170822 Afternoon Session Analysis

17 August 2022 Afternoon Session Analysis

New Zealand Dollar surged as hawkish tone from RBNZ.

The New Zealand Dollar rebounded from its lower following the rate hike decision from Reserve Bank of New Zealand. According to the latest monetary policy statement, the Monetary Policy Committee (MPC) decided to raise its official cash rate (OCR) from 3% to 2.5%. Besides, the committee also vowed that they would likely to maintain the pace of contractionary monetary policy as the current price stability in the New Zealand still highly uncertain. Recently, the global consumer price inflation has continued to surged as global rising commodity prices. The war in Ukraine continues to underpin high commodity prices, with global production costs and constraints further exacerbated by supply-chain bottlenecks. In addition, the MPC also reiterated that the domestic spending in the country still remained resilient, along with robust employment level. As of writing, the pair of NZD/USD appreciated by 0.19% to 0.6355.

In the commodities market, the crude oil price slumped 0.21% to $87.55 per barrel as of writing. The oil market extends its losses amid rising recession risk as well as the possibility of making deal consensus on the Iran Nuclear continue to weigh down the crude oil price. On the other hand, the gold price depreciated by 0.01% to $1775.15 per troy ounces as of writing as further aggressive rate hike expectation continue to linger in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Meeting Minutes

(18th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Jul) | 9.4% | 9.8% | – |

| 20:30 | USD – Core Retail Sales (MoM) (Jul) | 1.0% | -0.1% | – |

| 20:30 | USD – Retail Sales (MoM) (Jul) | 1.0% | 0.1% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 5.458M | -0.275M | – |

Technical Analysis

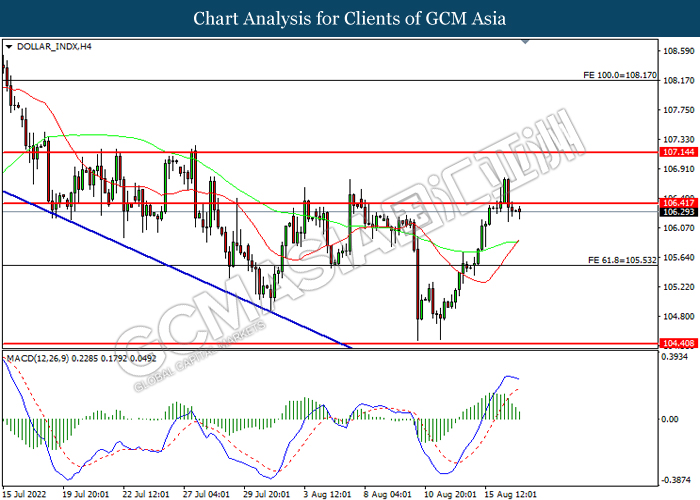

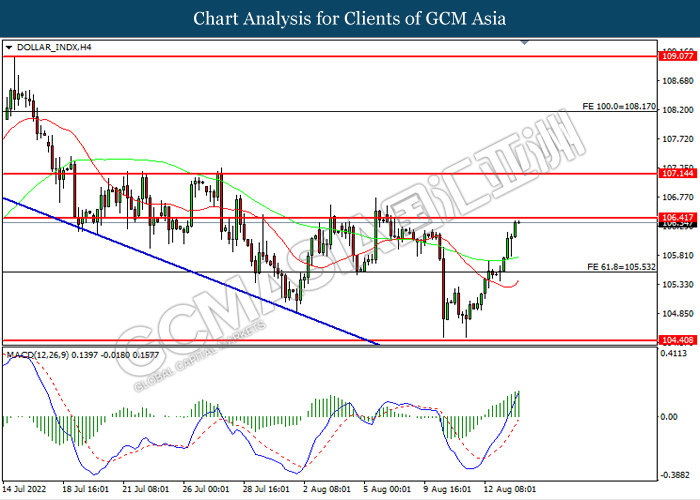

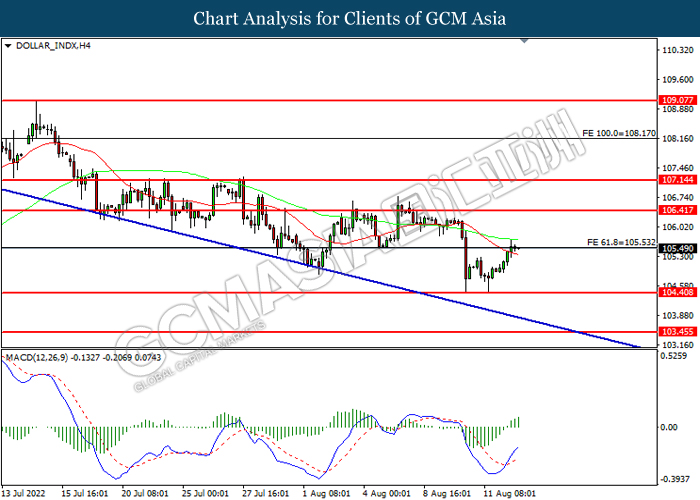

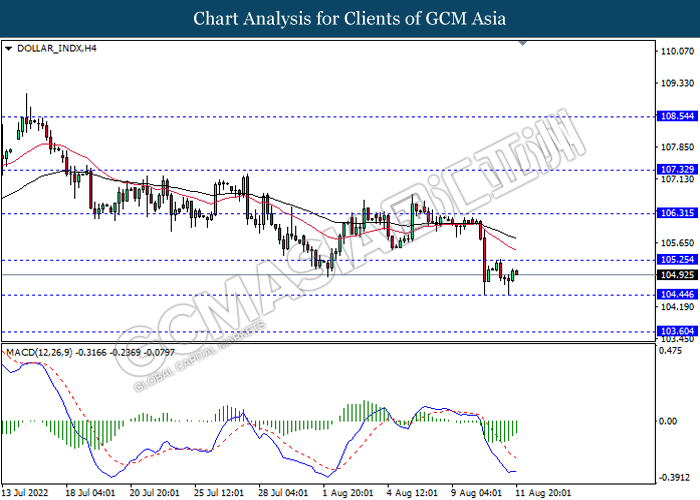

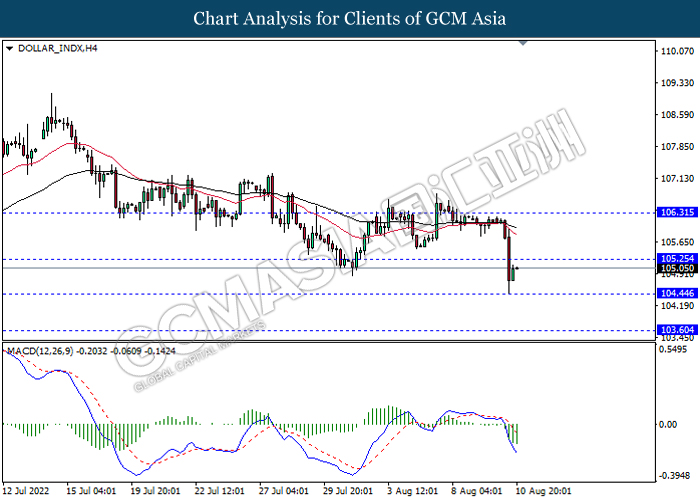

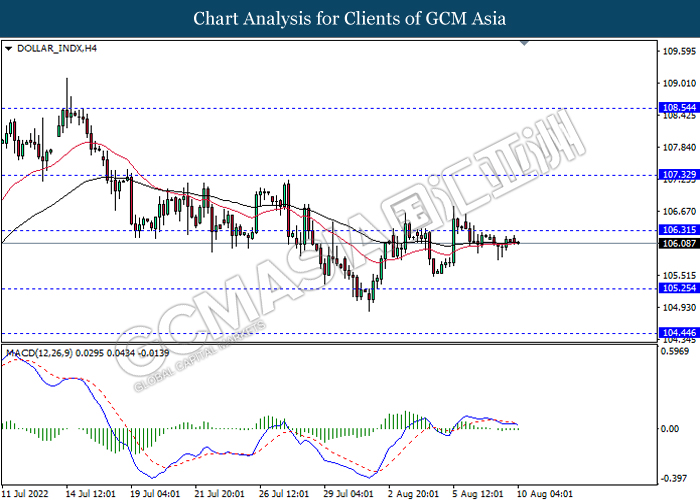

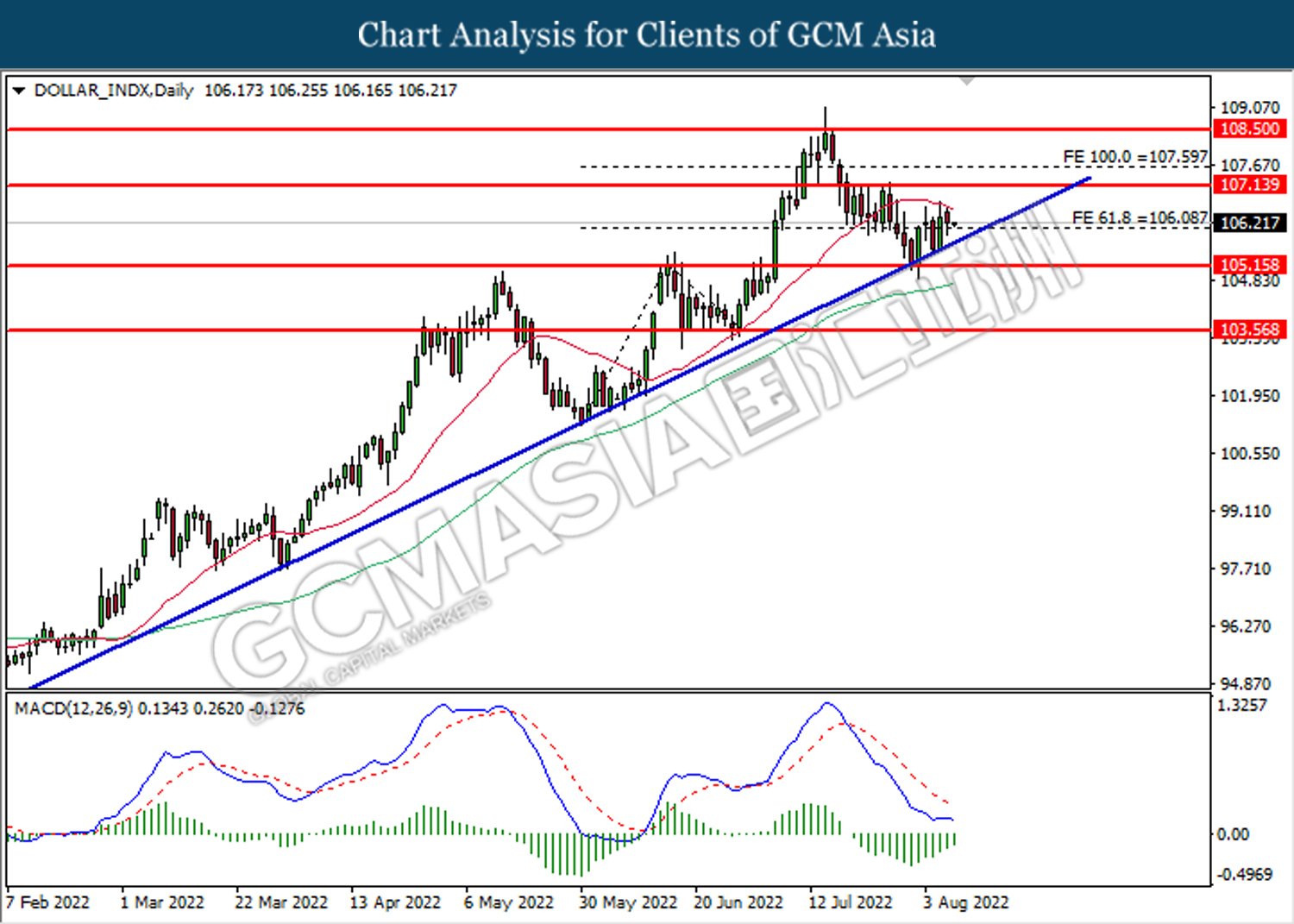

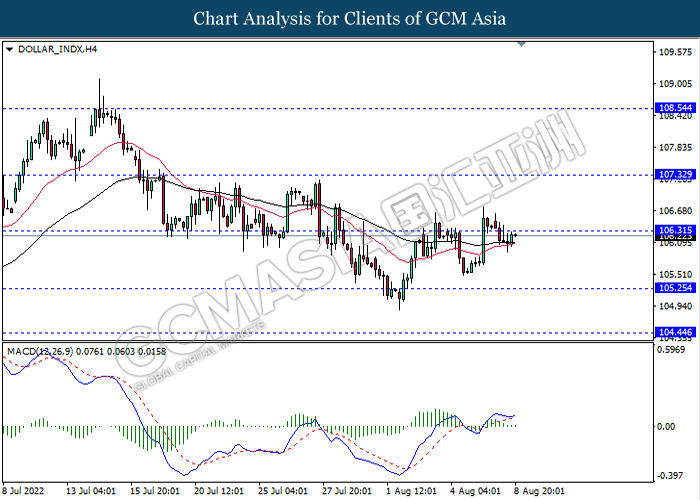

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 106.40, 107.15

Support level: 105.55, 104.40

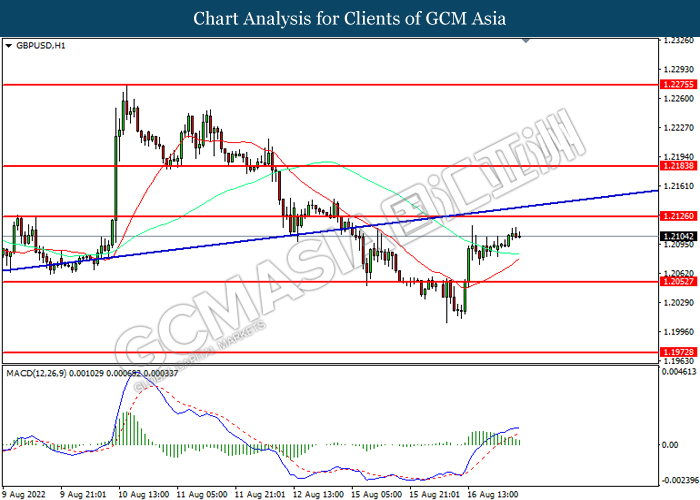

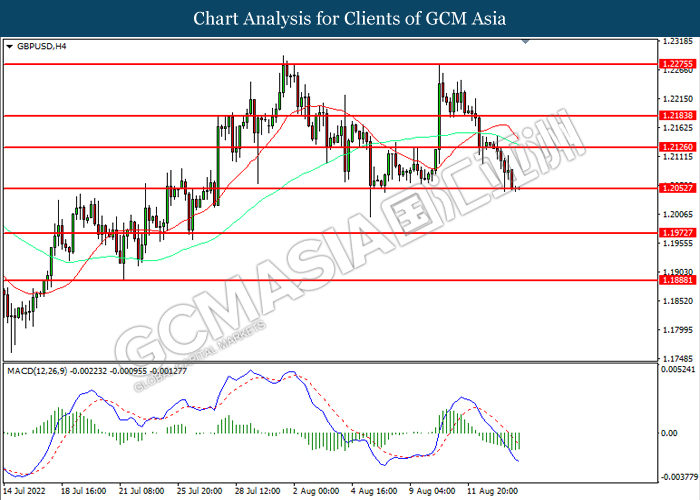

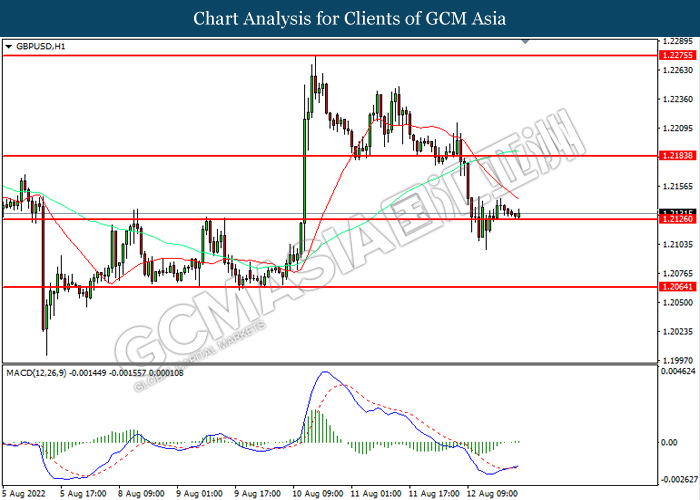

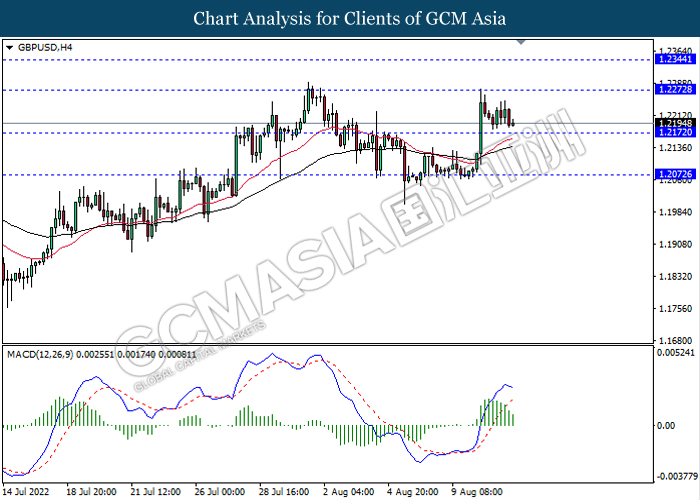

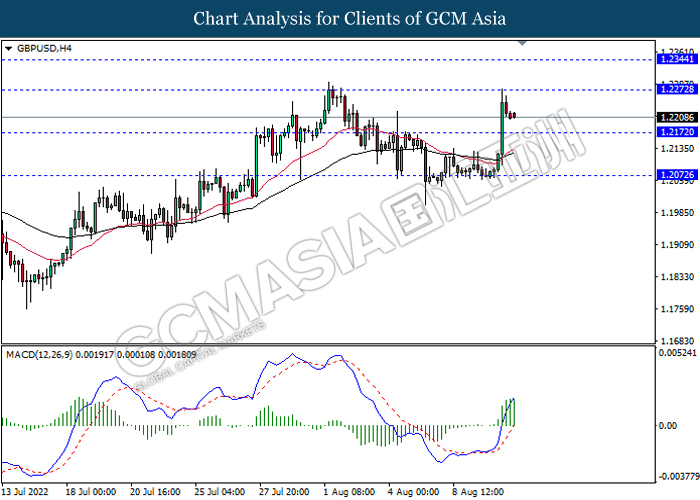

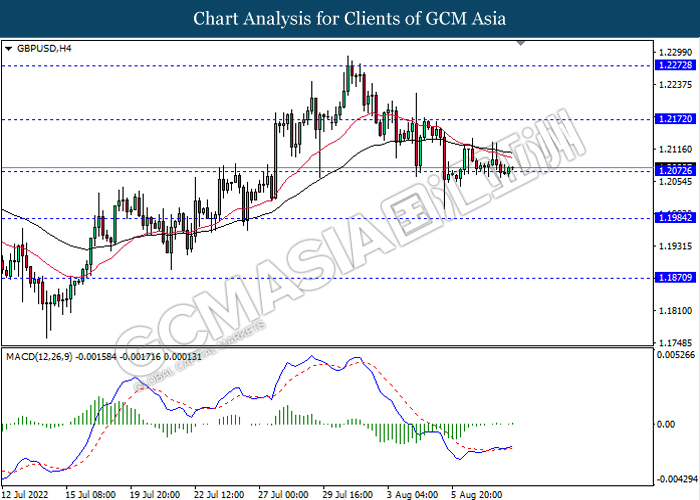

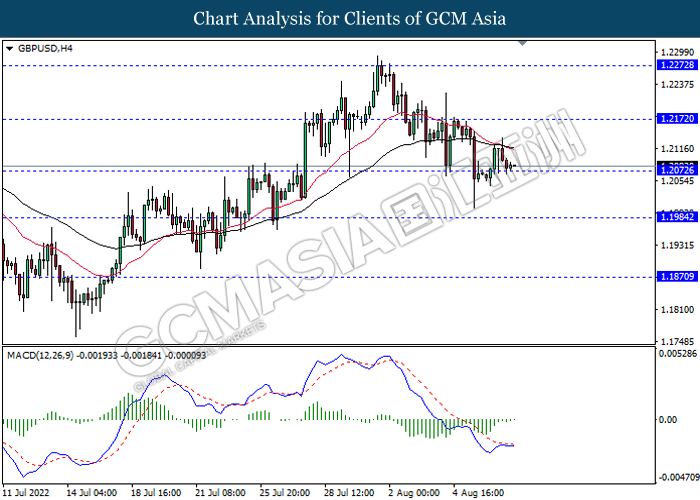

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2125, 1.2185

Support level: 1.2055, 1.1975

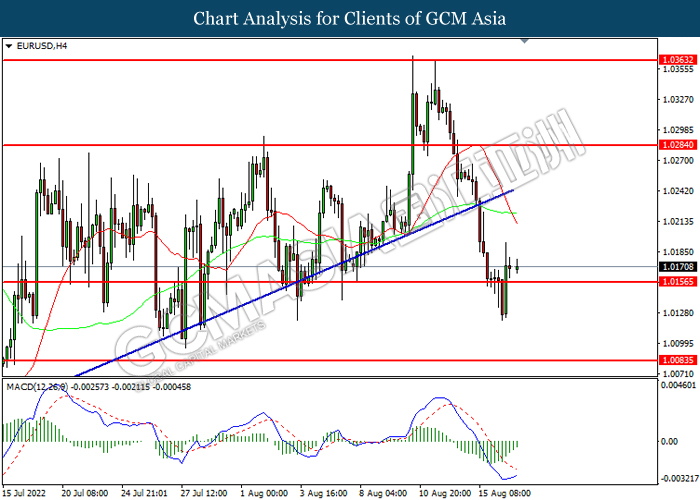

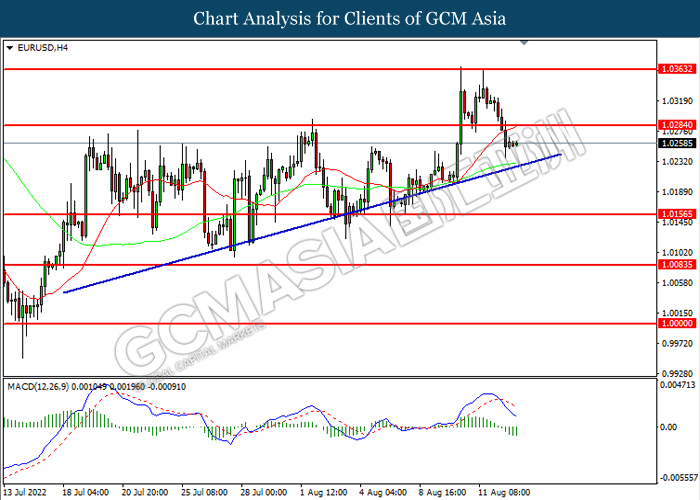

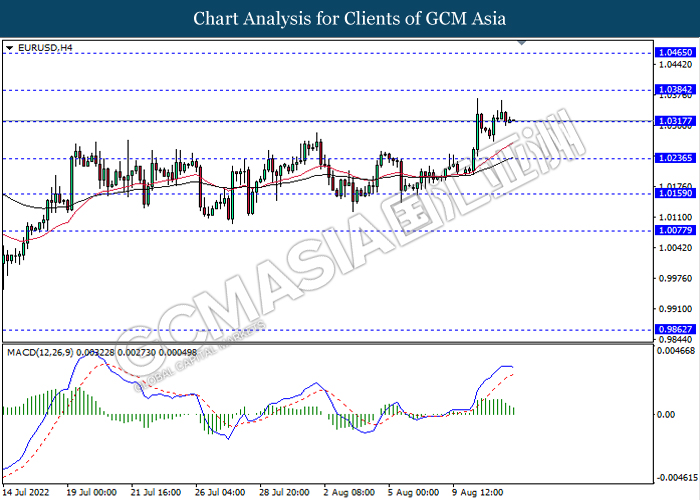

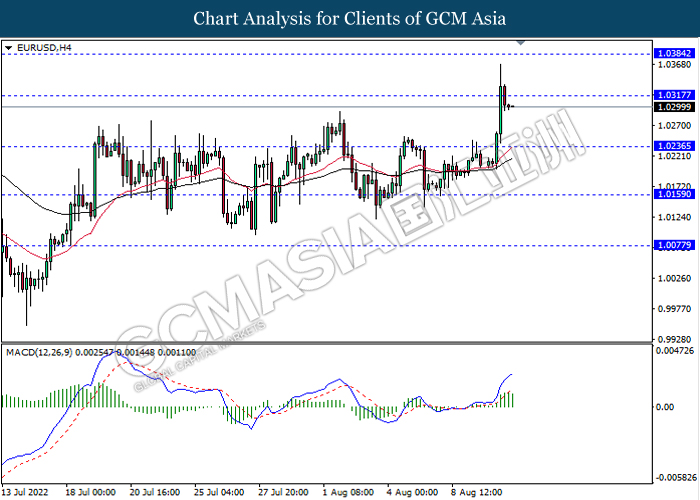

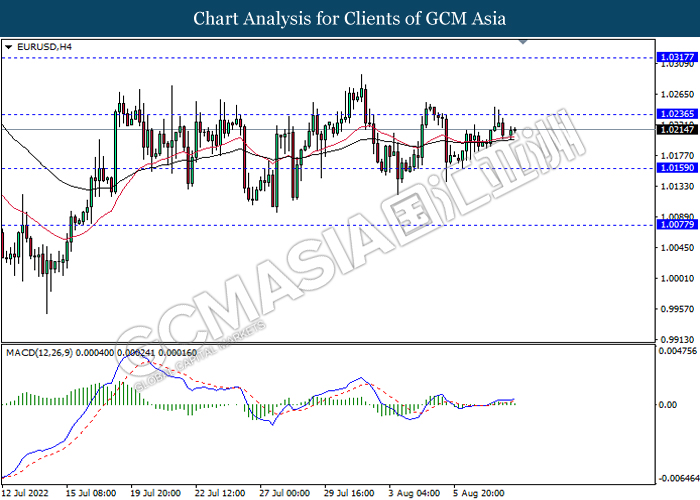

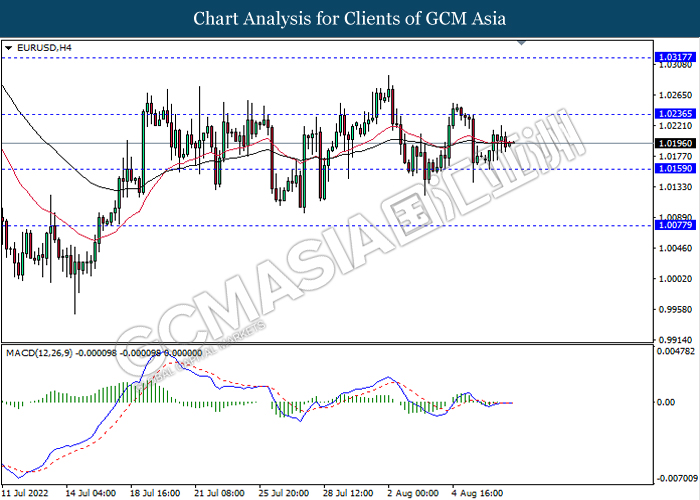

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0285, 1.0365

Support level: 1.0155, 1.0085

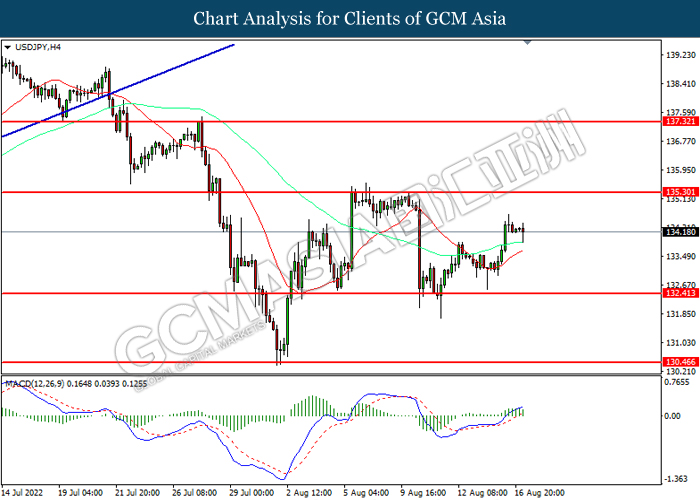

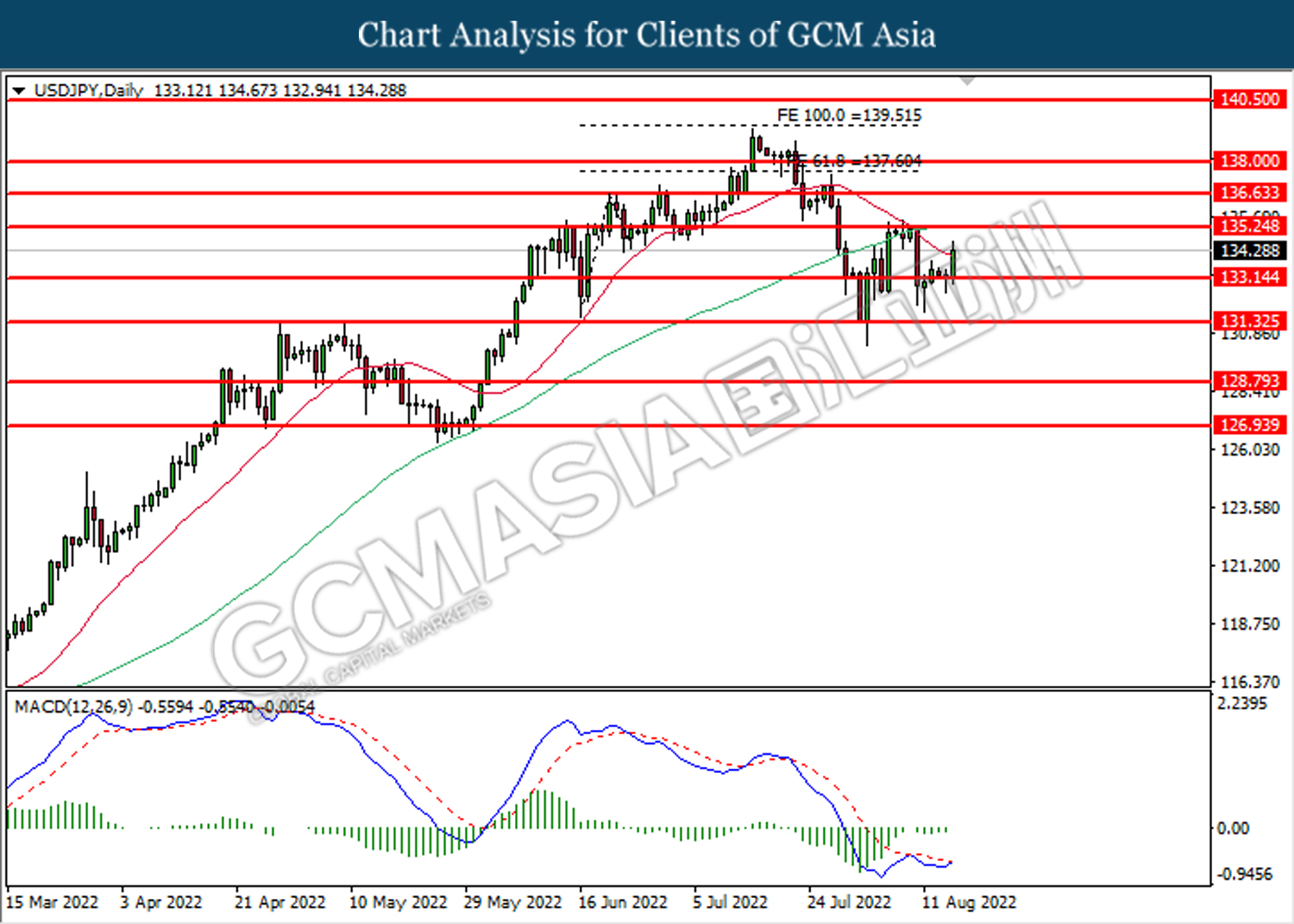

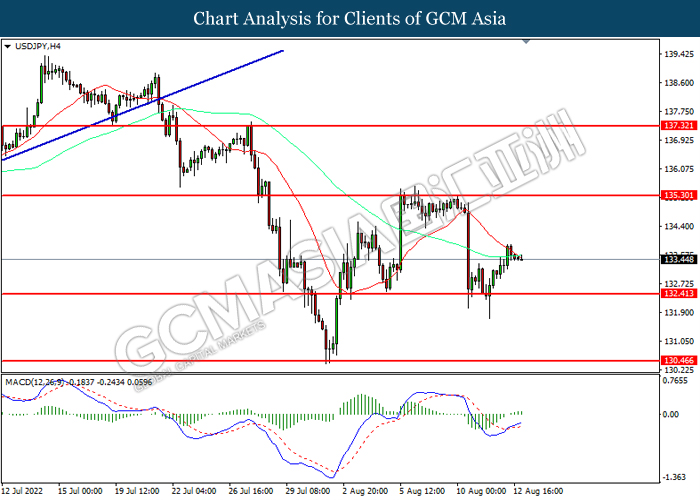

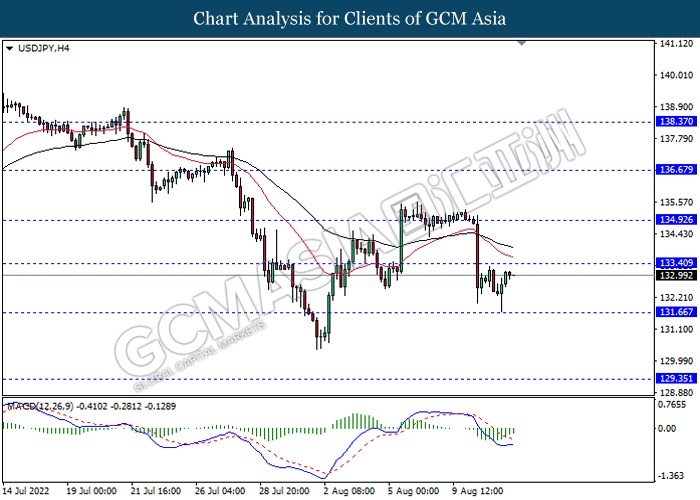

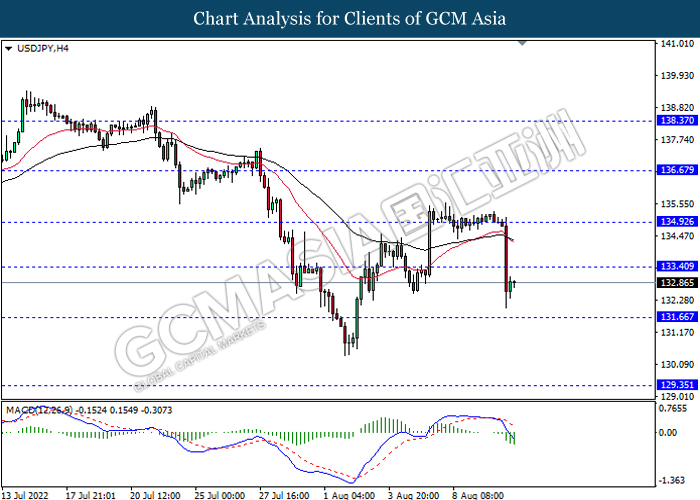

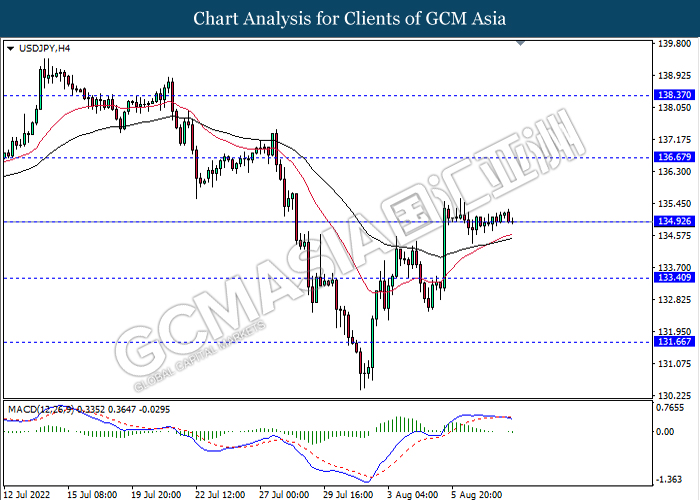

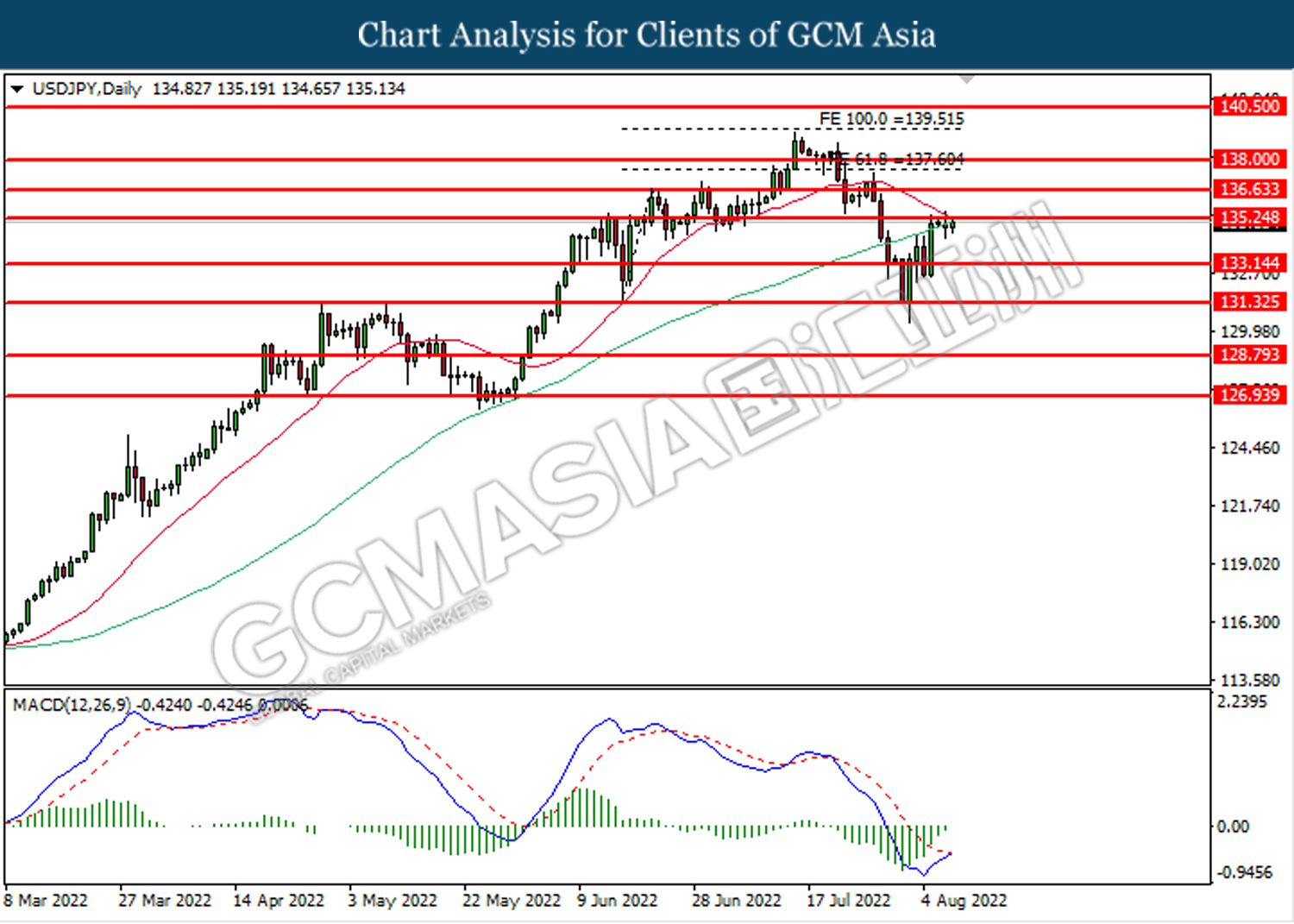

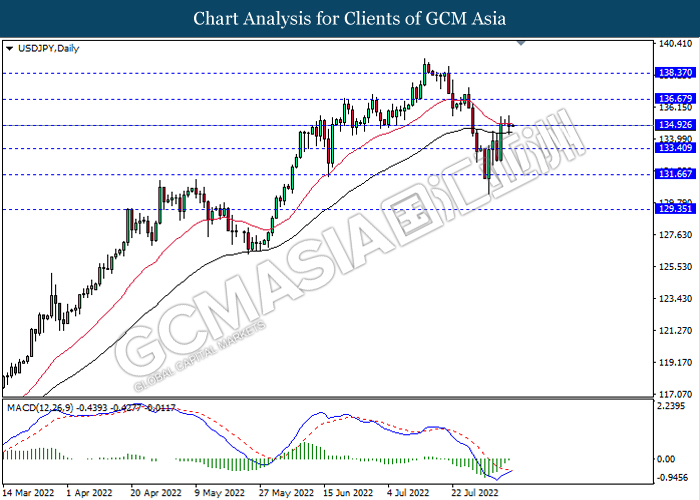

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend tis gains toward resistance level.

