120623 Afternoon Session Analysis

12 June 2023 Afternoon Session Analysis

US dollar at a standstill as US CPI looms.

The dollar index, which was traded against a basket of six major currencies, hovered near the lowest level in two weeks as the investors remained cautious ahead of a crucial week, where the long-awaited CPI and Fed’s interest rate decision will be released on Tuesday and Thursday, respectively. Since last year’s March, the Fed has been increasing the official cash rates by more than ten times consecutively. The core intention of the rate-hiking still remained the same, whereby 2% is still the long-term inflation target of the Fed. With that, the investors expect the high-interest rate would cool down the inflation rate from the prior month’s reading of 4.9% to a lower level. Besides, according to the CME FedWatch Tool, the probability of the Fed maintaining the interest rate at the current level is at 73.6%, whereas the chances of implementing another 25 basis points rate hike are at 26.4%. It is noteworthy to highlight that investors are suggested to relook at the FedWatch Tool again following the release of the CPI data, as it would make a huge difference in the target rate probabilities. A lower-than-expected inflation rate would diminish the likelihood of a further rate hike in the upcoming meeting. As of writing, the dollar index is up by 0.09% to 103.65.

In the commodities market, crude oil prices edged down -1.24% to $69.40 per barrel as the possibility of Iran reaching a nuclear deal with the US surged. Besides, gold prices were down by -0.24% to $1956.30 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

All Day AUD King’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

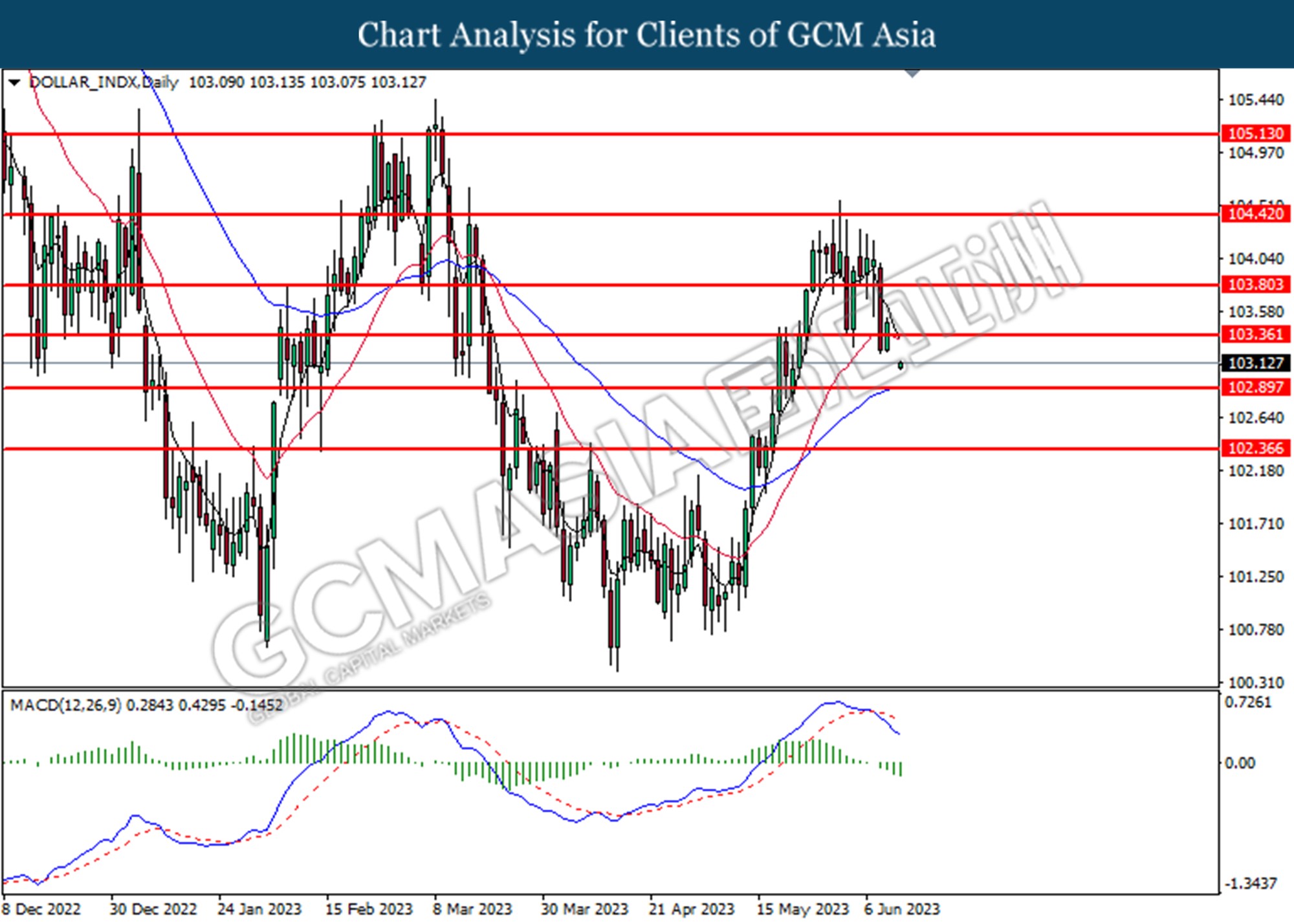

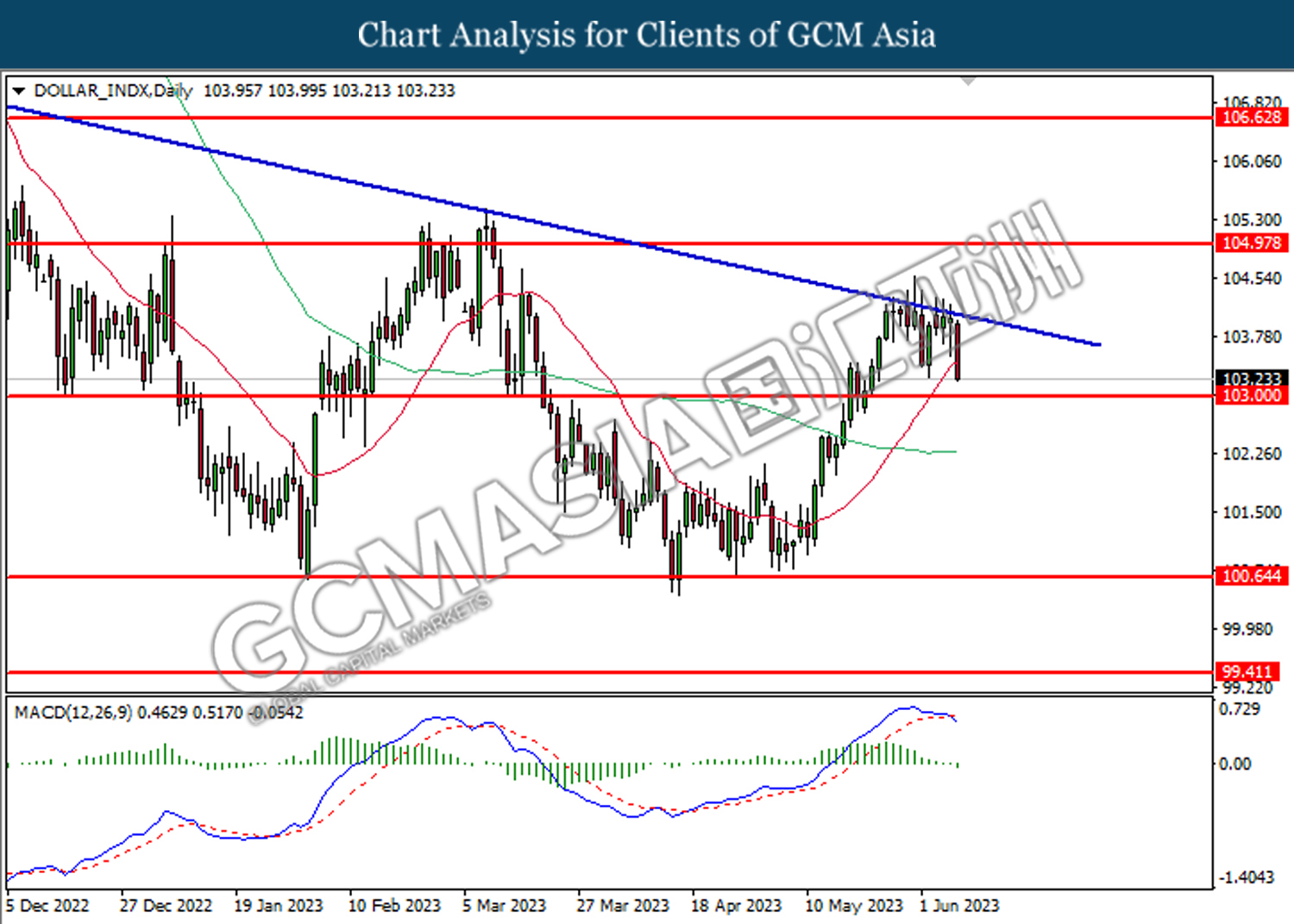

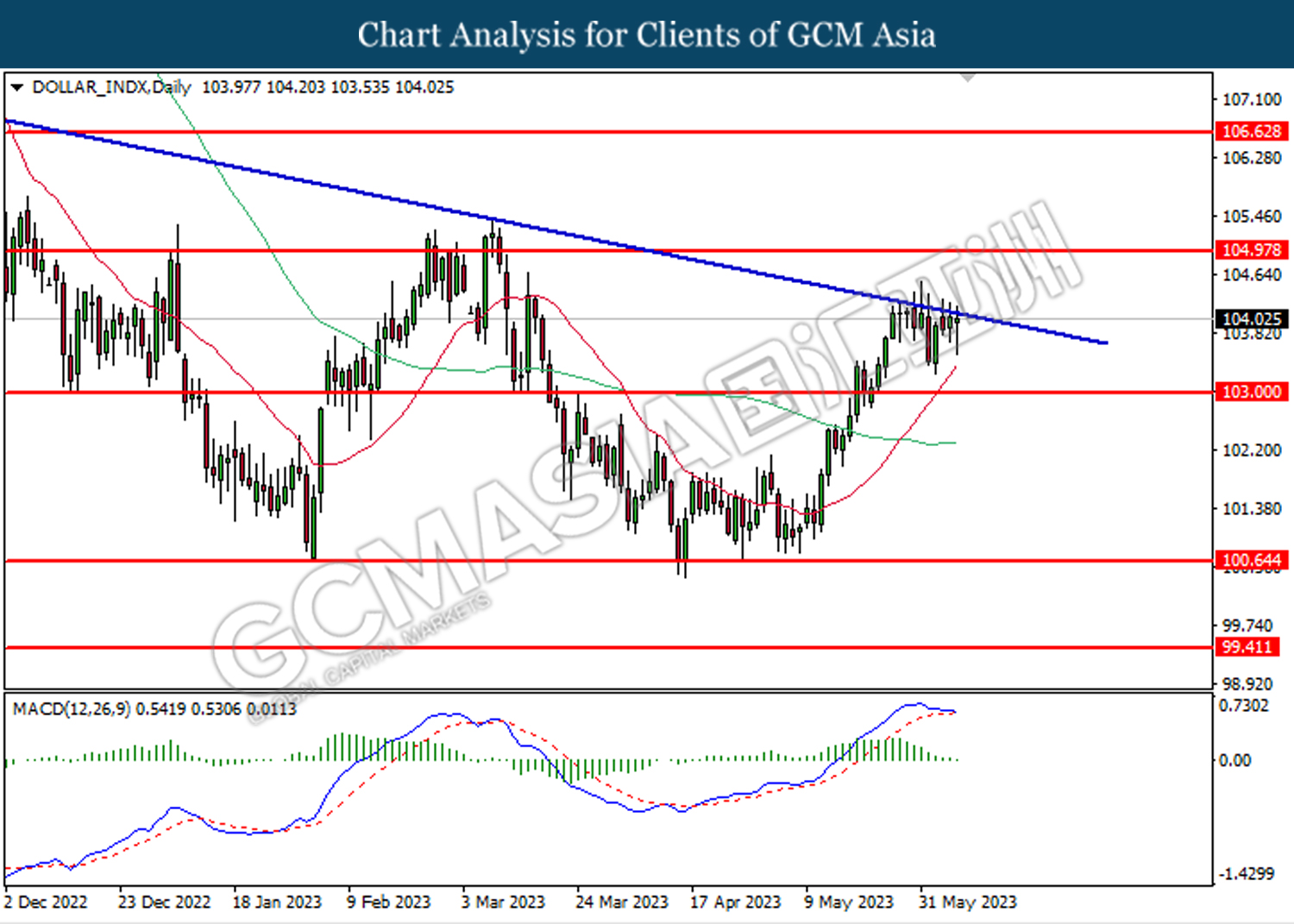

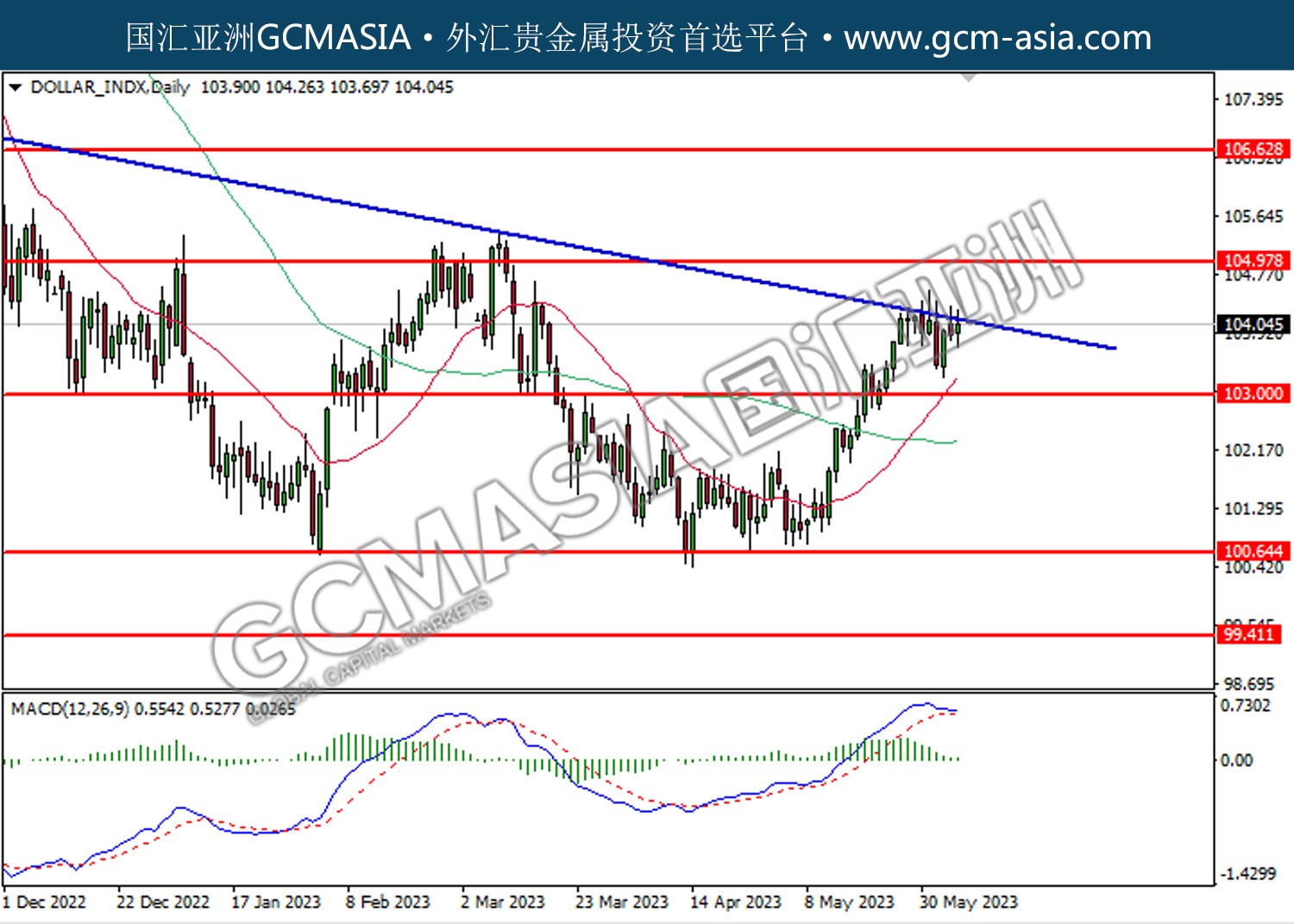

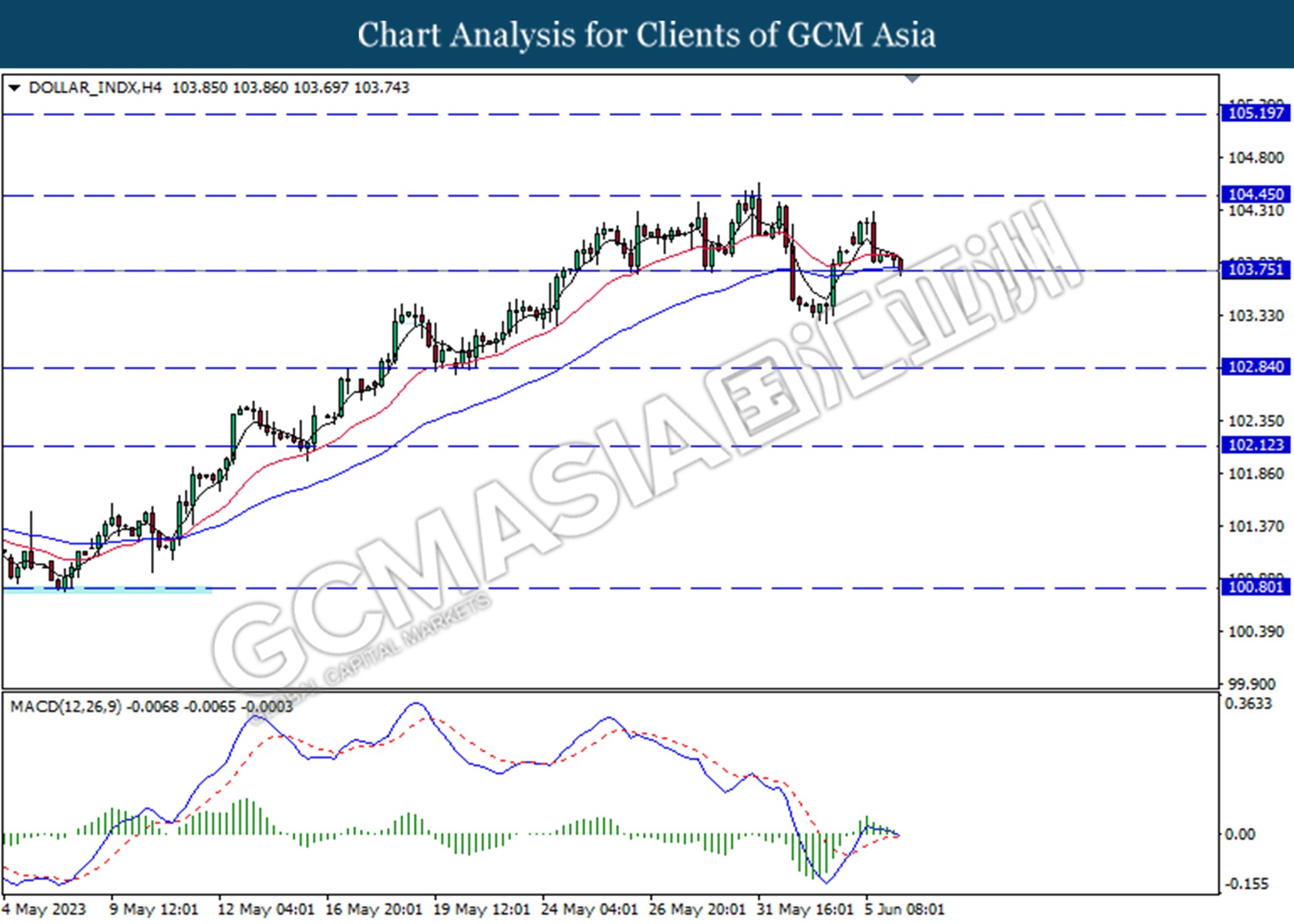

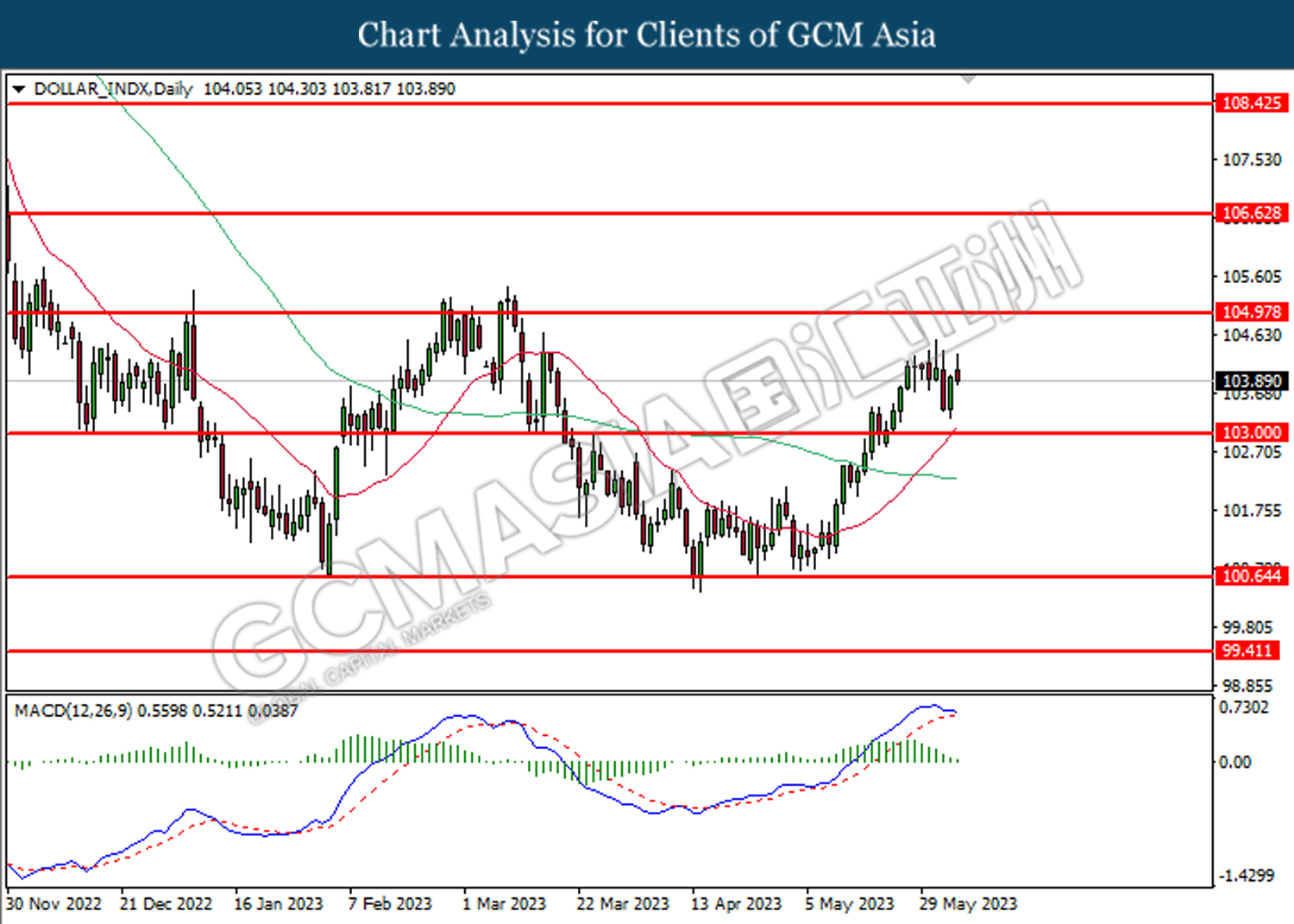

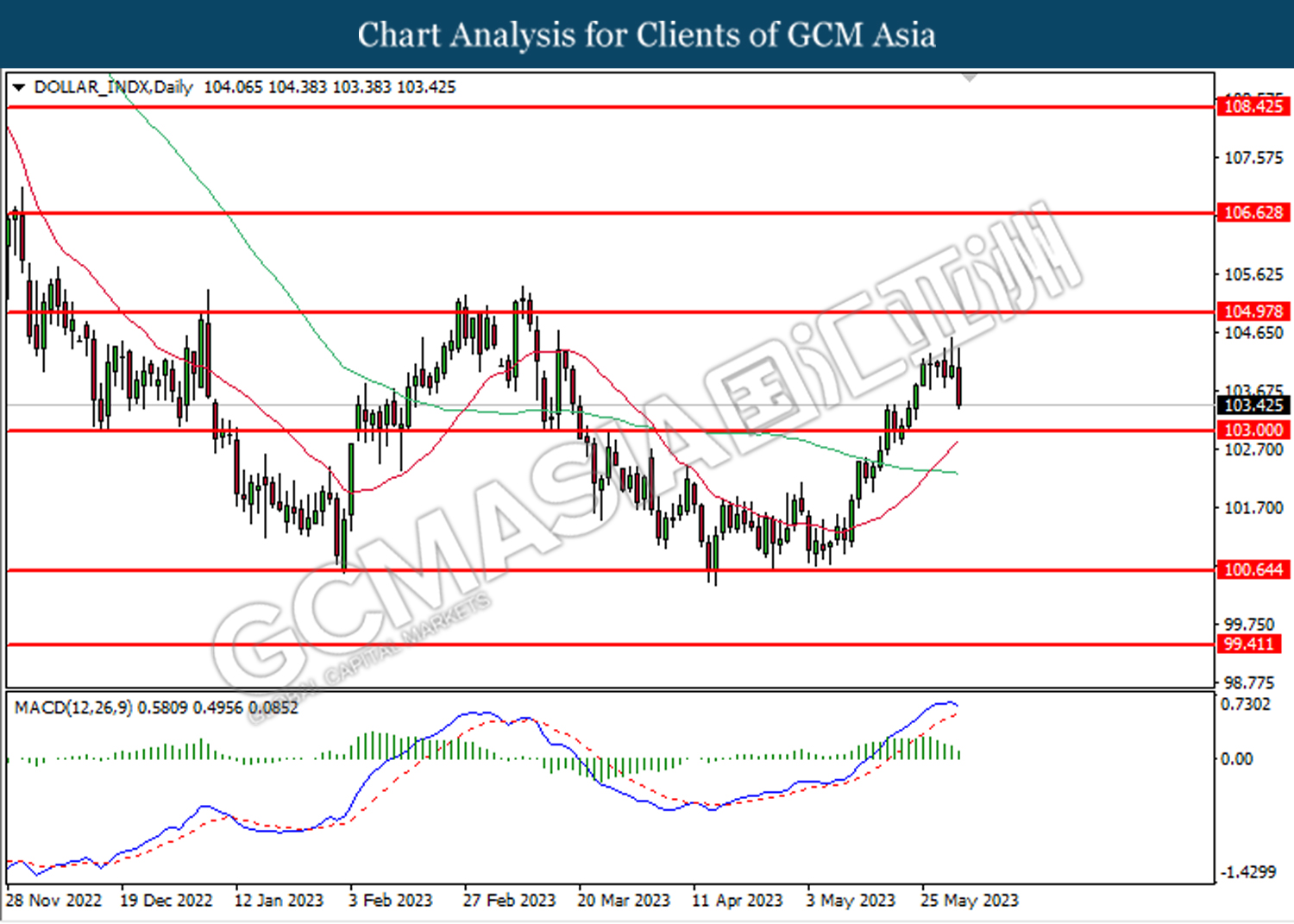

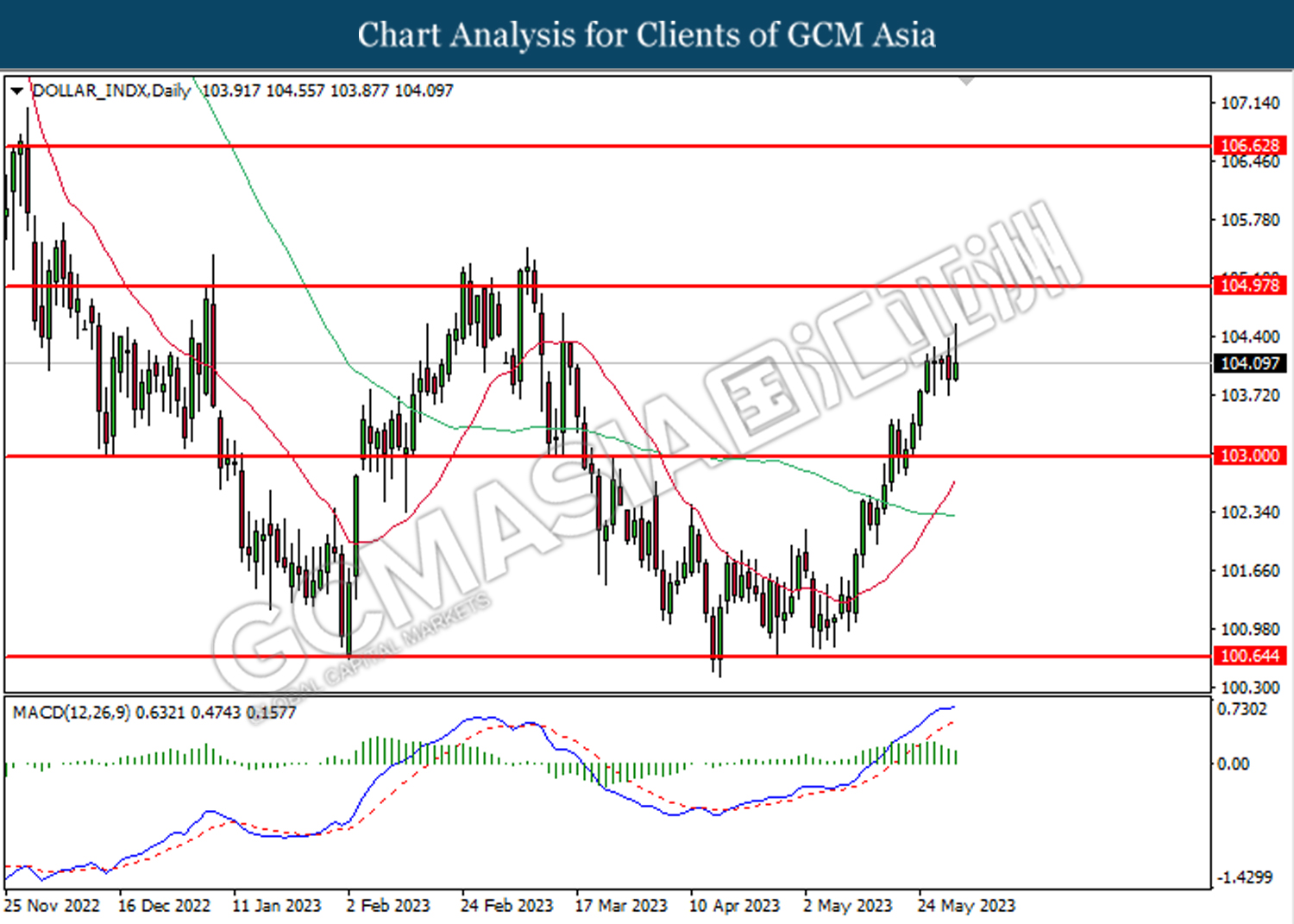

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

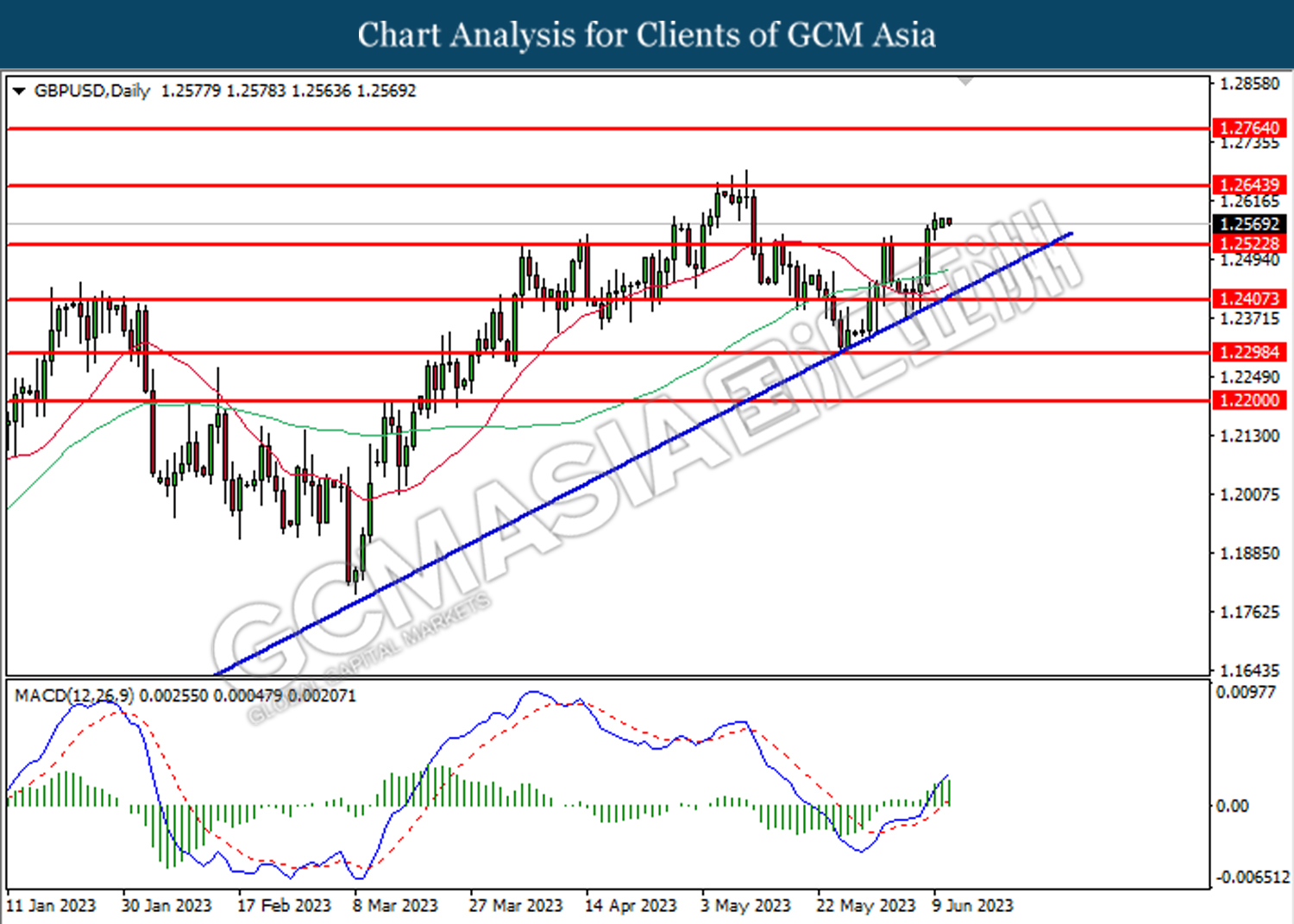

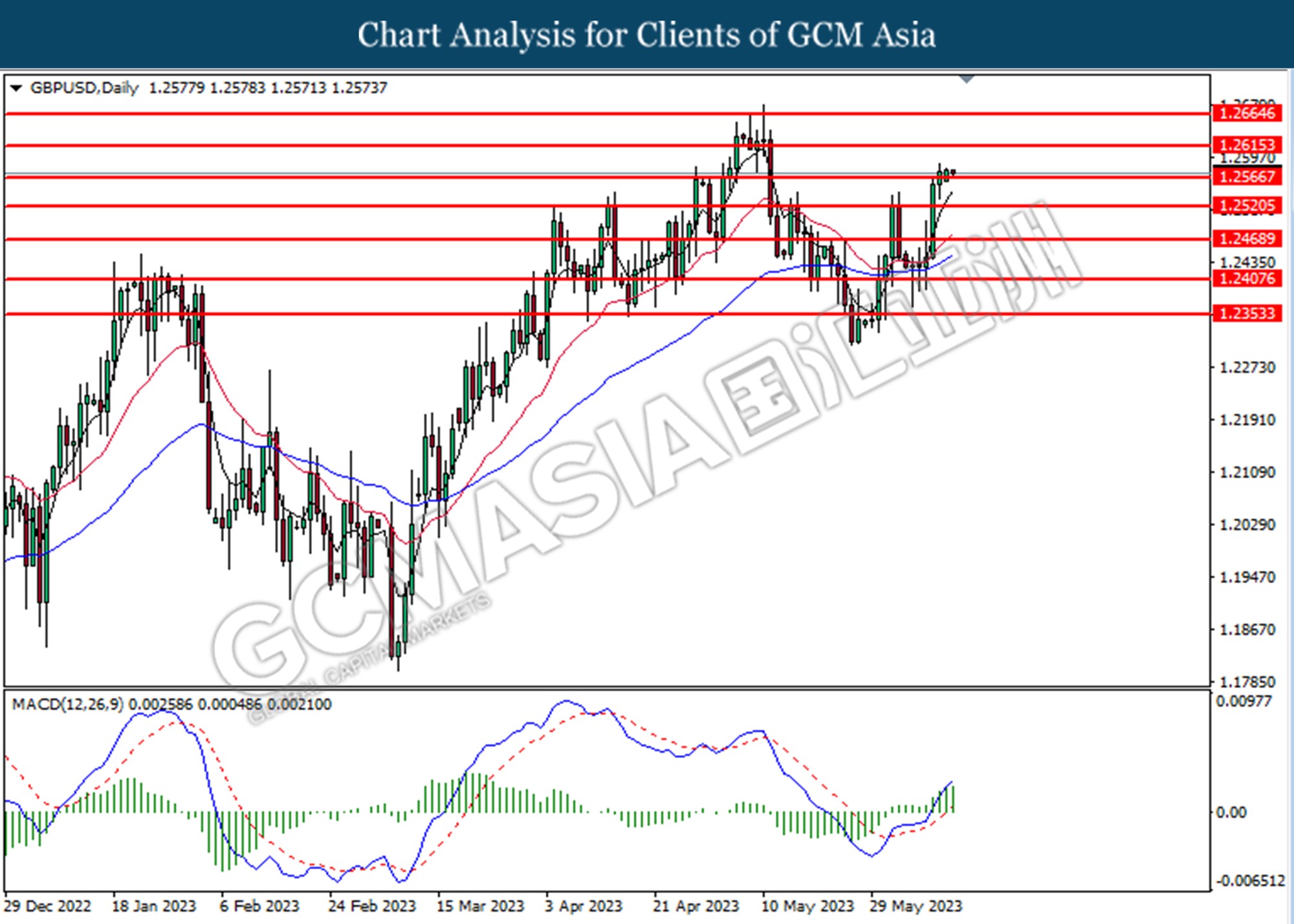

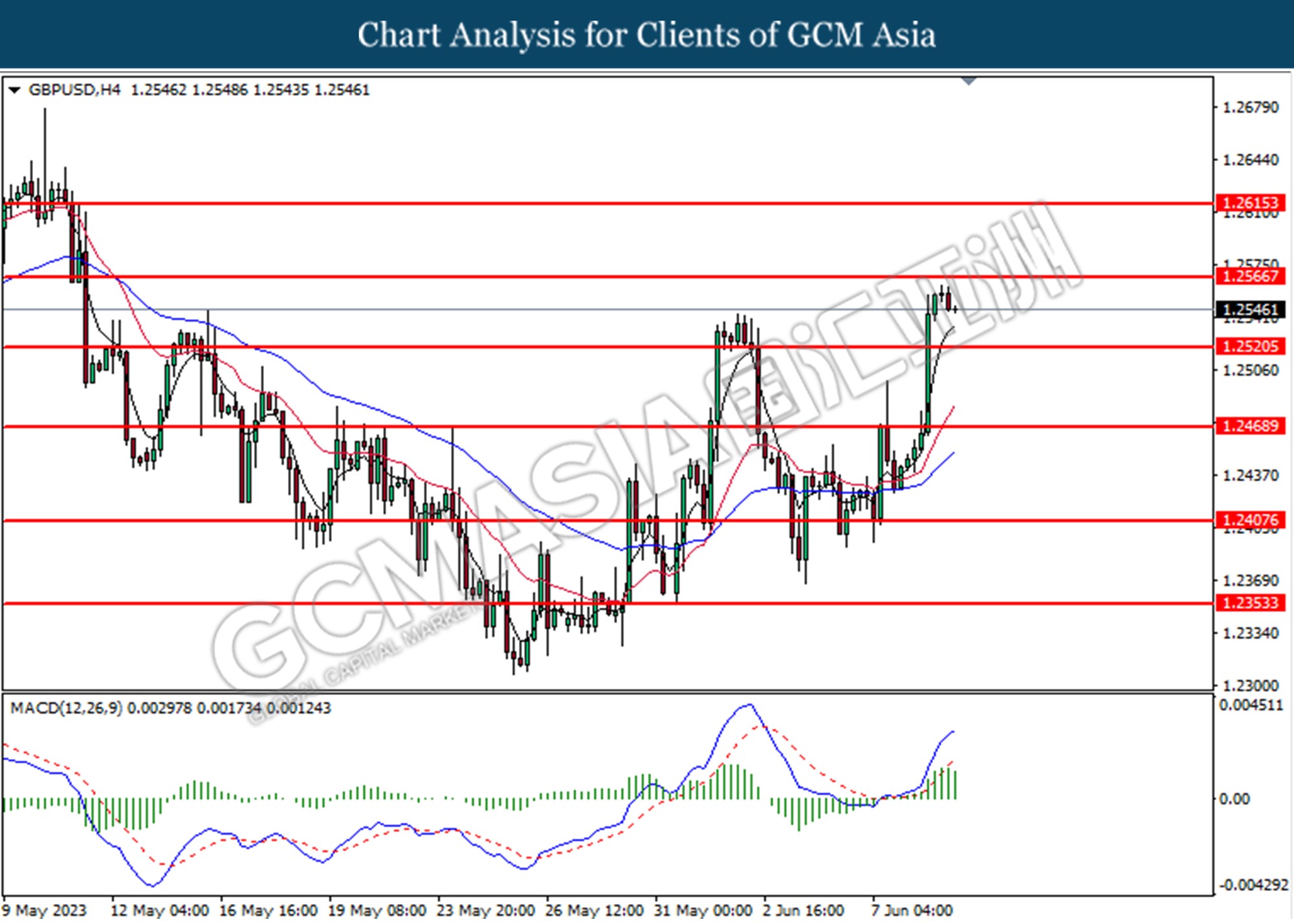

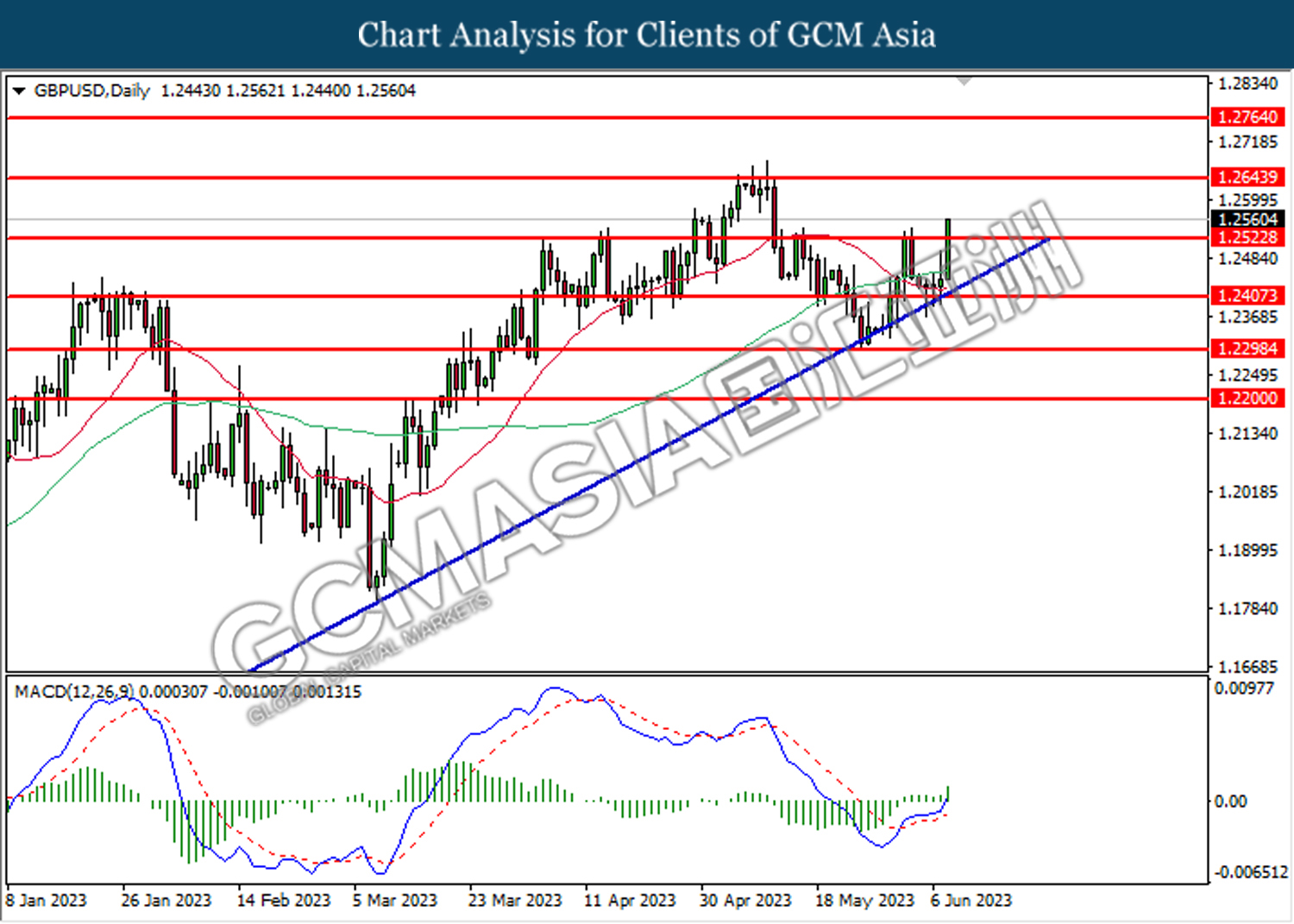

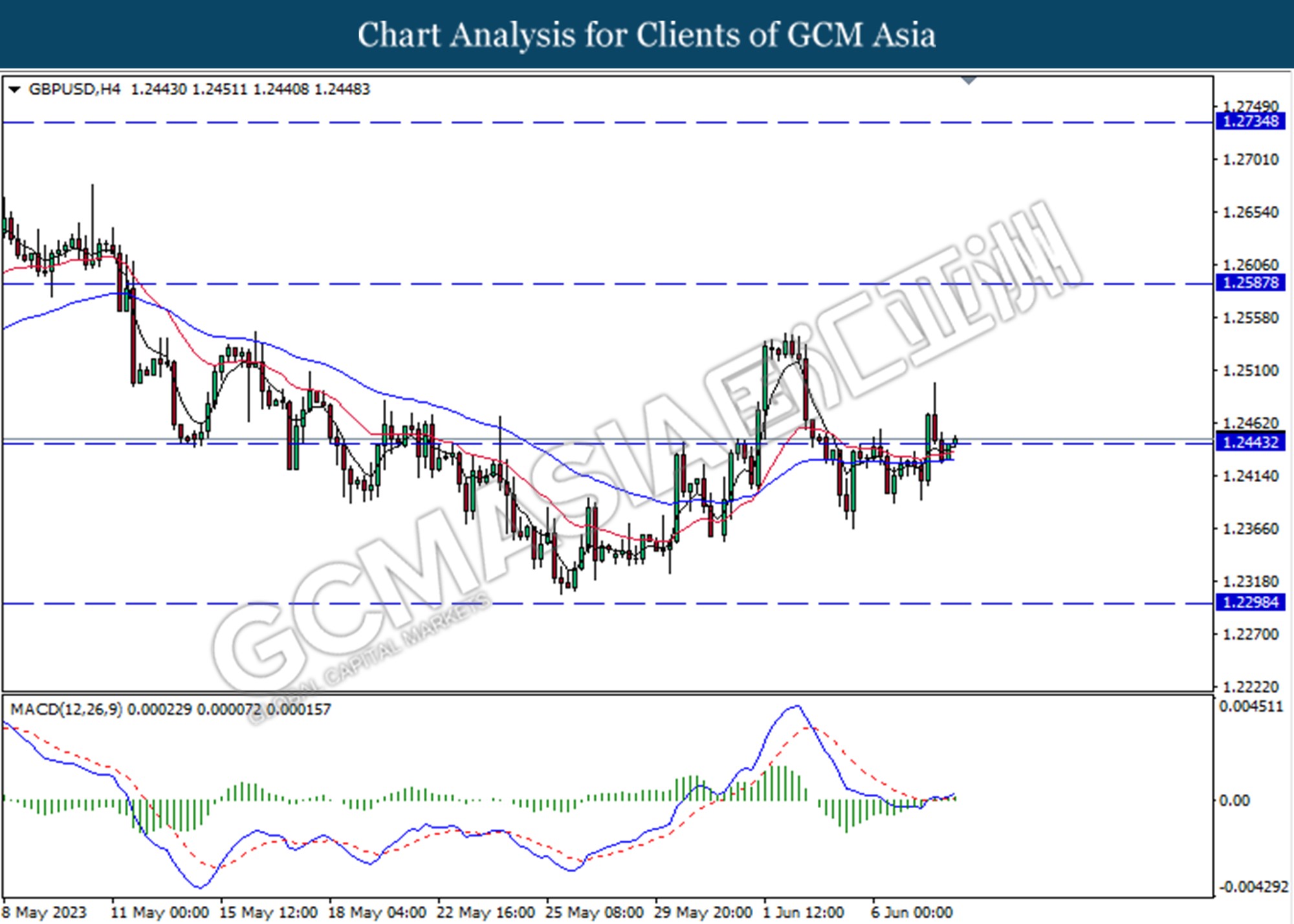

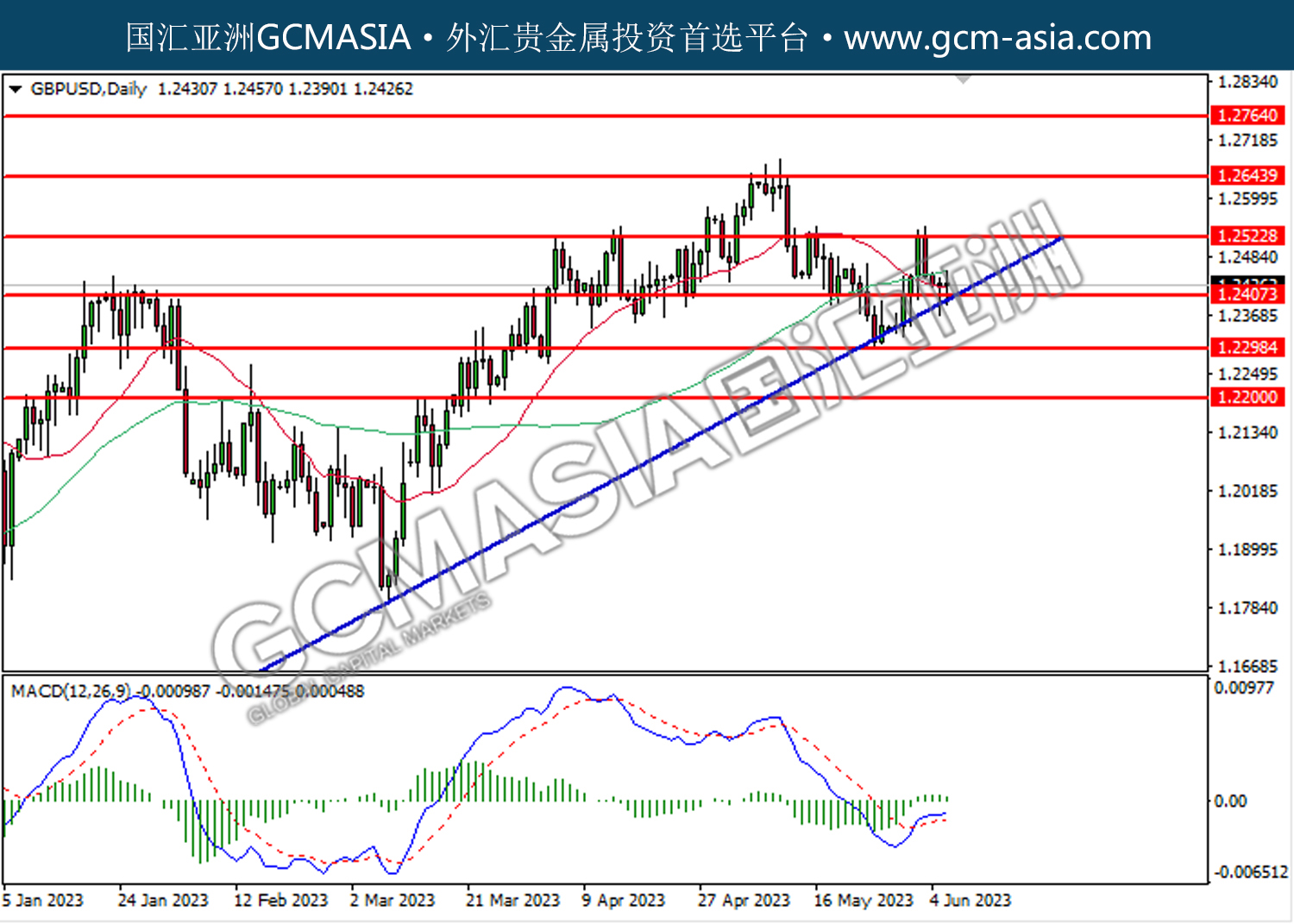

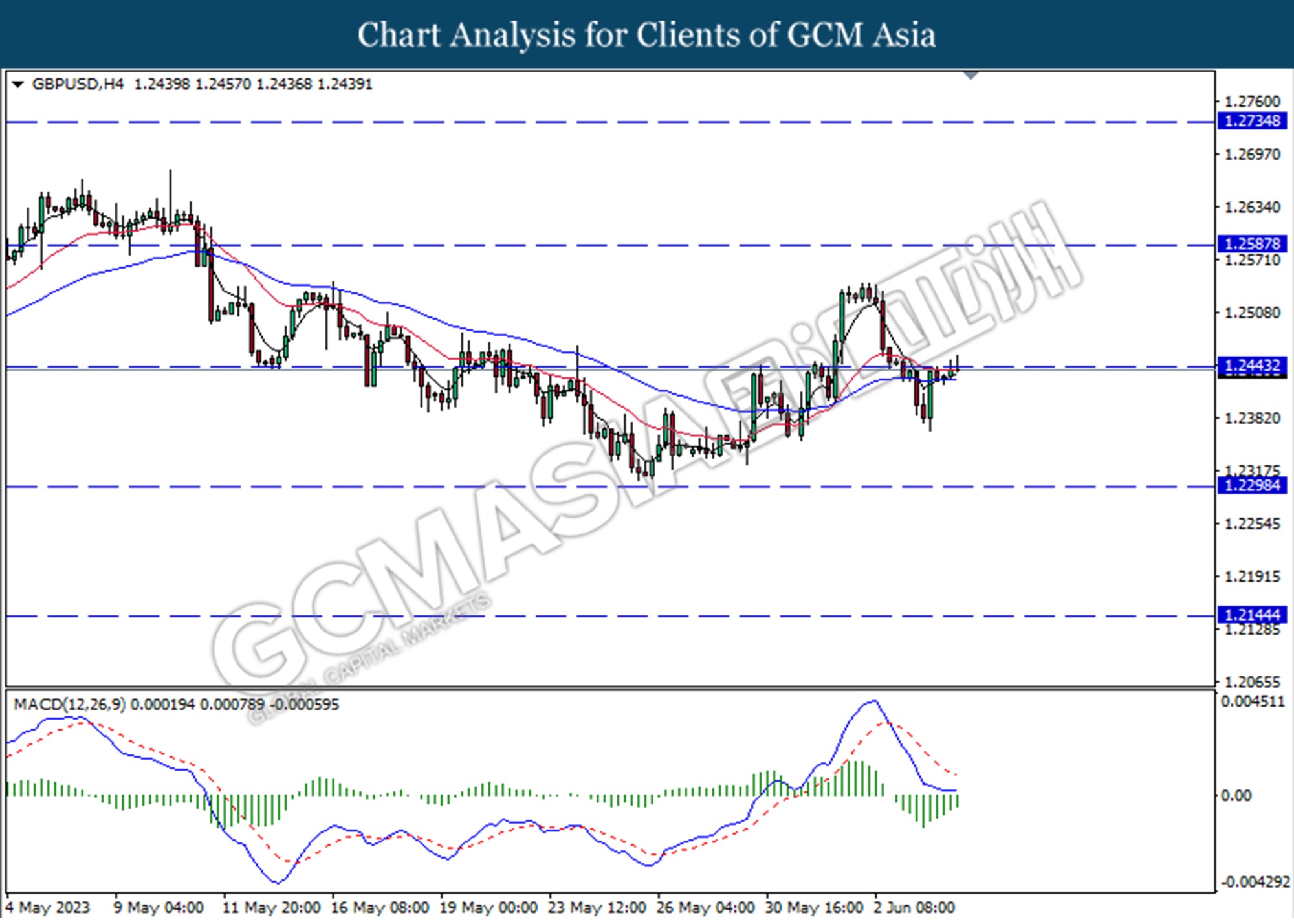

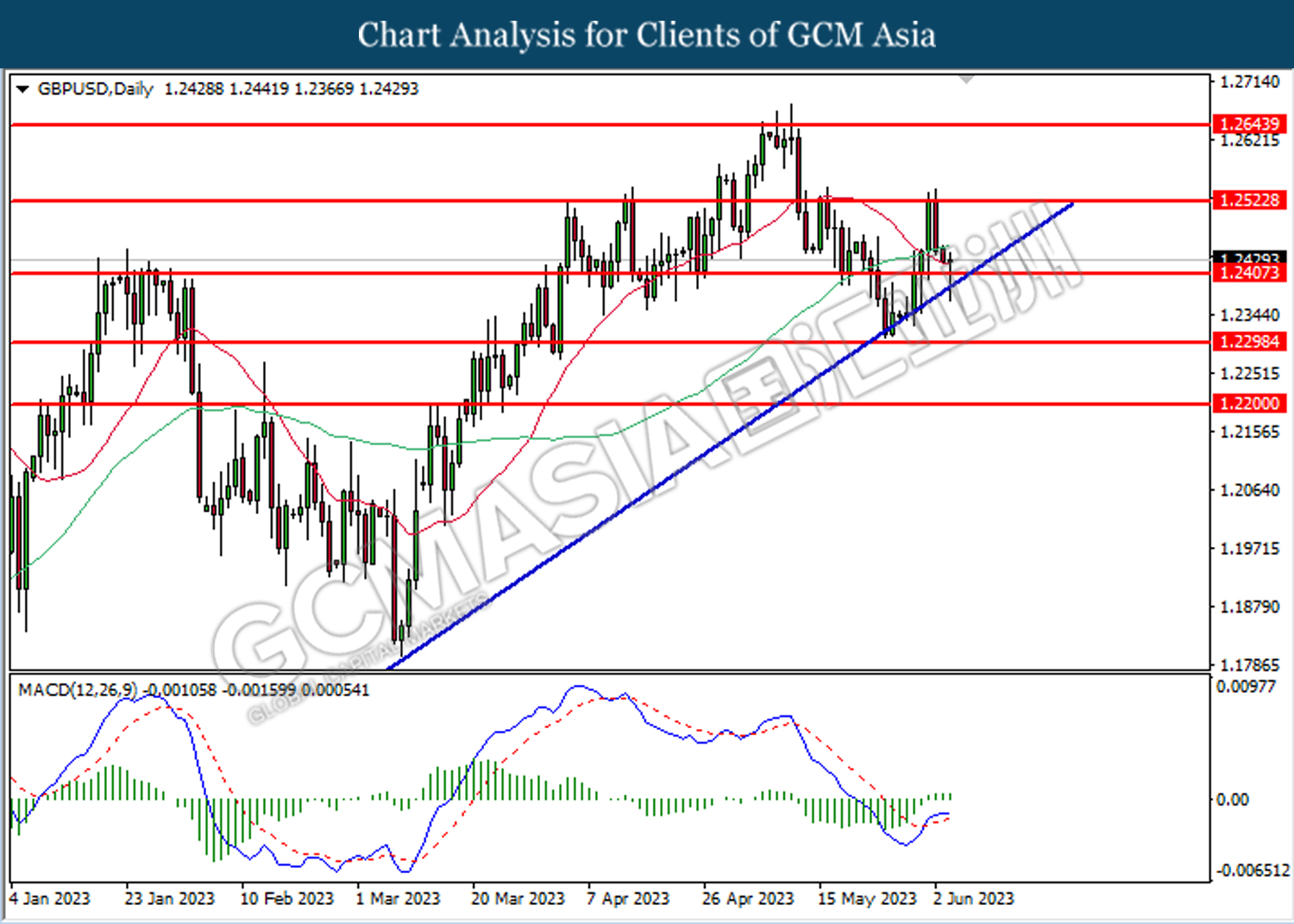

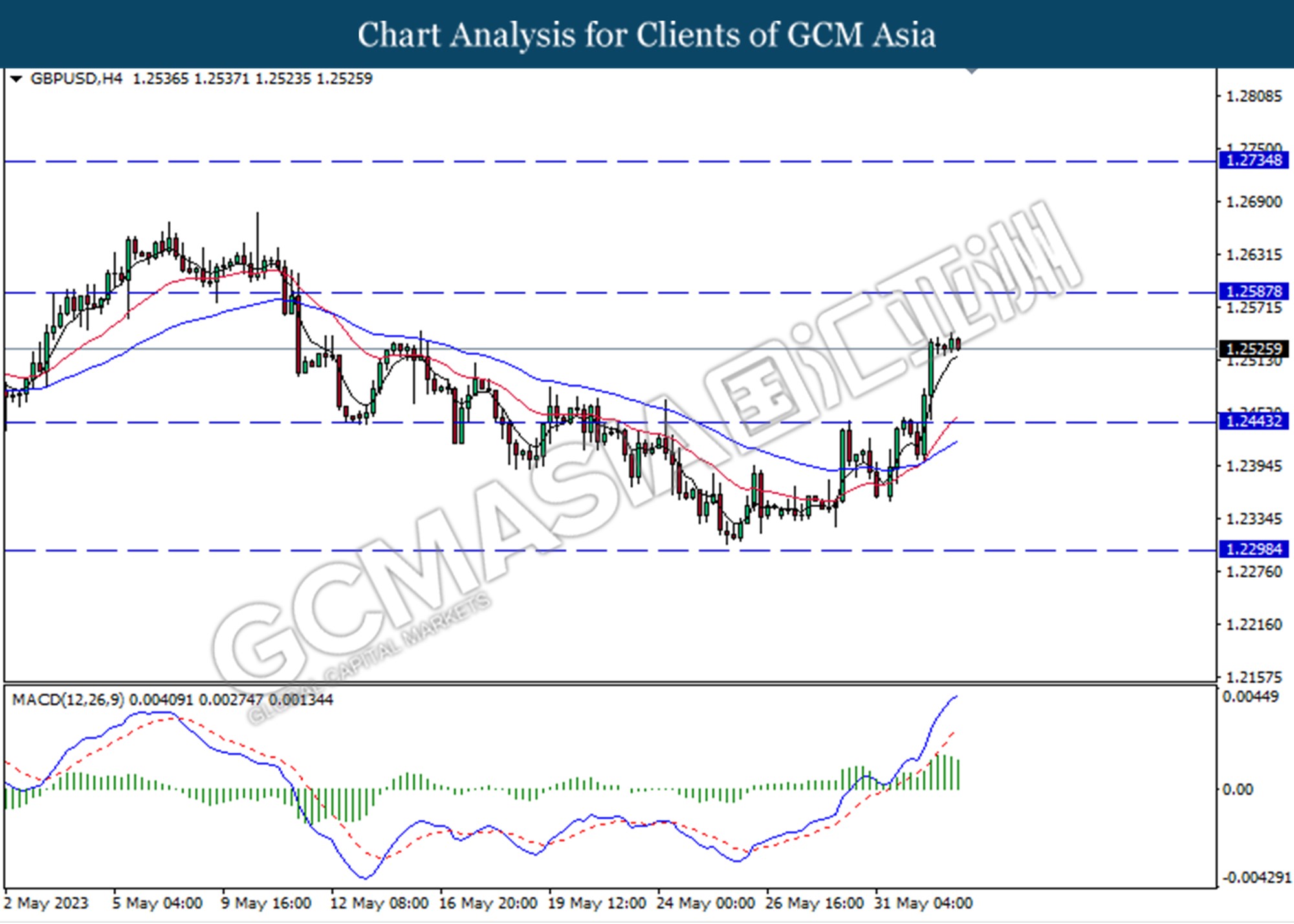

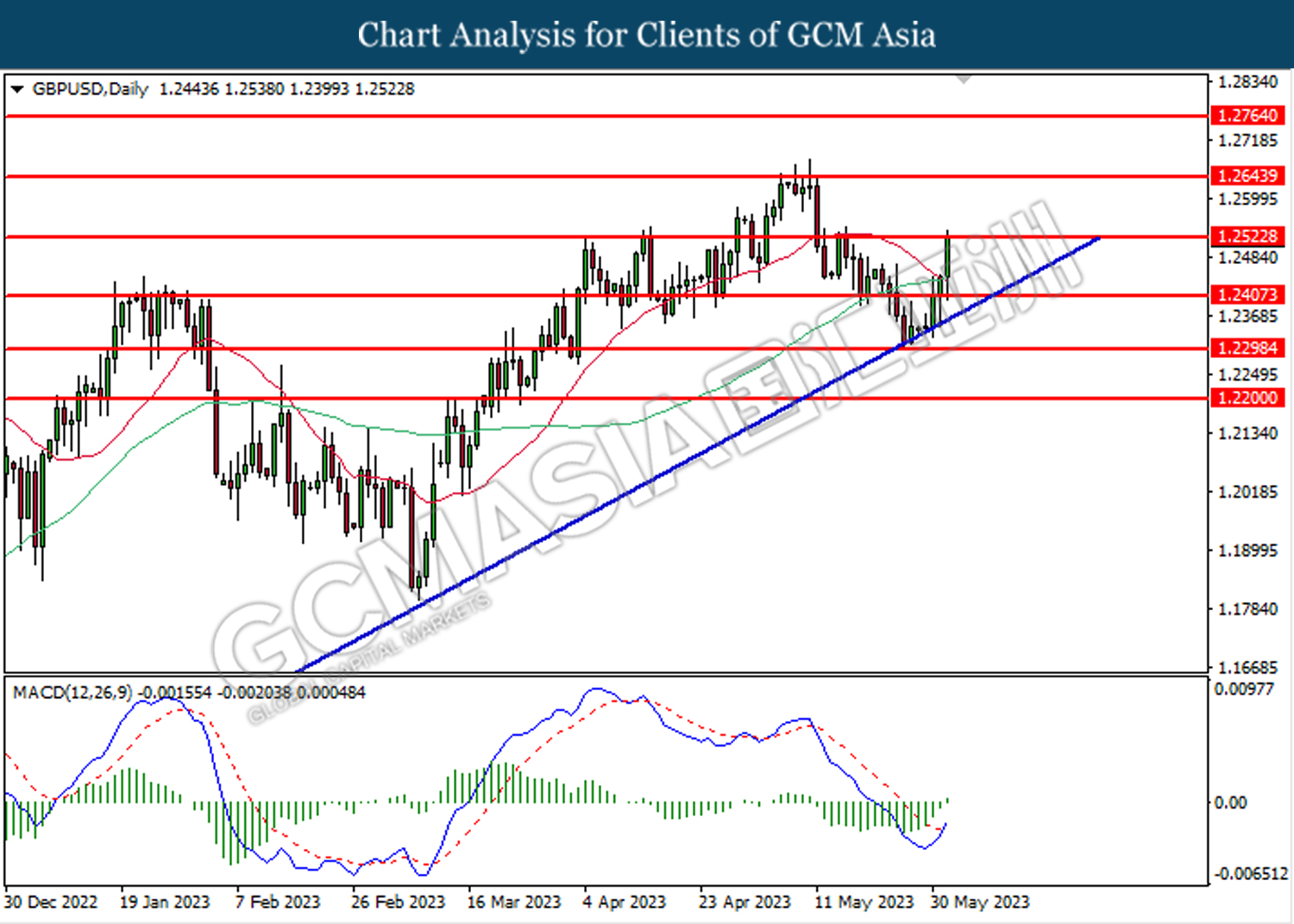

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2525. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2645.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

