081222 Afternoon Session Analysis

8 December 2022 Afternoon Session Analysis

Dollar lingered ahead of long-waited economic data.

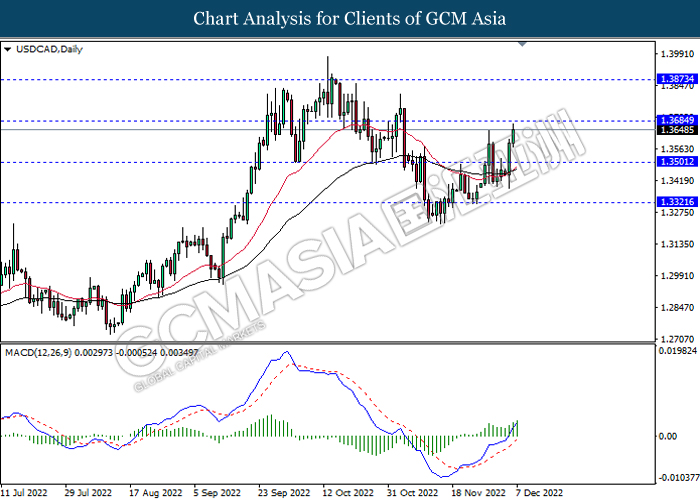

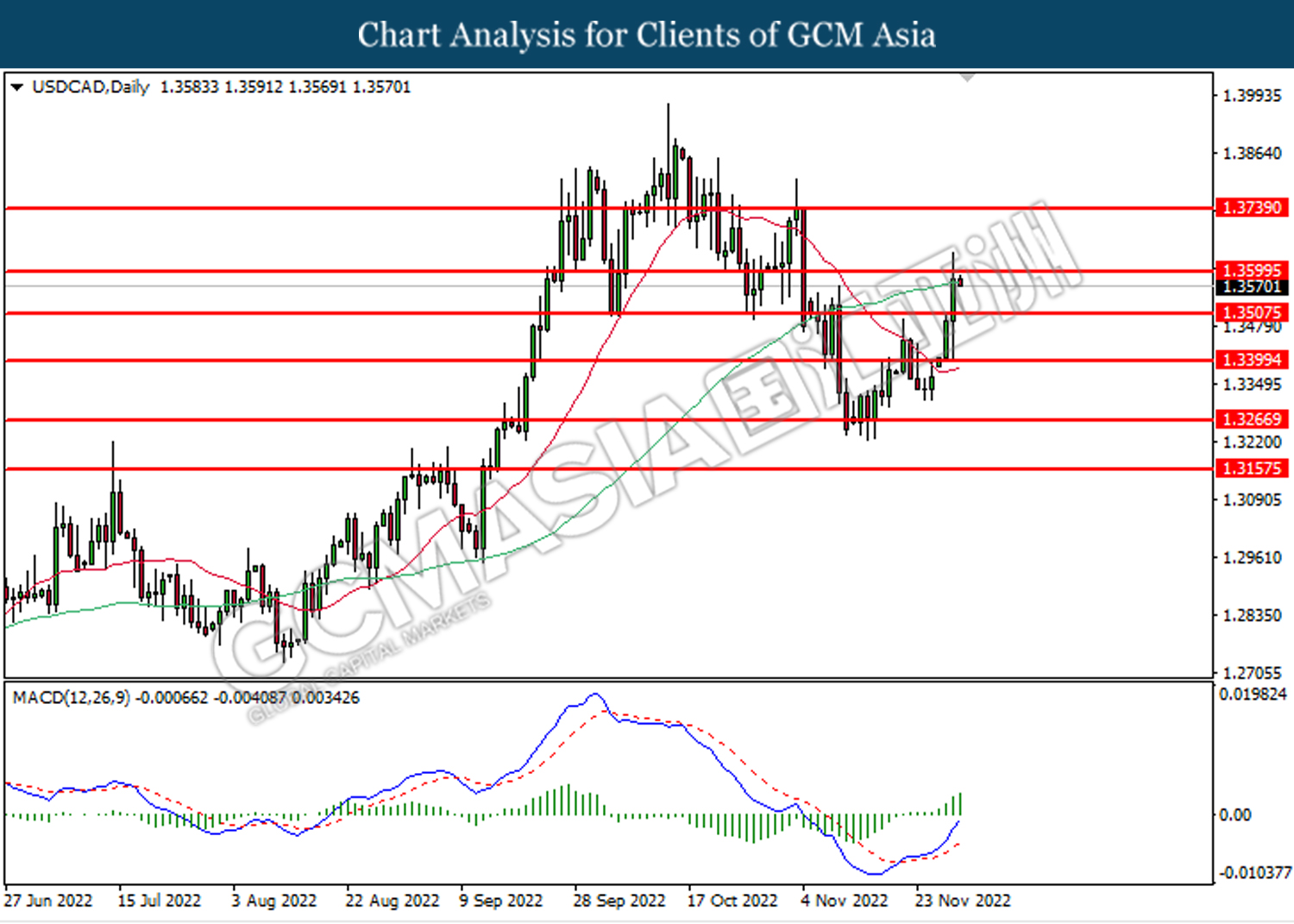

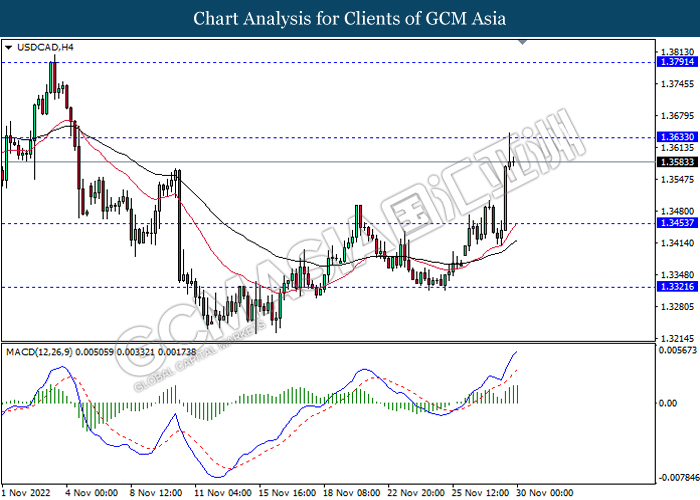

The dollar index, which was traded against a basket of six major currencies, hovered near the level of 105.00 since the beginning of the week as the market participants are waiting for more economic data to scrutinize the direction of the currency. Following the announcement of the ISM Non-Manufacturing PMI data, the dollar index has experienced a rather slow movement. Despite, we may notice that the dollar index somehow still recorded some gains during the previous trading session as the risk-off environment urged the investors to fly into safe haven currency. At this juncture, the market participant remains cautious while waiting for the Initial Jobless Claims data. On the other side, the pair of USD/CAD surged amid expected rate hike from the Bank of Canada (BoC). Yesterday, the official members of BoC adjusted its cash rate from 3.75% to 4.25%, in line with the expectation of the consensus. As of writing, the pair of USD/CAD rose 0.24% to 1.3685.

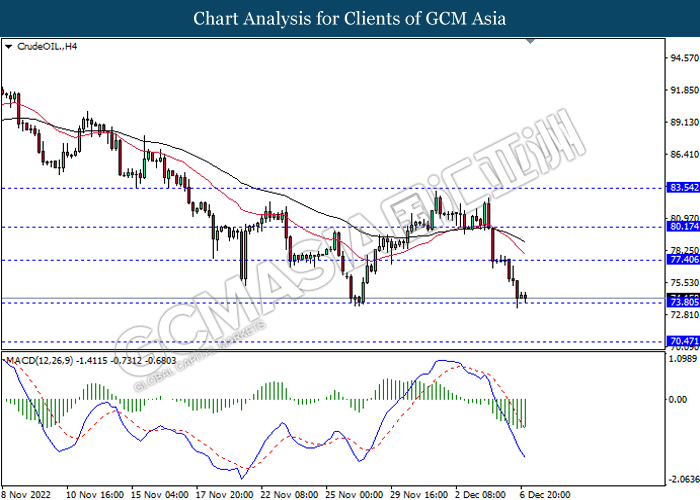

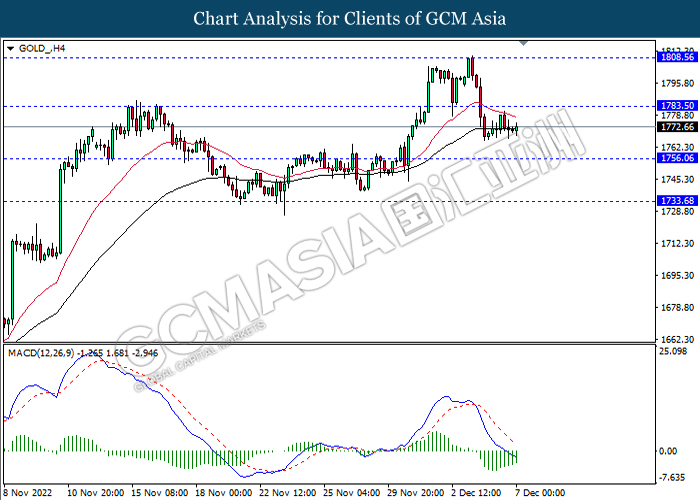

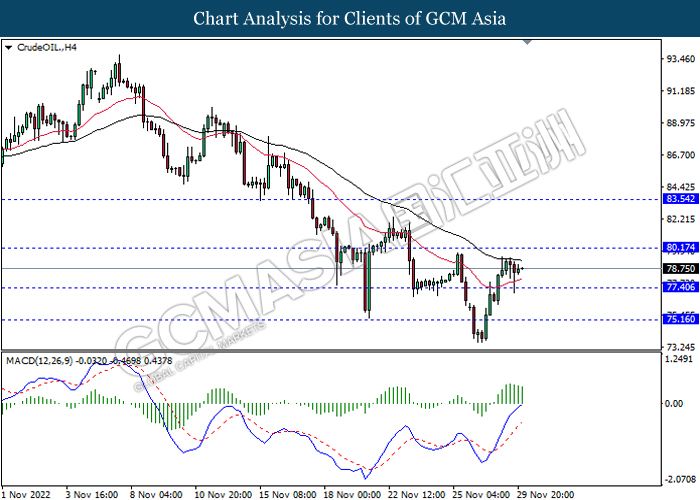

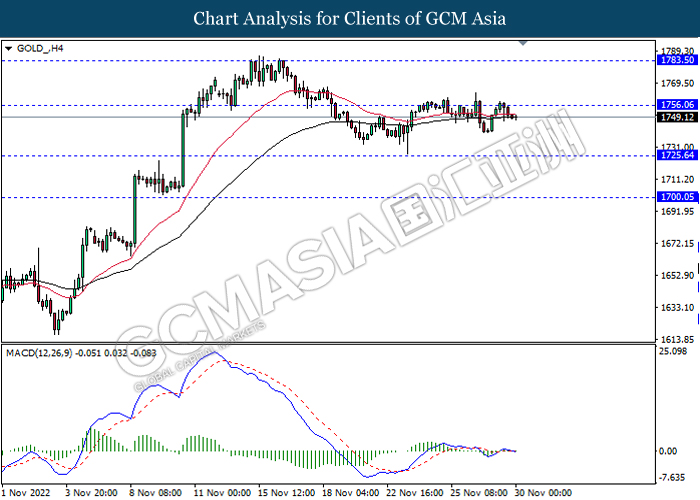

In the commodities market, the crude oil price rebounded by 0.22% to $72.85 per barrel after slumping more than 4% yesterday amid the stockpiles of distillates stock and petrol in the US. Besides, the gold prices dropped -0.22% to $1782.15 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 225K | 230K | – |

Technical Analysis

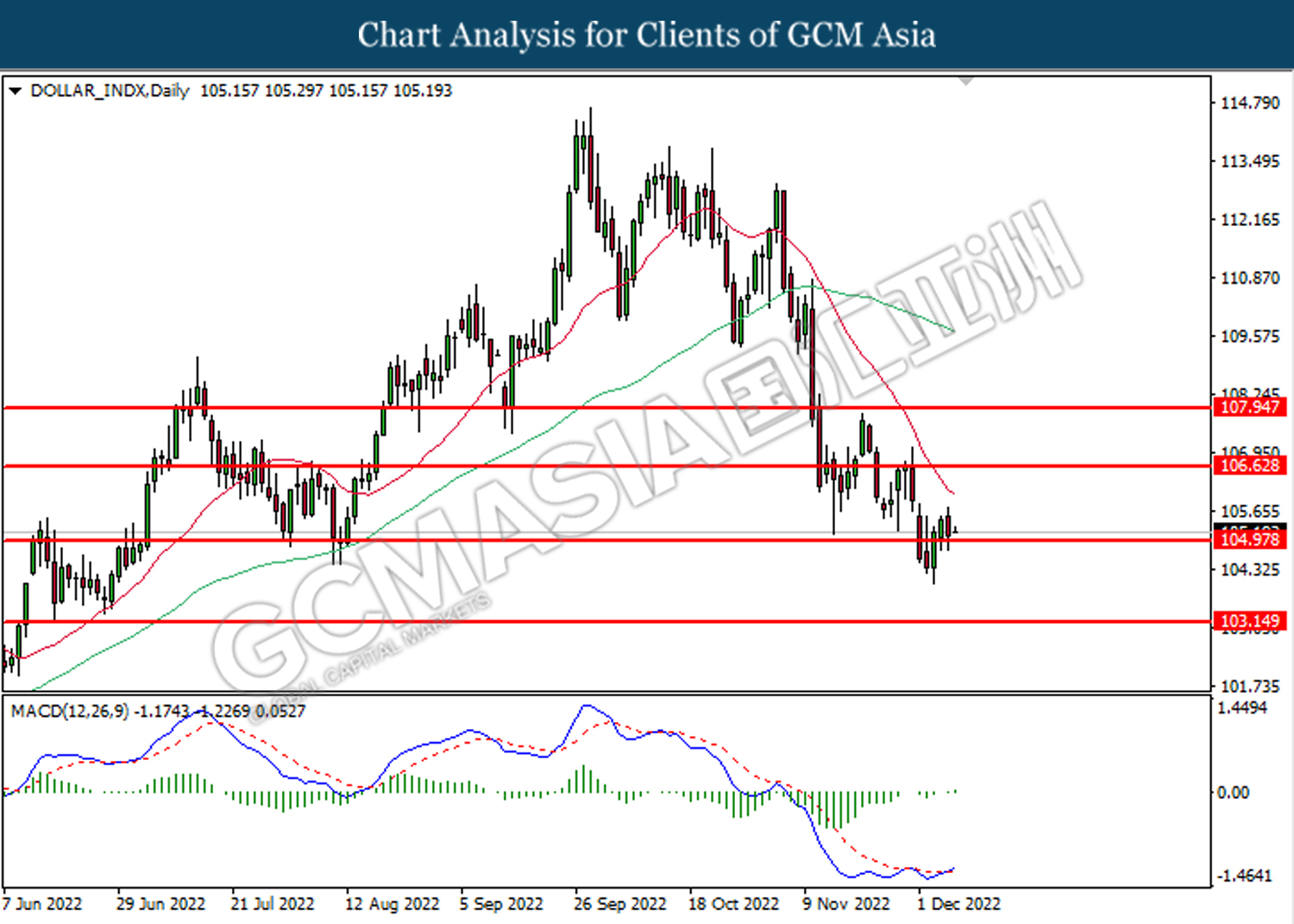

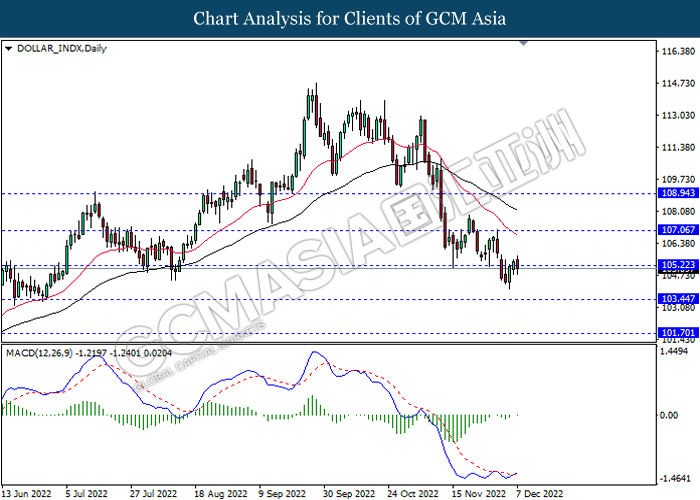

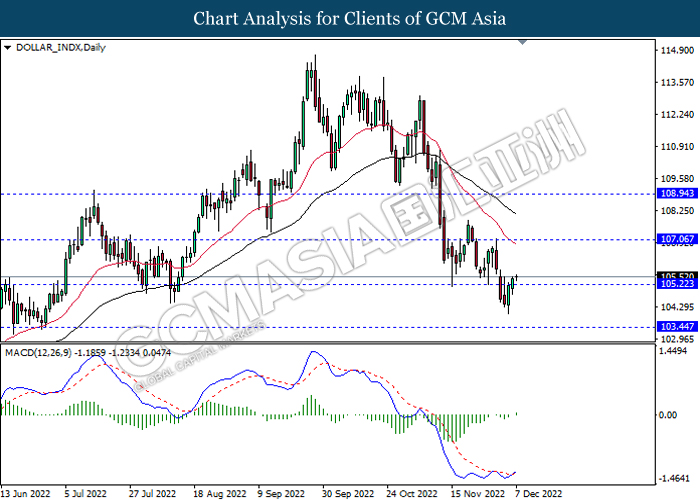

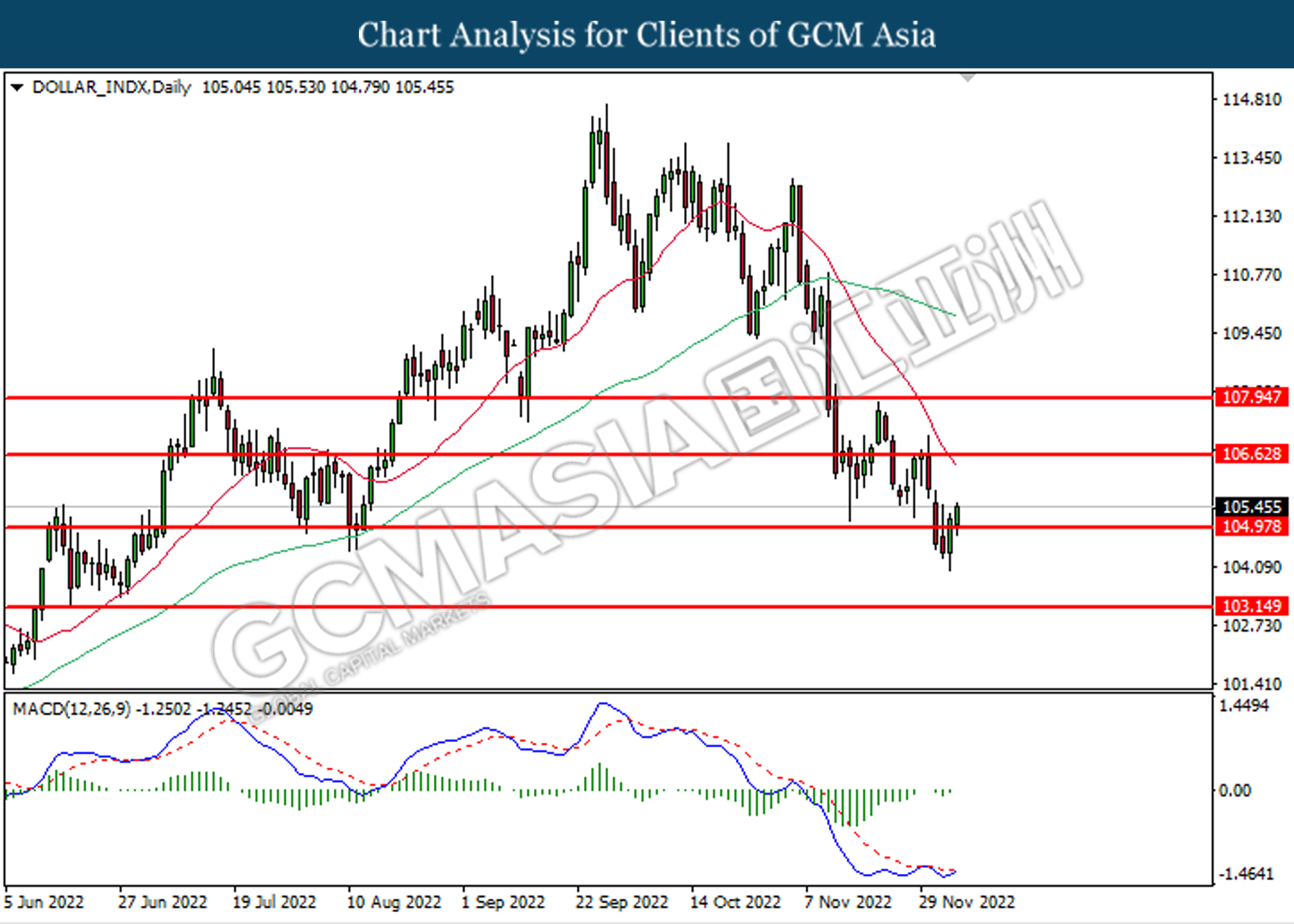

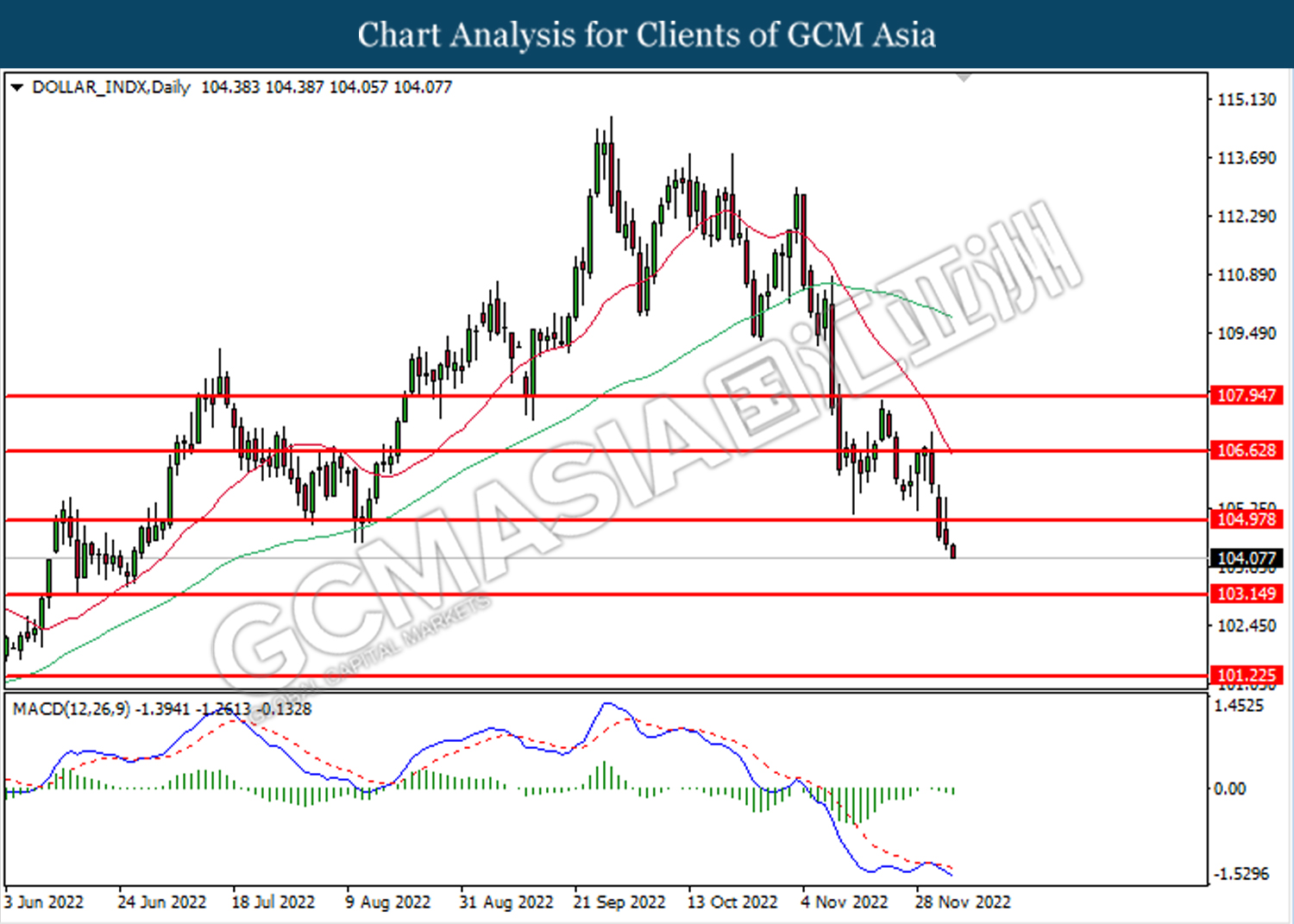

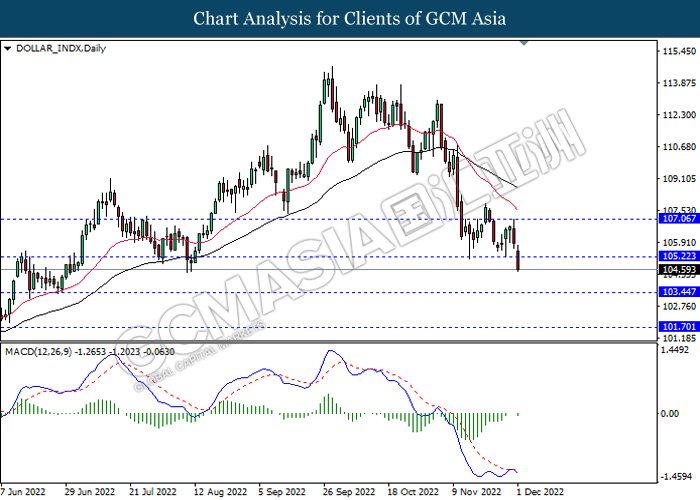

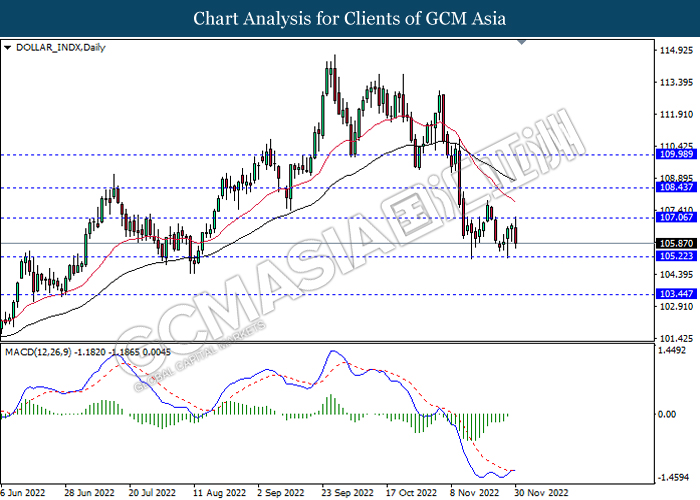

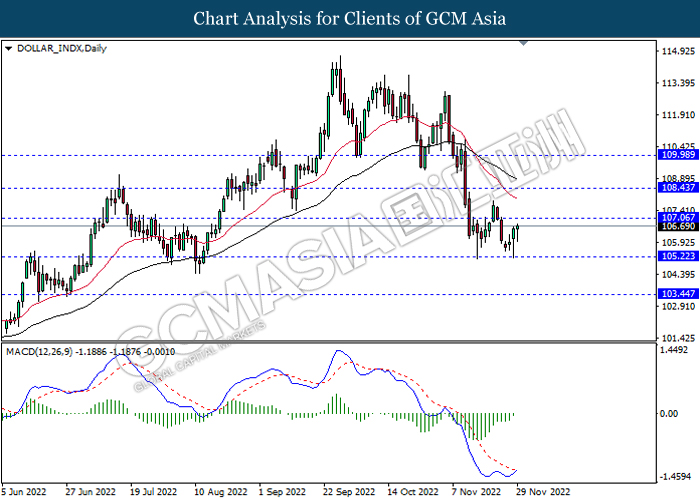

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 105.00. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 106.65.

