040423 Afternoon Session Analysis

04 April 2023 Afternoon Session Analysis

The RBA’s Philip Lowe dovish speech afterward Aussie slipped.

The Reserve Bank of Australia (RBA) Governor Philip Lowe had announced that the RBA decided to maintain the interest rate at 3.60%, and the Aussie slipped afterward. At its meeting today, RBA board members recognize that monetary policy operates with a lag, and the full effect of an interest rate hike is yet to be felt. Therefore, RBA decided to hold the interest rate steady this month. Meanwhile, the RBA’s Lowe mentioned that the global economy remains subdued and the central bank needs to reassess the outlook for monetary policy decisions following turmoil in the banking systems in the US and Switzerland. The central forecast is that inflation in Australia is likely to peak and back to 3% in the mid of 2025. The growth of Australia’s economy is expected to grow slowly over the next couple of years, as the high-interest rate environment and softer demand. According to Australian Bureau of Statistics, the average housing price data declined from 889.80 to 881.20. It indicates that a decline in house prices is leading to a substantial slowing in household spending. The decline in house prices will cause house owners less confident to spend as overall wealth is reduced. As economic growth slows, unemployment is expected to increase to 4% at mid of 2024. Since the economic outlook remains subdued, the RBA decide to soft-land on its monetary policy today. As of writing, the AUD/USD slipped -0.43% to $0.6755.

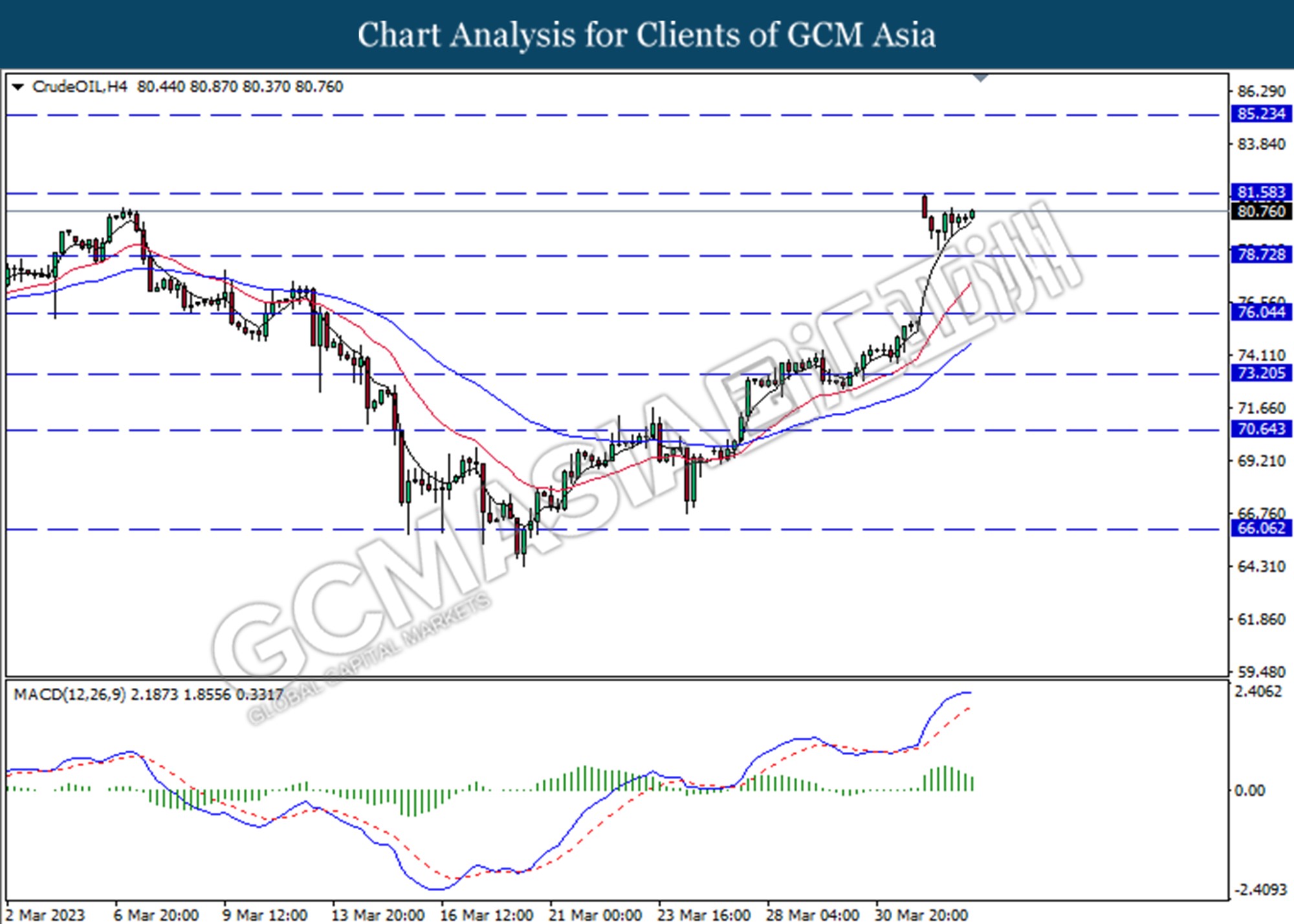

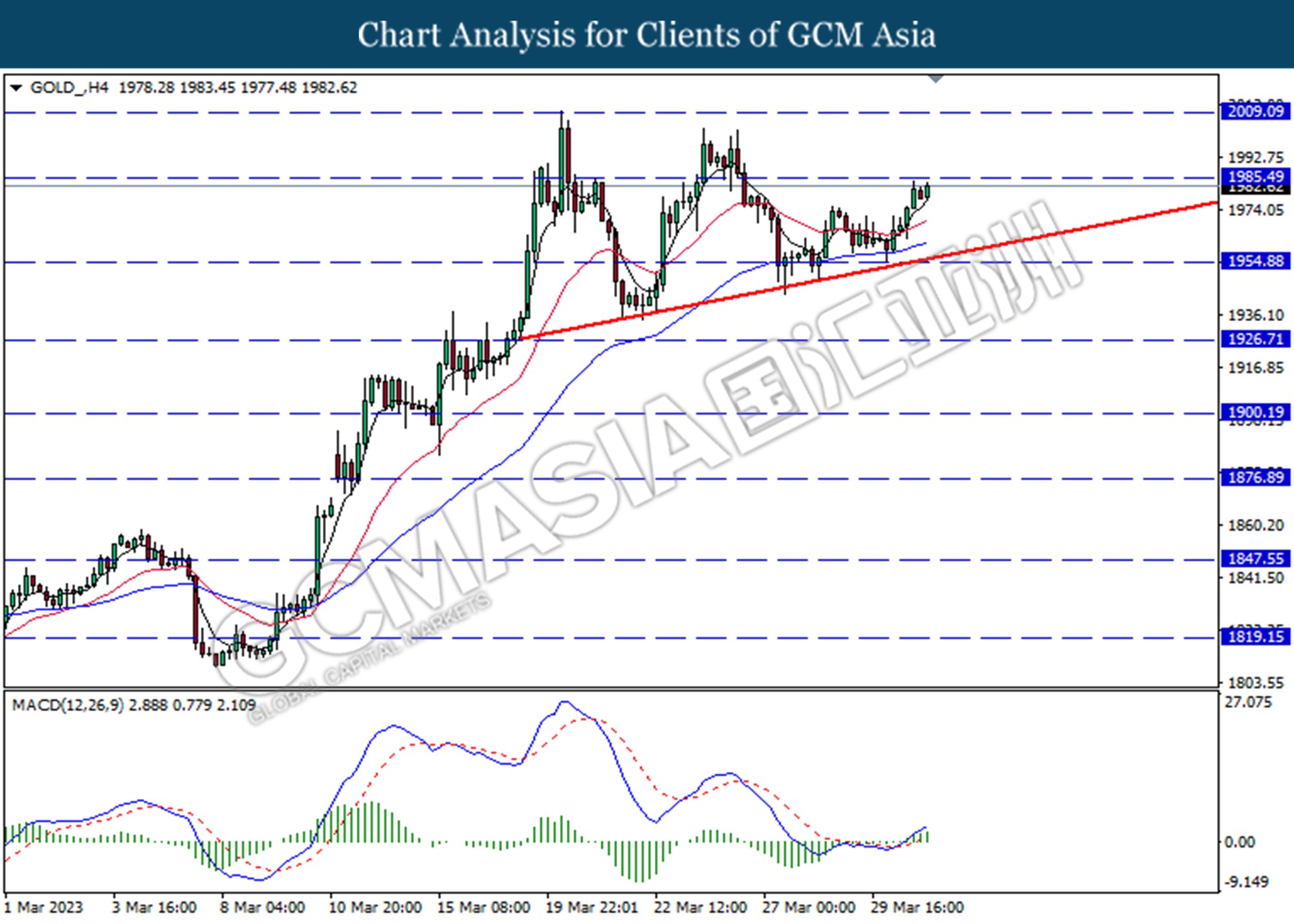

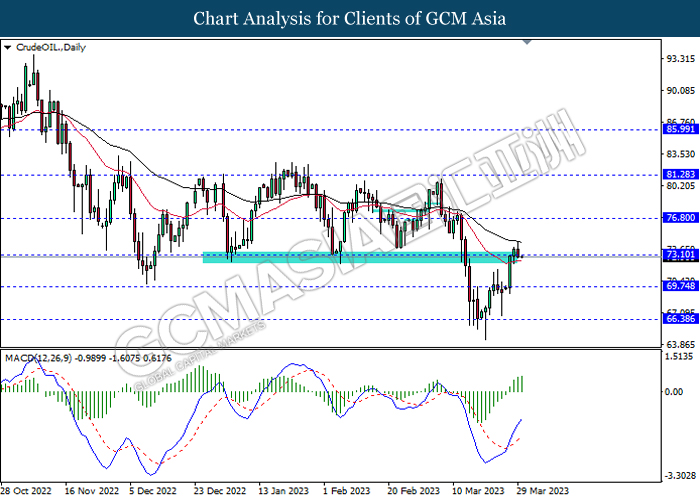

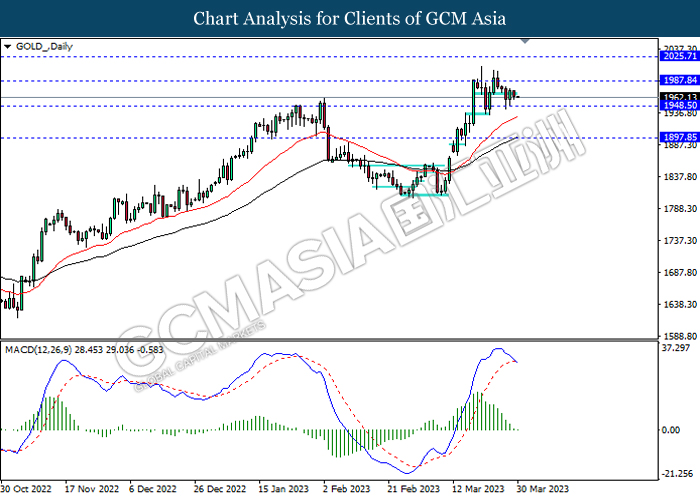

In the commodities market, crude oil prices edged up by 0.42% to $80.76 per barrel following a prior OPEC+ production cut. Besides, gold also edged down 0.19 per cent to $1,996.55 a troy ounce as investors digested the weak ISM manufacturing data and the US dollar rebounded.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – JOLTs Job Openings (Feb) | 10.824M | 10.400M | – |

Technical Analysis

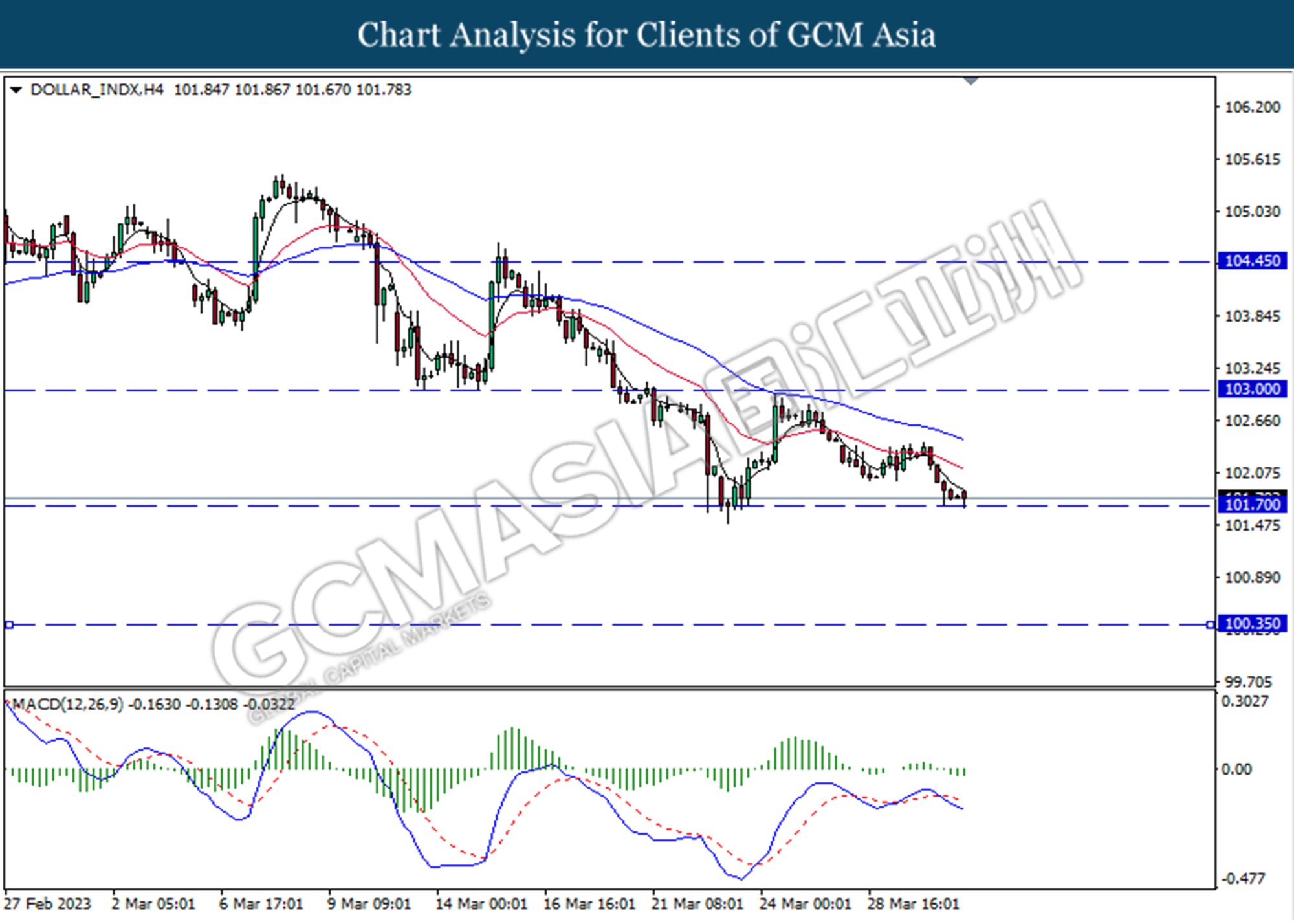

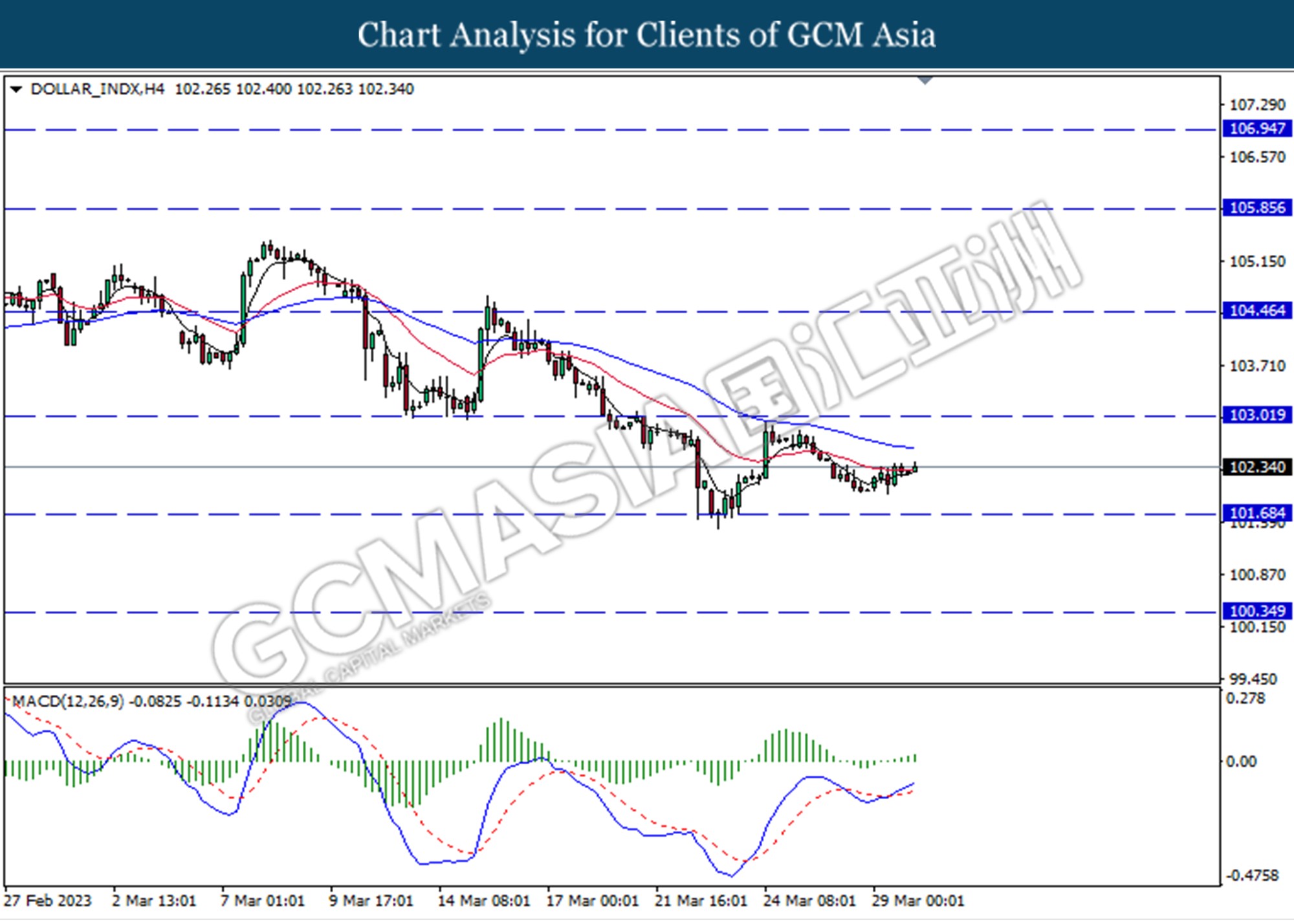

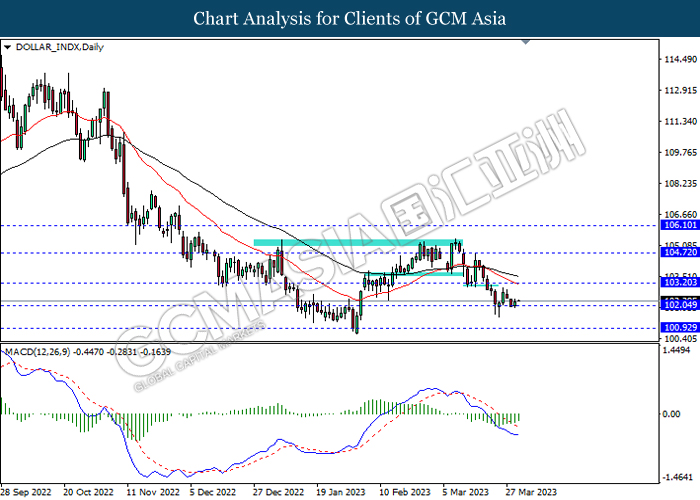

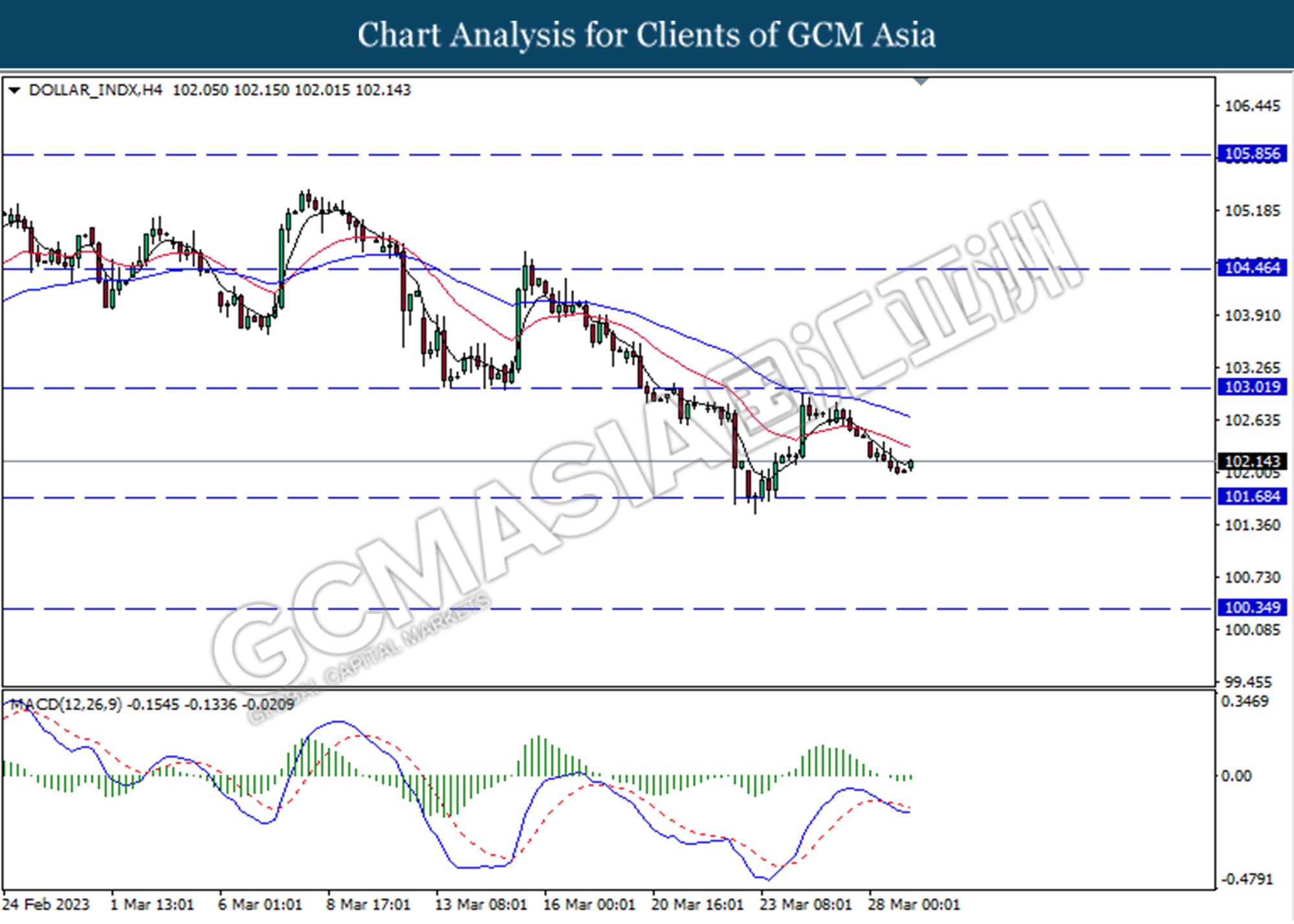

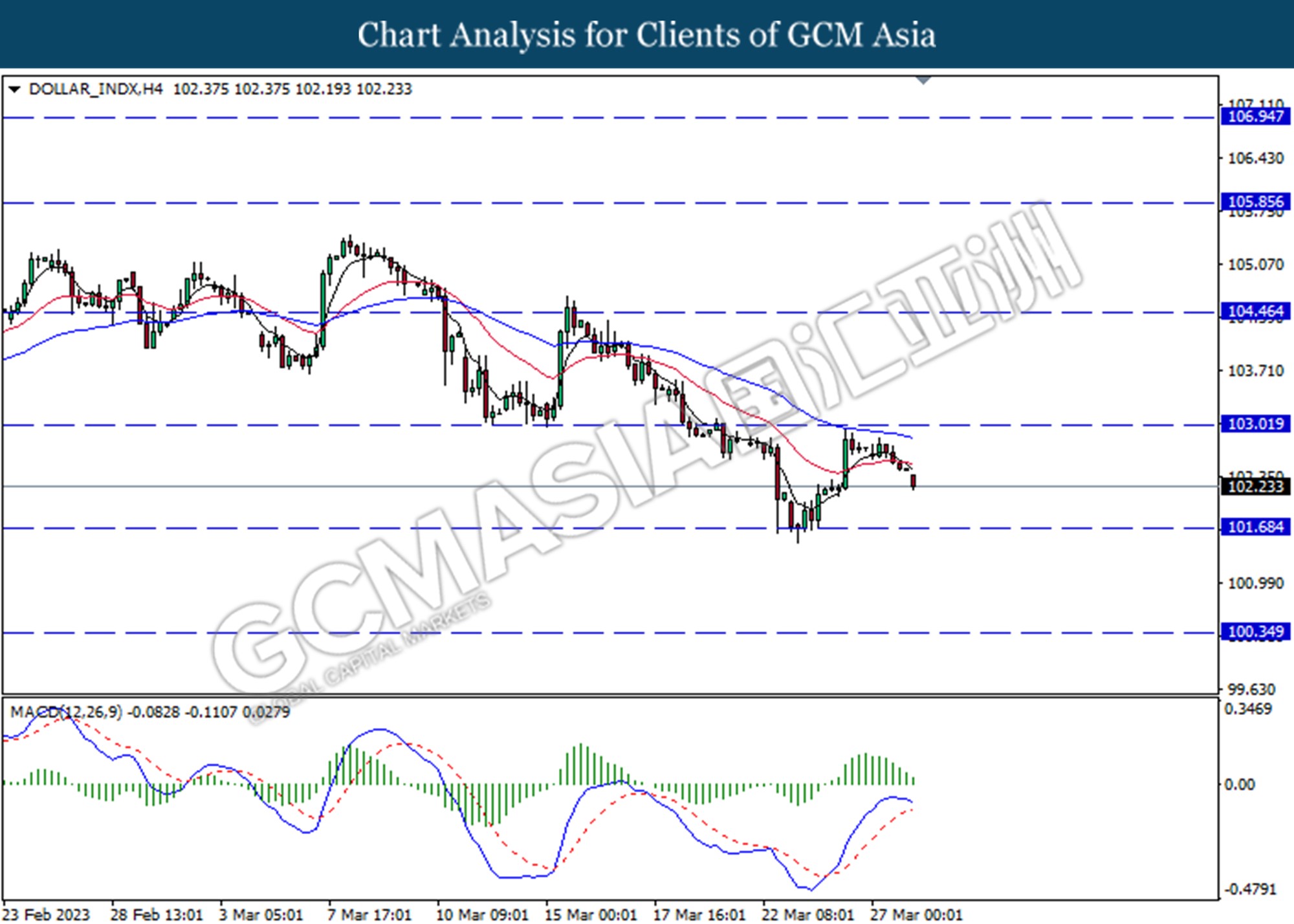

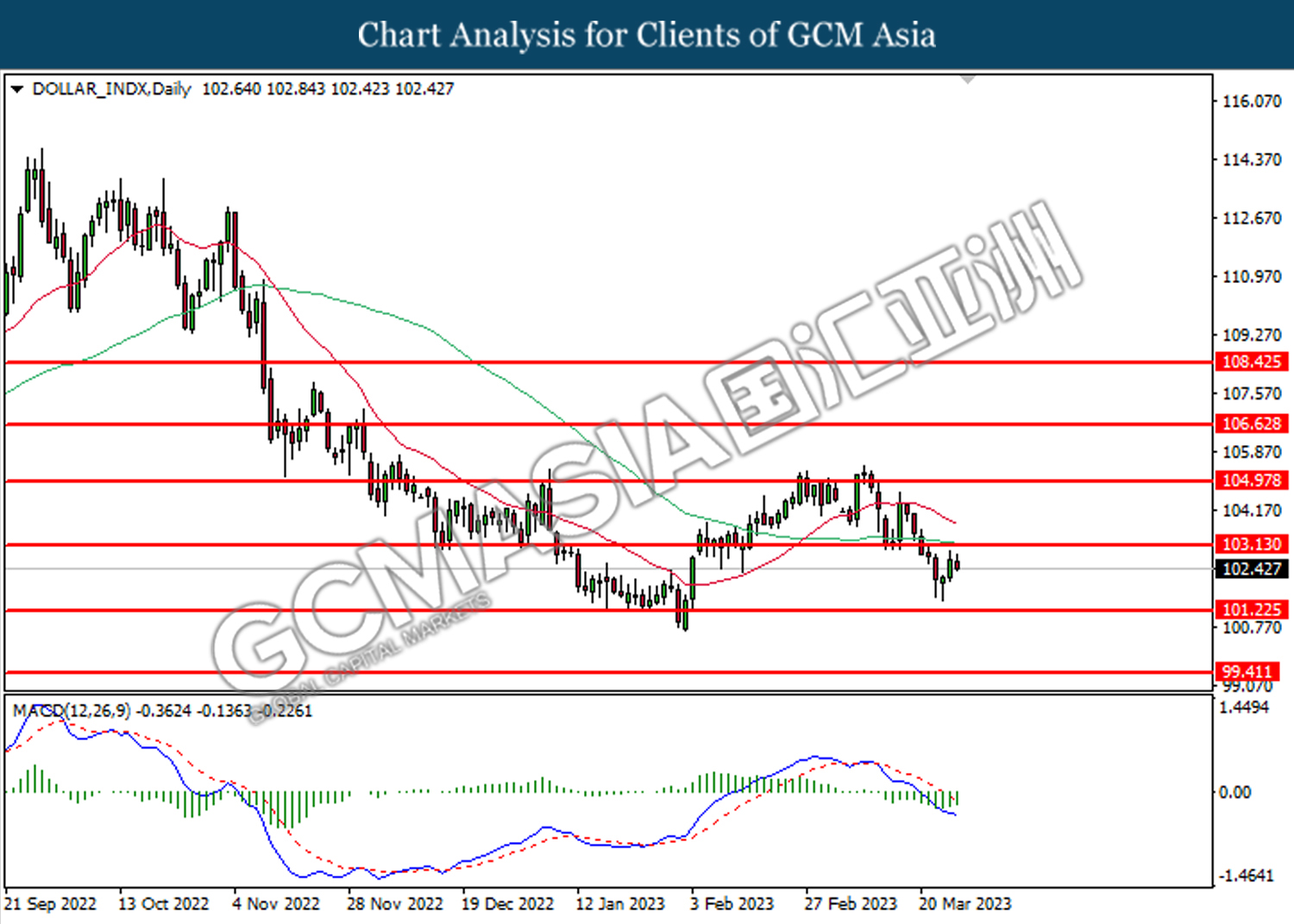

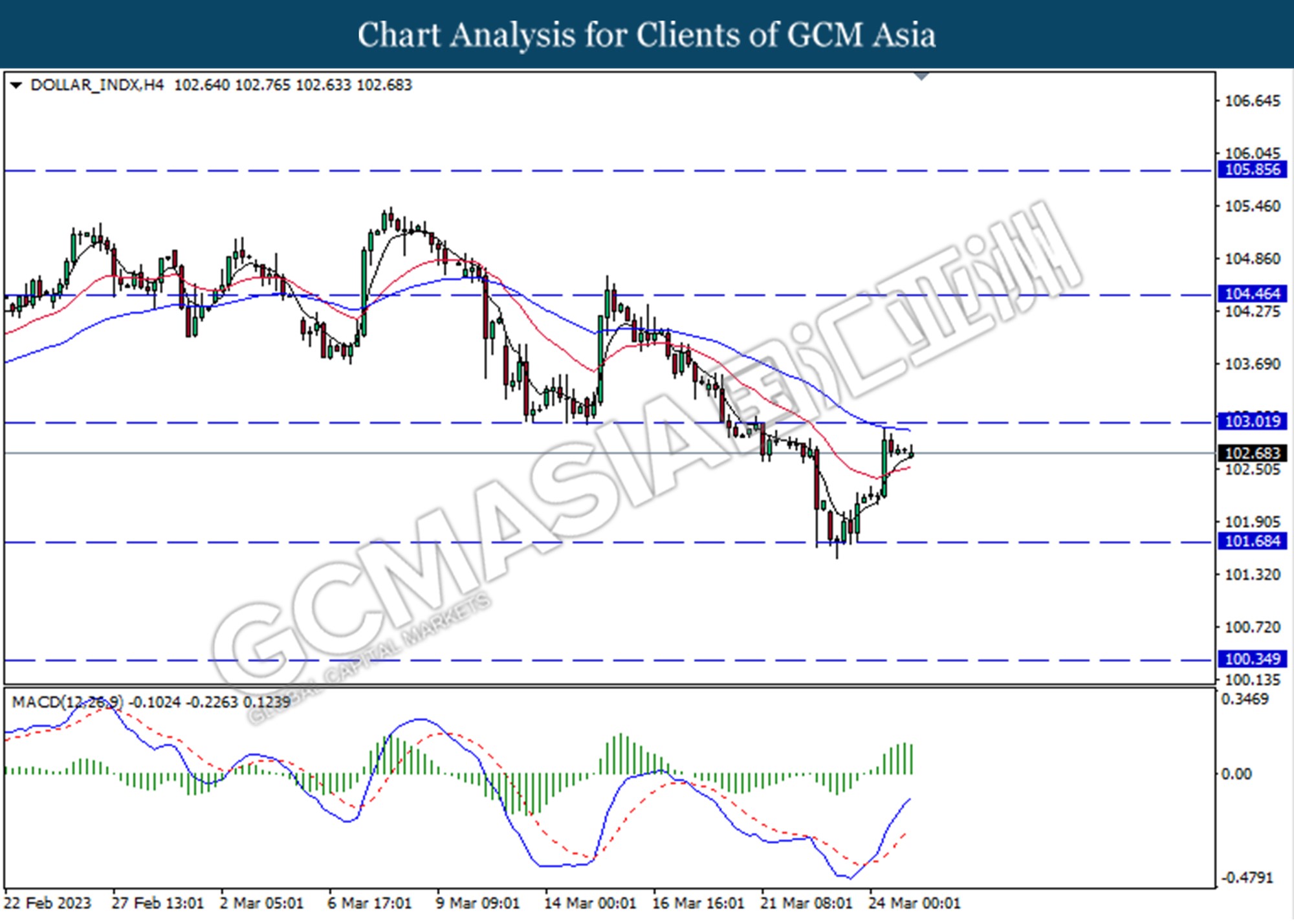

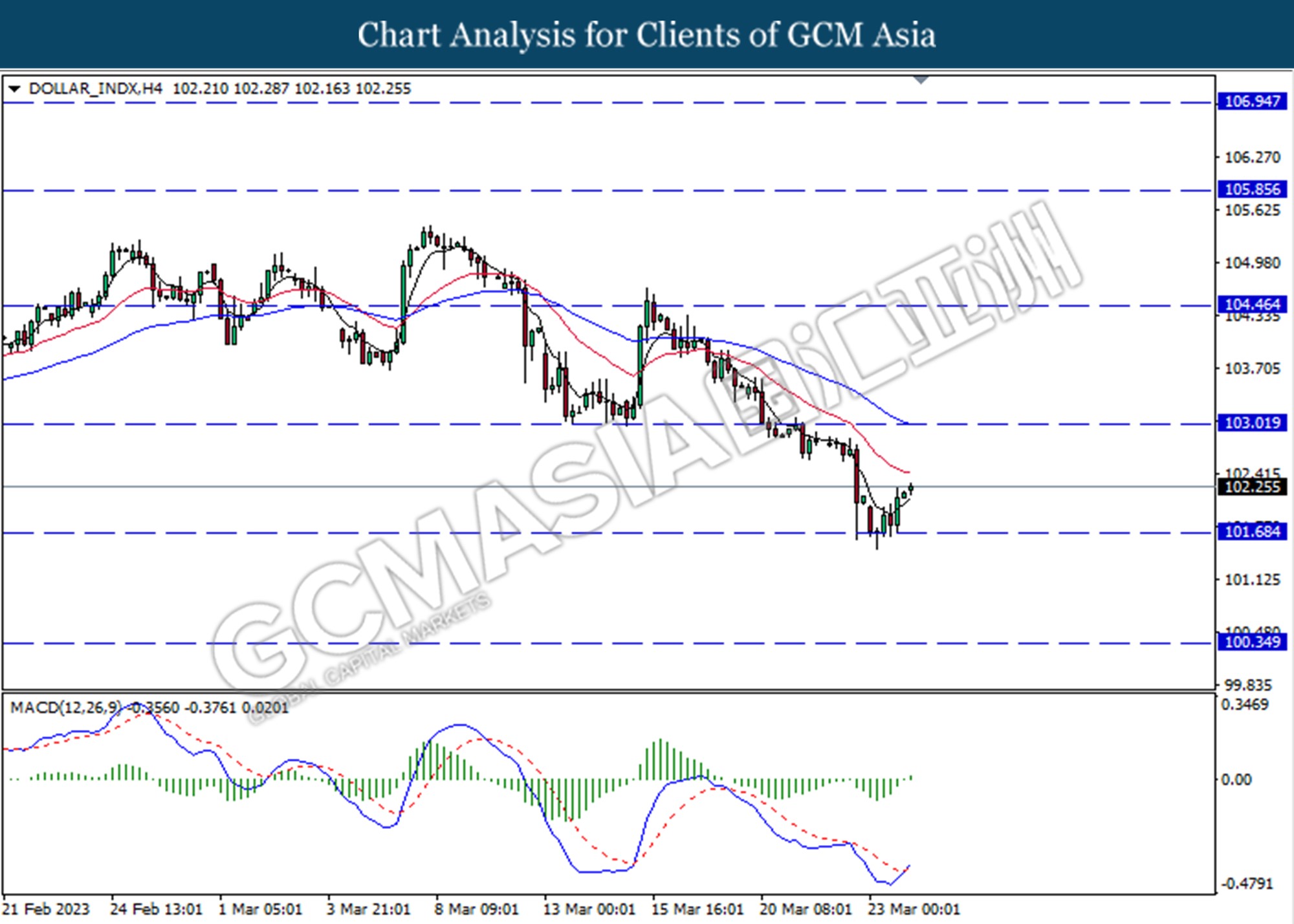

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the support level at 101.70. However, MACD which illustrated bearish momentum suggests the index undergoes technical correction in the short term.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

