280122 Morning Session Analysis

28 January 2022 Morning Session Analysis

US GDP delivers, will greenback extend its gains?

US dollar hovers at 19 months high after US economic growth notched in its fastest pace in more than 4 decades. According to US Bureau of Economic Analysis, Gross Domestic Product came in at 6.9% for the 4th quarter, significantly higher than forecast of 5.5%. US economic activity accelerated during end of last year due to strong spending among consumers and businesses. Likewise, the data also shows robustness in terms of both public and private sector by adjusting their business towards the new norm after pandemic began in 2020. Additionally, the data has also cemented the course for a faster rate hike pace from Federal Reserve. Higher growth in the economy which are largely driven by strong consumption and demand may propel inflation in the near-term. As such, Fed may need to act quickly via interest rate hike in order to control the stability of consumer goods prices. As of writing, the dollar index was up 0.01% to 97.18.

As for commodities, crude oil price rose 0.47% to $87.44 per barrel while investors speculate geopolitical tension in between Russia and Ukraine may led to oil supply deficit in the event of war. Otherwise, gold price was down by 0.01% to $1,797.56 a troy ounce due to stronger greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German GDP (QoQ) (Q4) | 1.70% | -0.20% | – |

Technical Analysis

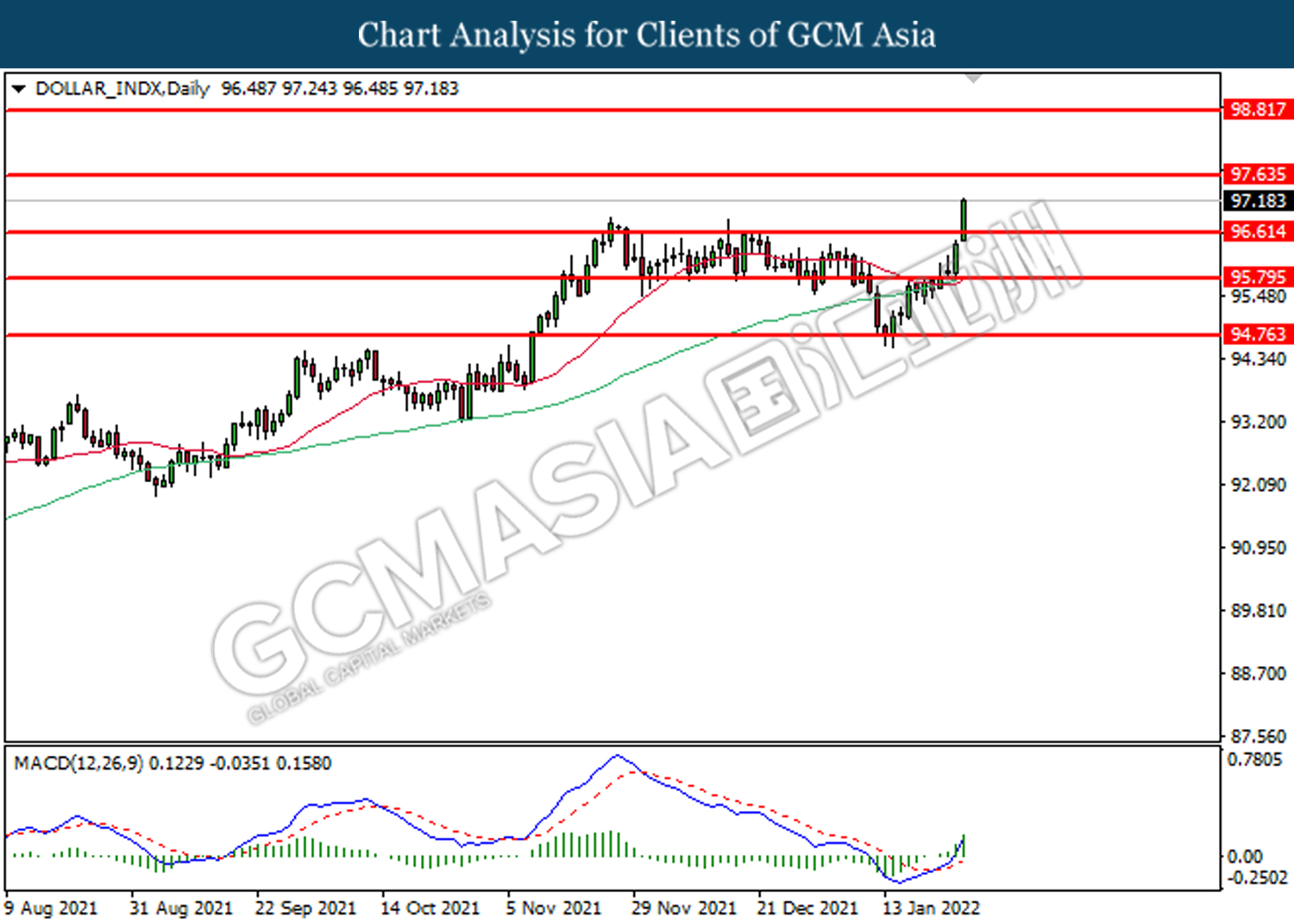

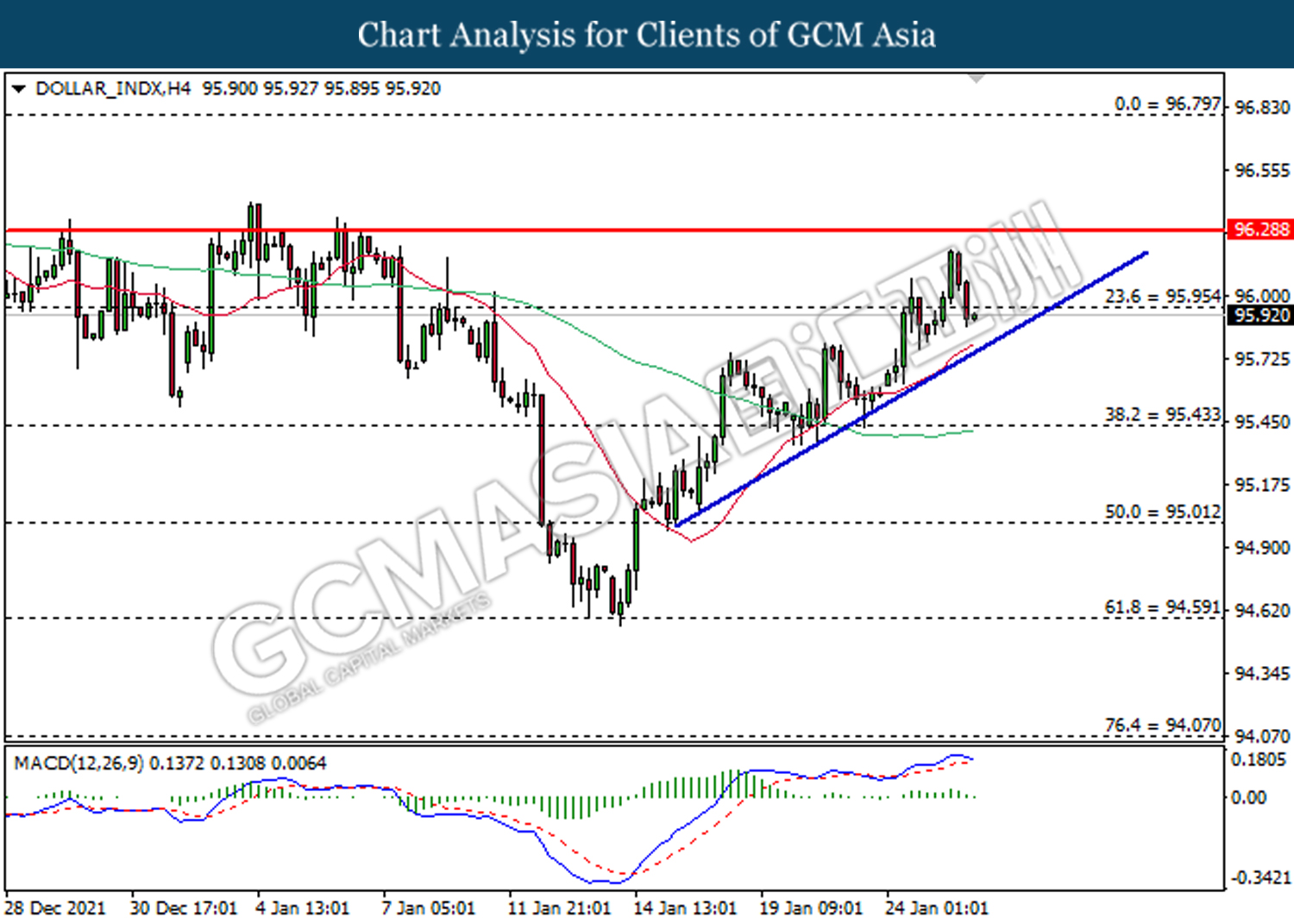

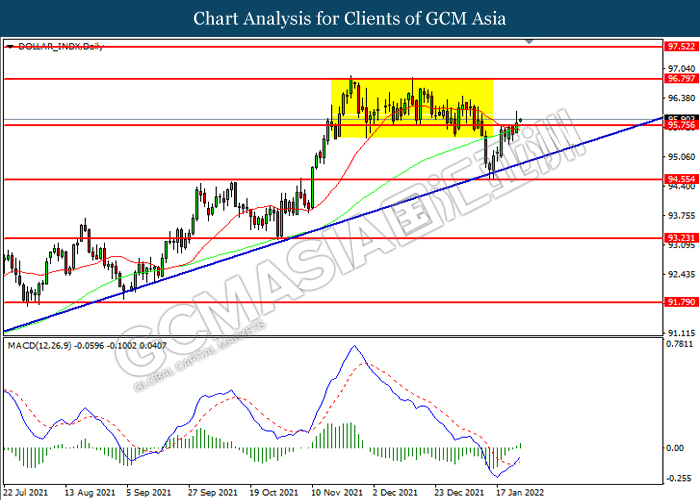

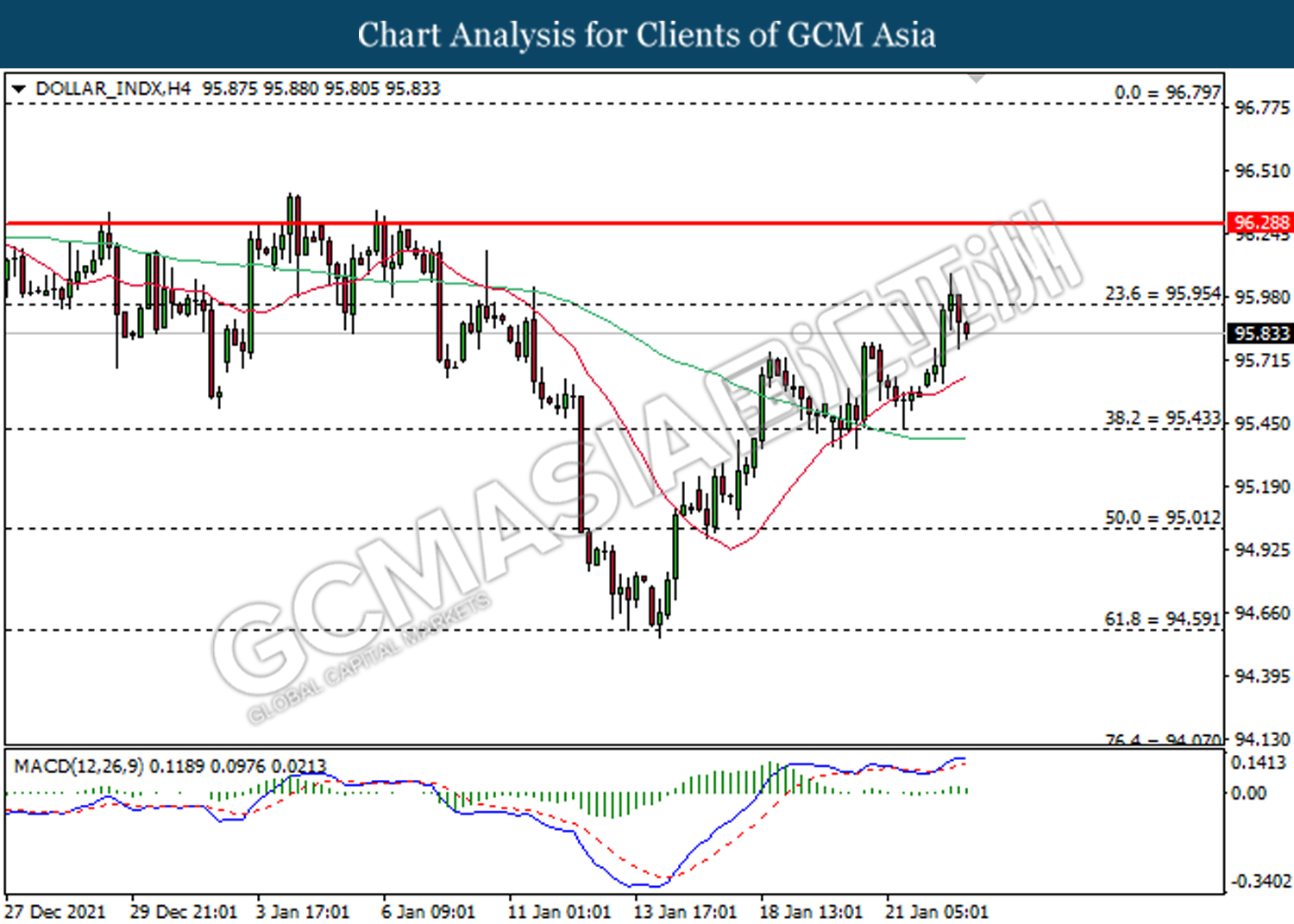

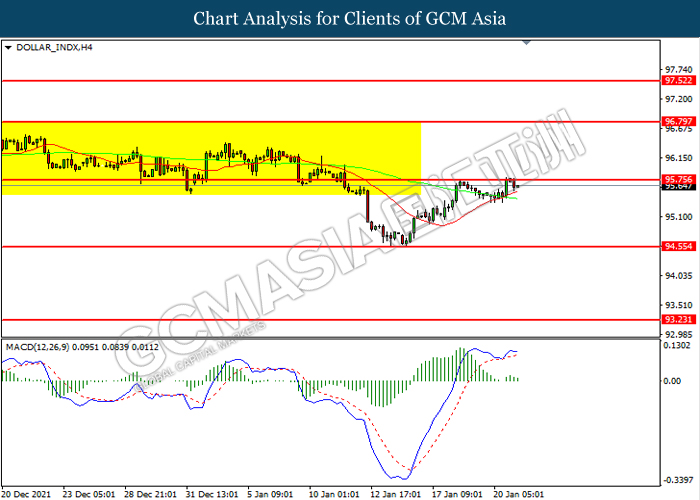

