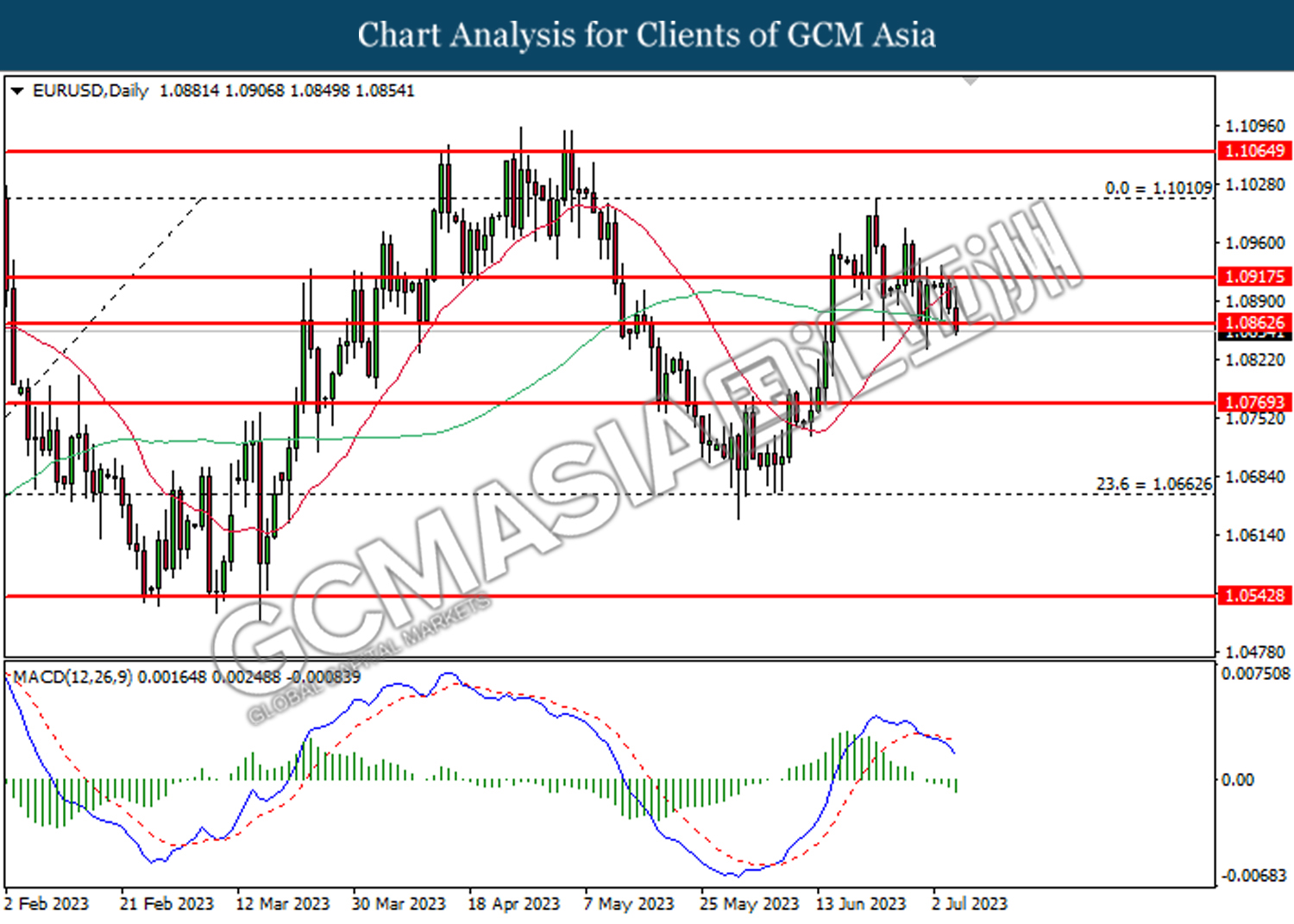

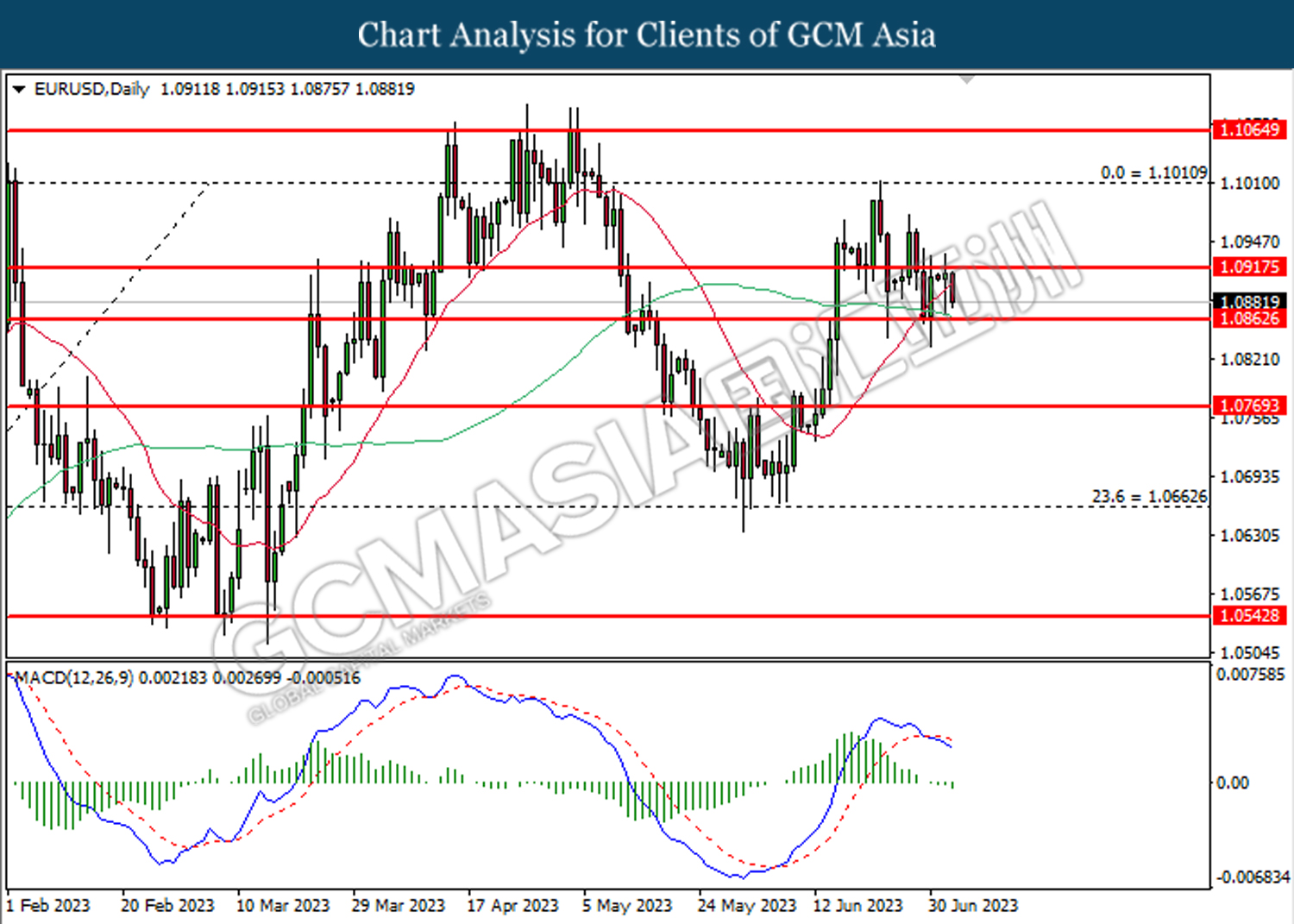

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.1155. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1240.

Resistance level: 1.1240, 1.1365

Support level: 1.1155, 1.1065

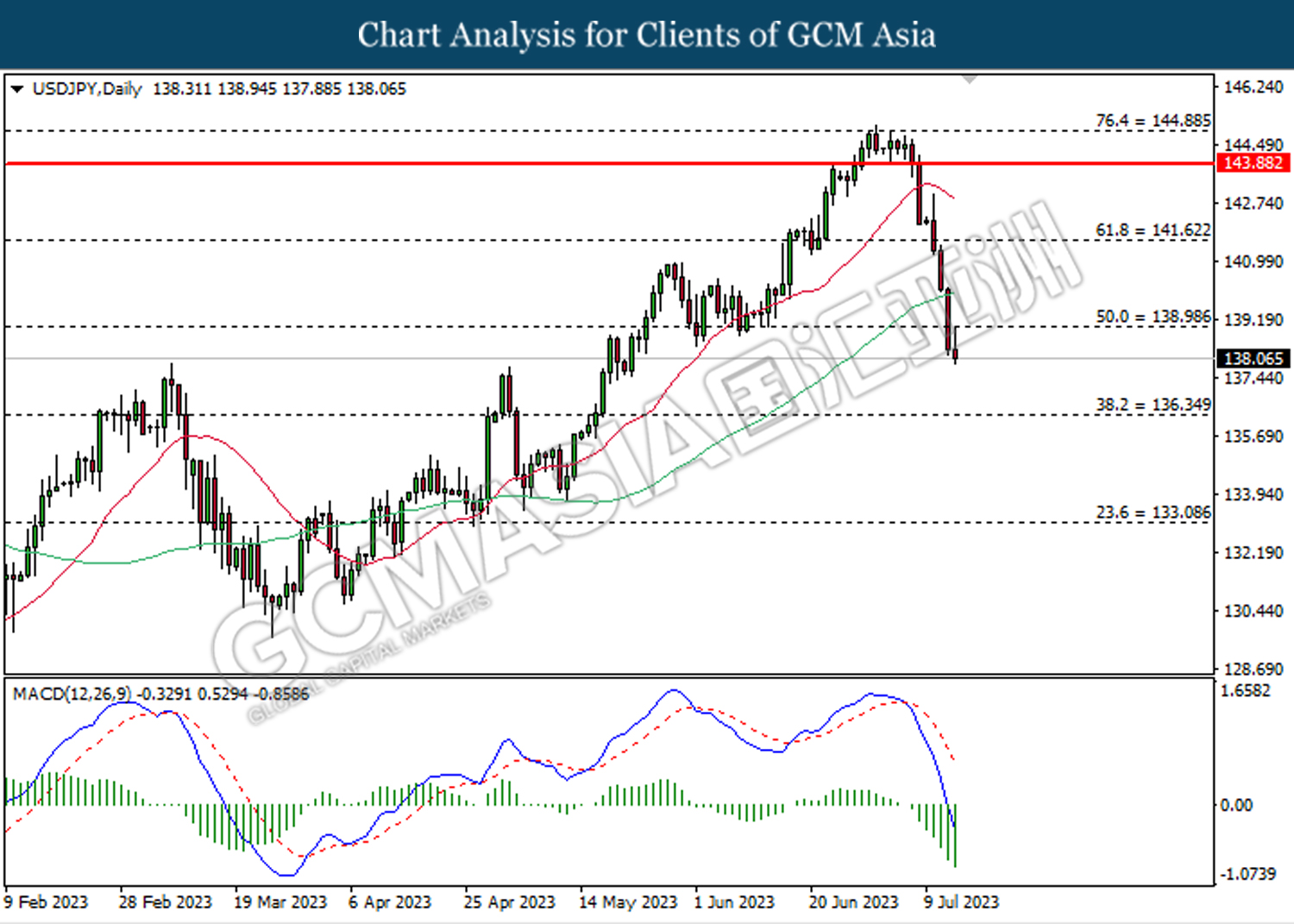

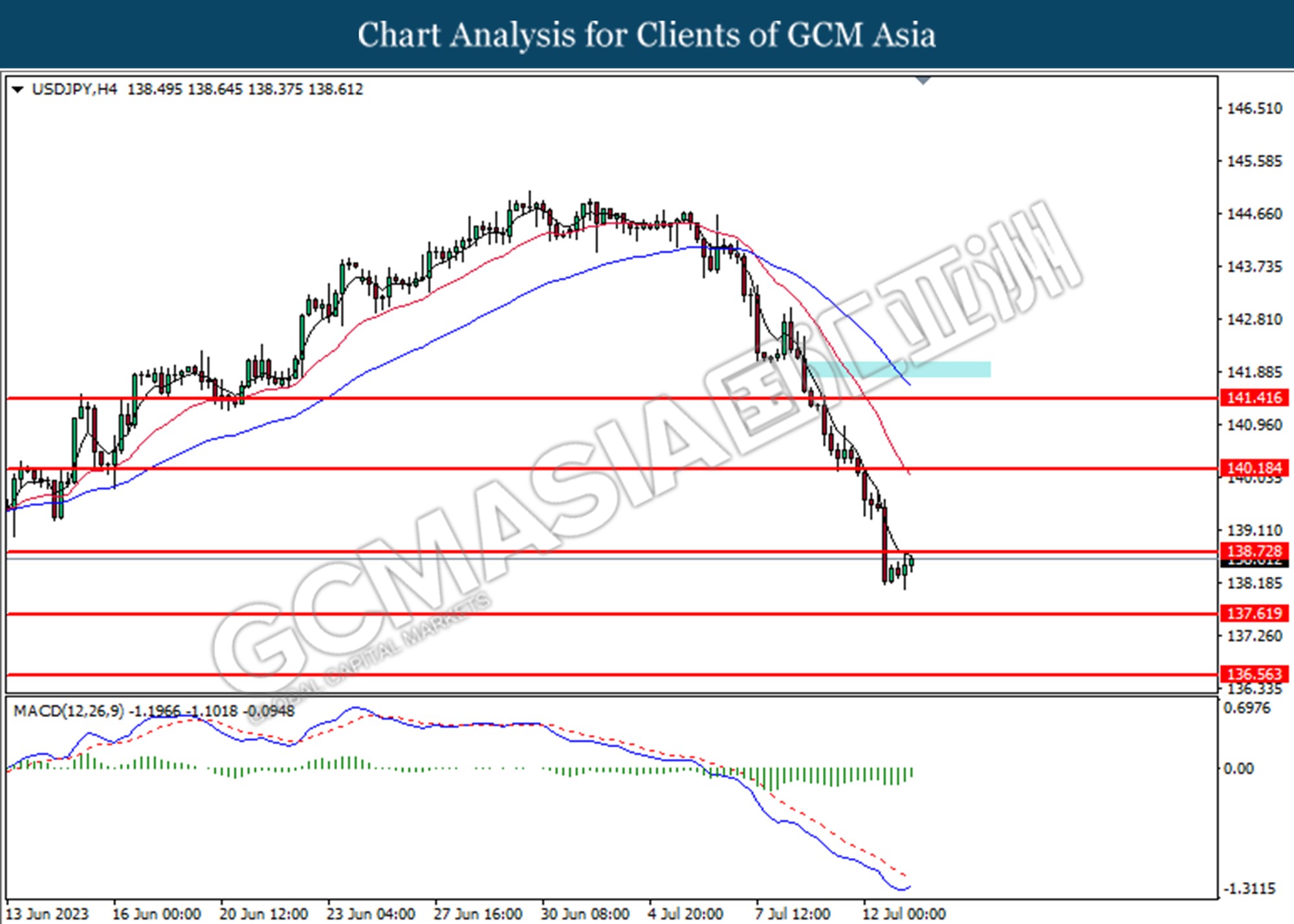

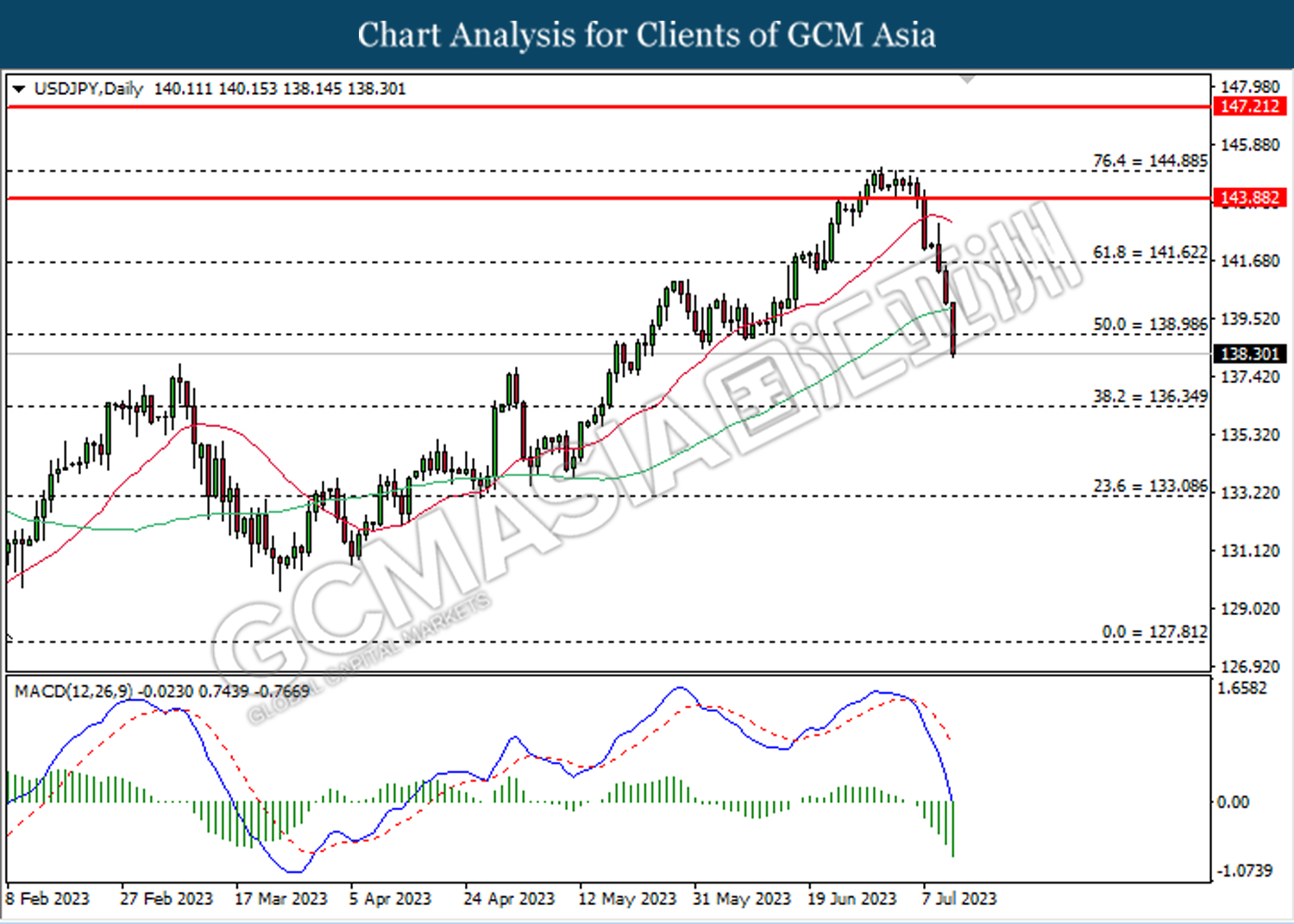

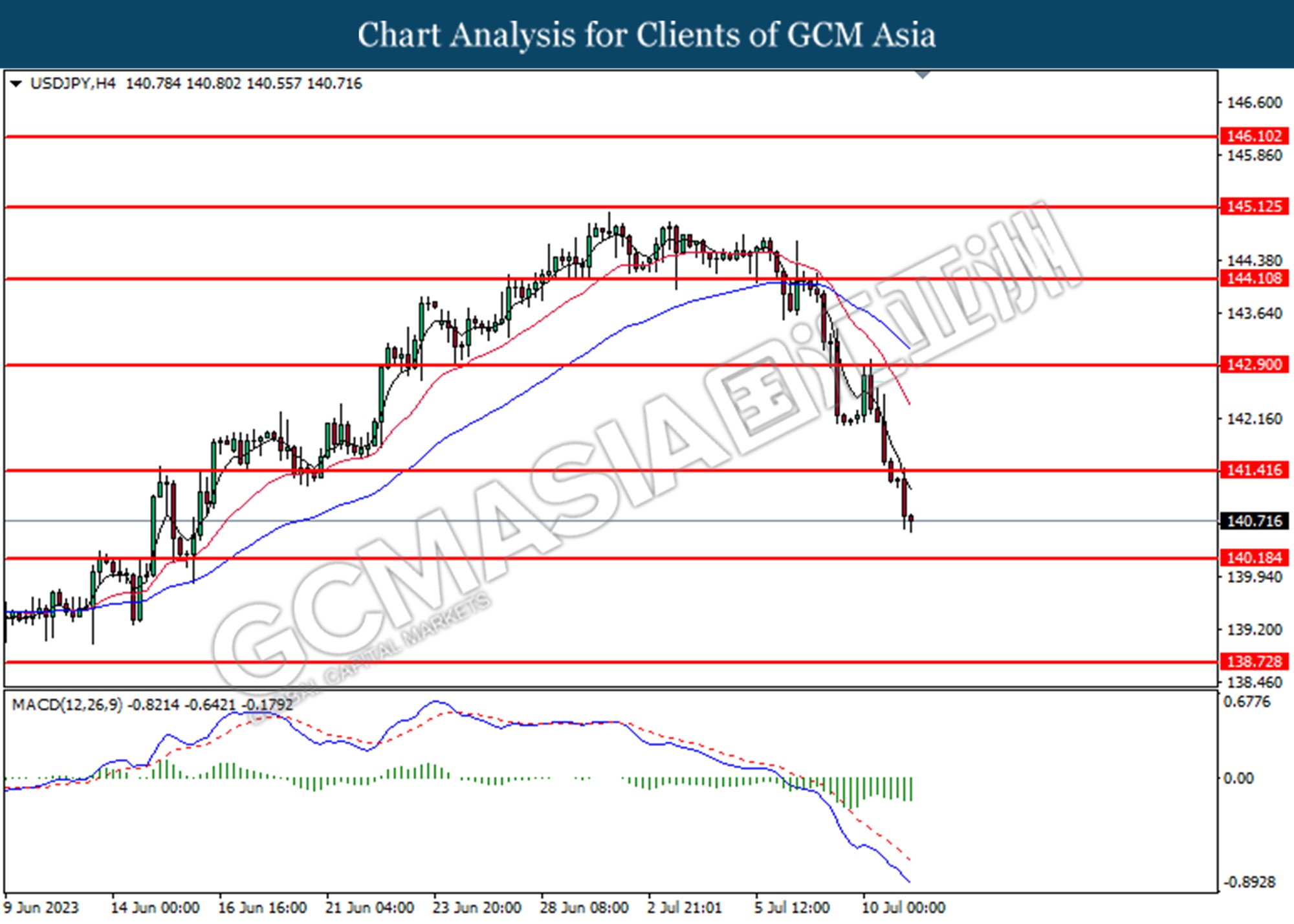

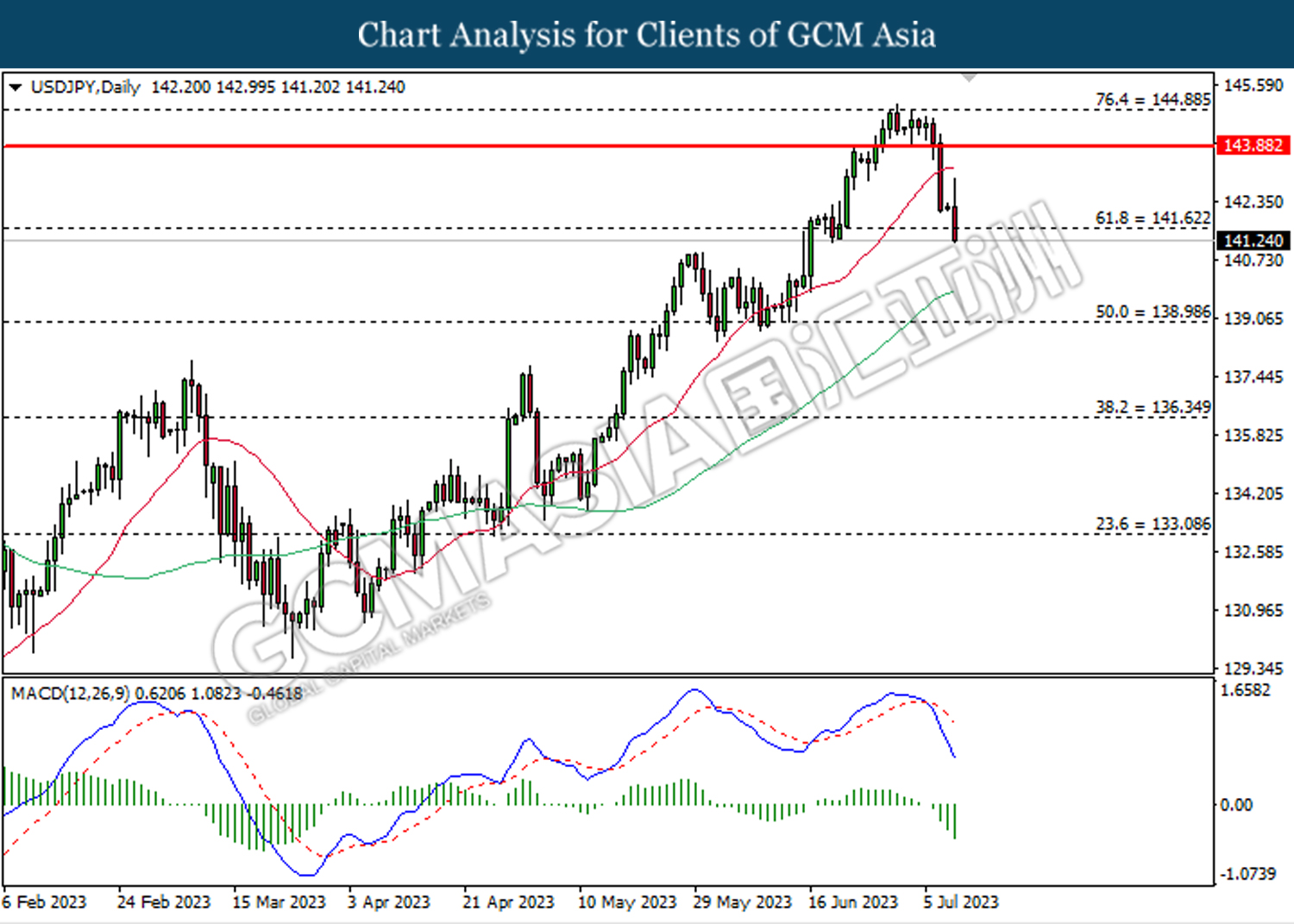

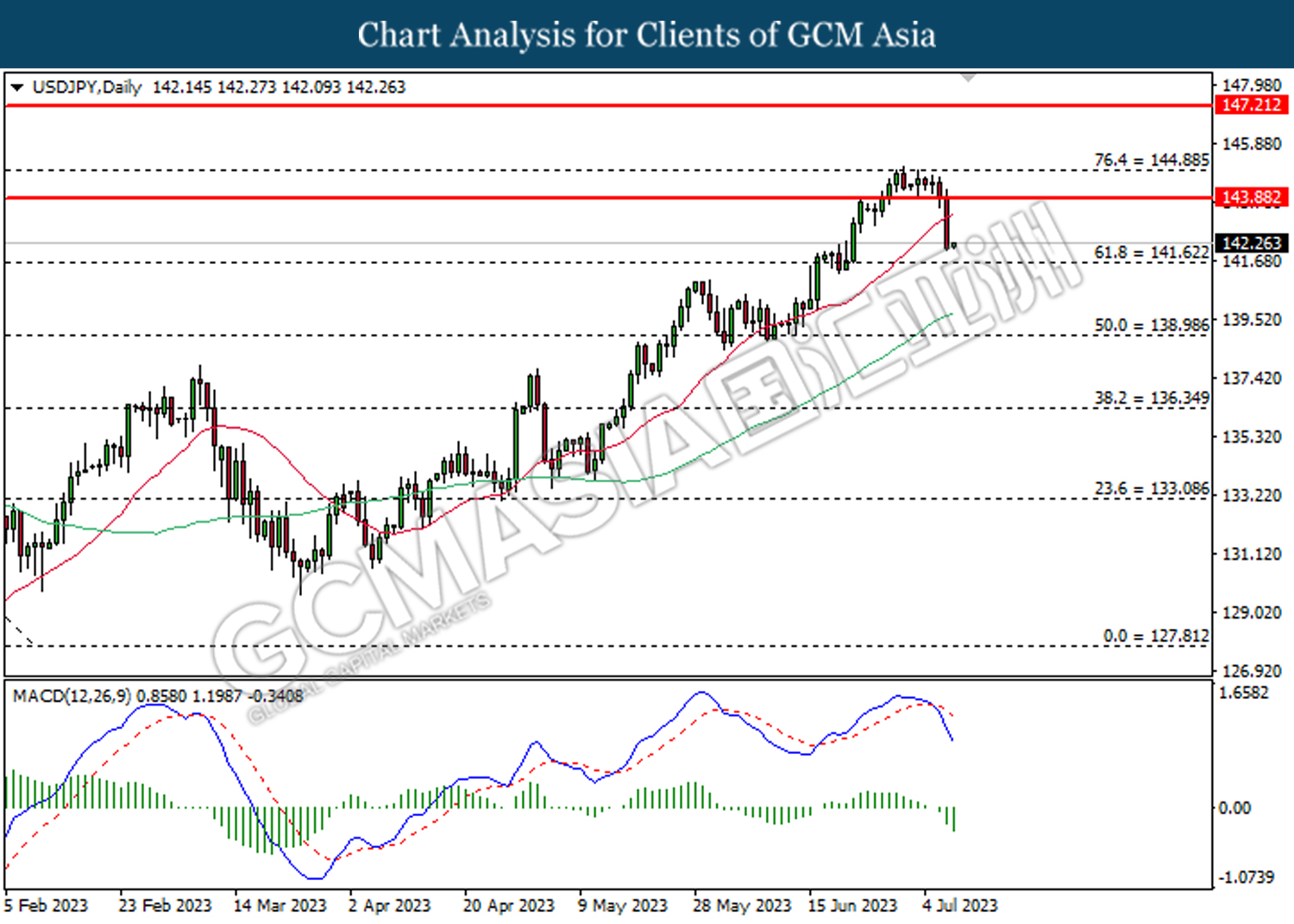

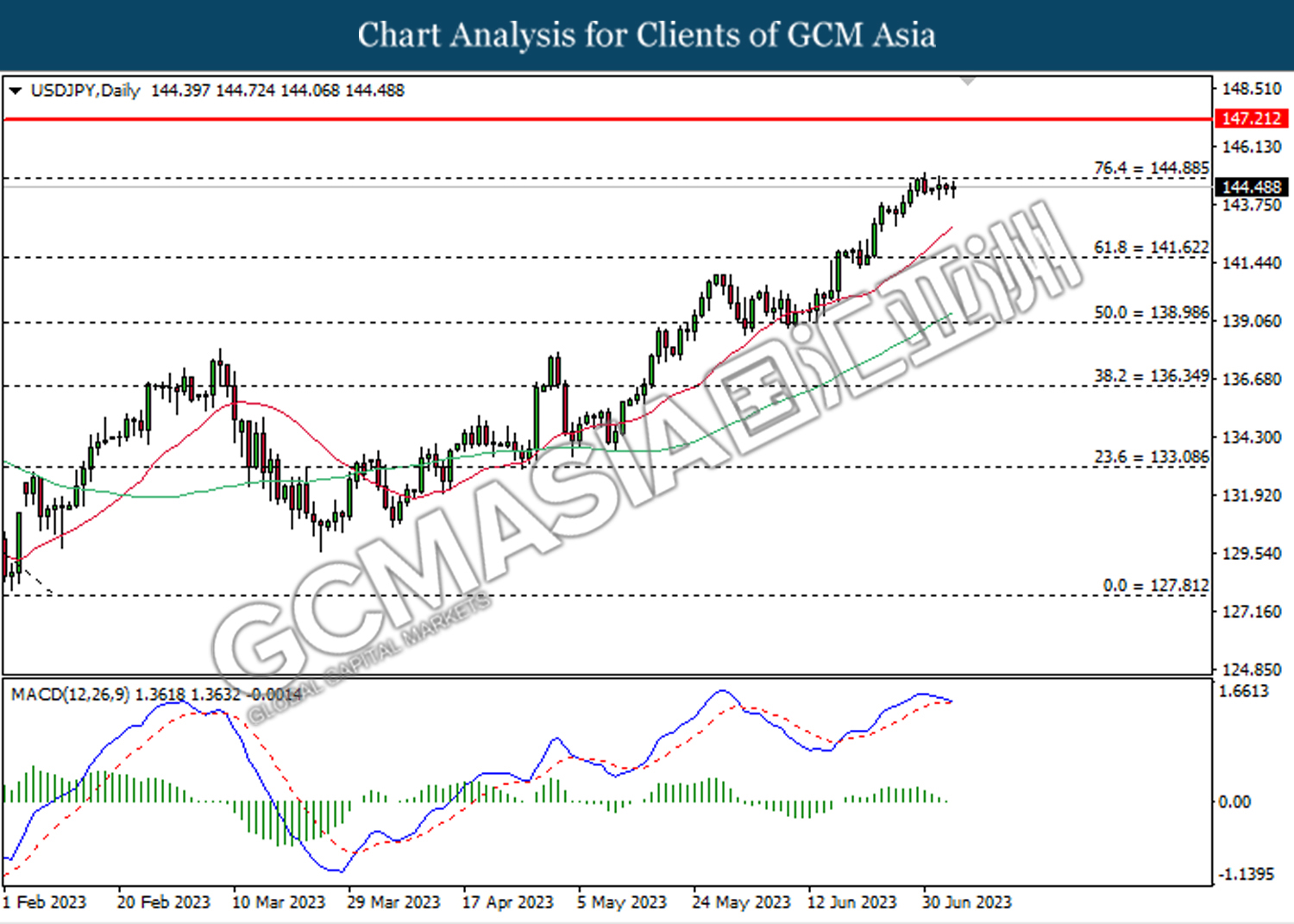

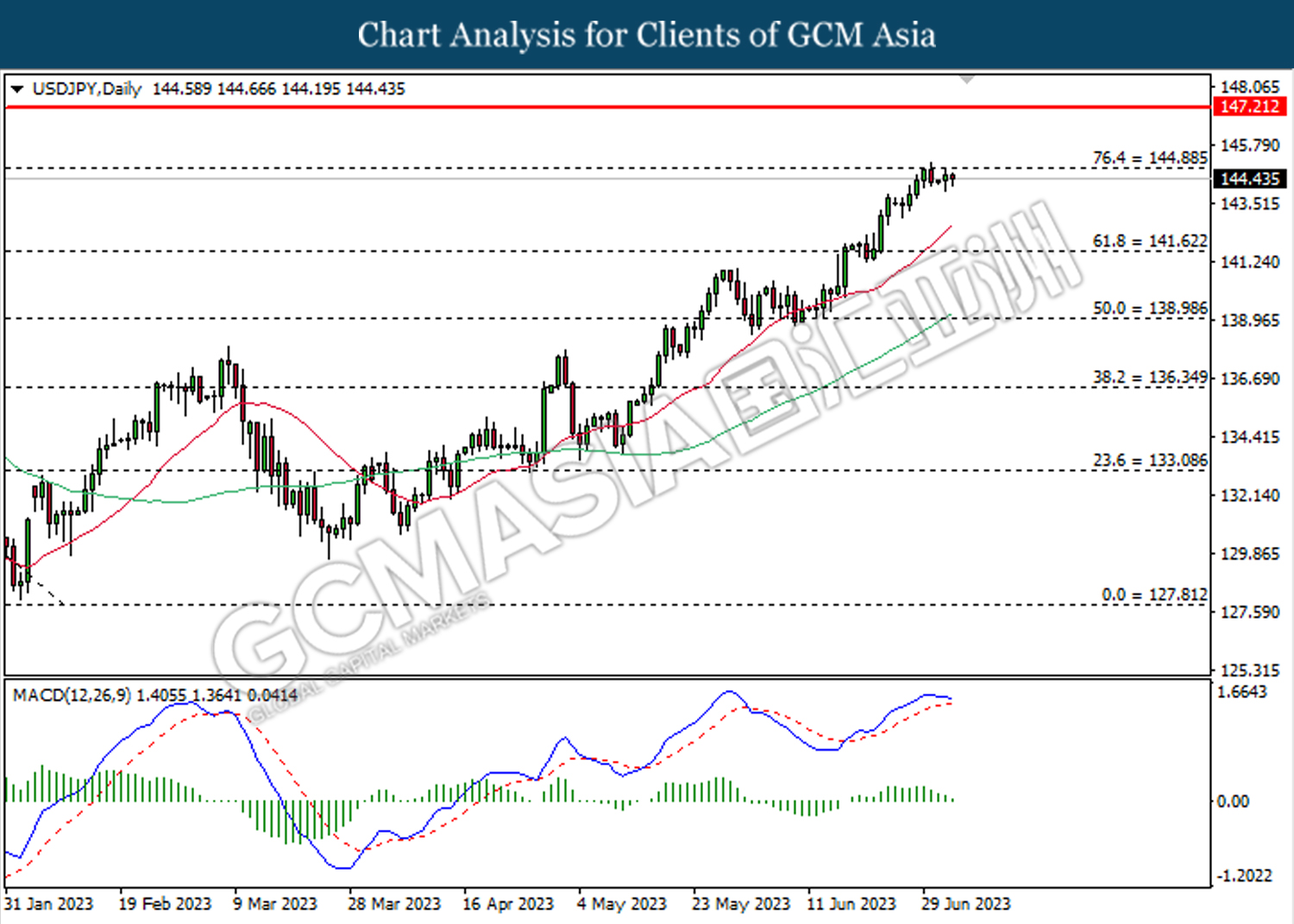

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 139.00. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 139.00, 141.60