Resistance level: 135.30, 137.30

Support level: 132.40, 130.45

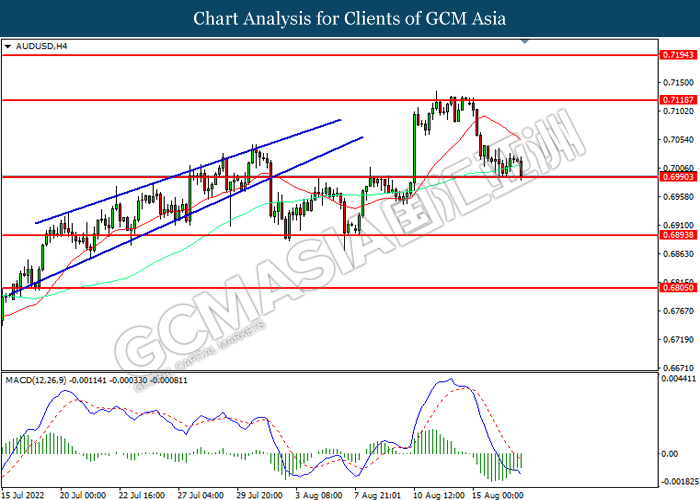

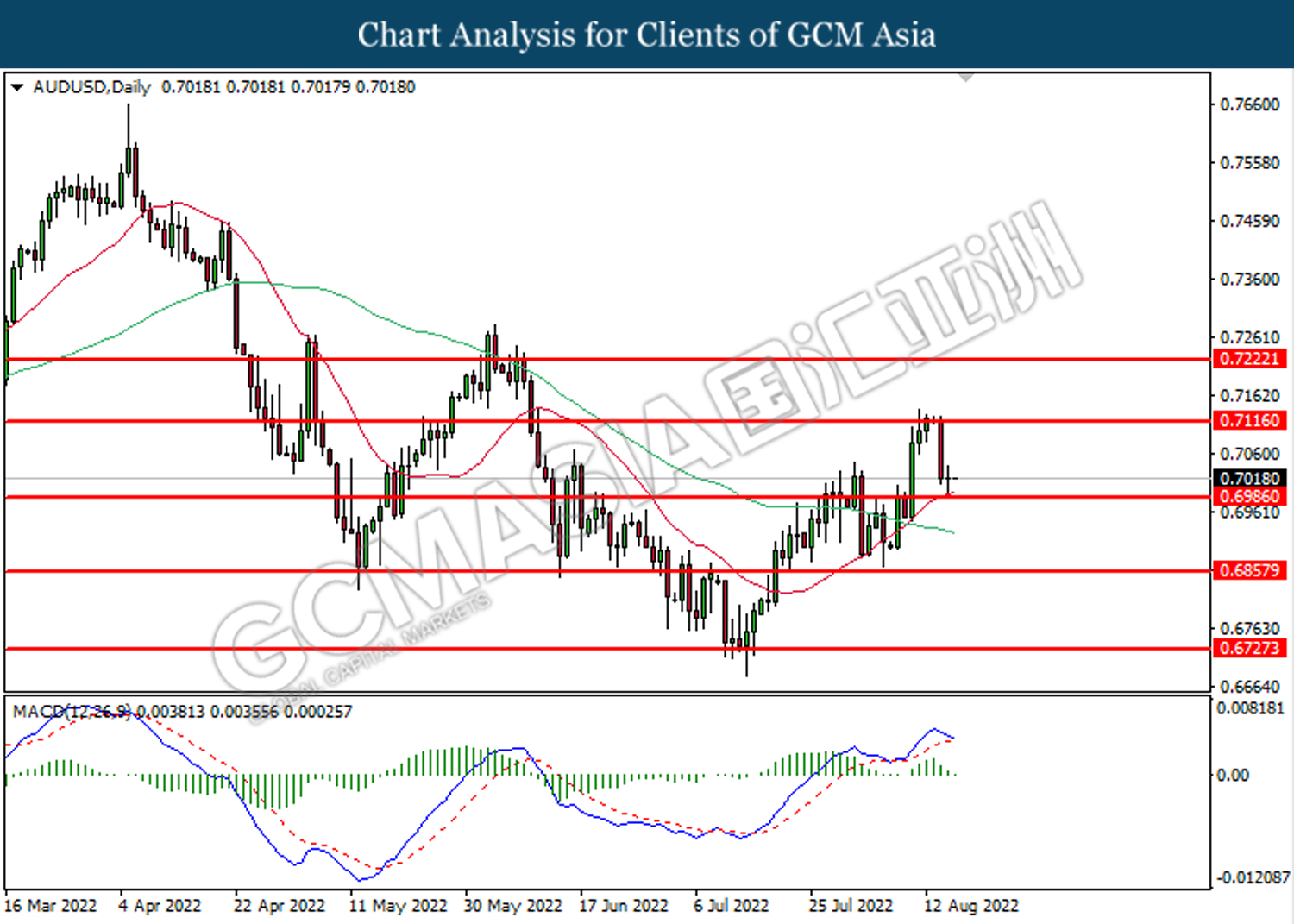

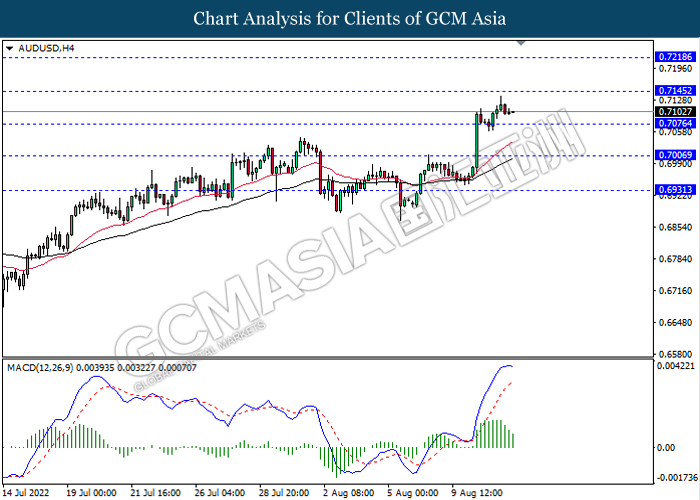

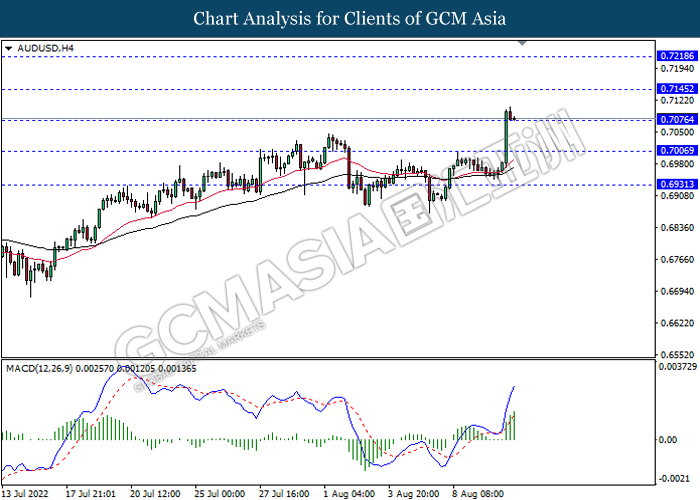

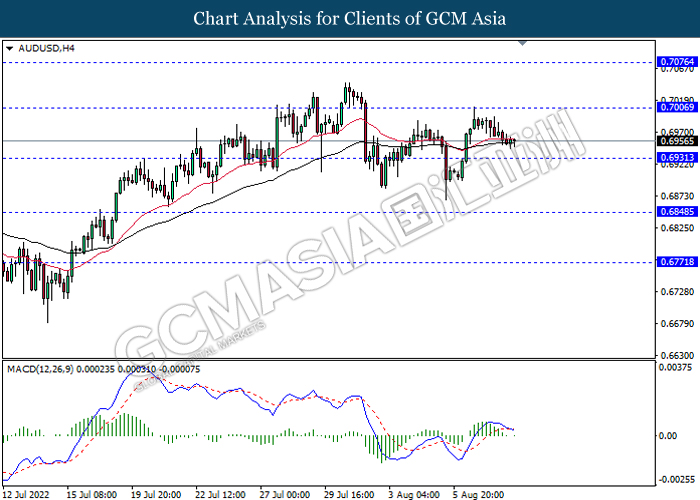

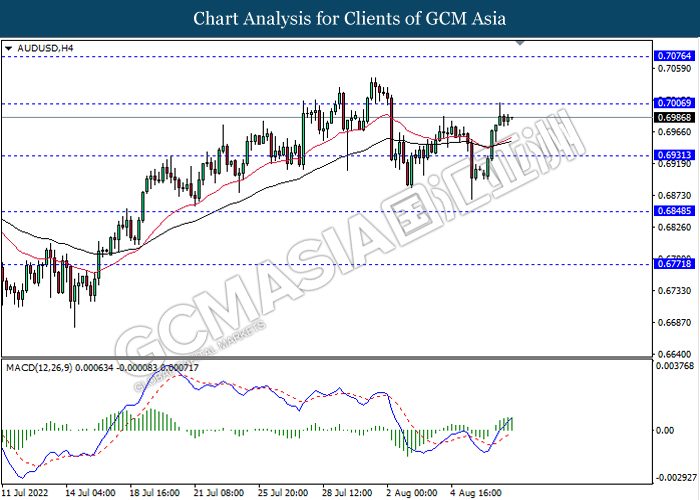

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7120, 0.7195

Support level: 0.6990, 0.6895

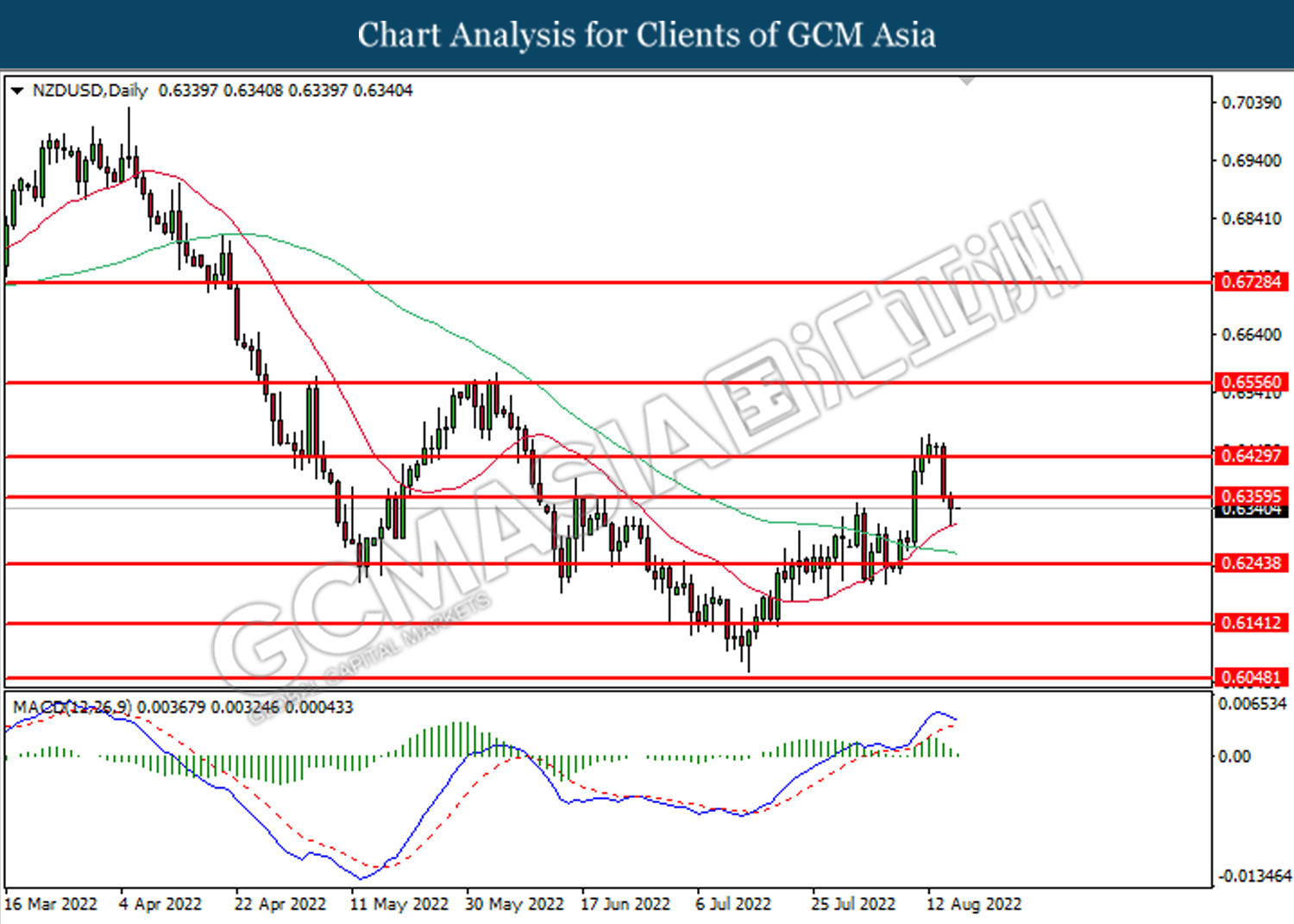

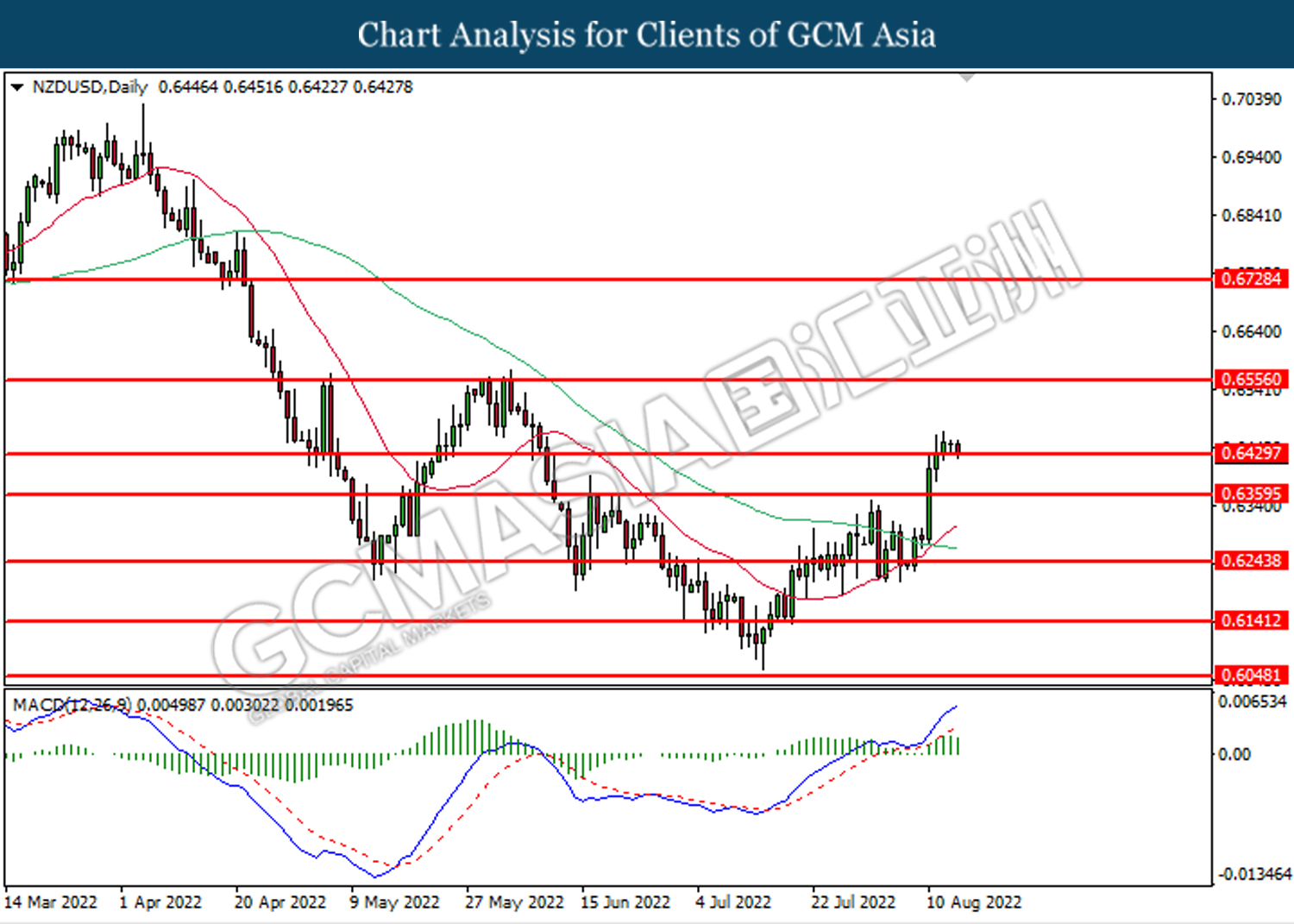

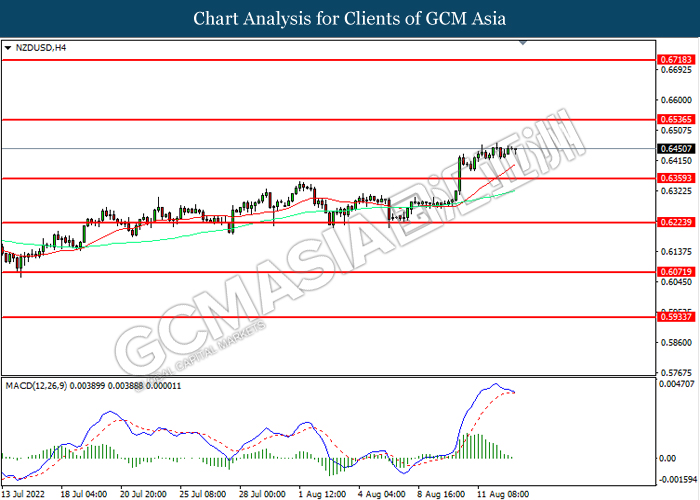

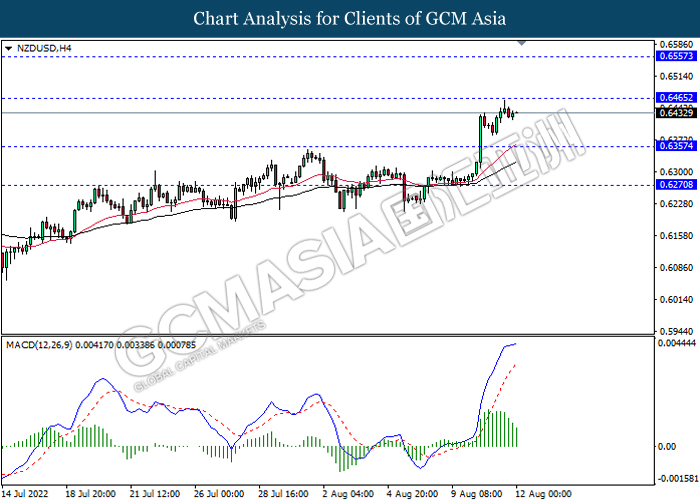

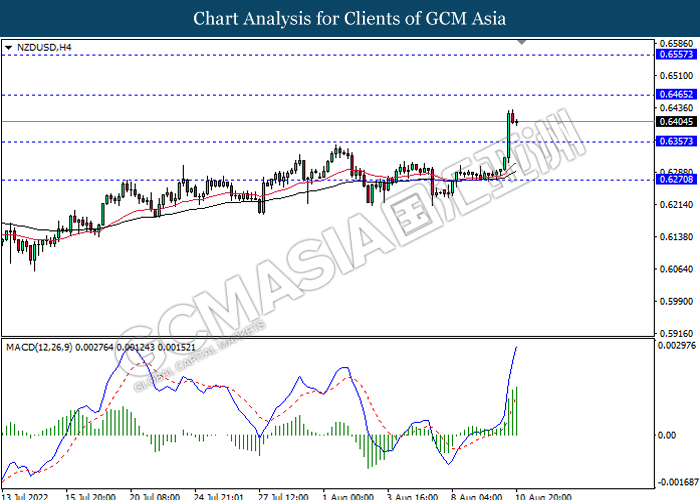

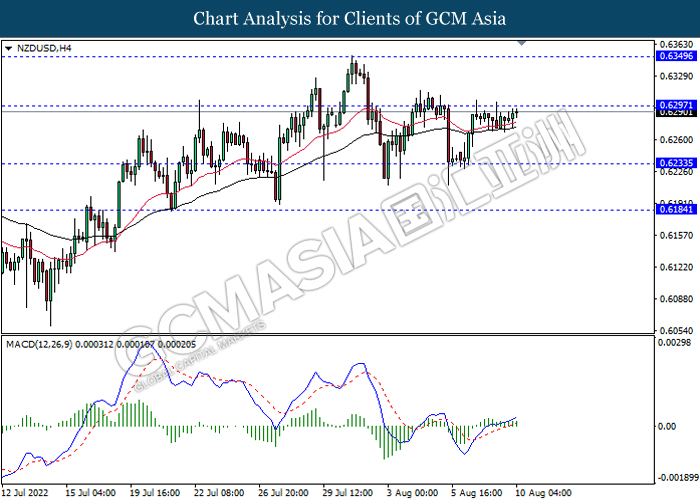

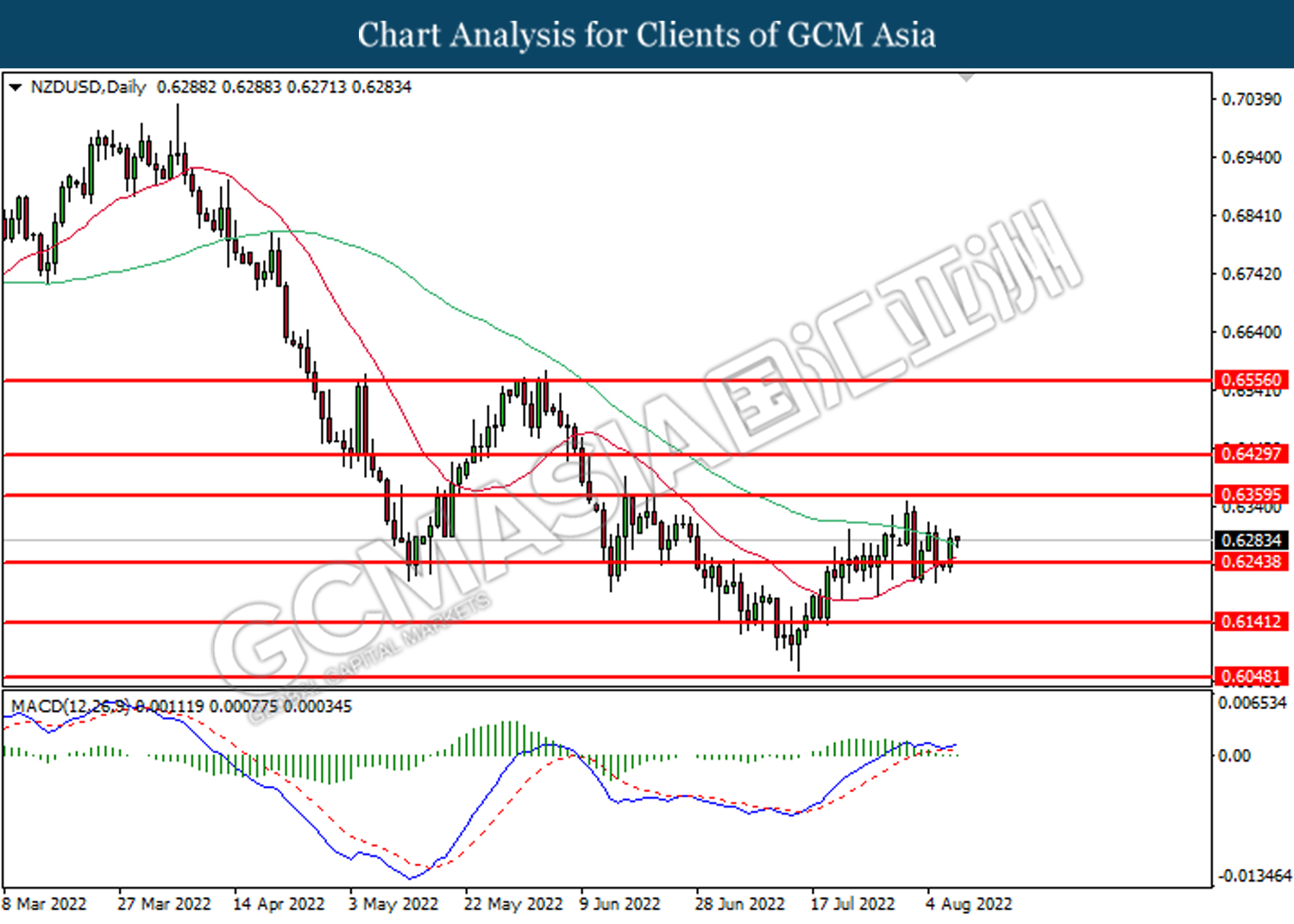

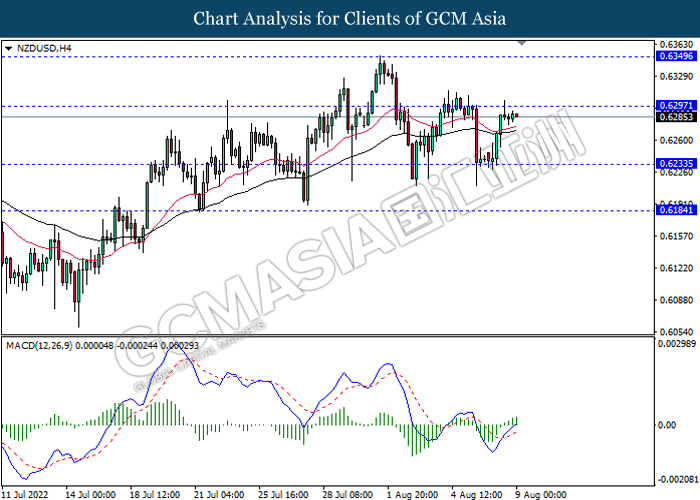

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6455, 0.6535

Support level: 0.6340, 0.6225

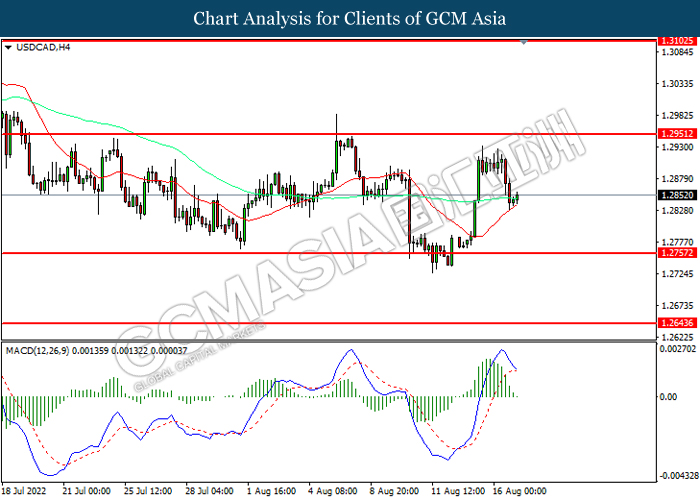

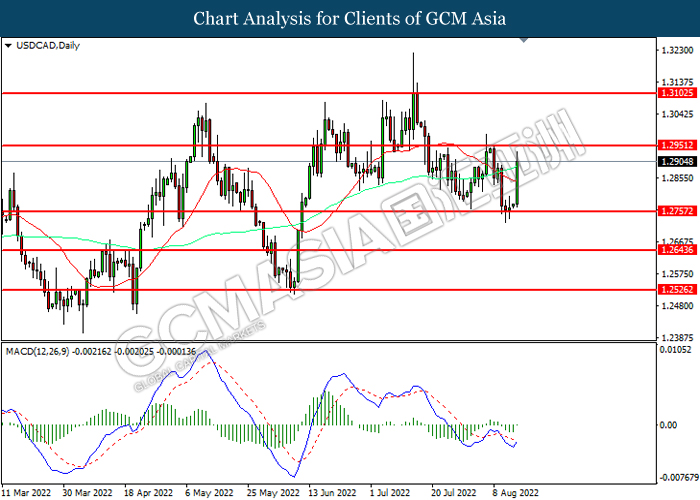

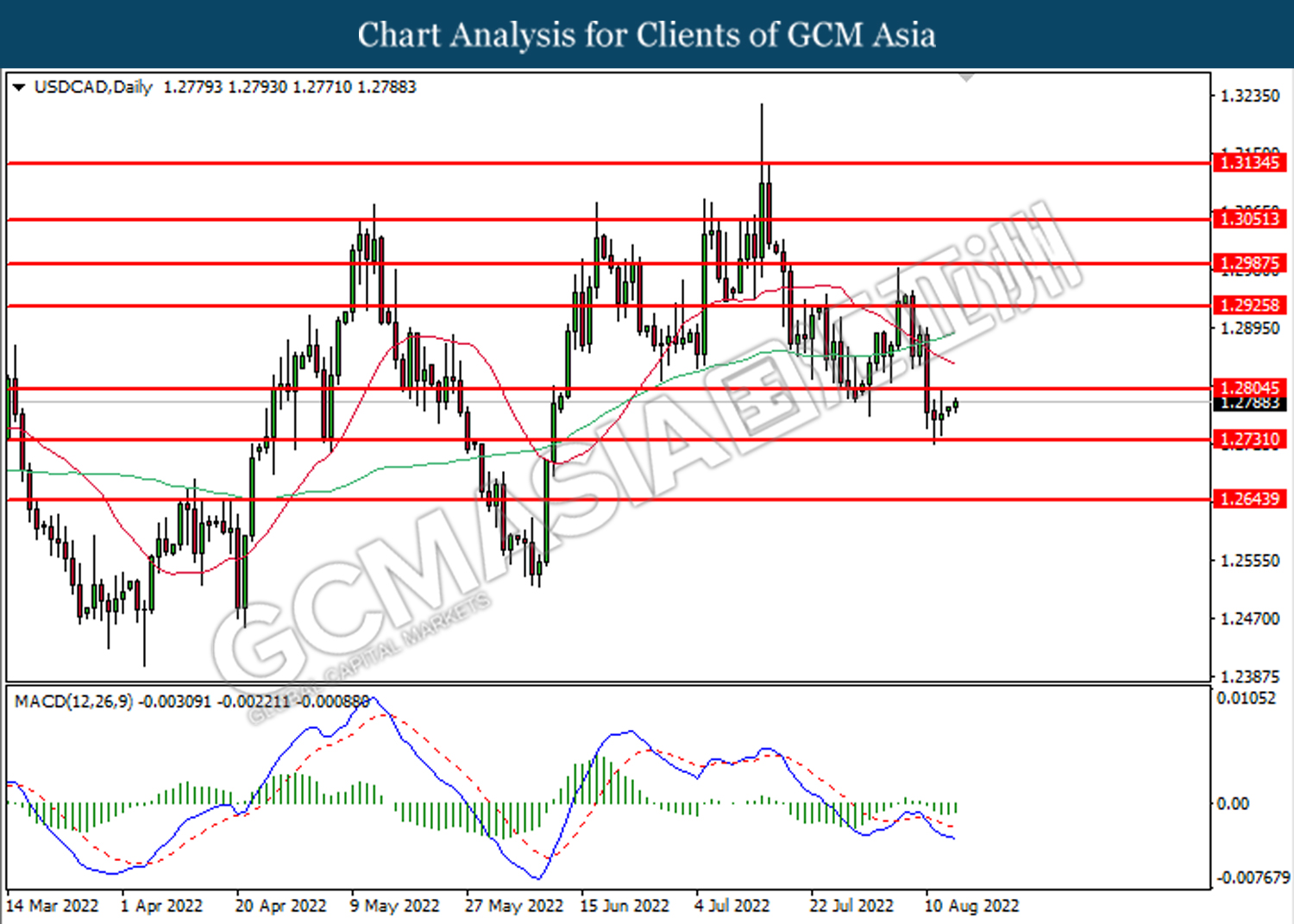

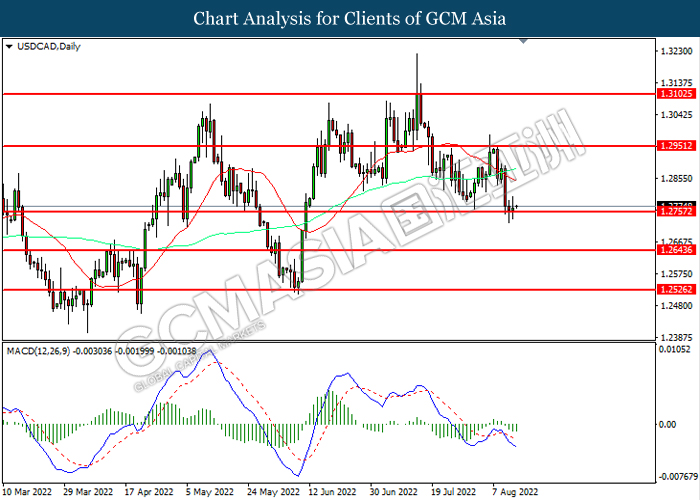

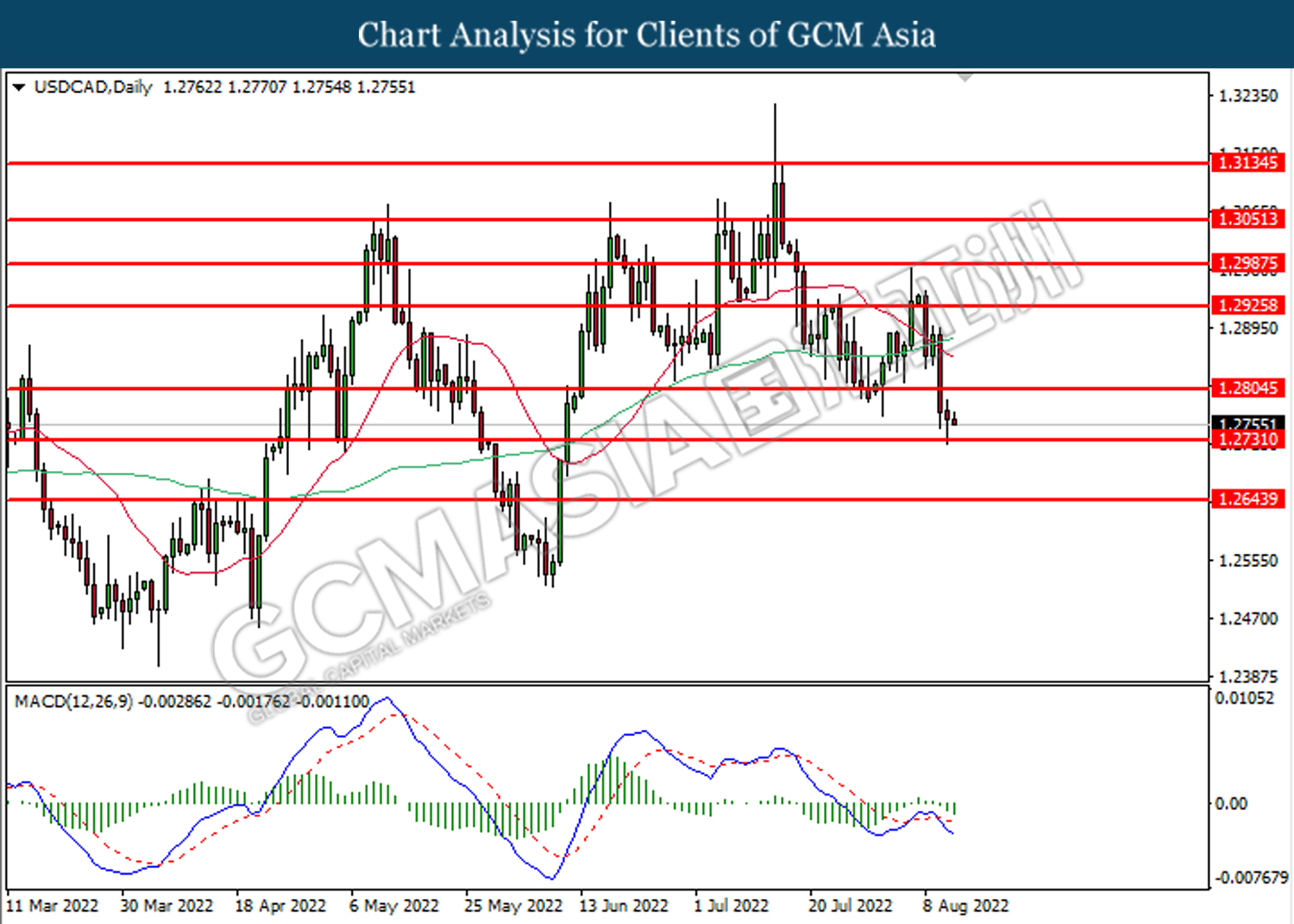

