291122 Morning Session Analysis

29 November 2022 Morning Session Analysis

Dollar surged following a hawkish rate-hike stance from Fed member.

The dollar index, which gauges its value against a basket of six major currencies, managed to regain its luster yesterday after muting for two trading sessions amid the Thanksgiving holiday. In the last trading session, the St. Louis Fed President James Bullard revealed that the official cash rate needed to increase further and hold for an extended period of time throughout the year of 2024 in order to effectively cool down the sky-high inflation. Besides, he also reiterated that the interest rate should be risen to the range between 5.00% to 5.25%, while their long-term inflation objective is still 2.0%. Importantly, James Bullard also warned that the market is now underpricing the risk FOMC may be more aggressive. With that, it reversed the earlier losses of the dollar index while urging investors to shift their capital into the appealing currency market. At this juncture, the economic data, such as GDP and NonFarm Payroll, are still being highly focused on by the market participant. As of writing, the dollar index rose by 0.65% to 106.65.

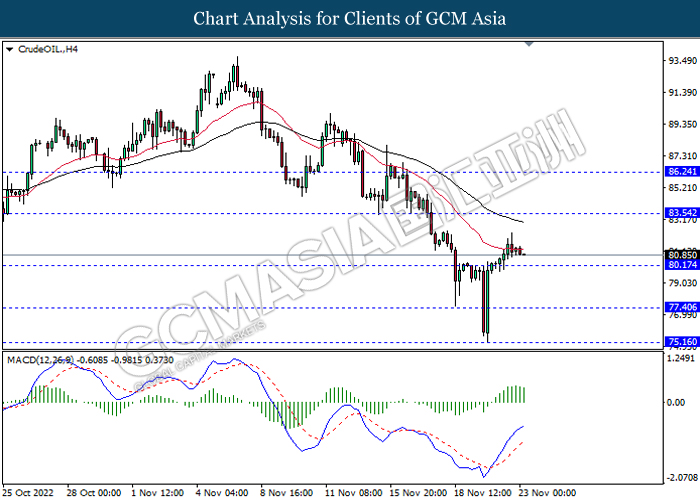

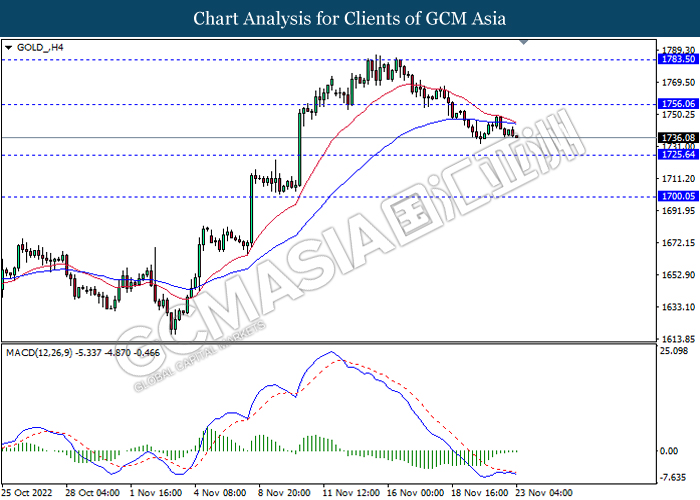

In the commodities market, the crude oil price declined by -0.14% to $77.05 per barrel after the China Covid-19 cases hit a new high record, which extinguished the market hopes of recovery in the world’s second-largest economy. Besides, the gold prices edged down -0.74% to $1741.60 per troy ounce amid a hawkish comment from the Fed’s Bullard.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:00 | EUR – German CPI (YoY) (Nov) | 10.4% | 10.4% | – |

| 21:30 | CAD – GDP (MoM) (Sep) | 0.1% | 0.1% | – |

| 23:00 | USD – CB Consumer Confidence (Nov) | 102.5 | 100.0 | – |

Technical Analysis

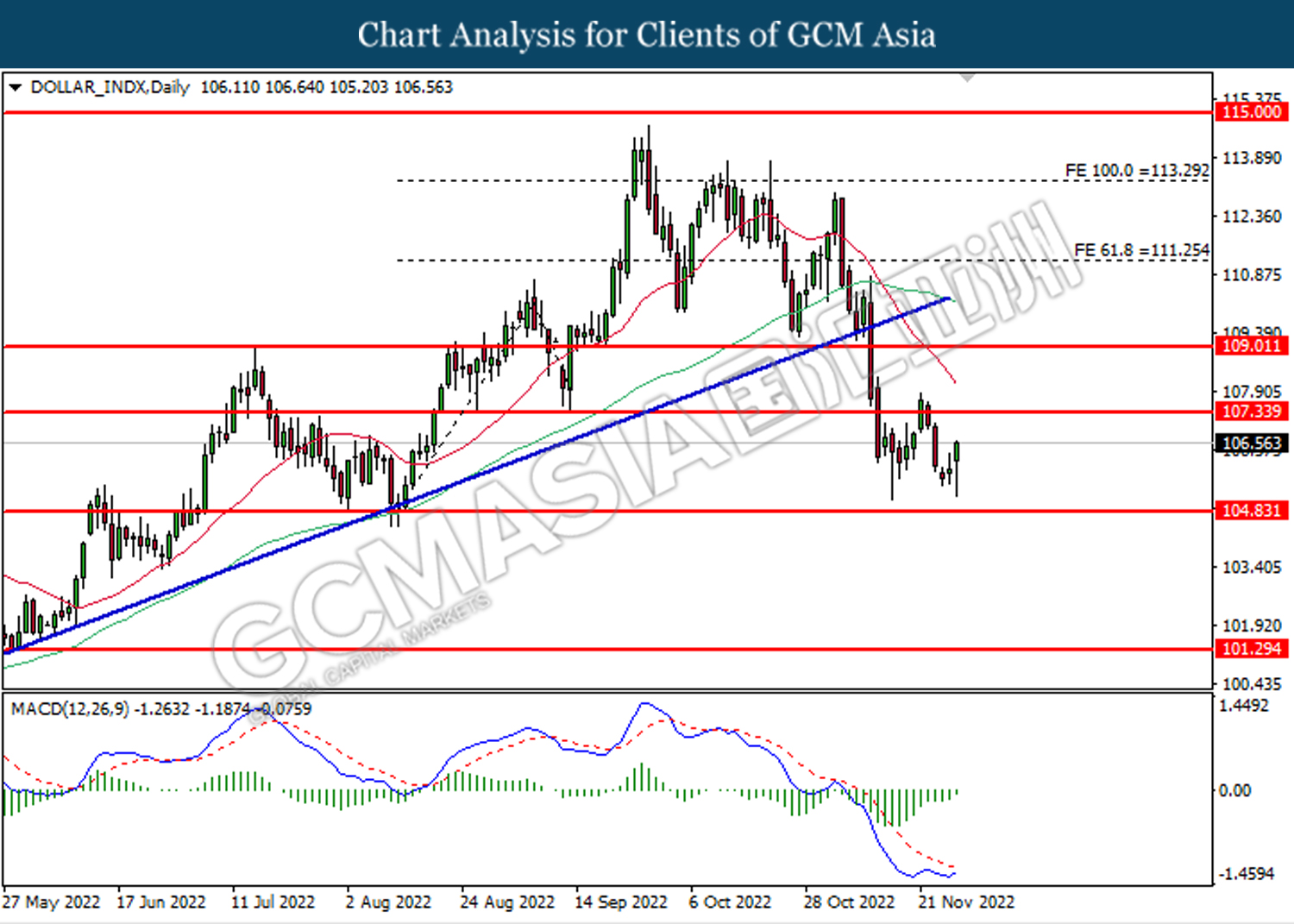

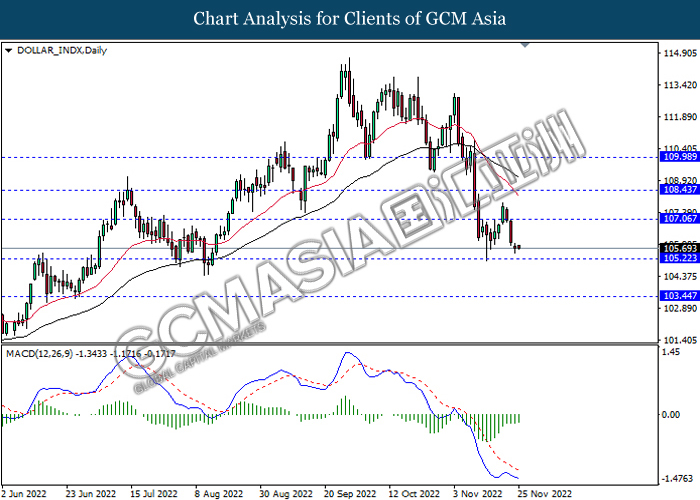

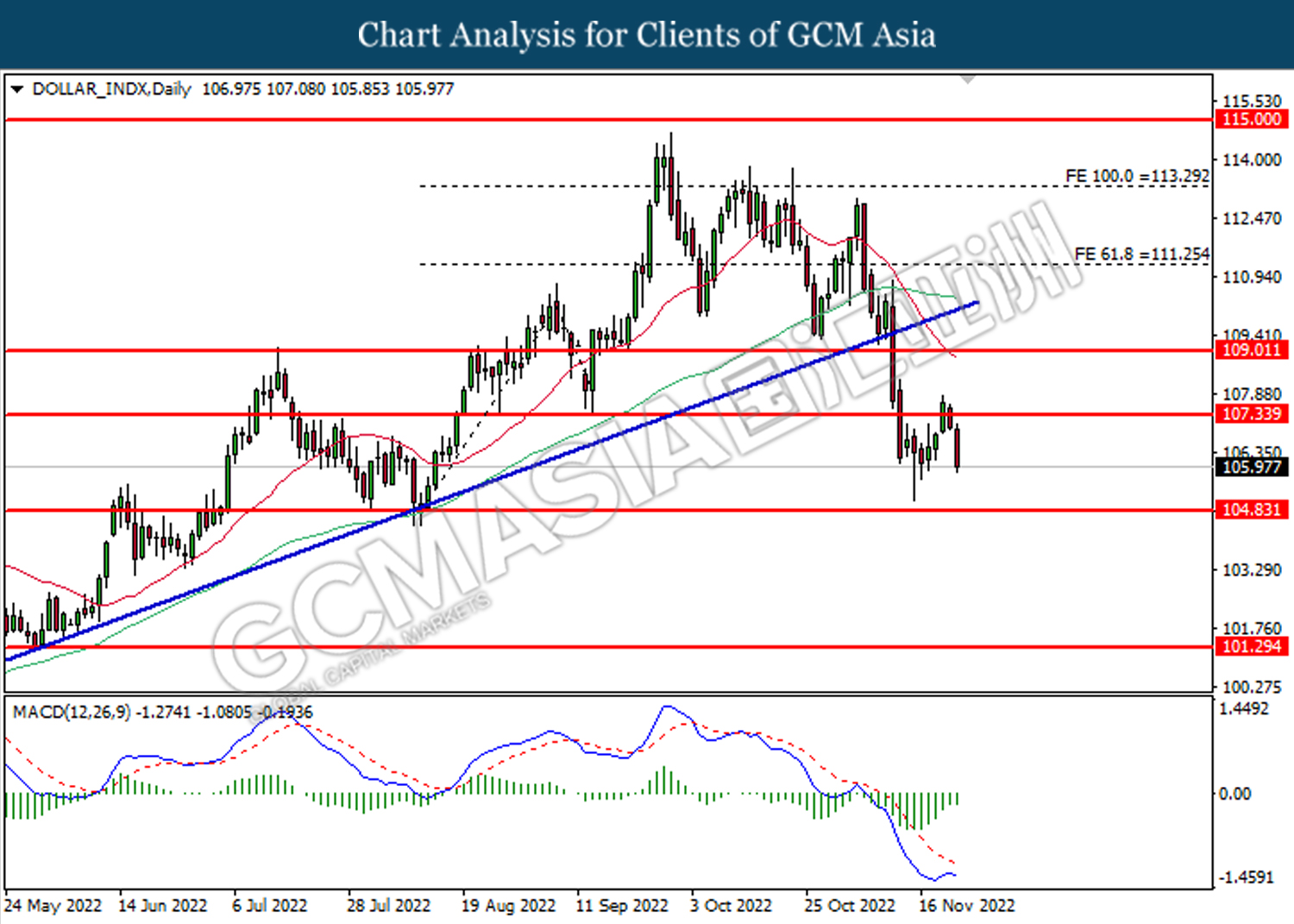

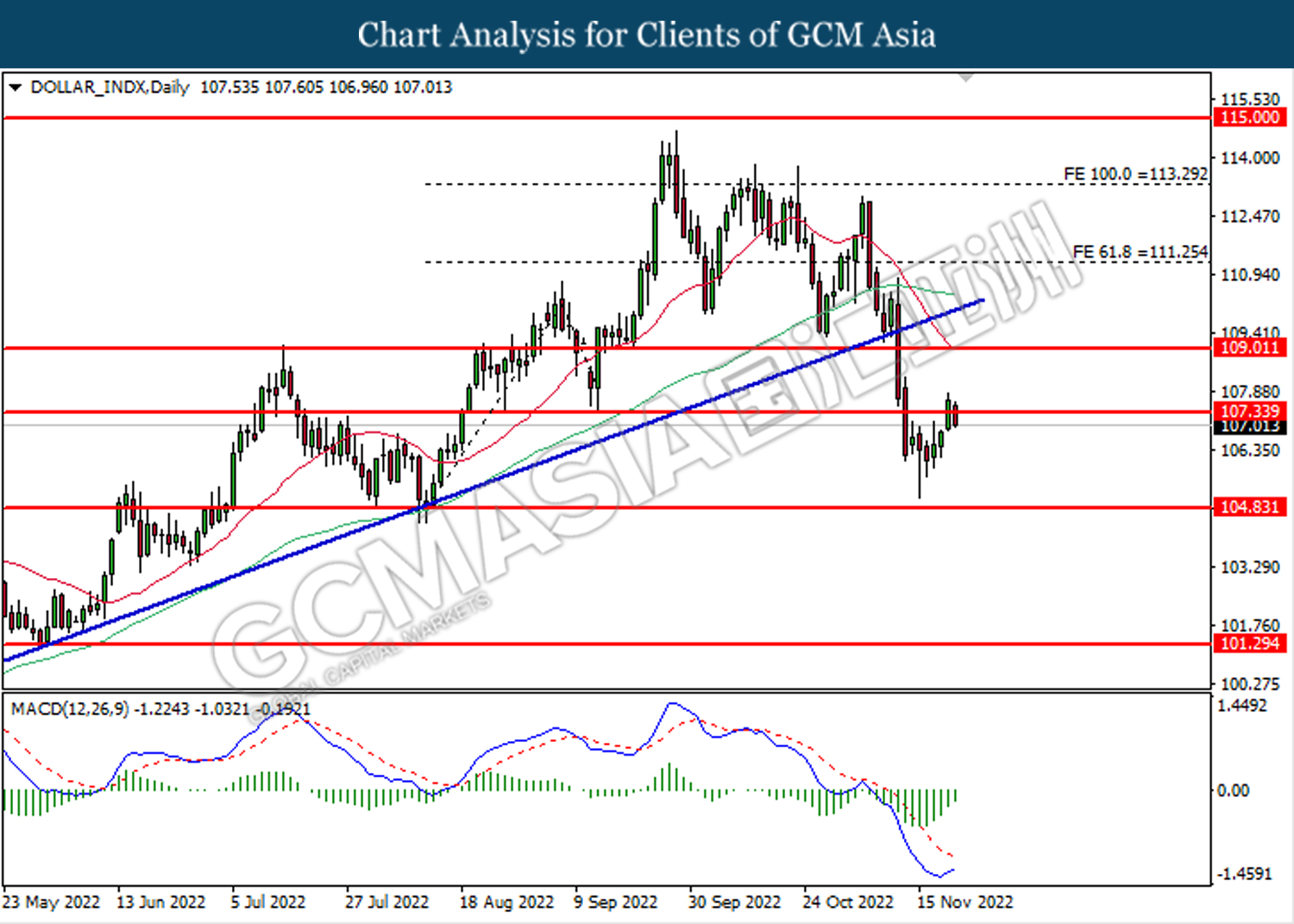

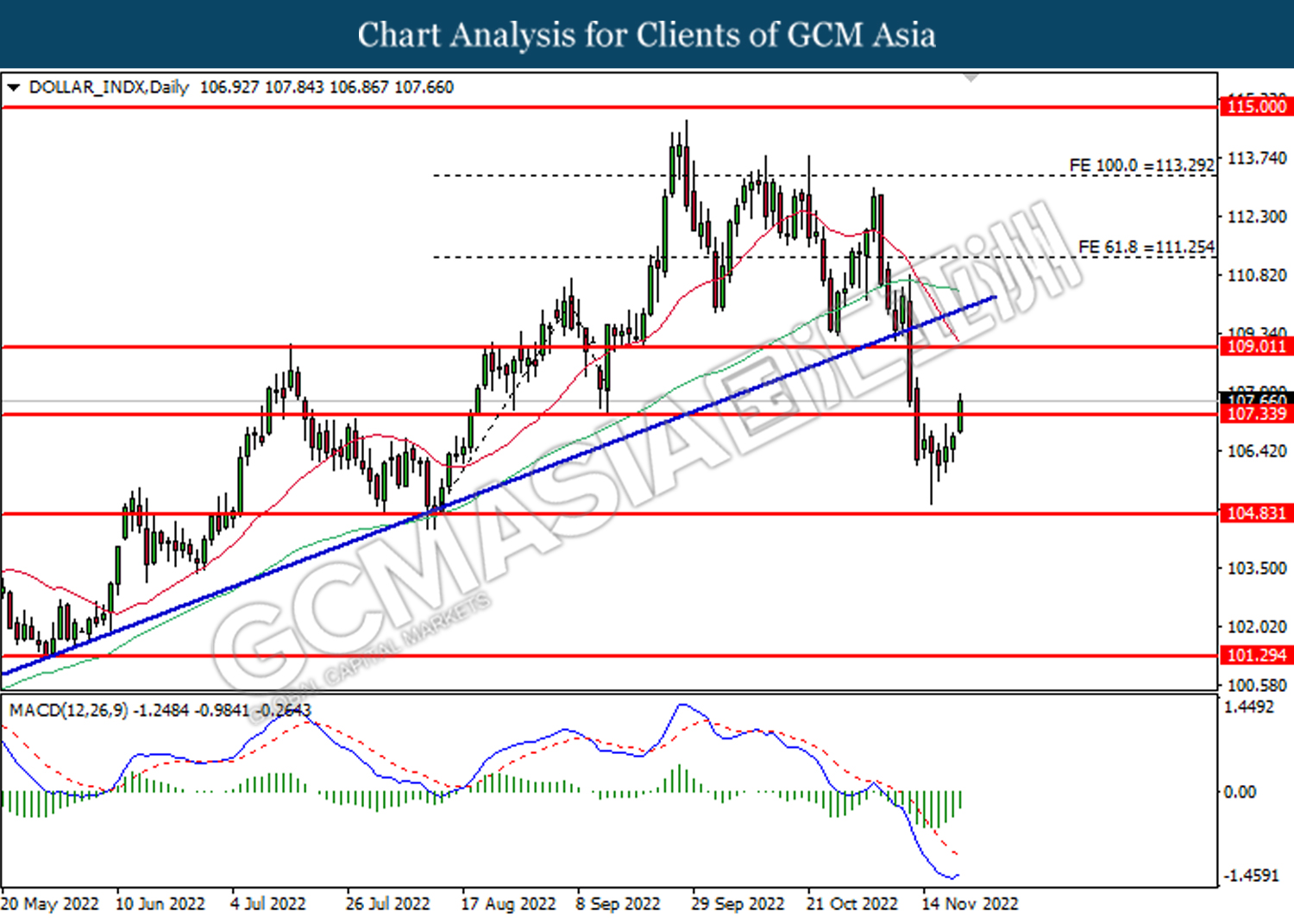

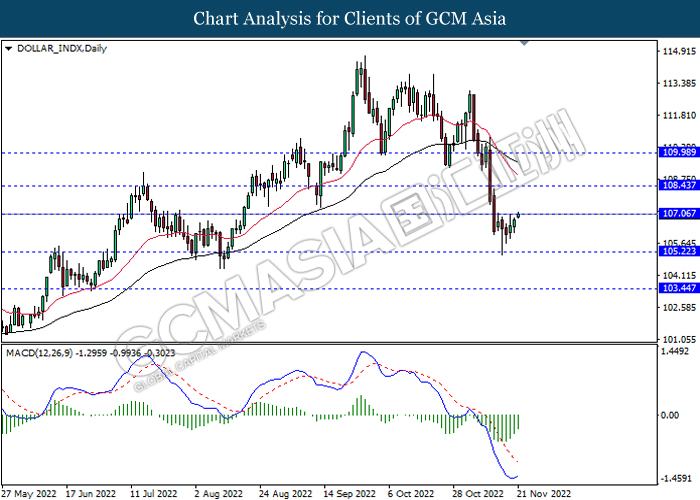

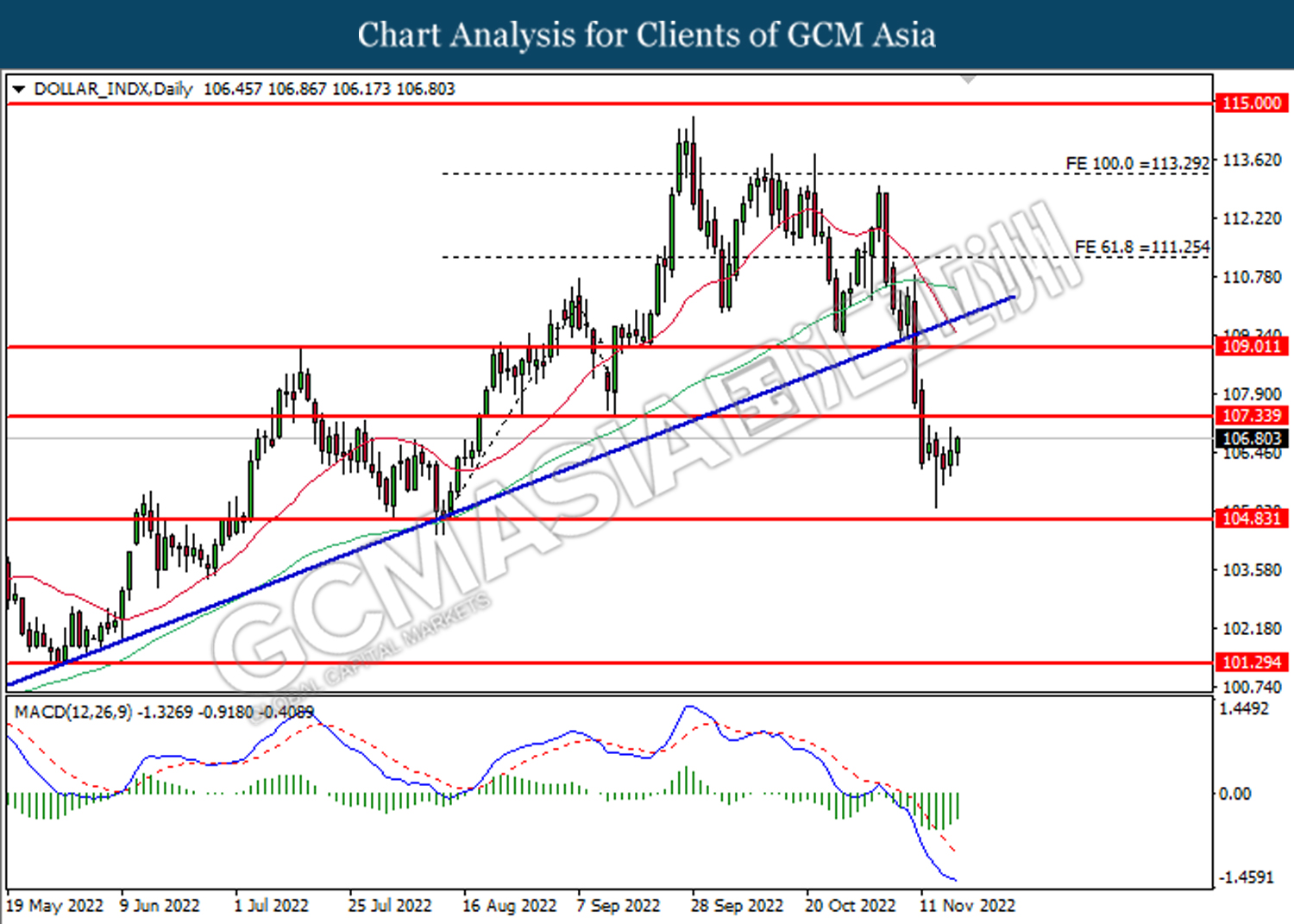

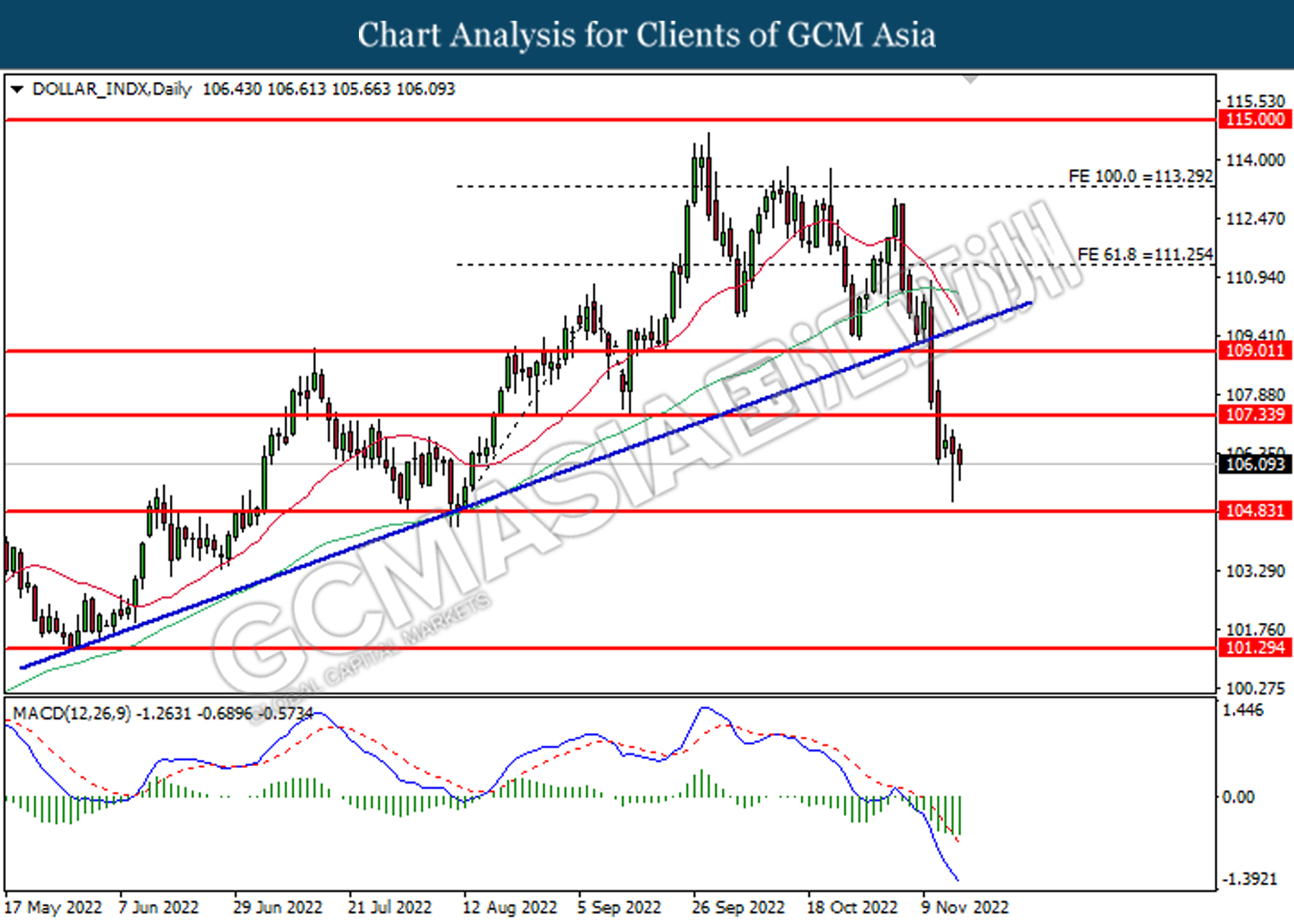

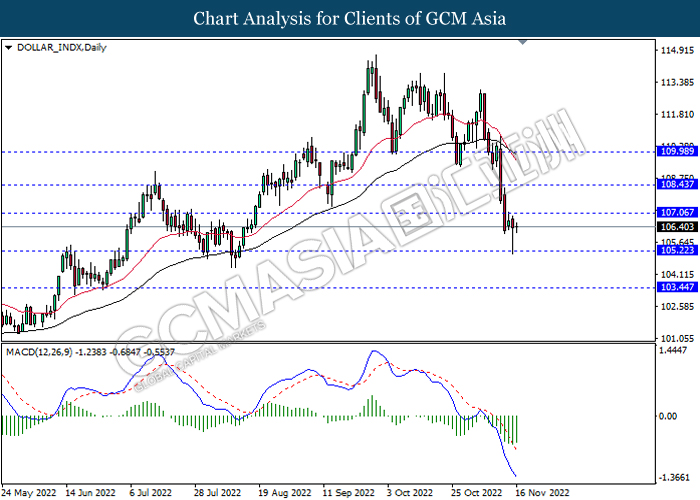

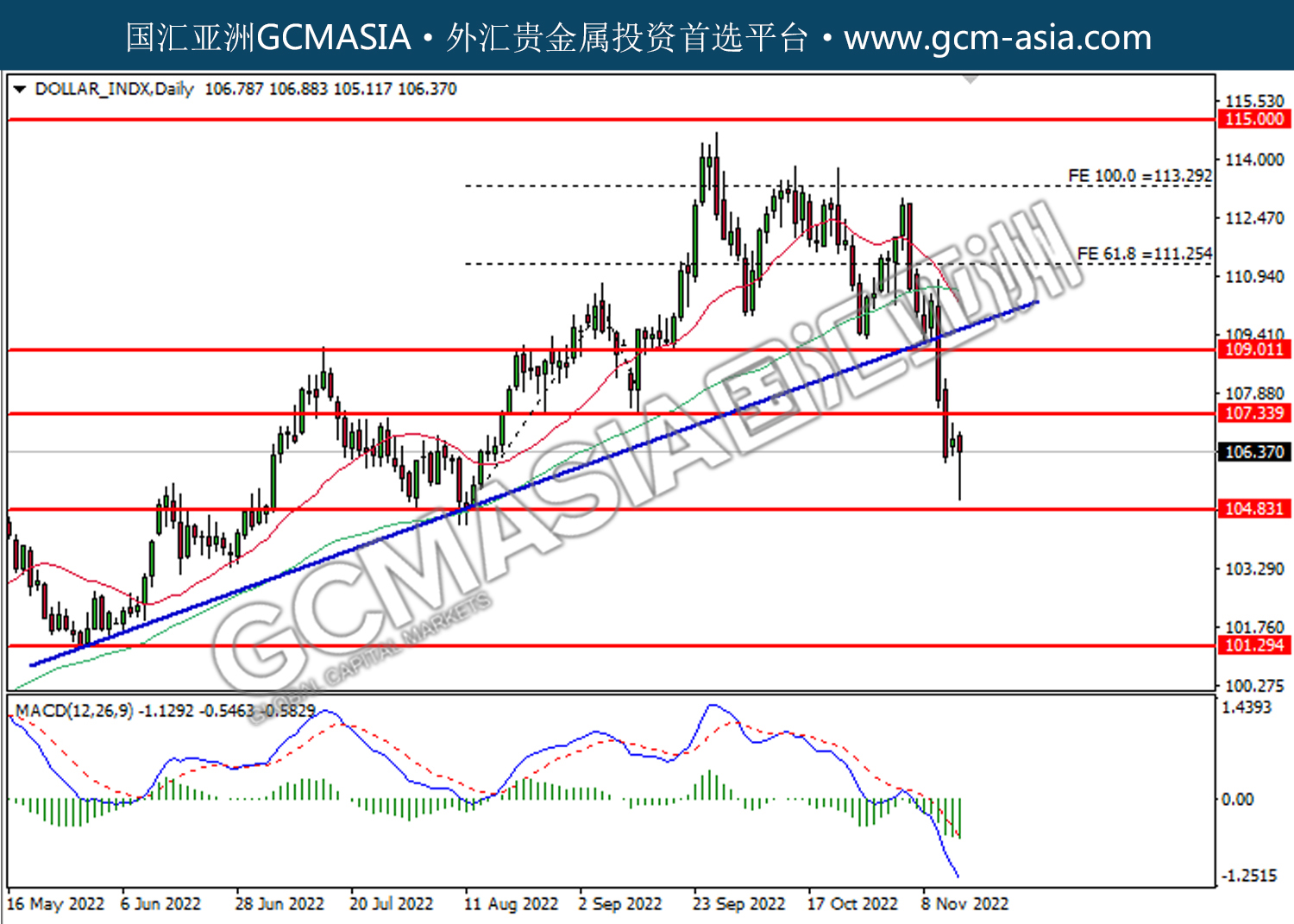

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.35.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

