131022 Morning Session Analysis

13 October 2022 Morning Session Analysis

US Dollar dropped despite upbeat PPI data.

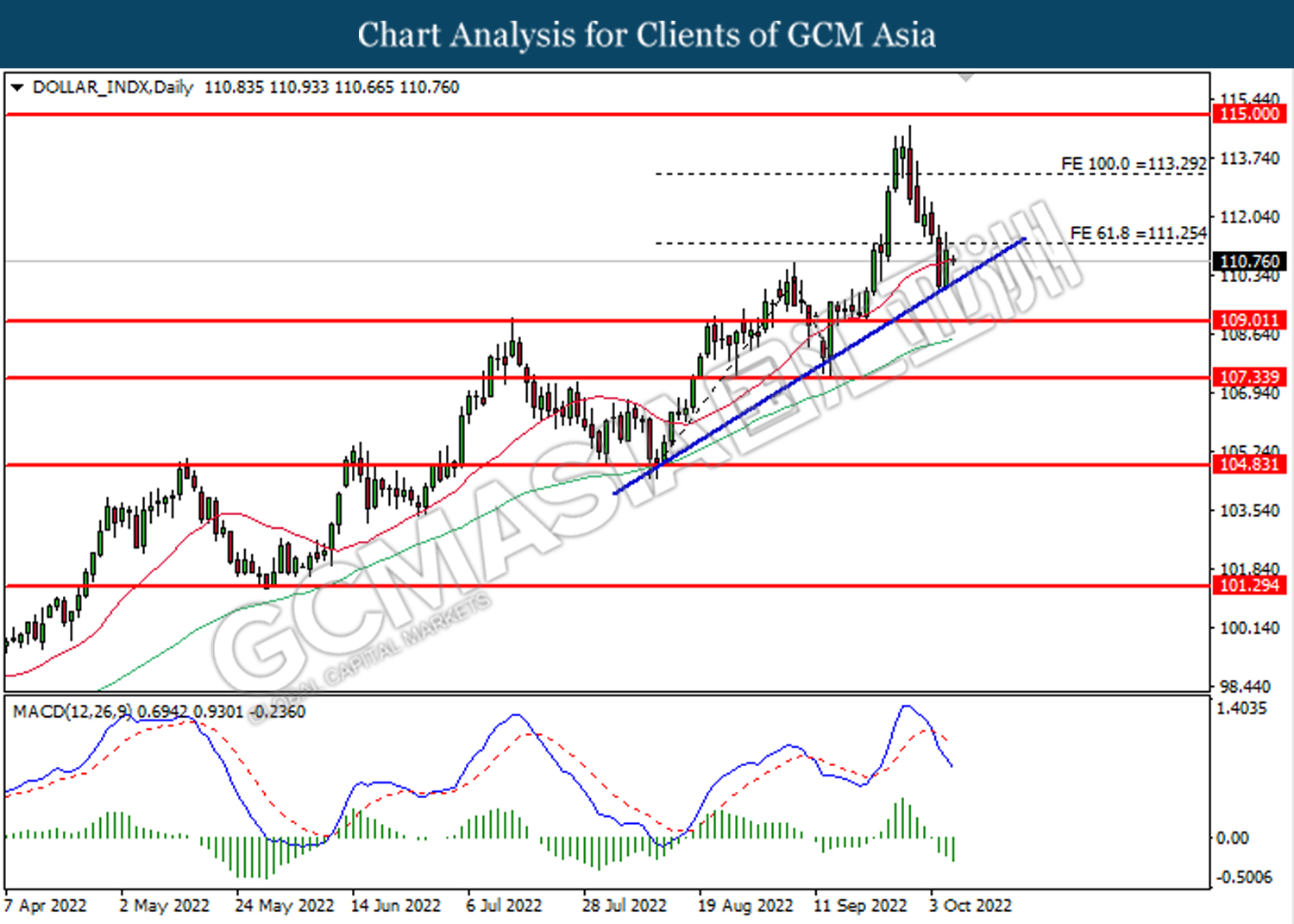

The Dollar Index which traded against a basket of six major currencies edged down on yesterday despite the higher-than-expected PPI data. According to the US Bureau of Labor Statistics, the US Producer Price Index (PPI) MoM in September notched up from the previous reading of -0.2% to 0.4%, which is higher than the consensus expectation of 0.2%. Nonetheless, as the market participants are highly eyeing on the CPI data which will be released tonight, the investors decided to flee the market in order to gauge the movement of Dollar Index. Though, the overall trend of Dollar Index remained bullish over the hawkish statement from Fed officials. During the FOMC Meeting Minutes, the Federal Reserve policymakers agreed to imply a more aggressive contractionary policy and maintain it for some time until the inflation risk lowered. In addition, the PPI data has given an upbeat figures, which hinted that the aggressive rate hike path would likely to continue. As of writing, the Dollar Index rose by 0.02% to 113.15.

In the commodities market, the crude oil price dropped by 0.06% to $87.22 per barrel as of writing amid the rising of API crude oil stock. The US API Weekly Crude Oil Stock has notched up from the prior figures of -1.770M to 7.054M. On the other hand, the gold price appreciated by 0.19% to $1674.03 per troy ounce as of writing. Yesterday, the gold price received bullish momentum amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German CPI (YoY) (Sep) | 10.0% | 10.0% | – |

| 20:30 | USD – Core CPI (MoM) (Sep) | 0.6% | 0.5% | – |

| 20:30 | USD – CPI (MoM) (Sep) | 8.3% | 8.1% | – |

| 20:30 | USD – Initial Jobless Claims | 219K | 225K | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -1.356M | – | – |