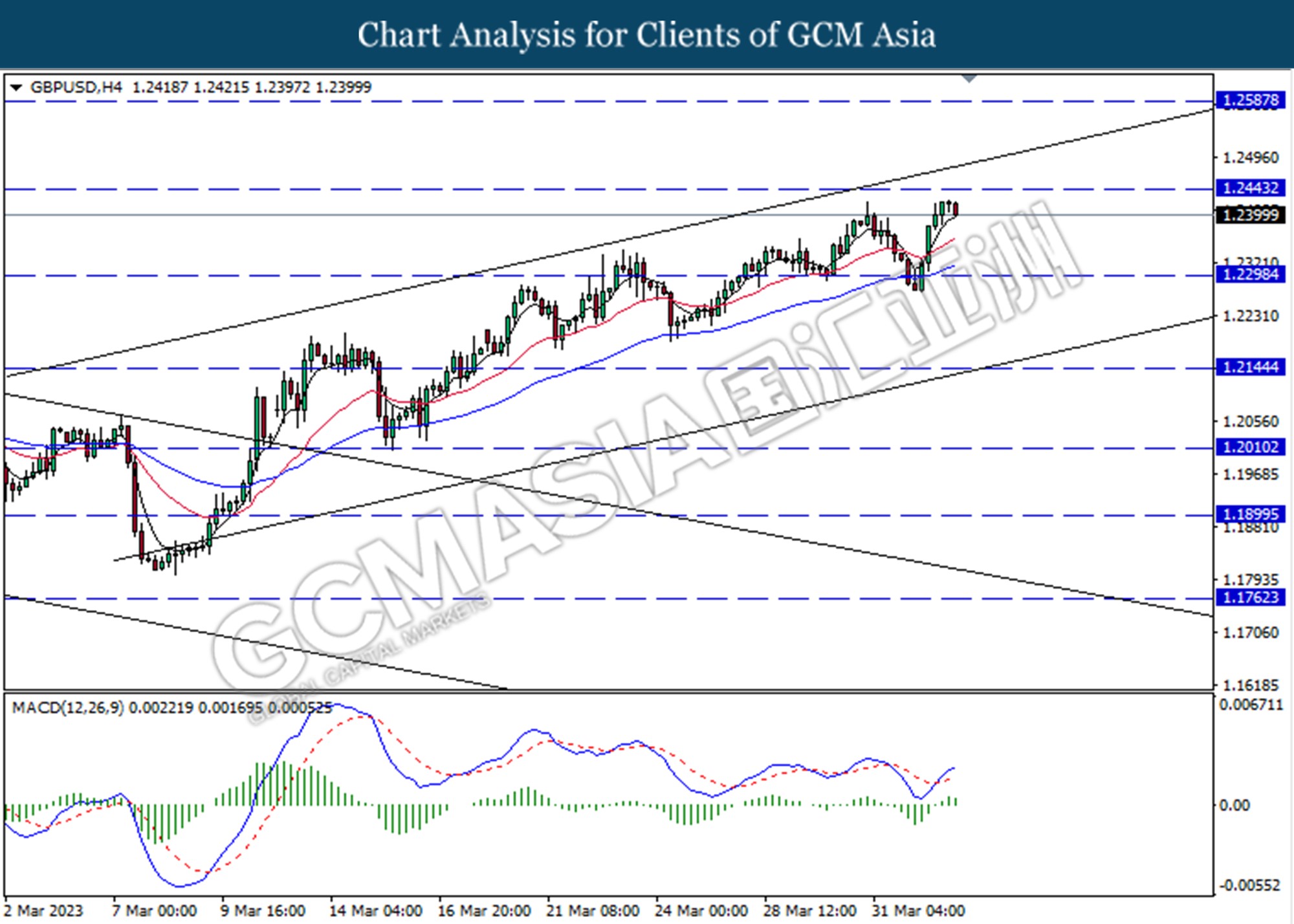

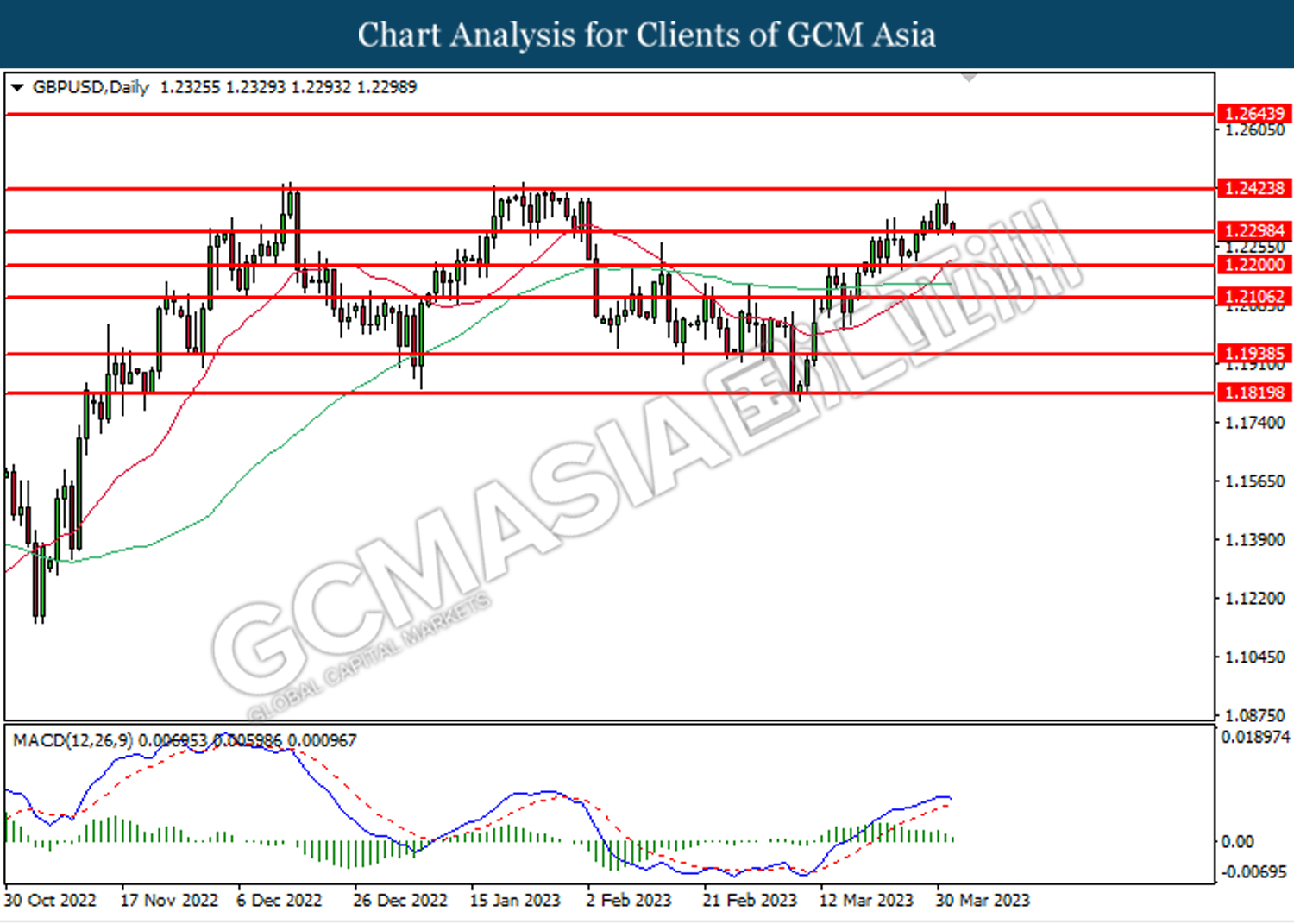

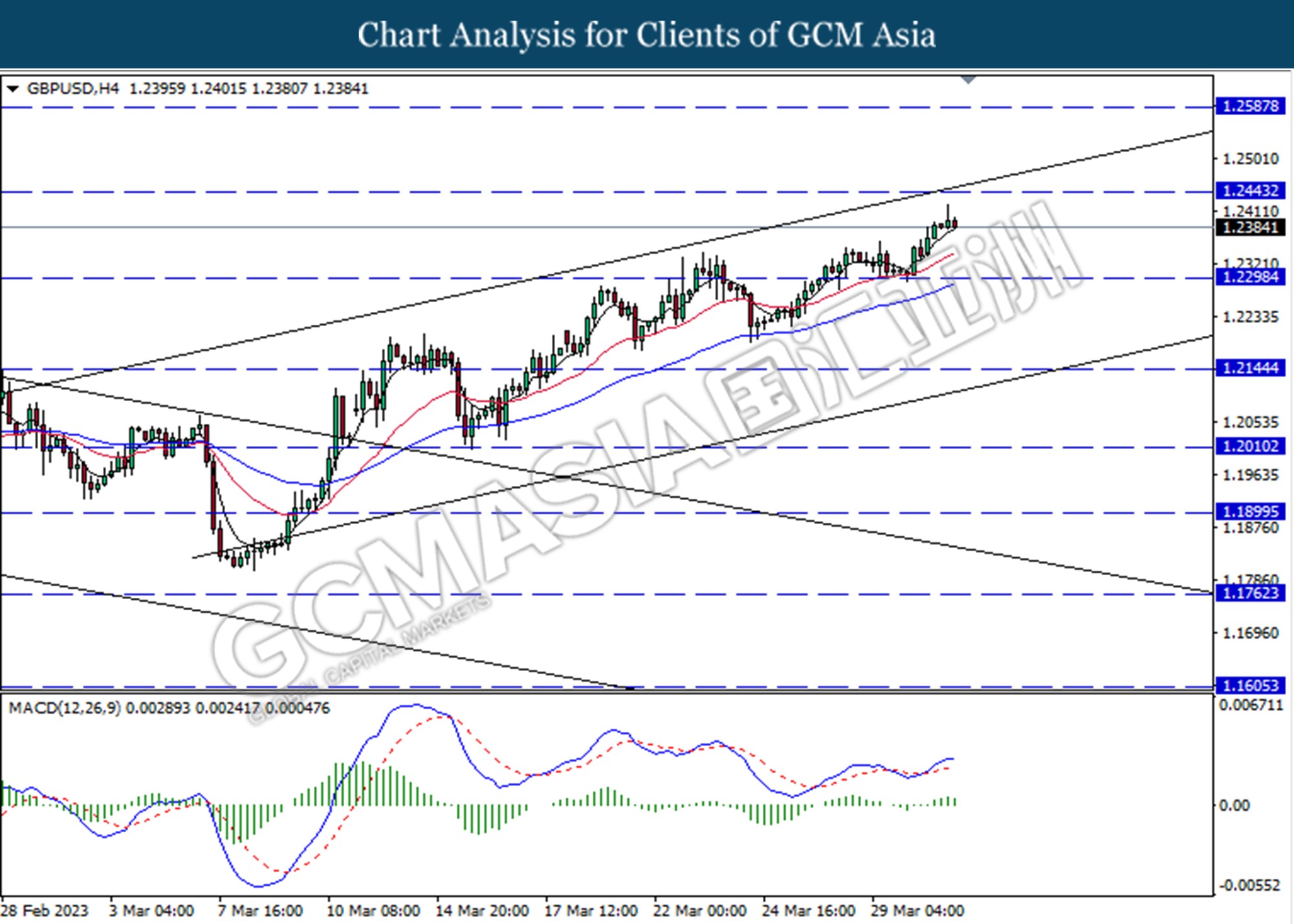

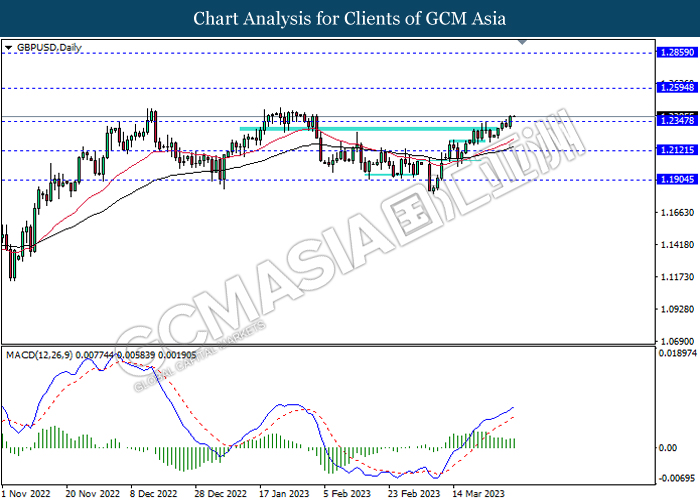

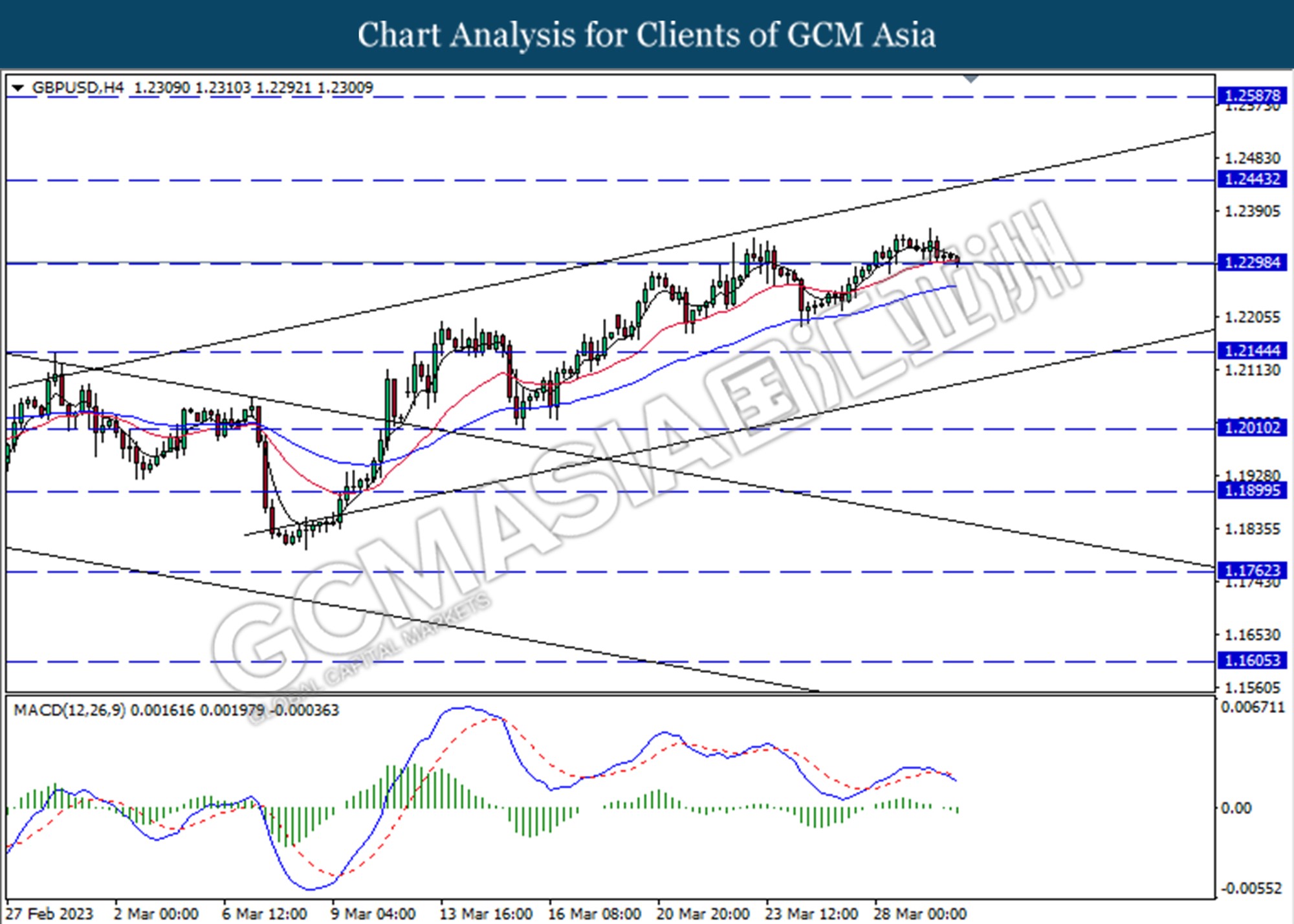

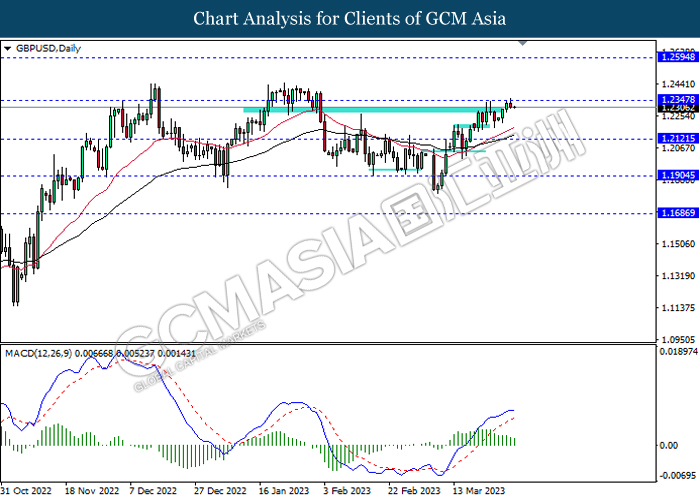

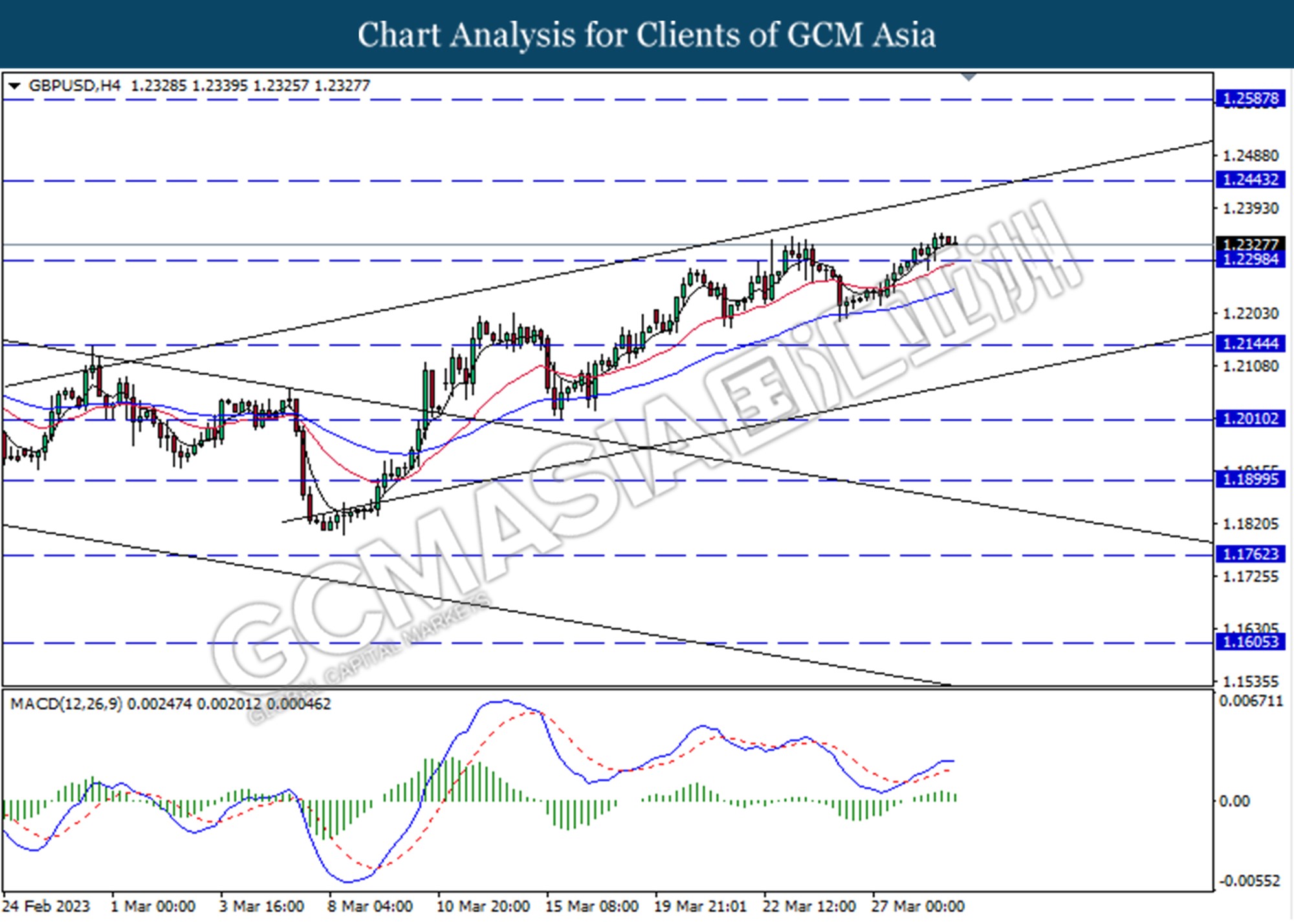

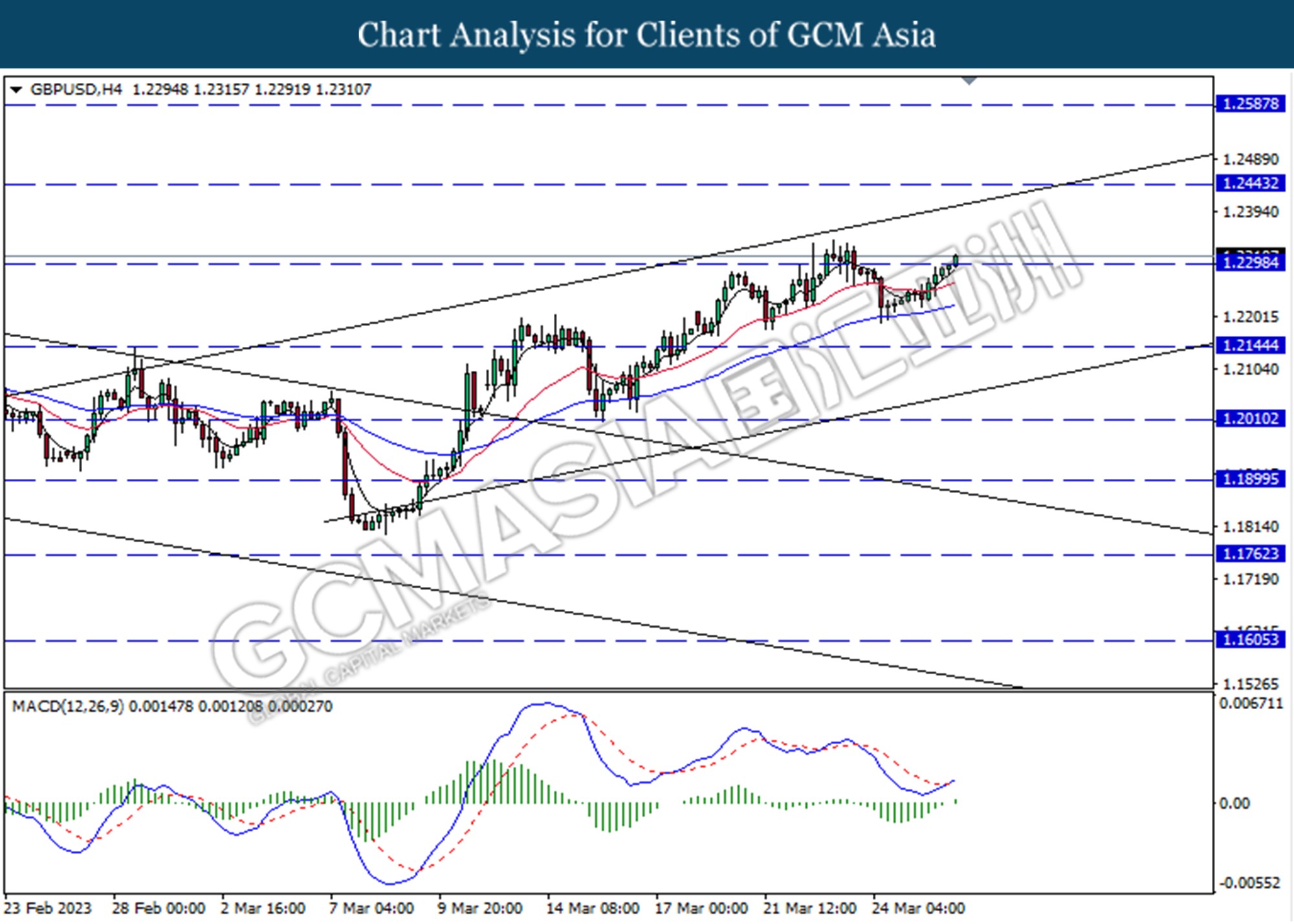

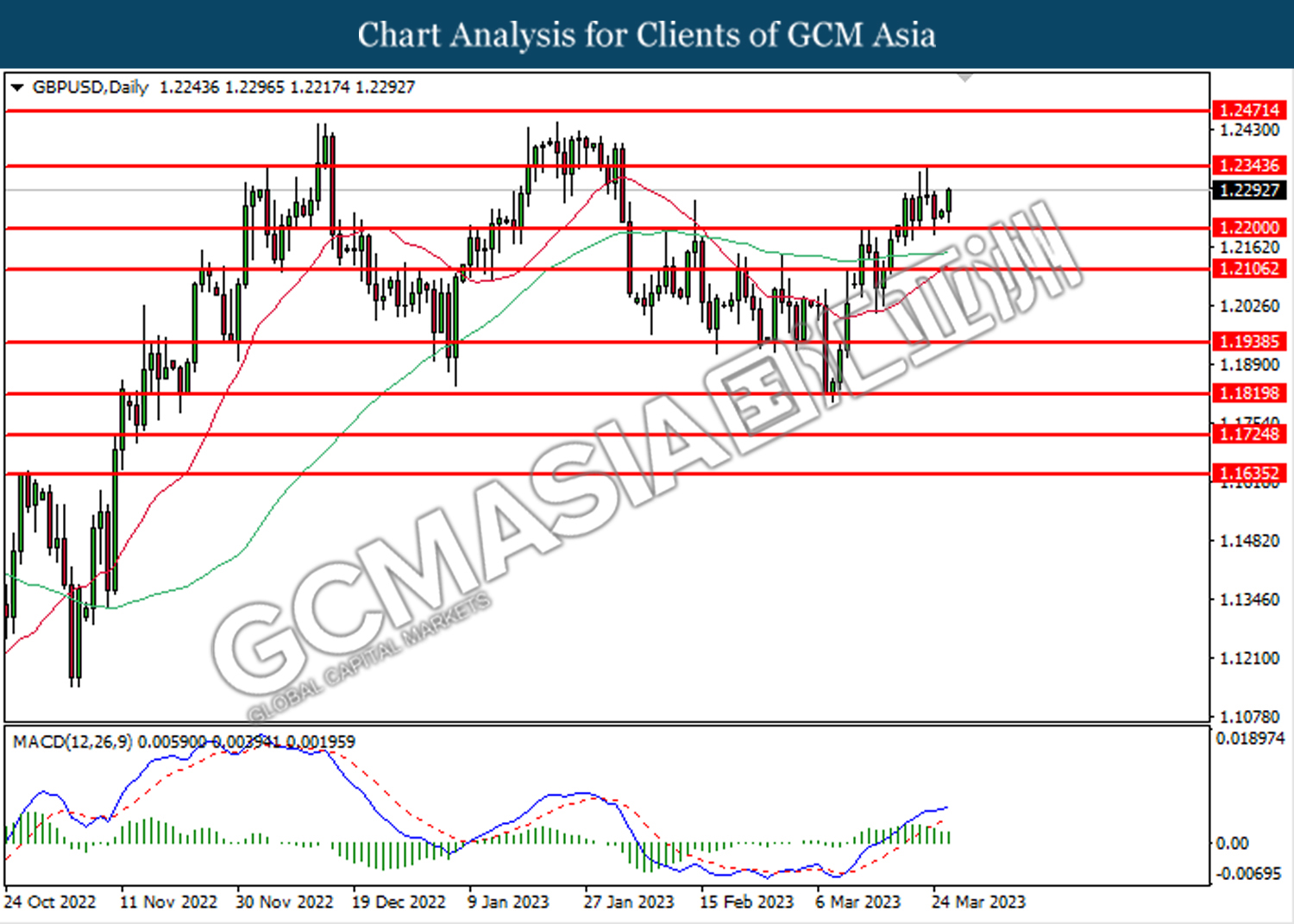

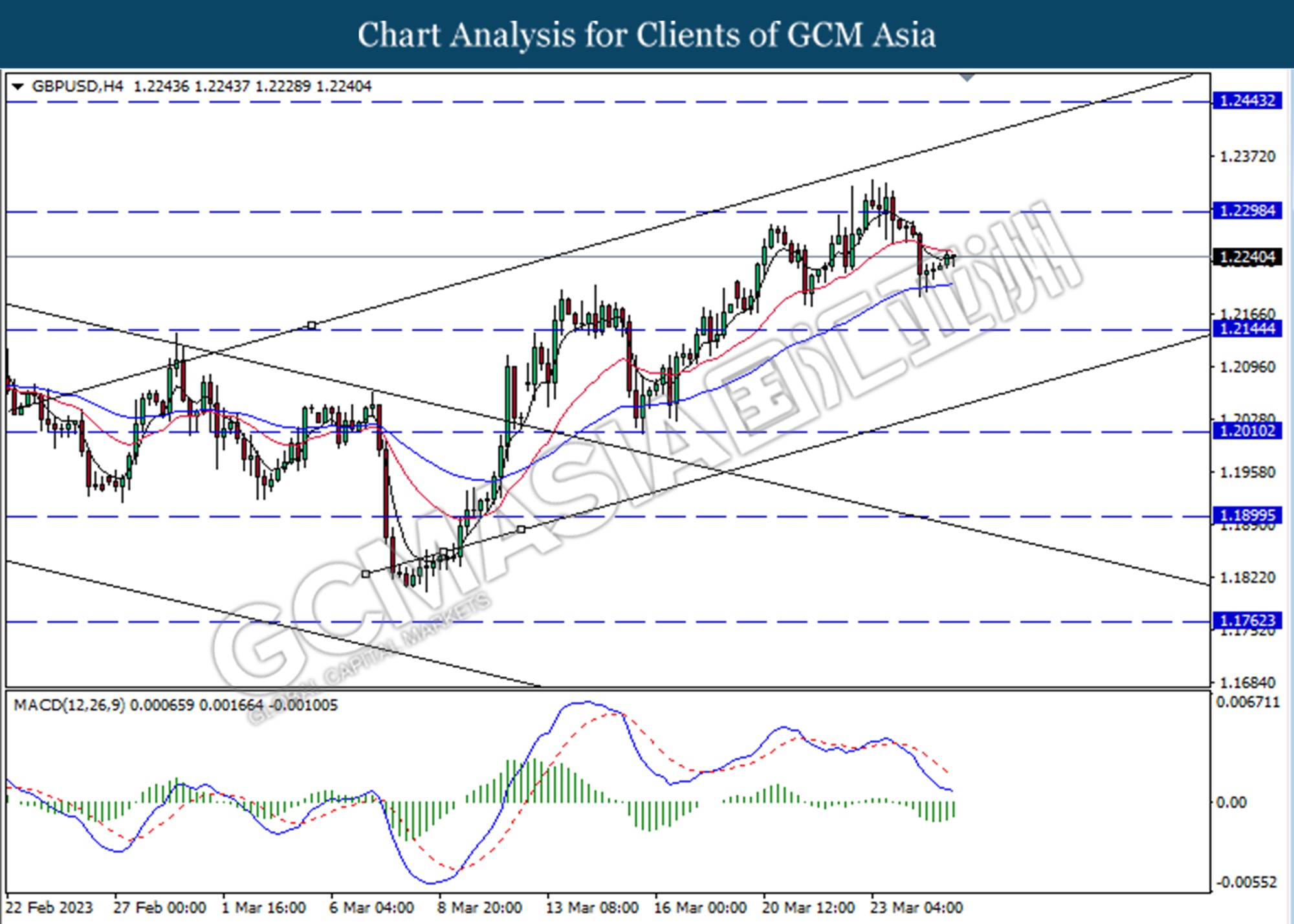

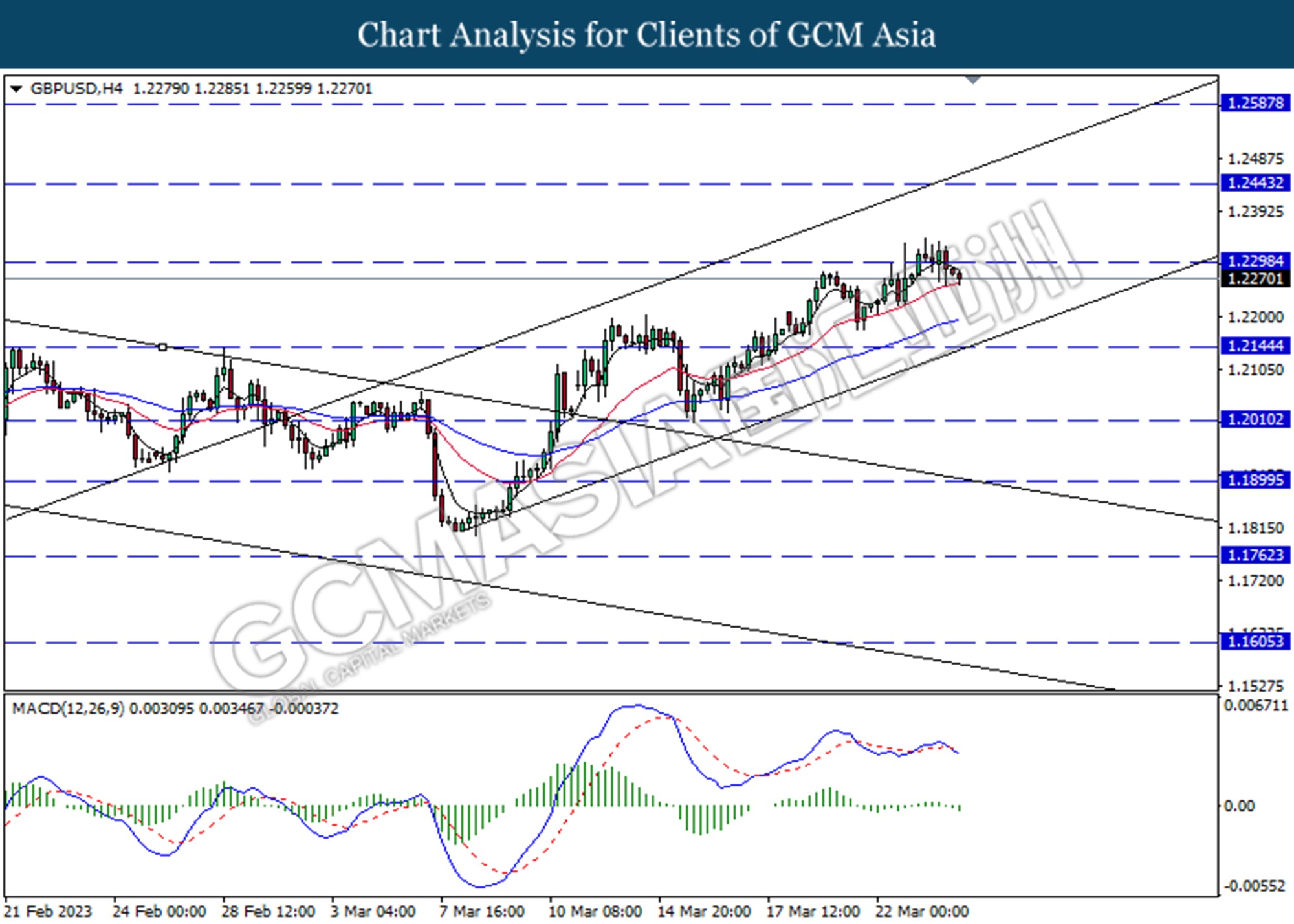

GBPUSD, H4: GBPUSD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

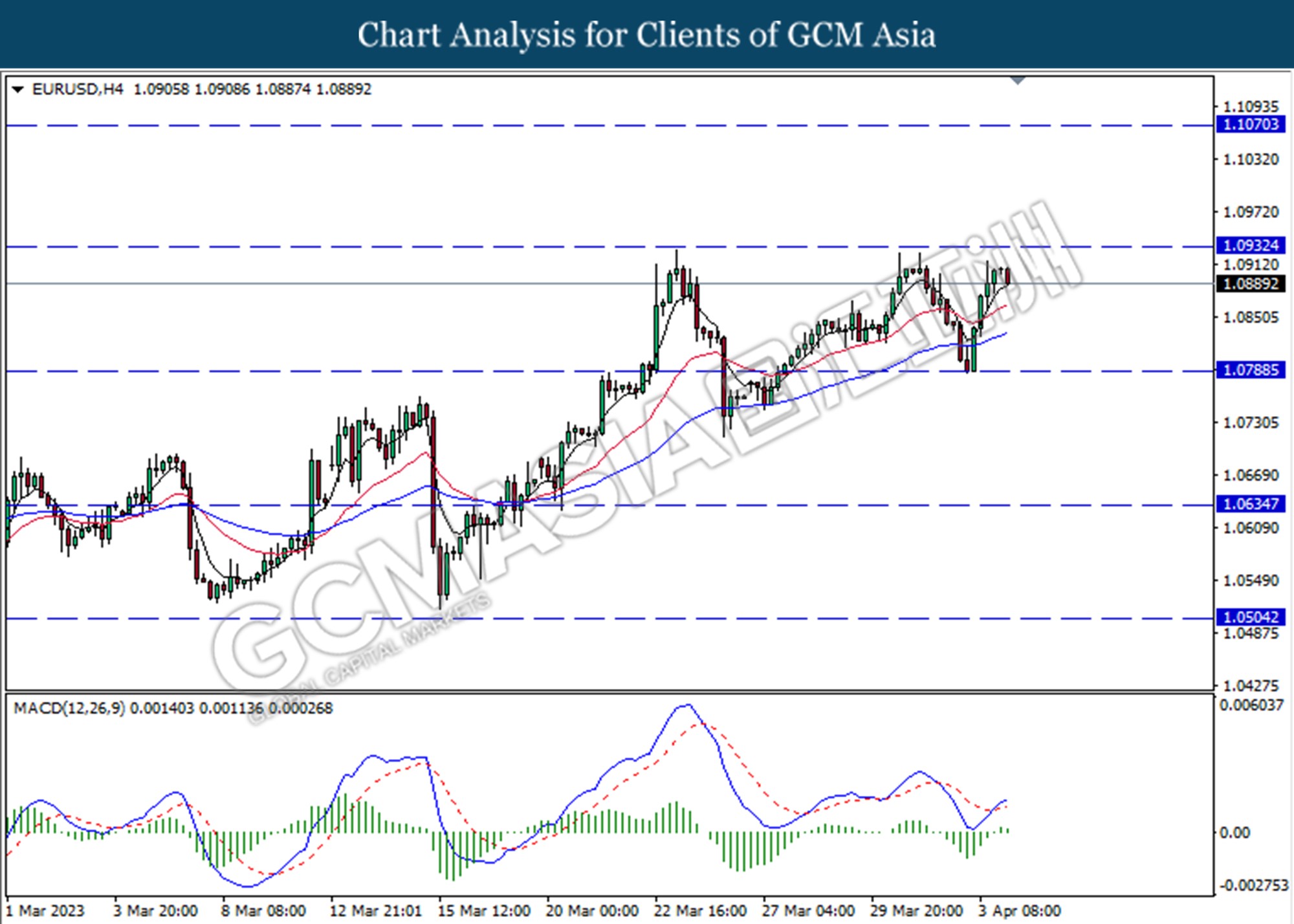

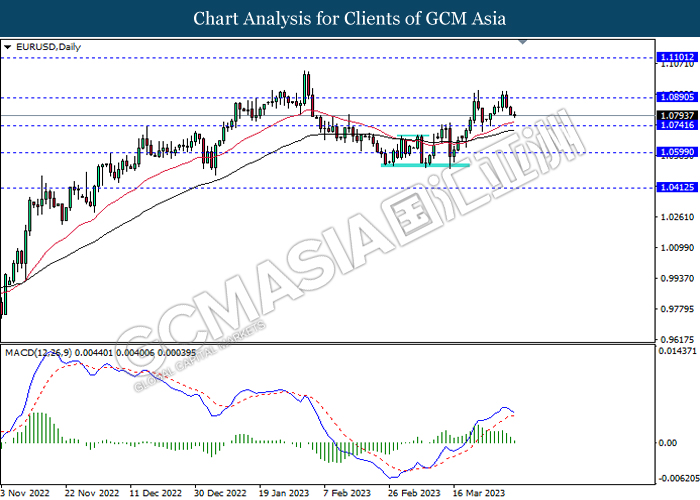

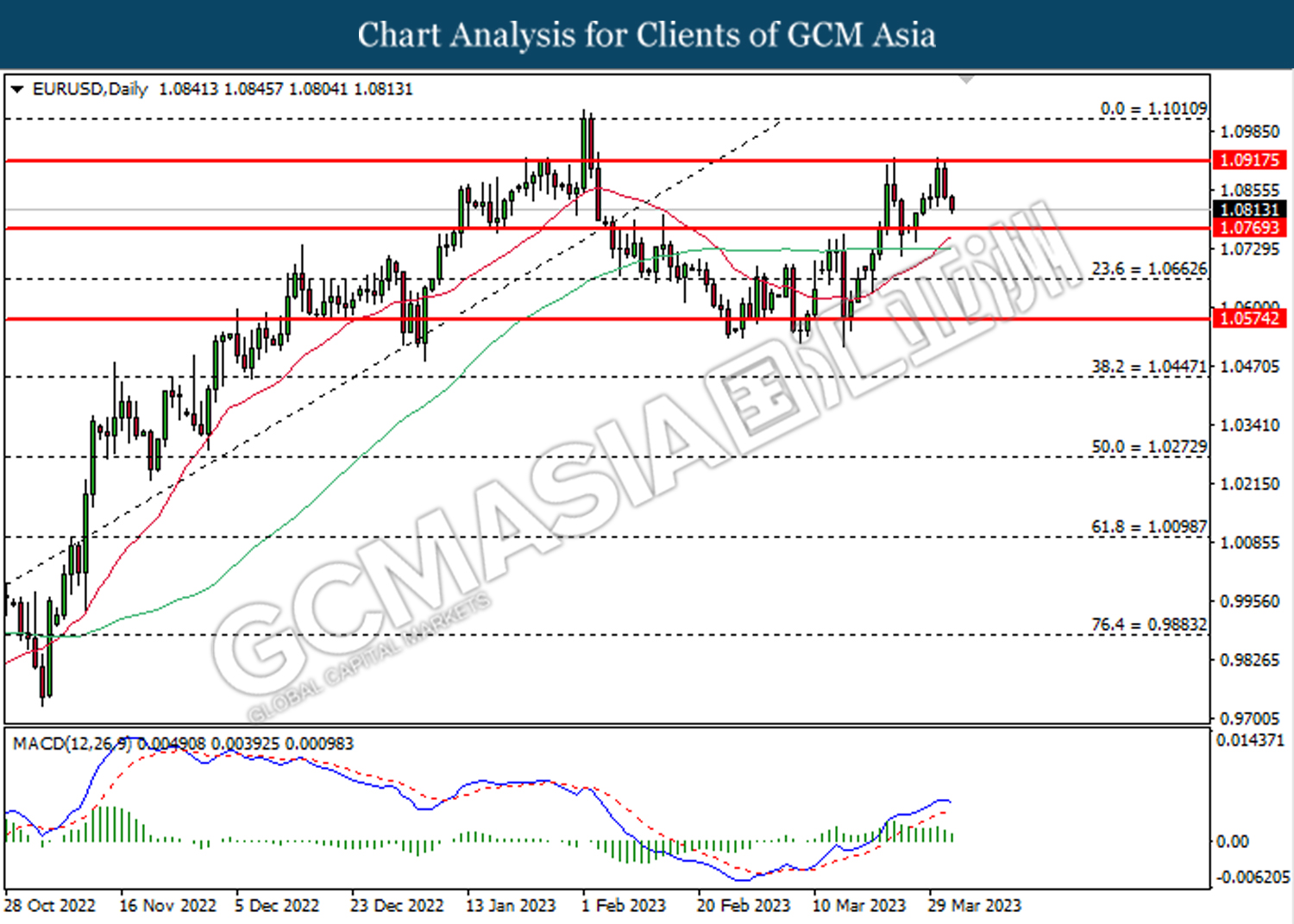

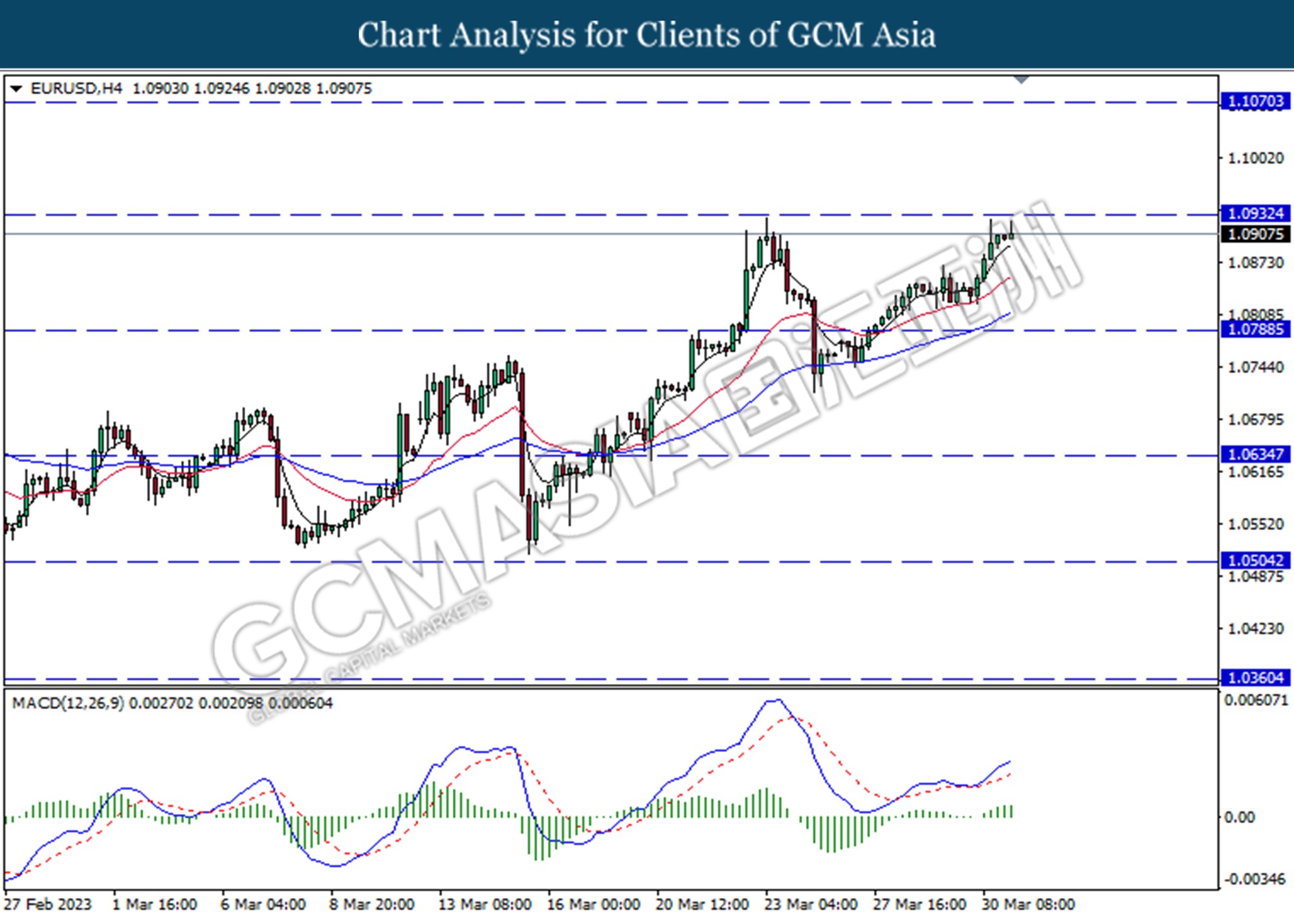

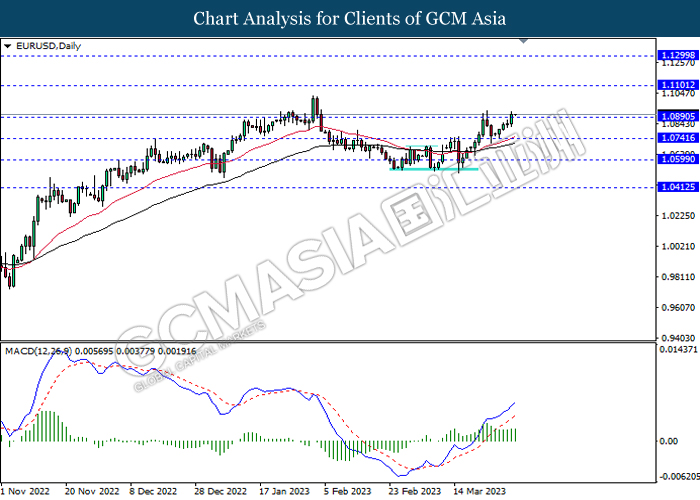

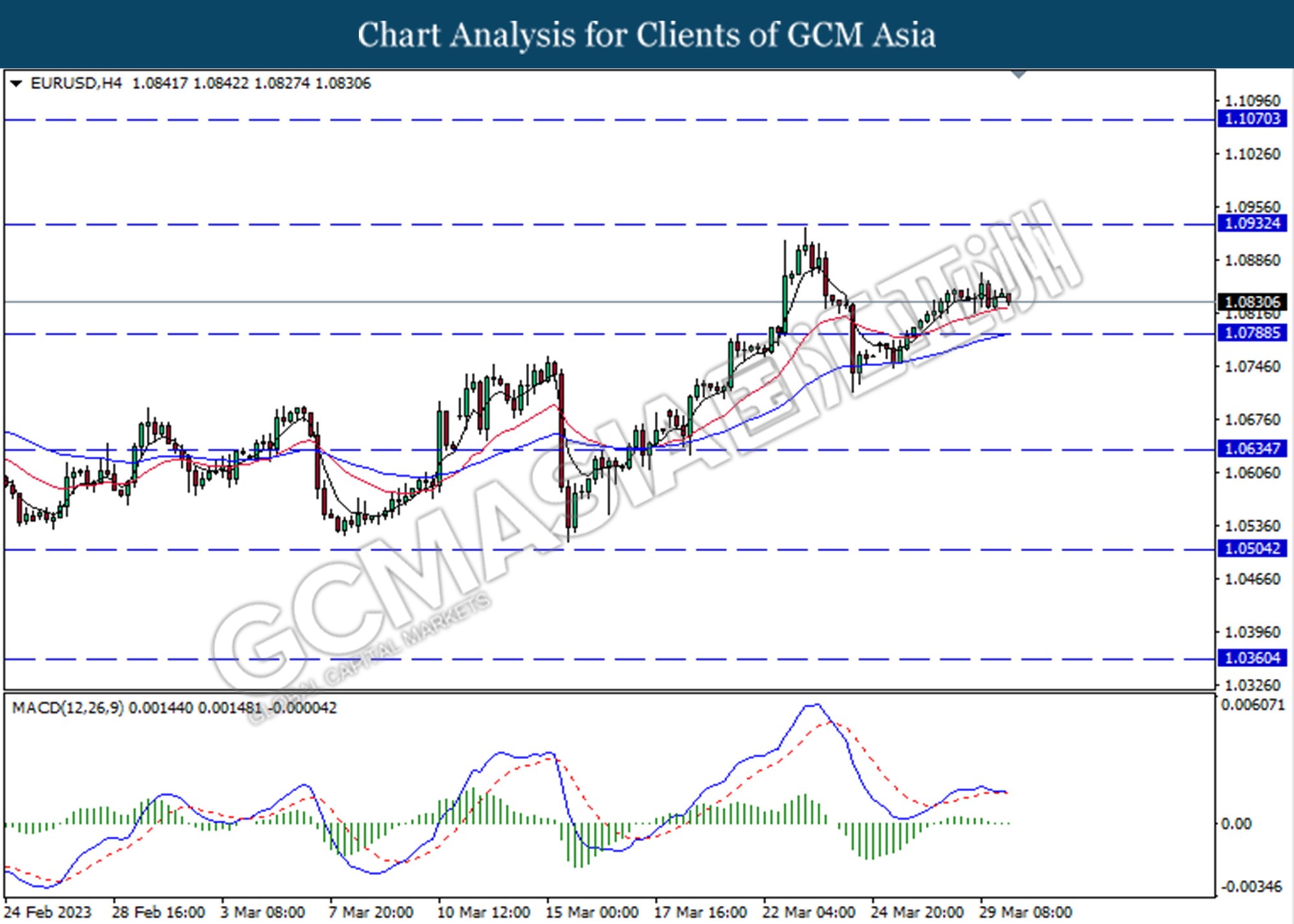

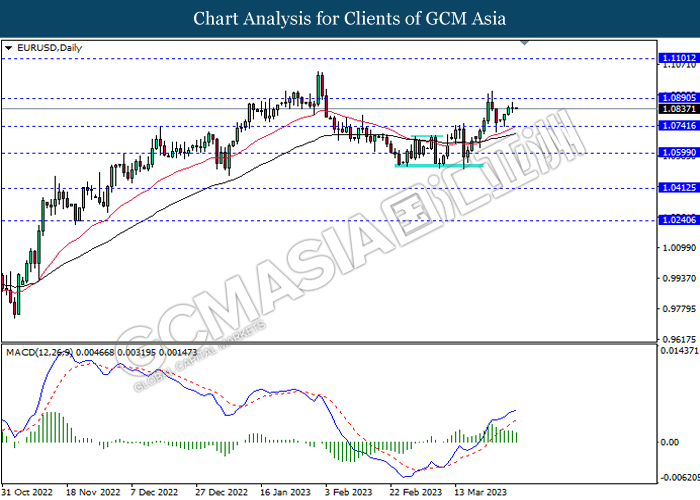

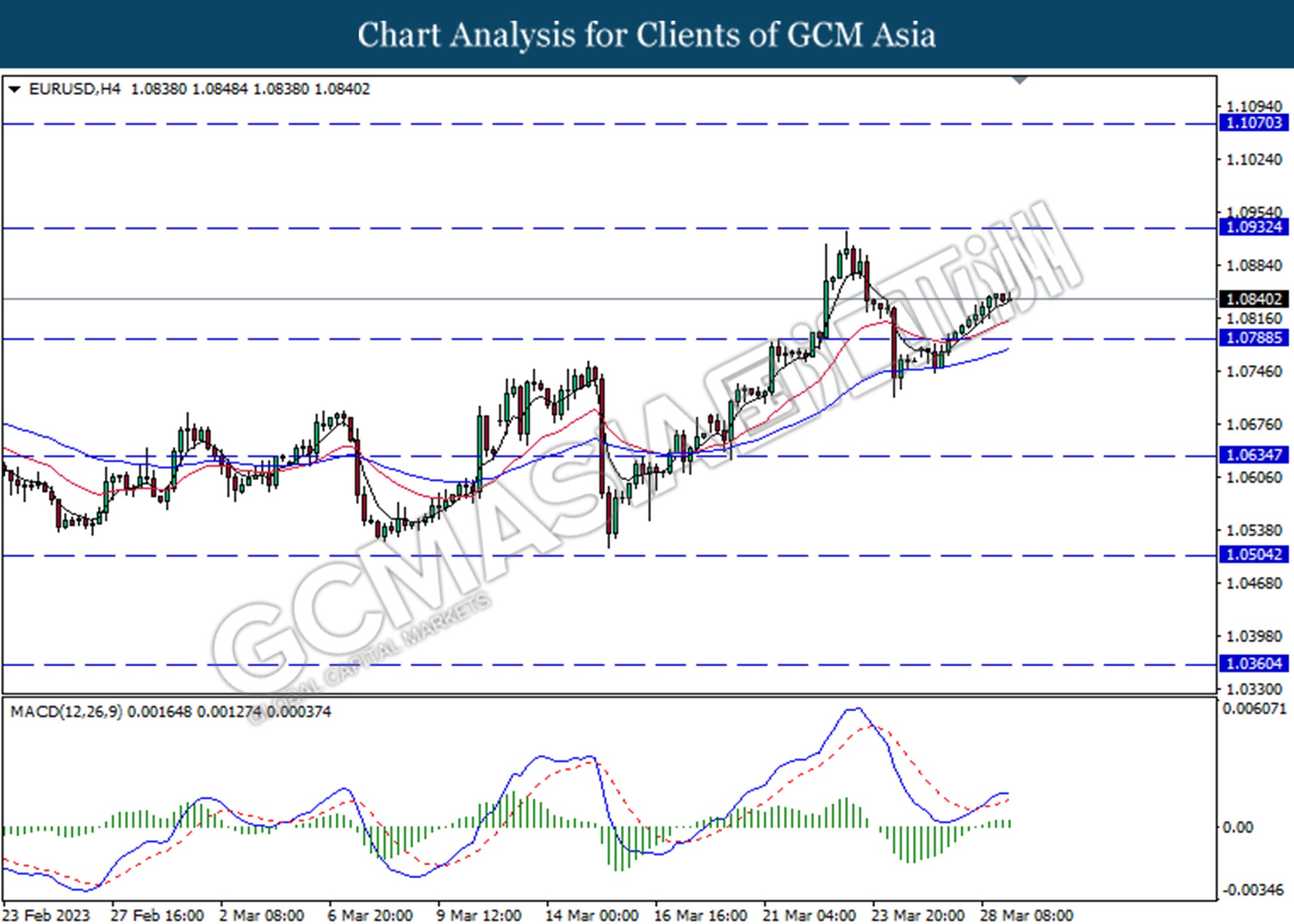