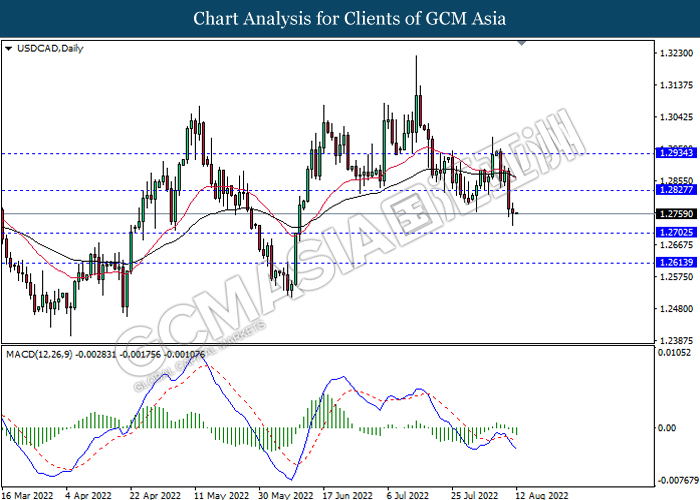

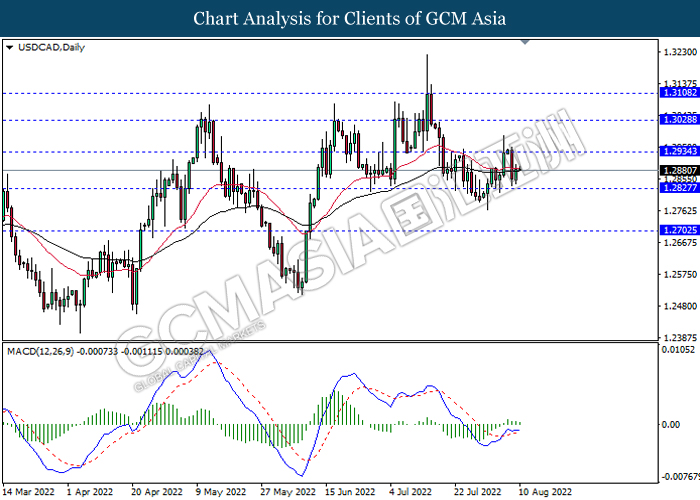

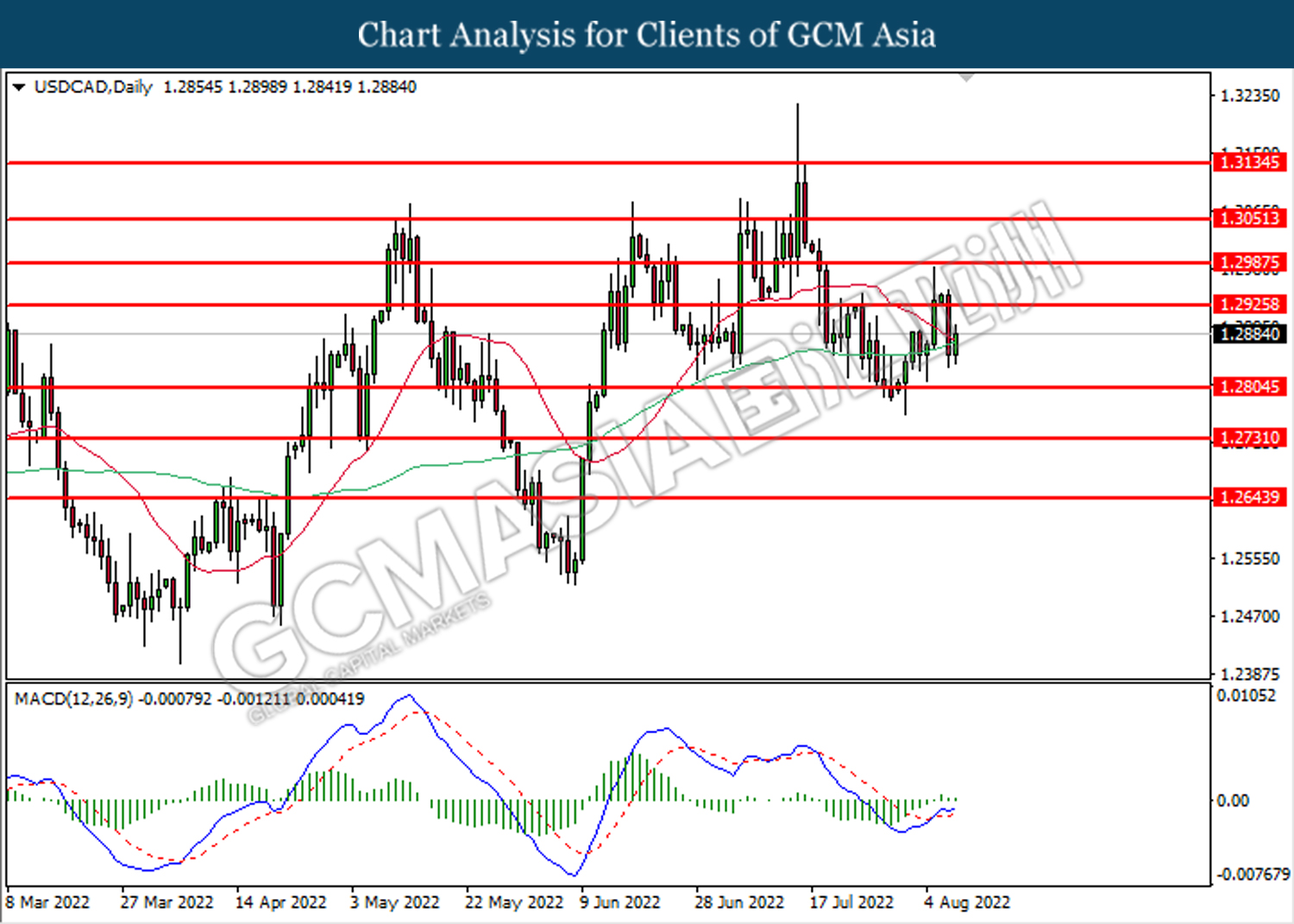

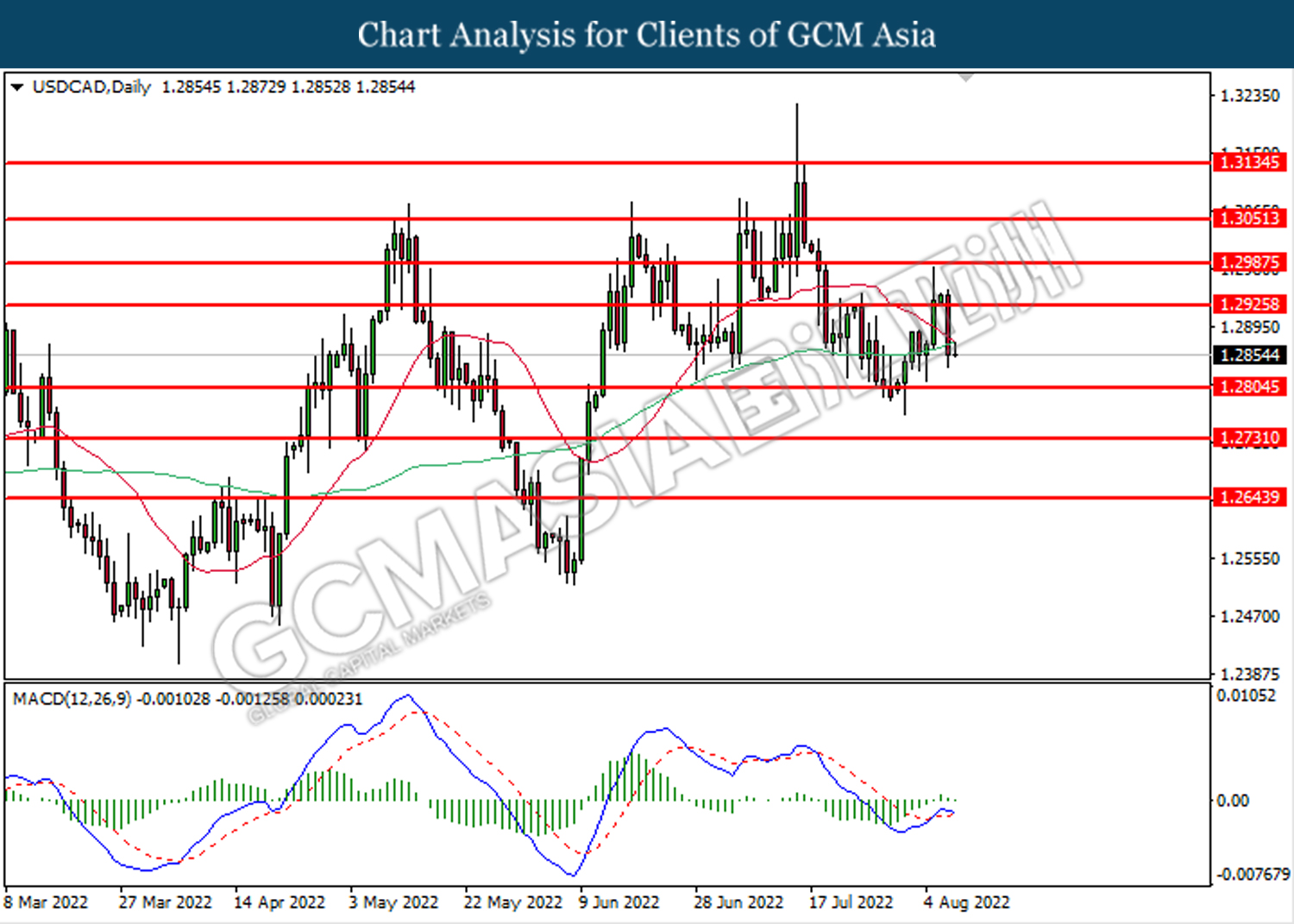

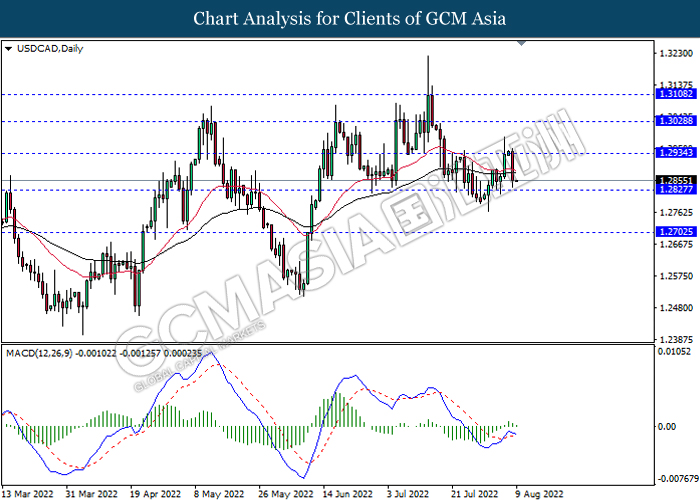

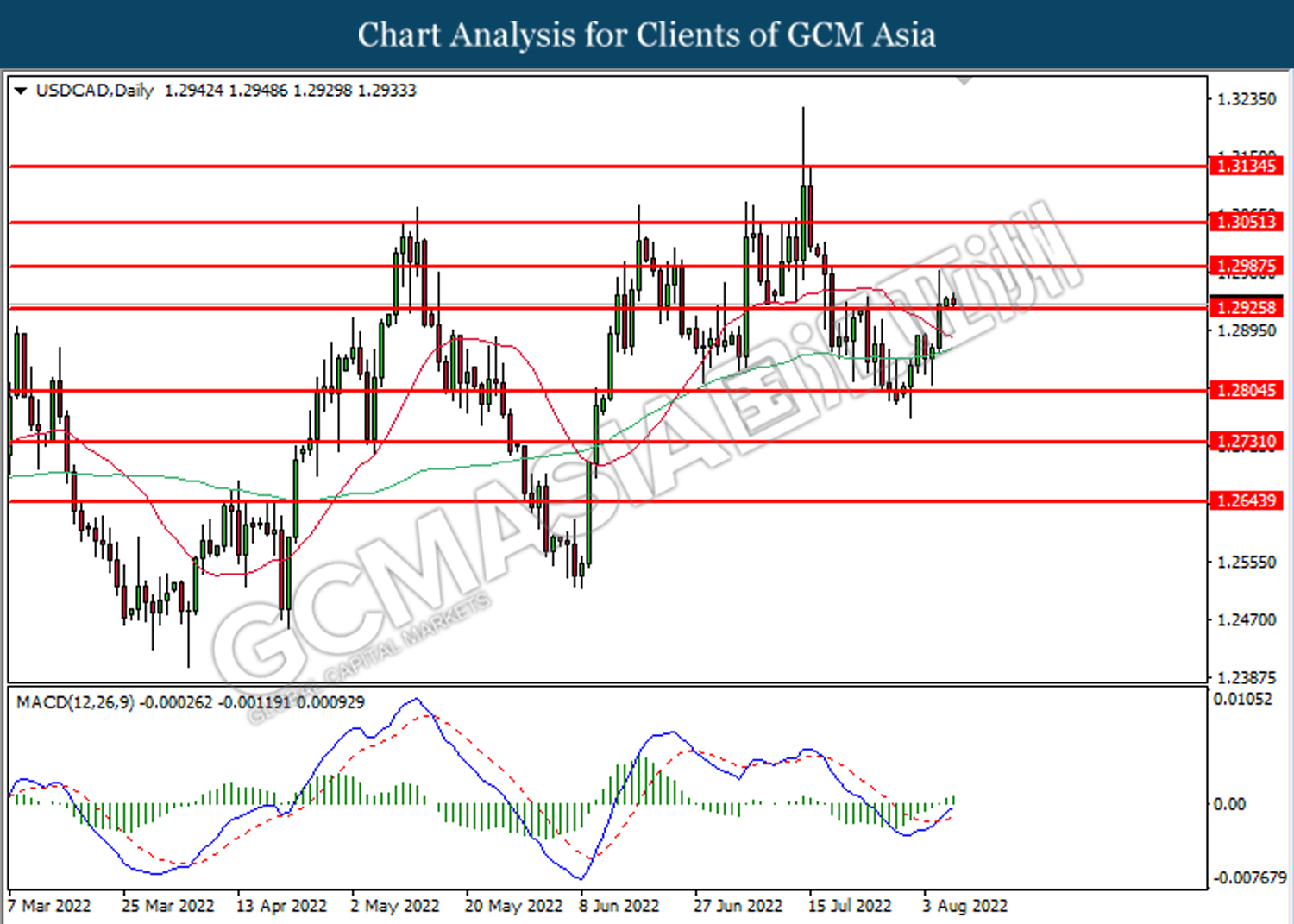

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.2950, 1.3105

Support level: 1.2755, 1.2645

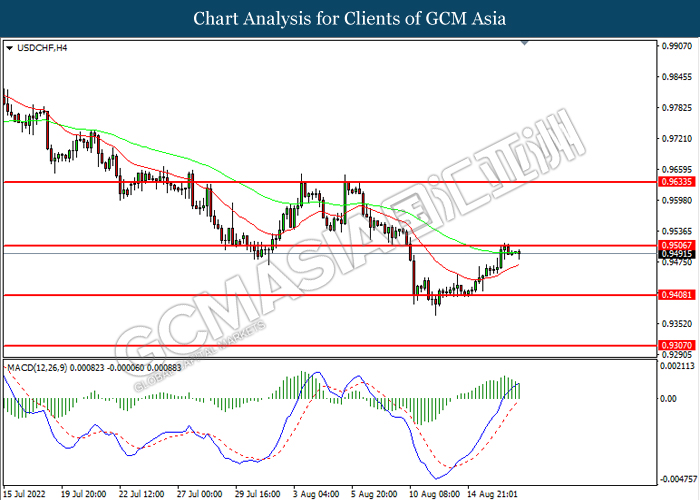

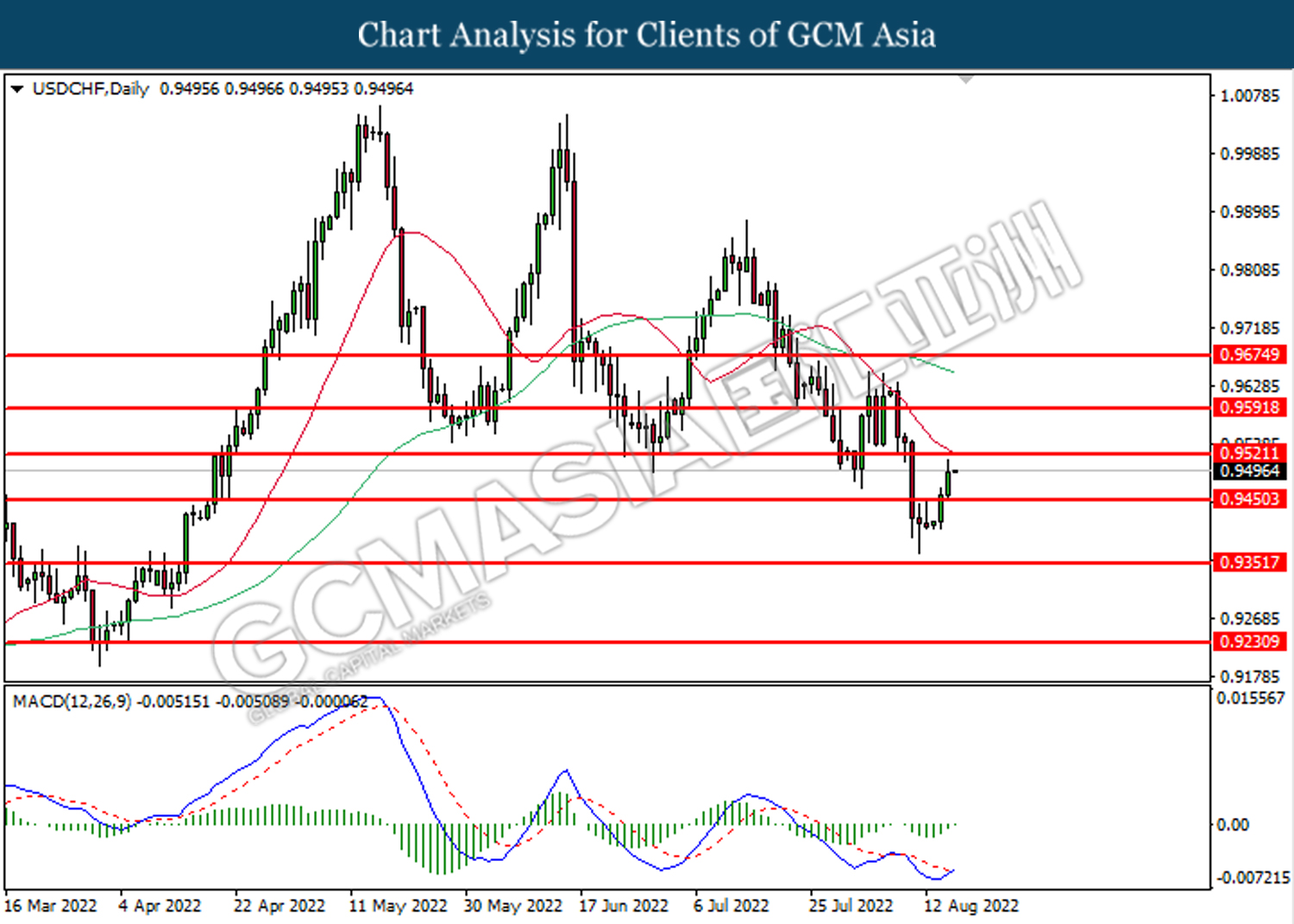

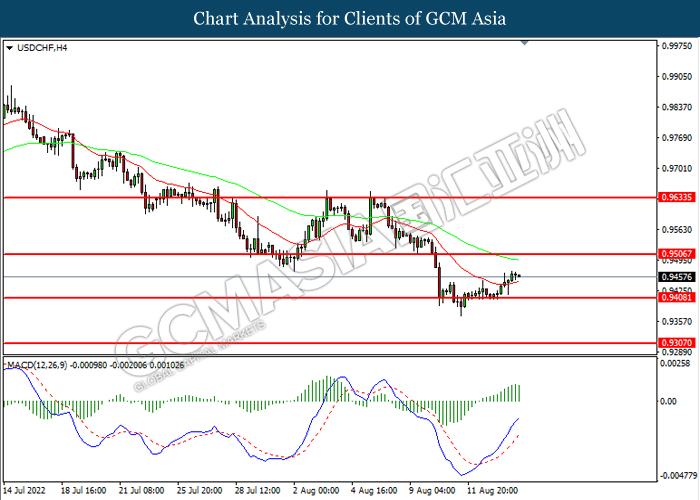

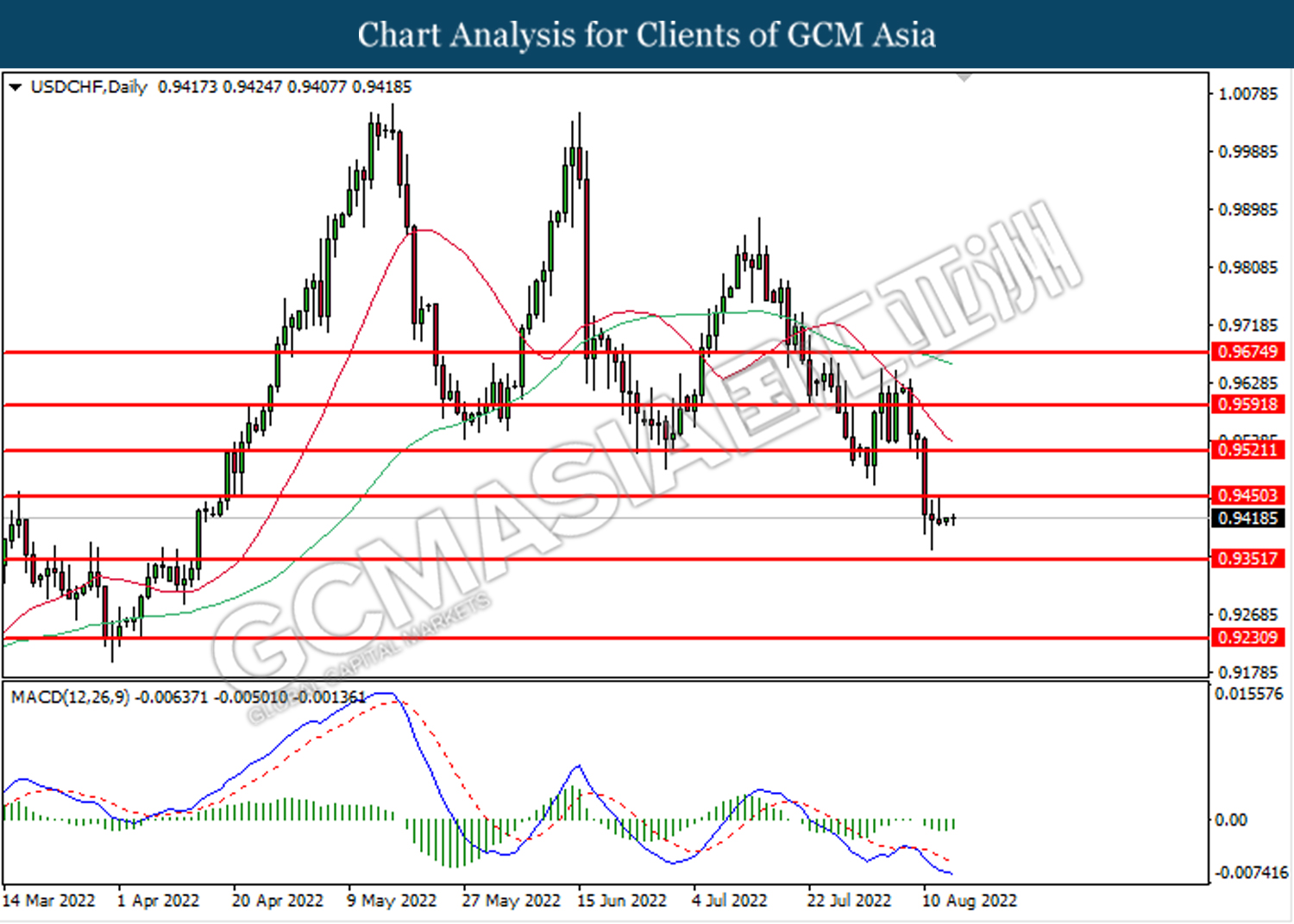

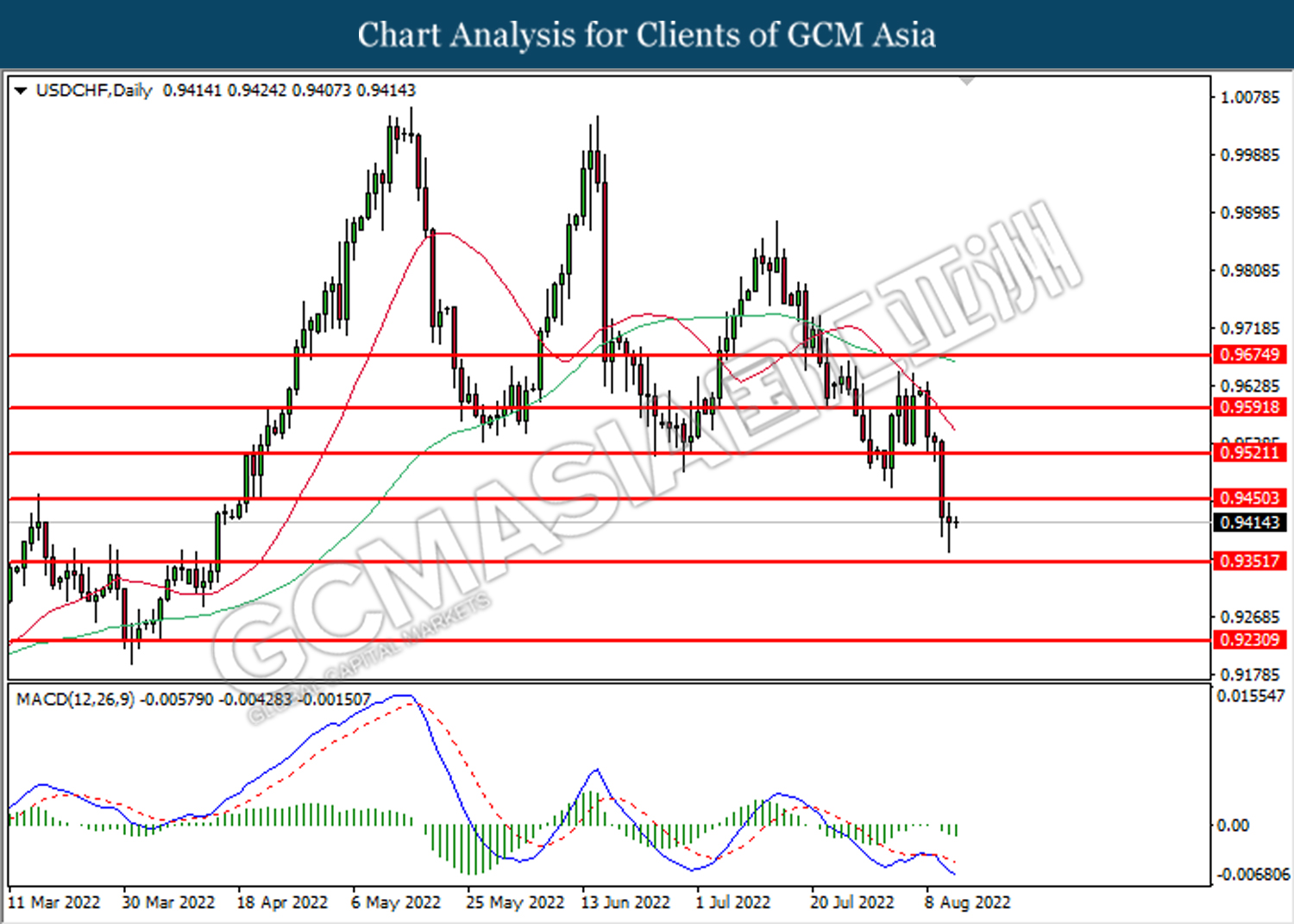

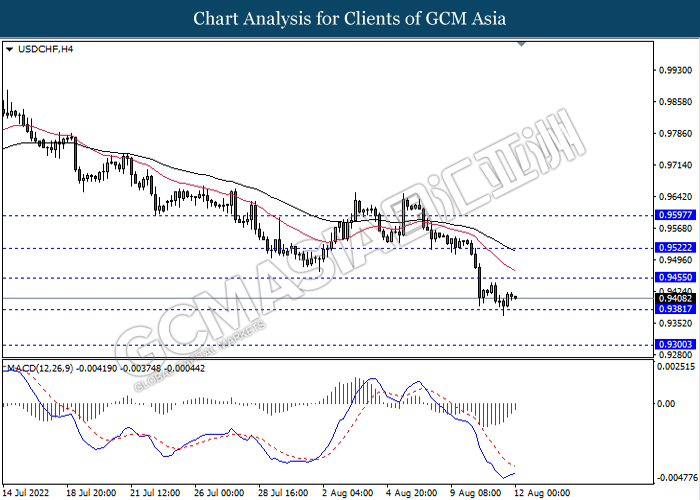

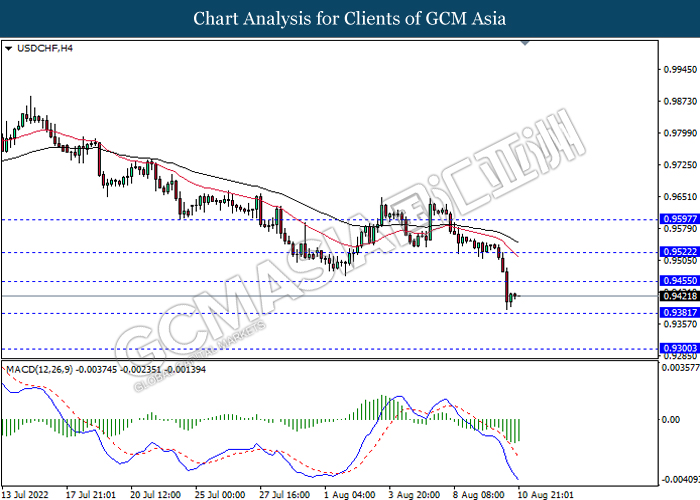

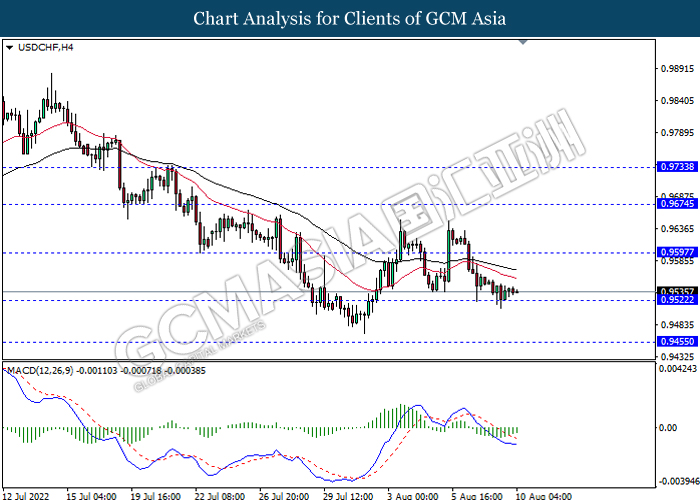

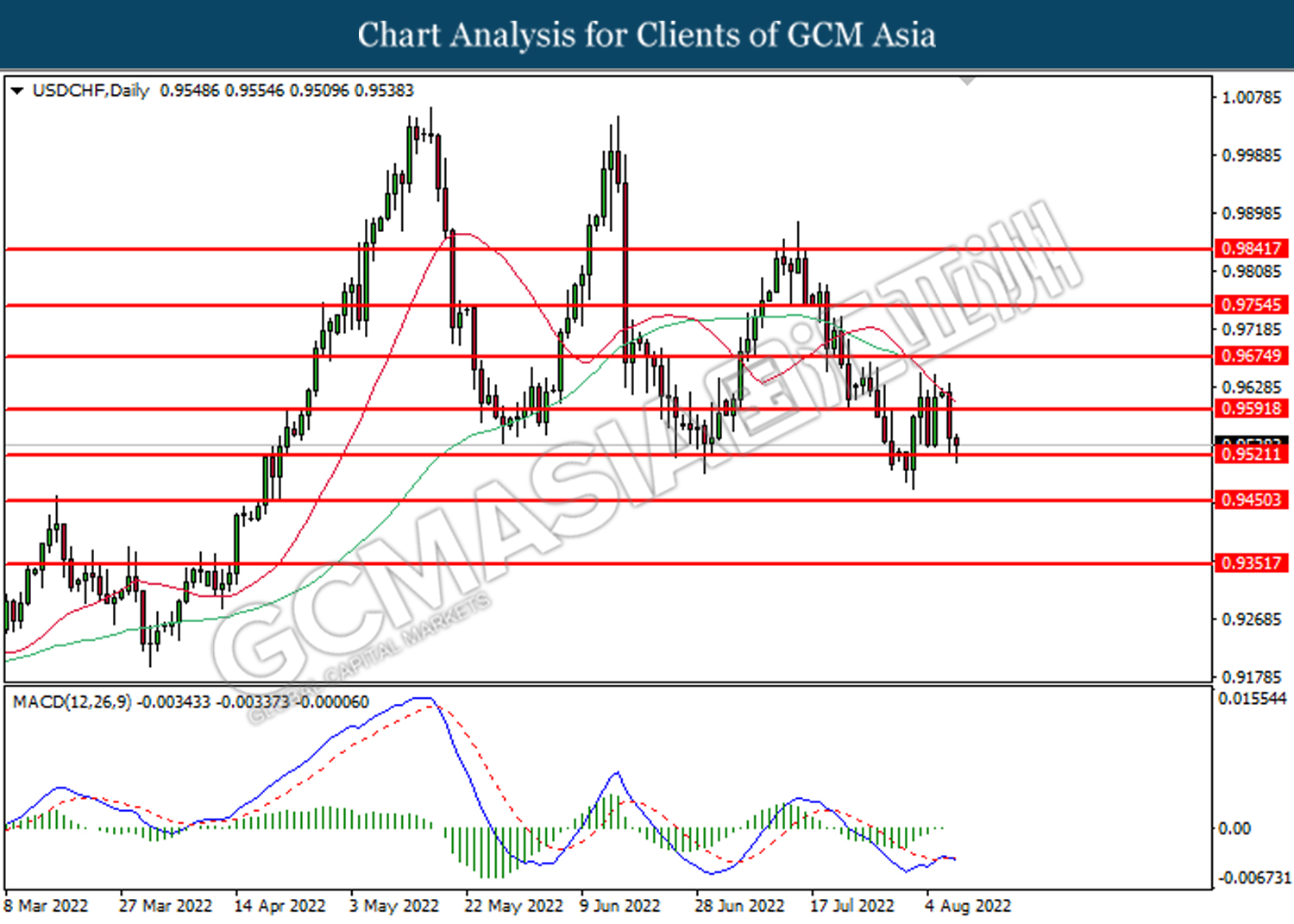

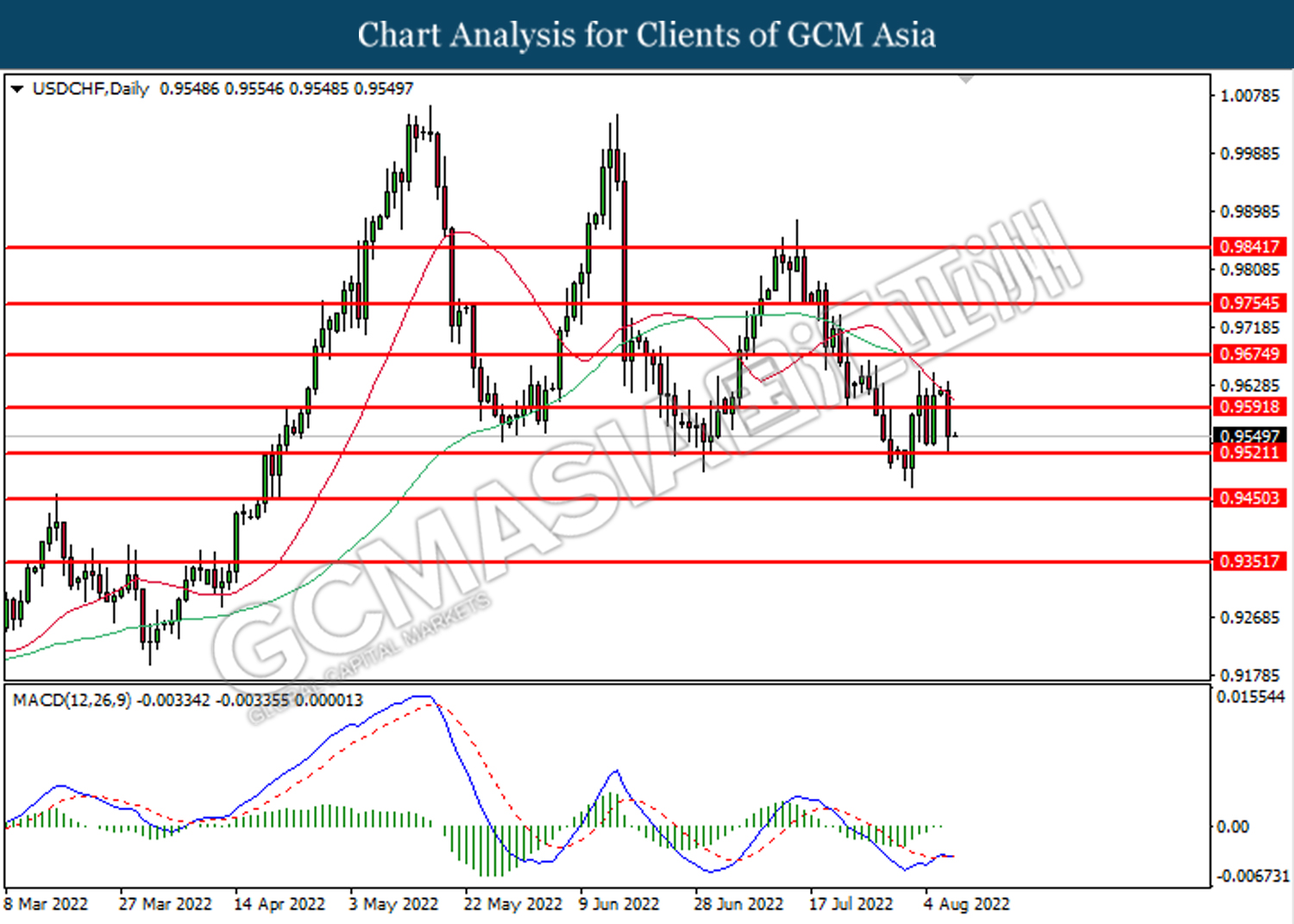

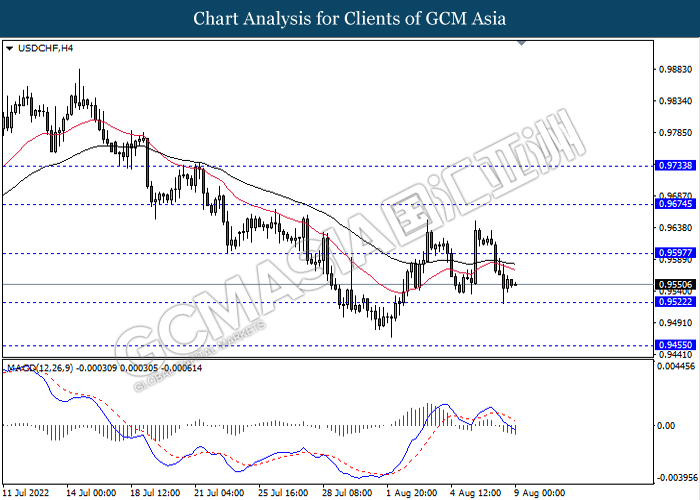

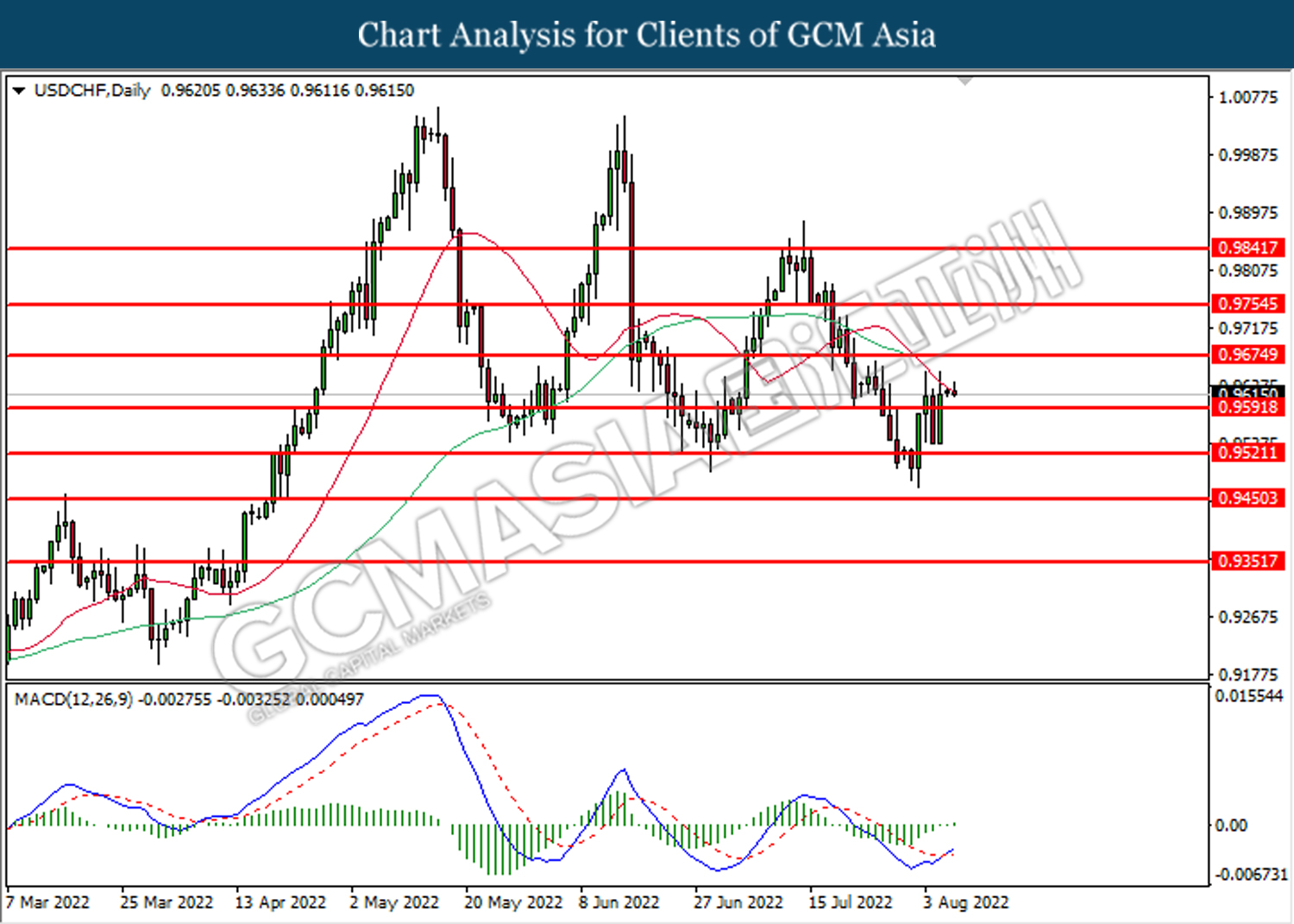

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9505, 0.9635

Support level: 0.9410, 0.9305

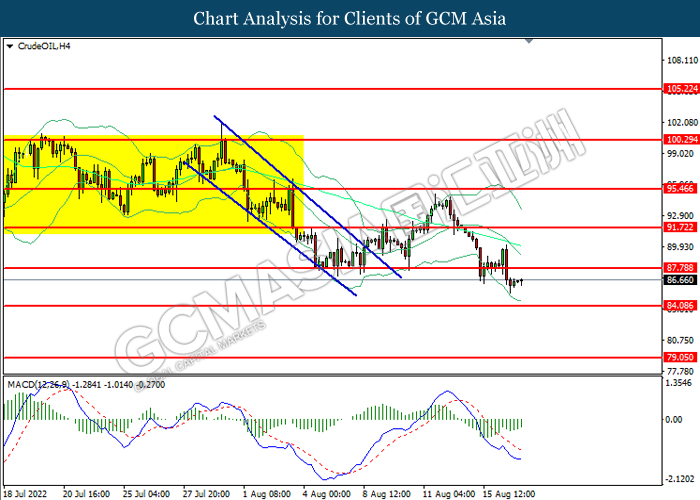

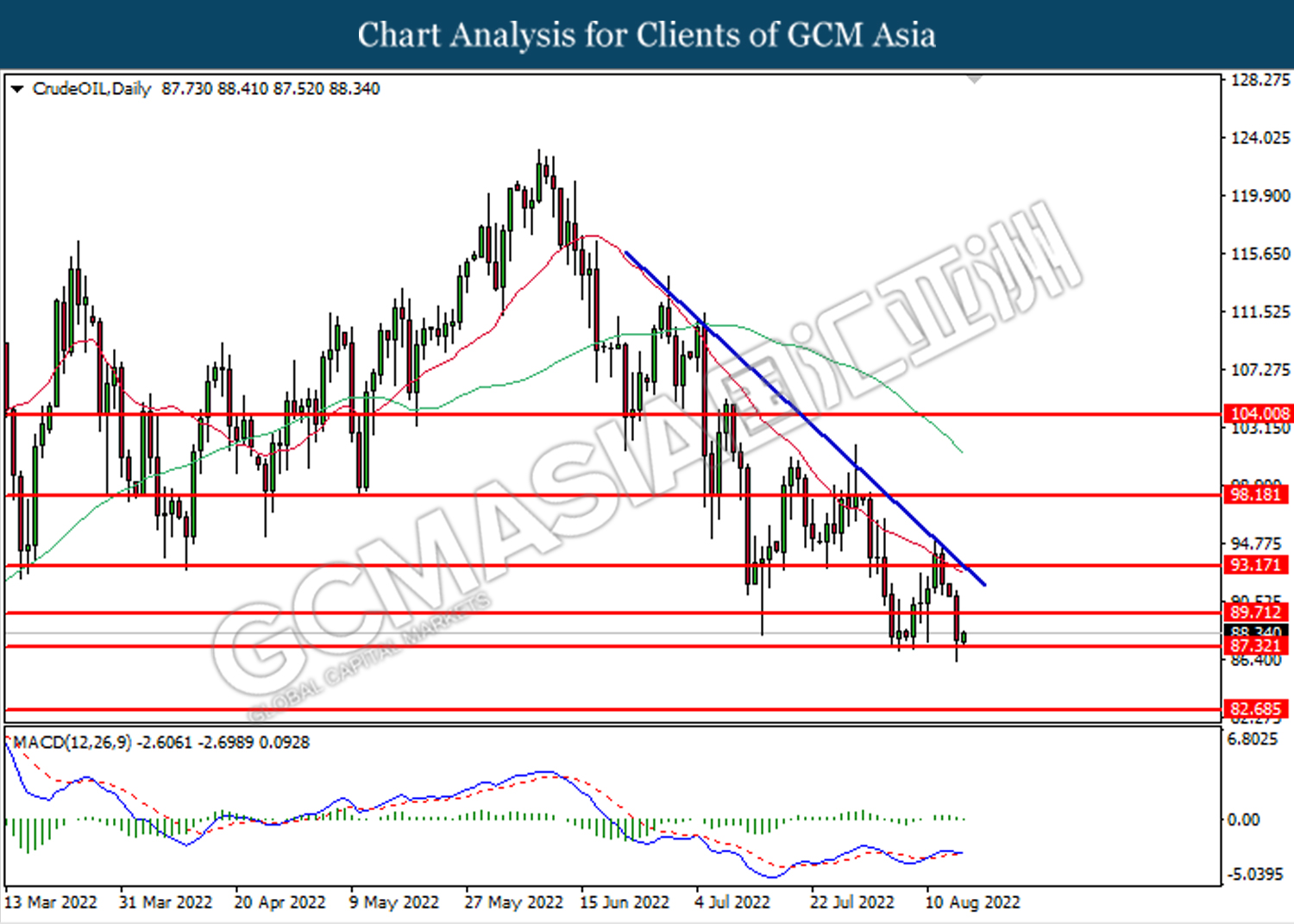