Resistance level: 106.65, 107.95

Support level: 105.00, 103.15

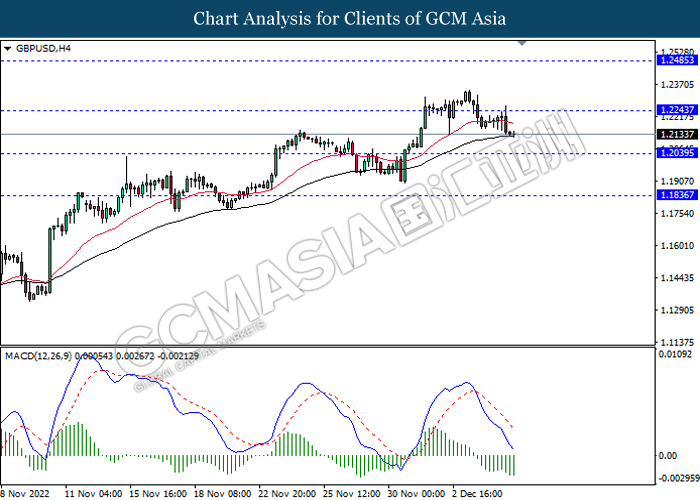

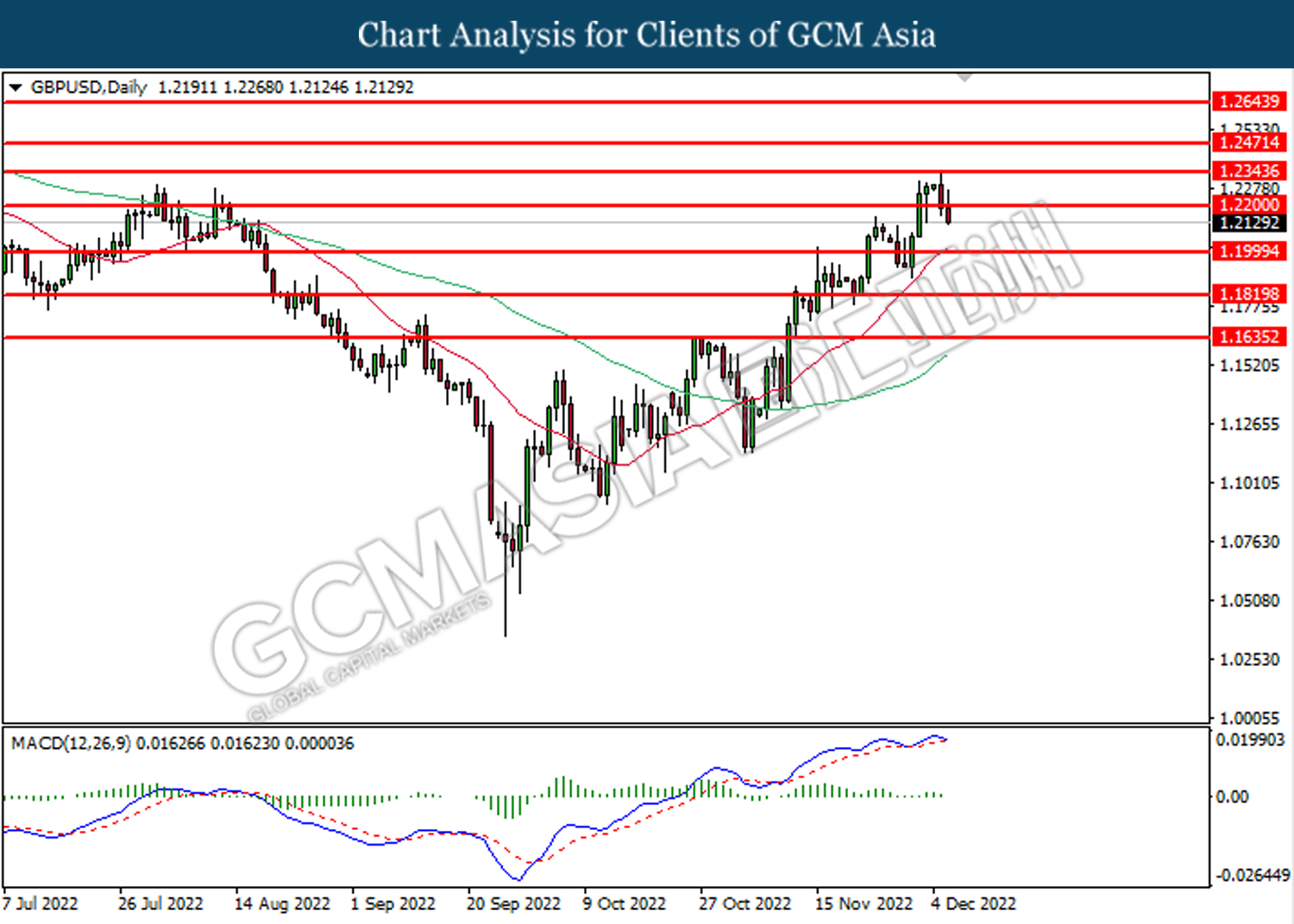

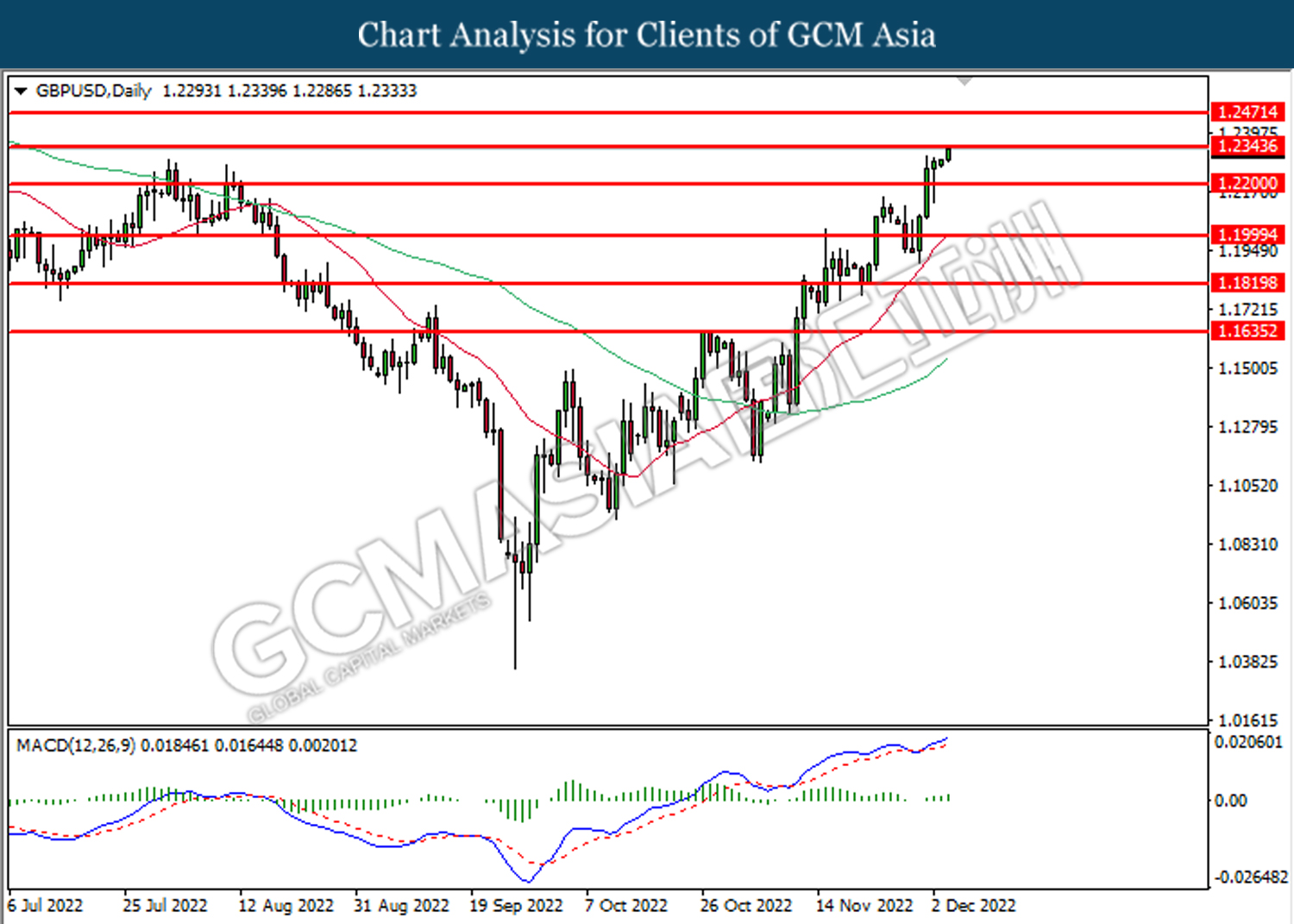

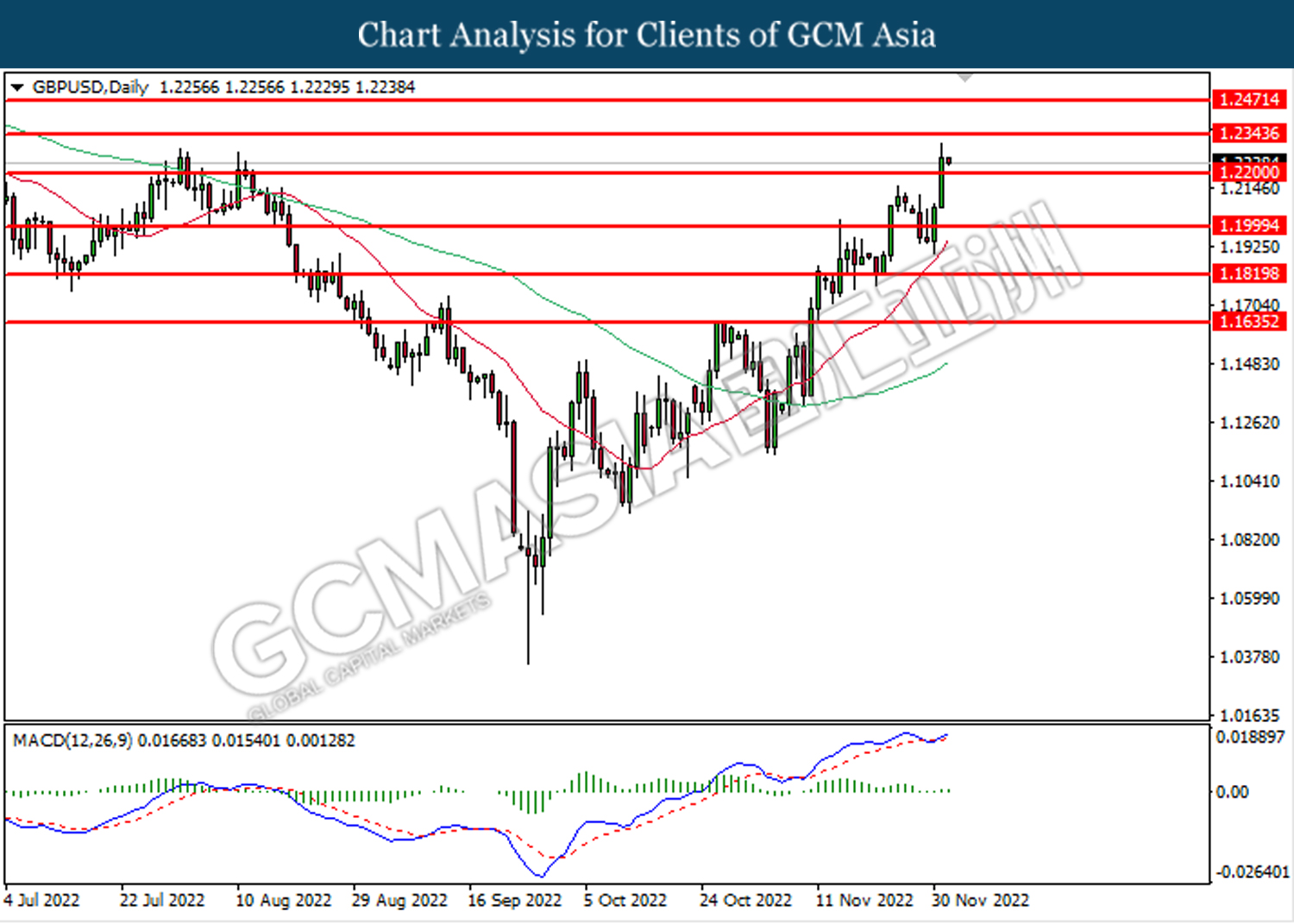

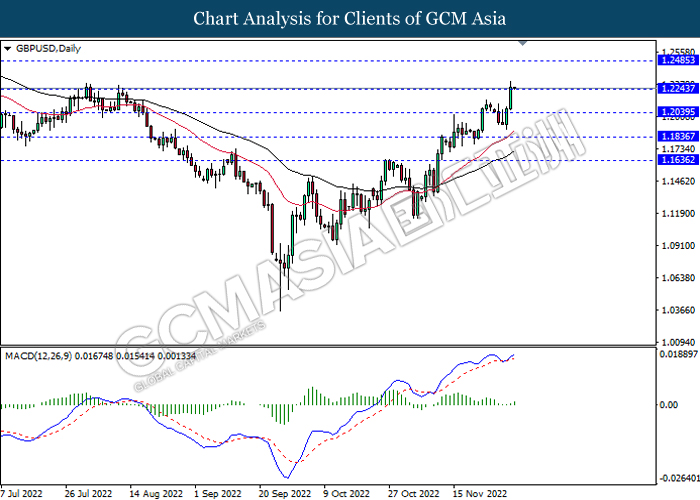

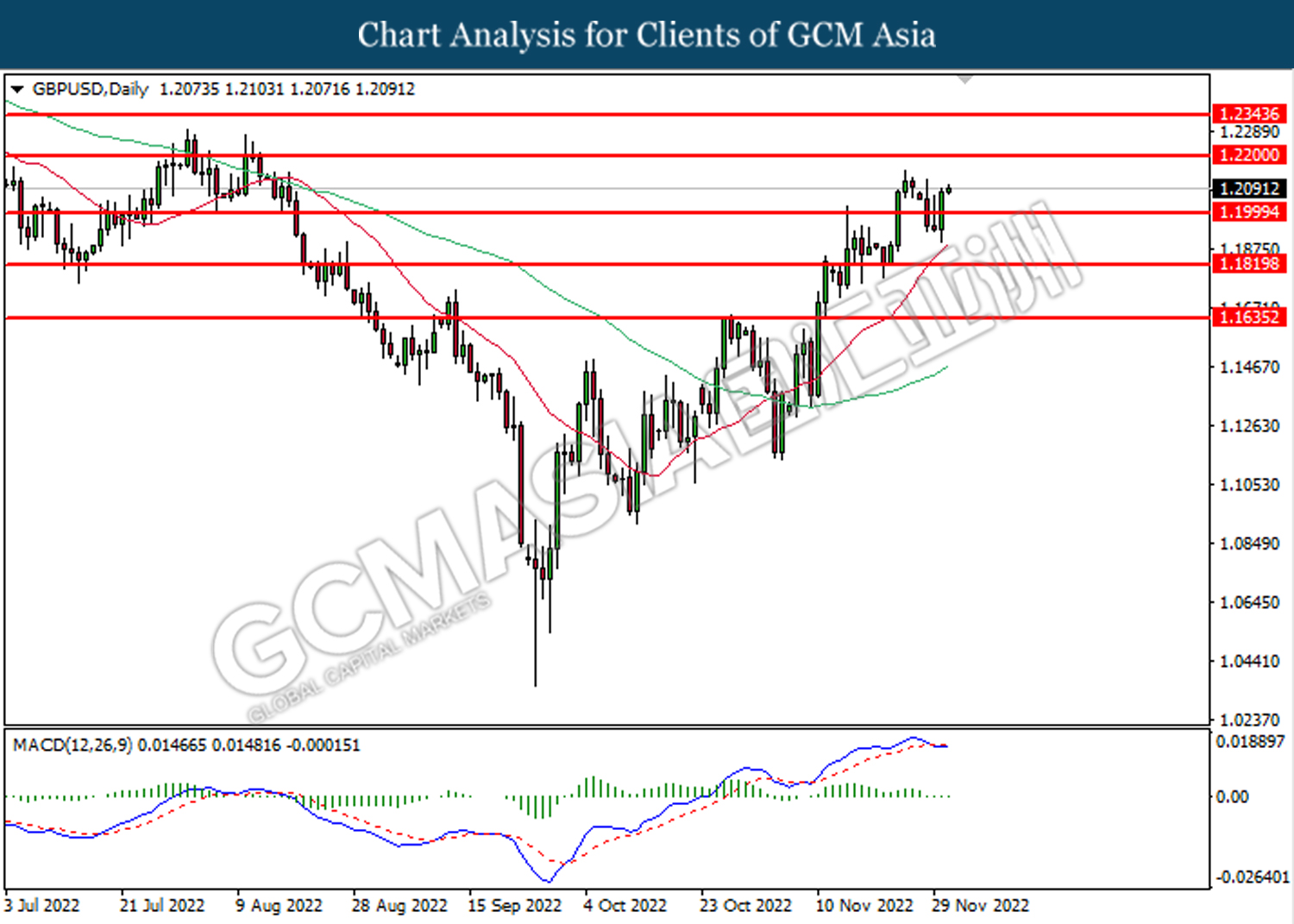

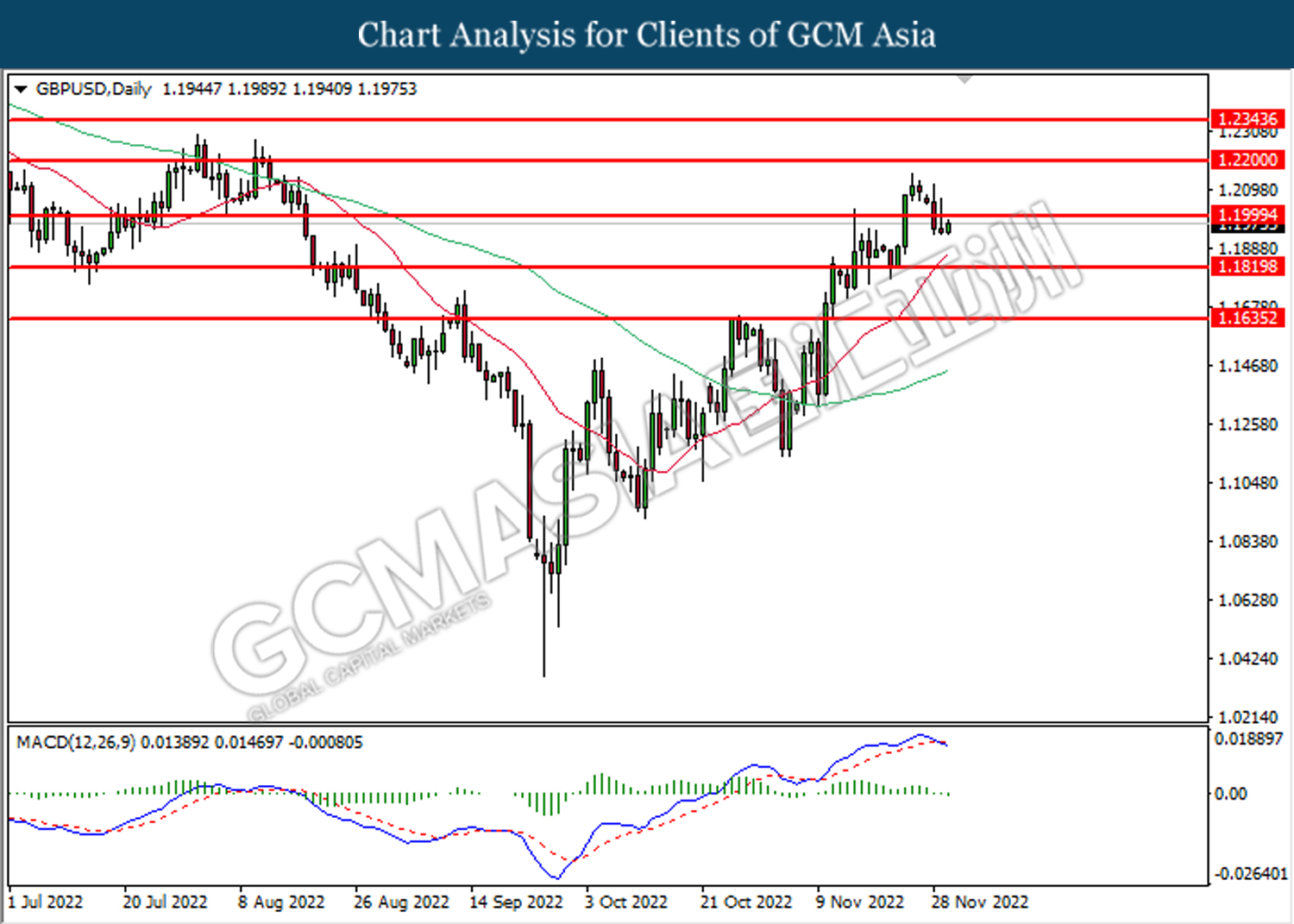

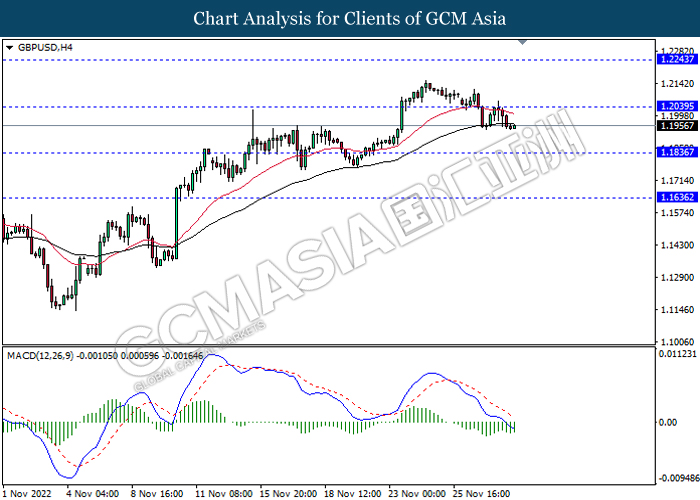

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. However, MACD which illustrated bearish bias momentum suggest the pair to undergo short term technical correction.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

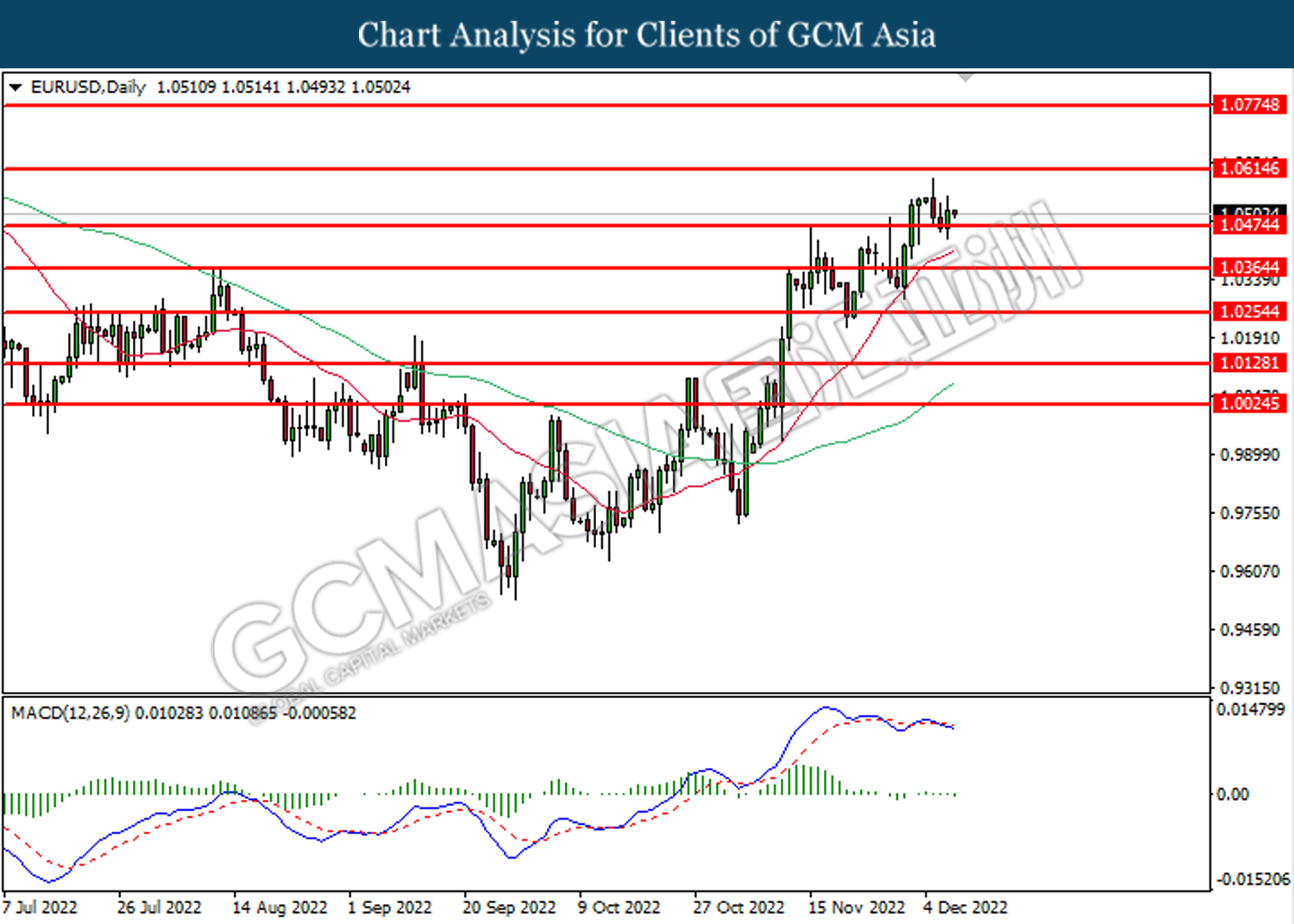

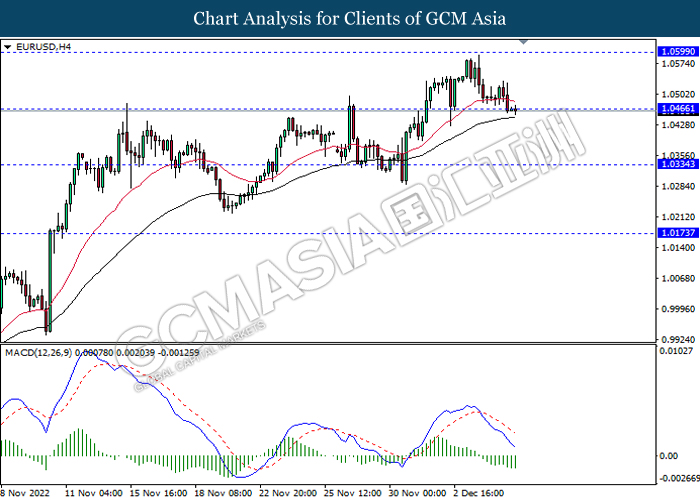

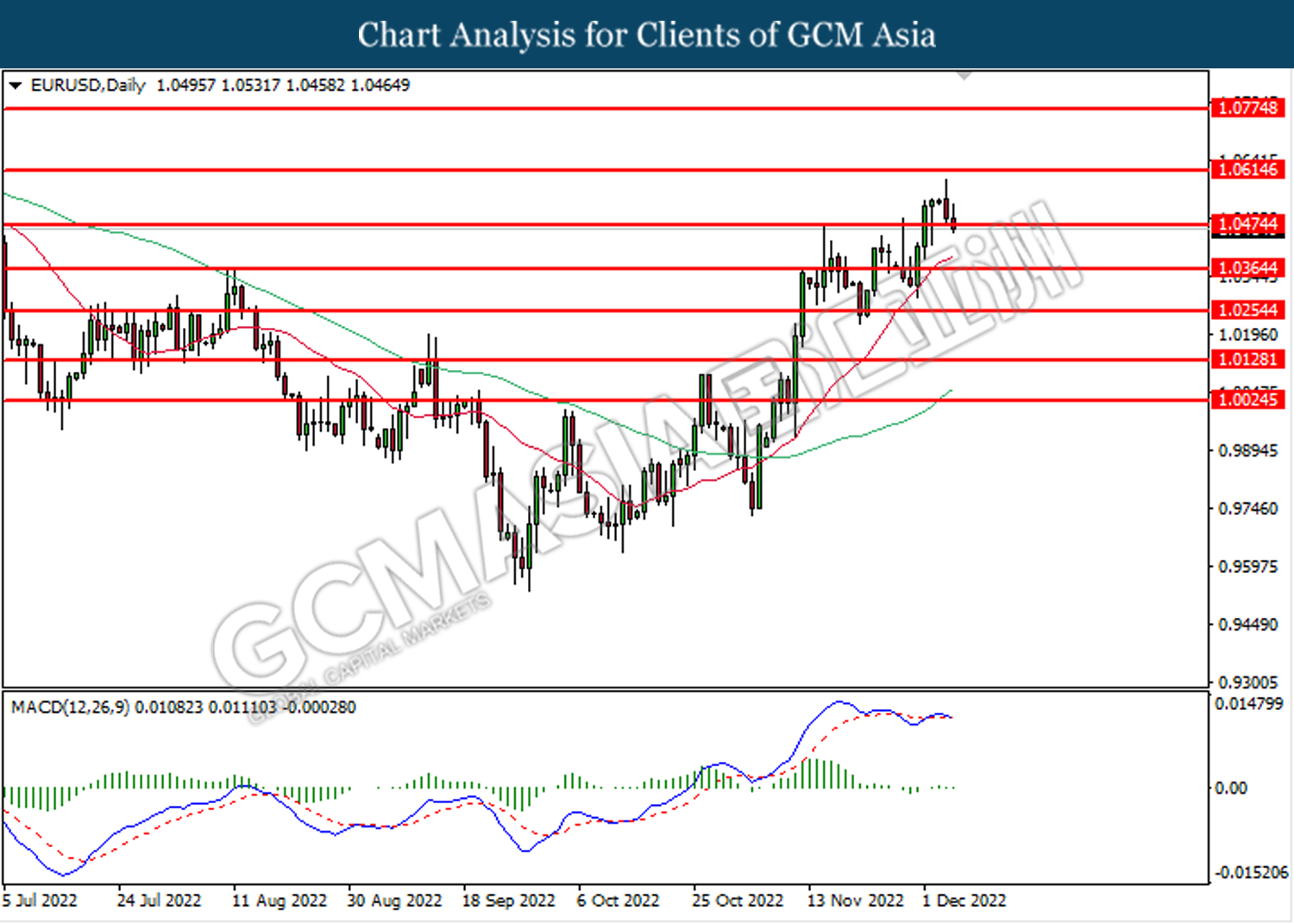

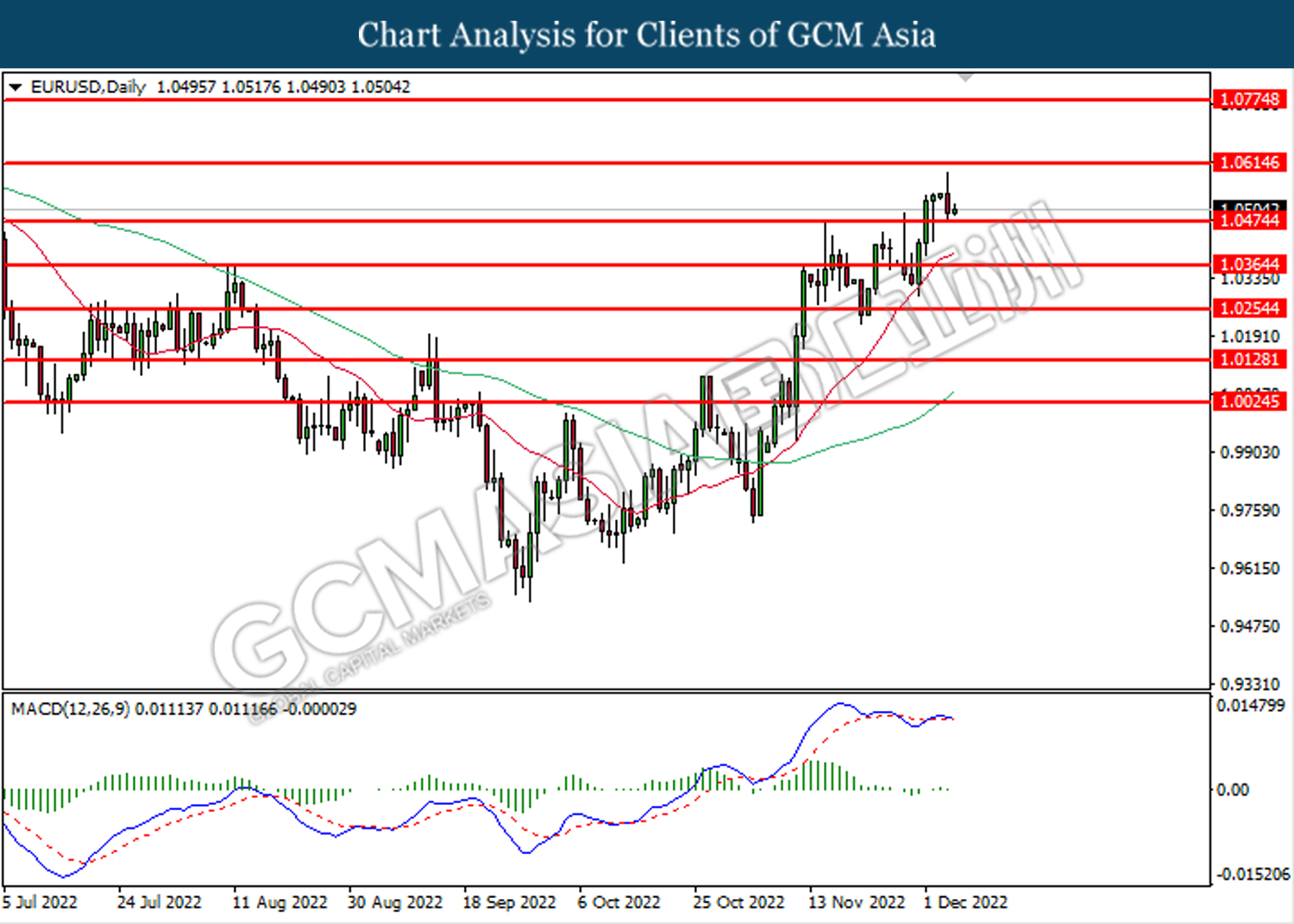

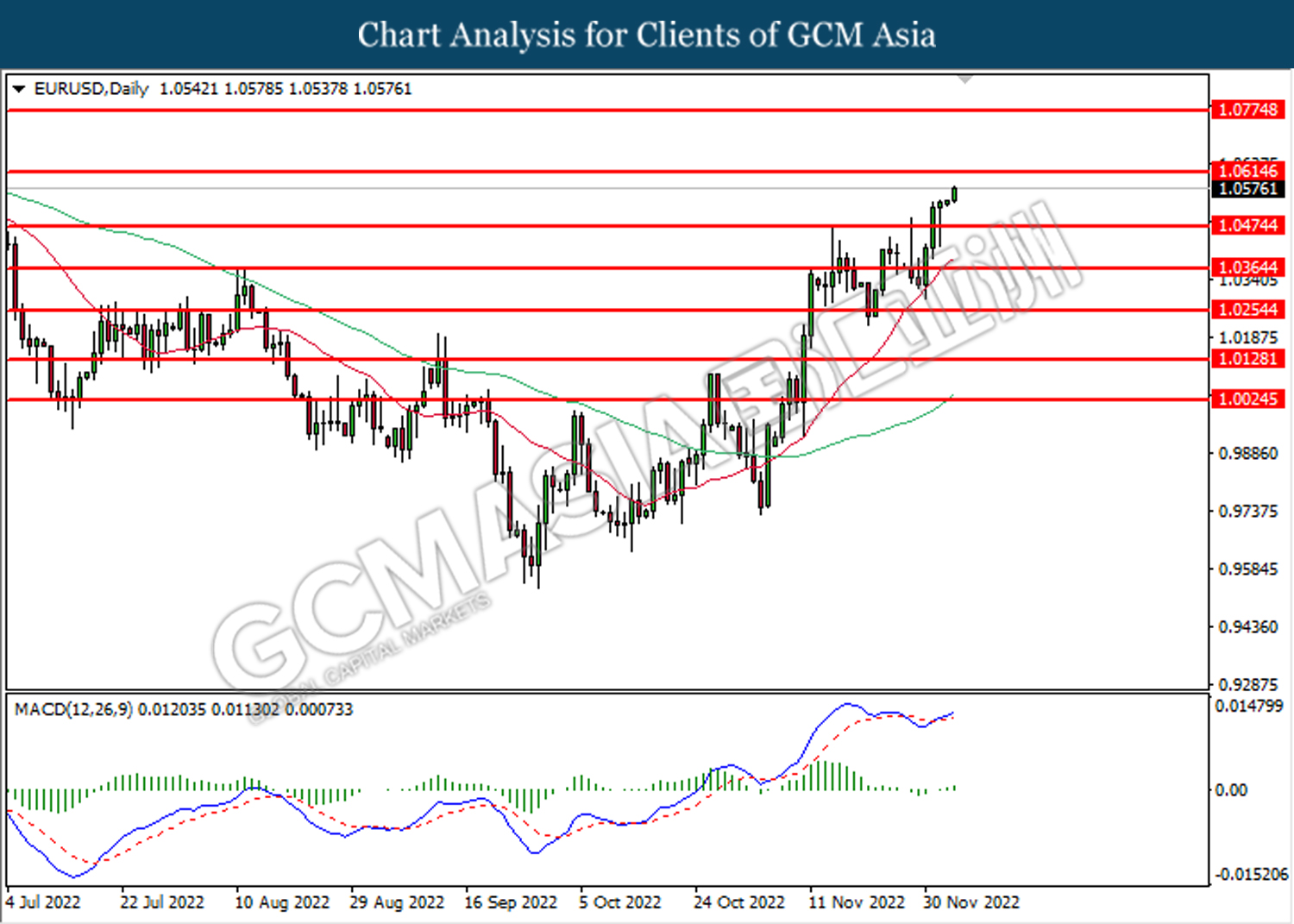

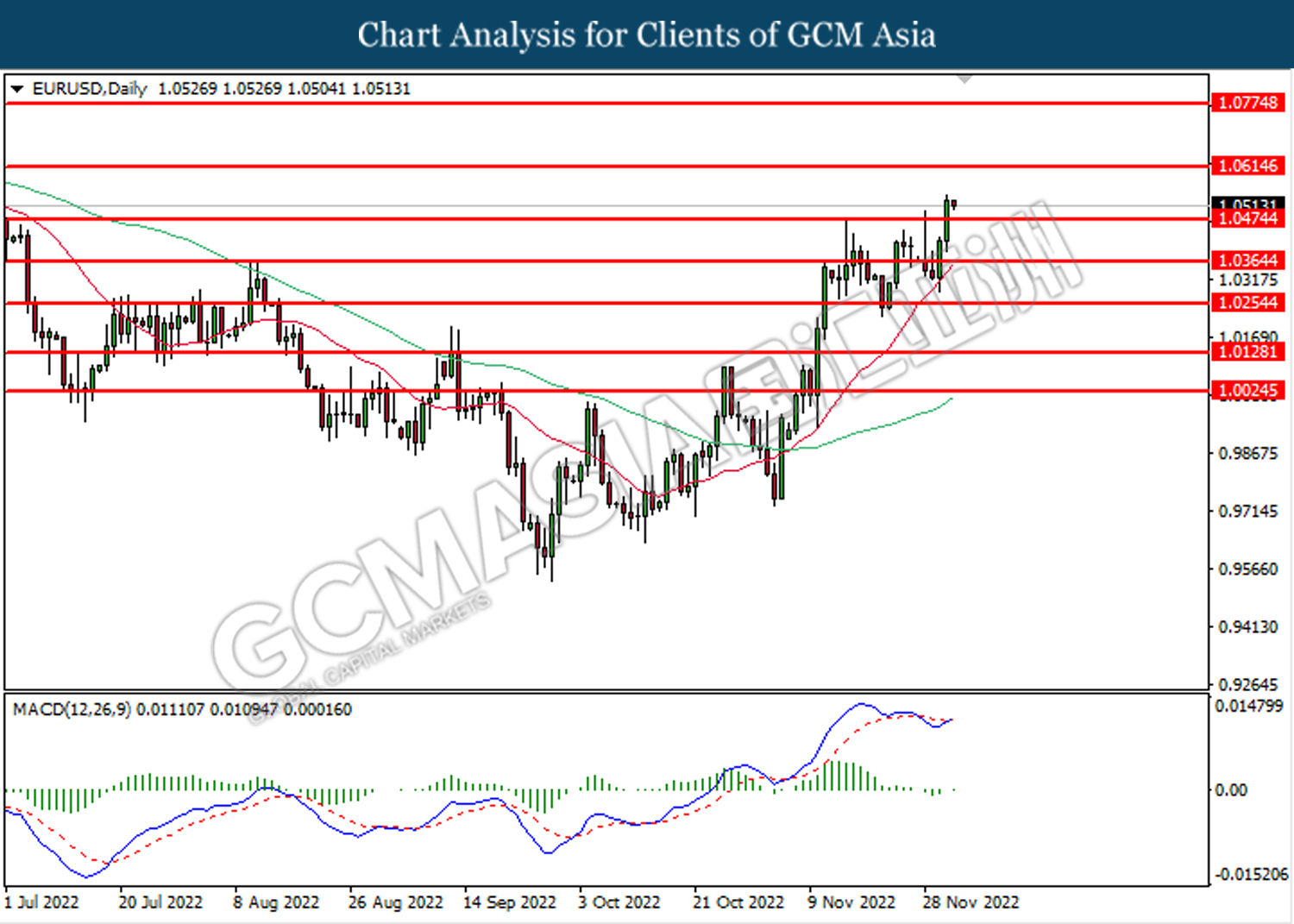

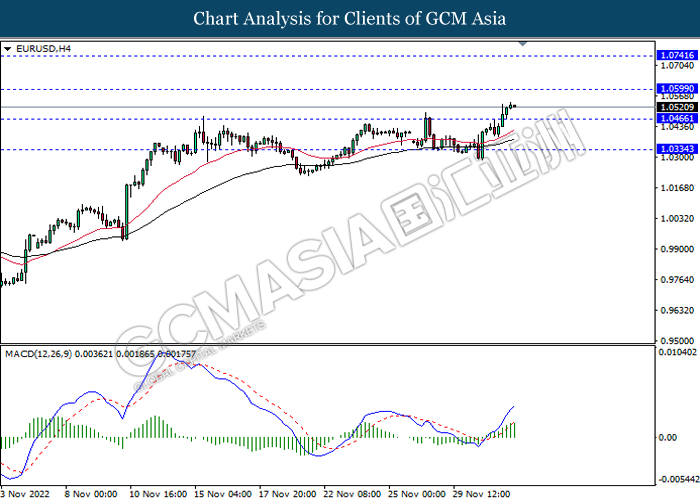

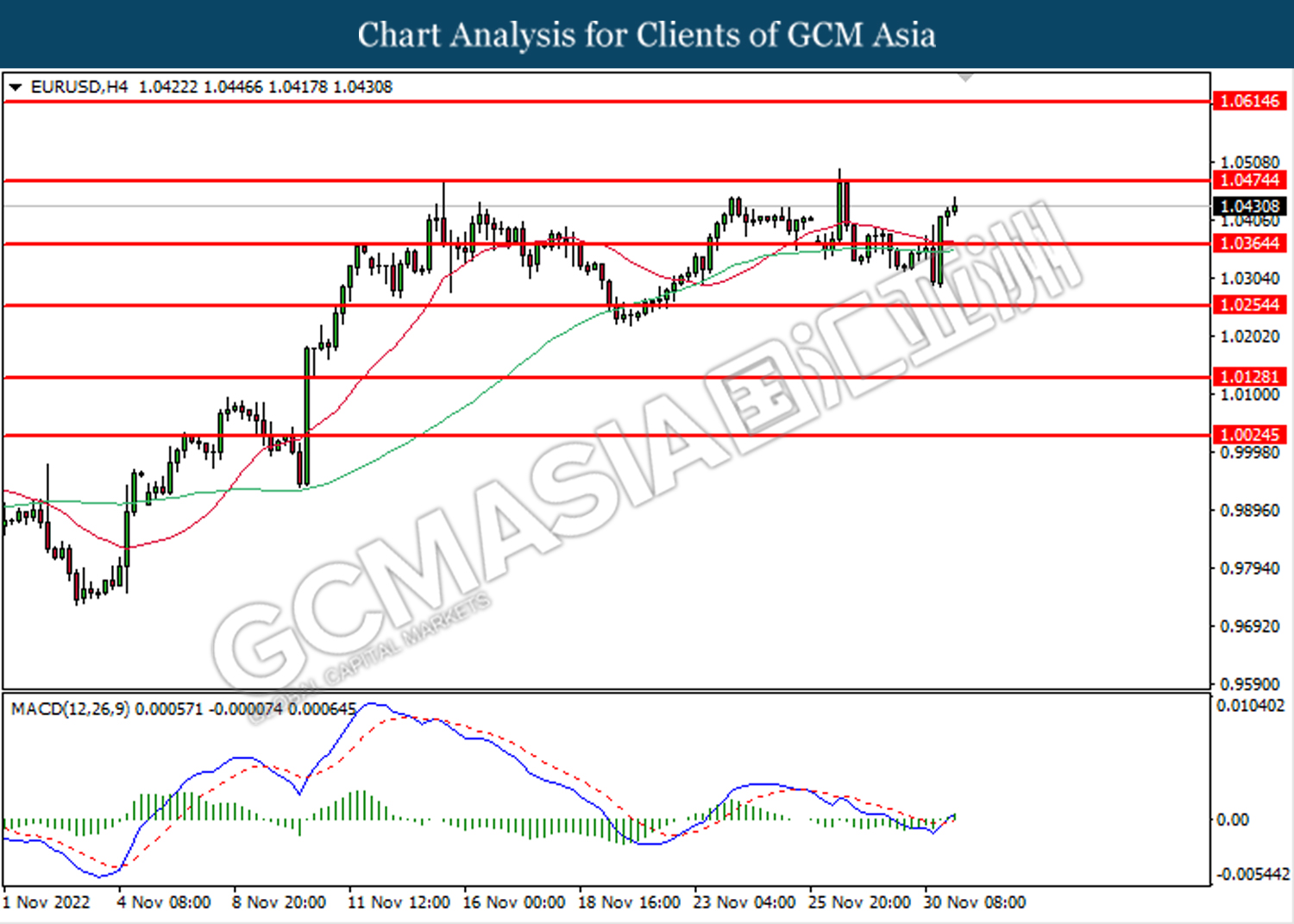

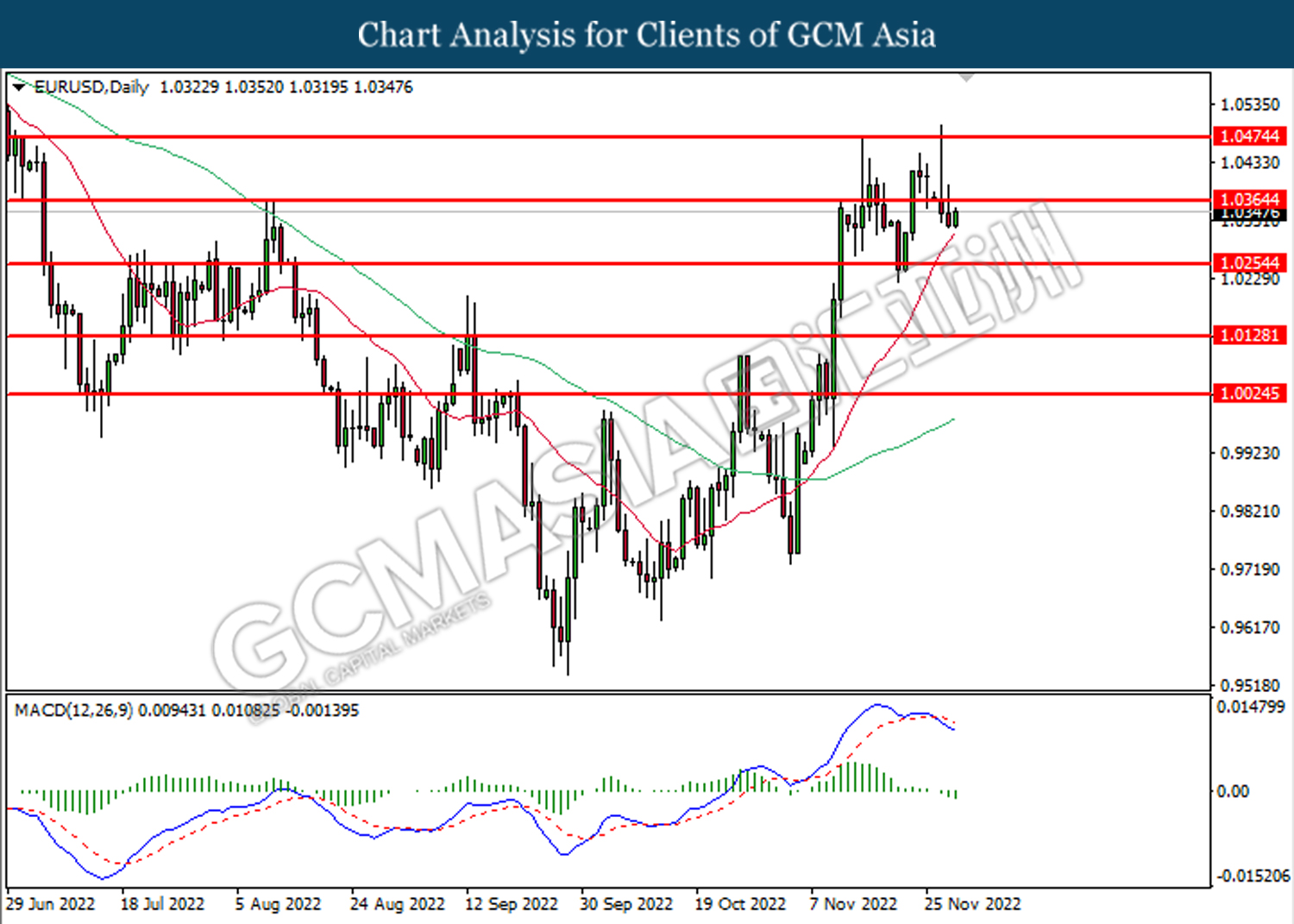

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0475. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

