240323 Morning Session Analysis

24 March 2023 Morning Session Analysis

US Dollar jumped as optimistic jobless claims report released.

The Dollar Index which traded against a basket of six major currencies regained its luster on yesterday following the positive economic data has dialed up the market optimism toward the economic progression in the US. According to the US Department of Labor, the US Initial Jobless Claims had notched down from the previous reading of 192K to 191K, missing the consensus forecast of 197K. In other words, the number of unemployment has reduced throughout last week, as well as indicating that the US labor market remained resilient amid the background of bank collapse. With that, it would likely to add the odds of further rate hike from Fed in the next meeting. On the other hand, the speech from the US Treasury Secretary has gathered the confident of investors upon US banking sector. According to CNBC, the US Treasury Secretary Janet Yellen claimed that the emergency federal action to support Silicon Valley Bank and Signature Bank customers would be deployed again in the future if necessary, which diminishing the market fears against the banking crisis that driven by aggressive rate hike plan. As of writing, the Dollar Index edged up by 0.03% to 102.27.

In the commodity market, the crude oil price depreciated by 0.64% to $69.51 per barrel as of writing following the OPEC might stick to its 2 million production cut that implemented last year. In addition, the gold price eased by 0.10% to $1990.60 per tory ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

21:30 USD FOMC Member Bullard Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Retail Sales (MoM) (Feb) | 0.5% | 0.2% | – |

| 16:30 | EUR – German Manufacturing PMI (Mar) | 46.3 | 47.0 | – |

| 17:00 | EUR – S&P Global Composite PMI (Mar) | 52.0 | 52.0 | – |

| 17:30 | GBP – Composite PMI | 53.1 | 52.7 | – |

| 17:30 | GBP – Manufacturing PMI | 49.3 | 50.0 | – |

| 17:30 | GBP – Services PMI | 53.5 | 53.0 | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Feb) | 0.8% | 0.2% | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Jan) | -0.6% | 0.6% | – |