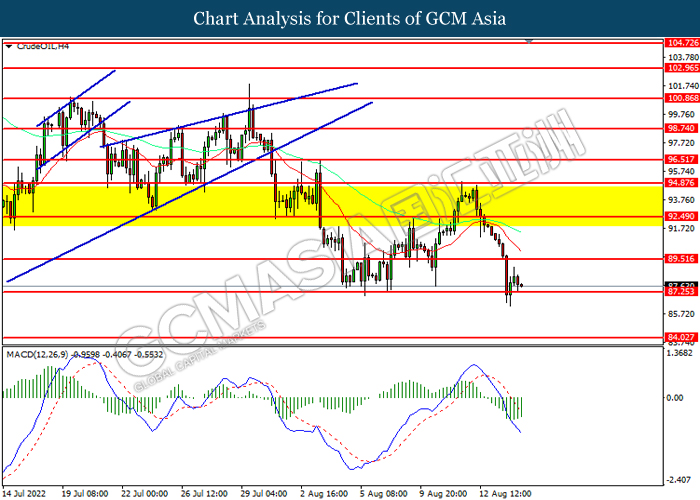

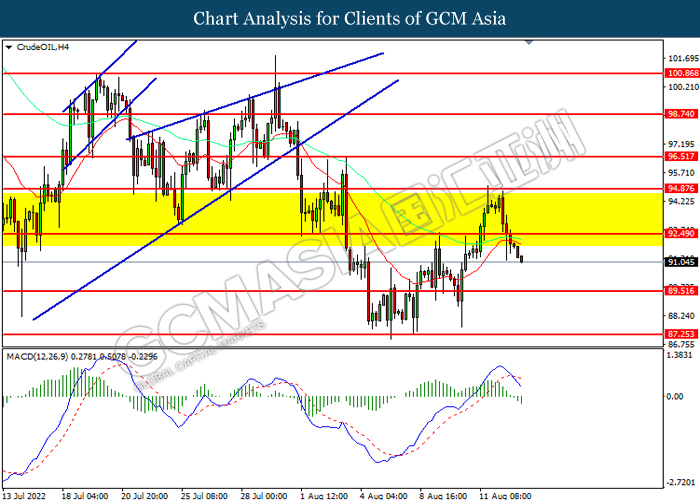

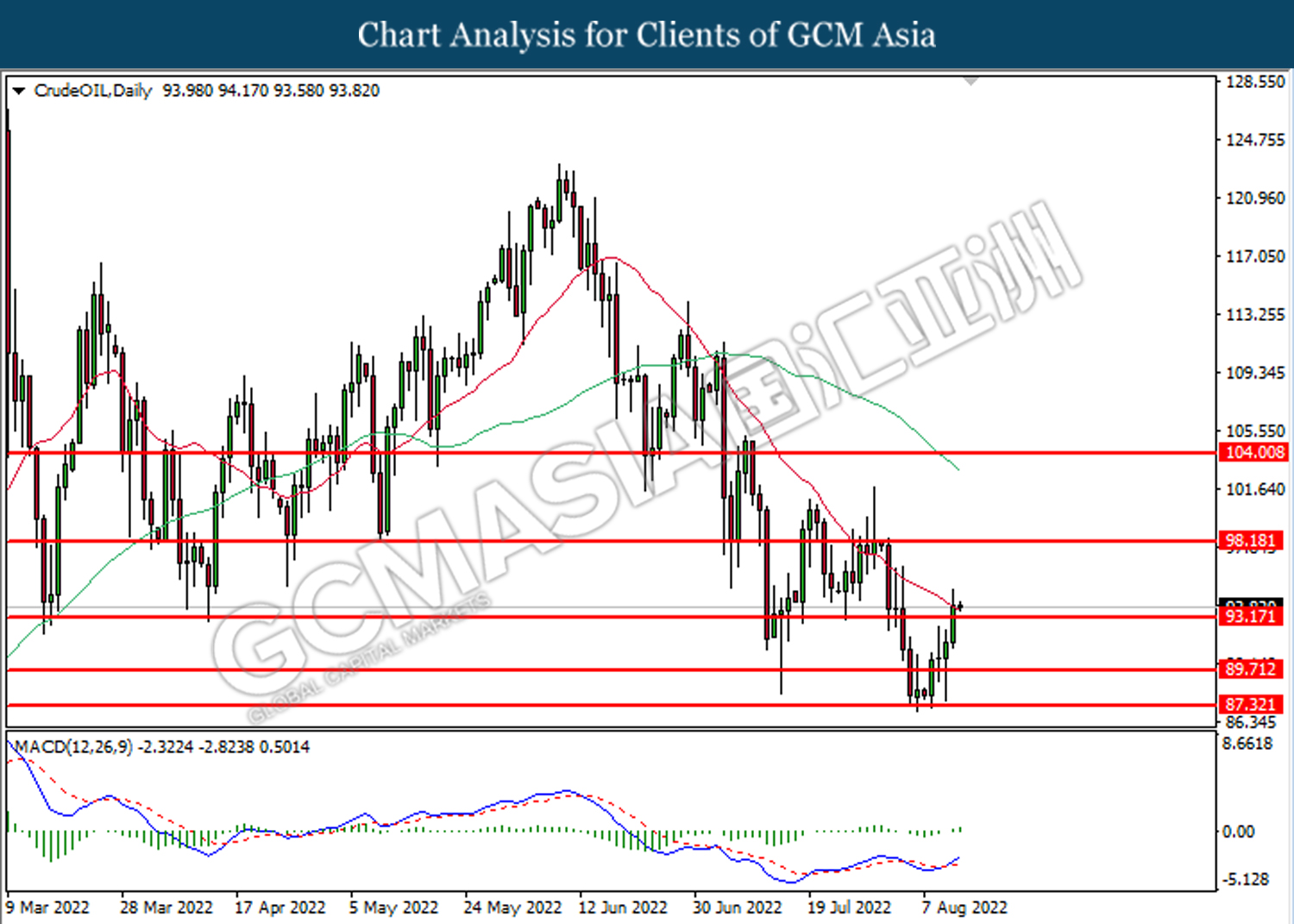

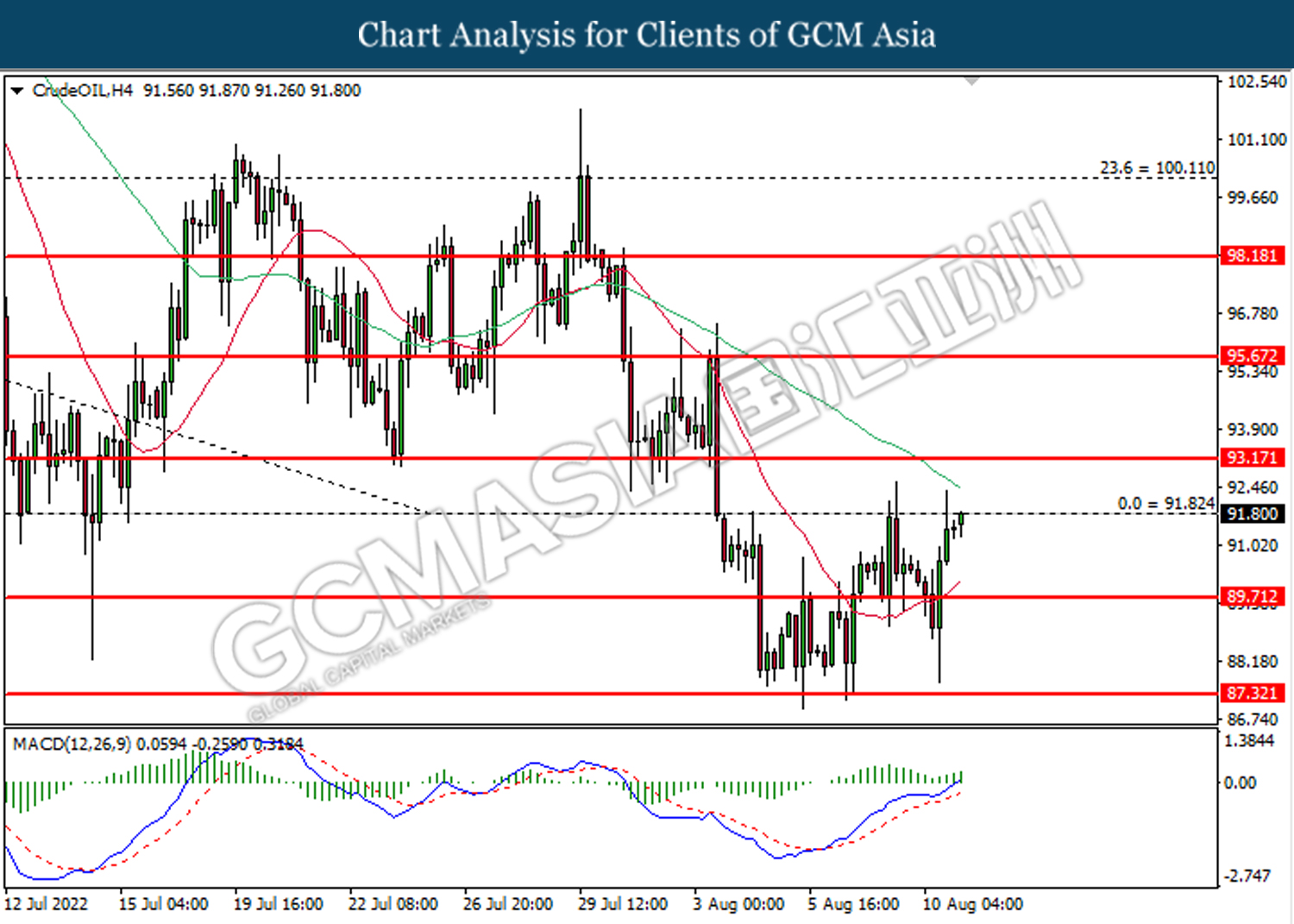

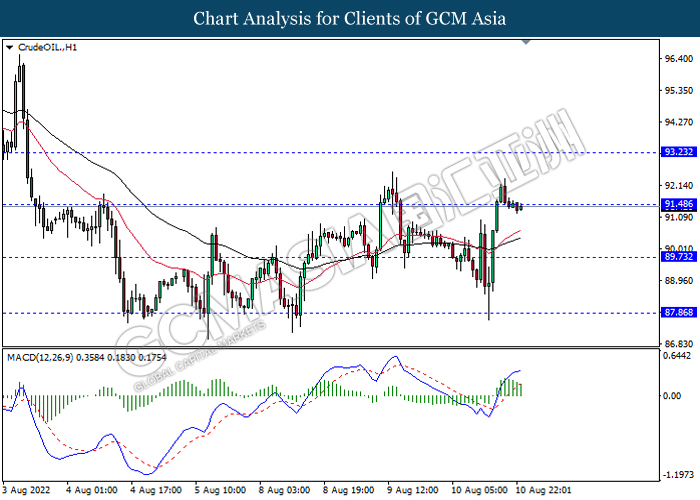

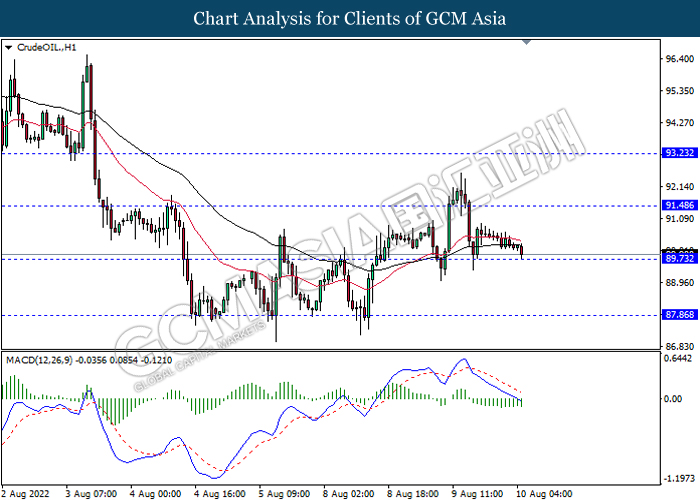

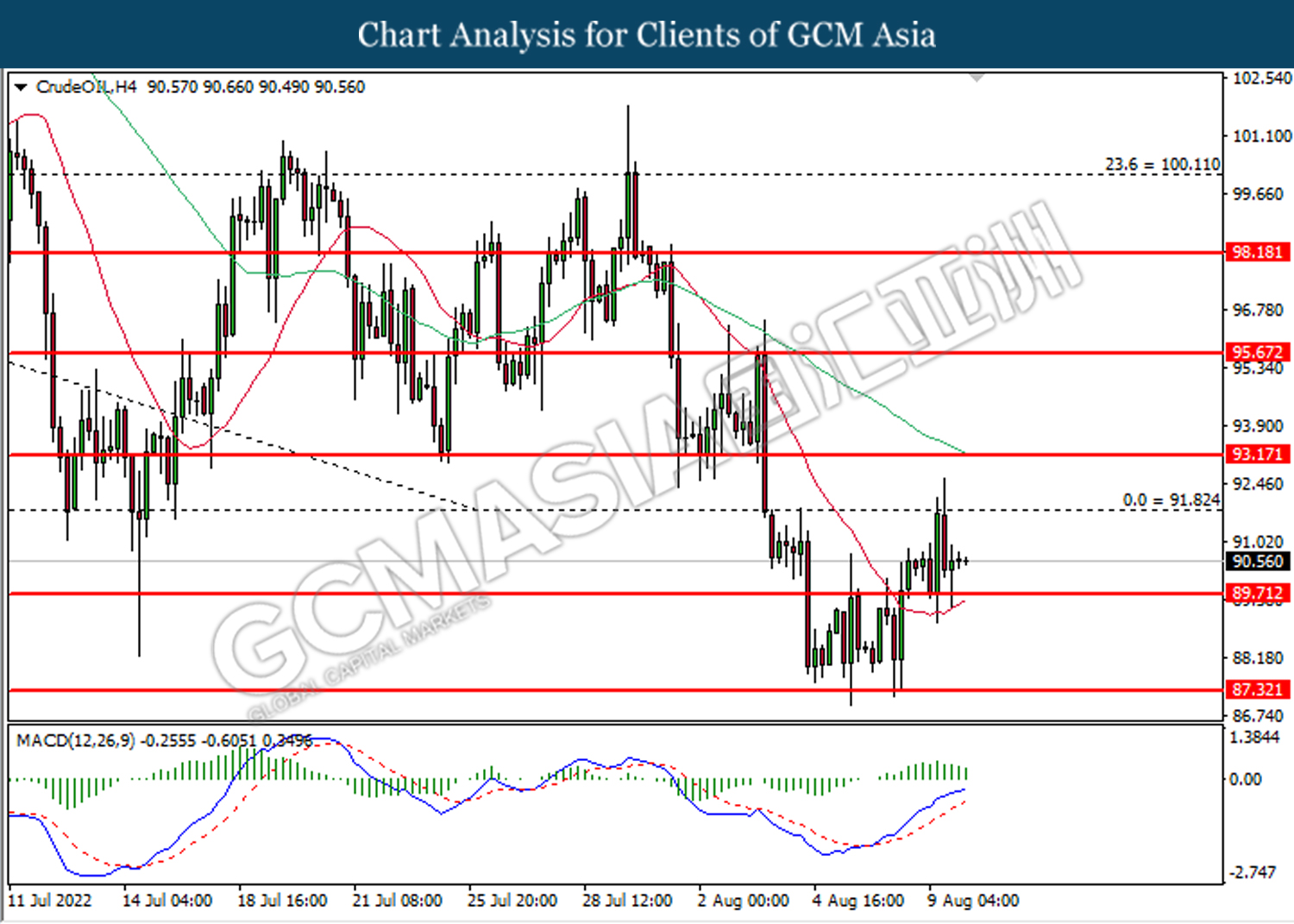

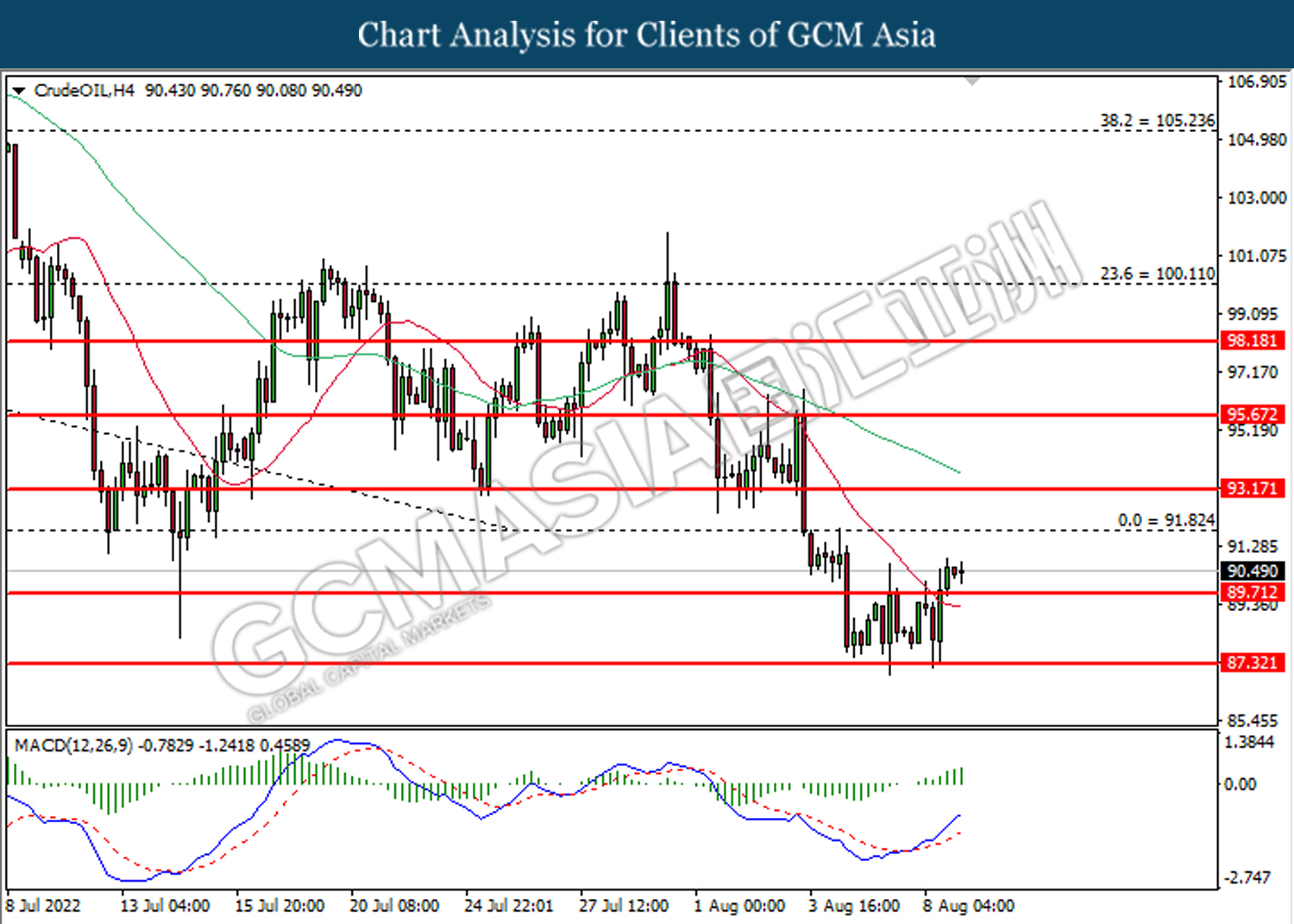

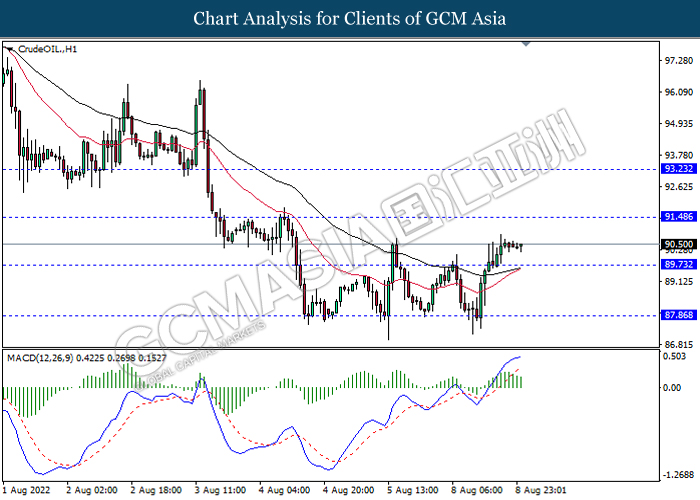

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 87.80, 91.70

Support level: 84.10, 79.05

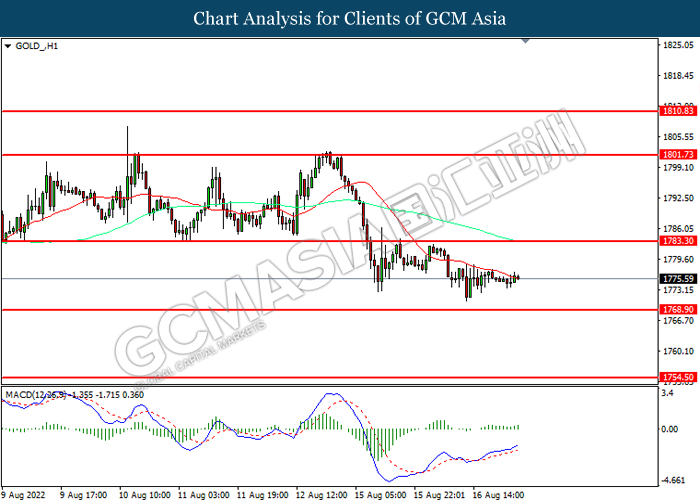

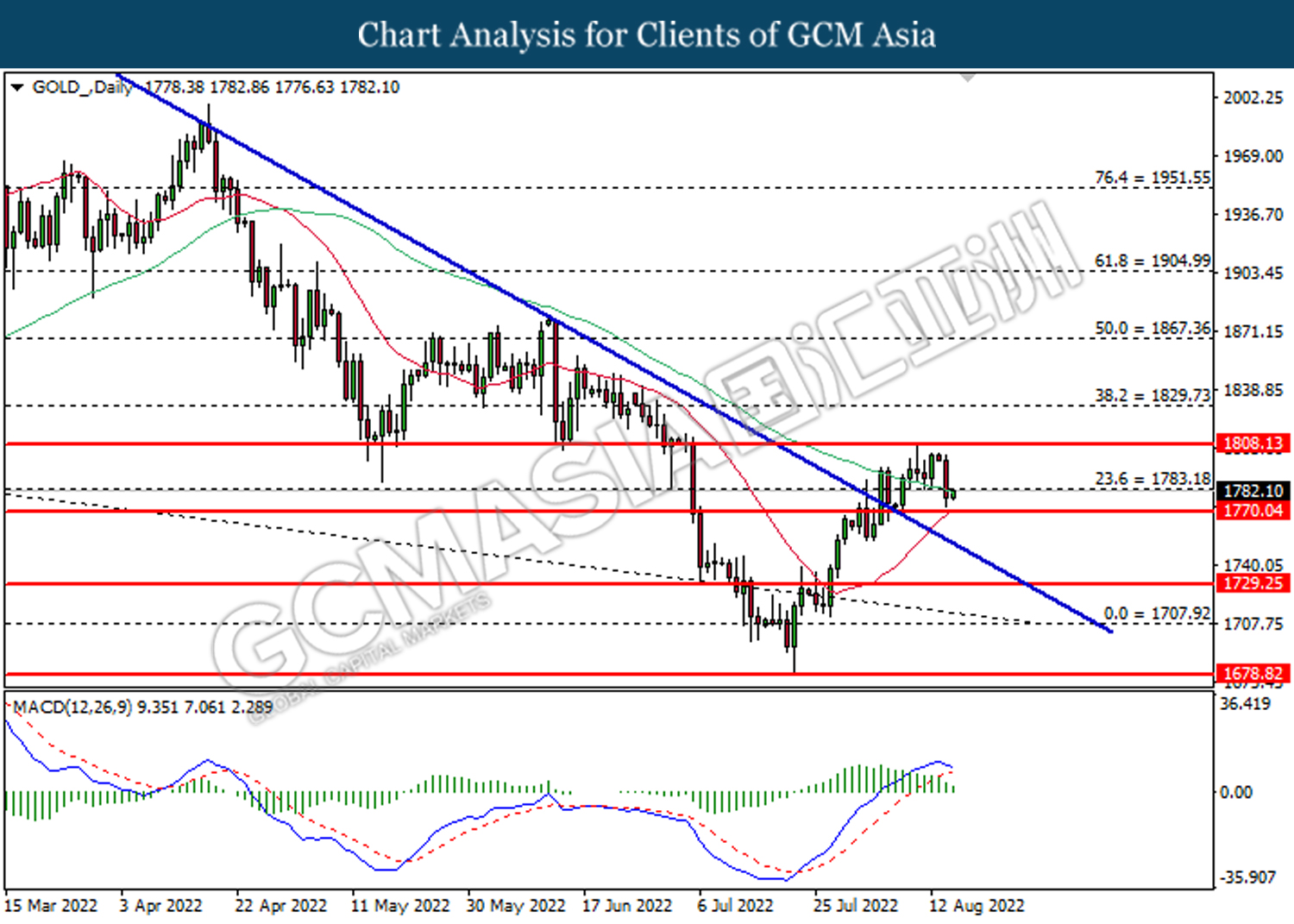

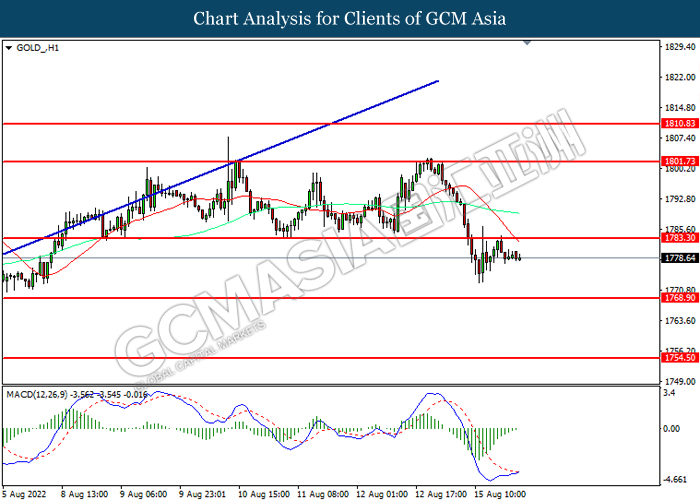

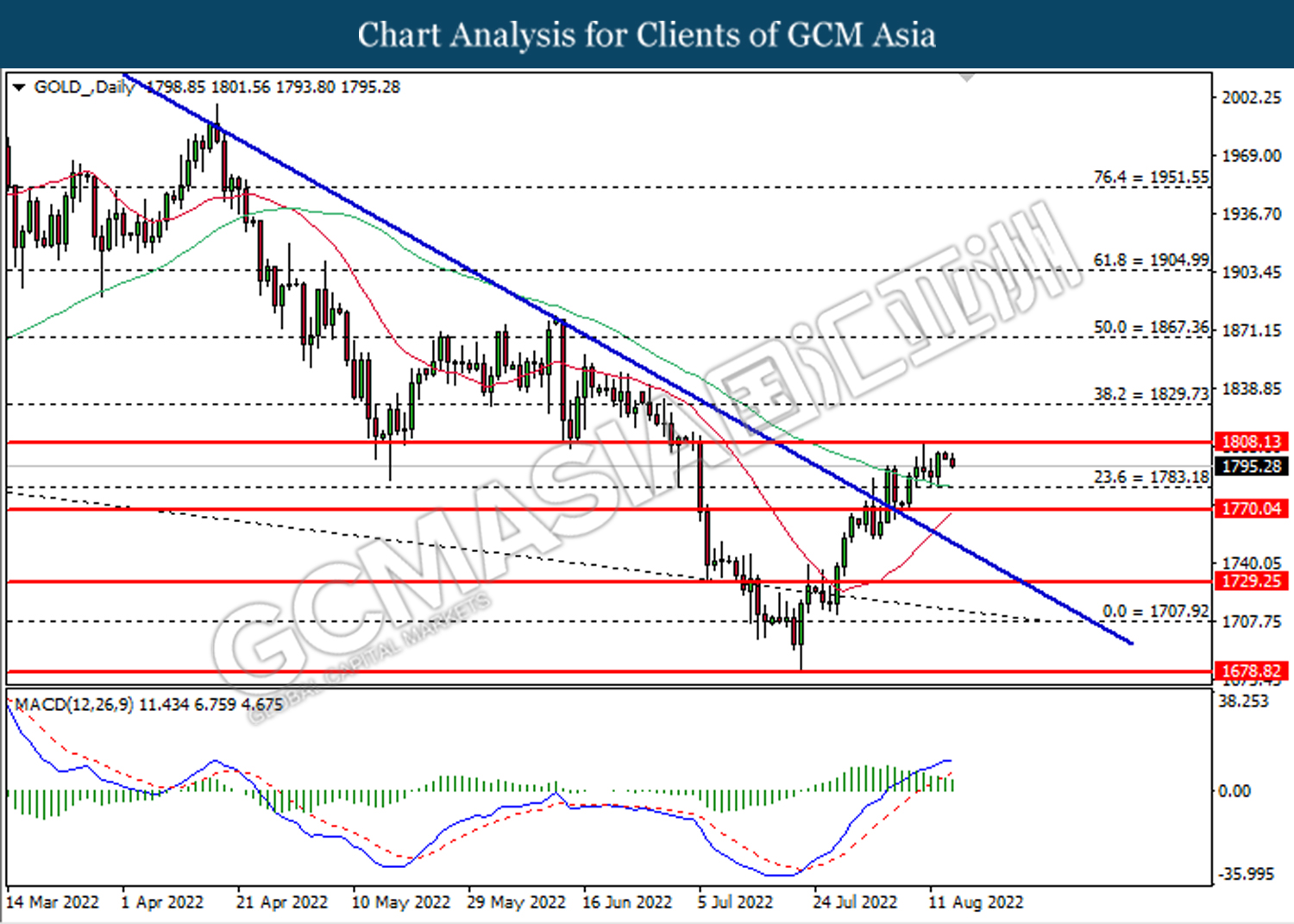

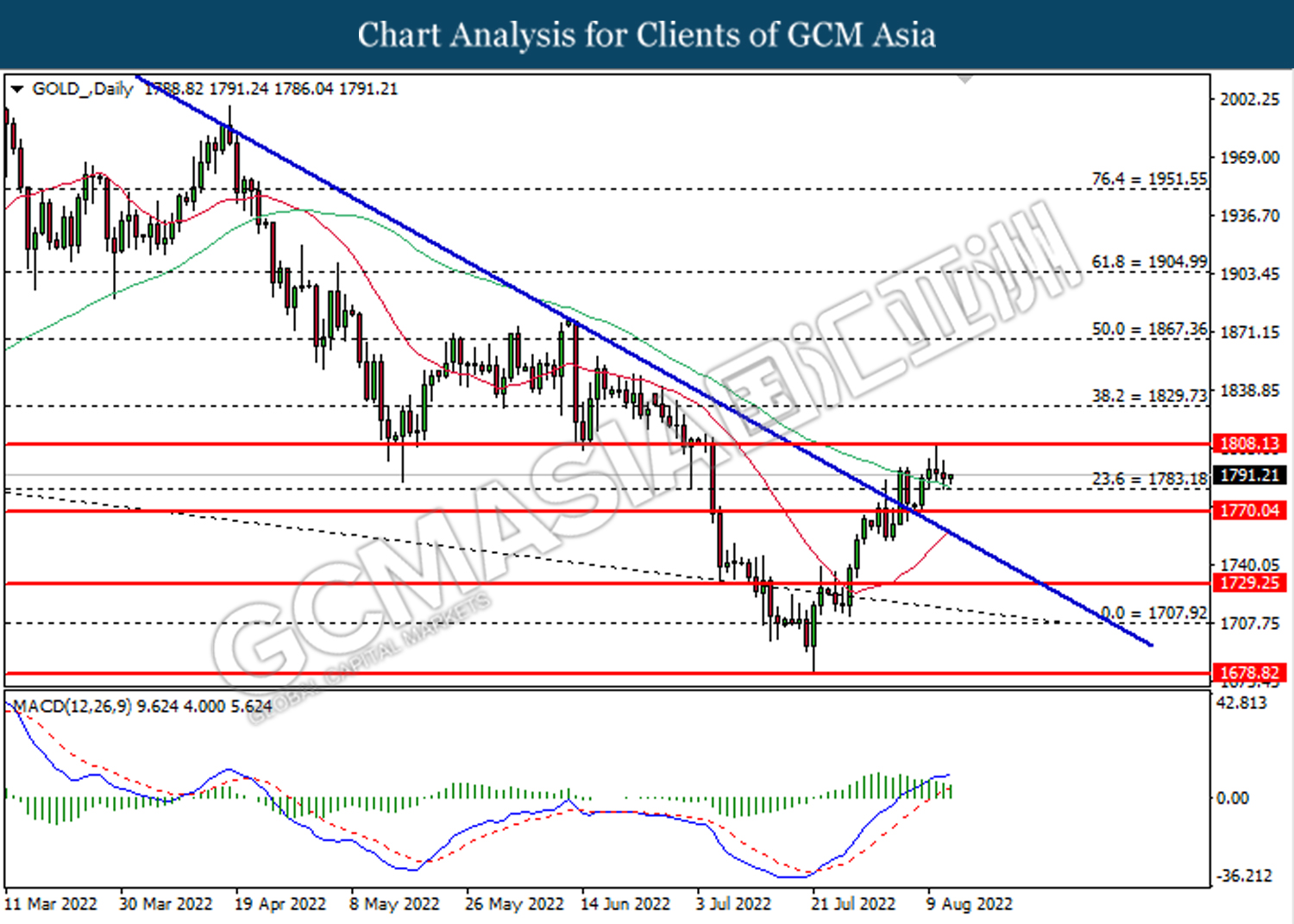

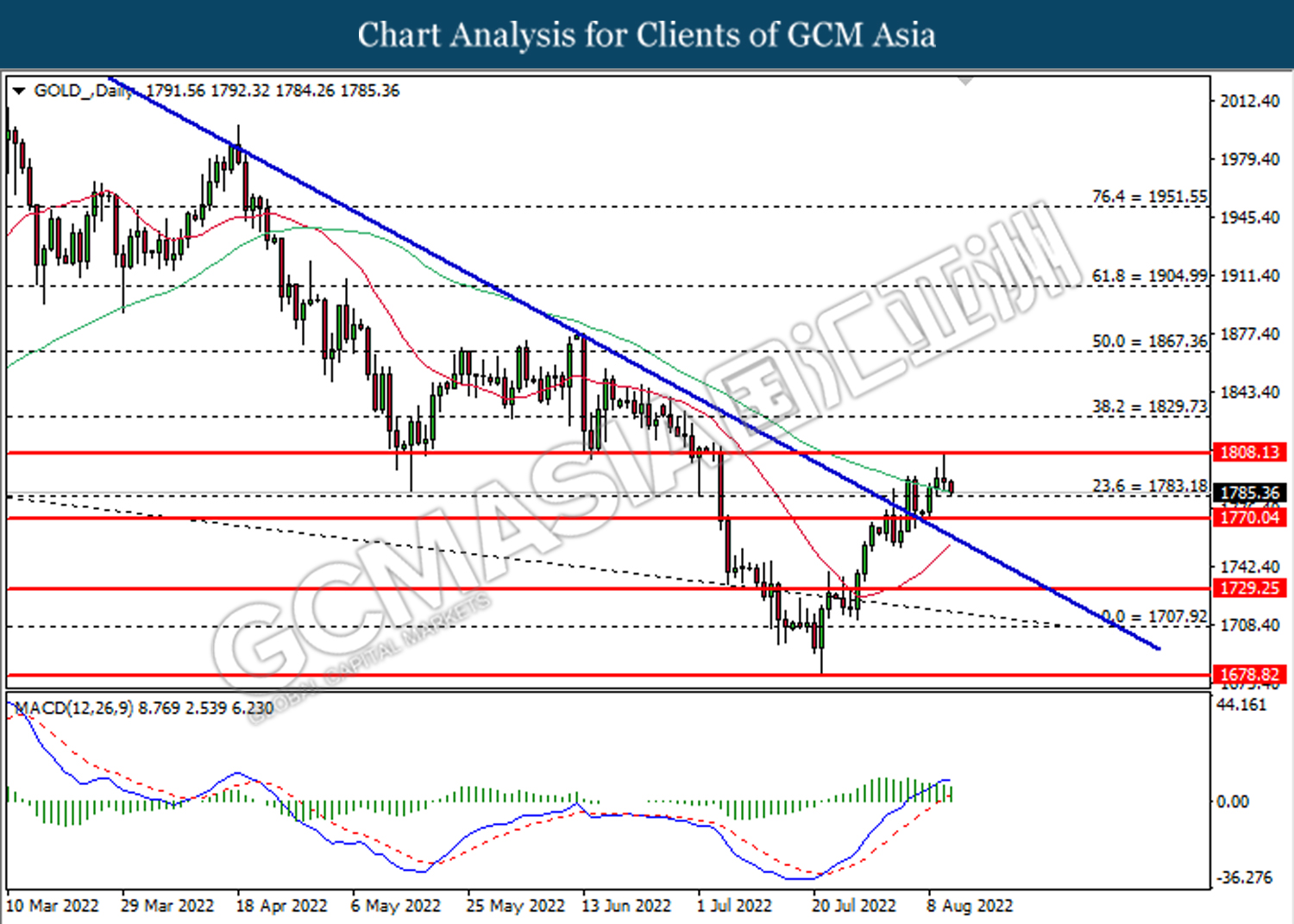

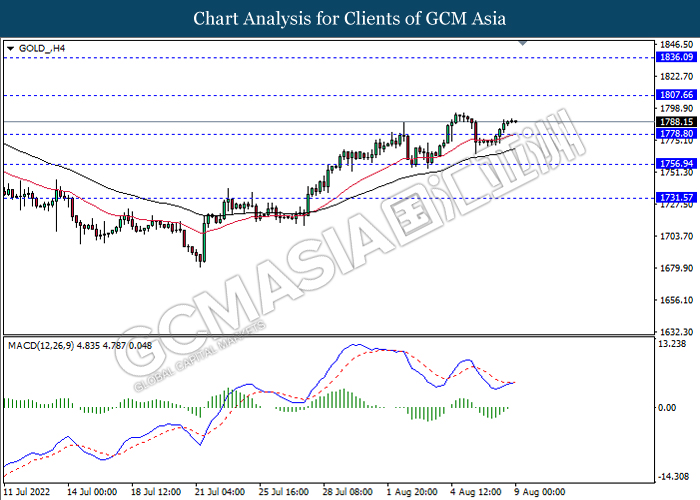

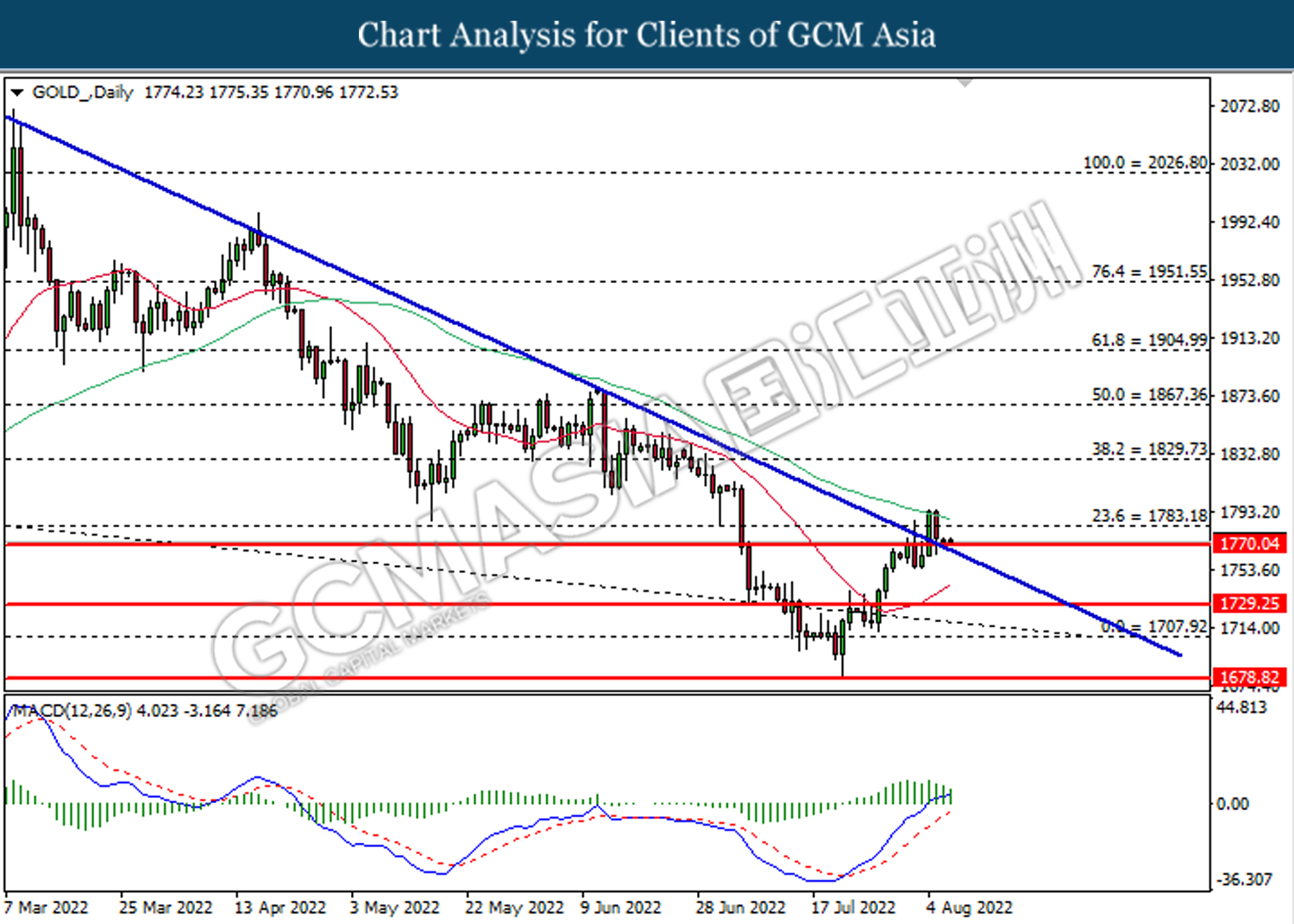

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1783.30, 1801.75

Support level: 1768.90, 1754.50

170822 Morning Session Analysis

17 August 2022 Morning Session Analysis

Dollar lingers ahead of Retail Sales and Fed meeting minutes.