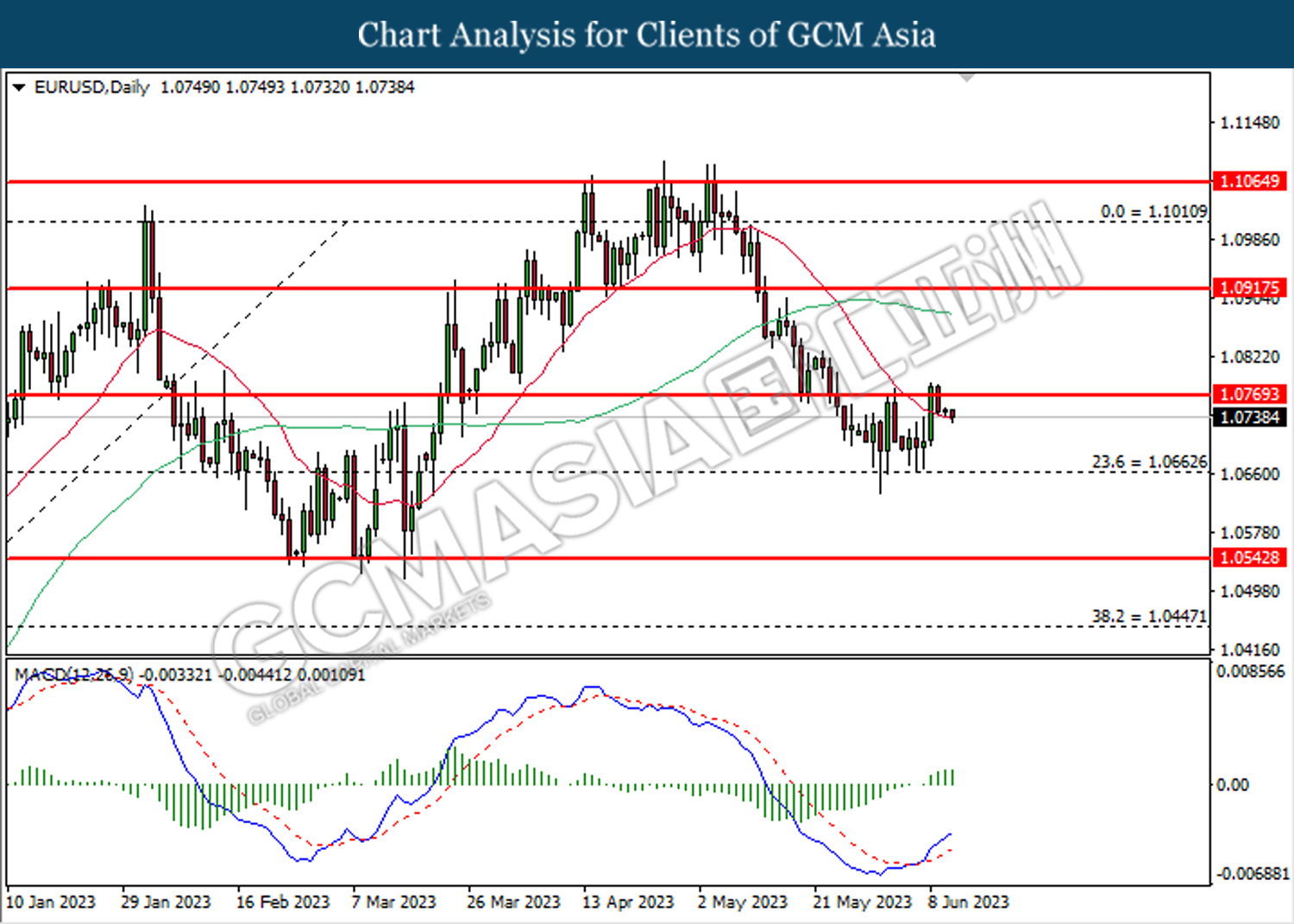

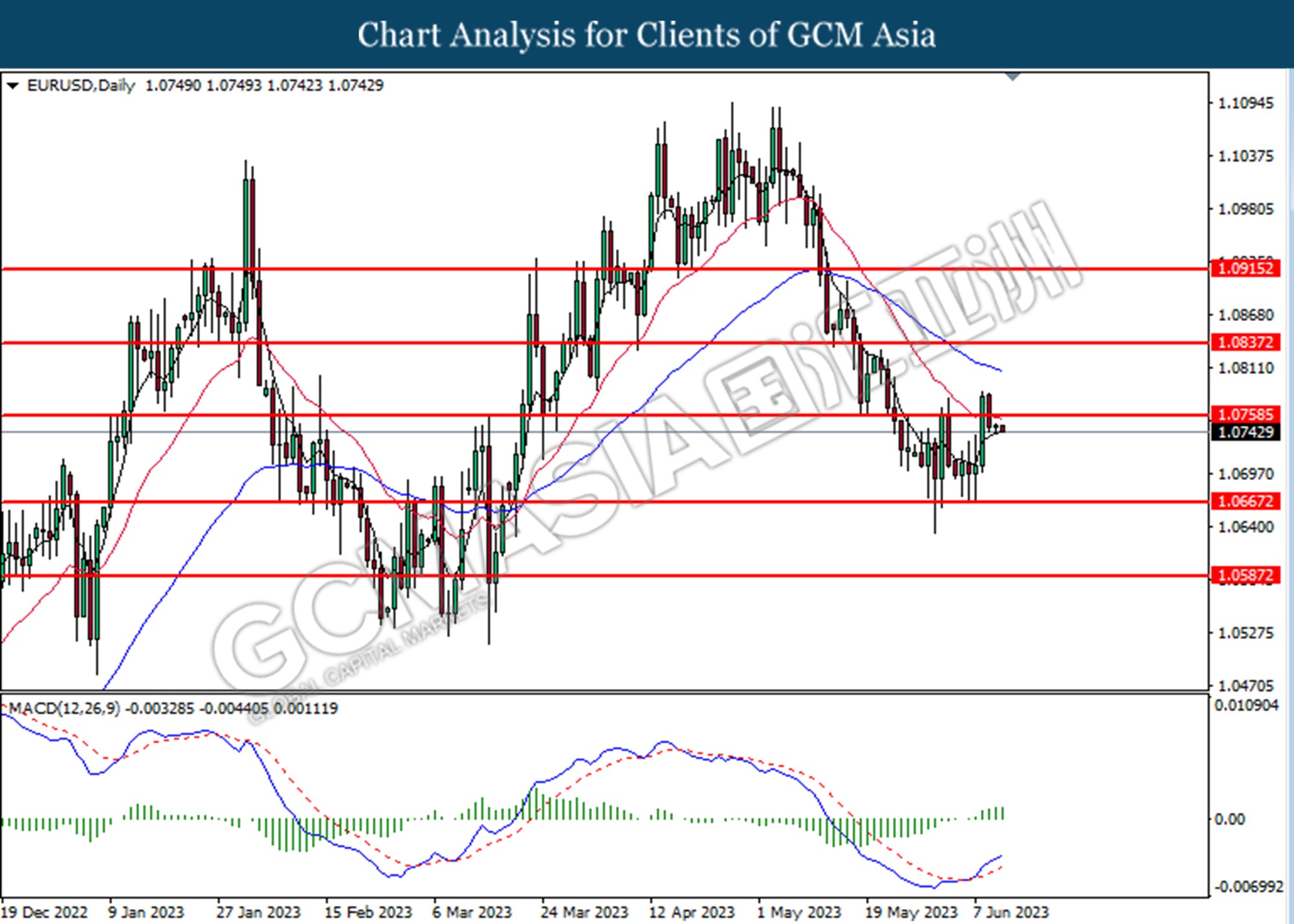

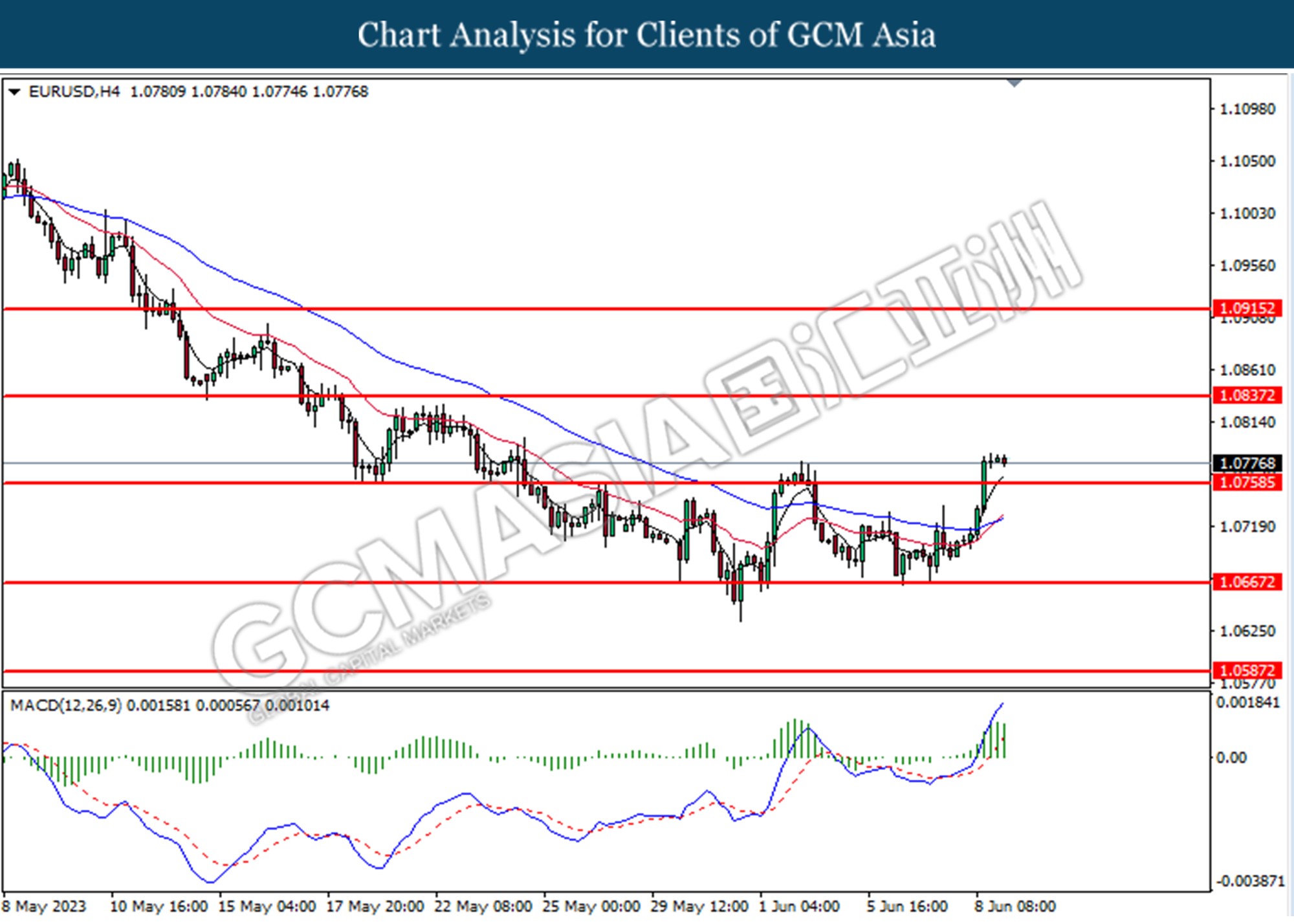

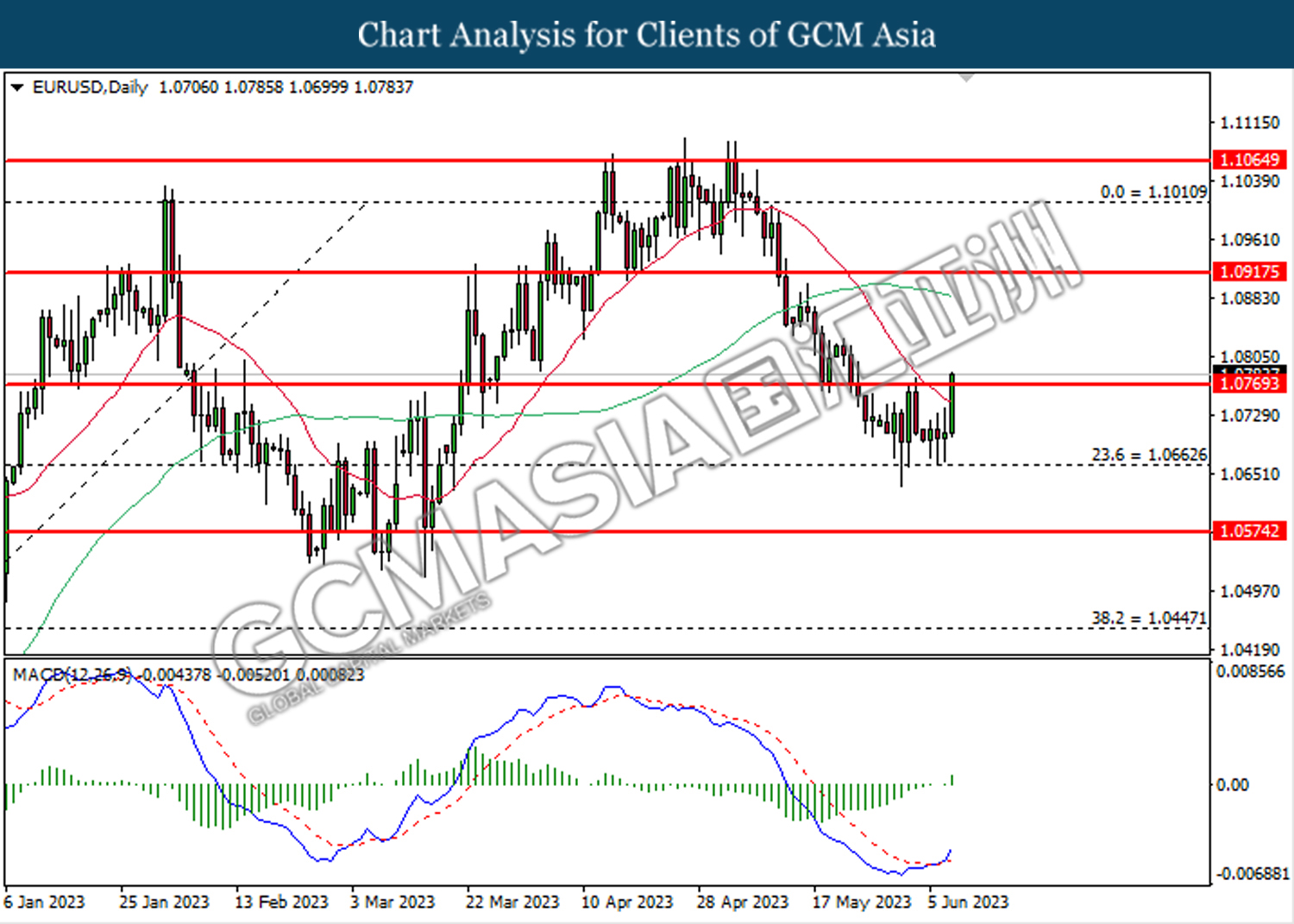

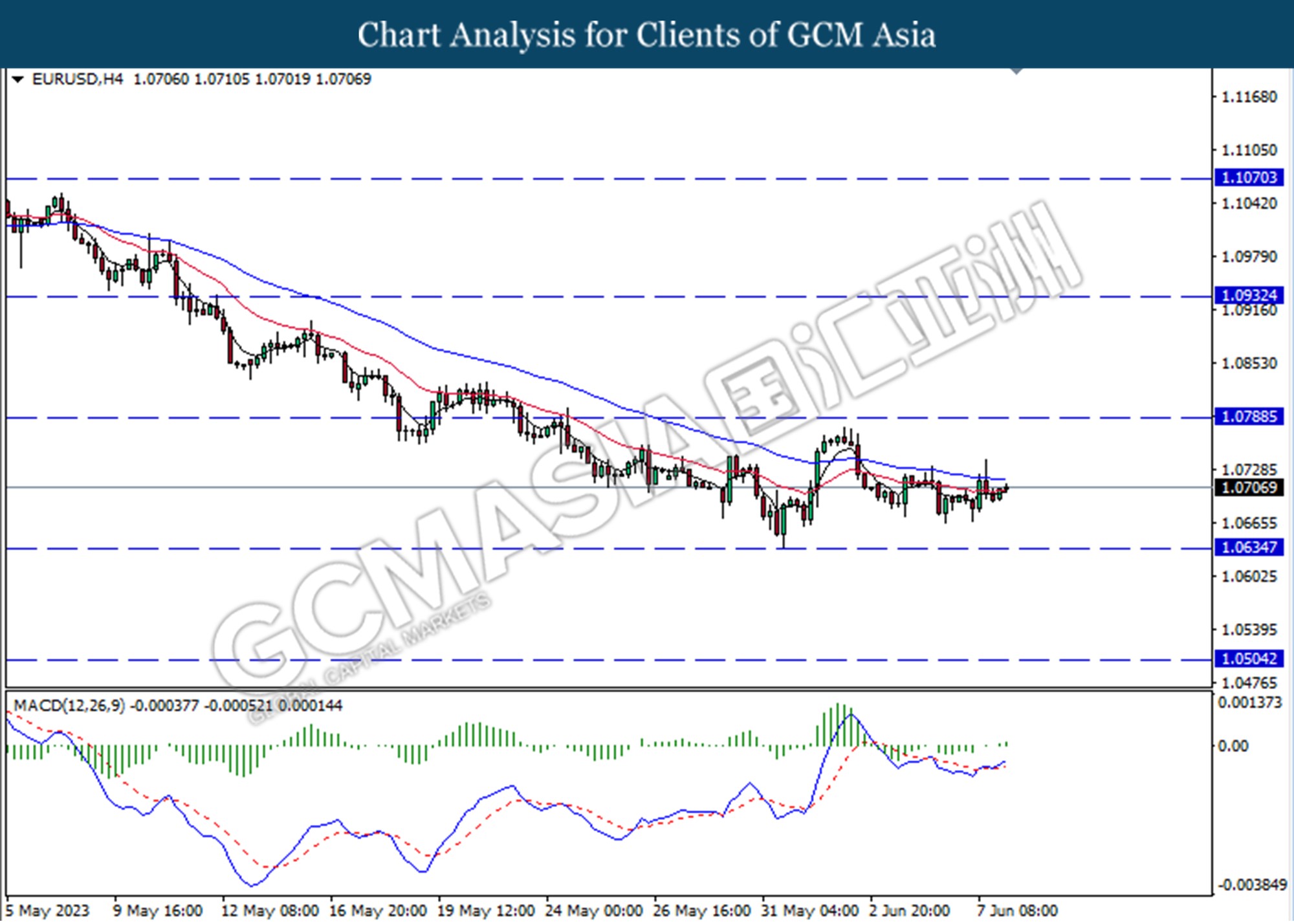

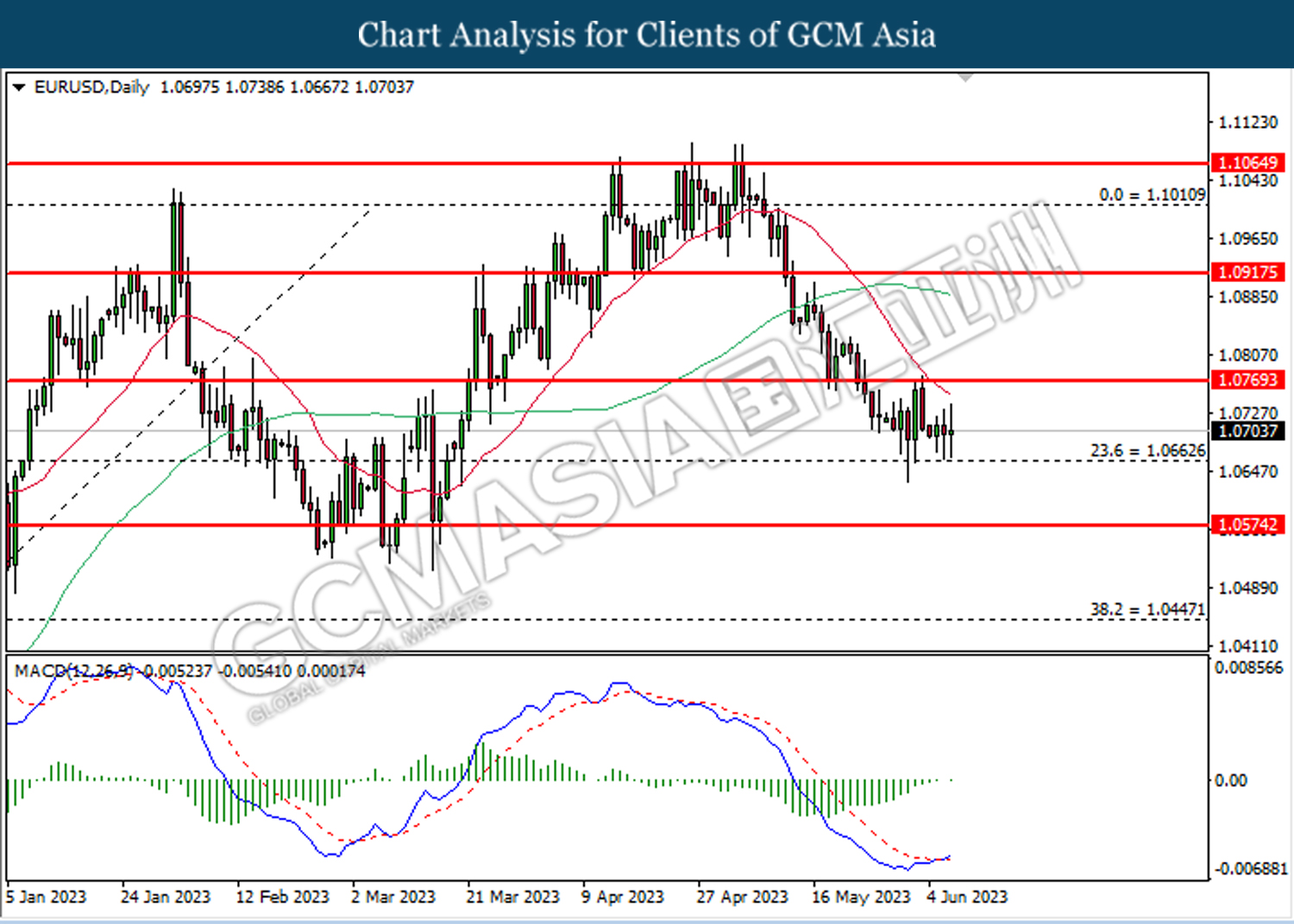

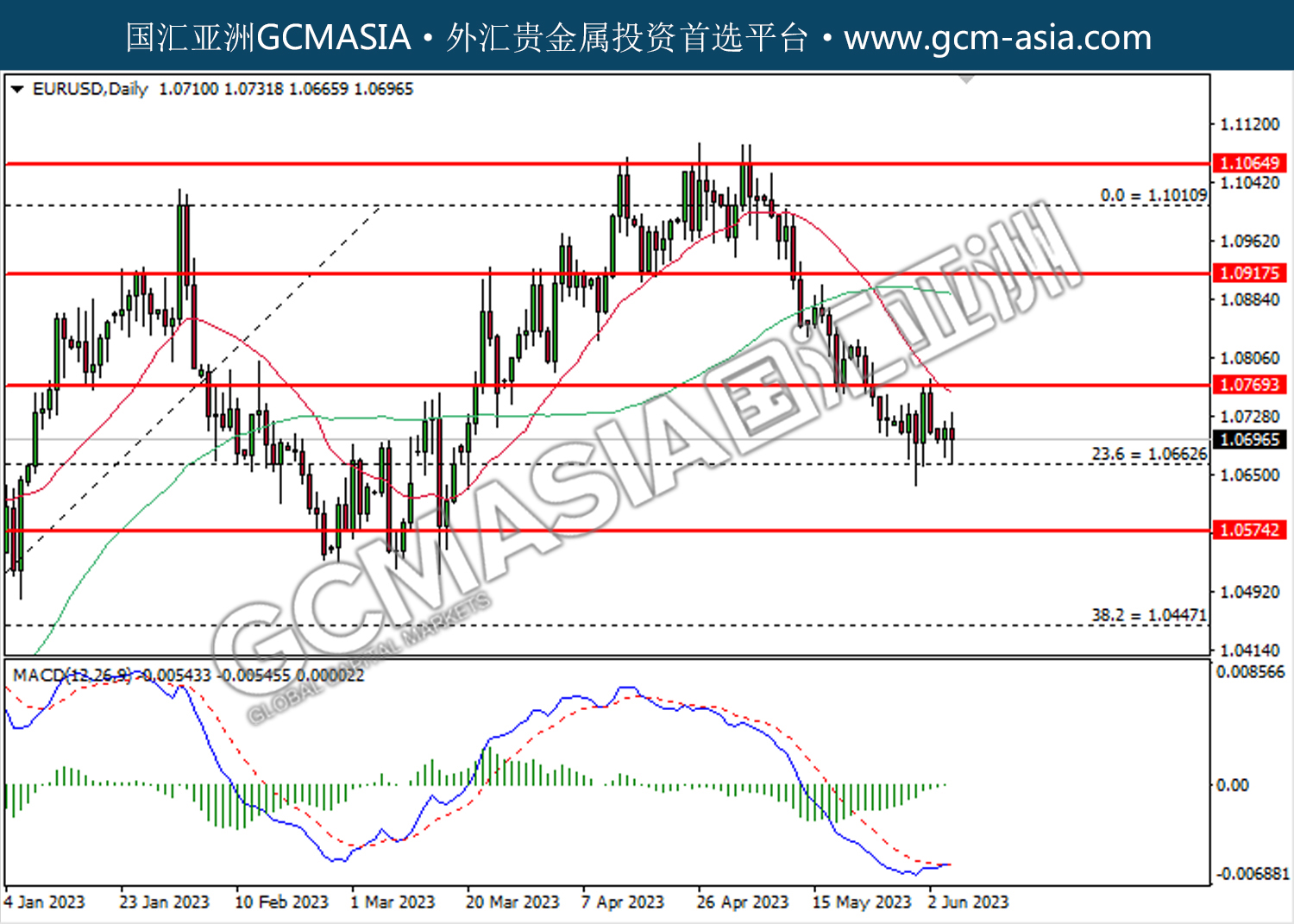

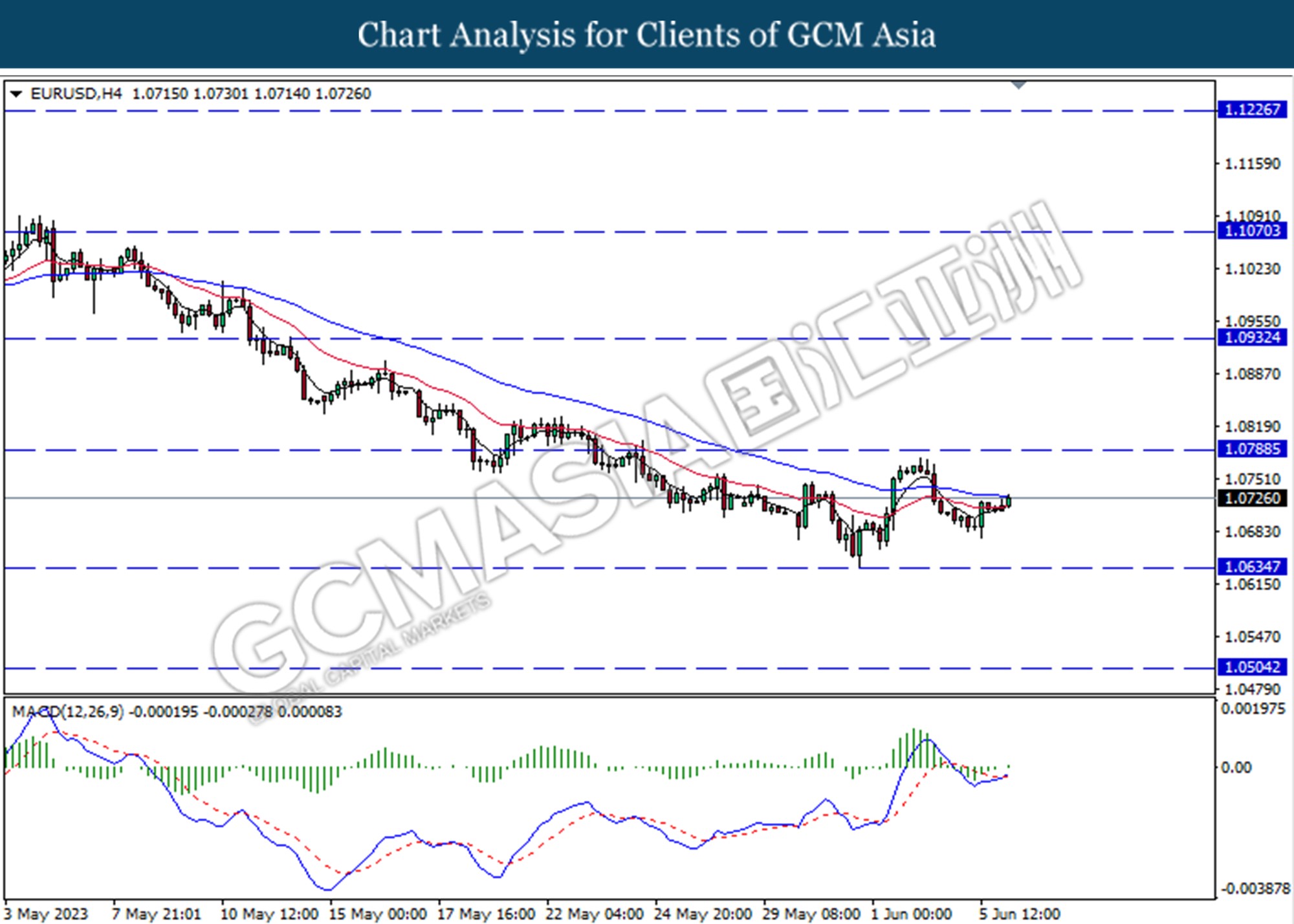

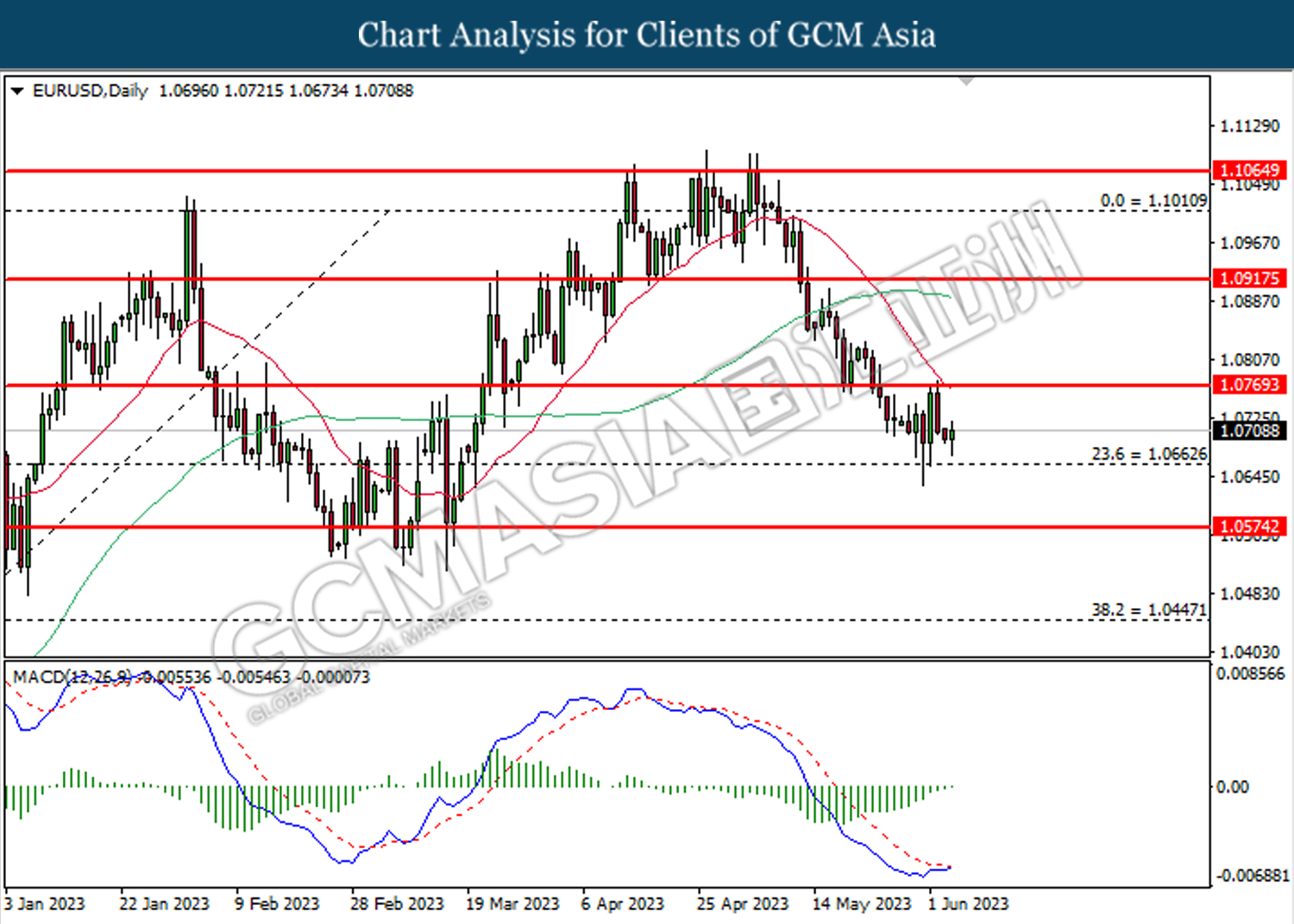

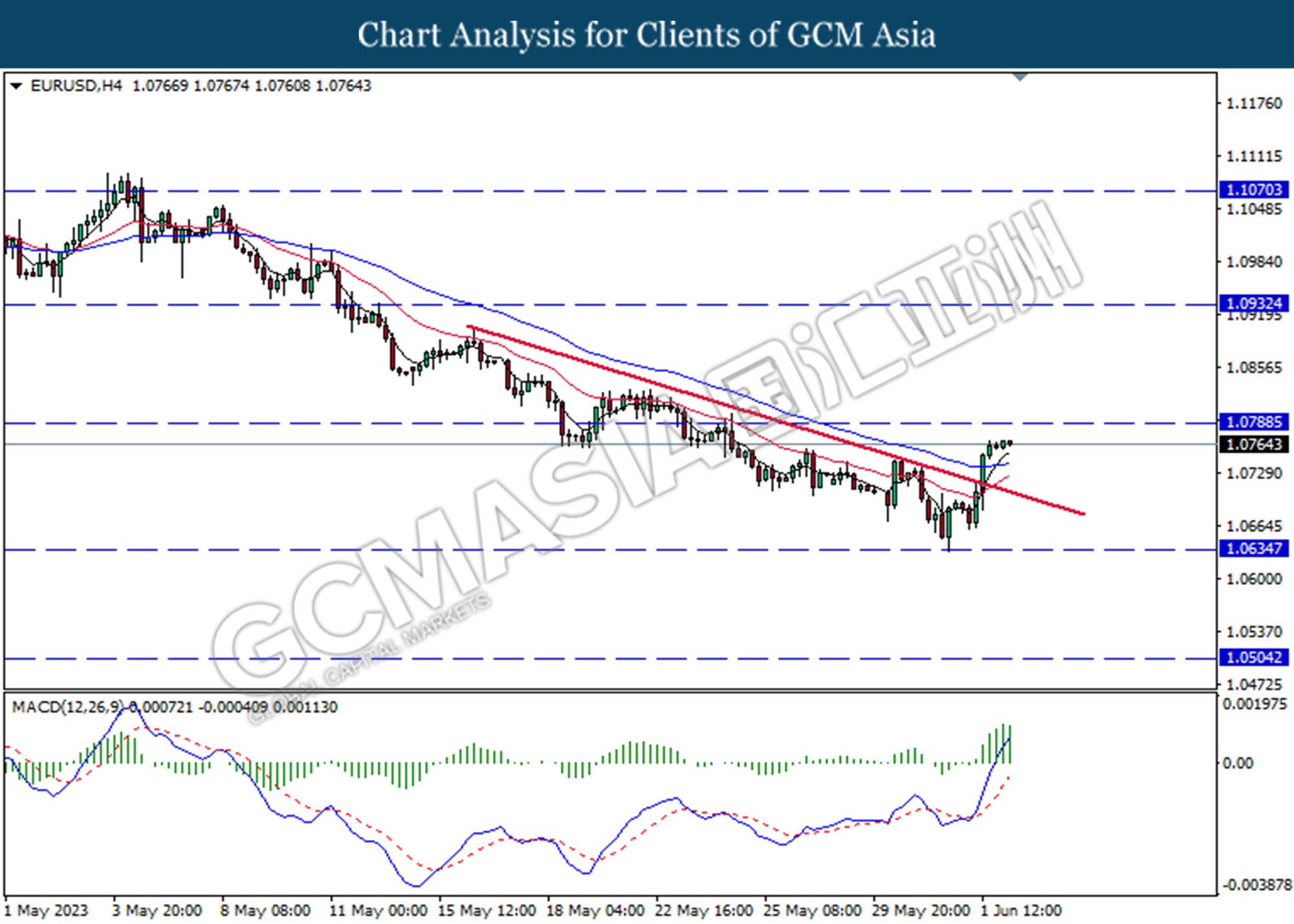

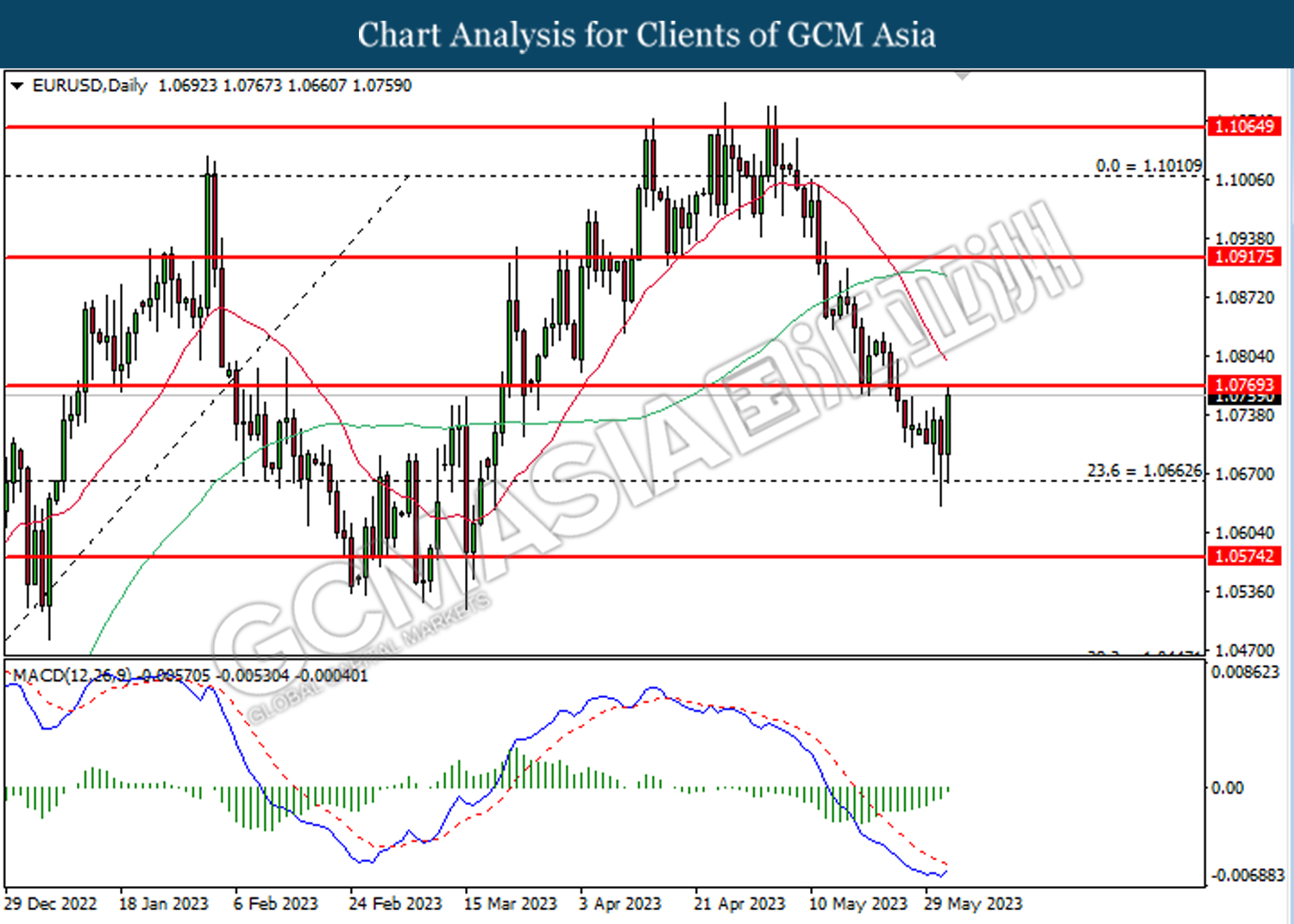

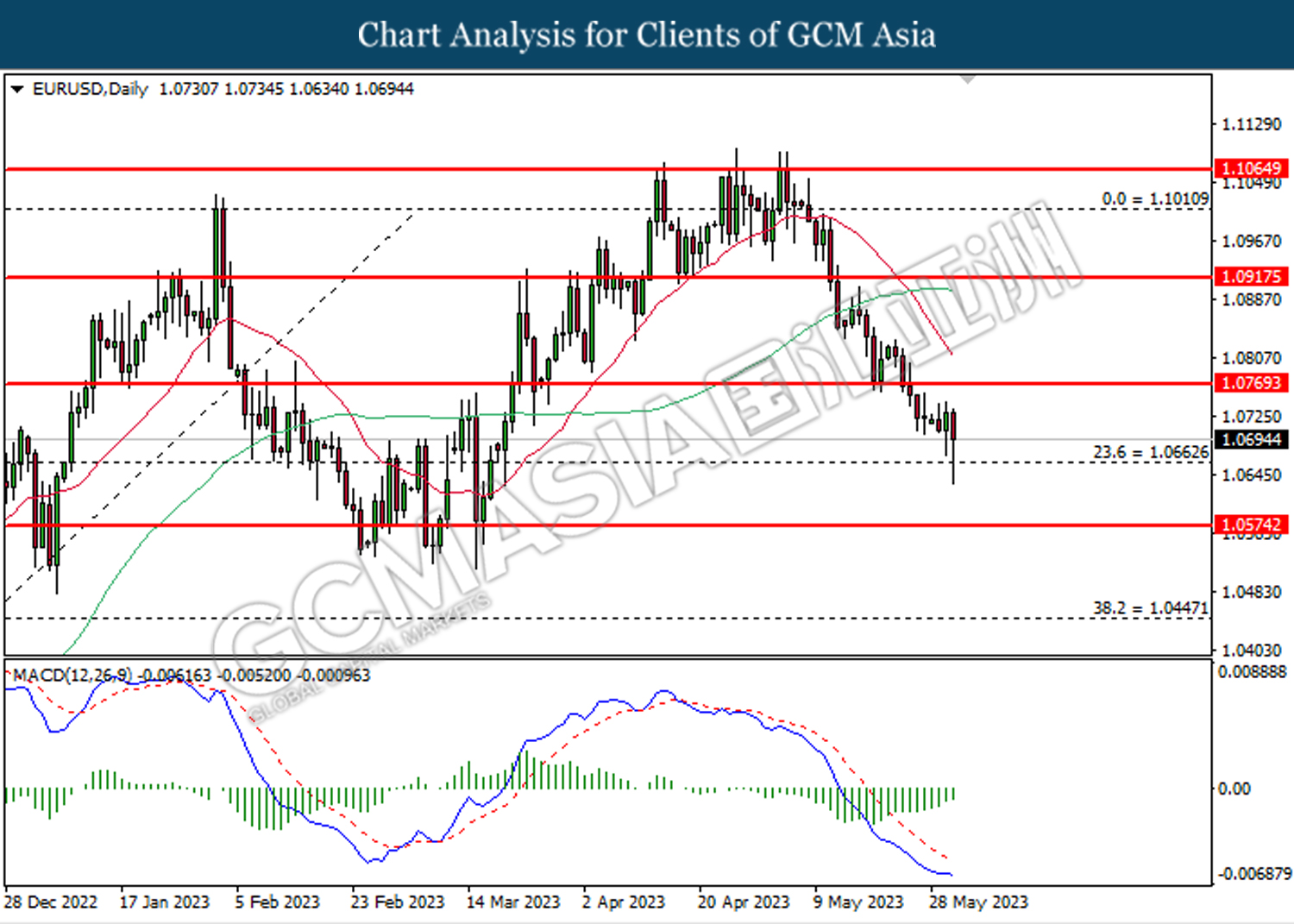

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.0770. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0665.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