Technical Analysis

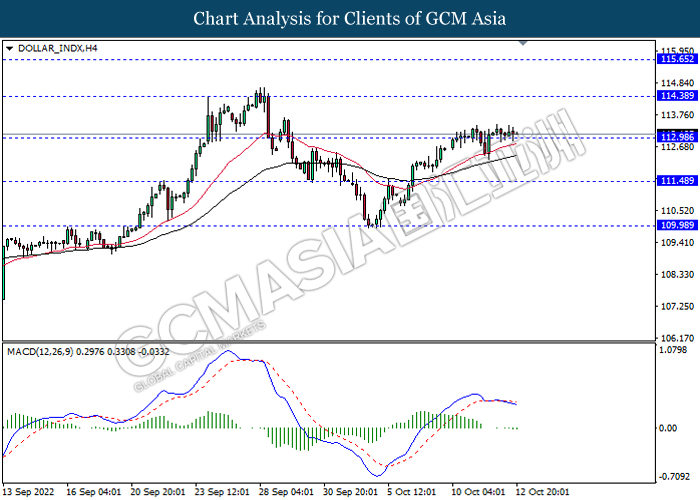

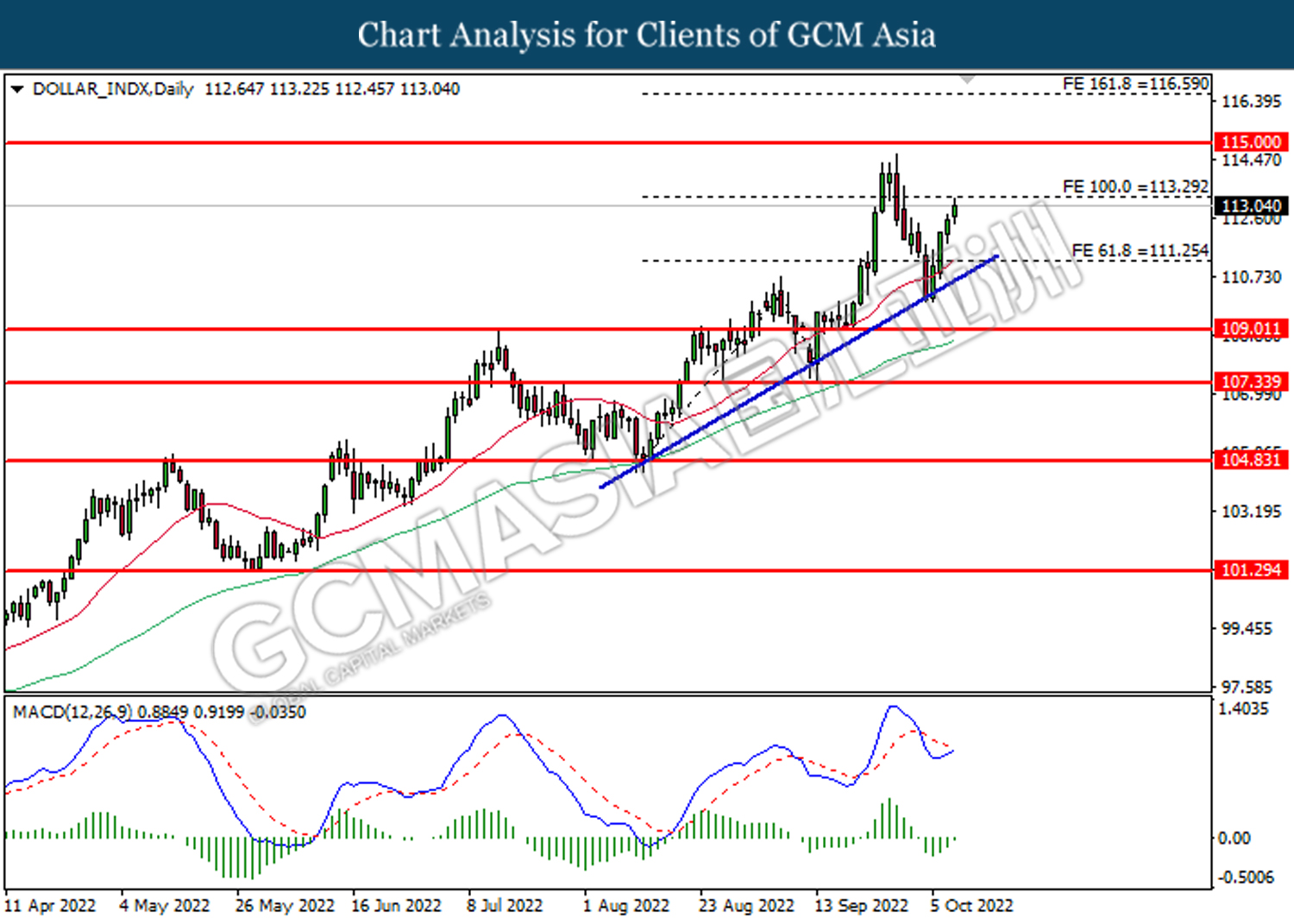

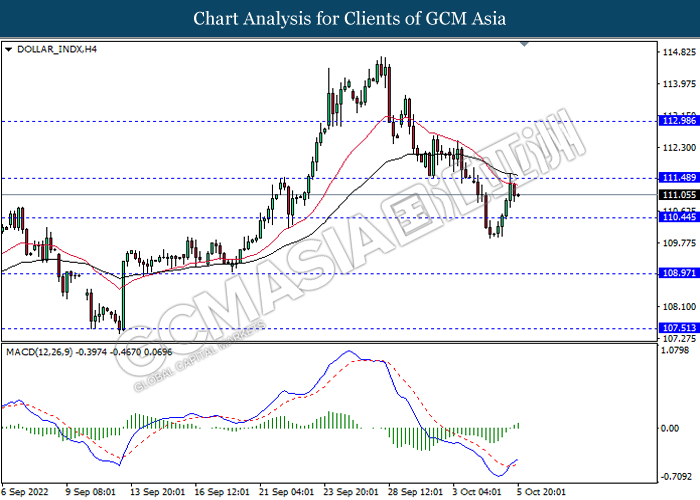

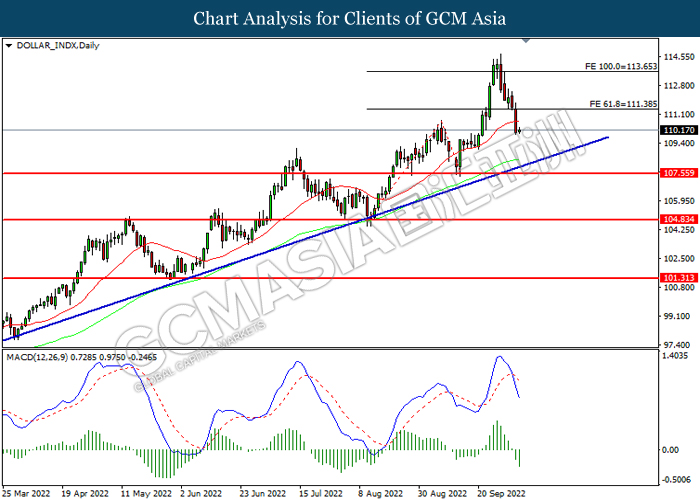

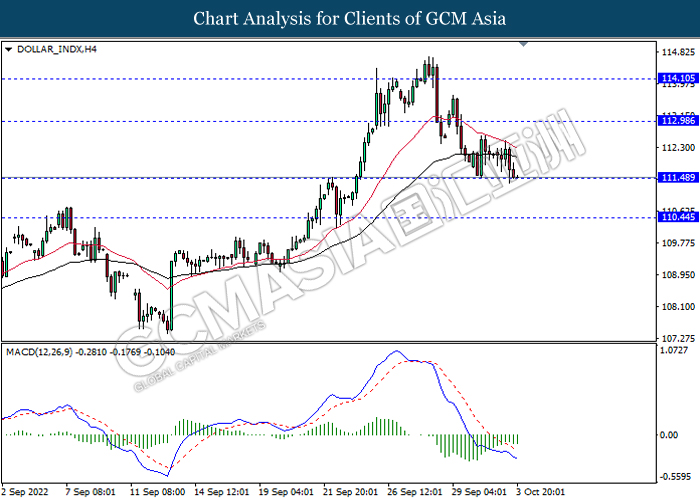

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 114.40, 115.65

Support level: 113.00, 111.50

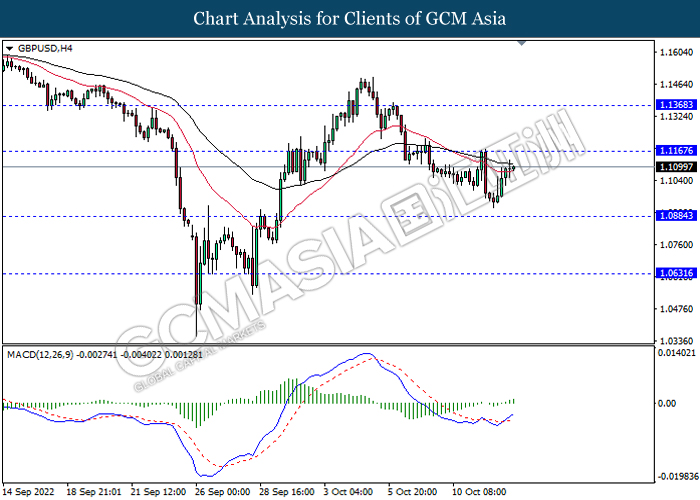

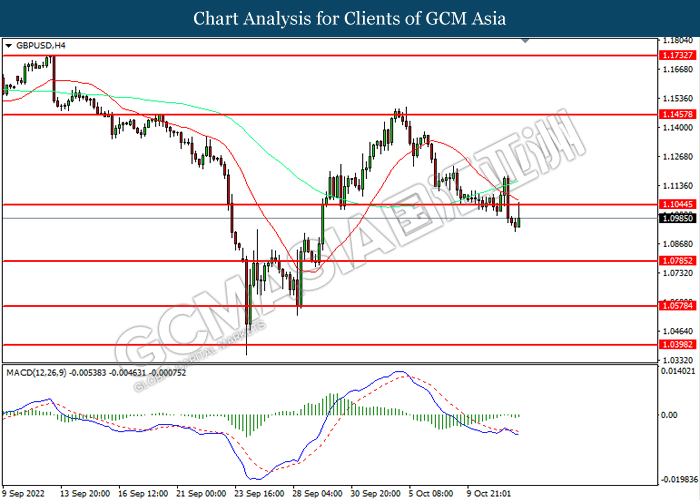

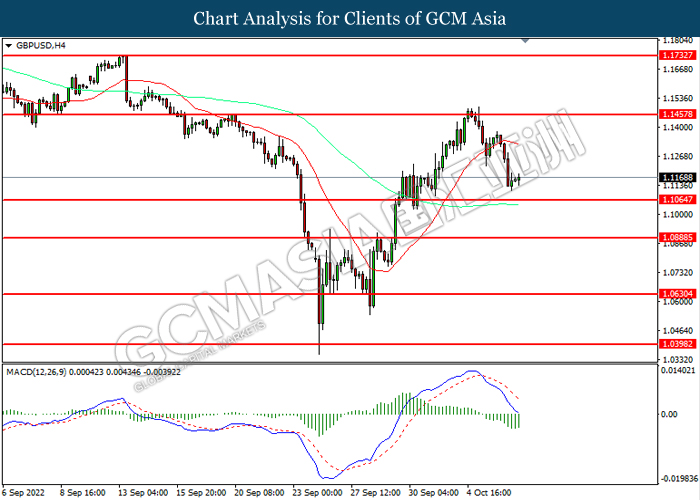

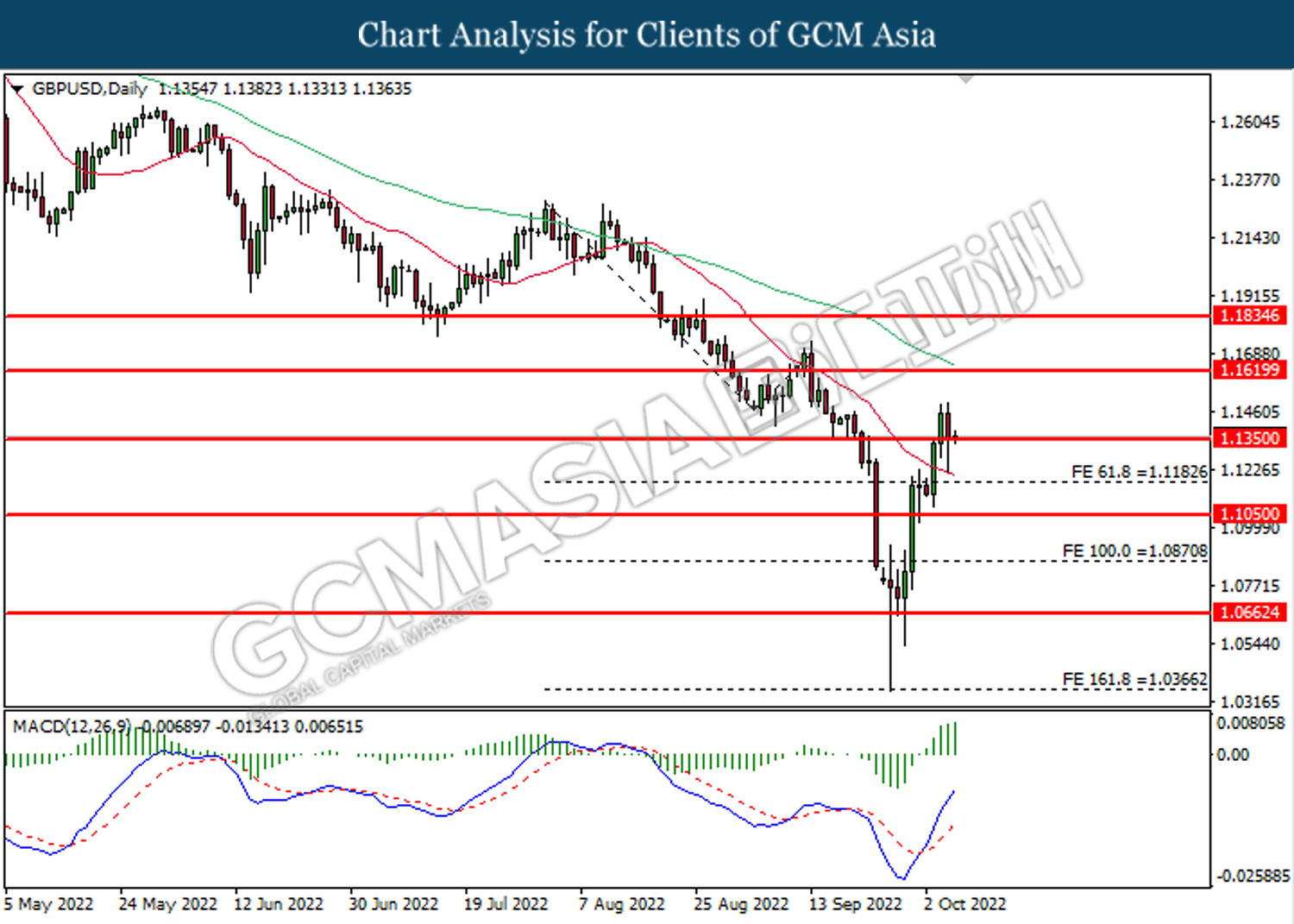

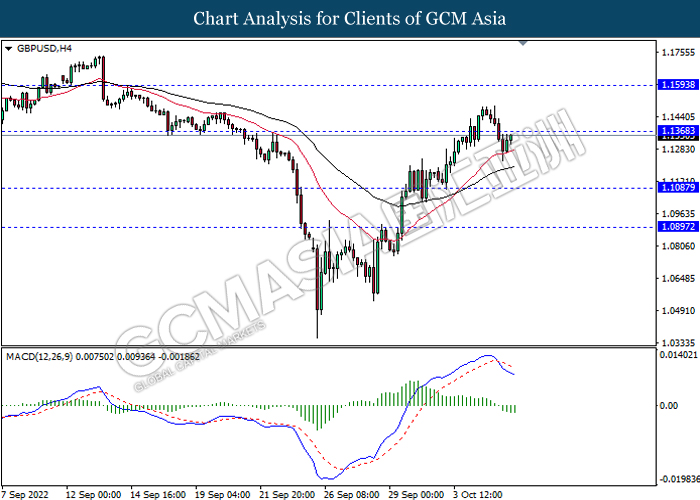

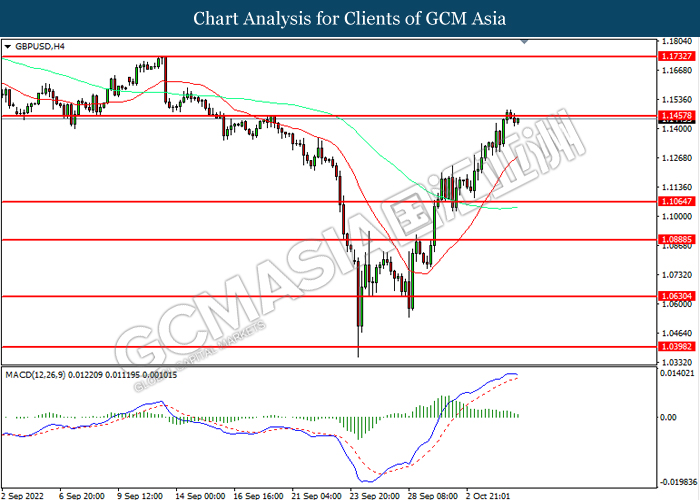

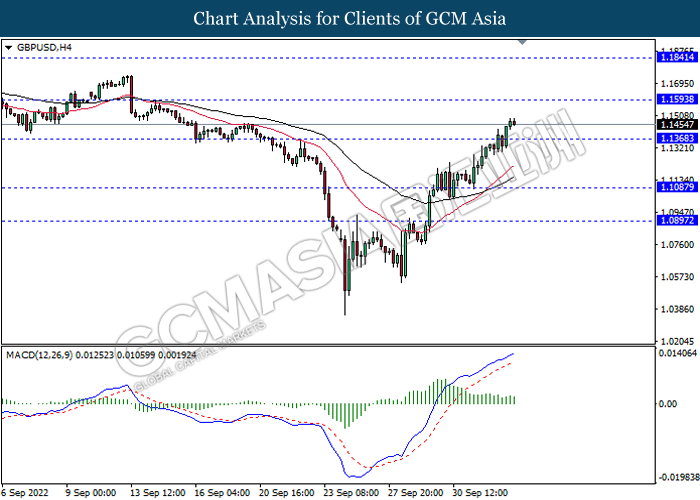

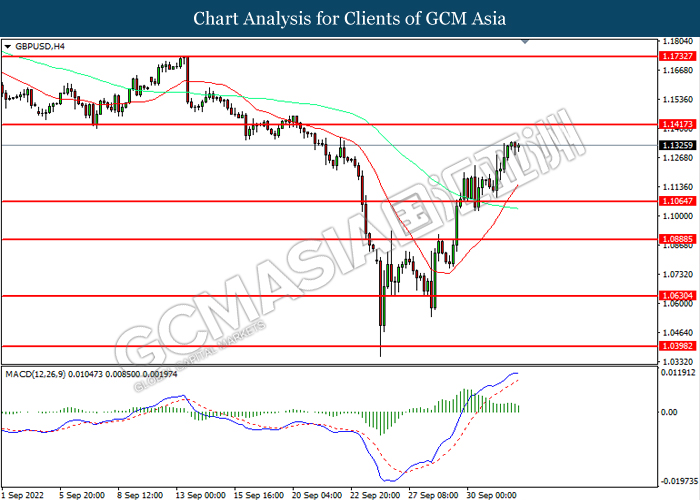

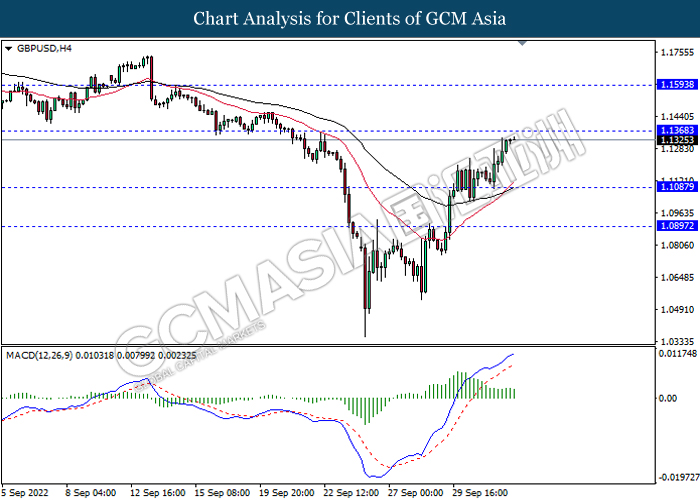

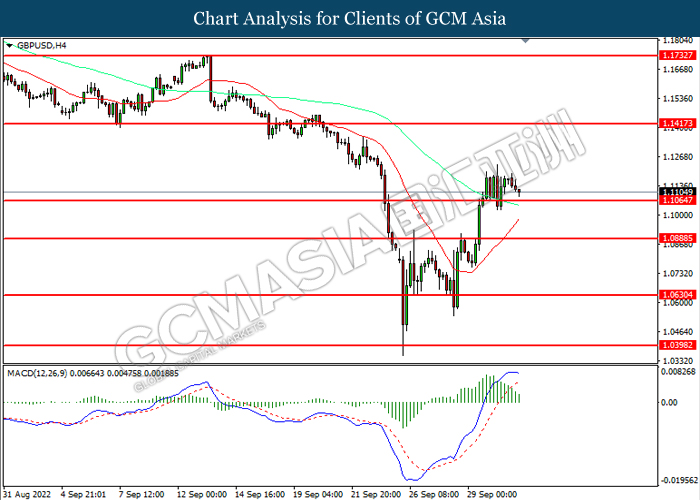

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1165, 1.1370

Support level: 1.0885, 1.0630

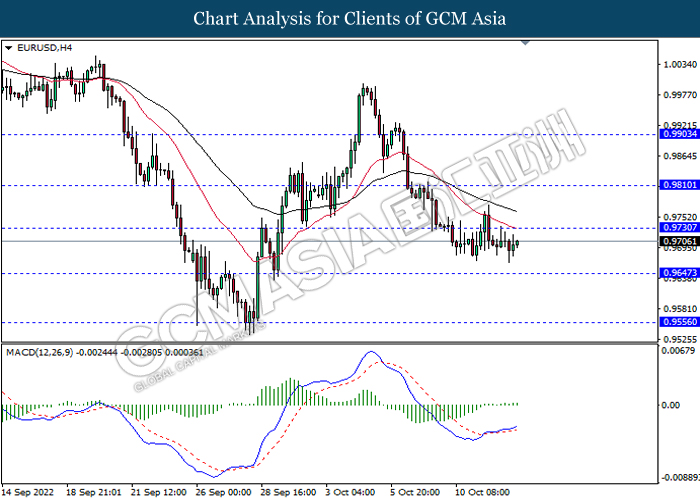

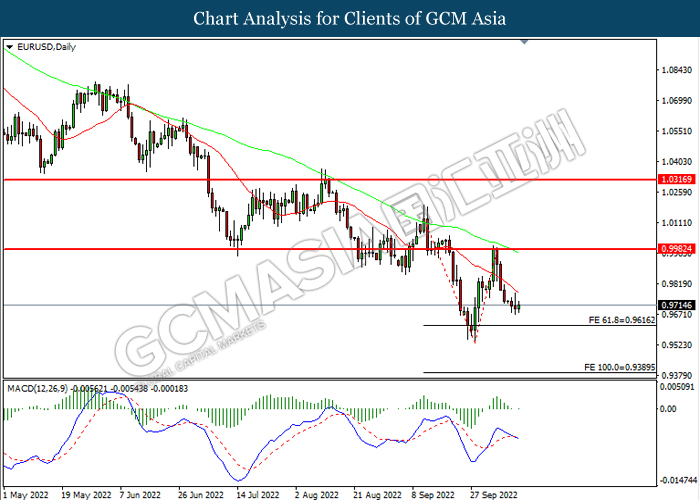

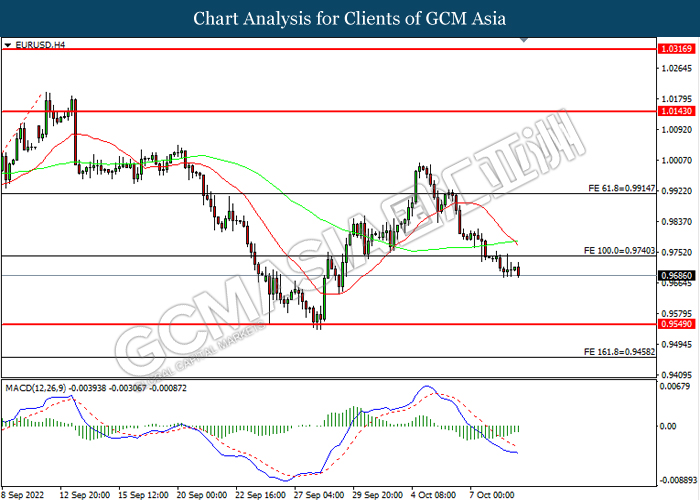

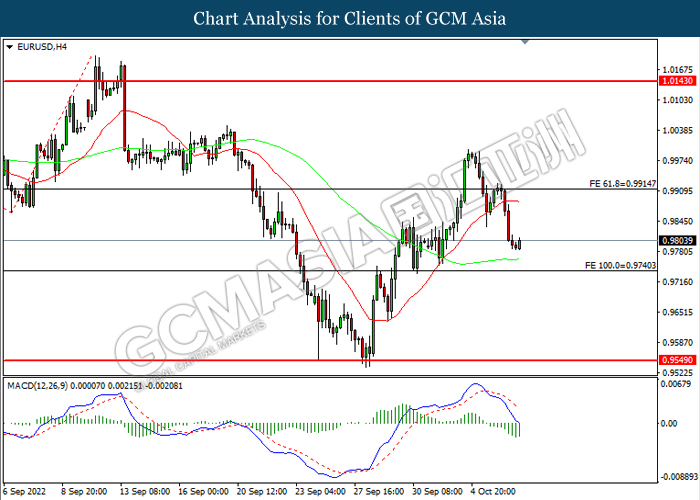

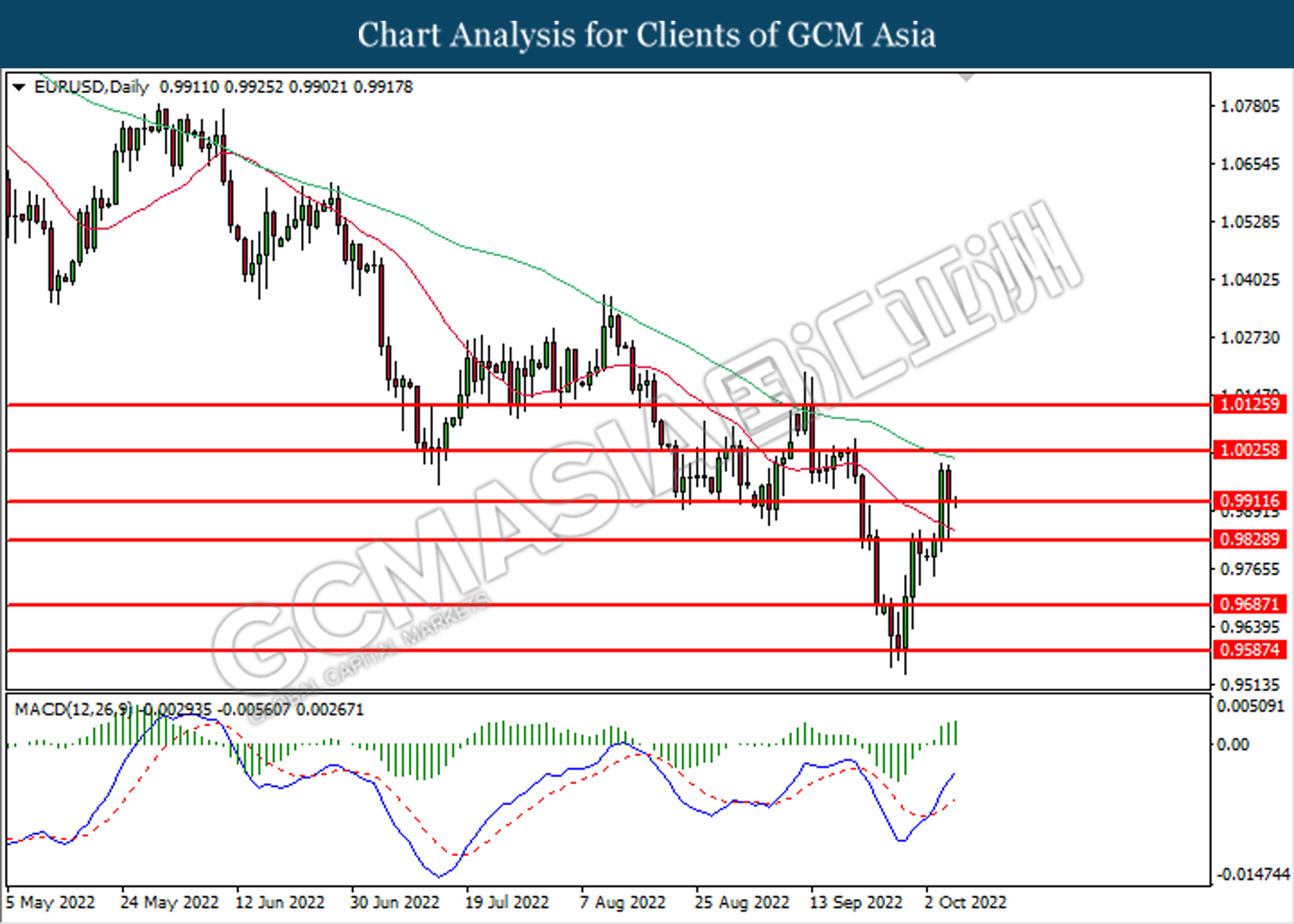