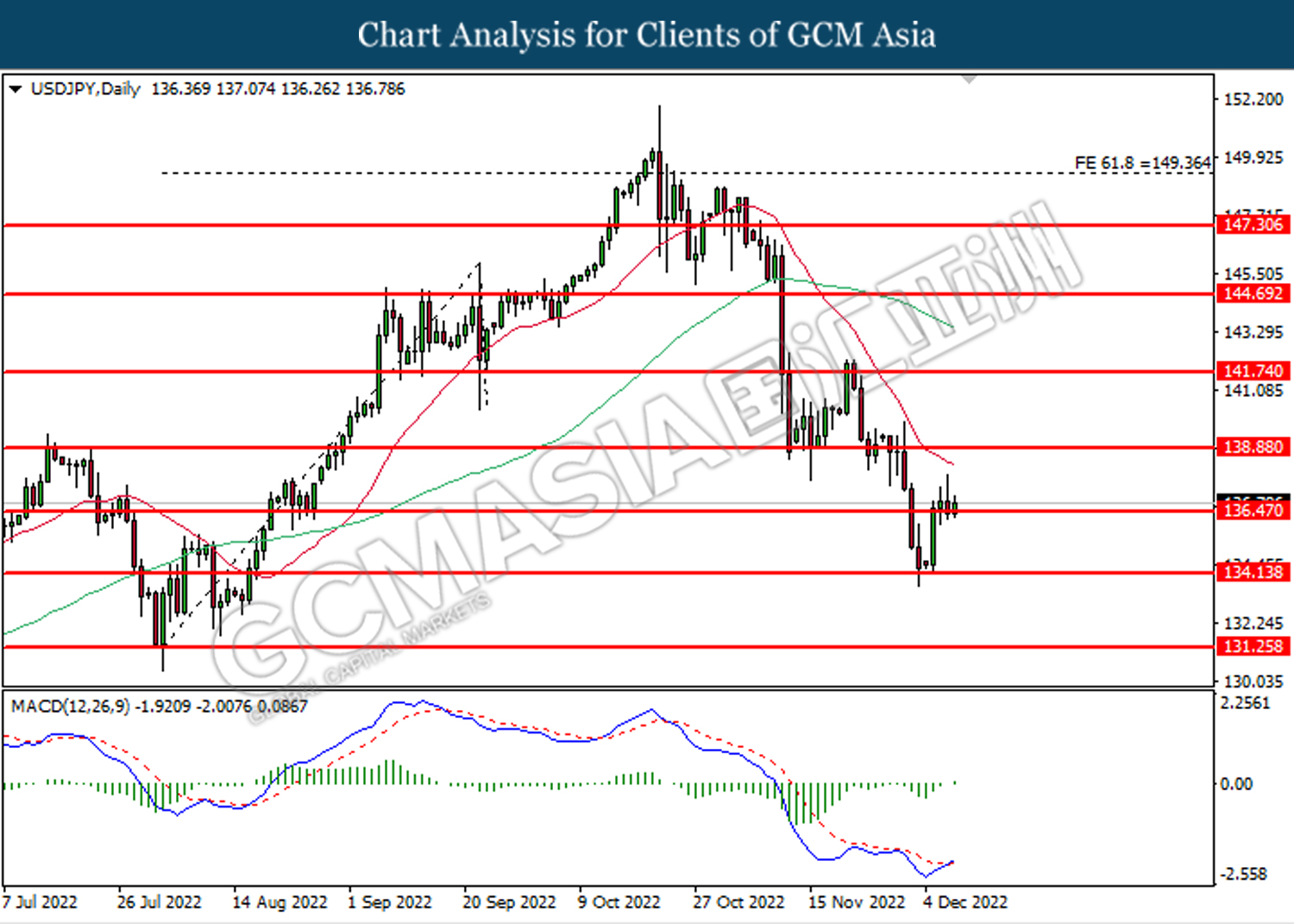

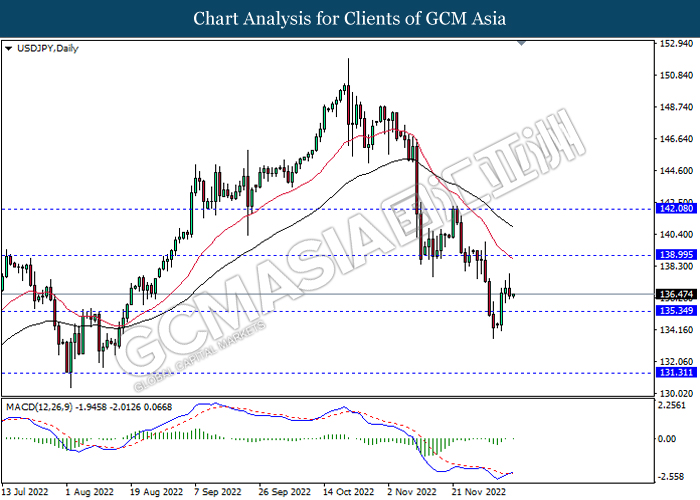

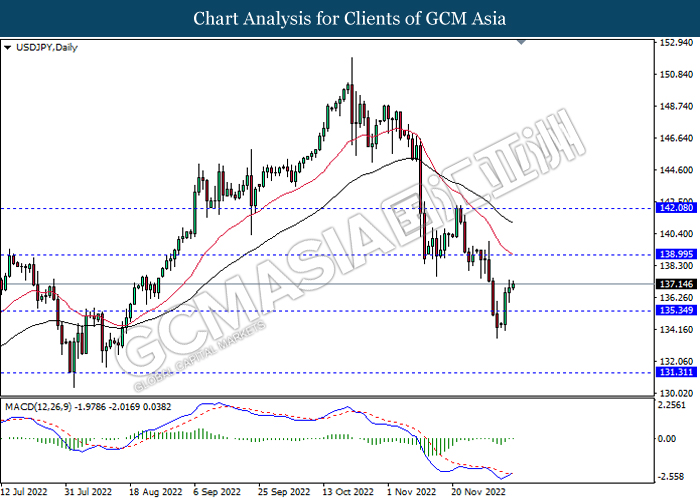

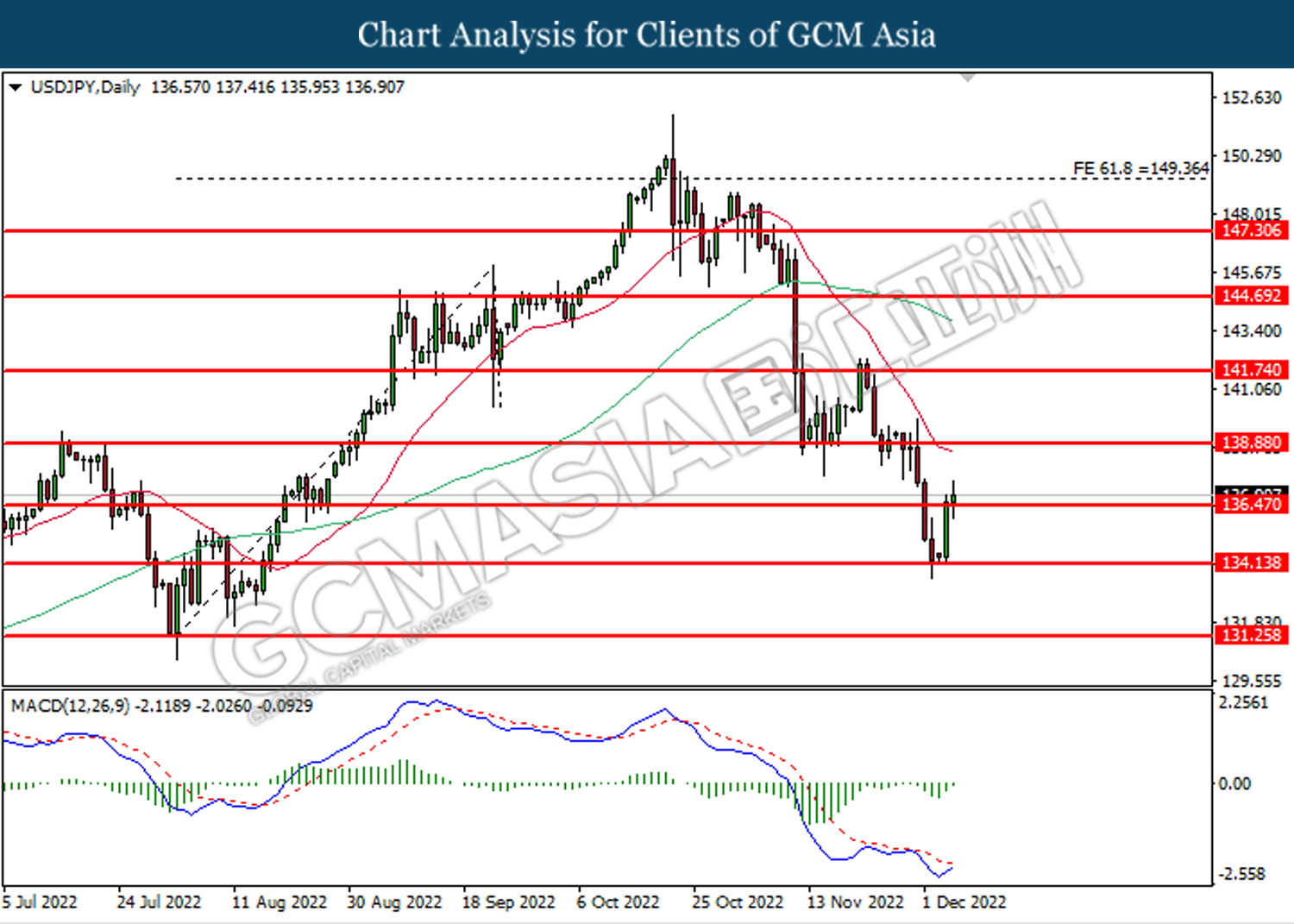

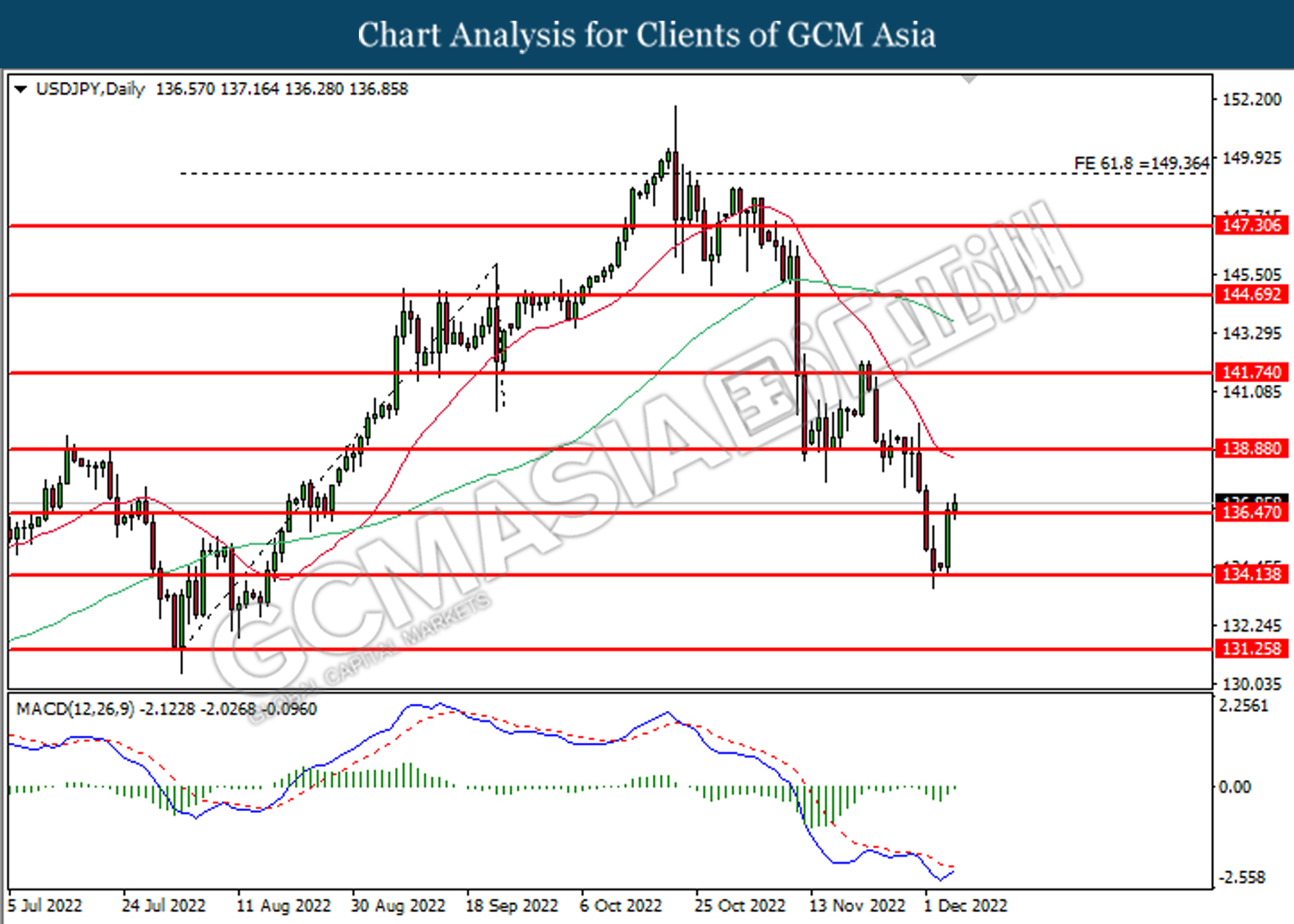

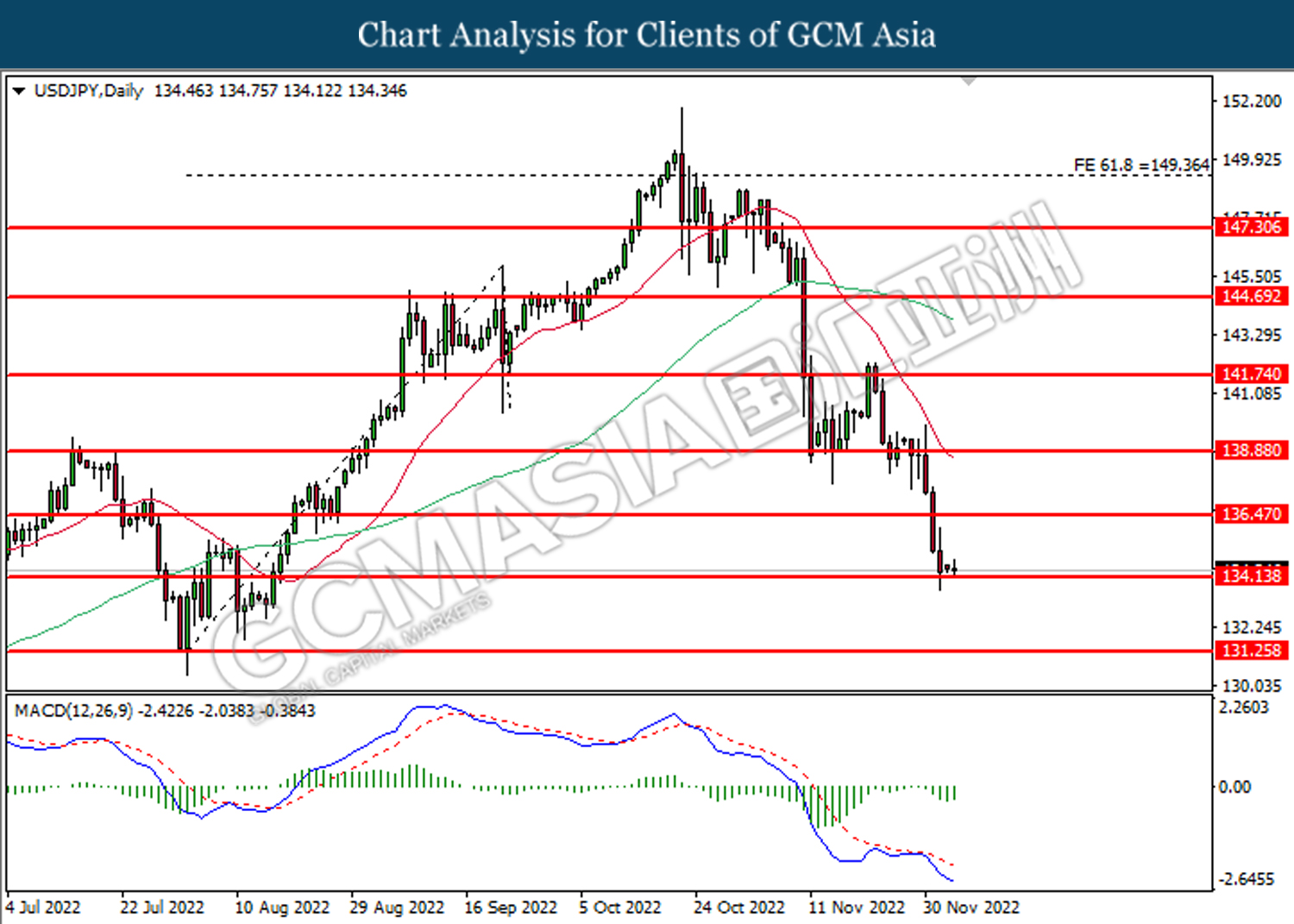

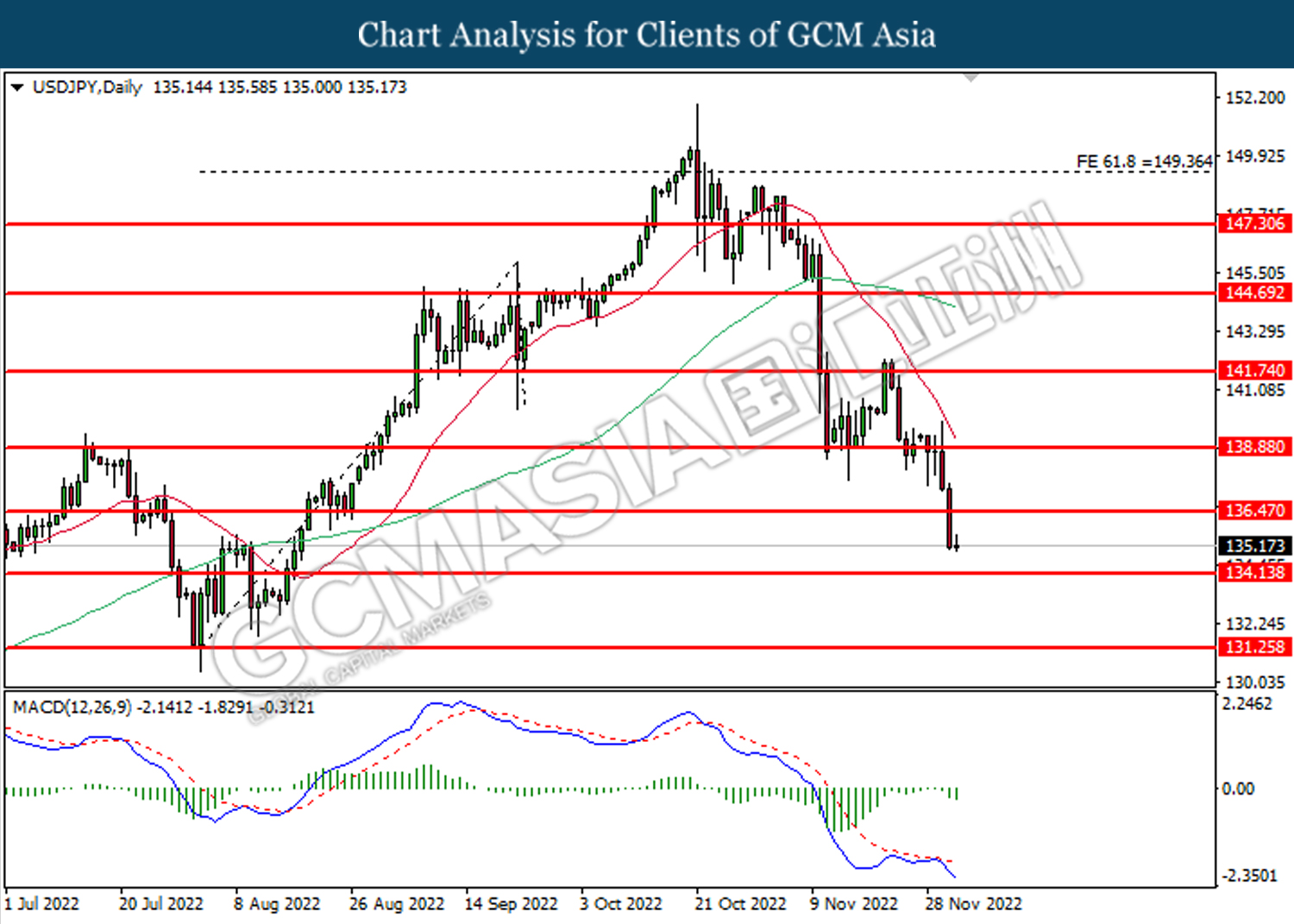

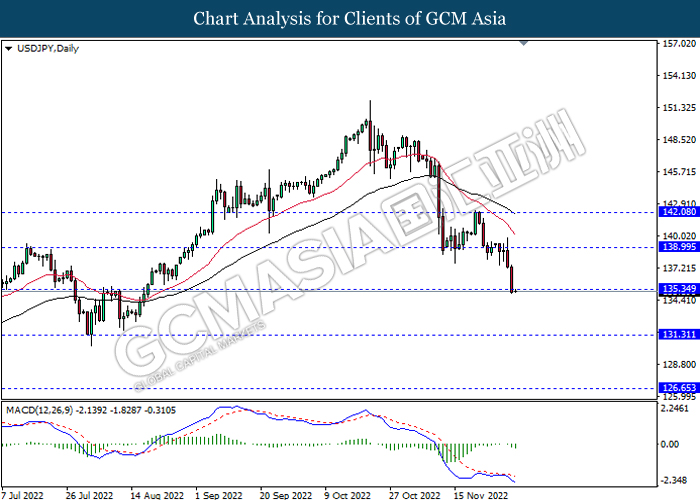

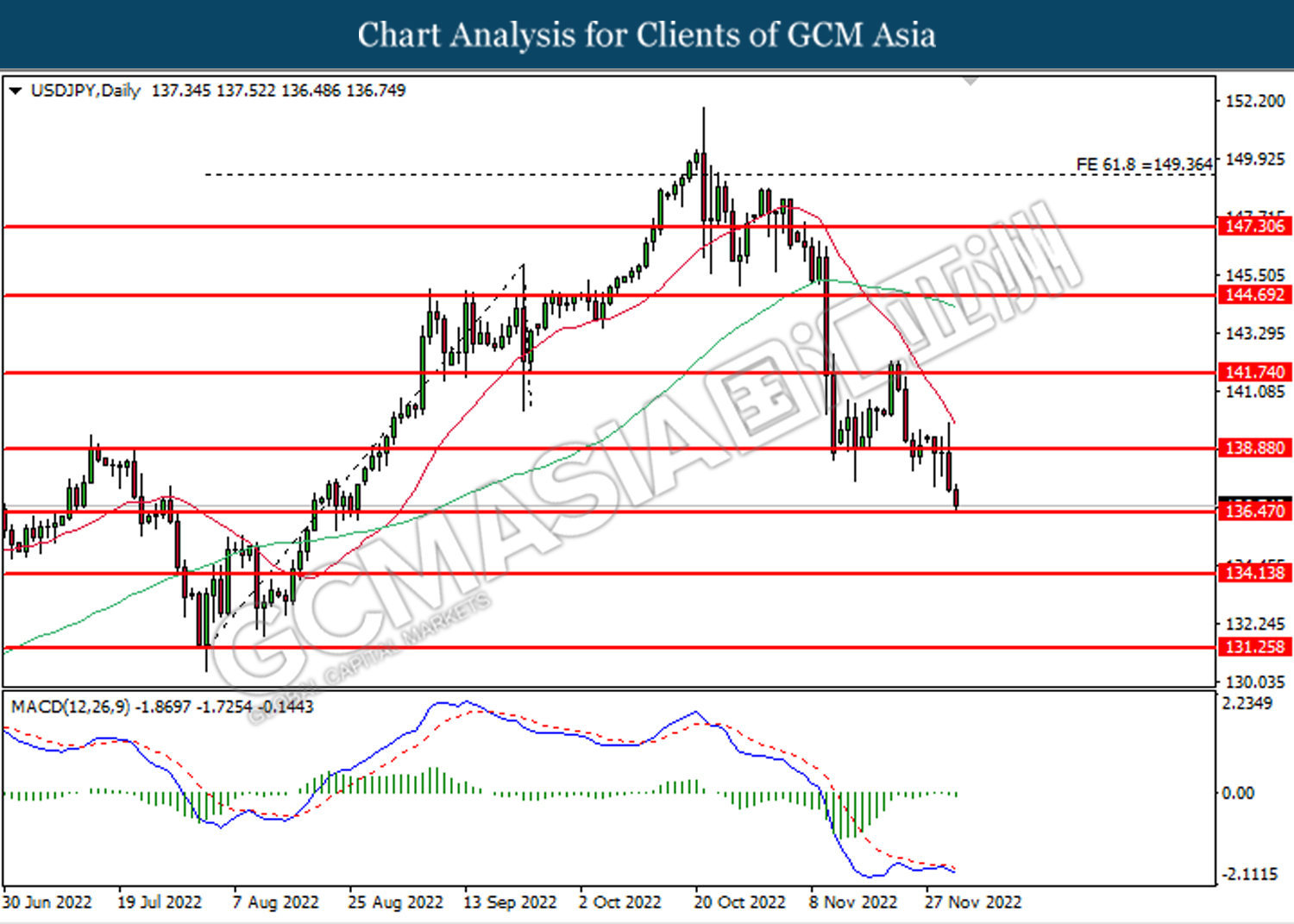

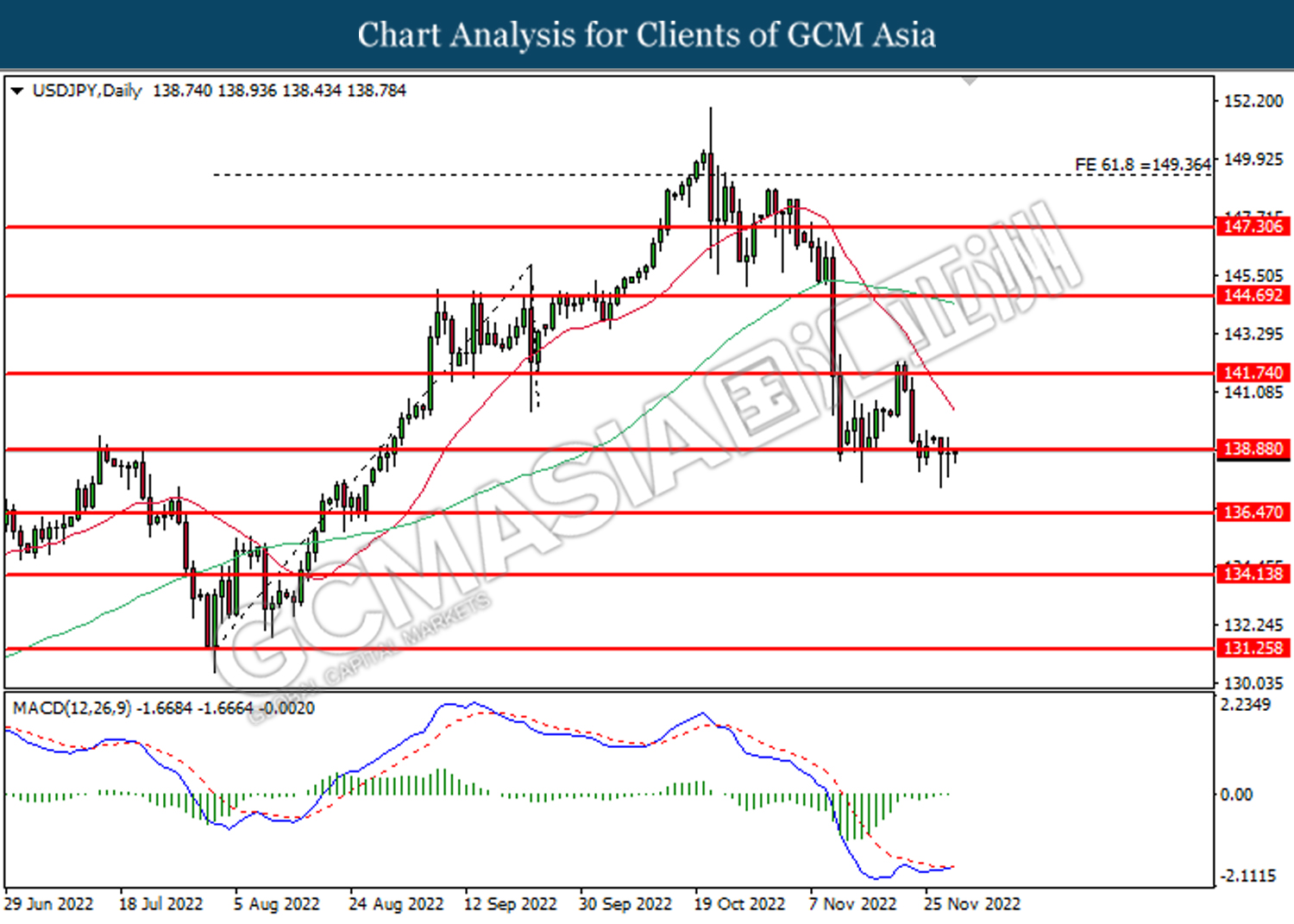

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

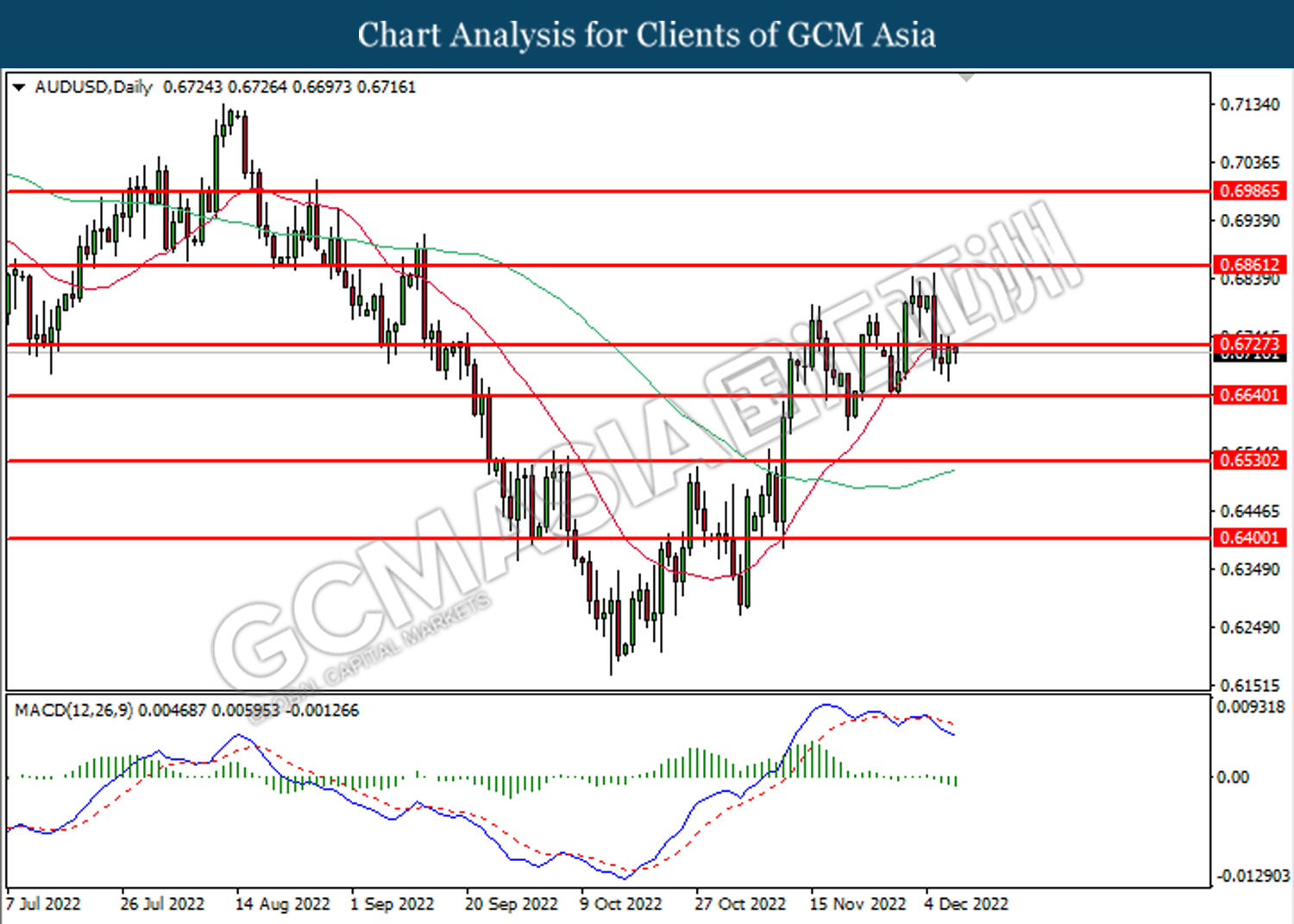

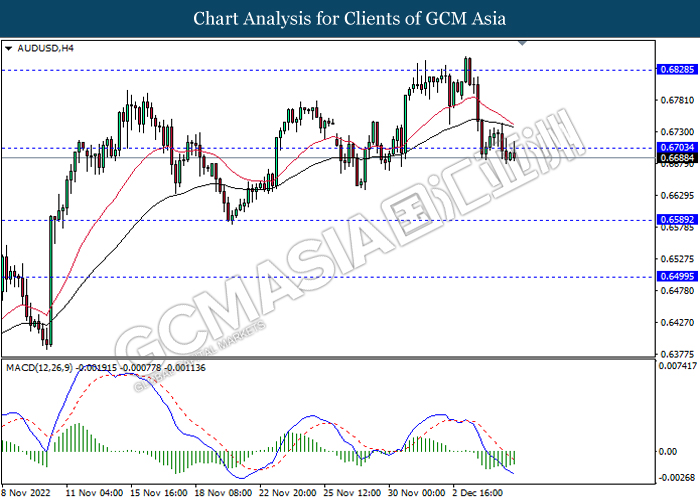

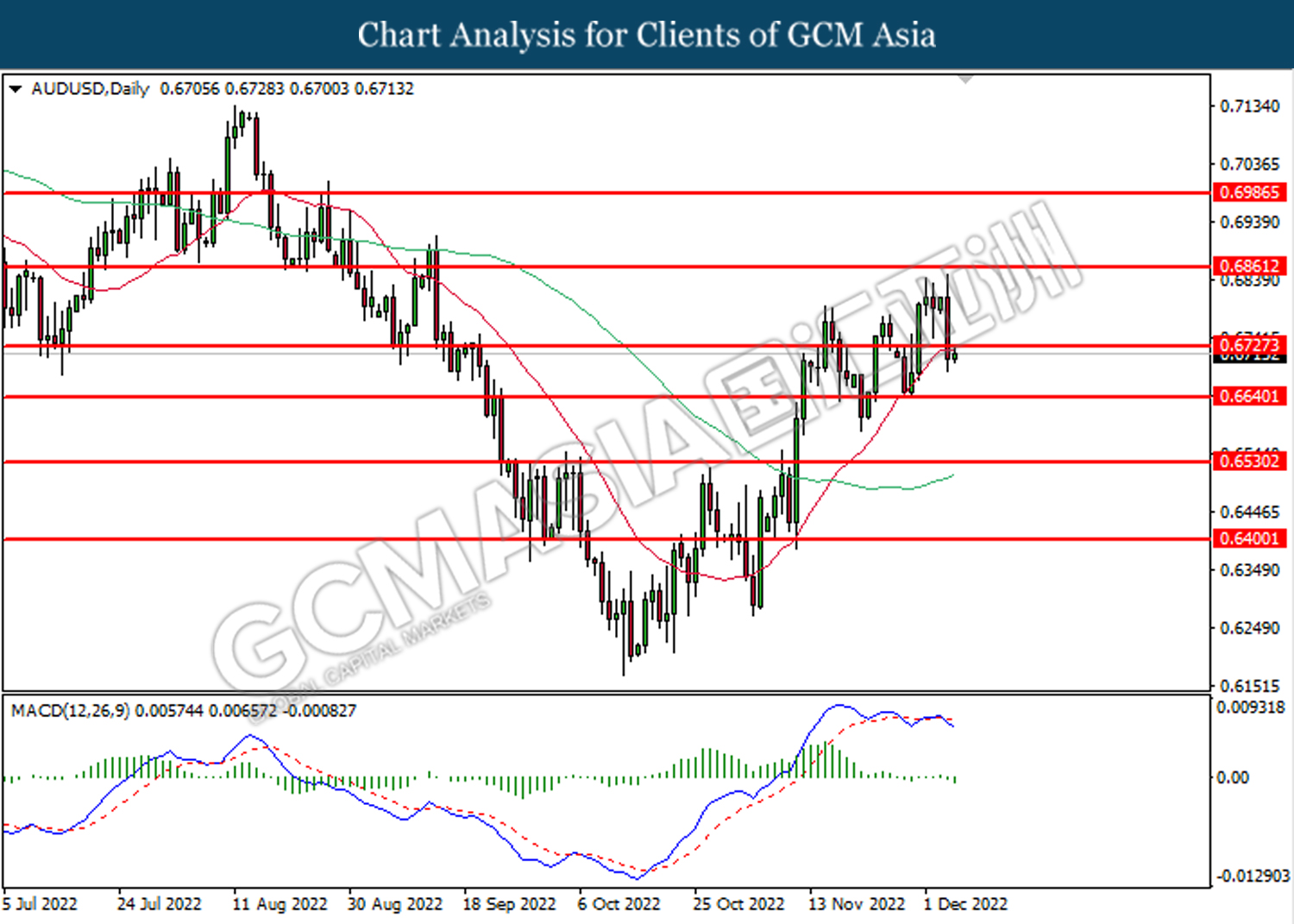

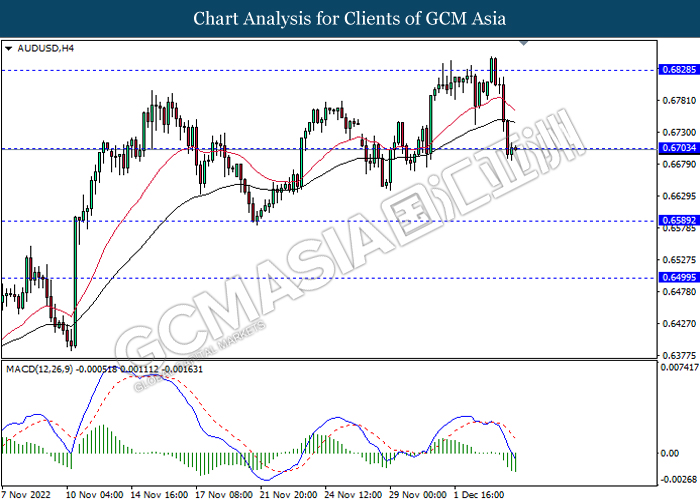

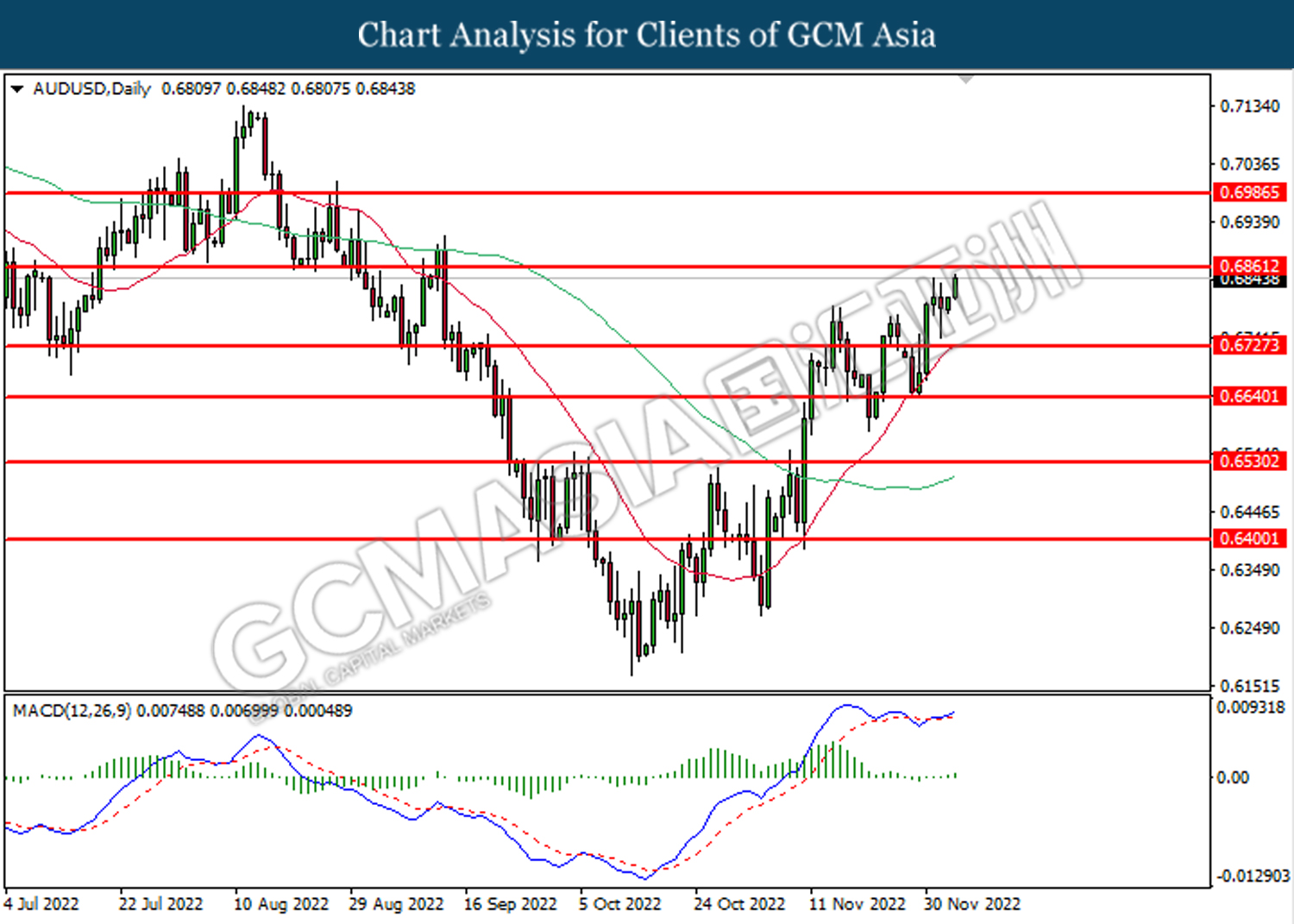

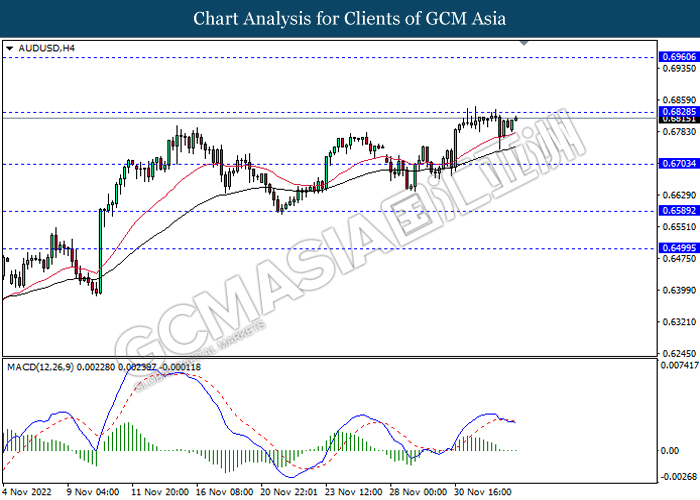

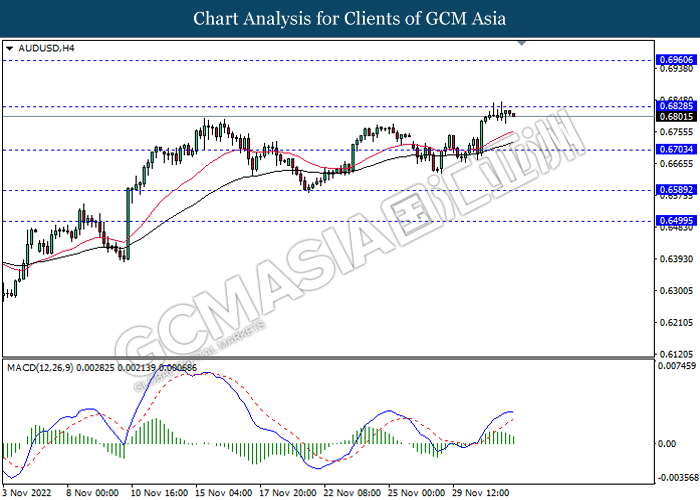

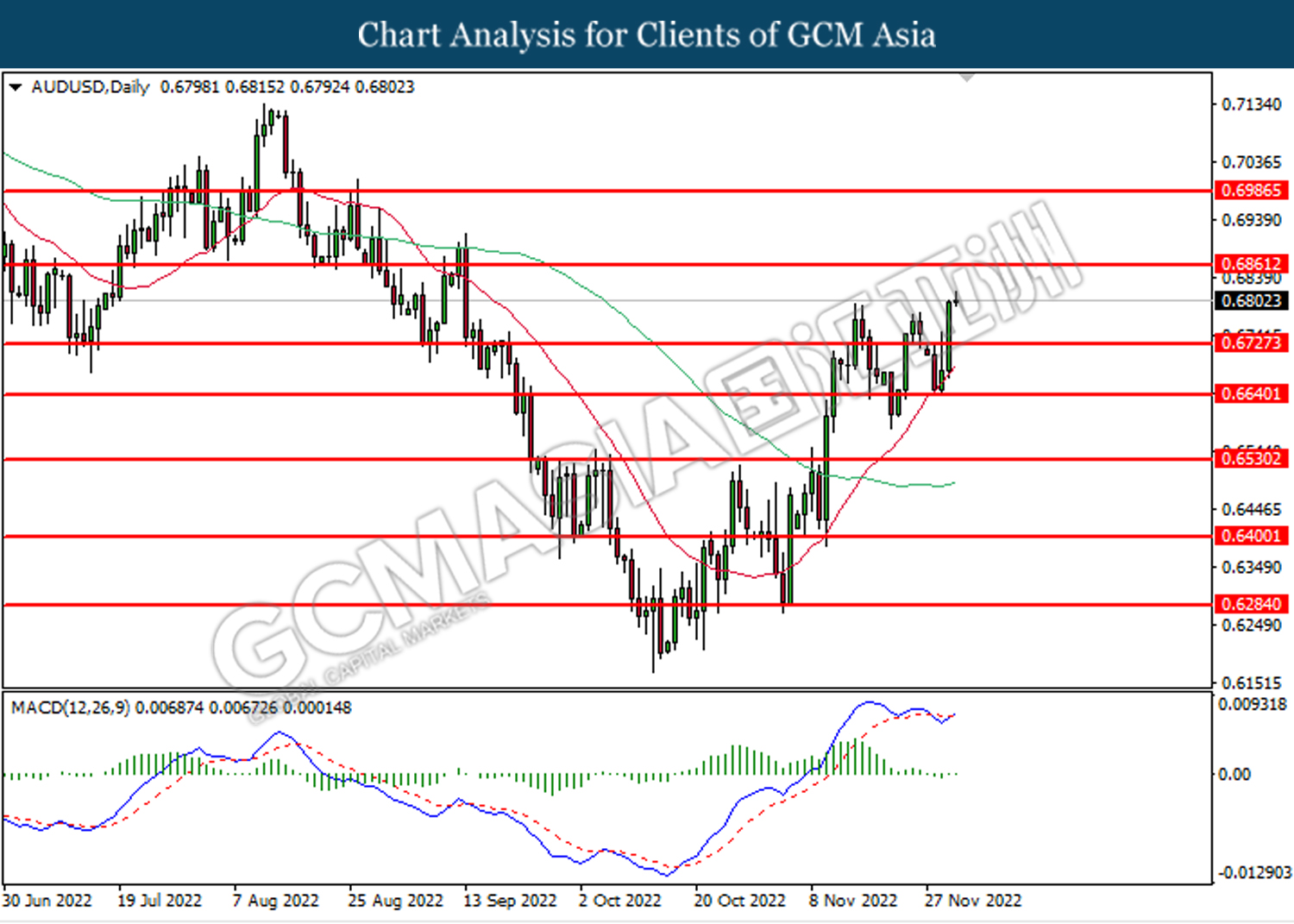

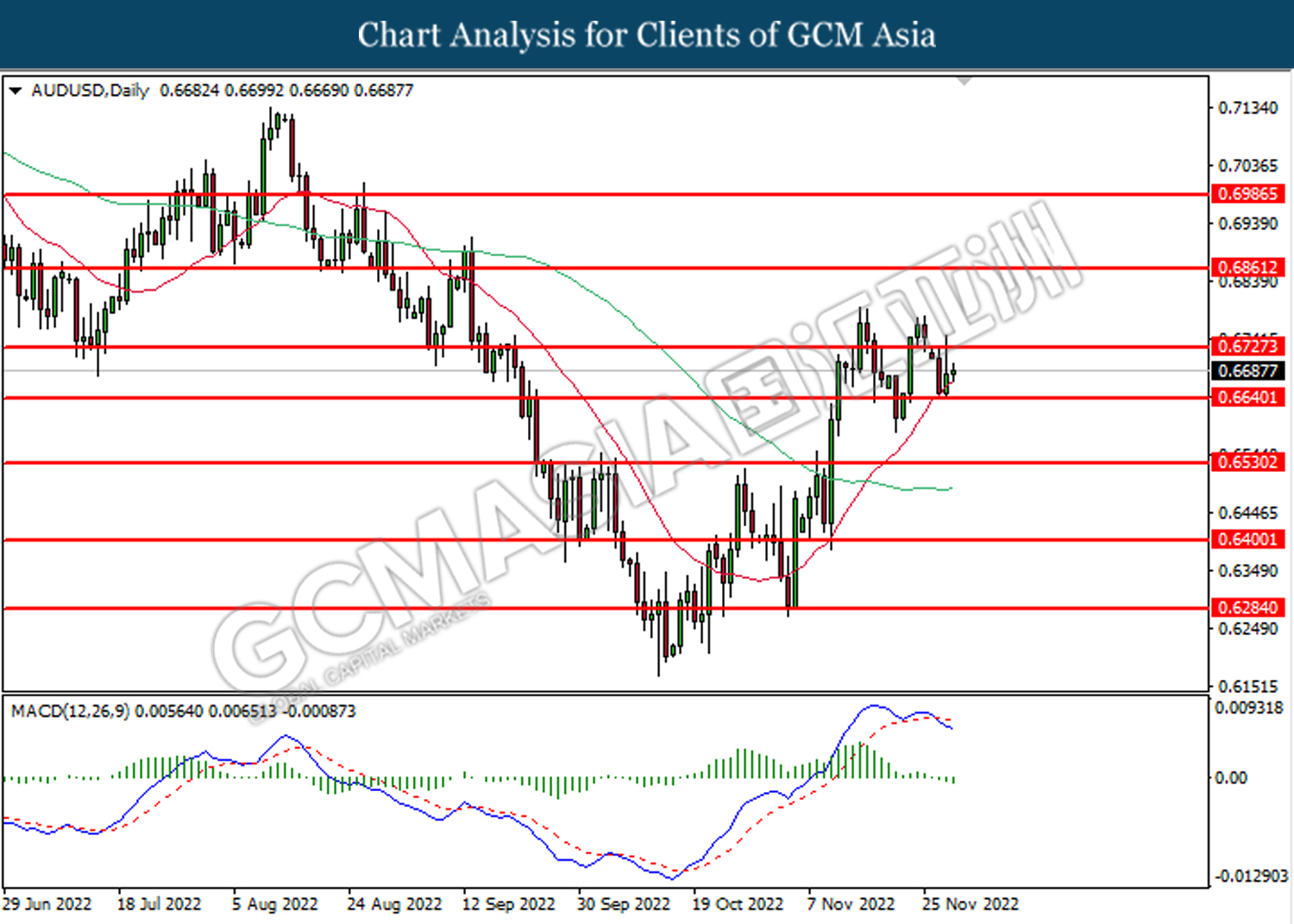

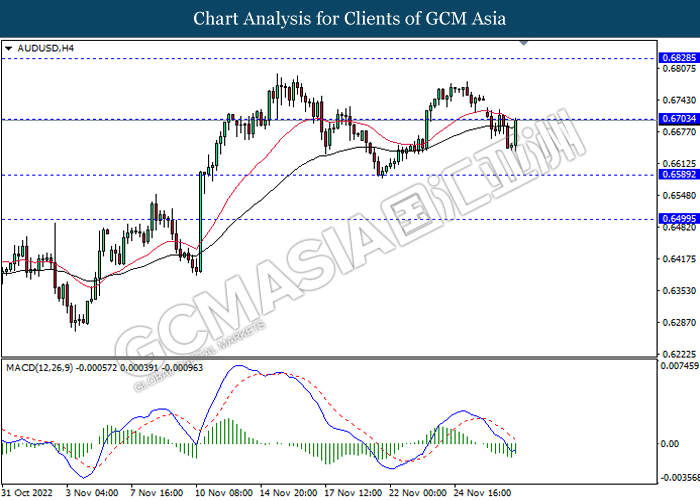

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

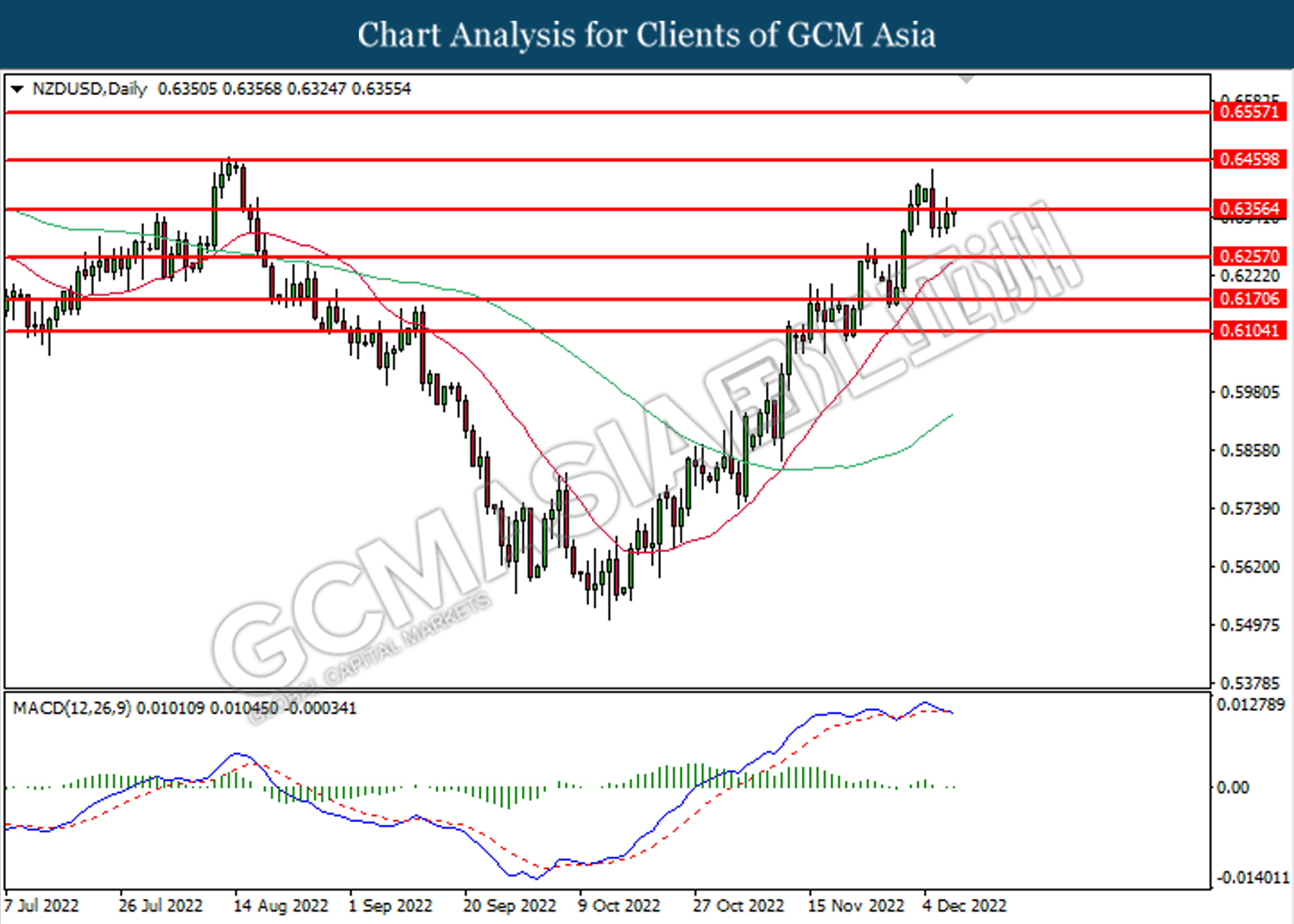