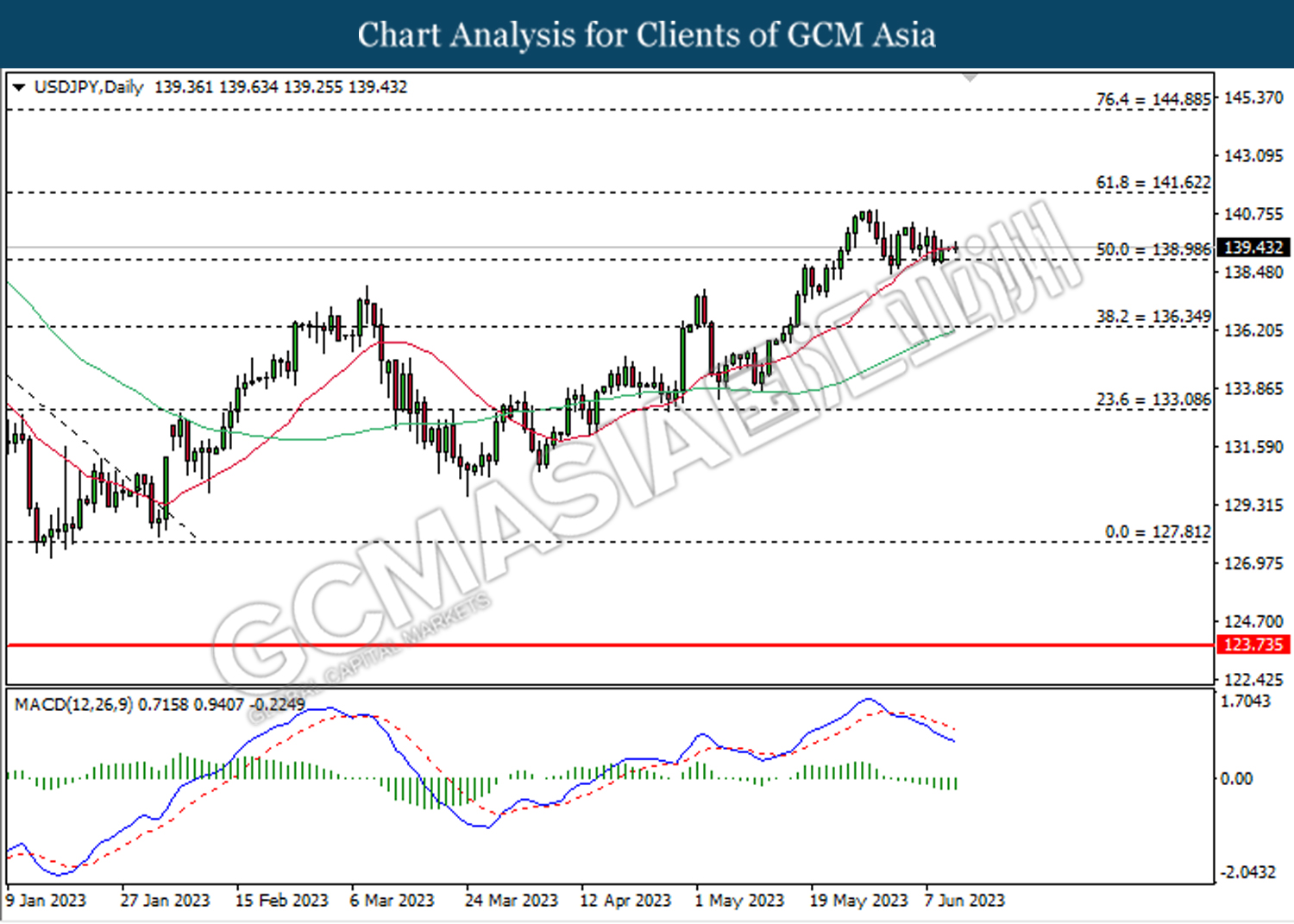

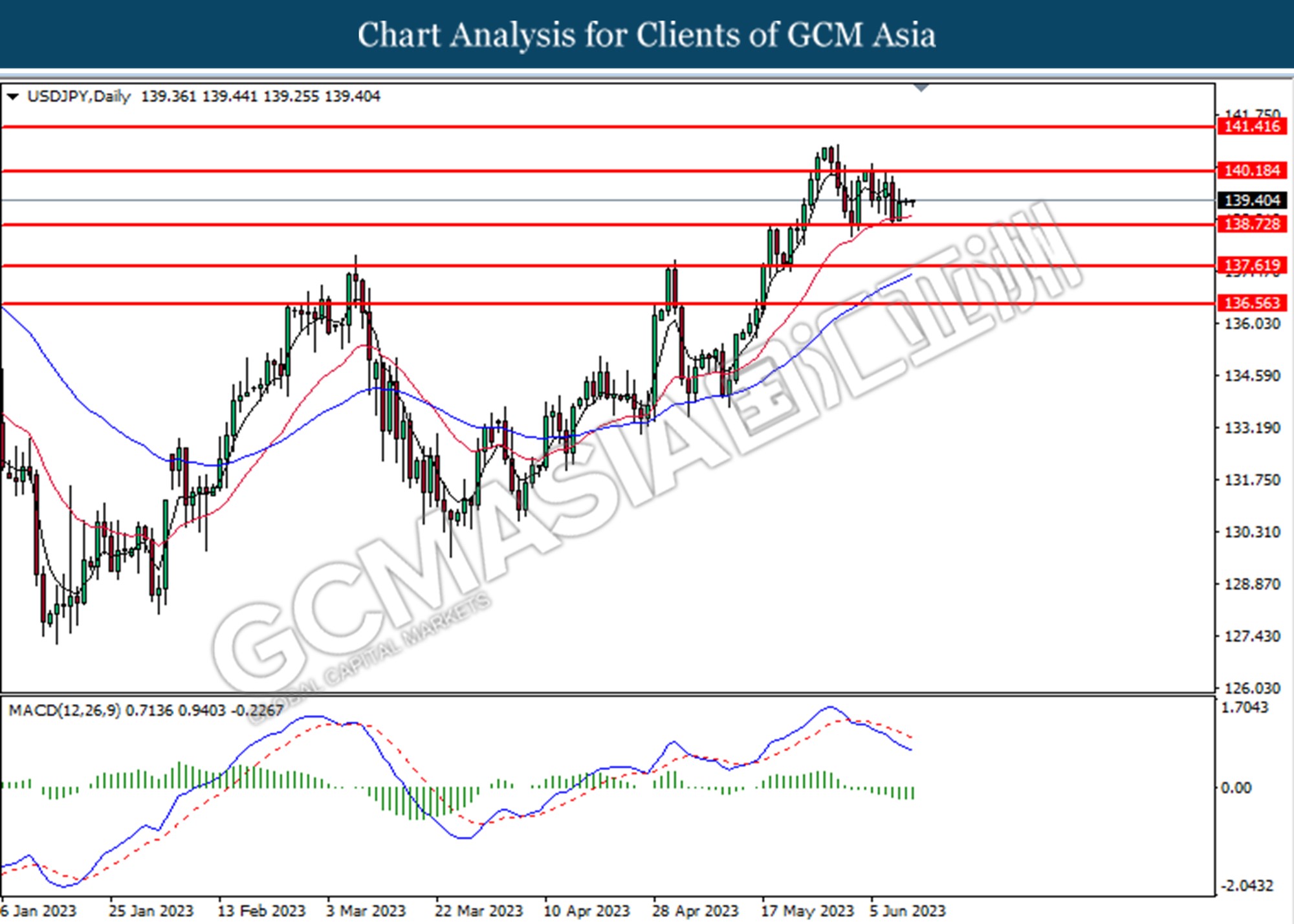

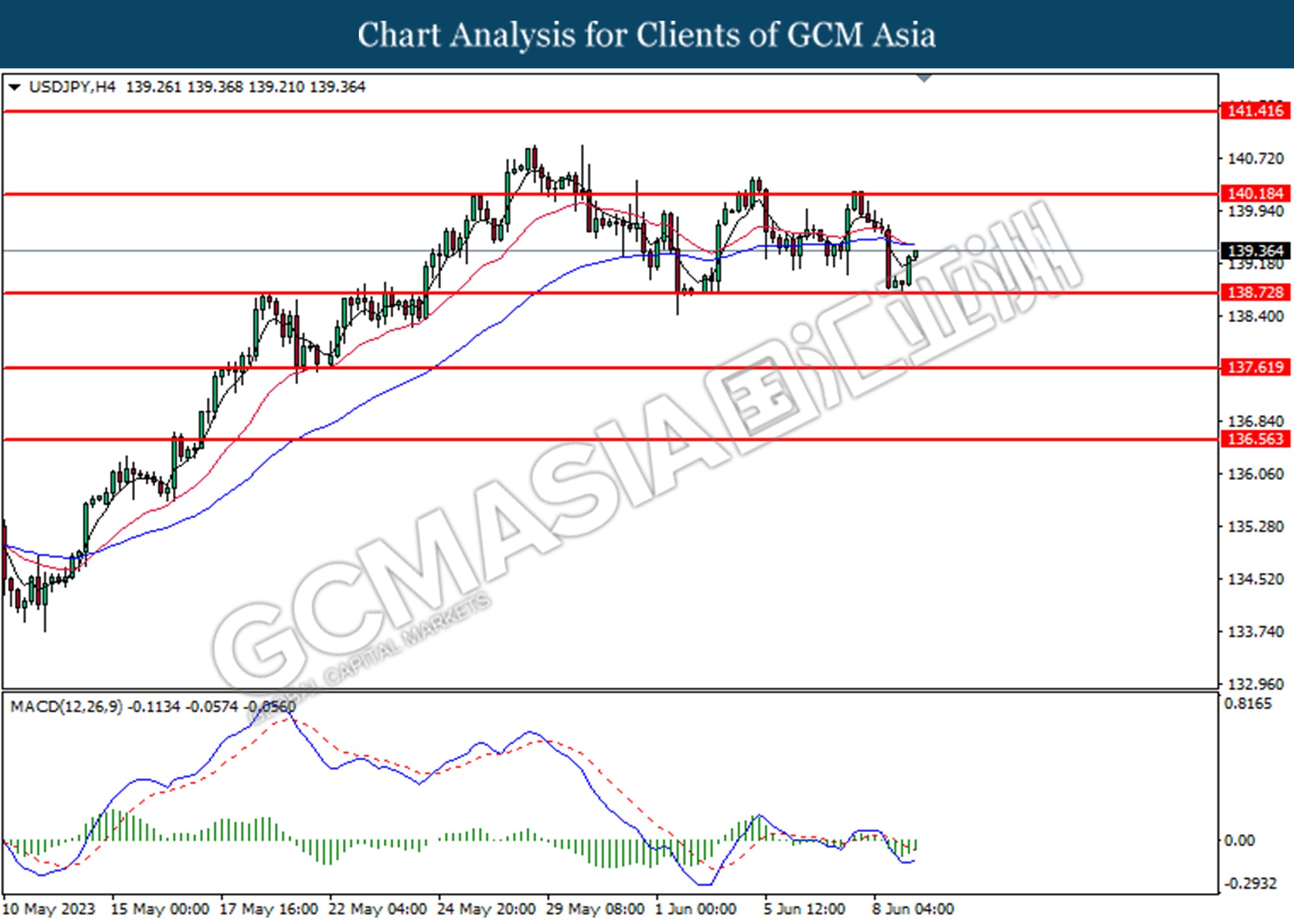

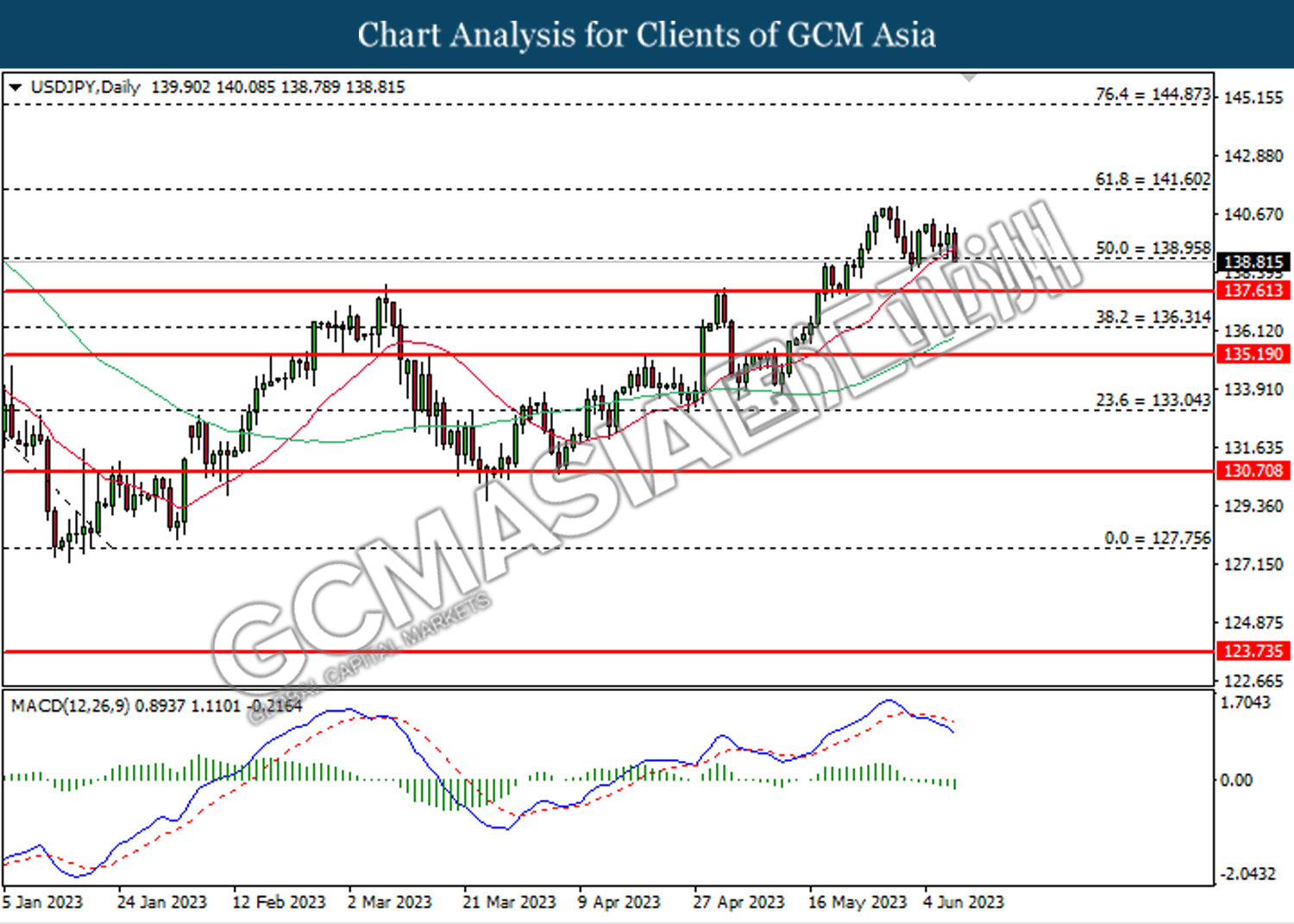

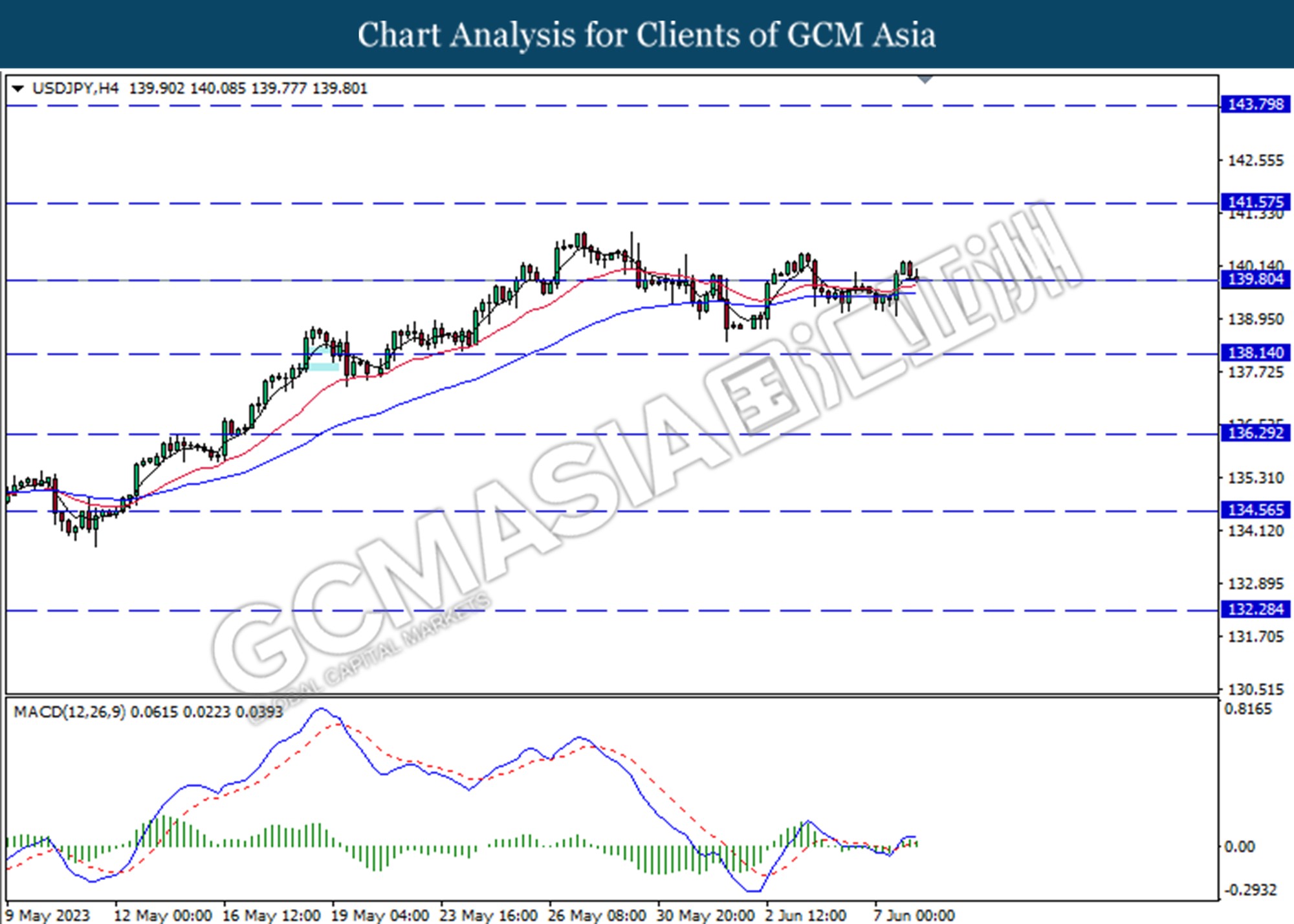

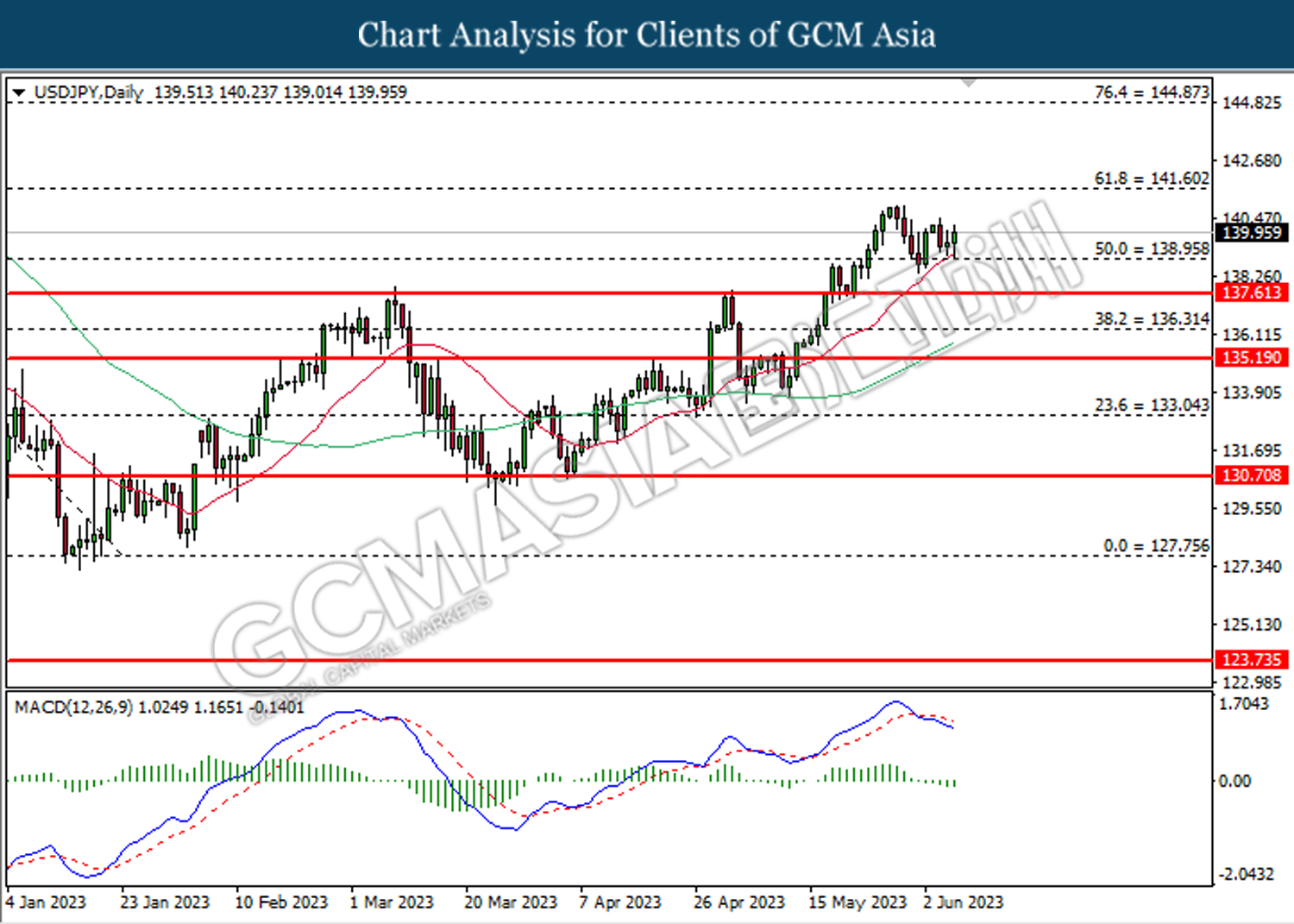

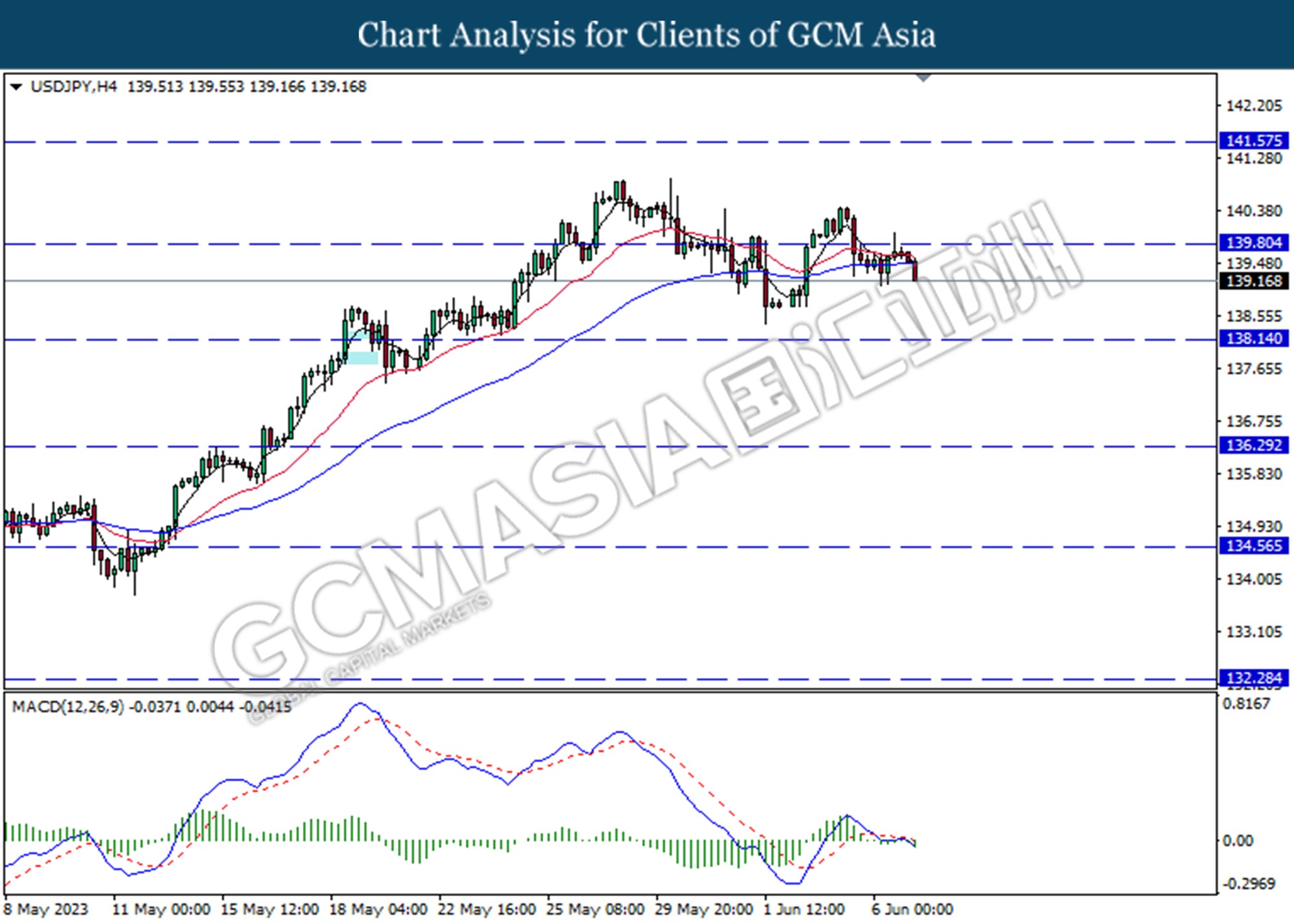

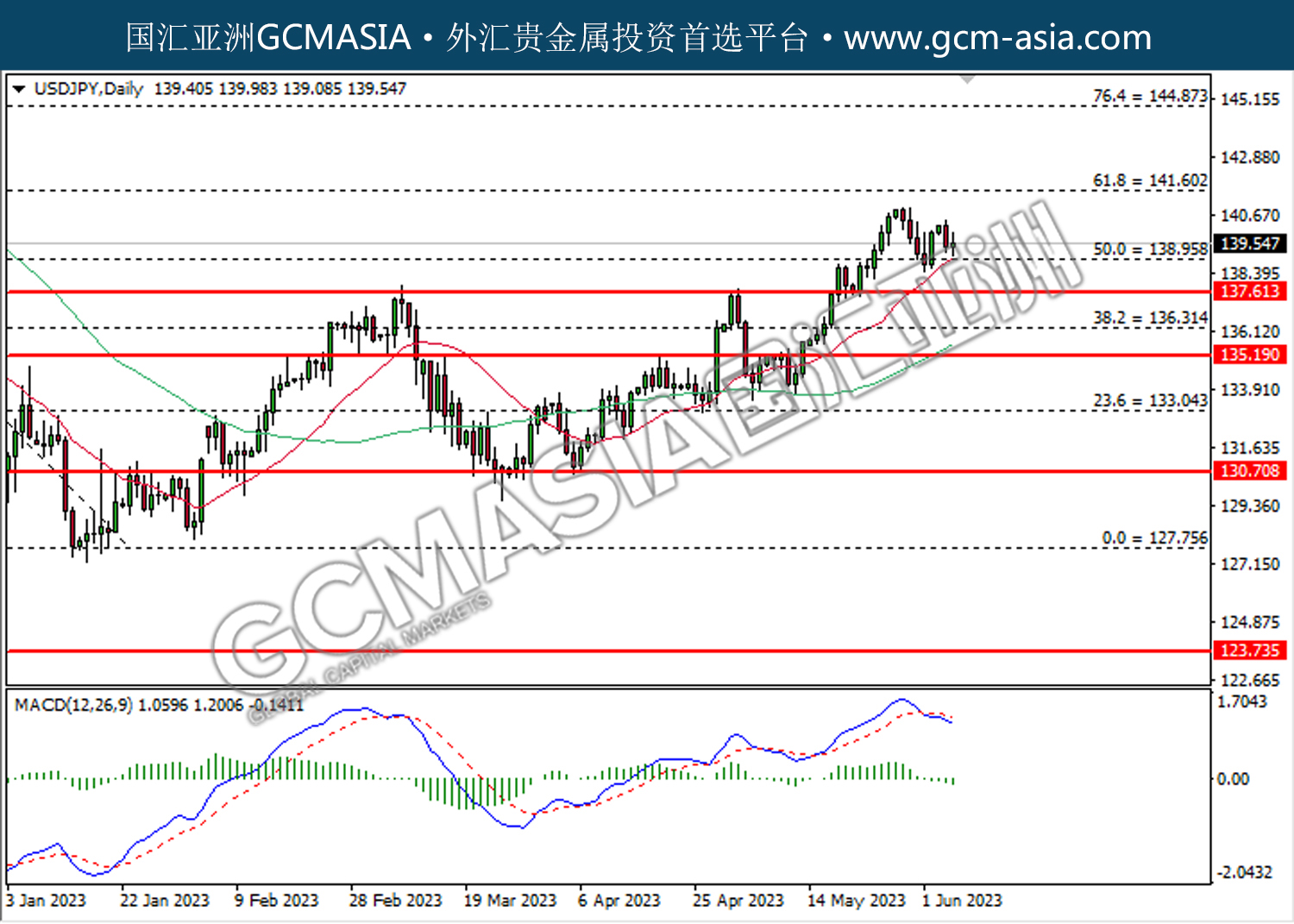

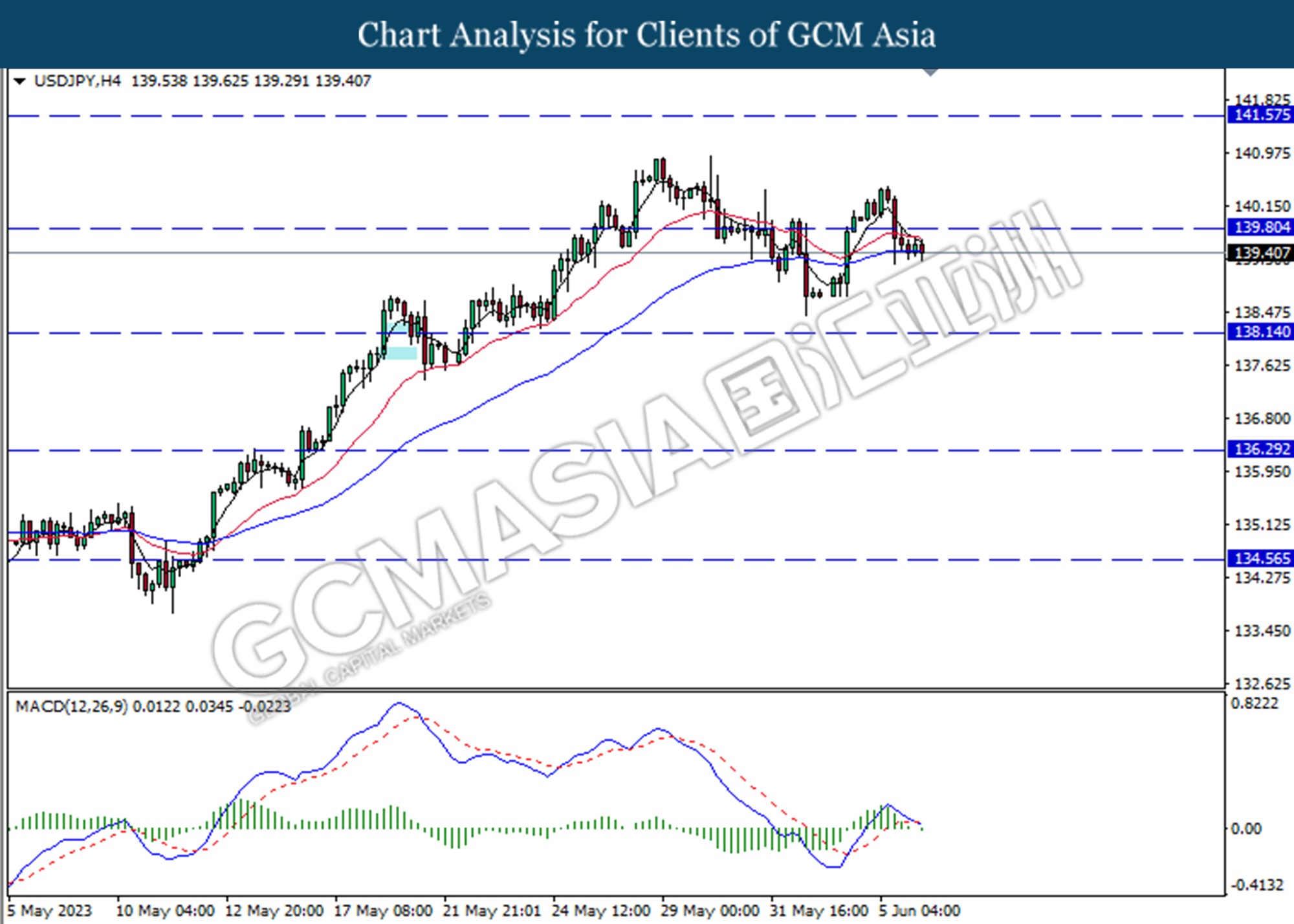

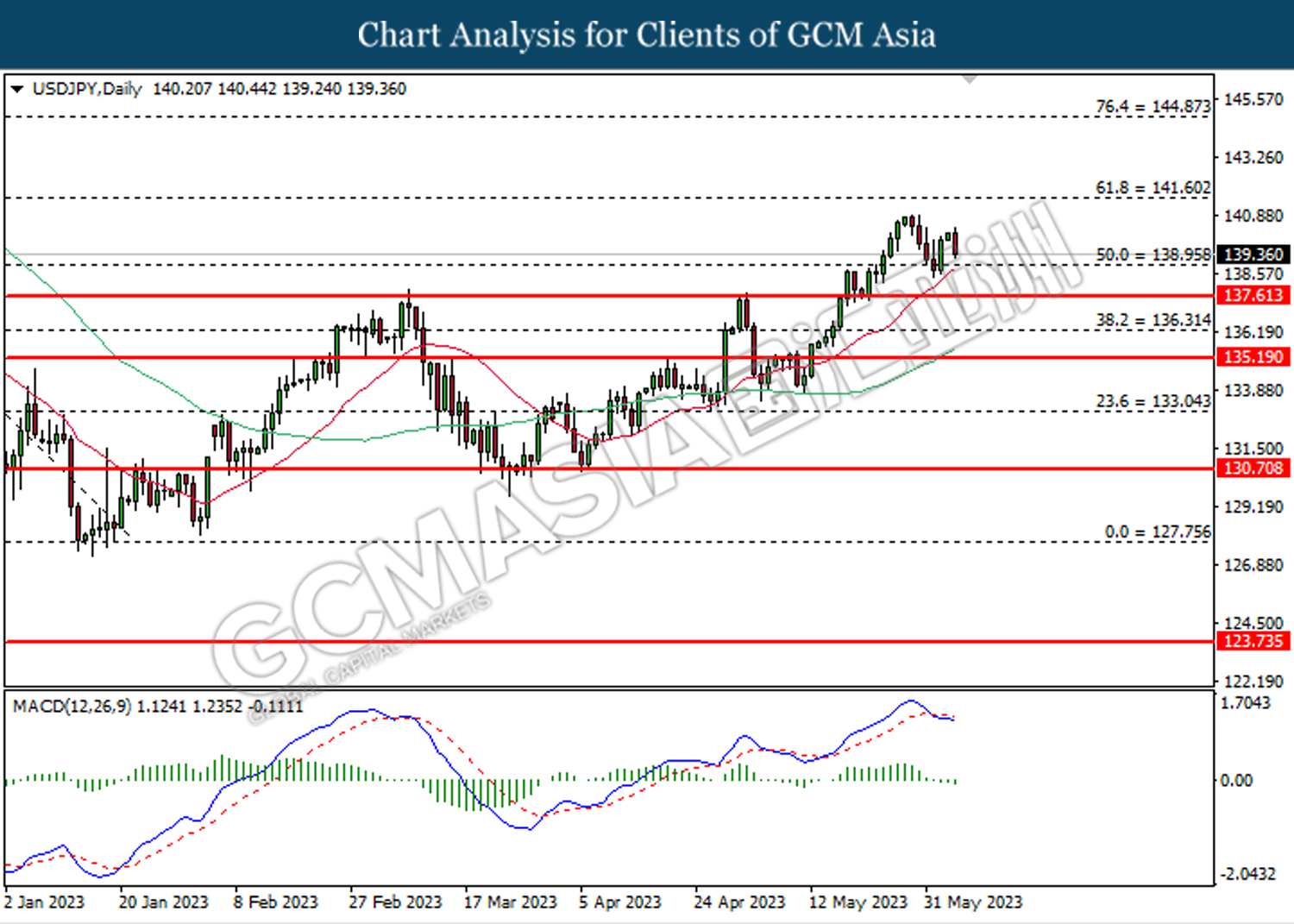

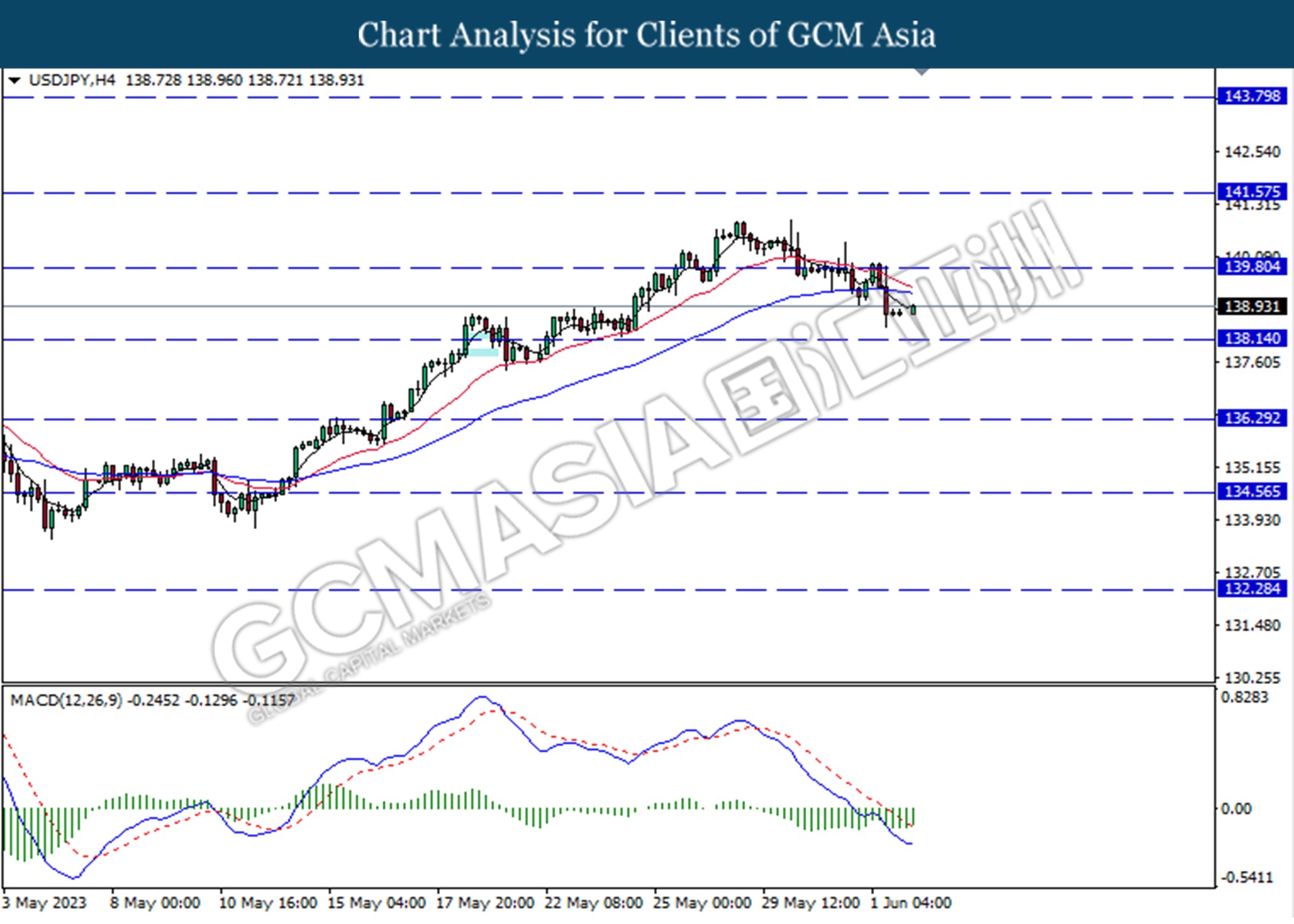

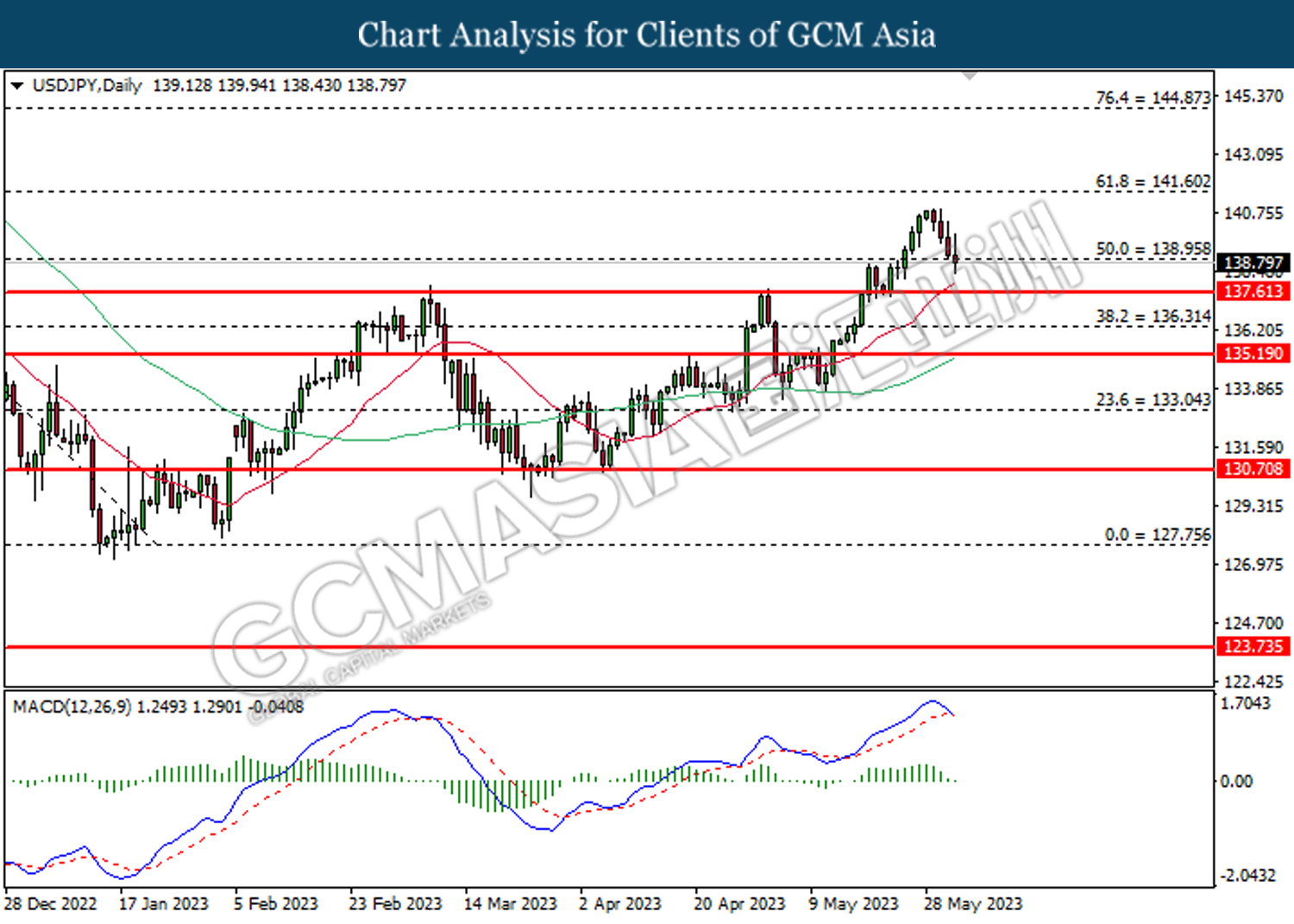

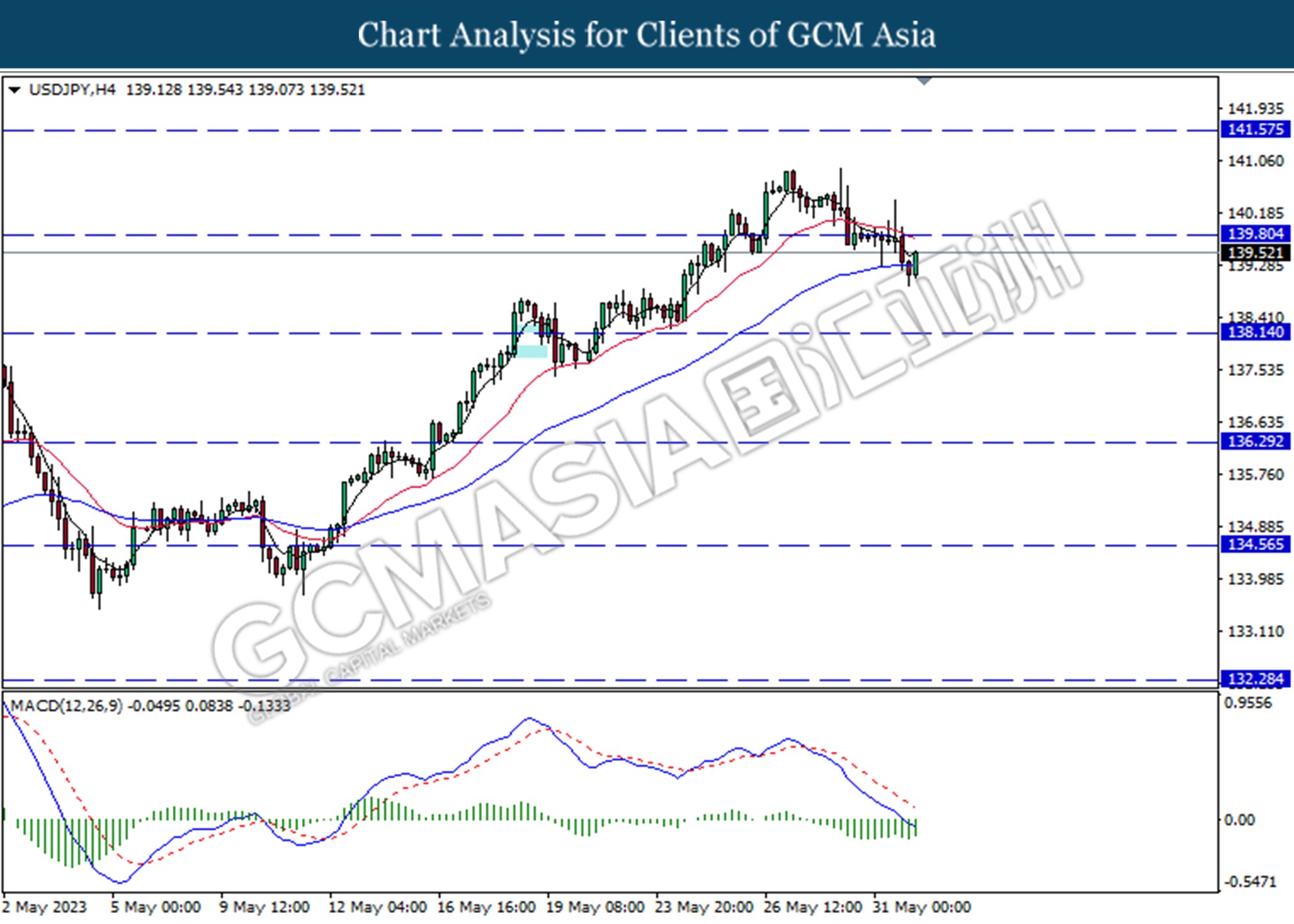

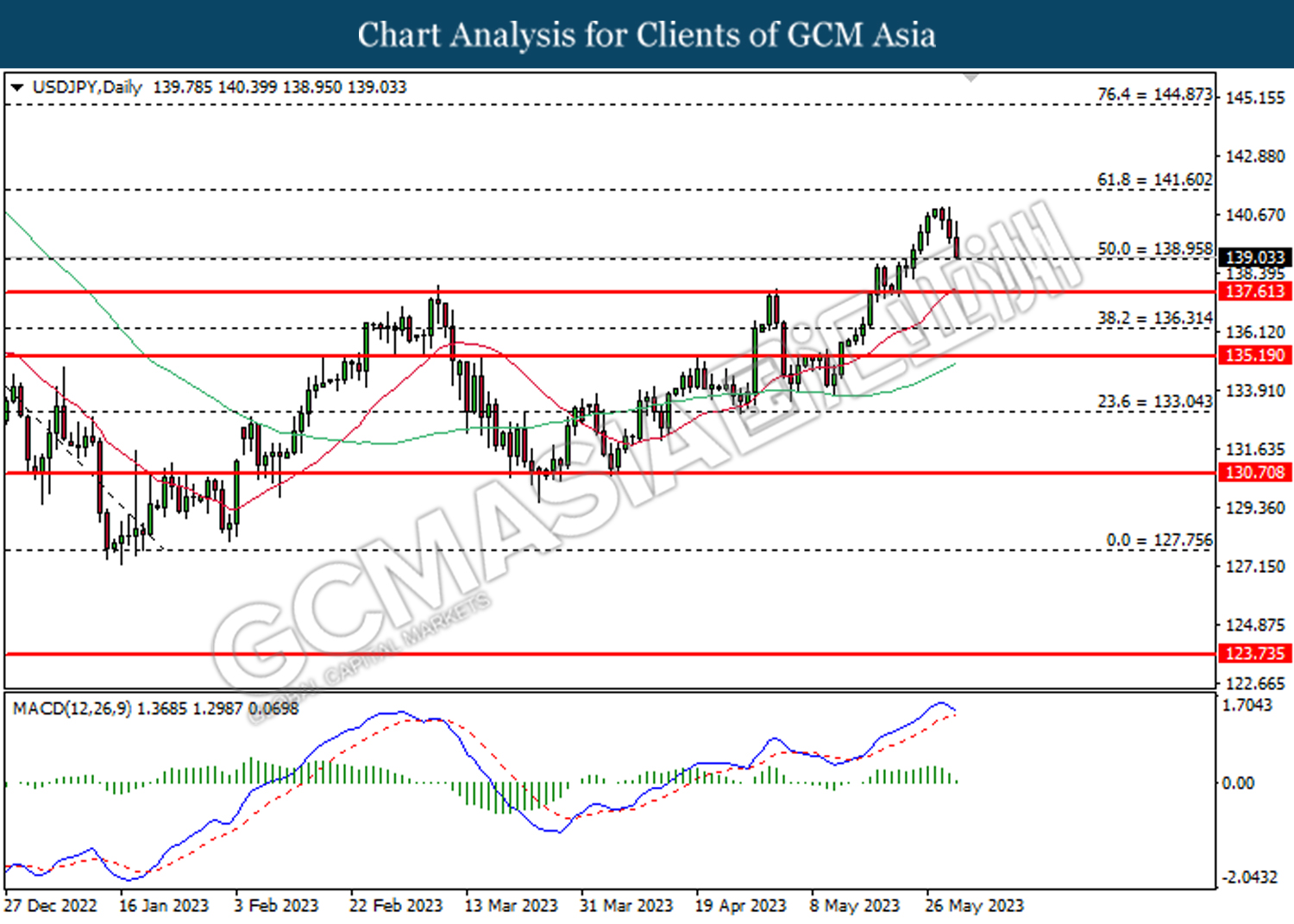

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.95. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