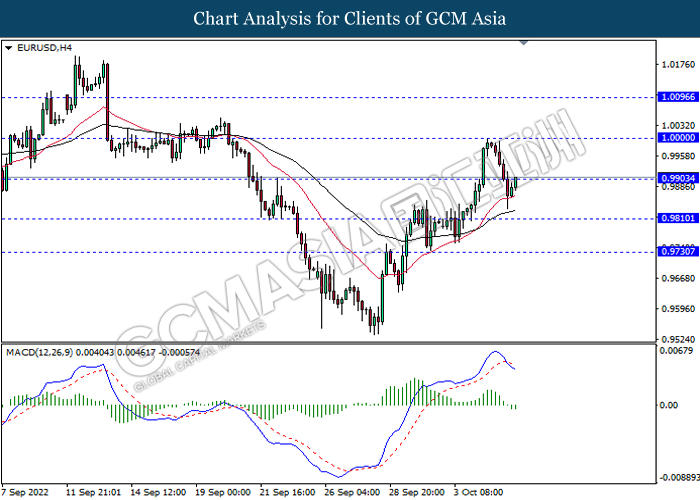

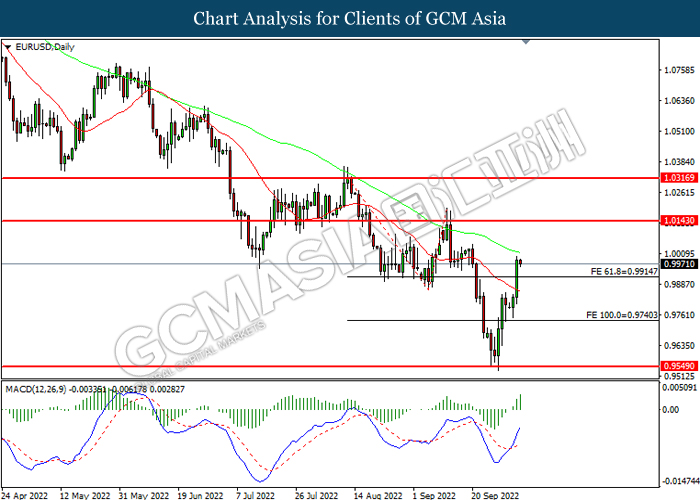

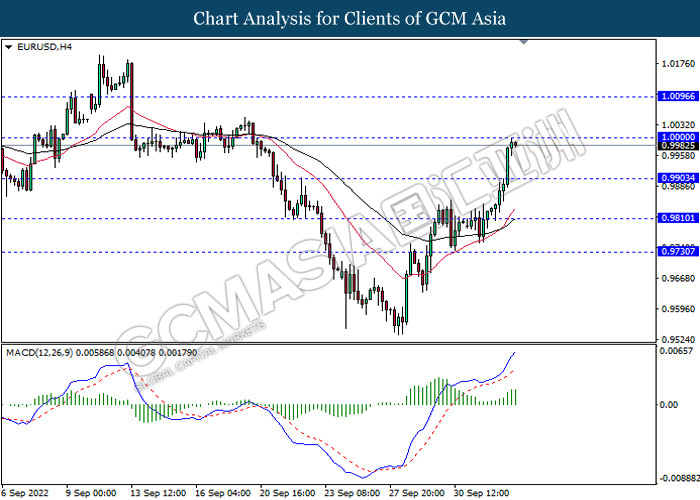

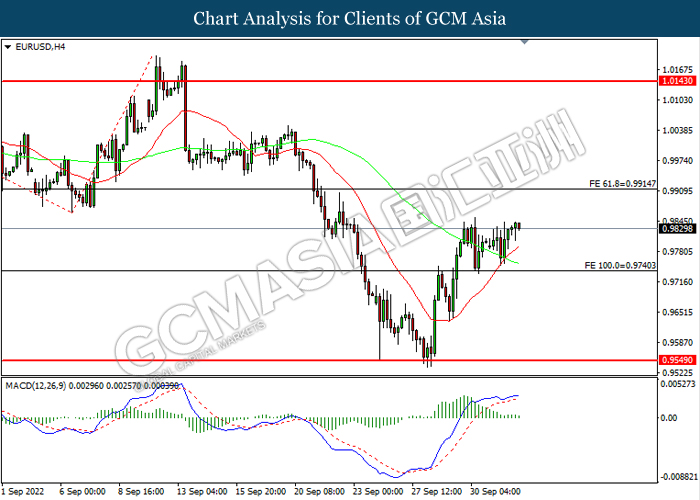

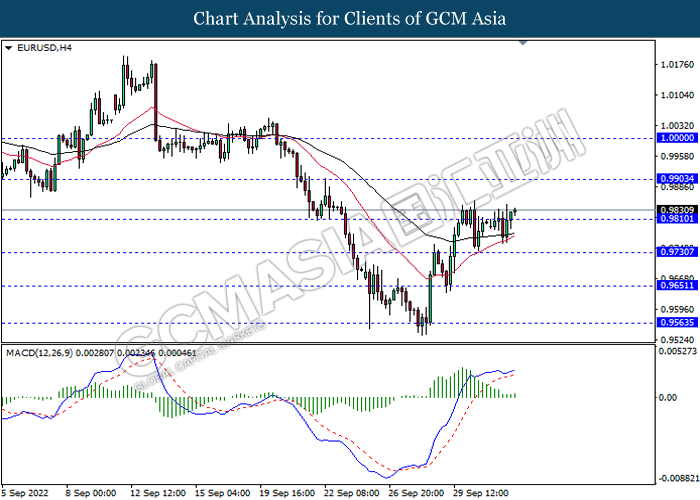

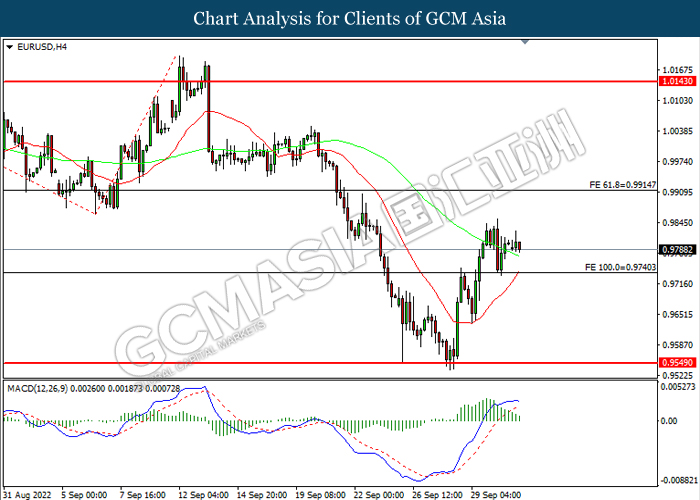

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9730, 0.9810

Support level: 0.9645, 0.9555

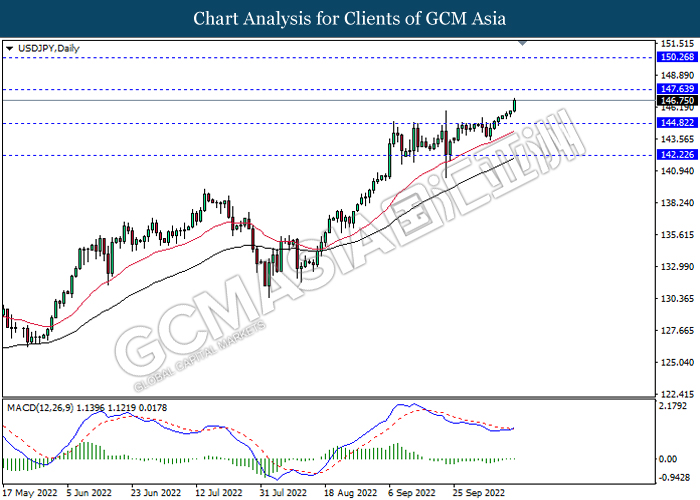

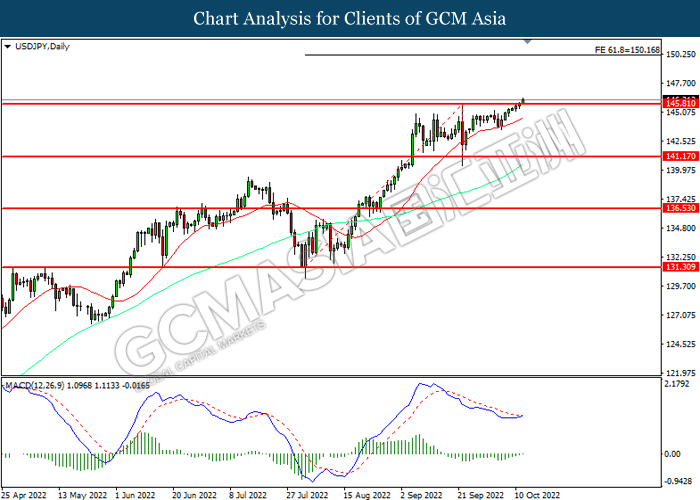

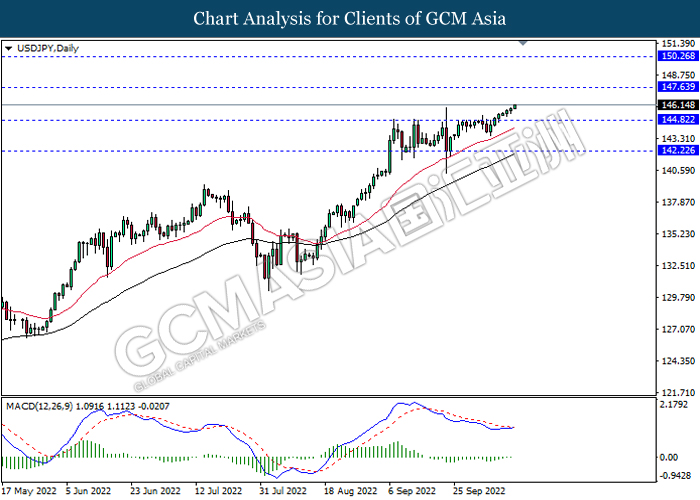

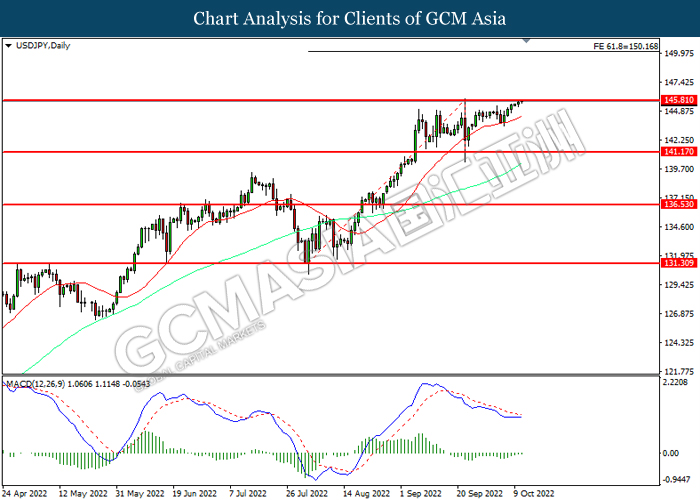

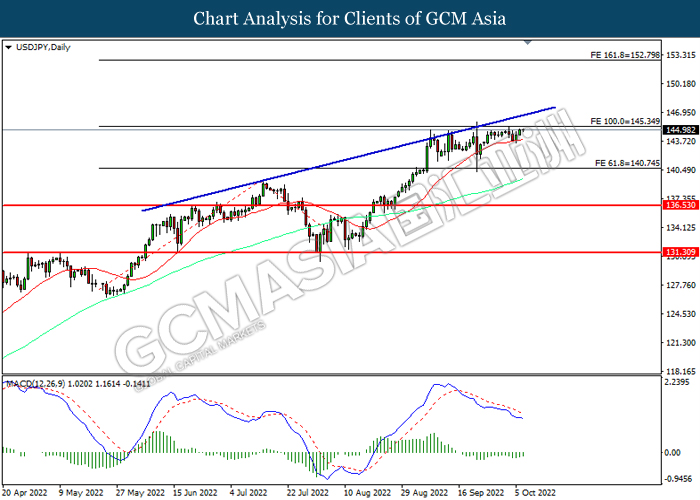

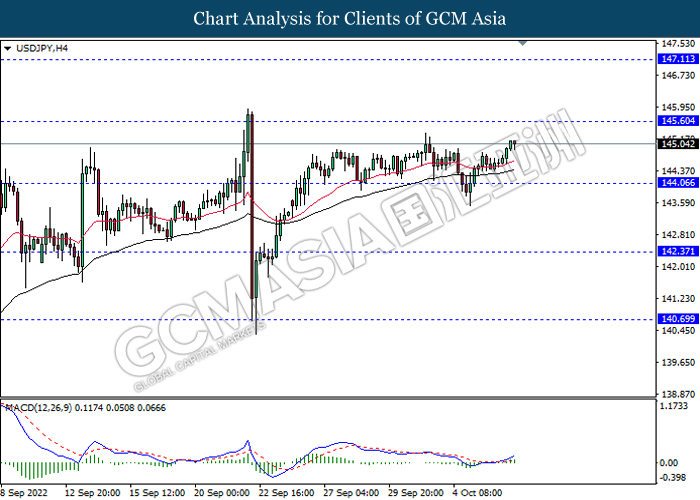

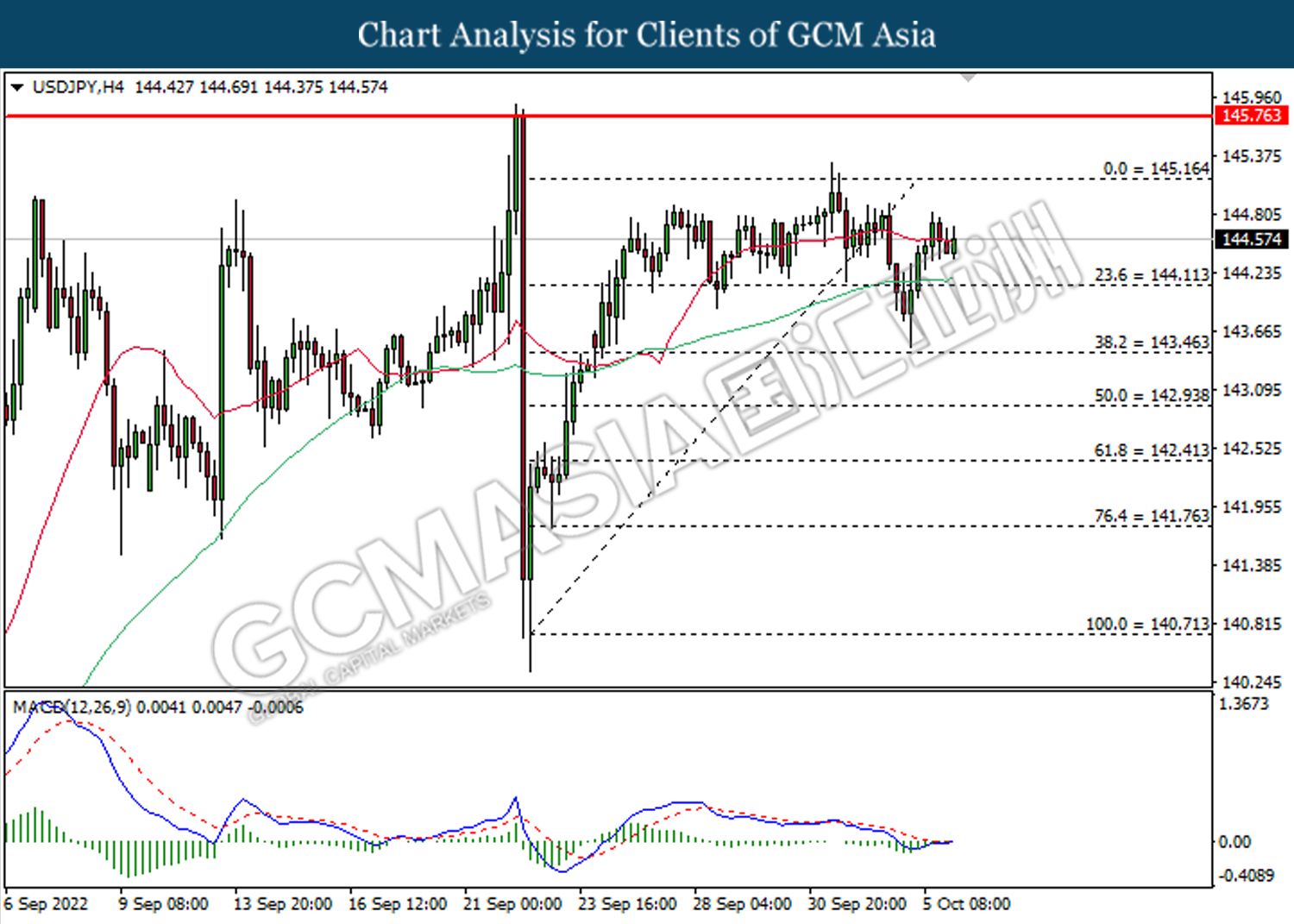

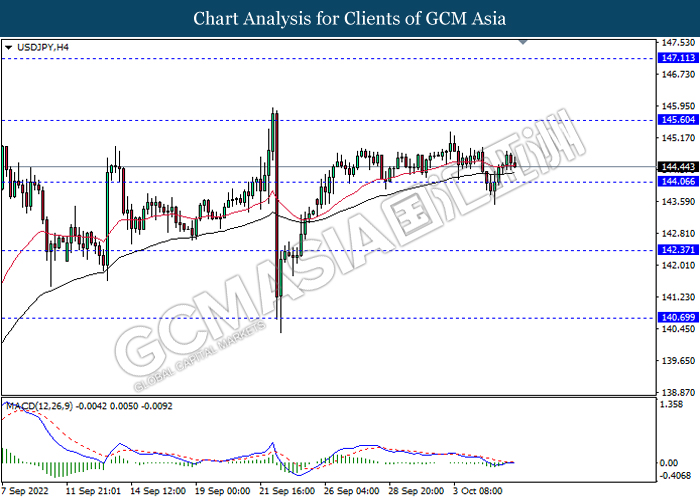

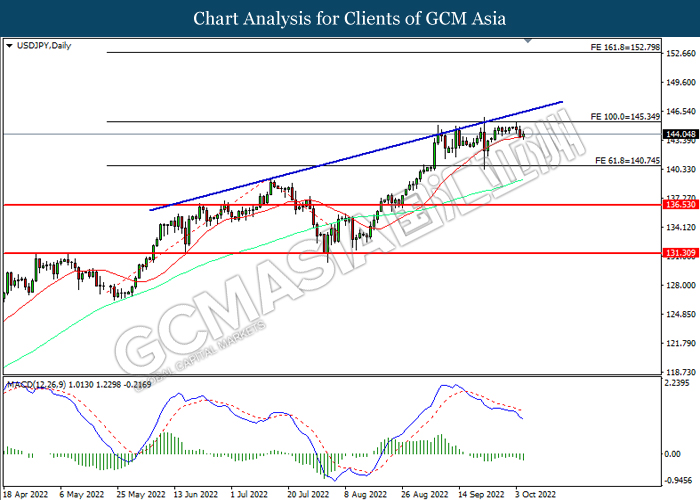

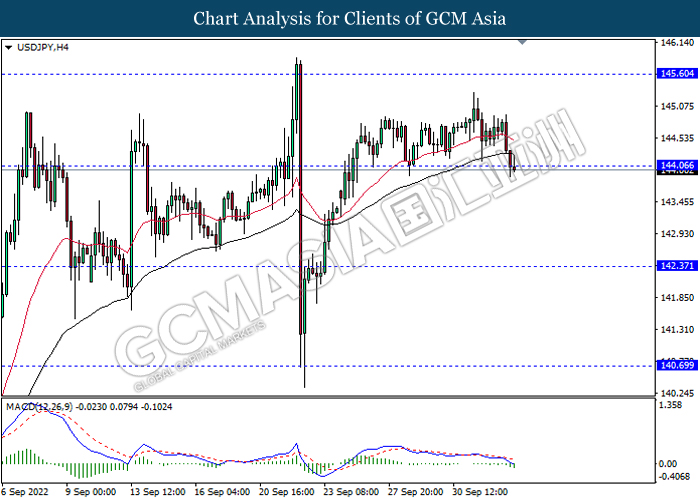

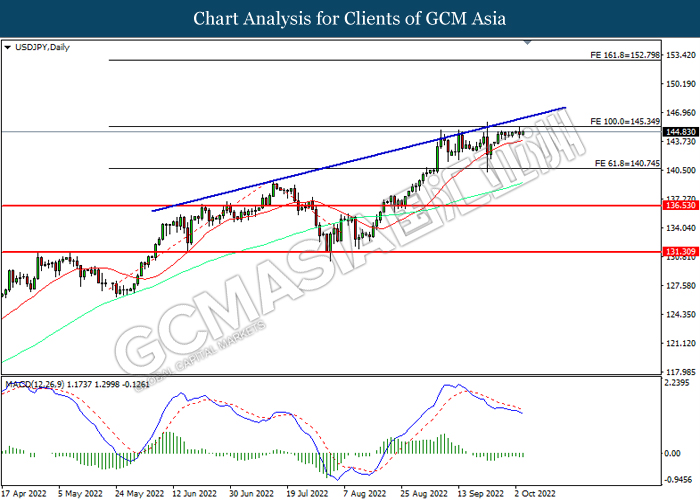

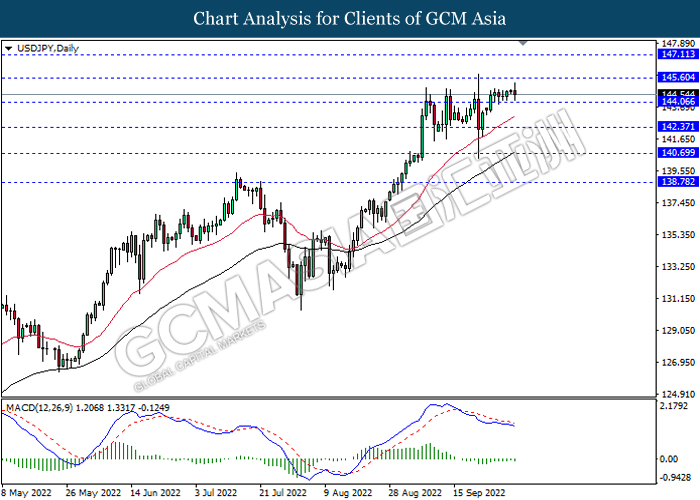

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

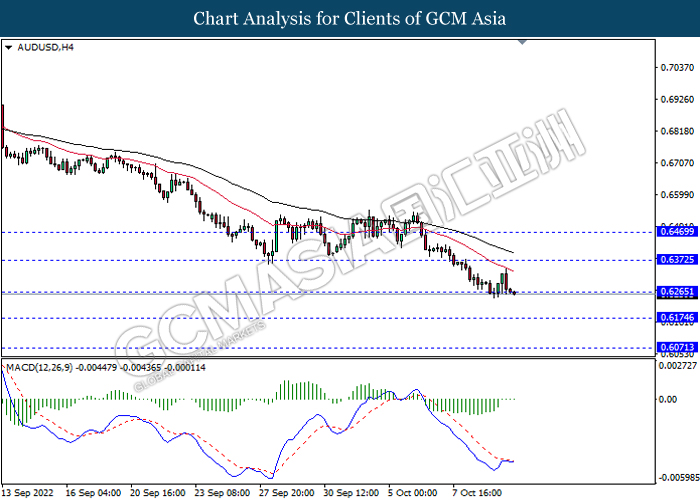

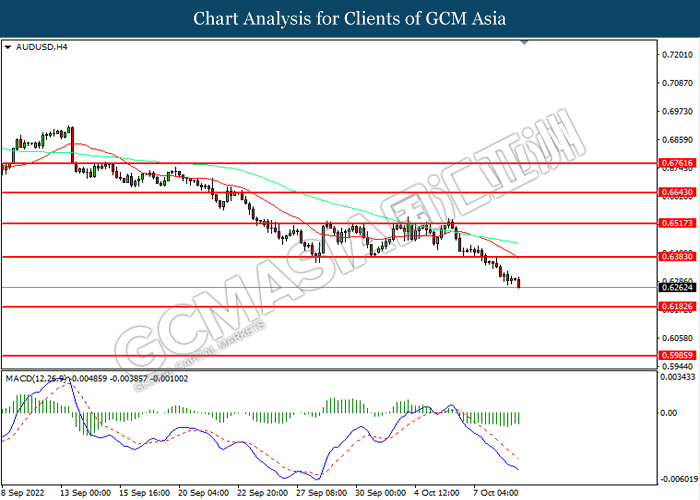

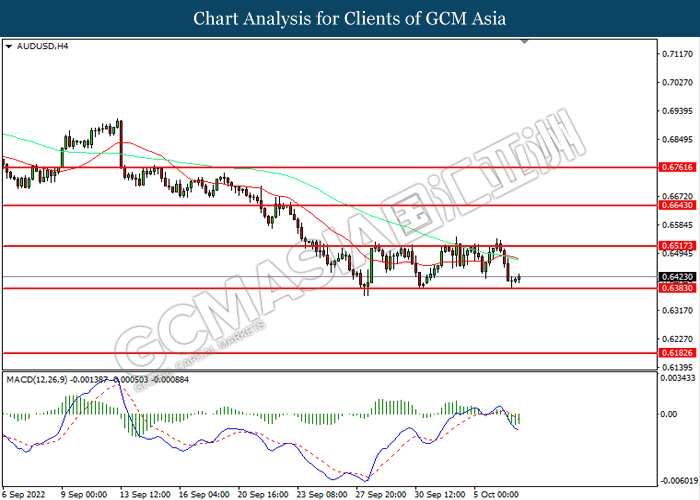