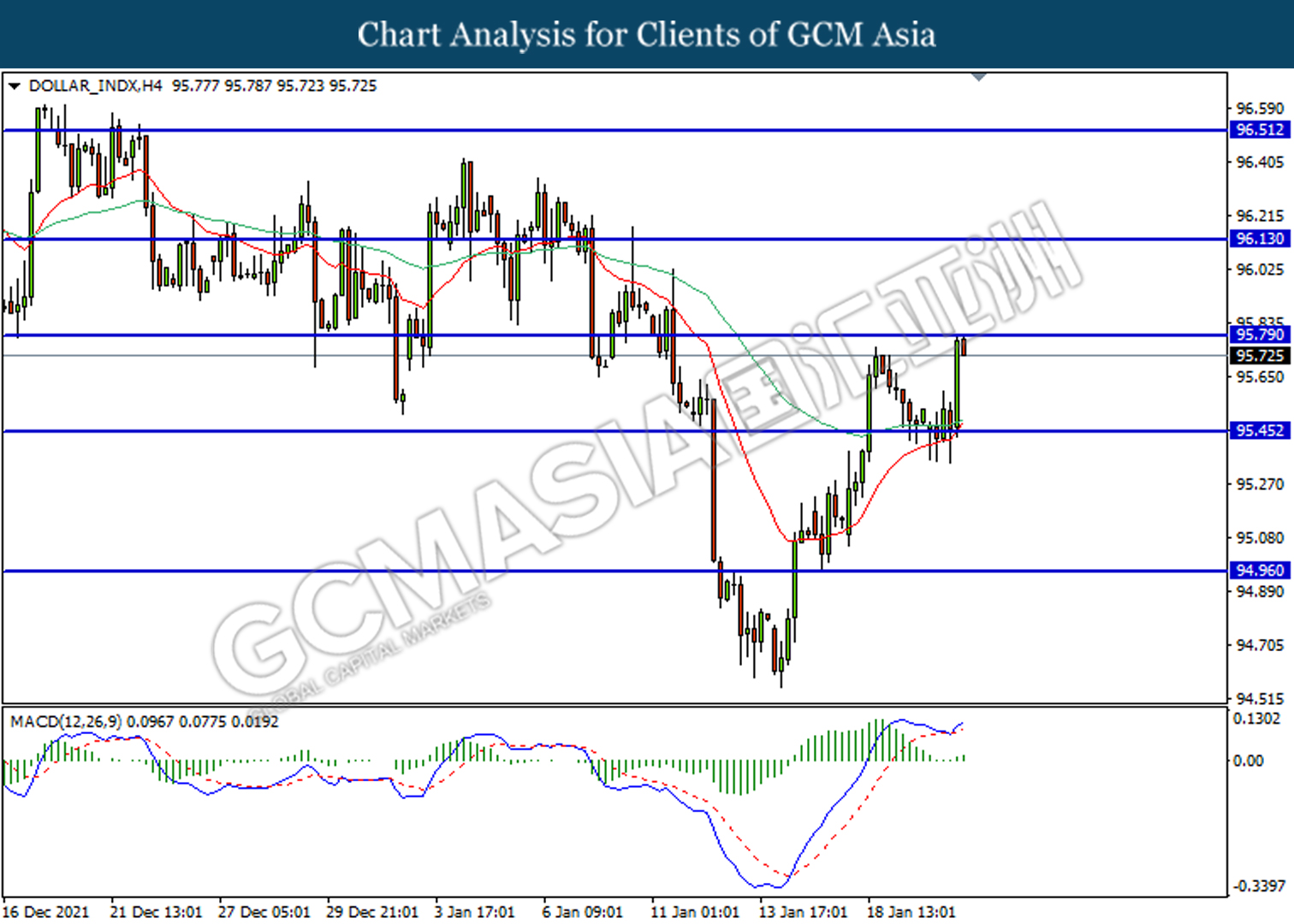

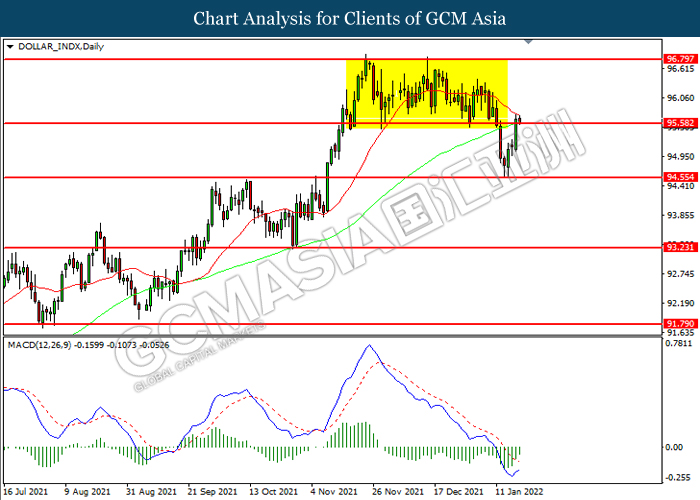

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

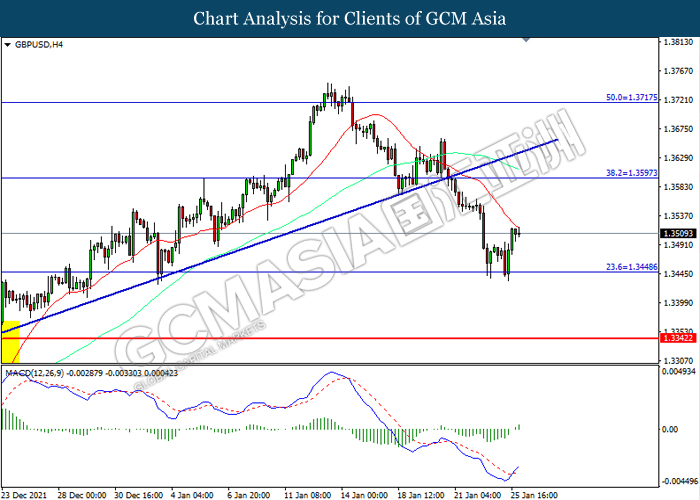

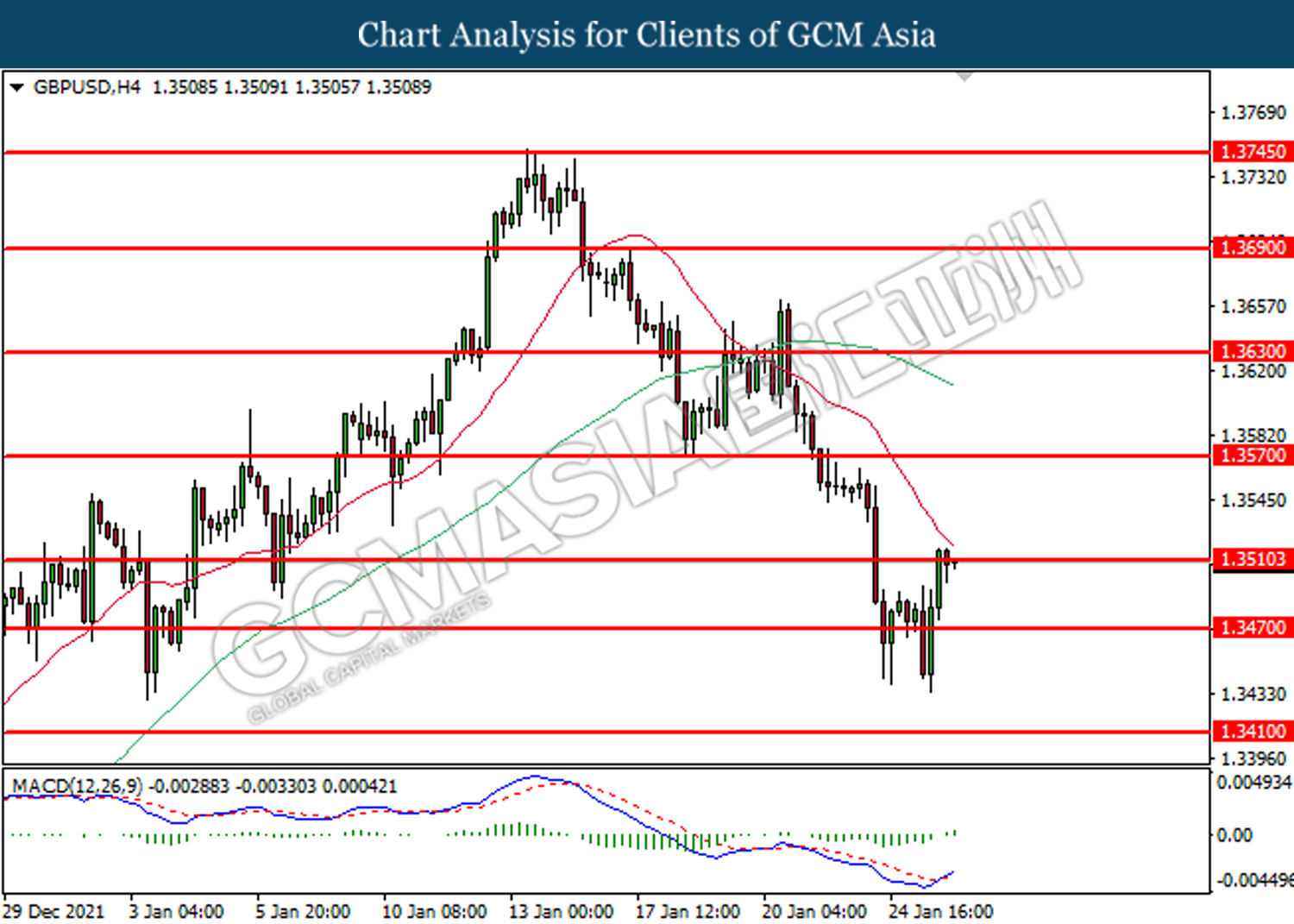

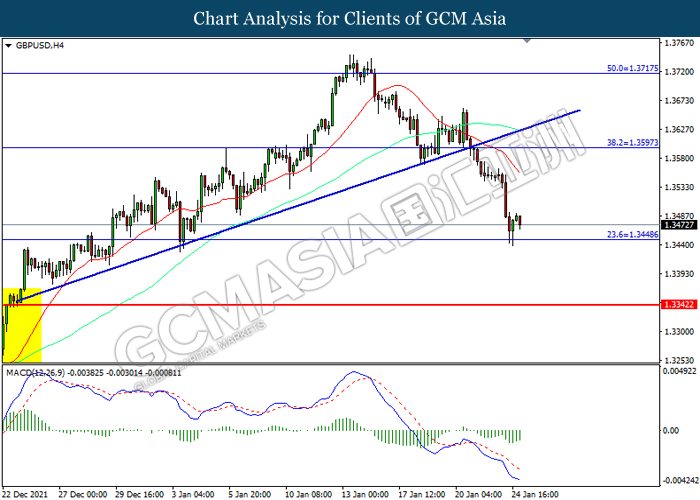

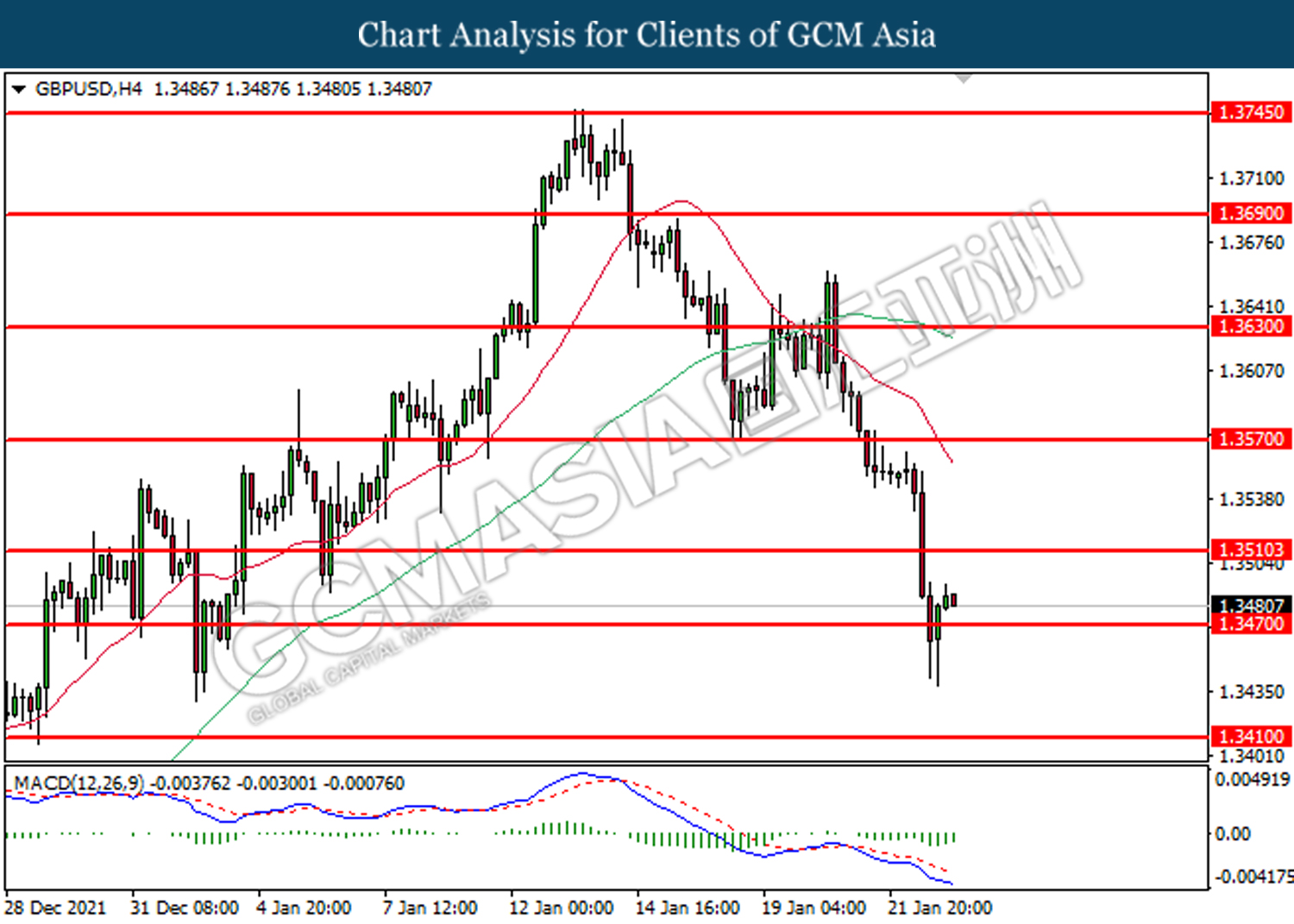

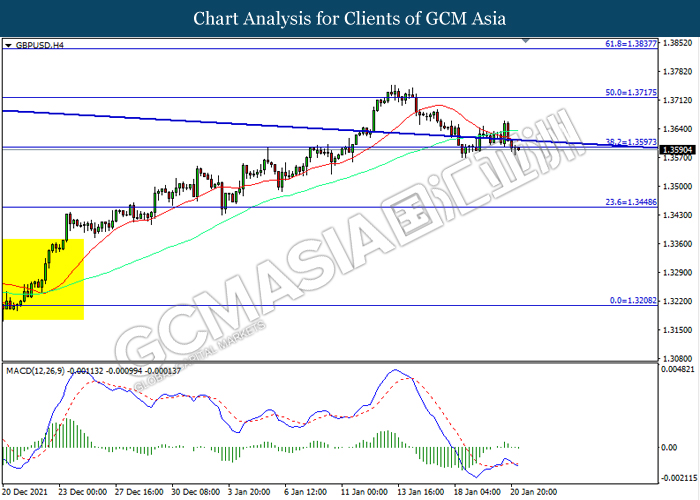

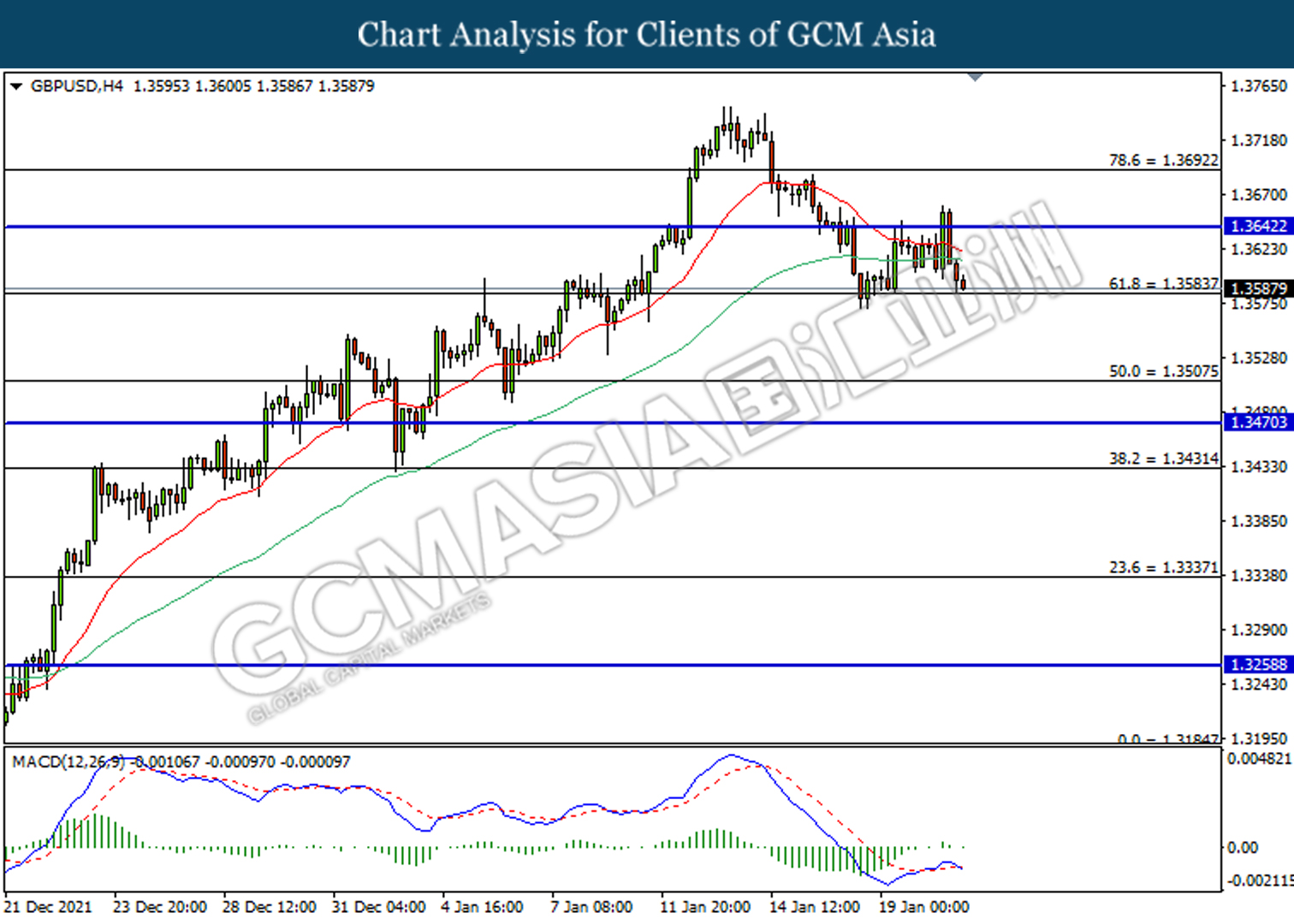

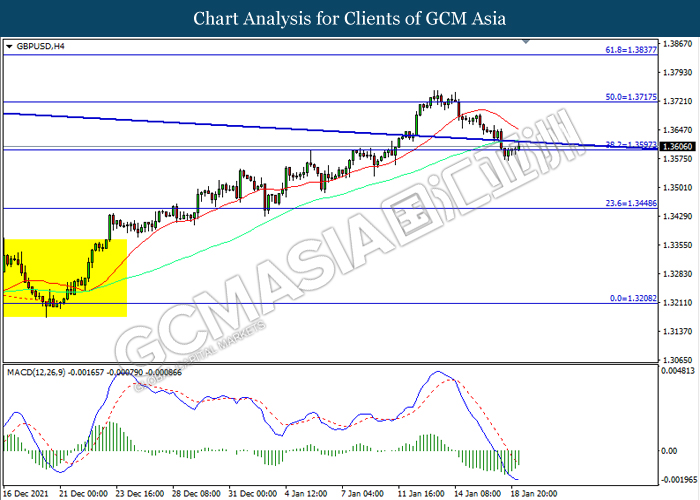

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3410, 1.3470

Support level: 1.3355, 1.3290

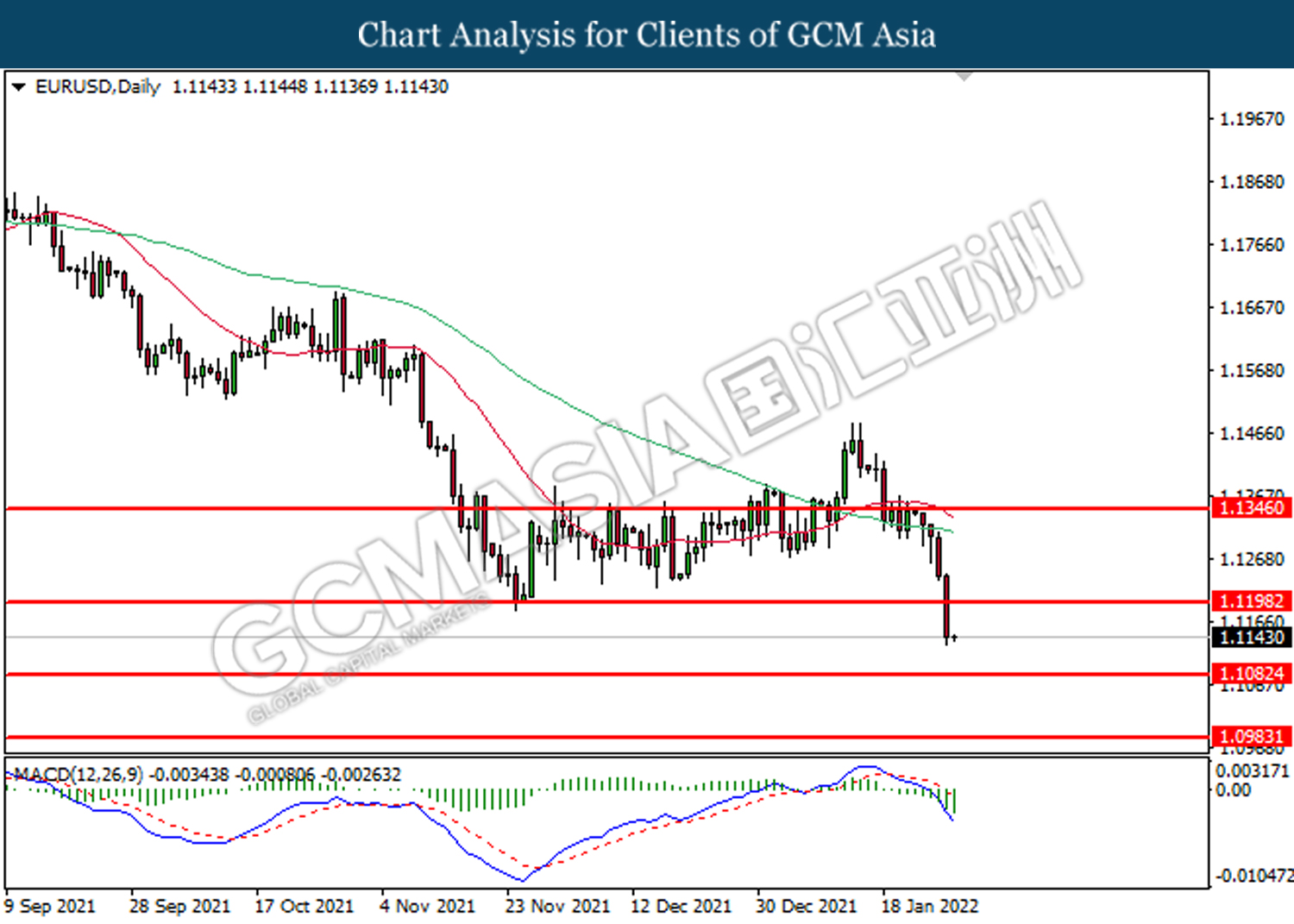

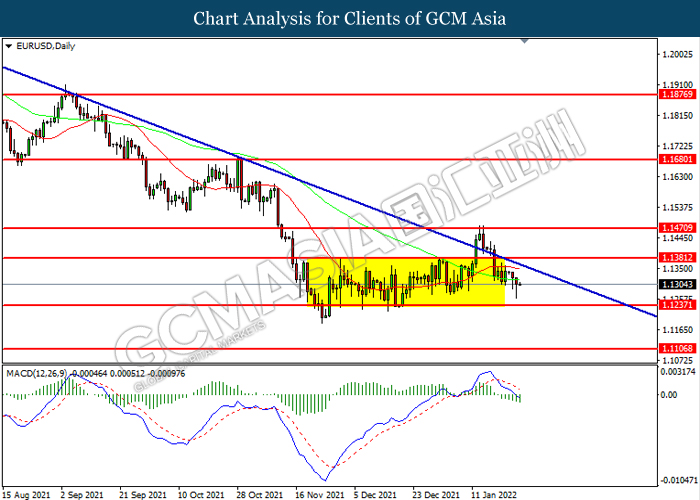

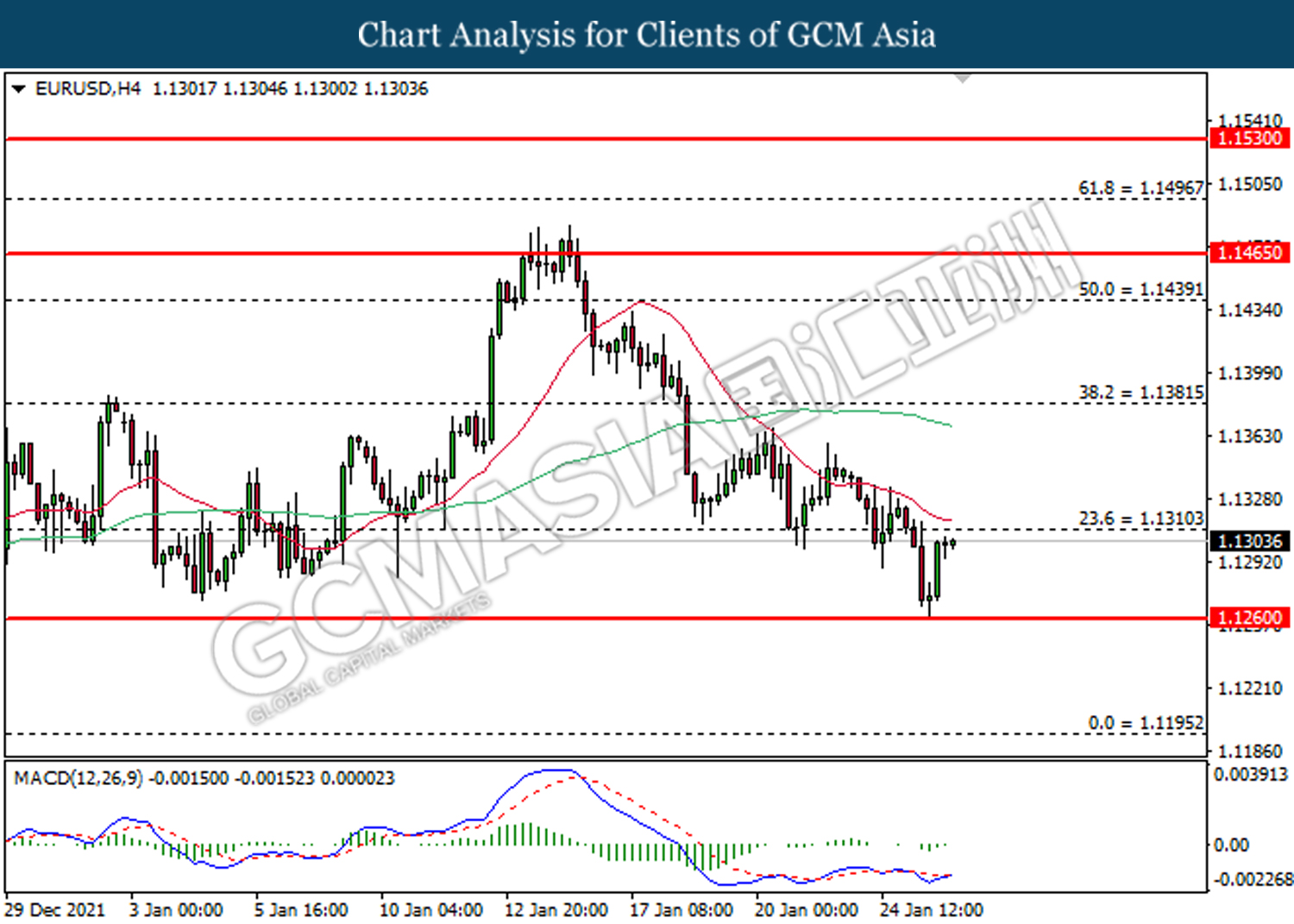

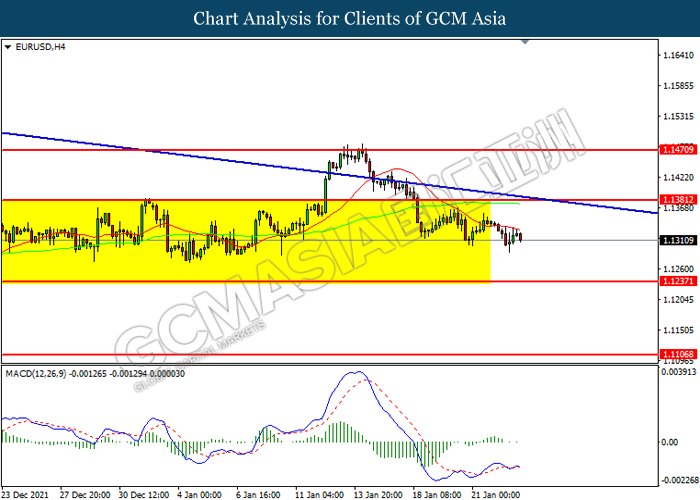

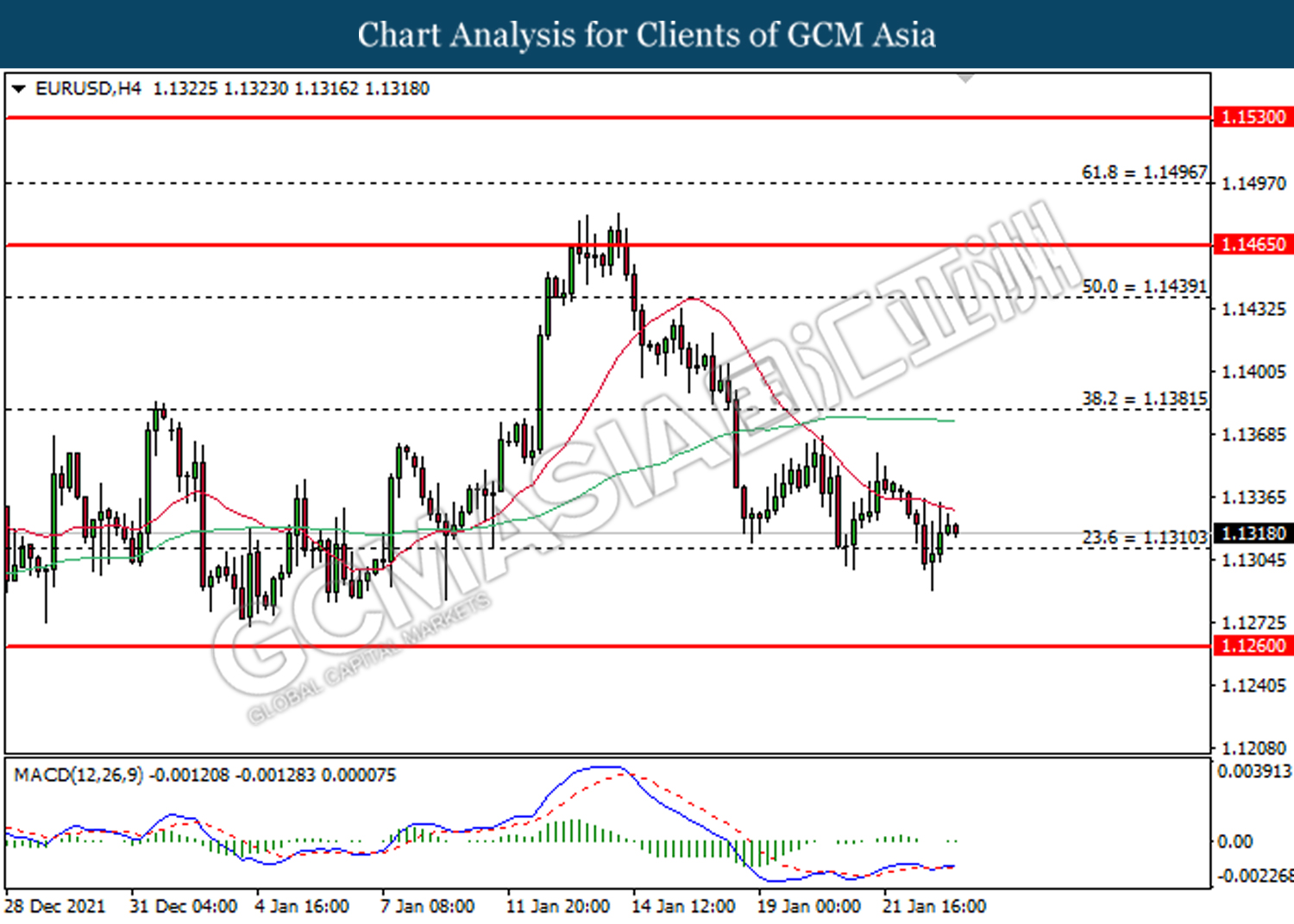

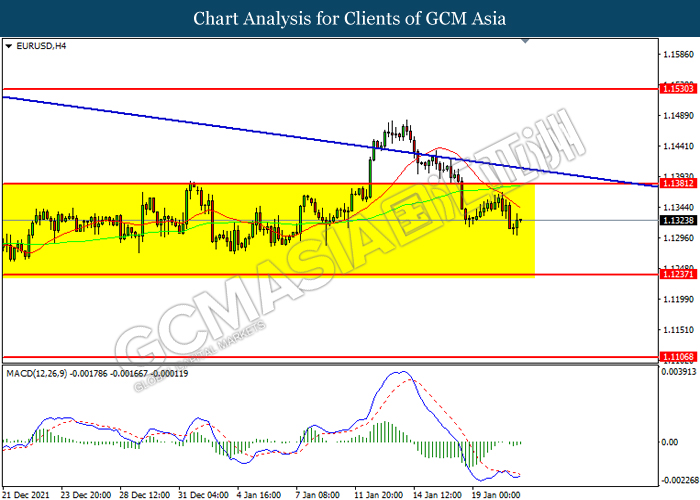

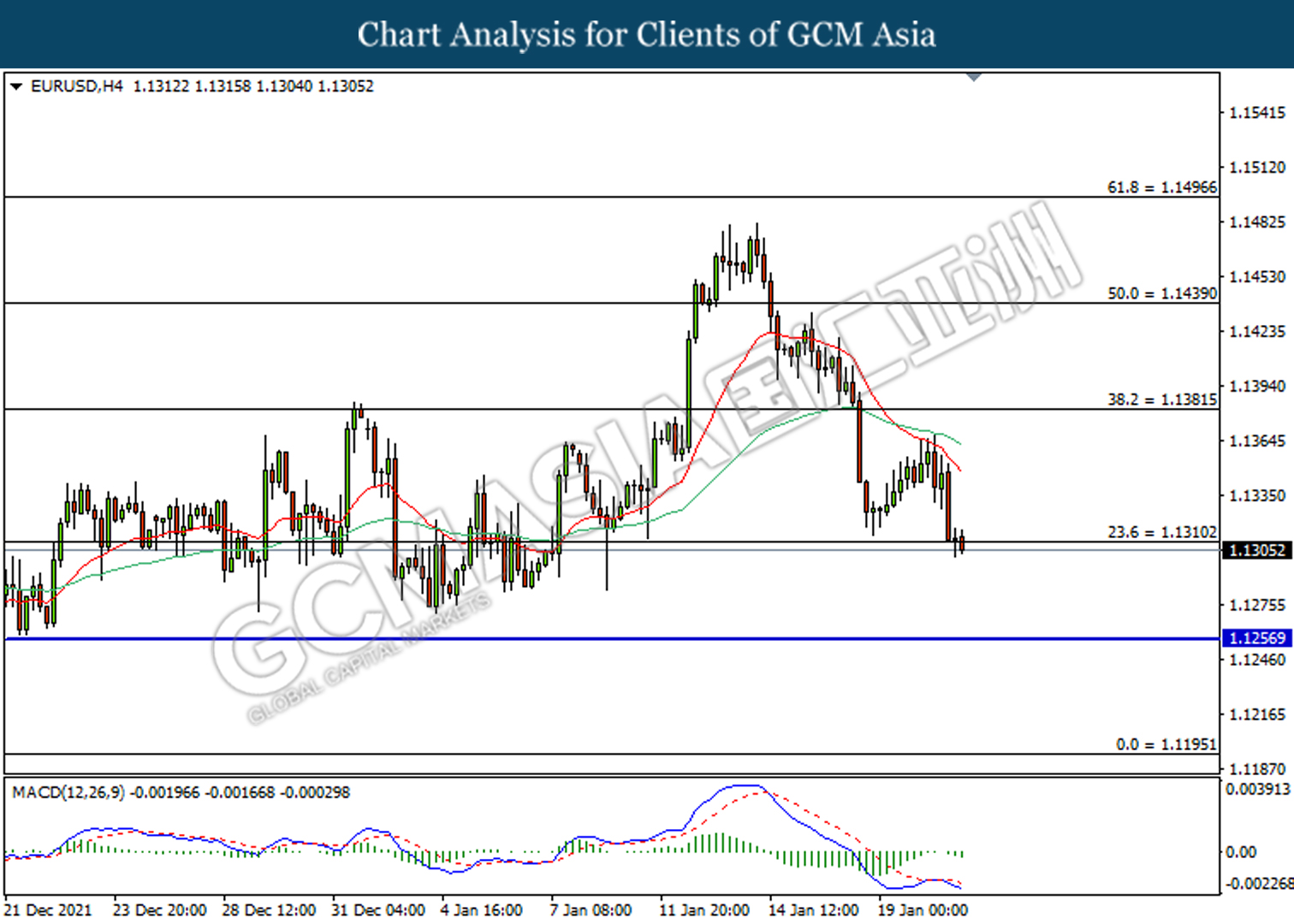

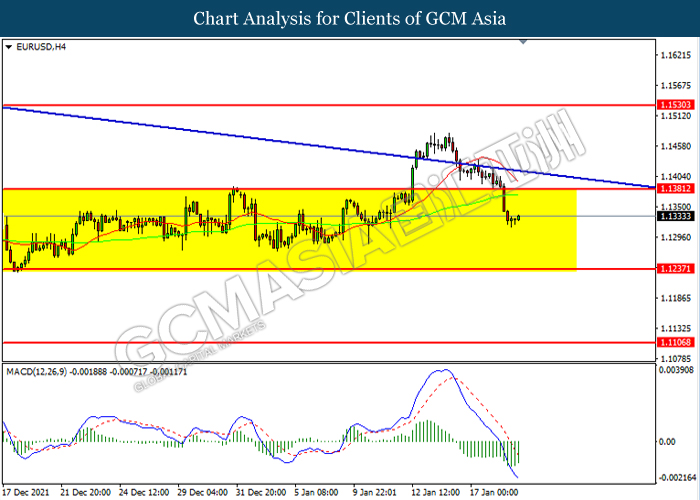

EURUSD, Daily: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1200, 1.1345

Support level: 1.1080, 1.0985

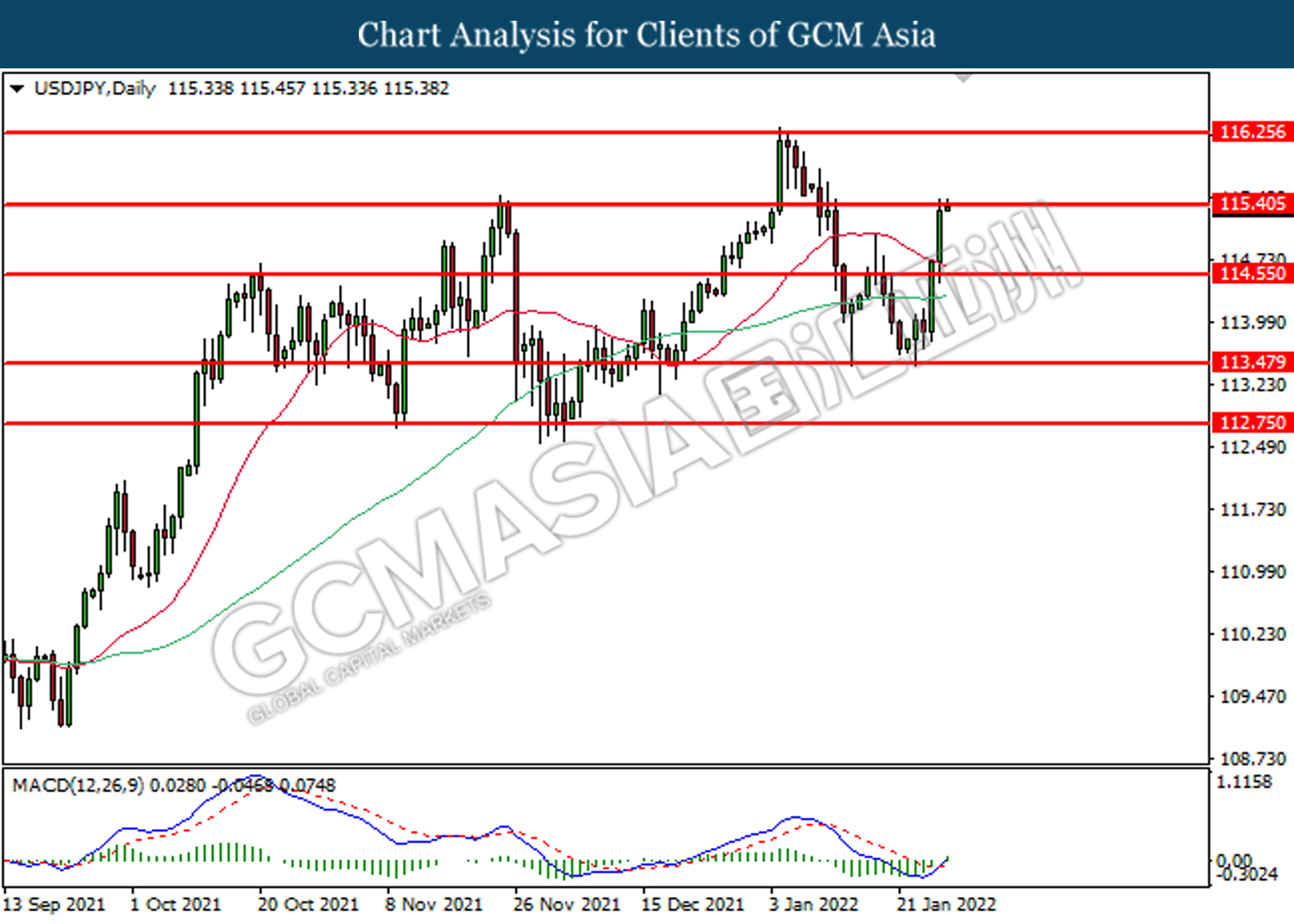

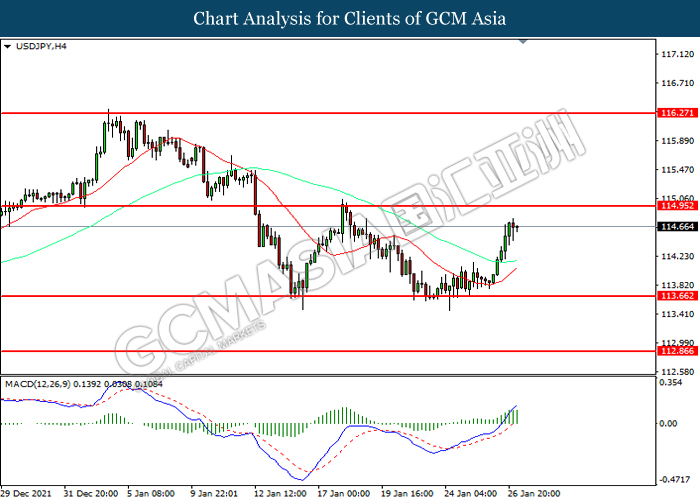

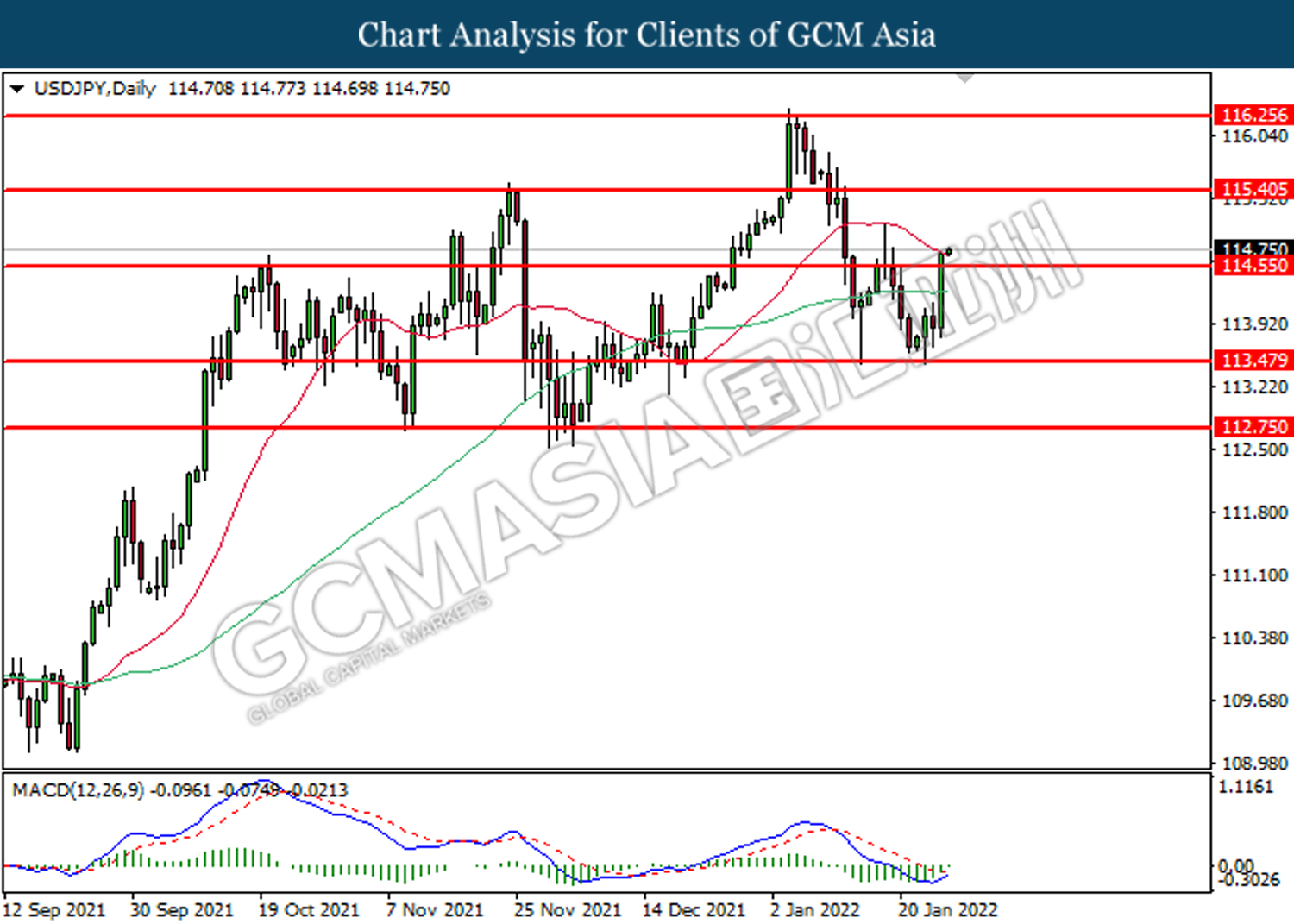

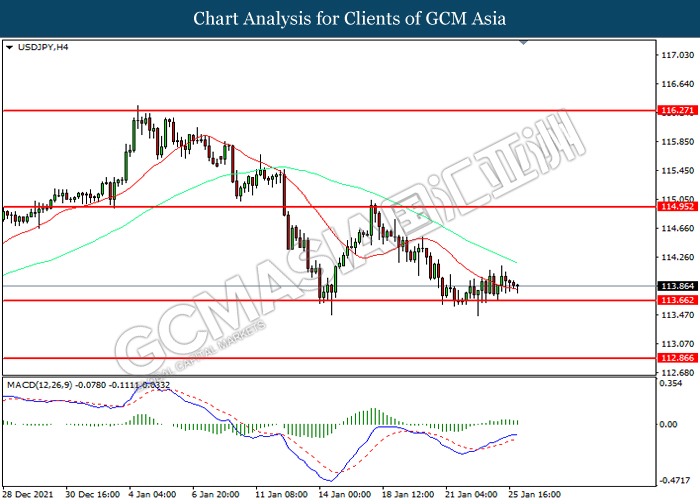

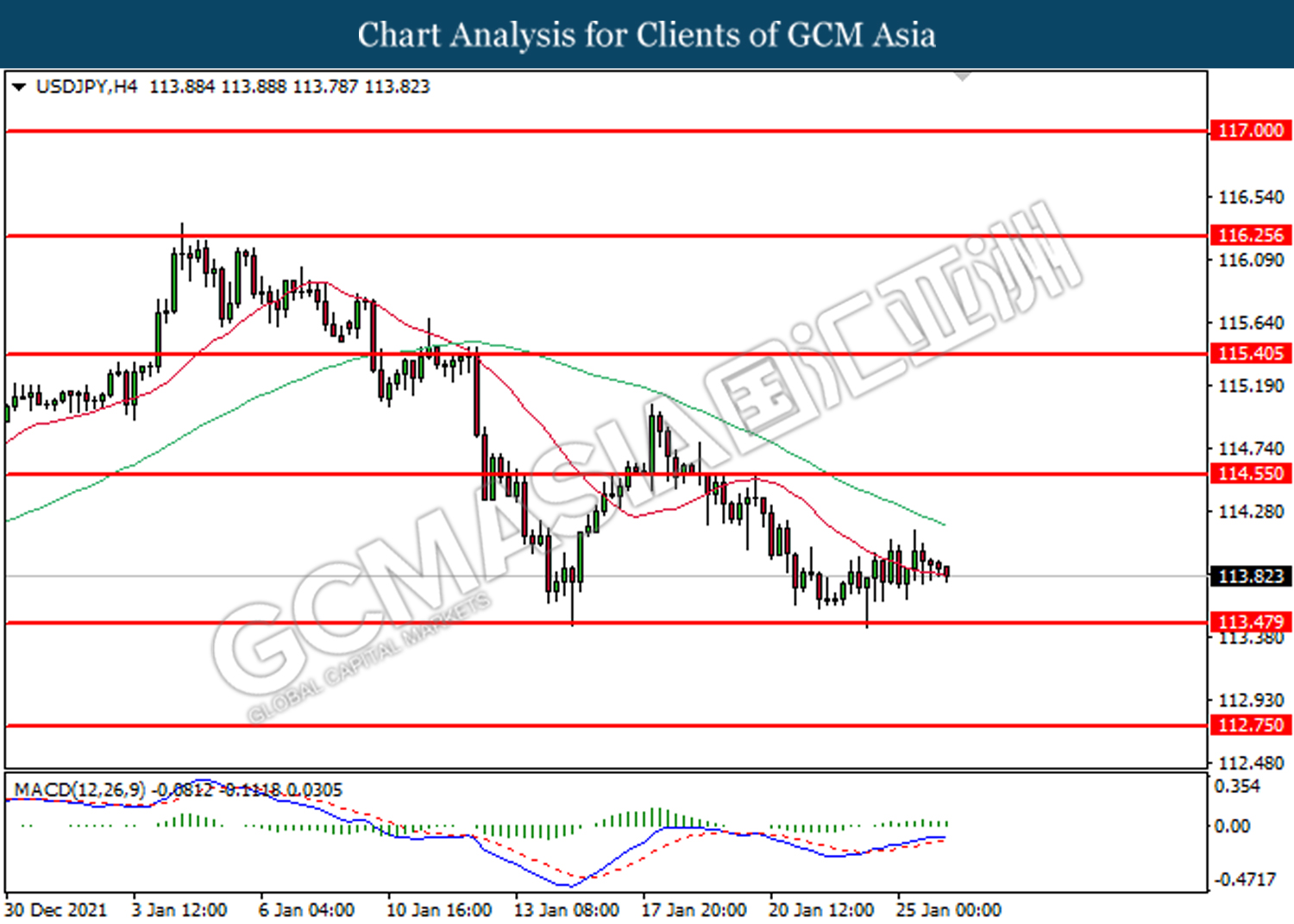

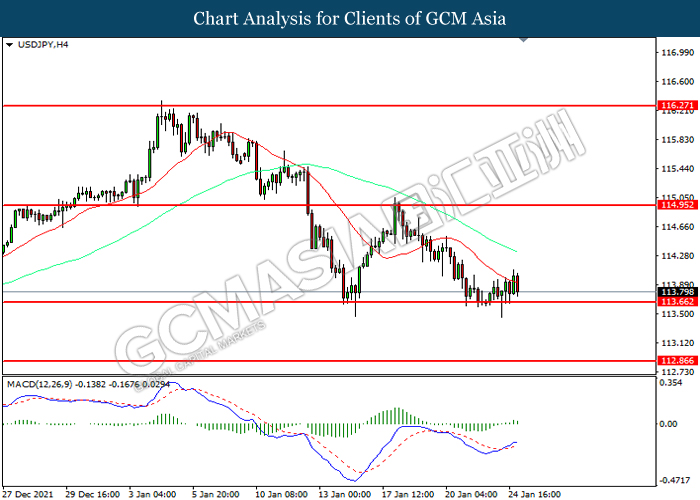

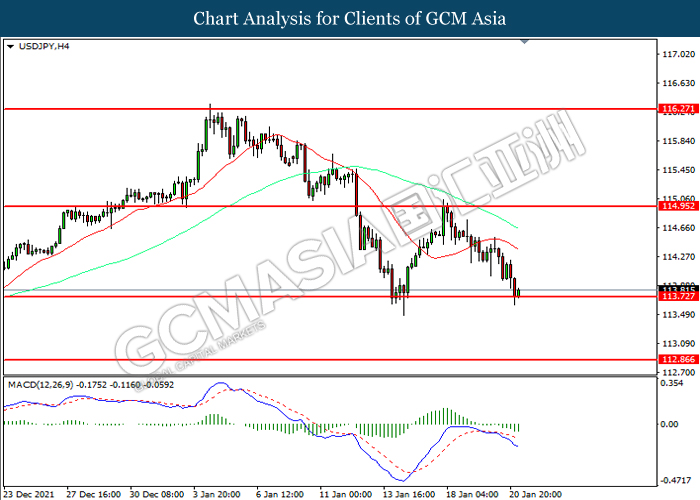

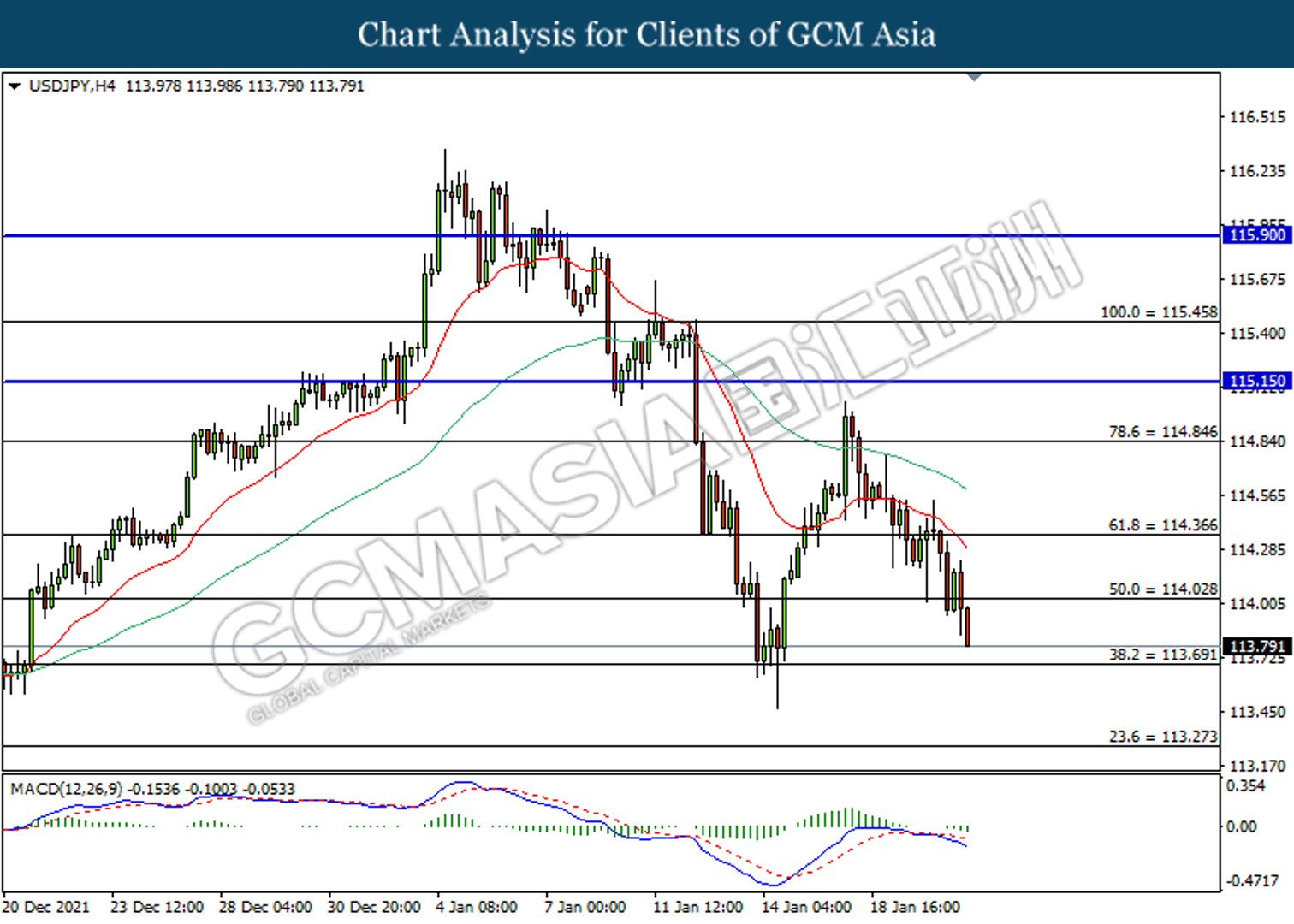

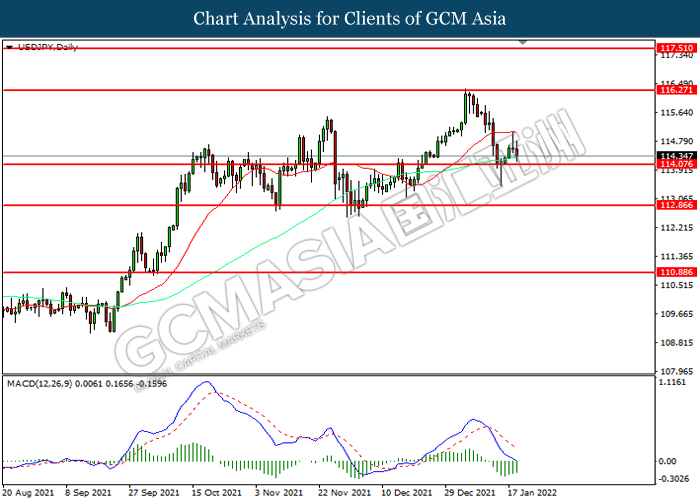

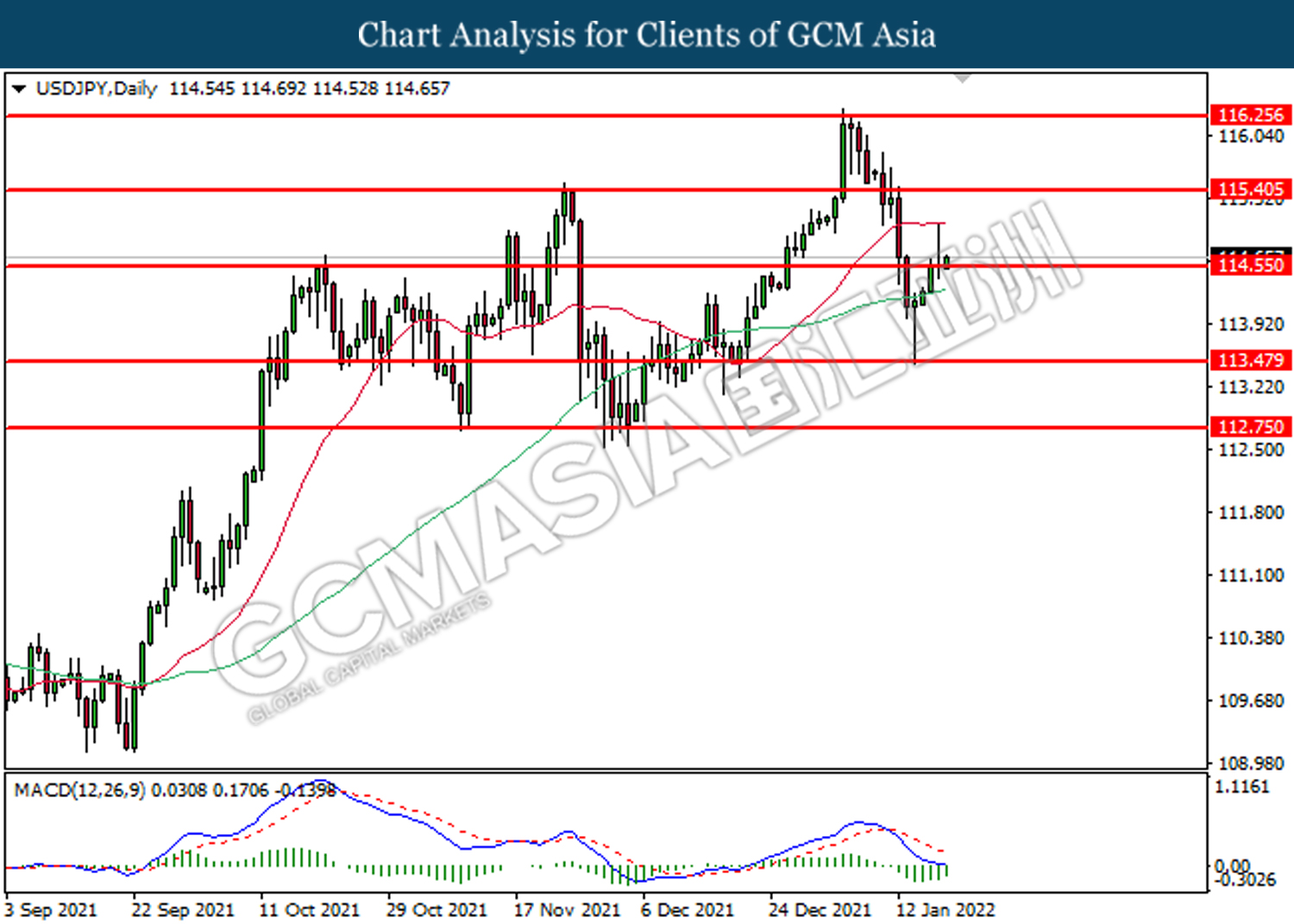

USDJPY, Daily: USDJPY was traded higher following rebound from 113.50. MACD which illustrate diminished bearish signal suggests the pair to be traded higher after it breaks the resistance level.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