| 21:45 | USD – S&P Global Composite PMI (Mar) | 50.1 | 47.5 | – |

Technical Analysis

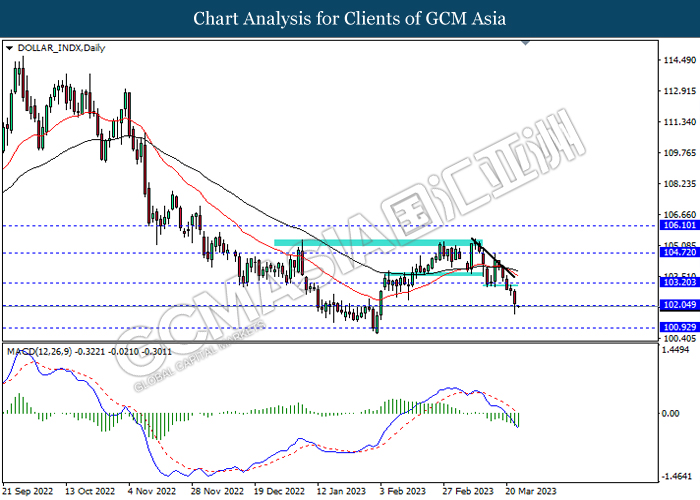

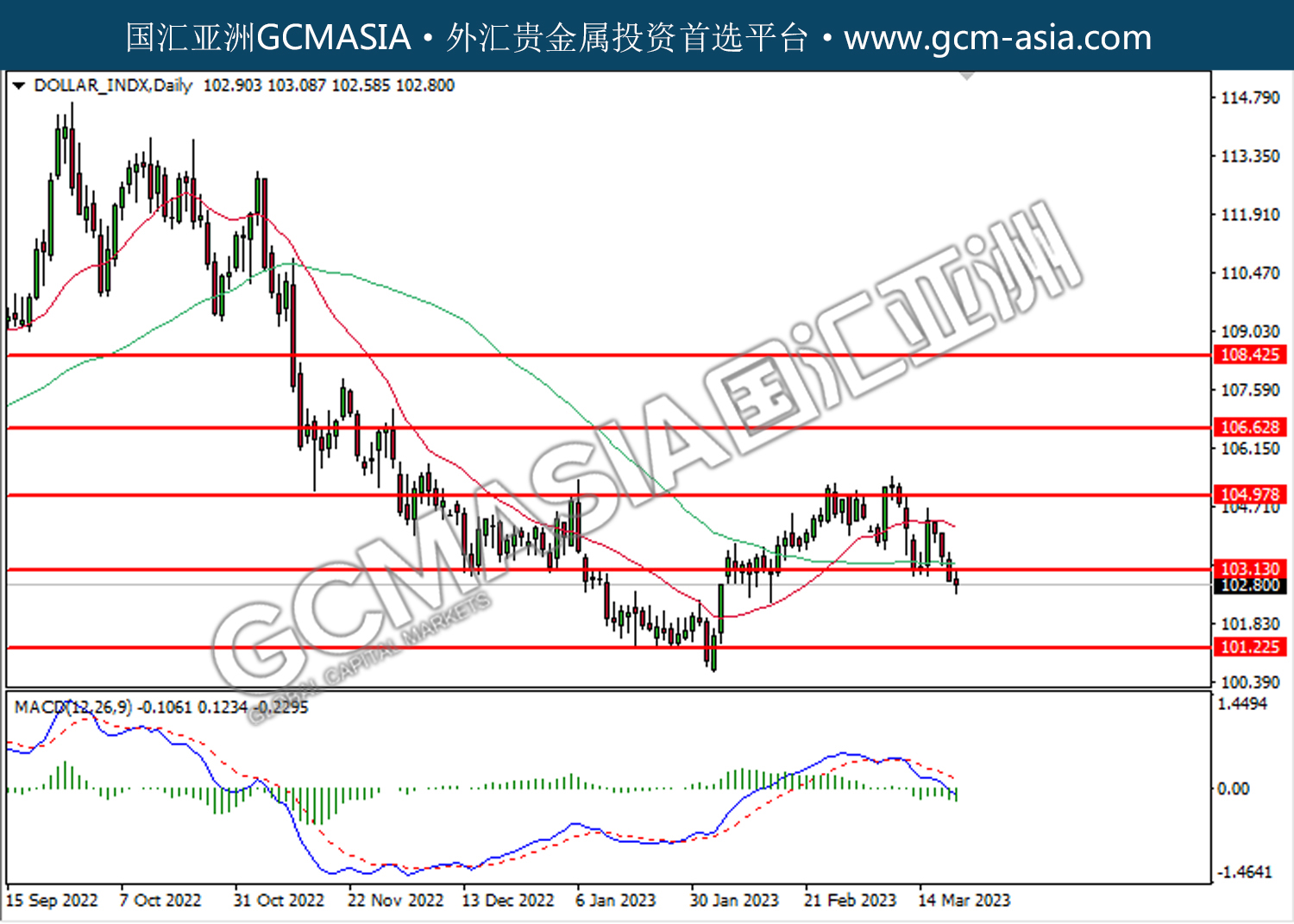

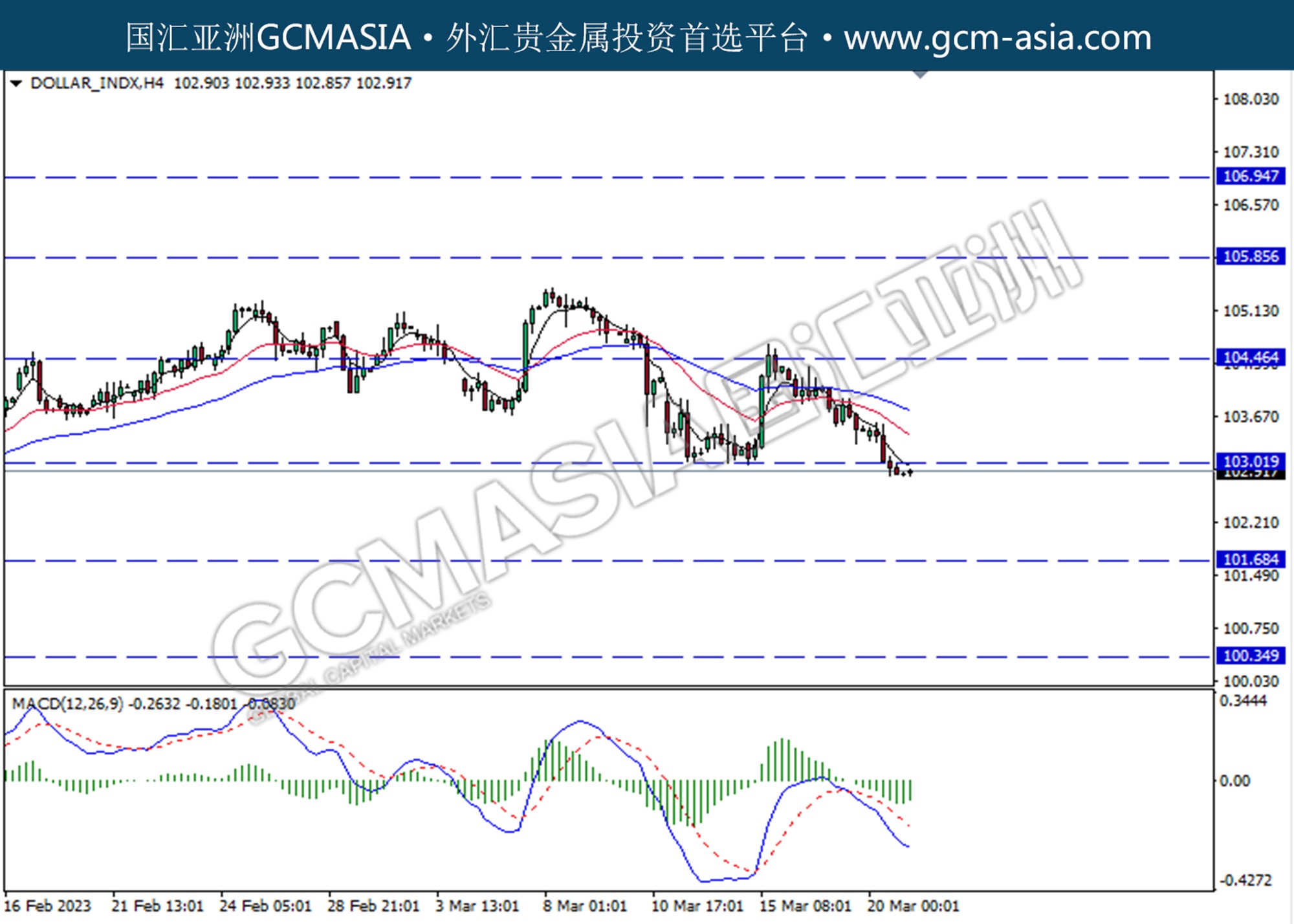

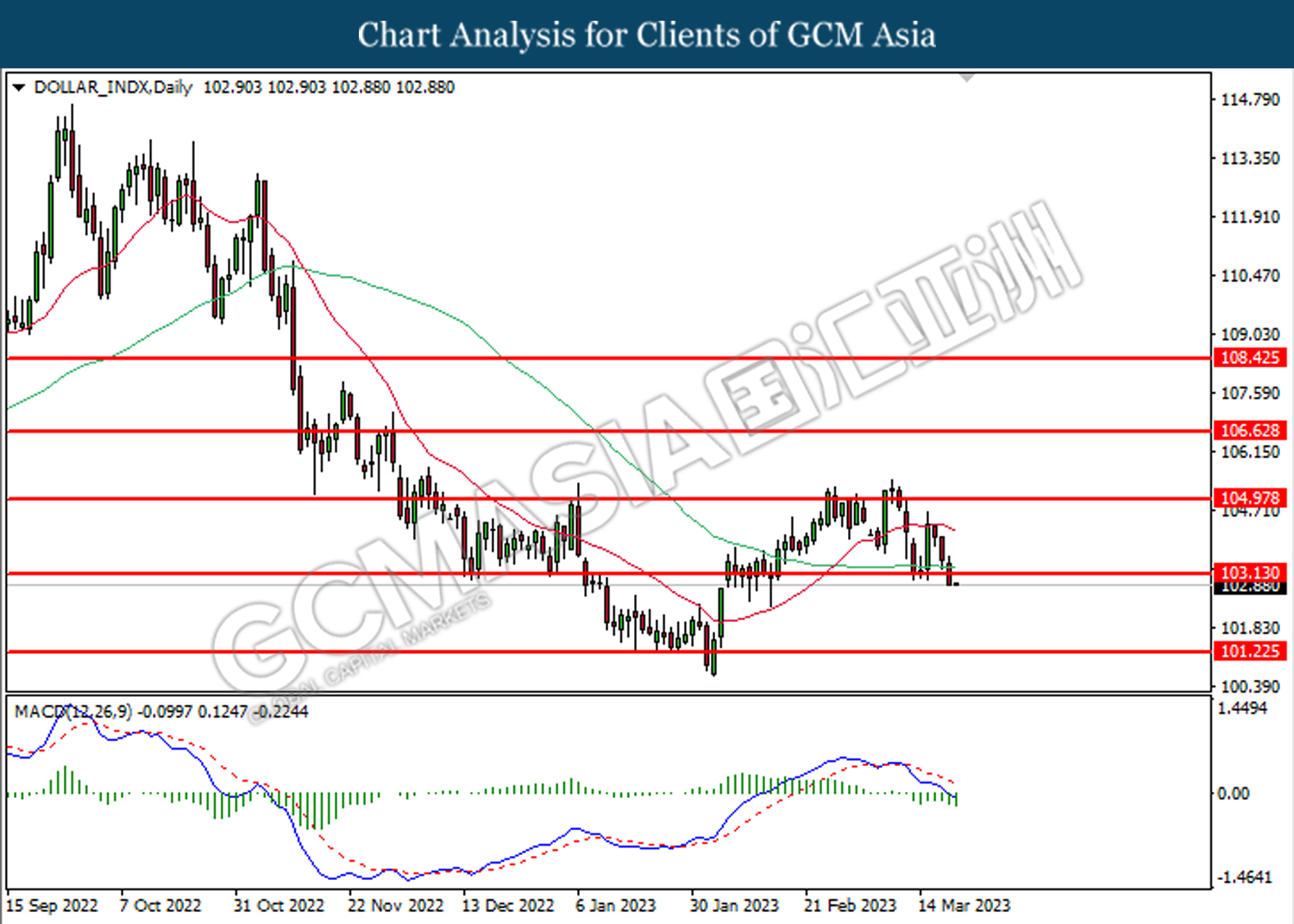

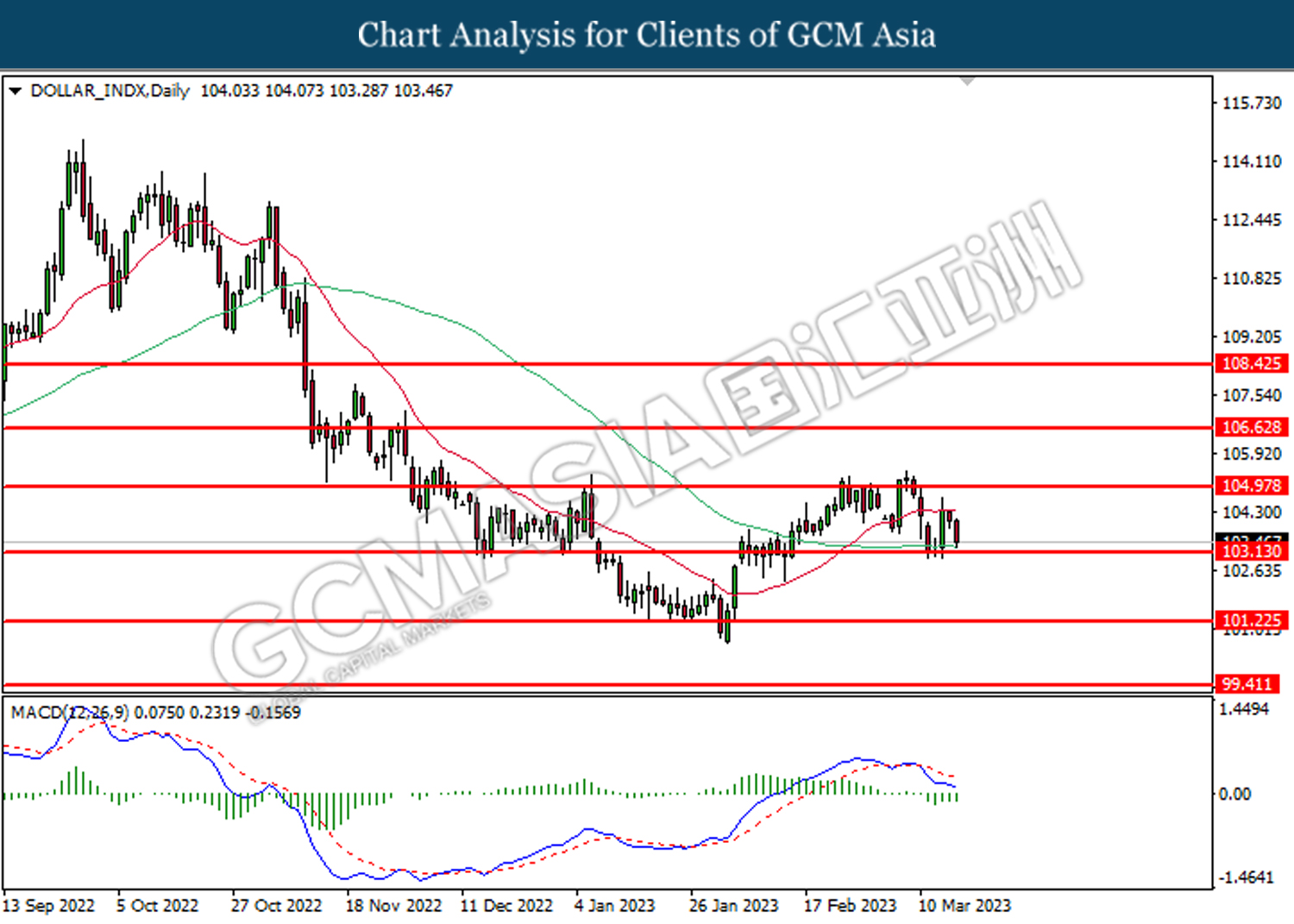

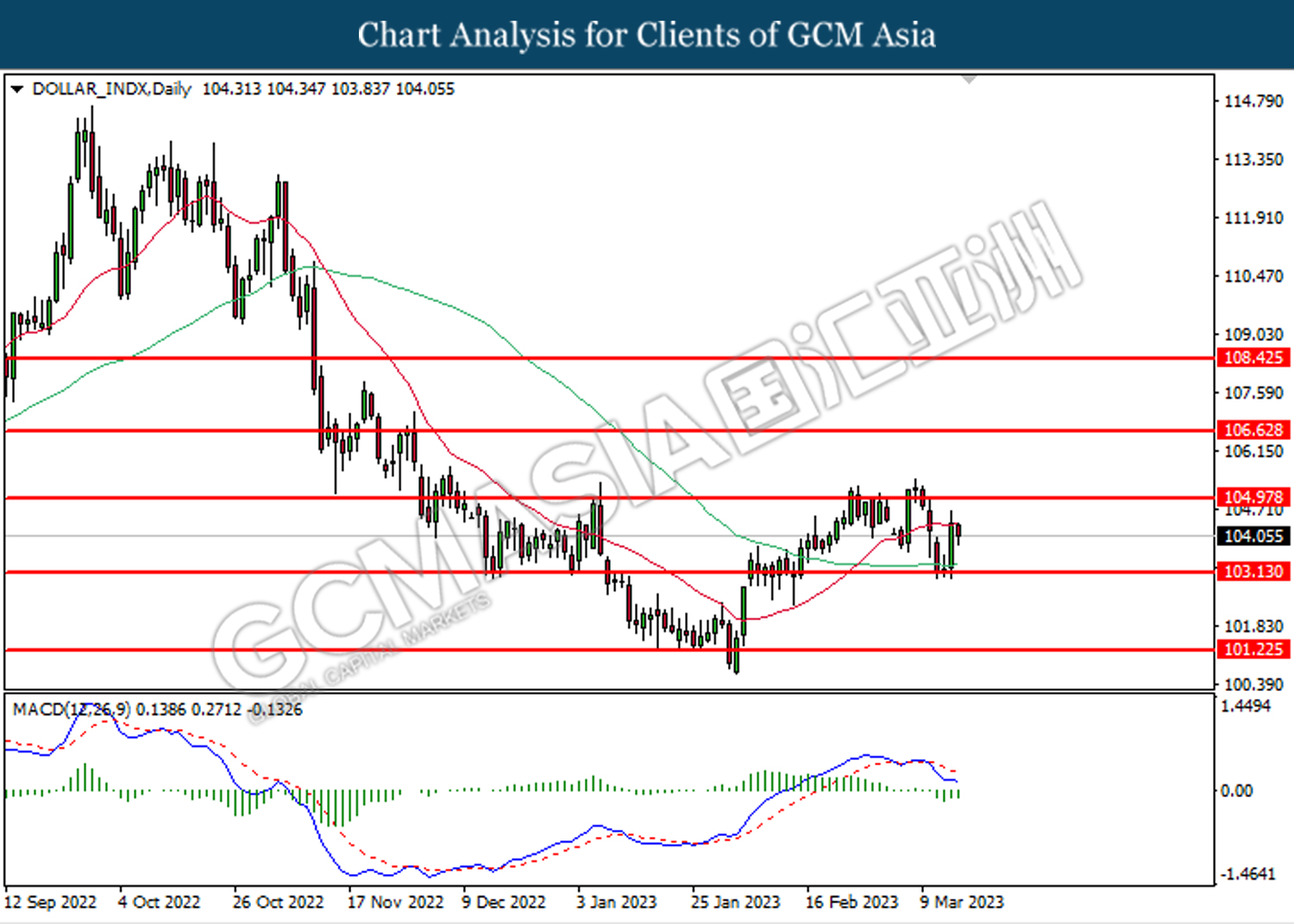

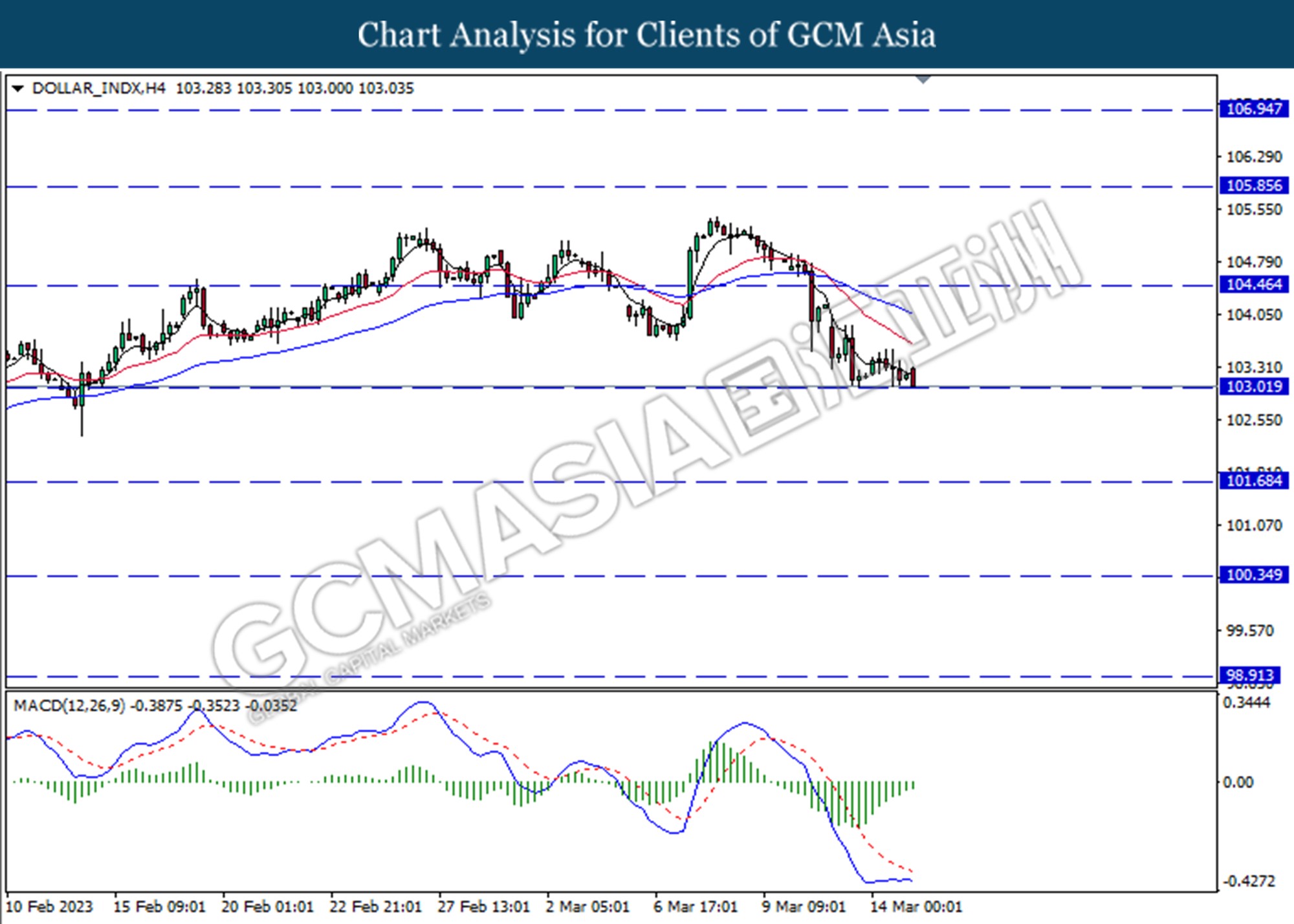

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

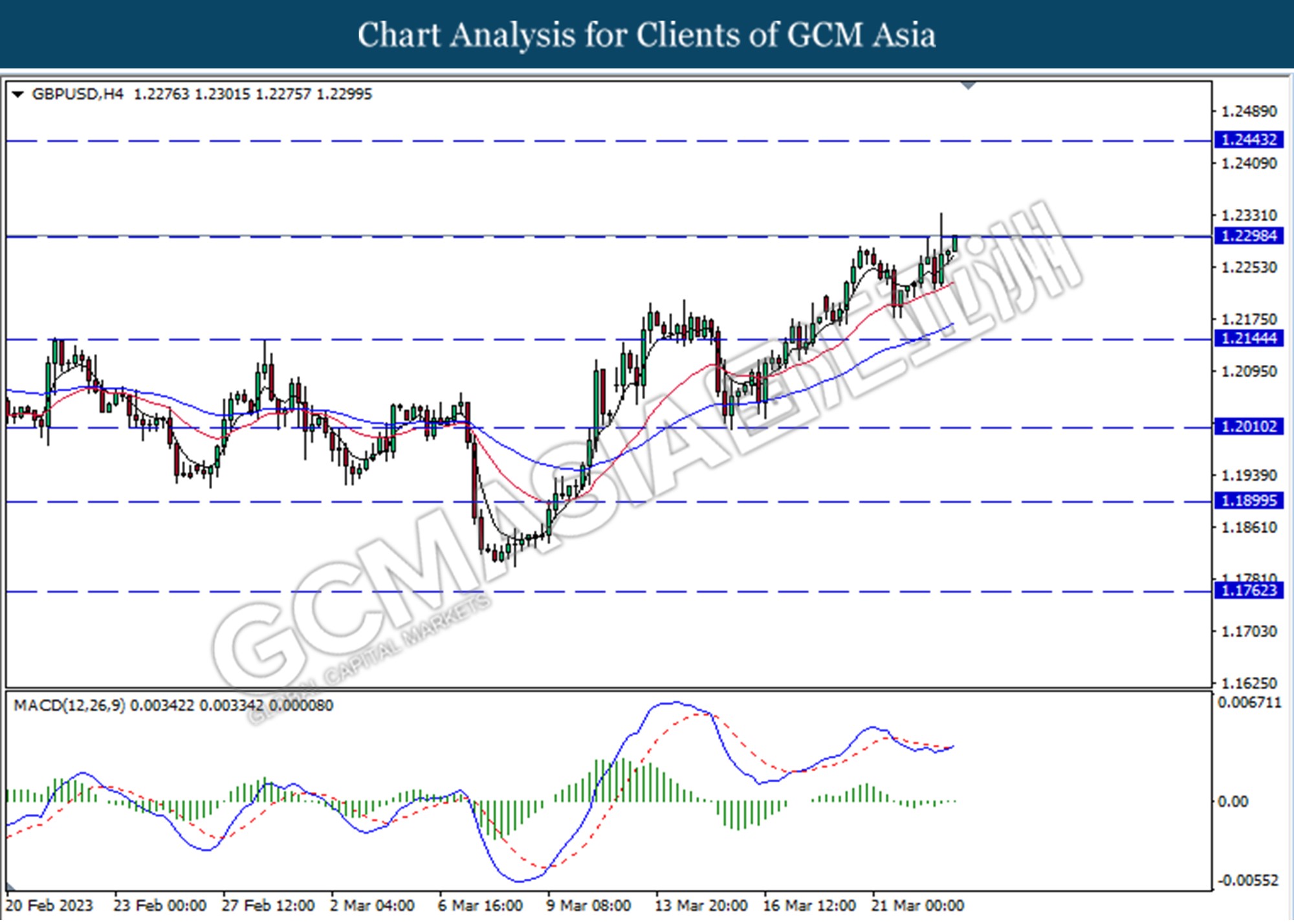

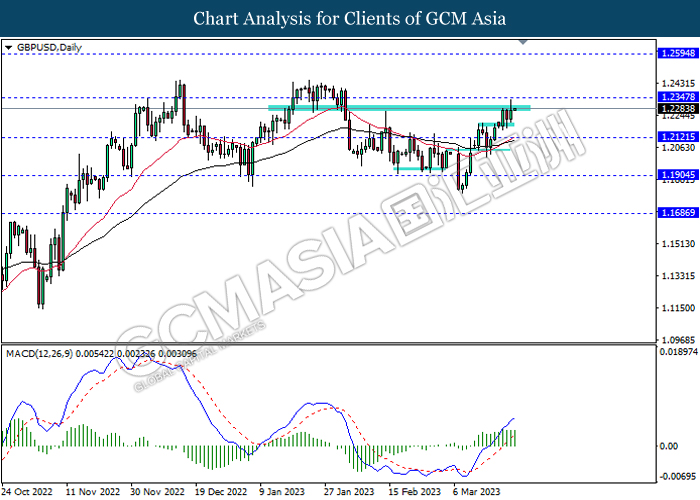

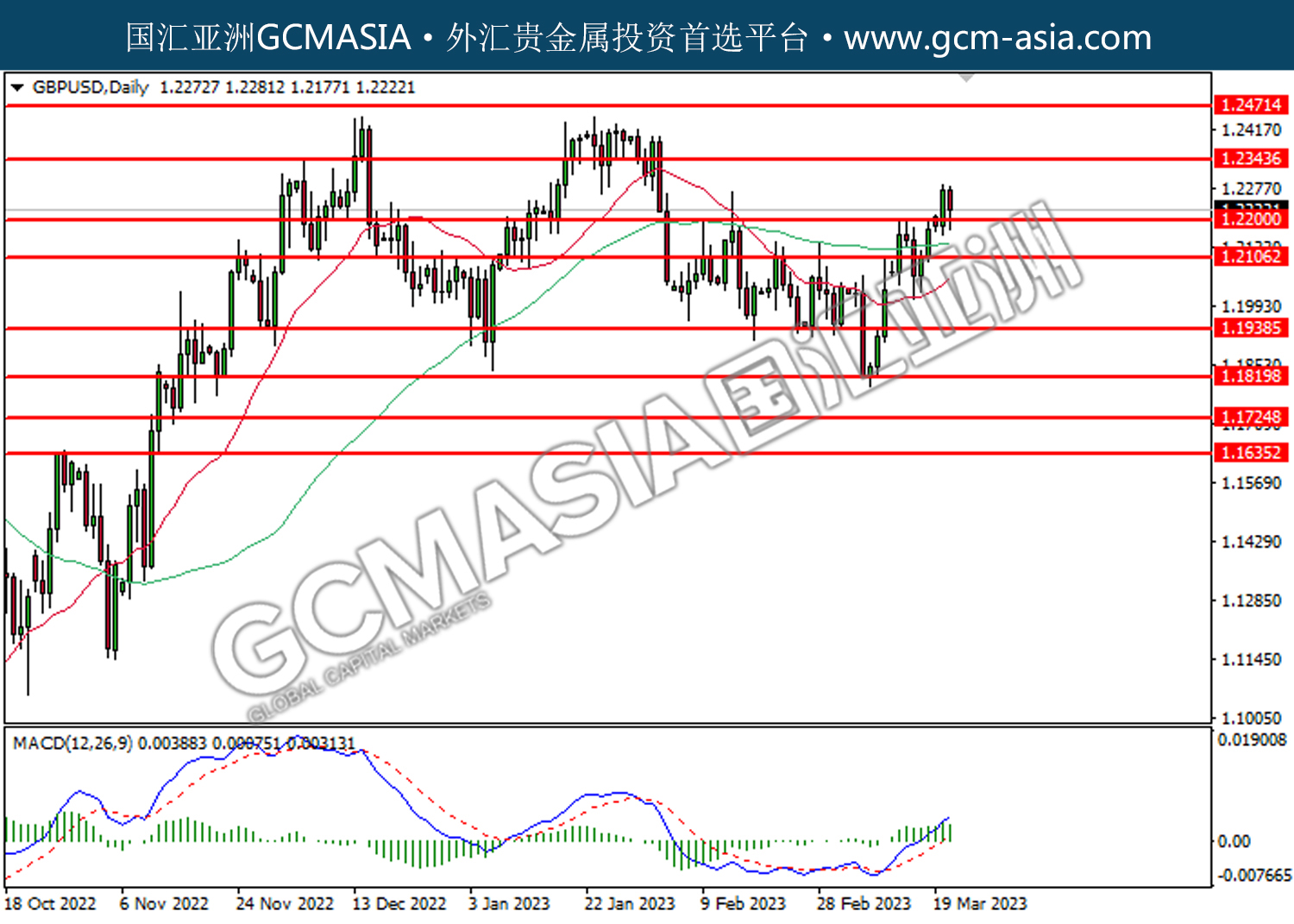

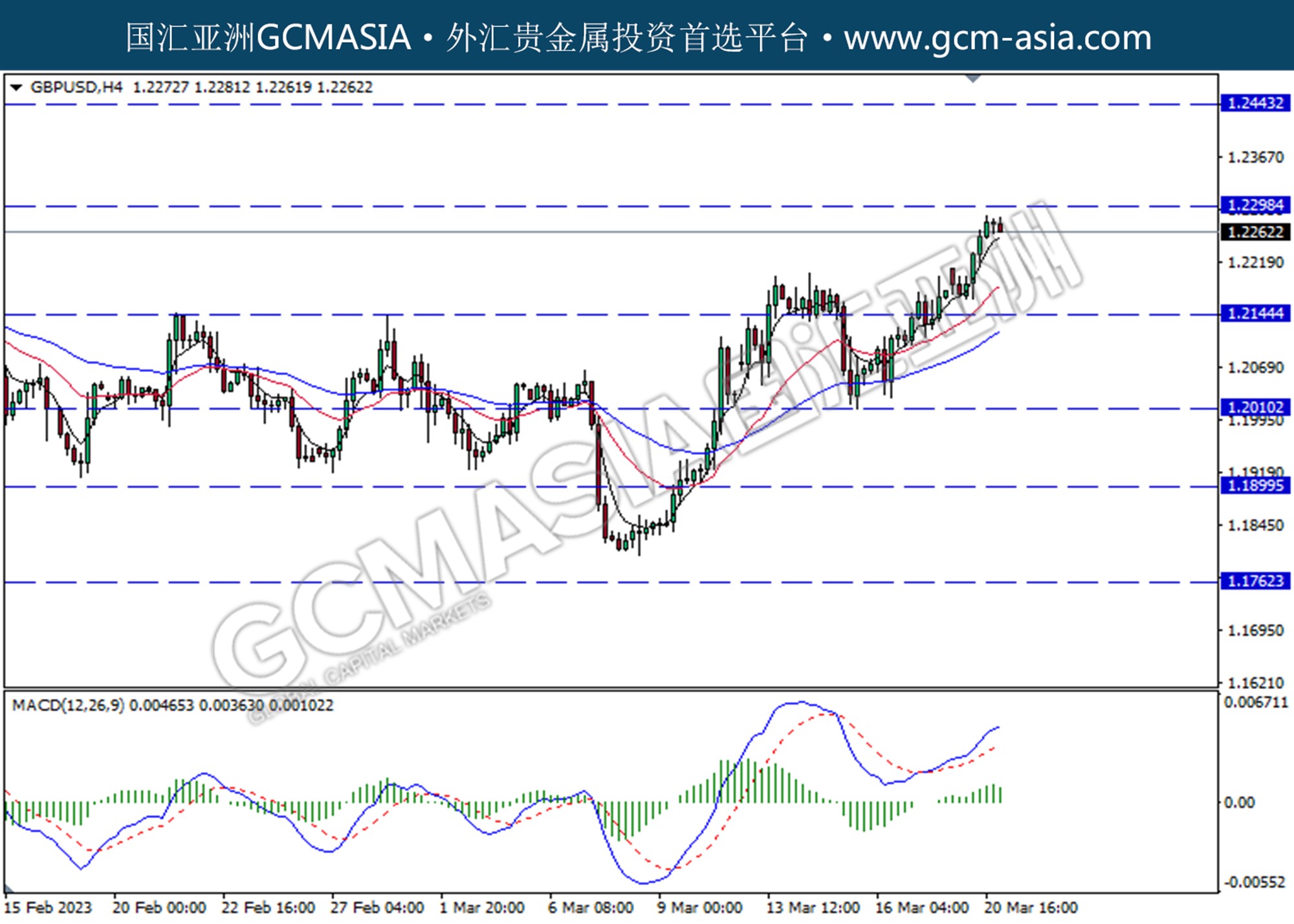

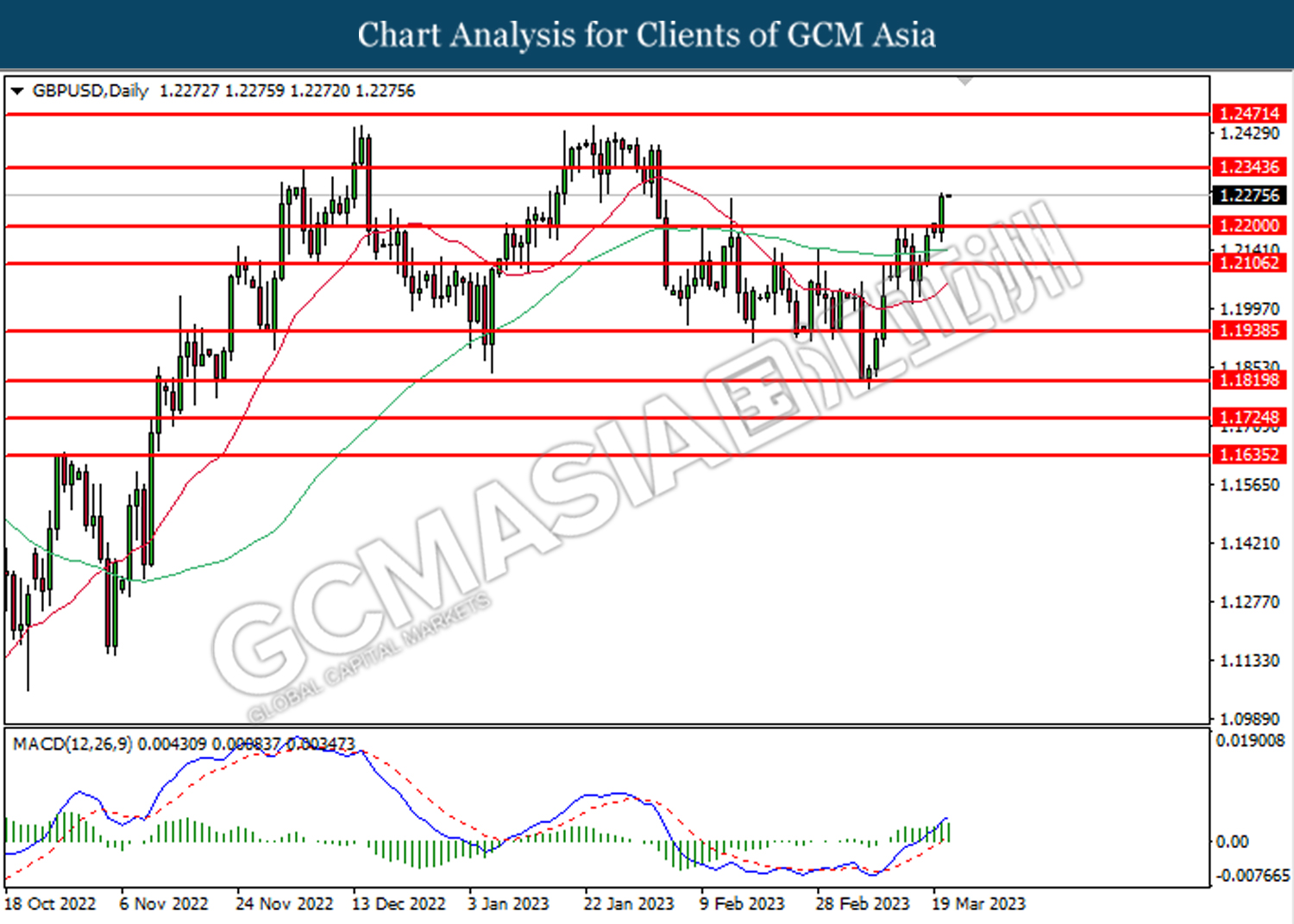

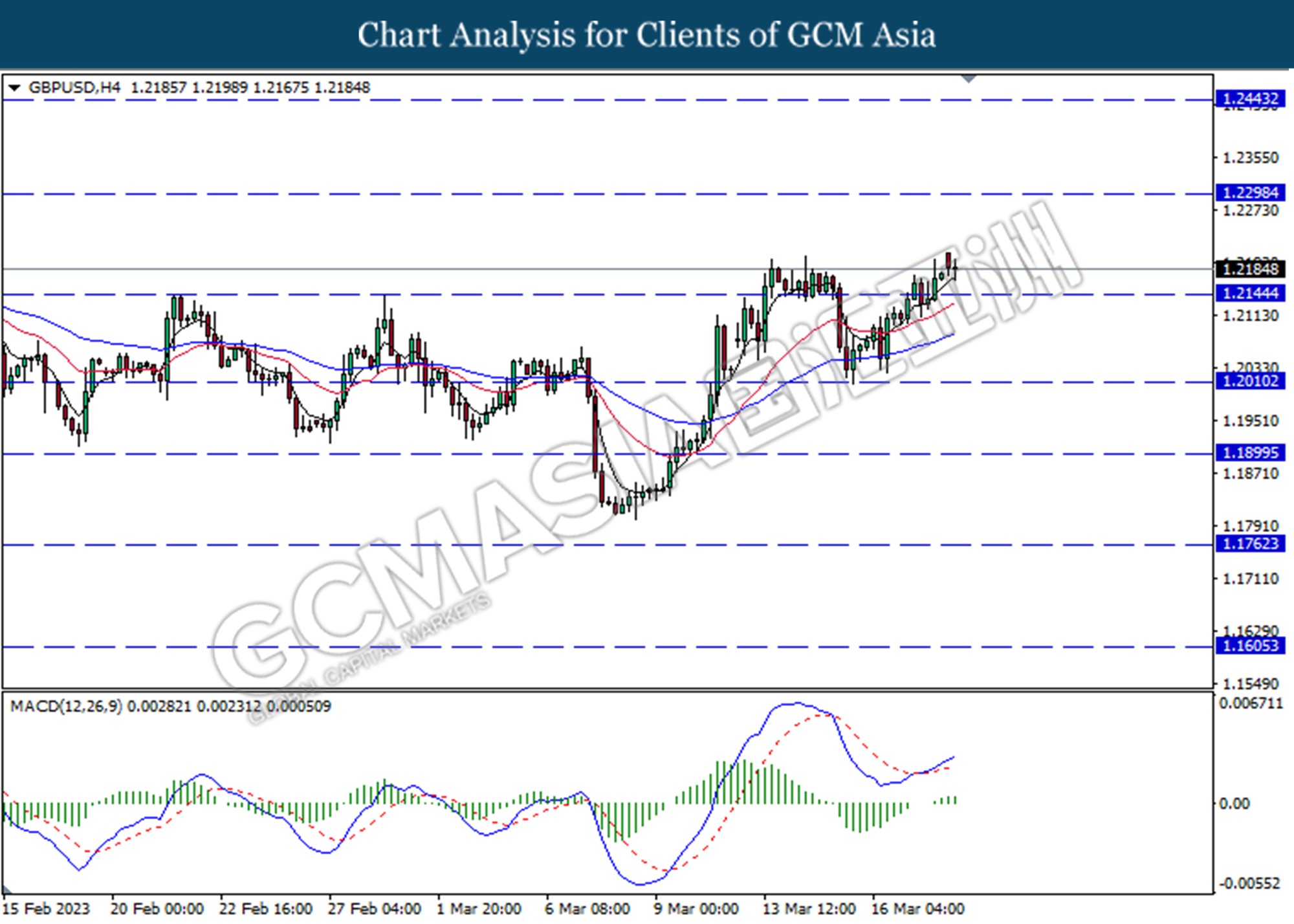

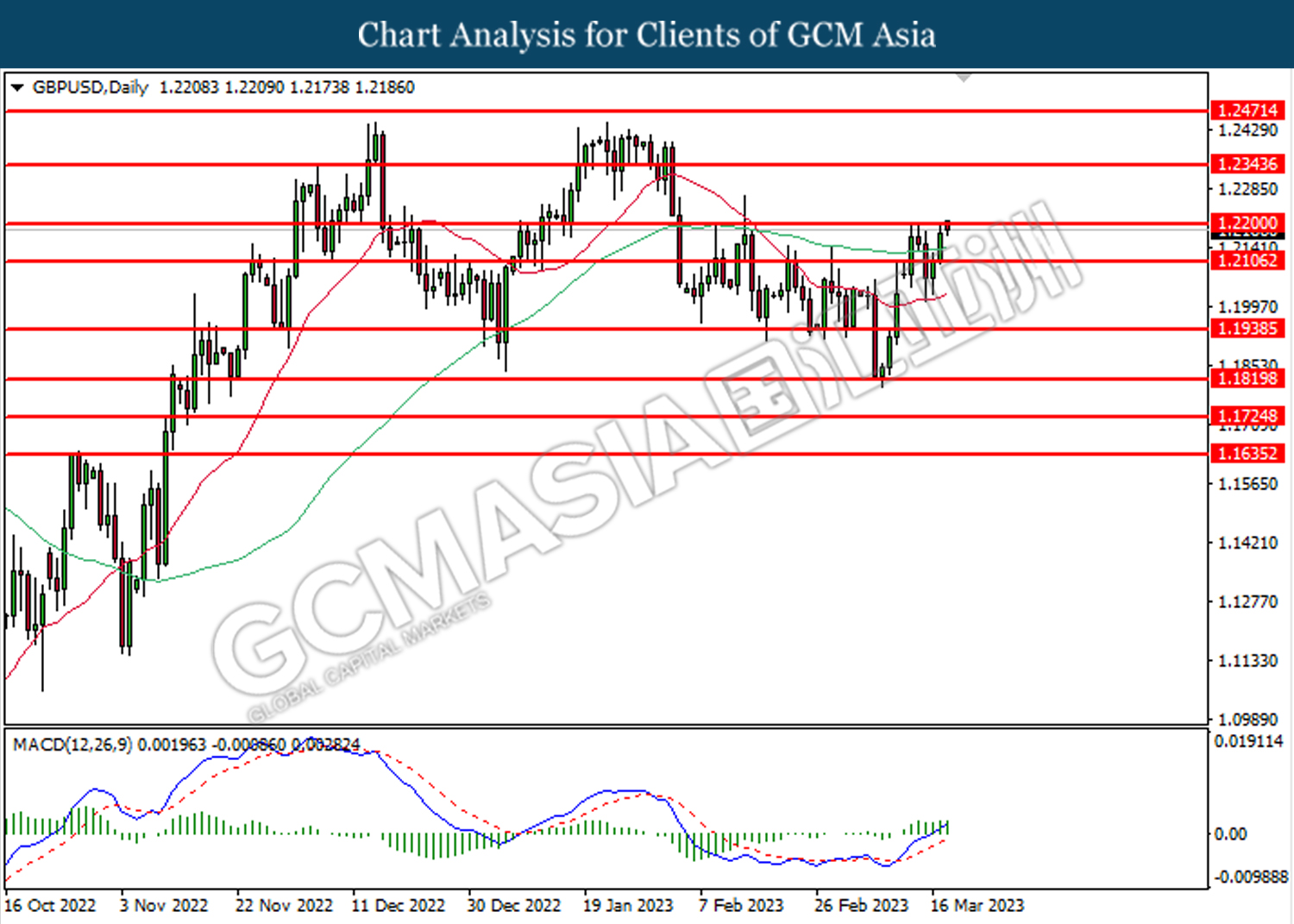

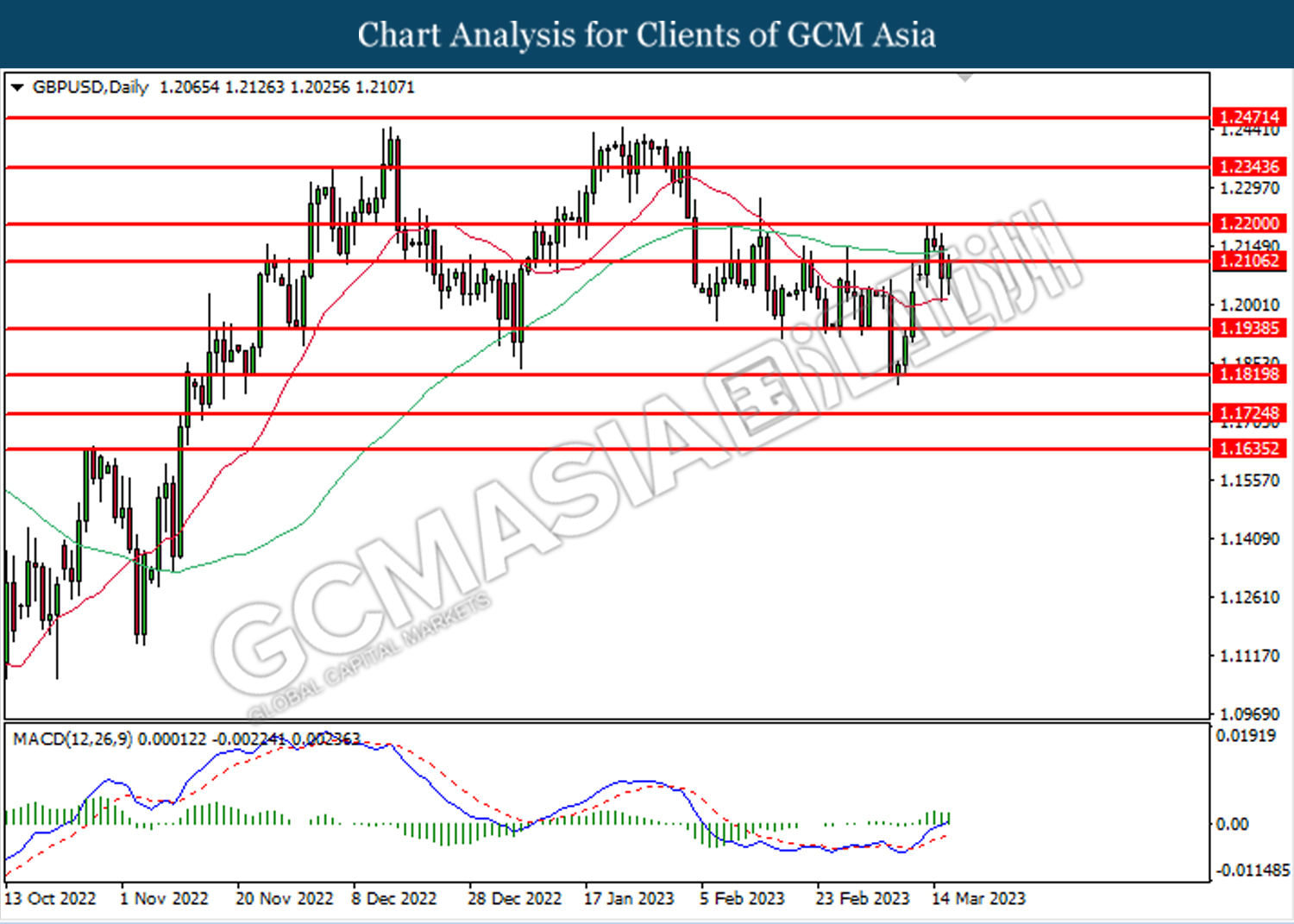

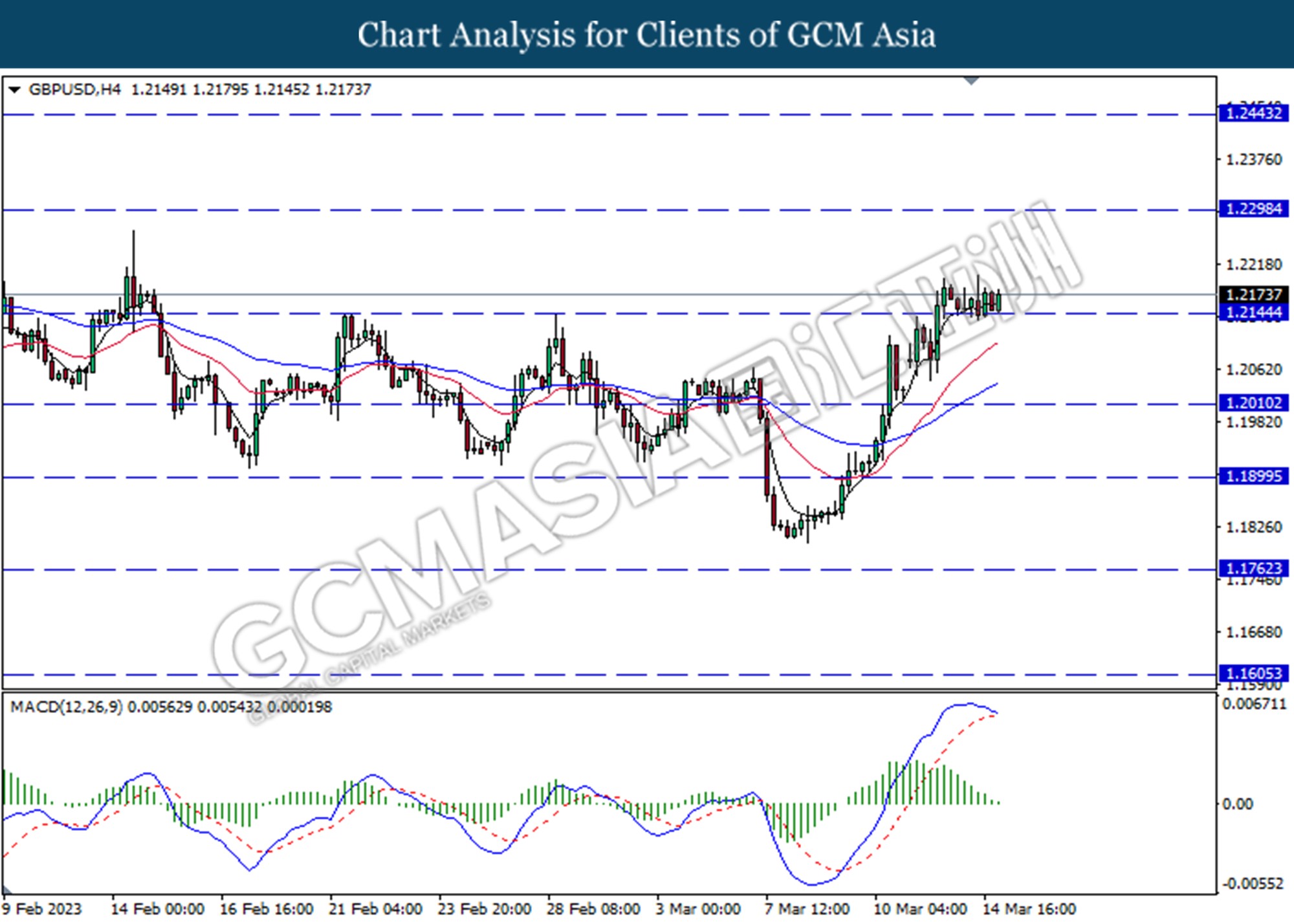

GBPUSD, Daily: GBPUSD was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

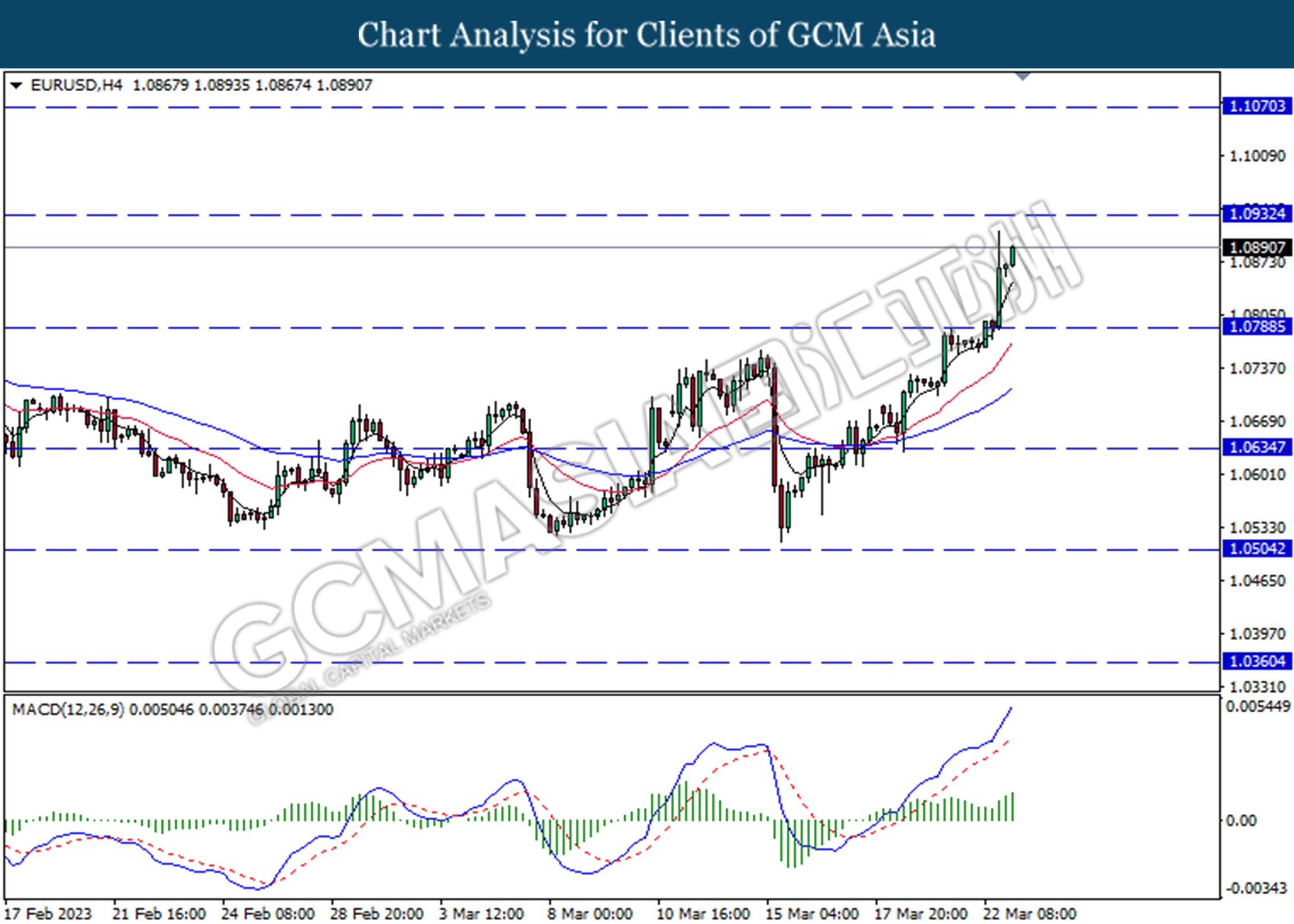

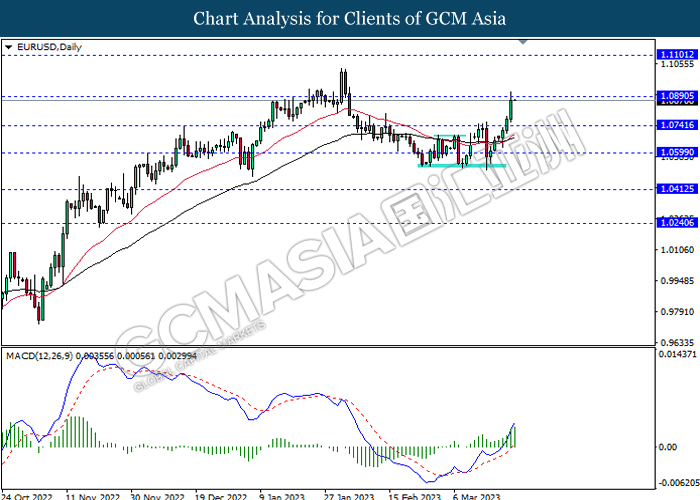

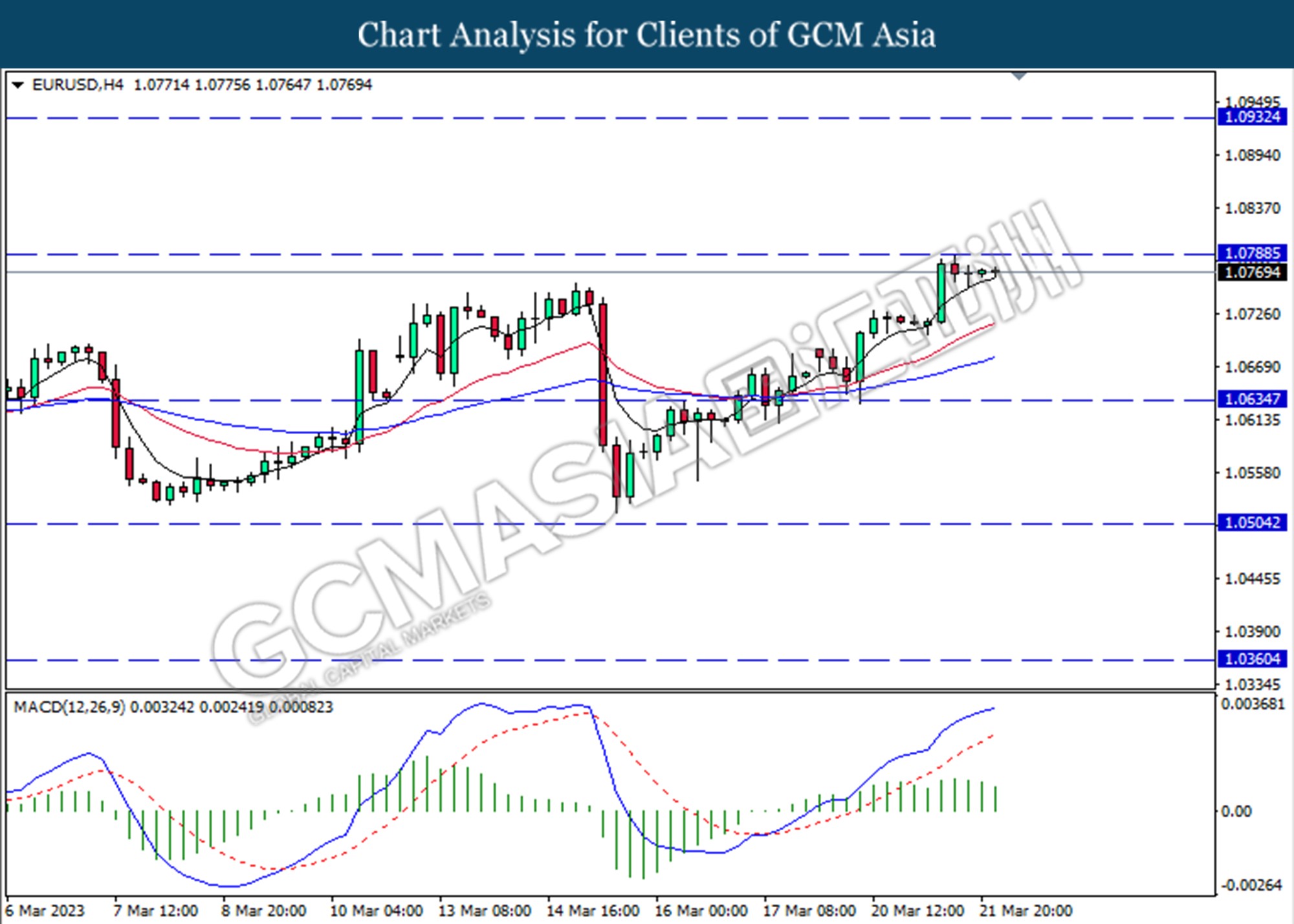

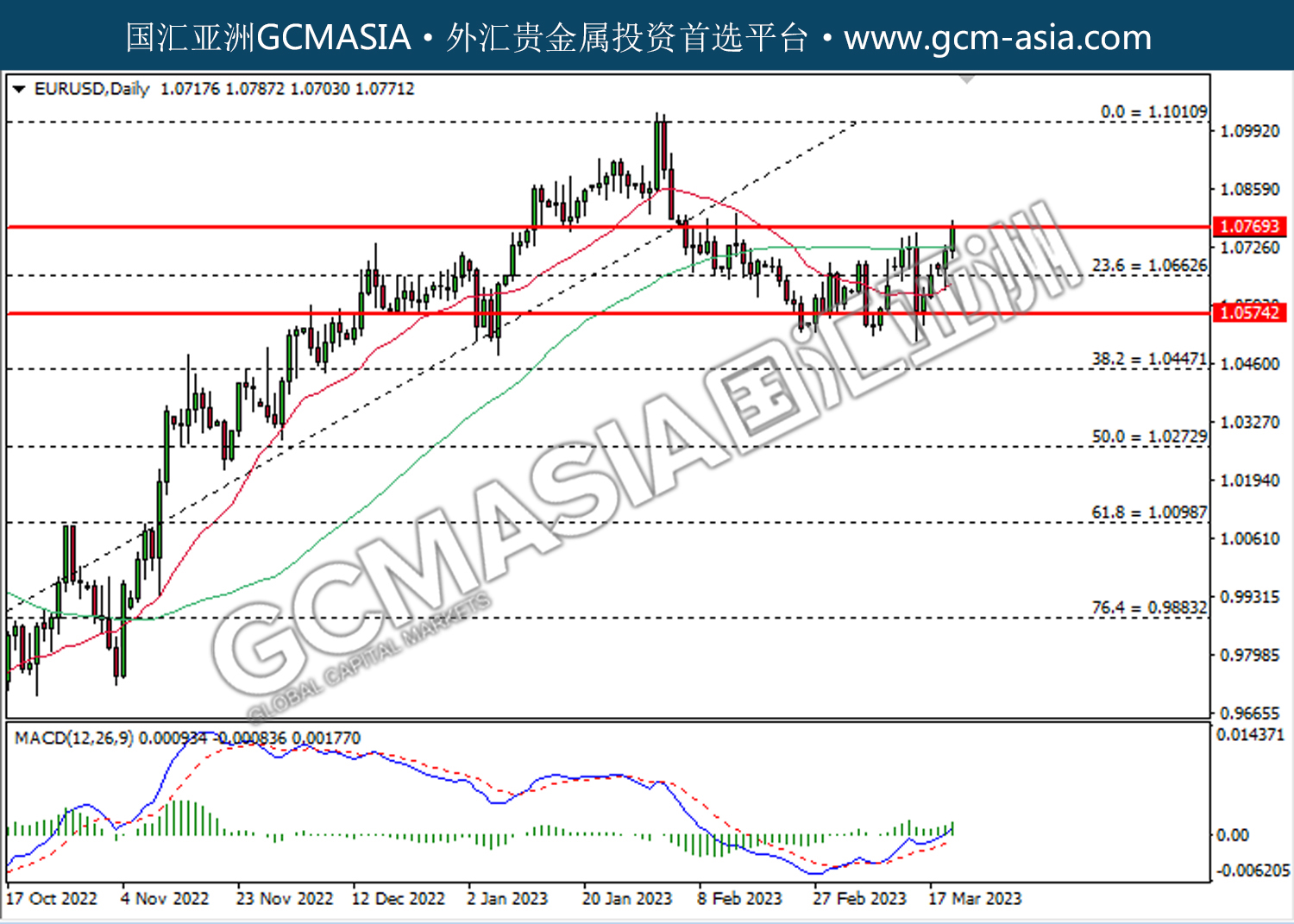

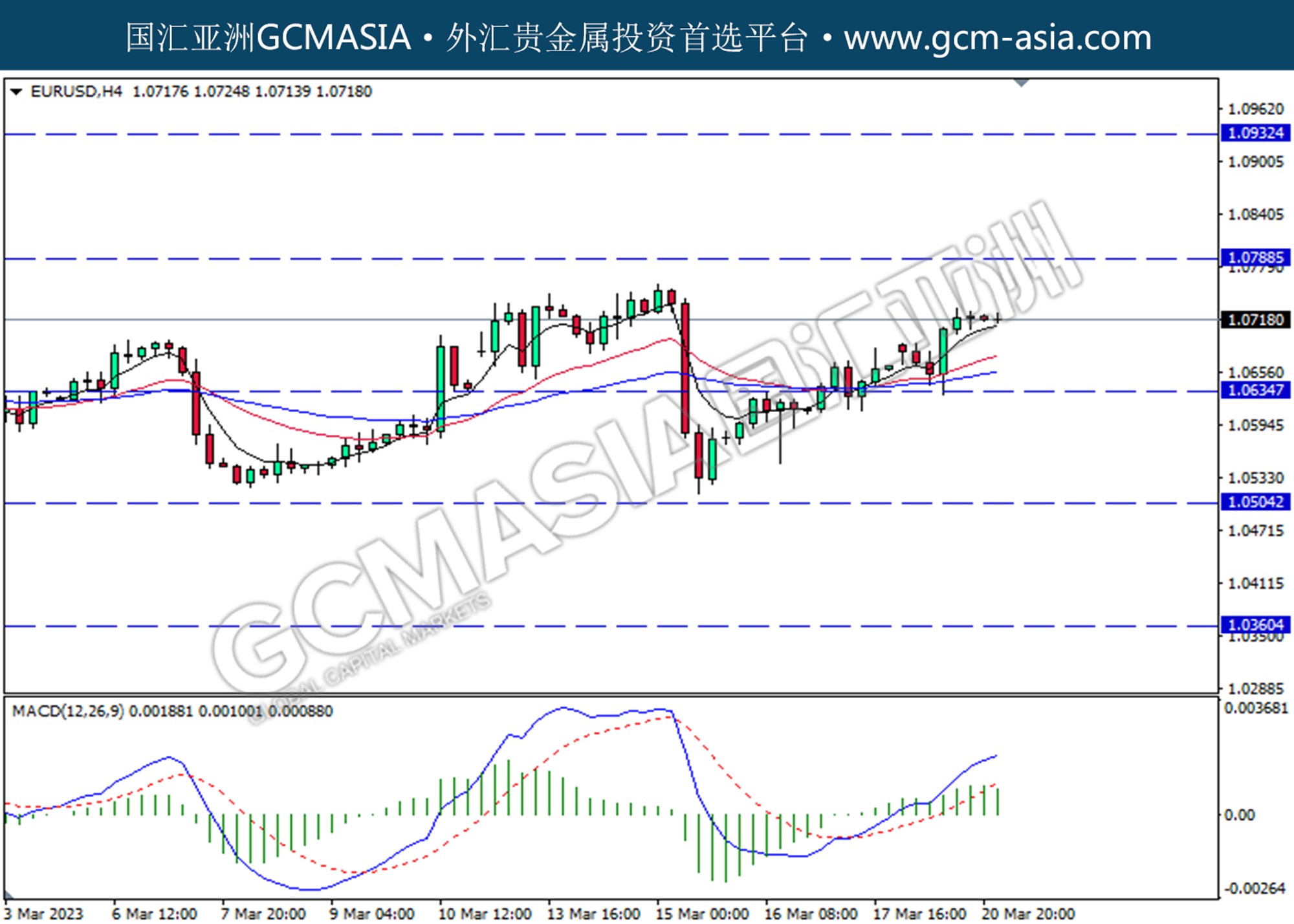