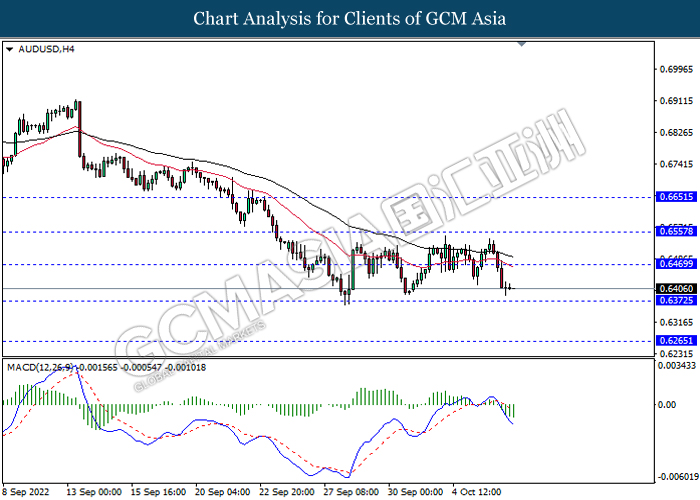

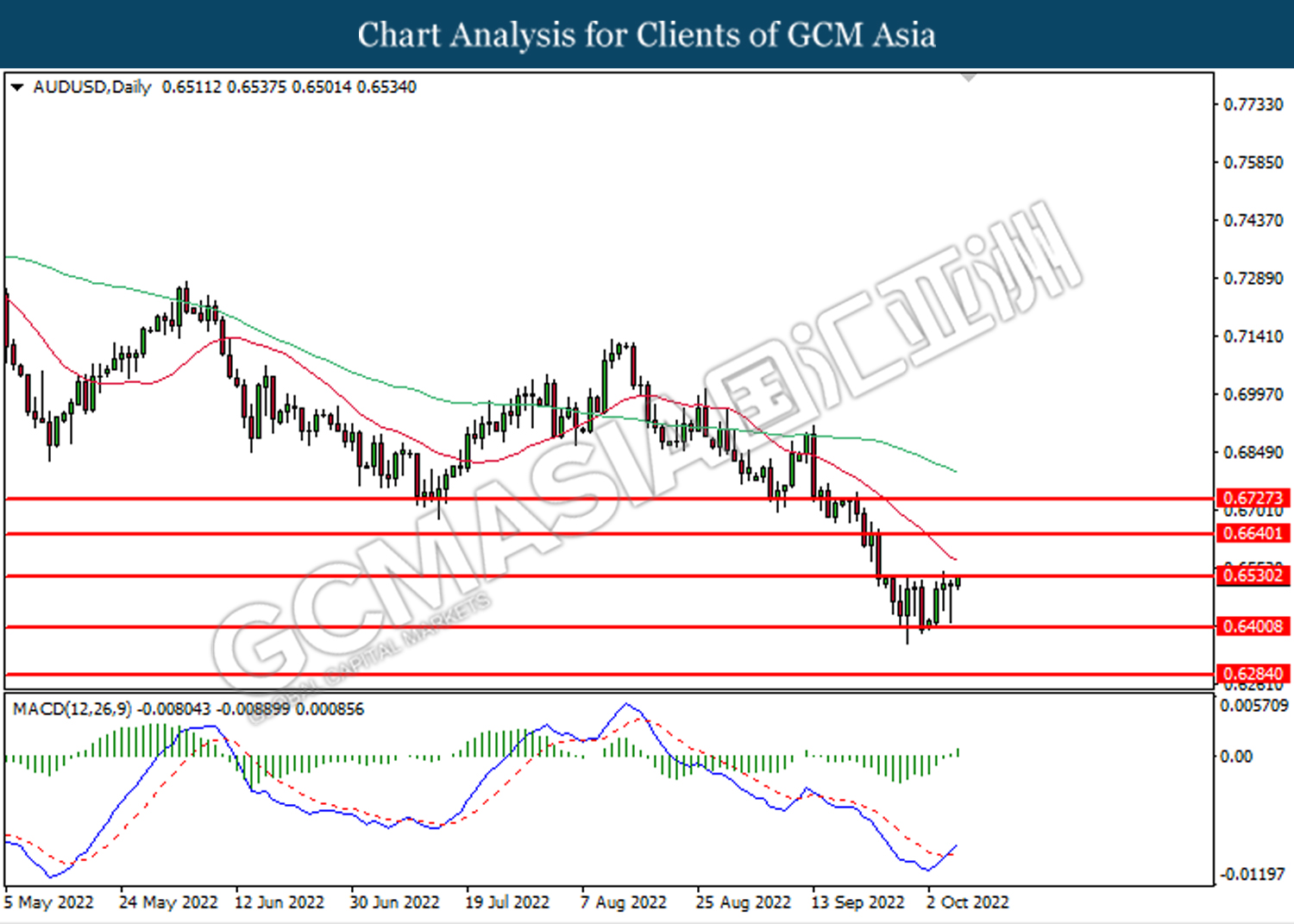

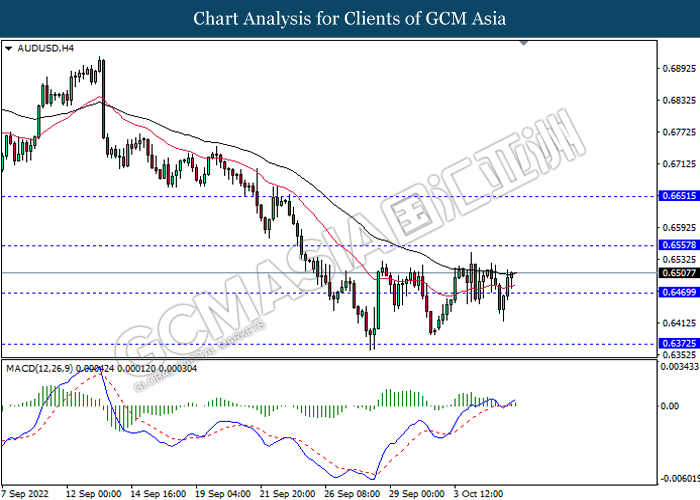

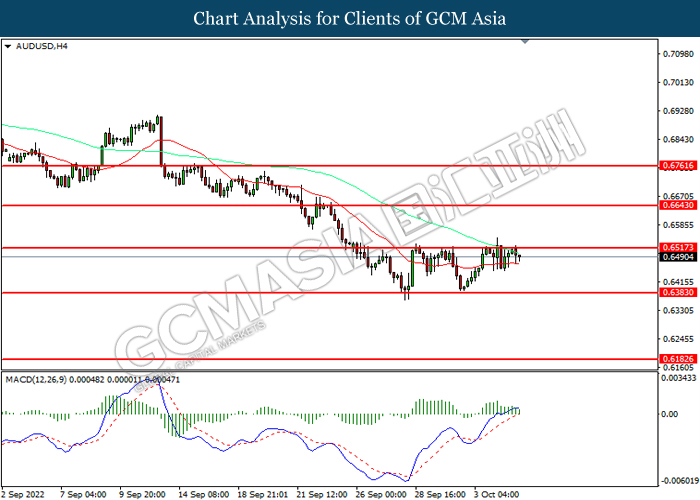

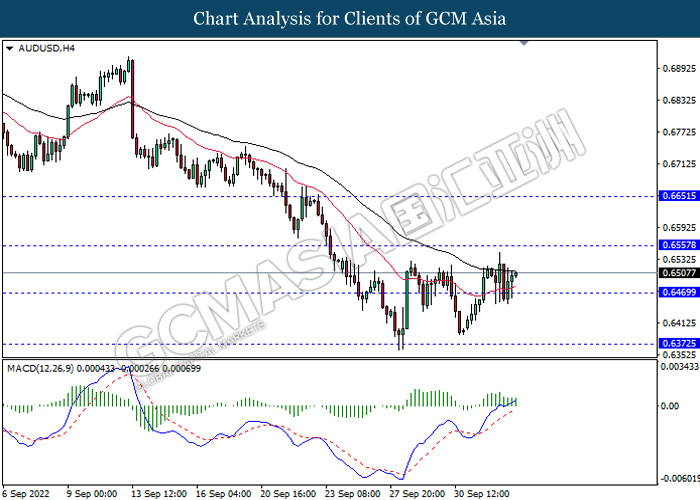

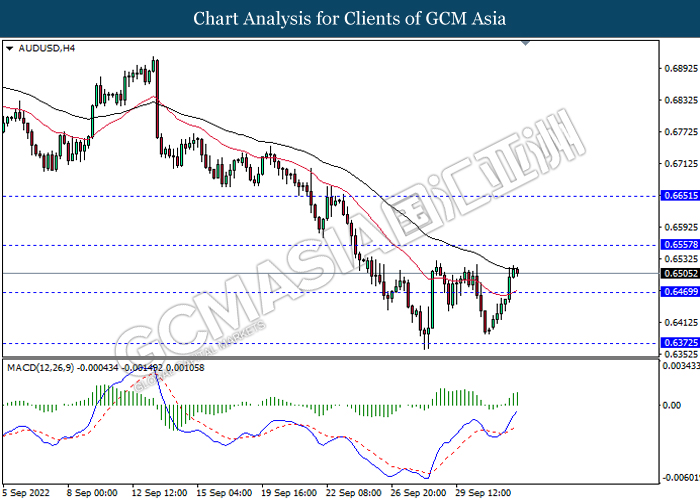

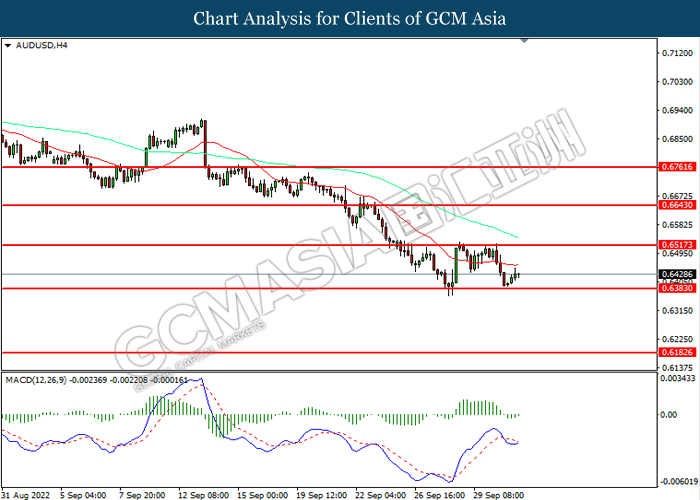

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6370, 0.6470

Support level: 0.6265, 0.6175

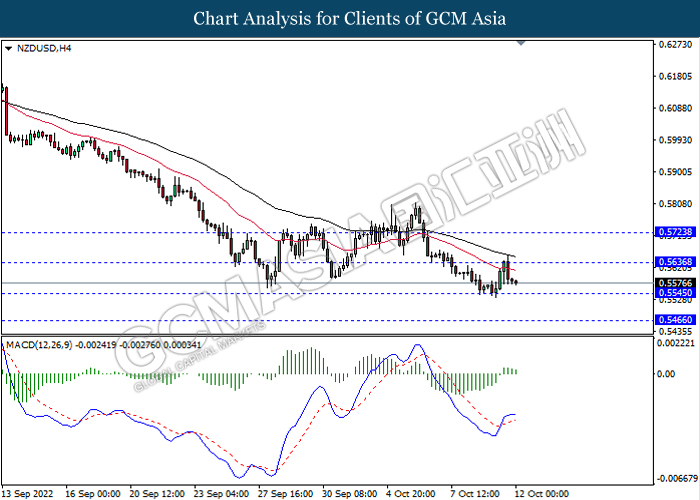

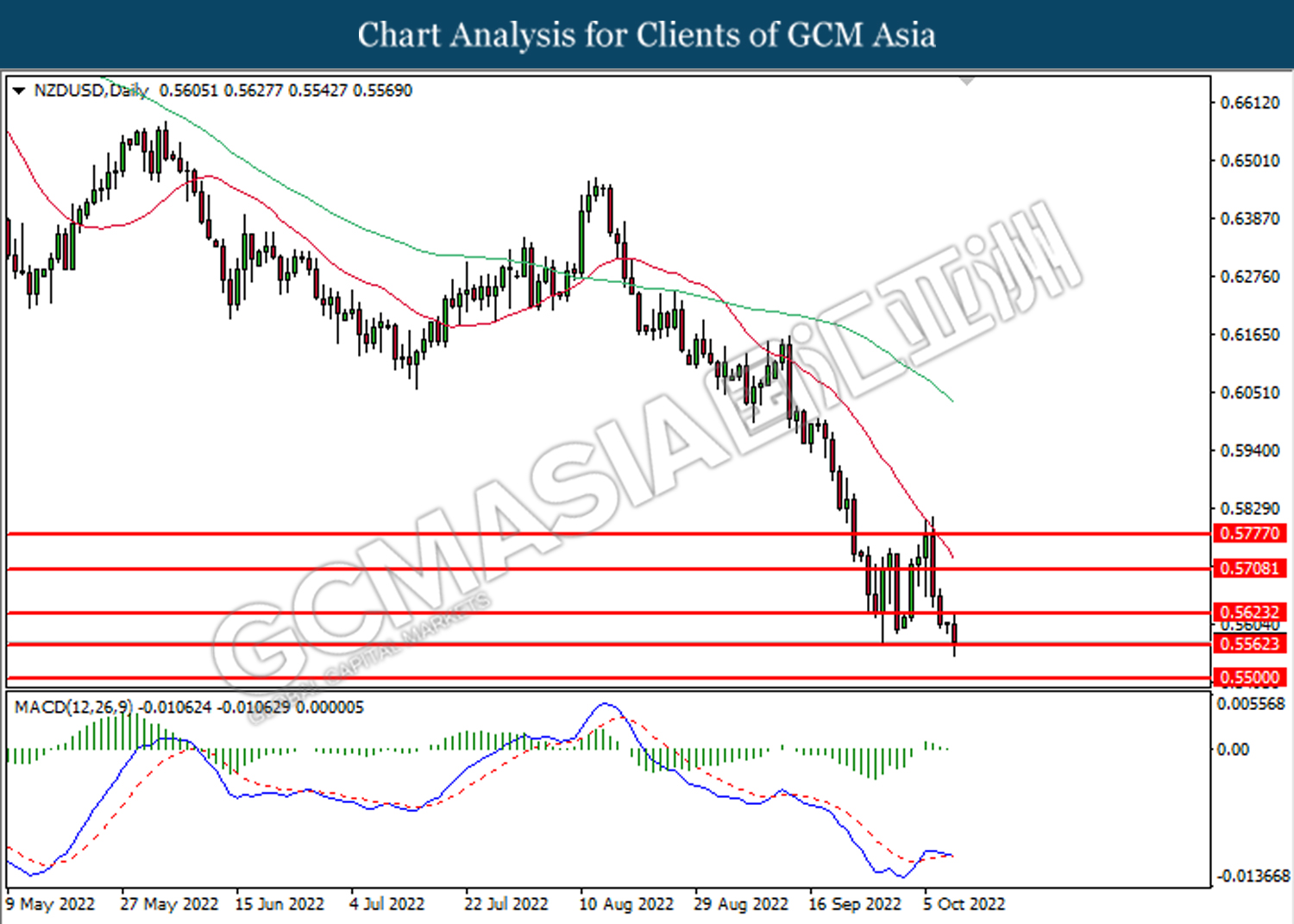

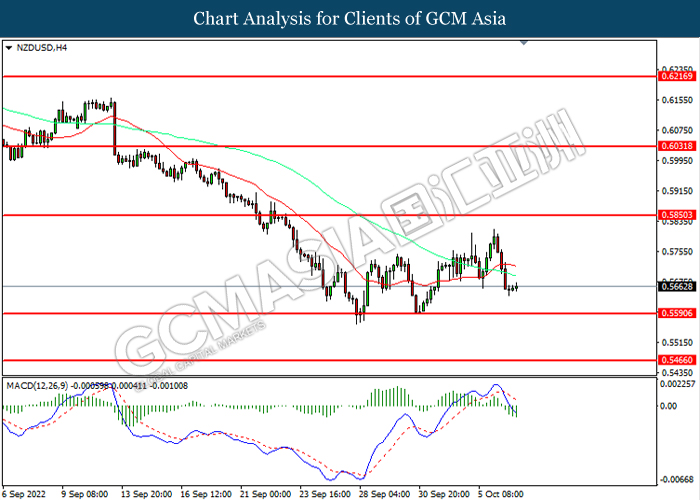

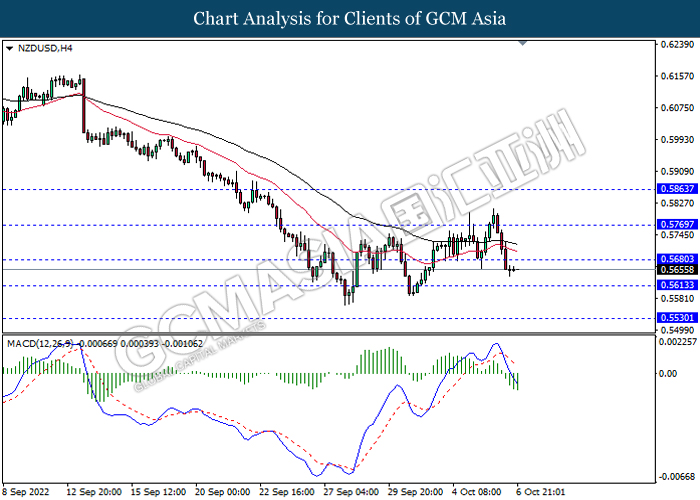

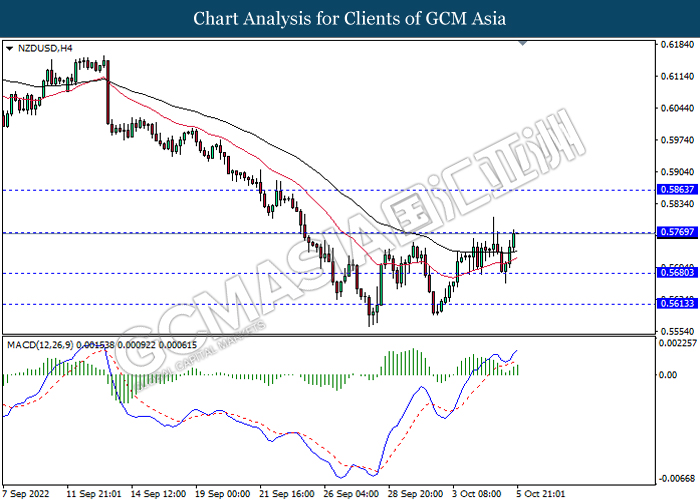

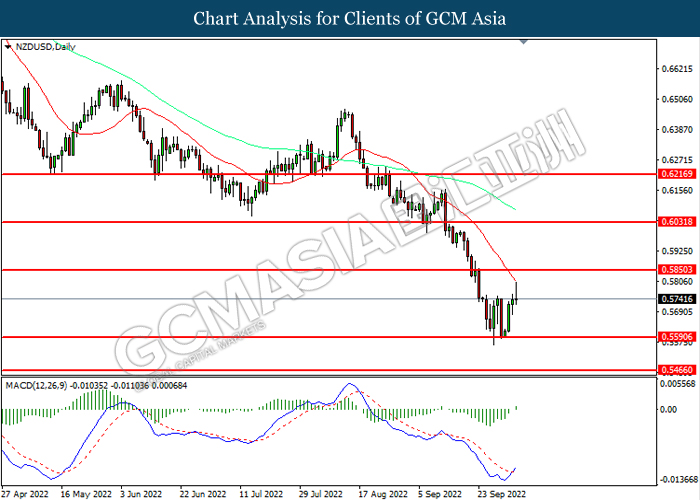

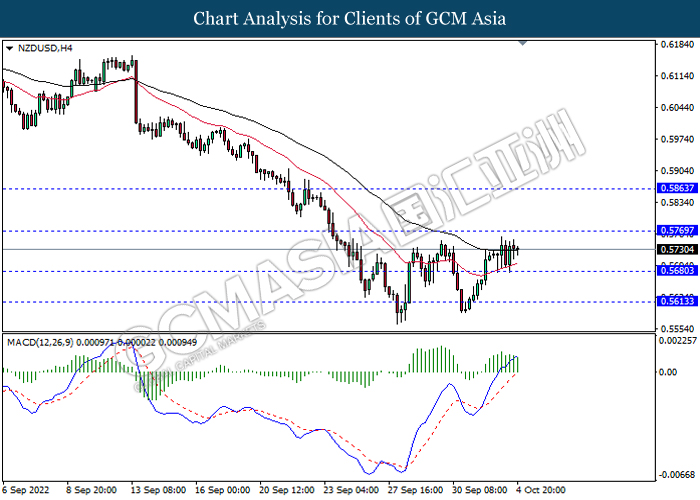

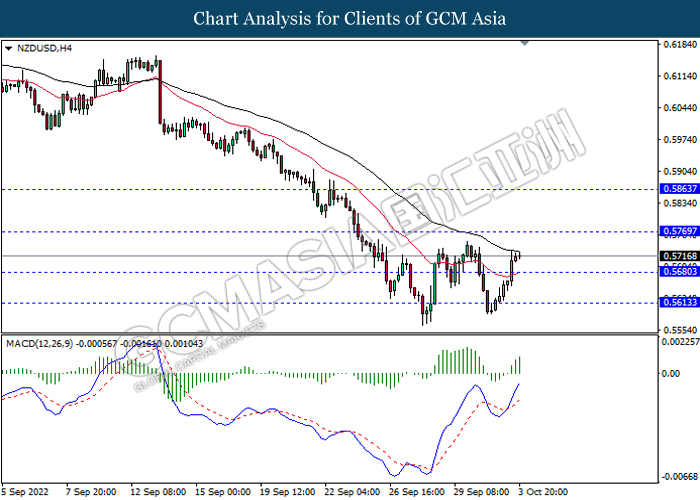

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.5635, 0.5725

Support level: 0.5545, 0.5465

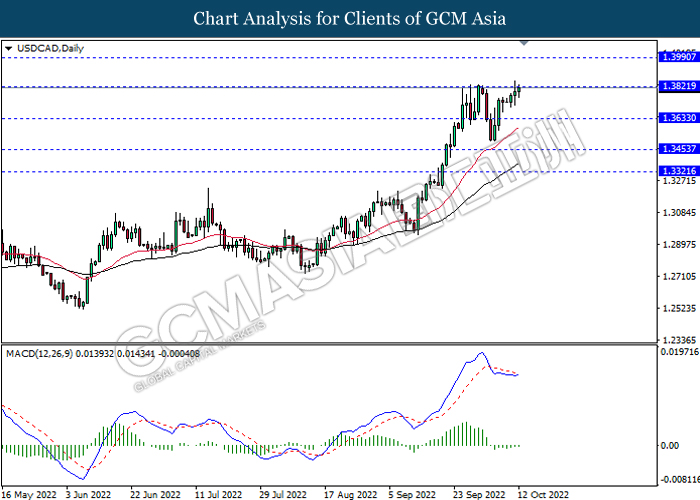

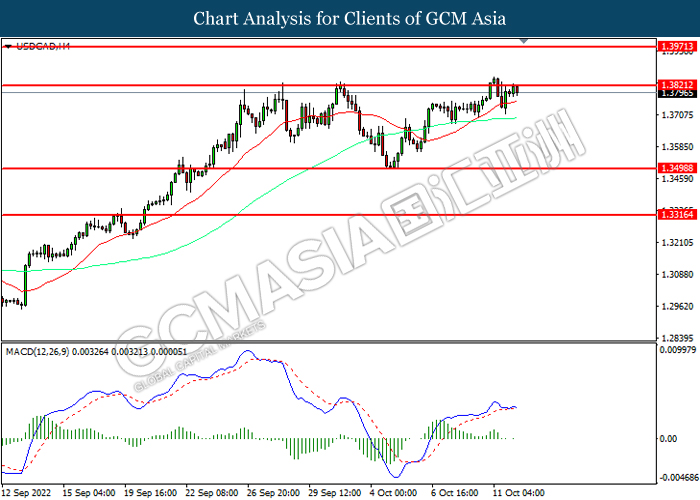

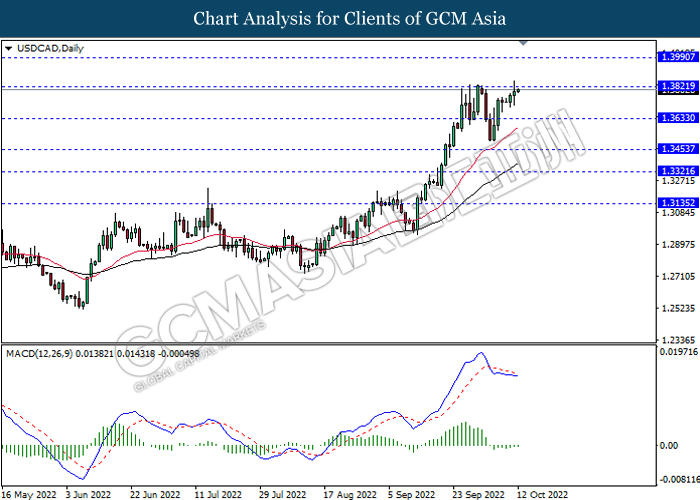

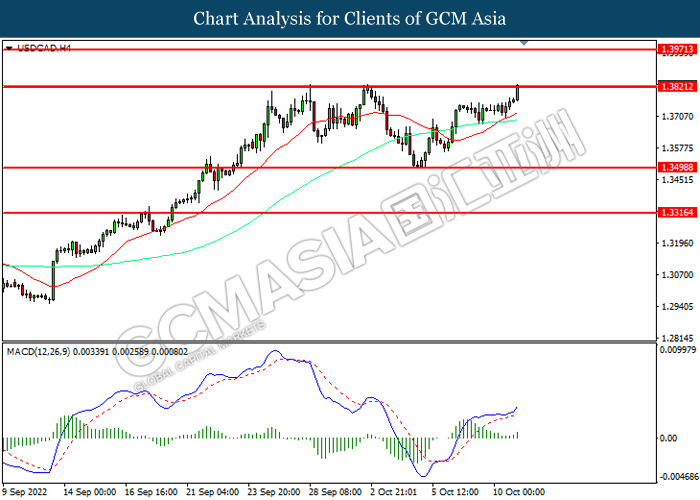

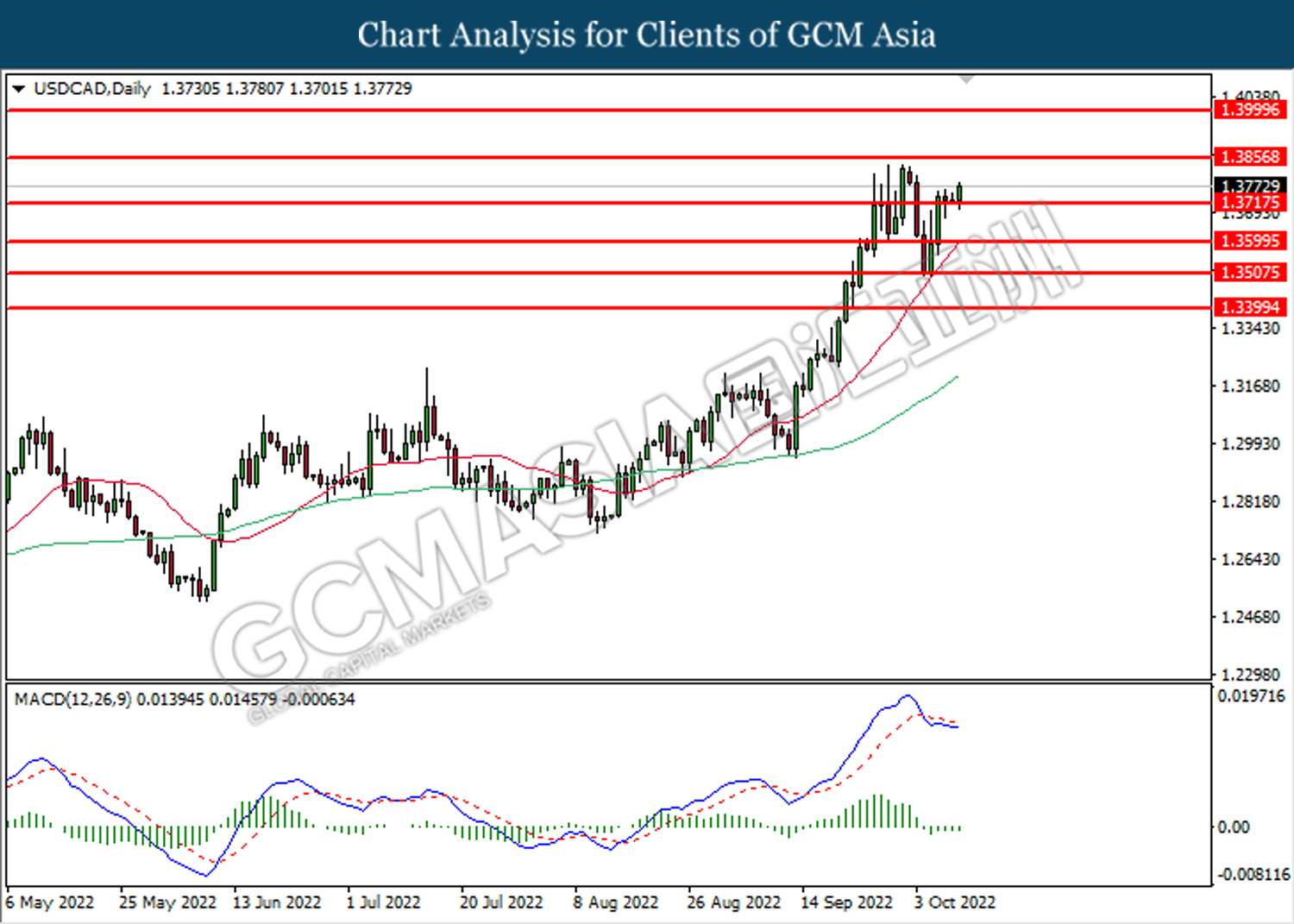

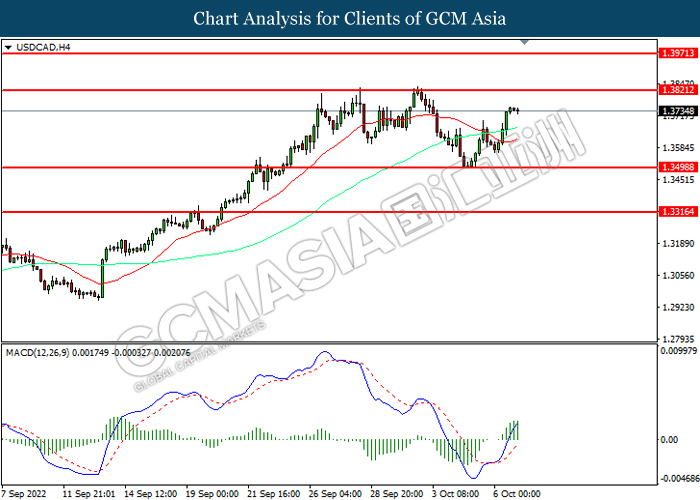