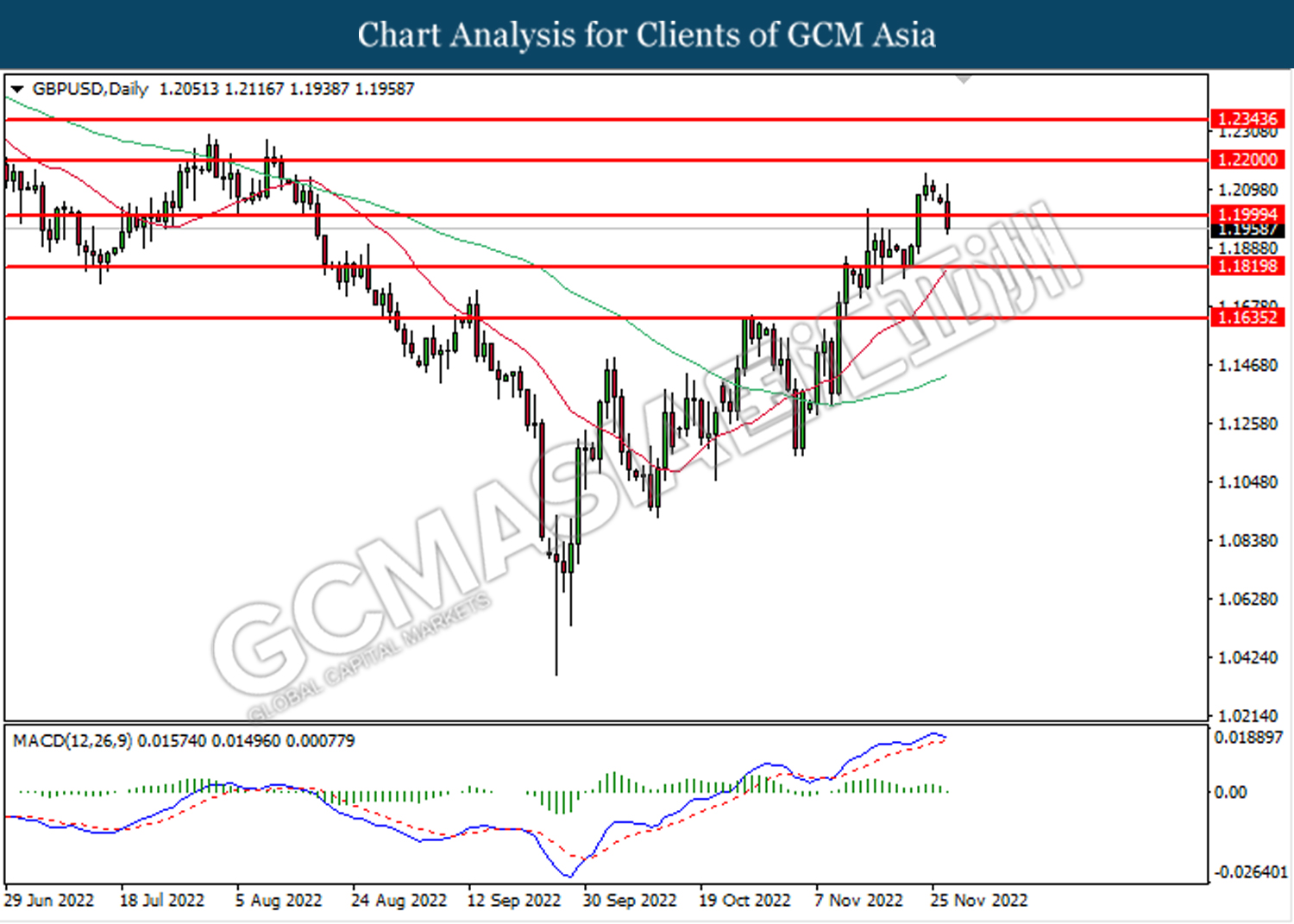

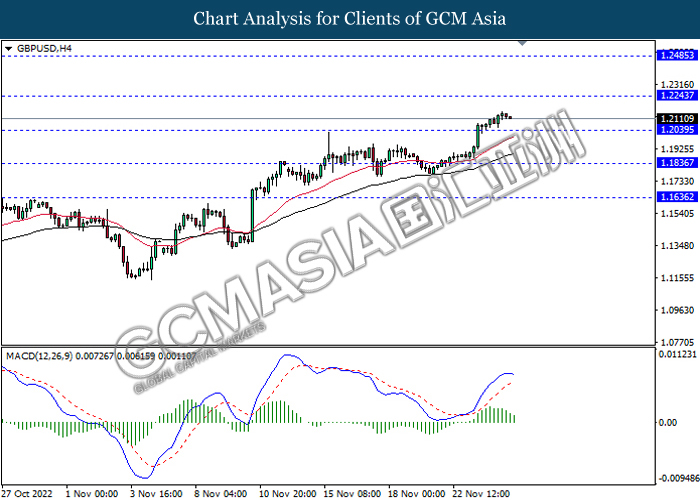

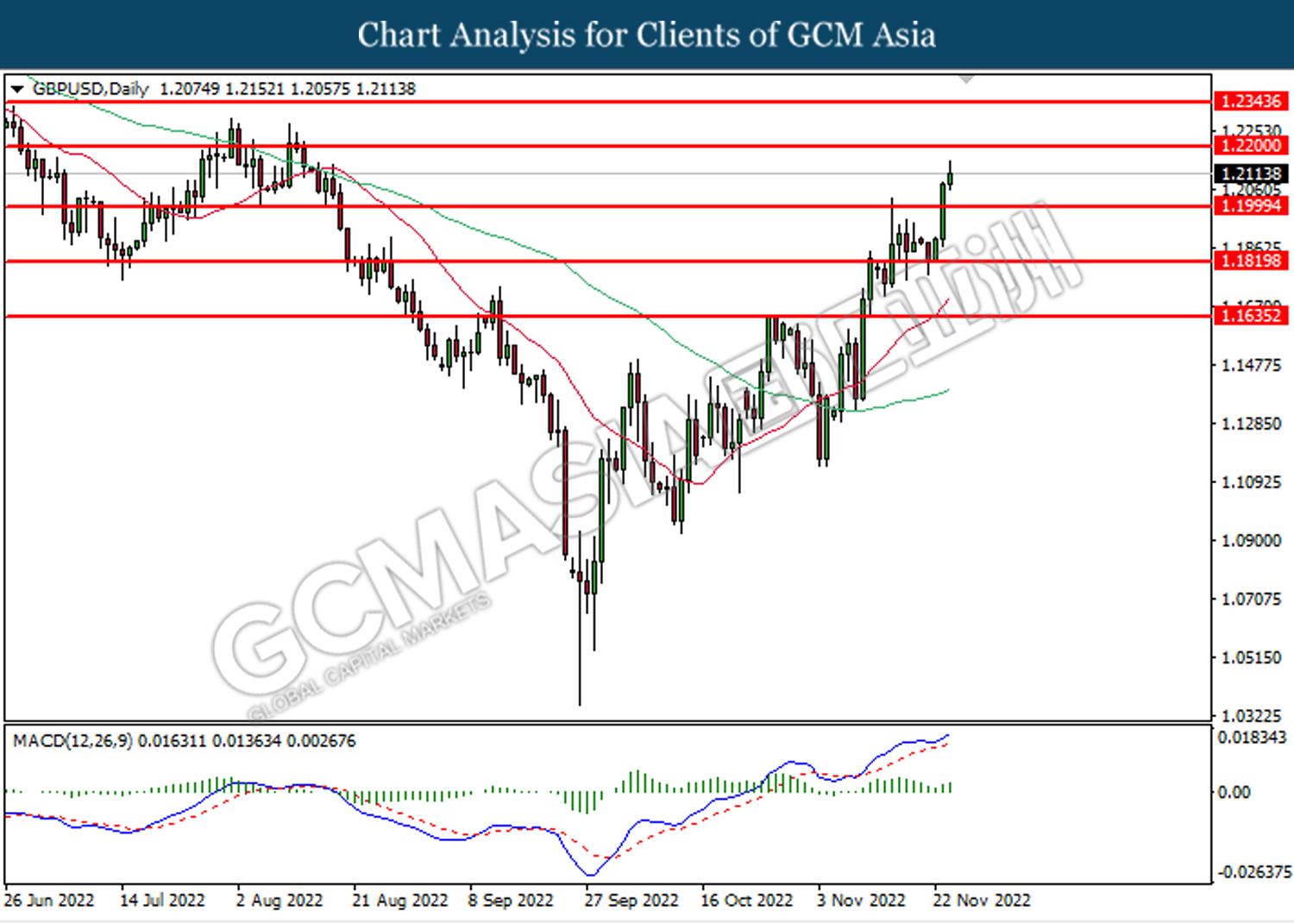

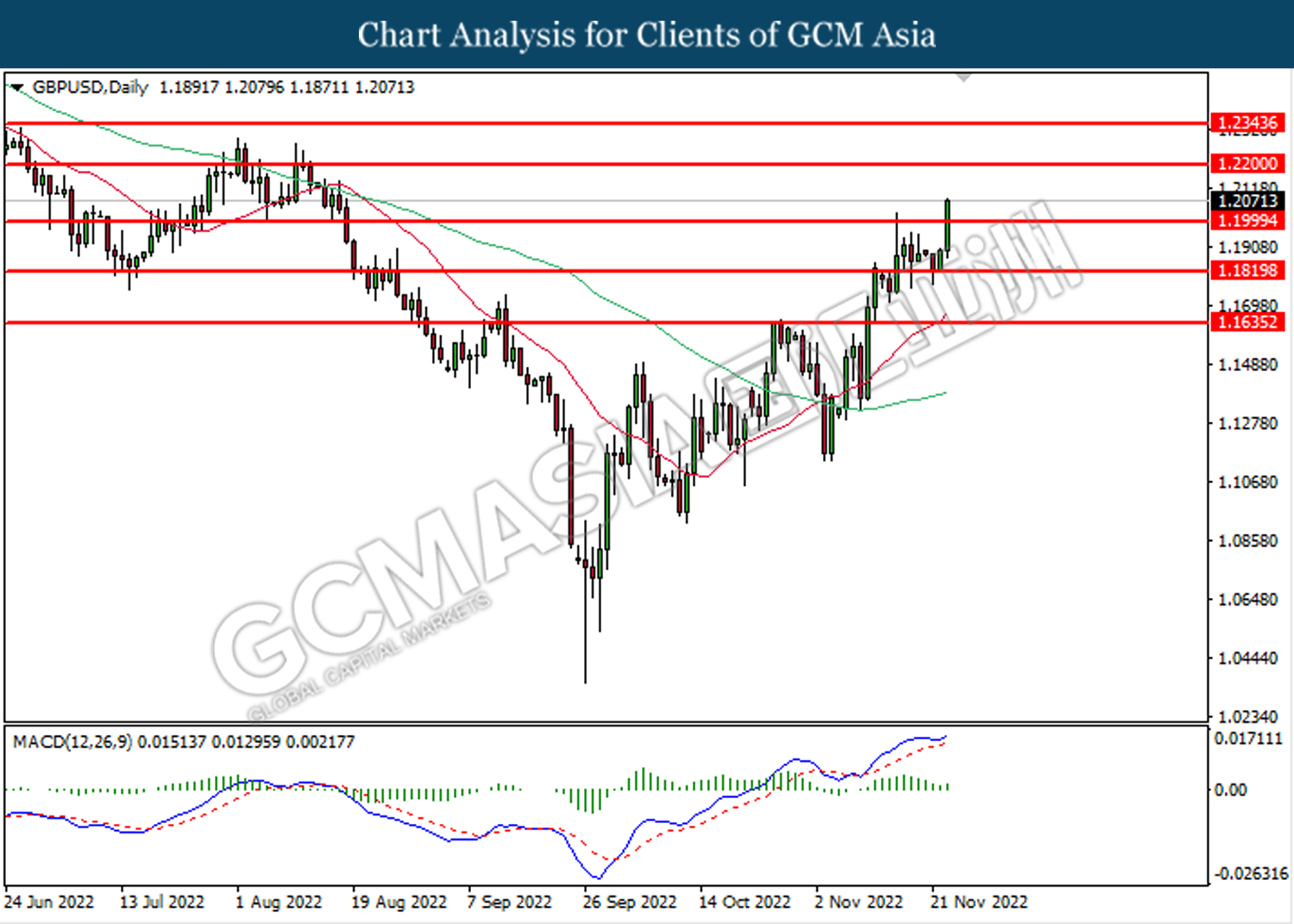

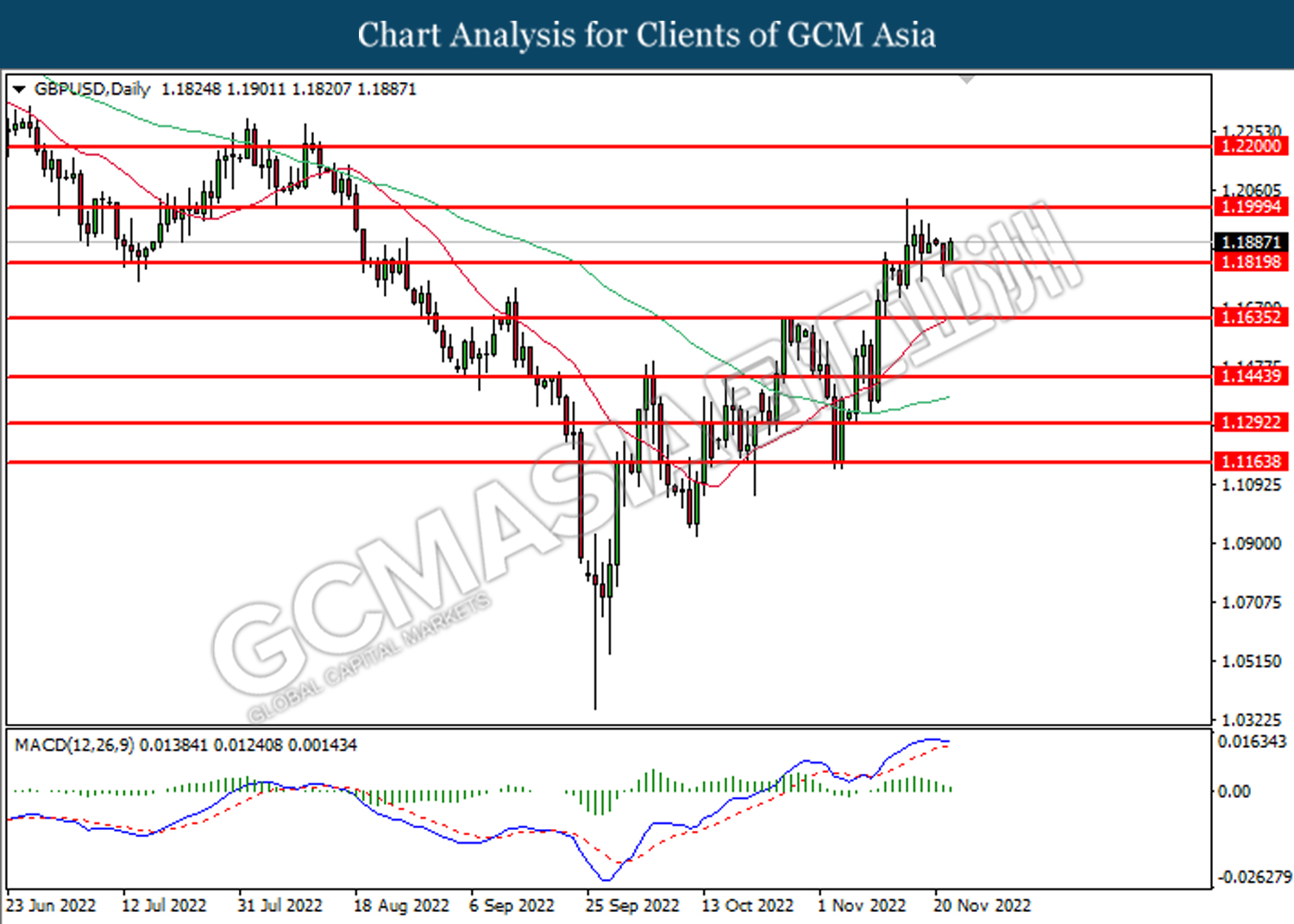

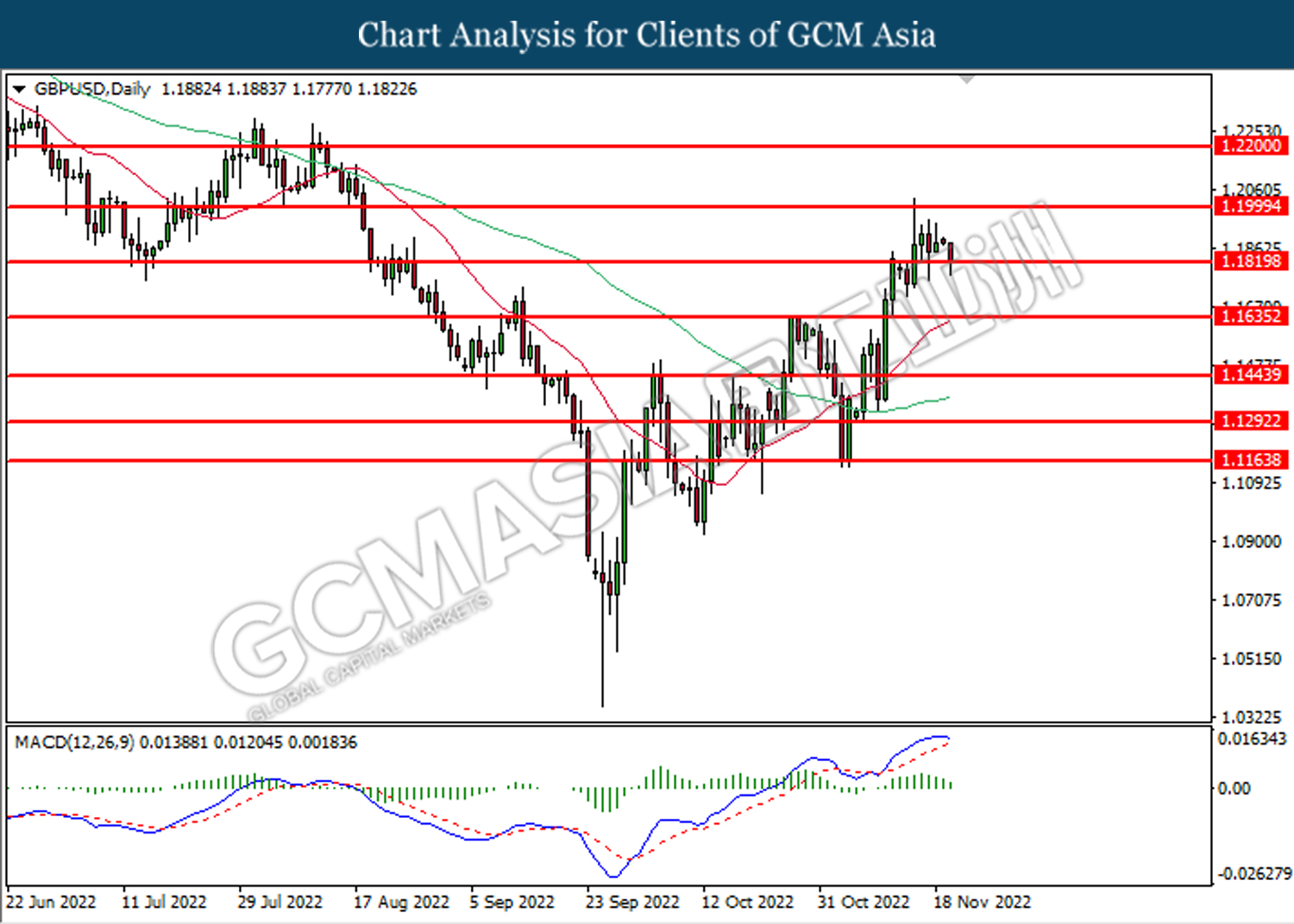

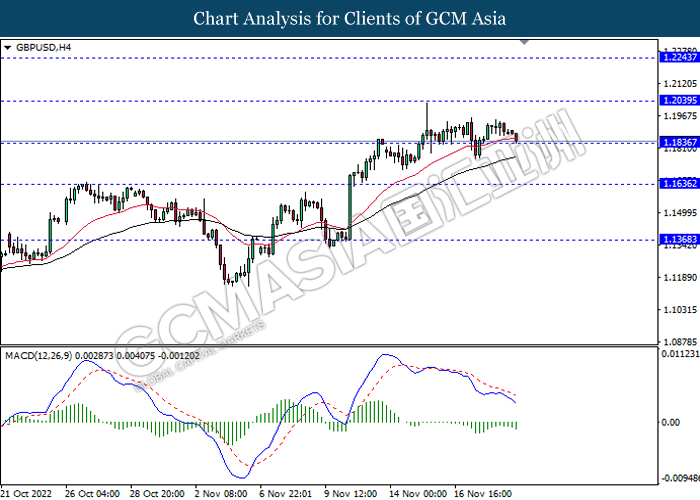

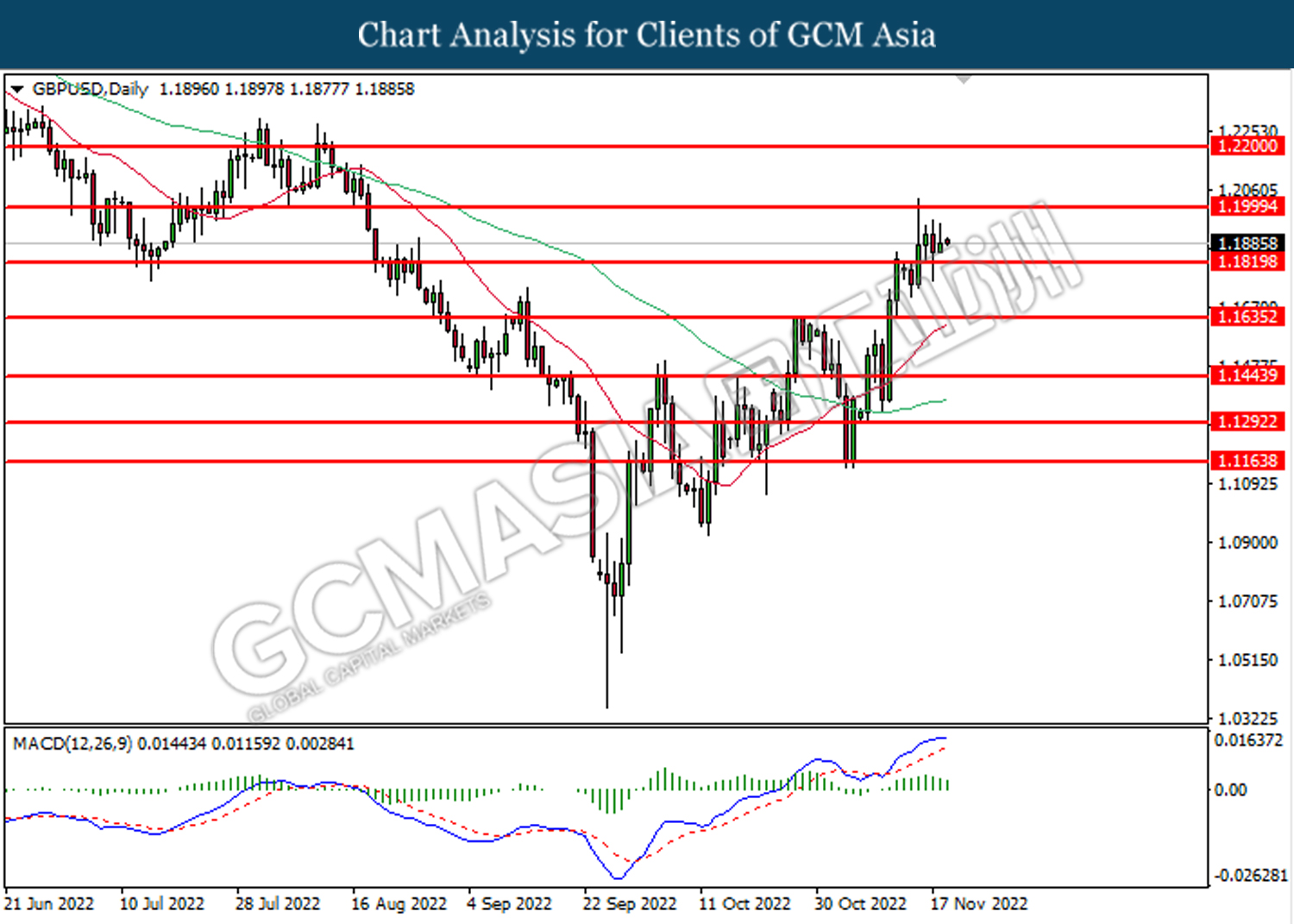

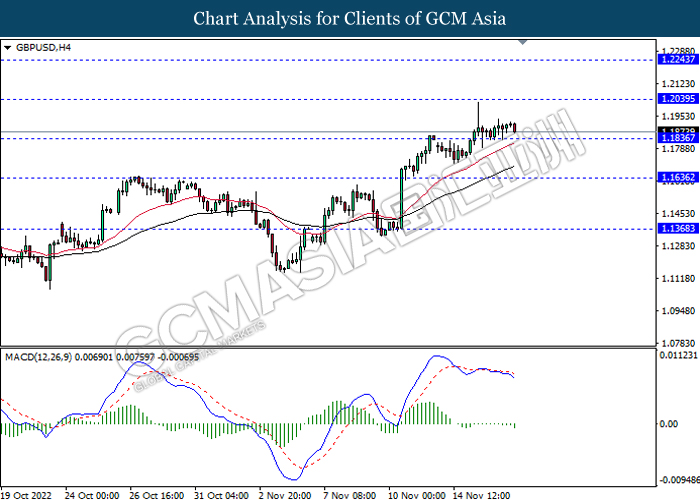

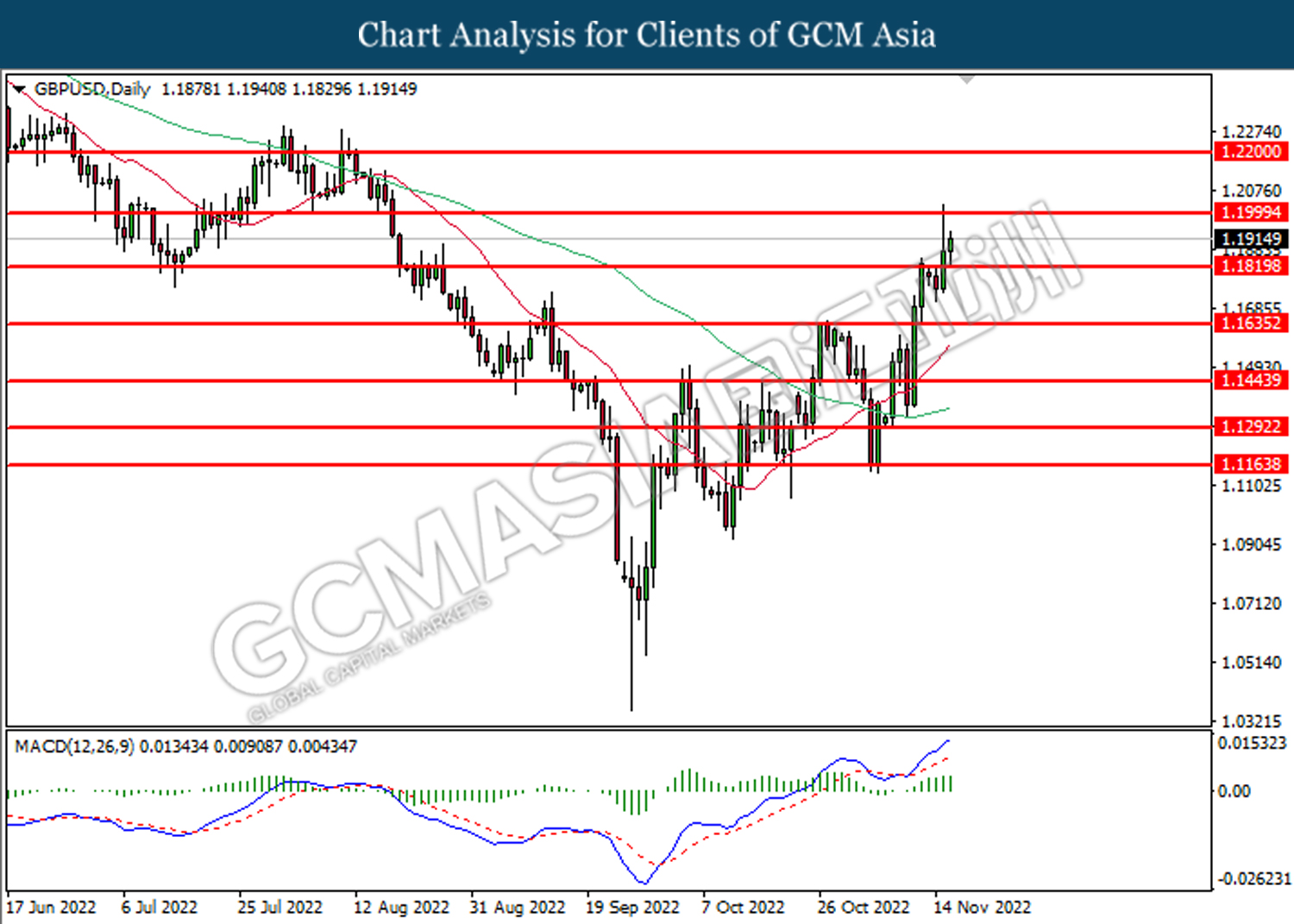

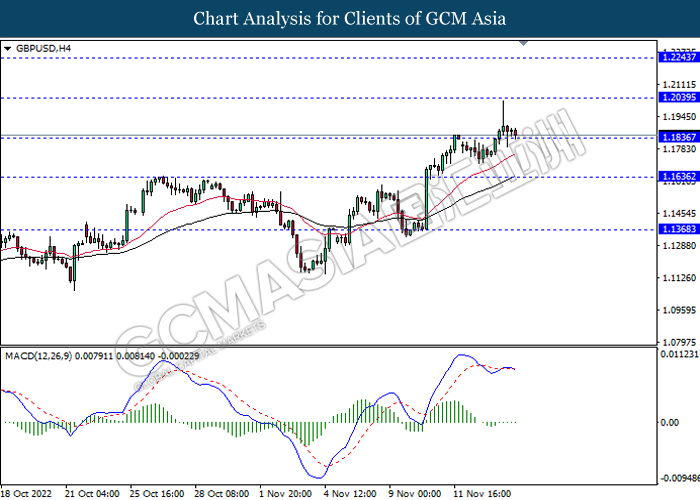

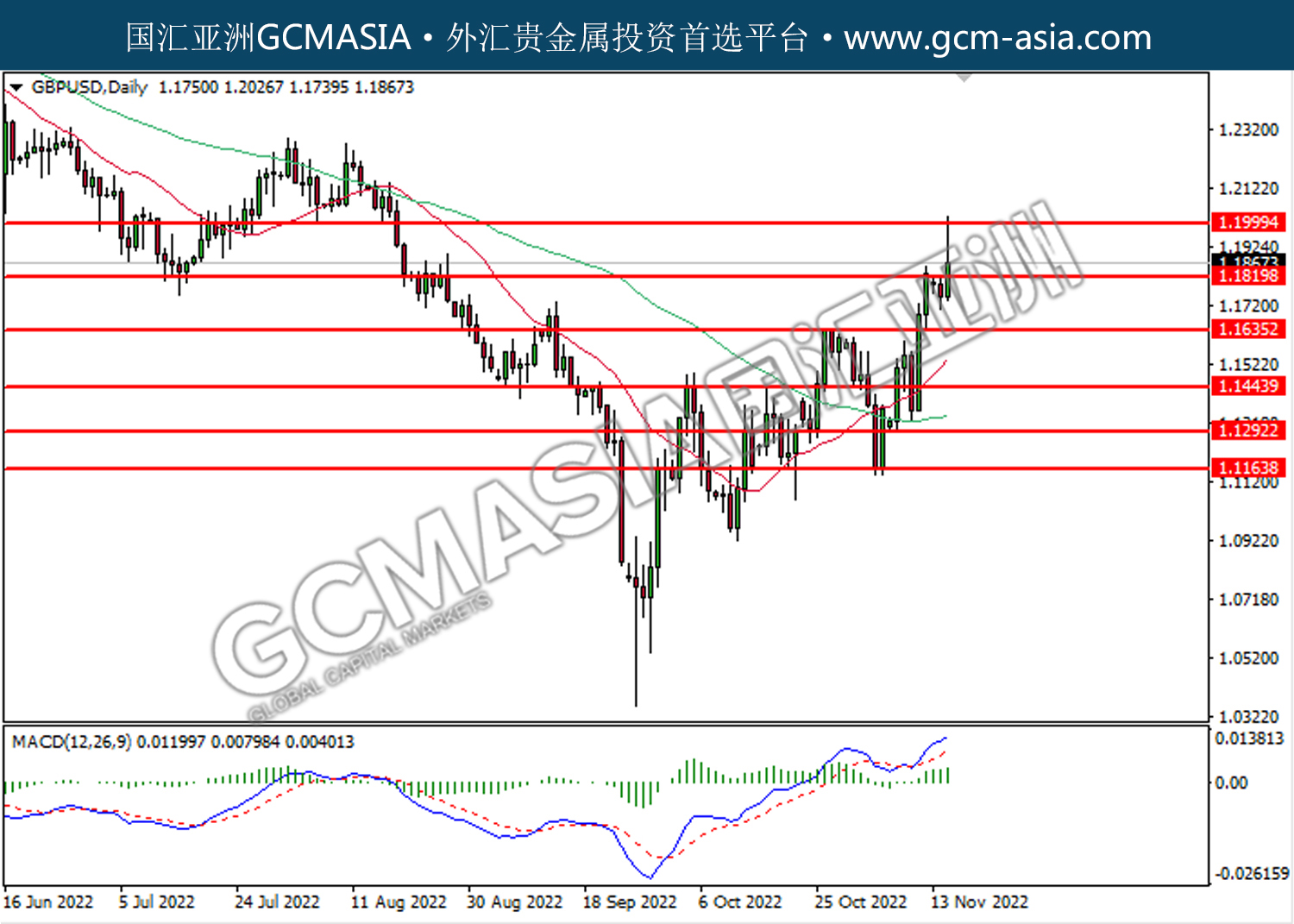

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2000. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