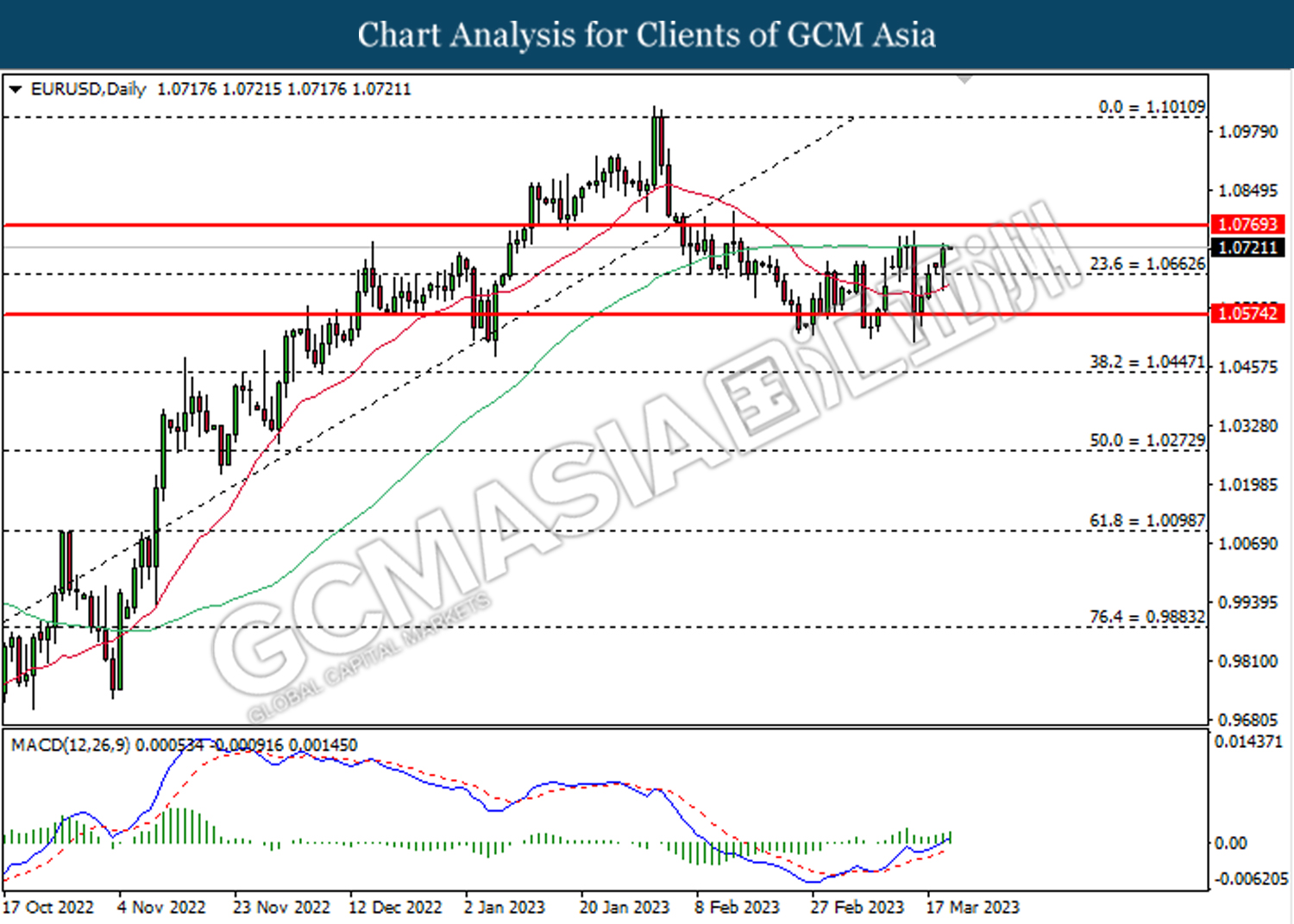

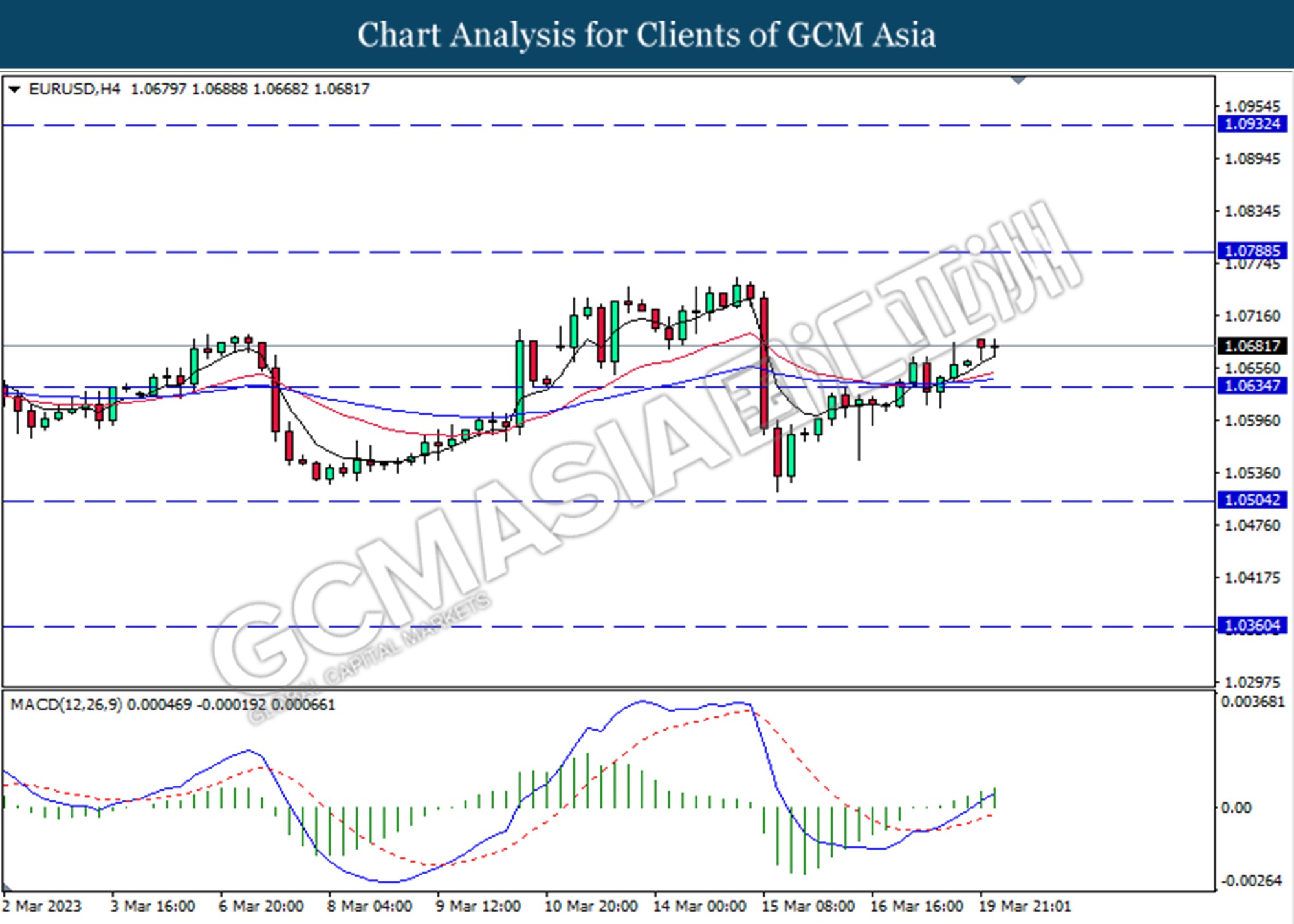

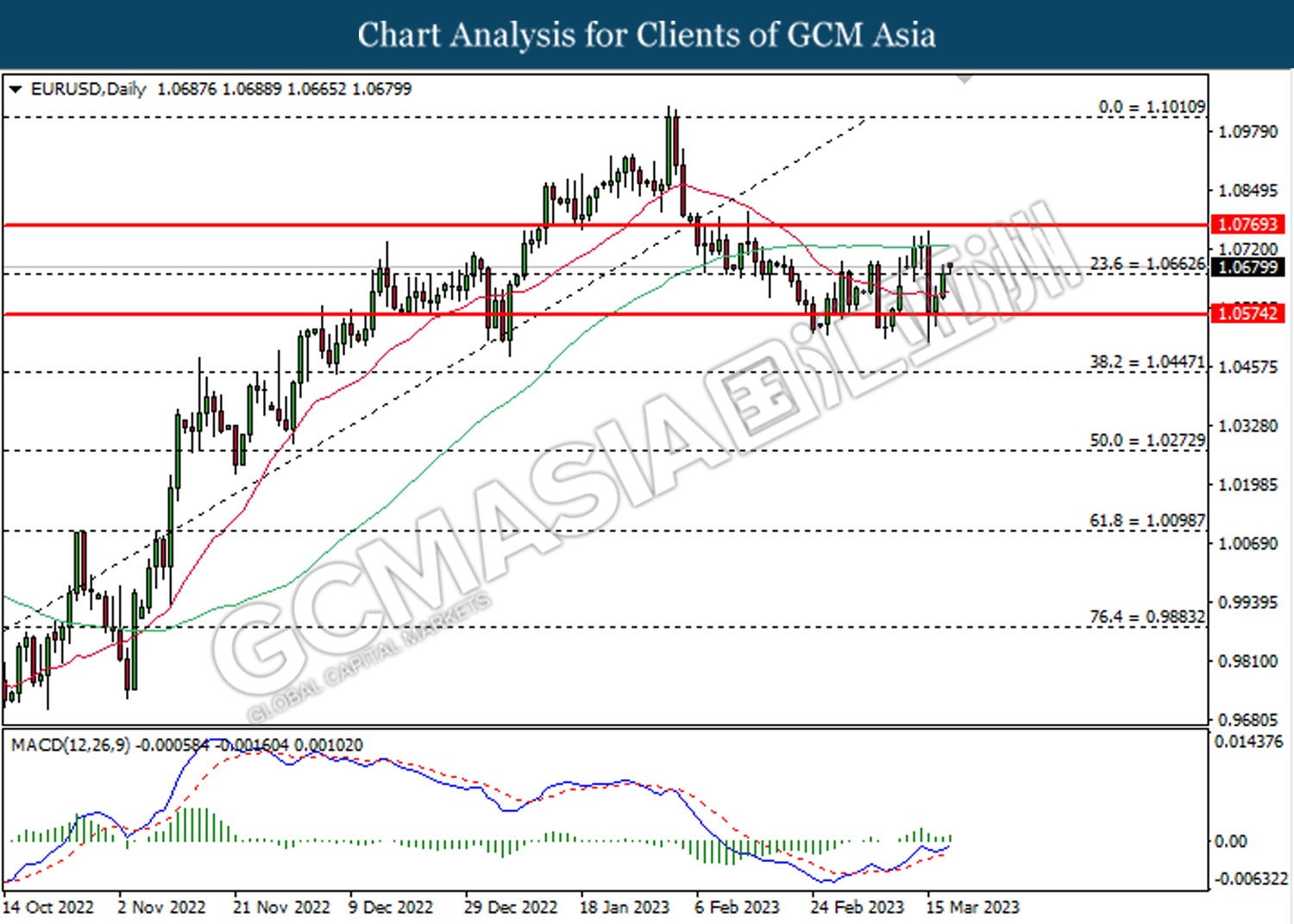

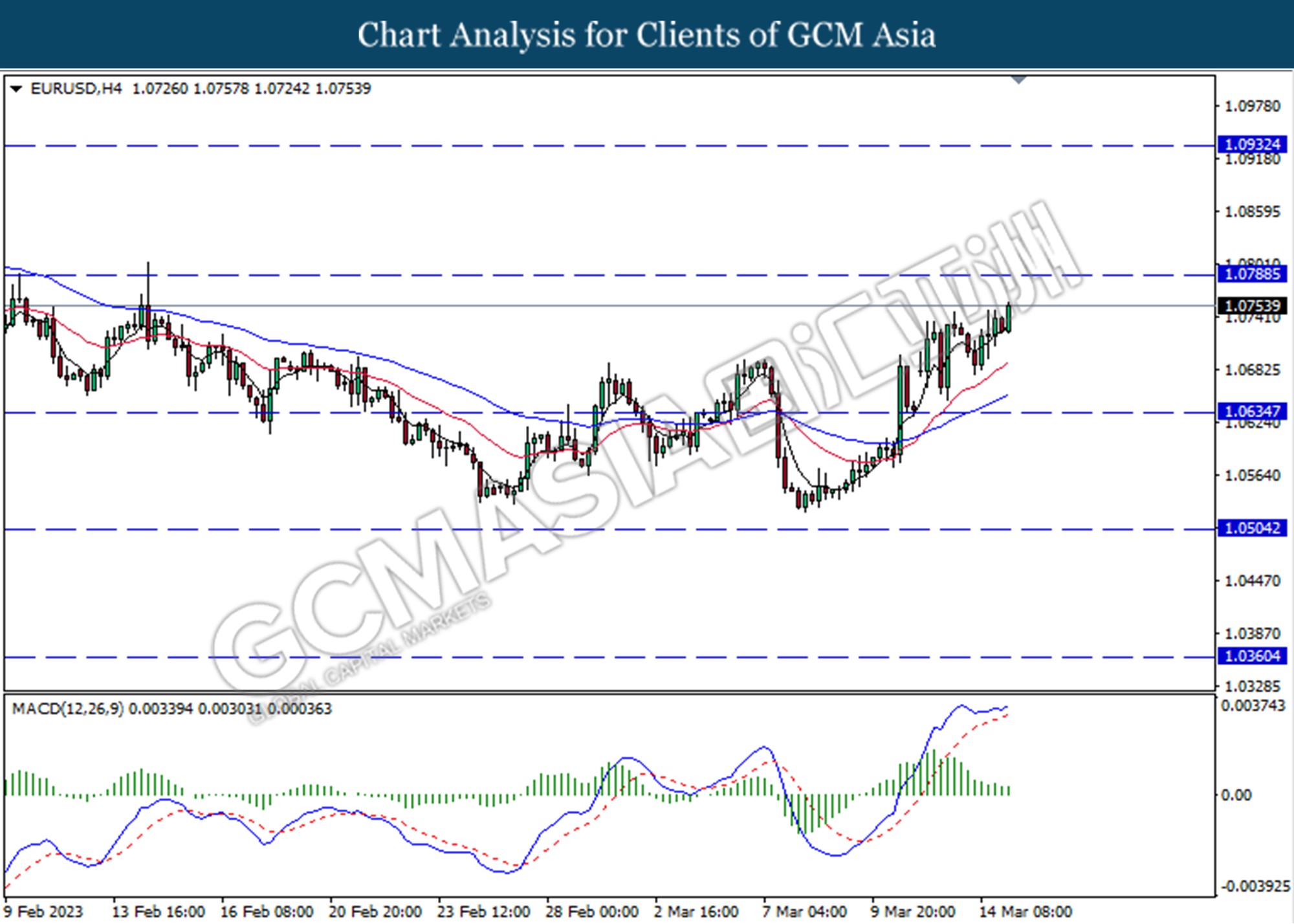

EURUSD, Daily: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

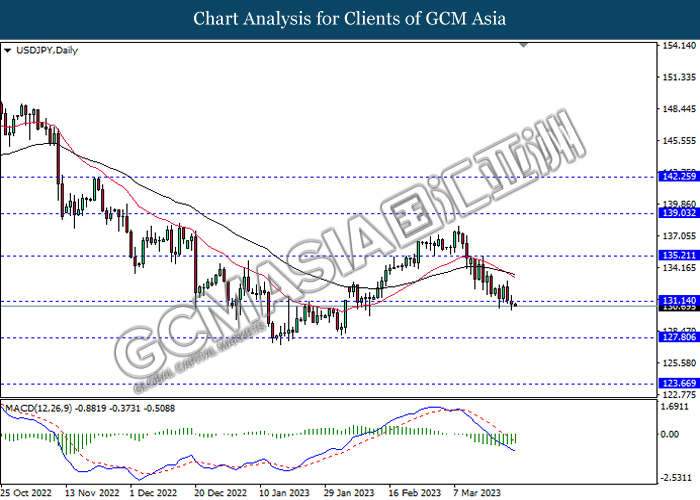

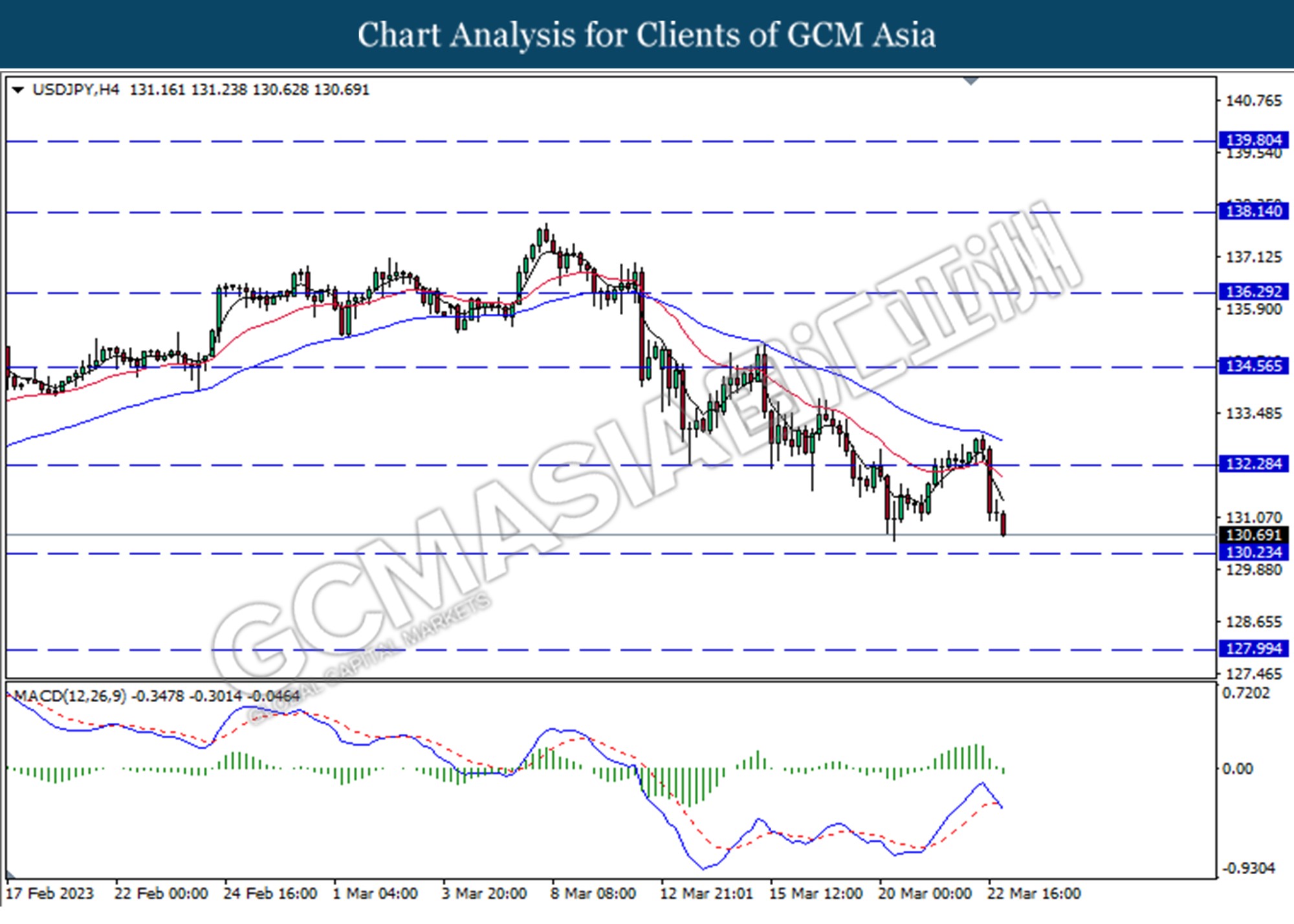

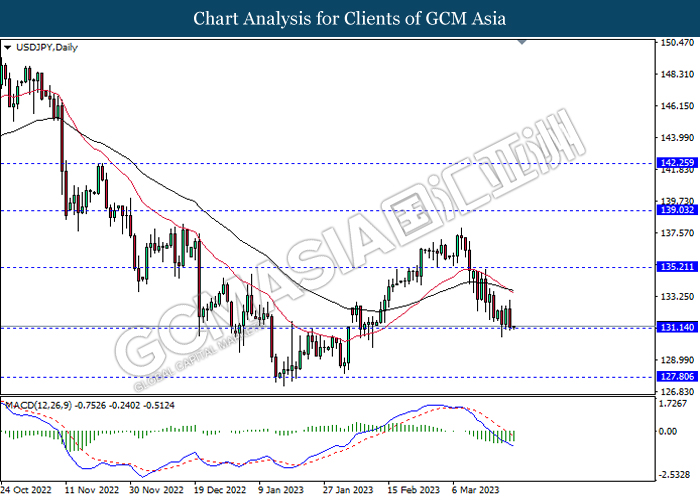

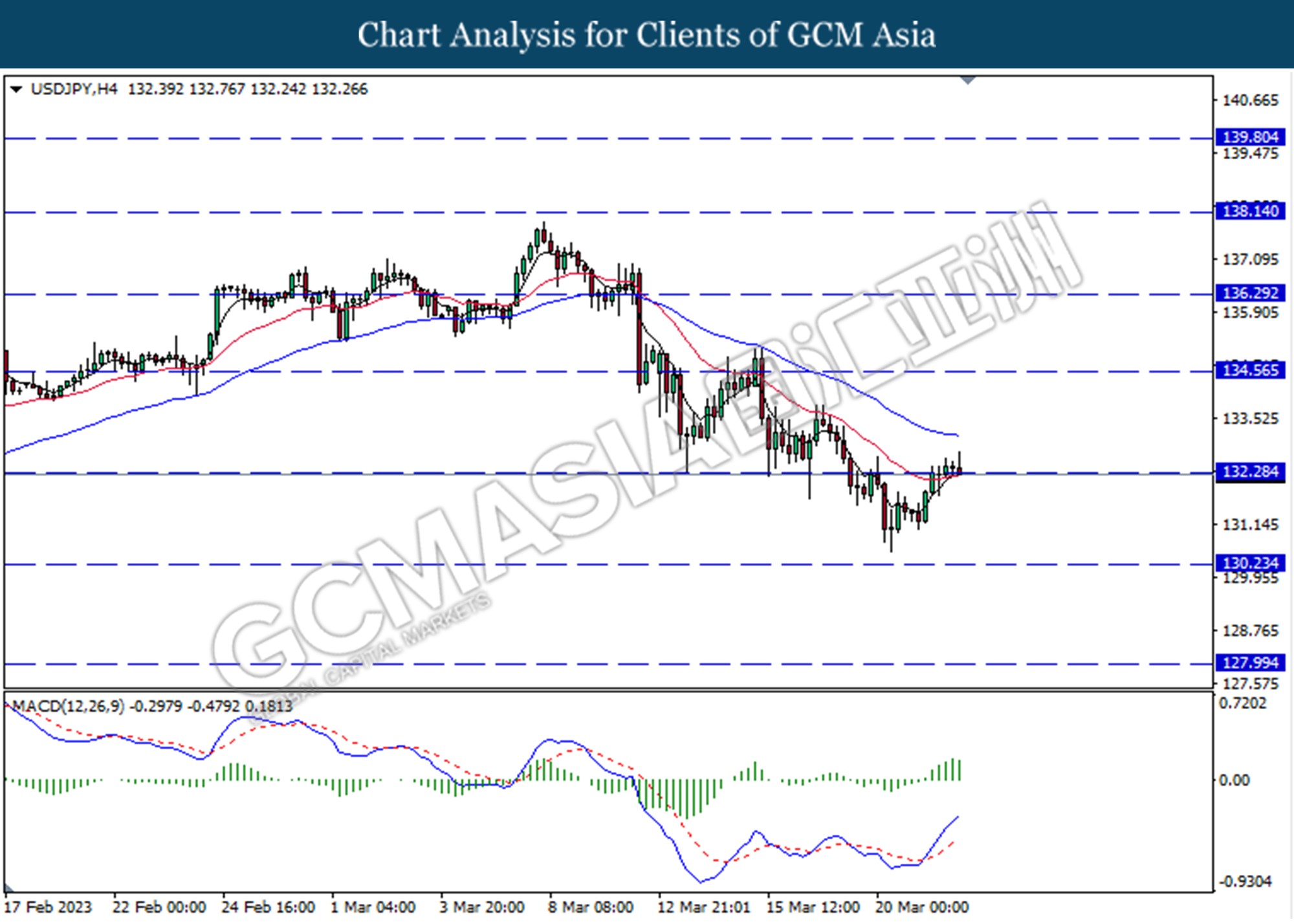

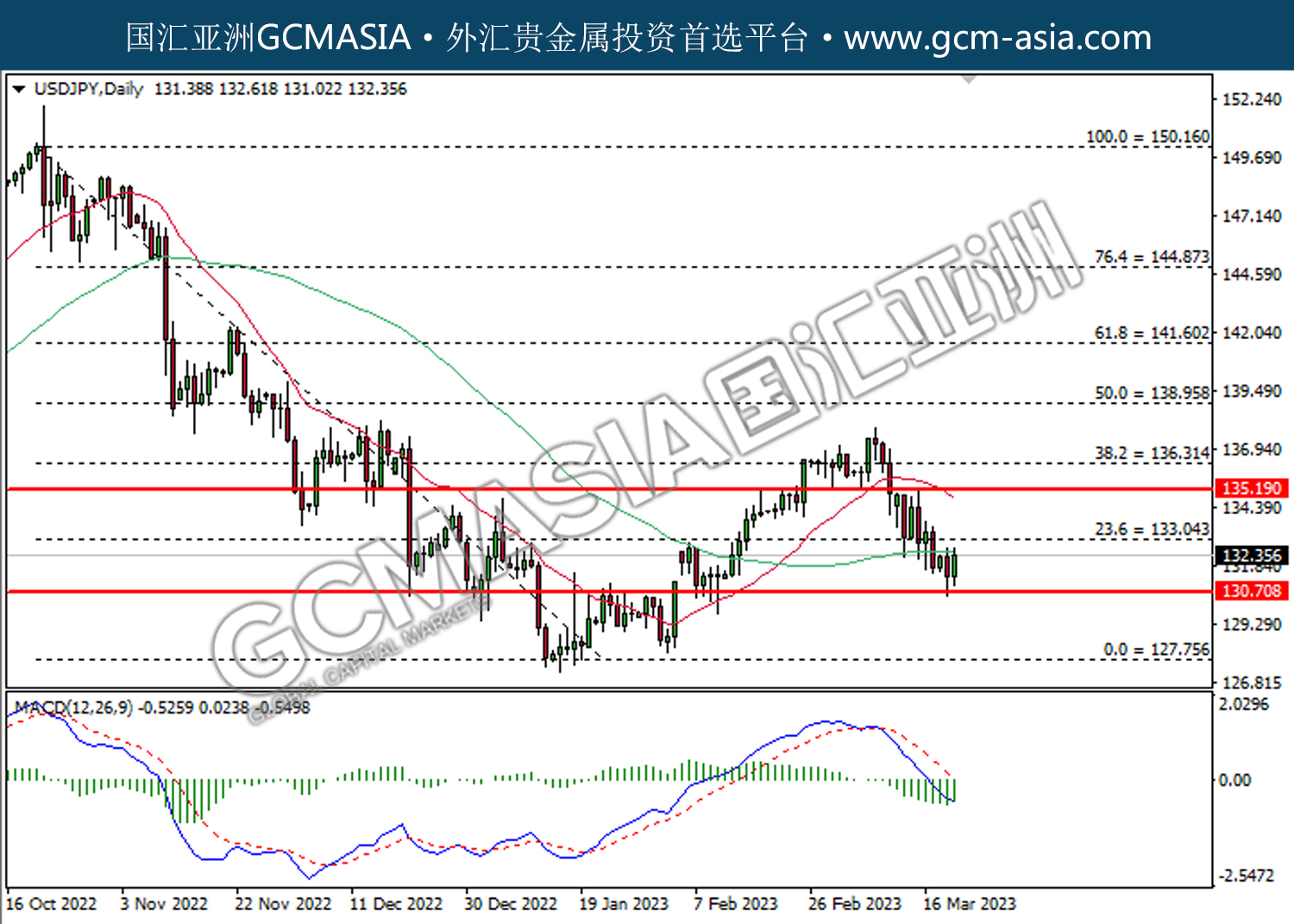

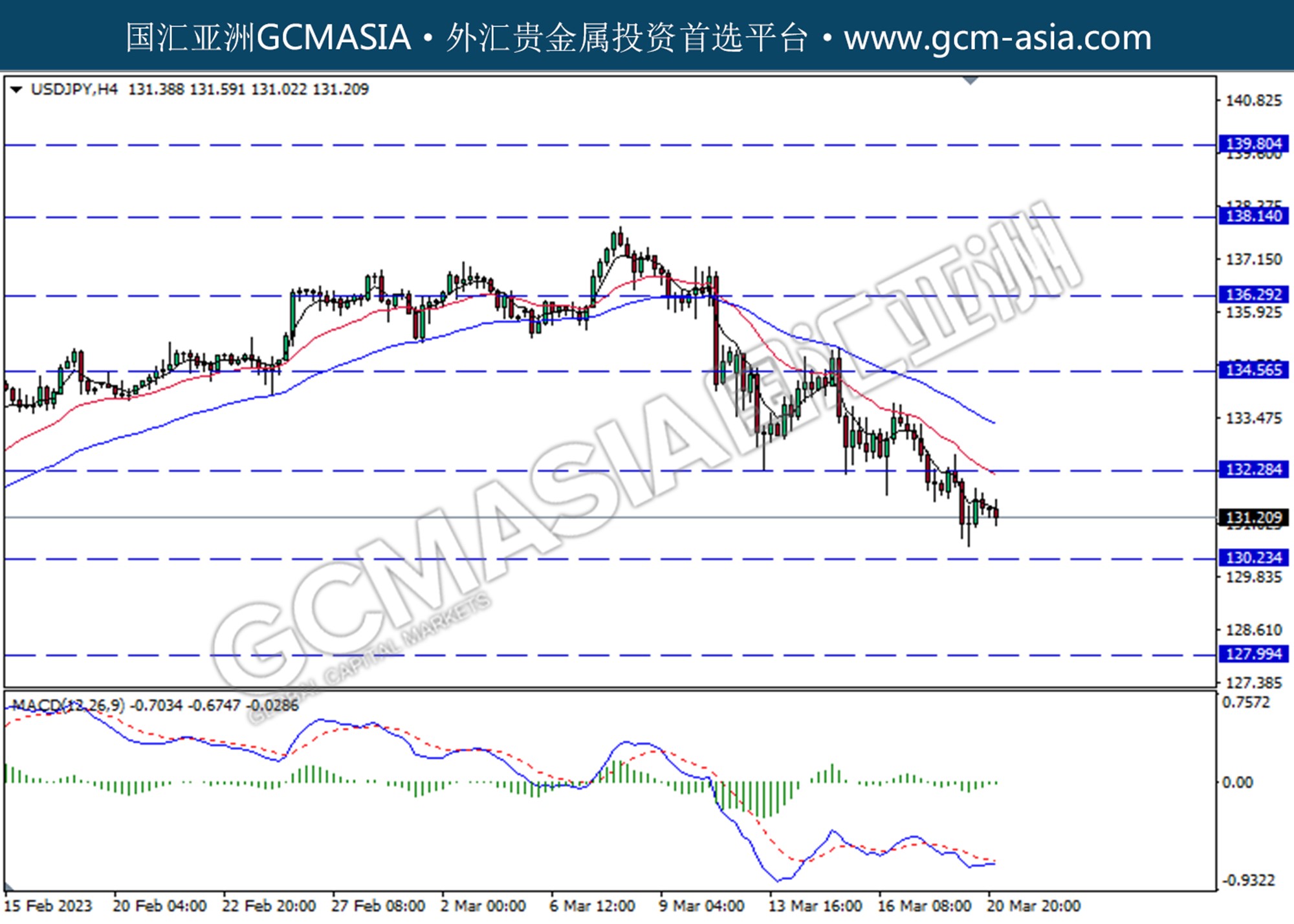

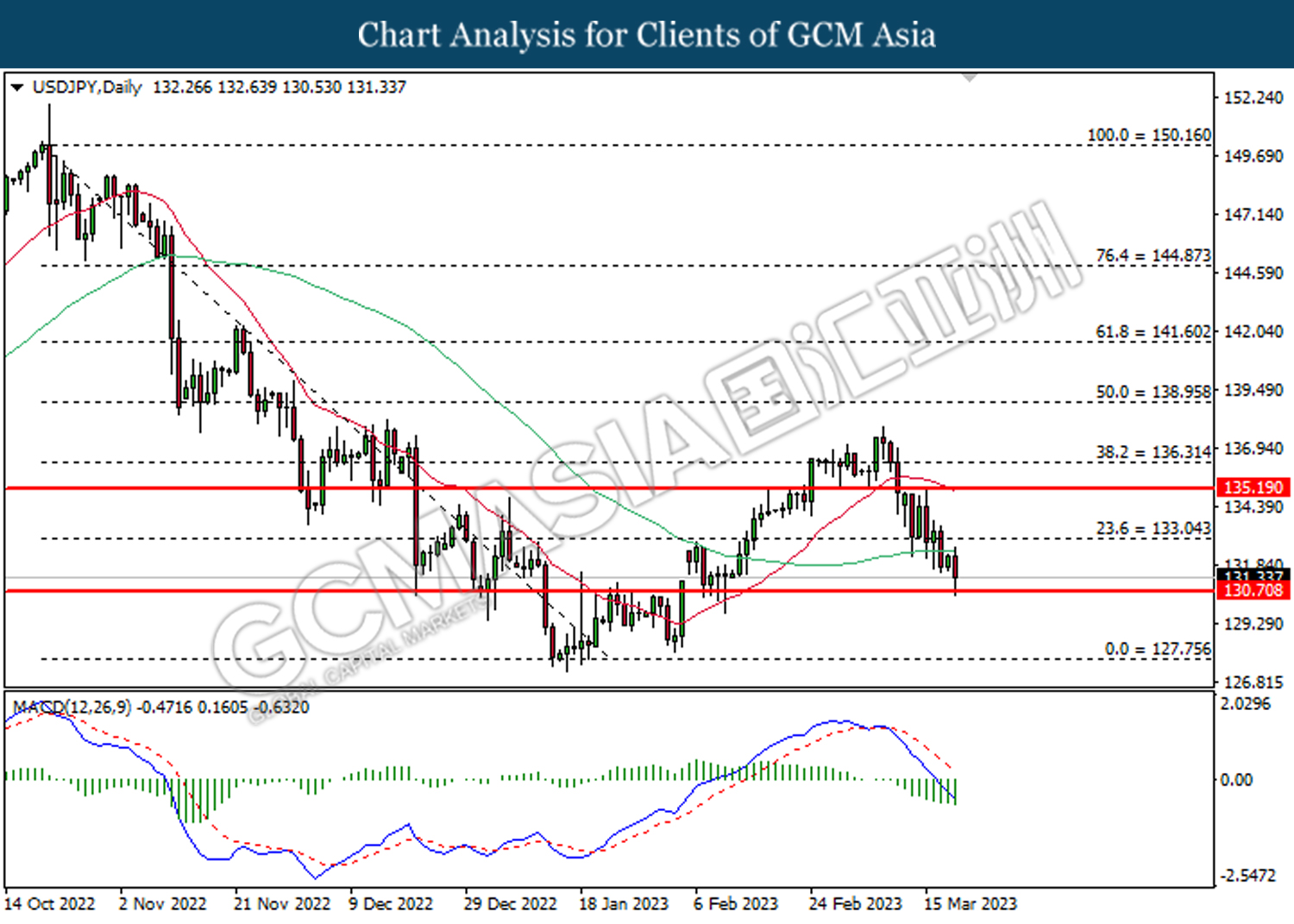

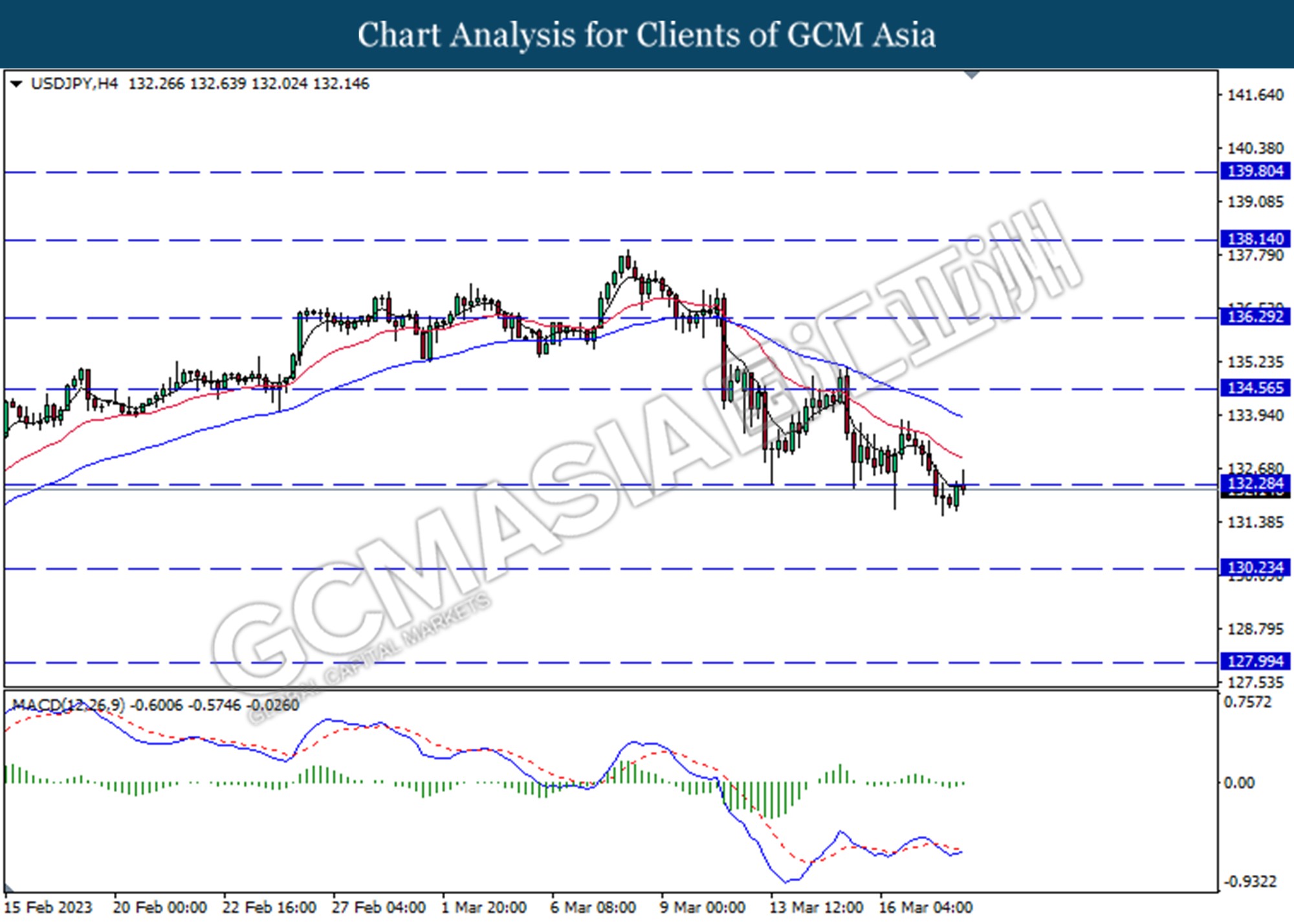

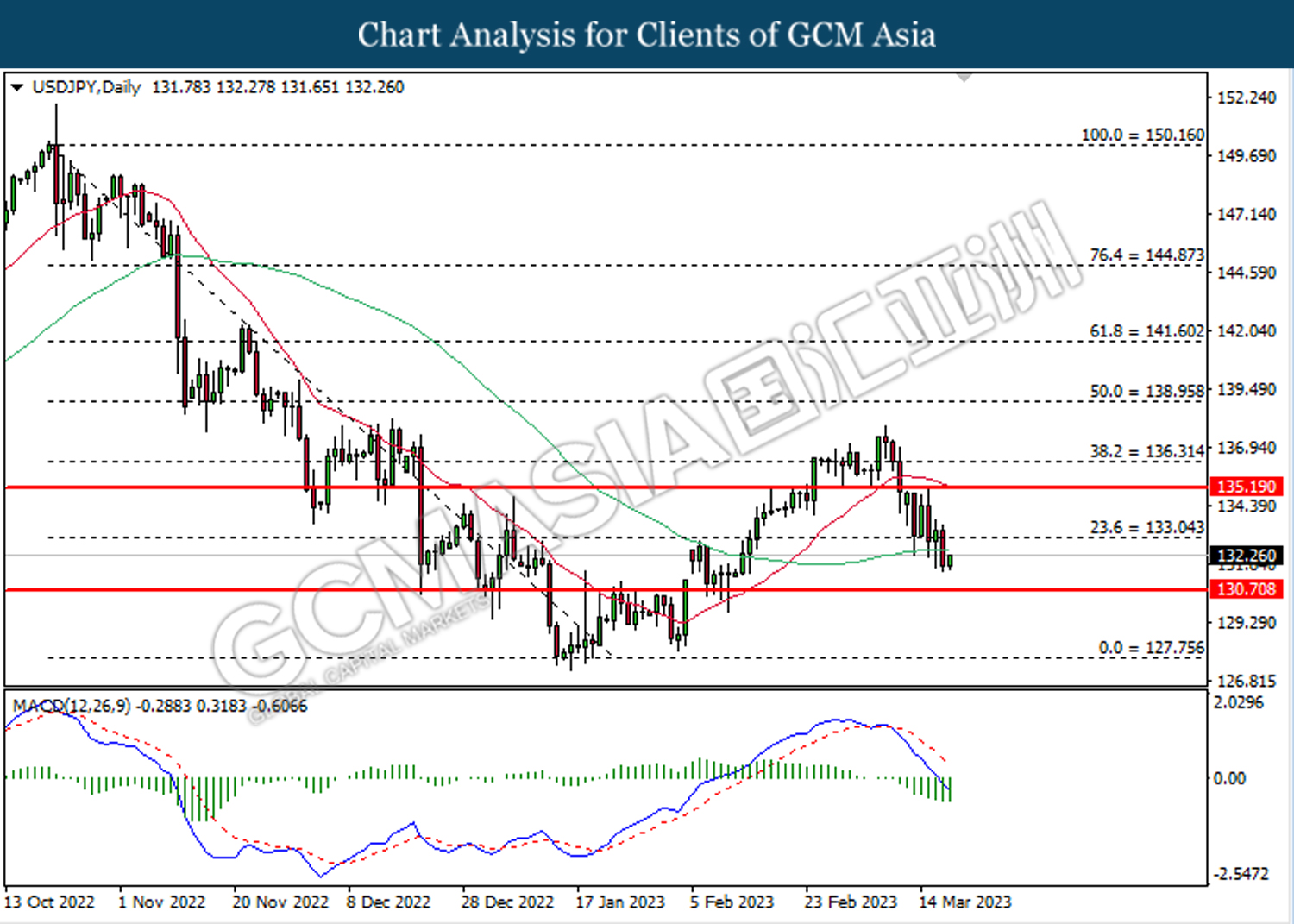

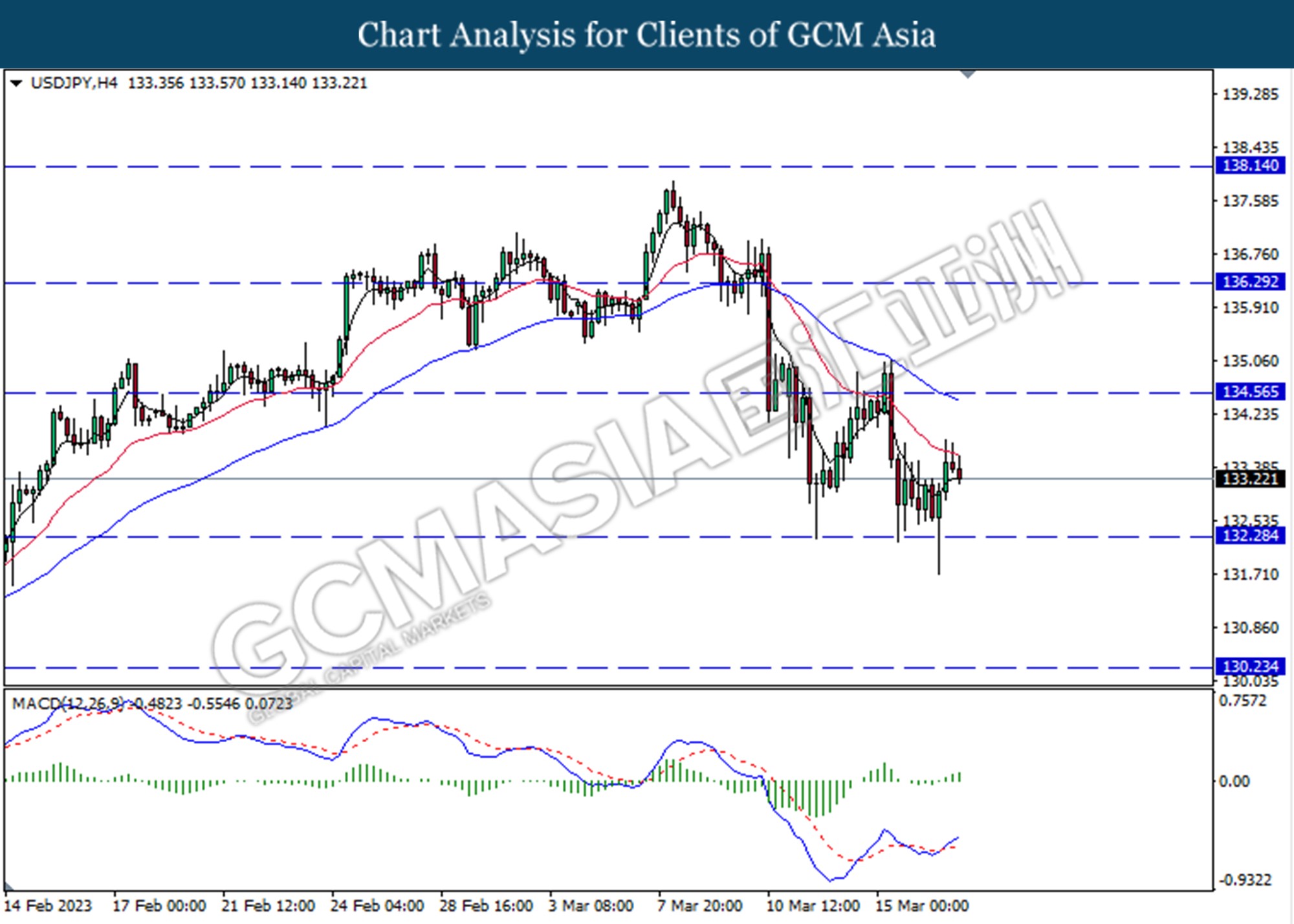

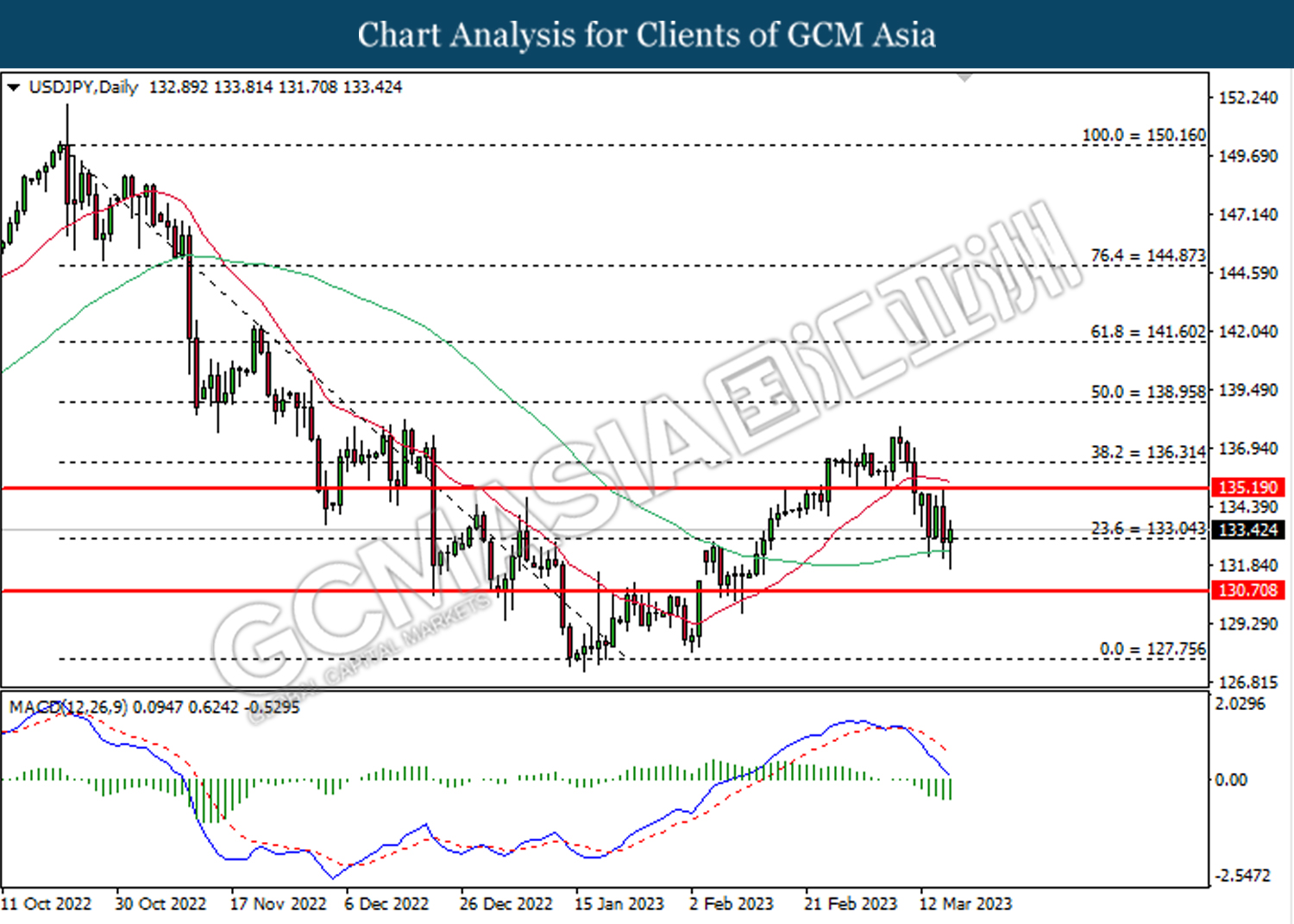

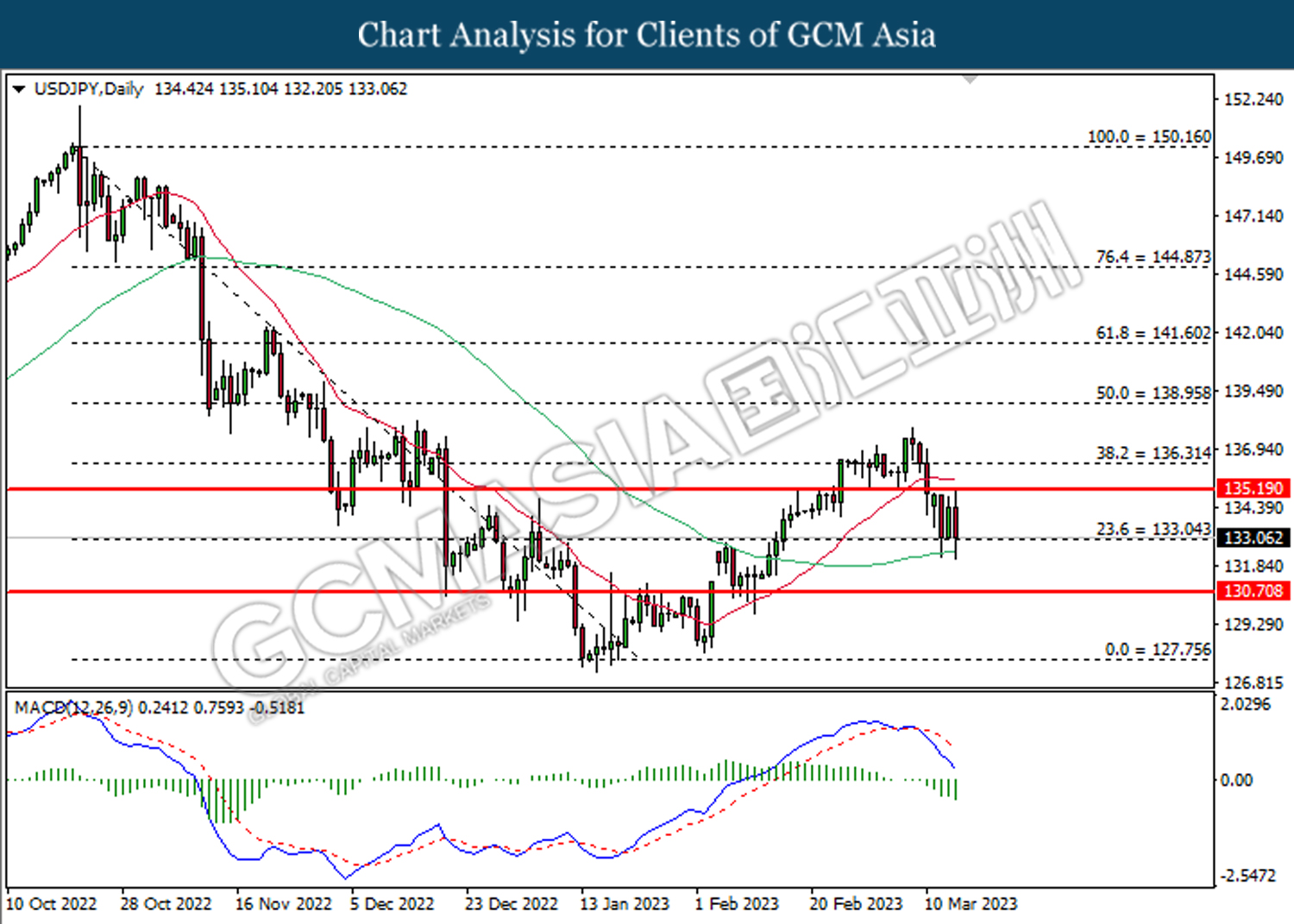

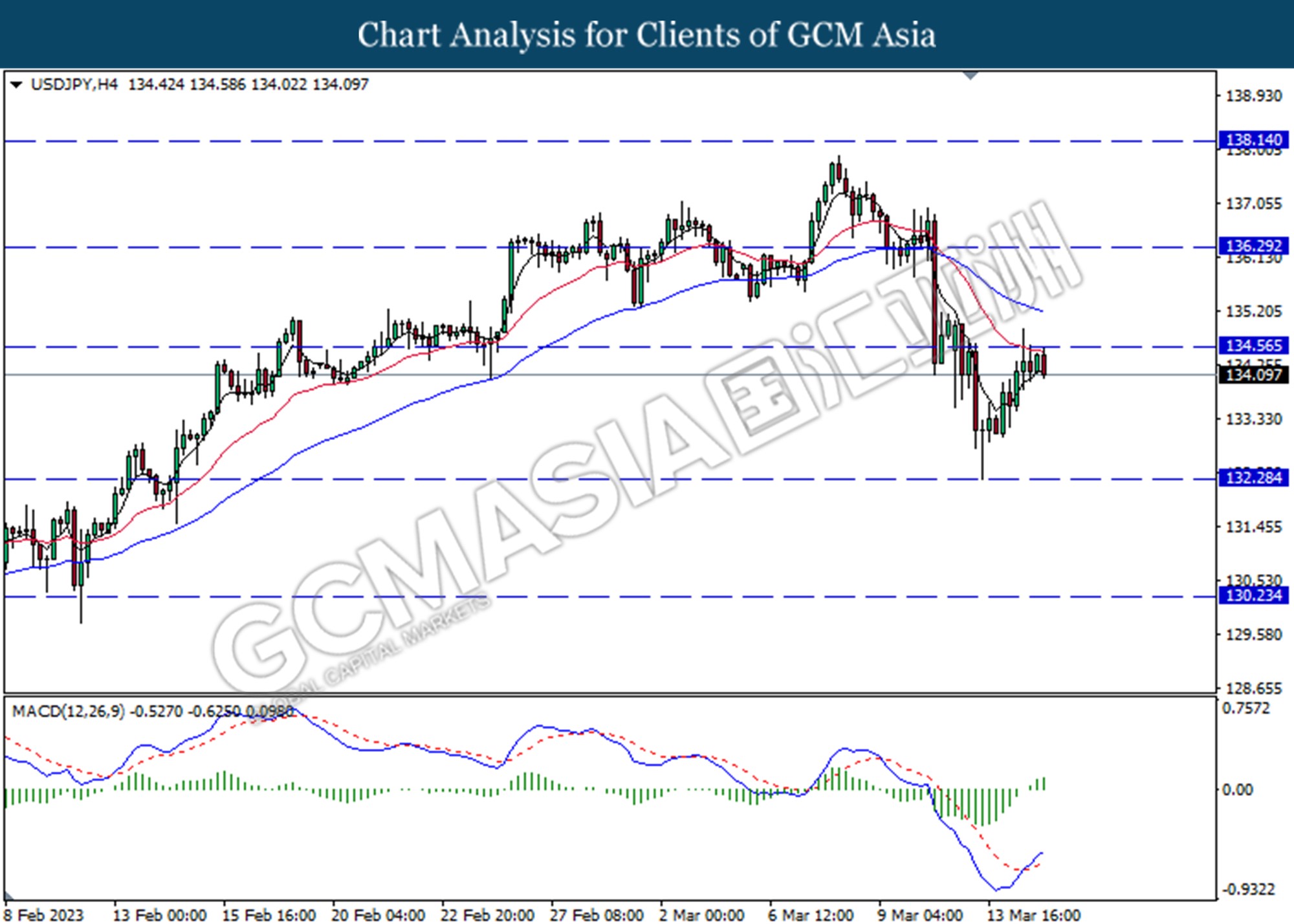

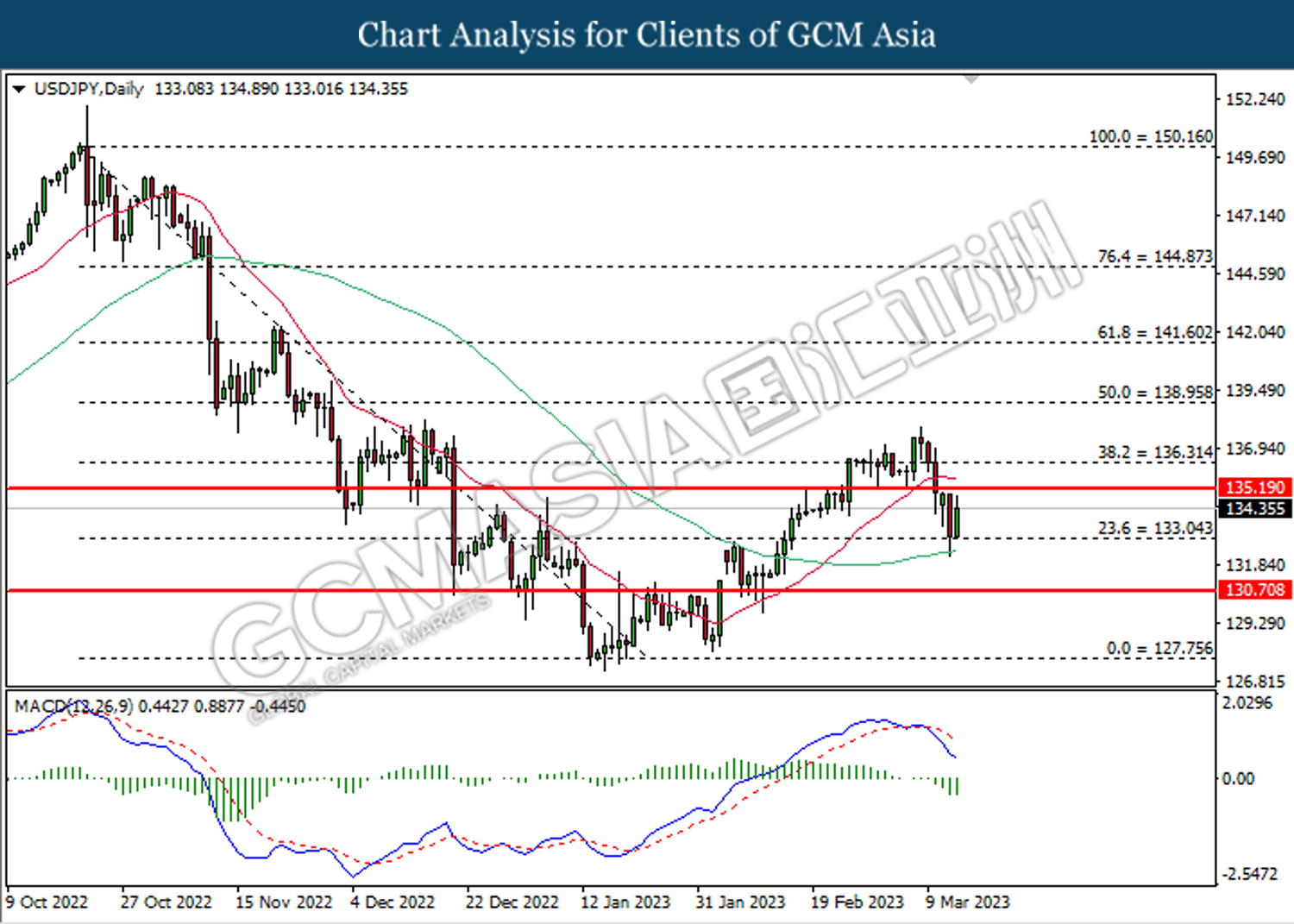

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 131.15, 135.20

Support level: 127.80, 123.65

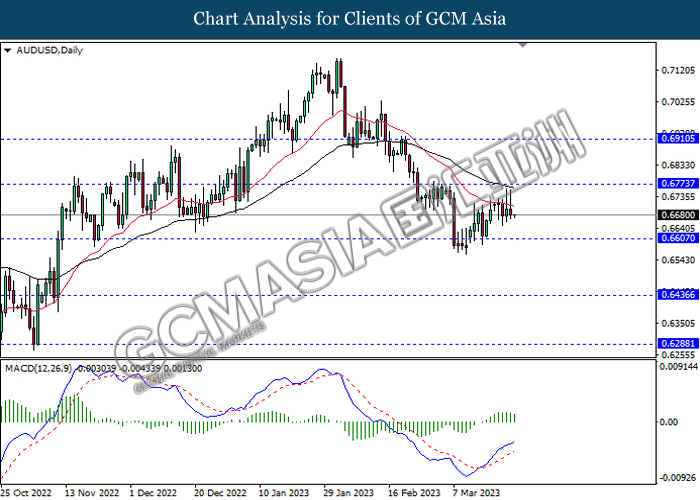

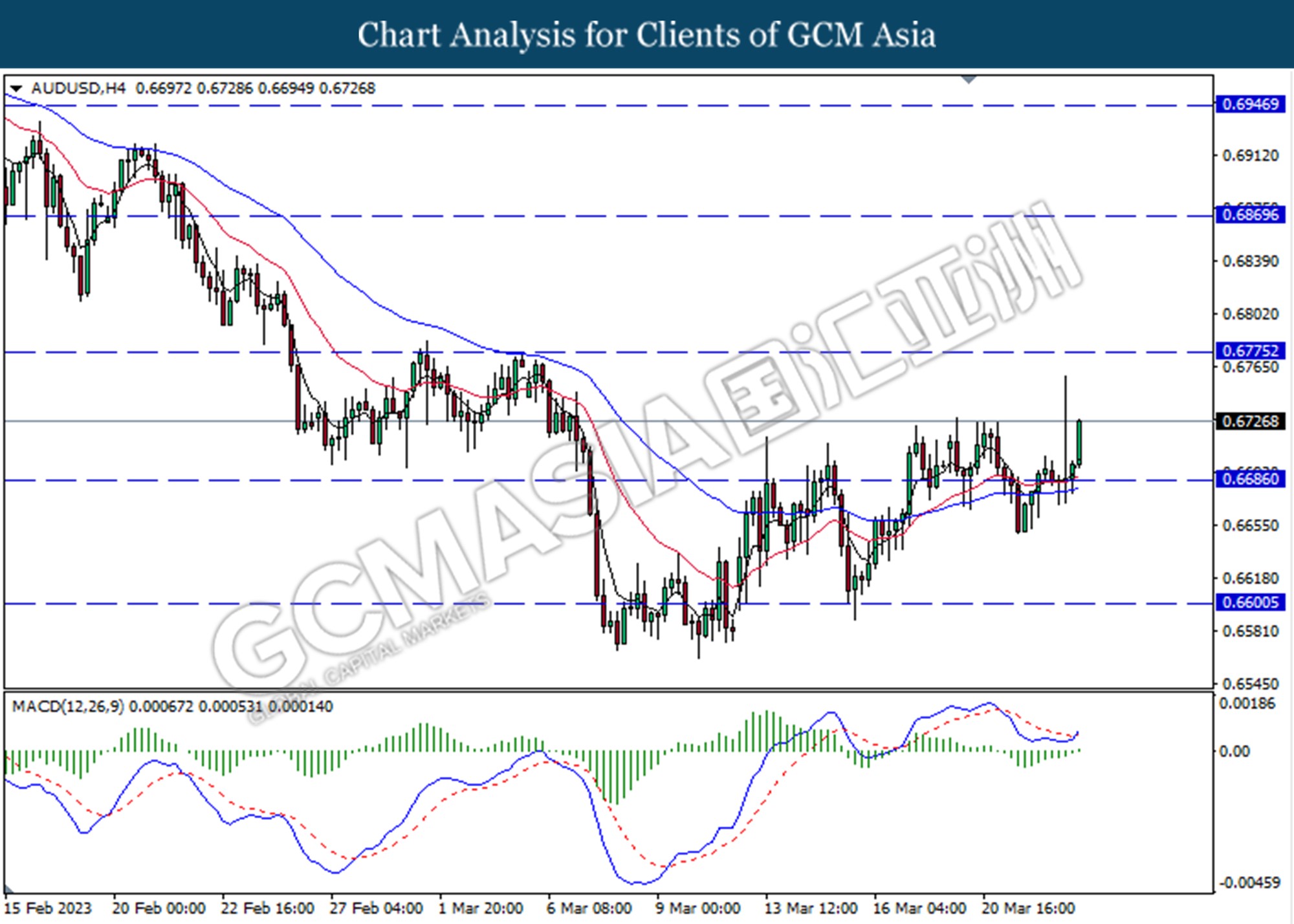

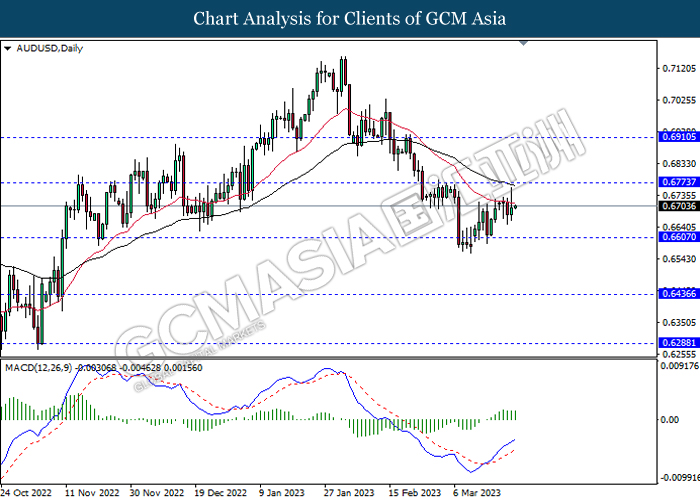

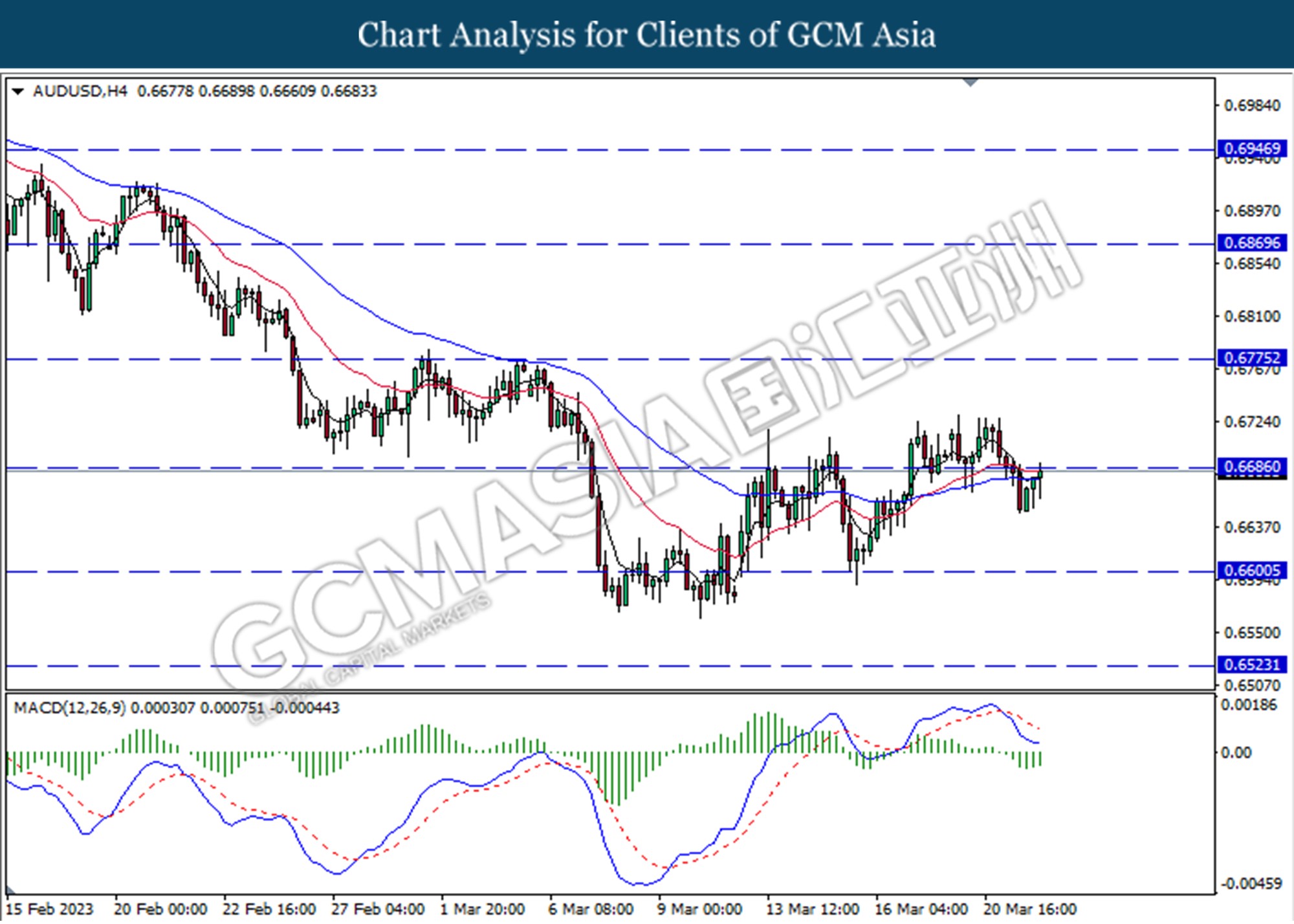

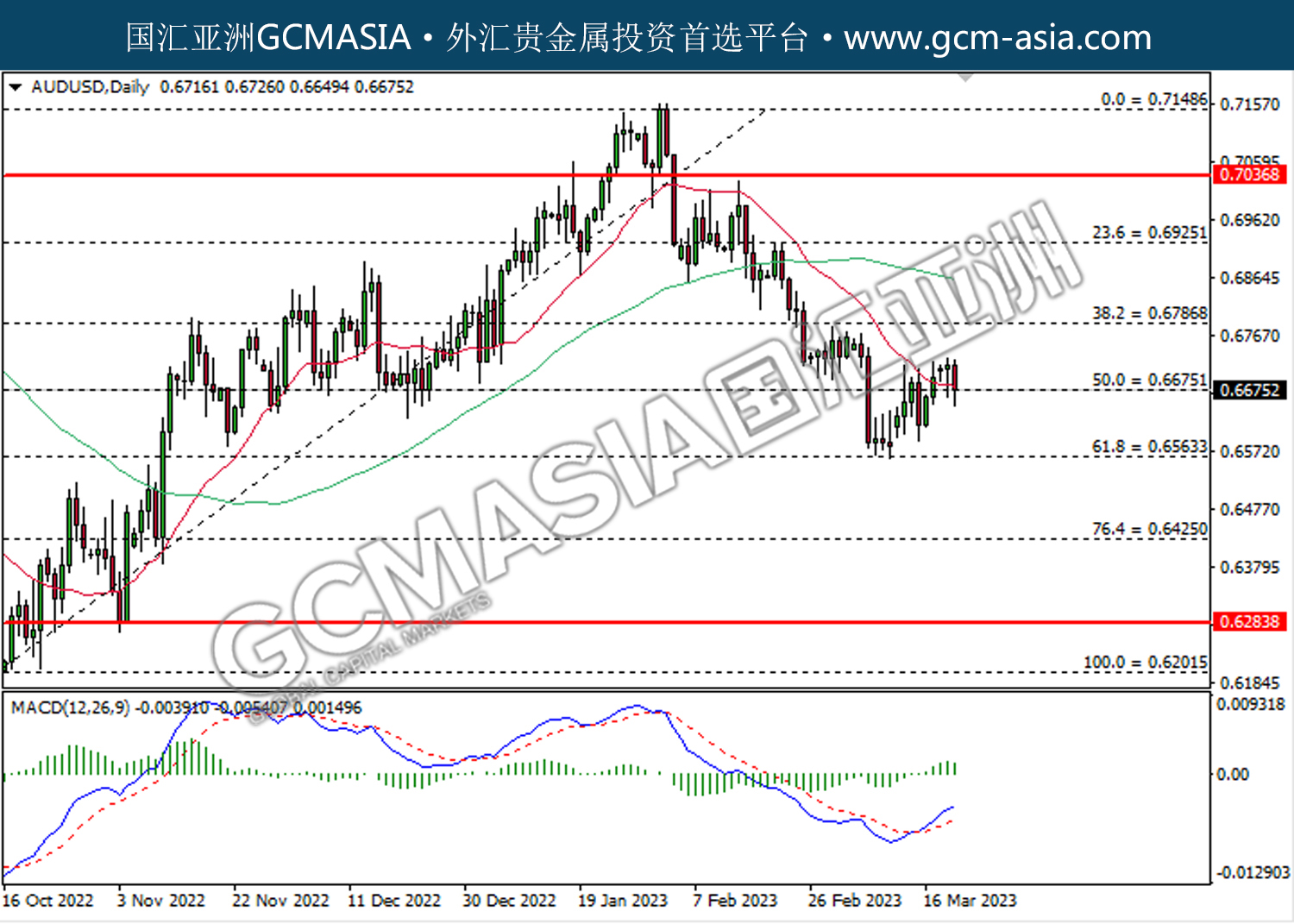