The dollar index, which traded against a basket of six currencies, traded flat yesterday as the market participants are waiting for the data on retail sales in the US as well as the central bank’s meeting minutes of the July meeting. Since the beginning of this week, the dollar index has bounced back from the six-week low as the heightening of global recession risk triggered the market risk-off sentiment, prompting the investors’ demand for the safe haven currency. It is noteworthy to mention that the US delegation’s visit to Taiwan has further increased the uncertainty in the global outlook as China immediately announced a fresh military drill near Taiwan as a dissatisfying response to the issue. Besides, Russian President Vladimir Putin also accused the US is seeking to prolong the conflict in Ukraine as the nation is obviously trying to fuel the conflicts elsewhere in the world. On the other side, the greenback managed to regain its previous losses as investors ramped up the bets that the US would continue to hike rates aggressively as the Fed officials maintained their hawkish tone on the tightening path of the monetary policy. At this juncture, investors will eye the crucial economic data such as Retail Sales, as well as the Fed meeting minutes to scrutiny the aggressiveness of the rate hike going forward. As of writing, the dollar index dropped 0.06% to 106.50.

In the commodities market, the crude oil price is down 0.36% to $86.50 a barrel amid the uncertainty over the Iran nuclear deal, where the investors are not sure if the US and Iran will achieve a consensus on sealing a deal. Besides, the gold prices appreciated by 0.01% to $1775.35 a troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 NZD RBNZ Press Conference

02:00 USD FOMC Meeting Minutes

(18th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 10:00 | NZD – RBNZ Interest Rate Decision | 2.50% | 3.00% | – |

| 14:00 | GBP – CPI (YoY) (Jul) | 9.4% | 9.8% | – |

| 20:30 | USD – Core Retail Sales (MoM) (Jul) | 1.0% | -0.1% | – |

| 20:30 | USD – Retail Sales (MoM) (Jul) | 1.0% | 0.1% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 5.458M | -0.275M | – |

Technical Analysis

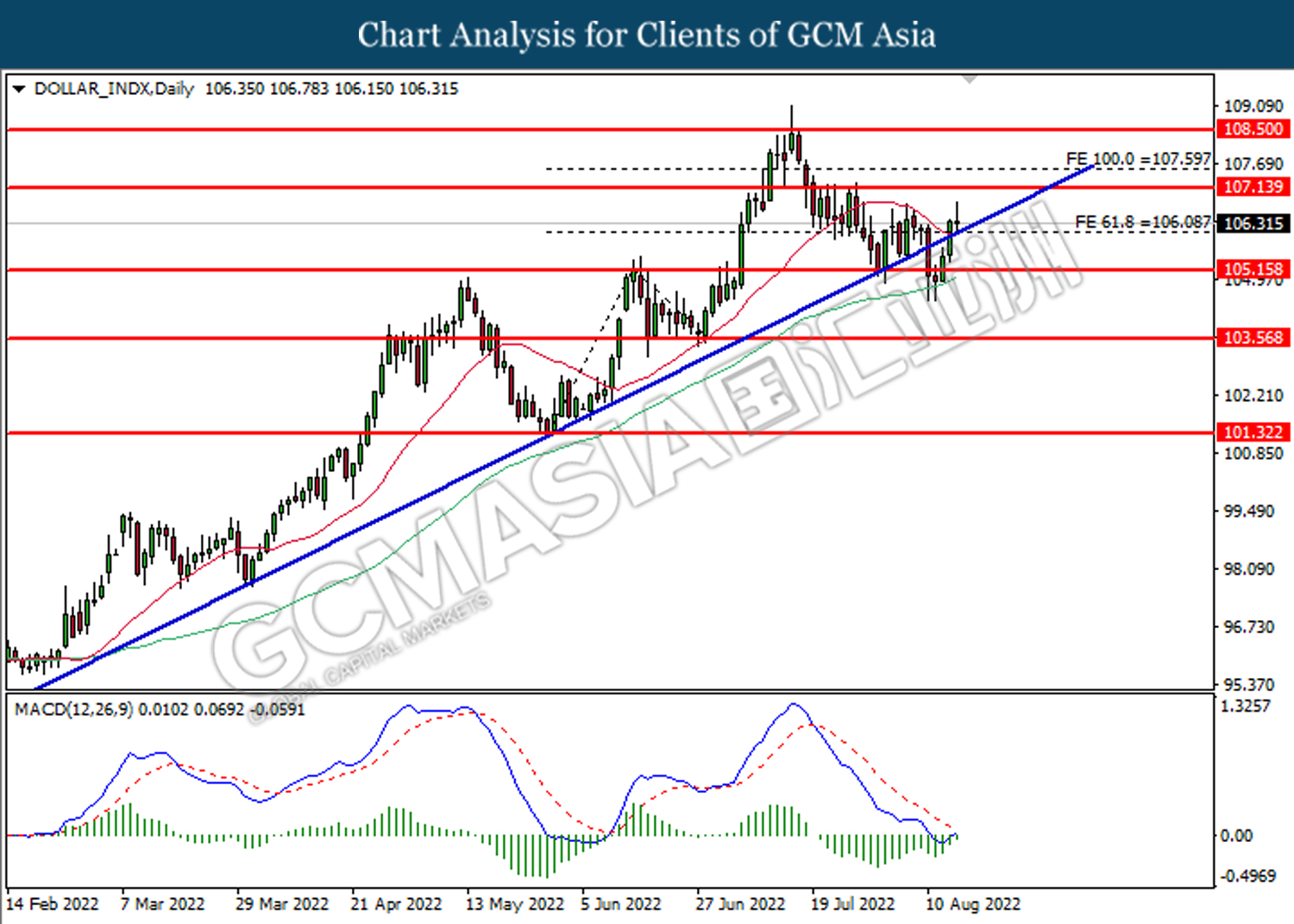

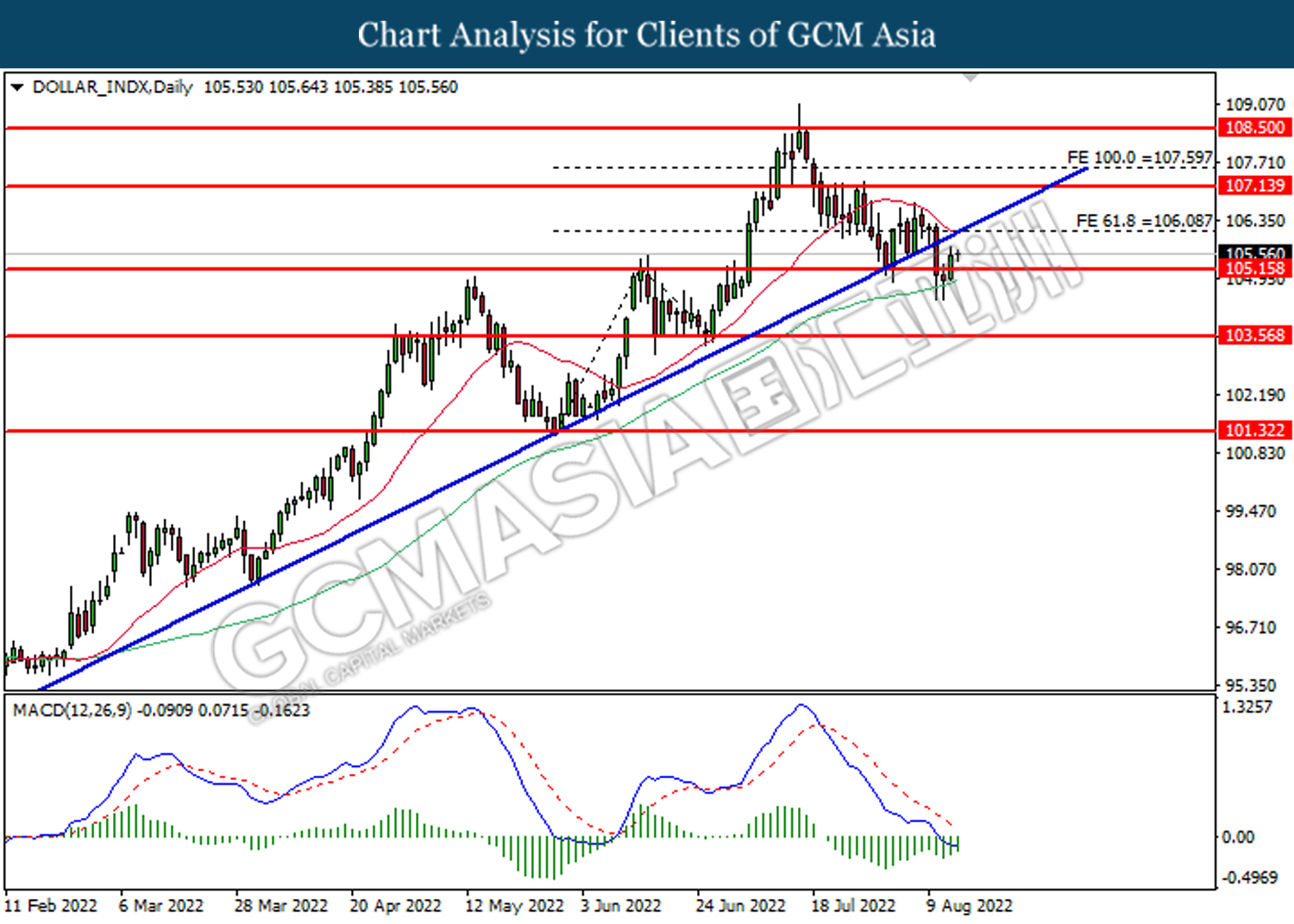

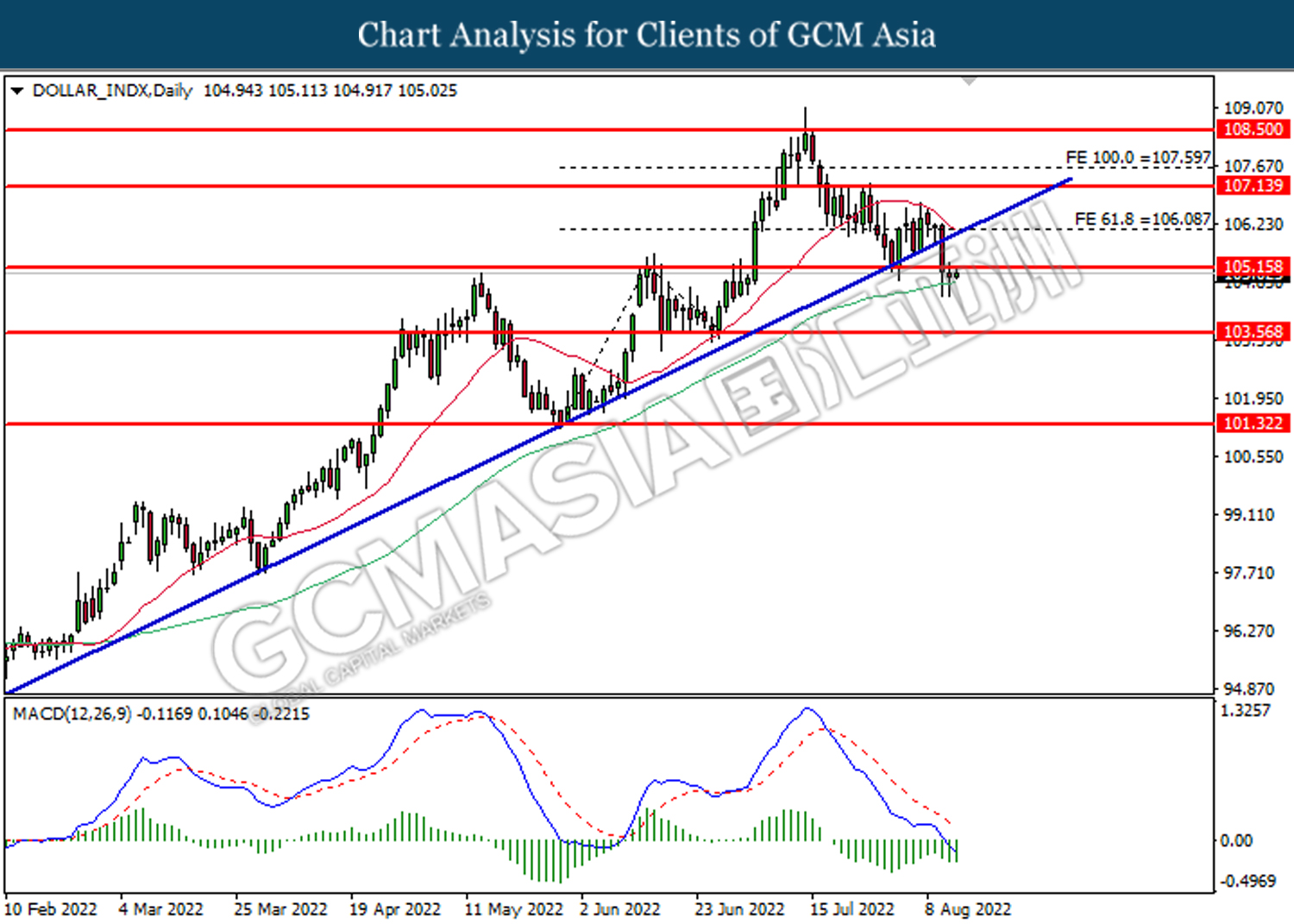

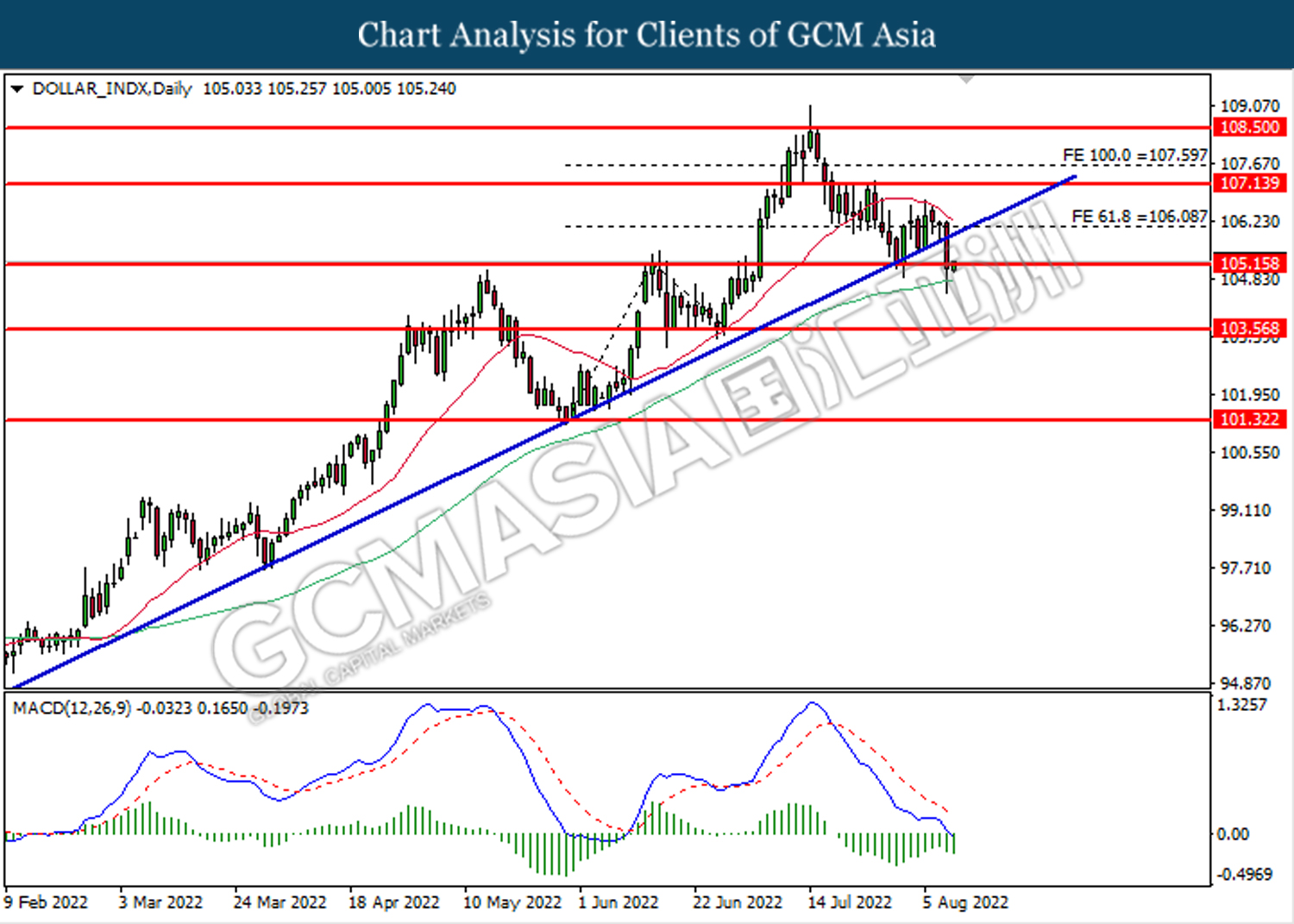

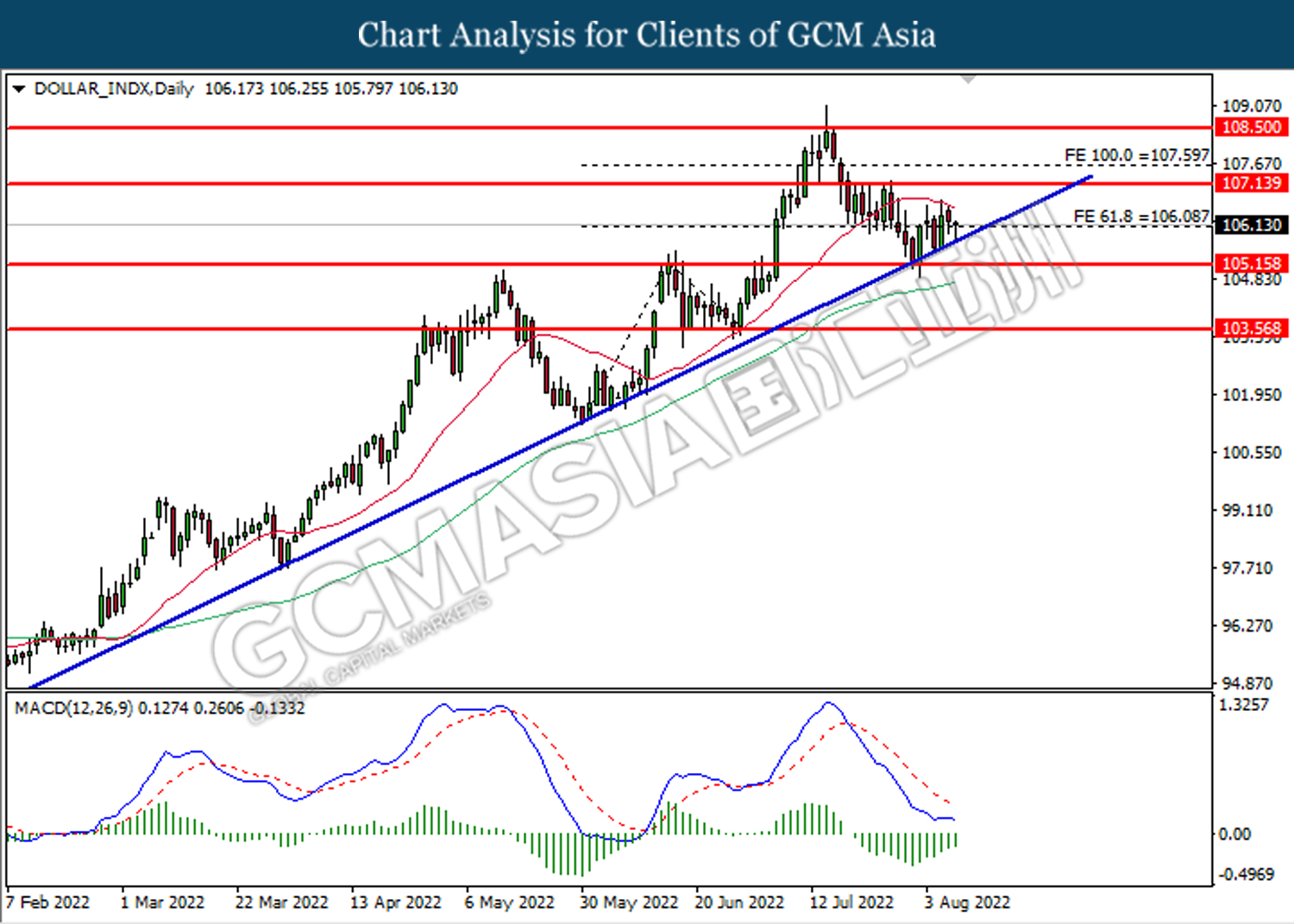

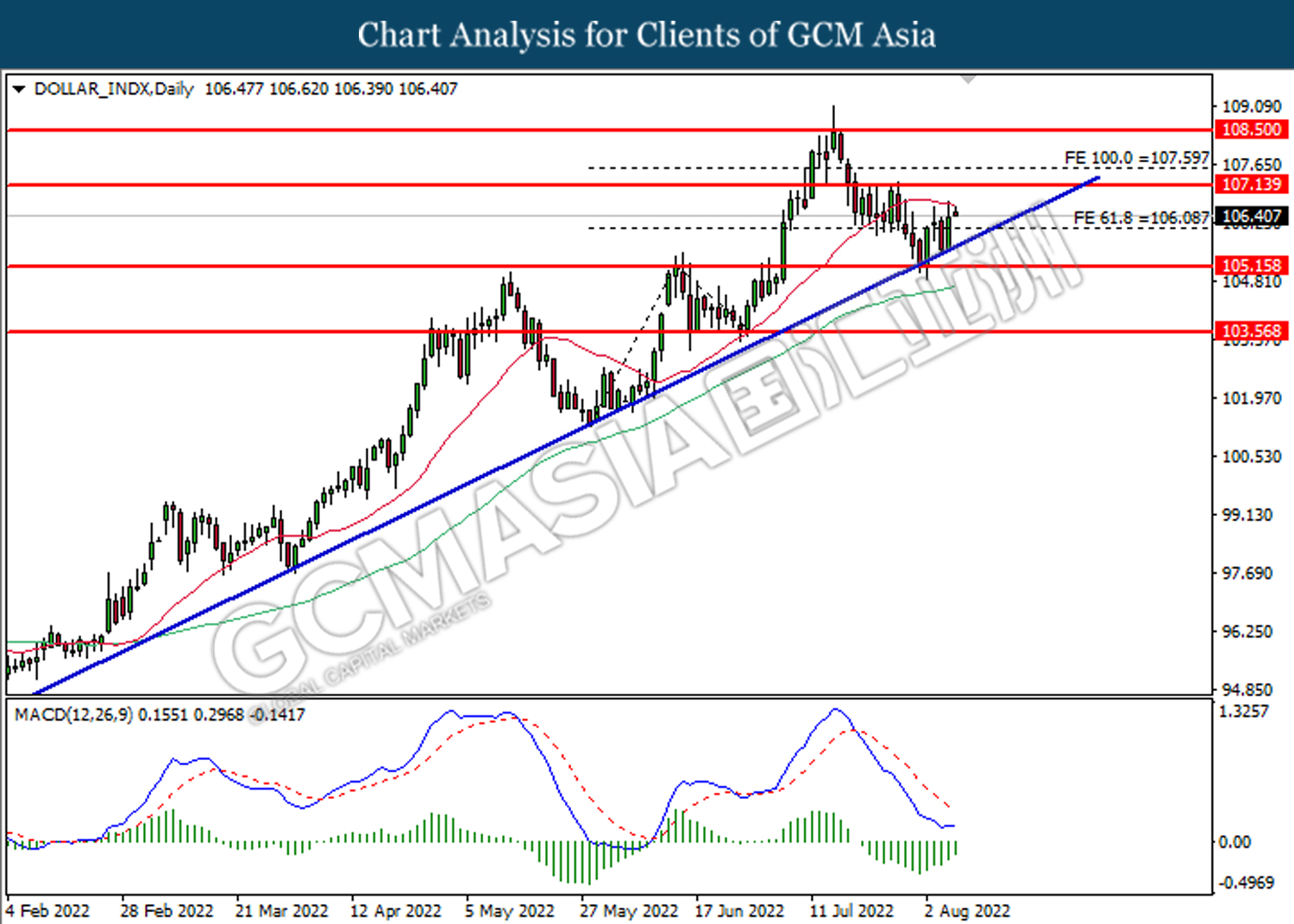

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

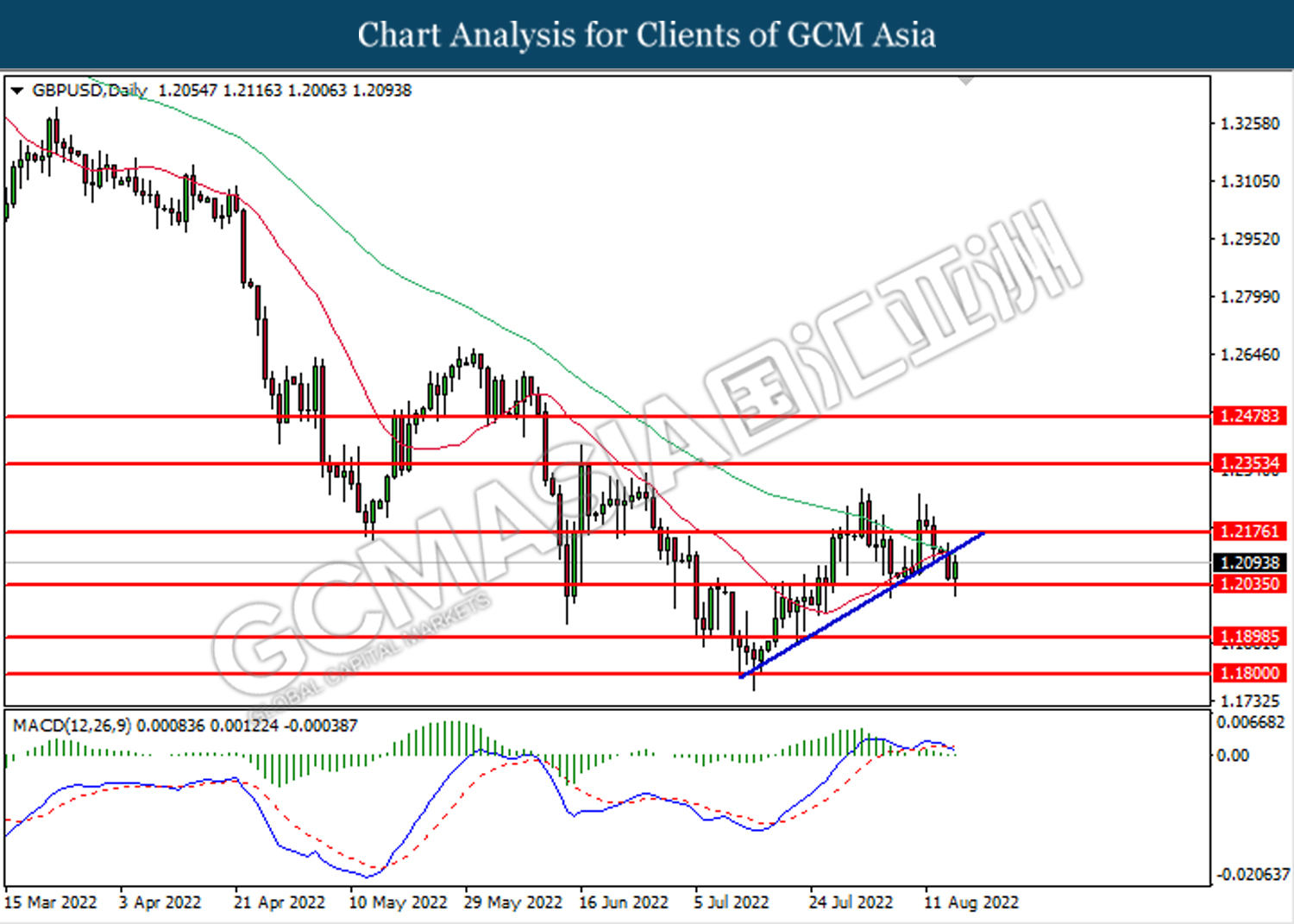

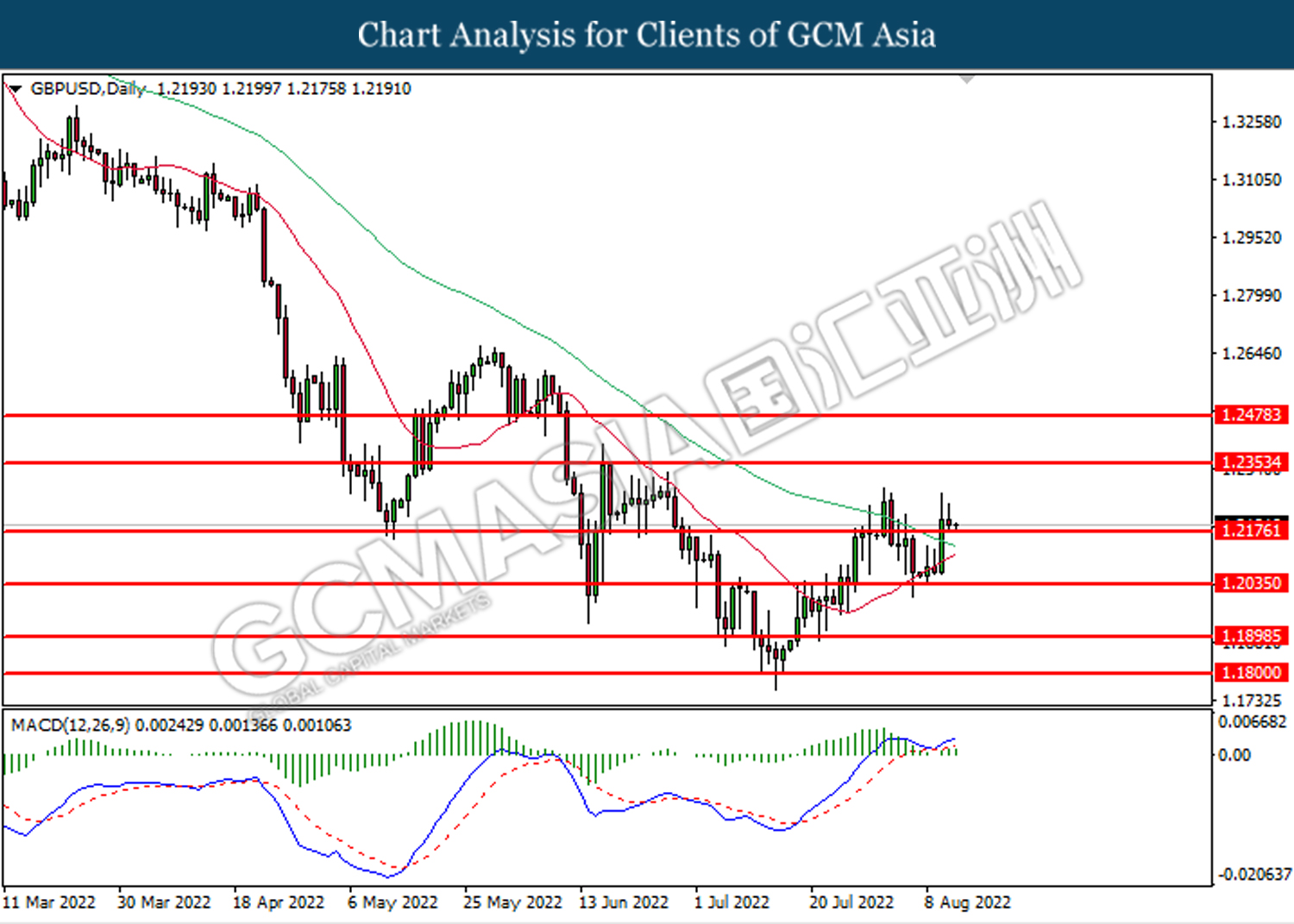

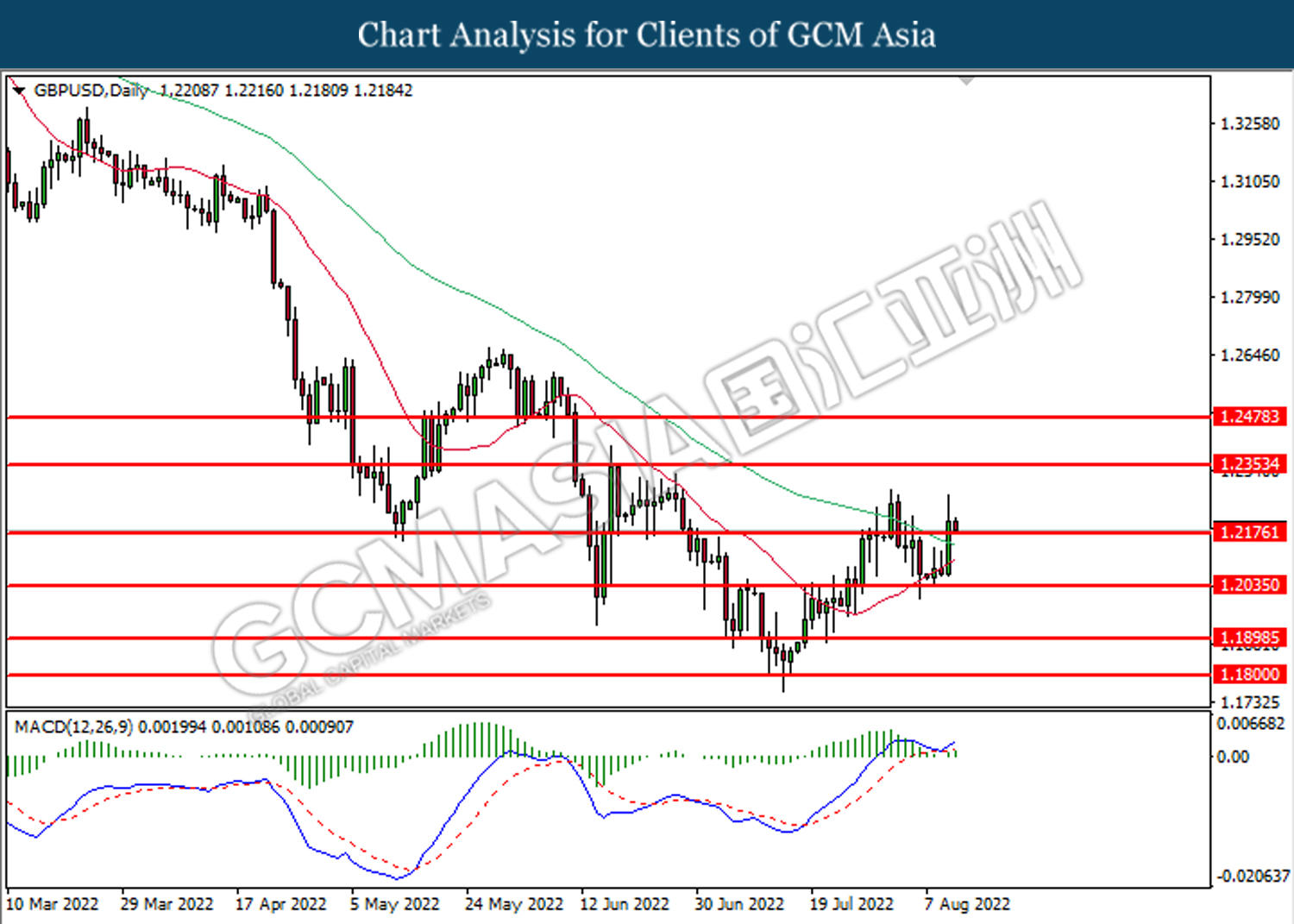

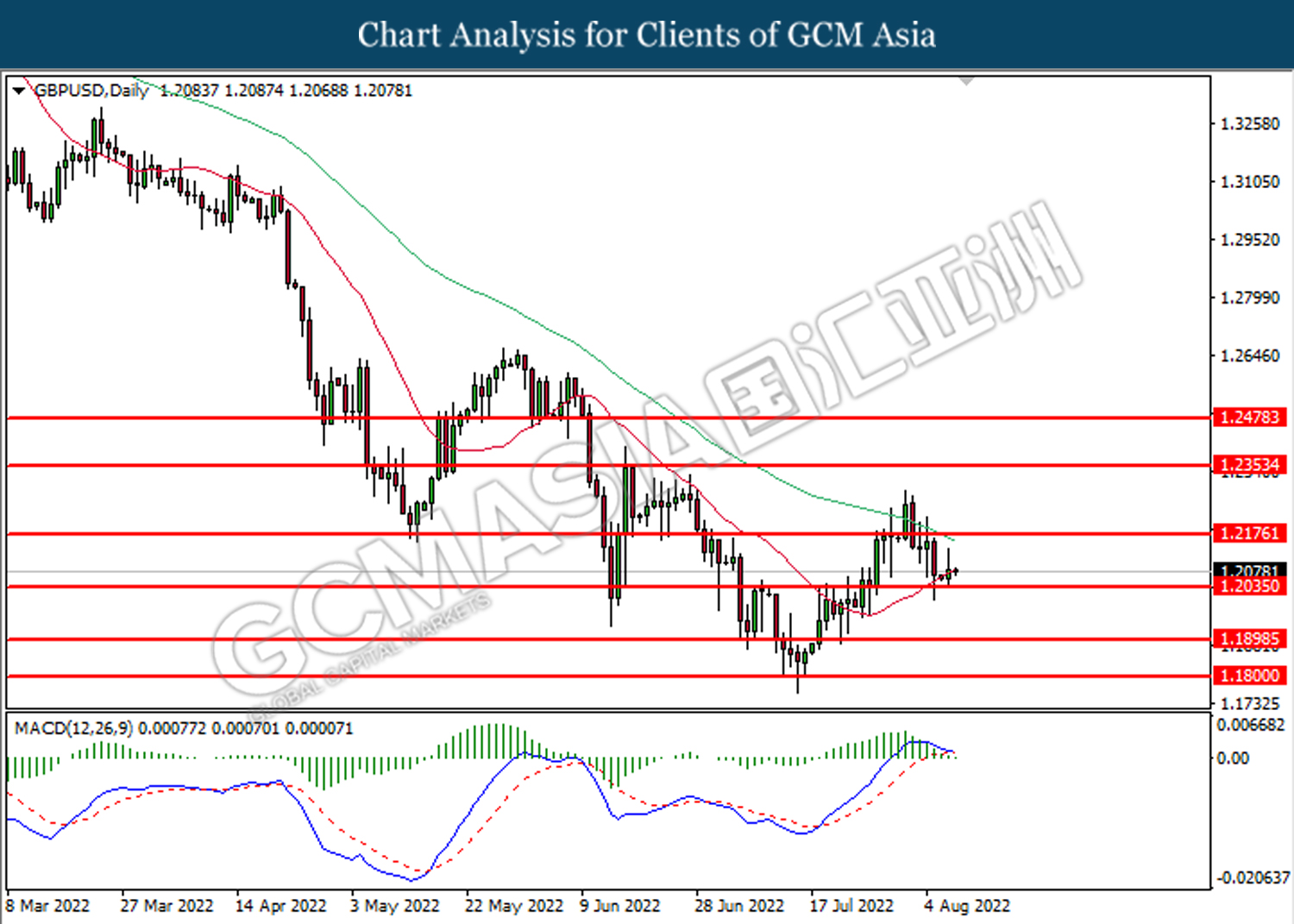

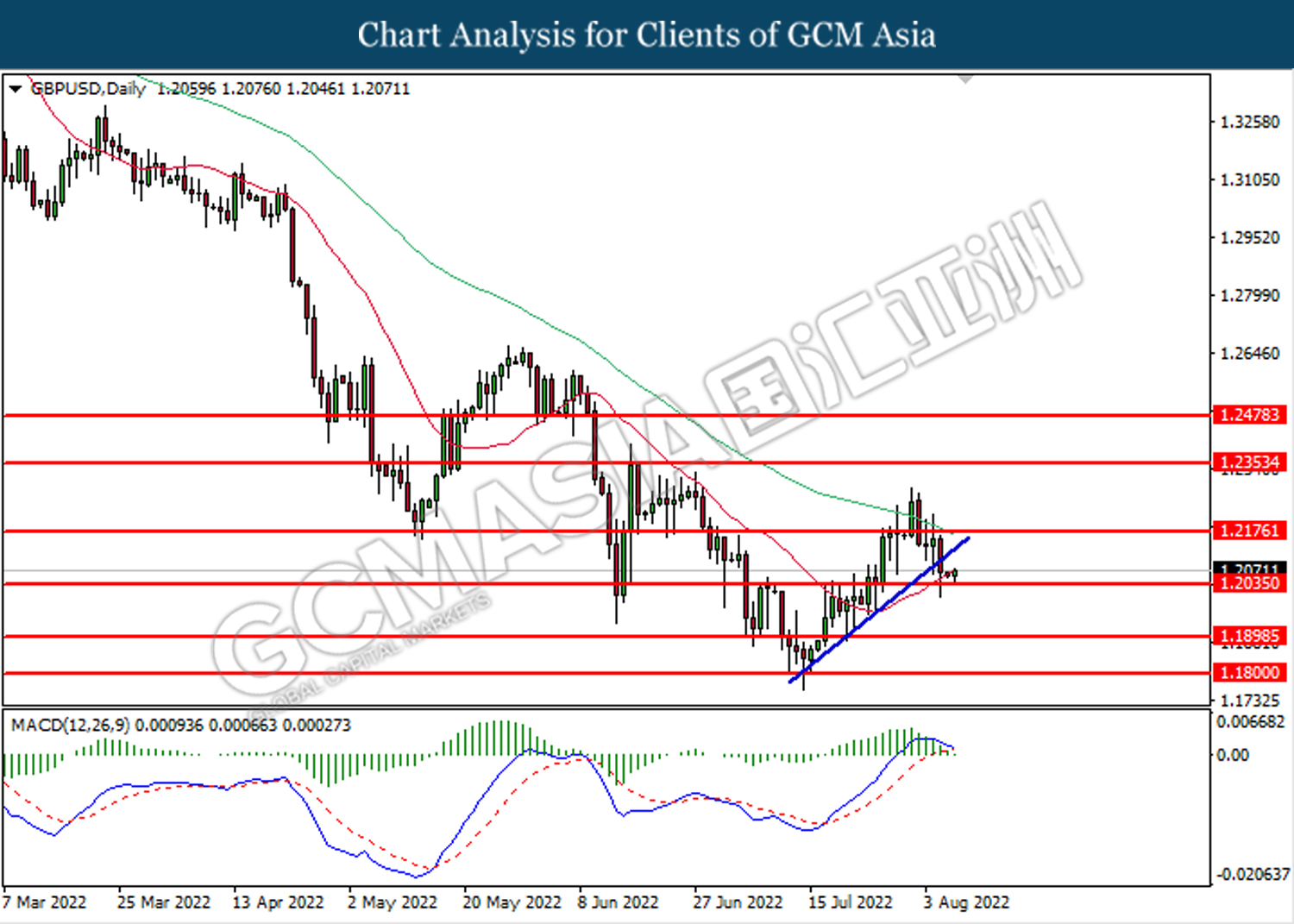

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2035. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