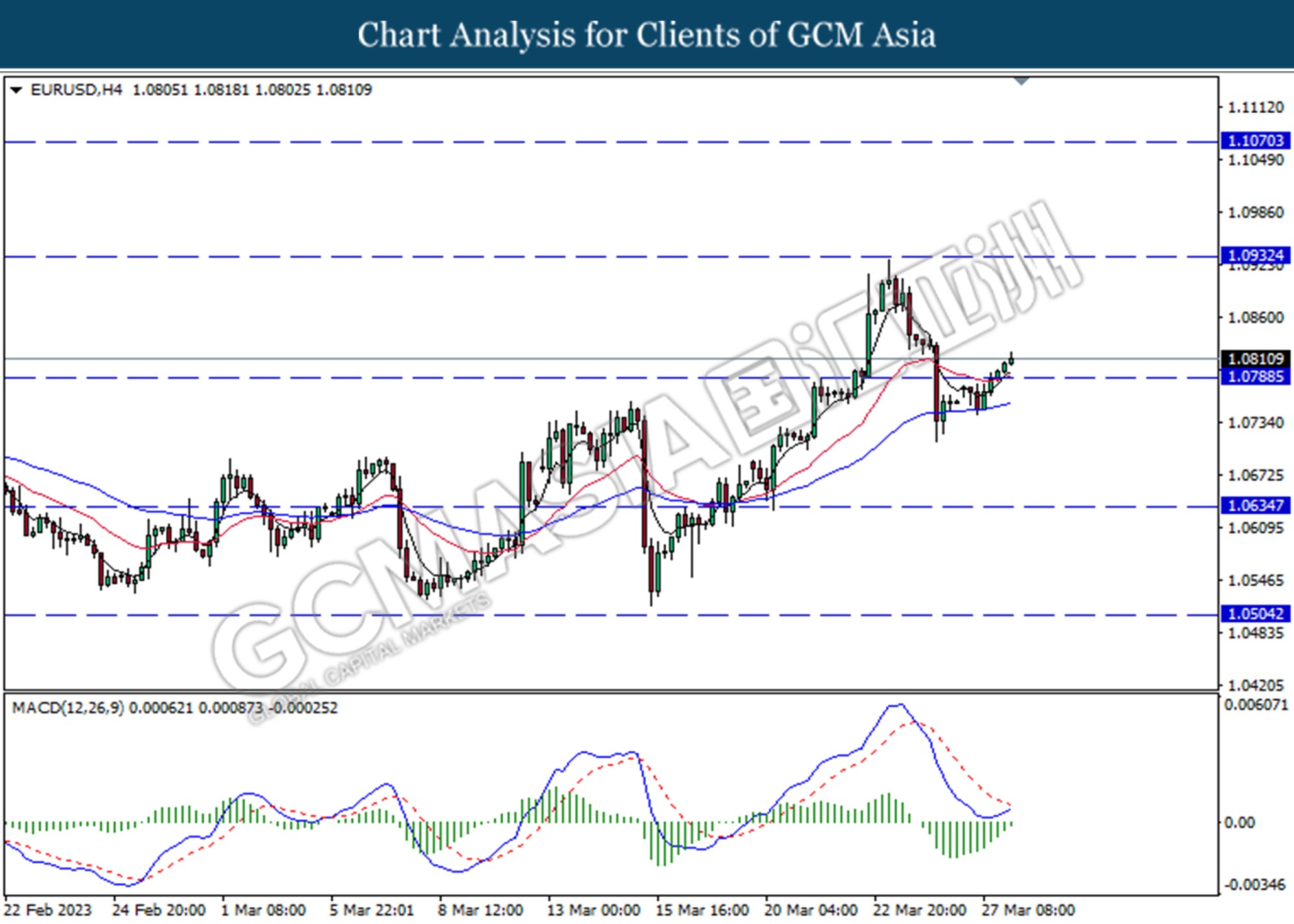

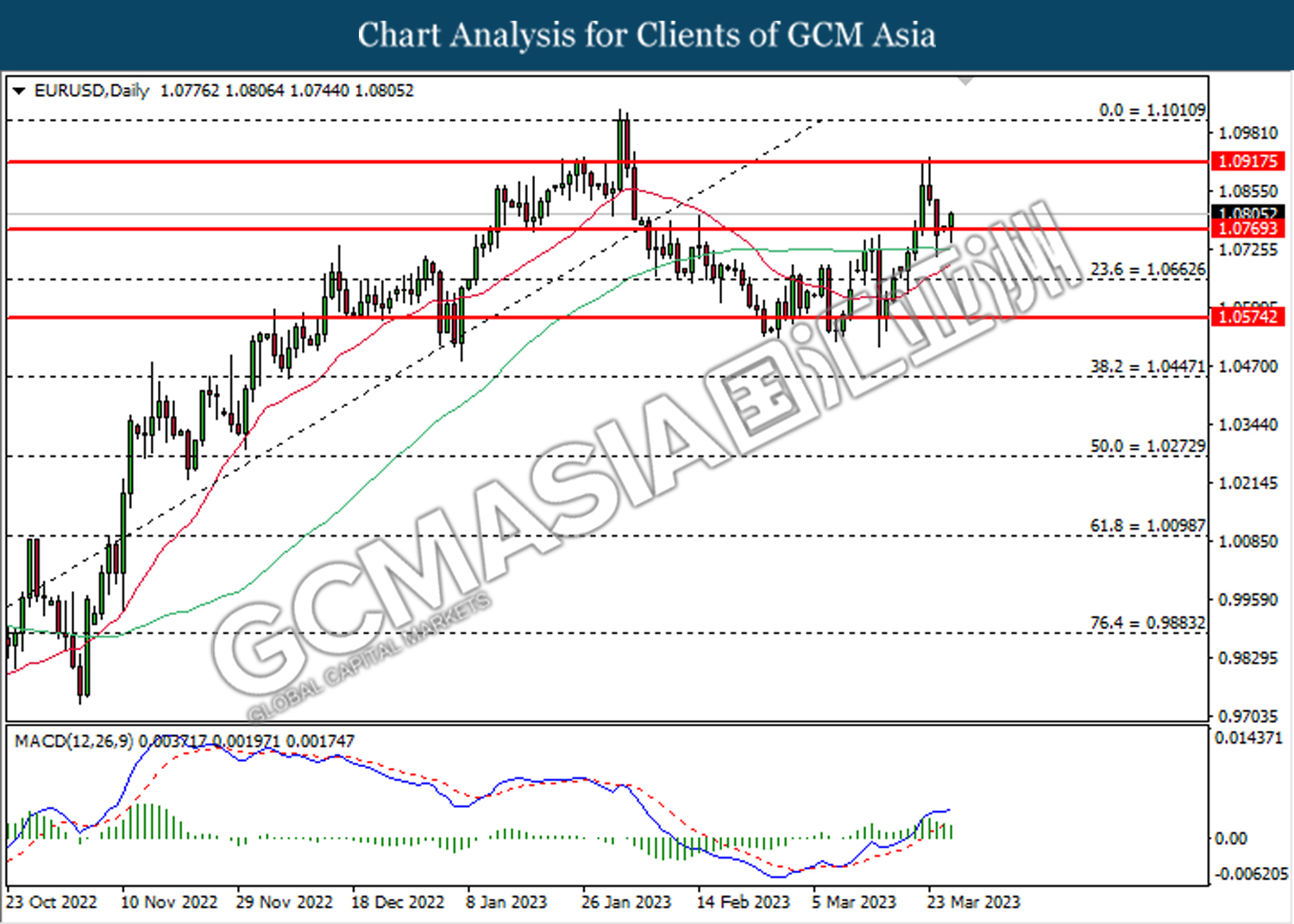

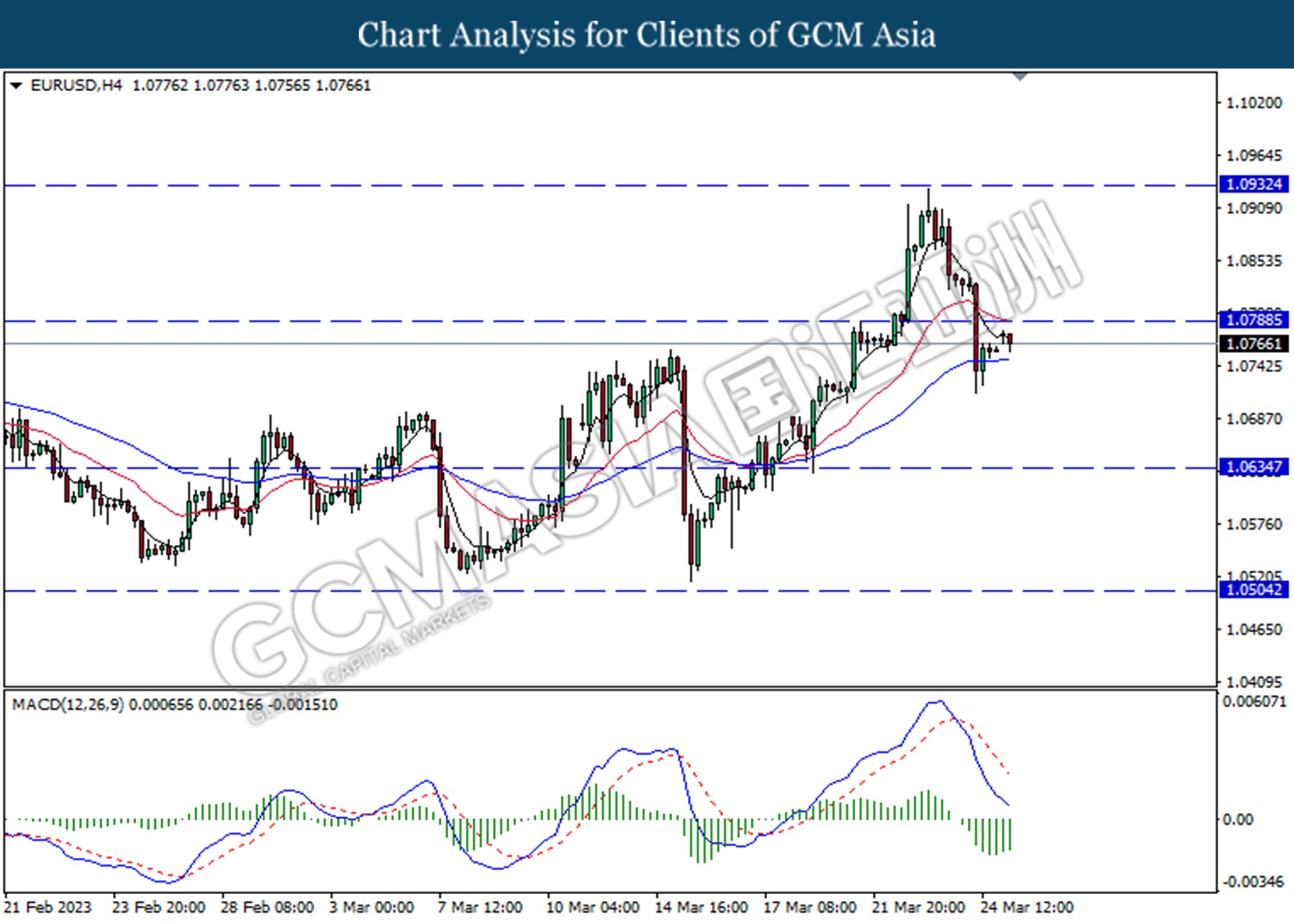

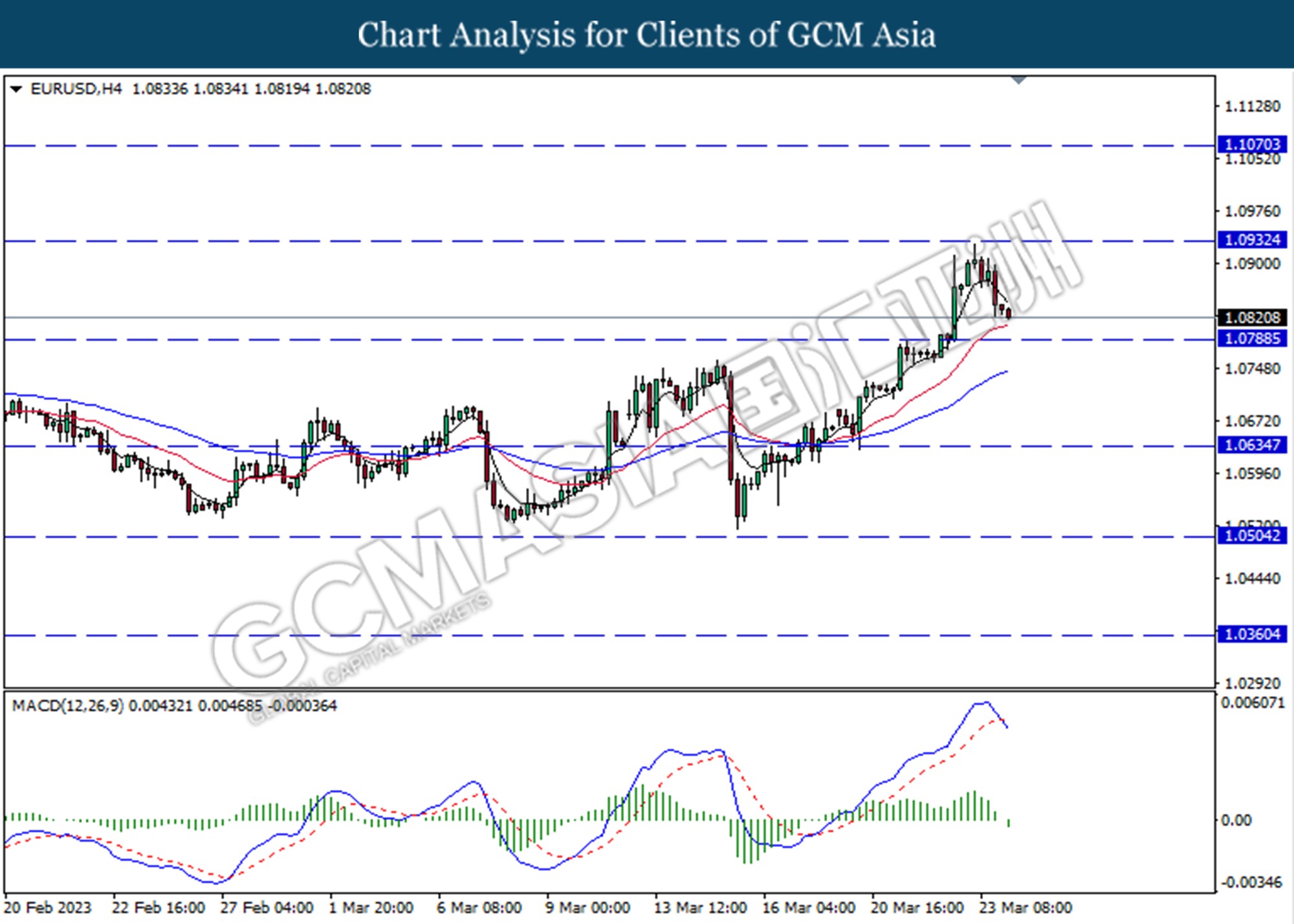

EURUSD, H4: EURUSD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

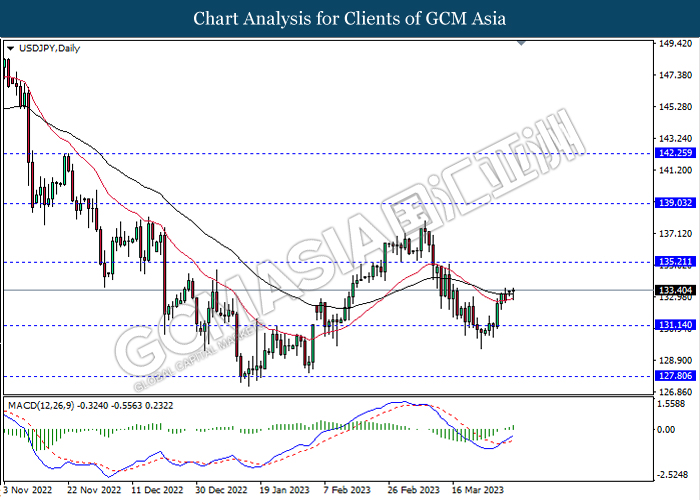

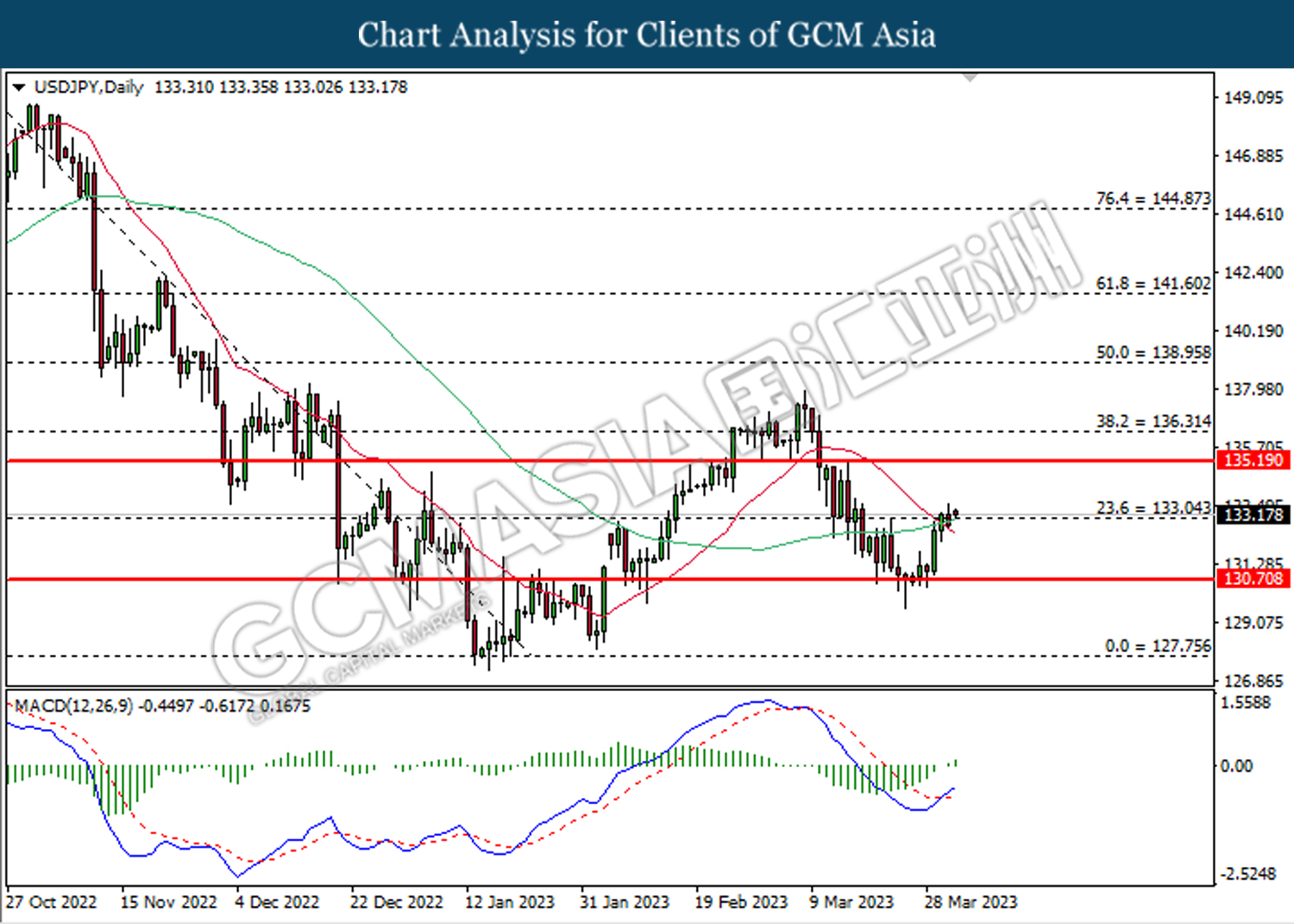

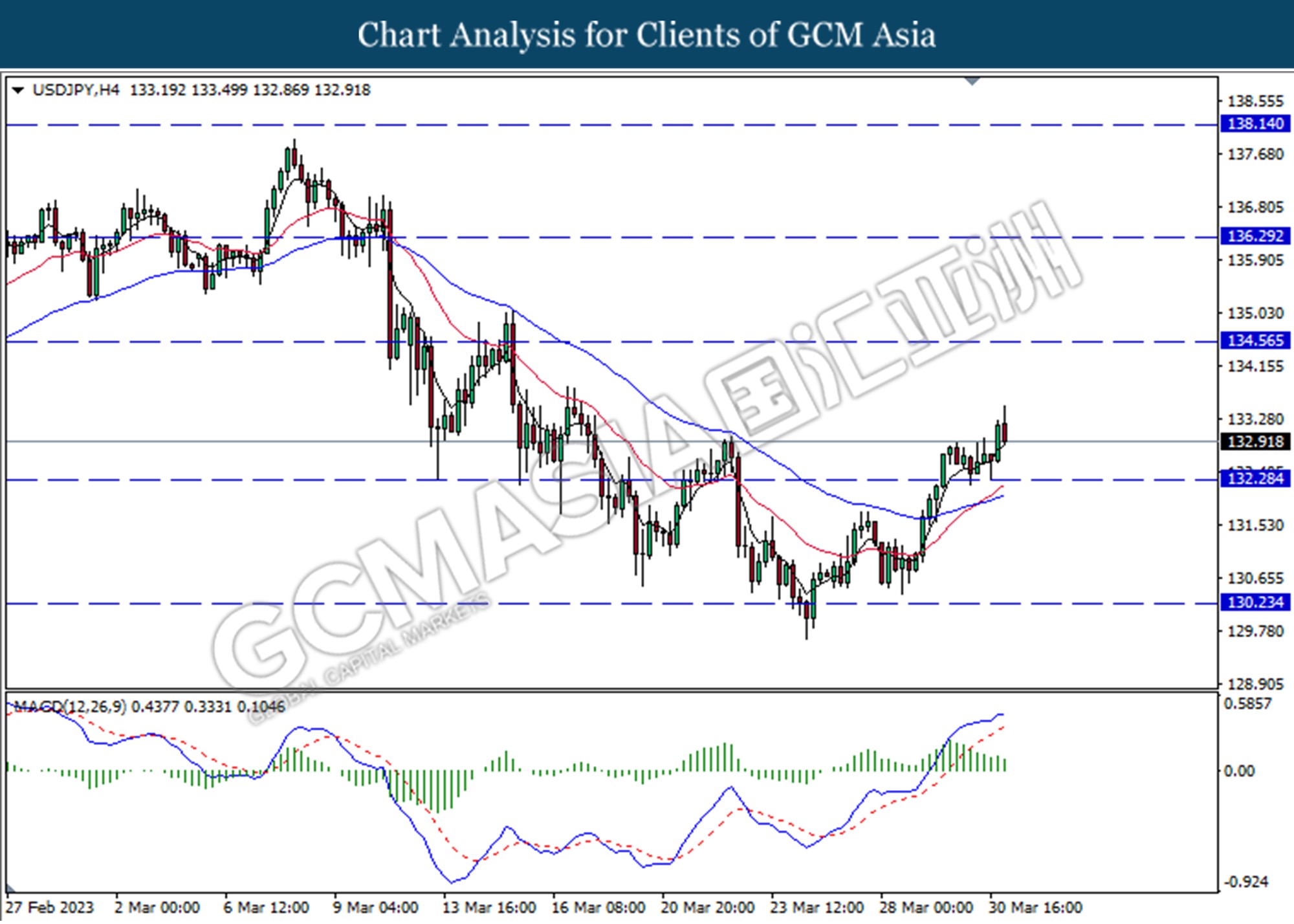

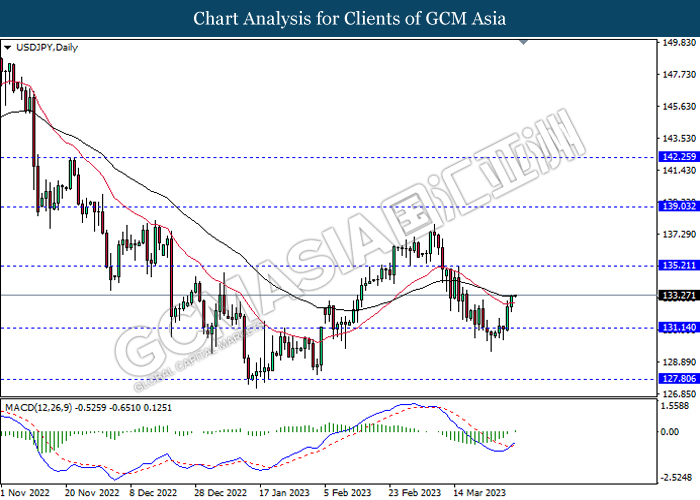

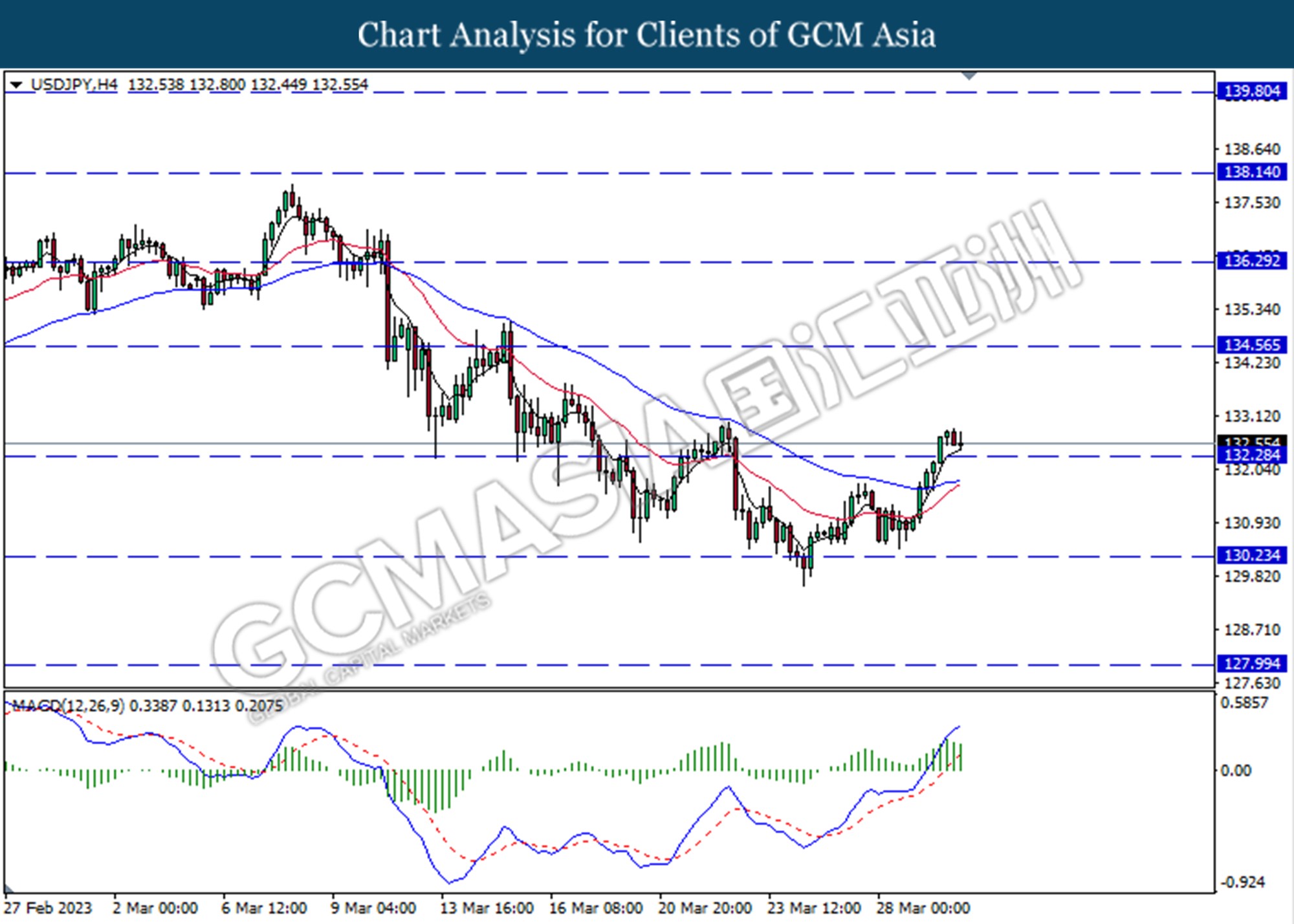

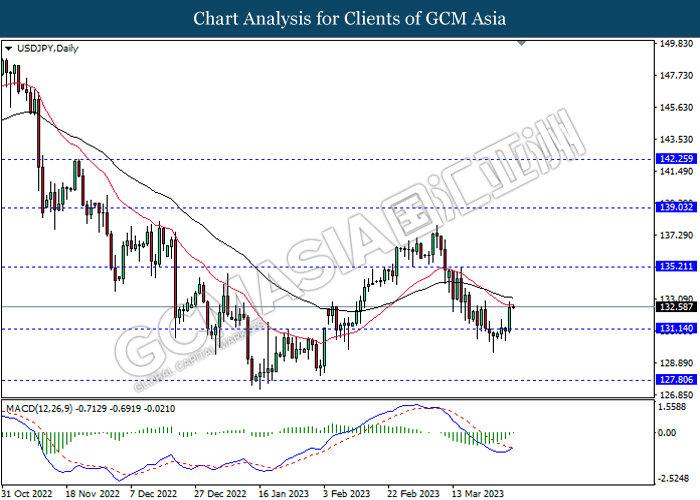

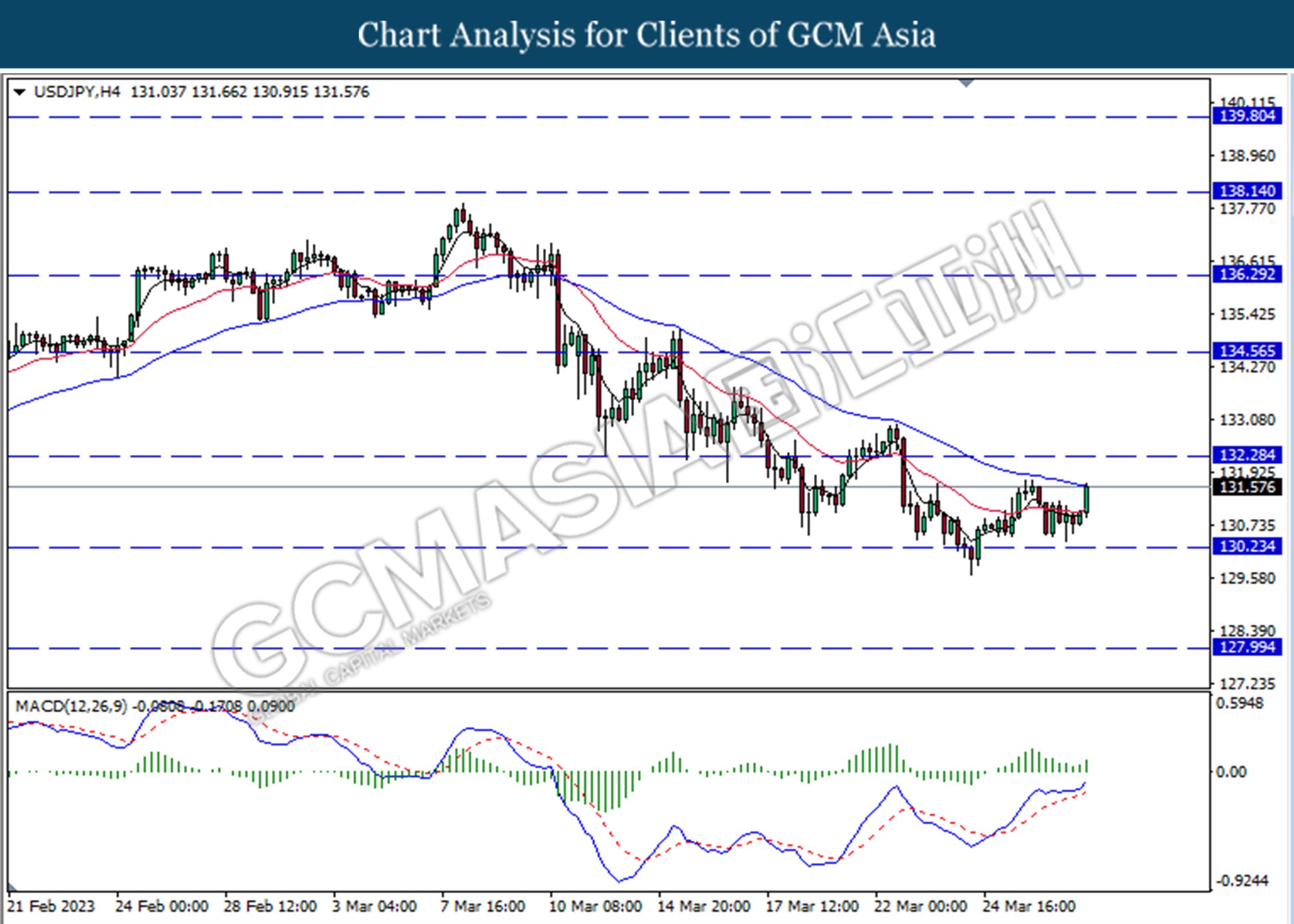

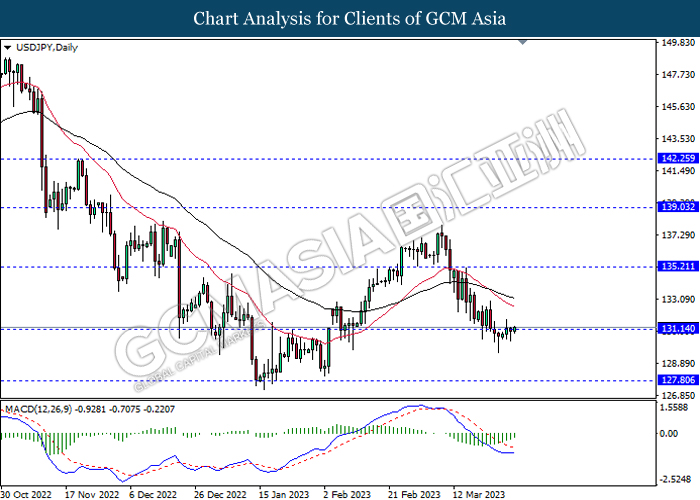

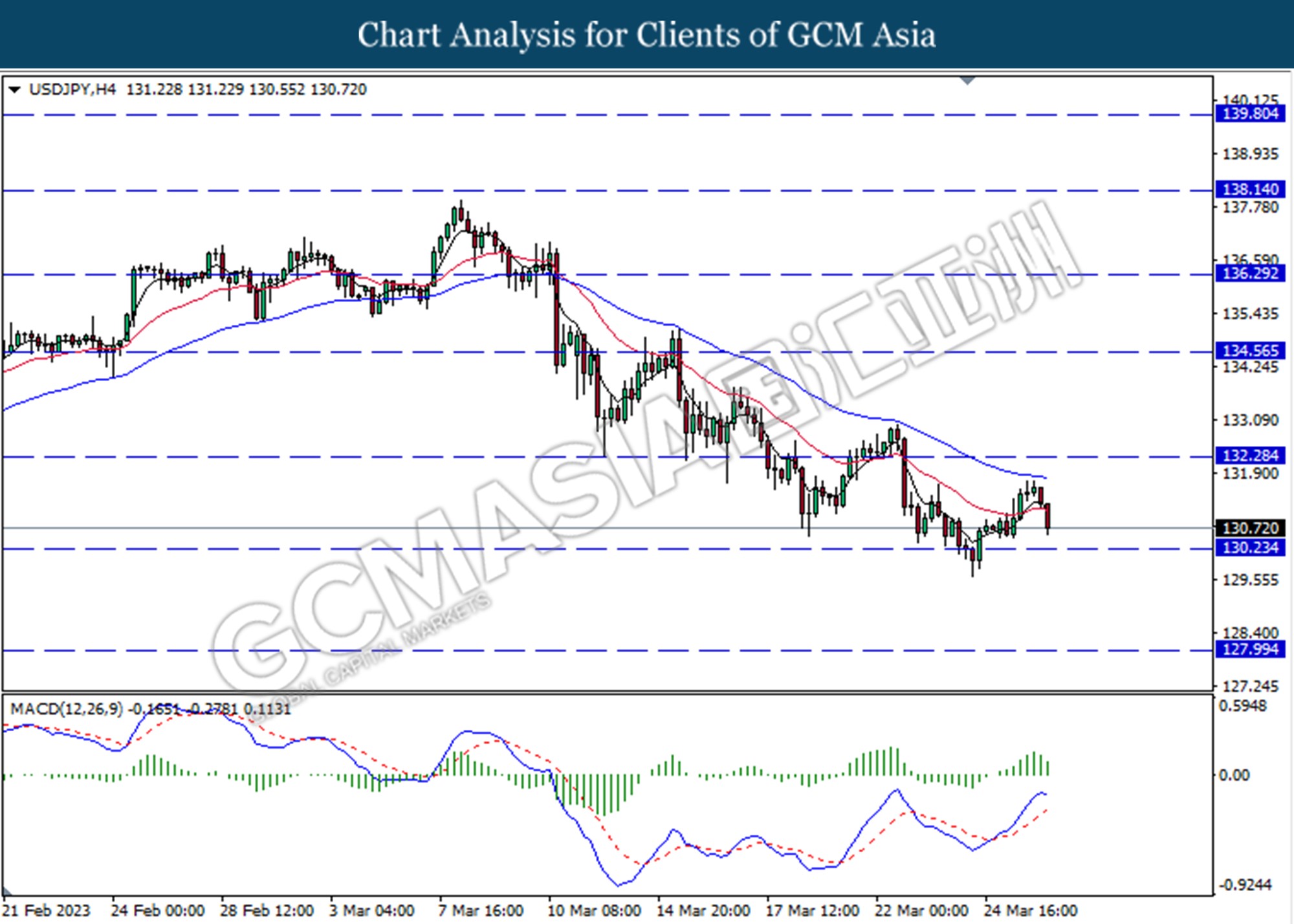

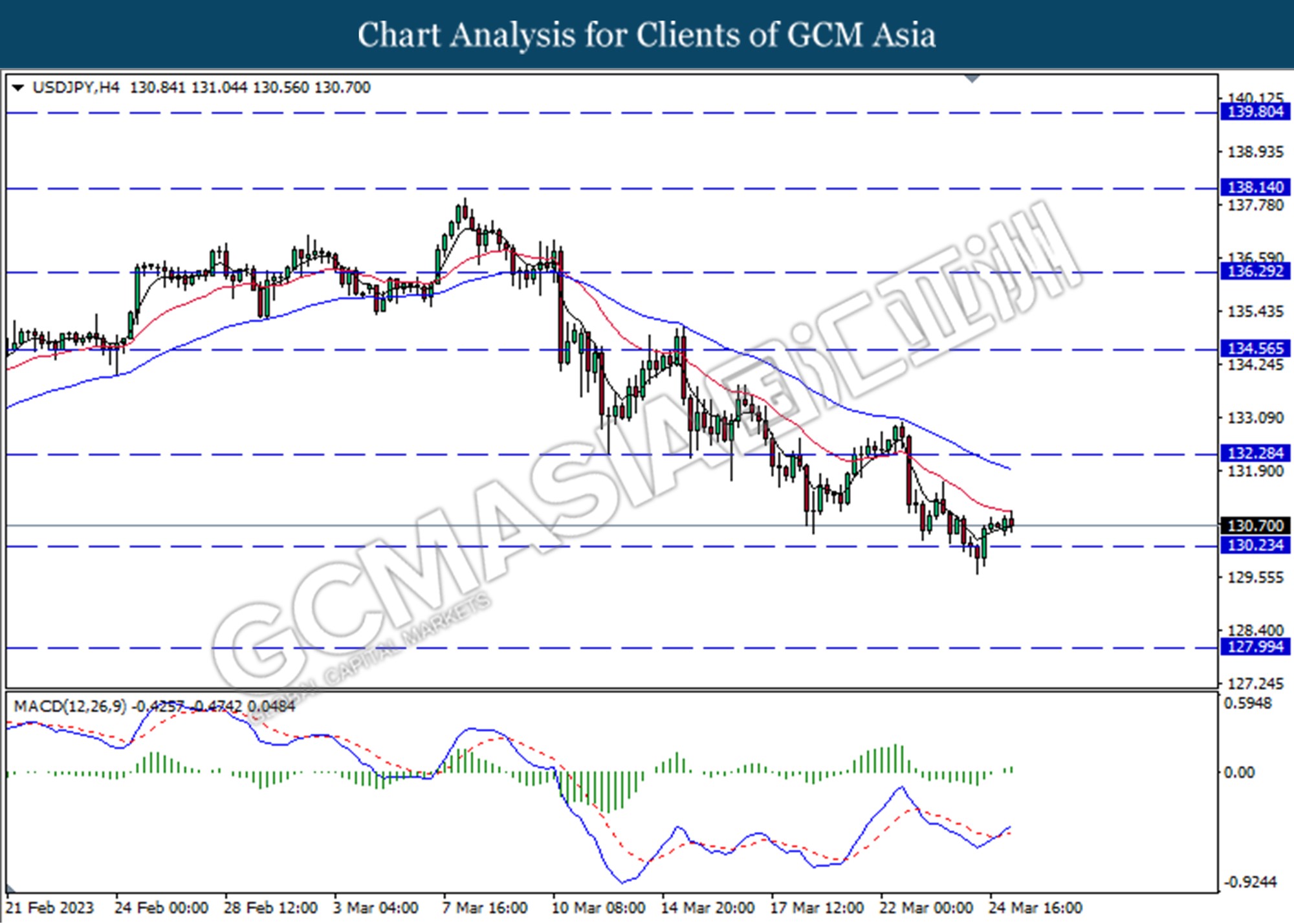

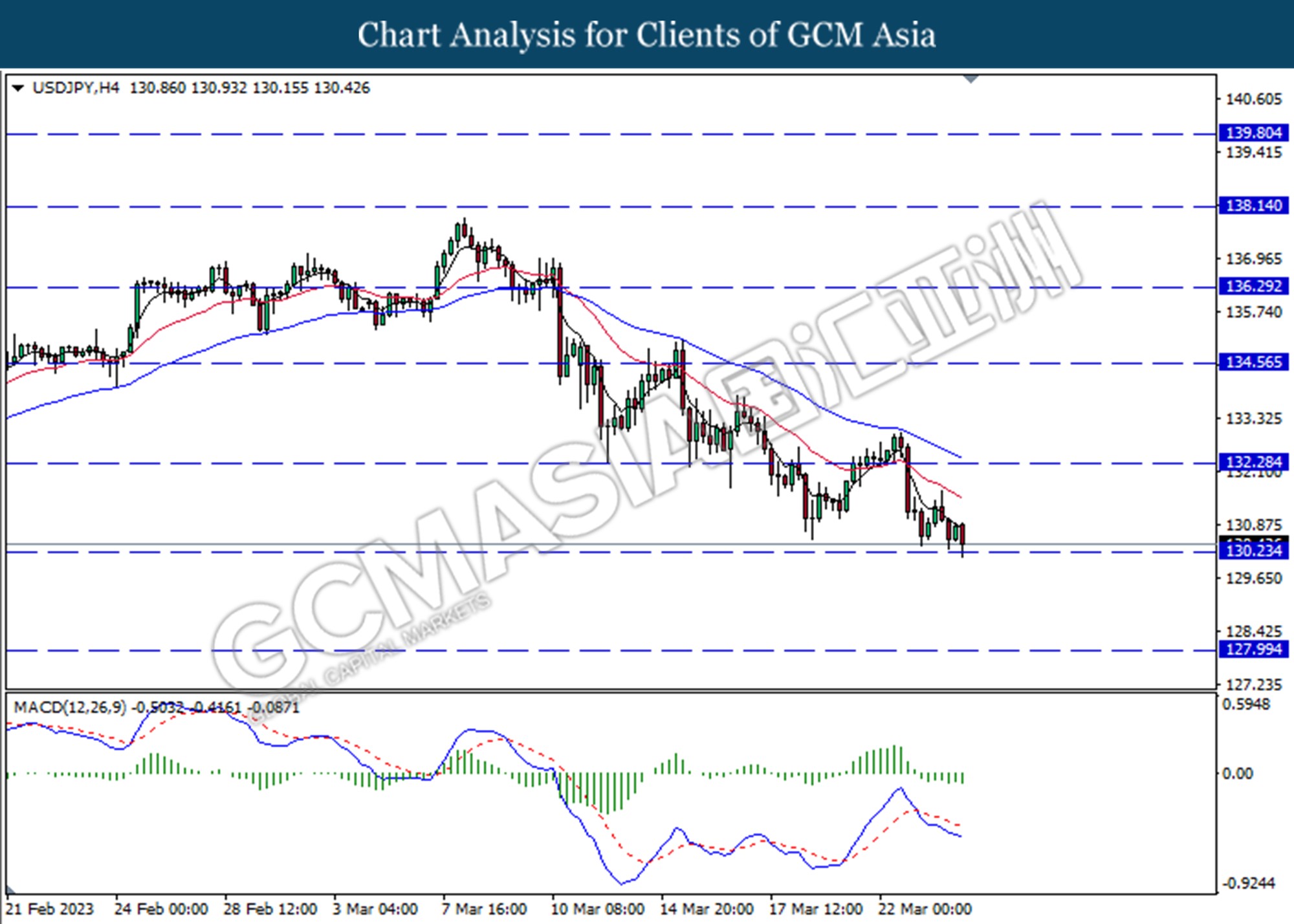

USDJPY, H4: USDJPY was traded higher following a prior rebounded from the support level at 133.30. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