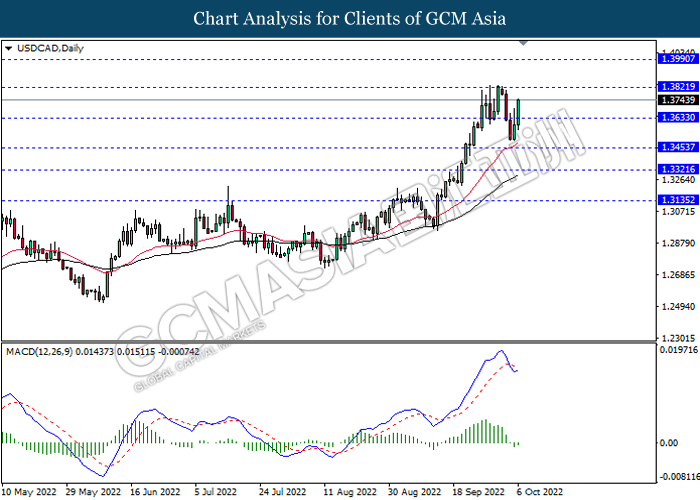

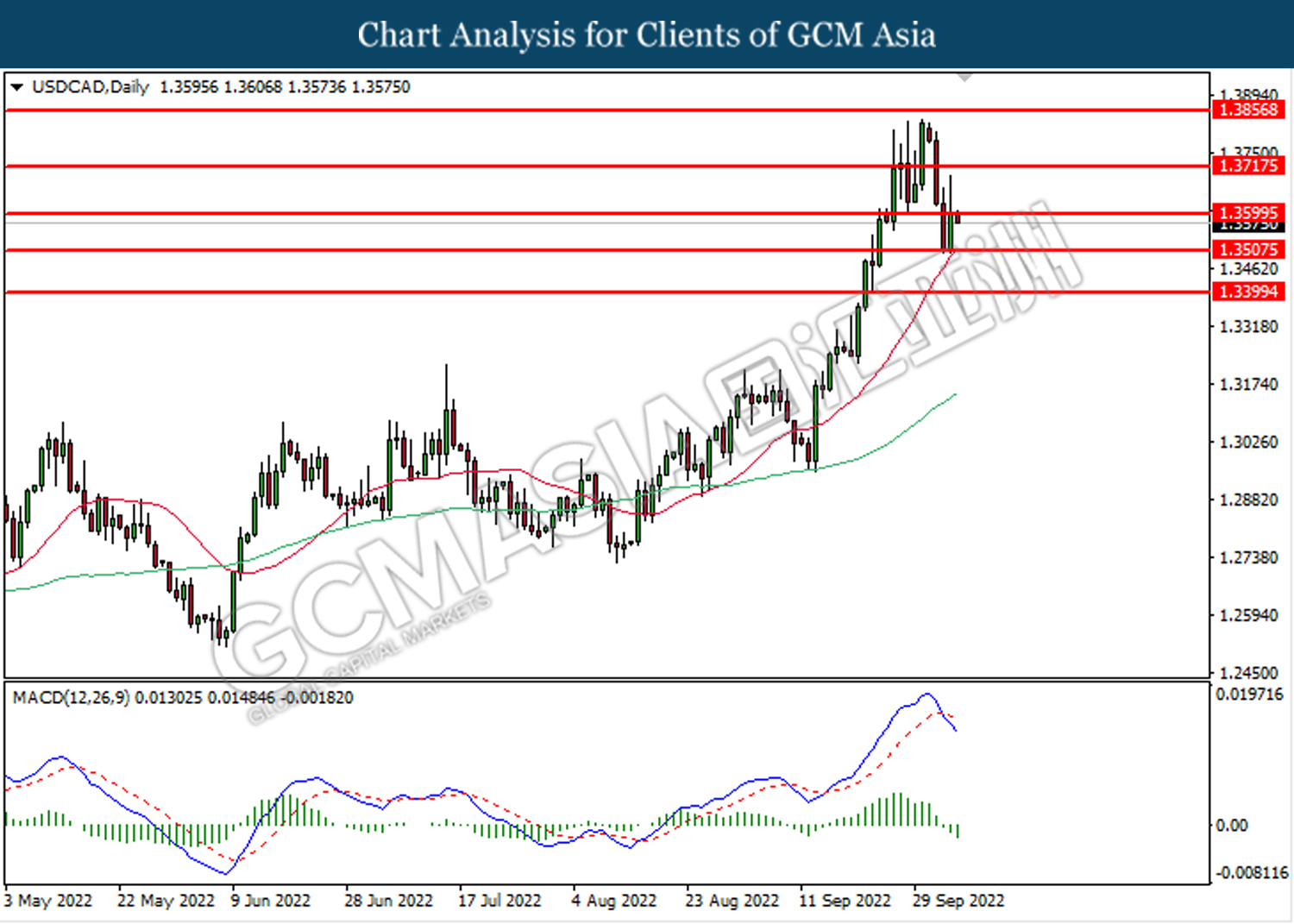

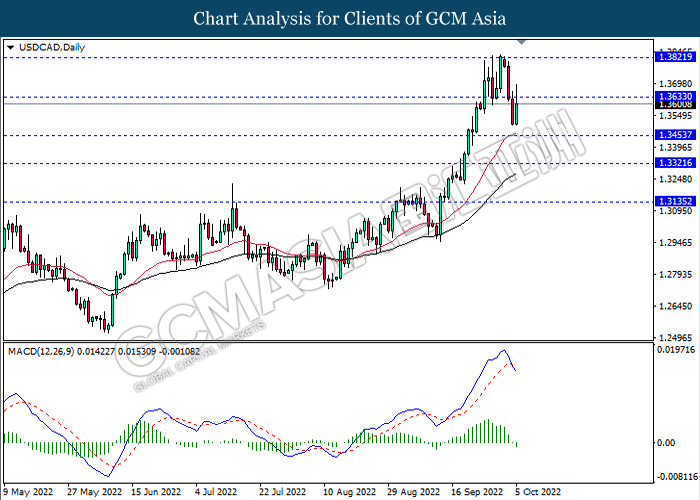

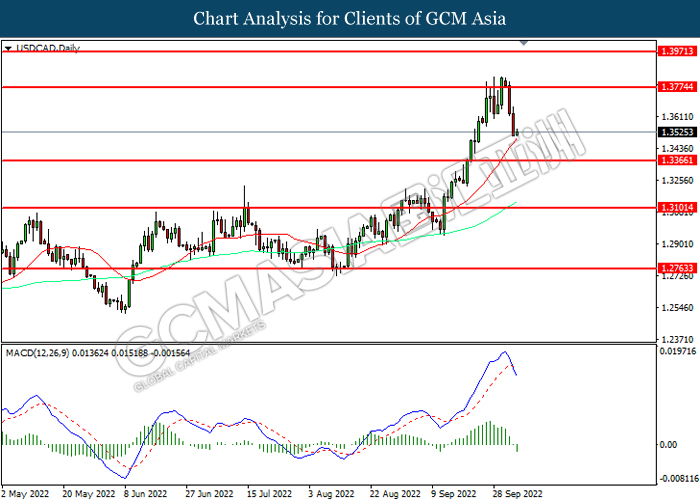

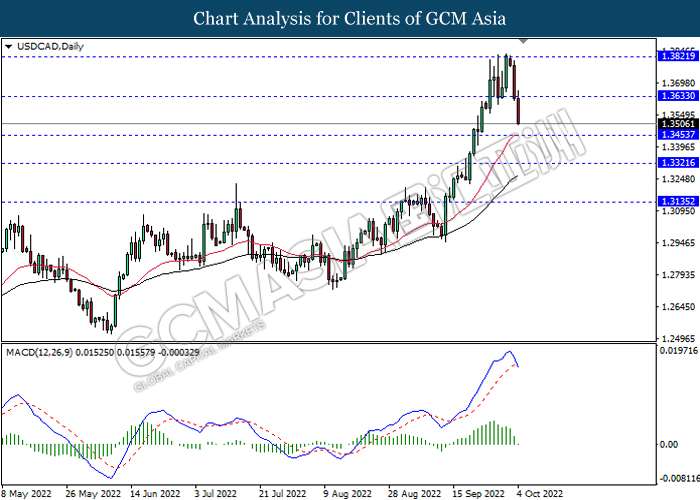

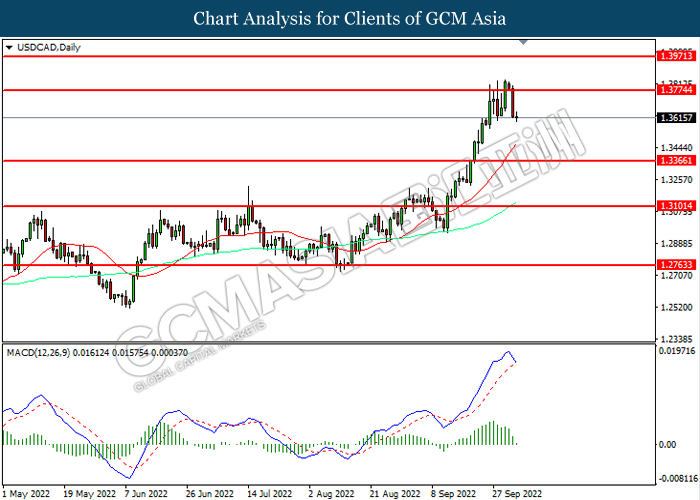

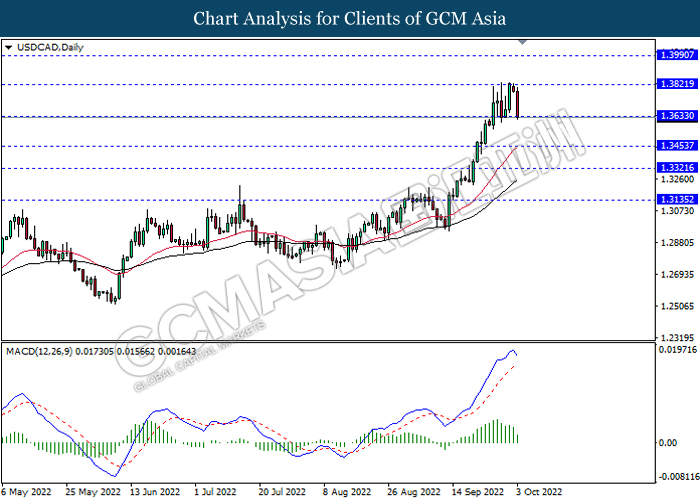

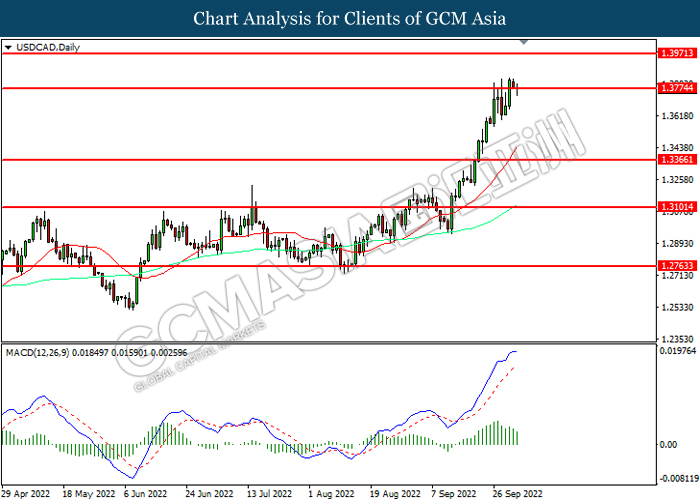

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

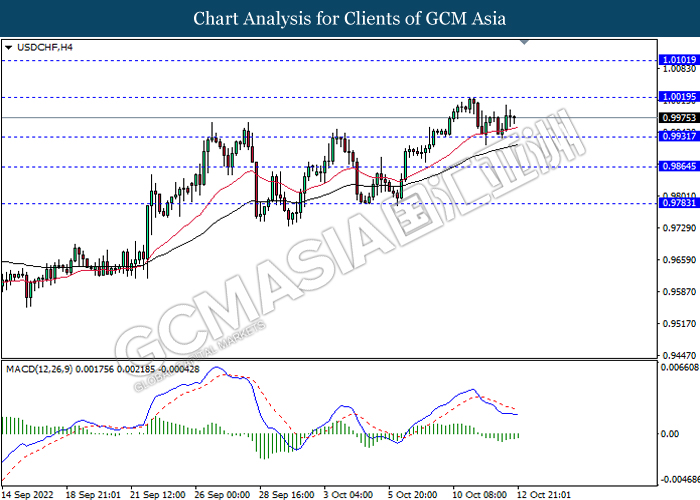

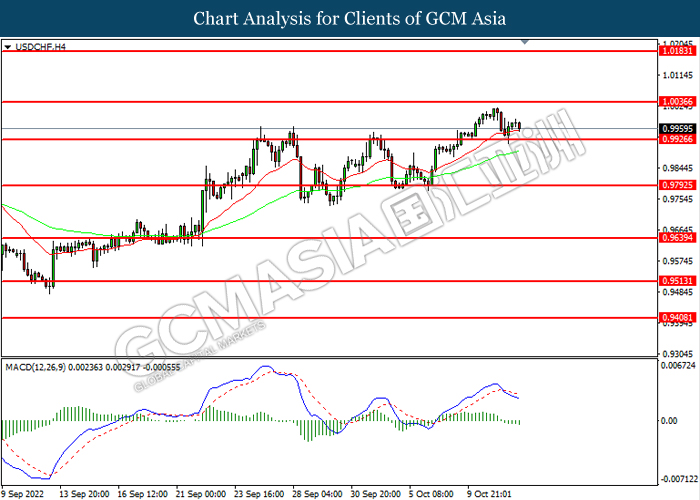

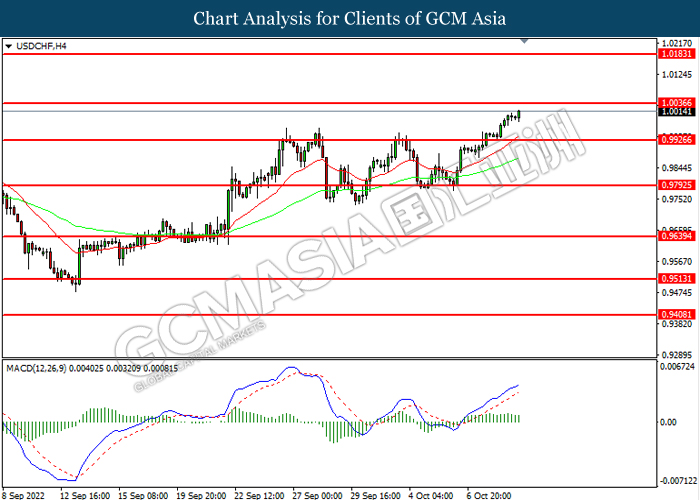

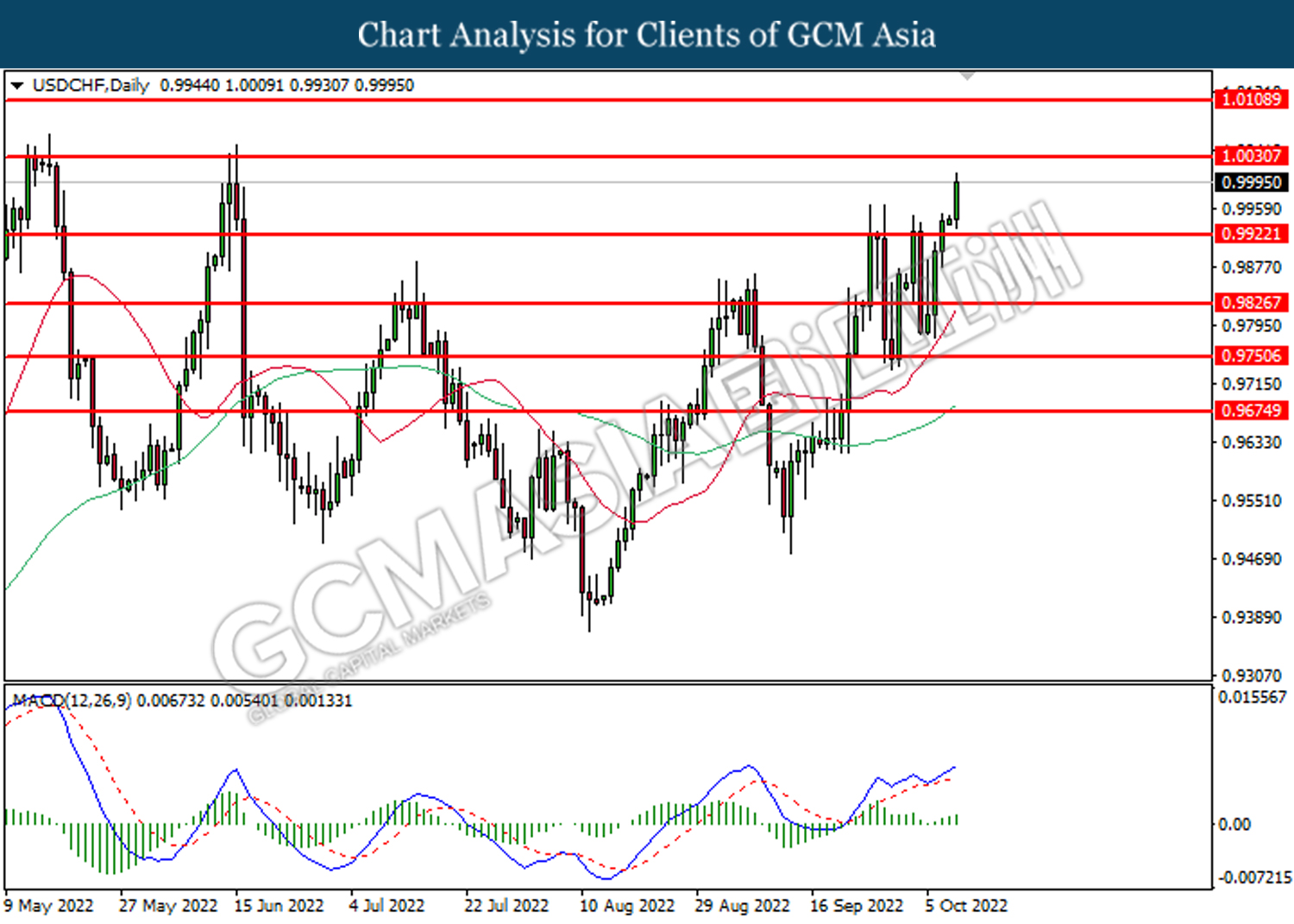

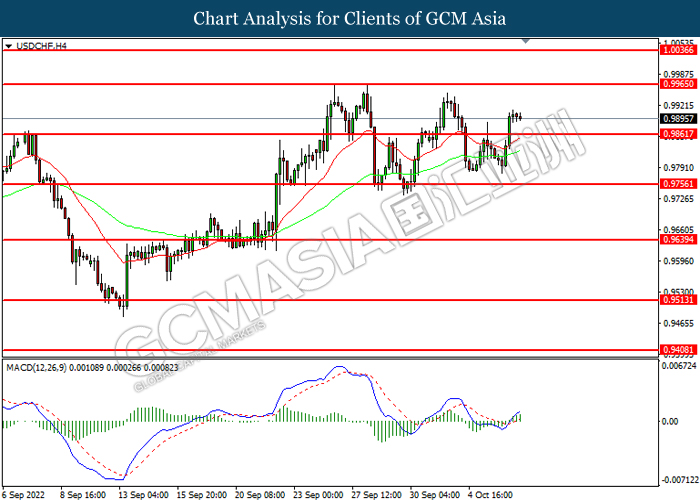

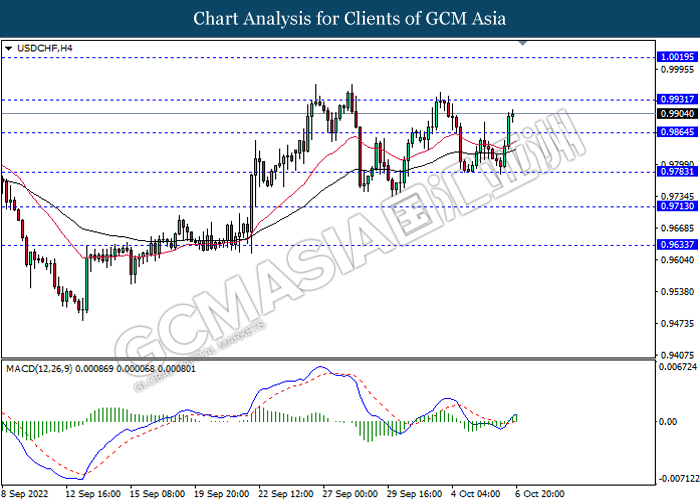

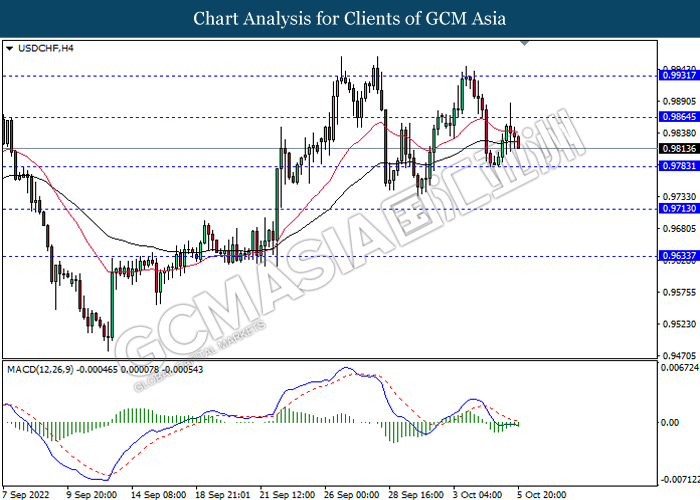

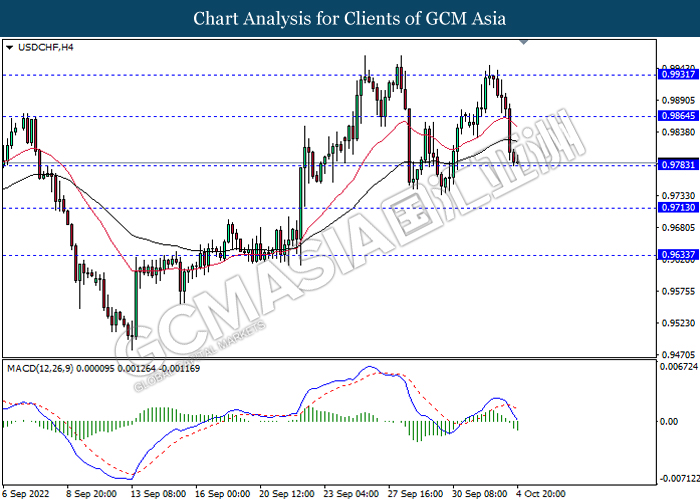

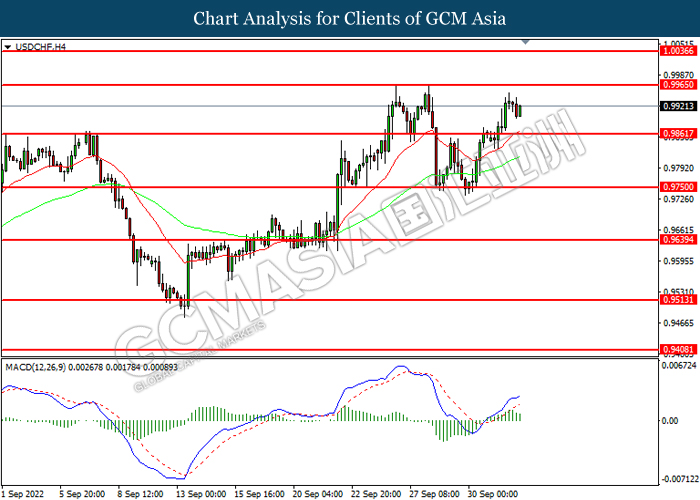

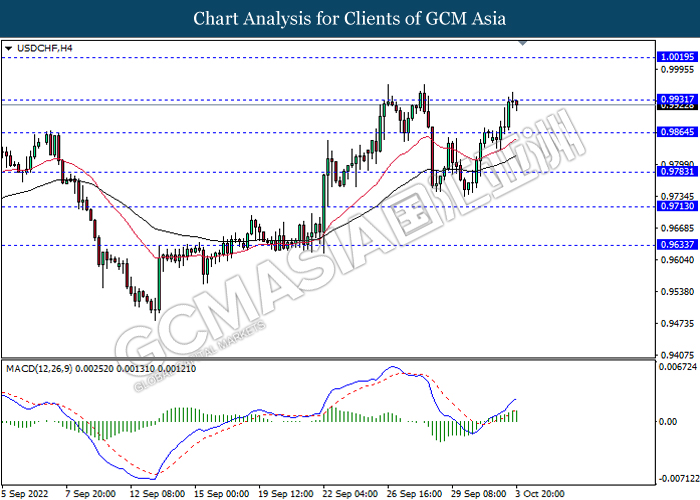

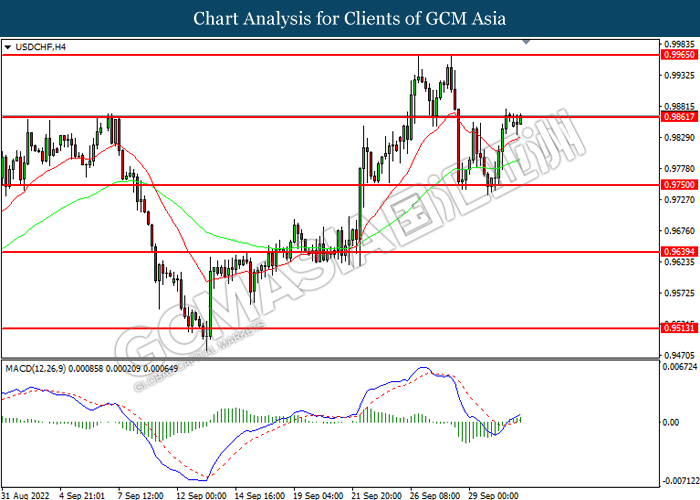

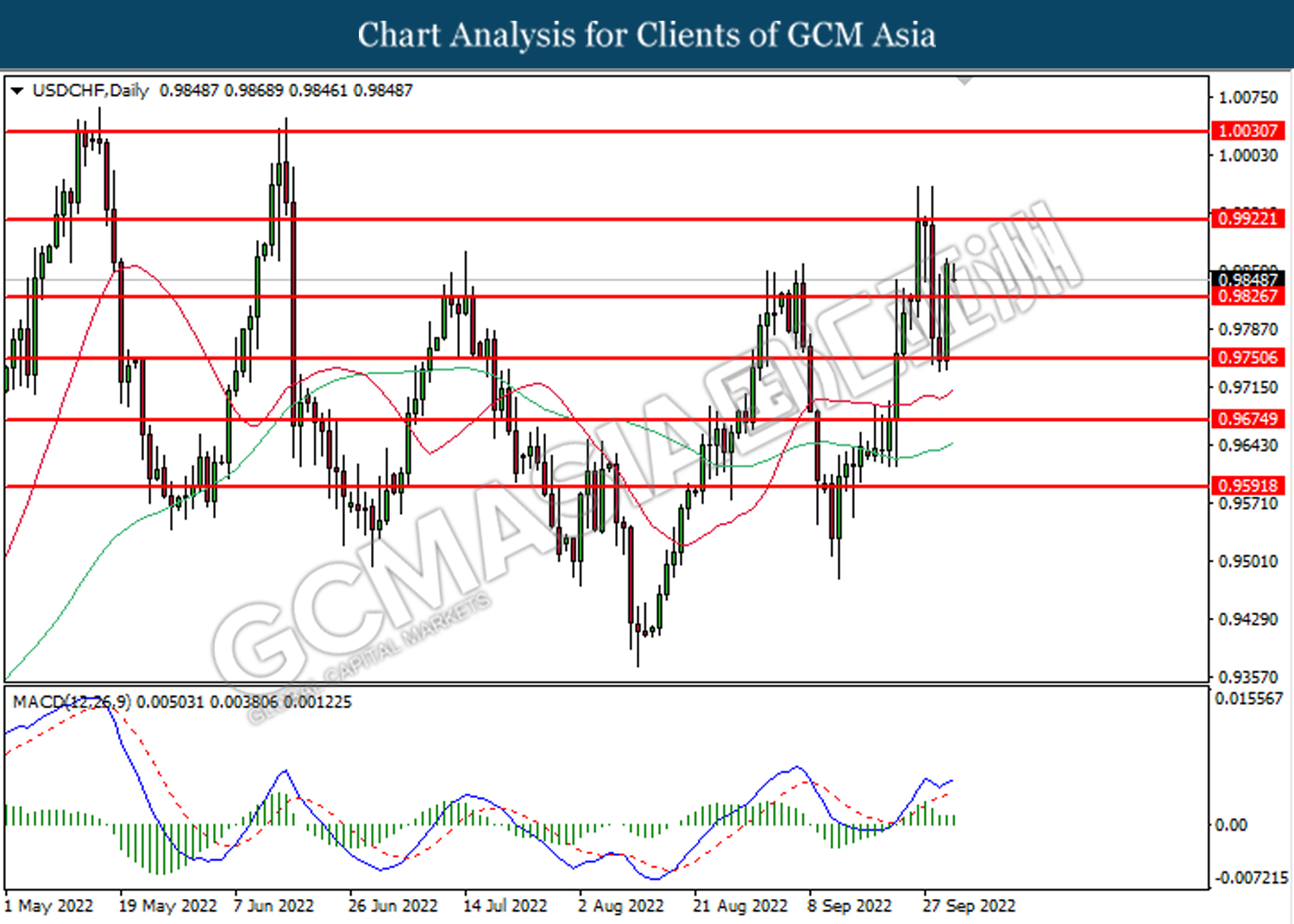

USDCHF, H4: USDCHF was traded higher following prior rebound form the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0020, 1.0100