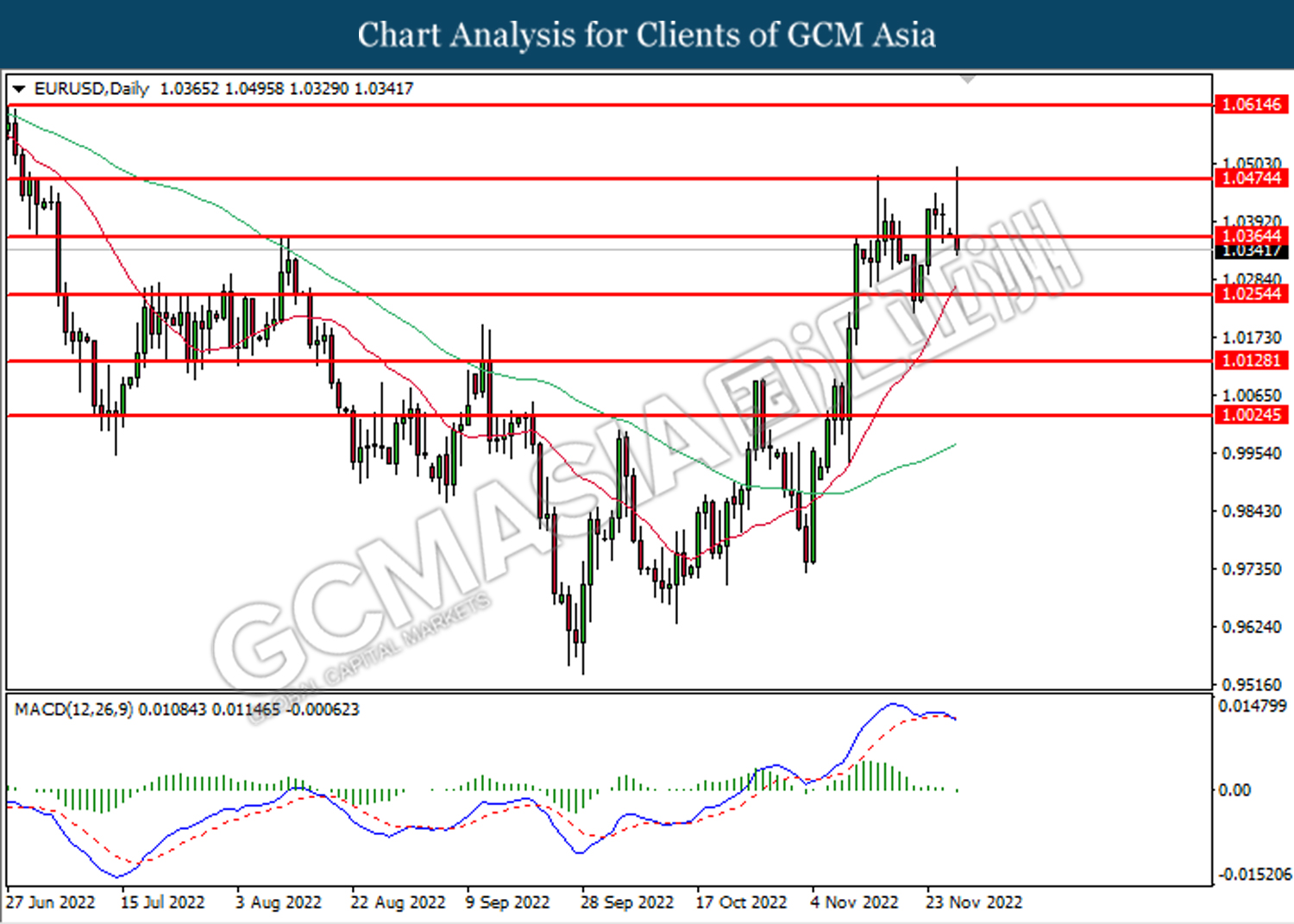

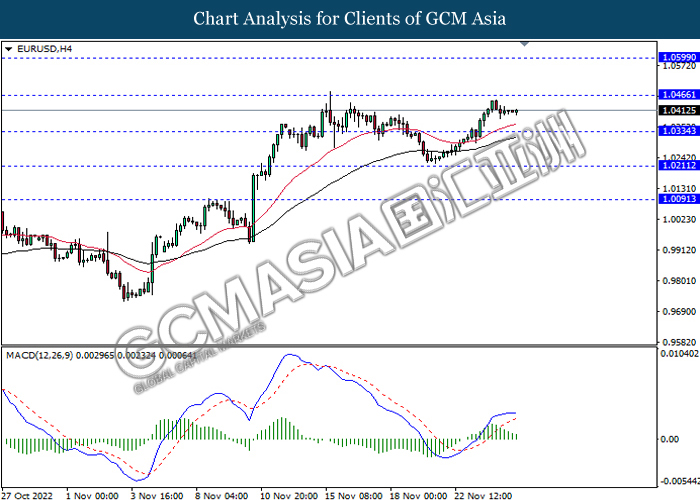

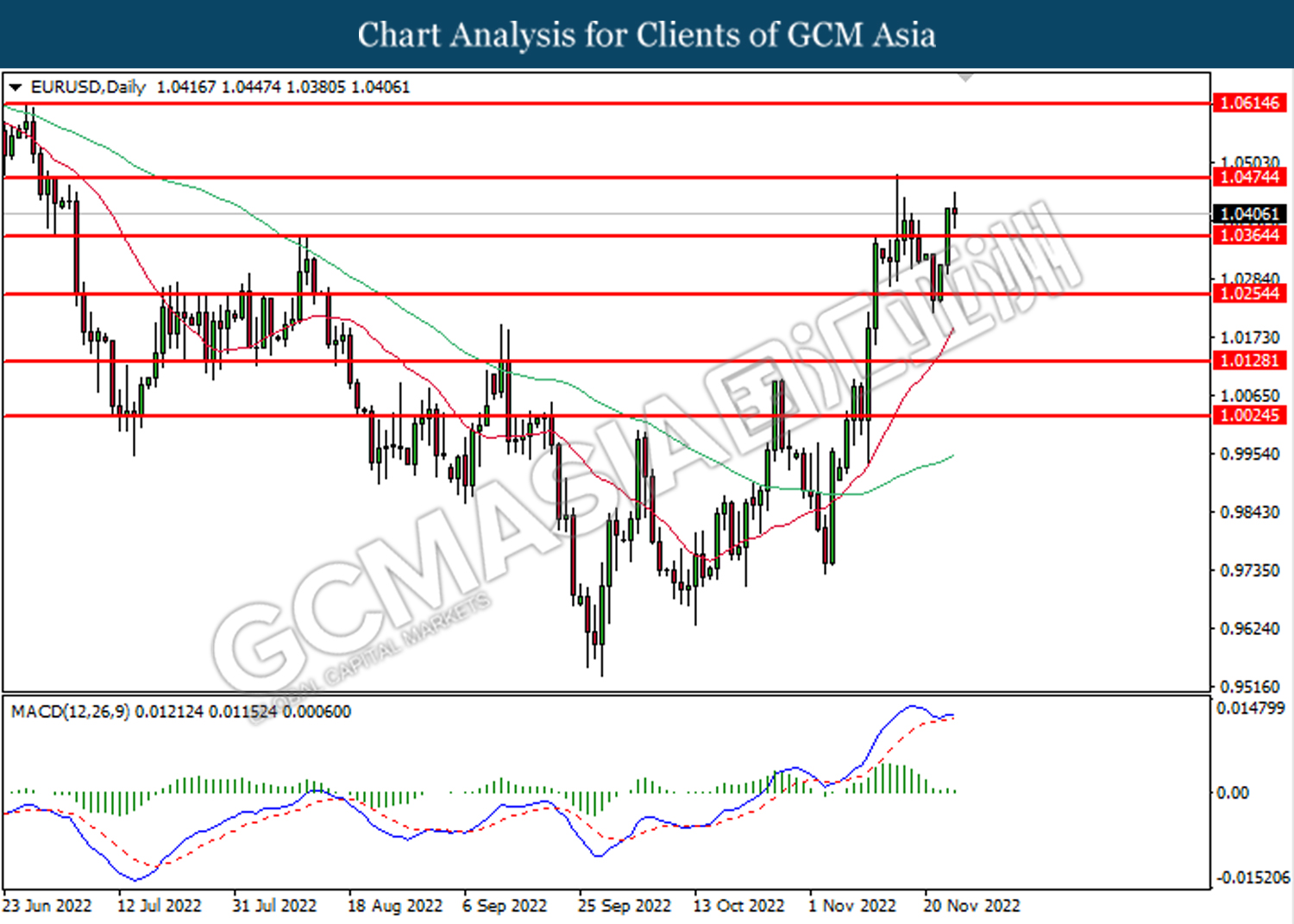

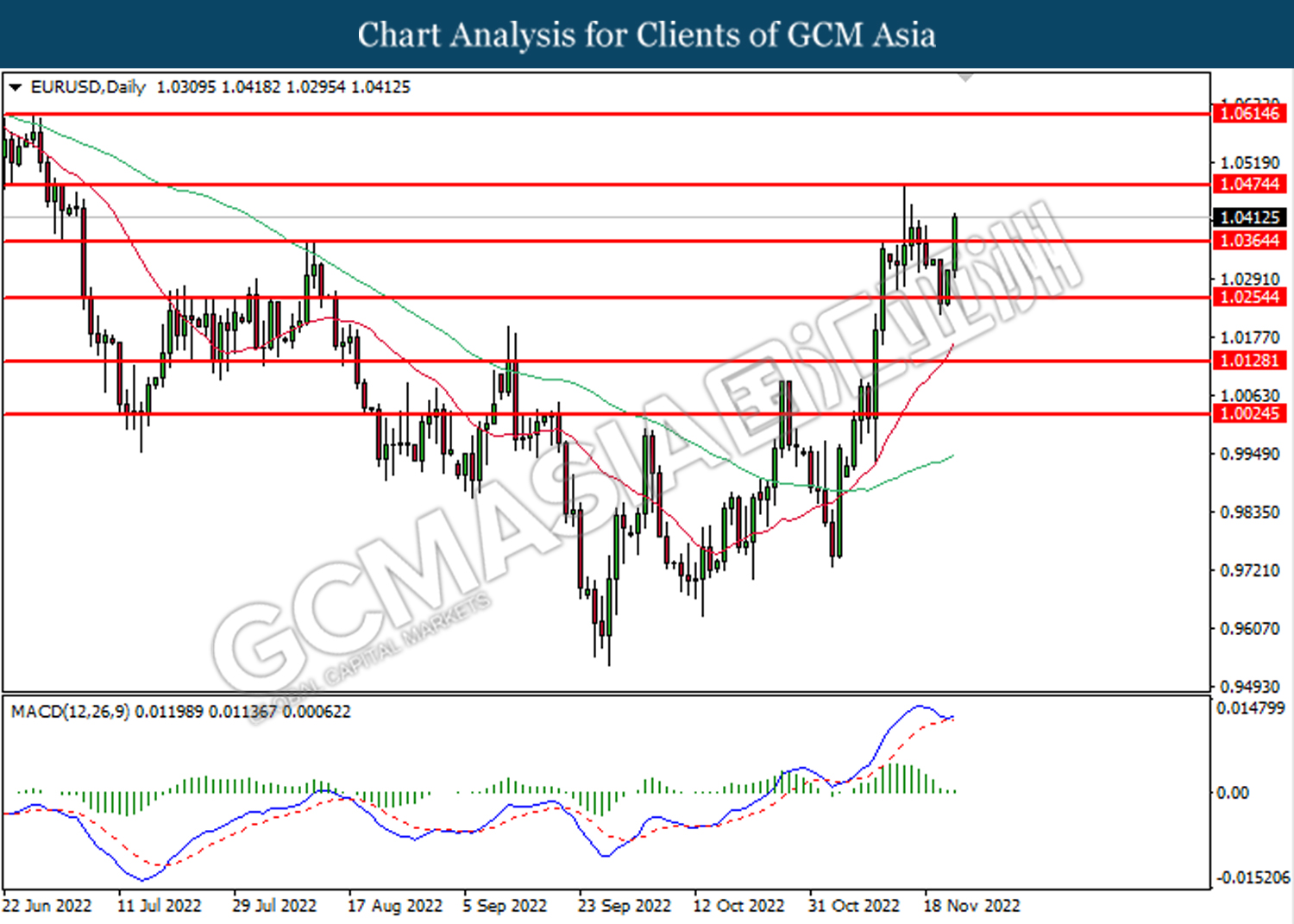

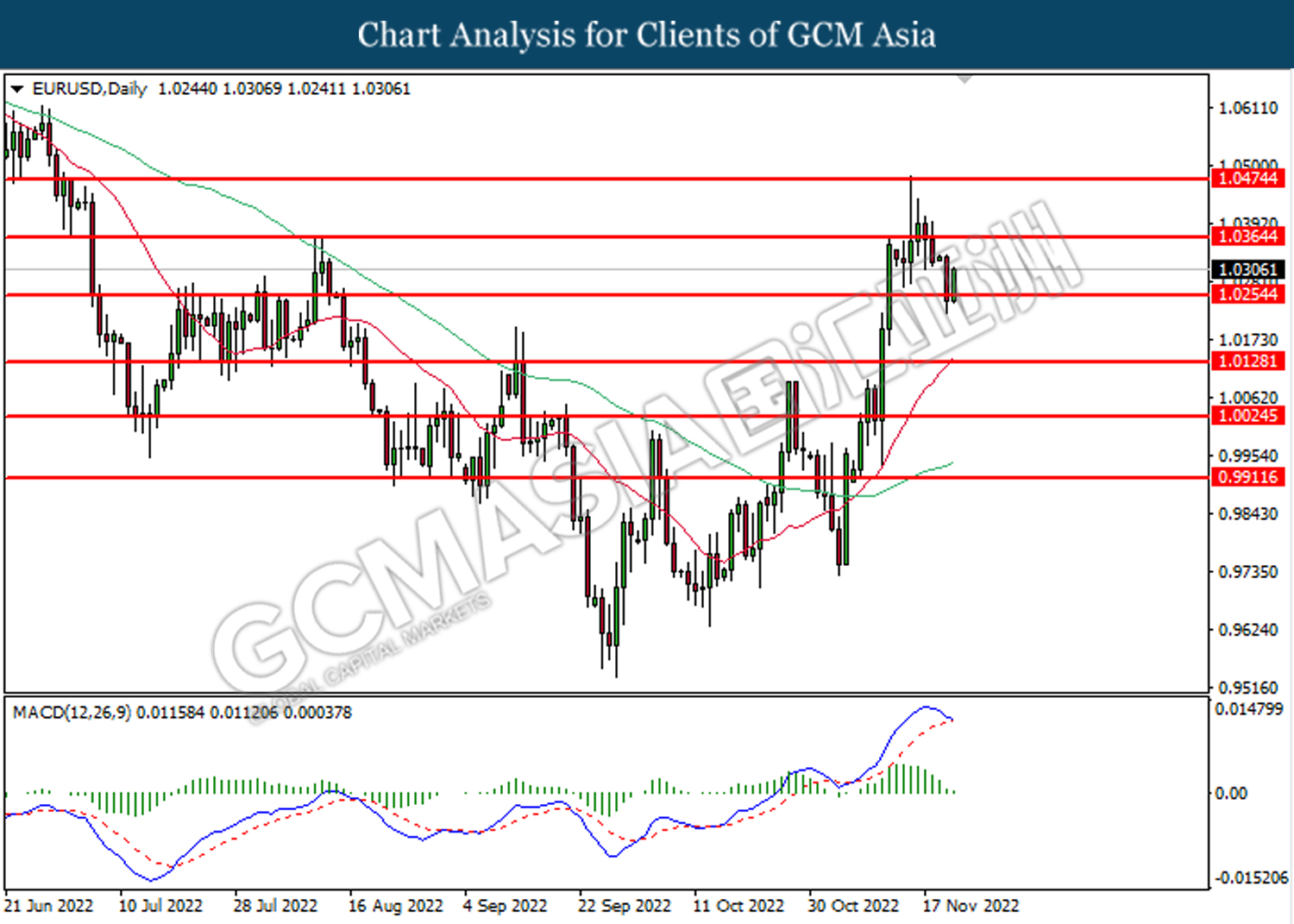

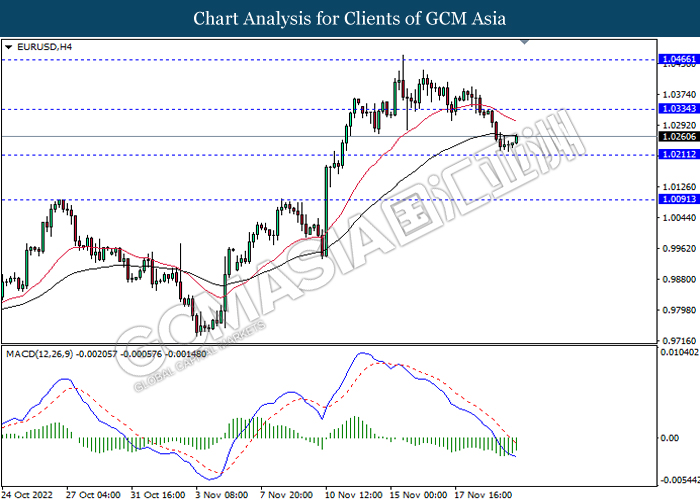

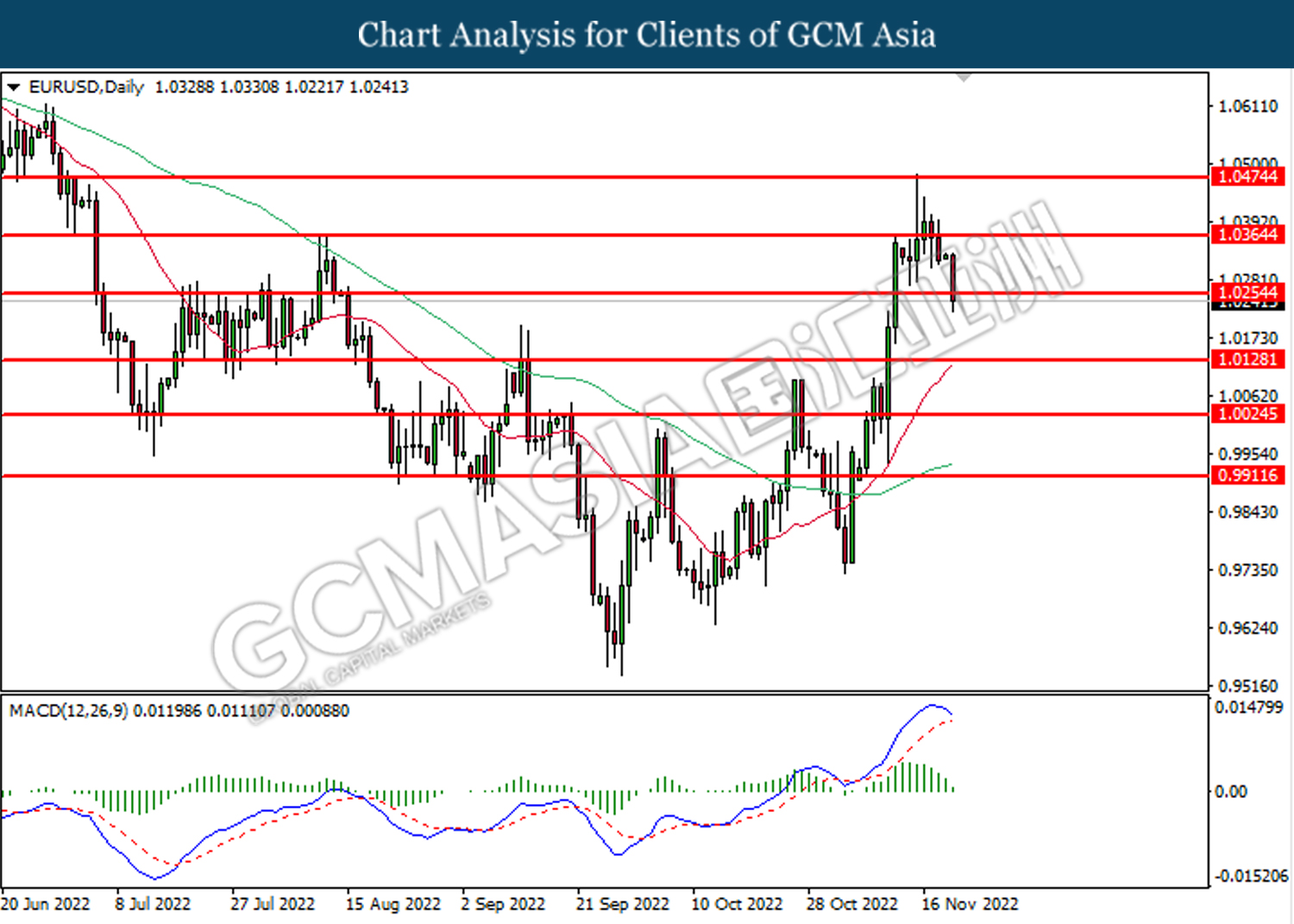

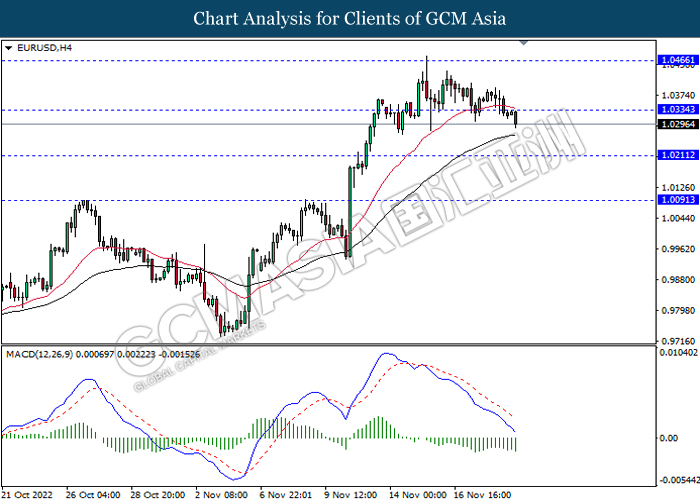

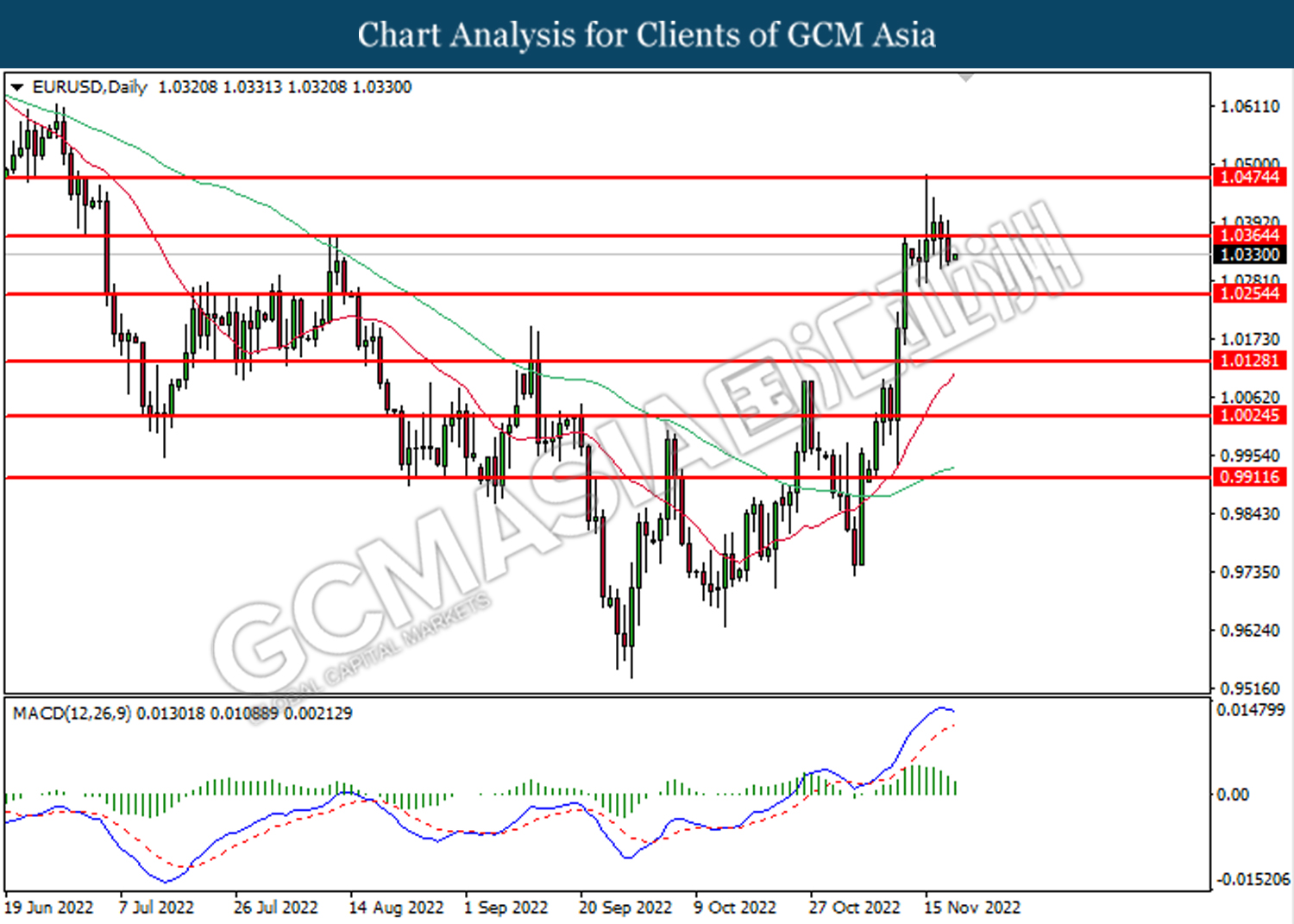

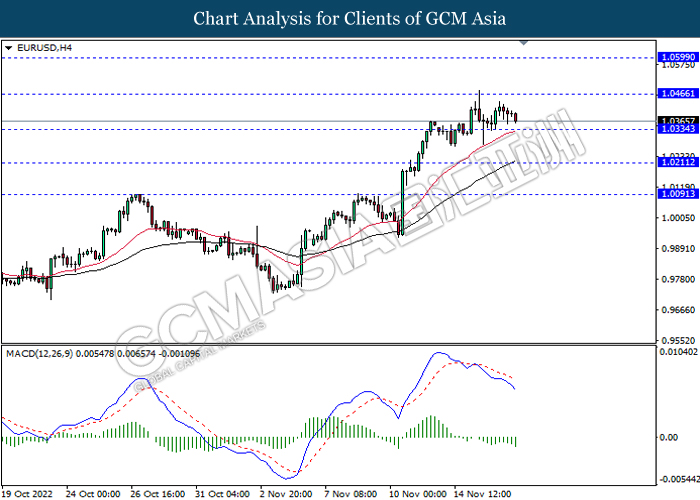

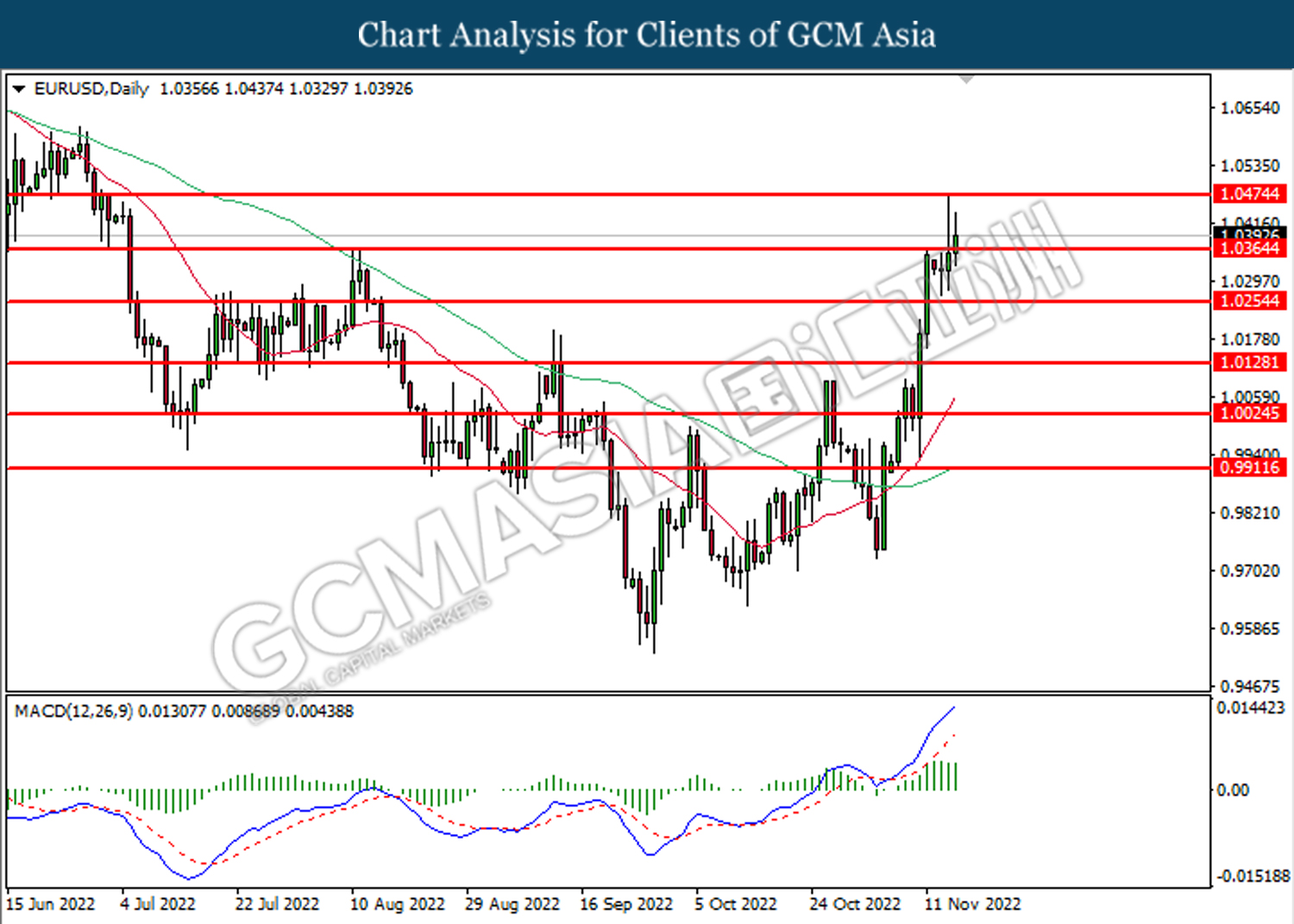

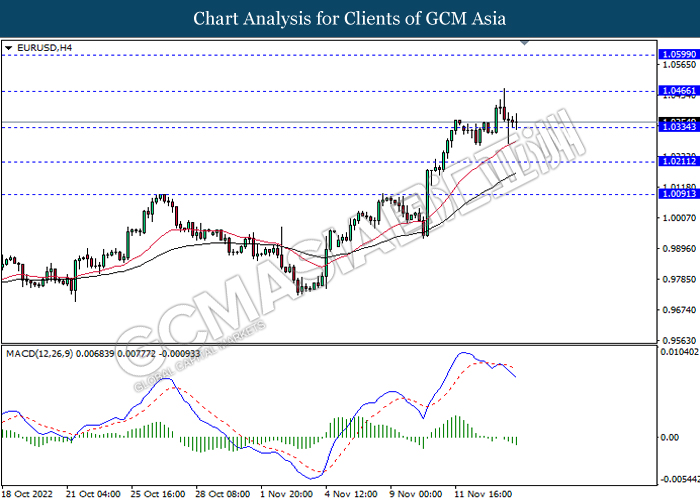

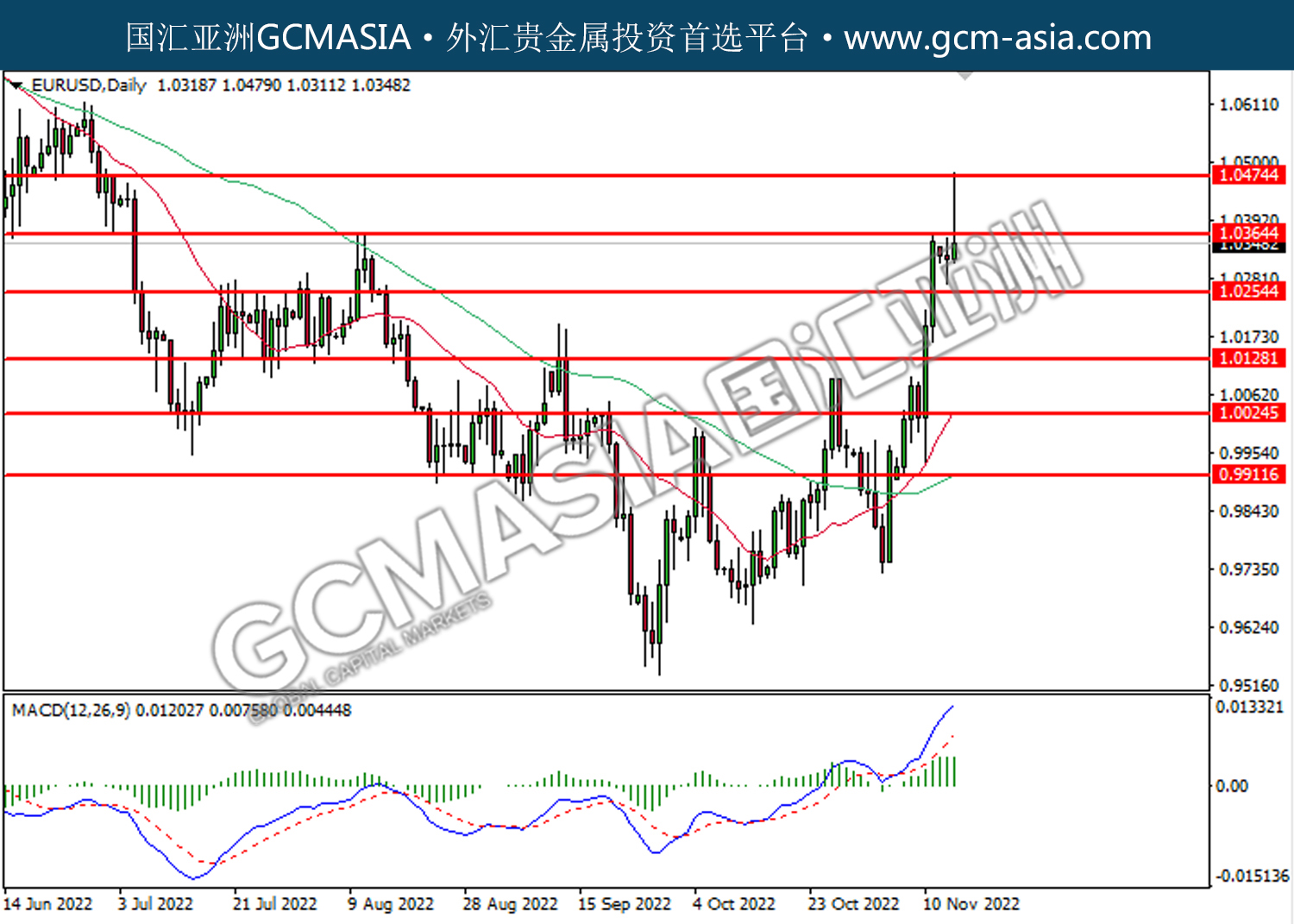

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0365. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0475, 1.0615

Support level: 1.0365, 1.0255

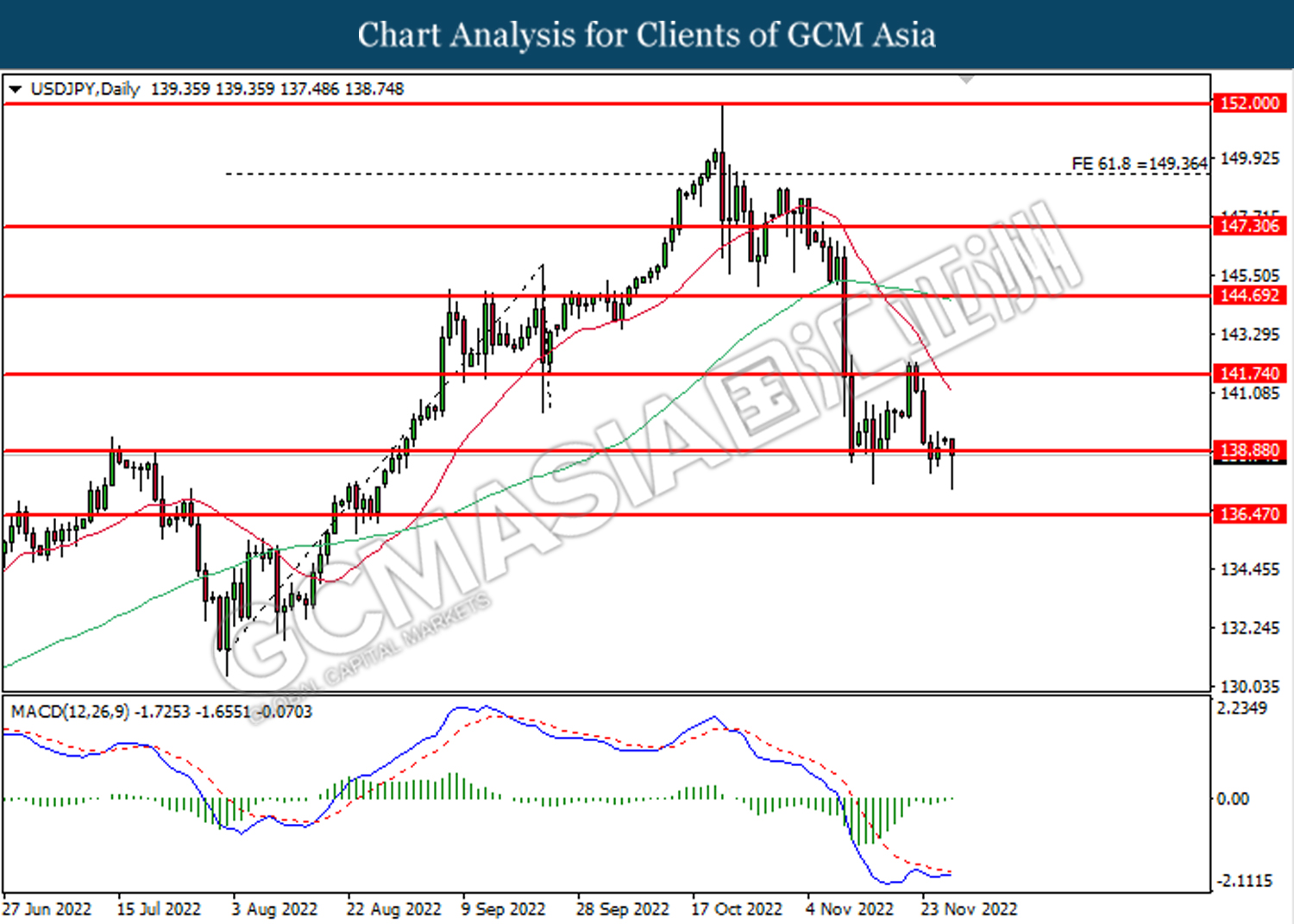

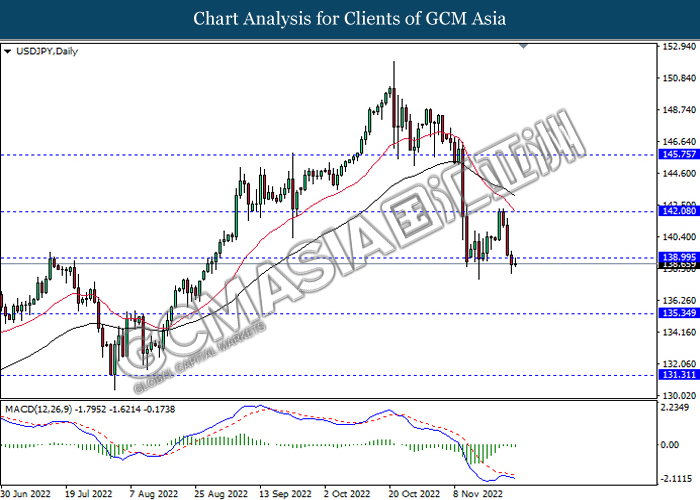

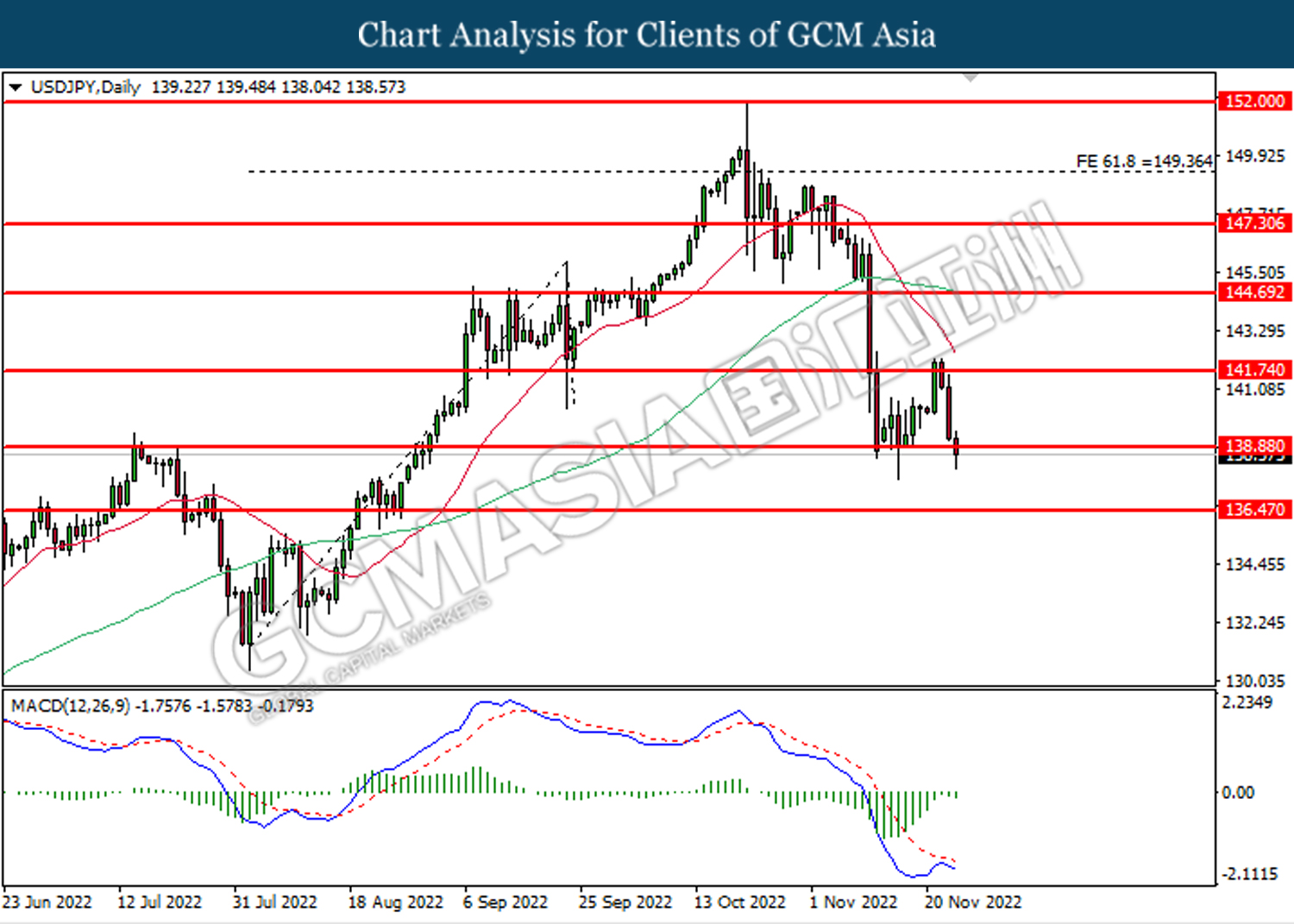

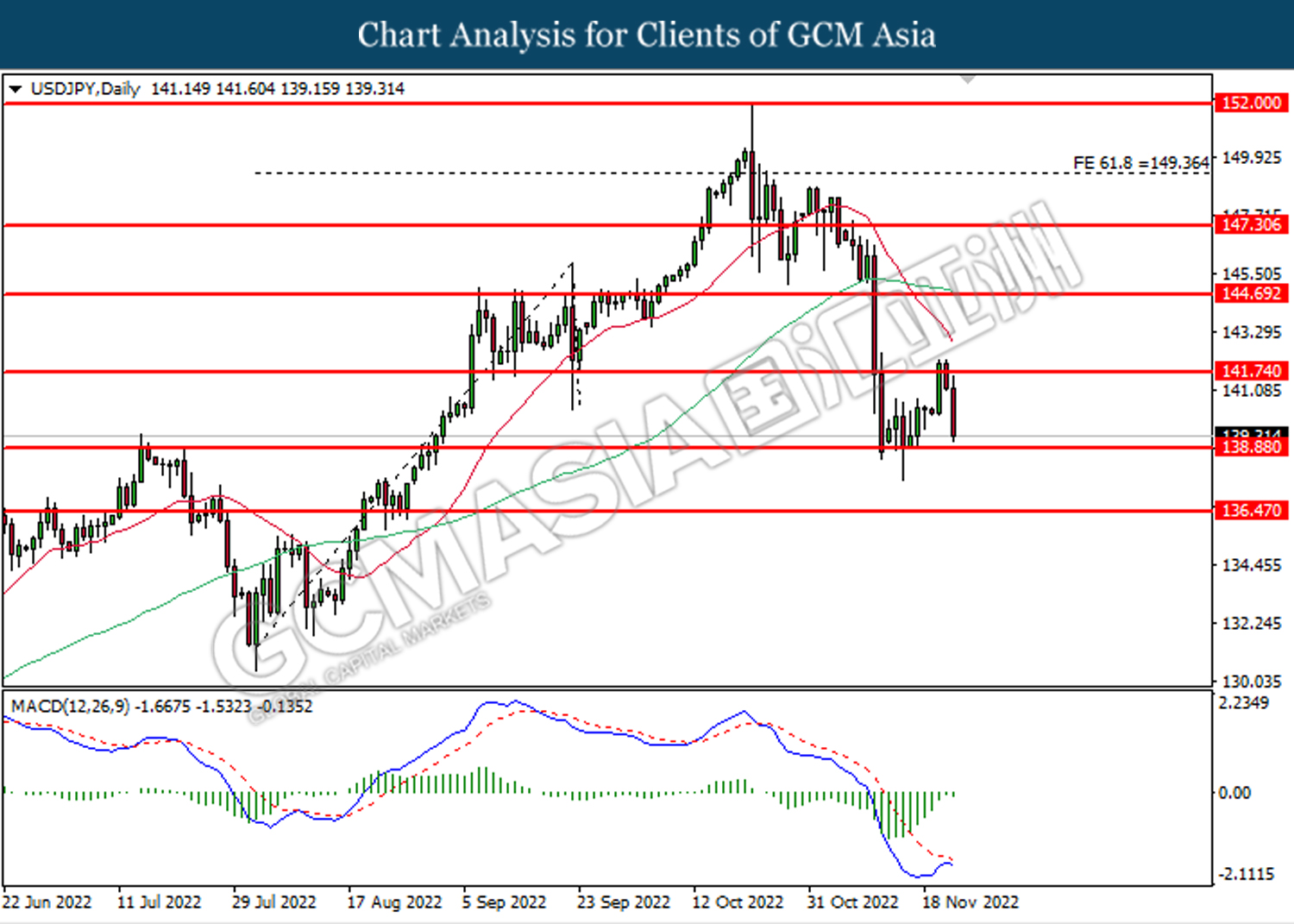

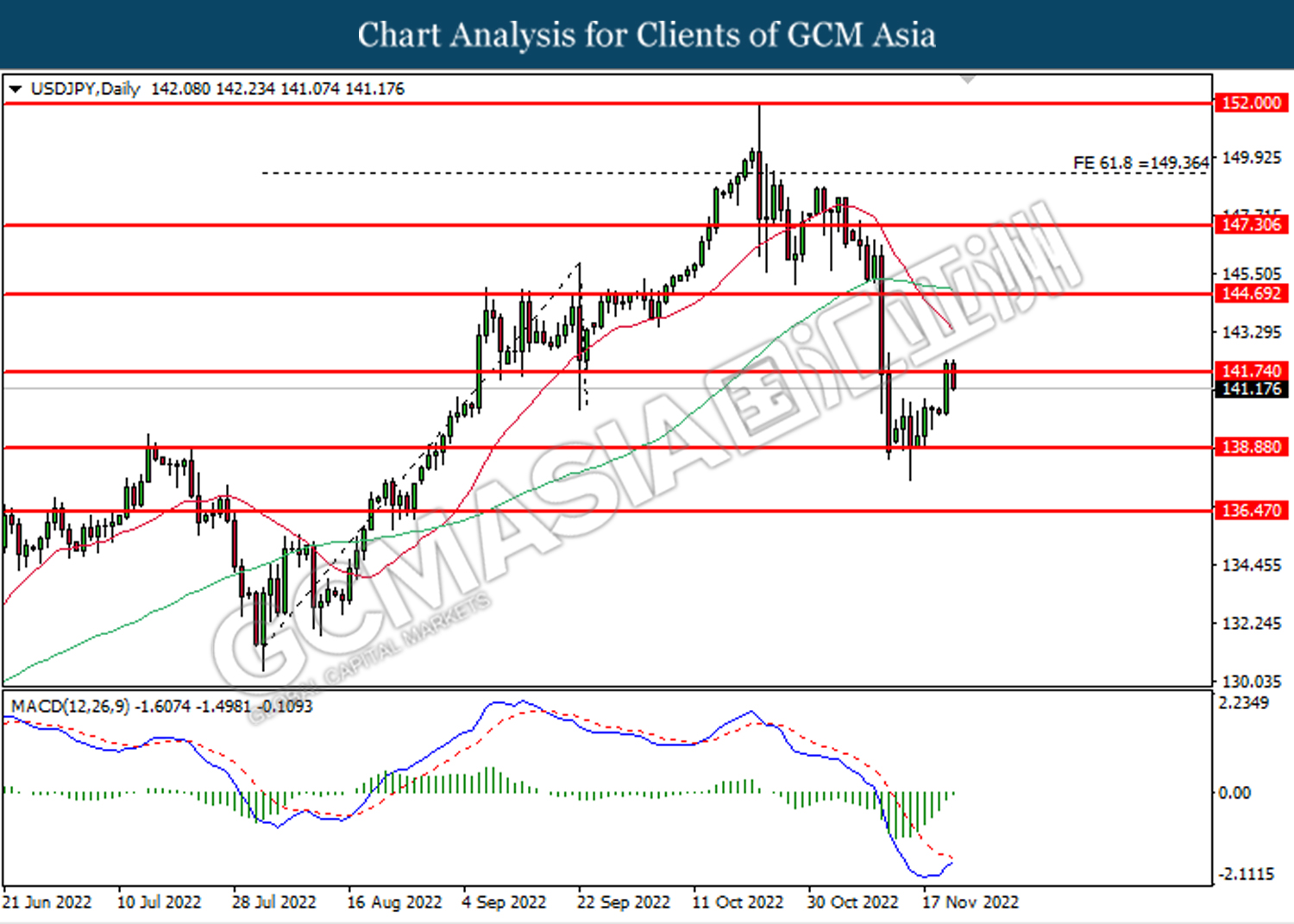

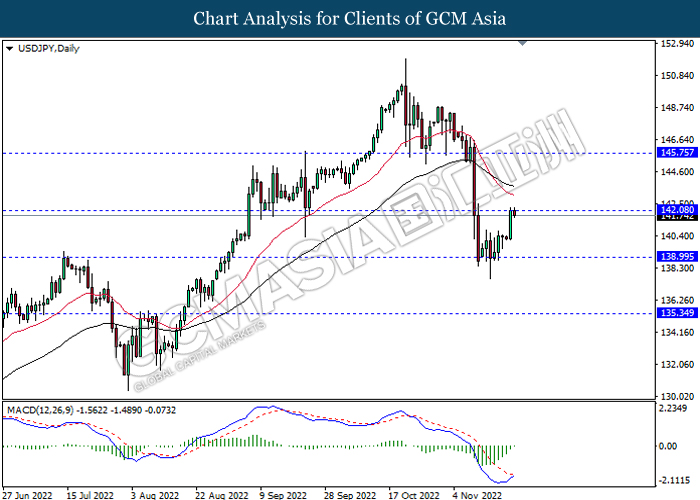

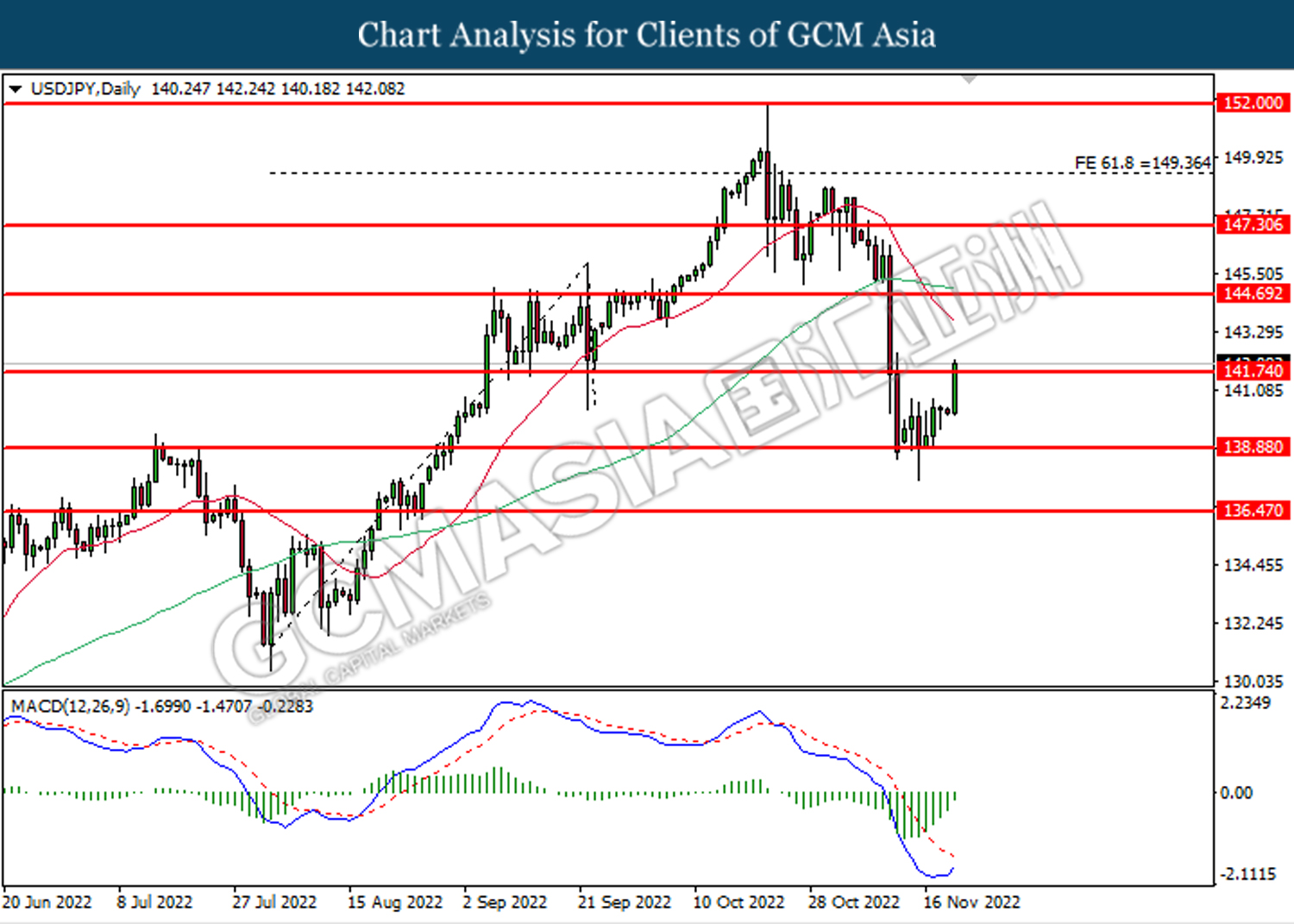

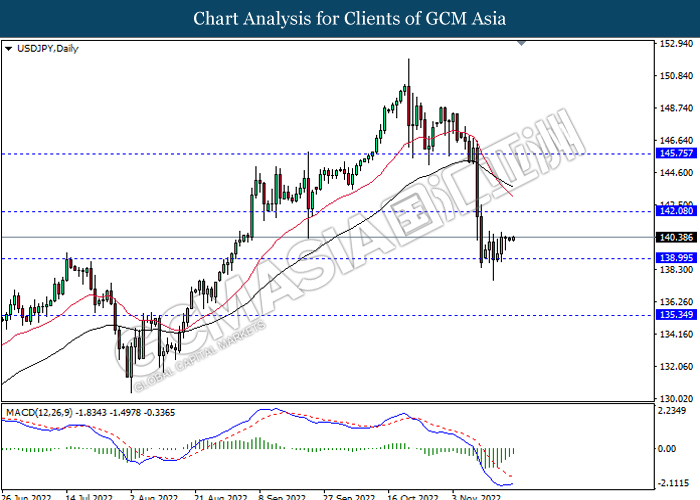

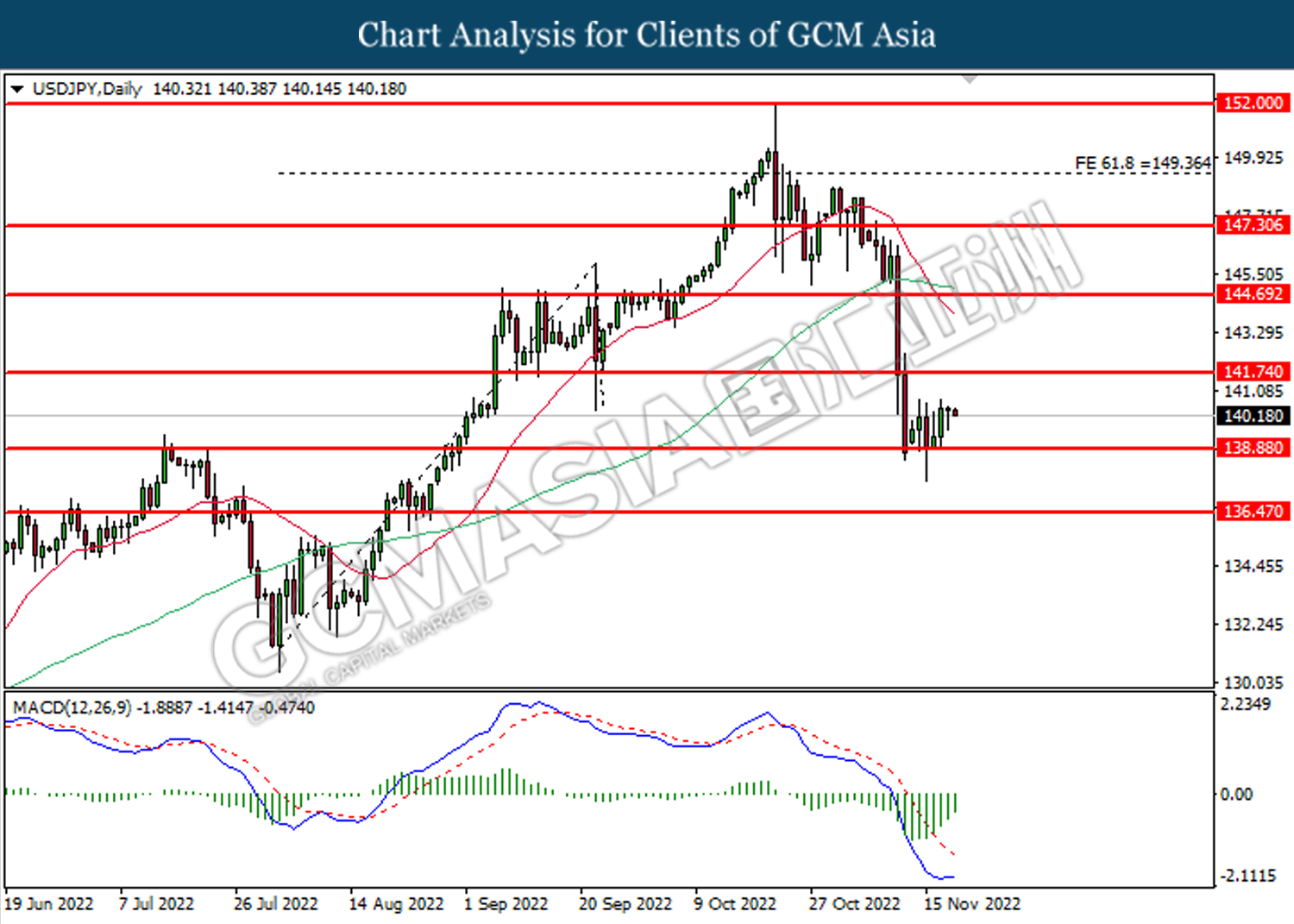

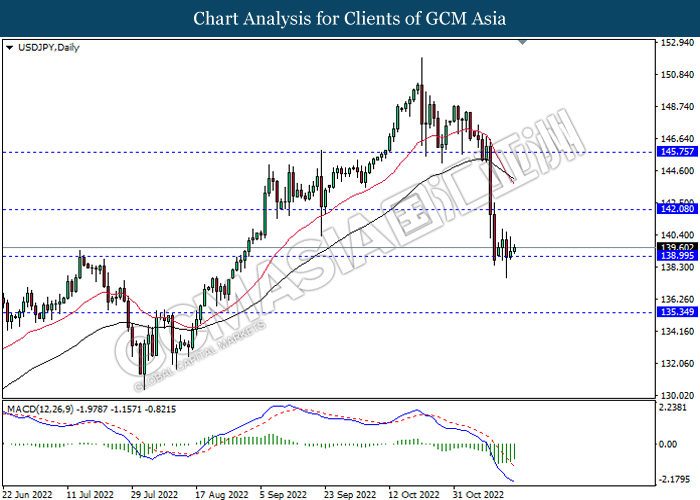

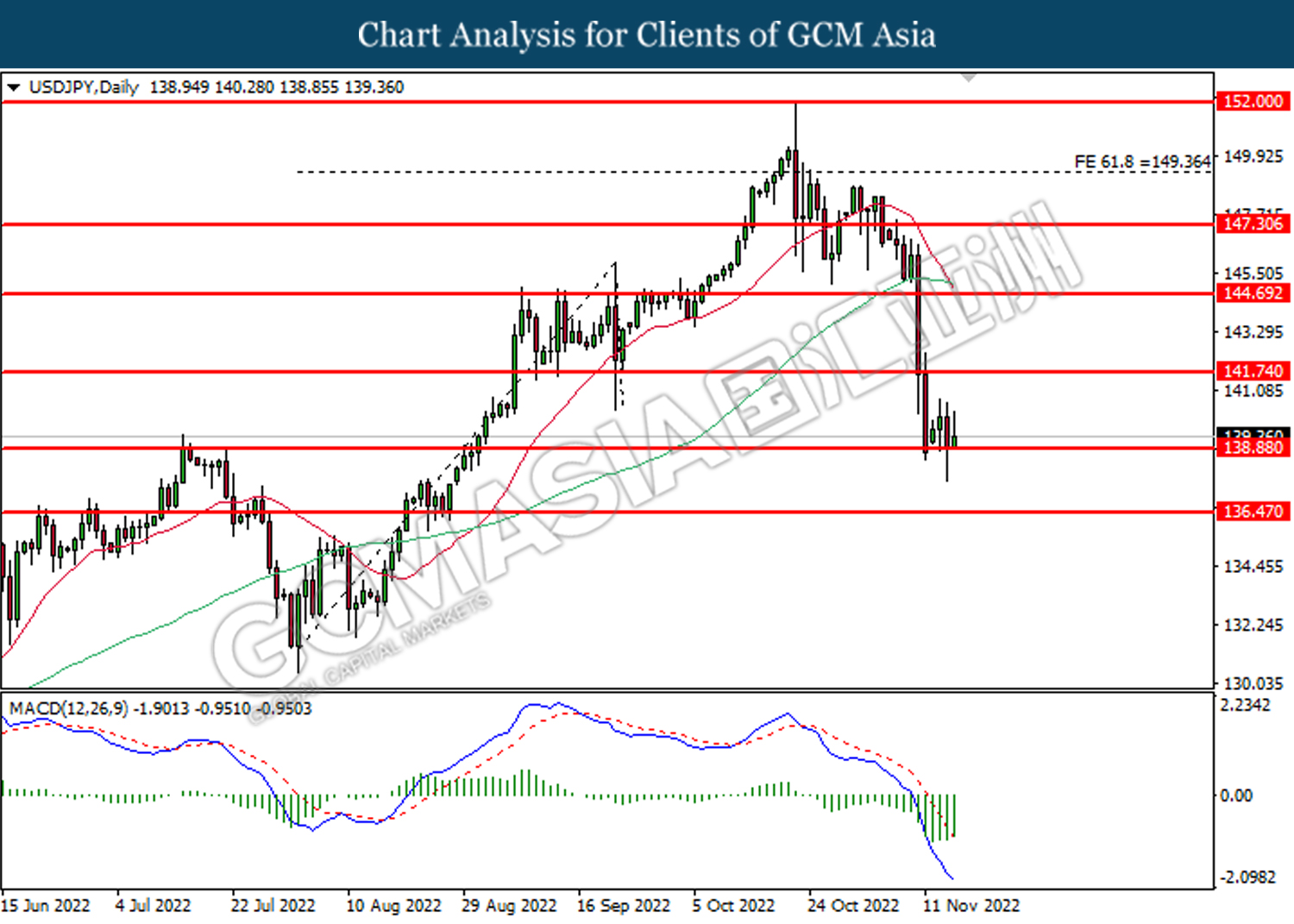

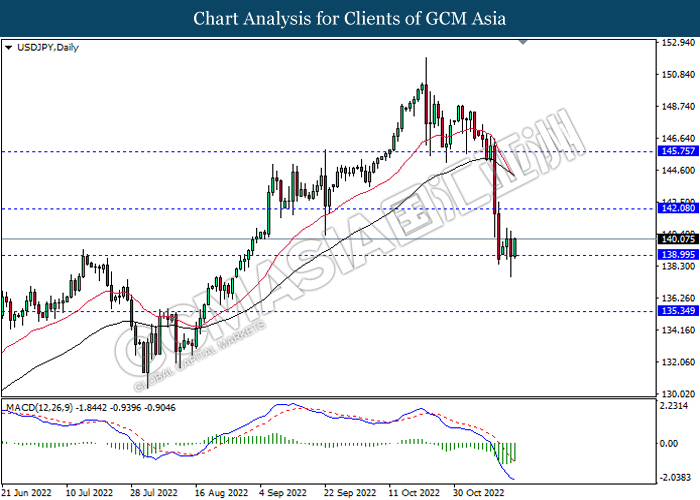

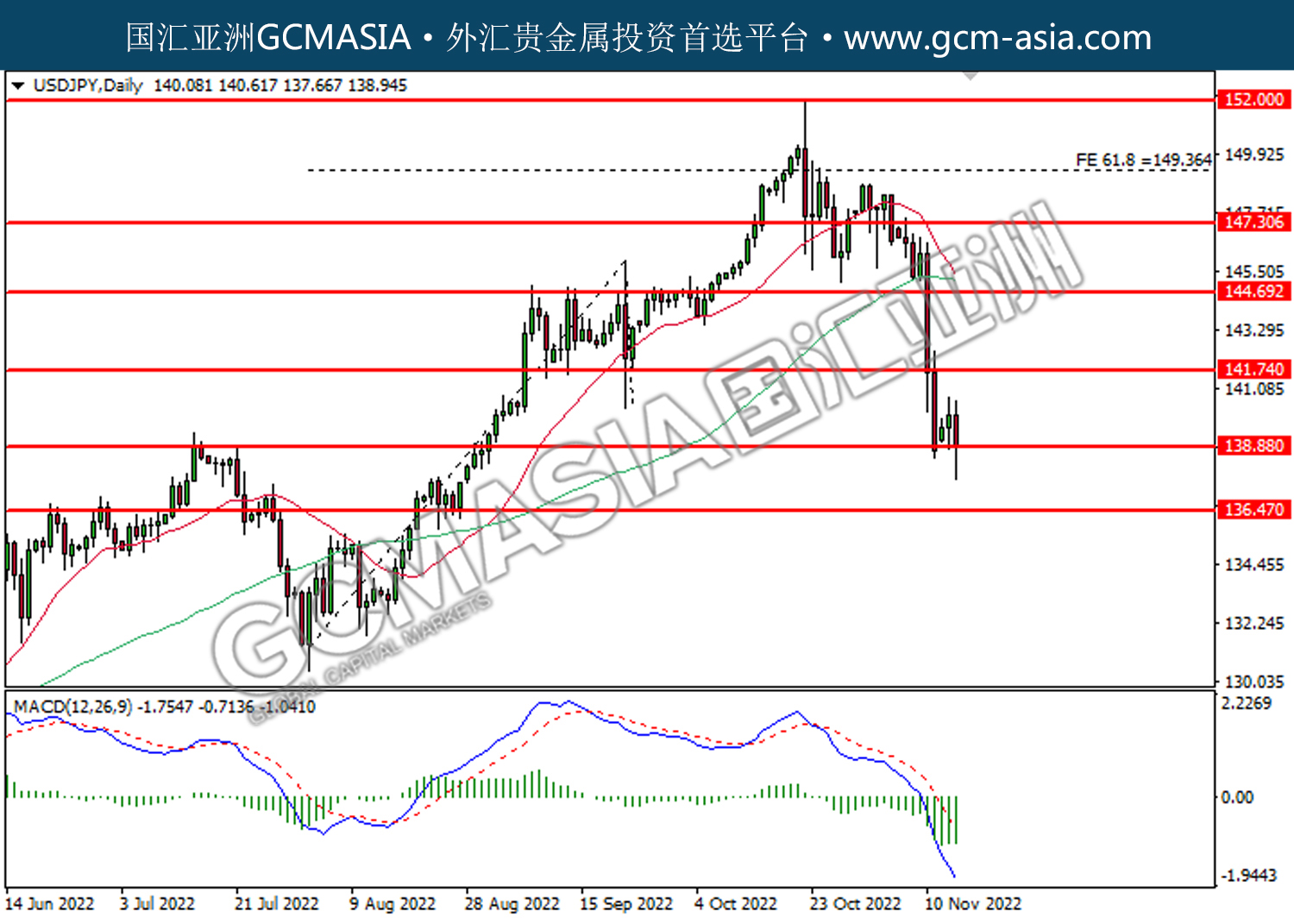

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.90. MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