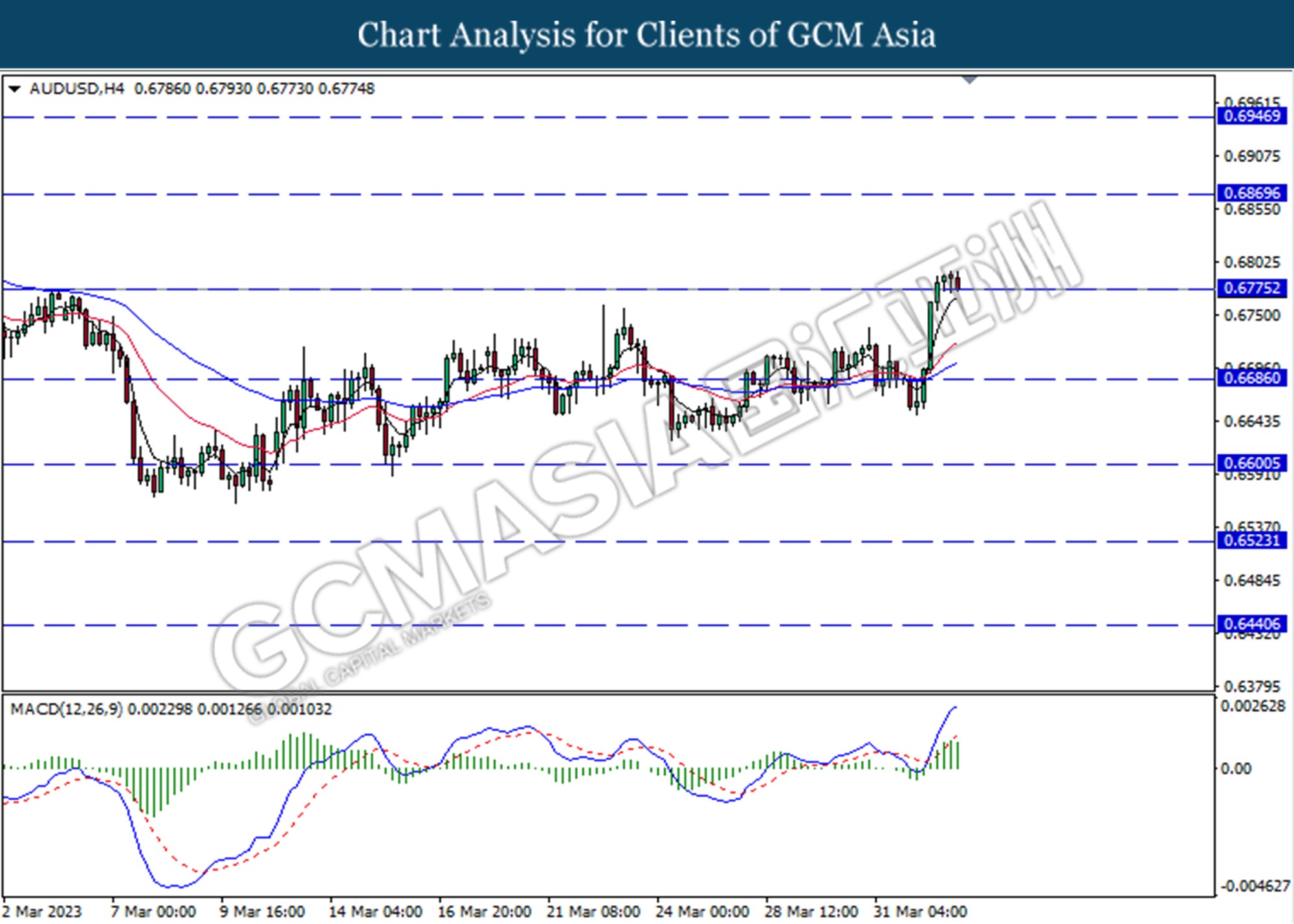

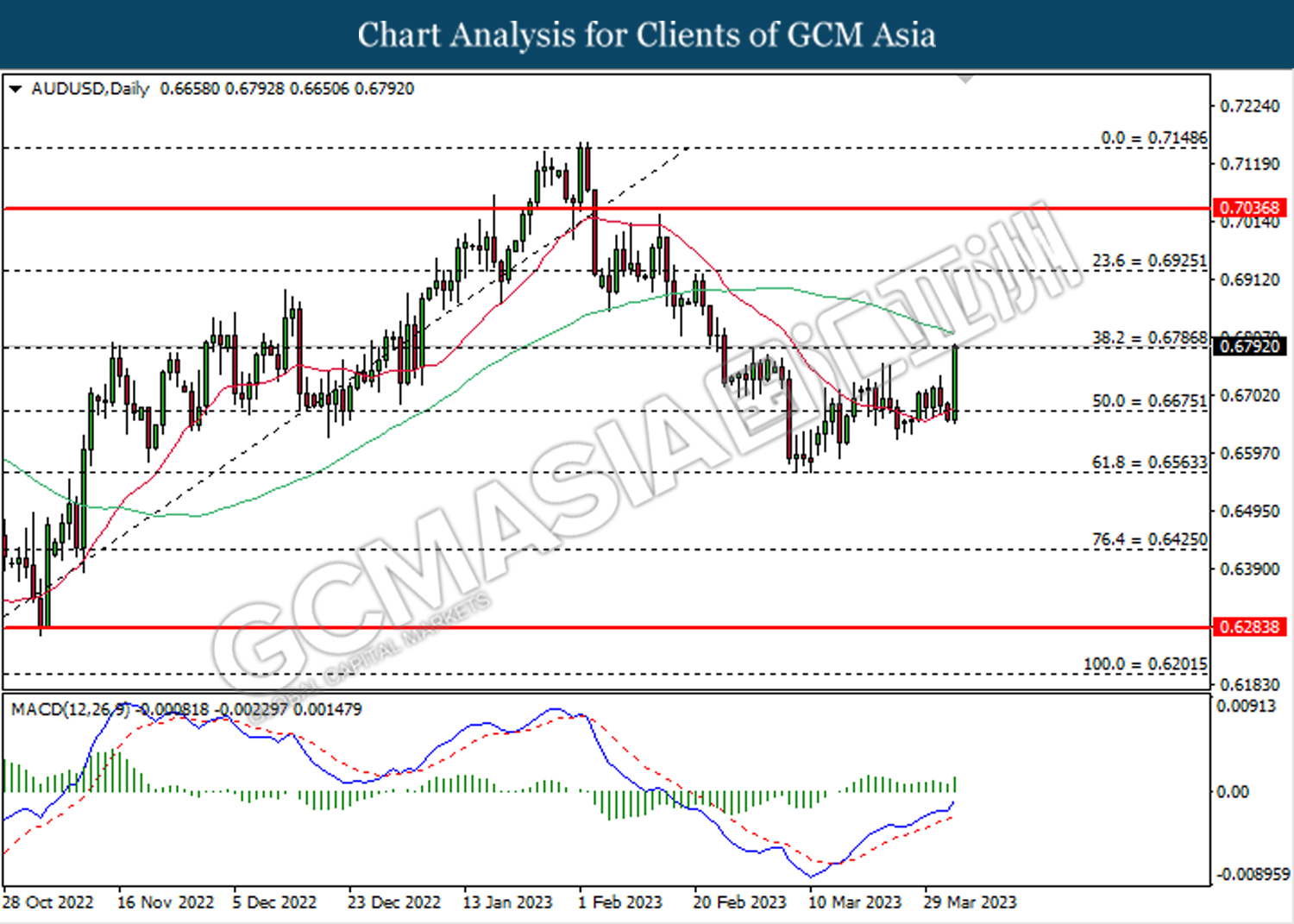

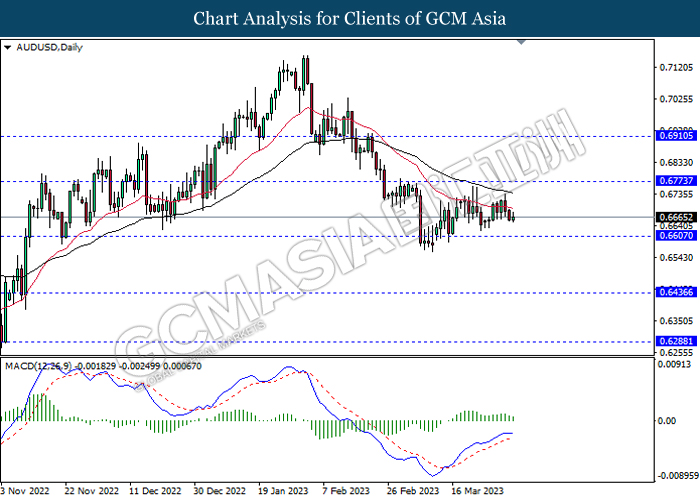

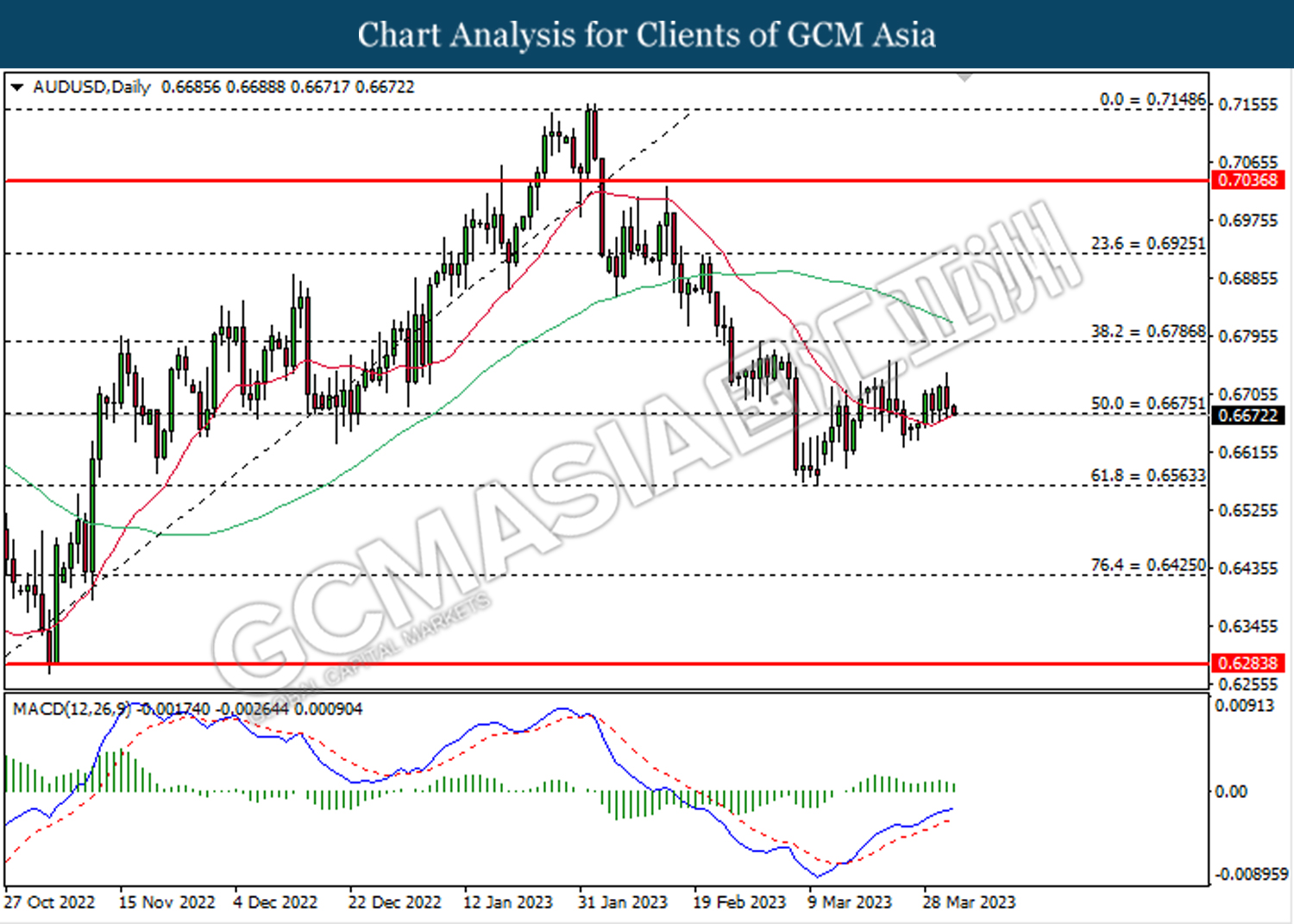

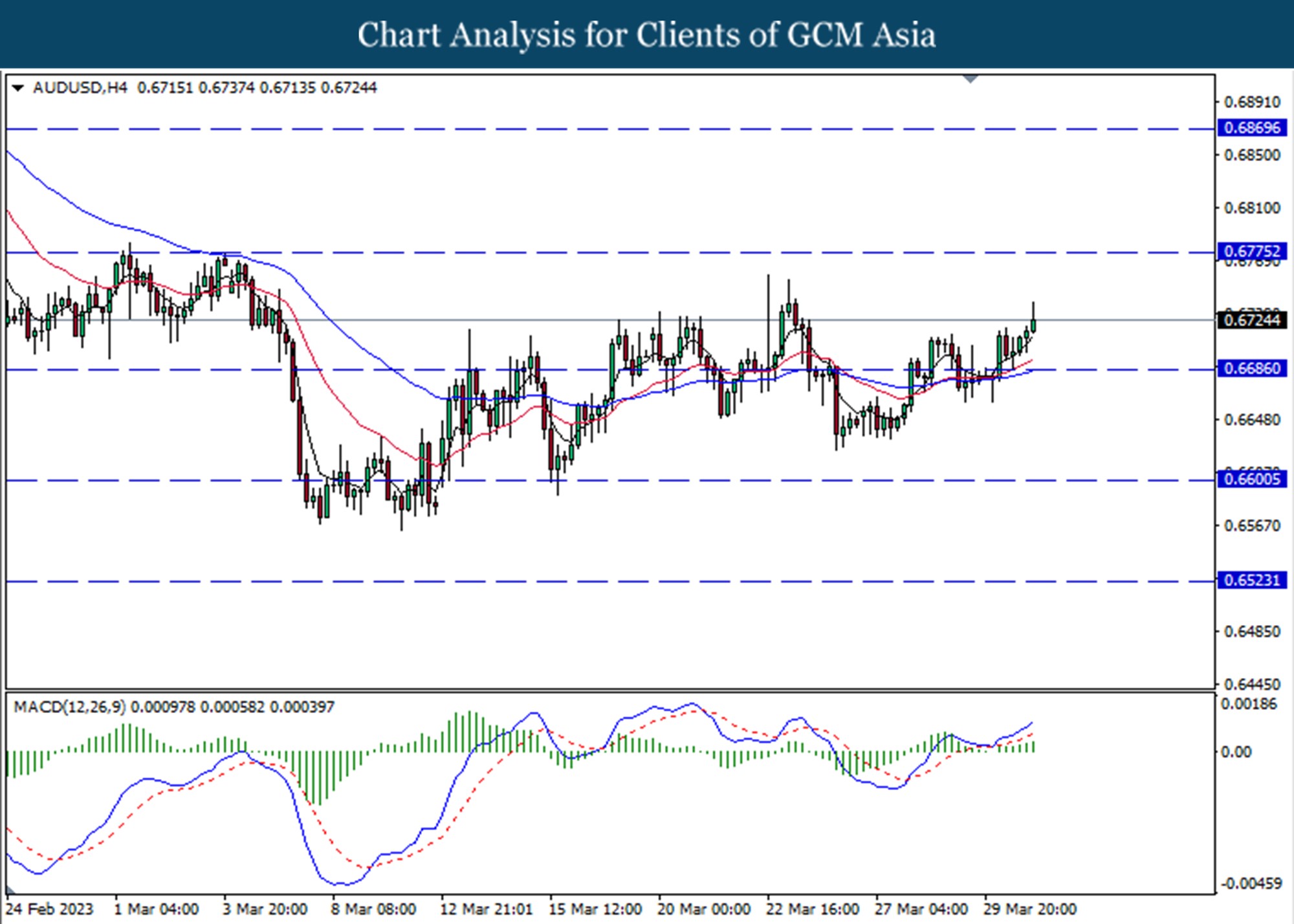

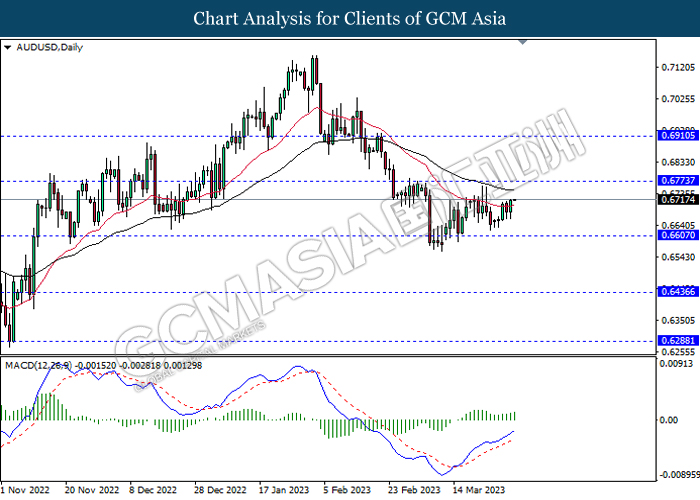

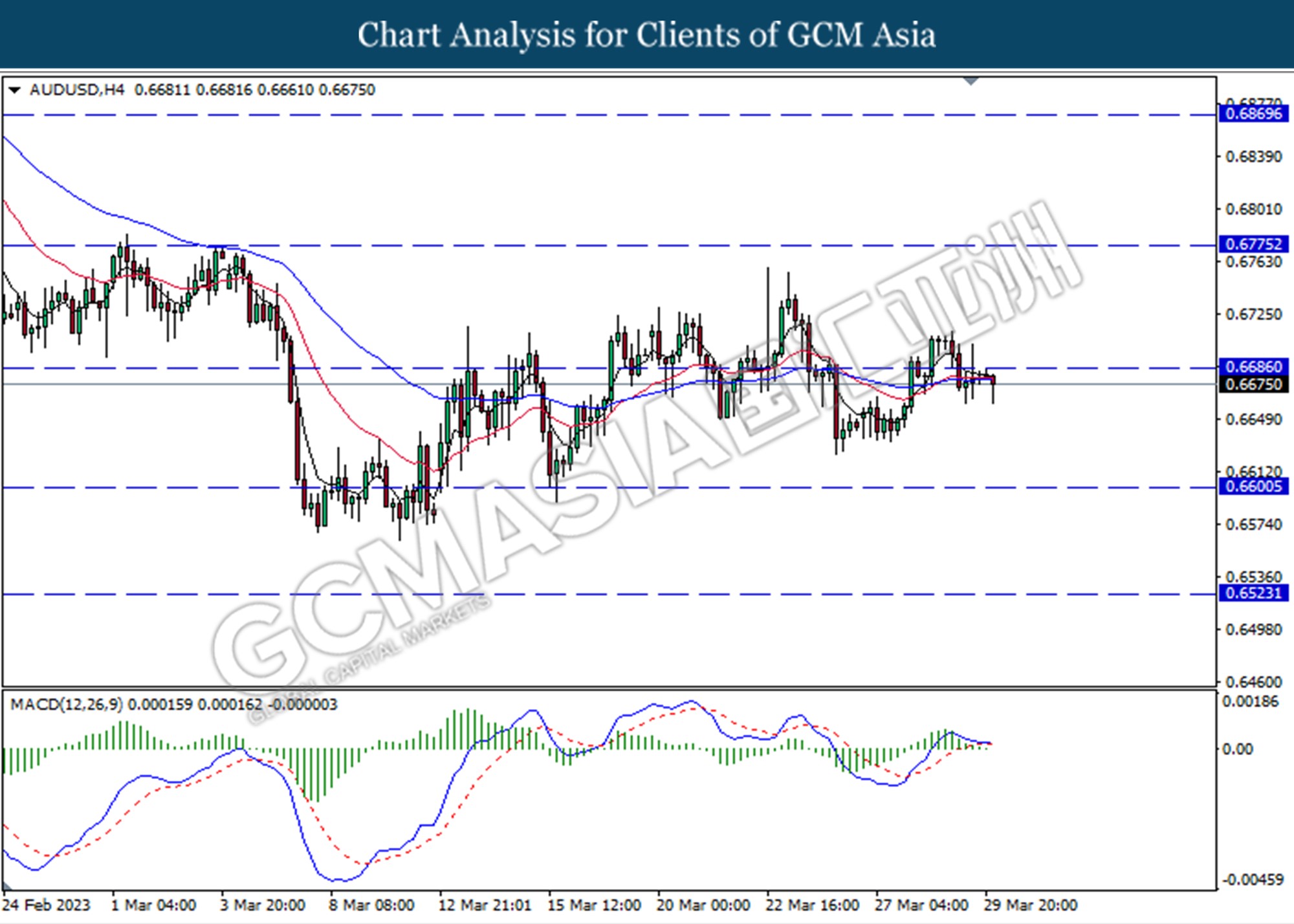

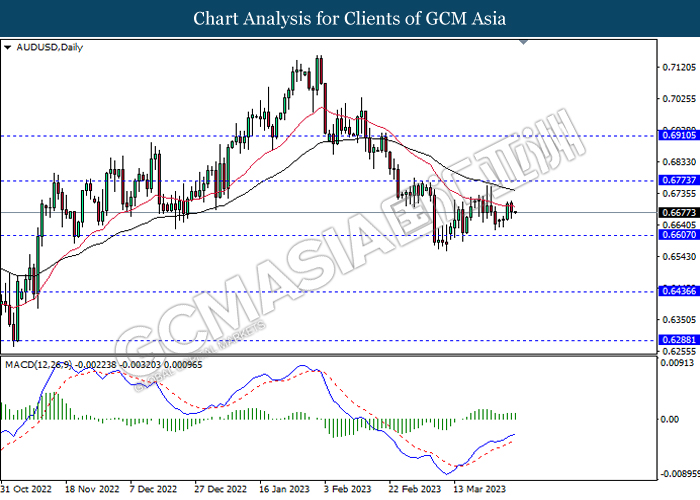

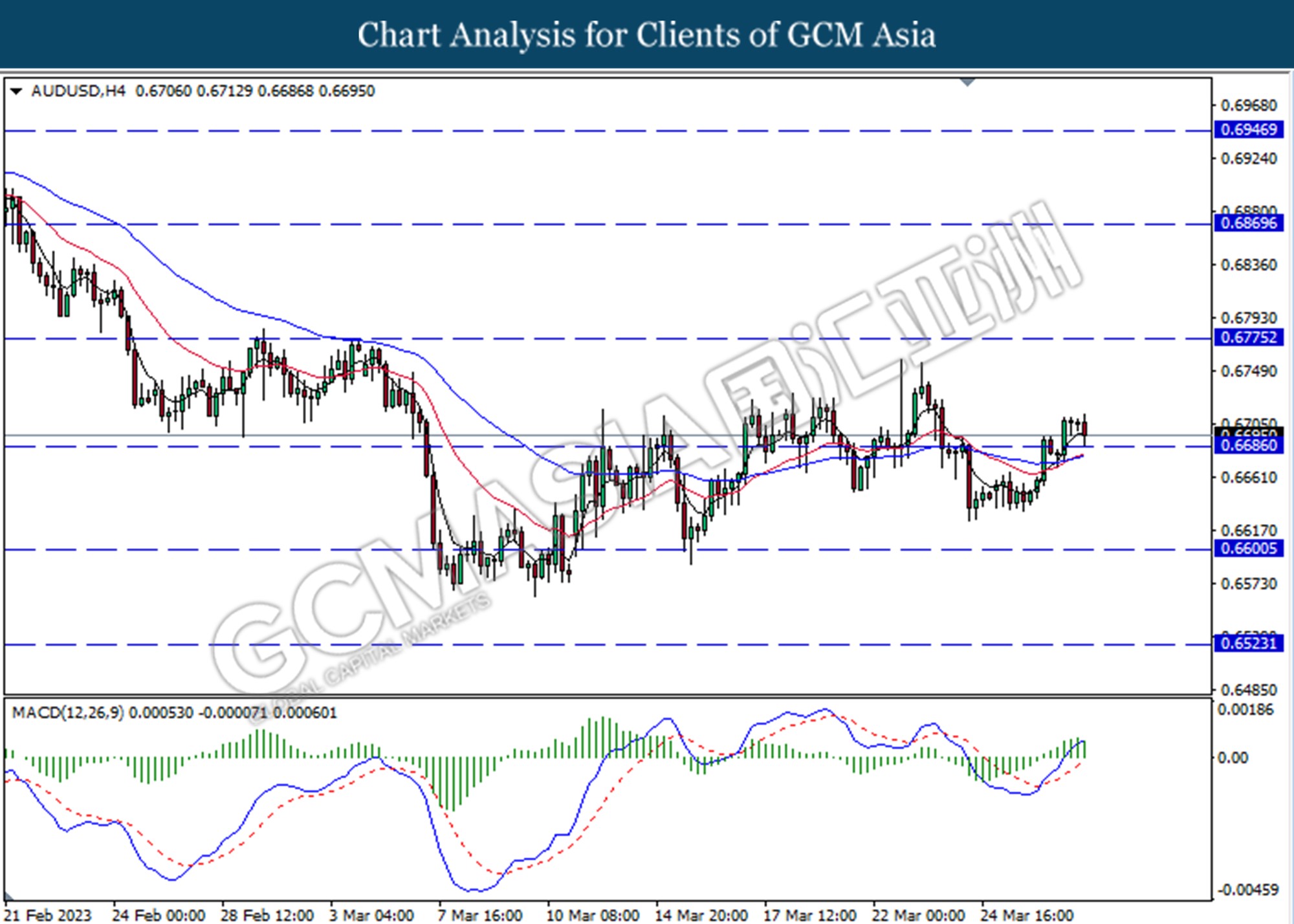

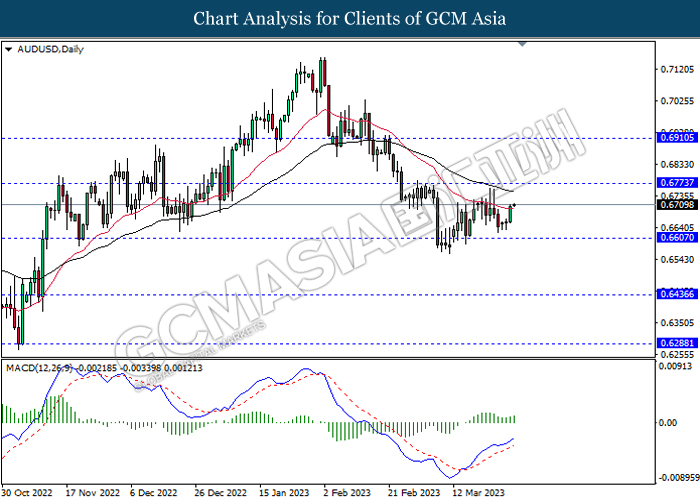

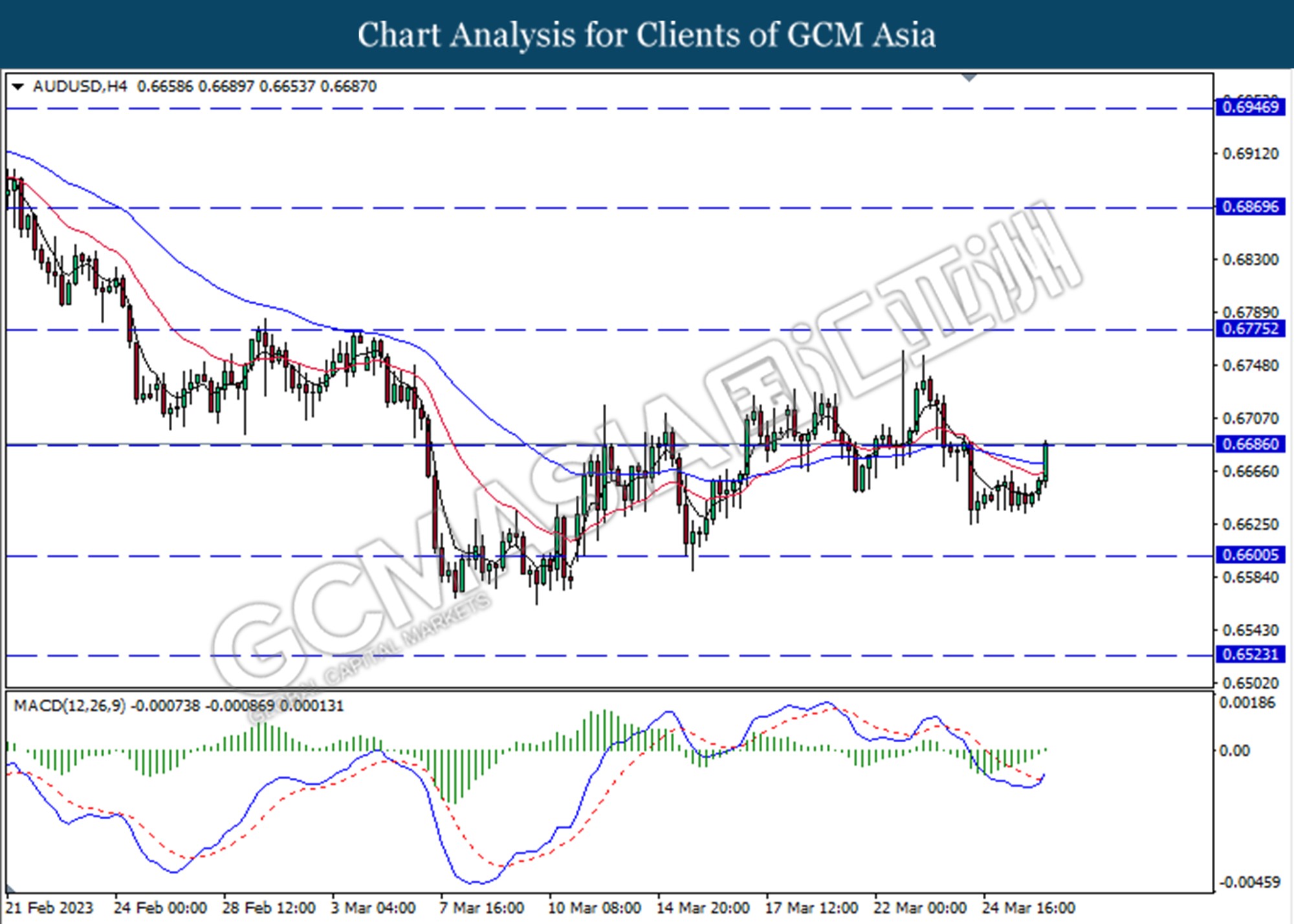

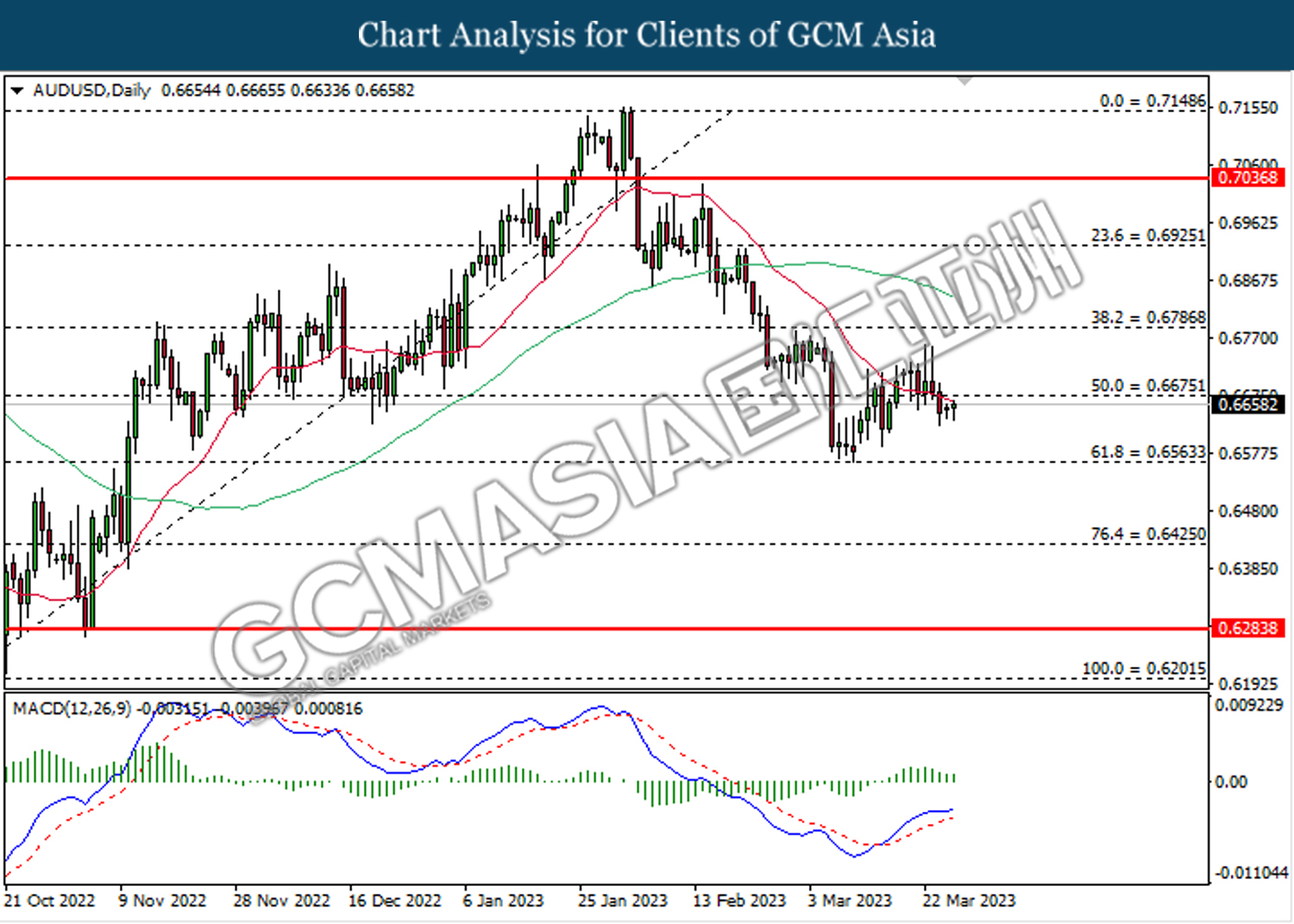

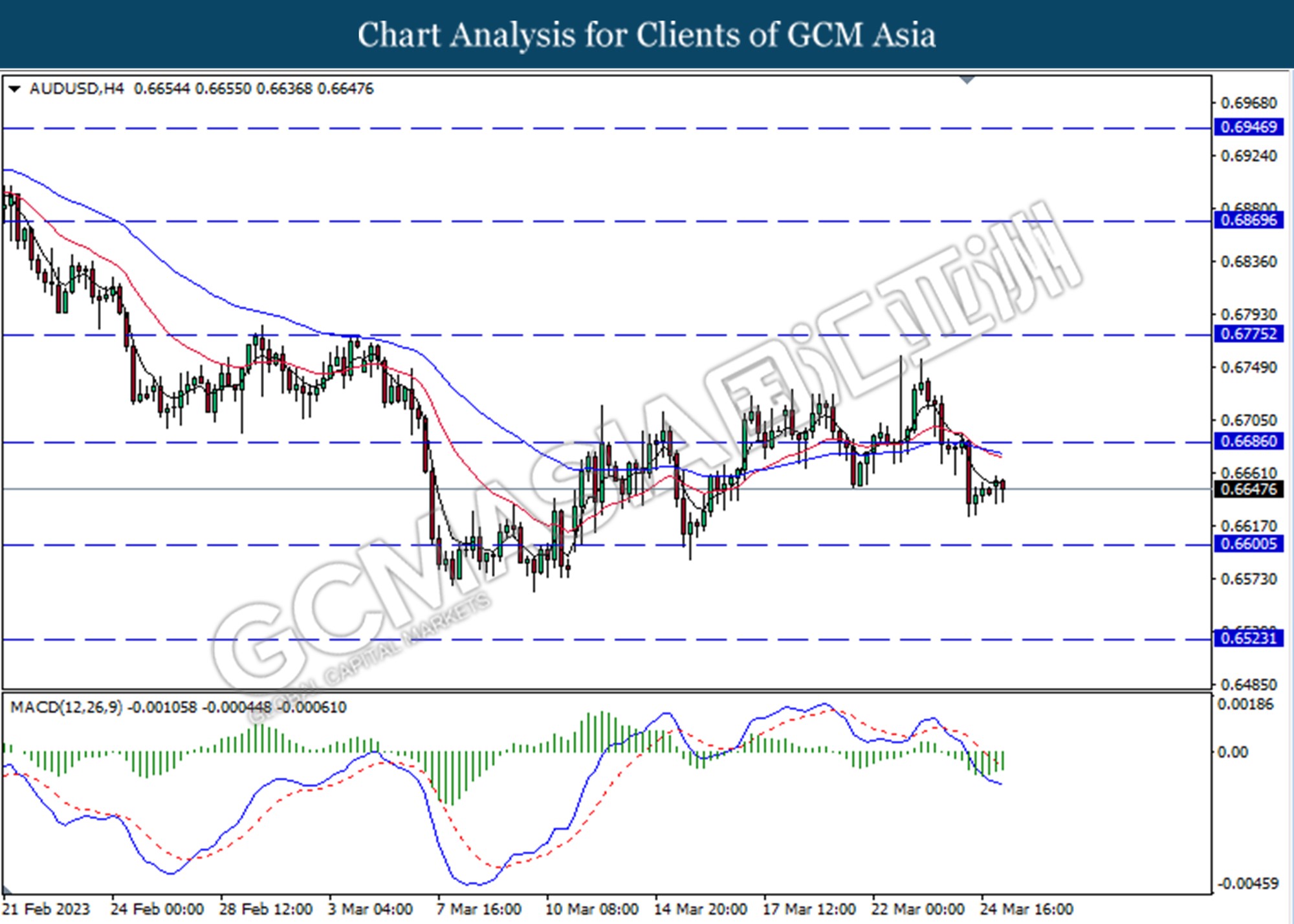

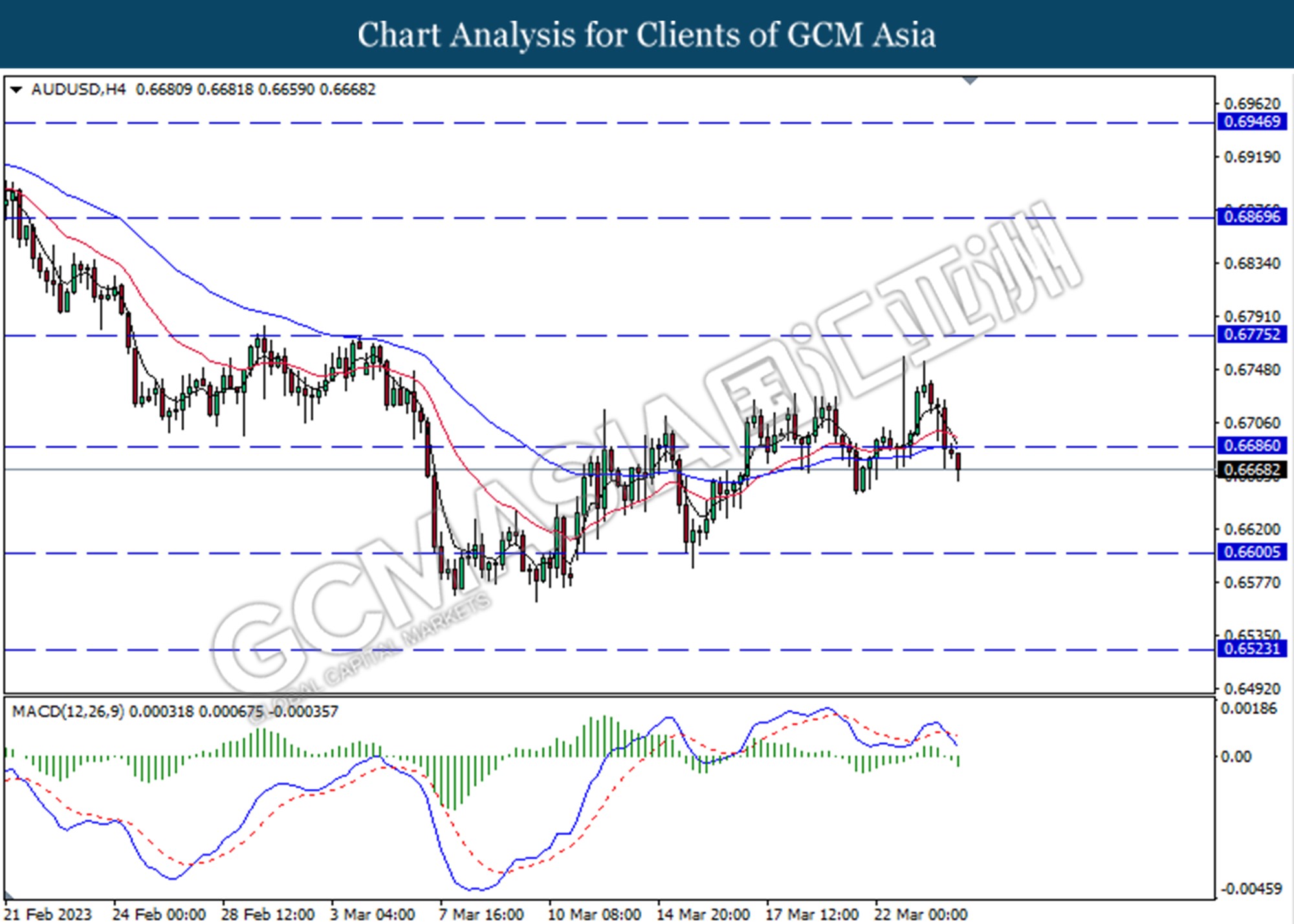

AUDUSD, H4: AUDUSD was traded lower while currently testing for the support level at 0.6775. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses after it successfully breakout below the support level.