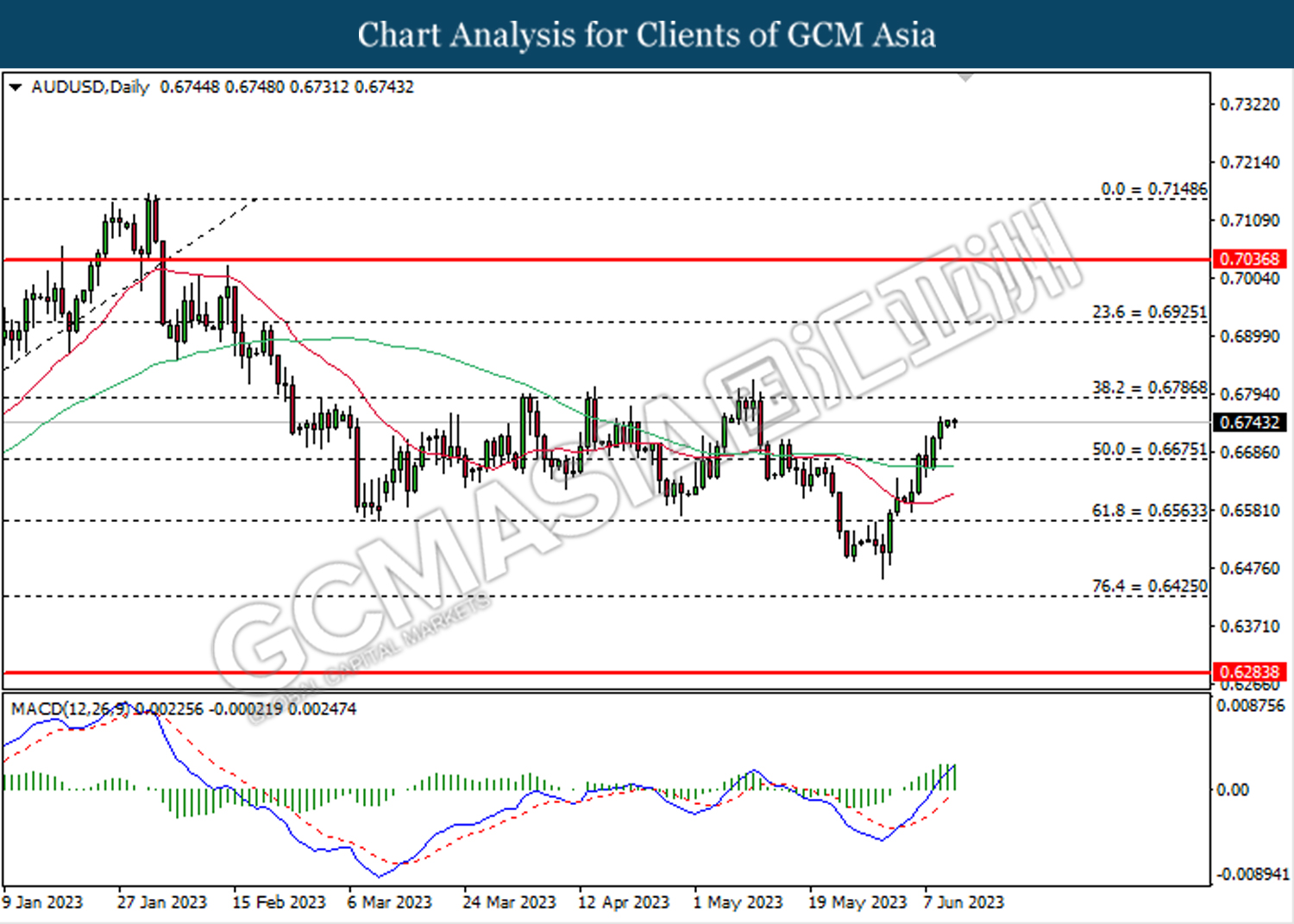

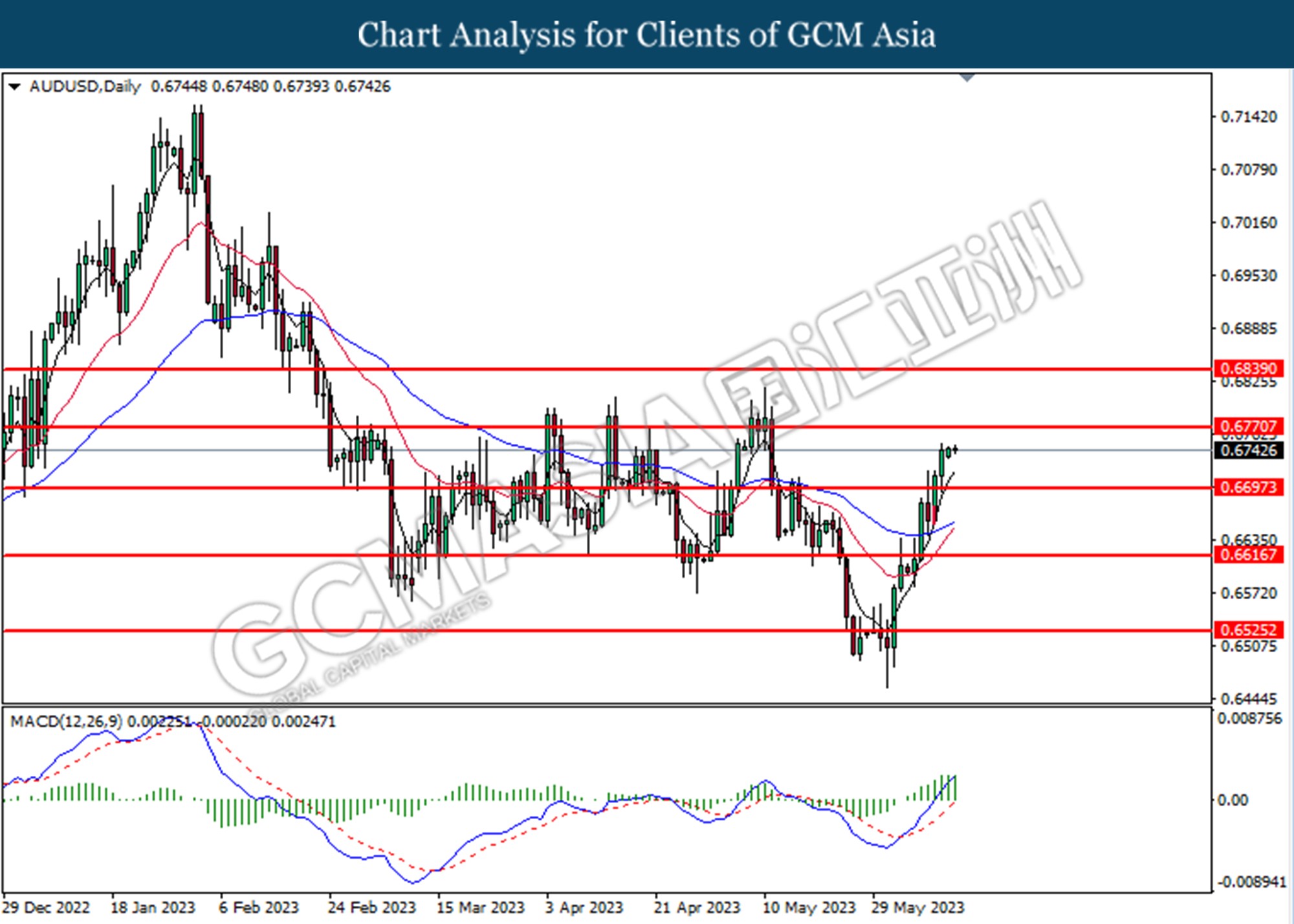

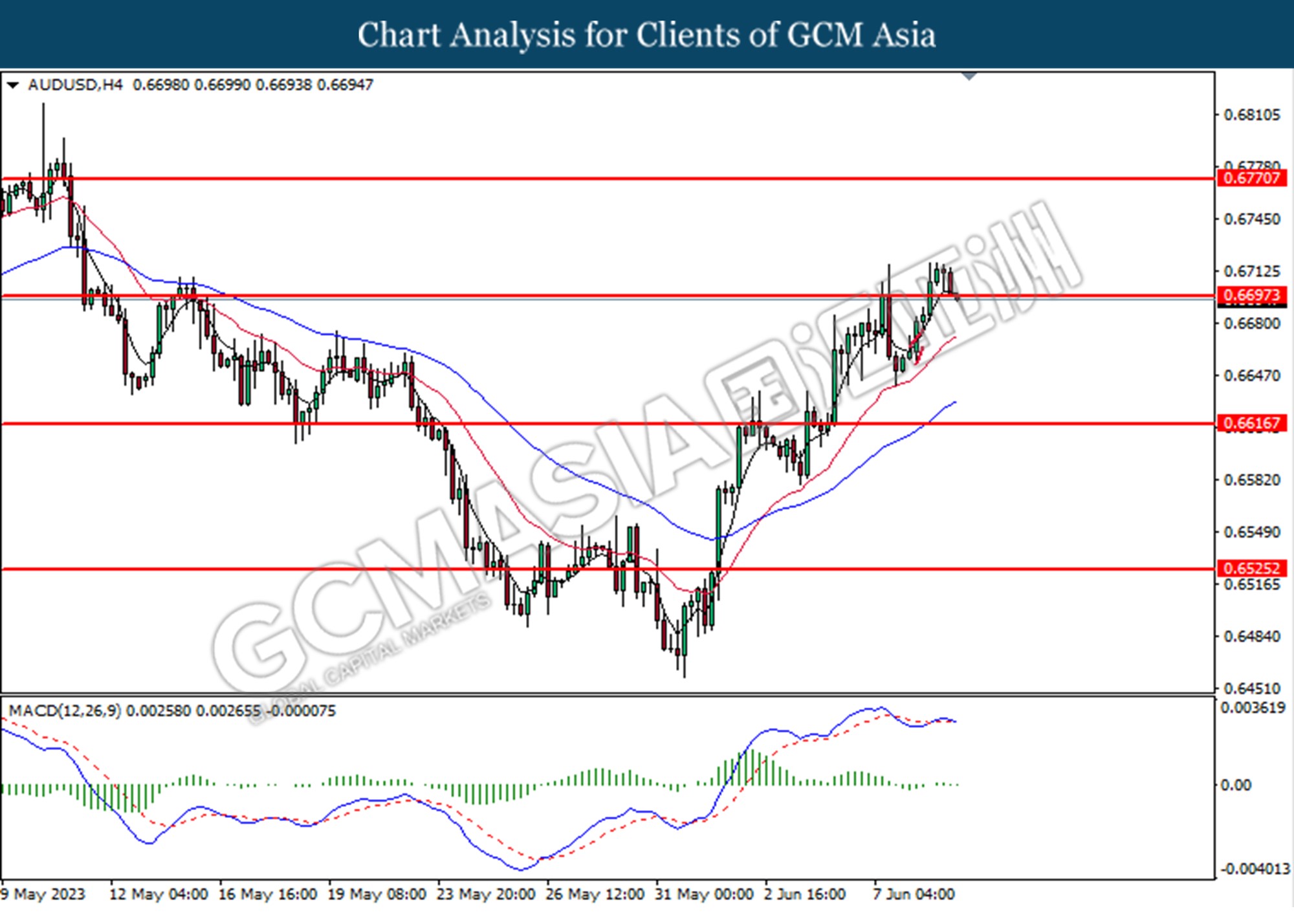

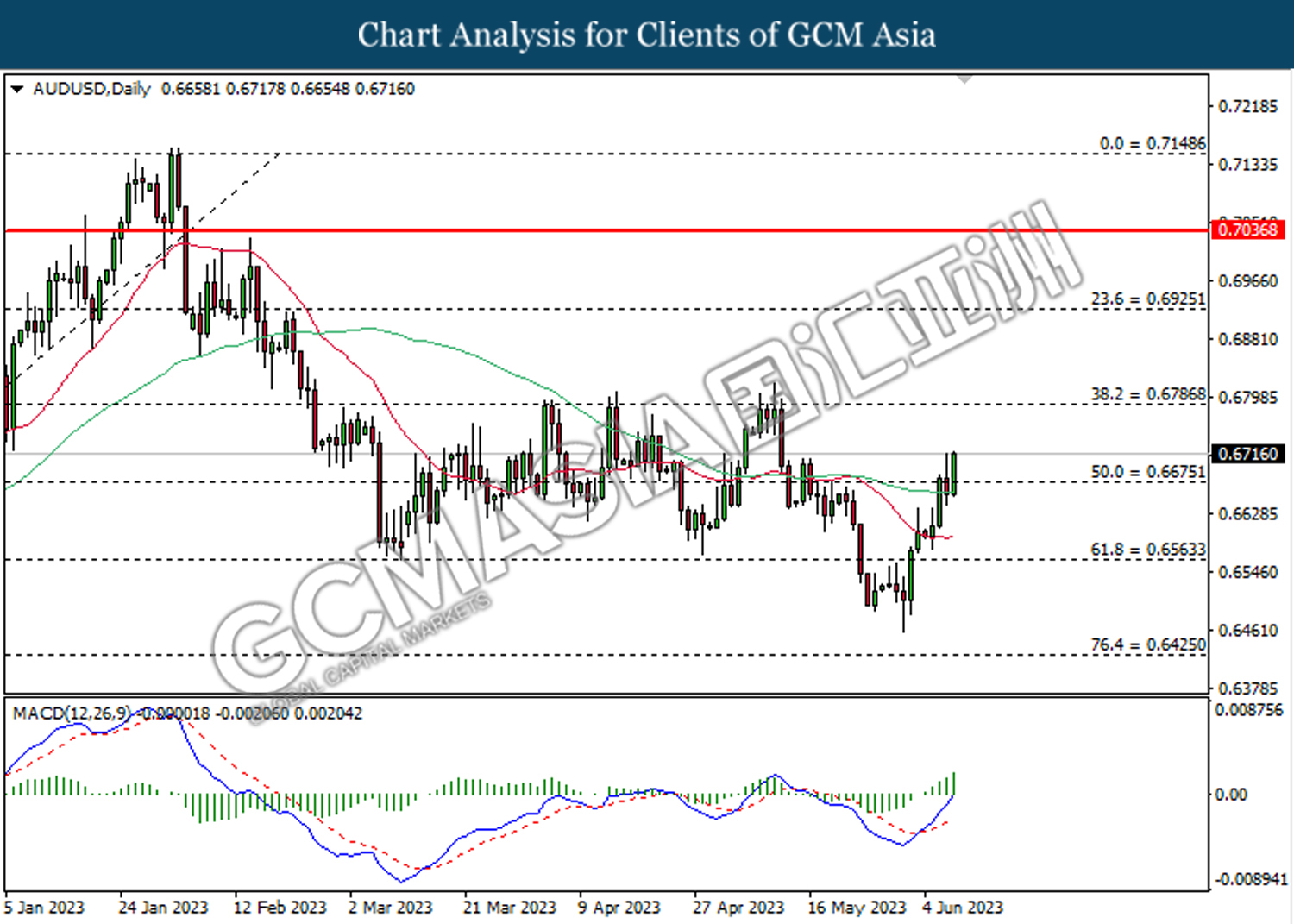

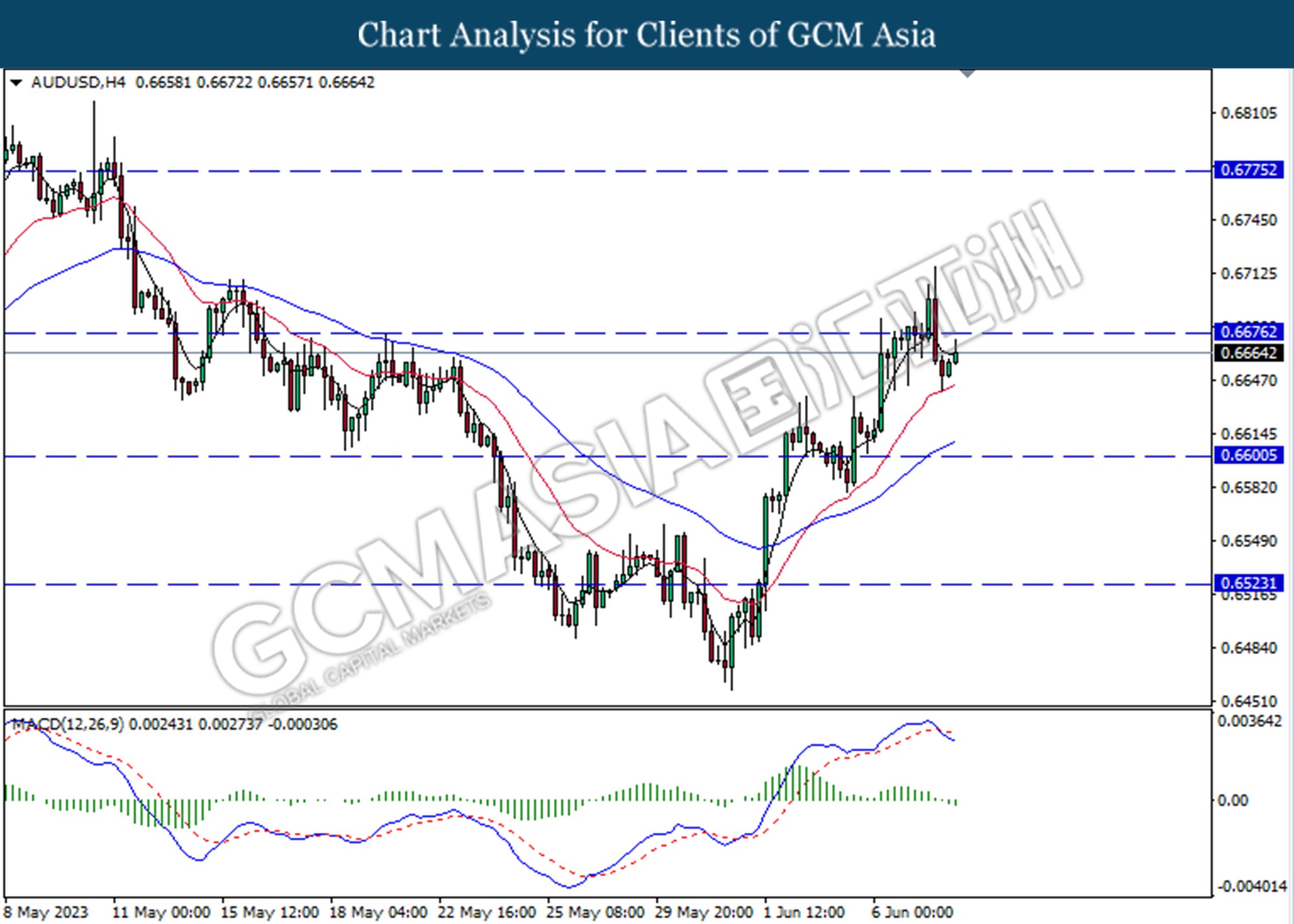

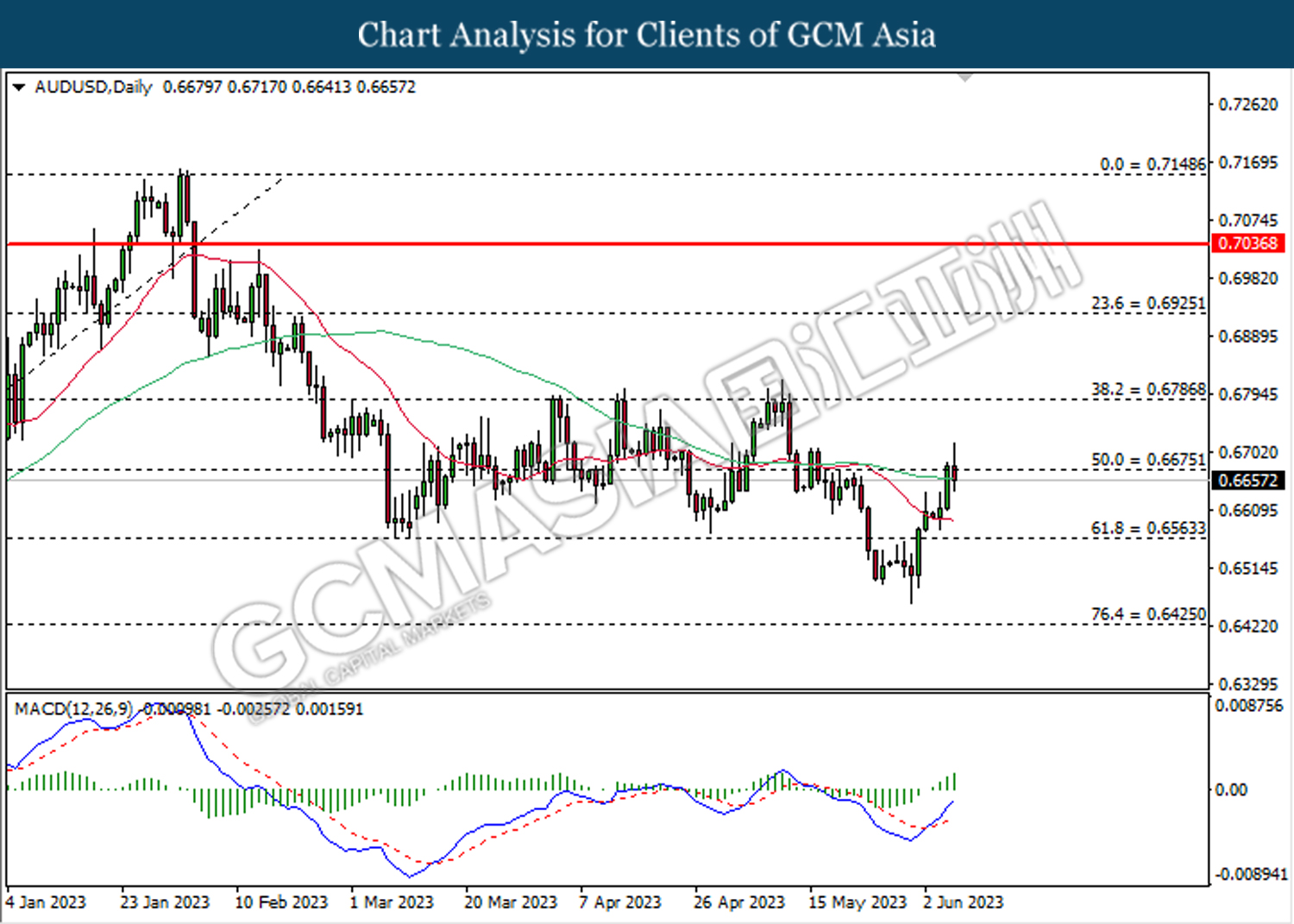

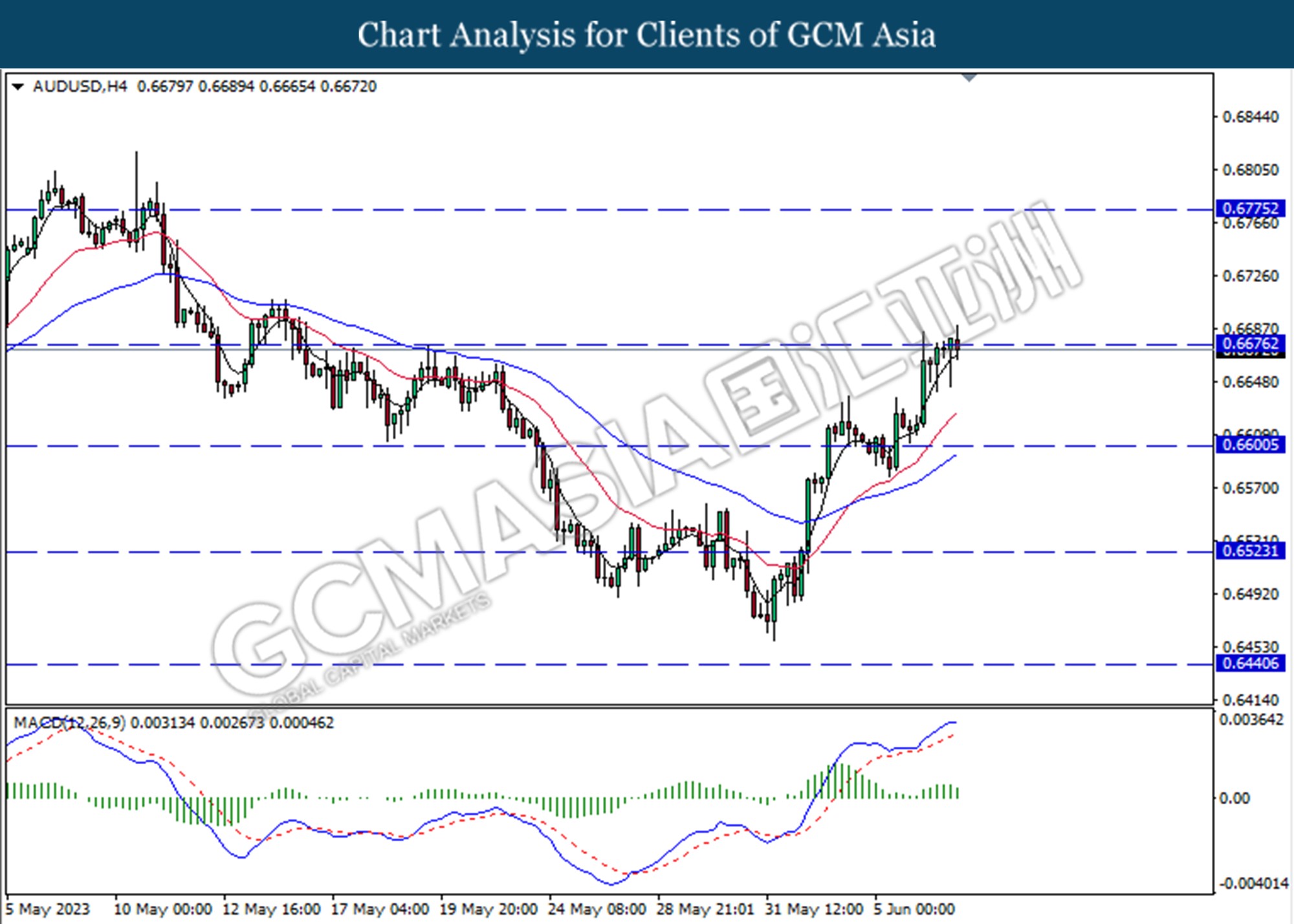

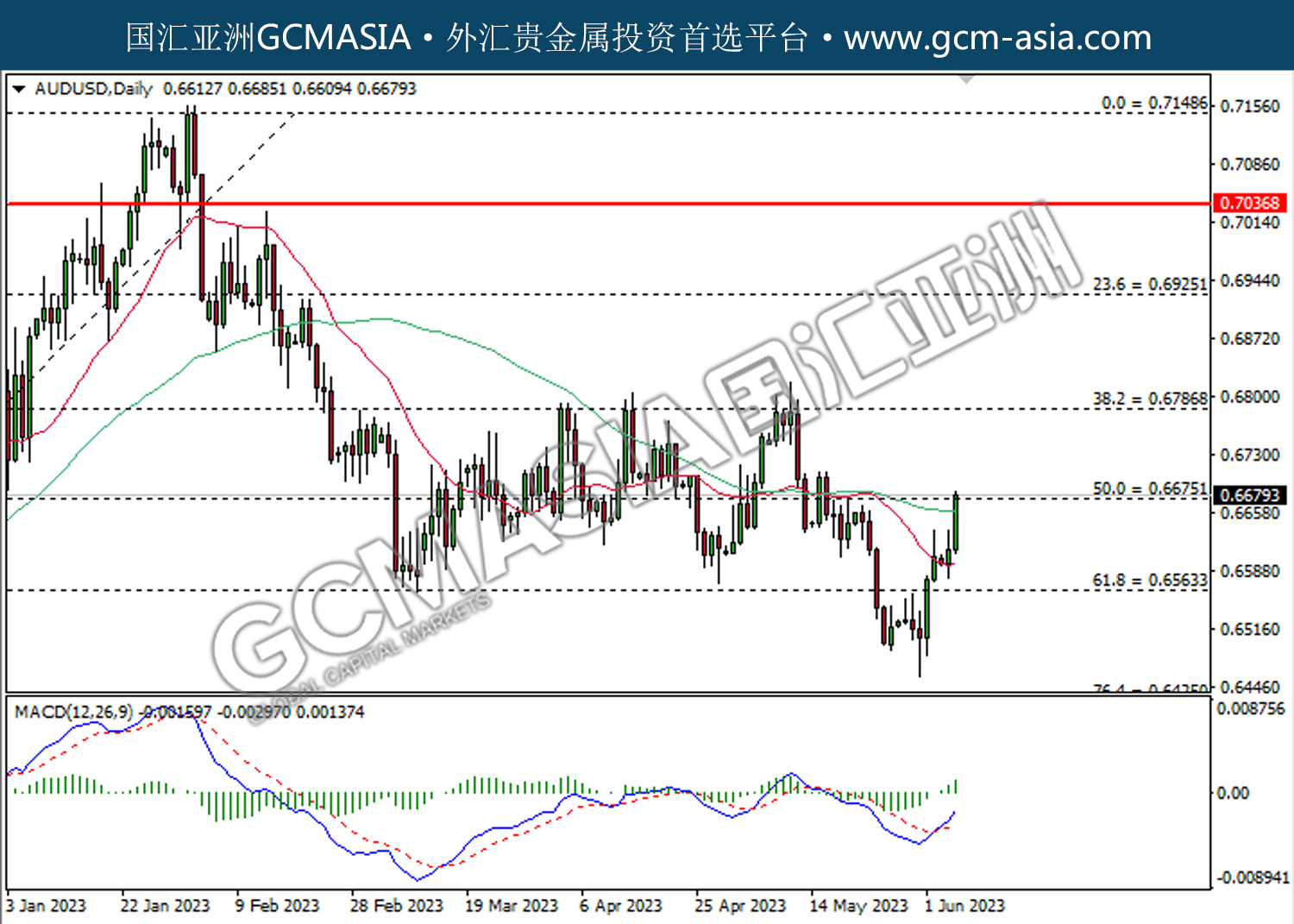

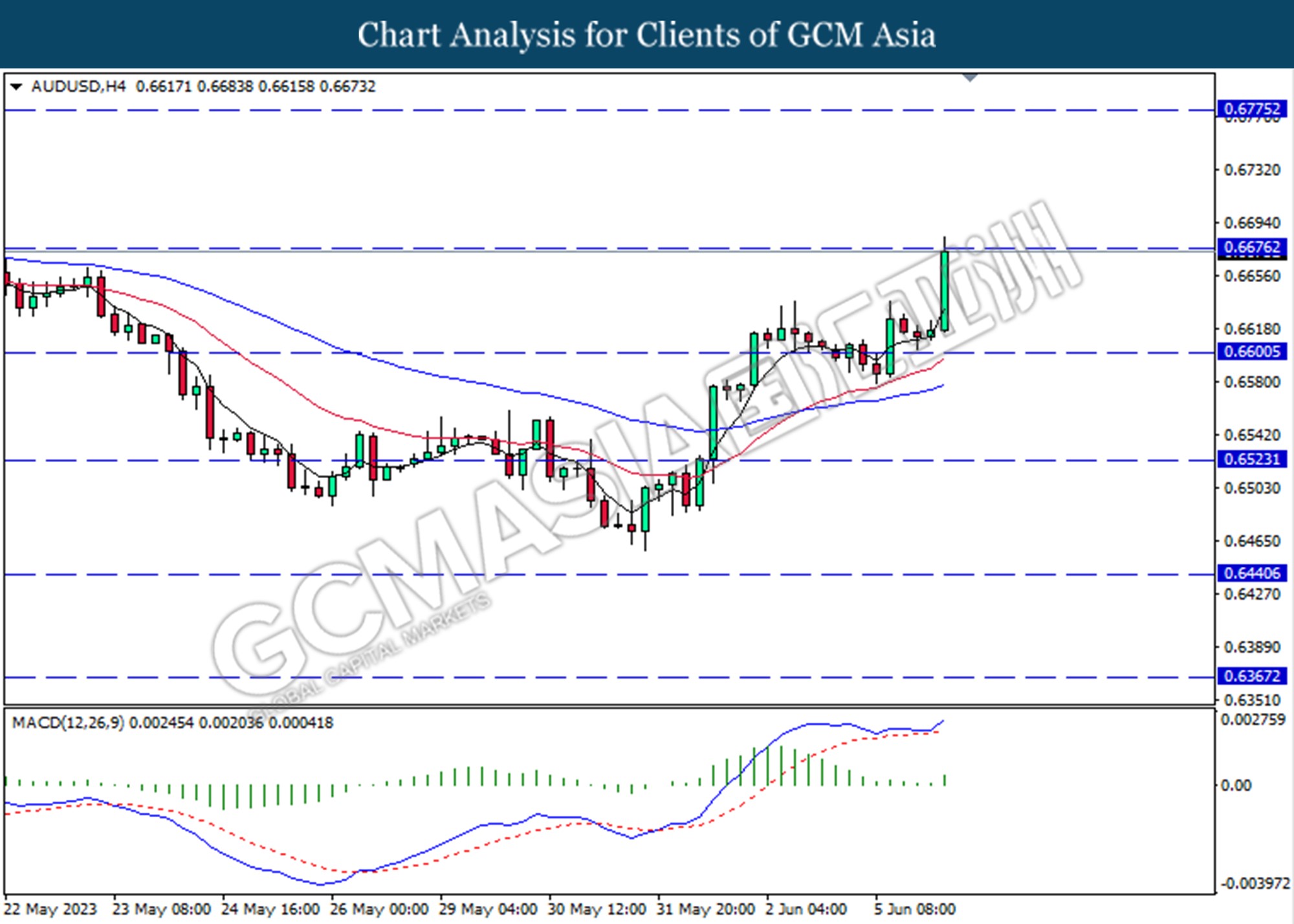

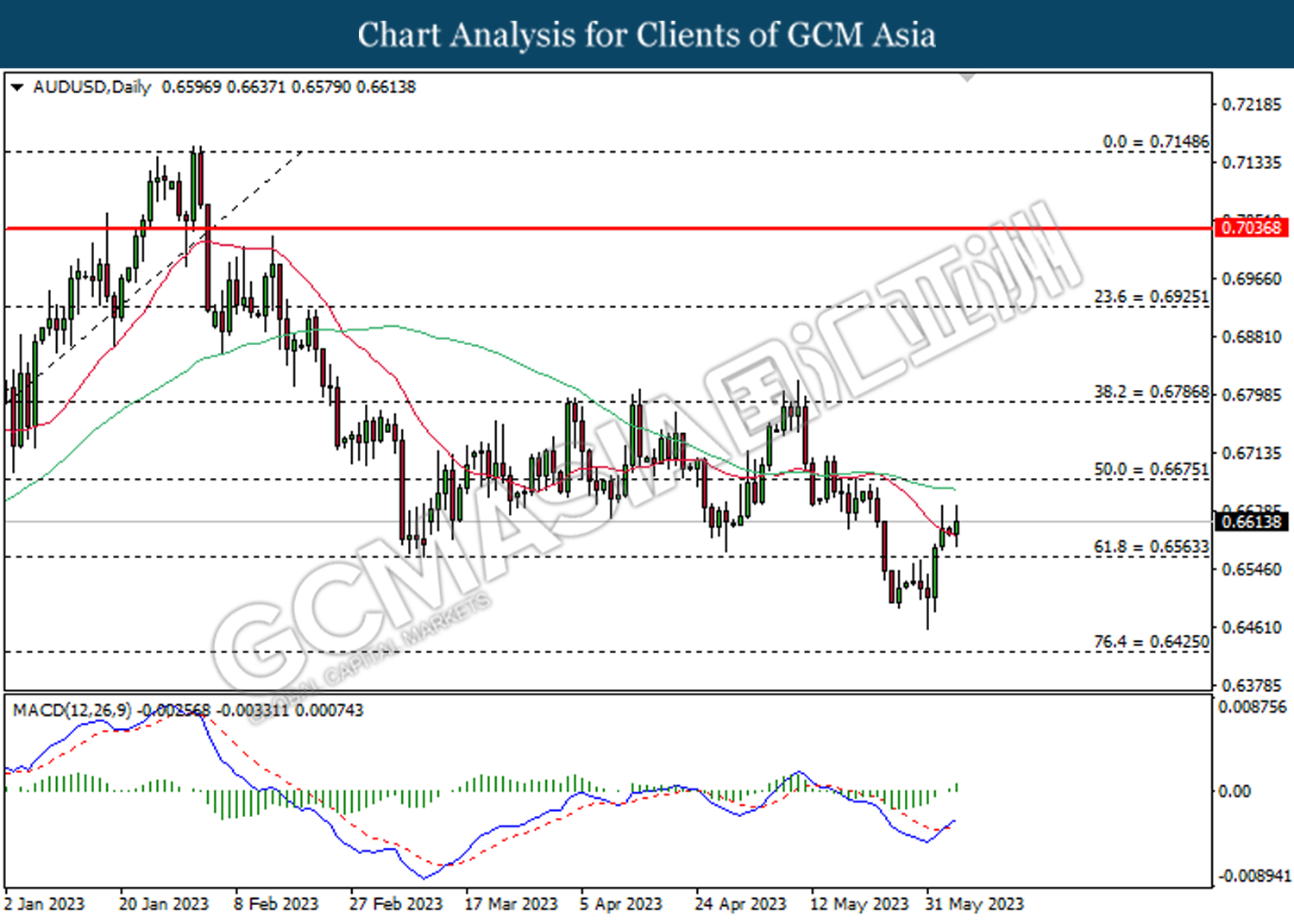

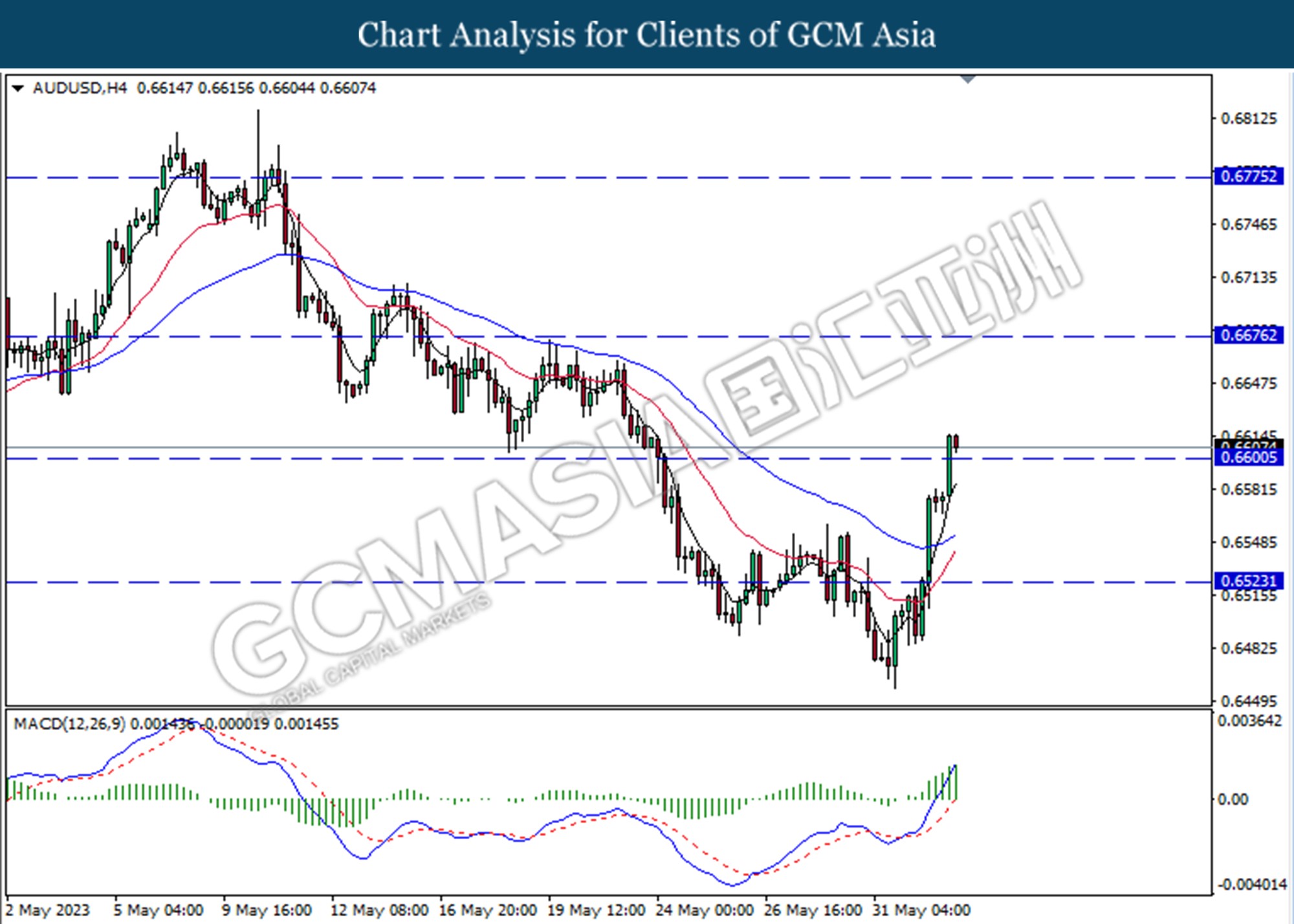

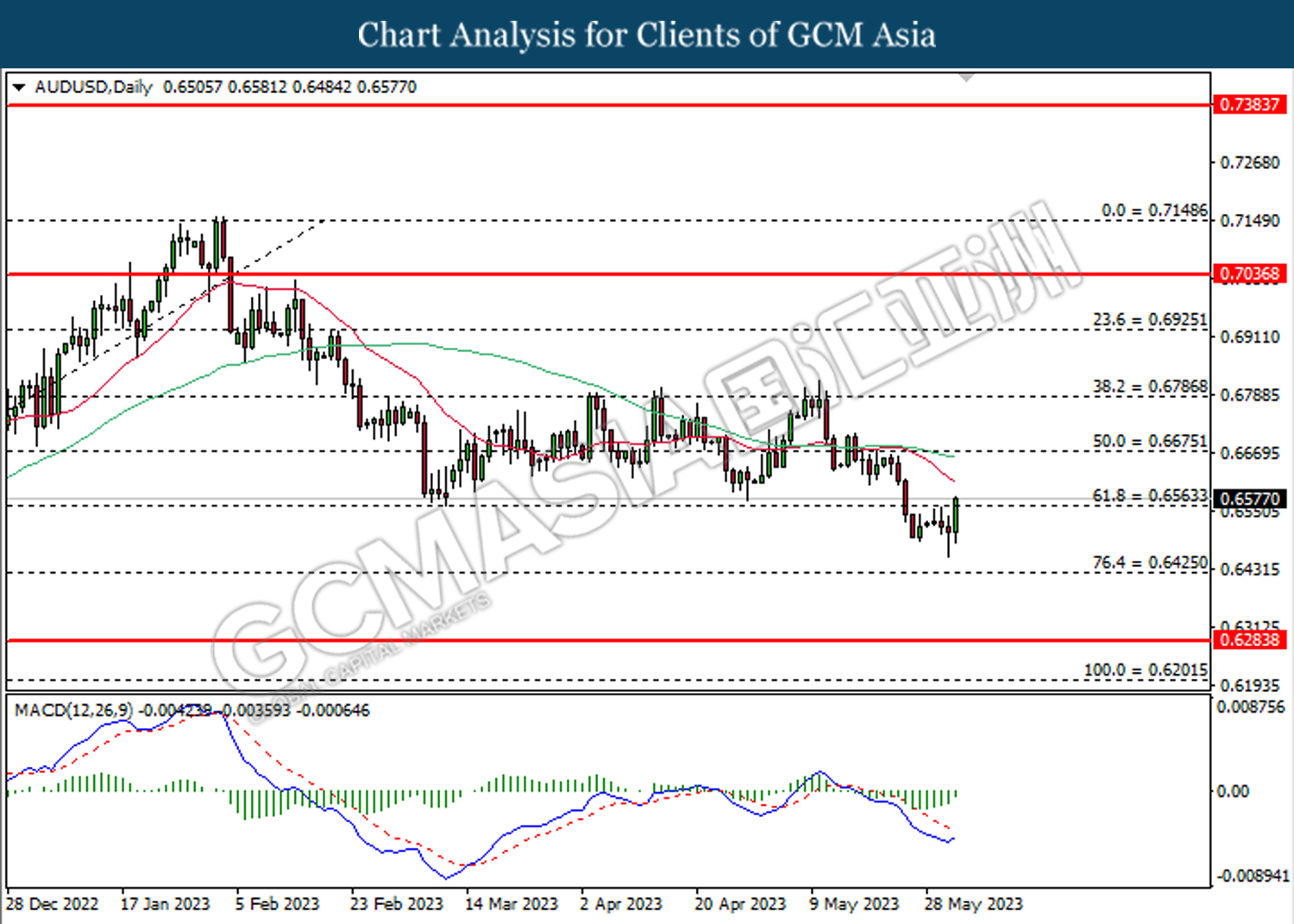

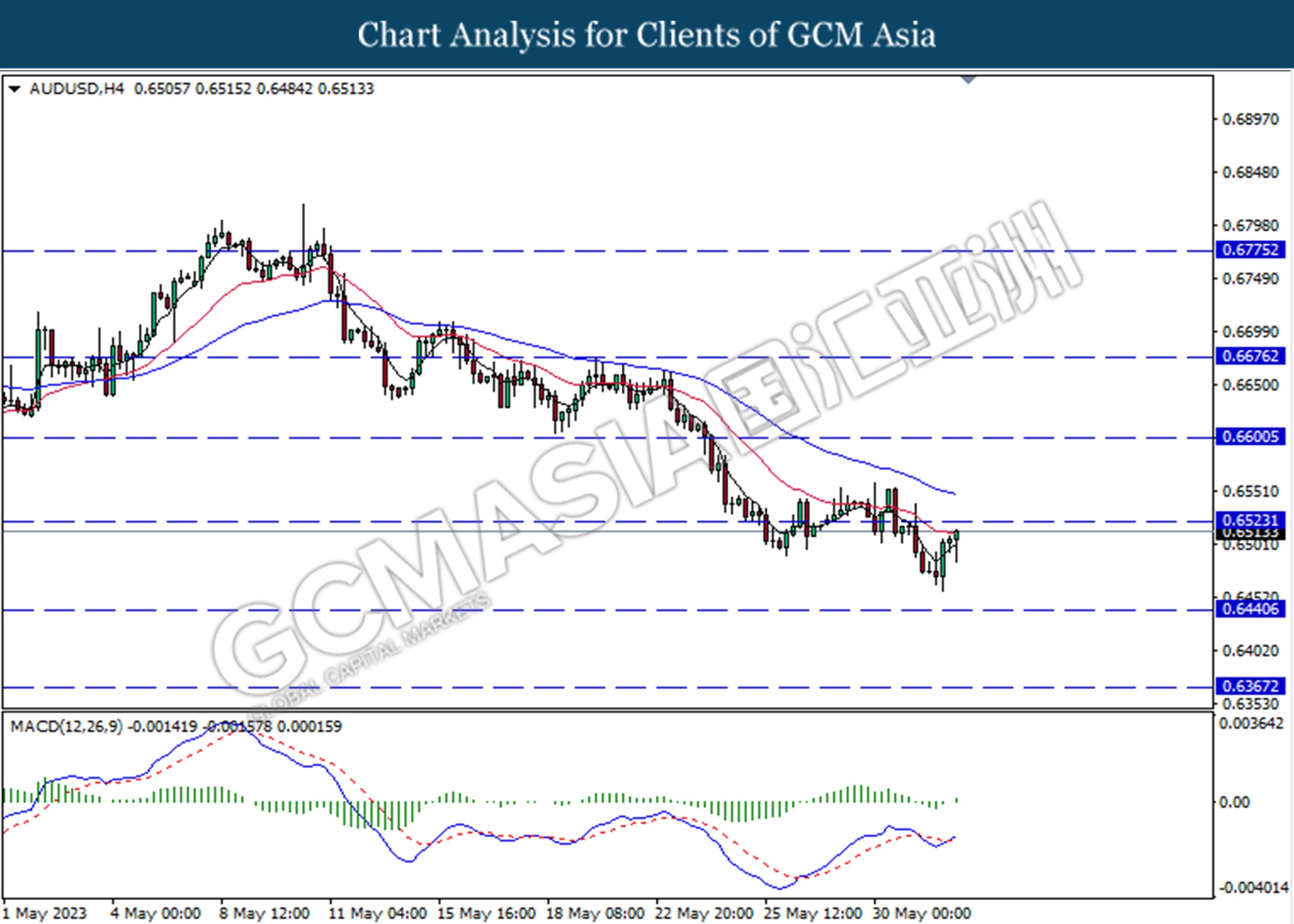

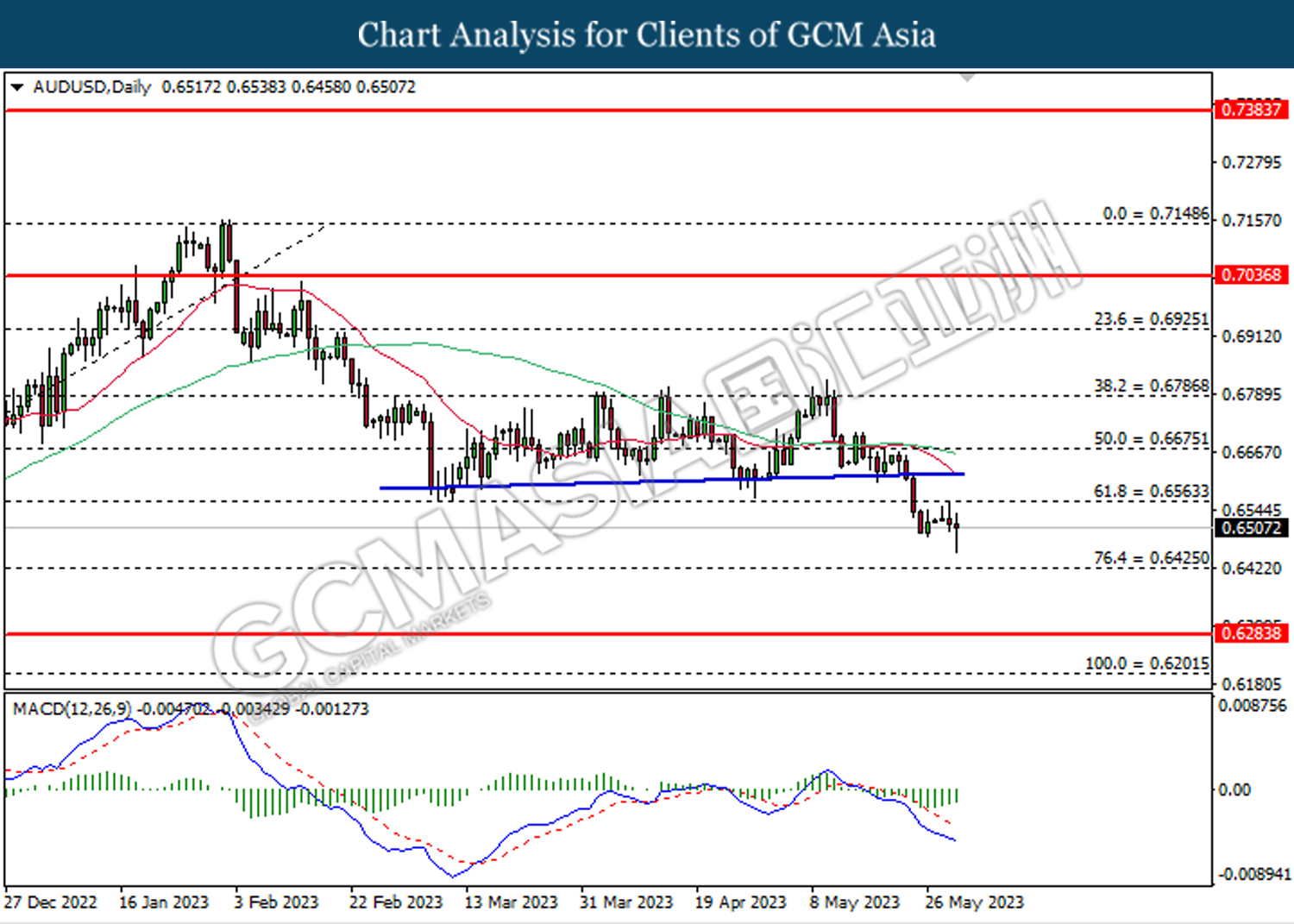

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

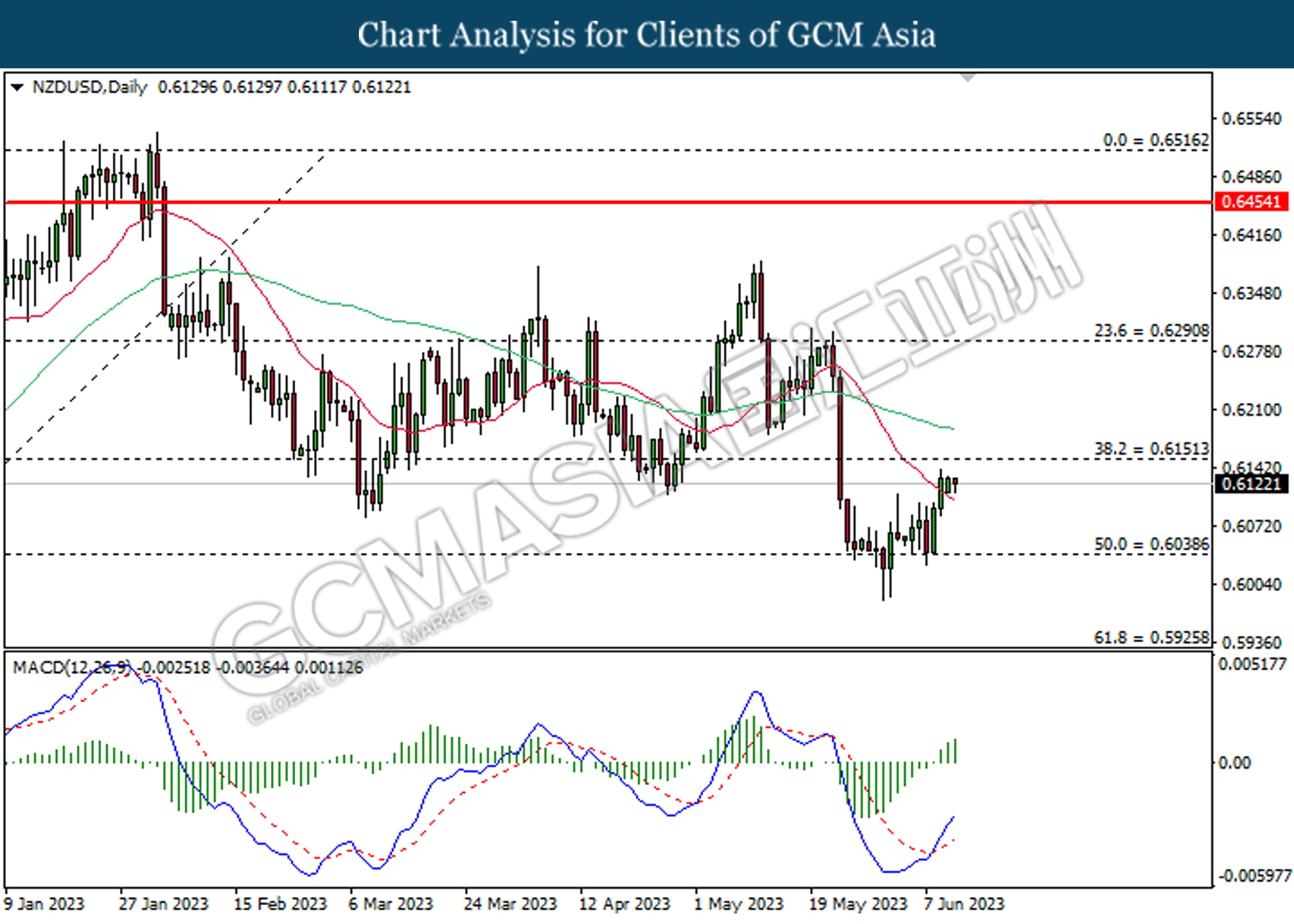

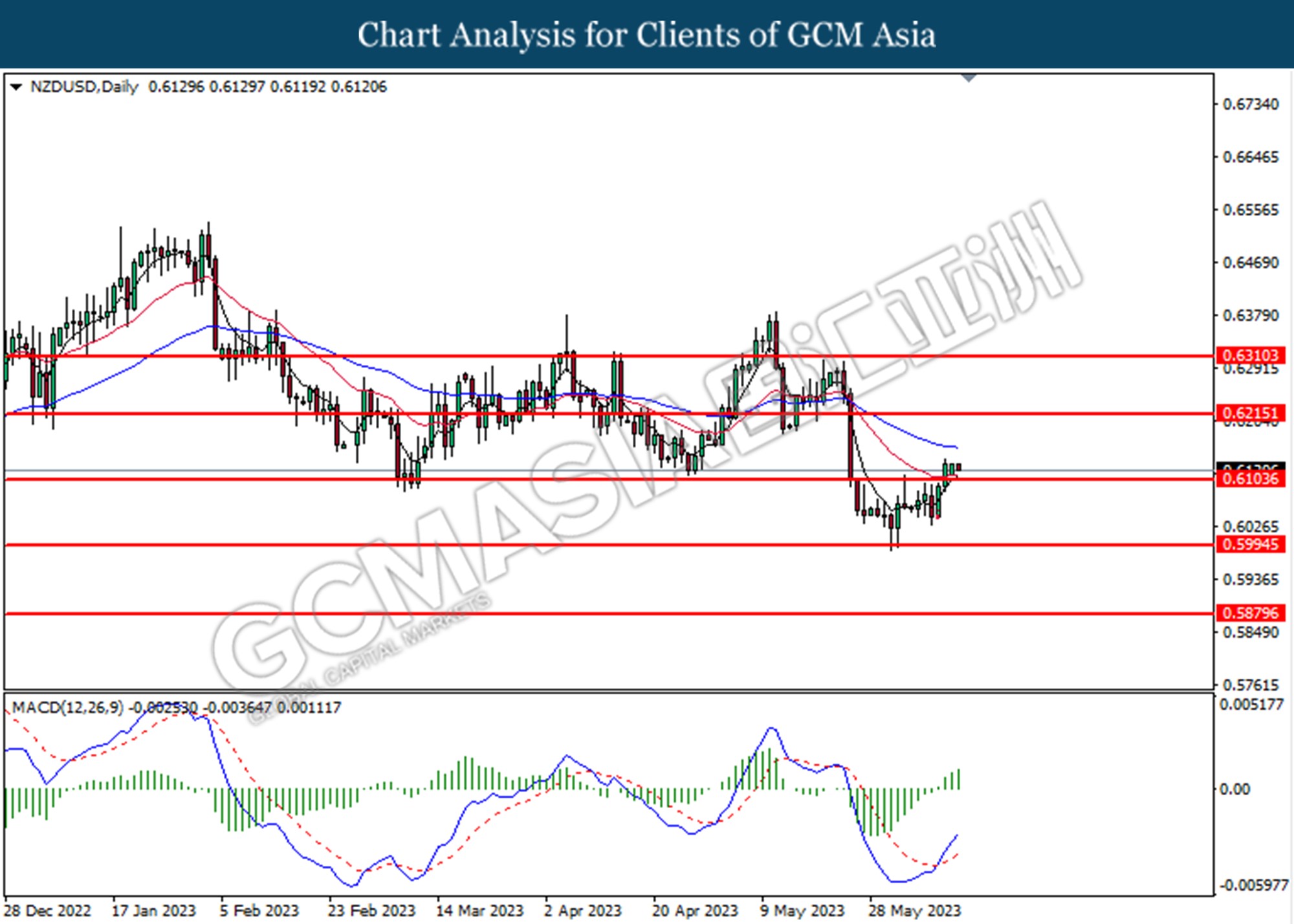

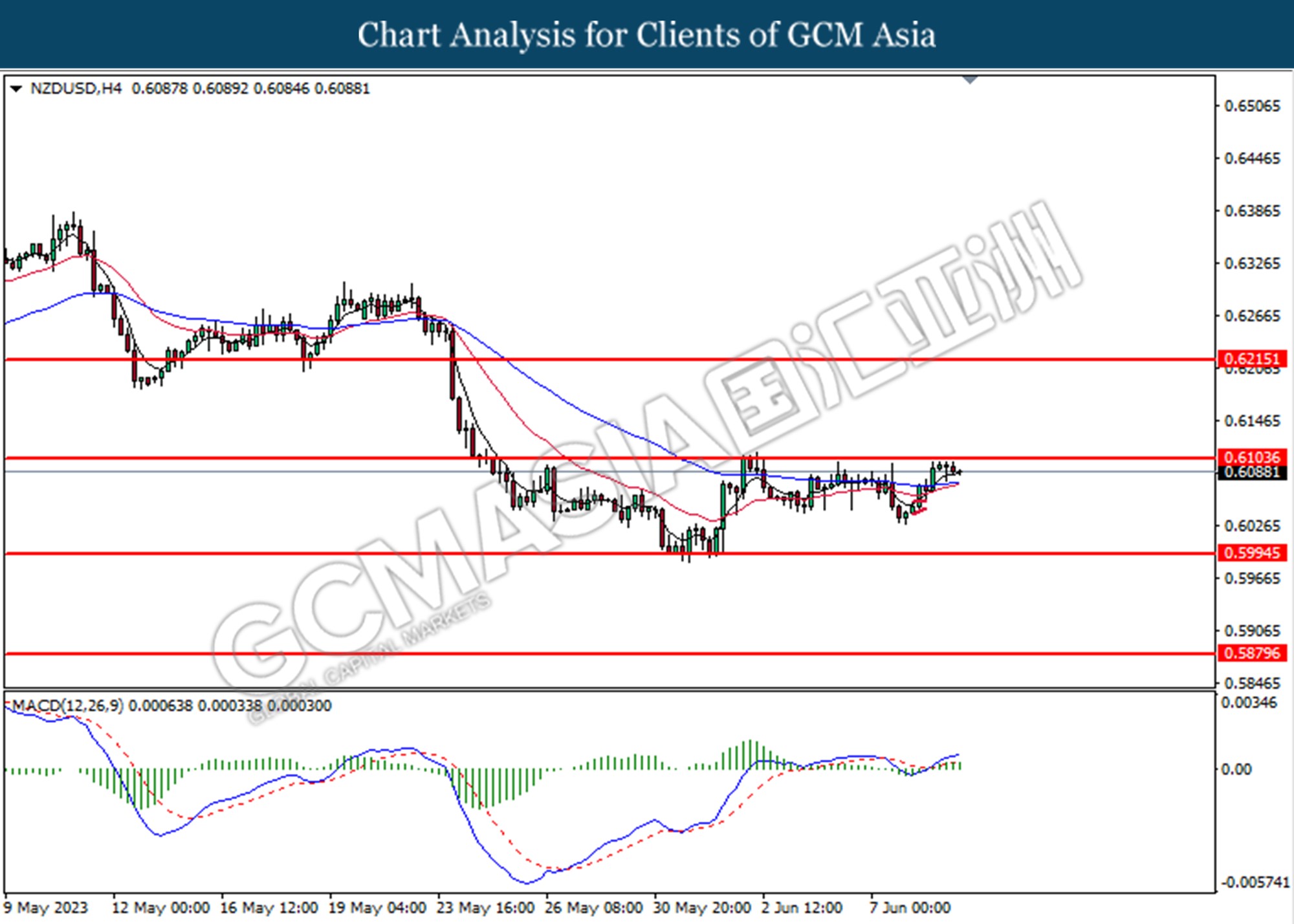

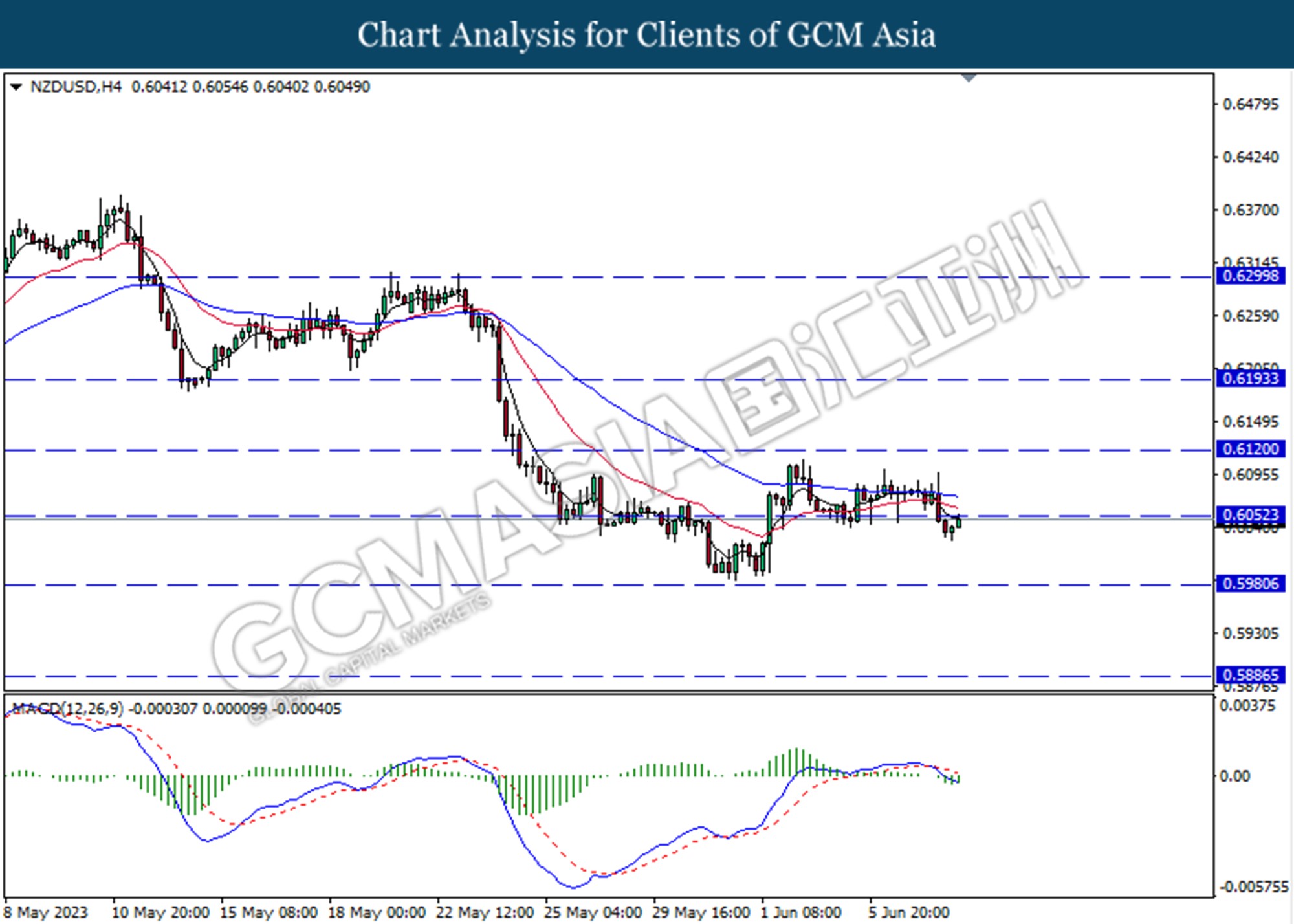

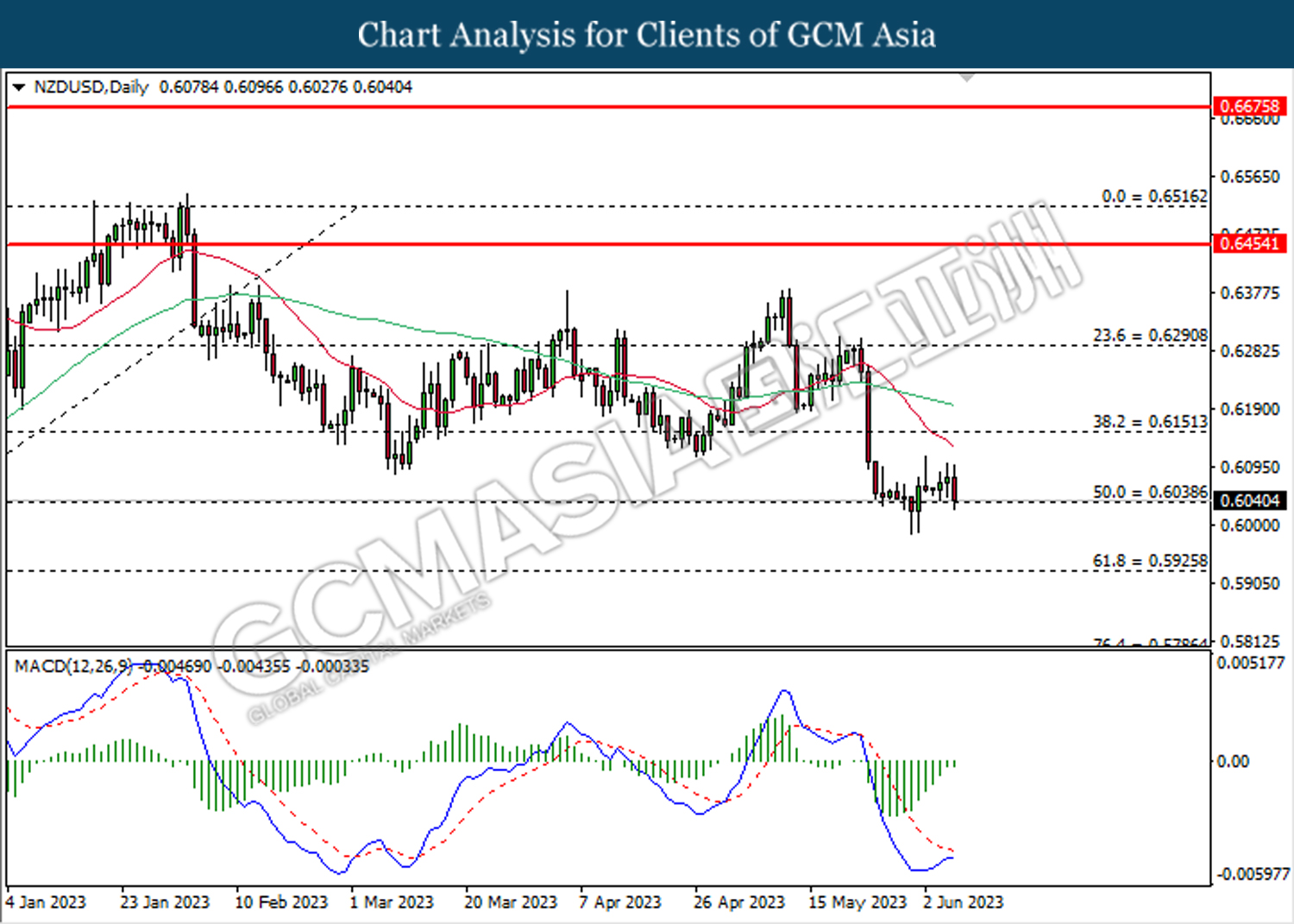

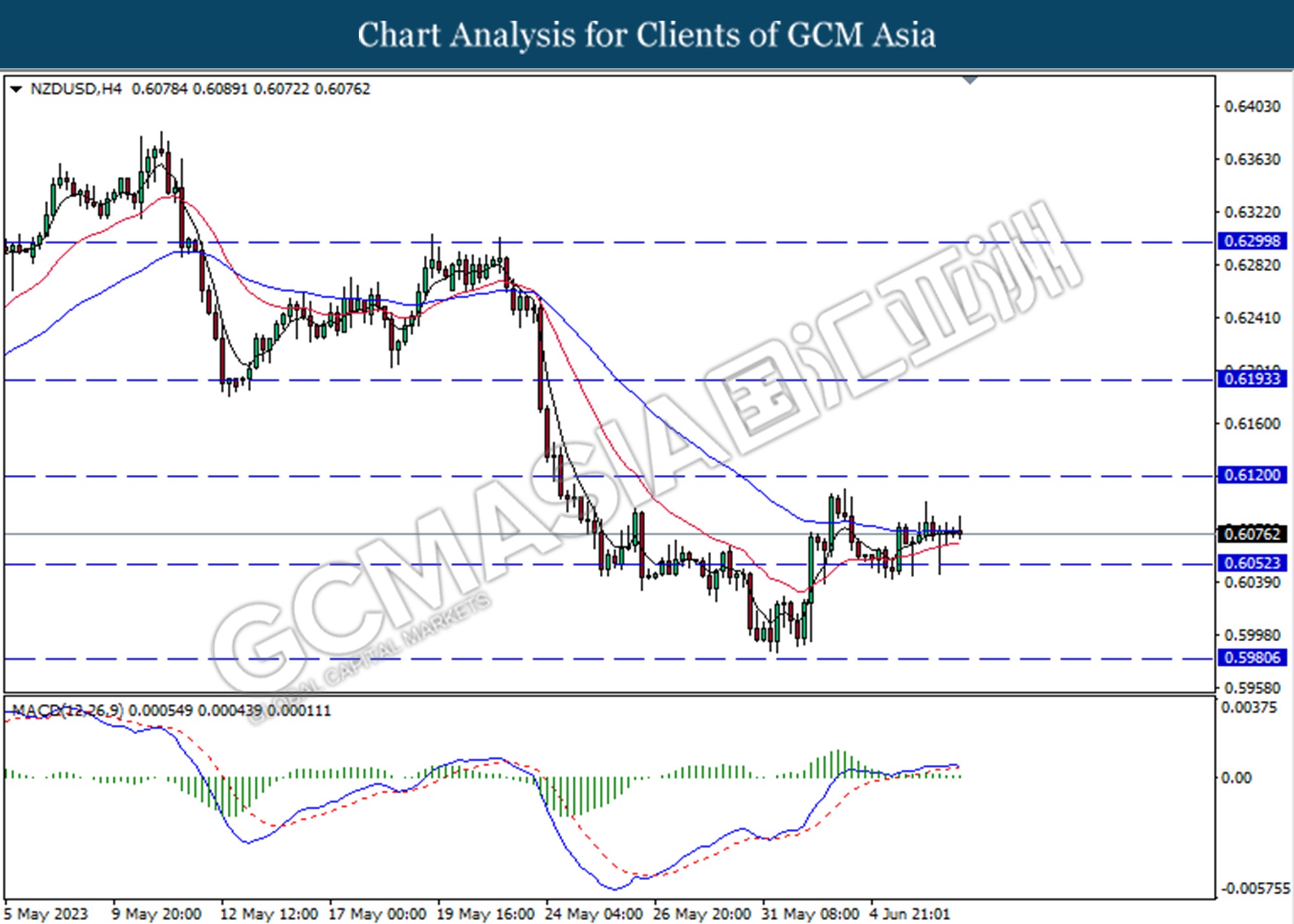

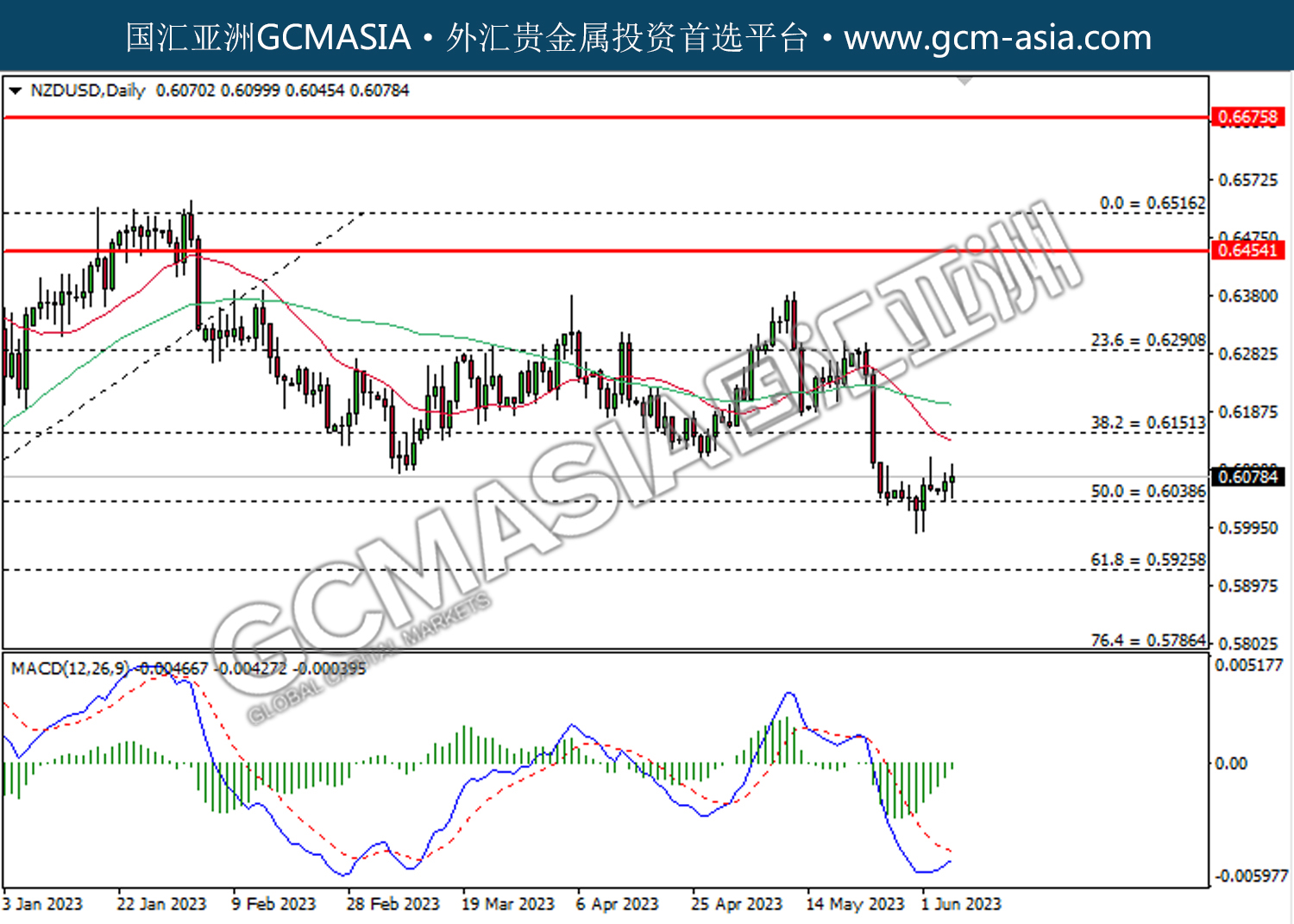

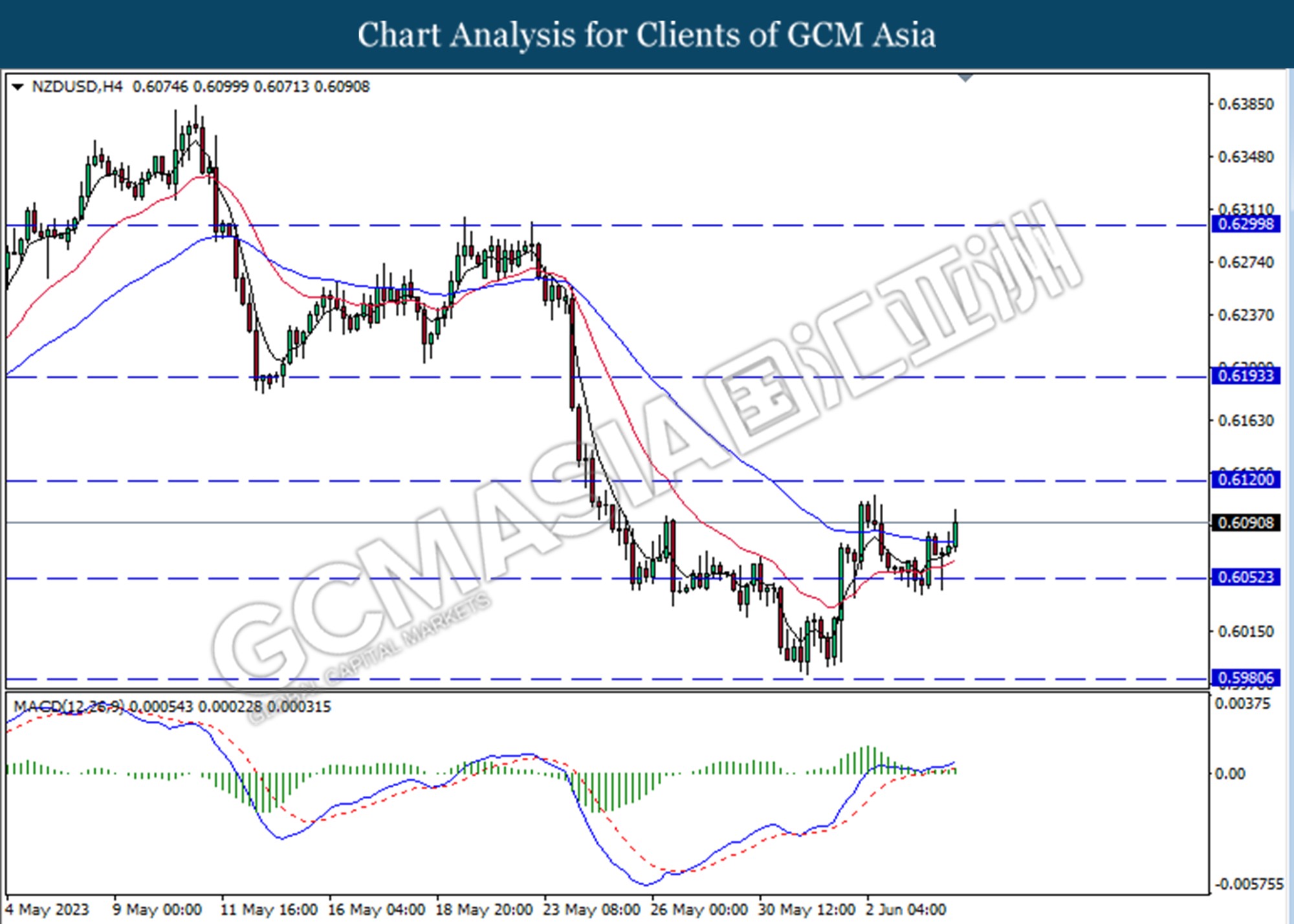

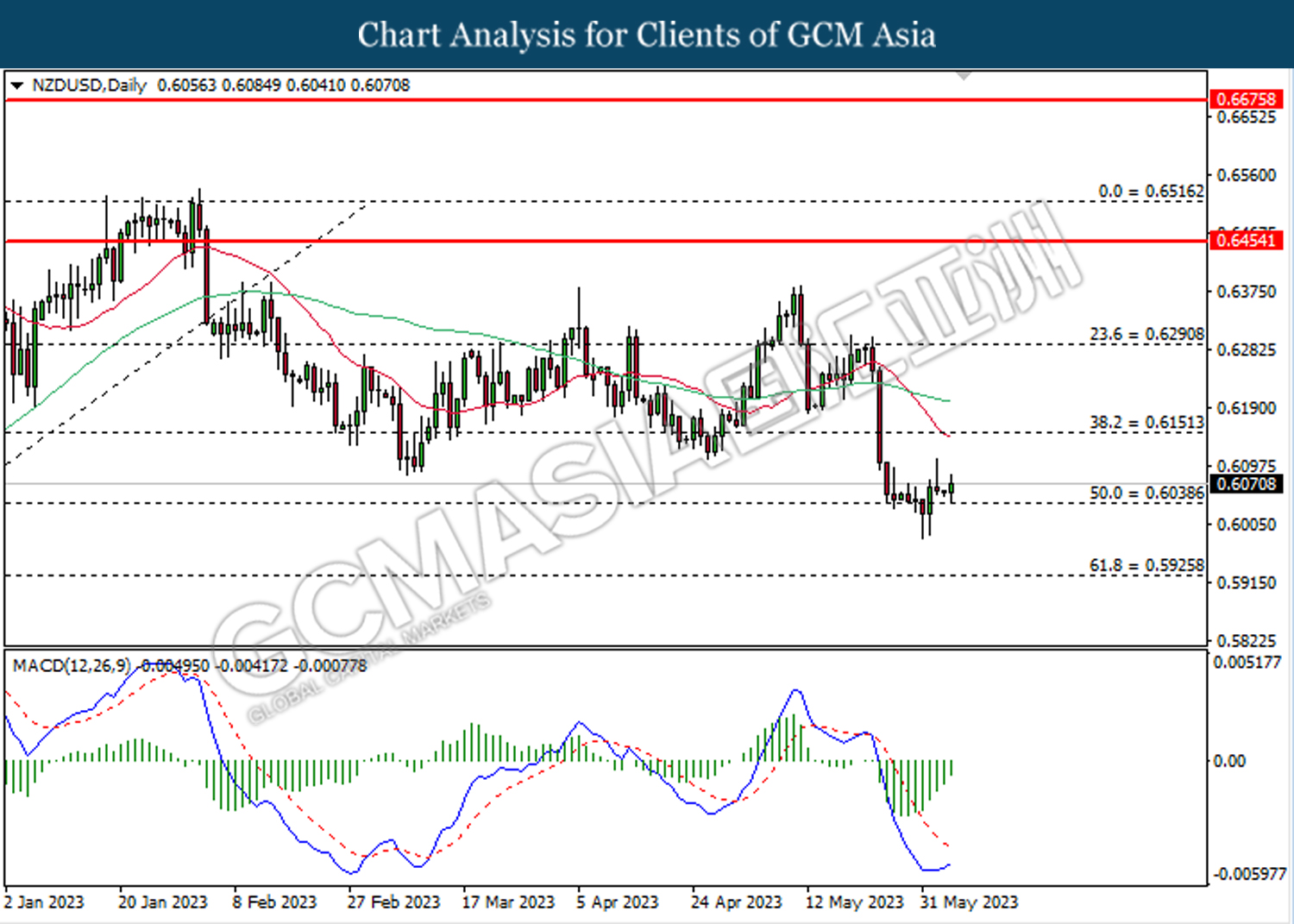

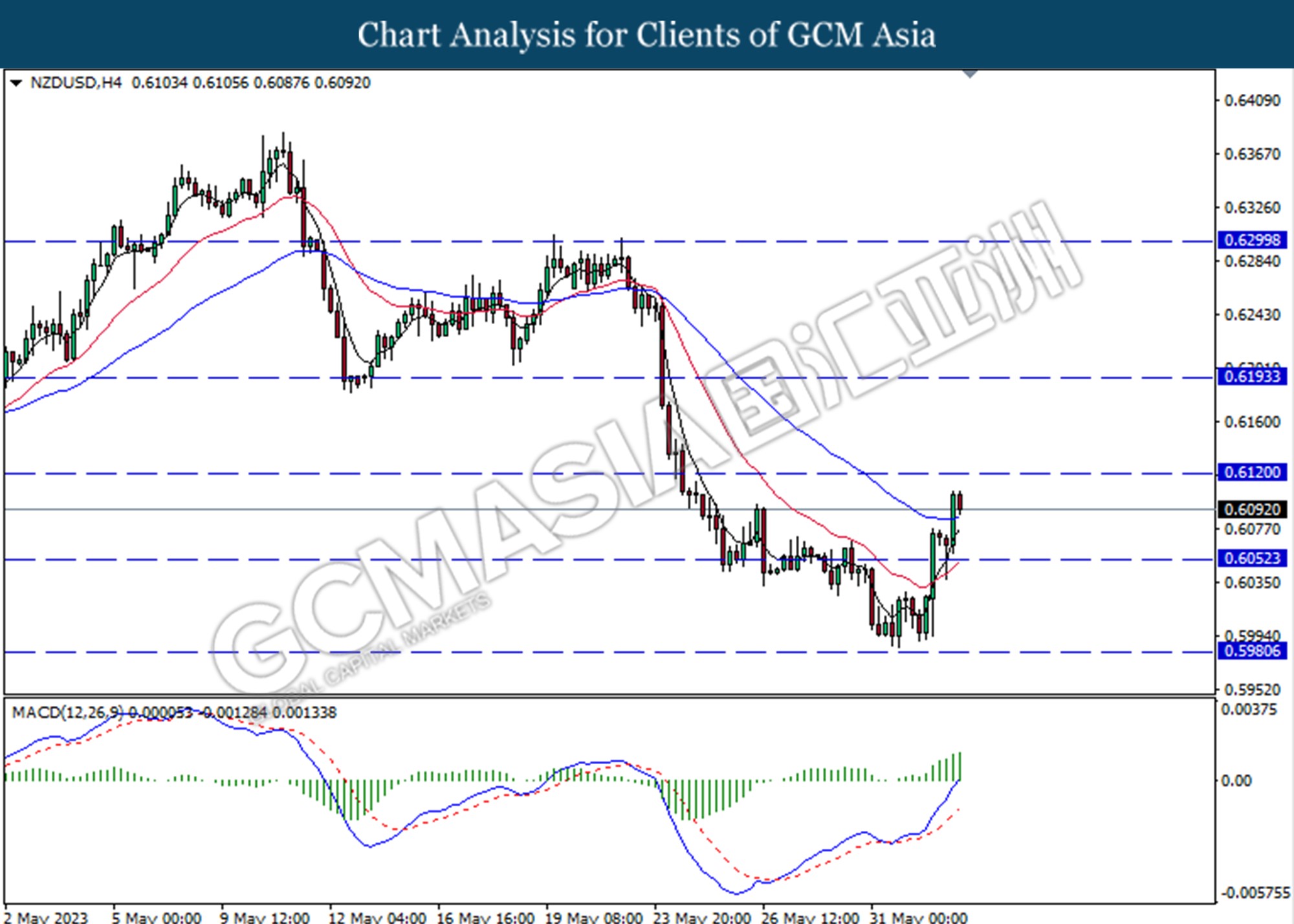

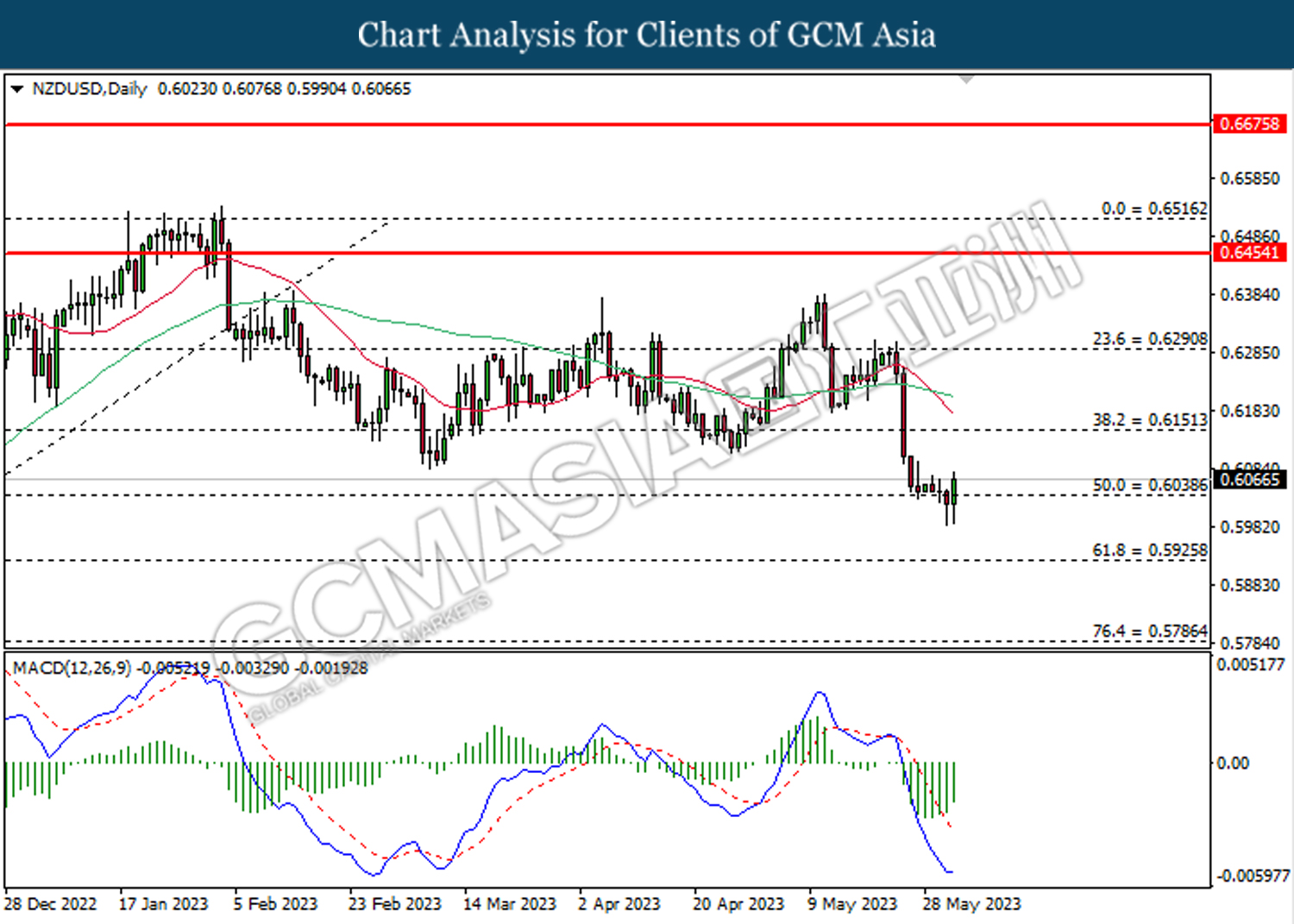

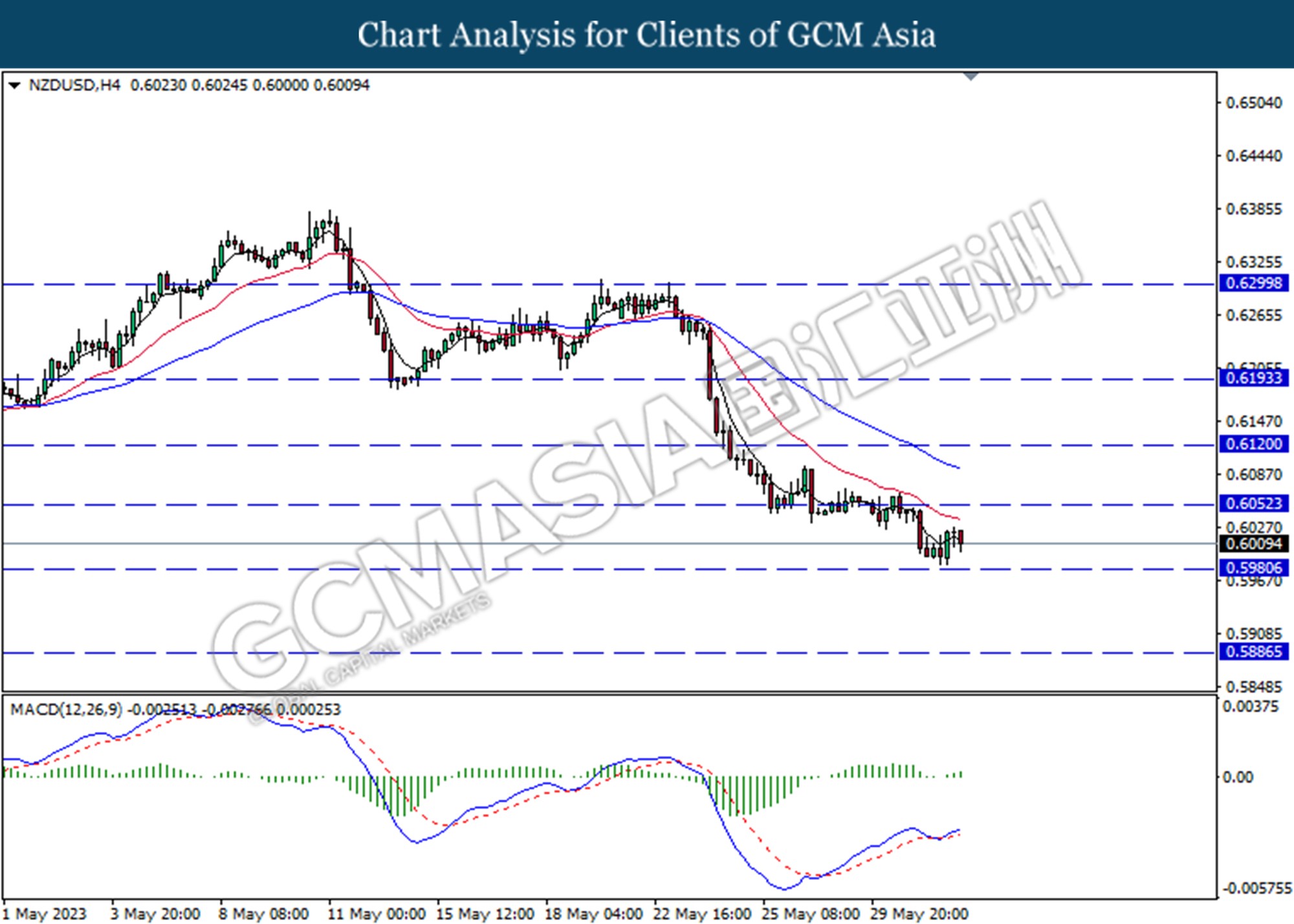

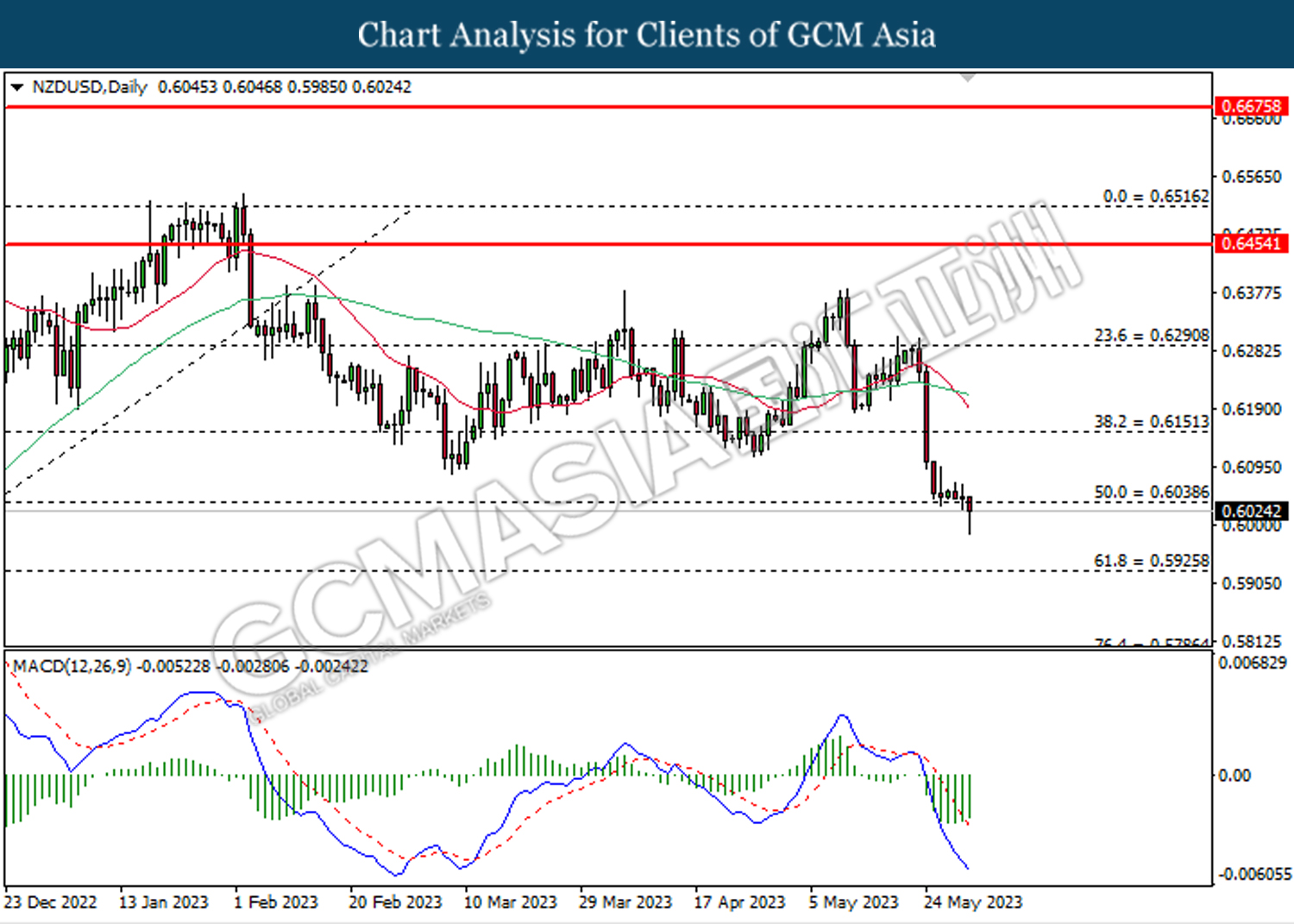

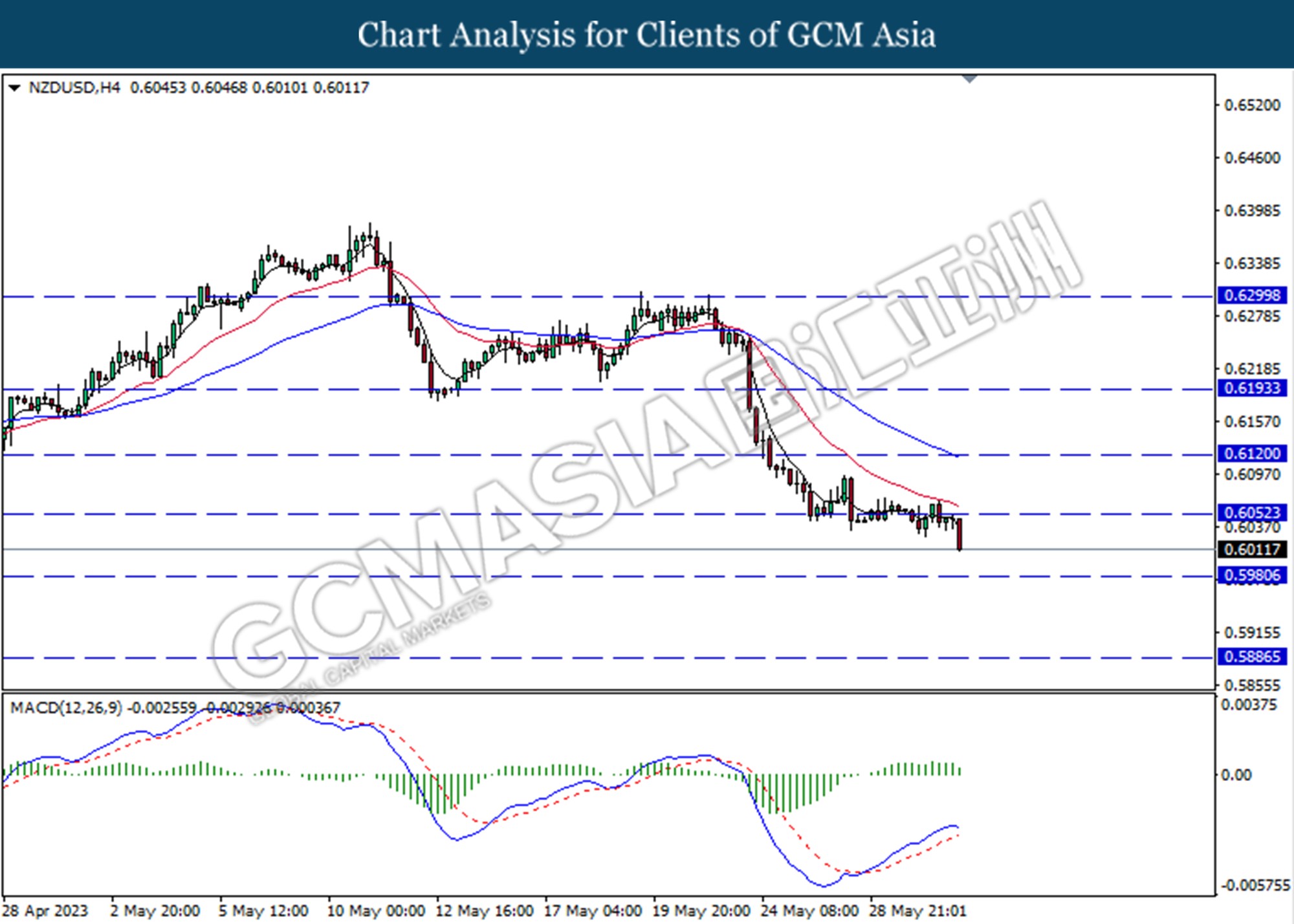

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6040. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