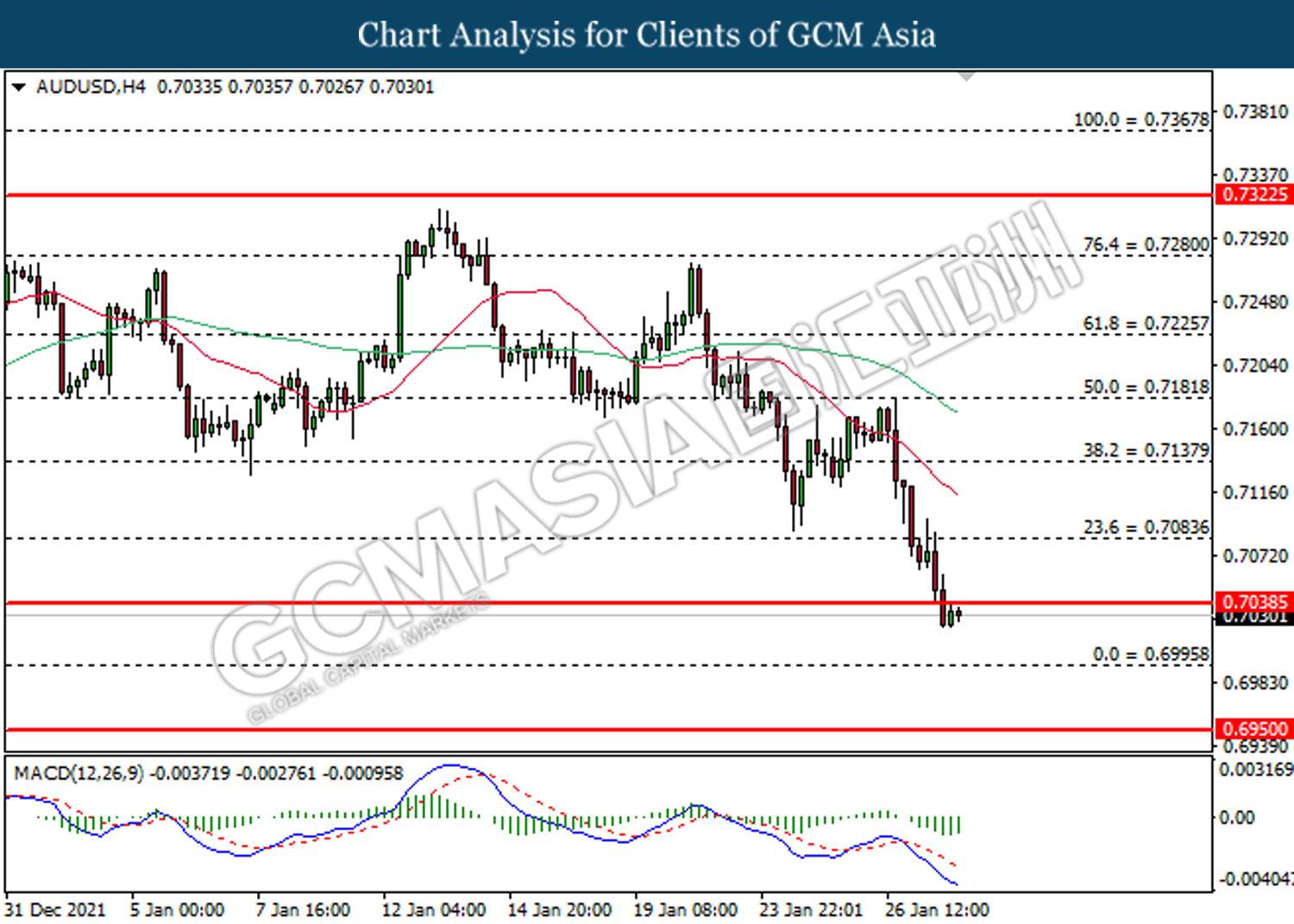

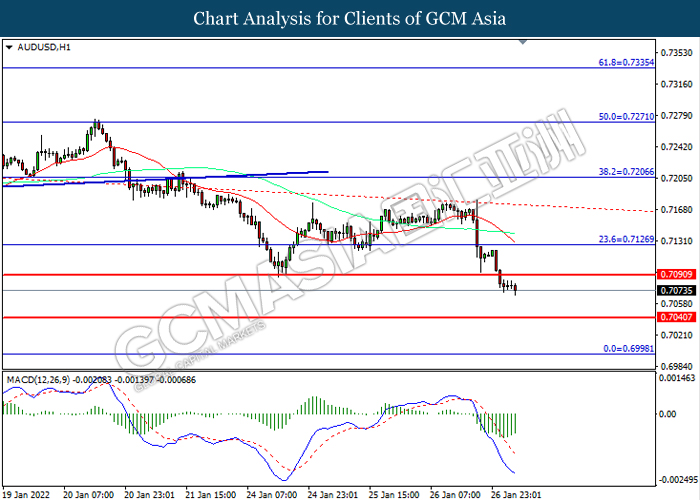

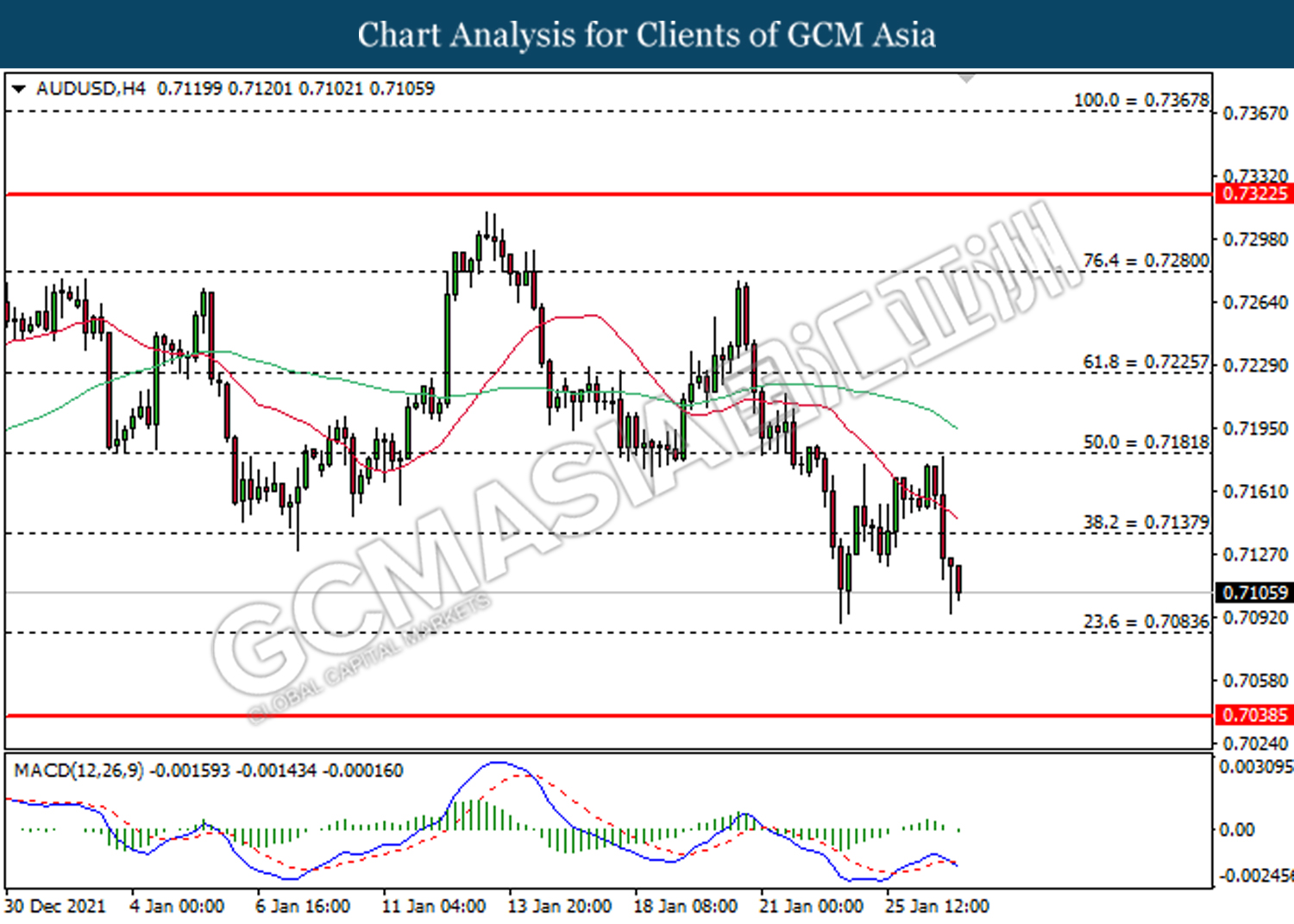

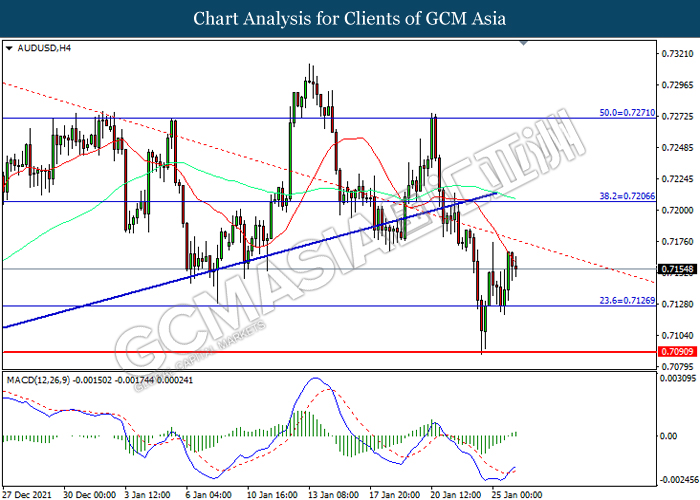

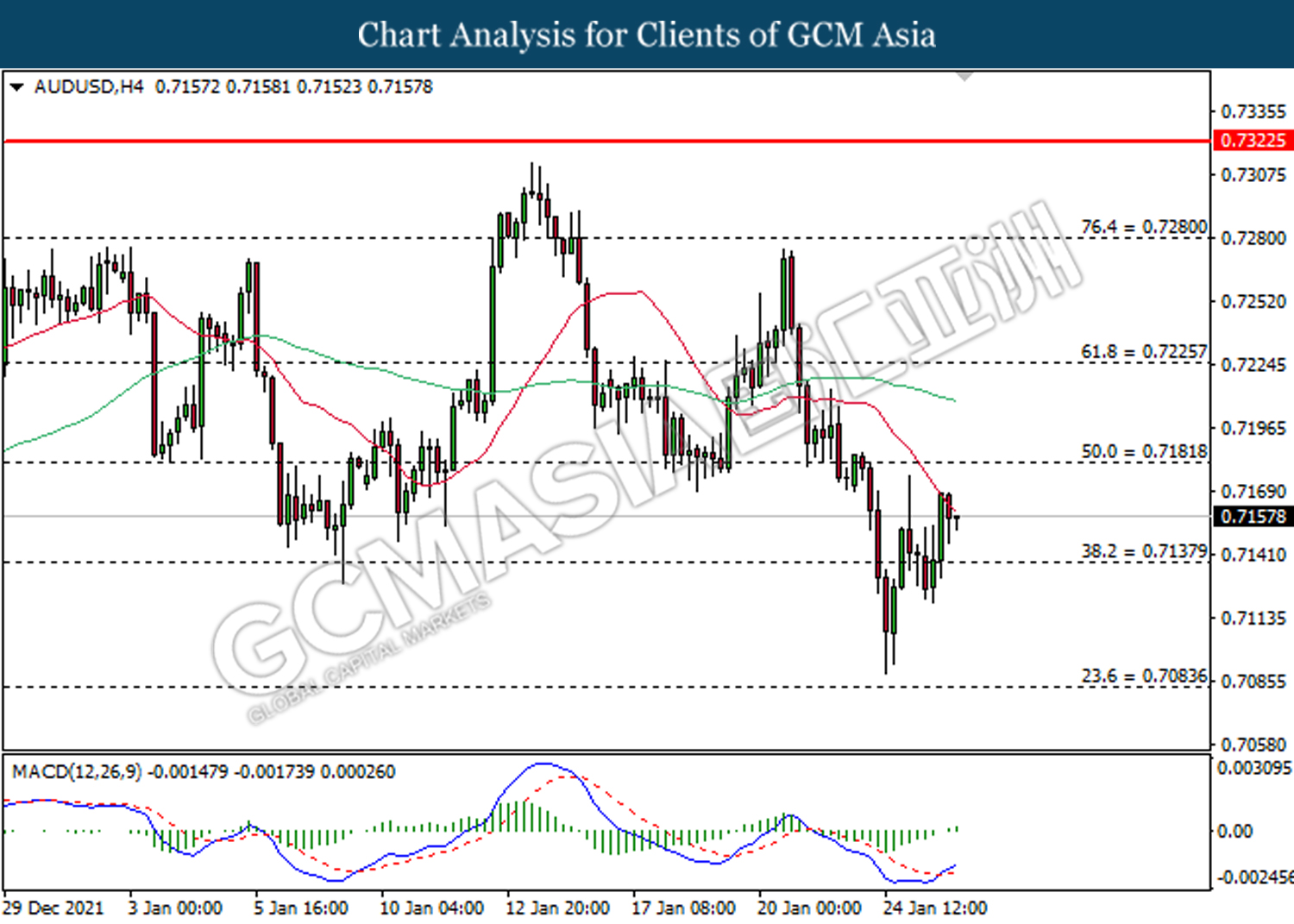

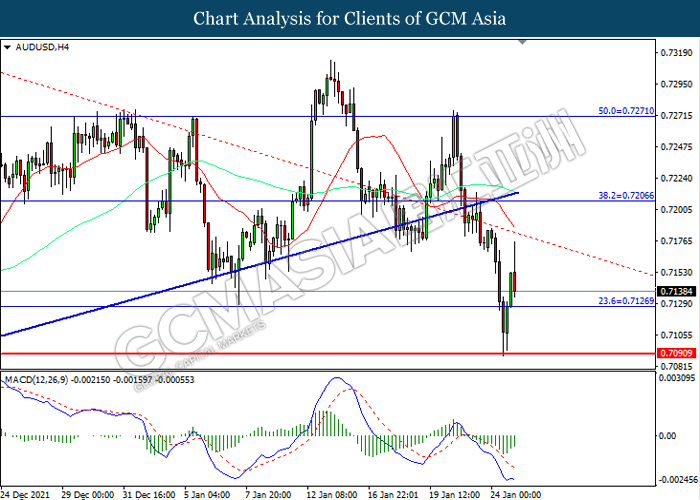

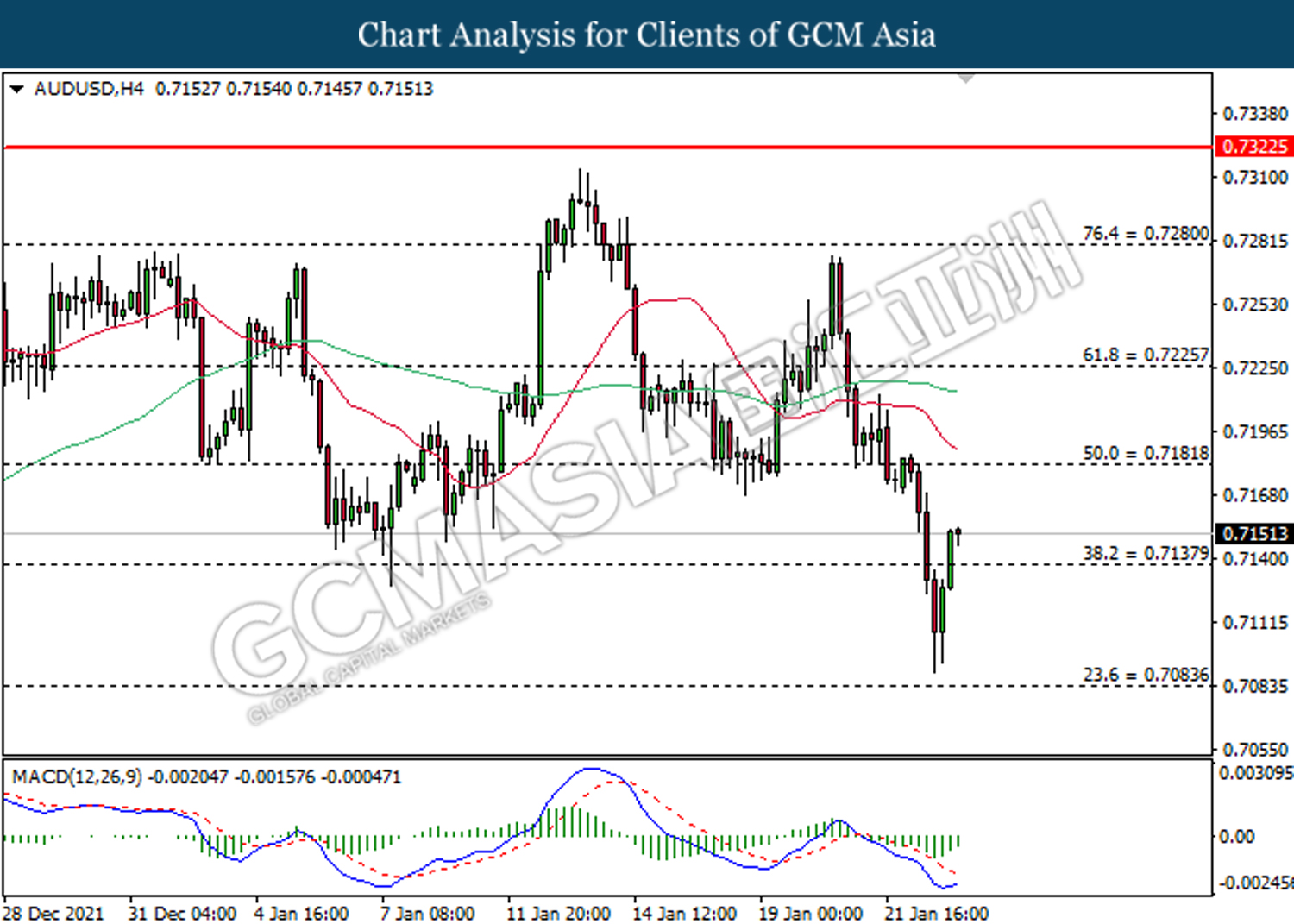

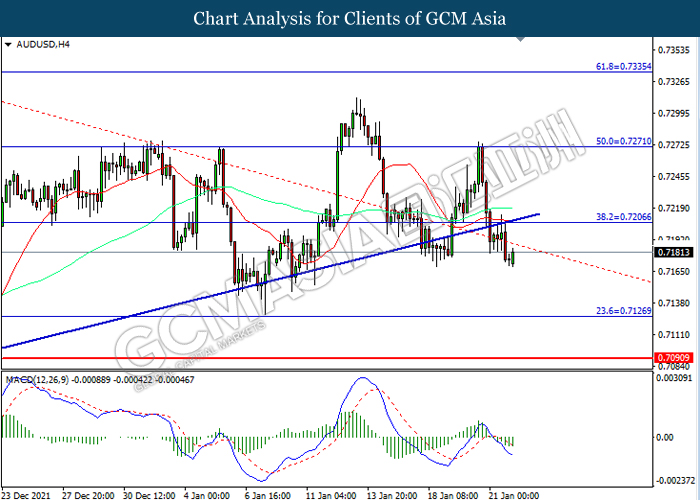

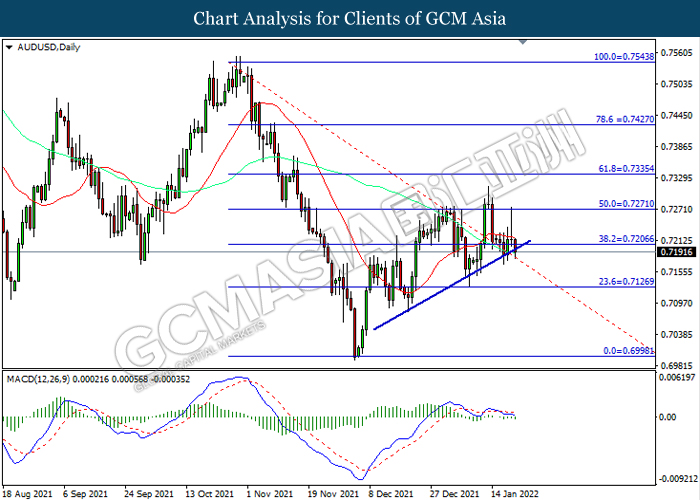

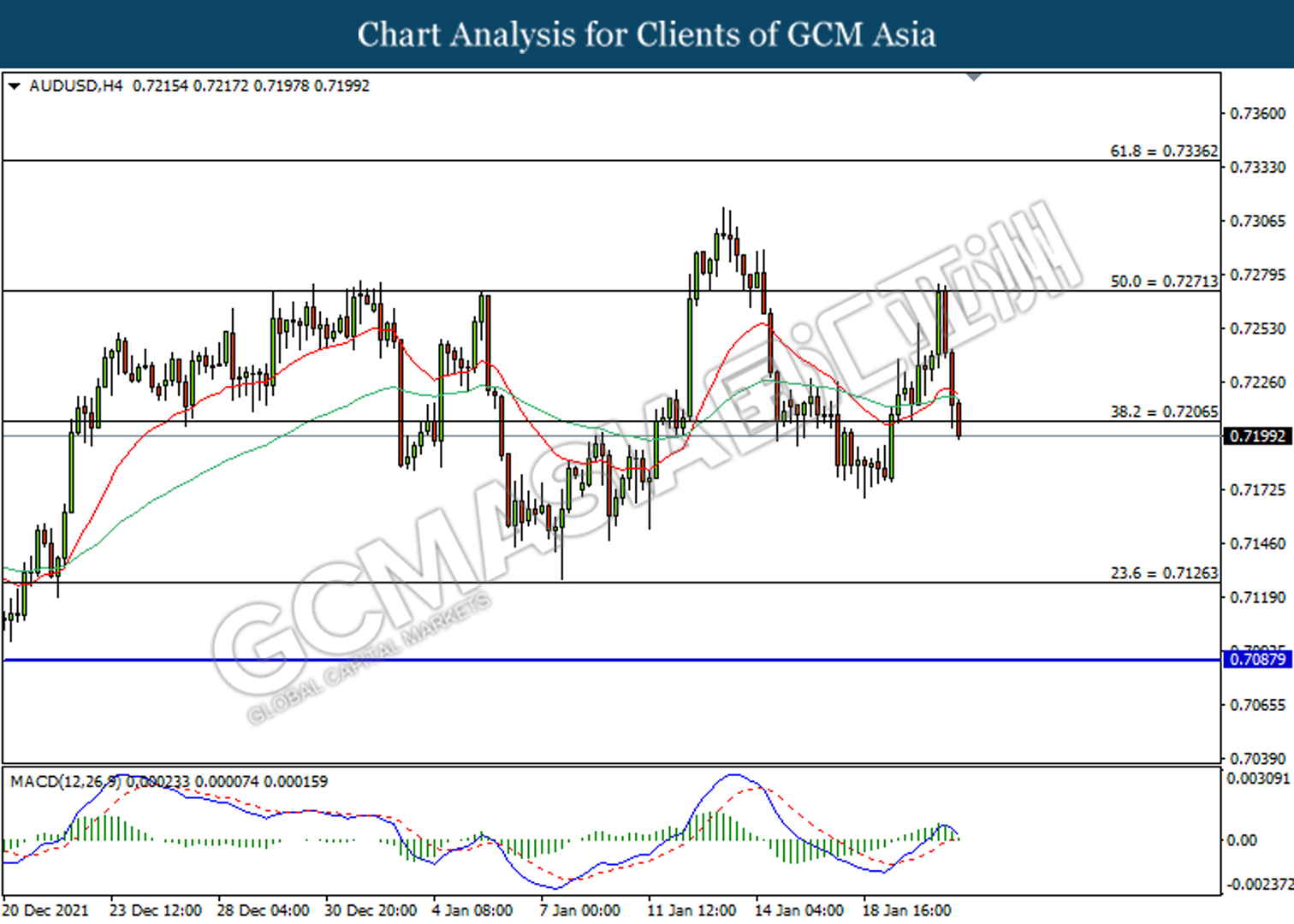

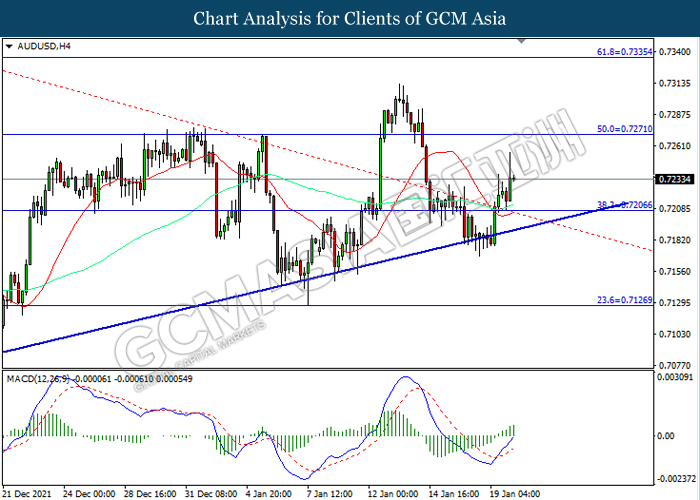

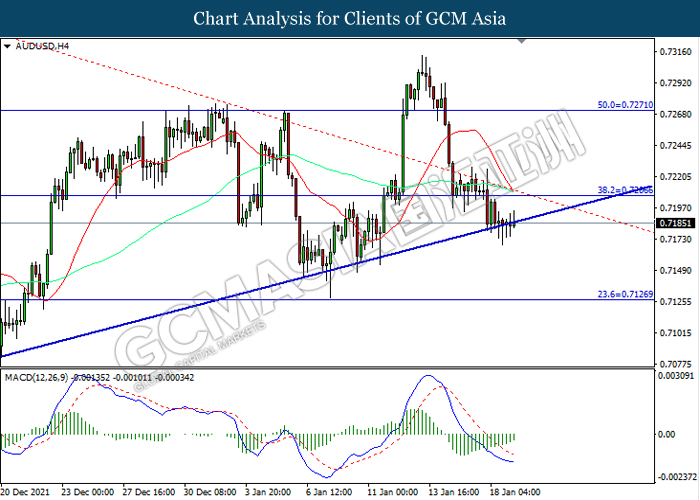

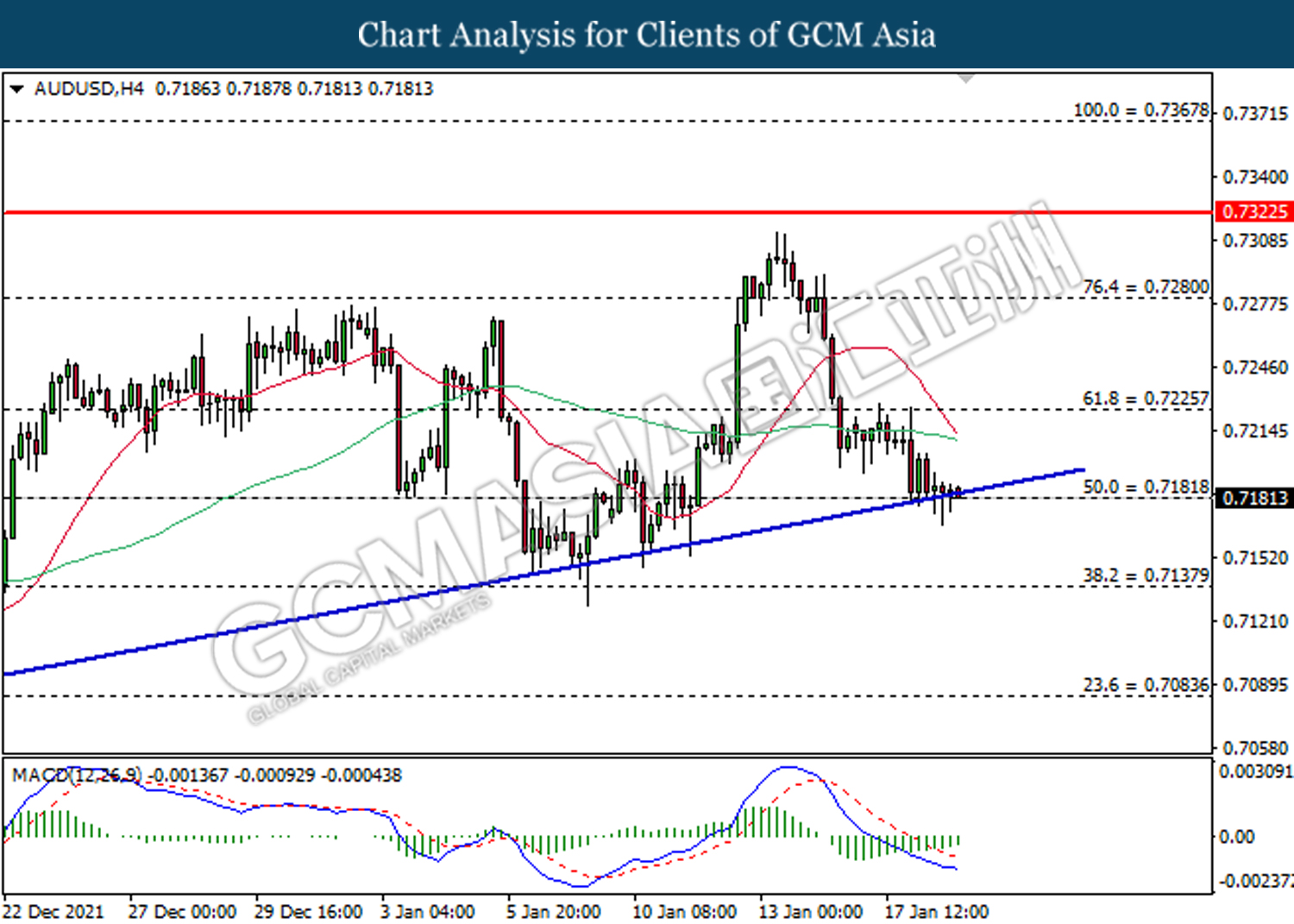

AUDUSD, H4: AUDUSD was traded lower following retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7040, 0.7085