Resistance level: 0.6870, 0.6945

Support level: 0.6775, 0.6685

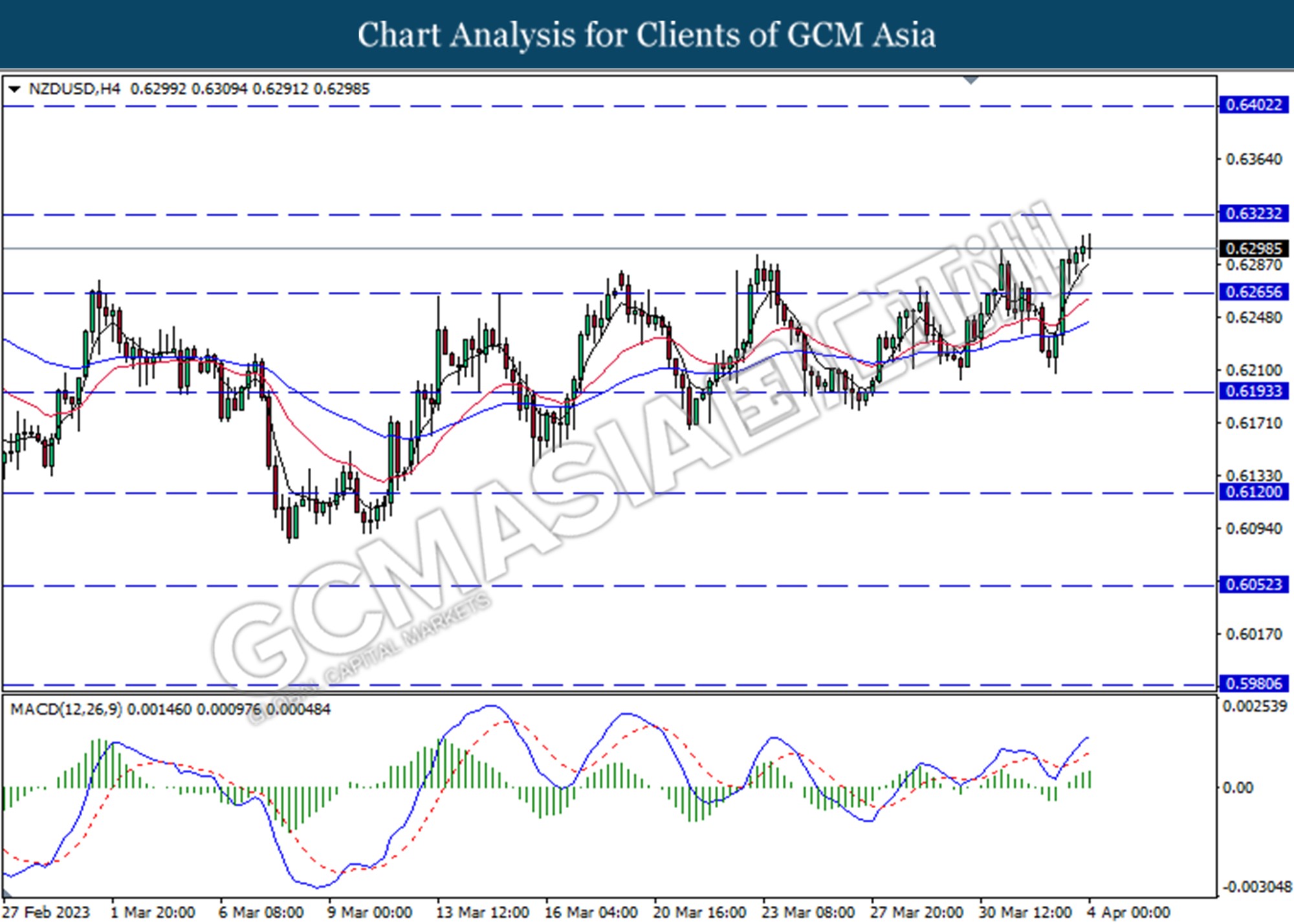

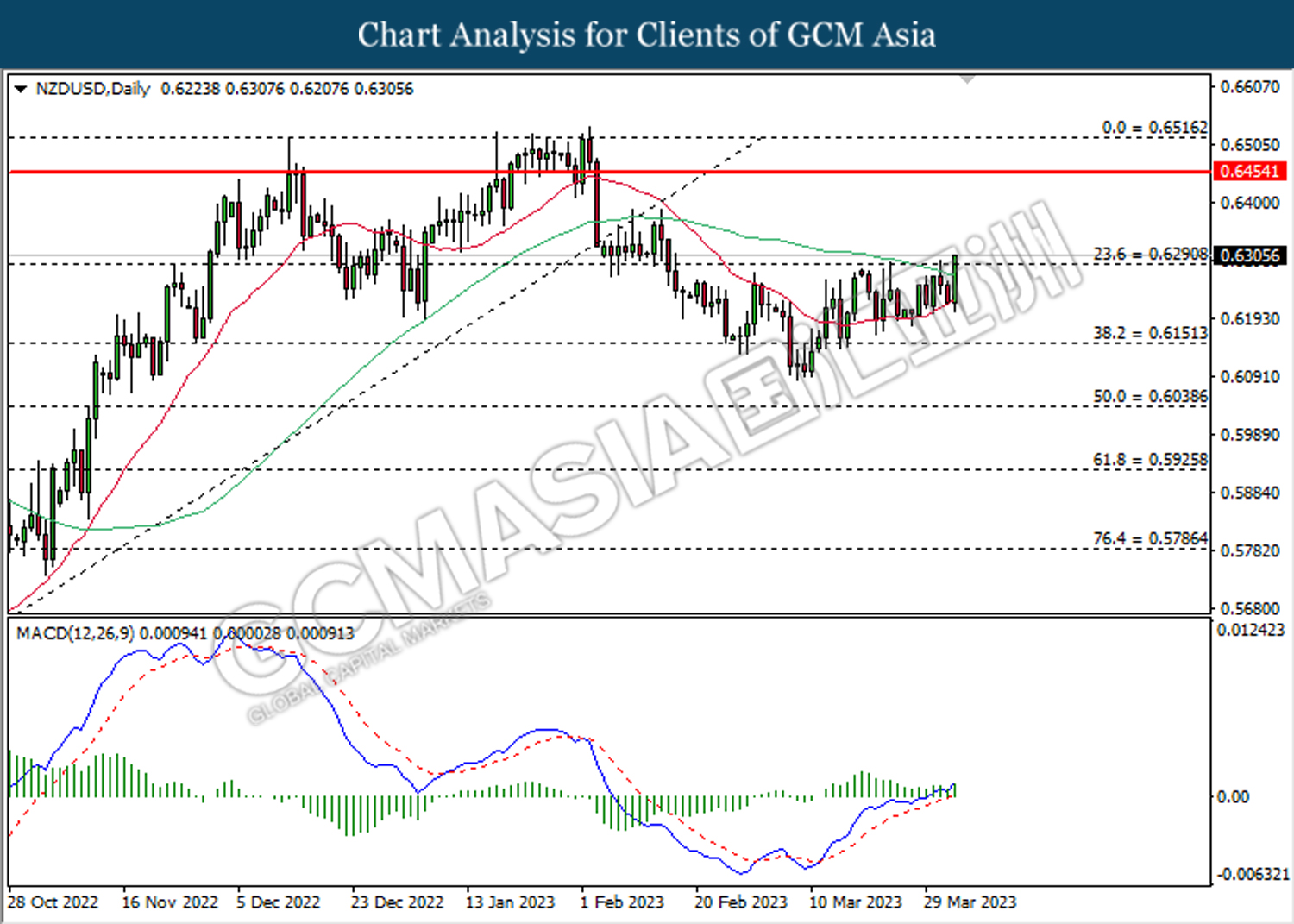

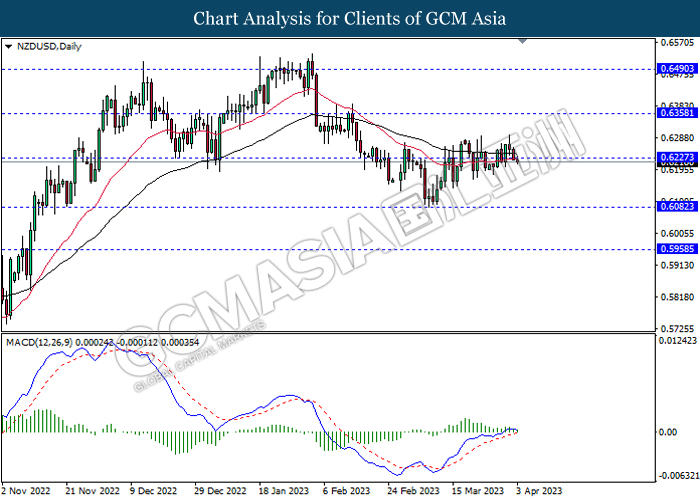

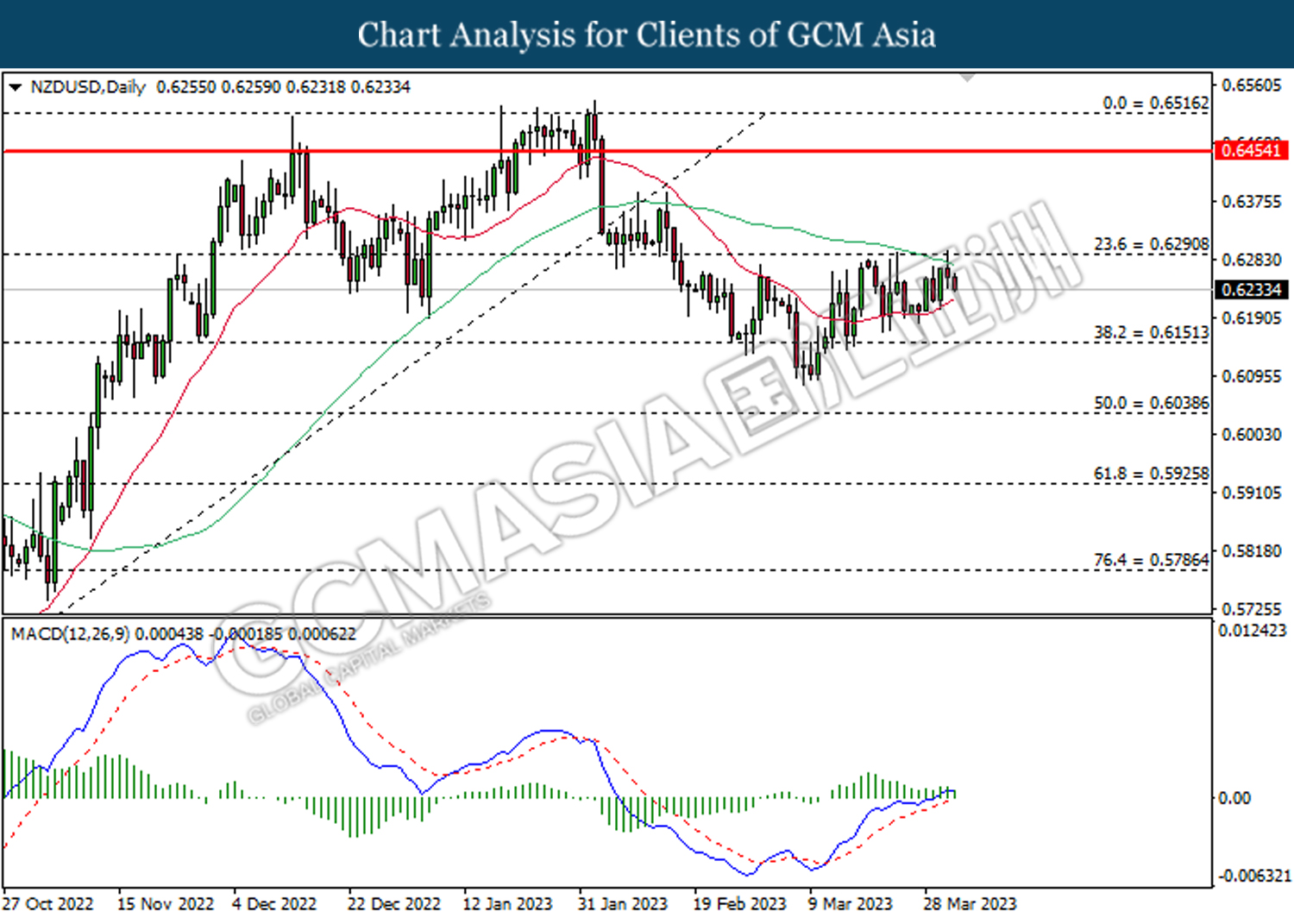

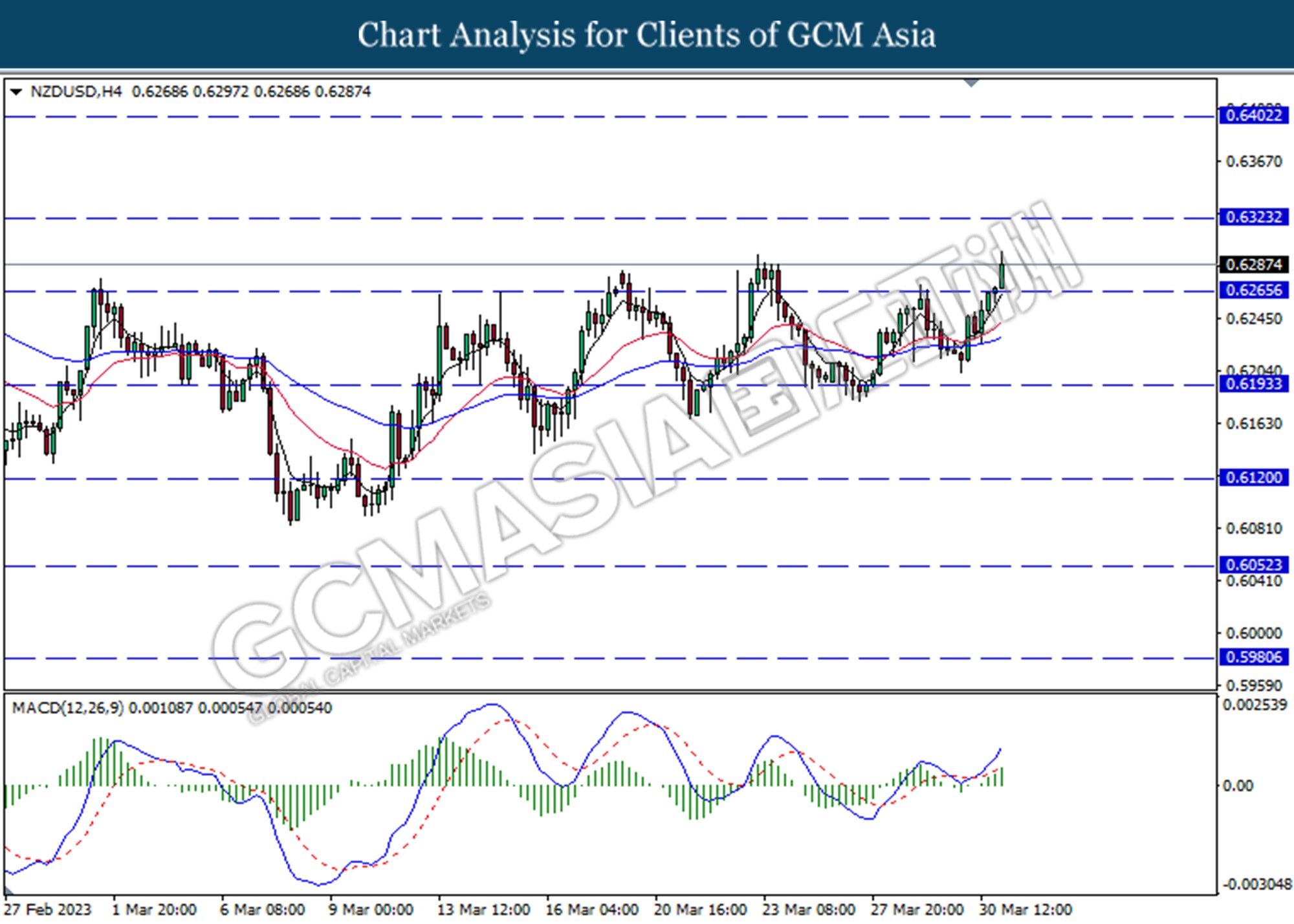

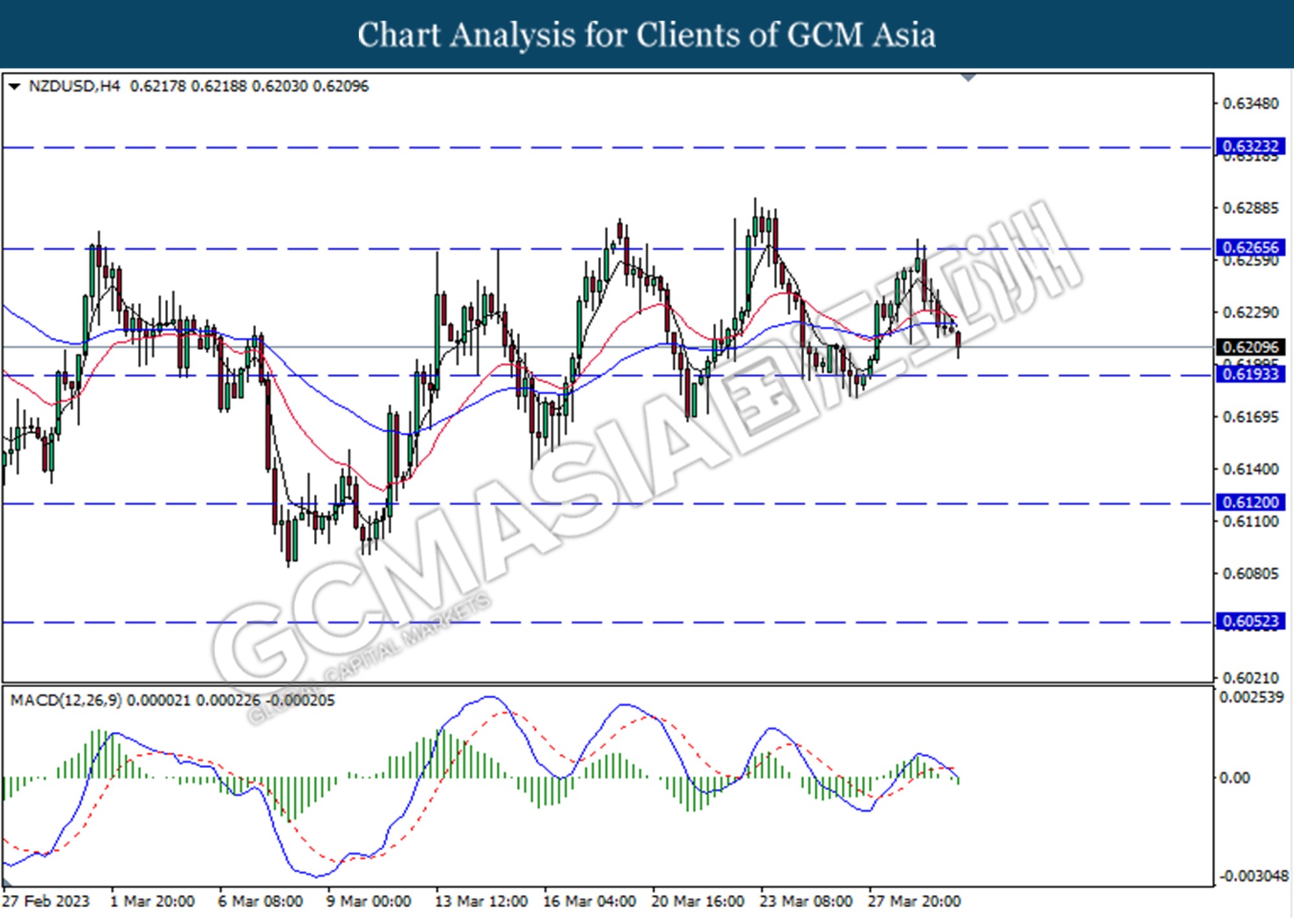

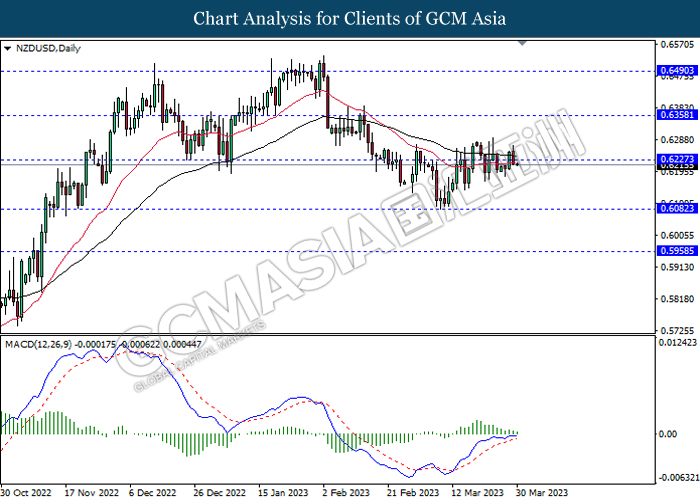

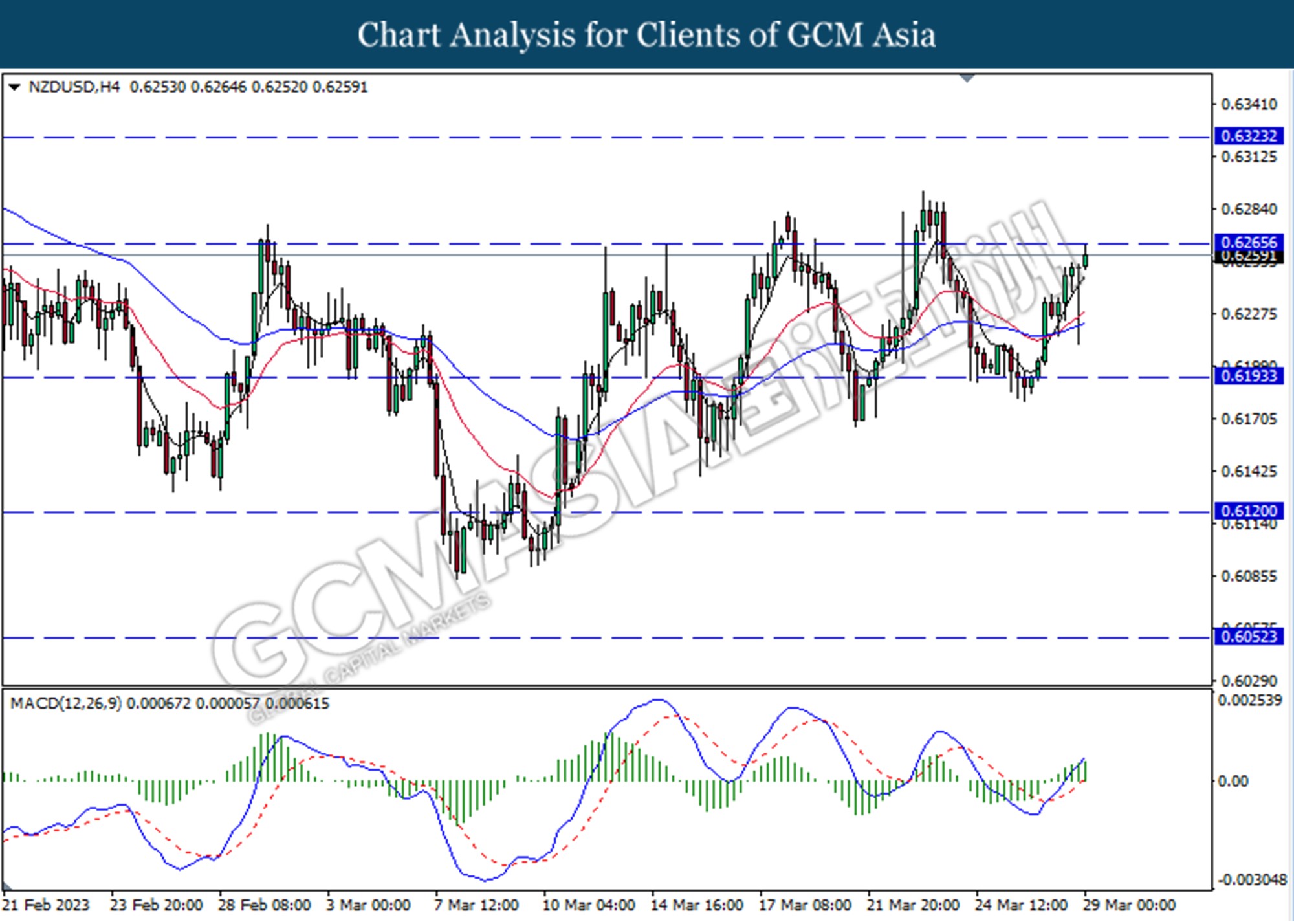

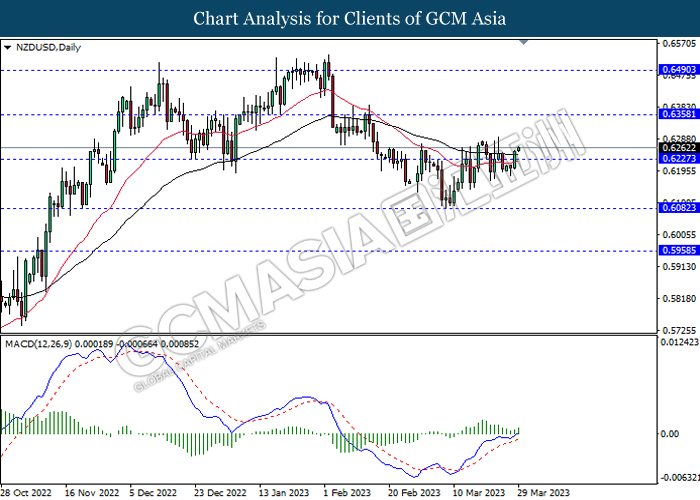

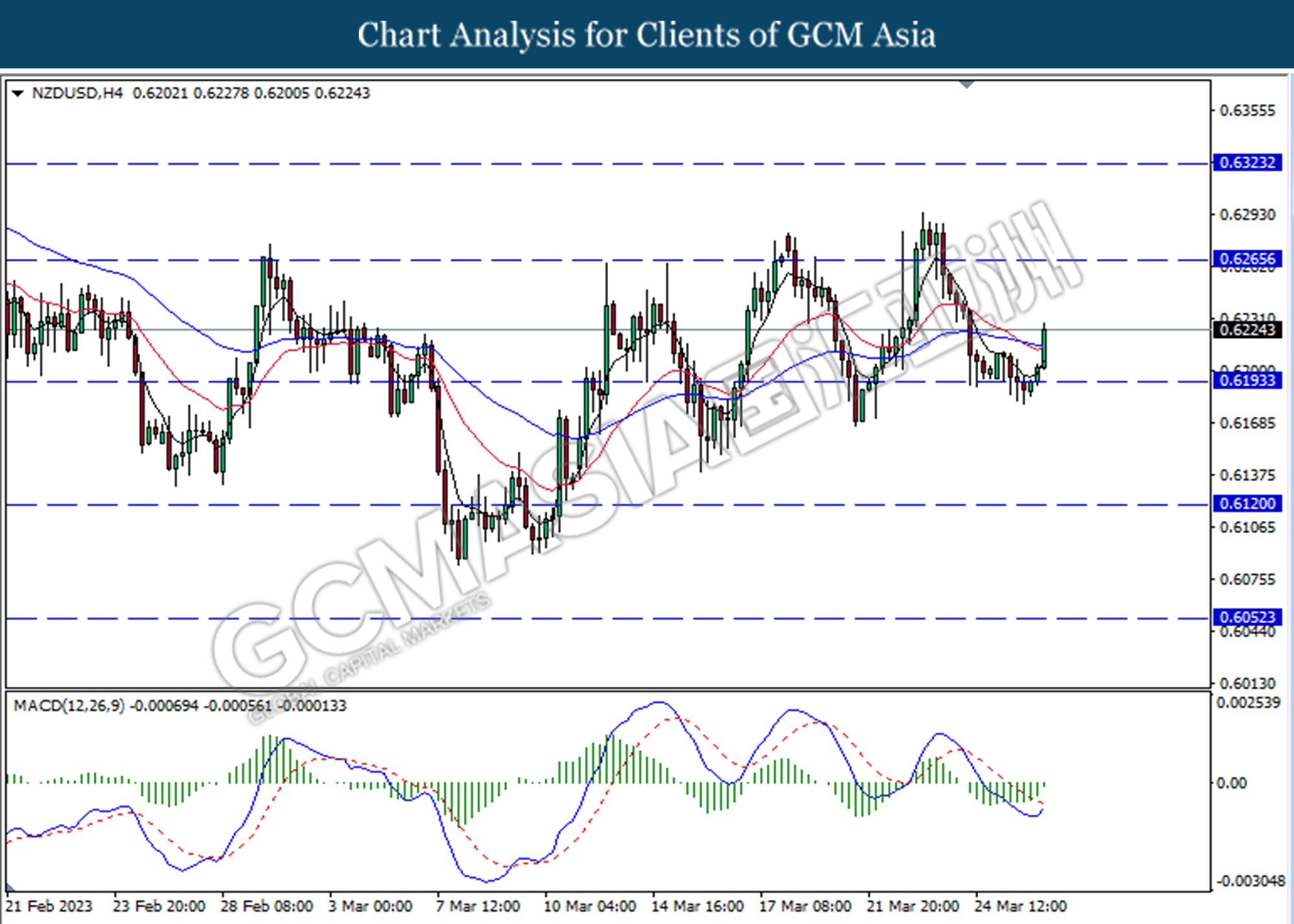

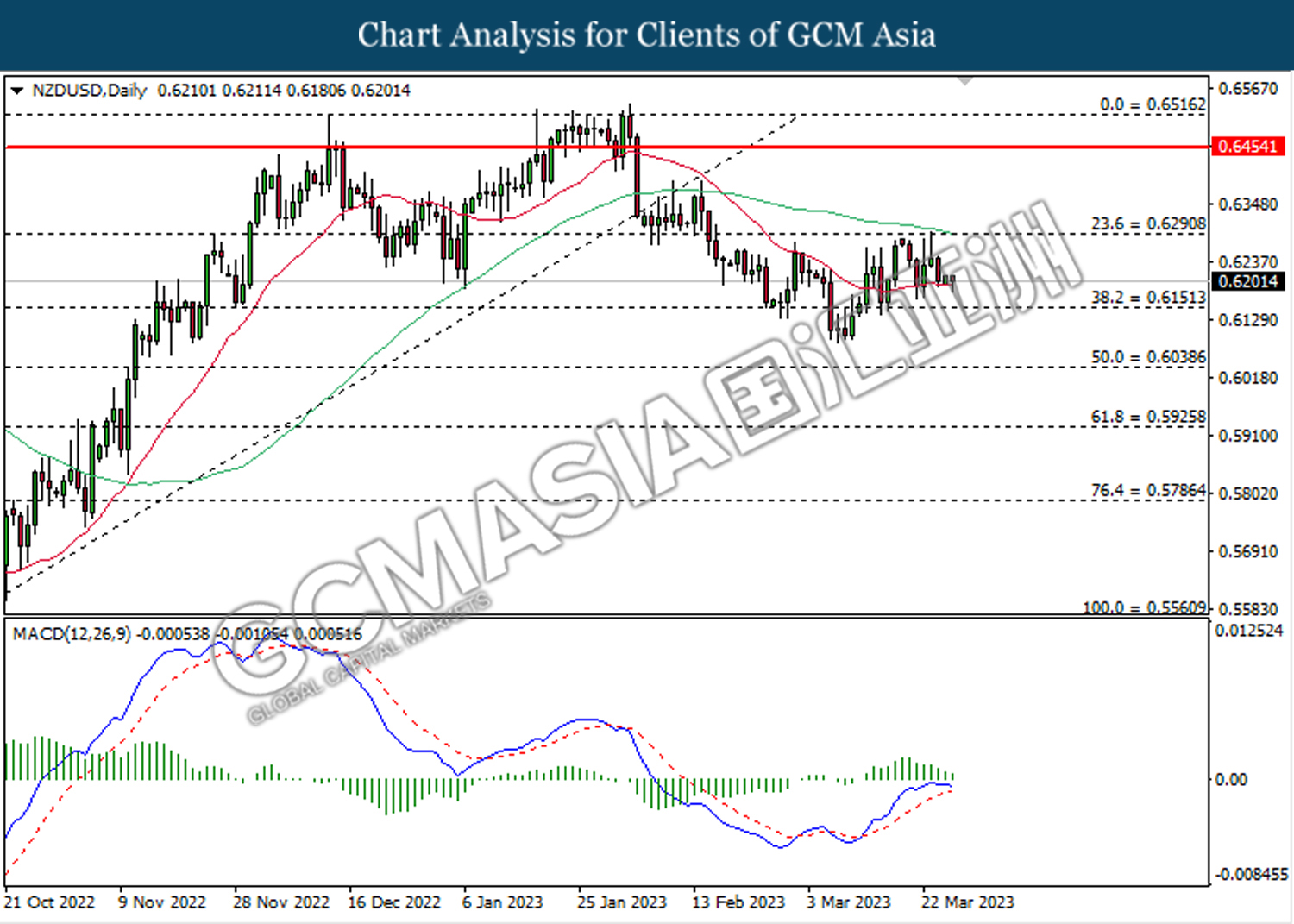

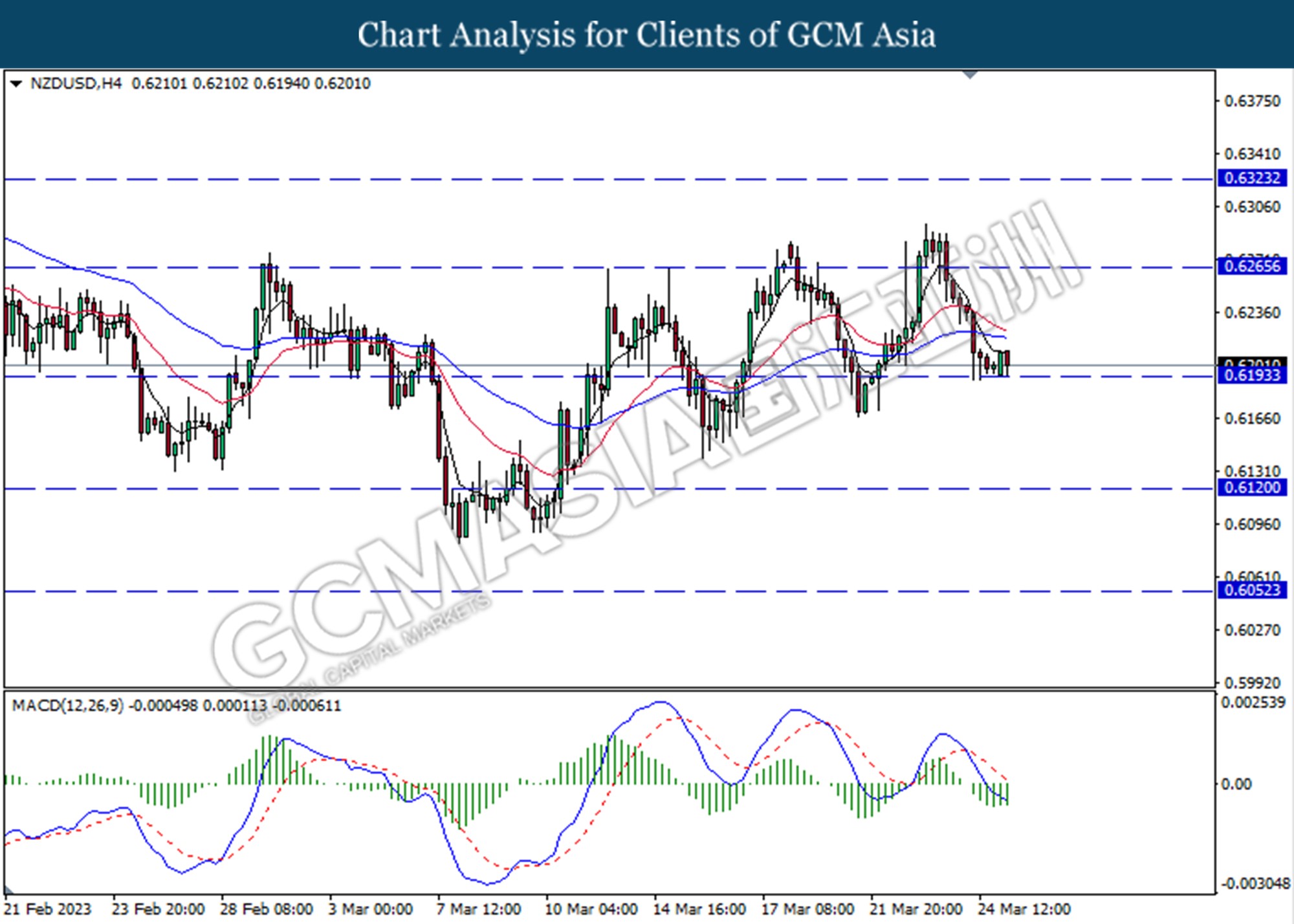

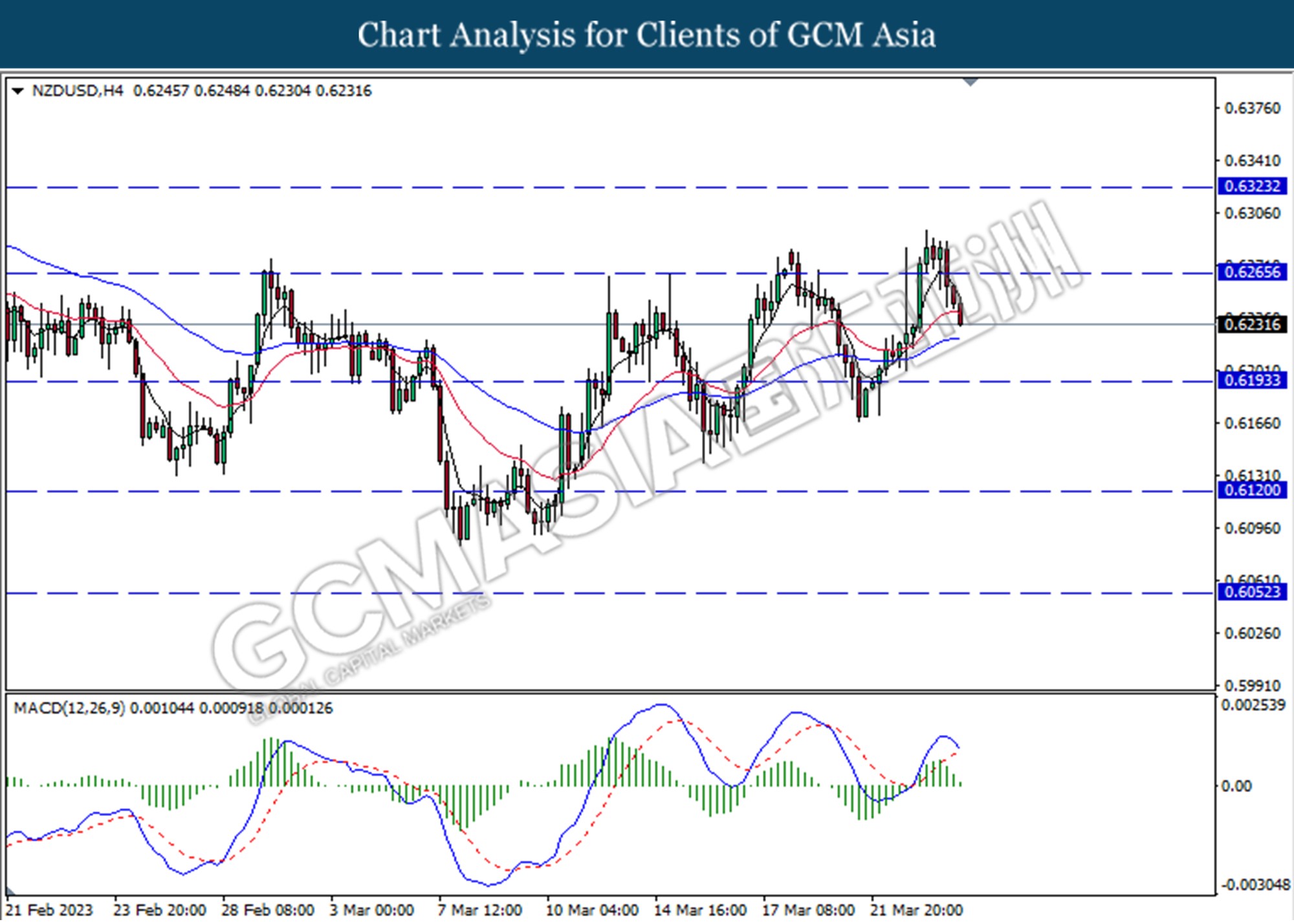

NZDUSD, H4: NZDUSD was traded higher following a prior break above the resistance level at 0.6265. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6325

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

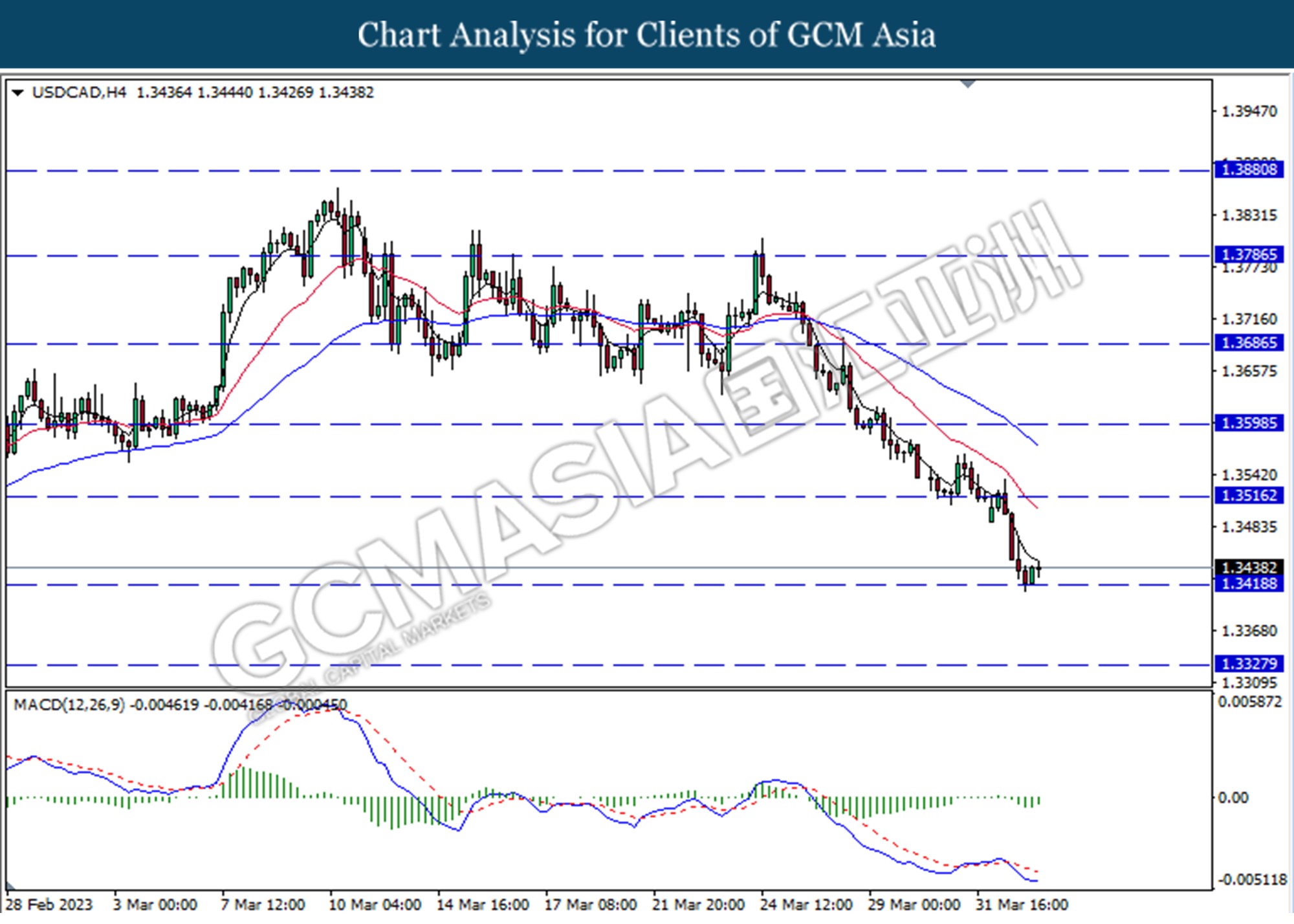

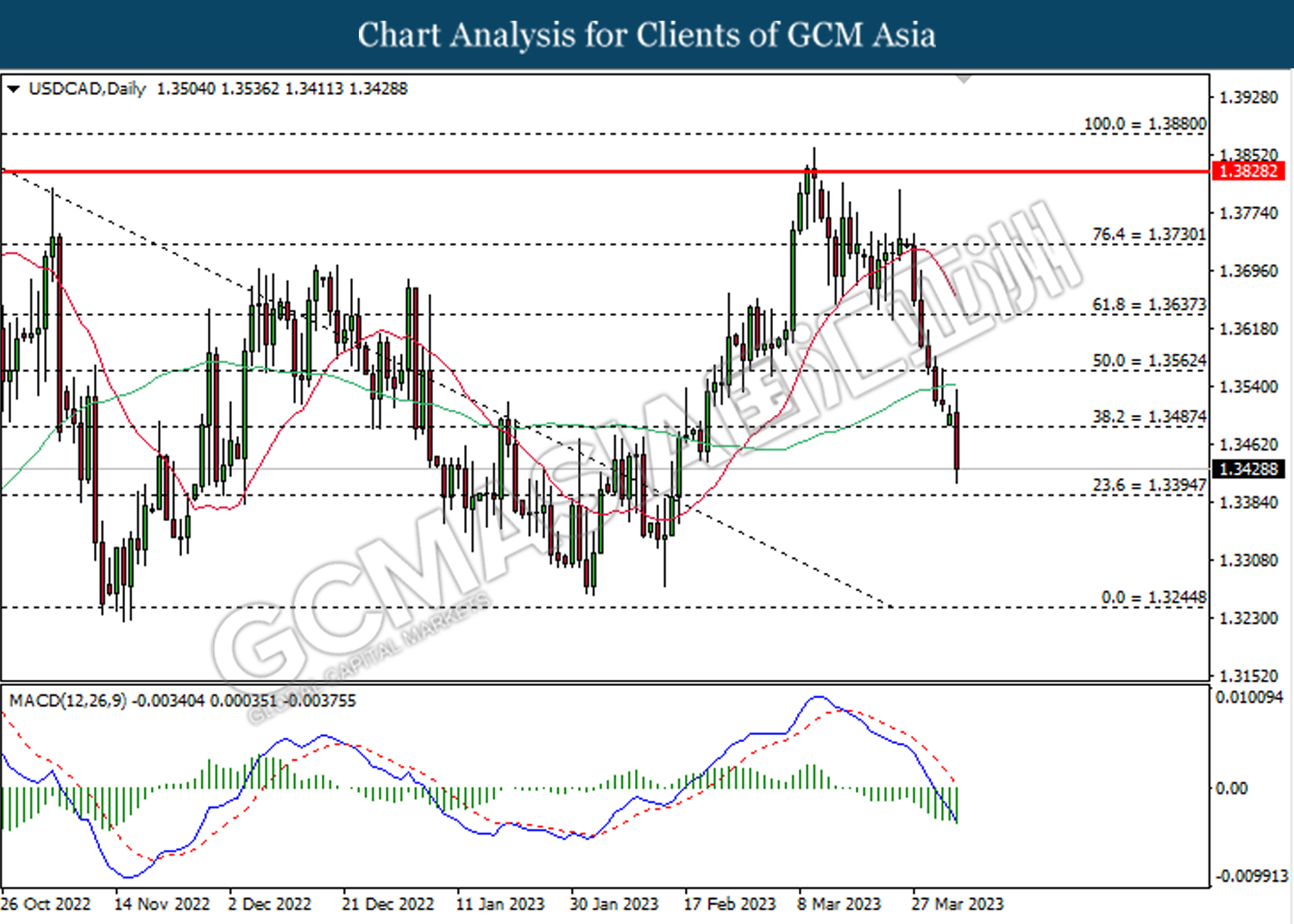

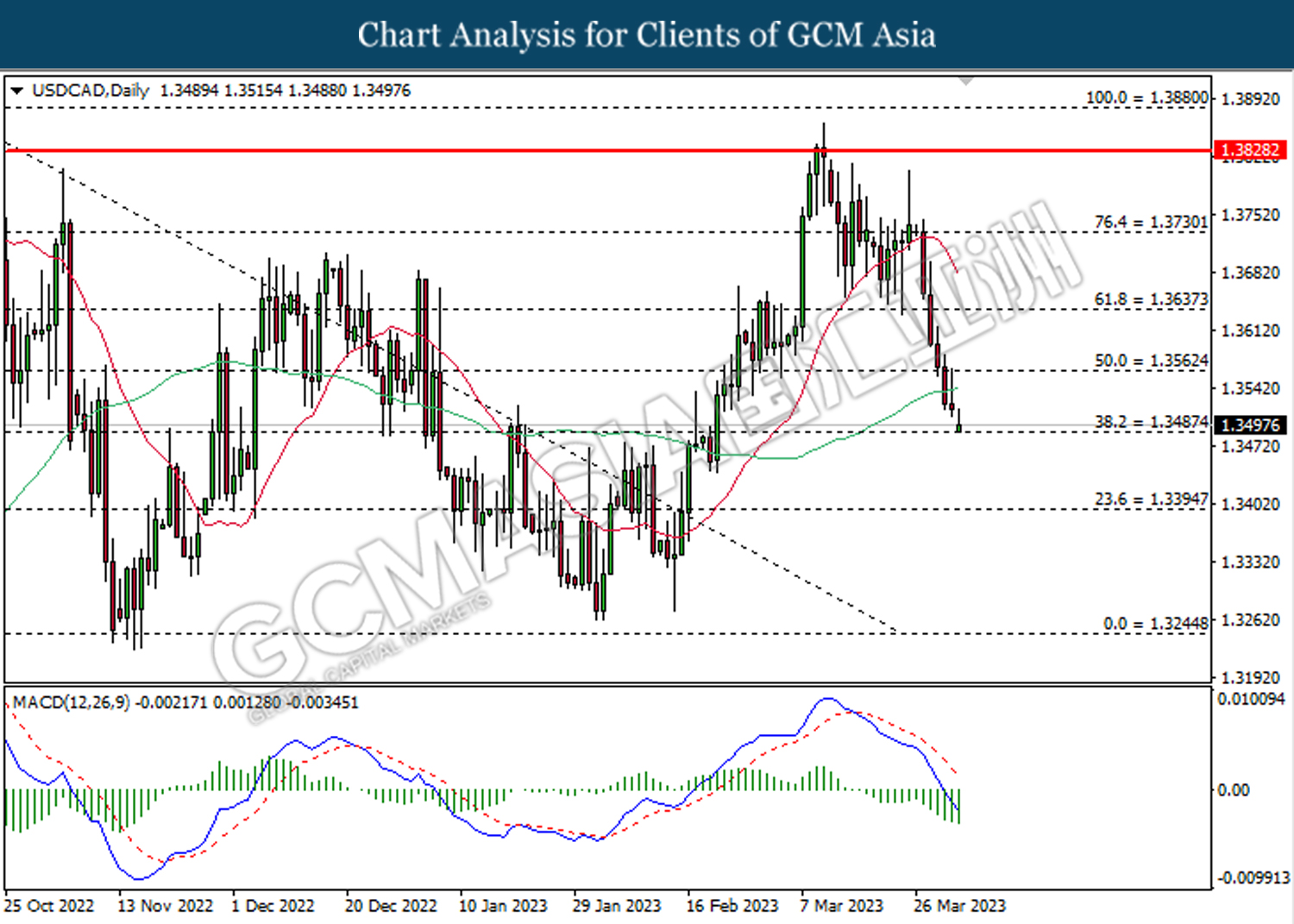

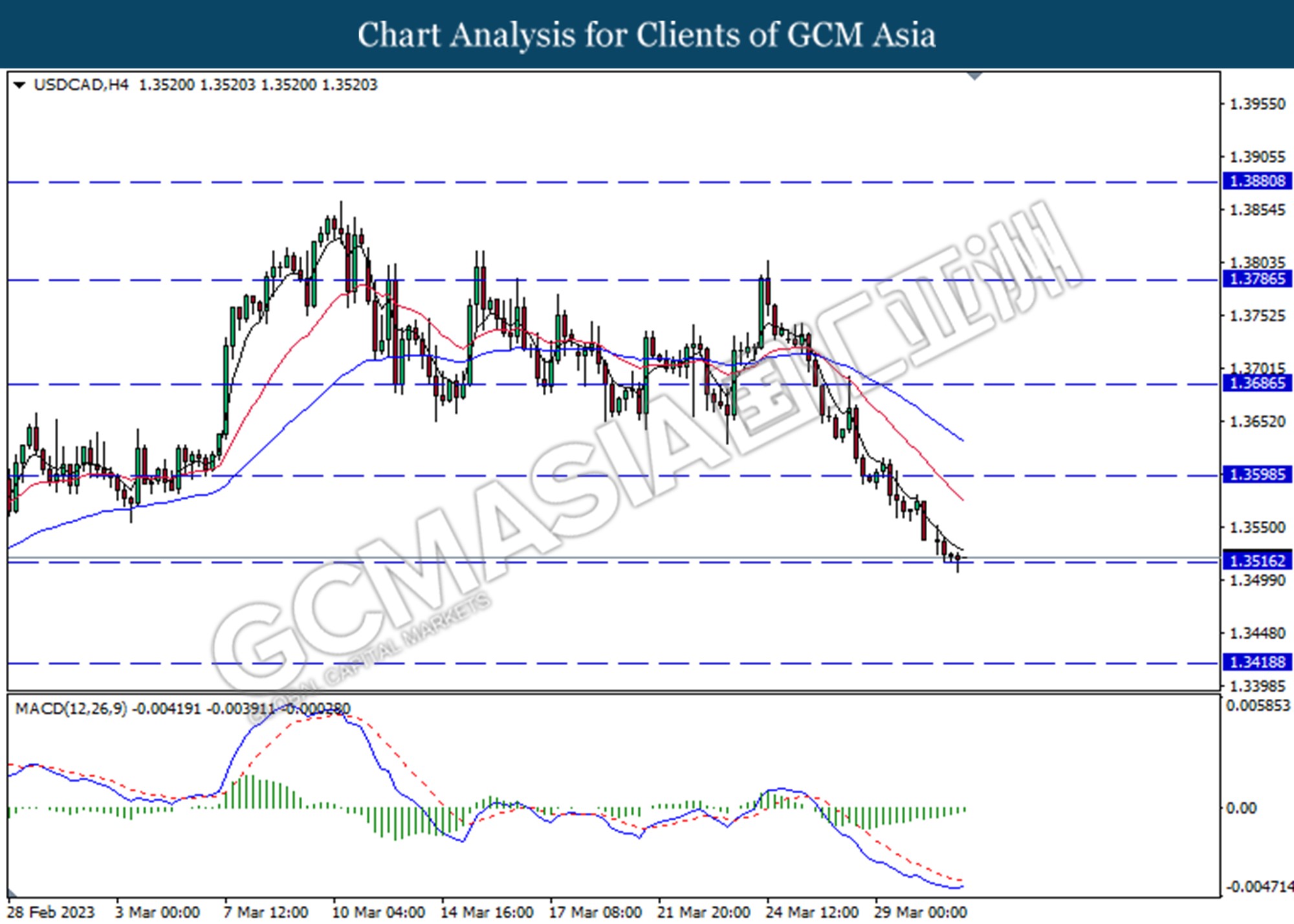

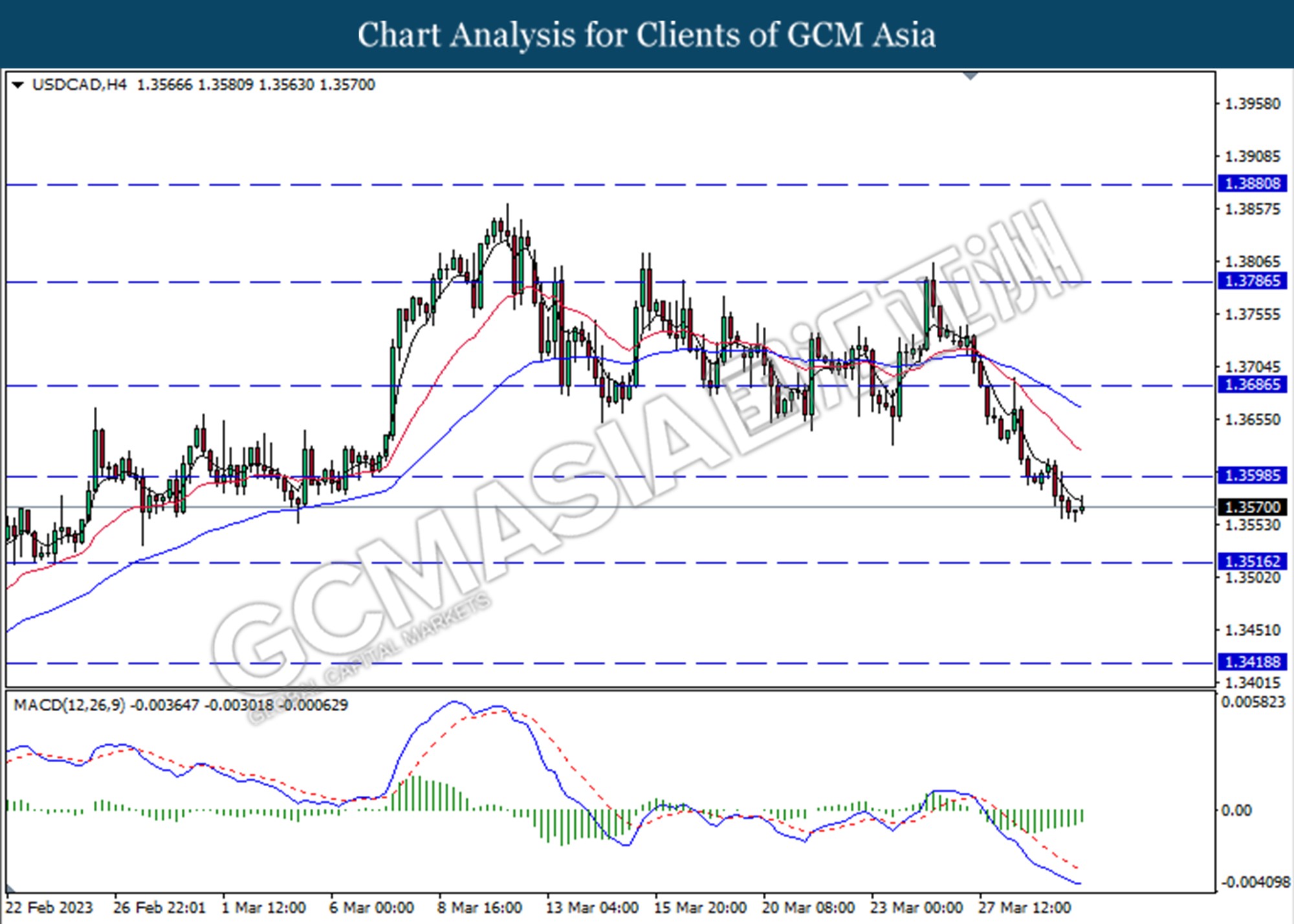

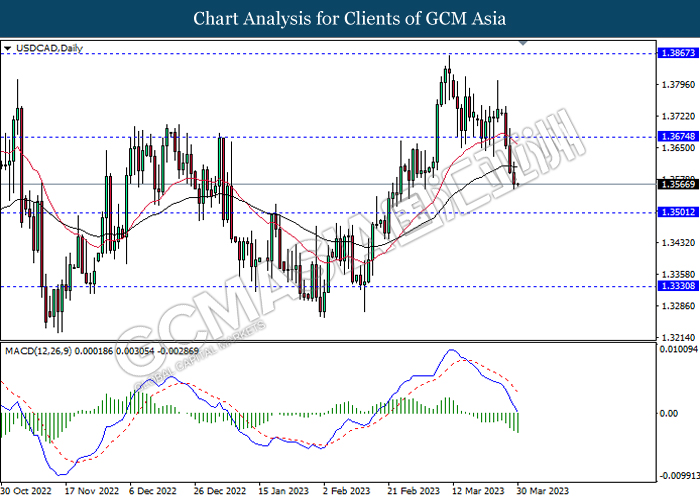

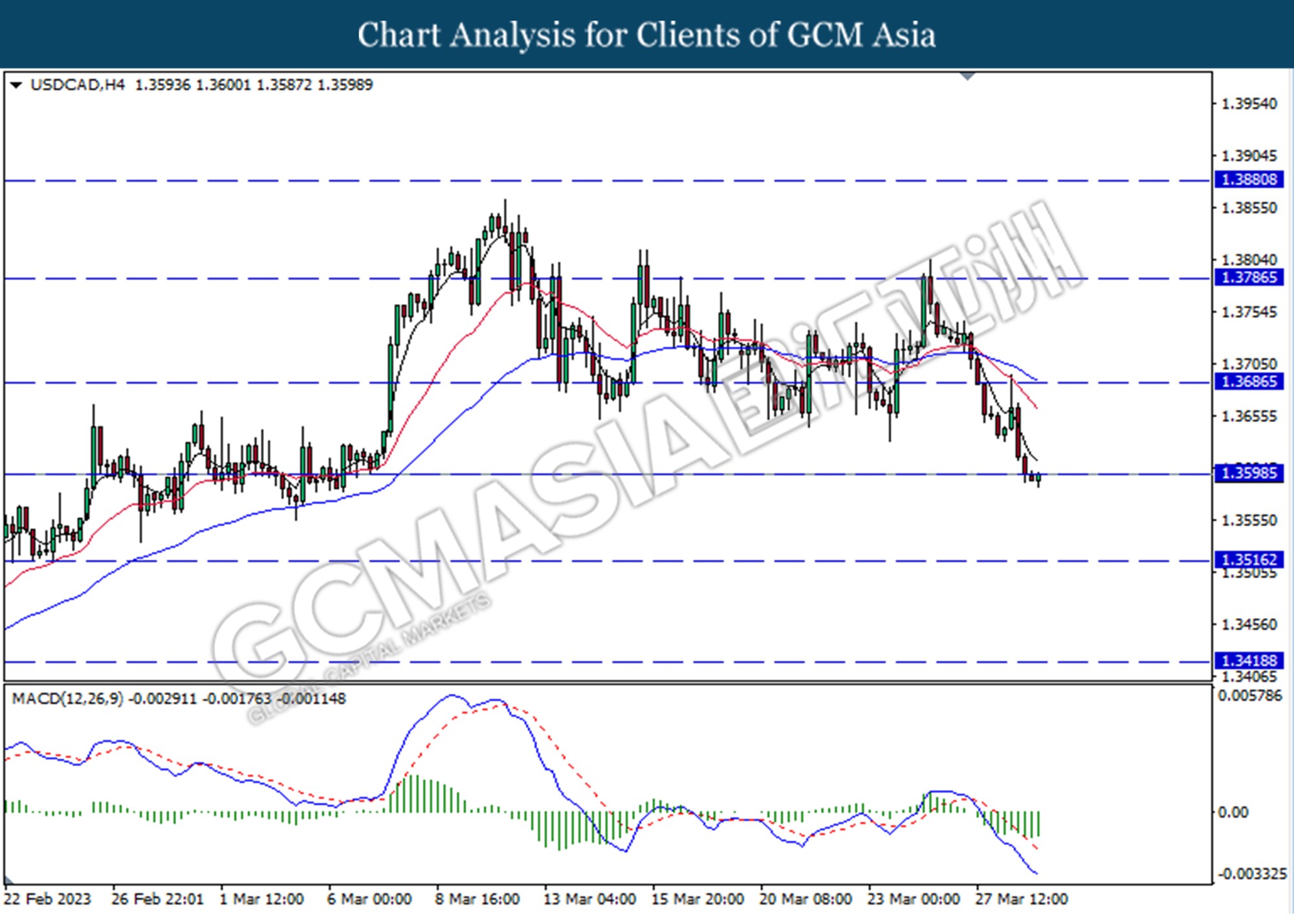

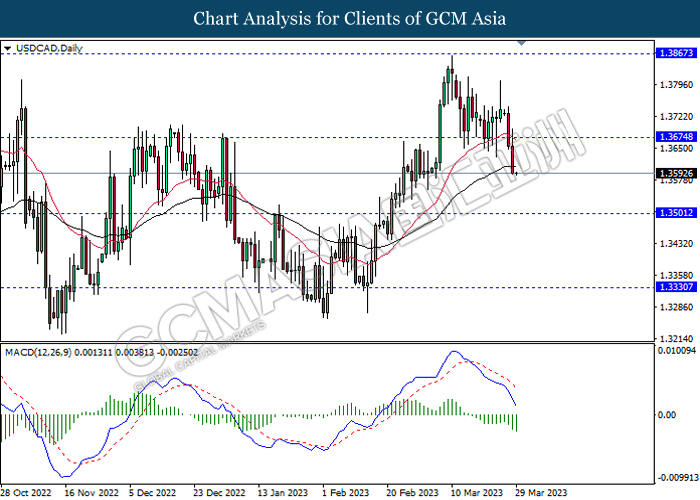

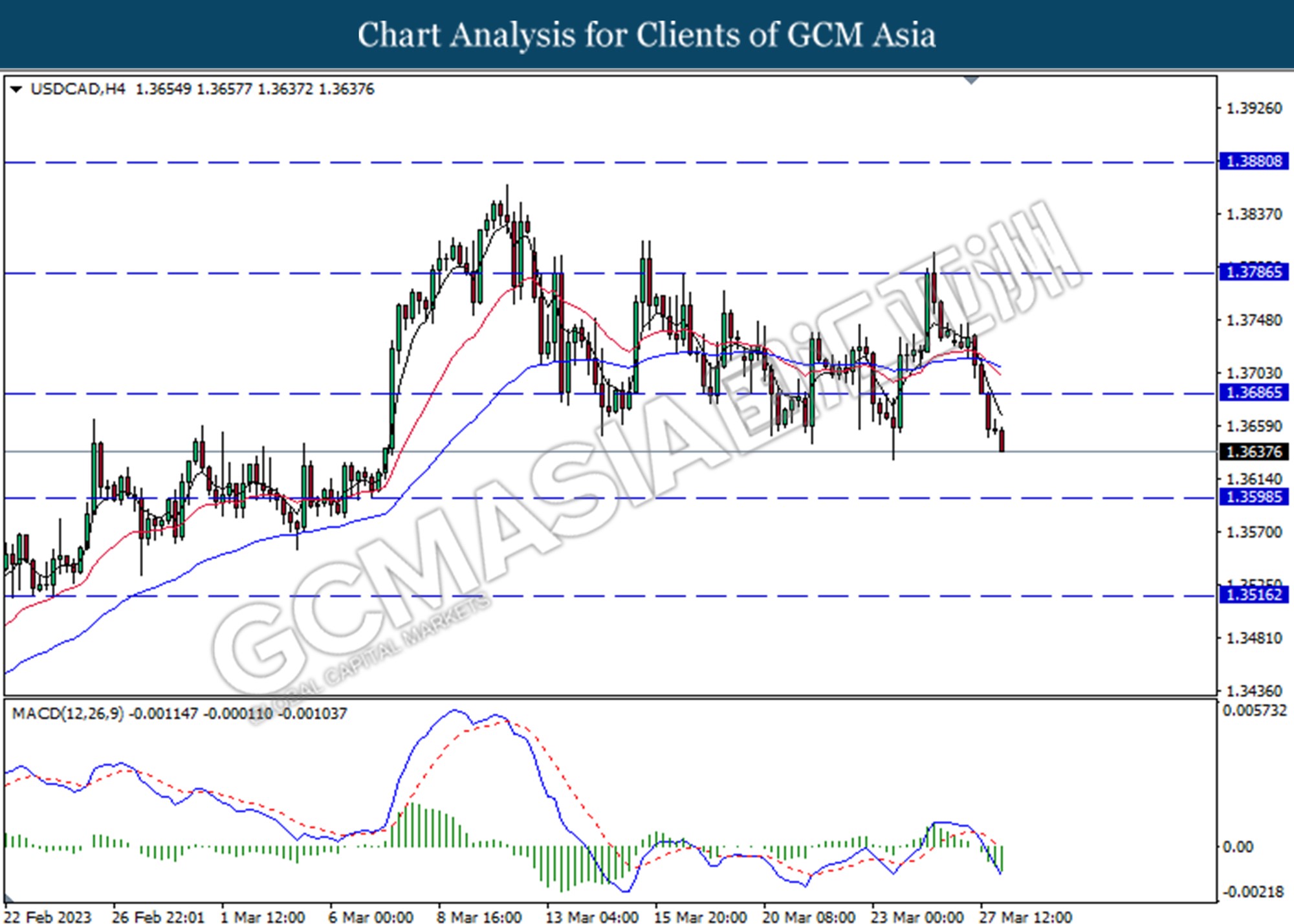

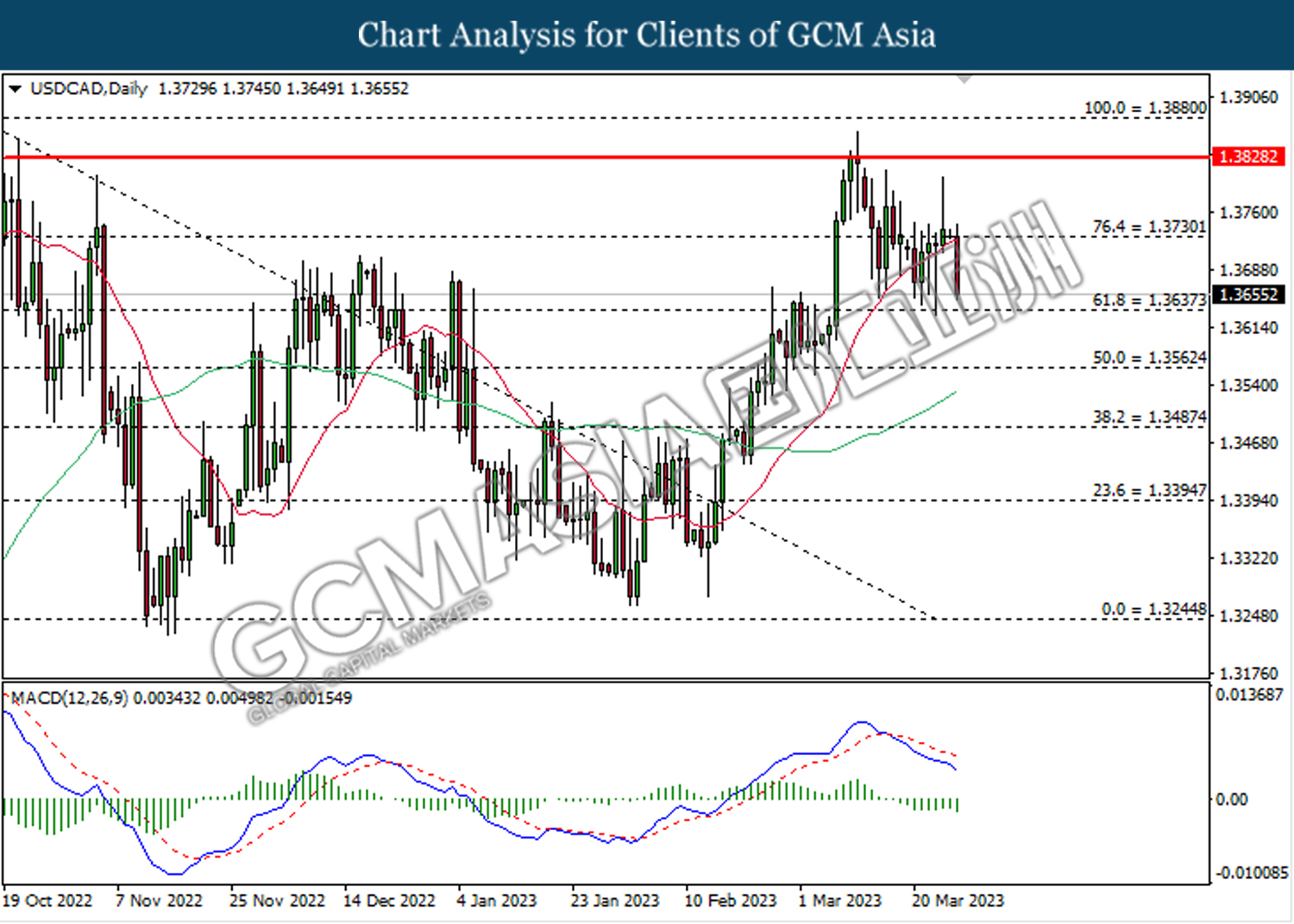

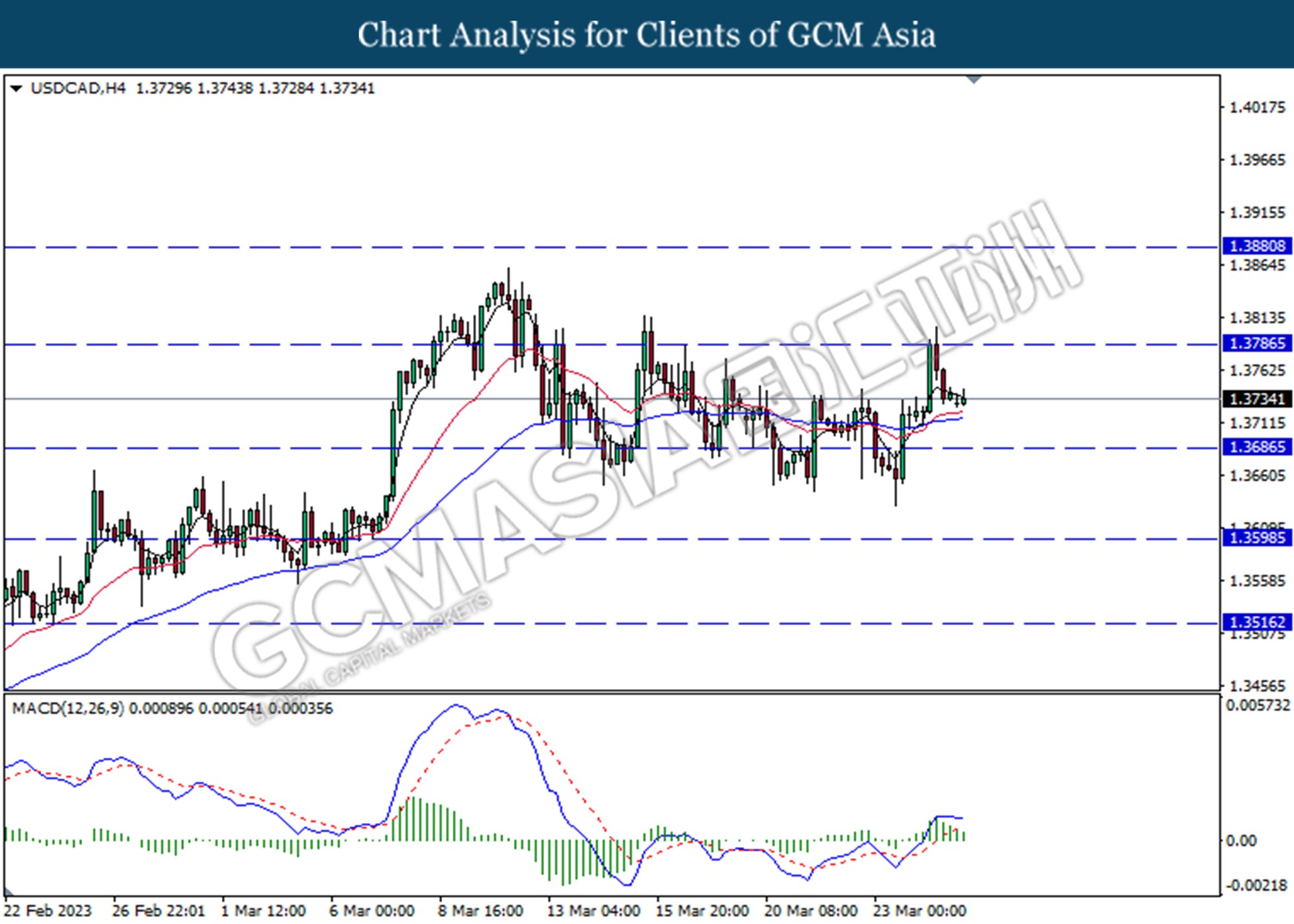

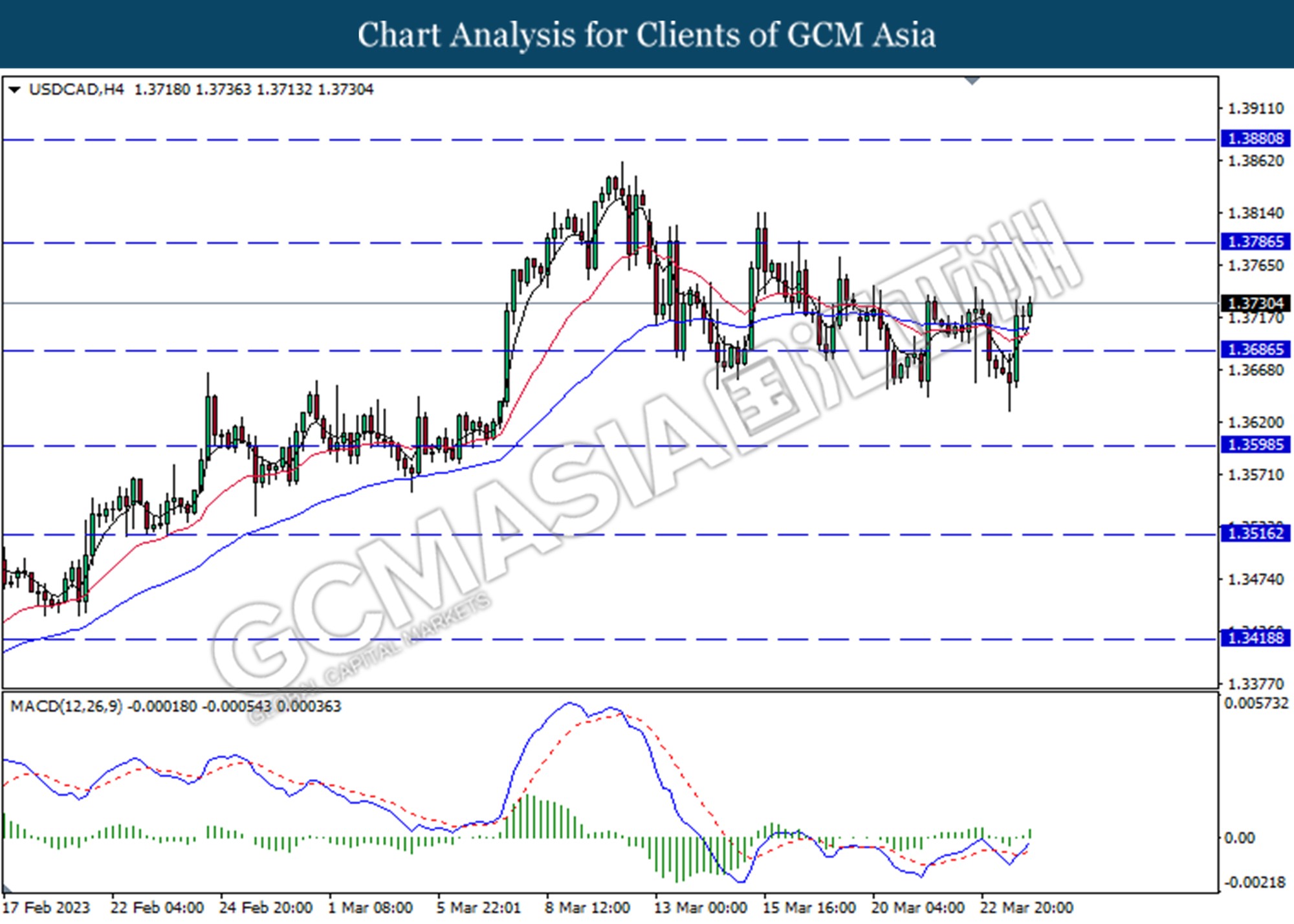

USDCAD, H4: USDCAD was traded higher following rebound from the support level at 1.3420. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.3520.