Support level: 136.35, 133.10

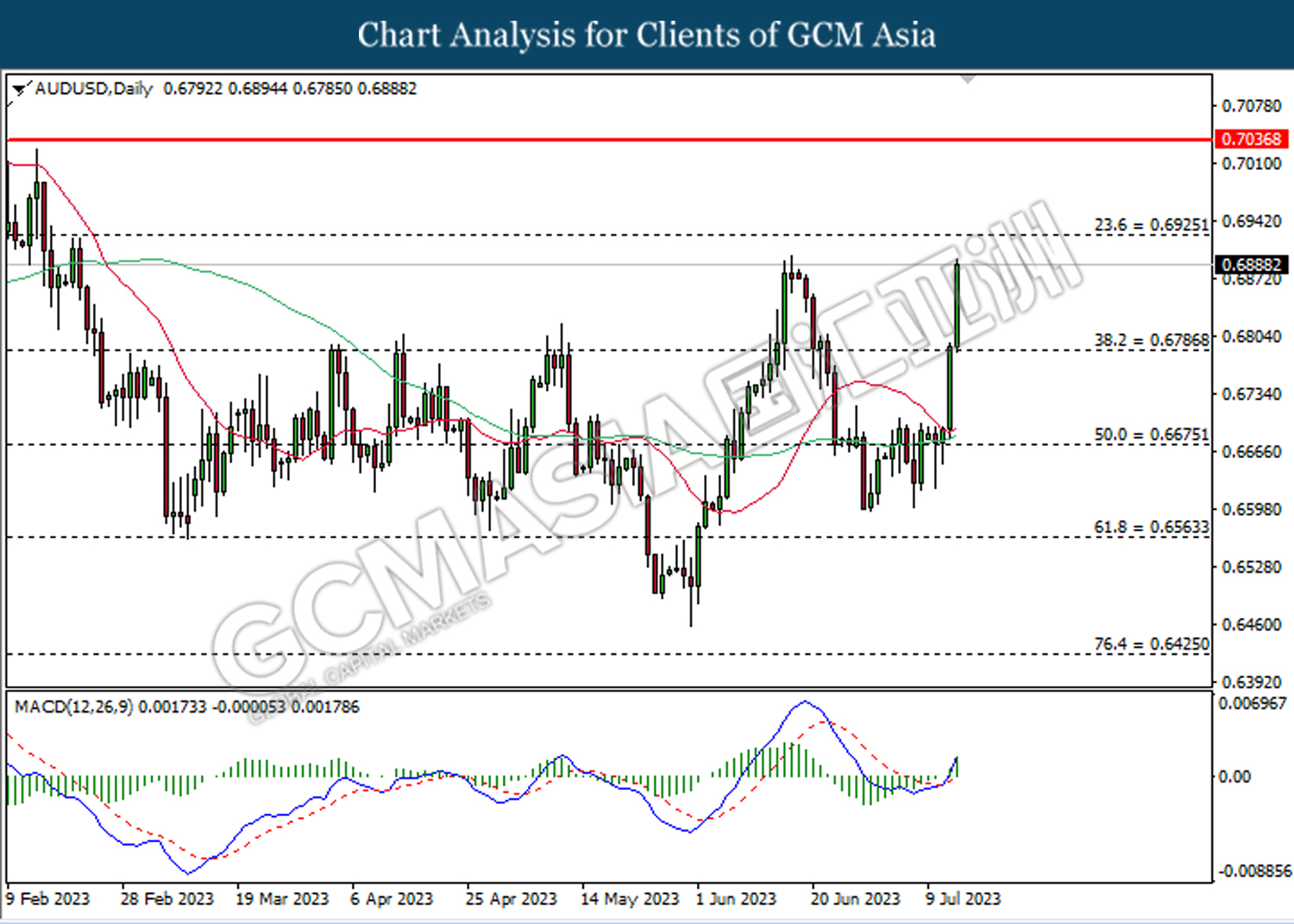

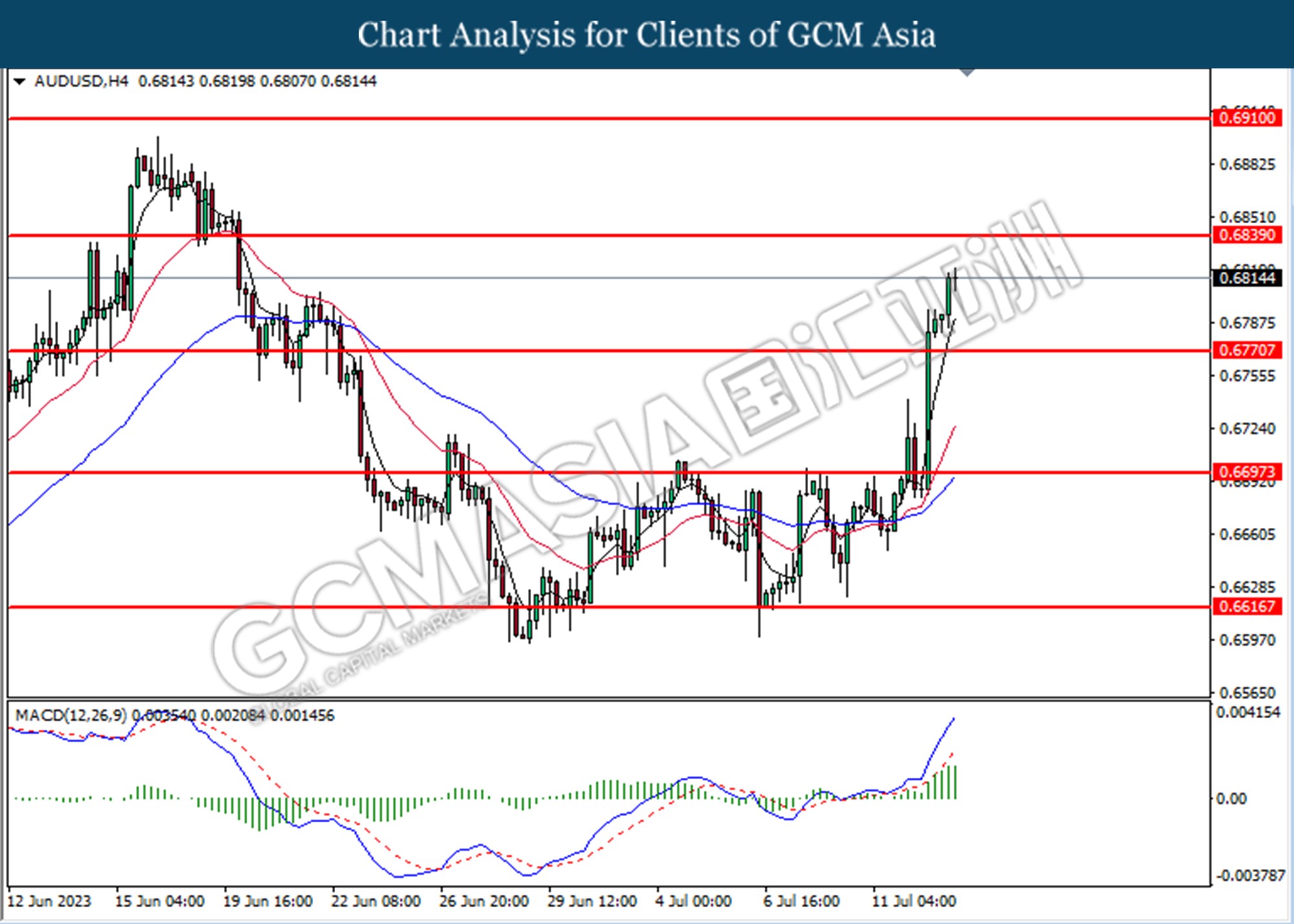

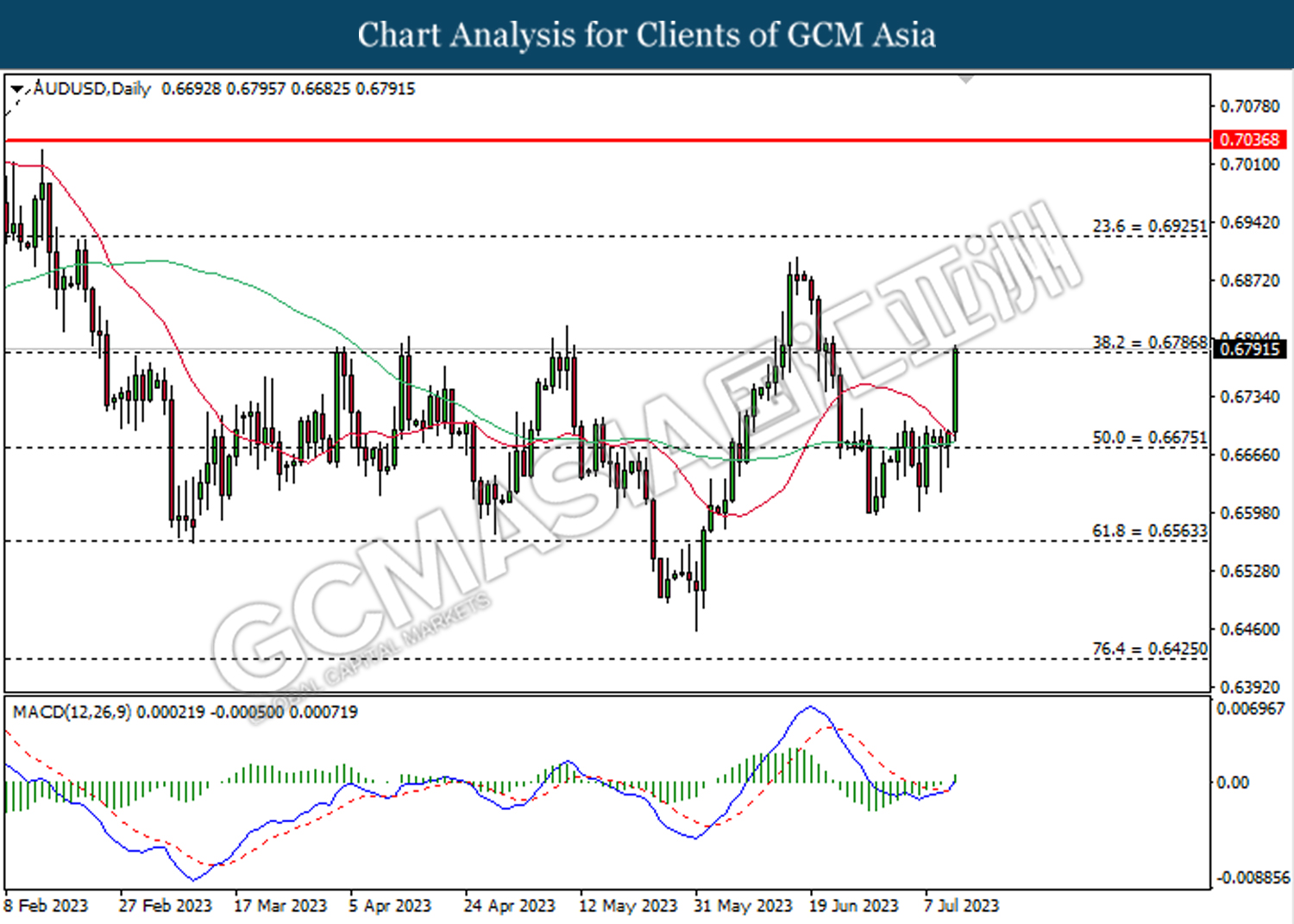

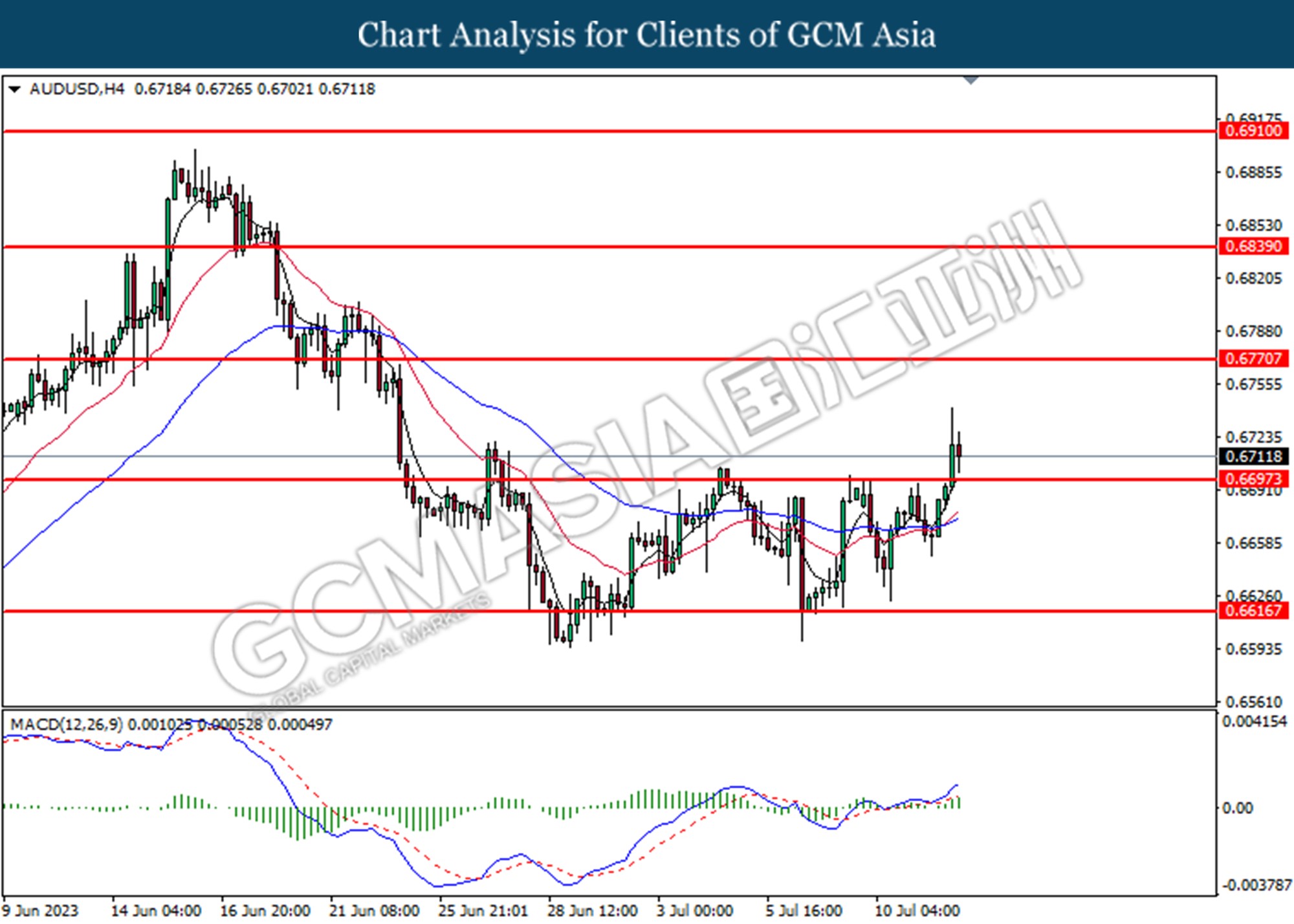

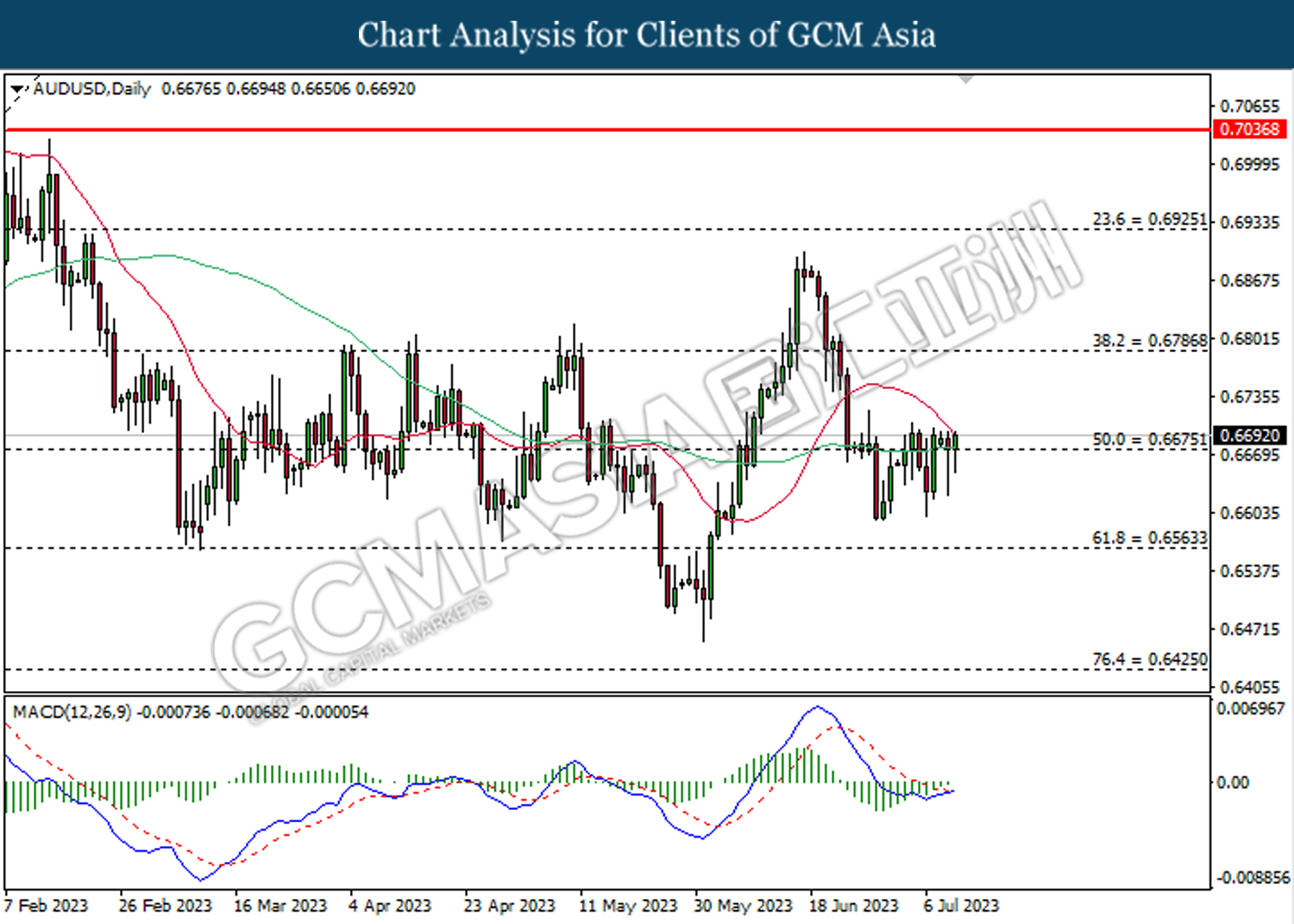

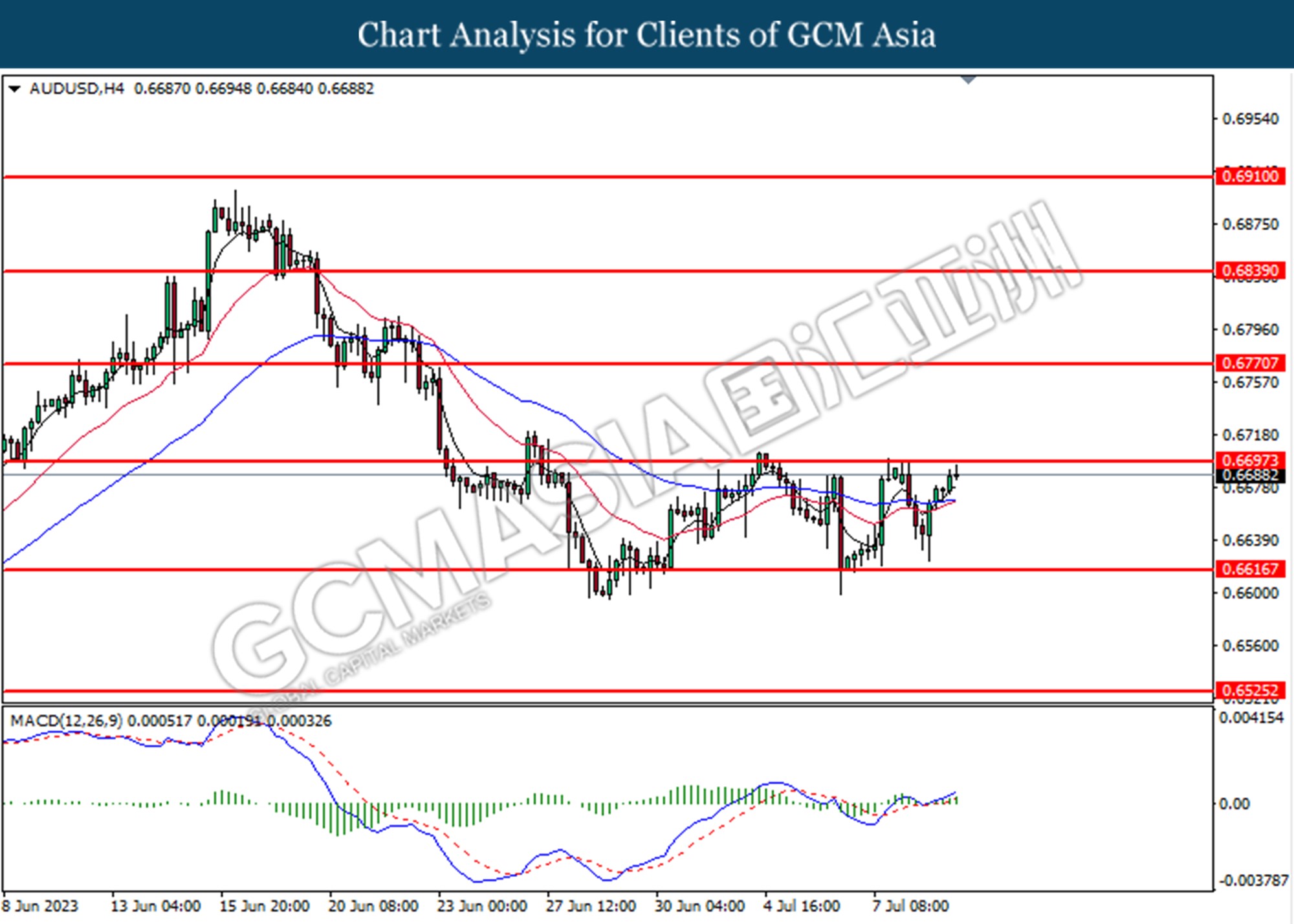

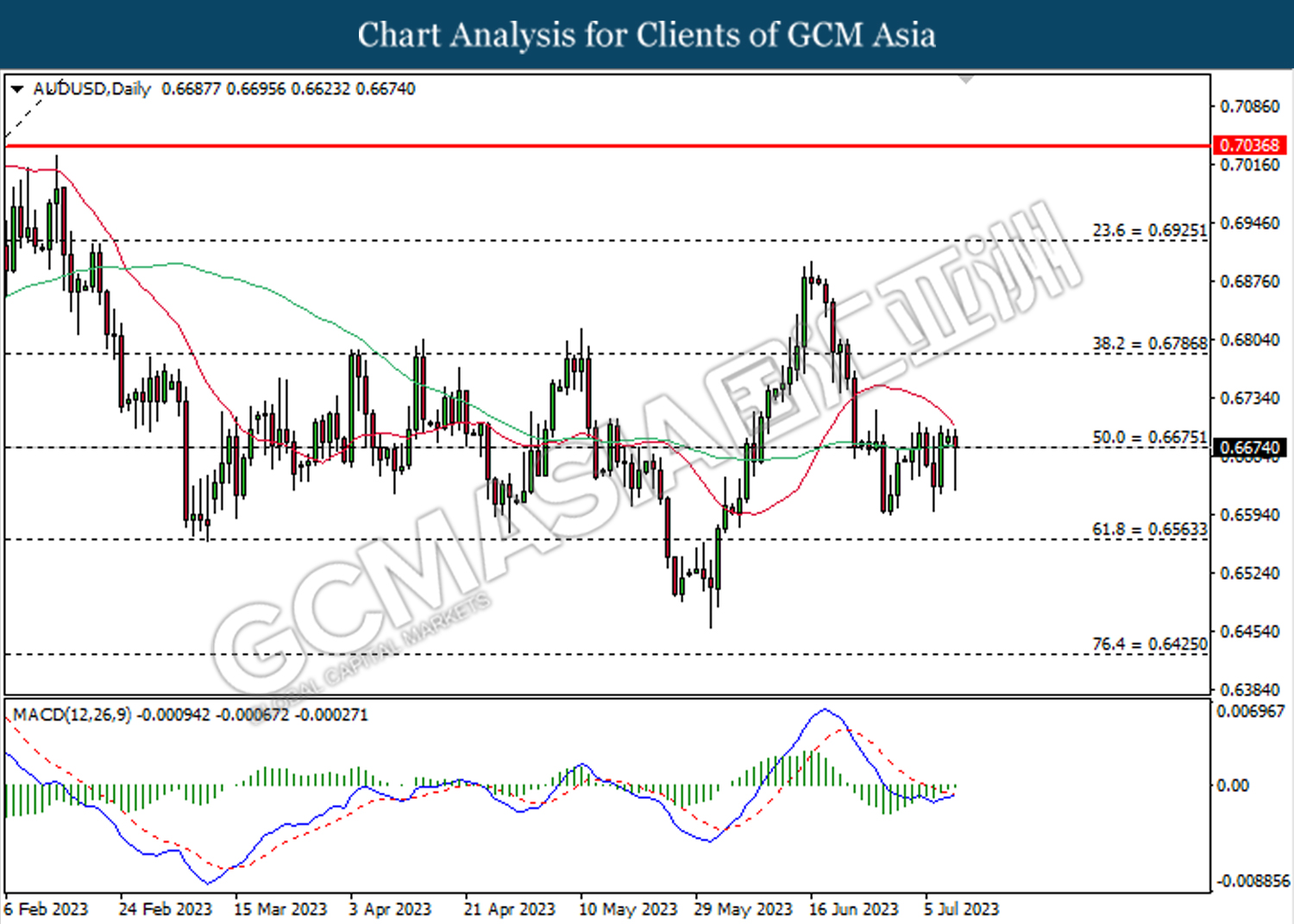

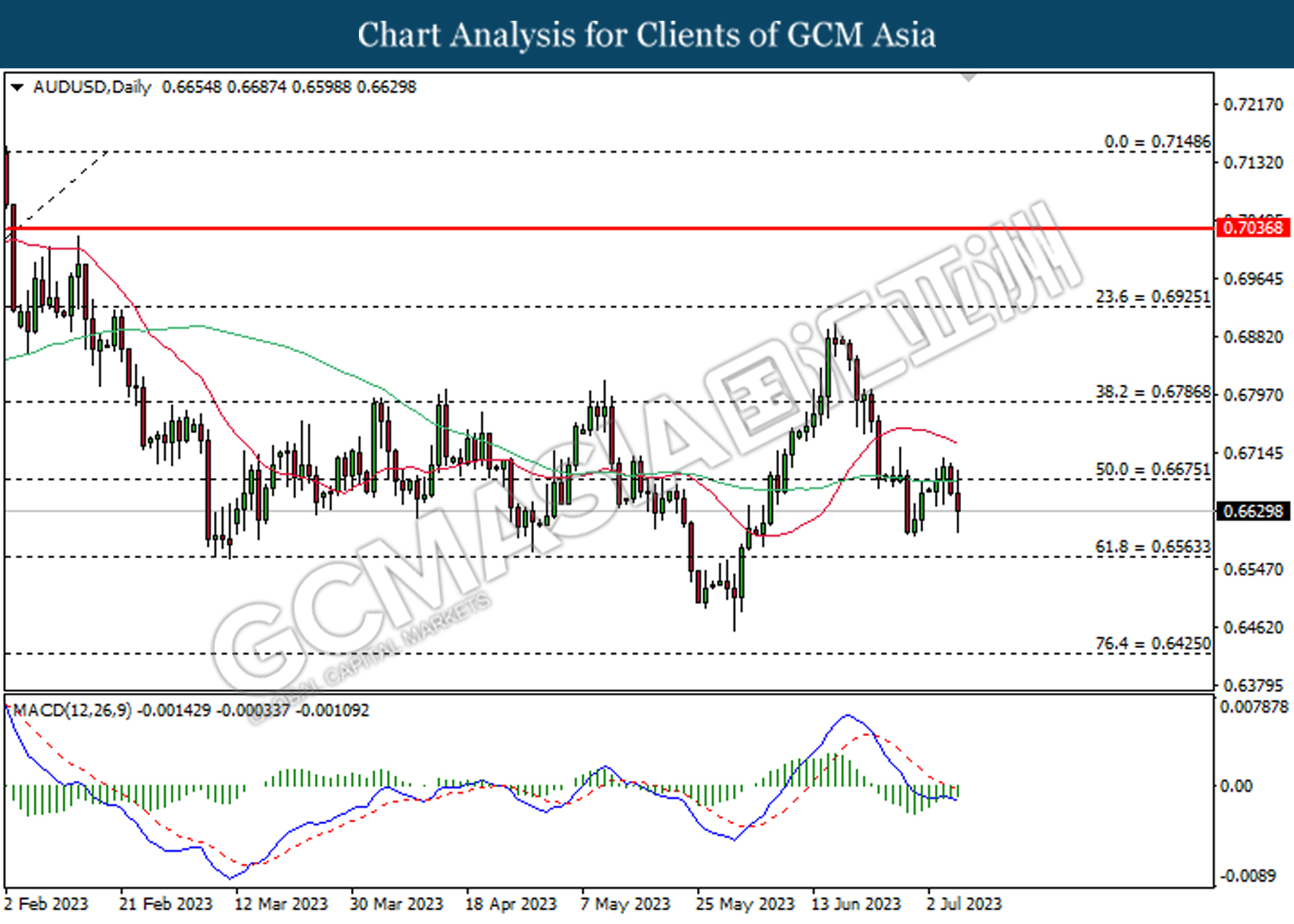

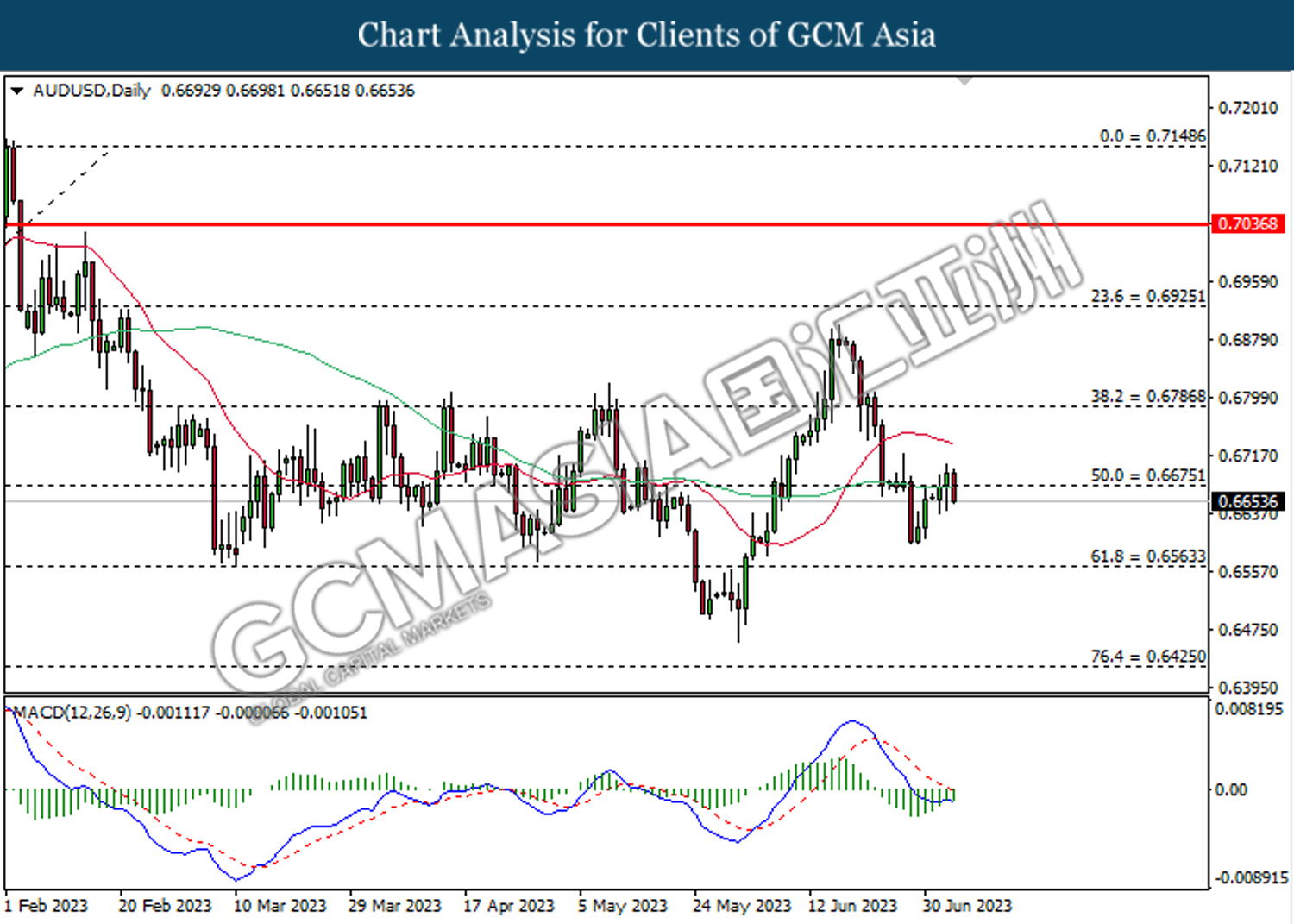

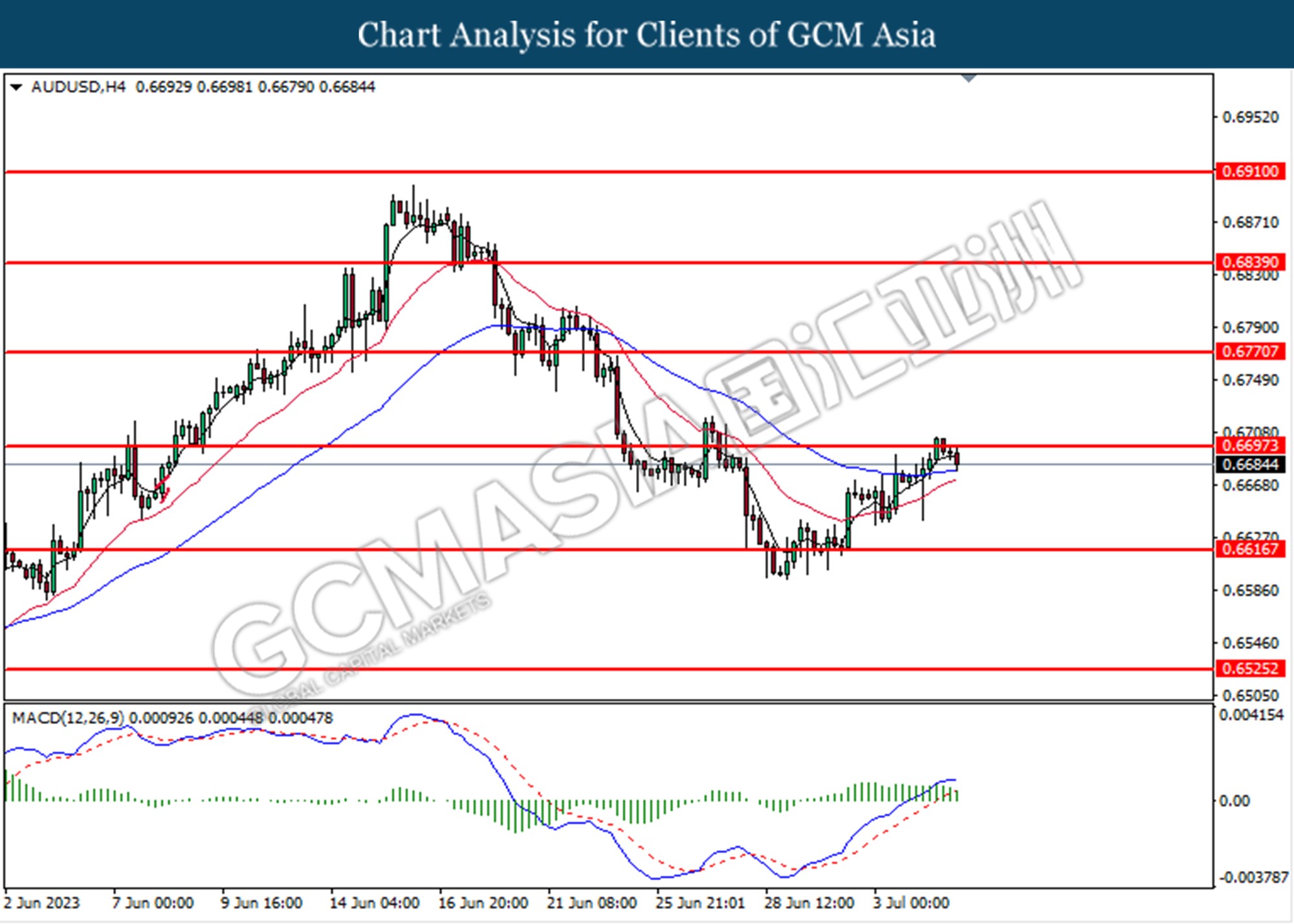

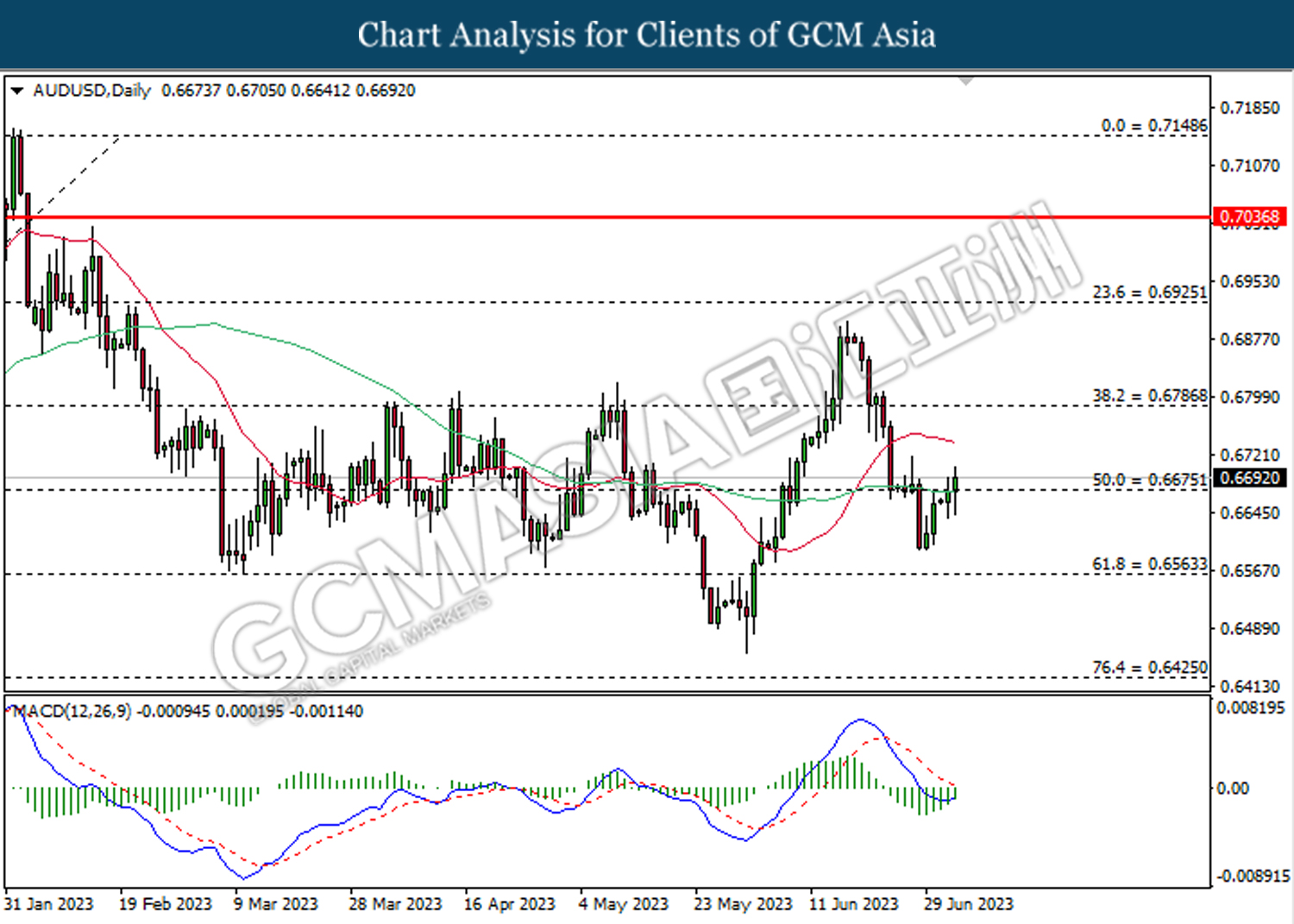

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6925.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