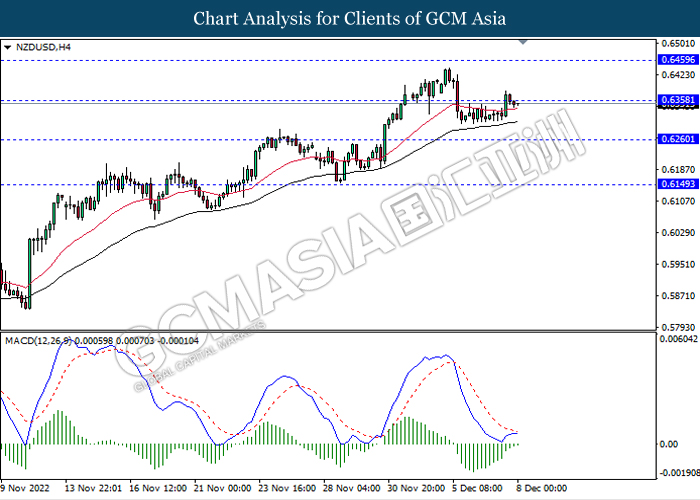

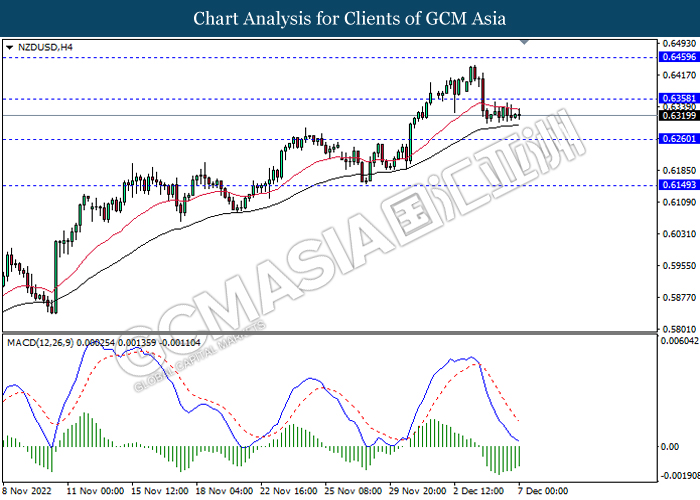

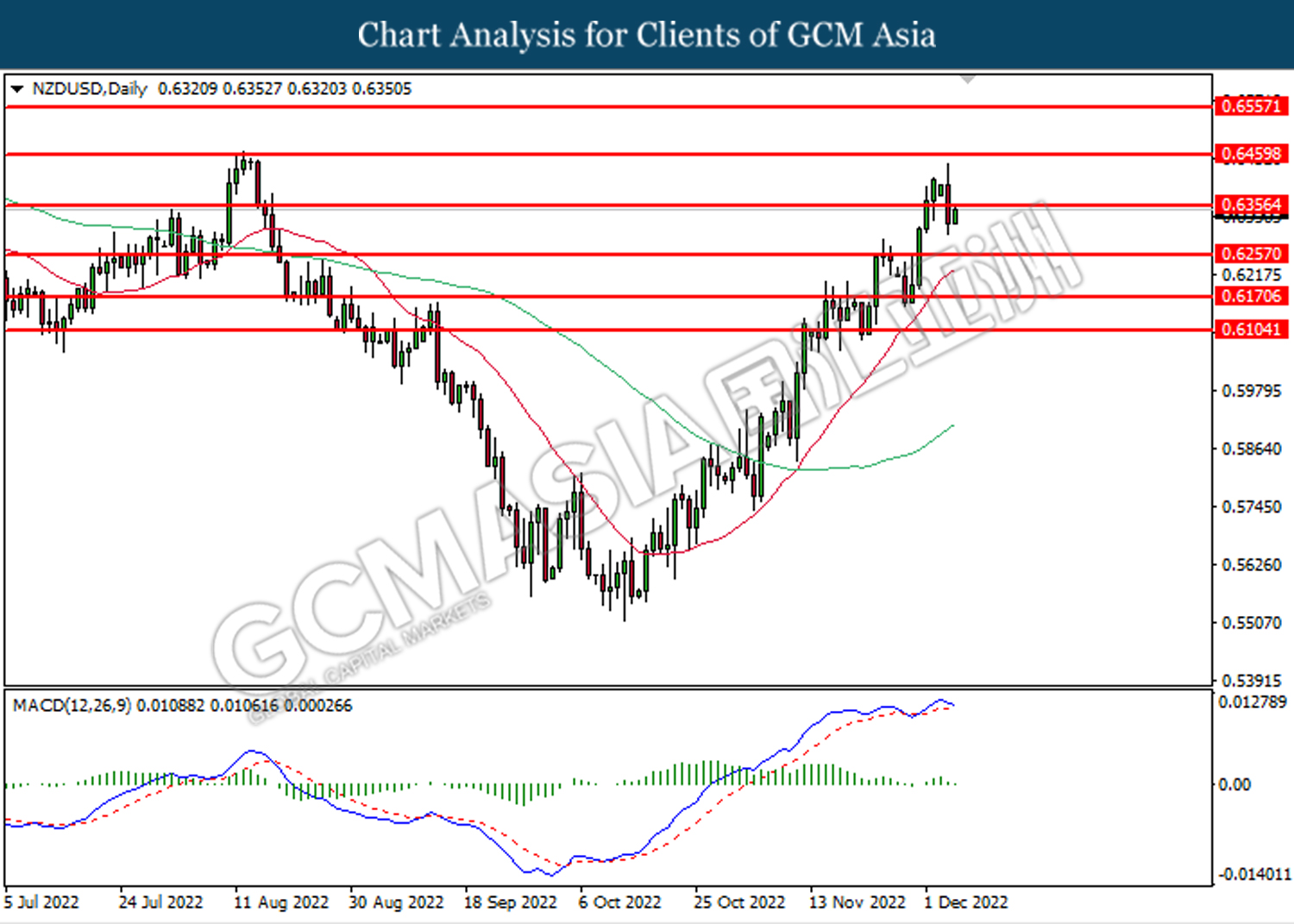

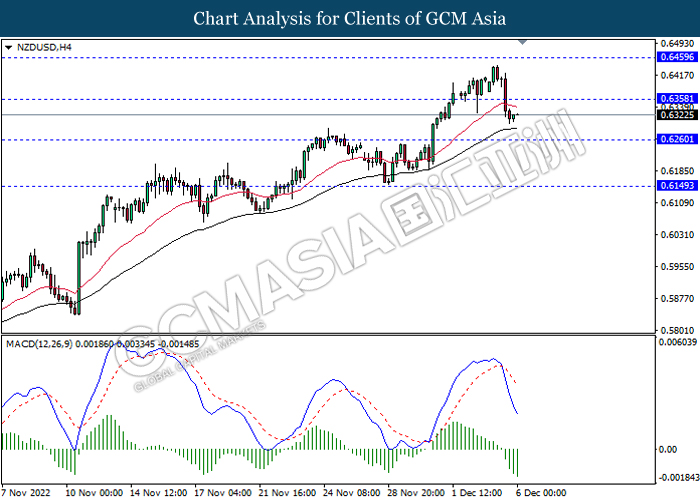

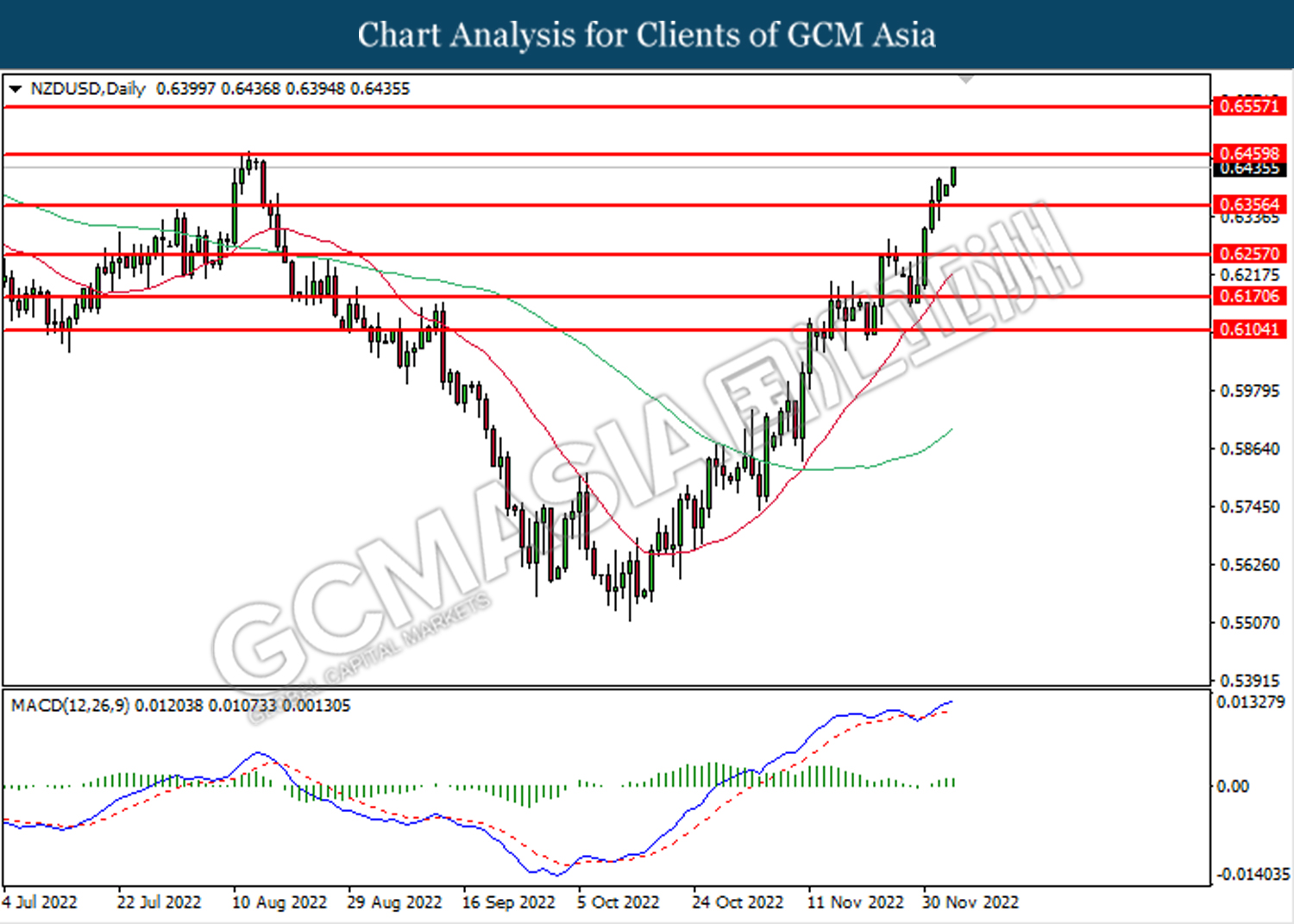

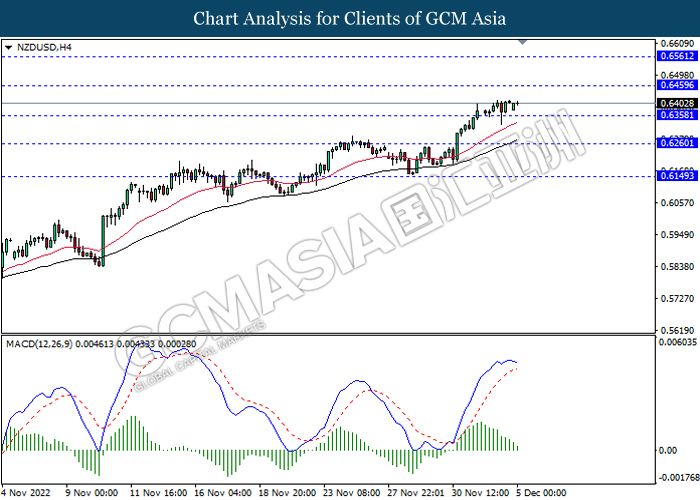

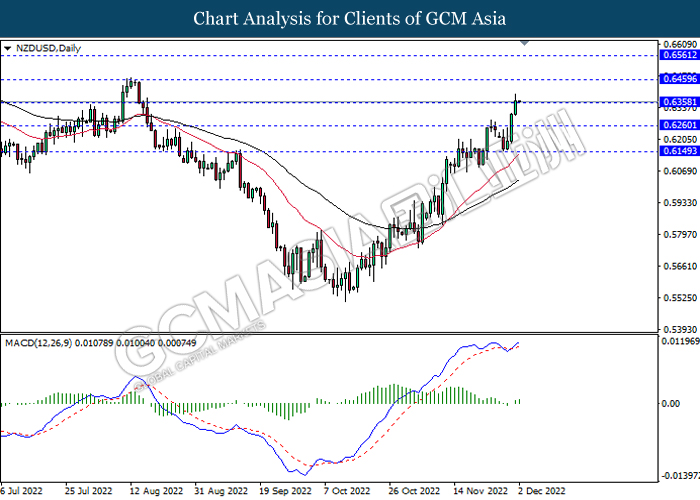

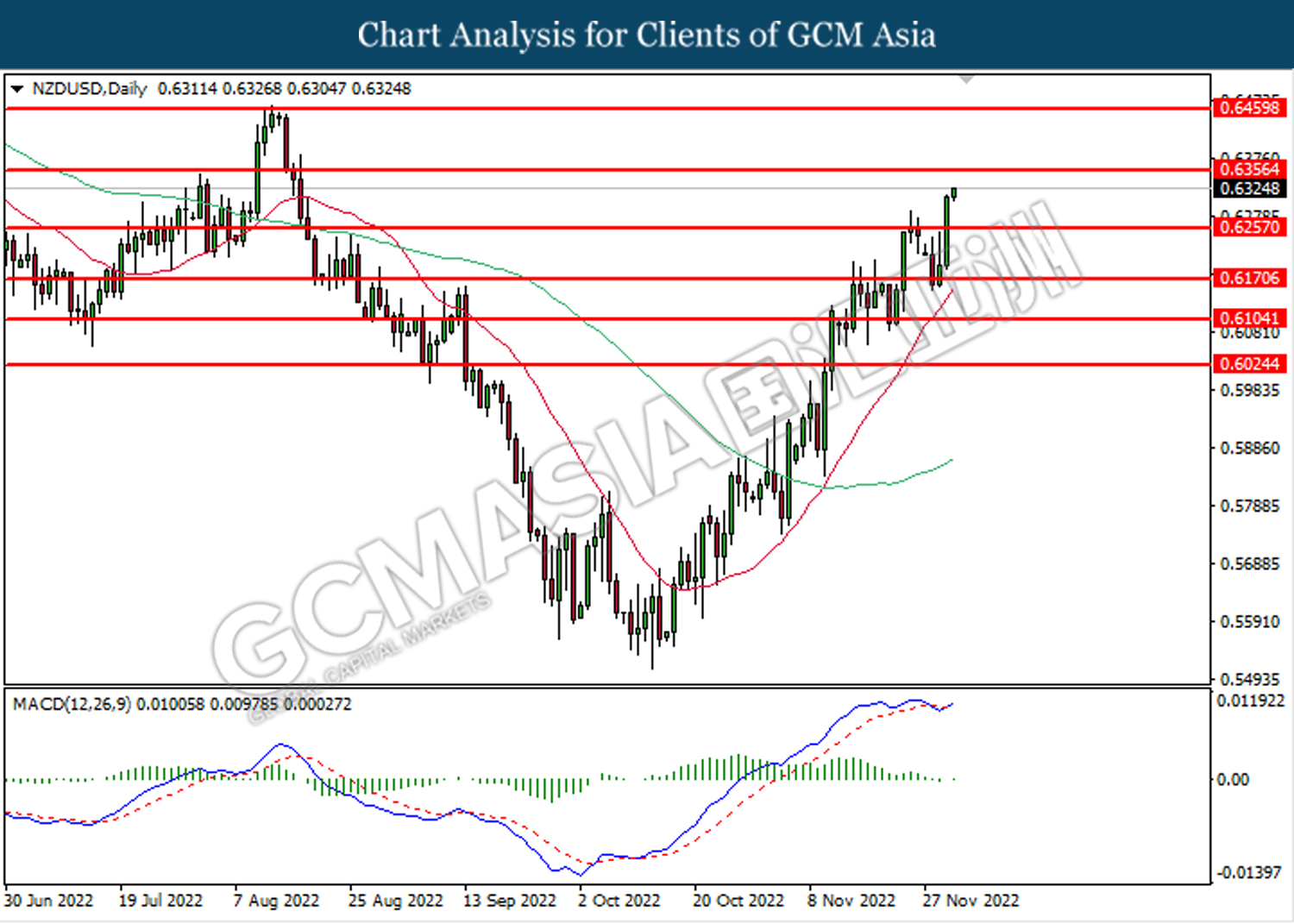

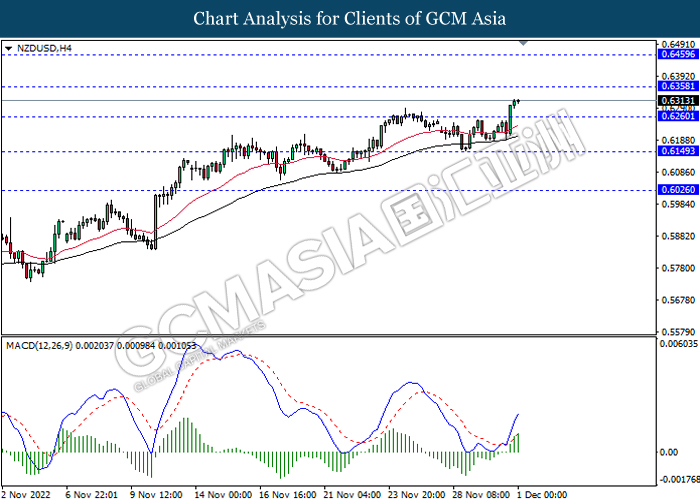

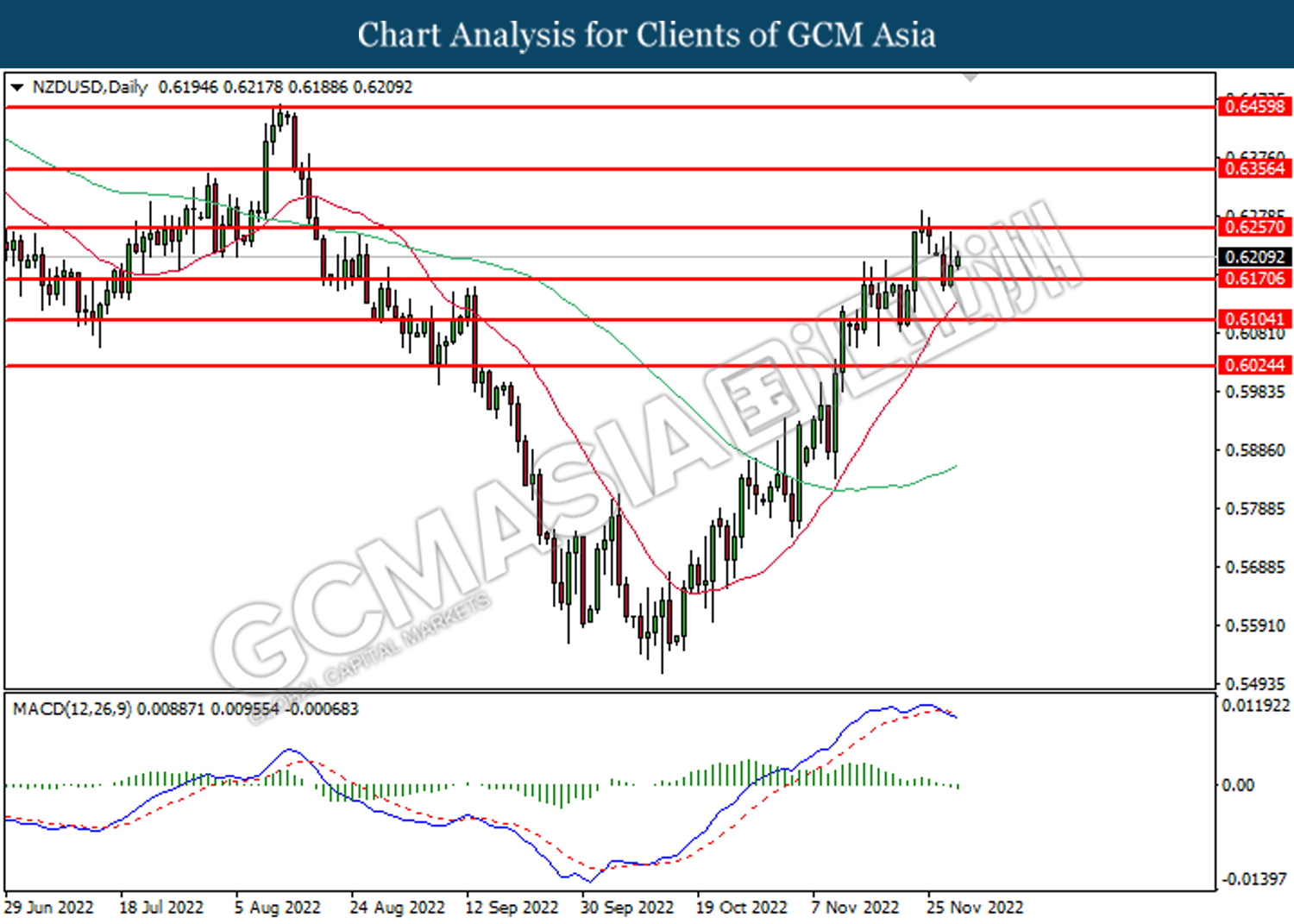

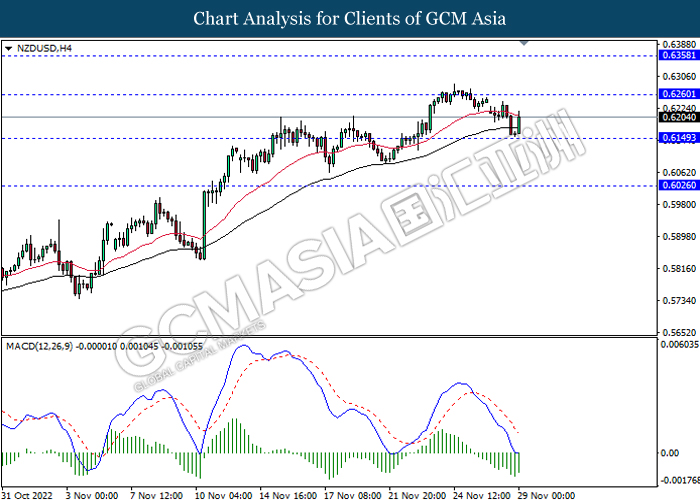

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

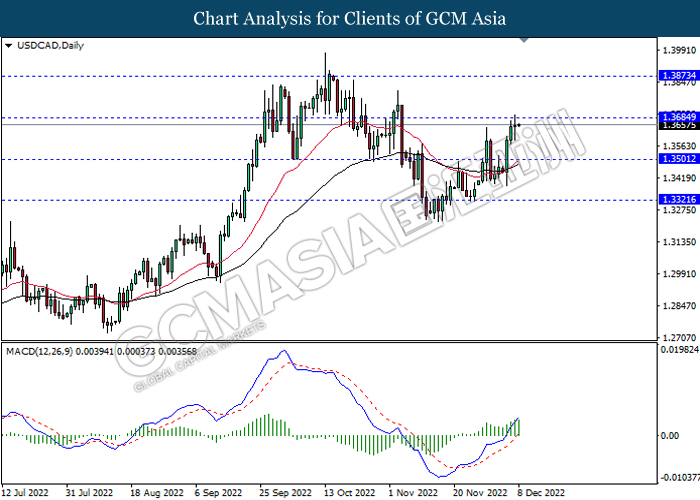

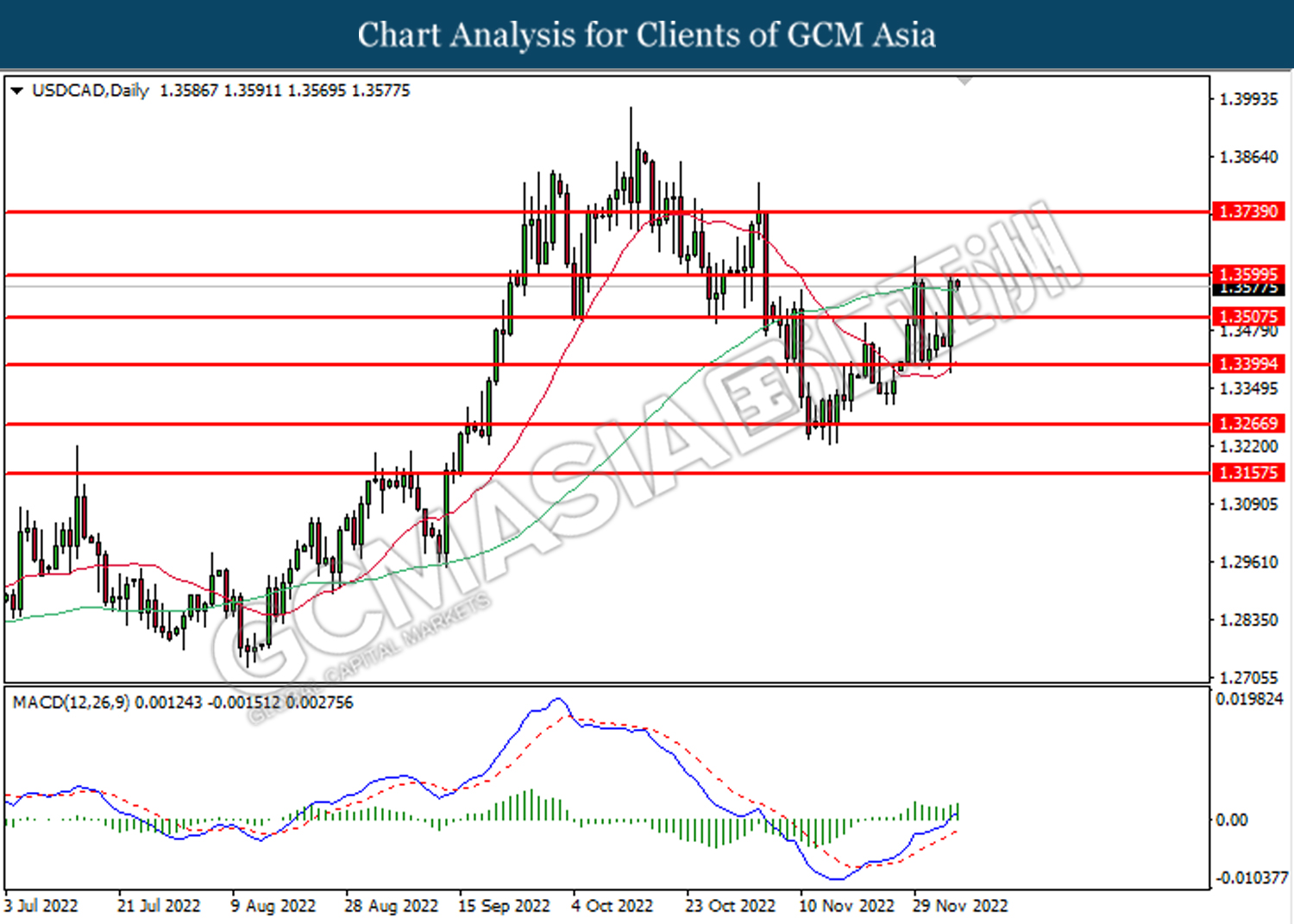

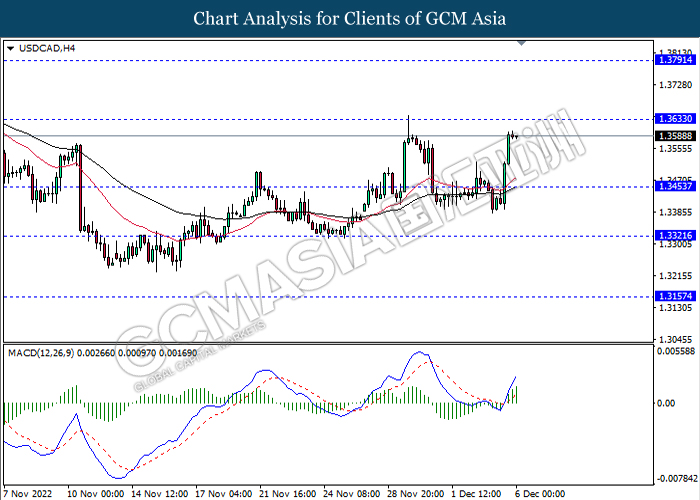

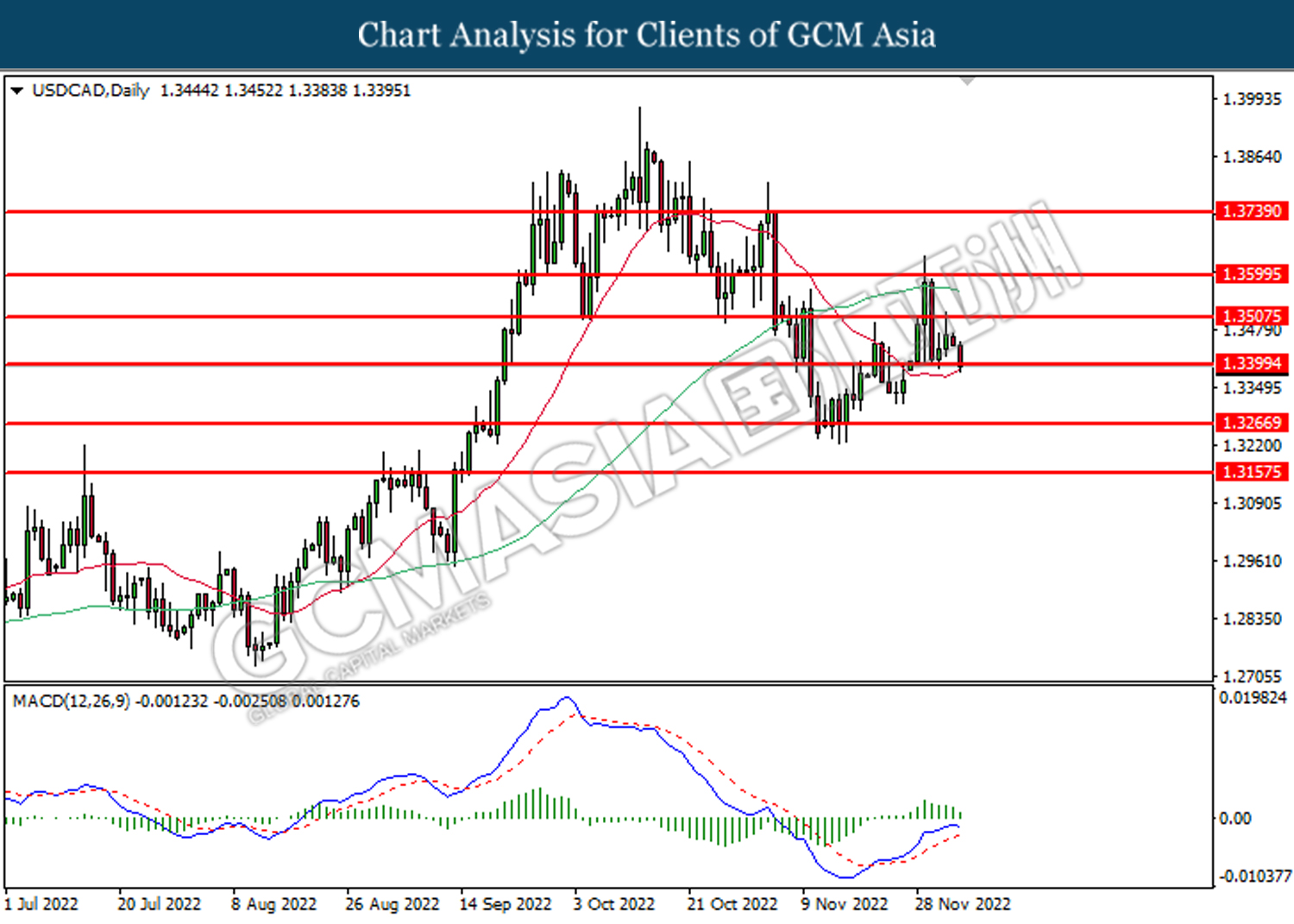

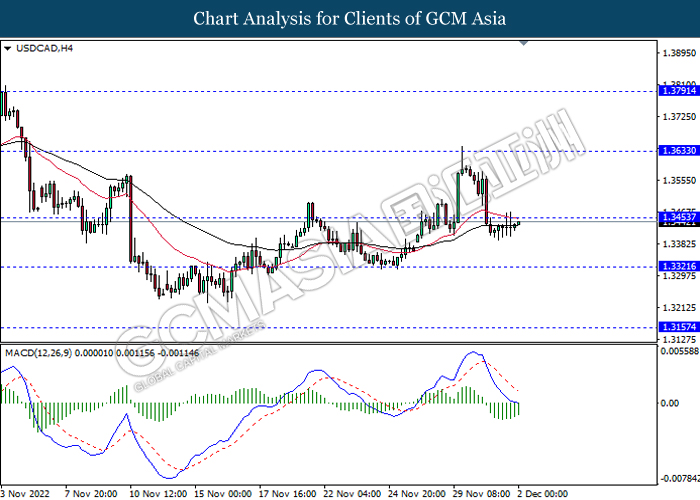

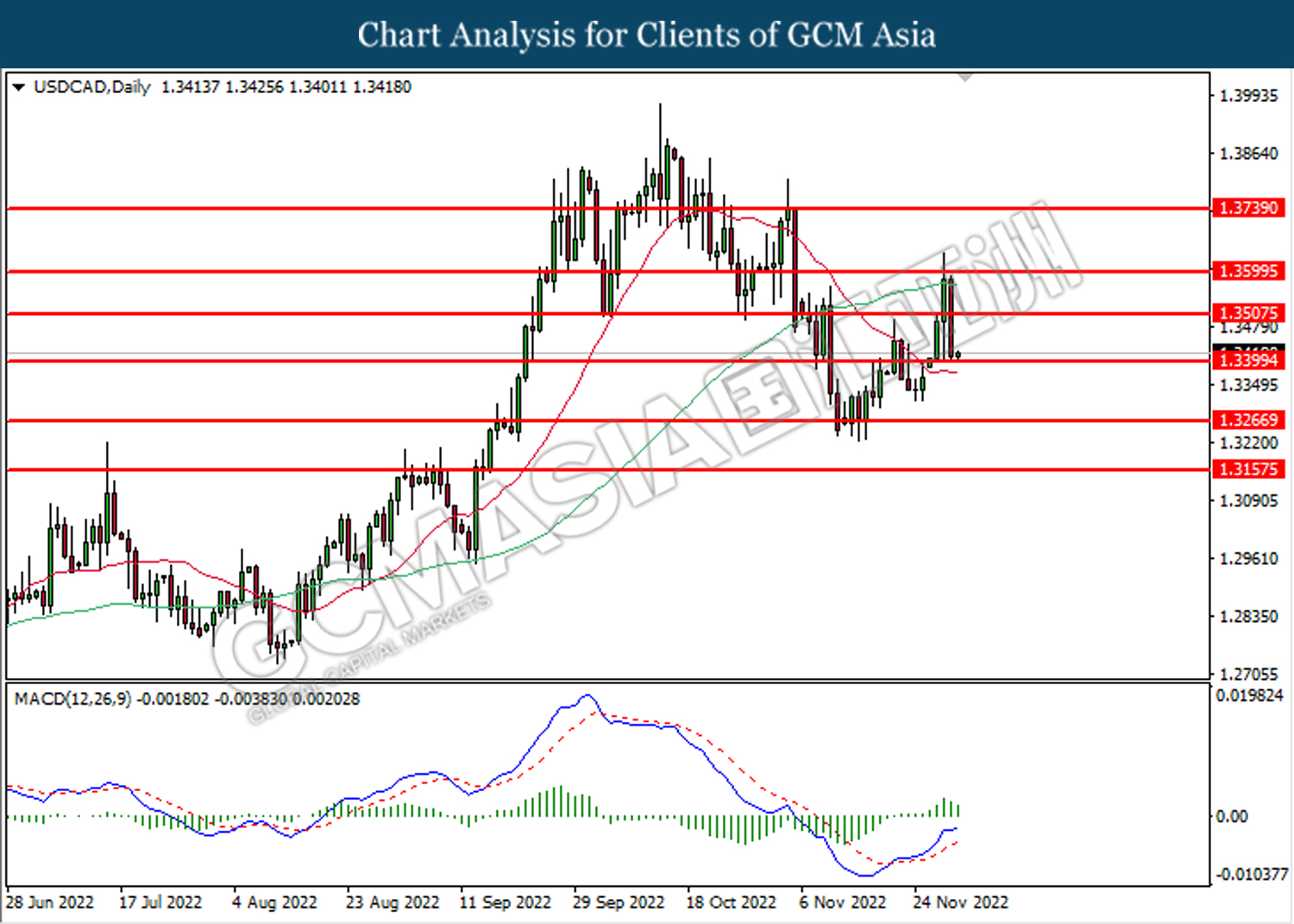

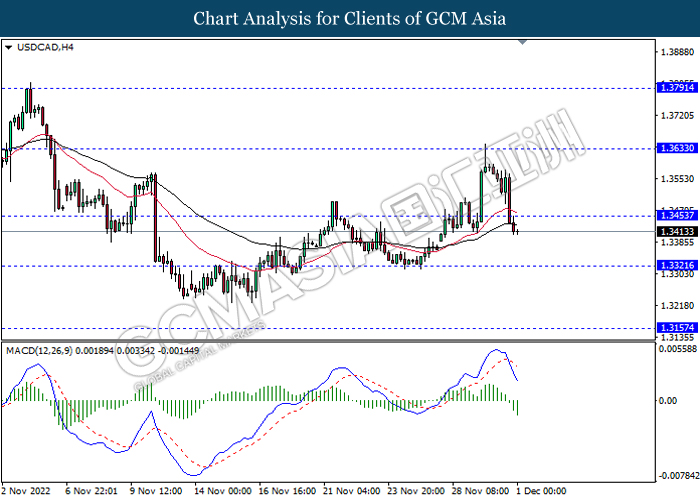

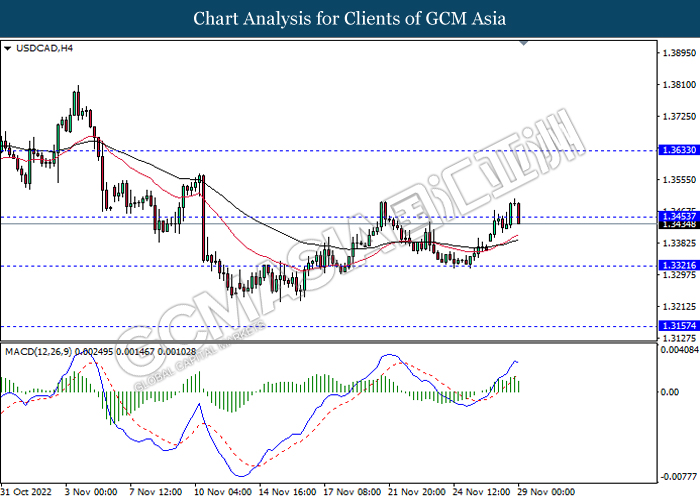

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend it gains toward the resistance level at 1.3740.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