Resistance level: 1.3520, 1.3560

Support level: 1.3420, 1.3330

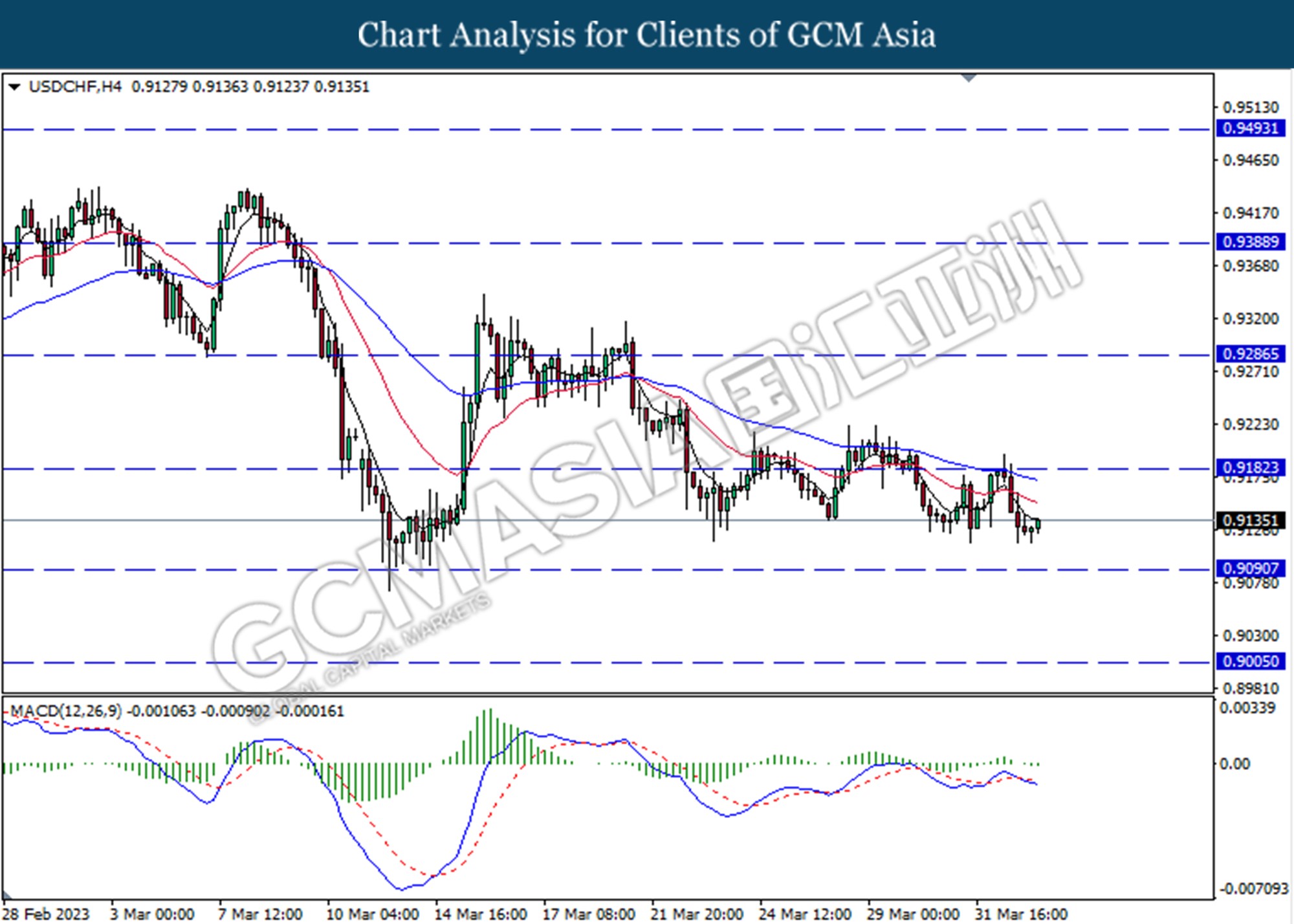

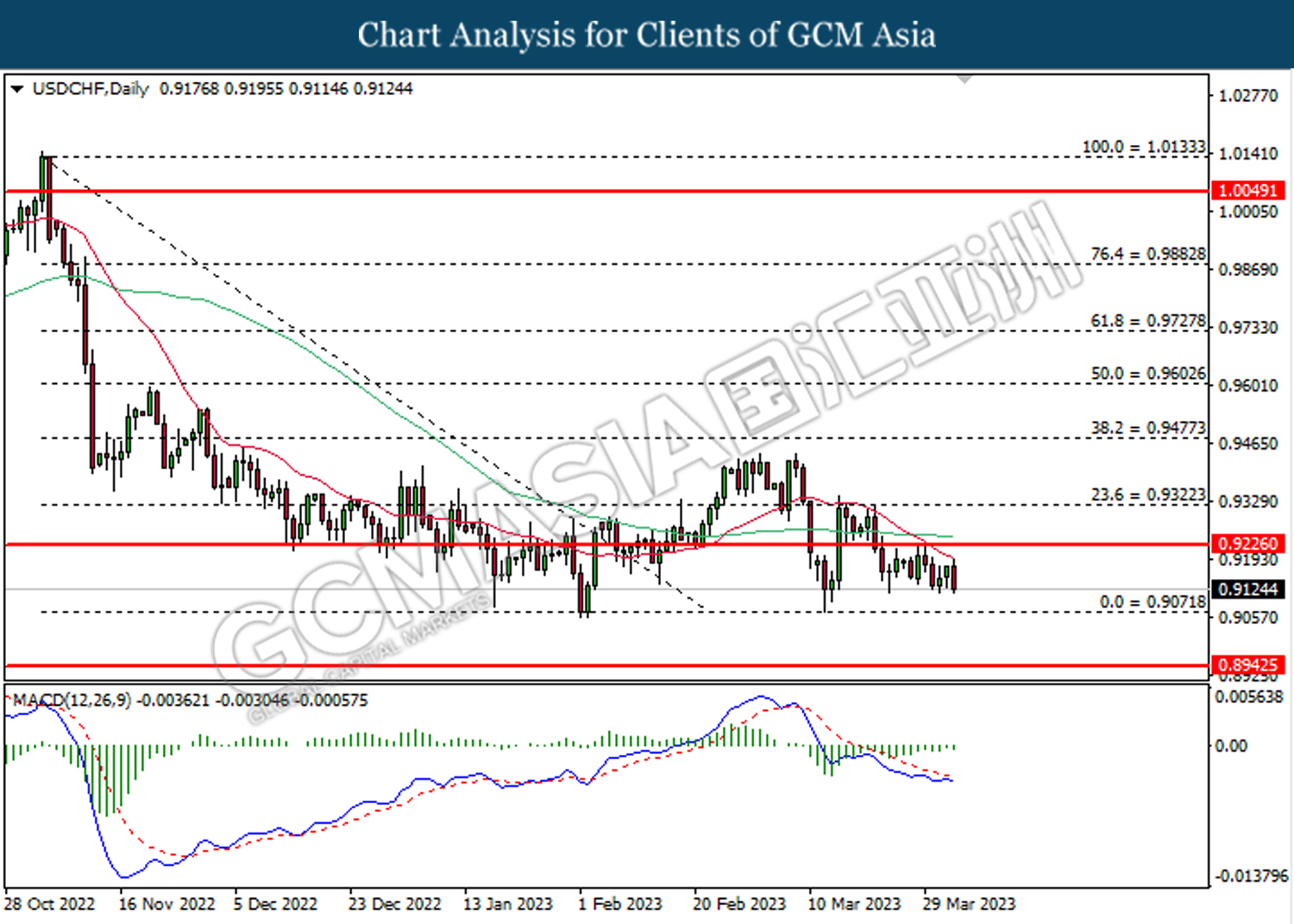

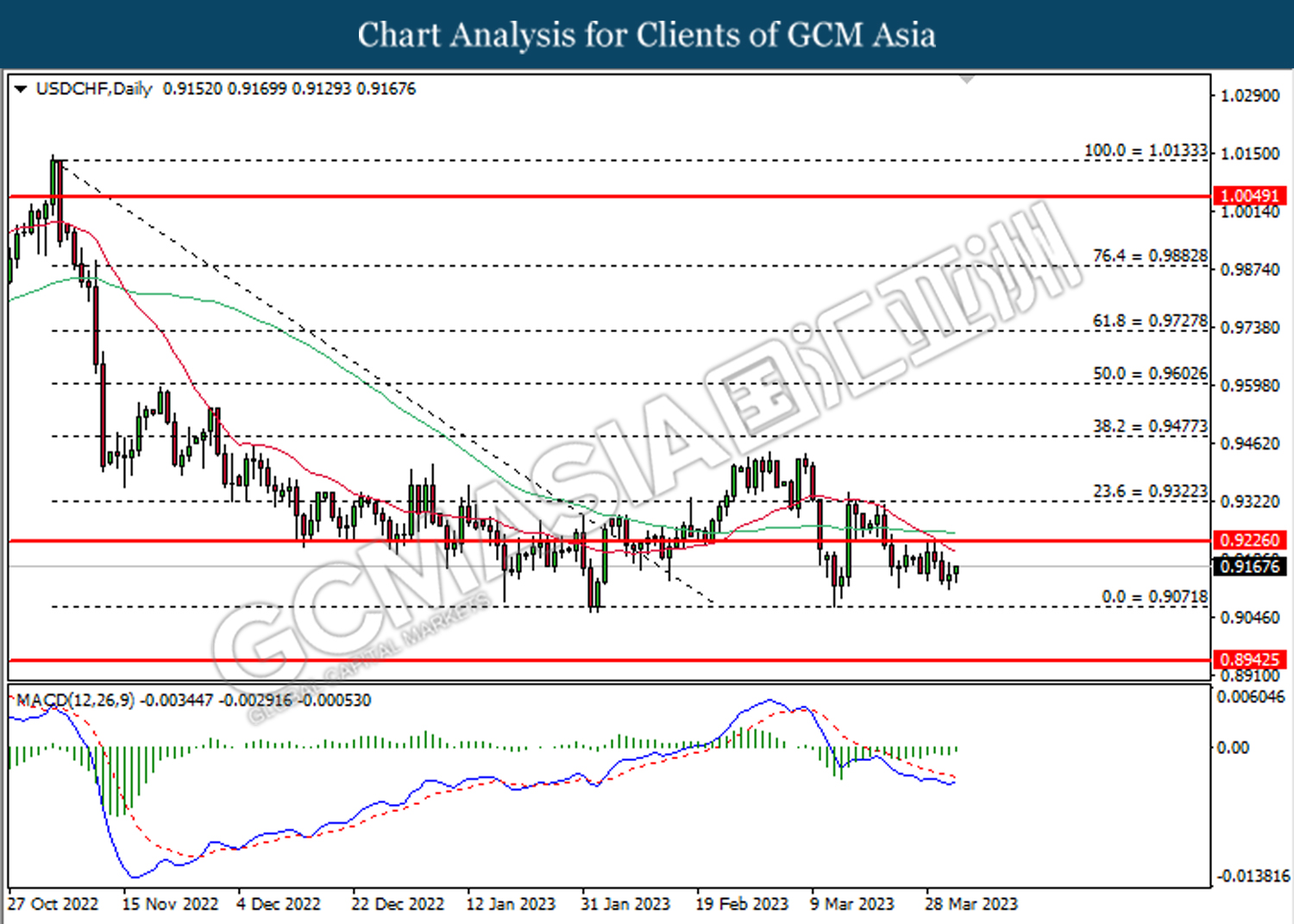

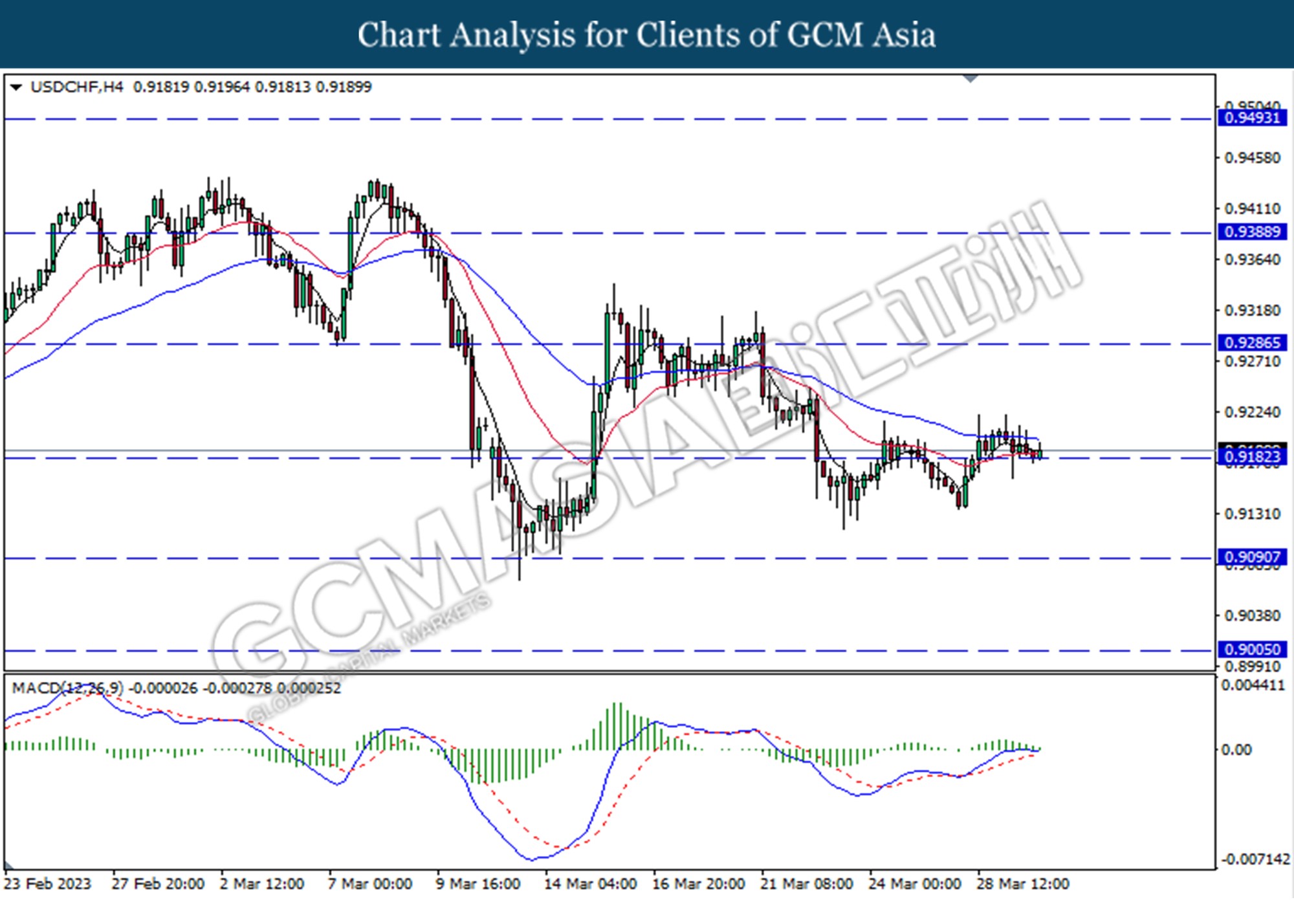

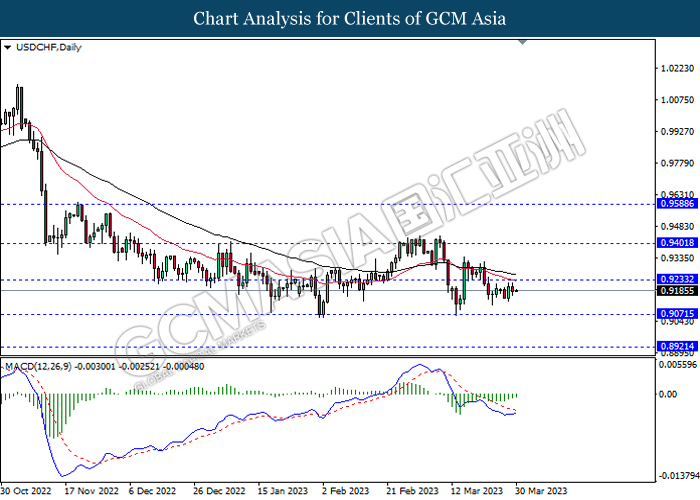

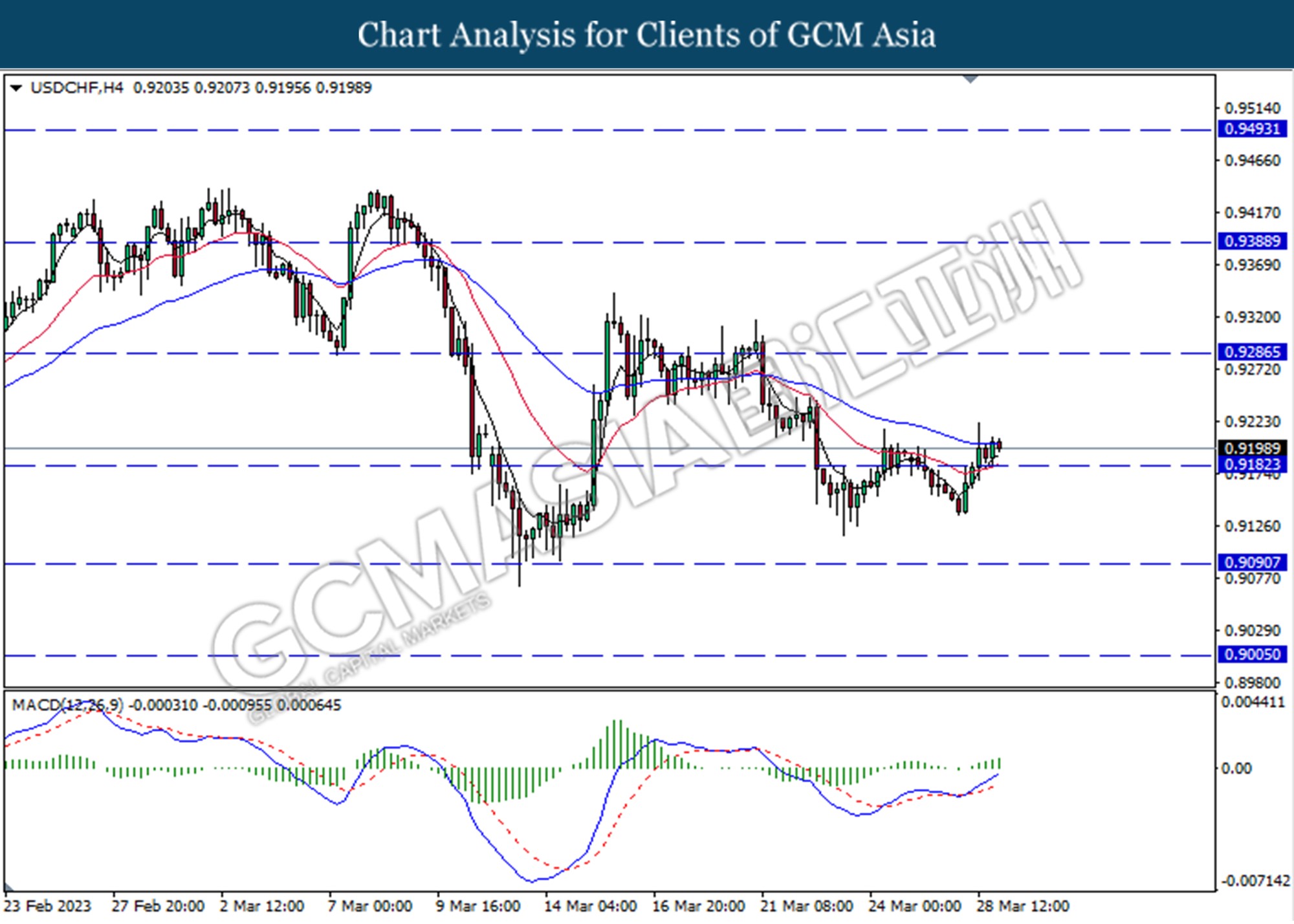

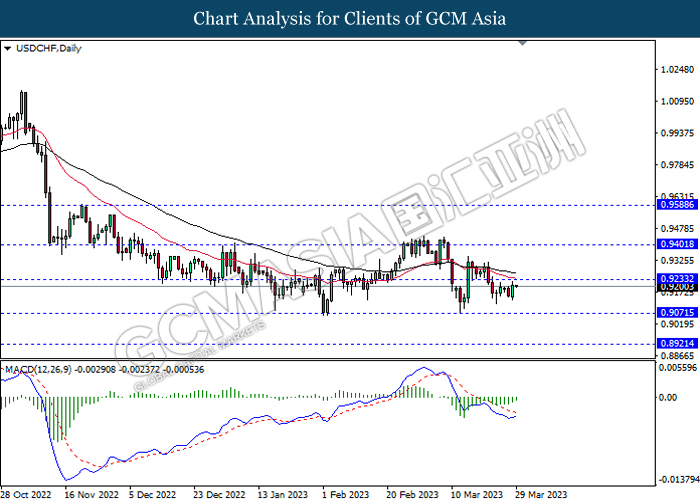

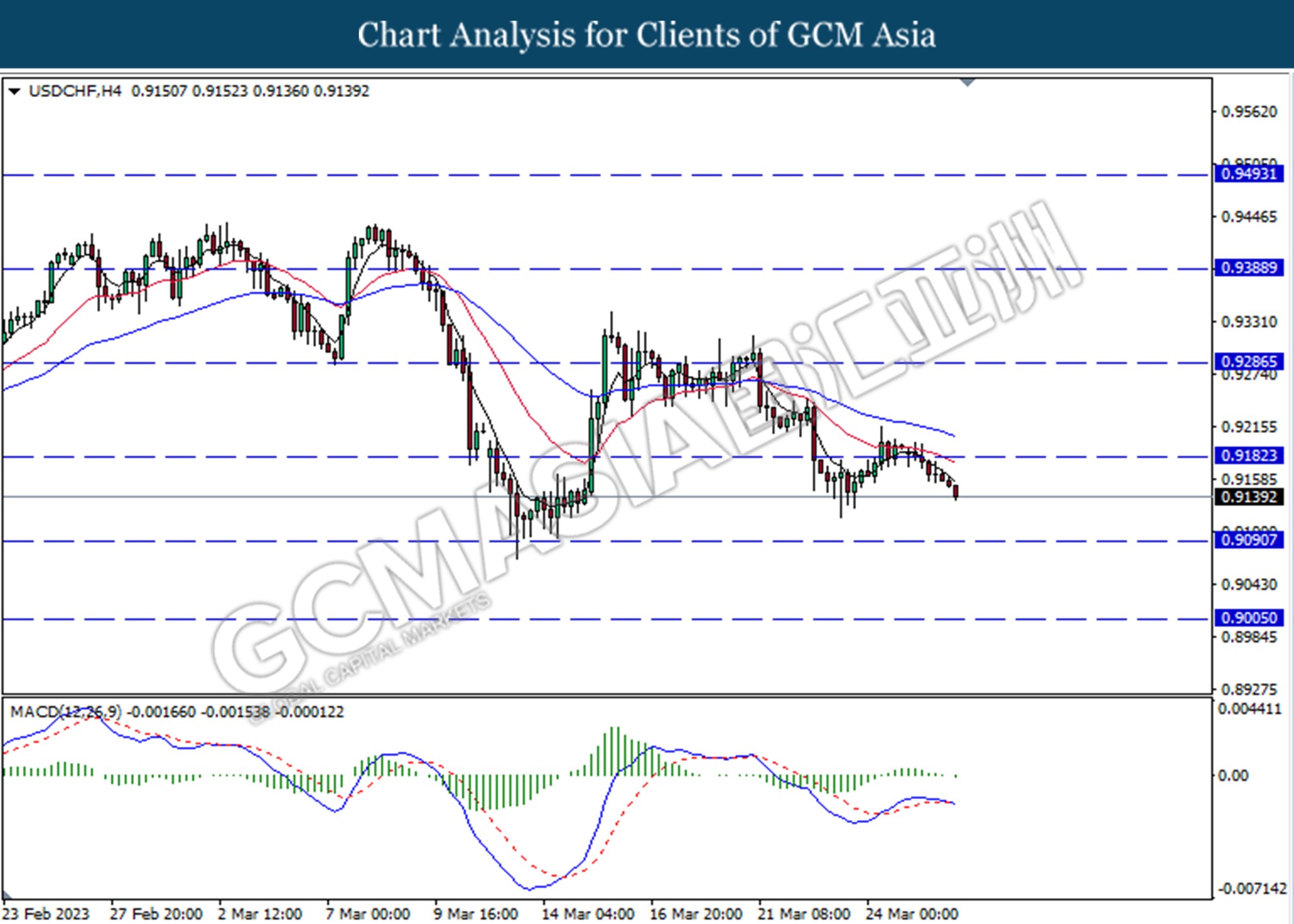

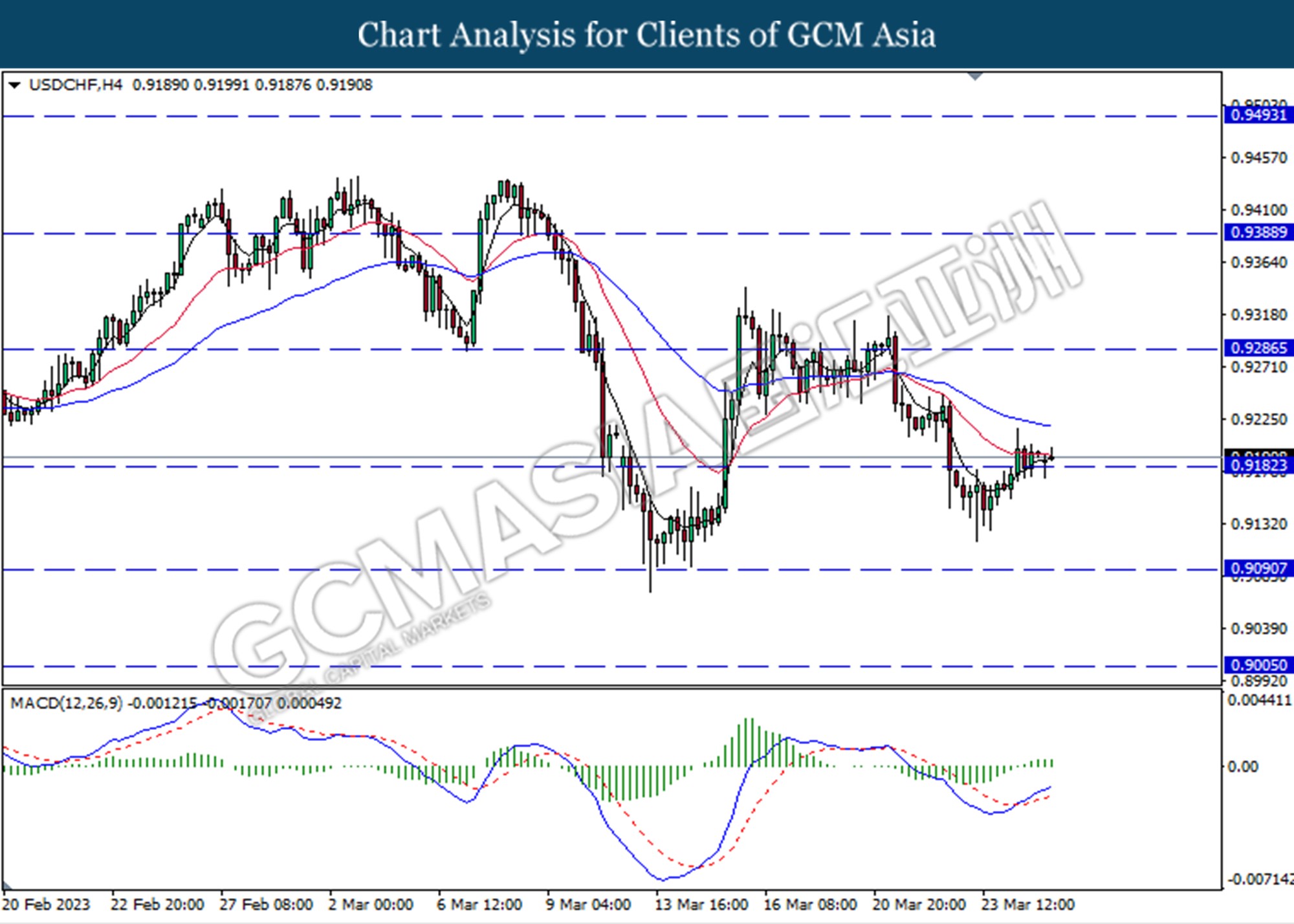

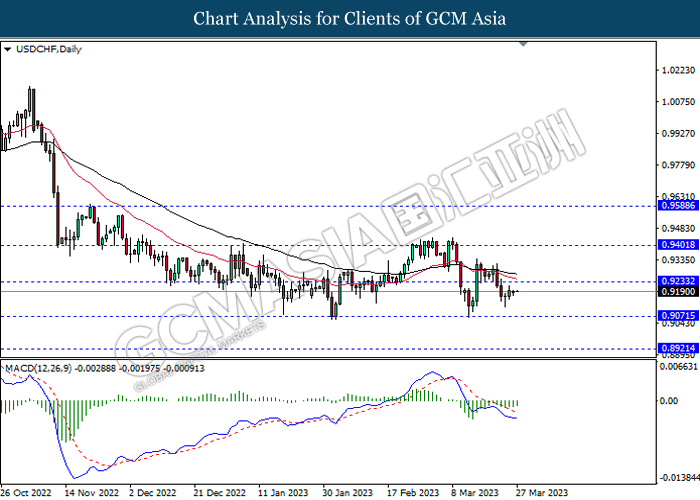

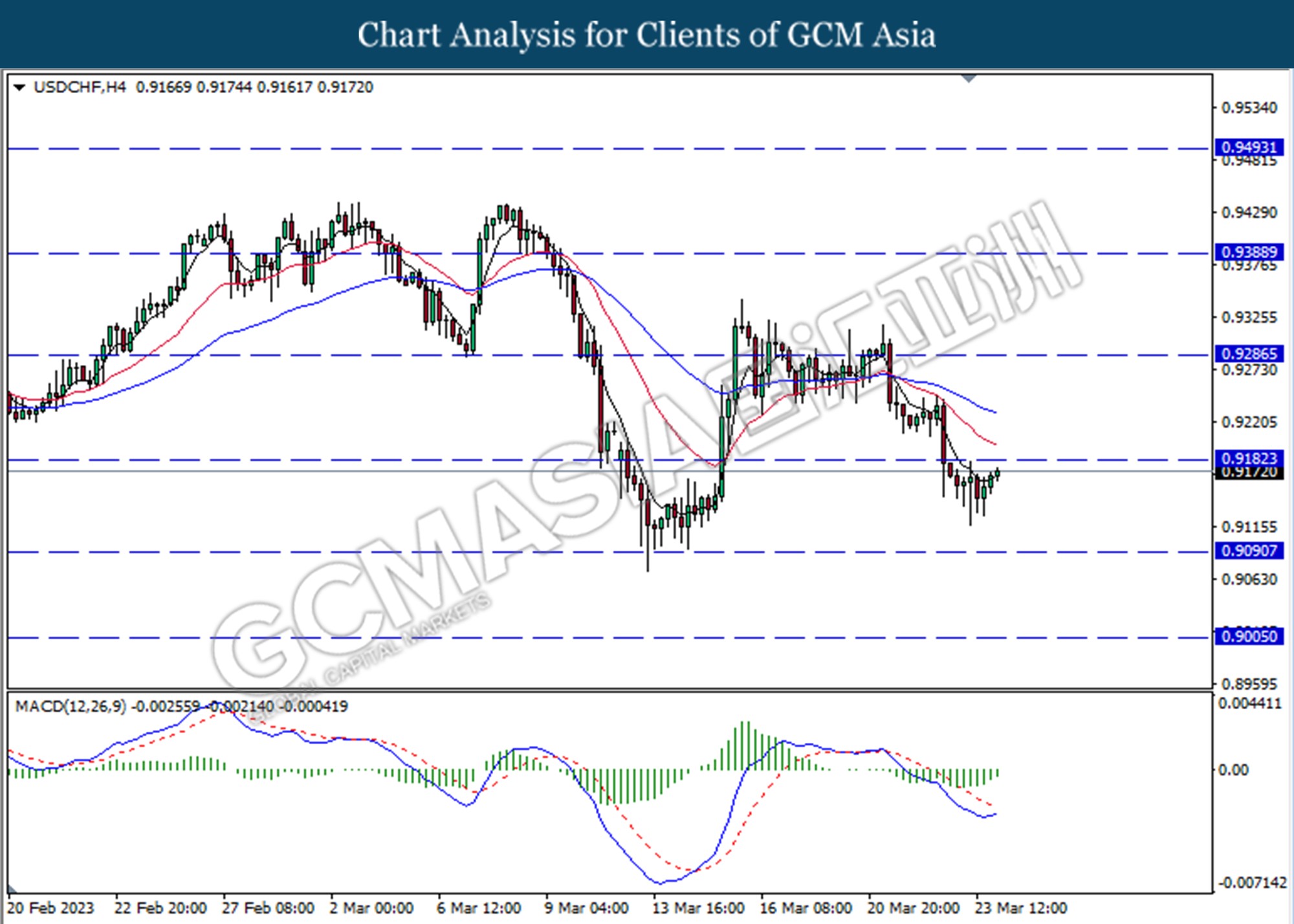

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.9180.

Resistance level: 0.9180, 0.9285

Support level: 0.9090, 0.9005

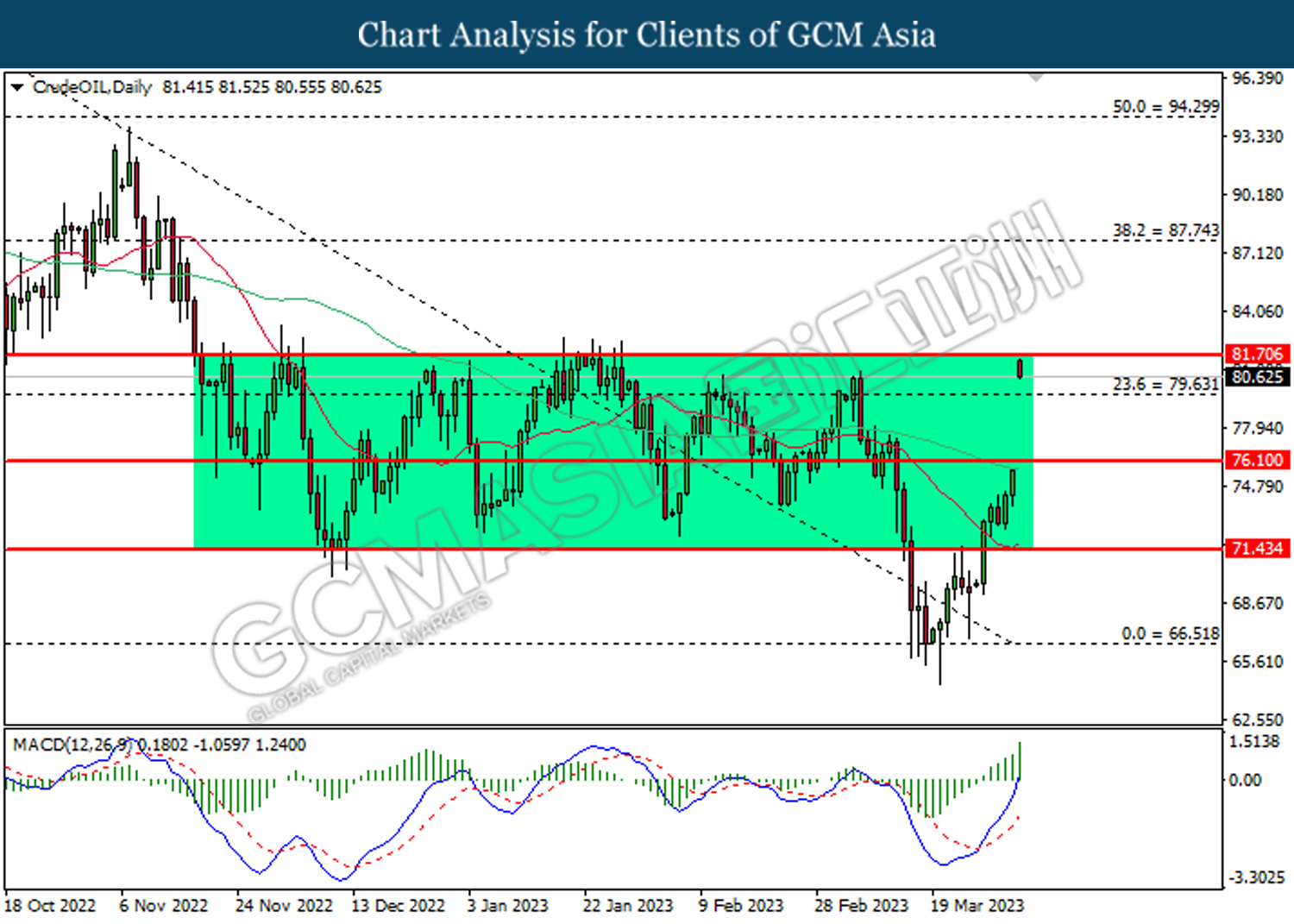

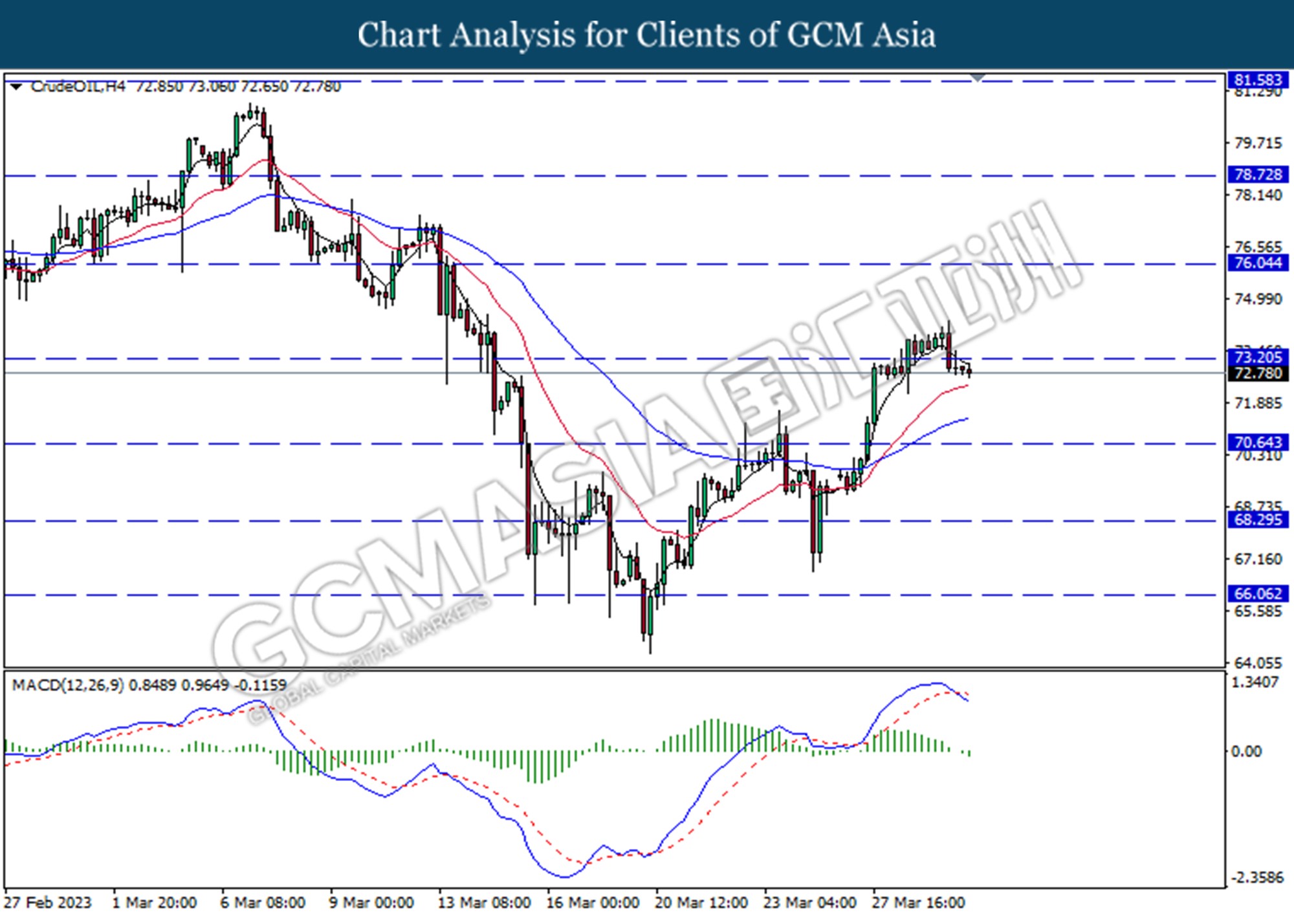

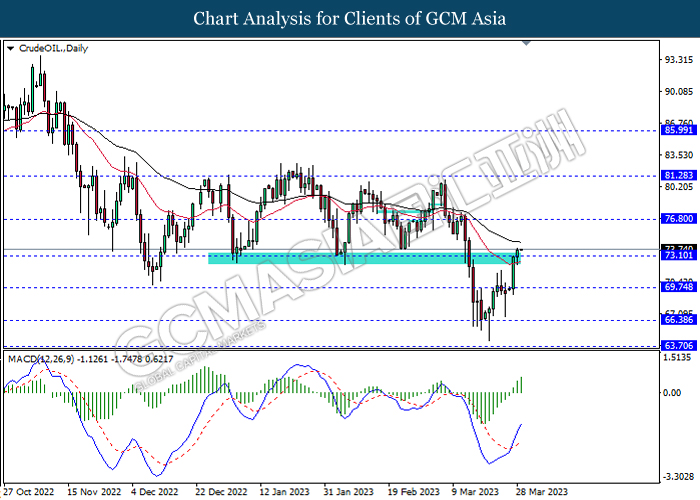

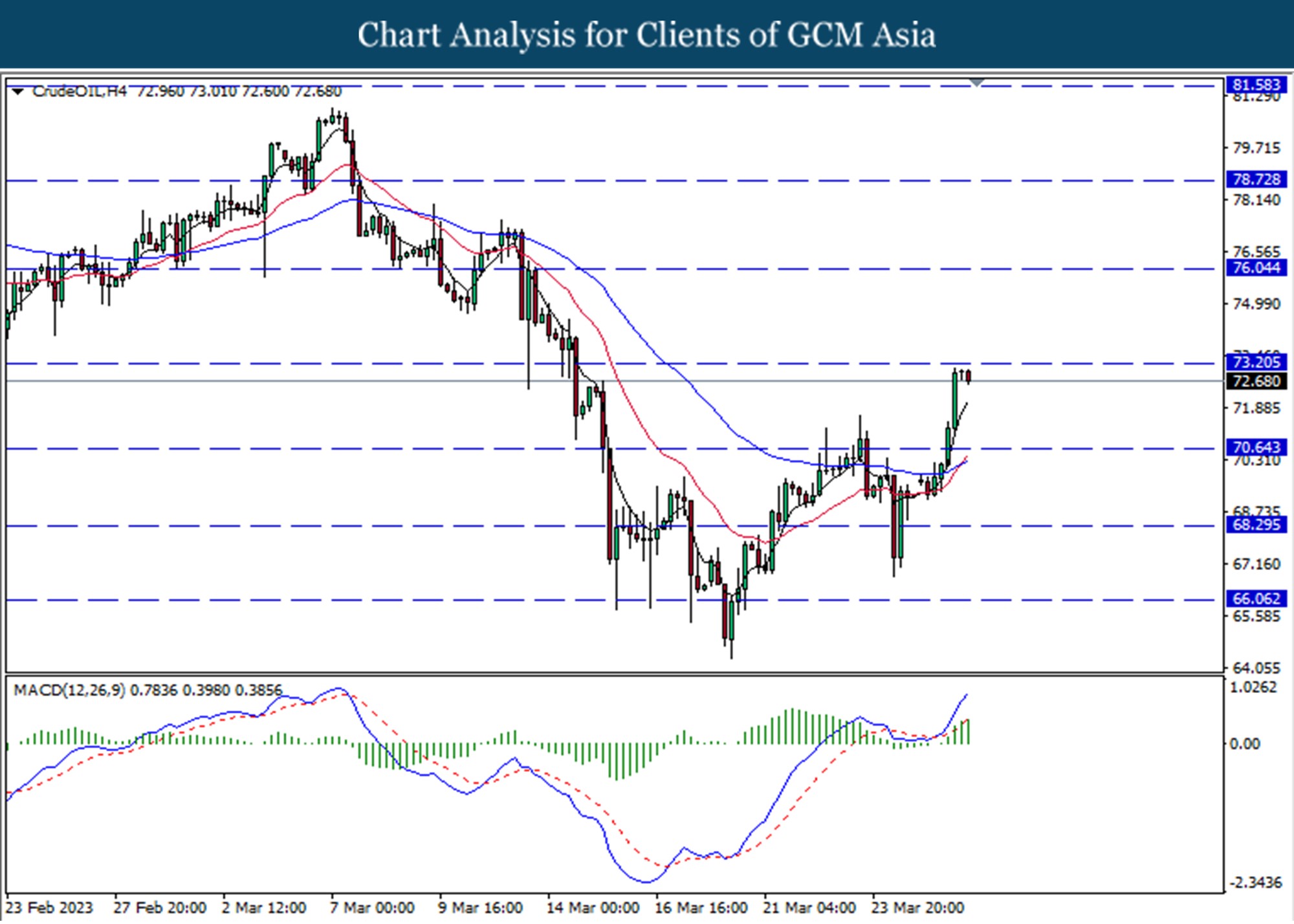

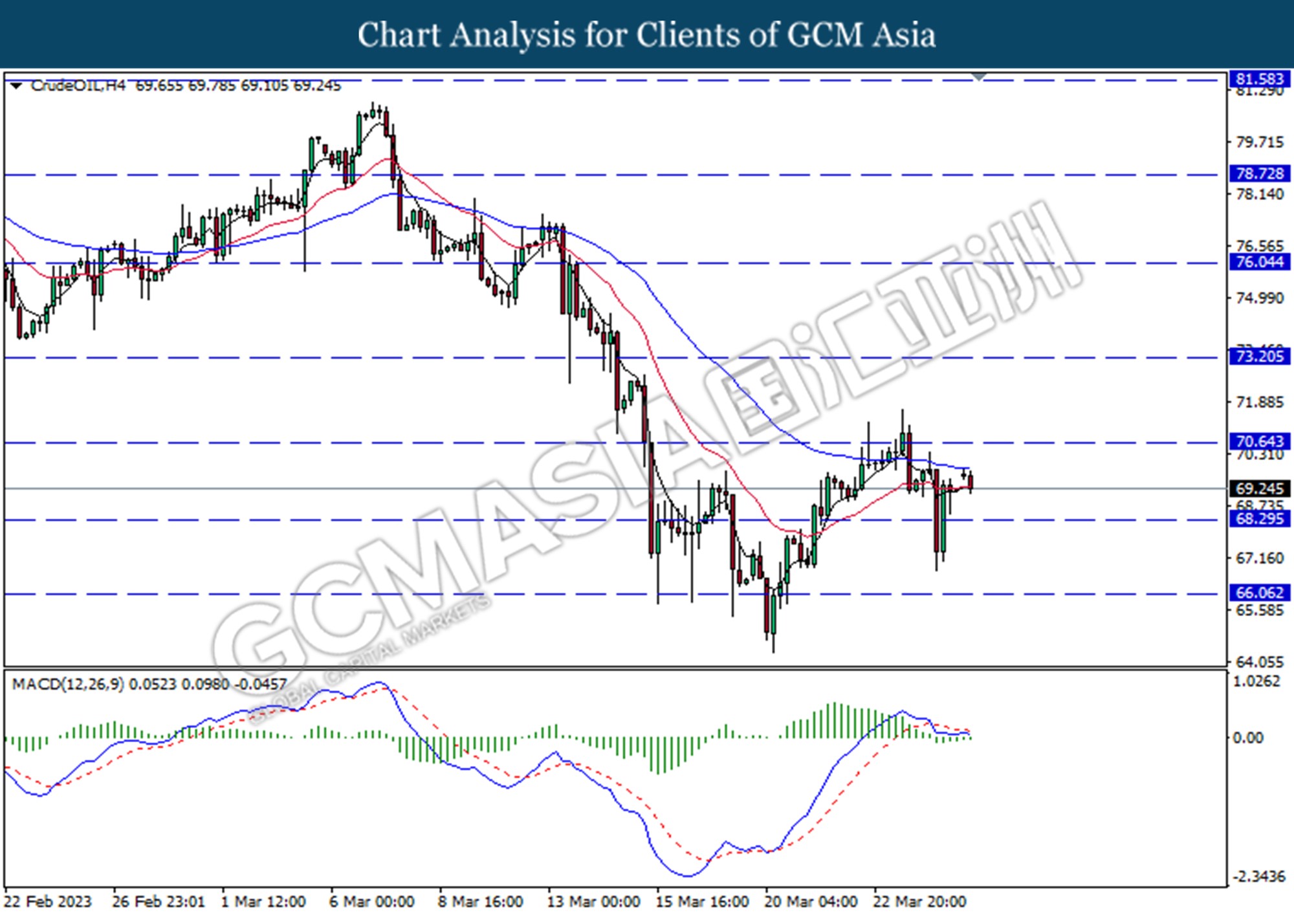

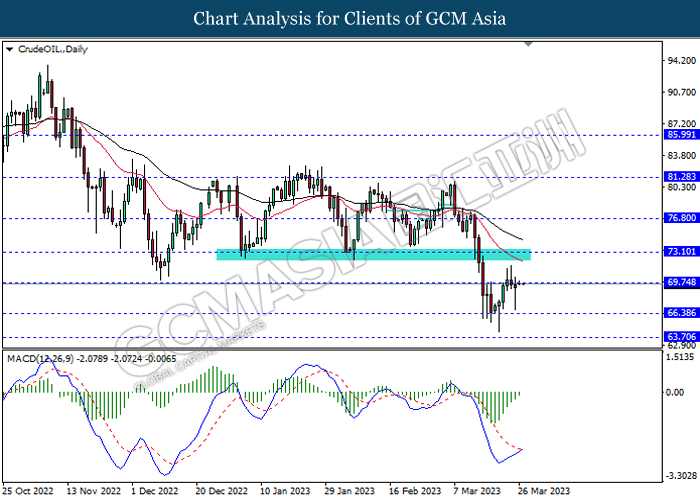

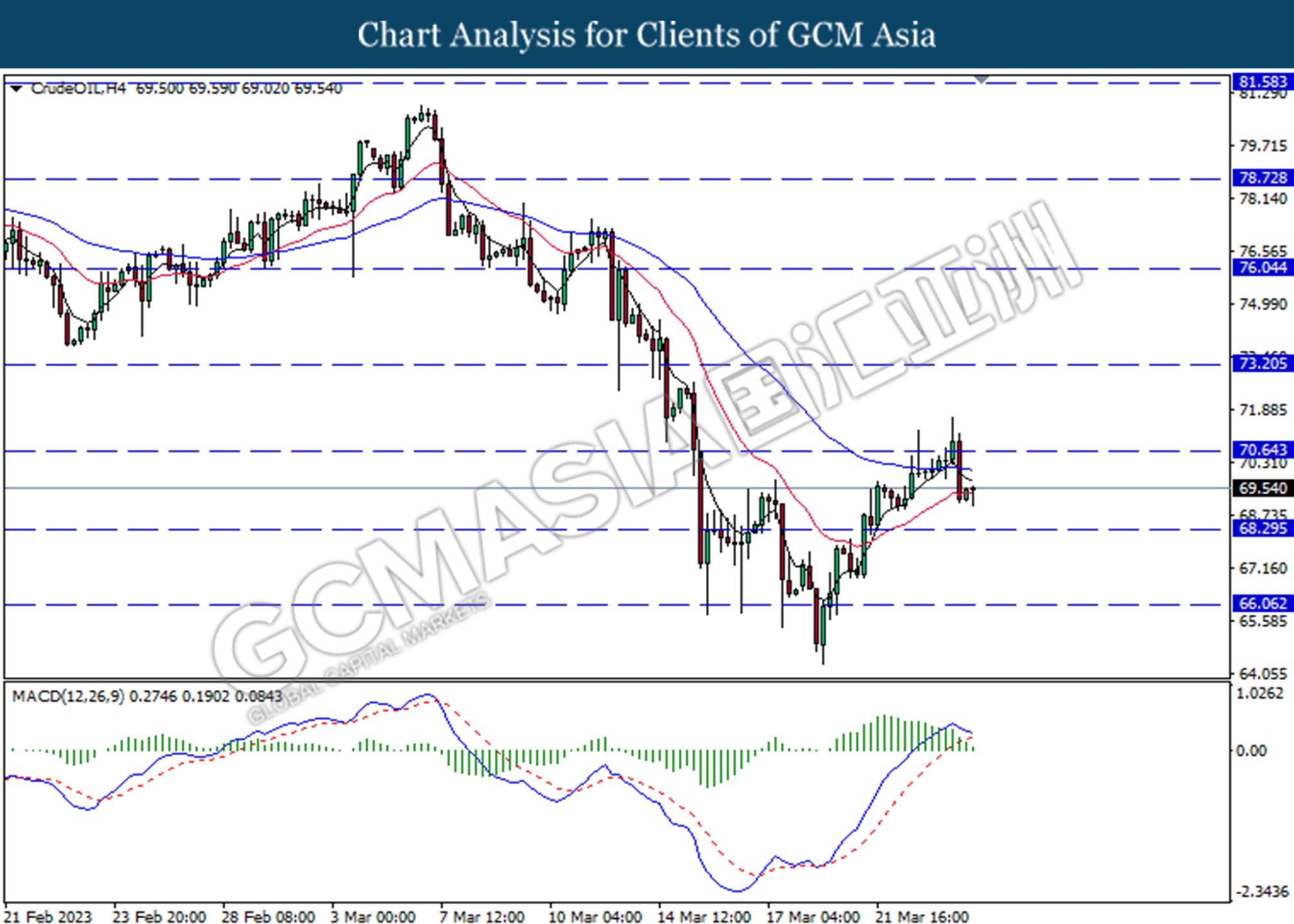

CrudeOIL, H4: Crude oil price was traded higher following rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