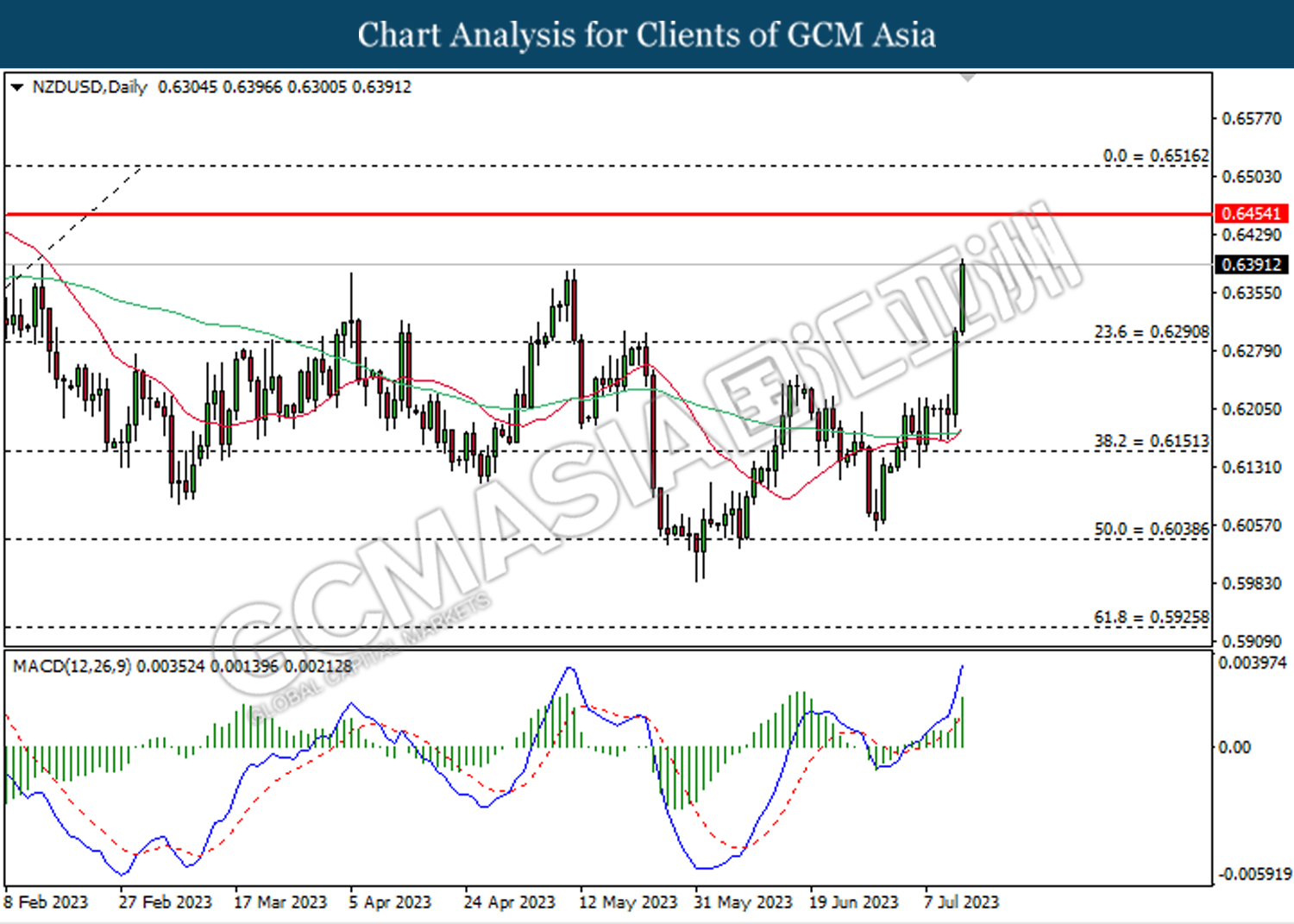

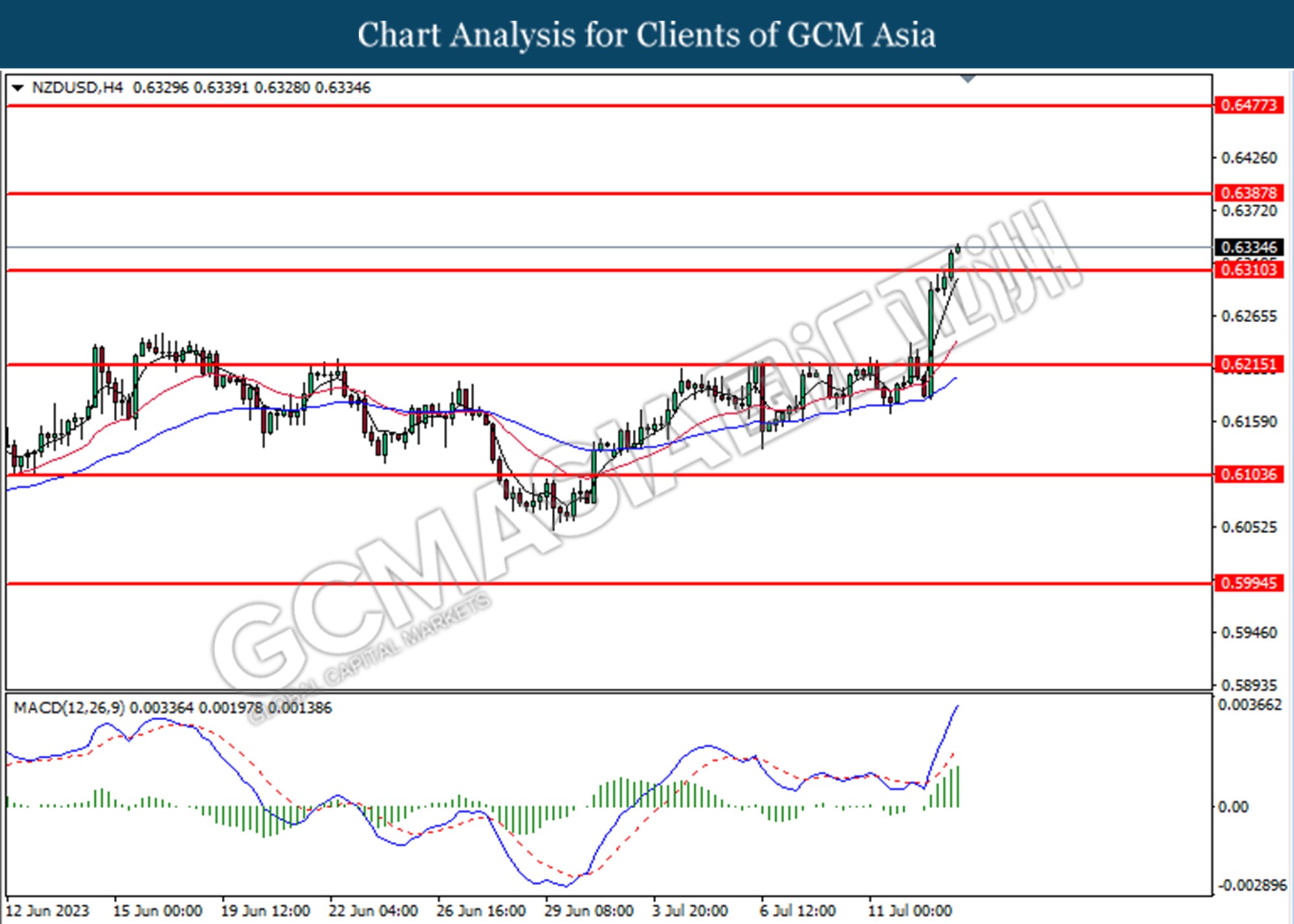

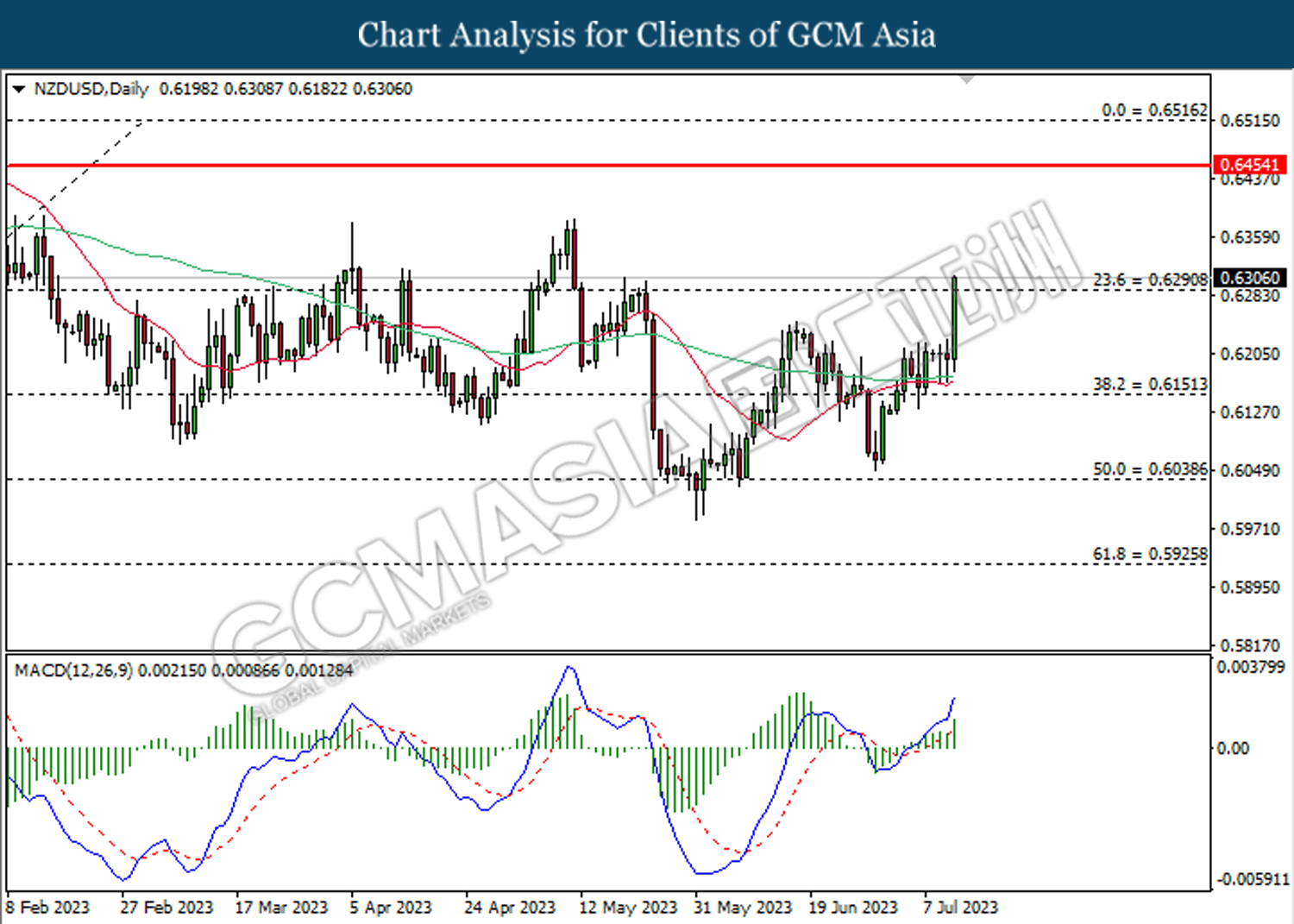

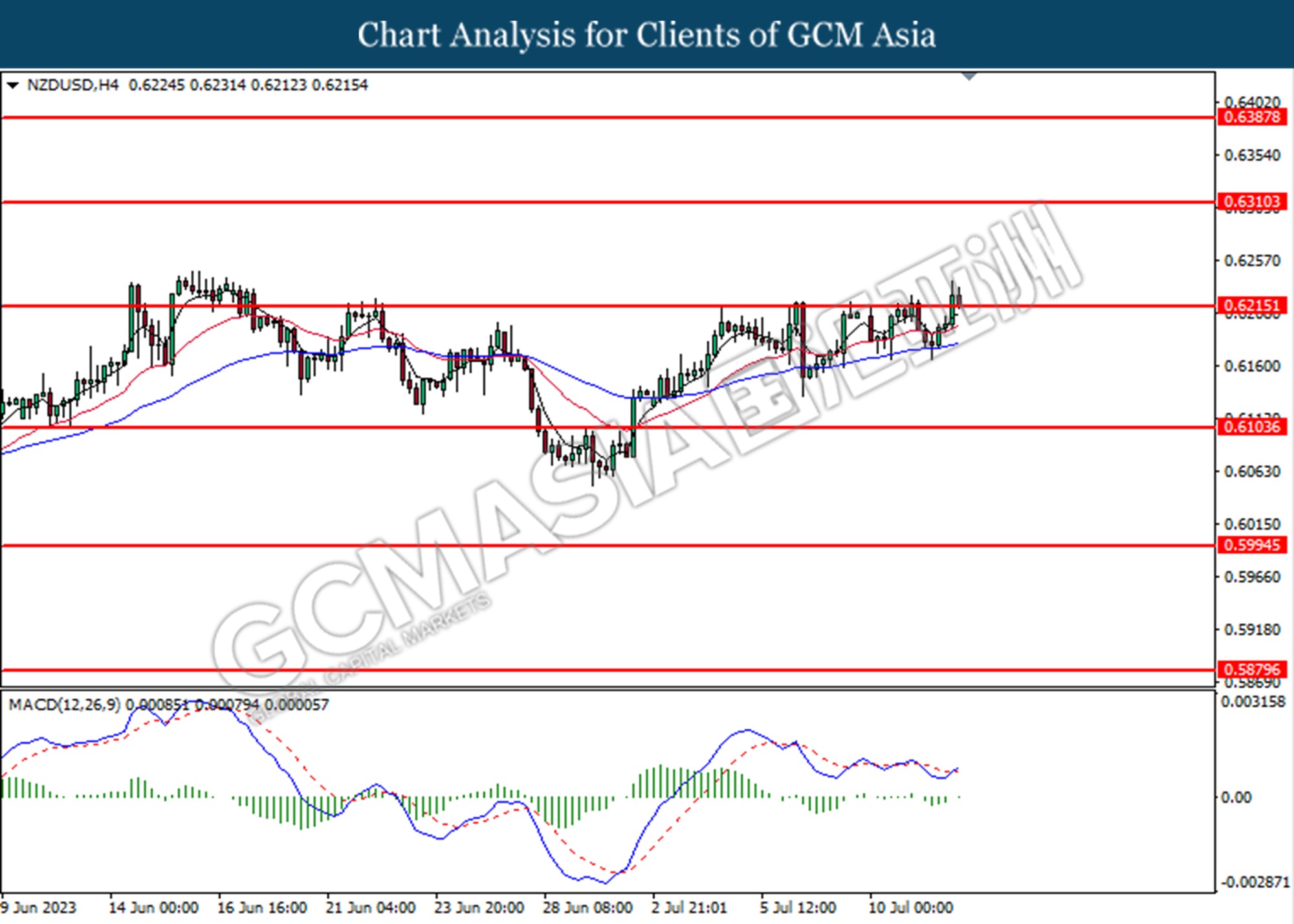

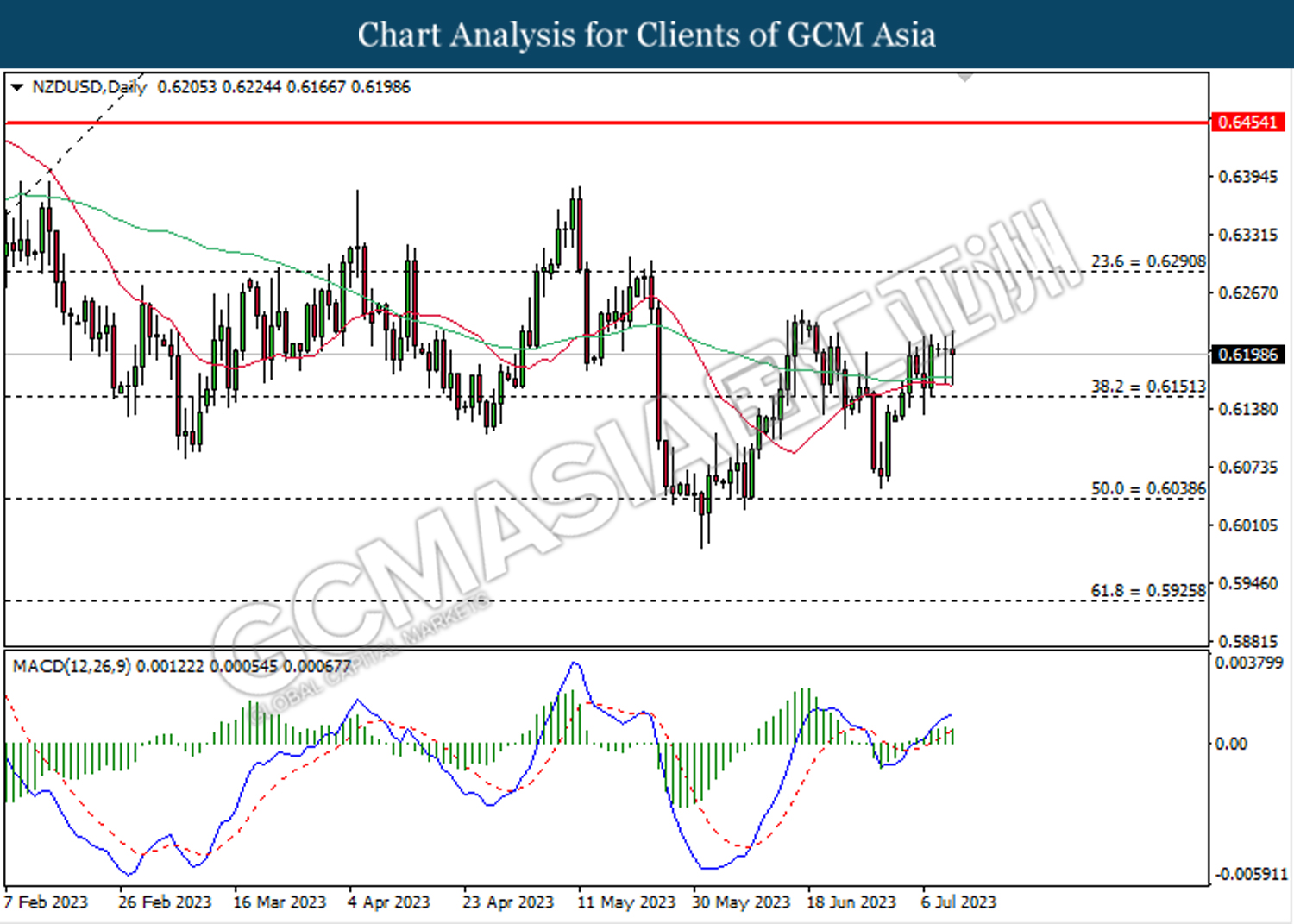

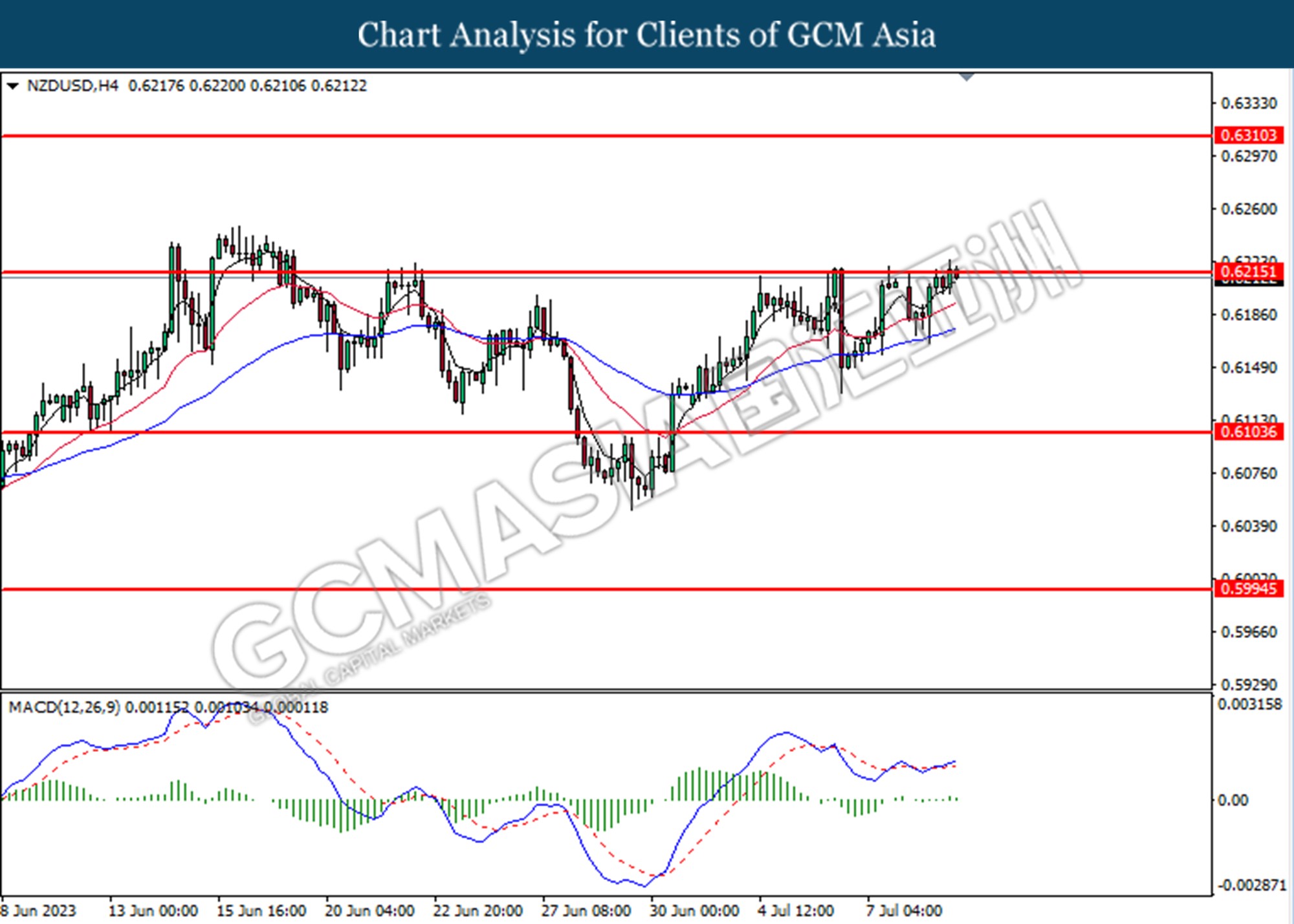

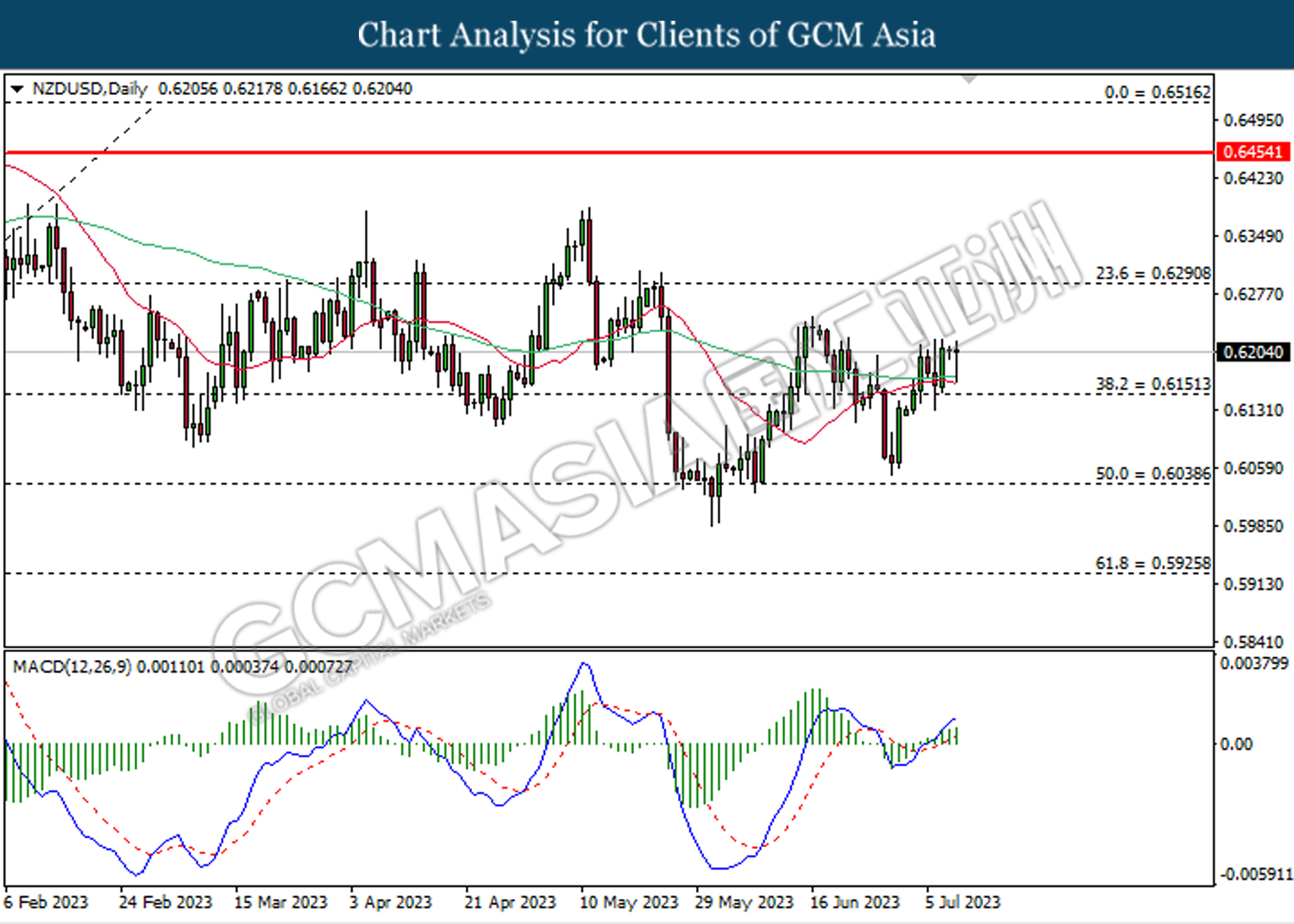

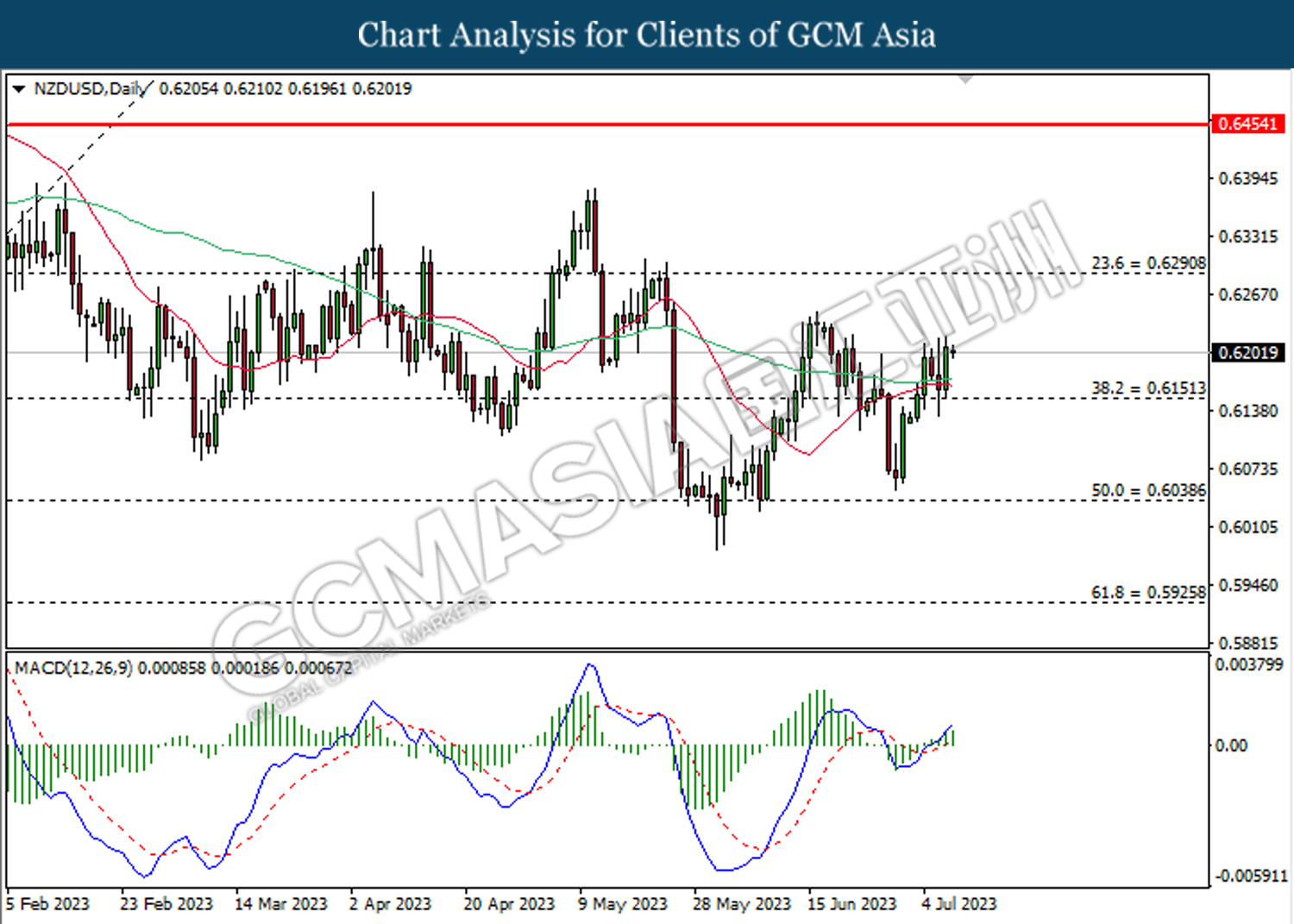

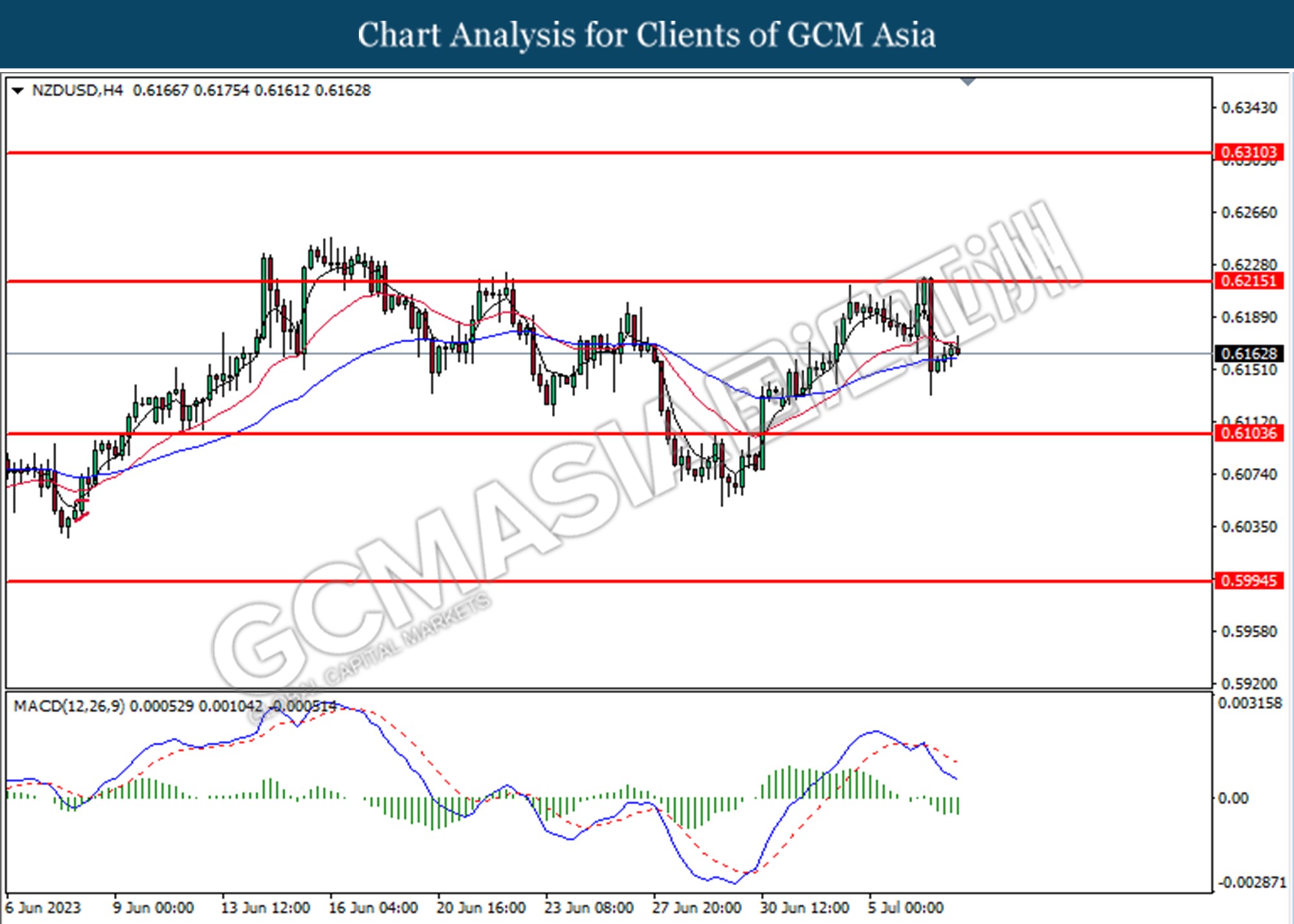

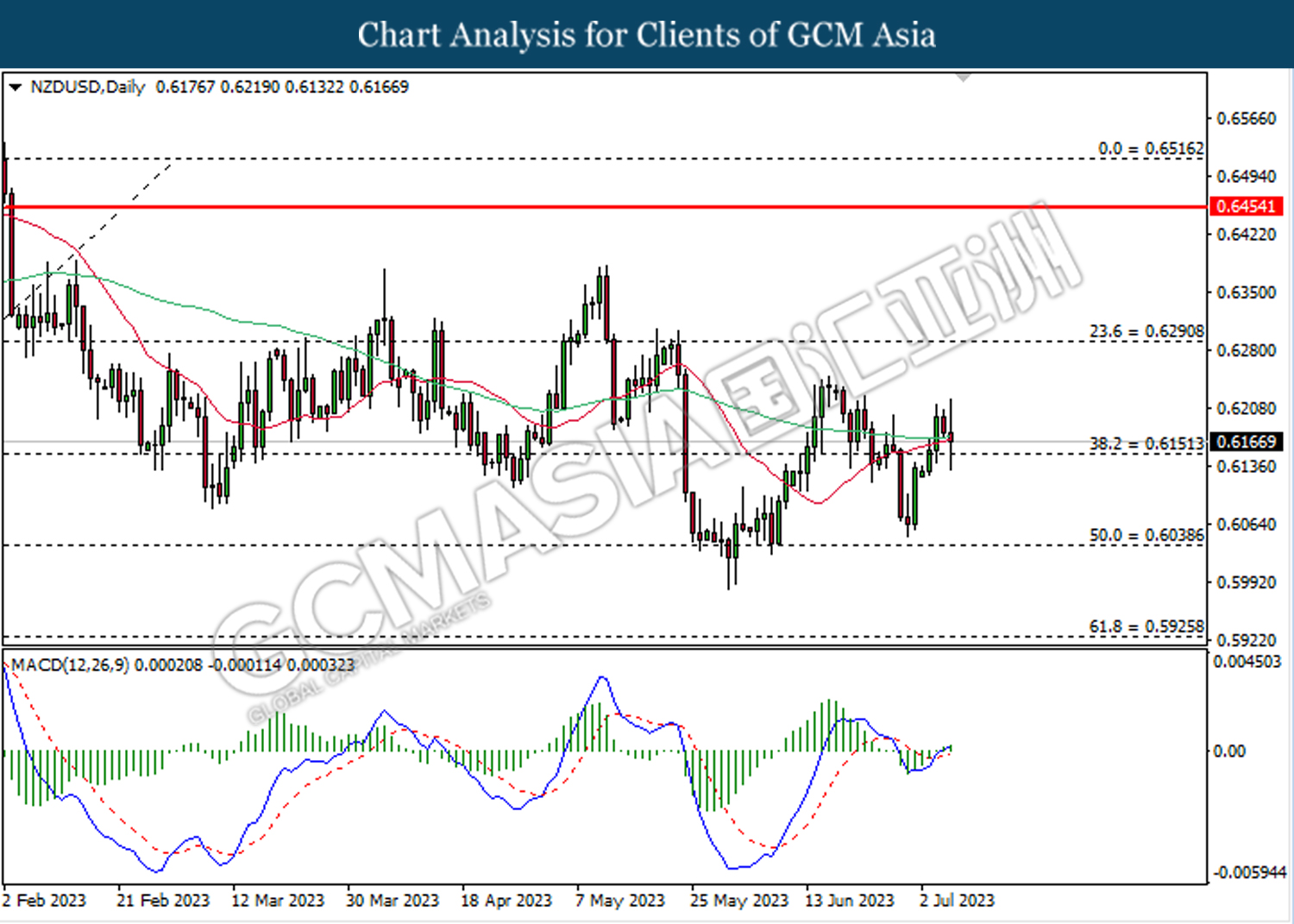

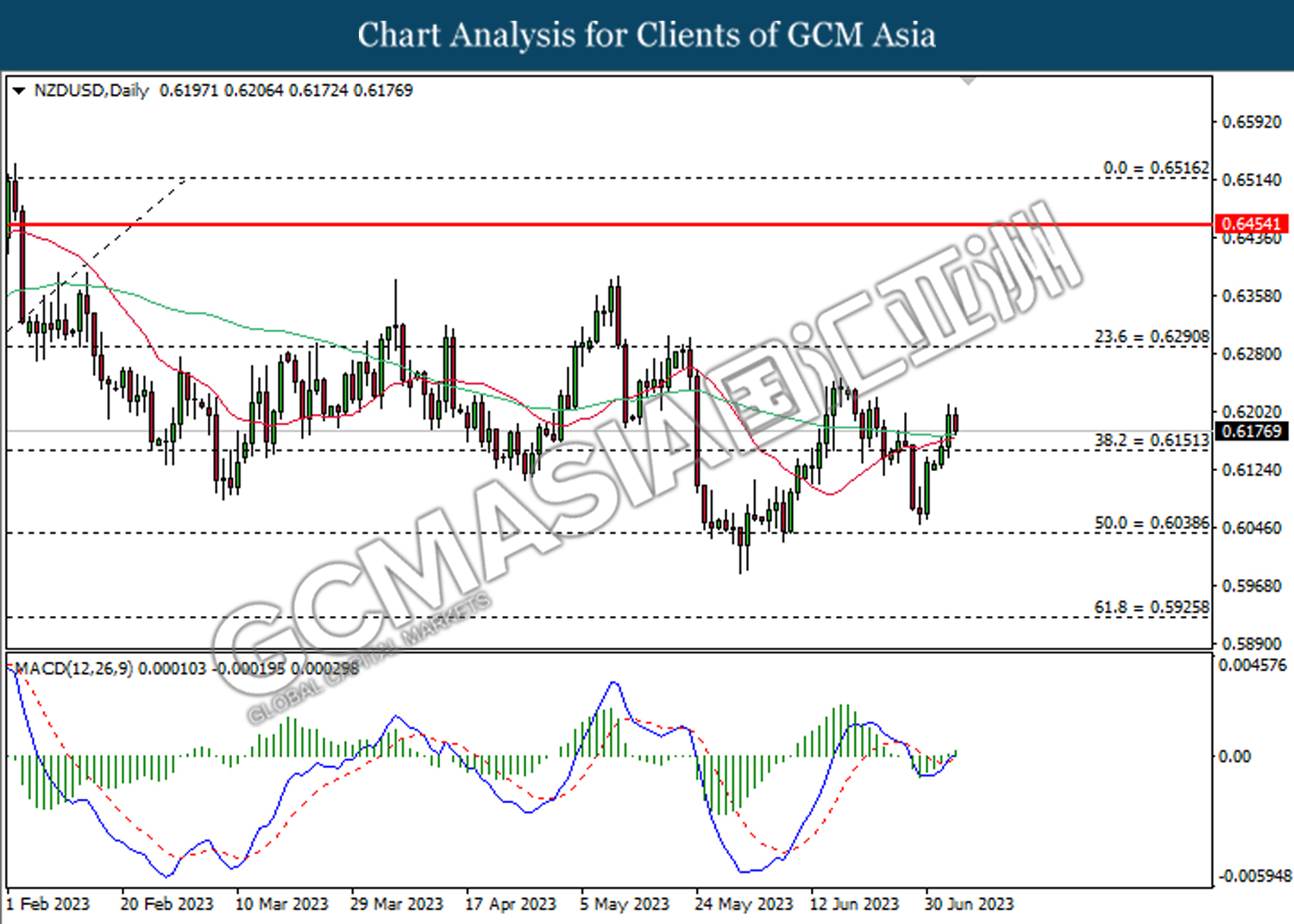

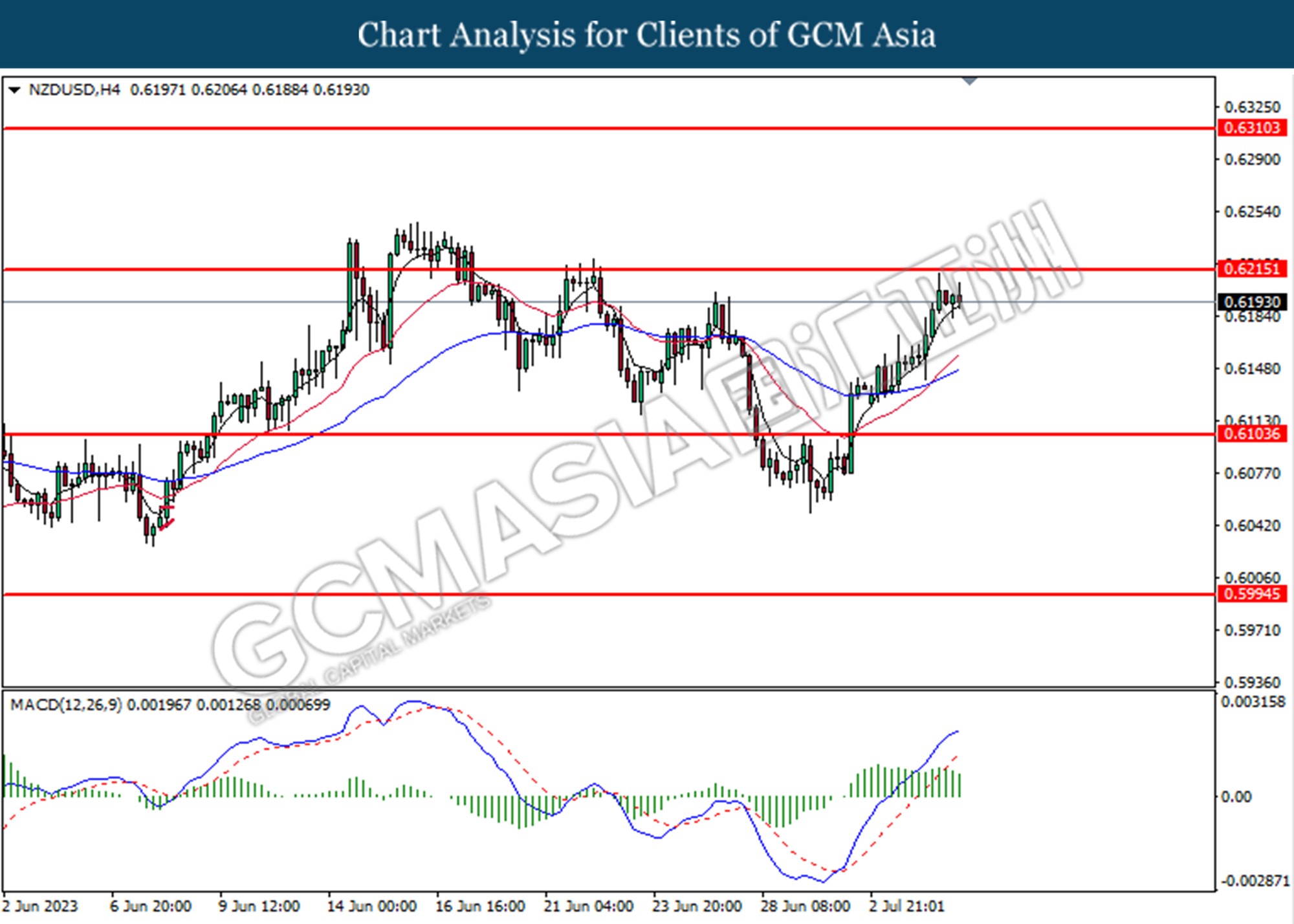

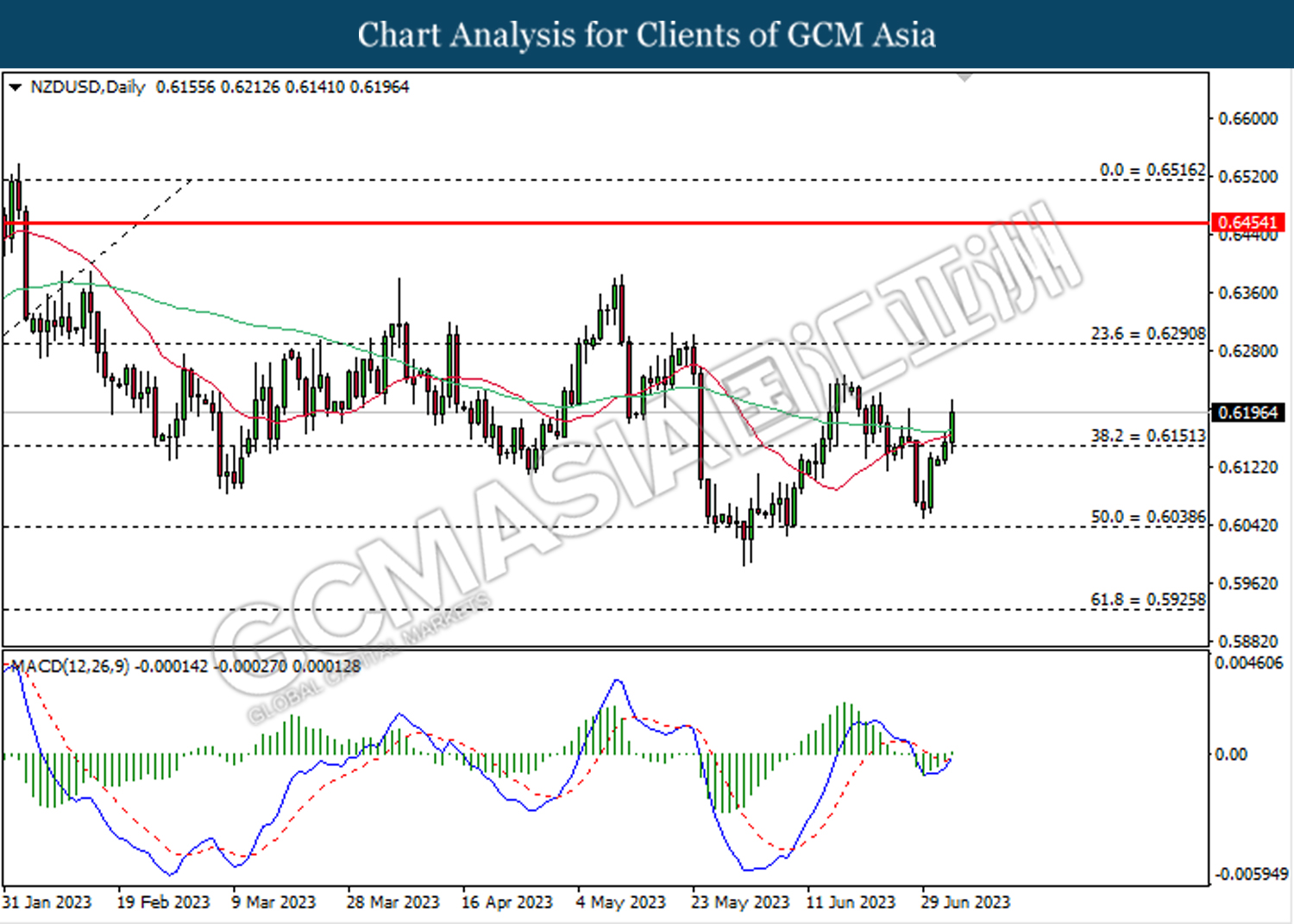

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

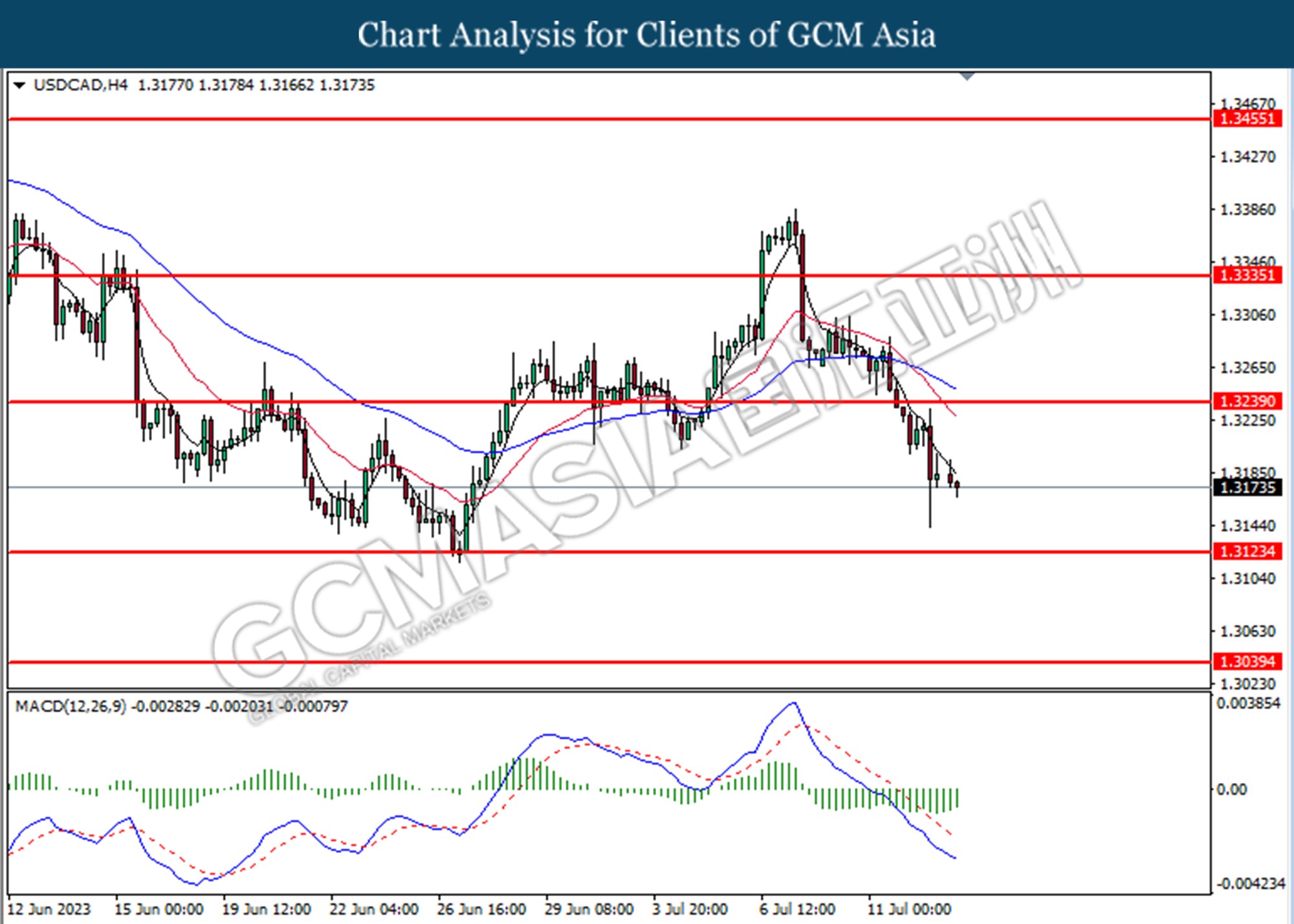

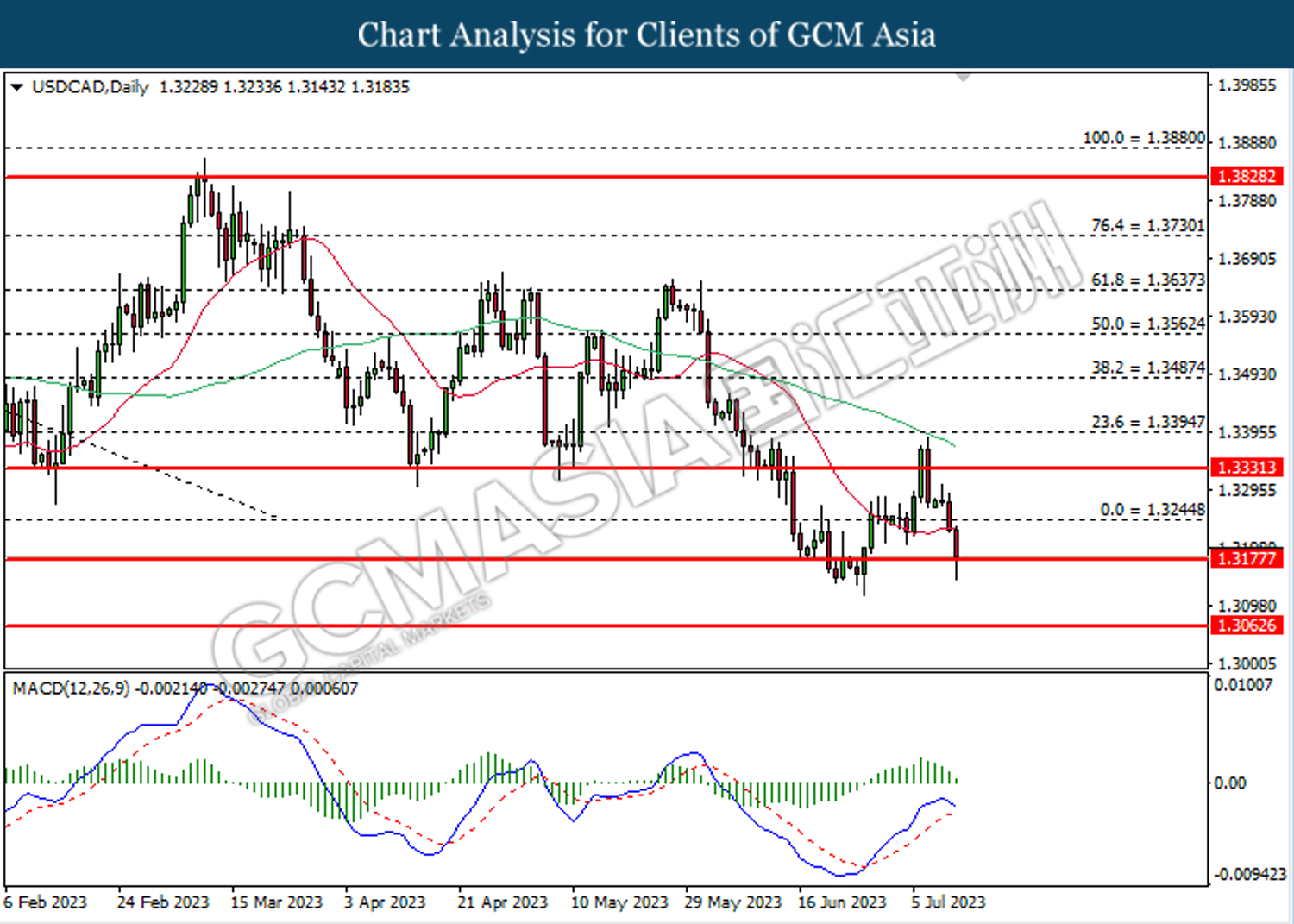

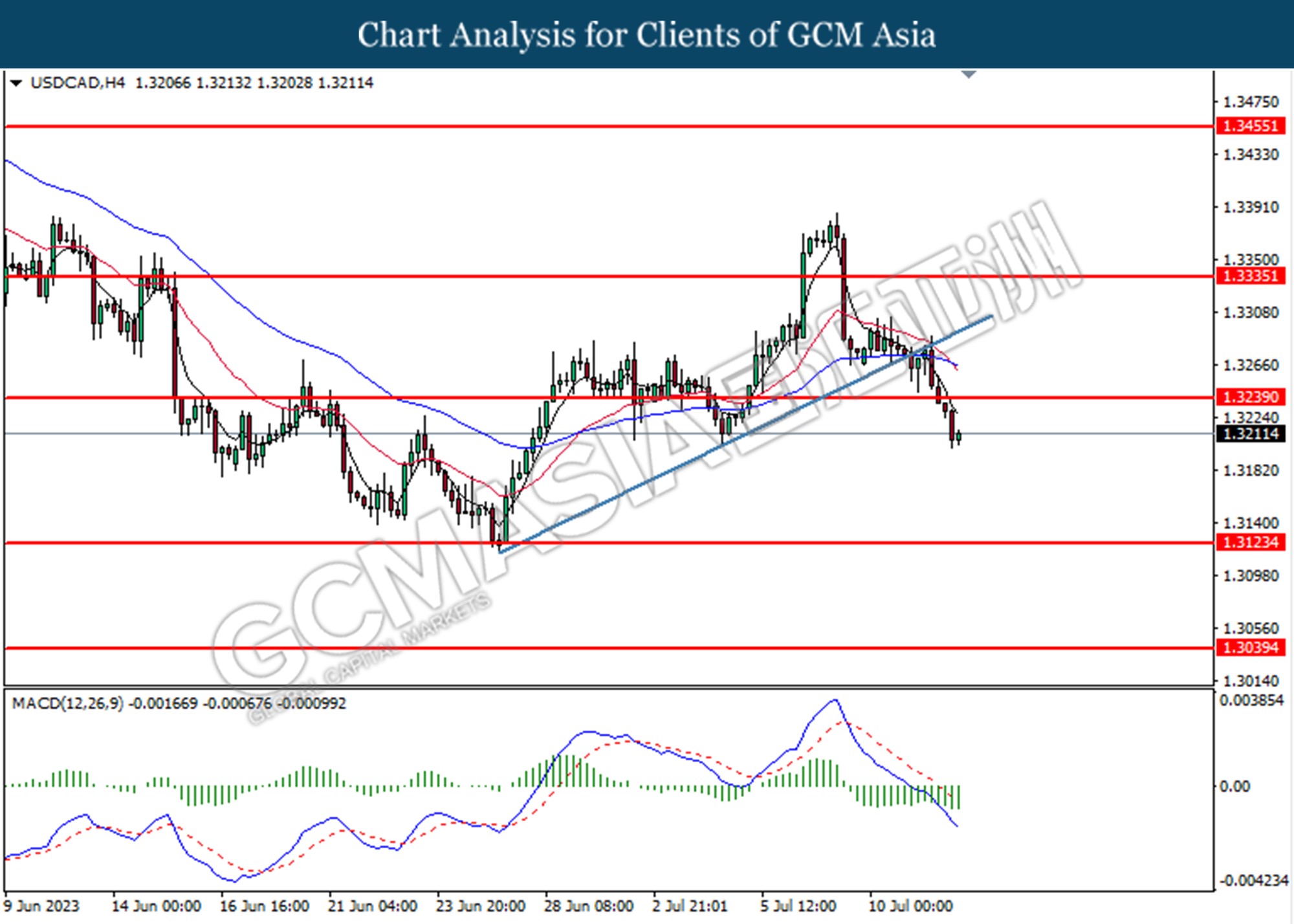

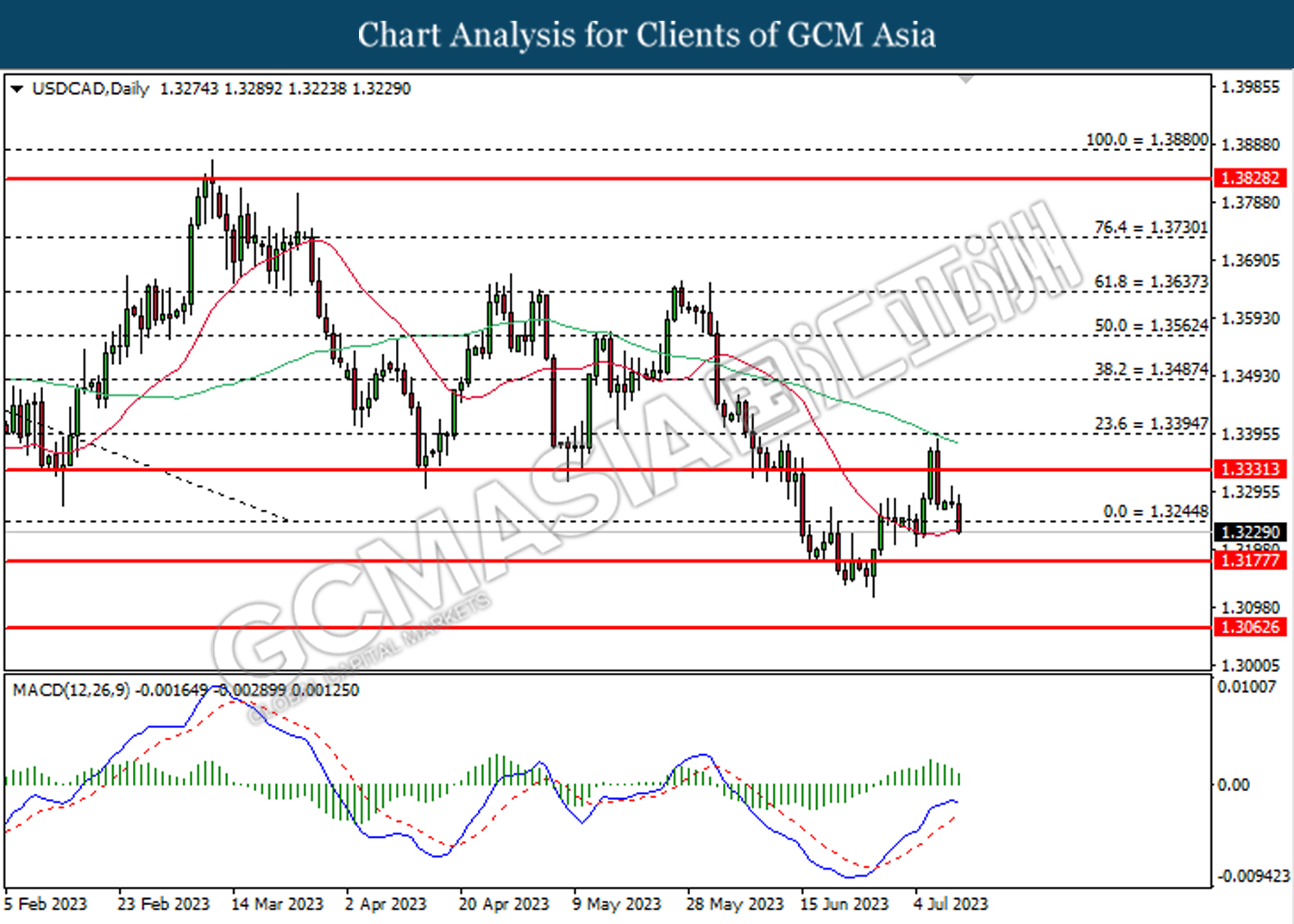

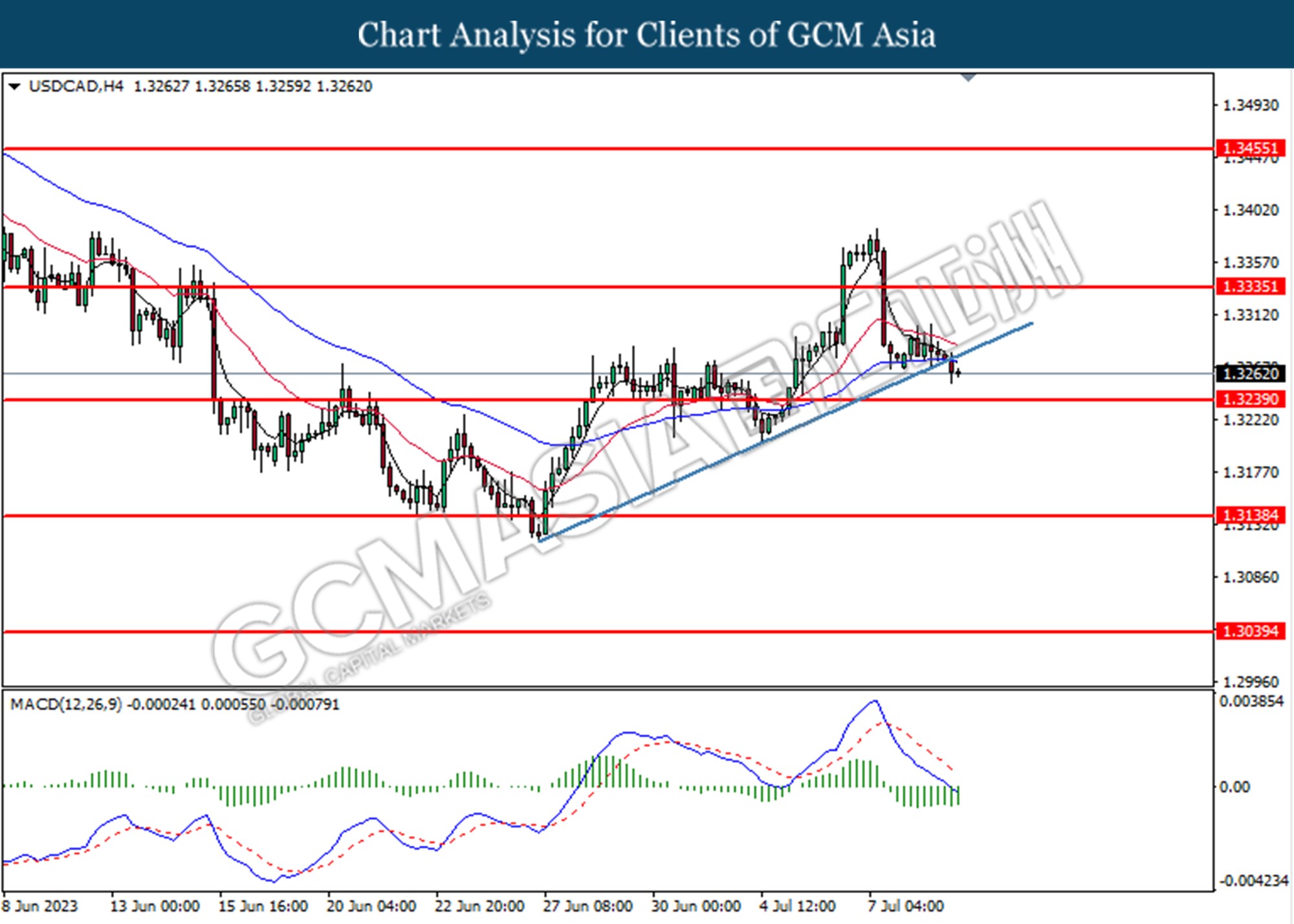

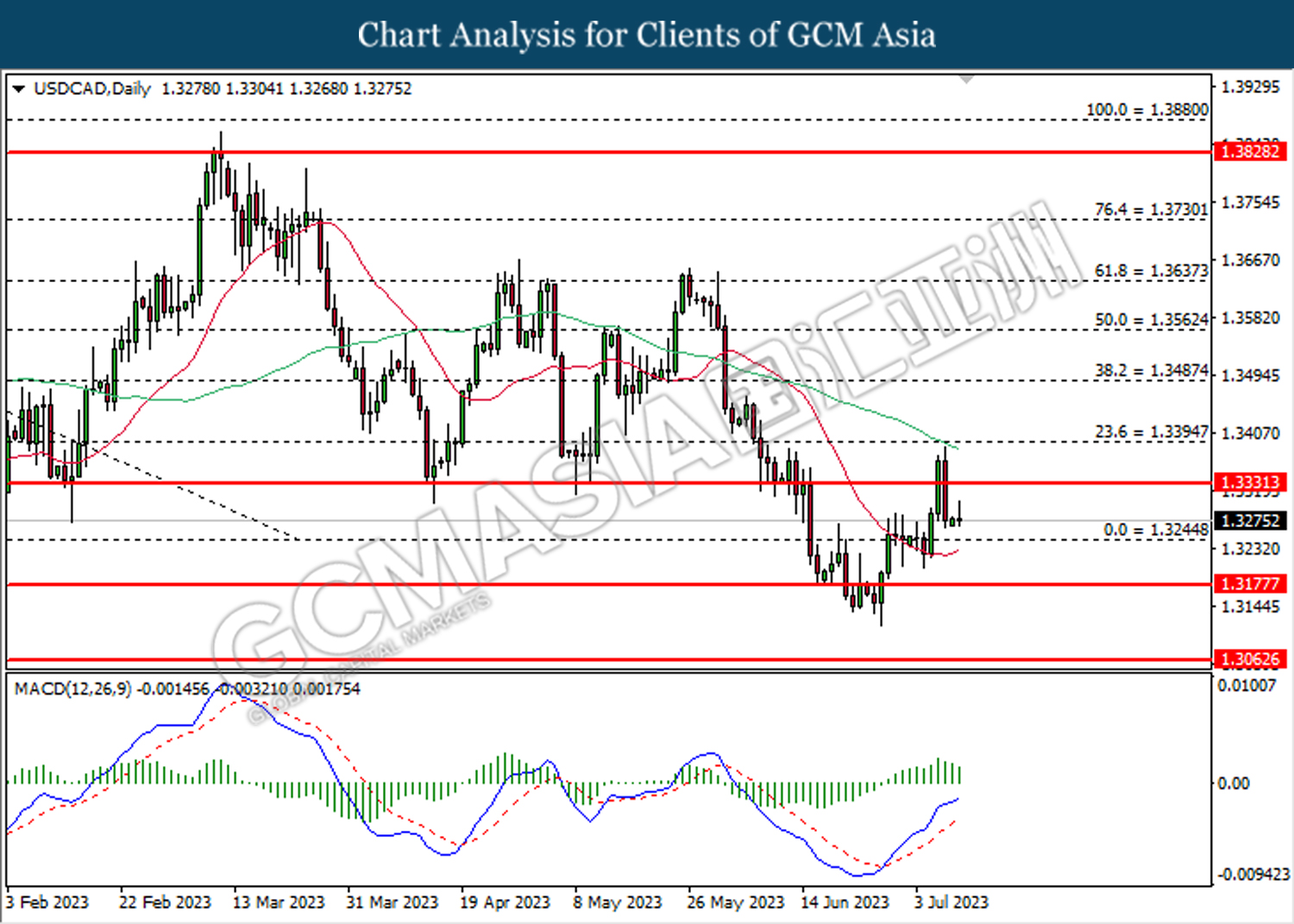

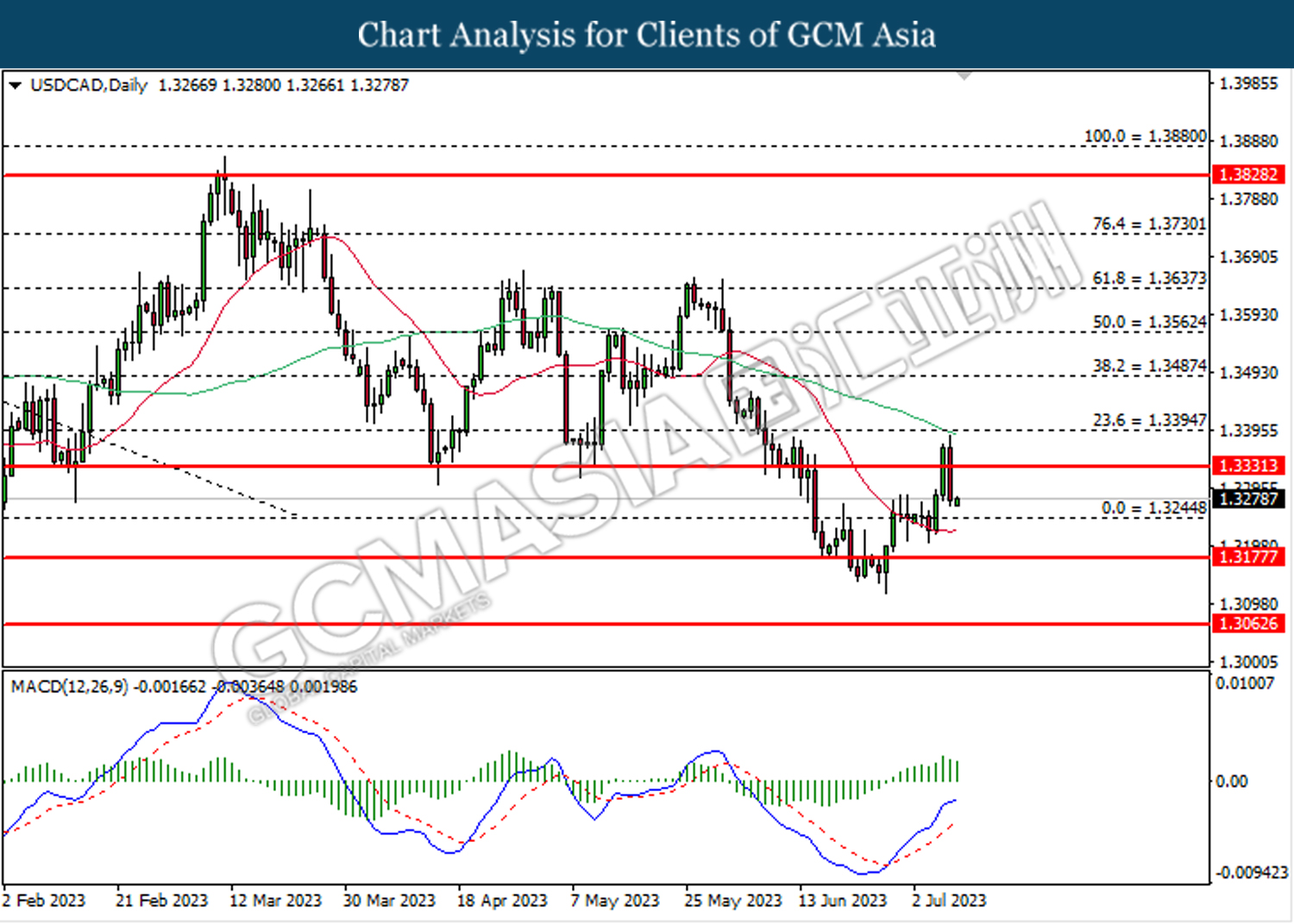

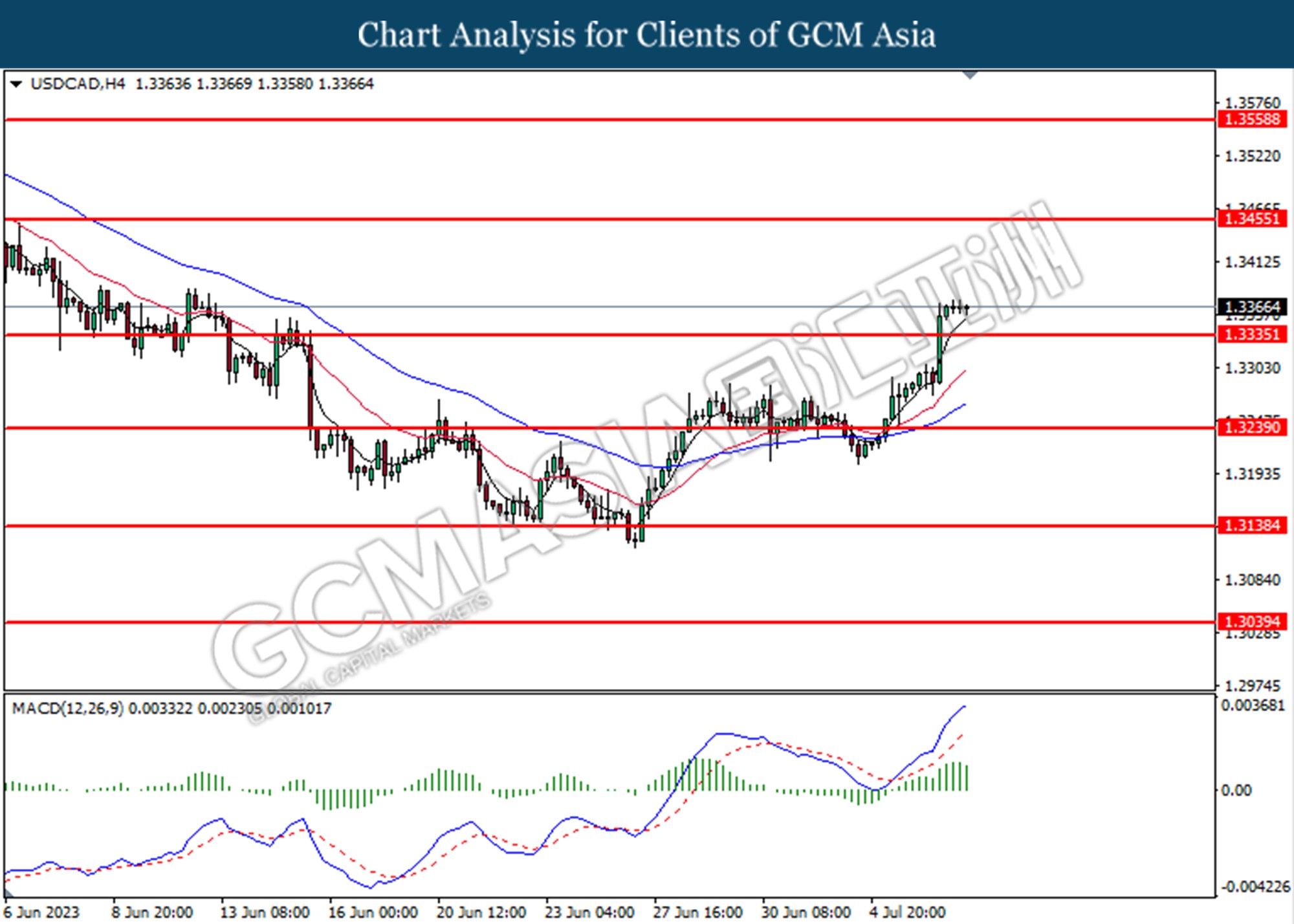

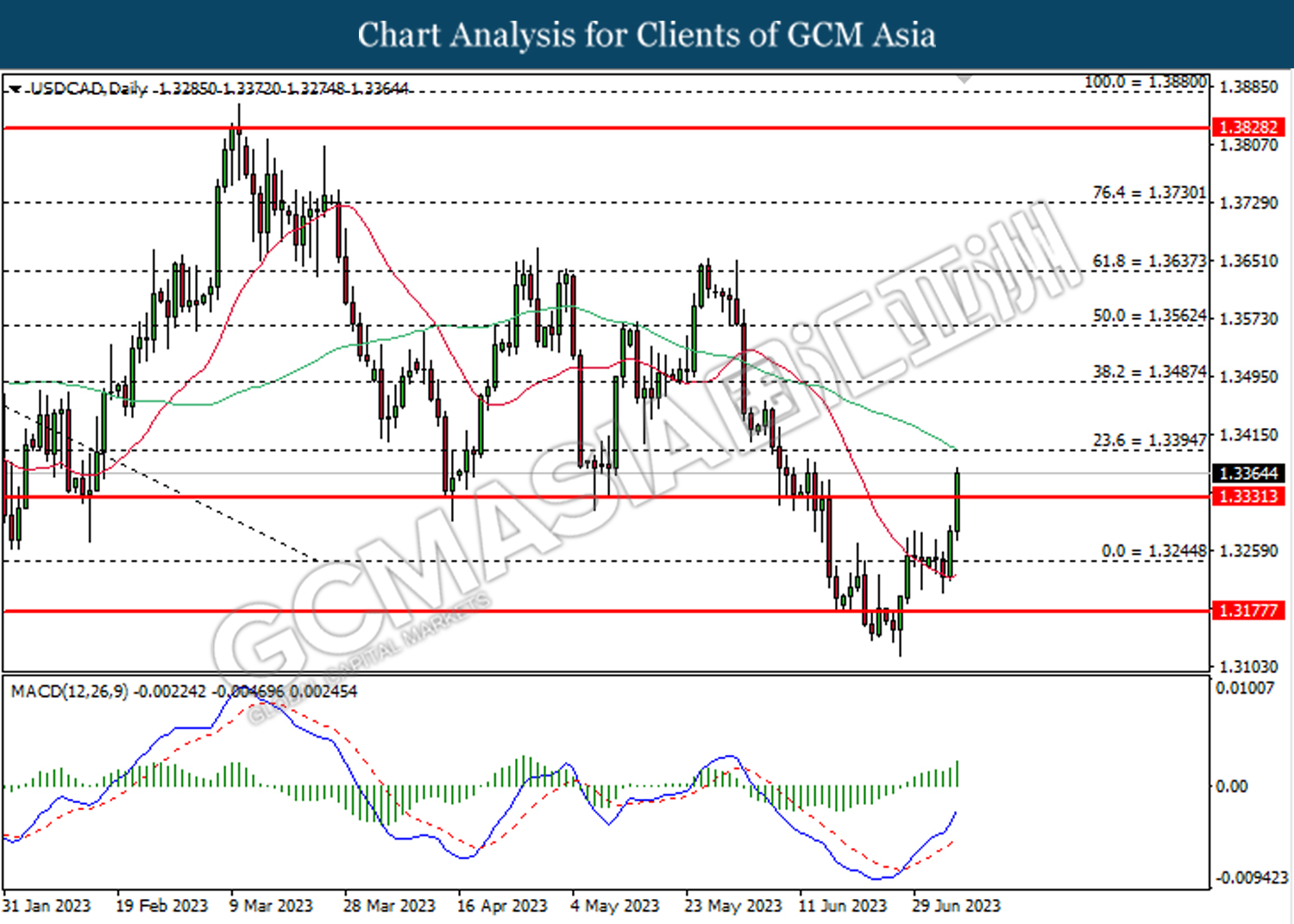

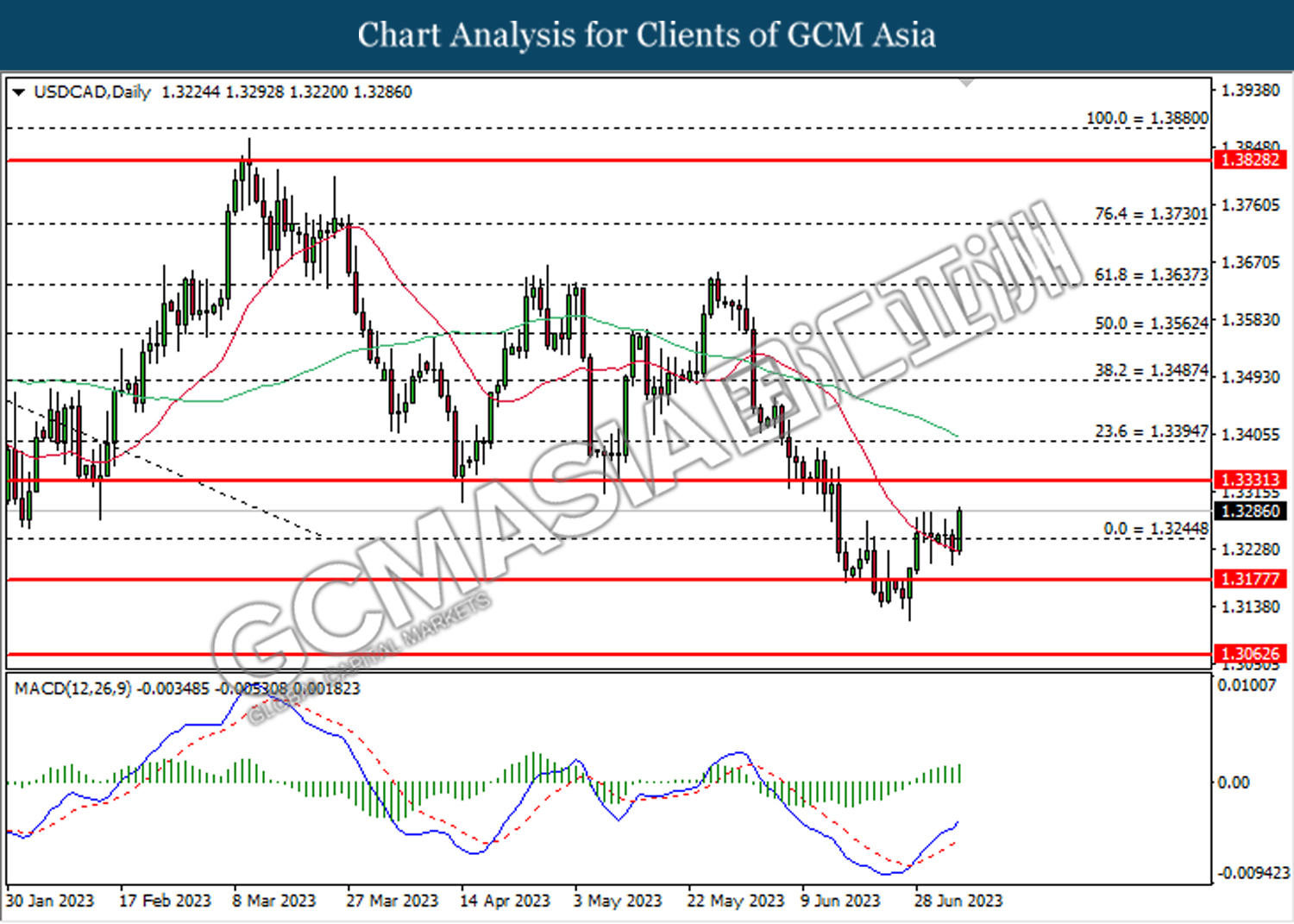

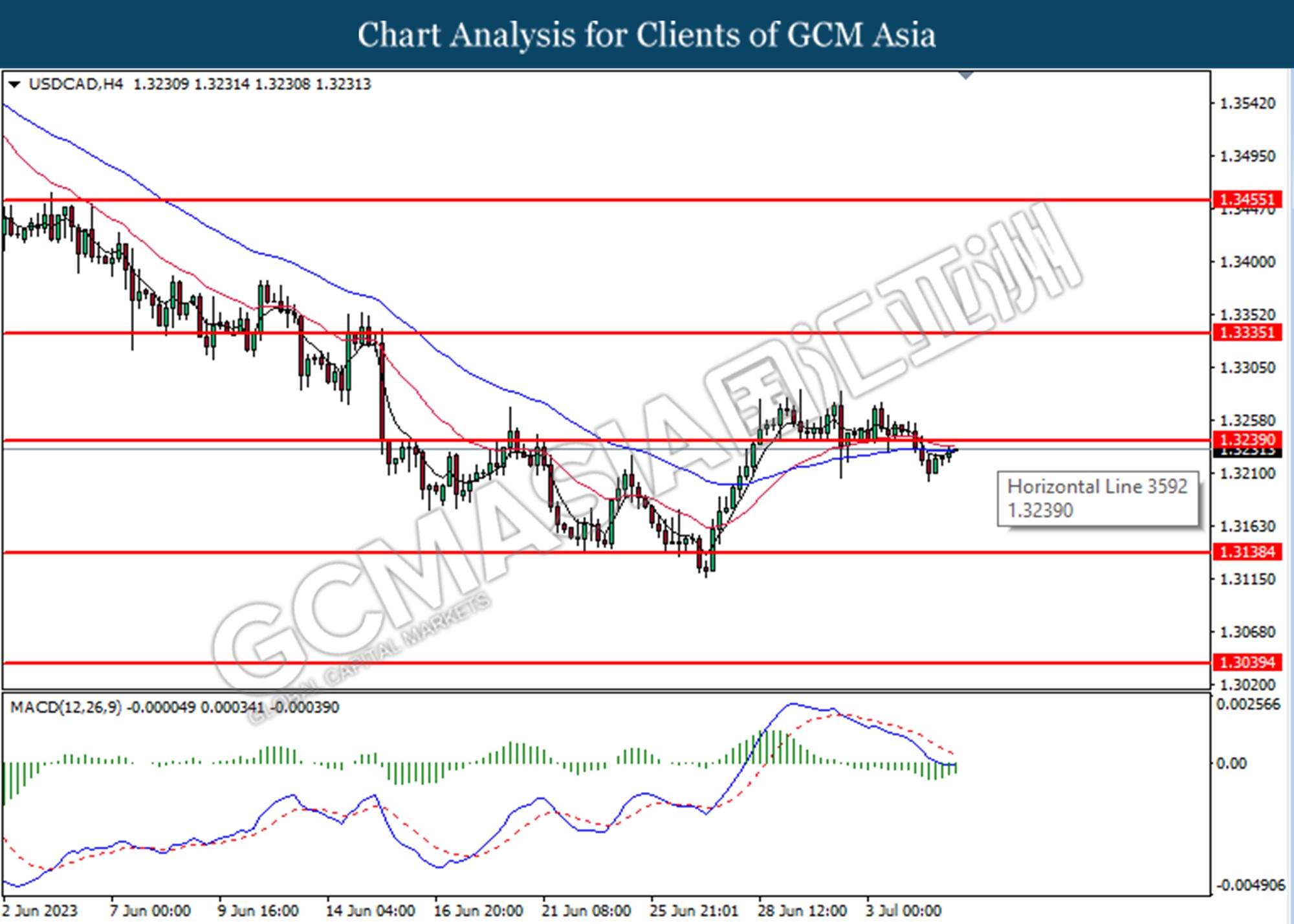

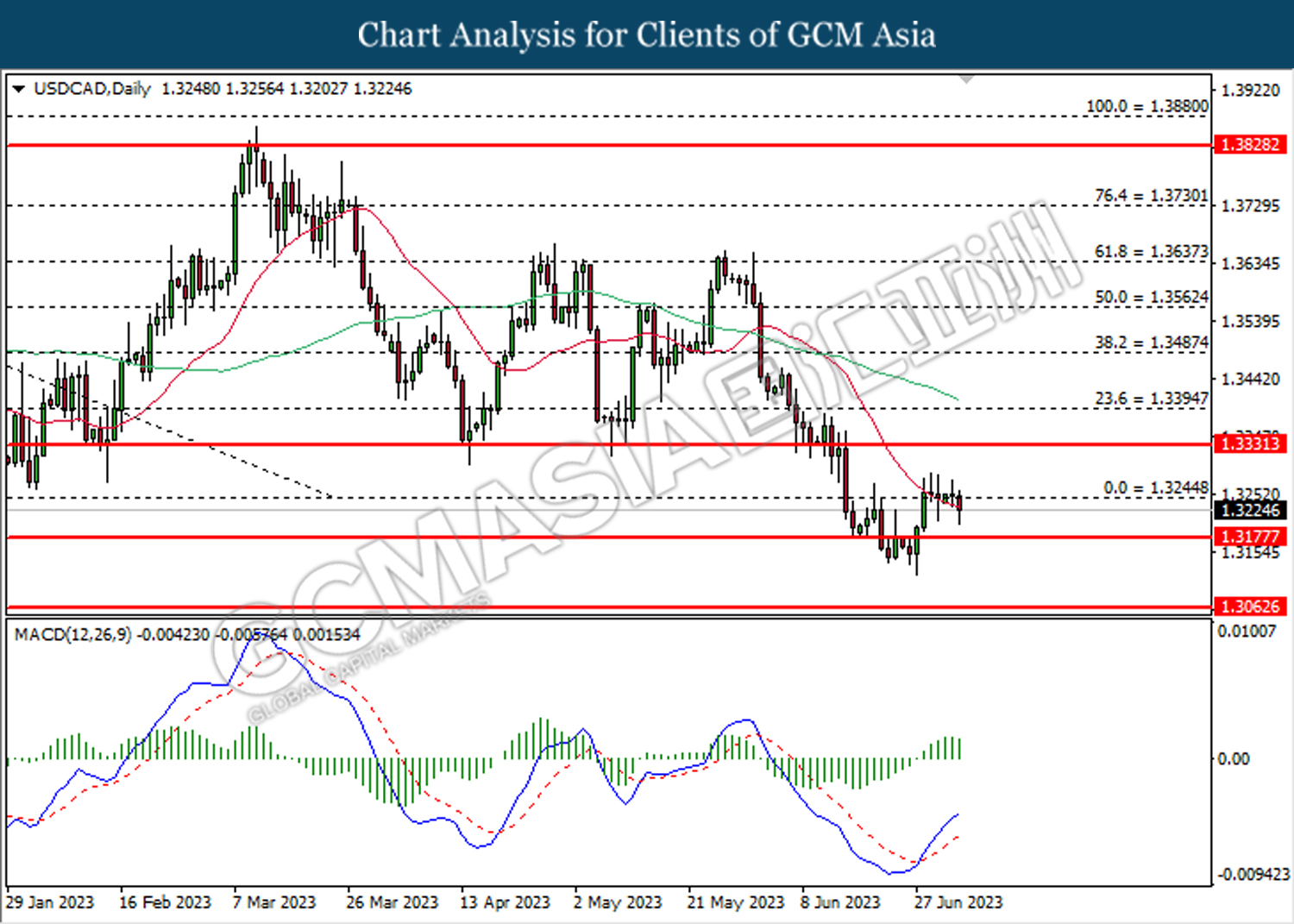

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3175. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3065.