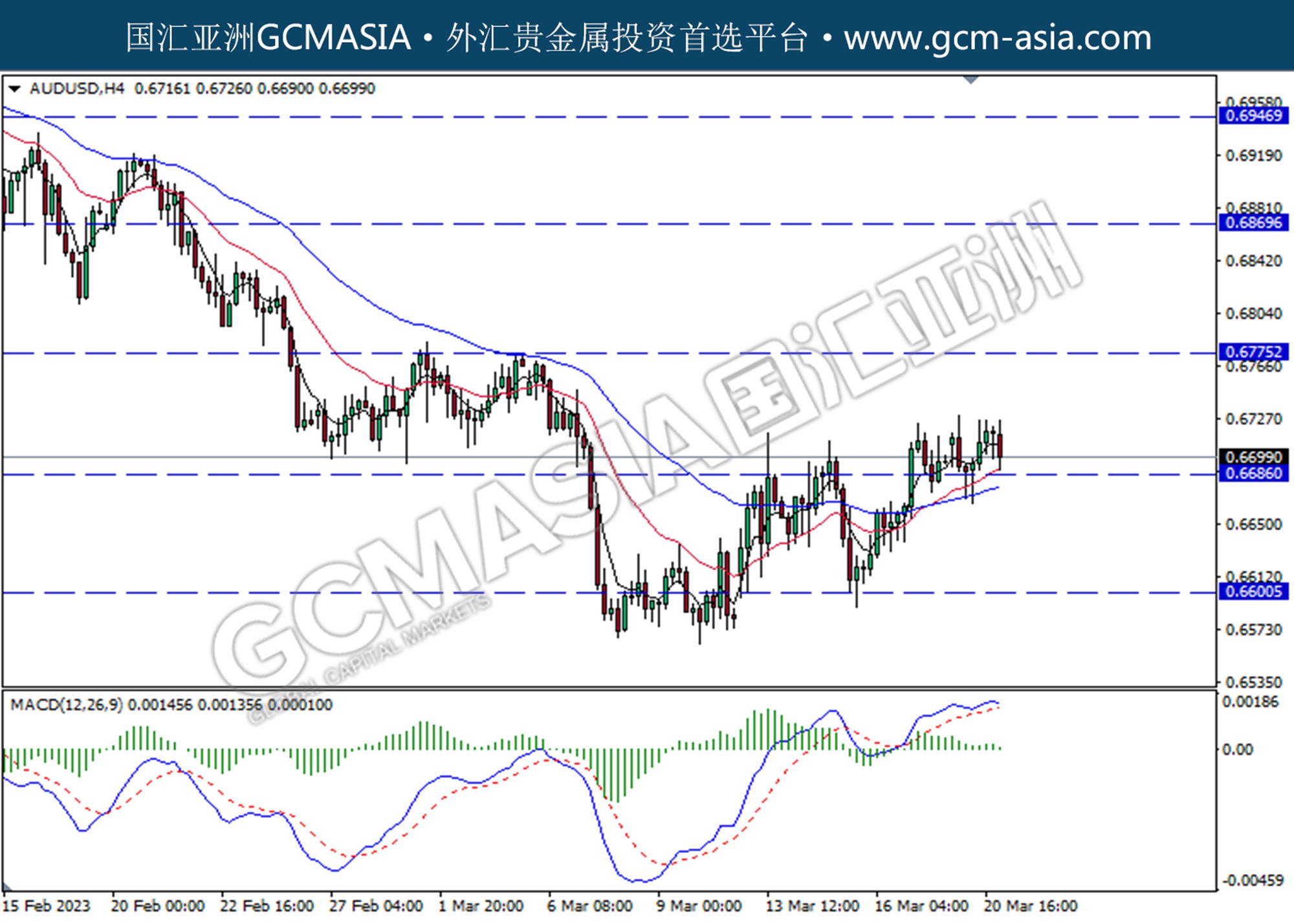

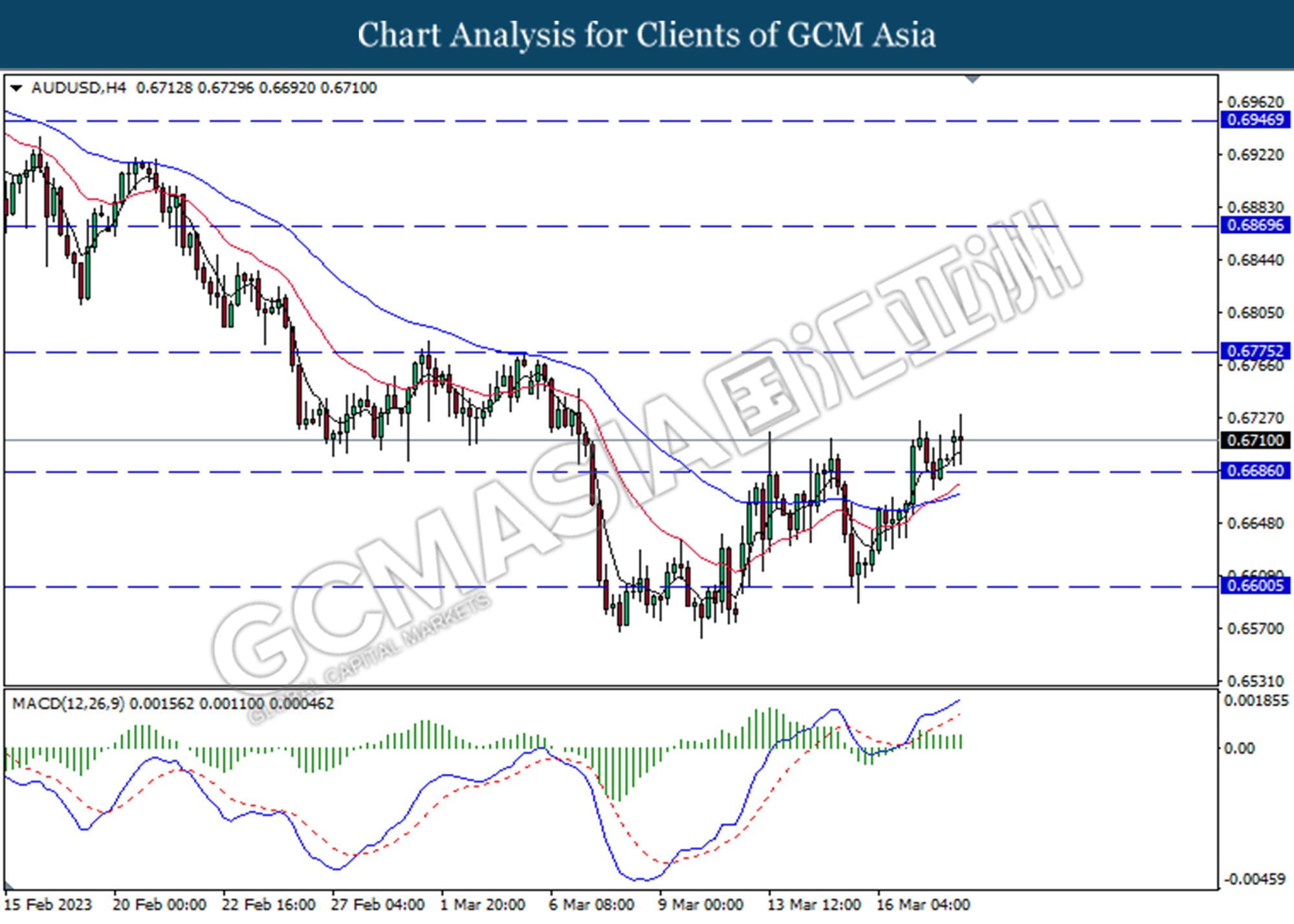

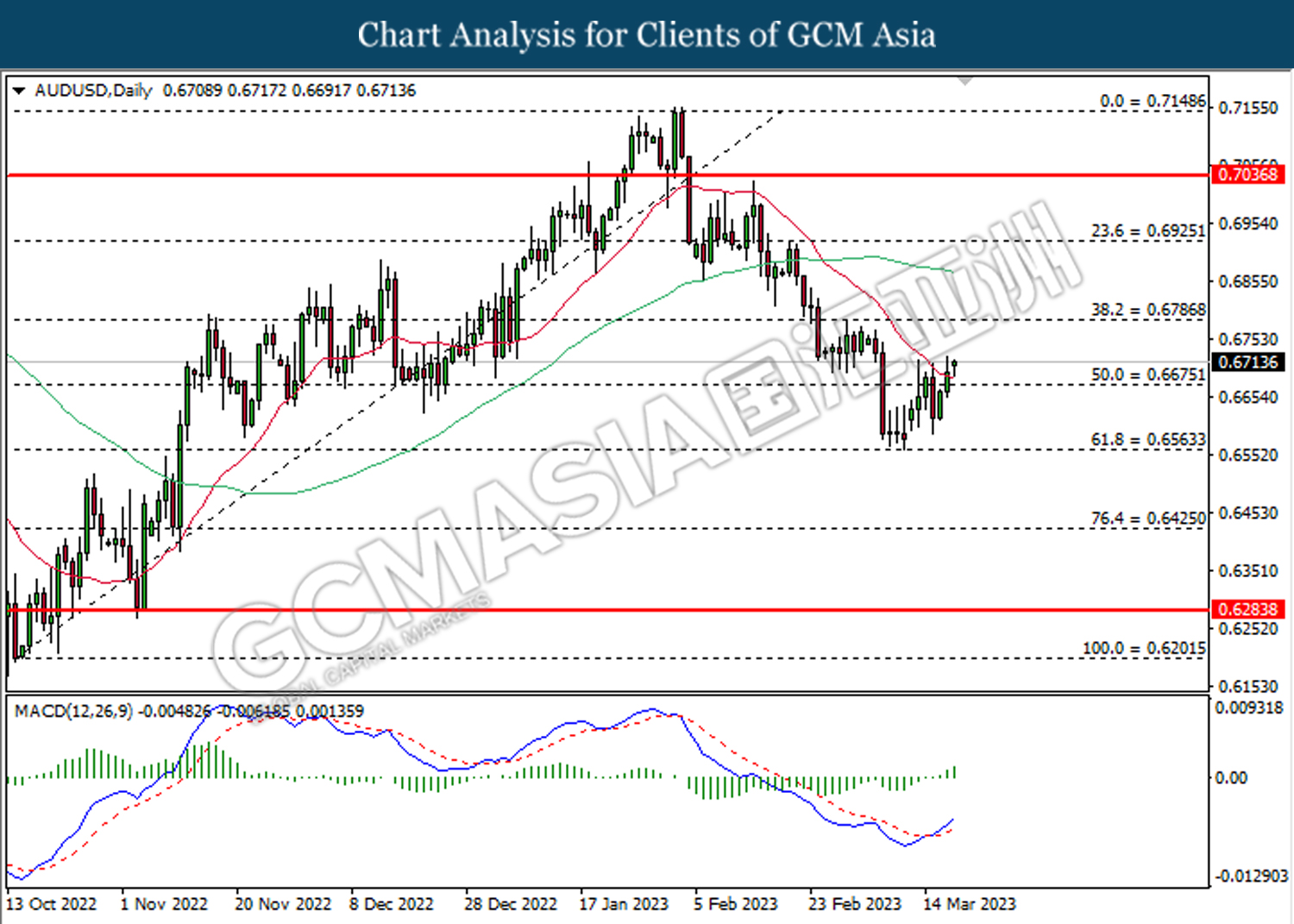

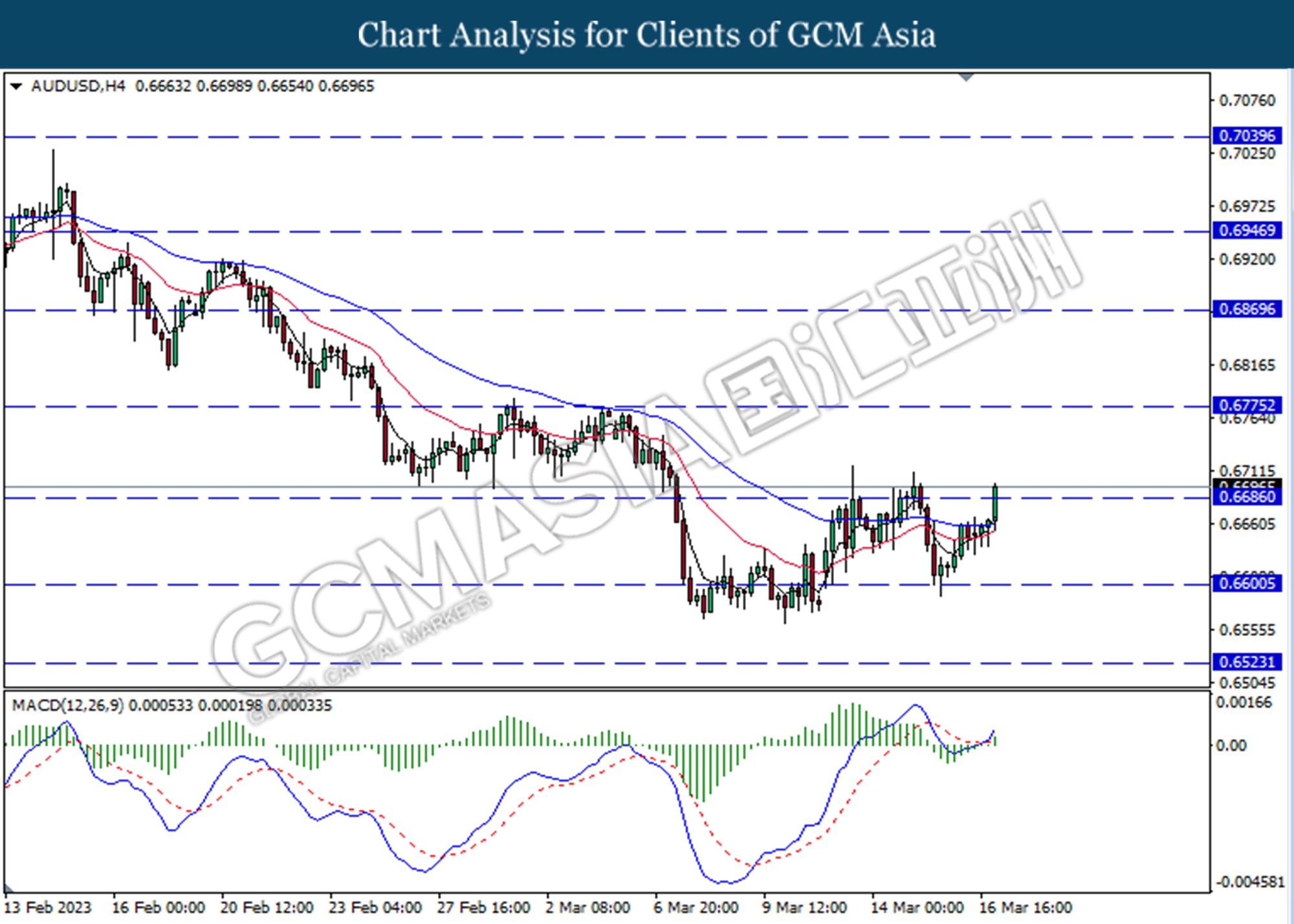

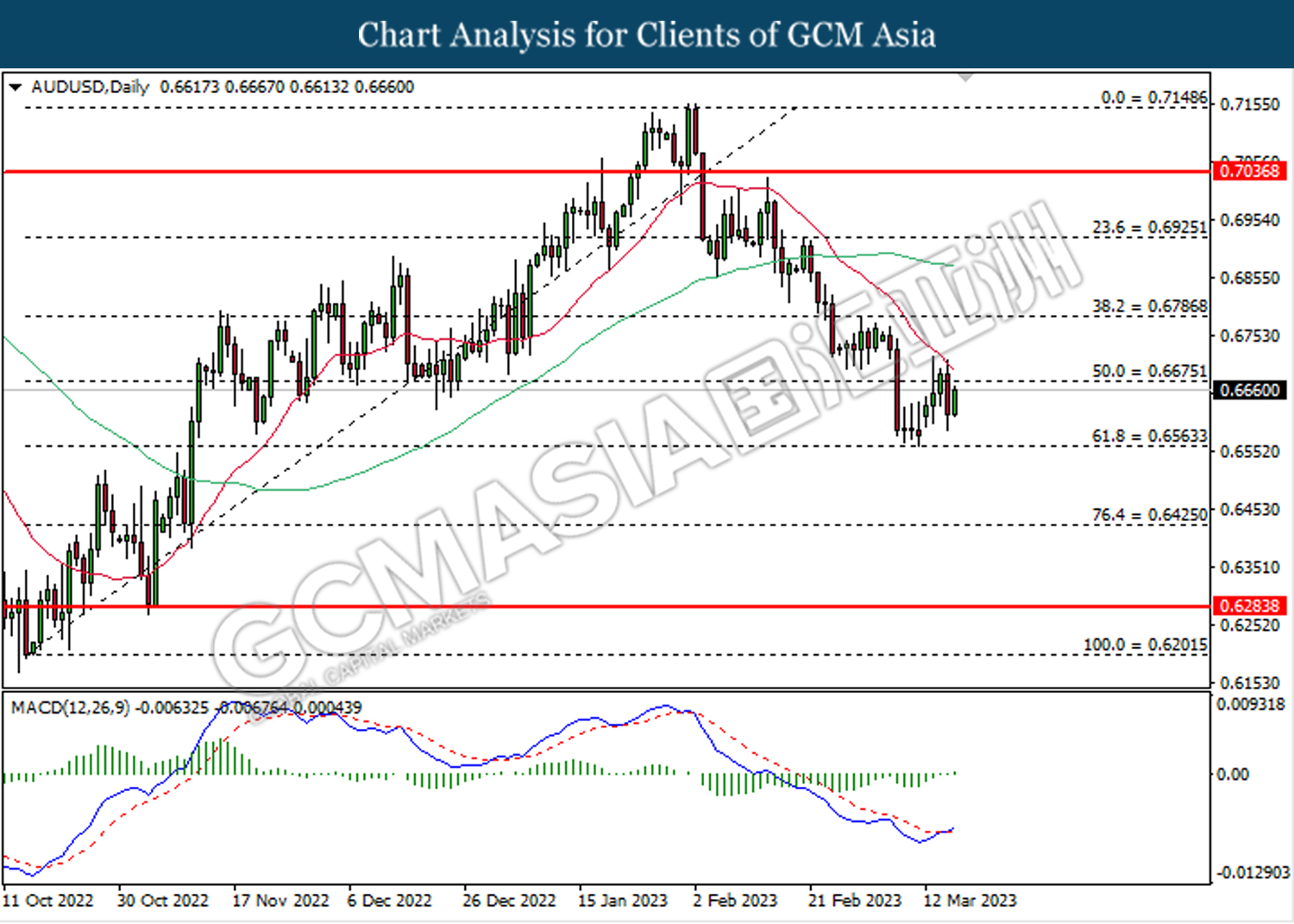

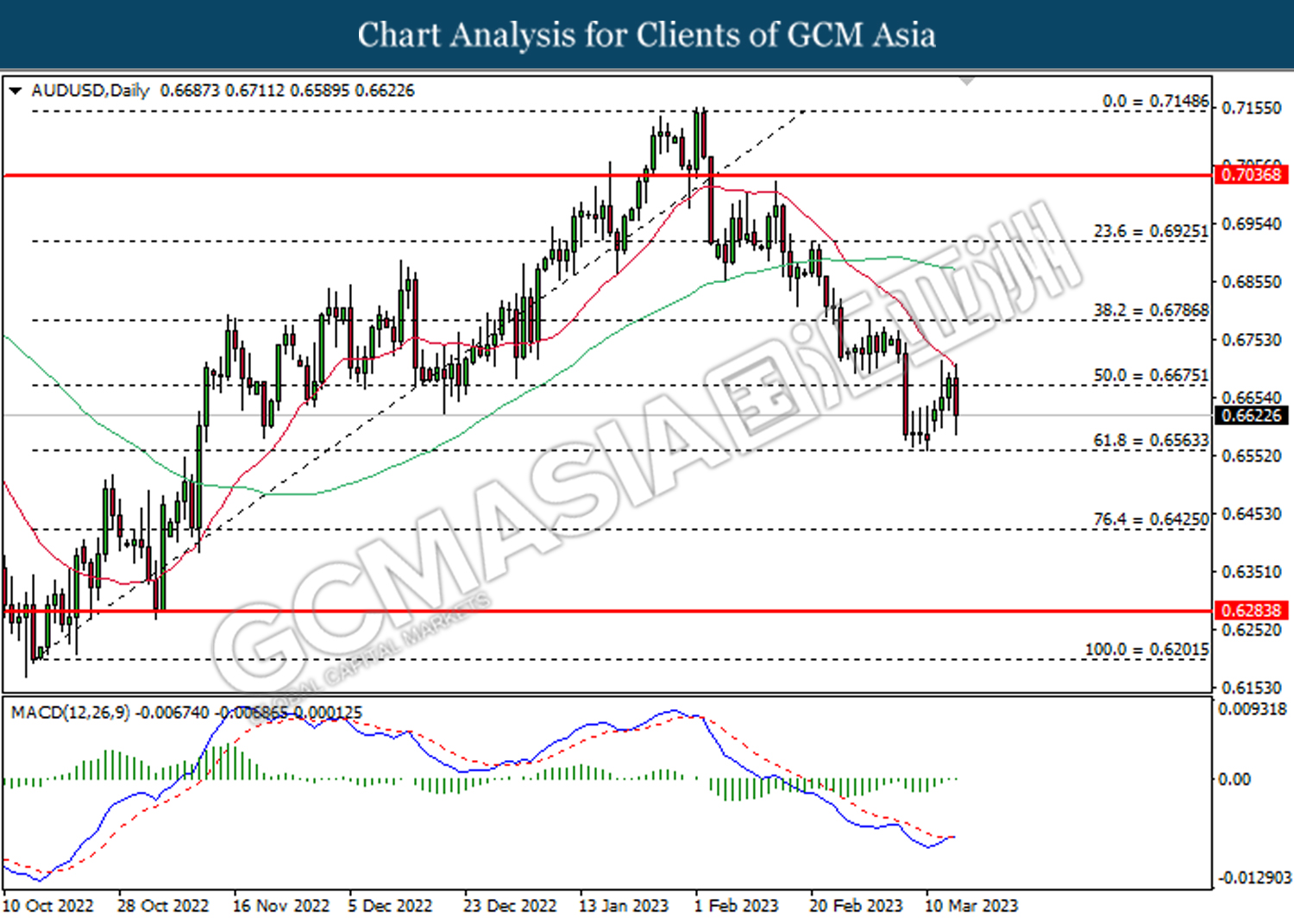

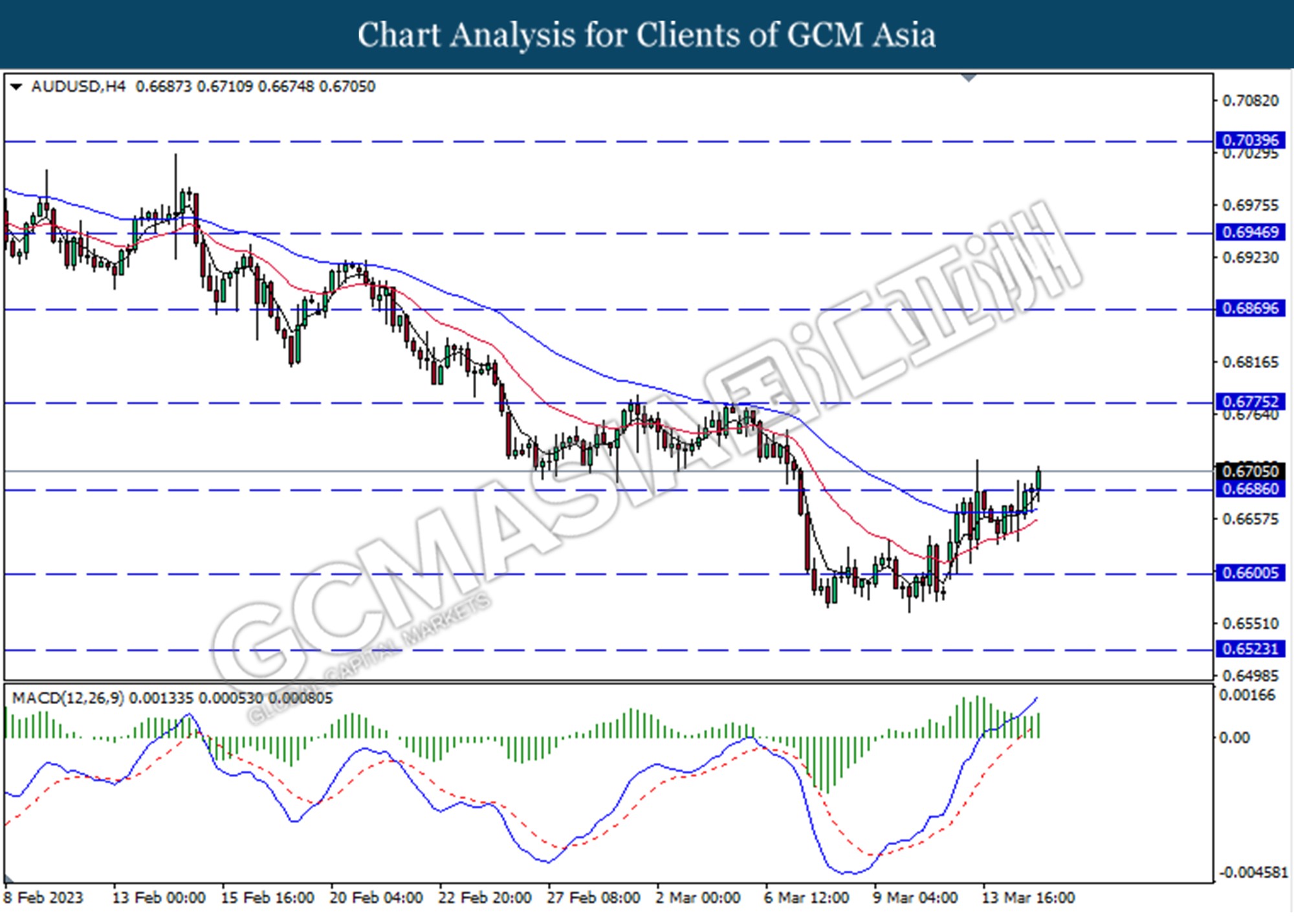

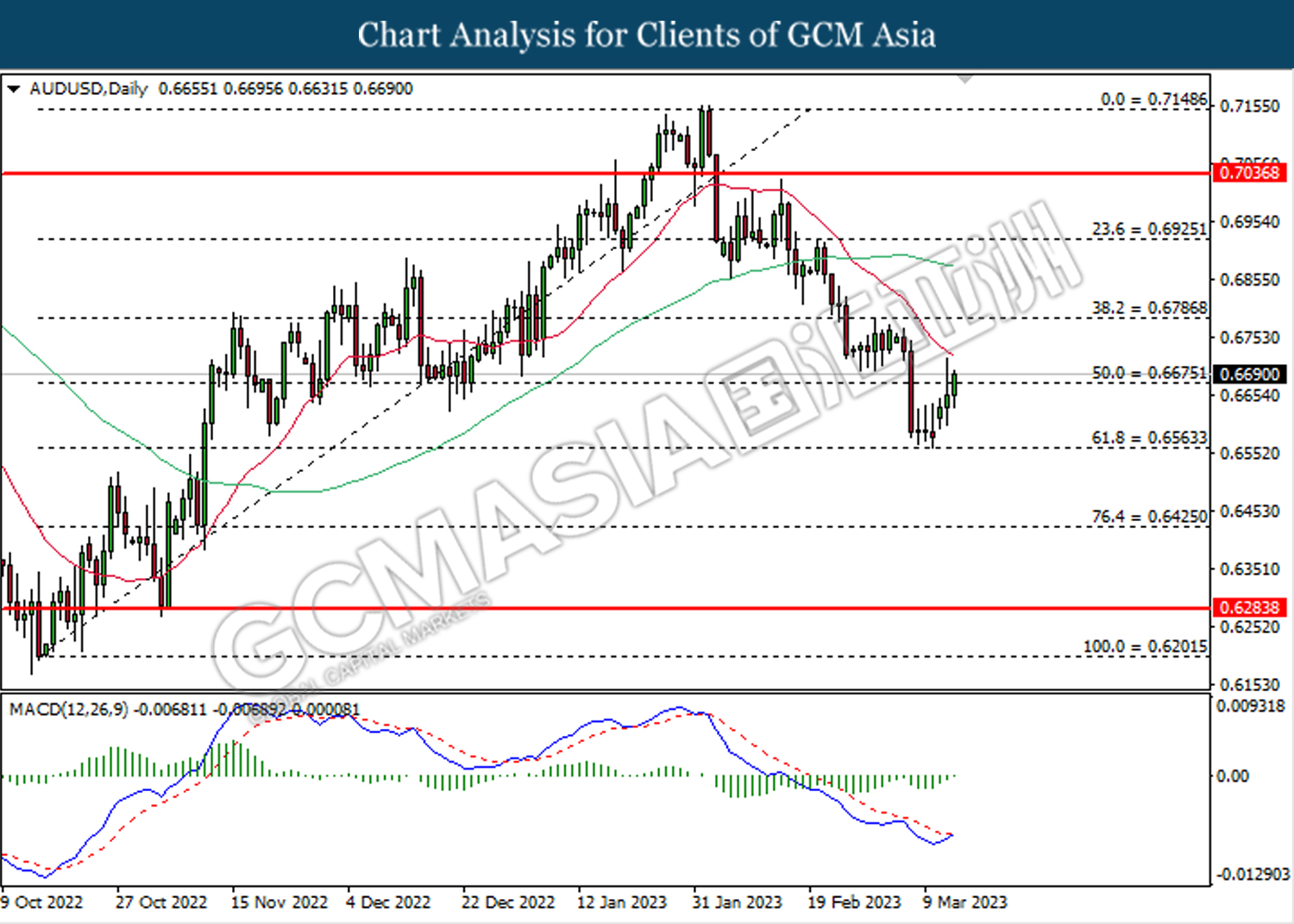

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

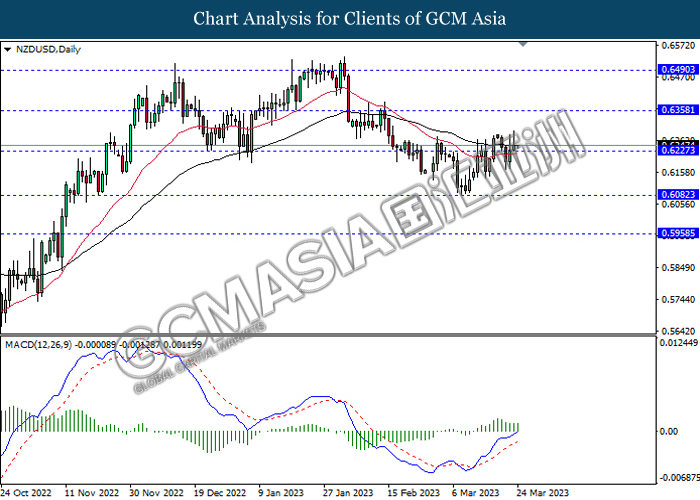

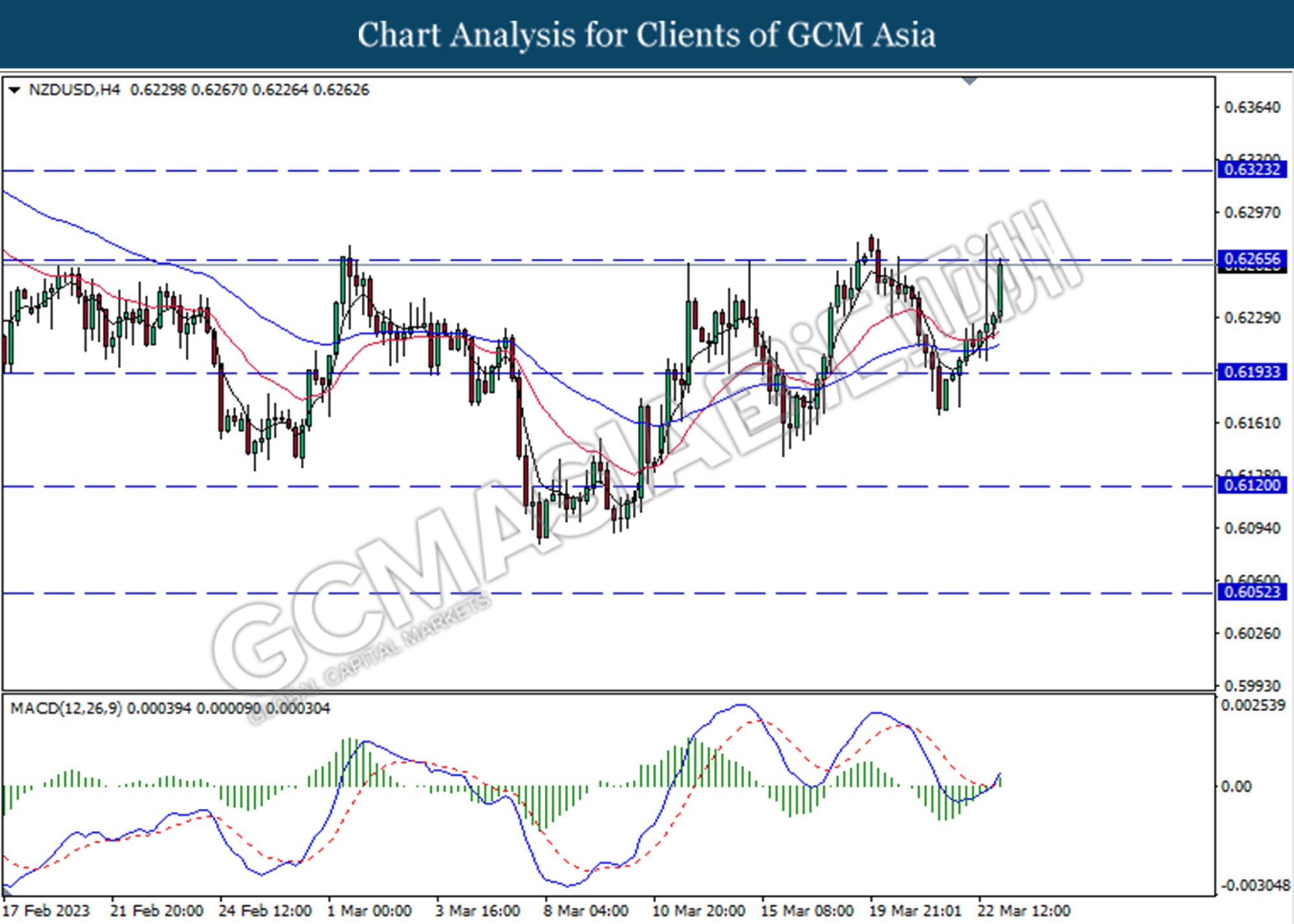

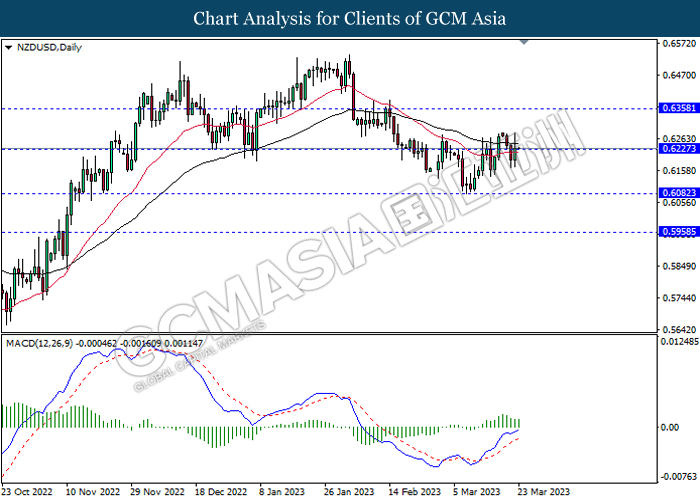

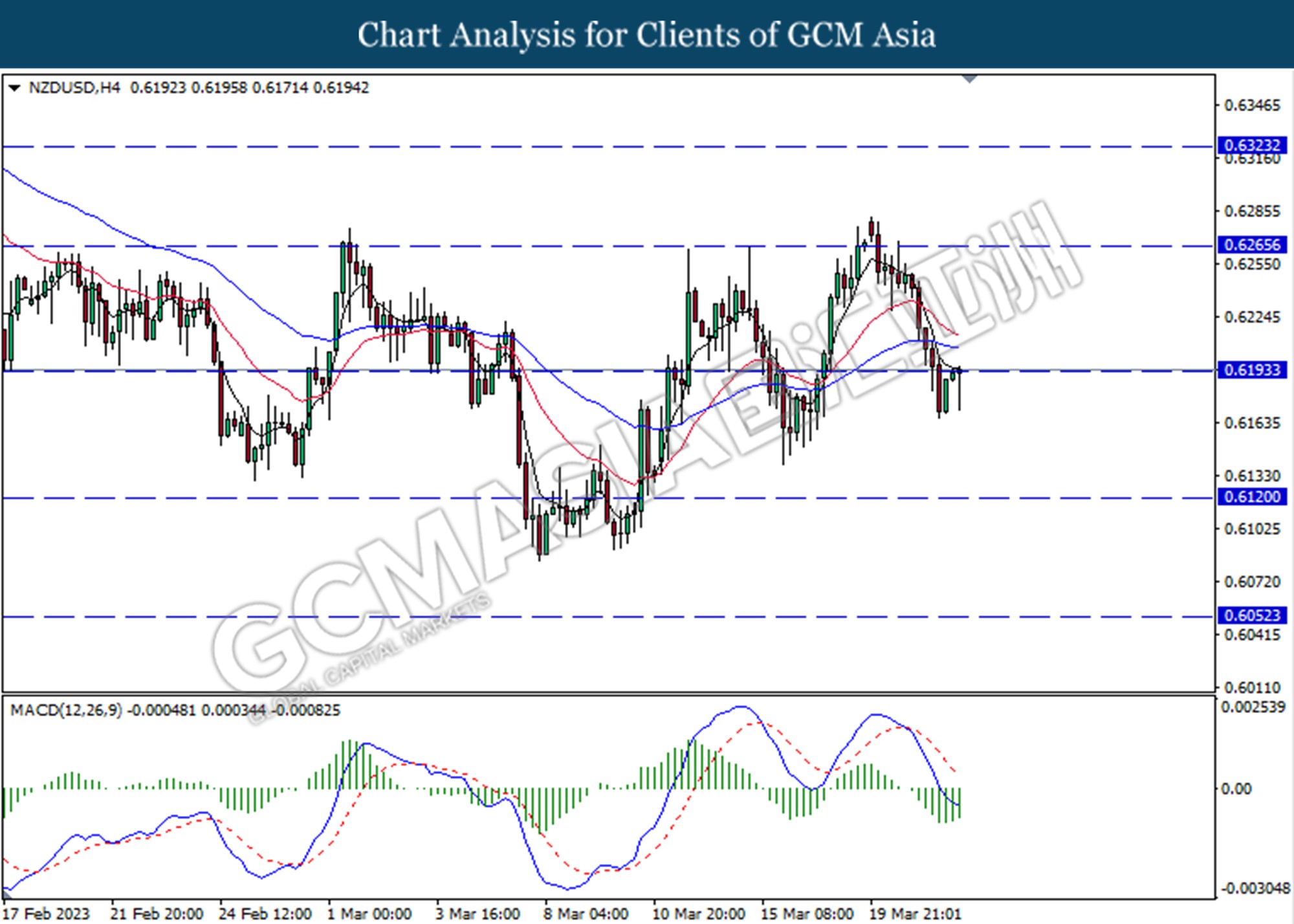

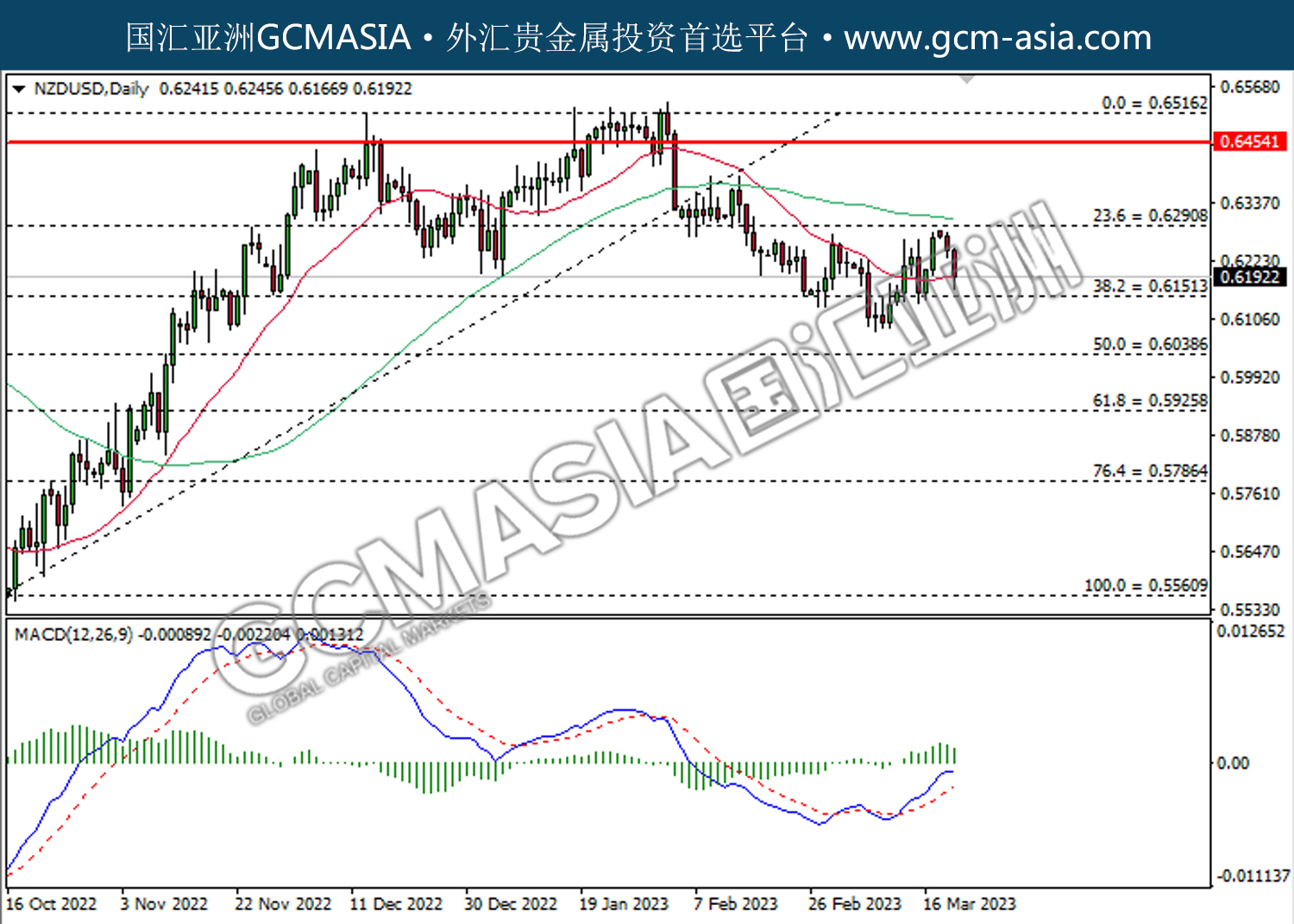

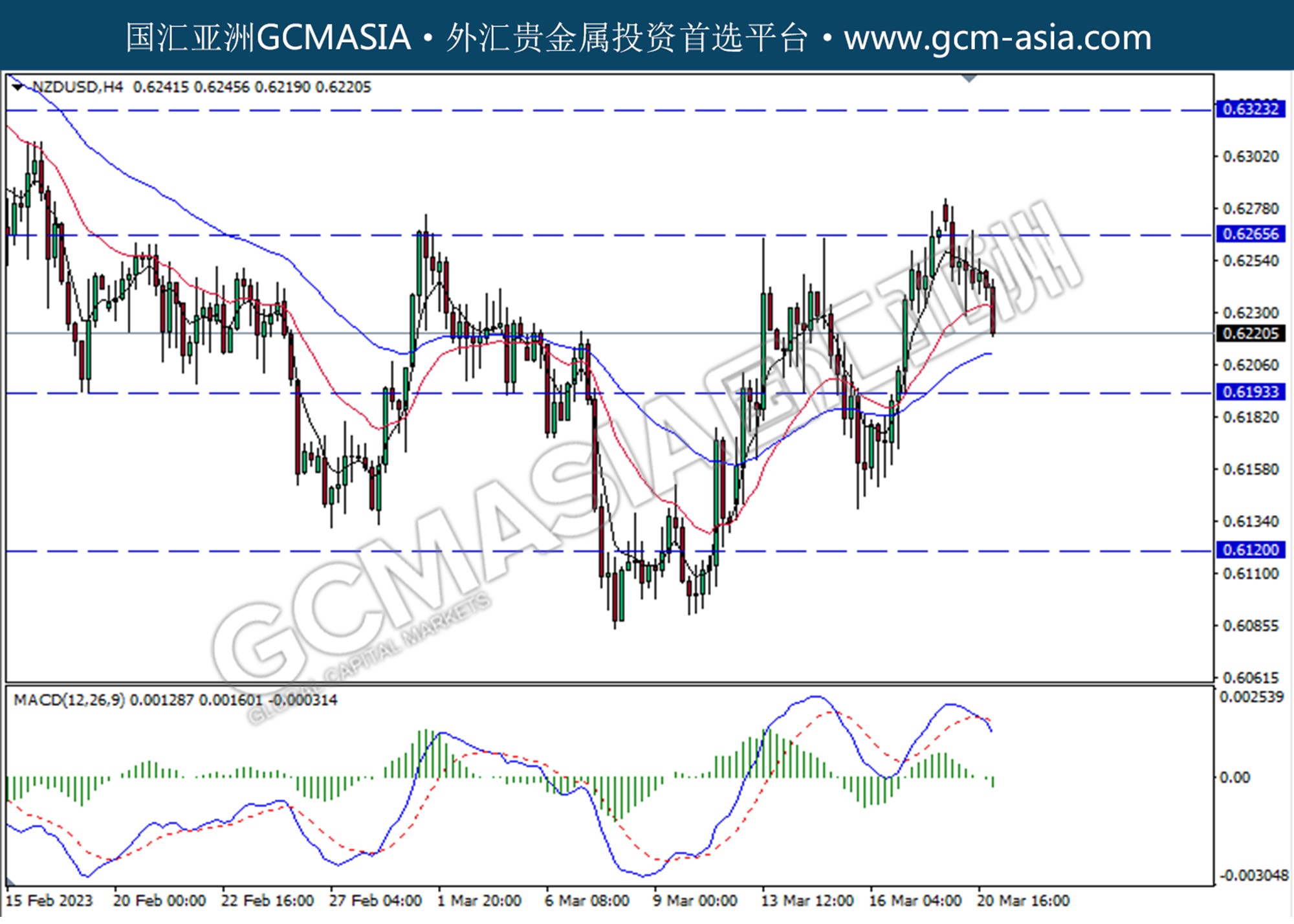

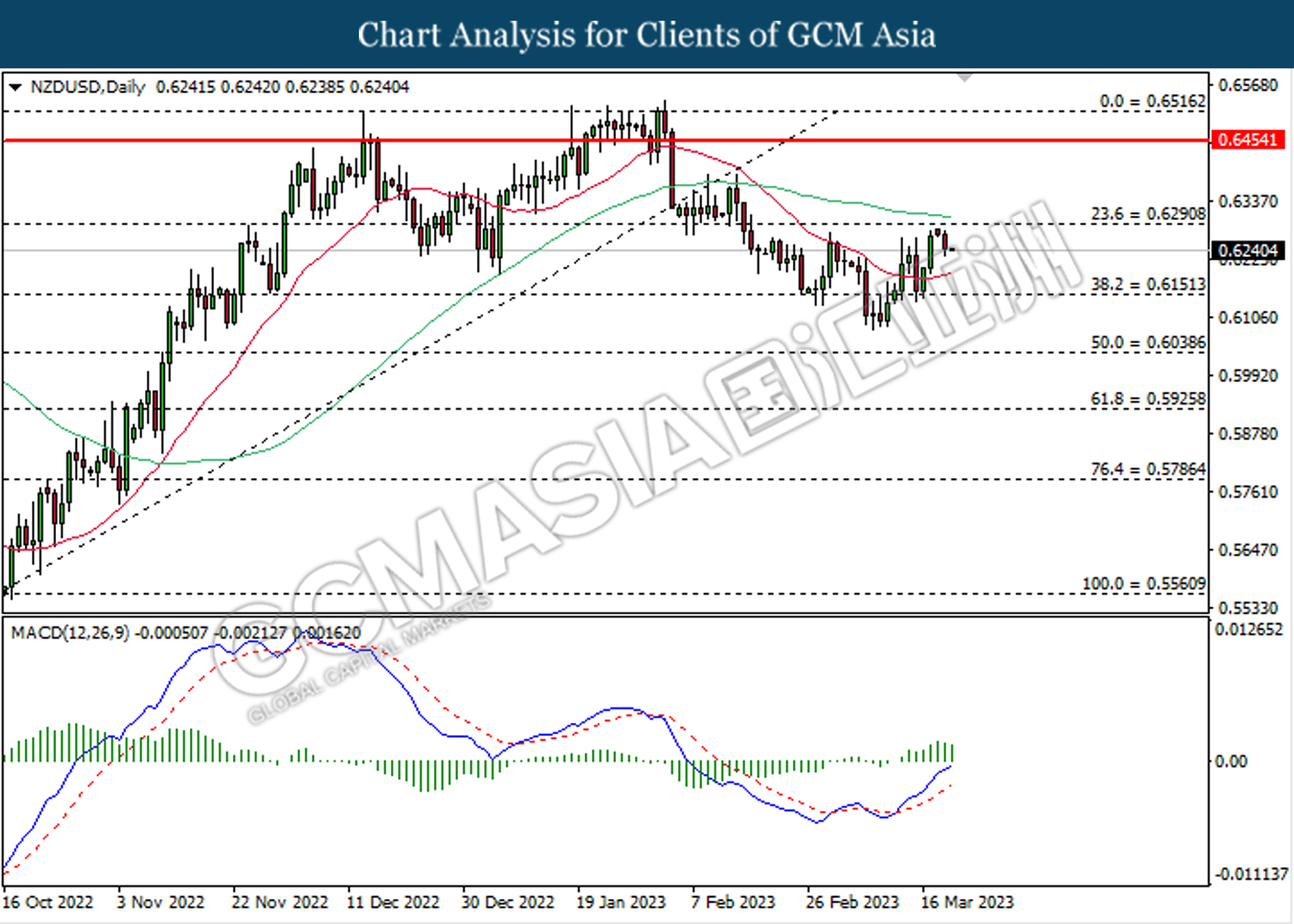

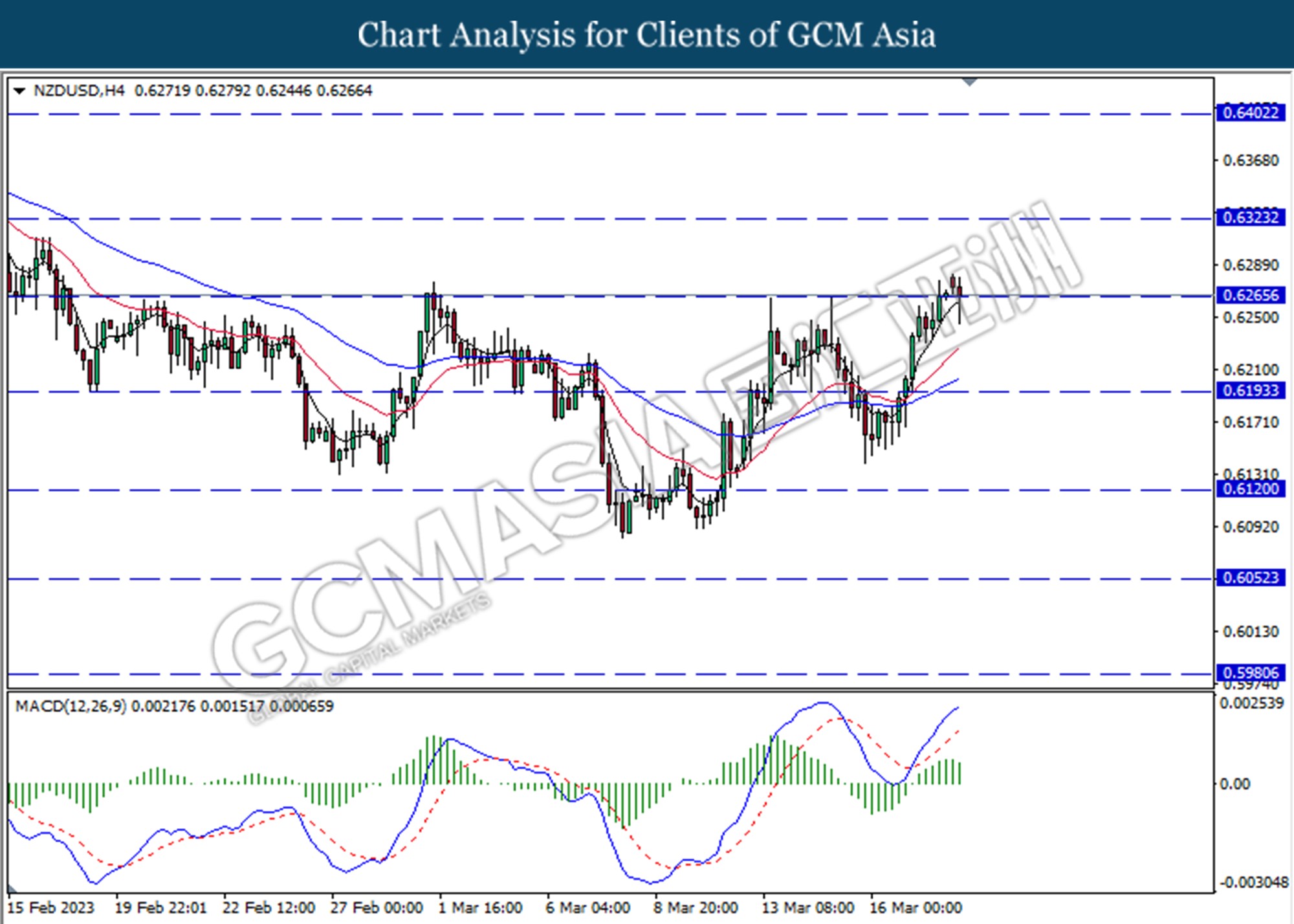

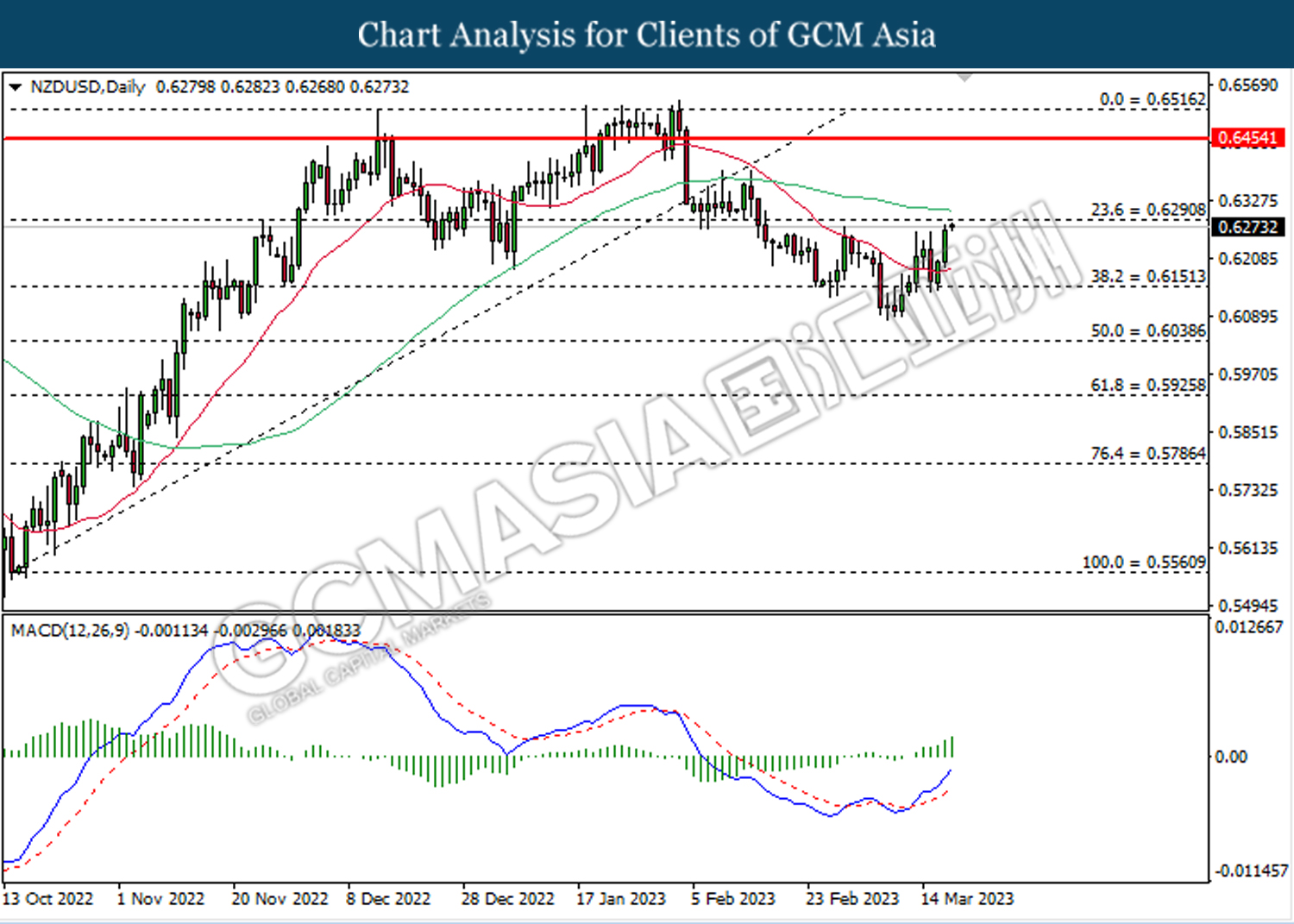

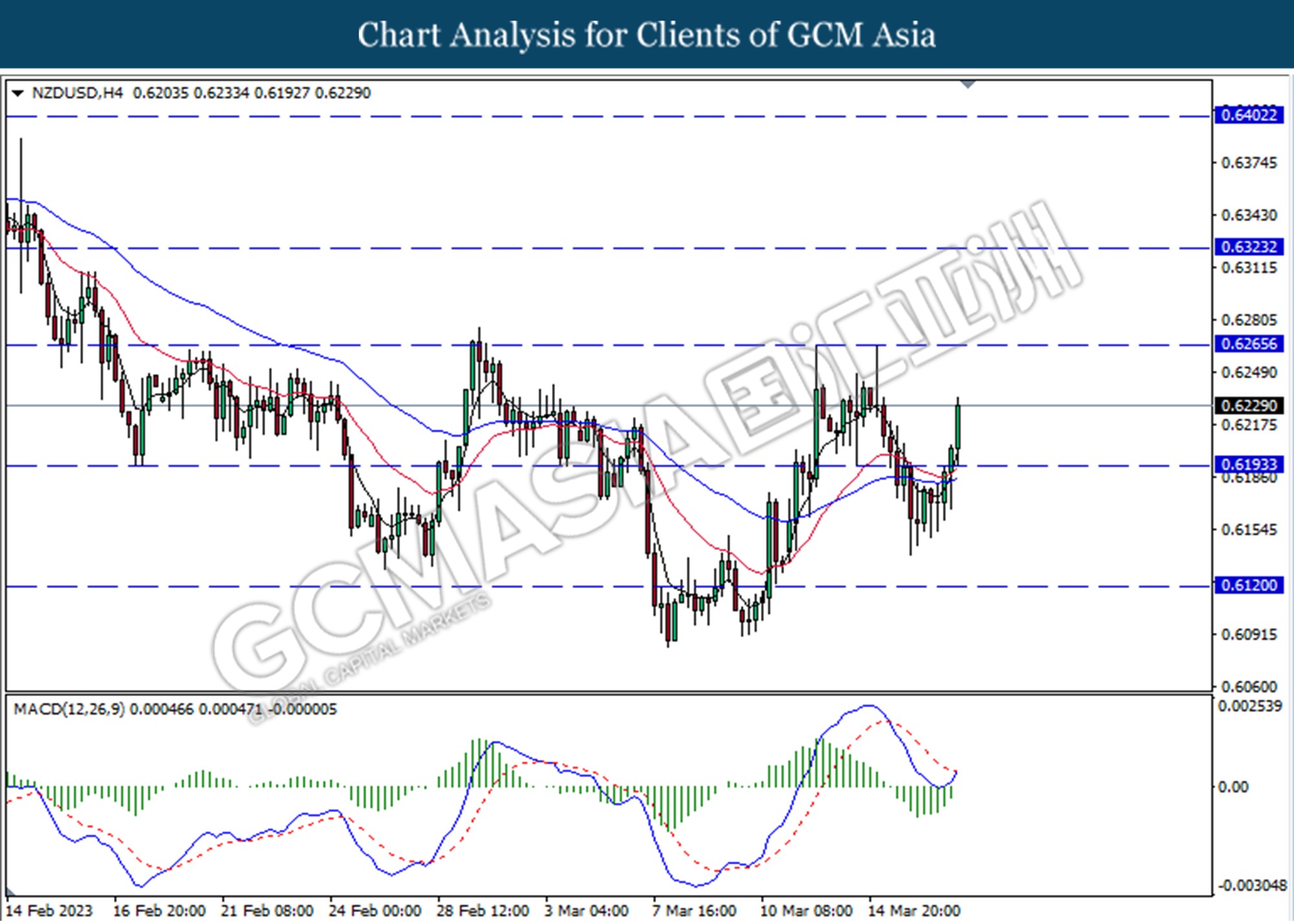

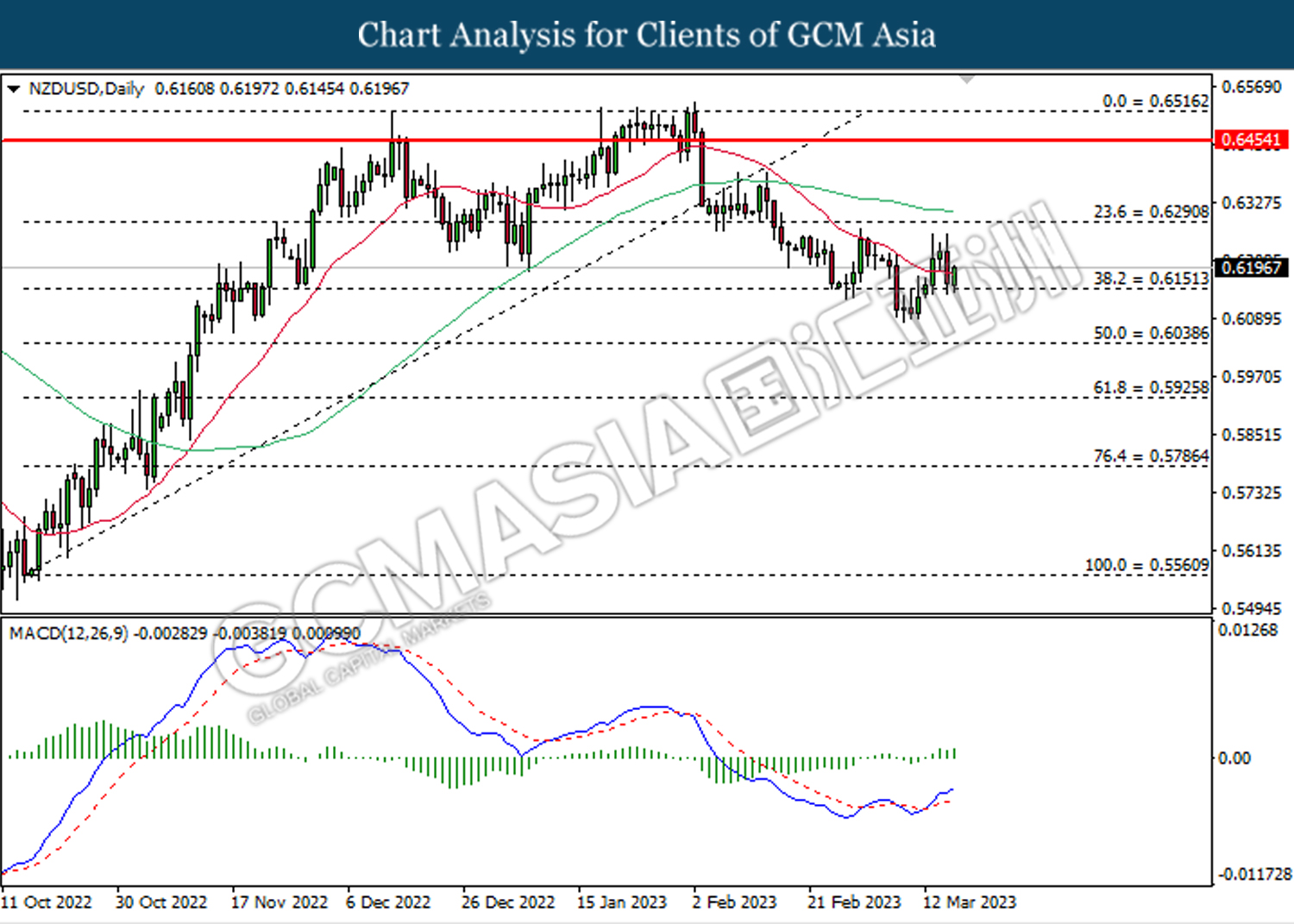

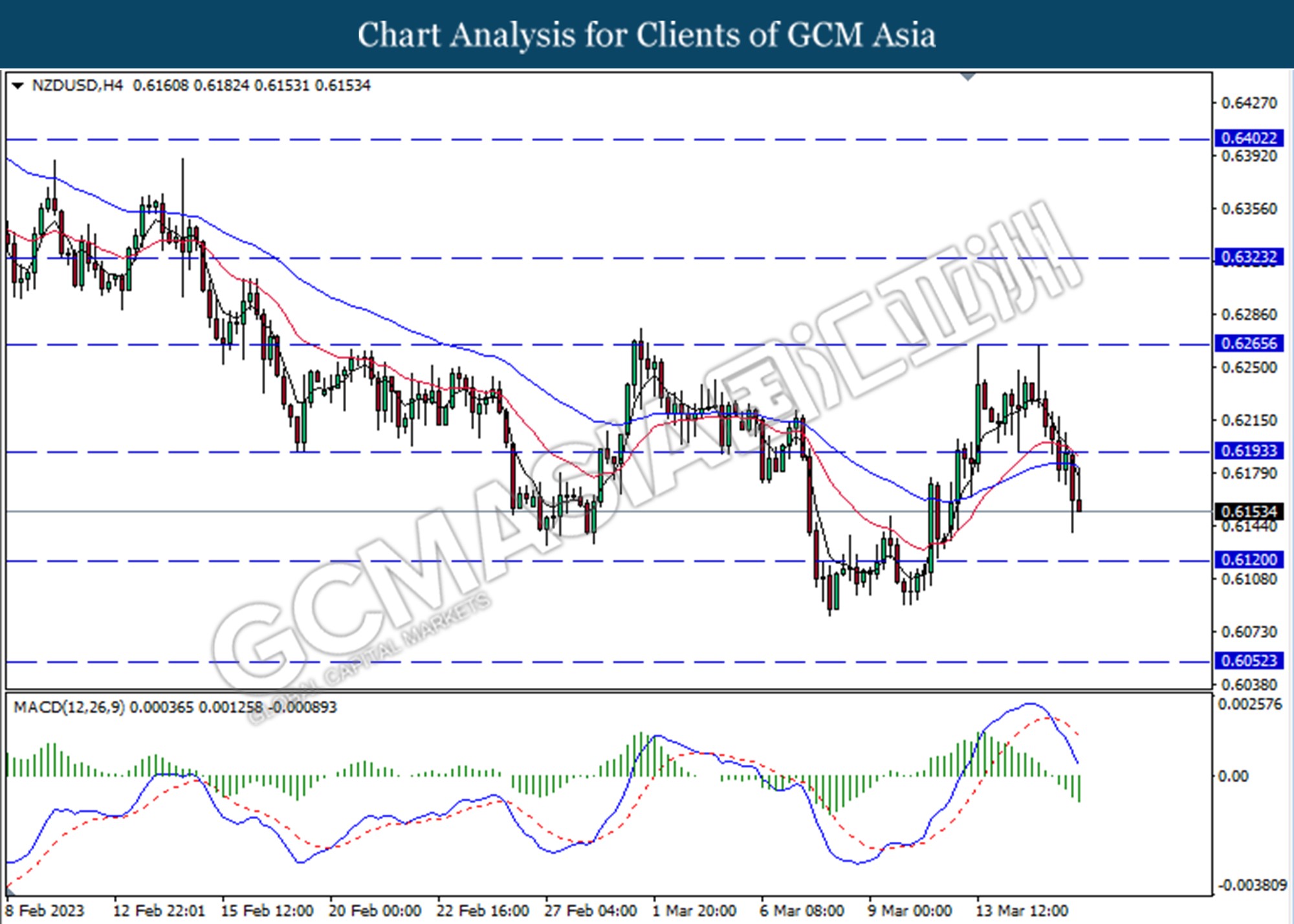

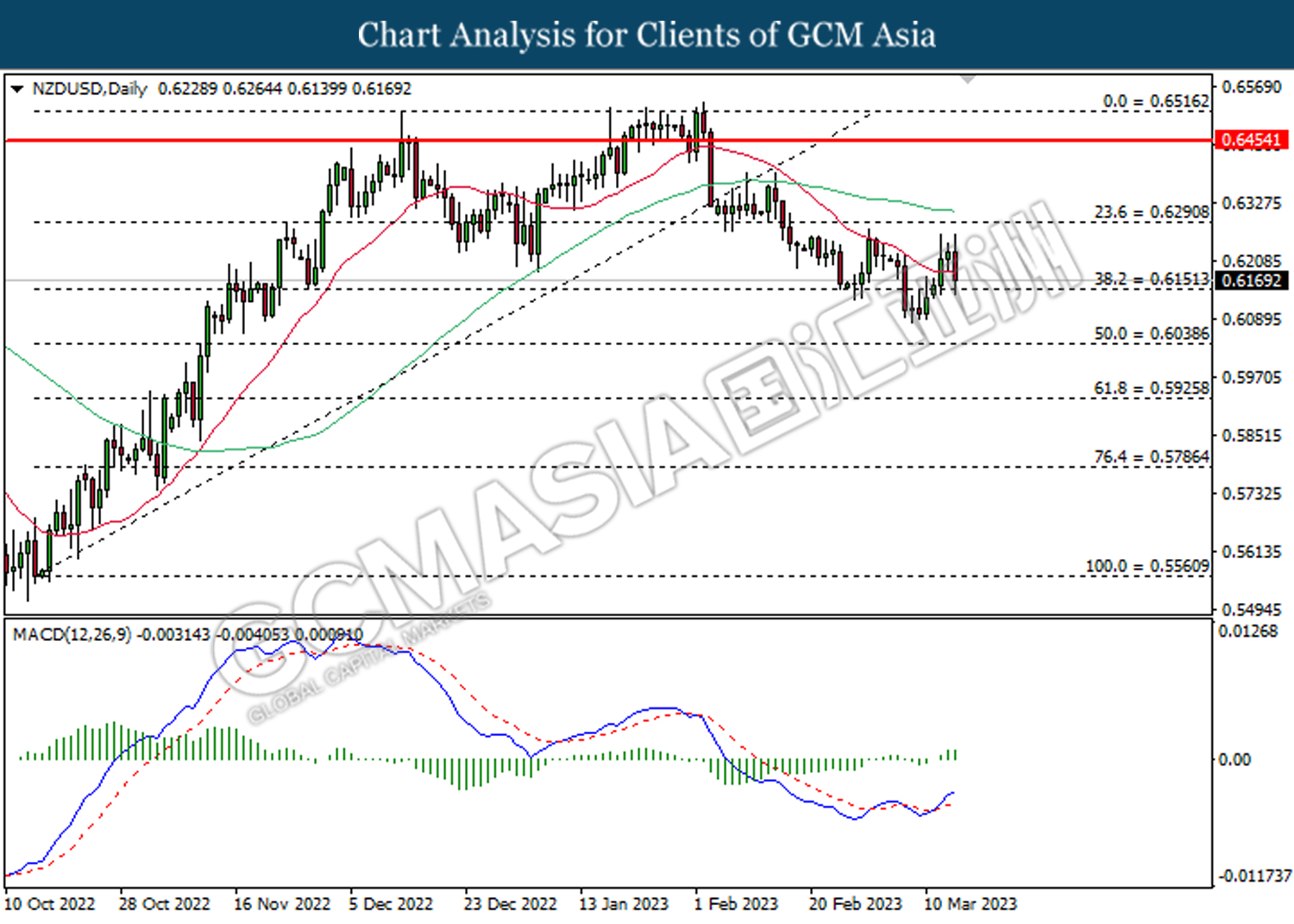

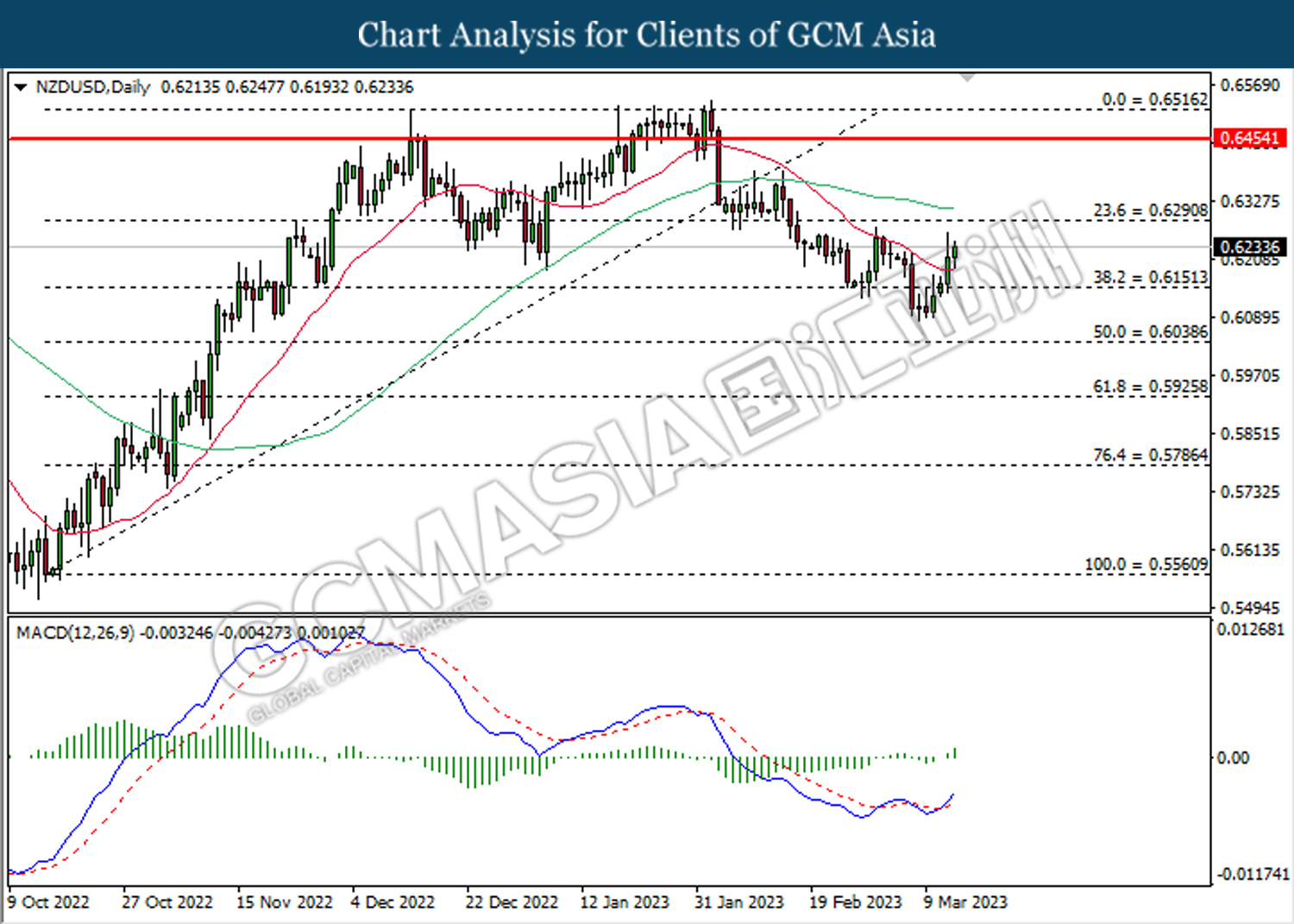

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

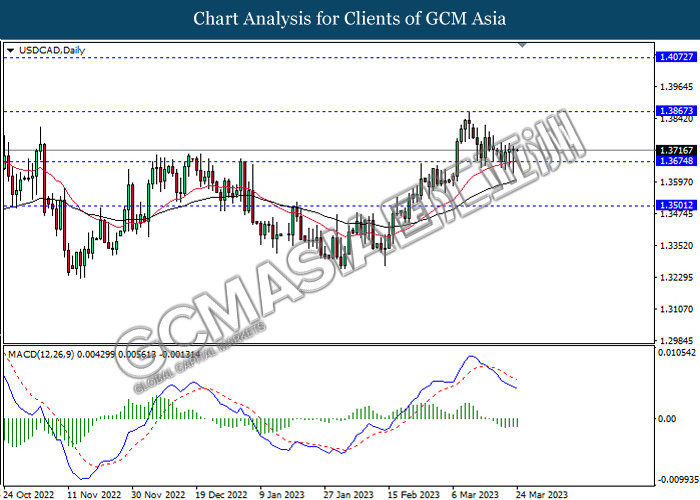

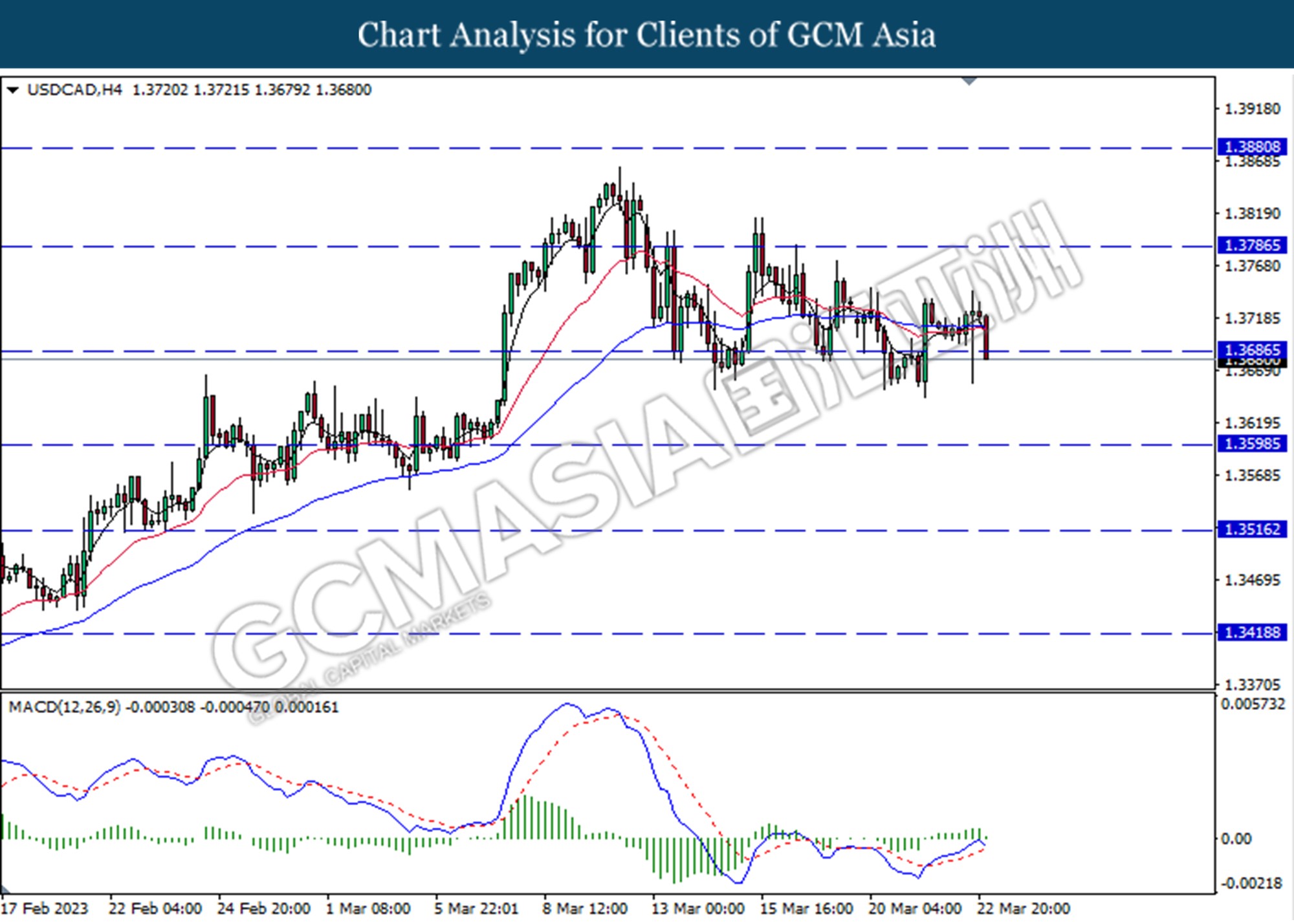