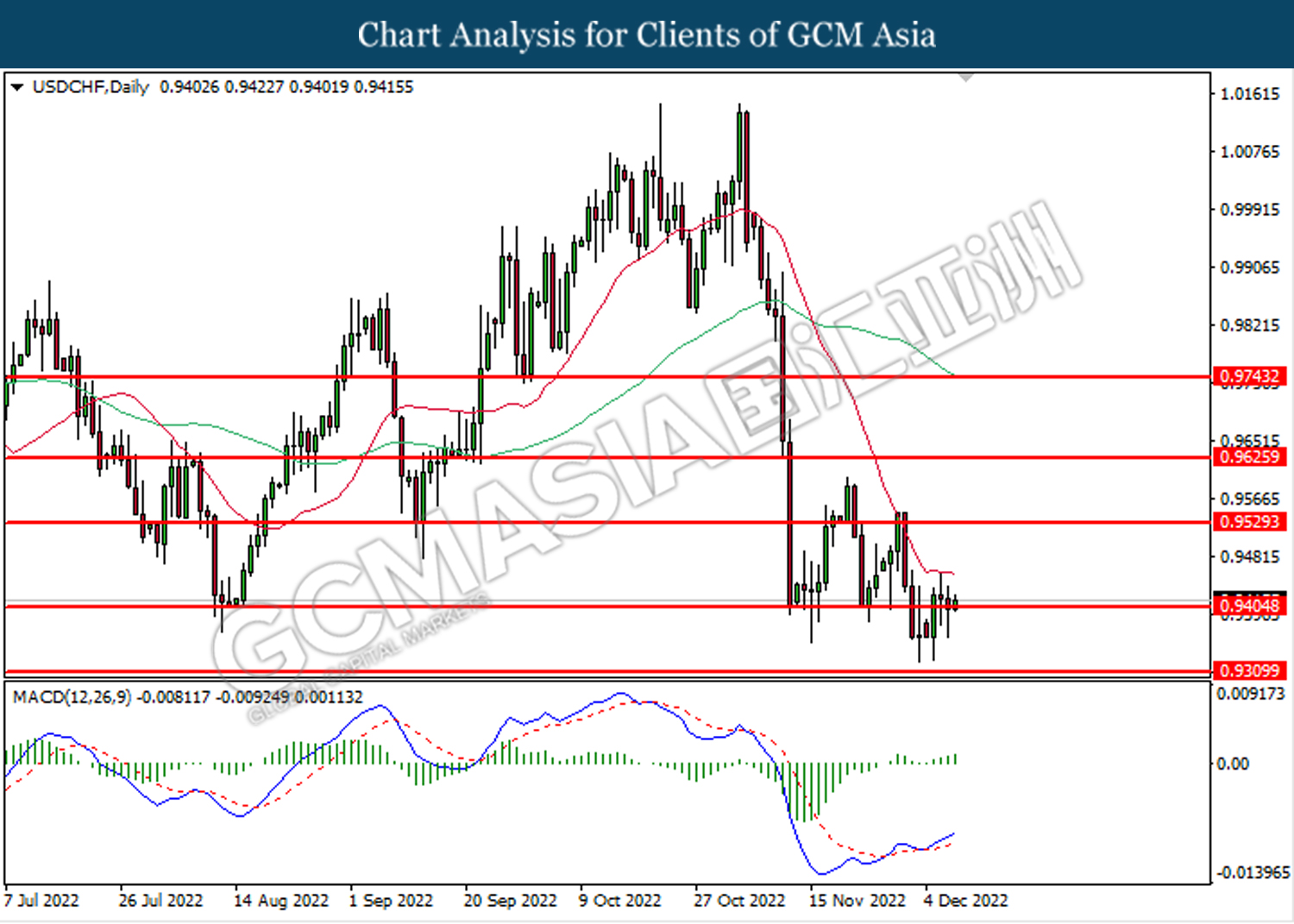

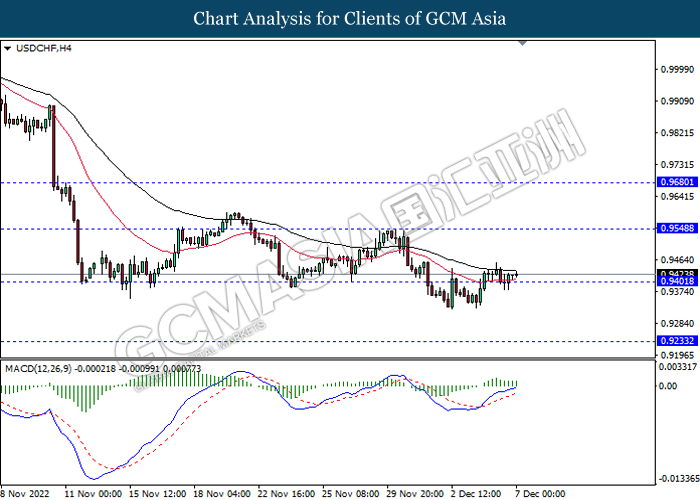

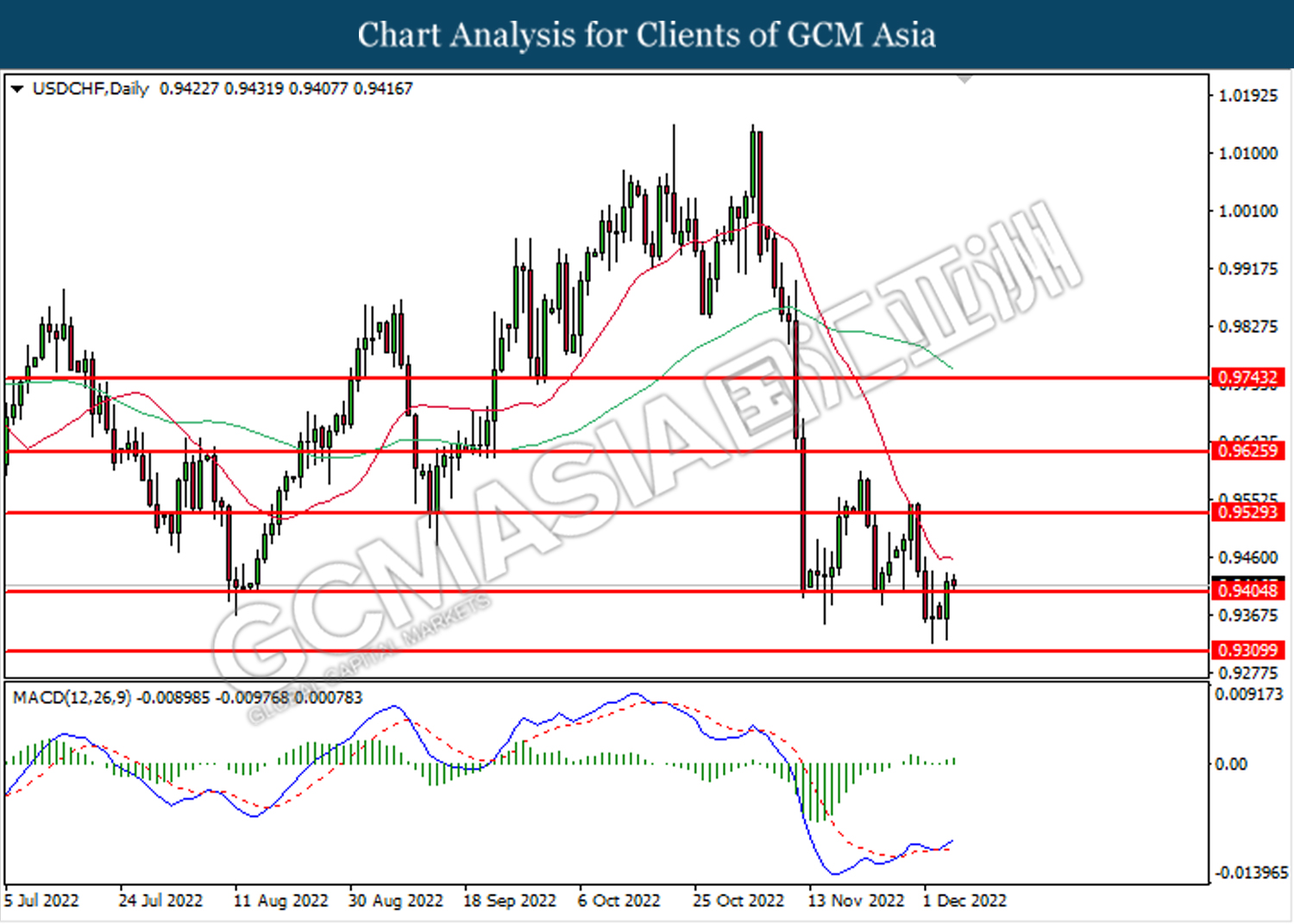

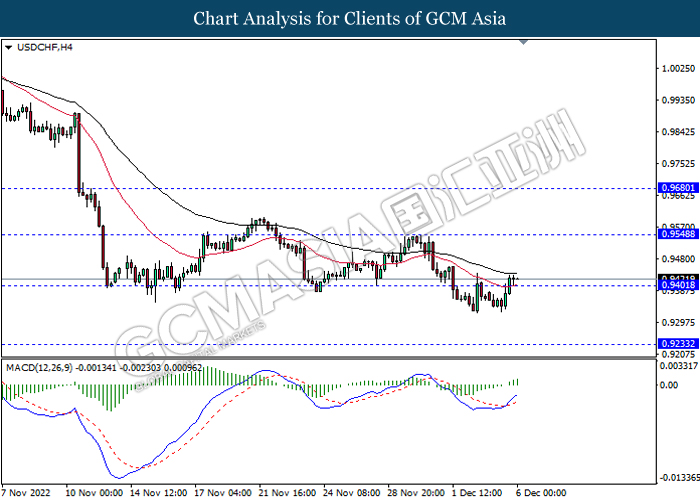

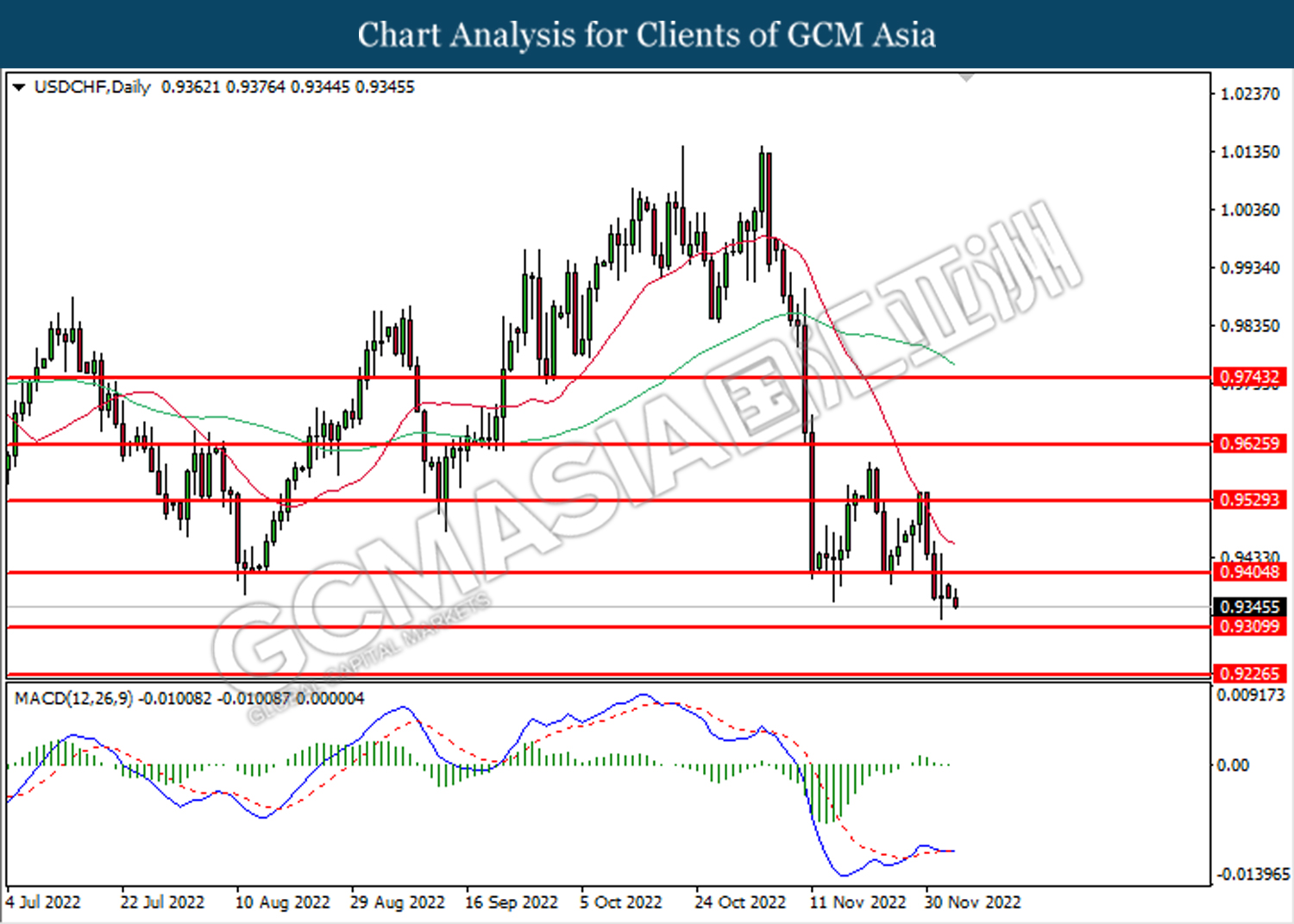

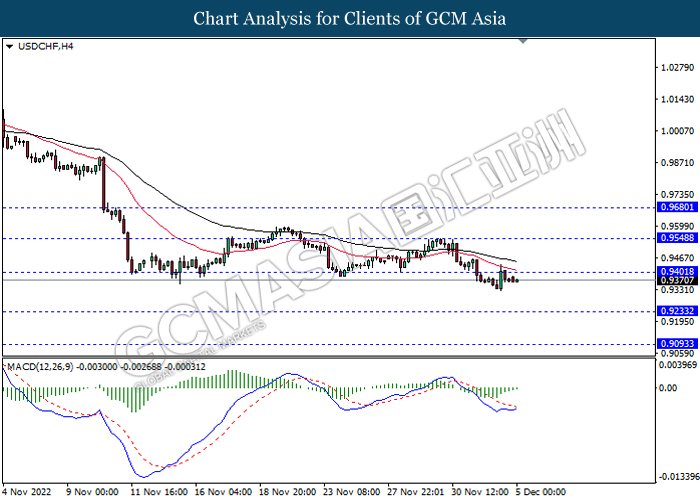

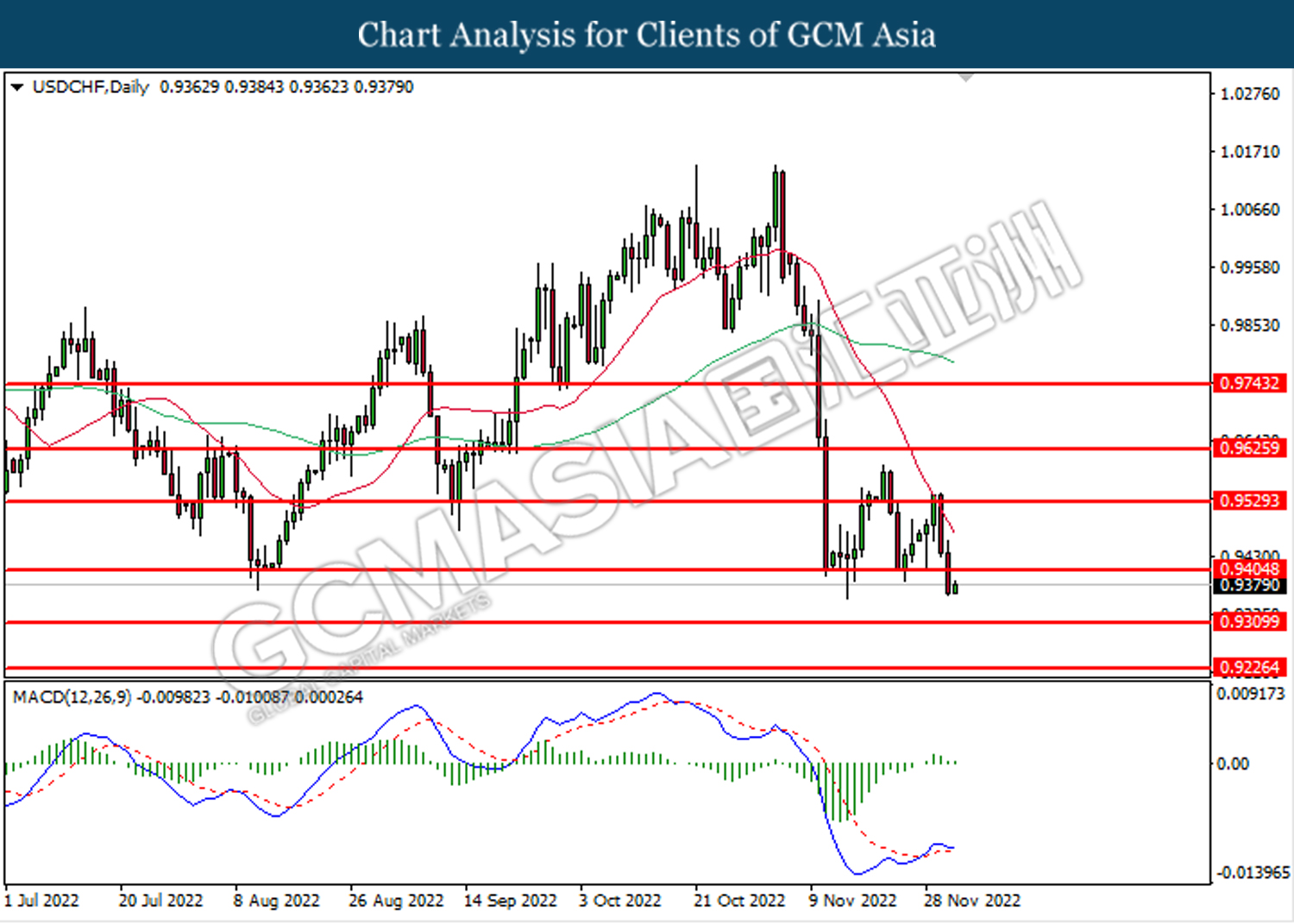

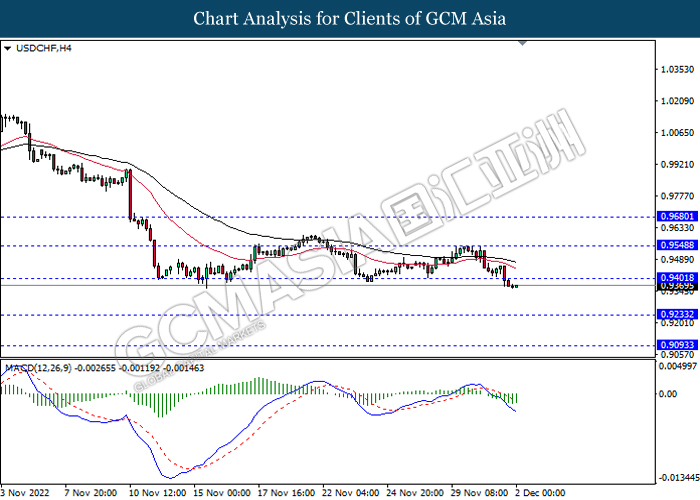

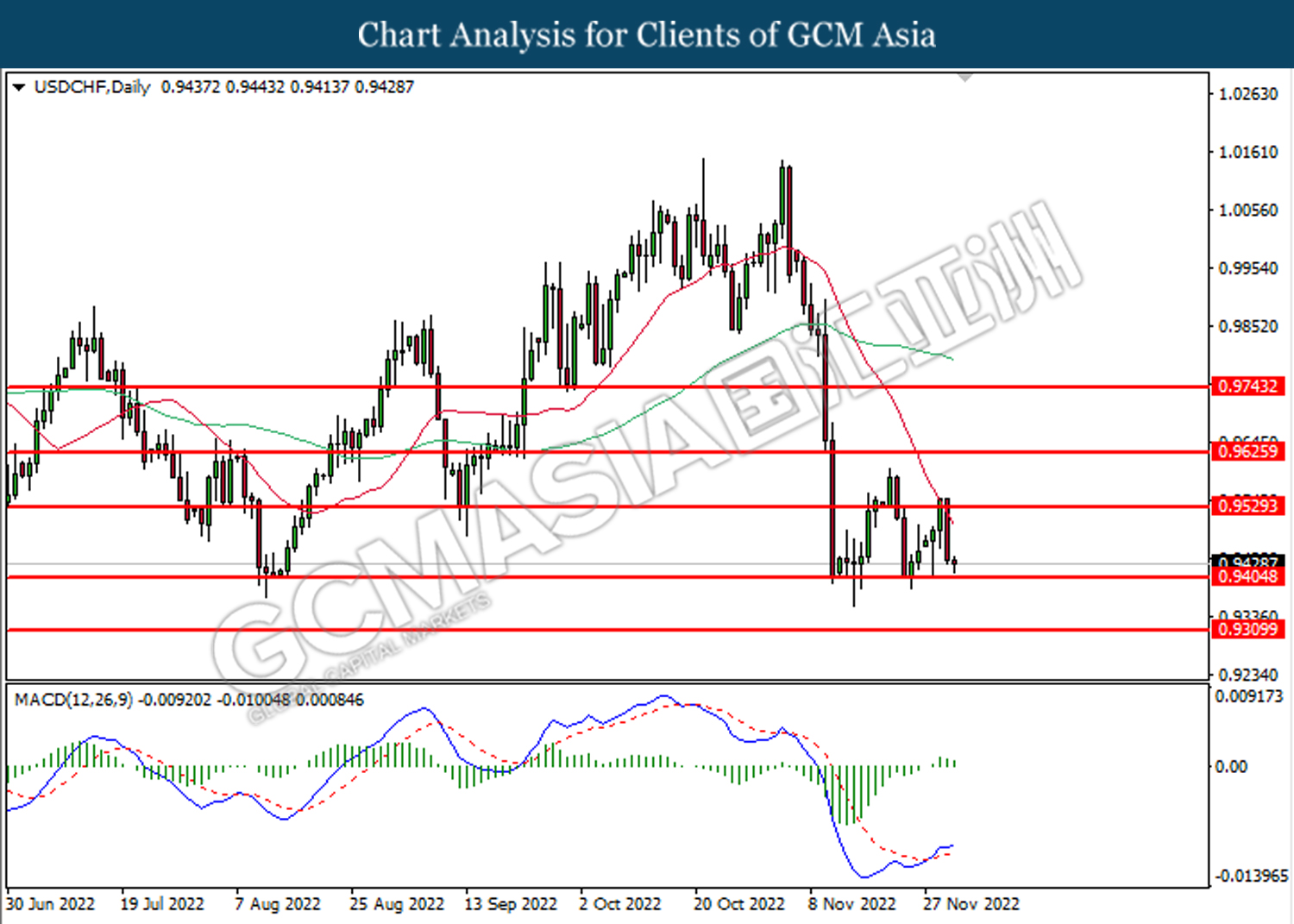

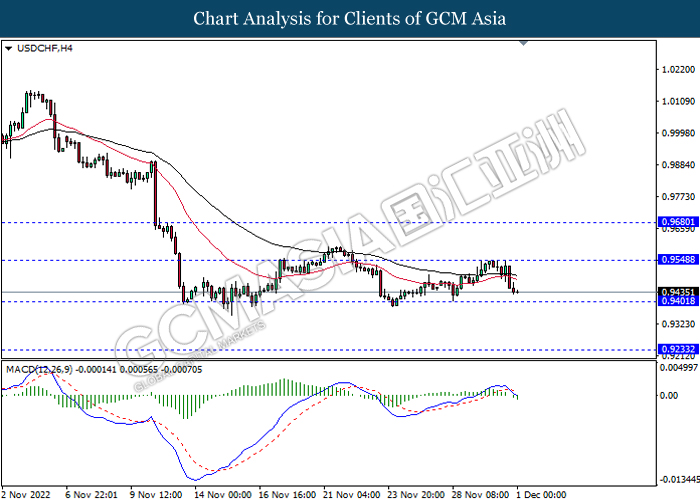

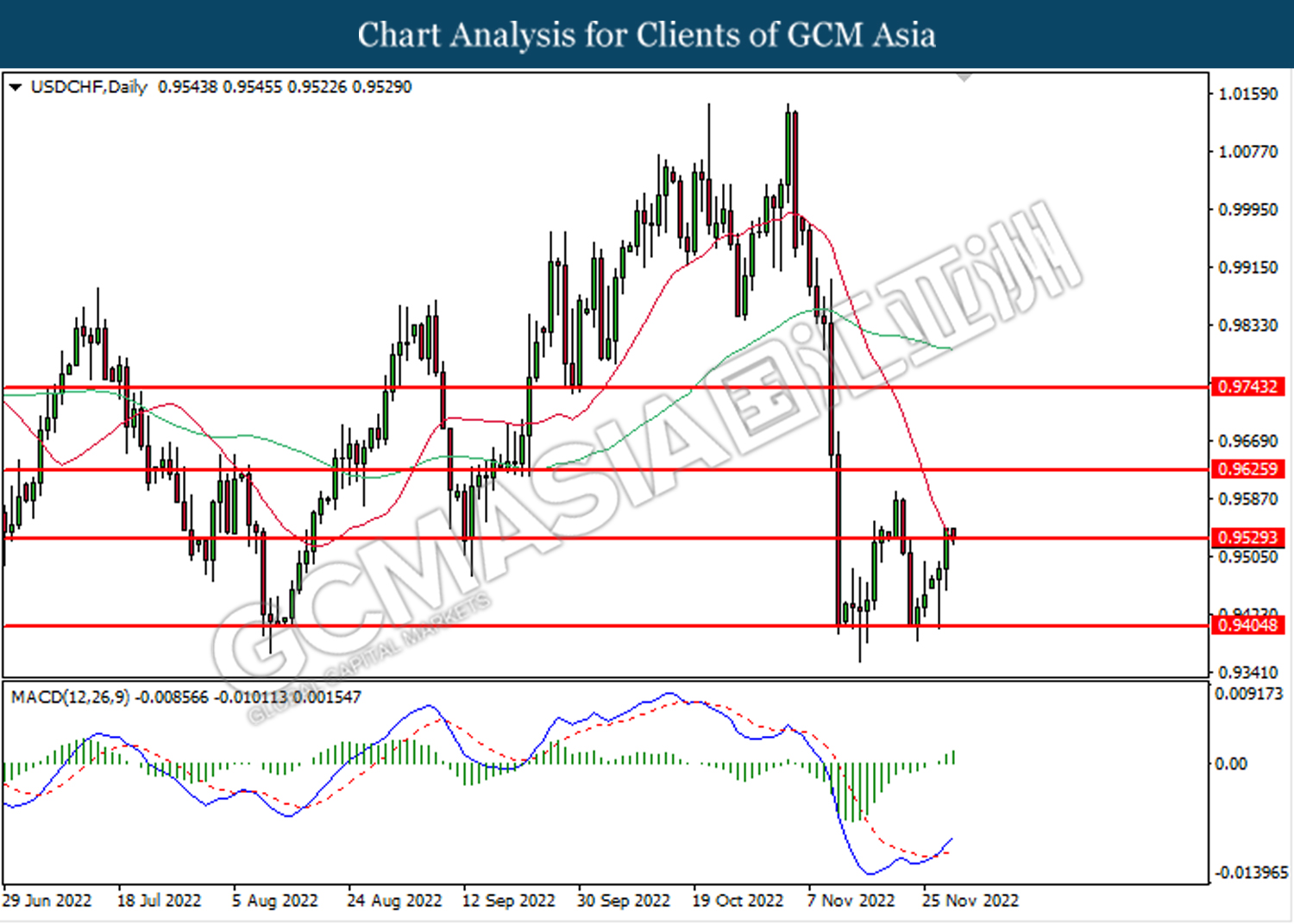

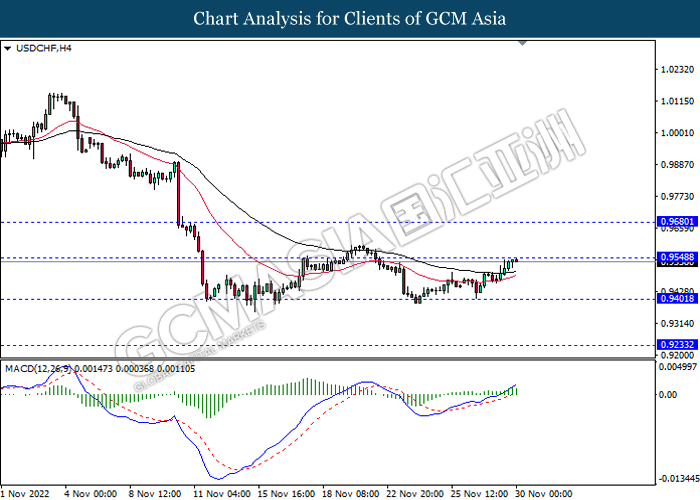

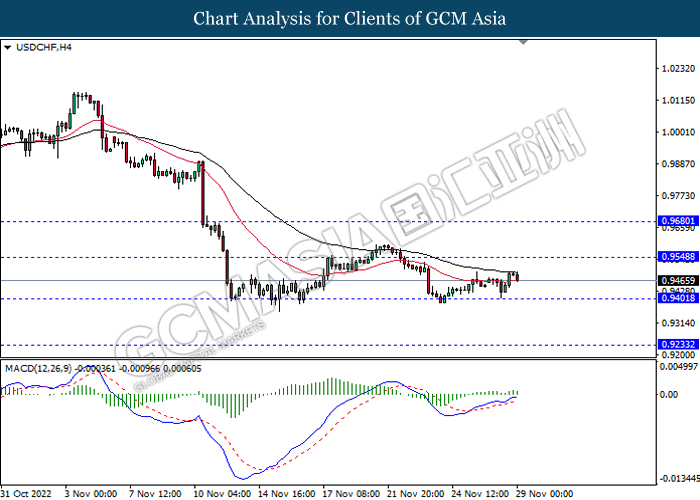

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