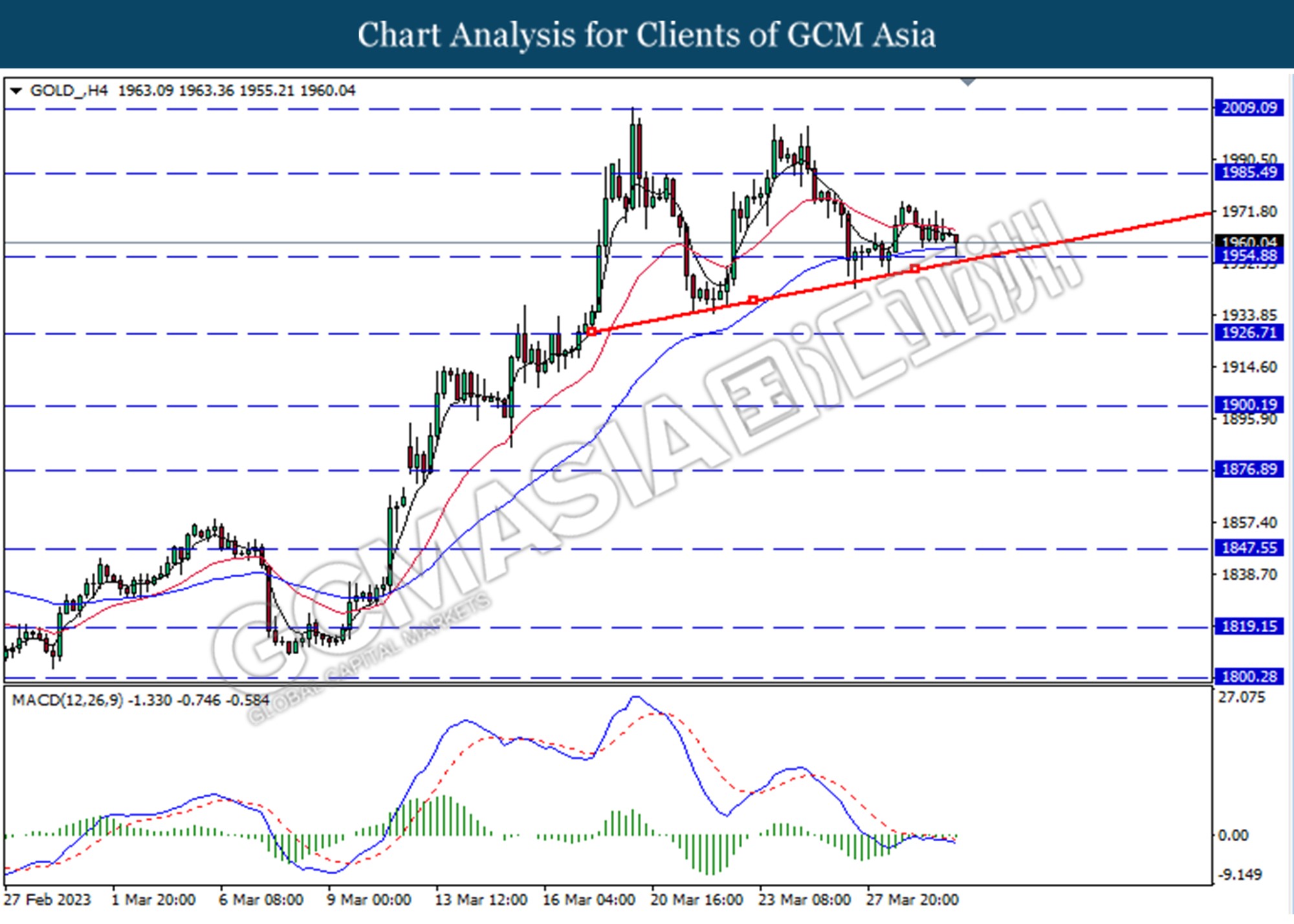

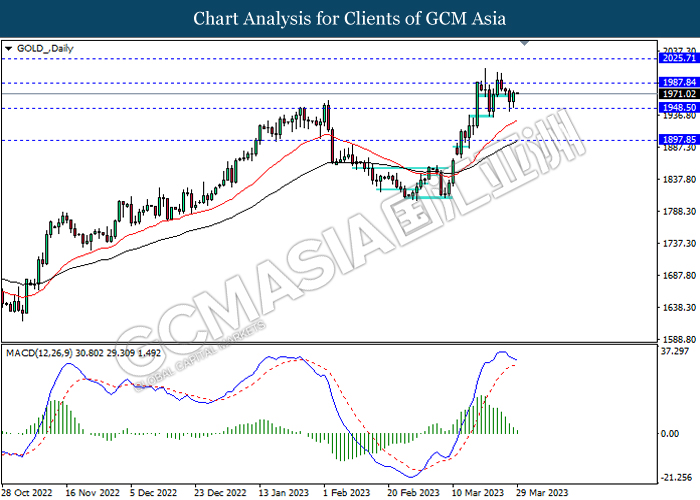

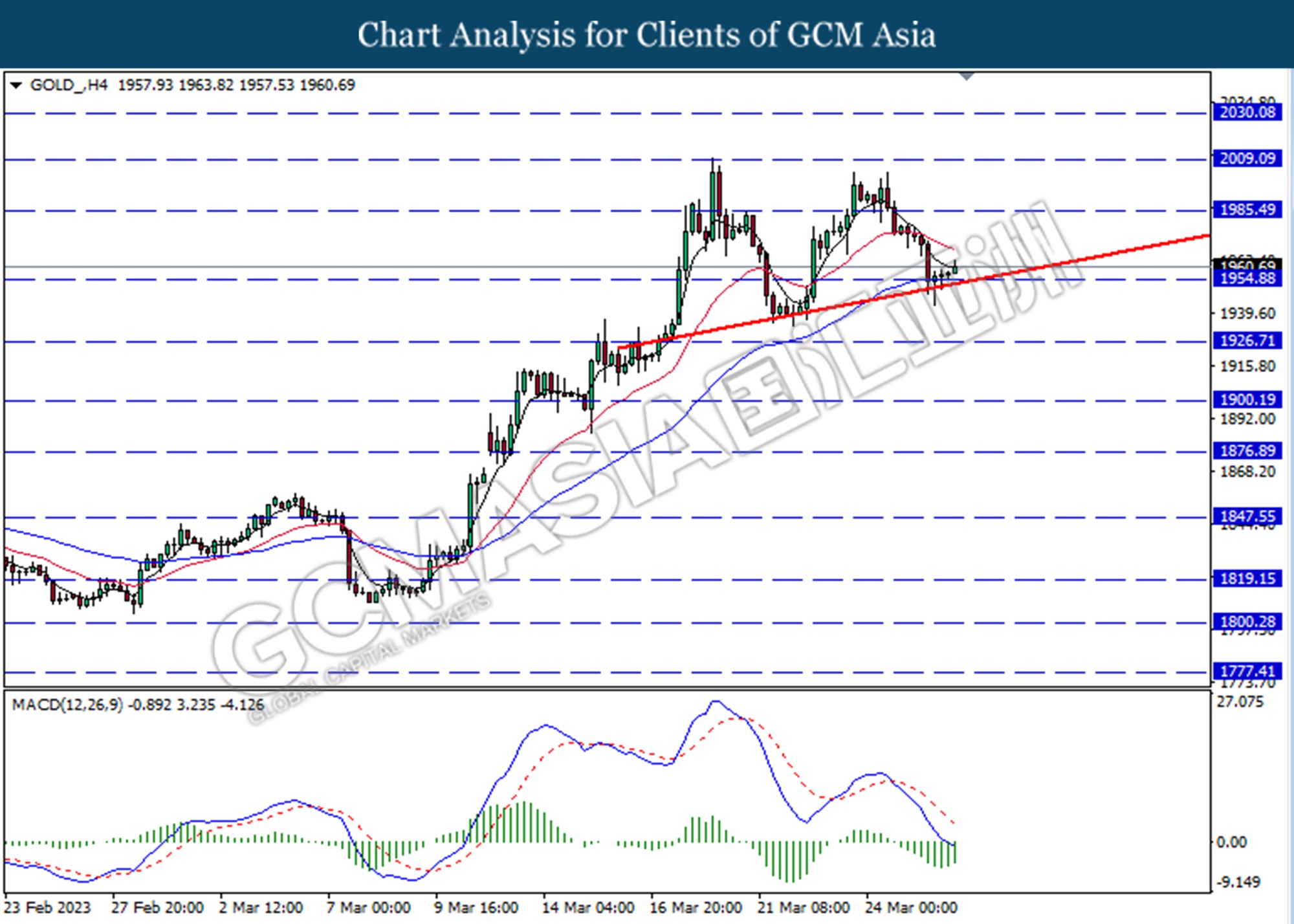

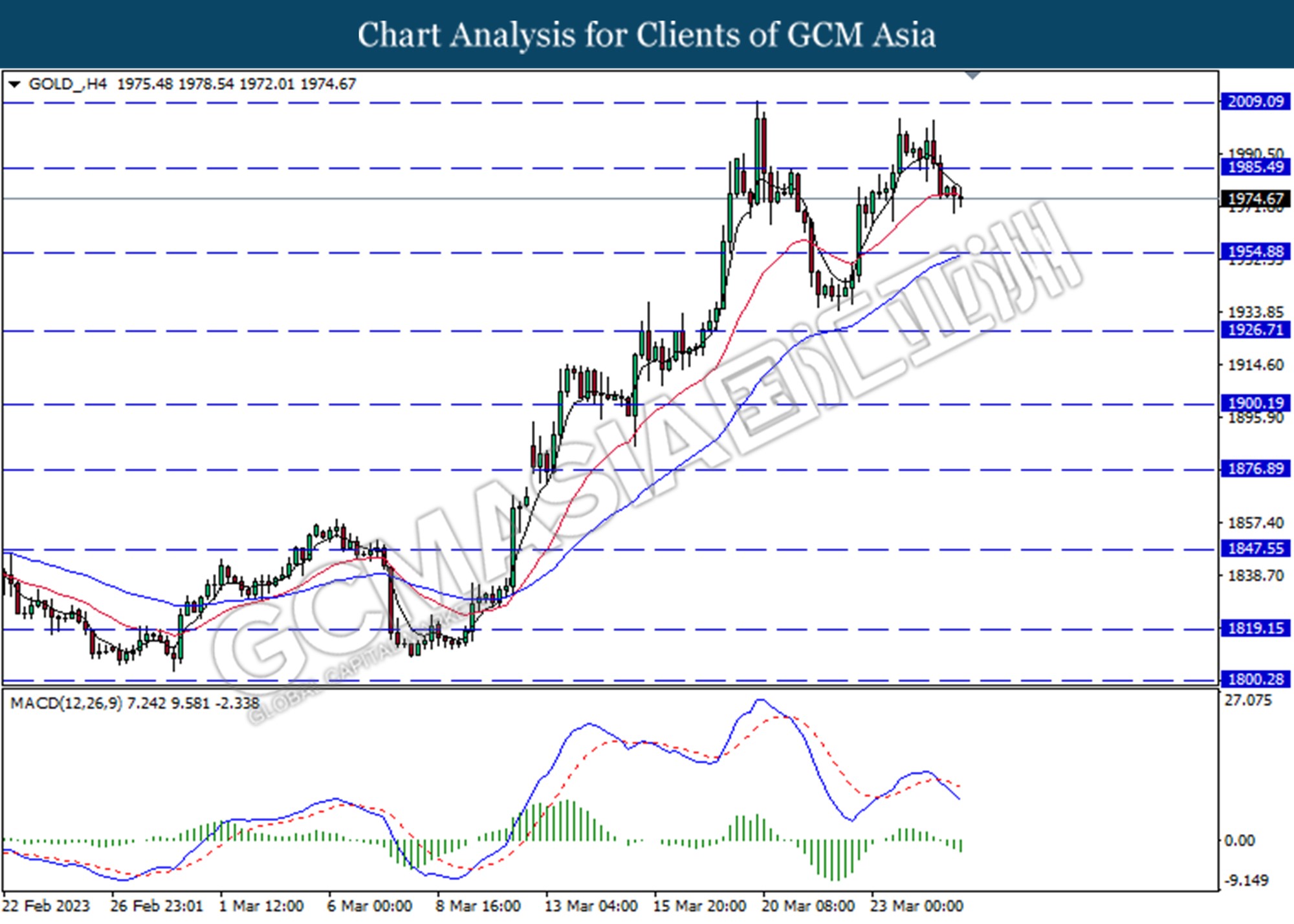

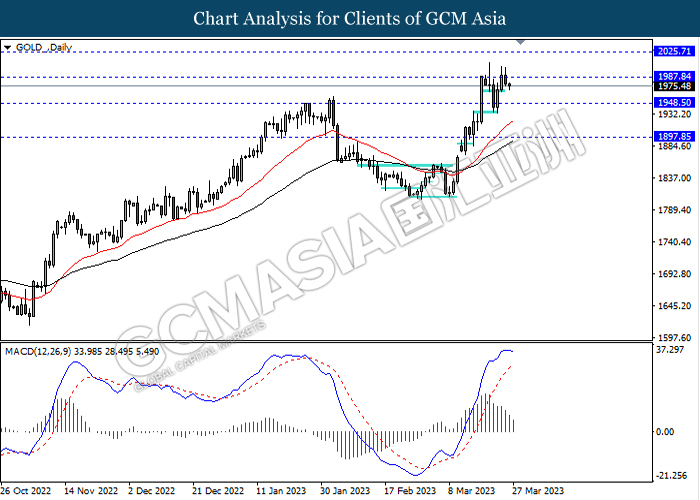

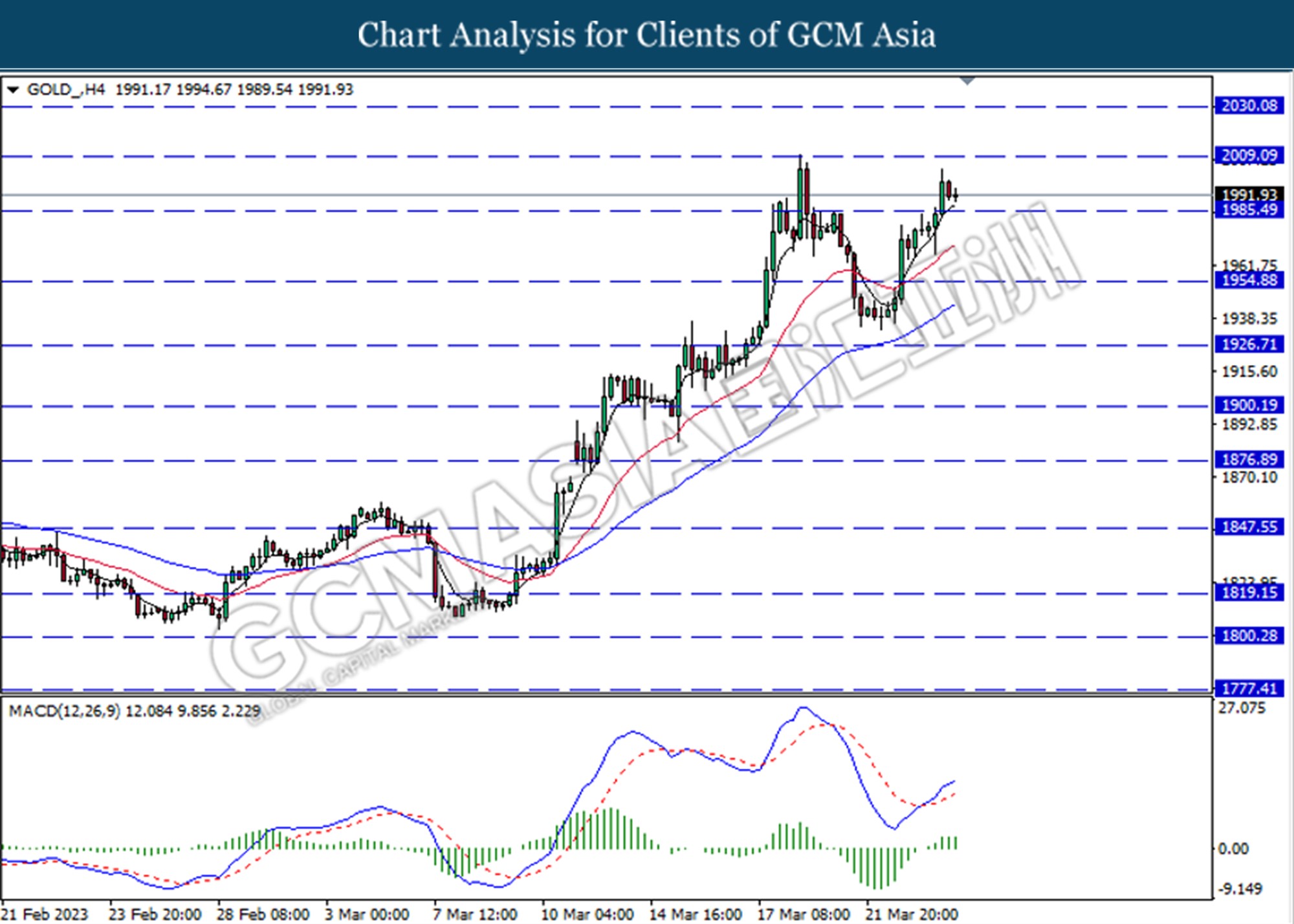

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1985.50. MACD which illustrated increasing bearish momentum suggests the commodity extended its gains after it successfully breakout above the resistance level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70

040423 Morning Session Analysis

04 April 2023 Morning Session Analysis

US Dollar sank into ‘red sea’ amid manufacturing activity weakened.

The dollar index, which is traded against a basket of six major currencies, was beaten down by huge selling pressures while re-testing the lowest level in two weeks following the release of the downbeat economic data. According to the Institute for Supply Management (ISM), the US Manufacturing PMI dropped further from 47.7 to 46.3 in March, missing the consensus forecast at 47.5, refreshing the record of contraction for the fifth consecutive month. It is noteworthy to highlight that an index level which below 50 indicates contraction in the sector, and the ISM’s index showed continuous contraction for five months in the US manufacturing sector. Heading forward, manufacturing activity is likely to sink deeper as the tighter credit conditions is expected to put pressure on investment spending. As such, it cast a shadow over the US economy and urged investors to sell off their dollar’s holdings as the further decline in the ISM figure could prompt the Federal Reserve to pause its rate hike plan earlier than expected. As of writing, the dollar index edged down by -0.45% to 102.05.

In the commodities market, crude oil prices were up by 0.02% to $80.30 per barrel as the OPEC+ surprise cut continued to hype the market sentiment. Besides, gold prices ticked up by 0.02% to $1983.90 per troy ounce as the downbeat ISM’s number exacerbated the market worries over the risk of recession.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Apr) | 3.60% | 3.60% | – |

| 22:00 | USD – JOLTs Job Openings (Feb) | 10.824M | 10.400M | – |

Technical Analysis

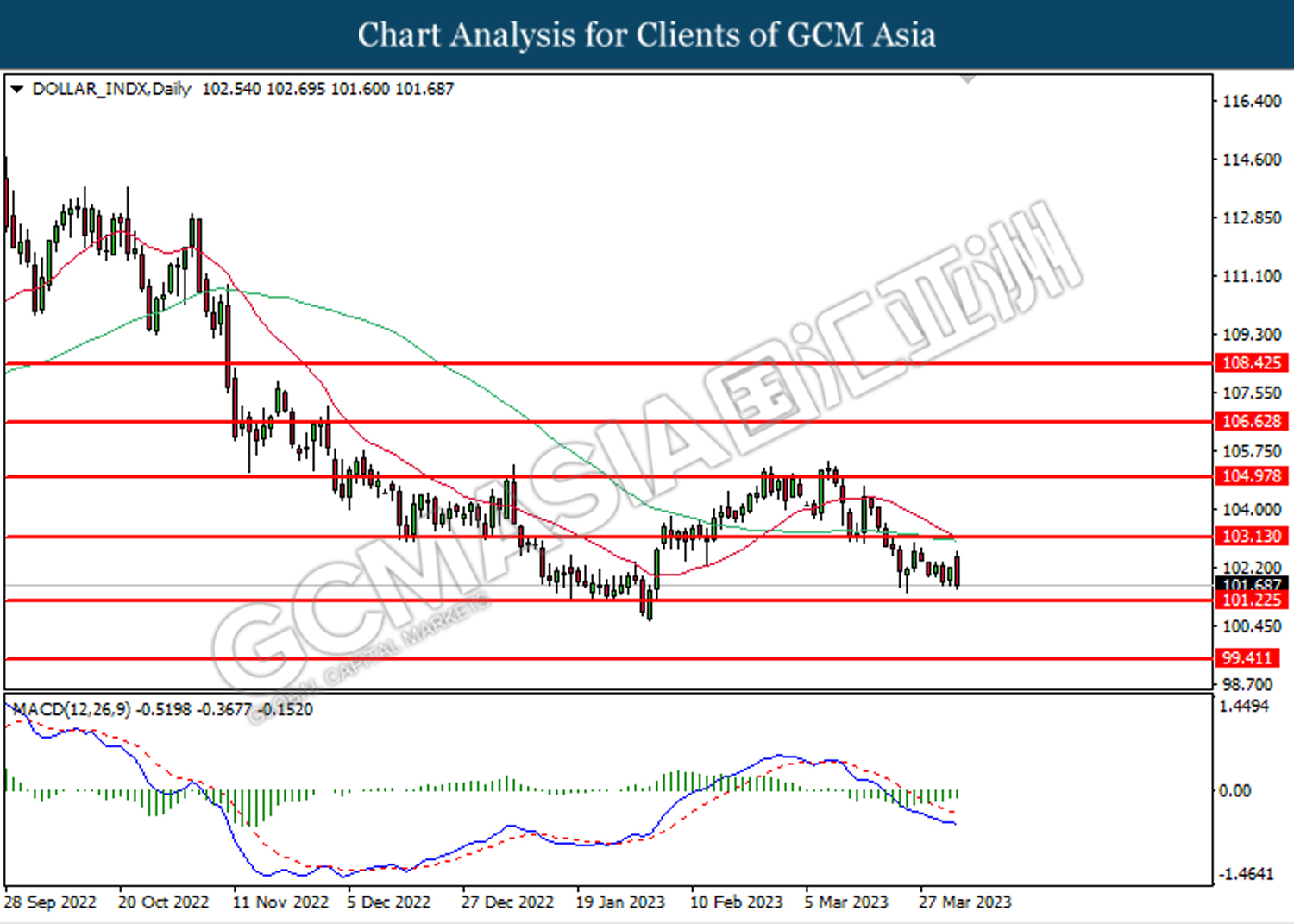

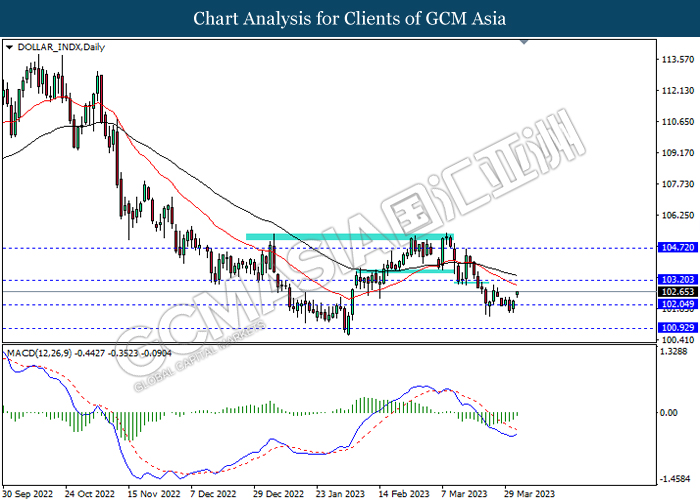

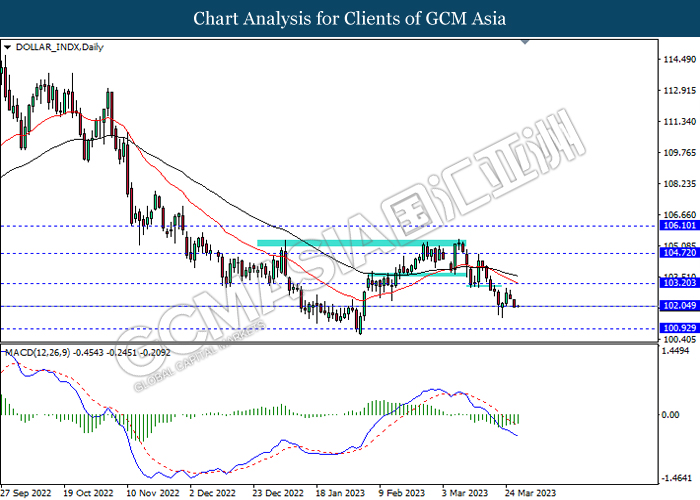

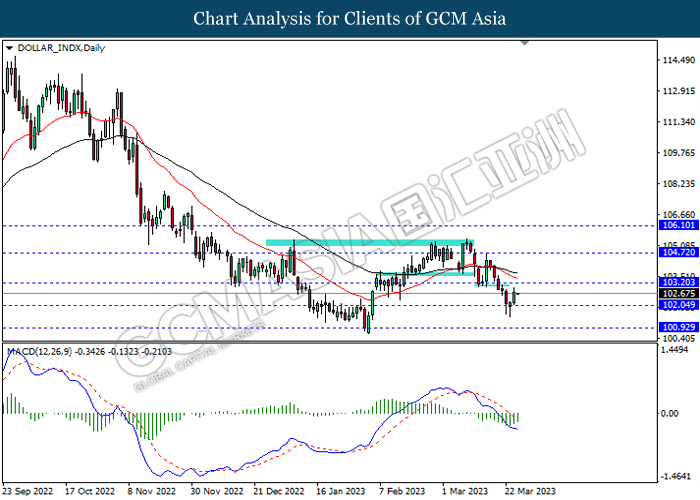

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

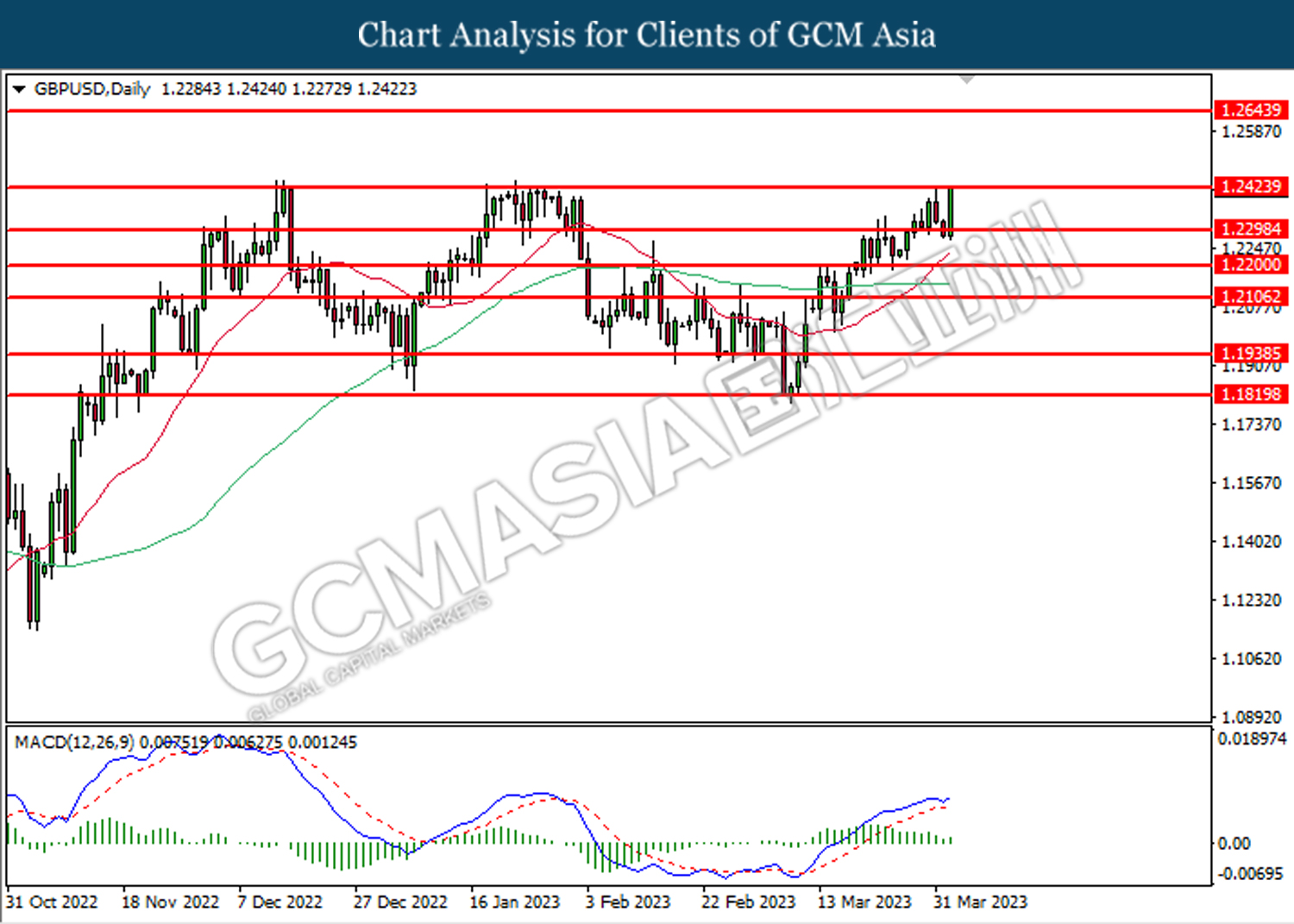

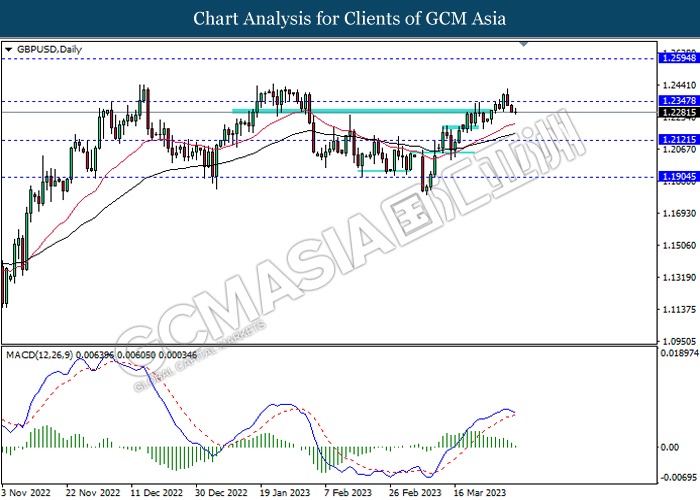

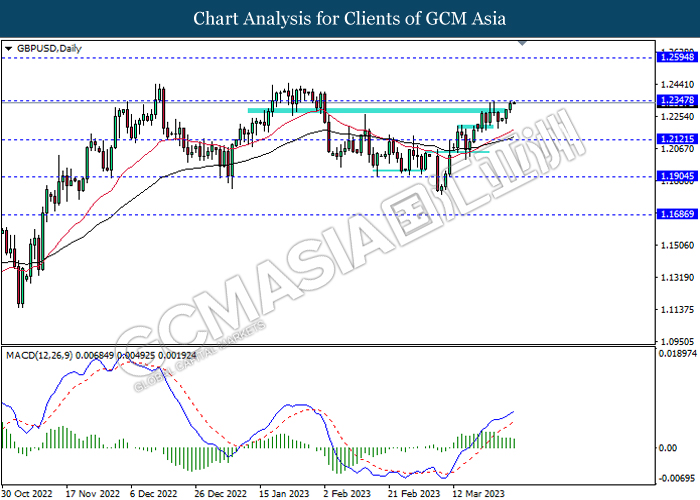

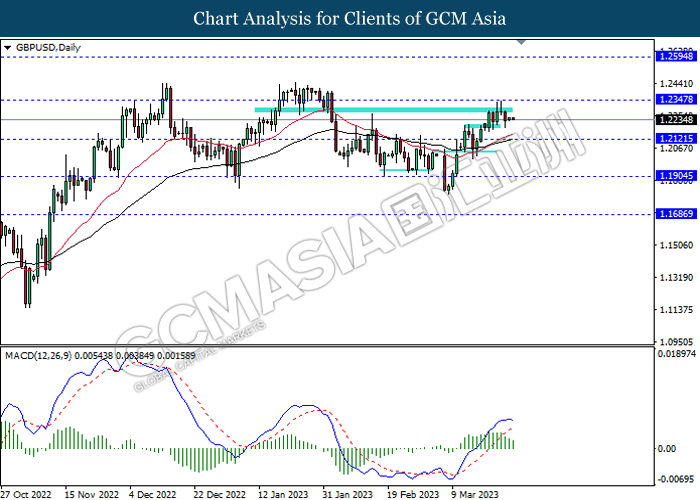

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2425. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2425, 1.2645

Support level: 1.2300, 1.2200

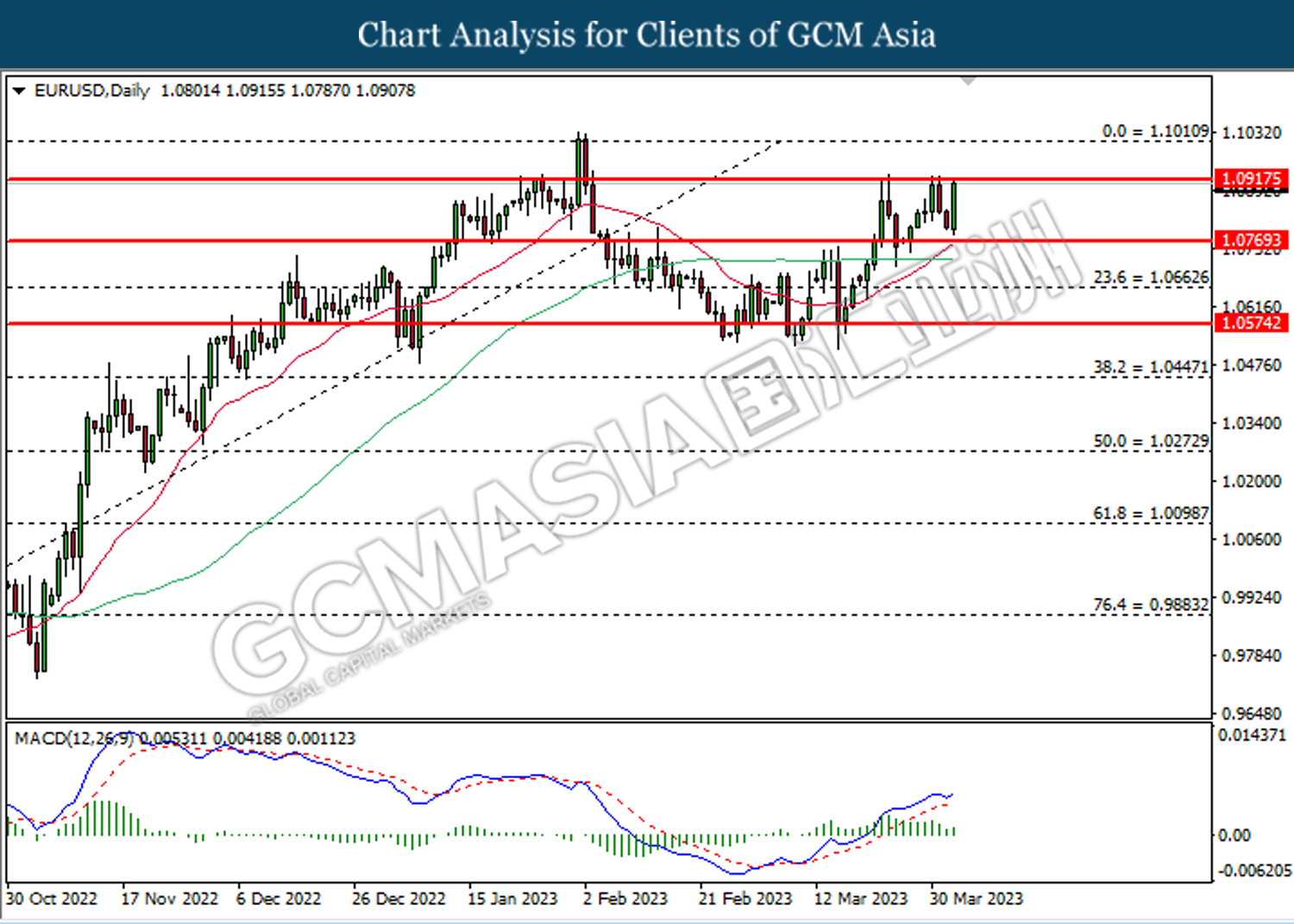

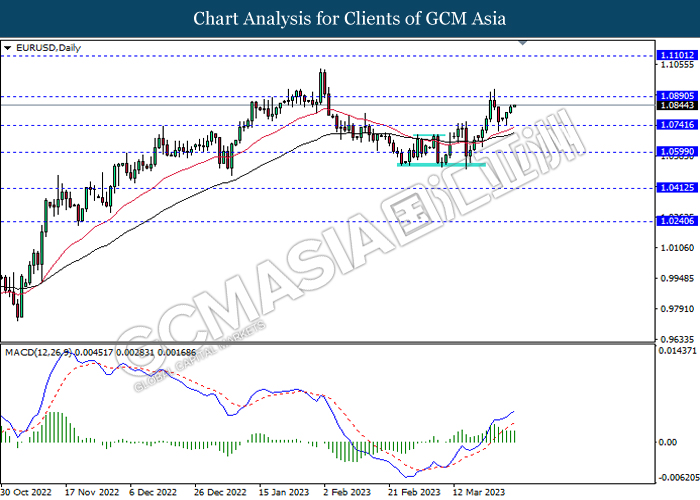

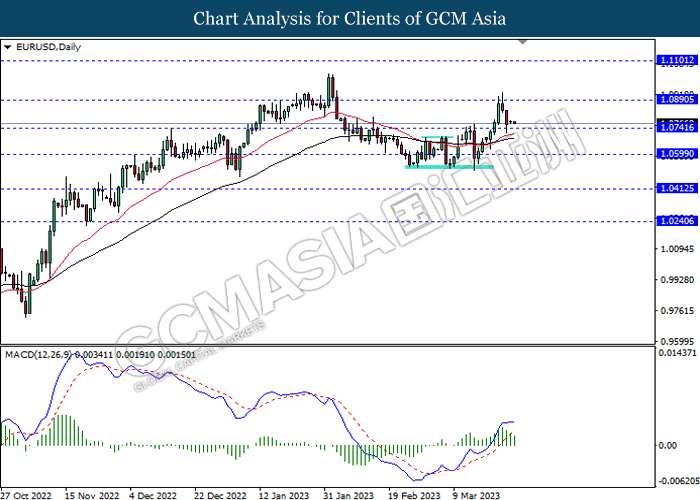

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0915 MACD which illustrated bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

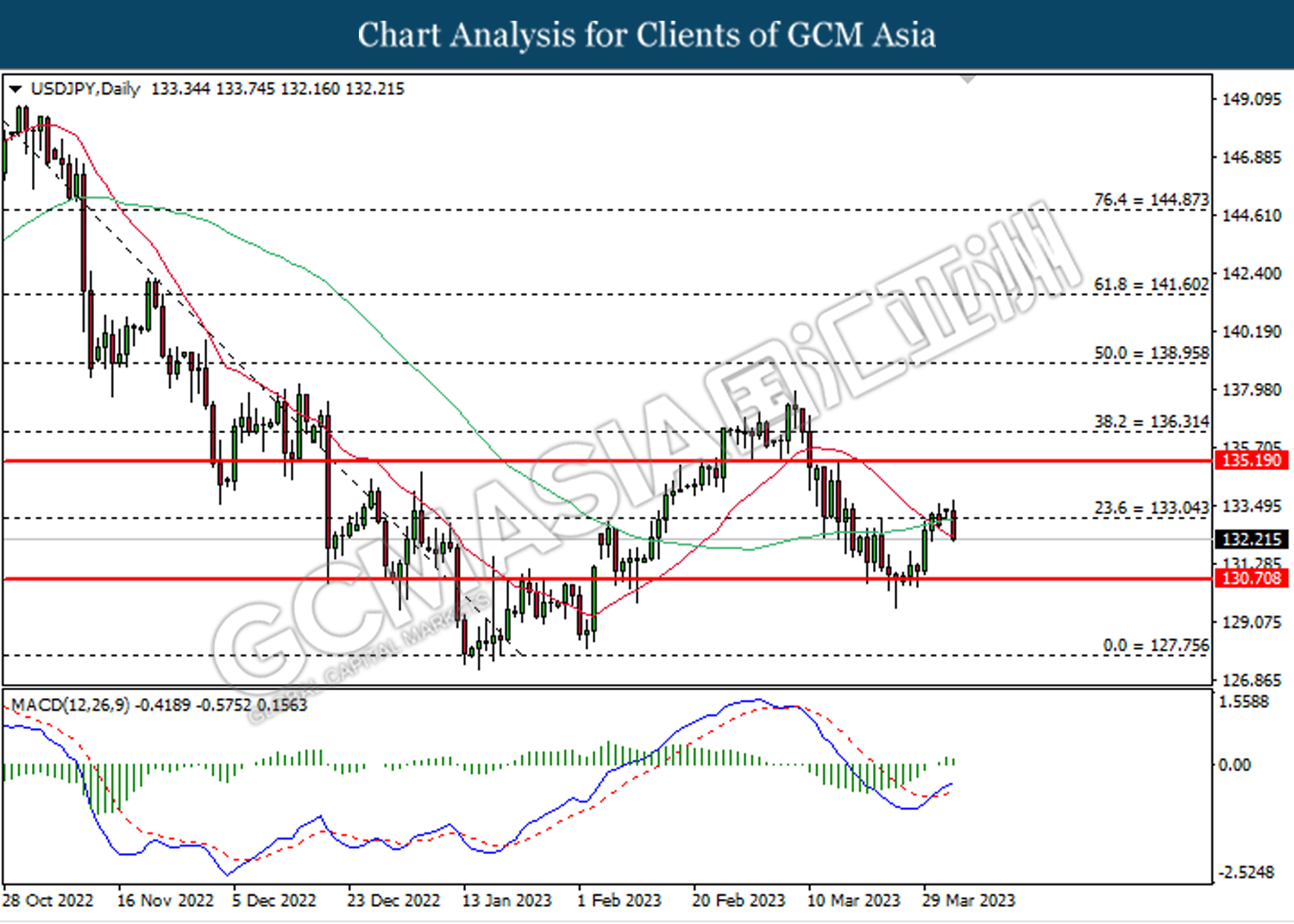

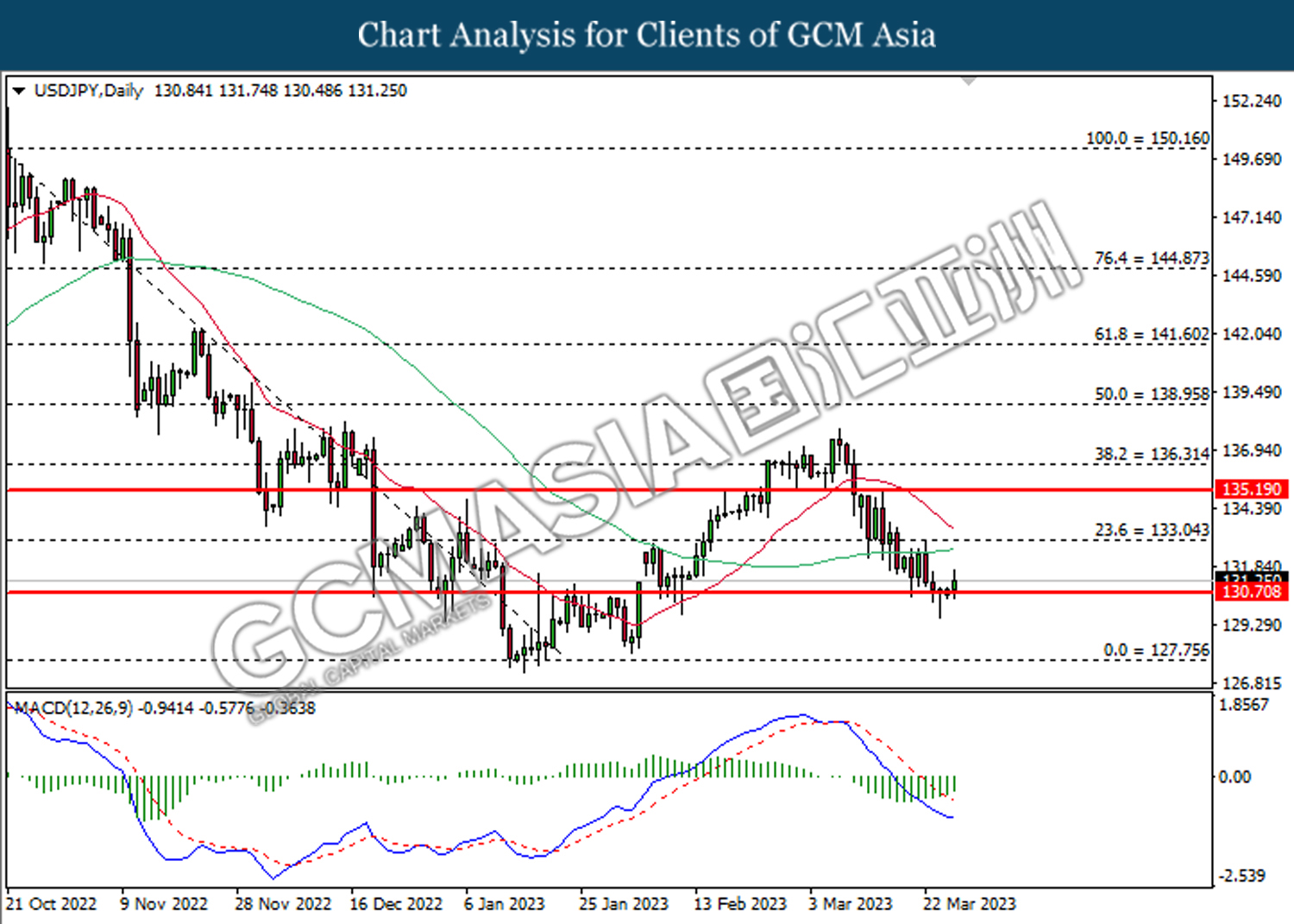

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.05. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6290. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3485. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3560, 1.3635

Support level: 1.3485, 1.3395

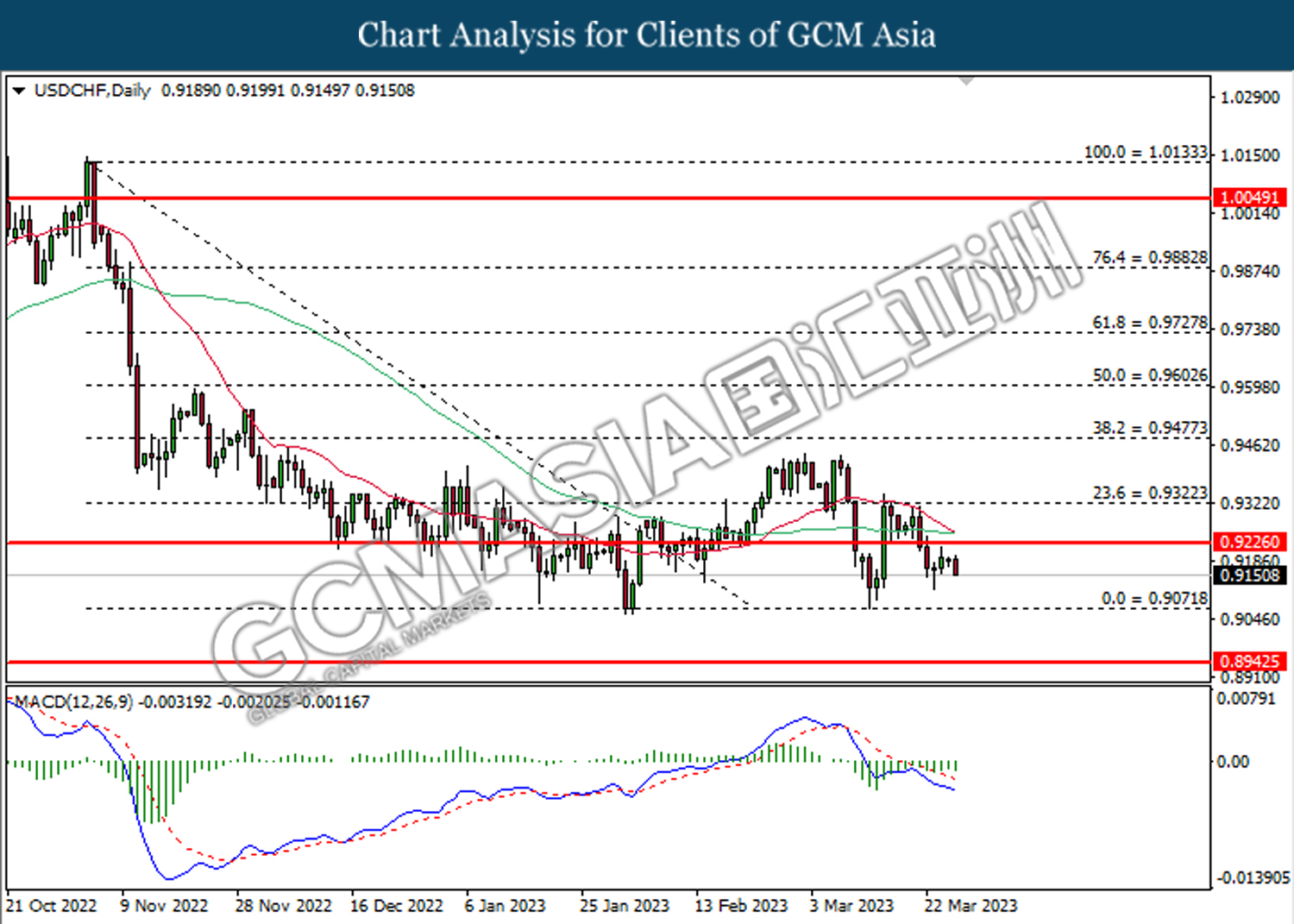

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9225. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9070.