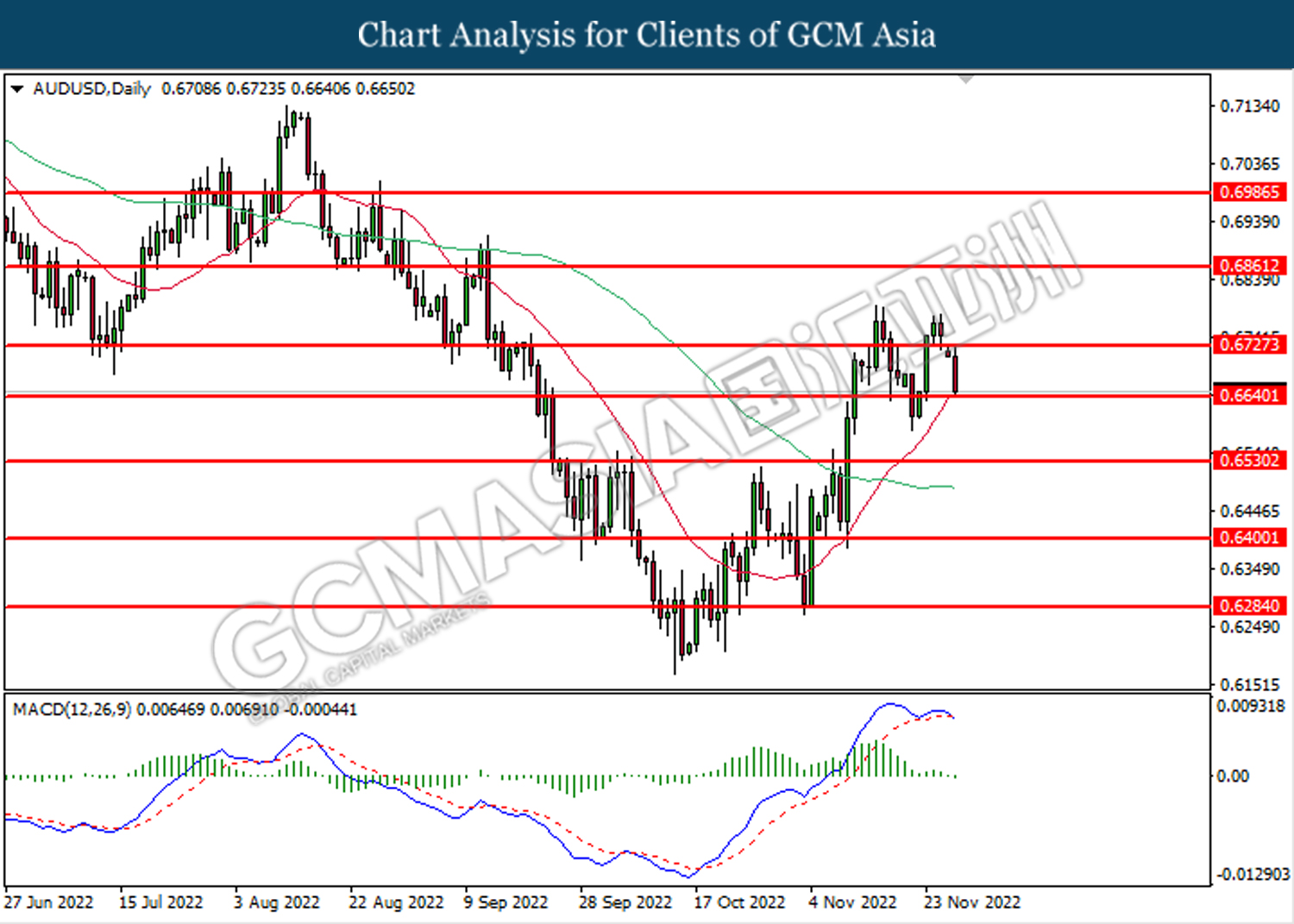

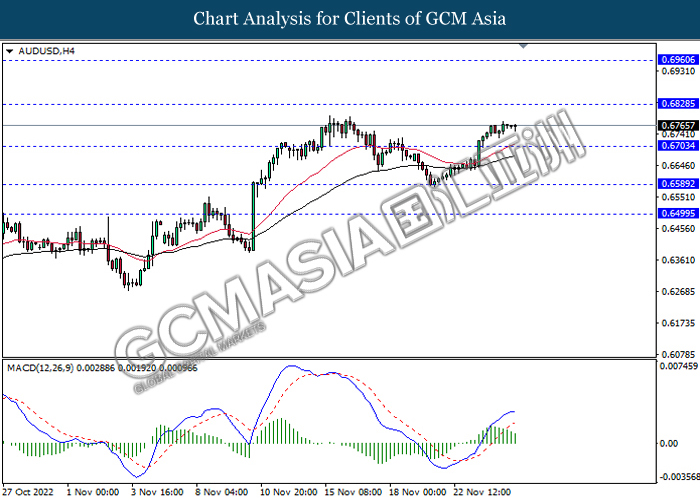

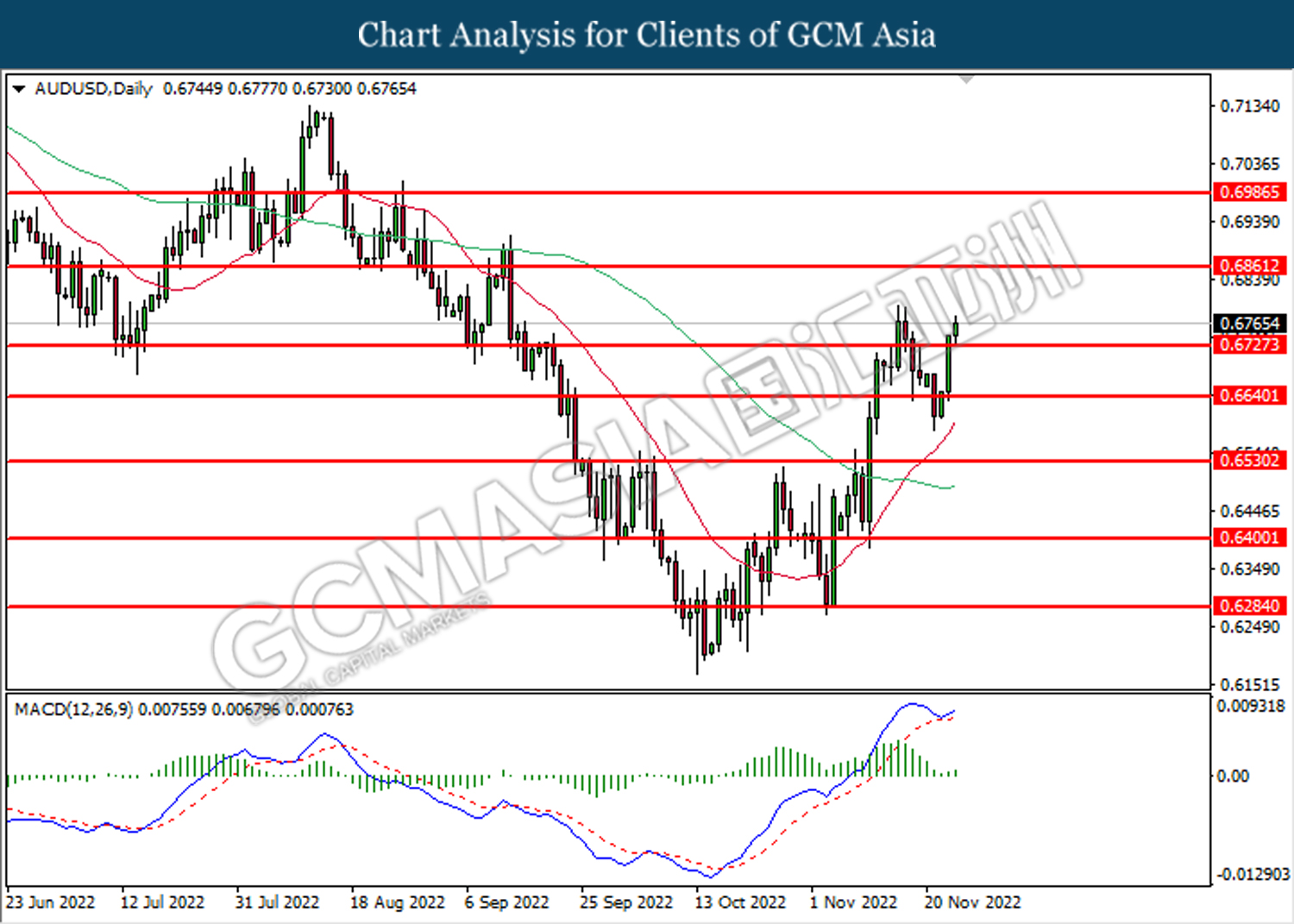

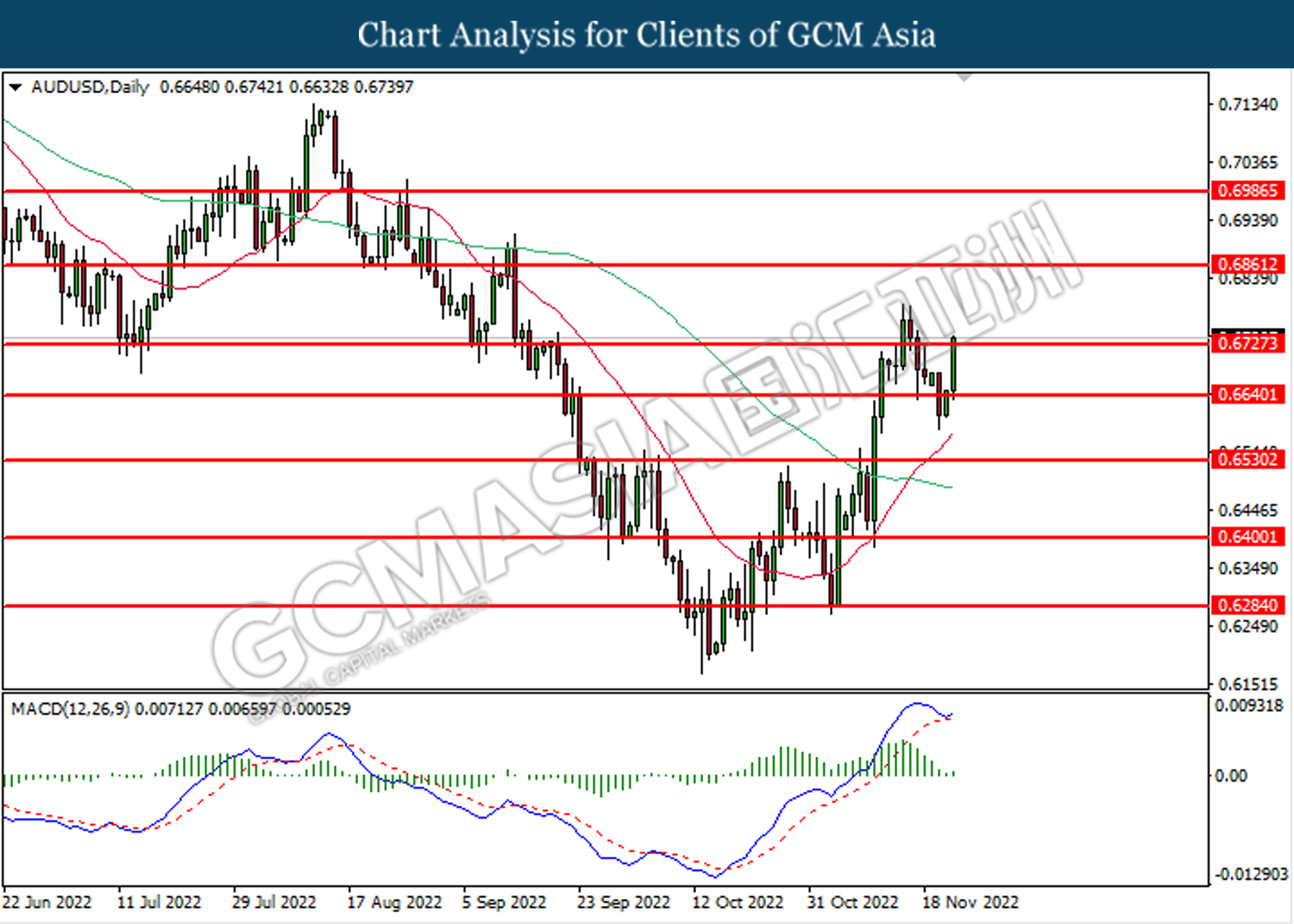

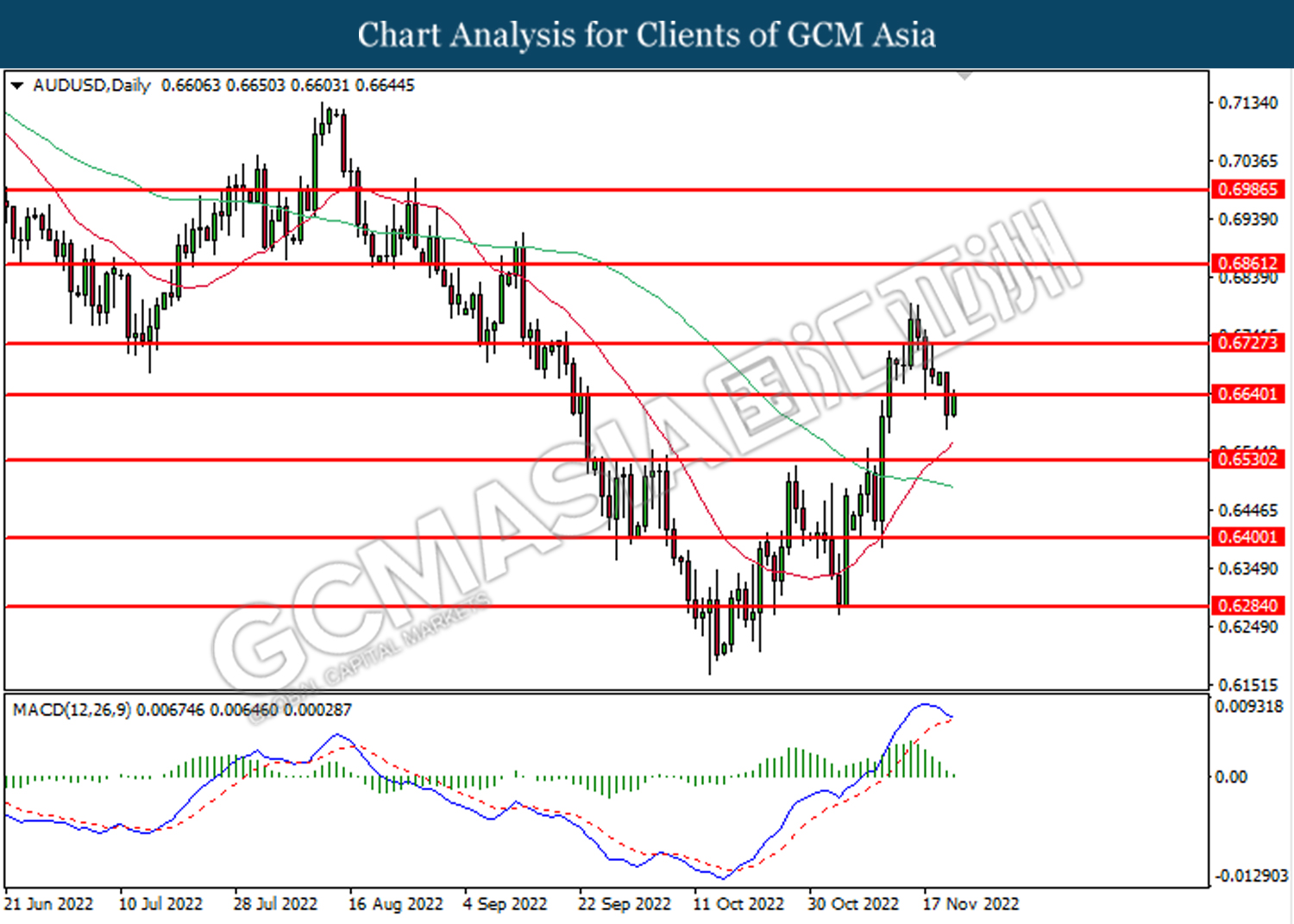

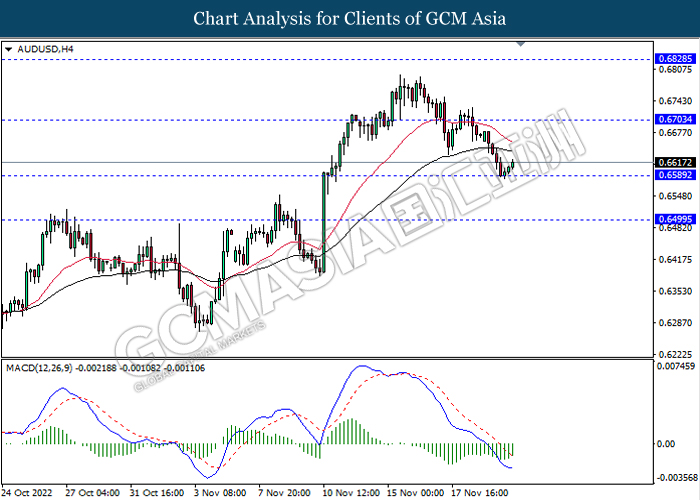

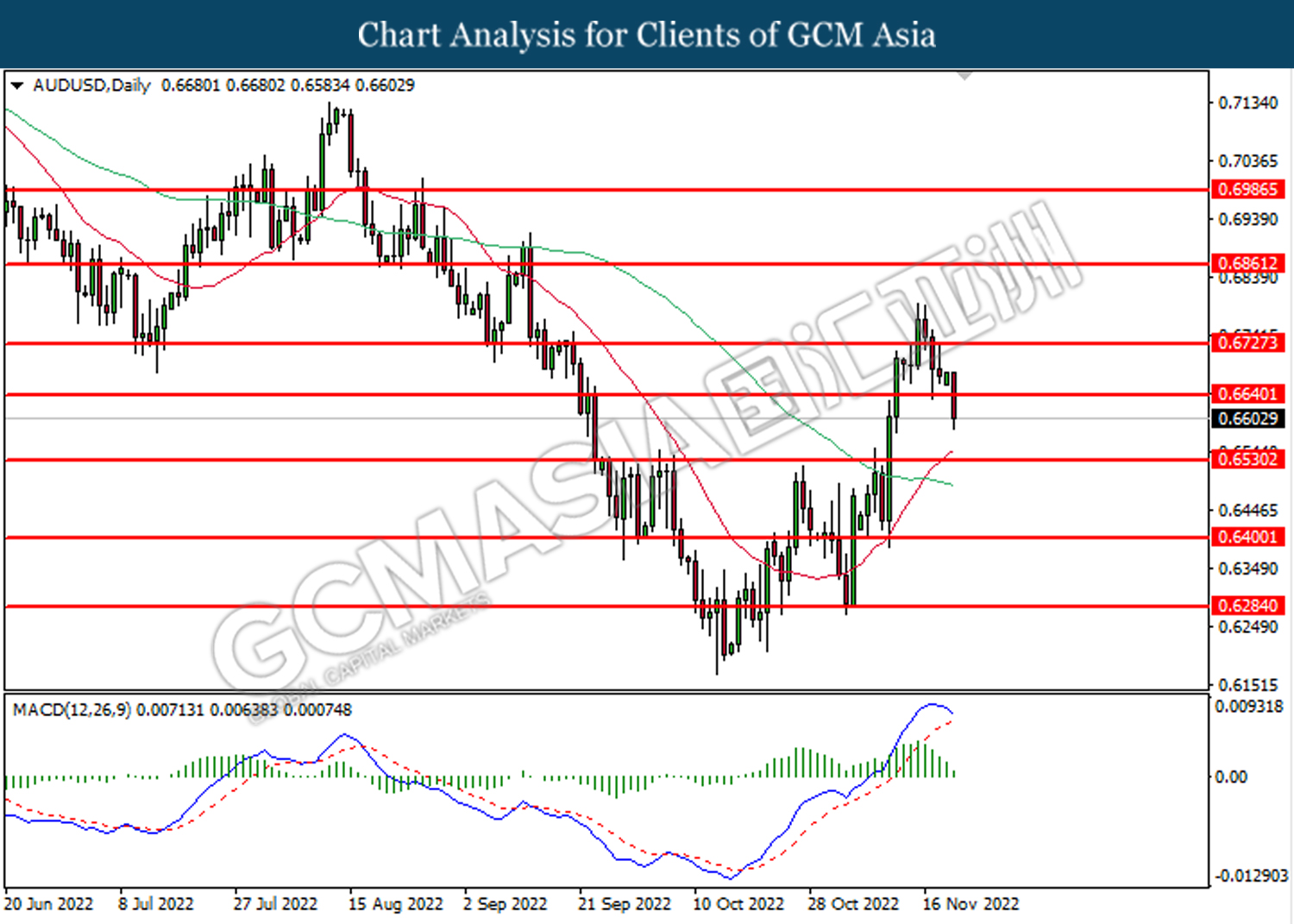

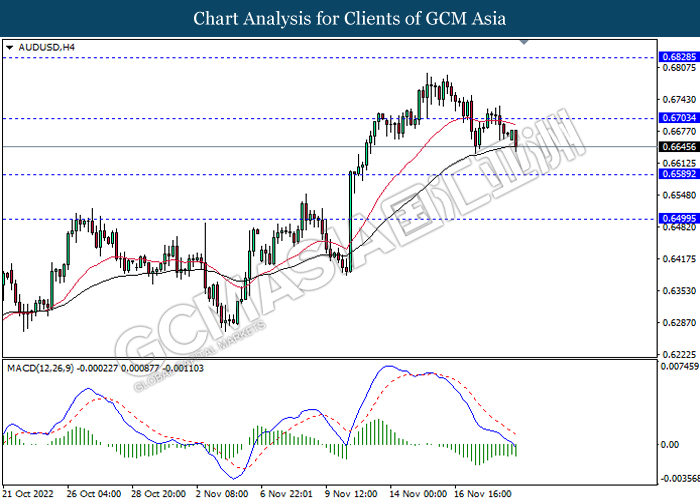

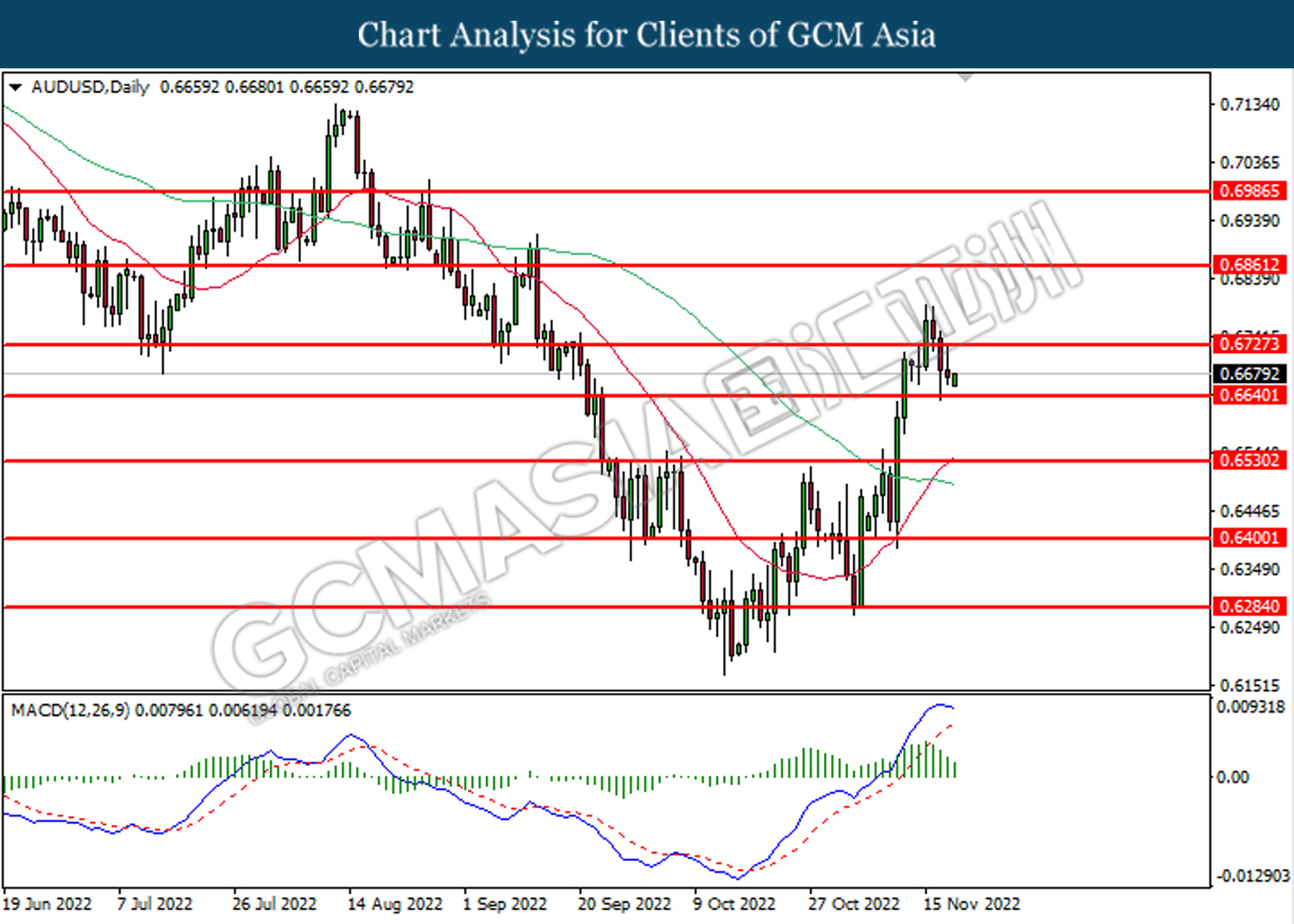

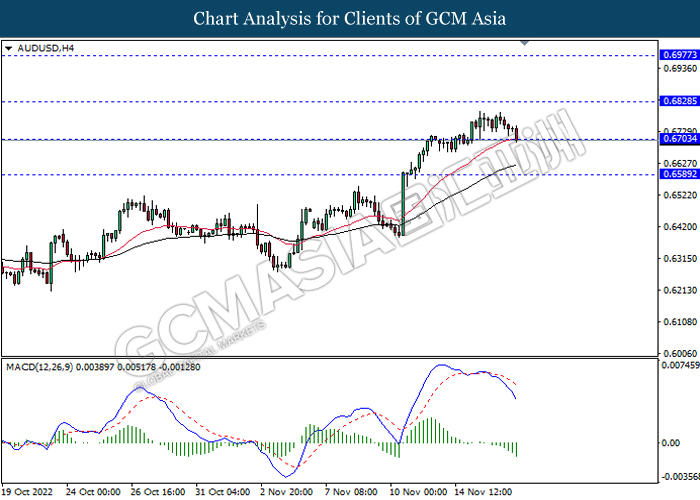

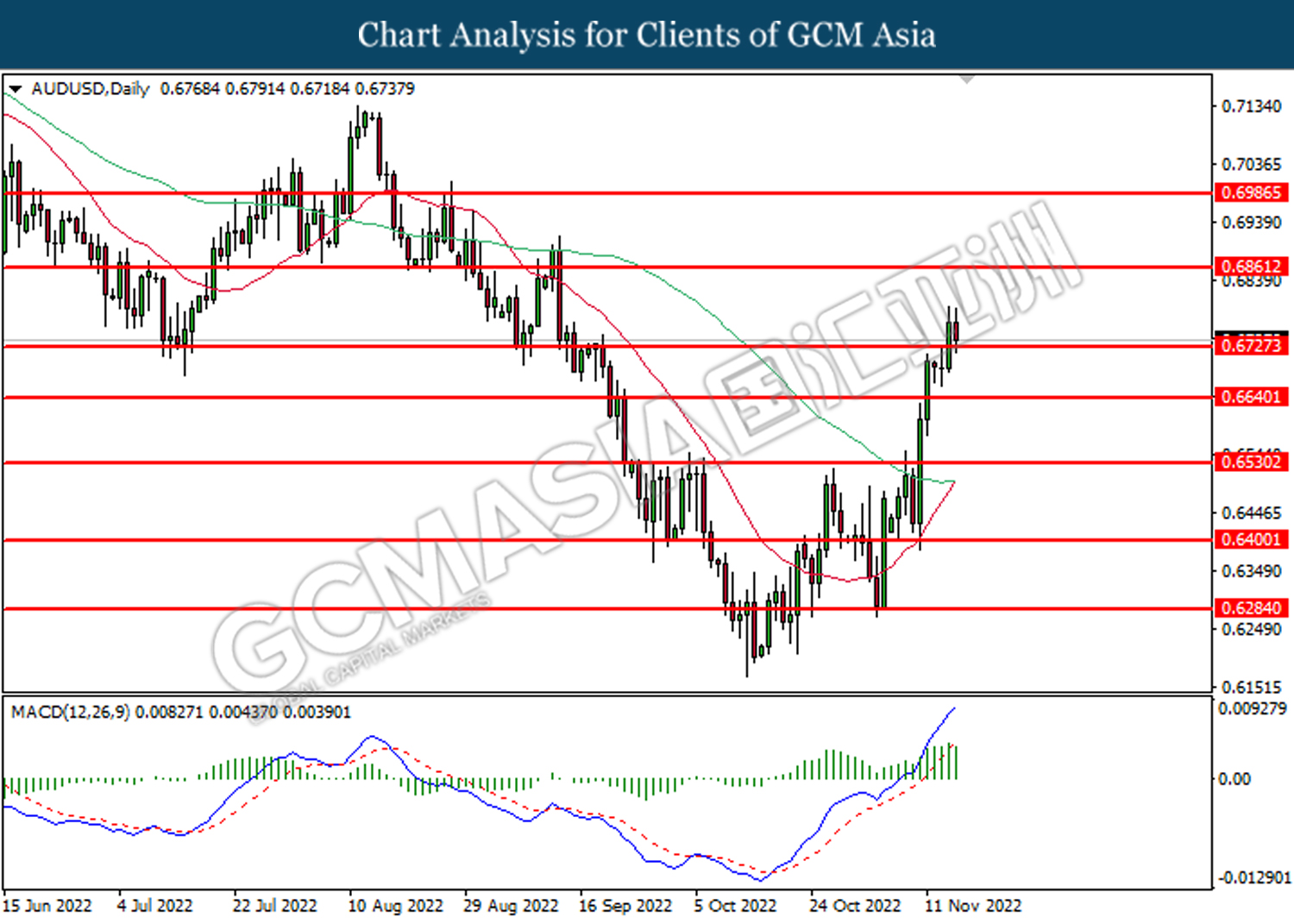

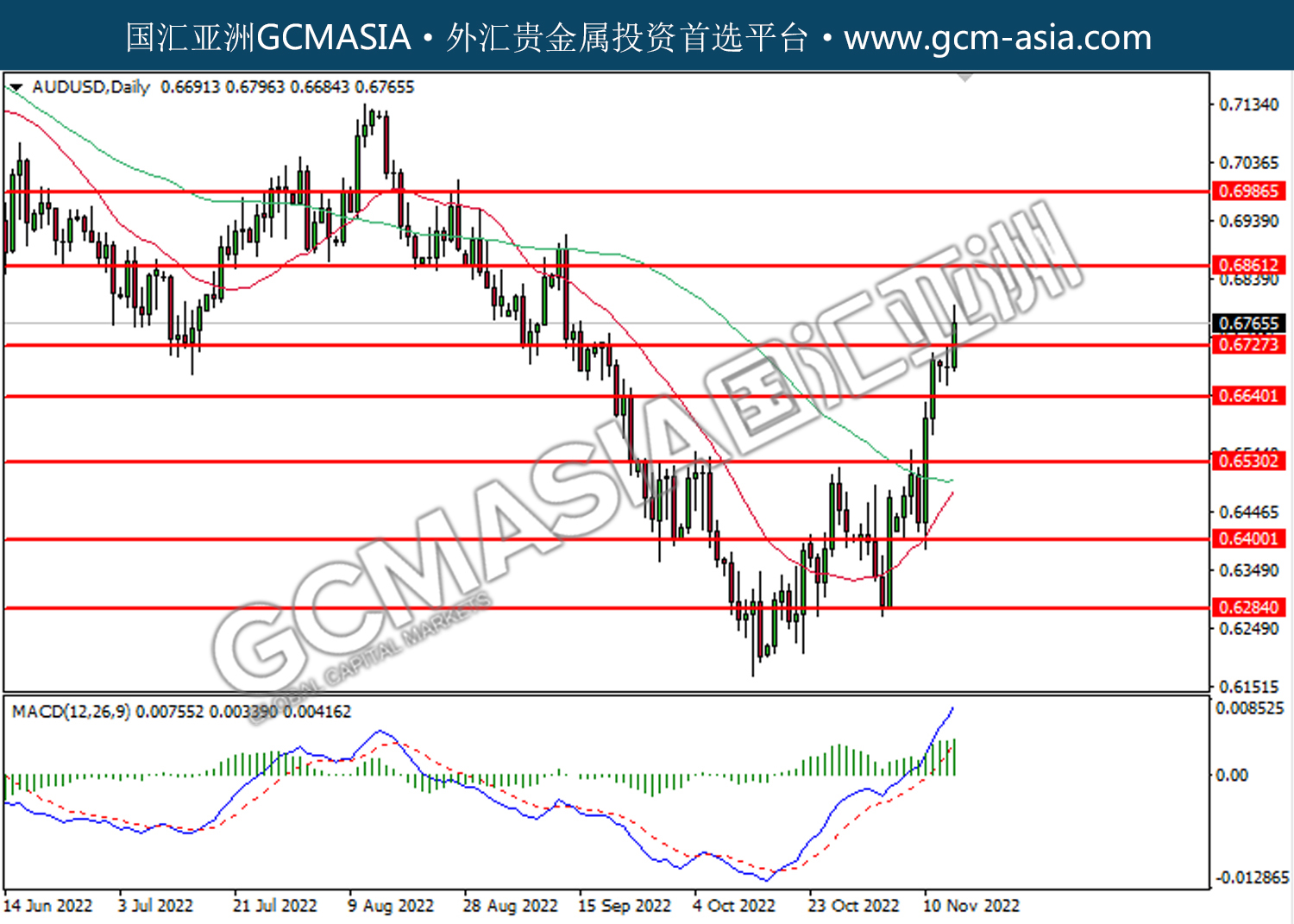

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6640. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