Support level: 0.9930, 0.9865

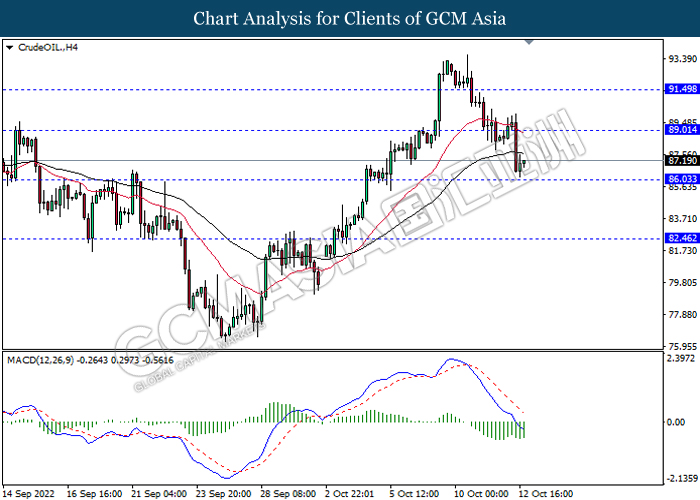

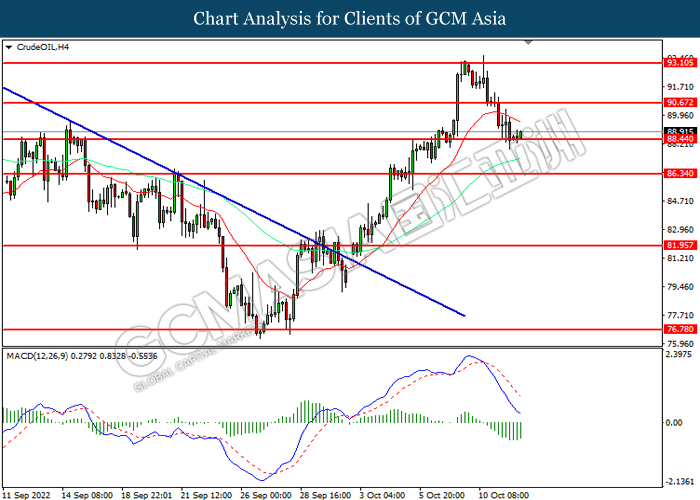

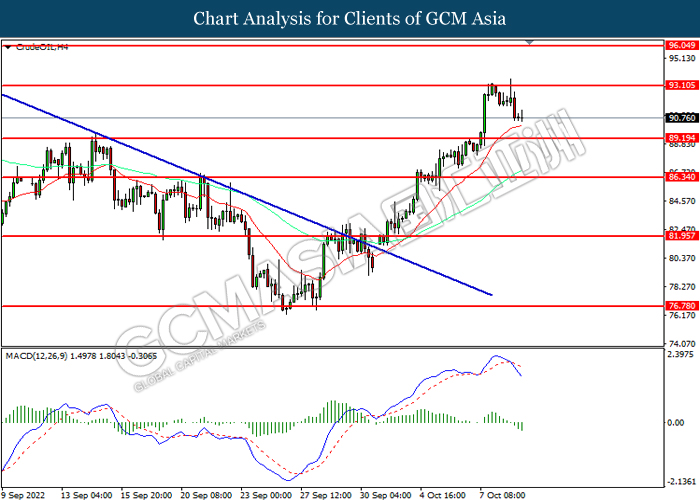

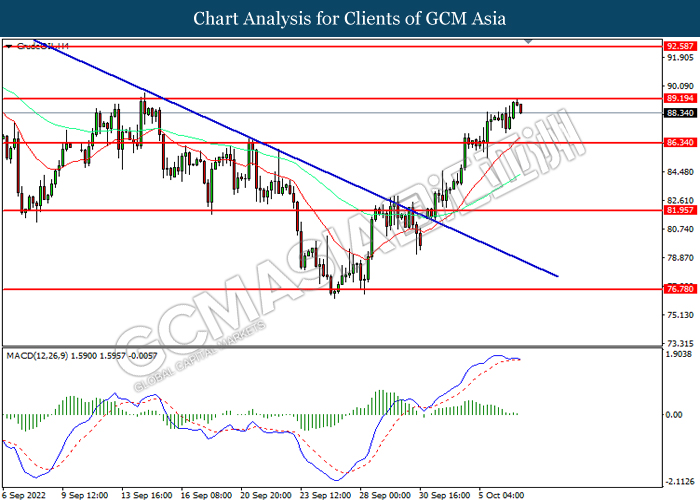

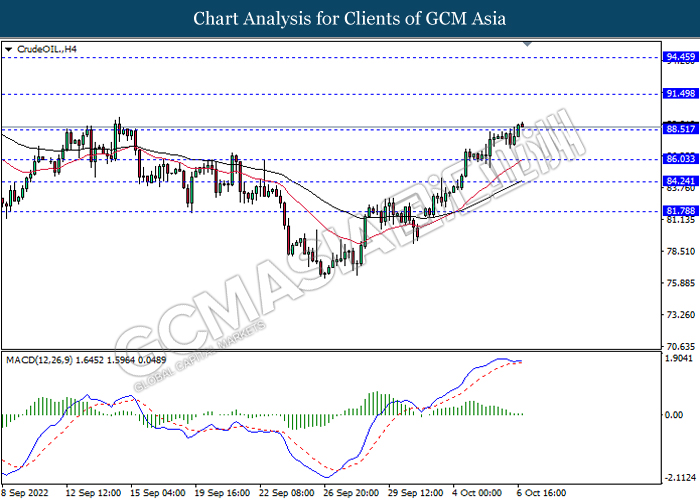

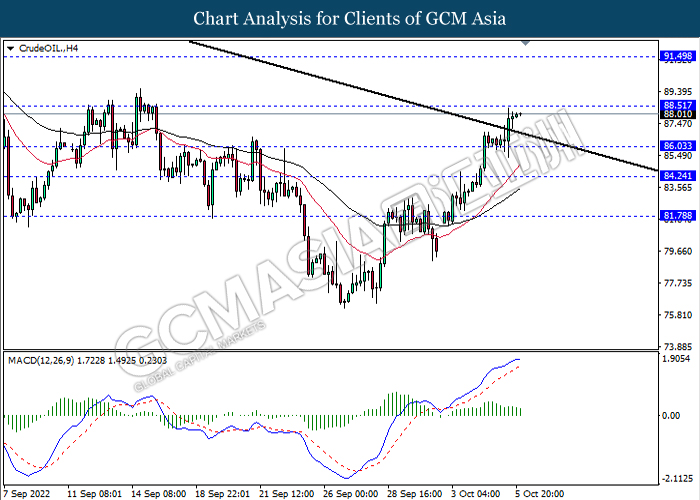

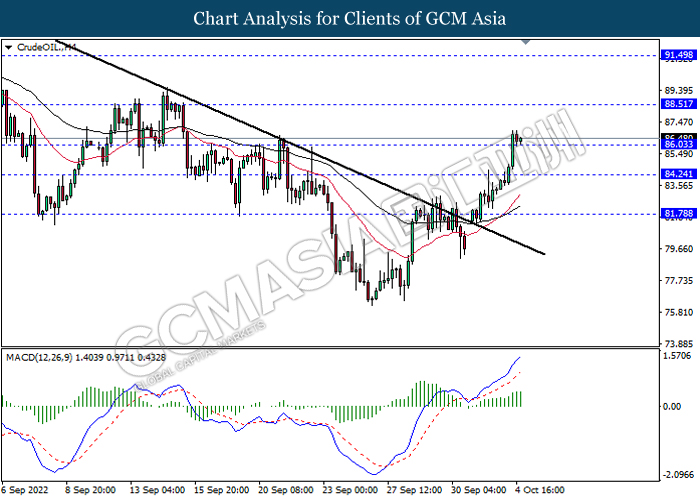

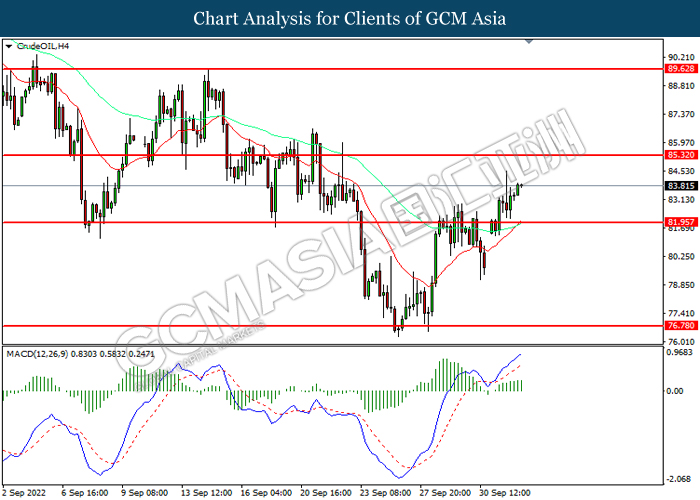

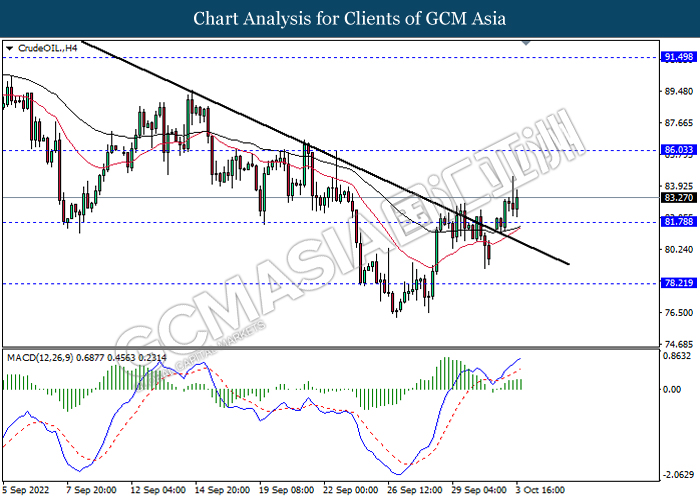

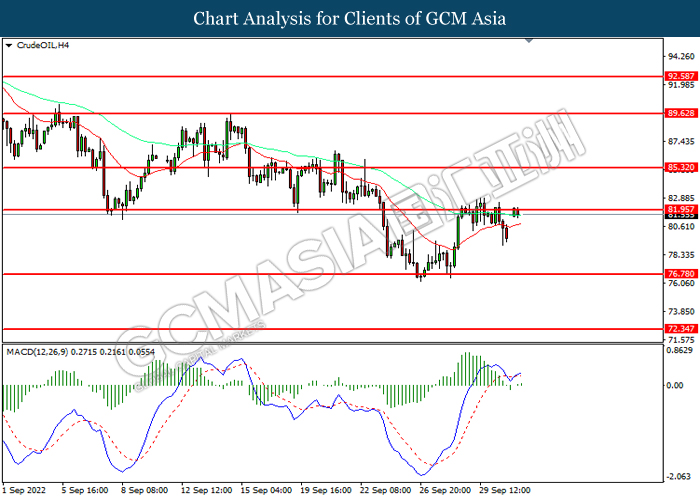

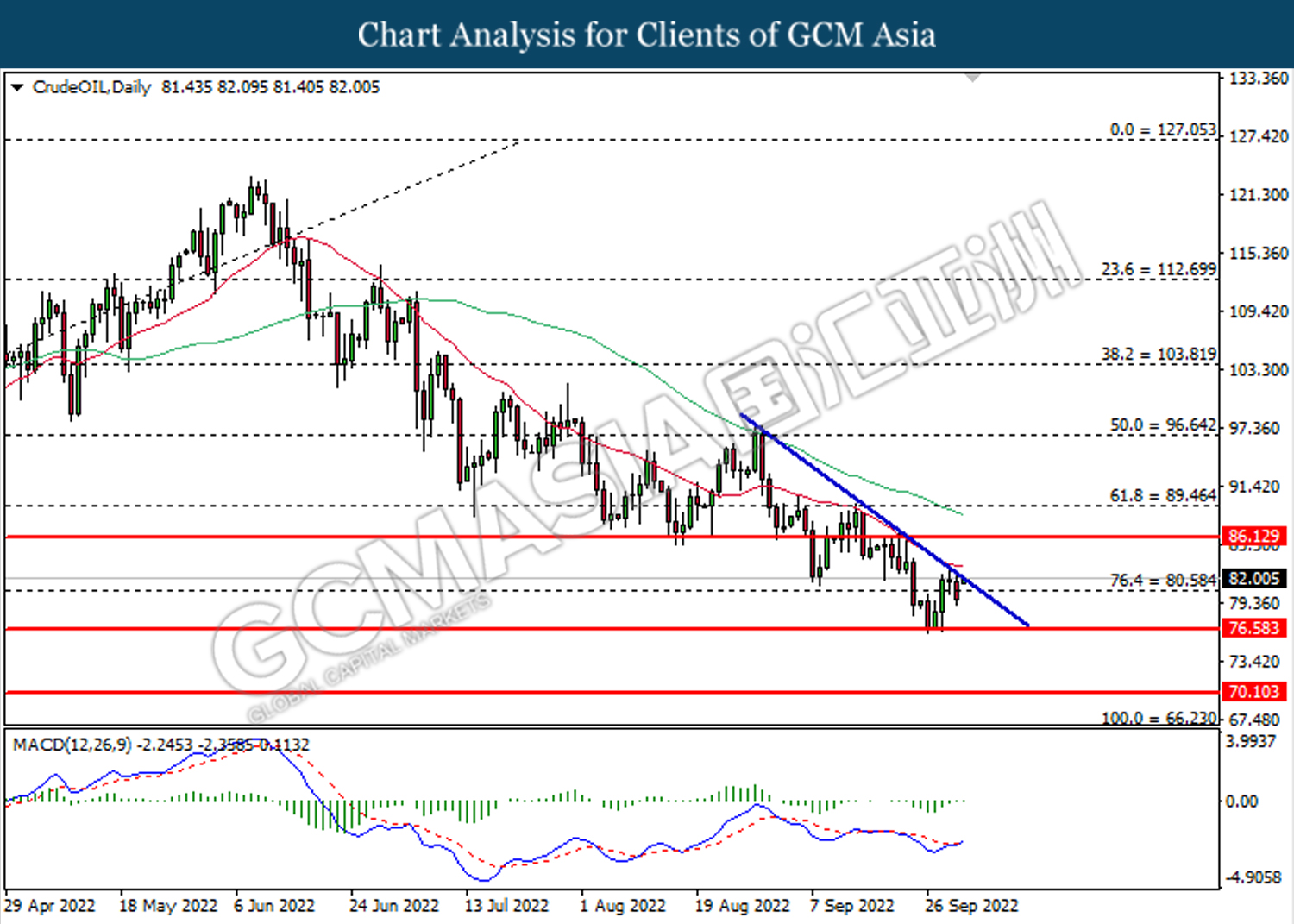

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 89.00, 91.50

Support level: 86.05, 82.45

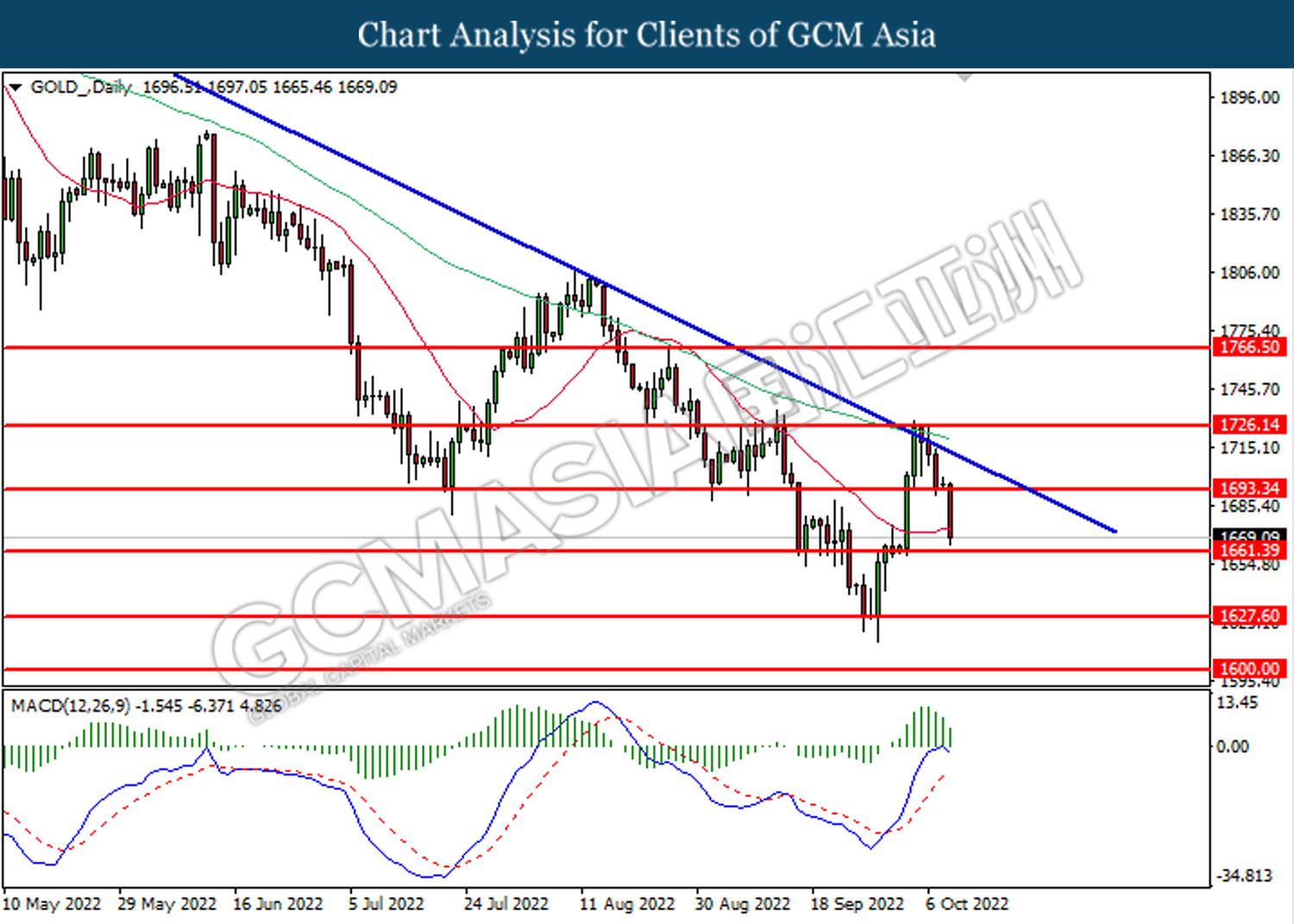

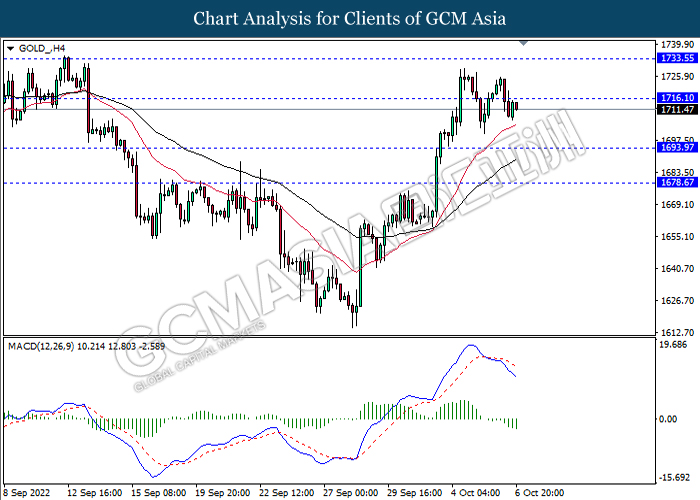

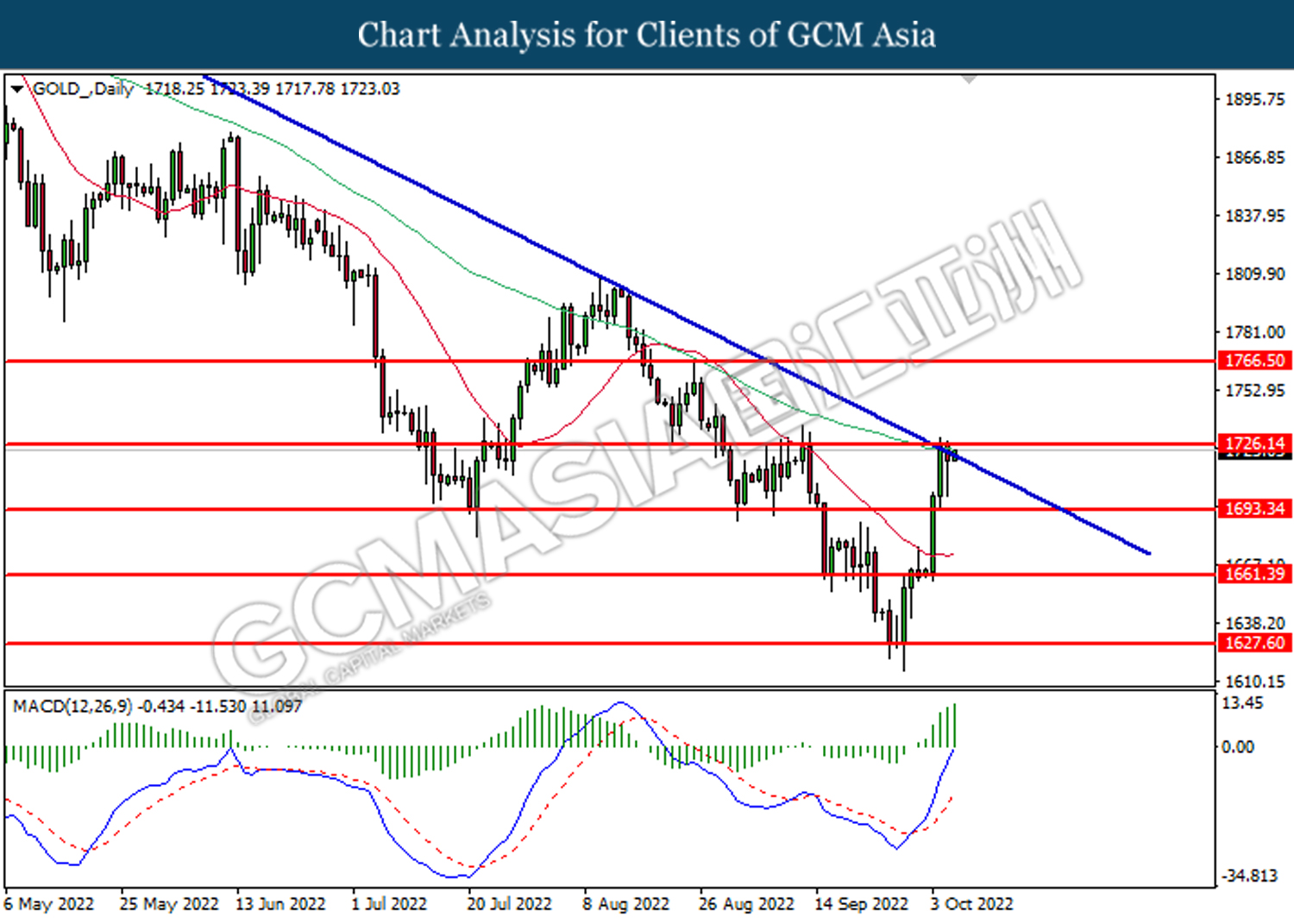

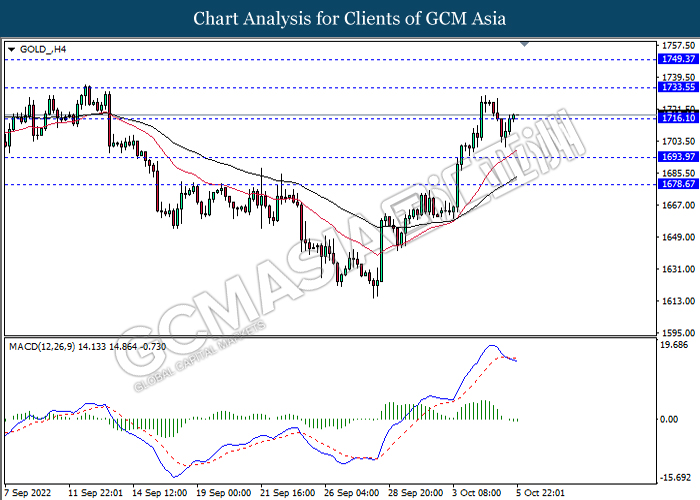

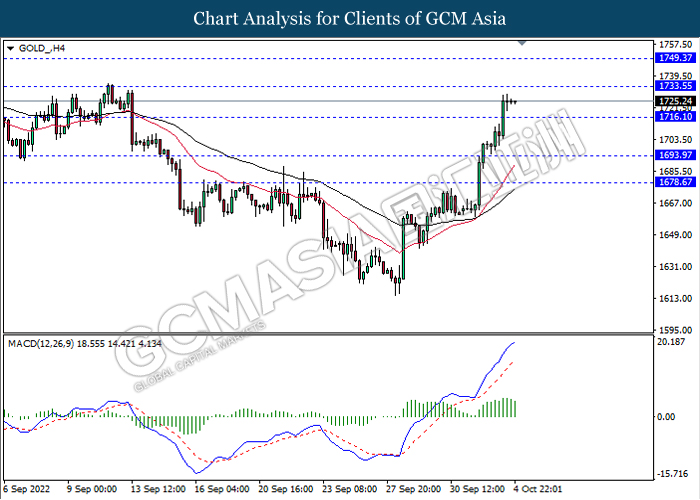

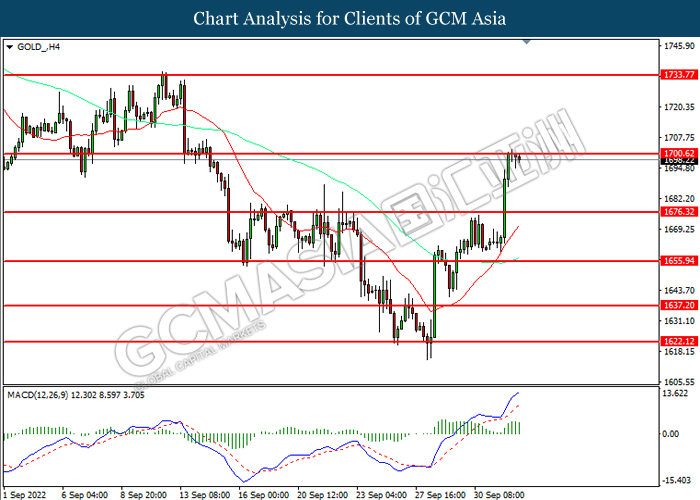

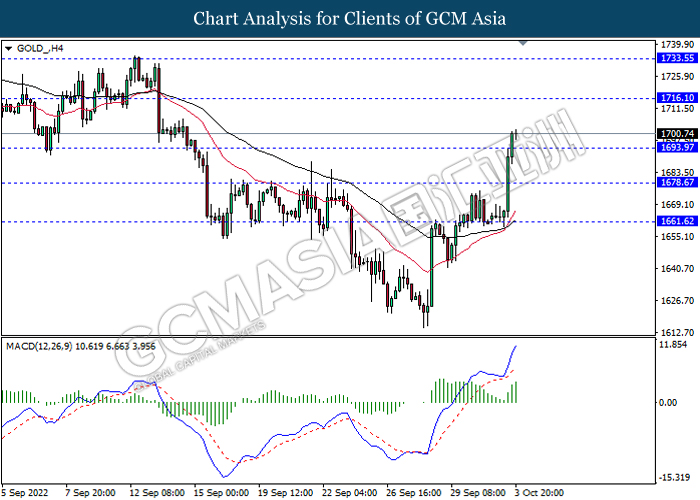

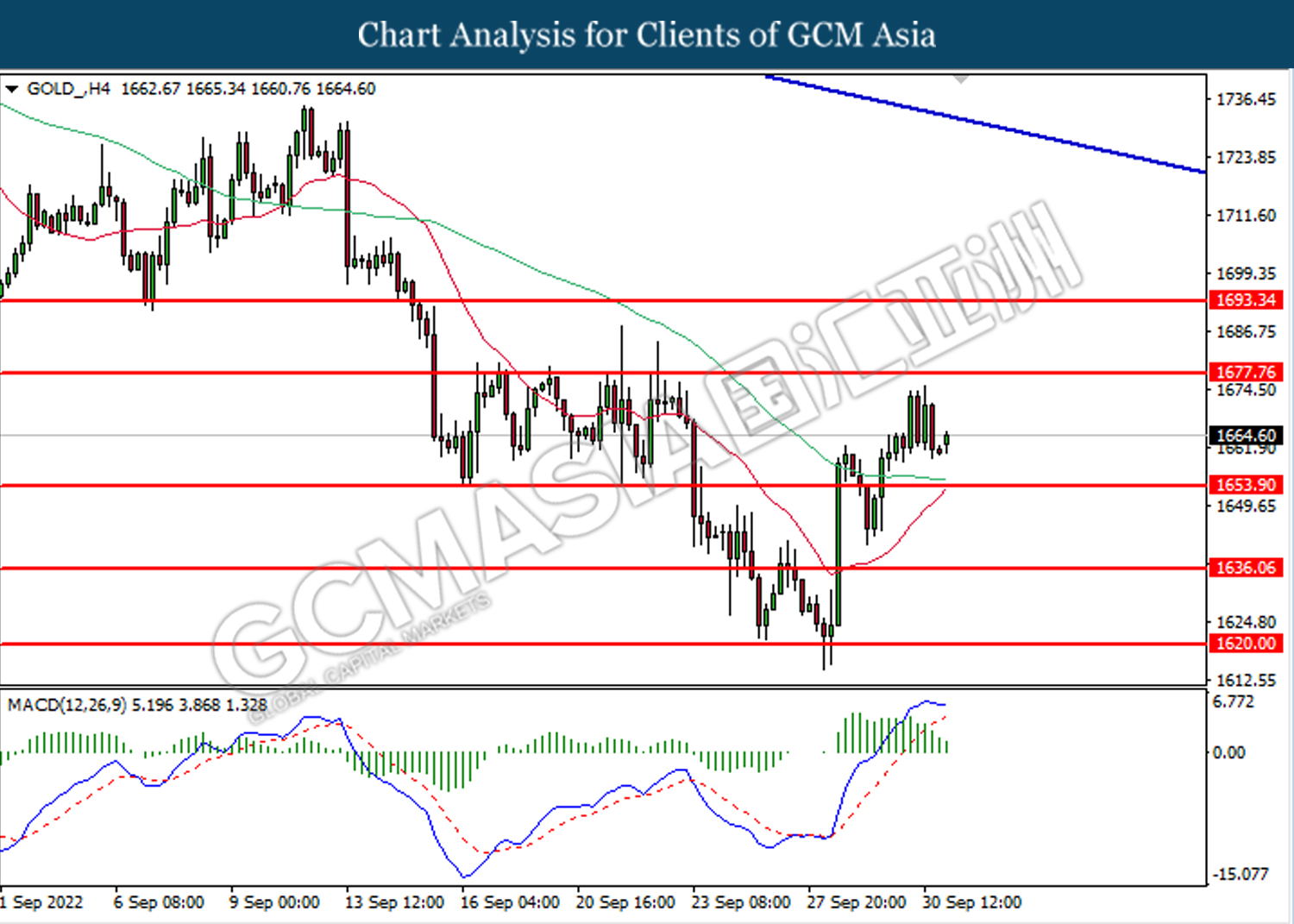

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1678.65, 1693.95

Support level: 1659.90, 1637.75

121022 Afternoon Session Analysis

12 October 2022 Afternoon Session Analysis

Japanese Yen slumped into 24-year low, trigger intervention expectation.

The Japanese Yen slumped into another new 24-year low to US Dollar on Wednesday, spurring market expectation upon the currency intervention by Bank of Japan (BOJ) to stabilize the significant depreciation of the currency. The Japan is currently struggling to cope with high inflation and expensive commodity imports, both of which jeopardizing the Japan’s economy this year. On the other hand, the aggressive rate hike expectation from Federal Reserve had also widened the interest rate gap between Japanese and US Treasury yield. The Bank of Japan has so far shown no indication to increase their interest rates from ultra-low levels, citing continued recession risk in the Japanese region. On the other hand, the US Dollar extend its gains following the International Monetary Fund cut its global economic growth forecast in 2023, which stoked a shift in sentiment toward the safe-haven US Dollar. As of writing, USD/JPY appreciated by 0.24% to 146.20 while the Dollar Index surged 0.21% to 113.25.

In the commodities market, the crude oil price depreciated by 0.01% to $88.60 per barrel as of writing. The oil market edged lower amid rising recession risk in global economy continue to weigh down the appeal for this black-commodity. On the other hand, the gold price dipped by 0.05% to $1665.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) | 0.2% | 0.0% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Aug) | 0.1% | 0.2% | – |

| 20:30 | USD – PPI (MoM) (Sep) | -0.1% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 114.35, 117.05