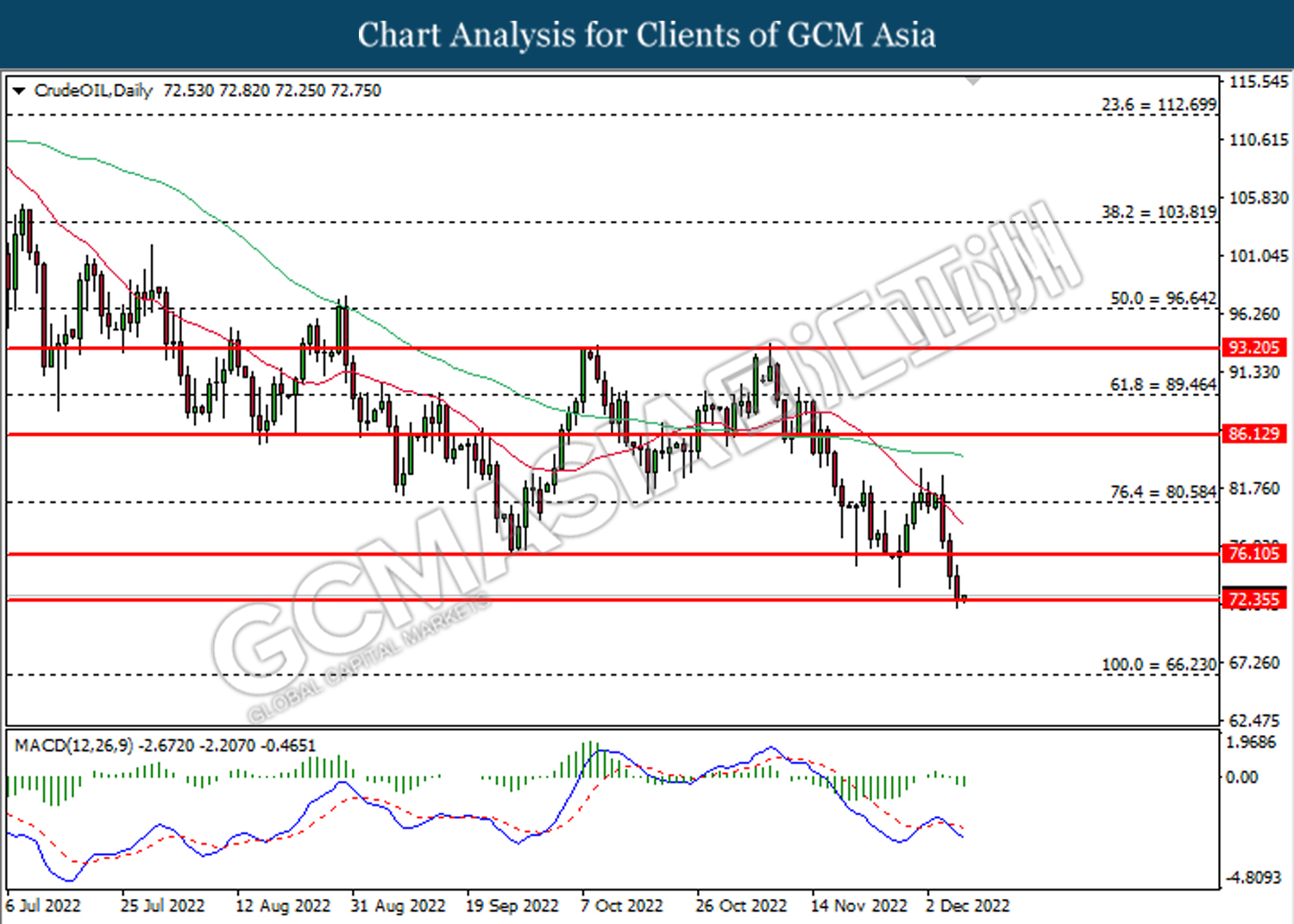

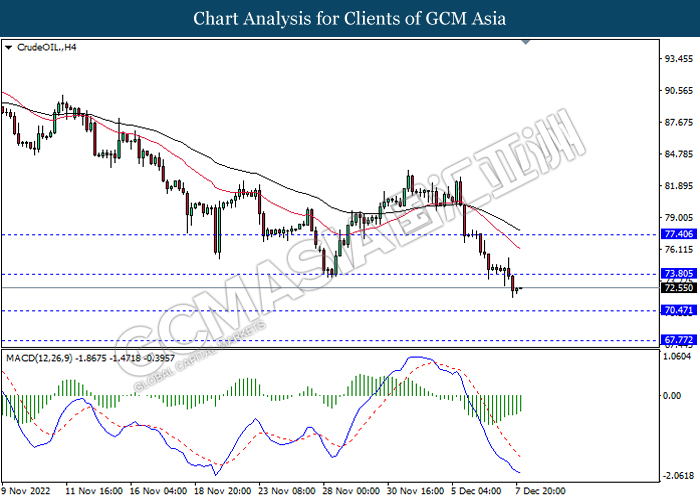

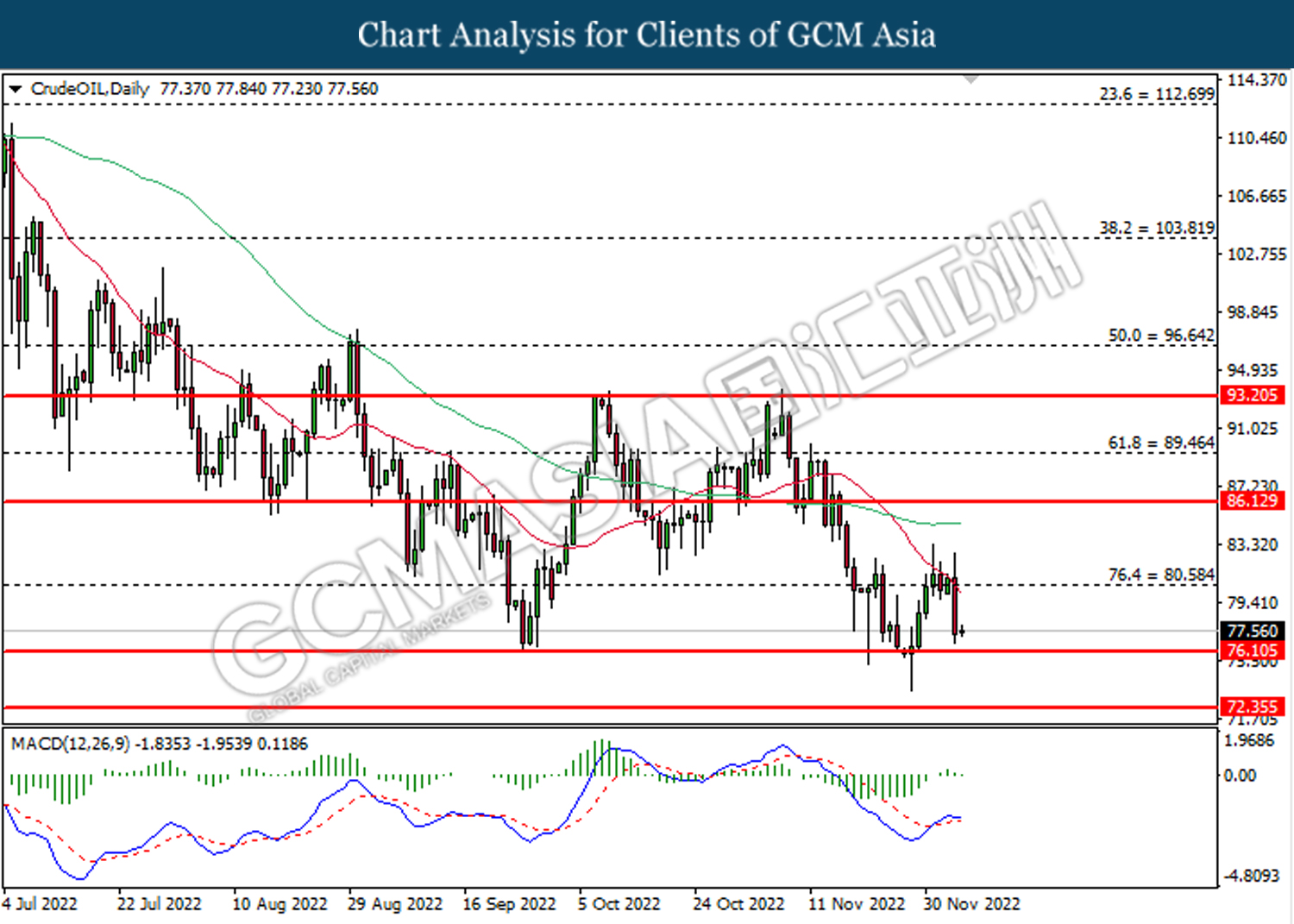

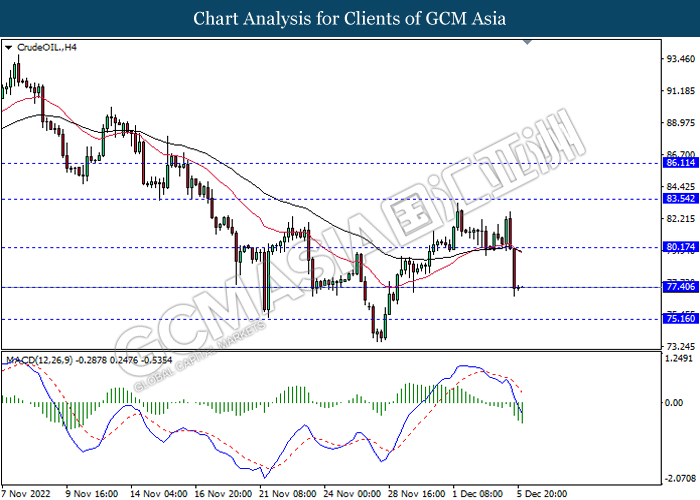

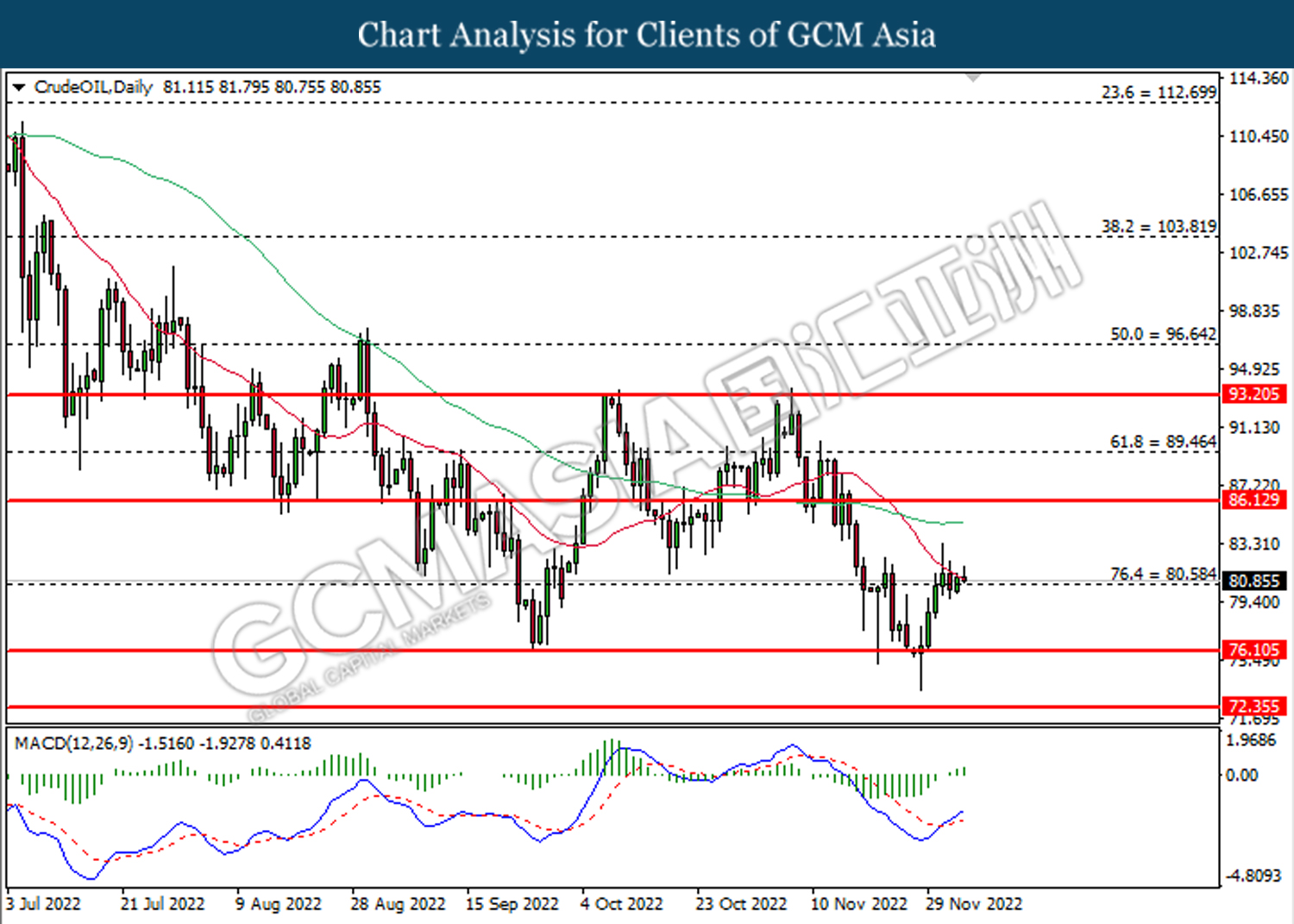

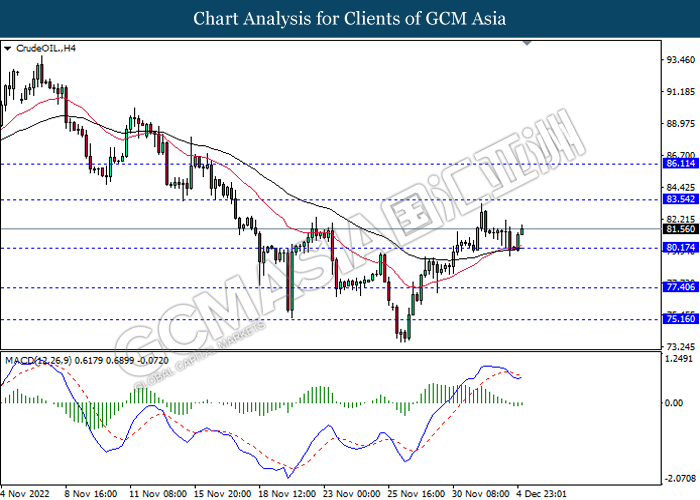

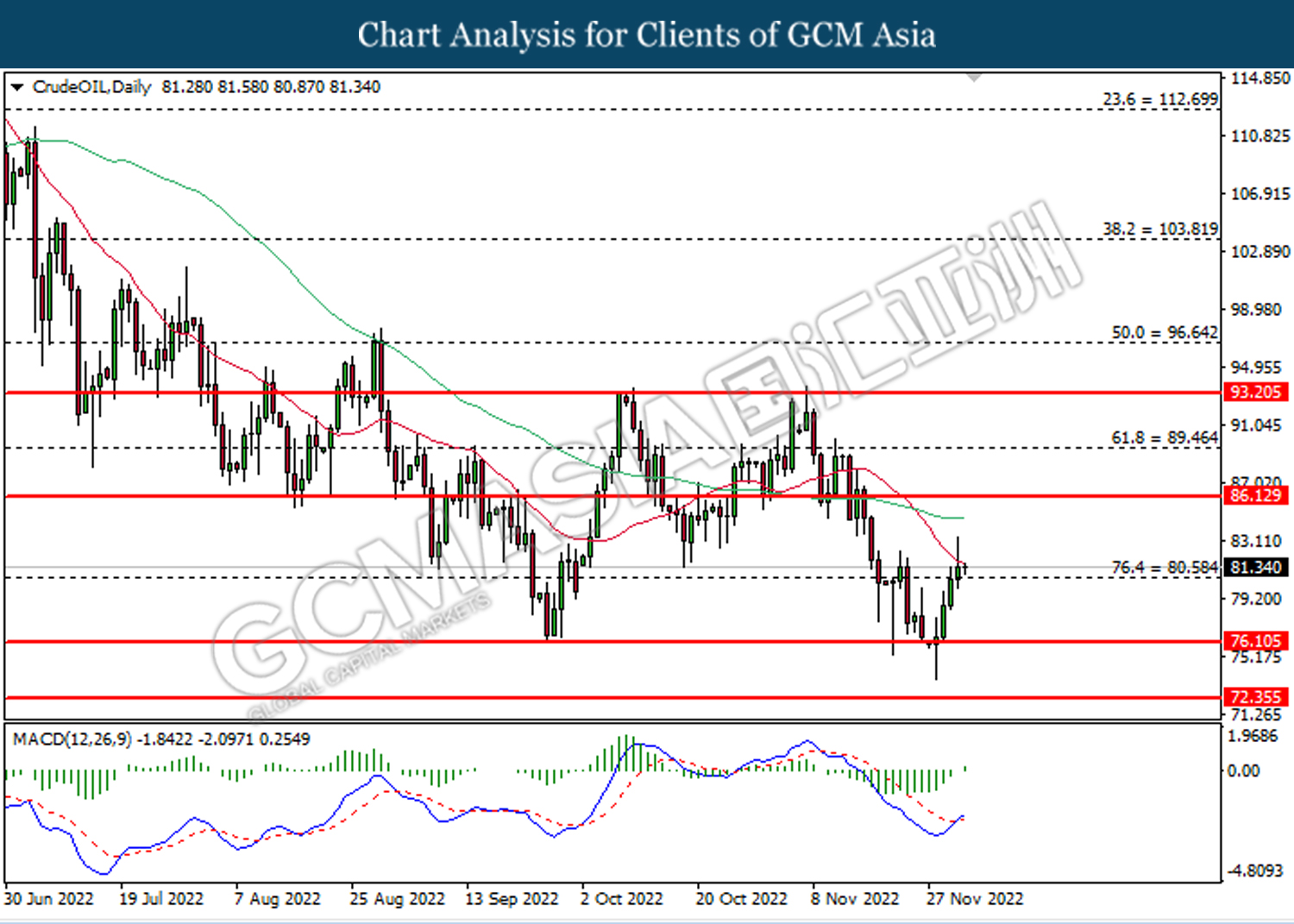

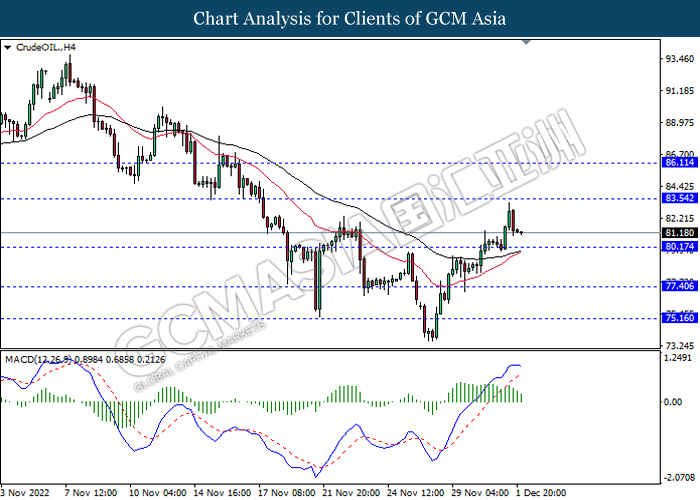

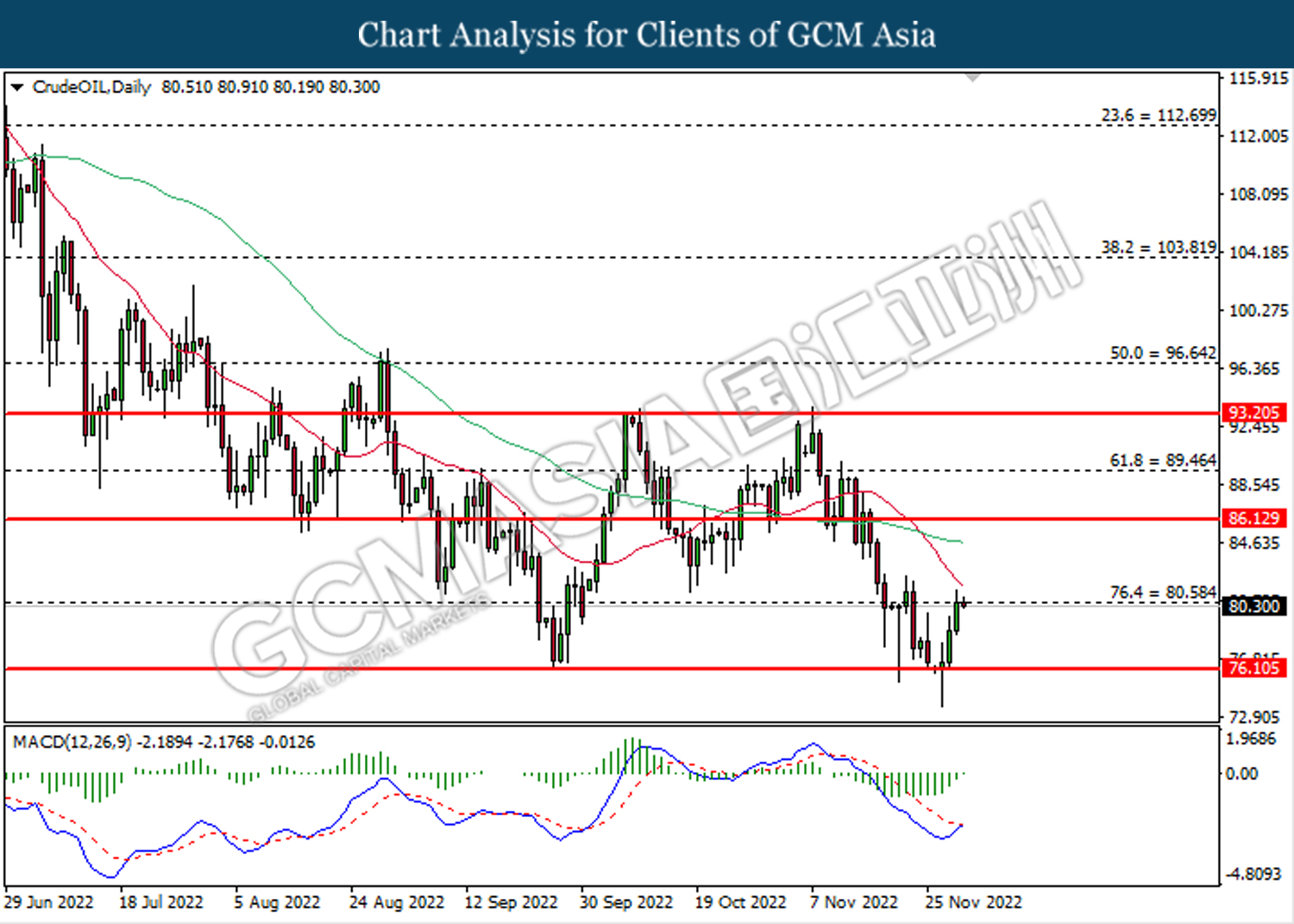

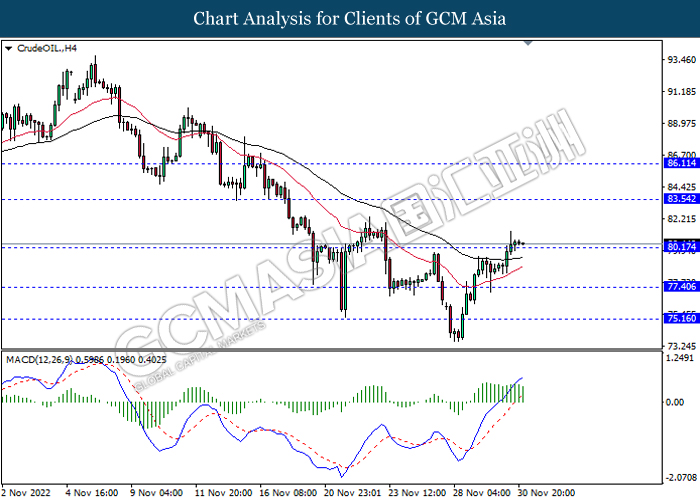

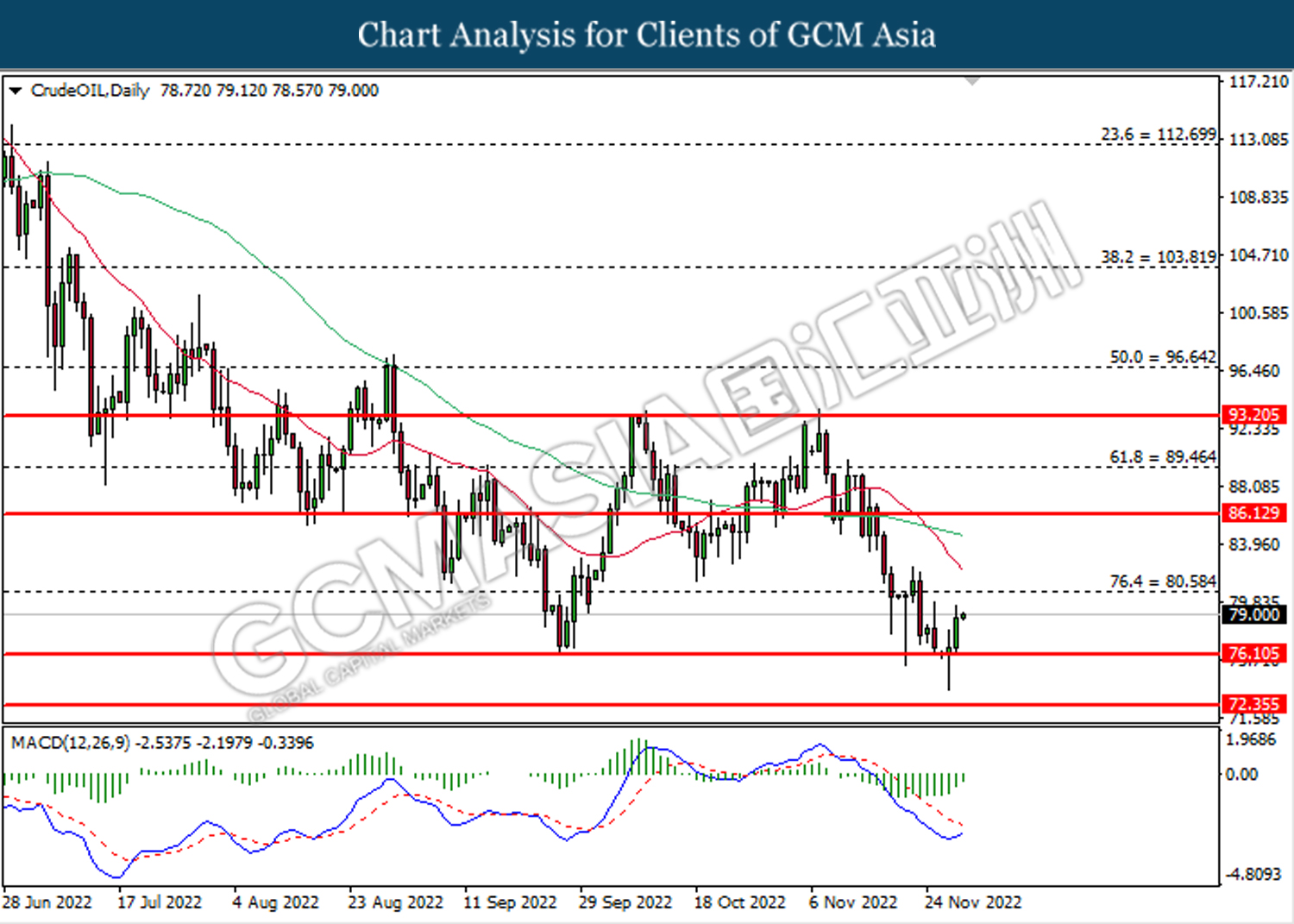

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 72.35. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 76.10, 80.60