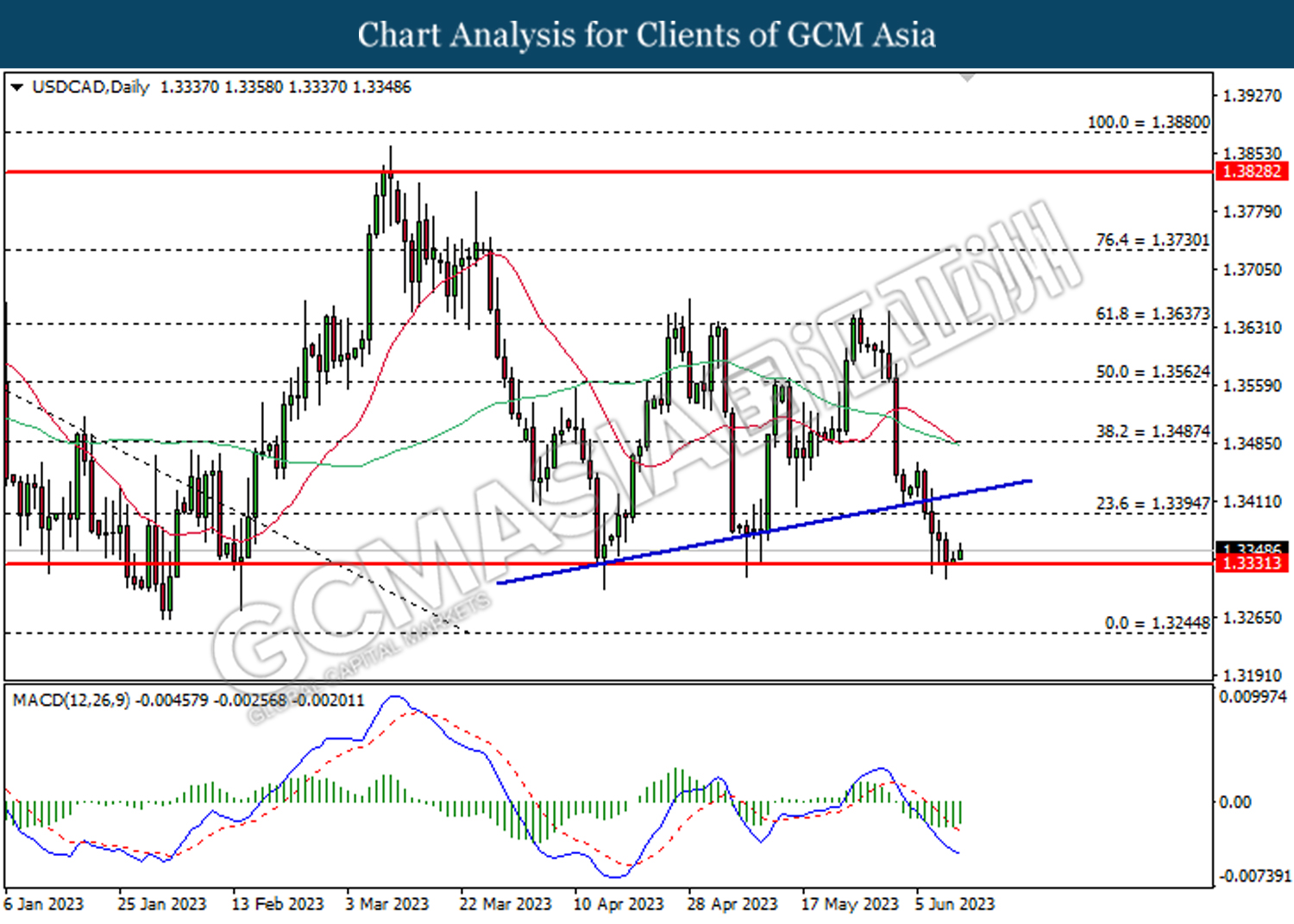

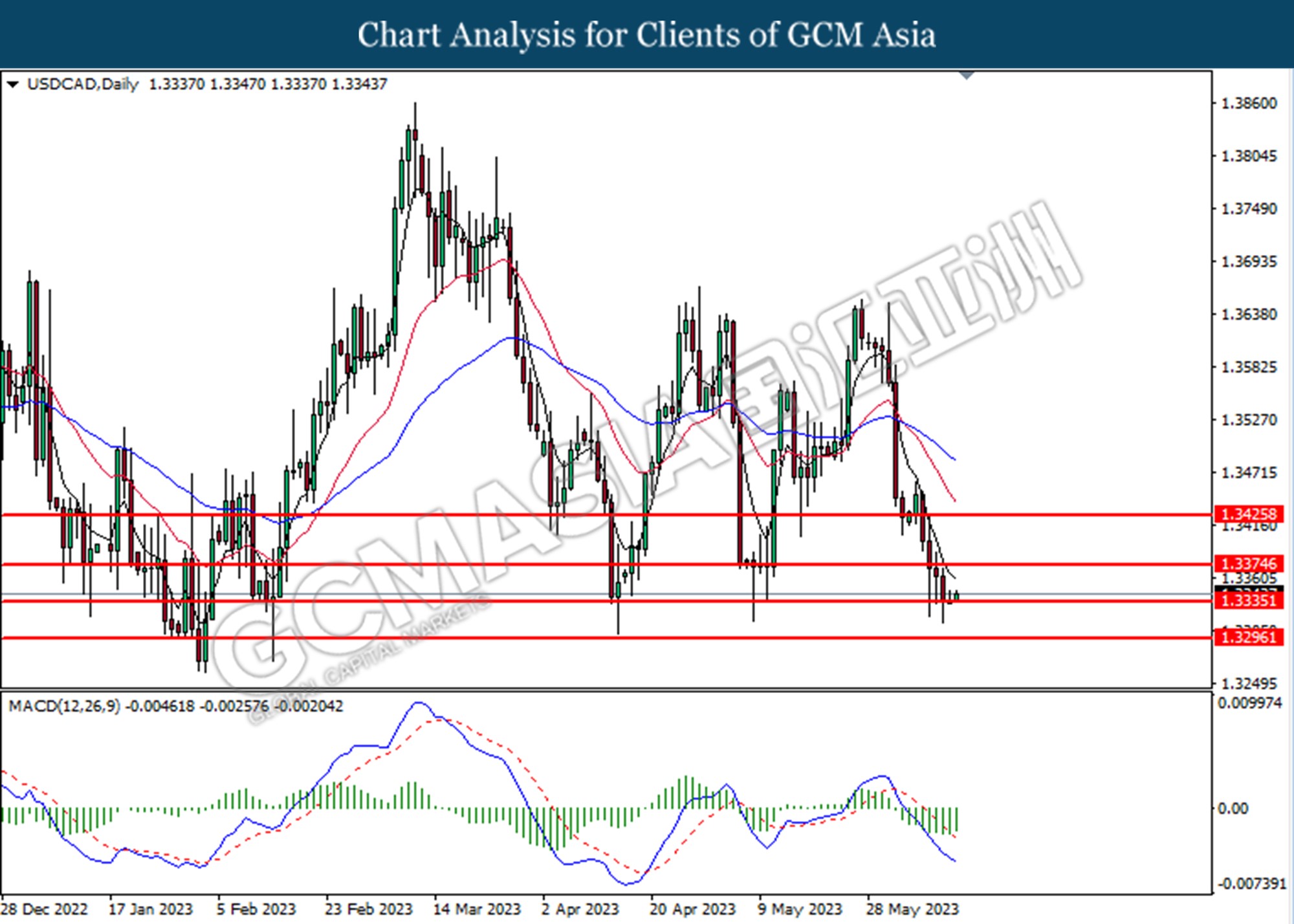

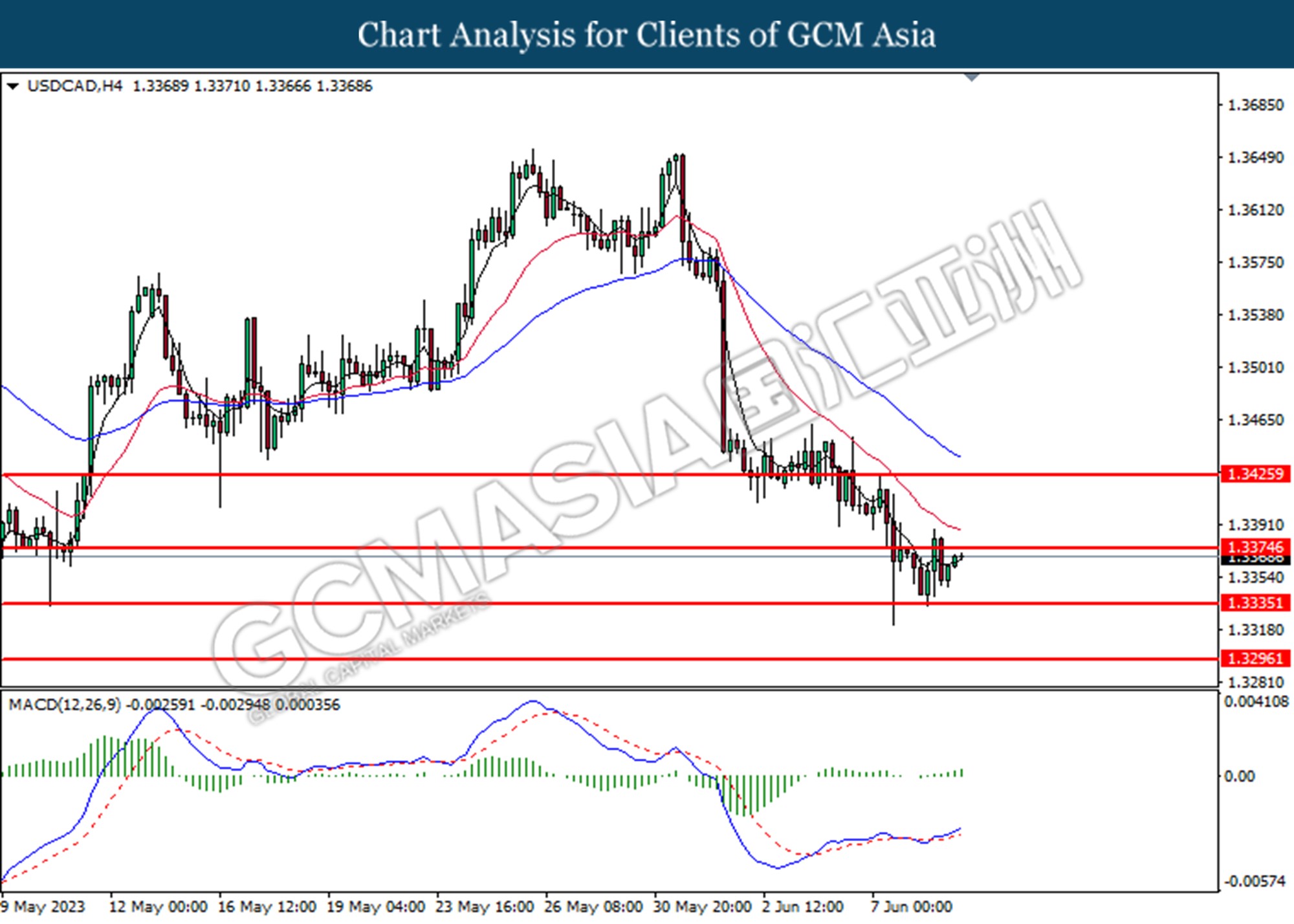

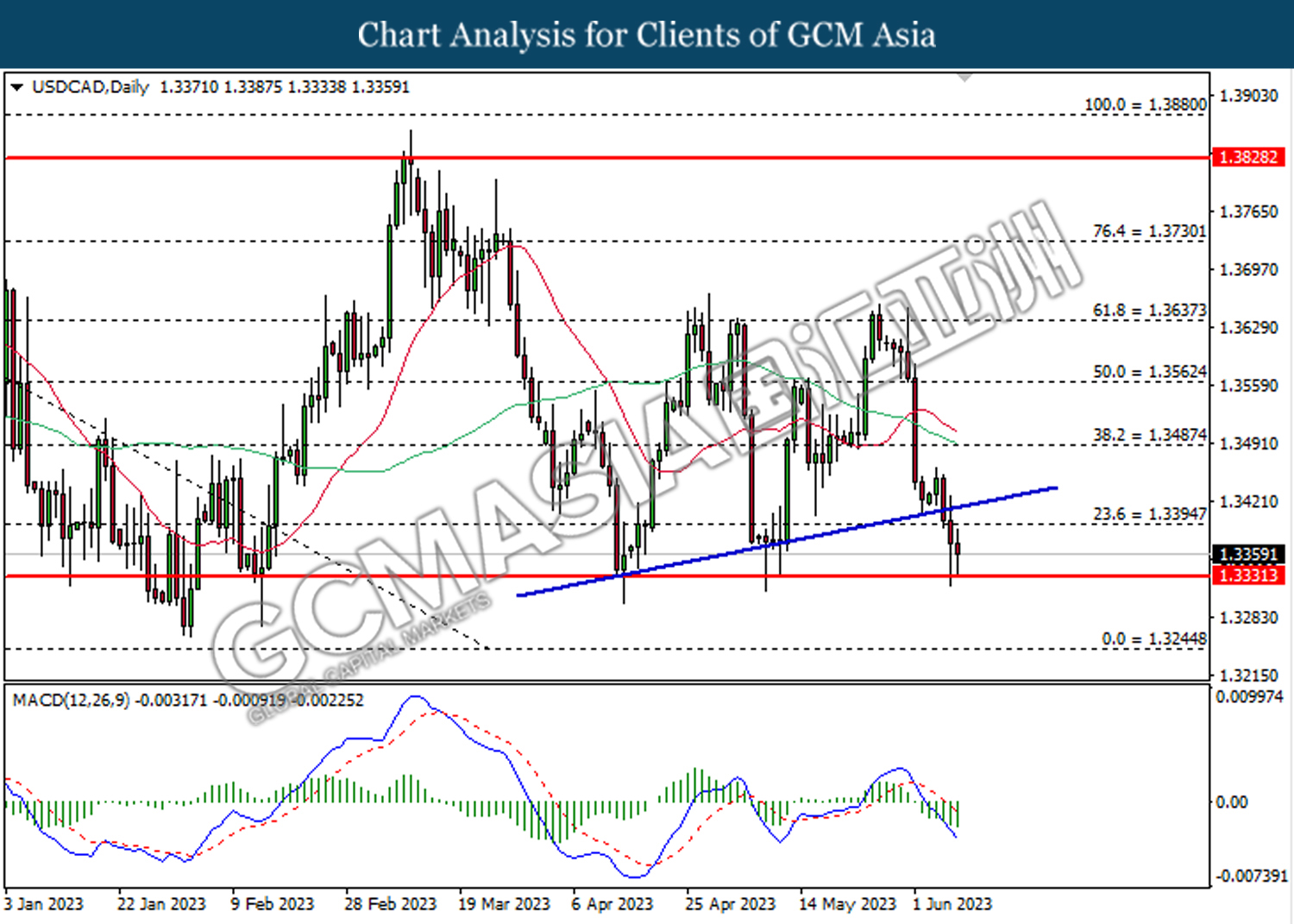

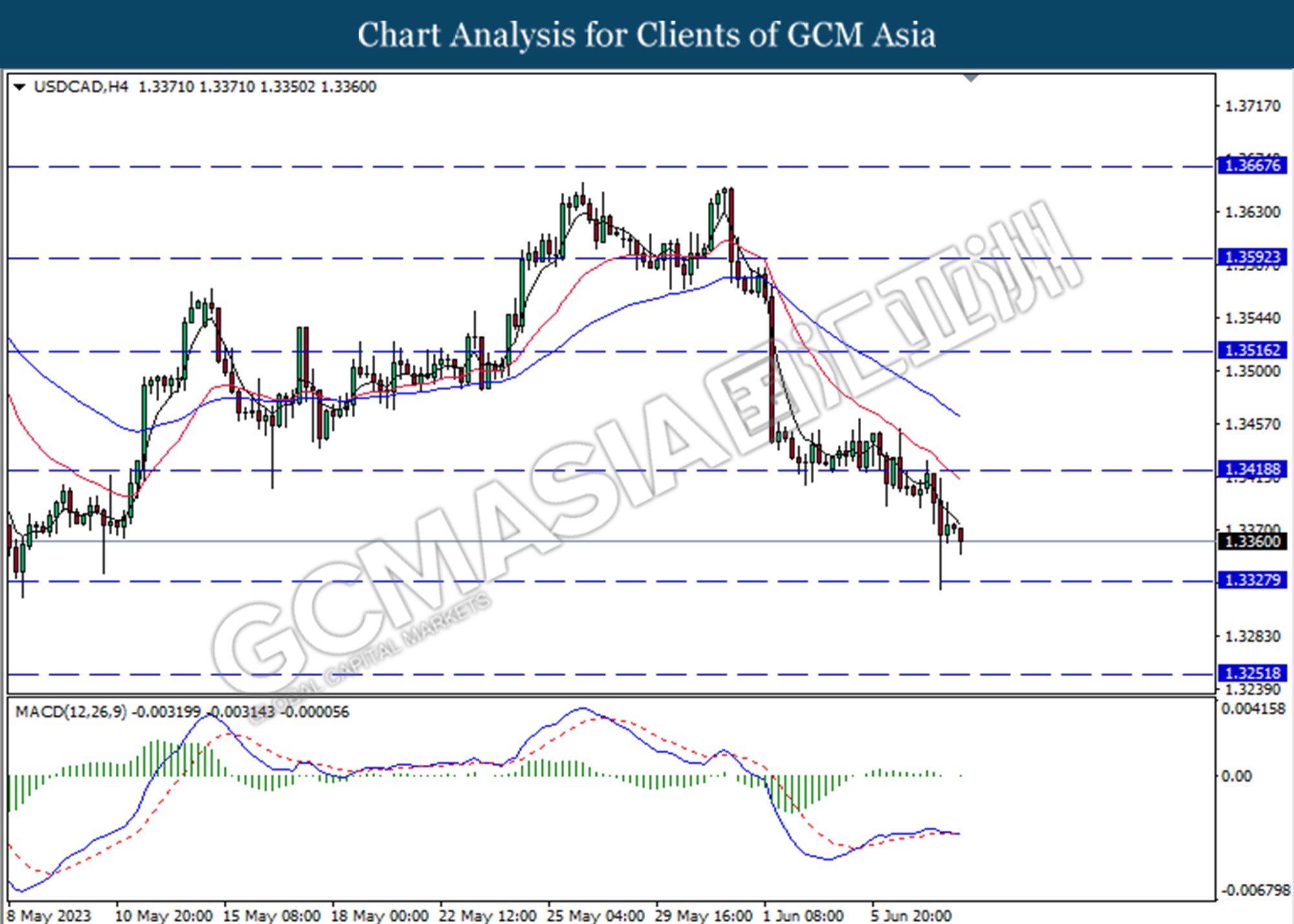

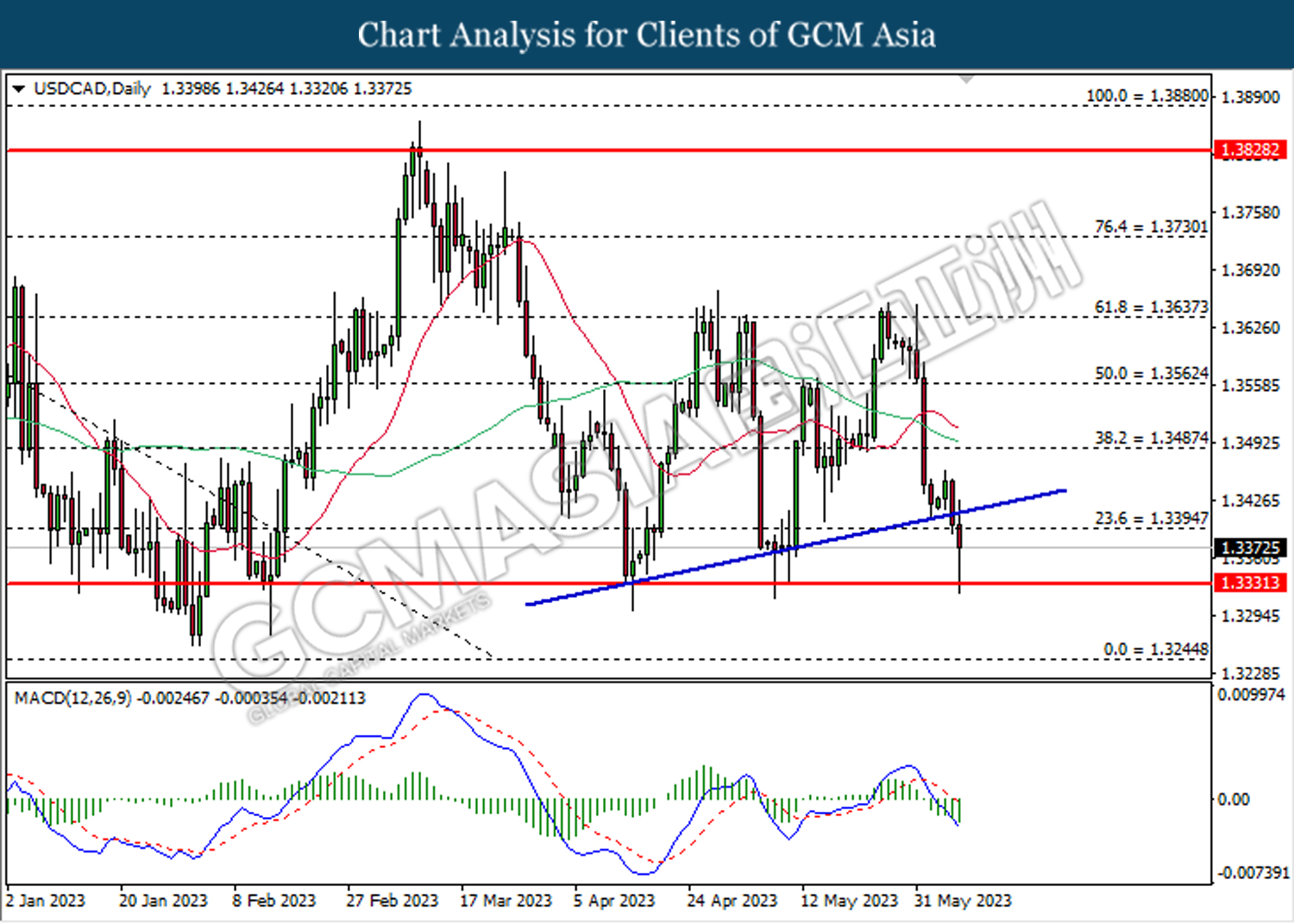

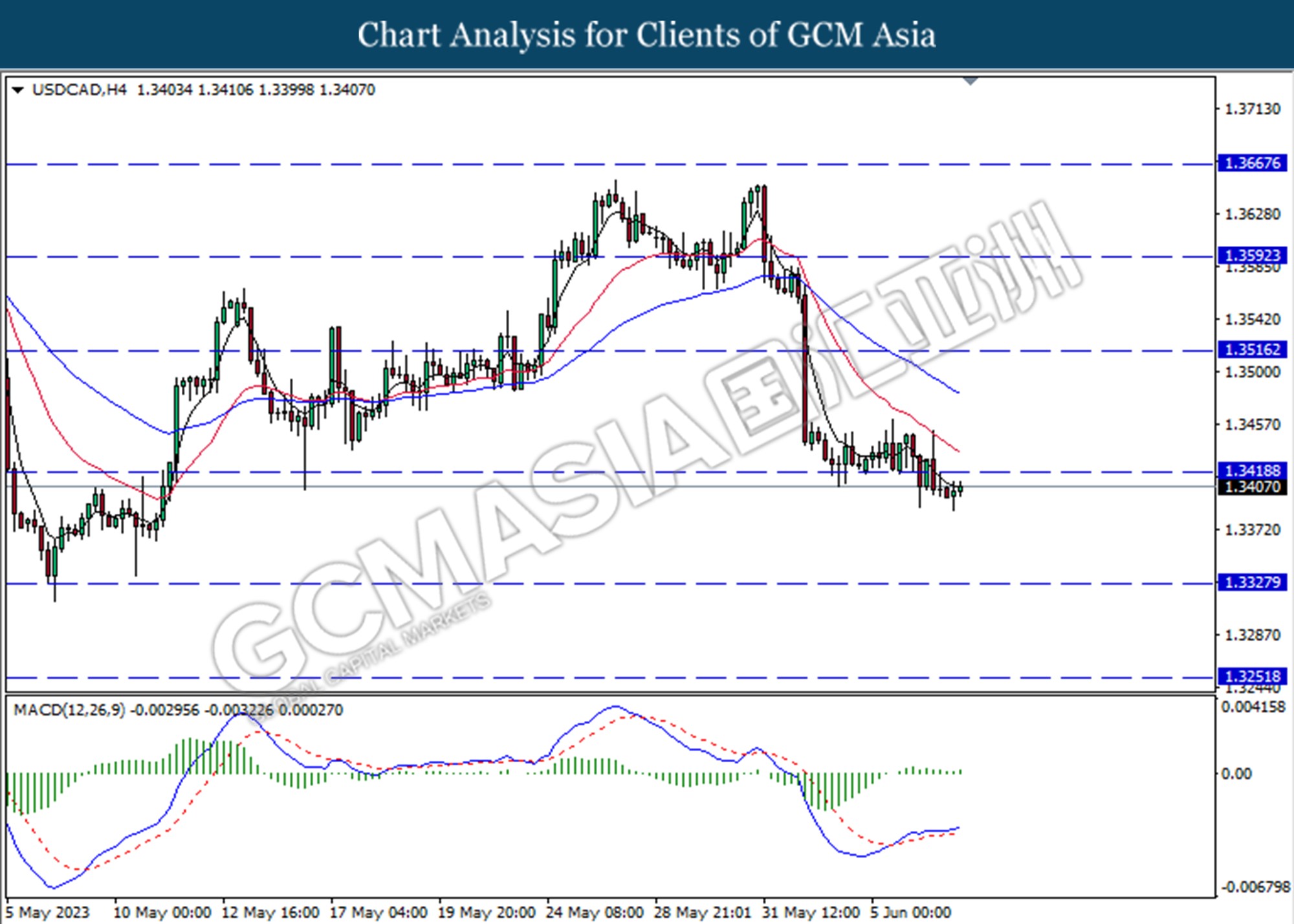

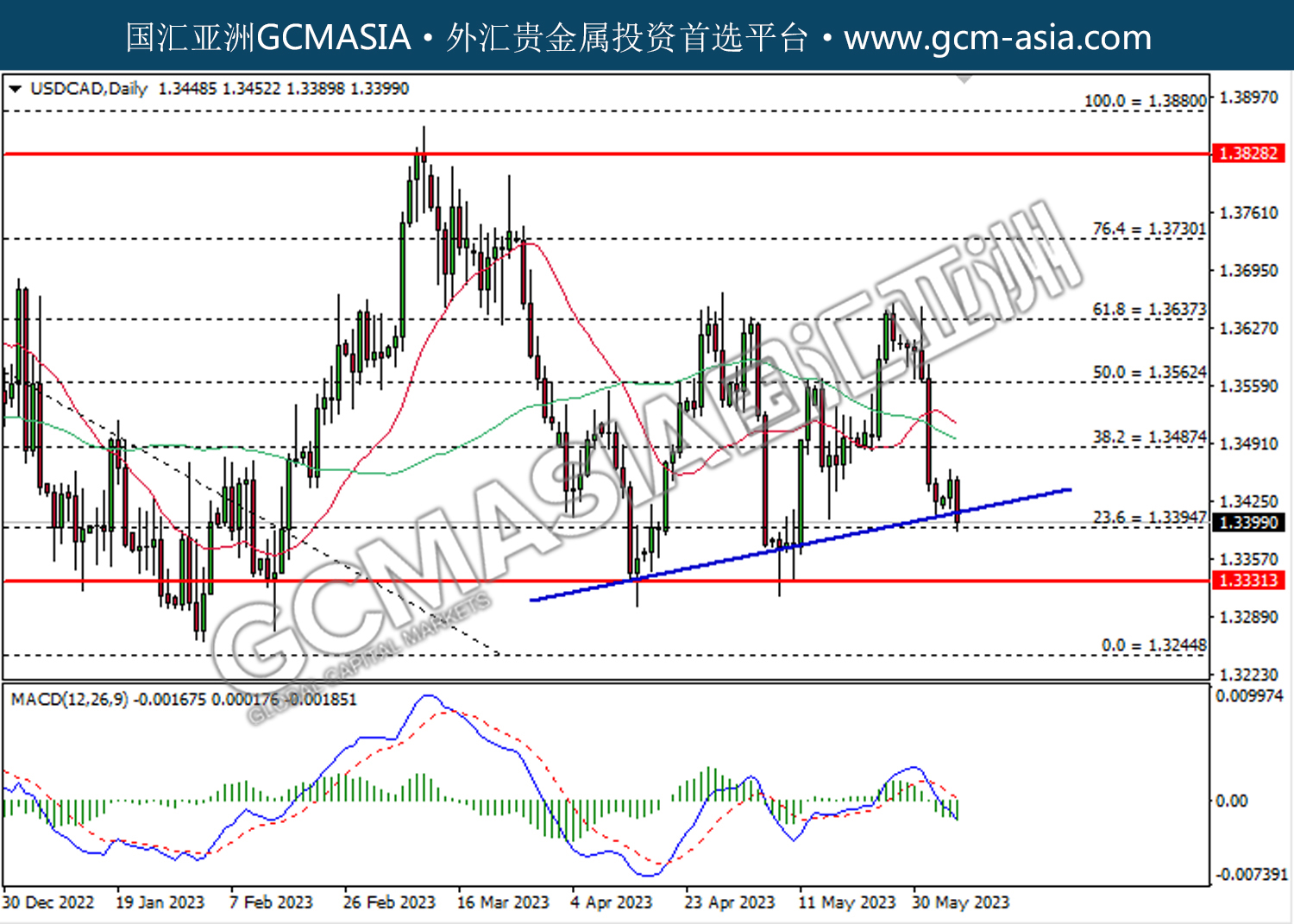

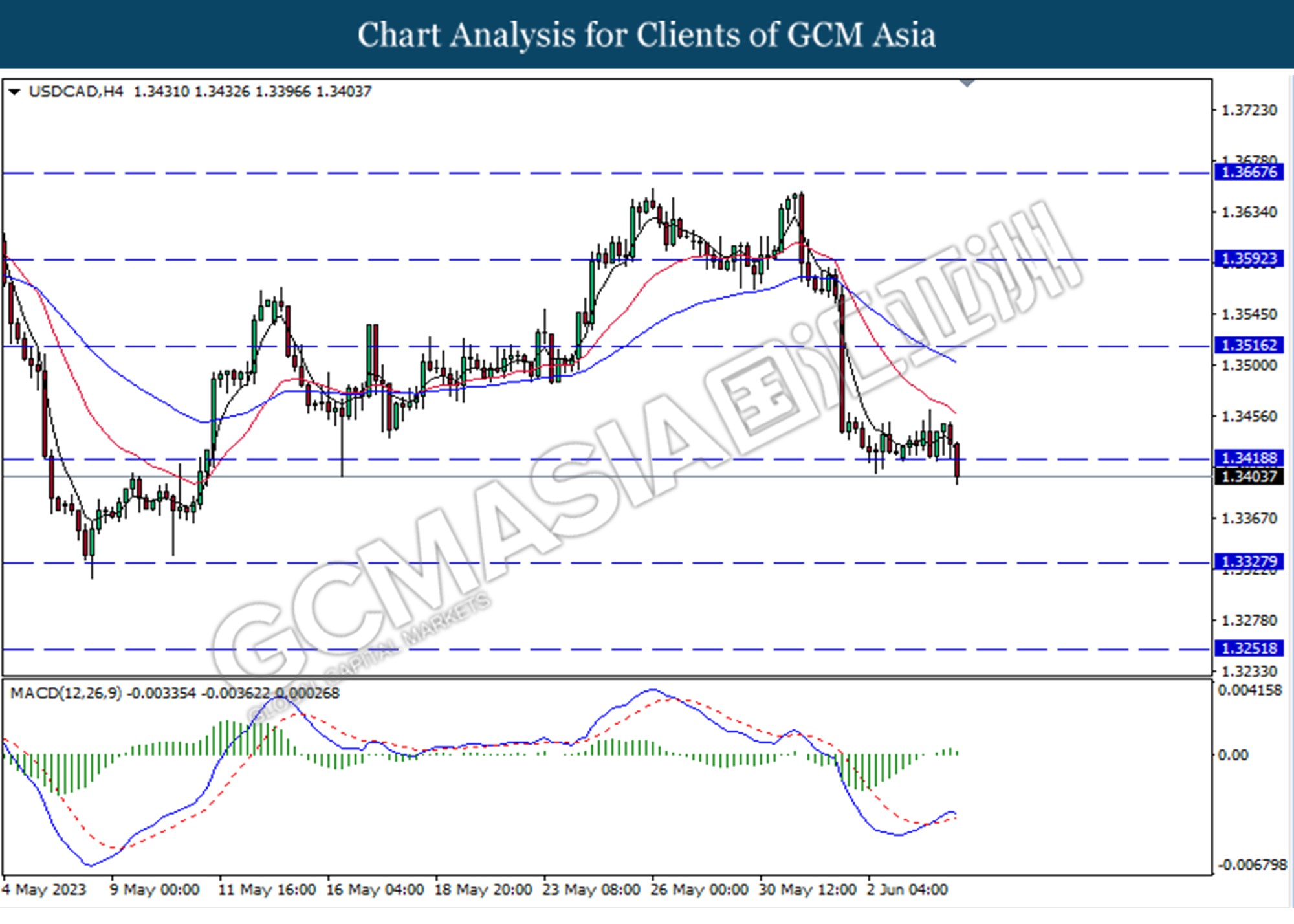

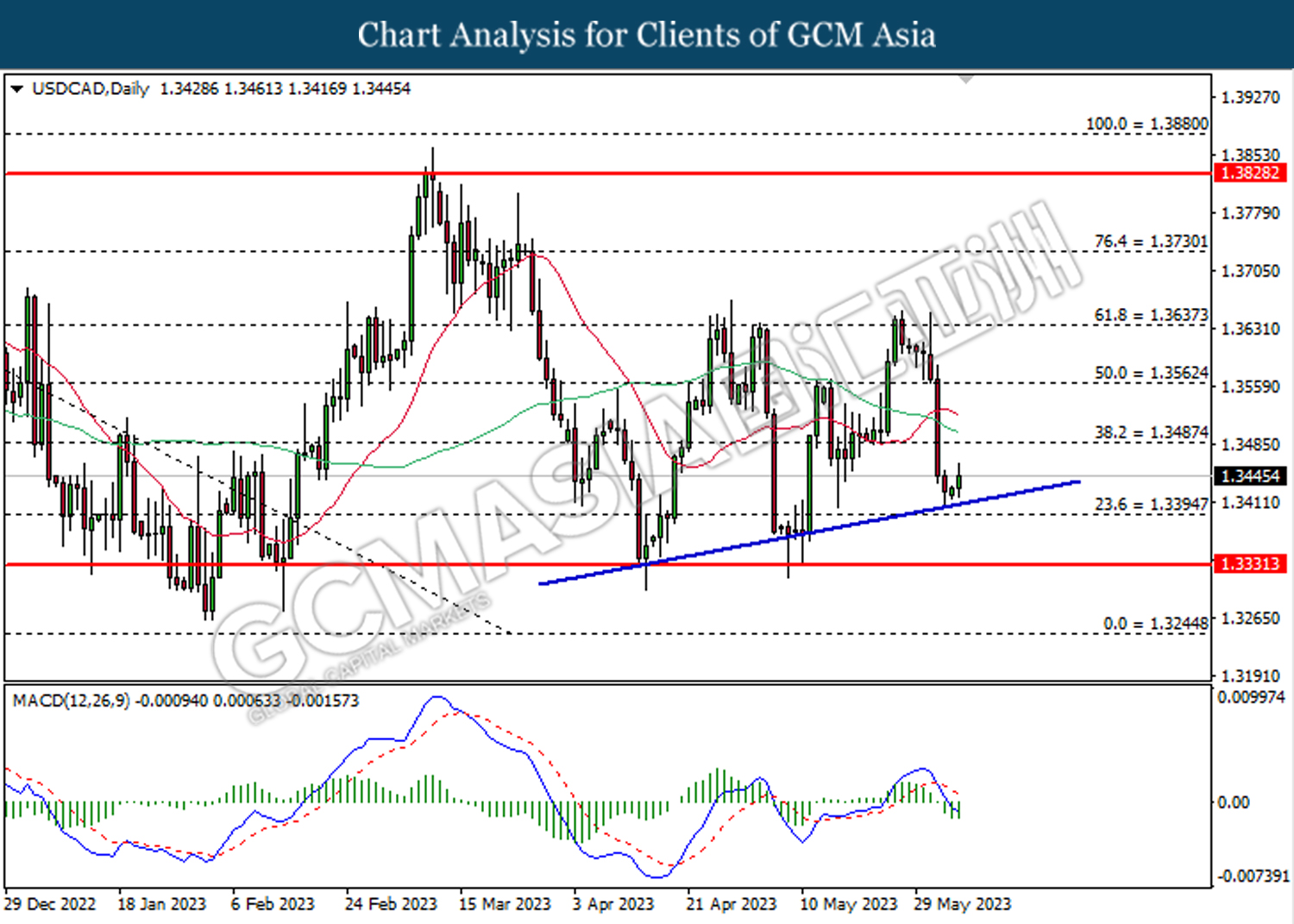

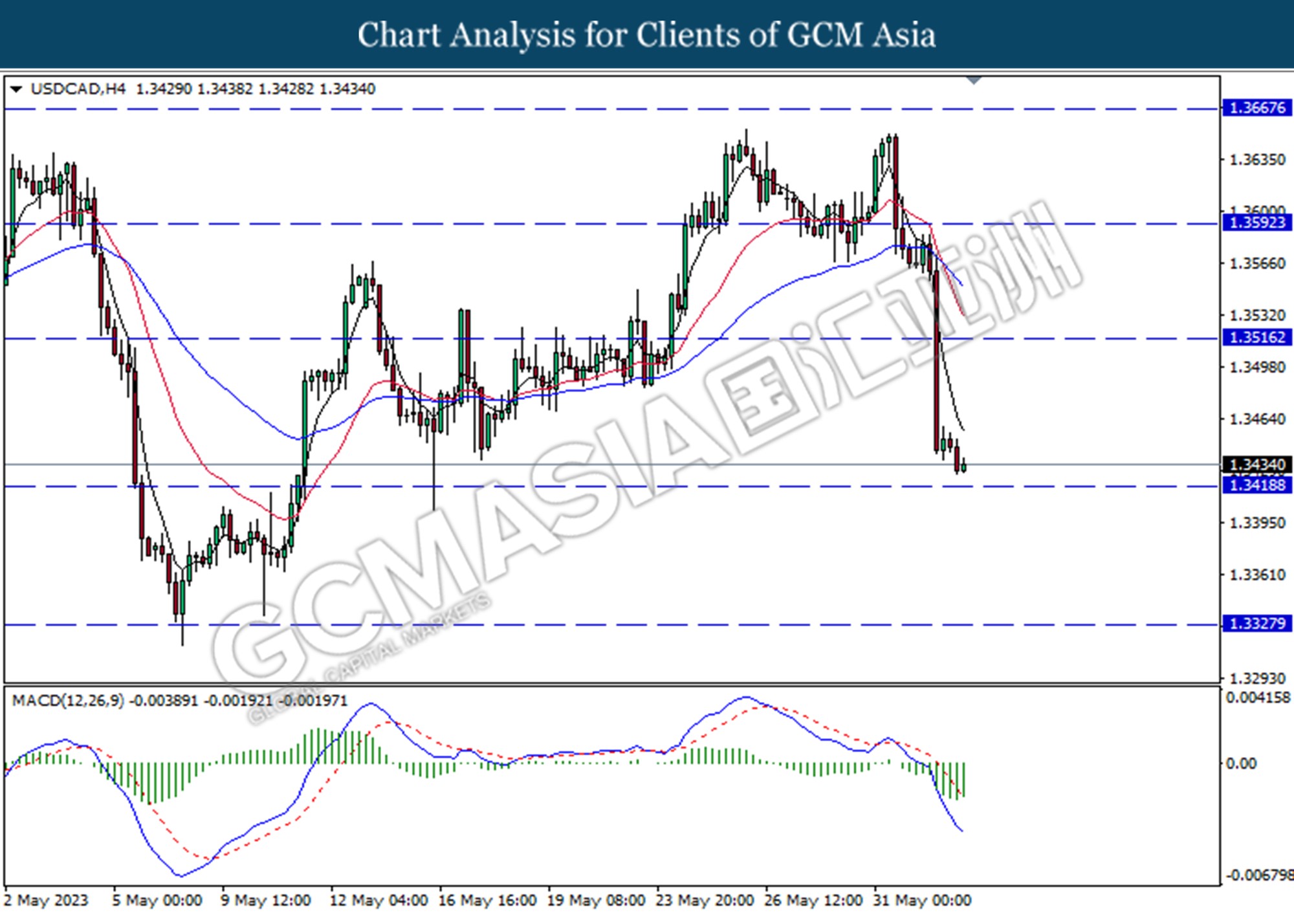

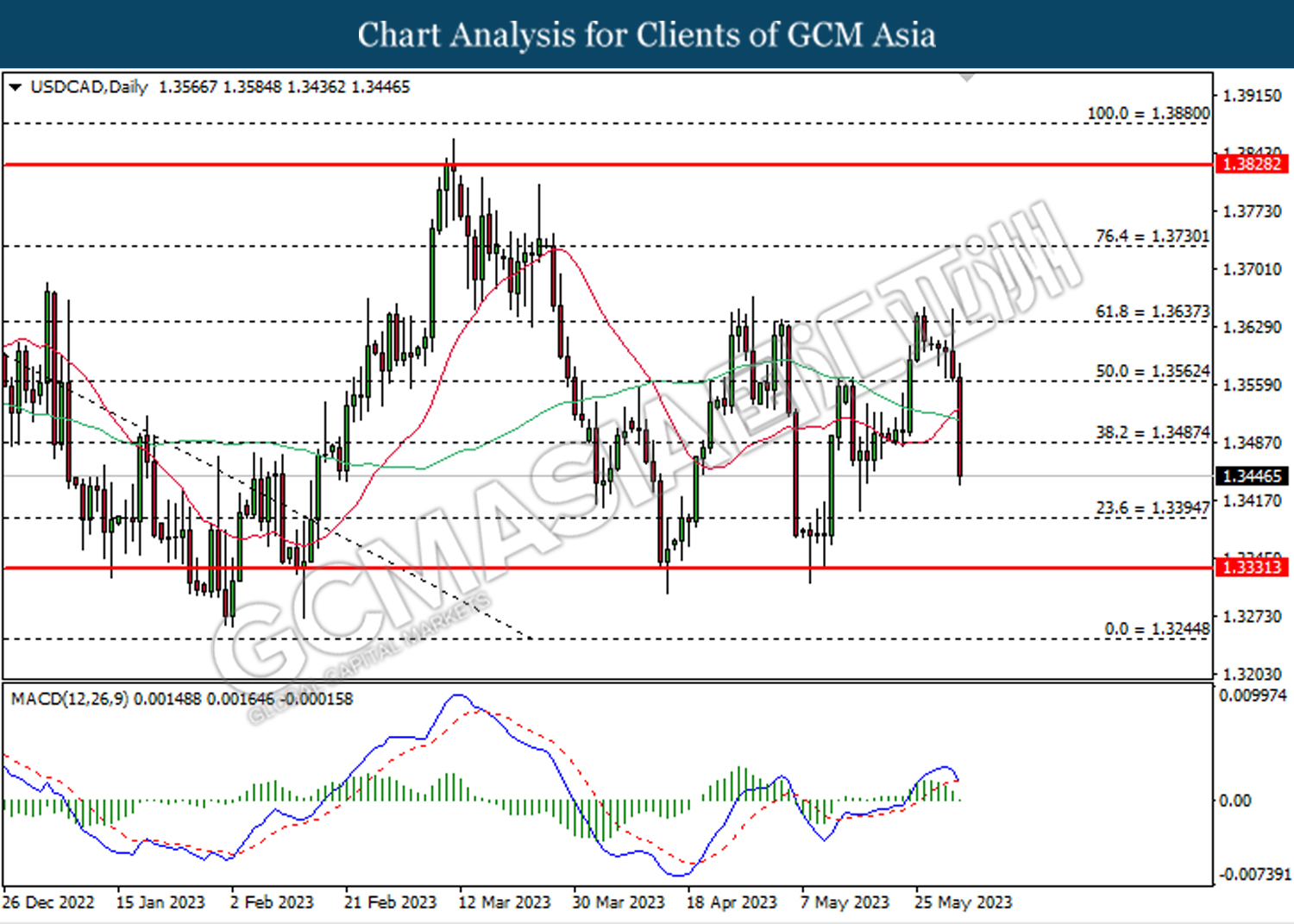

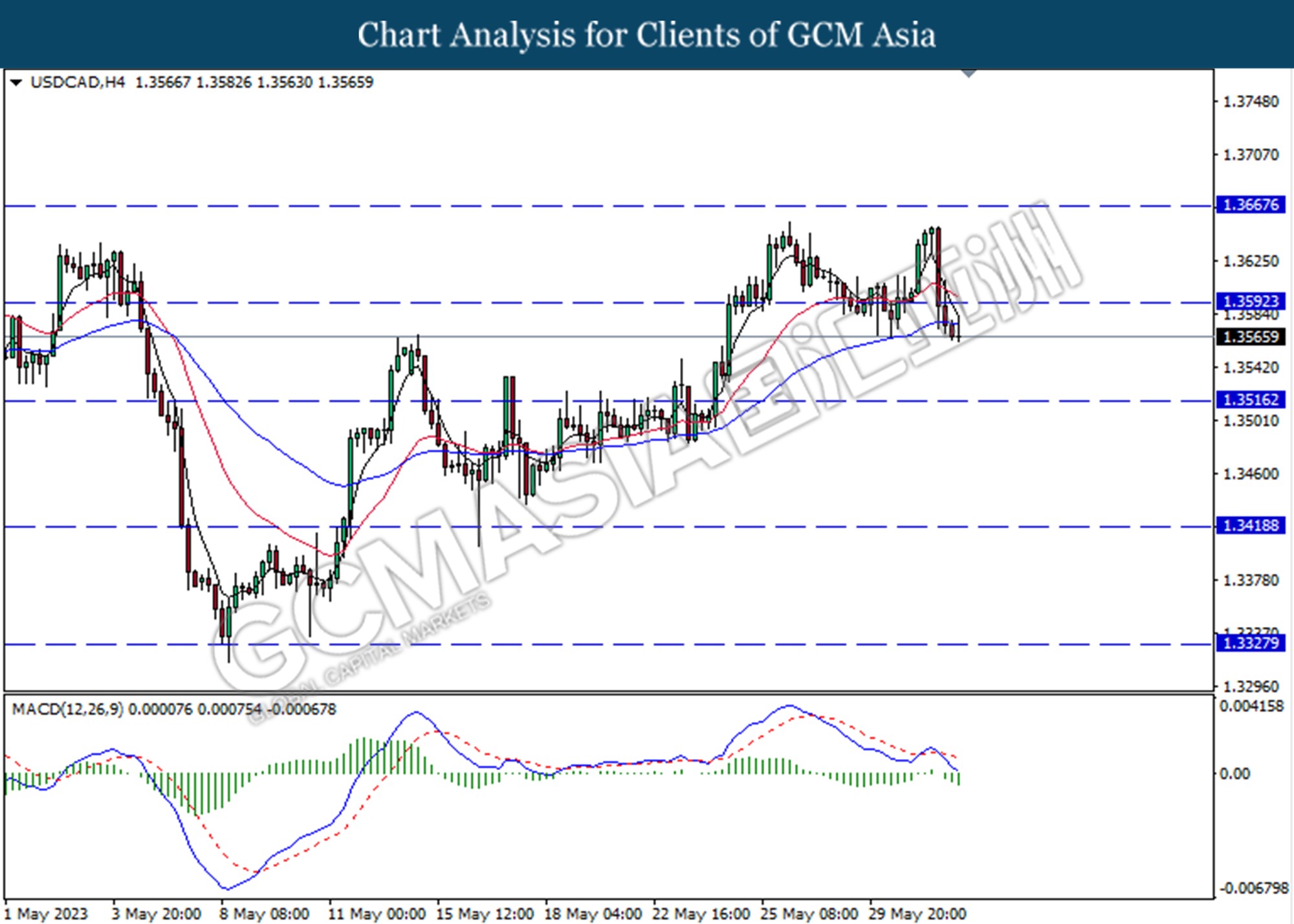

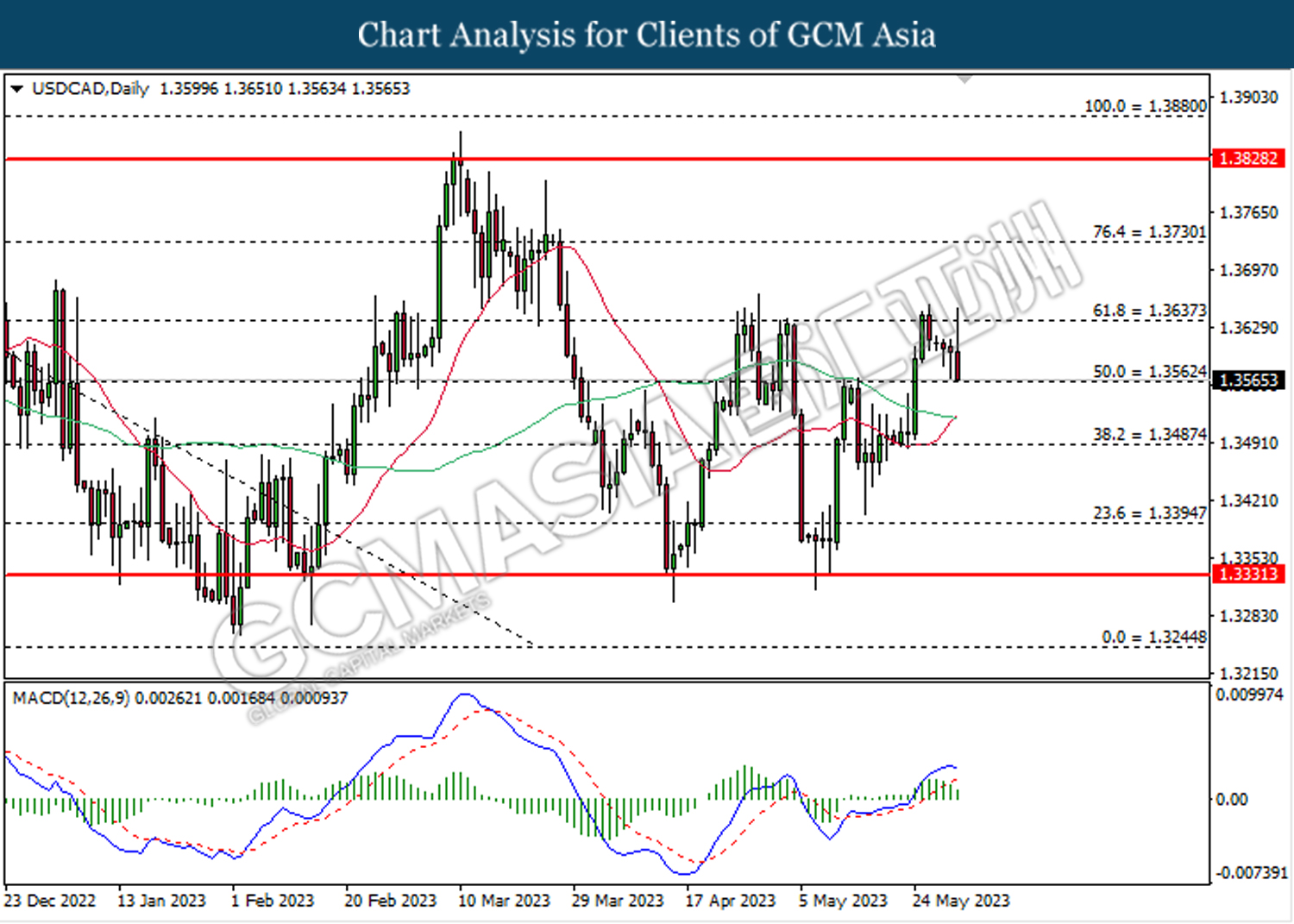

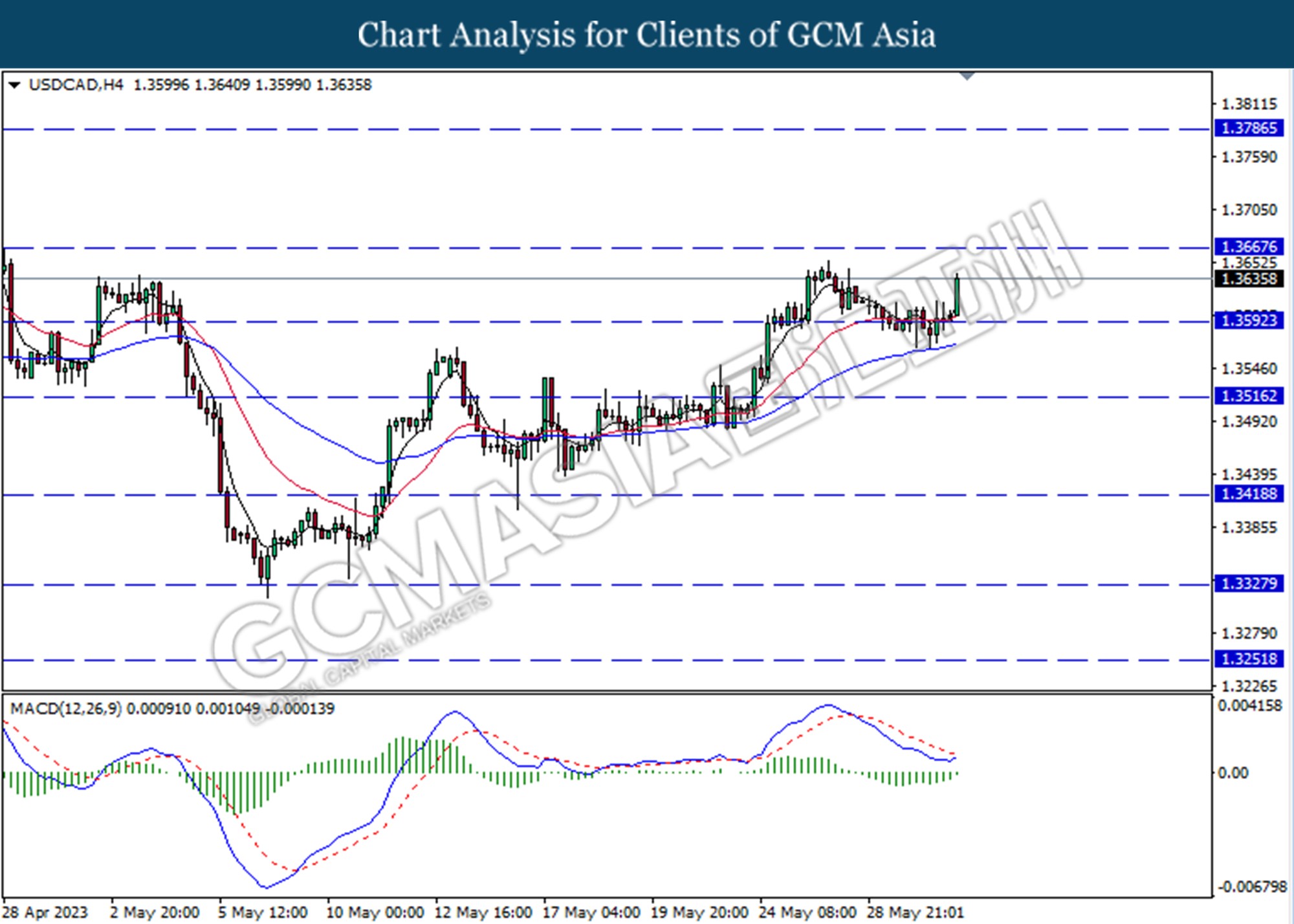

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3330. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