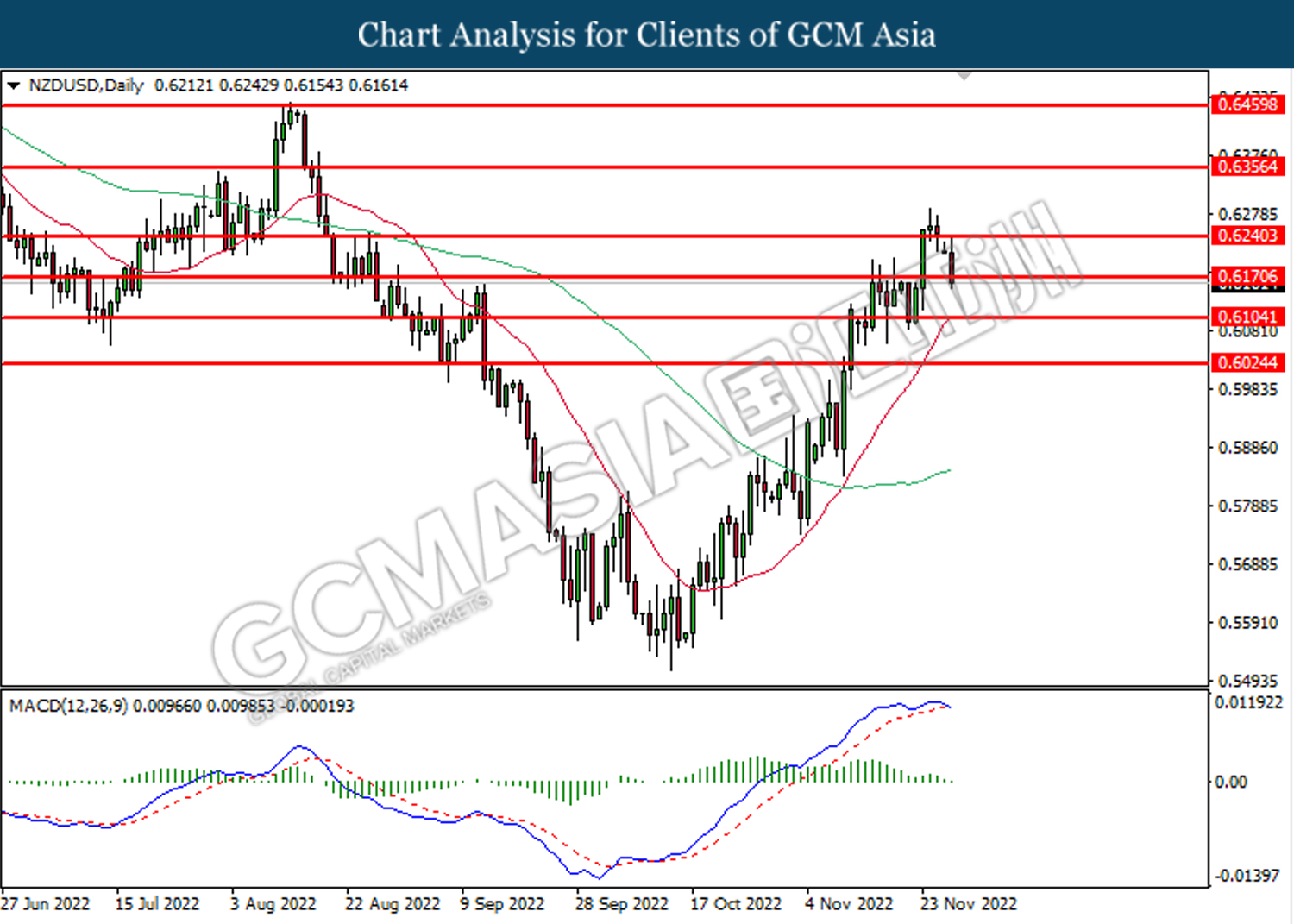

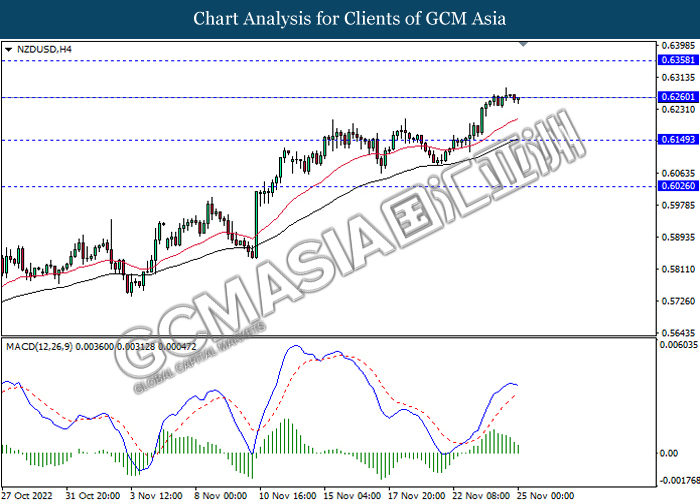

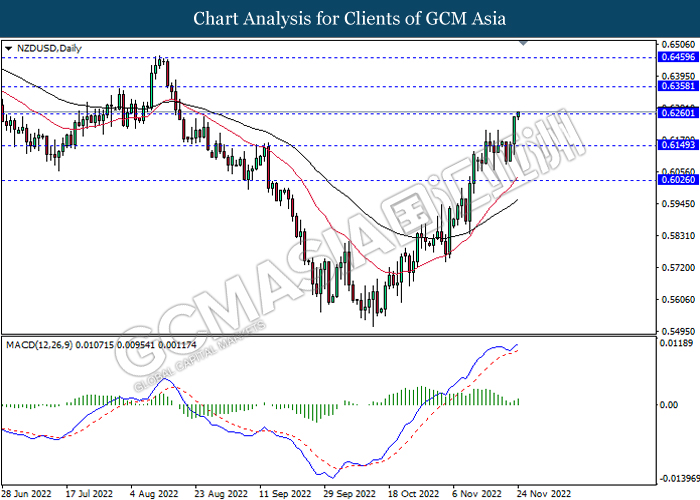

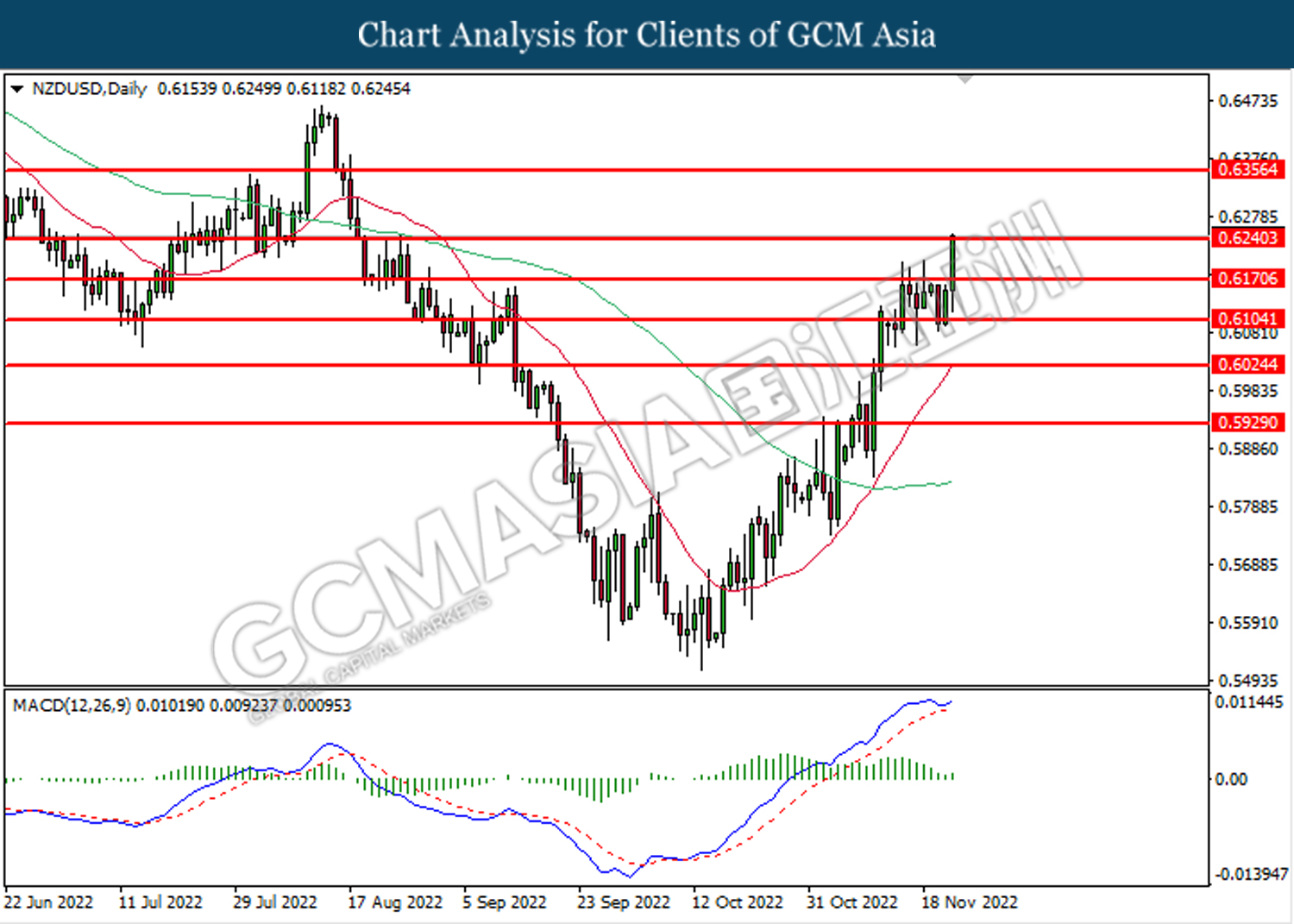

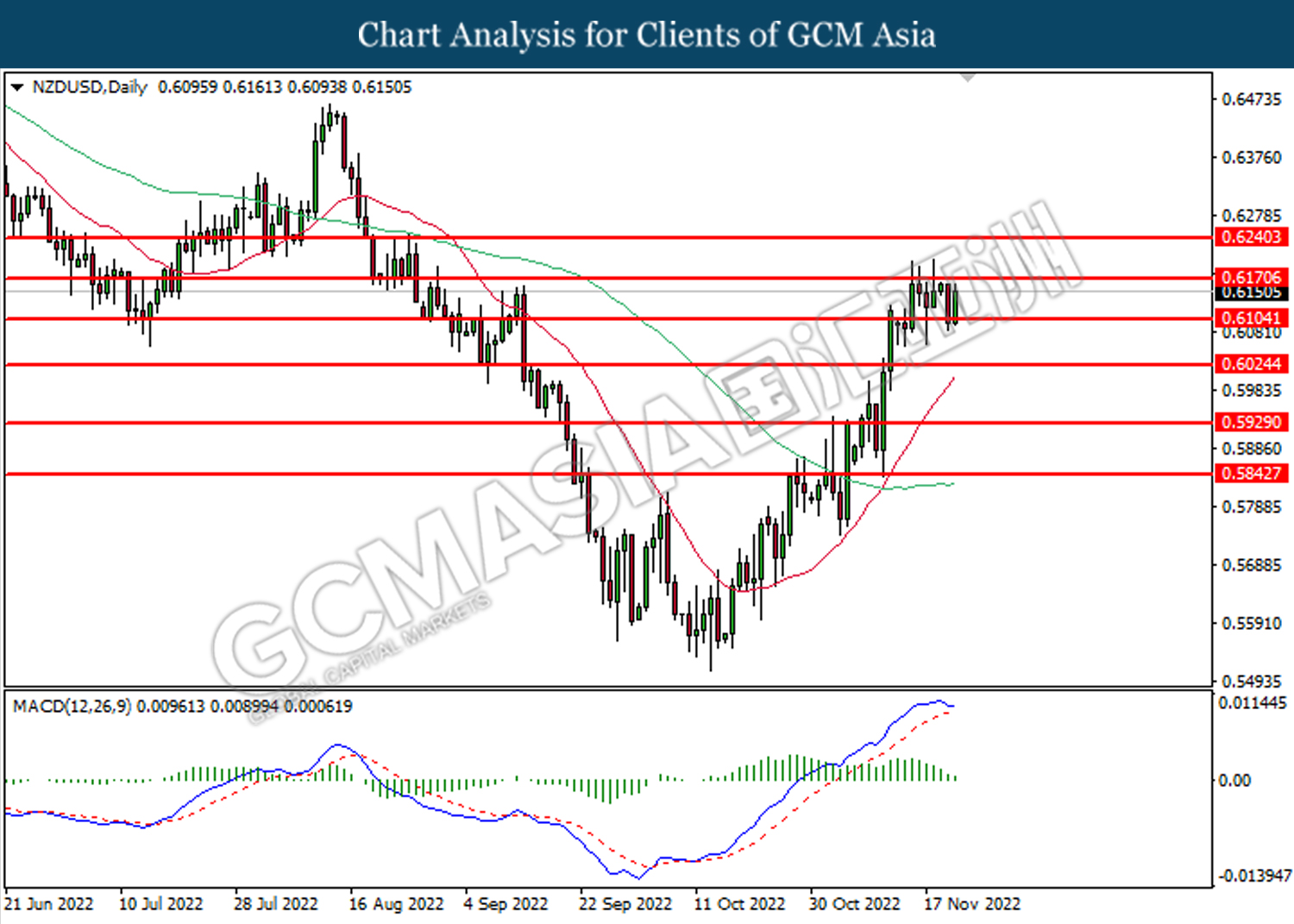

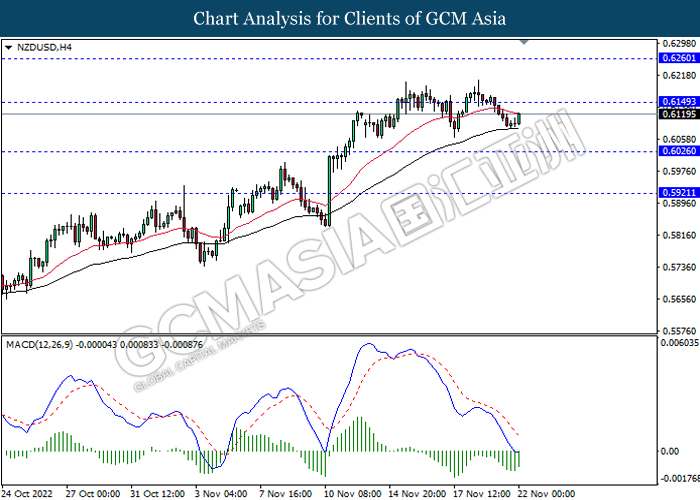

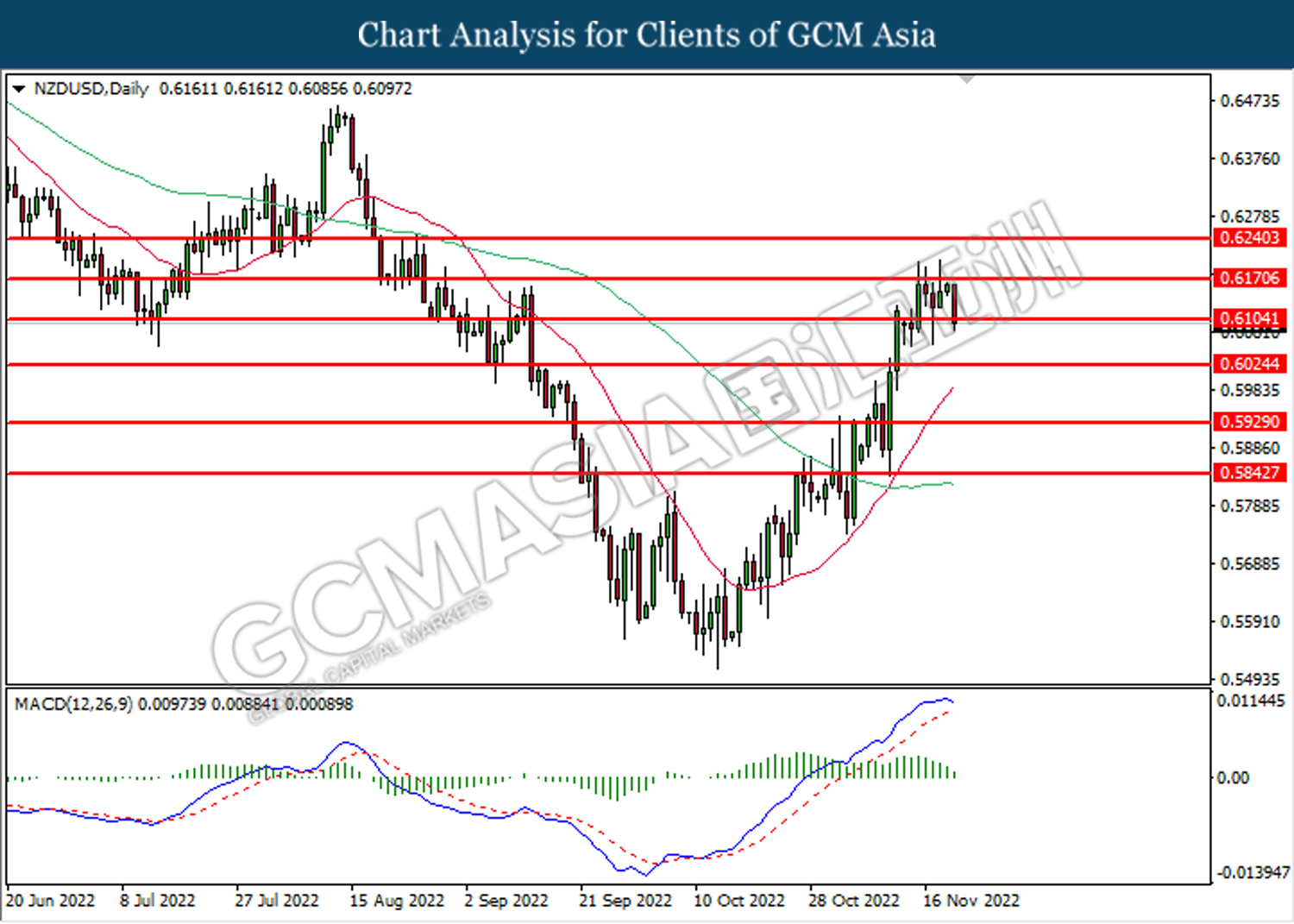

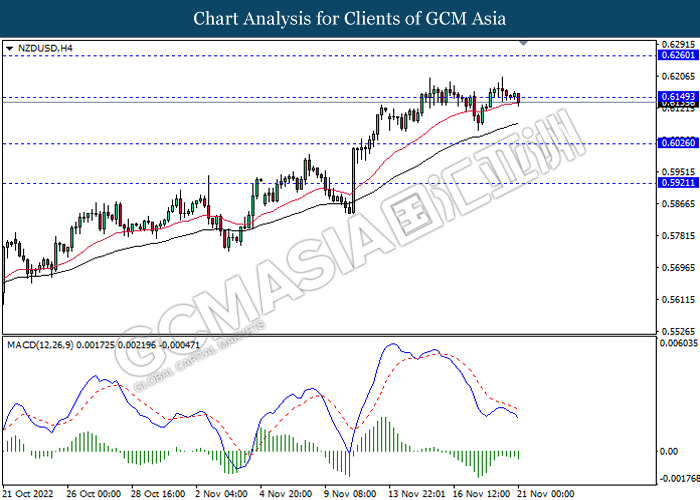

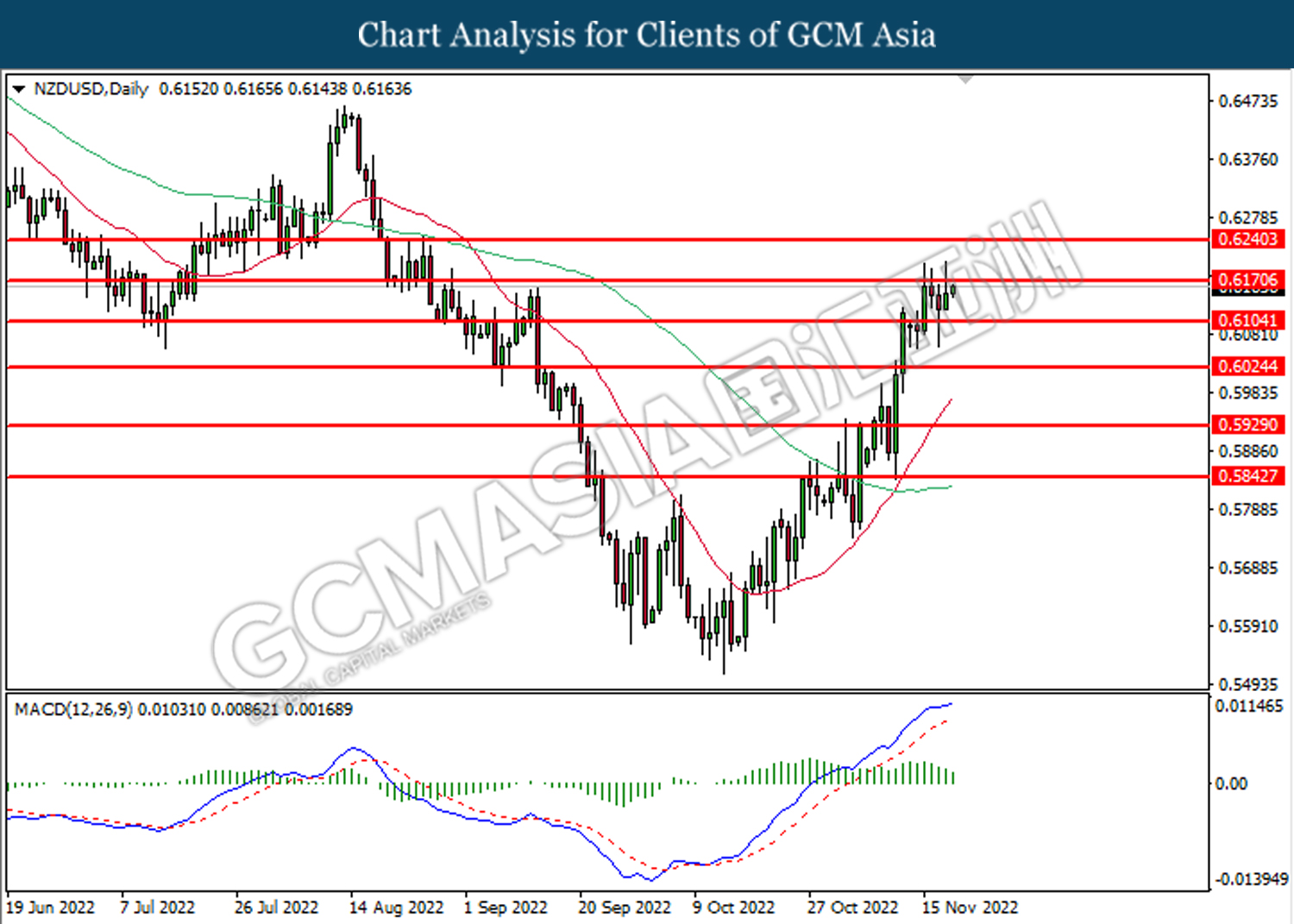

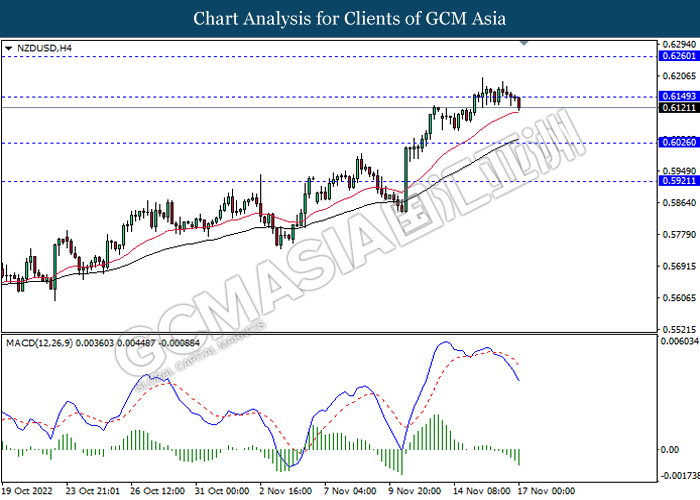

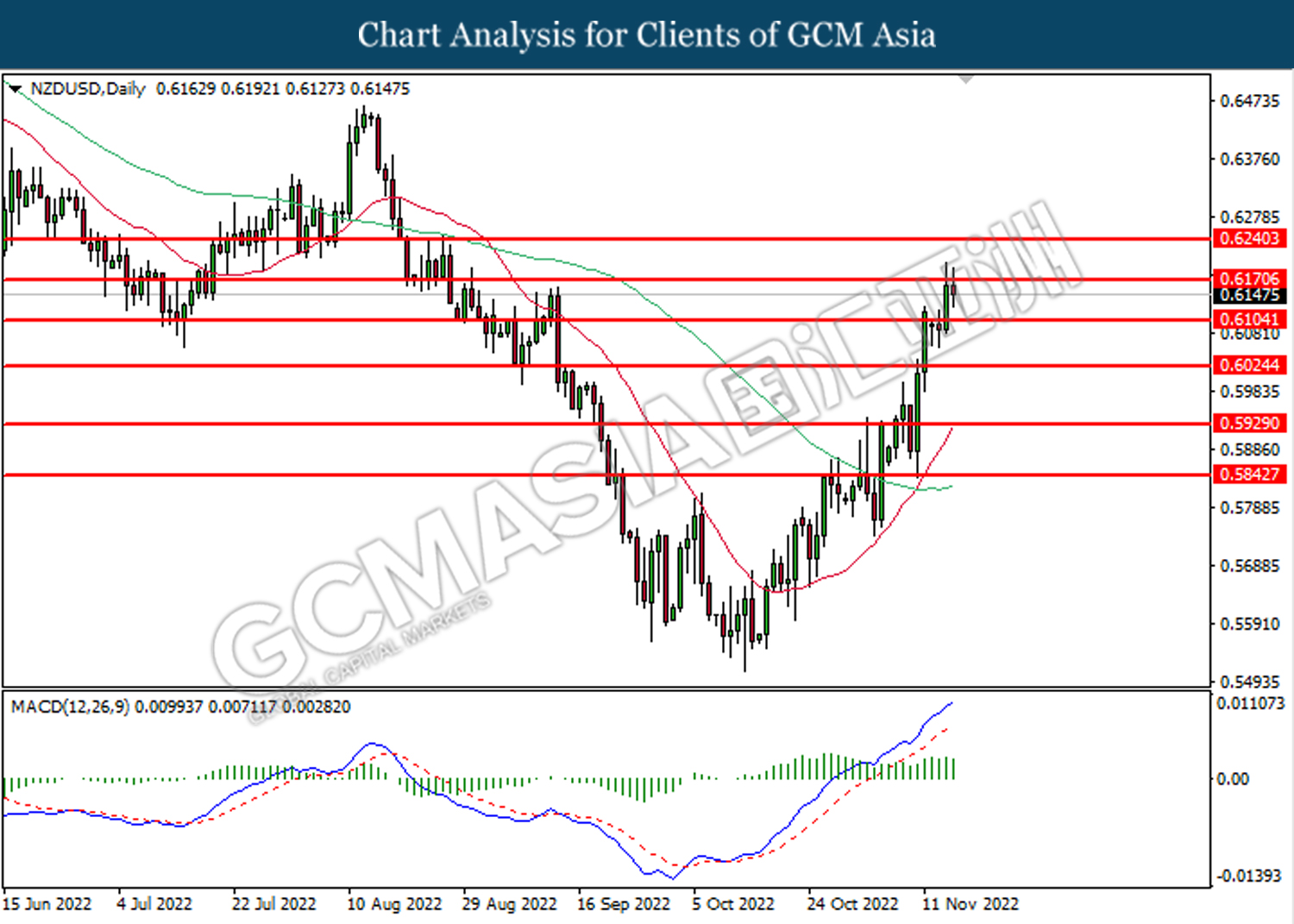

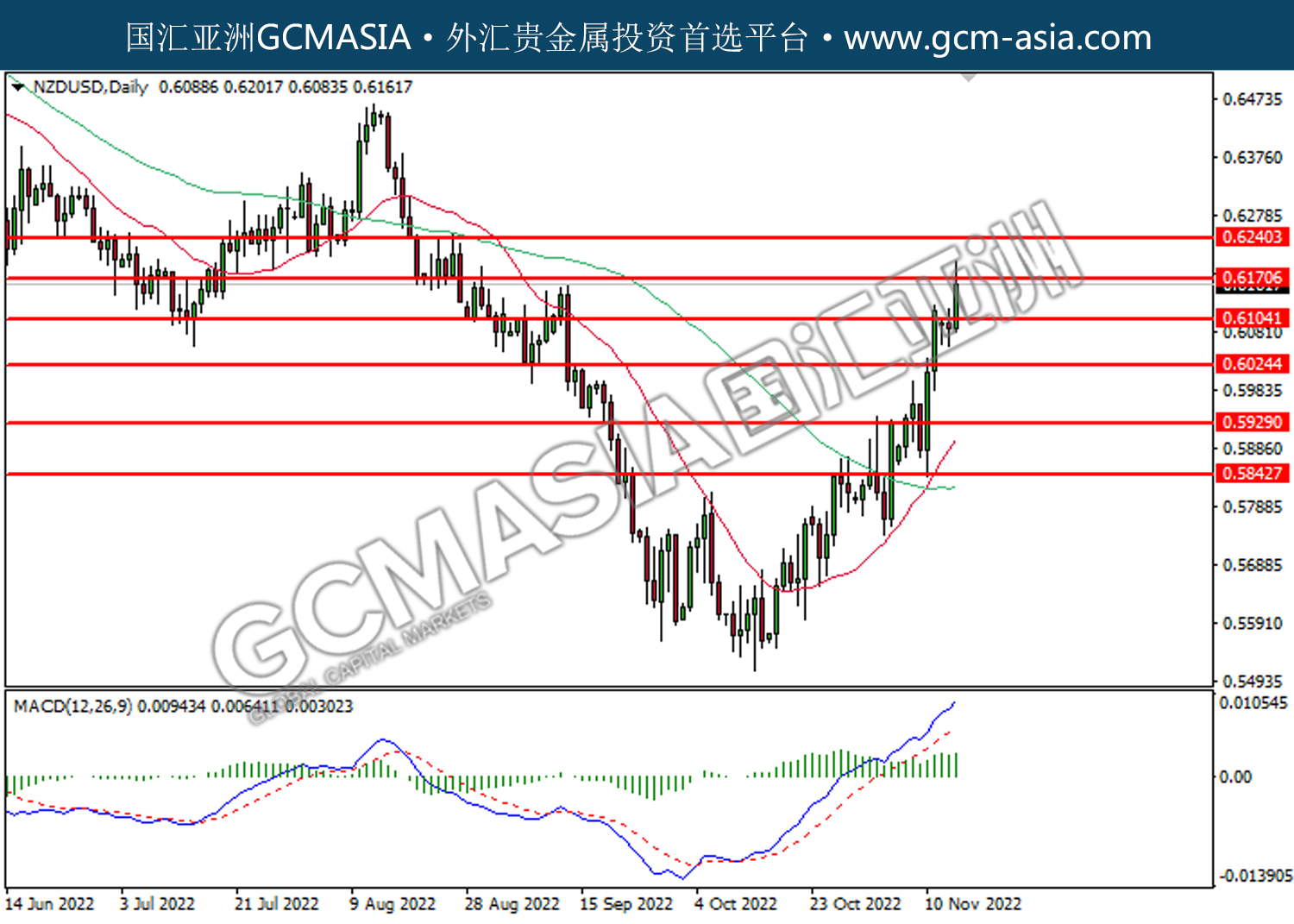

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6170. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6240, 0.6355