Support level: 0.6995, 0.6950

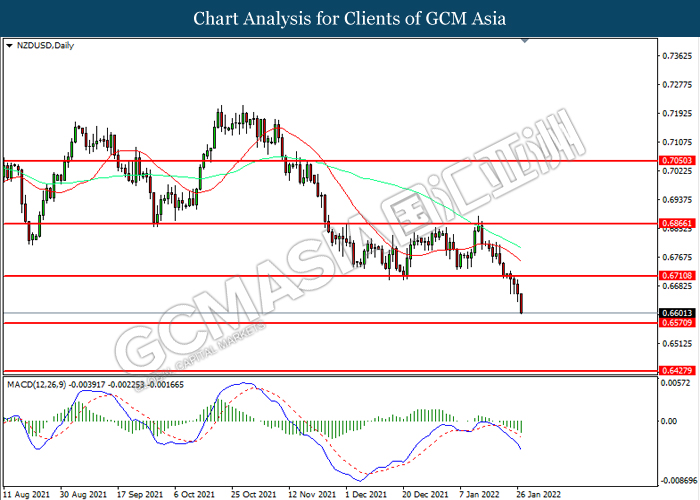

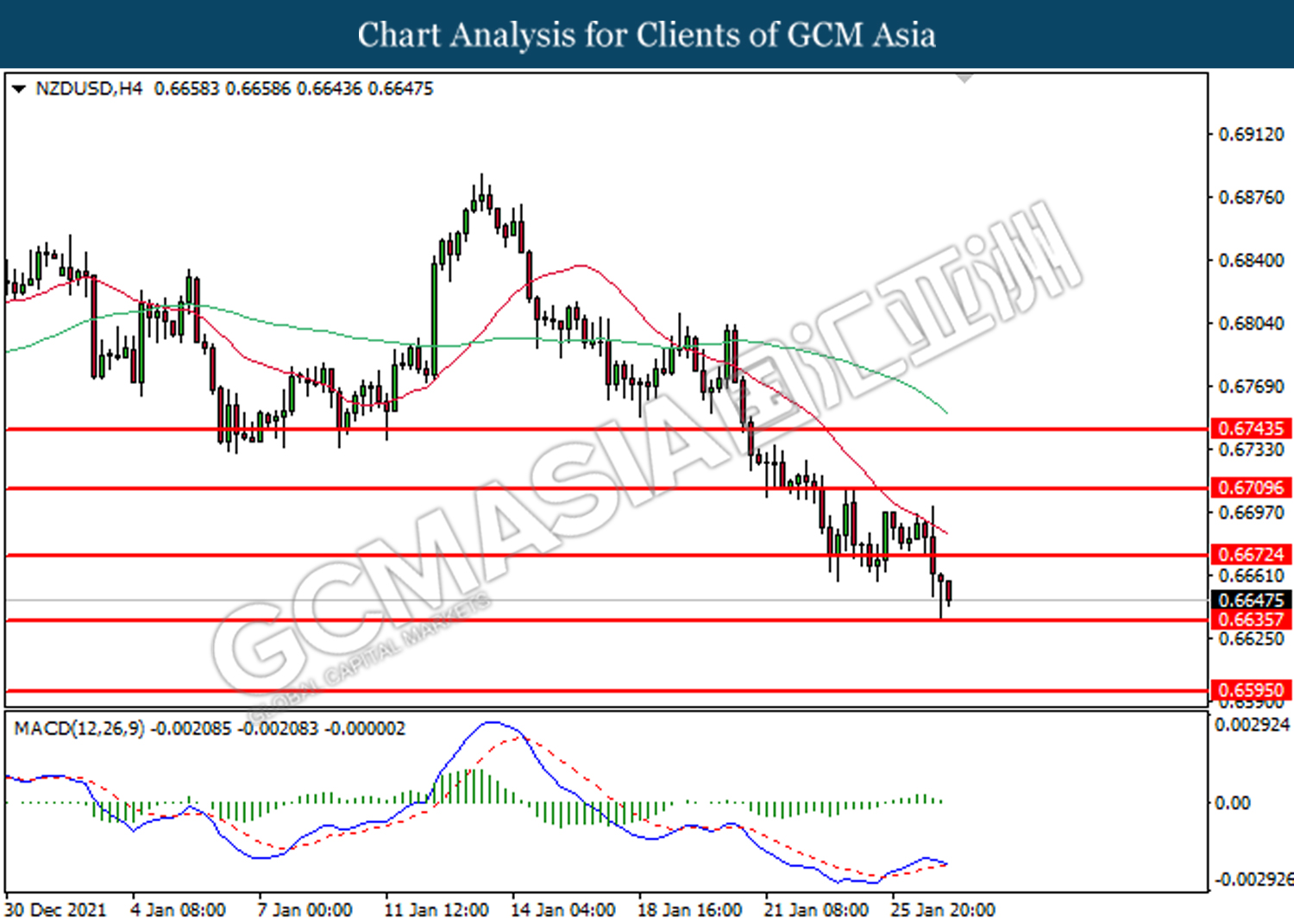

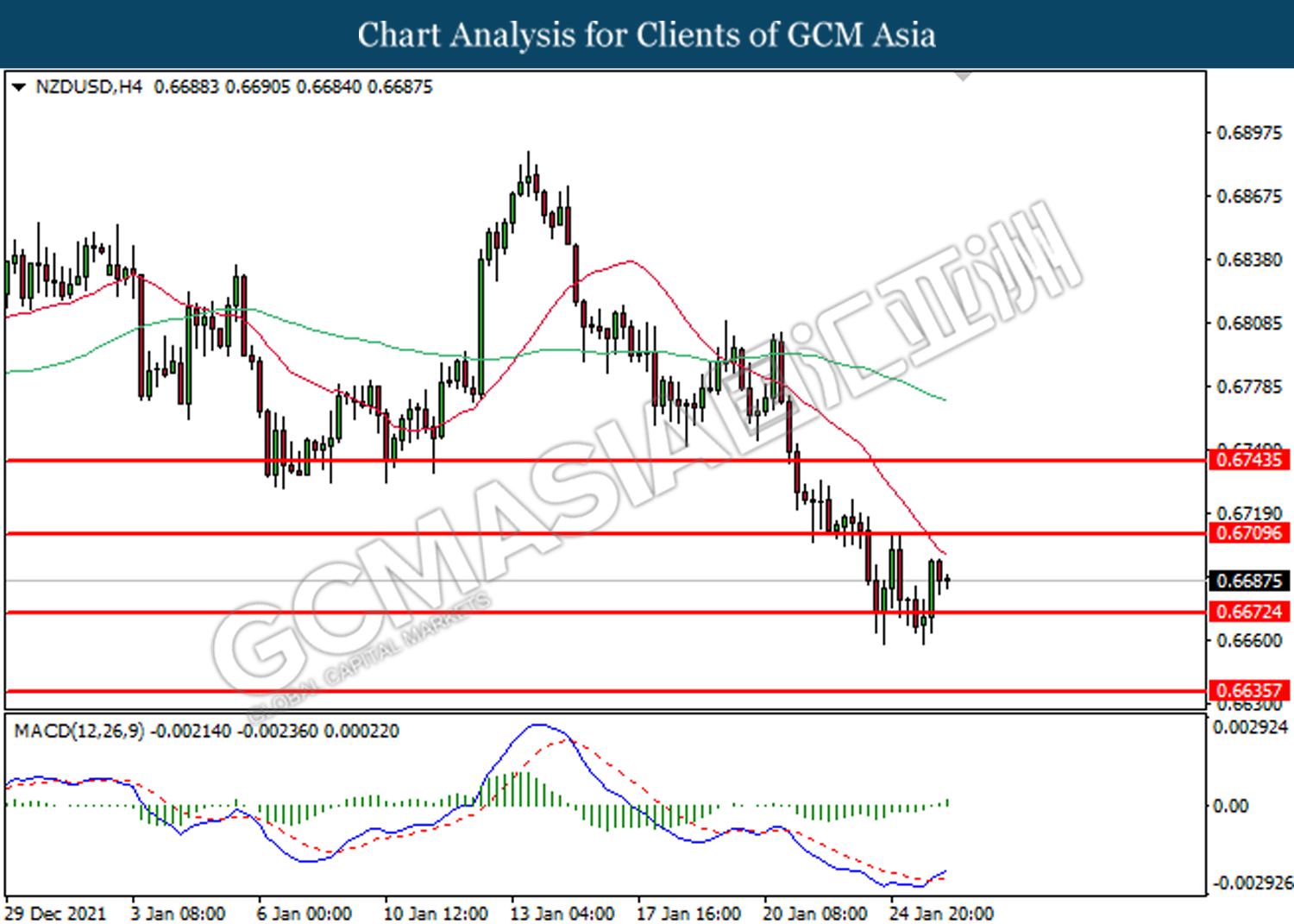

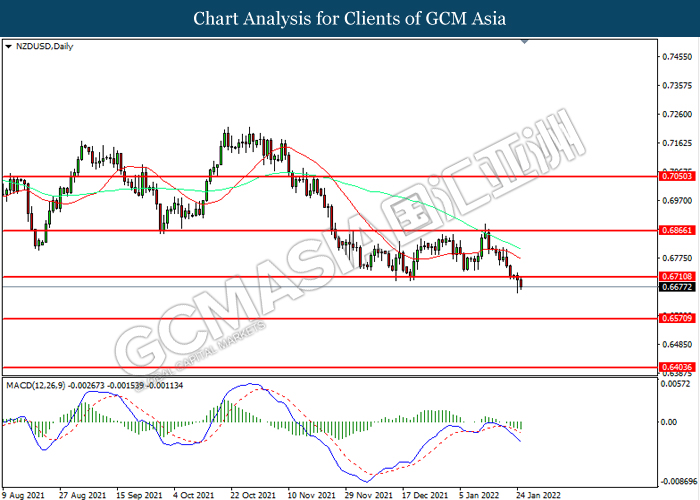

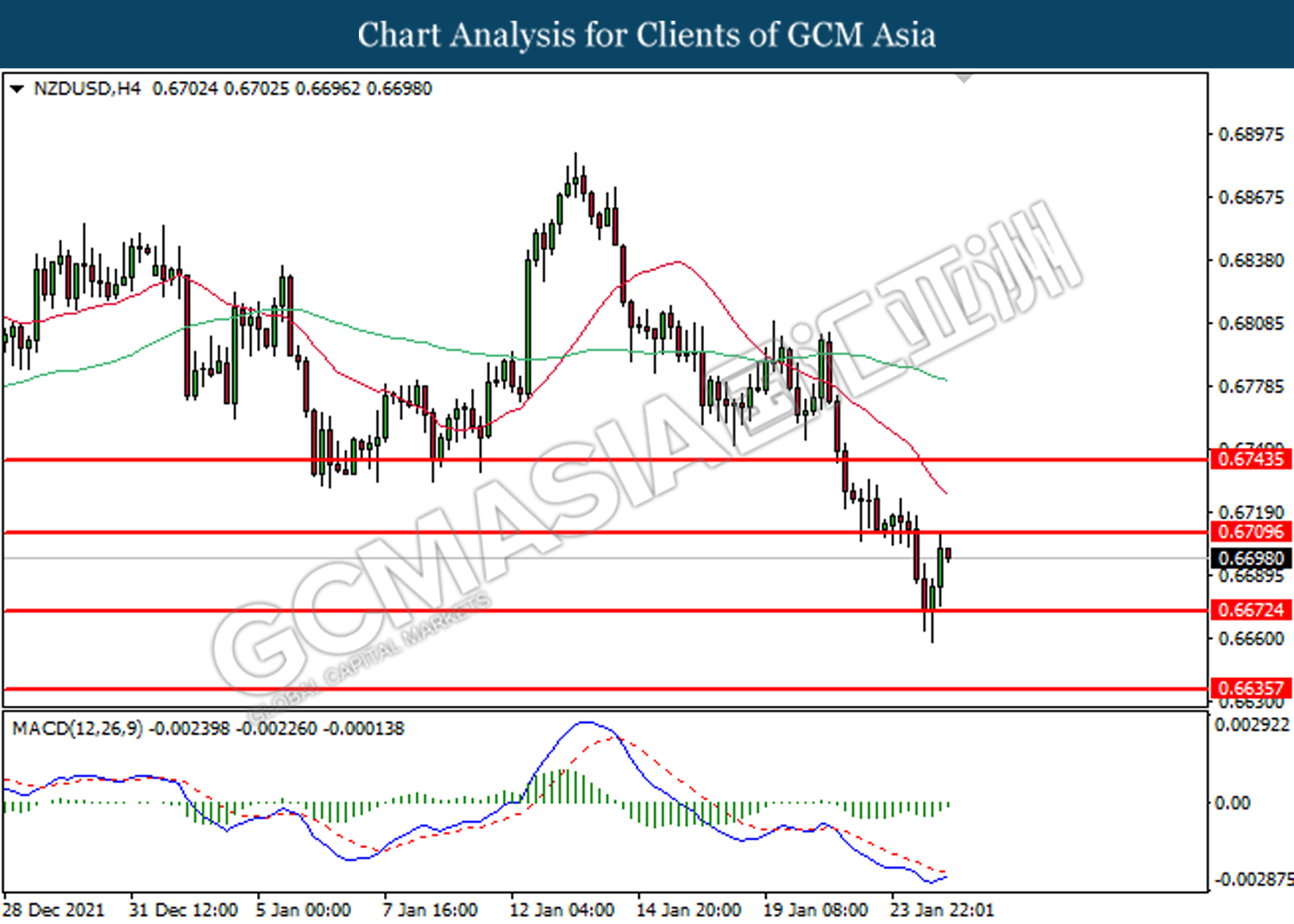

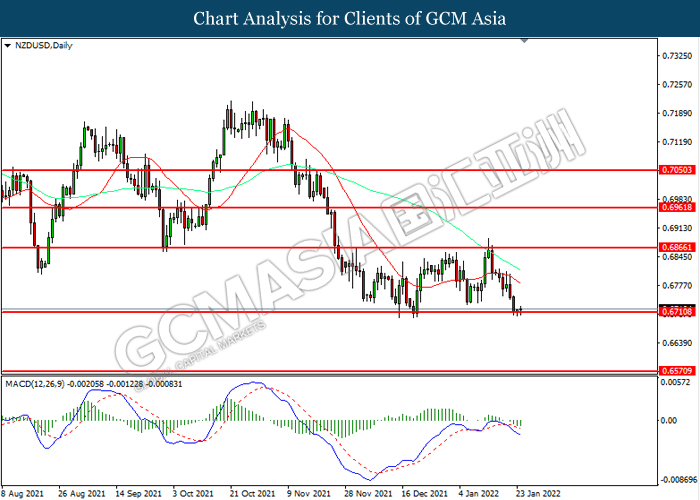

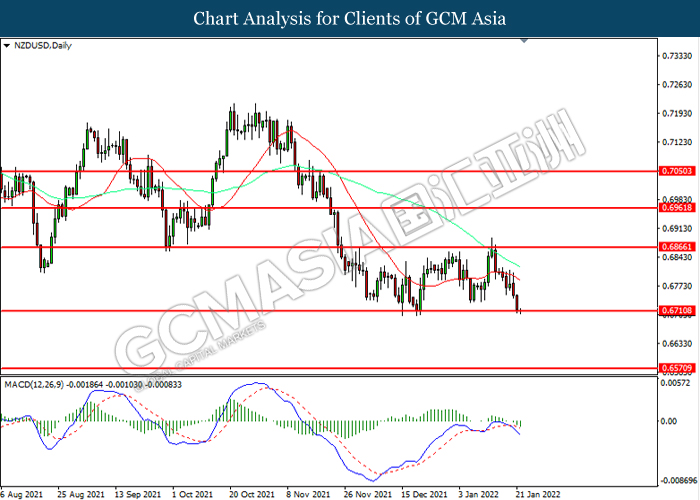

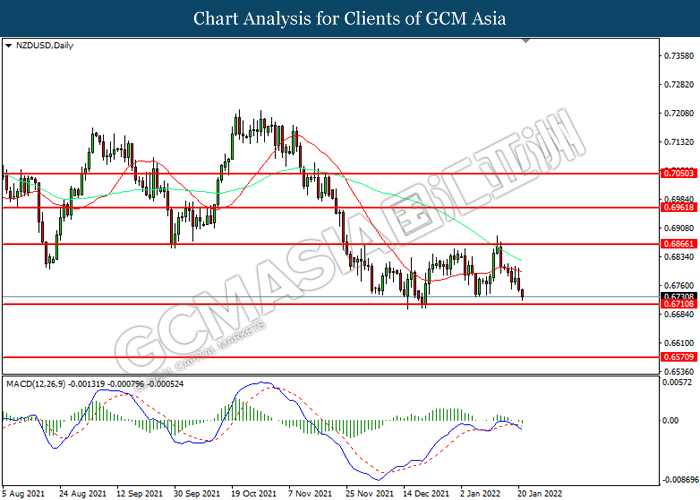

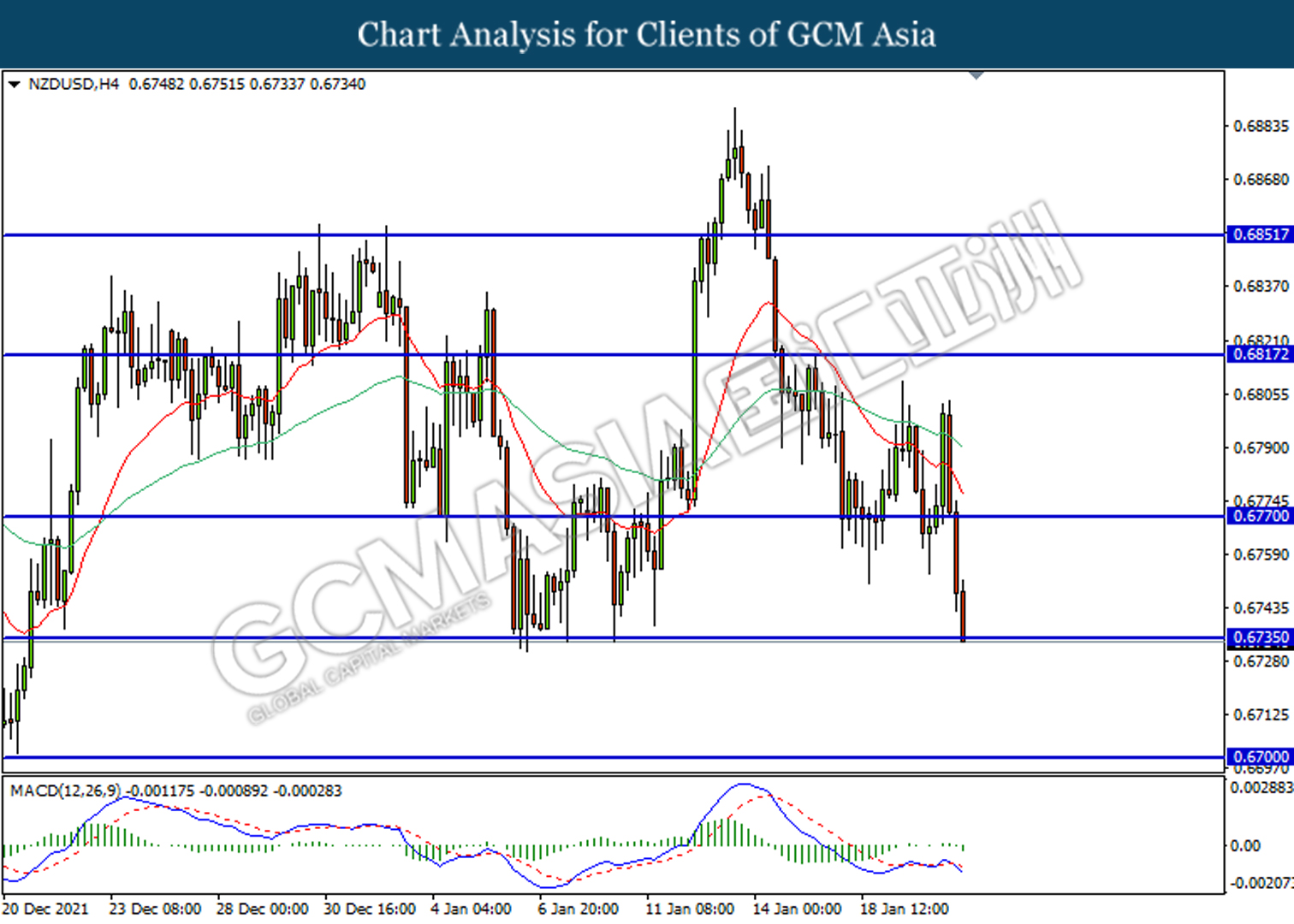

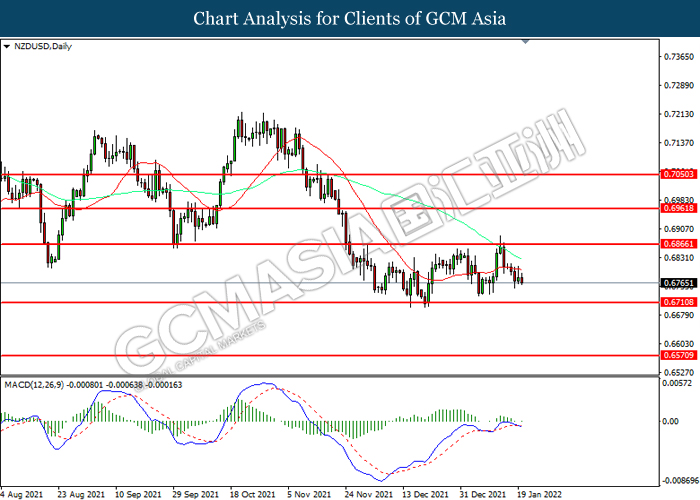

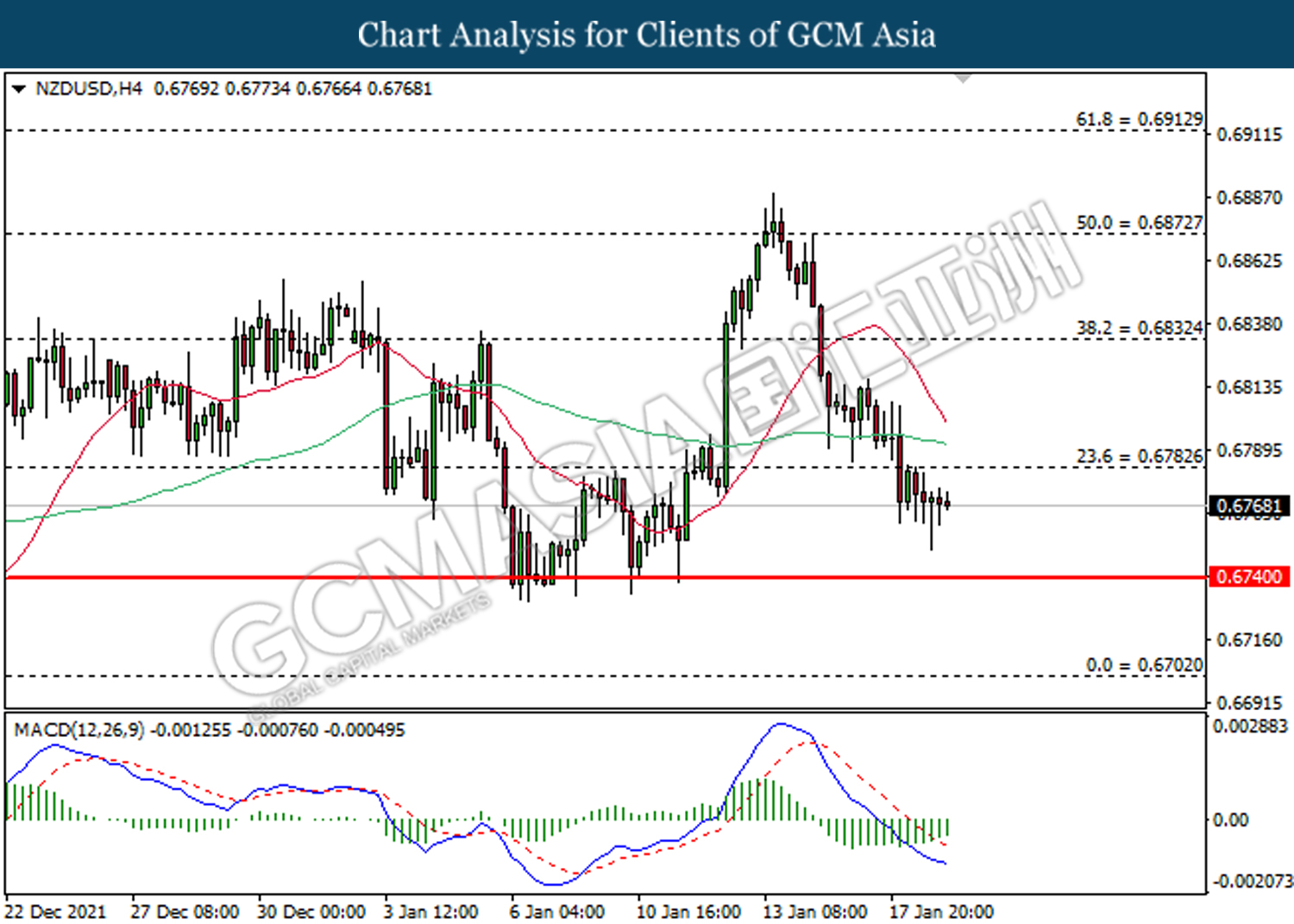

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6595, 0.6635

Support level: 0.6560, 0.6520

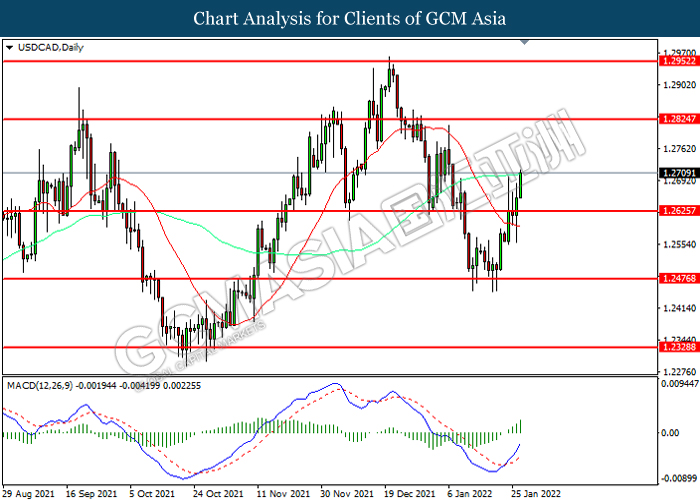

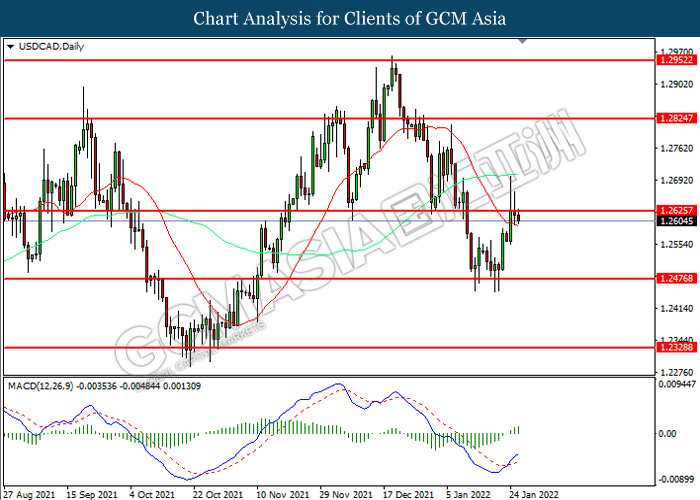

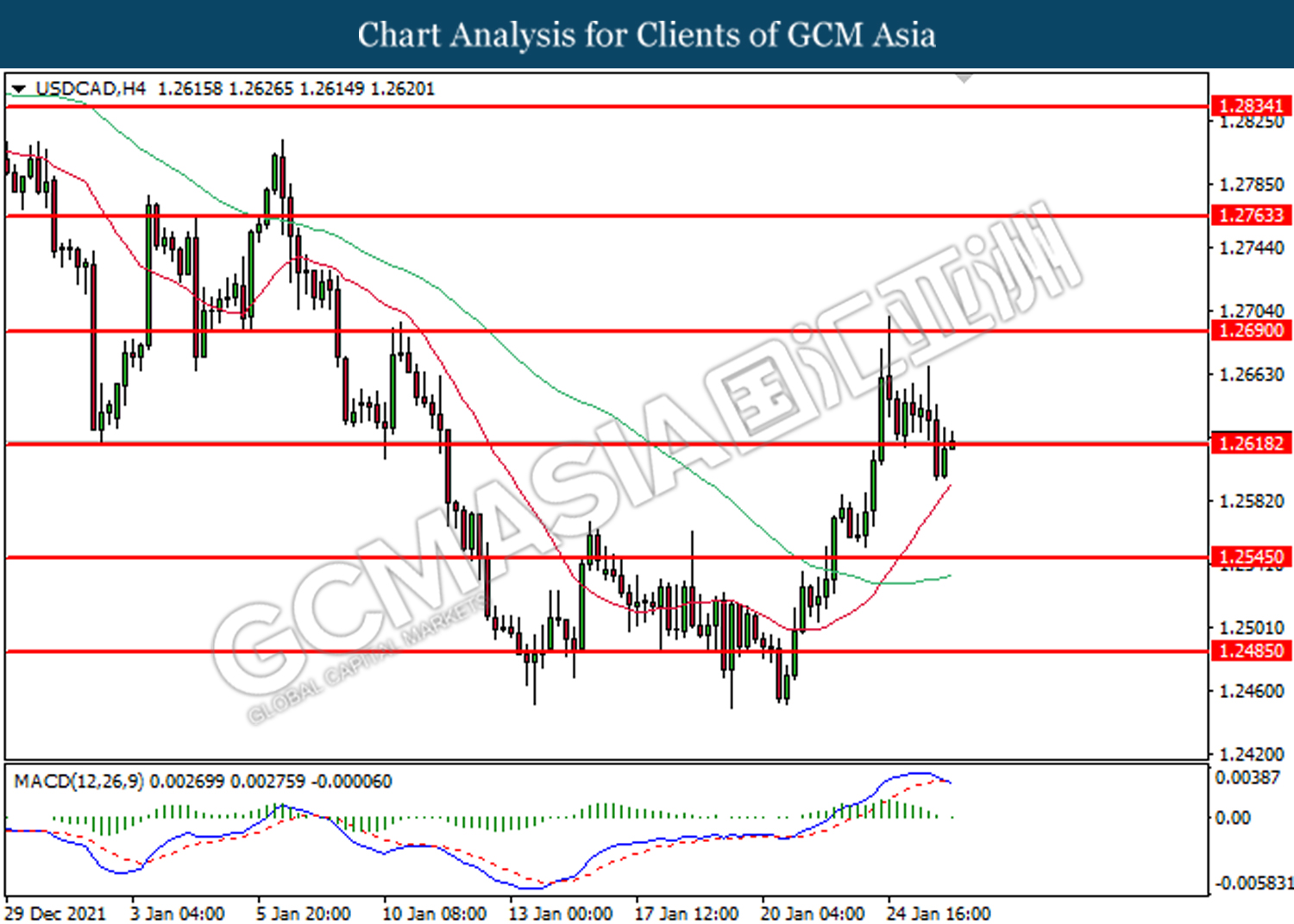

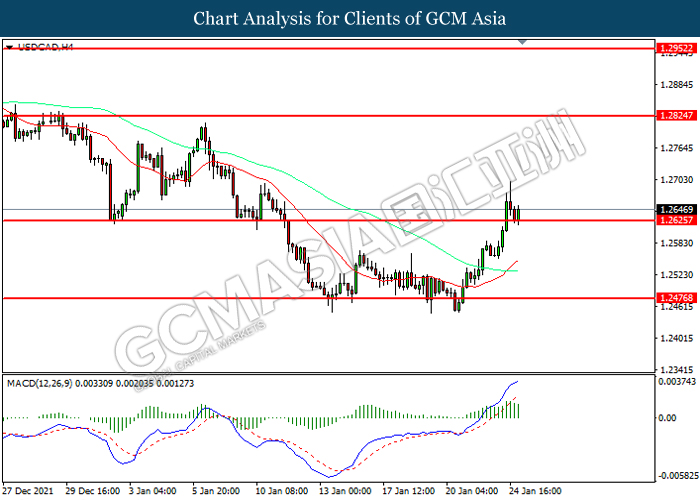

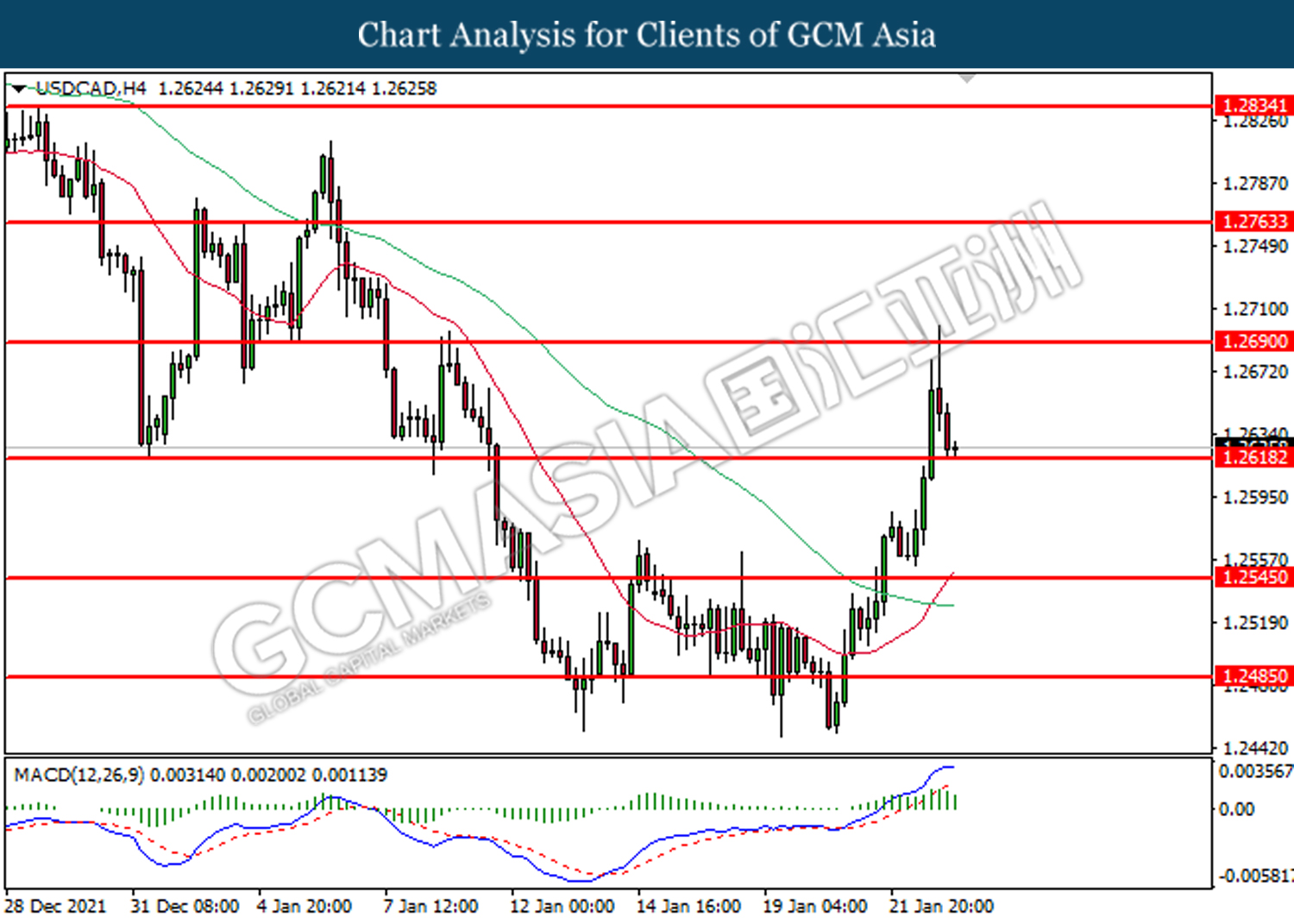

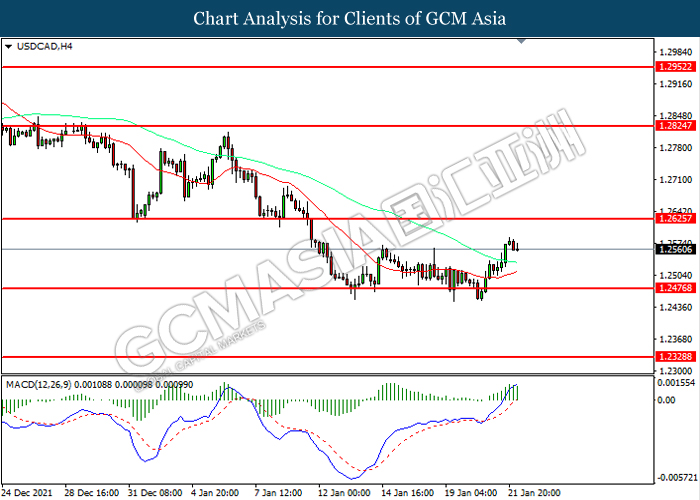