Resistance level: 1.3175, 1.3245

Support level: 1.3065, 1.2930

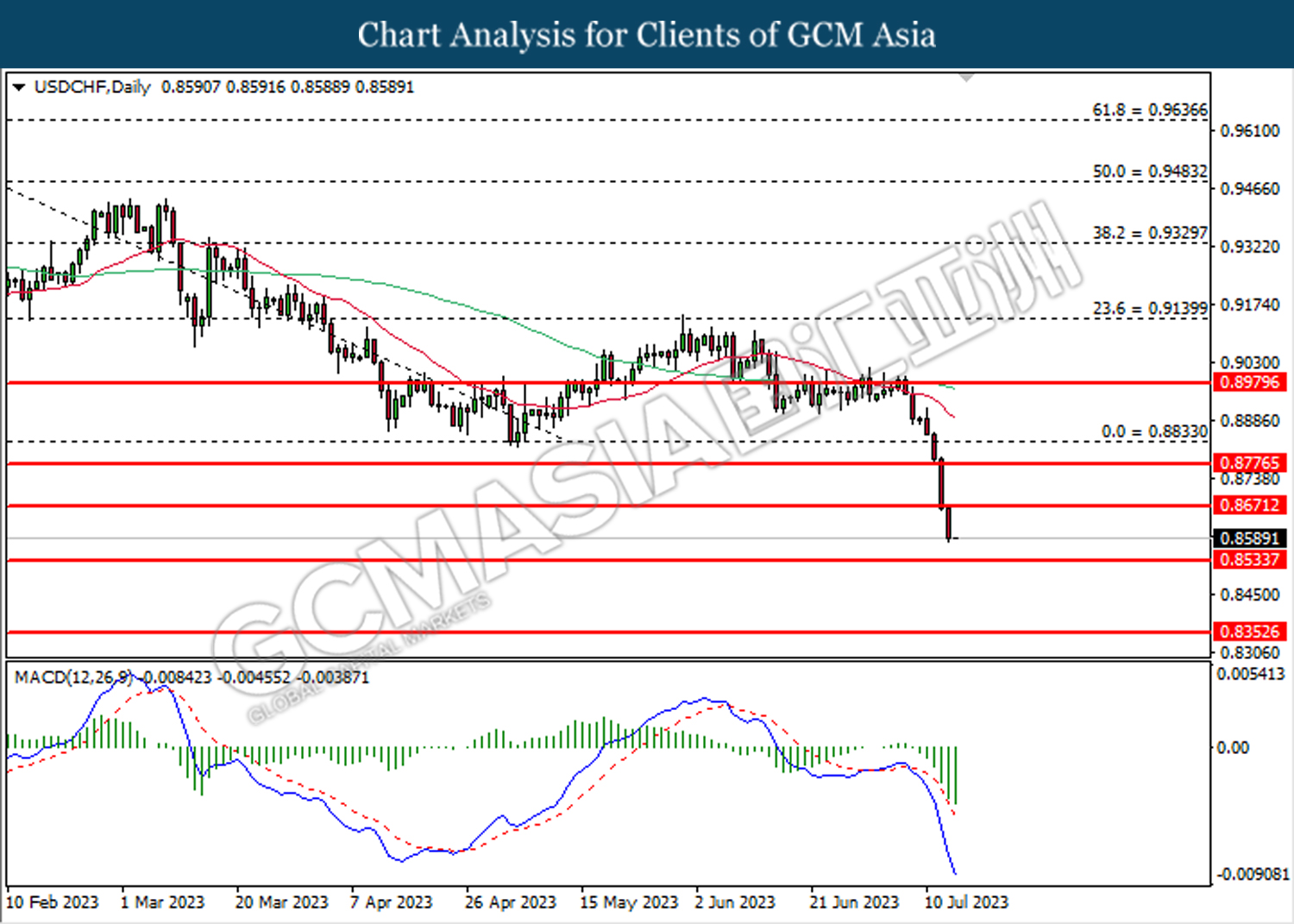

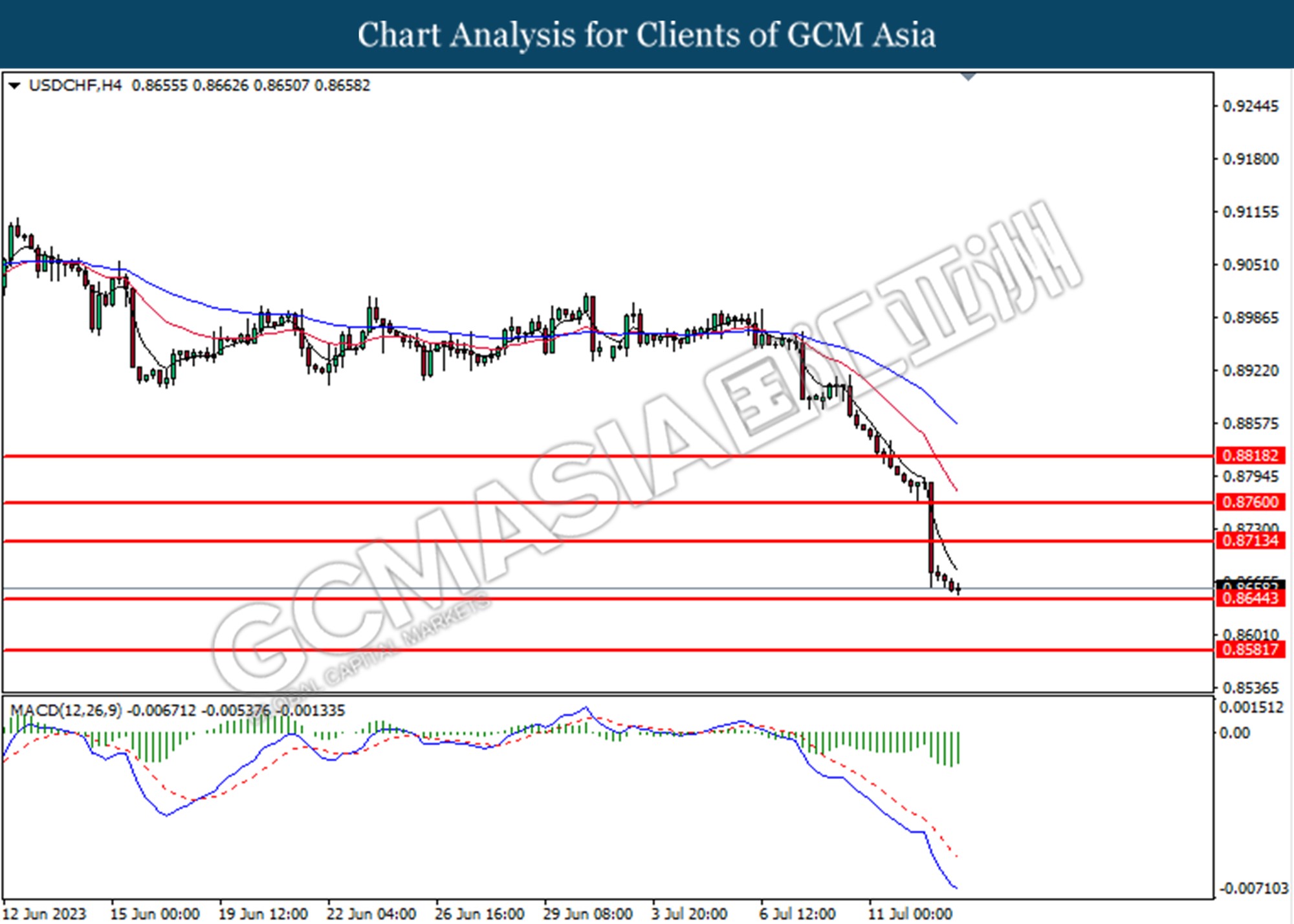

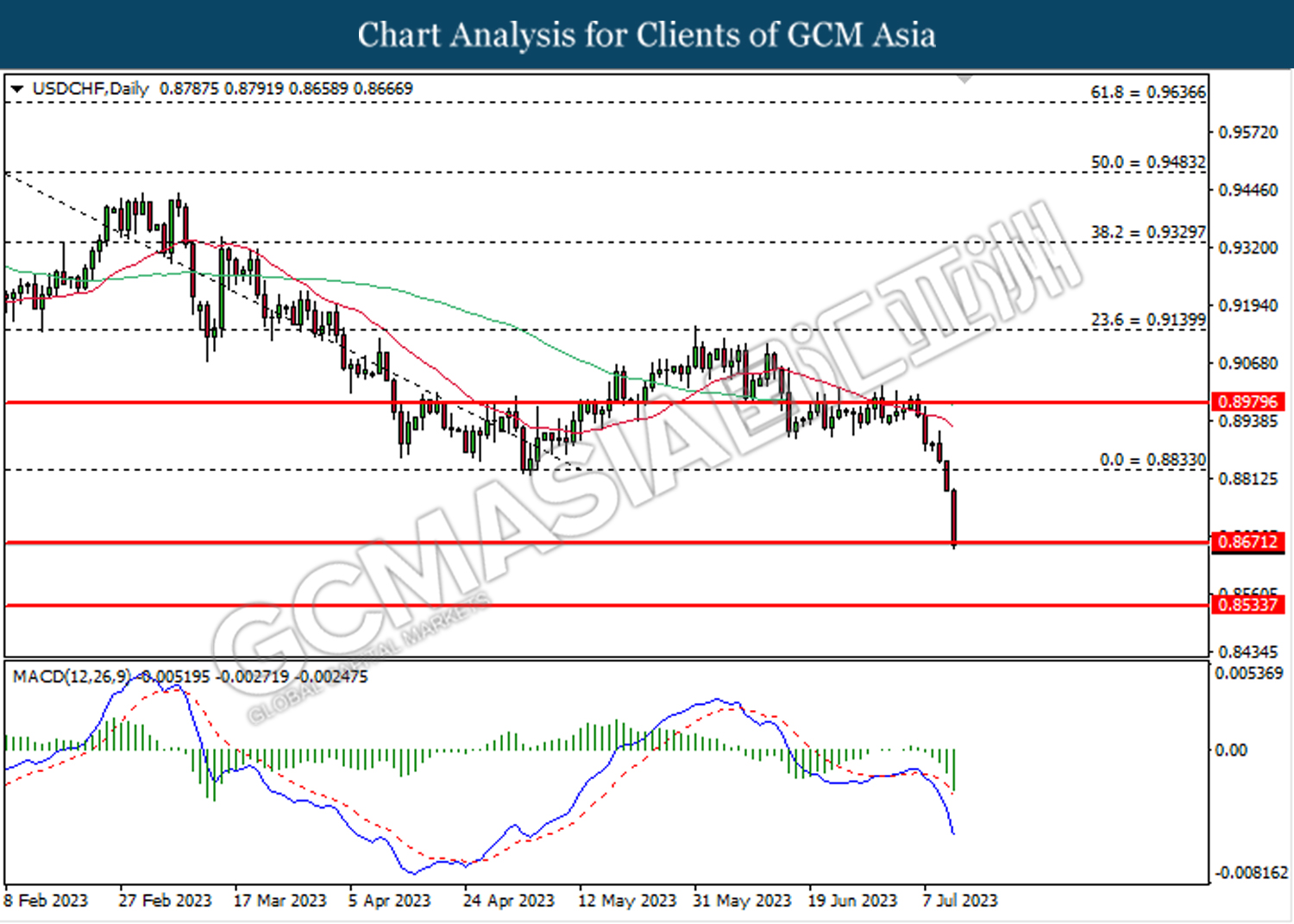

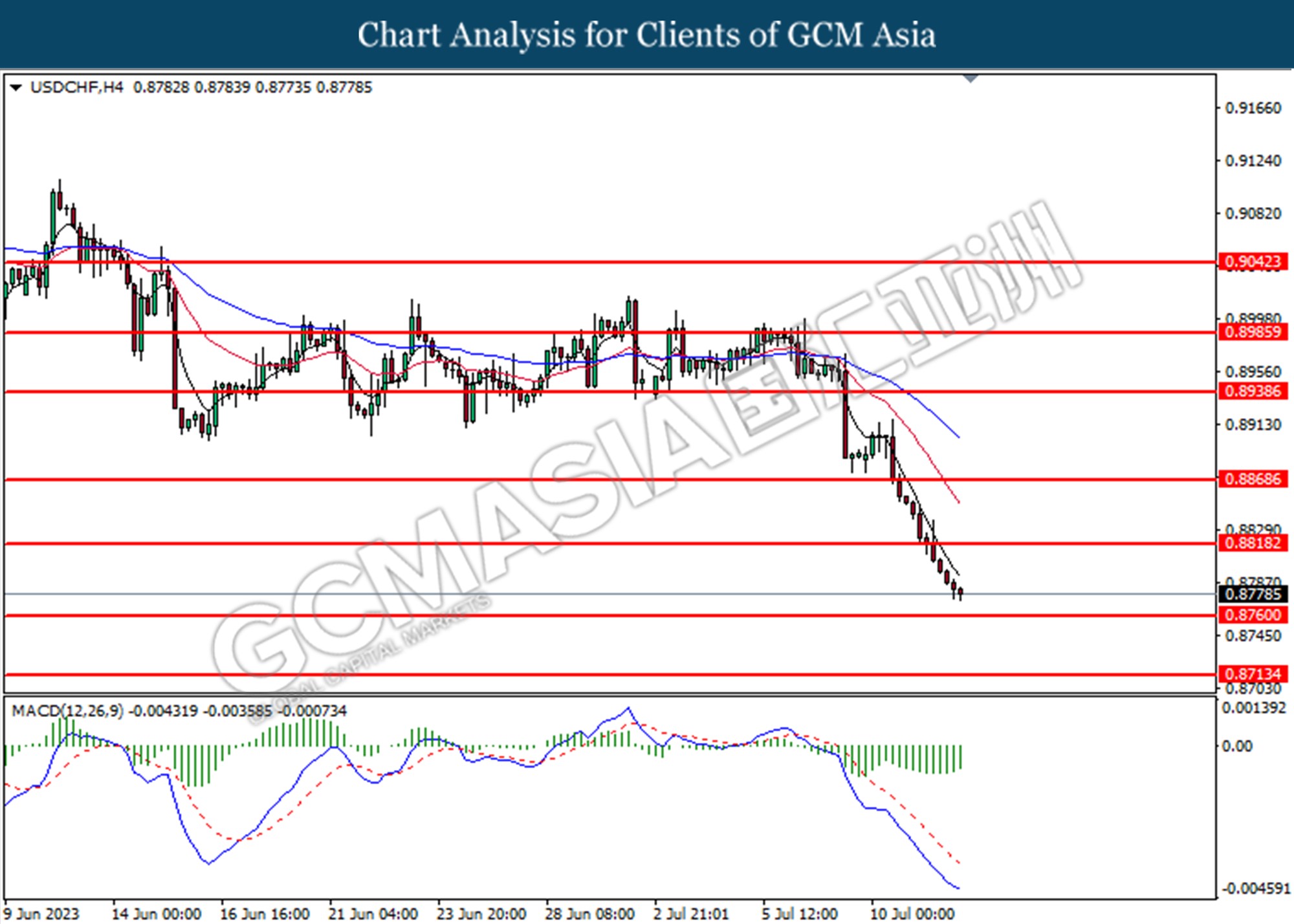

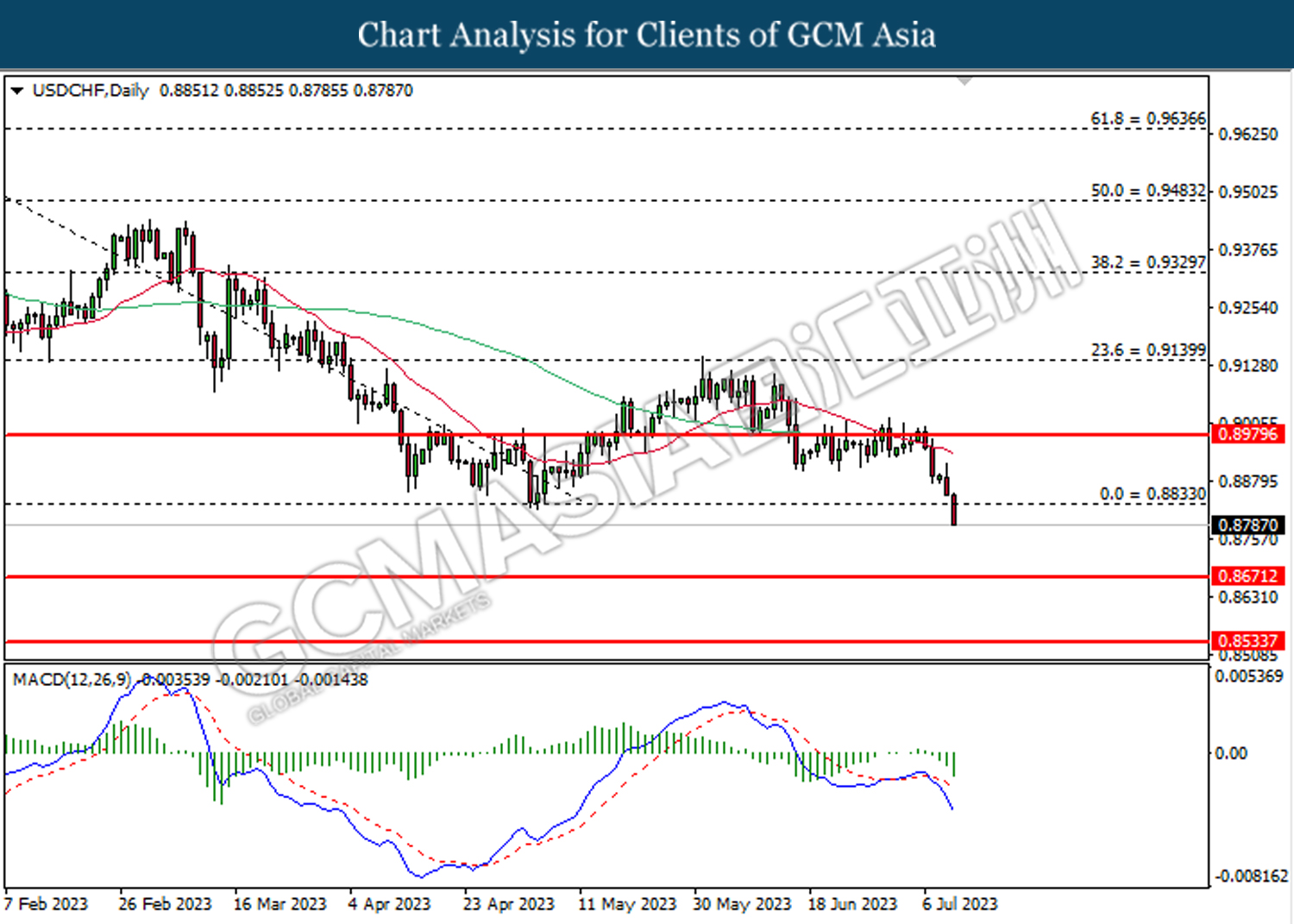

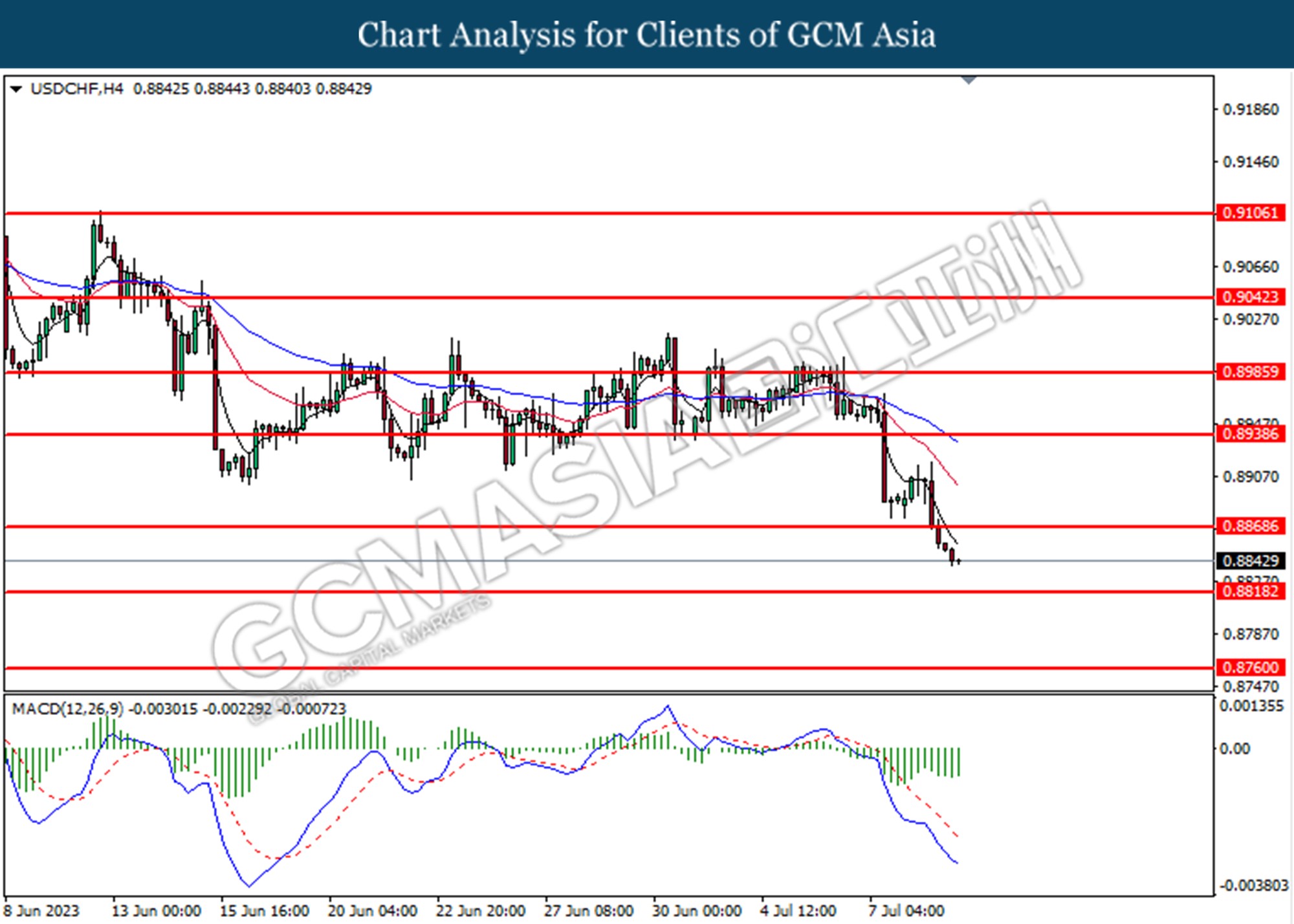

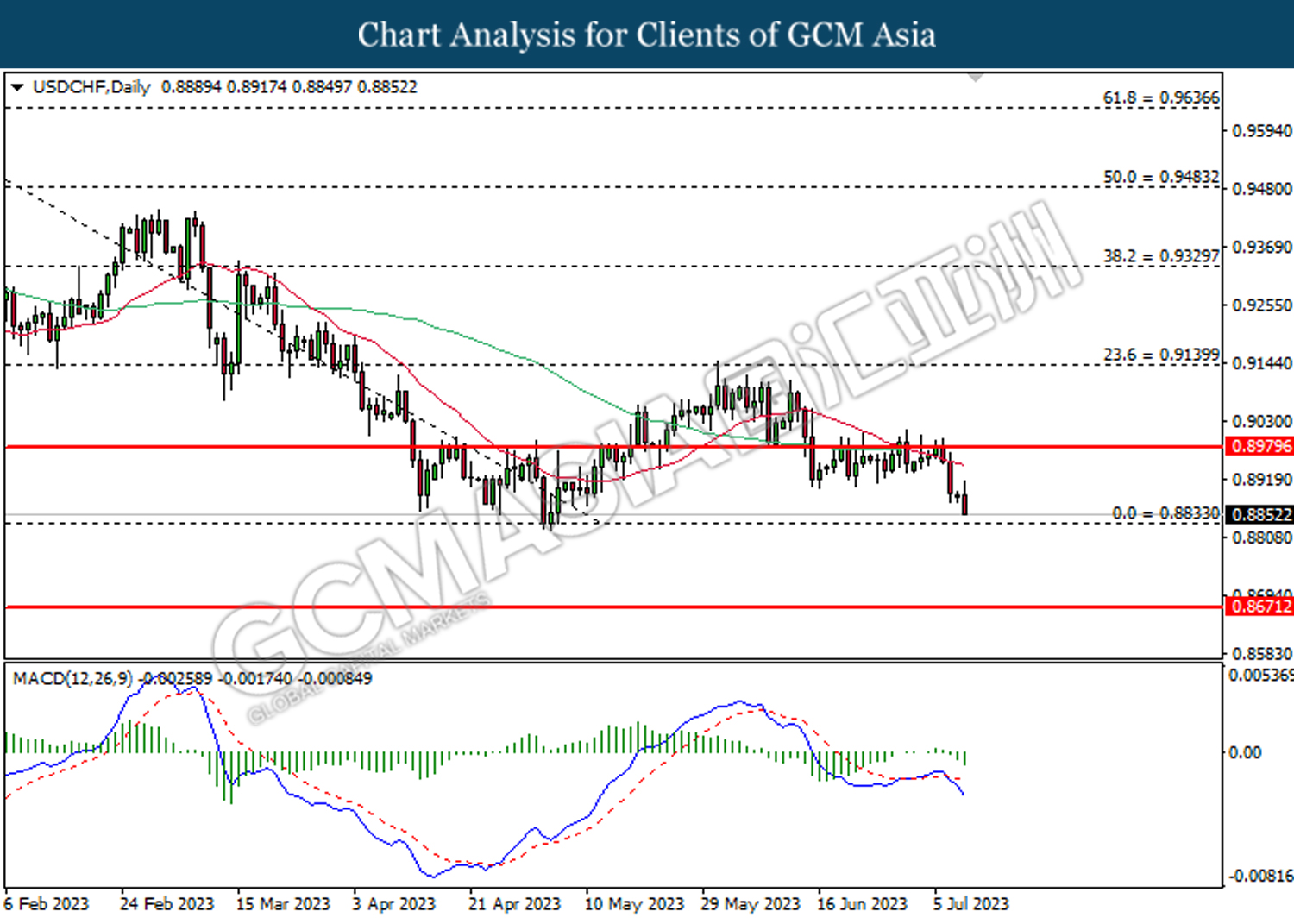

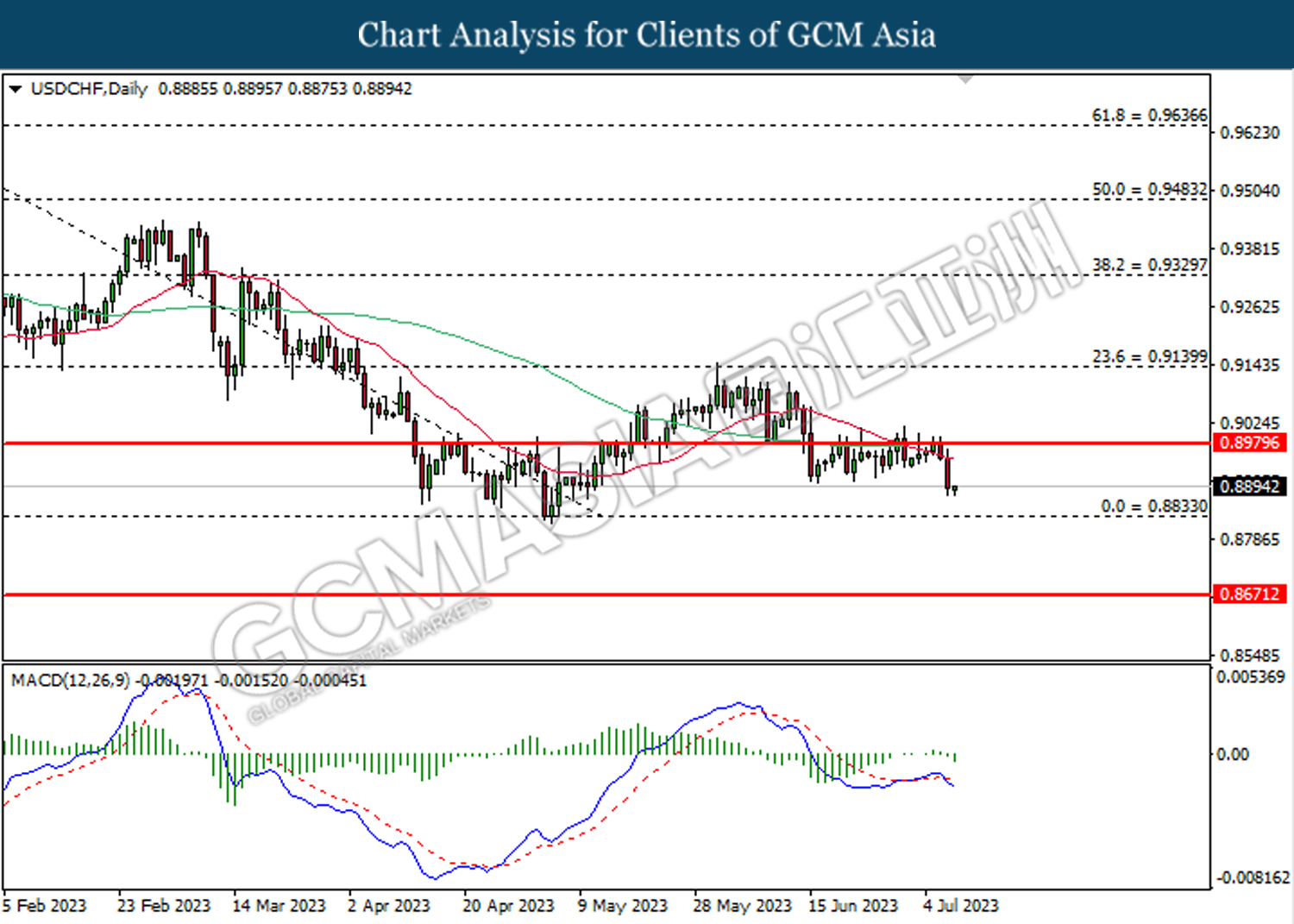

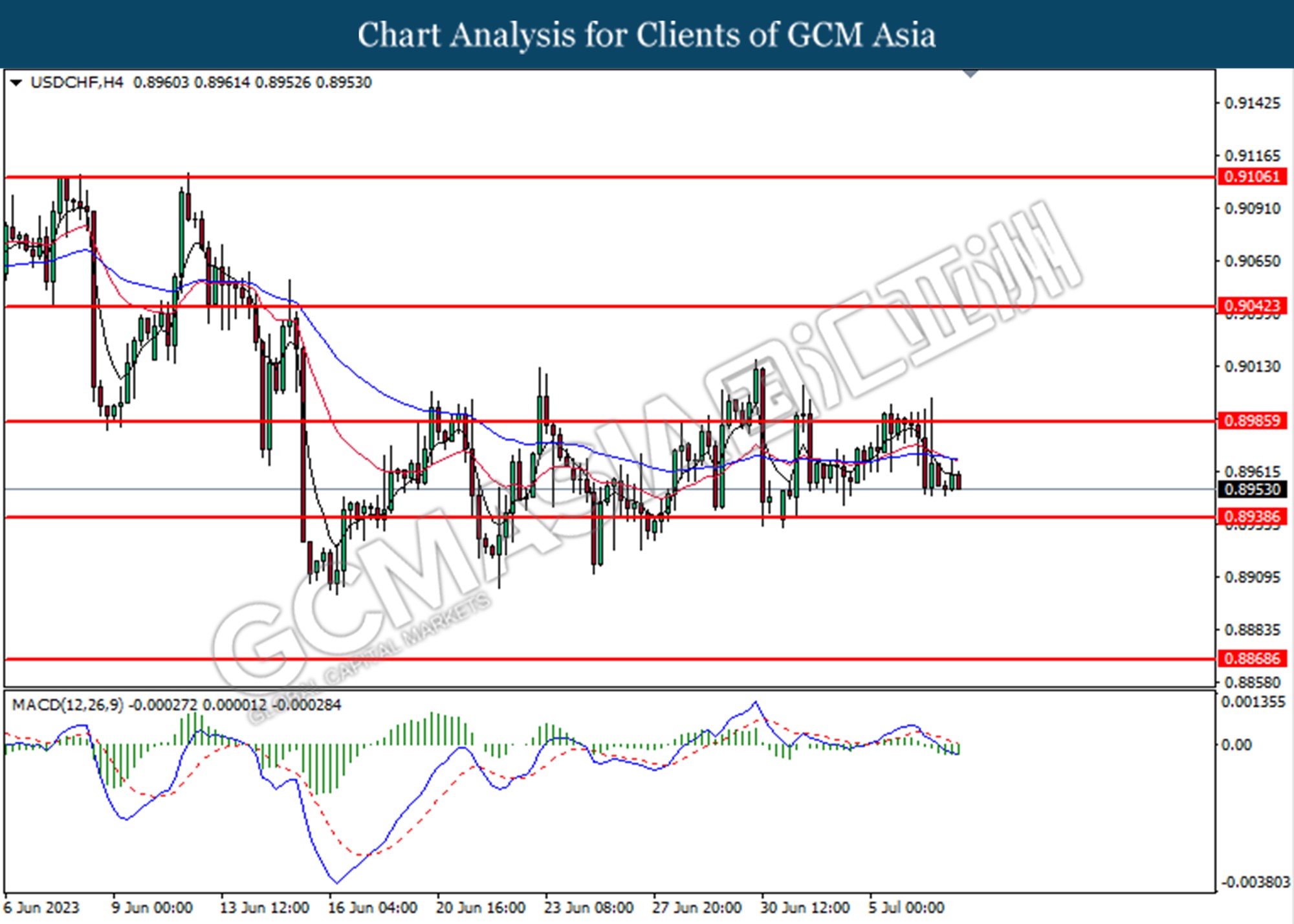

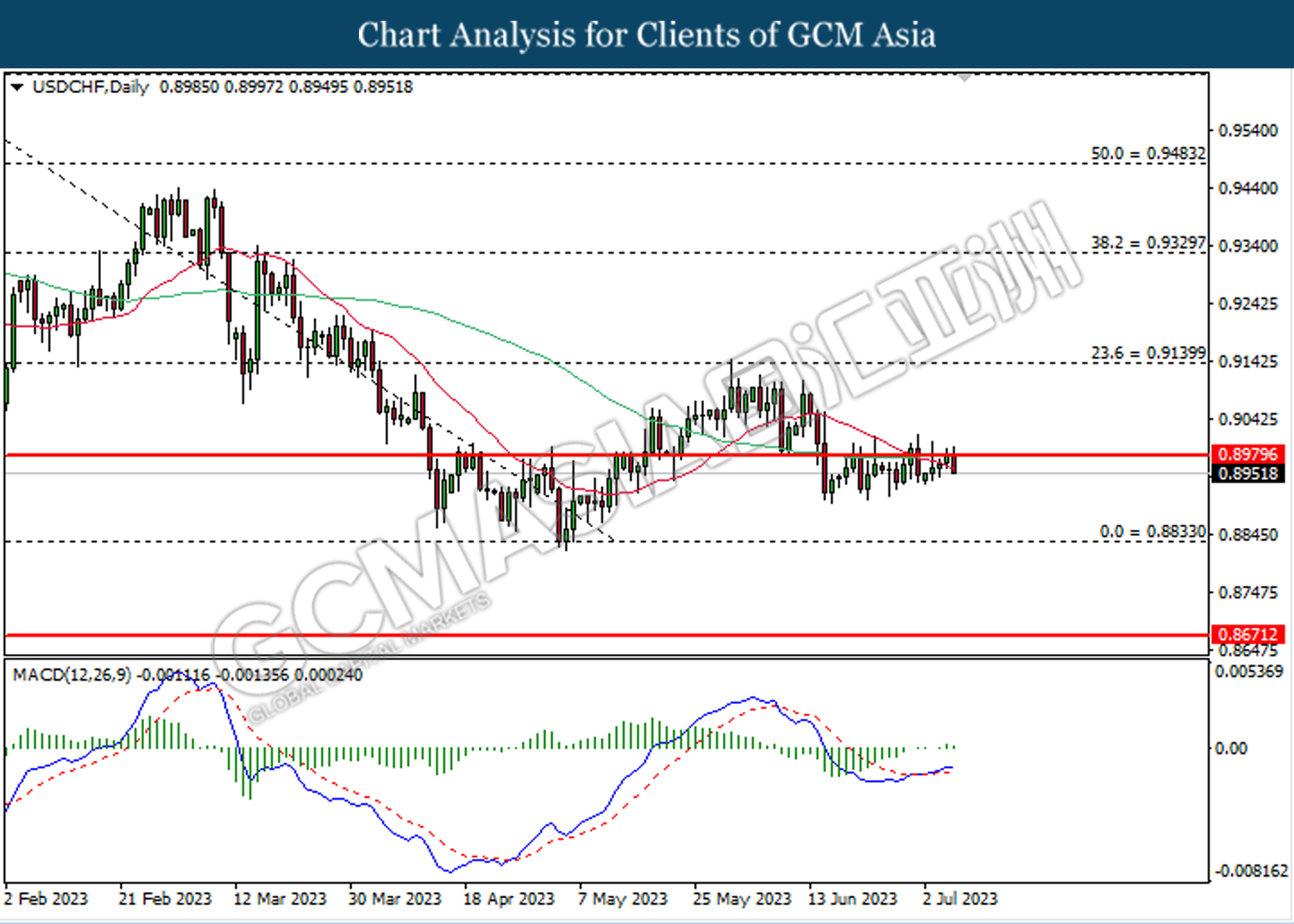

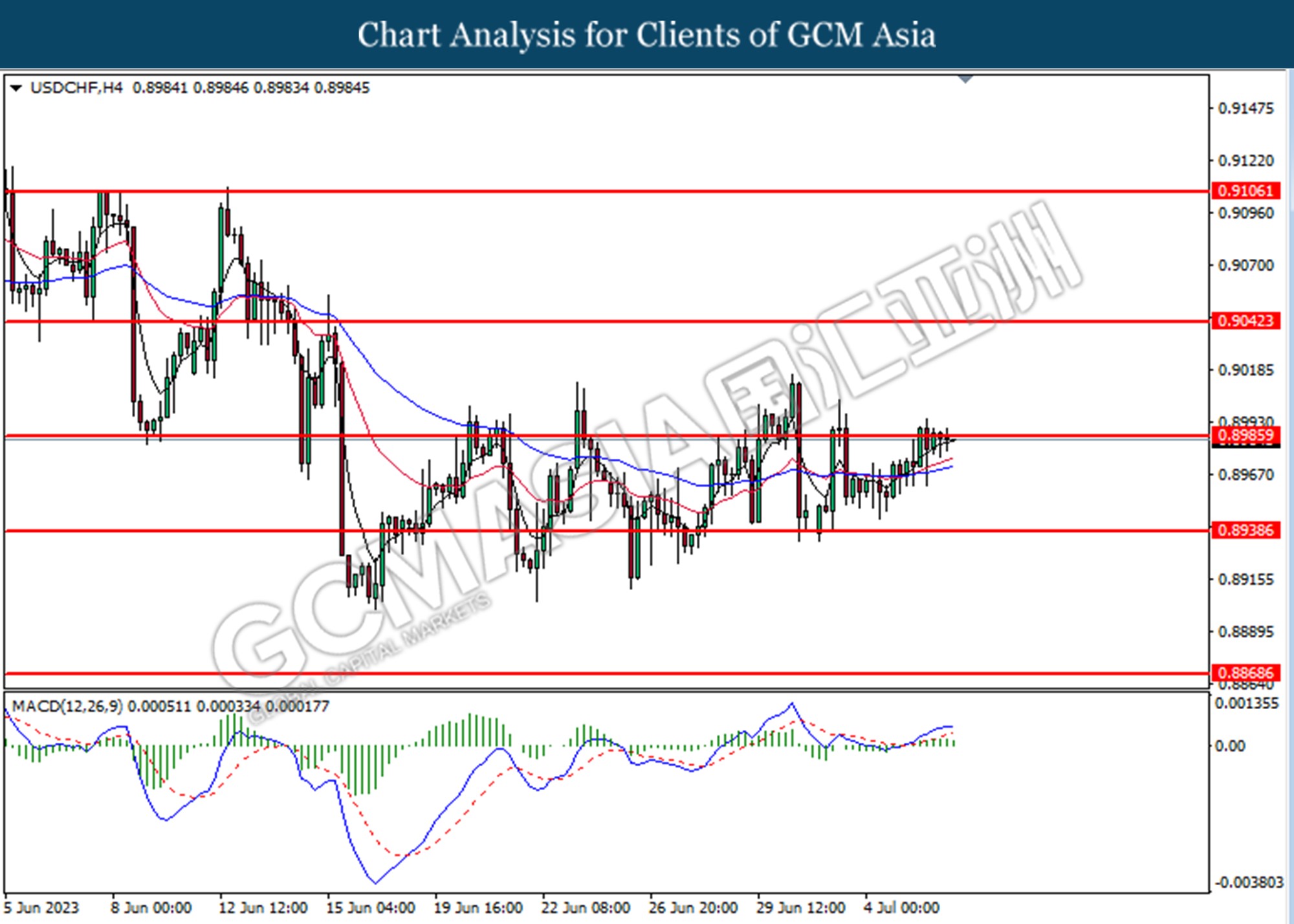

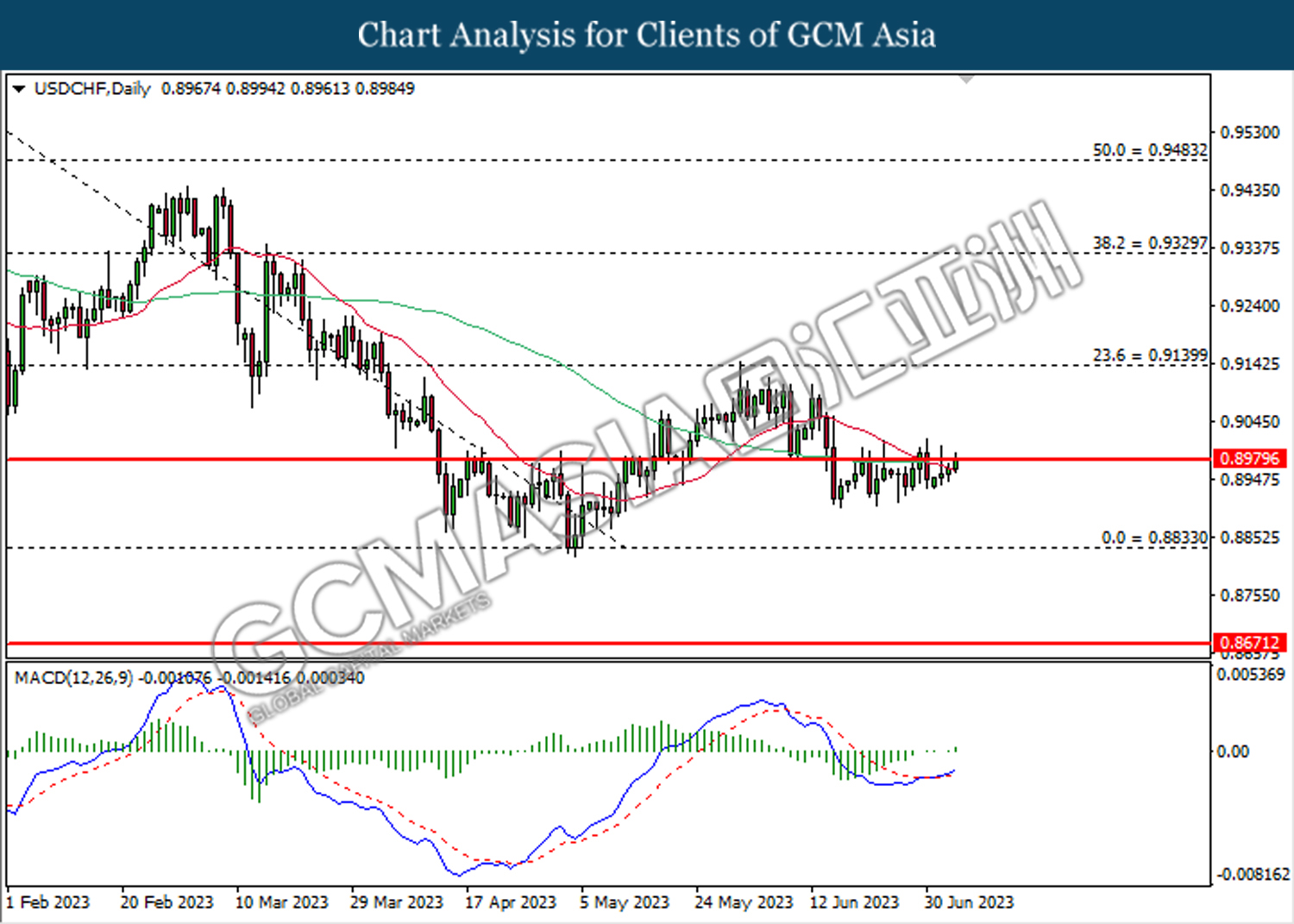

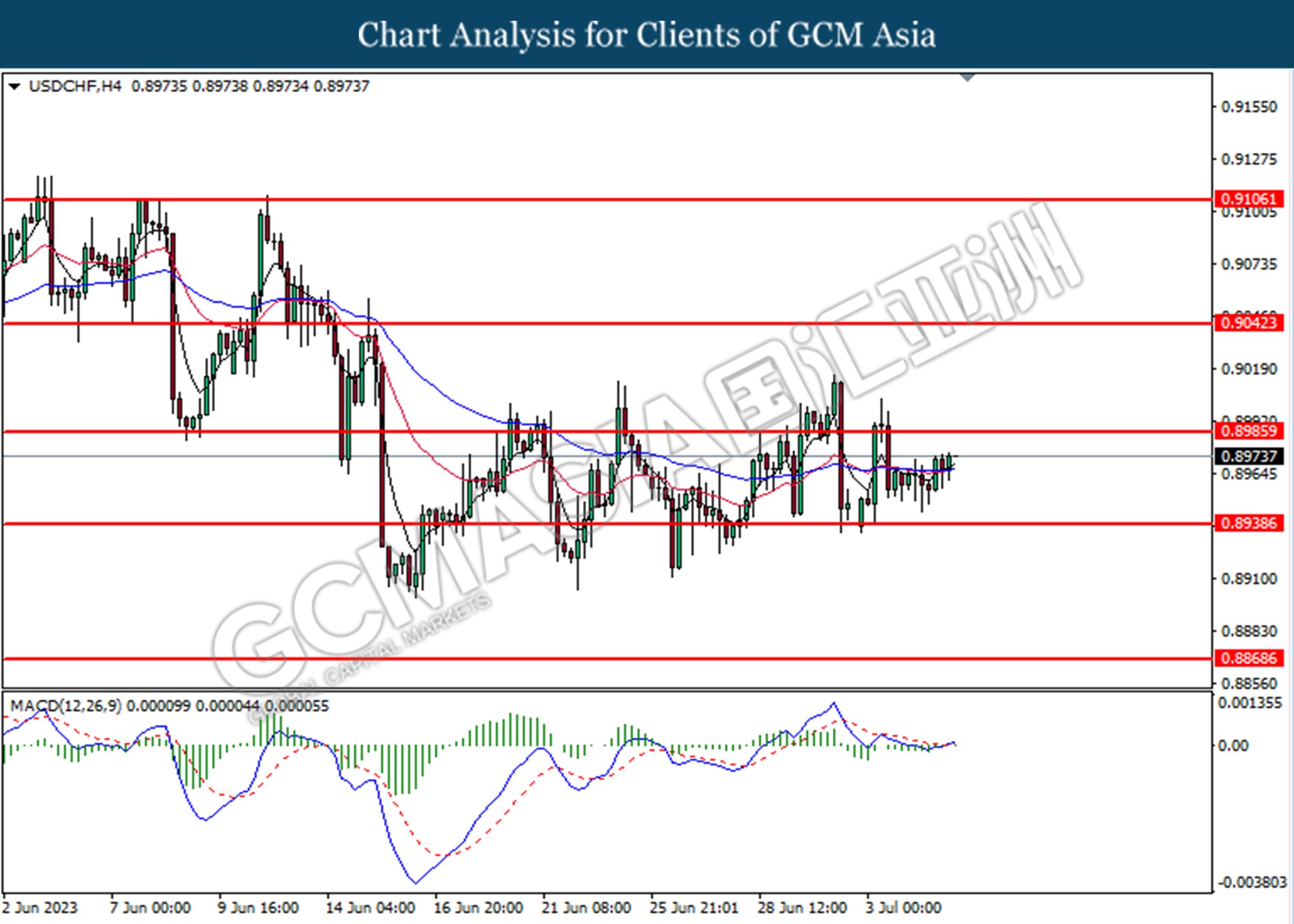

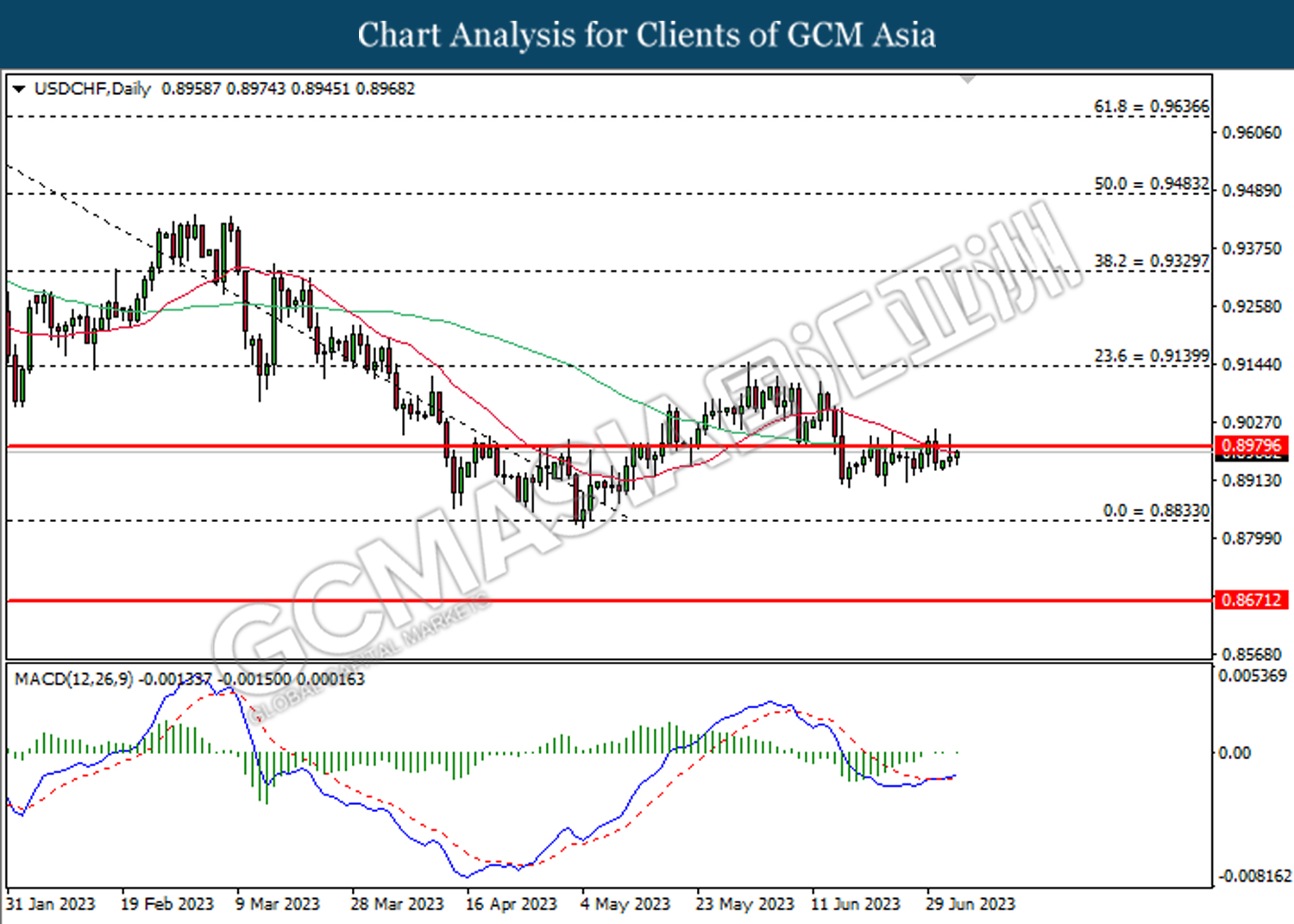

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.8670. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8535.