Support level: 72.35, 66.25

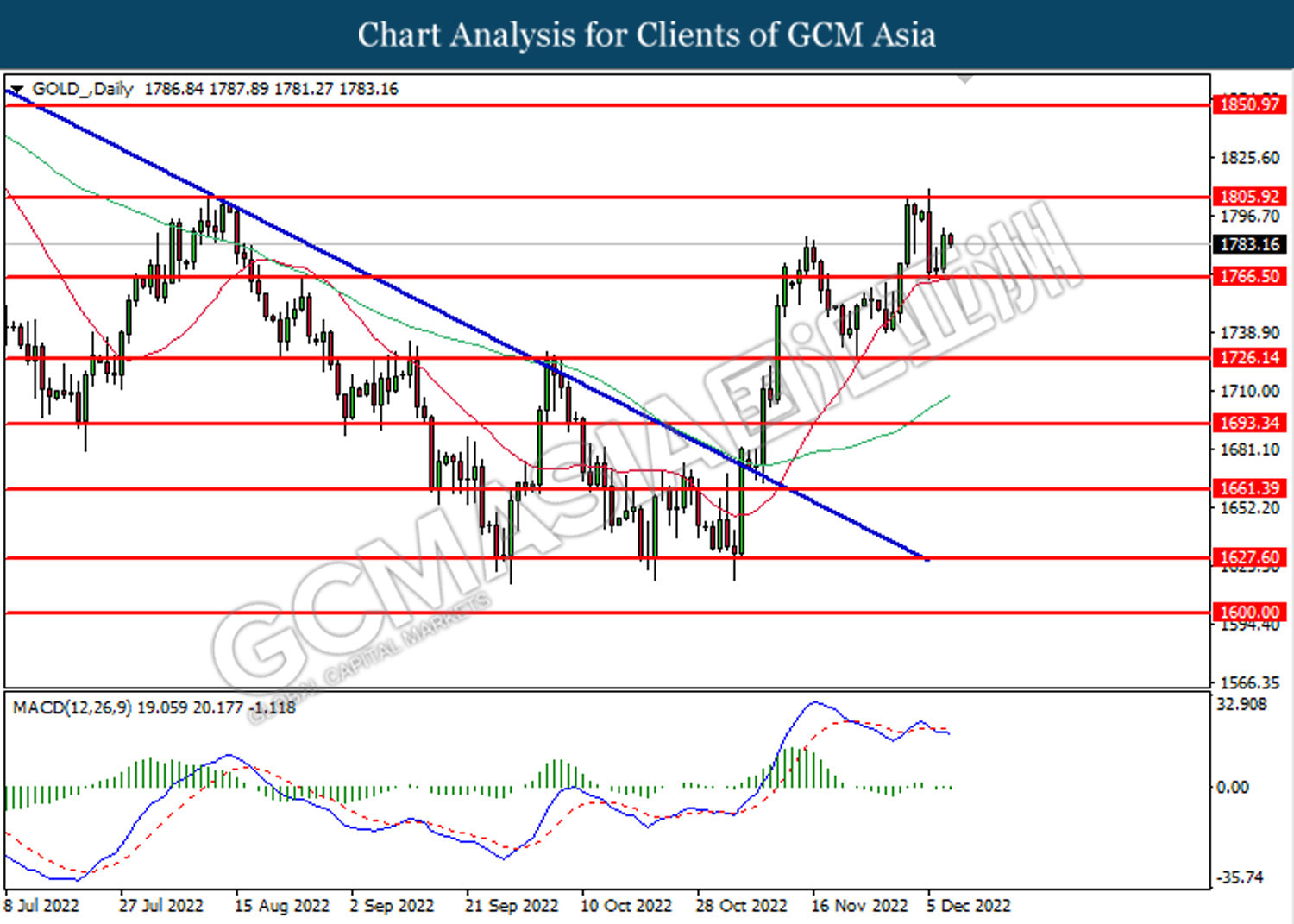

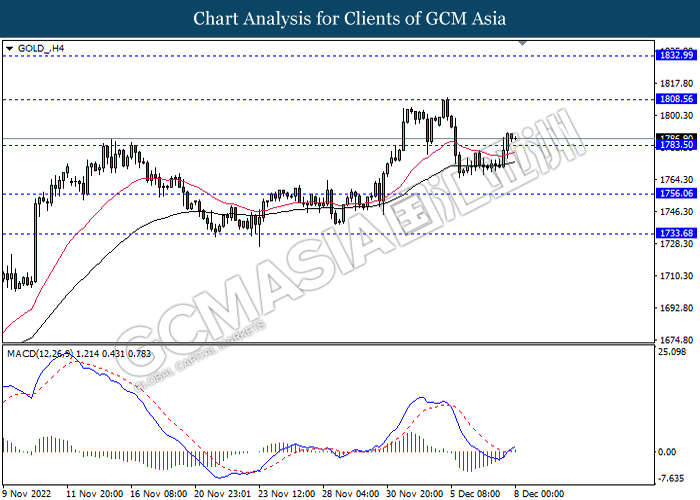

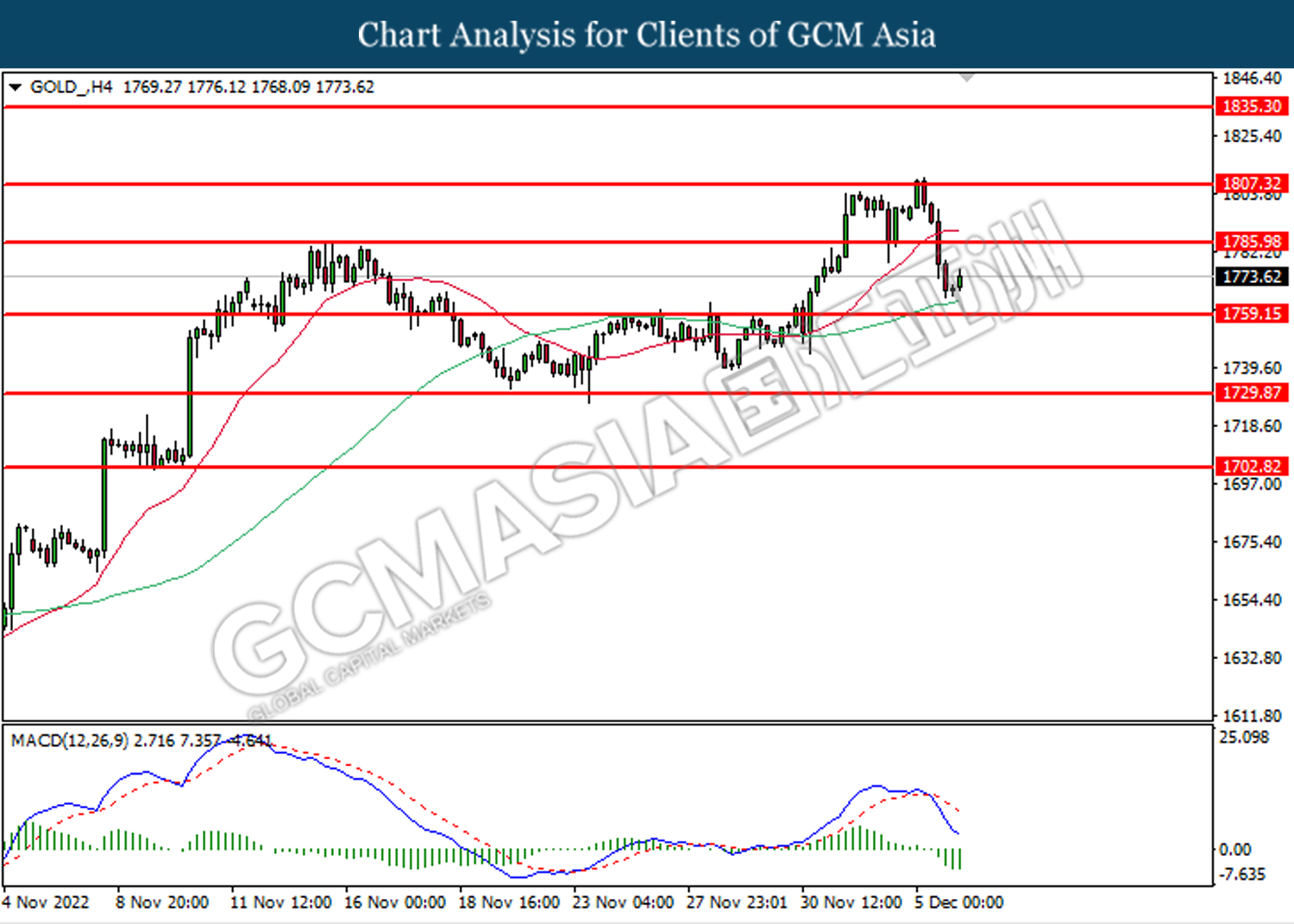

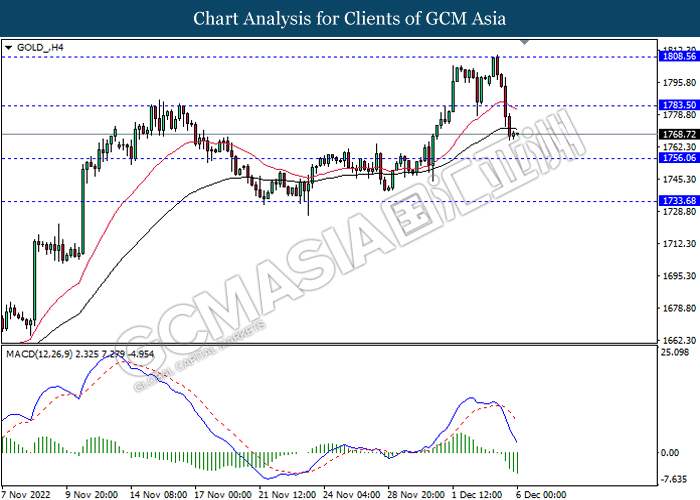

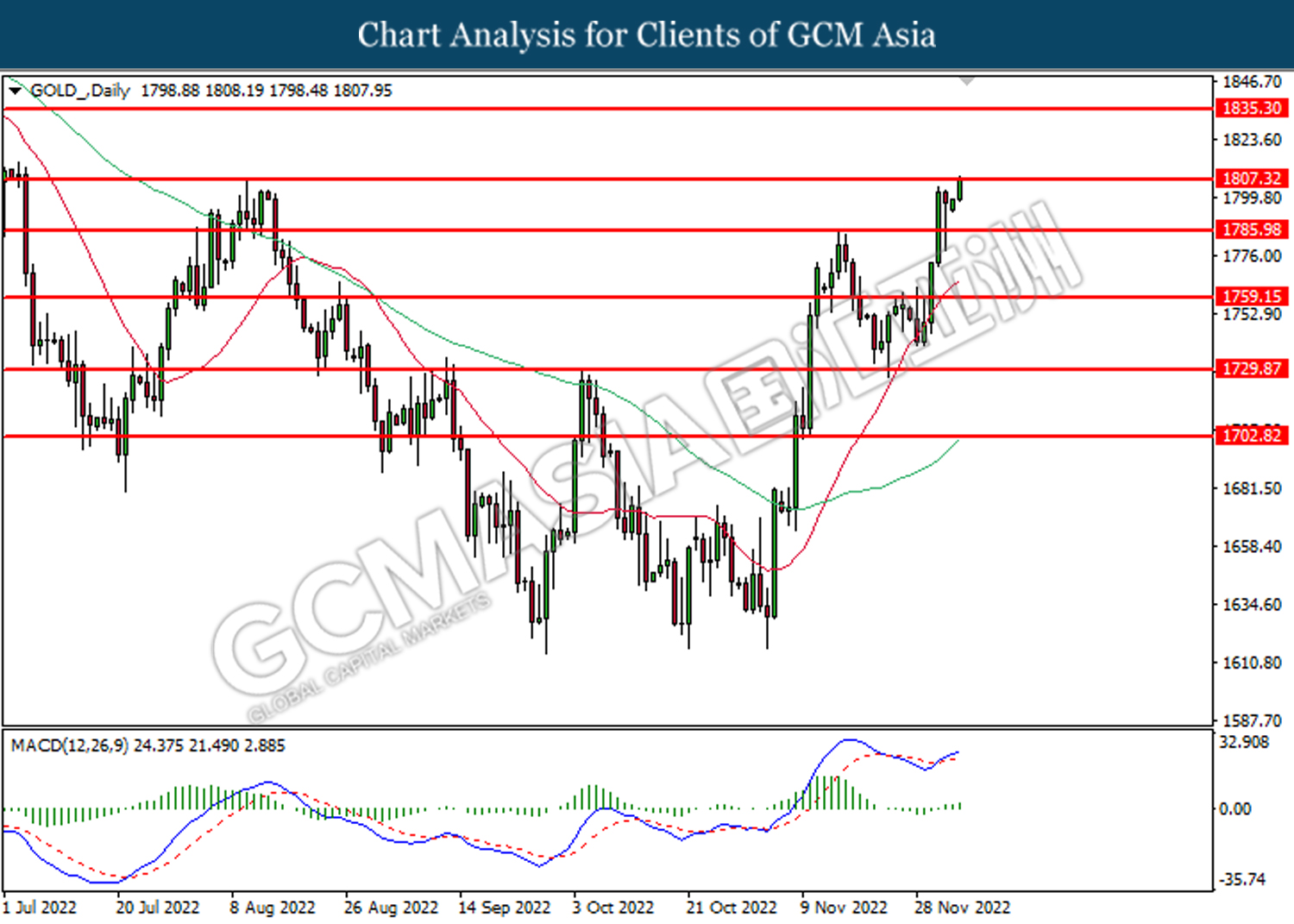

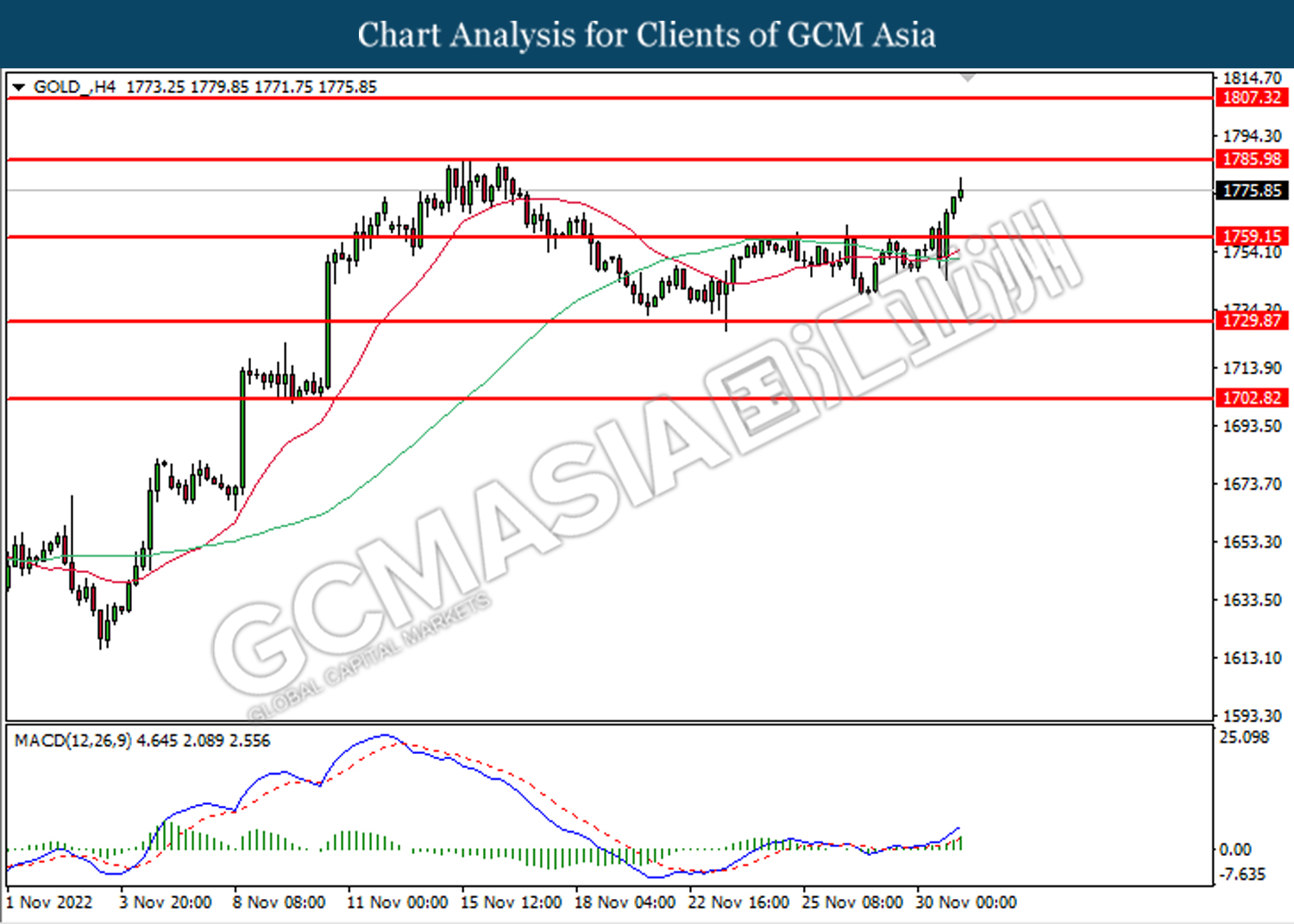

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1766.50. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1805.90, 1850.95

Support level: 1766.50, 1726.15

081222 Morning Session Analysis

8 December 2022 Morning Session Analysis

Euro rebounded as hefty rate increase implied.

The EUR/USD, which widely traded by major investors rose significantly amid the upbeat GDP data, which prompting investors to shift their capital toward Euro which having better prospects. According to Eurostat, the Eurozone Gross Domestic Product (GDP) QoQ for the third quarter notched up from the previous reading of 0.2% to 0.3%. The positive GDP data has outweighed investors’ thoughts of a recession in the Eurozone, while it provide more rooms for European Central Bank (ECB) to tighten its monetary policy further. On the other hand, the gains of Euro currency was extended following the hawkish statement by ECB member. According to Reuters, ECB policymaker Peter Kazimir claimed on Wednesday that the Europe central bank should not scale back the aggressive rate hike pace even the inflationary eased. Besides, he also reiterated that it would be too soon to diminish the rate hike size because of a single better inflation number, whereas emphasizing his stance to raise interest rate sharply. As of writing, the EUR/USD appreciated by 0.09% to 1.0514.

In the commodities market, the crude oil price rose by 0.29% to $72.62 per barrel as of writing. Though, the overall trend of oil price remained bearish following the US government data showed an unexpectedly large build in fuel stocks. In addition, the gold price edged up by 0.04% to $1787.03 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 225K | 230K | – |

Technical Analysis

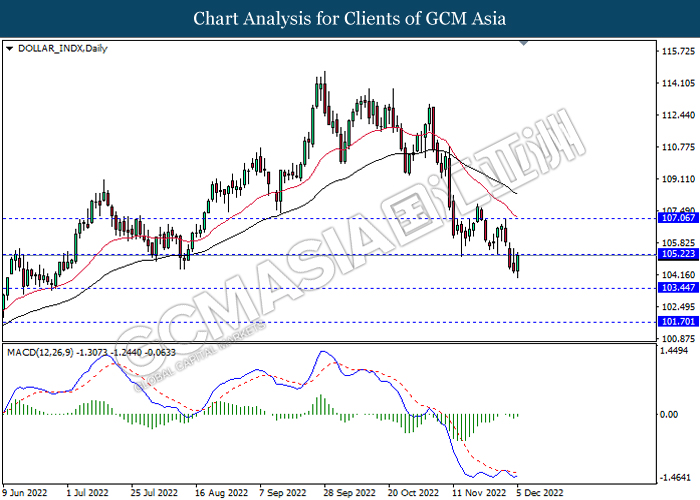

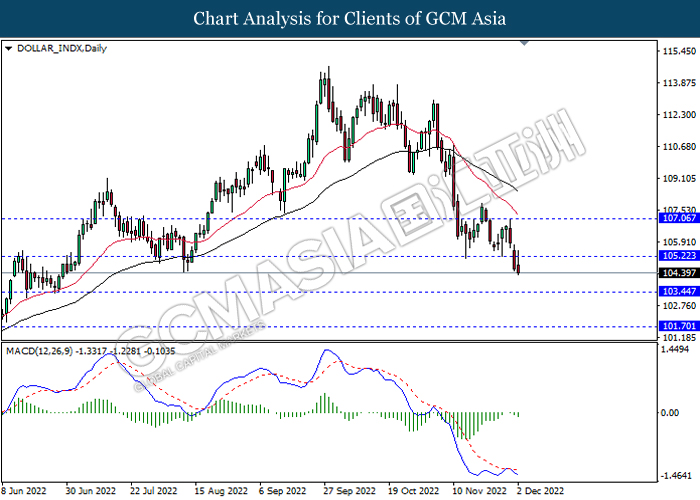

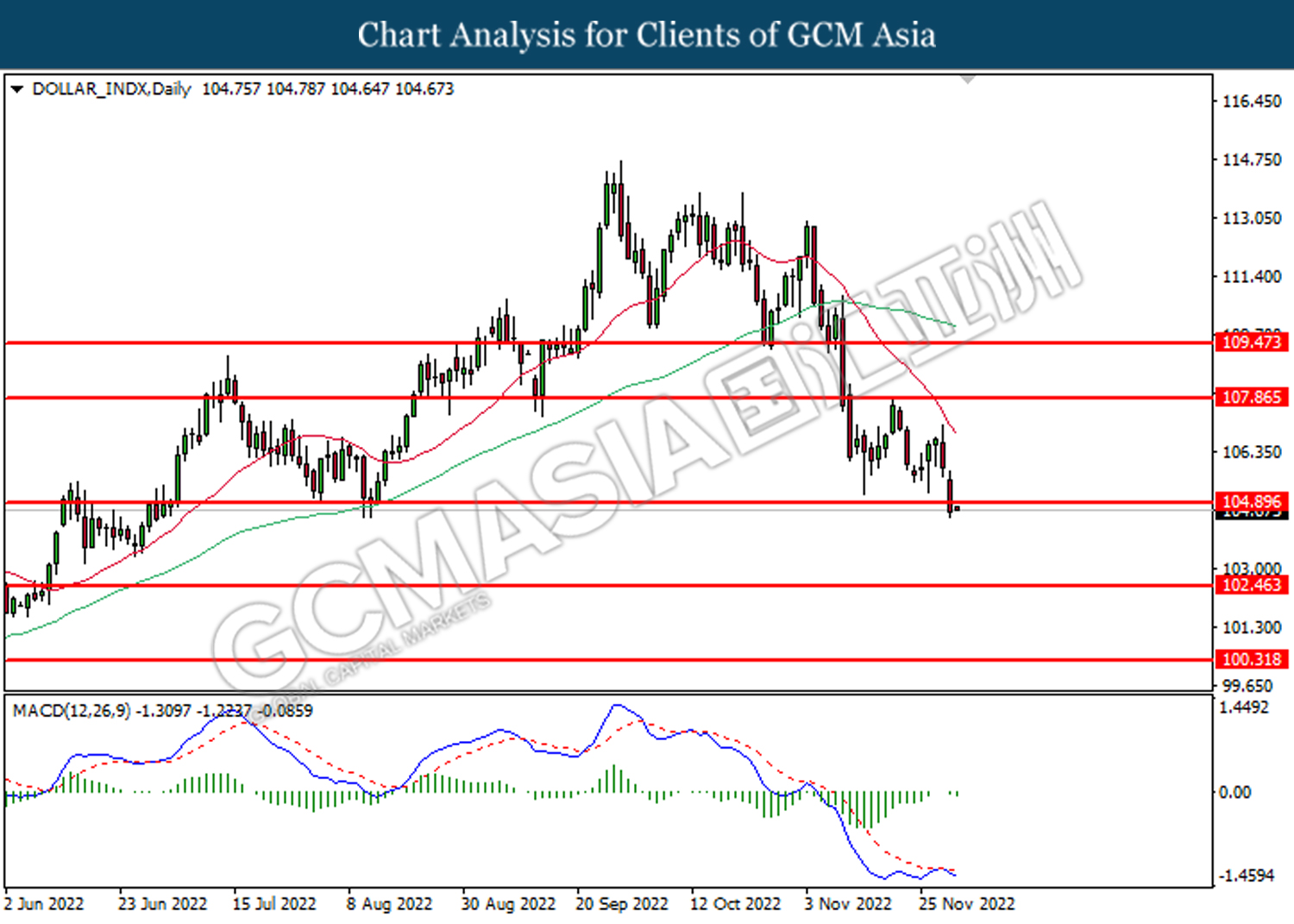

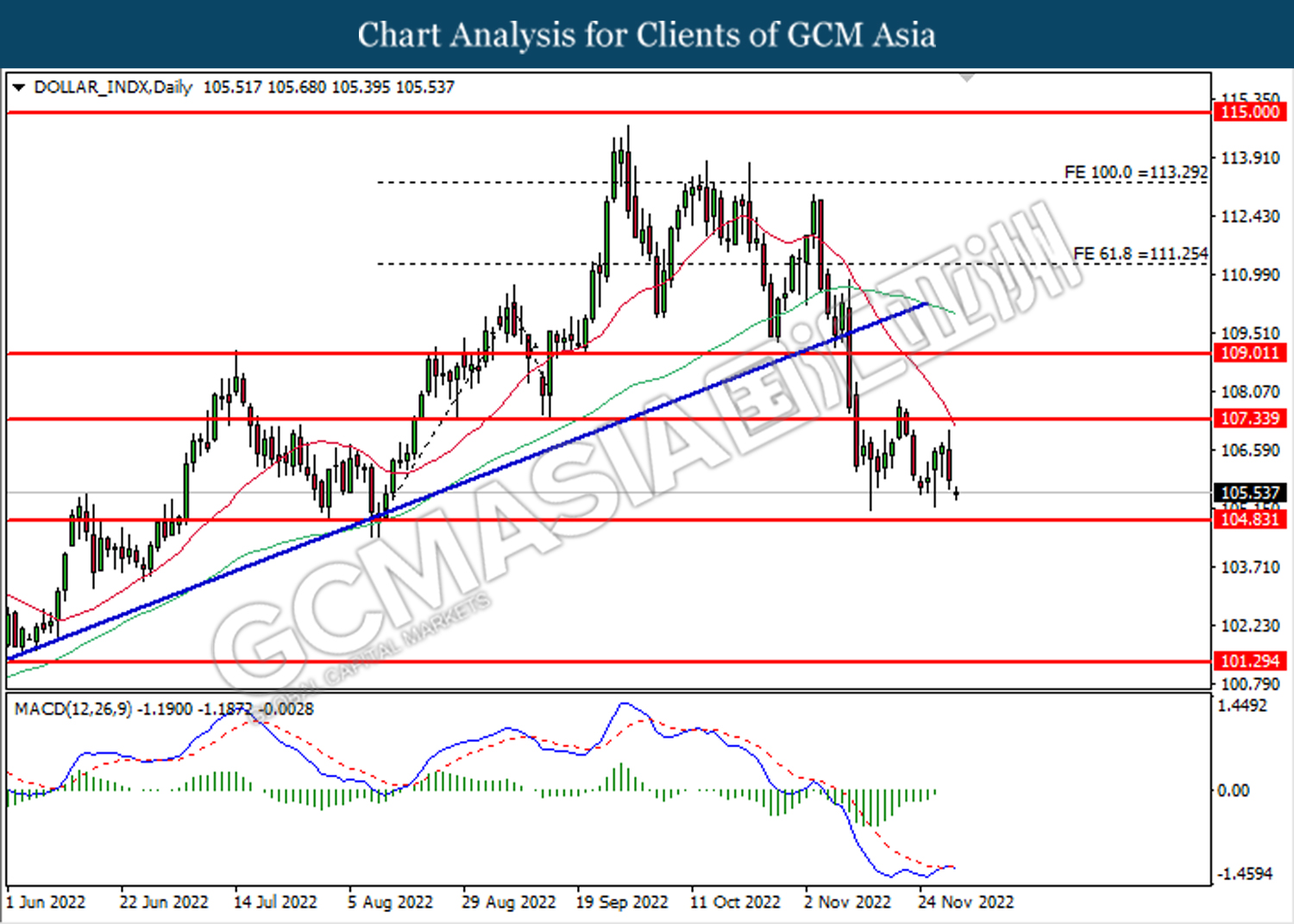

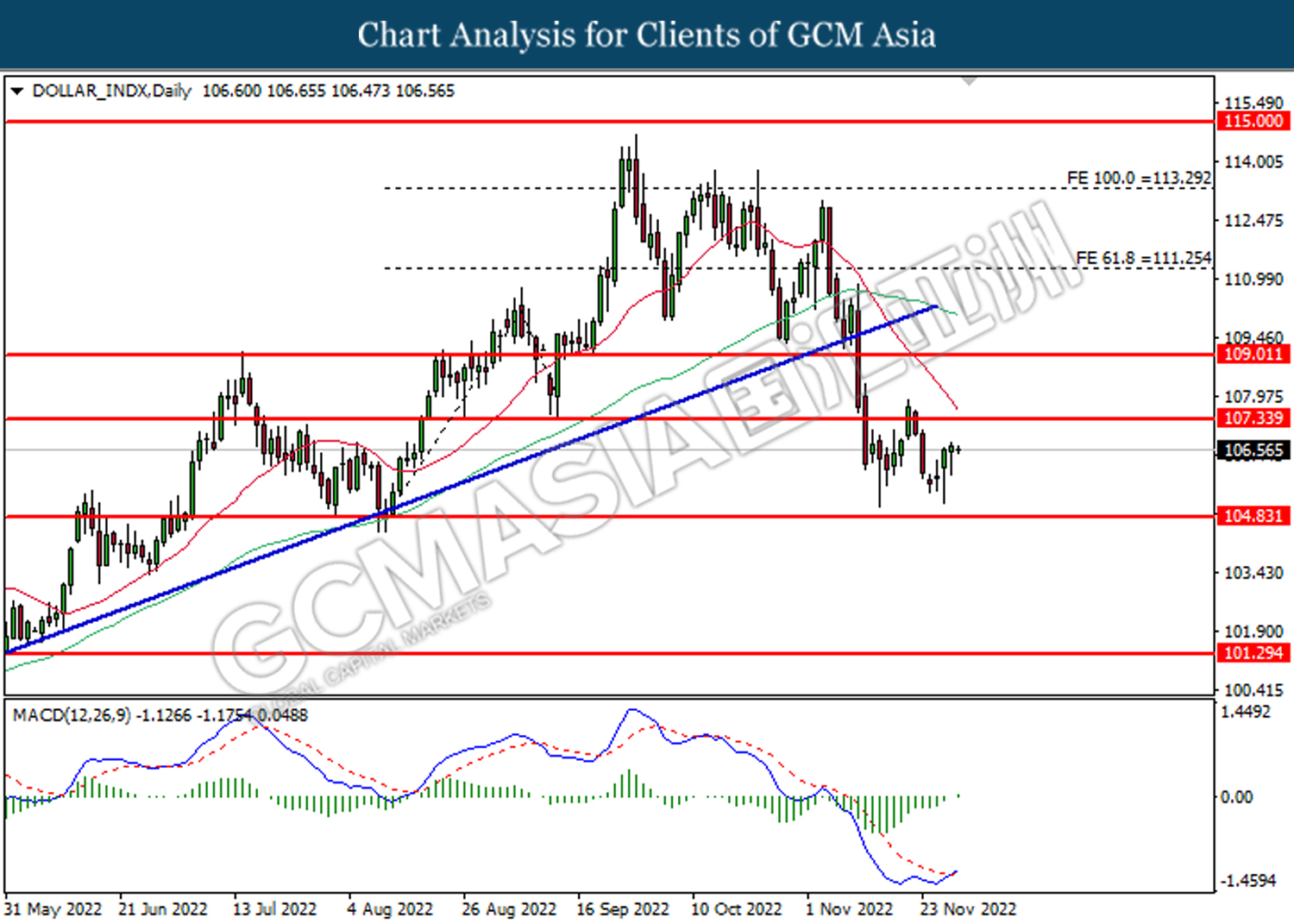

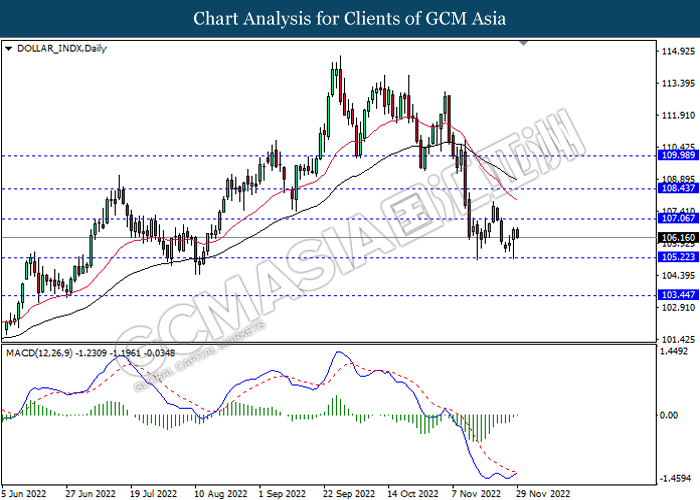

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

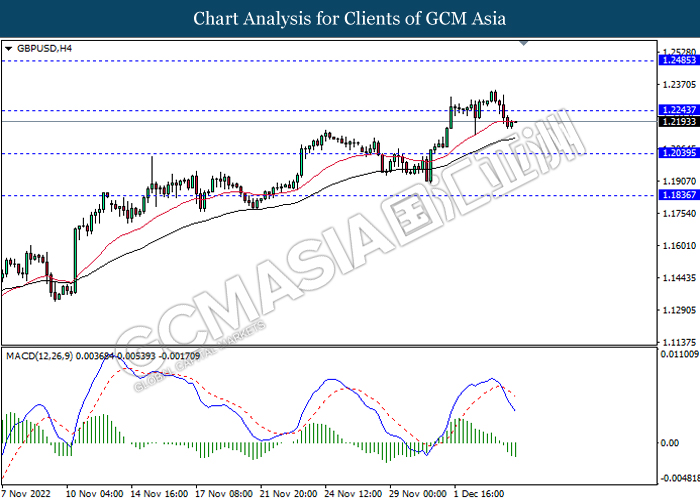

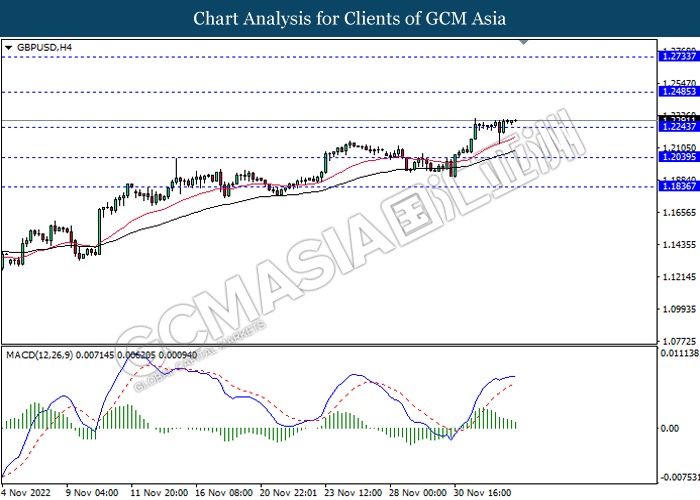

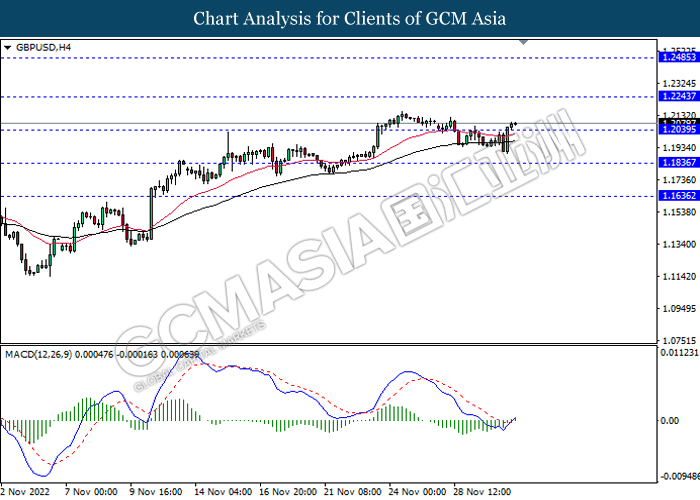

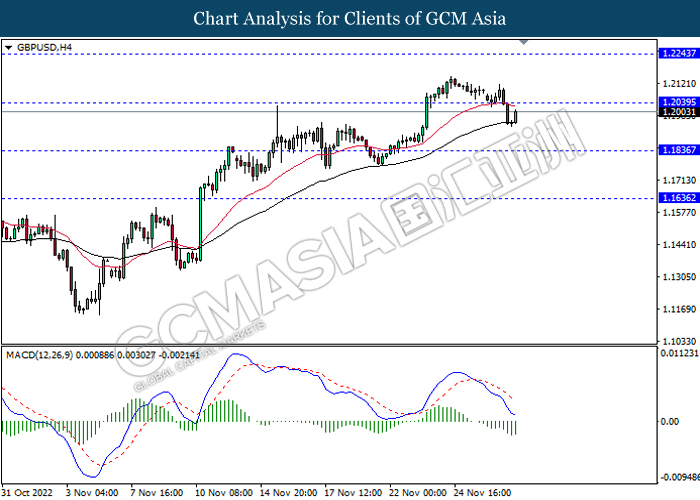

GBPUSD, H4: GBPUSD was traded higher while currently testing the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