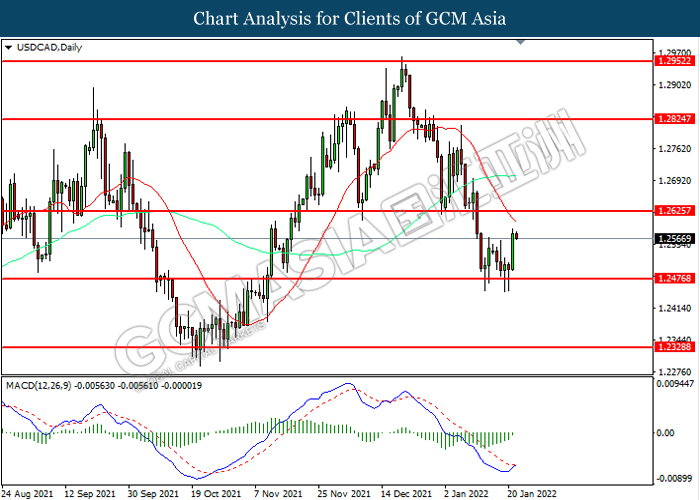

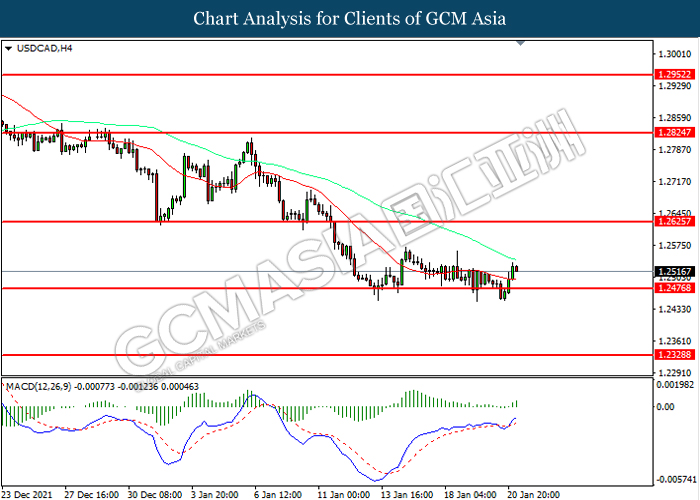

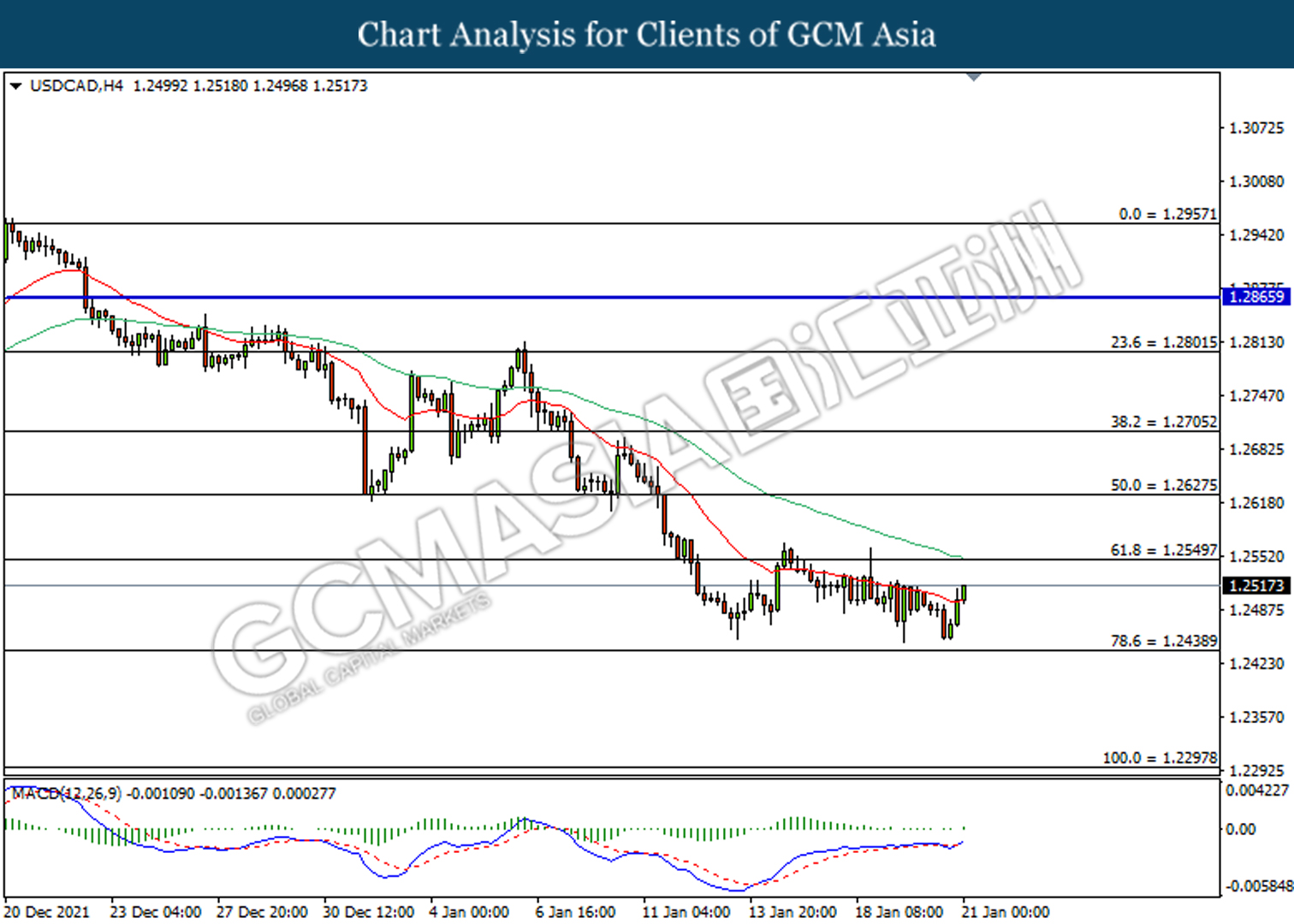

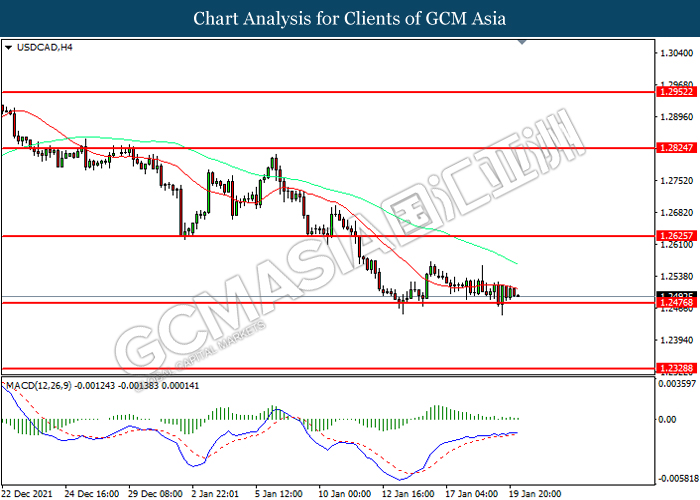

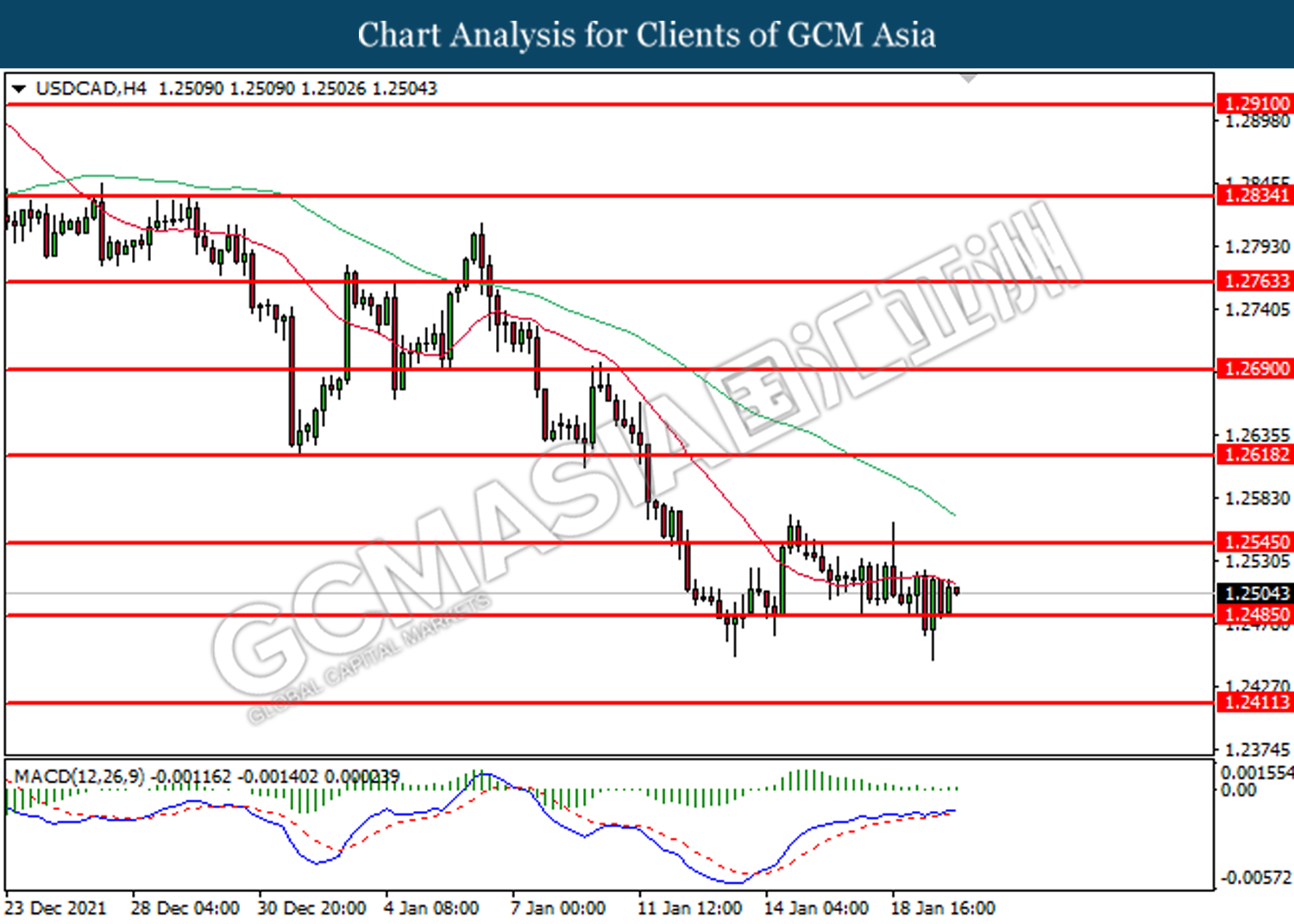

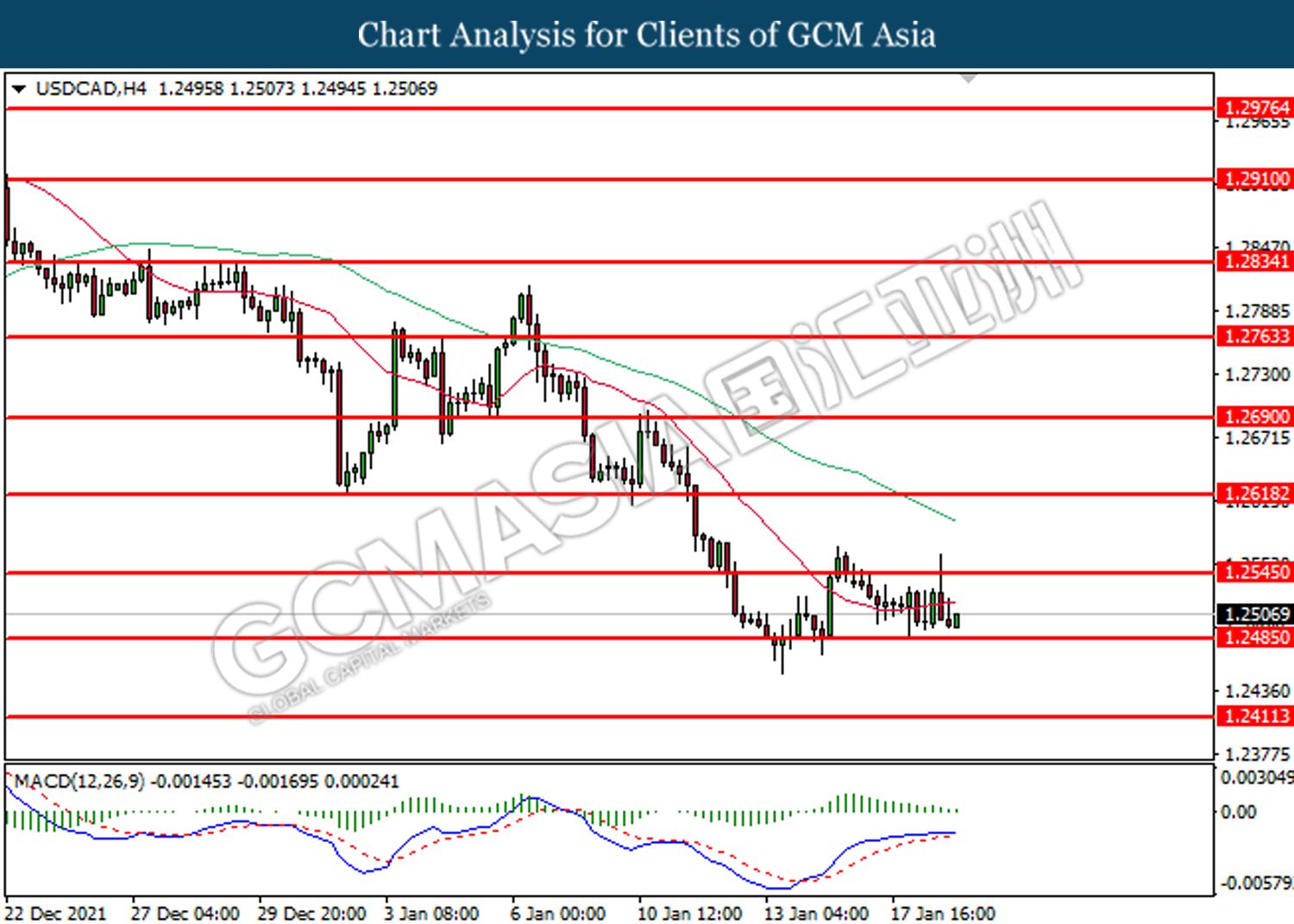

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher after breaking its resistance level.

Resistance level: 1.2765, 1.2835

Support level: 1.2690, 1.2620

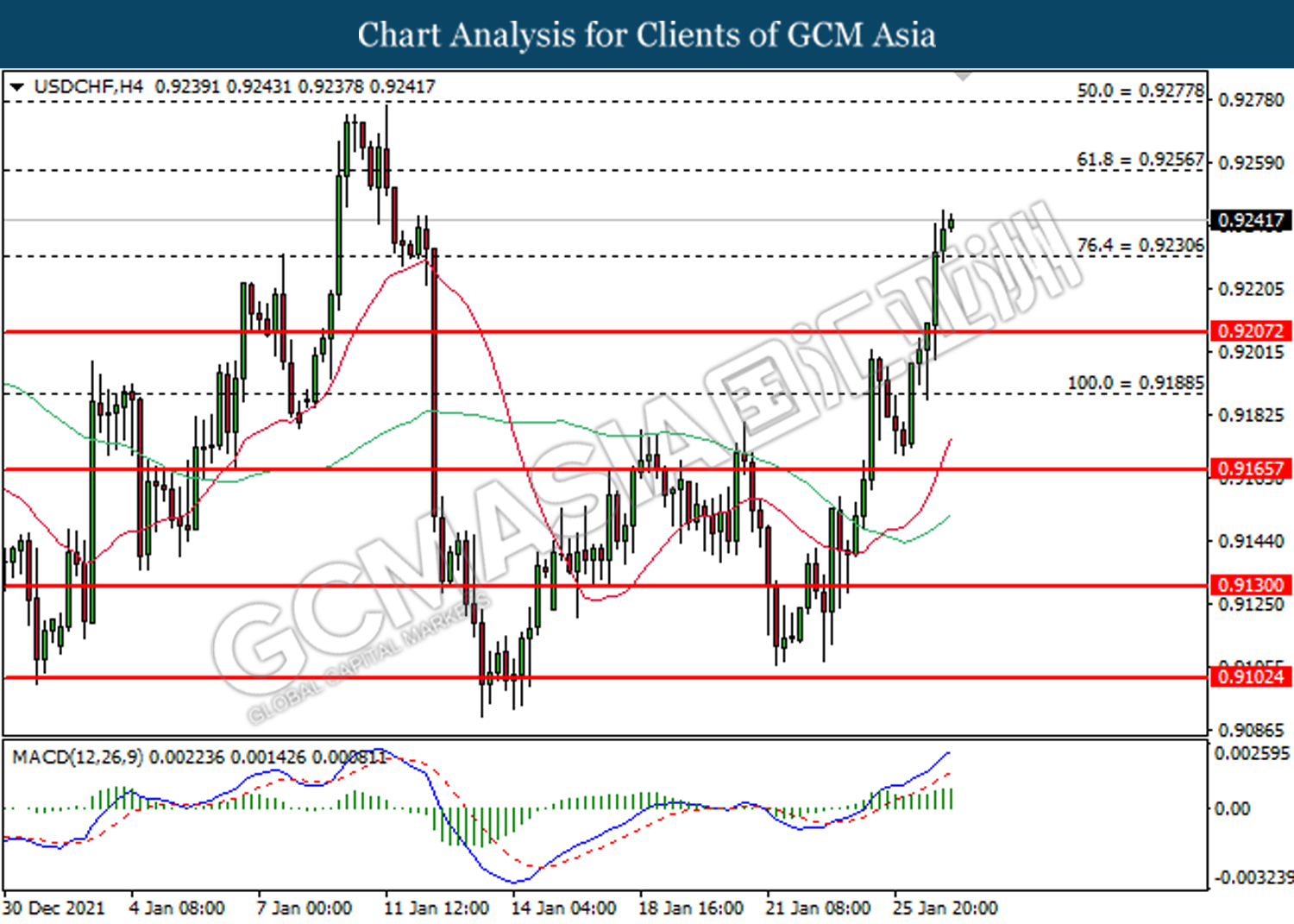

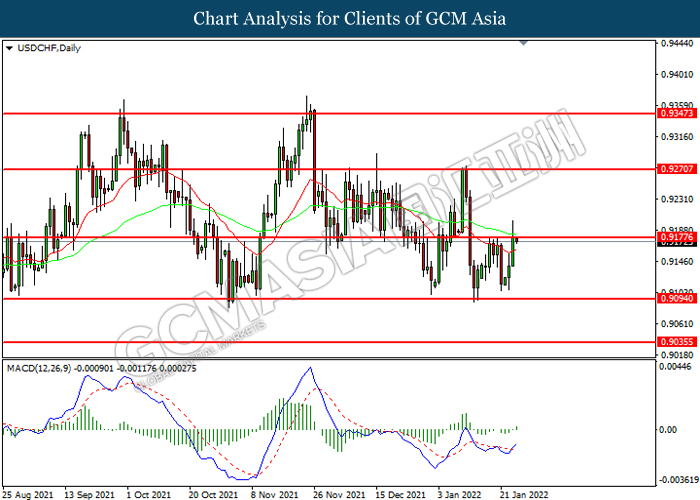

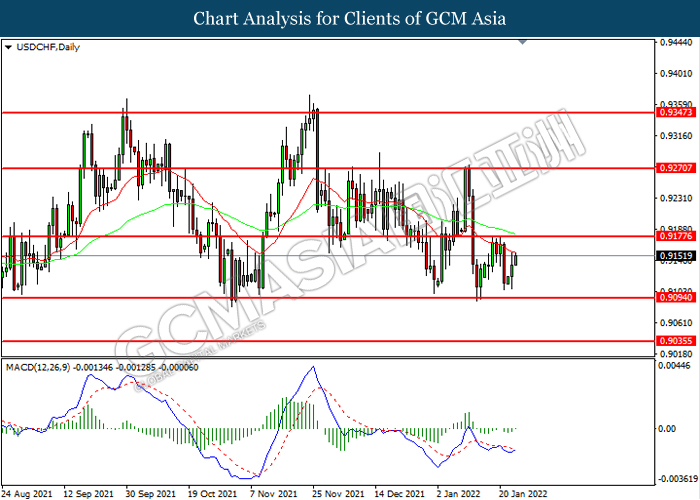

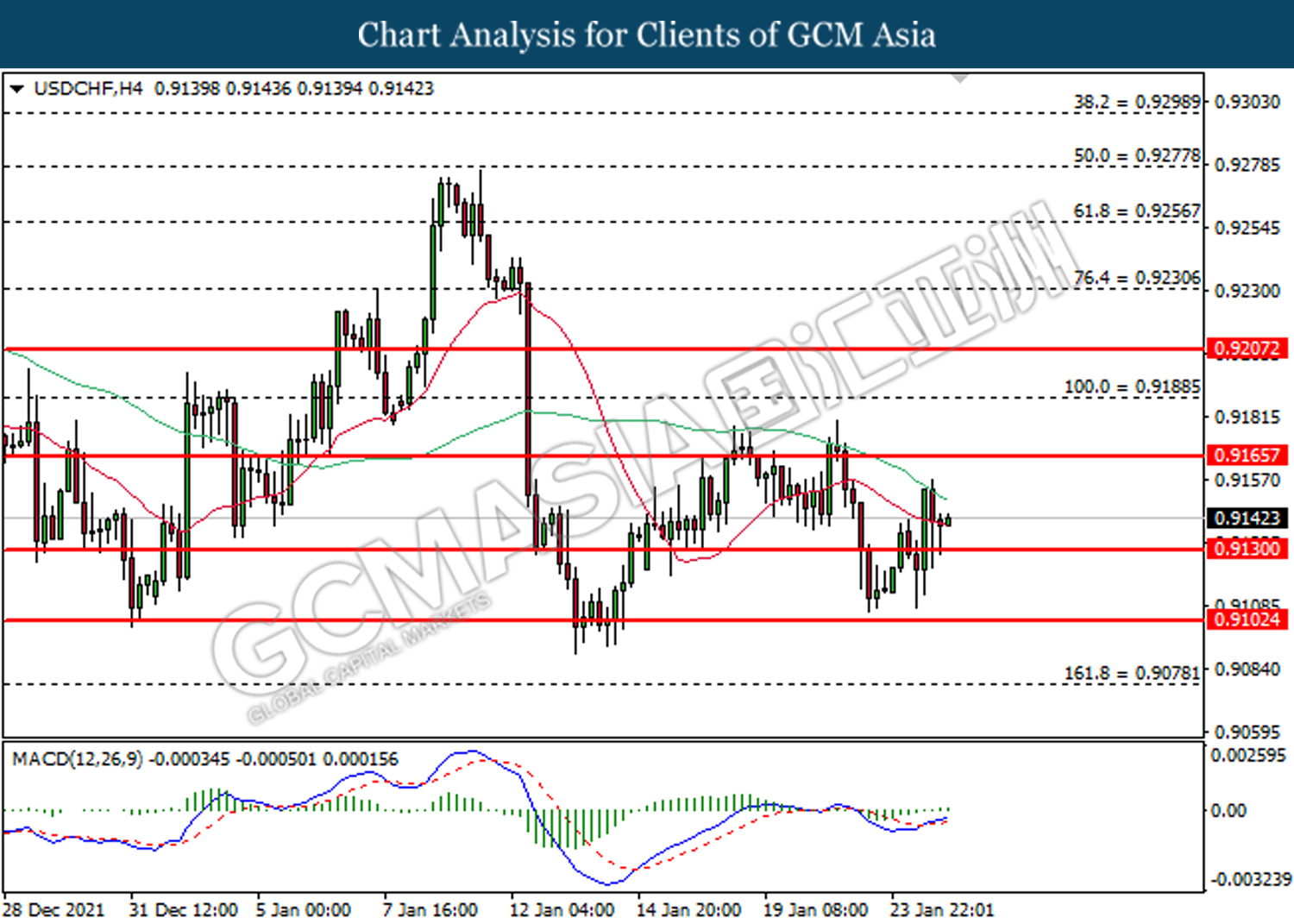

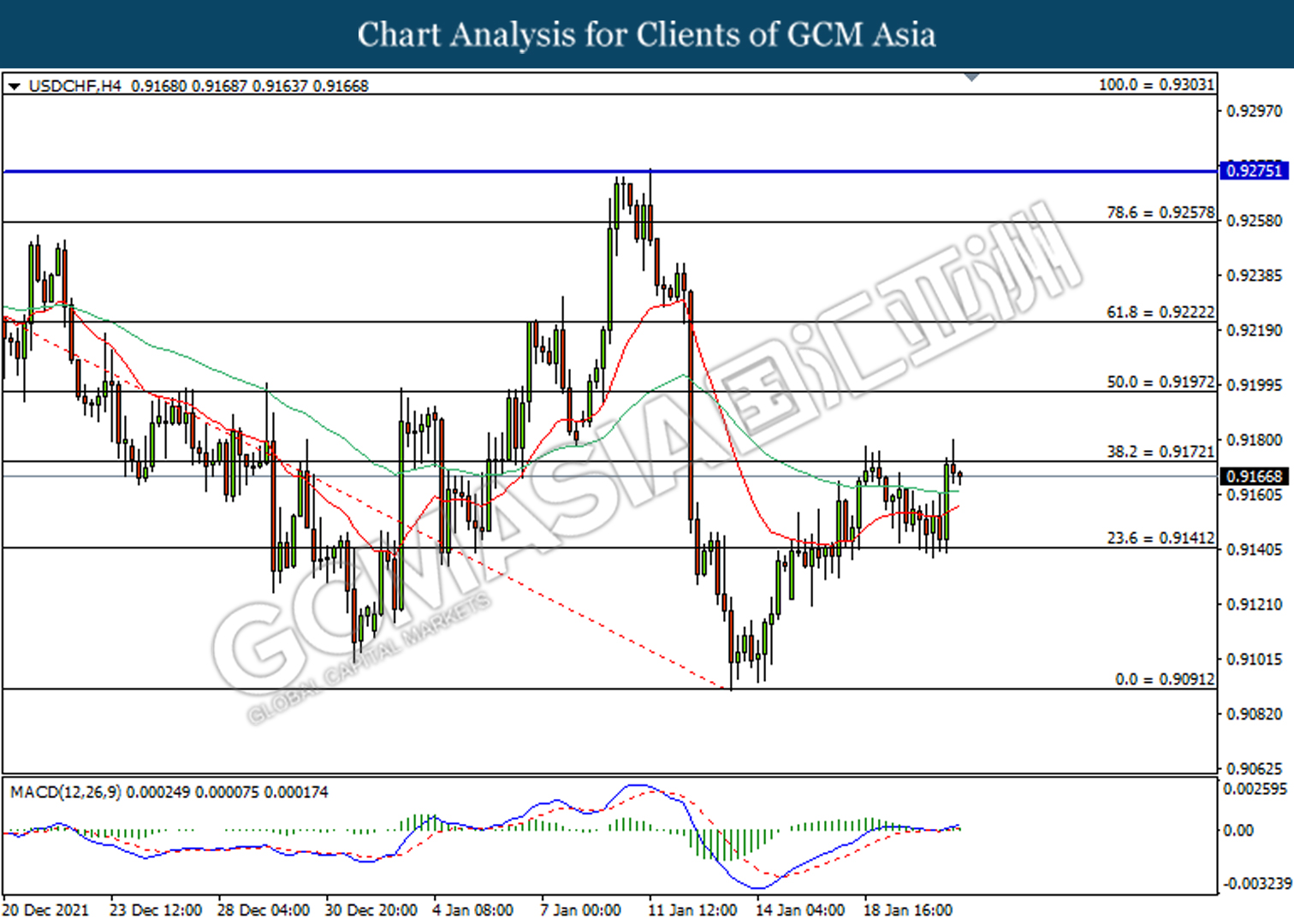

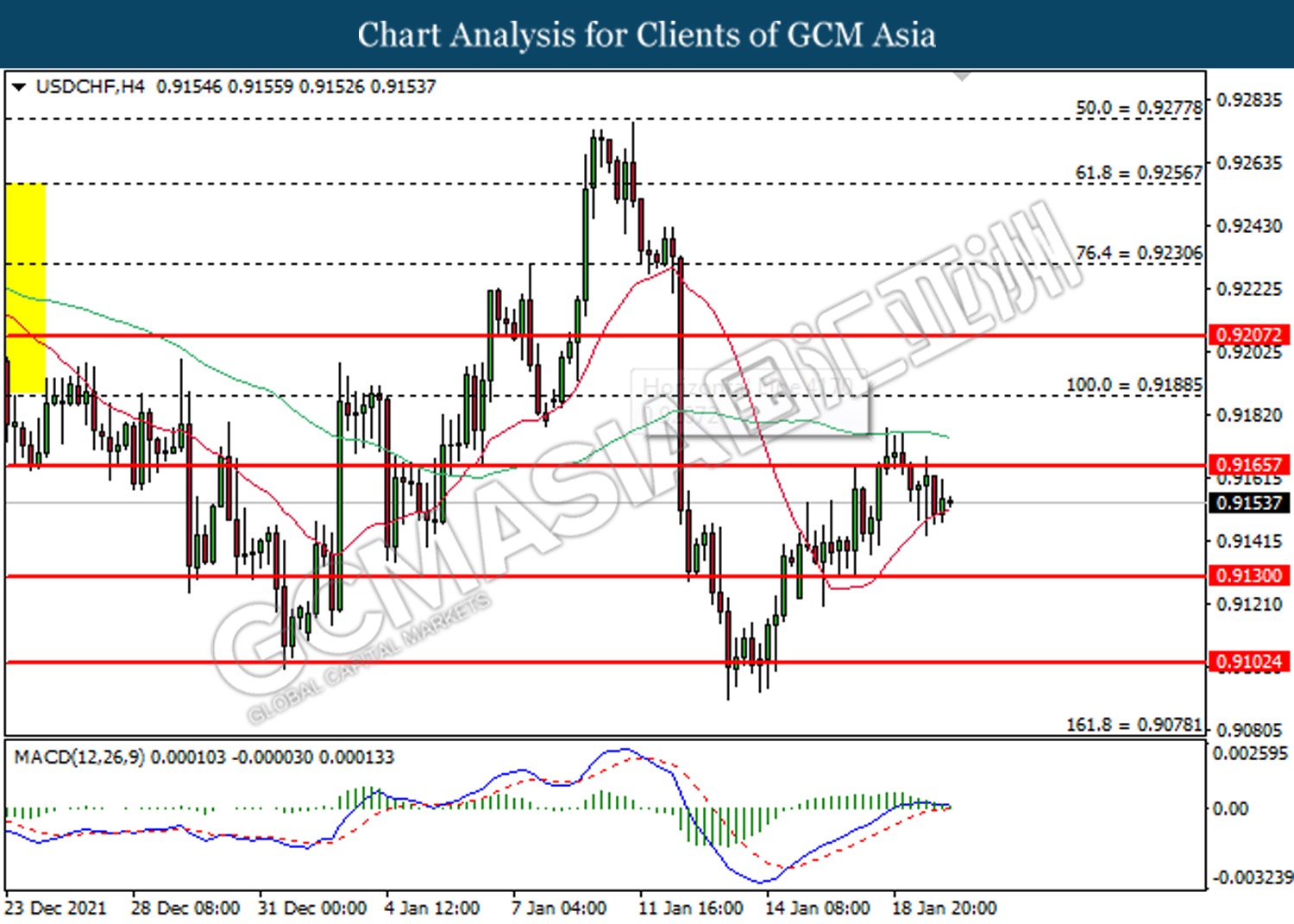

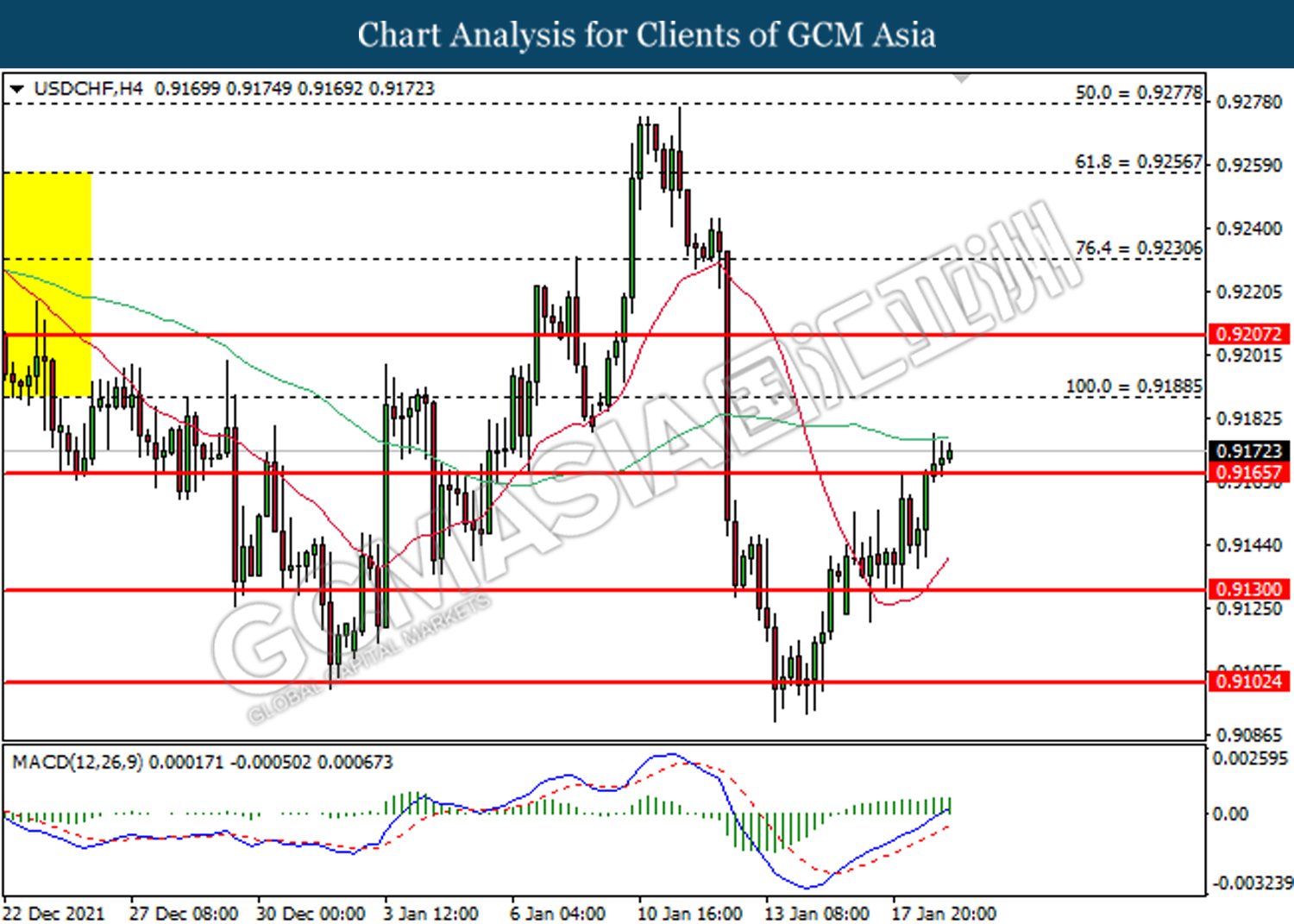

USDCHF, H4: USDCHF was traded higher following prior breakout at 0.9280. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9325, 0.9370