Resistance level: 0.8670, 0.8775

Support level: 0.8535, 0.8355

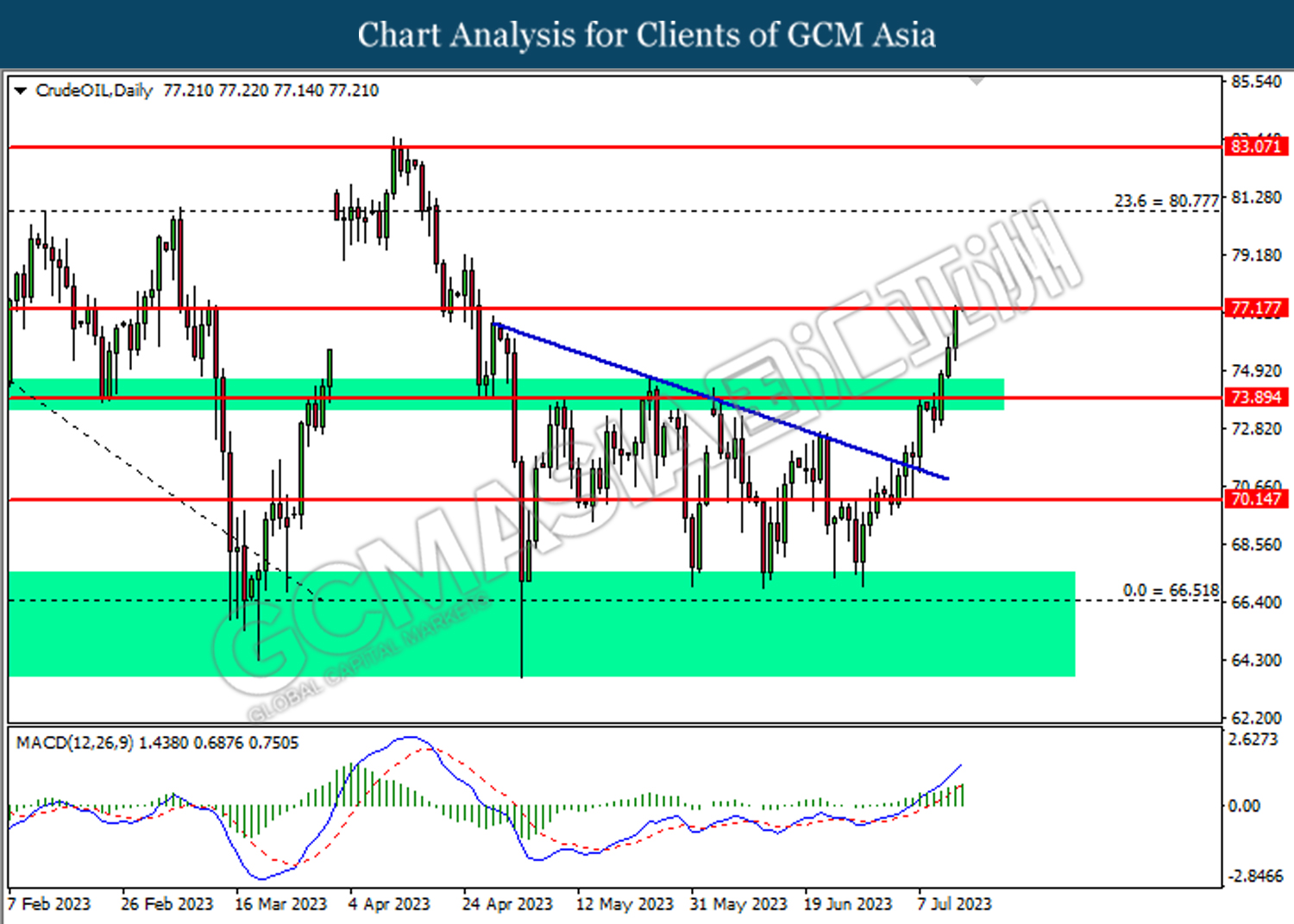

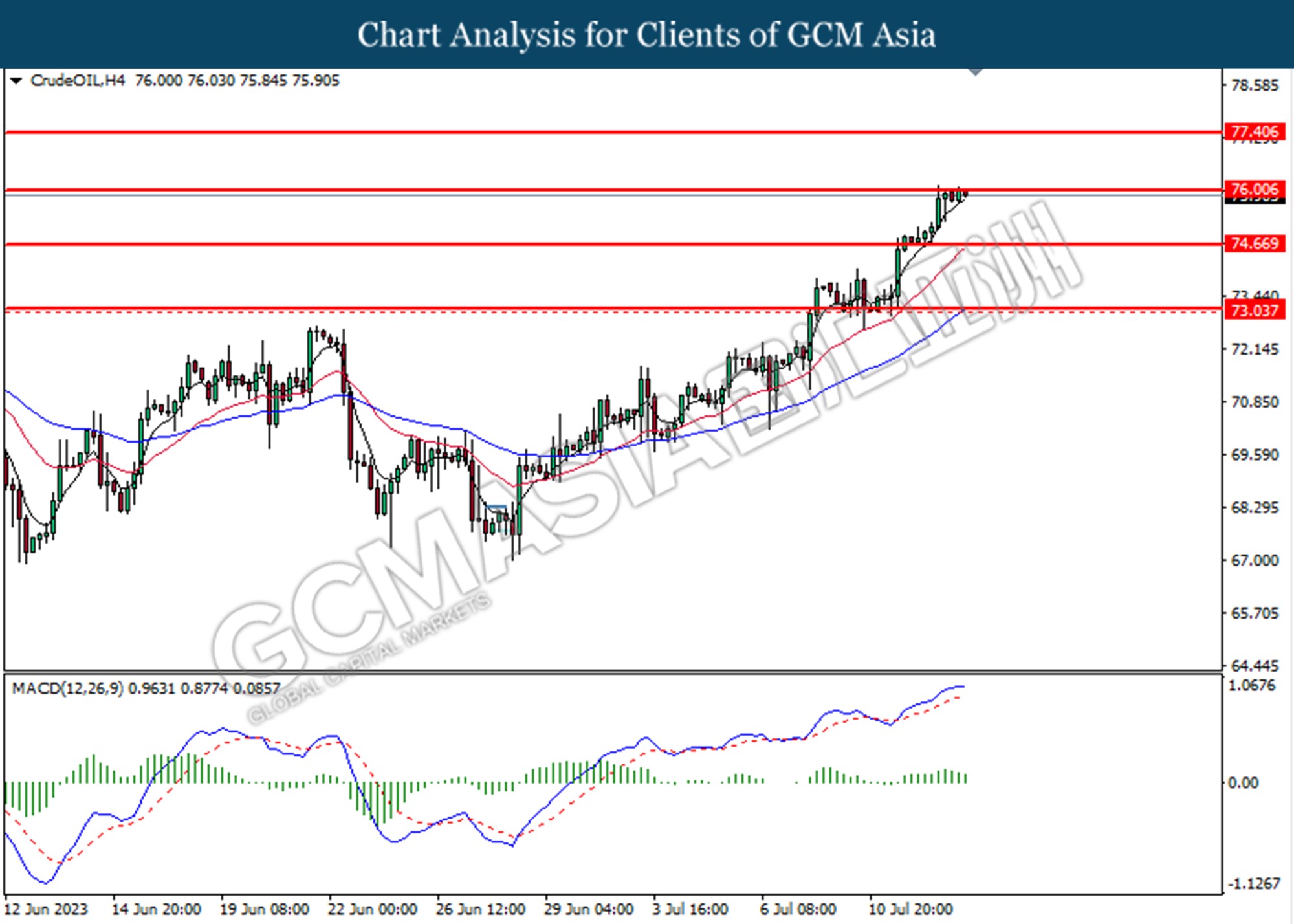

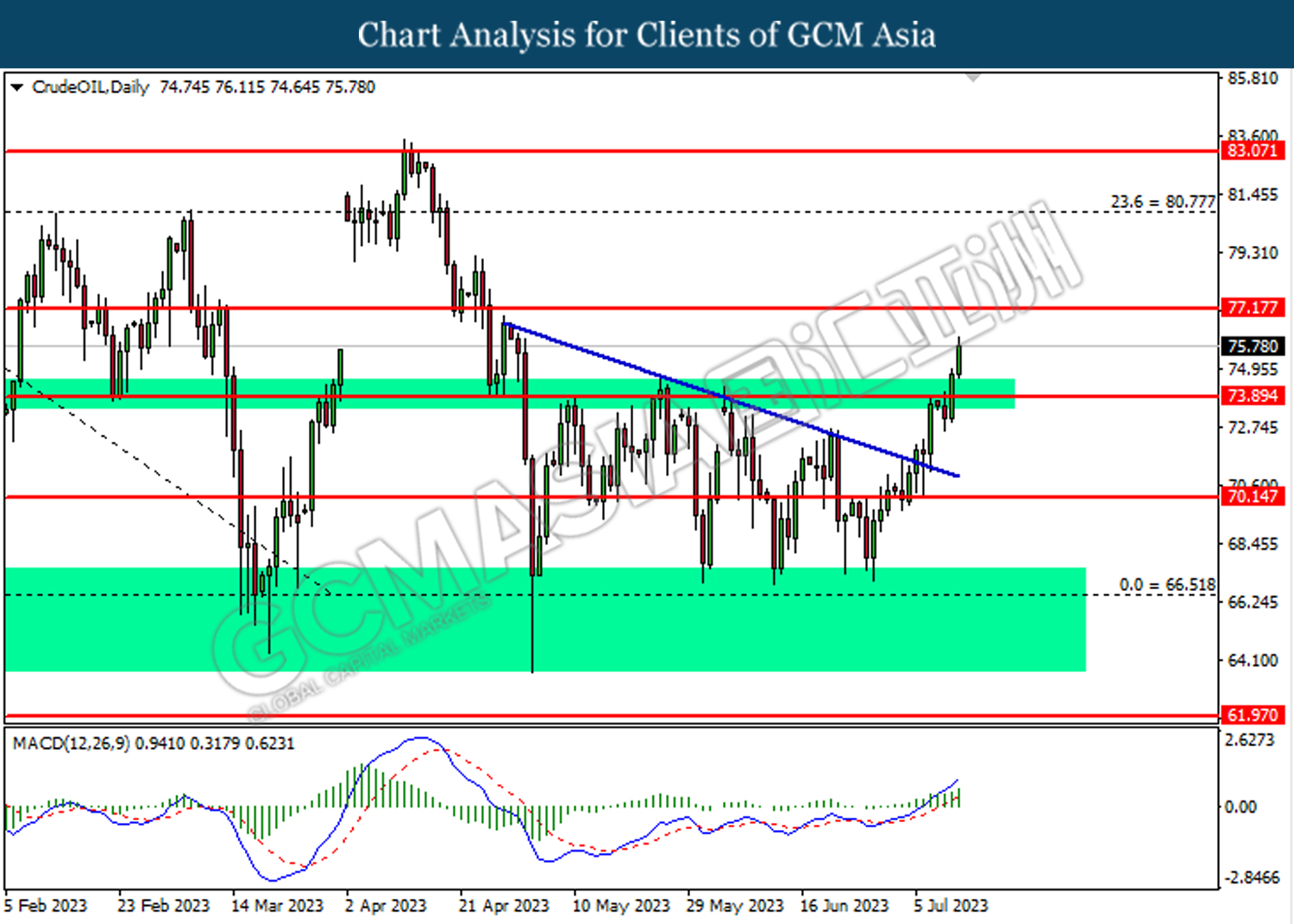

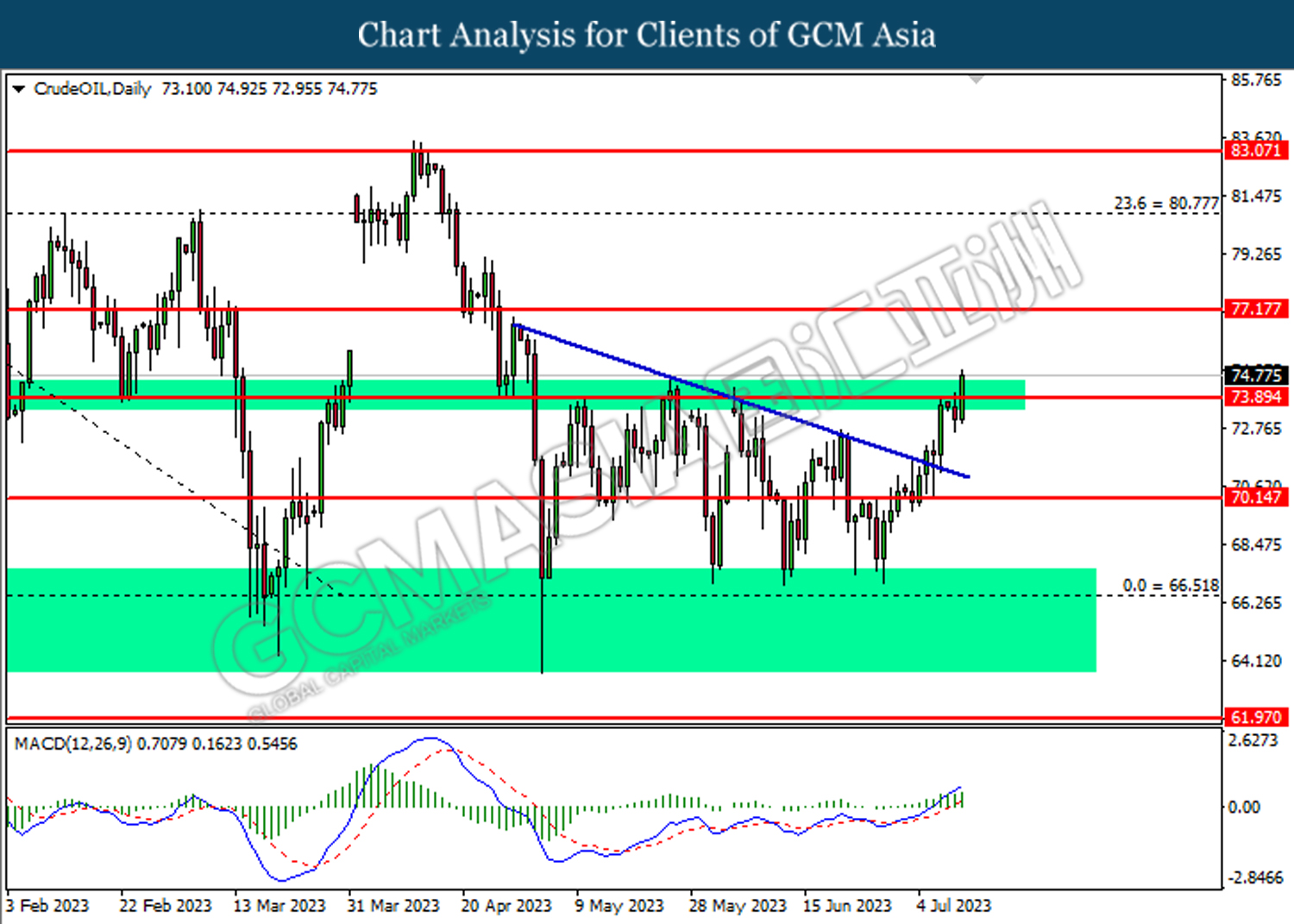

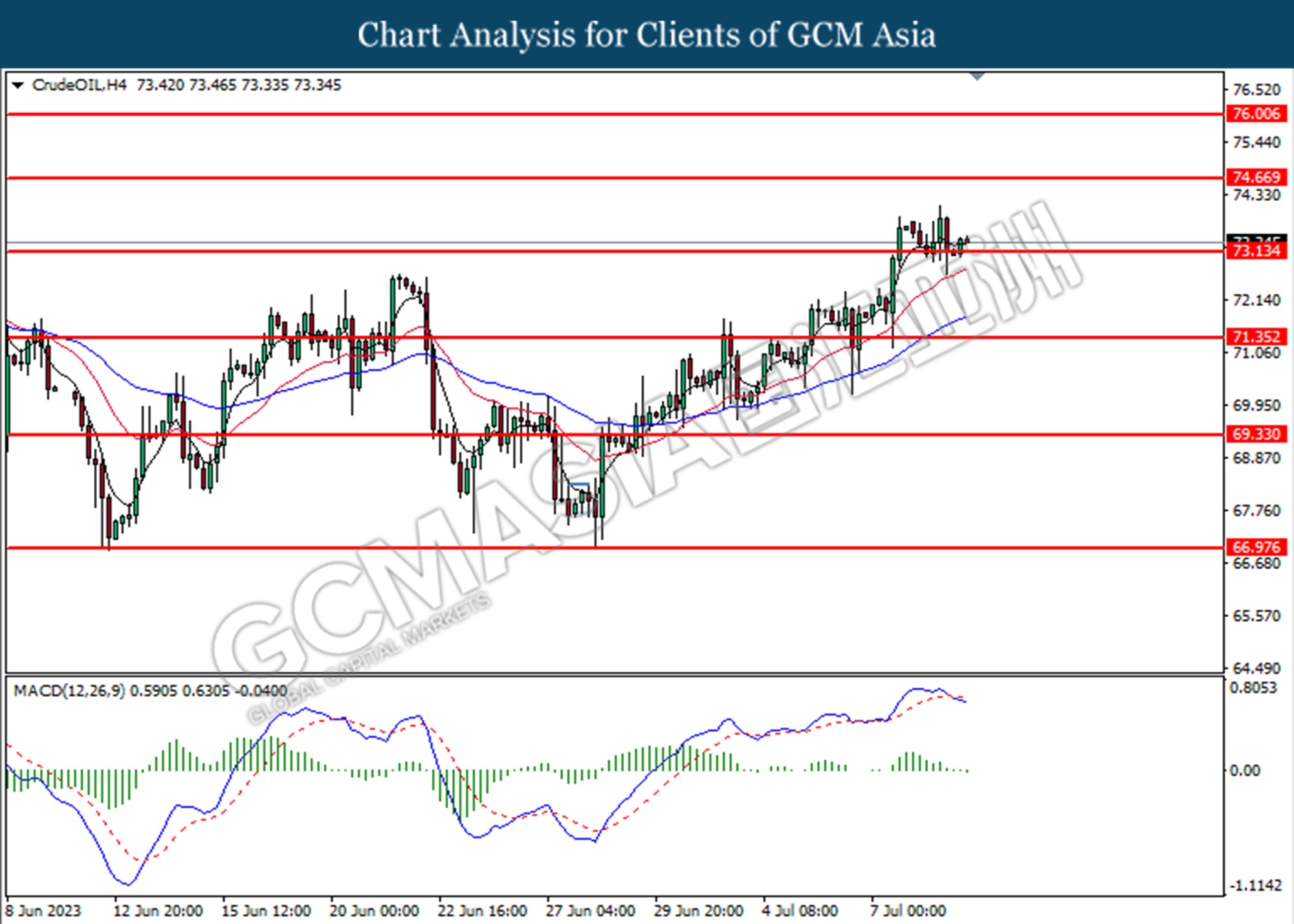

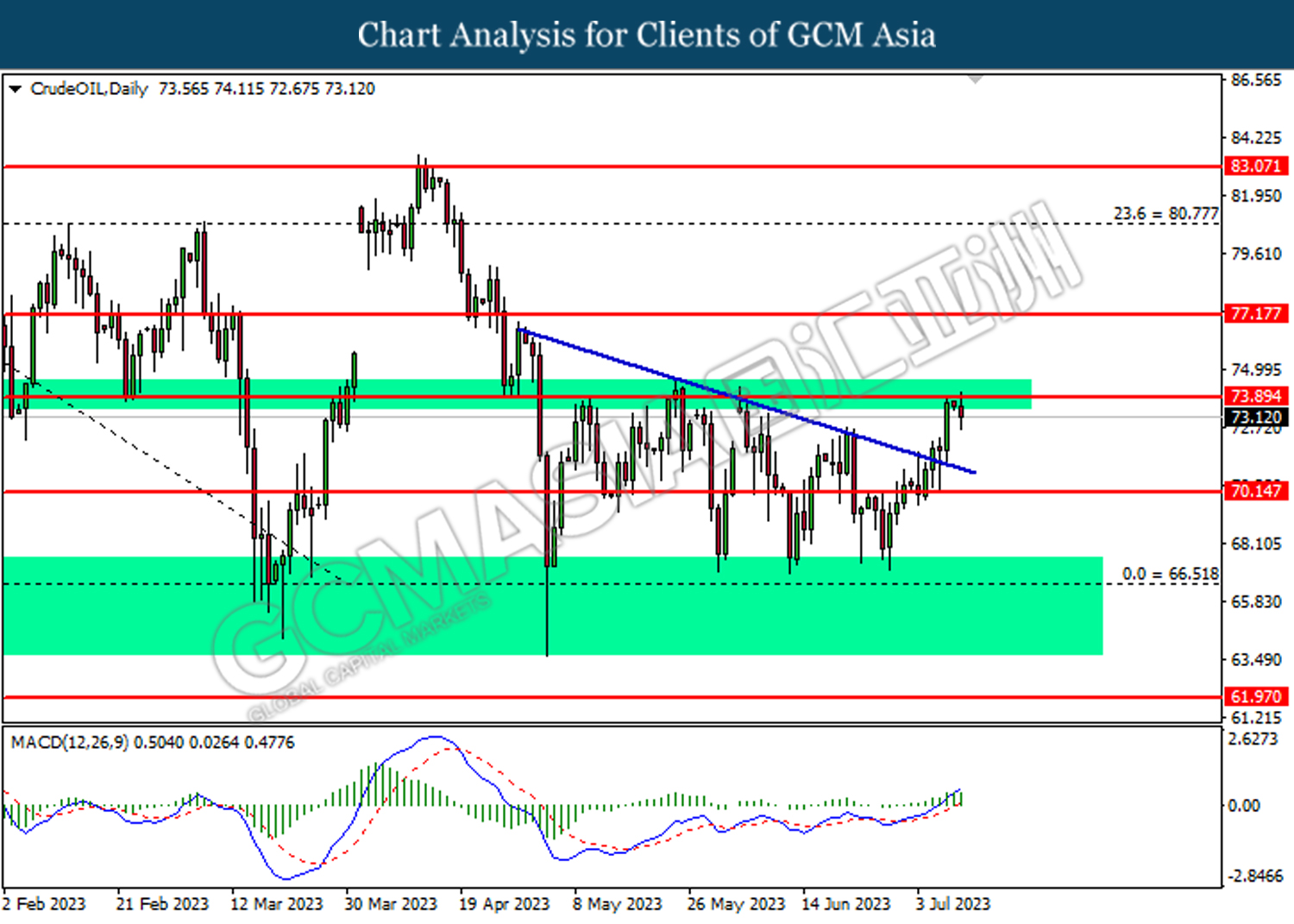

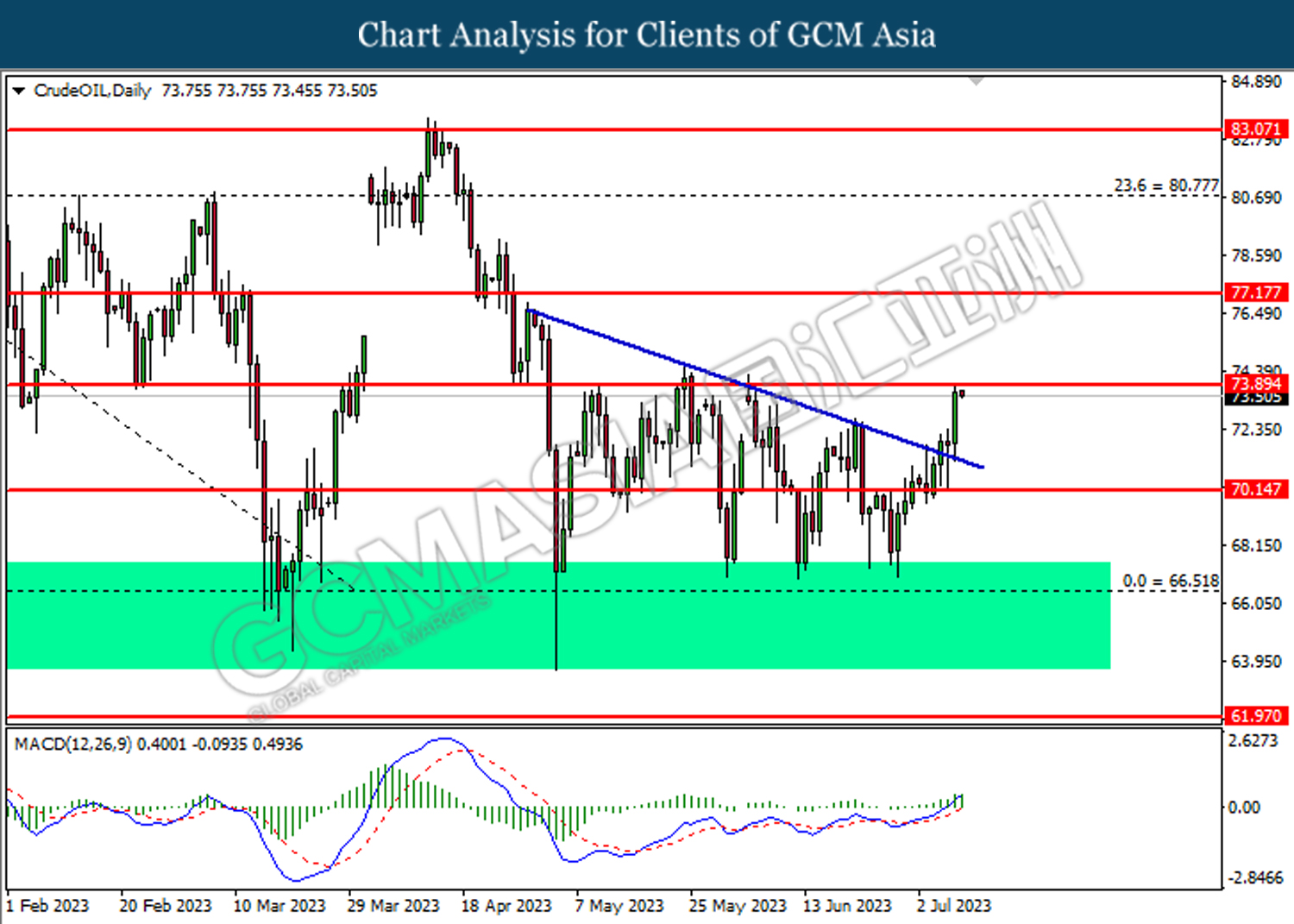

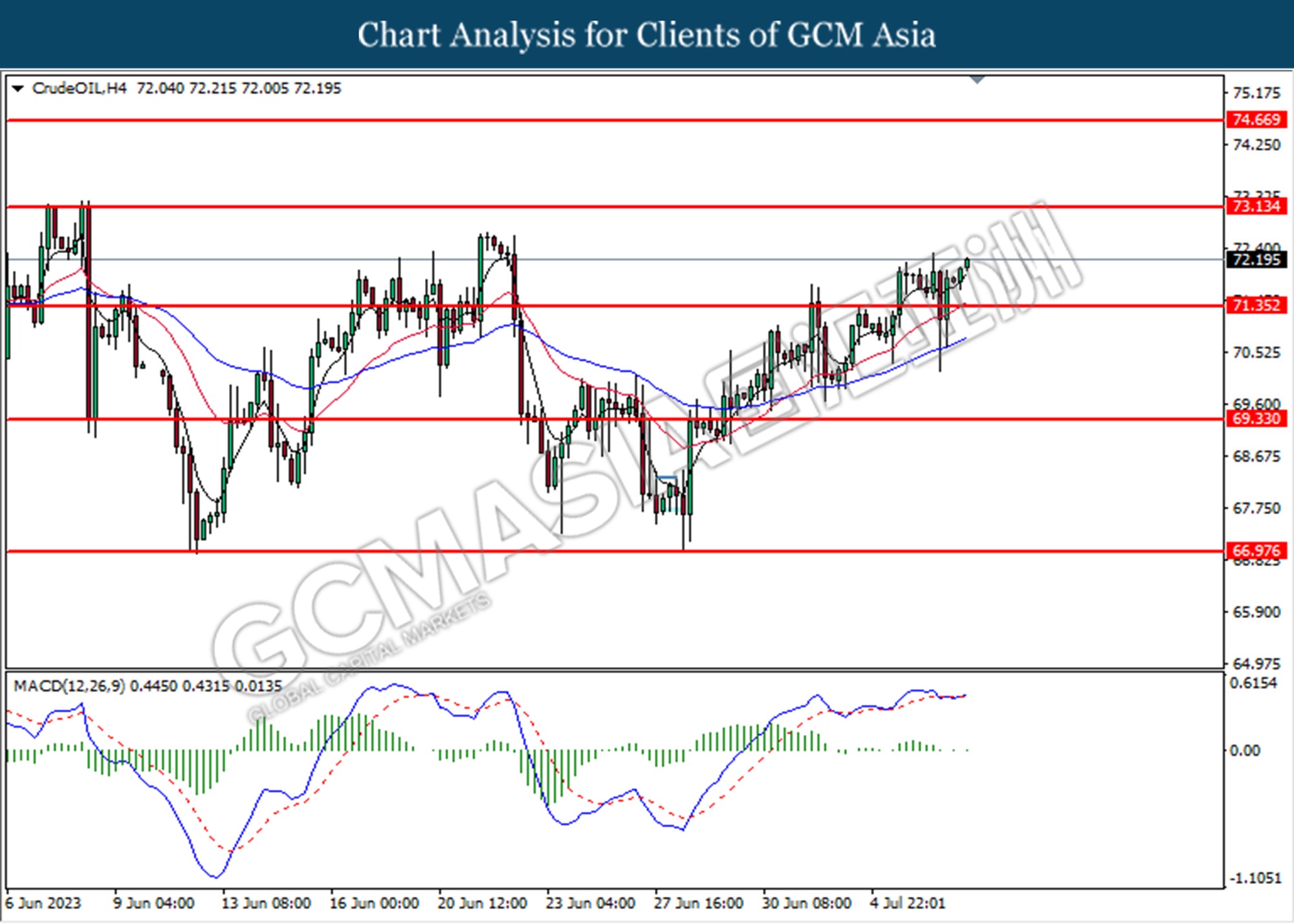

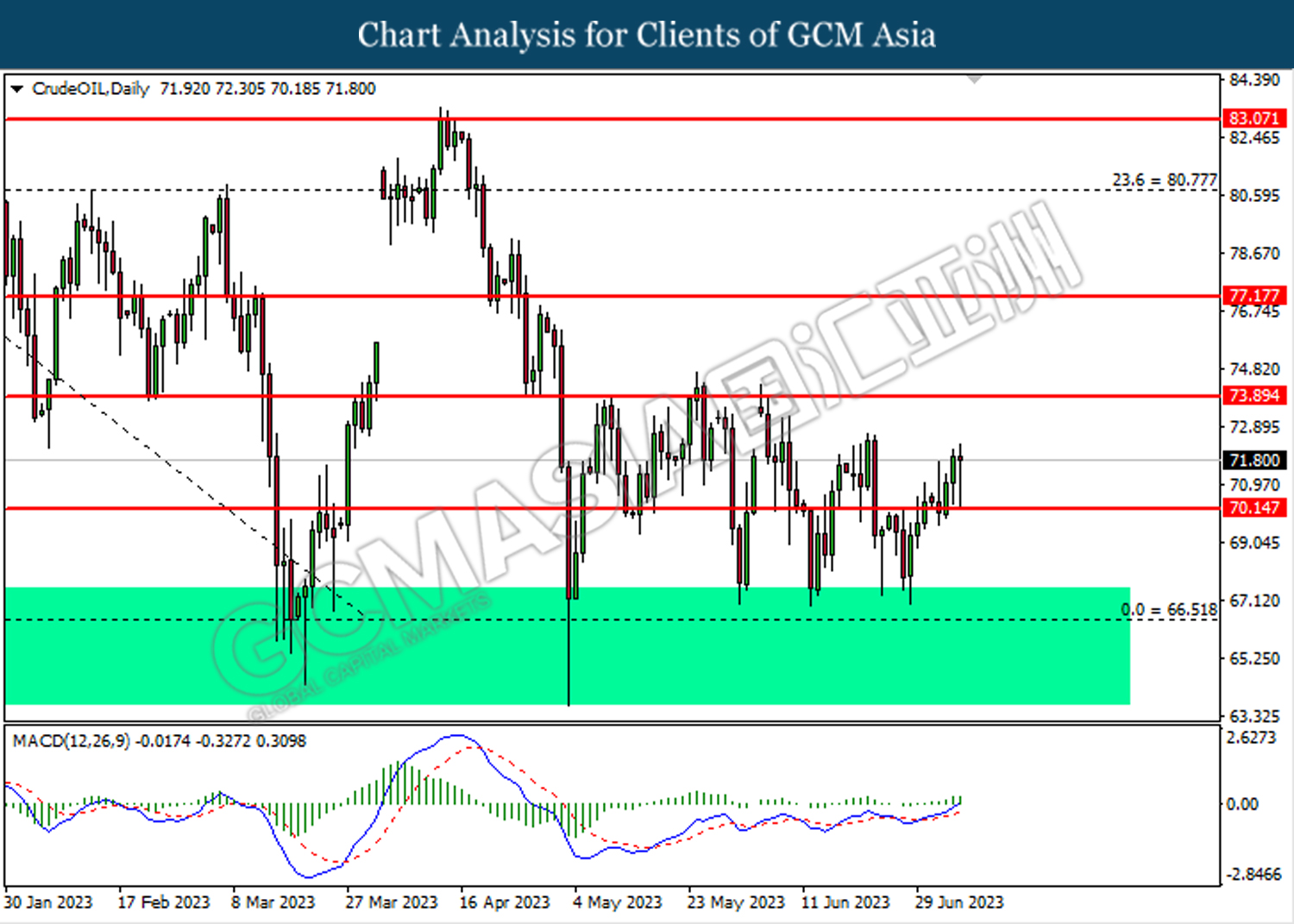

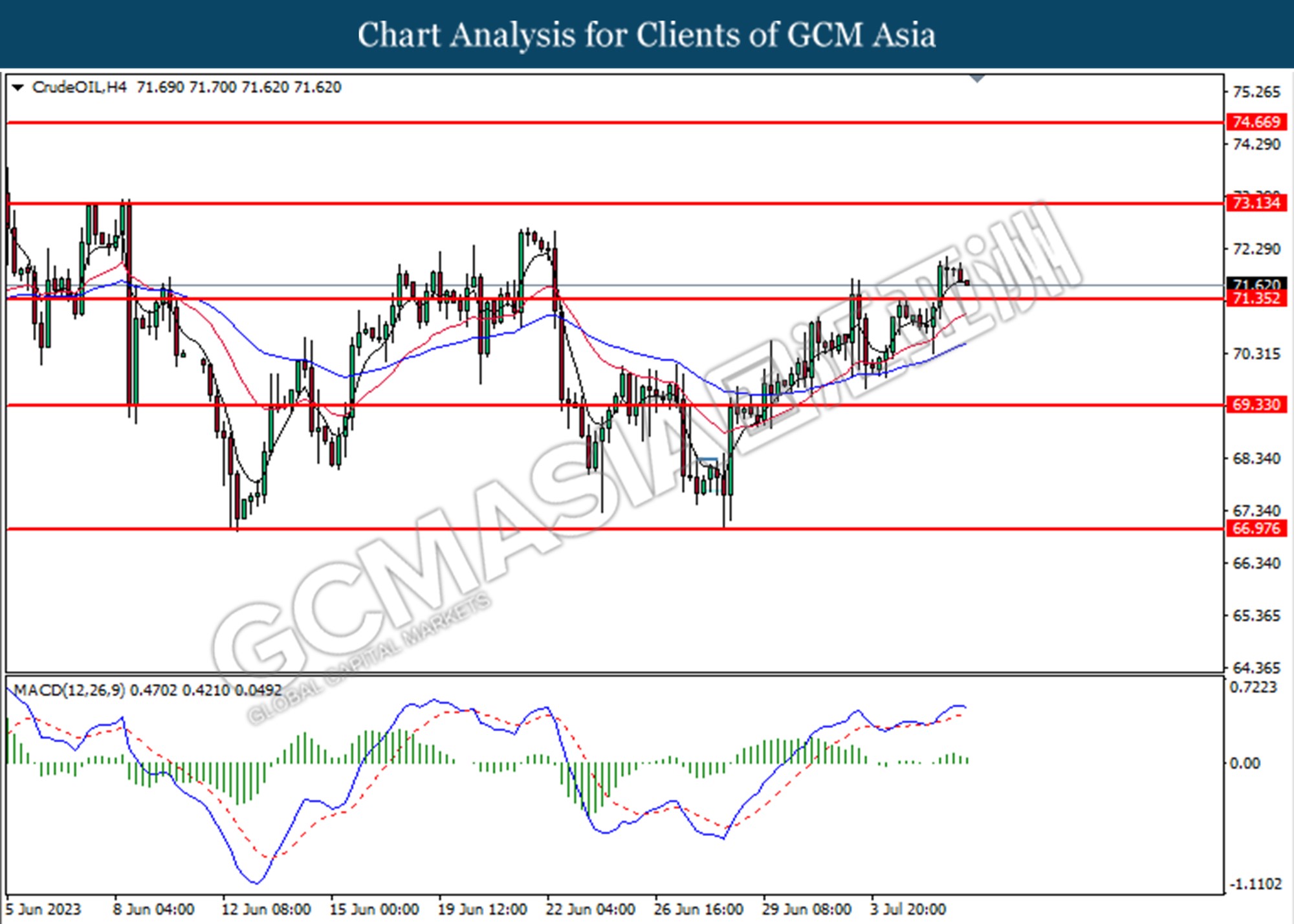

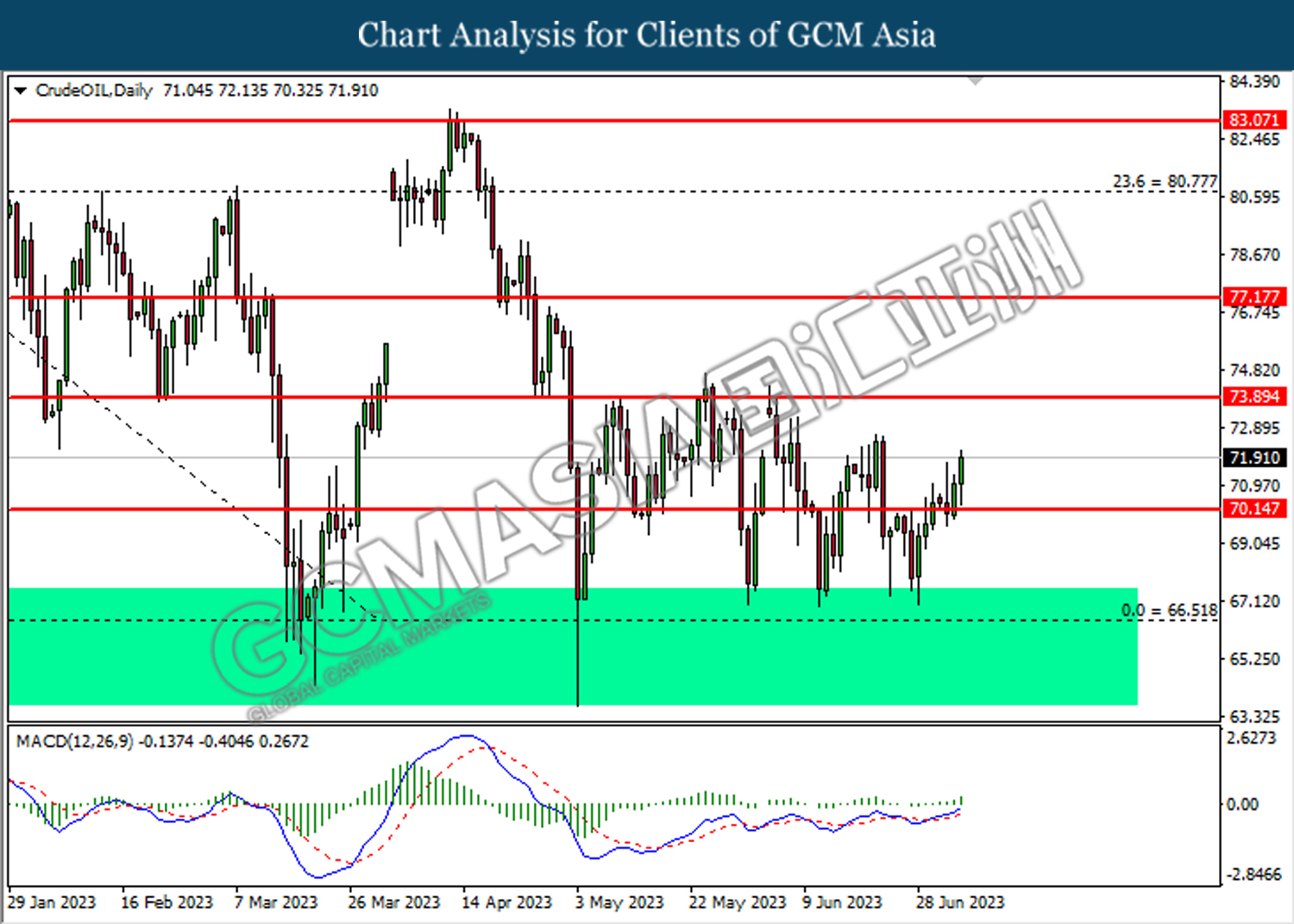

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 73.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 77.15.