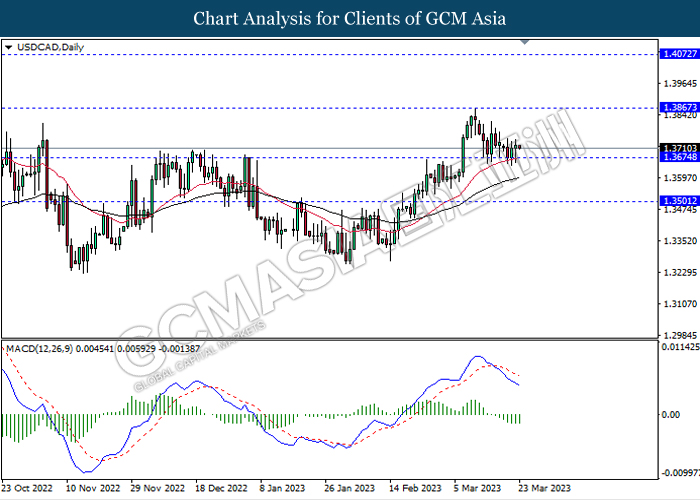

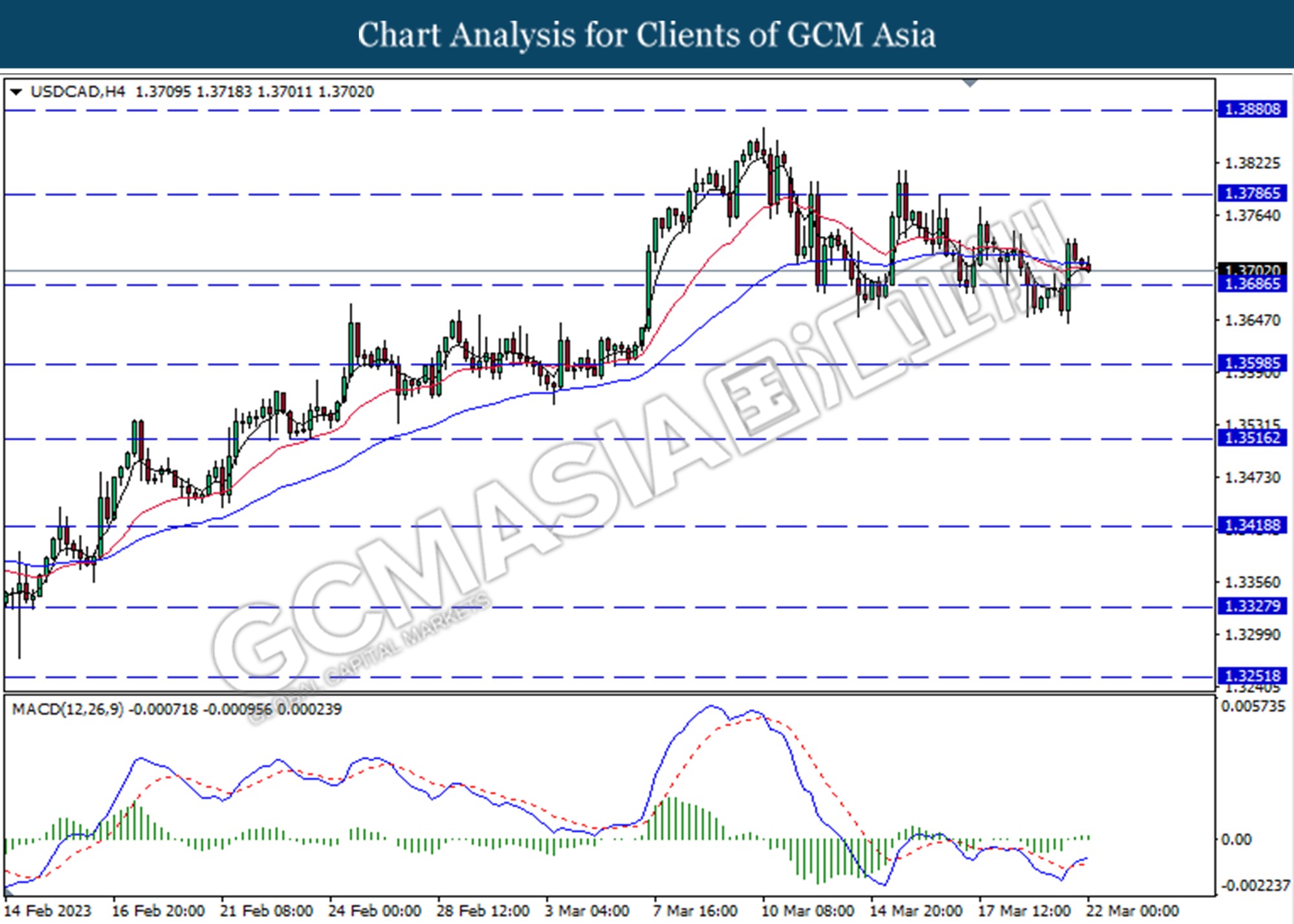

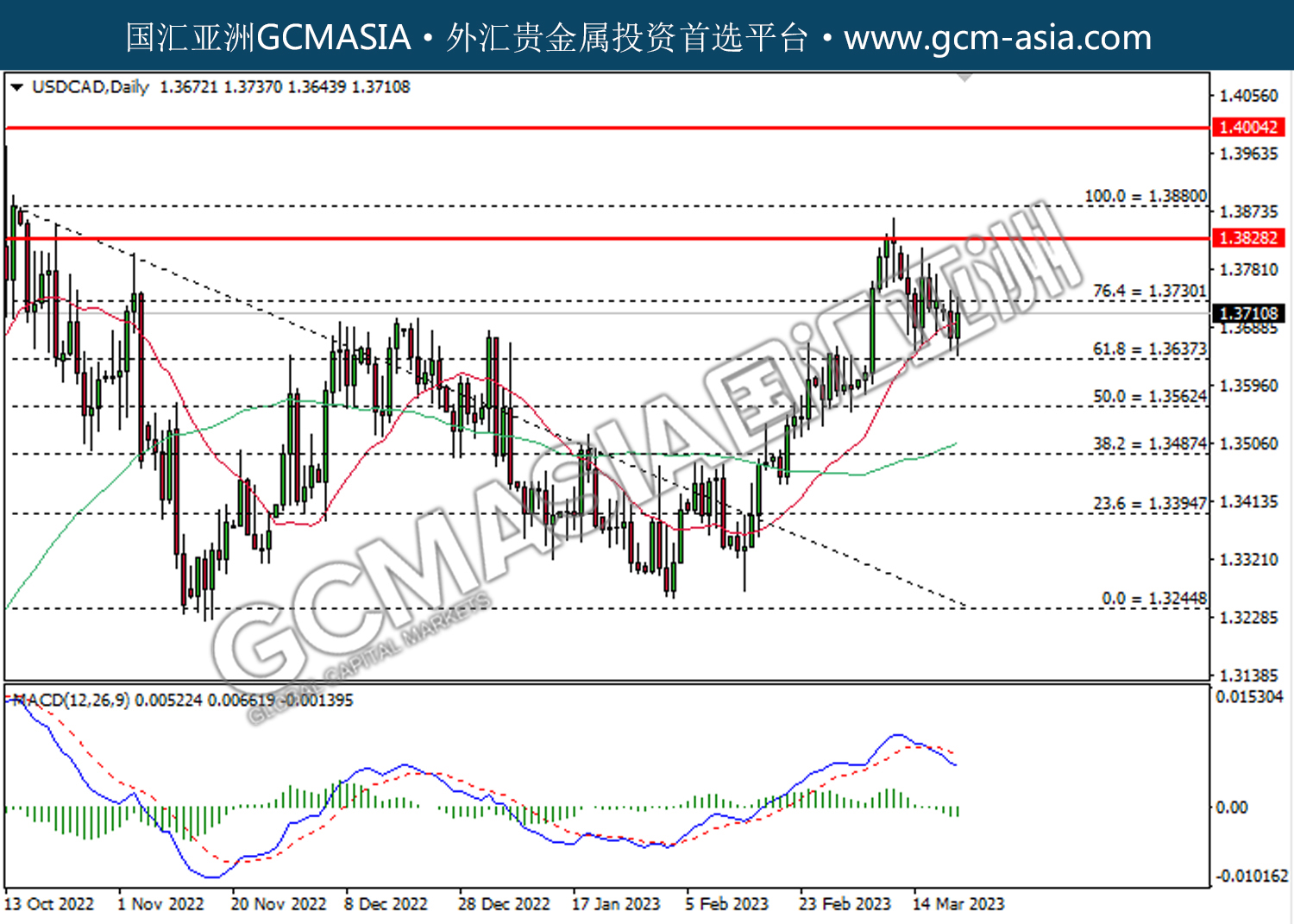

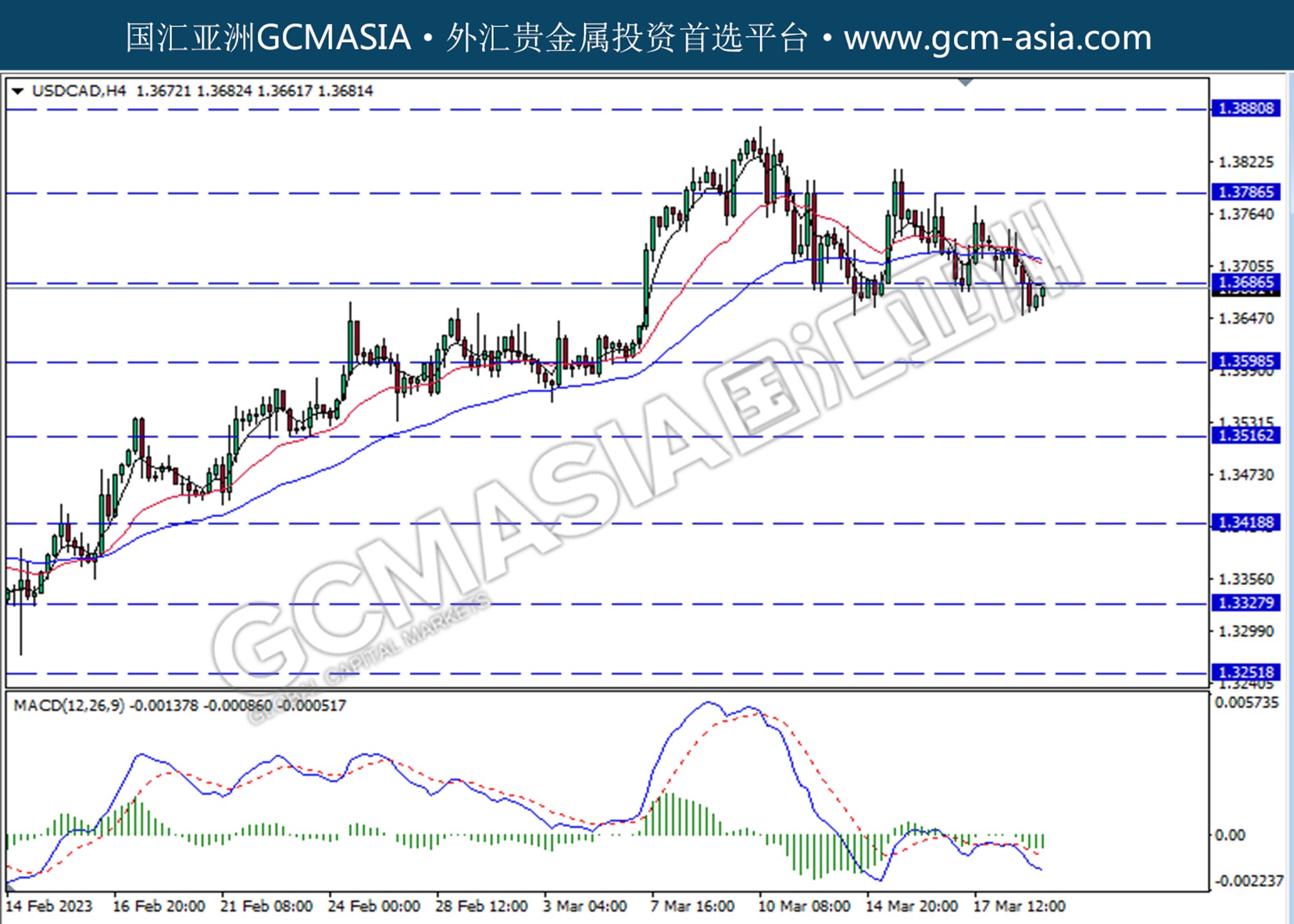

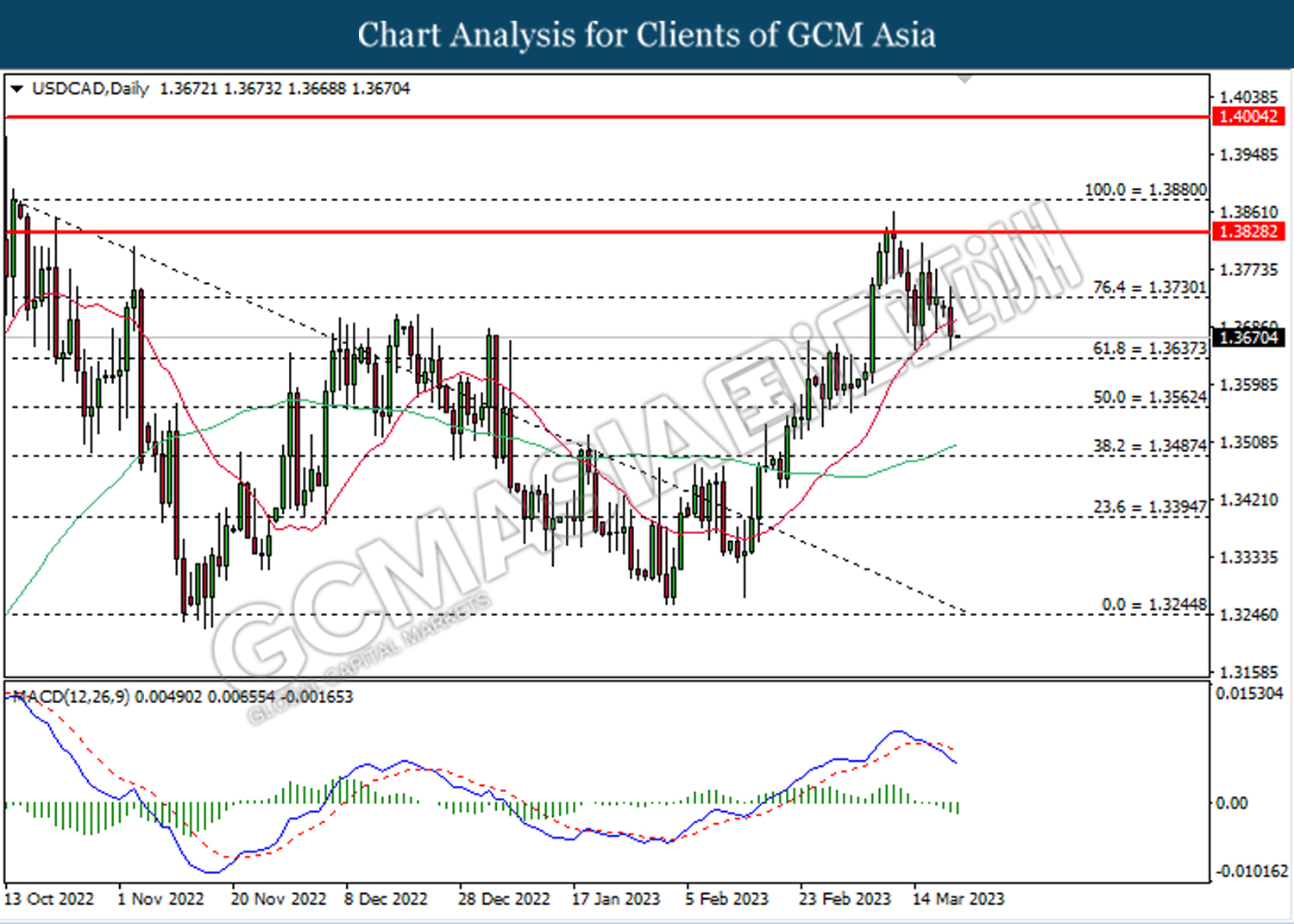

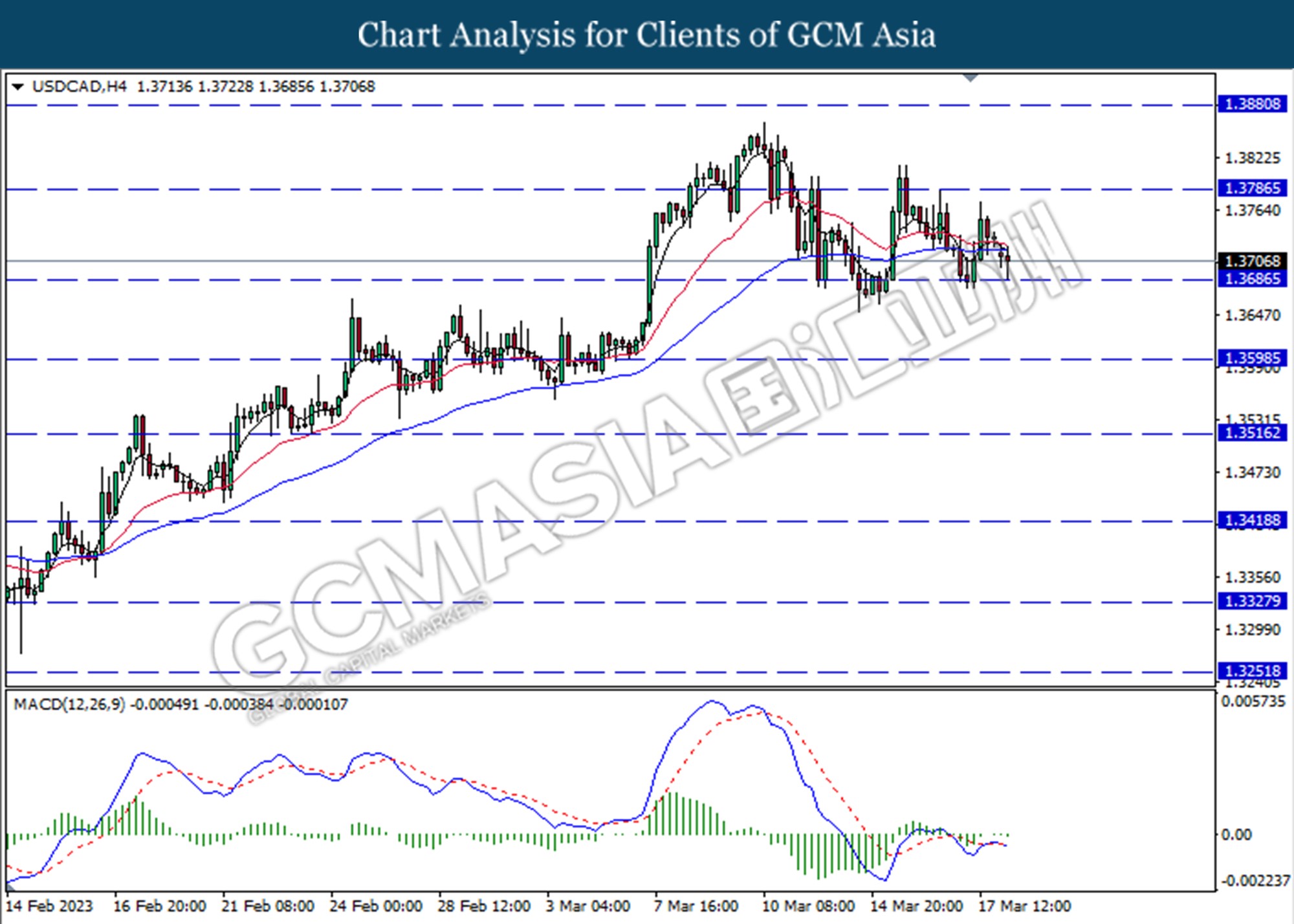

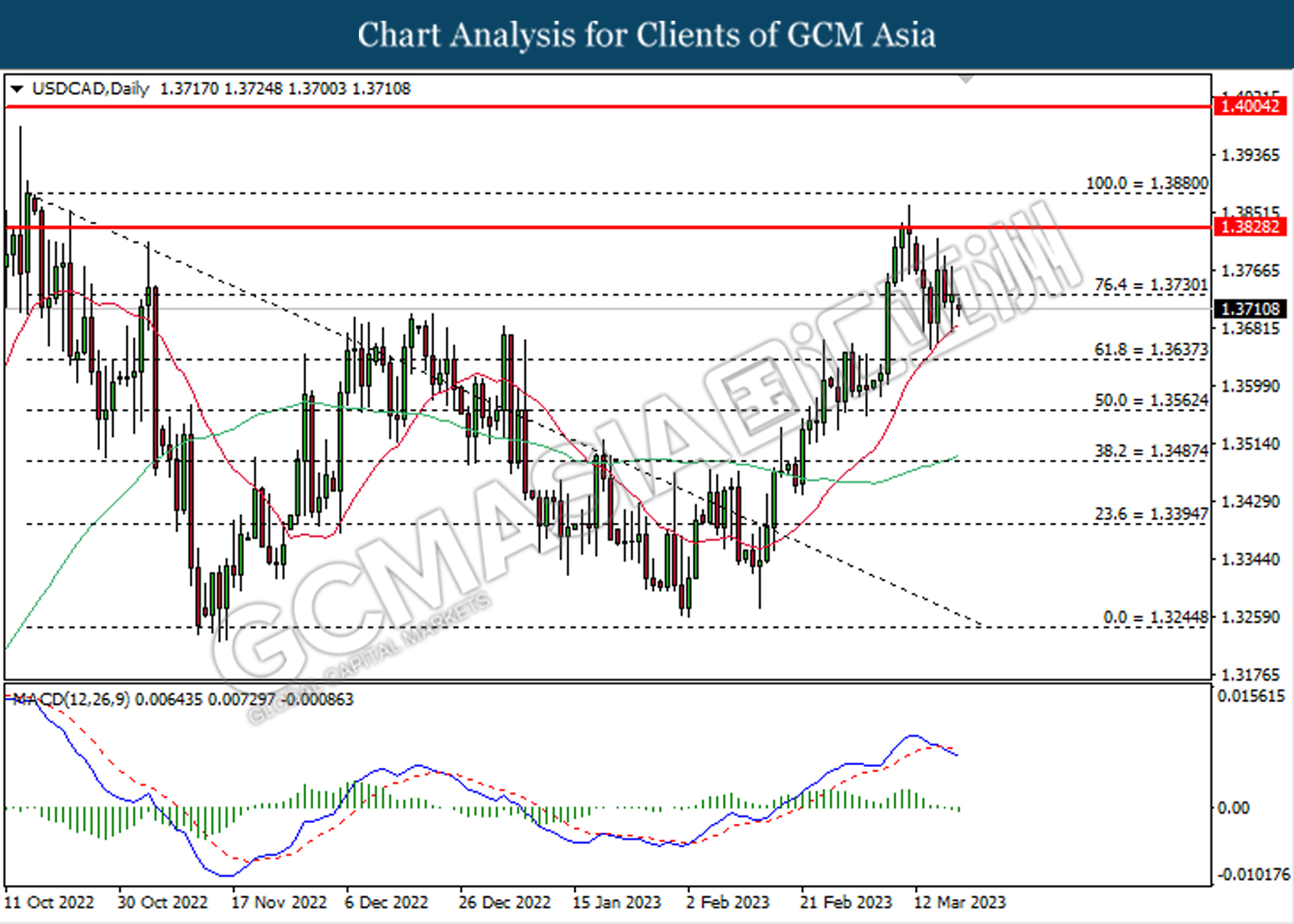

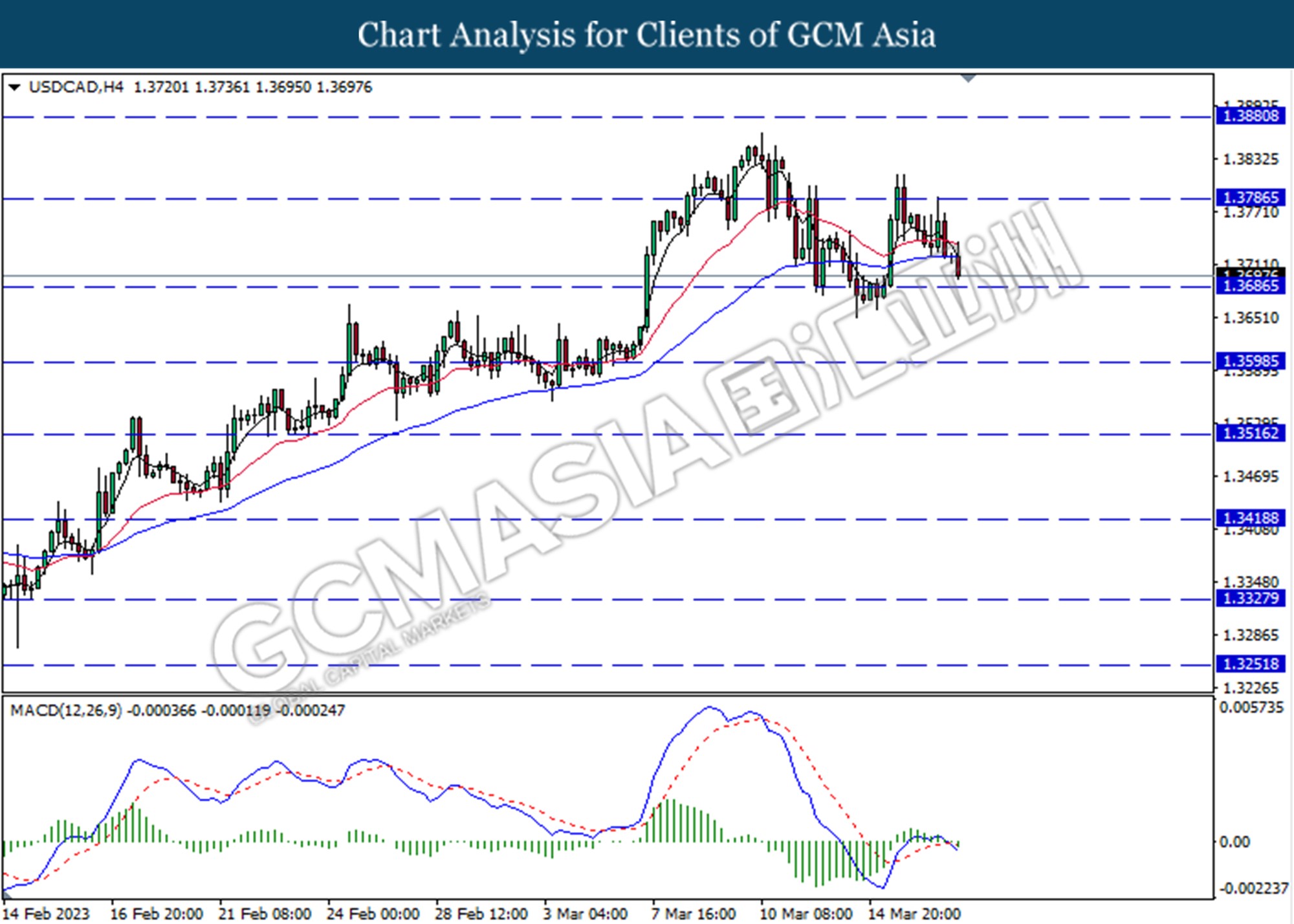

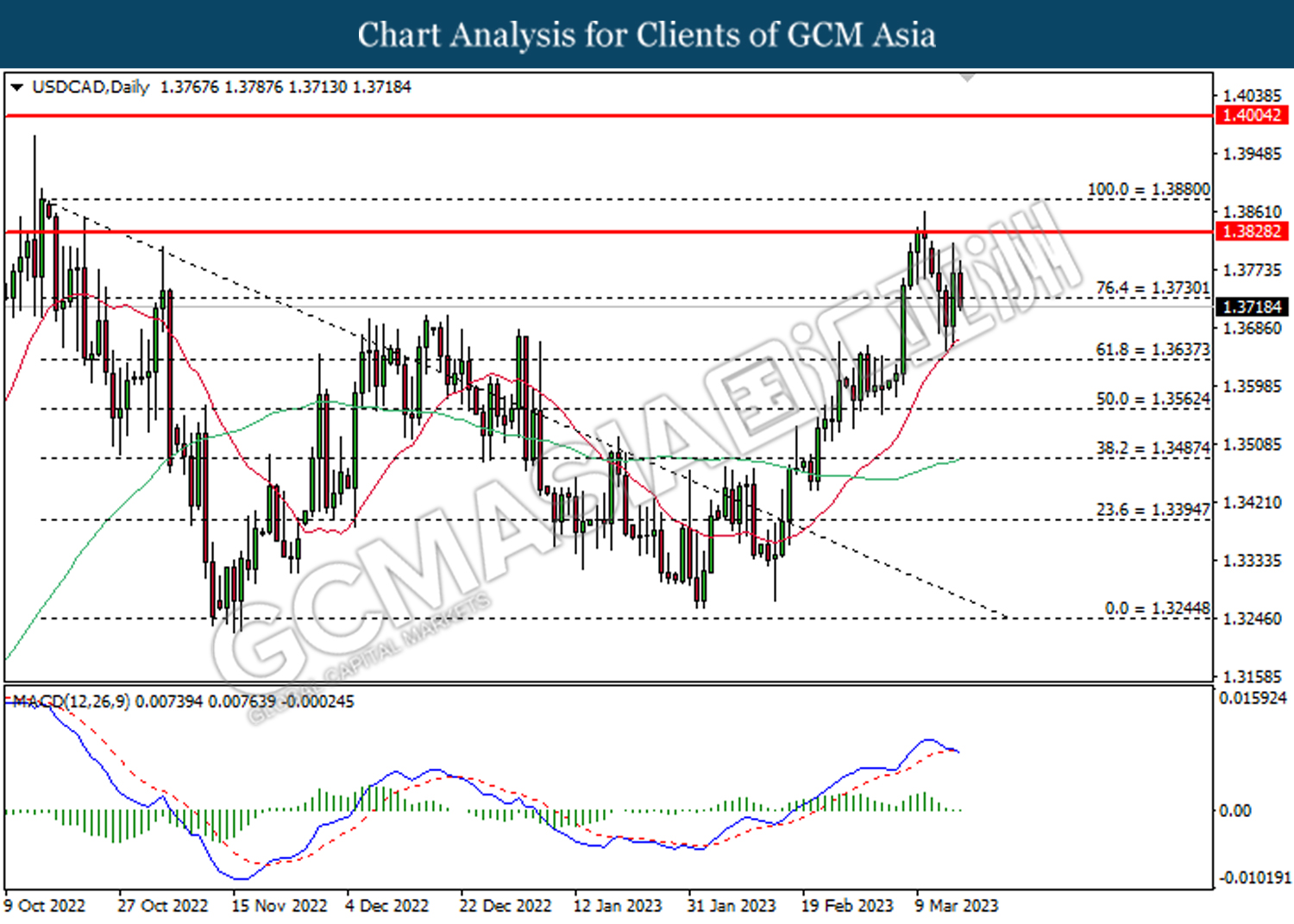

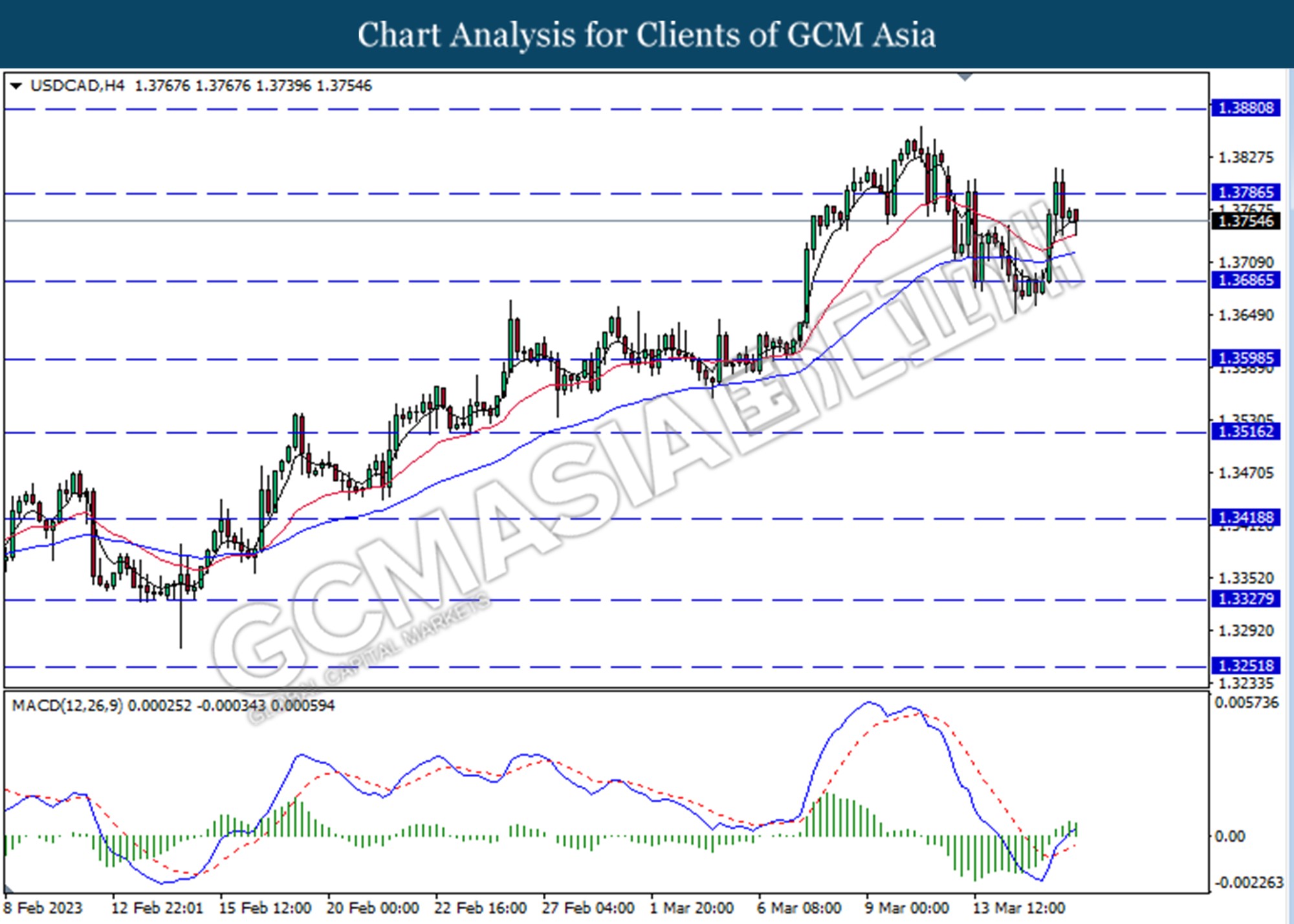

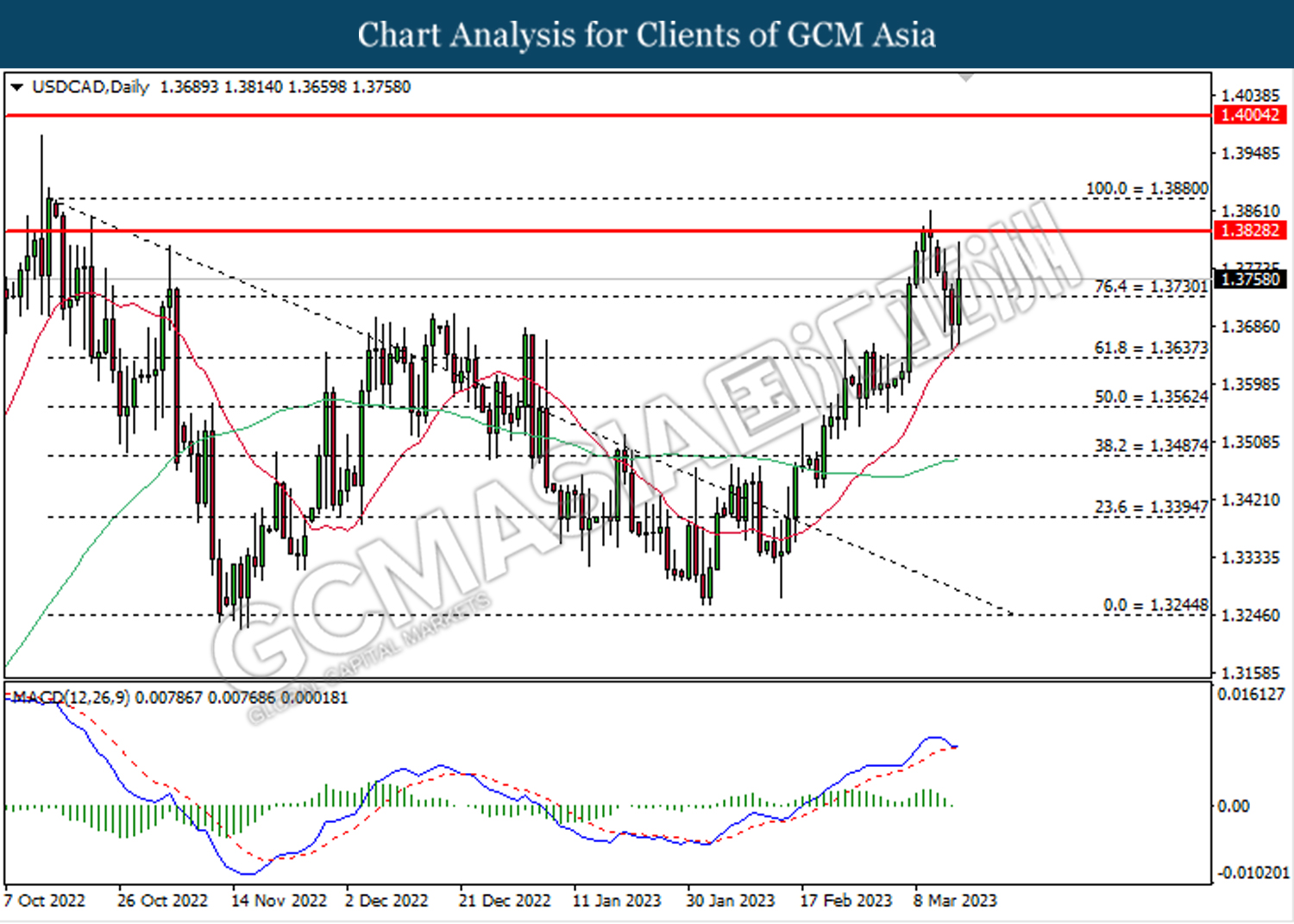

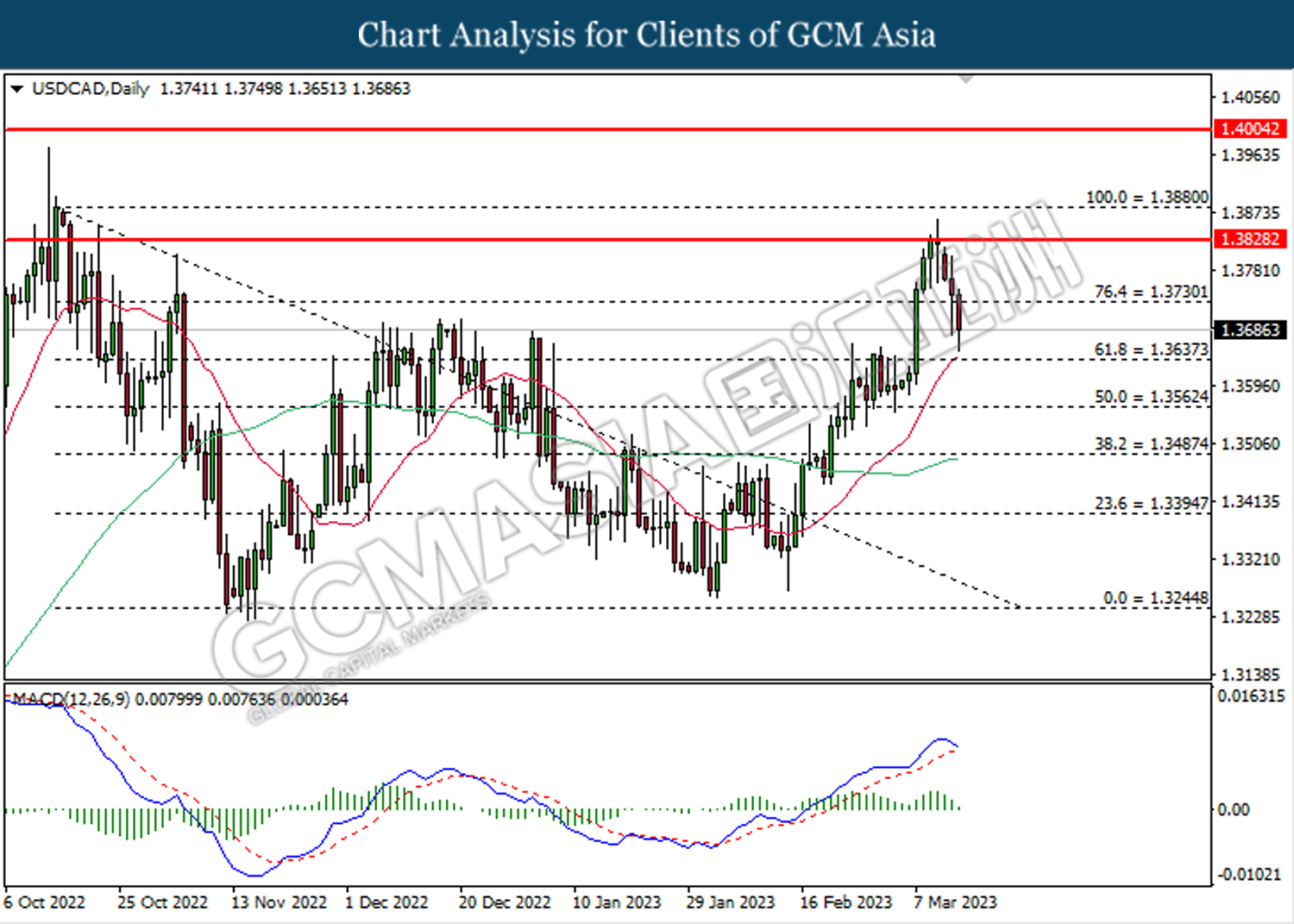

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

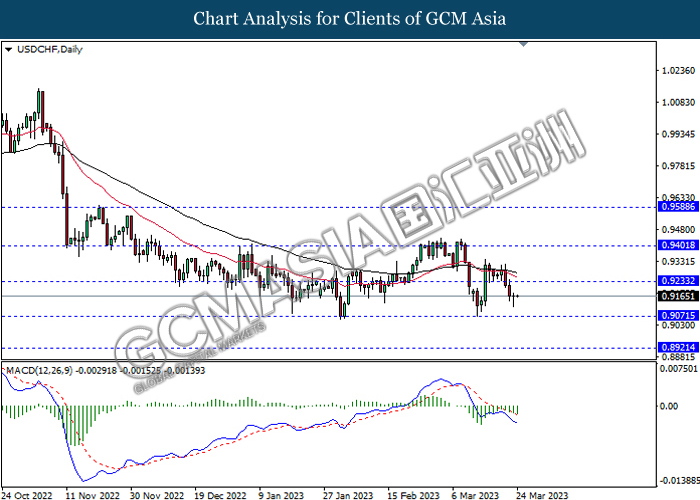

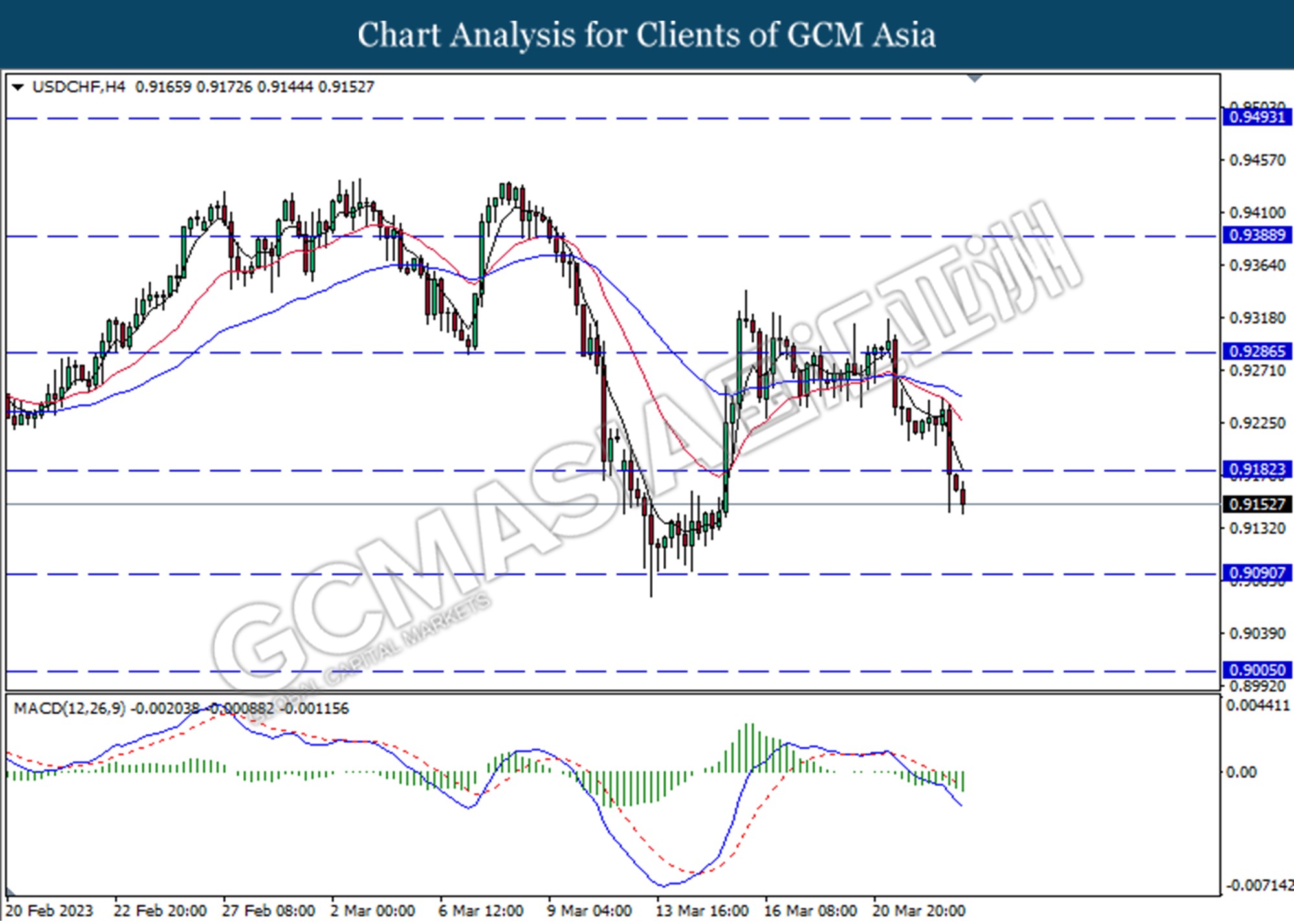

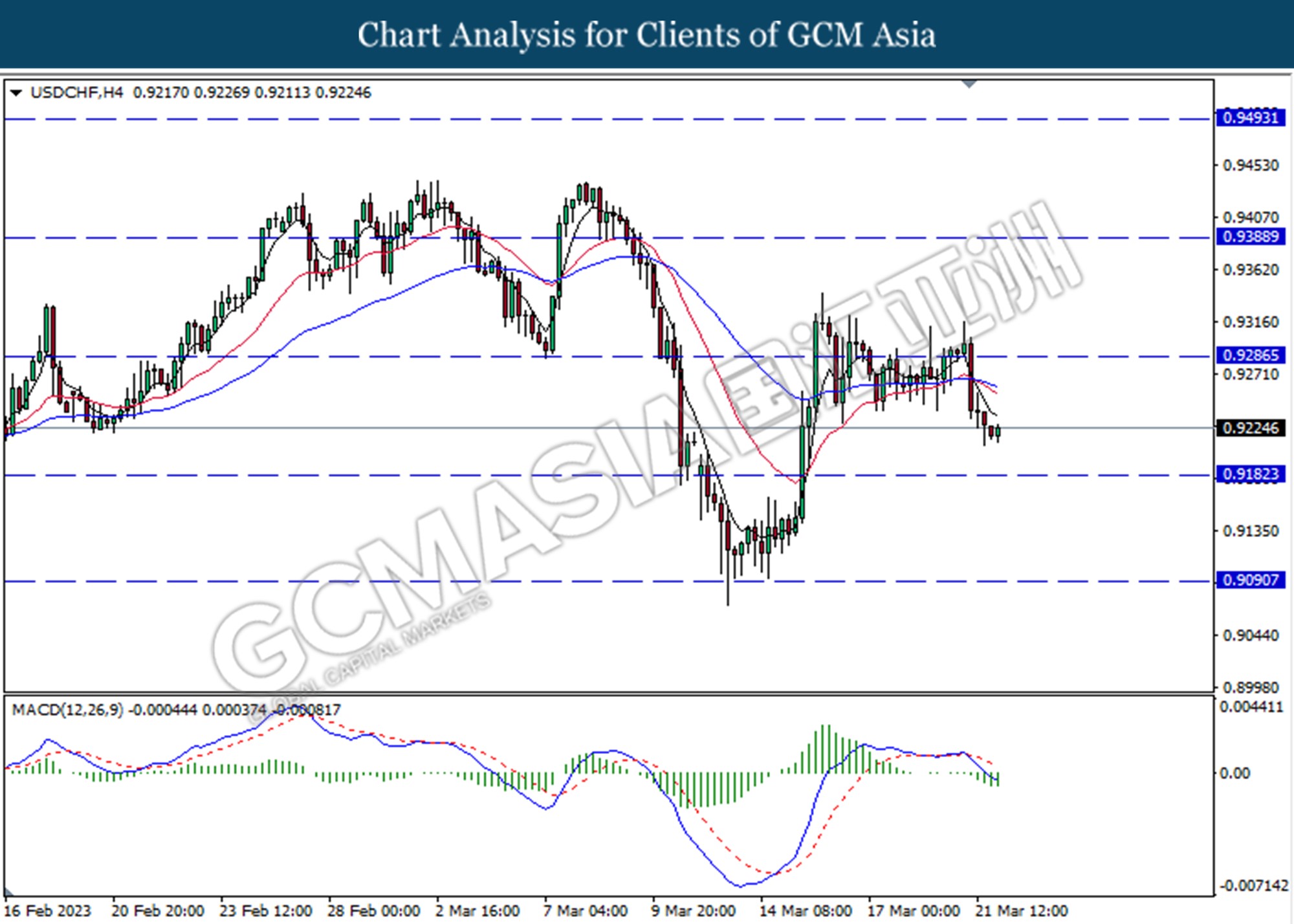

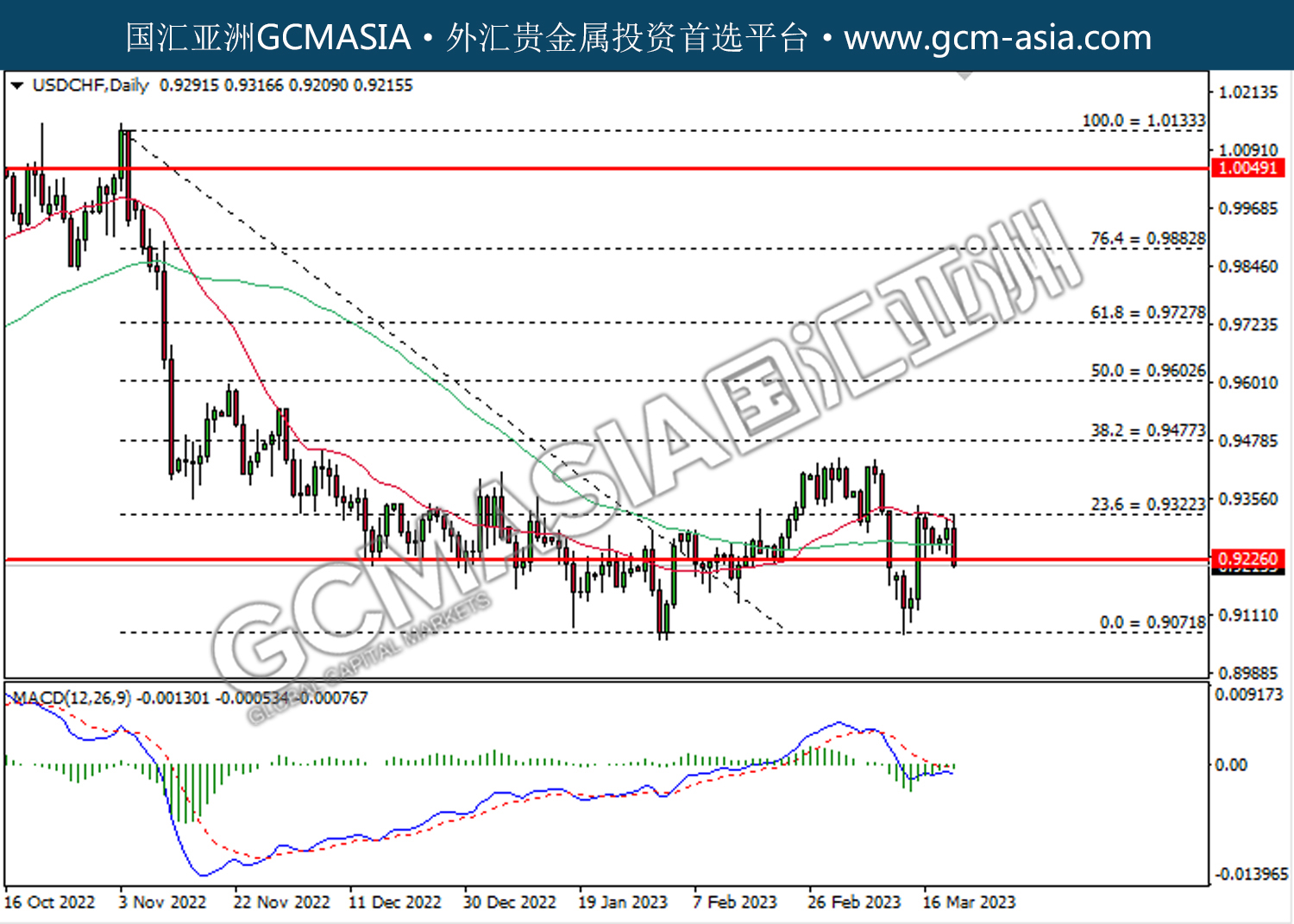

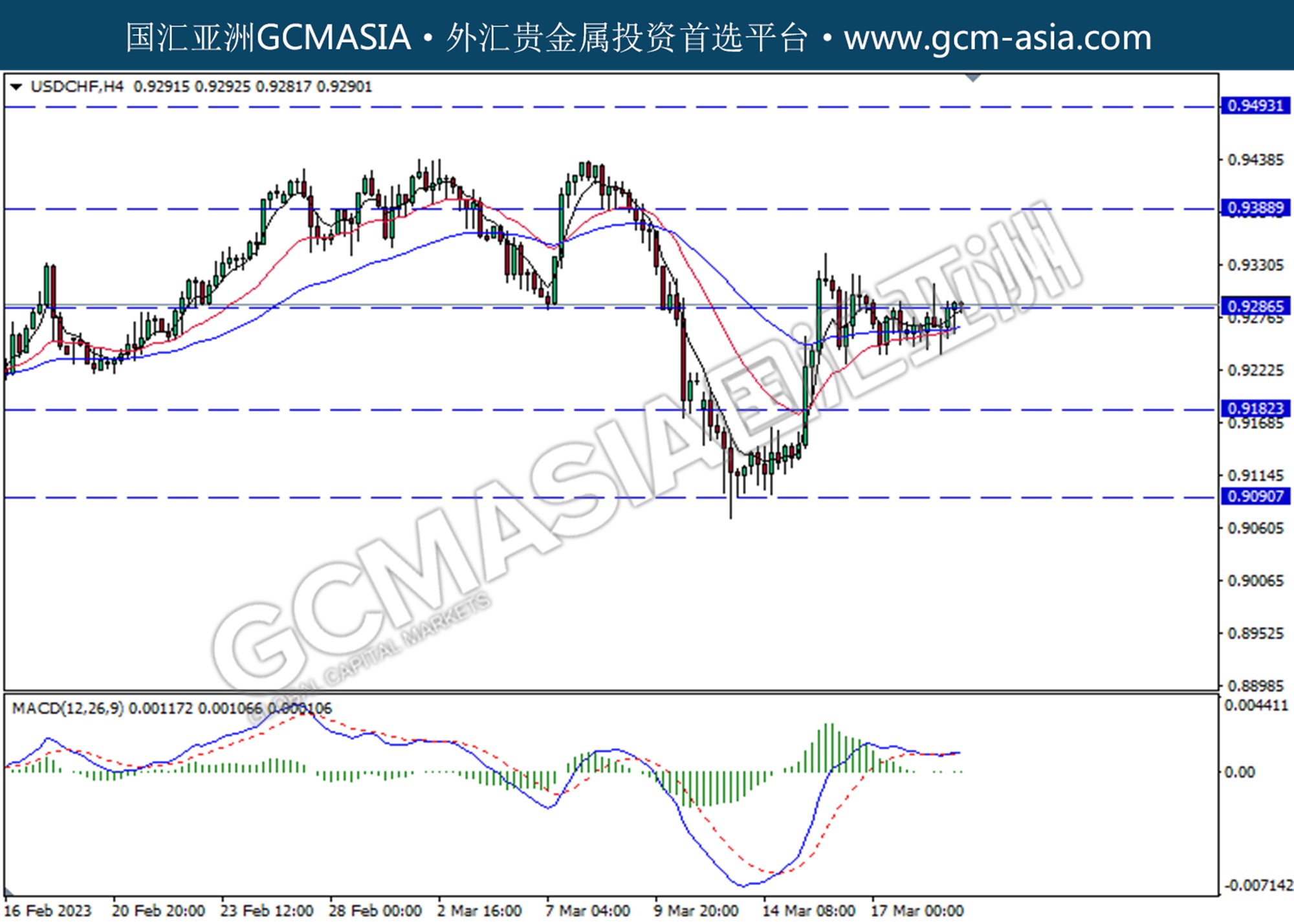

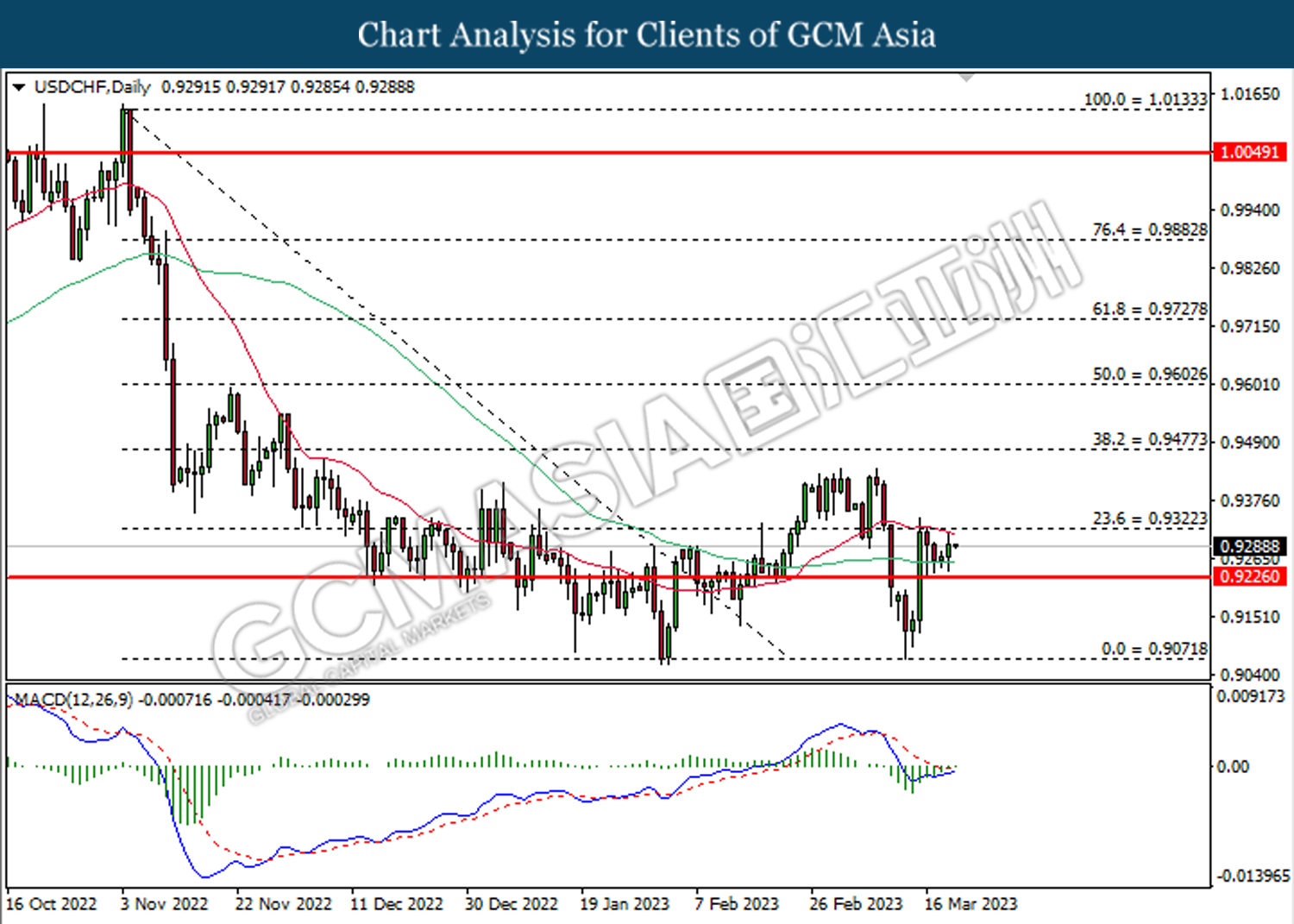

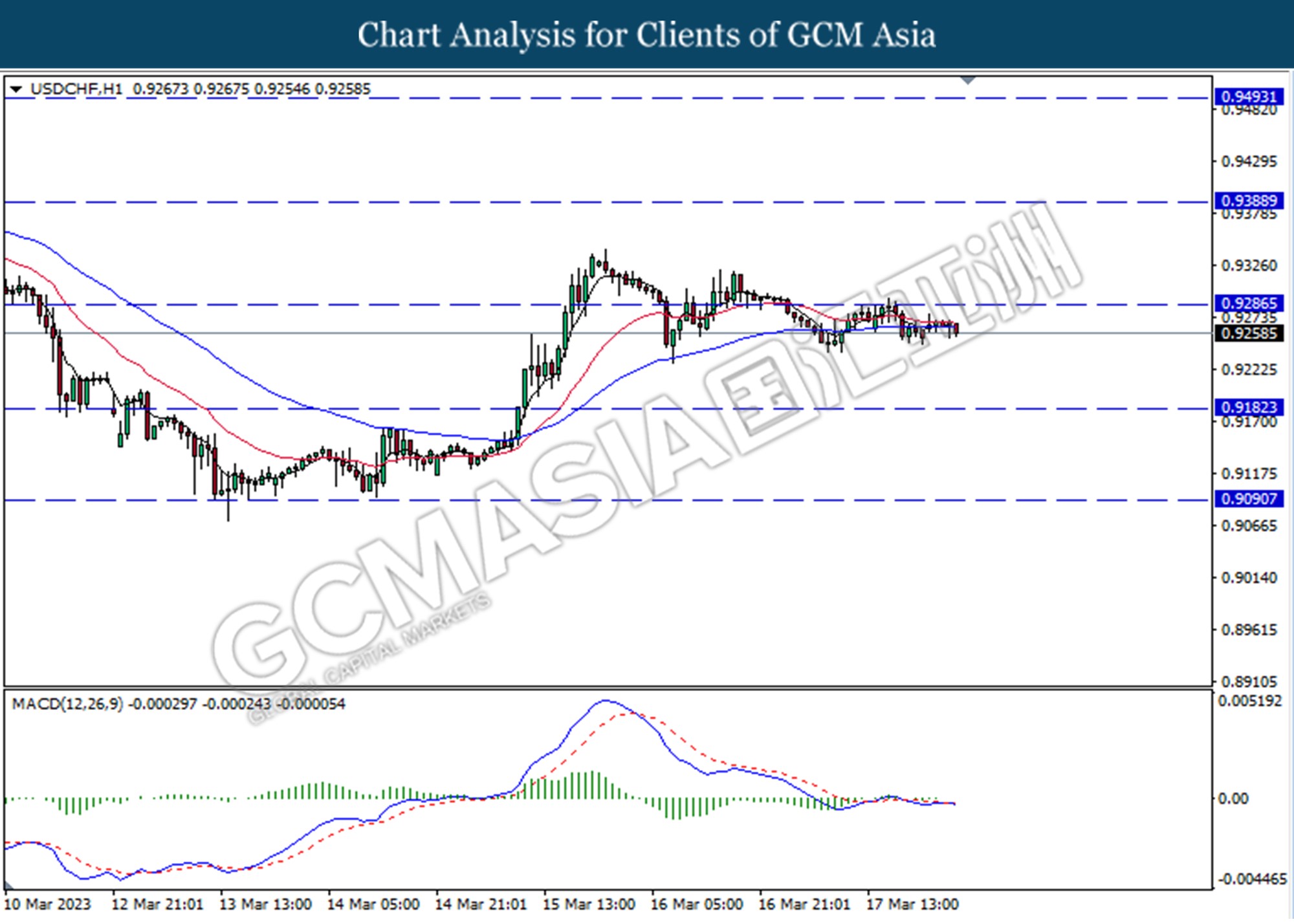

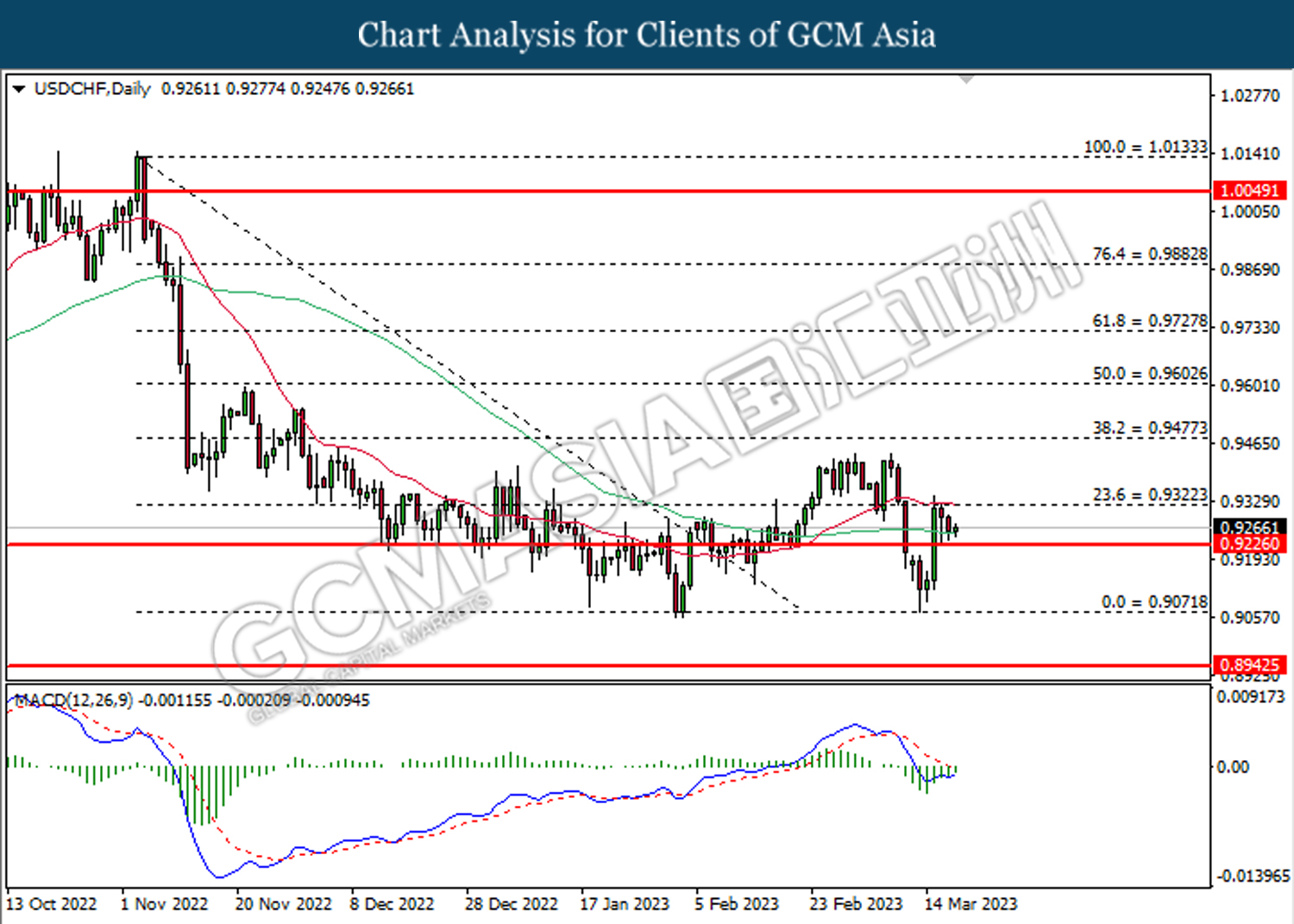

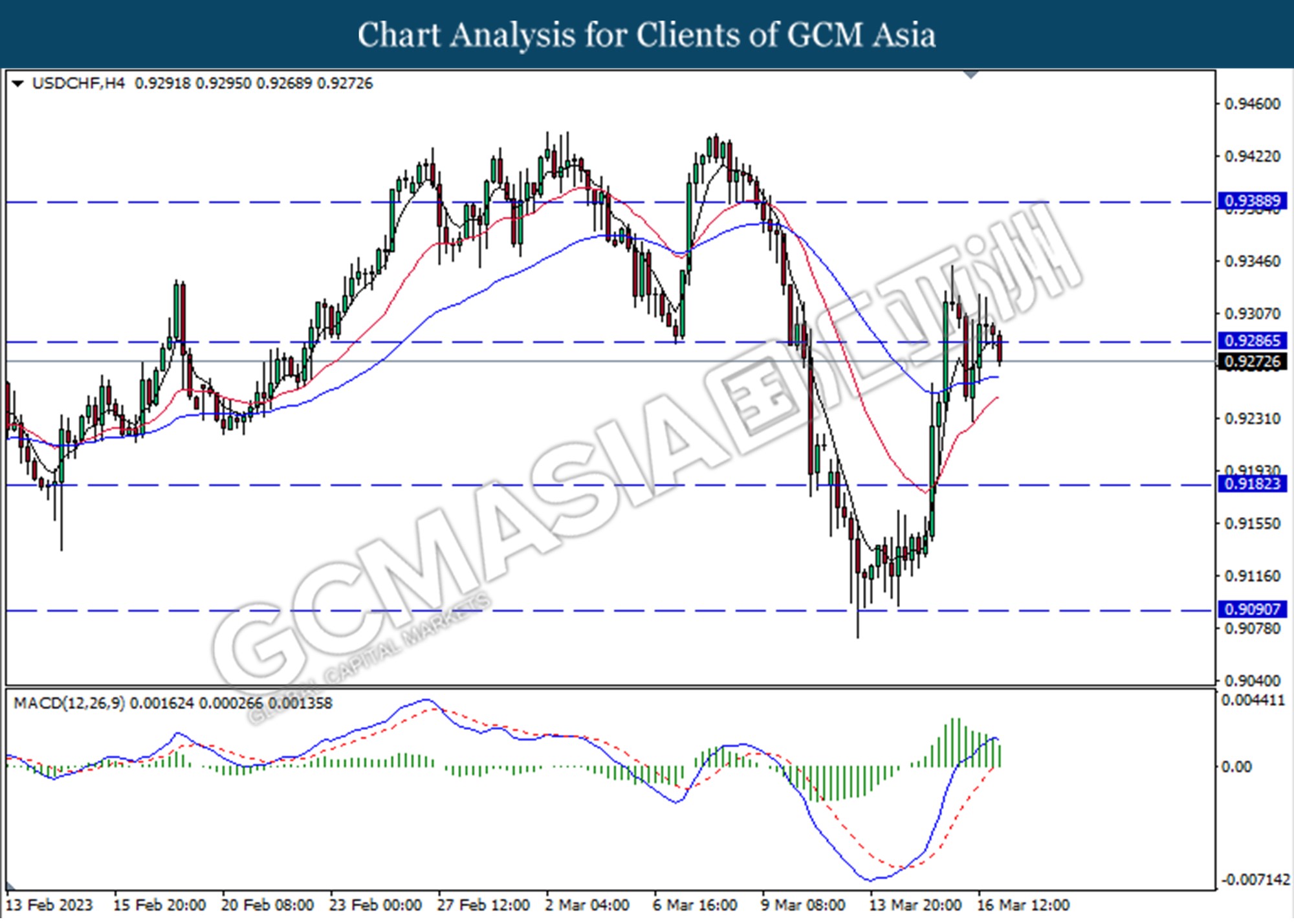

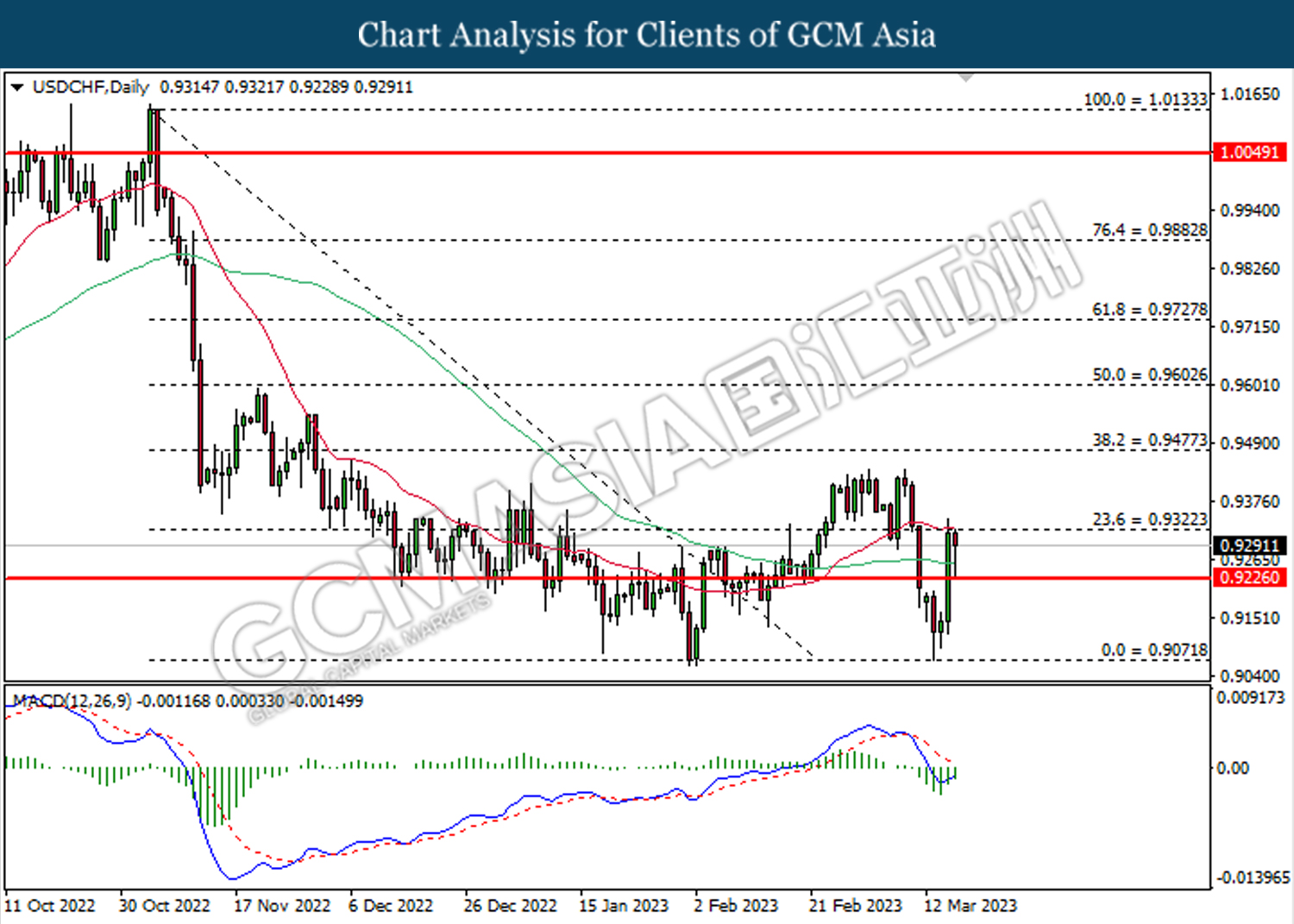

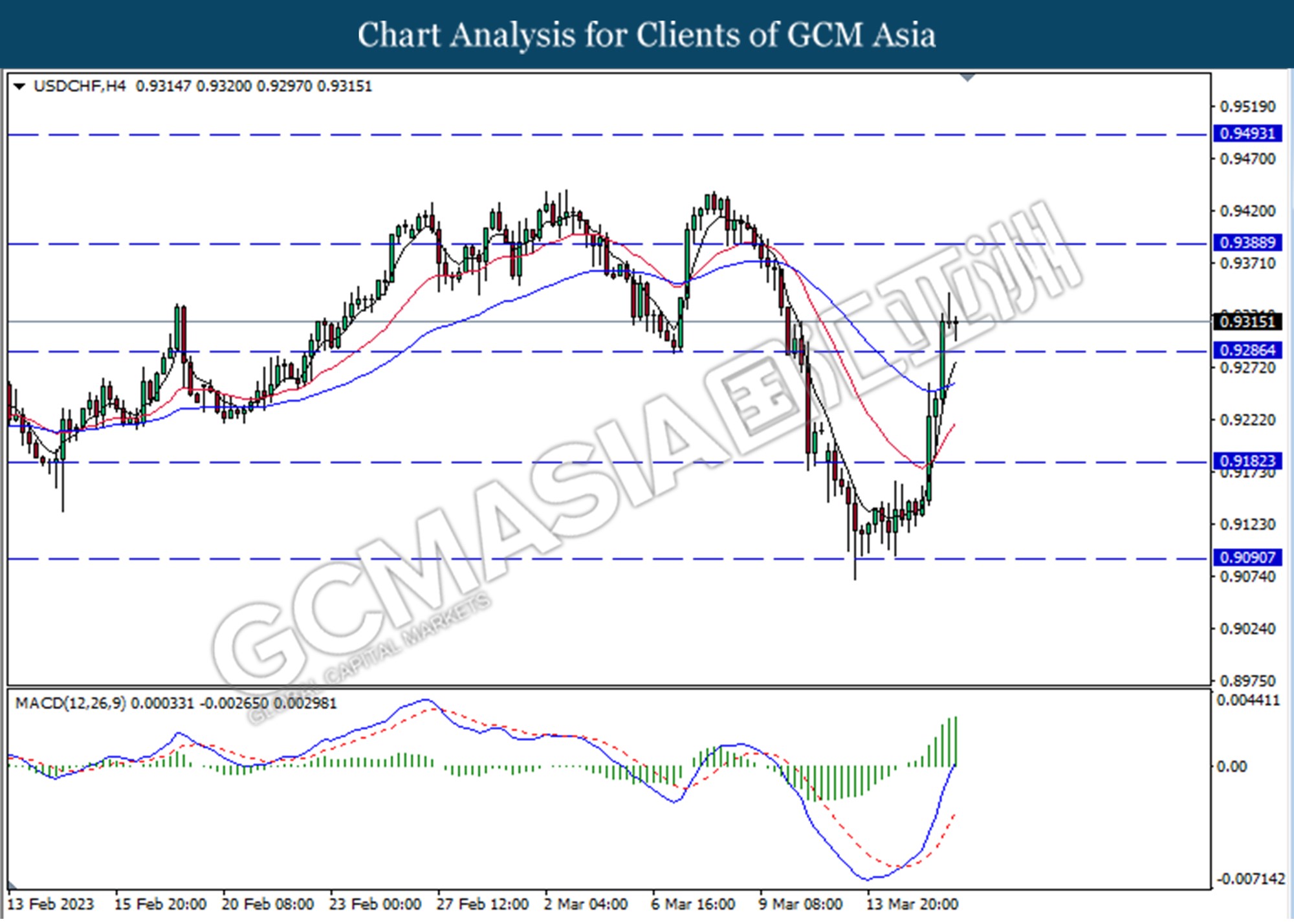

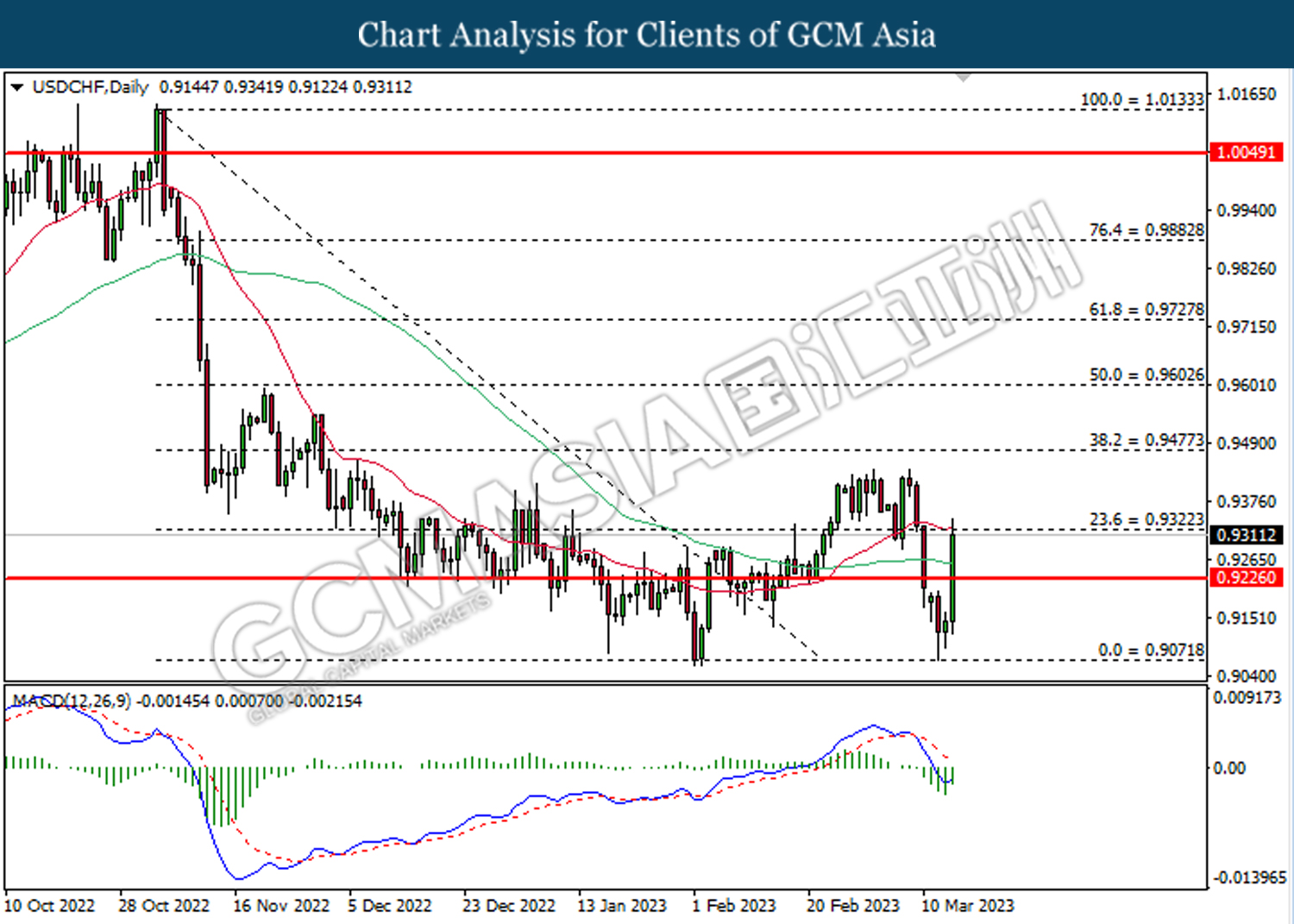

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