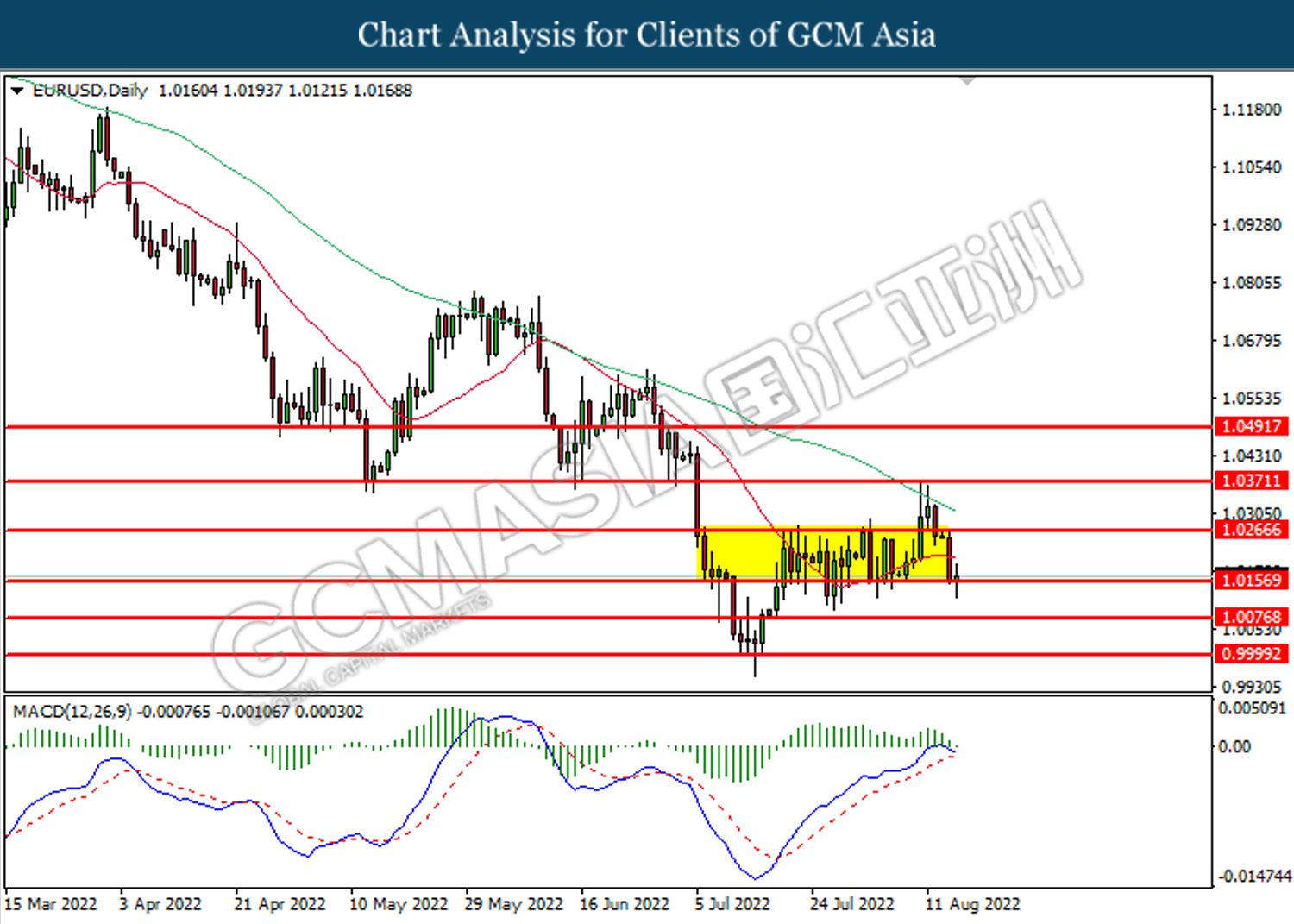

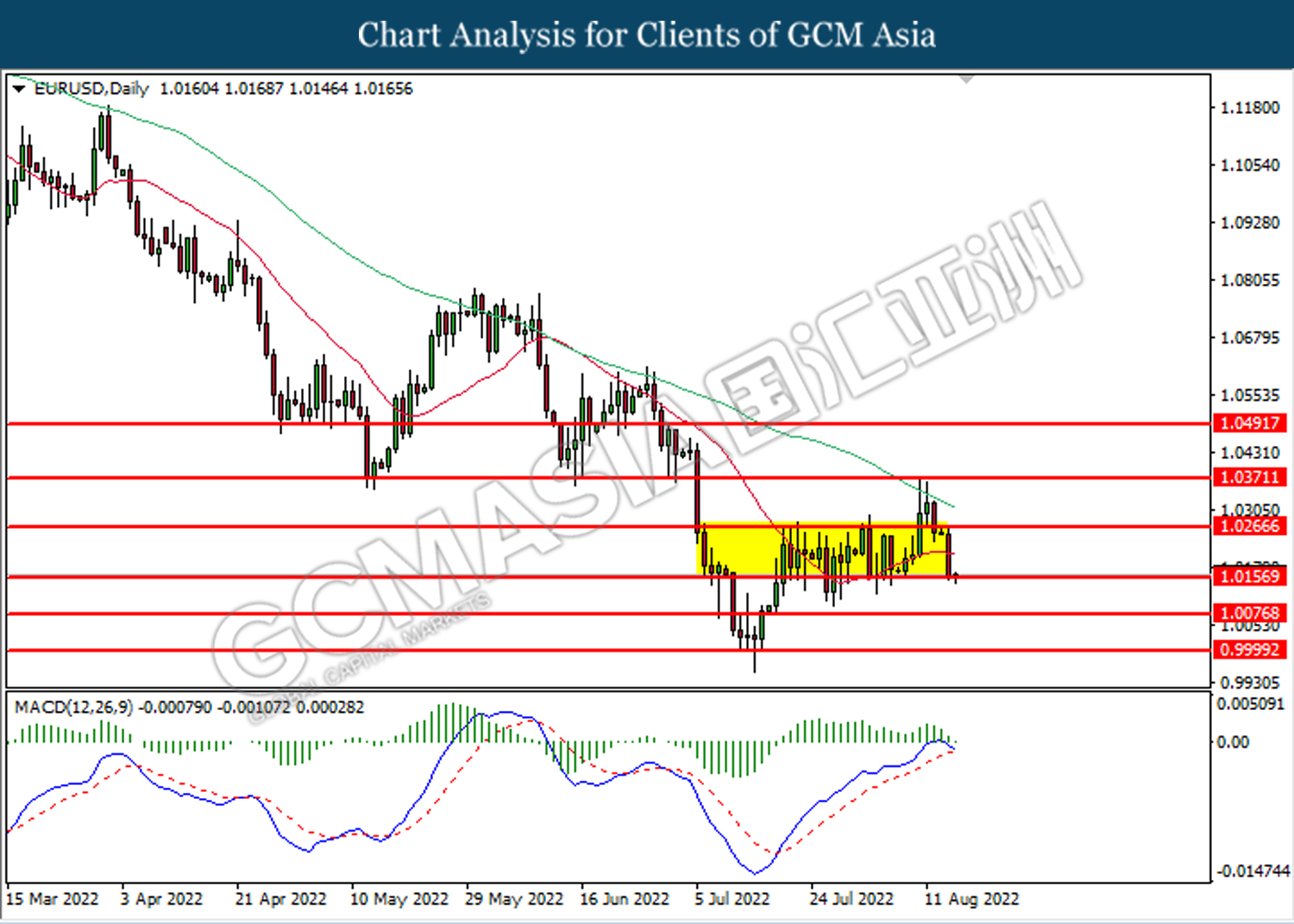

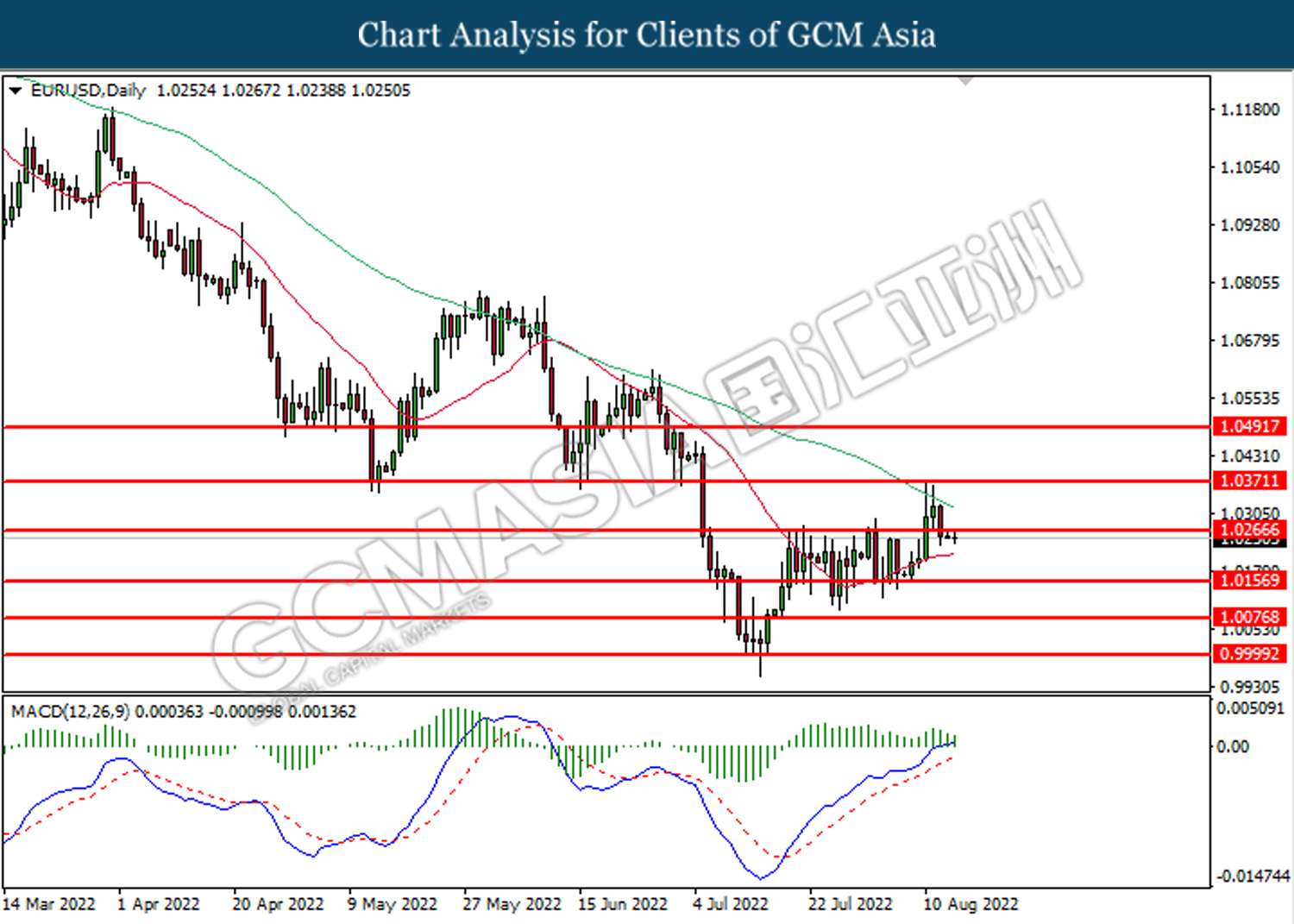

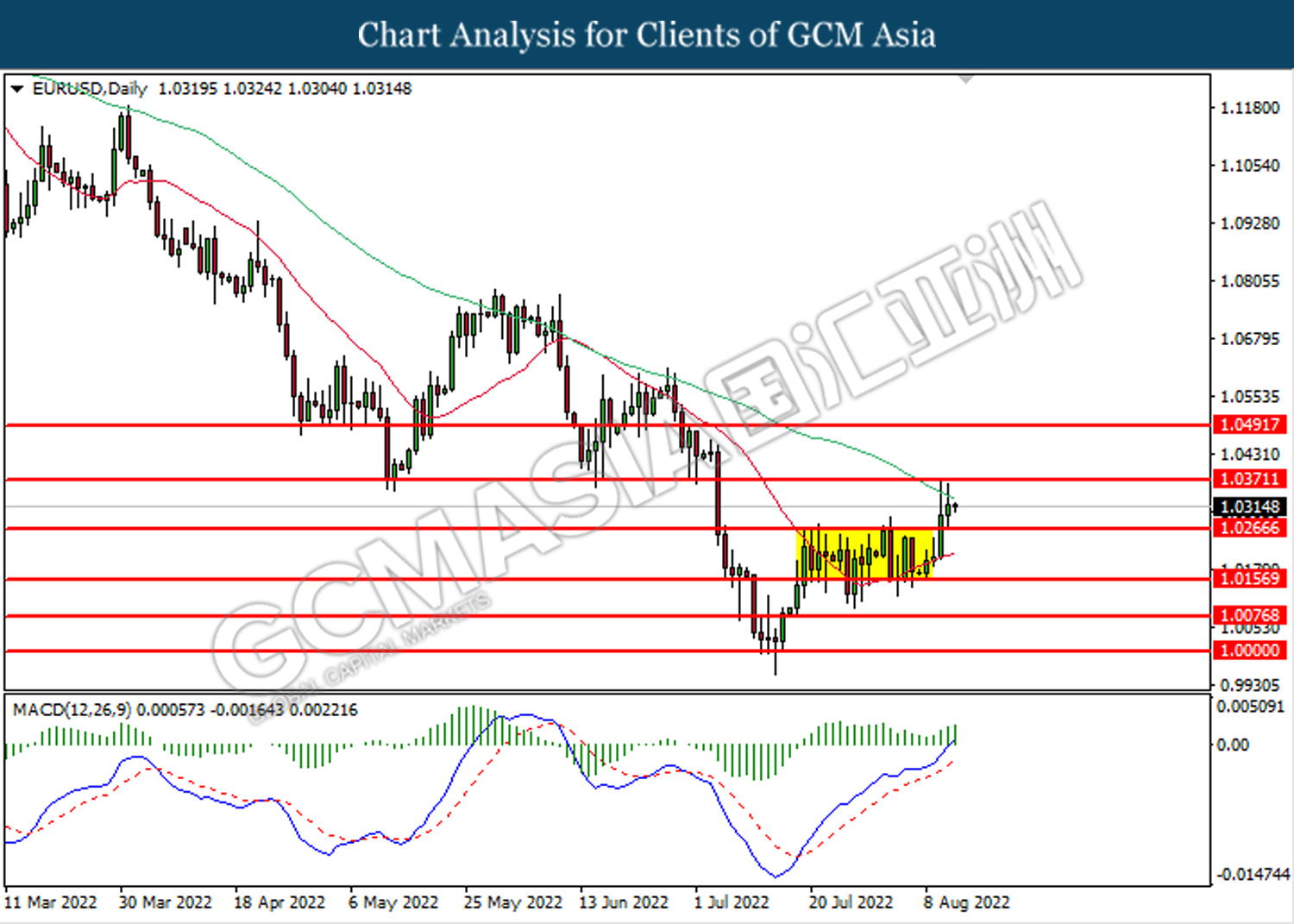

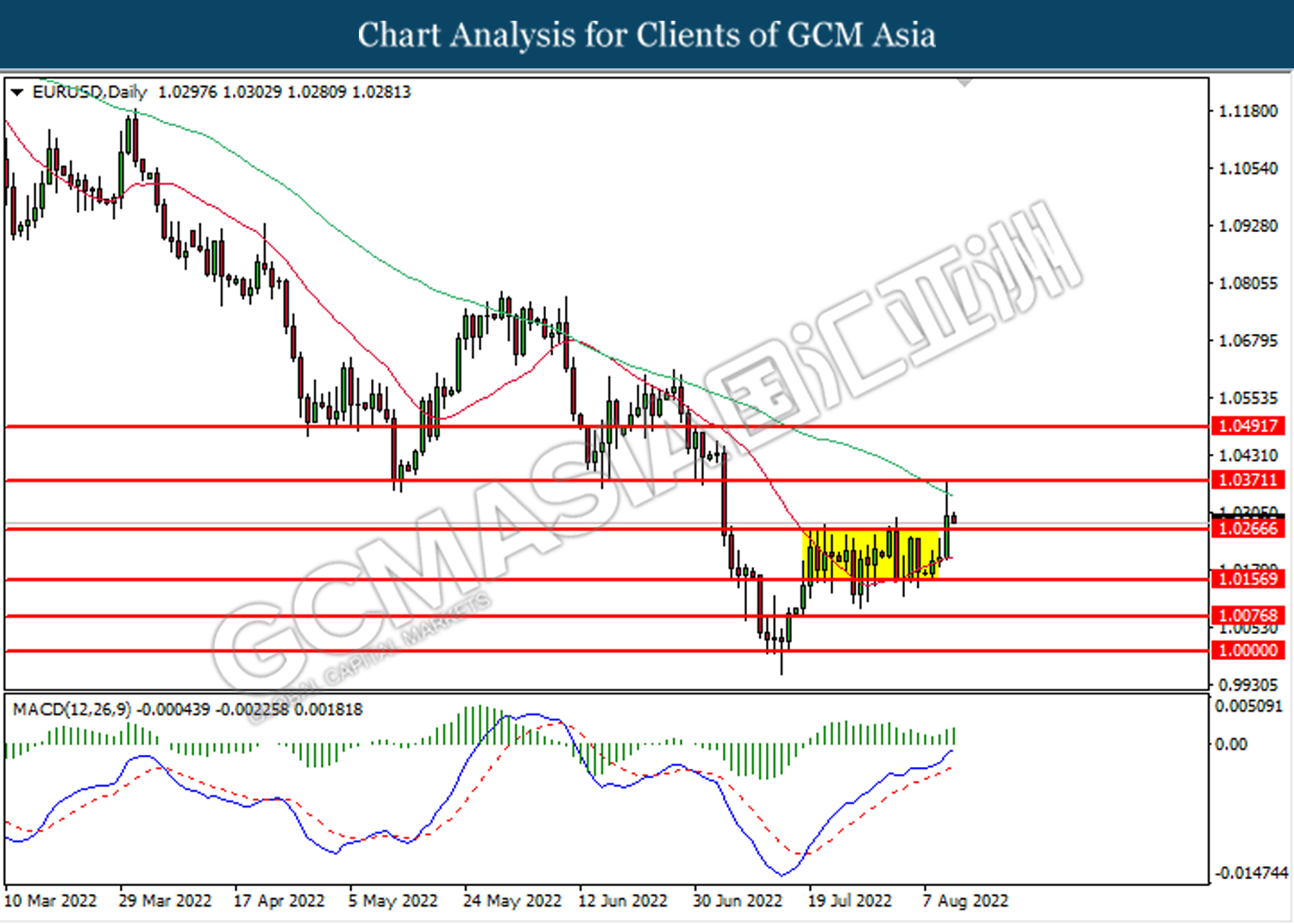

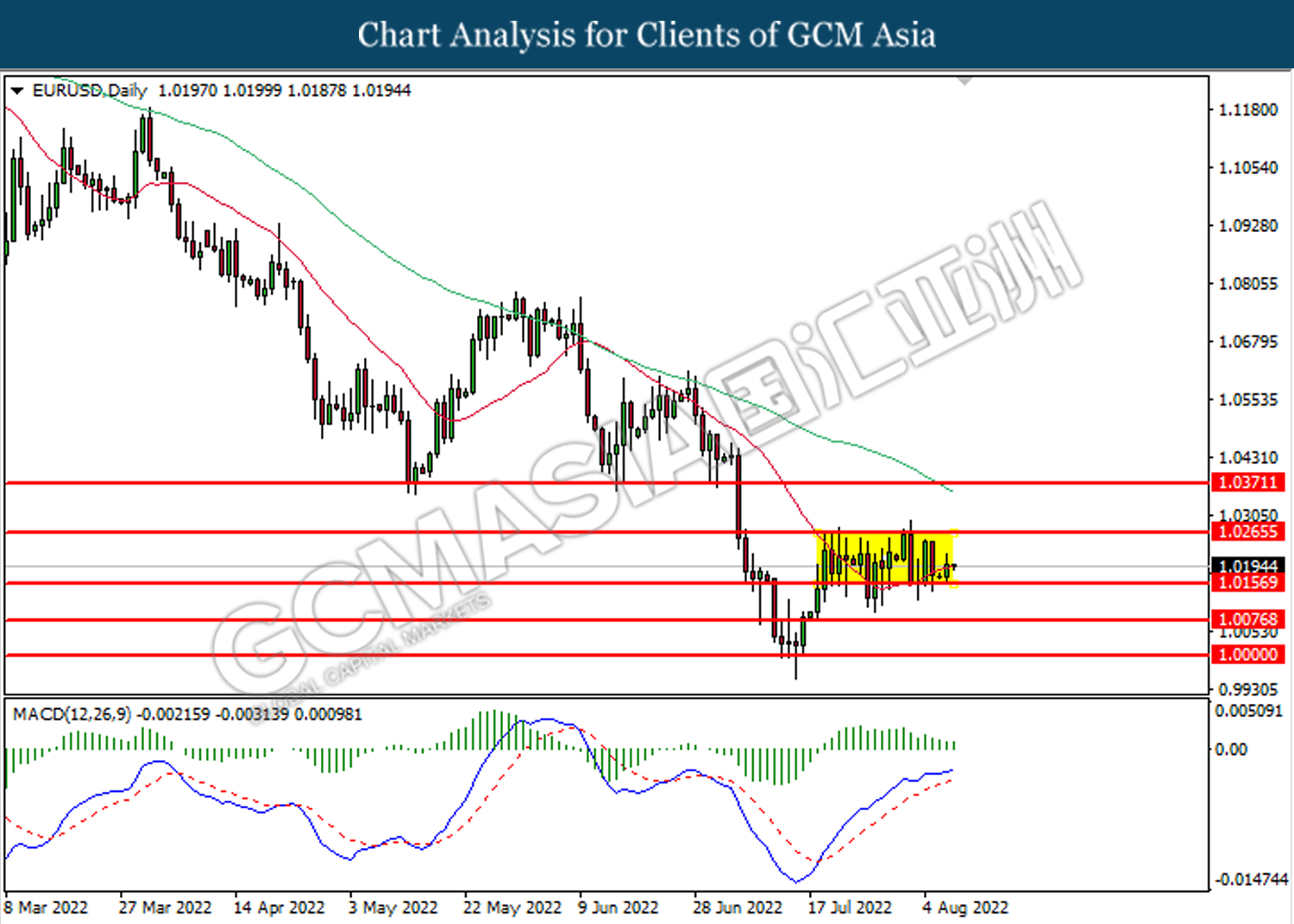

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0155. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

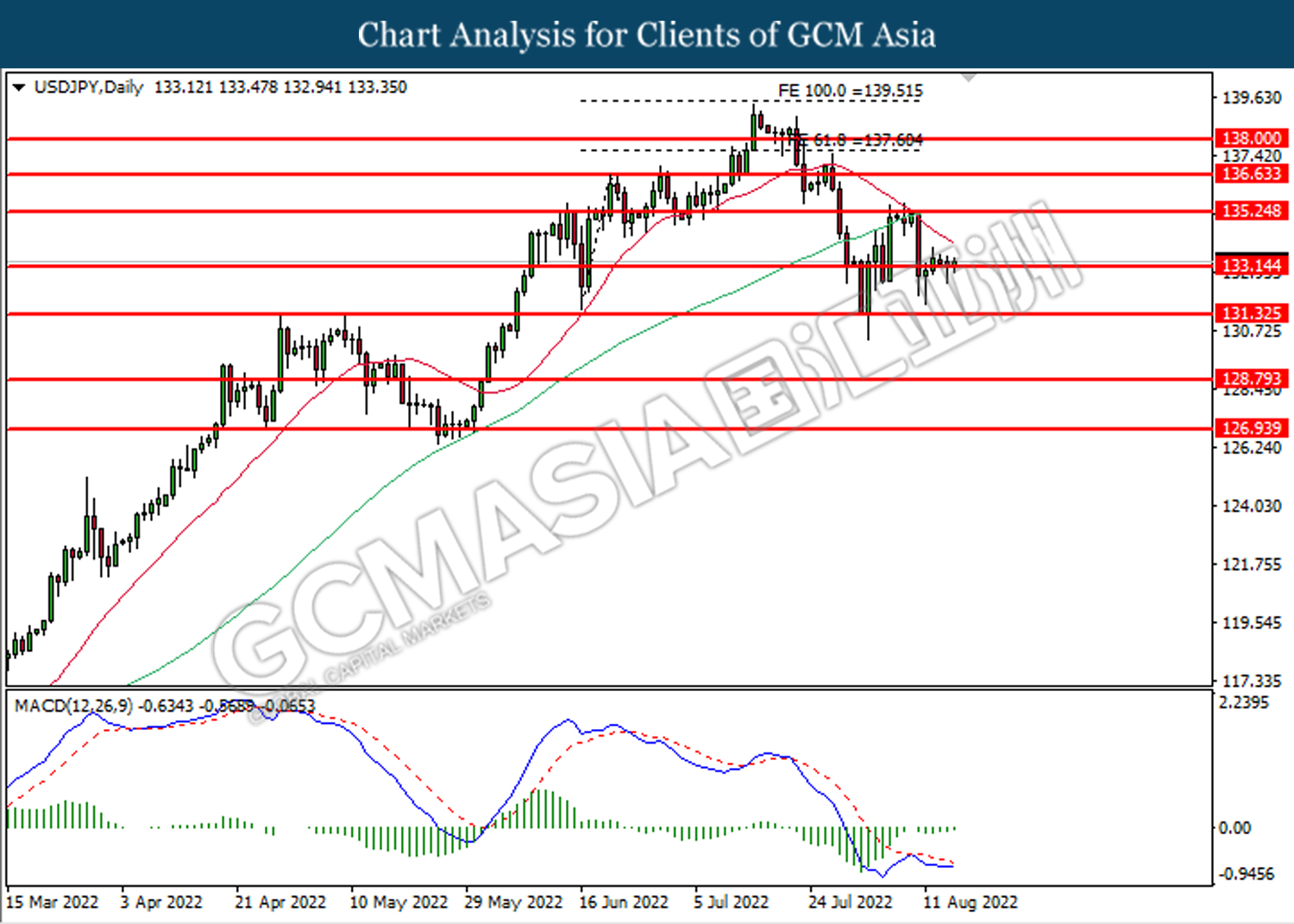

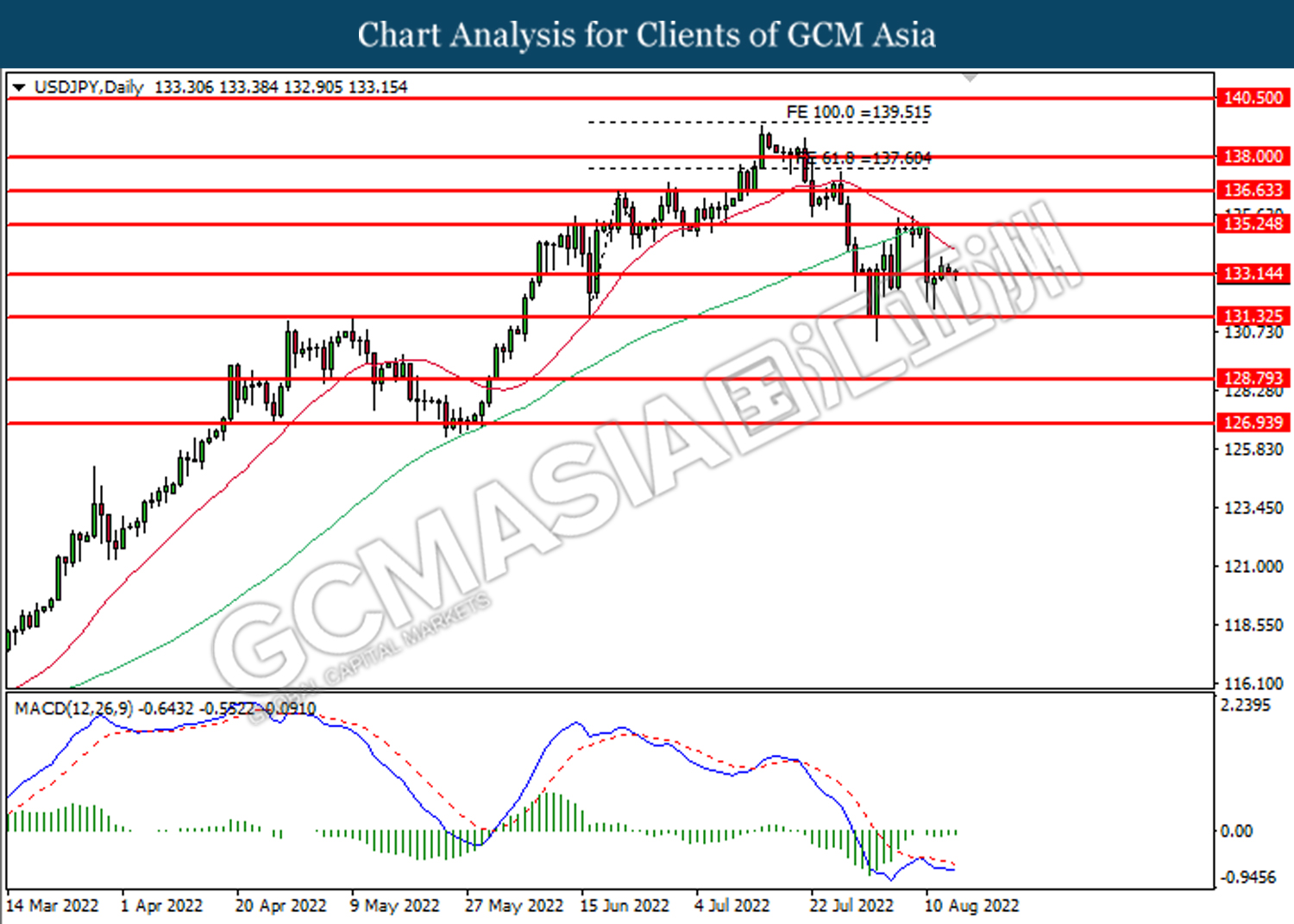

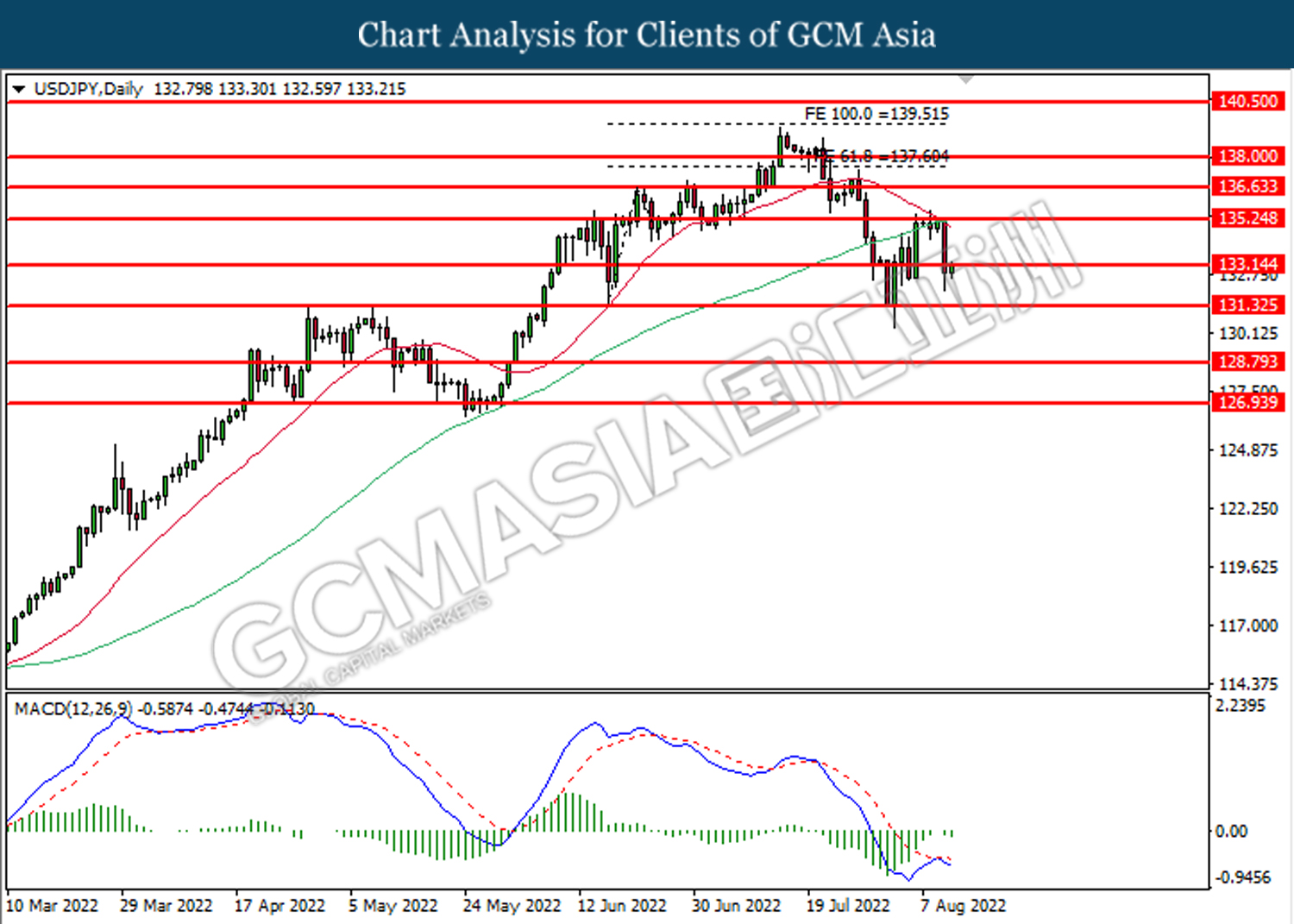

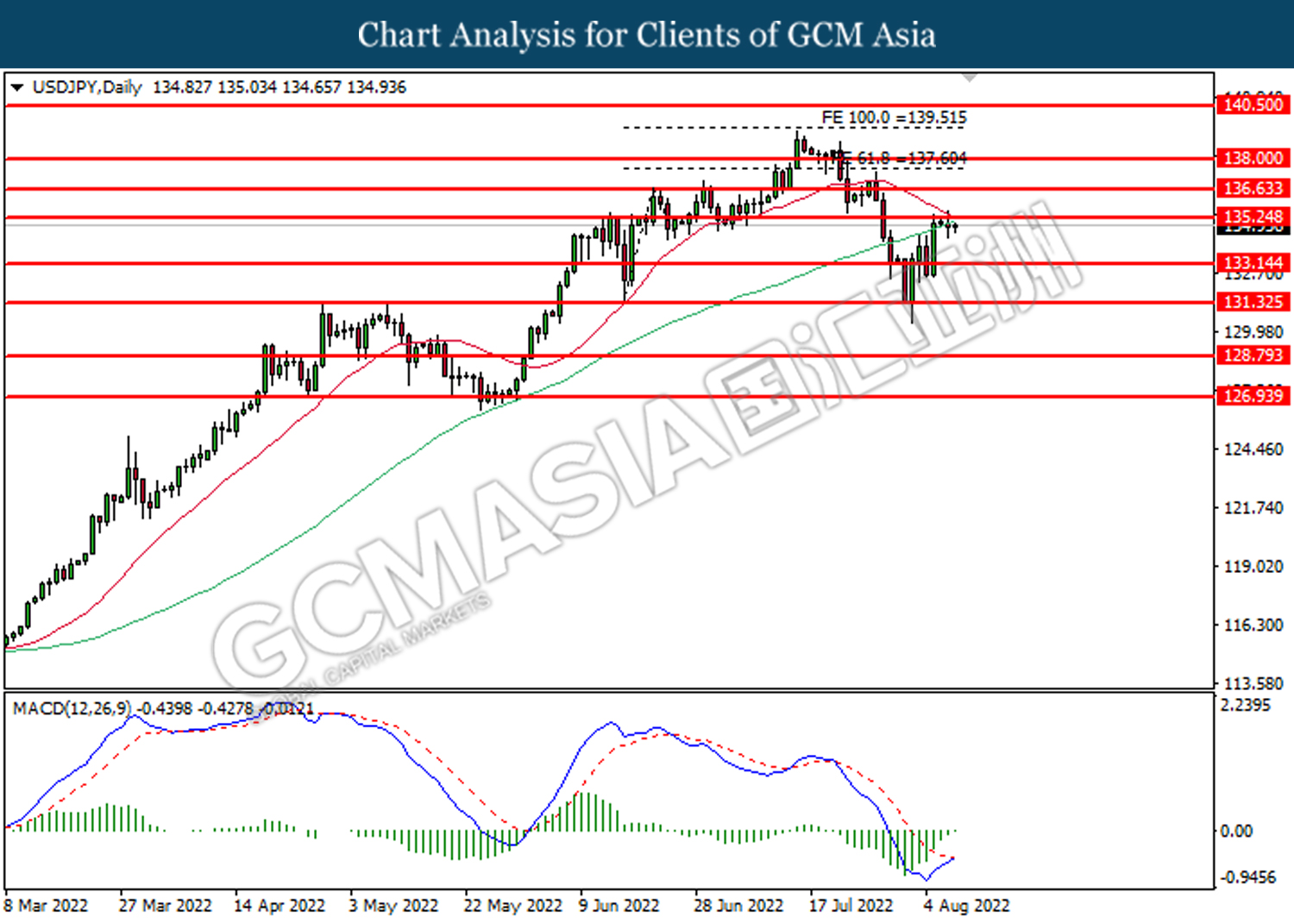

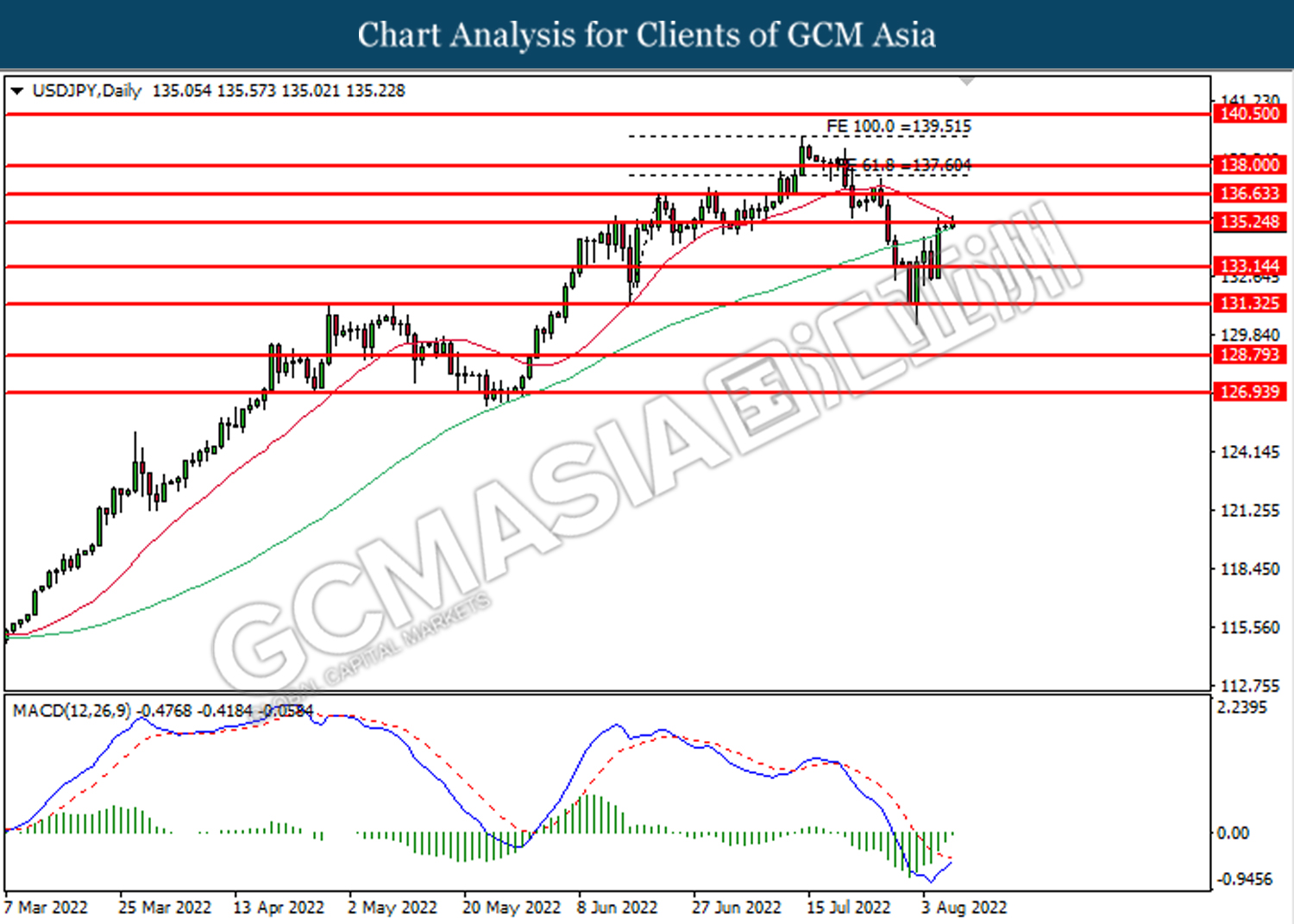

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 133.15. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 135.25.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.30