Support level: 0.9300, 0.9280

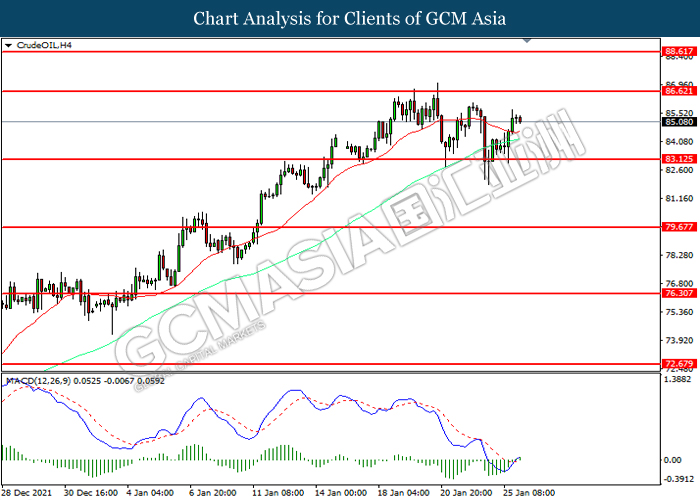

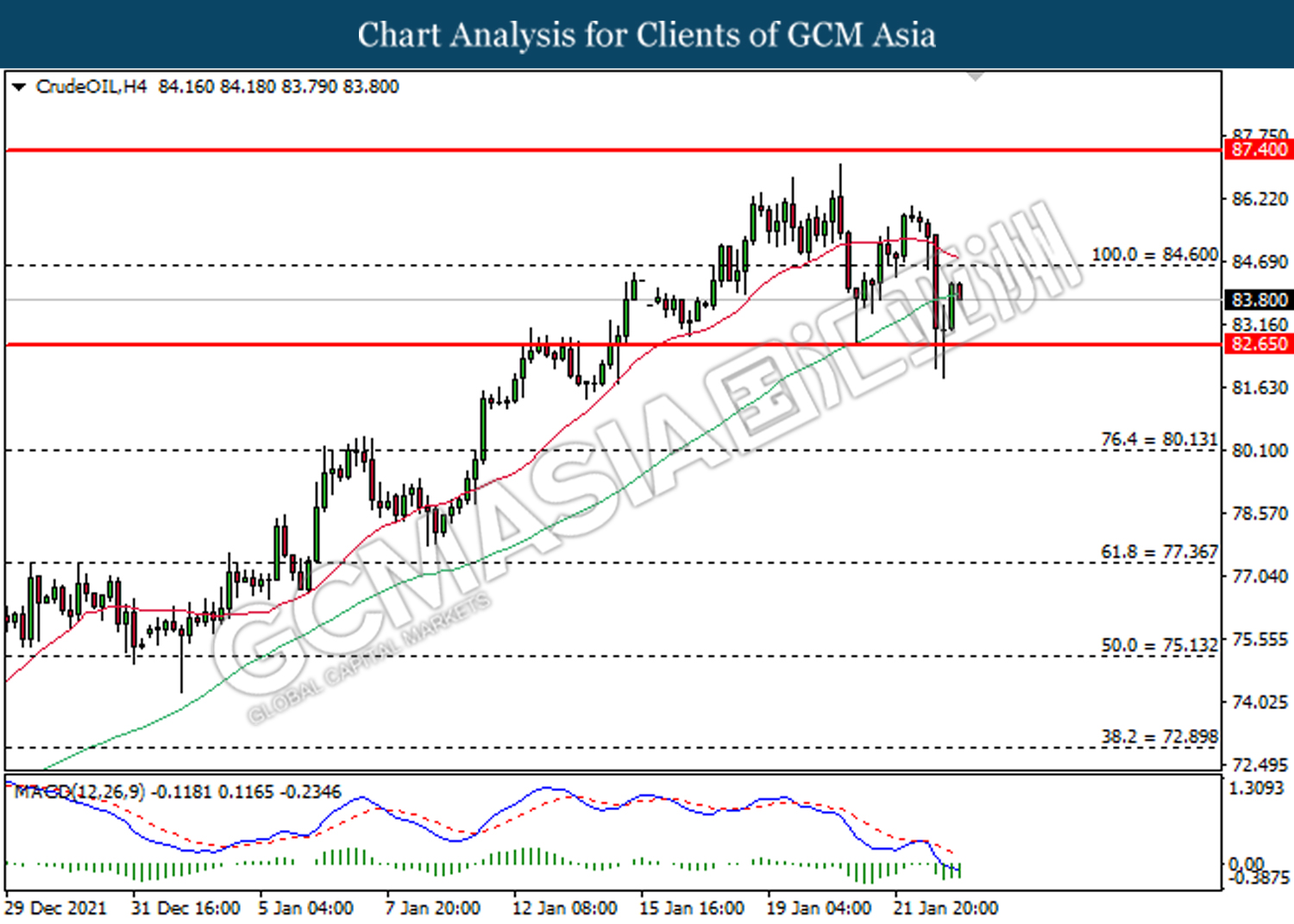

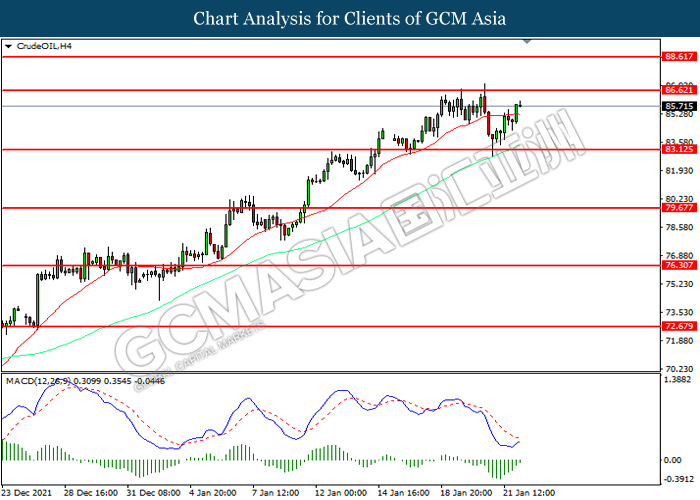

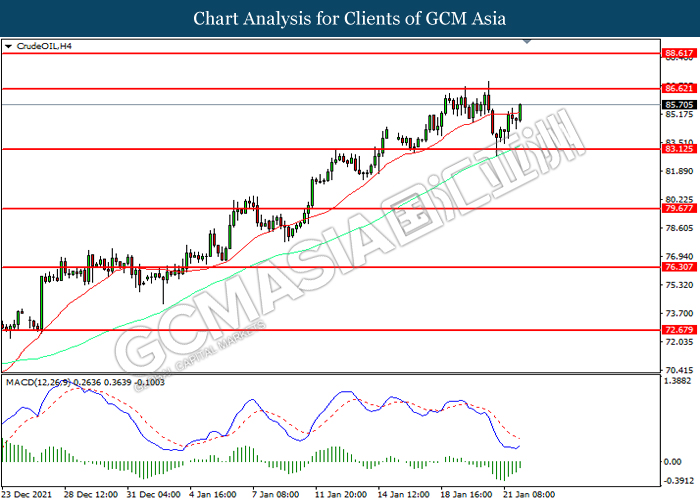

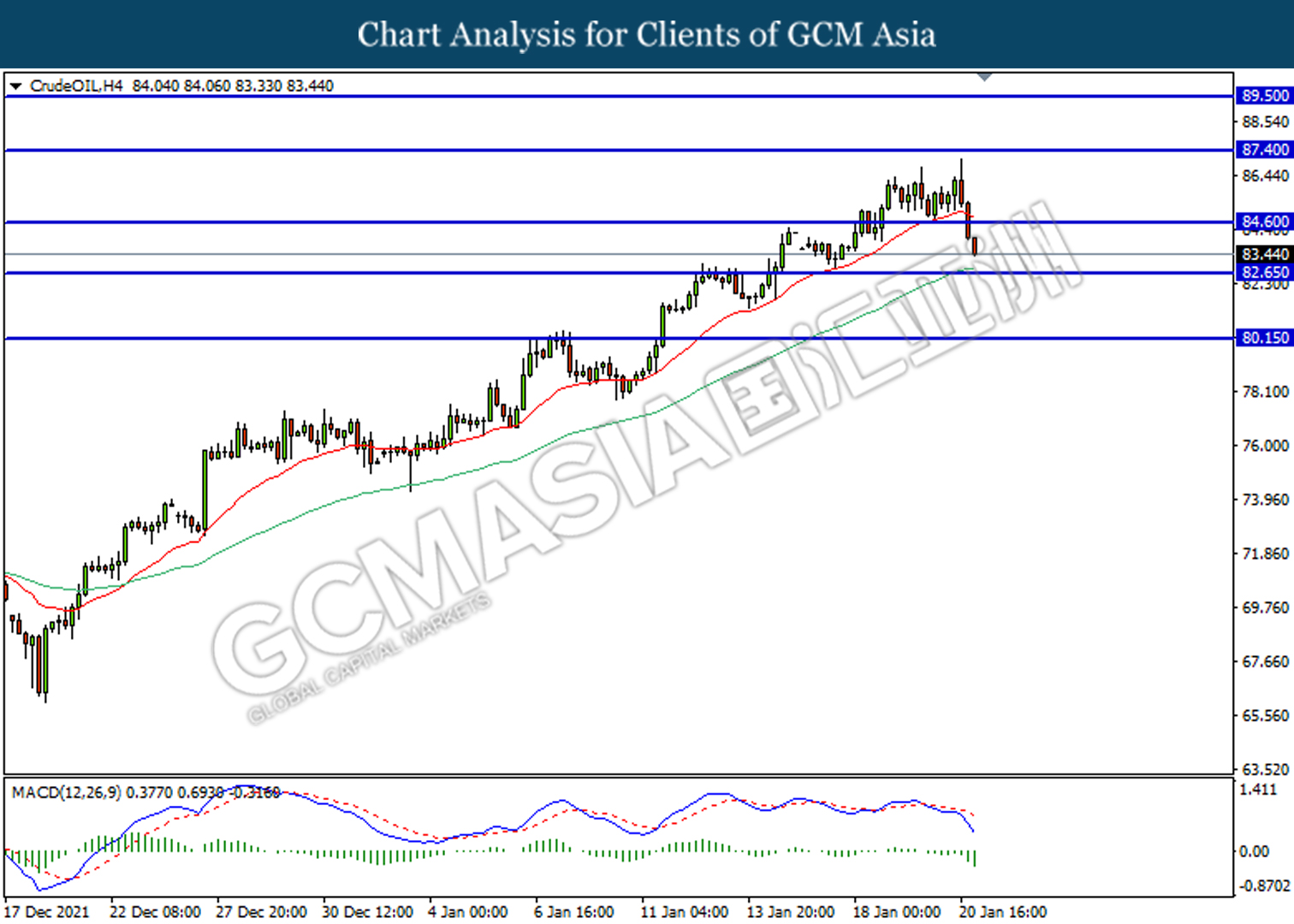

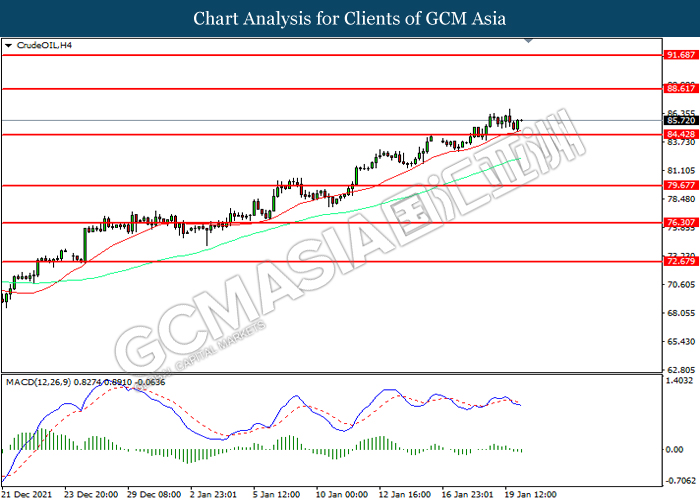

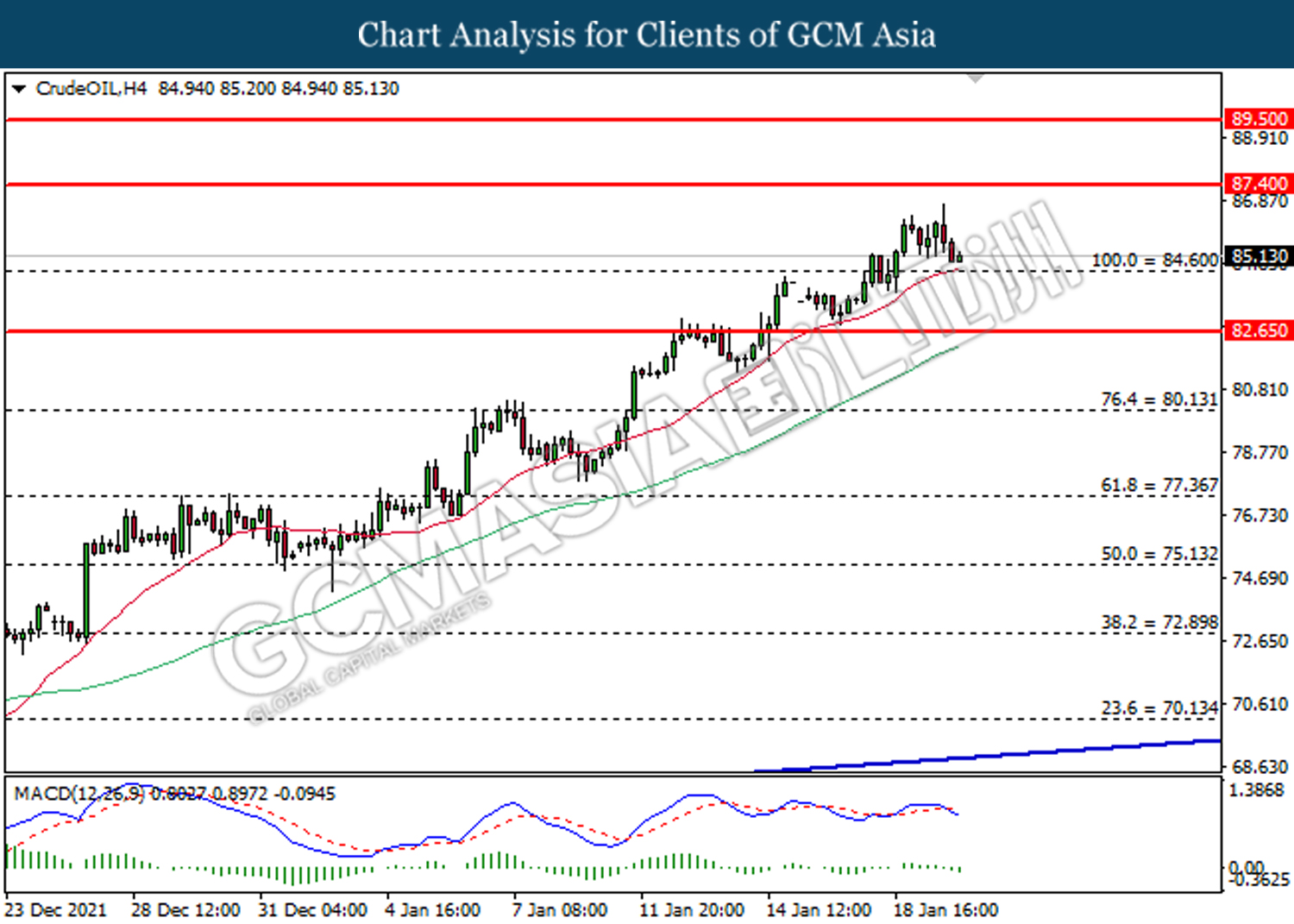

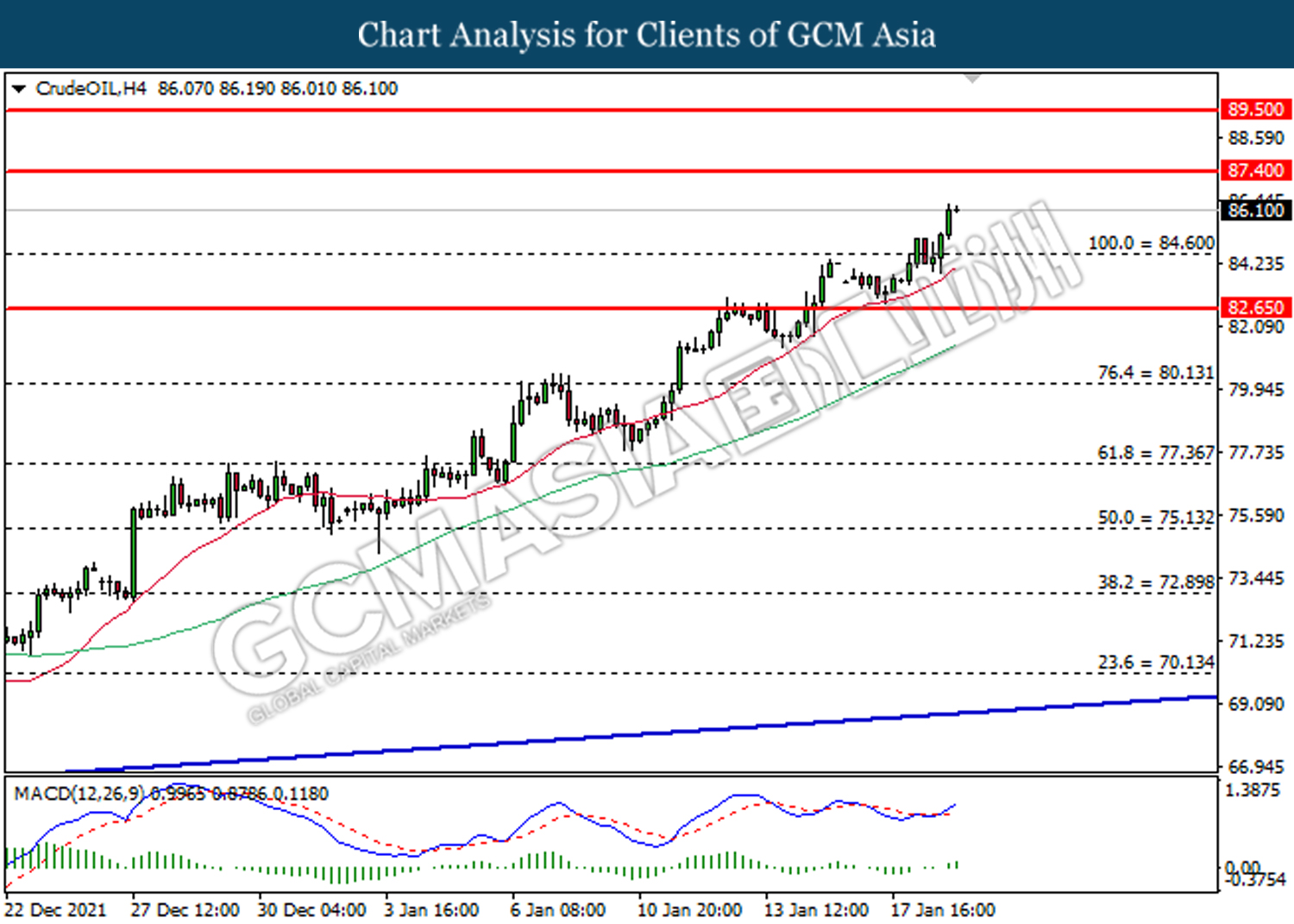

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 87.40, 89.50

Support level: 84.60, 82.65

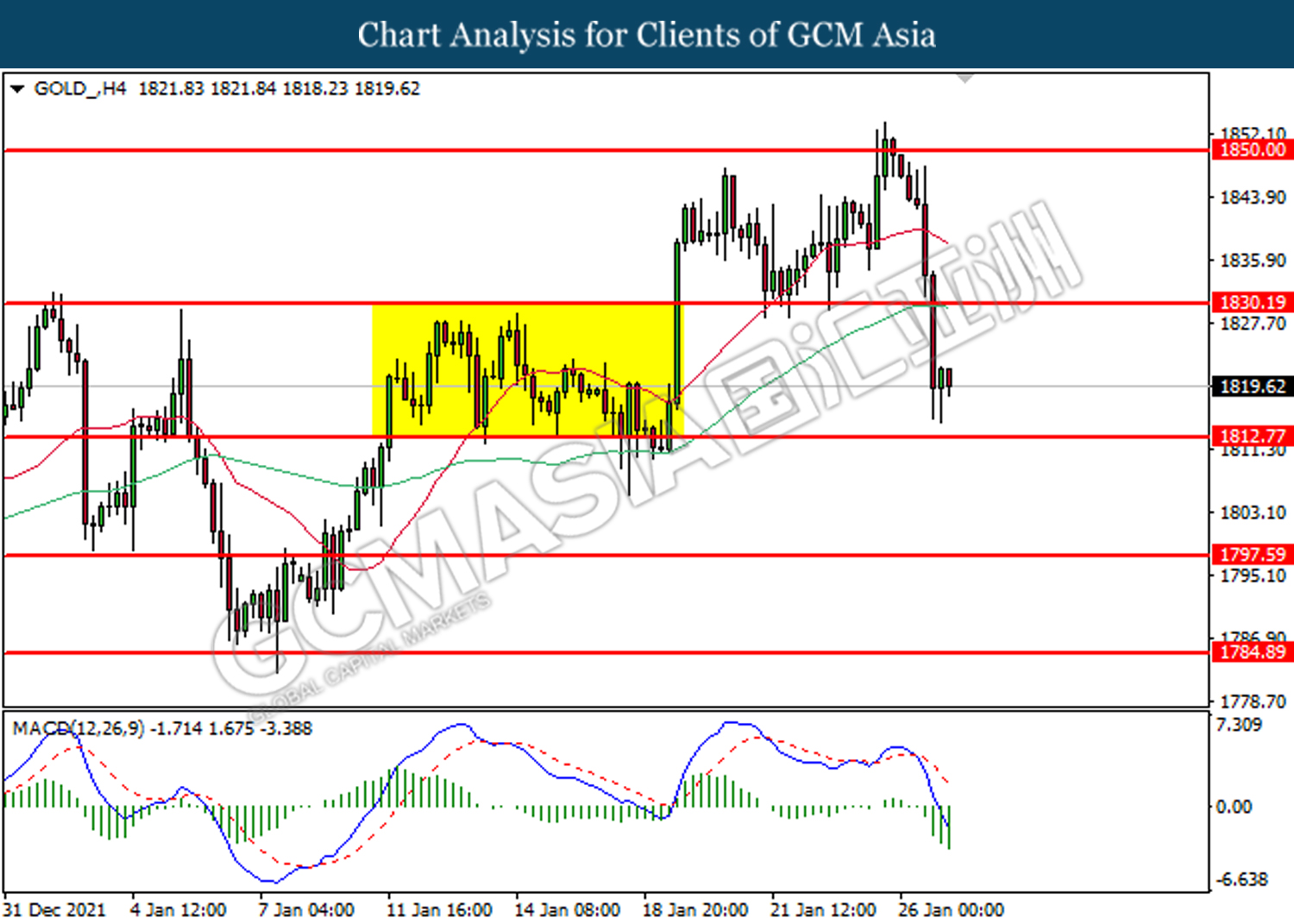

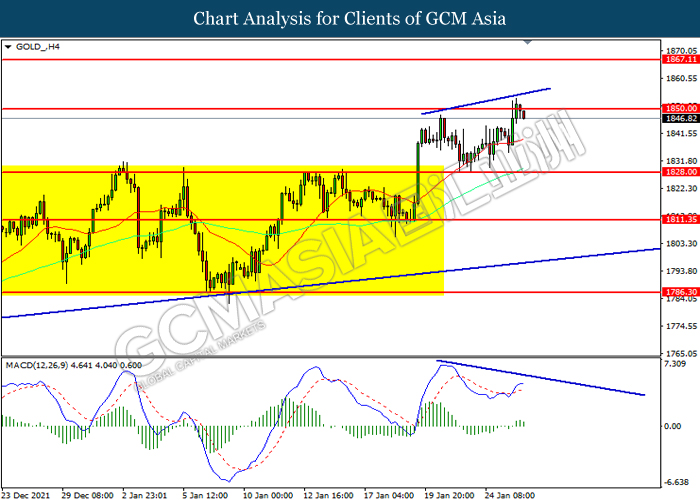

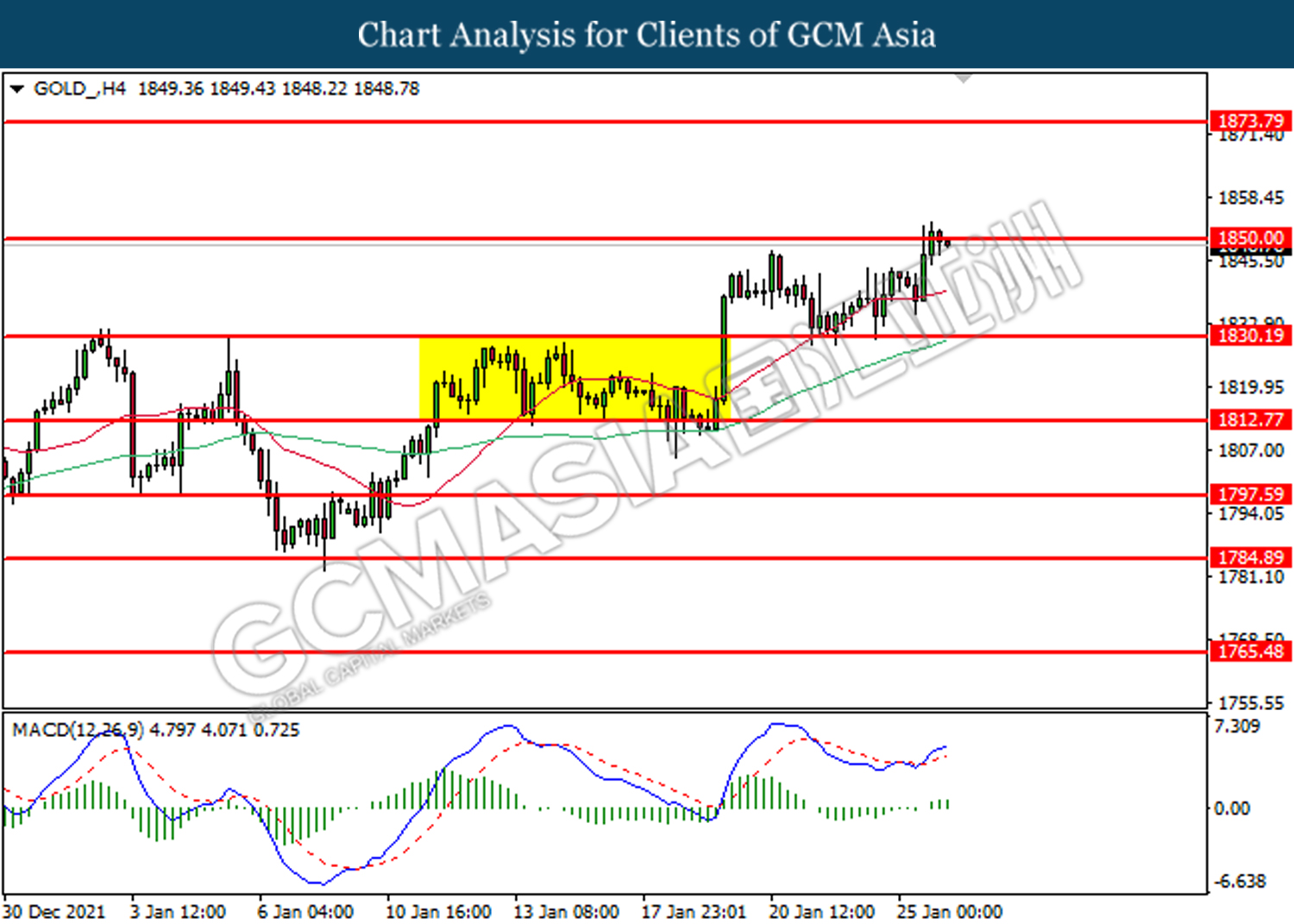

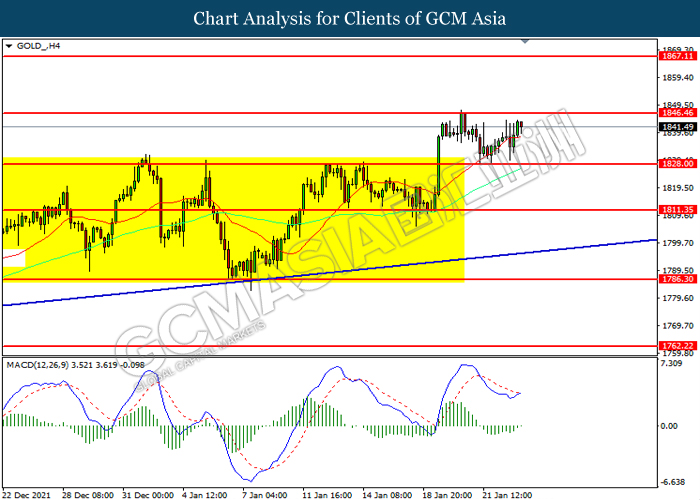

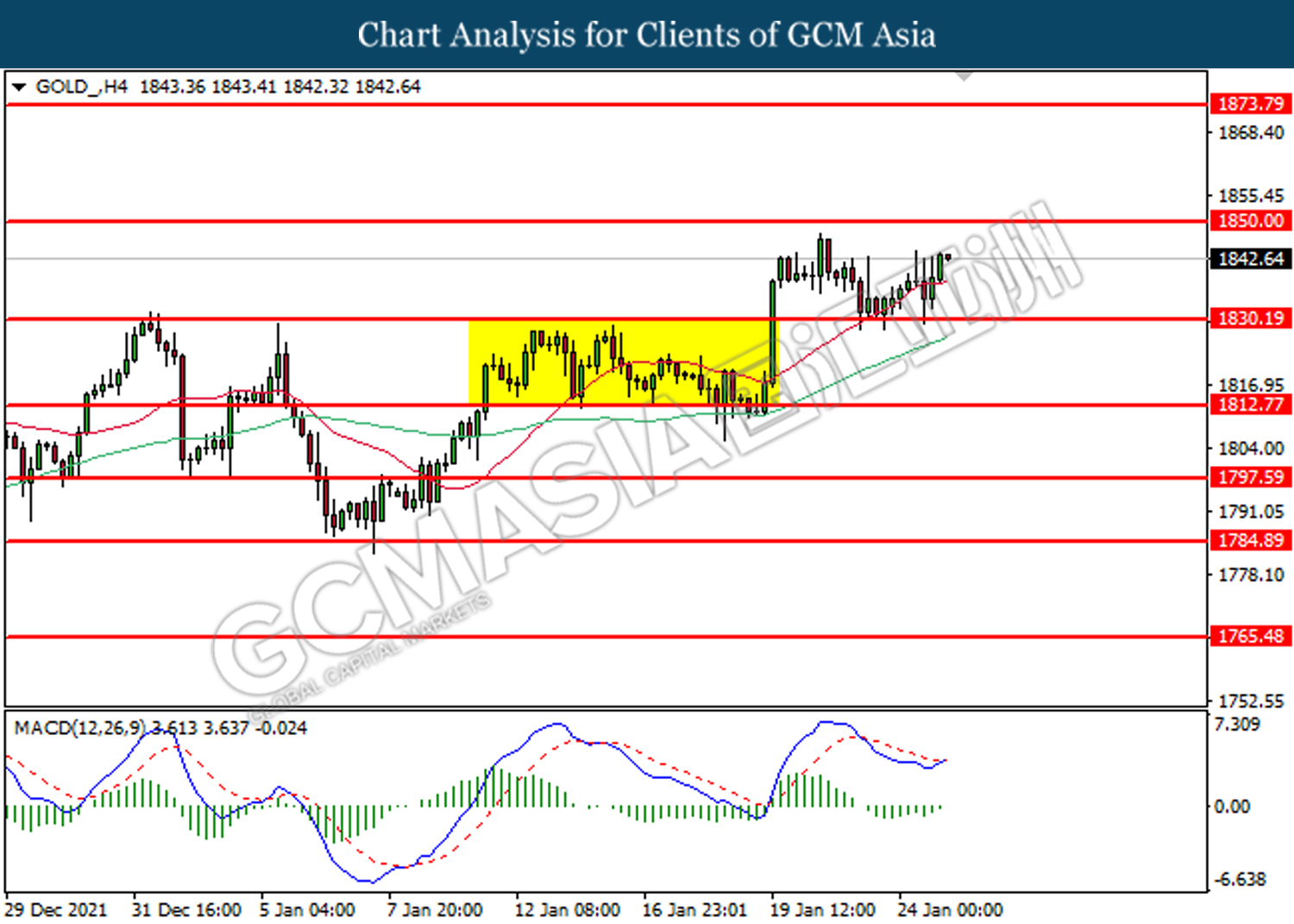

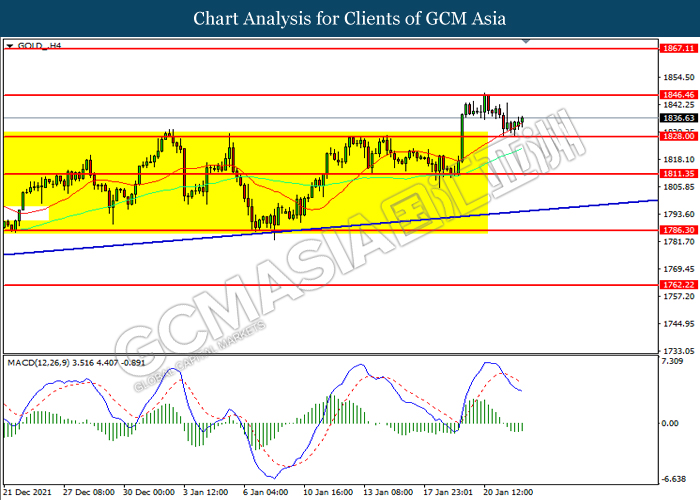

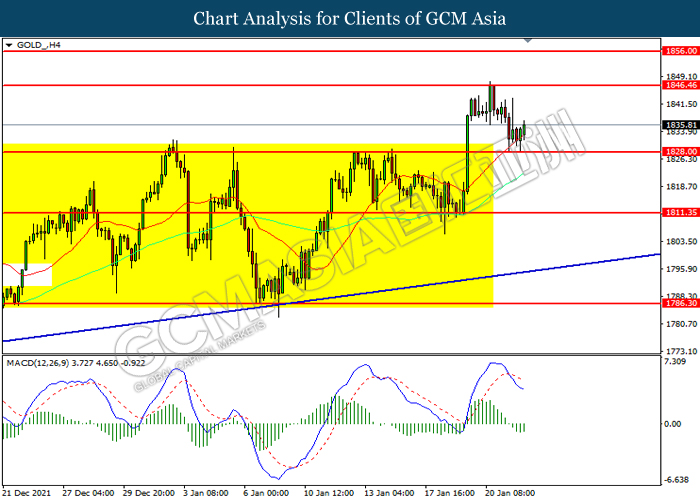

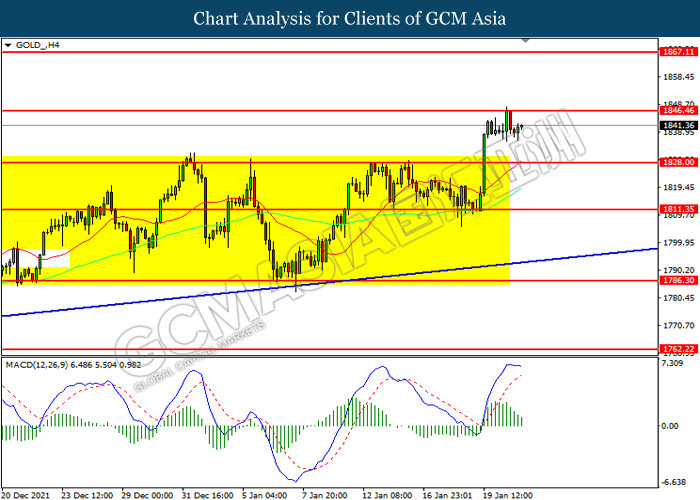

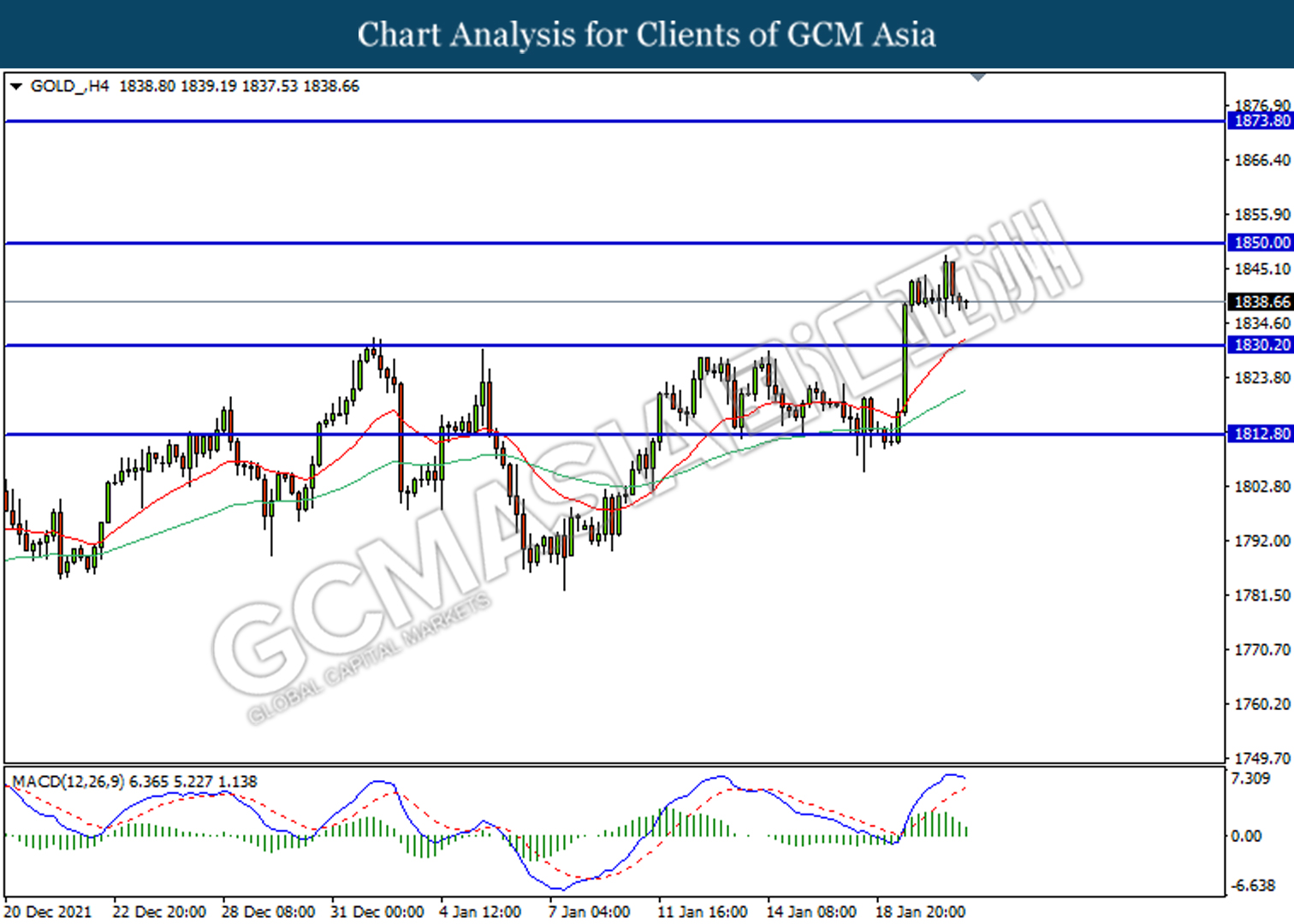

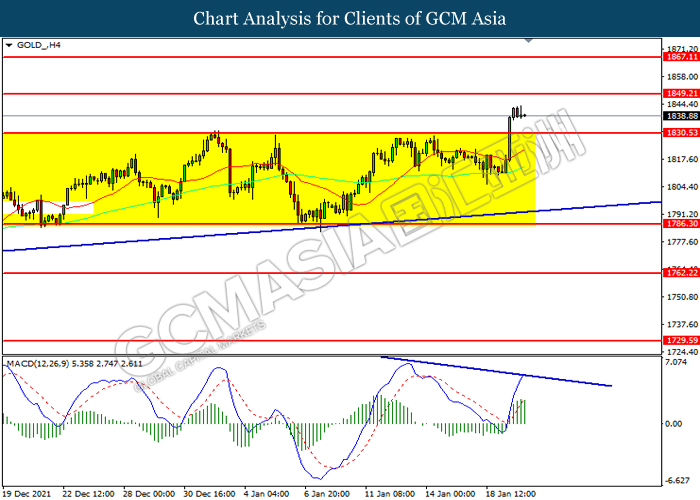

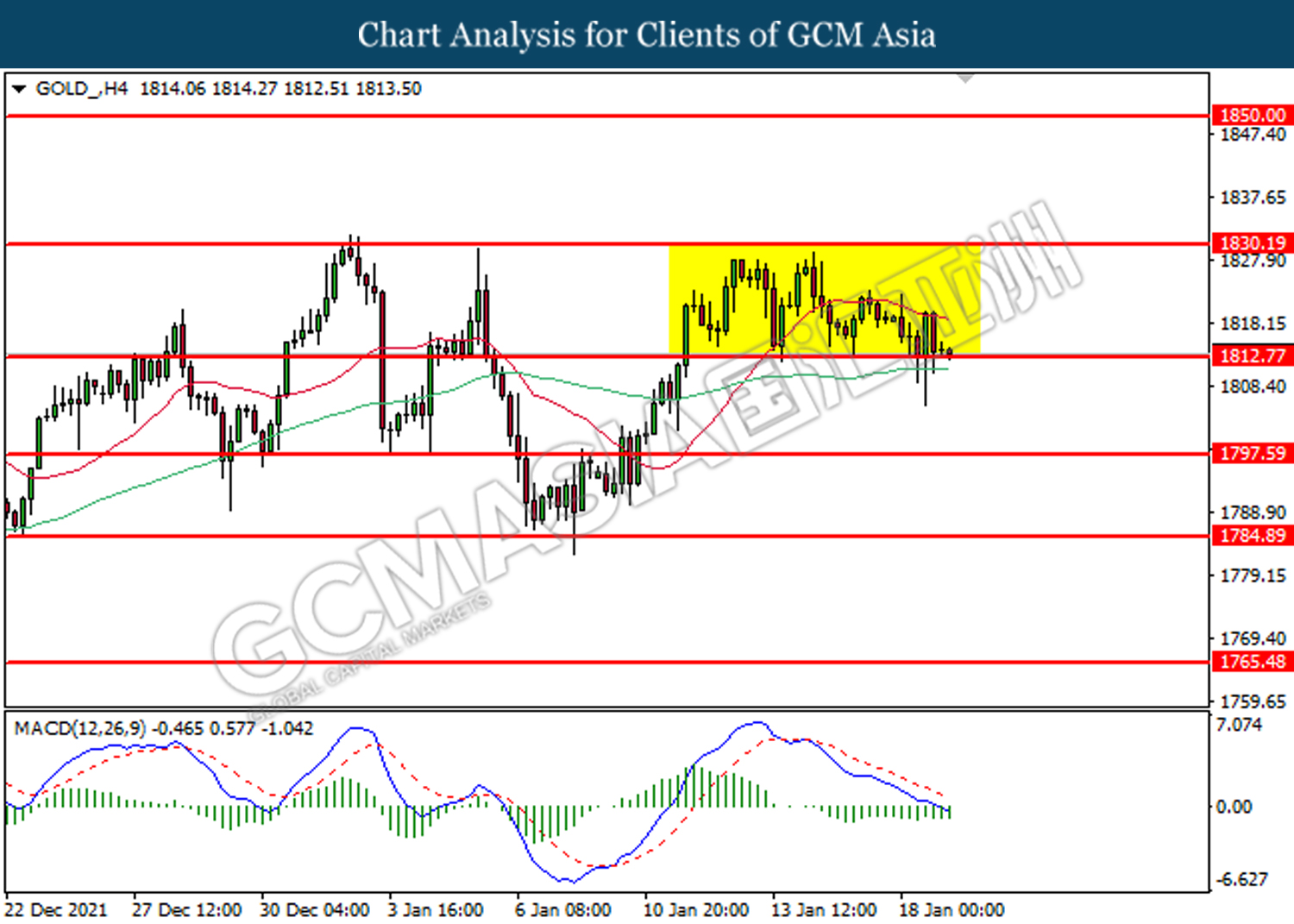

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 1797.60, 1812.80

Support level: 1784.90, 1765.50

270122 Afternoon Session Analysis

27 January 2022 Afternoon Session Analysis

Canada Dollar slumped following BoC statement.

The Canada Dollar slumped following the Bank of Canada held its target for the overnight rate unchanged at 0.25%, with the bank rate at 0.5% and deposit rate at 0.25%. Besides, the bank is continuing to maintain its bond buying program unchanged. On the inflation side, the Canada CPI inflation rate remains well above the target range, weighing down the economic momentum in the Canada. Persistent supply constraints combined with higher food and energy prices, are expected to cause the CPI inflation rate rose to 5% in the first half of 2022. In overall, the Bank of Canada projects the global GDP growth to moderate from 6.45% in the year of 2021 to 3.5 % in the year of 2022 and 2023. In Canada, GDP growth in the 2nd quarter of 2021 now looks to have been even stronger than expected. Nonetheless, investors would continue to focus on the Covid-19 development and crucial economic data to gauge the likelihood movement for Canada Dollar. As of writing, USD/CAD appreciated by 0.34% to 1.2705.