Resistance level: 77.15, 80.75

Support level: 73.90, 70.15

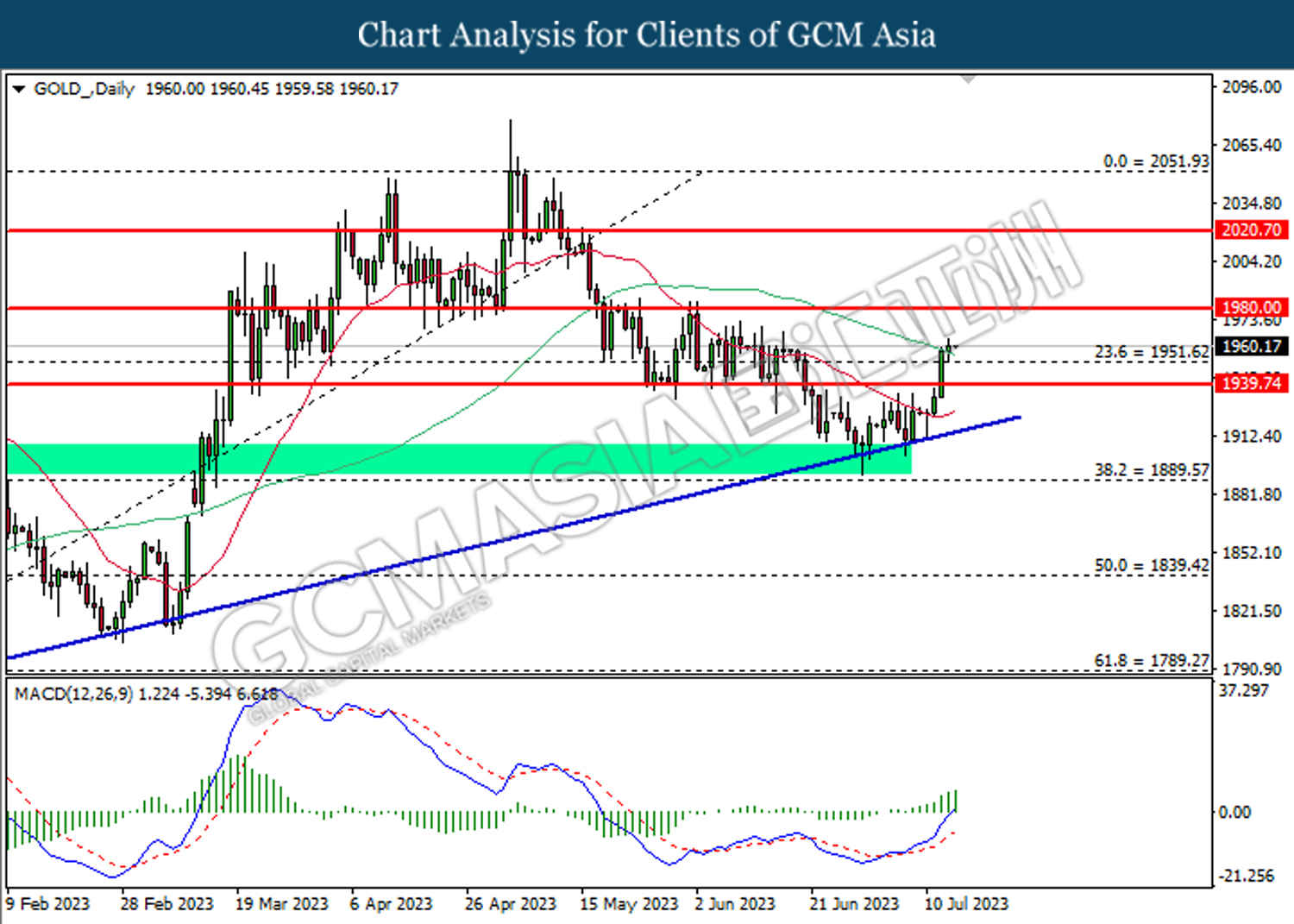

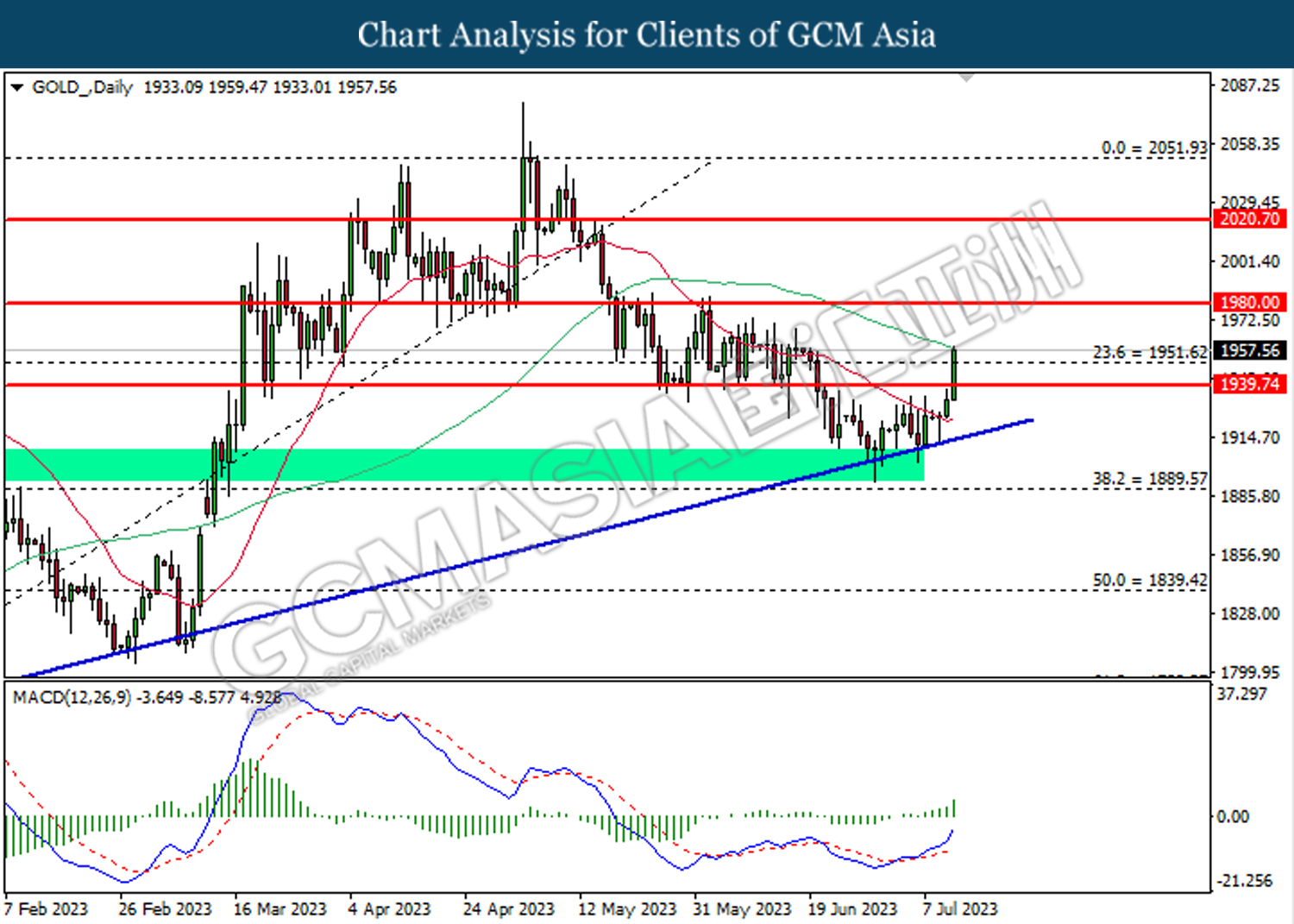

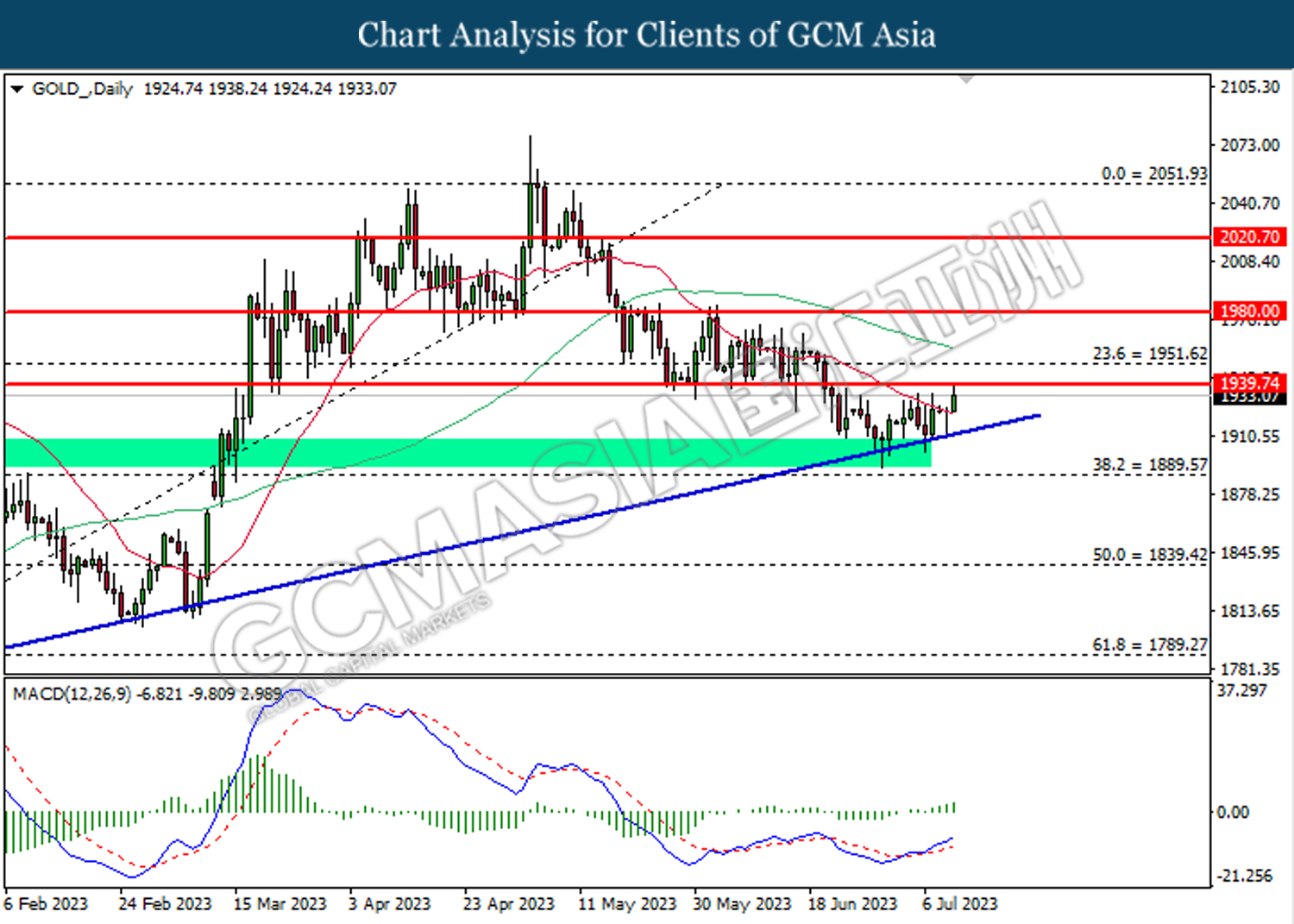

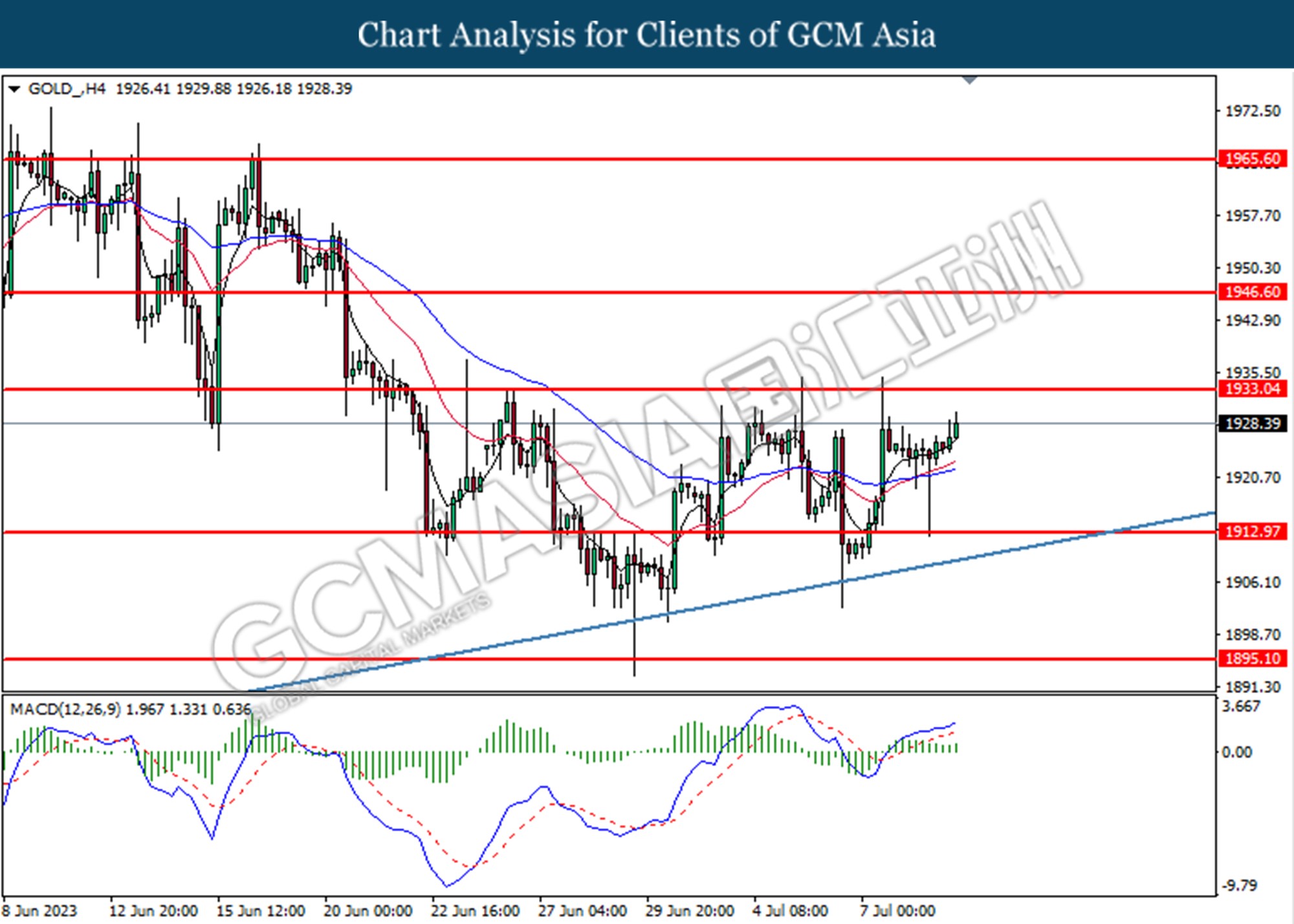

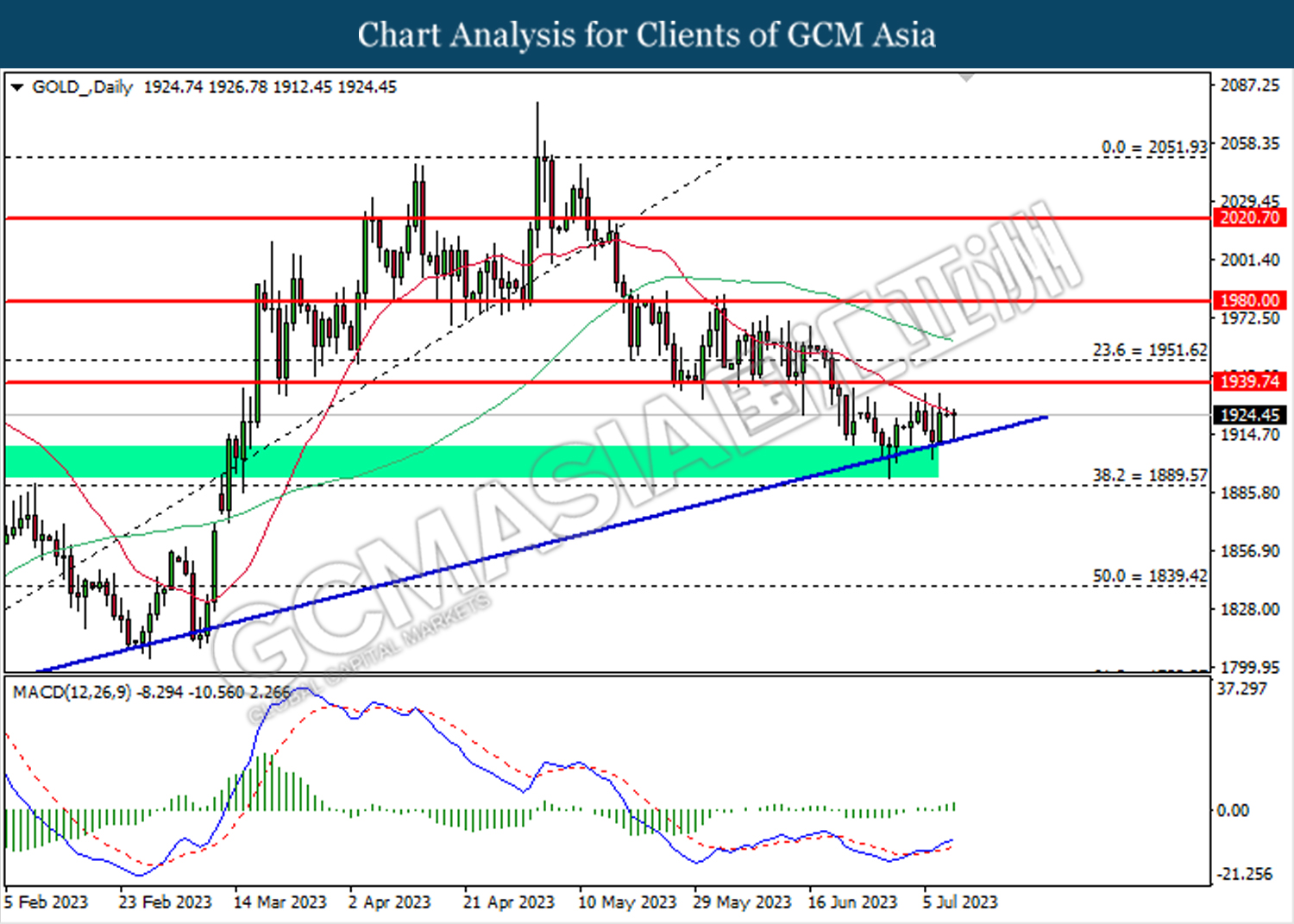

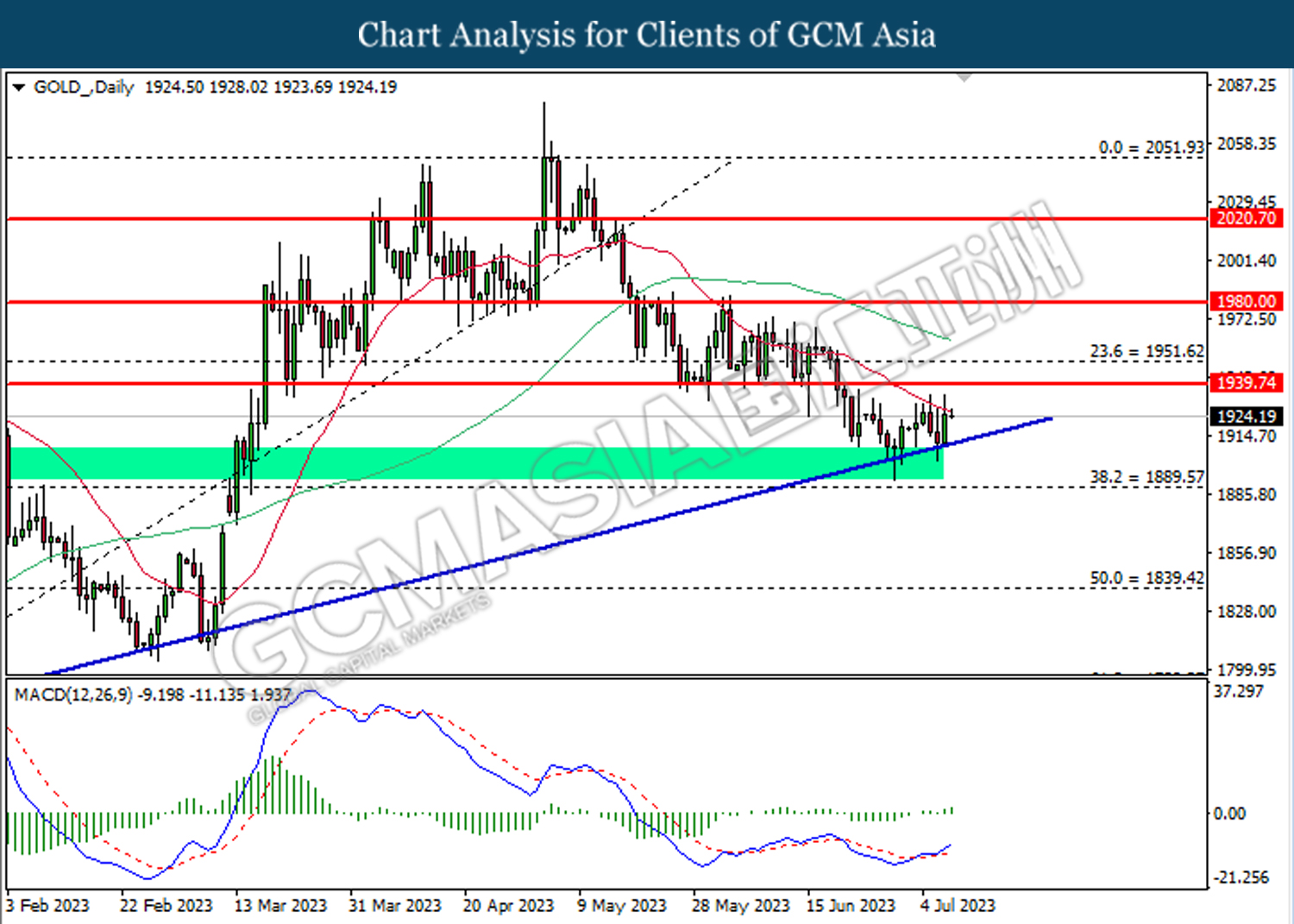

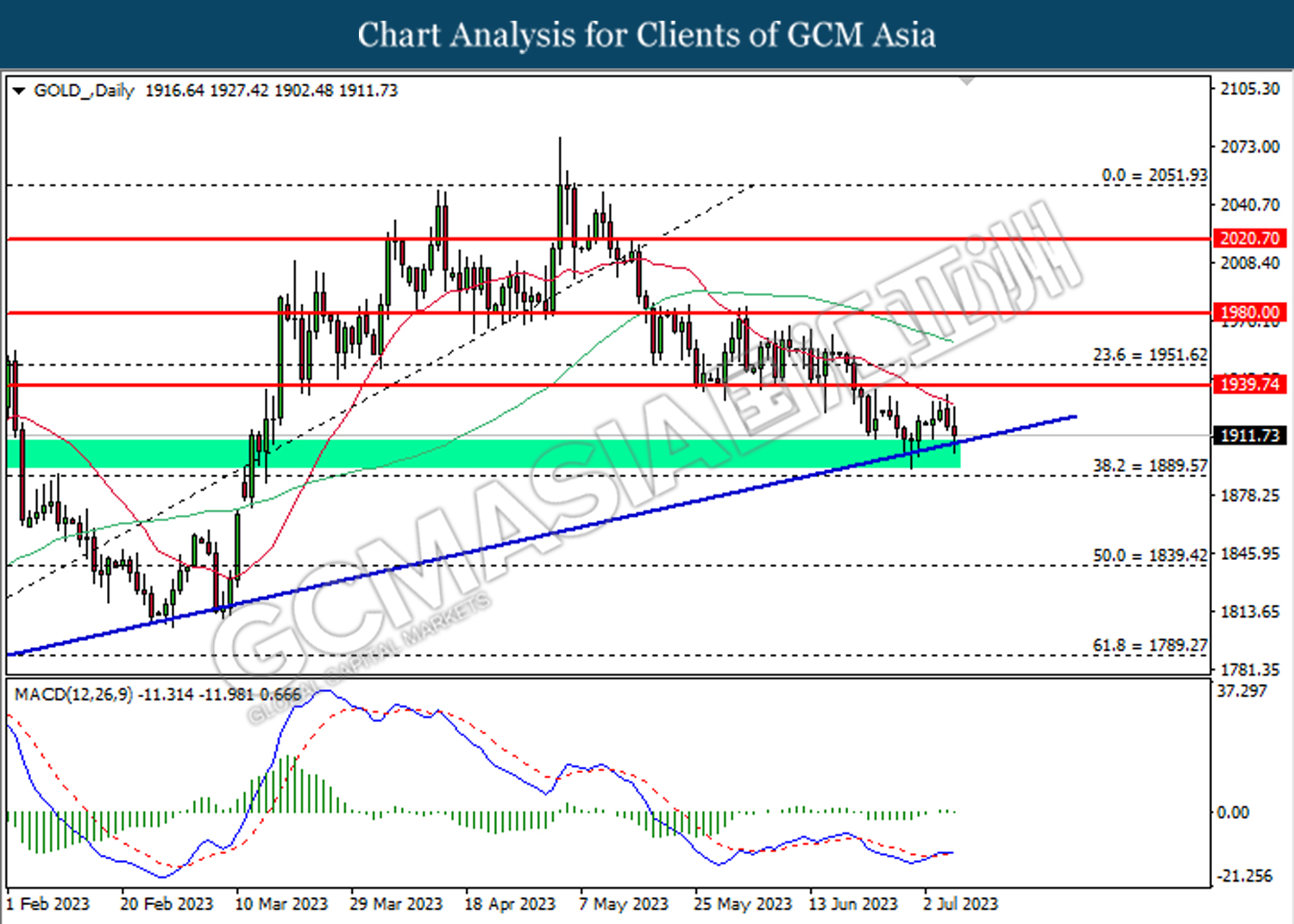

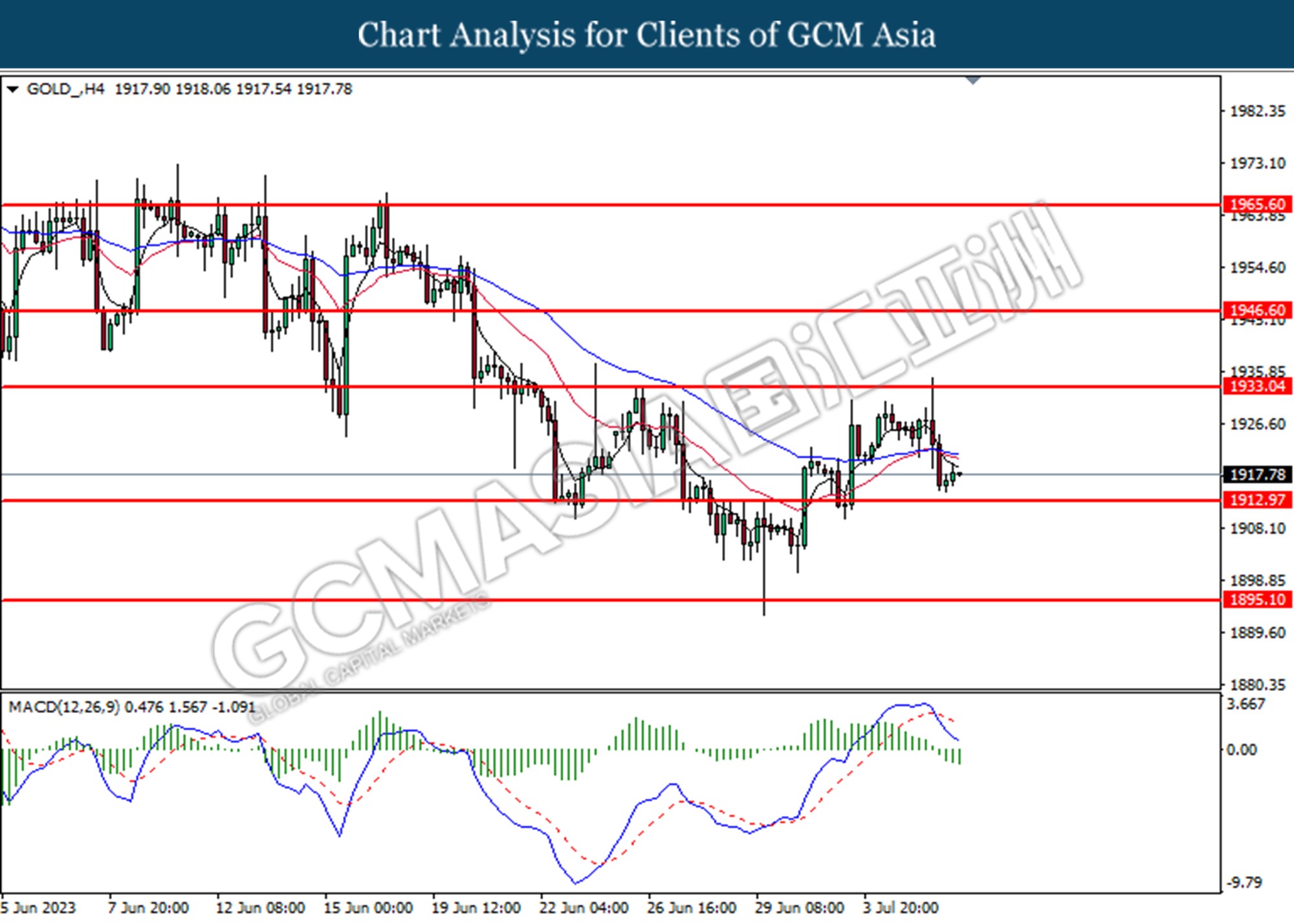

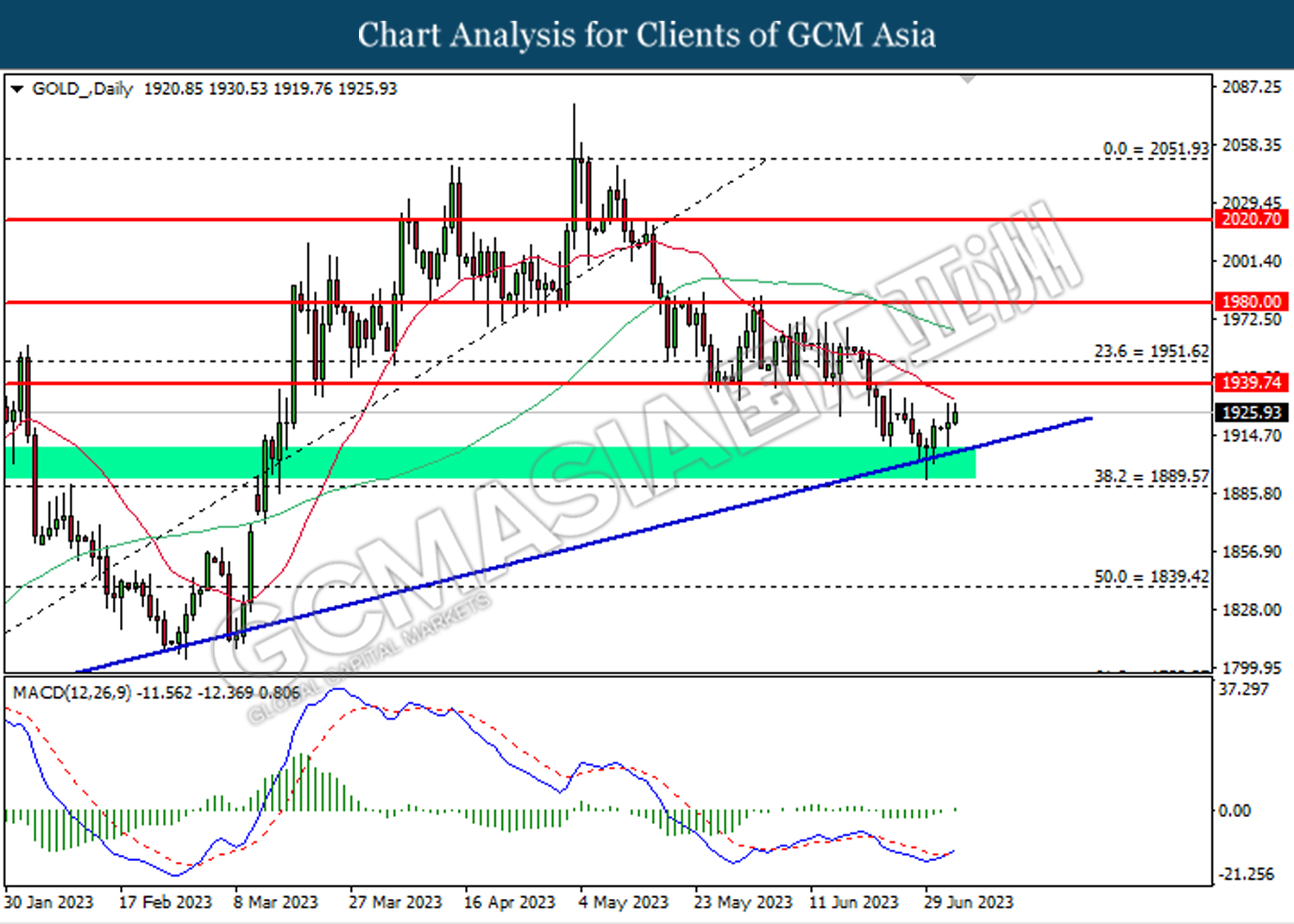

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1951.60. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75

130723 Afternoon Session Analysis

13 July 2023 Afternoon Session Analysis

Canadian dollar rises as Bank of Canada hikes rates to 23-year high.

The Canadian dollar, which traded against the dollar index extended its gains after the Bank of Canada (BoC) raised its interest rate to 5.0%, the highest level since 2001. The BoC announced that the board committees agreed to raise the monetary rate by 25 basis points to 5.00% from 4.75%, in line with market expectations. Although global inflation was easing, the Canadian robust demand and tight labour market are causing the underlying price pressure to remain more persistent than the central bank thought. The latest CPI report was eased in May to 3.4% from a peak of 8.1% in the summer, but it is still far from the BoC target of 2%. The bank now predicts that the headline inflation of 2% target will only be returned in mid of 2025, six months later than previously thought. The central bank also mentioned that the Canadian labour market remains tight with a shortage of workers and wage growth as recent data showed the unemployment rate stood at 5.4%. Following that, BoC Governor Mackle issues a mixed statement tone after the monetary policy decision. He mentioned that the central bank is close to the end of the tightening cycle but reiterates it is too early to be talking about rate cuts. BoC will be based on the latest economic data to decide on its monetary policy decision if the inflation is more persistent than expected, the central bank is prepared to hike again if needed. As of writing, the USDCAD niche is down by -0.06% to 1.3177.

In the commodities market, crude oil prices traded up by 0.41% to $76.06 per barrel as the dollar weakened after soft CPI data. On the other hand, the price of gold rose by 0.13% to 1959.95 as investors anticipate that Fed will less aggressive in its tightening moves.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 CrudeOIL IEA Monthly Report

19:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claim | 248K | 249K | – |

| 20:30 | USD – PPI (MoM) (Jun) | -0.3% | 0.2% | – |

Technical Analysis

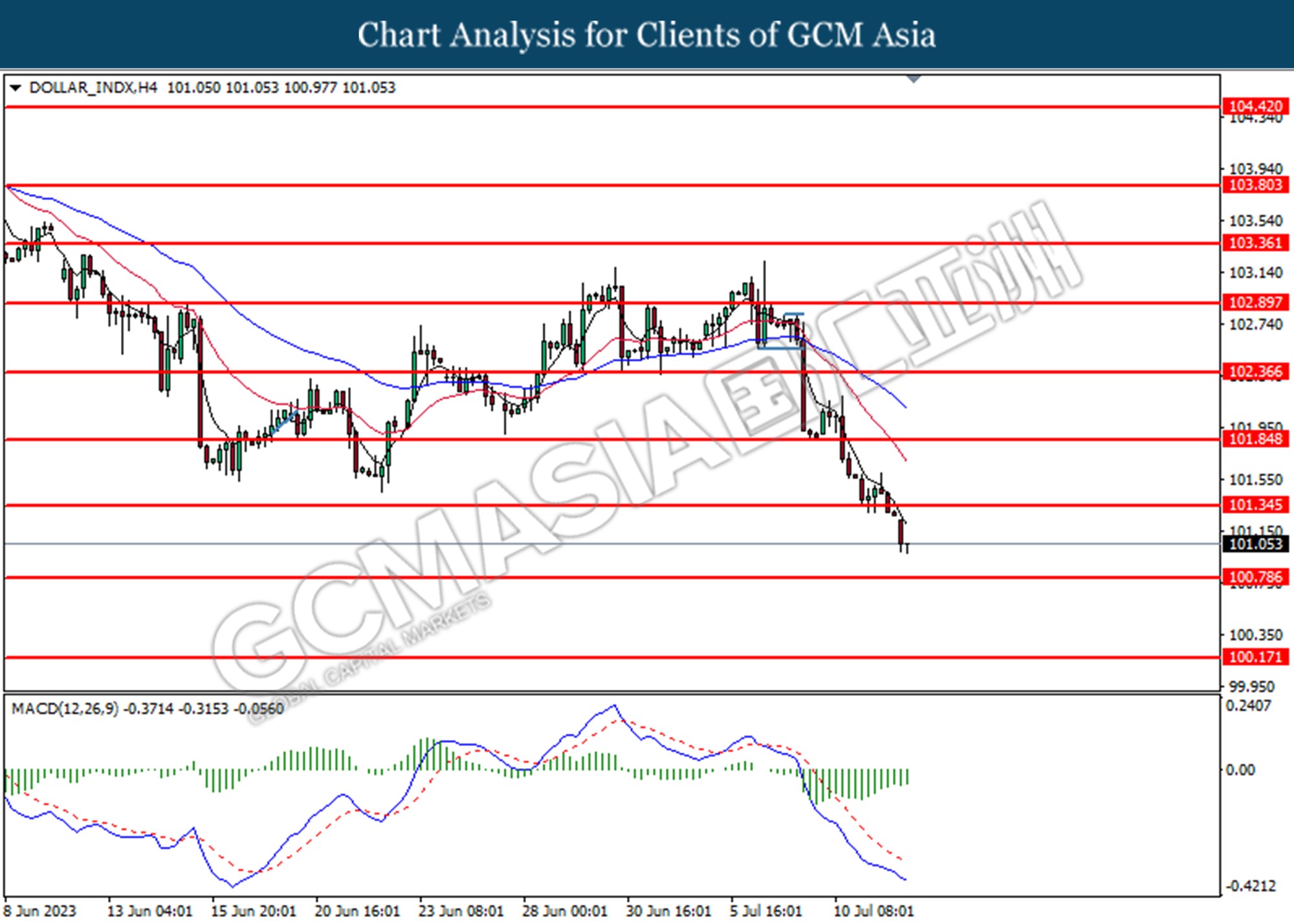

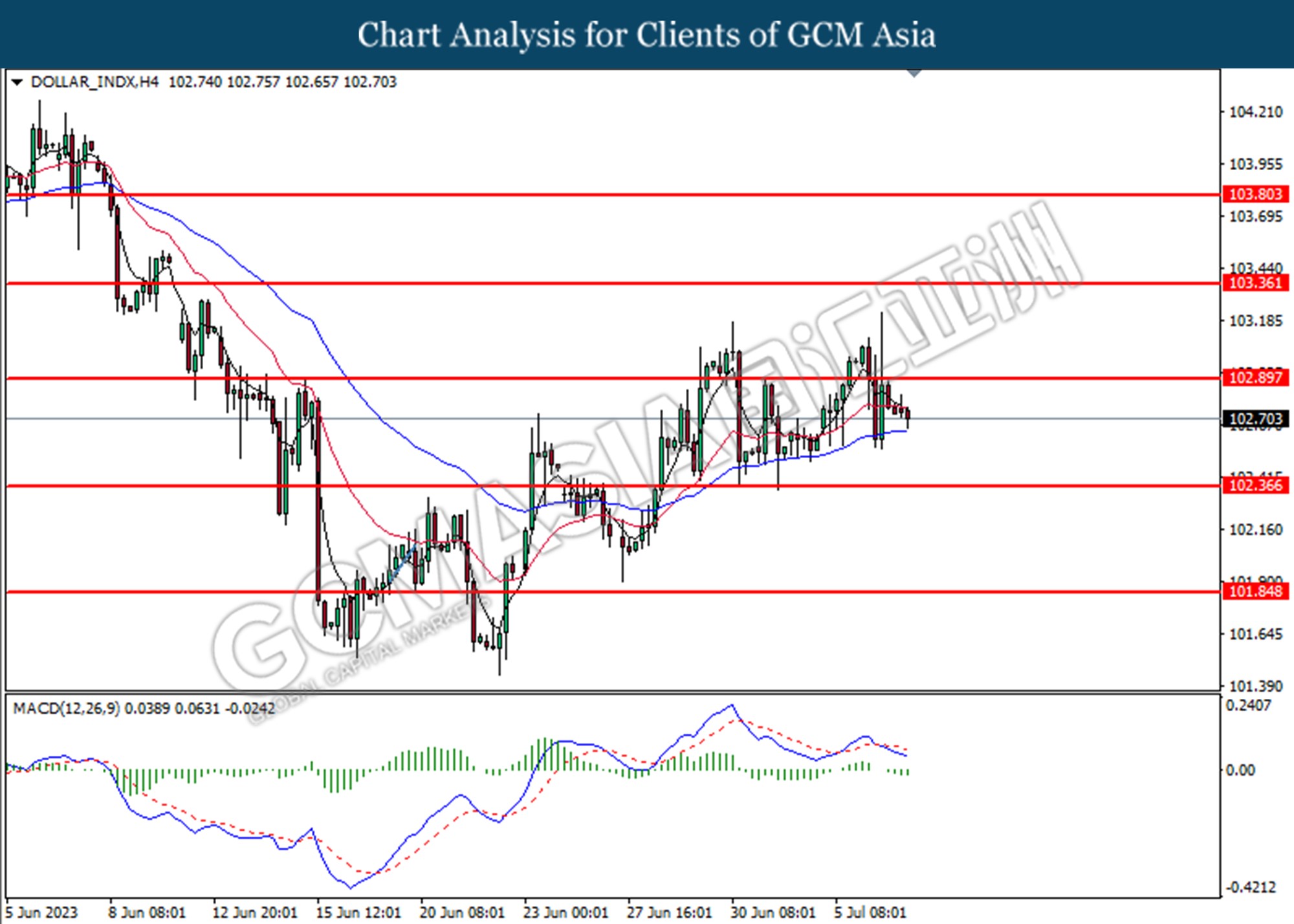

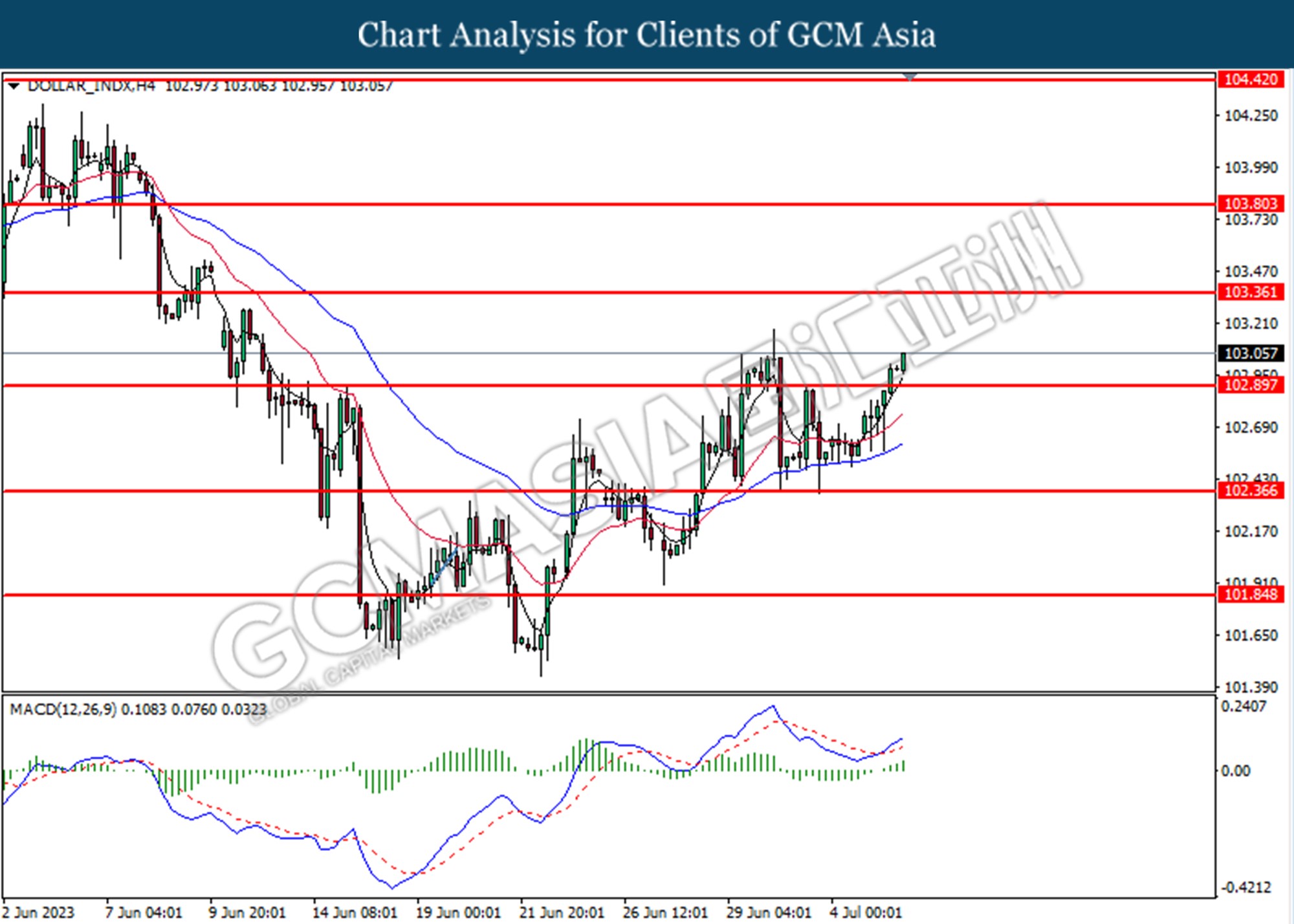

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breaks below for the previous support level at 100.20. However, MACD which illustrated diminishing bearish momentum suggests the index undergoes a technical correction in a short term.

Resistance level: 100.80, 100.20

Support level: 99.70, 99.25

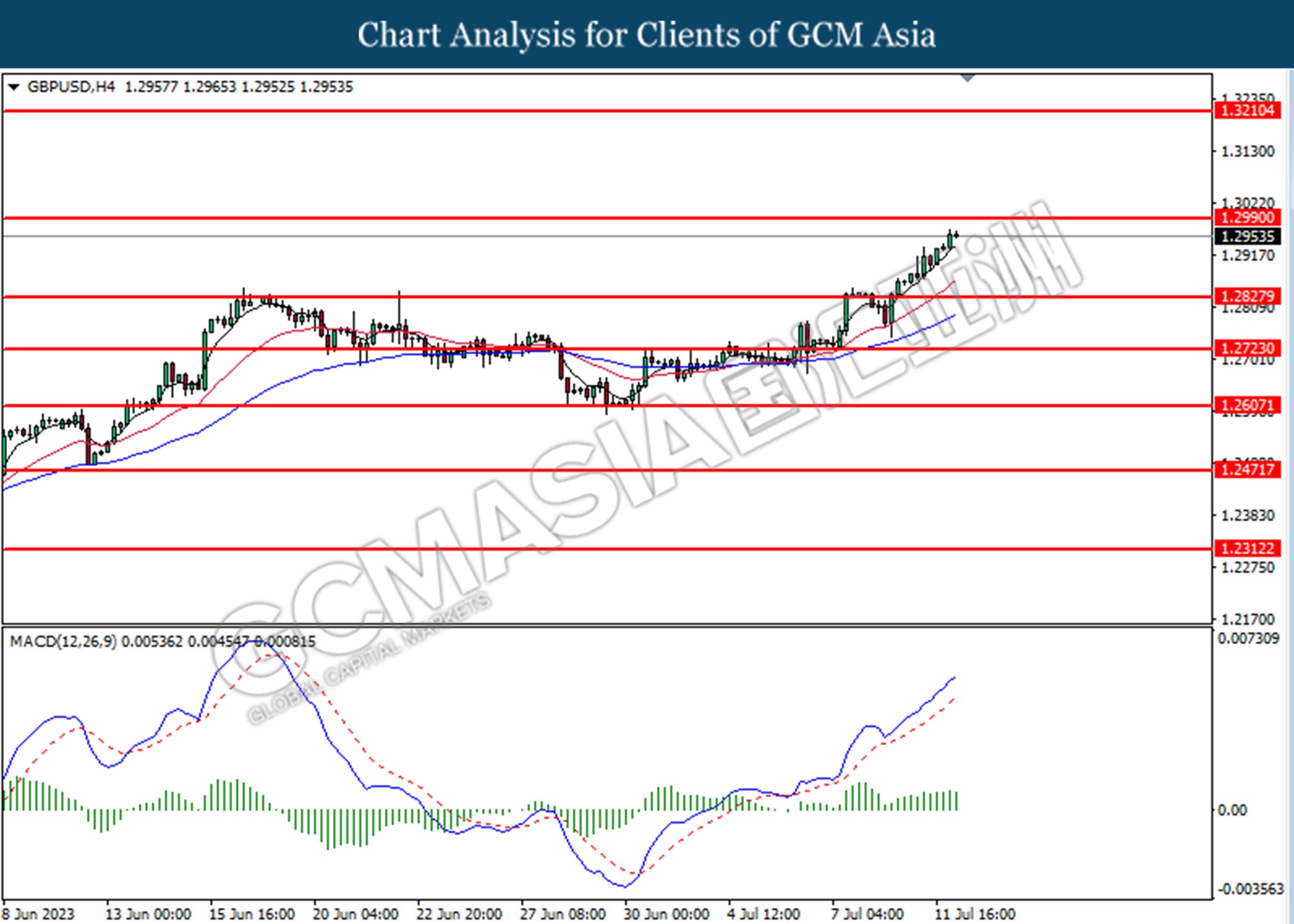

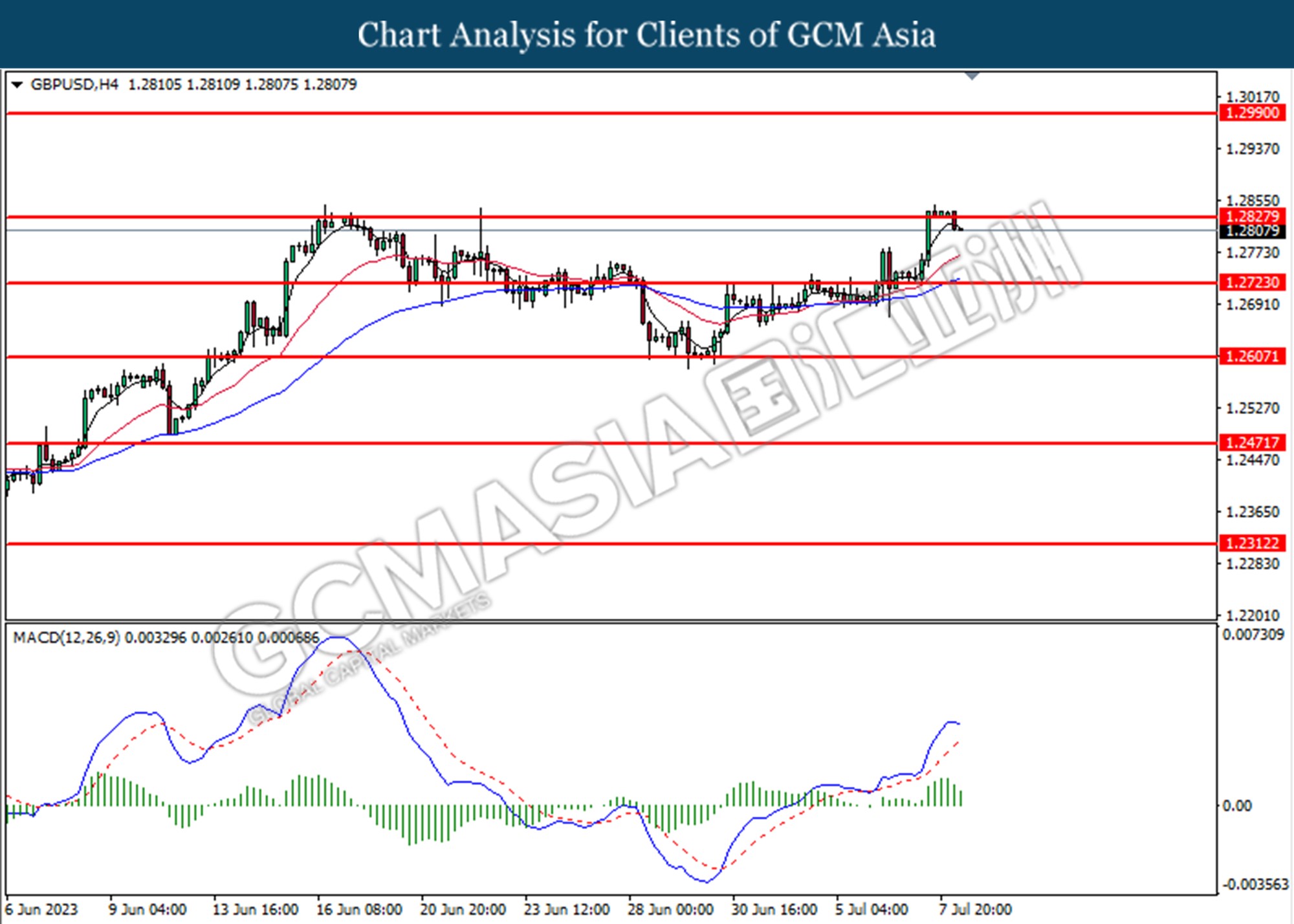

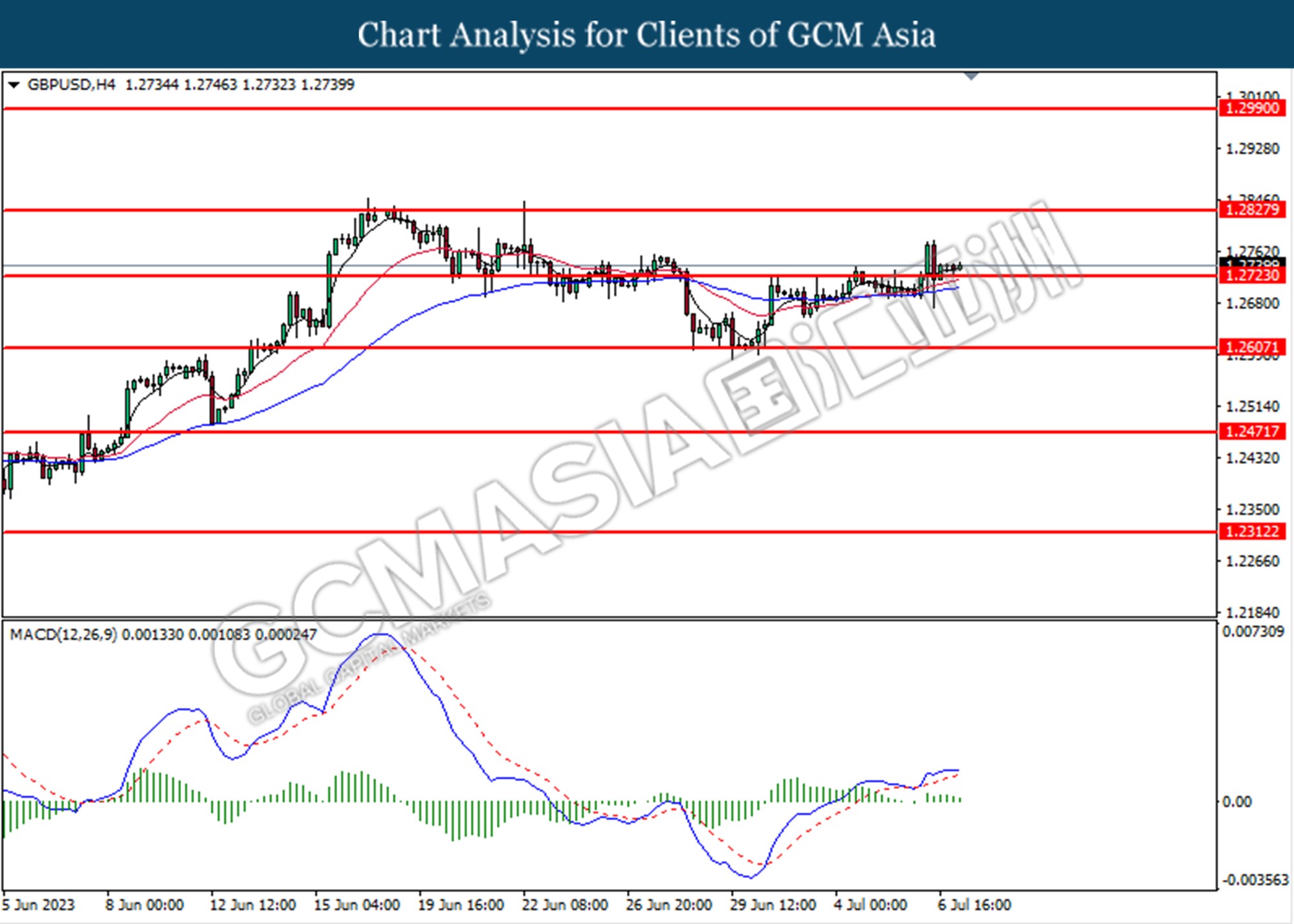

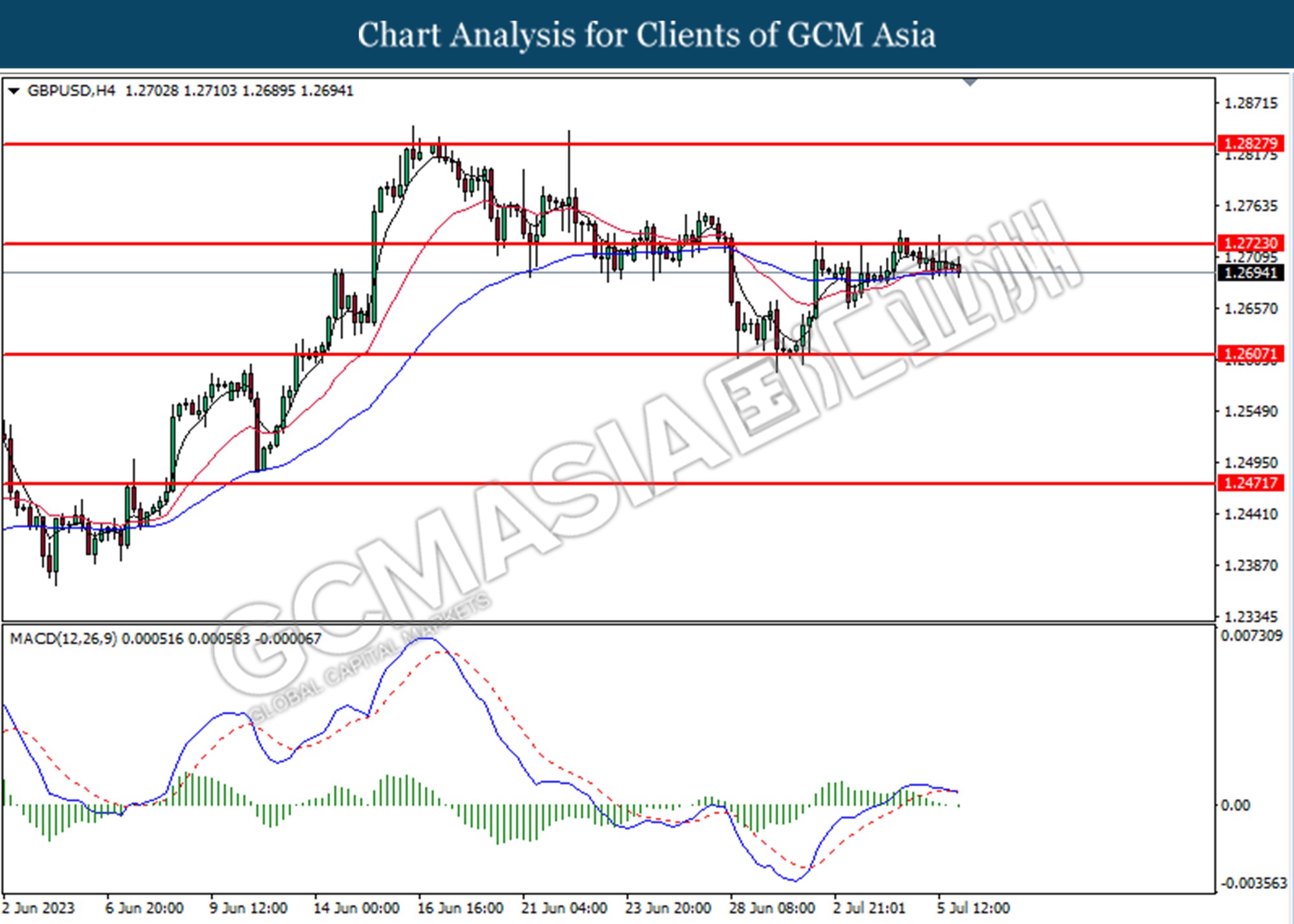

GBPUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2990. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.3210, 1.3435

Support level: 1.2990, 1.2830

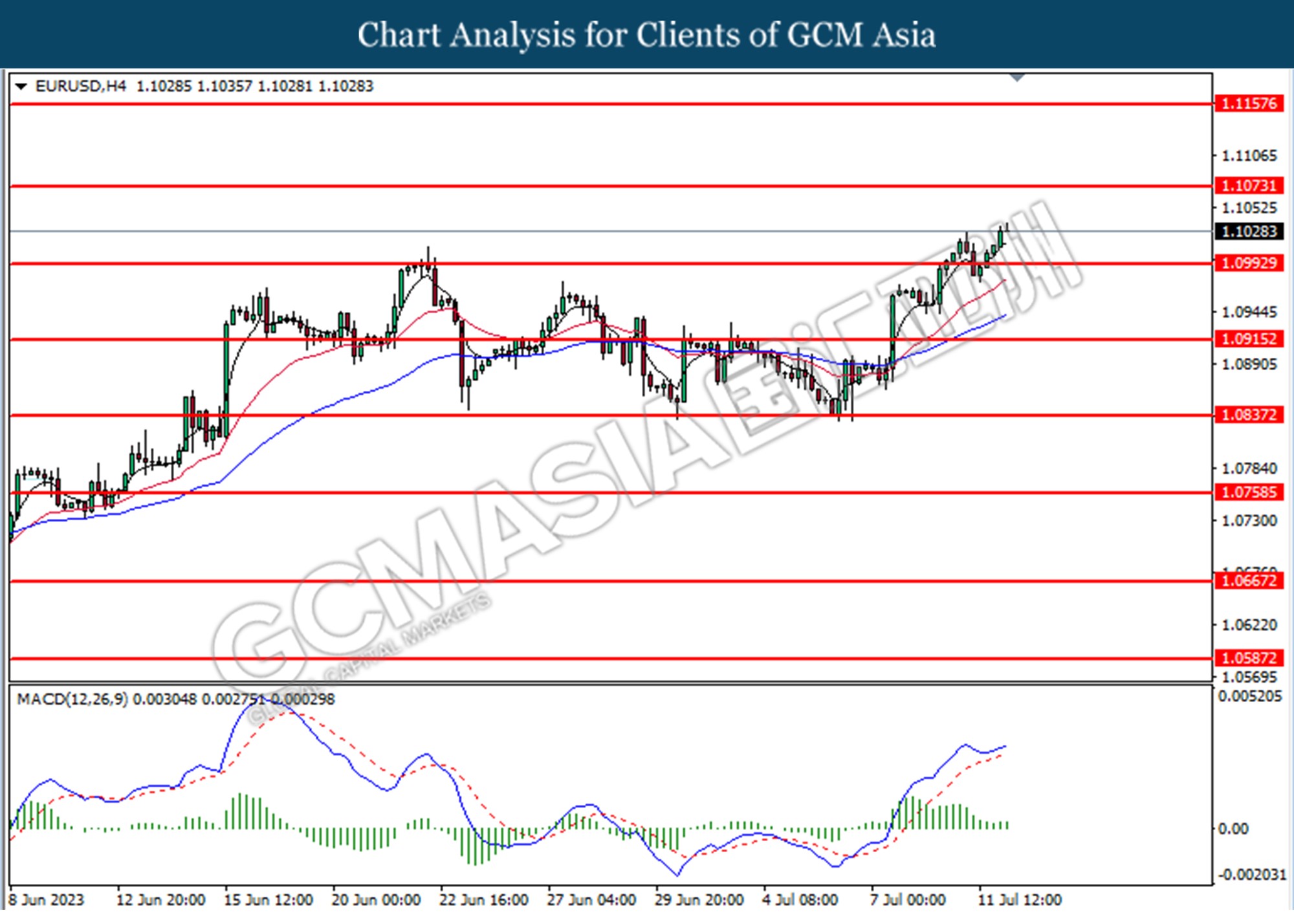

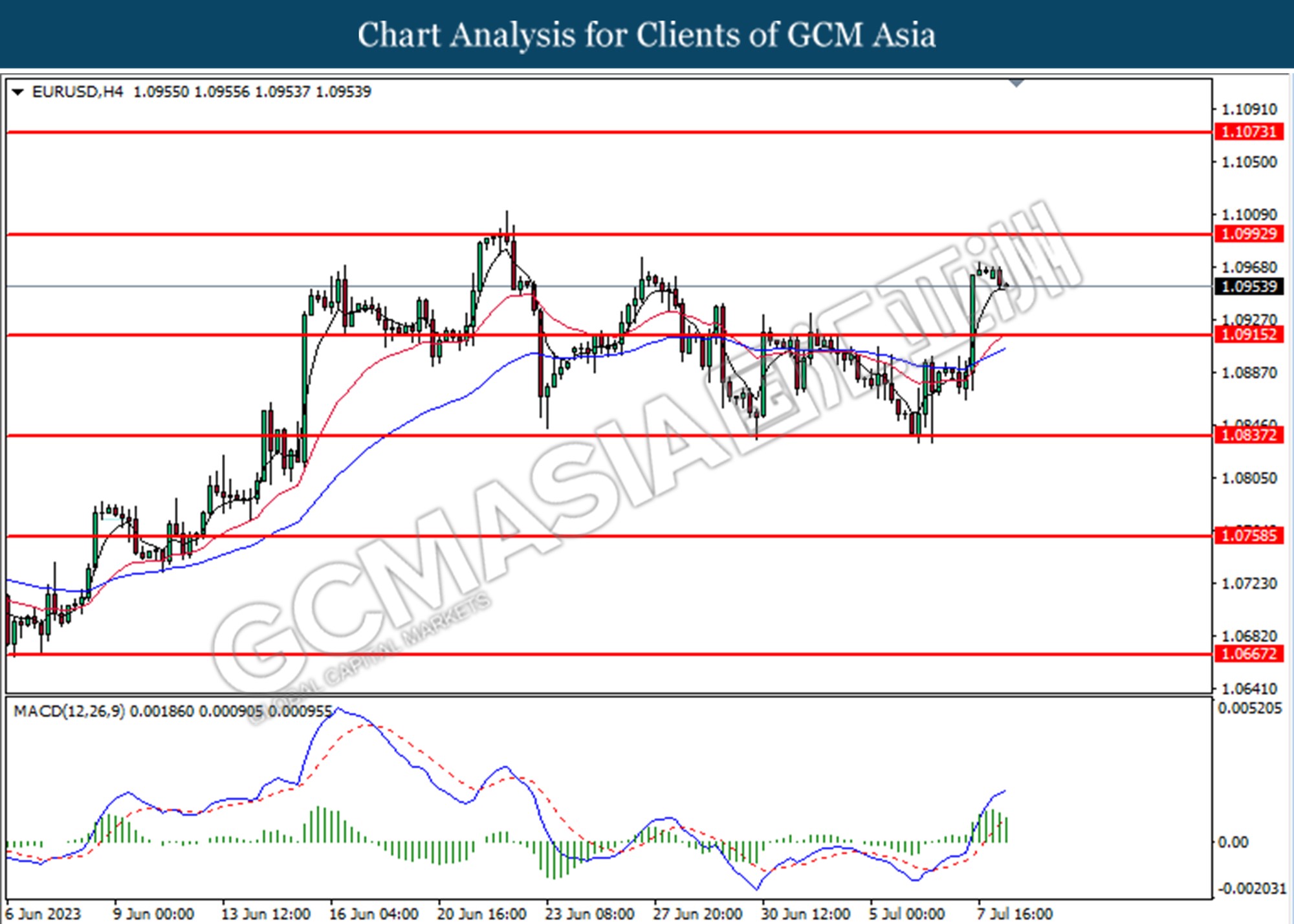

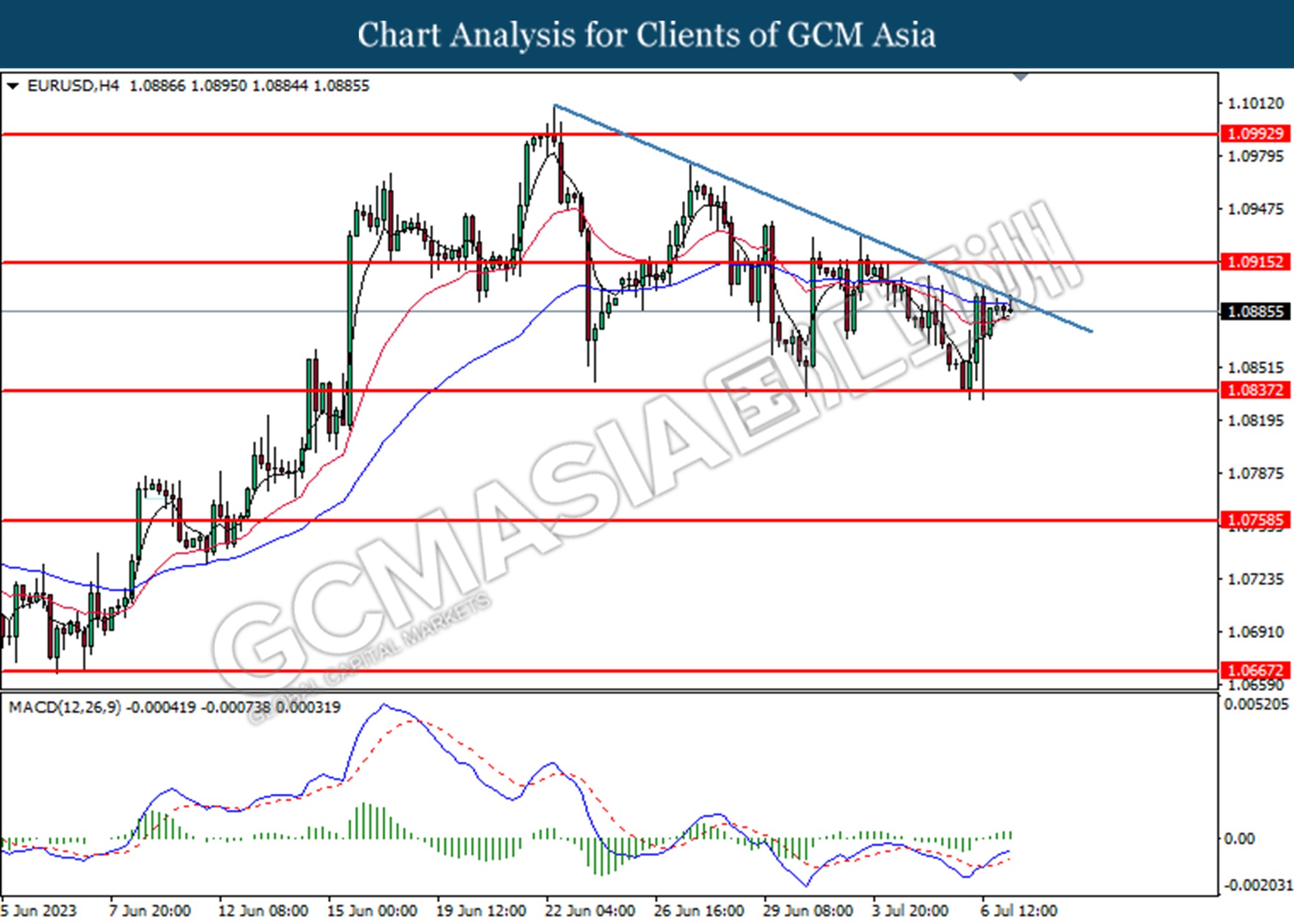

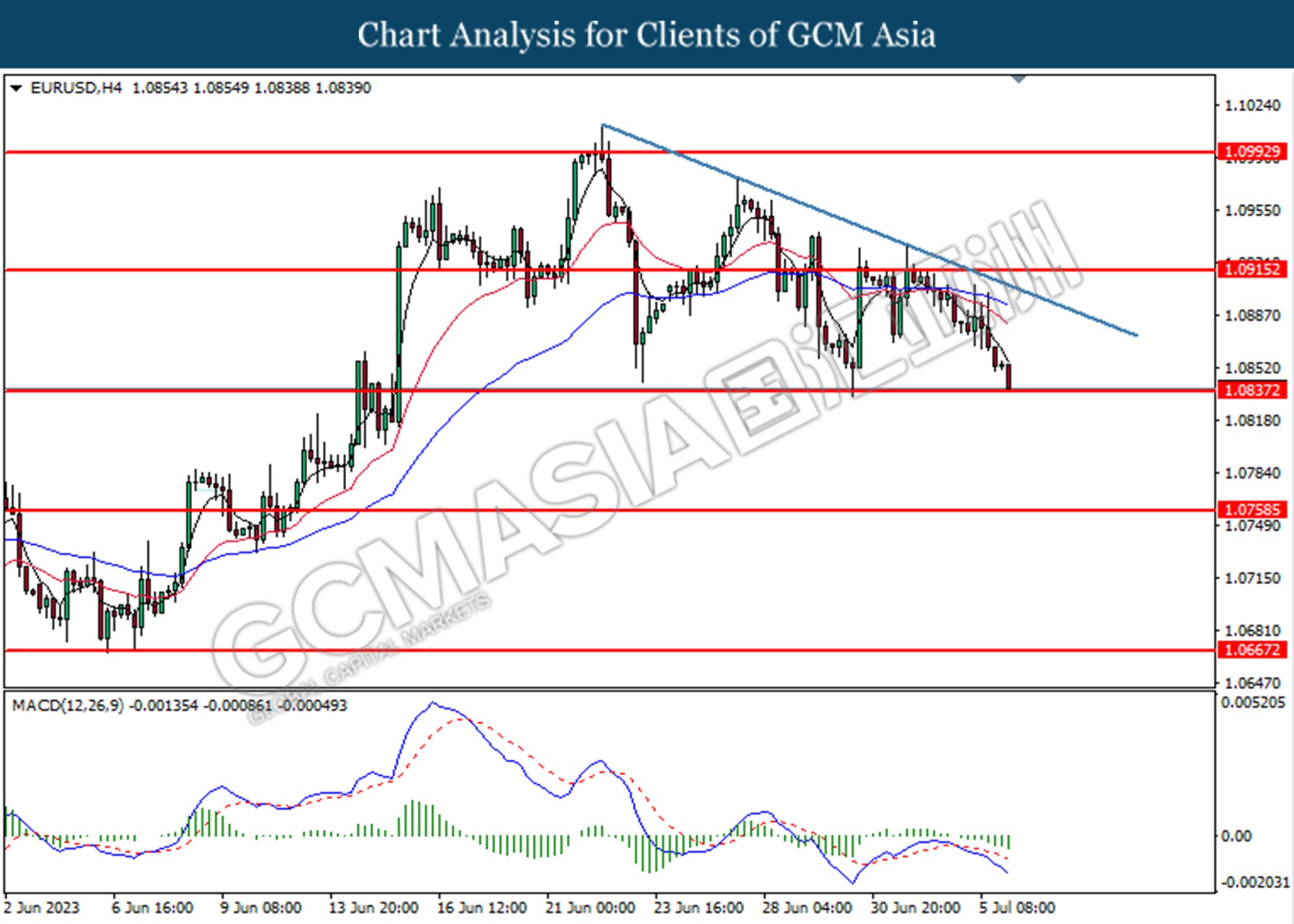

EURUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.1075. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.1160, 1.1275