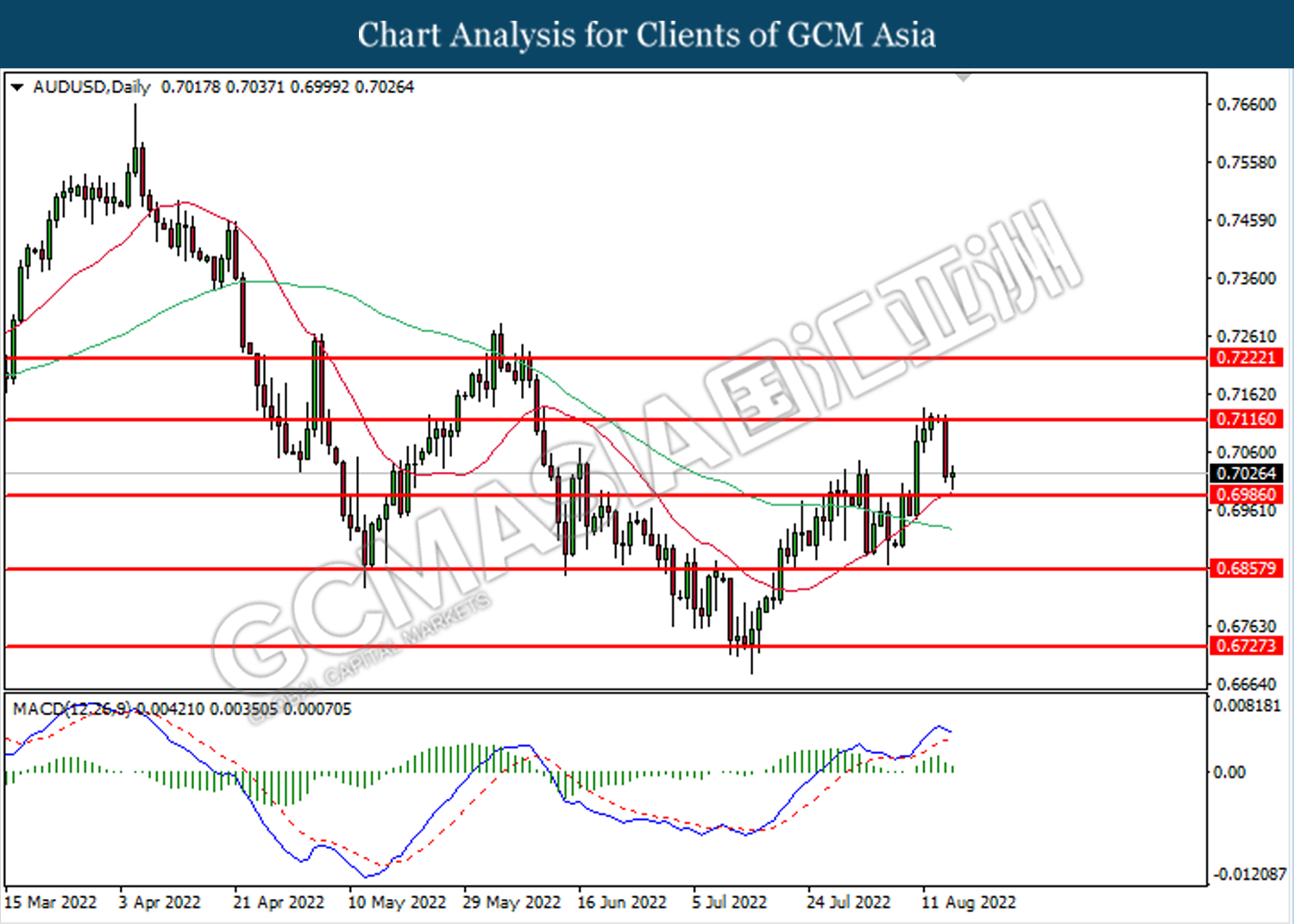

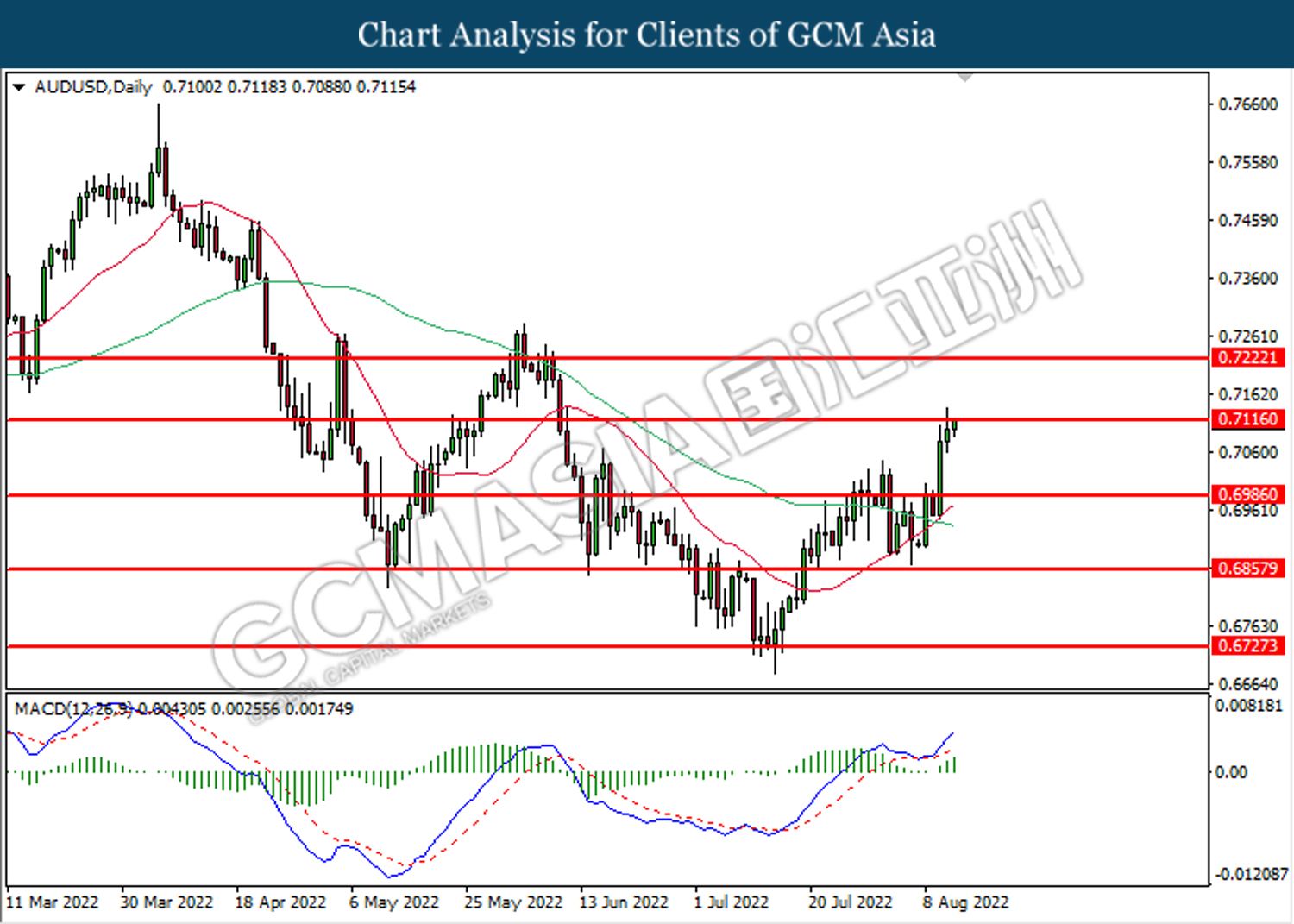

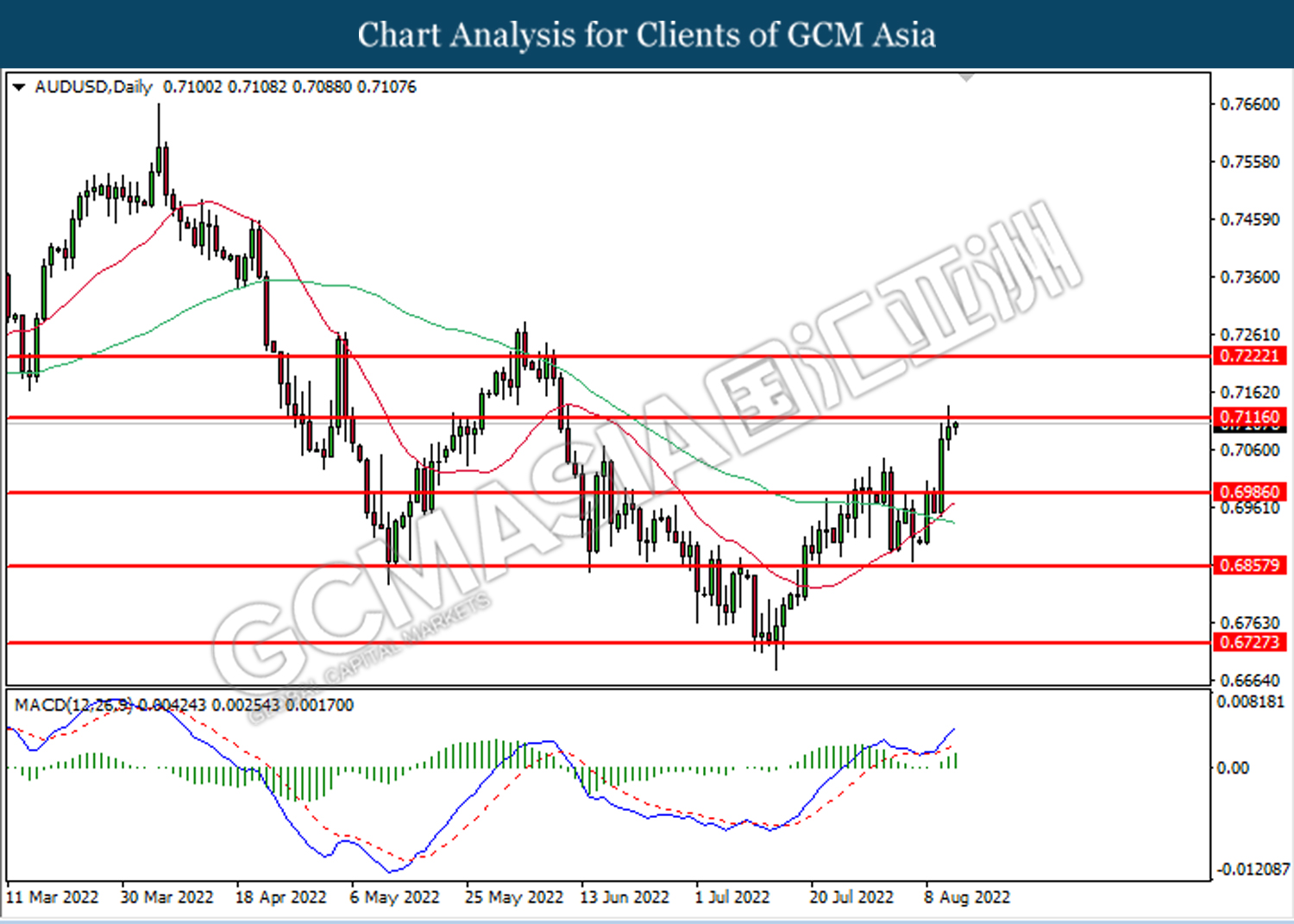

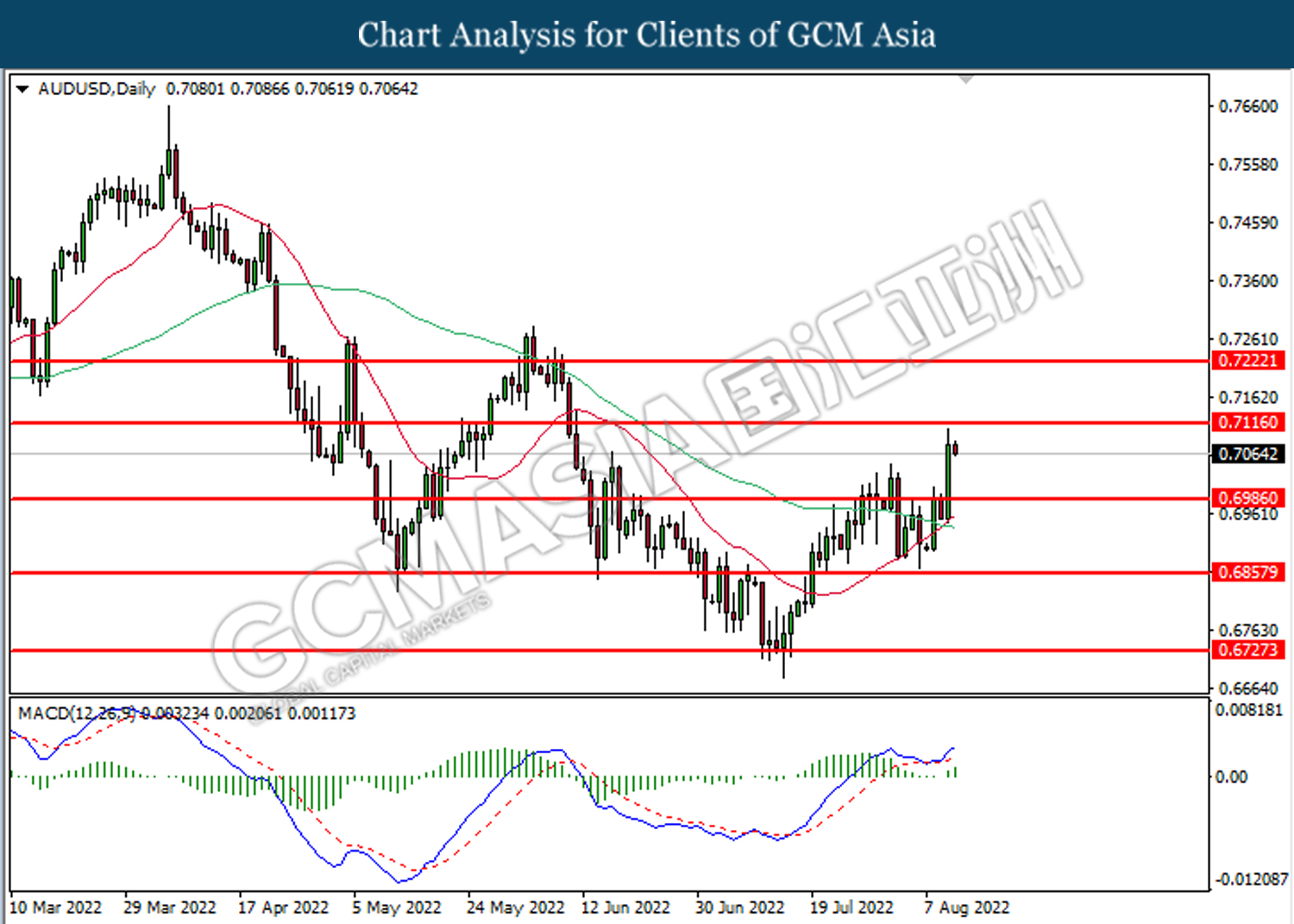

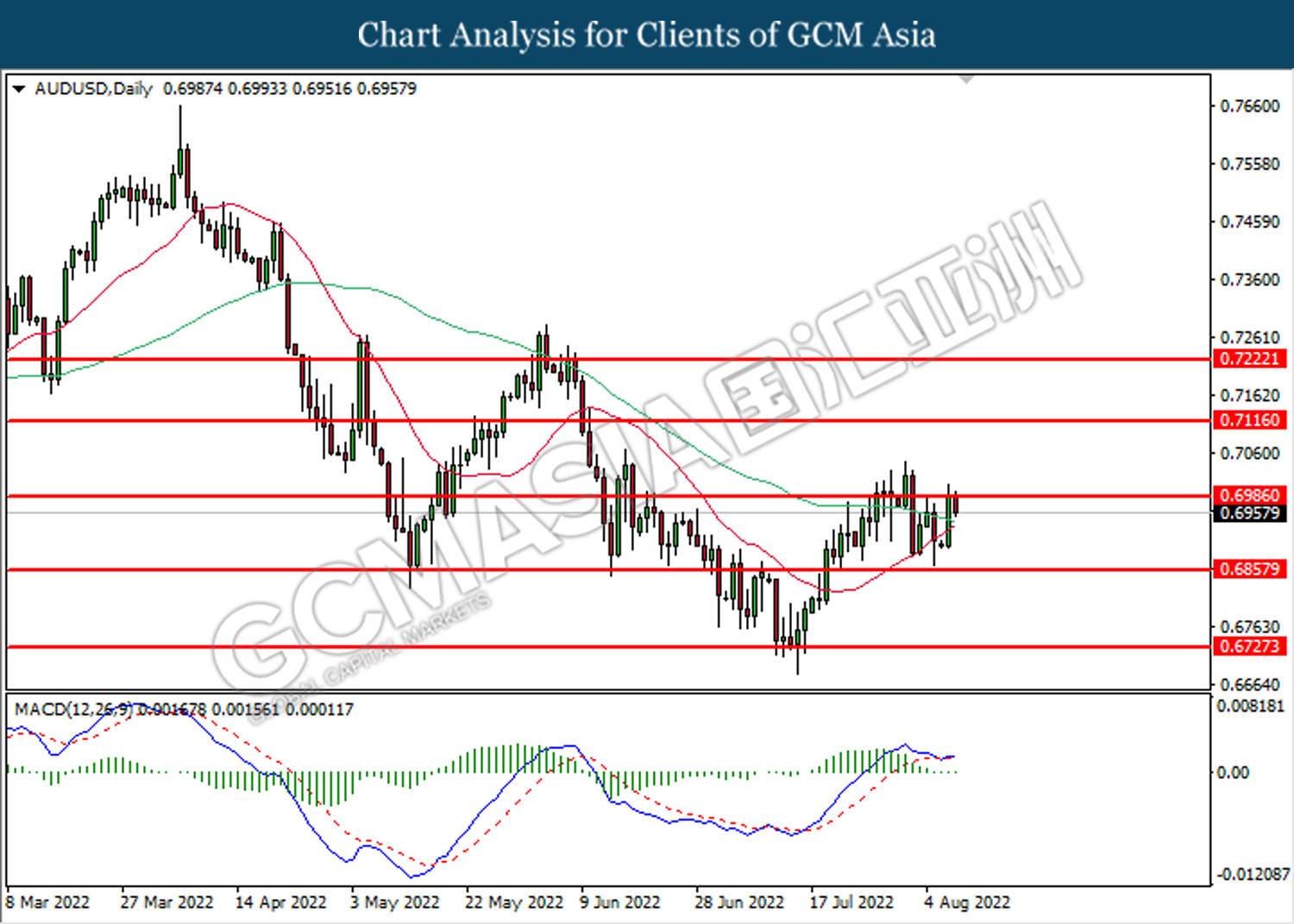

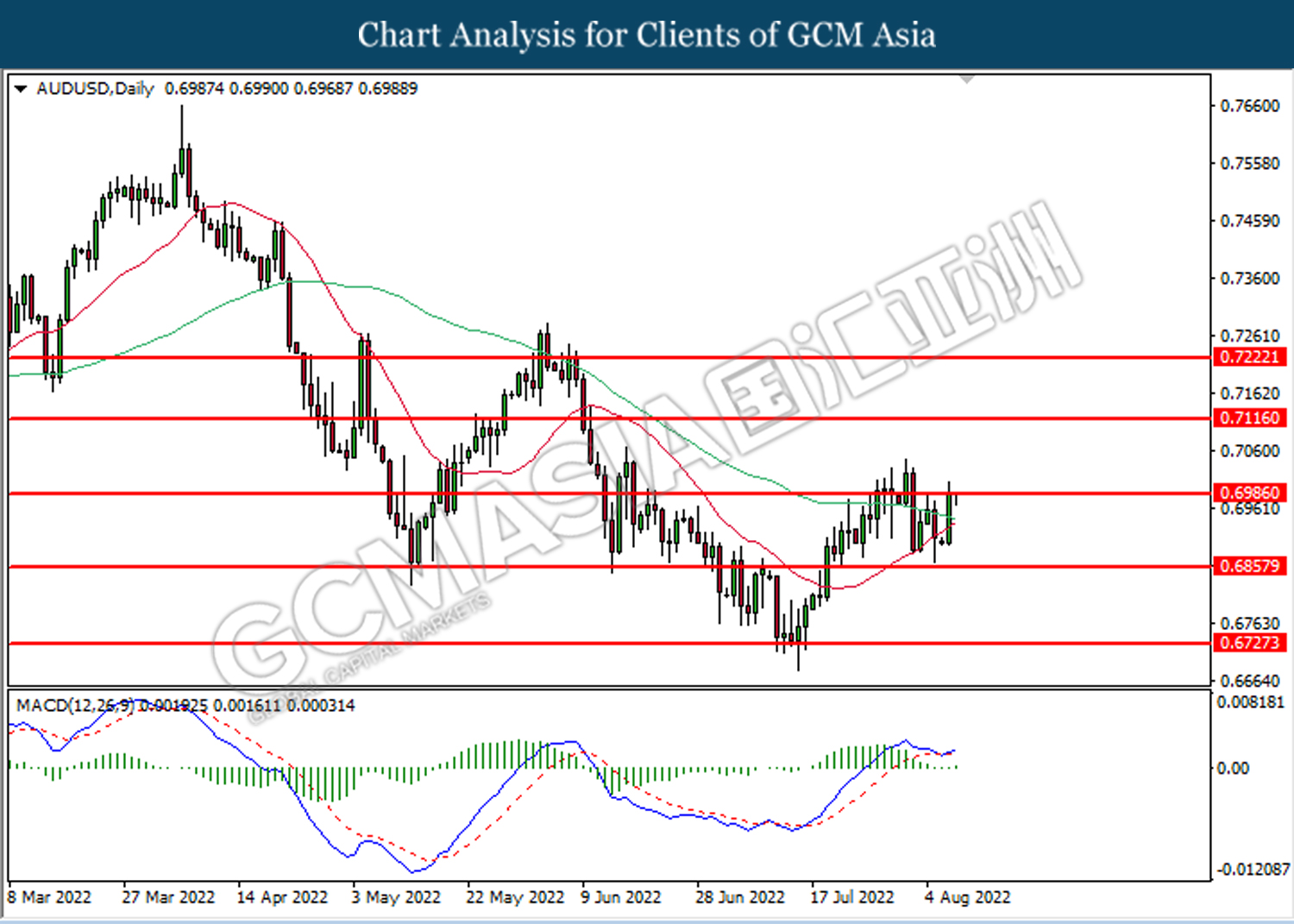

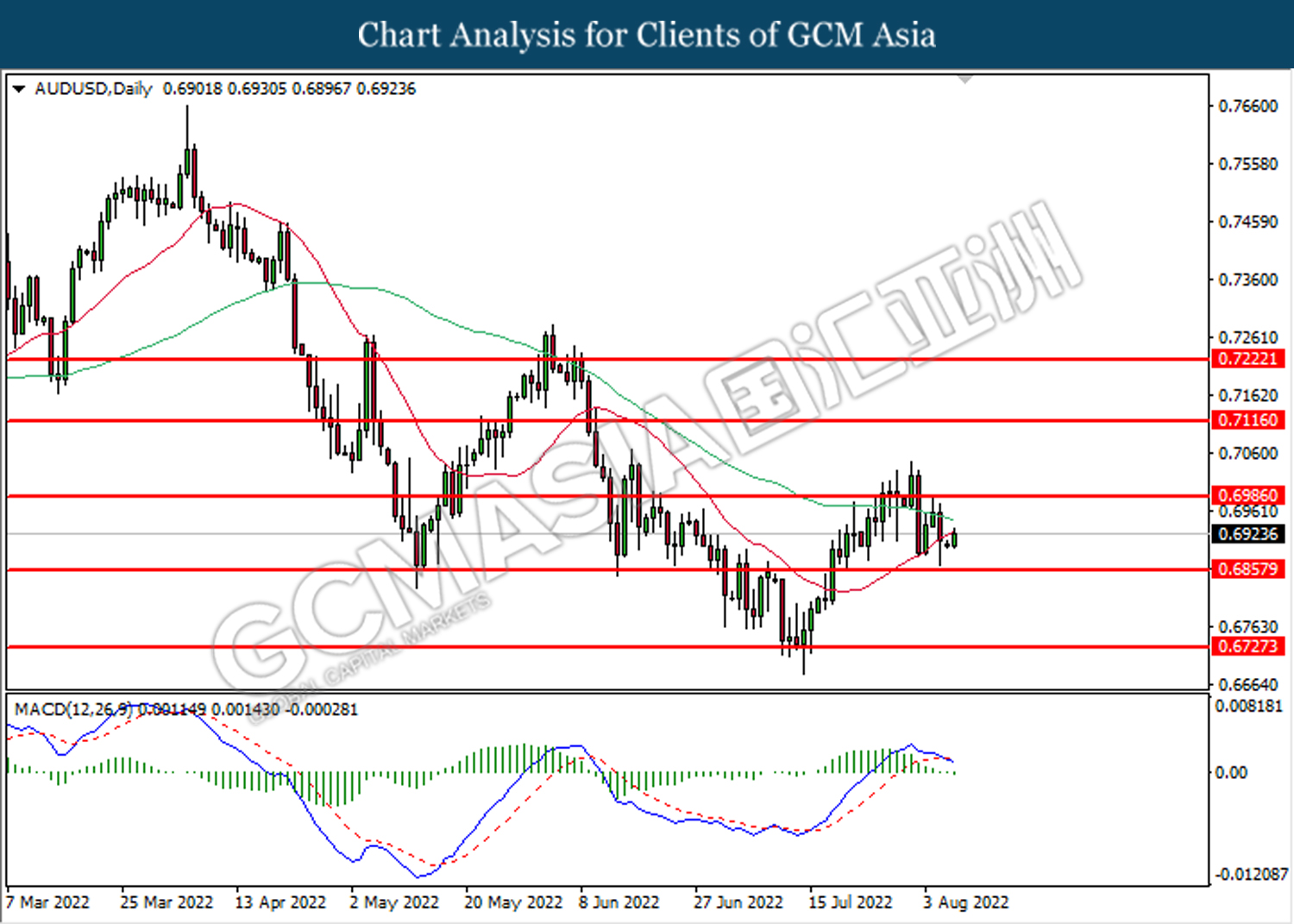

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.7115. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6985.

Resistance level: 0.7115, 0.7220

Support level: 0.6985, 0.6860

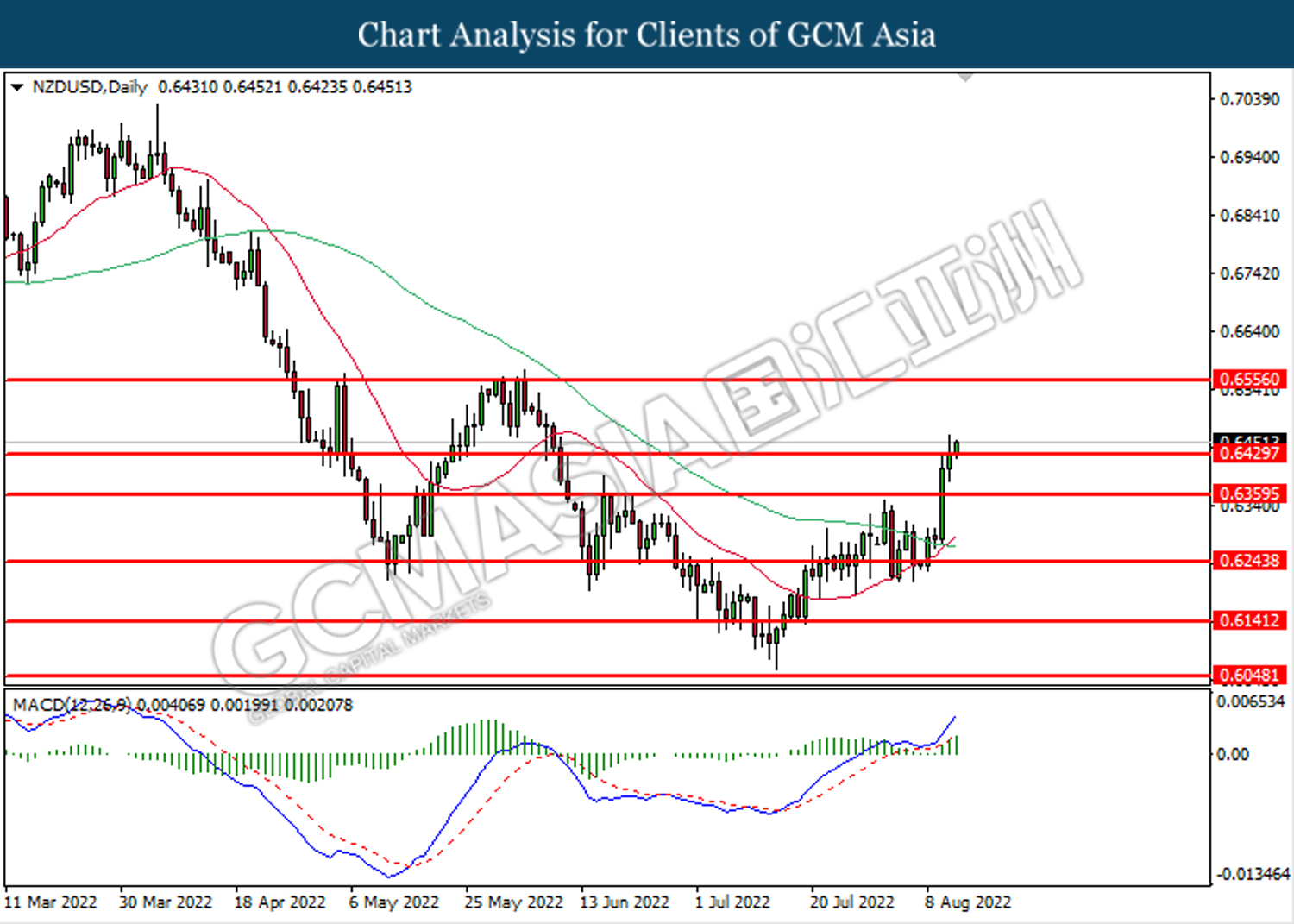

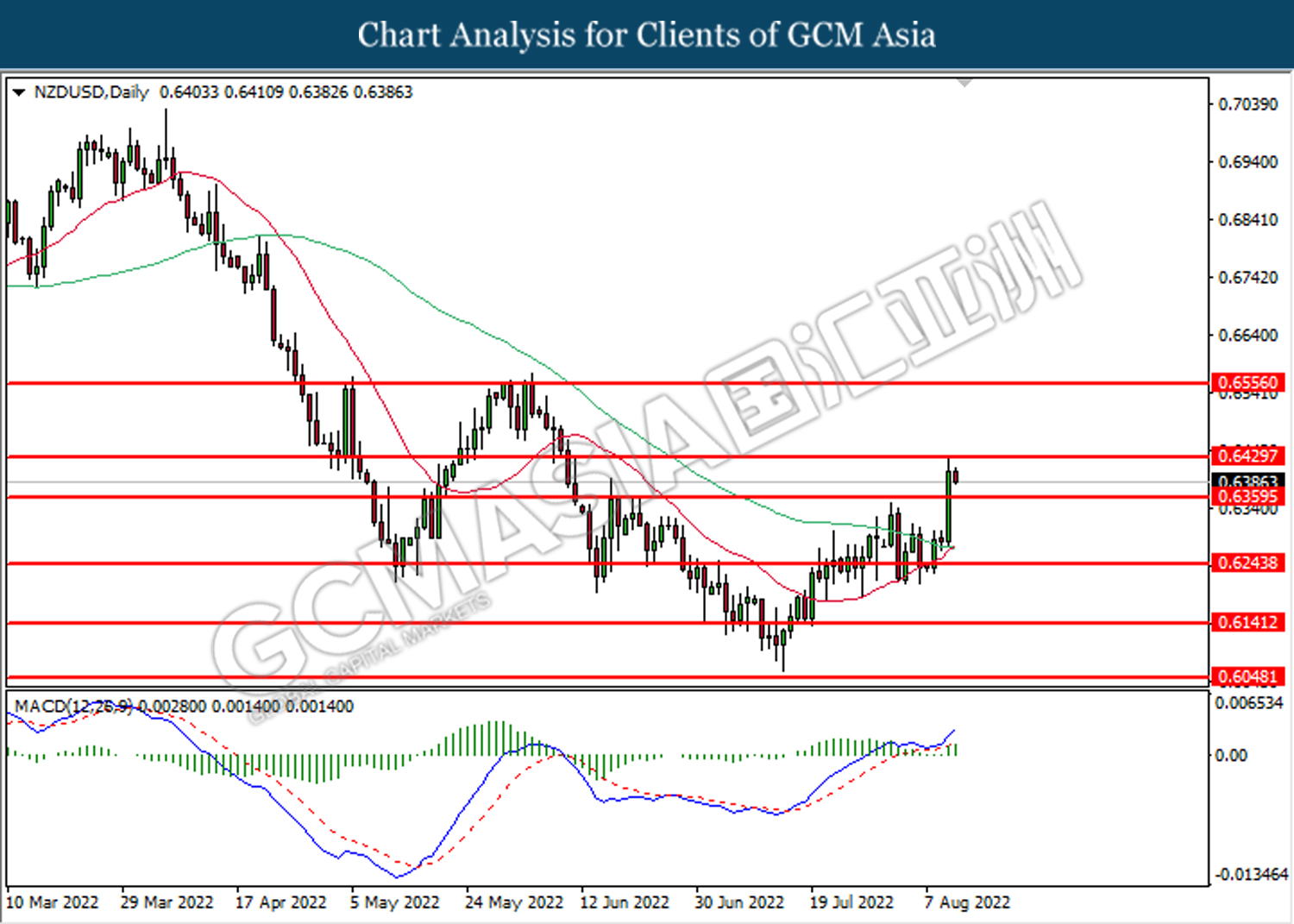

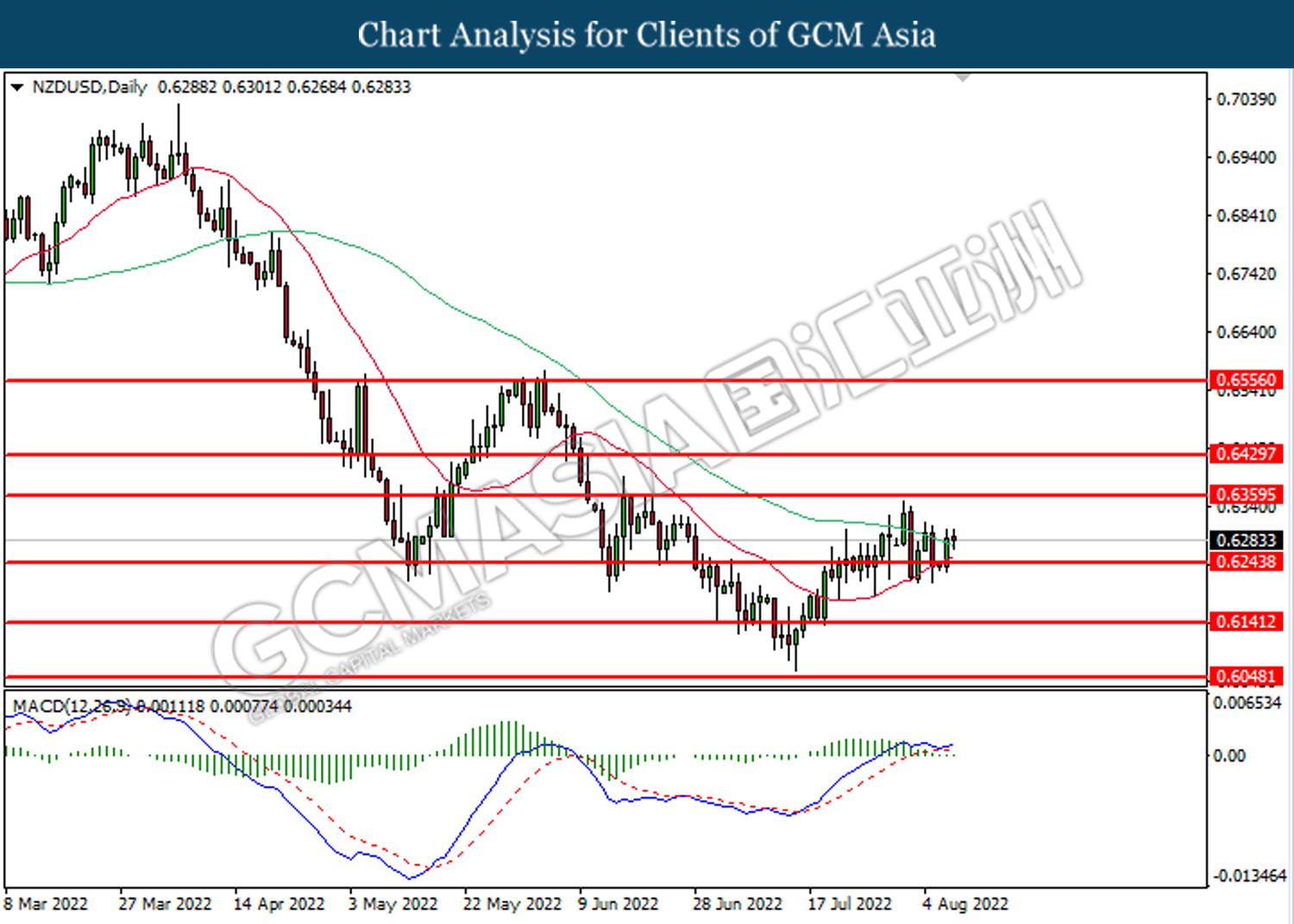

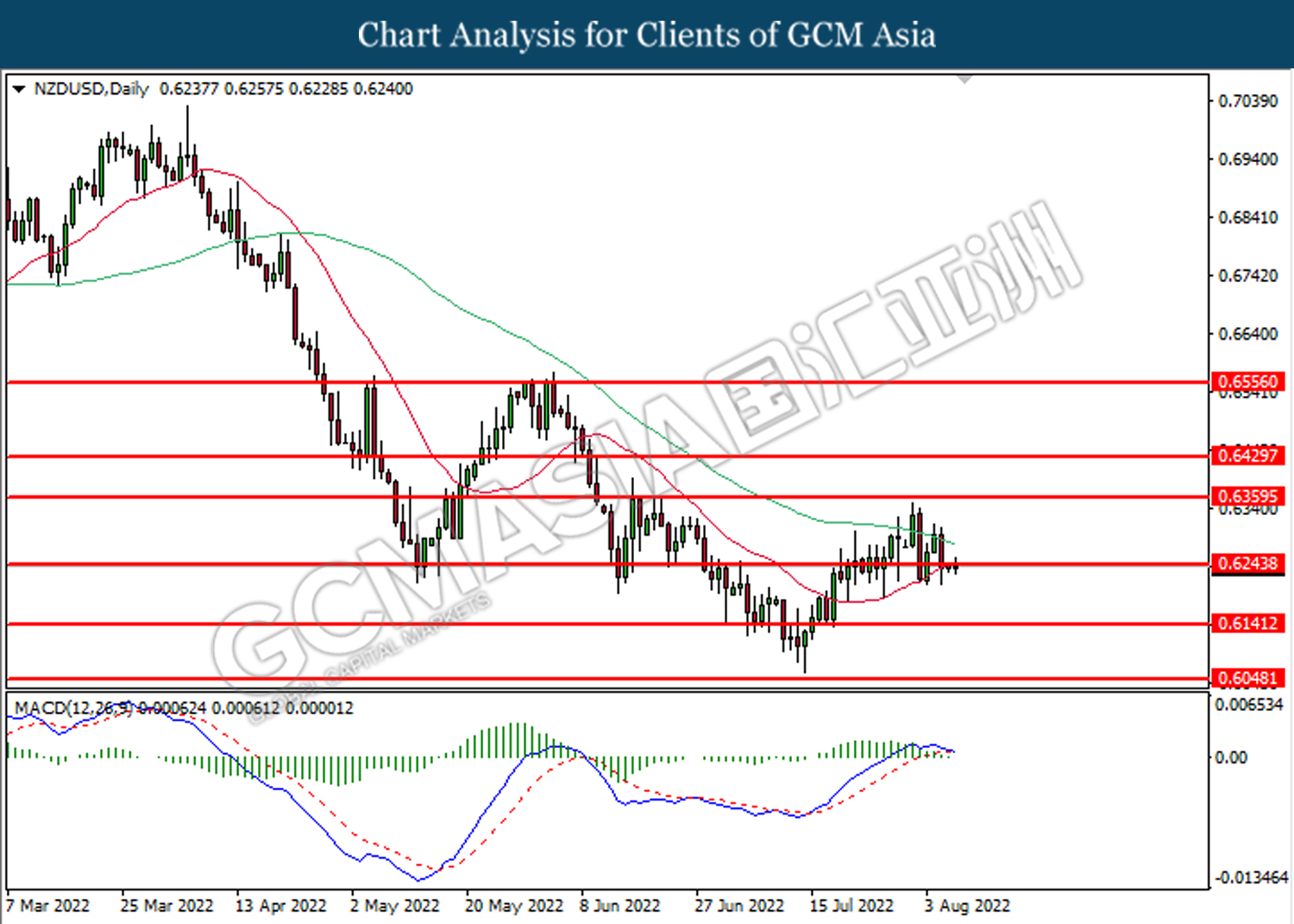

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6360. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6245.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