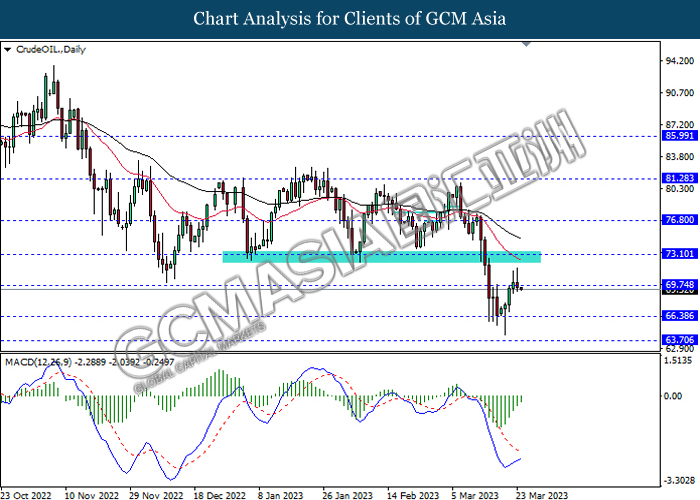

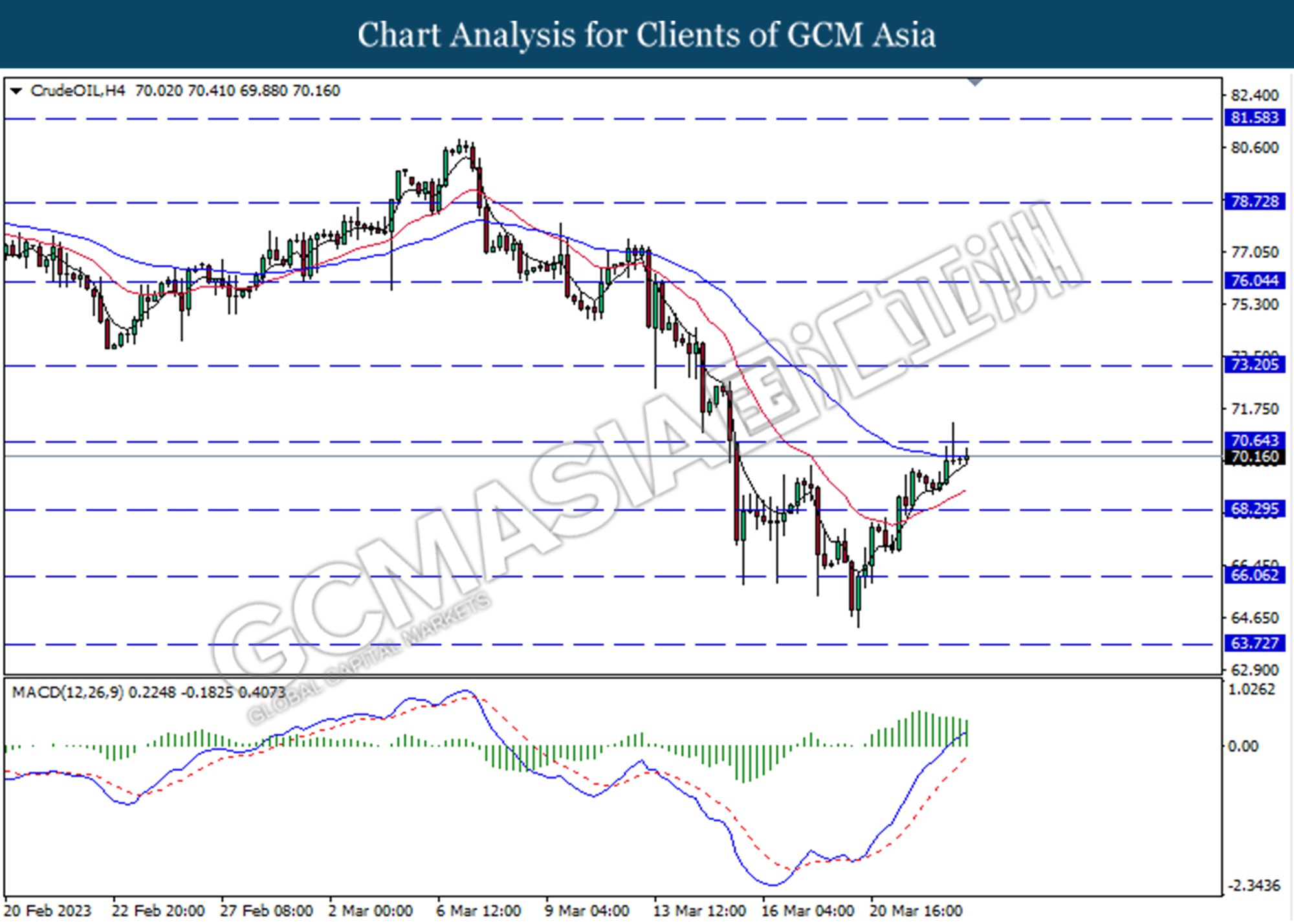

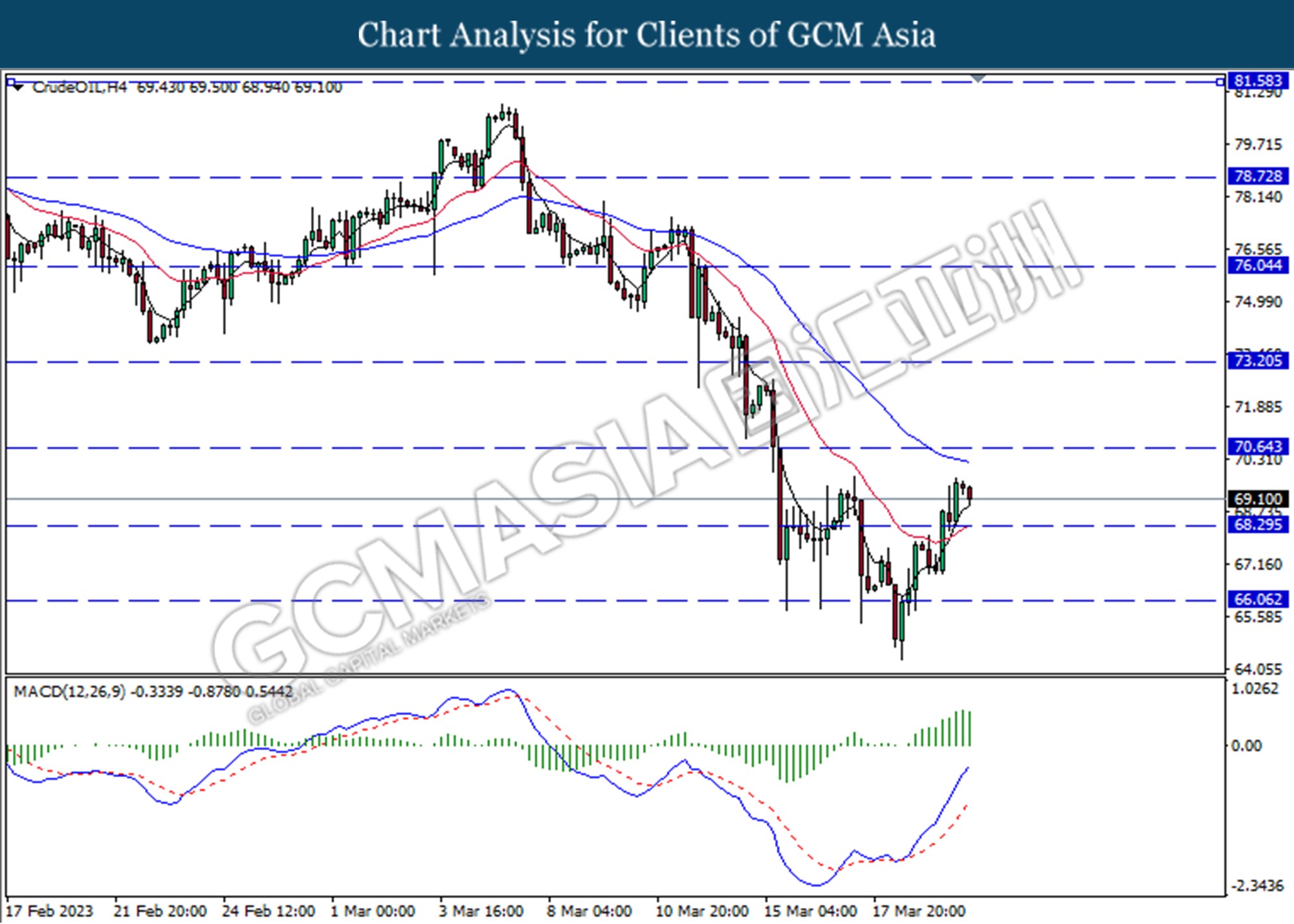

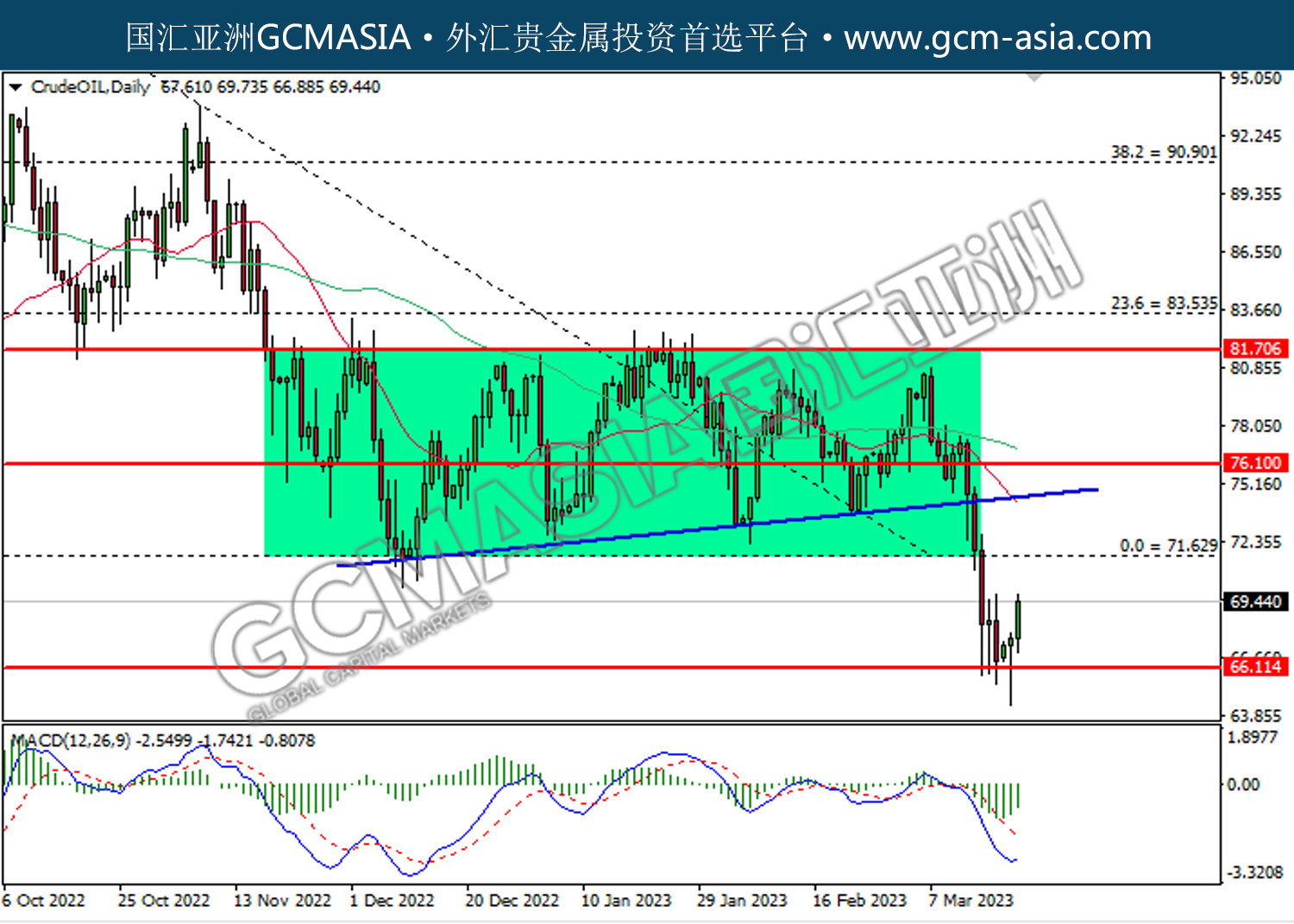

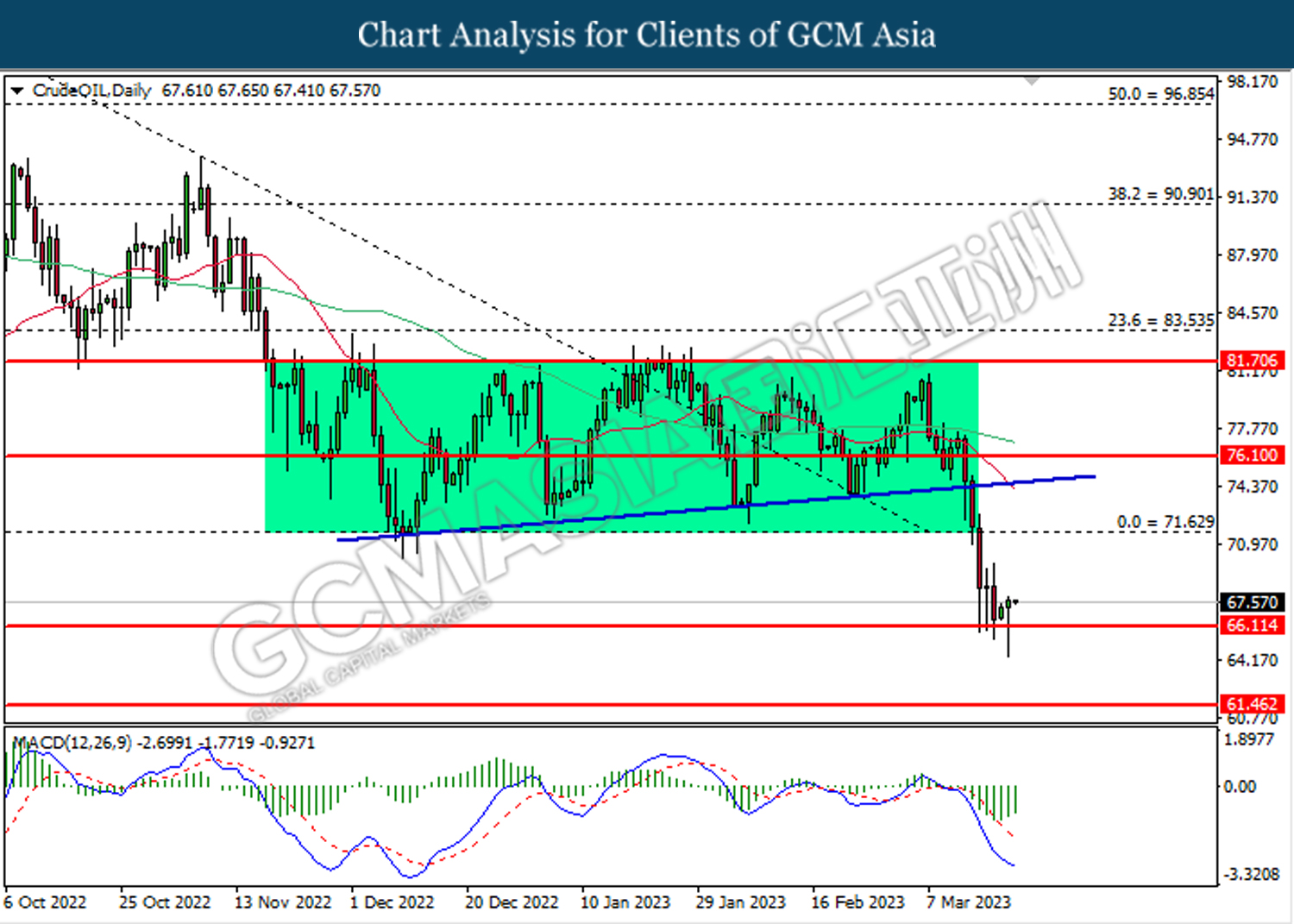

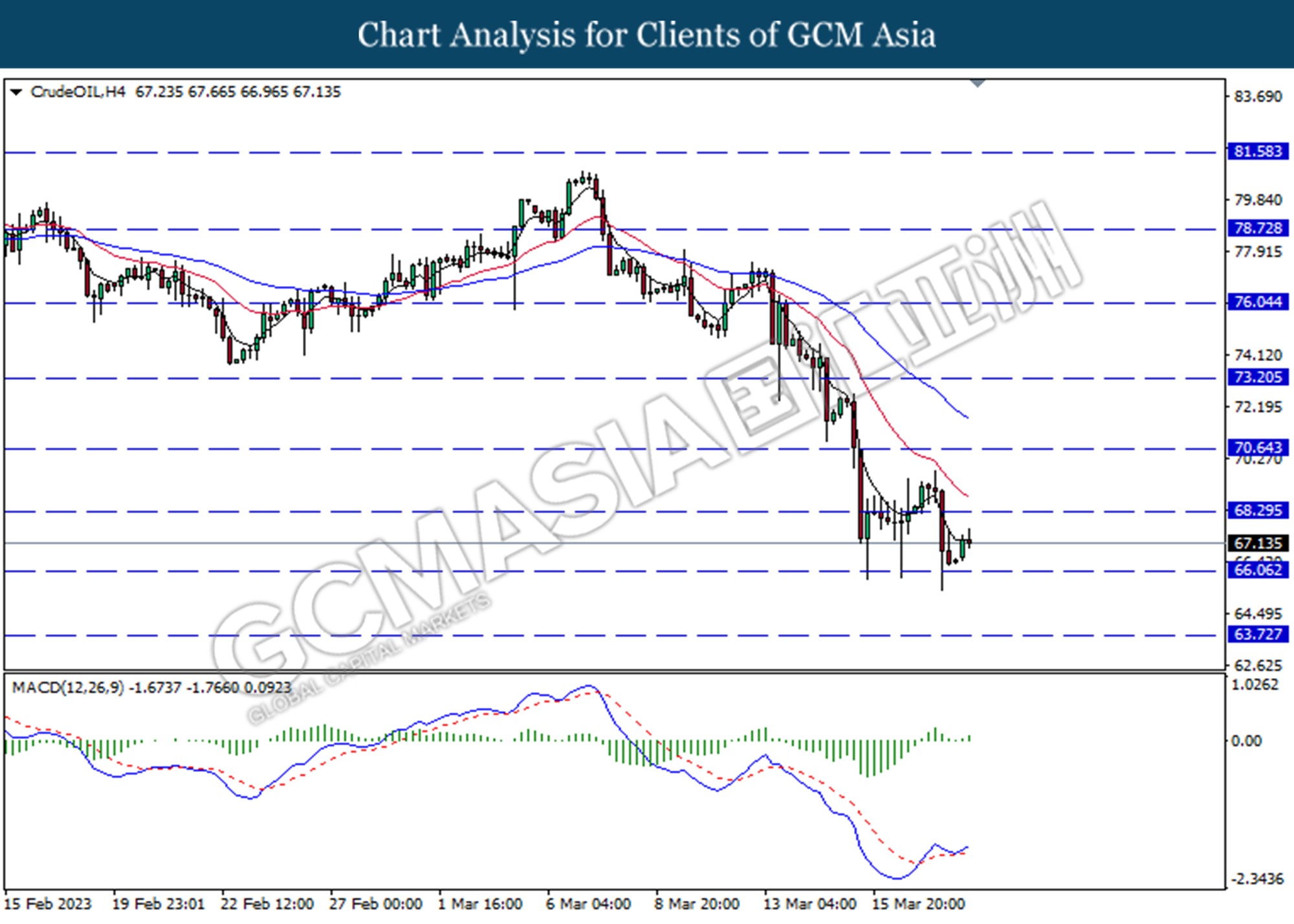

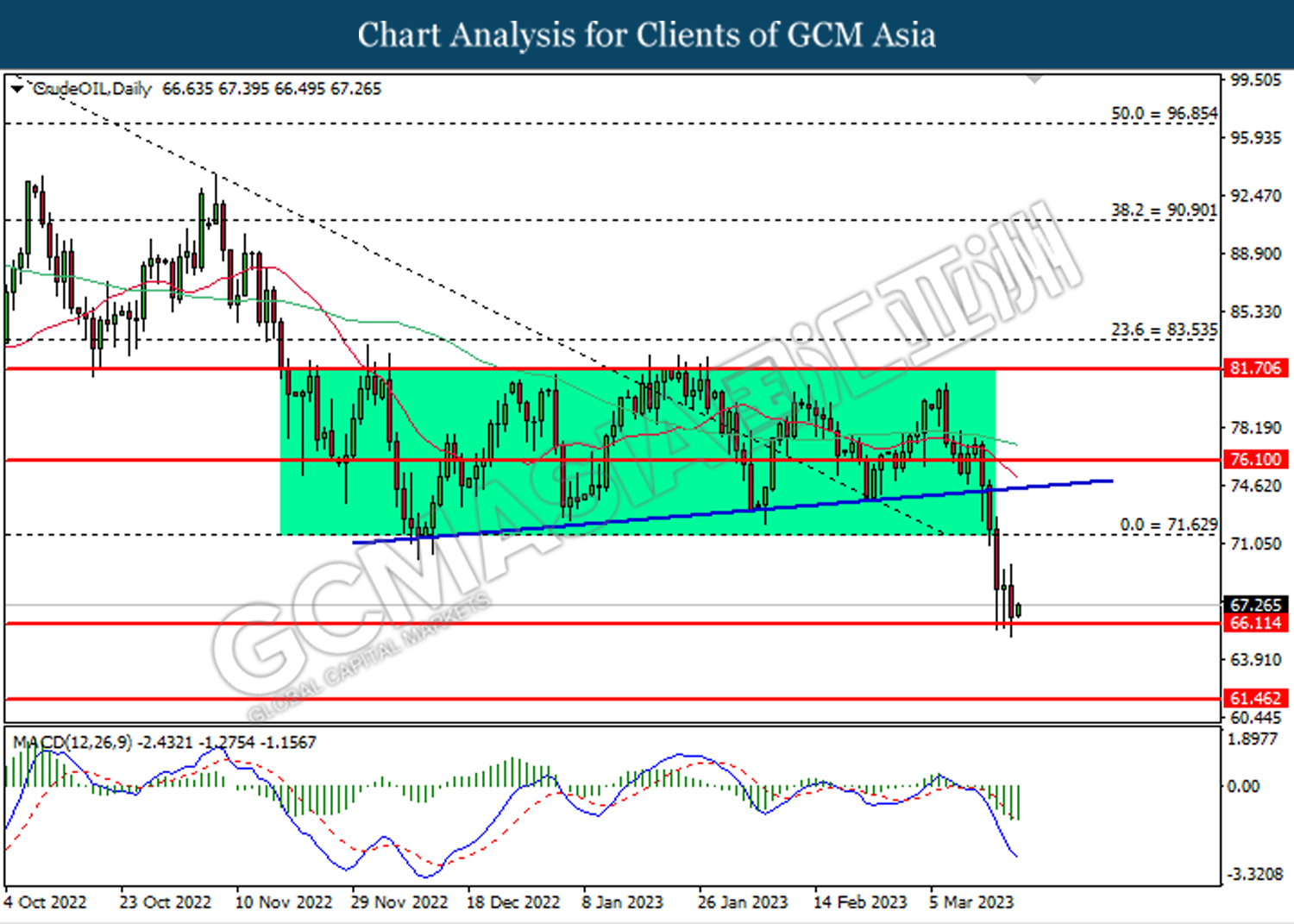

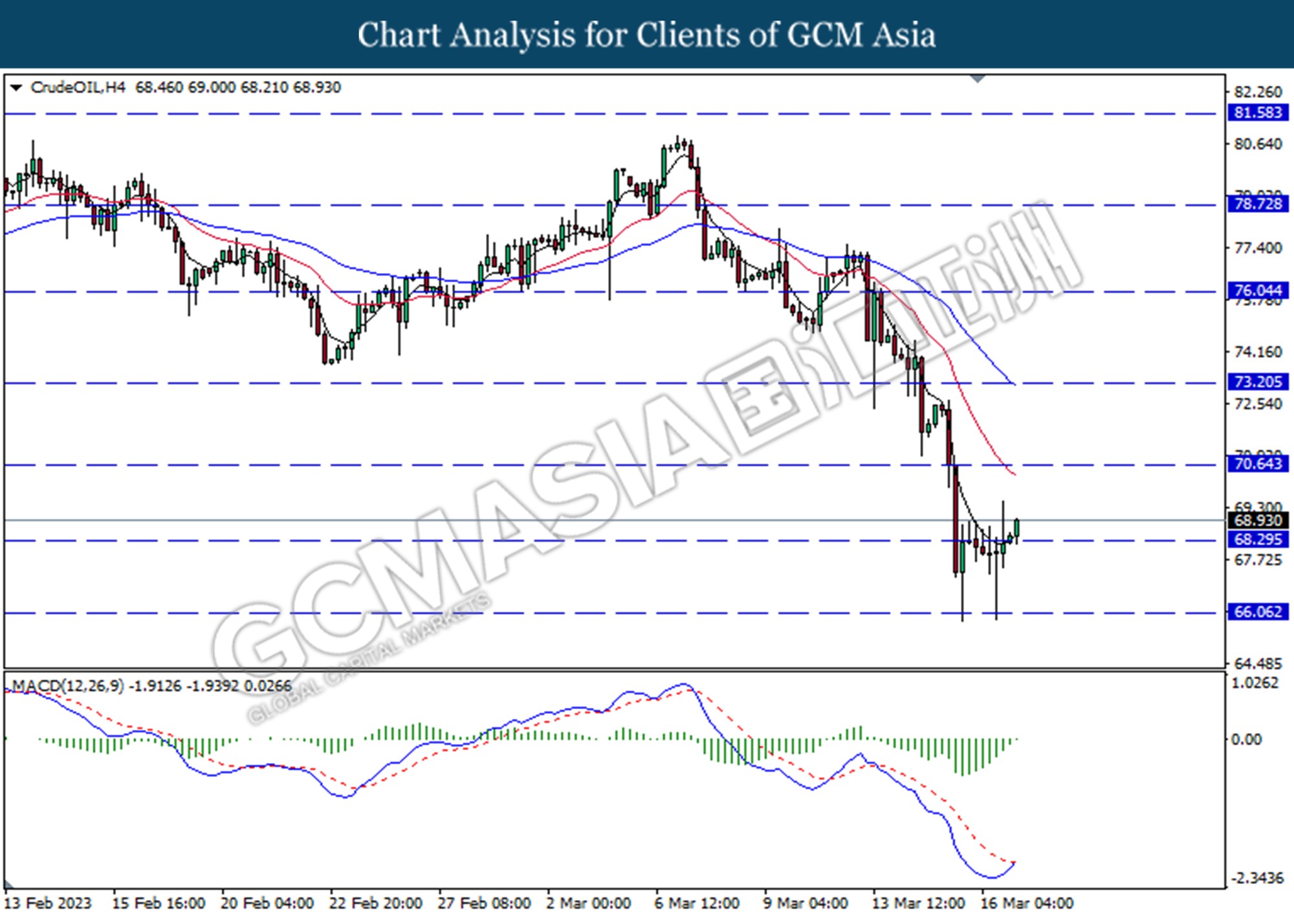

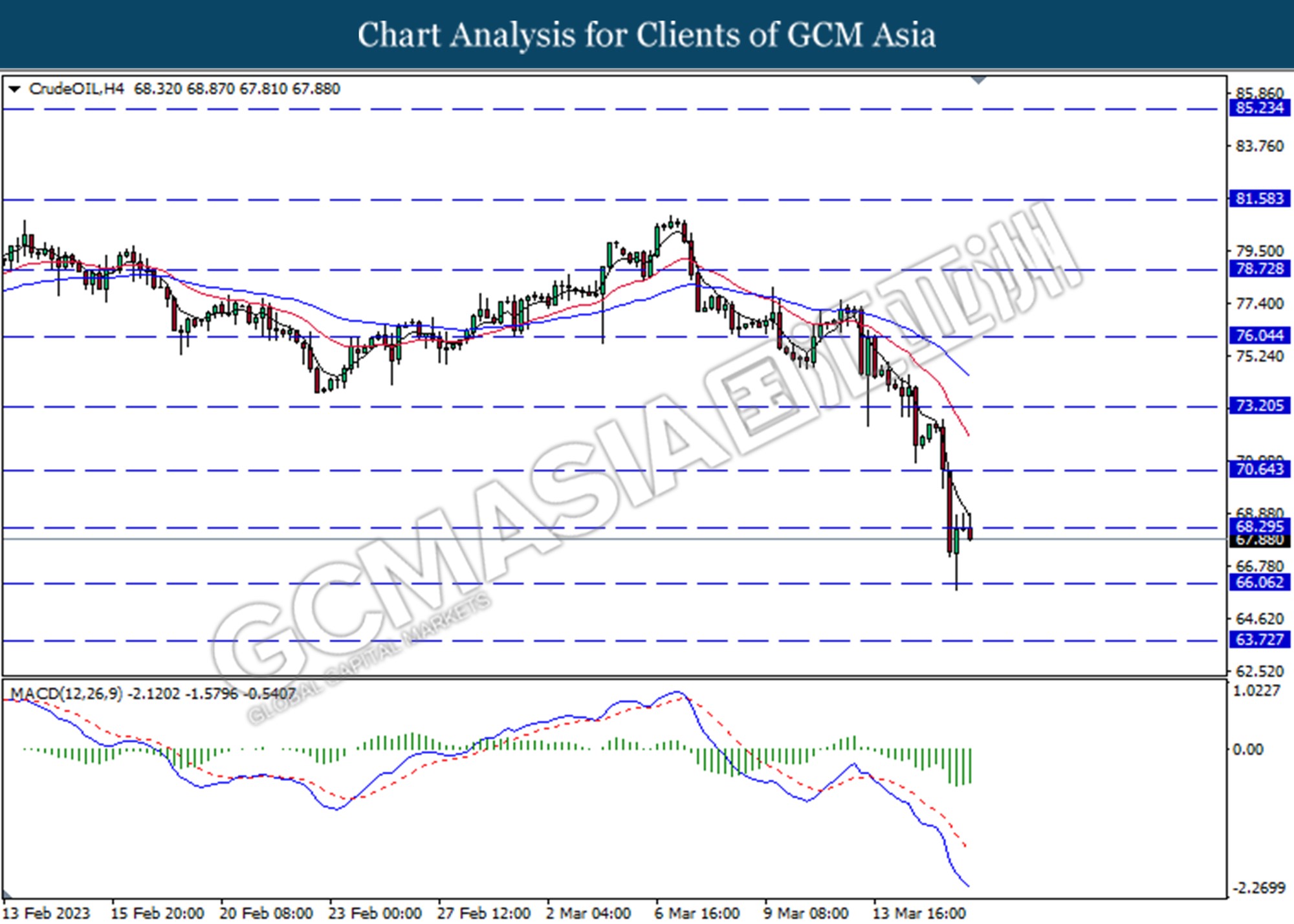

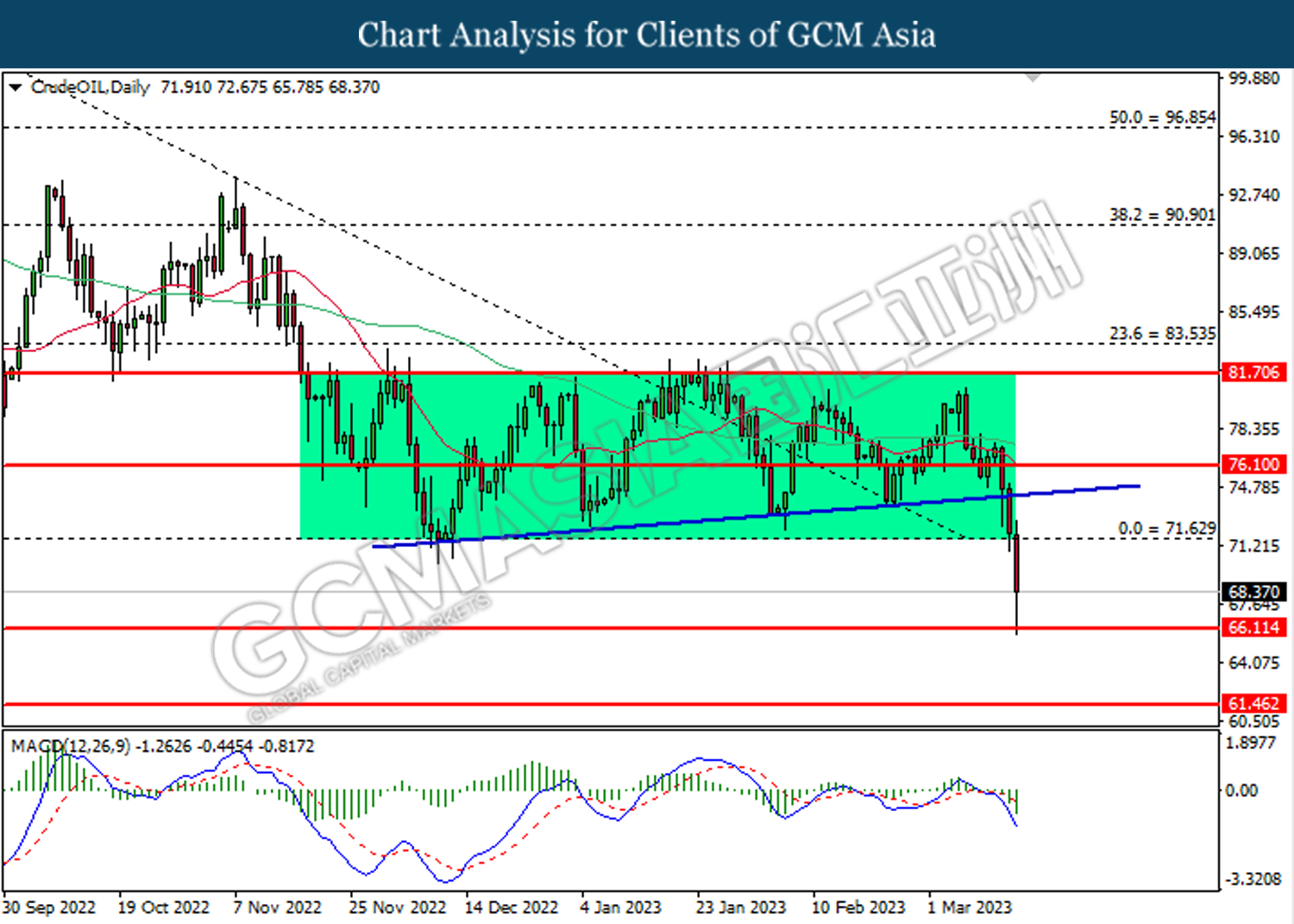

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 69.75, 73.10

Support level: 66.40, 63.70

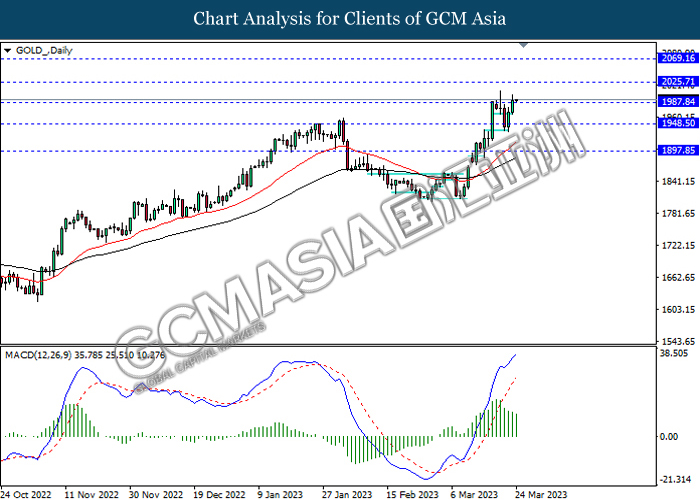

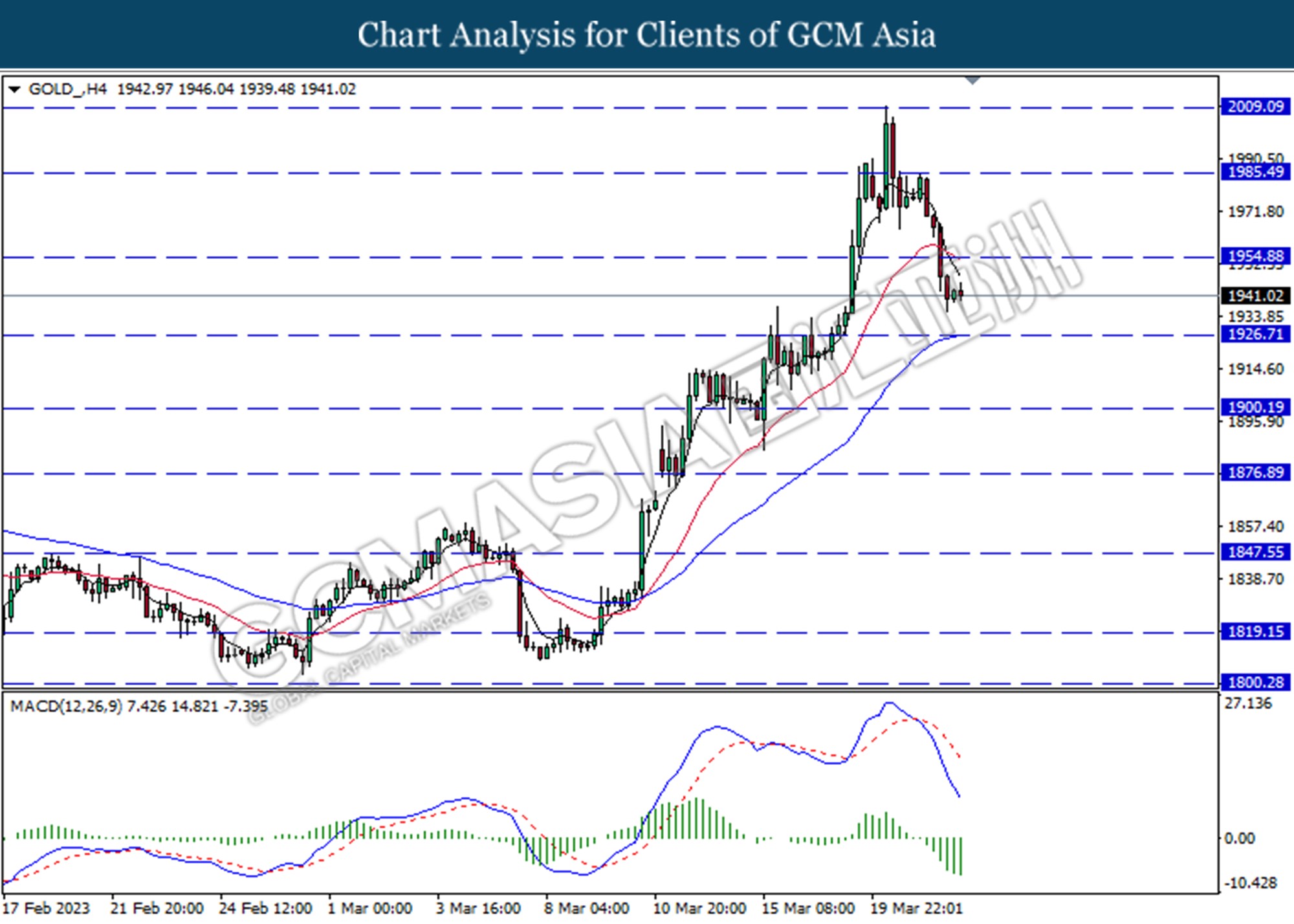

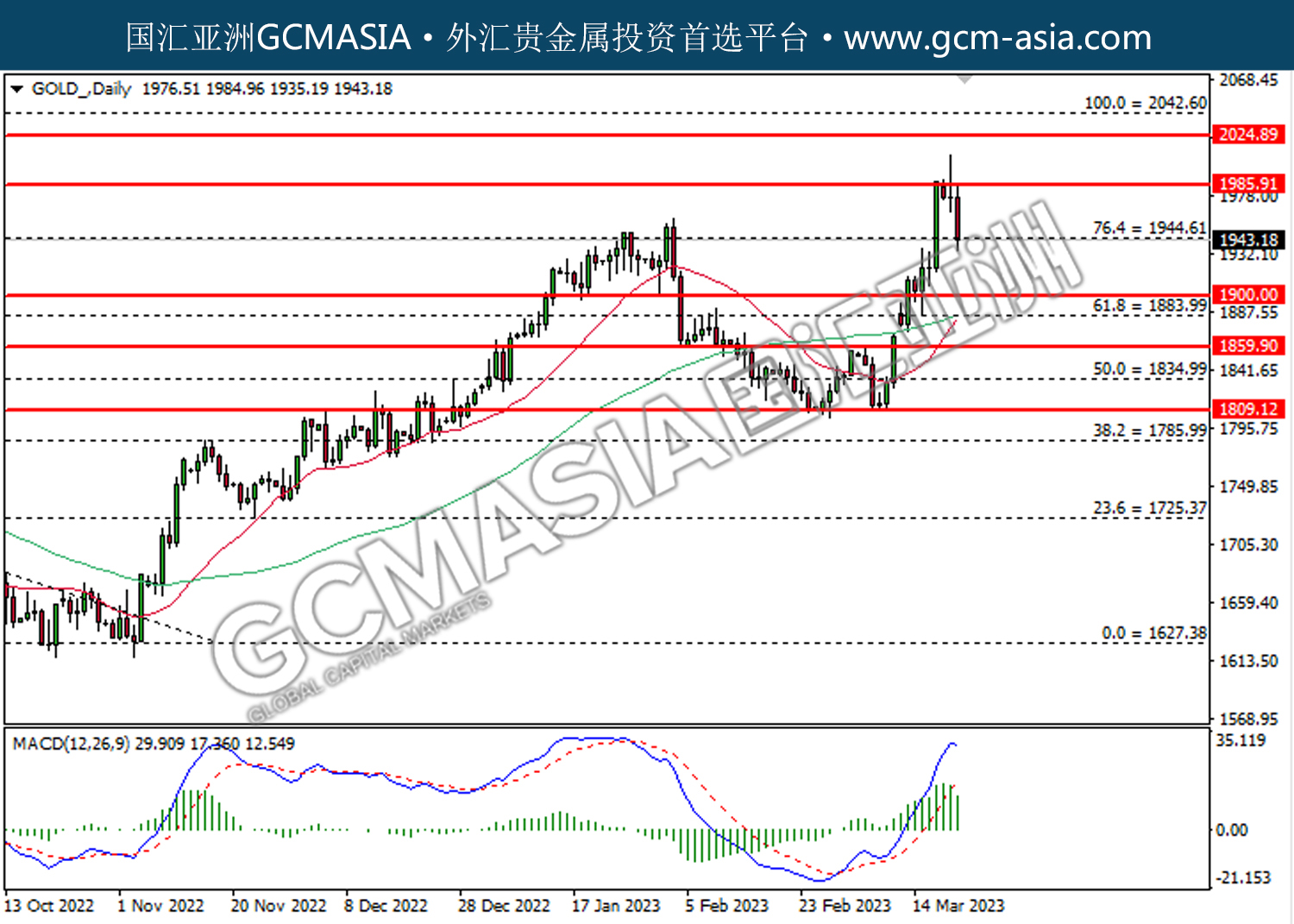

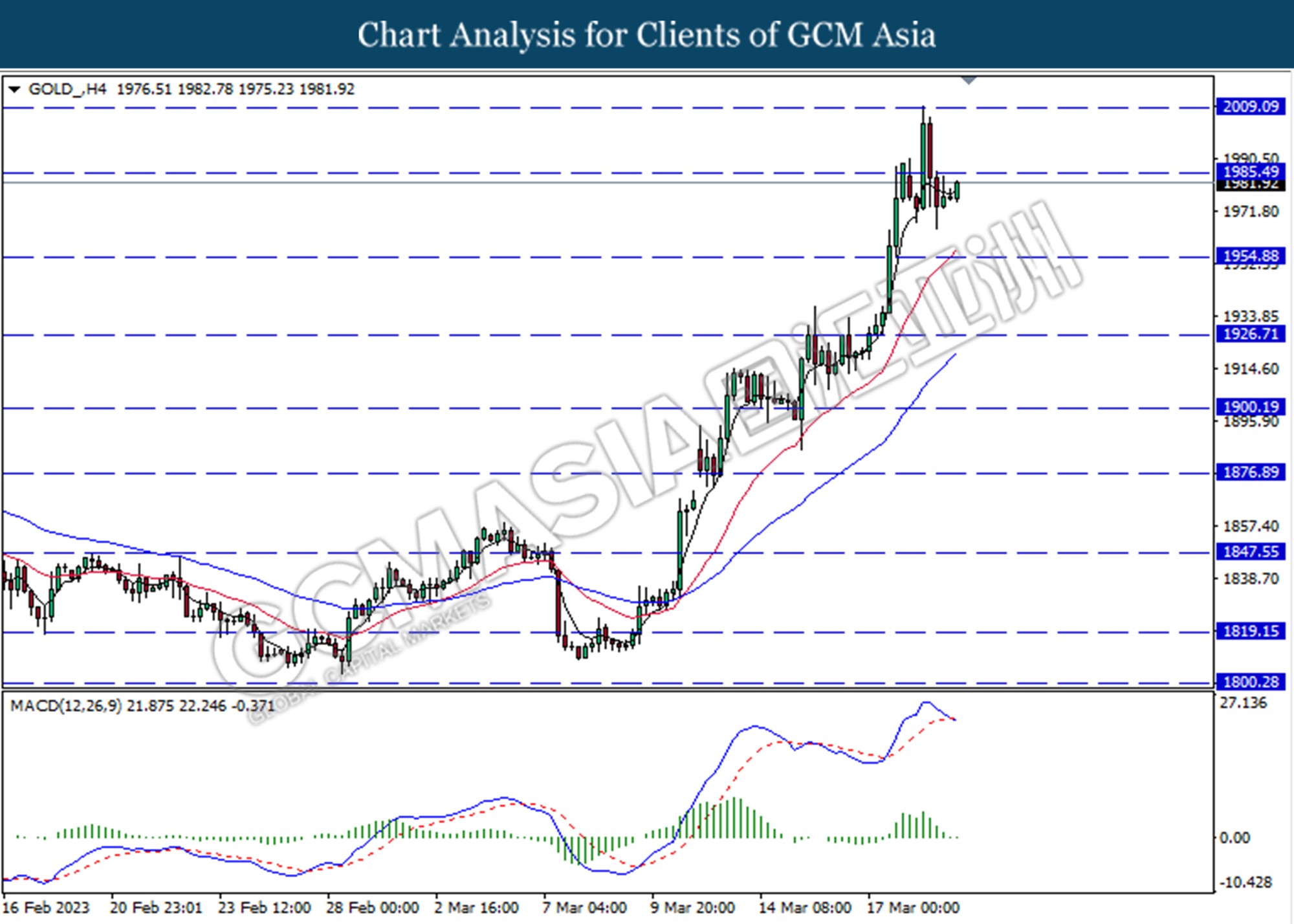

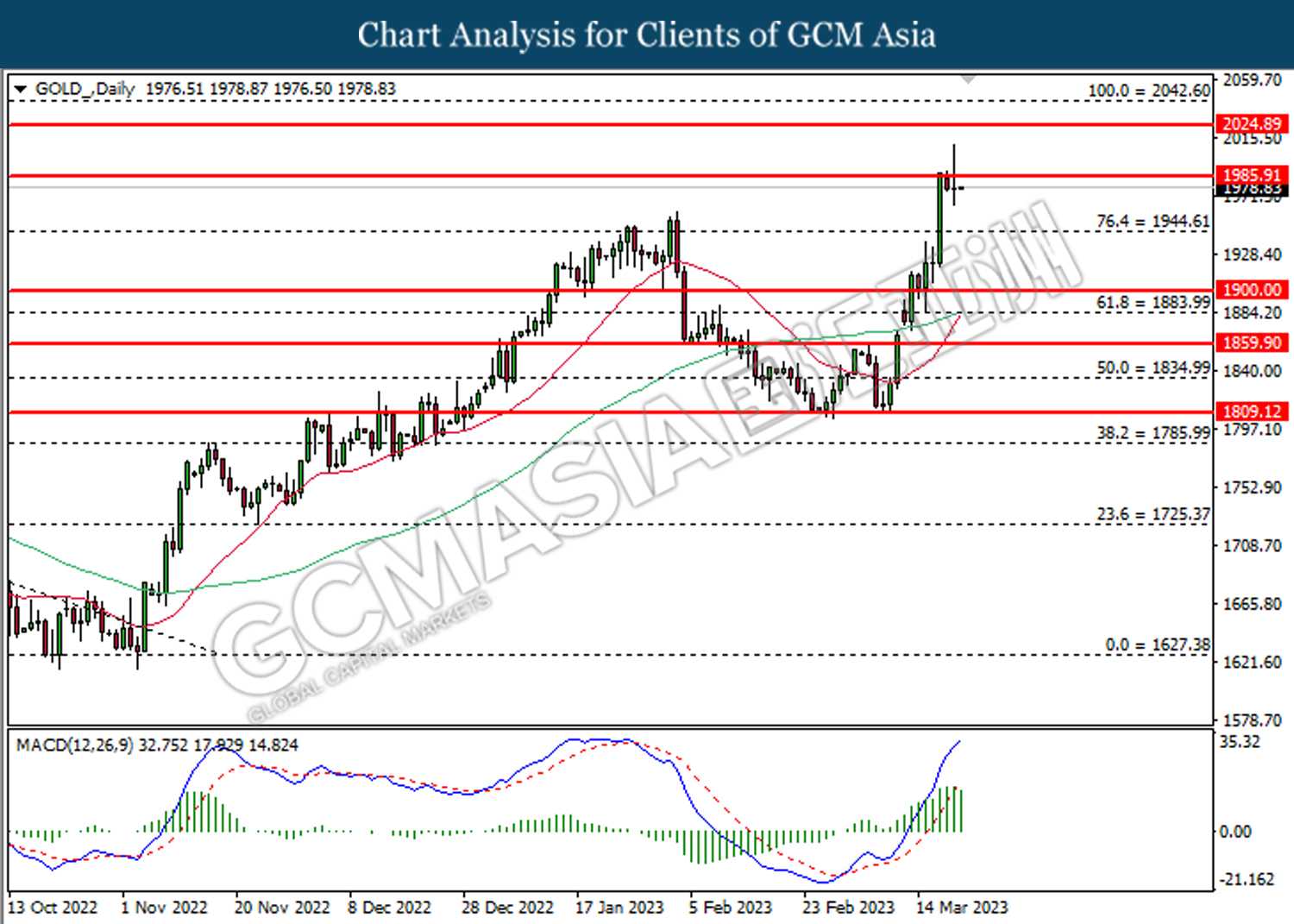

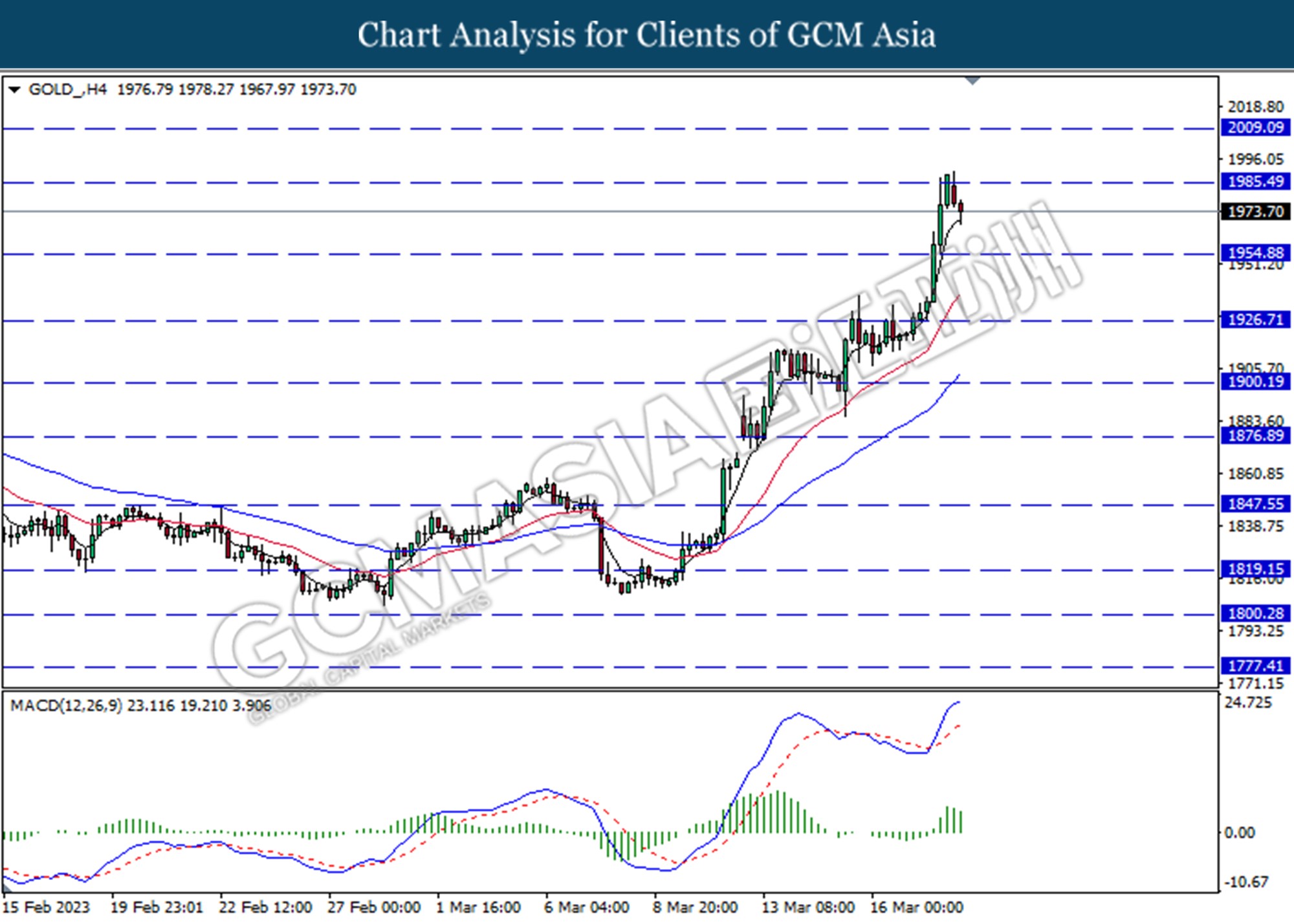

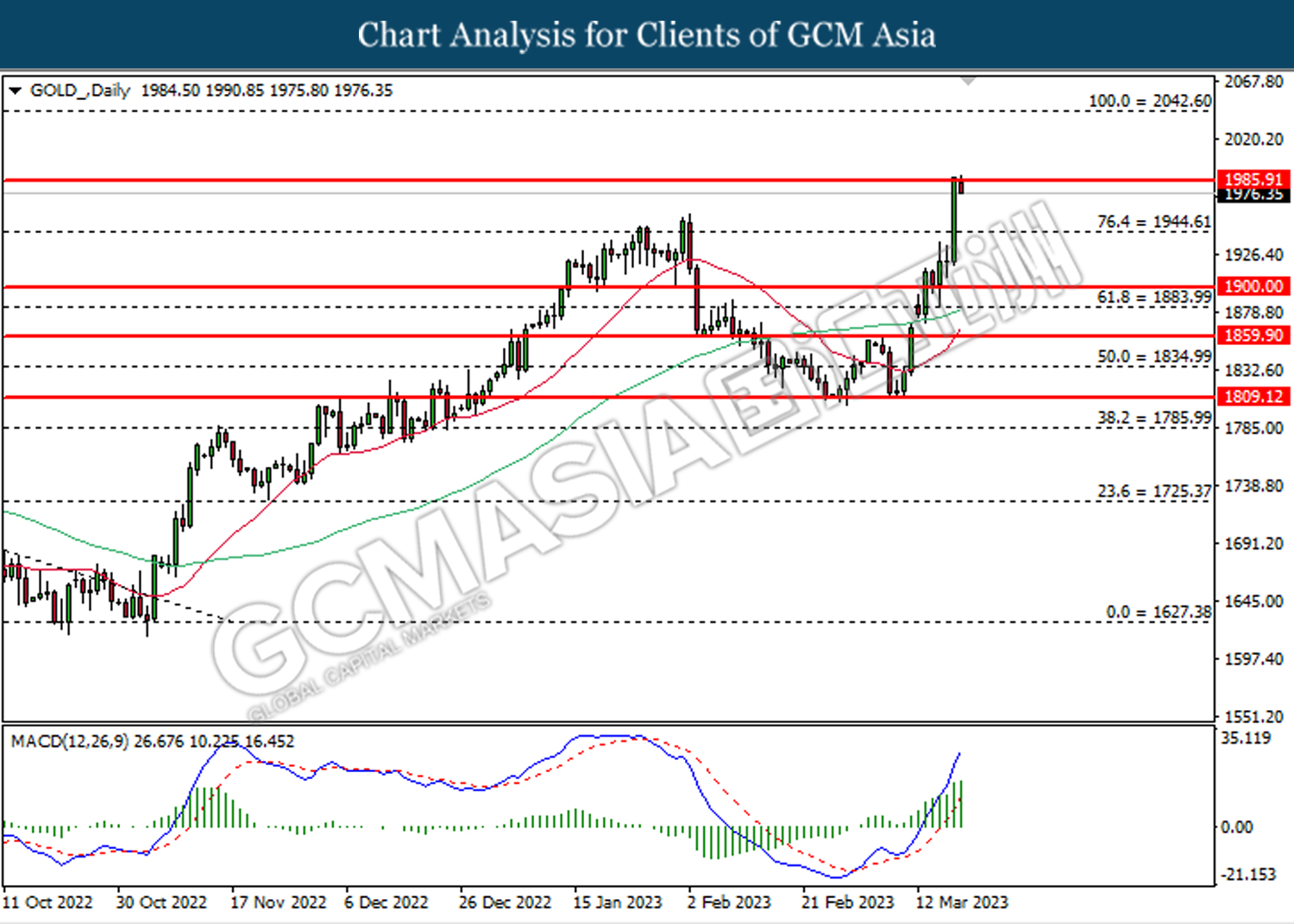

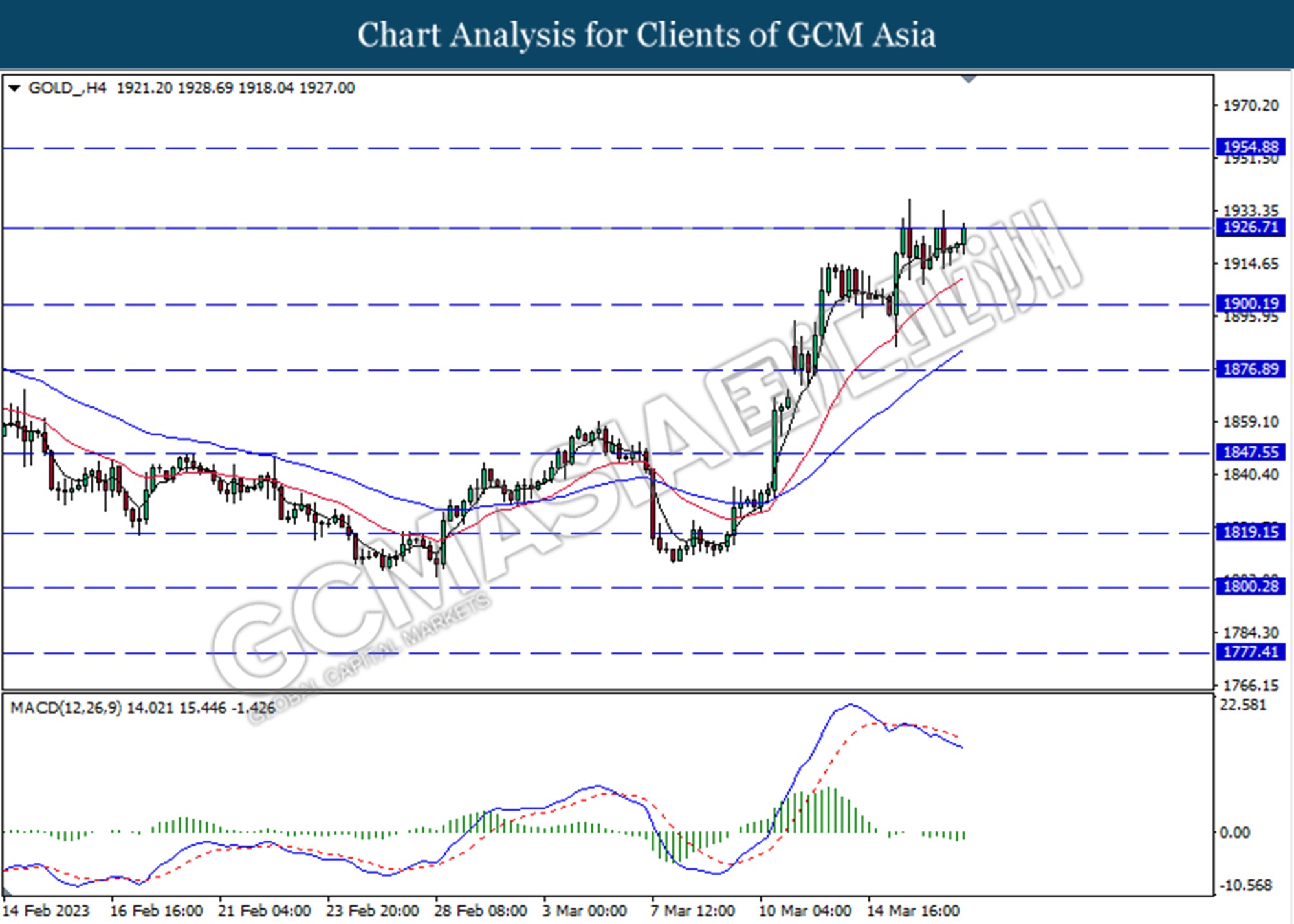

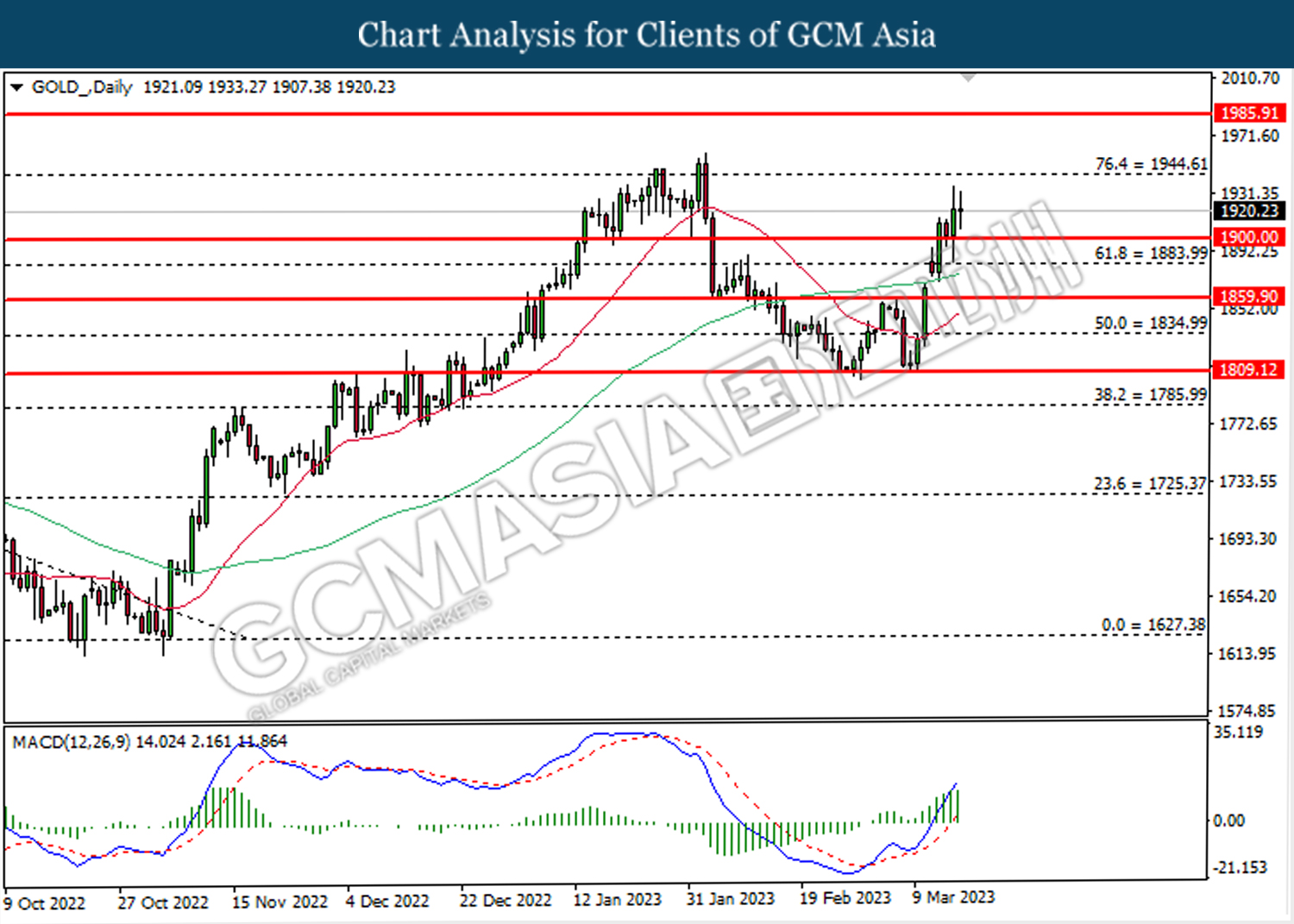

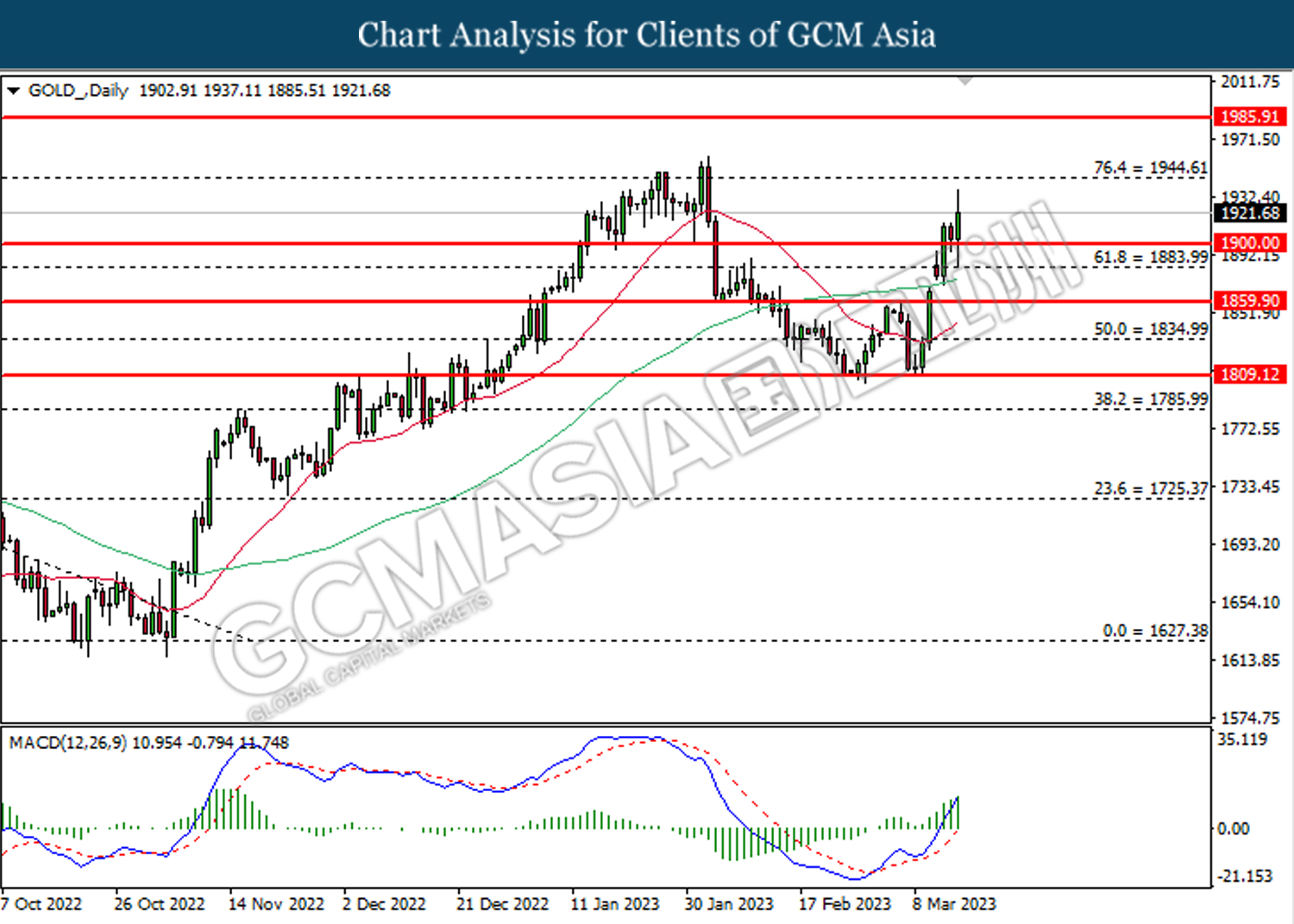

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50

230323 Afternoon Session Report

23 March 2023 Afternoon Session Analysis

UK inflations soars, GBP bounce back to January level.