Support level: 1.1075, 1.0990

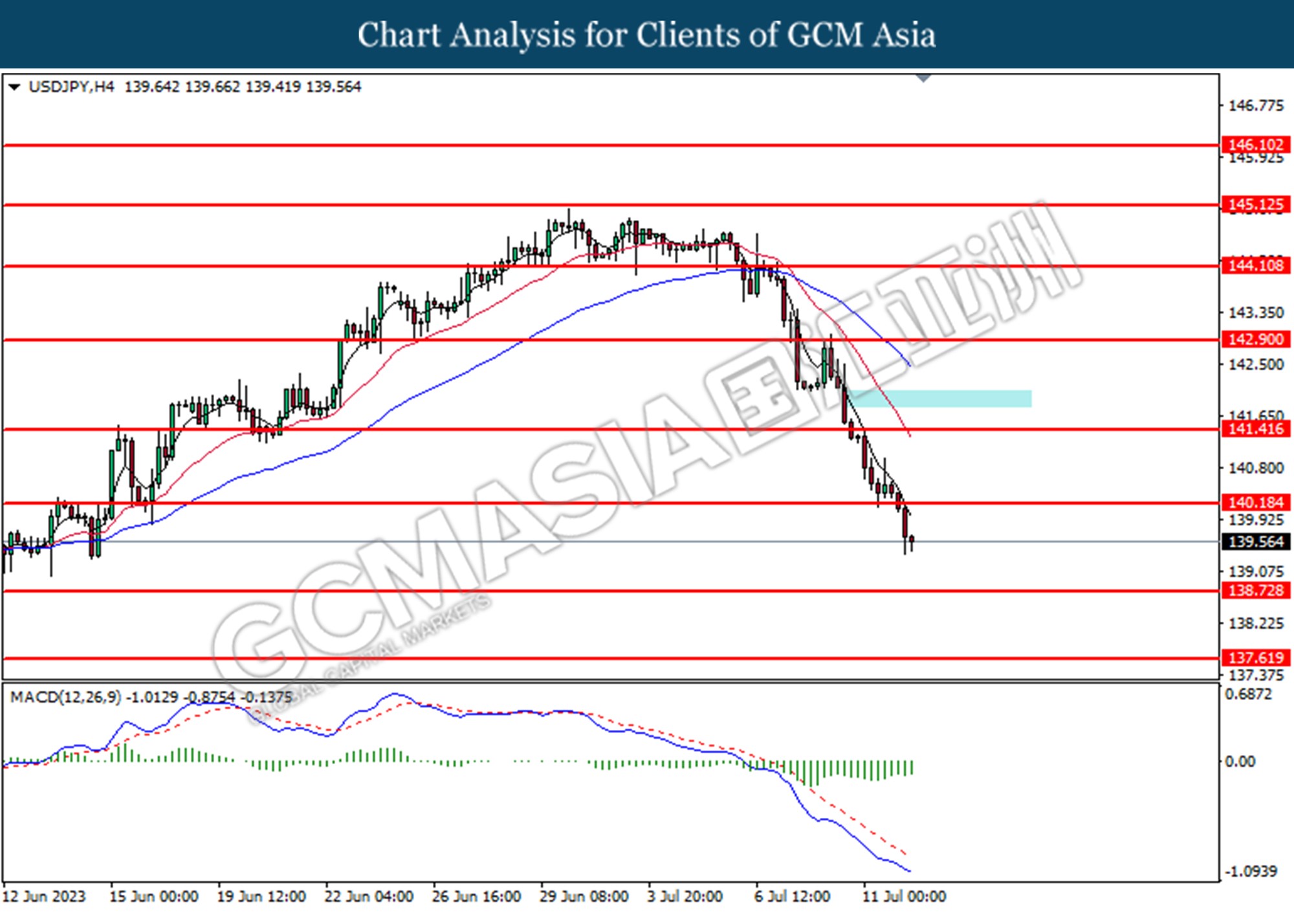

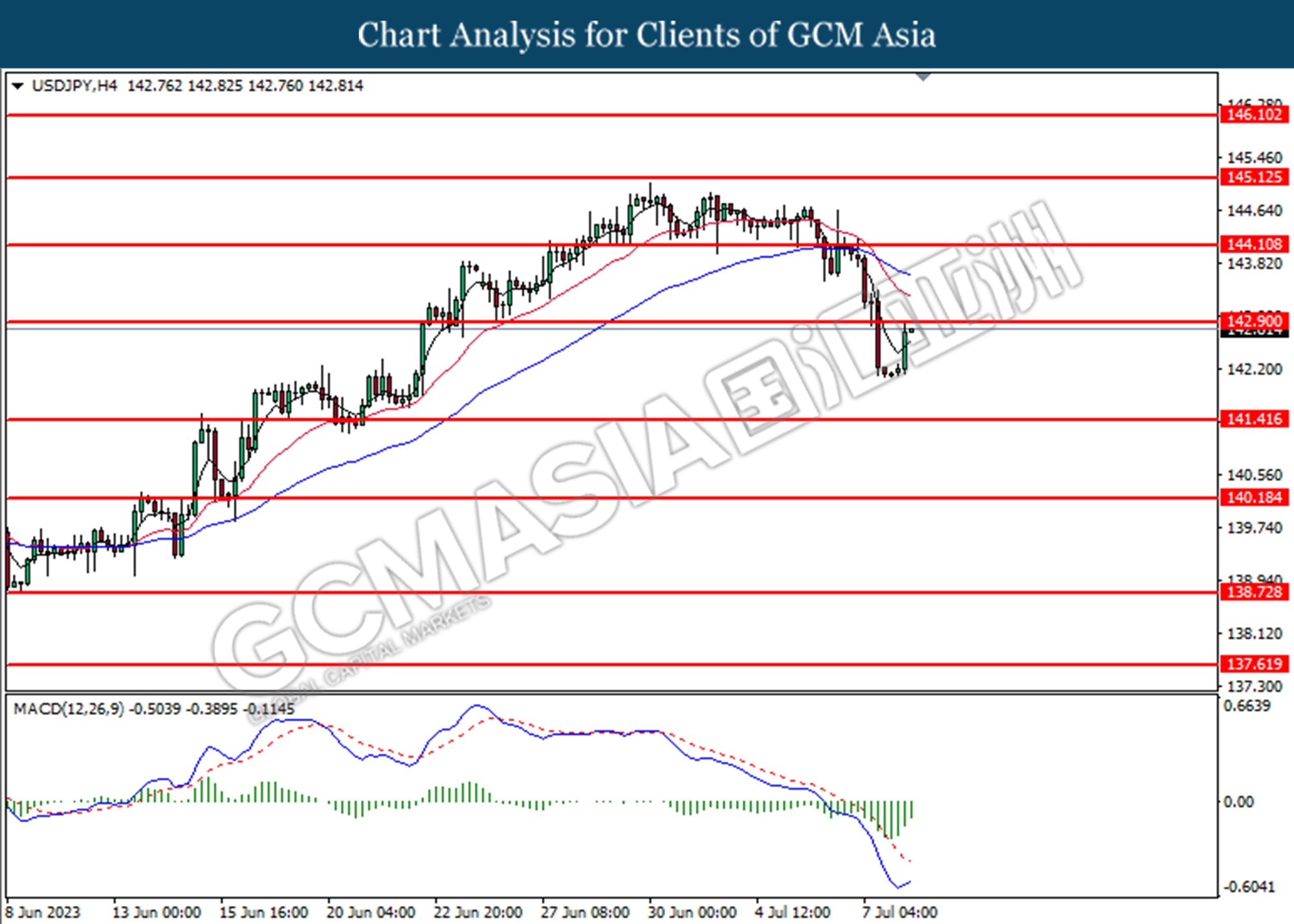

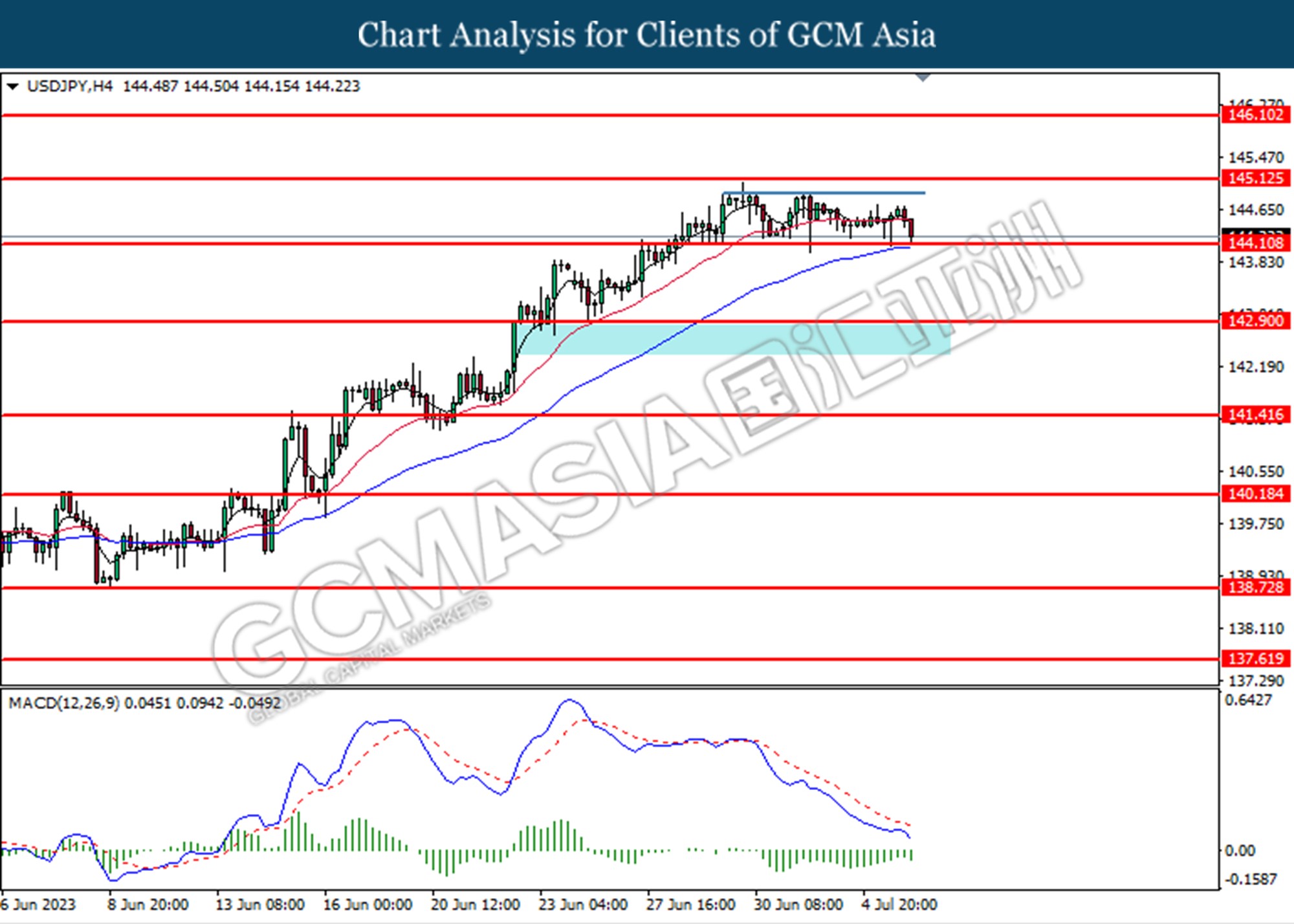

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains towards the resistance level at 138.70.

Resistance level: 138.70, 140.20

Support level: 137.60, 136.55

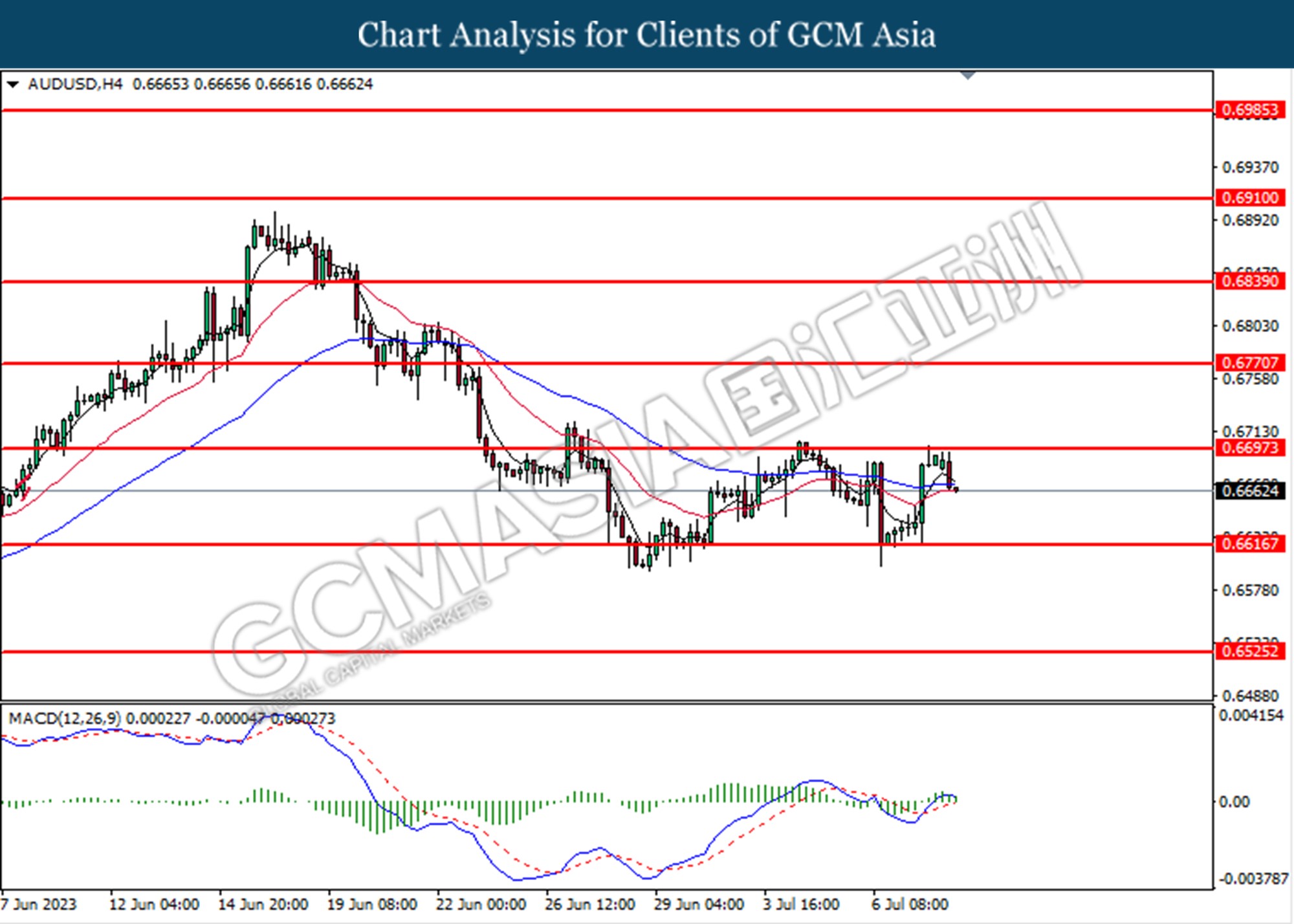

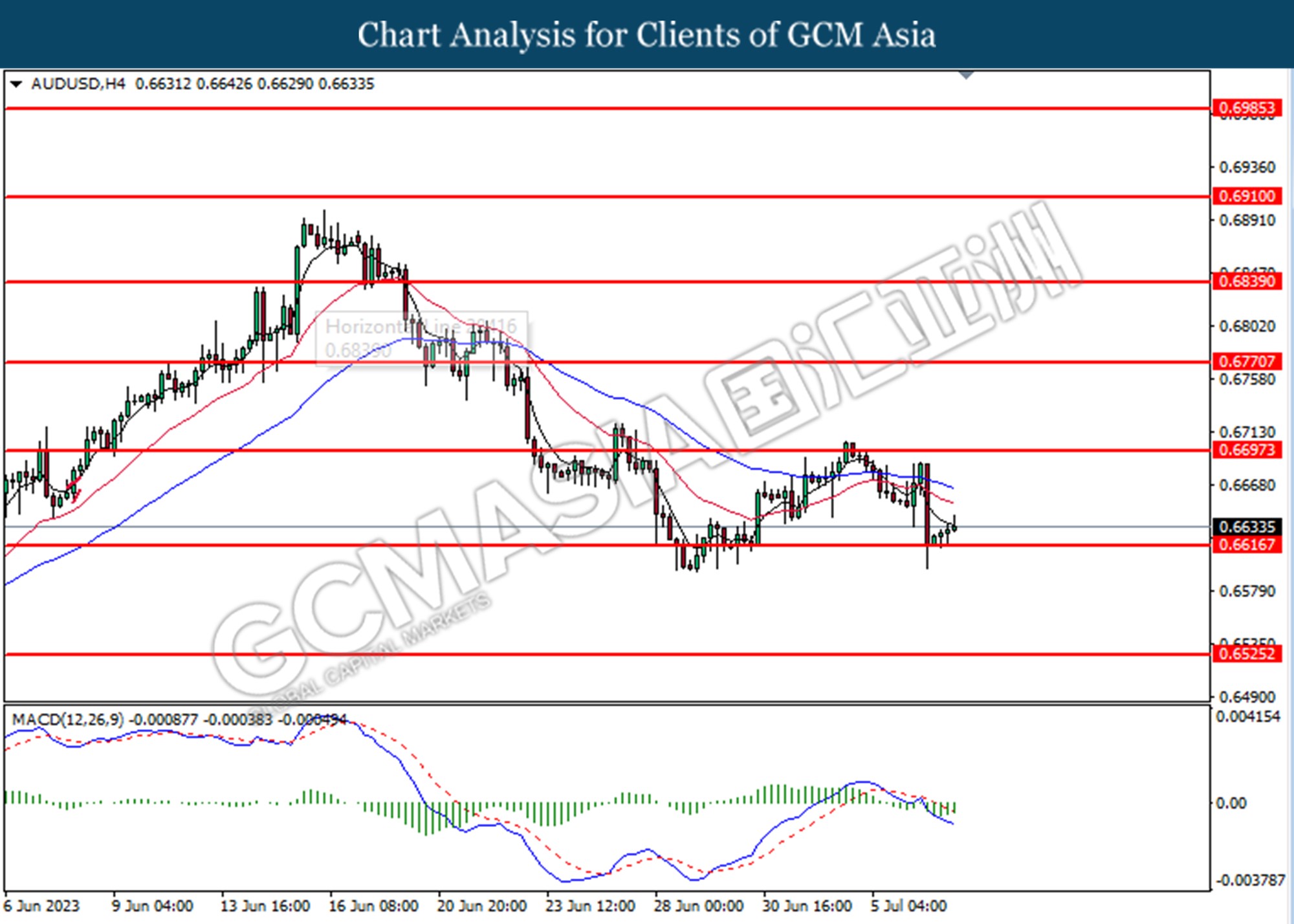

AUDUSD, H4: AUDUSD was traded higher following the prior breaks above the prior resistance level at 0.6770. However. MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.6840, 0.6910

Support level: 0.6770, 0.6700

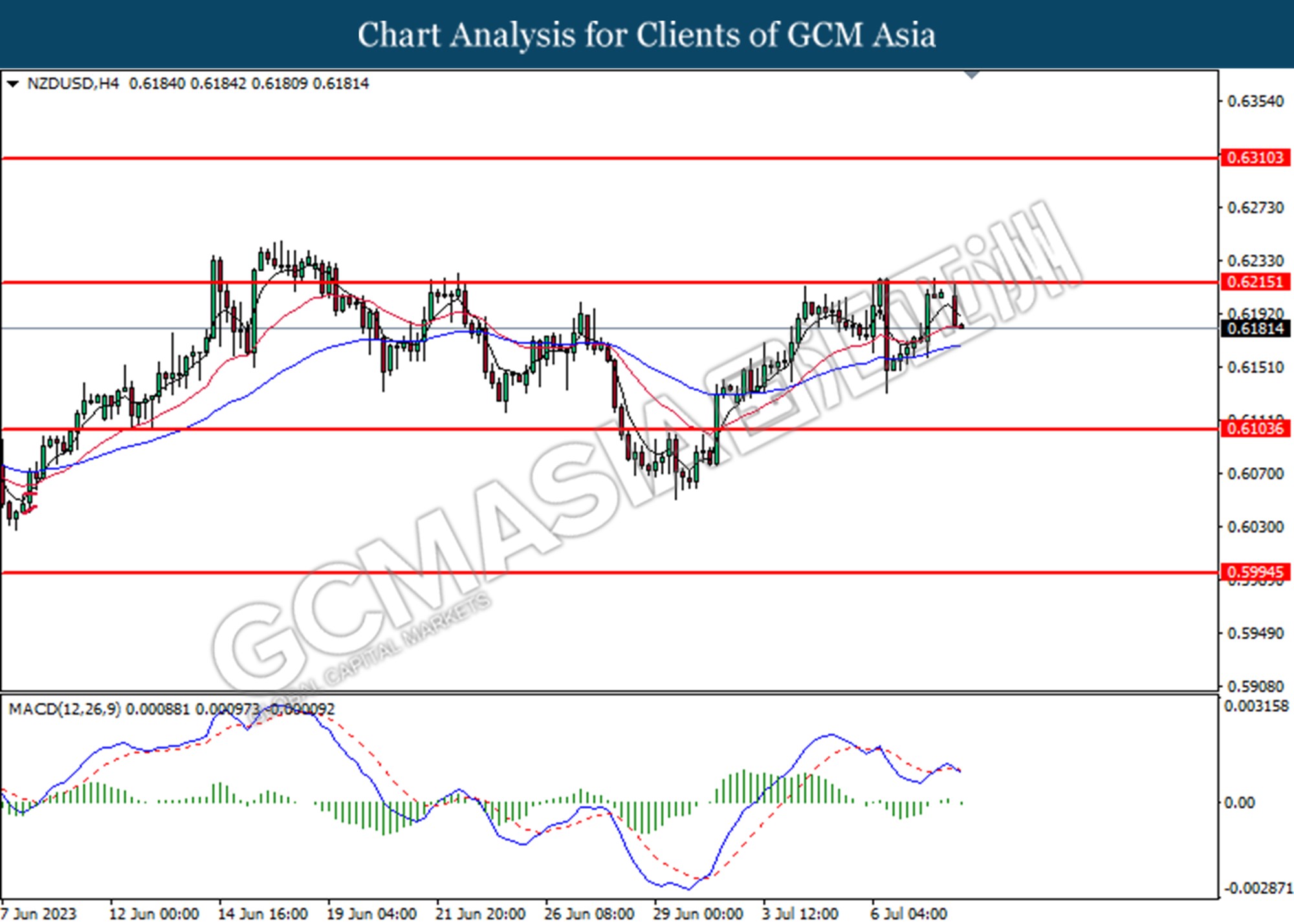

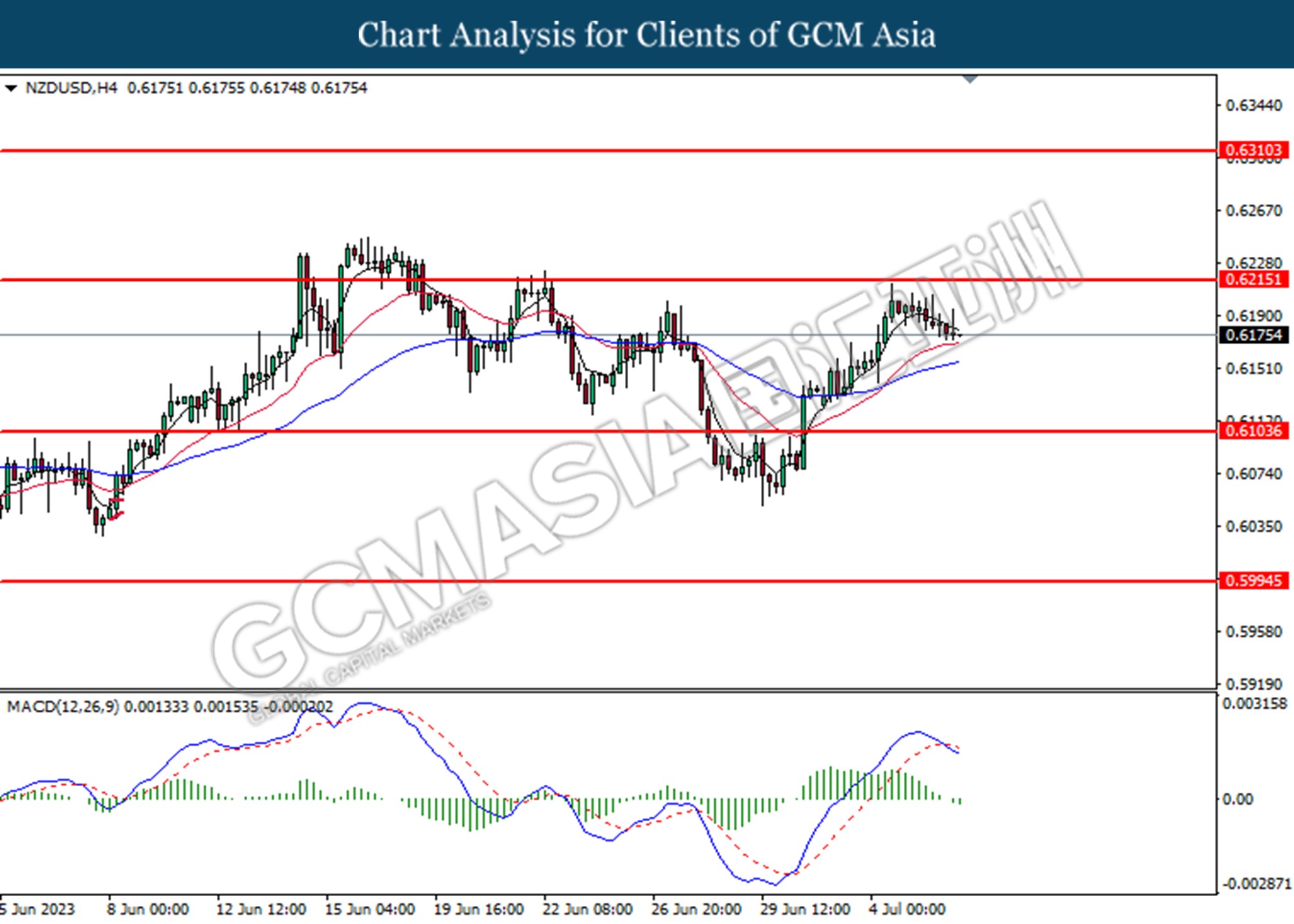

NZDUSD, H4: NZDUSD was traded higher following the prior breaks above the previous resistance level at 0.6310. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards to the resistance level.

Resistance level: 0.6390, 0.6480

Support level: 0.6310, 0.6215

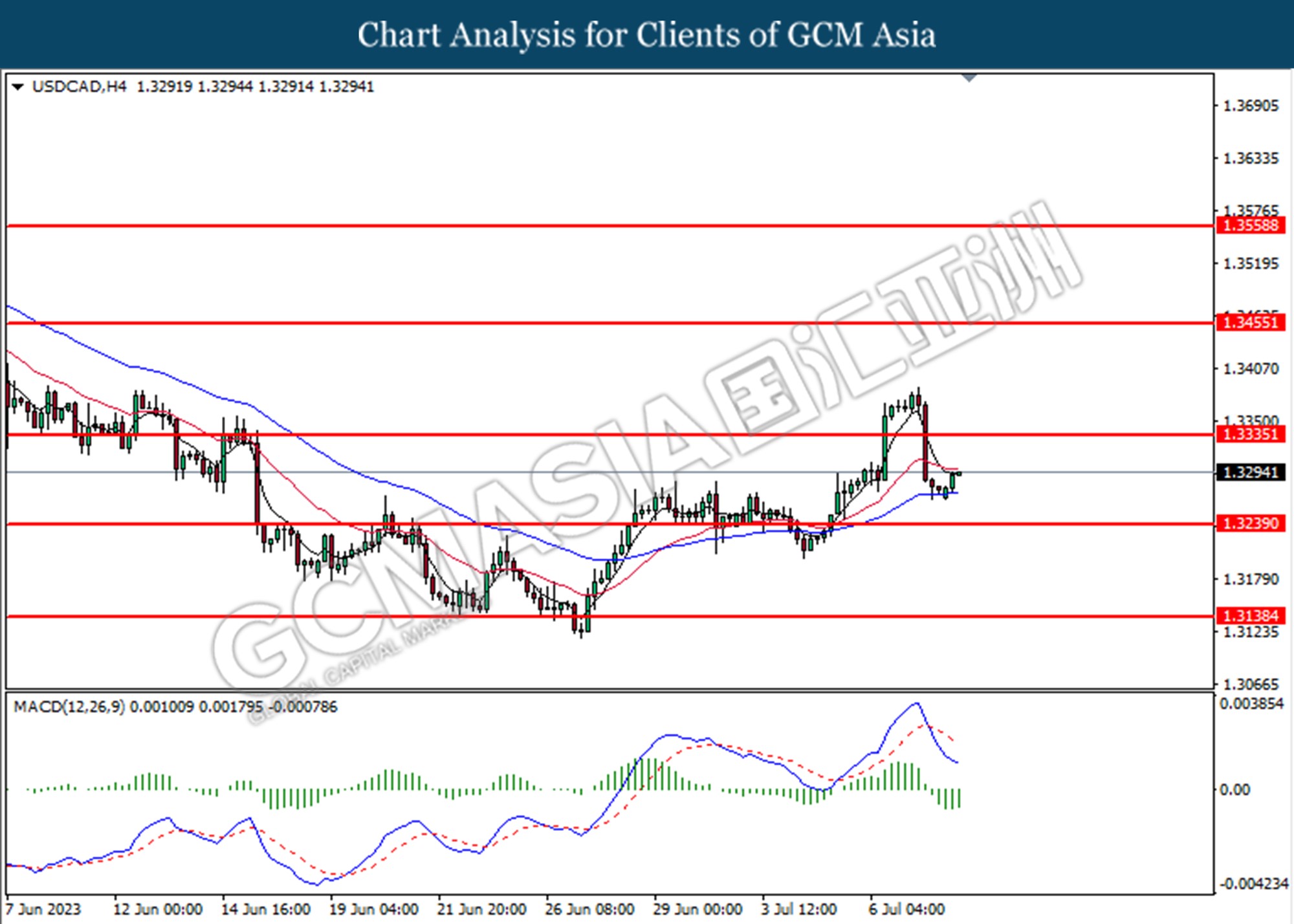

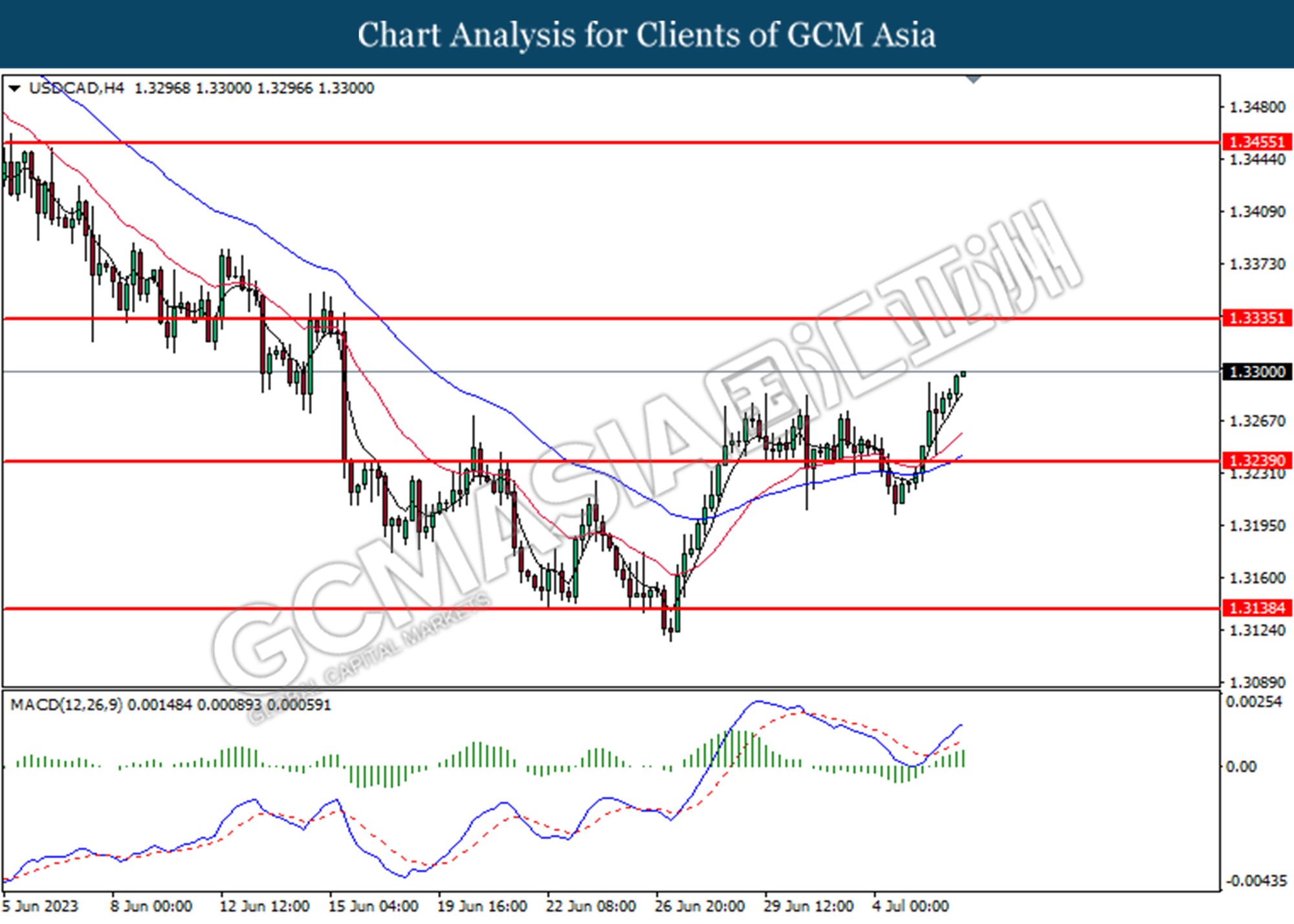

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

USDCHF, H4: USDCHF was traded lower following the prior breaks below from the previous support level at 0.8715. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.8760, 0.8715

Support level: 0.8645, 0.8580

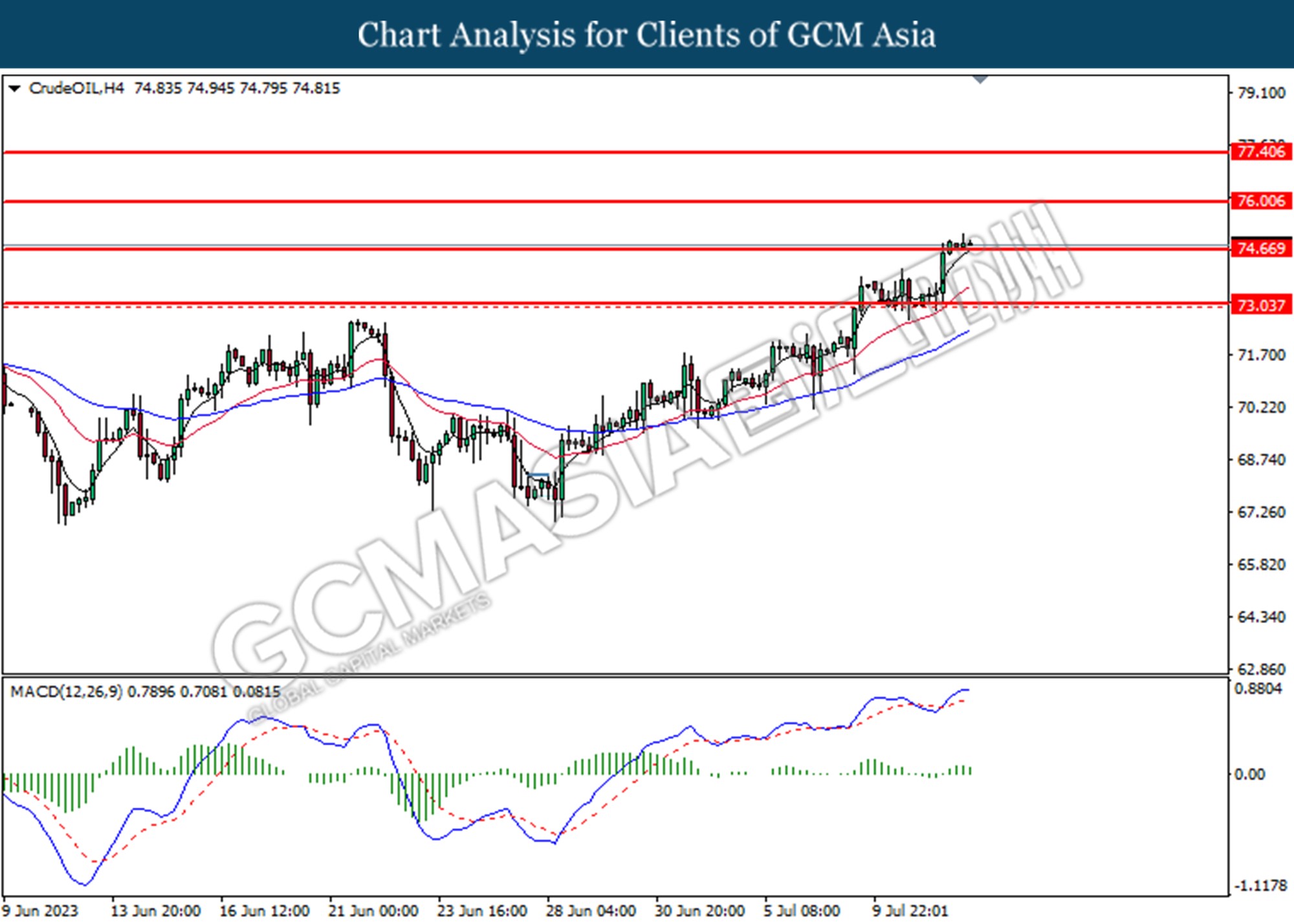

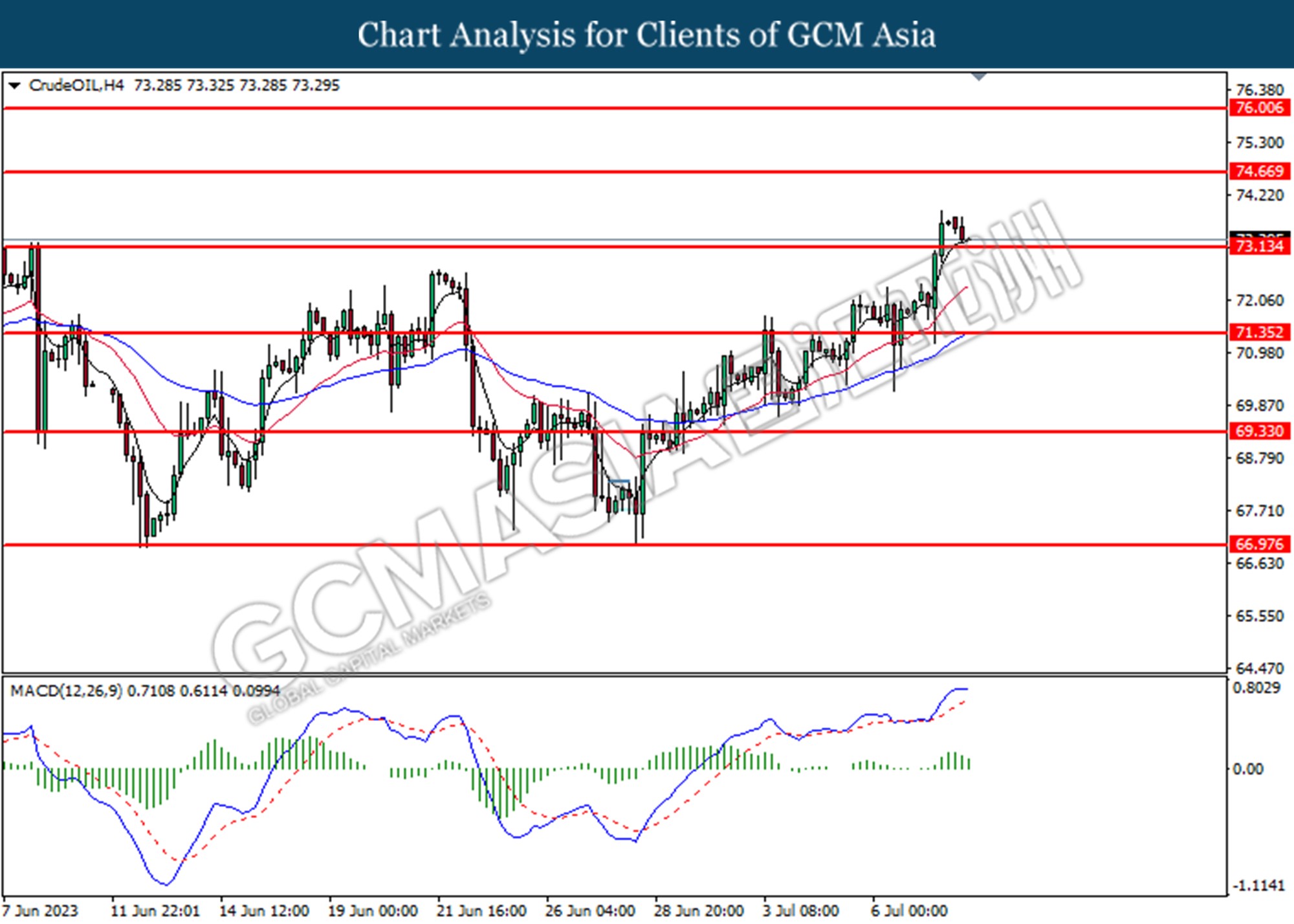

CrudeOIL, H4: Crude oil price was traded higher while currently testing for the resistance level at 76.00. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 76.00, 77.40

Support level: 74.65, 73.15

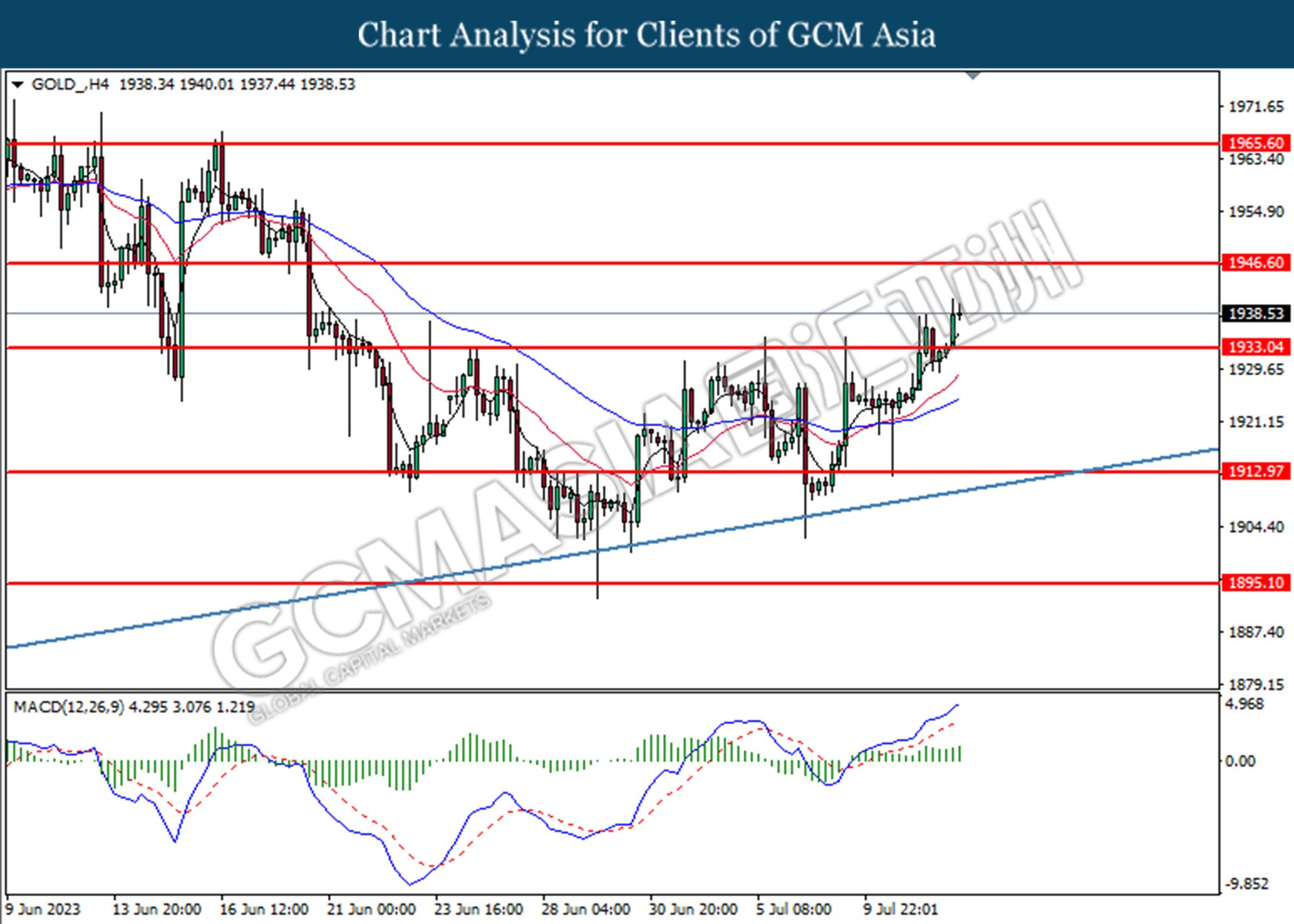

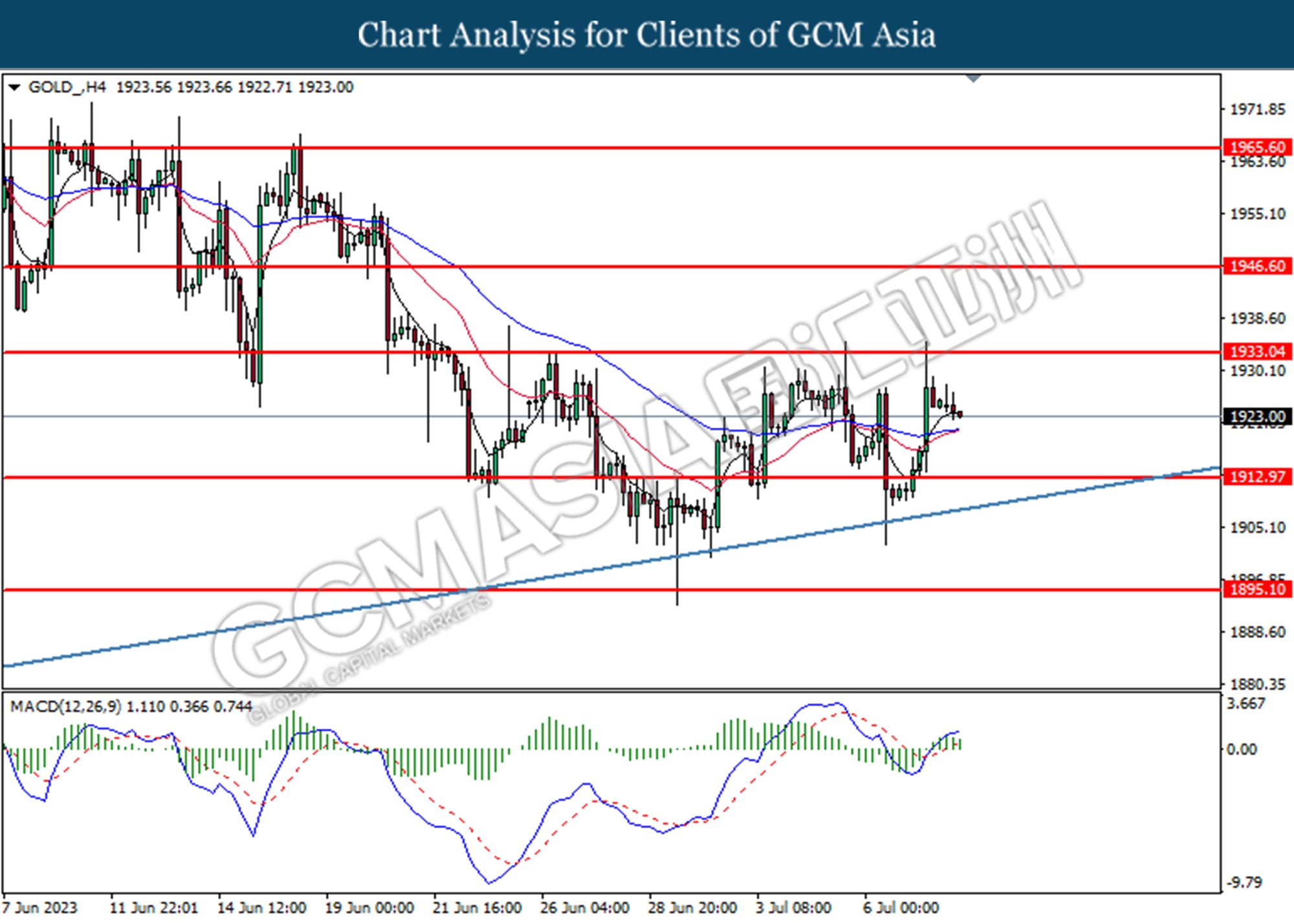

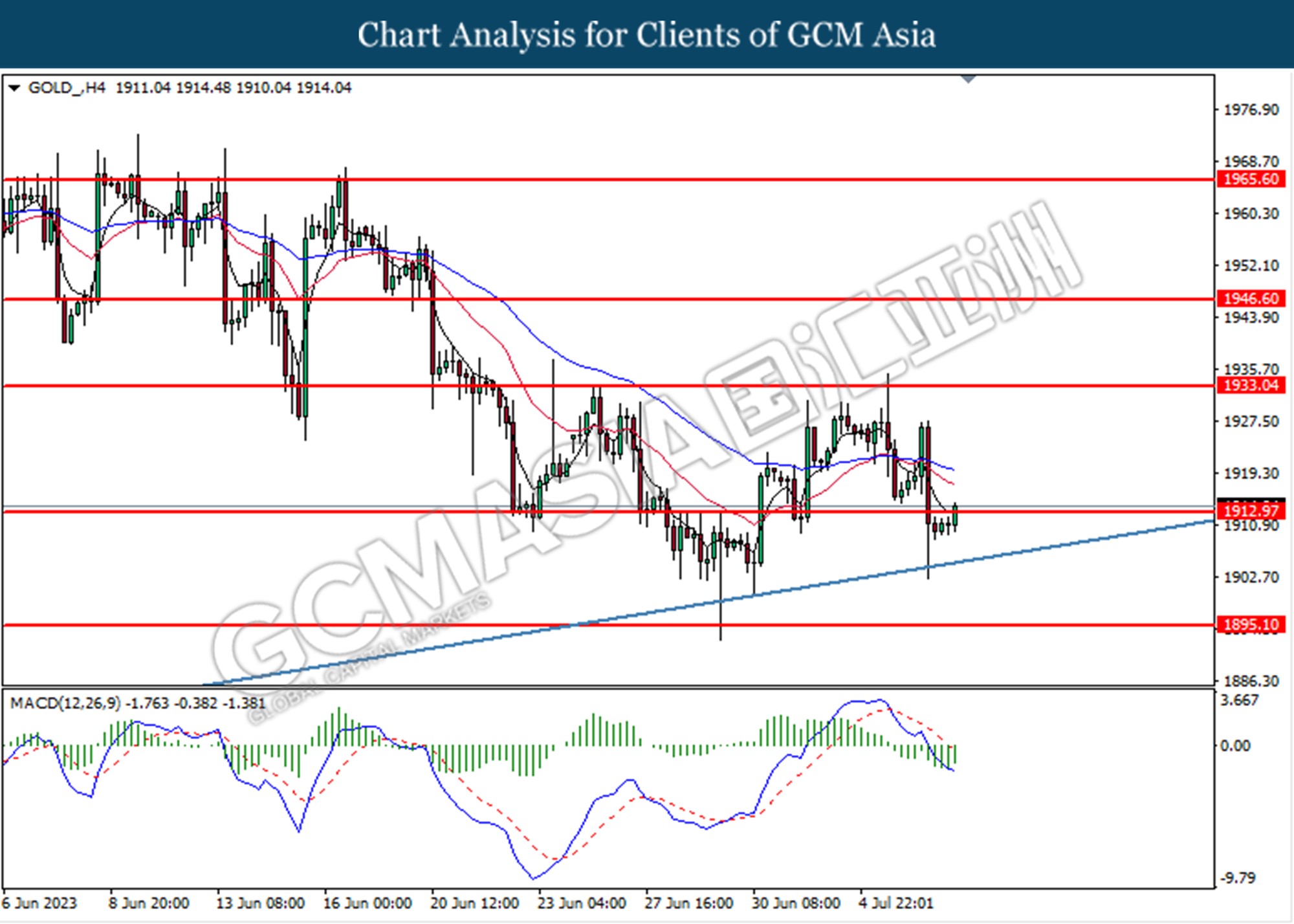

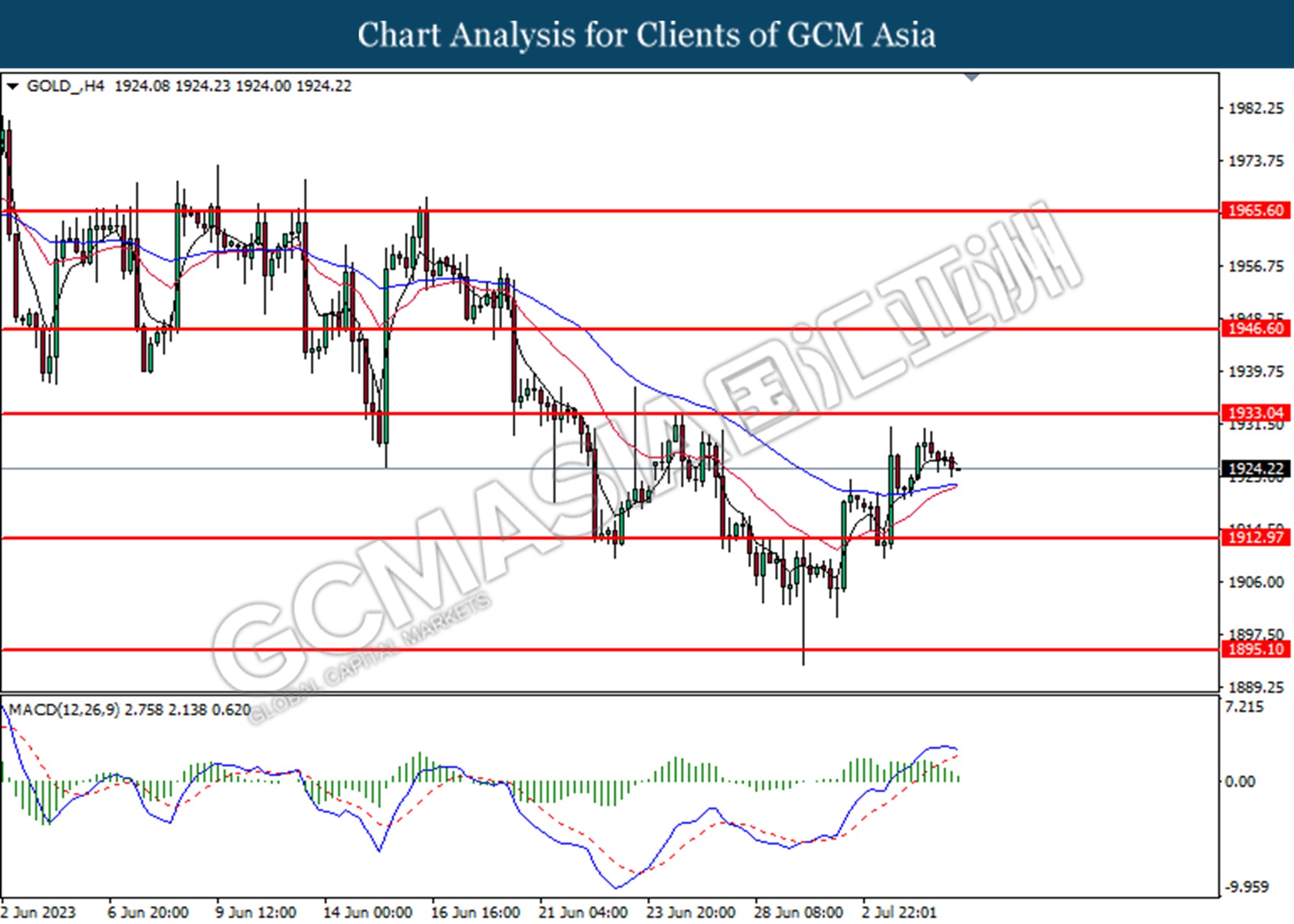

GOLD_, H4: Gold price was traded higher following the prior breaks above the previous resistance level at 1946.60. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 1965.60, 1963.25

Support level: 1946.60, 1933.05

130723 Morning Session Analysis

13 July 2023 Morning Session Analysis

Greenback plunged as inflation rate cooled further in June.