Support level: 0.6170, 0.6105

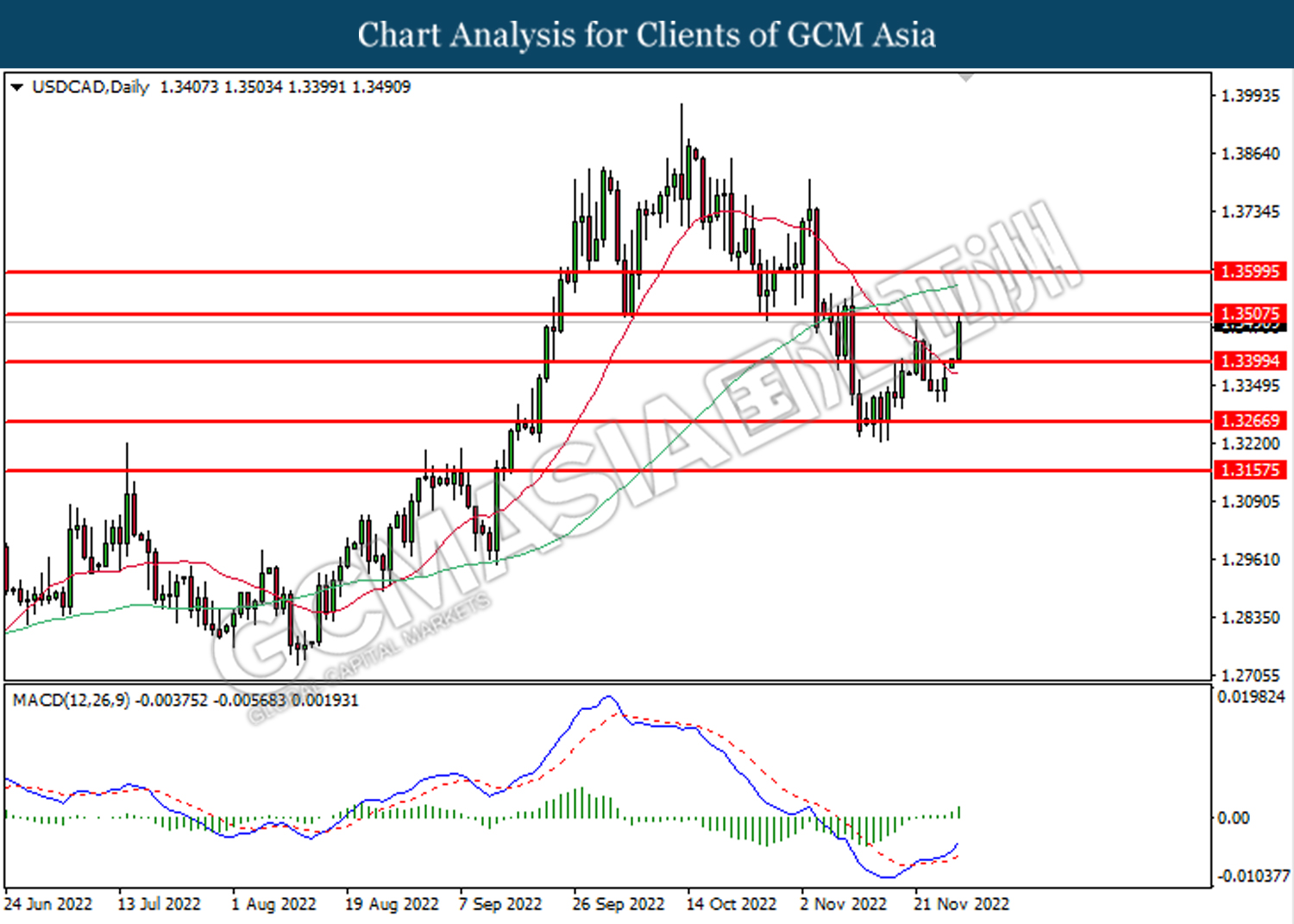

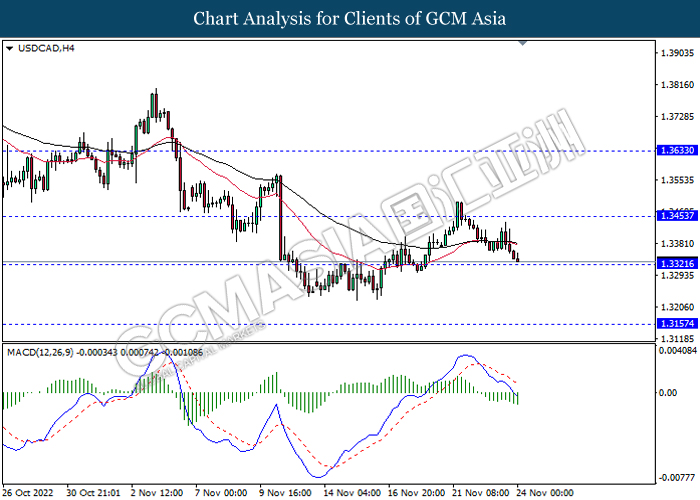

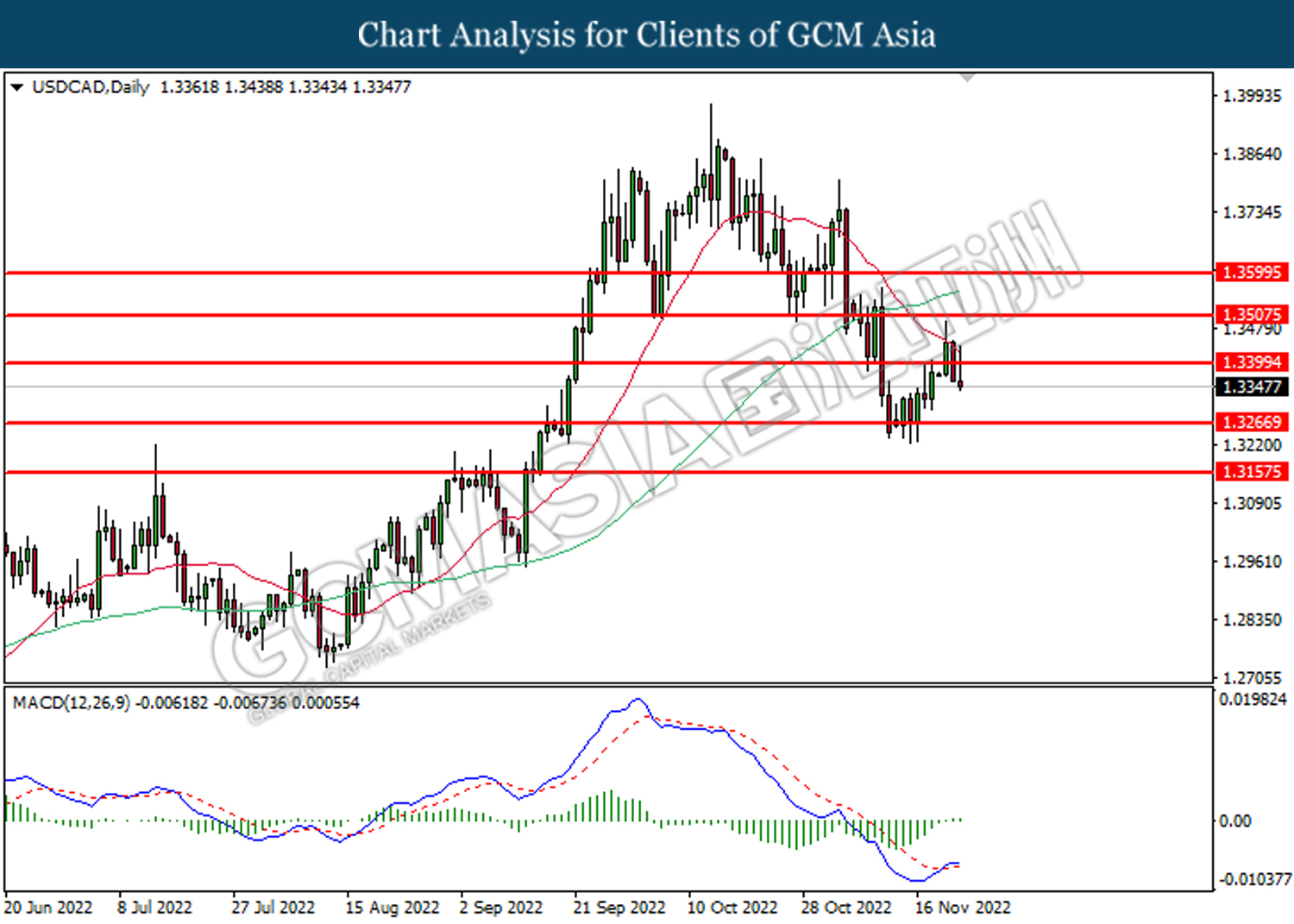

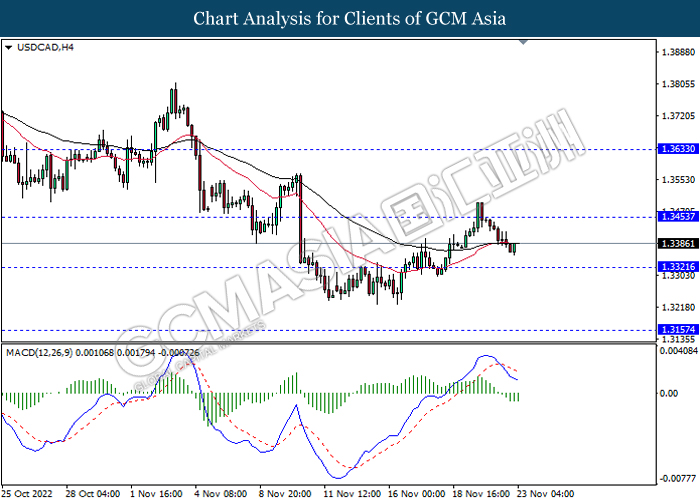

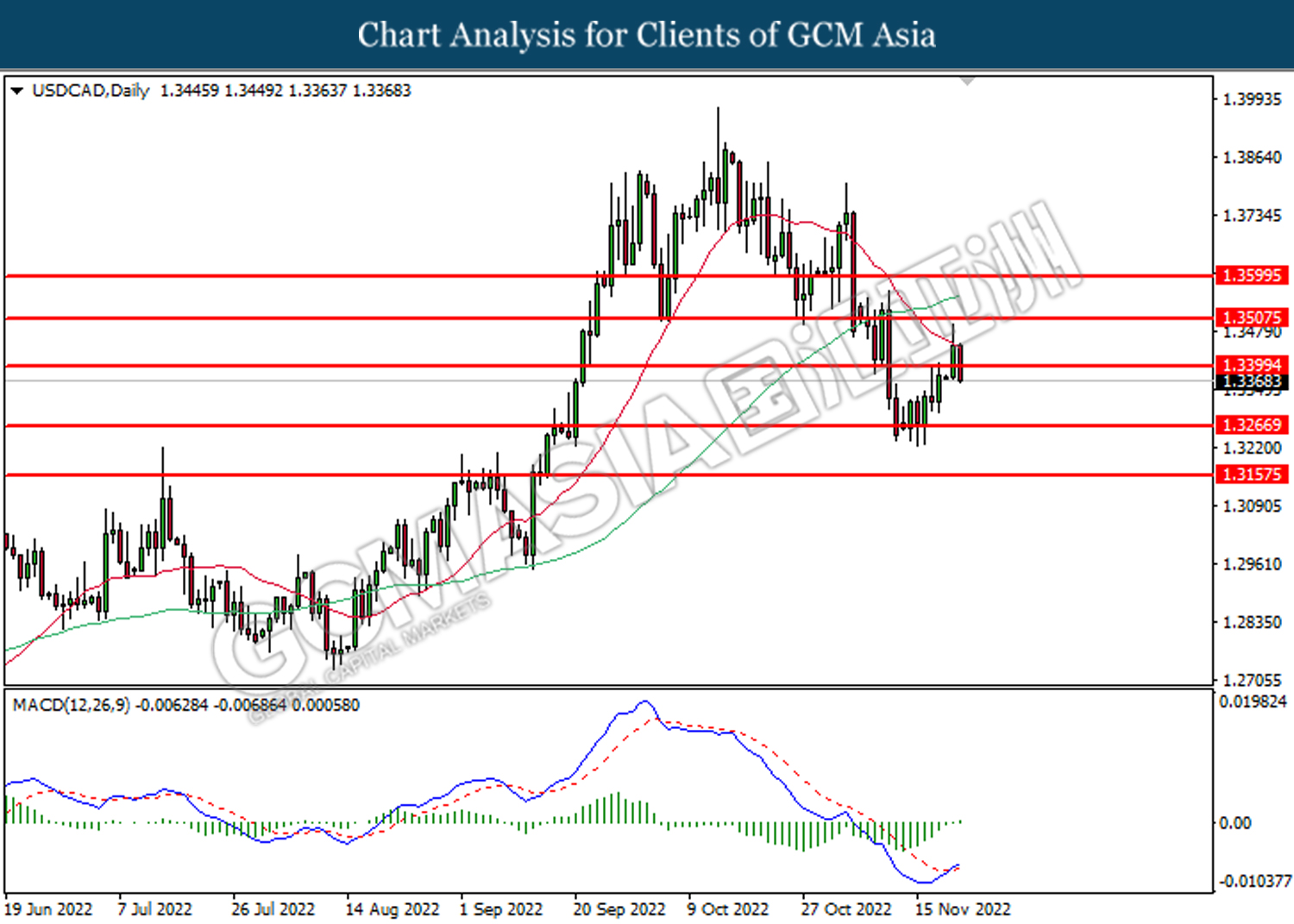

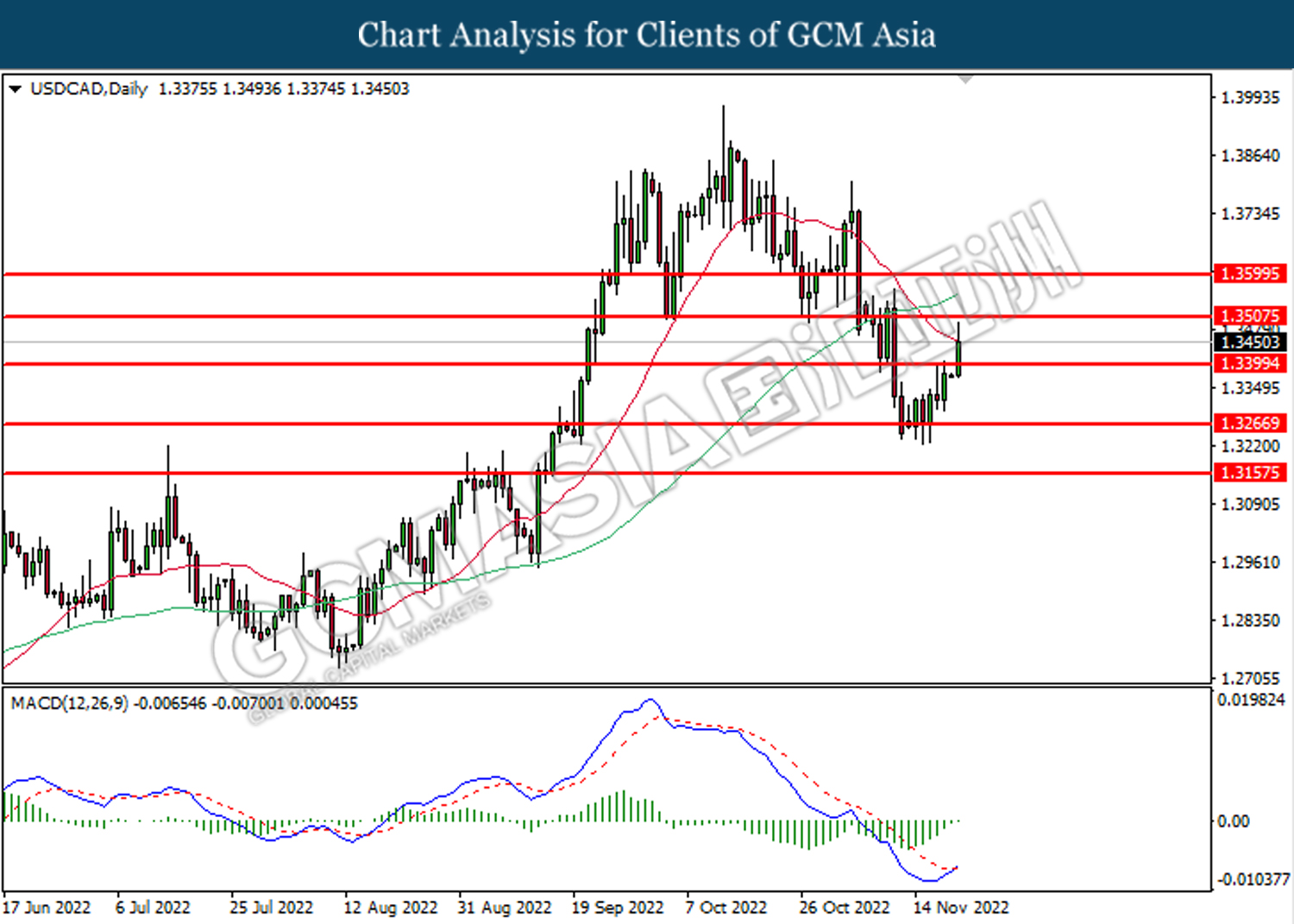

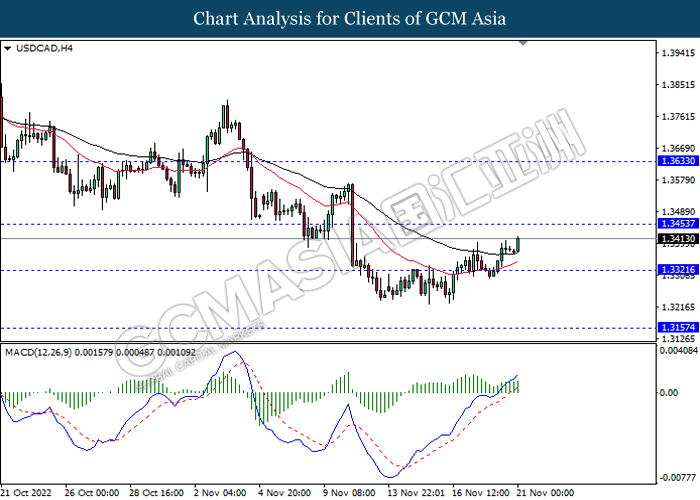

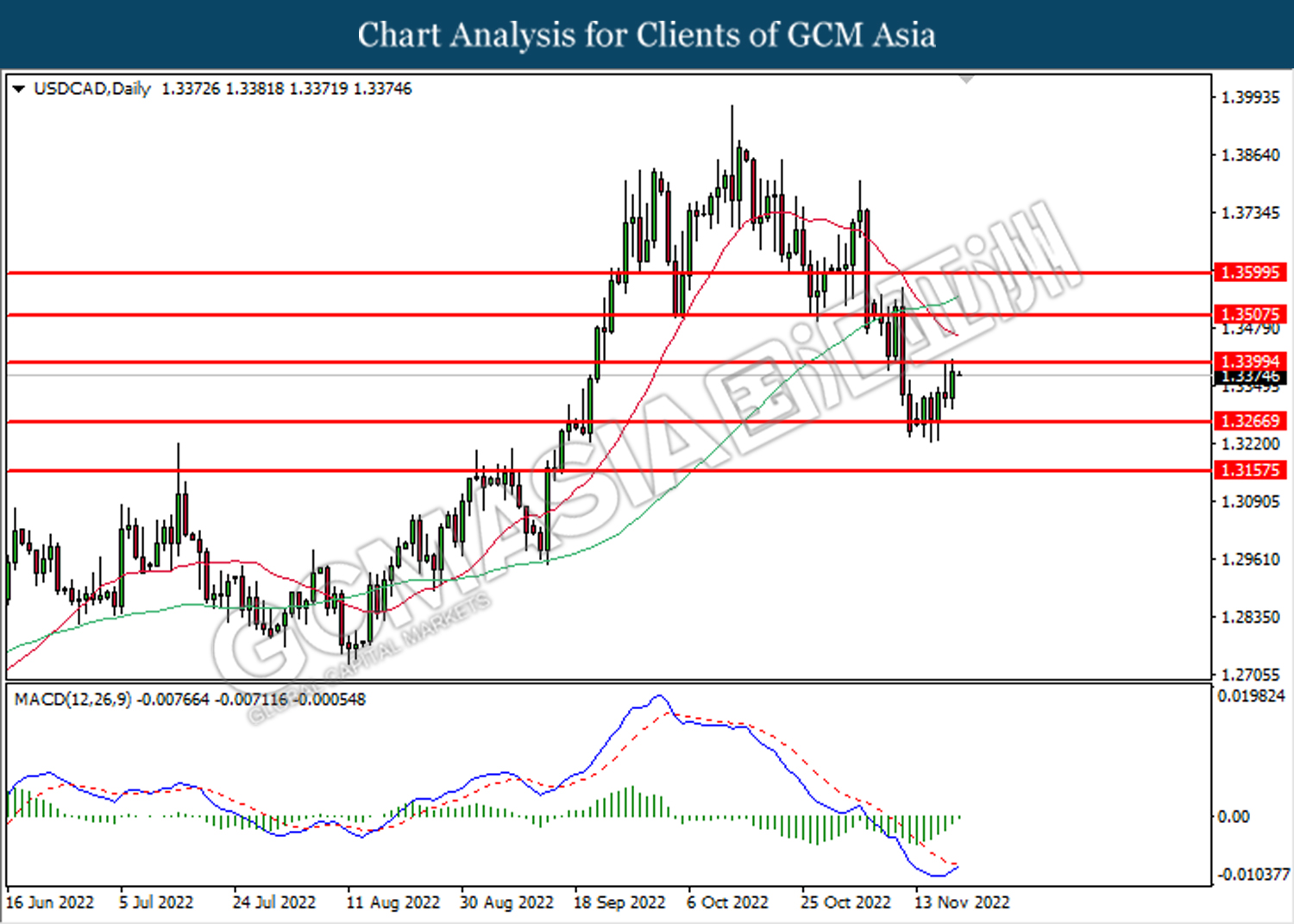

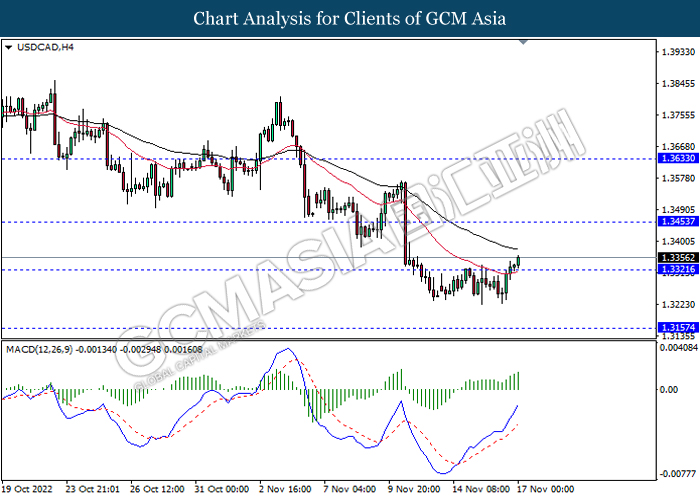

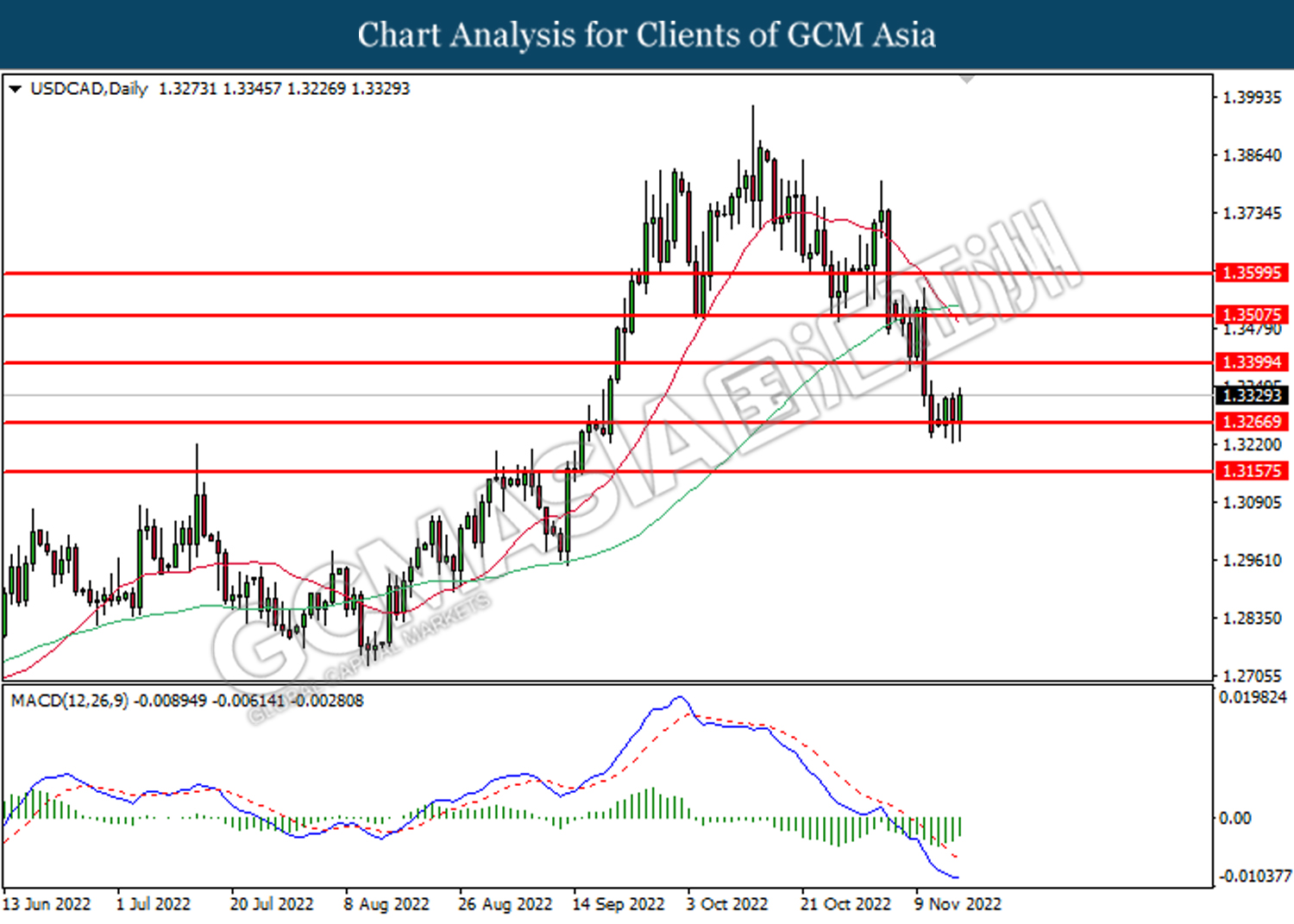

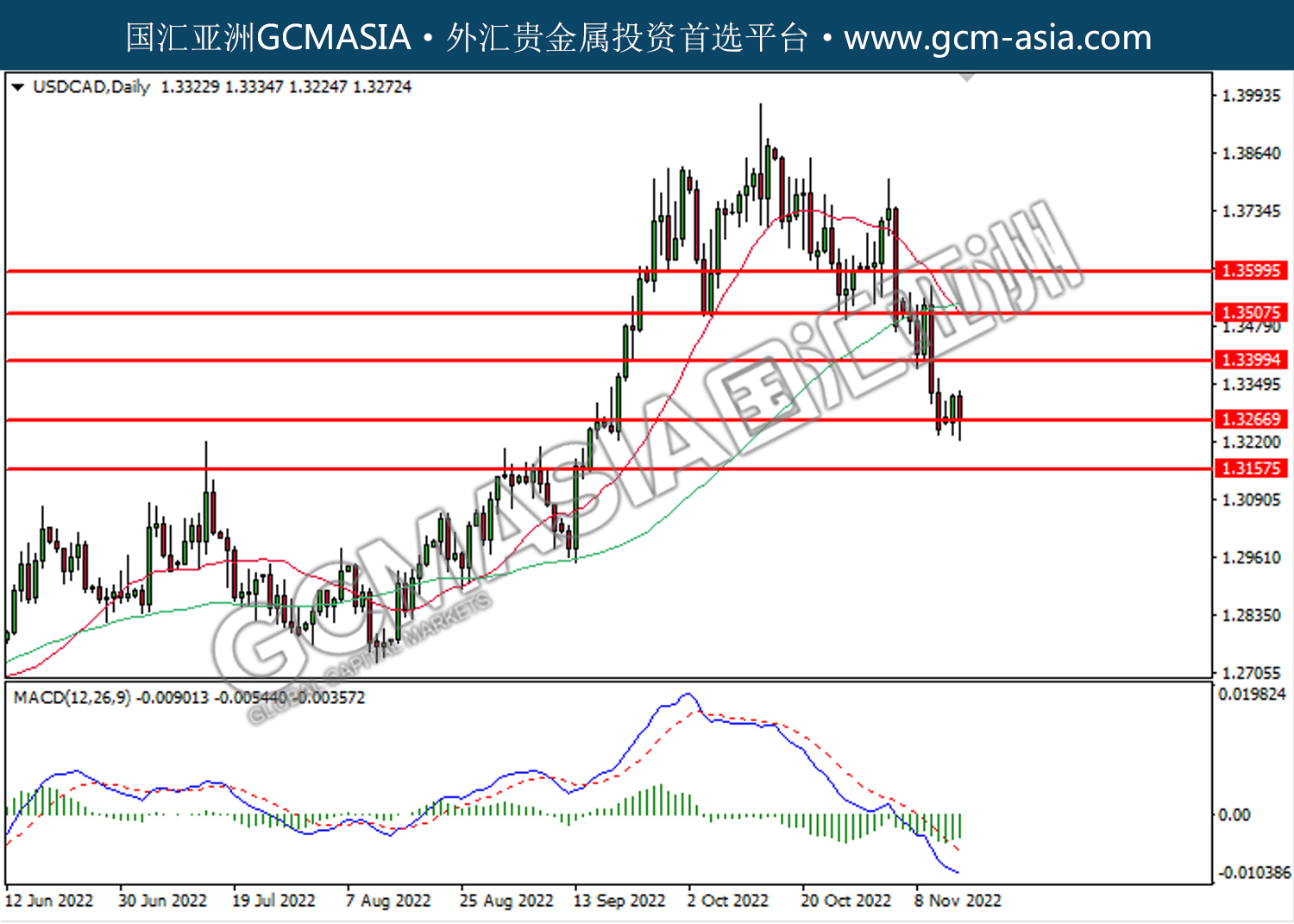

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3505. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