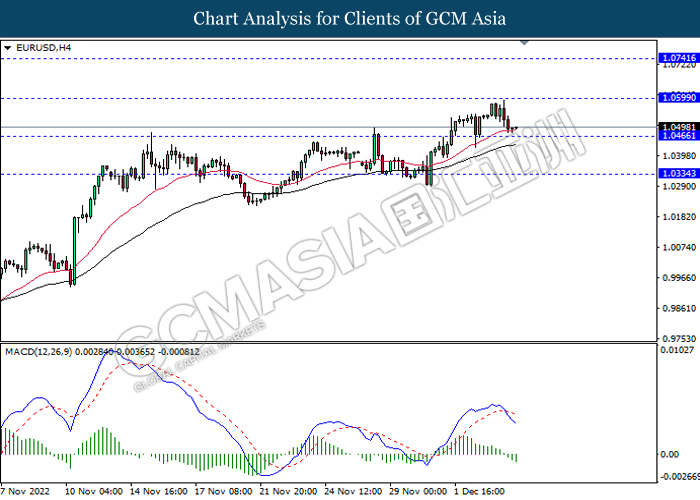

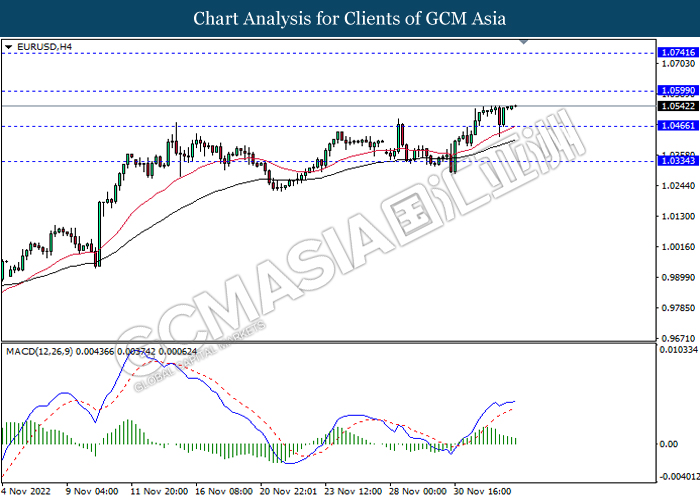

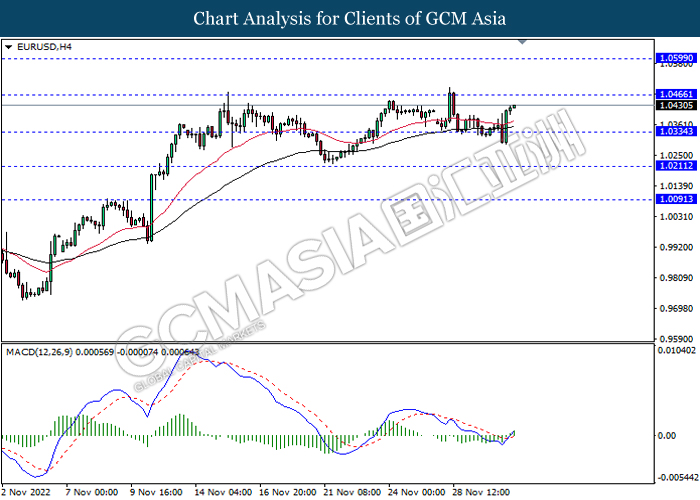

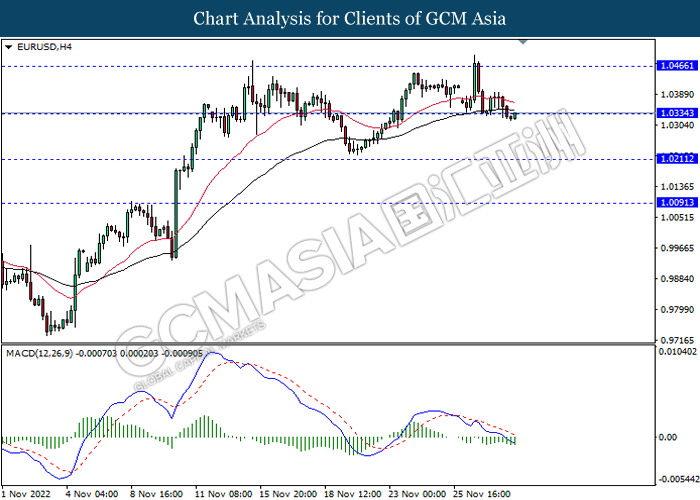

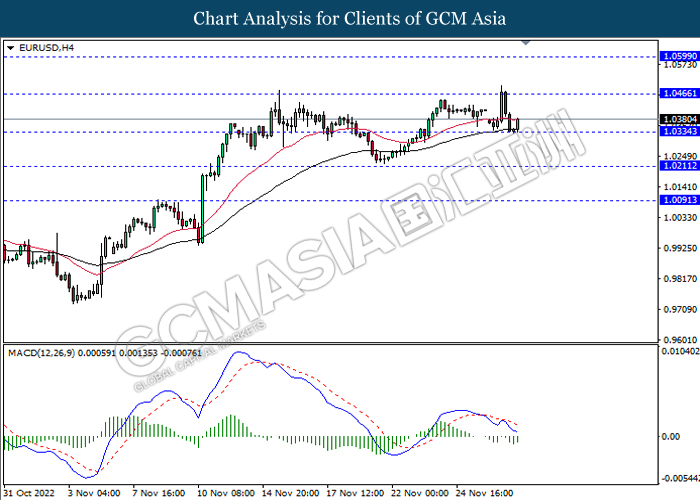

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

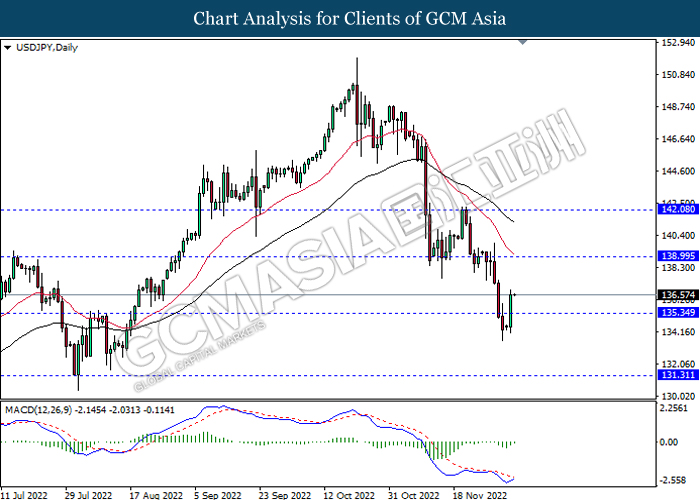

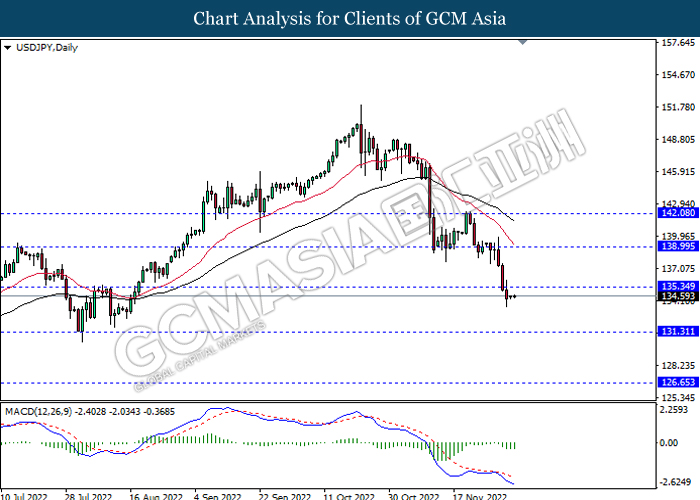

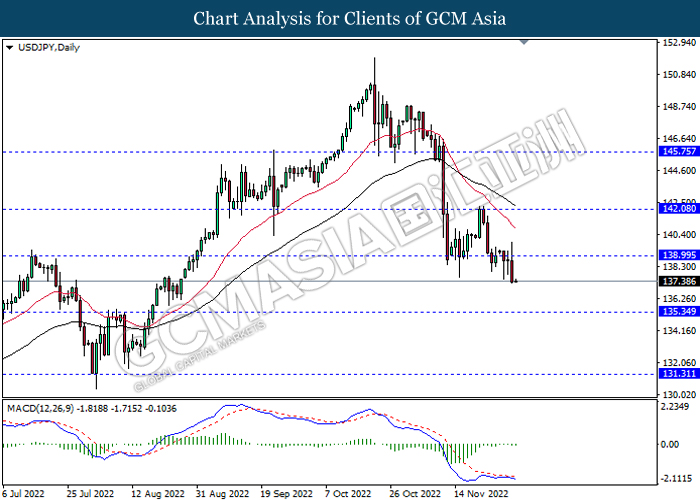

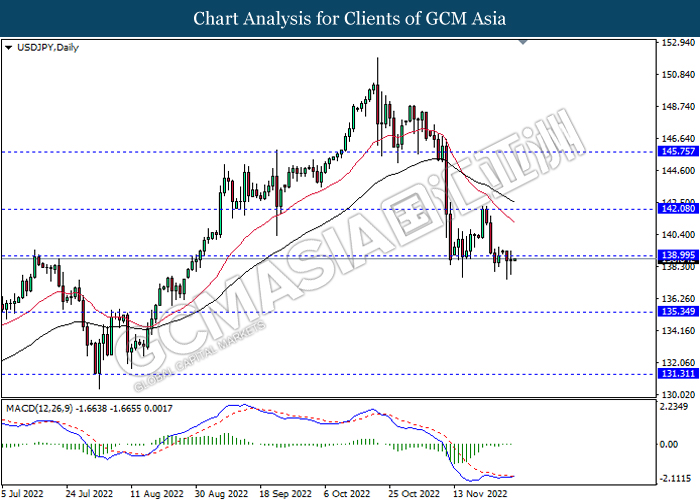

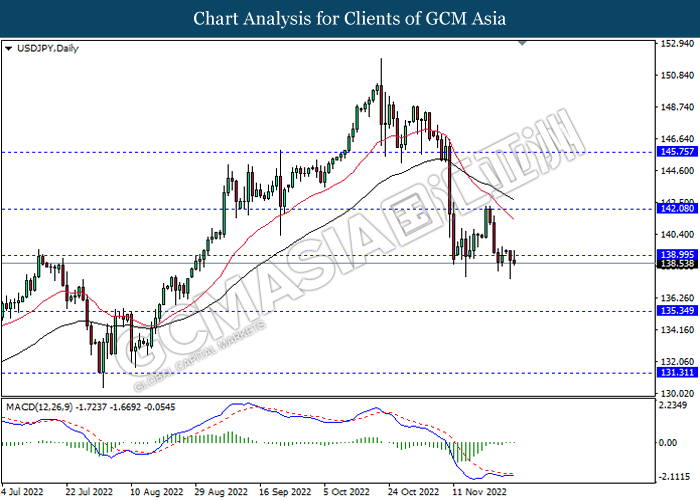

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

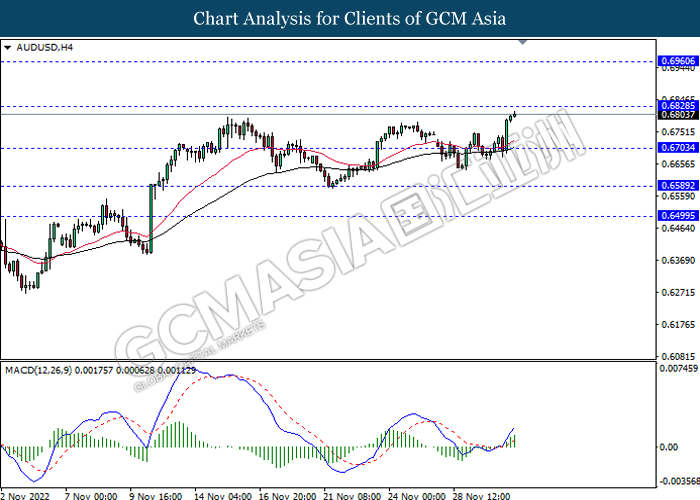

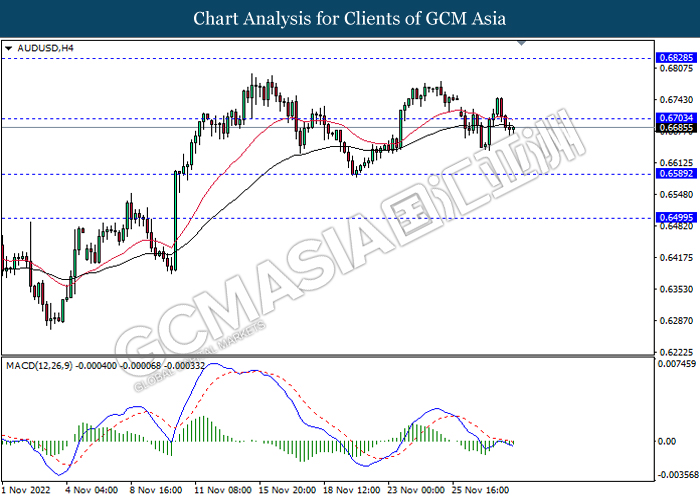

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

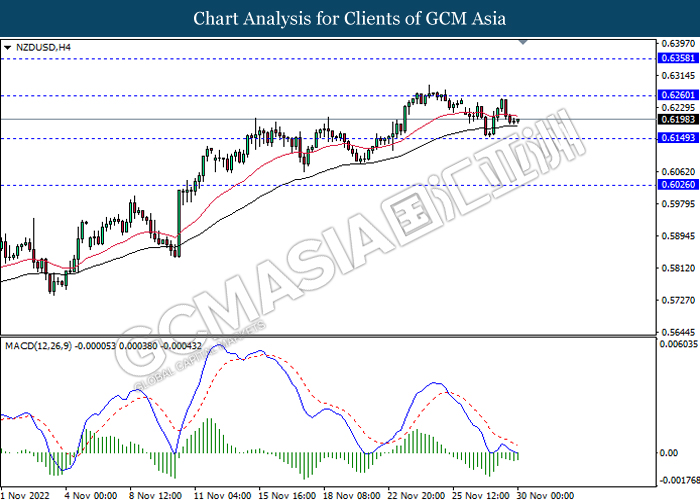

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

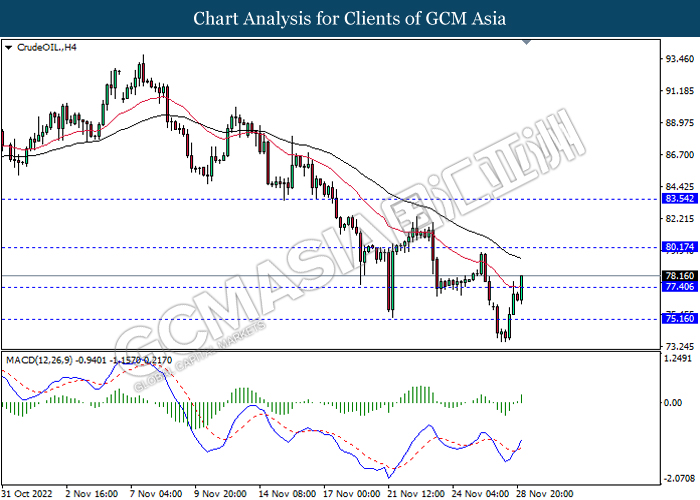

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 73.80, 77.40

Support level: 70.45, 67.75

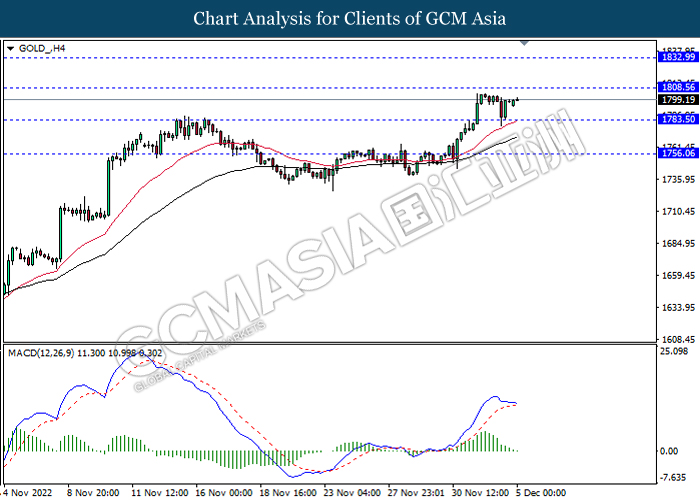

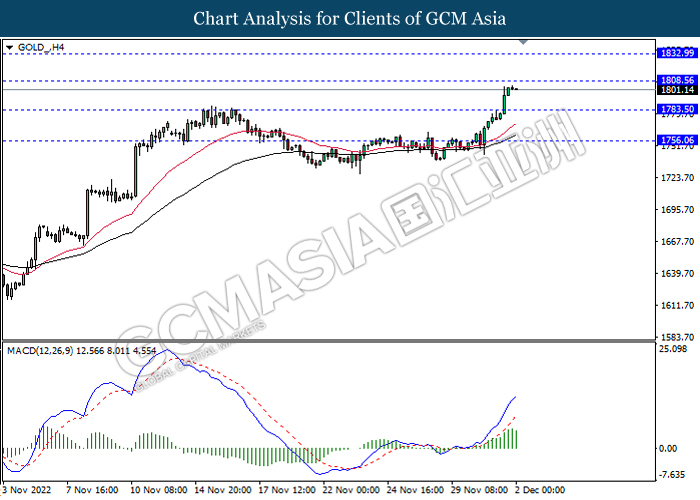

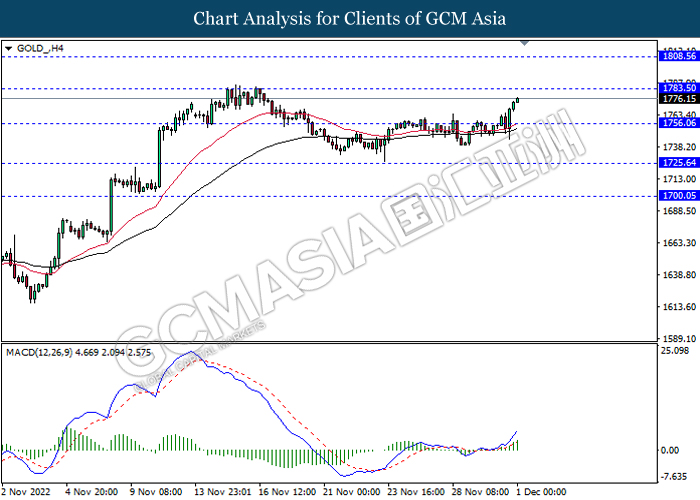

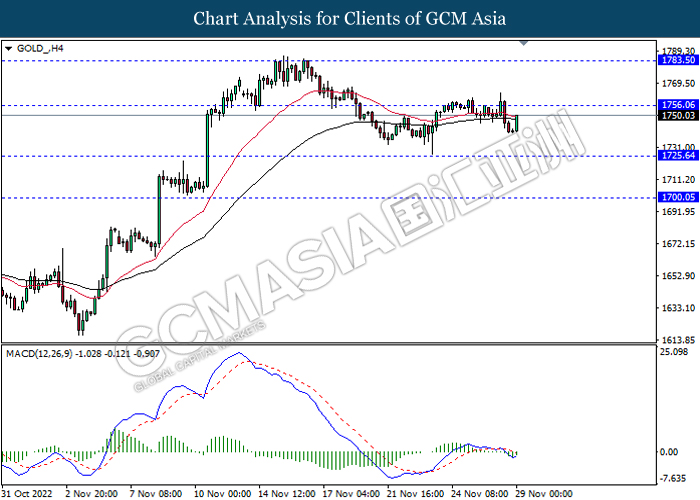

GOLD_, H4: Gold price was traded higher following prior breakout above the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05

071222 Afternoon Session Analysis

7 December 2022 Afternoon Session Analysis

Pound Sterling slipped following pessimistic market prospects.

The GBP/USD, which widely traded by global investors dropped significantly over the downbeat economic data, which clouded the economic outlook in the UK. According to Markit/CIPS, the UK Construction Purchasing Managers Index (PMI) for November notched down from the previous reading of 53.2 to 50.4, much lower than the consensus anticipation of 52.0. Besides, both Bank of England (BoE) and government’s Office for Budget Responsibility were estimating that the UK economy was entering recession, after output dropped by 0.2% in the three months to the end of September. With such background, it dialed down the market optimism toward economic progression in the UK. On the other hand, the value of Australia Dollar eased after the bearish economic data has been unleashed. The Australia Gross Domestic Product (GDP) QoQ for third quarter slid from the prior figure of 0.9% to 0.6%, missing the market expectation of 0.7%. As of writing, the GBP/USD edged down by 0.01% to 1.2136 while the AUD/USD down by 0.02% to 0.6690.

In the commodities market, the crude oil price depreciated by 0.23% to $74.08 per barrel as of writing following the economic uncertainty and the prospects of higher interest rate pressured oil price. In addition, the gold price appreciated by 0.04% to $1771.03 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 CAD BoC Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | CAD – BoC Interest Rate Decision | 3.75% | 4.25% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -12.580M | -3.305M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 107.05, 108.95

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 77.40, 80.15

Support level: 73.80, 70.45

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1783.50, 1808.55

Support level: 1756.05, 1733.70

071222 Morning Session Analysis

7 December 2022 Morning Session Analysis

Greenback surged amid risk-off sentiment heightened.

The dollar index, which was traded against a basket of six major currencies, lingered near the recent high, but still recorded some gains over the previous trading session despite the market was lack of catalyst. Yesterday, the dollar index received some buy-in pressures as the stock market was hit badly amid recession worries jolt markets. In the recent weeks, some major layoffs have been noticed in the giant companies, which further increases the odds that a hard landing in 2023 and enter a deep recession might be happened. The recent layoff trend has been extended following the news that Morgan Stanley is planning to cut 2% of its workforce as sluggish deal markets weigh on its profits. As such, the greenback benefited from the bearish sentiment in the equity market, and thus, pushing the value of the US dollar slightly higher in the last trading session. As of writing, the dollar index headed up 0.26% to 105.55.

In the commodities market, the crude oil price plummeted by -3.89% to $74.70 per barrel as the recession worries jitter the market sentiment. Besides, the gold prices jumped 0.17% to $1771.15 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 CAD BoC Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | CAD – BoC Interest Rate Decision | 3.75% | 4.25% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -12.580M | -3.305M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 105.00. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 106.65.

Resistance level: 106.65, 107.95

Support level: 105.00, 103.15

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2200. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0475. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6640.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6355. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6255.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend it gains after it successfully breakout above the resistance level.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 76.10. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 72.35.

Resistance level: 76.10, 80.60

Support level: 72.35, 66.25

GOLD_, H4: Gold price was traded lower following prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1786.00, 1807.30

Support level: 1759.15, 1729.85

061222 Afternoon Session Analysis

6 December 2022 Afternoon Session Analysis

Aussie dollar jumped after a 25 basis point of rate hike from RBA.

The Aussie dollar, which global investors majorly traded, regained its luster after the RBA decided to increase the interest rate by 25 basis points during its early morning meeting. At this juncture, the inflation figure in Australia is still high, at 6.9% for October. With that, the cash rate was adjusted upward from 2.85% to 3.10% to curb sky-high inflation. In the meeting, the official members came to a consensus that the inflation is expected to increase further over the months ahead, whereby the peak would be around 8% within these few months. However, in the long term, the ongoing resolution of global supply-side problems is expected to drag down inflation in the next year. Regarding the economic side, the Australian economy is still growing solidly in the post-covid-19 era. At the same time, the labor market remains very tight as firm is facing hardship in hiring workers. As of writing, the pair of AUD/USD was up by 0.59% to 0.6736.

In the commodities market, the crude oil price edged up 0.49% to $78.10 per barrel as the strengthening of the dollar index urged the non-US buyer to shy away from oil market temporarily. Besides, the gold prices jumped 0.28% to $1773.65 per troy ounce following the technical correction during the previous trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Nov) | 53.2 | 52 | – |

| 23:00 | CAD – Ivey PMI (Nov) | 50.1 | 51 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 105.00. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 106.65.

Resistance level: 106.65, 107.95

Support level: 105.00, 103.15

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0475. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6640.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend it gains after it successfully breakout above the resistance level.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 80.60. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 80.60, 86.15

Support level: 76.10, 72.35

GOLD_, H4: Gold price was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its rebound toward the resistance level at 1786.00.

Resistance level: 1786.00, 1807.30

Support level: 1759.15, 1729.85

061222 Morning Session Analysis

6 December 2022 Morning Session Analysis

US Dollar revived as positive economic data spurred hopes for rate hikes.

The Dollar Index which traded against a basket of six major currencies rose significantly on yesterday after the upbeat economic data has been released. According to Institute for Supply Management, the US ISM Non-Manufacturing Purchasing Managers Index (PMI) in November has notched up from the previous reading of 54.4 to 56.5, exceeding the consensus forecast of 53.3. On the other hand, the survey followed on the heels of stronger-than-expected job and wage growth data for November released last Friday, while consumer spending also accelerated in October. The upbeat reports have raised optimism the economy could avoid recession next year, with growth just slowing sharply, while also spurring speculation about how high rates will rise. However, it is noteworthy that Fed Chair Jerome Powell claimed last week the central bank could scale back the pace of rate hike as soon as December. Besides, the clouded economic outlook in the UK had also led US Dollar to climb higher. As of writing, the Dollar Index appreciated by 0.69% to 105.21.

In the commodities market, the crude oil price rose by 0.08% to $77.41 per barrel as of writing after a sharp decline throughout overnight trading session following the upbeat US economic data had raised the hopes of aggressive rate hikes from Fed. In addition, the gold price edged down by 0.01% to $1769.05 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

23:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Dec) | 2.85% | 3.10% | – |

| 17:30 | GBP – Construction PMI (Nov) | 53.2 | 52 | – |

| 23:00 | CAD – Ivey PMI (Nov) | 50.1 | 51 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3635, 1.3790

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 80.15, 83.55

Support level: 77.40, 75.15

GOLD_, H4: Gold price was traded lower following prior breakout below the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1783.50, 1808.55

Support level: 1756.05, 1733.70

051222 Afternoon Session Analysis

5 December 2022 Afternoon Session Analysis

Canadian dollar spiked amid upbeat employment data.

The Canadian dollar regained its luster and hit the highest level in one week following the release of the upbeat employment data. According to Statistics Canada, the Canada Employment Change came in at 10.1K, stronger than the consensus forecast of 5.0K, mirroring that the labor market in Canada remains resilient. However, the pairing of USD/CAD plunged tremendously during Friday’s trading session, mainly due to the knee-jerk reaction following the NFP data. Last Friday, the NFP unexpectedly rose by 263K, significantly higher than the consensus forecast at 200K. However, the market sentiment of the dollar reversed instantly as the upbeat employment data is not expected to shake the decision of a slower rate hike plan in the Fed’s Dec Meeting. Recently, the Fed’s chairman Jerome Powell revealed that they are likely to slow down the pace of rate hikes in the upcoming meeting. However, they are still cautious about the cooling of inflation figures. As of writing, the dollar index dropped -0.31% to 104.30.

In the commodities market, the crude oil price edged up 0.66% to $81.30 per barrel as major cities in China eased their Covid-19 control measures, fueling the hopes of economic recovery. Besides, the gold prices jumped 0.55% to $1807.75 per troy ounce amid the weakness of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Nov) | 48.3 | 48.3 | – |

| 17:30 | GBP – Services PMI (Nov) | 48.8 | 48.8 | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Nov) | 54.4 | 53.1 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 104.90. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 103.15.

Resistance level: 104.90, 107.85

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2345. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0475. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0615.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 134.15. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6355. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6460.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3400. MACD which illustrated diminishing bullish momentum suggests the pair to extend it losses after it successfully breakout below the support level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9310.

Resistance level: 0.9405, 0.9530

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 80.60. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 86.15.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1807.30. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1807.30, 1835.30

Support level: 1786.00, 1759.15

051222 Morning Session Analysis

5 December 2022 Morning Session Analysis

US Dollar skyrocketed upon bullish NFP figures.

The Dollar Index which traded against a basket of six major currencies rose significantly after the upbeat NFP data has been released. According to Bureau of Labor Statistics, the US Nonfarm Payrolls for November came in at the reading of 263K, higher than the market forecast of 200K. Besides, the US Unemployment Rate, which was announced at the same time has remained unchanged from the prior. These essential data have shown that the current US labor market was more substantial than widely expected, as well as boosted up the market optimism toward aggressive rate hikes from Fed. Nonetheless, the Dollar Index has retreated from its gains following the speech of Fed member. According to Reuters, Richmond Fed President Thomas Barkin claimed on Friday that the US was likely in a sustained period in which there will remain a shortage of workers, which complicating the Fed’s aim of getting labor demand back into balance. With that, investors decided to flee away from the US market in order to anticipate further about interest rate decision from Fed. As of writing, the Dollar Index depreciated by 0.07% to 104.42.

In the commodities market, the crude oil price rose by 2.01% to $81.59 per barrel as of writing following China announced an easing of Covid-19 curbs. In addition, the gold price appreciated by 0.17% to $1799.41 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Nov) | 48.3 | 48.3 | – |

| 17:30 | GBP – Services PMI (Nov) | 48.8 | 48.8 | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Nov) | 54.4 | 53.1 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2485, 1.2735

Support level: 1.2245, 1.2040

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 135.35, 139.00

Support level: 131.30, 126.65

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 83.55, 86.10

Support level: 80.15, 77.40

GOLD_, H4: Gold price was traded higher following prior breakout above the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05

021222 Afternoon Session Analysis

2 December 2022 Afternoon Session Analysis

Dollar plunged ahead of NonFarm Payroll.

The dollar index, which was traded against the six major currencies in the basket, plummeted more than 1% in the previous trading session as the inflation figure of the US came in at a lower-than-expected reading. The cooling down of high inflationary pressures in the nation has uplifted the probability that the Fed would scale back from its aggressive rate hike plan. While the chairman of the Federal Reserve warned the world that a single inflation figure does not precisely reflect the real situation of inflation, the Core PCE data likely further confirm the drop in inflation. According to the CME FedWatch Tool, the chances of a rate hike with only 50 basis points increased from the previous week’s 75.8% to 79.4%, while the probability of 75 basis points slumped to 20.6% from the prior week’s 24.2%. Going forward, investors are eyeing the long-awaited NonFarm Payroll data to gauge the further direction of the dollar index. As of writing, the dollar index rebounded 0.12% to 104.85.

In the commodities market, the crude oil price was down by -0.23% to $81.75 per barrel, while the market participants remain cautious ahead of the OPEC+ meeting. Besides, the gold prices edged down by -0.30% to $1797.80 per troy ounce following the rebound of the Greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 NZD RBNZ Gov Orr Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Nonfarm Payrolls (Nov) | 261K | 200K | – |

| 21:30 | CAD – Employment Change (Nov) | 108.3K | 5.0K | – |

| 22:56 | USD – Unemployment Rate (Nov) | 3.7% | 3.7% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 104.90. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 102.45.

Resistance level: 104.90, 107.85

Support level: 102.45, 100.30

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2345.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0475. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0615.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 136.45. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 134.15.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6355. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6460.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend it gains toward the resistance level at 1.3505.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9310.

Resistance level: 0.9405, 0.9530

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 80.60. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 86.15.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1805.90. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1805.90, 1850.95

Support level: 1766.50, 1726.15

021222 Morning Session Analysis

2 December 2022 Morning Session Analysis

US Dollar beaten down amid the easing inflationary risk.

The Dollar Index which traded against a basket of six major currencies remained its bearish trend following the easing of inflationary risk in the US. According to Bureau of Economic Analysis, the US Core PCE Price Index MoM that excluding the food and energy consumption notched down from the previous reading of 0.5% to 0.2%, missing the consensus forecast of 0.3%. Besides that, the US ISM Manufacturing Purchasing Managers Index (PMI) had given a downbeat reading, which post at the figures at 49.0 as well as lower than market expectation of 49.8. The lower-than-expected PCE figures add to signs that US inflation is falling, while the weakened manufacturing sector has dialed down the market optimism toward economic progression in the US. With such background, investors were anticipating that the lower rate hike would likely to be implemented in the December meeting, says 50 basis point. As of now, the announcement of NFP data tonight still highly attract the eye of investors, as it could provide a clearer view of interest rate decision. As of writing, the Dollar Index depreciated by 1.17% to 104.66.

In the commodities market, the crude oil price dropped by 0.11% to $81.33 per barrel as of writing following the various other officials of the oil producing alliance have privately told media that OPEC+ will likely stand pat on production at Sunday’s meeting. In addition, the gold price eased by 0.03% to $1802.30 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

10:40 EUR ECB President Lagarde Speaks

12:30 NZD RBNZ Gov Orr Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Nonfarm Payrolls (Nov) | 261K | 200K | – |

| 21:30 | CAD – Employment Change (Nov) | 108.3K | 5.0K | – |

| 22:56 | USD – Unemployment Rate (Nov) | 3.7% | 3.7% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

GBPUSD, Daily: GBPUSD was traded while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 135.35, 139.00

Support level: 131.30, 126.65

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

USDCAD, H4: USDCAD was traded higher while currently testing the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 83.55, 86.10

Support level: 80.15, 77.40

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05

011222 Afternoon Session Analysis

1 December 2022 Afternoon Session Analysis

Euro surged despite inflation started to cooldown.

The Euro, which was majorly traded by global investors, jumped despite the fact that the inflationary pressures in the Eurozone have started to ease in the last month. According to the statistical office of the European Union, the inflation figures are down from 10.6% to 10.0%, missing the economist forecast of 10.4%, reinforcing the case for a slowdown in European Central Bank rate hikes in the coming central bank meeting. In detail, the major dragger of the inflation figure in November was a substantial drop in energy prices. With that, the ECB is likely to take a slower pace of rate hike in the next meeting to tackle inflation. However, the significant drop in the dollar index urged the pairing of EUR/USD to skyrocket to a high level. Early today, the chairman of the Federal Reserve commented that the US central bank would scale back the pace of its rate hike plan alongside the inflationary pressures has started to ease over the past few months. As of writing, the pairing of EUR/USD rose 0.23% to 1.0430.

In the commodities market, the crude oil price edged up by 0.04% to $81.02 per barrel as a few of China’s districts eased the Covid-19 lockdown measures. Besides, the gold prices edged up 0.38% to $1775.40 per troy ounce amid the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Nov) | 46.7 | 46.7 | – |

| 17:30 | GBP – Manufacturing PMI (Nov) | 46.2 | 46.2 | – |

| 21:30 | USD – Core PCE Price Index (MoM) (Oct) | 0.5% | 0.3% | – |

| 21:30 | USD – Initial Jobless Claims | 240K | 235K | – |

| 23:00 | USD – ISM Manufacturing PMI (Nov) | 50.2 | 49.8 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in short term.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2200.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0475.

Resistance level: 1.0475, 1.0615

Support level: 1.0365, 1.0255

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 136.45. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 138.90, 141.75

Support level: 136.45, 134.15

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6255. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3400. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 80.60. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 80.60, 86.15

Support level: 76.10, 72.35

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1786.00.

Resistance level: 1786.00, 1807.30

Support level: 1759.15, 1729.85

011222 Morning Session Analysis

1 December 2022 Morning Session Analysis

US Dollar’s bear continued following dovish speech from Fed chairman.

The Dollar Index which traded against a basket of six major currencies slumped on Thursday early trading session amid the background of dovish statement from Fed. According to Reuters, the Federal Reserve Chairman Jerome Powell appeared a speech on Thursday that the aggressive rate hike pace could be slowed, and it may come as soon as the December meeting. In addition, he also acknowledged that the current level of interest rates were approaching “the level of restraint that will be sufficient to bring inflation down”, which further increased the odds of softer rate hike in the next meeting. Though, it is noteworthy that he reiterated that the rates were still a long way from peak levels. On the economic data front, a series of upbeat economic data has limited the losses of the Dollar Index. The data such as US Gross Domestic Product (GDP), JOLTs Job Openings and Pending Home Sales has given a better-than-forecast reading, which spurred bullish momentum toward US Dollar. As of writing, the Dollar Index depreciated by 0.79% to 105.92.

In the commodities market, the crude oil price appreciated by 0.09% to $80.55 per barrel as of writing following the diminishing of crude oil inventories. According to EIA, the US Crude Oil Inventories decreased by -12.580M barrels, higher than the expectation of market. On the other hand, the gold price rose by 0.29% to $1774.15 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Nov) | 46.7 | 46.7 | – |

| 17:30 | GBP – Manufacturing PMI (Nov) | 46.2 | 46.2 | – |

| 21:30 | USD – Core PCE Price Index (MoM) (Oct) | 0.5% | 0.3% | – |

| 21:30 | USD – Initial Jobless Claims | 240K | 235K | – |

| 23:00 | USD – ISM Manufacturing PMI (Nov) | 50.2 | 49.8 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 83.55, 86.10

Support level: 80.15, 77.40

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1783.50, 1808.55

Support level: 1756.05, 1725.65

301122 Afternoon Session Analysis

30 November 2022 Afternoon Session Analysis

Dollar standstill ahead of Fed Powell speech.

The dollar index, which gauges its value against a basket of six major currencies, teetering near the brink while market participants are waiting for the long-awaited speech from the Federal Reserve Chairman Jerome Powell. Recently, the St. Louis Fed President James Bullard commented that the official cash rate needed to increase further and hold for an extended period of time throughout the year of 2024 in order to effectively cool down the sky-high inflation. Importantly, James Bullard also warned that the market is now underpricing the risk FOMC may be more aggressive. Hence, it urged the market participants to eye on the speech from the Fed Chairman, in order to identify if there is any deviation on their standpoint regarding the rate hike plan. Moreover, the US GDP data which scheduled to release tonight, is expected to provide a crucial view on the economic current health situation to the investors. As of writing, the dollar index dropped -0.14% to 106.65.

In the commodities market, the crude oil price edged down by -0.03% to $79.40 per barrel as China Covid-19 cases remain high, whereby it deteriorated the outlook of the oil market. Besides, the gold prices edged up 0.22% to $1753.00 per troy ounce amid the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Nov) | 8K | 13K | – |

| 18:00 | EUR – CPI (YoY) (Nov) | 10.6% | 10.4% | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Nov) | 239K | 200K | – |

| 21:30 | USD – GDP (QoQ) (Q3) | 2.6% | 2.7% | – |

| 23:00 | USD – JOLTs Job Openings (Oct) | 10.717M | 10.300M | – |

| 23:00 | USD – Pending Home Sales (MoM) (Oct) | -10.2% | -5.0% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -3.691M | -2.758M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.35.

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1820.

Resistance level: 1.2000, 1.2200

Support level: 1.1820, 1.1635

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0365. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0255.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.90. MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6640. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6170. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6255, 0.6355

Support level: 0.6170, 0.6105

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9530. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9625.

Resistance level: 0.9625, 0.9745

Support level: 0.9530, 0.9405

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 80.60.

Resistance level: 80.60, 86.15

Support level: 76.10, 72.35

GOLD_, Daily: Gold price was traded higher following prior rebound from the lower level. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35

301122 Morning Session Analysis

30 November 2022 Morning Session Analysis

US Dollar rallied as interest rate might be increased further.

The Dollar Index which traded against a basket of six major currencies extended its gains on yesterday after the upbeat economic data has been released. According to Conference Board, the US CB Consumer Confidence for November came in at the reading of 100.2, slightly higher than the market forecast of 100.0. The higher-than-expected data figures indicated the higher US consumer optimism toward economic progression in the US, while showing that the US economy was not entering into recession yet. Besides that, the optimistic economic data has increased the odds of aggressive rate hikes by Fed. Earlier of the week, St. Louis Fed President James Bullard reiterated that the Federal Reserve needs to raise interest rates quite a bit further and then hold them there throughout next year and into 2024 to gain control of inflation and bring it back down toward the US central bank’s 2% goal. Thus, the GDP data and Fed Chairman’s speech in the upcoming events would be the key factors to determine the size of rate hike. As of writing, the Dollar Index appreciated by 0.09% to 106.73.

In the commodities market, the crude oil price rose by 0.84% to $78.84 per barrel as of writing following the investors anticipated that China will be pressured by its protesting citizens to reopen its economy from COVID lockdowns. In addition, the gold price dropped by 0.09% to $1746.90 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Nov) | 8K | 13K | – |

| 18:00 | EUR – CPI (YoY) (Nov) | 10.6% | 10.4% | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Nov) | 239K | 200K | – |

| 21:30 | USD – GDP (QoQ) (Q3) | 2.6% | 2.7% | – |

| 23:00 | USD – JOLTs Job Openings (Oct) | 10.717M | 10.300M | – |

| 23:00 | USD – Pending Home Sales (MoM) (Oct) | -10.2% | -5.0% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -3.691M | -2.487M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2040, 1.2245

Support level: 1.1835, 1.1635

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0335, 1.0465

Support level: 1.0210, 1.0090

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6260, 0.6360

Support level: 0.6150, 0.6025

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3635, 1.3790

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 80.15, 83.55

Support level: 77.40, 75.15

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1756.05, 1783.50

Support level: 1725.65, 1700.05

291122 Afternoon Session Analysis

29 November 2022 Afternoon Session Analysis

Aussie dived as Australia economic outlook remain clouded.

The AUD/USD, which widely traded by global investors slumped on yesterday after the downbeat economic data has been unleashed. According to Australian Bureau of Statistics, the Australia Retail Sales MoM in October notched down from the previous reading of 0.6% to -0.2%, lower than the market forecast of 0.5%. The diminishing of retail sales in Australia shown that the consumer spending of the nation has lowered, which brought negative prospects toward economic progression in Australia. Besides that, Australia Dollar extended its losses amid the exacerbating of pandemic Covid-19 in China. According to Reuters, China reported a new high record of 40,347 new infections on Monday, whereas 3,822 were symptomatic and 36,525 asymptomatic infections. As China Covid-19 cases did not show a sign of easing, the China government would likely to implement the “zero-Covid policy” again, that restrict the movement of citizens forcefully. With that, China economy would face the recession issues as well as the Australia economy might also be affected, since China was the trading partner for Australia. As of writing, the AUDUSD appreciated by 0.83% to 0.6701.

In the commodities market, the crude oil price raised by 0.96% to $77.98 per barrel as of writing following the market participants anticipated that the weakened oil demand might lead to more supply cuts by OPEC+. On the other hand, the gold price rose by 0.47% to $1748.70 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:00 | EUR – German CPI (YoY) (Nov) | 10.4% | 10.4% | – |

| 21:30 | CAD – GDP (MoM) (Sep) | 0.1% | 0.1% | – |

| 23:00 | USD – CB Consumer Confidence (Nov) | 102.5 | 100.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2040, 1.2245

Support level: 1.1835, 1.1635

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0465, 1.0600

Support level: 1.0335, 1.0210

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6260, 0.6360

Support level: 0.6150, 0.6025

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 80.15, 83.55

Support level: 77.40, 75.15

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1756.05, 1783.50

Support level: 1725.65, 1700.05