The dollar index, which was traded against a basket of six major currencies, extended its ground of losses yesterday as the US inflation cooled for the 12th straight month in June. According to the latest Consumer Price Index released Wednesday by the Bureau of Labor Statistics, the US annual inflation slowed to 3% last month, registering the record of the smallest year-on-year increase since March 2021 and following a 4.0% rise in May. The June Consumer Price Index (CPI) reading was just slightly above the average inflation level of 2.9% observed two decades before the global financial crisis. The data further indicates a moderation in the underlying price trends, highlighting an improved inflationary environment. With that, it probably will discourage the Federal Reserve from raising interest rates aggressively throughout the end of the year. However, it is noteworthy to highlight that the inflation rate remains well above the Federal Reserve’s target of 2% while the labour market continues to exhibit tight conditions. Therefore, the market participants are awaiting for the speeches and statements from the Federal officials in order to assess how far their tightening path may go. As of writing, the dollar index sank -1.15% to 100.55.

In the commodities market, crude oil prices edged up by 1.48% to $75.85 per barrel as the weaker–than–expected CPI weighed on the US dollar, prompting the demand for oil products to surge subsequently. Besides, gold prices ticked up 0.02% to $1957.85 per troy ounce as the US inflation rate showed further signs of easing.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 CrudeOIL IEA Monthly Report

19:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | CNY – Trade Balance (USD) (Jun) | 65.81B | 93.90B | – |

| 14:00 | GBP – GDP (MoM) (May) | 0.2% | 0.4% | – |

| 20:30 | USD – Initial Jobless Claim | 248K | 249K | – |

| 20:30 | USD – PPI (MoM) (Jun) | -0.3% | 0.2% | – |

Technical Analysis

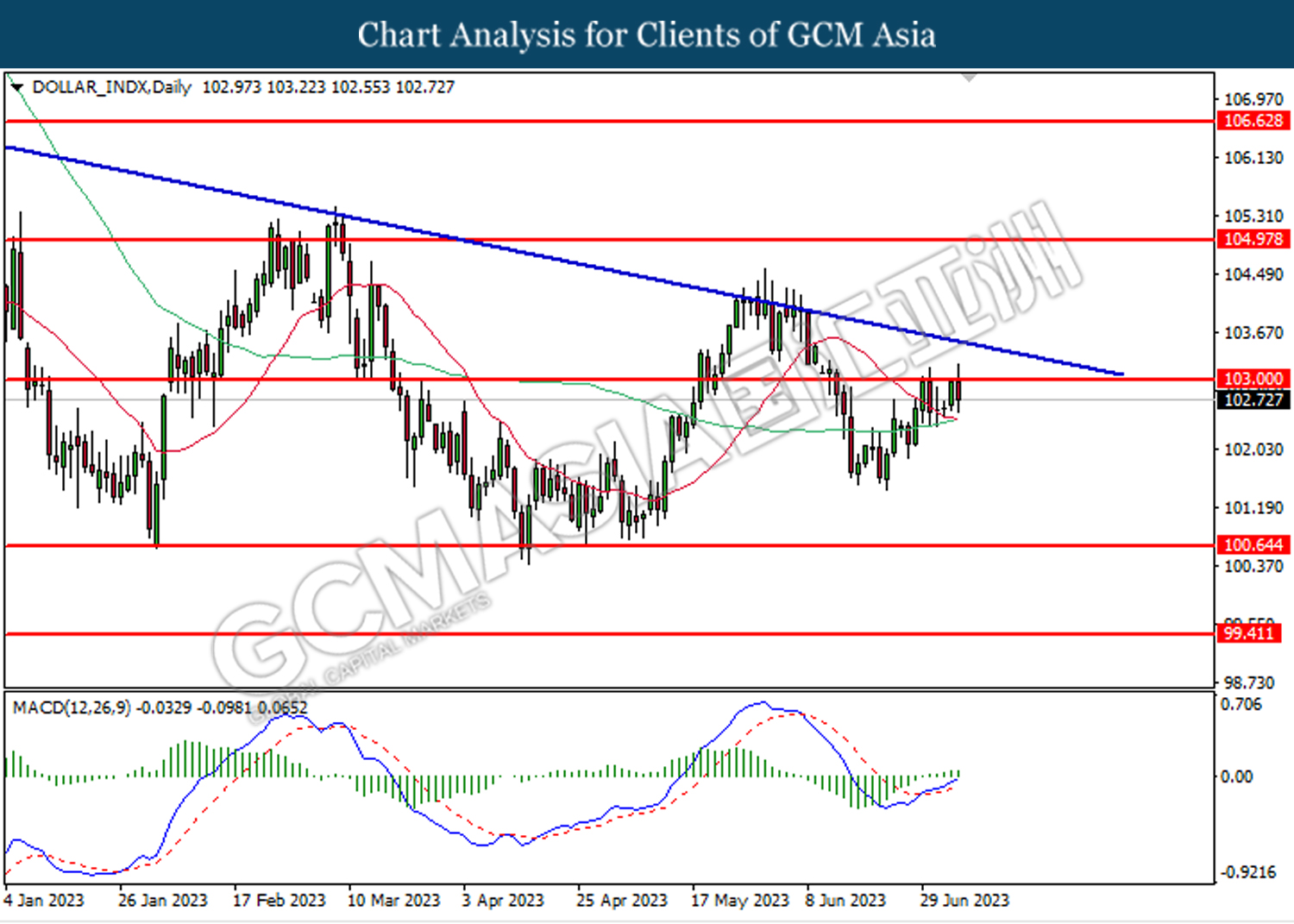

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 100.65. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 99.40.

Resistance level: 100.65, 103.00

Support level: 99.40, 97.75

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2970. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.3090.

Resistance level: 1.3090, 1.3260

Support level: 1.2970, 1.2875

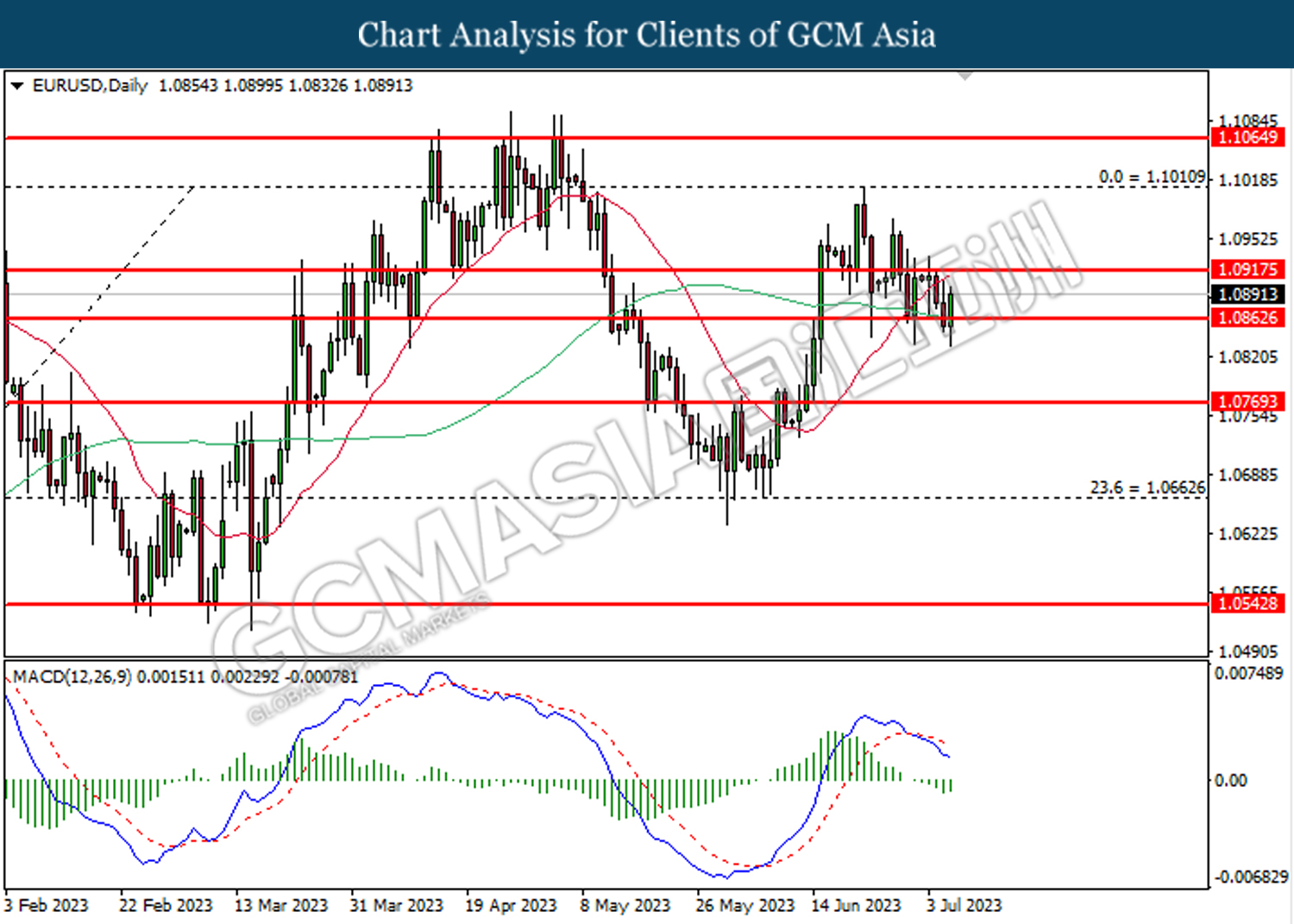

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.1065. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the previous resistance level at 1.1155.

Resistance level: 1.1155, 1.1240

Support level: 1.1065, 1.1010

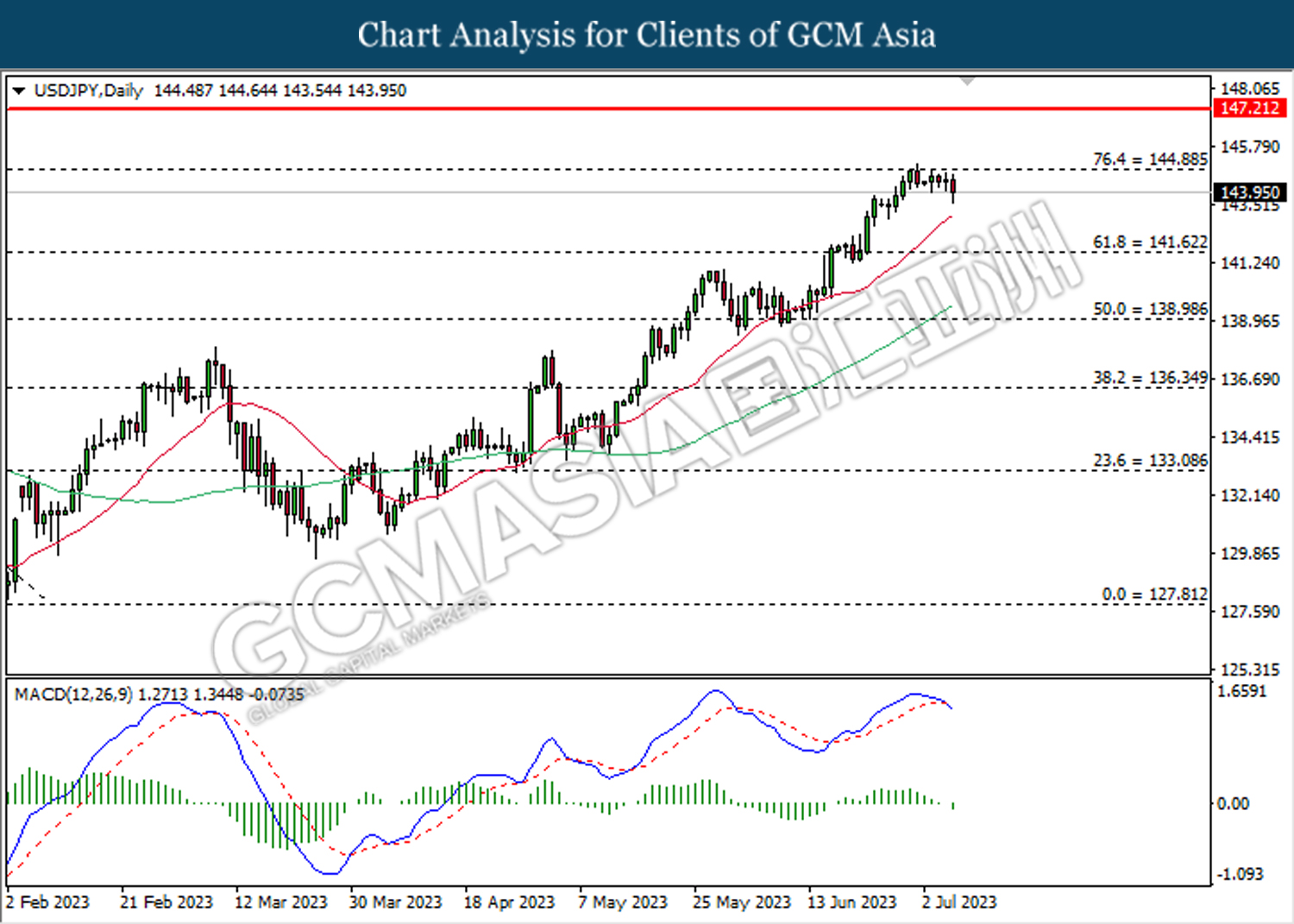

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 139.00. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 139.00, 141.60

Support level: 136.35, 133.10

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3175. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level at 1.3175.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.8670. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 73.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 77.15.

Resistance level: 77.15, 80.75

Support level: 73.90, 70.15

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1951.60. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75

120723 Afternoon Session Analysis

12 July 2023 Afternoon Session Analysis

The Kiwi edged up despite the central bank maintains its rate.

The New Zealand dollar (Kiwi dollar) which traded against the dollar index, fell before the Reserve Bank of New Zealand (RBNZ) monetary policy but rebound afterwards. The RBNZ left the official cash rate remains unchanged at 5.50% and issued a mixed monetary policy statement. The board members noted that monetary conditions had continued to tighten consumer spending and inflationary pressure, as the RBNZ continued a streak of 12 consecutive hikes to curb high inflation pressure in the country. The RBNZ opted not to raise rates and expressed confidence that consumer prices would return to the central bank’s 1% to 3% target However, the pair of NZDUSD quickly reverse its trend after the RBNZ interest rate decision as the core inflation remains high and it might prompt the central bank for a further rate hike. The recent data also continue showed employment remains above its maximum sustainable level, although an easing in labour market conditions. It’s providing room for RBNZ to further tighten. Some economists which included Bloomberg forecast that the RBNZ will resume its tightening moves at the end of the year. As of writing, the NZDUSD edged up by 0.40% to 0.6225.

In the commodities market, crude oil prices traded up by 0.17% to $74.96 per barrel after Russia’s July 4 weeks average crude oil sea export dropped by 205K bpd to 3.21 million bpd below its Feb reading of 3.38 million bpd. On the other hand, the price of gold rose by 0.34% to 1938.70 as investors fear ease ahead of the CPI report.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:45 USD FOMC Member Kashkari Speaks

22:00 CAD BoC Rate Statement

02:00 USD Beige Book

(13th)

04:00 USD FOMC Member Mester Speaks

(13th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Jun) | 0.4% | 0.3% | – |

| 20:30 | USD – CPI (YoY) (Jun) | 4.0% | 3.1% | – |

| 22:00 | CAD – BoC Interest Rate Decision | 4.75% | 5.00% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.508M | -2.156M | – |

Technical Analysis

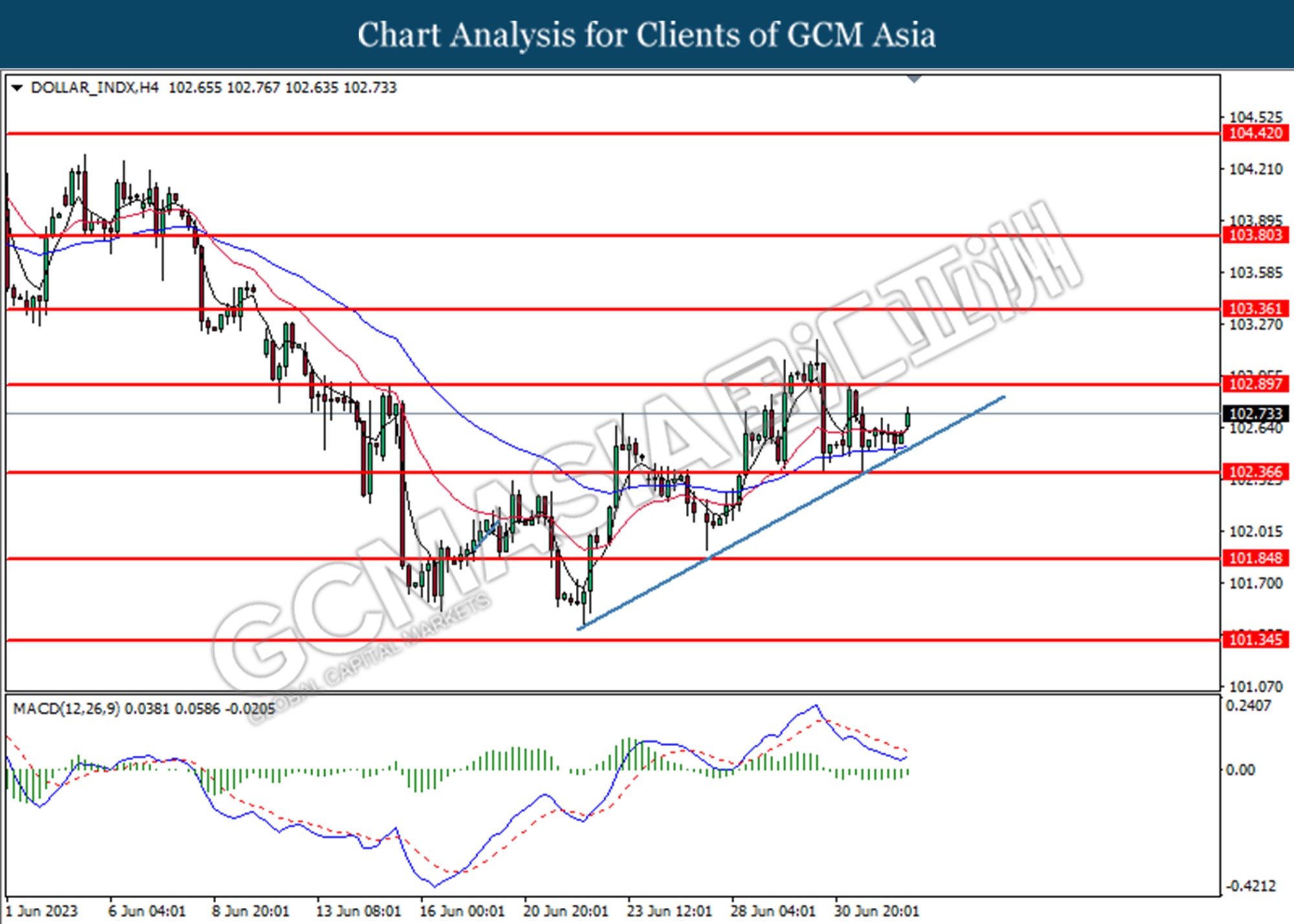

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breaks below for the previous support level at 101.35. However, MACD which illustrated diminishing bearish momentum suggests the index undergoes a technical correction in a short term.

Resistance level: 101.35, 101.85

Support level: 100.80, 100.20

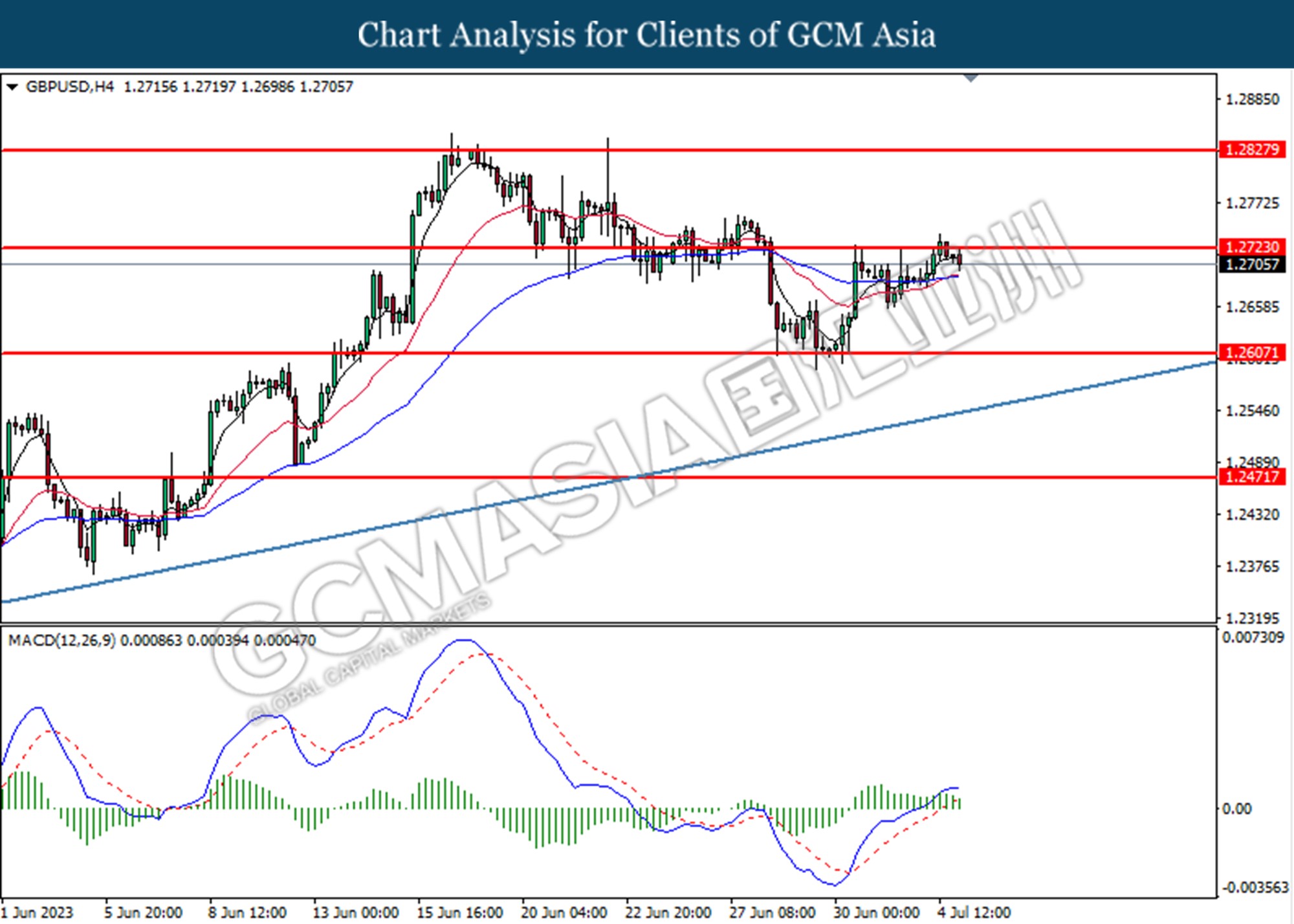

GBPUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2830. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 1.2990.

Resistance level: 1.2830, 1.2990

Support level: 1.2730, 1.2610

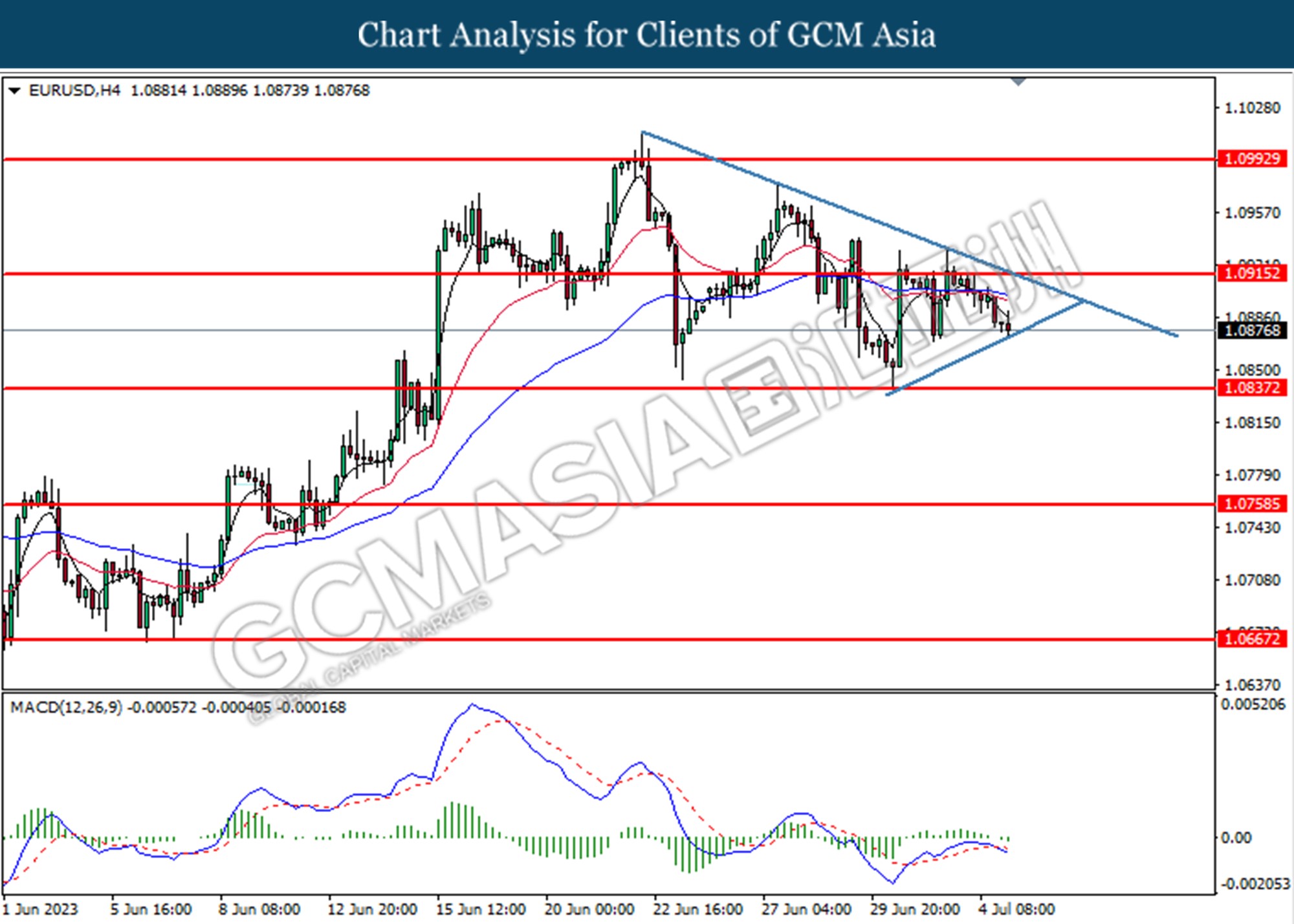

EURUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.0990. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.1075, 1.1160

Support level: 1.0990, 1.0915

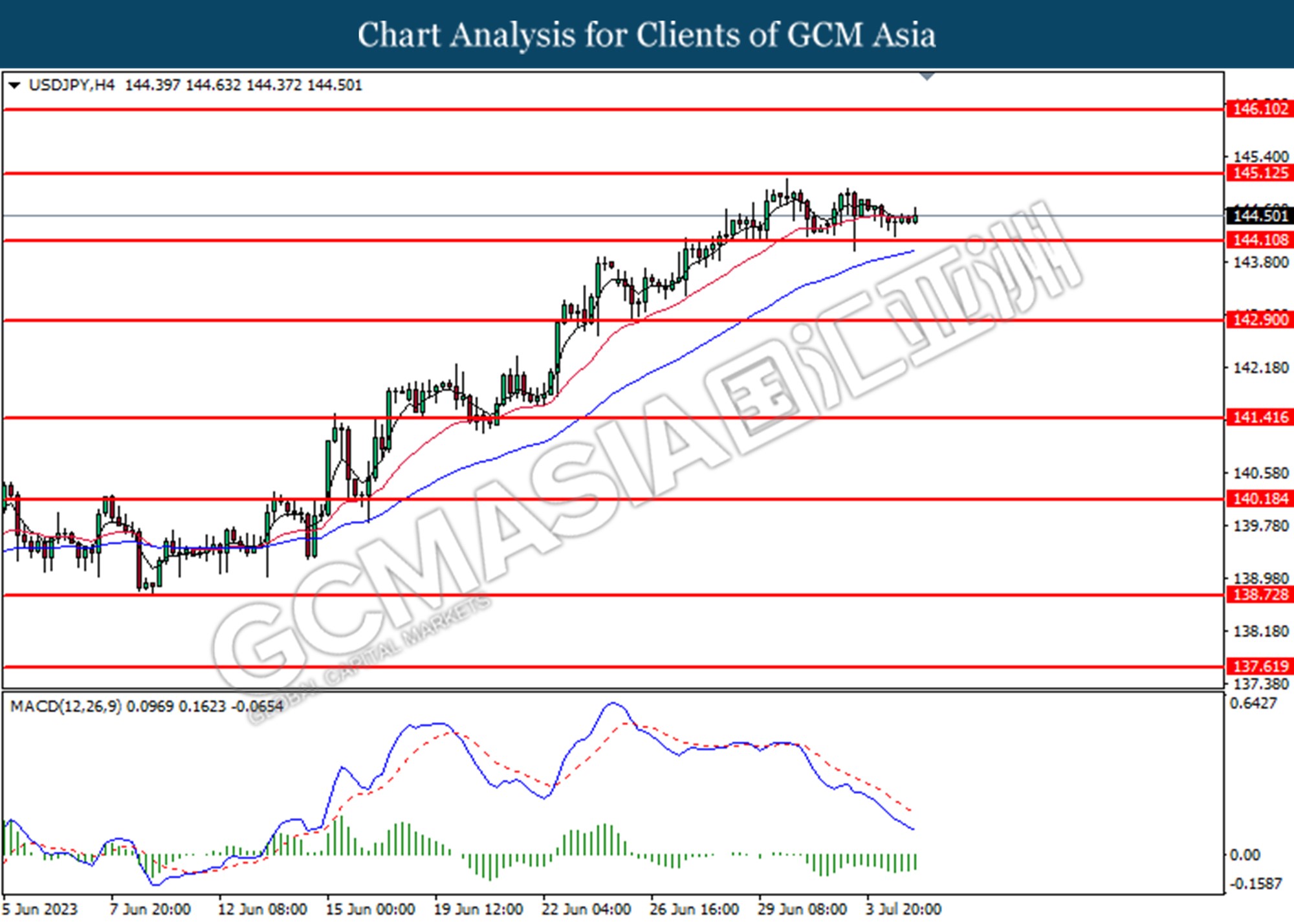

USDJPY, H4: USDJPY was traded lower following the prior breaks below the previous support level at 140.20. MACD which illustrated bearish momentum suggests the pair extended its losses towards the support level at 138.70

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

AUDUSD, H4: AUDUSD was traded higher following the prior breaks above the prior resistance level at 0.6700. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

NZDUSD, H4: NZDUSD was traded lower while currently testing for the support level at 0.6215. However, MACD which illustrated increasing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.6310, 0.6390

Support level: 0.6215, 0.6105

USDCAD, H4: USDCAD was traded lower following the prior breaks below the previous support level at 1.3240. MACD which illustrated bearish momentum suggests the pair extended its losses towards the support level.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

USDCHF, H4: USDCHF was traded lower following the prior breaks below from the previous support level at 0.8820. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.8820, 0.8870

Support level: 0.8760, 0.8715

CrudeOIL, H4: Crude oil price was traded higher following the prior breakout above the previous support level at 74.65. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 76.00, 77.40

Support level: 74.65, 73.15

GOLD_, H4: Gold price was traded higher following the prior breaks above the previous resistance level at 1933.05. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 1946.60.

Resistance level: 1946.60, 1965.60

Support level: 1933.05, 1913.00

120723 Morning Session Analysis

12 July 2023 Morning Session Analysis

US dollar lost its ground as Fed closed to the end of its tightening cycle.

The dollar index, which was traded against a basket of six major currencies, regained its luster unsuccessfully in the previous trading session as the sentiment remained weak in the dollar market. Prior to this, Federal Reserve officials have indicated that the United States central bank is nearing the end of its tightening cycle. These remarks had an impact on the value of the U.S. dollar, which urged it to drop to a two-month low of 101.66 against a basket of currencies. With that, investors adjusted their expectations regarding the extent to which U.S. rates might need to increase. On the other hand, the latest Nonfarm Payrolls (NFP) report, which was released on Friday, revealed potential weaknesses in the U.S. labour market for the first time since the COVID-19 pandemic. This development suggests that the Federal Reserve might only implement one more time of rate hike before it turns the table over. Also, investors are now putting all their attention on the upcoming CPI data as it can provide greater clarity on the Federal Reserve’s progress in addressing persistent high inflation. Forecasts indicate that U.S. consumer prices likely rose by 3.1% in June. As of writing, the US dollar dropped -0.30% to 101.67.

In the commodities market, crude oil prices edged up by 0.01% to $74.75 per barrel on a weaker US dollar and growing expectations of more stimulus plans in China. Besides, gold prices ticked up 0.07% to $1933.40 per troy ounce on a dollar stumble.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:45 USD FOMC Member Kashkari Speaks

22:00 CAD BoC Rate Statement

02:00 USD Beige Book

(13th)

04:00 USD FOMC Member Mester Speaks

(13th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Jun) | 0.4% | 0.3% | – |

| 20:30 | USD – CPI (YoY) (Jun) | 4.0% | 3.1% | – |

| 22:00 | CAD – BoC Interest Rate Decision | 4.75% | 5.00% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.508M | -2.156M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2875. MACD which illustrated bullish bias momentum suggest the pair to extend its toward the resistance level at 1.2970.

Resistance level: 1.2970, 1.3090

Support level: 1.2875, 1.2765

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1010. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the previous resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0865

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 141.60. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 139.00.

Resistance level: 141.60, 143.90

Support level: 139.00, 136.35

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3245. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3175.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.8835. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8670.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 73.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior rebound from the upward trend line. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

110723 Afternoon Session Analysis

11 July 2023 Afternoon Session Analysis

Pound Sterling extended gains after Bailey delivered hawkish guidance.

The Pound Sterling which traded against the dollar index extended its gains after Bank of England (BoE) Bailey delivered hawkish interest rate guidance. Before that, the UK inflation rate stood at 8.7% in the latest data, the highest among the G7 countries. Britain’s inflation remained elevated due to higher food price pressure and labour shortage in the market. According to a Reuters report, labour shortages as almost one in three female workers in the UK expect to stop working before reaching their retirement age with many citing health and well-being issues. With such a backdrop, financial markets bet that the BoE will raise the interest rate to 6.5% in early 2024, up from a previously expected peak of 6.25%. It also caused the two years UK government bond pushed to its highest level since 2008. Besides, BoE governor Bailer under pressure from politicians and some economists, said that price growth was stickier than BoE expected. This is also a big challenge for UK Prime Minister Rishi Sunak who promised to halve the price pressure by year-end. Meanwhile, investors will keenly observe UK employment changes data to get cues about inflation and interest rate guidance. As of writing, the GBPUSD edged up by 0.11% to 1.2873.

In the commodities market, crude oil prices traded up by 0.62% to $73.44 per barrel ahead of US inflation data announced on Wednesday. On the other hand, the price of gold rose by 0.08% to 1926.70 as investors await US inflation data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 USD FOMC Member Bullard Speaks

00:00 CrudeOIL EIA Short-Term Energy Outlook

(12th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 04:30

(12th) |

CrudeOIL – API Weekly Crude Oil Stock | -4.382M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing for the support level at 101.85. MACD which illustrated diminishing bearish momentum suggests the index extended its losses if successfully breaks the support level.

Resistance level: 101.85, 102.35

Support level: 101.35, 100.80

GBPUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2990. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2830, 1.2990

Support level: 1.2730, 1.2610

EURUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.0990. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.1075, 1.1160

Support level: 1.0990, 1.0915

USDJPY, H4: USDJPY was traded lower following the prior breaks below the previous support level at 141.40. MACD which illustrated bearish momentum suggests the pair extended its losses towards the support level at 140.20

Resistance level: 141.40, 142.90

Support level: 140.20, 138.70

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6700.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6215. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded lower following the prior breaks below from the upward trend line. MACD which illustrated bearish momentum suggests the pair extended its losses towards the support level at 1.3240.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

USDCHF, H4: USDCHF was traded lower following the prior breaks below from the previous resistance level at 0.8870. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.8870, 0.8940

Support level: 0.8820, 0.8760

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 73.15. MACD which illustrated increasing bearish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 74.65, 76.00

Support level: 73.15, 71.35

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 1933.05.

Resistance level: 1933.05, 1946.60

Support level: 1913.00, 1895.10

110723 Morning Session Analysis

11 July 2023 Morning Session Analysis

Greenback dipped as Fed’s rate hikes closed to an end.

The dollar index, which was traded against a basket of six major currencies, failed to revive from its previous day losses as a result of comments made by Federal Reserve officials, reinforcing the market’s anticipation that the U.S. central bank is approaching the end of its tightening cycle. Yesterday, the Federal Reserve officials’ statements aligned with their recent messaging regarding the necessity of raising interest rates to address inflation and bring it back to the target level. Despite the latest NFP data showing the smallest job gains in 2.5 years, it is widely expected that the Fed will proceed with another 25 basis points interest rate increase this month. Some of the Federal Reserve officials, led by San Francisco Fed President Mary Daly on Monday, expressed the view that the central bank will likely need to raise interest rates further to address the persistently high inflation. However, they also acknowledged that the end of the current monetary policy tightening cycle is drawing near. As a result, market participants made the decision to reallocate their capital away from the dollar and towards other riskier markets that are expected to experience more future interest rate hikes, such as Pound and Euro. As of writing, the dollar index dropped -0.31% to 101.95.

In the commodities market, crude oil prices were up by 0.02% to $73.20 per barrel as the depreciation of the US dollar urged non-US buyers of oil enter into the oil market. Besides, gold prices ticked up 0.01% to $1925.30 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 USD FOMC Member Bullard Speaks

00:00 CrudeOIL EIA Short-Term Energy Outlook

(12th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German CPI (MoM) (Jun) | 0.4% | 0.3% | – |

| 04:30

(12th) |

CrudeOIL – API Weekly Crude Oil Stock | -4.382M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2765. MACD which illustrated bullish bias momentum suggest the pair to extend its toward the resistance level at 1.2875.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0915. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0865

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 141.60. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 143.90, 144.90

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3330. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3245.

Resistance level: 1.3330, 1.3395

Support level: 1.3245, 1.3175

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8980. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8830.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 73.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior rebound from the upward trend line. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

100723 Afternoon Session Analysis

10 July 2023 Afternoon Session Analysis

Canadian dollar soars as job changes soar in June.

The Canadian dollar (Loonie) which traded against the dollar index, extended its gains after the Canadian June employment changes soared and weaker US labor conditions. The Canadian June employment increased to 59.9K from -17.3K, beating the market estimations of 20.0K, data from Statistic Canada (StatsCan) showed last Friday. However, the unemployment rate rose to 5.4% from 5.2%, more than the market expected of 5.3%. Canadian jobless rate increased for two consecutive months and hit its highest level since February 2022, though still below a pre-pandemic 12-month average, StatsCan reported. With such a backdrop, a stronger than expected employment conditions in June prompted investors that the central bank to hike for the next monetary policy, the Loonie strengthened. Nonetheless, the Ivey PMI reflects a fragile situation after the reading eased to 50.2 from 53.5, lower than expectations of 51.5. The Ivey PMI decreased for 4 straight months after the central bank continues its tightening its rates and limited the business for growth. At this movement, investors will eye on Bank of Canada’s monetary policy to get further direction of the policy moves. As of writing, the pair of USDCAD traded up by 0.16% to 1.3293.

In the commodities market, crude oil prices ticked down by -0.69% to $73.35 per barrel as the China CPI and PPI stood at 0.0% and -5.4%, slipping more than the expected 0.2% and -5.0%. On the other hand, the price of gold slipped by -0.06% to 1924.05 as the dollar rebounded after the significant drop in the previous session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the support level at 101.85. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level.

Resistance level: 102.35, 102.90

Support level: 101.85, 101.35

GBPUSD, H4: GBPUSD was traded lower following the prior breaks below the previous support level at 1.2830. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2830, 1.2990

Support level: 1.2730, 1.2610

EURUSD, H4: GBPUSD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses towards the support level at 1.0915.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

USDJPY, H4: USDJPY was traded higher while currently testing for the resistance level at 142.90. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains after it successfully breaks above the resistance level.

Resistance level: 142.90, 144.10

Support level: 141.40, 140.20

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6700. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 0.6615.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6215. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bearish momentum suggests the pair extended its gains towards the resistance level at 1.3335

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the commodity extended its losses towards the support level at 73.15.

Resistance level: 74.65, 76.00

Support level: 73.15, 71.35

GOLD_, H4: Gold price was traded lower following the prior retracement from the resistance level at 1933.05. MACD which illustrated diminishing bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 1933.05, 1946.60

Support level: 1913.00, 1895.10

100723 Morning Session Analysis

10 July 2023 Morning Session Analysis

US dollar plunged amid downbeat NFP report.

The dollar index, which was traded against a basket of six major currencies, lost its ground as the last Friday’s Nonfarm Payroll report disappointed the market participants, diminishing the market concern of how high the interest rate will go. In June, the U.S. economy saw the lowest job growth in two and a half years. According to the Labor Department’s employment report, there were 110,000 fewer jobs created in April and May, suggesting that businesses were becoming more cautious in expanding their workforce due to higher borrowing costs. The survey of establishments revealed that nonfarm payrolls only increased by 209,000 jobs in June, marking the smallest gain since December 2020. This figure fell short of economists’ expectations, as they had predicted a rise of 225,000 jobs. However, the US Unemployment managed to lighten up the optimism in the US labor market. According to the Bureau of Labour Statistics, the US unemployment rate dropped from 3.7% to 3.6%, in line with the market expectation. As of writing, the dollar index slipped -0.02% to 102.30.

In the commodities market, crude oil prices were up by 0.11% to $73.55 per barrel as the weakening of US dollar prompted the non-US oil buyers to rush into the oil market. Besides, gold prices spiked 0.08% to $1926.65 per troy ounce amid the disappointing Nonfarm Payroll report.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.00. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 100.65.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2765. MACD which illustrated bullish bias momentum suggest the pair to extend its toward the resistance level at 1.2875.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0915. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0865

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 143.90. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 143.90, 144.90

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3330. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3245.

Resistance level: 1.3330, 1.3395

Support level: 1.3245, 1.3175

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.8980. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8830.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 73.90. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior rebound from the upward trend line. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

070723 Afternoon Session Analysis

07 July 2023 Afternoon Session Analysis

Japan’s base salaries jumped putting BoJ policy into view.

The Japanese Yen which traded against the dollar index, edged lower after the Japanese Yen strengthened as Japan’s base salaries jumped to 28 years high since 1995. Global financial markets have been monitoring closely Japan’s wage data, as Bank of Japan (BoJ) Kazuo Ueda cited pay growth as a critical factor in deliberations about the shift in policy. Nominal wages, not adjusted for inflation, rose 2.5% from a year earlier to 283,868 yen ($1,972.16). While the real salaries which adjusted for the inflation rose 1.8% to 252,132 yen (USD 1751.67), labour ministry data showed. Economist comments that if inflation is sustainable at around 2% and nominal wages increase from 3% to 3.5%, these conditions would fuel the hopes that BOJ could end its ultra-loosen monetary policy. However, separate data on Friday showed household spending down to -4.0% from -4.4%, lower than market expectations of -2.4%. The high inflation effect weighed on household spending. Some economists commend that BoJ should maintain its ultra-loosen monetary policy to accelerate household spending and real wage growth. As of writing, the USDJPY slipped to -0.09% to 143.93.

In the commodities market, crude oil prices rose by 0.38% to $72.07 per barrel as EIA crude oil inventory showed a deficit result. On the other hand, the cost of gold edged up 0.01% to 1910.94 as the price of gold fell in the previous session after the US released mixed economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Average Hourly Earnings (MoM) (Jun) | 0.3% | 0.3% | – |

| 20:30 | USD – Nonfarm Payrolls (Jun) | 339K | 225K | – |

| 20:30 | USD – Unemployment Rate (Jun) | 3.7% | 3.7% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breaks above the previous support level at 102.90. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

GBPUSD, H4: GBPUSD was traded higher following the rebound from the support level at 1.2723. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.2830, 1.2990

Support level: 1.2730, 1.2610

EURUSD, H4: GBPUSD was traded higher following a prior rebound from the support level at 1.0840. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards the resistance level at 1.0915.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 144.10. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 142.90.

Resistance level: 144.10, 145.10

Support level: 142.90, 141.40

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6615. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded higher following the prior breaks above the previous resistance level at 1.3335. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.3455, 1.3560

Support level: 1.3335, 1.3240

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.8940.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded lower following the prior rebound from the support level at 71.35. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 73.15, 74.65

Support level: 71.35, 69.30

GOLD_, H4: Gold price was traded higher following the prior breaks above the previous resistance level at 1913.00. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 1933.05, 1946.60

Support level: 1913.00, 1895.10

070723 Morning Session Analysis

07 July 2023 Morning Session Analysis

US dollar surged amid strong labor and services data.

The dollar index, which was traded against a basket of six major currencies, spiked as the latest data revealing a robust U.S. labor market heightened the likelihood of the Federal Reserve raising interest rates later this month. According to the ADP National Employment report, private payrolls saw a significant surge in June, marking the largest increase since February 2022. The ADP data came in at 497K, far stronger than the consensus forecast and prior reading at 228K and 267K respectively. Other than that, in June, the U.S. services sector exhibited a faster-than-anticipated growth, driven by an upturn in new orders. According to the Institute for Supply Management (ISM), the non-manufacturing purchasing managers’ index (PMI) rose to 53.9 last month from May’s 50.3. A reading above 50 indicates expansion in the services industry, which contributes to over two-thirds of the economy. However, the gains of the dollar index was limited by other job data which was also released yesterday’s night. The US labor department reported a moderate rise in the number of new claims for unemployment benefits filed by Americans last week. Also, according to the JOLTs Job Openings released by the US Bureau of Labor Statistics (BLS), the total count of job openings on the final business day of May was 9.824 million, fell short of the market’s anticipated 9.935 million. As of writing, the dollar index dropped -0.25% to 103.10

In the commodities market, crude oil prices edged up by 0.10% to $71.85 per barrel after a big swings up and down followed by the announcement of a series of economic data in the US. Besides, the gold prices ticked up by 0.01% to $1910.90 per troy ounce after a sharp drop yesterday night amid upbeat economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Average Hourly Earnings (MoM) (Jun) | 0.3% | 0.3% | – |

| 20:30 | USD – Nonfarm Payrolls (Jun) | 339K | 225K | – |

| 20:30 | USD – Unemployment Rate (Jun) | 3.7% | 3.7% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 103.00. MACD which illustrated bullish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2765. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0865. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0915.

Resistance level: 1.0915, 1.1010

Support level: 1.0865, 1.0770

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 144.90. However, MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3330. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3330, 1.3395

Support level: 1.3245, 1.3175

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

060723 Afternoon Session Analysis

06 July 2023 Afternoon Session Analysis

Pound slips after the UK business shows a sign of vulnerability.

The Pound Sterling which traded against the dollar index, edged lower after the business momentum slowed in June showing a sign of vulnerability despite the business facing lower inflation. UK’s Service sector fell to 53.7 from 55.2, in line with market expectations, while the UK composite PMI also dropped to 52.8 from 54.0, in line with economist’s forecast. UK business momentum growth was reduced to a three-month low after the S&P Global survey showed a slower pace of business growth. According to S&P Global surveys, servicer providers experienced deceleration in overall input price but the cost pressure remains the most sustainable since the first survey began in July 1996. Salary payment continued to surge at the highest, offset by a decline in energy prices. Despite the inflation in the UK being eased, the Bank of England’s (BoE) unexpectedly rising interest rates from 4.50% to 5.00% weighed on consumer demand. Some economists expected that BoE rate rises will push the UK economy into recession later this year after quarter one GDP only grew by 0.1%. As of writing, the GBPUSD slipped by -0.02% to 1.2701.

In the commodities market, crude oil prices rose by 0.07% to $71.84 per barrel as the US crude oil stockpiles fell to -4.382M, lower than the market’s estimation. On the other hand, the price of gold edged up 0.17% to 1918.41 as the price of gold fell in the previous session after the Fed gave the hawkish meeting minutes.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Jun) | 278K | 230K | – |

| 20:30 | USD – Initial Jobless Claims | 239K | 245K | – |

| 21:45 | USD – Services PMI (Jun) | 54.9 | 54.1 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jun) | 50.3 | 51.0 | – |

| 22:00 | USD – JOLTs Job Openings (May) | 10.103M | 9.900M | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -9.603M | -0.729M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior breaks above the previous resistance level at 102.90. MACD which illustrated increasing bullish momentum suggests the index extended its gains toward the resistance level.

Resistance level:103.35, 103.80

Support level: 102.90, 102.35

GBPUSD, H4: GBPUSD was traded lower following the rebound from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward support level.

Resistance level: 1.2730, 1.2830

Support level: 1.2610, 1.2470

EURUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.0840. MACD which illustrated increasing bearish momentum suggests the pair extended its losses if successfully breaks below the support level.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

USDJPY, H4: USDJPY was traded lower following currently testing for the support level at 144.10. MACD which illustrated increasing bearish momentum suggests the pair extended its losses if successfully break below the support level.

Resistance level: 145.10, 146.10

Support level: 144.10, 142.90

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6615.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded higher following the prior breaks above the previous resistance level at 1.3240. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3335.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

USDCHF, H4: USDCHF was traded lower following the prior retracement from the resistance level at 0.8985. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 71.35.

Resistance level: 73.15, 74.65

Support level: 71.35, 69.30

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 1933.05, 1946.60

Support level: 1913.00, 1895.10

060723 Morning Session Analysis

06 July 2023 Morning Session Analysis

Greenback surged amid hawkish FOMC meeting minutes.

The dollar index, which was traded against a basket of six major currencies, managed to revert from its previous losses after the Federal Reserve released the minutes of its June monetary policy meeting, which tilted toward a hawkish stance as officials worried about a tight labor market. In the meeting minutes, it showed that the officials agreed to keep interest rates unchanged to assess the cumulative impact of previous tightening measures before a further rate hike. However, some Fed officials have advocated a quarter-point rate hike, citing a tight job market. Also, majority of the officials also noted that after rapidly tightening the stance of monetary policy last year, the Committee had already slowed the pace of tightening, and that would be appropriate to slow the pace of tightening further in order to have more time to observe the effects of the cumulative tightening and assess its impact on policy. At this point in time, the market participants are eyeing on the upcoming crucial data such as Nonfarm Payroll in order to scrutinize the future path of Fed’s tightening policy. As of writing, the dollar index rose 0.29% to 103.35.

In the commodities market, crude oil prices appreciated by 1.10% to $71.85 per barrel after a further draw in US oil stockpiles were reported by API. Besides, the gold prices ticked up by 0.08% to $1916.70 per troy ounce after slumping for more than $10 amid hawkish Fed’s meeting minutes.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Jun) | 278K | 230K | – |

| 20:30 | USD – Initial Jobless Claims | 239K | 245K | – |

| 21:45 | USD – Services PMI (Jun) | 54.9 | 54.1 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jun) | 50.3 | 51.0 | – |

| 22:00 | USD – JOLTs Job Openings (May) | 10.103M | 9.900M | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -9.603M | -0.729M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 103.00. MACD which illustrated bullish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2635. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2765.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0865. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0915, 1.1010

Support level: 1.0865, 1.0770

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 144.90. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40

050723 Afternoon Session Analysis

05 Jul 2023 Afternoon Session Analysis

The Australian dollar fell and rebounded after the monetary policy decision.

The Australian Dollar (AUSSIE) Which Traded Against The Dollar Index Fell and Rebounded After the Monetary Policy DeCision by the Reserve Bank of Australia (RBA) The rba kept the cash rate unchanged at 11 Years High of 4.10% after the Central Bank Lifted the rates by 400 basis points since May 2022. AUD/USD slips after central bank pause rate hikes Governor Philip Lowe’s comments in the statement mention that The central bank decided to keep interest rates stable at the current position and explained that the effect of previous rate hikes will take some time to assess the impact on the economy. Besides, growth in the Australian economy has slowed and the labor market has eased from its peak, which could be a reason to prompt the RBA a pause its rates. In addition, inflation in Australia had passed its peak and the recent month’s CPI indicator showed a further decline after the central bank aggressively tightened its monetary policy. However, Lowe reiterated that further tightening of monetary policy would be required if the inflation stays above the central bank target. A further tightening move is required to ensure the inflation returns to the central bank’s 2% target. As of writing, the AUDUSD slipped by -0.07% to 0.6685.

In the commodities market, crude oil prices increase by 1.46% to $70.81 per barrel as the market continues to weigh on supply cuts by Saudi Arabia with Russia and weaker China’s economic growth. Elsewhere, the gold price slightly decreases by -0.08% to 1924.44 ahead of the Fed minutes release.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Meeting Minutes

(6th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:50 | EUR – French Services PMI (Jun) | 52.5 | 48.0 | – |

| 15:55 | EUR – German Services PMI (Jun) | 57.2 | 54.1 | – |

| 16:00 | EUR – S&P Global Composite PMI (Jun) | 52.8 | 50.3 | – |

| 16:00 | EUR – Services PMI (Jun) | 55.1 | 52.4 | – |

| 16:30 | GBP – Composite PMI (Jun) | 54.0 | 52.8 | – |

| 16:30 | GBP – Services PMI (Jun) | 55.2 | 53.7 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 102.90.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2730. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2730, 1.2830

Support level: 1.2610, 1.2470

EURUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.0840.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

USDJPY, H4: USDJPY was traded higher following the prior rebound from the support level at 144.10. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 145.10, 146.10

Support level: 144.10, 142.90

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6700. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6105.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.3335.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.8985.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the resistance level at 71.35. MACD which illustrated \bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 71.35,73.15

Support level: 69.30, 67.55

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 1933.05, 1946.60

Support level: 1913.00, 1895.10

050723 Morning Session Analysis

05 July 2023 Morning Session Analysis

US dollar flat on Independence Day holiday.

The dollar index, which was traded against a basket of six major currencies, experienced a quiet trading session yesterday as the US markets was closed to commemorate the 247th anniversary of the Declaration of Independence signing. With US markets closed for the 4th July public holiday, market activity was relatively subdued. Investors are now awaiting Friday’s U.S. nonfarm payrolls report, which could influence the Federal Reserve’s next decision. Prior to that, the market participants are also eyeing on the FOMC Meeting Minutes for more clues on its interest rate hike path ahead. Also, they will provide valuable insight into why the Fed decided to pause its rate hike cycle and the likelihood of further hikes in the near term. Hence, the views of Federal Reserve on economic growth, monetary policy and inflation would definitely move the market. At this point in time, the probability of a rate hike at the upcoming July 26-27 meeting is now above 86%, according to the CME Fed Watch tool, which also shows growing expectations for another rate hike before the end of the year. As of writing, the dollar index rose 0.10% to 103.10.

In the commodities market, crude oil prices appreciated by 1.27% to $70.95 per barrel as market weighed on the plan of more production cut from Saudi Arabia and Russia in the month of August. Besides, the gold prices ticked up by 0.05% to $1927.00 per troy ounce during the Independence Day holiday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Meeting Minutes

(6th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:50 | EUR – French Services PMI (Jun) | 52.5 | 48.0 | – |

| 15:55 | EUR – German Services PMI (Jun) | 57.2 | 54.1 | – |

| 16:00 | EUR – S&P Global Composite PMI (Jun) | 52.8 | 50.3 | – |

| 16:00 | EUR – Services PMI (Jun) | 55.1 | 52.4 | – |

| 16:30 | GBP – Composite PMI (Jun) | 54.0 | 52.8 | – |

| 16:30 | GBP – Services PMI (Jun) | 55.2 | 53.7 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.00. However, MACD which illustrated bullish momentum suggests the index to undergo technical correction in short term.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2635. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2765.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.0915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0865.

Resistance level: 1.0915, 1.1010

Support level: 1.0865, 1.0770

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 144.90. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3245. However, MACD which illustrated bullish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50