The British Pound is one the most popular traded currency bounce back to the January level after the UK inflation soared. The UK inflation is expected to move sharply lower at the end of Q2, due to lower energy costs, and inflation is expected to hit 2.9% at the end of the year by the Office for Budget Responsibility (OBR). However, the headline inflation of the UK broke a three-month downtrend and rose in February, rising to 10.4% compared to 10.1% in January and market expectations of 9.9%. While the core inflation rose to 6.2% from 5.8% above market expectations. According to the Office for National Statistics (ONS), price increases in restaurants, hotels, food and non-alcoholic beverages, and clothing and footwear are primarily attributed to the annual inflation rate. An out-of-expectations data prompted the Bank of England (BoE) might more aggressively hike interest rate as the labor market remains resilient amid 50 years lower unemployment rate. Investors are awaiting a more clear signal from BoE’s upcoming monetary policy decision today. As of writing, the GBP/USD gained 0.53% to $1.2329.

In the commodity market, the crude oil price dropped by 1.16% to $70.07 per barrel as of writing on weak Fed signals and OPEC uncertainty. According to Reuters, OPEC countries are likely to keep output changed during the April meeting and will maintain the previously announced 2 million barrel per day cut. Besides, the gold price rose by 1.65% to $1981.75 per troy ounce as of writing as the dollar sinks in value.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

17:00 CHF SNB Press Conference

18:00 EUR EU Leaders Summit

Tentative GBP BOE Inflation Letter

20:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision (Q1) | 1.00% | 1.00% | – |

| 20:00 | GBP – BoE Interest Rate Decision (Mar) | 4.00% | 4.25% | – |

| 20:00 | USD – Building Permits | 1.339M | – | – |

| 20:30 | USD – Initial Jobless Claims | 192K | 199K | – |

| 22:00 | USD – New Home Sales (Feb) | 670K | 648K | – |

Technical Analysis

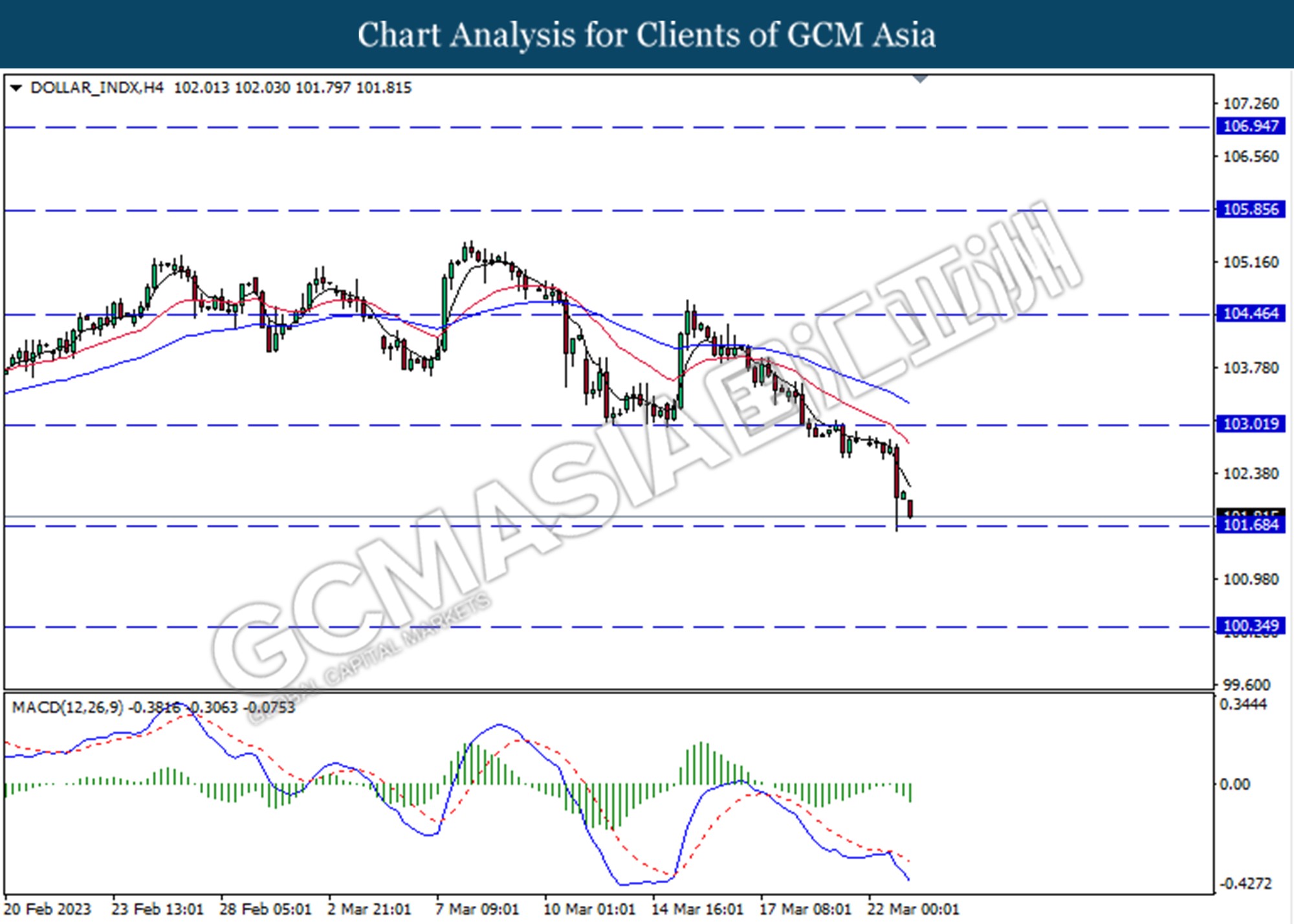

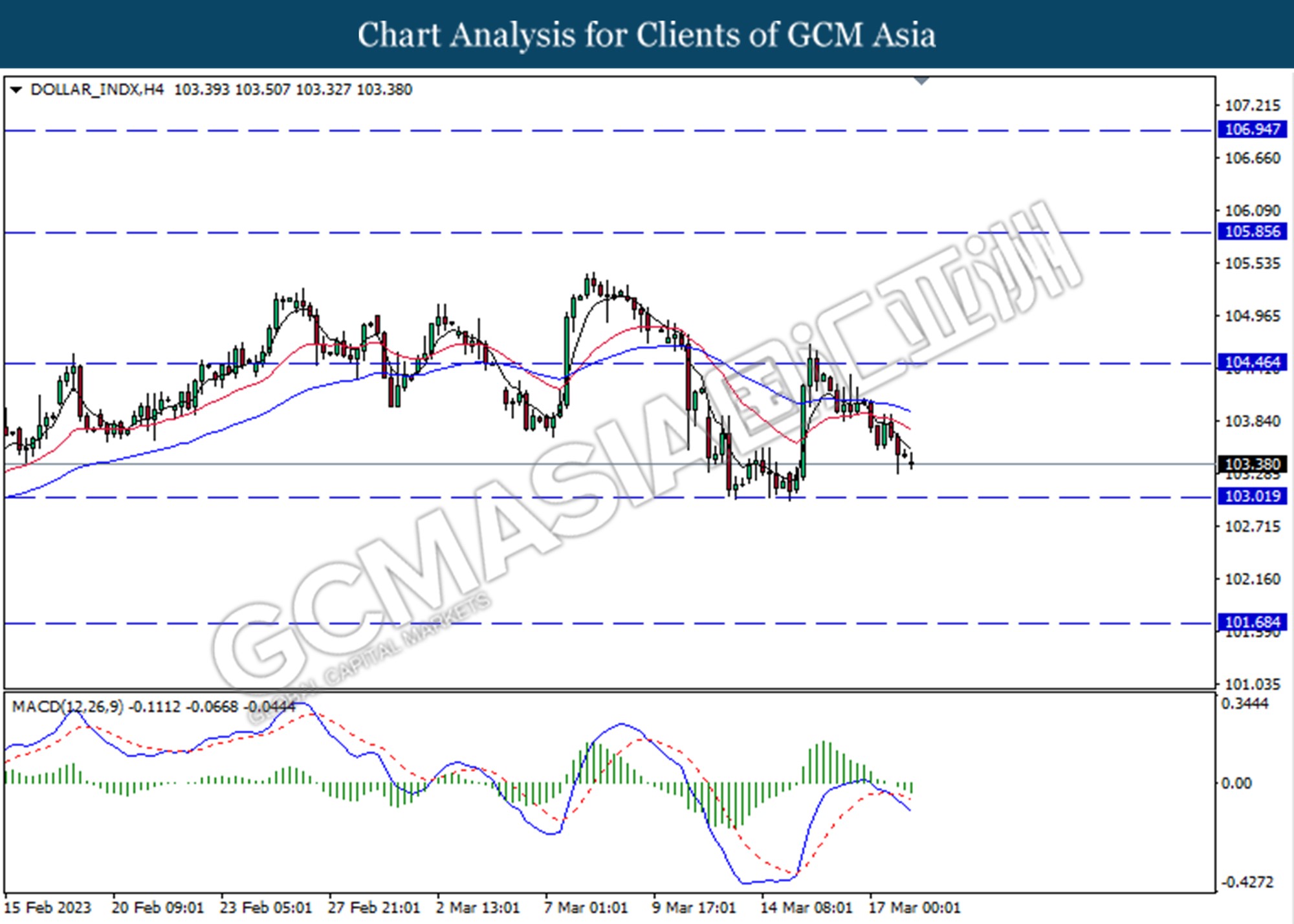

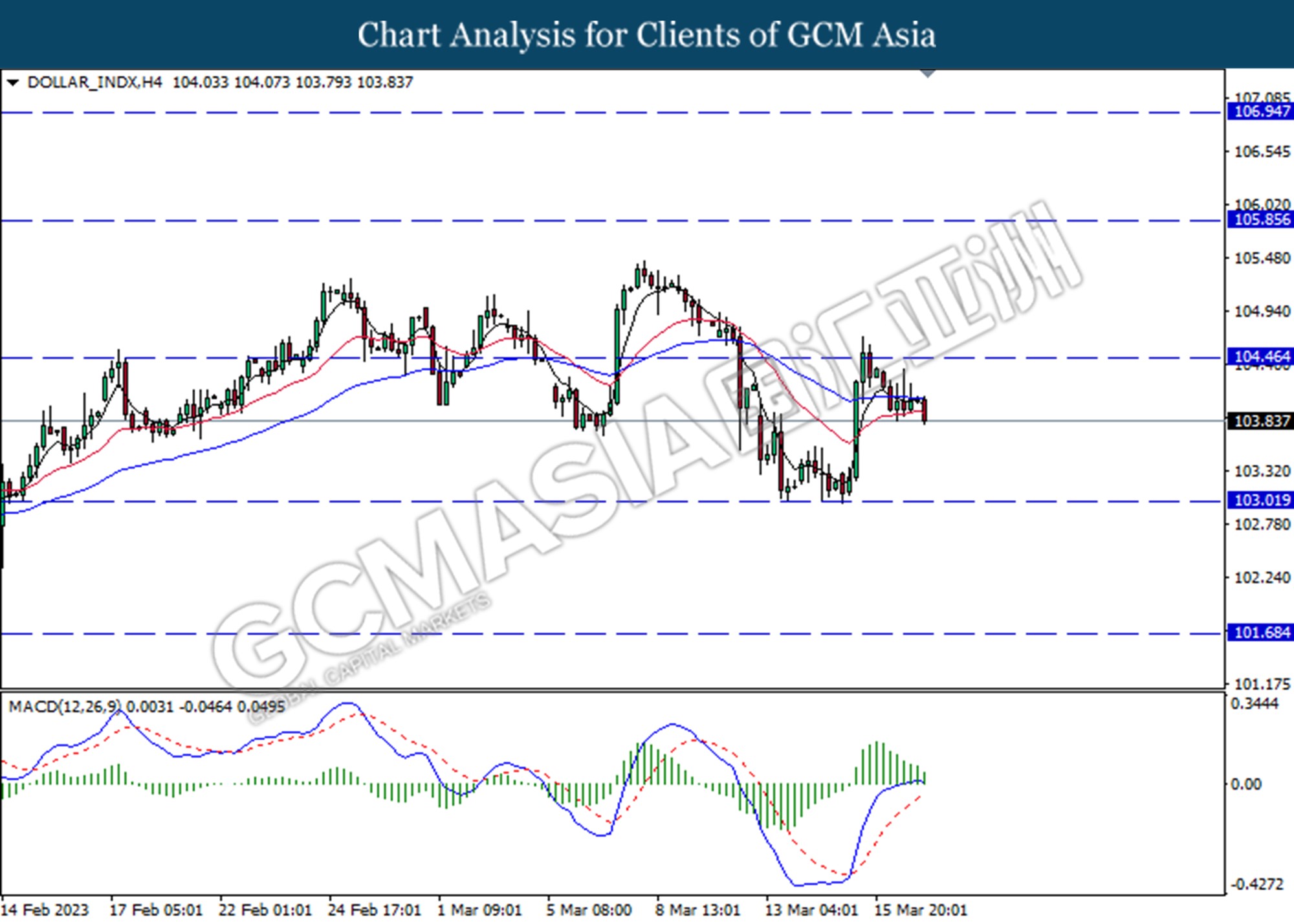

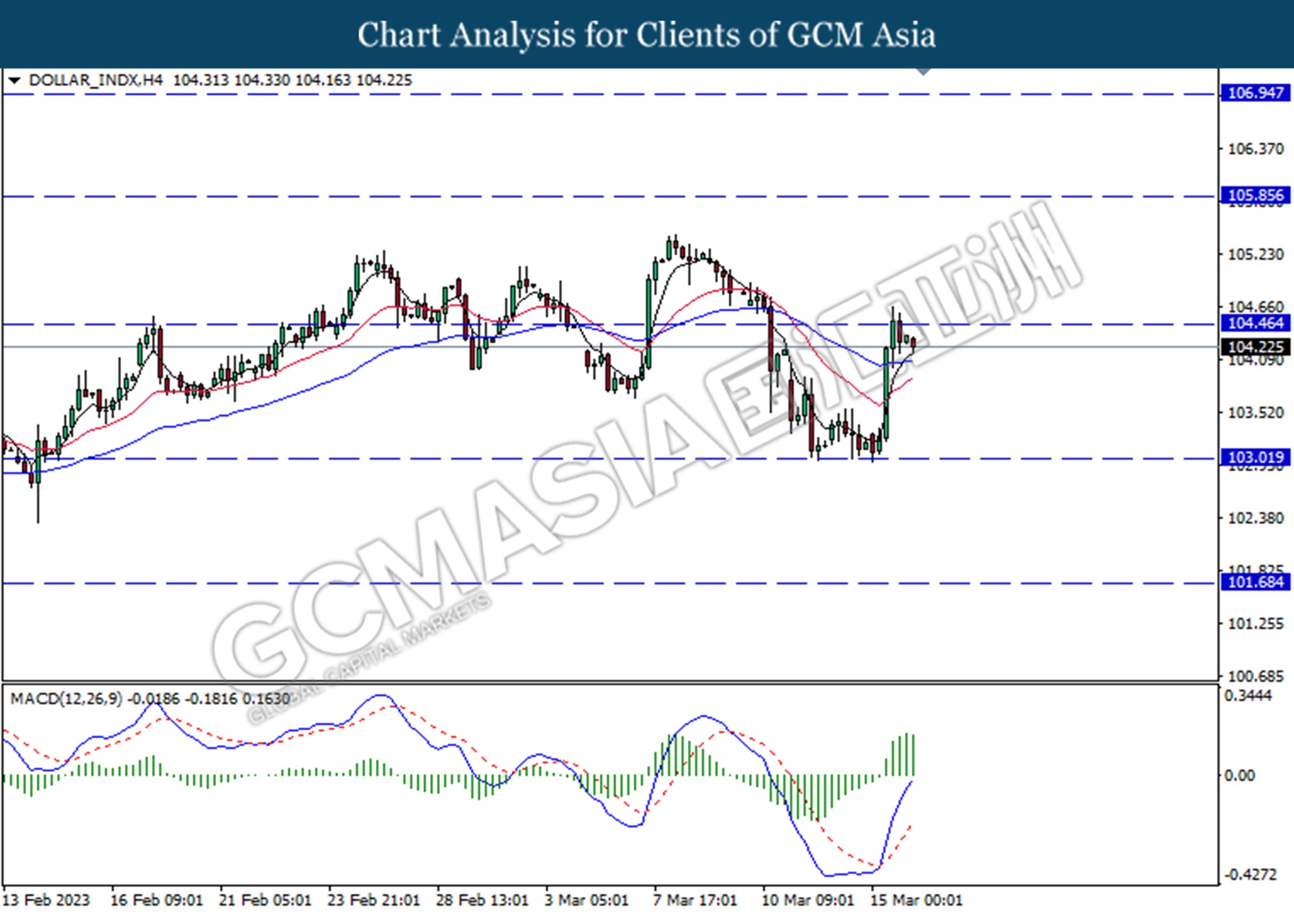

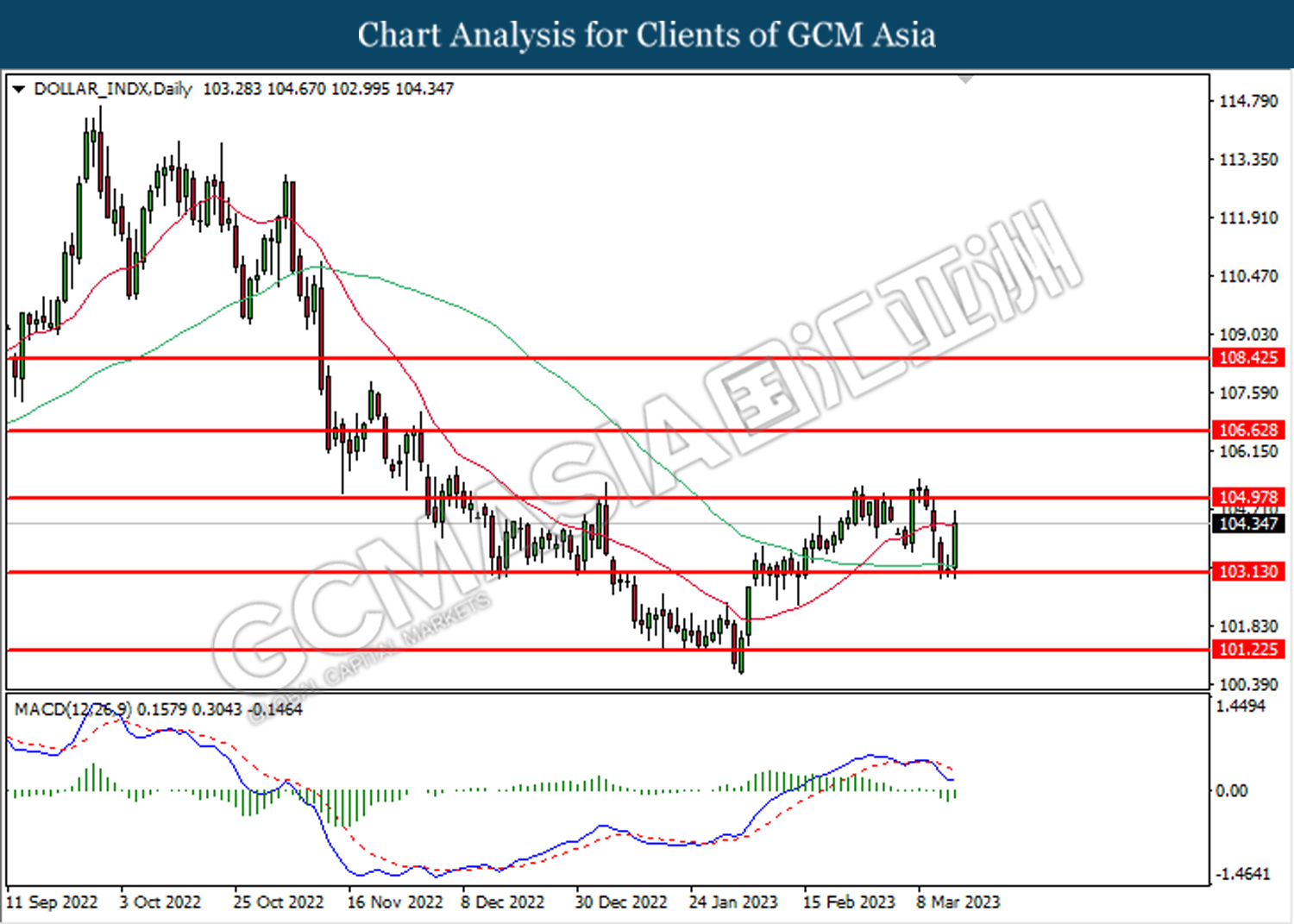

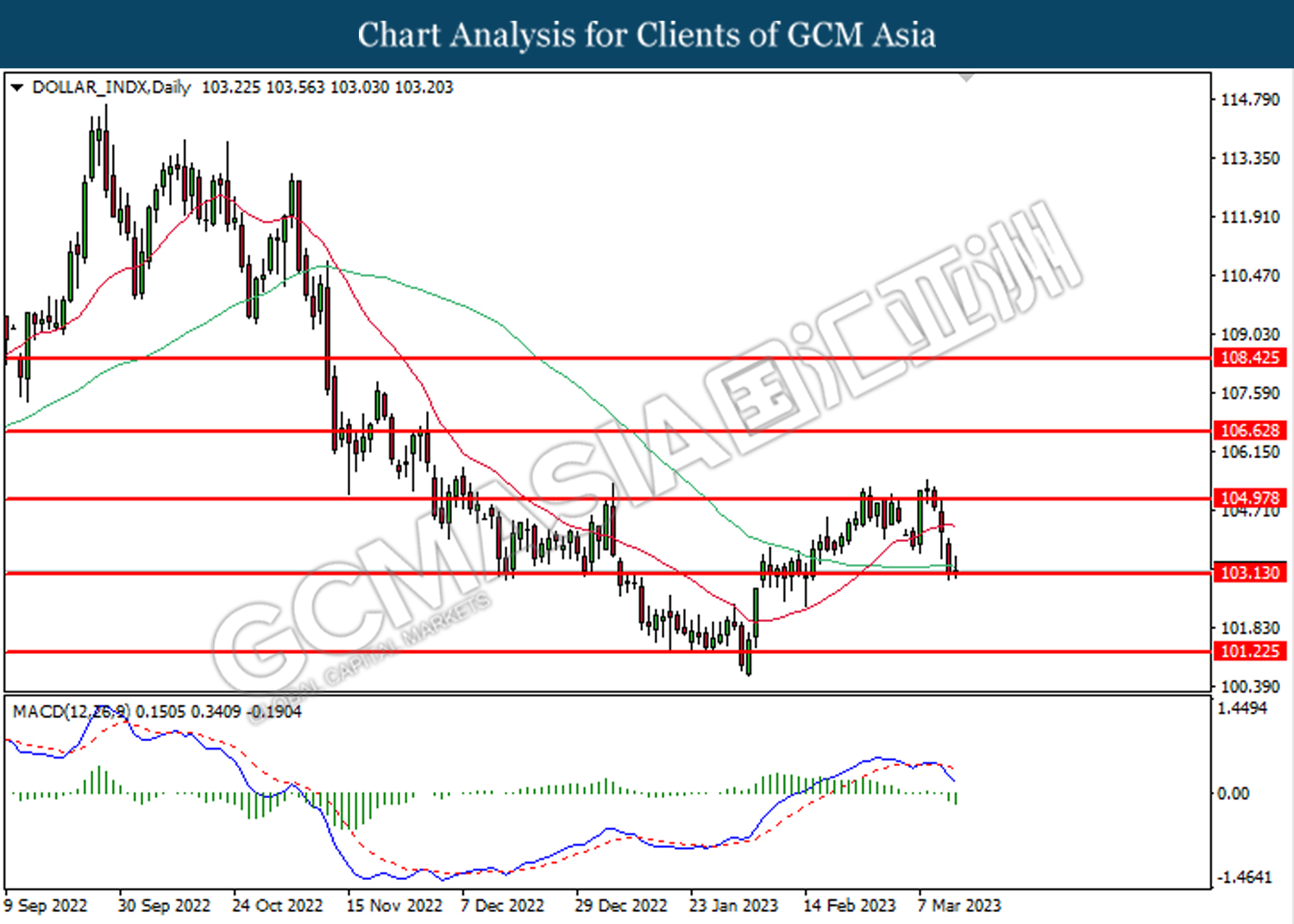

DOLLAR_INDX, H4: Dollar index was traded lower following a retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the index to extend its losses toward the support level at 101.70.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

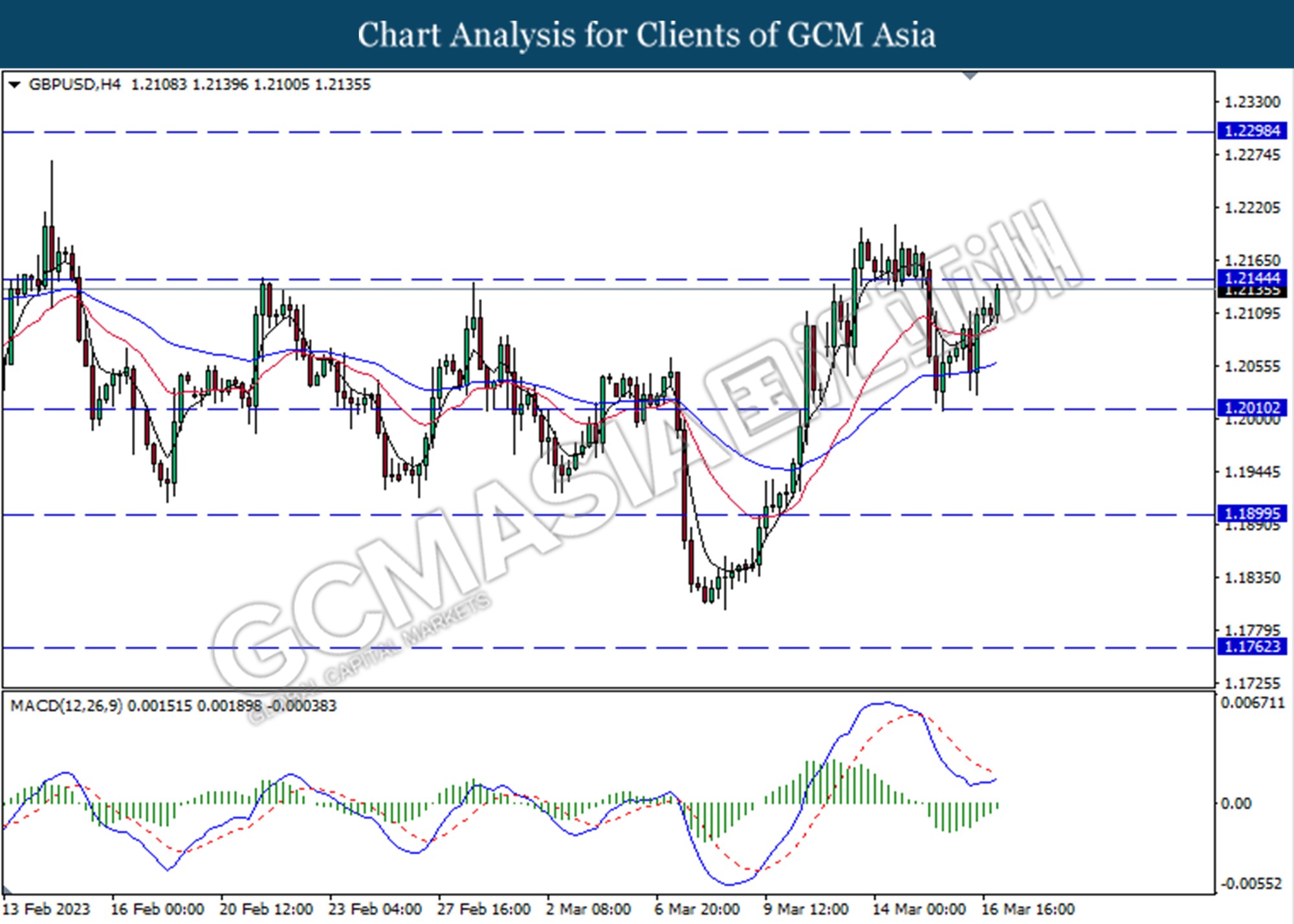

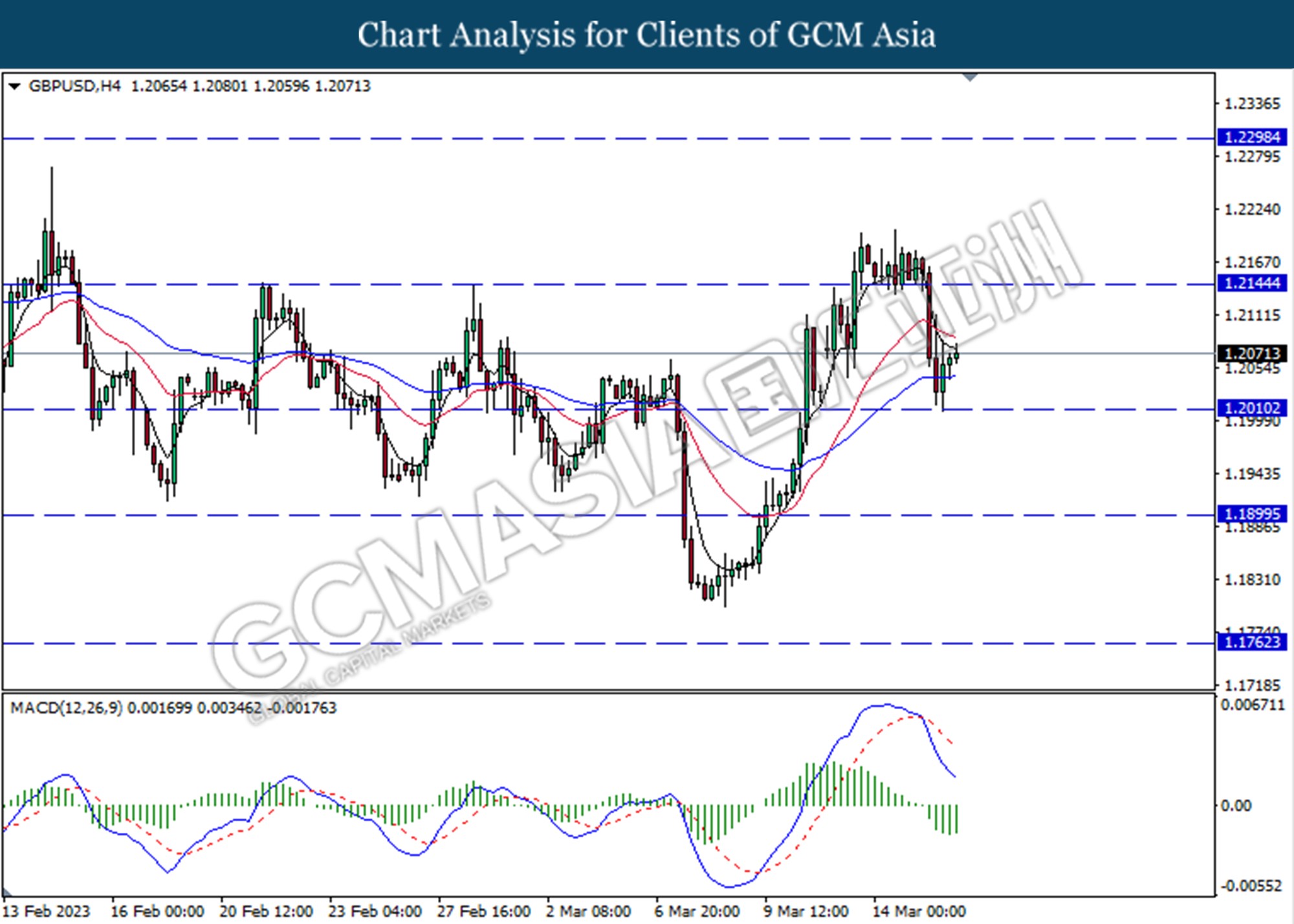

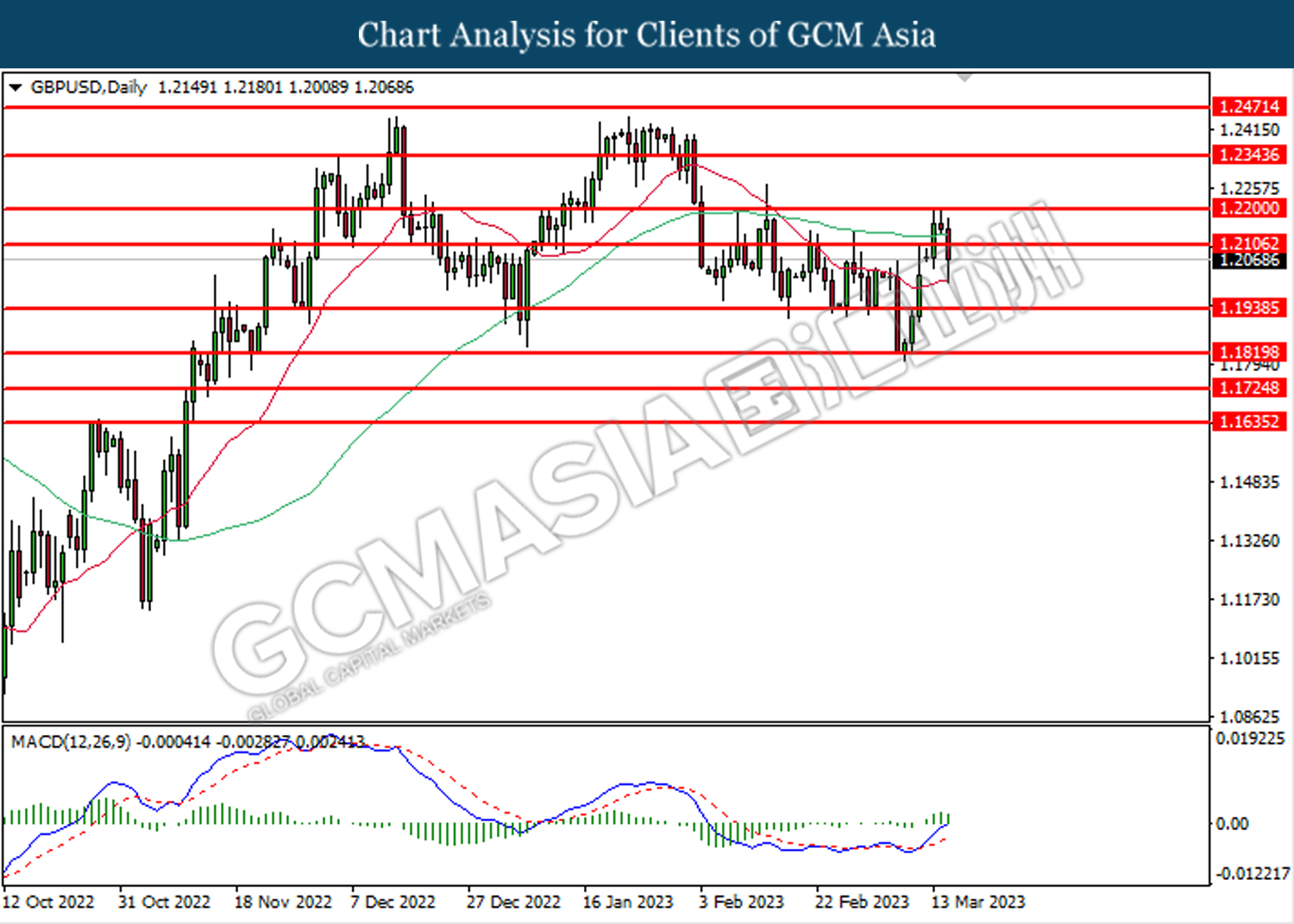

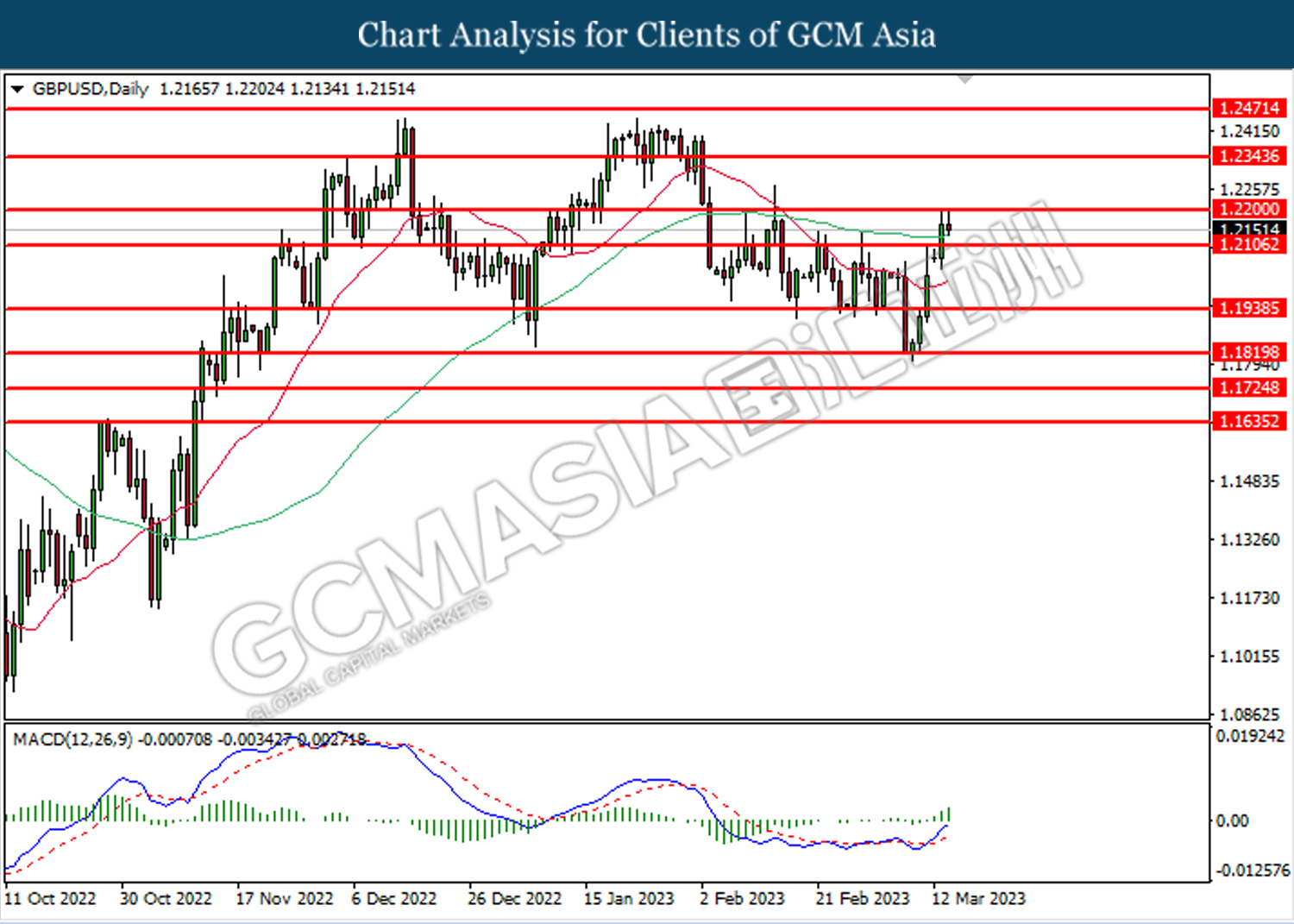

GBPUSD, H4: GBPUSD was traded higher while currently testing for the resistance level at 1.2300. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains if successfully break above the resistance level.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

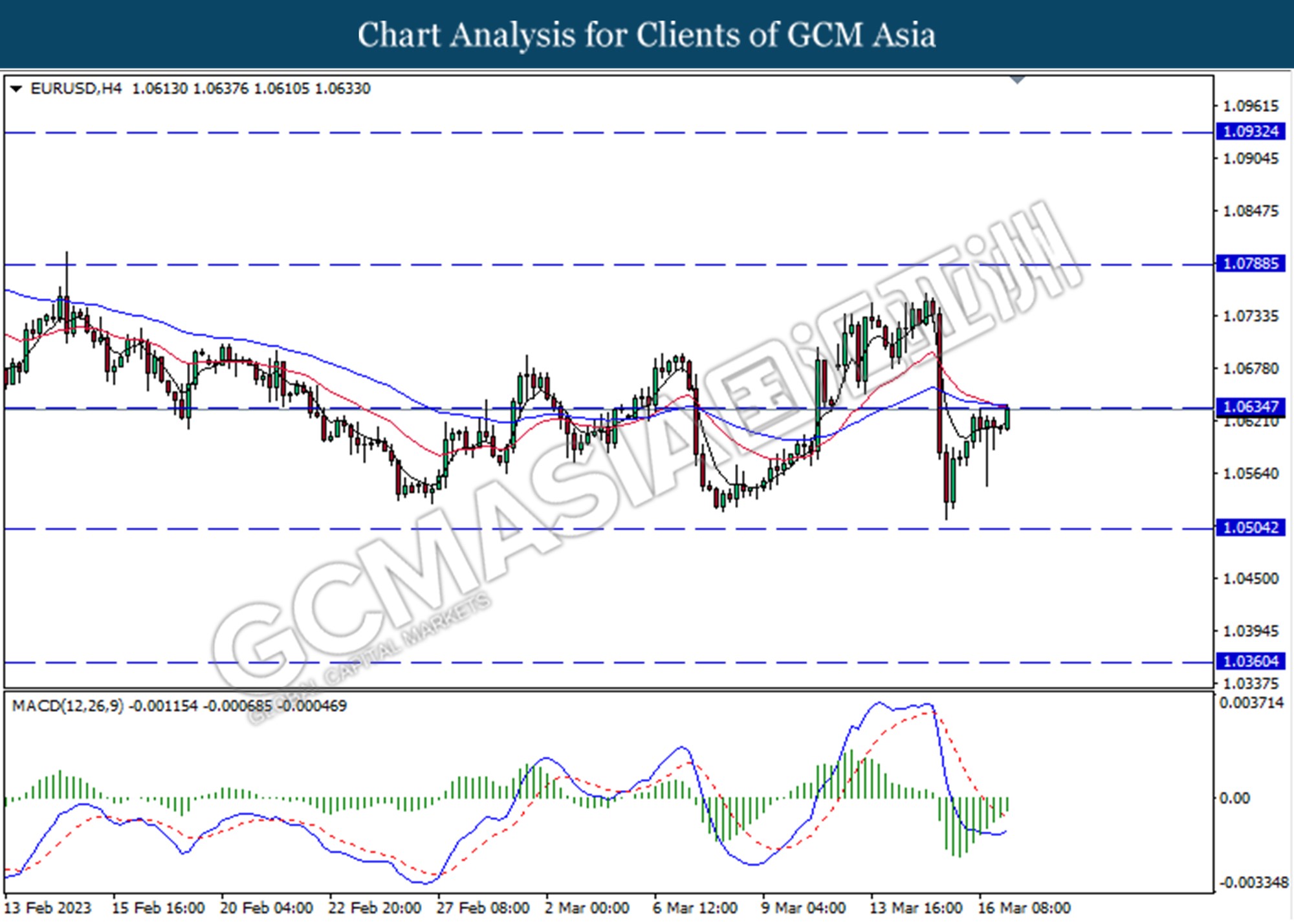

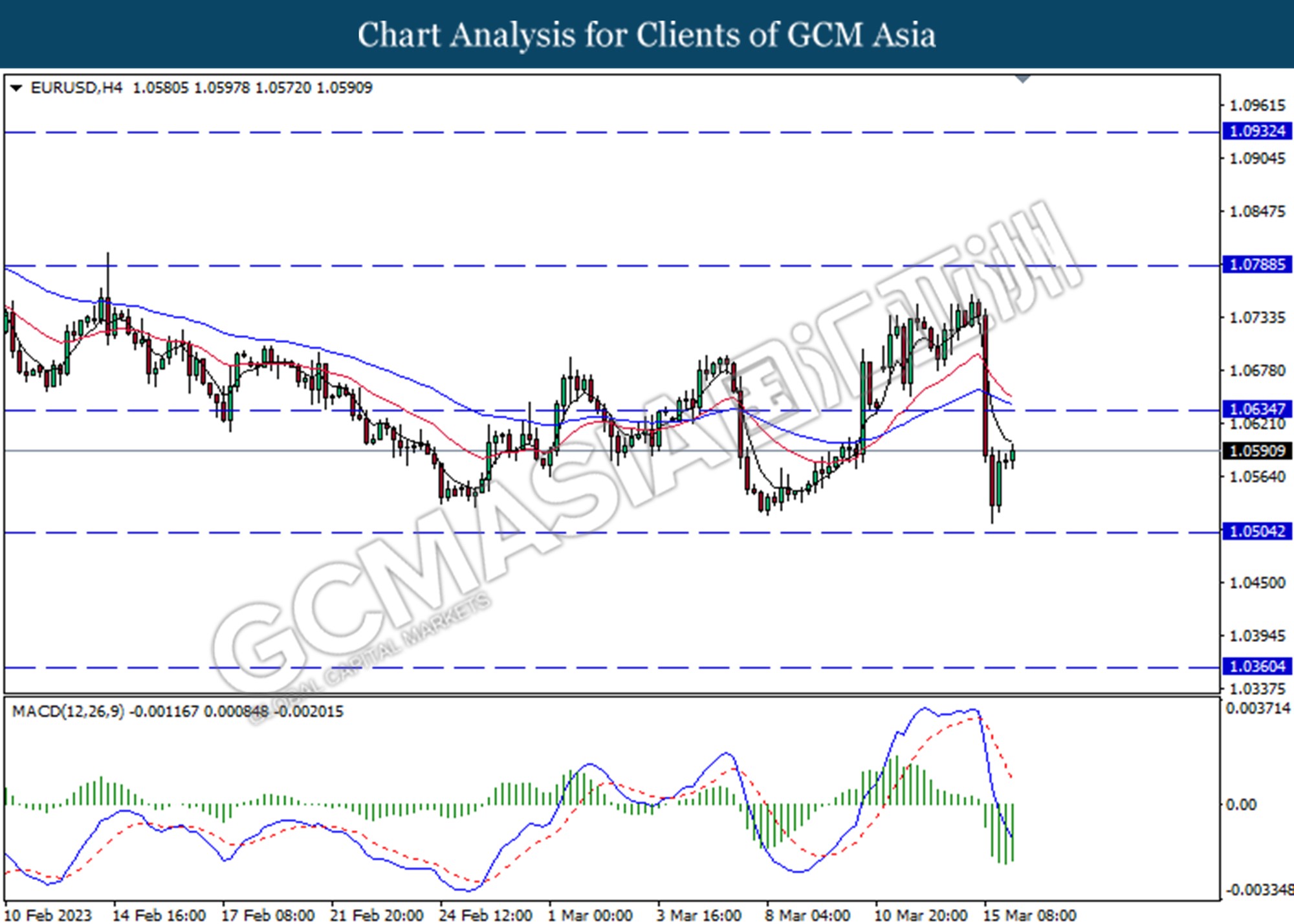

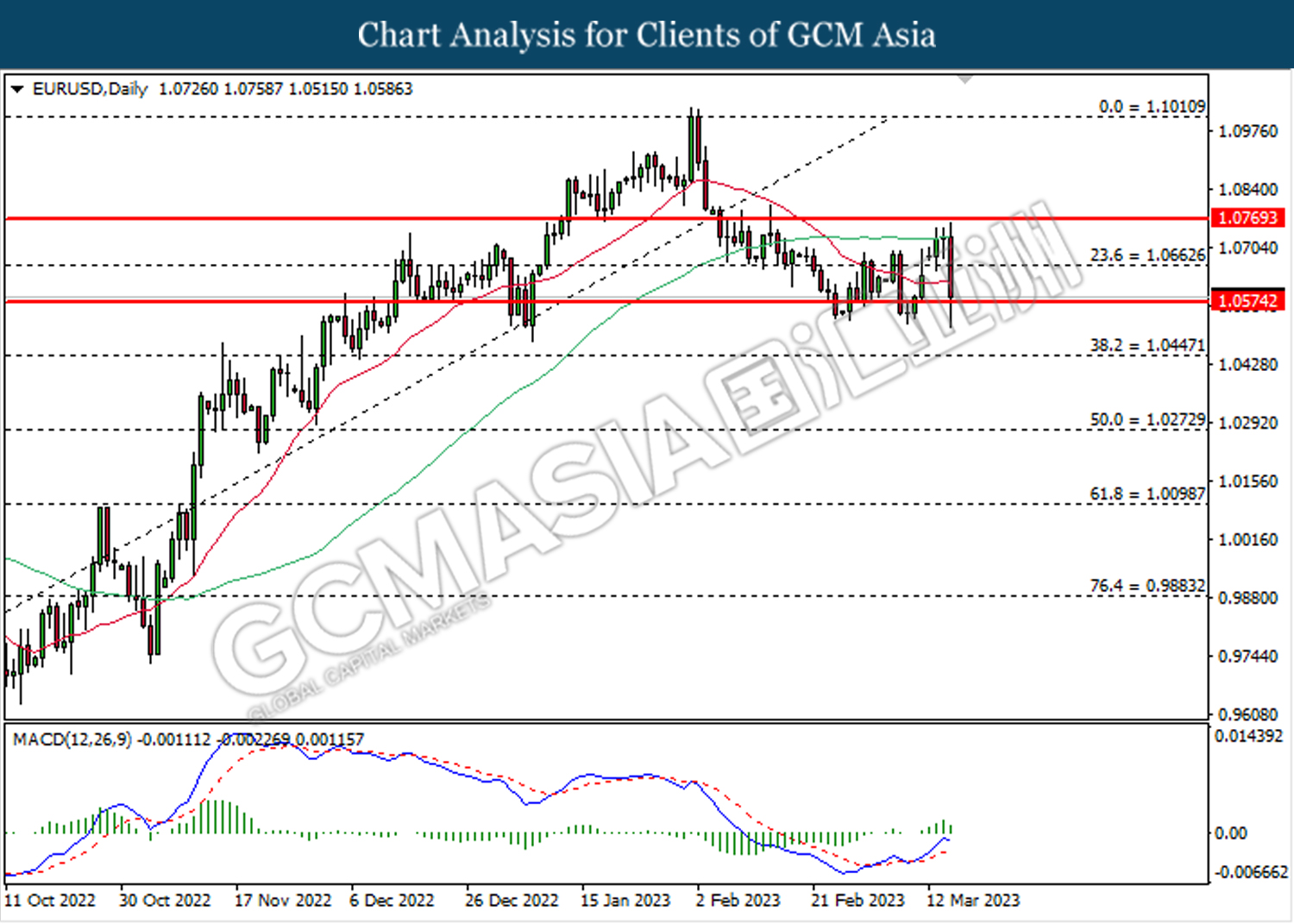

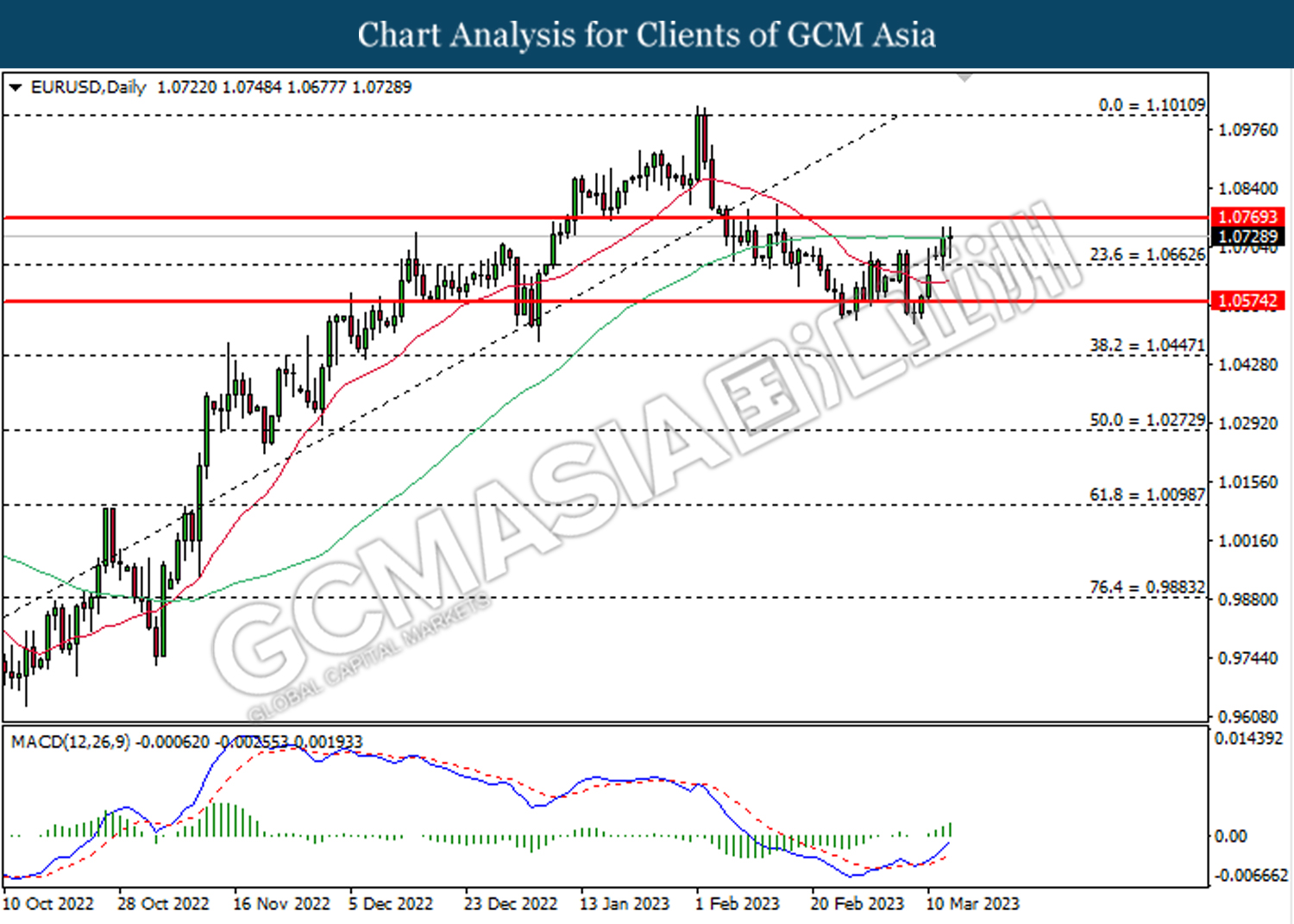

EURUSD, H4: EURUSD was traded higher following a prior break above the resistance level at 1.0790. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.0930.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

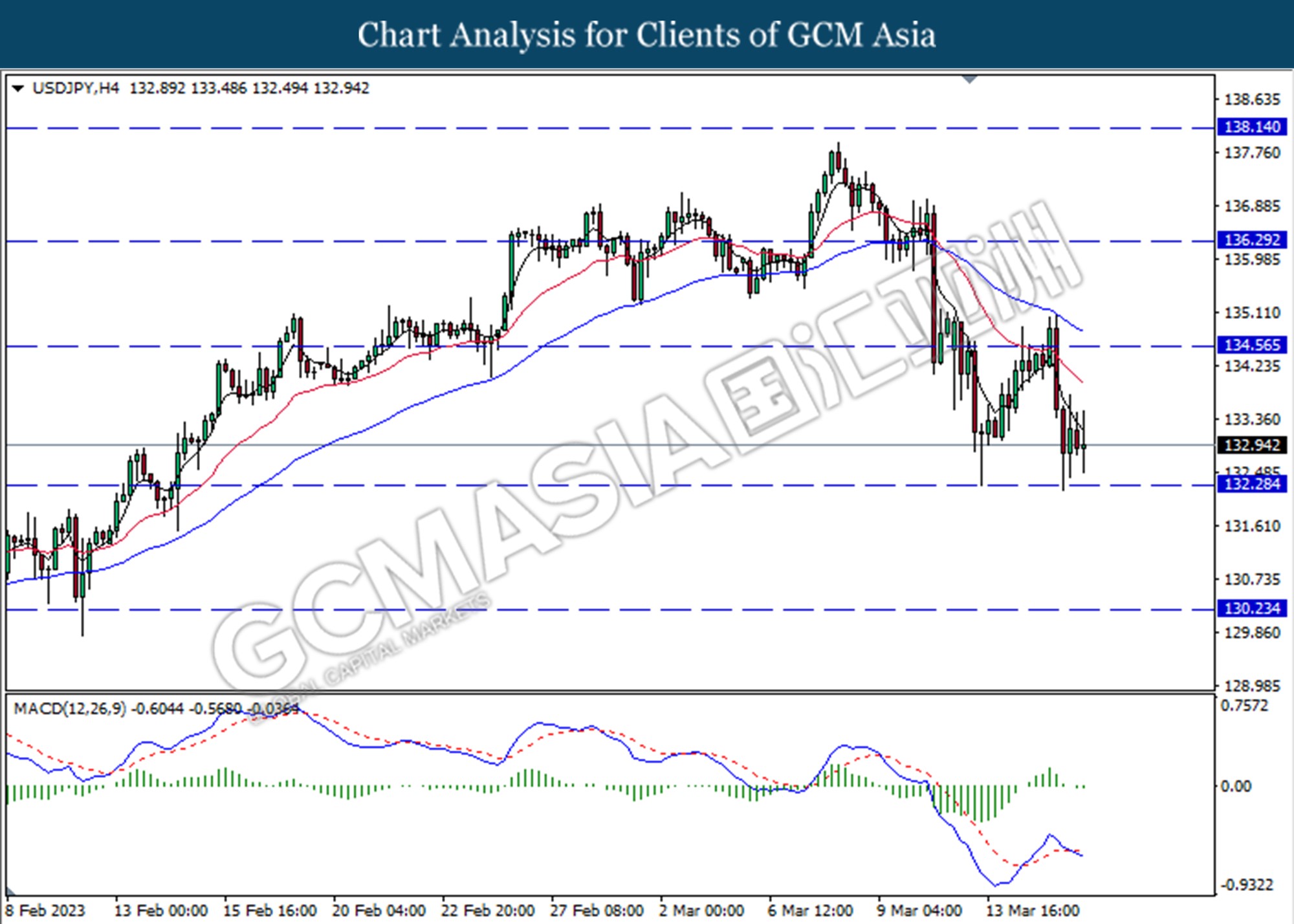

USDJPY, H4: USDJPY was traded lower following a prior break below the previous support level at 132.30. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 130.25.