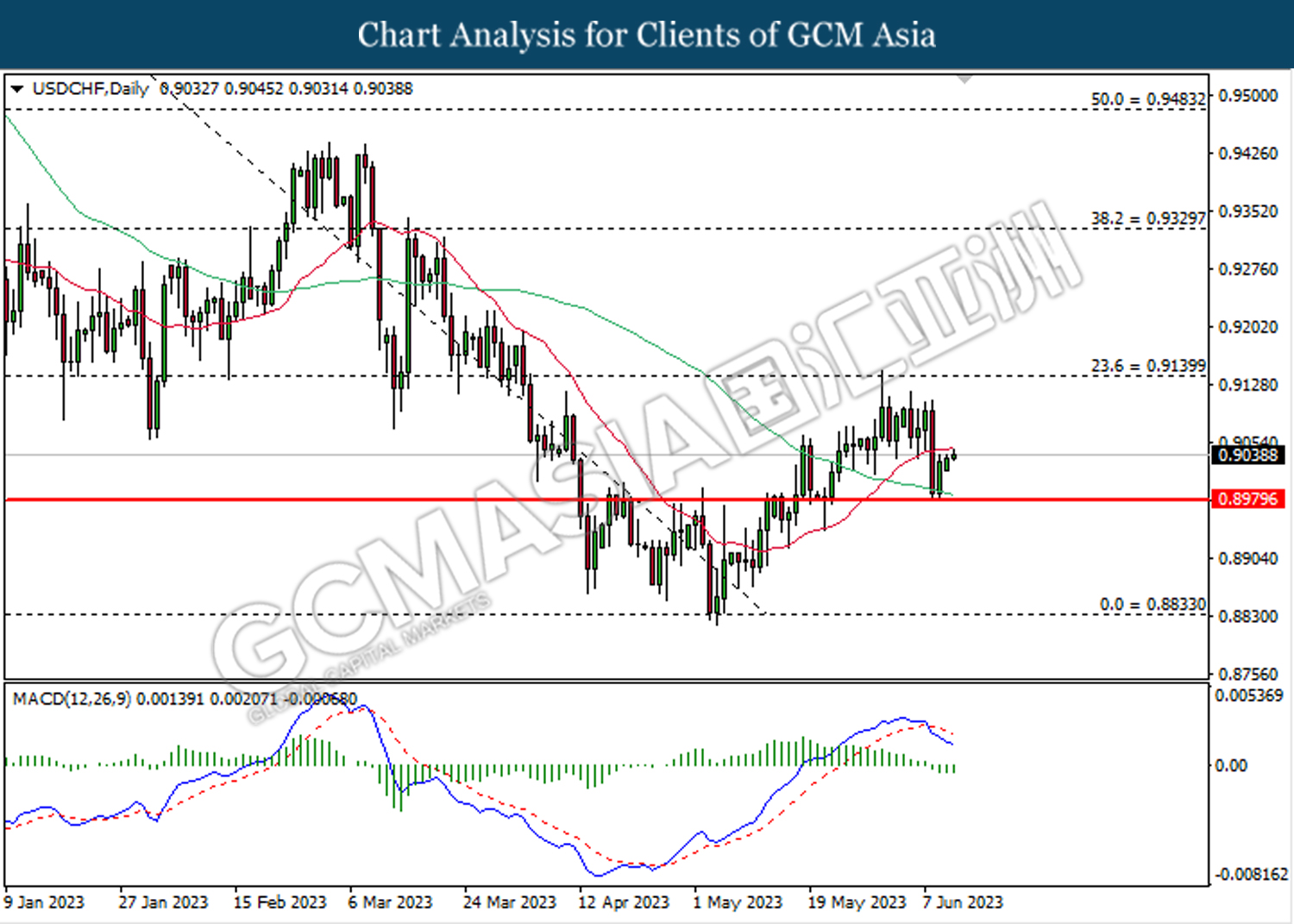

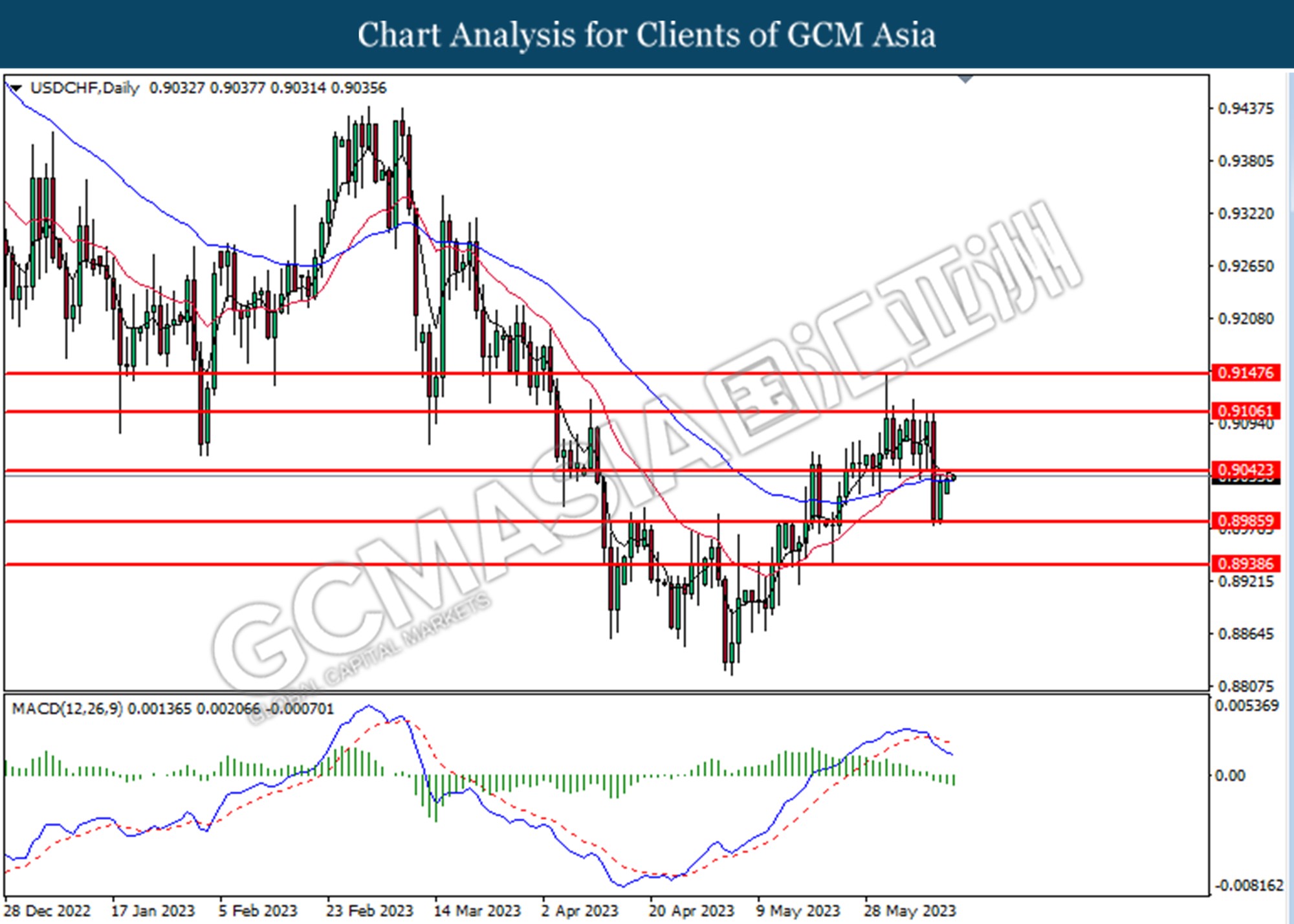

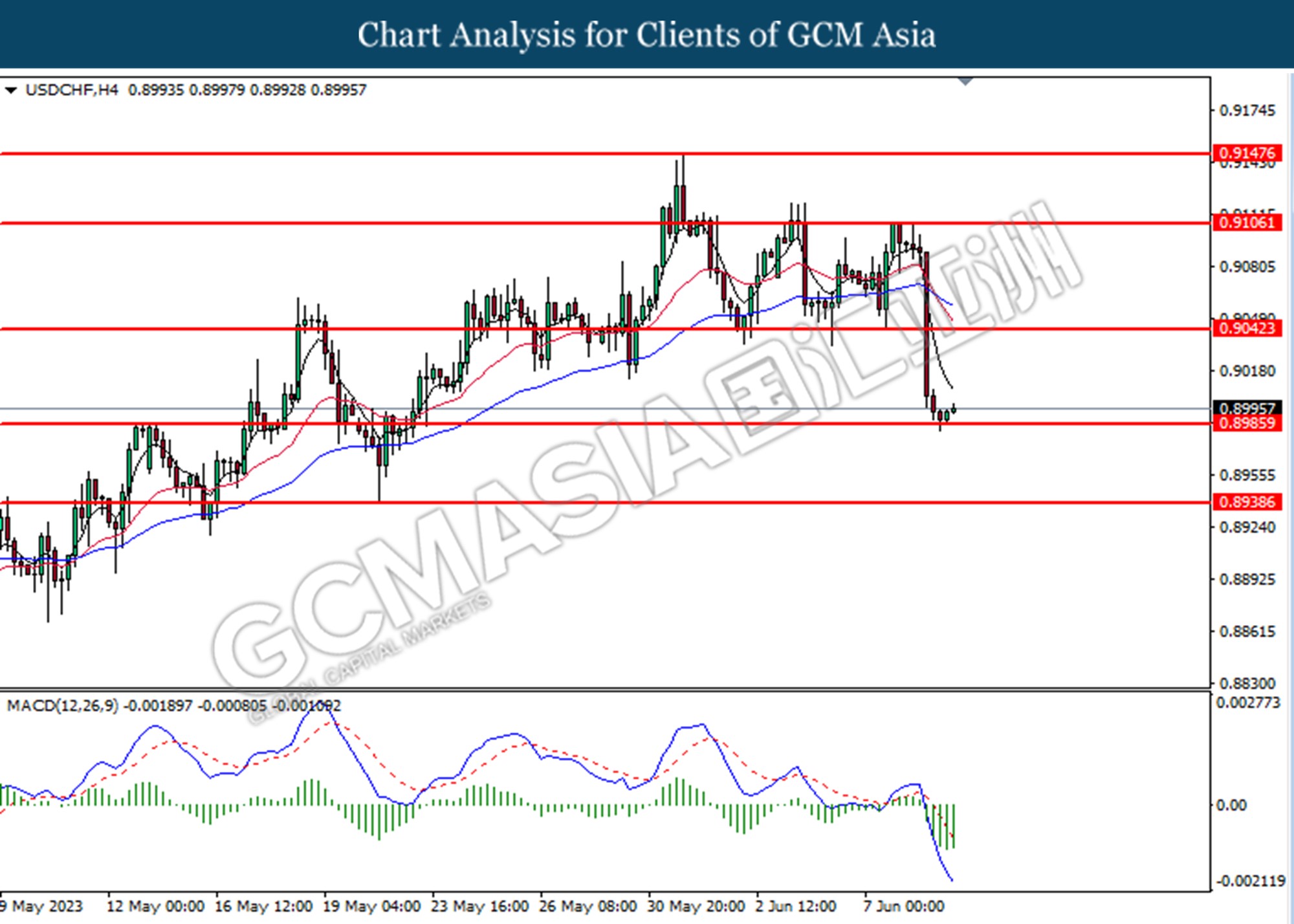

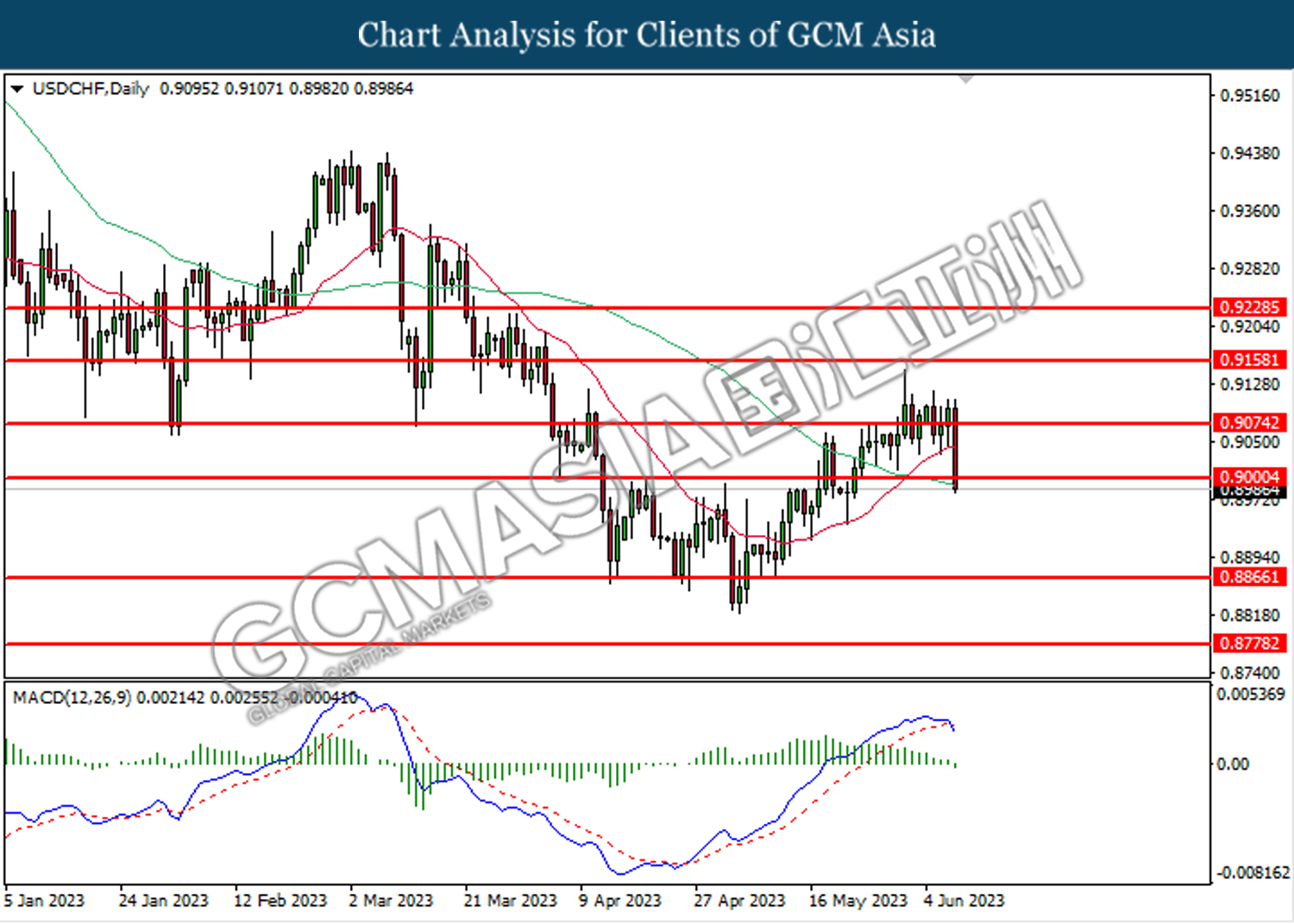

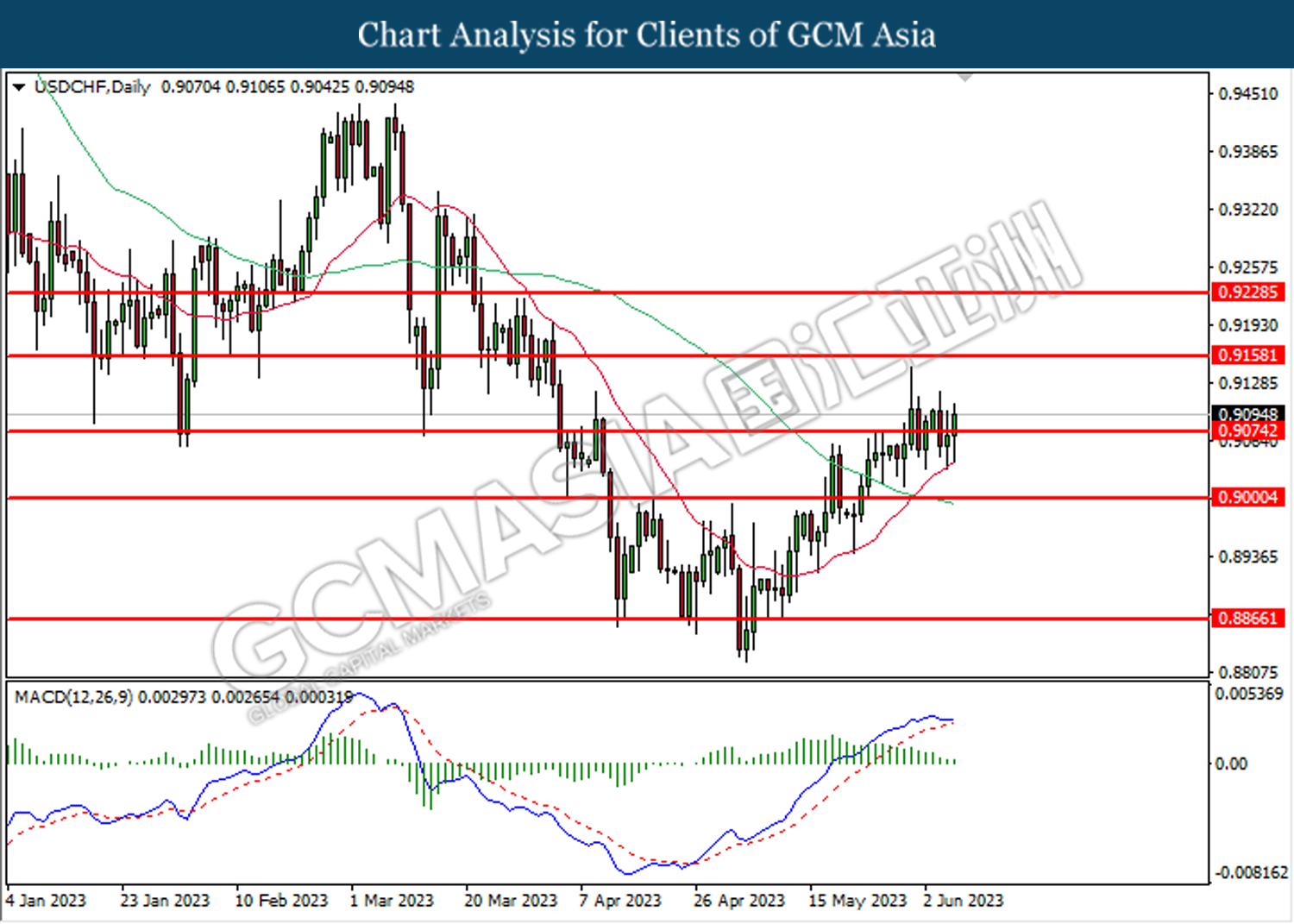

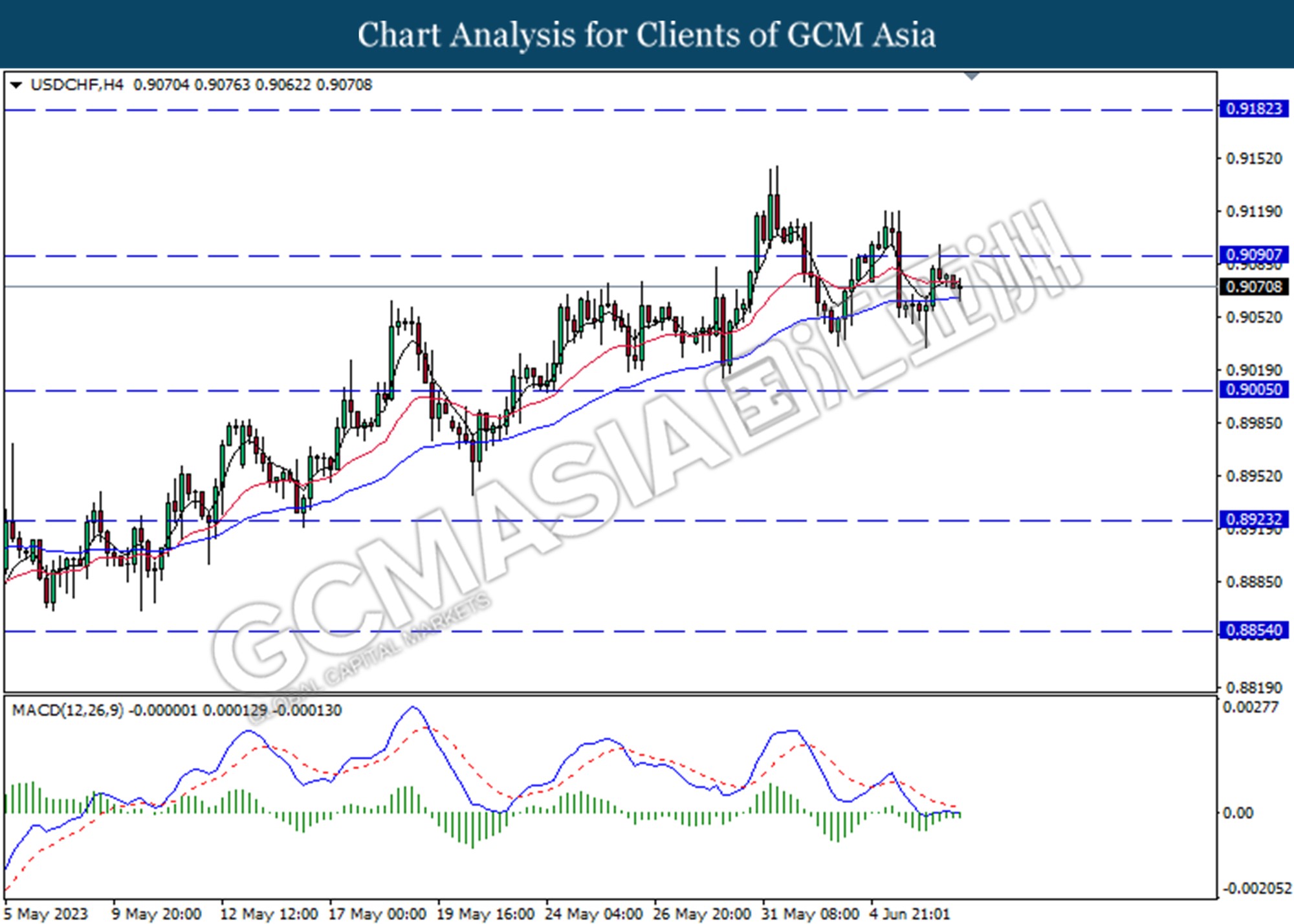

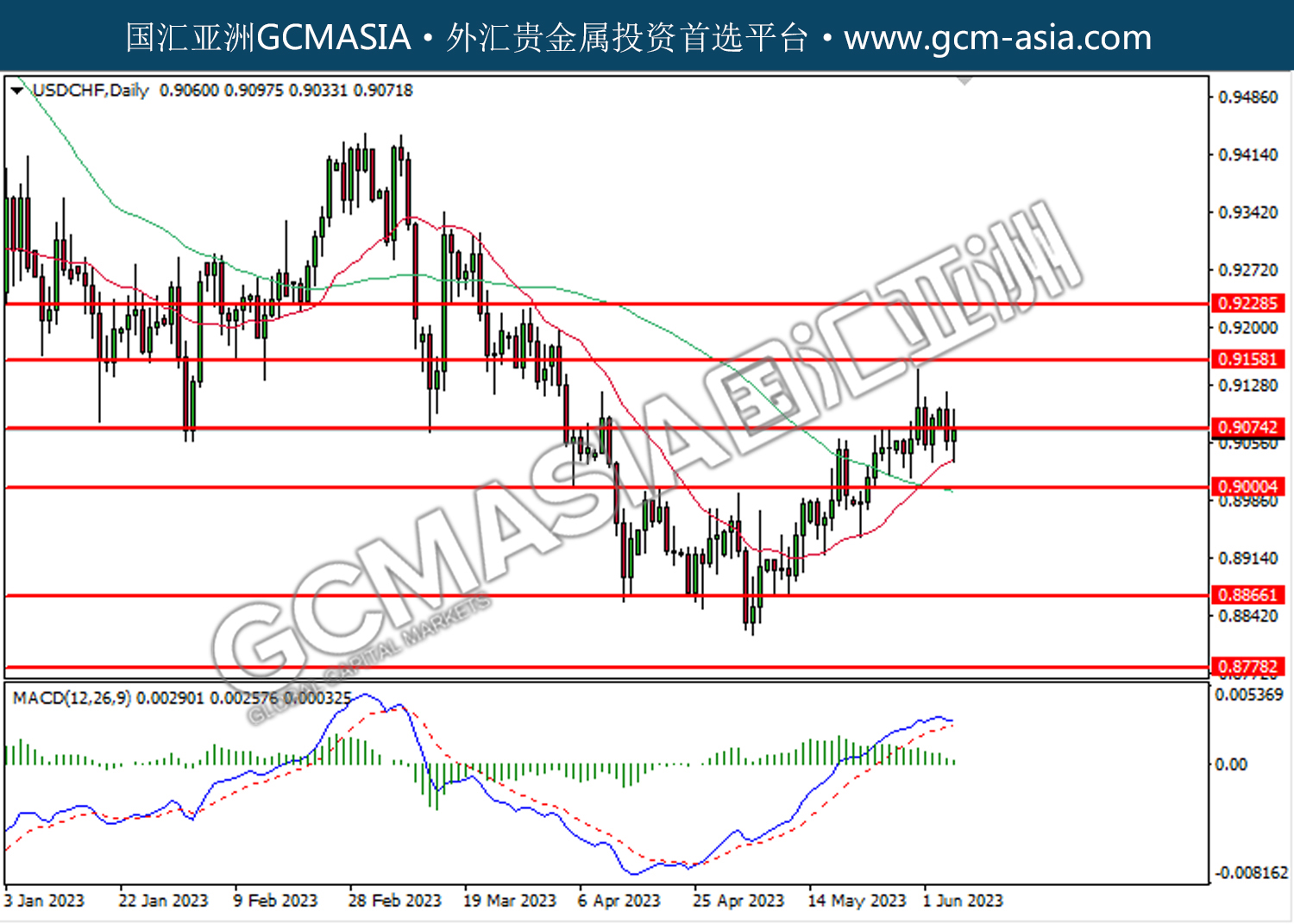

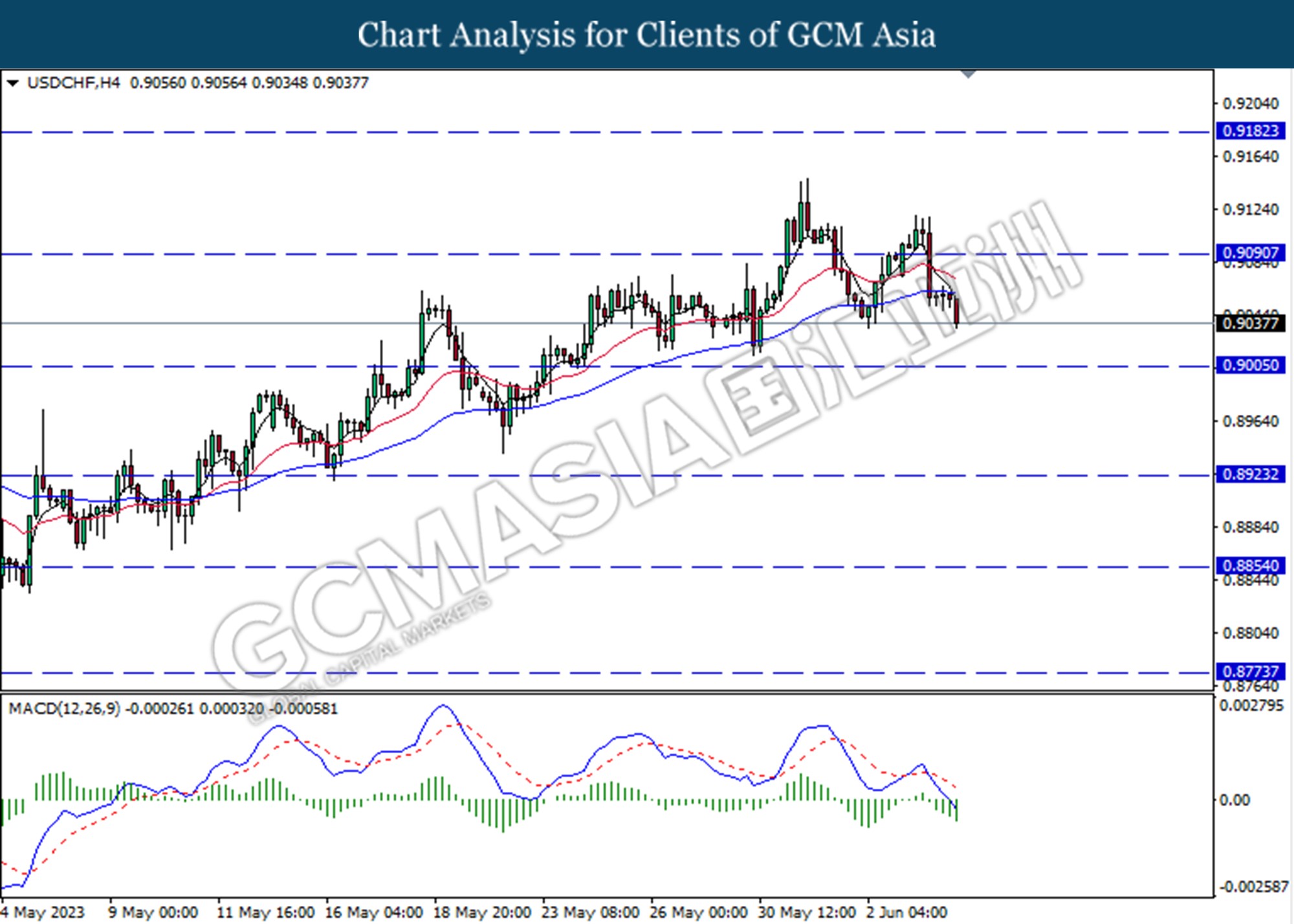

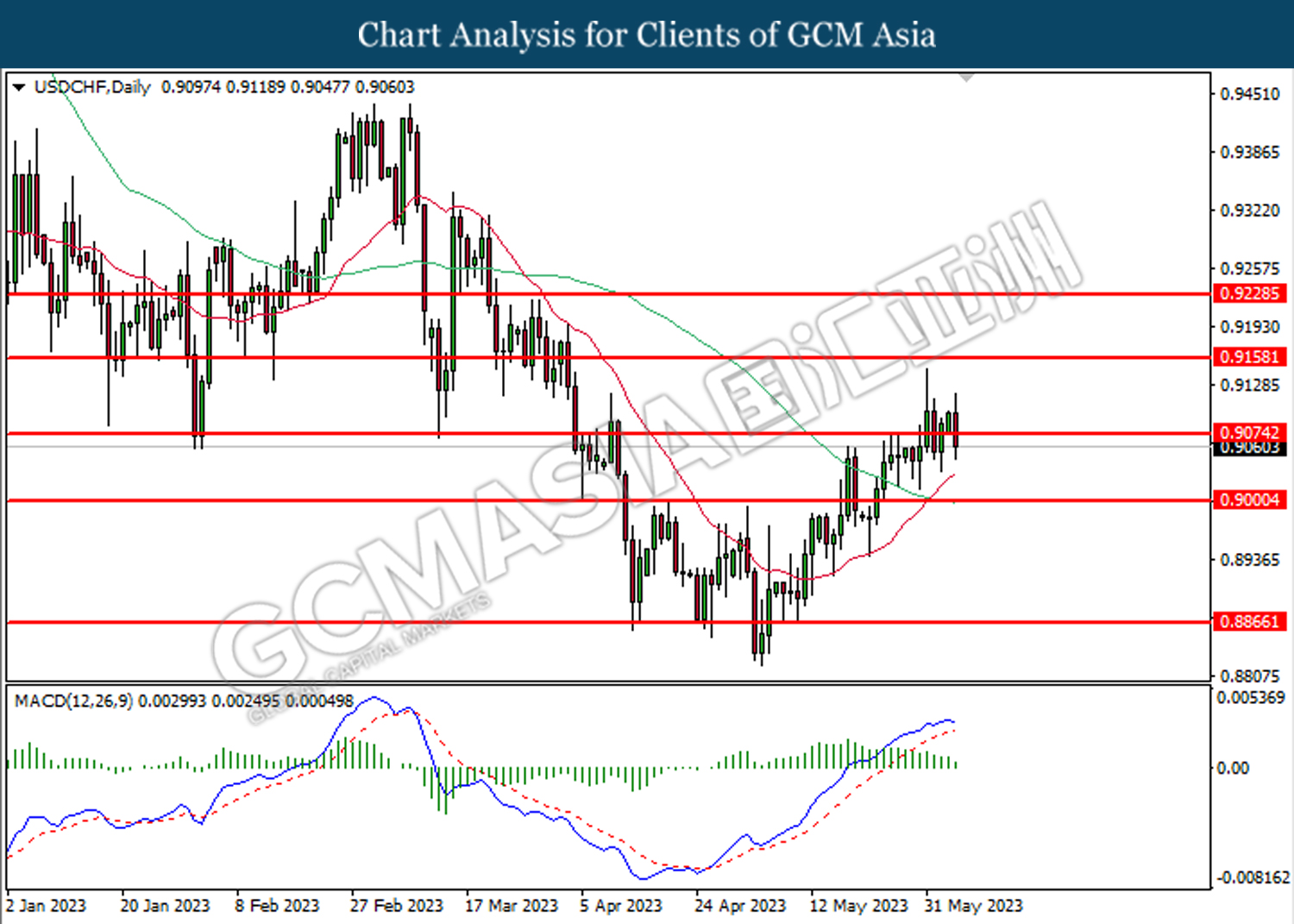

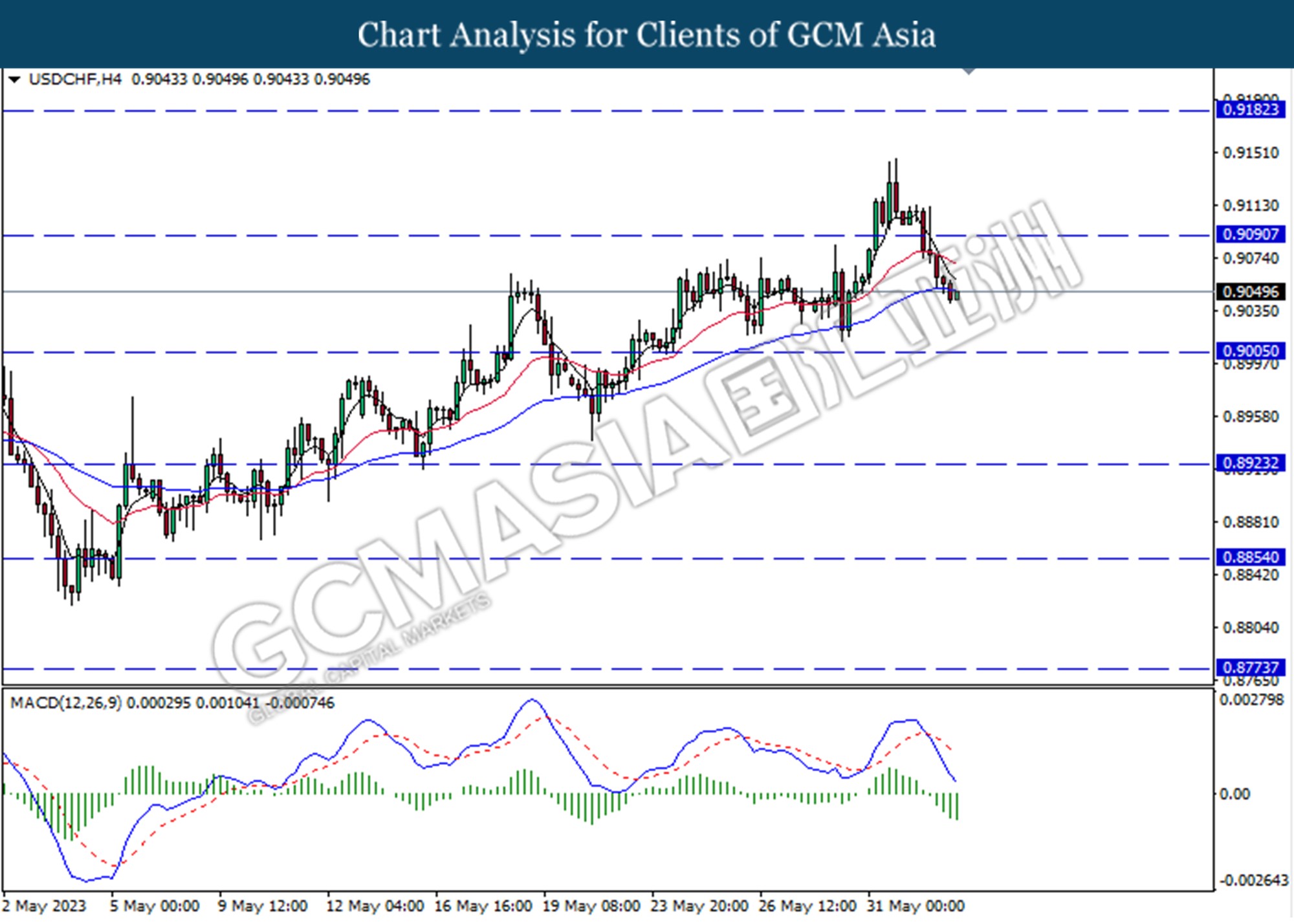

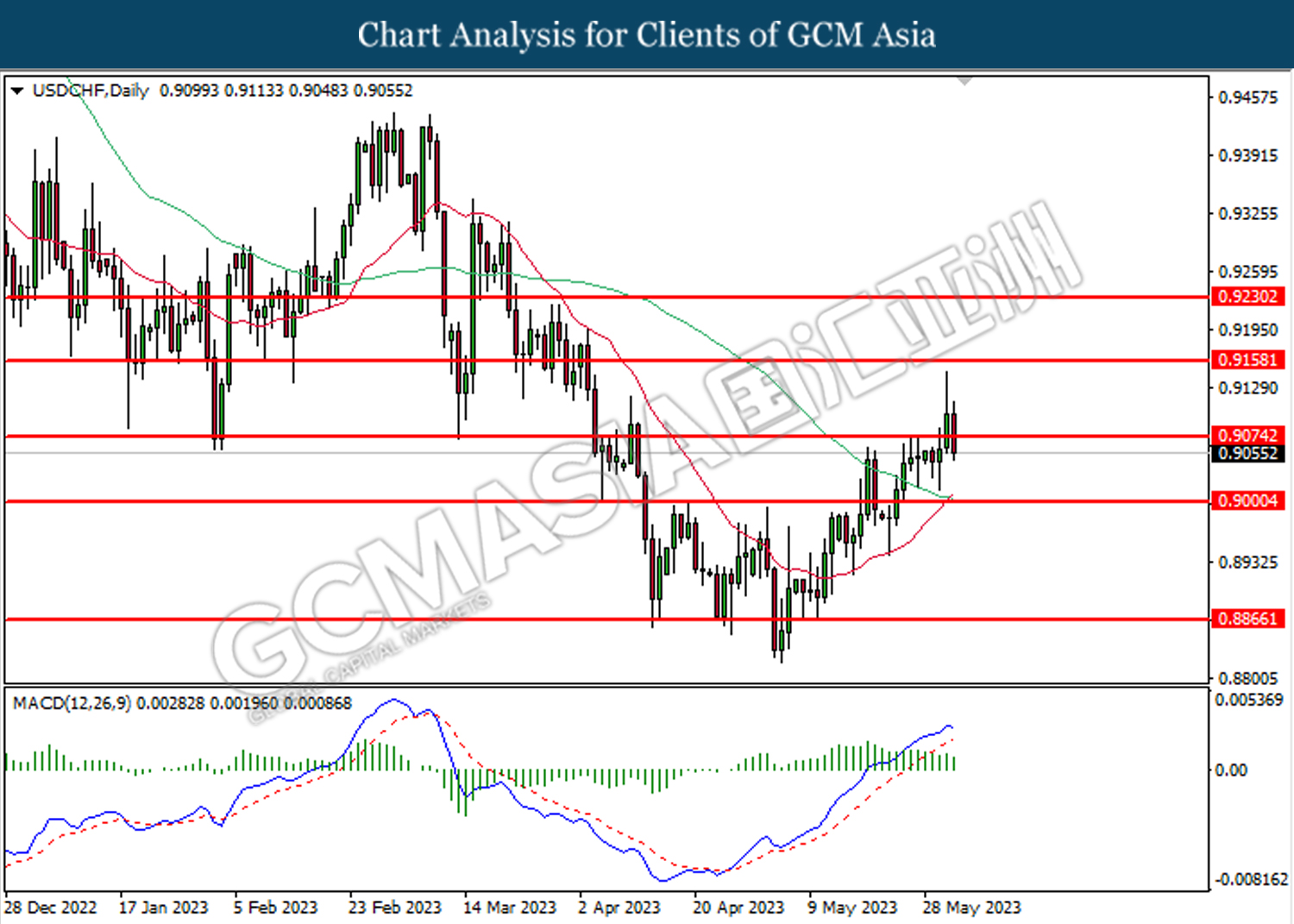

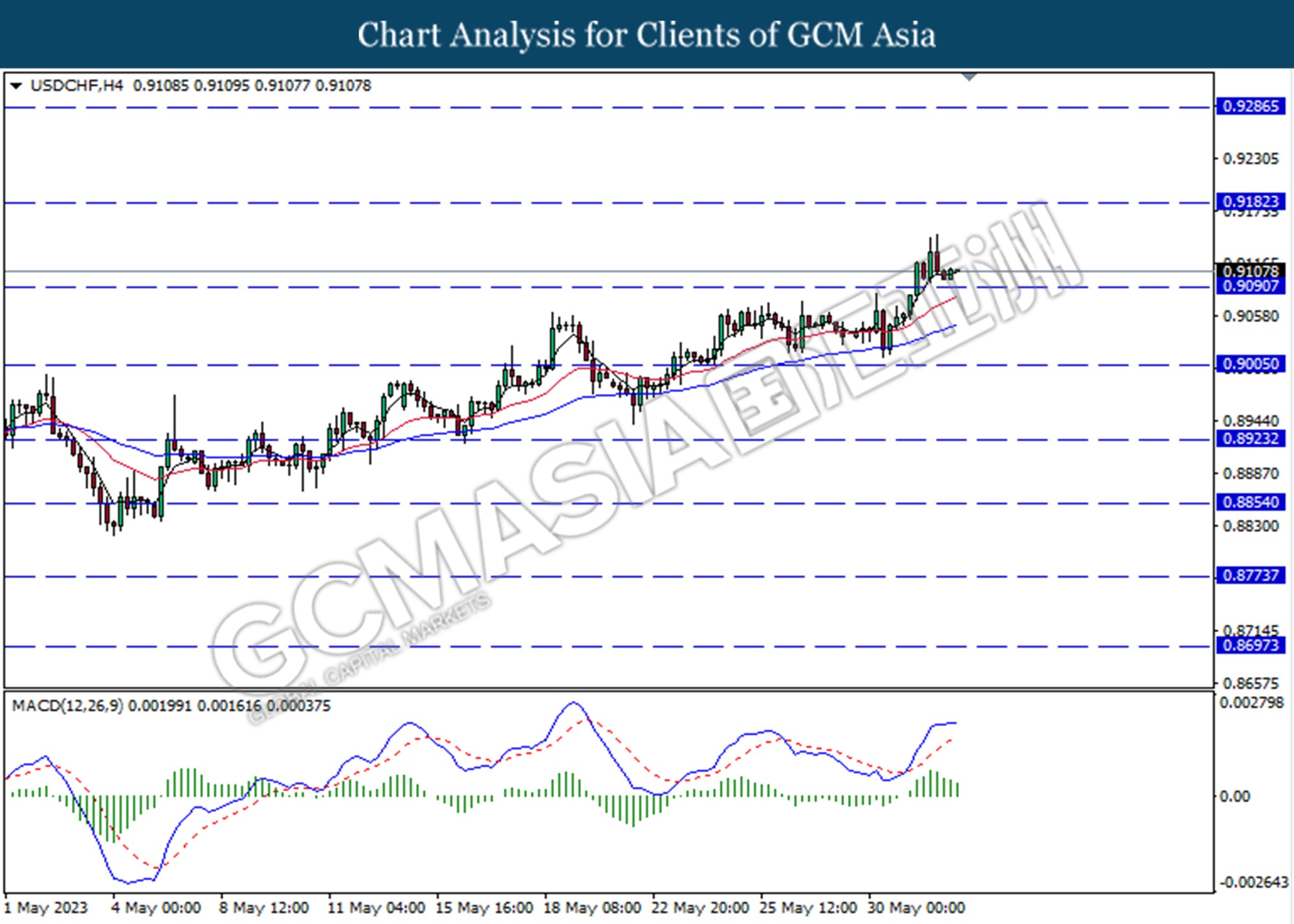

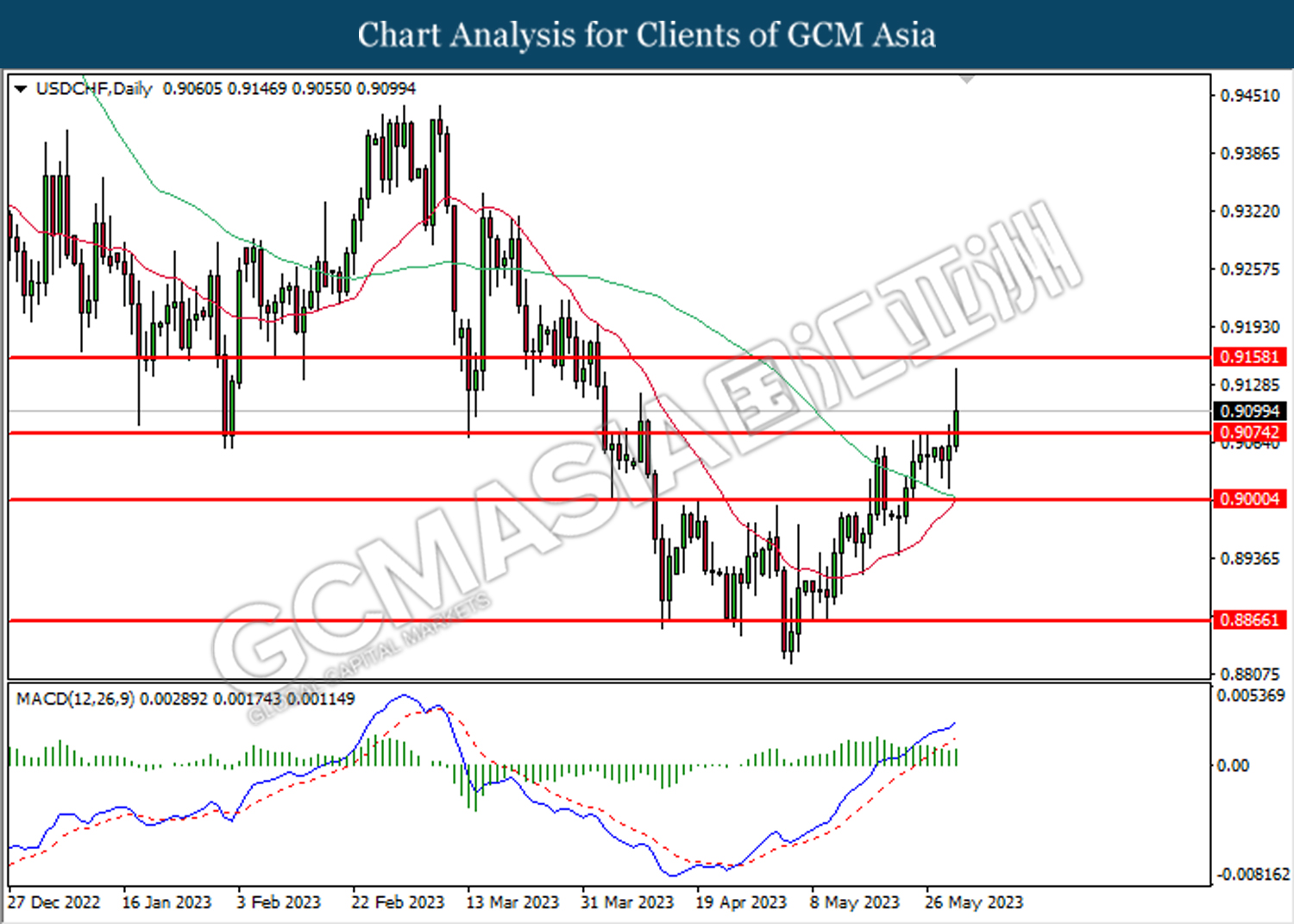

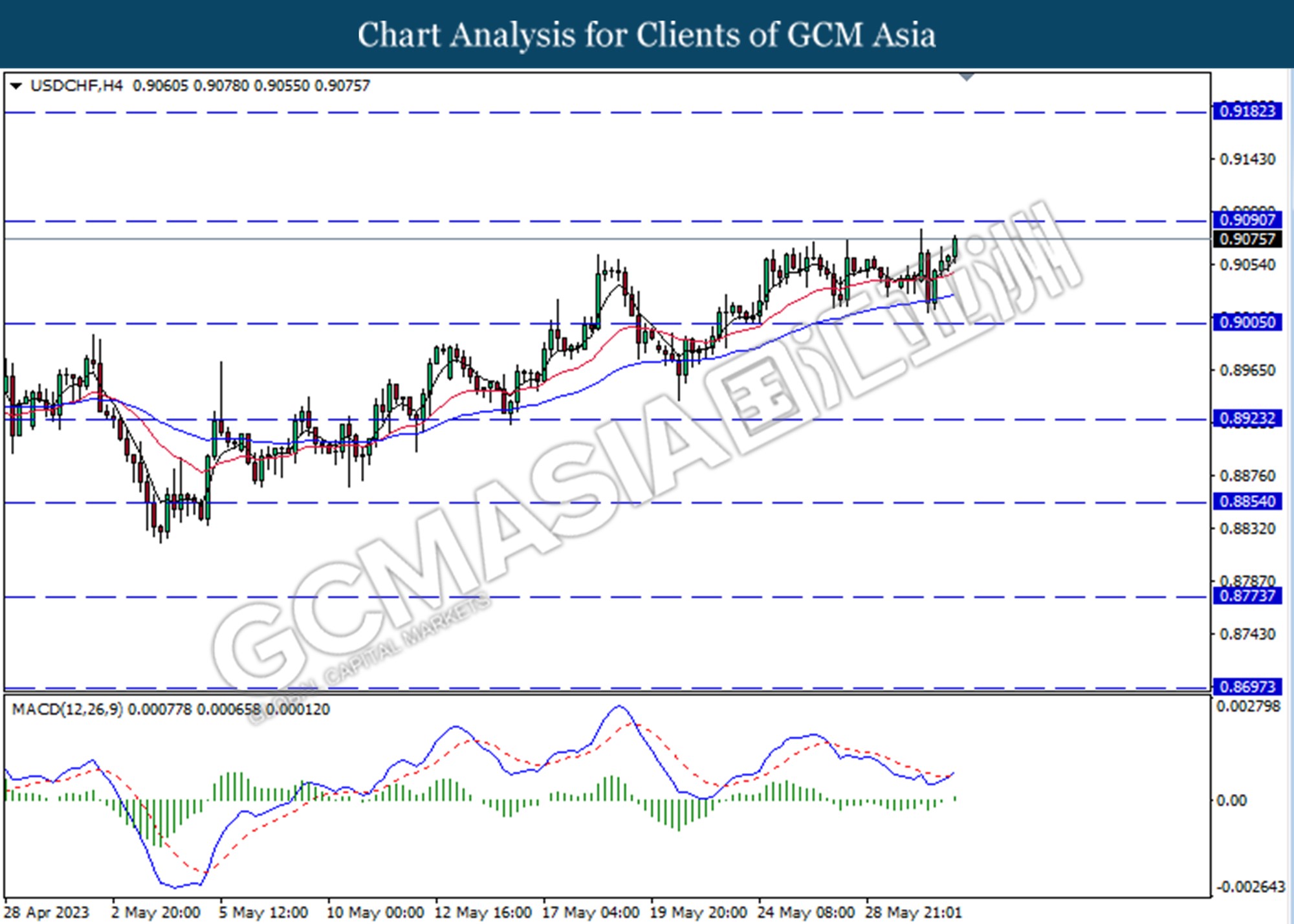

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8980. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9140, 0.9330