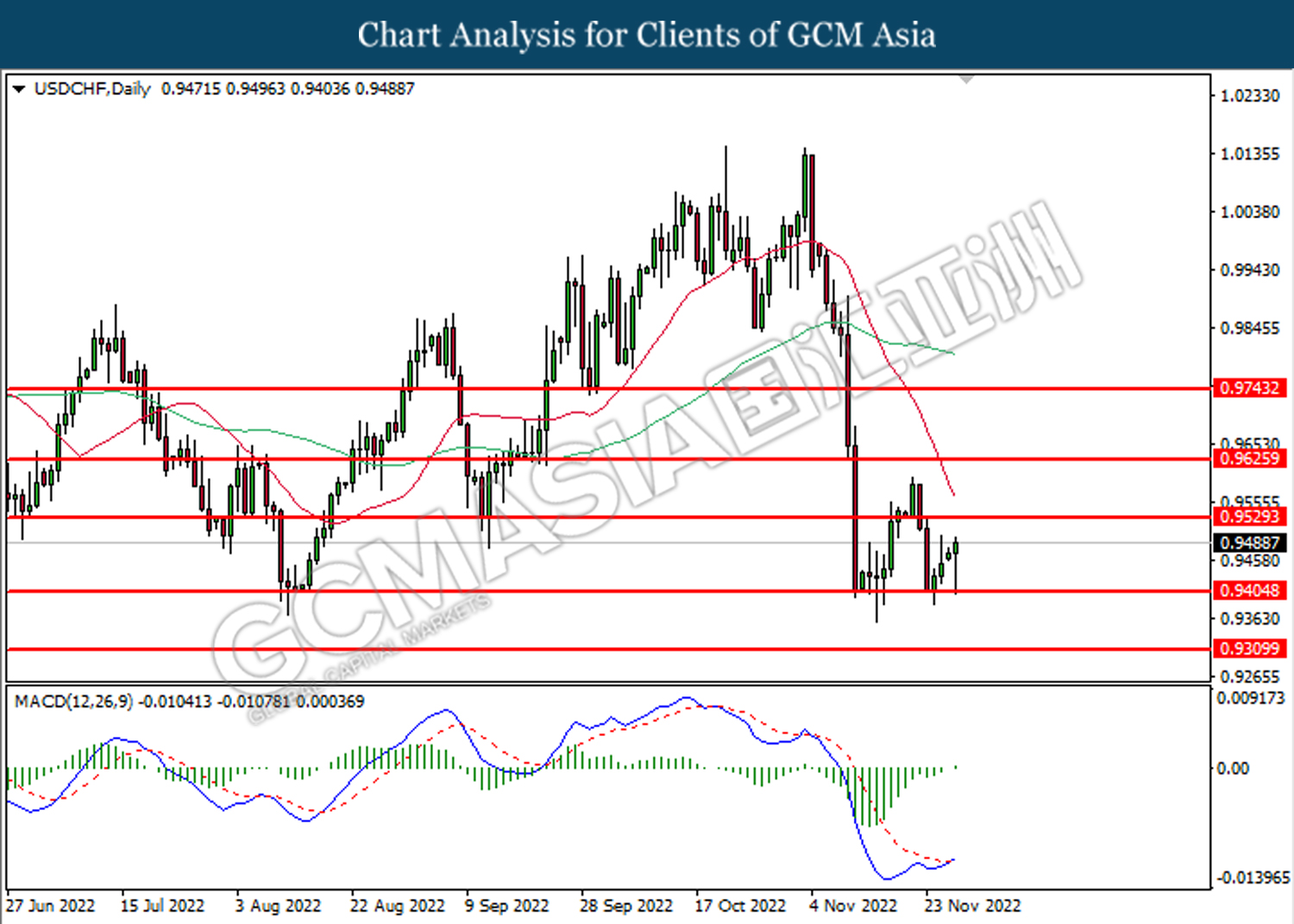

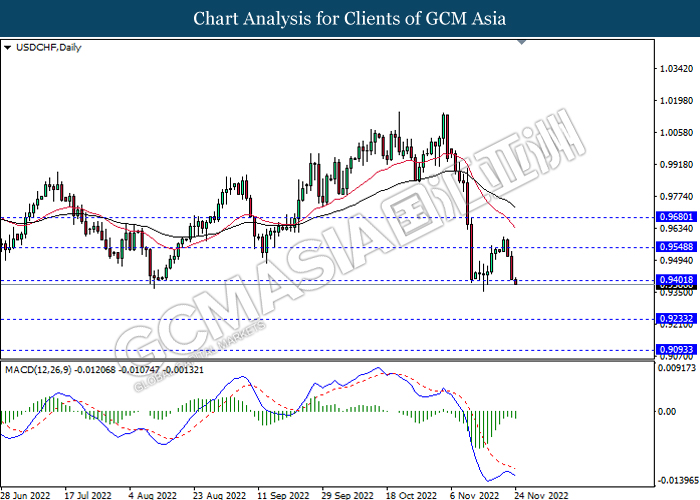

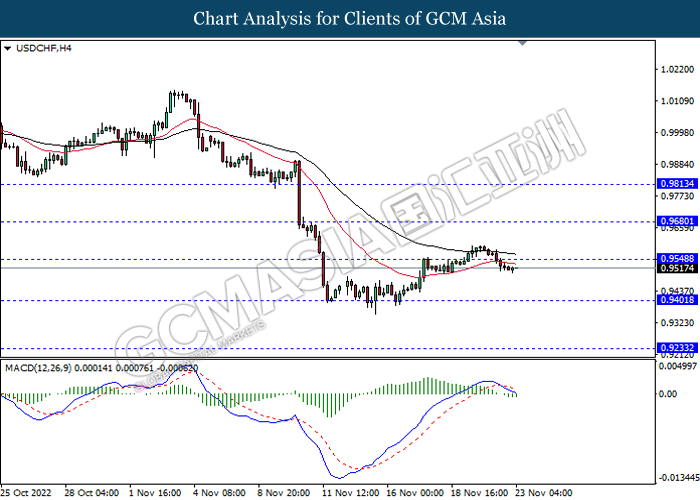

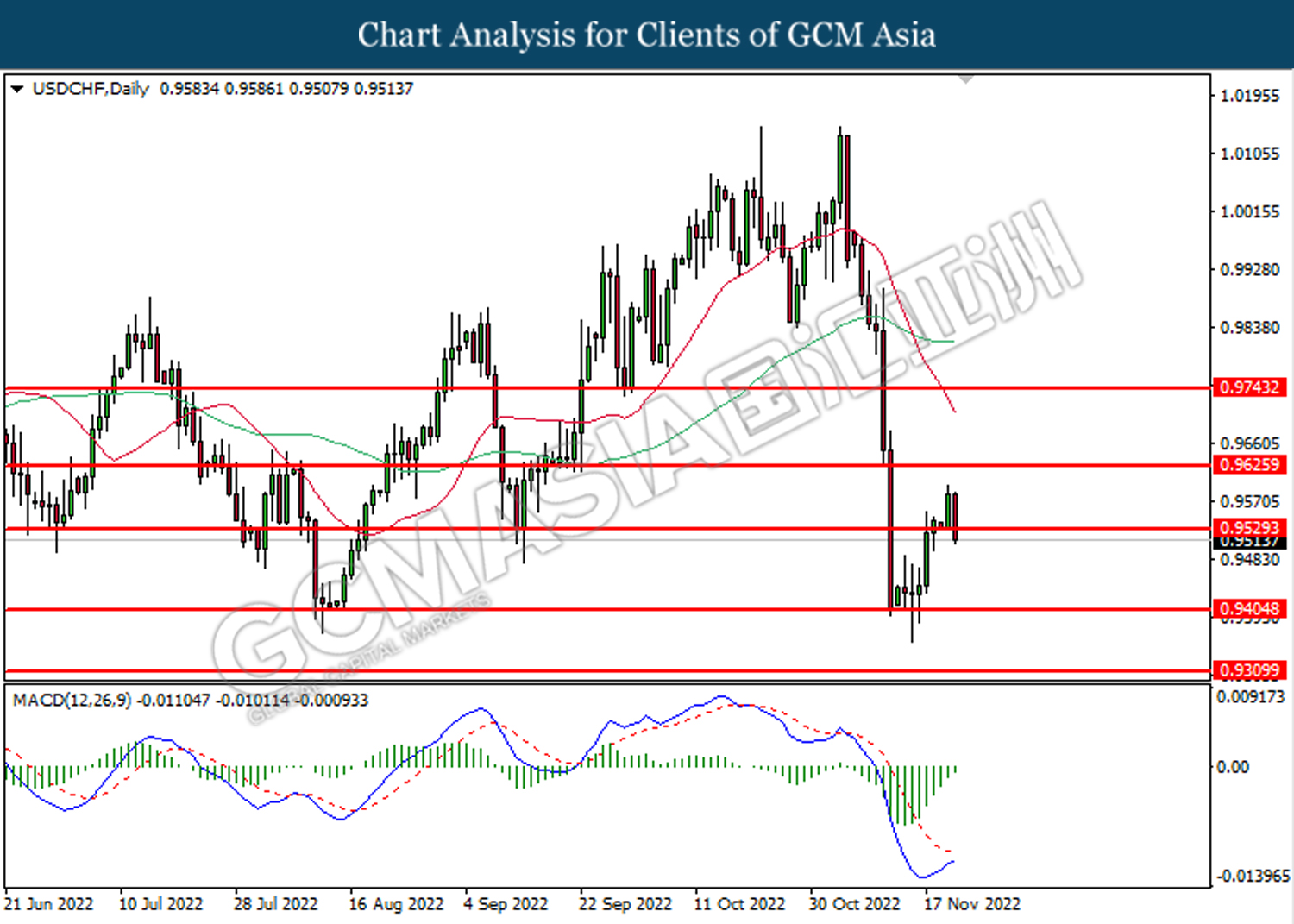

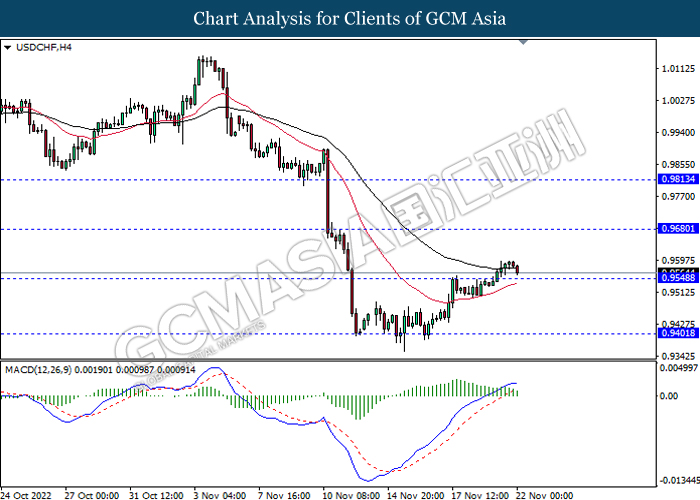

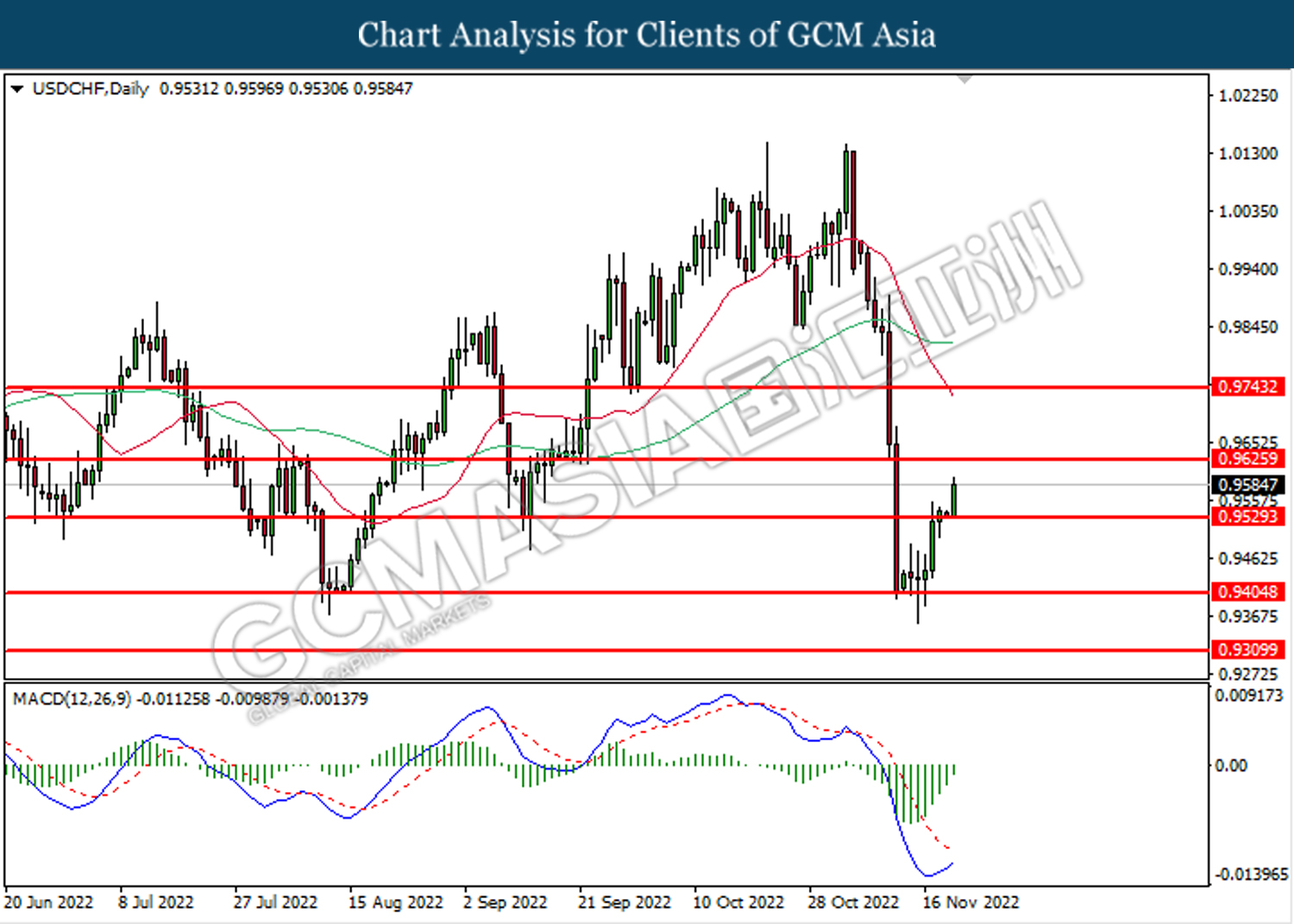

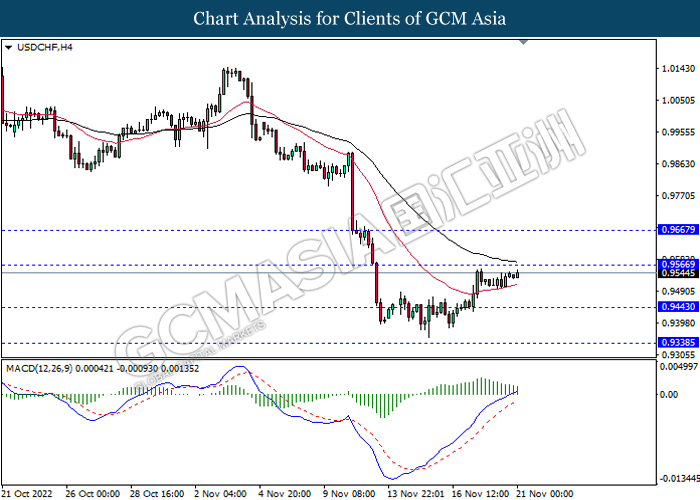

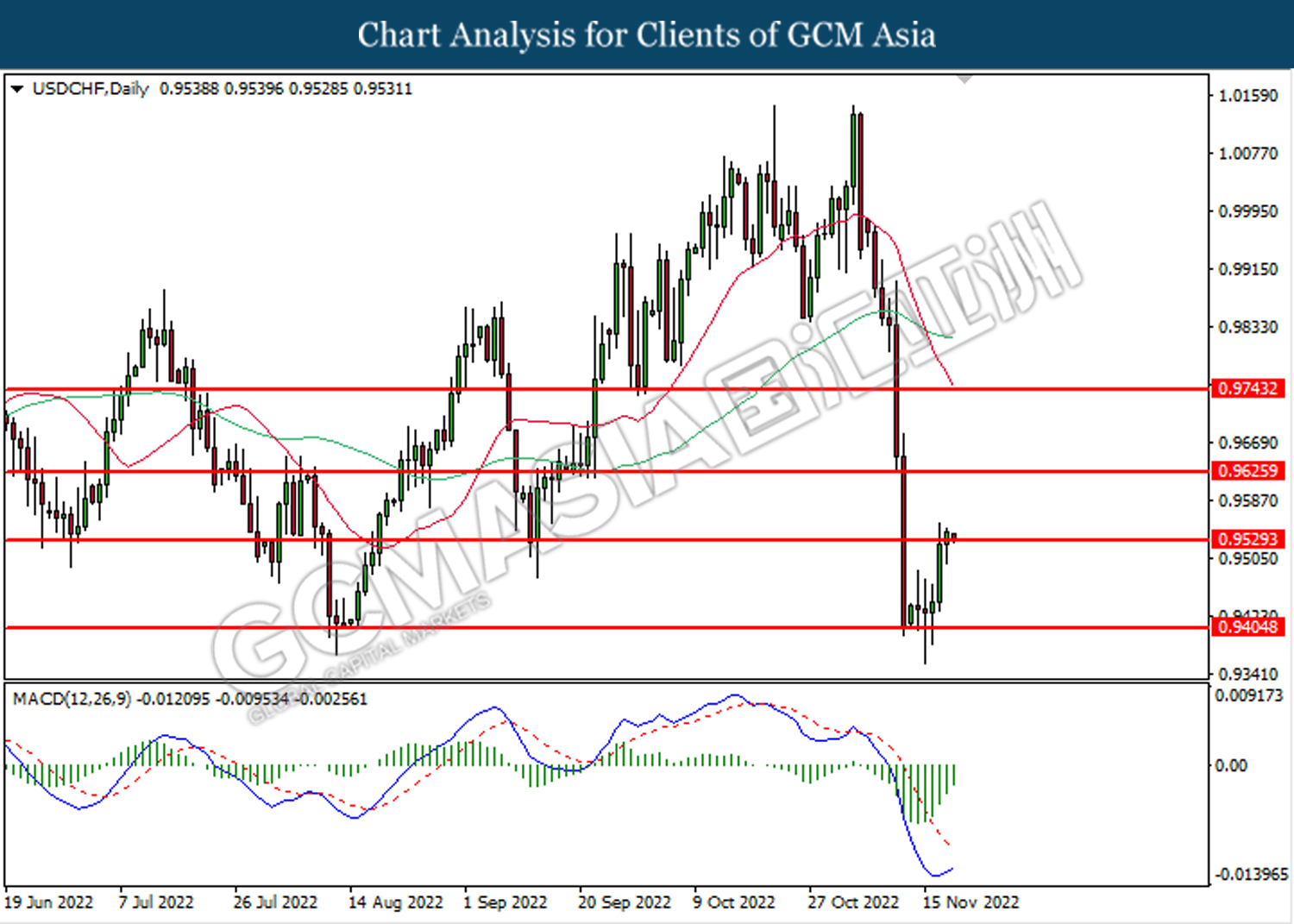

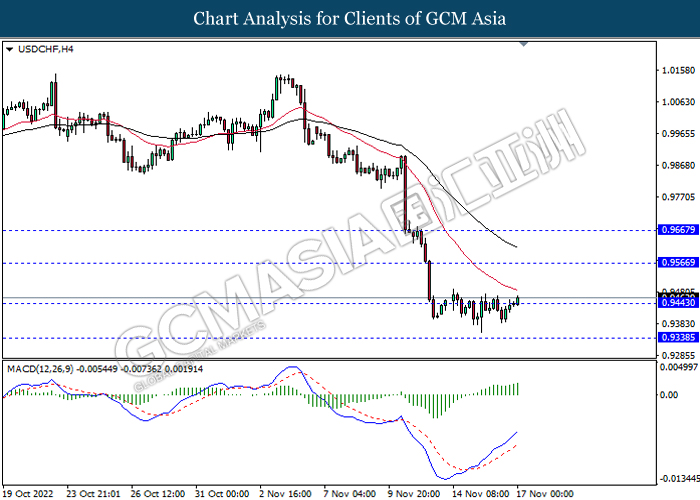

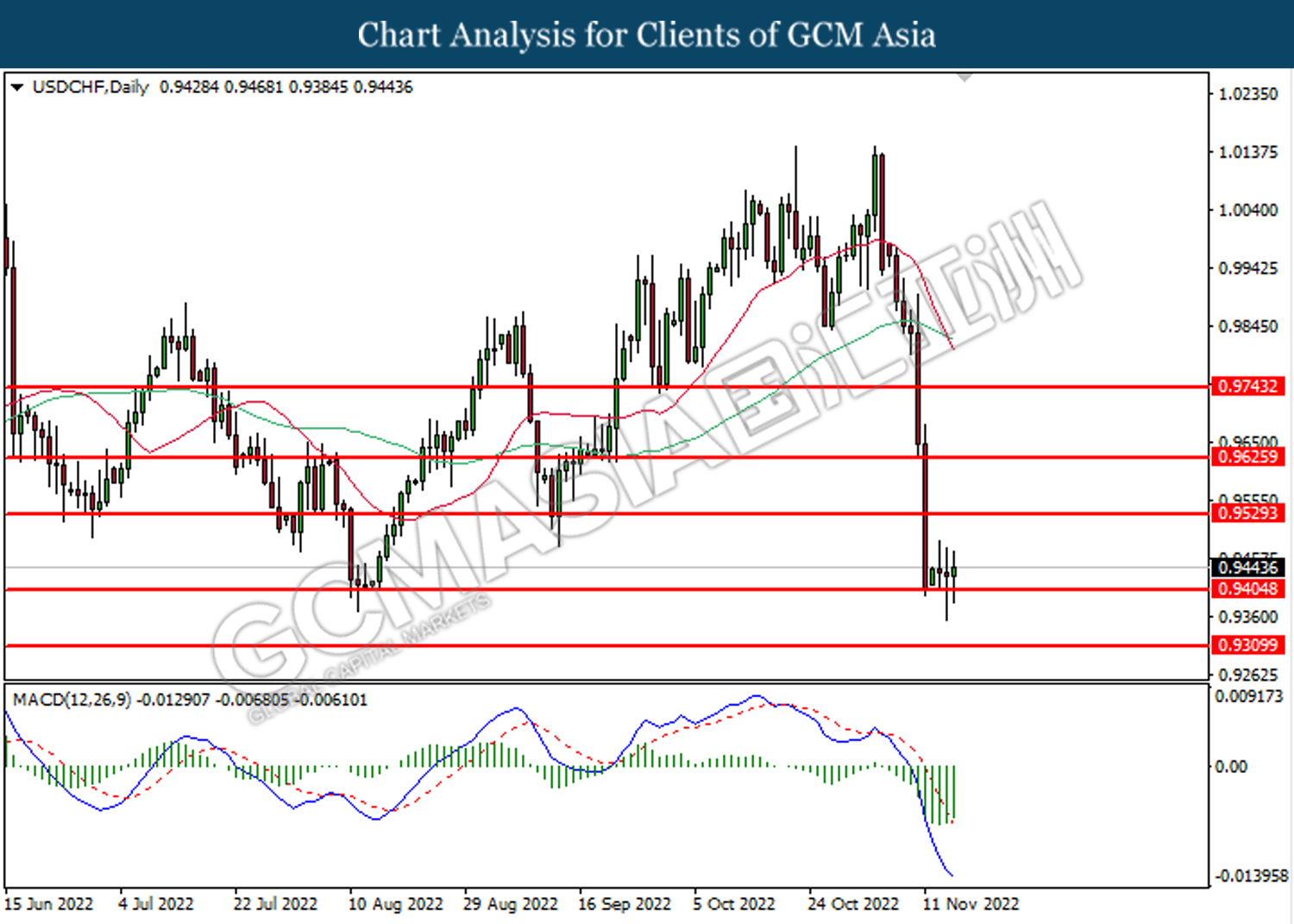

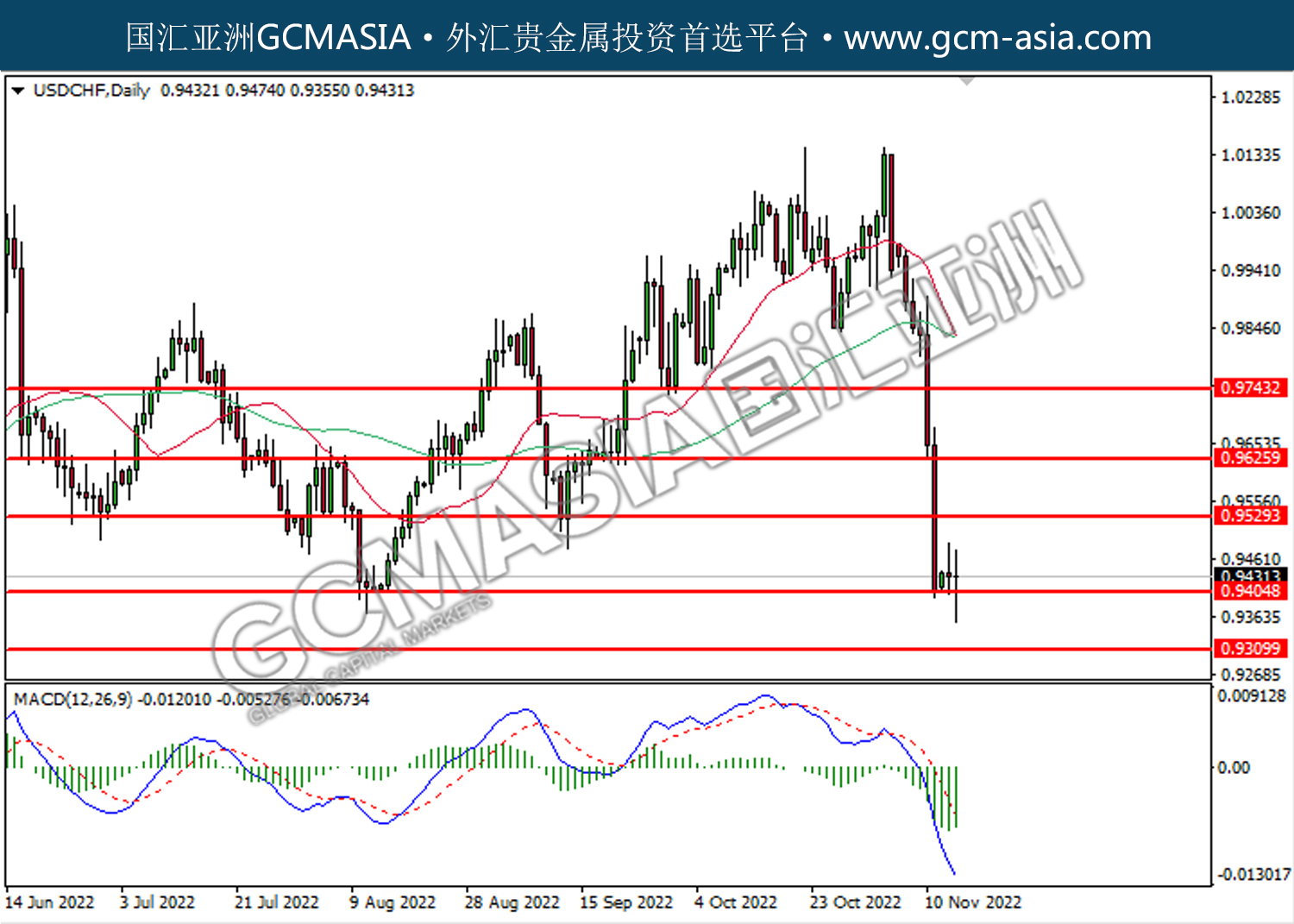

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

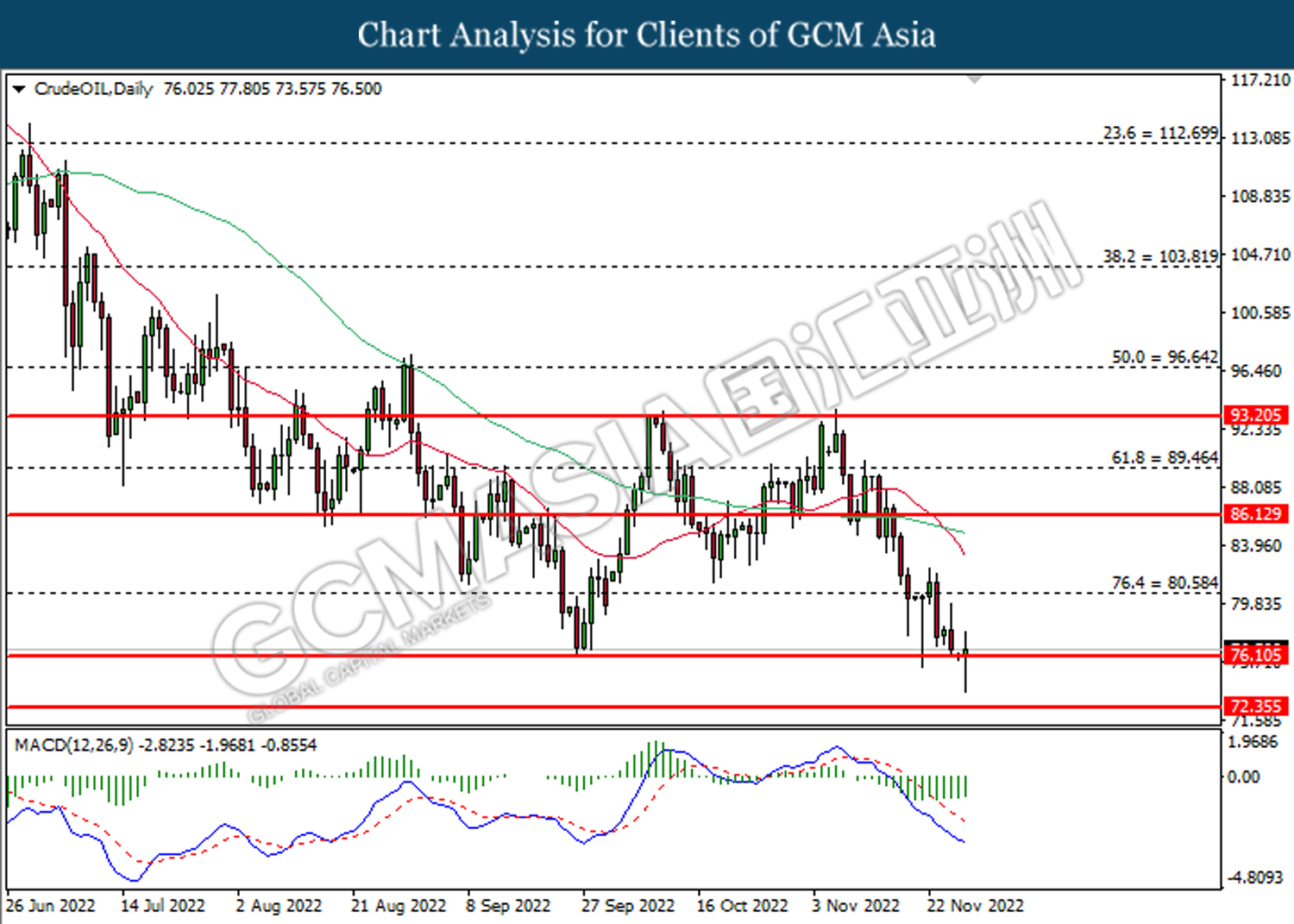

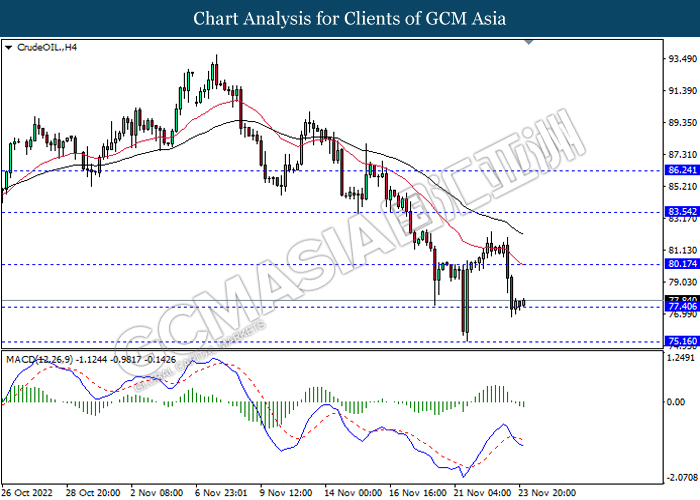

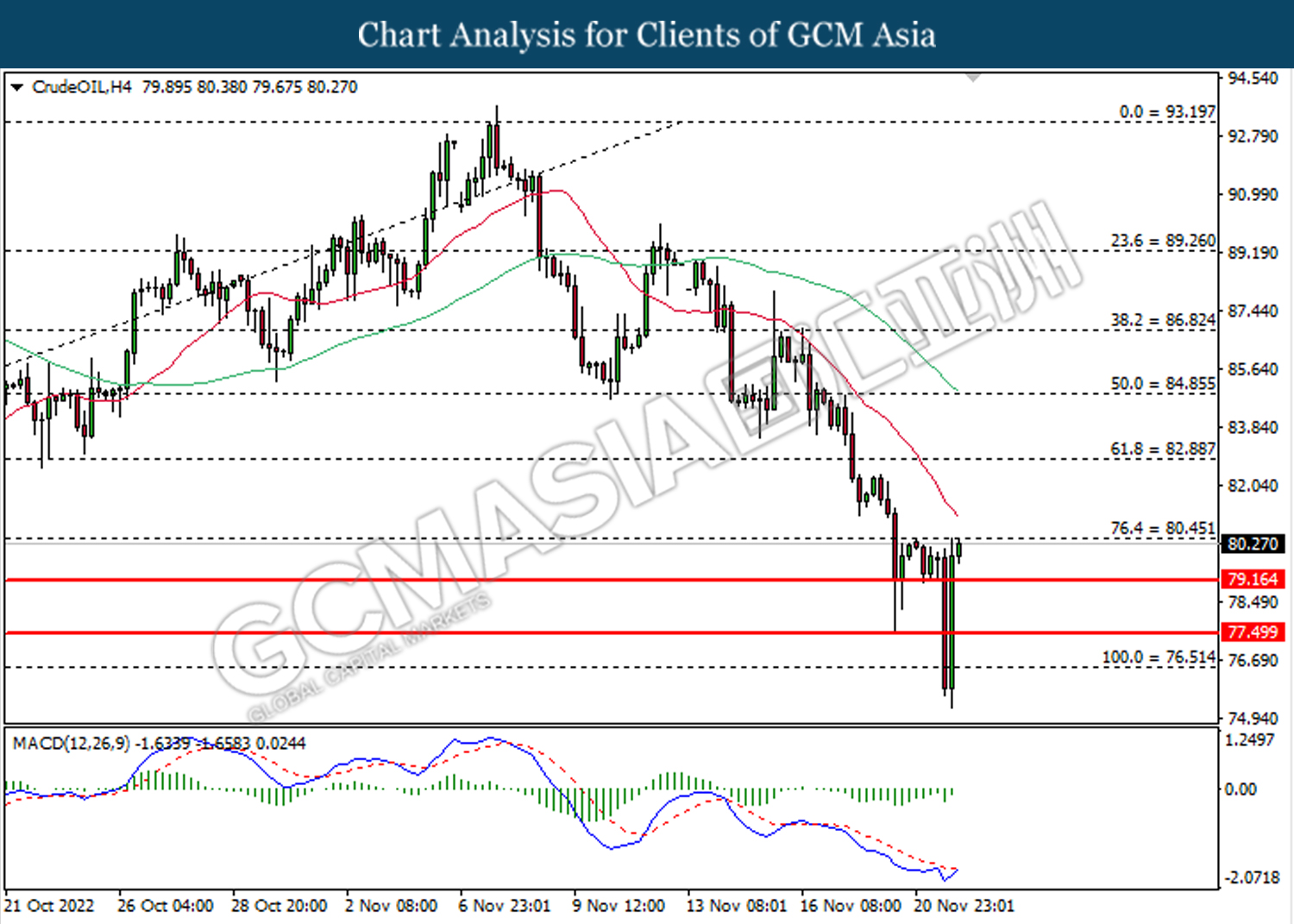

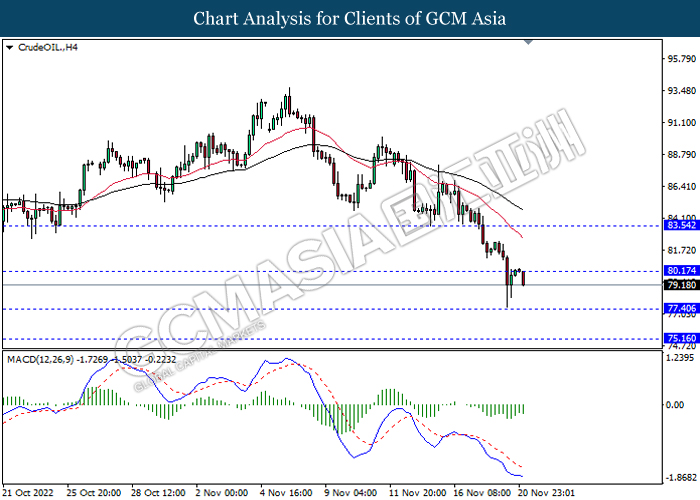

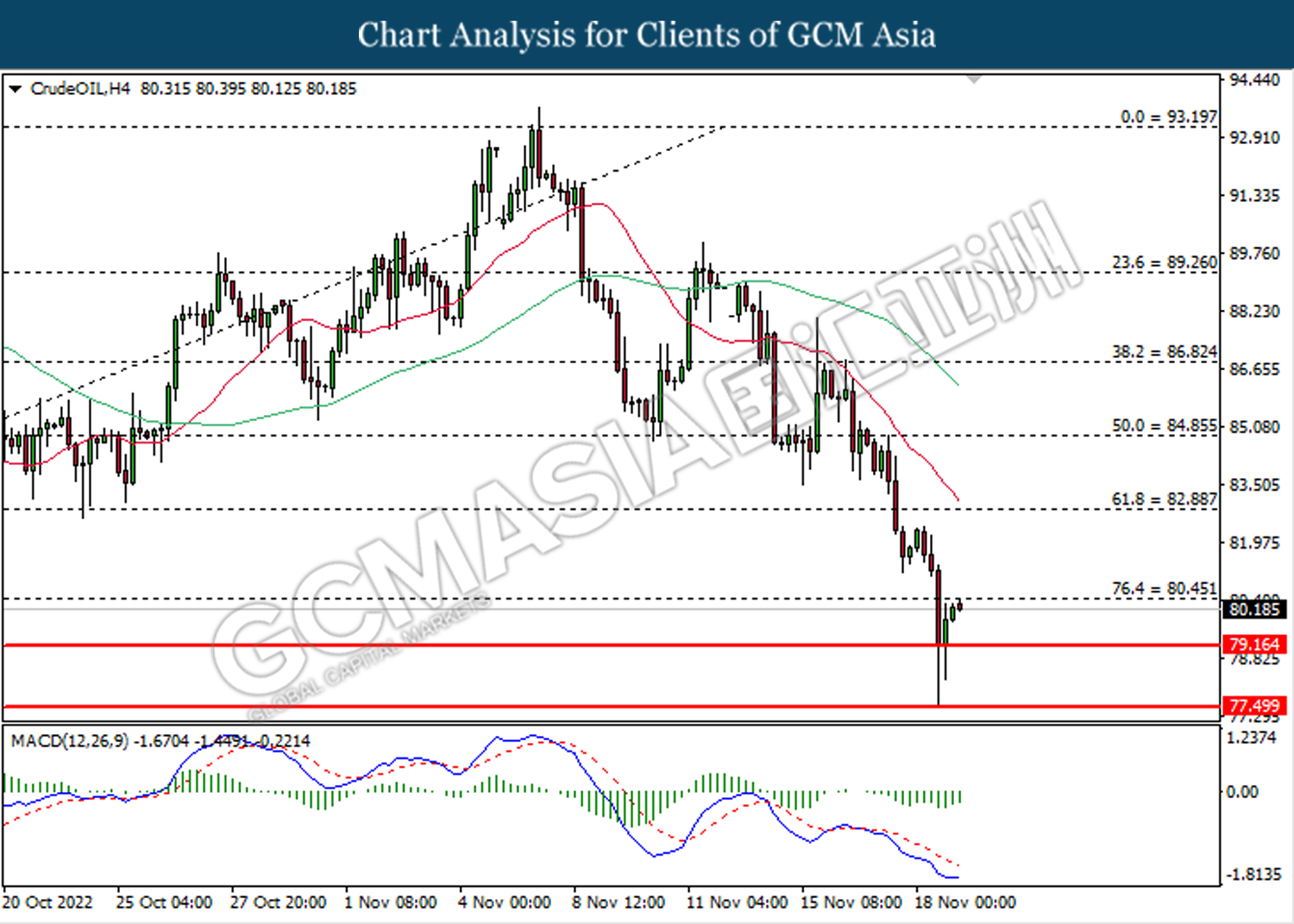

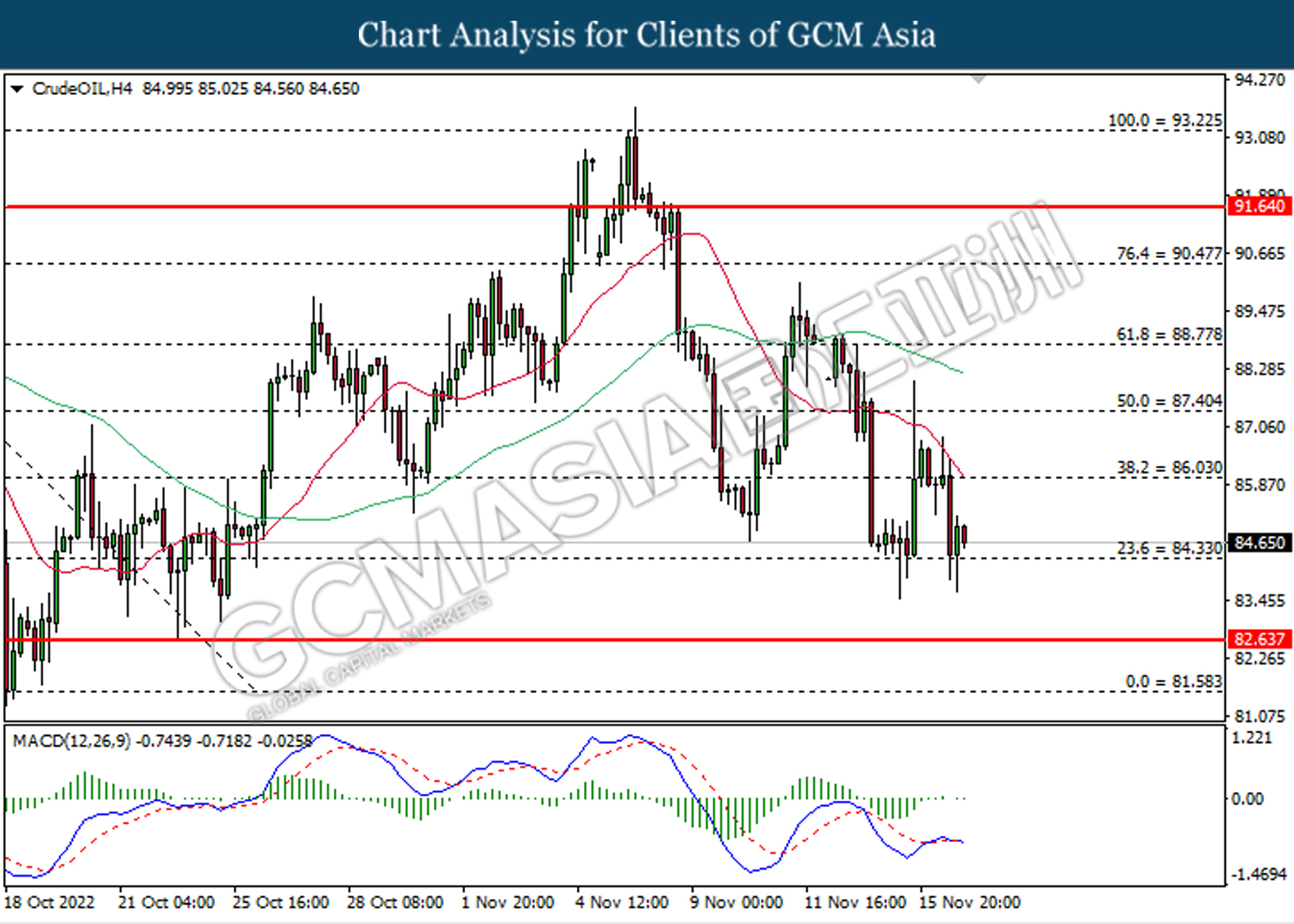

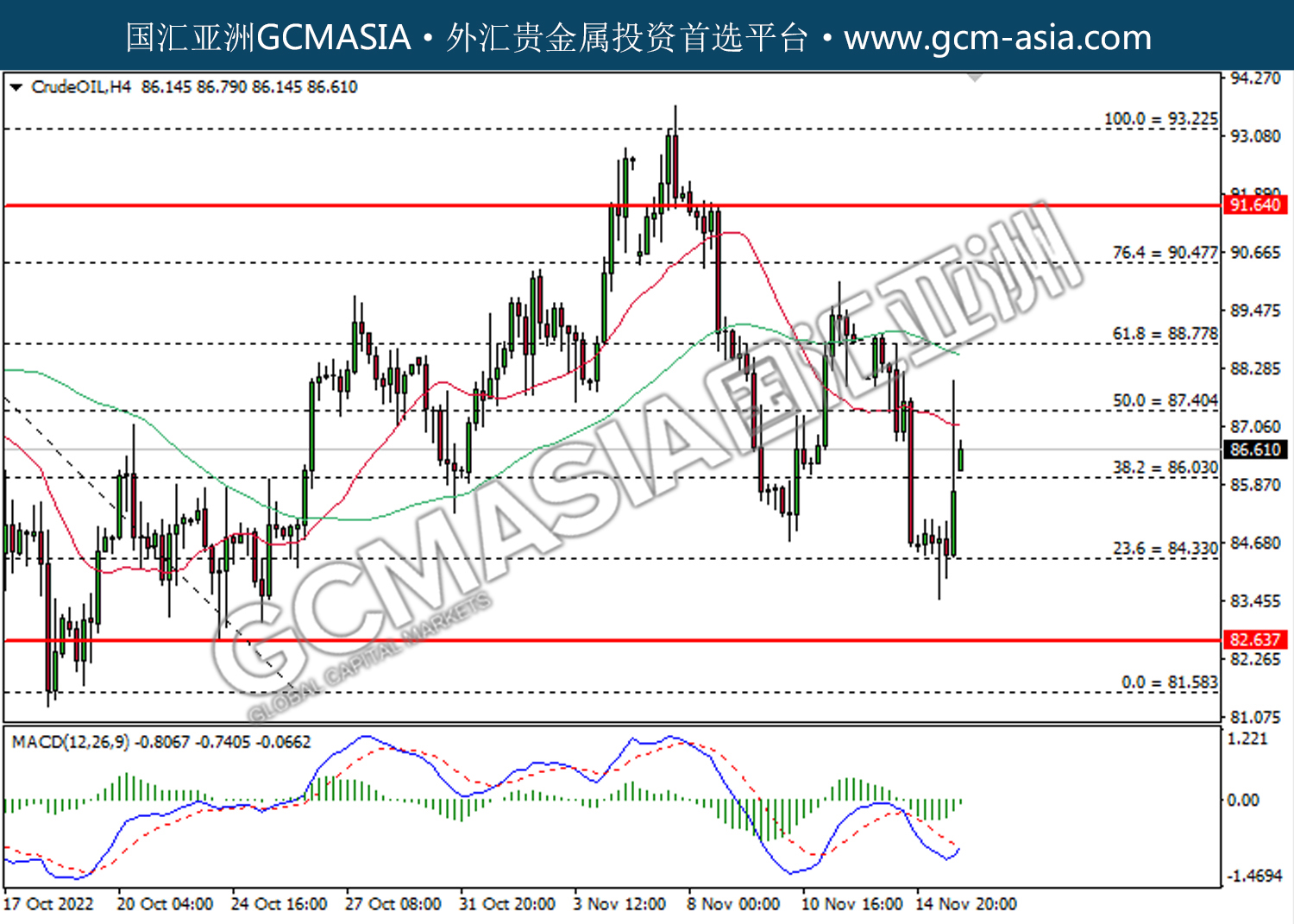

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 80.60, 86.15

Support level: 76.10, 72.35

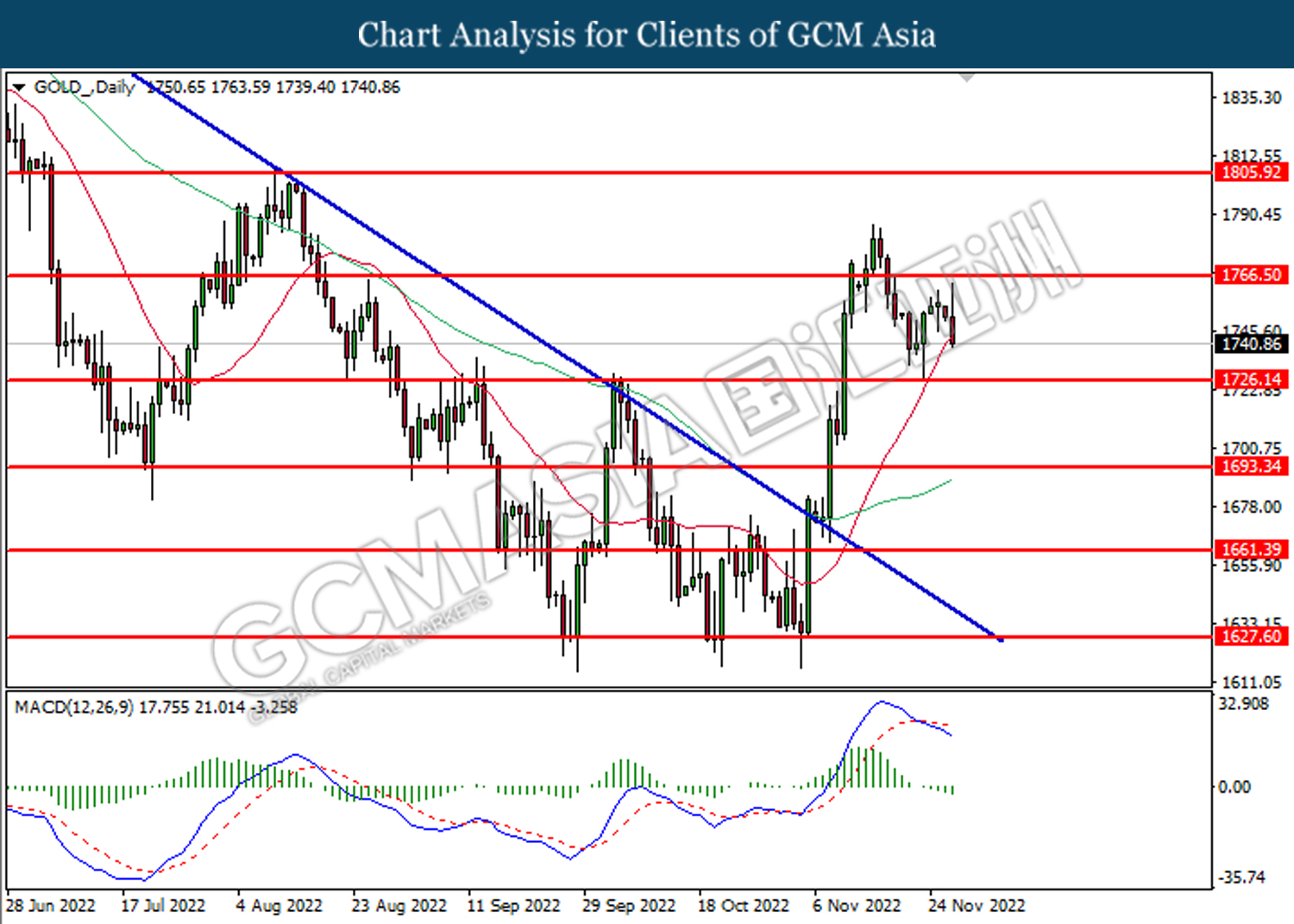

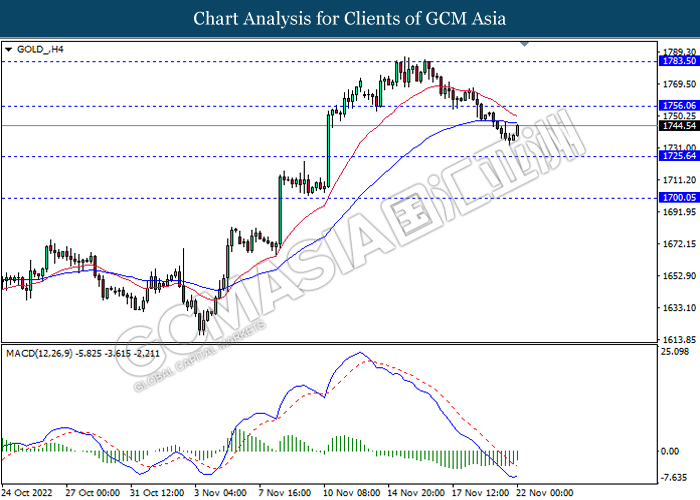

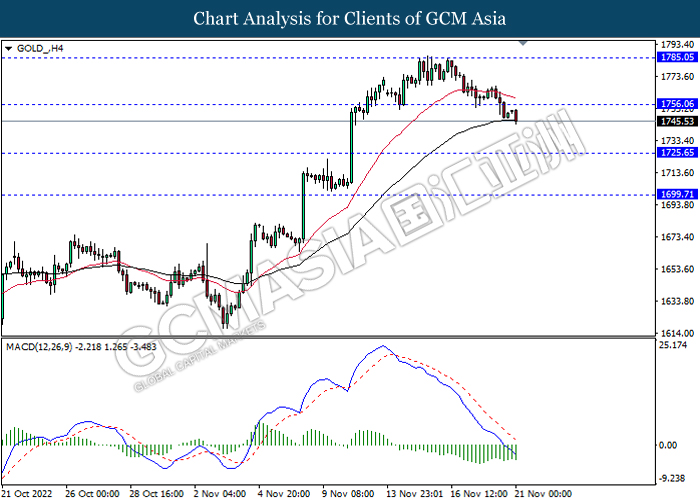

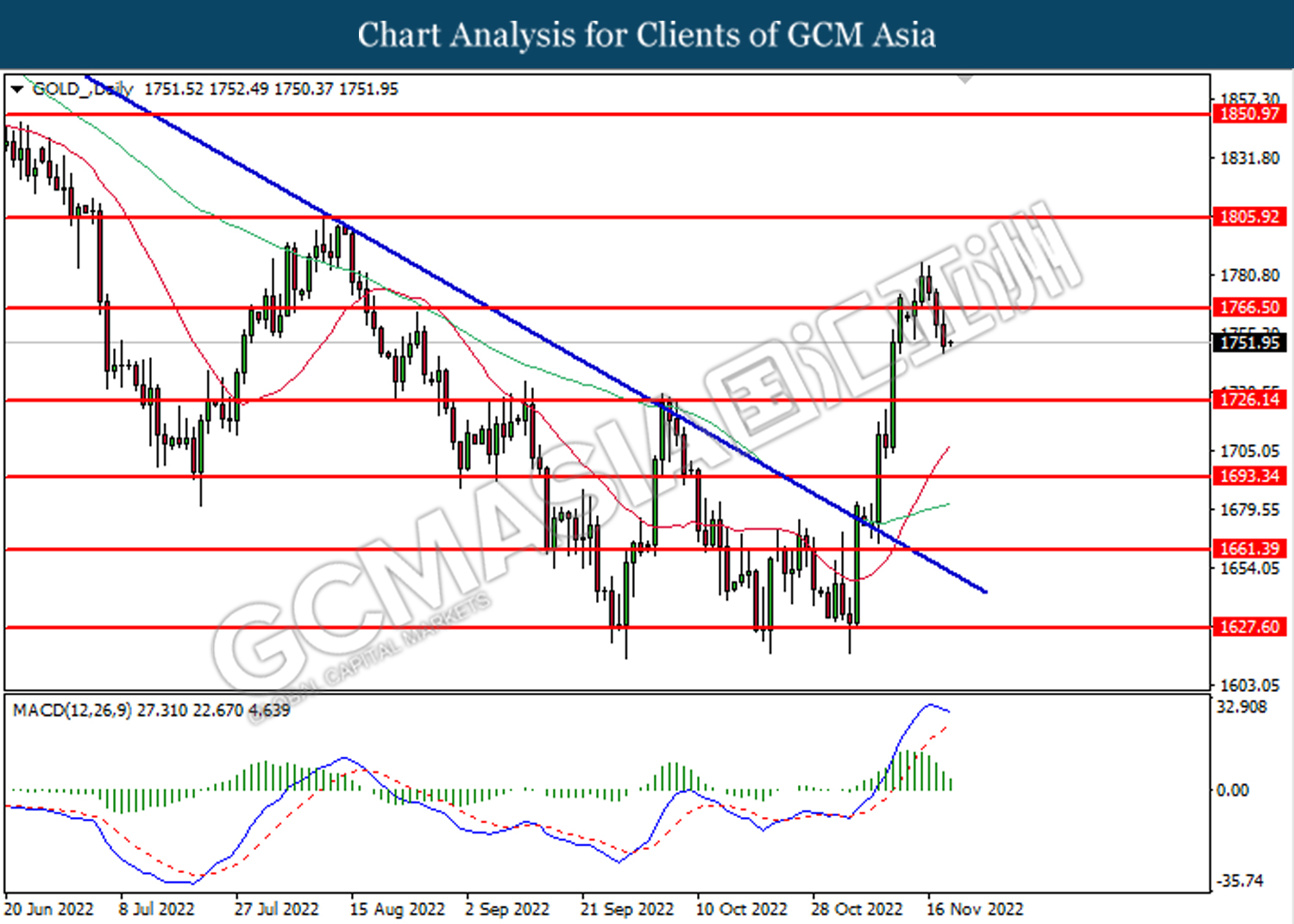

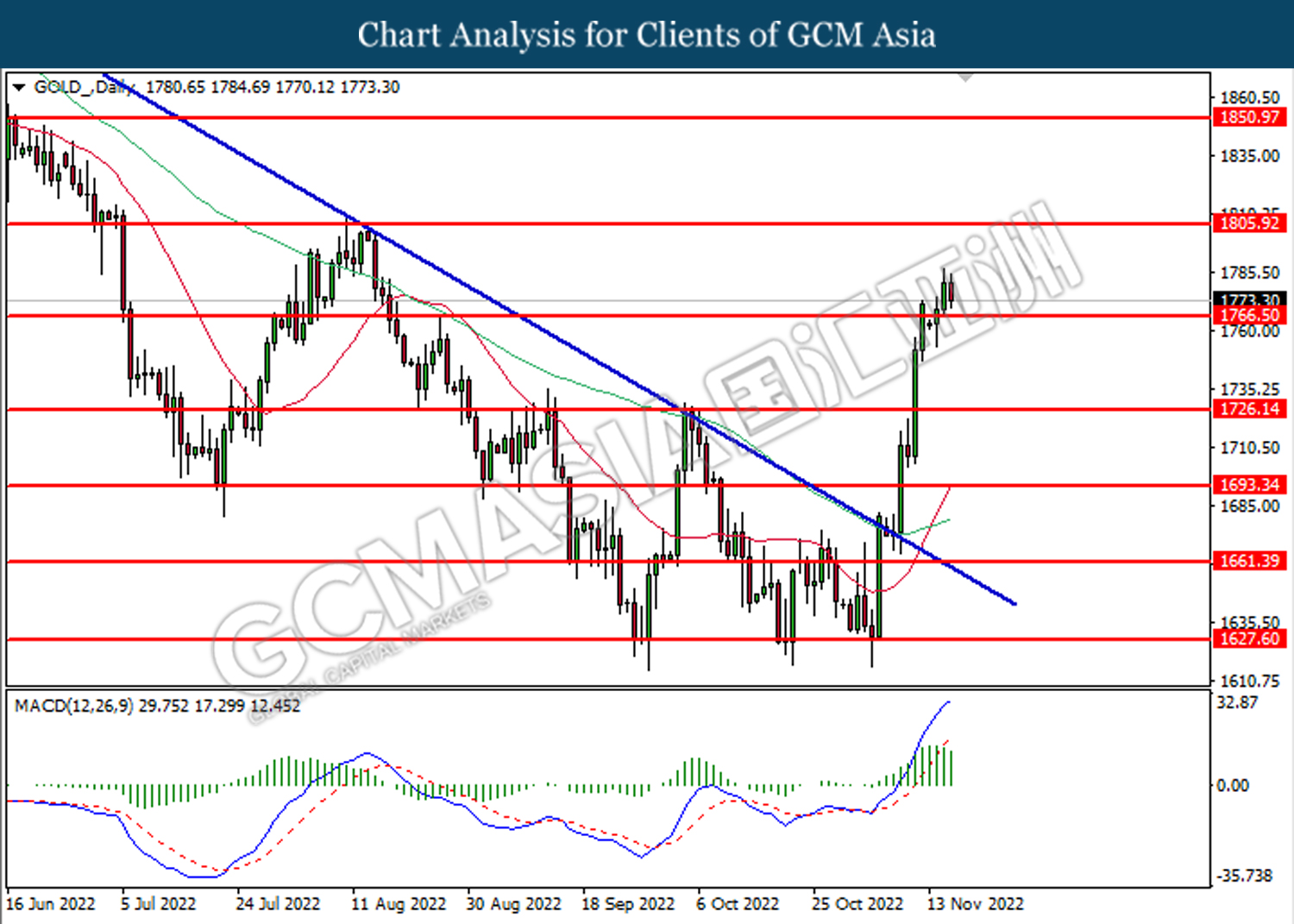

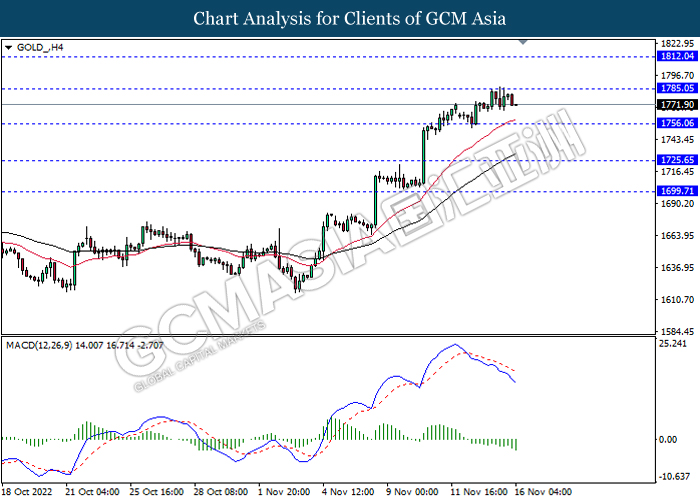

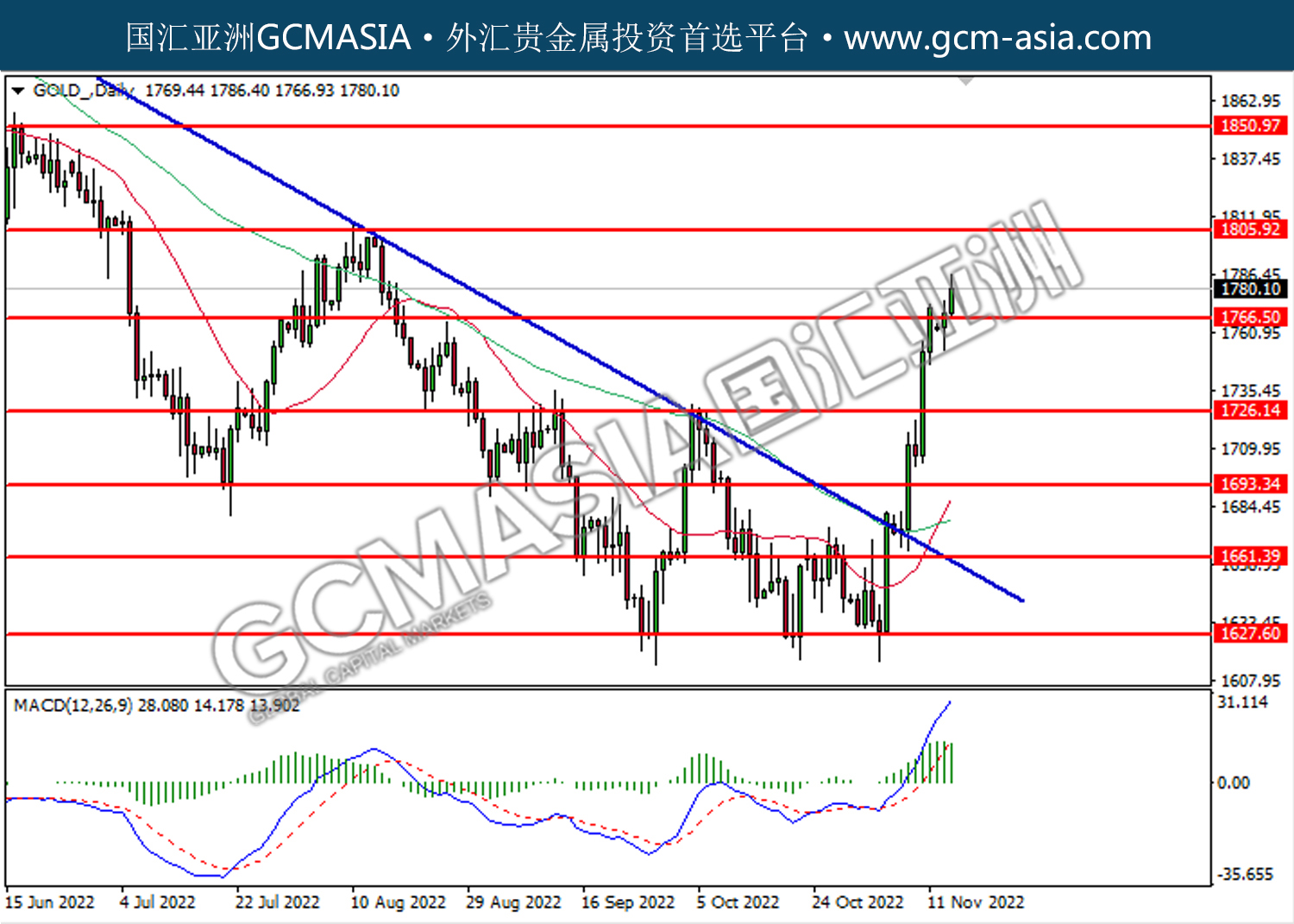

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1766.50. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1726.15.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35

251122 Afternoon Session Analysis

25 November 2022 Afternoon Session Analysis

Euro stayed strong as data shown Europe economy recession was easing.

The EUR/USD, which widely traded by global investors edged up on yesterday after the upbeat economic data has been released. According to Ifo Institute for Economic Research, the Germany Ifo Business Climate Index in November notched up from the previous reading of 84.5 to 86.3, exceeding the market forecast of 85.0. With that, it might hinted that the economic recession that driven by energy crisis with Russia and supply chain headwinds could prove less severe than consensus expectation, which dialed up the market optimism toward economic progression in the Eurozone. Besides that, the overall trend of Euro currency remained bullish over the hawkish stance from European Central Bank (ECB) member. According to Reuters, the ECB board member Isabel Schnabel had denied the suggestion of smaller rate hike, as well as reiterating that the softer move would likely to hamper effort to bring down the spiking inflation risk. She argued that expectations for a shallower rate path are even working against the ECB, taking the actual policy stance further away from what is required to bring inflation back to its 2% target. As of writing, the EUR/USD raised by 0.02% to 1.0410.

In the commodities market, the crude oil price appreciated by 0.32% to $78.19 per barrel as of writing following the G7 price cap and the EU ban on imports are aimed at cutting the revenue Russia receives from its exports of crude oil and products. In addition, the gold price appreciated by 0.15% to $1757.75 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day USD Thanksgiving Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q3) | 0.3% | 0.3% | – |