Resistance level: 132.30, 134.60

Support level: 130.25, 128.00

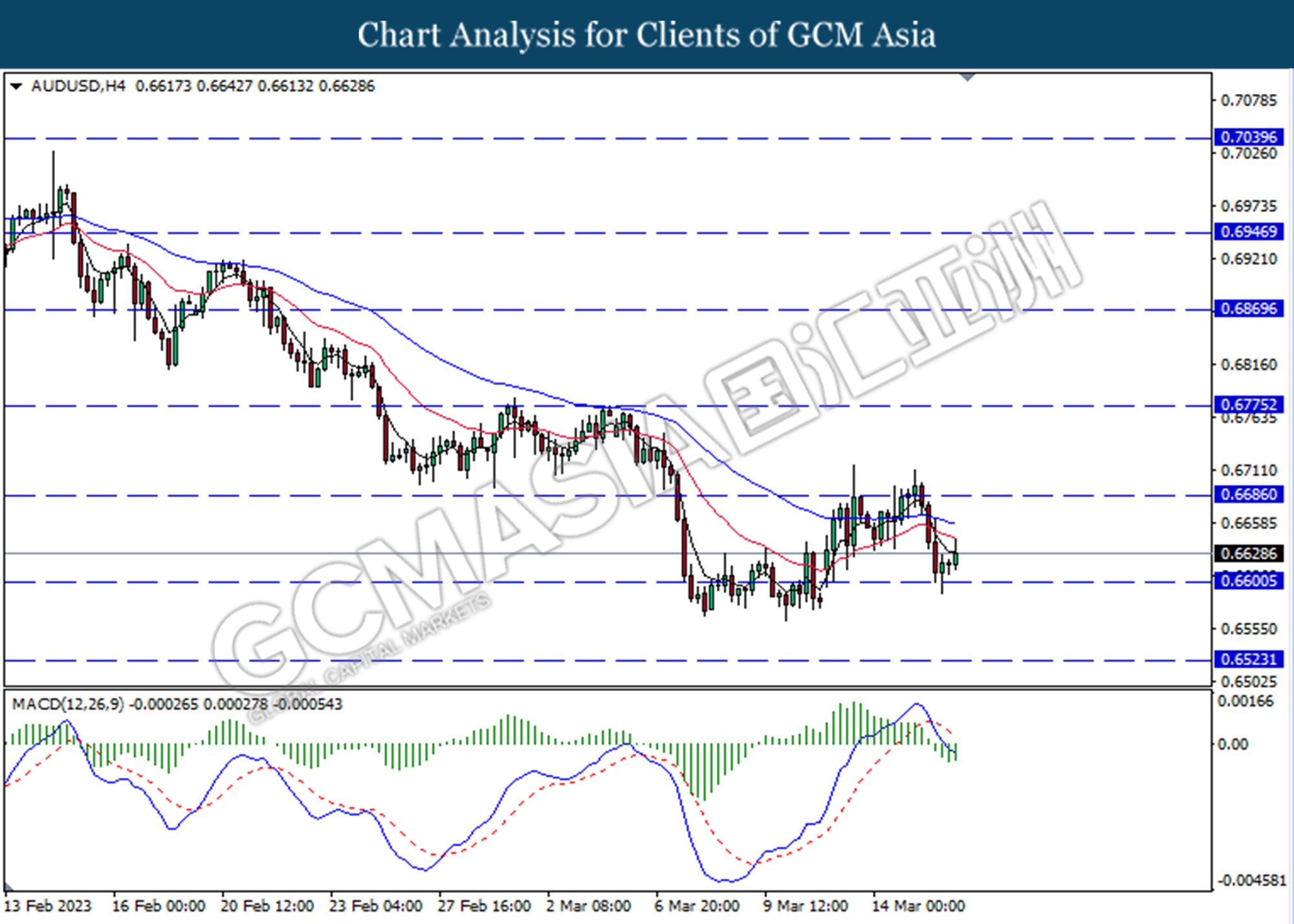

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6685. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6775.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

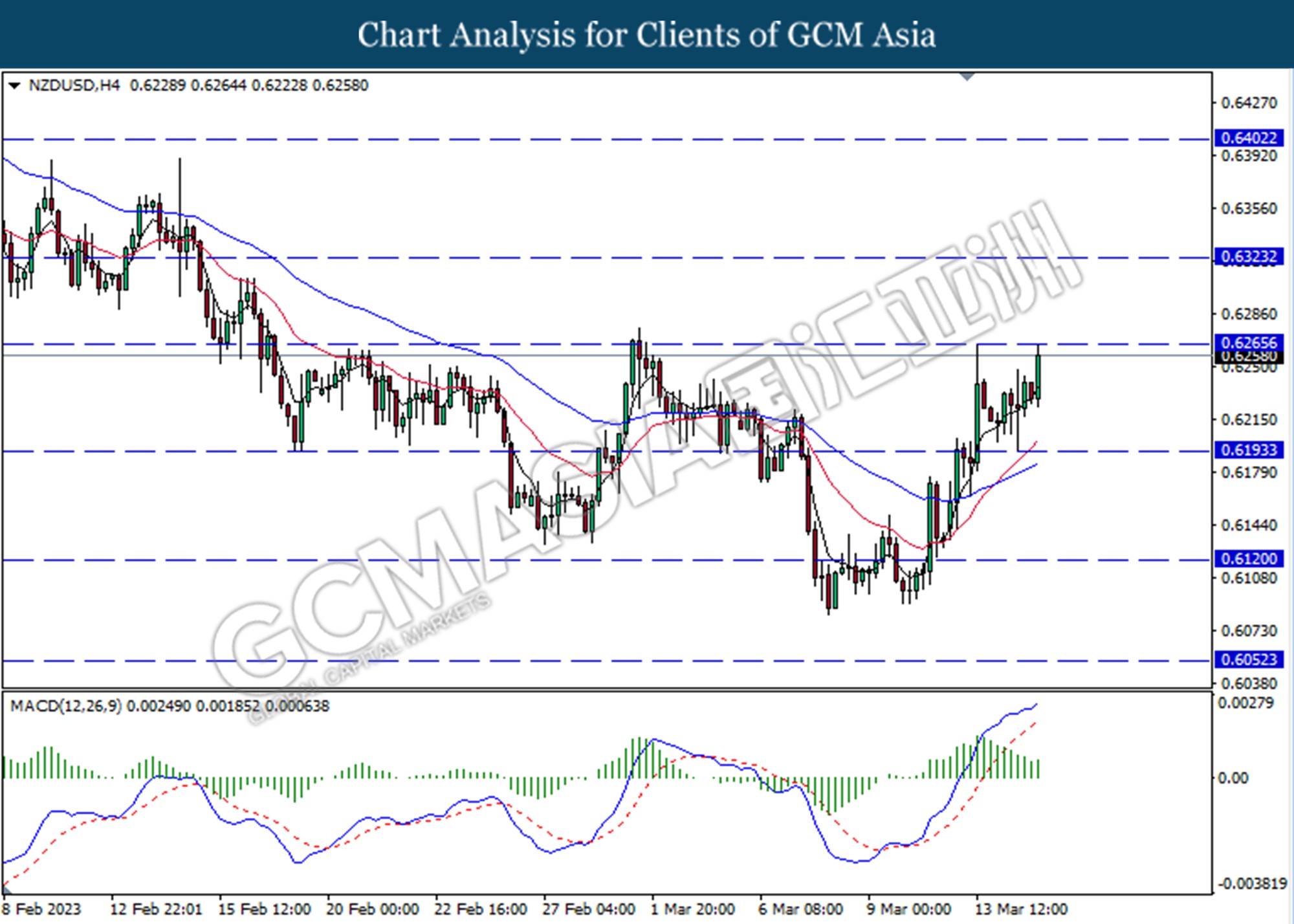

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6265. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains if breaks above the resistance level.

Resistance level: 0.6265, 0.6320

Support level: 0.6195, 0.6120

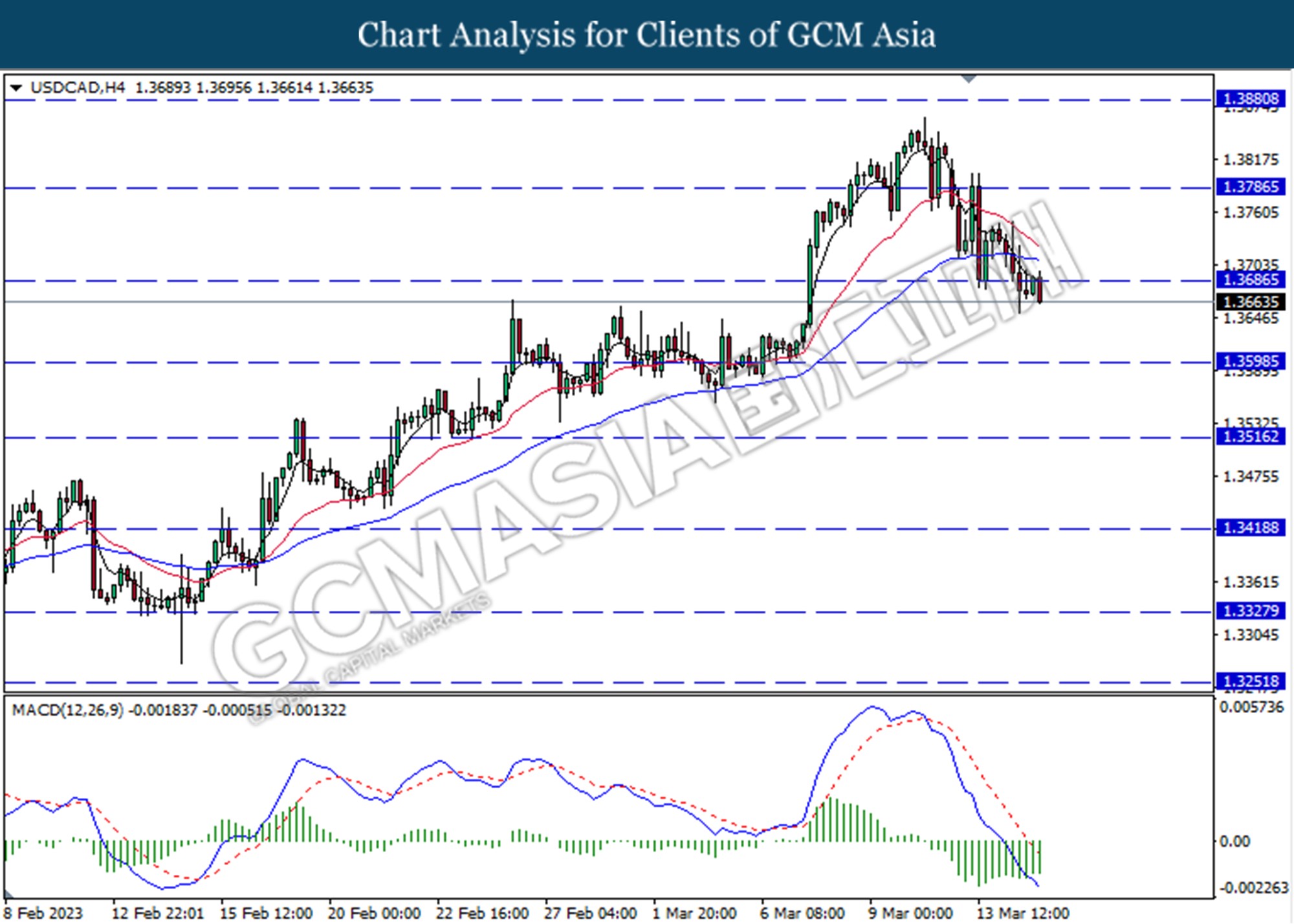

USDCAD, H4: USDCAD was traded lower following a prior break below the previous support level at 1.3685. MACD which illustrated diminishing bullish momentum suggests the pair extend its losses toward the support level at 1.3600.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

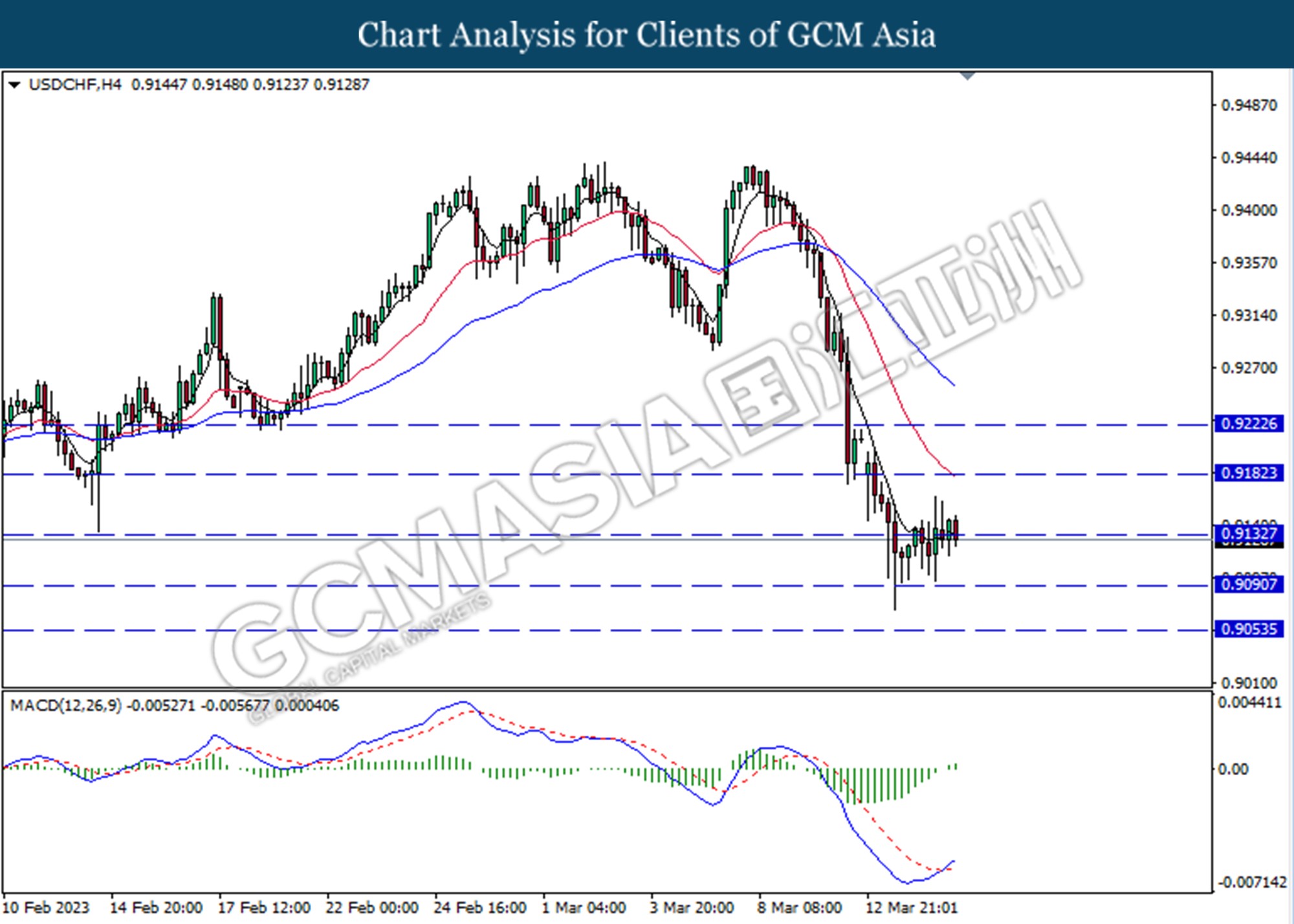

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level at 0.9182. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.9090.

Resistance level: 0.9180, 0.9285

Support level: 0.9090, 0.9005

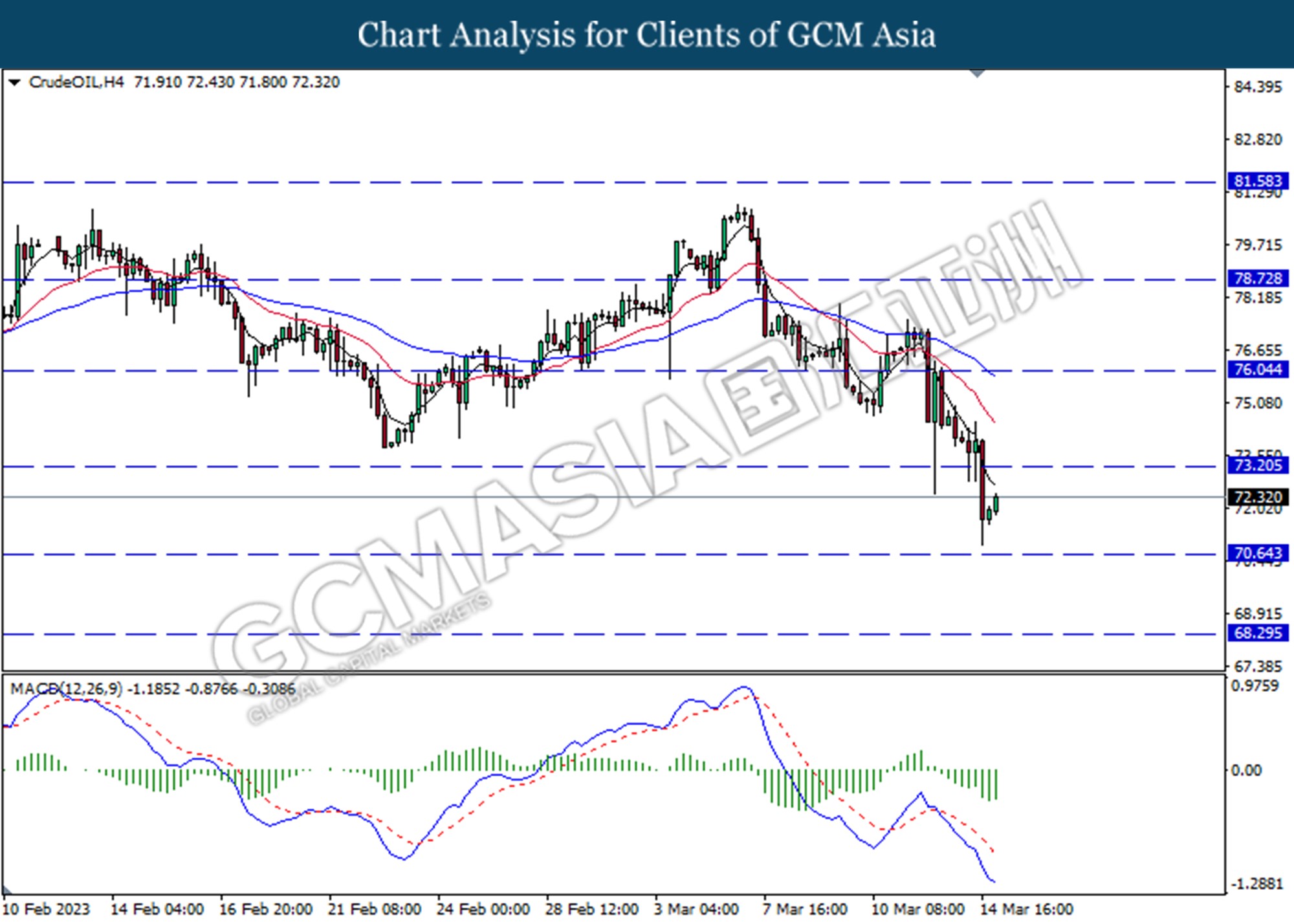

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. MACD which illustrated bullish momentum suggests the commodity to extend its gains toward the resistance level at 70.65.

Resistance level: 70.65, 73.20

Support level: 68.30, 66.05

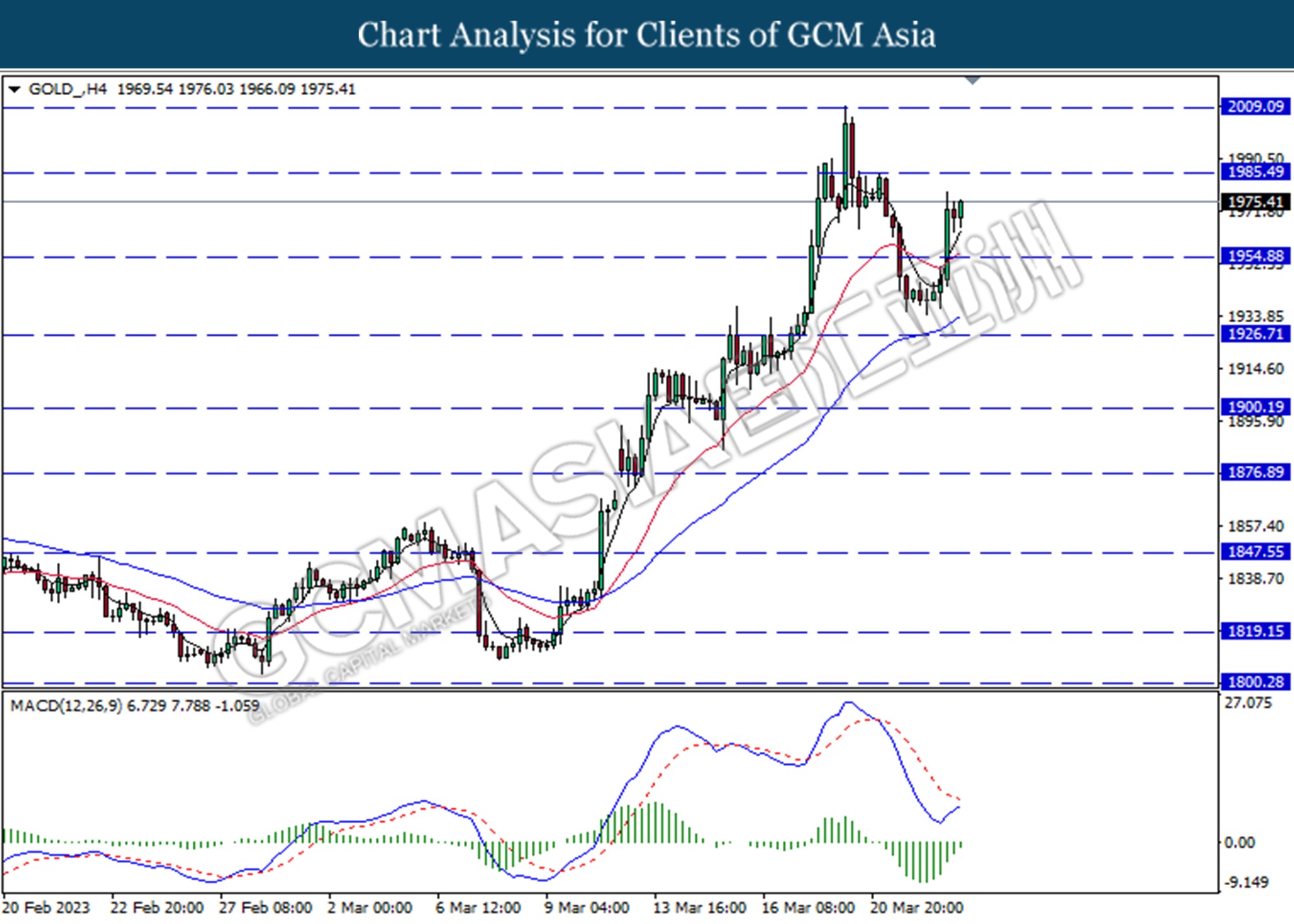

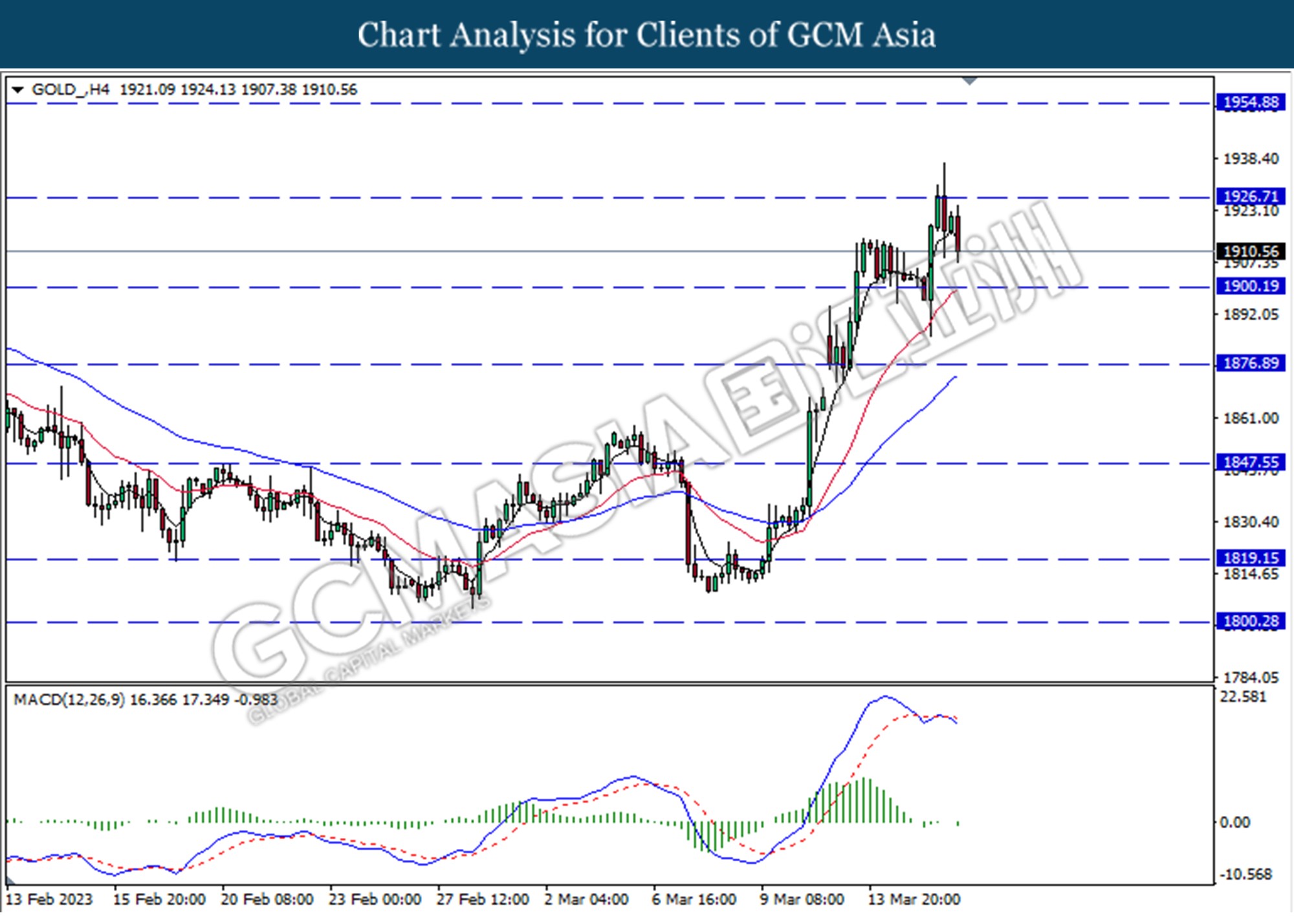

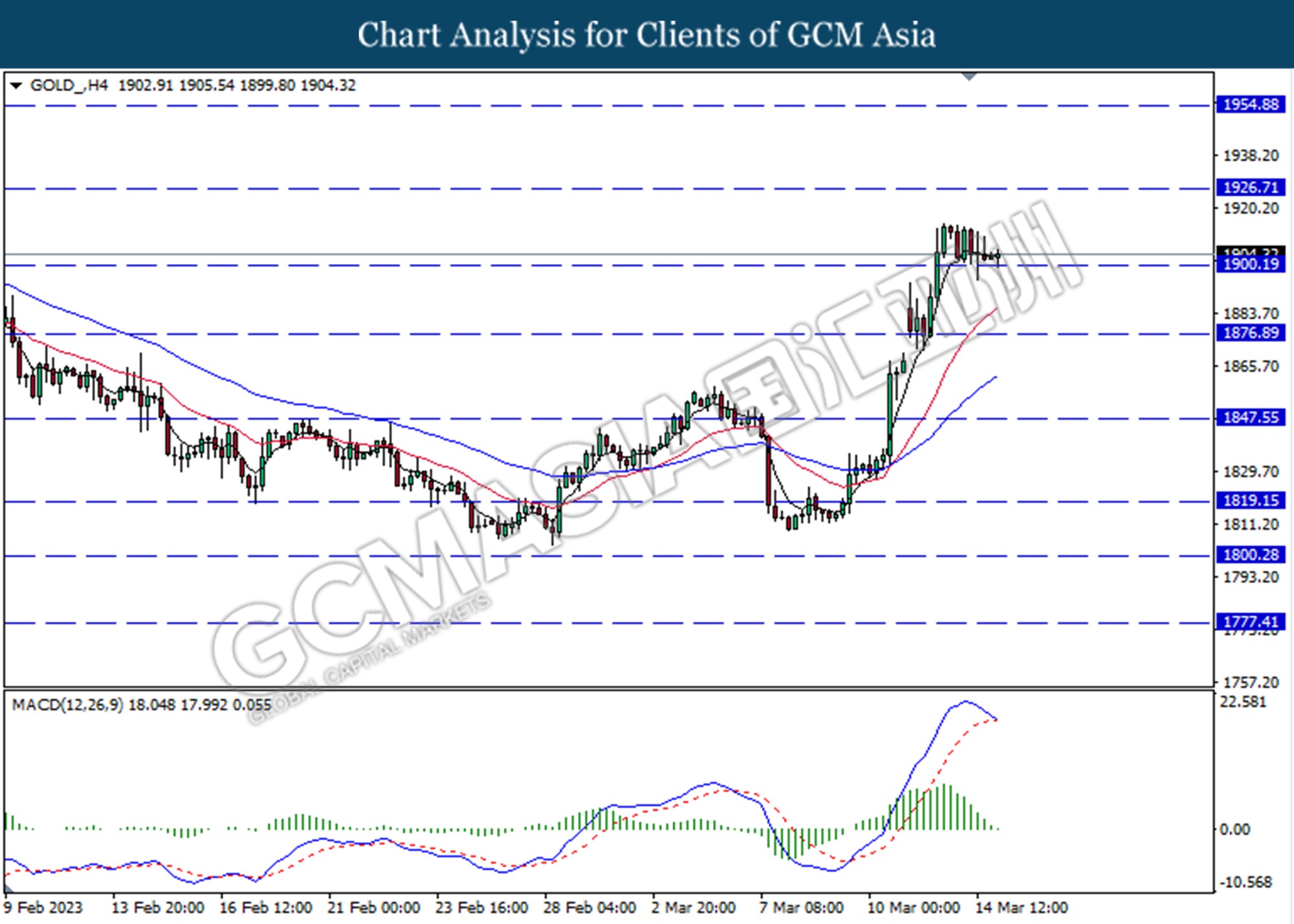

GOLD_, H4: Gold price was traded higher following a prior break above the previous resistance level at 1954.90. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 1985.50.

Resistance level: 1954.90, 1985.50

Support level: 1926.70, 1900.20

230323 Morning Session Analysis

23 March 2023 Morning Session Analysis

US Dollar plunged as rate hike might come to the end.

The Dollar Index which traded against a basket of sis major currencies slumped on Thursday after Fed released its interest rate decision. Earlier of the day, the US central bank decided to raise its cash rate by 25 basis point to 5.00%, which achieved the anticipation of consensus. After that, the following Press Conference that presented by Fed Chairman has given some clues on future rate hike path. The Federal Reserve Chair Jerome Powell has claimed that it might be one more rate hike would be implemented by the end of 2023. However, he also signaled that could represent an initial stopping point for the rate hike path. Prior to that, the bankruptcy of Silicon Valley Bank (SVB) and Signature Bank had shown that the recession in the US was becoming more serious, whereas another historical financial crisis would likely to occur. With that, Fed officials decided to scale down the rate hike pace in order to avoid the exacerbation of banking crisis, while dragging down the appeal of US Dollar. Nonetheless, it is note-worthy that the inflation fight does not over, said Jerome Powell. As of writing, the Dollar Index depreciated by 0.69% to 102.18.

In the commodity market, the crude oil price dropped by 1.16% to $70.07 per barrel as of writing following the crude oil inventories shown a stockpiles. According to EIA, the US Crude Oil Inventories increased by 1.117M barrels, which exceeding the market consensus. On the other hand, the gold price rose by 1.23% to $1970.50 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

17:00 CHF SNB Press Conference

18:00 EUR EU Leaders Summit

Tentative GBP BOE Inflation Letter

20:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision (Q1) | 1.00% | 1.00% | – |

| 20:00 | GBP – BoE Interest Rate Decision (Mar) | 4.00% | 4.25% | – |

| 20:00 | USD – Building Permits | 1.339M | – | – |

| 20:30 | USD – Initial Jobless Claims | 192K | 199K | – |

| 22:00 | USD – New Home Sales (Feb) | 670K | 648K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses of successfully breakout the support level.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

GBPUSD, Daily: GBPUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 73.10, 76.80

Support level: 69.75, 66.40

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1987.85, 2042.65

Support level: 1948.50, 1897.85

220323 Afternoon Session Analysis

22 March 2023 Afternoon Session Analysis

Loonie slipped as inflation slows in peace.

The Loonie, one of the most traded currencies for global investors, slipped as inflation slows in peace in February. Canadian February yearly basis inflation slowed to 4.7% compared with economists’ estimation of 4.8%. Inflation slowed for the fifth straight month and was the largest deceleration since April 2020. According to Statistics Canada. The decline in CPI in February was due to a steep monthly increase in price in February 2020 when the global supply was significantly affected by the Russian invasion of Ukraine. Furthermore, Investors are anticipated that the Bank of Canada will pause its interest rate hike as inflation slowdown in peace. Part of the analyst also argued that Canada’s economy is more sensitive to interest rate hikes than the US economy, amid Canadians’ participation in the hot housing market in recent years and the shorter Canadian mortgage cycle. A statistic announced by the National Bank of Canada that interest rate sensitive demand in Canada’s economy was 26% of final domestic demand when compared with 21% of the United States. Besides, Lonnie continues to slip ahead of the Fed interest rate decision as investors await more cues from the meeting. As of writing, the USD/CAD pairs depreciation by -0.08% to $1.3700.

In the commodities market, crude oil prices edged down by -0.89% to $69.05 per barrel as the market awaits interest rate decision looms. Besides, gold prices ticked up by 0.25% to $1945.95 per troy ounce amid the uncertainty about the Fed monetary policy decision.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:45 EUR ECB President Lagarde Speaks

02:00 USD FOMC Economic Projections

(23th)

02:00 USD FOMC Press Conference

(23th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.550M | -1.565M | – |

| 02:00

(23th) |

USD – Fed Interest Rate Decision | 4.75% | 5.00% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. However, MACD which illustrated diminishing bearish momentum suggests the index to traded higher as technical correction.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

GBPUSD, H4: GBPUSD was traded higher following the rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggest the pair to undergo technical correction in the short term.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

EURUSD, H4: EURUSD was traded higher following rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in the short term.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower while currently testing for the support level at 132.30. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses if successfully break below the support level.

Resistance level: 134.60, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.6685. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains if successfully break above the resistance level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher while currently testing for the resistance level at 0.6195. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains if breaks above the resistance level.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

USDCHF, H4: USDCHF was traded lower following a prior break below the previous support level at 0.9285. MACD which illustrated bearish momentum suggest the pair to extend its losses toward the support level at 0.9180

Resistance level: 0.9285, 0.9390

Support level: 0.9180, 0.9090

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 68.30.

Resistance level: 70.65, 73.20

Support level: 68.30, 66.05

GOLD_, H4: Gold price was traded lower following a prior break below the previous support level at 1954.90 MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 1926.70.

Resistance level: 1954.90, 1985.50

Support level: 1926.70, 1900.20

220323 Morning Session Analysis

22 March 2023 Morning Session Analysis

US dollar lingered ahead of Fed interest rate decision.

The dollar index, which traded against a basket of six major currencies, hovered near the 6 weeks low as the market participants were waiting for the interest rate decision from the Federal Reserve. In this week, there will be a slew of central bank meetings due, whereby the Fed rate decision was the spotlight among them. At the point in time, the CME FedWatch Tool shows that the probability for a rate hike of 25 basis point stands at 87.1%, whereas the remainders is the chances of Fed maintaining the interest rate at current level. Prior to that, majority of the investors bet that the Fed will take a step back from its tightening path amid the fallout of banks. However, the table was flipped over after the Federal Reserve offered a series of support to the banking sector. The Fed has come into a consensus with other major central banks on implementing swap lines to head off crisis, where the central banks offer 7-day US dollar operations on daily basis. Before that, the Federal Reserve has also widened its balance sheet by offering additional new funding to the short-cash banks tide through the hardship. In overall, the market participant’s remains divided in regards to the rate hike decision of Fed. As of writing, the dollar index dropped -0.06% to 103.20.

In the commodities market, crude oil prices appreciated by 2.39% to $69.30 per barrel as the market fears over the banking crisis subsided. Besides, gold prices ticked up by 0.05% to $1941.55 per troy ounce while the investors are waiting for the Fed interest rate decision.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:45 EUR ECB President Lagarde Speaks

02:00 USD FOMC Economic Projections

(23th)

02:00 USD FOMC Press Conference

(23th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Feb) | 10.1% | 9.9% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.550M | -1.565M | – |

| 02:00

(23th) |

USD – Fed Interest Rate Decision | 4.75% | 5.00% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2345.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.0770.

Resistance level: 1.0770, 1.1010

Support level: 1.0665, 1.0575

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 130.70. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 133.05.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3635. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3730.

Resistance level: 1.3730, 1.3830

Support level: 1.3635, 1.3565

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.9225.

Resistance level: 0.9320, 0.9475

Support level: 0.9225, 0.9070

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 66.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 71.65.

Resistance level: 71.65, 76.10

Support level: 66.10, 61.45

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1944.60. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level at 1944.60.

Resistance level: 1985.90, 2024.90

Support level: 1944.60, 1900.00

210323 Afternoon Session Analysis

21 March 2023 Afternoon Session Analysis

Euro appreciated after Lagarde’s optimistic speech.

The Euro dollar, which is one of the most popular traded currencies, continued to be favorable by global investors after Europe Central Banks (ECB) president Lagarde’s optimistic speech on Eurozone banking sectors. Before that, Christine Lagarde has acknowledged that turmoil in the banking sector could force the ECB to stop raising interest rates as the market jitters hit the Eurozone’s business and consumer spending. The total amount of lending in the Eurozone from banks in the bloc contracted by €61bn from January to February. However, Lagarde mentioned that the Eurozone banks had limited exposure to Credit Suisse after the joint efforts by Swiss National Banks (SNB) and UBS of taking over the bank. She also said Eurozone lenders were “well supervised”, with more than 2200 banks in Europe covered by Basel III rules requiring them to maintain a minimum 7% capital requirement. Additionally, Euro continued to benefit from the weakening of the dollar. The US Federal Reserve and other major central banks joint action of increasing the frequency of maturity operations from weekly to daily has improved the liquidity of the currencies. As a result, the joint plan has weakened the US dollar. As of writing, the EUR/USD pair slipped -0.12% to $1.0706, while the market participants are waiting for more cues from Germany’s ZEW Economic Sentiment.

In the commodities market, crude oil prices were traded down by -1.03% to $67.10 per barrel as the uncertainty of the Fed interest rate decision. Besides, gold prices depreciated by -0.32% to $1976.70 per troy ounce as the Fed meeting looms.

Today’s Holiday Market Close

Time Market Event

All Day JPY Vernal Equinox

Today’s Highlight Events

Time Market Event

20:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – German ZEW Economic Sentiment (Mar) | 28.1 | 16.4 | – |

| 20:30 | CAD – Core CPI (MoM) (Feb) | 0.3% | – | – |

| 22:00 | USD – Existing Home Sales | 4.00M | 4.17M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in the short term.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.2145.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.0365.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

AUDUSD, H4: AUDUSD was traded lower while currently testing for the support level at 0.6685. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully break below the support level.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6265. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

USDCAD, H4: USDCAD was traded higher while currently testing for the resistance level at 1.3685. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains if successfully break above the resistance level.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9285. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses if successfully break below the support level.

Resistance level: 0.9320, 0.9475

Support level: 0.9225, 0.9070

CrudeOIL, H4: Crude oil price was traded lower following retracement from the higher level. However, MACD which illustrated bullish momentum suggests the commodity to undergo technical correction in the short term.

Resistance level: 68.30, 70.65

Support level: 66.05, 63.70

GOLD_, H4: Gold price was traded higher following a prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in the short term.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70

210323 Morning Session Analysis

21 March 2023 Morning Session Analysis

Greenback slumped amid ongoing woes in US banking sector.

The dollar index, which traded against a basket of six major currencies, lost its ground while teetering near the brink of collapse as the ongoing banking sector woes coaxed investors to stay away from the dollar market. Yesterday, the US Federal Reserve and other major central banks took joint action for dollar liquidity to support the country’s tide through the banking crisis. In detail, the central banks, which include the Federal Reserve, the Bank of Canada, the Bank of England, the Bank of Japan, and the European Central Bank, have enhanced the swap lines’ effectiveness in providing US dollar funding, where all of them agreed to increase the frequency of 7-day maturity operations from weekly to daily and continuing at least until the end of April. The swap lines agreement was initially introduced during the era of the 08’ Lehman Crisis, when the Fed provided temporary dollar liquidity swaps to overseas central banks to address short-term dollar liquidity shortages outside the U.S. Against the backdrop, the action from the central banks dragged down the dollar value. On top of that, with the increasing expectation of a rate hike pause from the Fed, the appeal of the dollar index dropped further. As of writing, the dollar index edged down -0.39% to 103.30.

In the commodities market, crude oil prices were down by -0.19% to $67.35 per barrel as the uncertainty risk continued to linger in the market. Besides, gold prices ticked down by -0.02% to $1978.00 per troy ounce amid profit-taking by the traders.

Today’s Holiday Market Close

Time Market Event

All Day JPY Vernal Equinox

Today’s Highlight Events

Time Market Event

20:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – German ZEW Economic Sentiment (Mar) | 28.1 | 16.4 | – |

| 20:30 | CAD – Core CPI (MoM) (Feb) | 0.3% | – | – |

| 22:00 | USD – Existing Home Sales | 4.00M | 4.17M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2345.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0665. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.1010

Support level: 1.0665, 1.0575

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 133.05. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 130.70.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3730. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3635.

Resistance level: 1.3730, 1.3830

Support level: 1.3635, 1.3565

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9320. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9320.

Resistance level: 0.9320, 0.9475

Support level: 0.9225, 0.9070

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 66.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 71.65, 76.10

Support level: 66.10, 61.45

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1985.90. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1985.90, 2042.60

Support level: 1944.60, 1900.00

200323 Afternoon Session Analysis

20 March 2023 Afternoon Session Analysis

Japanese Yen nudge higher as resilient in economy

The Japanese Yen, one of the most traded currencies remains upward in its position after Japan’s economy has been resilient on the whole. According to the Bank of Japan (BoJ) monetary policy meeting statement, Firms in Japan have been optimistic about making business fixed investments and private consumption has been on a recovery trend. The fact that outlook for the long-term domestic economic growth rate has risen. Besides, investors flocked to the yen as a haven currency due to bank jitters recently. Most recently, Credit Suisse was one of the 30 banks worldwide collapsed after the main shareholder would not invest more money in the bank sparking market panic. This is the third bank, the two largest banks in the United States to fail, so the panic in the banking industry stimulated demand for the yen. However, the gains of the Japanese Yen were offset by ultra-loose monetary policy. Japanese government eyes effort worth two trillion Yen to defend the economy from slipping into a deflation zone. JPY gains are limited due to the current monetary easing. As of writing, the USD/JPY gained 0.01% to $131.80.

In the commodities market, crude oil prices traded down by -1.79% to $65.75 per barrel investors sold heavily on that the economy slows down. Besides, gold prices appreciated by 0.85% to $1990.25 per troy ounce after weakening in US dollar as market gauge Fed liquidity measures.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following retracement from the higher level. MACD which illustrated increasing bearish bias momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

GBPUSD, H4: GBPUSD was traded lower following a retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to traded higher as technical correction.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated increasing bullish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 132.30. However, MACD which illustrated decreasing bearish momentum suggests the pair to traded higher as technical correction.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6265. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

USDCAD, H4: USDCAD was traded lower while currently testing for the support level. MACD which illustrated bearish momentum suggests the pair to extend its losses if successfully break below the support level.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. However, MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 0.9180.

Resistance level: 0.9285, 0.9390

Support level: 0.9180, 0.9090

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the support level at 66.05. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level.

Resistance level: 68.30, 70.65

Support level: 66.05, 63.70

GOLD_, H4: Gold price was traded lower following retracement from the resistance level at 1985.50. MACD which illustrated decreasing bullish momentum suggests the commodity to extend losses toward the support level at 1954.90.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70

200323 Morning Session Analysis

20 March 2023 Morning Session Analysis

Greenback sank amid Fed rate hikes expectation eased.

The dollar index, which traded against a basket of six major currencies, lost its ground as the recent bank jitters tumbled the possibility of the Fed’s aggressive rate hike. Last week, the fallout of SVB and Signature Bank coaxed the market participants to rush into traditional safe-haven assets, in order to avoid market uncertainty. With the purpose of safeguarding the US banking sector, the Federal Reserve has implemented a new funding facility, which will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. As a result, cash-short banks have borrowed about $300 billion from the Federal Reserve in the past week. The plan has blunted the Fed’s ongoing quantitative program and re-widened the Fed’s balance sheet massively. Besides, the banking crisis urged investors to bet on a pause in hiking interest rates by the Federal Reserve in the upcoming meeting. Against this backdrop, the US dollar is likely to remain under pressure in the foreseeable future. As of writing, the dollar index edged up 0.04% to 103.75.

In the commodities market, crude oil prices were down by -0.02% to $66.35 per barrel as the banking turmoil in Europe and the US blurred the oil demand’s prospect. Besides, gold prices ticked down by -0.59% to $1977.80 per troy ounce after skyrocketing more than 3% last Friday amid the market contagion fears.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2200, 1.2345

Support level: 1.2105, 1.1940

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0665. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.1010

Support level: 1.0665, 1.0575

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 133.05. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 130.70.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3730. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3635.

Resistance level: 1.3730, 1.3830

Support level: 1.3635, 1.3565

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9320. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term toward the higher level.

Resistance level: 0.9325, 0.9475

Support level: 0.9225, 0.9070

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 66.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 71.65, 76.10

Support level: 66.10, 61.45

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1985.90. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1985.90, 2042.60

Support level: 1944.60, 1900.00

170323 Afternoon Session Analysis

17 March 2023 Afternoon Session Analysis

Euro jumped in the aftermath of ECB hikes rate.

The Euro, which is acted as the major currency in European Union, jumped aftermath of the ECB hikes rate by 50 basis points, as expected to 3.50%. Recently, the swift closure of Silicon Valley Bank, followed by the Signature bank rattled investors’ confidence and raised concern over the global tightening path. Following that, investors took a bet on a 25bps rate hike by the ECB rather than a 50bps of increment. However, the council decided to increase the interest rate by 50 points in order to return inflation to the ECB’s medium-term 2% target. In the press conference held by the president of the ECB, Christine Lagarde mentioned the inflation pressure in the Eurozone remains stubbornly high and strengthen the wage pressures. Elevated inflation has prompted the ECB to remain aggressive in its upcoming tightening monetary decisions. At the same time, investors are highly concerned about the upcoming inflation data for more signals from the ECB. As of writing, the EUR/USD gained 0.40% to $1.0647.

In the commodities market, crude oil prices settled up by 0.13% to $68.42 per barrel as Saudi-Russian assurances on production cuts stabled the oil prices. Besides, gold prices appreciated by 0.65% to $1935.65 per troy ounce as bank sector jitters spurred the market’s safe-haven demand.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR- CPI (YoY) (Feb) | 8.5% | 8.5% | |

| 22:00 | USD – Michigan Consumer Sentiment (Mar) | 67.0 | 67.0 |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2145

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded higher while currently testing for the resistance level at 1.0635. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains if successfully break above the resistance level at 1.0635.

Resistance level: 1.0635, 1.0790

Support level: 1.0505, 1.0360

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 134.60, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher following a prior break above the resistance level at 0.6685. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6775.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6195. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded following a prior retracement from the resistance level at 1.3785. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3685.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

USDCHF, H4: USDCHF was traded lower following a prior break below the previous support level at 0.9285. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 0.9180.

Resistance level: 0.9390, 0.9285

Support level: 0.9180, 0.9090

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 68.30. MACD which illustrated decreasing bearish momentum suggests the commodity to extend its gains toward the resistance level at 70.65.

Resistance level: 70.65, 73.20

Support level: 68.30, 66.05

GOLD_, H4: Gold price was traded higher while currently testing for the resistance level at 1926.75 MACD which illustrated decreasing bearish momentum suggests the commodity to extend its gains if successfully break above the resistance level.

Resistance level: 1926.75, 1954.90

Support level: 1900.20, 1876.90

170323 Morning Session Analysis

17 March 2023 Morning Session Analysis

US dollar was traded mixed following a series of economic data.

The dollar index, which traded against a basket of six major currencies, hovered near a similar level after a series of economic data were released. Last night, the US Department of Labor posted the Initial Jobless Claims at 192K, significantly lower than both the consensus forecast and the previous week’s reading at 205K and 212K respectively. The stronger-than-expected labor data showed that the US labor market remains resilient despite the recent banking turmoil. However, the US Philadelphia Fed Manufacturing Index was reported at -23.2, weaker than the consensus expectation of -15.6, suggesting continued declines for the region’s manufacturing sector. Following that, the US dollar was traded mixed by the investors while the market participants are weighing on the possibility of a rate pause and the fallout of the banking sector in the US. On the other hand, the European Central Bank agreed to increase its interest rate by 50 bps in yesterday’s meeting, as widely expected. With that, it triggered another round of sell-off in the US dollar market, pushing the pair of EUR/USD slightly above the recent low. As of writing, the US dollar dropped 0.19% to 104.45.

In the commodities market, crude oil prices were down by -0.05% to $68.75 per barrel as the continued banking turmoil in Europe and US weighed on the oil demand’s prospect. Besides, gold prices ticked up by 0.02% to $1919.50 per troy ounce as market risk-off sentiment remains high.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Feb) | 8.5% | 8.5% | – |

| 22:00 | USD – Michigan Consumer Sentiment | 67.0 | 67.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 103.15. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2105. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0575. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0665, 1.0770

Support level: 1.0575, 1.0445

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.05. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3730. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3830, 1.3880

Support level: 1.3730, 1.3635

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9325. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9325, 0.9475

Support level: 0.9225, 0.9070

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 66.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 71.65, 76.10

Support level: 66.10, 61.45

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1900.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1944.60.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00

160323 Afternoon Session Analysis

16 March 2023 Afternoon Session Analysis

The Aussie nudged higher after upbeat economic data.

The Aussie dollar, which is one of the most traded currencies, nudged higher after positive economic data released. The Feb employment changes grew positively from -11.0k to 64.6k versus the market expectation of 48.5k. According to the labor data released by the Australian Bureau of Statistics (ABS), the Australian unemployment rate slightly reduced by 0.2% to 3.5%, recorded as the lowest unemployment rate since the 1970s. Both upbeat data allows Reserve Bank of Australia to increase its cash rate further, although the Governor Philip Lowe signaled a rate hike pause recently. The positive labor data boosted the value of Aussie dollar, as the market expects strong consumer spending to keep inflation steadily at a higher level, and RBA will continue to hike rate to curb the high inflation figure. Besides, the Aussie also benefited from its largest trading partner China, after China released its economic data. In China, the asset investment jumped to 5.5%, highlighting a remarkable improvement in construction project investments. The optimistic data give support to the Aussie dollar by a way of hopefulness in commodity exports. As of writing, the AUD/USD was traded up to 0.30% to $0.6635.

In the commodities market, crude oil prices rebounded by 0.87% to $68.19 per barrel after Credit Suisse secured a lifeline from the Swiss Central Bank up to $54 billion. Besides, gold prices was traded lower by -0.39% to $1923.65 per troy ounce following the investor locked in recent profits.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:15 EUR ECB Monetary Policy Statement

21:45 EUR ECB Press Conference

23:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Feb) | 1.339M | 1.340M | – |

| 20:30 | USD – Initial Jobless Claims | 211K | 205K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Mar) | -24.3 | -15.6 | – |

| 21:15 | EUR – Deposit Facility Rate (Mar) | 2.50% | 3.00% | – |

| 21:15 | EUR – ECB Marginal Lending Facility | 3.25% | – | – |

| 21:15 | EUR – ECB Interest Rate Decision (Mar) | 3.00% | 3.50% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the previous support level at 104.45. However, MACD which illustrated bullish momentum suggests the index to traded higher as technical correction.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the support level at 1.2010. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2145.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level 1.0635.

Resistance level: 1.0635, 1.0790

Support level: 1.0505, 1.0360

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 132.30.

Resistance level: 134.60, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level at 0.6195. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6120.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded lower following a prior break below the previous support level at 1.3785. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3685.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

USDCHF, H4: USDCHF was traded higher following a prior break above a previous resistance level at 0.9285. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.9390.

Resistance level: 0.9390, 0.9495

Support level: 0.09285, 0.9180

CrudeOIL, H4: Crude oil price was traded lower following a break below the previous support level at 68.30. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 68.30, 70.65

Support level: 66.05, 63.70

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the commodity to extend it loses toward the support level at 1900.20.

Resistance level: 1926.70, 1954.90

Support level: 1900.20, 1876.90

160323 Morning Session Analysis

16 March 2023 Morning Session Analysis

US dollar surged as Credit Suisse renewed European bank worries.

The dollar index, which traded against a basket of six major currencies, revived from the tremendous sell-off which started last Wednesday as Credit Suisse led the Europe bank rout in renewed SVB fallout. In the early European trading session, the banking sector fell sharply in overall, led by Credit Suisse. A day ago, Credit Suisse acknowledged “material weakness” in its financial reporting, highlighting that the group failed to identify potential risks to financial statements. Prior to the revelations, the bank had delayed the publication of the annual report. As a matter of fact, the material weakness of the financial report did not really trigger a large sell-off in the market. However, the European stock market tumbled after the largest investor – Saudi National Bank (SNB) revealed today it would not buy more shares in the Swiss bank on regulatory grounds. As of now, the SNB holds a bank stake of 9.88% in Credit Suisse. A more than 10% shareholding by the SNB would cause new rules to kick in, whether it be by the Saudi regulator or the European regulator, or the Swiss regulator. With the prospect of no more extra cash would be pumped in by the largest backer, the market fears over the banking sector in the European market heightened, urging investors to run away from the euro financial market. As of writing, the dollar index rose 1.11% to 104.75.

In the commodities market, crude oil prices were down by -4.55% to $68.30 per barrel as the renewed banking turmoil in Europe weighed on the oil demand’s prospect further. Besides, gold prices jumped by 0.10% to $1920.25 per troy ounce following the renewed contagion fears over the banking sector around the world.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:15 EUR ECB Monetary Policy Statement

21:45 EUR ECB Press Conference

23:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Feb) | 1.339M | 1.340M | – |

| 20:30 | USD – Initial Jobless Claims | 211K | 205K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Mar) | -24.3 | -15.6 | – |

| 21:15 | EUR – Deposit Facility Rate (Mar) | 2.50% | 3.00% | – |

| 21:15 | EUR – ECB Marginal Lending Facility | 3.25% | – | – |

| 21:15 | EUR – ECB Interest Rate Decision (Mar) | 3.00% | 3.50% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 103.15. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2105. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2200, 1.2345

Support level: 1.2105, 1.1940

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0575. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0665, 1.0770

Support level: 1.0575, 1.0445

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.05. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3730. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3730, 1.3830

Support level: 1.3635, 1.3565

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9325. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9325, 0.9475

Support level: 0.9225, 0.9070

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 66.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 71.65, 76.10

Support level: 66.10, 61.45

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1900.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1944.60.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00

150323 Afternoon Session Report

15 March 2023 Afternoon Session Analysis

GBP dribbled as mixed UK data released.

The pair of GBP/USD, which is traded as one of the most popular traded currencies, dribbled around $1.2100 amid mixed UK data and a lack of hawkish move from the Bank of England (BoE). On Tuesday, the UK unemployment rate steadied at 3.7% for three months in a row, slightly lower than the expectation of 3.8%. The latest survey details from the UK Income Data Research (IDR) suggested that British employers agreed on a rise of averaging 5.0%. A tight labor market means consumer spending remains strong, likely to keep inflation buoyed at a high level. However, the Claimant Count Change increased to -11.2k in Feb, well above the market forecast at -12.4k, while the Average Earnings including Bonus data matched with analyst estimations at 5.7%. The possibility of a rate pauses by the BoE heightened after the announcement of the UK data. At this point in time, investors await more clues from the UK Budget 2023 announcement to scrutinize the further direction of the currency. As of writing, the GBP/USD slipped -0.05% to $1.2153.

In the commodities market, crude oil prices were traded up by 1.05% to $72.08 per barrel as investor awaits the key US Retails Sales Report, as well as the Produce Price Index (PPI) data. Besides, gold prices depreciated by -0.31% to $1905.00 per troy ounce amid rate hike uncertainty.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

20:30 GBP Spring Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Feb) | 2.3% | -0.1% | – |

| 20:30 | USD – PPI (MoM) (Feb) | 0.7% | 0.3% | – |

| 20:30 | USD – Retail Sales (MoM) (Feb) | 3.0% | -0.3% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.694M | 0.555M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 103.00. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in the short term.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from a support level at 1.2145. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo a technical correction in the short-term.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

EURUSD, H4: EURUSD was traded higher following the prior breakout above the higher level. However, MACD which illustrated diminishing bullish momentum suggests the pair to traded lower as technical correction.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 134.55. However, MACD which illustrated increasing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher following a prior break above the previous resistance level at 0. 6685. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6775.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher while currently testing for the resistance level at 0.6265. MACD which illustrated bullish bias momentum suggests the pair to extend its gains if successfully break above the resistance level.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded lower following the prior breakout below the previous support level at 1.3685. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 1.3600.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

USDCHF, H4: USDCHF was traded lower following the prior breakout below the previous support level at 0.9130. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in short-term.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 73.20.

Resistance level: 73.20, 76.05

Support level: 70.65, 68.30

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1900.20.

Resistance level: 1926.70, 1954.90

Support level: 1900.20, 1876.90

150323 Morning Session Analysis

15 March 2023 Morning Session Analysis

Greenback seesawed as CPI in-line with expectation.

The dollar index, which traded against a basket of six major currencies, experienced huge fluctuations following the release of the long-waited CPI data. According to the US Bureau of Labor Statistics, the Fed’s preferred inflation gauge – Consumer Price Index (CPI) dropped sharply from the prior month reading at 6.4% to 6.0%, in line with the consensus expectation. Excluding the volatile items such as food and energy prices, the US Core CPI came in at 0.5%, higher than the consensus forecast at 0.4%. With that, it added conundrum of Fed on whether they should keep rising the interest rate in order to tame the persistent price pressures or hold back on tightening monetary policy further following the recent banking turmoil. Prior to the headline CPI report, majority of the investors bet that the Fed might consider pausing its rate hike plan as the collapse of Silicon Valley Bank (SVB) and Signature Bank exacerbated the risk of recession in the US. However, the still-high inflation figure paved the way for a restrictive monetary policy. Nonetheless, the final decision of the Fed would be revealed in next week’s policy meeting. As of writing, the dollar index rose 0.08% to 103.65.

In the commodities market, crude oil prices were down by -0.10% to $71.00 per barrel as the US banking turmoil continued to weigh on the oil demand’s prospect. Besides, gold prices dipped -0.02% to $1904.20 per troy ounce as the US dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

20:30 GBP Spring Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Feb) | 2.3% | -0.1% | – |

| 20:30 | USD – PPI (MoM) (Feb) | 0.7% | 0.3% | – |

| 20:30 | USD – Retail Sales (MoM) (Feb) | 3.0% | -0.3% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.694M | 0.555M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2200, 1.2345

Support level: 1.2105, 1.1940

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0665. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.1010

Support level: 1.0665, 1.0575

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 133.05. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3730. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3635.

Resistance level: 1.3730, 1.3830

Support level: 1.3635, 1.3565

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.9225. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9070.

Resistance level: 0.9225, 0.9325

Support level: 0.9070, 0.8945

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 71.65. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 76.10, 81.70

Support level: 71.65, 66.10

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1900.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1944.60.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00