Support level: 0.8980, 0.8835

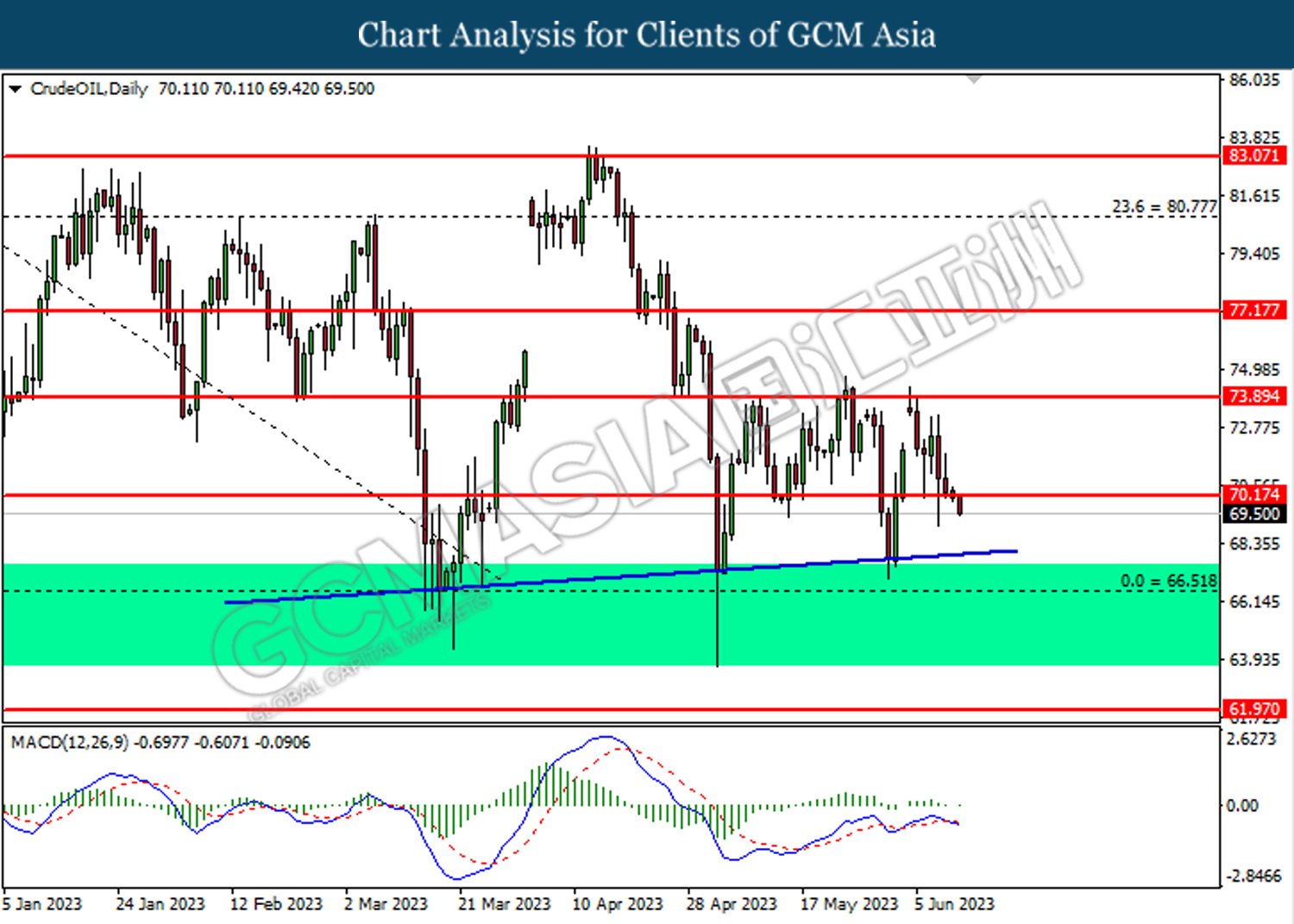

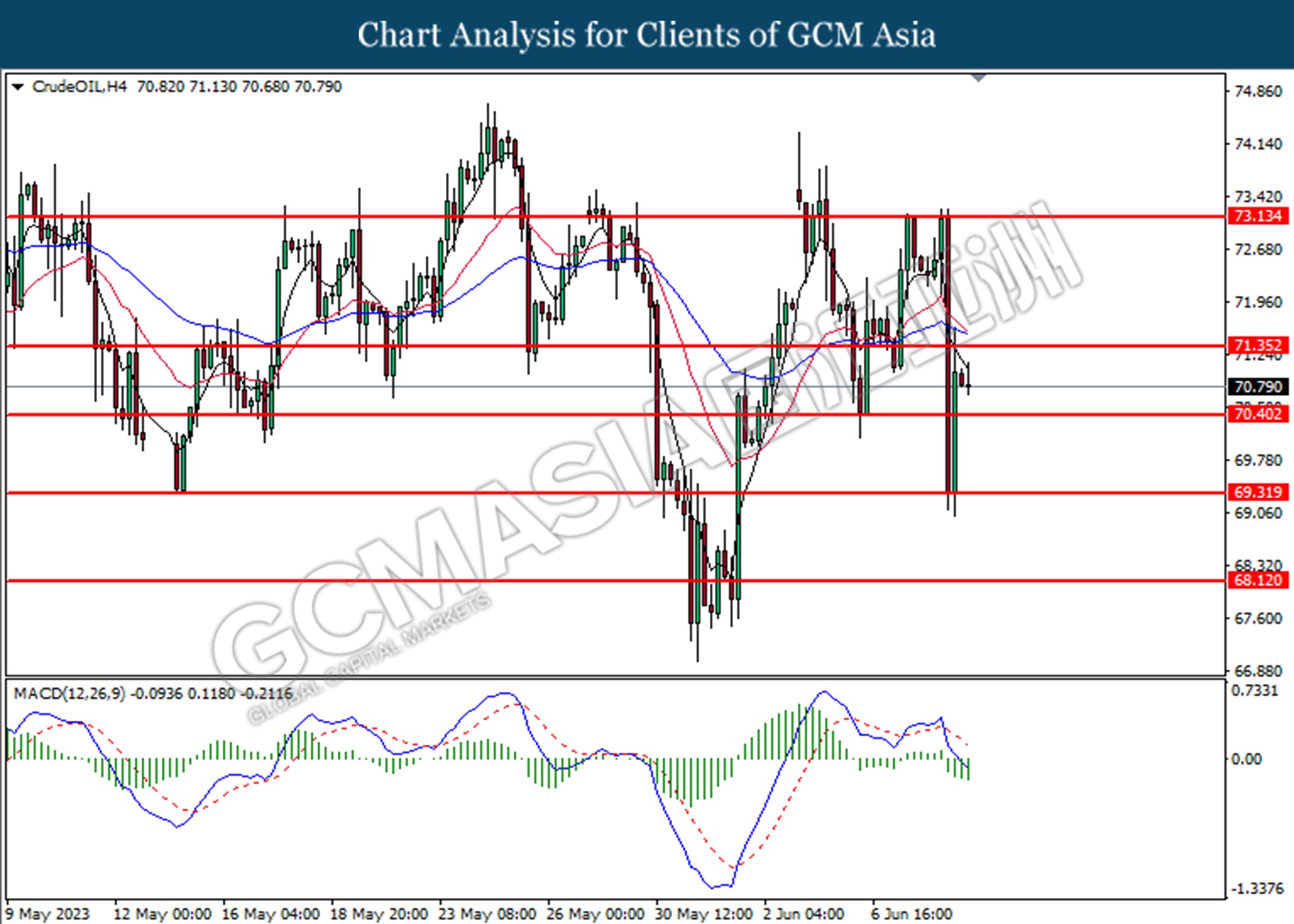

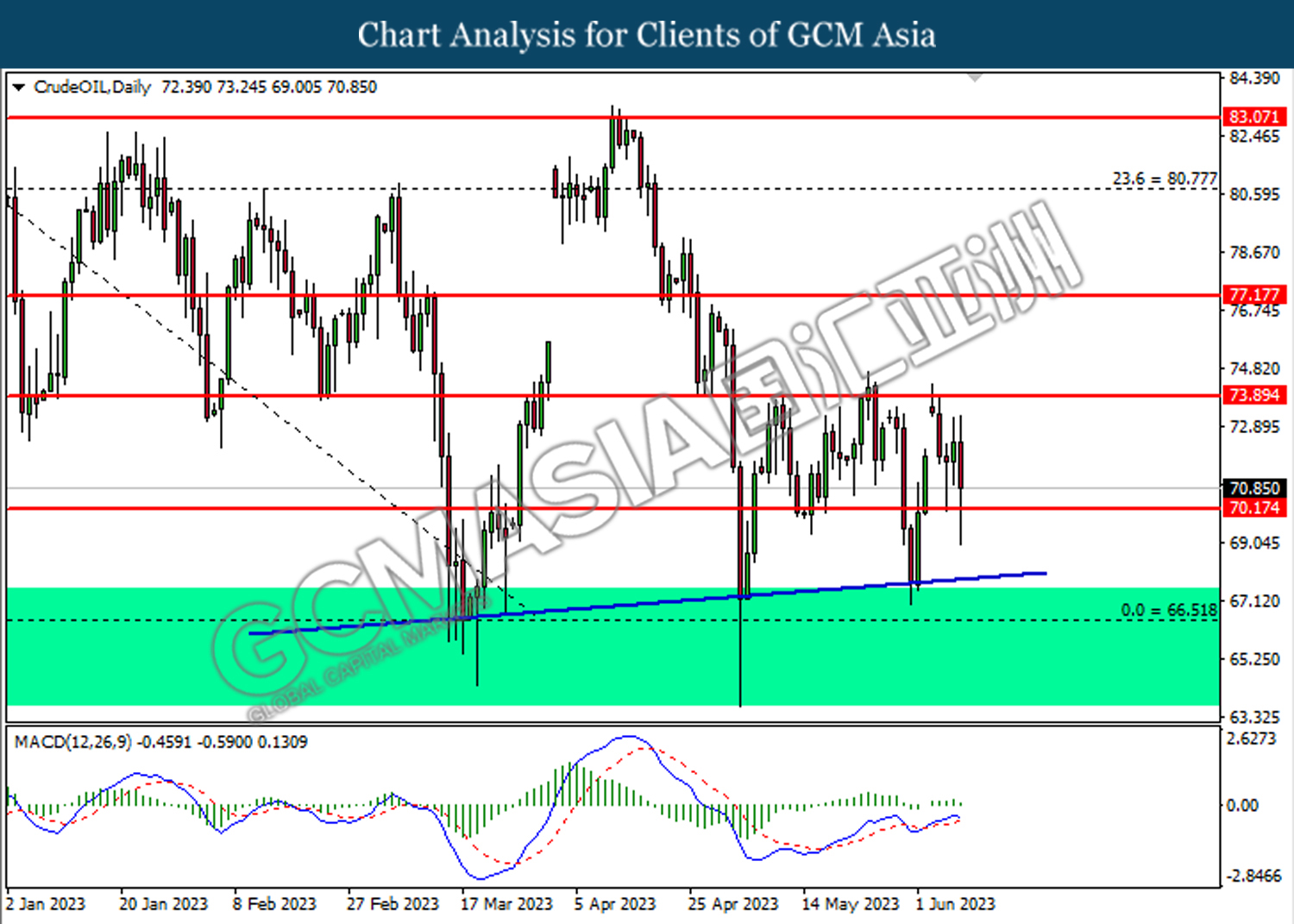

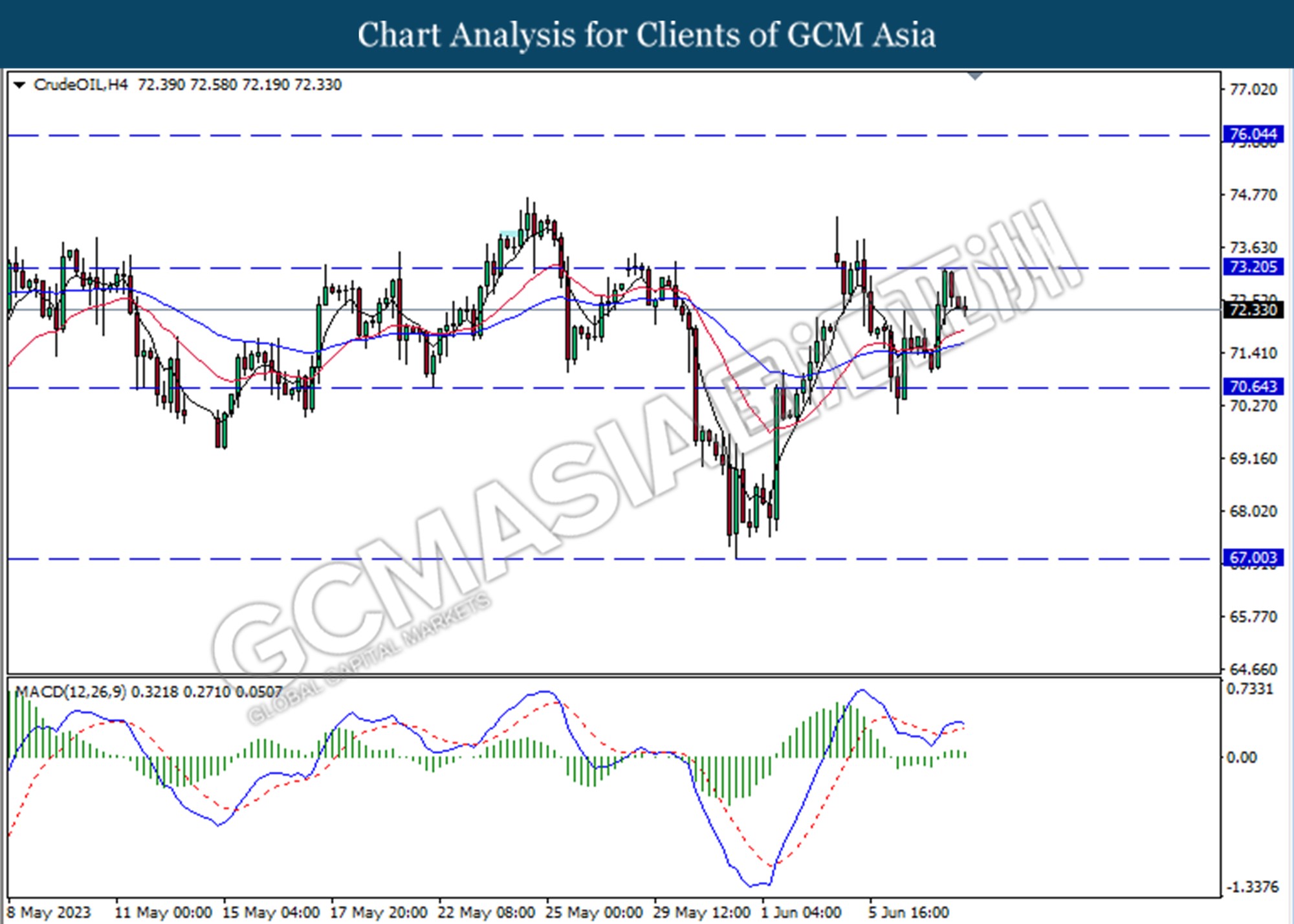

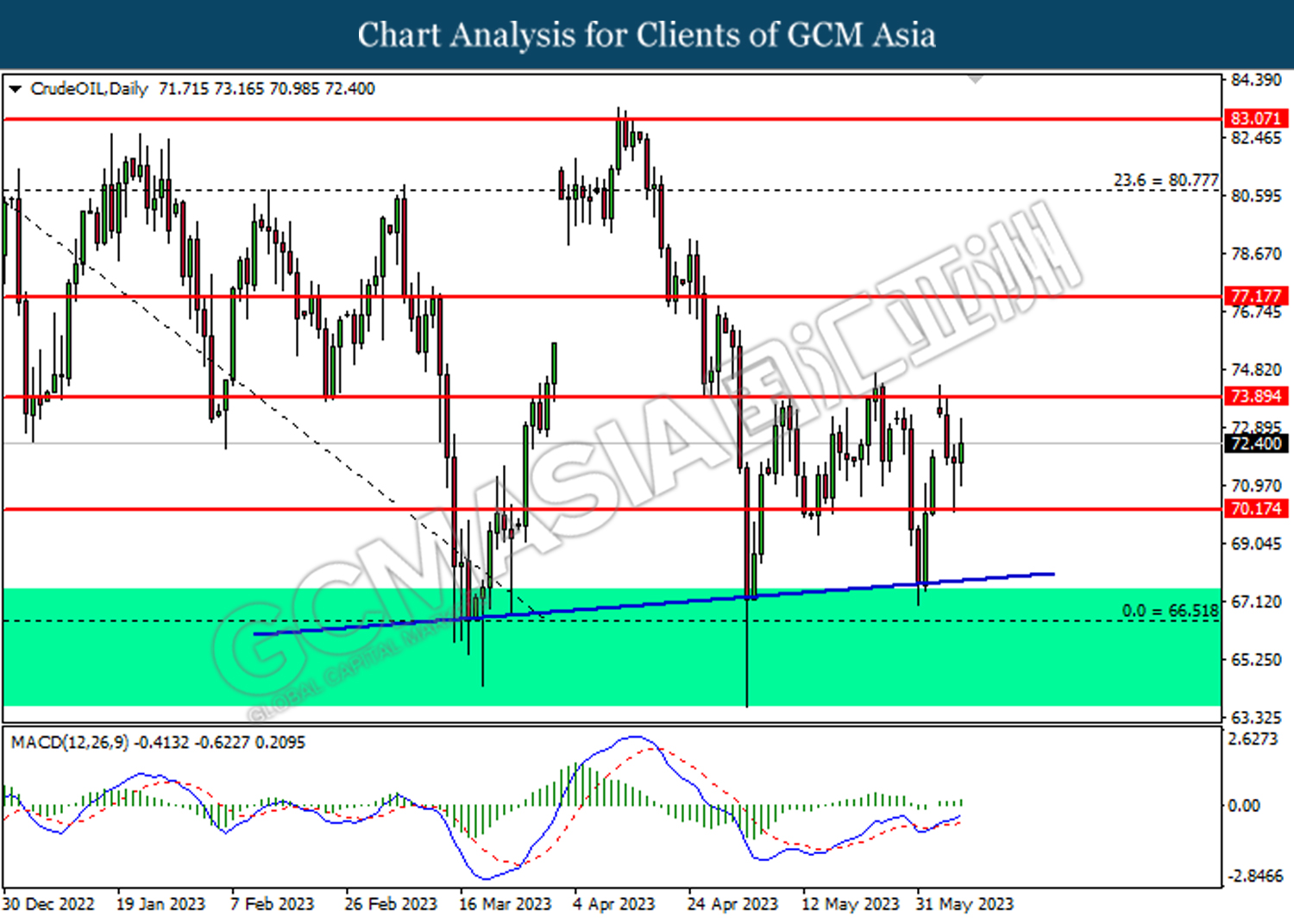

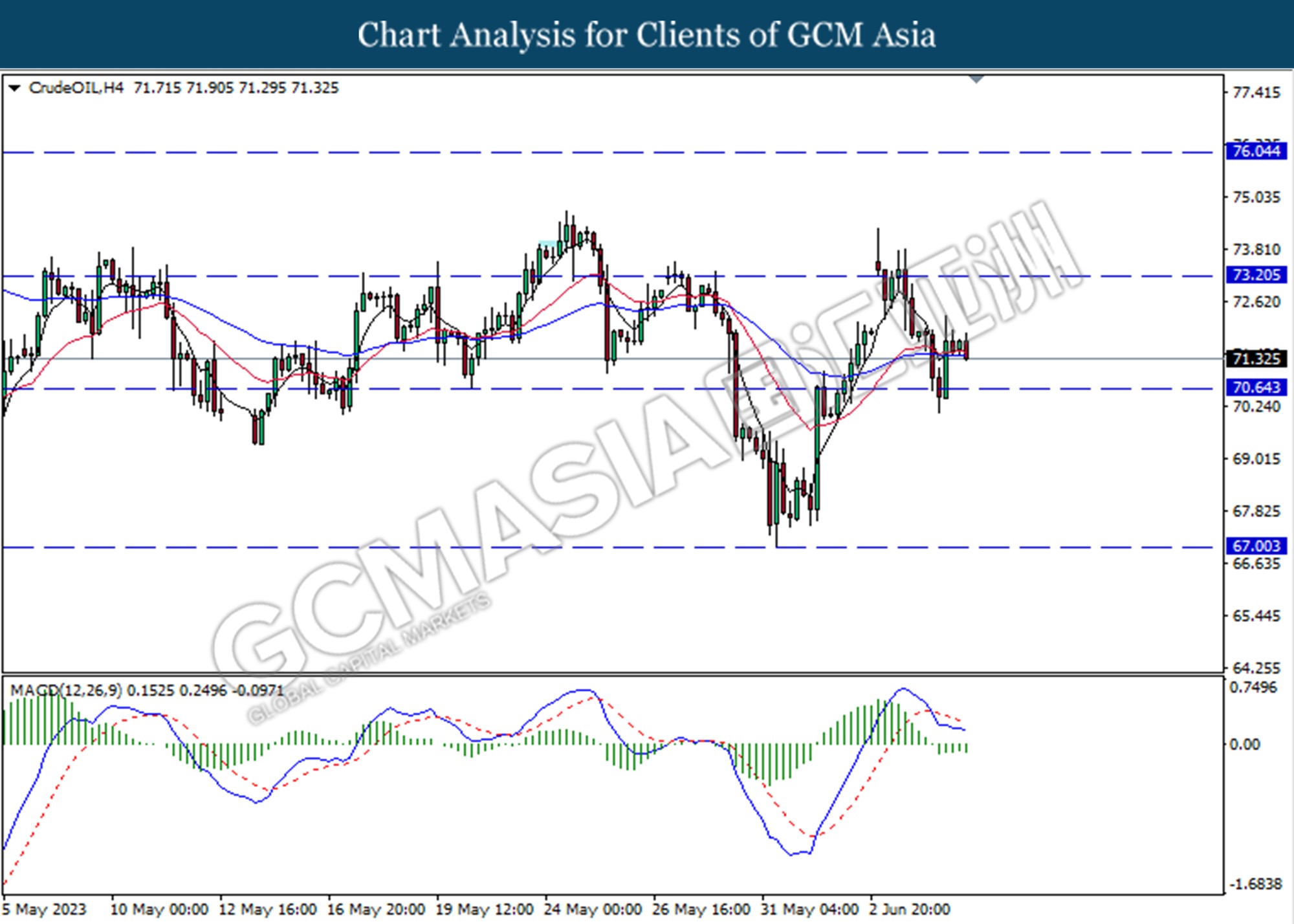

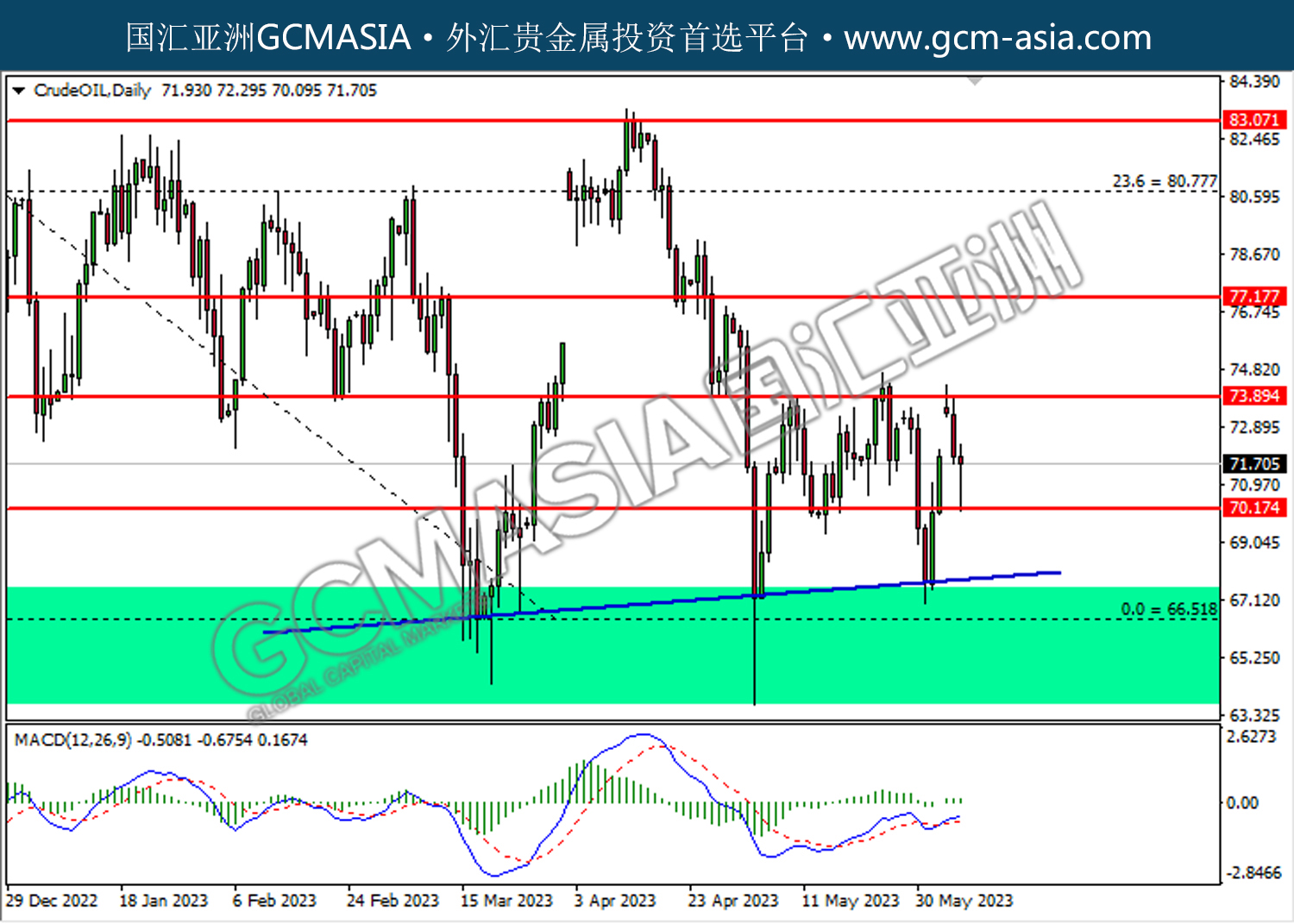

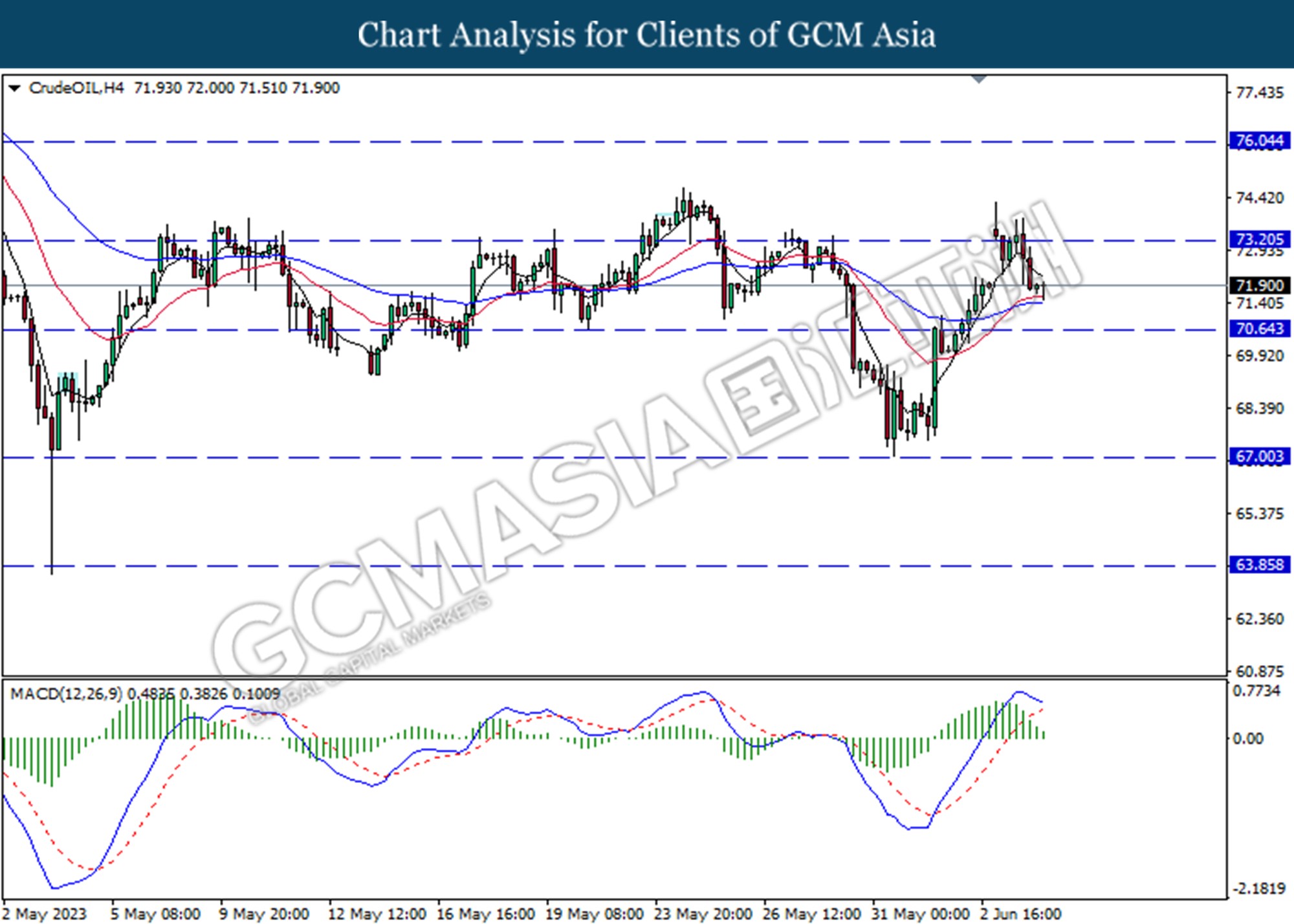

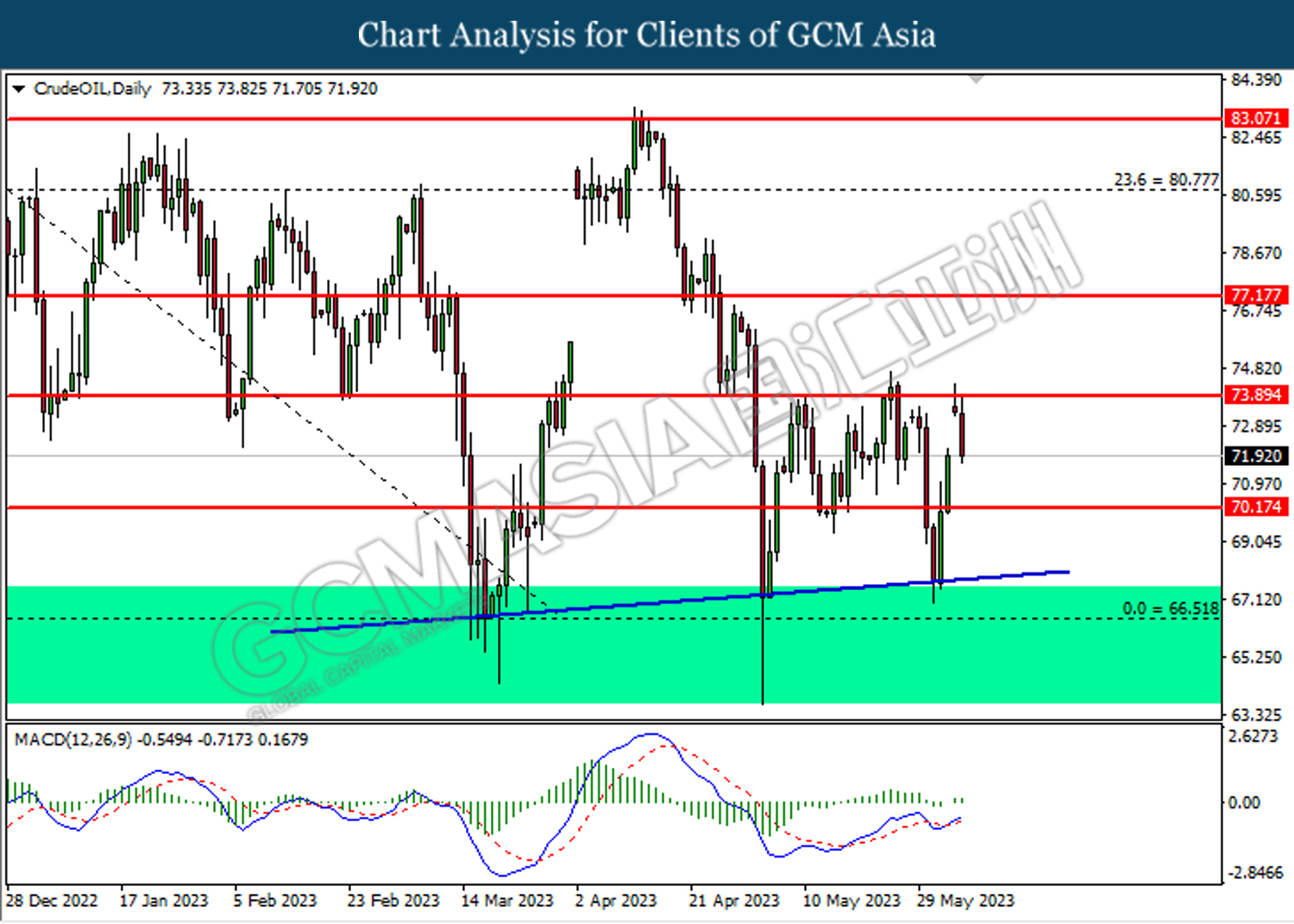

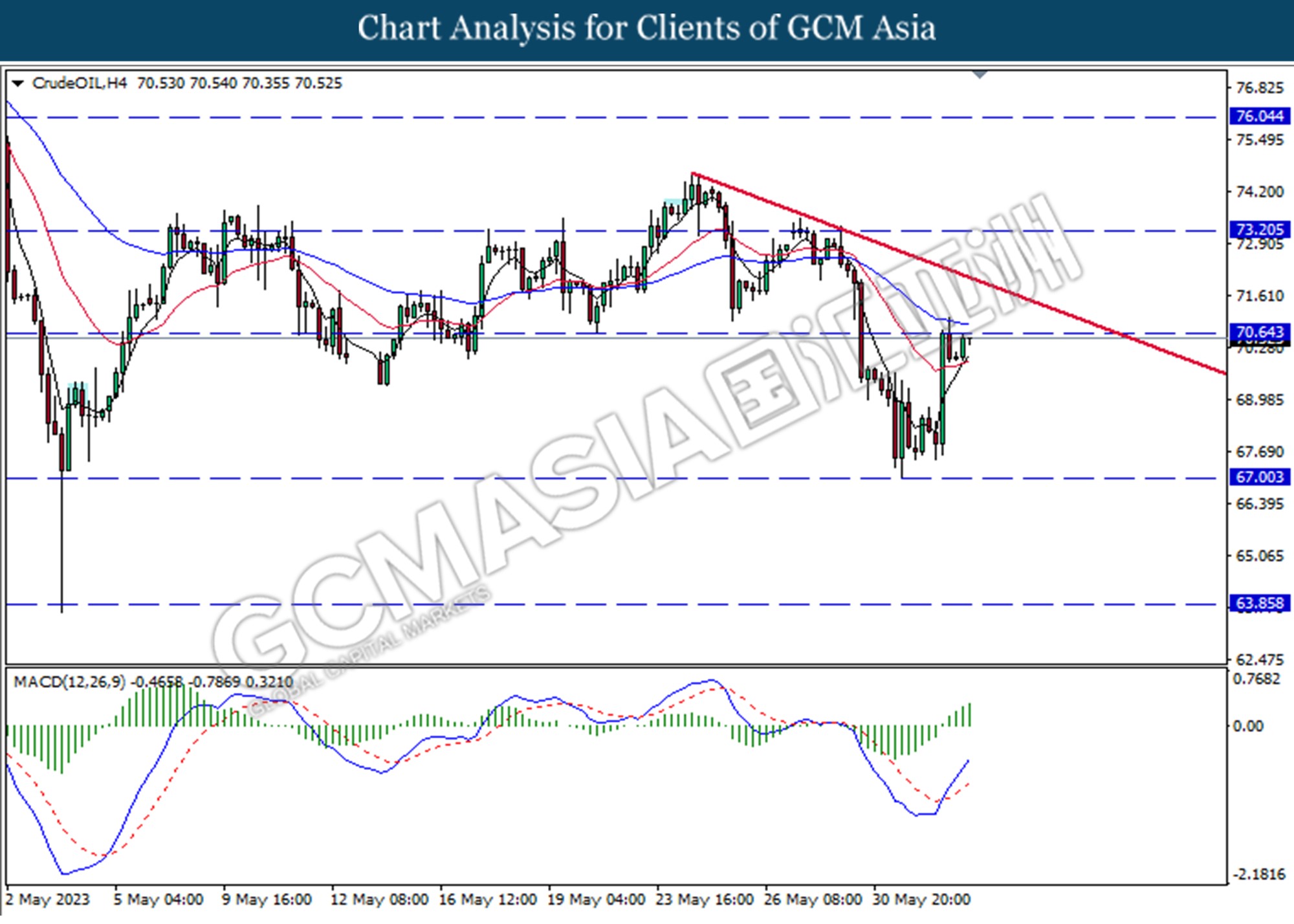

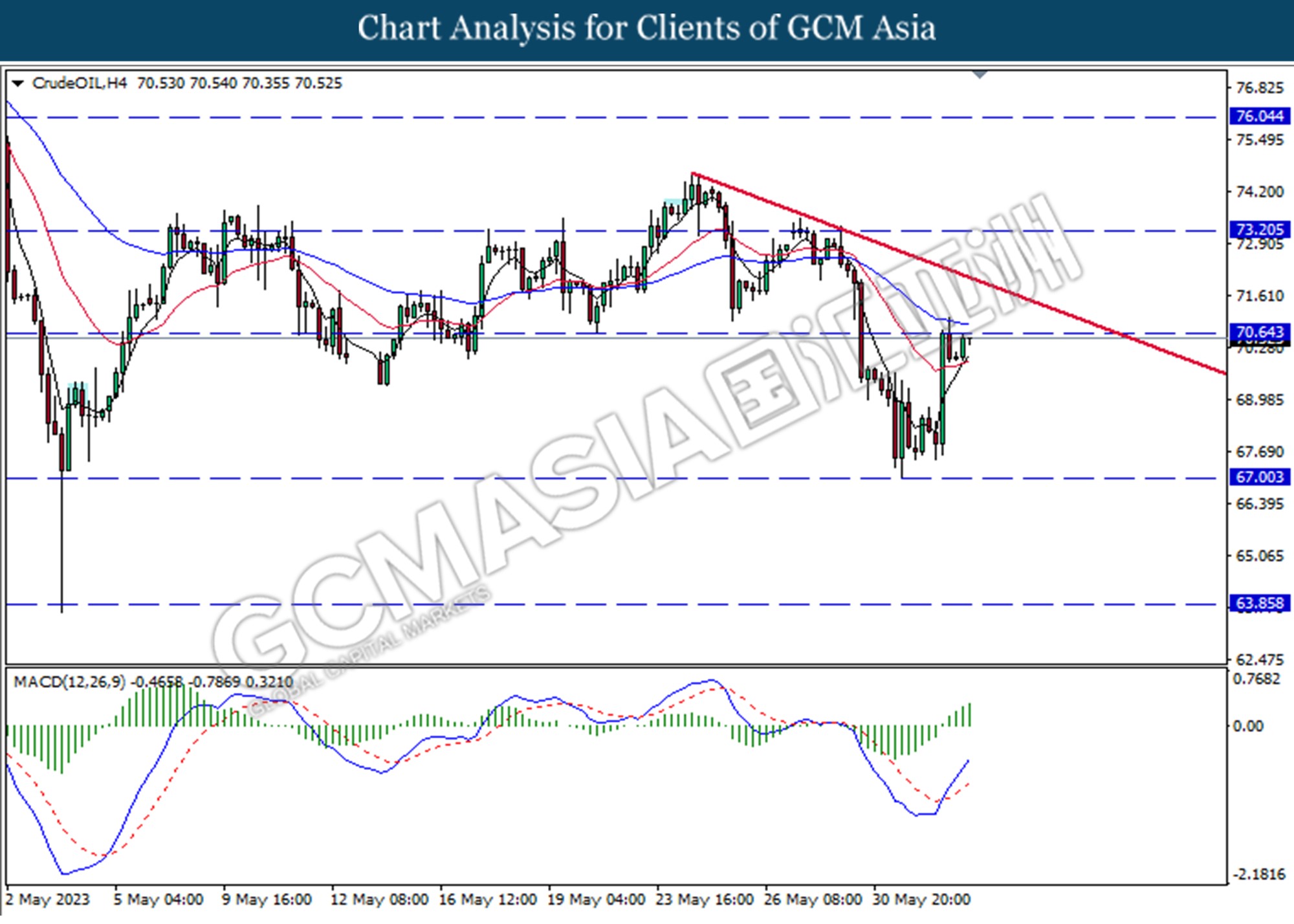

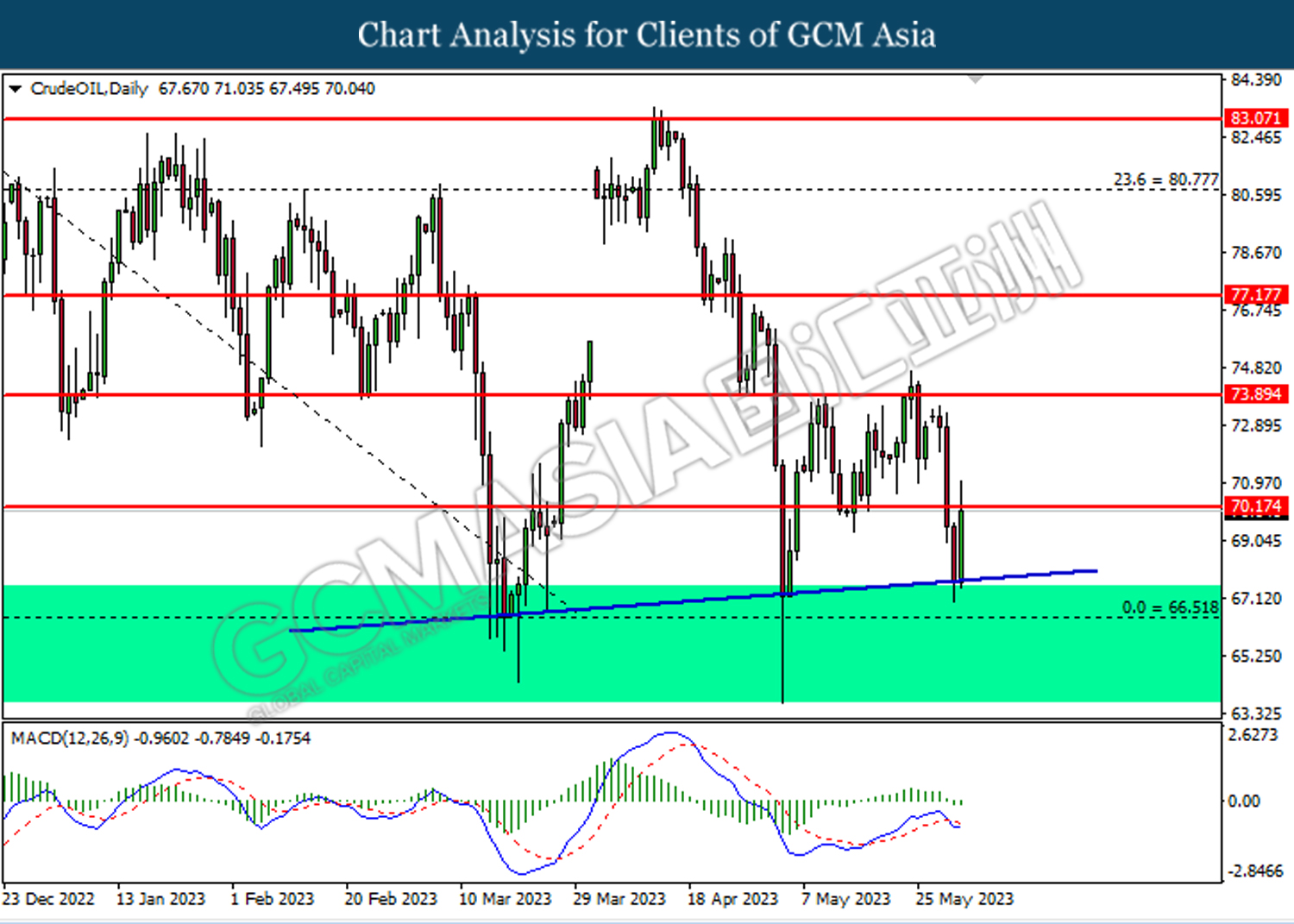

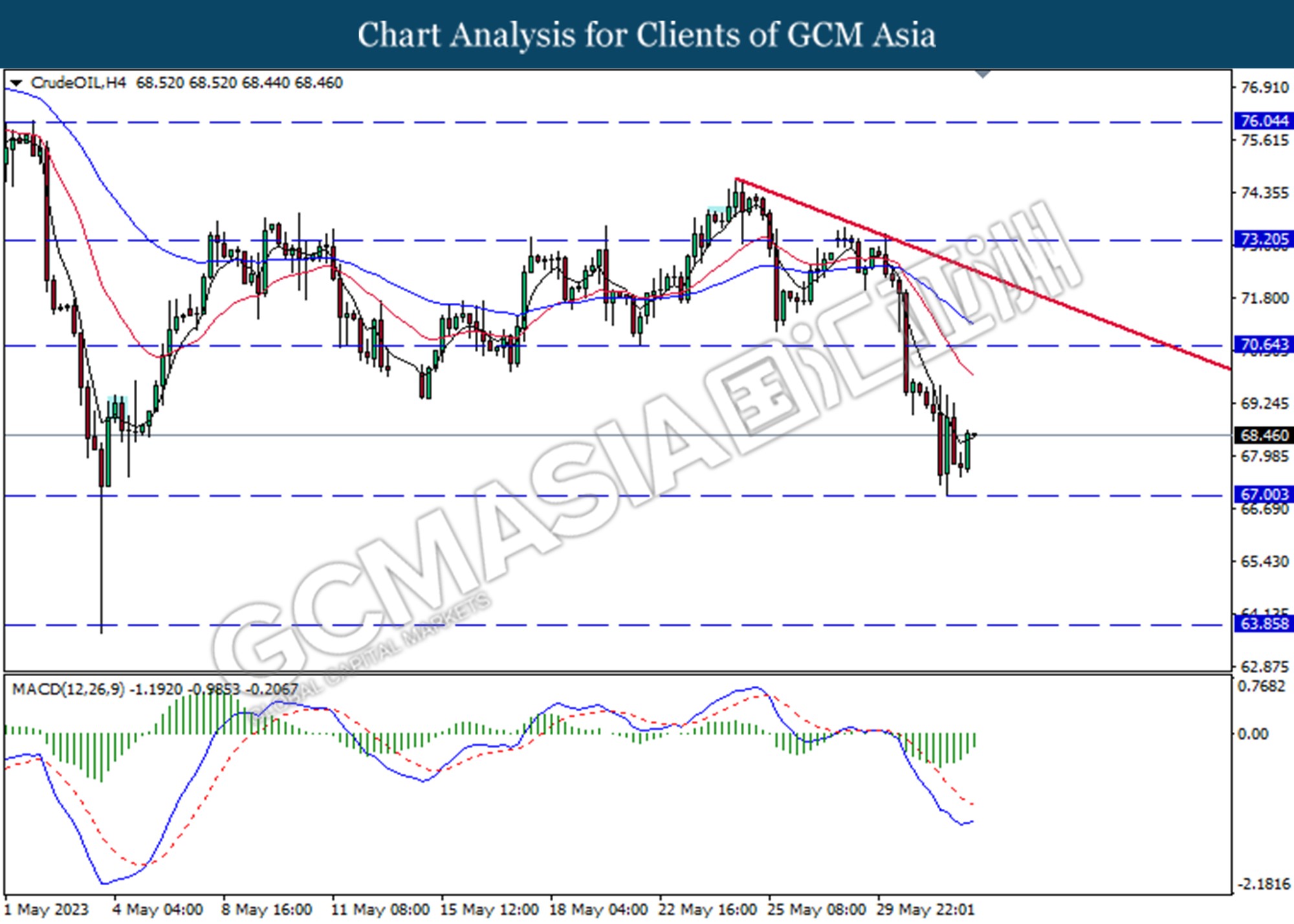

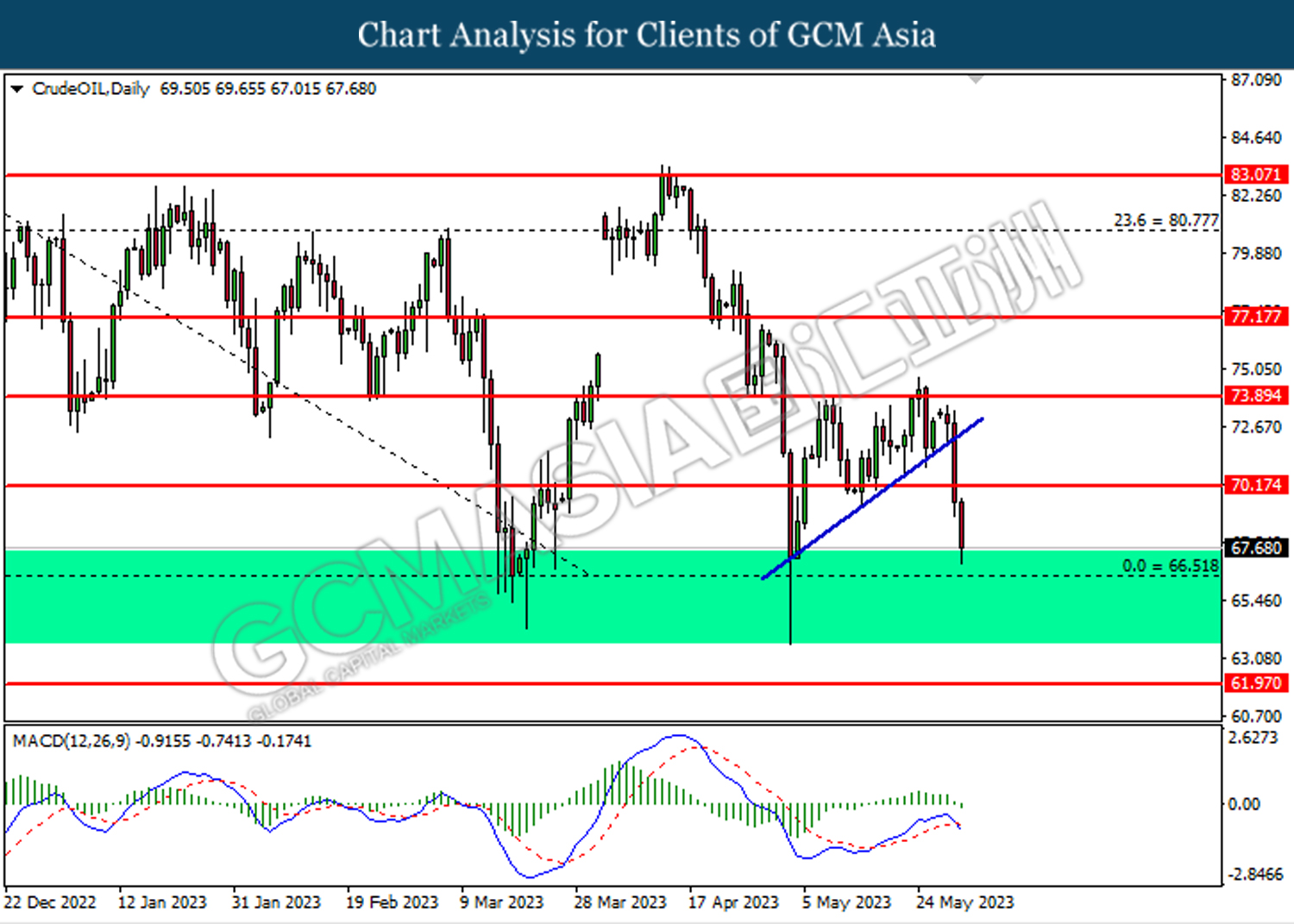

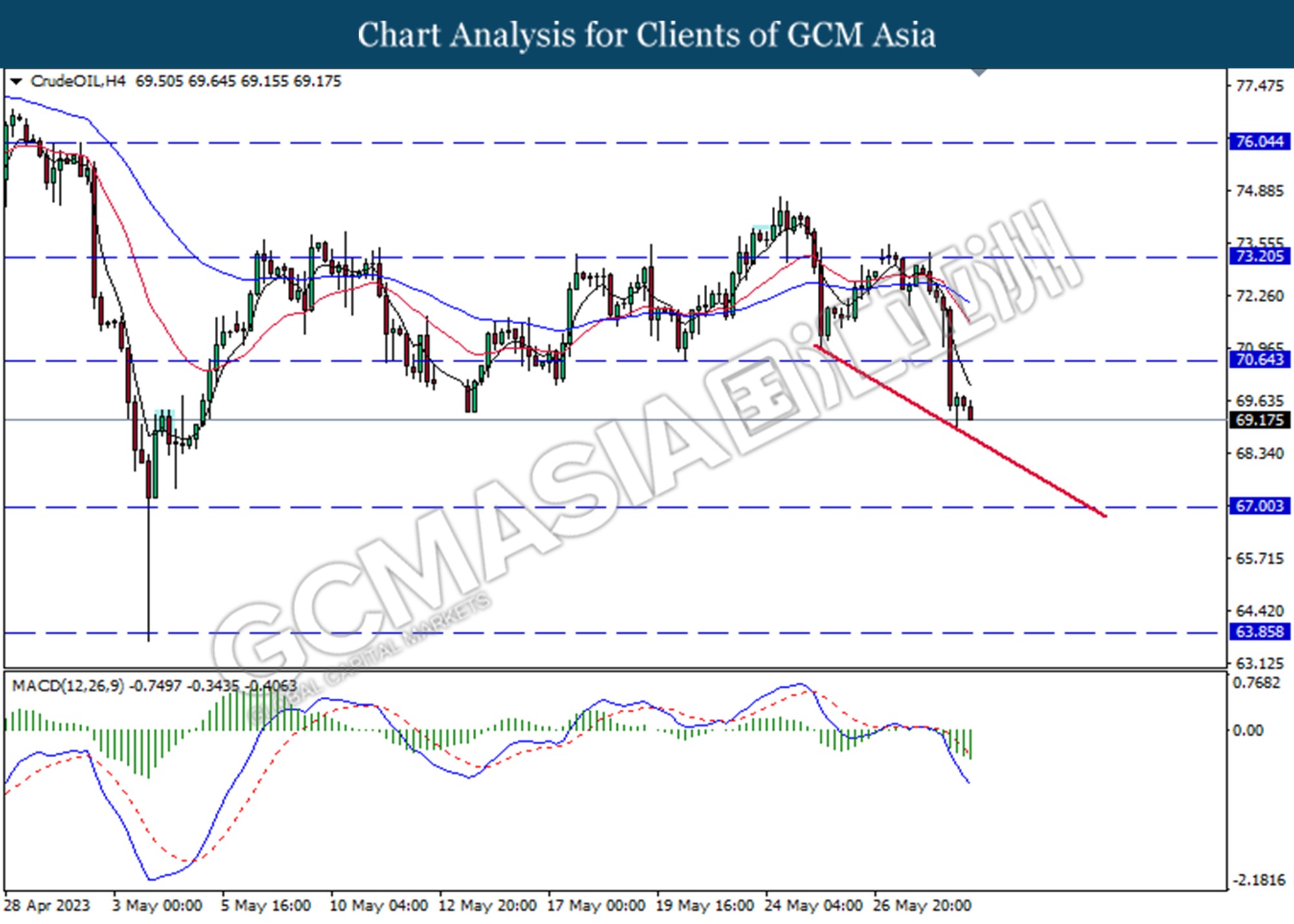

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 70.15. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