In the commodities market, the crude oil price depreciated by 0.88% to $86.40 per barrel as of writing amid bearish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at 2.377M, missing the market forecast at -0.728M. The gold price slumped 0.20% to $1815.55 per troy ounces as of writing following the Federal Reserve unleashed their hawkish tone.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Dec) | 0.80% | 0.40% | – |

| 21:30 | USD – GDP (QoQ) (Q4) | 2.30% | 5.40% | – |

| 21:30 | USD – Initial Jobless Claims | 286K | 255K | – |

| 23:00 | USD – Pending Home Sales (MoM) (Dec) | -2.20% | 0.30% | – |

Technical Analysis

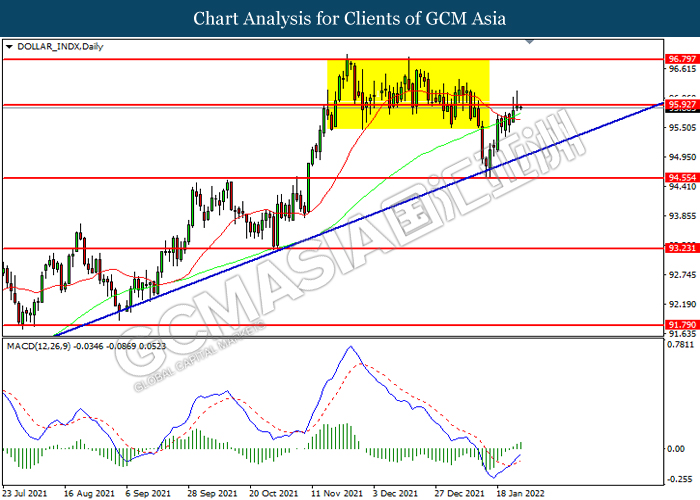

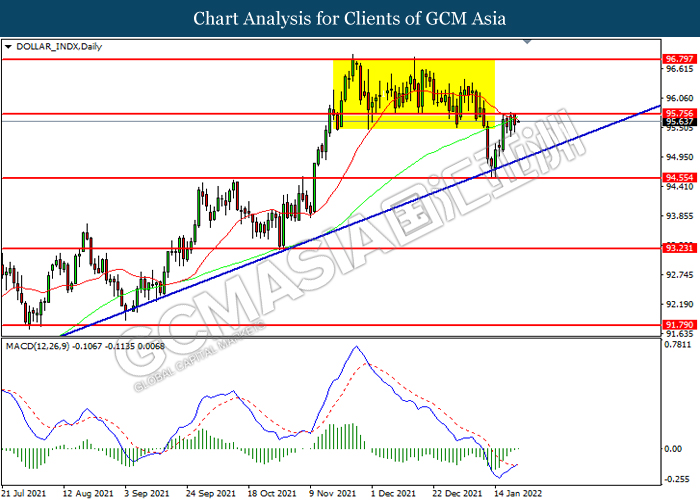

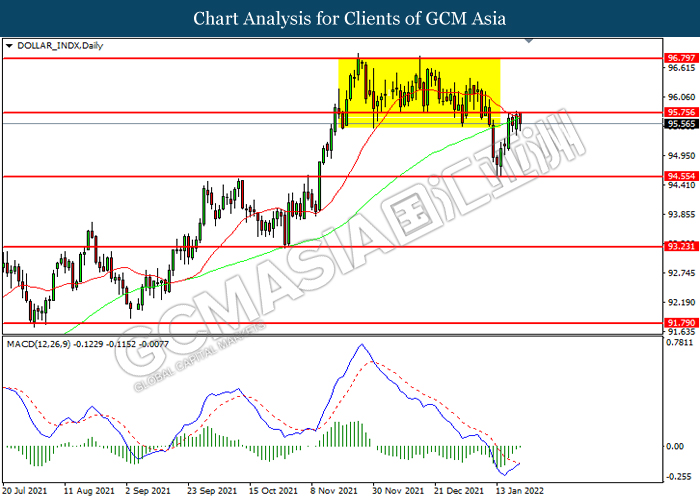

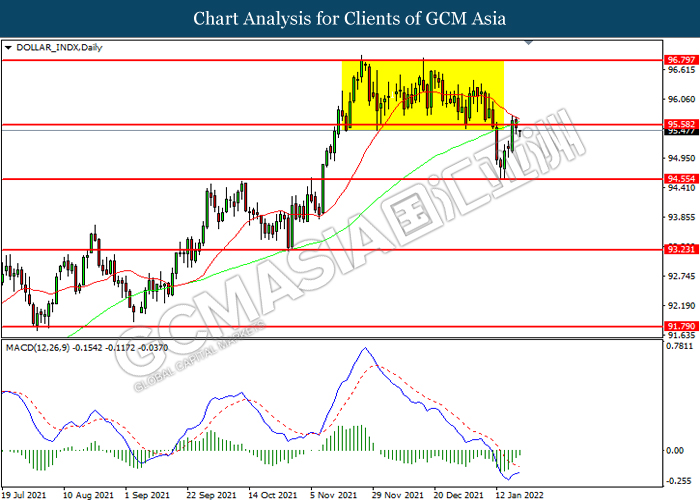

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 96.80. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 96.80, 97.50

Support level: 95.95, 94.55

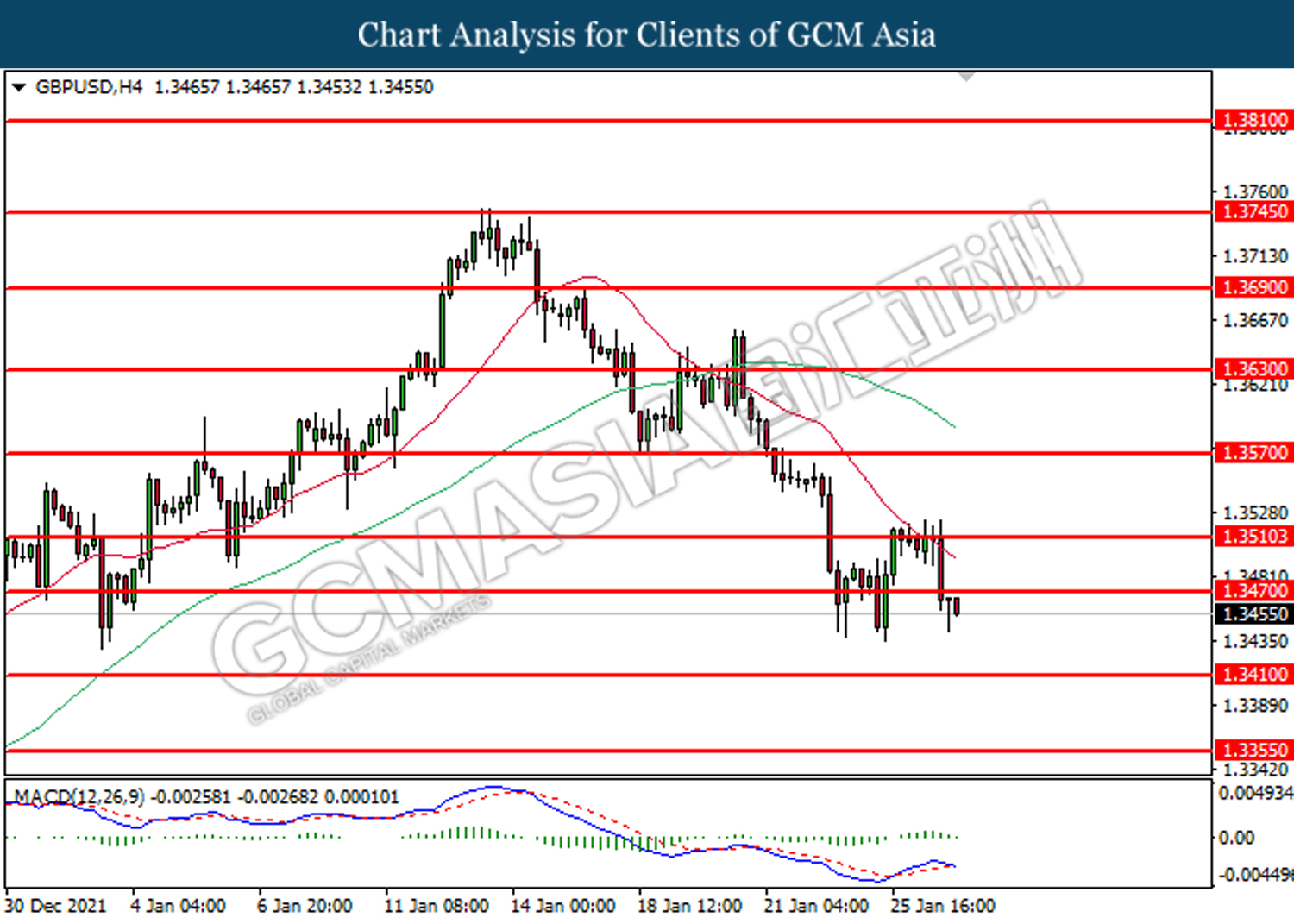

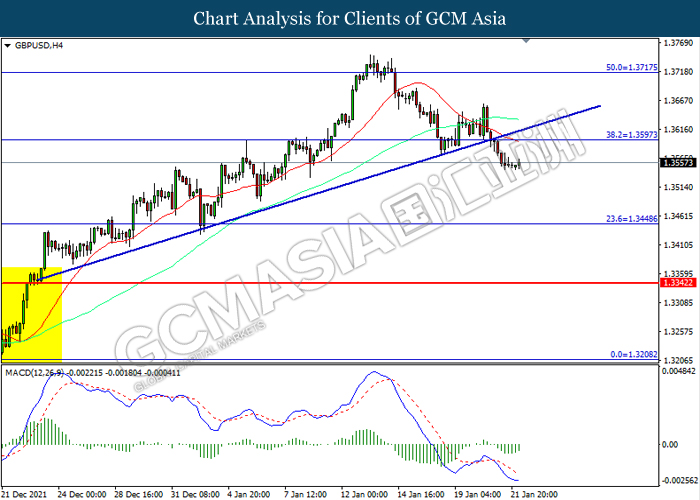

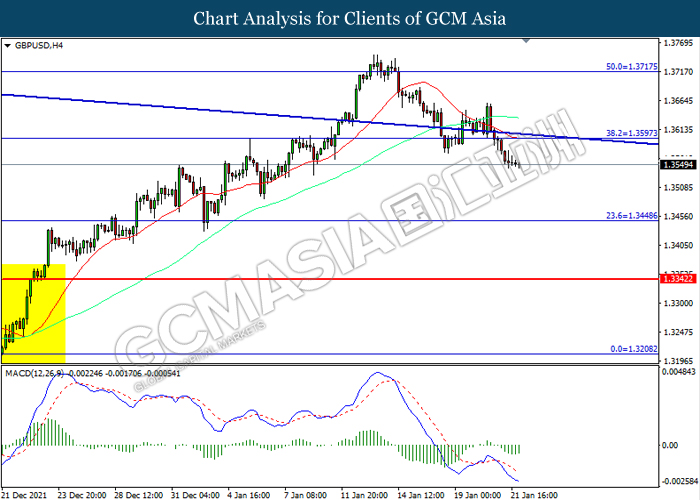

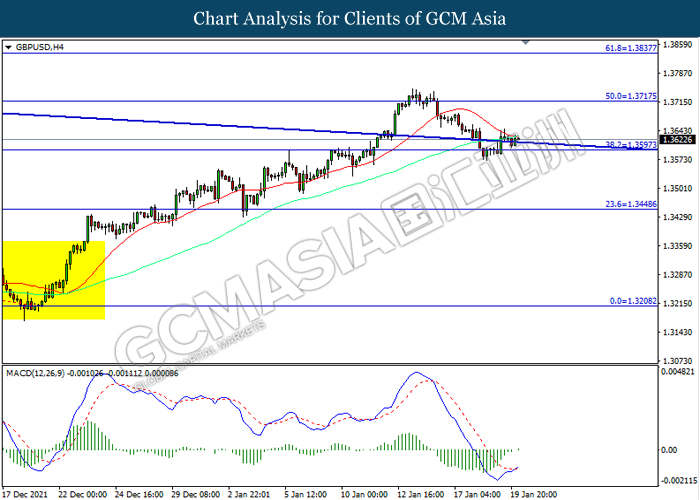

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3450. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3340.

Resistance level: 1.3450, 1.3595

Support level: 1.3340, 1.3210

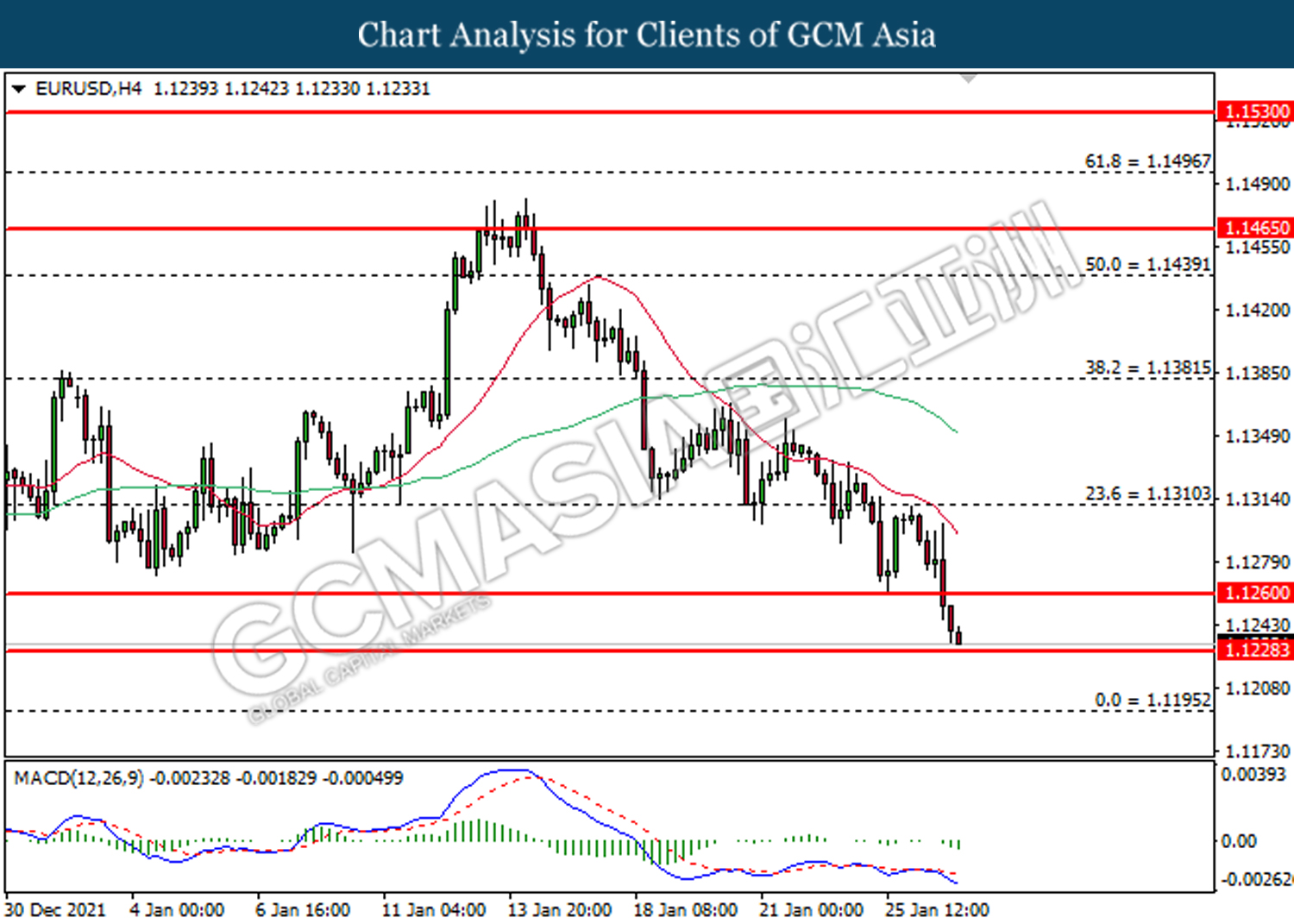

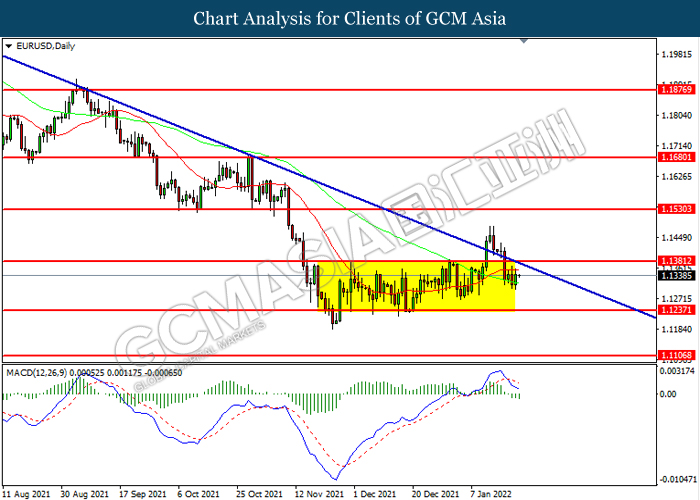

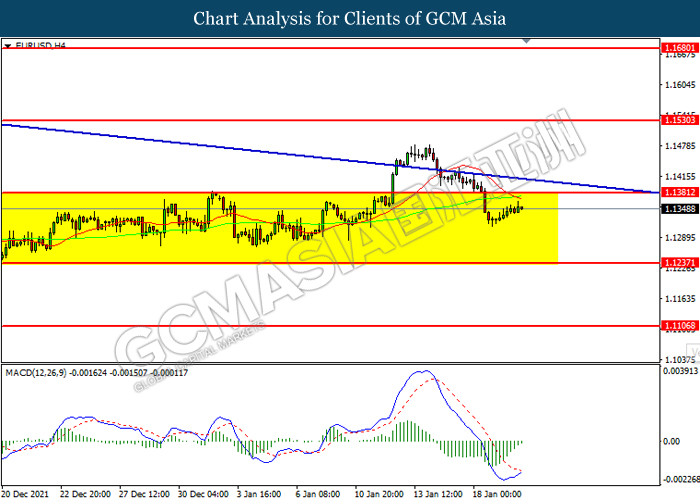

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1200. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1380, 1.1530

Support level: 1.1200, 1.1105

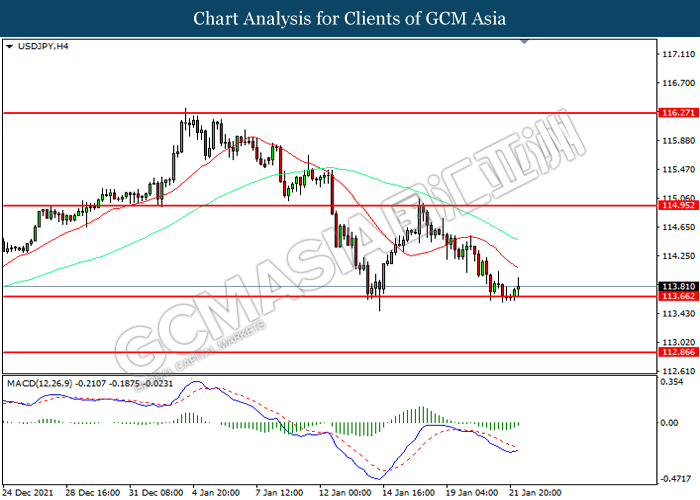

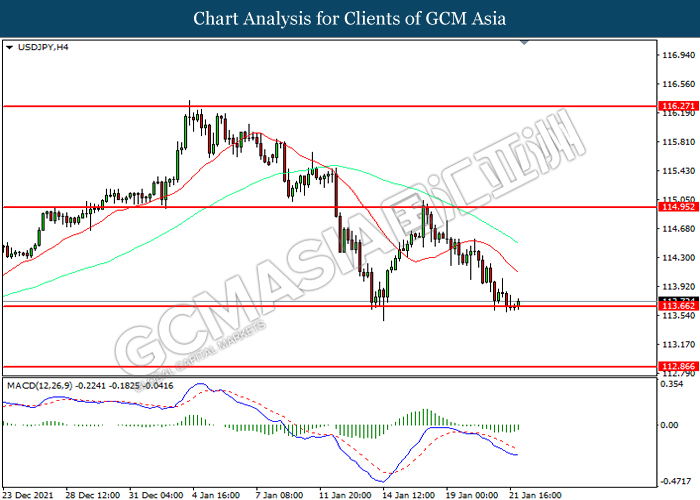

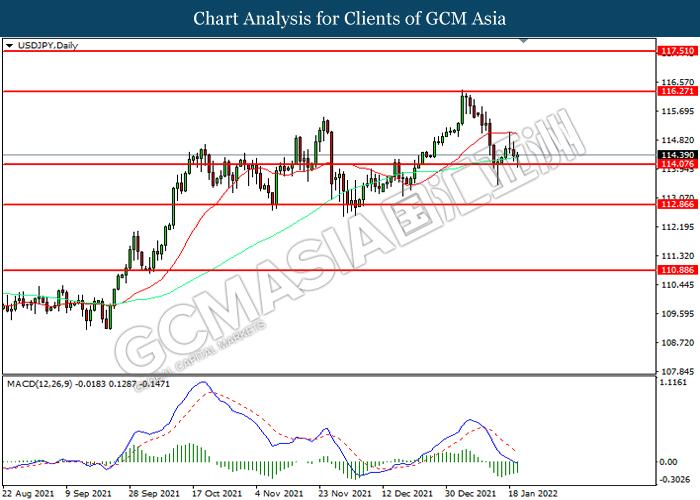

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 114.95. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 114.95, 116.25

Support level: 113.65, 112.85

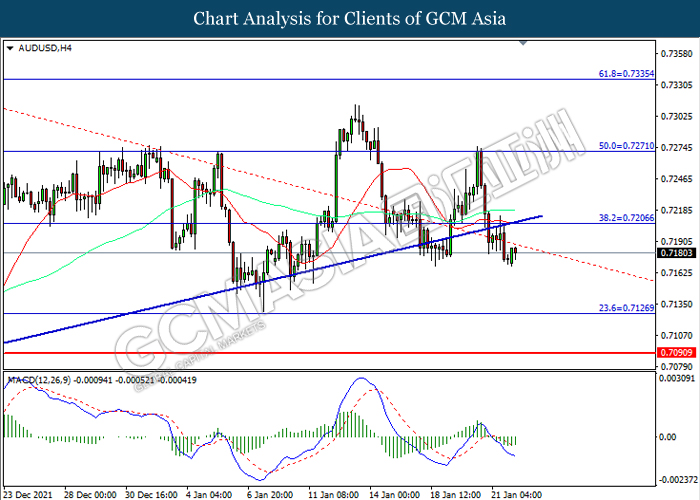

AUDUSD, H1: AUDUSD was traded lower following prior breakout below the previous support level at 0.7090. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7090, 0.7125

Support level: 0.7040, 0.7000

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6570. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6710, 0.6865

Support level: 0.6570, 0.6405

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2625. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2825.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9270. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level

Resistance level: 0.9270, 0.9345

Support level: 0.9170, 0.9095

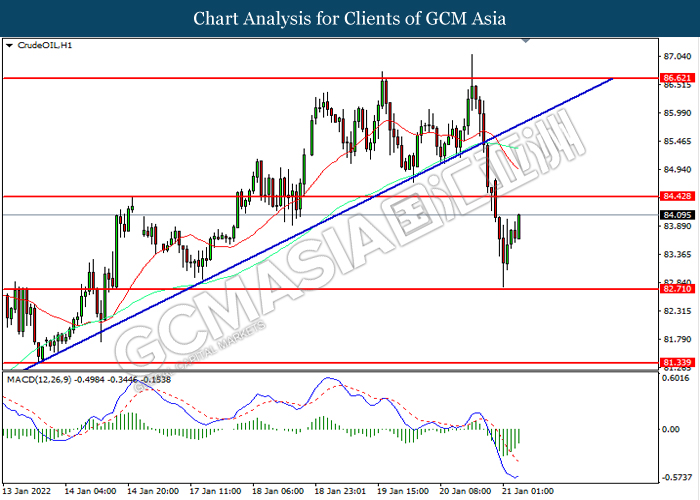

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level at 86.40. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 88.60, 91.25

Support level: 86.40, 83.15

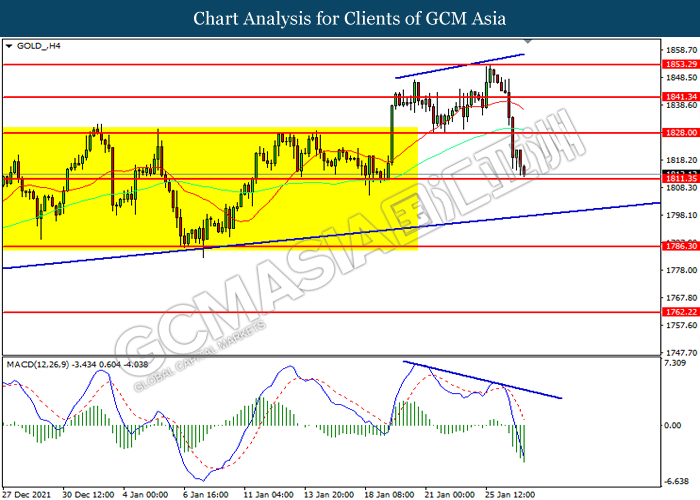

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1811.35. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1828.00, 1841.35

Support level: 1811.35, 1786.30

270122 Morning Session Analysis

27 January 2022 Morning Session Analysis

Powell reinvigorates US dollar.

Greenback extended its gains earlier today as Federal Reserve unleashes hawkish tilts during its monetary policy meeting. As expected, Federal Reserve has maintained its current monetary policy setting in terms of interest rate and bond purchasing program. Overall, market focus towards Fed’s meeting is more focused on their views towards the economy and how hawkish their stance could be. Several Fed officials reveals that they may increase interest rates if current economic condition allows for such action to be taken. However, Fed Chair Jerome Powell stated that US economy is still subjected to risks ahead due to the spread of Omicron variant. Likewise, he expects inflationary pressure to subside substantially if current issues such as supply chain disruption and scarcity of raw materials is resolved in the near future. Nonetheless, Powell emphasized that they have an ample of room to increase interest rates without jeopardizing the labor market while such action will be highly dependent on future economic data. As of writing, the dollar index was up 0.02% to 96.40.

In the commodities market, crude oil price rose 0.71% to $87.34 per barrel as Saudi Arabia is expected to raise their oil selling price next month over the backdrop of rising global demand. On the other hand, gold price was down by 0.05% to $1,821.62 a troy ounce as US dollar extended its gains.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | Core Durable Goods Orders (MoM) (Dec) | 0.80% | 0.40% | – |