Resistance level: 0.9225, 0.9325

Support level: 0.9070, 0.8945

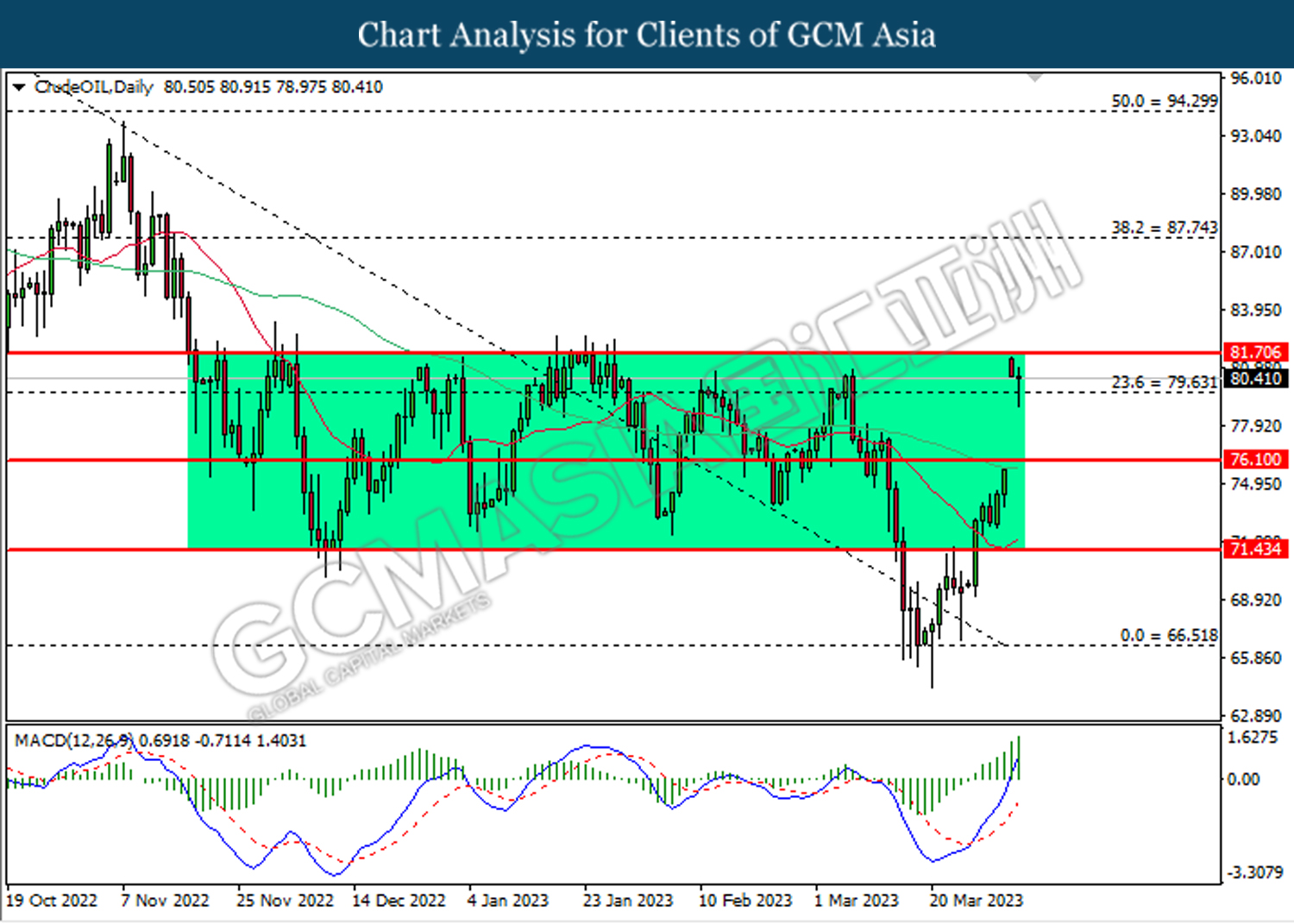

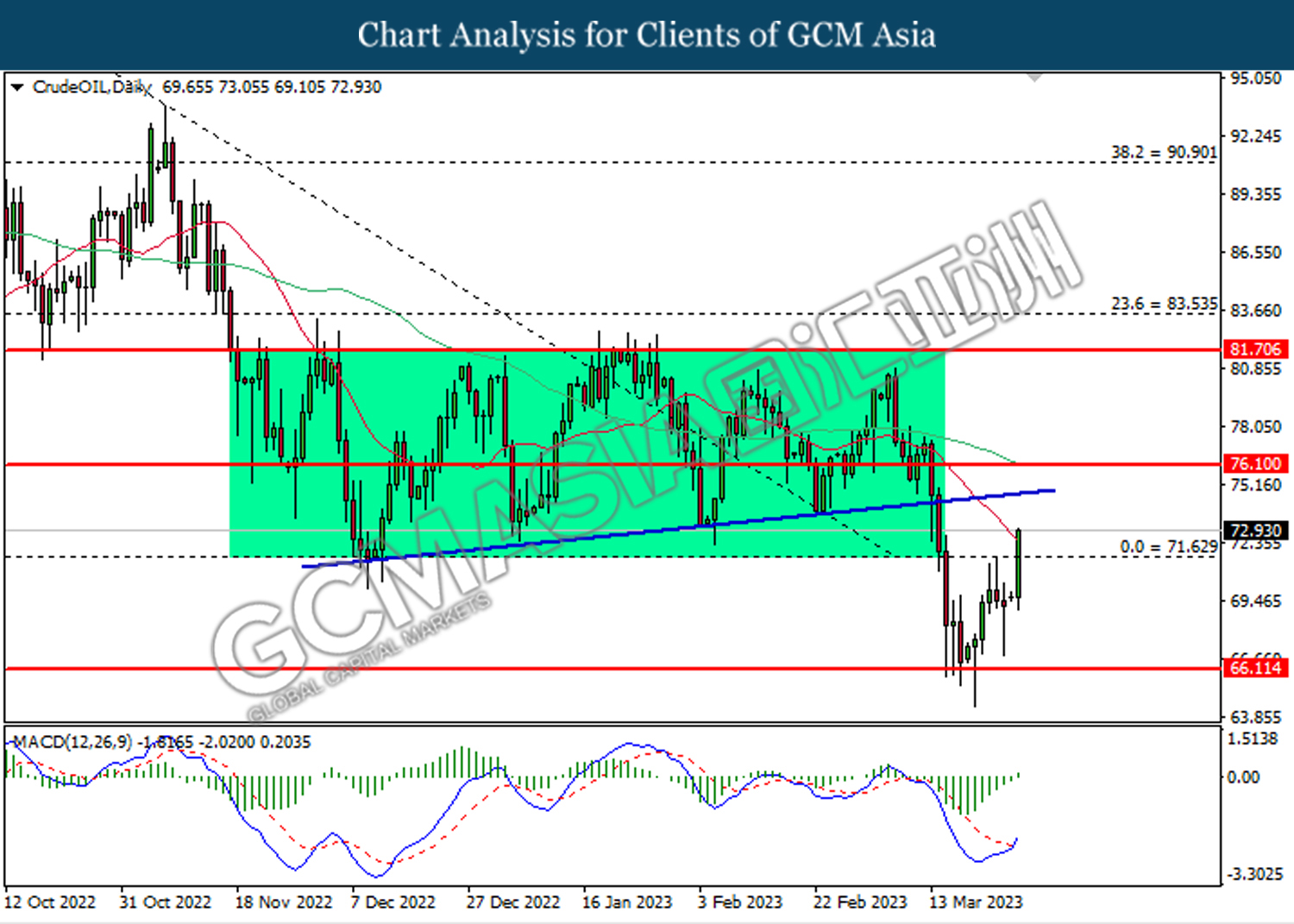

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 79.65. However, MACD which illustrated bullish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 81.70, 87.75

Support level: 79.65, 76.10

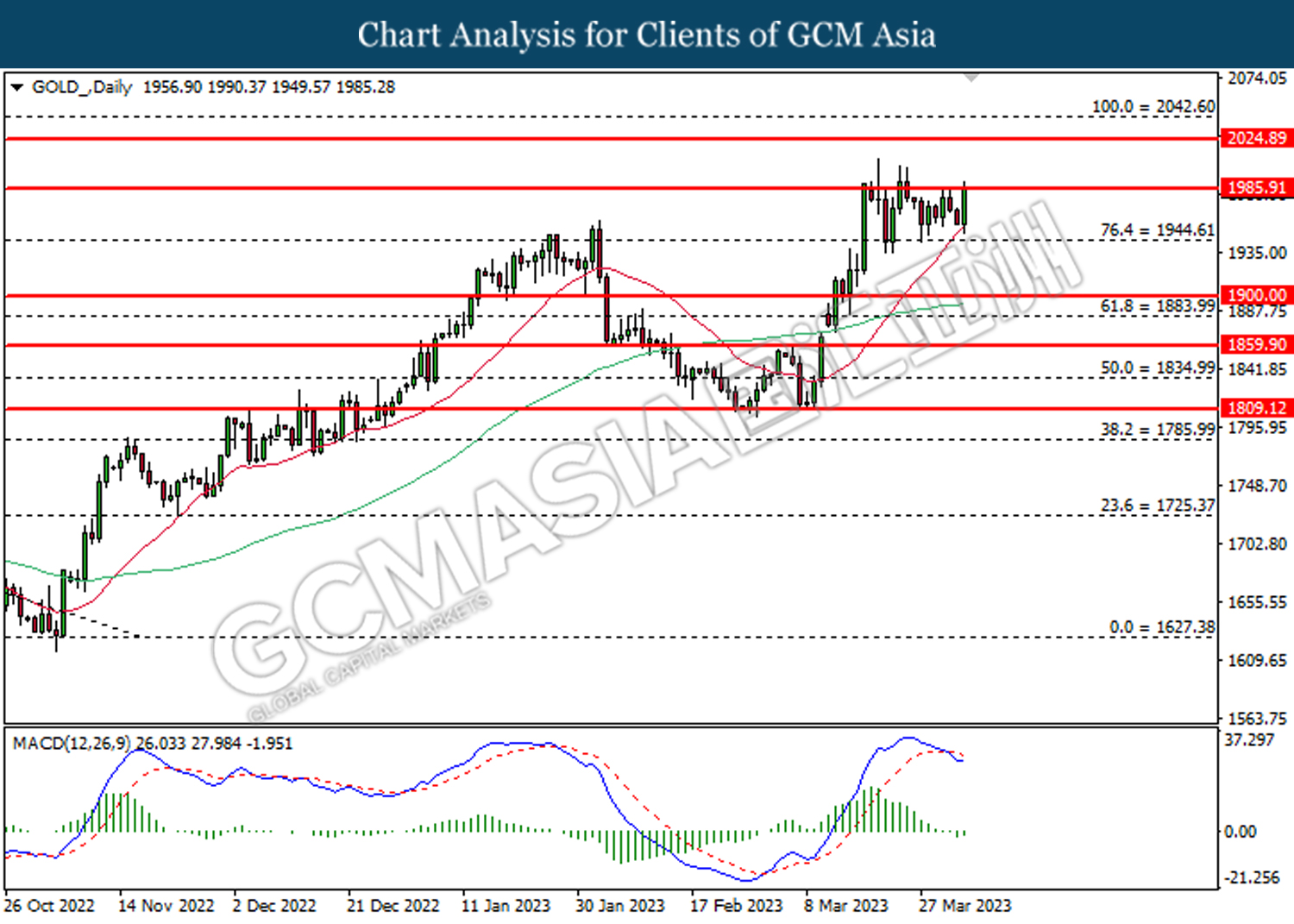

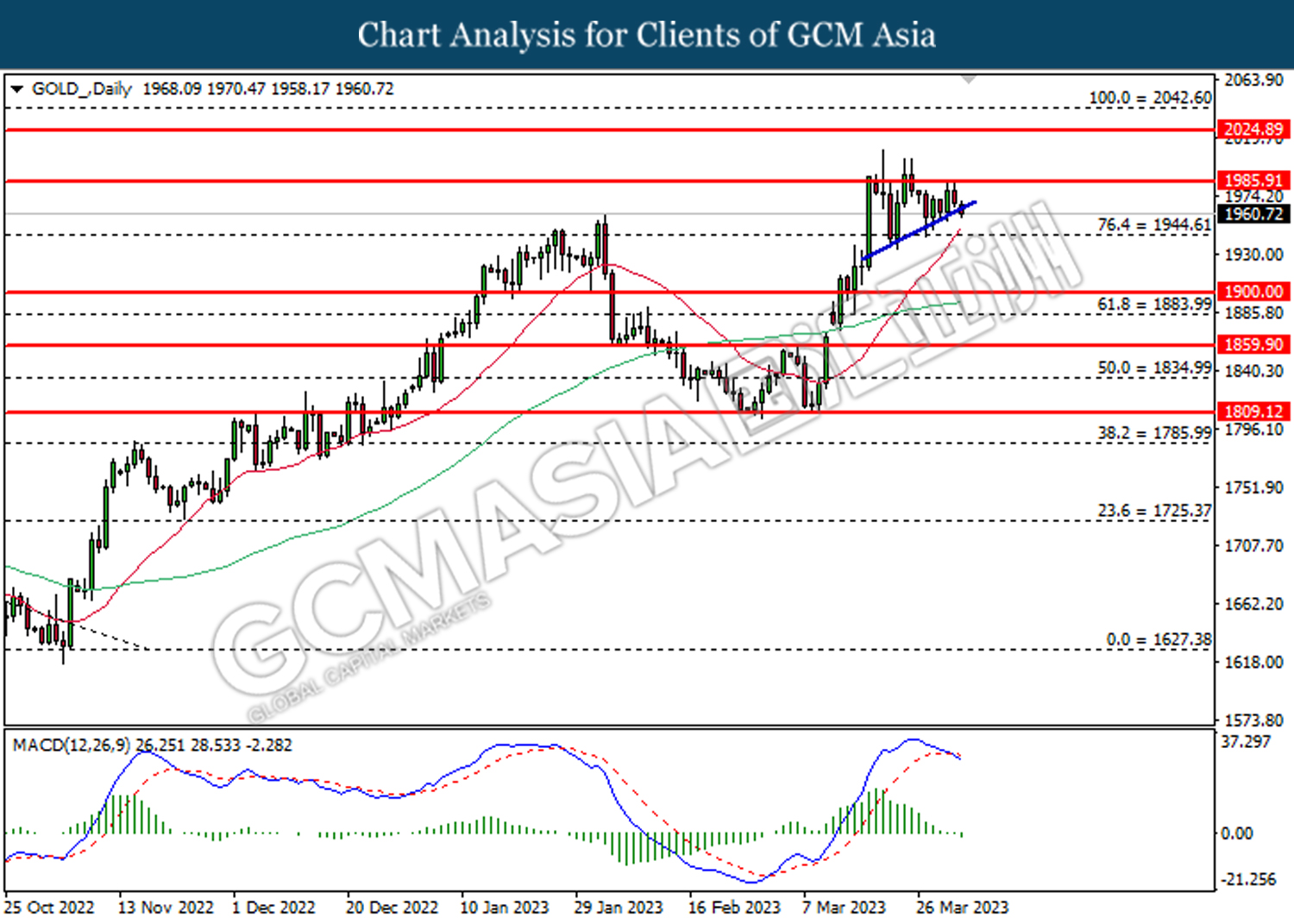

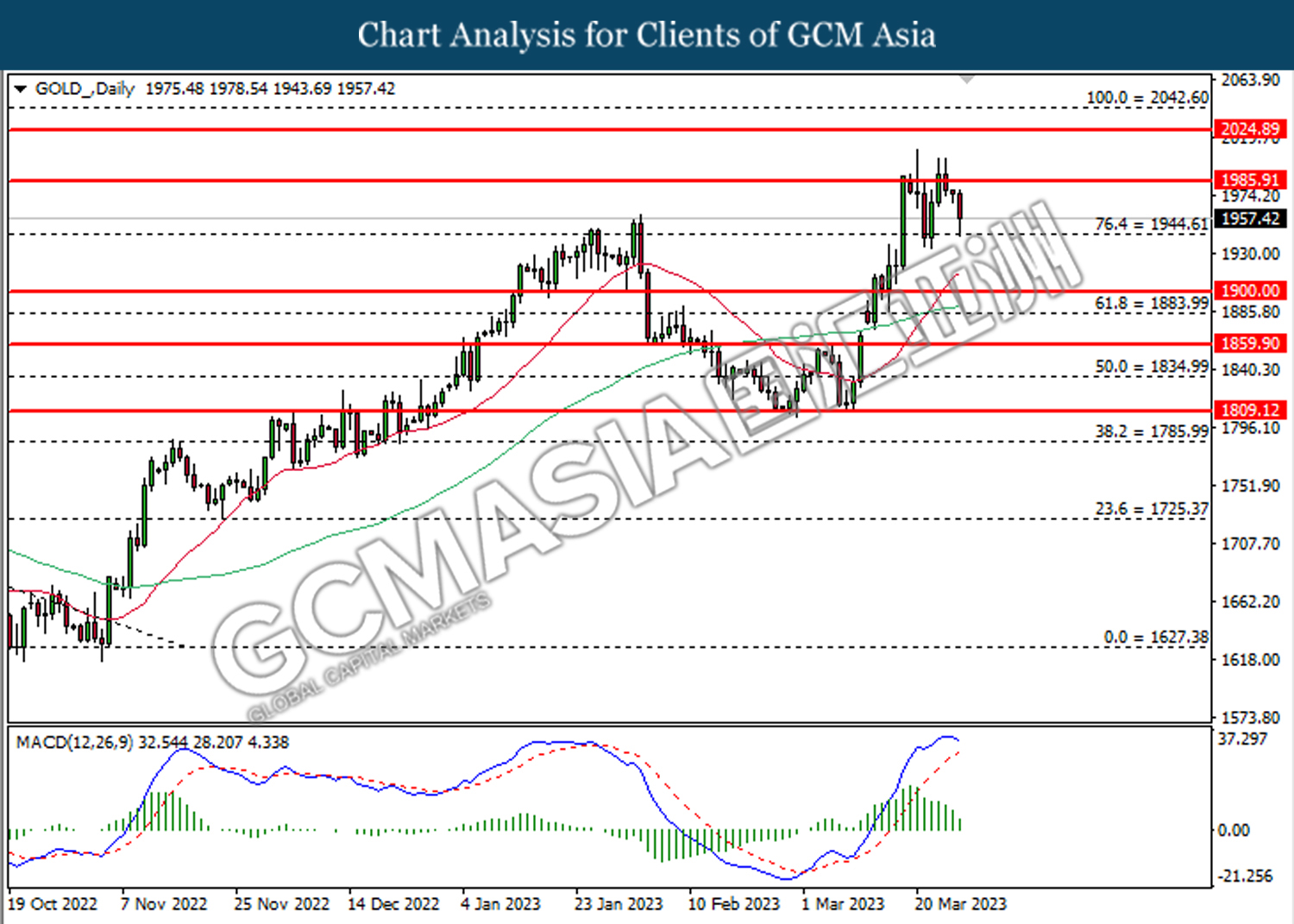

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1985.90. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1985.90, 2024.90

Support level: 1944.60, 1900.00

030423 Afternoon Session Analysis

3 April 2023 Afternoon Session Analysis

Euro slided following easing inflation risk.

The EUR/USD, which traded by majority of global investors slumped on last Friday following the inflationary risk in the Eurozone has diminished. According to Eurostat, the Eurozone Consumer Price Index (CPI) YoY dropped significantly from the previous reading of 8.5% to 6.9%, which is lower than the consensus forecast of 7.1%. The main factor of easing inflation was the decline of energy price such as crude oil, whereas reducing the pressure on the living cost of European residents. Though, CNBC reported that the food price in Eurozone remained stubbornly high, as well as the likelihood aggressive rate hike by European Central Bank (ECB) still exist. On the other hand, the losses of Euro was limited amid the hawkish statement of ECB President. ECB President Christine Lagarde claimed on Friday that there is some room to raise its interest rate, as the core inflation in the Eurozone still remained in a high level. With that, it reflected the ECB’s determination to keep inflation down to 2%. Another ECB member, Francois Villeroy de Galhau also echoed the standpoint of ECB, as he deemed that there is a long way to tamp down the inflation risk. As of writing, the EUR/USD depreciated by 0.31% to 1.0793.

In the commodities market, the crude oil prices rose significantly by 5.56% to $79.88 per barrel as of writing following the positive speech toward the US economy has dialed up the market optimism on oil demand. In addition, the gold price dropped by 0.94% to $1951.06 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – Ching Ming Festival

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Mar) | 44.4 | 44.4 | – |

| 16:30 | GBP – Manufacturing PMI (Mar) | 48.0 | 48.0 | – |

| 22:00 | USD – ISM Manufacturing PMI (Mar) | 47.7 | 47.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

EURUSD, Daily: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3330

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 81.30, 86.00

Support level: 76.80, 73.10

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1987.85, 2025.70

Support level: 1948.50, 1897.85

030423 Morning Session Analysis

03 April 2023 Morning Session Analysis

US dollar revived despite a series of downbeat data.

The dollar index, which is traded against a basket of six major currencies, regained its luster last Friday following the release of a series of economic data. According to the University of Michigan, the US consumer sentiment index dropped from 63.4 to 62.0, lower than the consensus forecast at 63.2, mirroring the market worries that the recent fallout in the banking sector might have a far-reaching impact on the US economy. Besides, the US Bureau of Economic Analysis posted the Core PCE Price Index dropped from the prior month’s reading at 0.5% to 0.3% in February, also weaker than the consensus forecast of 0.4%. Despite this, the sharp drop in the Feb Core PCE report did not trigger large sell-off pressures in the dollar market as US President Joe Biden’s hawkish statement twisted the market sentiment. In the statement from President Joe Biden on February PCE Report, he mentioned that the US is making progress in curbing inflation, which has been proven by a nearly 30 percent down in annual inflation rate this summer. Alongside, the labor market remains resilient while steady growth was able to see in the US economy over the months. He also highlighted the fight against inflation is not over yet, signaling that he is still in favor of high-interest rates at this point in time. As of writing, the dollar index rose 0.20% to 102.70.

In the commodities market, crude oil prices were up by 7.41% to $81.20 per barrel following the surprise cuts of around 1.16 million barrels per day from May to the end of the year. Besides, gold prices edged down by -0.39% to $1962.30 per troy ounce as Biden’s hawkish statement diminished the appeal of the safe haven asset.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – Ching Ming Festival

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Mar) | 44.4 | 44.4 | – |

| 16:30 | GBP – Manufacturing PMI (Mar) | 48.0 | 48.0 | – |

| 22:00 | USD – ISM Manufacturing PMI (Mar) | 47.7 | 47.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2300. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2425, 1.2645

Support level: 1.2300, 1.2200

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0770.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 133.05. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 135.20.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3485. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3560, 1.3635

Support level: 1.3485, 1.3395

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9225.

Resistance level: 0.9225, 0.9325

Support level: 0.9070, 0.8945

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 81.70. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 81.70, 87.75

Support level: 79.65, 76.10

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1985.90. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1944.60.

Resistance level: 1985.90, 2024.90

Support level: 1944.60, 1900.00

310323 Afternoon Session Analysis

31 March 2023 Afternoon Session Analysis

The Aussie rose after the strong Chinese PMI was released.

The Aussie dollar climbed higher after strong Chinese PMI data was released, as China is one of the major trading partners in Australia. The China Composite PMI readings rose to 57.0, from the previous reading of 56.4, while the manufacturing PMI at 51.9 and non-manufacturing PMI at 58.2, both figures were above the consensus. The stronger-than-expected result suggests China’s economy is recovering from a contraction after the easing of covid epidemic prevention measures. The recovery in China’s business activity will likely give a boost to Australia’s economy going forward. Besides, the Australian prime minister recommended minimum wages increase that matches the inflation in Australia. According to Reuters, the Australian Council of Trade Unions is demanding a 7% increase in the wage rate. However, Prime Minister said the government’s submission to the Fair Work Commission (FWC) did not contain a specific figure for the minimum wage increase, and he welcomed any figure that matched the increase in inflation. The increase in the minimum wage can relieve the pressure on households against inflation and improve consumption power, thus promoting the Australian economy and strengthening the currency. As of writing, the AUD/USD appreciated by 0.18% to 0.6719.

In the commodity market, the crude oil prices were traded up by 0.01% to $74.38 per barrel as of writing as the expansion of China’s manufacturing activity lifted the crude oil demands. In addition, the gold price edged up by 0.06% to $1998.80 per troy ounce as of writing due to the weakening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (Mar) | 2K | 3K | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 8.50% | 7.20% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Feb) | 0.60% | 0.40% | – |

| 20:30 | CAD – GDP (MoM) (Jan) | -0.10% | 0.40% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing for a support level at 101.70. MACD which illustrated increasing bearish momentum suggests the index extended its losses if it successfully breaks below the support level.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. However, MACD which illustrated decreasing bullish momentum suggests the pair to traded lower as technical correction.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.0930.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded lower following a retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 132.30.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the support level at 0.6685. MACD which illustrated increasing bullish momentum suggests the pair extended its gains.

Resistance level: 0.6775, 0.6910

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following a prior breakout above the previous resistance level at 0.6265. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6320.

Resistance level: 0.6320, 0.6400

Support level: 0.6262, 0.6195

USDCAD, H4: USDCAD was traded lower while currently testing for the support level at 1.3515. However, MACD which illustrated decreasing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded lower following a prior breakout below the previous support level at 0.9180. MACD which illustrated bearish momentum suggests the pair extend its losses toward the support level at 0.9090

Resistance level: 0.9180, 0.9285

Support level: 0.9090, 0.9005

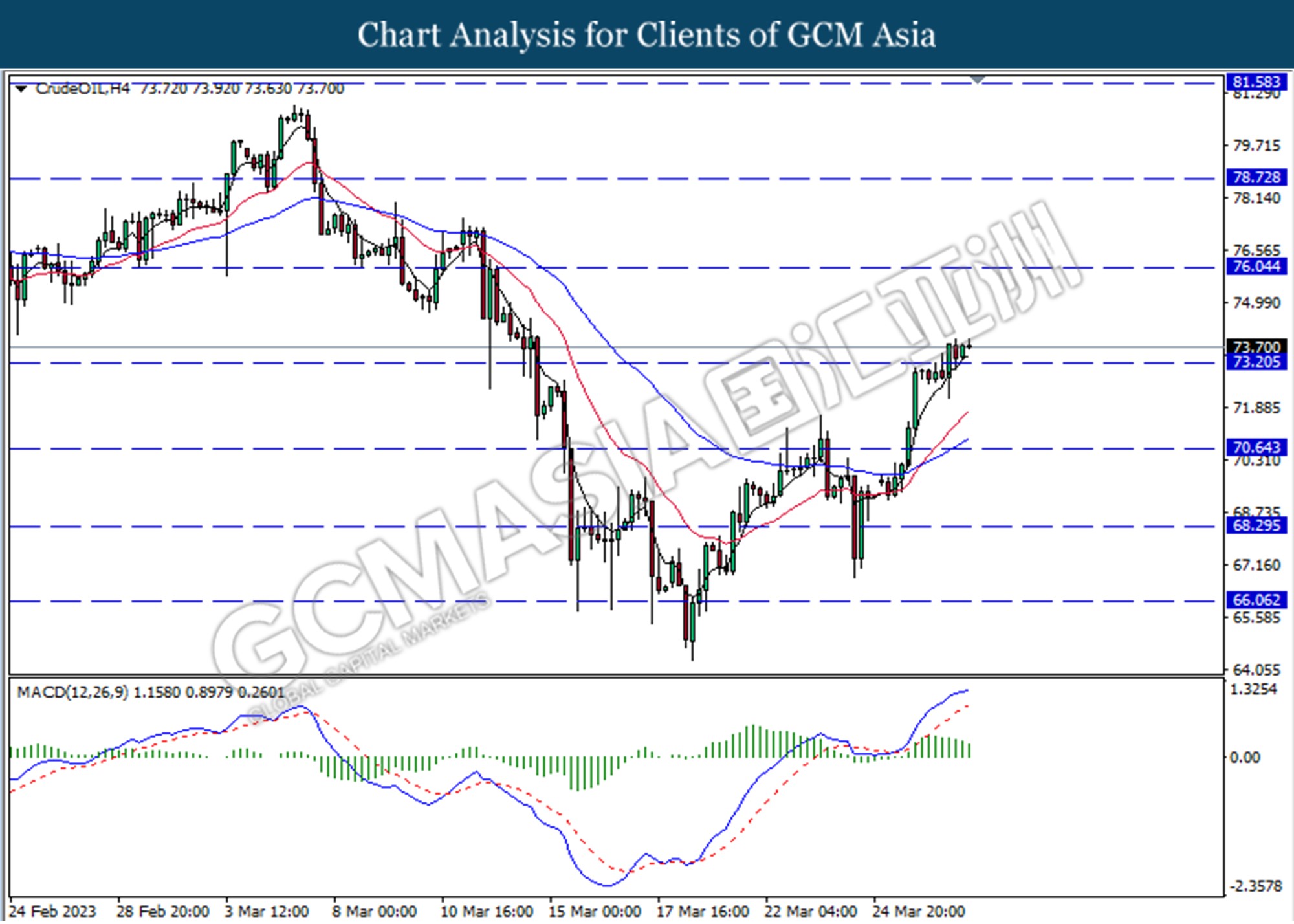

CrudeOIL, H4: Crude oil price was traded higher following a prior breakout above the resistance level at 73.20. MACD which illustrated decreasing bearish momentum suggests the commodity extended its gains toward the resistance level at 76.05

Resistance level: 73.20, 76.05

Support level: 70.65, 68.30

GOLD_, H4: Gold price was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 1985.50

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70

310323 Morning Session Analysis

31 March 2023 Morning Session Analysis

US Dollar retreated as economy outlook weakened.

The Dollar Index which traded against a basket of six major currencies received significant bearish momentum on Thursday following the downbeat economic data had beaten down the value of US Dollar. According to Bureau of Economic Analysis, the US Gross Domestic Product (GDP) in the forth quarter has notched down from the previous reading of 3.2% to 2.6%, missing the market forecast of 2.7%. Besides, the Initial Jobless Claims report had shown that the labor market in the US turned fragile, whereby the citizen who looking for the unemployment insurance increased last week. With such background, it cut the space for Fed officials to implement further rate hike in the future in order to restore economy stability. On the other hand, several Fed members offered their views on inflation and interest rates on yesterday. Though, the Dollar Index keep ranging at the recent low level, due to their different thoughts. One of the member claimed on yesterday that the inflation was still high in the US, which signaling Fed to increase its rate, while another member was concerned about the side effects of high interest rate. Thus, the Core PCE data that will be released today would be the key to gauge the next move of Fed. As of writing, the Dollar Index depreciated by 0.43% to 101.85.

In the commodity market, the crude oil price edged up by 0.01% to $74.38 per barrel as of writing following the halt to exports from Iraq’s Kurdistan region. In addition, the gold price depreciated by 0.04% to $1978.84 per troy ounce as of writing amid the strengthening of US Dollar at the moment.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) (Q4) | 0.20% | 0.40% | – |

| 14:00 | GBP – GDP (QoQ) (Q4) | -0.20% | -0.20% | – |

| 15:55 | EUR – German Unemployment Change (Mar) | 2K | 3K | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 8.50% | 7.20% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Feb) | 0.60% | 0.40% | – |

| 20:30 | CAD – GDP (MoM) (Jan) | -0.10% | 0.40% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

USDCAD, Daily: USDCAD was traded lower following prior breakout below the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3330

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 76.80, 81.30

Support level: 73.10, 69.75

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to b traded lower as technical correction.

Resistance level: 1987.85, 2025.70

Support level: 1948.50, 1897.85

300323 Afternoon Session Analysis

30 March 2023 Afternoon Session Analysis

BoE’s Mann hawkish statement limited sterling’s losses.

The pound sterling, the most traded currency among global investors, fell yesterday, but hawkish statements from Bank of England Catherine Mann limited the losses. In the communique, Mann mentioned that the Silicon Valley Bank (SVB) collapse was due to inadequate management and poor risk monitoring. The collapse was not caused by monetary policy, and British banks remain resilient. This statement gave investors a boost of confidence while urging the pound higher. At the same time, the fall in energy prices will ease the headline inflation toward the BoE 2% inflation target, but increasing in core goods and services will bring the core CPI to buoyed at a high level, comments from Mann. To bring inflation back to the Bank of England’s target, Mann has given a clear decision that, she is going to vote for a 25-basis point rate hike at the next monetary policy committee (MPC) meeting. The recent economic data showed unexpected growth in the UK economy, which increased the odds that the BoE will continue to hike the rate in the next MPC meeting. As of writing, the GBP/USD was traded higher by 0.05% to $1.2319.

In the commodity market, the crude oil price edged up by 0.15% to $73.08 per barrel while investors continued to eye on the upcoming German inflation data. On the other hand, the gold price appreciated by 0.02% to $1984.65 per troy ounce following the prior drop as the risk appetite eased.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative GBP BOE Inflation Letter

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | EUR – German CPI (YoY) (Mar) | 8.70% | 7.30% | – |

| 20:30 | USD – GDP (QoQ) (Q4) | 2.70% | 2.70% | – |

| 20:30 | USD – Initial Jobless Claims | 191K | 196K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the index to extend it gains toward the resistance level at 103.00

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2300. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses is successfully breaks below the support level.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair to be extend its losses toward the support level at 1.0790.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 132.30.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded lower following a prior breakout below the previous support level at 0.6685. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 0.6600.

Resistance level: 0.6775, 0.6910

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded lower following a prior retracement from the support level at 0.6195. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6265, 0.6320

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3600.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded higher following a prior rebound from the support level at 0.9180. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9285, 0.9390

Support level: 0.9180, 0.9090

CrudeOIL, H4: Crude oil price was traded lower following a prior breakout below the previous support level at 73.20. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 70.65

Resistance level: 73.20, 76.05

Support level: 70.65, 68.30

GOLD_, H4: Gold price was traded lower while currently testing for the support level at 1954.90. MACD which illustrated bearish momentum suggest the commodity to extend its losses if successfully breaks below the support level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70

300323 Morning Session Analysis

30 March 2023 Morning Session Analysis

US Dollar firmed as Fed official ensured US banking condition.

The Dollar Index which traded against a basket of six major currencies found its ground on yesterday amid the background of easing fears on bank collapse. As the Silicon Valley Bank (SVB) has been takeover by First Citizen Bank, it diminished the market expectations of a financial crisis. Besides, the speech from Fed official might signaled that the banking system in the US was remaining in a healthy condition. Michael Barr, the Fed’s vice chairman for supervision claimed on Wednesday that the bankruptcy of SVB was led by its own risk management fault, while it would likely to be an isolated case. With that, it could cause investors to shift their views and start thinking the Fed may have more room to keep raising rates. On the economic data front, the upbeat economic data has brought US Dollar higher. According to National Association of Realtors, the US Pending Home Sales MoM in February came in at the reading of 0.8%, which exceeding the market expectation of -2.3%. Though, investors are also awaiting for the announcement of upcoming essential economic data, such as GDP and Core PCE Price Index, in order to gauge the next move of Fed. Thus, the gains of Dollar Index was limited following investors decided to step back from the market. As of writing, the Dollar Index appreciated by 0.19% to 102.30.

In the commodity market, the crude oil price eased by 0.12% to $72.92 per barrel as of writing following the Russia output cut was lesser than market anticipation. On the other hand, the gold price depreciated by 0.19% to $1962.80 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative GBP BOE Inflation Letter

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | EUR – German CPI (YoY) (Mar) | 8.70% | 7.30% | – |

| 20:30 | USD – GDP (QoQ) (Q4) | 2.70% | 2.70% | – |

| 20:30 | USD – Initial Jobless Claims | 191K | 196K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded lower following prior breakout below the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3330

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 73.10, 76.80

Support level: 69.75, 66.40

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1987.85, 2025.70

Support level: 1948.50, 1897.85

290323 Afternoon Session Analysis

29 March 2023 Afternoon Session Analysis

The Aussie softened amid inflation slowdown in Australia.

The Australian dollar, which is the most popular trade by global investors, softened amid the inflation slow in Australia. Australian Consumer Price Index (CPI) fell to 6.8% YoY, lower than the 7.1% market consensus and prior reading of 7.4%. Australia’s annual inflation slowed in Feb, led by small rises in fuel and housing, adding to evidence that the worst price increases have passed. Given the last slump in inflation, adding the odd of another 0.25% rate hike from the Reserve Bank of Australia become unwelcome, especially after the downbeat Australian retail sales in February. The recent data also showed that consumer spending and economic activity are like to slow down as the effects of higher interest began to be felt by the economy. According to the RBA rate tracker, the market expectations for interest rates maintained at the next RBA meeting increased from 91% to 95%. However, the inflation reading still remained well above the RBA’s target range of 2-3% which the central bank will likely only achieve in the mid of 2025. The pair of AUD/USD lost more than 2% after the data was released by the Australian Statistician. As of writing, the AUD/USD slipped -0.48% to $0.6677.

In the commodity market, the crude oil price traded higher by 0.79% to $73.77 per barrel as of writing following the market concerns on Kurdistan crude oil export halted and US API crude oil inventory in deficit. In addition, the gold price dipped by -0.54 % to $ 1979.80 per troy ounce as of writing over market risk appetite has improved.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Pending Home Sales (MoM) (Feb) | 8.1% | -2.3% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.117M | 0.092M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 103.00.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

GBPUSD, H4: GBPUSD was traded higher following a rebound from the support level at 1.2300. However, MACD which illustrated decreasing bullish momentum suggests the pair to be traded lower as a technical correction.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded higher following a prior rebound from the support level at 1.0790. MACD which illustrated bullish momentum suggests the pair to be extend its gains toward the resistance level at 1.0930.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 132.30.

Resistance level: 132.30, 134.60

Support level: 130.25, 128.00

AUDUSD, H4: AUDUSD was traded lower while currently testing for the support level at 0.6685. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses if successfully break below the support level.

Resistance level, 0.6775, 0.6870

Support level: 0.6685, 0.6605

NZDUSD, H4: NZDUSD was traded higher while currently testing for the resistance level at 0.6265. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains if successfully break above the resistance level.

Resistance level: 0.6265, 0.6320

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded higher while currently testing for the resistance level at 1.3600. However, MACD which illustrated bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded higher following a prior breakout above the previous resistance level at 0.9180. MACD which illustrated increasing bullish momentum suggests the pair to extend it gains toward the resistance level at 0.9285.

Resistance level: 0.9285, 0.9390

Support level: 0.9180, 0.9090

CrudeOIL, H4: Crude oil price was traded higher following a prior breakout above the previous resistance level at 73.20. However, MACD which illustrated decreasing bullish momentum suggests the commodity to traded lower as technical correction.

Resistance level: 76.05, 78.70

Support level: 73.20, 70.65

GOLD_, H4: Gold price was traded lower following a prior retracement from the higher level. However, MACD which illustrated decreasing bearish momentum suggests the commodity to traded higher as technical correction.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70

290323 Morning Session Analysis

29 March 2023 Morning Session Analysis

US Dollar remained weak amid easing fears of banking crisis.

The Dollar Index which traded against a basket of six major currencies lost its luster again on yesterday despite the upbeat economic data. According to Conference Board, the US CB Consumer Confidence for March has notched up from the previous reading of 103.4 to 104.2, exceeding the consensus forecast of 101.0. The data has shown that the market optimism toward economic progression in the US was increasing. However, it did not bring much bullish momentum on the US Dollar amid the background of easing fears of banking crisis. First Citizens Bank was acquiring all of failed lender Silicon Valley Bank’s deposits and loans, while it reduces the problem of users not being able to withdraw money. Besides, there was no further bank collapse have emerged in global banking in recent sessions, whereby dialing up the risk-appetite of investors on riskier assets and currencies. On the other hand, the Dollar Index extended its losses after the US President appeared its speech. The US President Joe Biden reiterated on Wednesday that the banking crisis was ‘not end yet’, which could mean some problems still lurk in the financial system. As of writing, the Dollar Index edged up by 0.01% to 102.07.

In the commodity market, the crude oil price appreciates by 0.74% to $73.81 barrel as of writing following the oil exports about 450,000 barrels per day from northern Kurdistan region has been halted. In addition, the gold price rose by 0.04% to $1972.18 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Pending Home Sales (MoM) (Feb) | 8.1% | -2.3% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.117M | 0.092M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

USDCAD, Daily: USDCAD was traded lower following prior breakout below the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3330

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 76.80, 81.30

Support level: 73.10, 69.75

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1987.85, 2025.70

Support level: 1948.50, 1897.85

280323 Afternoon Session Analysis

28 March 2023 Afternoon Session Analysis

BoE Bailey’s hawkish speech supports Pound gains.

The British Pound extended its gains amid the Bank of England (BoE) Governor Andrew Bailey’s hawkish statement. In the speech, Bailey reiterated that the UK CPI inflation is persistent at a higher level of 10.4%, and must return the CPI back to the BoE 2% target. Recently, there has been evidence of more resilience in economic activity, as nominal wage growth and retail sales data showed upbeat results. The data signaled to BoE that inflation will not be entirely smooth, where the cost and price pressures will likely to remain elevated. Since inflation is at a higher level, the BoE will likely to further tighten its monetary policy if necessary. Simultaneously, the Pound was strengthened against the dollar after risk sentiment improved. The BoE’s Bailey also mentioned the UK banking system is resilient, with robust capital and sufficient liquidity to support the economy while giving confidence to the investors. Hence, the overall UK economic prospect remains bright, giving the BoE more room to tighten its monetary policy further. The pair of GBP/USD appreciated 0.27% to $1.2317 as of writing.

In the commodities market, the crude oil prices were soaring by 0.21% to $72.96 per barrel as of writing amid the supply interruption from Kurdistan continued to weigh on the market. Besides, gold prices edged up by 0.11% to $1973.40 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:45 GBP BoE Gov Bailey Speaks

21:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Mar) | 102.9 | 101.0 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 101.70.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

GBPUSD, H4: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2300. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 1.2445.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded higher following the prior break above the previous resistance level at 1.0790. MACD which illustrated diminishing bearish bias momentum suggests the pair to extend its gains toward the resistance level at 1.0930.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 130.25.

Resistance level: 132.30, 134.60

Support level: 130.25, 128.00

AUDUSD, H4: AUDUSD was traded higher while currently testing for the resistance level at 0.6685. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains if successfully breaks above the resistance level.

Resistance level: 0.6685, 0.6775

Support level: 0.6605, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior break above the previous resistance level at 0.6195. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6320

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded lower following the prior break below from the previous support level at 1.3685. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3600.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

USDCHF, H4: USDCHF was traded lower following the prior break below from the previous support level at 0.9180. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 0.9090.

Resistance level: 0.9180, 0.9285

Support level: 0.9090, 0.9005

CrudeOIL, H4: Crude oil price was traded lower following a prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the commodity to undergo technical correction in the short term.

Resistance level: 70.65, 73.20

Support level: 68.20, 66.05

GOLD_, H4: Gold price was traded higher following a prior rebound from the support level at 1954.90. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1985.50.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70

280323 Morning Session Analysis

28 March 2023 Morning Session Analysis

US dollar retreated as bank contagion fears eased.

The dollar index, which traded against a basket of six major currencies, failed to extend its rally yesterday as the market worries around the Deutsche Bank eased following a large sell-off in the later of last week. Yesterday, the share price of Deutsche Bank rebounded sharply alongside the slide in cost of insuring its debt against default as the majority of the analysts reassured that the financial health of the largest bank in Germany was strong. According to the CMAQ pricing, the spreads on five-year senior credit default swaps (CDS) fell from as high as 226.9 bps to 198.6 bps on Monday. With that, it reignited the market confidence toward the future prospect of the bank and slacked up the market speculation over the possibility of happening crisis. As a result, the investors moved back their capital from the US dollar market to Euro market. At the same time, the news released early Monday that First Citizens BancShares agreed to acquire Silicon Valley Bank’s deposits and loans has calmed down the market concerns surrounding the health of smaller US banks. According to the Federal Deposit Insurance Corporation (FDIC) statement, the takeover transaction covers US$119 billion in deposits and $72 billion in assets, and SVB’s 17 branches will open as First Citizens starting from now onward. The takeover deal boosted the market sentiment of dollar index yesterday. As of writing, the dollar index -dipped 0.27% to 102.85.

In the commodities market, crude oil prices was traded higher by 5.22% to $72.70 per barrel as the market fears over the banking crisis subsided following the significant drop in Deutsche Bank’s CDS spread. Besides, gold prices ticked up by 0.06% to $1957.75 per troy ounce after falling significantly yesterday amid banking fears eased.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:45 GBP BoE Gov Bailey Speaks

21:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Mar) | 102.9 | 101.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2345.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0915.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 130.70. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 133.05.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3730. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3635.

Resistance level: 1.3730, 1.3830

Support level: 1.3635, 1.3565

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9225. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9070.

Resistance level: 0.9225, 0.9325

Support level: 0.9070, 0.8945

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 71.65. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 71.65, 76.10

Support level: 66.10, 61.45

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1944.60. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level at 1944.60.

Resistance level: 1985.90, 2024.90

Support level: 1944.60, 1900.00

270323 Afternoon Session Analysis

27 March 2023 Afternoon Session Analysis

Pound steadied as UK’s optimistic economic outlook.

Sterling held steady as Bank of England (BoE) Governor Andrew Bailey expressed optimism about the UK’s economic outlook. Bailey said in an interview broadcast on Friday that he expects Britain would now able to avoid recession this year although economic growth prospects remained subdued. Prior to this, the BoE expected the UK economy to shrink in the first quarter, but a series of official data published earlier in March showed the economy has returned to growth in Jan unexpectedly. Retail sales data released on Friday hit 1.2%, stronger than market expectation of 0.2%, higher than prior reading, based on the Britain’s Office for National Statistics. At the same time, the UK released its Composite PMI data last Friday, where the services PMI were positive at 52.8, above the 50-level threshold, while the manufacturing PMI slipped to 48.0, representing 8 months of contraction. Despite, the S&P Global said the improvement of confidence was reflected by an easing of post-Covid supply chain difficulties and raising in retail sales. The economists also revised their expectation of the UK economic outlook after the PMI survey showed a second month of rising output in March. As of writing the GBP/USD gained slightly by 0.02% to $1.2234.

In the commodity market, the crude oil prices were traded up by 0.95% to $69.91 per barrel after hitting the 15 month low as the market concerns over an economic slowdown. On the other side, the gold price dipped by -0.62% to $1988.90 per troy ounce as of writing amid investors locked in profits after substantial gains in bullion prices.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Mar) | 91.1 | 91 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the index to extend its losses toward the support level at 101.70.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

GBPUSD, H4: GBPUSD was traded lower following a prior rebound from the lower level. However, MACD which illustrated decreasing bearish momentum suggests the pair to be traded higher as technical correction.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

EURUSD, H4: EURUSD was traded lower following a prior retracement from the higher level. However, MACD which illustrated decreasing bearish momentum suggests the pair traded higher as technical correction.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the pair to be traded higher as technical correction.

Resistance level: 132.30, 134.60

Support level: 130.25, 128.00

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the higher level. However, MACD which illustrated decreasing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.6685, 0.6775

Support level: 0.6605, 0.6525

NZDUSD, H4: NZDUSD was traded lower while currently testing for the support level at 0.6195. However, MACD which illustrated decreasing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.6265, 0.6320

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded higher following a prior rebound from the lower level. However, MACD which illustrated decreasing bullish momentum suggests the pair to traded lower as technical correction.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

USDCHF, H4: USDCHF was traded lower following a prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.9285, 0.9390

Support level: 0.9180, 0.9090

CrudeOIL, H4: Crude oil price was traded lower following retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the commodity to extend its losses toward the support level at 68.30

Resistance level: 70.65, 73.20

Support level: 68.20, 66.05

GOLD_, H4: Gold price was traded lower following a prior break below from the previous support level at 1985.50. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 1954.90.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70

270323 Morning Session Analysis

27 March 2023 Morning Session Analysis

US Dollar boosted as market’s risk-aversion raised.

The Dollar Index which traded against a basket of six major currencies found its ground on Friday following the fresh fears among the European banking sector. According to Reuters, the cost of insuring the Deutsche Bank’s debt against the risk of default rose higher than a four-year high, leading the share of the bank slumped on the day. Deutsche Bank’s credit default swaps (CDS) – a form of insurance for bondholders, had shot up above 220 basis points from 142 bps just two days ago, which is the most since late 2018, based on data from S&P Market Intelligence. With that, it indicated that the European banks would likely to face a financial crisis that could lead to bankruptcy, just as Silicon Valley Bank and Signature Bank did two weeks ago. Consequences, Euro has lost the eye of investors, as well as the market participants are preferring to purchase safe-haven dollar. On the other hand, the hawkish statement presented by Fed officials had also extended the gains of US Dollar. Federal Reserve Bank of St. Louis President James Bullard claimed on Friday that the current inflation in the US has declined, but it still higher than the headline measure. As of writing, the Dollar Index dropped by 0.09% to 102.70.

In the commodity market, the crude oil price appreciates by 0.48% to $69.59 per barrel as of writing following the Iraq has stopped its oil exports after it won a longstanding arbitration case against Turkey. In addition, the gold price depreciated by 0.33% to $1974.19 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Mar) | 91.1 | 91 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

GBPUSD, Daily: GBPUSD was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 131.15, 135.20

Support level: 127.80, 123.65

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 69.75, 73.10

Support level: 66.40, 63.70

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1987.85, 2025.70

Support level: 1948.50, 1897.85

240323 Afternoon Session Report

24 March 2023 Afternoon Session Analysis

Bank of England raises interest as expectations, Pound nudged up.

The pound sterling nudged up after the Bank of England (BoE) raised interest rate by 25 basis points to 4.25%, a new 15 years high. The decision comes a day after the Office for National Statistics (ONS) announced inflation rate rose to 10.4% in February, amid food prices raised and robust wage growth in the UK. The BoE warned that further tightening in monetary policy would be required even though inflation fall in February. Meanwhile, economists raised their forecasts for UK growth by 0.4 percent following the government’s new budget The new fiscal support from the UK government included energy price support for households and SMEs and new tax relief for loss-making R&D-intensive SMEs. However, a series of optimistic economic data was announced in the US, strengthening the dollar and offsetting the gains of the pound. The US’s labor market remains resilient as initial Jobless claims reduced by 1k to 191k, lower reading than the prior month’s reading of 192K. In addition, sterling gains were offset by Governor Andrew’s earlier dovish statement. Bailey had signaled after a 50-basis point hike in February that the bank might not tighten policy any further, and inflations are expected to fall sharply at the end of the year. This statement increases the odds that BoE will not further rate hikes. As of writing, the GBPUSD slipped -0.04% to $1.2279.

In the commodity market, the crude oil price edged up by 0.13% to $70.06 per barrel as of writing Before this, the oil prices traded down as prior session on US officials said it will be difficult to immediately refill the country’s Strategic Petroleum Reserve (SPR). On the other side, the gold price traded down by 0.29% to $1990.615 per troy ounce as of writing following prior optimistic economic data from the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

21:30 USD FOMC Member Bullard Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Mar) | 46.3 | 47.0 | – |

| 17:00 | EUR – S&P Global Composite PMI (Mar) | 52.0 | 52.0 | – |

| 17:30 | GBP – Composite PMI | 53.1 | 52.7 | – |

| 17:30 | GBP – Manufacturing PMI | 49.3 | 50.0 | – |

| 17:30 | GBP – Services PMI | 53.5 | 53.0 | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Feb) | 0.8% | 0.2% | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Jan) | -0.6% | 0.6% | – |

| 21:45 | USD – S&P Global Composite PMI (Mar) | 50.1 | 47.5 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the support level at 101.70. MACD which illustrated increasing bullish momentum suggests the index to extend its gains toward the resistance level at 103.00.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

GBPUSD, H4: GBPUSD was traded lower following a prior breakout the previous support level a t 1.2300. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.2145.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

EURUSD, H4: EURUSD was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded lower while currently testing for the support level at 130.25. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses if successfully break below the support level.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

AUDUSD, H4: AUDUSD was traded lower following a prior breakout below the previous support level at 0.6685. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6600.

Resistance level: 0.6775, 0.6685

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded lower following a prior breakout below the previous support level at 0.6265. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6195.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3685. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3785.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

USDCHF, H4: USDCHF was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.9180.

Resistance level: 0.9180, 0.9285

Support level: 0.9090, 0.9005

CrudeOIL, H4: Crude oil price was traded lower following a prior break below from the previous support level at 70.65. MACD which illustrated decreasing bullish momentum suggests the commodity to extend its losses toward the support level at 68.30.

Resistance level: 70.65, 73.20

Support level: 68.30, 66.05

GOLD_, H4: Gold price was traded lower following a prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the commodity to undergo a technical correction in the short term.

Resistance level: 2030.10, 2009.10

Support level: 1985.50, 1954.90