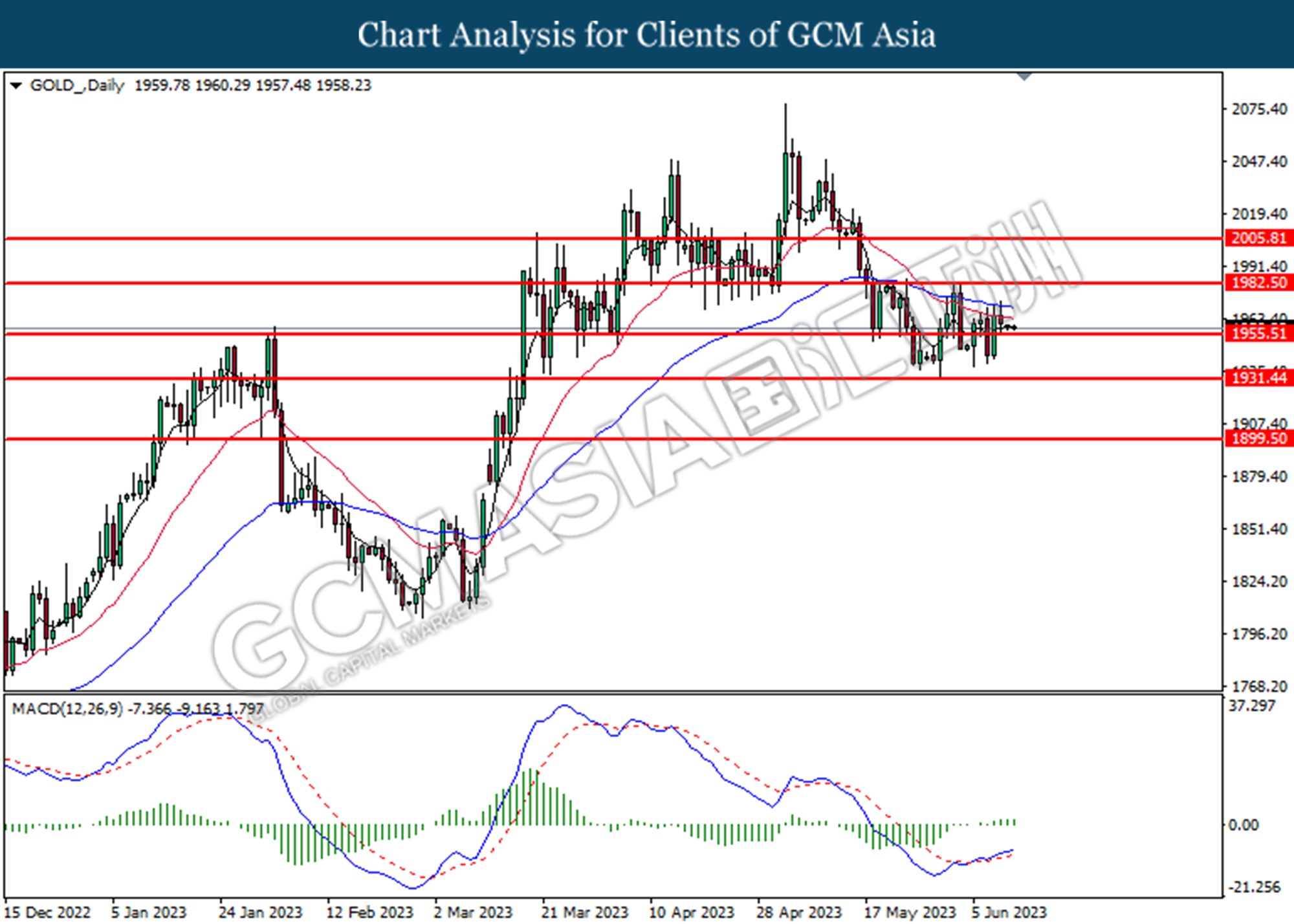

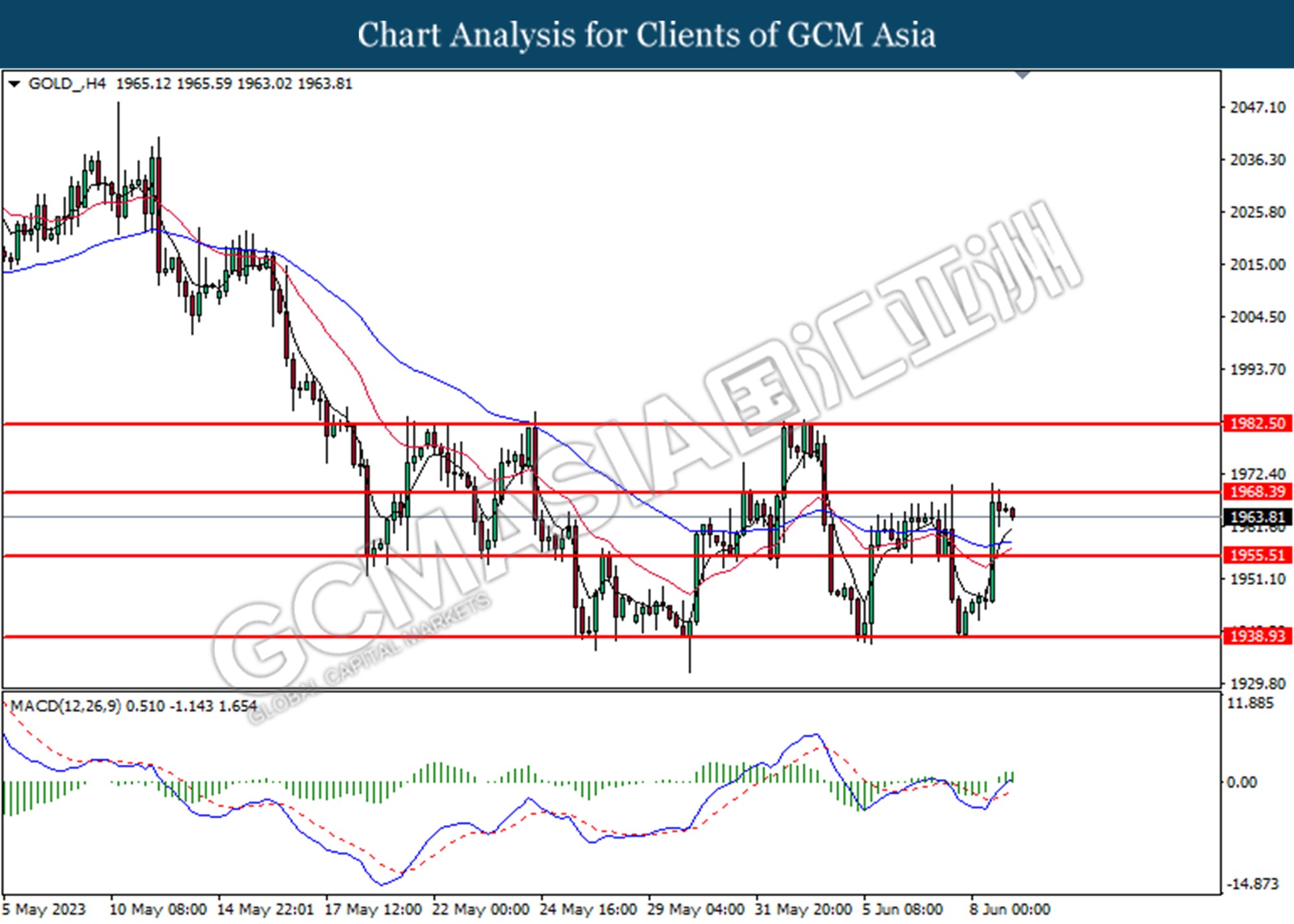

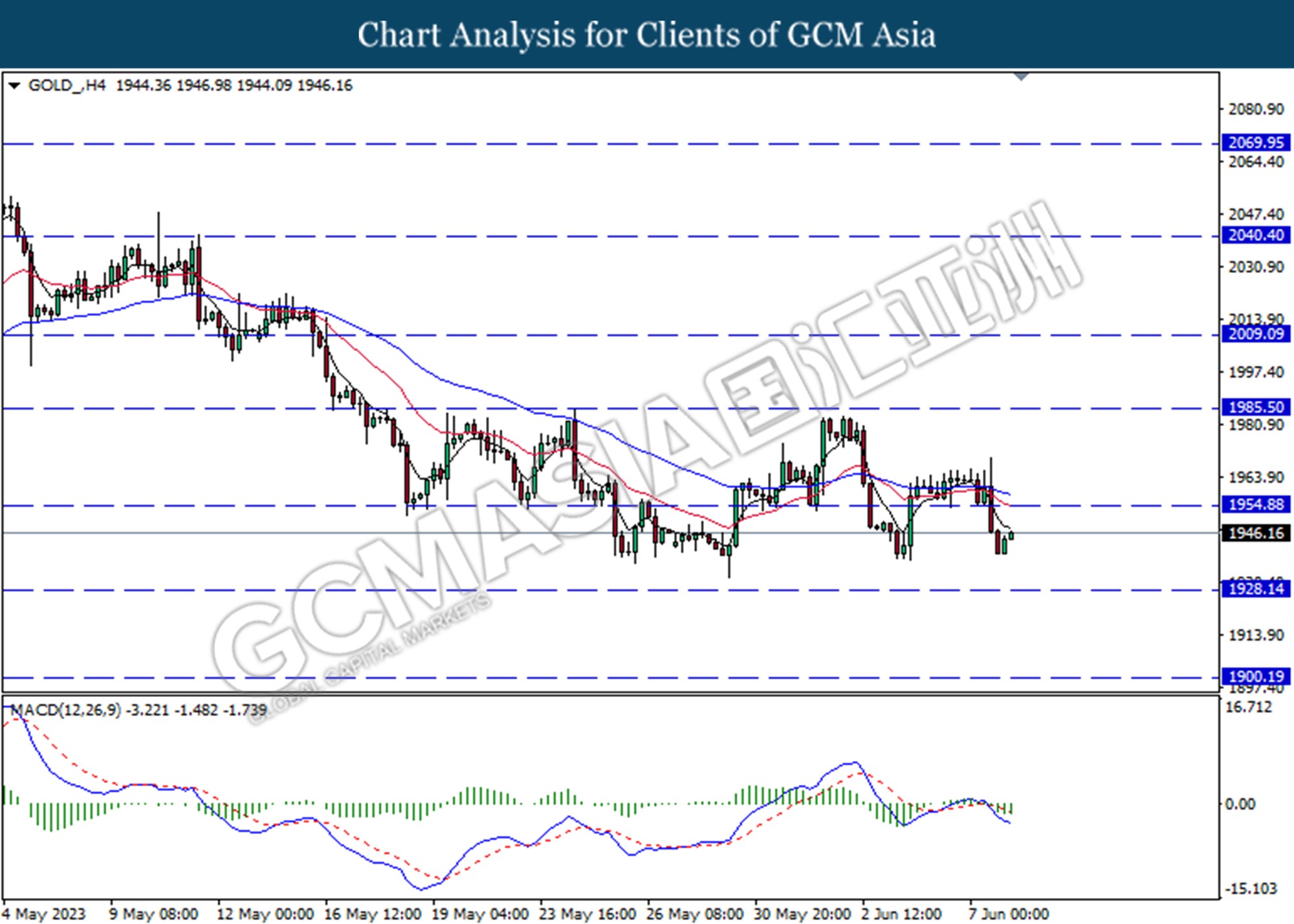

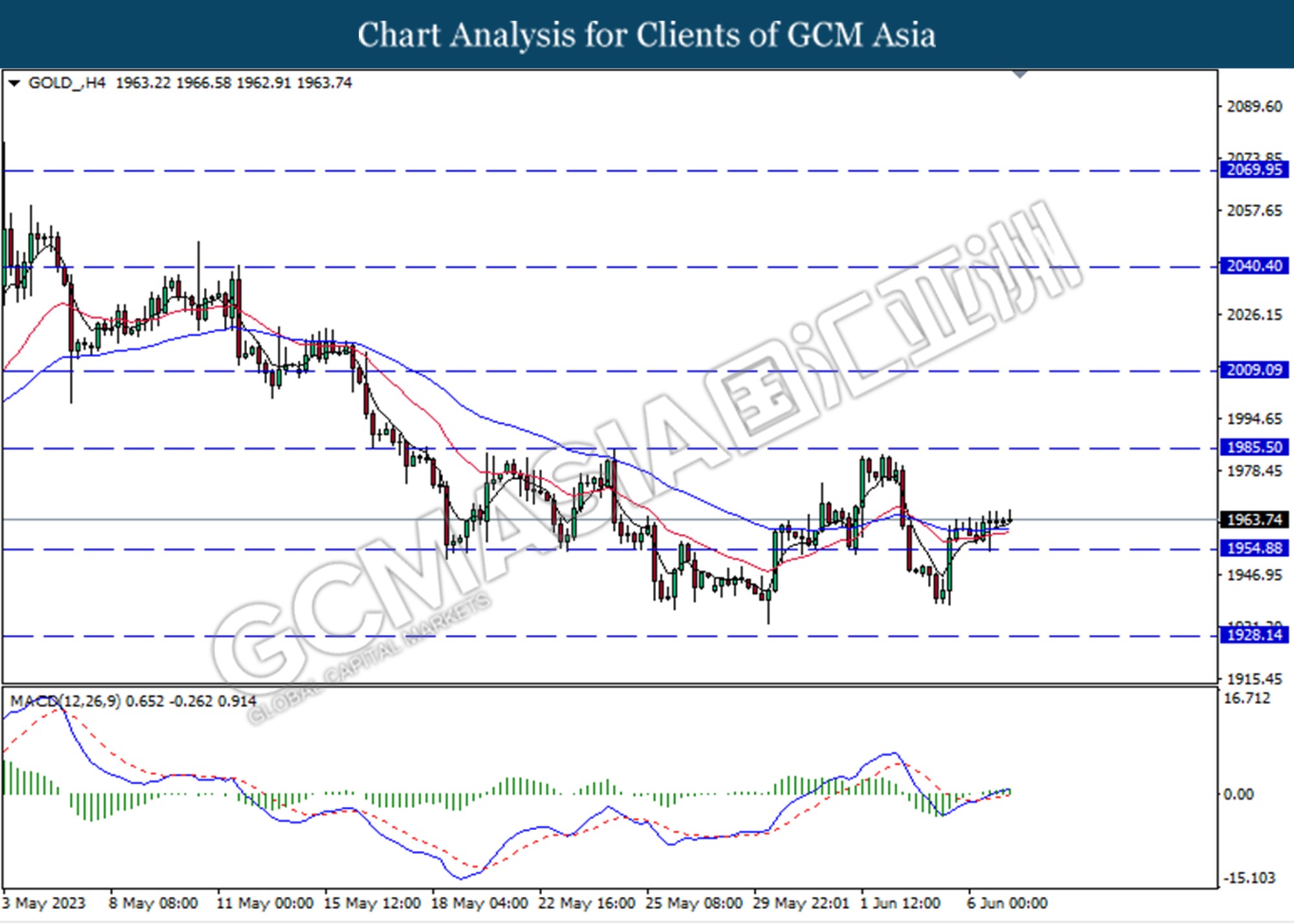

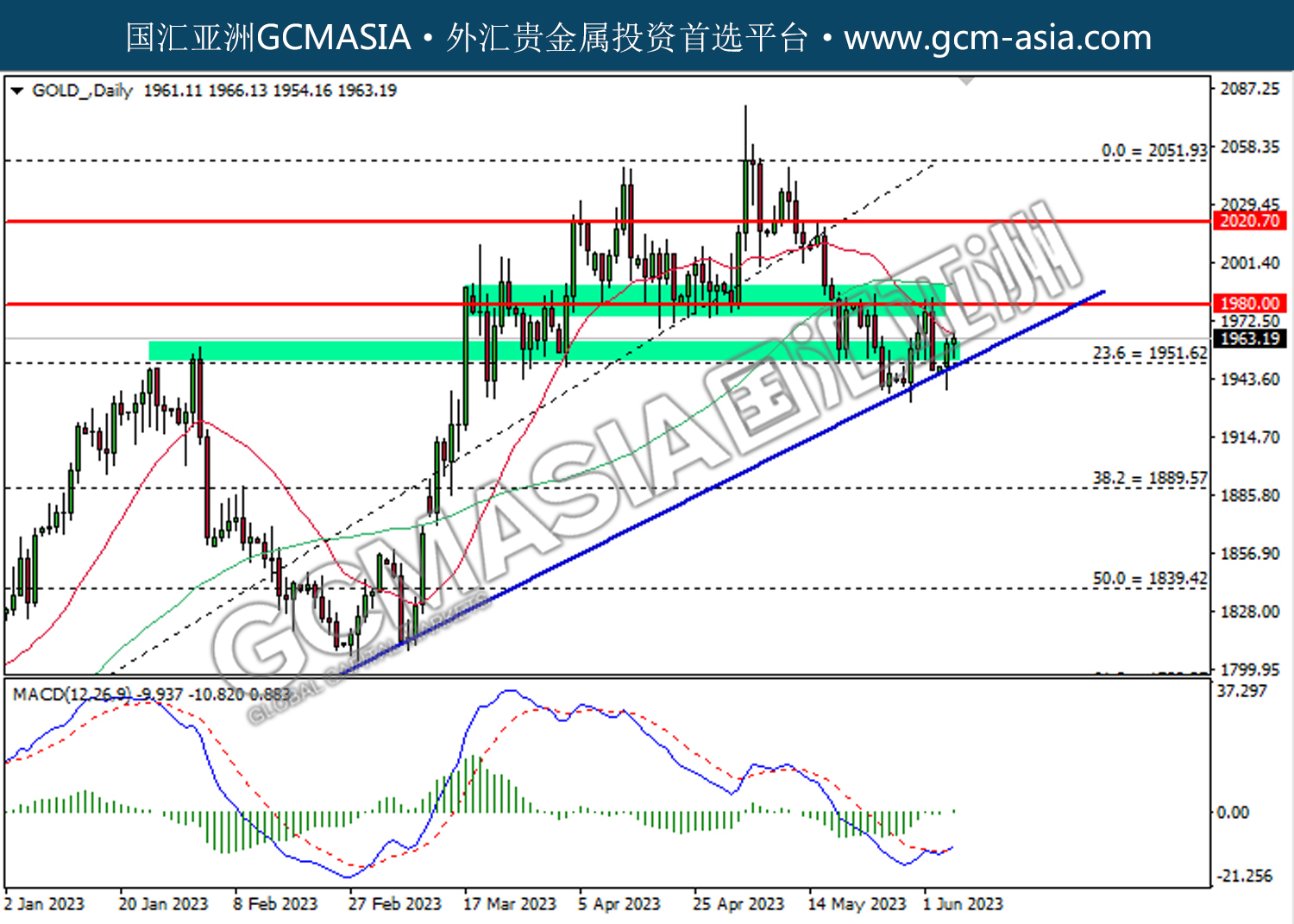

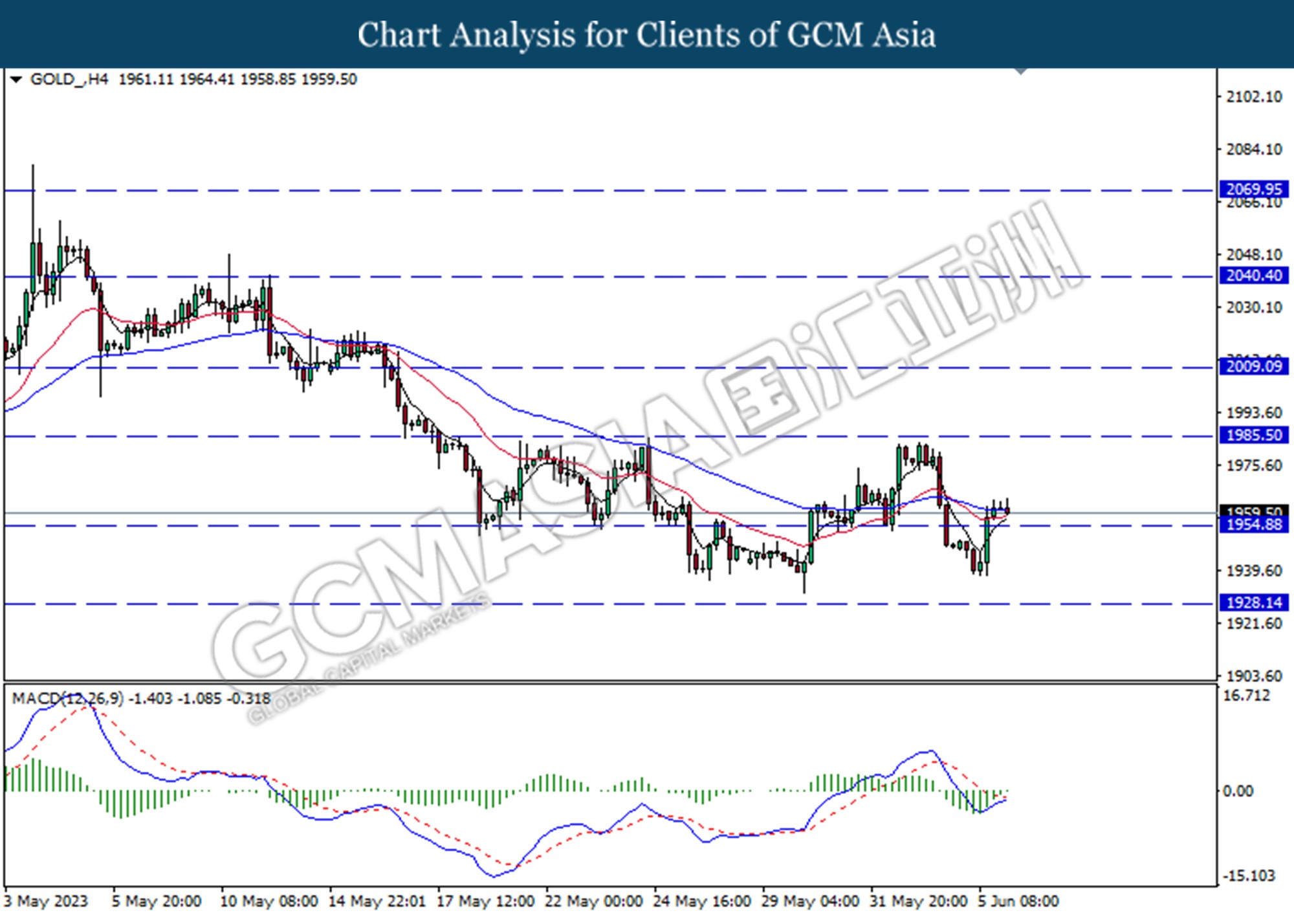

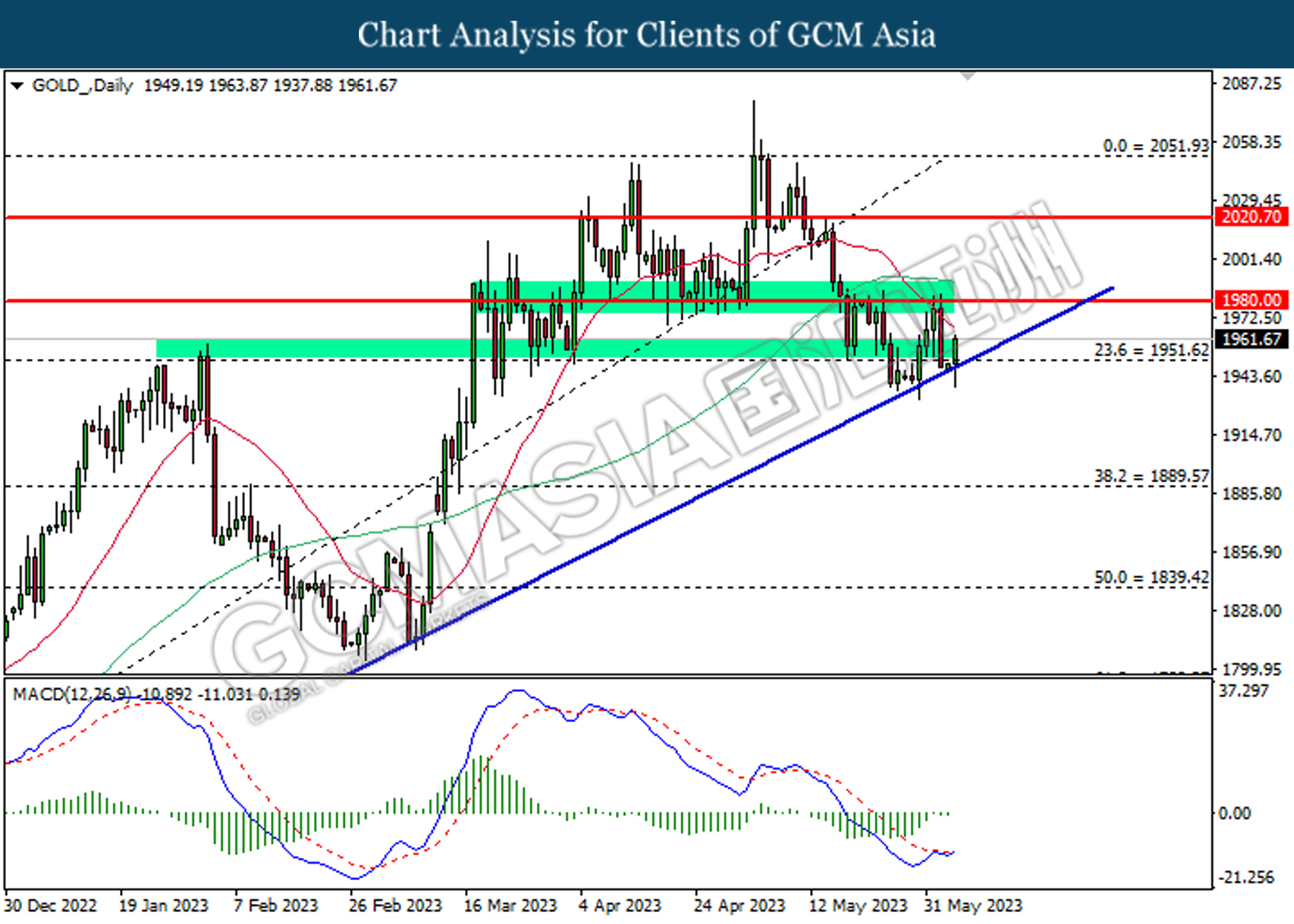

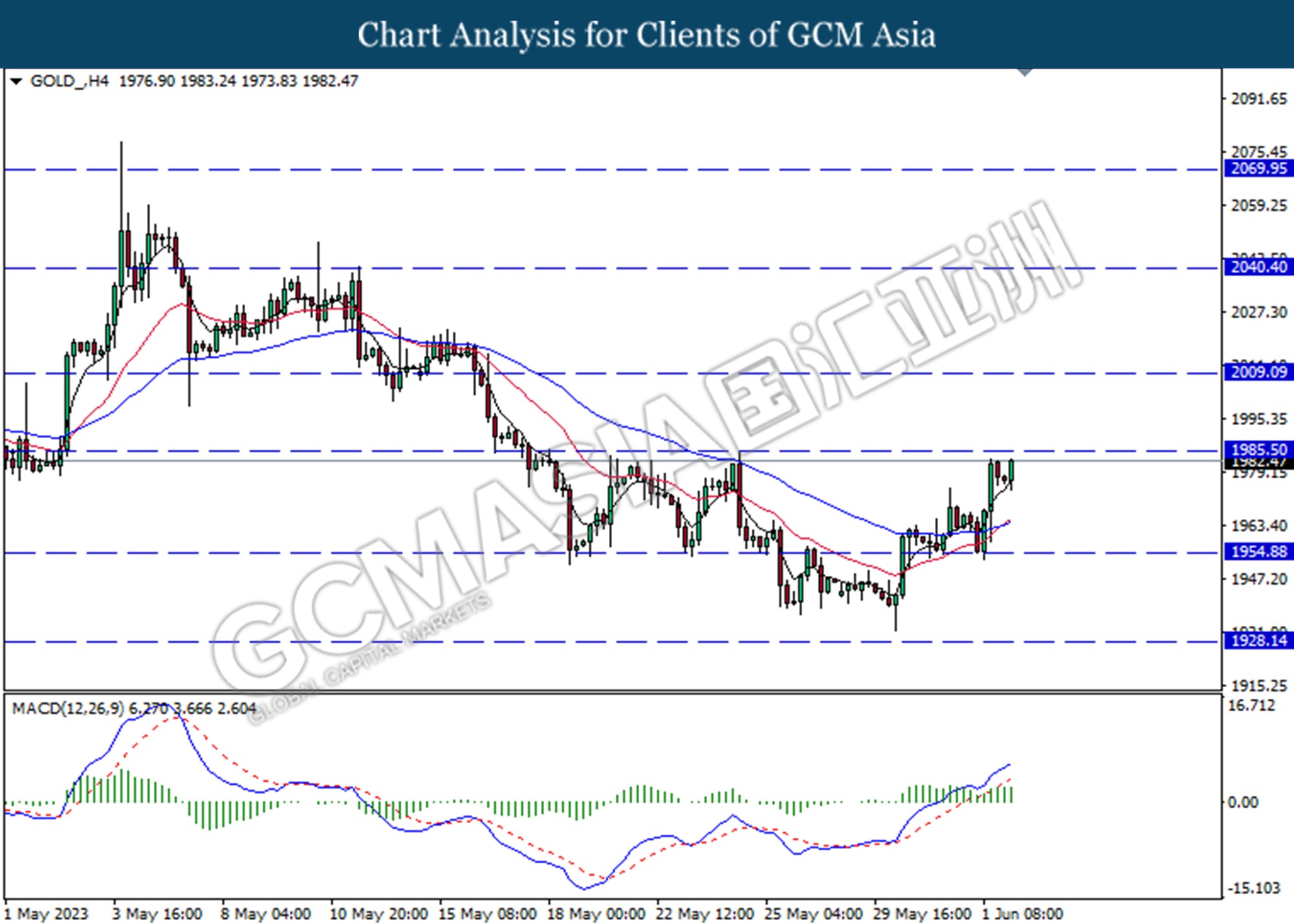

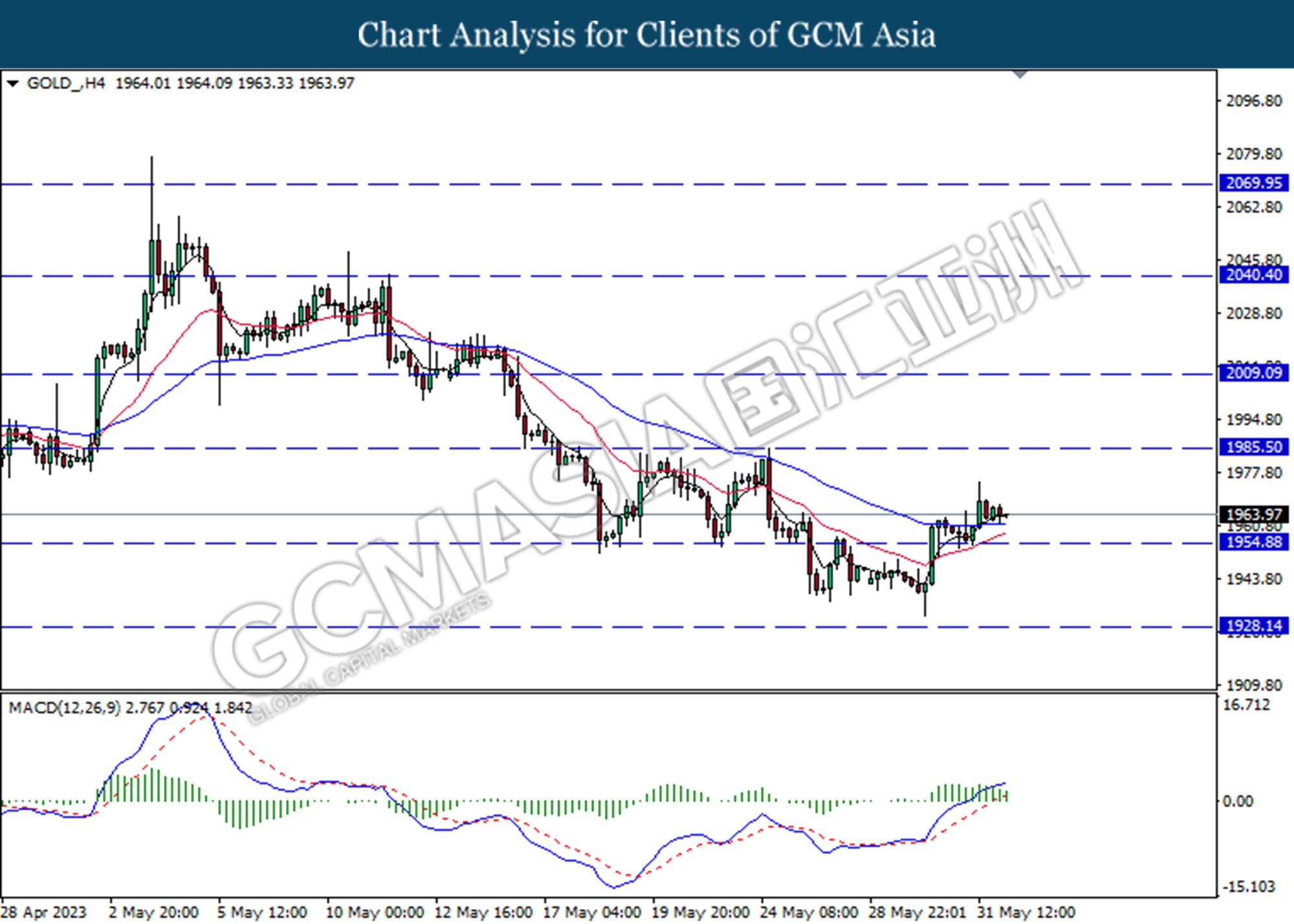

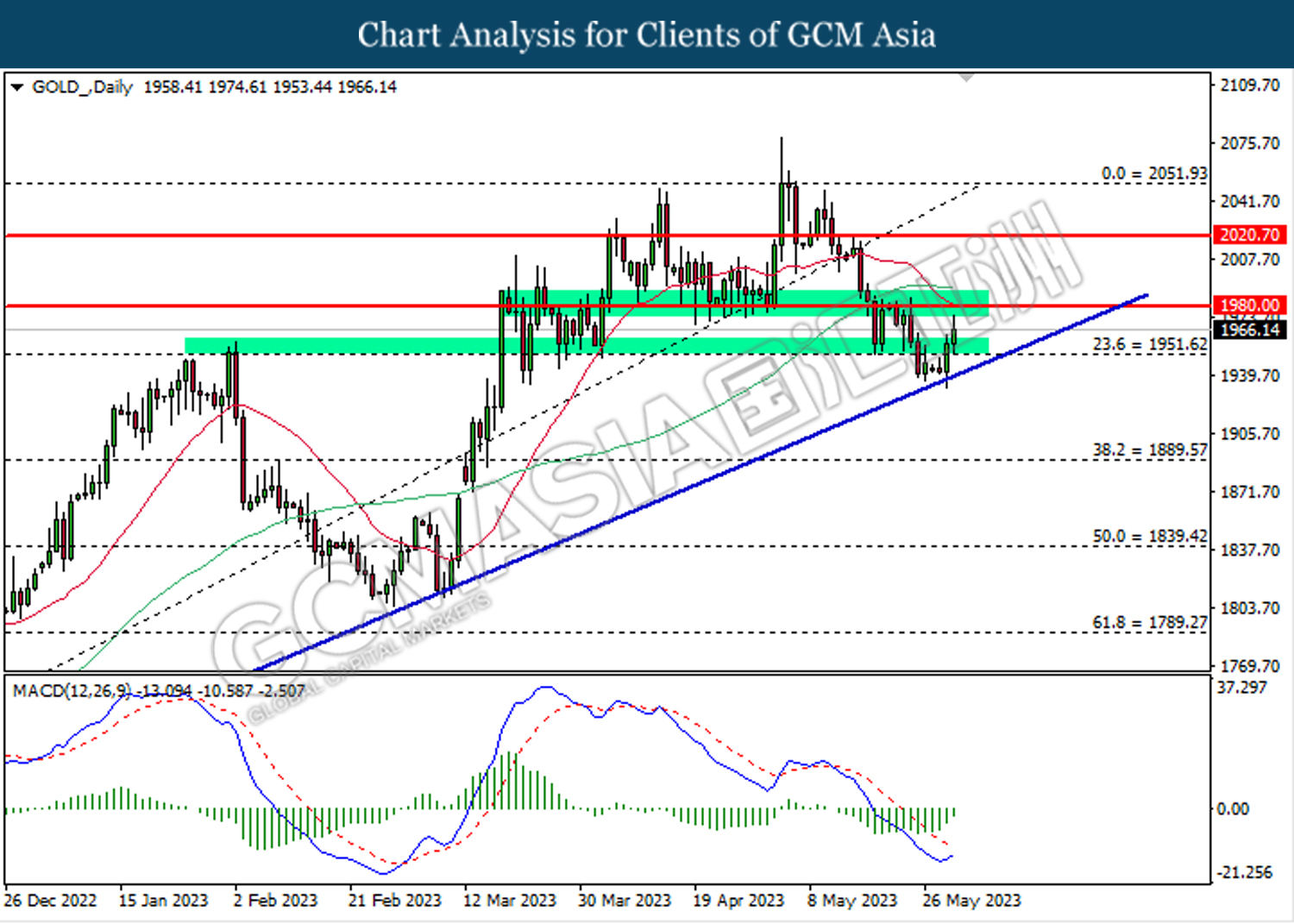

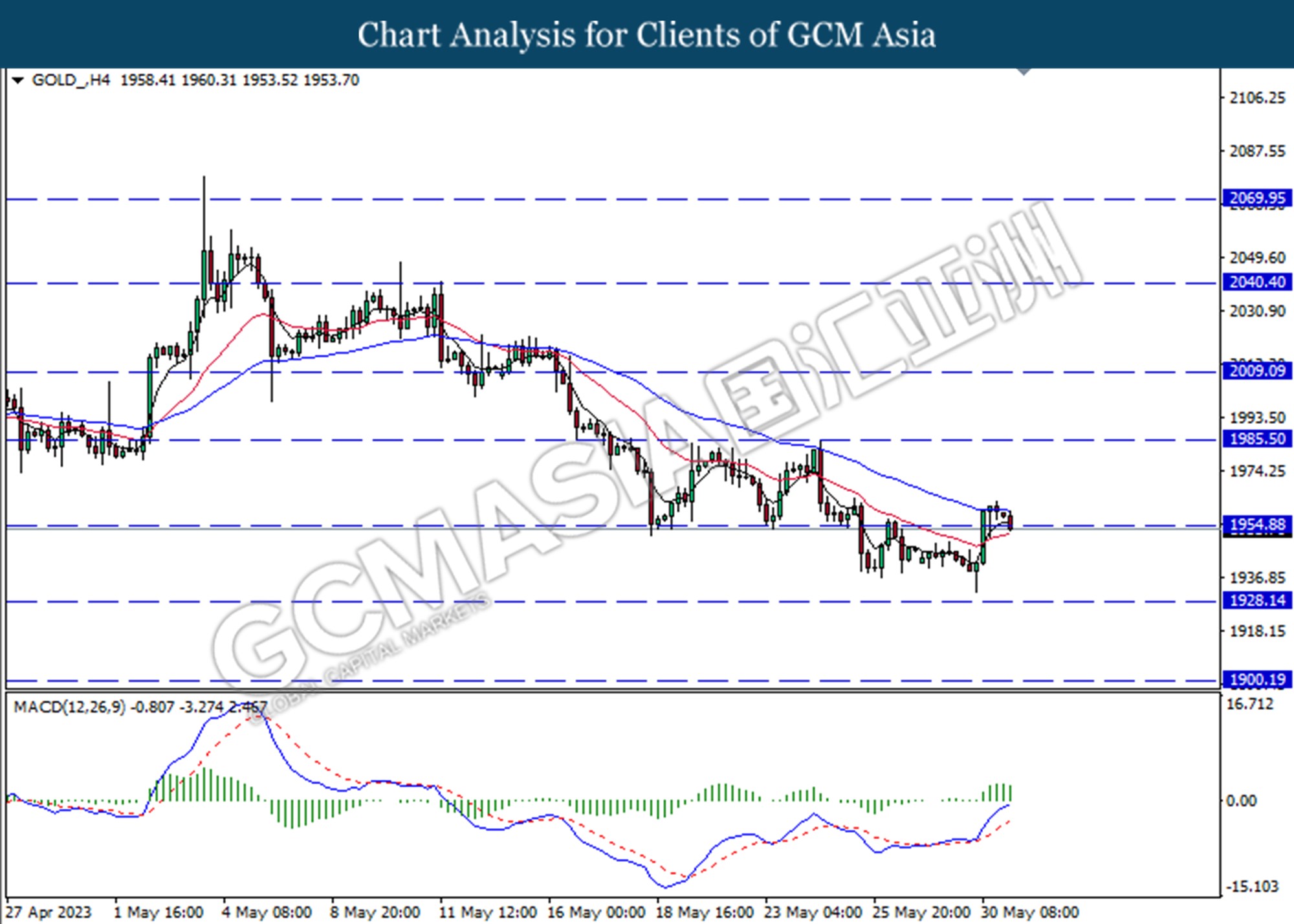

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1951.60. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55

120623 Morning Session Analysis

12 June 2023 Morning Session Analysis

Doller rebound weak China economic data.

The dollar index, which was traded against a basket of six major currencies, rebounded after a sharp loss in the previous session after weak employment data prompted the Fed to pause the monetary tightening. The rebound of the greenback comes after the weak China economic data. China, the second largest economy, showed some softening demand and falling exports caused inflation to stay at low levels in May. According to China official’s data, CPI in May was marked at -0.2%, lower than market expectations of -0.1% and the previous reading of -0.1%. While, the PPI index in May reduced the most in seven years, more than economists expected. The PPI data plunged to -4.6% from the previous -3.6%, lower than market estimations of -4.3% signaling that the China economy was struggling to rebound from the COVID hit. Investors put money into U.S. markets and benefited from the greenback as the Chinese economy slowed. At the moment, investors wait for inflation data and the Fed interest rate decision this week for any clues from the Fed. According to CME Fed watch tools, the Fed is expected to hold the rates steady at its 14 June meeting but is likely to remain hawkish in July if the inflations stay above the central bank’s projection. As of writing, the dollar index ticked up by 0.01% to 103.56.

In the commodities market, crude oil prices depreciated by -0.41% to $69.86 per After China’s economy struggles to recover from coronavirus hit and erodes crude demand. Besides, gold prices slipped by -0.06% to $1959.90 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

All Day AUD Australia – King’s Birthday

Today’s Highlight Events

Time Market Event

Today’s Highlight Economic Data

N/A

Technical Analysis

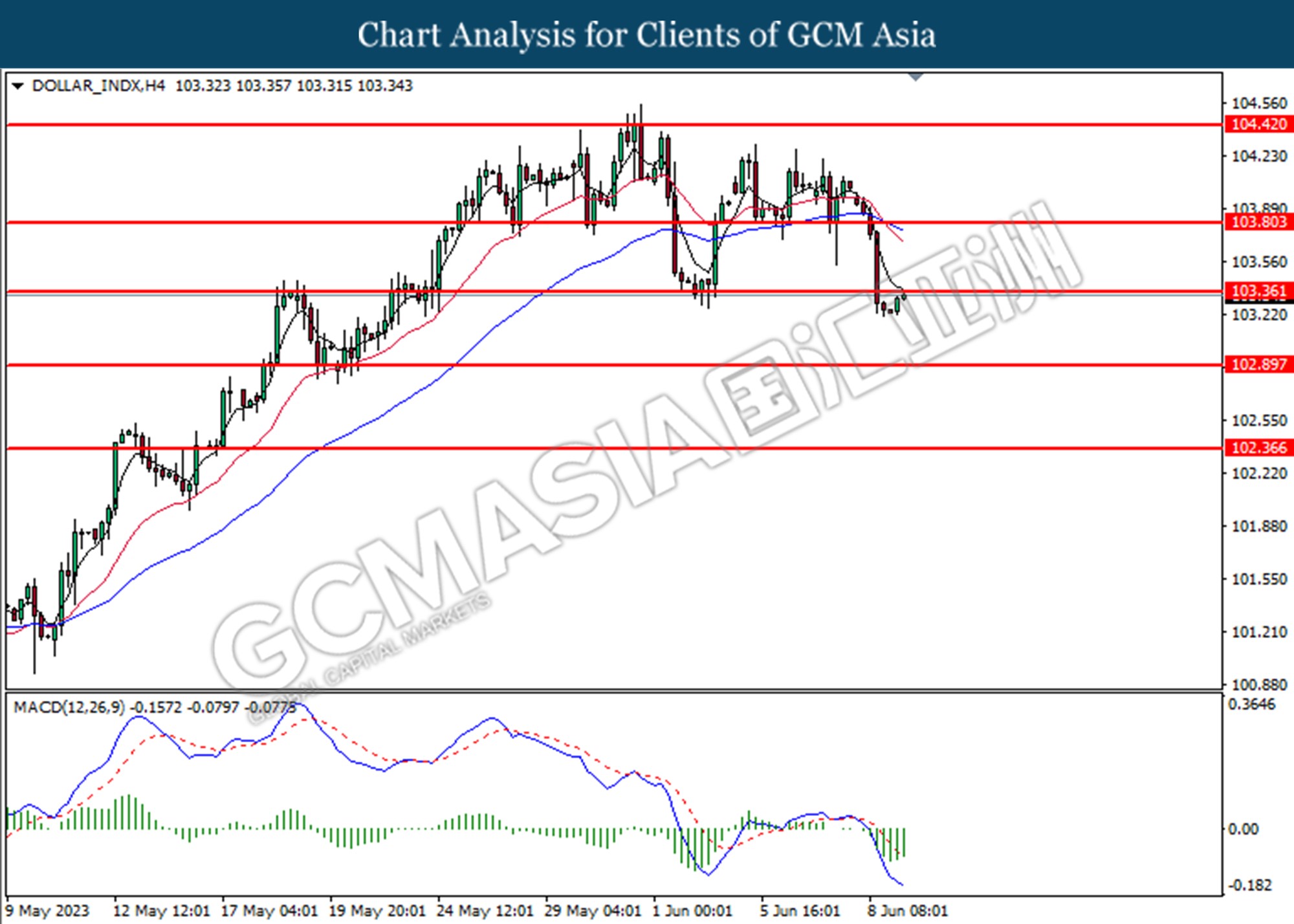

DOLLAR_INDX, DAILY: Dollar index was traded lower following the prior retracement from the higher level at 103.35. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 102.90.

Resistance level: 103.35, 103.80

Support level: 102.90, 102.35

GBPUSD, DAILY: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2565. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 1.2615, 1.2665

Support level: 1.2565, 1.2520,

EURUSD, DAILY: EURUSD was traded lower following the prior breaks below from the previous support level at 1.0760. However, MACD which illustrated increasing bullish momentum suggests the pair undergoes technical correction in the short term.

Resistance level: 1.0760, 1.0835

Support level: 1.0670, 1.0590

USDJPY, DAILY: USDJPY was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair undergoes technical correction in the short term.

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

AUDUSD, DAILY: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6770.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

NZDUSD, DAILY: NZDUSD was traded lower following the prior breaks above from the previous resistance level at 0.6105. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6215, 0.6310

Support level: 0.6100, 0.5995

USDCAD, DAILY: USDCAD was traded higher following the prior rebound from the support level at 1.3335. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 13375, 1.3425

Support level: 1.3335, 1.3300

USDCHF, DAILY: USDCHF was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.9040, 0.9105

Support level: 0.8985, 0.8940

CrudeOIL, DAILY: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 69.30.

Resistance level: 70.40, 71.35

Support level: 69.30, 67.55

GOLD_, DAILY: Gold price was traded lower following the prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the commodity to undergo a technical correction in the short term.

Resistance level: 1982.50, 2005.80

Support level: 1955.50, 1930.45

090623 Afternoon Session Analysis

09 June 2023 Afternoon Session Analysis

Euro climbs despite downbeat EU GDP data.

The pair of EUR against the dollar index climbed higher despite downbeat GDP data released by Eurostat on Thursday. Eurozone Gross Domestic Product (GDP) was growth to 1.0%, lower than the estimation of growth of 1.3%, Eurostat data showed. Slow economic growth in the European Union has been hurt after German officials indicated that the bloc’s largest economy would enter recession early in 2023 According to a survey in Germany, consumer spending accounts for half of Germany’s GDP. After being hit by high inflation, consumers are cautious and reduce spending. Nonetheless, a slowing down of the eurozone economy cannot limit the gains of the pair of EURUSD. Eurostat said that employment remains in tightened conditions with a growth accelerated at the start of 2023, rising to 0.6% in the first quarter from 0.3% in the fourth quarter of 2022, in line with economist estimation. Moreover, price pressure and inflation data in the EU were reduced, but not enough to deter the ECB from continuing to tighten its monetary policy. Following that, ECB President Christine Lagarde make her hawkish tone in the early week and said that “it was too early to call a peak in core inflation”. The message prompted investors that the central bank will raise the interest rate again at the upcoming meeting. As of writing, the EUR/USD traded down by -0.05% to 1.0779.

In the commodities market, crude oil prices depreciated by -0.53% to $70.91 per barrel as weak economic data from China will erode simple oil demand. Besides, gold prices slipped by -0.04% to $1964.90 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (May) | 41.4K | 23.2K | – |

Technical Analysis

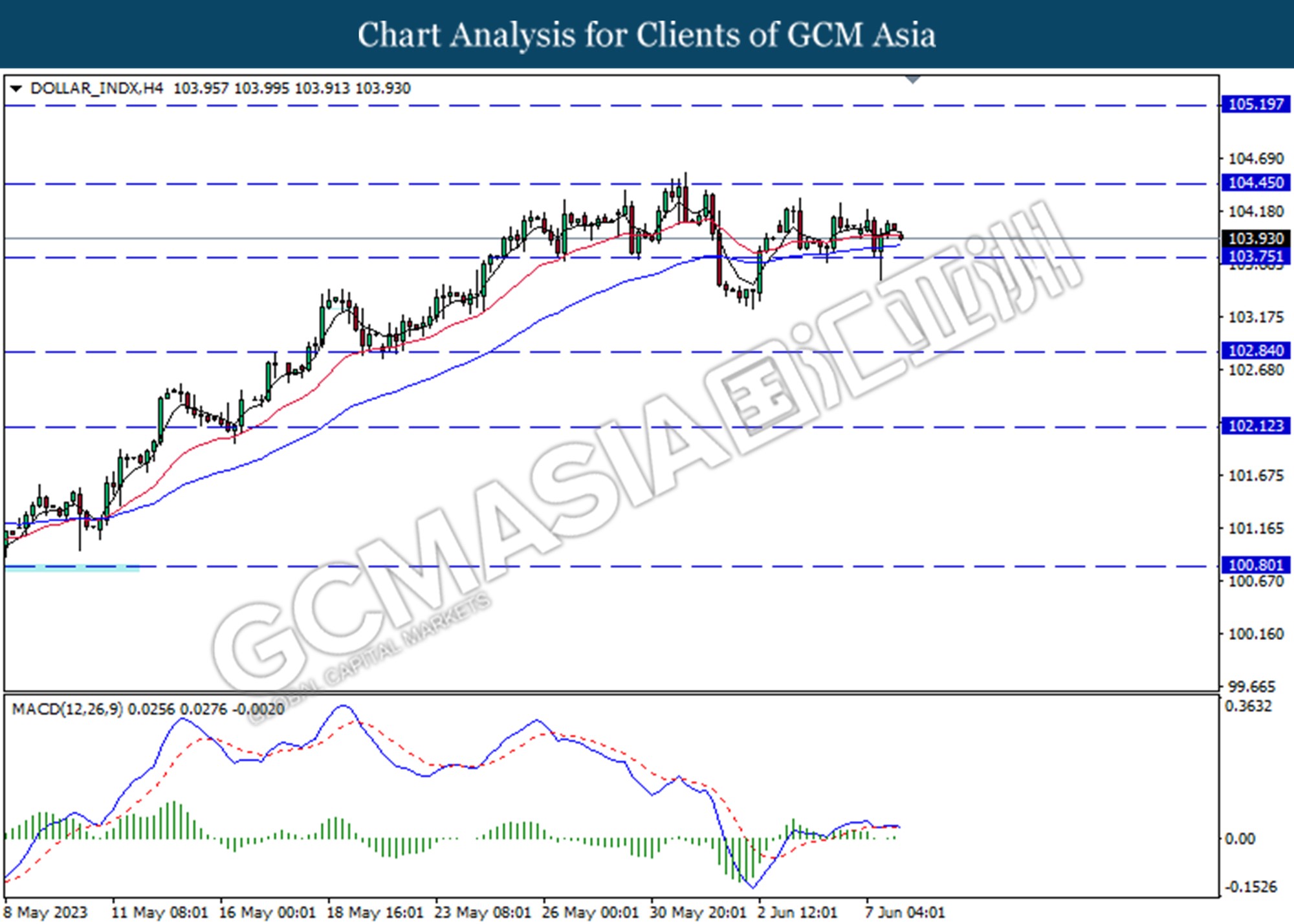

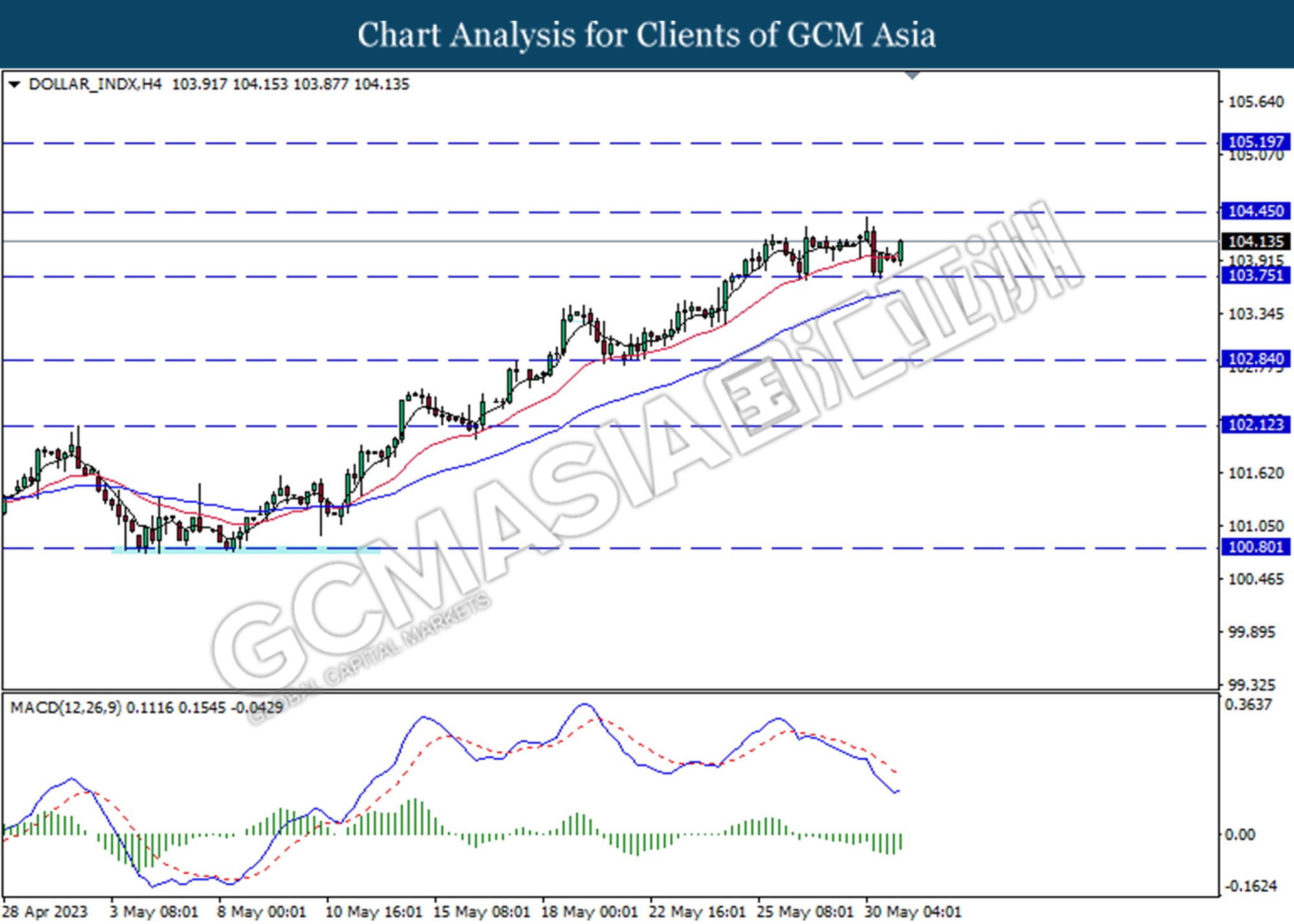

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing for the resistance level at 103.35. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breaks above the resistance level.

Resistance level: 103.35, 103.80

Support level: 102.90, 102.35

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 1.2565, 1.2615

Support level: 1.2520, 1.2470

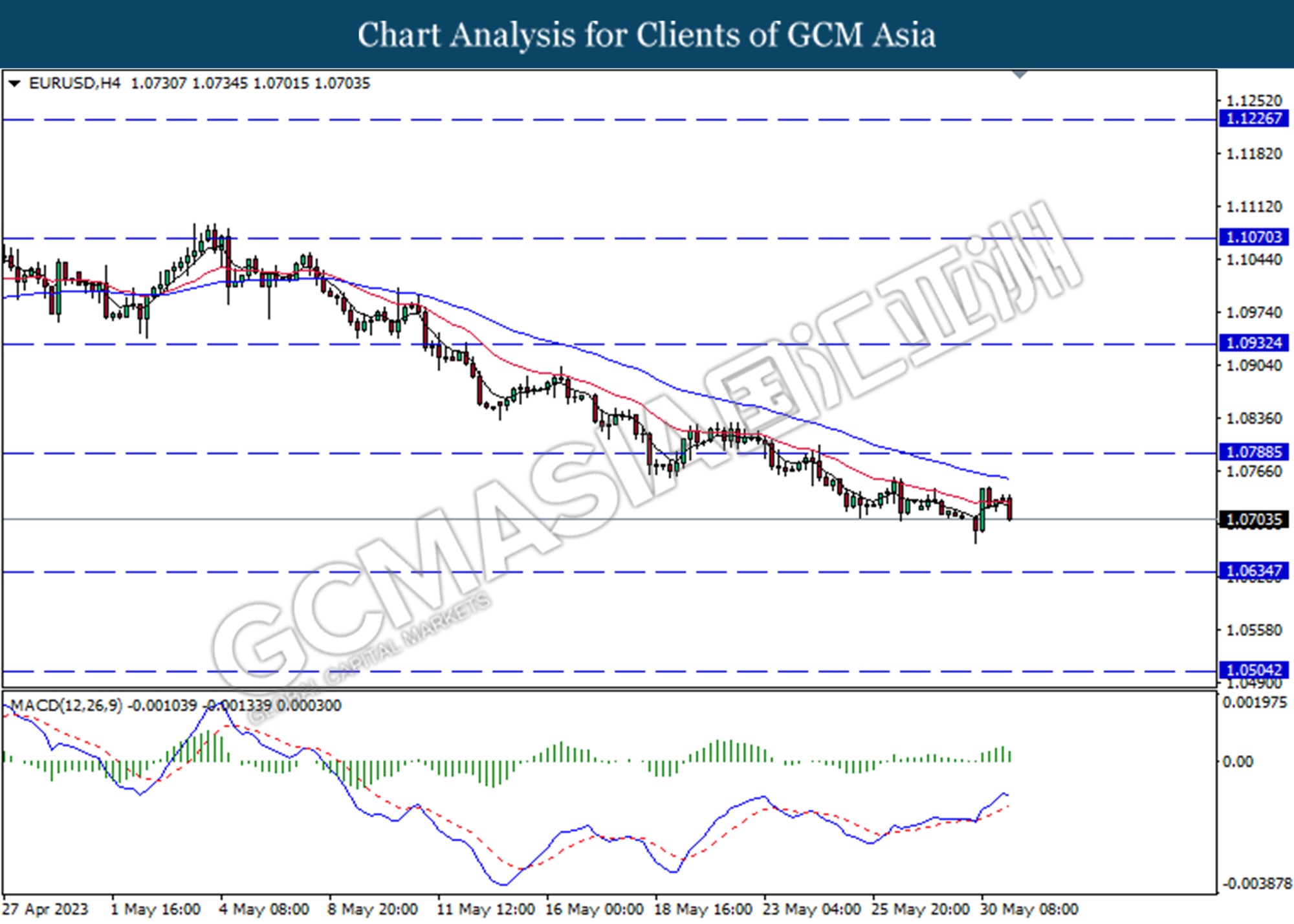

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.0760.

Resistance level: 1.0840, 1.0915

Support level: 1.0760, 1.0670

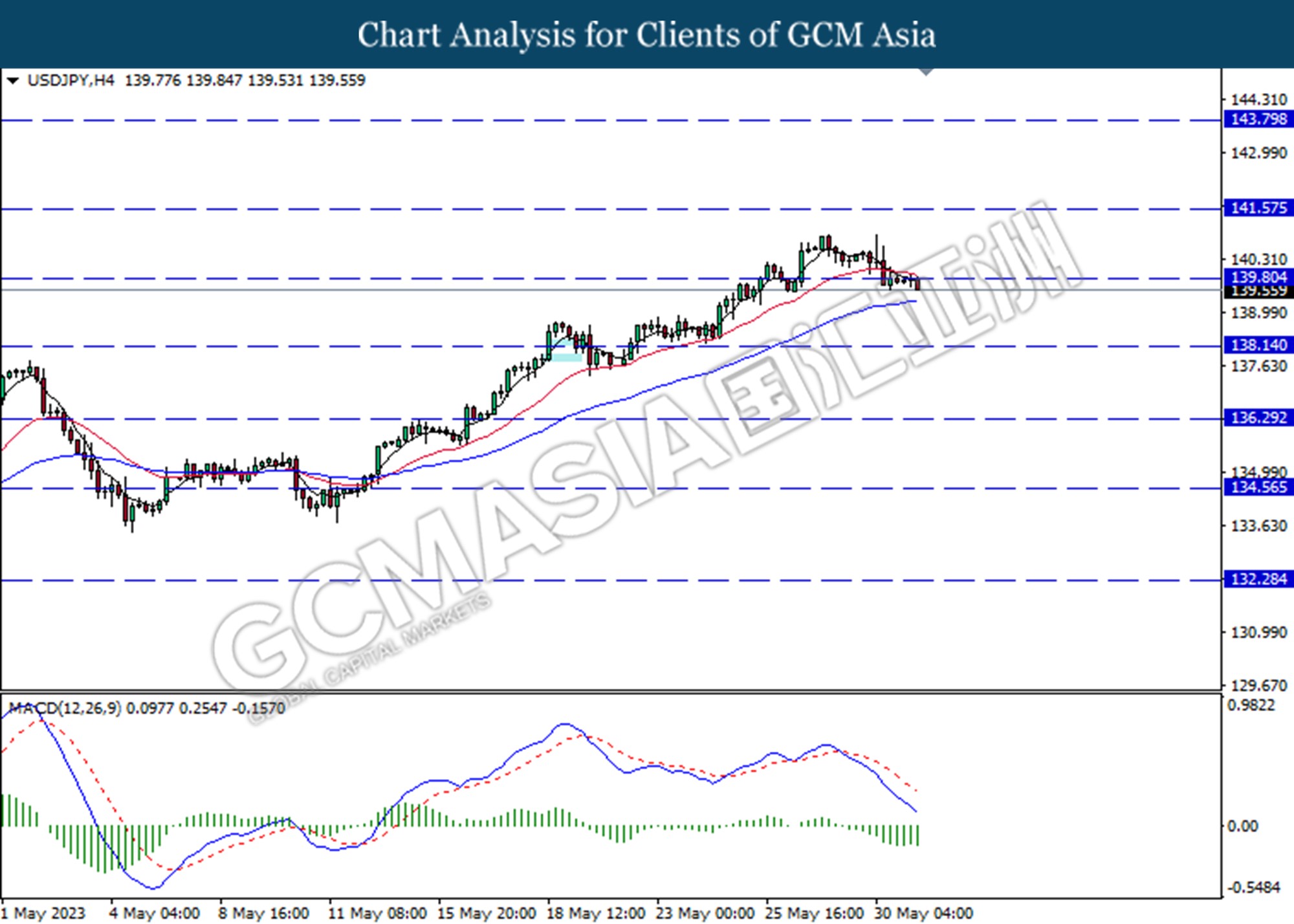

USDJPY, H4: USDJPY was traded higher following the prior rebound from the support level at 138.70. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 140.20.

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

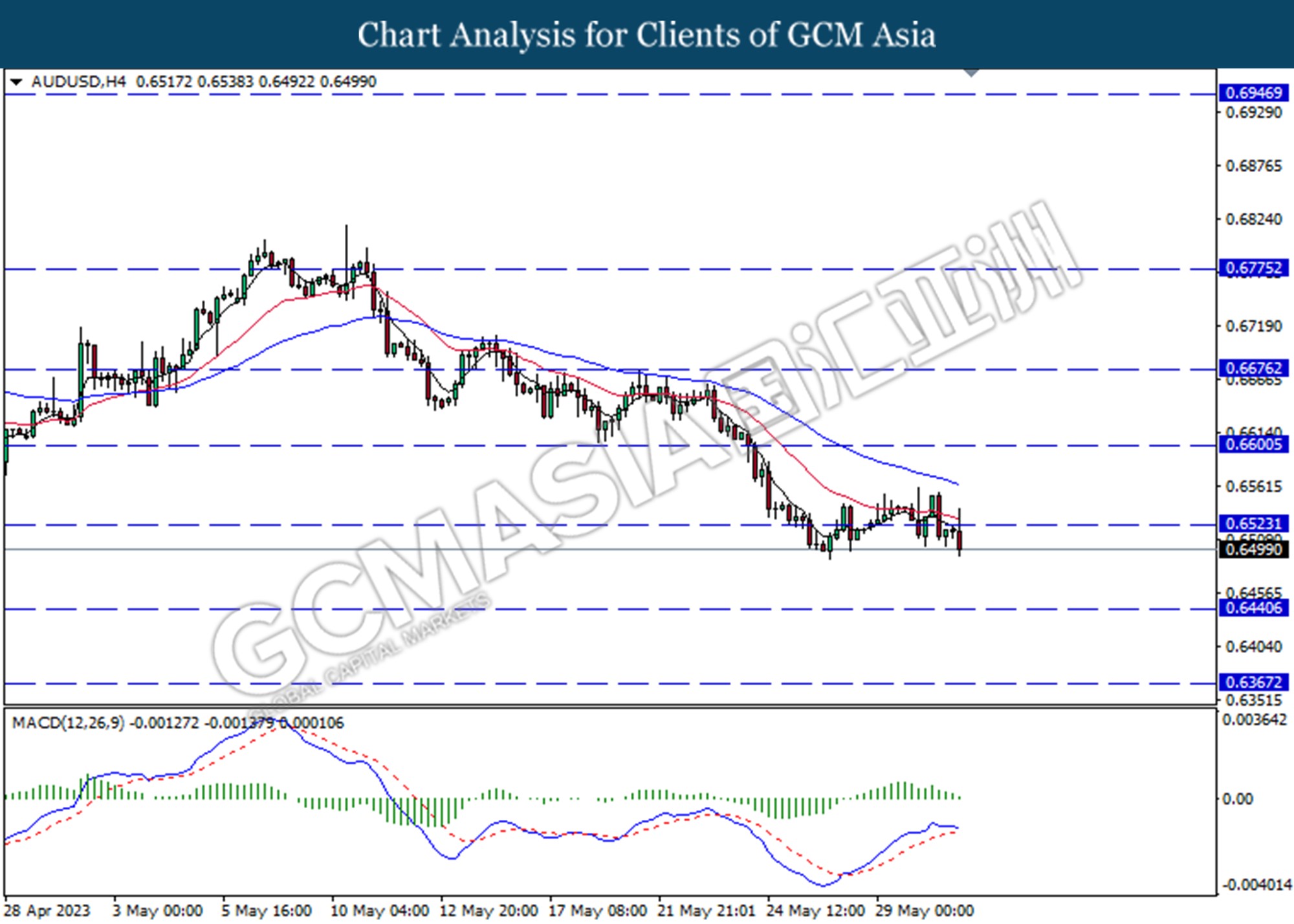

AUDUSD, H4: AUDUSD was traded lower following the prior breaks below the previous support level at 0.6700. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6135. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.6105, 0.6215

Support level: 0.5995, 0.5880

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3375.

Resistance level: 1.3375, 1.3425

Support level: 1.3335, 1.3300

USDCHF, H4: USDCHF was traded higher following the prior rebound from the support level at 0.8985. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 0.9040, 0.9105

Support level: 0.8985, 0.8940

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 70.40.

Resistance level: 71.35, 73.15

Support level: 70.40, 69.30

GOLD_, H4: Gold price was traded lower following the prior retracement from the resistance level at 1968.40. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 1968.40, 1982.50

Support level: 1955.50, 1938.95

090623 Morning Session Analysis

09 June 2023 Morning Session Analysis

Greenback plunged amid jobless claims spiked.

The dollar index, which was traded against a basket of six major currencies, teetered near the brink of collapse after the country reported downbeat job data yesterday. According to the Department of Labor, the US Initial Jobless Claims came in at 261K, significantly higher than the market consensus at 235K, refreshing the record high since the end of 2021. The big surprise in the initial jobless claims could be signaling that the mounting layoff is starting to translate into job cuts. However, a conclusion should not be attached with just a single weekly job data as the volatility of claims from week to week could influence the data reading easily. Prior to that, the Nonfarm Payrolls data were released with a stronger-than-expected reading, prompting investors to rush into the US dollar market despite a jump of 0.3% in the employment rate. With the backdrop of jobless claims spiked, the possibility of Fed to maintain the interest rate rose as the health condition of the labor market would exacerbated if more rate hikes were to implement. Nevertheless, the investors are now shifting their focus to the crucial data and events in next week, such as Consumer Price Index (CPI) and Fed’s meeting. As of writing, the dollar index plummeted -0.75% to 103.30.

In the commodities market, crude oil prices dropped by -2.90% to $71.00 per barrel as Iran and US were getting closer to a deal, which could allow Iran to resume its oil exportation of about 1 million per day. Besides, gold prices rose by 0.02% to $1966.05 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (May) | 41.4K | 23.2K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2525. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.95. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6040. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3330. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 70.15. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1951.60. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55

080623 Afternoon Session Analysis

08 June 2023 Afternoon Session Analysis

Canadian dollar soars as BoC hike interests to 22 years hike.

The pair of dollar index against the Canadian dollar plunged amid the Bank of Canada’s (BoC) increase in the interest rate by 25 basis points to 4.75%, a 22-year high. The BoC decisions surprised the economist as they forecast the rate will remain unchanged at 4.50%. Following that,BoC Governor Tiff Macklem commenting on the BoC policy announcement, said there is accumulating evidence that current monetary policy is not sufficient to bring the Canada inflation return to the 2% target, as a result, the central bank hikes the interest.. Although consumer price inflation is coming down driven by lower energy prices compared to a year ago, underlying inflation remains stubbornly high. Based on the consumer price index (CPI) data released on 16th May was unexpectedly rose to 4.4% after several months of decrease. It prompted the central bank to continue rate hikes after Canada’s economy was stronger than expected in the first quarter of 2023 with a GDP growth of 3.1%. However, the pair of the USDCAD limited its losses after investors increase their expectations on bets that the Fed will hike interest rates for another 25 basis points to curb inflation. As of writing, the pair of USDCAD tickled down by -0.08% to 1.3358.

In commodity markets, crude oil prices fell -0.19% to $72.39 a barrel as investors weighed on supply and demand drivers. Besides, gold prices were inched up by 0.35% to $1946.87 per troy ounce ahead of the Fed meeting.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 238K | 232K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the index undergoes a technical correction in the short term.

Resistance level: 104.45, 105.20

Support level: 103.75, 102.85

GBPUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2445. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.0790.

Resistance level: 1.0790,1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower while currently testing for the support level at 139.80. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses after it successfully break below the support level.

Resistance level: 141.60, 143.80

Support level: 139.80, 138.15

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.6675, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6050. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains after it successfully breakout above the resistance level.

Resistance level: 0.6050, 0.6120

Support level: 0.5980, 0.5885

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 1.3330.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9090. However, MACD which illustrated bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 0.9180,0.9285

Support level: 0.9090, 0.9005

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the resistance level at 73.20. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 76.05, 73.20

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded lower following the prior from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level at 1954.90.

Resistance level: 1954.90, 1985.50

Support level: 1928.15, 1900.20

080623 Morning Session Analysis

08 June 2023 Morning Session Analysis

Greenback trod water at high ahead of inflation data and Fed interest rate decision.

The dollar index, which was traded against a basket of six major currencies, lingered near its 11 week highs as the market sentiment remained vague, where the investors are awaiting for the US inflation figure for the month of May and also the Fed’s rate hike decision next week. At this point in time, the market participants are expecting the Fed would likely to take a step back from its aggressive rate hike policy, maintaining the cash rate at current level before further rate hike to be taken. The majority of the Fed’s members have mentioned that they intended to avoid another rate hike in the June meeting as they need to evaluate the impact of the recent rate hike on the economy thoroughly. However, minority of the Fed’s member such as James Bullard revealed that further rate hike is needed in order to cool down the still-high inflation toward their long term target, which is at 2%. Nonetheless, investors are reminded to understand that the core objective of the rate adjustment were to slowdown the inflation level. With that, the US Consumer Price Index (CPI), which is scheduled on next Wednesday, would be the crucial data for the Fed as it would influence the next Thursday interest rate decision. As of writing, the dollar index edged down -0.01% to 104.10.

In the commodities market, crude oil prices edged up by 2.35% to $72.44 per barrel as the EIA data showed some draw in the US crude oil inventories. According to EIA, the US crude oil inventories reduced by -0.451M, while the economist expectation was an increase of 1.022M in the oil inventory. Besides, gold prices were up by 0.12% to $1942.40 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 238K | 232K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

GBPUSD, Daily: GBPUSD was traded lower while currently testing support level at 1.2405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0665. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 138.95. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6040. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3330. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9075. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1951.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55

070623 Afternoon Session Analysis

07 June 2023 Afternoon Session Analysis

AUDUSD soars on RBA rate hike quarter basis points.

The pair of the Australian dollar against the dollar index, extended its gains to its one-week highest after the Reserve Bank of Australia (RBA) hiked interest rate by a quarter basis points to 4.10%. The central bank remarked the risk of ongoing high inflation contributes to both prices and wages rising, given the limited spare capacity in the economy. Although inflation has passed its peak in Australia, it is still far from the RBA’s 2-3% target range. Meanwhile, the labor market remains in tightening conditions as the unemployment rate was recorded at 3.7% in April, giving RBA space to hike the rate. Following the rate hike, RBA Governor Philip Lowe made the following hawkish comments early in the morning. Governor Lowe said there was evidence that higher interest rates were working and that inflation was falling, but that did not mean the board would tolerate higher inflation persisting. However, the gains of the pairs of AUD/USD were limited after the Gross Domestic Product (GDP) growth was less than market expectations. GDP in the first three months rose to 0.2%, weaker than the prior month’s reading of 0.6%, as well as market estimates of 0.8%. The weak reading was driven by a slowdown in household spending as higher interest rates environment consumer tightened their purse. As of writing, the pair of AUDUSD edged up by 0.065 to 0.6675.

In the commodities market, crude oil prices ticked down by -0.36% to $71.48 per barrel after weak Chinese economic data was released. Besides, gold prices appreciated by 0.01% to $1963.41 per troy ounce amid Fed uncertainty on monetary policy.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CAD – BoC Interest Rate Decision | 4.50% | 4.50% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 4.488M | 1.152M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the index undergoes a technical correction in the short term.

Resistance level: 104.45, 105.20

Support level: 103.75, 102.85

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.2445.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 139.80. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 139.80, 141.60

Support level: 138.15, 136.30

AUDUSD, H4: AUDUSD was traded lower following the prior breaks below from the previous resistance level at 0.6675. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6675, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the support level at 0.6050. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.6120.

Resistance level: 0.6120, 0.6190

Support level: 0.6050, 0.5980

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair extended its losses toward the resistance level at 1.3420

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the commodity extended its losses toward the support level at 70.65.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1954.90. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15

070623 Morning Session Analysis

07 June 2023 Morning Session Analysis

Greenback lingered amid Fed blackout and a light calendar.

The dollar index, which was traded against a basket of six major currencies, hovered near its recent high as the market was weighed by the uncertainty of rate hike in the upcoming meeting. At this point in time, the investors are still unsure about the future path of the Fed’s rate hike plan as there is a divergence among the Fed’s officials. Before the FOMC blackout period, some of the members had given their own outlook regarding the path of monetary policy over the past 2 weeks. Take an example, the Fed’s members such as Bostic and Jefferson were in the camp who would like to hold interest rates steady in the next meeting, while James Bullard aimed for more rate hikes in the coming meeting. Also, a series of positive economic data had provided a more than sufficient of room for Fed to increase the interest rate if necessary. With that, investors are blurred with the future path of the US monetary policy ahead of the monetary policy meeting and the major inflation data in next week. It is also noteworthy to mention that the Fed officials are in a blackout period, where no members are allowed to speak publicly between a week prior to the Saturday preceding a Federal Open Market Committee (FOMC) meeting and the Thursday following that meeting. As of writing, the dollar index dipped -0.02% to 104.15.

In the commodities market, crude oil prices edged down by -0.51% to $71.60 per barrel ahead of the major economic releases today, which includes the trade balances from China. Besides, gold prices were up by 0.02% to $1963.80 per troy ounce as the greenback ticked down.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CAD – BoC Interest Rate Decision | 4.50% | 4.50% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 4.488M | 1.152M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

GBPUSD, Daily: GBPUSD was traded lower while currently testing support level at 1.2405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0665. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6040. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9075. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 73.90. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 70.15.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1951.60. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55

060623 Afternoon Session Analysis

06 June 2023 Afternoon Session Analysis

The GBPUSD lifted after PMI slips lower than expected.

The pair of the Pound sterling against the dollar index lifted after the composite PMI slipped lower than economists forecast. The UK composite PMI falls to 54.0 in May from 53.3 in April, higher than economists polled by Reuters forecast of 53.9. Besides, the service PMI slightly reduced from 55.9 in April to 55.2 in May, upbeat the market consensuses forecast at 55.2. Although the PMI reading is diminished, the readings are above the 50 threshold reflecting the overall economy expanded in the month. According to a survey by S&P Global, the main contribution to the growth of service companies in the UK was the strongest input costs, as higher wage payments led to a sharp rise in price charges. Input costs have edged up since February and, while well below their historic peak a year ago, remain above levels seen before the COVID-19 pandemic. Furthermore, the gains of the GBPUSD pairs bolster the weakening of the dollar. The US service industry reported a slowing pace of growth and recorded at 54.9 in May when compared to 53.6 the previous month, data announced by Markit. Therefore, it increases the odds that the Fed will pause on a rate hike in the next monetary policy. As of writing, the pair of GBPUSD inched up by 0.06% to 1.2447.

In the commodities market, crude oil prices were traded lower by -0.64% to $71.70 per barrel after investors digest the news on Saudi Arab production cuts. Besides, gold prices edged down by -0.10% to $1960.12 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (May) | 51.1 | 51.0 | – |

| 22:00 | CAD – Ivey PMI (May) | 56.8 | 57.2 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing for the support level at 103.75. MACD which illustrated diminishing bullish momentum suggests the index extended its losses after it successfully break below the support level at 103.75.

Resistance level: 104.45, 105.20

Support level: 103.75, 102.85

GBPUSD, H4: GBPUSD was traded higher while currently testing for the resistance level at 1.2445. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains if successfully break above the resistance level.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.0790.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower following the prior breaks below from the previous resistance level at 139.80. MACD which illustrated diminishing bullish momentum suggests the pair extended its gains toward the support level.

Resistance level: 139.80, 141.60

Support level: 138.15, 136.30

AUDUSD, H4: AUDUSD was traded higher while currently testing for the resistance level at 0.6675. MACD which illustrated increasing bullish momentum suggests the pair extended its gains if successfully break above the resistance level.

Resistance level: 0.6675, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards the resistance level at 0.6120

Resistance level: 0.6120, 0.6195

Support level: 0.6050, 0.5980

USDCAD, H4: USDCAD was traded following the prior breaks below the previous support level at 1.3420. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.9005.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 70.65.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded higher following the prior breaks above from the resistance level at 1954.90. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15

060623 Morning Session Analysis

06 June 2023 Morning Session Analysis

US dollar dipped amid weaker-than-expected Services PMI.

The dollar index, which was traded against a basket of six major currencies, failed to ride on the bullish trend further as the downbeat economic data wiped out the buying pressures in the market. According to the Institute for Supply Management (ISM), the US Services PMI printed at 50.3, lower than both the market forecast and prior reading at 51.8 and 51.9, respectively. A reading above 50 indicates expansion in the services industry, which accounts for more than two-thirds of the US economy. With that, it showed that the US services sector expanded at a slower pace in the month of May, where the sector is cooling down at this point in time. Before that, the services sector had been experiencing strong growth since the reopening of the economy. However, the Fed’s rate hikes started to put pressure on the services sector, where the cooling of demand dragged down the services inflation. As a result, it slightly reduced the possibility of further rate hikes in the next Fed meeting. On top of that, the stronger-than-expected economic data from the UK also attracted investors to move their capital into the Pound’s market, putting pressure on the dollar’s market. As of writing, the dollar index dropped -0.02% to 104.00.

In the commodities market, crude oil prices surged by 1.35% to $72.90 per barrel amid the surprise voluntary cut by Saudi Arabia, with an oversupply concern. Besides, gold prices were up by 0.01% to $1962.10 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Jun) | 3.85% | 3.85% | – |

| 16:30 | GBP – Construction PMI (May) | 51.1 | 51.0 | – |

| 22:00 | CAD – Ivey PMI (May) | 56.8 | 57.2 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

GBPUSD, Daily: GBPUSD was traded lower while currently testing support level at 1.2405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0665. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6565. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6040. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3485.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9075. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9160, 0.9230

Support level: 0.9075, 0.9000

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 73.90. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 70.15.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1951.60. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55

020623 Afternoon Session Analysis

02 June 2023 Afternoon Session Analysis

The EURUSD soars despite eurozone inflation dipped.

The pair of the Euro against the dollar index soared despite eurozone inflation showing some sign of price pressure has eased. The Eurozone Consumer Price Index (CPI), data announced by Eurostat yesterday, was eased from 7.0% to 6.1%, slipped more than market expectations for 6.3%. While the Core goods price index which measures excluding food, energy, alcohol and tobacco eased to 5.3% from 5.6%, lower than the market expectation of 5.5%. CPI and core CPI data prompted the central bank to pause it’s tightening action for the upcoming monetary policy decision, but central bank governor Christine Lagarde followed with her hawkish statement. In her speech, Lagarde mentioned that inflation in the eurozone was too high and would last for too long, so the European Central Bank decided to further tighten monetary policy until inflation returned to the European Central Bank’s 2% annual target range. On the other hand, the greenback traded under sell-off pressure after the Fed’s member, Patrick Harker recommends a rate paused at the next meeting. With such a backdrop, the dollar weakened and support the Euro. As of writing, the EUR/USD edged up by 0.06% to 1.0768.

In the commodities market, crude oil prices were traded up by 0.66% to $70.56 per barrel as bullish sentiment following the Congress approves the US debt ceiling bill. Besides, gold prices lifted up by 0.26% to $1982.61 per troy ounce as investors eyed non-farm payroll data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Average Hourly Earnings (MoM) (May) | 0.5% | 0.4% | – |

| 20:30 | USD – Nonfarm Payrolls (May) | 253K | 180K | – |

| 20:30 | USD – Unemployment Rate (May) | 3.4% | 3.5% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the breaks below the previous support level at 103.75. MACD which illustrated bearish momentum suggests the index extended its losses toward the support level at 102.85.

Resistance level: 103.75, 104.45

Support level: 102.85, 102.10

GBPUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2445. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 139.80. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 138.15.

Resistance level: 139.80, 141.60

Support level: 138.15, 136.30

AUDUSD, H4: AUDUSD was traded higher following the prior breaks above the previous resistance level at 0.6600. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6675, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards the resistance level at 0.6120

Resistance level: 0.6120, 0.6195

Support level: 0.6050, 0.5980

USDCAD, H4: USDCAD was traded following the prior breaks below the previous support level at 1.3515. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.3515, 1.3590

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded lower following the prior breaks below the previous support level at 0.9090. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 70.65.

Resistance level: 70.65, 73.20

Support level: 67.00, 63.85

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level at 1985.50

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15

020623 Morning Session Analysis

02 June 2023 Morning Session Analysis

The dollar plummeted as Fed will likely skip the rate hike in the June meeting.

The dollar index, which was traded against a basket of six major currencies, failed to extend its rally yesterday as the market sentiment continued to be hammered by the Fed’s dovish statement. Yesterday, the Philadelphia Federal Reserve President Patrick Harker said, “It is the time to hit the stop button for at least one meeting.” The statement was followed by the justification that the current monetary policy will likely do its work in order to cool down inflation back to its long-term target in a timely manner. However, he also reiterated that the uncertainty in the US economy is high; further economic data will be taken into consideration before determining to have an extra tightening step or not. As the investor’s expectation of a further rate hike started to fade, yesterday’s upbeat data failed to ignite the dollar market. According to Automatic Data Processing (ADP), the US Nonfarm Employment Change dropped from the prior reading of 291K to 278K in May, but far higher than the market consensus at 170K. At the same time, the Department of Labor in the US also reported the Initial Jobless Claims data at 232K, lower than the forecast of 235K. These positive job data provided well-enough room to Fed for further rate hike if needed. As of writing, the dollar index edged down -0.73% to 103.55.

In the commodities market, crude oil prices skyrocketed by 4.85% to $70.90 per barrel as the weakness of the US dollar benefited the non-US oil buyer in terms of their cost of purchasing. Besides, gold prices were up by 0.20% to $1977.30 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Average Hourly Earnings (MoM) (May) | 0.5% | 0.4% | – |

| 20:30 | USD – Nonfarm Payrolls (May) | 253K | 180K | – |

| 20:30 | USD – Unemployment Rate (May) | 3.4% | 3.5% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2525. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0770. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.95. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6565. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6565, 0.6675

Support level: 0.6425, 0.6285

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6040. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3485. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3565, 1.3635

Support level: 1.3485, 1.3395

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9075. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9160, 0.9230

Support level: 0.9075, 0.9000

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1980.00. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55

010623 Afternoon Session Analysis

01 June 2023 Afternoon Session Analysis

The euro fell after CPI in major countries cooled.

The pair of the euro against the greenback, fell after cpi in major countries showed cooled conditions and hint the European Bank (ECB) to pause its tightening monetary policy. Data released on Wednesday included French Consumer Price Index (CPI) and German CPI Data. The CPI in French slipped more than expected from 0.6% to -0.1%, as the market expects the reading slightly reduce to 0.4%. While the German CPI eased to -0.1% from 0.4% in the previous month’s reading, lower than market expectations of 0.6%. The euro finally lost its appeal to investors as the data eased pressure on the European Central Bank to tighten policy further. Moreover, French consumer spending fell to -1.0% from -0.8% the previous month. The data continues to plummet due to lower energy consumption and a further fall in food consumption, as household fall in purchasing power after the significant impact of the inflationary context. It is clear that the French economy will fall sharply as consumer spending is unlikely to contribute a positive reading to the GDP growth in the second quarter. This may also make the European Central Bank choose not to raise interest rates in the upcoming interest rate decision. As of writing, the EUR/USD edged up 0.01% to 1.0690.

In the commodities market, crude oil prices were traded up by 0.63% to $68.50 per barrel following the prior large surprise build in US crude stocks. Besides, gold prices ticked up by 0.14% to $1965.33 per troy ounce amid bets on the Fed pause in June.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:30 EUR ECB President Lagarde Speaks

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (May) | 42.9 | 42.9 | – |

| 16:30 | GBP – Manufacturing PMI (May) | 46.9 | 46.9 | – |

| 17:00 | EUR – CPI (YoY) (May) | 7.0% | 7.0% | – |

| 20:30 | USD – ADP Nonfarm Employment Change (May) | 296K | 170K | – |

| 20:30 | USD – Initial Jobless Claims | 229K | 235K | – |

| 22:00 | USD – ISM Manufacturing PMI (May) | 47.1 | 47.0 | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -12.456M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the resistance level at 104.45. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level at 103.75.

Resistance level: 104.45, 105.20

Support level: 103.75, 102.85

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2445. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair to undergoes technical correction in the short term.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 139.80.

Resistance level: 139.80, 141.60

Support level: 138.15, 136.30

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6525.

Resistance level: 0.6525, 0.6600

Support level: 0.6440, 0.6370

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.6050, 0.6120

Support level: 0.5980, 0.5885

USDCAD, H4: USDCAD was traded lower following the prior breaks below the previous support level at 1.3590. MACD which illustrated increasing bearish momentum suggests the pair extended its losses towards the support level at 1.3515.

Resistance level: 1.3590, 1.3670

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded lower following the prior rebound from the lower level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.9180, 0.9285

Support level: 0.9090, 0.9005

CrudeOIL, H4: Crude oil price was traded lower following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 70.65, 73.20

Support level: 67.00, 63.85

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 1954.90.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15

010623 Morning Session Analysis

01 June 2023 Morning Session Analysis

Dollar surged amid the stronger-than-expected JOLTs job data.

The dollar index, which was traded against a basket of six major currencies, managed to extend its gains and hit its 11-week highs yesterday as the upbeat labor data boosted the market sentiment in the US. According to the Bureau of Labor Statistics, the US JOLTs Job Openings data rose from the prior reading of 9.745M to 10.103M this month, significantly higher than the consensus forecast at 9.775M, signaling that the US labor market remained resilient despite the continuous rate hike by Federal Reserve. With that, it could compel the Fed to increase the interest rate further as the positive job data provided more room for Fed to do so. However, the dollar index backed off from its highs after Fed’s members slashed the possibility of further rate hike in the upcoming Fed’s meeting. Early today, the President of the Federal Reserve Bank of Philadelphia Patrick T. Harker commented that they do not have to hike the cash rate at every meeting. Besides, Fed’s Philip Jefferson revealed that higher rates could exacerbate the banking stress, signaling his high unwillingness of further rate hike in the upcoming meeting. As of writing, the dollar index rose 0.06% to 104.25.

In the commodities market, crude oil prices plunged by -1.96% to $68.20 per barrel as the strengthened of US dollar and weaker-than-expected China Manufacturing PMI dampened the outlook of this black commodity product. Besides, gold prices were up by 0.20% to $1966.45 per troy ounce following the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:30 EUR ECB President Lagarde Speaks

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (May) | 42.9 | 42.9 | – |

| 16:30 | GBP – Manufacturing PMI (May) | 46.9 | 46.9 | – |

| 17:00 | EUR – CPI (YoY) (May) | 7.0% | 7.0% | – |

| 20:30 | USD – ADP Nonfarm Employment Change (May) | 296K | 170K | – |

| 20:30 | USD – Initial Jobless Claims | 229K | 235K | – |

| 22:00 | USD – ISM Manufacturing PMI (May) | 47.1 | 47.0 | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -12.456M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 103.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2405, 1.2525

Support level: 1.2300, 1.2200

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0665. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 141.60. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6425.

Resistance level: 0.6565, 0.6675

Support level: 0.6425, 0.6285

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6040. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3560. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9075. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous support level at 70.15. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 66.50.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1951.60. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55

310523 Afternoon Session Analysis

31 May 2023 Afternoon Session Analysis

The Aussie dipped after the crucial economic data release.

The pair of AUS/USD, which is commonly knowns as the Aussie, failed to extend its gains after a series of crucial economic data releases. A stronger-than-expected consumer price index (CPI) and private sector spending in April pushed the Aussie higher but revised its trend to decline after weaker Chinese manufacturing data. The CPI rose to 6.8% in April from a year earlier, Australian Statistician data showed on Wednesday, compared with 7.0% in the previous reading and market expectations of 6.4%. While the private sector credit marked at 0.6% on a monthly basis, higher than the previous figure of 0.2% and market expectations of 0.3%. Both economic data reflect that Australian consumer spending power remains resilient despite the Reserve Bank of Australia rose the interest rate by 375 basis points since May last year to 11 years higher 3.85%. Consumer prices rose more than expected in April, with strong consumer spending suggesting sticky inflation could weigh on the central bank. Nonetheless, the Aussie changed its moves from gains to losses after China manufacturing showed a contraction in business activity in May. Manufacturing PMI in May recorded 48.8 in May, lower than 49.2 in April, China Logistics Information central data showed, as economists expect the figures to rise back to 51.4. China’s manufacturing sector has contracted for two consecutive months, which will lead to a decline in Australian export transactions. As a result, demand for the Australian dollar falls. As of writing, the AUD/USD dipped by -0.37% to 0.6494.

In the commodities market, crude oil prices shrank by –0.29% to $59.26 per barrel after China’s manufacturing sector showed a contraction condition. Besides, gold prices were traded down by -0.07% to $1958.03 per troy ounce following the dollar strengthening

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (May) | 24K | – | – |

| 20:00 | EUR – German CPI (MoM) (May) | 0.4% | 0.6% | – |

| 20:30 | CAD – GDP (MoM) (Mar) | 0.1% | 0.2% | – |

| 22:00 | USD – JOLTs Job Openings (Apr) | 9.590M | 9.775M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 104.45.

Resistance level: 104.45, 105.20

Support level: 103.75, 102.85

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2445. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.0635.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower following the prior breaks below the previous support level at 139.80. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 139.80, 141.60

Support level: 138.15, 136.30

AUDUSD, H4: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6525. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6525, 0.6600

Support level: 0.6440, 0.6365

NZDUSD, H4: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6050. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.5980.

Resistance level: 0.6050, 0.6120

Support level: 0.5980, 0.5885

USDCAD, H4: USDCAD was traded higher following the prior rebound from the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3665.

Resistance level: 1.3665, 1.3785

Support level: 1.3590, 1.3515

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.9090.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded lower following the prior breaks below the previous support level at 70.65. MACD which illustrated increasing bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 70.65, 73.20

Support level: 67.00, 63.85

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1954.90. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses after it successfully breakout below the support level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15