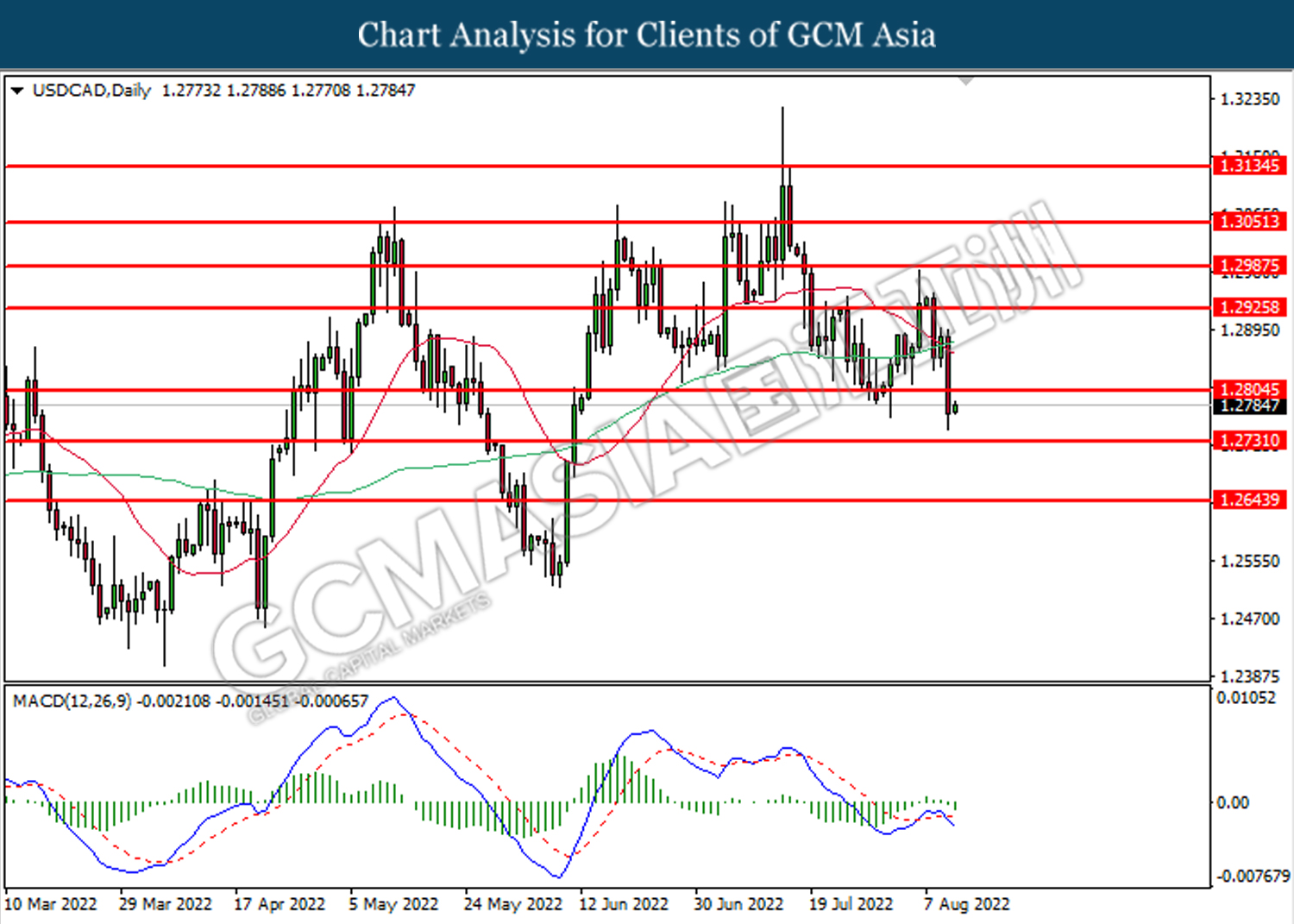

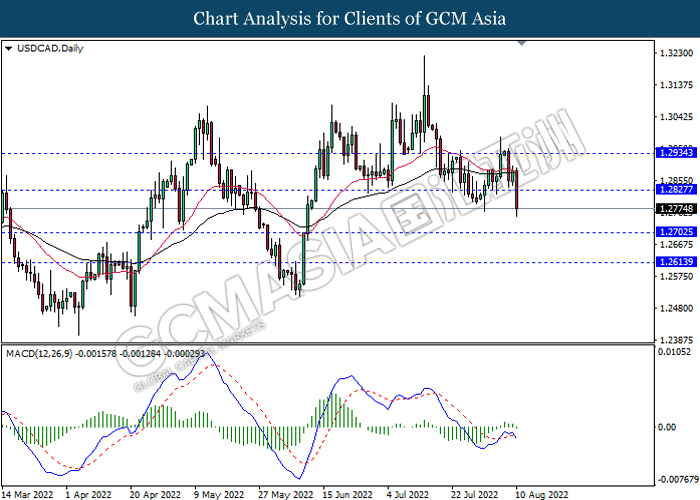

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.2925. MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

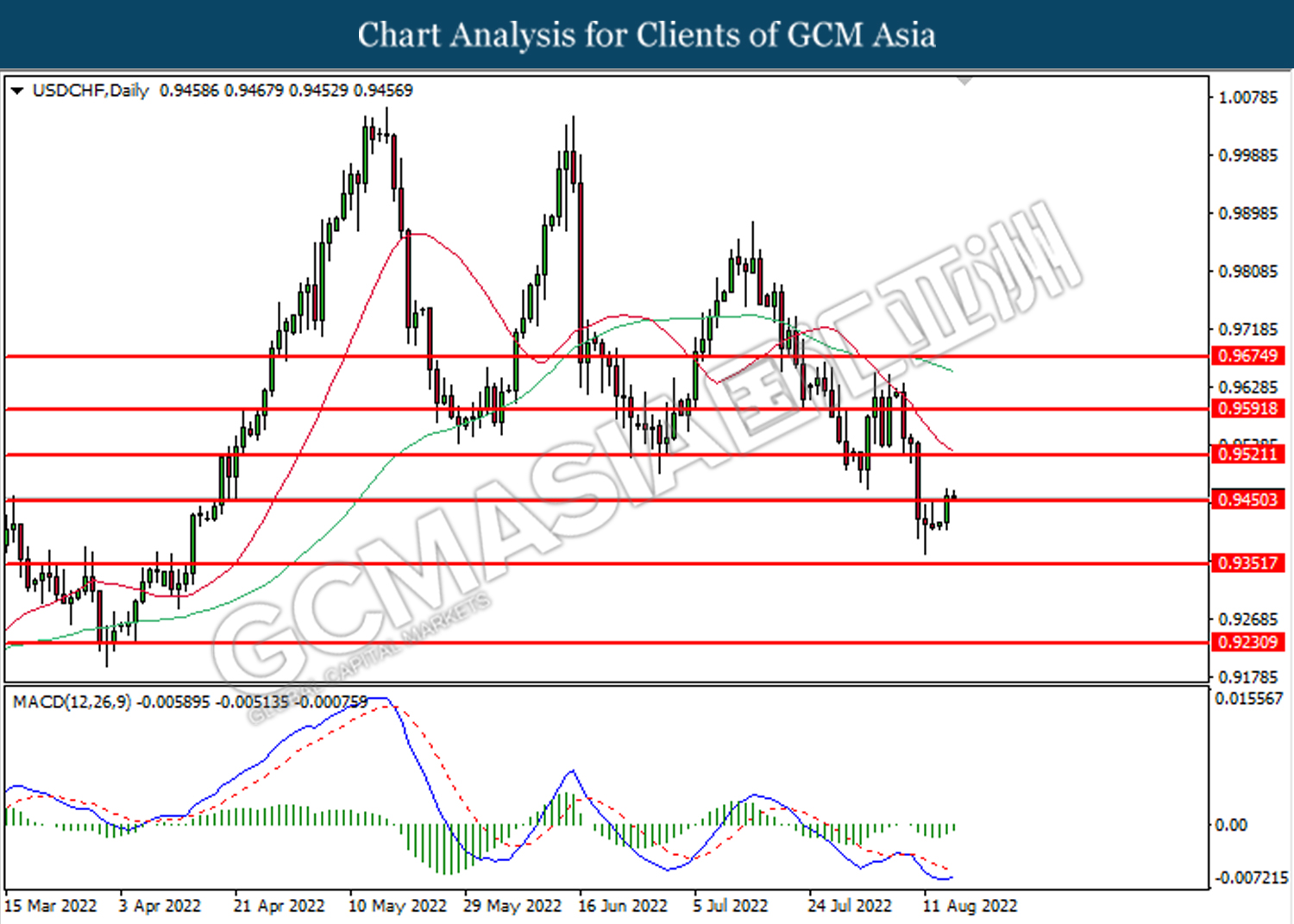

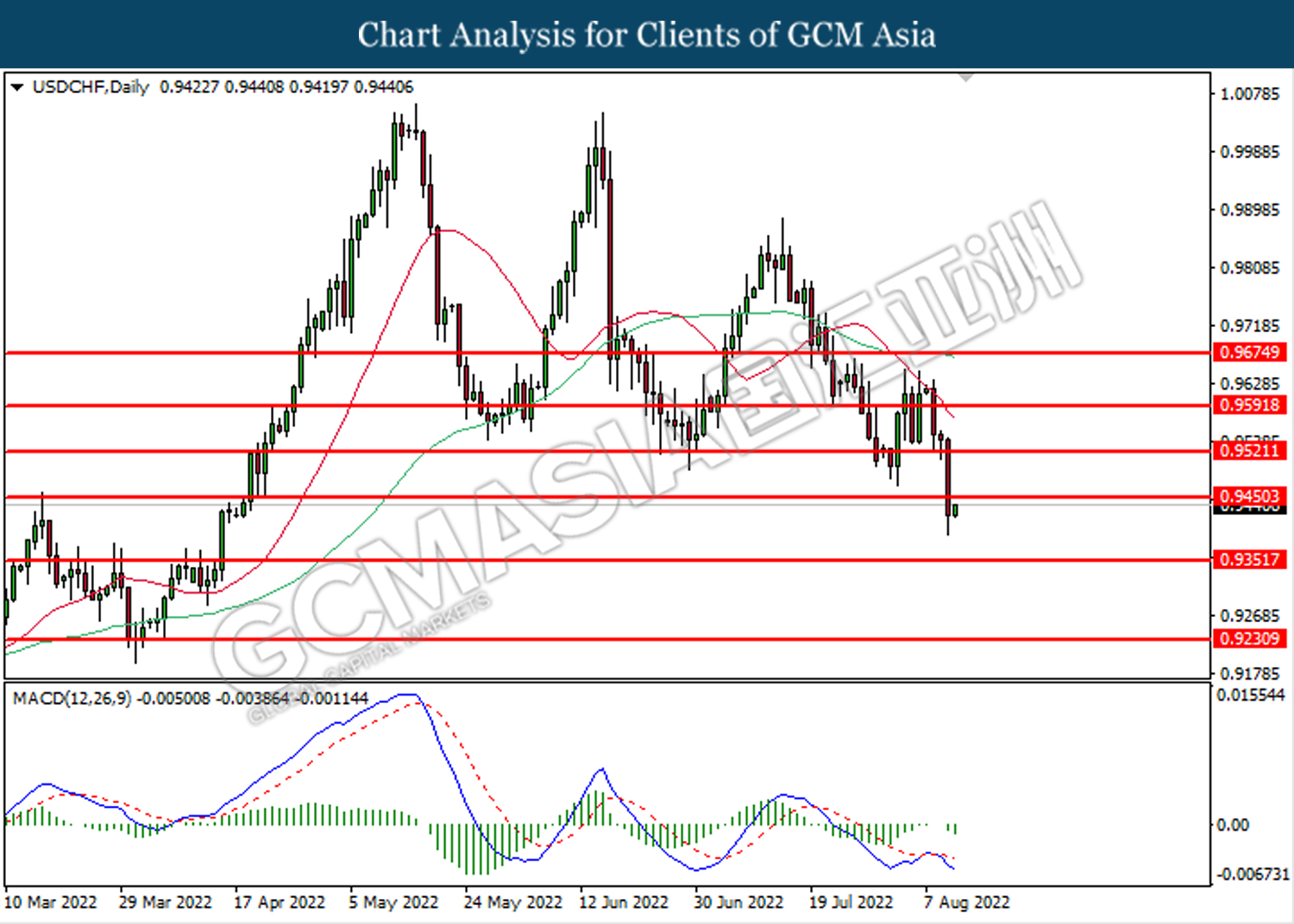

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9450. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9520.

Resistance level: 0.9520, 0.9590

Support level: 0.9450, 0.9350

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 87.30. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 84.00.

Resistance level: 87.30, 89.70

Support level: 84.00, 79.65

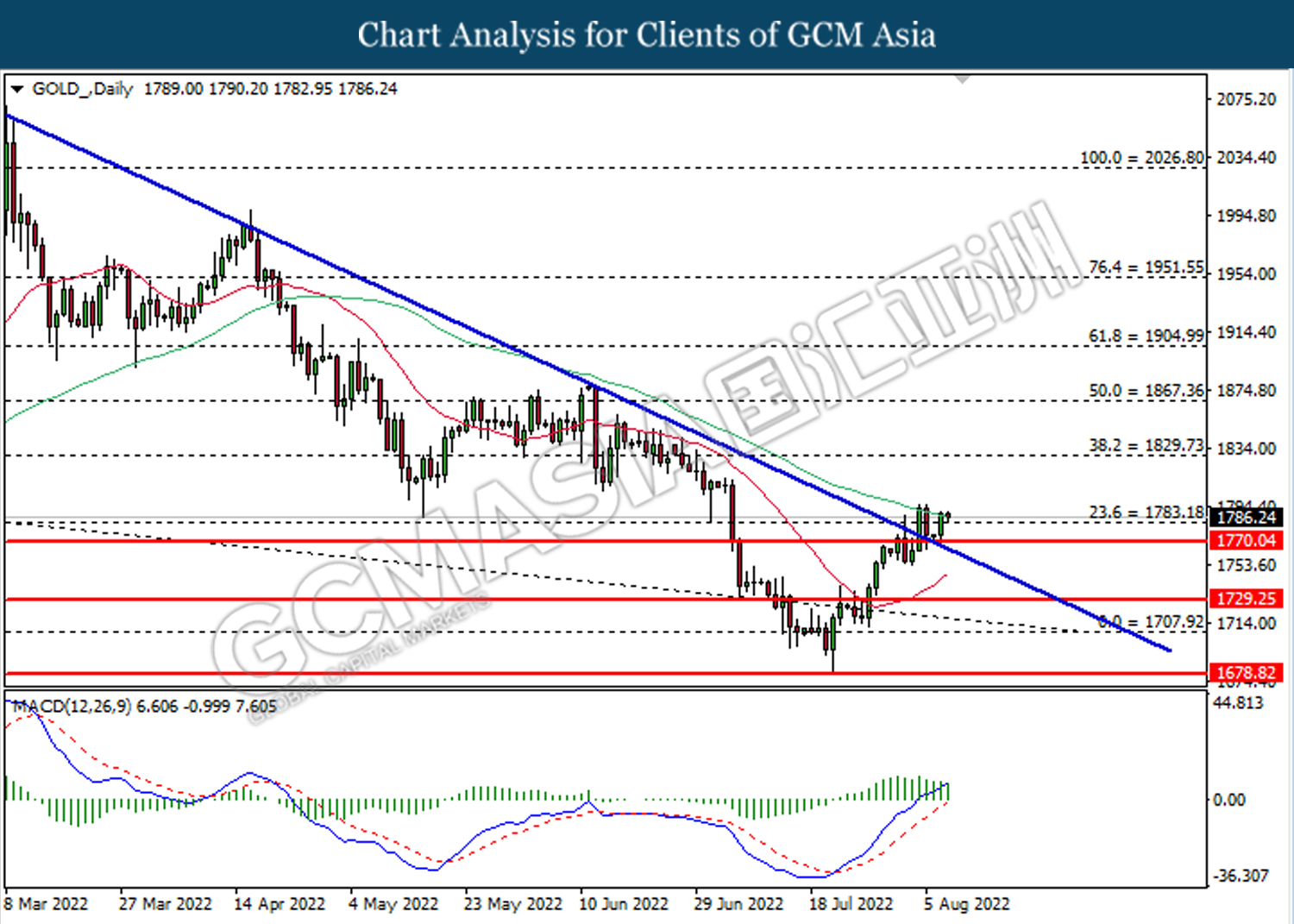

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1783.20, 1808.15

Support level: 1770.05, 1729.25

160822 Afternoon Session Analysis

16 August 2022 Afternoon Session Analysis

Aussie revived following the release of RBA meeting minutes.

The Australian dollar, which is widely known as Aussie, rebounded after falling significantly yesterday amid the announcement of the Reserve Bank of Australia (RBA) meeting minutes. In the meeting minutes, the RBA officials had discussed the inflation level in Australia, where they actually noted that the inflation in the nation is high now and well above the target. The main factors that caused the sky-high inflation were due to the Covid-19 relation disruption to supply chains and the war in Ukraine. However, the members revealed that they reckon the inflation to peak later in 2022 and will start to decline back to the range between 2% – 3% by the end of 2024. On the labour market front, Australia’s employment market was growing strongly and the unemployment rate was at its lowest level in almost 50 years. Nonetheless, the path of the monetary policy would still be guided by the upcoming data as well as the economic outlook. The board is still committed to bringing down inflation to the long-term target of 2% to 3% over time. As of writing, the pair of AUD/USD is up by 0.17% to 0.7035.

In the commodities market, the crude oil price climbed 1.14% to $89.40 a barrel, but still lingered near the recent low level amid the heightening of market concern over Chinese demand. Besides, the gold prices appreciated by 0.15% to $1782.00 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Jun) | 6.20% | 4.50% | – |

| 14:00 | GBP – Claimant Count Change (Jul) | -20.0K | – | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Aug) | -53.8 | -52.7 | – |

| 20:30 | USD – Building Permits (Jul) | 1.696M | 1.640M | – |

| 20:30 | CAD – Core CPI (MoM) (Jul) | 0.30% | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2035. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0155. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.15. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.30

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.7115. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6985.

Resistance level: 0.7115, 0.7220

Support level: 0.6985, 0.6860

NZDUSD, Daily: NZDUSD was traded lower while currently retesting the support level at 0.6360. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6430, 6555

Support level: 0.6360, 0.6245

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2925. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9450. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9520.

Resistance level: 0.9520, 0.9590

Support level: 0.9450, 0.9350

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 87.30. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical retracement in short term.

Resistance level: 89.70, 93.15

Support level: 87.30, 82.70

GOLD_, Daily: Gold price was traded higher following prior rebound near the support level at 1770.05. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical retracement in short term.

Resistance level: 1783.20, 1808.15

Support level: 1770.05, 1729.25

160822 Morning Session Analysis

16 August 2022 Morning Session Analysis

US Dollar extends its gain as accelerating risk-off sentiment in the global market.

The Dollar Index which traded against a basket of six major currencies extend its gains on yesterday while Chinese-proxy currencies such as Australia Dollar and New Zealand Dollar retreated over the backdrop of a string of downbeat economic data from China. According to National Bureau of Statistics, China Industrial Production notched down from the preliminary reading of 3.9% to 3.8%, missing the market forecast at 4.6%, which indicating the recovery momentum for the Chinese economy still remained stagnant. Such downbeat economic data had sparked further risk-off sentiment in the global financial market, increasing the appeal for the safe-haven US Dollar. On the monetary policy front, the People’s Bank of China had reduced its benchmark lending rate by 10 basis points to 2.75%, diminishing the market demand for the Chinese Yuan. The unexpected move from the People’s Bank of China had prompted investors to shift their portfolio into US Dollar as investors speculated the rate hike possibilities from the Federal Reserve in future. As of writing, the Dollar Index appreciated by 0.82% to 106.50.

In the commodities market, the crude oil price tumbled significantly on yesterday, while closing its price at $87.25 per barrel. The overall trend for the crude oil remained bearish amid weak economic data from China had added further pressure toward the global recession risk. On the other hand, the gold market slumped 0.01% to $1779.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Jun) | 6.20% | 4.50% | – |

| 14:00 | GBP – Claimant Count Change (Jul) | -20.0K | – | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Aug) | -53.8 | -52.7 | – |

| 20:30 | USD – Building Permits (Jul) | 1.696M | 1.640M | – |

| 20:30 | CAD – Core CPI (MoM) (Jul) | 0.30% | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 106.40, 107.15

Support level: 105.55, 104.40

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2125, 1.2185

Support level: 1.2055, 1.1975

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0285, 1.0365

Support level: 1.0155, 1.0085

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 135.30, 137.30

Support level: 132.40, 130.45

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7120, 0.7195

Support level: 0.6990, 0.6895

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6455, 0.6535

Support level: 0.6340, 0.6225

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2950, 1.3105

Support level: 1.2755, 1.2645

USDCHF, H4: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9505, 0.9635

Support level: 0.9410, 0.9305

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 89.50, 92.50

Support level: 87.25, 84.05

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1783.30, 1801.75

Support level: 1768.90, 1754.50

150822 Afternoon Session Analysis

15 August 2022 Afternoon Session Analysis

Pound dived despite better-than-expected GDP released.

The Pound Sterling, which is widely traded by global investors, plunged as the UK economy closed its second quarter of 2022 in a recession. According to the Office for National Statistics, the UK GDP data came in at -0.1%, far weaker than the prior quarter’s reading of 0.8% growth. The downbeat UK GDP data showed that the UK economy shrank significantly, where it heads toward recession amid the rising of inflationary pressures and political uncertainty heightened. Besides, the Bank of England (BoE) warned that the UK economy is likely fall into recession this year, whereby the recession is expected to last for more than a year. With that, the high possibility of prolonged recession risk suppressed the value of the UK currency, while putting the pound’s outlook in a cloudy state. On the other side, the strengthening of dollar index amid the heightening of risk-off sentiment also squeezed the value of GBP/USD, retaining the currency pair from a rebound. As of writing, the pair of GBP/USD dipped by 0.12% to 1.2115.

In the commodities market, the crude oil price dipped -0.95% to $90.55 a barrel as the flows of oil through Druzhba pipeline resumed after the payment has been made by Russia. Besides, the gold prices depreciated -0.48% to $1794.80 per troy ounce amid the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 105.15. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 106.10.

Resistance level: 106.10, 107.15

Support level: 105.15, 103.55

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support upward trendline. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the trendline.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0265. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0155.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.15. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.30

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.7115. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7115, 0.7220

Support level: 0.6985, 0.6860

NZDUSD, Daily: NZDUSD was traded lower while currently retesting the support level at 0.6430. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6555, 0.6730

Support level: 0.6430, 0.6360

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2730. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2805.

Resistance level: 1.2805, 1.2925

Support level: 1.2730, 1.2645

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9450. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9350.

Resistance level: 0.9450, 0.9520

Support level: 0.9350, 0.9230

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the upward trendline. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level ate 89.70.

Resistance level: 93.15, 98.20

Support level: 89.70, 87.30

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1808.15. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1783.20.

Resistance level: 1808.15, 1829.75

Support level: 1783.20, 1770.05

150822 Morning Session Analysis

15 August 2022 Morning Session Analysis

US Dollar surged as fears upon nuclear disaster sparked demand on safe-haven asset.

The Dollar Index which traded against a basket of six major currencies rebounded significantly from its lower level as the escalating tensions between Russia-Ukraine had stoked a shift in sentiment toward the safe-haven Greenback. According to Reuters, Ukraine is currently targeting Russian soldiers who war at Europe’s largest nuclear power station, sparking a fear upon the nuclear catastrophe. The International Atomic Energy Agency (IAEA), which is seeking to monitor the nuclear plant, has warned of a nuclear disaster if multiple incidents of shelling continue to persist at the Zaporizhzhia facility in southern Ukraine. Besides, the US Dollar extend its gains over the backdrop of hawkish statement from Federal Reserve recently. San Francisco Federal Reserve Bank President Mary Daly claimed that the Federal Reserve was still open the possibility of another 75-basis point rate hike in September. As of writing, the US Dollar appreciated by 0.04% to 105.70.

In the commodities market, the crude oil price extends its losses by 0.29% to $91.15 per barrel as of writing. The oil market edged lower as fears upon the global recession risk continue to weigh down the market demand on this black-commodity. On the other hand, the gold market appreciated by 0.01% to $1800.05 per troy ounces as of writing amid diminishing risk appetite in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 106.40, 107.15

Support level: 105.55, 104.40

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2185, 1.2275

Support level: 1.2125, 1.2065

EURUSD, H4: EURUSD was traded lower following prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0285, 1.0365

Support level: 1.0155, 1.0085

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.30, 137.30

Support level: 132.40, 130.45

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7120, 0.7195

Support level: 0.7030, 0.6955

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6535, 0.6720

Support level: 0.6360, 0.6225

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2950, 1.3105

Support level: 1.2755, 1.2645

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9505, 0.9635

Support level: 0.9410, 0.9305

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 92.50, 94.85

Support level: 89.50, 87.25

GOLD_, H1: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction

Resistance level: 1801.75, 1810.85

Support level: 1794.00, 1785.30

120822 Afternoon Session Analysis

12 August 2022 Afternoon Session Analysis

Pound topped, while investors wait for GDP data.

The Pound Sterling, which is widely traded by global investors, lingered near the higher level in 1-week amid the dollar index softening, while the market participants are waiting for the crucial economic data to be released. Over the past two days, the US has released a series of downbeat inflation figure, whereby the inflationary pressures in the nation has peaked and signaled some sign of easing. The lower-than-expected inflation figure urged the investors to flee away from the dollar market as they bet the Federal Reserve would implement a less aggressive rate hike plan going forward. On the UK front, the Bank of England (BOE) warned last week that the UK economy will enter its longest recession since the global financial crisis (GFC) in the fourth quarter of 2022. With the pessimistic forecast, the investors are all-eyed on the GDP, which will be announced later today, in order to gauge the direction of the currency before the recession comes in. As of writing, the pair of GBP/USD dropped 0.17% to 1.2190.

In the commodities market, the crude oil price dipped 0.22% to $93.85 a barrel as the demand outlook remains clouded amid an extension of lockdown in China’s cities. Besides, the gold prices appreciated by 0.04% to $1790.00 per troy ounce amid dollar index weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) (Q2) | 8.70% | 2.80% | – |

| 14:00 | GBP – GDP (QoQ) (Q2) | 0.80% | -0.20% | – |

| 14:00 | GBP – GDP (MoM) | 0.50% | -1.20% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Jun) | 1.40% | -1.20% | – |

| 14:00 | GBP – Monthly GDP 3M/3M Change | 0.40% | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 105.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 103.55.

Resistance level: 105.15, 106.10

Support level: 103.55, 101.30

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2175. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2355.

Resistance level: 1.2355, 1.2480

Support level: 1.2175, 1.2035

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0265. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0370.

Resistance level: 1.0370, 1.0490

Support level: 1.0265, 1.0155

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 133.15. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 133.15, 135.25

Support level: 131.30, 128.80

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7115.

Resistance level: 0.7115, 0.7220

Support level: 0.6985, 0.6860

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6430. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6430.

Resistance level: 0.6430, 0.6555

Support level: 0.6360, 0.6245

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.2805. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.2730.

Resistance level: 1.2805, 1.2925

Support level: 1.2730, 1.2645

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9450. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9350.

Resistance level: 0.9450, 0.9520

Support level: 0.9350, 0.9230

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 93.15. MACD which illustrated ongoing bullish momentum suggests the commodity to extend its gains toward the resistance level at 98.20.

Resistance level: 98.20, 104.00

Support level: 93.15, 89.70

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1783.20. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1808.15, 1829.75

Support level: 1783.20, 1770.05

120822 Morning Session Analysis

12 August 2022 Morning Session Analysis

US Dollar weakened over the easing inflationary pressure.

The Dollar Index which traded against a basket of six major currencies slipped on yesterday after the inflationary data has been released. According to the US Bureau of Labor Statistics, the US Producer Price Index (PPI) MoM for July notched down from the previous reading of 1.0% to -0.5%, missing the market anticipation of 0.2%. The PPI data is one of the crucial data to gauge the inflationary pressure in a nation. Thus, the lower-than-expected figures had showed that the inflation risk in the US was cooling down, which suggested a rate hikes which is less forceful would be implemented. According to CME FedWatch Tool, the possibility of 50 basis point rate increase had raised to about 61.5%, which indicated that the majority of investors are predicting that the half-of-percentage rate hikes from Fed would be decided instead of 75 basis point. Nonetheless, the losses experienced by the Dollar Index was limited amid the upbeat employment data. The US Initial Jobless Claims posted at the reading of 262K, which is lower than the market forecast of 263K. As of writing, the Dollar Index depreciated by 0.10% to 104.98.

In the commodities market, the crude oil price dropped by 0.38% to $93.98 per barrel as of writing. However, the oil price surged on yesterday amid the International Energy Agency (IEA) raised its oil demand growth forecast for this year. On the other hand, the gold price eased by 0.21% to $1787.42 per troy ounce as of writing following the bullish employment data from the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) (Q2) | 8.70% | 2.80% | – |

| 14:00 | GBP – GDP (QoQ) (Q2) | 0.80% | -0.20% | – |

| 14:00 | GBP – GDP (MoM) | 0.50% | -1.20% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Jun) | 1.40% | -1.20% | – |

| 14:00 | GBP – Monthly GDP 3M/3M Change | 0.40% | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 105.25, 106.30

Support level: 104.45, 103.60

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2270, 1.2345

Support level: 1.2170, 1.2070

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0385, 1.0465

Support level: 1.0315, 1.0235

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 133.40, 134.90

Support level: 131.65, 129.35

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7145, 0.7220

Support level: 0.7075, 0.7005

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6465, 0.6555

Support level: 0.6355, 0.6270

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2825, 1.2935

Support level: 1.2700, 1.2615

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9455, 0.9520

Support level: 0.9380, 0.9300

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 95.35, 97.70

Support level: 93.25, 91.50

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1807.65, 1836.10

Support level: 1778.80, 1756.95

110822 Afternoon Session Analysis

11 August 2022 Afternoon Session Analysis

Pound surged ahead of GDP data.

The Pound Sterling, which is widely traded by global investors, skyrocketed yesterday amid the larger-than-expected decline in the inflation figures diminished the appeal of the US dollar. After the much-anticipated inflation report was released from the US, the investor’s risk appetite improved dramatically as the CPI data came in at 8.5% only, far lower than the consensus forecast of 8.7%. The soft inflationary pressures are mainly attributed to the significant fall in energy prices over the past two months. Following the inflation rate trimmed, the tightening path of the Federal Reserve is expected to be narrowed, but a consecutive fall in the inflation figures would be a favorable scenario before they stop the rate hike plan. On the other side, the pound is still waiting for the upcoming GDP data, which is due on Friday, as it could provide further scrutiny regarding the economic development of the UK in the past quarter. In the meantime, investors also waiting for the final election of the new prime minister, which will succeed Boris Johnson next month. As of writing, the pair of GBP/USD dropped by -0.34% to 1.2177.

In the commodities market, the crude oil price is up 0.05% to $91.65 a barrel amid the weakening of the dollar index causing the price of this black commodity cheaper for the non-US oil buyer. Besides, the gold prices dropped -by 0.40% to $1784.55 per troy ounce despite the inflation figure weakened.

Today’s Holiday Market Close

Time Market Event

All Day JPY Mountain Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 260K | 263K | – |

| 20:30 | USD – PPI (MoM) (Jul) | 1.10% | 0.30% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 105.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 103.55.

Resistance level: 105.15, 106.10

Support level: 103.55, 101.30

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2175. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2355.

Resistance level: 1.2355, 1.2480

Support level: 1.2175, 1.2035

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0265. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0370.

Resistance level: 1.0370, 1.0490

Support level: 1.0265, 1.0155

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 133.15. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 131.35.

Resistance level: 133.15, 135.25

Support level: 131.30, 128.80

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7115.

Resistance level: 0.7115, 0.7220

Support level: 0.6985, 0.6860

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6430. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6430.

Resistance level: 0.6430, 0.6555

Support level: 0.6360, 0.6245

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.2805. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.2730.

Resistance level: 1.2805, 1.2925

Support level: 1.2730, 1.2645

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9450. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9350.

Resistance level: 0.9450, 0.9520

Support level: 0.9350, 0.9230

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 91.80. MACD which illustrated ongoing bullish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 91.80, 93.15

Support level: 89.70, 87.30

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1783.20. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1808.15, 1829.75

Support level: 1783.20, 1770.05

110822 Morning Session Analysis

11 August 2022 Morning Session Analysis

US Dollar dived as inflation pressure soften.

The Dollar Index which traded against a basket of six major currencies slumped on yesterday after the CPI data has been unleashed. According to the US Bureau of Labor Statistics, the US Consumer Price Index (CPI) YoY for July notched down from the previous reading of 9.1% to 8.5%, lower than the market forecast of 8.7%. Besides, the US Core Consumer Price Index (CPI) MoM, which excluding food and energy price, has posted at the reading of 0.3% while it was lower than the consensus expectation of 0.5%. The lower-than-expected inflationary data has showed that the inflation risk in the US has reached its peak and easing. Thus, it might indicate that the less aggressive rate hikes from Fed would be implemented. According to CME FedWatch Tool, the possibility of 50 basis point rate hike is about 57.5% while the chance of 75 basis point rate increase has reduced to 42.5%. As of writing, the Dollar Index depreciated by 1.08% to 105.10.

In the commodities market, the crude oil price dropped by 0.55% to $91.42 per barrel as of writing. Nonetheless, the oil price received bullish momentum during the overnight trading session amid the slump of US Dollar. On the other hand, the gold price eased by 0.39% to $1791.11 per troy ounce as of writing. Though, the trend of gold price remained bullish amid the rising tensions between US and China.

Today’s Holiday Market Close

Time Market Event

All Day JPY Japan – Mountain Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 260K | 263K | – |

| 20:30 | USD – PPI (MoM) (Jul) | 1.10% | 0.30% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 105.25, 106.30

Support level: 104.45, 103.60

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2270, 1.2345

Support level: 1.2170, 1.2070

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0315, 1.0385

Support level: 1.0235, 1.0160

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 133.40, 134.90

Support level: 131.65, 129.35

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7145, 0.7220

Support level: 0.7075, 0.7005

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6465, 0.6555

Support level: 0.6355, 0.6270

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2825, 1.2935

Support level: 1.2700, 1.2615

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9455, 0.9520

Support level: 0.9380, 0.9300

CrudeOIL, H1: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 91.50, 93.25

Support level: 89.75, 87.85

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1807.65, 1836.10

Support level: 1778.80, 1756.95

100822 Afternoon Session Analysis

10 August 2022 Afternoon Session Analysis

Pound turned sour upon potential power suspension.

The GBP/USD, which widely traded by majority of investors dipped during the overnight trading session amid the backdrop of rising uncertainty of energy crisis which faced by UK. According to Bloomberg, UK had drawn up plans for potential power cuts to homes and industries in January’s winter, which driven by the storm of cold weather and gas shortages. Besides, the UK government had asked for the emergency plans from food and beverage industry in order to avoid empty shelves in case of blackout happened. The move implemented by UK government would bring negative impacts on businesses and homes across the country, as well as forcing the closure of railways, libraries and other Government buildings. In addition, Pound Sterling remained under pressure following the economy slowdown that caused by soaring inflation risk. Last week, Bank of England had emphasized that UK economy would enter to a recession in fourth quarter. As of writing, GBP/USD edged up by 0.03% to 1.2084.

In the commodities market, the crude oil price depreciated by 0.33% to $90.20 per barrel as of writing. Nonetheless, crude oil price surged on yesterday as Ukraine has stopped the oil pipeline which from Russia flows to Europe. On the other hand, the gold price appreciated by eased by 0.28% to $1790.93 per troy ounce as of writing. Though, trend of gold price remained bullish over the rising tensions between US and China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Jul) | 0.7% | 0.5% | – |

| 20:30 | USD – CPI (YoY) (Jul) | 9.1% | 8.7% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 4.467M | 0.073M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2170, 1.2270

Support level: 1.2070, 1.1985

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0235, 1.0315

Support level: 1.0160, 1.0075

USDJPY, H4: USDJPY was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 136.65, 138.35

Support level: 134.90, 133.40

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

NZDUSD, H4: NZDUSD was traded higher while current testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2935, 1.3030

Support level: 1.2825, 1.2700

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 91.50, 93.25

Support level: 89.75, 87.85

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1807.65, 1836.10

Support level: 1778.80, 1756.95

100822 Morning Session Analysis

10 August 2022 Morning Session Analysis

US dollar paralyzed ahead of inflation report.

The Dollar Index which traded against a basket of six major currencies hovered near the level above 106.00 since early this week as market participants are waiting for the announcement of the inflation data. The Consumer Price Index (CPI), which is used to gauge the inflationary pressures of the nation, is scheduled to be announced later today, whereby it would provide further clues on the tightening path of the Federal Reserve going forward. According to the Fed Rate Monitor Tool, the possibility of a 75-basis point rate hike is about 58.0% as of now, while 42% of the possibility that the Fed would only hike a 50-basis points in the upcoming meeting. With the backdrop of falling energy prices, economists are expecting the inflation figures for the month of July to fall from 9.1% to 8.7%. If the final reading of the data does not deviate from the market expectation far, it would likely urge the Fed officials to tilt toward a less aggressive rate hike in the next Fed meeting, says a 50-basis point instead of 70-basis point. As of writing, the dollar index edged lower -0.12% to 106.30.

In the commodities market, the crude oil price dropped by 0.02% to $90.50 per barrel as the API Weekly Crude Oil Stock has shown some stockpile over the week, where the crude oil inventories rose by 2.156M, missing the consensus forecast of 0.073M. On the other hand, the gold price appreciated by 0.05% to $1793.55 per troy ounce as the market risk appetite dwindled amid the ongoing tensions between the US and China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Jul) | 0.7% | 0.5% | – |

| 20:30 | USD – CPI (YoY) (Jul) | 9.1% | 8.7% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 4.467M | 0.073M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the upward trendline. However, MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.2035. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0155. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.35

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.2925. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.2805.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9520. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 89.70. MACD which illustrated ongoing bullish momentum suggests the commodity to extend its gains toward the resistance level at 91.80.

Resistance level: 91.80, 93.15

Support level: 89.70, 87.30

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1783.20. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1829.75.

Resistance level: 1829.75, 1867.35

Support level: 1783.20, 1770.05

090822 Afternoon Session Analysis

9 August 2022 Afternoon Session Analysis

Sentiment in Pound market remains sour.

The Pound Sterling, which is widely traded by global investors, lingered near the lowest level since the outbreak of Covid-19 in March 2020. The majority of the market participants are still holding a pessimistic view toward the economic outlook of the UK amid the political uncertainty, where the New prime minister is still undecided yet. According to the latest news, Conservative MPS have chosen the final two British candidates, whereby the former Treasury secretary Rishi Sunak and the current foreign secretary Liz Truss is vying to succeed Boris Johnson. As of now, the candidates will continue with their election campaign, where Sunak and Truss will travel the country to make a series of speeches in order to gain support from the members of the Conservative party in the UK. According to the polls, it indicates that Rishi Sunak is in the “best place” to win over the United Kingdom in the upcoming election. The new prime minister is expected to be elected during the first week of September. As of writing, the pair of GBP/USD rose 0.02% to 1.2080.

In the commodities market, the crude oil price was down 0.36% to $90.30 a barrel amid the heightening of geopolitical tensions between the US and China continued to threaten the demand outlook of the commodity. Besides, the gold prices dropped -0.21% to $1785.40 per troy ounce after surging for $20 yesterday amid the ongoing tensions between the US and China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.2035. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0155. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo short term technical correction.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.35

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.2925. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.2805.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9520. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 89.70. MACD which illustrated ongoing bullish momentum suggests the commodity to extend its gains toward the resistance level at 91.80.

Resistance level: 91.80, 93.15

Support level: 89.70, 87.30

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1783.20. MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 1829.75, 1867.35

Support level: 1783.20, 1770.05

090822 Morning Session Analysis

9 August 2022 Morning Session Analysis

US Dollar dived as inflation expectation lowered.

The Dollar Index which traded against a basket of six major currencies eased on Monday after Federal Reserve Bank of New York released its monthly Consumer Expectation survey. According to the survey, the inflation expectations at the 1-year horizon slipped to 6.22% in July from the previous month of 6.78%, which is the lowest since February. At the same time, median three-year-ahead inflation expectations also declined from 3.62% to 3.18%, the lowest since April 2021. The reducing inflation expectation had suggested a less forcefully rate hikes from Fed, which dragged down the market interest on US Dollar. As of now, investors would continue to scrutinize the latest updates with regards of the announcement of CPI data in order to gauge the likelihood movement of the US Dollar. Currently, the market participants are predicting that the CPI in July would notch down from the previous reading of 9.1% to 8.7%. As of writing, the Dollar Index depreciated by 0.20% to 106.38.

In the commodities market, the crude oil price rallied by 0.29% to $90.50 per barrel as of writing following China purchased 8.79 million barrels of oil in July, which is higher than market expectations. On the other hand, the gold price edged up by 0.05% to $1789.85 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2170, 1.2270

Support level: 1.2070, 1.1985

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0235, 1.0315

Support level: 1.0160, 1.0075

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 134.90, 136.65

Support level: 133.40, 131.65

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2935, 1.3030

Support level: 1.2825, 1.2700

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 91.50, 93.25

Support level: 89.75, 87.85

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1807.65, 1836.10

Support level: 1778.80, 1756.95

080822 Afternoon Session Analysis

8 August 2022 Morning Session Analysis

Dollar surged as risk-off sentiment took hold.

The dollar index, which was traded against a basket of major currencies, jumped as the deteriorating of the tensions between the US and China exerted unstoppable bullish momentum in the market. According to the latest development, China has taken some retaliatory measures such as halting the dialogue between the US and Chinese defense officials, while suspending the co-operation on issue of illegal immigrants returns, climate change and International crime. Such decision was made following the visit of Ms Pelosi to Taiwan a week ago, which showing the US obstinate stance on disregarding the China’s strong opposition and serious representations. Going forward, we reck on that the military drill would likely to keep going for an extended of time, whereby the geopolitical tensions would heighten further. On the other side, the upbeat NFP and unemployment data have also pushed the dollar index higher on last Friday trading session. As of writing, the dollar index retraced slightly by 0.02% to 106.60.

In the commodities market, the crude oil price up 0.47% to $90.10 a barrel as the black commodity market is still surrounded by the supply shortage concerns. However, with the heightening of geopolitical tensions between the US and China, the black commodity outlook remains clouded. Besides, the gold prices dropped -0.14% to $1772.40 per troy ounce as the upbeat employment data dragged down the traditional safe-haven asset.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2035. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0155. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo short term technical correction.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.35

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6855. However, MACD which illustrated bearish momentum suggest the pair to undergo a short term technical correction.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

NZDUSD, Daily: NZDUSD was traded lower while currently testing near the support level at 0.6245. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2925. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.2985.

Resistance level: 1.2985, 1.3050

Support level: 1.2925, 1.2805

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9755

Support level: 0.9590, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 87.30. MACD which illustrated ongoing bullish momentum suggests the commodity to extend its gains toward the resistance level at 89.70.

Resistance level: 89.70, 91.80

Support level: 87.30, 82.70

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1783.20, 1829.75

Support level: 1770.05, 1729.25