Support level: 109.95, 107.55

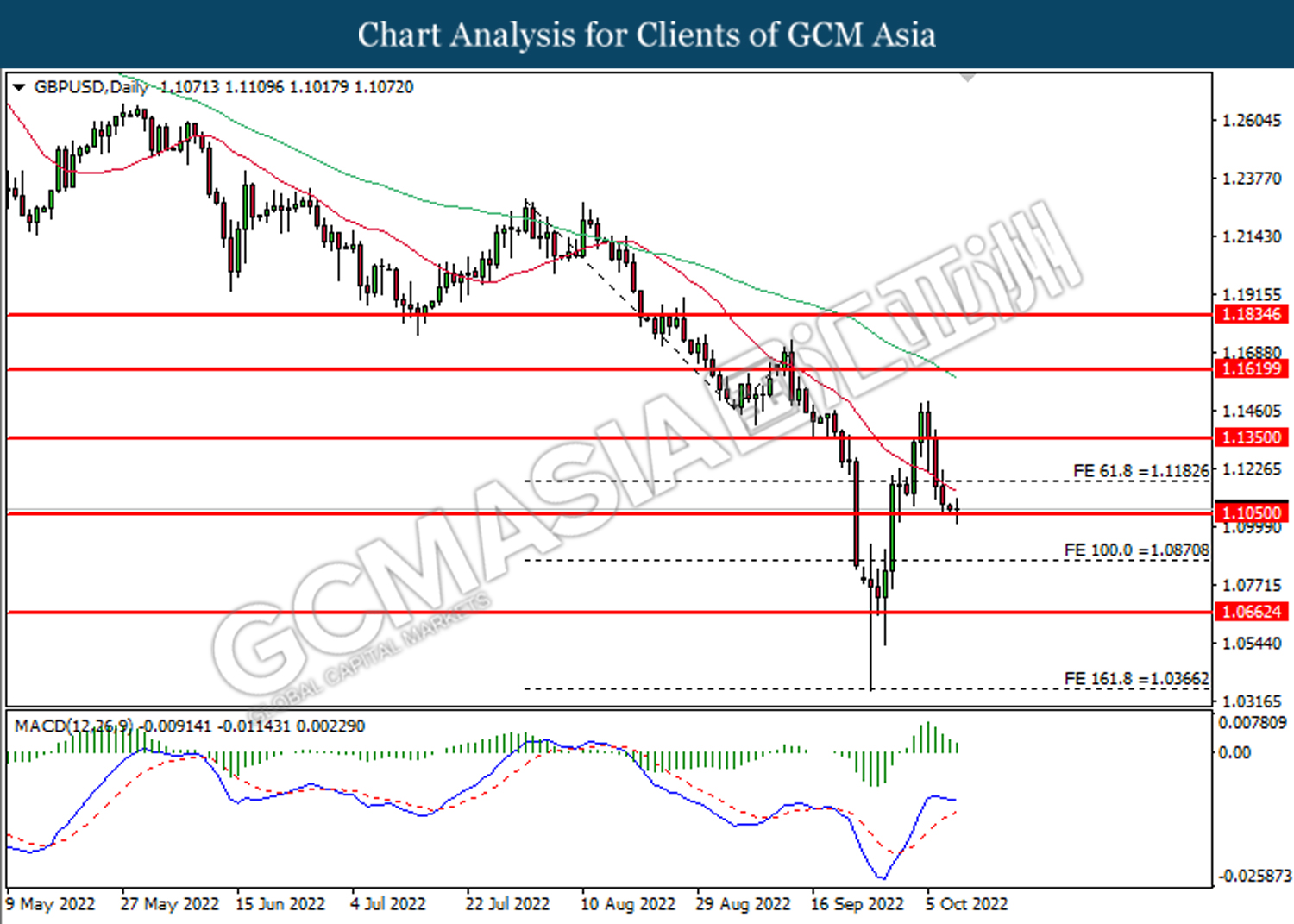

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.1045, 1.1455

Support level: 1.0785, 1.0580

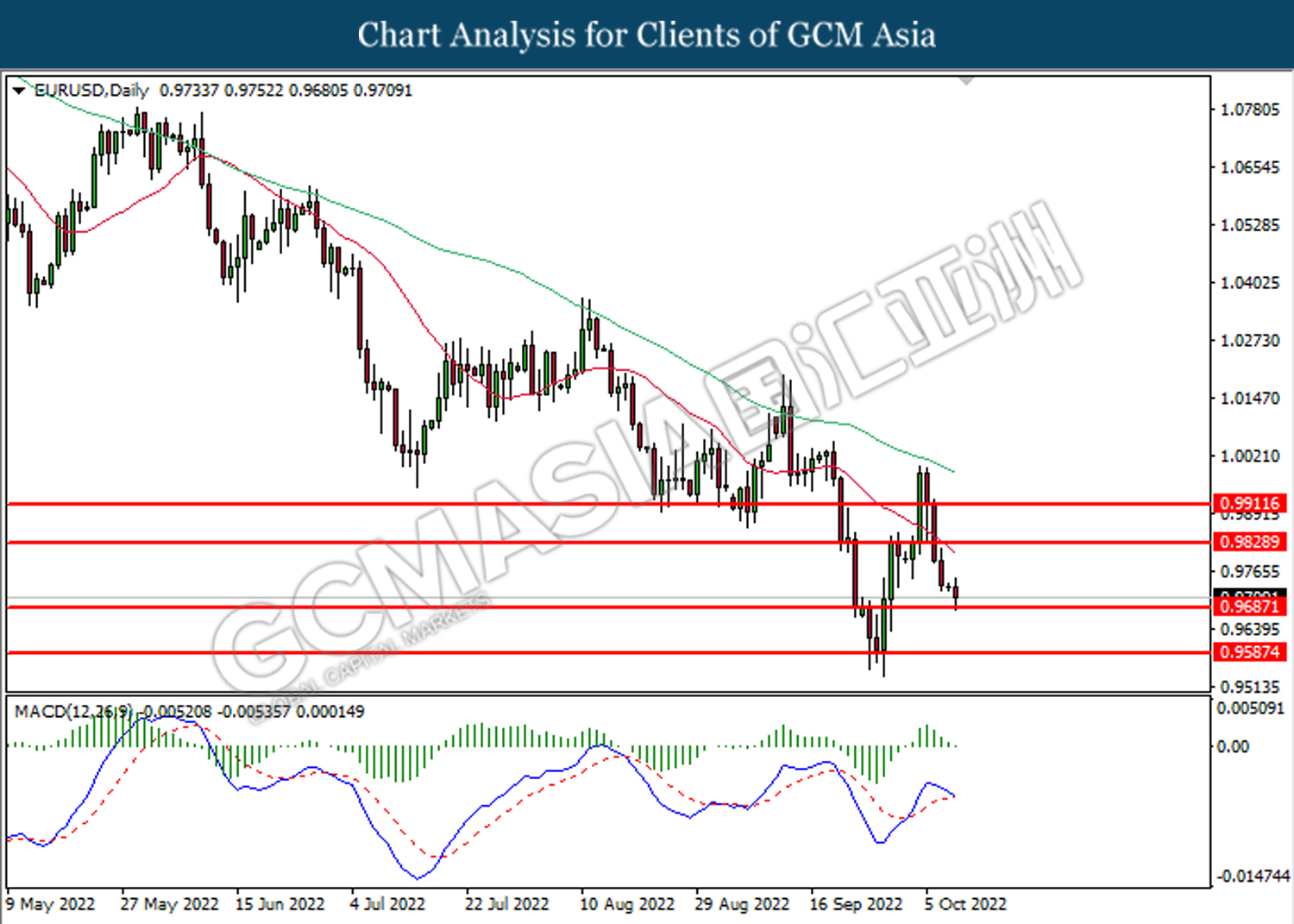

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9980, 1.0315

Support level: 0.9615, 0.9390

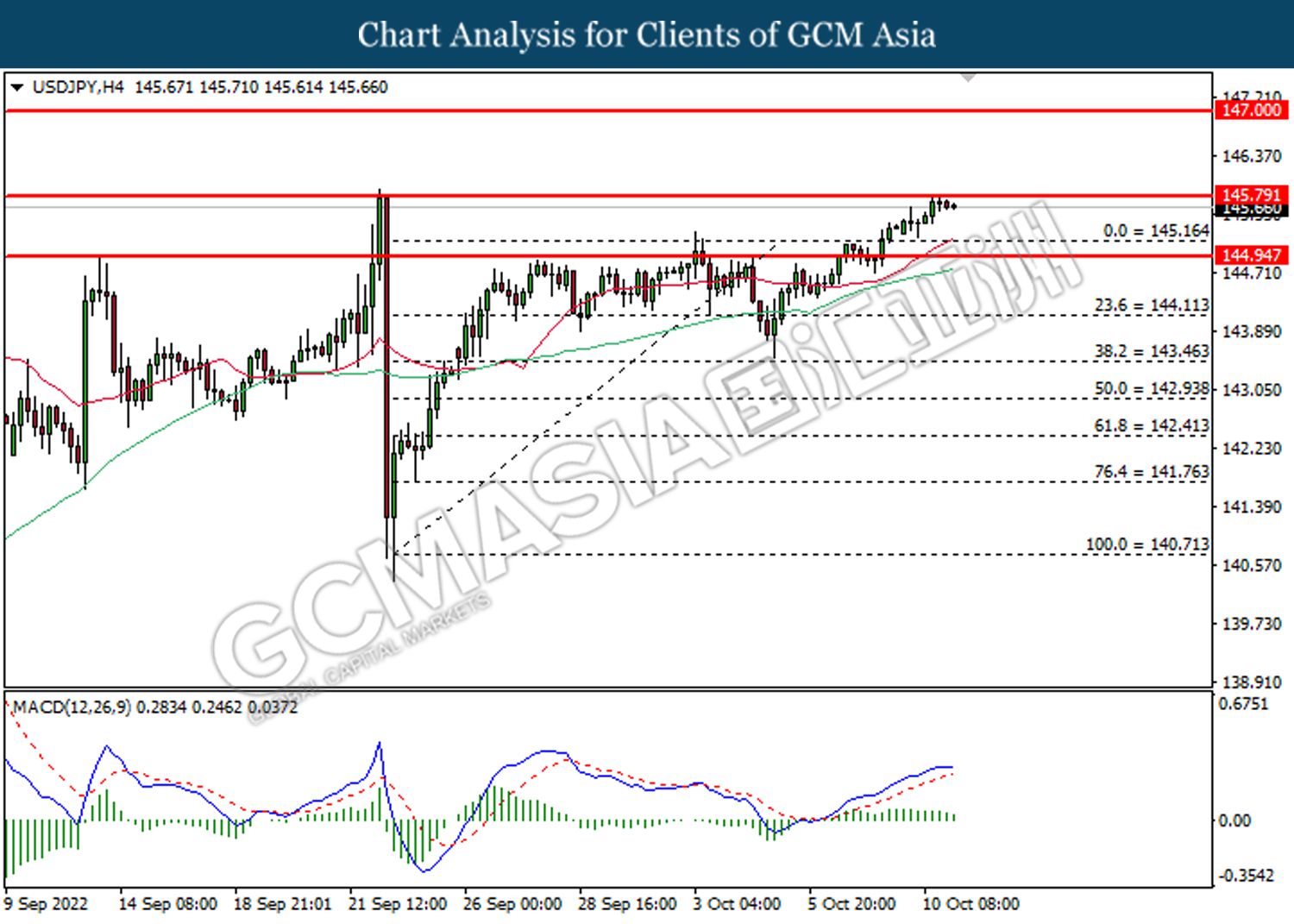

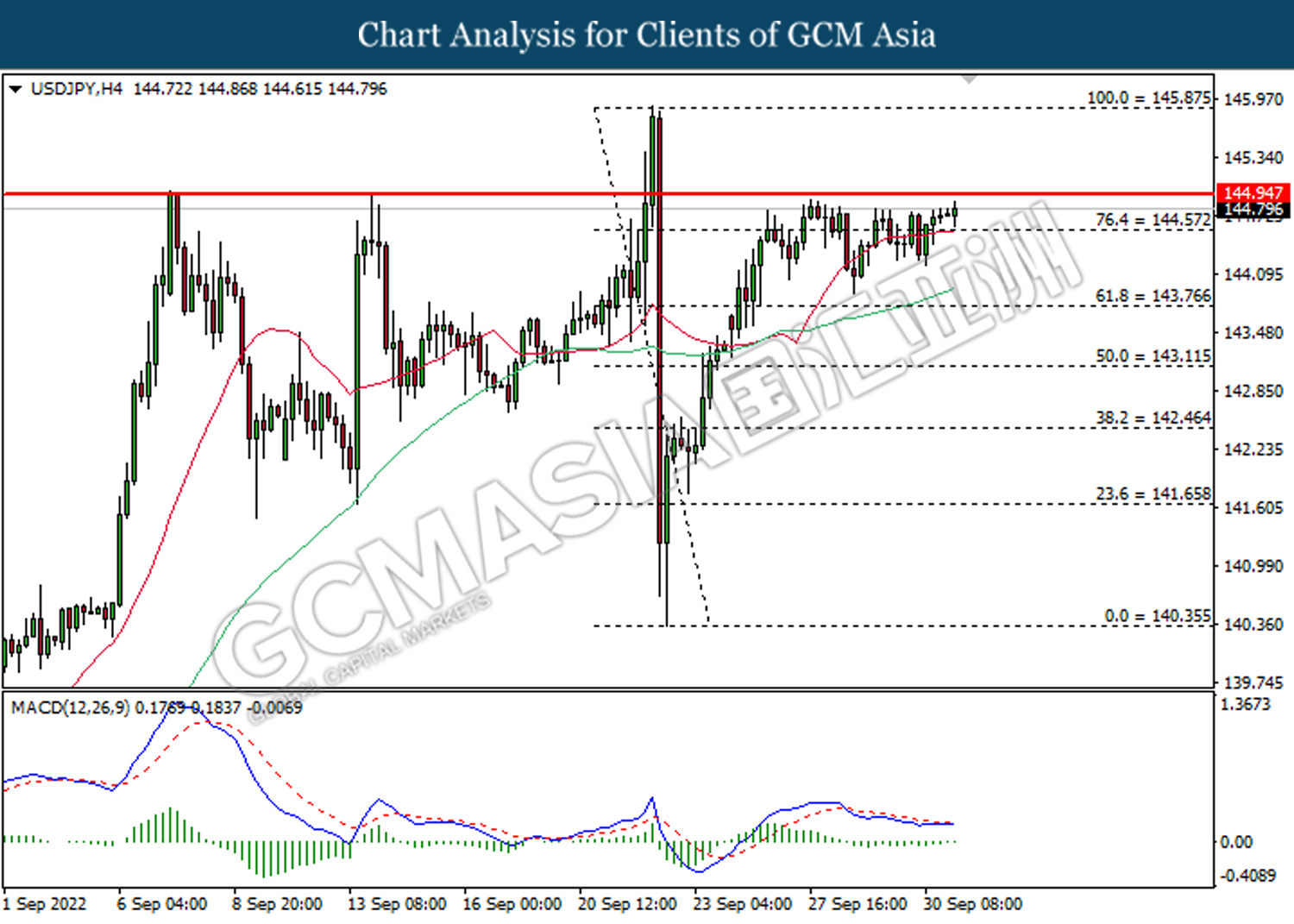

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 145.80, 150.15

Support level: 141.15, 136.55

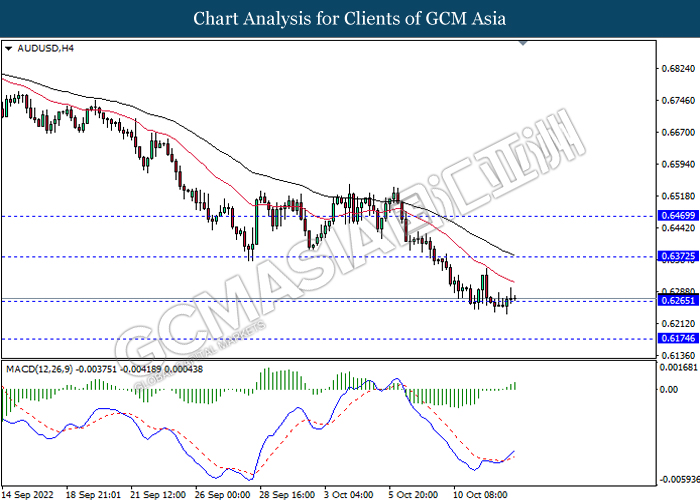

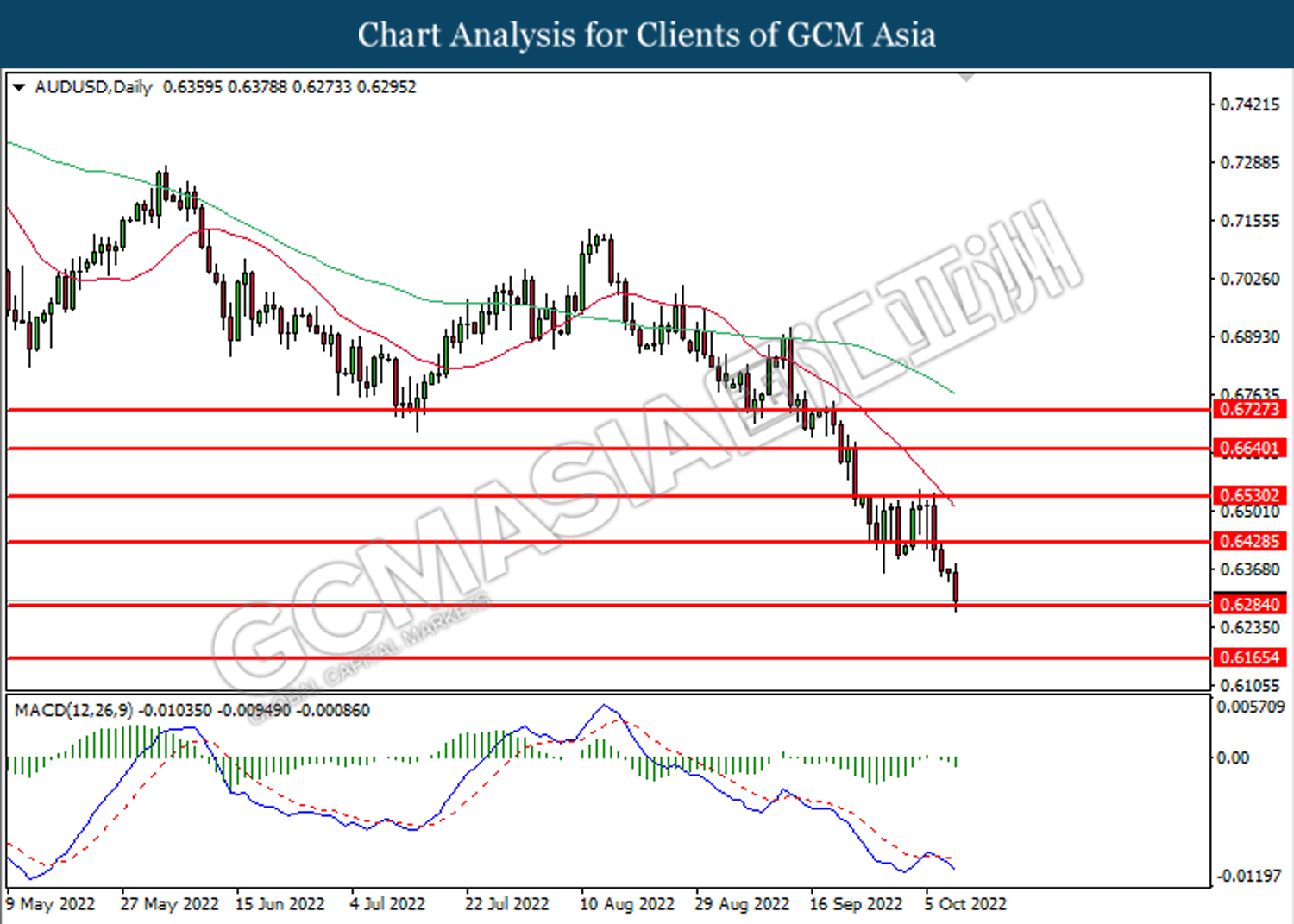

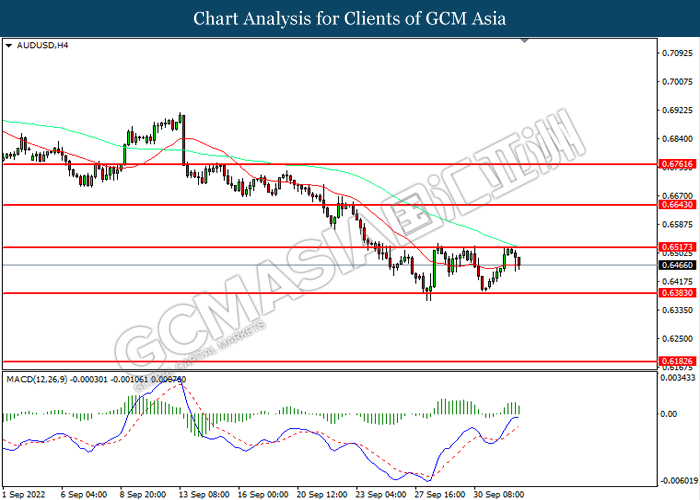

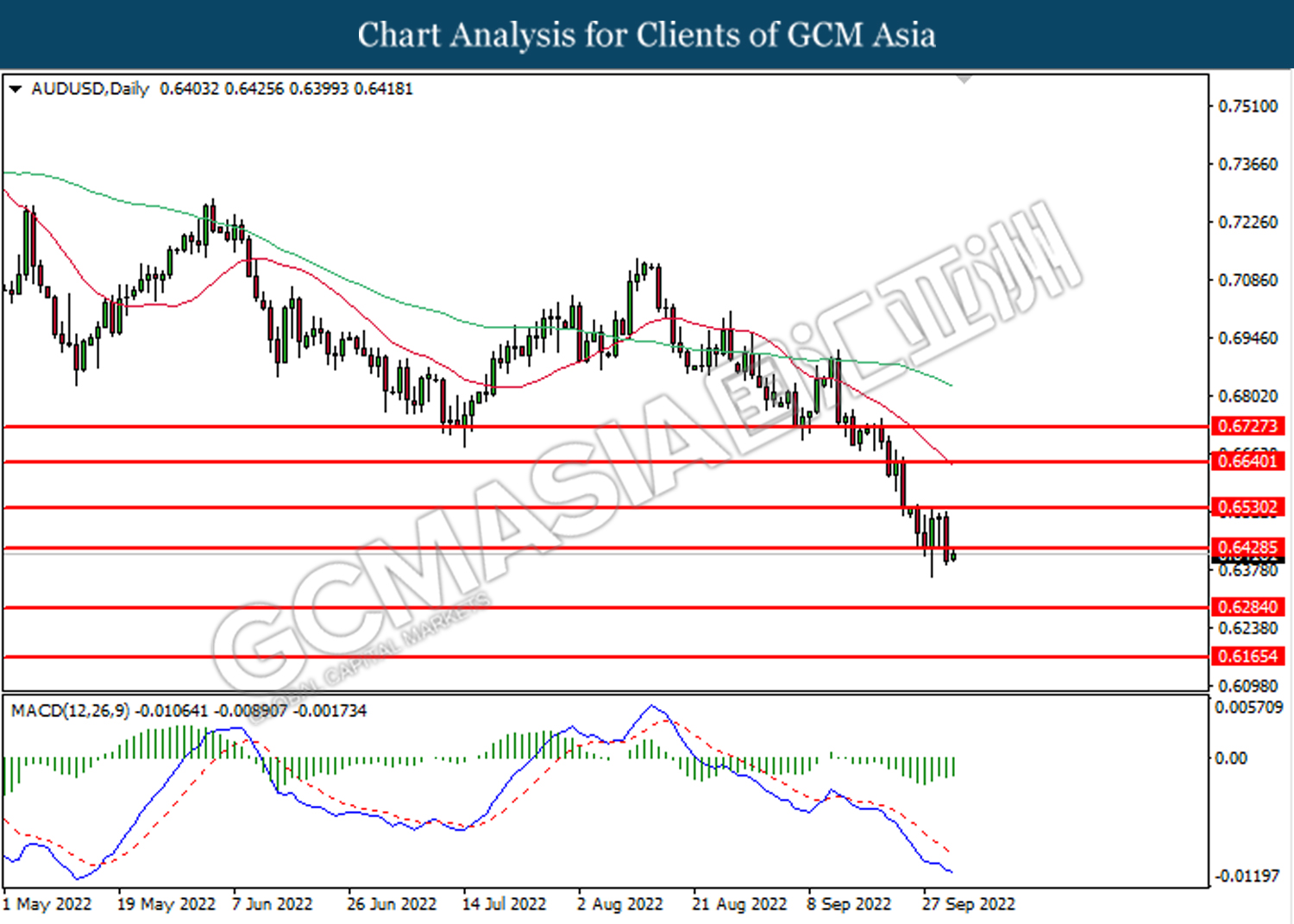

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6515

Support level: 0.6185, 0.5985

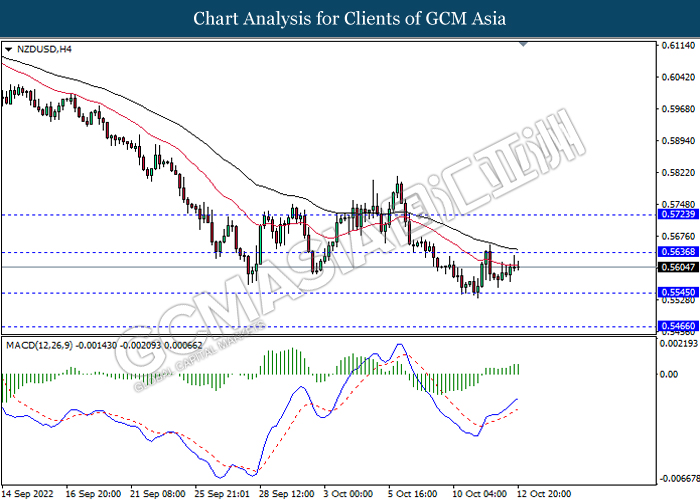

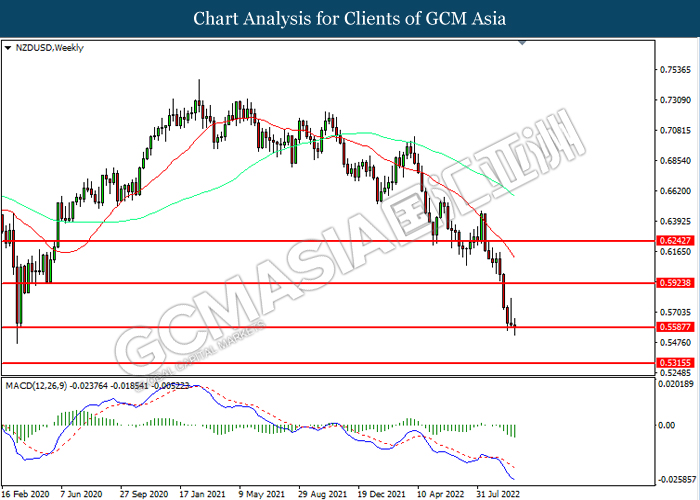

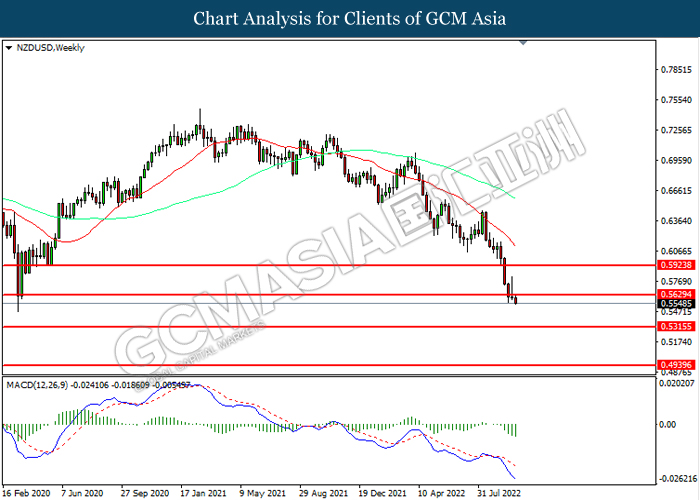

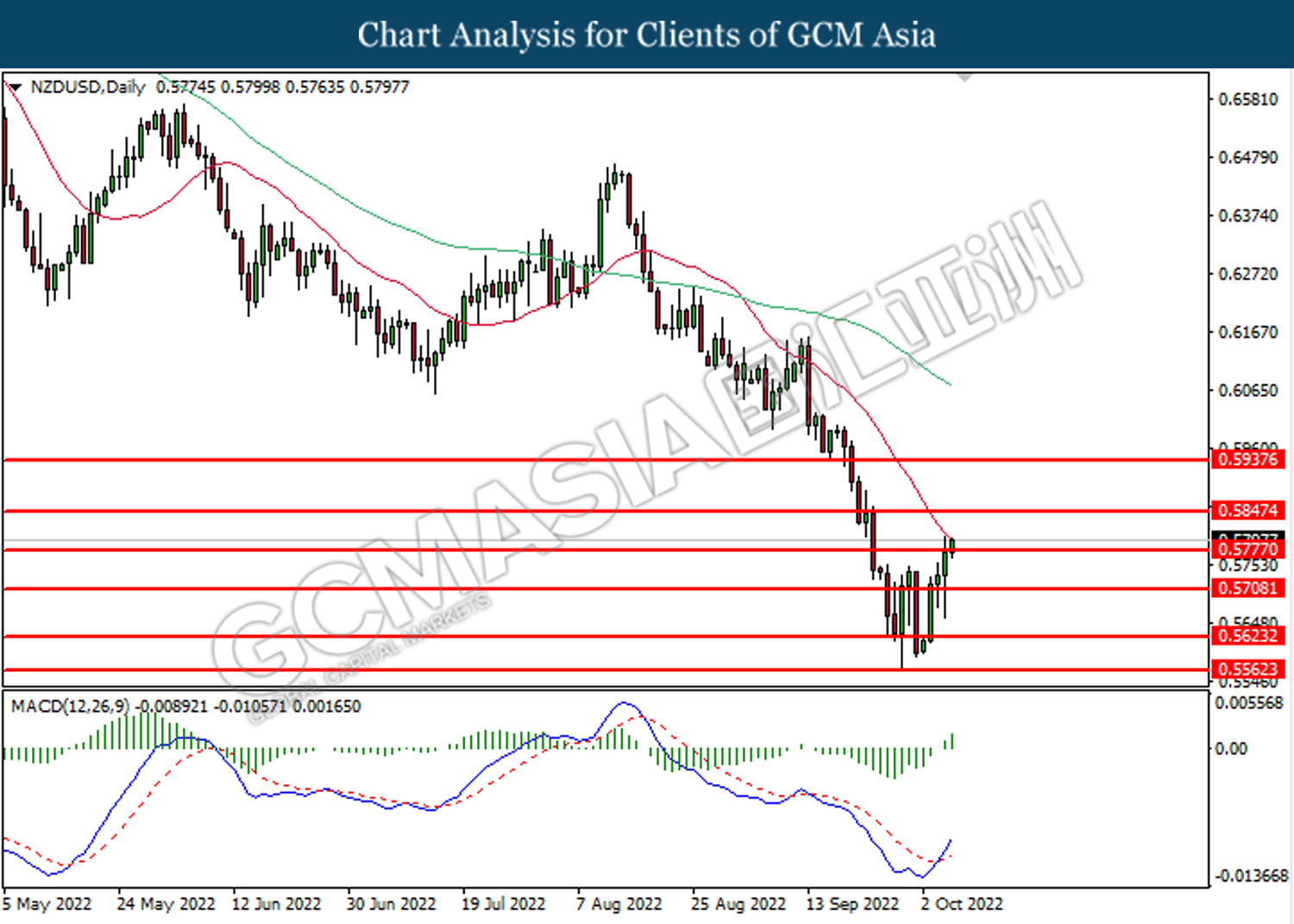

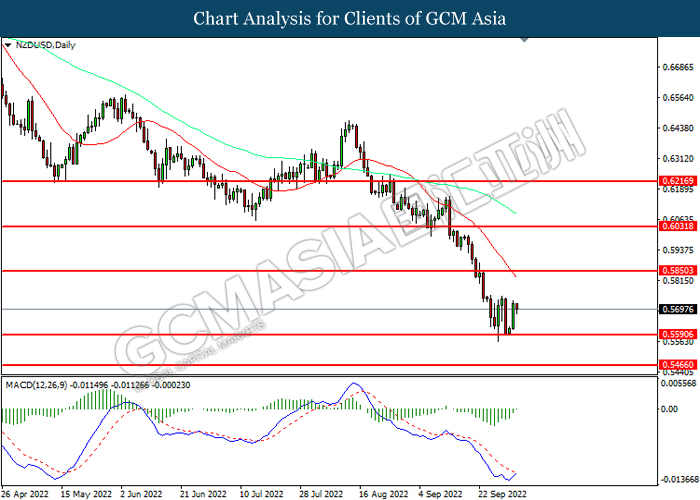

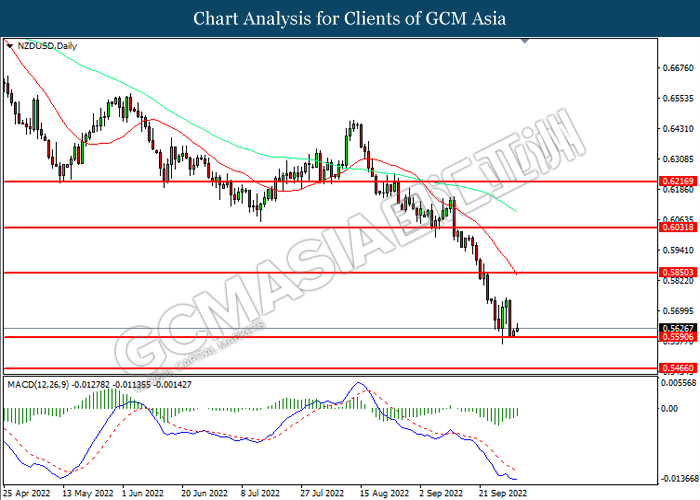

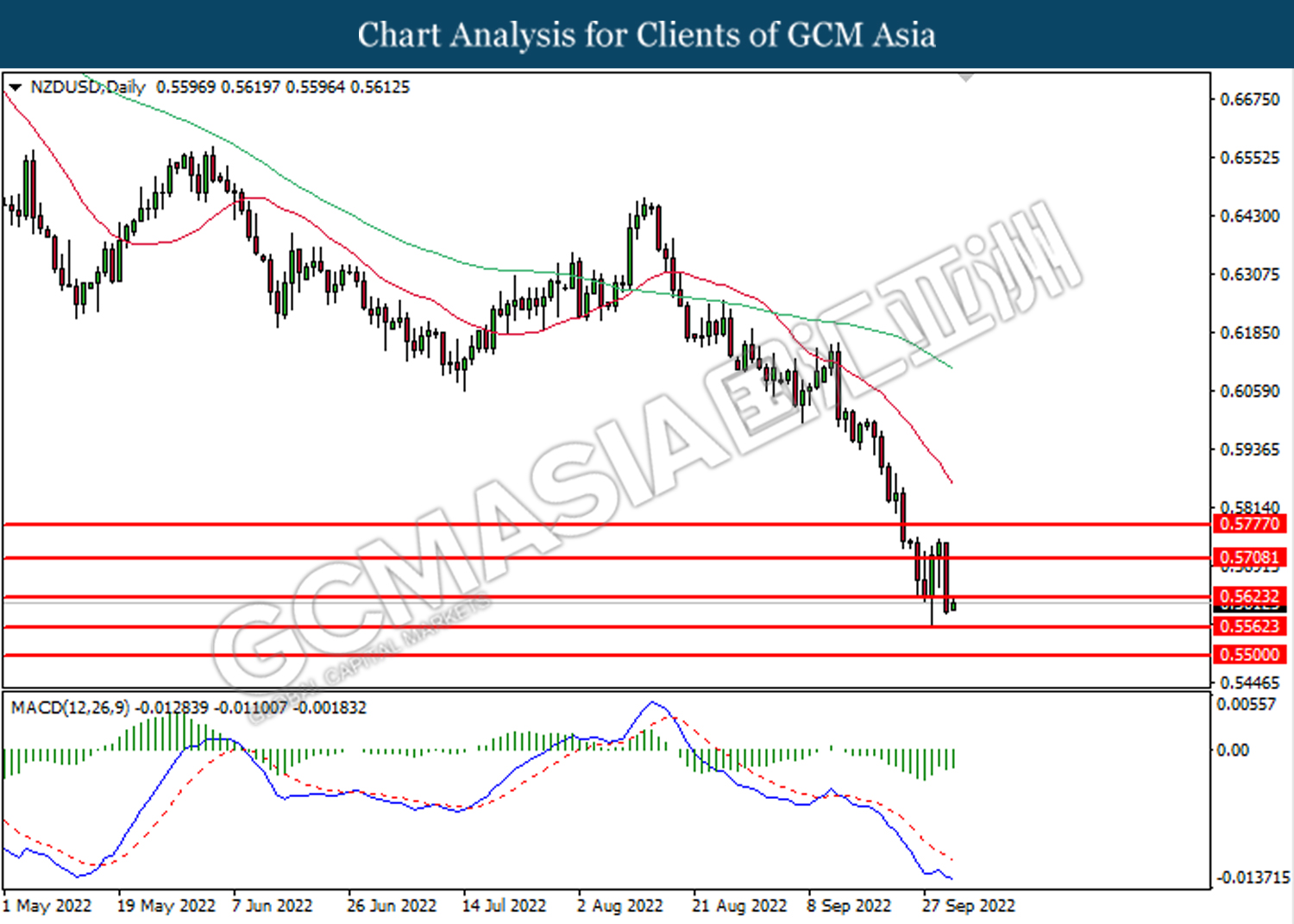

NZDUSD, Weekly: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.5925, 0.6245

Support level: 0.5585, 0.5315

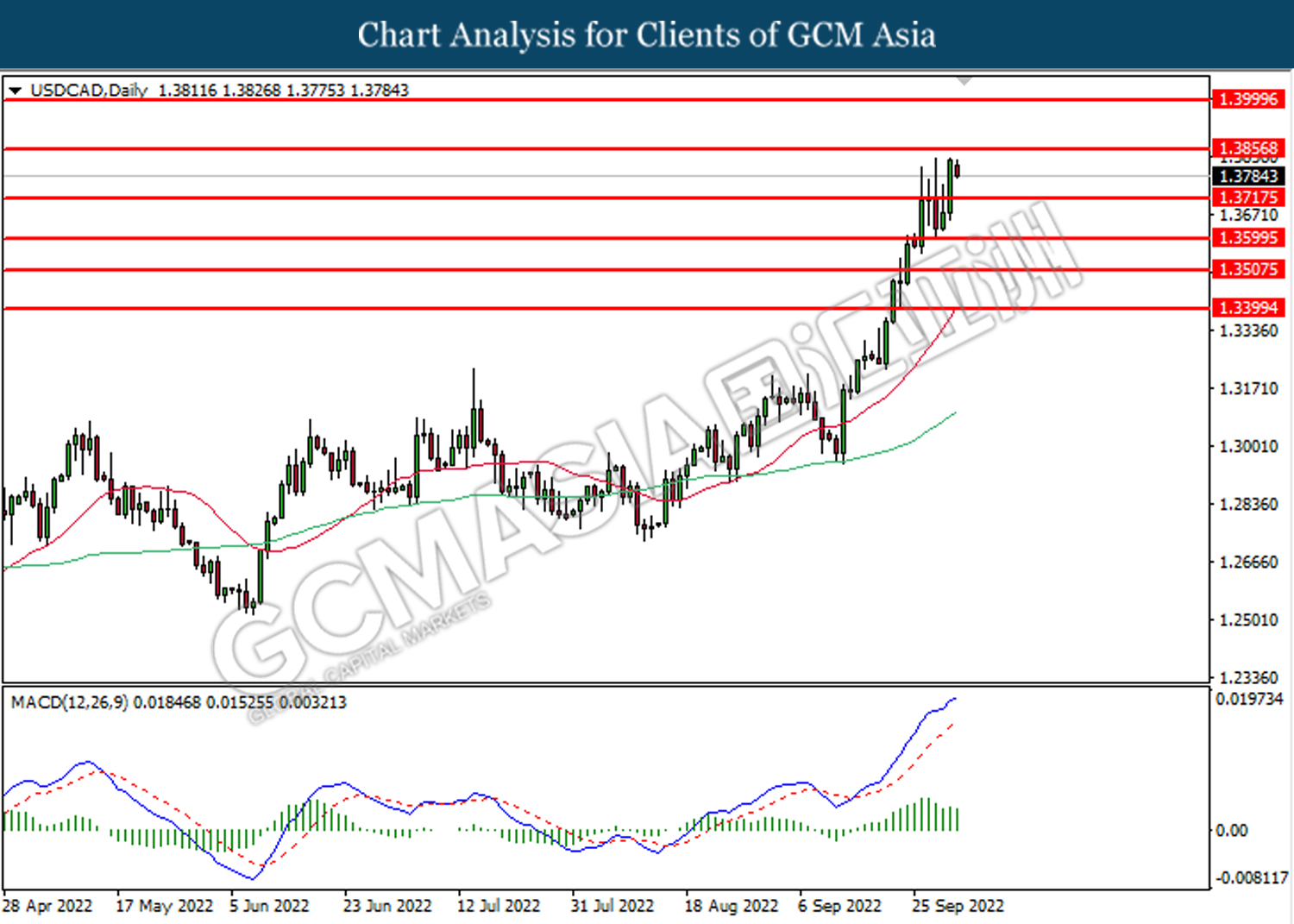

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3820, 1.3970

Support level: 1.3500, 1.3315

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 90.65, 93.10

Support level: 88.45, 86.35

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1676.30, 1700.60

Support level: 1660.95, 1642.85

121022 Morning Session Analysis

12 October 2022 Morning Session Analysis

Pound Sterling slipped as UK financial market remained fragile.

The GBP/USD, which is widely traded by global investors dropped significantly amid the instability of UK financial markets. According to CNBC, Bank of England Governor Andrew Bailey claimed on today early morning that the market volatility was over bank stress test, which lead a serious risk on the UK financial markets. Besides that, he reiterated that the bond buying program was “temporary”, saying that the support from the UK central bank is about to end soon while the gilts market condition still remained fragile, which diminishing the market confidence on the UK economic progression. Nonetheless, the losses experienced by Pound Sterling was limited over the upbeat economic data. According to Office for National Statistics, the UK Average Earnings Index + Bonus notched up from the previous reading of 5.5% to 6.0%, exceeding the consensus forecast of 5.9%. As of now, investors would continue to scrutinize the unleash of UK GDP data in order to gauge the likelihood movement of the pairing. As of writing, GBP/USD edged up by 0.10% to 1.0975.

In the commodities market, the crude oil price depreciated by 0.83% to $88.60 per barrel as of writing as China suffered another wave of Covid-19 pandemic, which prompted local authorities hastily closing schools, entertainment venues and tourist spots. On the other hand, the gold price eased by 0.83% to $1665.39 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) | 0.2% | 0.0% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Aug) | 0.1% | 0.2% | – |

| 20:30 | USD – PPI (MoM) (Sep) | -0.1% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 114.40, 115.65

Support level: 113.00, 111.50

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1165, 1.1370

Support level: 1.0885, 1.0630

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9730, 0.9810

Support level: 0.9645, 0.9555

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6265, 0.6370

Support level: 0.6175, 0.6070

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.5635, 0.5725

Support level: 0.5545, 0.5465

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

USDCHF, H4: USDCHF was traded higher following prior rebound form the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0020, 1.0100

Support level: 0.9930, 0.9865

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 89.00, 91.50

Support level: 86.05, 82.45

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1678.65, 1693.95

Support level: 1659.90, 1637.75

111022 Afternoon Session Analysis

11 October 2022 Afternoon Session Analysis

Escalate tensions between Russia-Ukraine, weigh down Euro.

The Euro extends its losses significantly following the heightening tensions between Russia-Ukraine continue to spark further uncertainty toward the economic momentum in European region. According to Reuters, Russia unleashed its most widespread strikes against Ukraine in a month, knocked out power and water, shattered buildings and killed people in Ukraine. Ukraine’s Emergency Services claimed that nearly 100 people were wounded in the morning rush hour attacks that Russia launched from the air. The strike would likely to intensify the tensions between European countries and Russia, leading to a more aggressive sanction as tit-for-tat for Russia. On the other hand, the pair of EUR/USD received further bearish momentum as rate hike expectation from the Federal Reserve continue to prompt investors to shift their investment from Euro into US Dollar. Fed Vice Chair Lael Brainard unleashed his hawkish statement recently, reiterating that the Federal Reserve will keep raising interest rates in the near-term. As of writing, EUR/USD depreciated by 0.07% to 0.9690.

In the commodities market, the crude oil price appreciated by 0.01% to $90.75 per barrel as of writing. The overall prospect for the crude oil still remained bullish as market participants remained concerns that potential escalation conflict between Russia-Ukraine would lead to supply disruption for this black-commodity. On the other hand, the gold price depreciated by 0.15% to $1665.45 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Aug) | 5.5% | 5.9% | – |

| 14:00 | GBP – Claimant Count Change (Sep) | 6.3K | 4.2K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 114.35, 117.05

Support level: 109.95, 107.55

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1455, 1.1735

Support level: 1.1040, 1.0785

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9740, 0.9915

Support level: 0.9550, 0.9460

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 145.80, 150.15

Support level: 141.15, 136.55

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6385, 0.6515

Support level: 0.6185, 0.5985

NZDUSD, Weekly: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.5630, 0.5925

Support level: 0.5315, 0.4940

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3820, 1.3970

Support level: 1.3500, 1.3315

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 93.10, 96.05

Support level: 89.20, 86.35

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1676.30, 1700.60

Support level: 1660.95, 1642.85

111022 Morning Session Analysis

11 October 2022 Morning Session Analysis

Greenback surged amid upbeat job reports.