| 21:30 | GDP (QoQ) (Q4) | 2.30% | 5.40% | – |

| 21:30 | Initial Jobless Claims | 286K | 255K | – |

| 23:00 | Pending Home Sales (MoM) (Dec) | -2.20% | 0.30% | – |

Technical Analysis

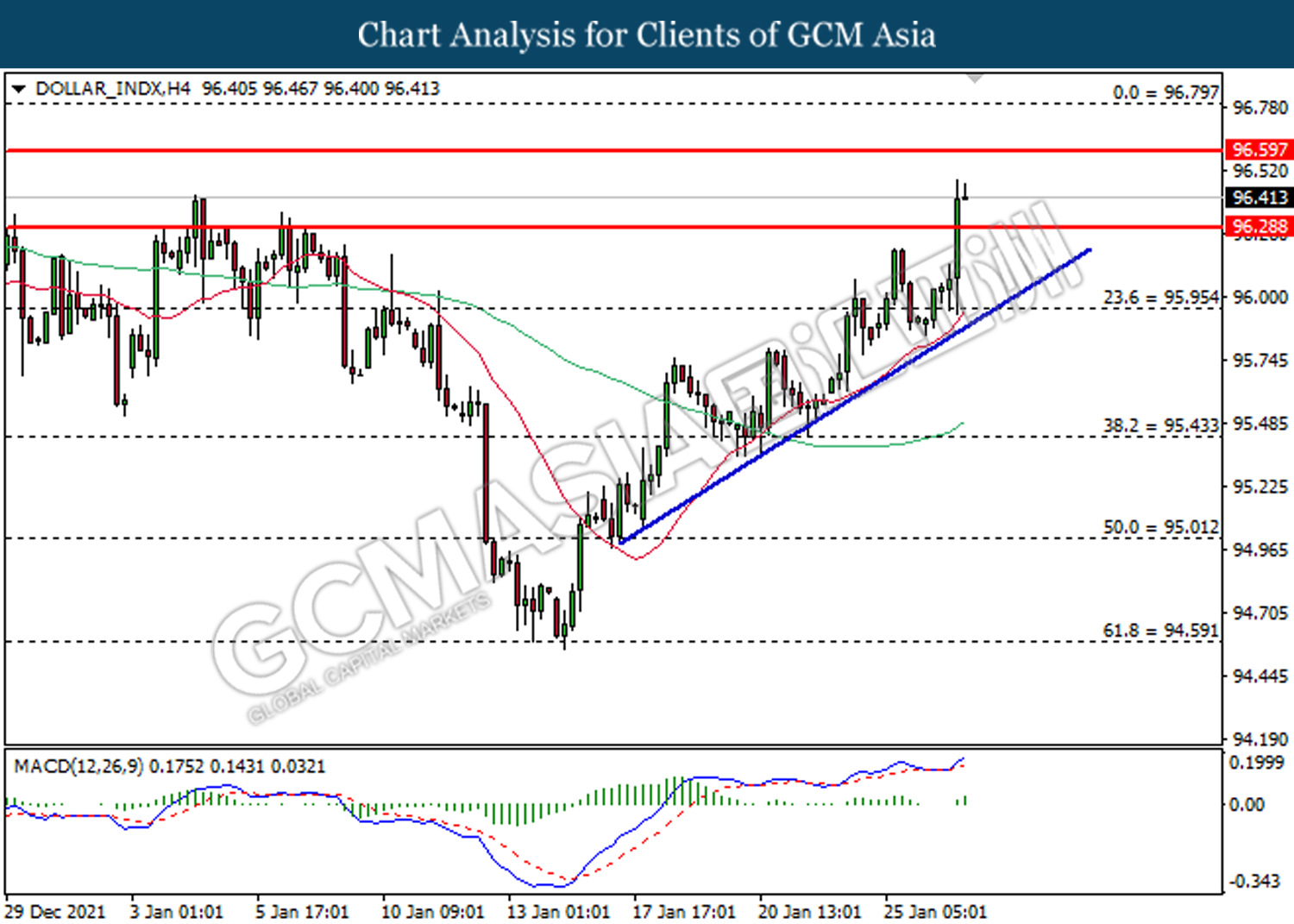

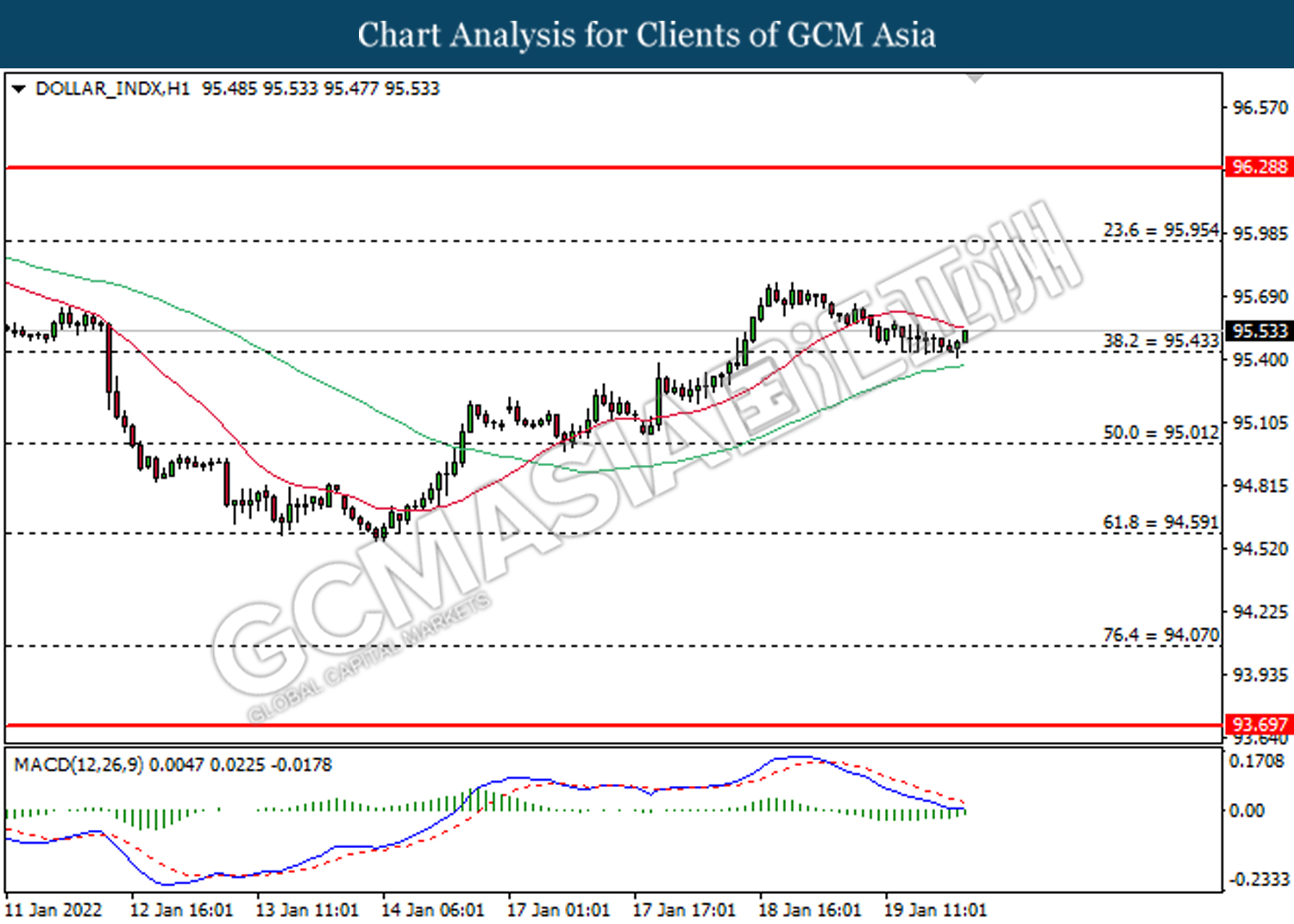

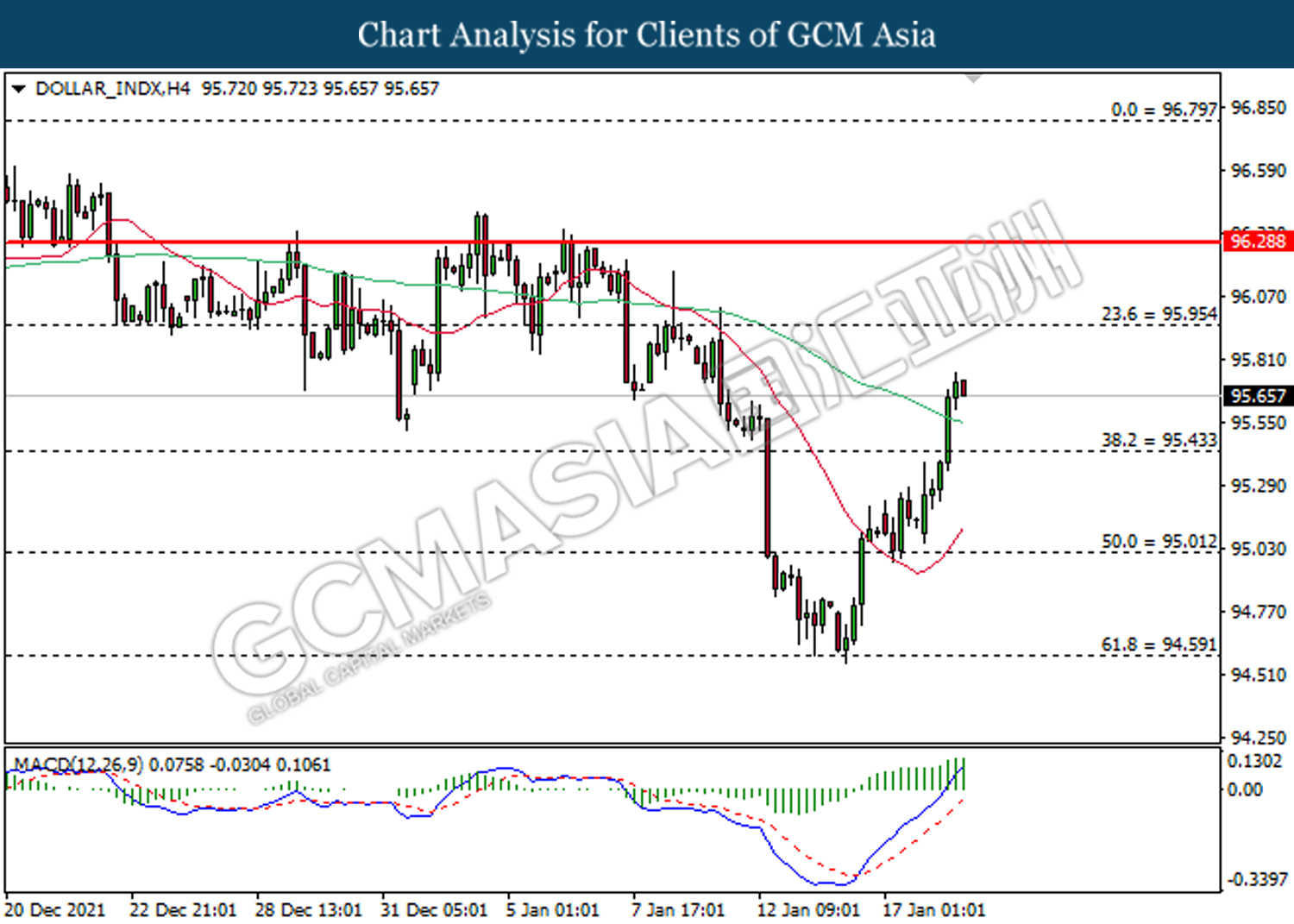

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 96.60, 96.80

Support level: 96.30, 95.95

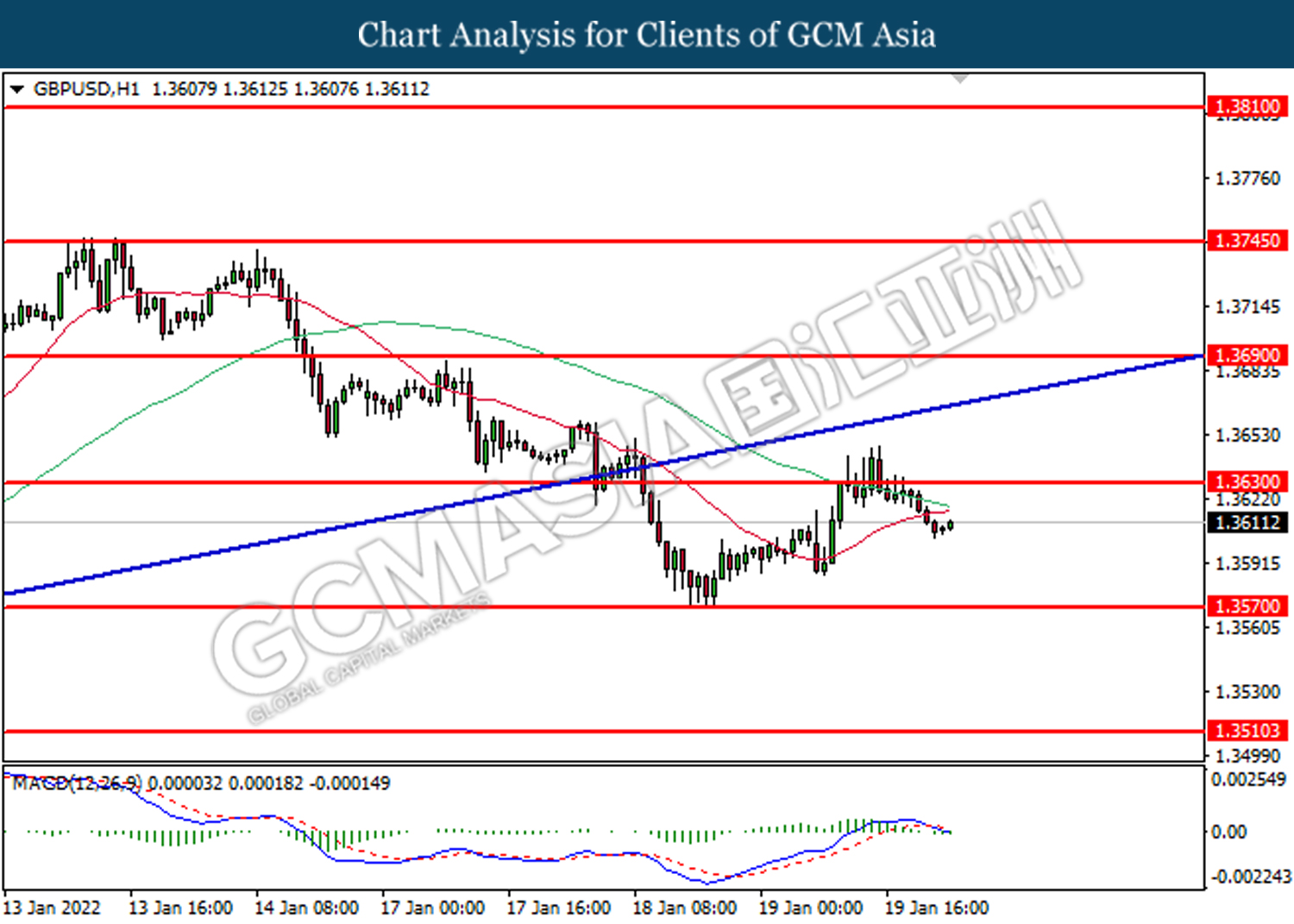

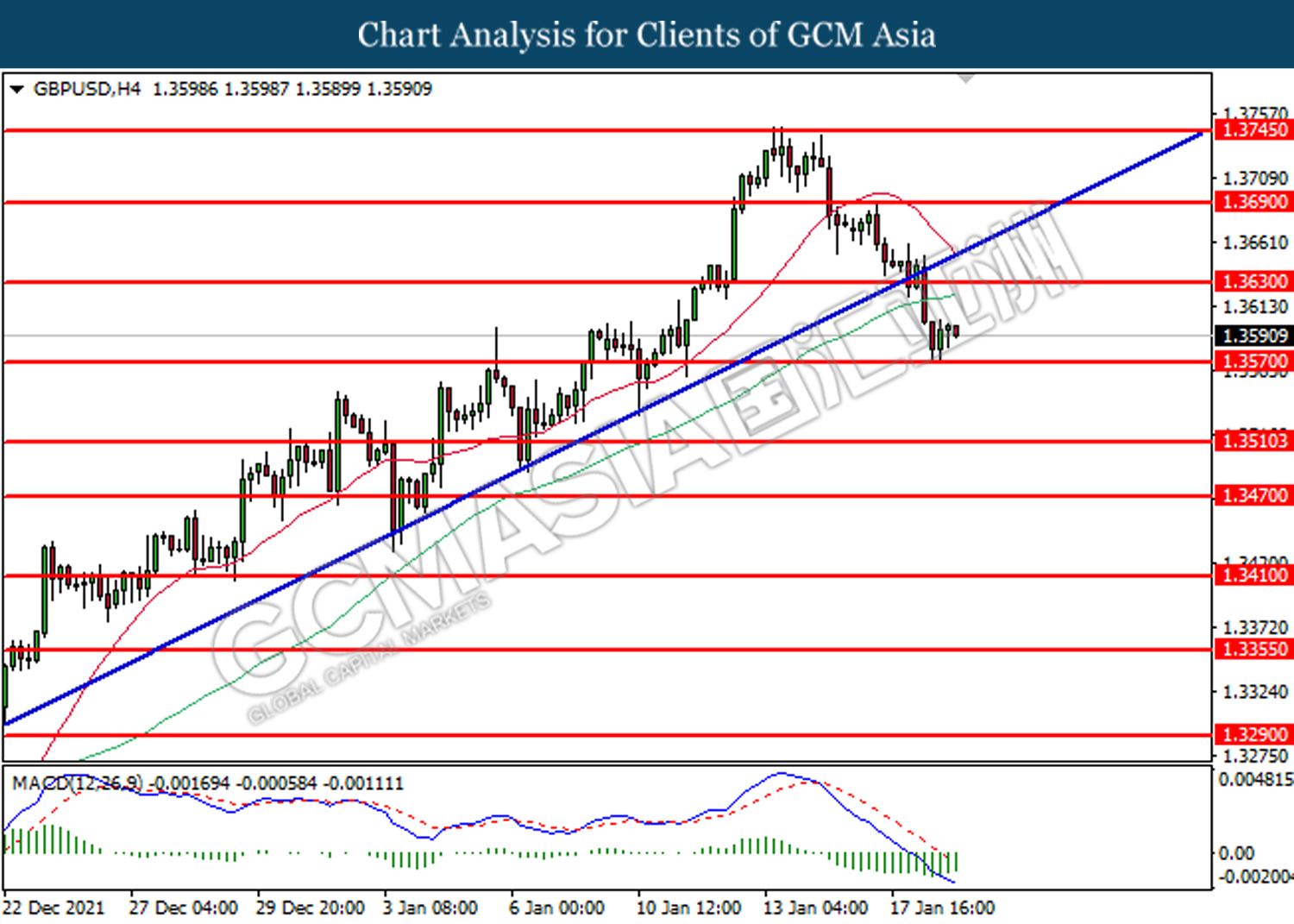

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3470, 1.3510

Support level: 1.3410, 1.3355

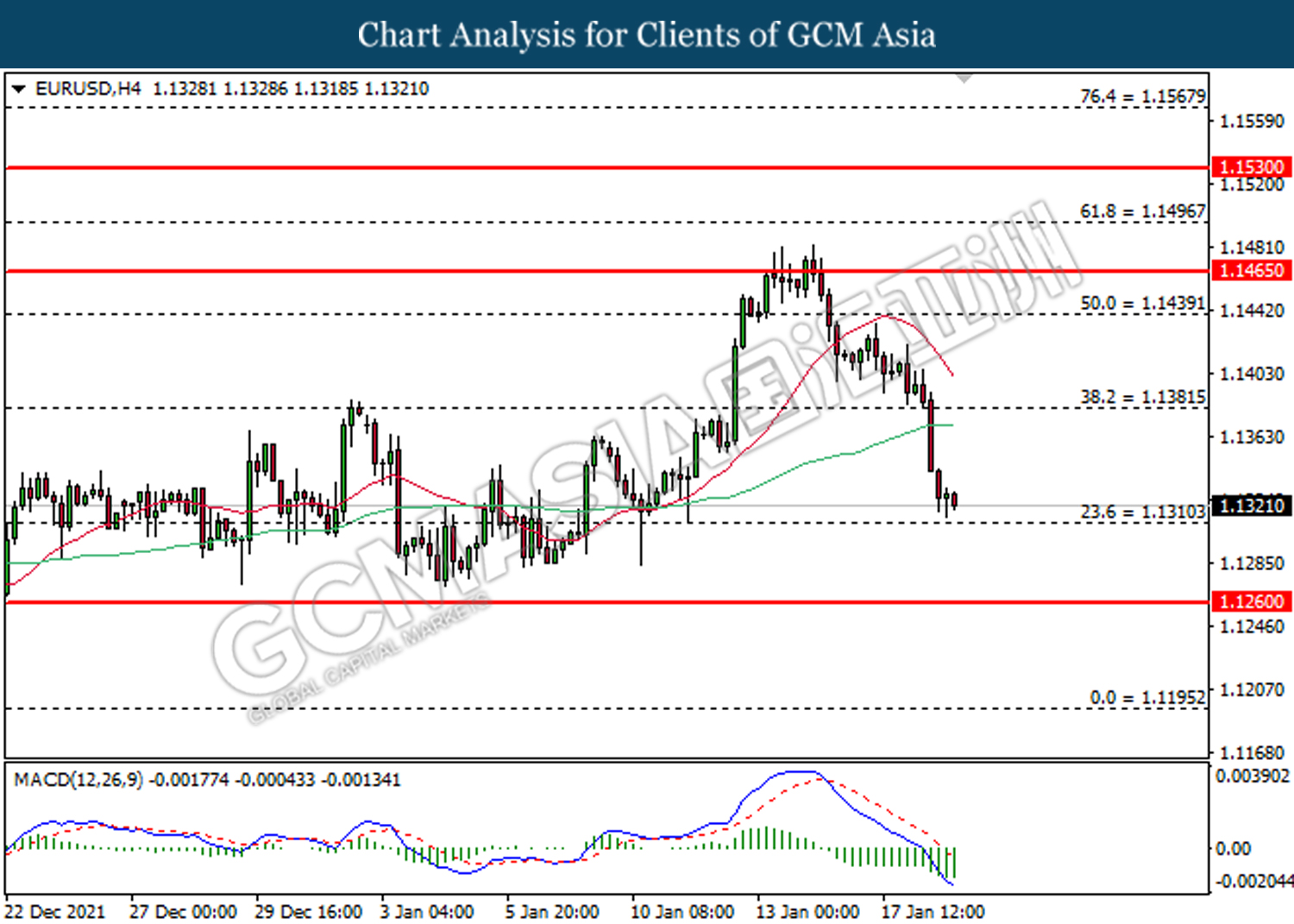

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.1260, 1.1310

Support level: 1.1230, 1.1195

USDJPY, Daily: USDJPY was traded higher following rebound from 113.50. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in mid-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

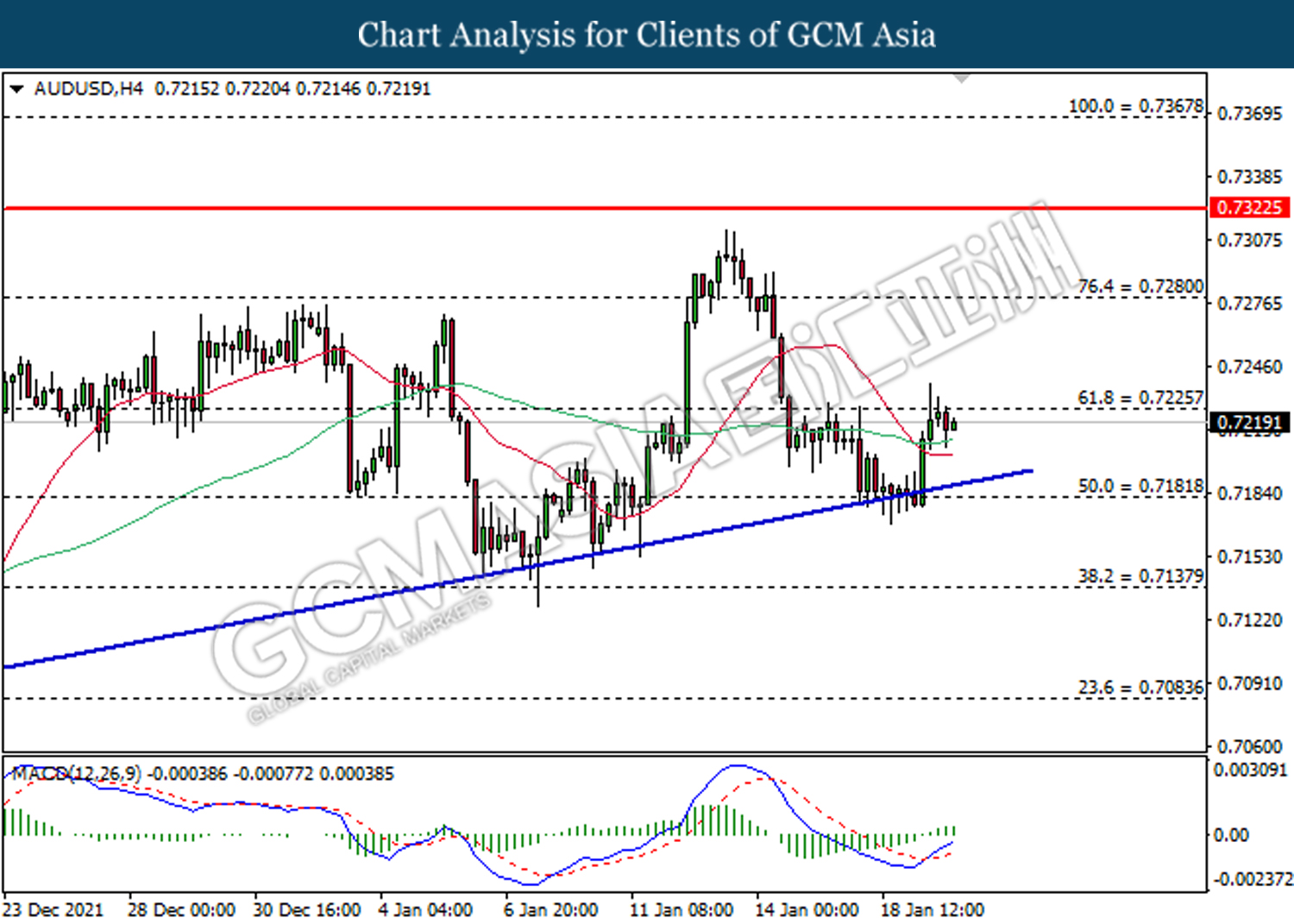

AUDUSD, H4: AUDUSD was traded lower following retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.7140, 0.7180

Support level: 0.7085, 0.7040

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6670, 0.6710

Support level: 0.6635, 0.6595

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher after breaking its resistance level.

Resistance level: 1.2690, 1.2765

Support level: 1.2620, 1.2545

USDCHF, H4: USDCHF was traded higher following prior breakout at 0.9210. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded higher following prior closure above 84.60. MACD which illustrate bullish signal suggests its price to be traded higher after breaking its resistance level.

Resistance level: 87.40, 89.50

Support level: 84.60, 82.65

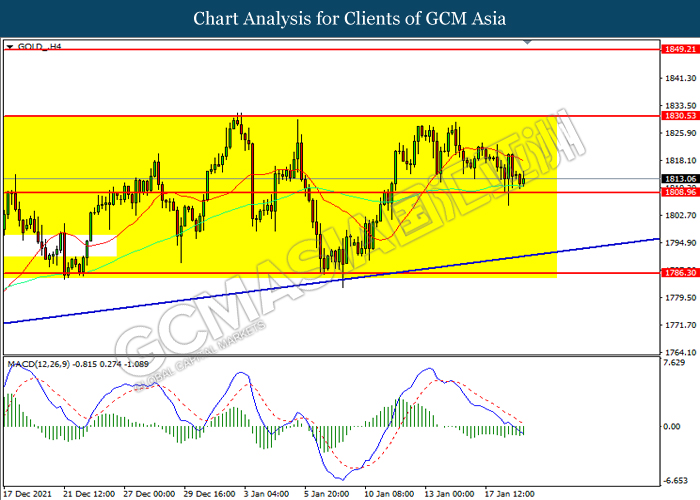

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower after closing below 1812.80.

Resistance level: 1830.20, 1850.00

Support level: 1812.80, 1797.60

260122 Afternoon Session Analysis

26 January 2022 Afternoon Session Analysis

Rising geopolitical tensions, sparkling the appeal for safe-haven Yen.

The safe-haven Japanese Yen surged amid escalating tensions between Russia and Ukraine, which diminishing risk appetite in the global financial market while spurring bullish momentum for the safe-haven asset. According to Reuters, Western leaders had stepped up preparations for any Russian military action in Ukraine. The tensions between the both counties remained high following NATO claimed on Monday that they were putting forces on standby and reinforcing Eastern Europe with more ships and fighter jets in response to a Russian troop build-up near the border with Ukraine. Besides, the United States and European Union have threatened to impose economic sanctions if Russia launched their invasion to Ukraine. The rising geopolitics tensions as well as spiking numbers of Covid-19 cases around the world would continue to jeopardize the economic momentum, prompting investors to shift their portfolio toward safe-haven asset. As of writing, USD/JPY depreciated by 0.03% to 113.85.

In the commodities market, the crude oil price surged 0.04% to $85.70 per barrel as of writing on the concerns over the possibility of supply disruption following the rising tensions between both Russia and Ukraine. On the other hand, the gold price appreciated by 0.03% to $1847.45 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 CAD BoC Monetary Policy Report

23:30 CAD BoC Press Conference

03:00 (27th) USD FOMC Statement

03:30 USD FOMC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – New Home Sales (Dec) | 744K | 760K | – |

| 23:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.25% | – |

| 23:30 | USD – Crude Oil Inventories | 0.515M | – | – |

| 03:00 (27th) | USD – Fed Interest Rate Decision | 0.25% | 0.25% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.95. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.3450. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3595.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1235.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 113.65. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 114.95, 116.25

Support level: 113.65, 112.85

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7125. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7205.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7090

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6710. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6570.

Resistance level: 0.6710, 0.6865

Support level: 0.6570, 0.6405

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2625. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2625, 1.2825

Support level: 1.2470, 1.2330

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9175. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 83.15. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 86.60.

Resistance level: 86.60, 88.60

Support level: 83.15, 79.65

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1850.00. However, MACD which illustrated diminishing bullish momentum suggest the gold price to be traded lower in short-term as technical correction.

Resistance level: 1850.00, 1867.10

Support level: 1828.00, 1811.35

260122 Morning Session Analysis

26 January 2022 Morning Session Analysis

IMF kicks greenback down.

Greenback undergoes technical correction from its prior high levels after International Monetary Fund (IMF) releases bleak outlook with regards to global economy. From the report, IMF expects global economic growth to subside during the year of 2022 due to ongoing uncertainty stemming from inflation, pandemik and supply chain disruption. IMF expects economic growth to peak at 4.4% this year, 0.5% lower than previous forecast. They also emphasized that Omicron variant which is spreading rapidly may cap global economic growth as it triggers shortage of staff in certain industry. In addition, ongoing restriction and SOPs due to the pandemic may continue to jeopardize any recovery in supply chain. As of US, IMF expects its GDP growth to cap at 4% for the year and it may depreciate further to 2.6% for 2023. The forecast was made due to US President Joe Biden’s failure to introduce new round of stimulus, faster paced monetary policy tightening as well as supply disruption in the market. As of writing, the dollar index was flat at 95.91.

As for commodities, crude oil price rose 0.02% to $85.36 per barrel as geopolitical tension in between Russia and Ukraine rises further. Otherwise, gold price ticked down 0.03% to $1,849.65 a troy ounce due to technical correction from its higher levels.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 CAD BoC Monetary Policy Report

23:30 CAD BoC Press Conference

03:00 (27th) USD FOMC Statement

03:30 USD FOMC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | New Home Sales (Dec) | 744K | 760K | – |

| 23:00 | BoC Interest Rate Decision | 0.25% | 0.25% | – |

| 23:30 | Crude Oil Inventories | 0.515M | – | – |

| 03:00 (27th) | Fed Interest Rate Decision | 0.25% | 0.25% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retrace from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 95.95, 96.30

Support level: 95.45, 95.00

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3510, 1.3570

Support level: 1.3470, 1.3410

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1310, 1.1380

Support level: 1.1260, 1.1195

USDJPY, H4: USDJPY was traded lower following prior retrace from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 114.55, 115.50

Support level: 113.50, 112.75

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7085

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower after closing below 1.2620.

Resistance level: 1.2690, 1.2765

Support level: 1.2620, 1.2545

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9190, 0.9210

Support level: 0.9165, 0.9130

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher in short-term.

Resistance level: 86.30, 87.40

Support level: 84.60, 82.65

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1850.00, 1873.80

Support level: 1830.20, 1812.80

250122 Afternoon Session Analysis

25 January 2022 Afternoon Session Analysis

Pound slumped following downbeat data were released.

The Pound Sterling dipped over the backdrop of a string of bearish economic data from UK region yesterday. According to Markit Economics, UK Composite Purchasing Managers’ Index (PMI) notched down from the previous reading of 53.6 to 53.4, missing the market forecast at 55.0. Meanwhile, UK Manufacturing PMI and UK Services PMI came in at 56.9 and 53.3, which both fared worse-than-expectation at 57.7 and 53.9 respectively. The UK business activity cooled unexpectedly amid spiking numbers of Omicron cases in UK last month continue to jeopardize the economic recovery momentum for the United Kingdom. However, UK consumer price inflation hit a nearly 30-year high of 5.4% for last year, sparkling hope for the Bank of England to increase the interest rate in future to combat the inflation risk. As of writing, GBP/USD depreciated by 0.12% to 1.3470.

In the commodities market, the crude oil price depreciated by 0.64% to $84.10 per barrel as of writing. The oil market edged lower amid technical correction. Nonetheless, the overall prospect for this black-commodity remained bullish on the concerns over possible supply disruption following rising geopolitical tensions in both Russia and Ukraine. On the other hand, the gold price surged 0.05% to $1840.75 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Jan) | 94.7 | 94.7 | – |

| 23:00 | USD – CB Consumer Confidence (Jan) | 115.8 | 111.8 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.75. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.75, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3595. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1235.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 113.65. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 114.95, 116.25

Support level: 113.65, 112.85

AUDUSD, H4: AUDUSD was traded lower while currently near the support level at 0.7125. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7090

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6710. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6570.

Resistance level: 0.6710, 0.6865

Support level: 0.6570, 0.6405

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2425. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2825

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9175. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 83.15. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 86.60, 88.60

Support level: 83.15, 80.15

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1846.45. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1846.45, 1867.10

Support level: 1828.00, 1811.35

250122 Morning Session Analysis

25 January 2022 Morning Session Analysis

Greenback waits for Fed’s meeting.

US dollar was traded flat as market participants waits for the upcoming Federal Reserve policy meeting. Prior, traders speculate that Fed may adopt a more aggressive approach in terms of monetary policy tightening as inflationary pressure is expected to rise further. According to US Inflation Expectation report, the data rose for the second consecutive day to 2.38% for a 10-year breakeven period, a significant rebound from previous four-month low. Escalating inflation expectation was mainly due to hawkish tilt by several Fed officials which deemed current inflation is far too high. Likewise, several of them also postulate that inflation may rise further up due to strong economic rebound in the US and ongoing supply chain issues due to pandemic. As of writing, dollar index was traded flat at around 95.83.

In the commodities market, crude oil price rose 0.21% to $84.00 per barrel due to ongoing struggles from OPEC to increase their oil production. On the other hand, gold price rose 0.04% to $1,842.15 a troy ounce following technical corrections from lower levels.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Jan) | 94.7 | 94.7 | – |

| 23:00 | USD – CB Consumer Confidence (Jan) | 115.8 | 111.8 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retrace from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 95.95, 96.30

Support level: 95.45, 95.00

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3510, 1.3570

Support level: 1.3470, 1.3410

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1380, 1.1440

Support level: 1.1310, 1.1260

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 114.55, 115.50

Support level: 113.50, 112.75

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7085

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower after closing below 1.2620.

Resistance level: 1.2690, 1.2765

Support level: 1.2620, 1.2545

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9165, 0.9190

Support level: 0.9130, 0.9100

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher after breaking its resistance level.

Resistance level: 86.40, 87.40

Support level: 82.65, 80.15

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1850.00, 1873.80

Support level: 1830.20, 1812.80

240122 Afternoon Session Analysis

24 January 2022 Afternoon Session Analysis

Pound dipped amid bearish data.

The Pound Sterling slumped over the backdrop of bearish economic data on last Friday, dialed down the market optimism toward the economic progression in the United Kingdom. According to Office for National Statistics, UK Retail Sales for last month notched down significantly from the previous reading of 1.0% to -3.7%, missing the market forecast at -0.6% due to the spiking numbers of the Omicron variant continue to weigh down the economic momentum in the United Kingdom. Nonetheless, economist still predicted that the Bank of England was still likely to increase the interest rates for a second time in two months in February in order to combat the high inflation rate. According to the latest inflation data, British consumer price inflation had hit a nearly 30-year high of 5.4% for the year of 2021. Rising energy prices and labor cost due to supply constraint had continue to increase the inflation risk in future. Nonetheless, investors would continue to scrutinize the latest updates with regards of the monetary policy decision to gauge the likelihood movement for the Pound Sterling. As of writing, GBP/USD appreciated by 0.02% to 1.3556.

In the commodities market, the crude oil price surged 1.32% to $86.56 per barrel as of writing amid rising geopolitical tensions in Eastern Europe and the Middle East had heightened concerns for the supply disruption in future, while OPEC and its allies continued to struggle to raise their output due to lack of capacity. On the other hand, the gold price was traded flat at $1835.75 per troy ounces as of writing as market participants are still eyeing on the monetary policy decision from Federal Reserve before entering the gold market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Jan) | 57.4 | 57.0 | – |

| 17:30 | GBP – Composite PMI | 53.6 | – | – |

| 17:30 | GBP – Manufacturing PMI | 57.9 | 57.7 | – |

| 17:30 | GBP – Services PMI | 53.6 | 53.9 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.75. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.75, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3595. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1235.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 113.65. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 114.95, 116.25

Support level: 113.65, 112.85

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7205. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7125.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7090

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6710. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2475. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2625.

Resistance level: 1.2625, 1.2825

Support level: 1.2475, 1.2330

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9095. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 83.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 86.60

Resistance level: 86.60, 88.60

Support level: 83.15, 79.70

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1828.00. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1846.45, 1856.00

Support level: 1828.00, 1811.35

240122 Morning Session Analysis

24 January 2022 Morning Session Analysis

US Dollar was traded flat, investors are eyeing on FOMC meeting.

The Dollar Index which traded against a basket of six major currency slumped amid technical correction while investors are still waiting for crucial Federal Reserve meeting in this week for more clarity on the outlook for rate hikes in short-term basis. The expectation for the Fed to tighten the monetary policy at faster pace than previously anticipated had caused the US Treasury yield to increase significantly earlier last week. Market participants are pricing in as many as four rate hikes in the year of 2022 while expecting the Fed to start trimming its $8 trillion-plus balance sheet within months. Contractionary monetary policy as well as rate hike in future will diminish the money circulation in the US financial market, which spurring bullish momentum on the US Dollar. As of writing, the Dollar Index depreciated by 0.10% to 95.65.

In the commodities market, the crude oil price appreciated by 0.33% to $85.45 per barrel as of writing. The oil market edged higher following the U.S energy firms this week cut oil rigs for the first time in 13 weeks. According to Baker Hughes, U.S. oil rigs fell by one to 491 this week. On the other hand, the gold price depreciated by 0.26% to $1834.75 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Jan) | 57.4 | 57.0 | – |

| 17:30 | GBP – Composite PMI | 53.6 | – | – |

| 17:30 | GBP – Manufacturing PMI | 57.9 | 57.7 | |

| 17:30 | GBP – Services PMI | 53.6 | 53.9 |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.75. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.75, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3595. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3450.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1235.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 113.65. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 114.95, 116.25

Support level: 113.65, 112.85

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7205. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7125.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7090

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6710. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2475. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.2625.

Resistance level: 1.2625, 1.2825

Support level: 1.2475, 1.2330

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9095. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 83.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 86.60

Resistance level: 86.60, 88.60

Support level: 83.15, 79.70

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1828.00. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1846.45, 1856.00

Support level: 1828.00, 1811.35

210122 Afternoon Session Analysis

21 January 2022 Afternoon Session Analysis

US Dollar dived following US Treasury yield eased.

The Dollar Index which traded against a basket of six major currency pairs slumped over the backdrop of a string economic data. According to Department of Labor, US Initial Jobless Claims notched up significantly from the previous reading of 231K to 286K, missing the market forecast at 220K. Besides, US Existing Home Sales came in at 6.18M, which also fared worse than market expectation at 6.44M. As both crucial economic data came in at negative reading, which dialing down the market optimism toward the economic progression in the United States while reducing the odds for the Federal Reserve to reduce interest rate. The US Treasury yields retreated from multi-year high, dragging down the appeal for the US Dollar. Nonetheless, investors would continue to scrutinize the latest updates with regards of monetary policy statement from Fed to receive further trading signal. As of writing, the Dollar Index depreciated by 0.05% to 95.70.

In the commodities market, the crude oil price depreciated by 0.93% to $84.35 per barrel as of writing. The crude oil price edged lower amid the profit-taking following the released of bearish US Inventory data. According to Energy Information Administration (EIA), the US Crude Oil Inventories came in at 0.515M, missing the market forecast at -0.938M. On the other hand, the gold price appreciated by 0.07% to $1840.80 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Dec) | 1.40% | -0.60% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | 1.30% | 1.30% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 95.60. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 95.75, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3595. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3715, 1.3840

Support level: 1.3595, 1.3450

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 113.75. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 114.95, 116.25

Support level: 113.75, 112.85

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 07205. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7125.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7000

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6710. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2475. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.2625.

Resistance level: 1.2625, 1.2825

Support level: 1.2475, 1.2330

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9180. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level at 82.70. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 84.45.

Resistance level: 84.45, 86.60

Support level: 82.70, 81.35

GOLD_, H4: Gold price was traded within a range while currently testing the resistance level at 1846.45. MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1846.45, 1867.10

Support level: 1828.00, 1811.35

210122 Morning Session Analysis

21 January 2022 Morning Session Analysis

Euro tumbles as doves emerges.

Euro halts is recent recovery and tumbles further after European Central Bank reemphasize their dovish views upon recent inflation appreciation. According to meeting minutes, several ECB members has voiced out their views that current appreciation in inflation is temporary and will likely depreciate throughout the year of 2022. Their view came in as market is previously speculating for a change in monetary policy strategy after EU inflation rose to 5.0%, its highest level in 30 years. Following the release of minutes, ECB President Christine Lagarde emphasize that it is too early to initiate a rate hike as it may jeopardize economic recovery momentum. She also reiterates the differences of economic fundamental in between US and EU and Federal Reserve could initiate a rate hike earlier due to strong economic recovery. As of writing, EUR/USD was down 0.02% to 1.1312.

In the commodities market, crude oil price was down by 0.58% to $84.15 per barrel following the release of US inventory data. Last week, crude oil inventory was up by 0.5 million barrels, significantly higher than forecasted reading to decrease by 0.9 million barrels. Likewise, gold price was down by 0.01% to $1,838.10 a troy ounce due to a rebound in US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Dec) | 1.40% | -0.60% | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Dec) | 1.30% | 1.30% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 95.80, 96.15

Support level: 95.45, 94.95

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.3640, 1.3690

Support level: 1.3585, 1.3510

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.1380, 1.1440

Support level: 1.1310, 1.1260

USDJPY, H4: USDJPY was traded lower following retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 114.00, 114.35

Support level: 113.70, 113.30

AUDUSD, H4: AUDUSD was traded lower following retracement from higher level. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.7270, 0.7335

Support level: 0.7210, 0.7125

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.6770, 0.6820

Support level: 0.6735, 0.6700

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded in short-term.

Resistance level: 1.2550, 1.2630

Support level: 1.2440, 1.2300

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher after breaking the resistance level.

Resistance level: 0.9170, 0.9200

Support level: 0.9140, 0.9090

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded in short-term.

Resistance level: 84.60, 87.40

Support level: 82.65, 80.15

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 1850.00, 1873.80

Support level: 1830.20, 1812.80

200122 Afternoon Session Analysis

20 January 2022 Afternoon Session Analysis

Aussie surged amid resilient job data.

The Australia Dollar surged over the backdrop of upbeat economic data from Australia region. According to Australian Bureau of Statistics, Australia Employment Change came in at 64,800 in December, exceeding the market forecast at 43,300 and adding to November’s record jump of 366,000. Meanwhile, the unemployment rate fell from the previous reading of 4.6% to 4.2% in November, the lowest reading since August 2008. As both crucial economic data fared better than expectation, dialled up the market optimism toward the economic progression in Australia. Nonetheless, the gains experienced by the Australian Dollar was limited by the spiking numbers of Omicron variant, which spooking consumers away from shops and restaurants. As of writing, AUD/USD appreciated by 0.38% to 0.7240.

In the commodities market, the crude oil price surged 0.90% to $86.45 per barrel as of writing. The oil market touched tis highest level since October 2014 following the International Energy Agency claimed that the supply outlook for the oil industry is tighter than previously thought while the demand remained resilient amid easing symptoms of the Omicron variant. On the other hand, the gold price surged 0.10% to $1839.70 per troy ounces as of writing amid rising geopolitical tensions between Russia and Ukraine had stoked a shift in sentiment toward the safe-haven asset such as gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Dec) | 5.00% | 5.00% | – |

| 21:30 | USD – Initial Jobless Claims | 230K | 220K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Jan) | 15.4 | 20 | – |

| 23:00 | USD – Existing Home Sales (Dec) | 6.46M | 6.43M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.60. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.60, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3595. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3715, 1.3840

Support level: 1.3595, 1.3450

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 114.10. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 116.25, 117.50

Support level: 114.10, 112.85

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7205. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7270.

Resistance level: 0.7270, 0.7335

Support level: 0.7205, 0.7125

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6865. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6710.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2475. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2625, 1.2825

Support level: 1.2475, 1.2330

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9180. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 84.45. However, MACD which illustrated increasing baerish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 88.60, 91.70

Support level: 84.45, 79.70

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1830.55. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1849.20.

Resistance level: 1849.20, 1867.10

Support level: 1830.55, 1786.30

200122 Morning Session Analysis

20 January 2022 Morning Session Analysis

UK inflation at its highest since 1992.

UK inflation appreciates at its fastest pace in 30 years despite rising coronavirus cases during last December. According to UK’s Office for National Statistics (ONS), Consumer Price Index rose for the fifth month with 5.4%, its highest level since March 1992. The rise in inflation is mainly attributed to the rising cost of commodities such as gasoline as well as food and non-alcoholic drinks. During a speech, Bank of England’s Governor Andrew Bailey commented that commodity prices are “sticky” and that it might take a longer period of time to retrace from its recent high levels. Moreover, Bailey emphasized that rising tension in between Russia and Ukraine may help propel commodity prices further, with the market speculating for a possible deficit in supply if war breaks out. Rising inflation in the UK has also sparked discussion of a possible rate hike as early as March from the Bank of England. As of writing, pair of GBP/USD depreciates by 0.05% to 1.3609.

As for commodities market, crude oil price slumped 0.43% to $85.07 per barrel following bearish inventory data from the US. According to American Petroleum Institute, last week’s oil inventory was up by 1.4 million barrels, missing economist’s forecast for a draw of 1.1 million barrels. On the other hand, rising tension in between Russia and Ukraine has provided further support for gold price. During Asian trading session, gold price rose 0.02% to $1,838.94 a troy ounce.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Dec) | 5.00% | 5.00% | – |

| 21:30 | USD – Initial Jobless Claims | 230K | 220K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Jan) | 15.4 | 20 | – |

| 23:00 | USD – Existing Home Sales (Dec) | 6.46M | 6.43M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearsih signal suggests the index to be traded higher in short-term.

Resistance level: 95.95, 96.30

Support level: 95.45, 95.00

GBPUSD, H1: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.1380, 1.1440

Support level: 1.1310, 1.1260

USDJPY, Daily: USDJPY was traded lower following retracement from 114.55. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 114.55, 115.50

Support level: 113.50, 112.75

AUDUSD, H4: AUDUSD was traded lower following retracement from higher level. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower in short-term.

Resistance level: 0.7225, 0.7280

Support level: 0.7180, 0.7140

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6780, 0.6830

Support level: 0.6740, 0.6700

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower after closing below 1.2485.

Resistance level: 1.2545, 1.2620

Support level: 1.2485, 1.2410

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9165, 0.9190

Support level: 0.9130, 0.9100

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower after breaking its support level.

Resistance level: 87.40, 89.50

Support level: 84.60, 82.65

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1850.00, 1873.80

Support level: 1830.20, 1812.80

190122 Afternoon Session Analysis

19 January 2022 Afternoon Session Analysis

Pound slumped amid political uncertainty.

The Pound Sterling slumped amid rising political tensions in the United Kingdom, which dialing down the market optimism toward the economic progression. According to ABC News, U.K. Prime Minister Boris Johnson faced new calls for his resignation over a party he and his wife attended with Downing Street staff in May 2020, when the country was still under lockdown. Despite Boris Johnson had apologized for violating the Standard Operating Procedure (SOP) for the Covid-19 pandemic, the apology still did little to wave off calls to resign from opposition politician party. Nonetheless, the losses experienced by the Pound Sterling was limited amid positive sentiment around improving trends recently in Covid-19 infections rates and hospital admission. According to the latest NHS data, Covid-related hospital admission are failing in every region of England. As of writing, GBP/USD surged 0.10% to 1.3606.

In the commodities market, the crude oil price appreciated by 0.05% to $86.40 per barrel as of writing. The oil price extends its gains while reaching seven-year high amid an outage on a pipeline from Iraq to Turkey spurred concerns over the supply disruption for the crude oil commodity. According to Reuters, Turkey’s state pipeline operators Botas claimed on Tuesday that the explosion on the Kirkuk-Ceyhan pipeline had affected the oil export from Iraq to Turkish port. On the other hand, the gold price depreciated by 0.04% to $1813.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Dec) | 5.10% | 5.20% | – |

| 21:30 | USD – Building Permits (Dec) | 1.717M | 1.701M | – |

| 21:30 | CAD – Core CPI (MoM) (Dec) | 0.60% | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 95.60. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 95.60, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3595. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3715, 1.3840

Support level: 1.3595, 1.3450

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1380. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1235.

Resistance level: 1.1380, 1.1530

Support level: 1.1235, 1.1105

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 114.10. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 116.25, 117.50

Support level: 114.10, 112.85

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7205. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7000

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6865. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6710.

Resistance level: 0.6865, 0.6960

Support level: 0.6710, 0.6570

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2475. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2625, 1.2825

Support level: 1.2475, 1.2330

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9180. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9175, 0.9270

Support level: 0.9095, 0.9035

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 84.45. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 88.60, 91.70

Support level: 84.45, 79.70

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1808.95. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1830.55, 1849.20

Support level: 1808.95, 1786.30

190122 Morning Session Analysis

19 January 2022 Morning Session Analysis

US Treasury hits 2 years high.

US dollar may be in run for its best week yet in 2022 as investors gears up for upcoming Federal Reserve policy meeting due next week. Over the recent weeks, several Fed officials such as John Williams dan Mary Daly grumbles over high inflationary pressure and calls for more action to be done in order to curb its appreciation. Recent rise in Omicron has continued to place pressure upon global supply chain and Fed officials expects inflation to rise further due to scarcity of certain materials or goods. They also commented that current monetary policy approach is inadequate and urged for a change in order to control price of goods. Hawkish comments provided by several Fed members has sparked speculation that Fed may take into account of adopting a different strategy during its upcoming policy meeting. Thus, the speculation has led to a rise in US Treasury yield, peaking at 2 years high around 1.884%. As of writing, dollar index rose 0.03% to 95.65.

In the commodities market, crude oil price skyrocketed 1.08% to $86.20 per barrel following geopolitical tension in the Middle East. According to Reuters, Houthi group has launched an attack on UAE’s oil truck, causing 3 casualties. They also warned to launch more attacks on UAE’s oil facilities in the future which may jeopardize the country’s oil supply in the near-term. On the other hand, gold price notched down 0.01% to $1,814.12 a troy ounce due to rising US Treasury yield and US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Dec) | 5.10% | 5.20% | – |

| 21:30 | USD – Building Permits (Dec) | 1.717M | 1.701M | – |

| 21:30 | CAD – Core CPI (MoM) (Dec) | 0.60% | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 95.95, 96.30

Support level: 95.45, 95.00

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

EURUSD, H4: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.1380, 1.1440

Support level: 1.1310, 1.1260

USDJPY, Daily: USDJPY was traded higher following rebound from 113.50. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in mid-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

AUDUSD, H4: AUDUSD was traded lower following retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.7225, 0.7280

Support level: 0.7180, 0.7140

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6780, 0.6830

Support level: 0.6740, 0.6700

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower after closing below 1.2485.

Resistance level: 1.2545, 1.2620

Support level: 1.2485, 1.2410

USDCHF, H4: USDCHF was traded higher following prior breakout at 0.9165. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9190, 0.9200

Support level: 0.9165, 0.9130

CrudeOIL, H4: Crude oil price was traded higher following prior closure above 84.60. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 87.40, 89.50

Support level: 84.60, 82.65

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower after closing below 1812.80.

Resistance level: 1830.20, 1850.00

Support level: 1812.80, 1797.60