Technical Analysis

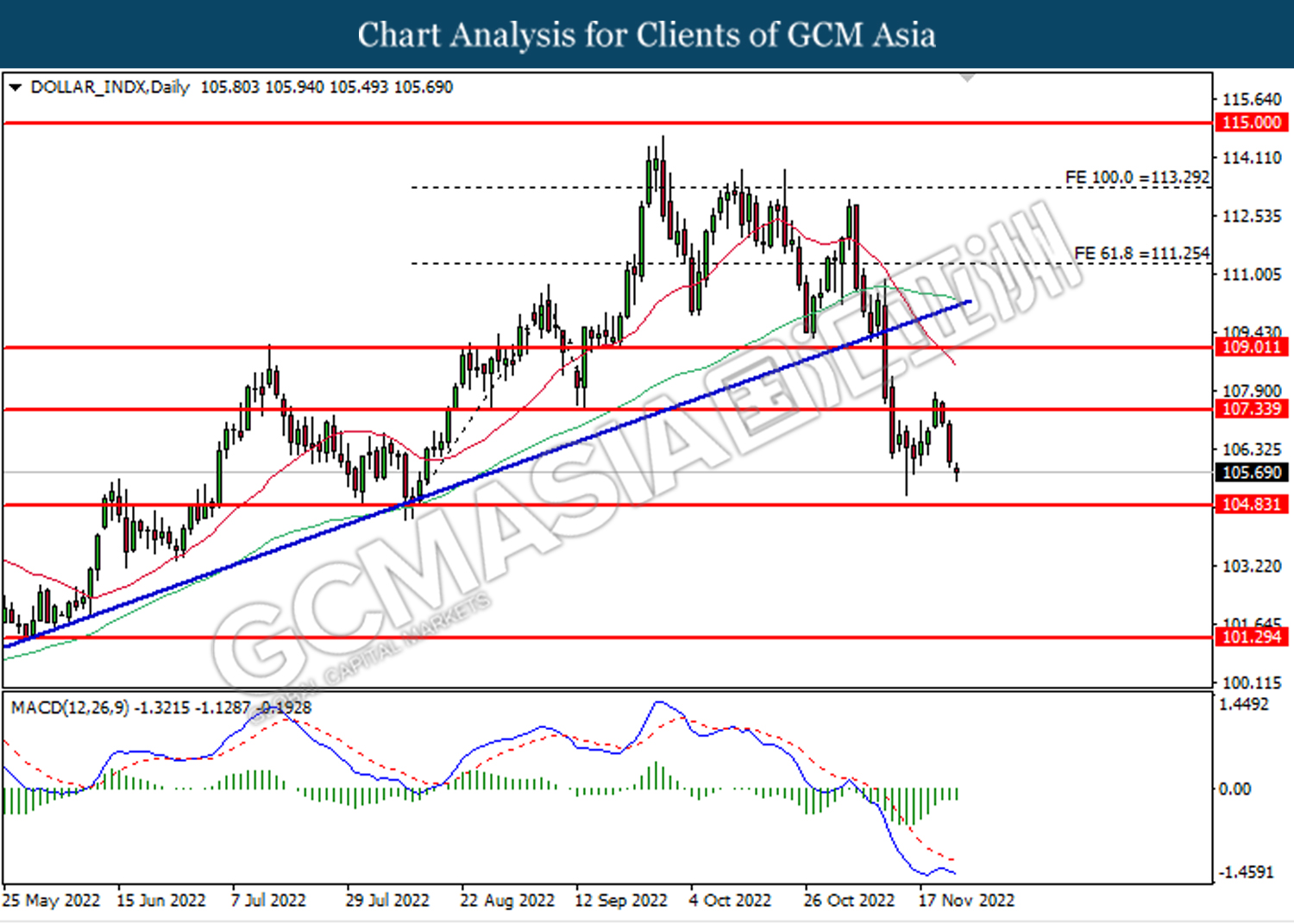

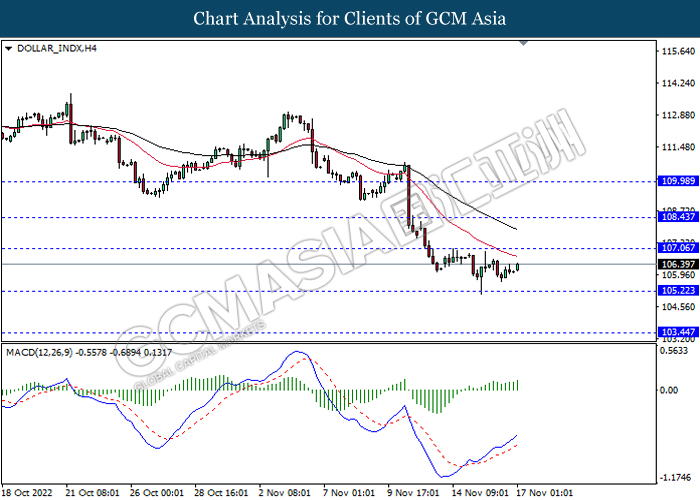

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

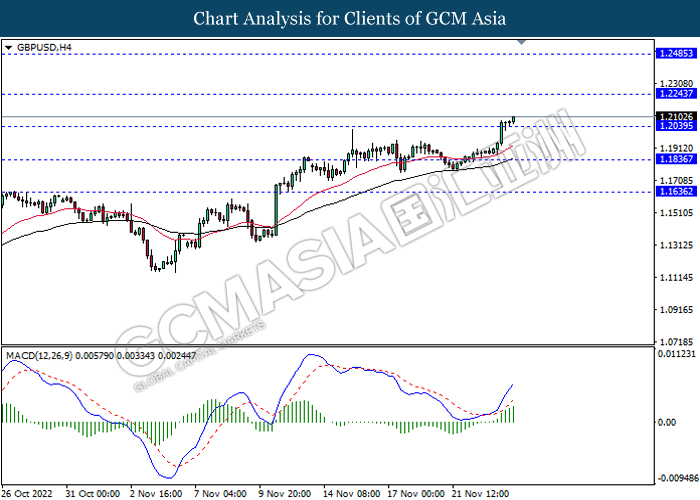

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

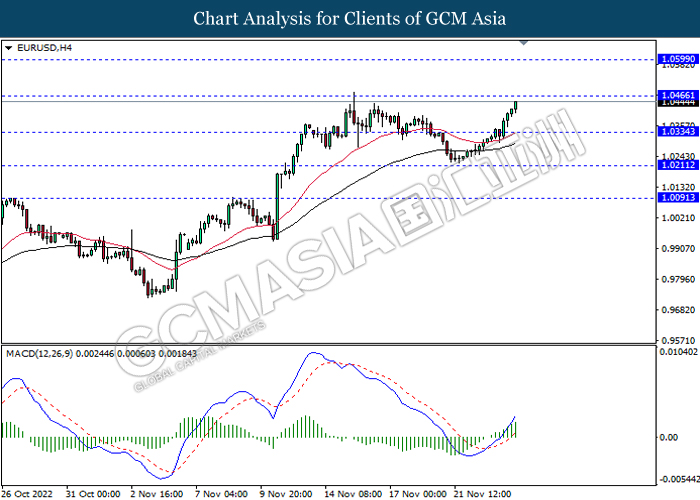

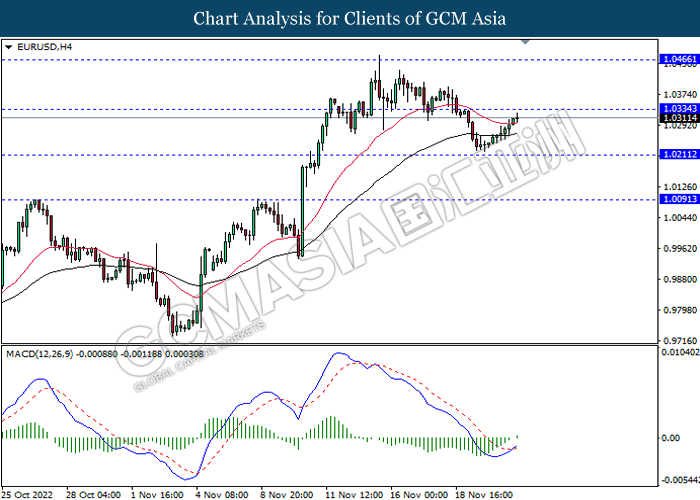

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

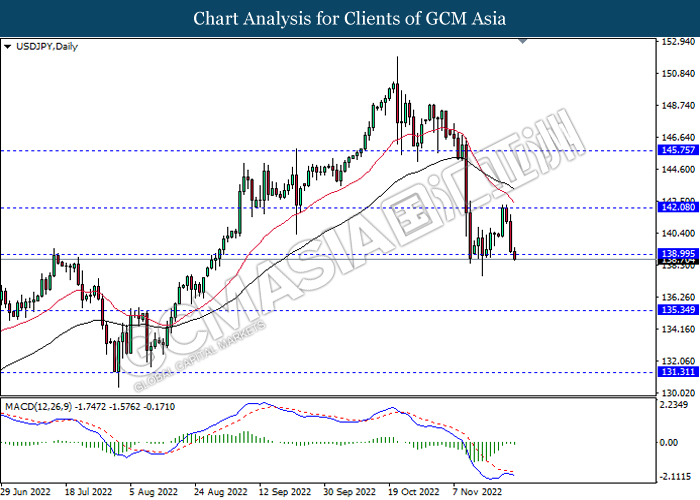

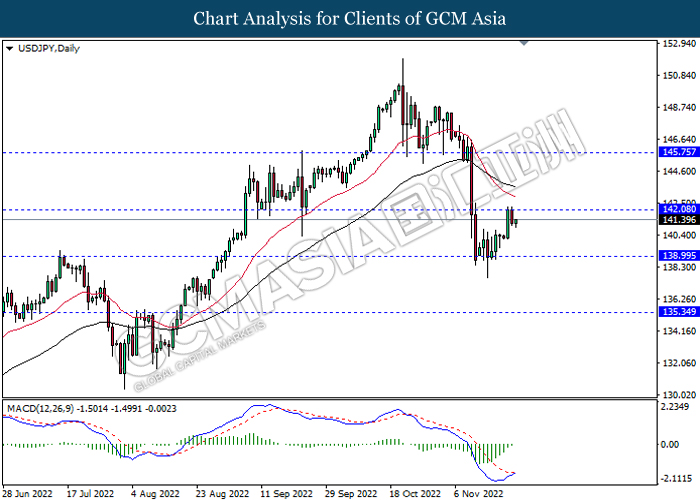

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

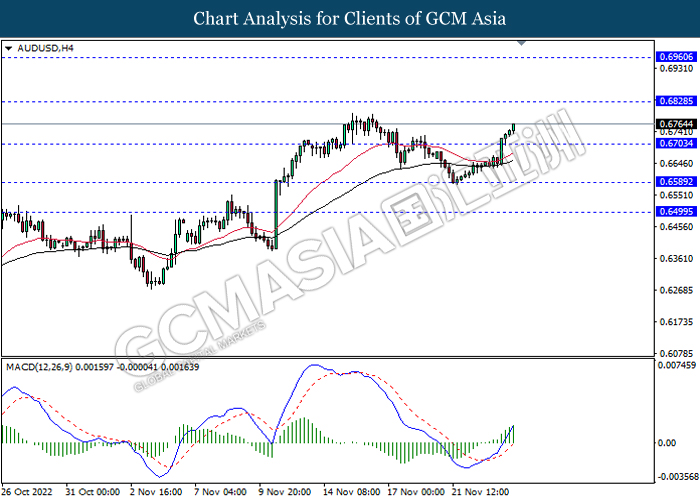

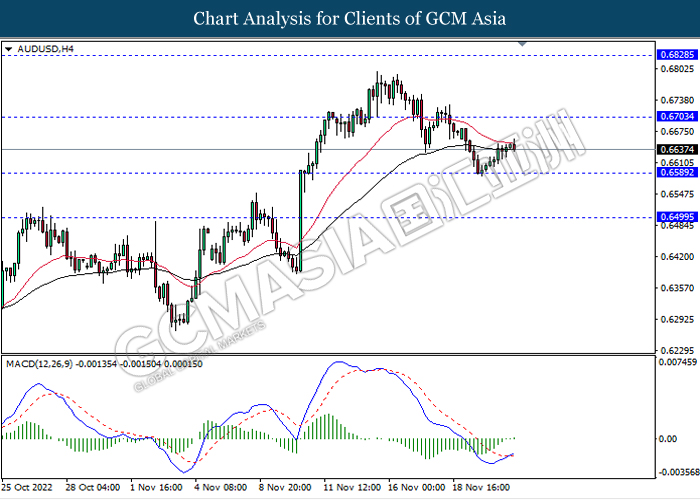

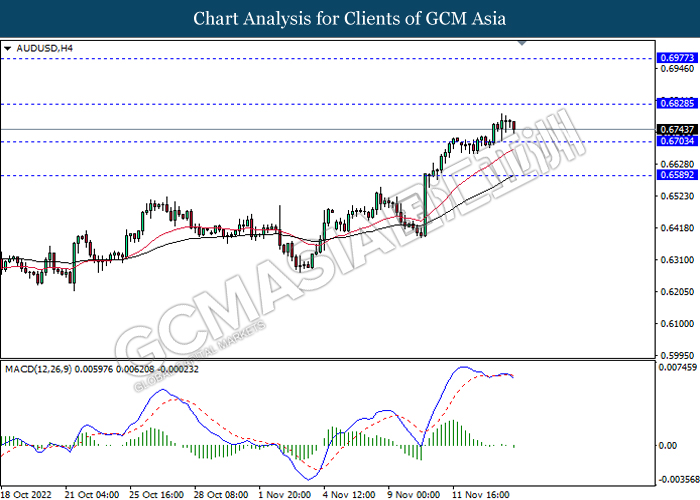

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

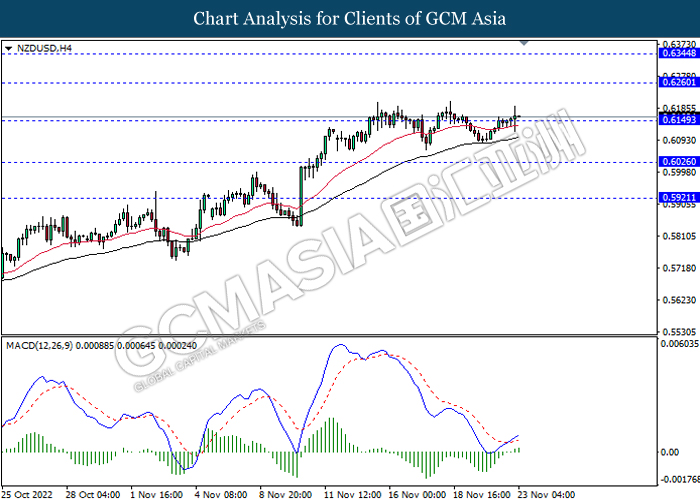

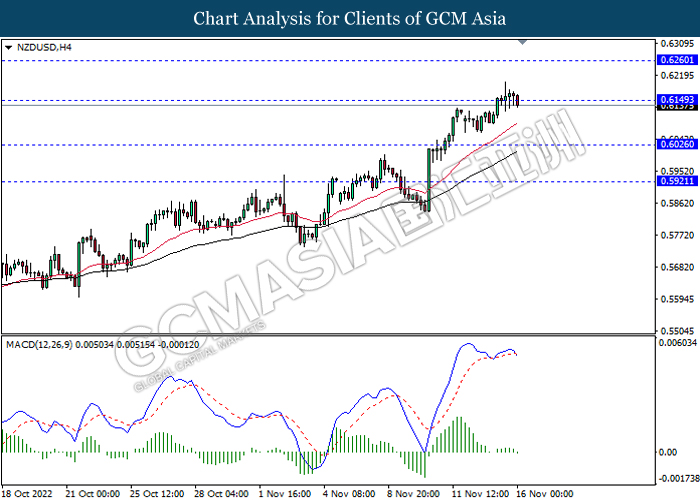

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6260, 0.6360

Support level: 0.6150, 0.6025

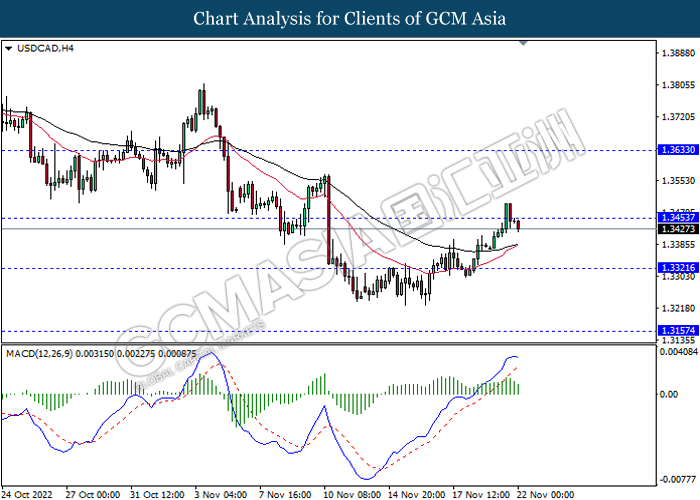

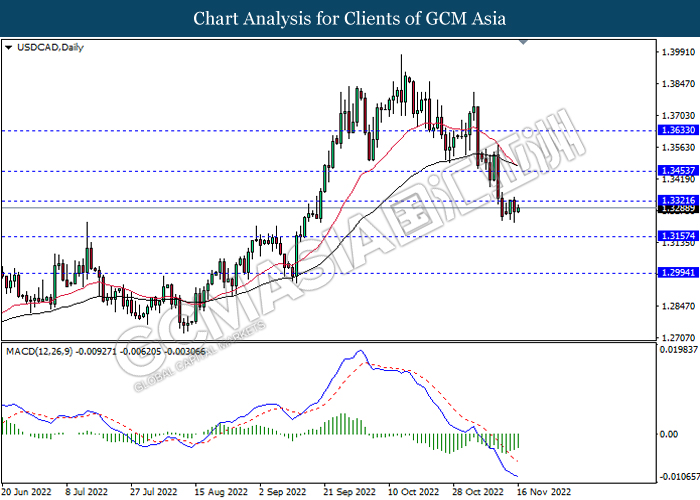

USDCAD, H4: USDCAD was traded lower while currently testing the support level. Hoiwever, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

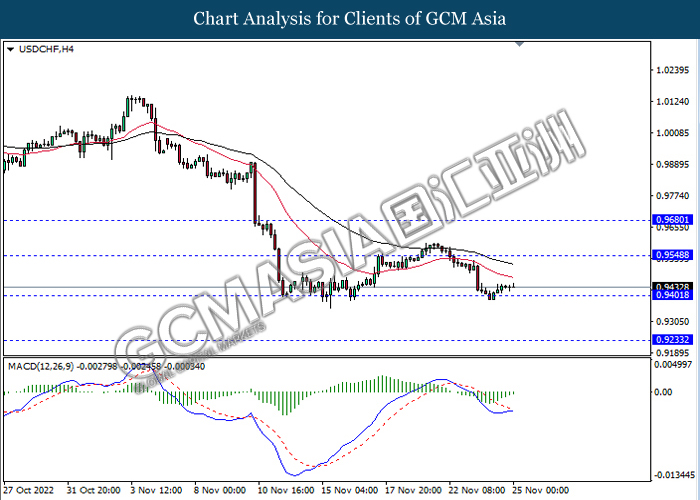

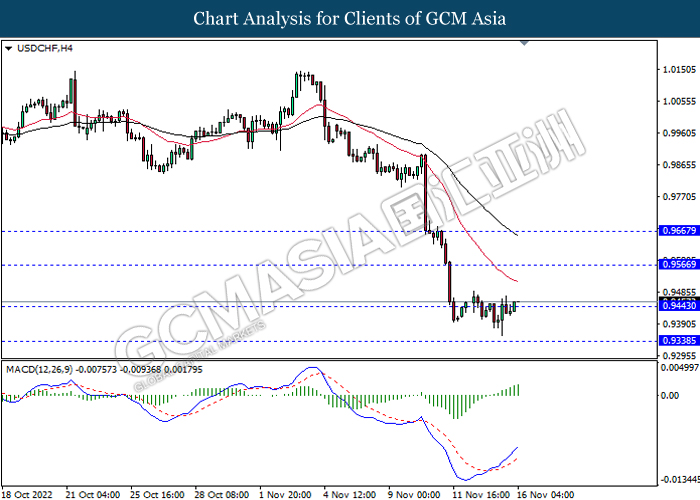

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

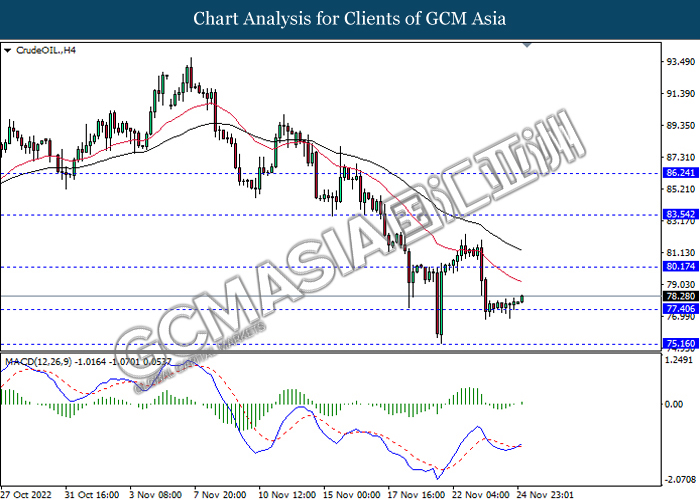

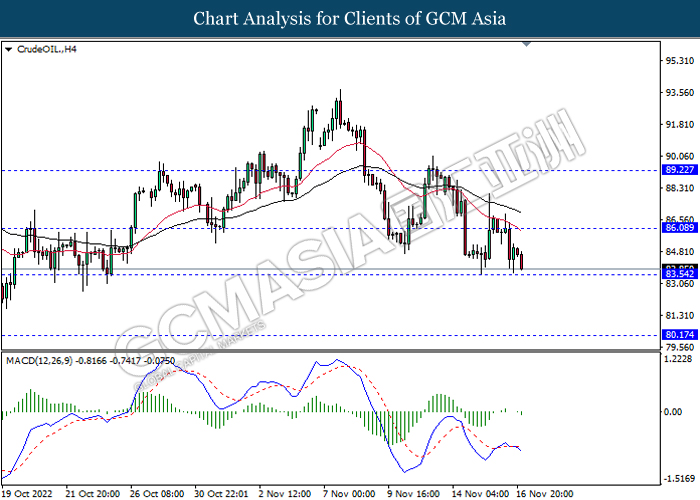

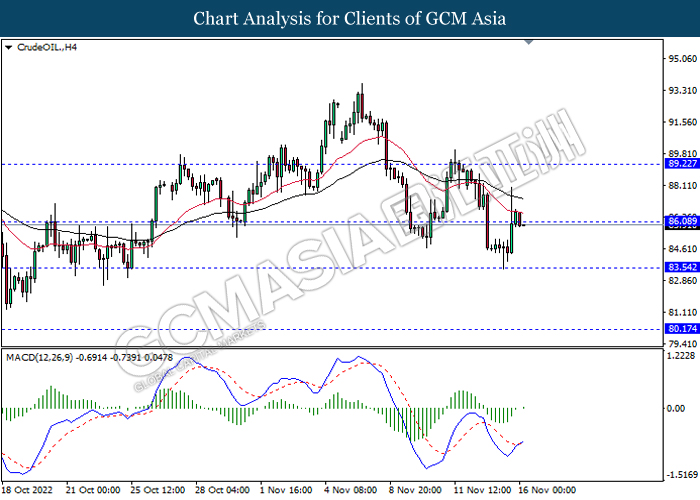

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 80.15, 83.55

Support level: 77.40, 75.15

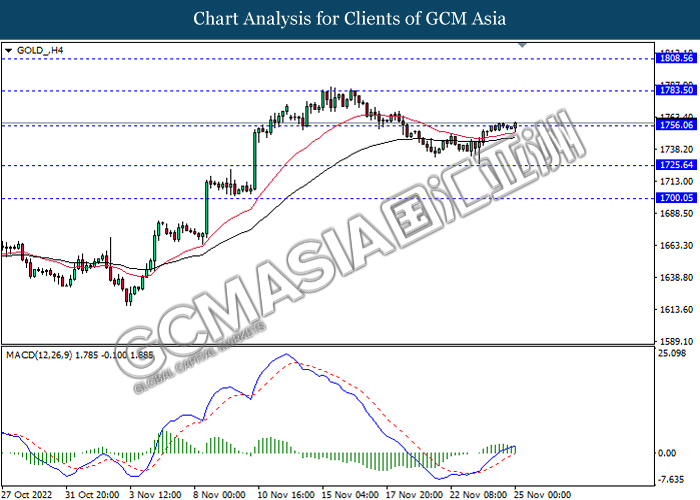

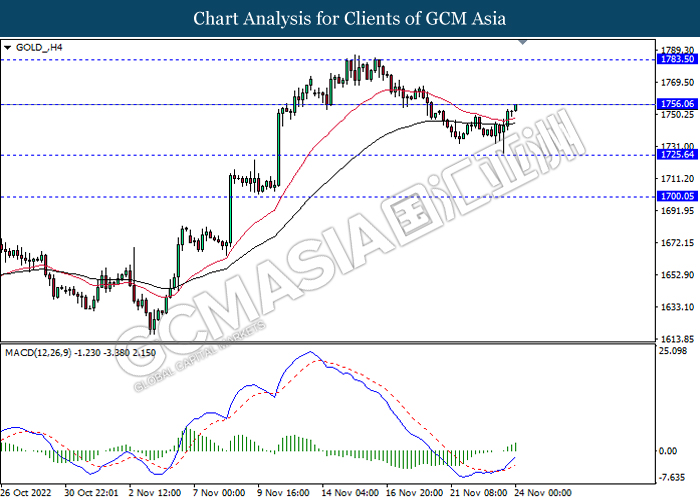

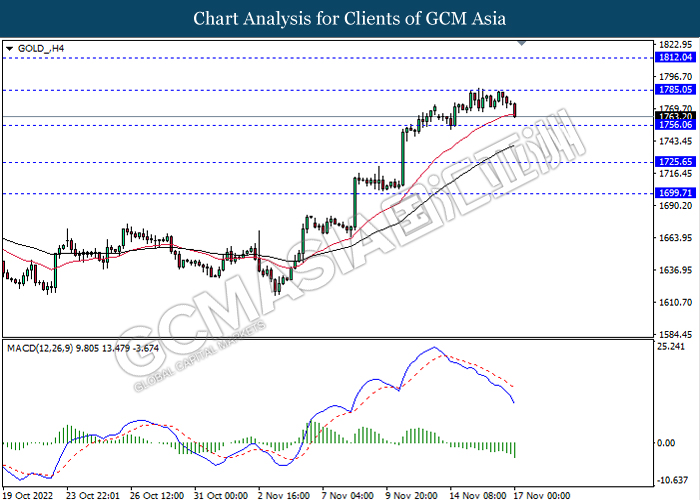

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1783.50, 1808.55

Support level: 1756.05, 1725.65

251122 Morning Session Analysis

25 November 2022 Morning Session Analysis

Greenback slipped during the Thanksgiving Holidays.

The dollar index, which gauges its value against a basket of six major currencies, is teetering on the brink as market risk sentiment improved after Fed meeting minutes were released. Early yesterday, the Fed minutes reported that the officials agreed with a smaller rate hike in the upcoming December meeting. It means that a 50-basis point rate rise is likely to happen in the next month after 4 consecutive 75-basis points of a rate hike. At this juncture, the CME FedWatch tool shows that the possibility of 50 basis points of a rate hike is about 76%, while the possibility of 75 basis points of a rate hike is 24%. With that, it dampened the appeal of the dollar market and urged the market participants to seek other shinier markets. Besides, with the Thanksgiving Holiday, the forex market had relatively low liquidity as it was thinly traded throughout the day. As such, the market is expected to have slow movement or low fluctuation for the rest of the trading session in this week. As of writing, the dollar index edged down -0.20% to 105.85.

In the commodities market, the crude oil price rose by 0.68% to $77.95 per barrel amid a technical rebound after plunging for more than 5% in the previous trading session. Besides, the gold prices edged up by 0.33% to $1755.40 per troy ounce amid the dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day USD Thanksgiving Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q3) | 0.3% | 0.3% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 107.35. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 104.85.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2200.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0475.

Resistance level: 1.0475, 1.0615

Support level: 1.0365, 1.0255

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.90. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6240. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6240, 0.6170

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3400. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 76.55. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 80.60, 86.15

Support level: 76.55, 70.10

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1726.15. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1766.50.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35

241122 Afternoon Session Analysis

24 November 2022 Afternoon Session Analysis

Pound Sterling jumped, supported by bullish economic data.

The GBP/USD, which widely traded by global investors surged on yesterday following the upbeat economic data has been announced. A series of UK data such as UK Composite Purchasing Managers’ Index (PMI), Manufacturing Purchasing Managers Index (PMI) as well as Services Purchasing Managers Index (PMI) has given a higher-than-expected reading, which dialed up the market confidence to invest in UK currency. Nonetheless, the figures that lower than 50 indicated that contraction in economic sector, while it led part of investors to remain concerns toward UK economic progression. On the other hand, the USD/CAD slumped throughout yesterday trading session amid the hawkish speech from Bank of Canada (BoC) member. According to Reuters, the BoC Governor Tiff Macklem claimed on Wednesday that higher interest rate was is needed in order to restore price stability, as the inflationary risk faced by Canada remained strong. Despite the inflationary data – CPI in Canada was cooled down to 6.9% since August, but it still far from the 2% target that set by the central bank. As of writing, GBPUSD appreciated by 0.42% to 1.2098 while USDCAD eased by 0.13% to 1.3334.

In the commodities market, the crude oil price dropped by 0.06% to $77.88 per barrel as of writing as the spiking Covid-19 cases in China keep threatening the demand of oil. In addition, the gold price rose by 0.55% to $1755.15 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day USD Thanksgiving Day

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Nov) | 84.3 | 85.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses of successfully breakout the support level.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 80.15, 83.55

Support level: 77.40, 75.15

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1756.05, 1783.50

Support level: 1725.65, 1700.05

241122 Morning Session Analysis

24 November 2022 Morning Session Analysis

Greenback plunged amid dovish Fed meeting minutes.

The dollar index, which gauges its value against a basket of six major currencies, extended its losses during the previous trading session as dovish meeting minutes and downbeat economic data suppressed the sentiment of dollar’s market. Earlier today, the minutes of the Fed’s November meeting has showed that the officials agreed that a smaller interest rate hike should happen soon as the tightening monetary policy is expected to have effect on the US economy. According to the minutes, a majority of the Fed members nod their head a smaller rate hikes as it gives a chance to the policymakers to take a breath while evaluating the impact policy is having on the economy Despite, the officials said they still see few signs of inflation abating. On the other hand, the number of people filing for the unemployment benefit in the US has risen from 223K to 240K, missing the forecast of the consensus at 225K. The downbeat employment data has dampened the appeal of the Greenback as it is reflecting that the US labor market turned fragile. As of writing, the dollar index plummeted -1.01% to 106.15.

In the commodities market, the crude oil price plunged by -4.66% to $78.05 per barrel as the Group of Seven (G7) nations considered a price cap on Russian oil above the current market level. Besides, the gold prices edged up by 0.01% to $1749.75 per troy ounce amid the dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day USD Thanksgiving Day

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Nov) | 84.3 | 85.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 107.35. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 104.85.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2000, 1.2200

Support level: 1.1820, 1.1635

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 141.75. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 138.90.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6240. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6240, 0.6355

Support level: 0.6170, 0.6105

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3400. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 77.50. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 79.15, 80.45

Support level: 77.50, 76.50

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1726.15. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1766.50.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35

231122 Afternoon Session Analysis

23 November 2022 Afternoon Session Analysis

Euro rose as hefty rate hike was suggested.

The EUR/USD, which widely traded by global investors extended its gains on yesterday over the hawkish statement from the European Central Bank (ECB) members. According to Bloomberg, the Governing Council member Gediminas Simkus claimed on Tuesday that the central bank was suggested to take at least 50 basis point rate hike in December meeting in order to tamp down inflationary risk, while a higher rate increase is still on the table. Starting from July, ECB had raised its interest rate by 200 basis points – the most aggressive hike in ECB’s history. Furthermore, with the Eurozone inflation running in double digits of 10.6%, it dialed up the hopes of aggressive contractionary monetary implementation by ECB. In addition, Bundesbank President Joachim Nagel appeared a speech on yesterday that Eurozone’s interest rate were still so low as to stimulate the economy and “relatively far” from restricting it, which sparkling the appeal of Euro currency. Though, the gains experienced by EUR/USD was limited following the Organisation for Economic Cooperation and Development (OECD) anticipated that the Europe economy would be hit by hard recession. As of writing, the EUR/USD appreciated by 0.19% to 1.0322.

In the commodities market, the crude oil price edged up by 0.04% to $80.98 per barrel as of writing following OPEC+ remained its output cuts plan. On the other hand, the gold price depreciated by 0.04% to $1739.20 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Nov) | 45.1 | 45.2 | – |

| 17:30 | GBP – Composite PMI | 48.2 | 47.2 | – |

| 17:30 | GBP – Manufacturing PMI | 46.2 | 45.7 | – |

| 17:30 | GBP – Services PMI | 48.8 | 48.0 | – |

| 21:00 | USD – Building Permits | 1.526M | – | – |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Oct) | -0.5% | 0.1% | – |

| 21:30 | USD – Initial Jobless Claims | 222K | 225K | – |

| 23:00 | USD – New Home Sales (Oct) | 603K | 570K | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -5.400M | -1.055M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2040, 1.2245

Support level: 1.1835, 1.1635

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0335, 1.0465

Support level: 1.0210, 1.0090

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6260, 0.6345

Support level: 0.6150, 0.6025

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 83.55, 86.25

Support level: 80.15, 77.40

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1756.05, 1783.50

Support level: 1725.65, 1700.05

231122 Morning Session Analysis

23 November 2022 Morning Session Analysis

Dollar dipped following the recovery of market risk sentiment.

The dollar index, which gauges its value against a basket of six major currencies, waned its gains after a day of strong gains, which was due to the deteriorating Covid-19 situation in China that urged investors shied away from the riskier currencies. Recently, the resurgence of Covid-19 has boosted the number of new COVID-19 cases in China, with record-high daily infections prompting new lockdown measures in several economic hubs, including Beijing and Shanghai. Besides, China has reported the first Covid-19-related death after six months’ time, raising market fears over the possibility of a stricter lockdown would be implemented by the China government in order to curb the spread of the virus. Despite the heightening of market worries, the market participants looked past the flare-ups of high Covid-19 cases in China while waiting for the announcement of the FOMC Meeting Minutes. The Fed’s hawkish stance on the rate-hike plan is expected to remain under the dollar, but a view of a slower pace of rate hike from the Fed’s members is not ruled out. As of writing, the dollar index declined -0.64% to 107.15.

In the commodities market, the crude oil price jumped by 1.12% to $81.90 per barrel as the API reported another crude draw over the past week. Besides, the gold prices edged up by 0.05% to $1740.00 per troy ounce amid the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Nov) | 45.1 | 45.2 | – |

| 17:30 | GBP – Composite PMI | 48.2 | 47.2 | – |

| 17:30 | GBP – Manufacturing PMI | 46.2 | 45.7 | – |

| 17:30 | GBP – Services PMI | 48.8 | 48.0 | – |

| 21:00 | USD – Building Permits | 1.526M | – | – |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Oct) | -0.5% | 0.1% | – |

| 21:30 | USD – Initial Jobless Claims | 222K | 225K | – |

| 23:00 | USD – New Home Sales (Oct) | 603K | 570K | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -5.400M | -1.055M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 107.35. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.1820. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2000, 1.2200

Support level: 1.1820, 1.1635

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0255. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 141.75. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6640. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6640, 0.6725

Support level: 0.6530, 0.6400

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6105. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6170, 0.6240

Support level: 0.6105, 0.6025

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3400. However, MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9530. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9625, 0.9745

Support level: 0.9530, 0.9405

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 80.45. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 82.90.

Resistance level: 82.90, 84.85

Support level: 80.45, 79.15

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1766.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1726.15.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35

221122 Afternoon Session Analysis

22 November 2022 Afternoon Session Analysis

Germany PPI unexpectedly dropped, Euro sinks.

The EUR/USD, which well known by majorities of investor slipped on yesterday after the inflationary data has been released. According to Destatis, the Germany Producer Price Index (PPI) MoM in October accidentally notched down from the previous reading of 2.3% to -4.2%, far lower than the consensus expectation of 0.9%. With the backdrop of easing inflationary pressure in Germany, it would likely to the diminishing of inflation risk in Eurozone, which decrease the odds of aggressive tightening monetary policy by European Central Bank (ECB). On the other hand, the Euro’s losses was extended following the smaller rate hike was implied. According to Reuters, ECB chief economist Philip Lane appeared a speech on Monday that the ECB would raise interest rate again in December, but the rate increase might be smaller than the prior. Thus, it might hinted that the 50 basis point rate hike would likely to be carried out in the next meeting, which dragged down the appeal of Euro. As of writing, EUR/USD rose by 0.24% to 1.0266.

In the commodities market, the crude oil price rallied by 0.36% to $80.33 per barrel as of writing. Nonetheless, the overall trend of oil price remained bearish over the exacerbating pandemic Covid-19 in China. In addition, the gold price appreciated by 0.28% to $1744.85 per troy ounce as of writing following the value of US Dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – Core Retail Sales (MoM) (Sep) | 0.7% | -0.6% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 108.45, 109.95

Support level: 107.05, 105.20

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2040, 1.2245

Support level: 1.1835, 1.1635

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0335, 1.0465

Support level: 1.0210, 1.0090

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6150, 0.6260

Support level: 0.6025, 0.5920

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9680, 0.9815

Support level: 0.9550, 0.9400

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 83.55, 86.25

Support level: 80.15, 77.40

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1756.05, 1783.50

Support level: 1725.65, 1700.05

221122 Morning Session Analysis

22 November 2022 Morning Session Analysis

Dollar soared on risk aversion.

The dollar index, which gauges its value against a basket of six major currencies, managed to regain its luster amid the heightening of market risk aversion. Recently, the big fuss that China is currently facing was the resurgence of Covid-19 cases. The global risk sentiment was dented following the rising of Covid-19 cases in China, as some major cities, such as Beijing, have implemented a semi-lockdown in order to curb the spread of the virus. Besides, other districts in China which, including Chaoyang, Dongcheng, Changping, and so on, also warned the residents to stay at home and reduce cross-district personnel flow. The resurgence of Covid-19 cases has cast doubt on hopes that the government could soon ease its restriction, the outlook of continuous economic recovery clouded with uncertainty. With such a backdrop, investors took a dim view of riskier currencies and shifted their capital toward safe haven currencies such as the dollar index. As of writing, the dollar index rose 0.82% to 107.80.

In the commodities market, the crude oil price jumped by 0.50% to $80.20 per barrel as Saudi Arabia denied the plan for oil production hike. Besides, the gold prices edged down by -0.75% to $1737.85 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – Core Retail Sales (MoM) (Sep) | 0.7% | -0.6% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 107.35. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1820. MACD which illustrated diminishing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2000, 1.2200

Support level: 1.1820, 1.1635

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0255. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.75. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6640. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6105. MACD which illustrated diminishing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6170, 0.6240

Support level: 0.6105, 0.6025

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3505. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9530. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9625.

Resistance level: 0.9625, 0.9745

Support level: 0.9530, 0.9405

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 80.45. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 80.45, 82.90

Support level: 79.15, 77.50

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1766.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1726.15.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35

211122 Afternoon Session Analysis

21 November 2022 Afternoon Session Analysis

Aussie dived as China Covid-19 cases keep rising.

The AUD/USD, which widely traded by majority of investors dropped significantly on last week over the backdrop of surging Covid-19 cases in China. According to Reuters, Beijing residents were urged to stay at home on Monday, extending a request from the weekend as the city’s Covid-19 case number rose, with many business shut and school in area shifting classes online. Last week, new case numbers started to spike near April peaks as China battles outbreaks in cities across the country, from Zhengzhou in central Henan province to Guangzhou in the south and Chongqing in the southwest. In current situation, the aggressive lockdown move that reiterated by China government might be implemented again, which brought negative prospects toward economic progression in the China. As the trading partners with China, Australia economy would likely to be dragged down, which spurring bearish momentum on Aussie. As of writing, the AUD/USD depreciated by 0.34% to 0.6648.

In the commodities market, the crude oil price slumped by 0.94% to $79.36 per barrel as of writing as the rising Covid-19 cases in China had weighed down the demand of this black commodity. On the other hand, the gold price eased by 0.43% to $1745.47 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains of successfully breakout the resistance level.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2040, 1.2245

Support level: 1.1835, 1.1635

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0335, 1.0465

Support level: 1.0210, 1.0090

USDJPY, Daily: USDJPY was traded higher following prior rebound form the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6150, 0.6260

Support level: 0.6025, 0.5920

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9565, 0.9665

Support level: 0.9445, 0.9340

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 80.15, 83.55

Support level: 77.40, 75.15

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1756.05, 1785.05

Support level: 1725.65, 1699.70

211122 Morning Session Analysis

21 November 2022 Morning Session Analysis

Dollar remains pressured as the pace of rate hike is likely to ease.

The dollar index, which gauges its value against a basket of six major currencies, hovered near its recent low level as the market participants are waiting for more economic data as well as comment from the Federal Reserve Chairman to gauge the further direction of Greenback. Over the past week, the US dollar net positioning turned net short for the first time since mid-July 2021. According to the Reuters and US Commodity Futures Trading Commission, the data showed that the value of the dollar positioning turned the table from a net long position of $2.36 billion to a net short position of $10.5 million for the week ended 15th November. With that, it is reflecting that the investors’ sentiment turned bearish on the dollar as the recent inflation figures, which including Consumer Price Index (CPI) and Producer Price Index (PPI), showed sign of easing, whereby it could urge the Federal Reserve to slowdown its pace on rising the interest rate. As of writing, the dollar index edged up 0.26% to 106.95.

In the commodities market, the crude oil price plunged by -1.99% to $77.55 per barrel amid market concern over the weakened demand in China. Besides, the gold prices edged down by -0.05% to $1750.85 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.35.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.1820. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2000.

Resistance level: 1.2000, 1.2200

Support level: 1.1820, 1.1635

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0365. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0255.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 138.90. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 141.75.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6725. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6640.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6170. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6170, 0.6240

Support level: 0.6105, 0.6025

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3265. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3400.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9530. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9625.

Resistance level: 0.9625, 0.9745

Support level: 0.9530, 0.9405

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from support level at 79.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 80.45.

Resistance level: 80.45, 82.90

Support level: 79.15, 77.50

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1766.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1726.15.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35

171122 Afternoon Session Analysis

17 November 2022 Afternoon Session Analysis

Pound Sterling rallied as data shown soaring inflation in UK.

The GBP/USD, which widely traded by majority of investors rose significantly on yesterday amid the background of rising inflationary risk. According to Office for National Statistics, the UK Consumer Price Index (CPI) YoY jumped to a 41-year high of 11.1% in October, exceeding the market consensus forecast of 10.7%. The soaring of food, transport and energy price keep threatening household and business, which sparkling the hopes of aggressive rate hike from Bank of England (BoE). In addition, Pound Sterling’s gains has been extended following the hawkish statement form BoE. According to Reuters, BoE Governor Andrew Bailey claimed on Wednesday that the UK labor market is still ‘tight’, as well as more rate hikes are likely to be implemented in order to bring down sky-rocketed price. With that, it attracted the eye of investors and stoke a shift in sentiment toward UK currency. As of now, market participants would scrutinize on fiscal statement that delivered by UK Finance Minister Jeremy Hunt on Thursday night. As of writing, GBP/USD depreciated by 0.29% to 1.1874.

In the commodities market, the crude oil price slumped by 1.33% to $84.45 per barrel as of writing as the rising Covid-19 cases in China had weighed down the demand of this black commodity. On the other hand, the gold price eased by 0.51% to $1763.33 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 GBP Autumn Forecast Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Oct) | 10.7% | 10.7% | – |

| 21:30 | USD – Building Permits (Oct) | 1.564M | 1.512M | – |

| 21:30 | USD – Initial Jobless Claims | 225K | 225K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Nov) | -8.7 | -6.2 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2040, 1.2245

Support level: 1.1835, 1.1635

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

USDJPY, Daily: USDJPY was traded higher following prior rebound form the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6830, 0.6975

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6150, 0.6260

Support level: 0.6025, 0.5920

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9565, 0.9665

Support level: 0.9445, 0.9340

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 86.10, 89.20

Support level: 83.55, 80.15

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1785.05, 1812.05

Support level: 1756.05, 1725.65

171122 Morning Session Analysis

17 November 2022 Morning Session Analysis

Dollar revived following the release of solid retail sales data.

The dollar index, which gauges its value against a basket of six major currencies, managed to hold its ground yesterday as upbeat economic data sparked bullish momentum in the dollar market. According to the Census Bureau, US Retail Sales came in at 1.3%, stronger than the consensus forecast of 1.0%, showing households stepped up their spending throughout the month of October. On the other hand, the US Core Retail Sales data also rose solidly, from 0.1% to 1.3%, beating the consensus forecast of 0.4%. Following the upbeat data as well as the sign of a slowdown in inflation, actually adds to cautious optimism that the economy could avoid an expected recession next year or experience only a mild one. Besides, the Fed’s Waller also reiterated his point of view regarding the rate hike, whereby he is in favor of a 50-basis point of a rate hike. Similarly, he also emphasized that how high rates have to go hinges on the upcoming economic data. As of writing, the dollar index is up by 0.13% to 106.25.

In the commodities market, the crude oil price plunged by -1.77% to $85.60 per barrel as the oil supply to Hungary via the Druzhba pipeline resumed after being suspended temporarily in the past day. Besides, the gold prices edged down by -0.28% to $1773.90 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 GBP Autumn Forecast Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Oct) | 10.7% | 10.7% | – |

| 21:30 | USD – Building Permits (Oct) | 1.564M | 1.512M | – |

| 21:30 | USD – Initial Jobless Claims | 225K | 225K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Nov) | -8.7 | -6.2 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level at 107.35. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 104.85

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.1820. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2000.

Resistance level: 1.2000, 1.2200

Support level: 1.1820, 1.1635

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

USDJPY, Daily: USDJPY was traded lower while currently testing the support level ta 138.90. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6170. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6170, 0.6240

Support level: 0.6105, 0.6025

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3265. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3400.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from support level at 84.35. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into market.

Resistance level: 86.05, 87.40

Support level: 84.35, 82.65

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1766.50. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1805.90.

Resistance level: 1805.90, 1850.95

Support level: 1766.50, 1726.15

161122 Afternoon Session Analysis

16 November 2022 Afternoon Session Analysis

Pound Sterling spiked after bullish economic data announced.

The GBP/USD, which widely traded by majority of investors rose significantly on yesterday as the upbeat economic data has been unleashed. According to Office for National Statistics, the UK Average Earnings Index +Bonus came in at the reading of 6.0%, exceeding the market forecast of 5.9%. Besides, the UK Claimant Count Change notched down from the previous reading of 3.9K to 3.3K, far lower than the consensus expectation of 17.3K. These two data that higher-than-expected figures had brought positive prospects toward economic progression in the UK, while it attracted the market participants to invest in UK market. In addition, Pound Sterling extended its gains following the depreciation of US Dollar, which leaded by the easing inflationary pressure in the US. As of now, investors would highly scrutinize on the announcement of CPI data in UK, which it could provide a clearer rate hike path for BoE. Currently, economist are anticipating the CPI reading would reach 10.7%, which higher than the previous reading of 10.1%. As of writing, GBP/USD edged down by 0.03% to 1.1855.

In the commodities market, the crude oil price dropped by 0.41% to $86.56 per barrel as of writing as the rising fears of lower oil demand that caused by exacerbating pandemic Covid-19 in China. On the other hand, the gold price depreciated by 0.01% to $1773.45 per troy ounce as of writing following prior rebound of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:15 GBP BoE Gov Bailey Speaks

22:15 GBP Inflation Report Hearings

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Oct) | 10.1% | 10.7% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Oct) | 0.1% | 0.4% | – |

| 21:30 | USD – Retail Sales (MoM) (Oct) | 0.0% | 1.0% | – |

| 21:30 | CAD – Core CPI (MoM) (Oct) | 0.4% | – | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 3.925M | -0.440M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2040, 1.2245

Support level: 1.1835, 1.1635

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

USDJPY, Daily: USDJPY was traded higher following prior rebound form the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6830, 0.6975

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6150, 0.6260

Support level: 0.6025, 0.5920

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3320, 1.3455

Support level: 1.3155, 1.2995

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9565, 0.9665

Support level: 0.9445, 0.9340

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 86.10, 89.20

Support level: 83.55, 80.15

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1785.05, 1812.05

Support level: 1756.05, 1725.65

161122 Morning Session Analysis

16 November 2022 Morning Session Analysis

Greenback plummeted amid lighter-than-expected inflation report.

The dollar index, which gauges its value against a basket of six major currencies, lost its stance while slumping more than 1% during the previous trading session as another inflation report showed further slowdown in price increases. According to the US Bureau of Labor Statistics, US PPI for the month of October came in at 0.2%, far weaker than the consensus forecast at 0.4%, showing some sign that inflationary pressures in the nation had been abating over the past 1 month. Following the announcement of the data, the probability of a 50-basis point rate hike in the upcoming Dec meeting ticked up from 80.6% to 83.0%, while the probability of a 75-basis point dropped from 19.4% to 17.0%, according to the CME FedWatch Tool. With such a backdrop, the dollar index was sold off by the investors, while shifting their capital toward other riskier asset. As of writing, the dollar index dropped -0.09% to 106.55.

In the commodities market, the crude oil price surged by 1.91% to $87.15 per barrel following a significant draw in crude inventories. According to the API, the US crude oil inventories fell by -5.835M, recording a larger drop compared to the consensus forecast of -0.400M. Besides, the gold prices up by 0.04% to $1778.10 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:15 GBP BoE Gov Bailey Speaks

22:15 GBP Inflation Report Hearings

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Oct) | 10.1% | 10.7% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Oct) | 0.1% | 0.4% | – |

| 21:30 | USD – Retail Sales (MoM) (Oct) | 0.0% | 1.0% | – |

| 21:30 | CAD – Core CPI (MoM) (Oct) | 0.4% | – | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 3.925M | -0.440M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level at 107.35. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 104.85

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1820. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1820, 1.2000

Support level: 1.1635, 1.1445

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

USDJPY, Daily: USDJPY was traded lower while currently testing the support level ta 138.90. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6170. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6170, 0.6240

Support level: 0.6105, 0.6025

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3265. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 86.05. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 87.40.

Resistance level: 87.40, 88.80

Support level: 86.05, 84.35

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1766.50. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1805.90.

Resistance level: 1805.90, 1850.95

Support level: 1766.50, 1726.15