The dollar index, which is traded against a basket of six major currencies managed to extend its gains while heading back to the recent high as the currency was still supported by Friday’s job data from the US. According to the Bureau of Labor Statistics, the US Nonfarm Payrolls came in at 263K, slightly higher than the consensus forecast at 250K. On top of that, another crucial data used to gauge the US labour market condition also posted a solid reading last Friday. The US Unemployment Rate dropped from the previous month’s reading of 3.7% to 3.5%, proving that employment in the US is still growing at a solid pace. This series of positive data diminished the market expectation of a U-turn of an aggressive rate hike by the Federal Reserve while confirming the prospect of another jumbo-sized rate hike in the next meeting. Going forward, the market participants would have all eyes on the upcoming inflation data – CPI, which would definitely provide further hints for the direction of the Fed’s monetary path. As of writing, the US dollar is up 0.34% to 113.20.

In the commodities market, the crude oil price edged down -0.05% to $90.90 per barrel as the trades took profit after the oil price hit the highest level in 6 weeks. Besides, the gold prices depreciated by -0.01% to $1668.40 per troy ounce amid the US dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Aug) | 5.5% | 5.9% | – |

| 14:00 | GBP – Claimant Count Change (Sep) | 6.3K | 4.2K | – |

Technical Analysis

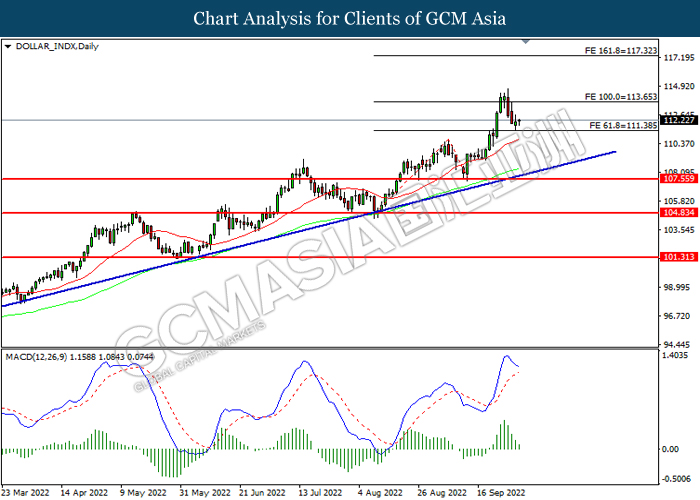

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 113.30. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1050. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1185, 1.1350

Support level: 1.1050, 1.0870

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9685. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 145.80. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 145.80, 147.00

Support level: 145.15, 144.95

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6285. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6430, 0.6530

Support level: 0.6285, 0.6165

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.5560. MACD which illustrated diminishing bullish momentum suggest the pair to extend losses after it successfully breakout below the support level.

Resistance level: 0.5625, 0.5710

Support level: 0.5560, 0.5500

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3715. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3855.

Resistance level: 1.3855, 1.4000

Support level: 1.3715, 1.3600

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9920. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0030.

Resistance level: 1.0030, 1.0110

Support level: 0.9920, 0.9825

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 89.45.

Resistance level: 96.65, 103.80

Support level: 89.45, 86.15

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1661.40. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1693.35, 1726.15

Support level: 1661.40, 1627.60

071022 Afternoon Session Analysis

7 October 2022 Afternoon Session Analysis

Euro slumped as recession risk heightened.

The Euro retreated from its higher level following the European Central Bank expressed their concerns toward the economic slowdown in the Euro area. After a significant rebound in manufacturing activity in the first half of 2022, the recent data had signaled to a substantial slowdown in economic growth in European region, with the economy expected to stagnate later in 2022 and in the first quarter of 2023 as the rising rate hike decision as well as stagflation risk continue to spur negative prospect toward the global economic growth. In addition, the adverse geopolitical situation as the Russia’s war in Ukraine had also diminished the confidence of businesses and consumers. Currently, the inflation remained far too high and was likely to stay above target for an extended period. Spiking soaring energy and food prices, demand pressures in some sectors following the reopening of the economy still accelerated the inflation. As of writing, EUR/USD appreciated by 0.21% to 0.9810.

In the commodities market, the crude oil price surged 0.01% to $88.40 per barrel as of writing. The oil price was traded higher following the OPEC+ decided to reduce their oil production at 2 million barrels per day (bpd), while Goldman Sachs has raised its oil price forecast for this year and 2023. On the other hand, the gold price depreciated by 0.02% to $1712.00 per troy ounces ahead of crucial Nonfarm Payroll data tonight.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – National Day

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Sep) | 315K | 250K | – |

| 20:30 | USD – Unemployment Rate (Sep) | 3.70% | 3.70% | – |

| 20:30 | CAD – Employment Change (Sep) | -39.7K | 20.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 113.65, 117.30

Support level: 111.40, 109.95

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.1455, 1.1730

Support level: 1.1065, 1.0890

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6515, 0.6645

Support level: 0.6385, 0.6185

NZDUSD, H4: NZDUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.5850, 0.6030

Support level: 0.5590, 0.5465

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3820, 1.3970

Support level: 1.3500, 1.3315

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9965, 1.0035

Support level: 0.9860, 0.9755

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 89.20, 92.60

Support level: 86.35, 81.95

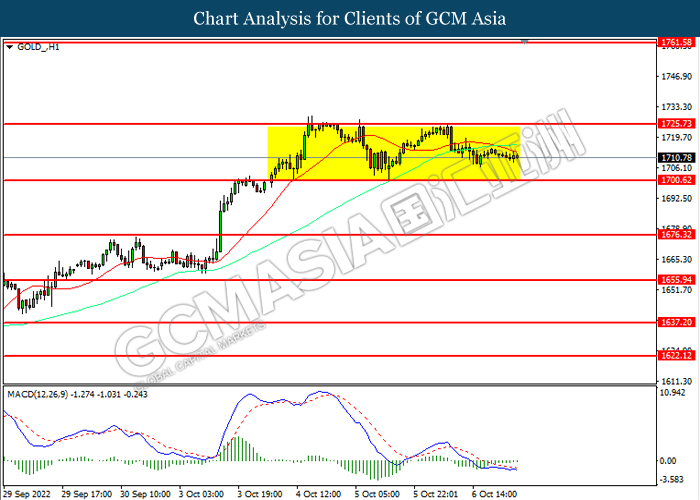

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1725.75, 1761.60

Support level: 1700.60, 1676.30

071022 Morning Session Analysis

7 October 2022 Morning Session Analysis

US Dollar rallied despite the US weekly jobless claims increased.

The Dollar Index which traded against a basket of six major currencies rose significantly on yesterday although the downbeat employment data has been released. According to Department of Labor, the US Initial Jobless Claims notched up from the previous reading of 190K to 219K, exceeding the market expectation of 203K. Such bearish data has shown that the increasing of unemployment. Nonetheless, within the background of hawkish statement from Fed’s member, the Dollar Index has extended its gains. According to Reuters, the Chicago Fed President Charles Evans claimed on Thursday that the Fed’s policy rate was likely headed to 4.5% – 4.75% by the spring of 2023 in order to bring down too-high inflation back to 2%. Besides, Fed Governor Lisa Cook and Minneapolis Fed President Neel Kashkari has emphasized that the Fed would stand with its contractionary monetary policy as long as the inflation fights was ongoing. As the Fed officials showed little sign of backing away from rate hikes, it sparked the appeal of US Dollar. As of now, the investors would continue to scrutinize the announcement of Nonfarm Payrolls data to receive further trading signals. As of writing, the Dollar Index appreciated by 1.08% to 112.20.

In the commodities market, the crude oil price rallied by 0.59% to $88.97 per barrel as of writing after an output cut announcement from OPEC+. On the other hand, the gold price depreciated by 0.03% to $1711.78 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – National Day

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Sep) | 315K | 250K | – |

| 20:30 | USD – Unemployment Rate (Sep) | 3.70% | 3.70% | – |

| 20:30 | CAD – Employment Change (Sep) | -39.7K | 20.0K | – |

Technical Analysis

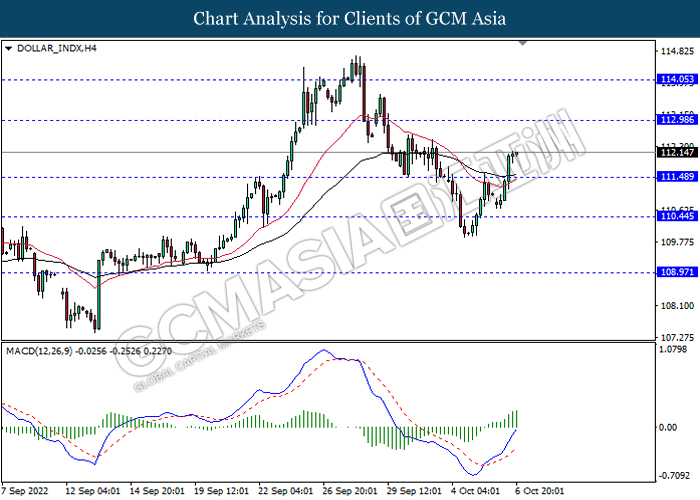

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 113.00, 114.05

Support level: 111.50, 110.45

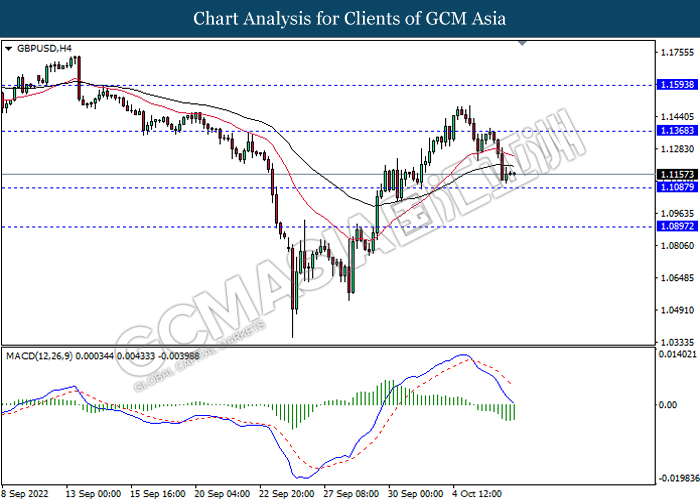

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1370, 1.1595

Support level: 1.1085, 1.0895

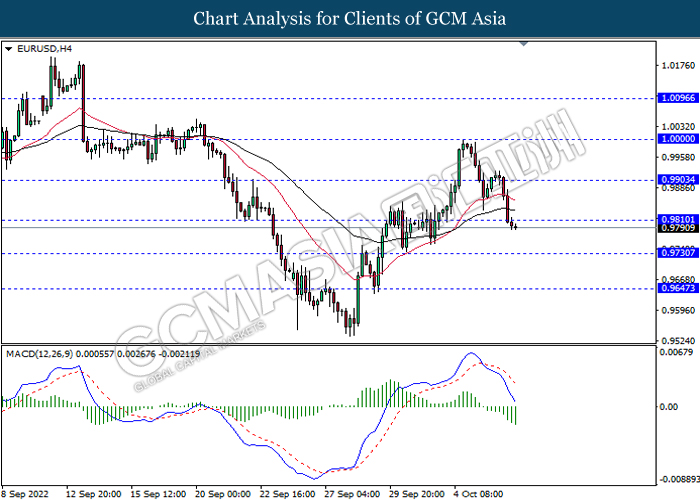

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9810, 0.9905

Support level: 0.9730, 0.9645

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6470, 0.6555

Support level: 0.6370, 0.6265

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.5680, 0.5770

Support level: 0.5615, 0.5530

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9930, 1.0020

Support level: 0.9865, 0.9785

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 91.50, 94.45

Support level: 88.50, 86.05

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1716.10, 1733.55

Support level: 1693.95, 1678.65

061022 Afternoon Session Analysis

6 October 2022 Afternoon Session Analysis

Kiwi surged amid the expected rate hike by RBNZ.

The currency of the New Zealand dollar, which is widely known as the Kiwi, managed to extend its gains toward a higher level following the expected rate hike by the Reserve Bank of New Zealand (RBNZ) yesterday. With the backdrop of persistent sky-high inflationary pressures clouding the New Zealand economy, RBNZ decided to lift the interest rates to a seven-year high, in line with their promise of cooling the overheating economy and stabilize the inflation figure within the territory between 1% to 3% in long term. In the RBNZ October meeting, the central bank raised the cash rate by 0.50% from 3.0% to 3.5%, renewing the record of hiking the rate for the fifth outsized move as well as the eighth hike in the past 1 year. Besides, RBNZ also reiterated that the consumer price inflation is too high and the labour resources are scarce. Compared with the other currencies, persistently high inflation and on-track rate hike boosted the shininess of the Kiwi. As of writing, the pair of NZD/USD rose 0.78% to 0.5780.

In the commodities market, the crude oil price edged up 0.05% to $87.95 per barrel as OPEC agreed to cut oil production by 2 million barrels per day. Besides, the gold prices appreciated by 33% to $1721.95 per troy ounce following the slight retracement of the dollar index.

Today’s Holiday Market Close

Time Market Event

All Day CNY National Day

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Sep) | 49.2 | 48 | – |

| 20:30 | USD – Initial Jobless Claims | 193K | 203K | – |

| 22:00 | CAD – Ivey PMI (Sep) | 60.9 | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the upward trendline. However, MACD which illustrated bearish bias momentum suggests the index to undergo short term technical correction.

Resistance level: 111.25, 113.30

Support level: 109.00, 107.35

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1350. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1620, 1.1835

Support level: 1.1350, 1.1185

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9910. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0025, 1.0125

Support level: 0.9910, 0.9830

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 144.10. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 145.15.

Resistance level: 145.15, 145.75

Support level: 144.10, 143.45

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6530. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5775. MACD which illustrated bullish bias momentum suggest the pair to extend gains after its candle successfully closed above the resistance level.

Resistance level: 0.5775, 0.5845

Support level: 0.5710, 0.5625

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. MACD which illustrated bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3600, 1.3715

Support level: 1.3505, 1.3400

USDCHF, H4: USDCHF was traded lower while currently testing the upward trend line. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the upward trend line.

Resistance level: 0.9825, 0.9920

Support level: 0.9750, 0.9675

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous downward trendline. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 89.45.

Resistance level: 89.45, 96.65

Support level: 86.15, 80.60

GOLD_, Daily: Gold price was traded higher while currently testing the upward trendline. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1725.15, 1766.50

Support level: 1693.35, 1661.40

061022 Morning Session Analysis

6 October 2022 Morning Session Analysis

Bullish economic data pushed US Dollar higher.

The Dollar Index which traded against a basket of six major currencies surged on yesterday amid the backdrop of upbeat economic data. Yesterday, the US ADP Nonfarm Employment Change has notched up from the previous reading of 185K to 208K, exceeding the market forecast at 200K. Besides that, the US ISM Non-Manufacturing Purchasing Managers Index (PMI) in September had also given a higher-than-expected figures, which posted in at the reading of 56.7 while the consensus expectation was 56.0. These two data has shown that the current US labor market remained tight and the US servicing sector was in expansion, which brought positive prospects toward economic progression in the US. On the other hand the Dollar Index extended its gains over the hawkish statement from Fed member. According to Reuters, Philip Jefferson, one of the recent additions to the Fed’s Washington, D.C.- based board of governors, claimed that the Fed’s willingness to accept “a period of below-trend growth” as it fights to dampen inflation, hinted that the Fed would less likely to slow down the pace of aggressive rate hike. As of writing, the Dollar Index rose by 1.04% to 111.12.

In the commodities market, the crude oil price appreciated by 0.41% to $88.12 per barrel as of writing amid diminishing of crude oil inventories. According to EIA, the US Crude Oil Inventories decreased by 1.356M barrels, while the market was anticipating the increasing by 2.052M barrels. In addition, the gold price rallied by 0.34% to $1717.96 per troy ounce as of writing following the value of US Dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – National Day

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Sep) | 49.2 | 48 | – |

| 20:30 | USD – Initial Jobless Claims | 193K | 203K | – |

| 22:00 | CAD – Ivey PMI (Sep) | 60.9 | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 111.50, 113.00

Support level: 110.45, 108.95

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.1370, 1.1595

Support level: 1.1085, 1.0895

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9905, 1.0000

Support level: 0.9810, 0.9730

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6555, 0.6650

Support level: 0.6470, 0.6370

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.5770, 0.5865

Support level: 0.5680, 0.5615

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9865, 0.9930

Support level: 0.9785, 0.9715

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 88.50, 91.50

Support level: 86.05, 84.25

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1733.55, 1749.35

Support level: 1716.10, 1693.95

051022 Afternoon Session Analysis

5 October 2022 Afternoon Session Analysis

Euro extends its gains as hawkish tone from ECB.

The Euro extends its gains following the European Central Bank unleashed their hawkish tone toward the economic prospect. According to Reuters, the European Central Bank claimed that they would begin to stop stimulating the economy through its monetary policy as inflation rate climbed to all time high, while reiterating to increase interest rate back to its “neutral” territory. Earlier, the Euro zone inflation exceeded past forecasts to hit 10.0% in September, a new record high which will reinforce the European Central Bank for another jumbo interest rate hike next month. Recently, the energy prices started to rebound from its lower level over the speculation of OPEC oil cut, which continue to spur further inflation risk for the Euro zone. While the ECB’s next interest rate meeting is still almost a month away, the policymakers have already made statement with regards of another 75-basis point rate hike on 27th October following a combined 125 basis point of moves in earlier two meetings. As of writing, EUR/USD depreciated by 0.14% to 0.9965.

In the commodities market, the crude oil price appreciated by 0.01% to $86.15 per barrel as of writing over the backdrop of downbeat inventory data. According to American Petroleum Institute (API), US API Weekly Crude Oil Stock came in at -1.770M, missing the market forecast at 1.966M. On the other hand, the gold price appreciated by 0.39% to $1719.30 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – National Day

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Sep) | 48.4 | 48.4 | – |

| 16:30 | GBP – Services PMI (Sep) | 49.2 | 49.2 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Sep) | 132K | 205K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Sep) | 56.9 | 56 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.215M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 111.40, 113.65

Support level: 107.55, 104.85

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1455, 1.1730

Support level: 1.1065, 1.0890

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0145, 1.0315

Support level: 0.9915, 0.9740

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6515, 0.6645

Support level: 0.6385, 0.6185

NZDUSD, Daily: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.5850, 0.6030

Support level: 0.5590, 0.5465

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.3775, 1.3970

Support level: 1.3365, 1.3100

USDCHF, H4: USDCHF was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9860, 0.9965

Support level: 0.9750, 0.9640

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 86.35, 89.65

Support level: 81.95, 76.80

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1733.75, 1761.60

Support level: 1700.60, 1676.30

051022 Morning Session Analysis

5 October 2022 Morning Session Analysis

US Dollar beaten down by bearish economic data.

The Dollar Index which traded against a basket of six major currencies slumped on yesterday after the downbeat employment data has been unleashed. According to Bureau of Labor Statistics, the US JOLTs Job Openings in August has notched down from the previous reading of 11.170M to 10.053M, missing the market forecast of 10.775M. It was the second biggest drop since the global Covid-19 lockdown in April 2020. The lower-than-expected figure of the data has shown that the job recruitments in the US was diminishing, which dialed down the market optimism toward economic progression in the US. Besides that, according to CNBC, the Chicago Purchasing Managers Index in September fell to its lowest level since 2020, and these two data might slow down the rate hike path of Fed in the upcoming meeting, which spurred further bearish momentum on the US Dollar. As of now, in order to gauge the likelihood movement of Dollar Index, market participants would pay their attentions on the announcement of ADP Nonfarm Employment data. As of writing, the Dollar Index dropped by 1.42% to 110.06.

In the commodities market, the crude oil price depreciated by 0.08% to $86.44 per barrel as of writing. Nonetheless, the current trend of oil price remained bullish over the output cut expectation from OPEC+. On the other hand, the gold price raised by 0.18% to $1724.70 per troy ounce as of writing amid the US Dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – National Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Sep) | 48.4 | 48.4 | – |

| 16:30 | GBP – Services PMI (Sep) | 49.2 | 49.2 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Sep) | 132K | 205K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Sep) | 56.9 | 56 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.215M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 110.45, 111.50

Support level: 108.95, 107.50

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1595, 1.1840

Support level: 1.1370, 1.1085

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0000, 1.0095

Support level: 0.9905, 0.9810

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 144.05, 145.60

Support level: 142.35, 140.70

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6555, 0.6650

Support level: 0.6470, 0.6370

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.5770, 0.5865

Support level: 0.5680, 0.5615

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9865, 0.9930

Support level: 0.9785, 0.9715

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 88.50, 91.50

Support level: 86.05, 84.25

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1733.55, 1749.35

Support level: 1716.10, 1693.95

041022 Afternoon Session Analysis

4 October 2022 Afternoon Session Analysis

Dollar extend its bearish trend following downbeat manufacturing data.

The Dollar Index which traded against a basket of six major currencies extend its losses over the backdrop of downbeat economic data yesterday. According to Institute for Supply Management, US ISM Manufacturing Purchasing Managers Index (PMI) notched down significantly from the previous reading of 52.8 to 50.9, missing the market forecast at 52.2. Such downbeat economic data indicated that currently the US manufacturing activity grew at its slowest pace in nearly 2 years as new orders diminished following the aggressive rate hike from the Federal Reserve continue to weigh down demand and stabilize inflation risk. On the other hand, the Australia Dollar slumped significantly following the Australia’s central bank surprised markets by lifting interest rate by a smaller-than-expected 25 basis point. According to the latest monetary policy meeting, the Monetary Policy Committee (MPC) decided to increase their interest rate from the preliminary reading of 2.35% to 2.60%, lower than the market expectation at 2.85%. As of writing, the Dollar Index slumped by 0.01% to 111.45 while the pair of AUD/USD depreciated by 0.58% to 0.6480.

In the commodities market, the crude oil price surged by 0.66% to $84.15 per barrel as of writing. The oil market was edged higher ahead of crucial OPEC+ meeting on Wednesday. On the other hand, the gold price appreciated by $1699.25 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – National Day

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Oct) | 2.35% | 2.85% | – |

| 22:00 | USD – JOLTs Job Openings (Aug) | 11.239M | 10.650M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after breakout.

Resistance level: 113.65, 117.30

Support level: 111.40, 107.55

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1415, 1.1730

Support level: 1.1065, 1.0890

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6515, 0.6645

Support level: 0.6385, 0.6185

NZDUSD, Daily: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.5850, 0.6030

Support level: 0.5590, 0.5465

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.3775, 1.3970

Support level: 1.3365, 1.3100

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9965, 1.0035

Support level: 0.9860, 0.9750

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 85.30, 89.65

Support level: 81.95, 76.80

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1700.60, 1733.75

Support level: 1676.30, 1655.95

041022 Morning Session Analysis

4 October 2022 Morning Session Analysis

Pound Sterling revived as Truss dropped part of tax cuts plan.

The GBP/USD, which widely traded by majority of investors surged on yesterday trading session amid the reversing plan from the Liz Truss government. According to CNBC, the UK government had announced a series of tax cuts just weeks into its tenure. However, the step taken by the government was poorly received by financial markets. The top rate of tax paid on high-paid group which set at the 40% was seen as particular politically toxic, as British citizens are dealing with their soaring living cost. Thus, the government decided to drop the plan in order to stimulus the financial stability in the nation. In the perspective of investors, the U-turn of the UK government stand would increase the national income, which boosted up the value of Pound Sterling. On the economic data front, the gains experienced by GBP/USD was limited after the bearish economic data has been released. The UK Manufacturing Purchasing Managers Index (PMI) posted in at the reading of 48.4, missing the consensus forecast of 48.5. As of writing, GBP/USD rose by 0.09% to 1.1333.

In the commodities market, the crude oil price dropped by 0.25% to $83.42 per barrel as of writing. Yesterday, the crude oil price surged as OPEC+ considered to reduce output by more than 1 million barrels per day, the biggest cut since 2020. In addition, the gold price appreciated by 0.50% to $1701.77 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – National Day

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Oct) | 2.35% | 2.85% | – |

| 22:00 | USD – JOLTs Job Openings (Aug) | 11.239M | 10.650M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 113.00, 114.10

Support level: 111.50, 110.45

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1370, 1.1595

Support level: 1.1085, 1.0895

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9905, 1.0000

Support level: 0.9810, 0.9730

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6555, 0.6650

Support level: 0.6470, 0.6370

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.5770, 0.5865

Support level: 0.5680, 0.5615

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9930, 1.0020

Support level: 0.9865, 0.9785

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 86.05, 91.50

Support level: 81.80, 78.20

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1716.10, 1733.55

Support level: 1693.95, 1678.65

031022 Afternoon Session Analysis

3 October 2022 Afternoon Session Analysis

US Dollar surged following PCE data.

The Dollar Index which traded against a basket of six major currencies rebounded from its support level following the Personal Consumption Expenditures (PCE) Price Index jumped 0.6% after being unchanged in July, which exceeding the market expectation at 0.5%. The economic data from the United States on Friday indicated that the underlying inflation pressures remained high, providing cover for the Federal Reserve to maintain their aggressive contractionary monetary policy path. Though, the long-term prospect for the US Dollar still remained negative as slowing in wage growth combined with stiff interest rate hikes from the Fed, has increased the vulnerability to recession in United States region next year. On the other hand, the Euro extend its gains yesterday following the released of upbeat inflation data, rising odds for the European Central Bank (ECB) to unleash hawkish tone. According to Eurostat, Eurozone Consumer Price index (CPI) came in at 10.0%, exceeding the market forecast at 9.7%. As of writing, the Dollar Index appreciated by 0.02% to 112.05 while EUR/USD surged by 0.14% to 0.9815.

In the commodities market, the crude oil price appreciated by 2.42% to $81.85 per barrel as of writing amid speculation over the production cut from OPEC+ by more than 1 million barrels a day continue to spark bullish momentum on this black-commodity. On the other hand, the gold price depreciated by 0.20% to $1664.35 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY National Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Sep) | 48.3 | 48.3 | – |

| 16:30 | GBP – Manufacturing PMI (Sep) | 48.5 | 48.5 | – |

| 22:00 | USD – ISM Manufacturing PMI (Sep) | 52.5 | 51.9 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses after breakout.

Resistance level: 113.65, 117.30

Support level: 111.40, 107.55

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout below the support level.

Resistance level: 1.1415, 1.1730

Support level: 1.1065, 1.0890

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6515, 0.6645

Support level: 0.6385, 0.6185

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5850, 0.6030

Support level: 0.5590, 0.5465

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3775, 1.3970

Support level: 1.3365, 1.3100

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout the resistance level.

Resistance level: 0.9860, 0.9965

Support level: 0.9750, 0.9640

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 81.95, 85.30

Support level: 76.80, 72.35

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1664.80, 1678.20

Support level: 1648.20, 1621.40

031022 Morning Session Analysis

3 October 2022 Morning Session Analysis

Pound rallied amid an unexpected reversal from the economic downturn.

The Pound, which was one of the biggest currencies markets traded by global investors, surged after the new economic figure showed a reversal from recession last Friday. According to the Office for National Statistics, the British economy grew by 0.2% in the second quarter, contrary to the consensus forecast of -0.1%, mirroring that the UK economy is not in recession while against the prediction of recession by the Bank of England earlier this month. However, the gains in the Pound market were limited as the economy was still far below its pre-pandemic peak, while the overall picture of the UK economy is still in the worst shape. Going forward, the market participants would continue to put their attention on the upcoming economic data and the new government stimulus plan to scrutinize the further movement of the currency. As of writing, the pair of GBP/USD is up by 0.11% to 1.1170.

In the commodities market, the crude oil price edged up 2.87% to $82.00 per barrel following the depreciation of the US dollar, which boosted the shininess of oil products. Besides, the gold prices appreciated by 0.20% to $1664.40 per troy ounce following the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

All Day CNY National Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Sep) | 48.3 | 48.3 | – |

| 16:30 | GBP – Manufacturing PMI (Sep) | 48.5 | 48.5 | – |

| 22:00 | USD – ISM Manufacturing PMI (Sep) | 52.5 | 51.9 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following a breakout below the previous support level at 113.30. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 111.25.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1185. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1185, 1.1350

Support level: 1.1050, 1.0870

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 0.9830. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 144.95. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 144.95, 145.85

Support level: 144.55, 143.75

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6430. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6285.

Resistance level: 0.6430, 0.6530

Support level: 0.6285, 0.6165

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.5625. MACD which illustrated bearish bias momentum suggest the pair to extend losses toward the support level at 0.5560.

Resistance level: 0.5625, 0.5710

Support level: 0.5560, 0.5500

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3715. MACD which illustrated bullish bias momentum suggests the pair to extend gains toward the resistance level at 1.3855.

Resistance level: 1.3855, 1.4000

Support level: 1.3715, 1.3600

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9825. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9920.

Resistance level: 0.9920, 1.0030

Support level: 0.9825, 0.9750

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the downward trendline. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the downward trendline.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.70

GOLD_, H4: Gold price was traded higher following prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 1677.75, 1693.35

Support level: 1653.90, 1636.10